The Daily Shot: 24-Apr-24

• The United States

• The United Kingdom

• The Eurozone

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

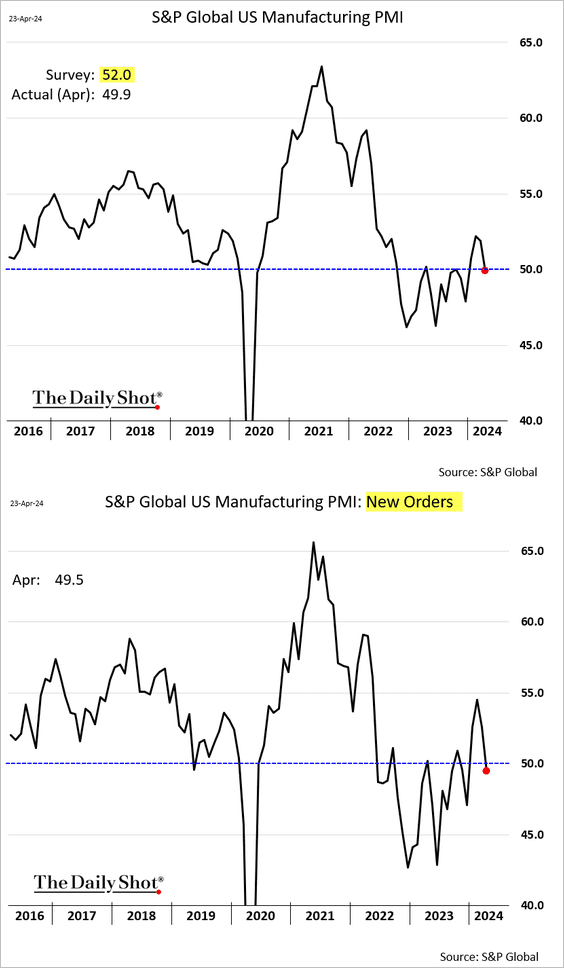

1. The flash PMI indicators from S&P Global showed a pullback in US business activity this month.

• Factory growth stalled as the new orders index dipped into contraction territory.

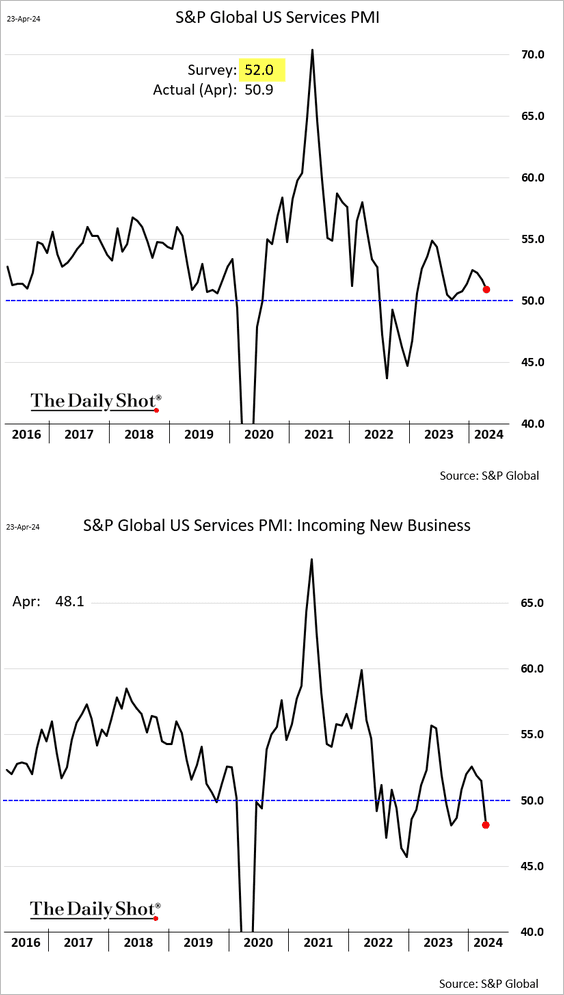

• Service sector activity decelerated as well, with the April PMI reading falling short of expectations.

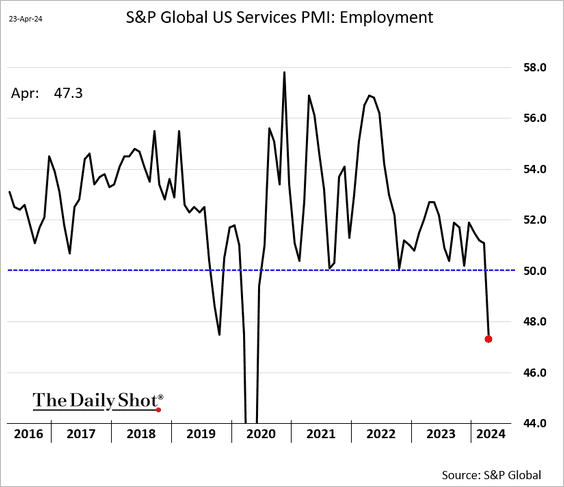

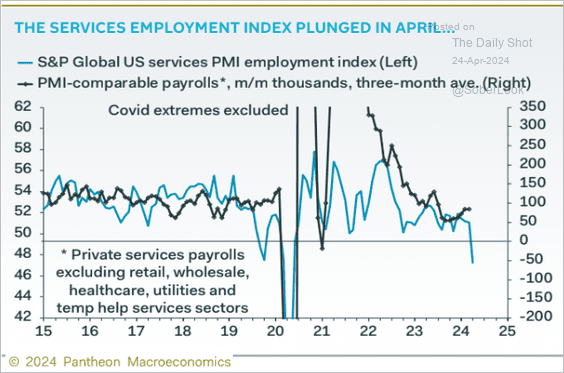

• The report’s most startling aspect was the sharp contraction in service-sector employment, …

… which signals a much weaker job growth this month.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

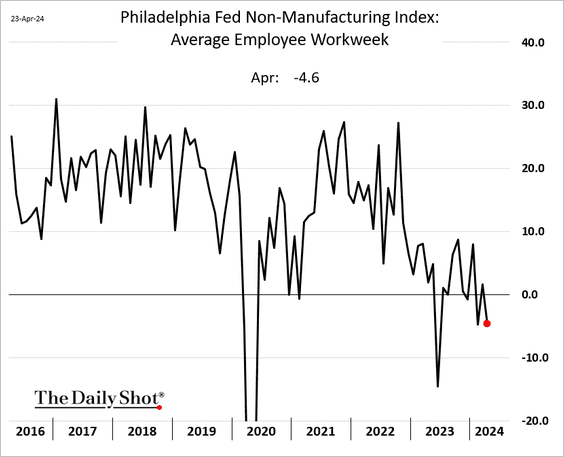

2. The Philly Fed’s regional service sector report shows companies cutting back employee hours.

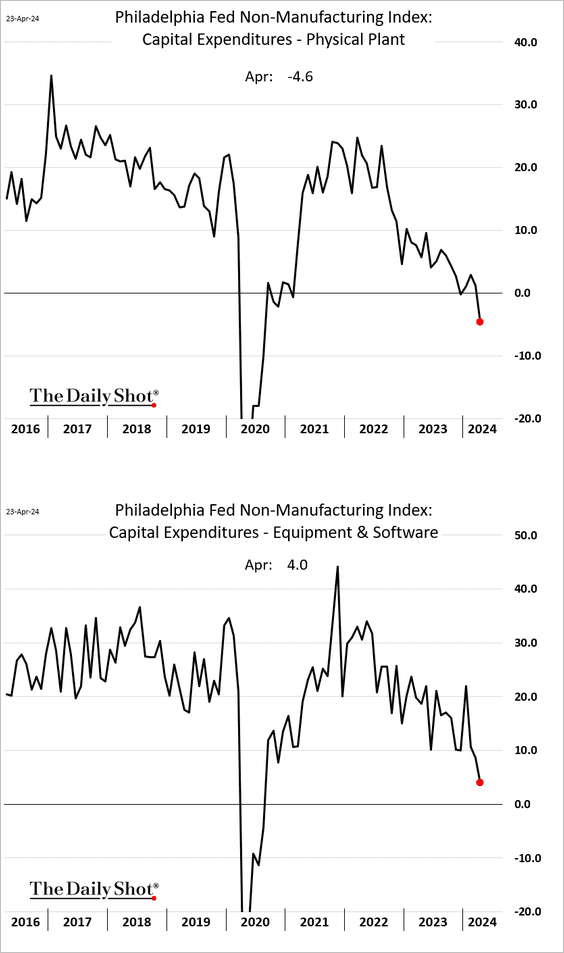

• The region’s service firms are curtailing their CapEx plans.

——————–

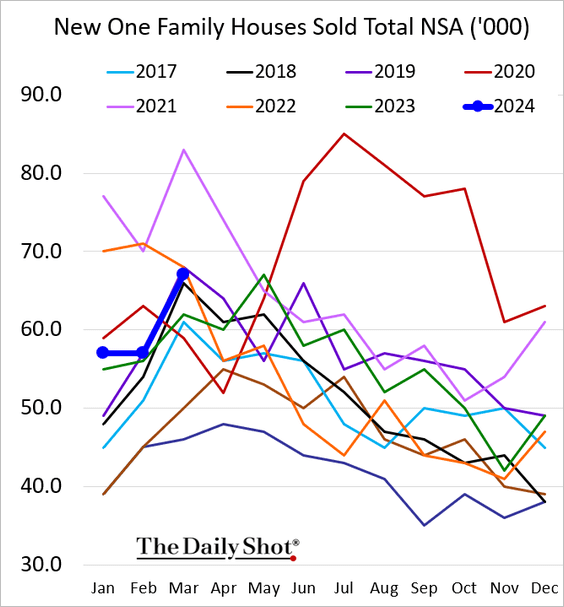

3. New home sales climbed well above 2023 levels in March.

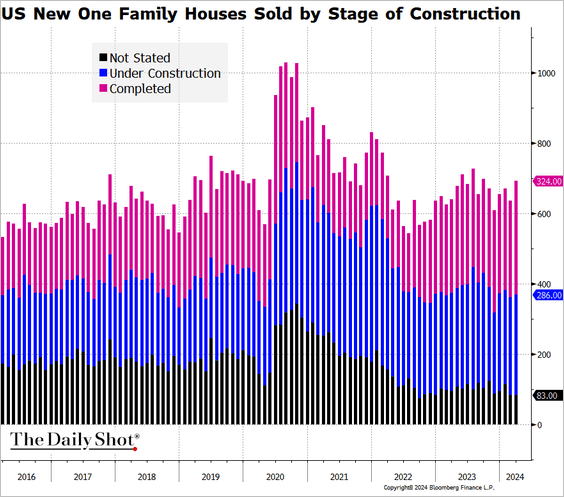

• This chart shows the seasonally adjusted trend by stage of construction.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

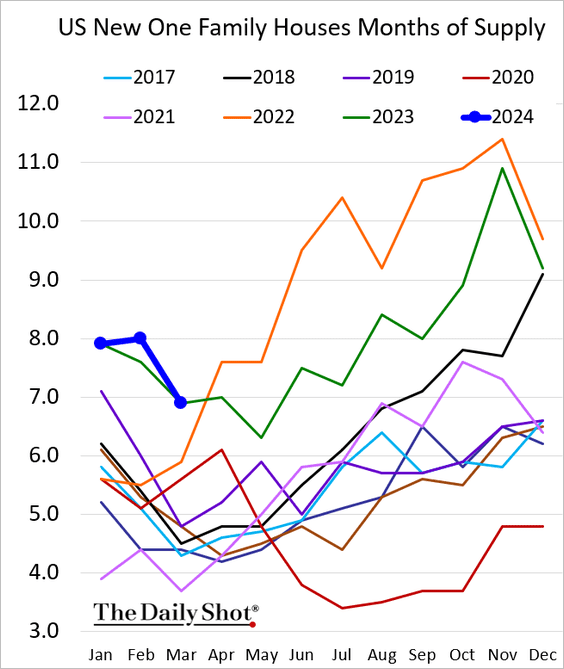

• Inventories (measured in months of supply) are running at last year’s levels.

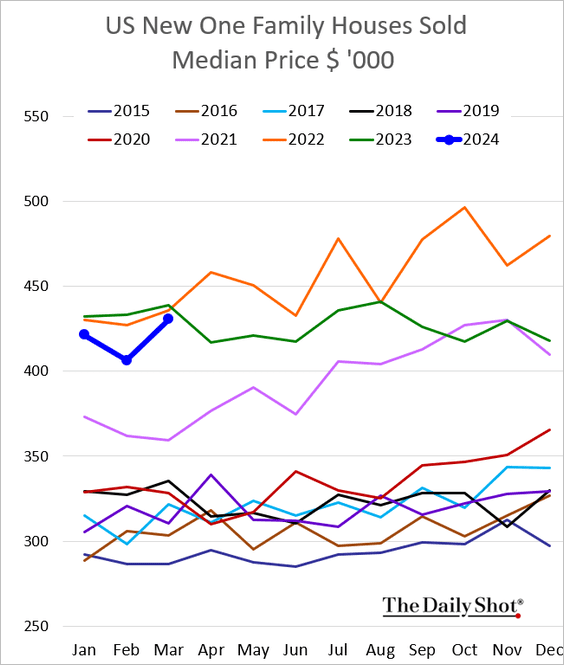

• The median price increased last month.

——————–

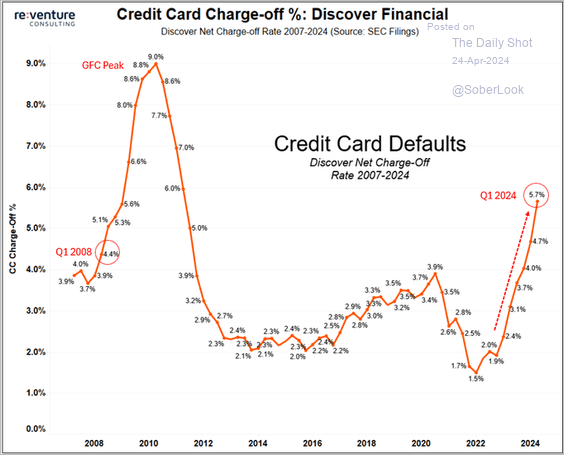

4. Discover Financial’s charge-off data suggests consumers are increasingly struggling to meet their credit card payment obligations.

Source: @nickgerli1

Source: @nickgerli1

Back to Index

The United Kingdom

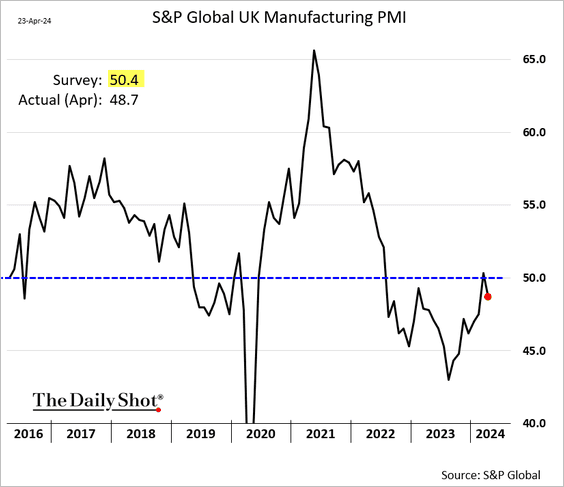

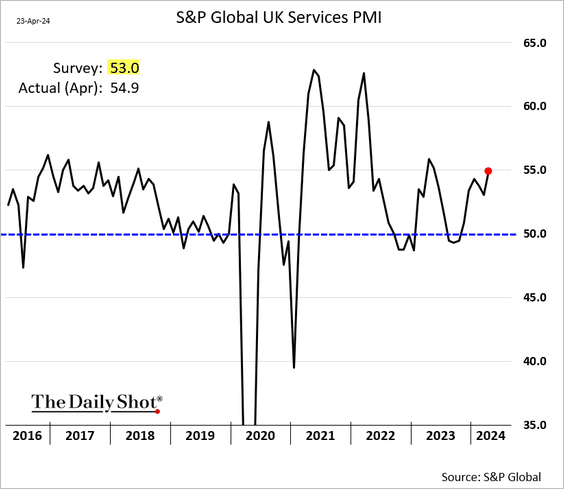

1. UK business activity strenghened this month.

Source: Reuters Read full article

Source: Reuters Read full article

• While the manufacturing sector is back in contraction mode, …

… service firms are reporting stronger growth.

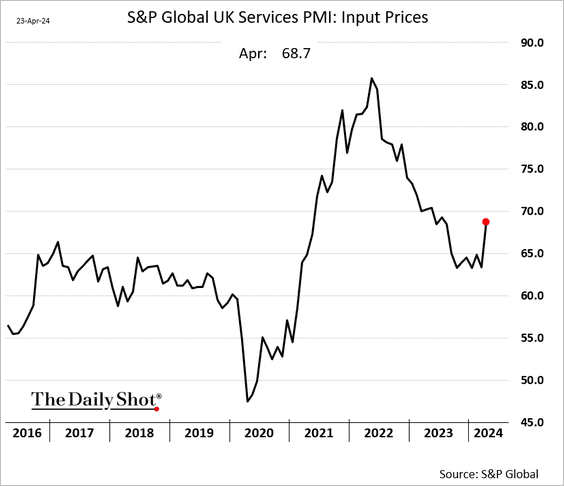

• Service firms also face increased cost pressures.

——————–

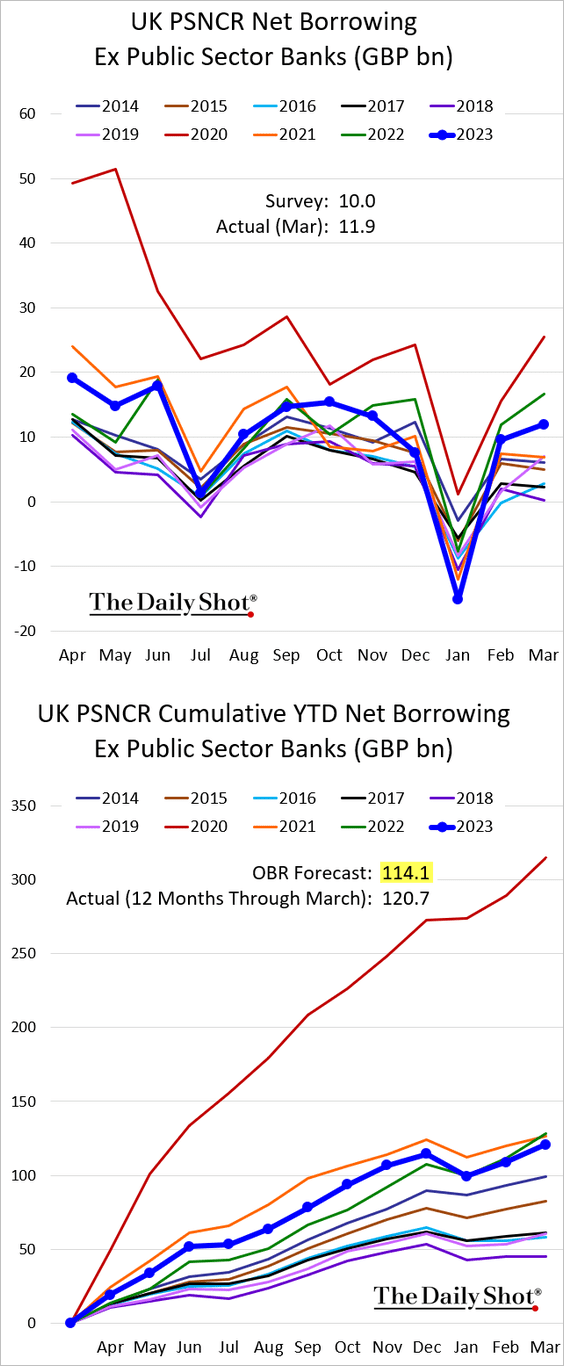

2. UK government borrowing for the 12 months through March was lower than in 2023 yet exceeded the OBR’s projections.

Source: @economics Read full article

Source: @economics Read full article

——————–

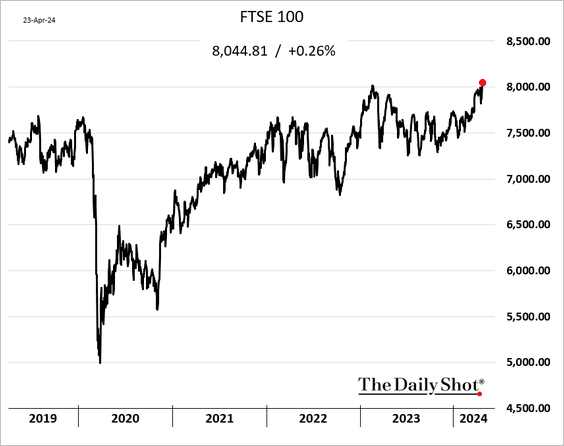

3. The FTSE 100 hit a new high.

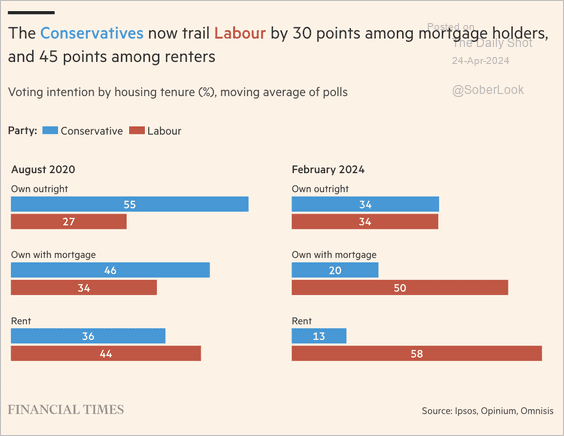

4. Here is a look at voting intentions by housing tenure.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

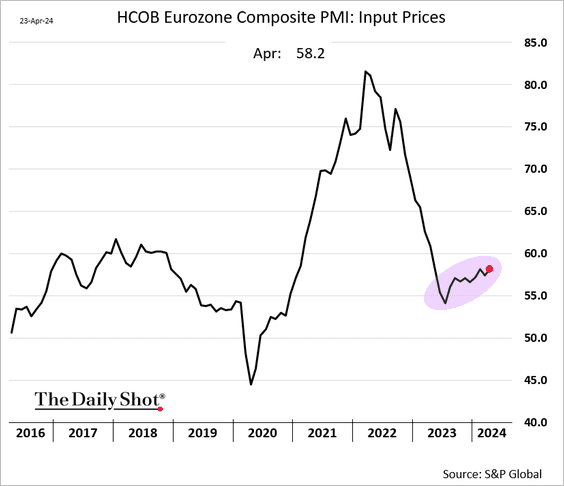

The Eurozone

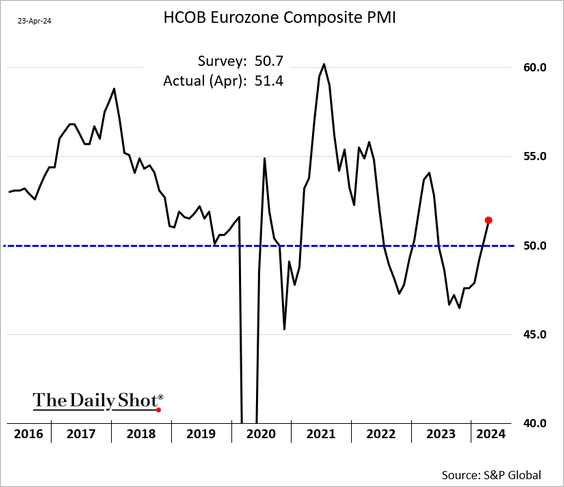

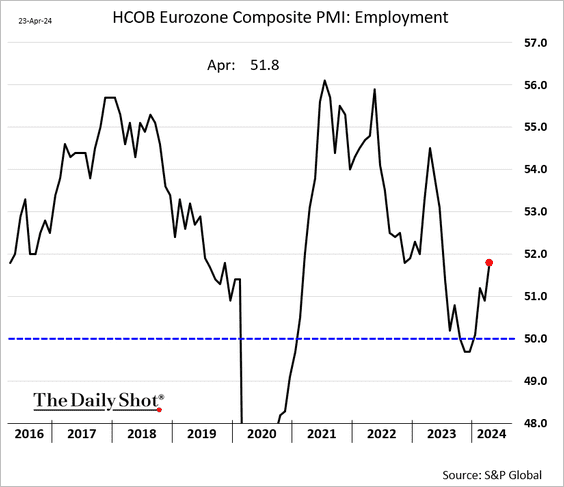

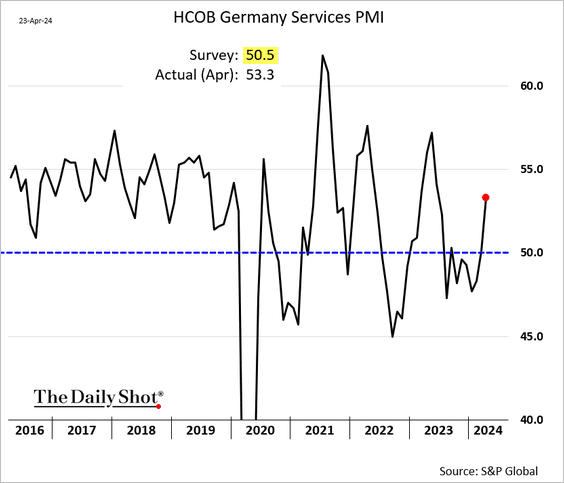

1. Euro-area business activity has picked up momentum in April, driven by services.

Source: Reuters Read full article

Source: Reuters Read full article

• Hiring strengthened.

• Cost pressures have been gradually increasing.

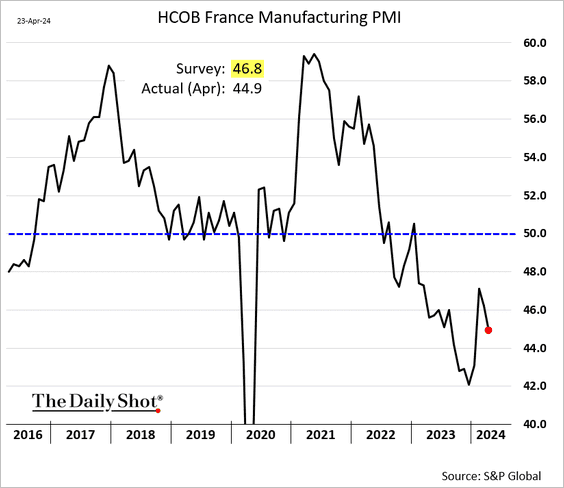

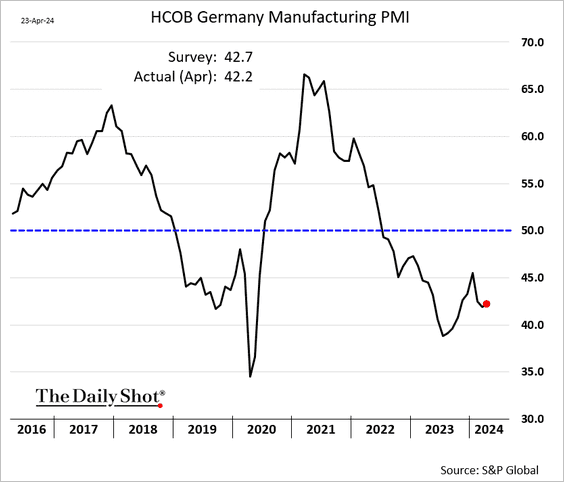

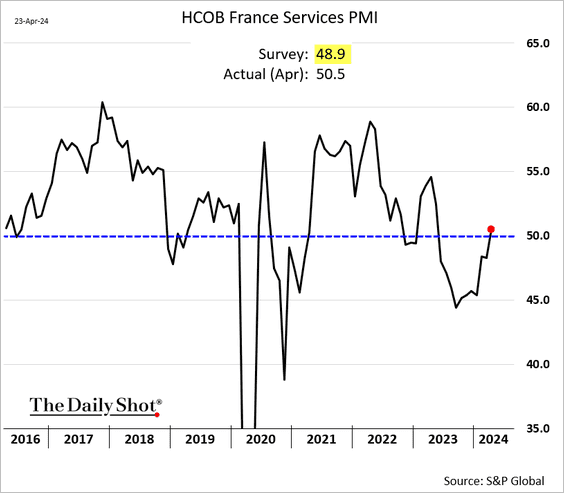

Here are the trends for France and Germany:

• Manufacturing:

– France (very weak):

– Germany (also deep in recession territory):

• Services:

– France (back to growth):

– Germany (acceleration):

——————–

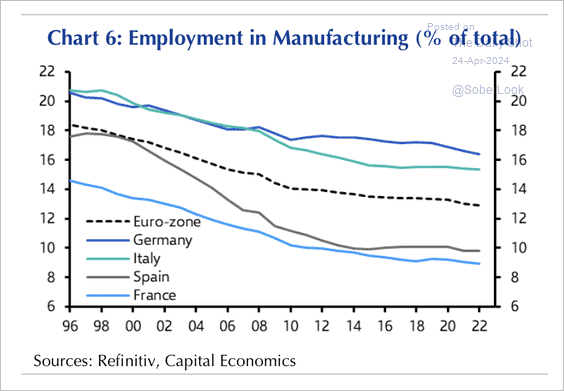

2. Manufacturing accounts for a larger share of total employment in Germany than in other major eurozone economies.

Source: Capital Economics

Source: Capital Economics

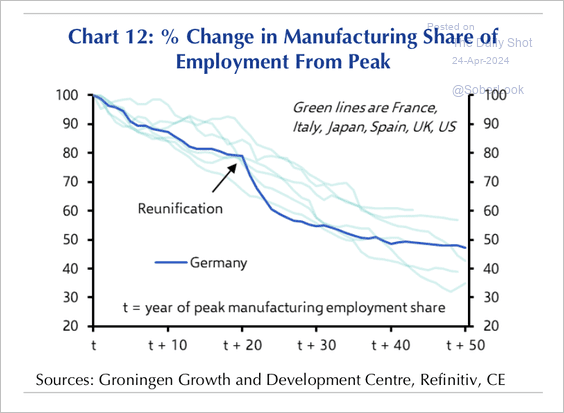

• However, German manufacturing has declined as a share of total employment at a much faster pace than other major developed markets.

Source: Capital Economics

Source: Capital Economics

——————–

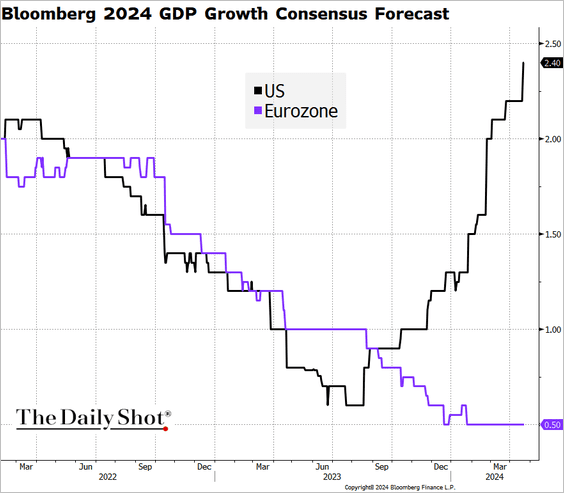

3. The US and Eurozone GDP growth forecasts for 2024 continue to diverge.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

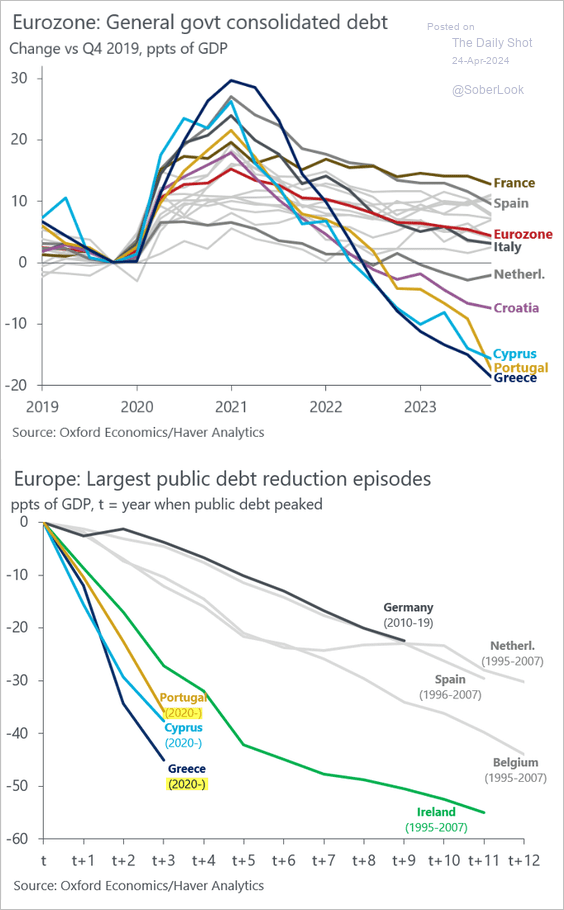

4. Portugal and Greece have achieved significant success in improving their fiscal positions.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

Back to Index

Japan

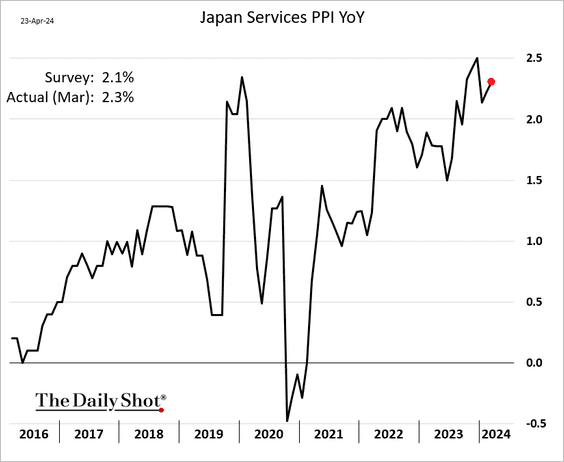

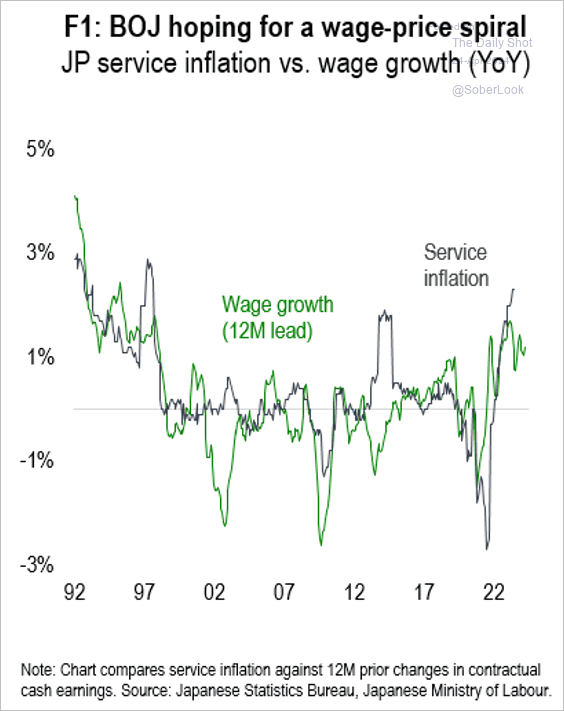

1. Last month’s services PPI topped expectations.

• The rise in wage growth and service inflation could prompt another BoJ rate hike.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

——————–

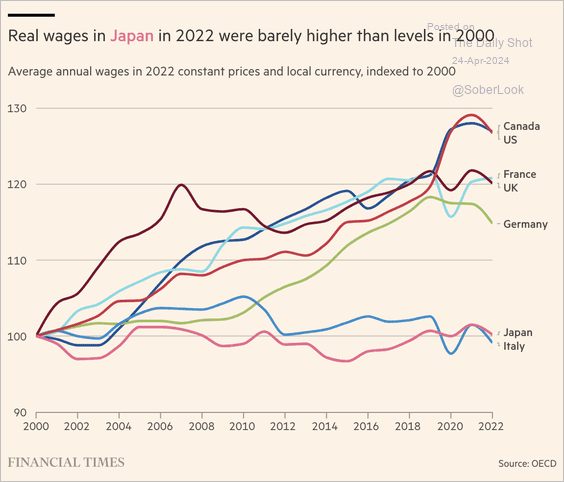

2. Japan’s real wages have been depressed for decades.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Asia-Pacific

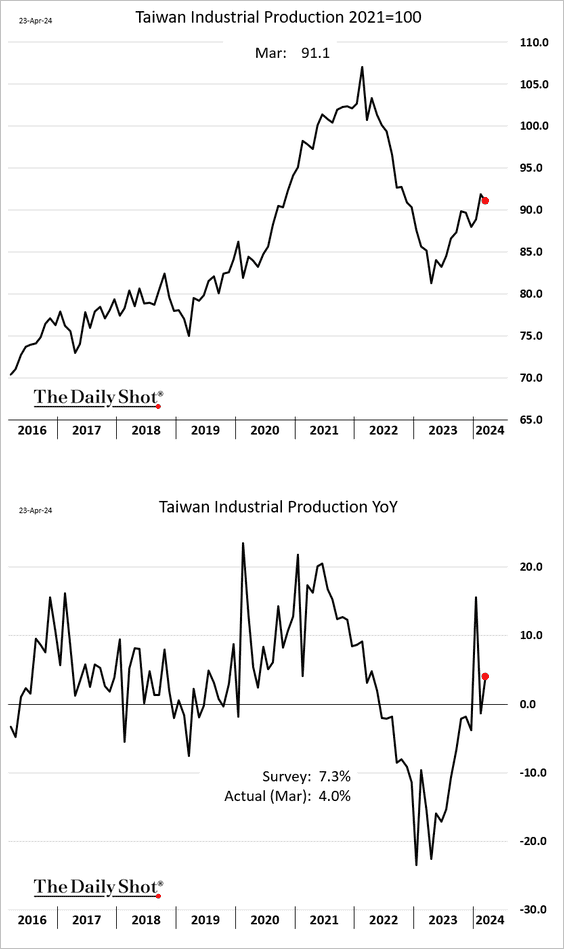

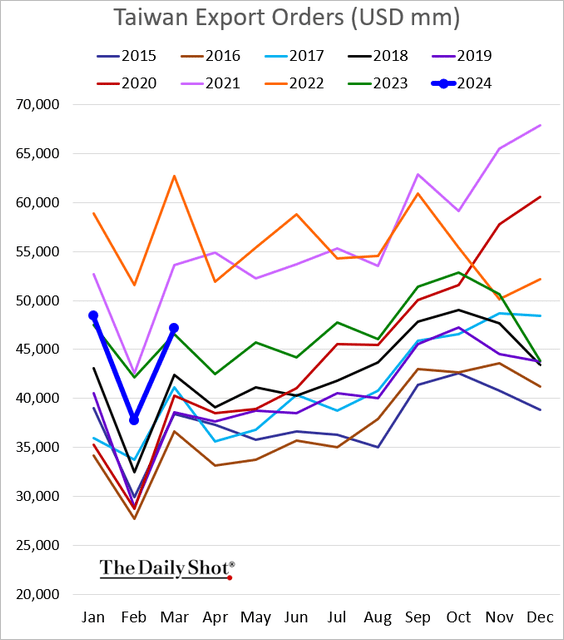

1. Taiwan’s industrial production edged lower in March.

• Export orders were back above 2023 levels but softer than expected.

——————–

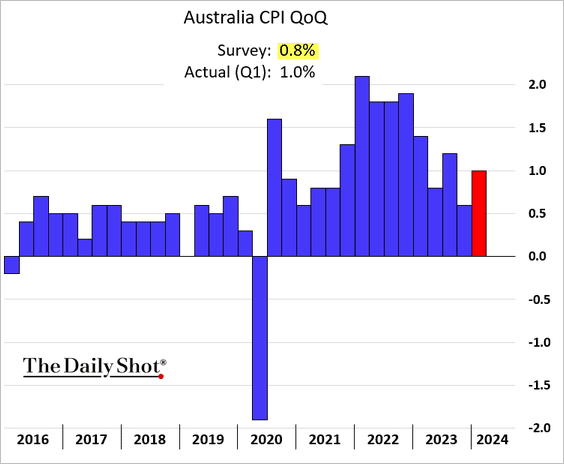

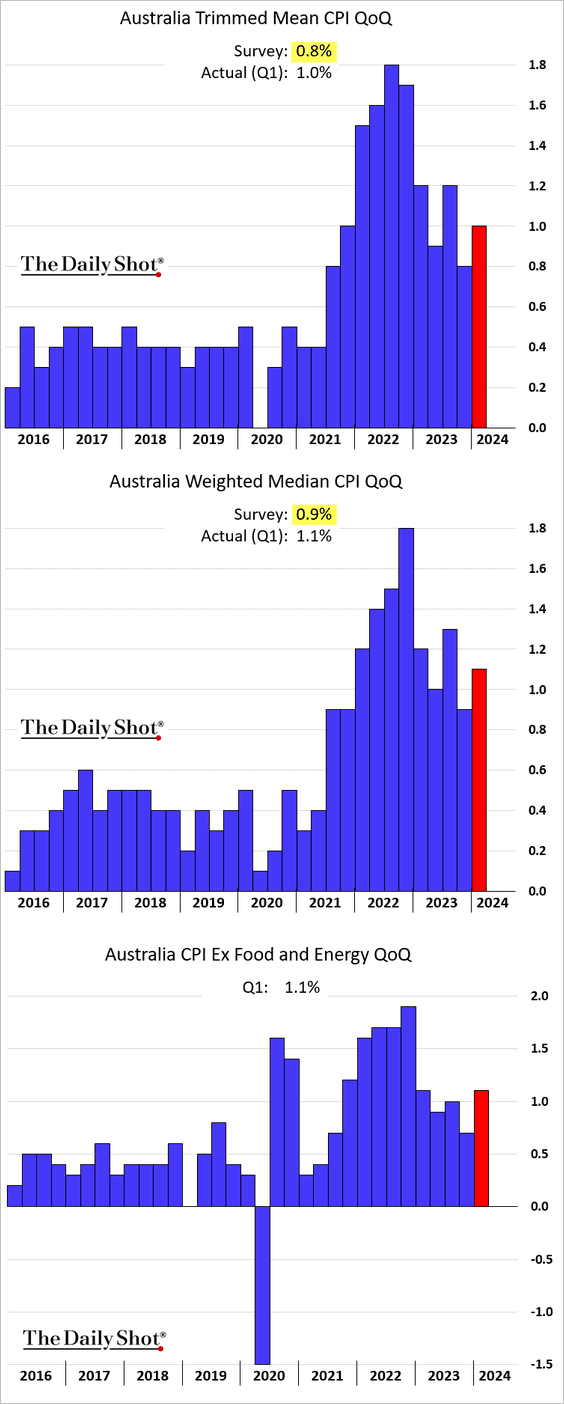

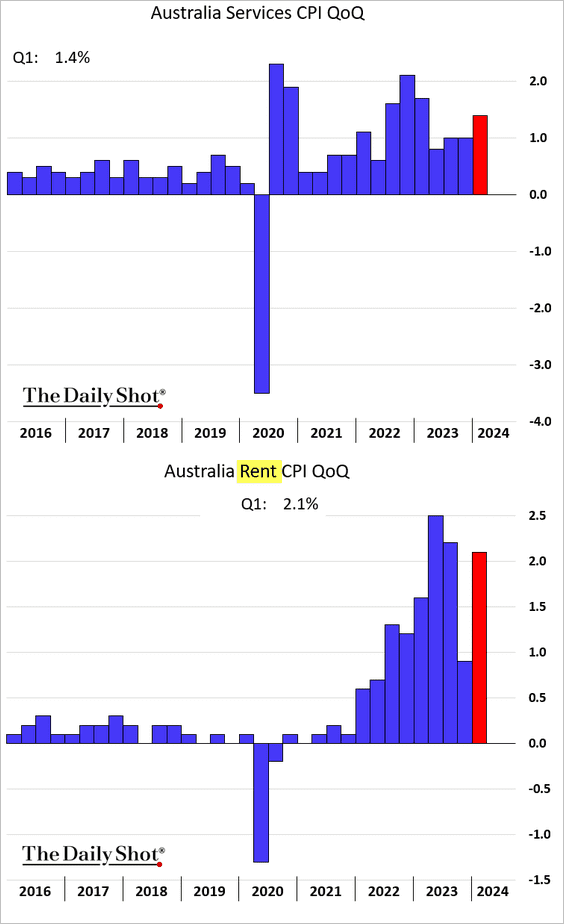

2. Australia’s CPI report topped expectations.

– Headline:

– Core inflation:

– Services CPI (pulled higher by rental costs):

Source: @economics Read full article

Source: @economics Read full article

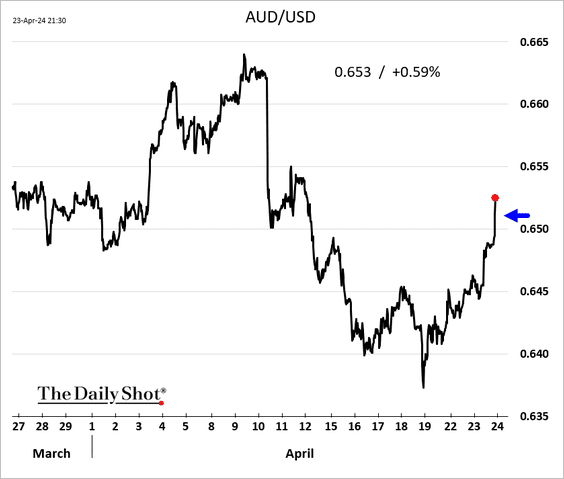

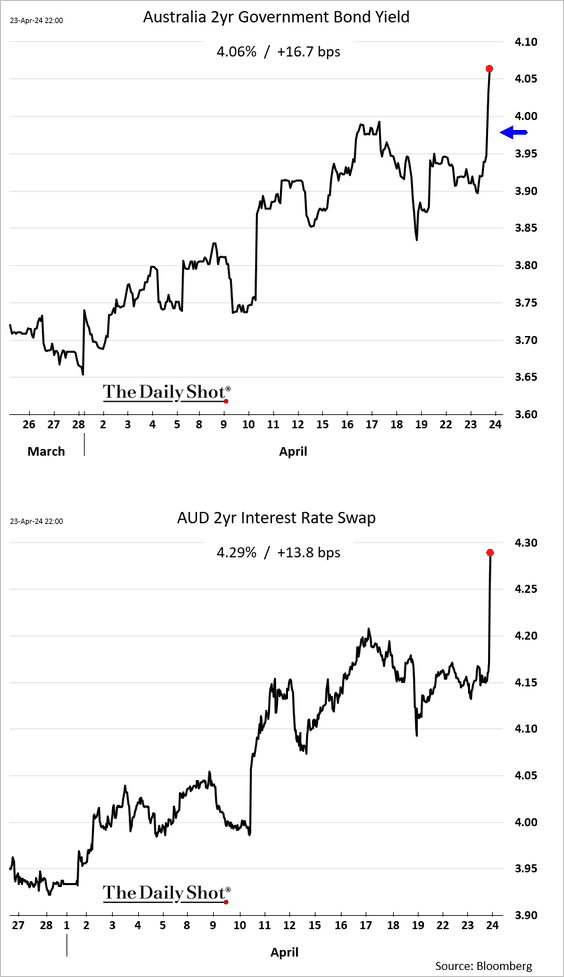

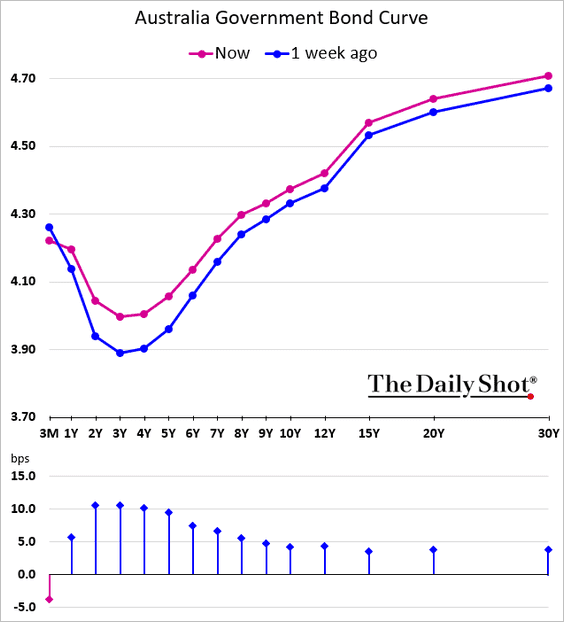

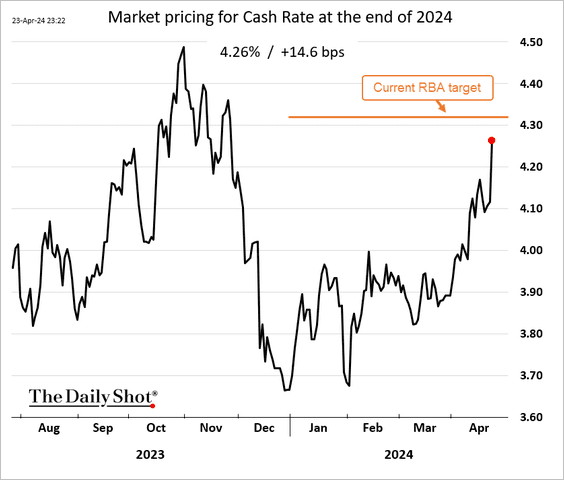

• The markets responded vigorously to Australia’s inflation report.

– The Aussie dollar:

– Rates:

– The yield curve:

Based on the latest market pricing, we may not see any RBA rate cuts this year.

Back to Index

China

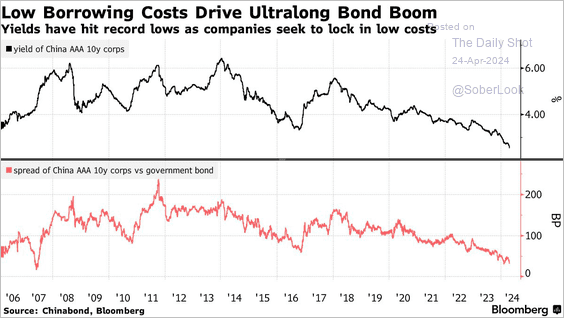

1. Corporate bond yields and spreads have been sinking.

Source: @markets Read full article

Source: @markets Read full article

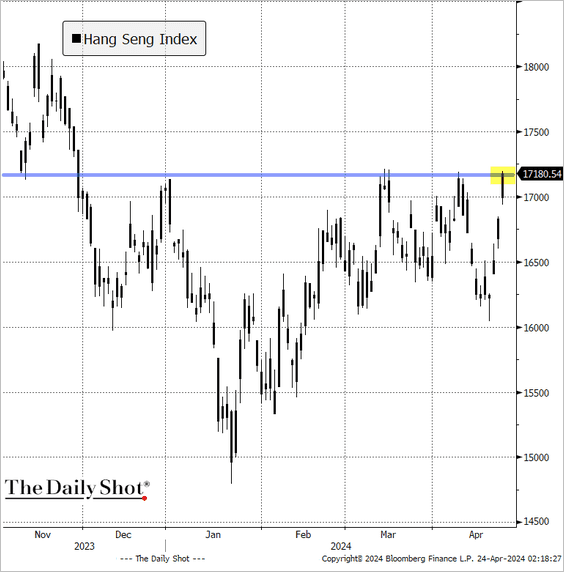

2. The Hang Seng Index (Hong Kong-listed shares) is at resistance.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

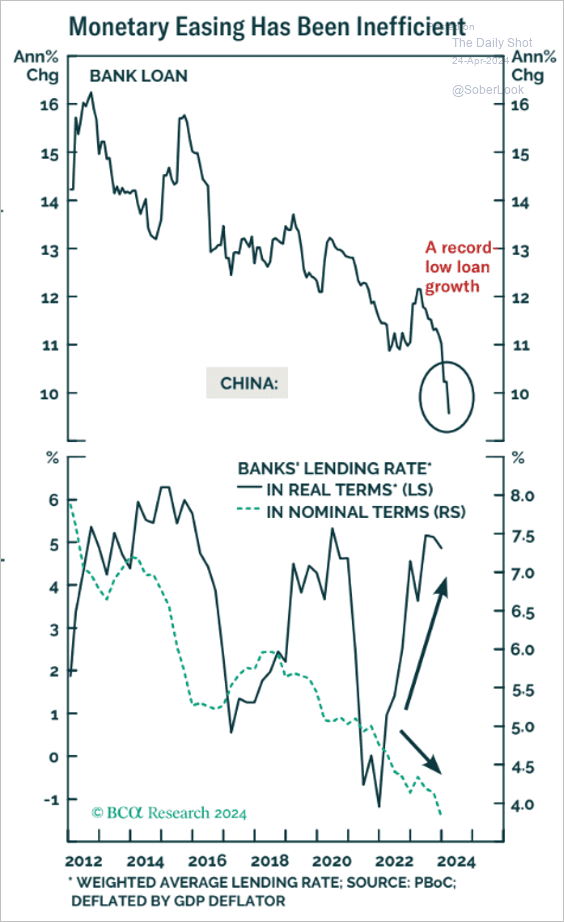

3. Elevated real rates have been putting pressure on credit growth.

Source: BCA Research

Source: BCA Research

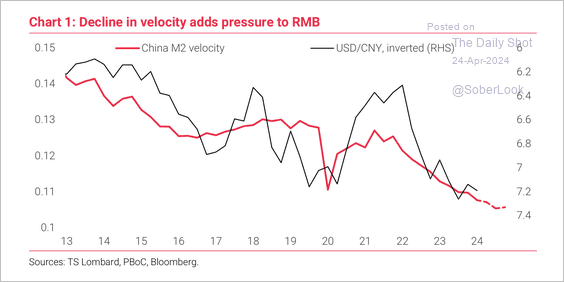

4. The collapse in money velocity occurred alongside a decline in the renminbi.

Source: TS Lombard

Source: TS Lombard

5. This chart illustrates the decreasing presence of political heirs in China’s Central Committee.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Emerging Markets

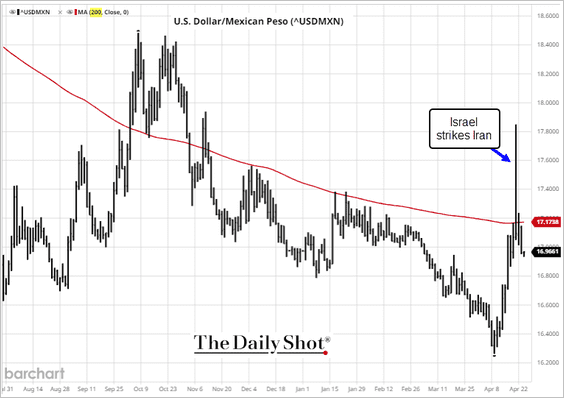

1. The Mexican peso is rebounding as carry trades are reloaded. USD/MXN is back below its 200-day moving average.

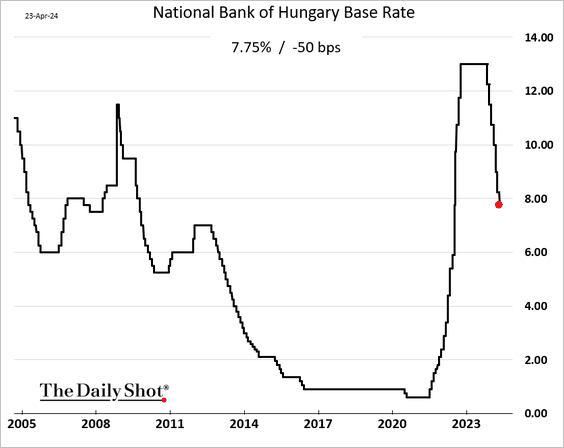

2. Hungary’s central bank cut rates again.

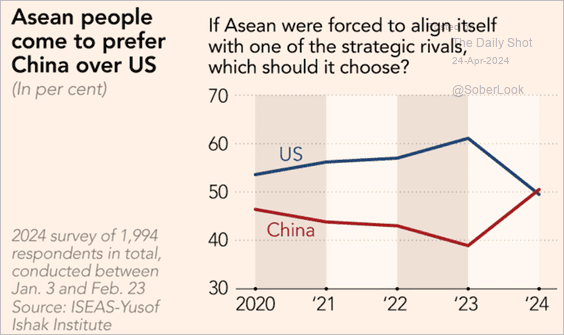

3. This chart illustrates the shift in ASEAN strategic preferences in choosing between the US and China.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Commodities

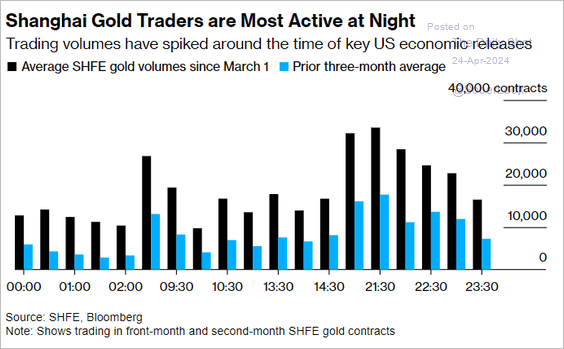

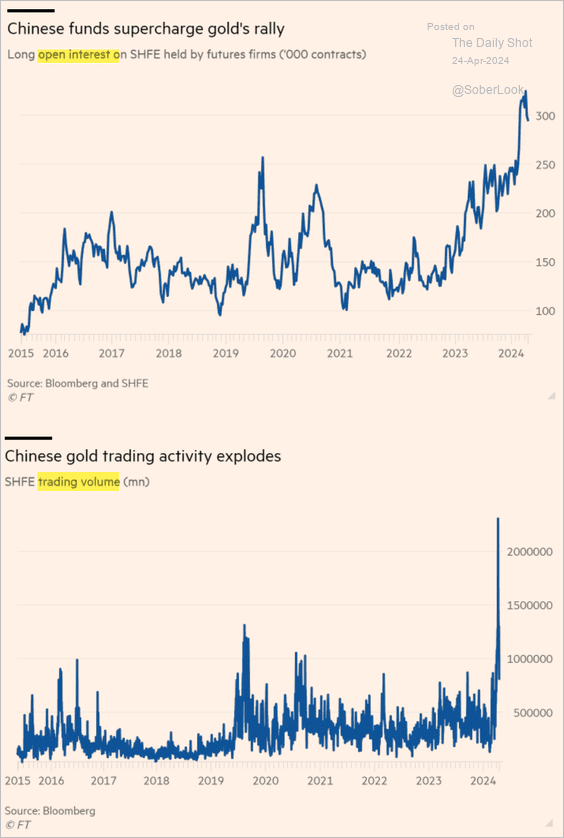

1. Some analysts have suggested that China has driven the recent gold rally.

Source: @markets Read full article

Source: @markets Read full article

Open interest and trading volumes in Shanghai gold futures have surged.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

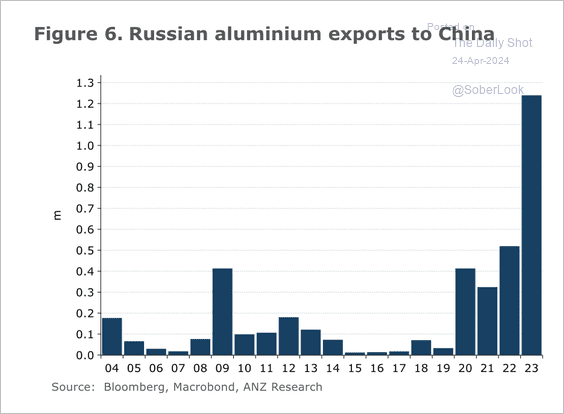

2. There was a sharp rise in Russian aluminum exports to China last year. Going forward, because of new sanctions, trade will likely be conducted under direct deals rather than via exchanges. This could weigh on prices on the Shanghai Futures Exchange, according to ANZ.

Source: @ANZ_Research

Source: @ANZ_Research

Source: S&P Global Read full article

Source: S&P Global Read full article

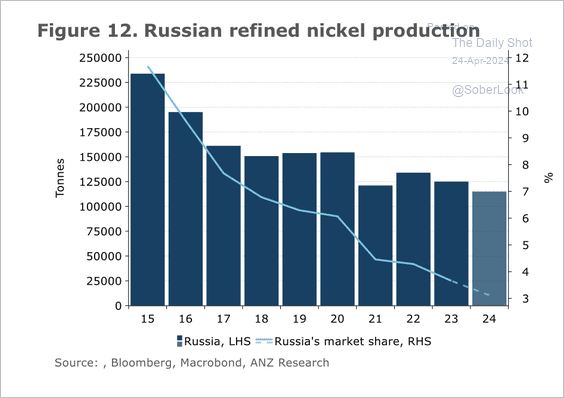

• Russia’s share of the global supply of Nickel has declined, partly because of the rise in Indonesia’s output in recent years.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Energy

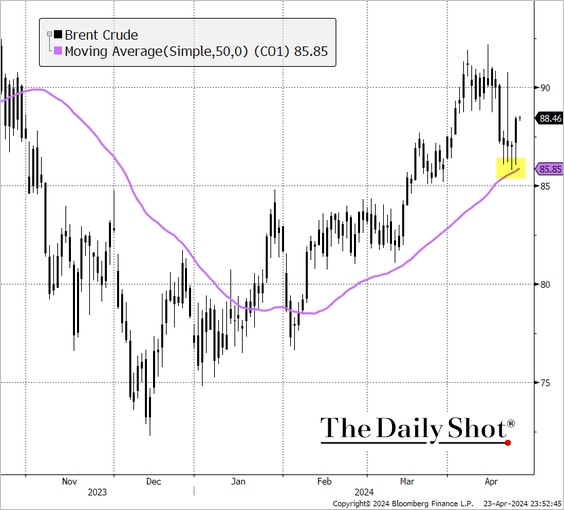

1. Brent crude held support at the 50-day moving average amidst US sanctions targeting vessels and refineries involved with Iranian oil.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

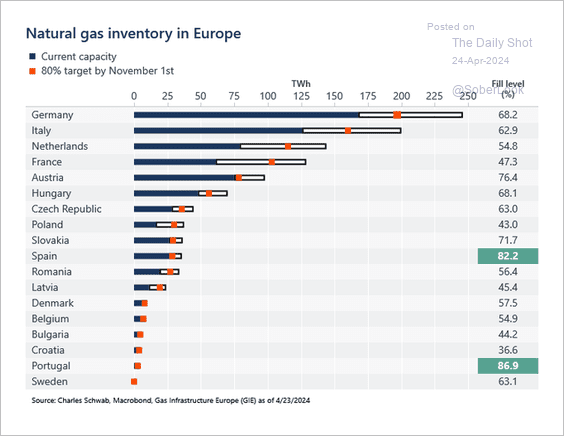

2. European natural gas storage levels remain elevated.

Source: @JeffreyKleintop

Source: @JeffreyKleintop

Back to Index

Equities

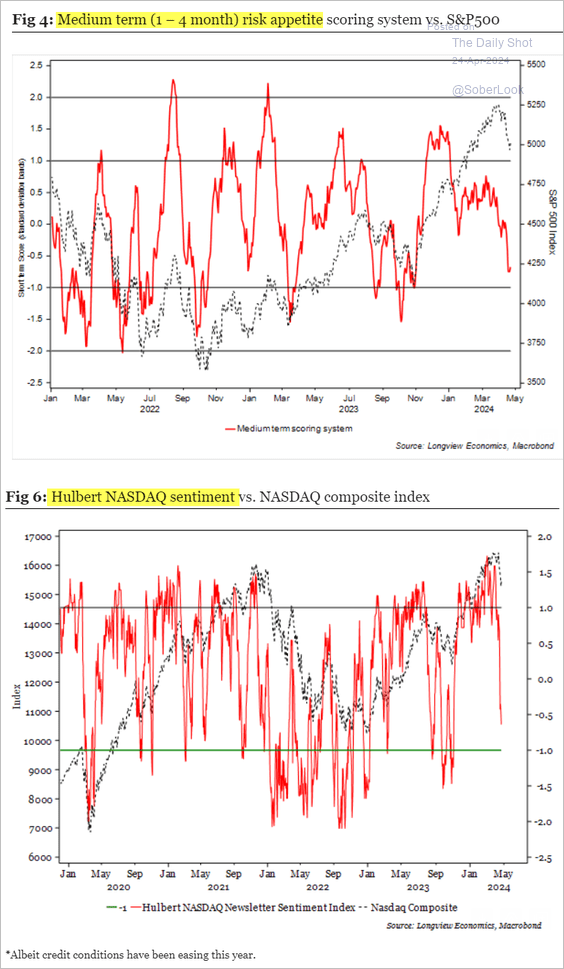

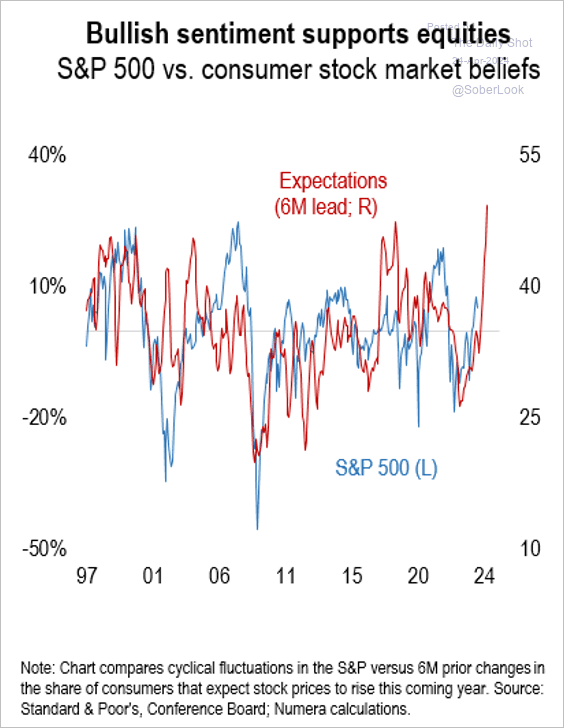

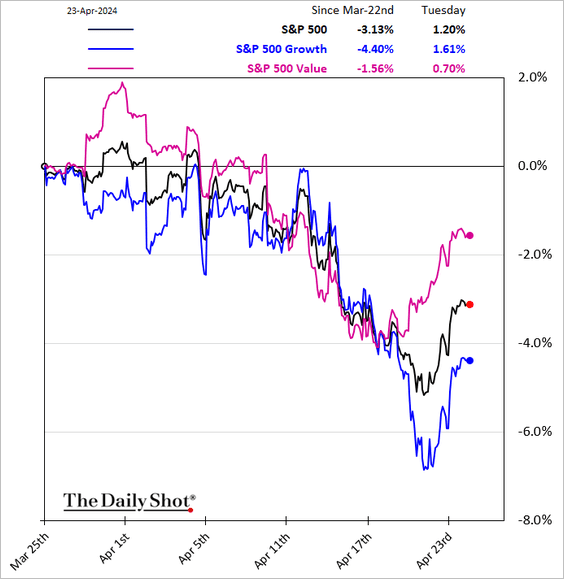

1. Sentiment has deteriorated sharply in recent days, …

Source: Longview Economics

Source: Longview Economics

… although consumer stock market expectations remain high.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

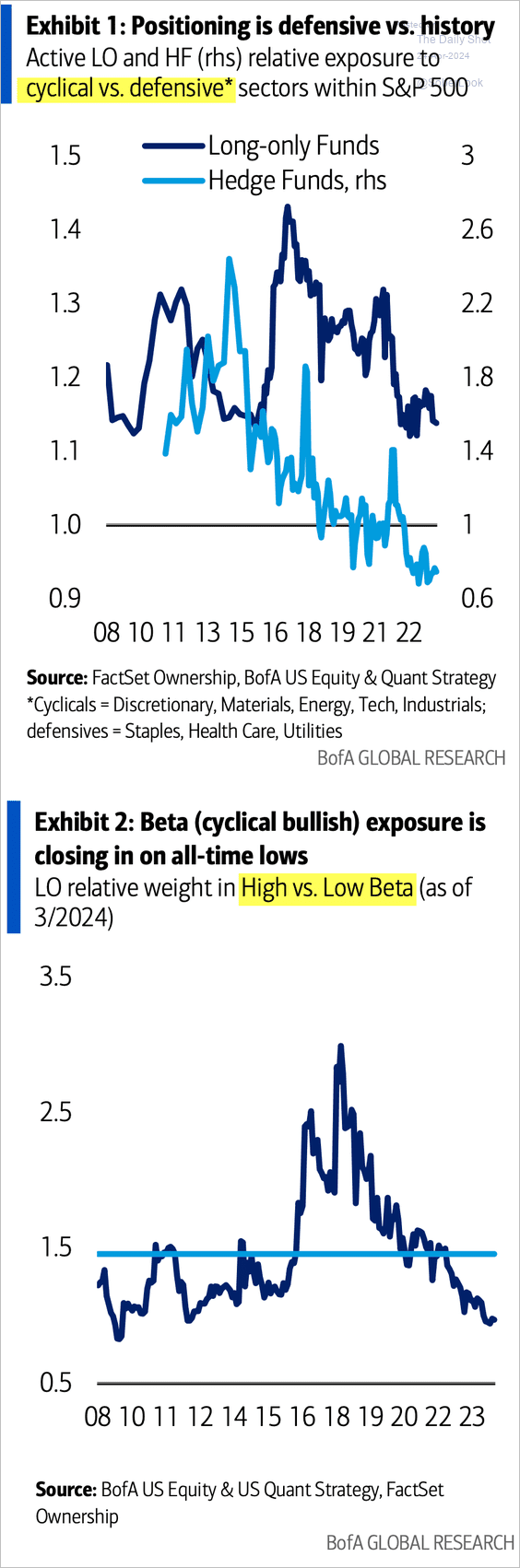

2. Funds’ positioning has been cautious.

Source: BofA Global Research; @dailychartbook

Source: BofA Global Research; @dailychartbook

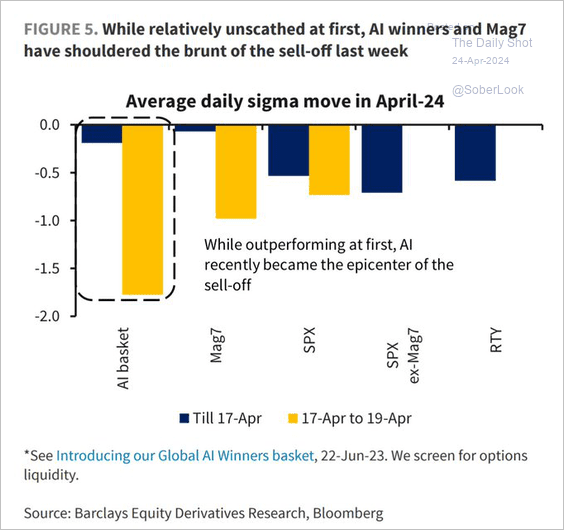

3. The AI basket selloff was significant.

Source: Barclays Research; @WallStJesus

Source: Barclays Research; @WallStJesus

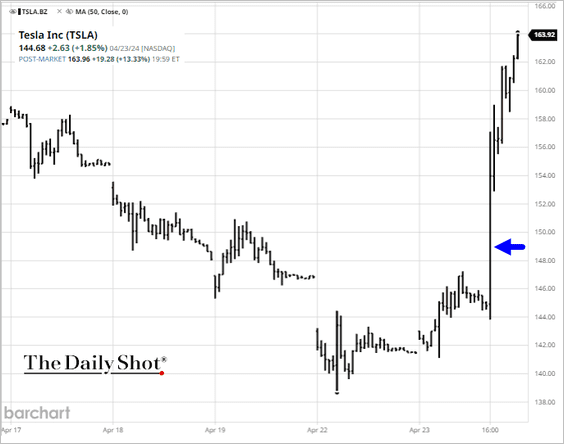

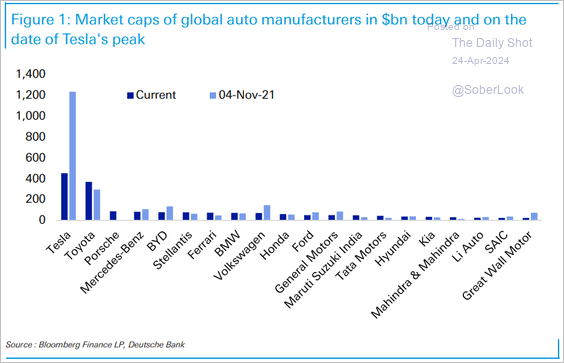

4. Tesla’s massive decline in sales was not as bad as feared. Shares surged after the close.

• Tesla’s market cap has significantly declined from its peak, which narrowed its lead against Toyota.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

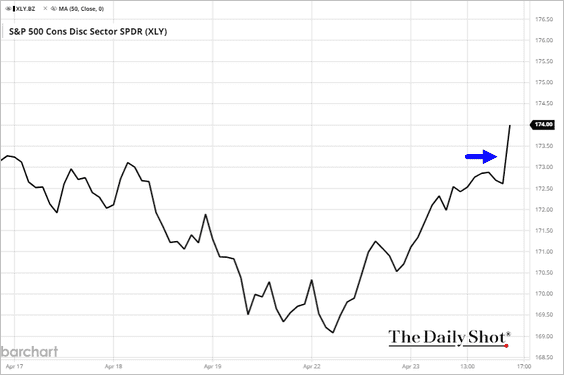

• The consumer discretionary index could get a boost from Tesla today.

——————–

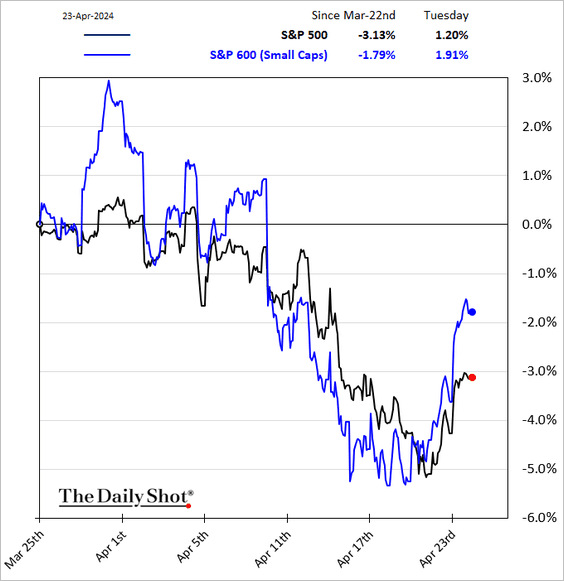

5. Small caps have been outperforming in recent days.

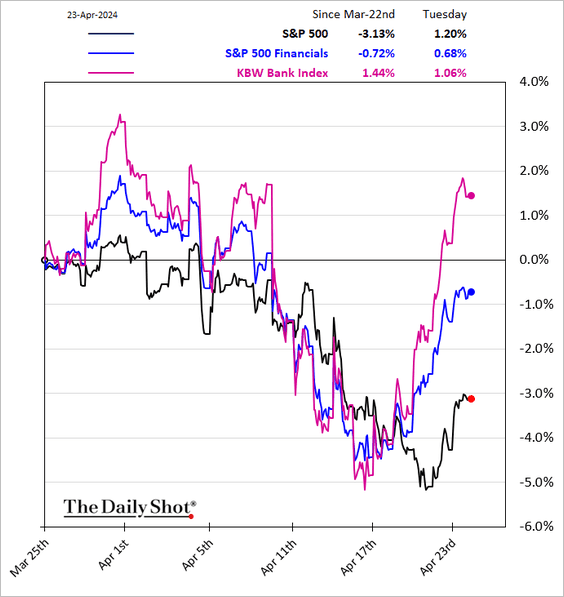

6. Bank stocks are surging.

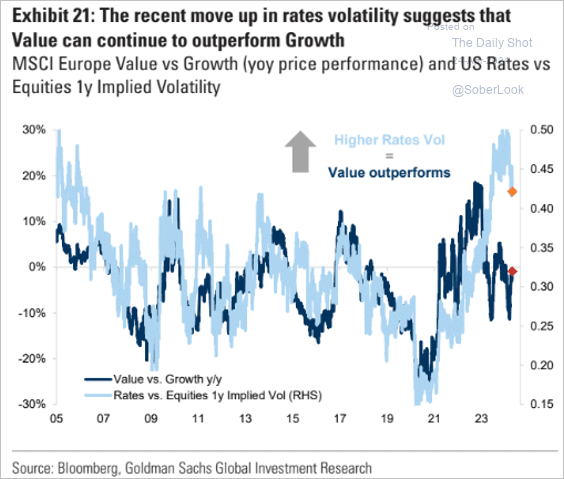

7. Could value continue outperforming growth?

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

——————–

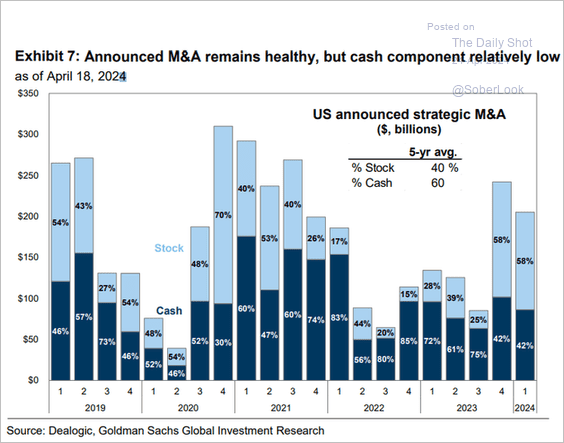

8. Here is a look at M&A activity.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

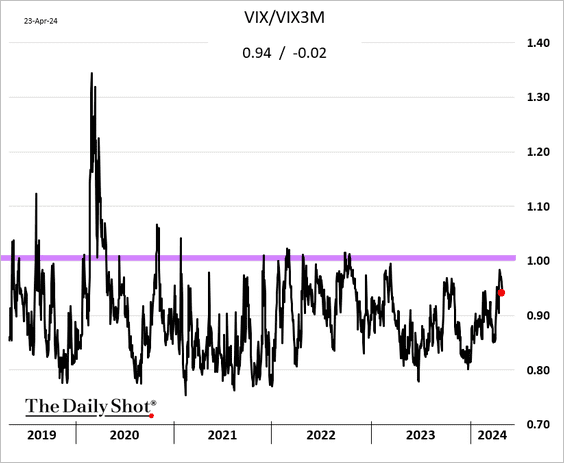

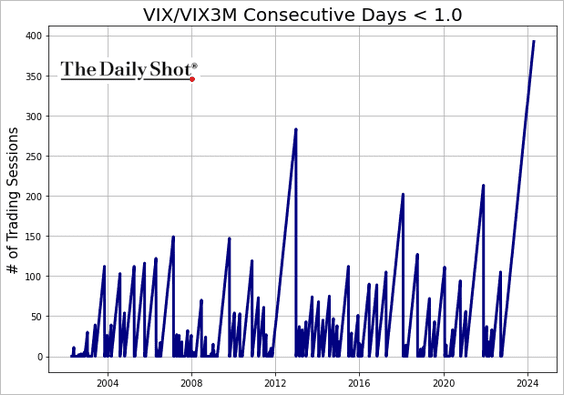

9. The VIX/VIX3M ratio (1-month vol to 3-month vol) has stayed below one for nearly 400 trading sessions, even during the latest market selloff, suggesting that market participants are not overly concerned.

h/t Barclays Equity Derivatives Research

h/t Barclays Equity Derivatives Research

Back to Index

Credit

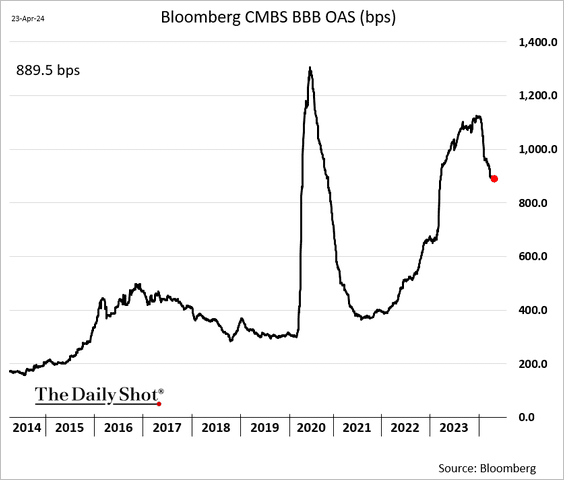

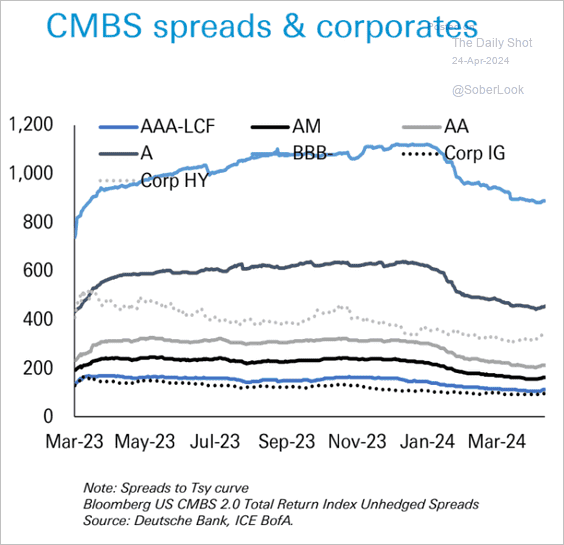

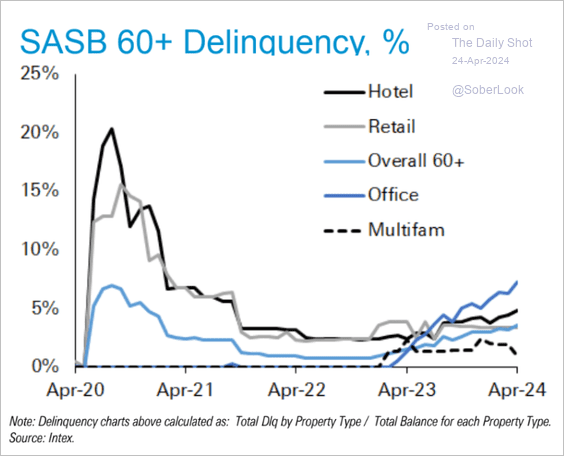

1. CMBS spreads remain elevated as concerns about commercial property debt persist in some sectors.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

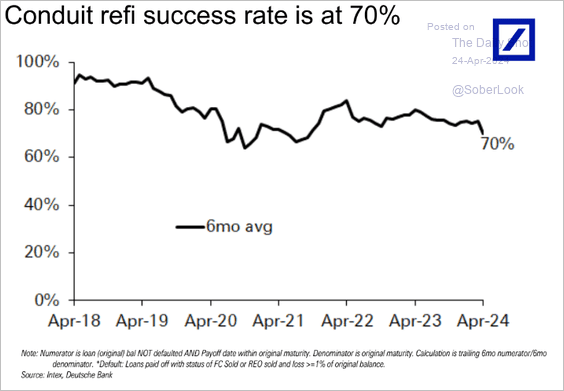

• The refinancing success rate in commercial real estate loan conduits has been trending lower.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Here is a look at delinquency rates for structured asset-backed securities’ loan portfolios.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

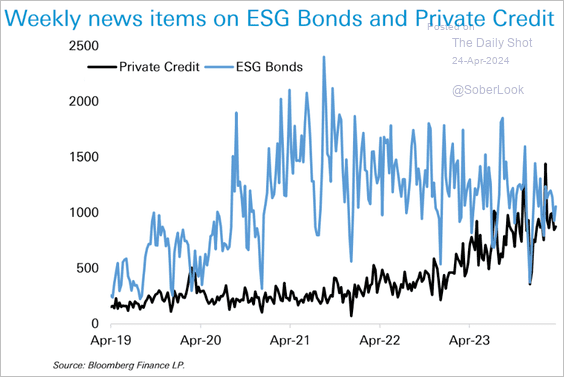

2. The focus has shifted from ESG bonds to private credit.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Rates

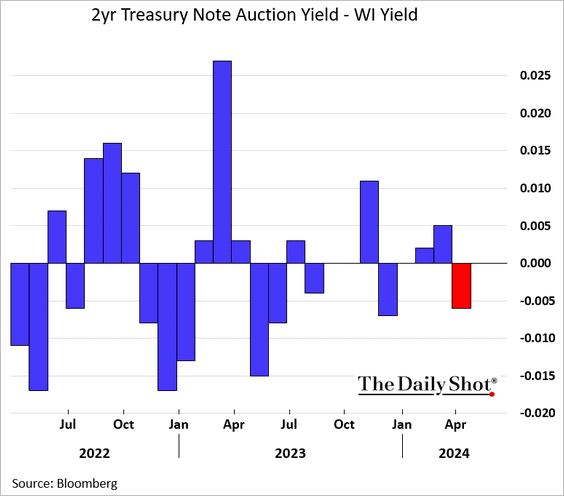

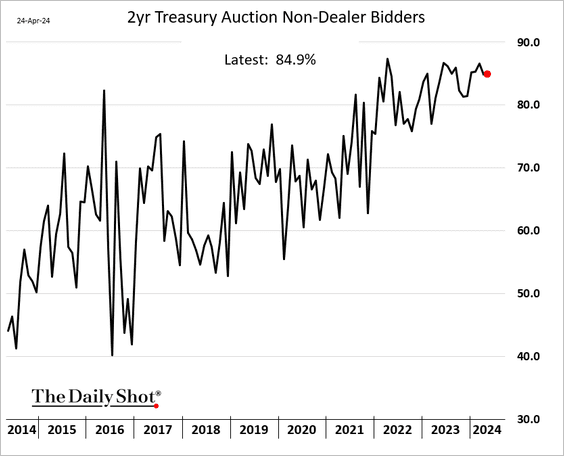

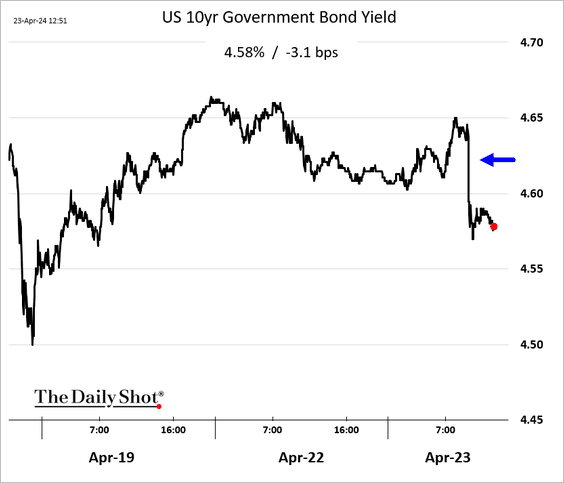

1. The massive 2-year Treasury note auction proceeded surprisingly well.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

• The auction yield came in lower than expected.

• Non-dealer participation was strong.

• Treasury yields declined.

——————–

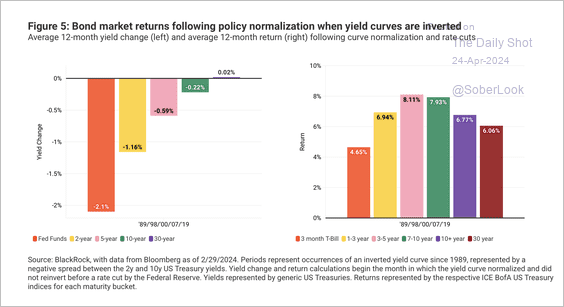

2. The Treasury yield curve typically steepens during rate cuts, with the highest returns found in the 3-5-year part of the curve.

Source: BlackRock Investment Institute

Source: BlackRock Investment Institute

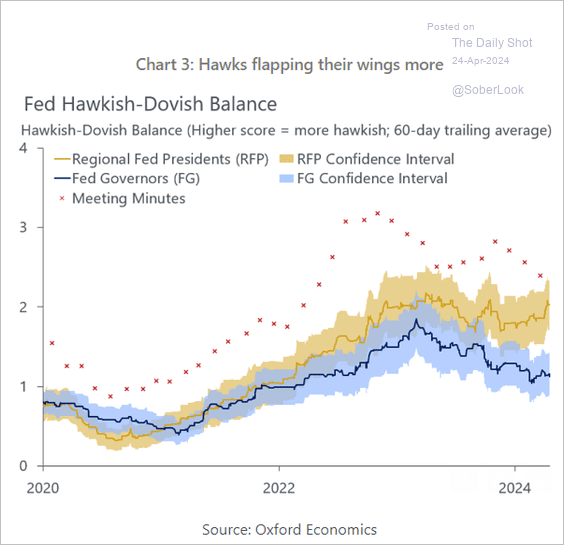

3. Regional Fed presidents have been increasingly hawkish this year.

Source: Oxford Economics

Source: Oxford Economics

——————–

Food for Thought

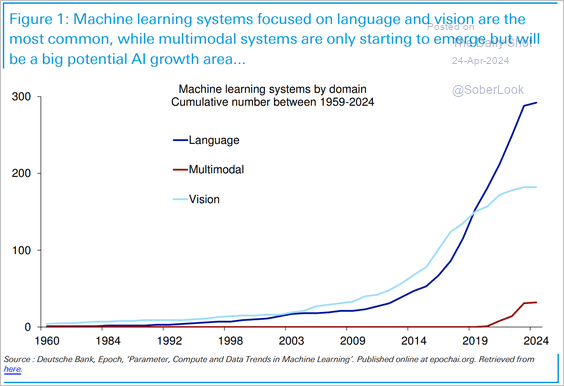

1. Rapid progress in machine learning systems:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

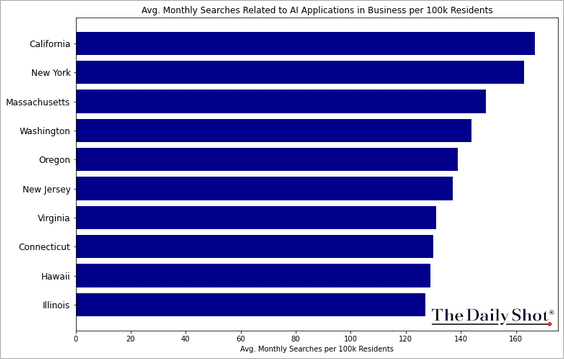

2. Top 10 states with the greatest interest in AI applications for business:

Source: StoryChief.io

Source: StoryChief.io

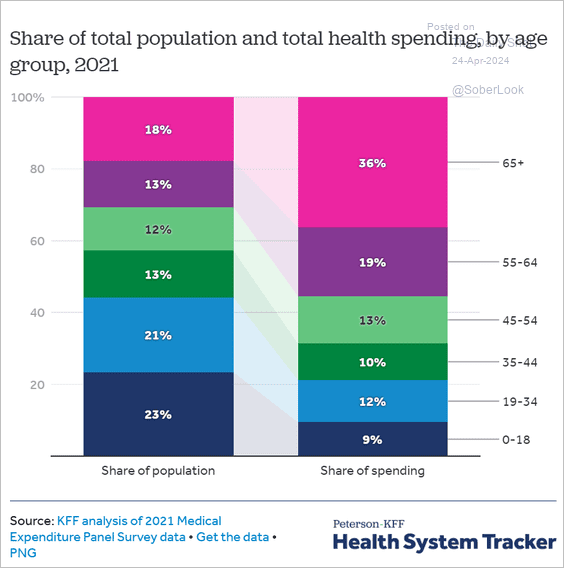

3. Age group distribution of population and health spending in the US:

Source: Health System Tracker Read full article

Source: Health System Tracker Read full article

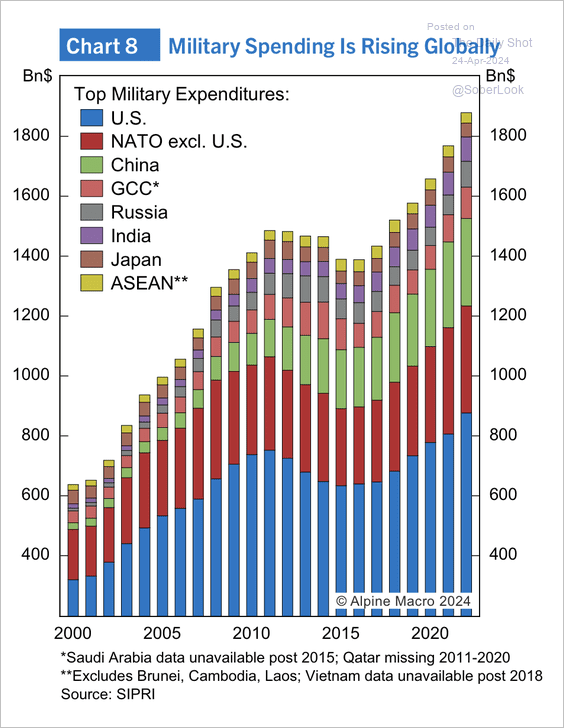

4. Global military spending:

Source: Alpine Macro

Source: Alpine Macro

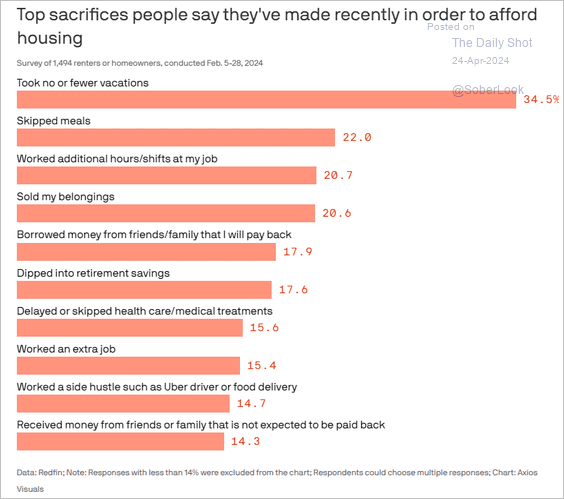

5. Sacrifices made by households to afford housing:

Source: @axios Read full article

Source: @axios Read full article

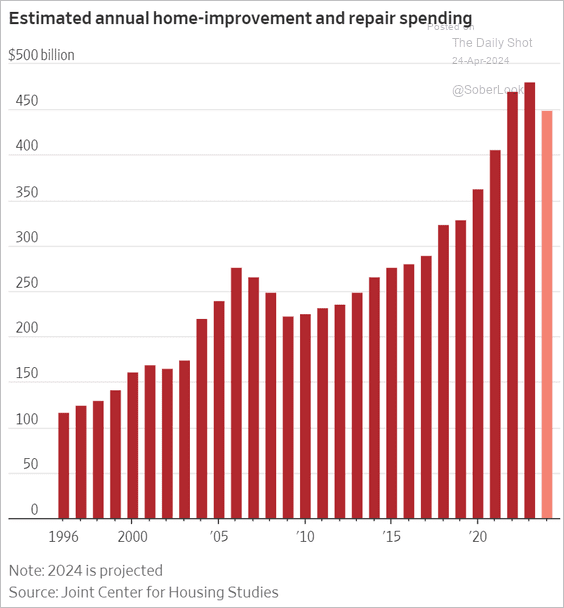

6. Less demand for home offices?

Source: @WSJ Read full article

Source: @WSJ Read full article

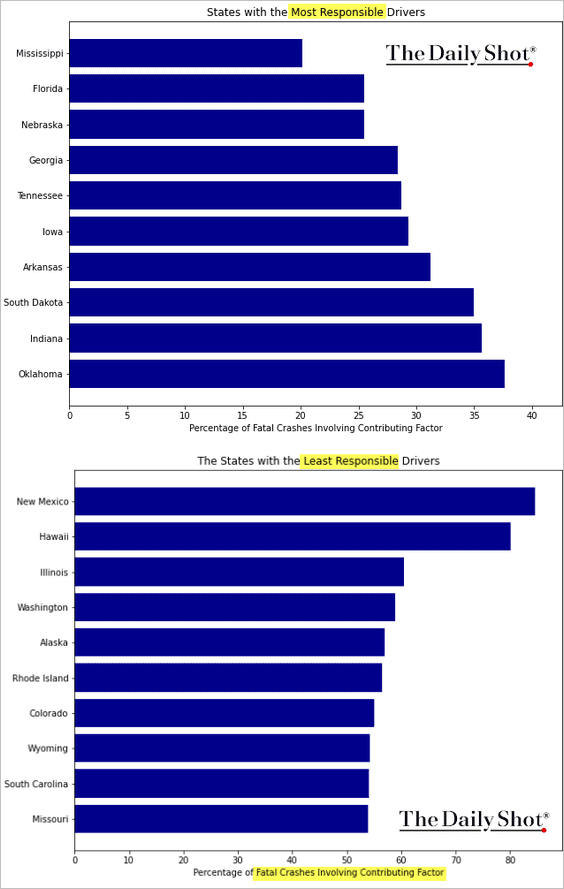

7. States with most and least responsible drivers:

Source: Injured in Florida

Source: Injured in Florida

——————–

Back to Index