The Daily Shot: 27-Jun-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

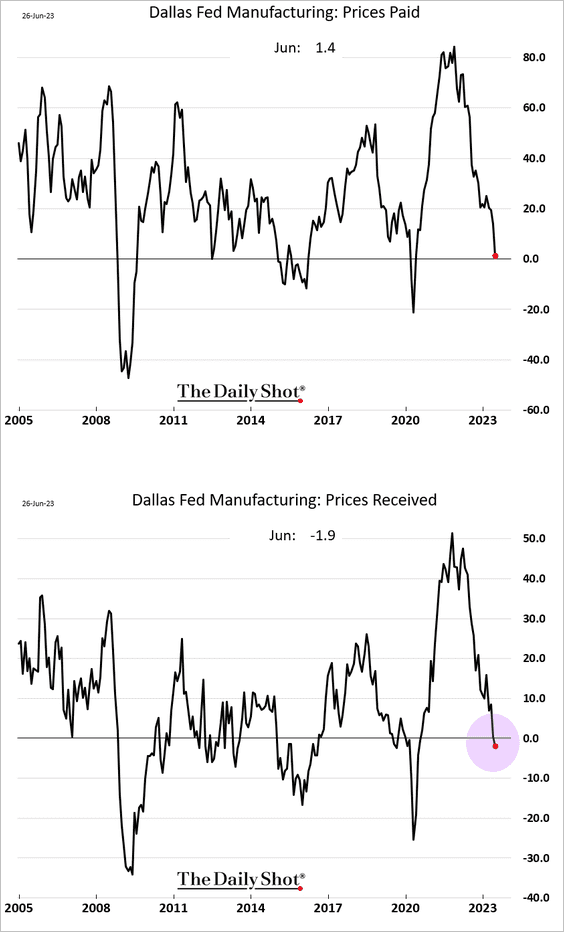

1. The Dallas Fed’s manufacturing index continues to show persistent weakness in the Texas-area factory activity.

• Demand has been deteriorating.

• Factories are now cutting sales prices.

• Companies are reducing workers’ hours.

• However, manufacturers are becoming more upbeat about the future.

——————–

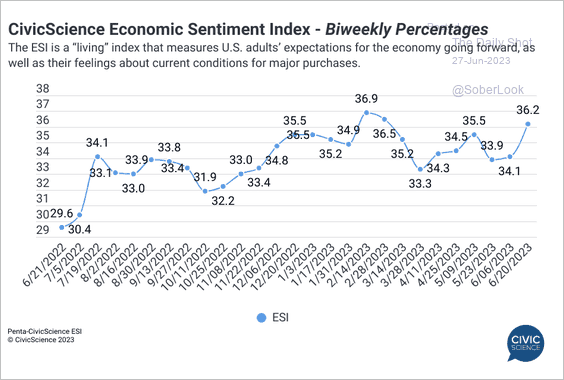

2. The Penta-CivicScience Economic Sentiment Index shows improving consumer sentiment this month.

Source: @CivicScience Read full article

Source: @CivicScience Read full article

3. When will we see the first negative payroll print? Here is a forecast from Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

4. NDR’s model shows a 1% chance of a recession based on state economic conditions.

Source: @NDR_Research

Source: @NDR_Research

5. Next, we have some updates on the housing market.

• Mortgage delinquencies remain very low.

• Homeowners have secured exceptionally low mortgage rates and remain largely unaffected by the recent surge in rates.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

• Homebuilder shares keep widening their outperformance.

——————–

6. Over the past decade, corporate profits strengthened despite productivity growth falling below the long-term average.

Source: Fidelity Investments Read full article

Source: Fidelity Investments Read full article

Back to Index

Canada

1. The loonie has experienced an upswing this month.

2. Similar to the S&P 500, the TSX Index typically finds a seasonal bottom in June before rallying into August.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

3. Retail sales topped expectations in April.

Back to Index

The United Kingdom

1. Retail sales declined again this month.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

2. UK core inflation stands out relative to the Eurozone and the US.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• As a result, market pricing for the UK policy rate is outpacing other DM economies.

Source: Capital Economics

Source: Capital Economics

• Price increases at UK retail stores appear to have peaked.

——————–

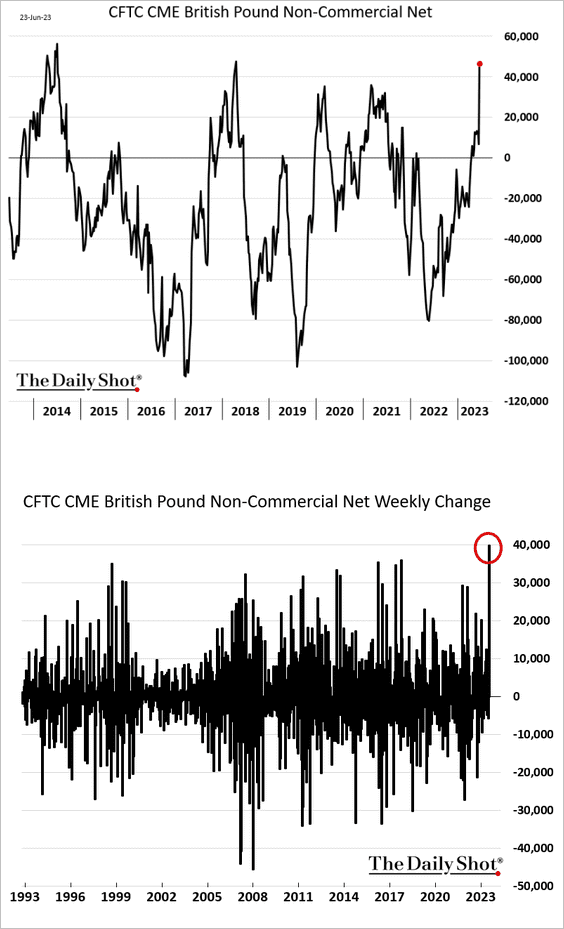

3. Last week witnessed the largest surge in speculators’ bets on British pound futures ever recorded.

Back to Index

The Eurozone

1. Germany’s Ifo index of business expectations tumbled this month, …

… which, combined with the soft PMI report, signals a longer recession.

Source: Reuters Read full article

Source: Reuters Read full article

Below is a comment from Capital Economics.

The slump in the German Ifo, together with the drop in the PMIs, released on Friday, suggests that German GDP probably contracted for the third quarter in a row in Q2. We expect the economy to remain in recession throughout 2023.

Here is a look at the Ifo index by sector.

Source: ifo Institute

Source: ifo Institute

——————–

2. The Greek 10-year bond spread continues to tighten.

3. Widening corporate margins have been a significant contributor to inflation.

Source: @IMFNews Read full article

Source: @IMFNews Read full article

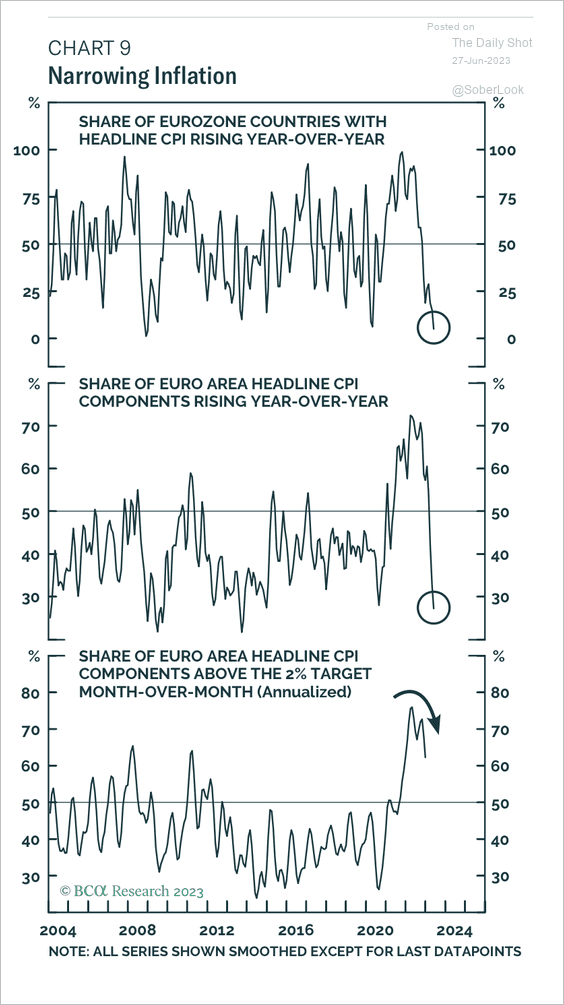

• Inflation is narrowing across the Eurozone.

Source: BCA Research

Source: BCA Research

——————–

4. The euro area’s neutral policy rate is likely between 1 and 2%, which is well below the discounted peak in policy rates.

Source: BCA Research

Source: BCA Research

Back to Index

Europe

1. Czech business and consumer sentiment worsened this month.

2. Here is the European drought monitor.

Source: @CopernicusEMS

Source: @CopernicusEMS

Back to Index

Japan

1. Speculators have been boosting their bets against the yen.

2. Inflation has been broadening.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

3. There is growing pressure on the BoJ to tighten policy.

Source: BCA Research

Source: BCA Research

Back to Index

Asia-Pacific

1. Taiwan’s industrial production showed an improvement in May.

2. Singapore’s industrial production surprised to the downside.

3. The RBA has become more hawkish over the past month.

Source: @ANZ_Research

Source: @ANZ_Research

ANZ Research expects Australia’s inflation to remain elevated over the next year.

Source: @ANZ_Research

Source: @ANZ_Research

——————–

4. One more hike for the RBNZ in August?

Source: Exchange Rates UK Read full article

Source: Exchange Rates UK Read full article

Interest rate differentials could narrow slightly as the Fed policy rate approaches New Zealand’s official cash rate, which could weigh on NZD/USD.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

China

1. Corporate cash levels have moved in tandem with the PPI.

Source: @ANZ_Research

Source: @ANZ_Research

2. China’s money market funds’ AUM continues to grow.

Source: Fitch Ratings

Source: Fitch Ratings

Money market funds are becoming less concentrated.

Source: Fitch Ratings

Source: Fitch Ratings

——————–

3. It’s been warm in Beijing.

Source: @JKempEnergy

Source: @JKempEnergy

Back to Index

Emerging Markets

1. Brazil’s consumer confidence is back at pre-COVID levels.

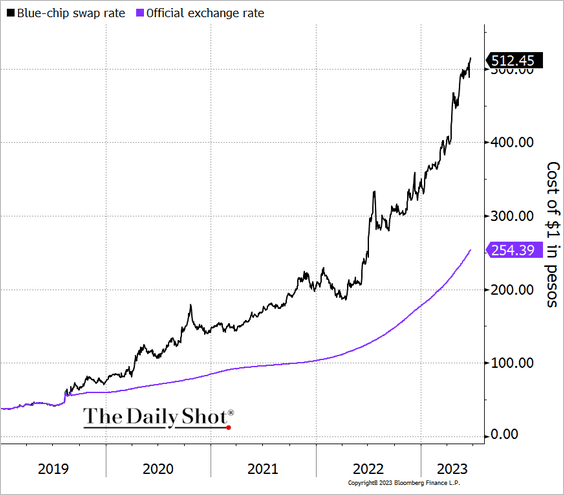

2. The Argentine peso devaluation is accelerating.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

3. Mexico’s economic activity continues to climb.

Speculative accounts are boosting their bets on the Mexican peso.

——————–

4. Turkey’s trade deficit has been widening.

5. Inflation has been largely falling short of expectations.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Commodities

1. Some industrial metals have been under pressure. Here are the trends for aluminum and nickel.

2. Cocoa futures have been rallying.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

3. The Chicago wheat rally is fading.

4. Milk futures have been crashing.

Source: Wisconsin State Farmer Read full article

Source: Wisconsin State Farmer Read full article

Back to Index

Energy

1. The front-month WTI oil futures contract is holding support above its 40-month moving average.

Source: Symbolik

Source: Symbolik

2. Oil consumption growth is strongest in EM/China, offsetting weakness in developed markets.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

Oil production remains well below trend, which could benefit prices.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

——————–

3. Who is refining Russian oil and subsequently exporting refined products?

Source: The Economist Read full article

Source: The Economist Read full article

4. The WTI oil put/call ratio is rising off 2022 lows.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

5. Energy-focused equity funds continue to see outflows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Equities

1. Deutsche Bank’s positioning indicator keeps moving deeper into “overweight” territory.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Here is the aggregate futures positioning.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Goldman’s positioning indicator is in “stretched” territory.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

• The S&P 500 appears overdue for a modest 3-5% correction.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

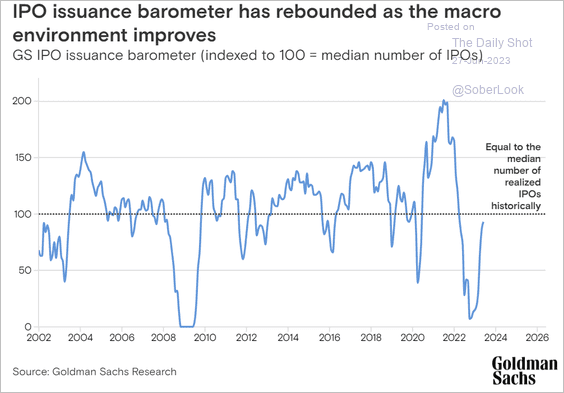

2. IPO activity is rebounding.

Source: Goldman Sachs

Source: Goldman Sachs

Source: @axios Read full article

Source: @axios Read full article

——————–

3. The recent S&P 500 gains have been inside the range of previous bull markets.

Source: LPL Research

Source: LPL Research

4. Meme stocks have been selling off sharply in recent days.

5. The Nasdaq 100 is highly concentrated.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

6. Long-duration stocks underperformed on Monday.

Back to Index

Credit

1. The share of distressed companies surged during this financial tightening cycle.

Source: @jessefelder, @lisaabramowicz1, h/t @dailychartbook Read full article

Source: @jessefelder, @lisaabramowicz1, h/t @dailychartbook Read full article

2. Here is a forecast for leveraged loan default rates.

Source: JP Morgan Research; III Capital Management

Source: JP Morgan Research; III Capital Management

3. A substantial proportion of high-yield bonds issued recently have been secured.

Source: @WSJ Read full article

Source: @WSJ Read full article

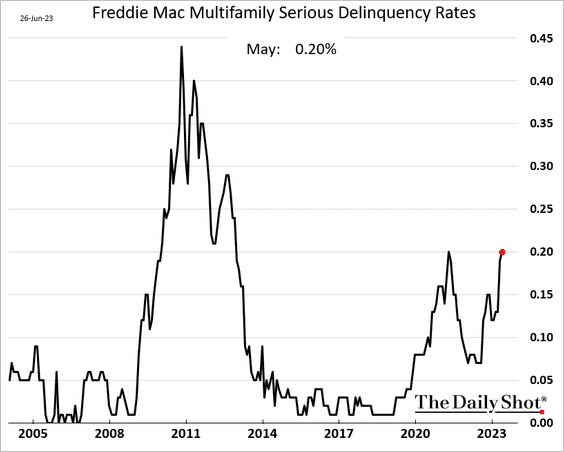

4. Multifamily debt delinquencies have been rising.

Back to Index

Rates

1. As yields have risen on the front end of the Treasury curve, so have ETF flows. (2 charts)

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

——————–

2. Treasury securities outstanding as a share of GDP have declined but remain substantially higher than pre-pandemic levels.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. The Fed’s reverse repo facility balance has been rolling over.

——————–

Food for Thought

1. Modes of transportation among US commuters:

Source: Statista

Source: Statista

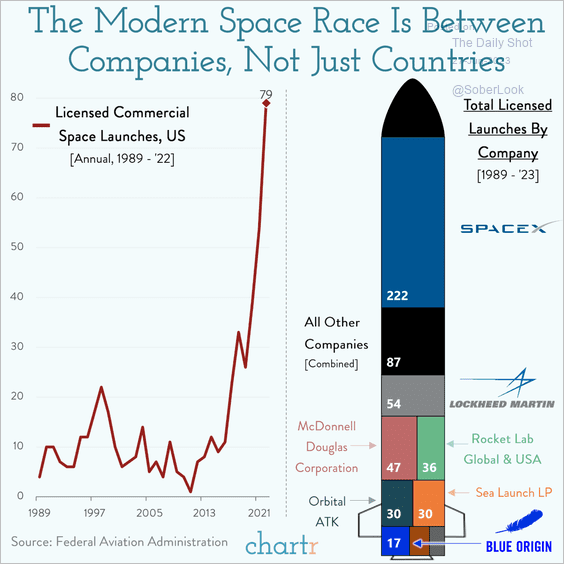

2. Space launches:

Source: @chartrdaily

Source: @chartrdaily

3. MBA graduates’ gender pay gap (current, post-MBA, and pre-MBA comparisons):

Source: @JeffAGreen, @BW Read full article

Source: @JeffAGreen, @BW Read full article

4. School shootings:

Source: @axios Read full article

Source: @axios Read full article

5. Canadian wildfires’ carbon emissions:

Source: @m_parrington Read full article

Source: @m_parrington Read full article

6. Foreign-born share of the US labor force:

Source: @WSJ Read full article

Source: @WSJ Read full article

7. Views on Russia’s leadership in the ex-Soviet republics:

Source: Gallup Read full article

Source: Gallup Read full article

8. The Wagner Group’s global footprint:

Source: Statista

Source: Statista

9. The longest-running Broadway shows:

Source: Statista

Source: Statista

——————–

Back to Index