The Daily Shot: 29-Mar-21

• Administrative Update

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Global Developments

• Financial Quant Survey – Part 2

• Food for Thought

Administrative Update

Please note that The Daily Shot will not be published this Friday, April 2nd.

Back to Index

The United States

1. Incomes and spending declined in February as the impact of the $600 government checks ebbed while the deep freeze in parts of the country dampened economic activity.

Source: ING

Source: ING

• Here is credit/debit-card spending in Texas which was severely impacted by the polar vortex.

Source: @WSJ Read full article

Source: @WSJ Read full article

• This chart compares the recovery in consumer spending with the previous recession.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

• But that spending dip is over, as the $1,400 checks hit households’ bank accounts.

Source: Oxford Economics

Source: Oxford Economics

Spending is accelerating again (2 charts).

Source: BofA Global Research

Source: BofA Global Research

Source: The Daily Feather

Source: The Daily Feather

And credit card balances remain well below pre-COVID levels.

——————–

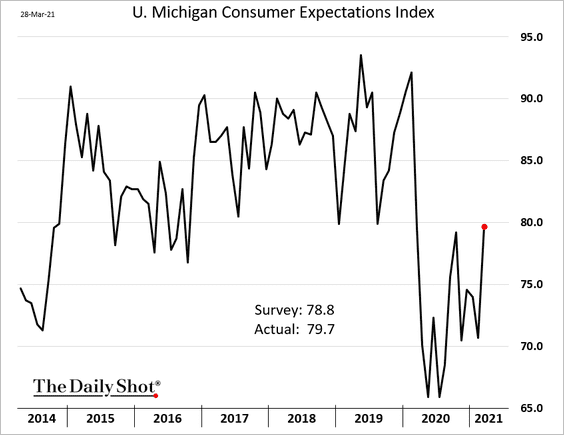

2. The updated U. Michigan consumer sentiment index improved further in the second half of the month.

Younger Americans have been more optimistic relative to those aged 55 and above.

Source: @TCosterg

Source: @TCosterg

——————–

3. Next, we have some updates on inflation.

• The core PCE inflation (the Fed’s preferred measure) was a bit softer than expected last month (2nd chart).

• This chart shows the PCE inflation for durable and nondurable goods as well as services (year-over-year).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Here is the trimmed mean PCE inflation from the Dallas Fed (which is also monitored closely by the FOMC).

• A key driver of lower services inflation has been rent. Nordea’s model suggests that we may see a reversal in that trend.

Source: Nordea Markets

Source: Nordea Markets

• Healthcare inflation has also been soft recently. But hospital services prices increased sharply last month.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• 5-10 year consumer inflation expectations are back near average levels.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Long-term market-based inflation expectations are grinding higher.

——————–

4. The US Treasury’s cash balances dipped below $1.0 trillion as the stimulus checks went out.

5. The nation’s trade deficit in goods hit a record high.

Back to Index

The United Kingdom

1. February’s retail sales topped expectations.

• Clothing sales have been particularly weak this year. Online sales continue to dominate.

Source: ING

Source: ING

——————–

2. The UK’s furlough numbers have been diverging from Eurozone peers.

Source: Fitch Ratings

Source: Fitch Ratings

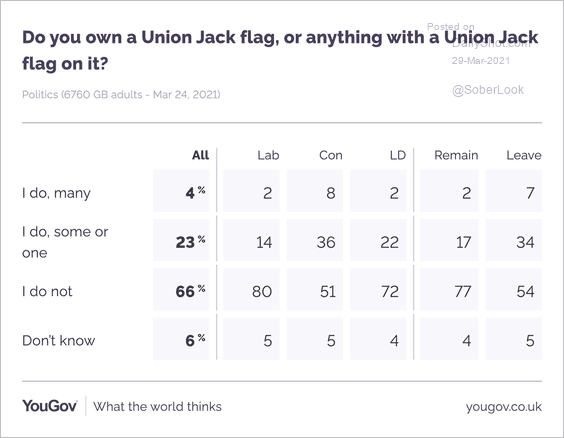

3. Who owns a Union Jack flag?

Source: YouGov Read full article

Source: YouGov Read full article

Back to Index

The Eurozone

1. Germany’s business expectations surged this month.

Manufacturers’ sentiment has been particularly strong.

Source: ifo Institute

Source: ifo Institute

——————–

2. Italy’s consumer confidence recovery has stalled.

But manufacturers are more upbeat than they were before the pandemic.

——————–

3. Manufacturers’ enthusiasm is driven by external demand.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

4. Spain’s mortgage lending remains soft.

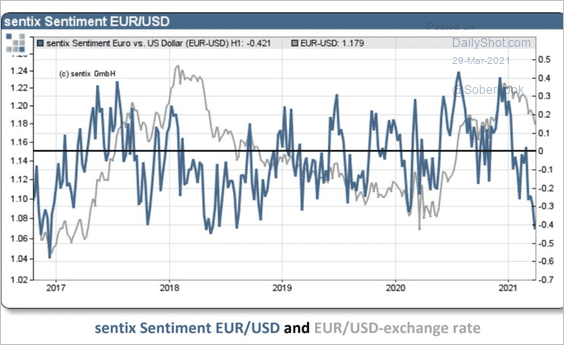

5. Investors have soured on the euro.

Source: @Callum_Thomas

Source: @Callum_Thomas

6. Eurozone market-based inflation expectations are grinding higher.

7. The euro-area financial centers are benefiting from Brexit.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Asia – Pacific

1. Japan’s 10-year government bond yield is trading at the upper bound of the BoJ’s tolerance band.

Source: Fitch Ratings

Source: Fitch Ratings

2. Singapore’s industrial production remains robust.

Bond yields are now at pre-pandemic levels.

Back to Index

China

1. The renminbi is rolling over.

2. Savings rose sharply last year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

3. Commodities inflation will likely decline over the next year.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

The recovery in headline inflation will be limited, according to Pantheon Macroeconomics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

4. Construction business activity softened this quarter, according to China Beige Book.

Source: China Beige Book

Source: China Beige Book

5. The Hong Kong dollar is weaker amid drought in high-profile IPOs (which attract foreign investors).

Back to Index

Emerging Markets

1. Brazil’s foreign direct investment jumped last month.

2. Chile’s debt-to-GDP ratio keeps climbing.

Source: Scotiabank Economics

Source: Scotiabank Economics

3. Turkey’s manufacturing confidence is holding up well.

4. Many EM currencies are still undervalued relative to their 2019 average levels.

Source: TS Lombard

Source: TS Lombard

Nonetheless, Capital Economics is forecasting further weakness this year.

Source: Capital Economics

Source: Capital Economics

——————–

5. US equities and the dollar are key drivers of EM equity returns (more so than Treasuries), according to TS Lombard.

Source: TS Lombard

Source: TS Lombard

Back to Index

Cryptocurrency

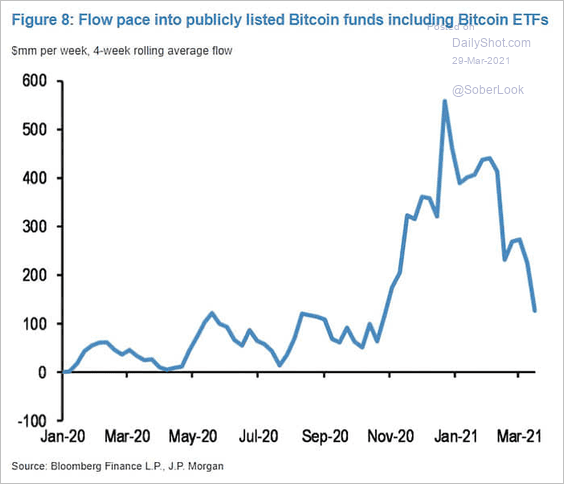

1. Bitcoin funds continue to see outflows.

Source: @ISABELNET_SA, @jpmorgan

Source: @ISABELNET_SA, @jpmorgan

2. CME bitcoin futures are starting to lead the way out of contango.

Source: @skewdotcom

Source: @skewdotcom

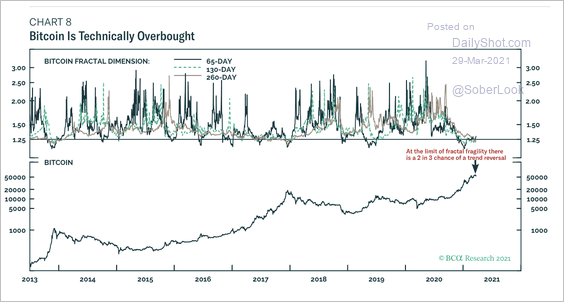

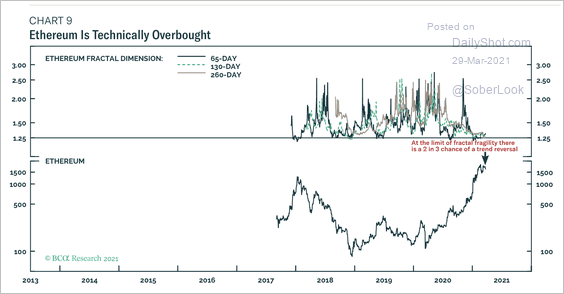

3. Technicals suggest that bitcoin and ether are overbought, with support around $40K and $1,300, respectively (2 charts).

Source: BCA Research

Source: BCA Research

Source: BCA Research

Source: BCA Research

The monthly bitcoin RSI is near prior extremes, which suggests limited upside for BTC/USD.

Source: Dantes Outlook Read full article

Source: Dantes Outlook Read full article

——————–

4. This chart shows the “narrative” around bitcoin over time.

Source: @hasufl, @nic__carter

Source: @hasufl, @nic__carter

Back to Index

Commodities

1. Fitch Solutions has a bearish outlook for copper prices over the short-term.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

2. Steel prices in China keep climbing.

3. Next, we have some data on lithium reserves.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

4. China’s credit impulse keeps pointing to a pullback in commodity prices.

Source: @AndreasSteno

Source: @AndreasSteno

5. Chicago hog futures continue to rally. And more cases of African Swine Fever were discovered over the weekend in China.

Back to Index

Energy

1. The number of operating oil rigs in the US continues to recover.

2. Here is a 5-year forecast for Brent prices from BCA Research.

Source: BCA Research

Source: BCA Research

Back to Index

Equities

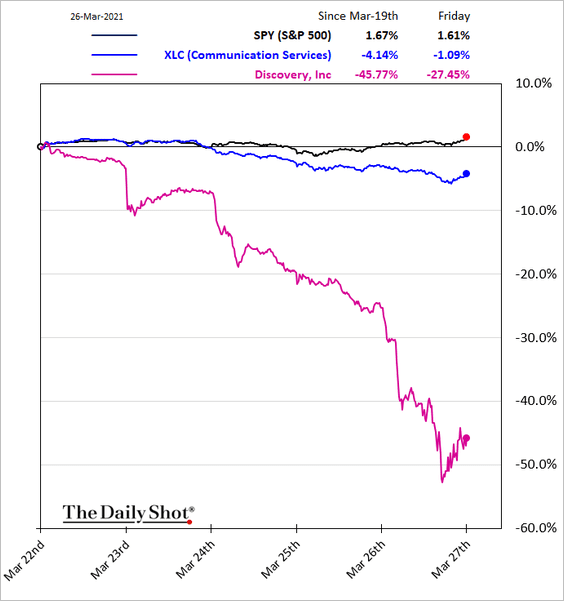

1. The forced position unwind at Archegos Capital resulted in a massive selloff in some stocks.

Source: CNBC Read full article

Source: CNBC Read full article

Nomura’s stock is down sharply today due to the same event.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

2. The reflation trade was alive and well last week.

• Metals & Mining:

• Materials:

• Transportation:

• REITs:

• Homebuilders:

——————–

3. It was a good week for consumer staples.

4. Extreme underperformance of financial and energy stocks indicates further upside potential (2 charts).

Source: Truist Advisory Services

Source: Truist Advisory Services

Source: Truist Advisory Services

Source: Truist Advisory Services

——————–

5. The popular ARK Innovation ETF has been under pressure.

6. Does KOSPI suggest that US stocks are about to peak?

Source: @Not_Jim_Cramer

Source: @Not_Jim_Cramer

7. The earnings yield of global tech stocks is now below the 10-year Treasury yield.

Source: BCA Research

Source: BCA Research

8. Money market fund balances remain at elevated levels despite the equity rally.

Source: Alpine Macro

Source: Alpine Macro

9. There has been some nervousness about the recent rally in small caps. Here is the ratio of RVX (the Russell 2000 VIX-equivalent) to VIX.

10. Finally, we have some updates on retail investors.

• The Reddit crowd taking pride in ignorance:

Source: @WSJ Read full article

Source: @WSJ Read full article

• Low- and high-frequency trading volumes by market participant:

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

• Call option volume is moderating as mobility improves:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Here is a comment from Parag Thatte, Deutsche Bank.

… the recent decline in call volumes has coincided with a rising pace of reopening. This jives with our view that as retail investors have other things to do, the attention focused on the equity market will start to fade. In turn a strategy of buying stocks with heavy call exposure has been losing money since mid-February, after posting outsized gains since November. While retail investors are likely to put a good chunk of stimulus payments into stocks as per our survey, two-thirds of those payments have already been distributed, implying that the incremental impact should start to fade. As call volumes have fallen, vol premiums have been declining.

Back to Index

Global Developments

1. Container shipping rates are highly elevated but appear to have peaked.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

2. Global food prices keep climbing.

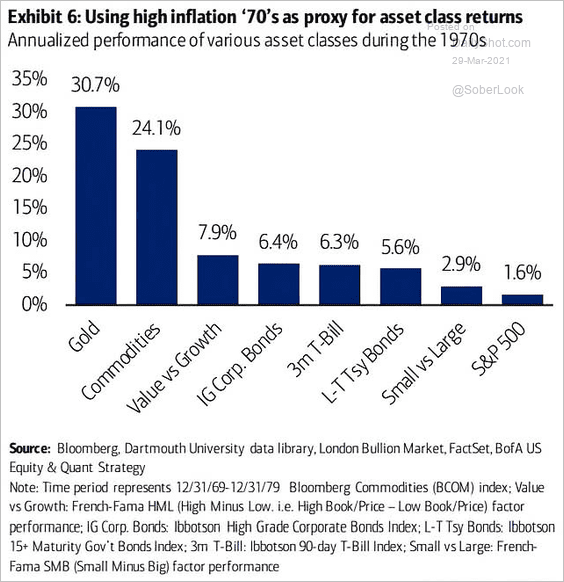

3. What happened to asset prices during the 1970s when inflation spiked?

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

4. Traders continue to trim their bets against the dollar.

Source: @GoldmanSachs

Source: @GoldmanSachs

The dollar index (DXY) is above its 200-day moving average.

Source: barchart.com

Source: barchart.com

——————–

5. OECD governments are expected to maintain heavy borrowing this year.

Source: @adam_tooze, @OECD Read full article

Source: @adam_tooze, @OECD Read full article

Back to Index

Financial Quant Survey – Part 2

How much do financial quants earn?

• Compensation distribution by institution type:

Source: Baruch MFE Program and The Daily Shot

Source: Baruch MFE Program and The Daily Shot

• Compensation distribution by role:

Source: Baruch MFE Program and The Daily Shot

Source: Baruch MFE Program and The Daily Shot

——————–

Food for Thought

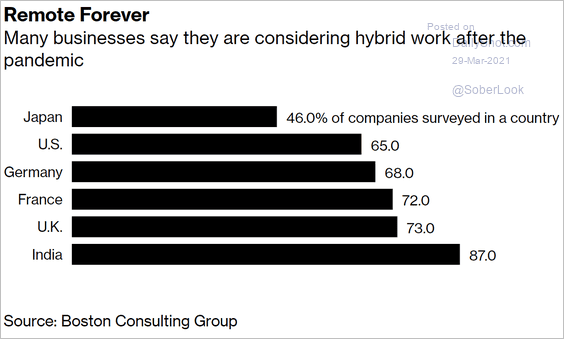

1. Companies considering hybrid work:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

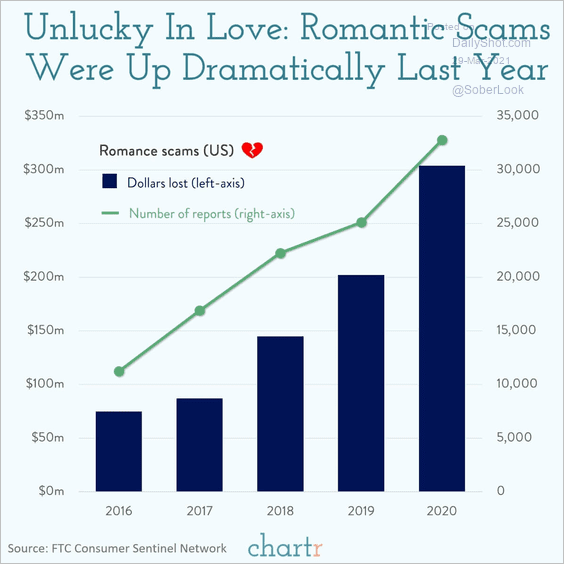

2. Romance scams:

Source: @chartrdaily

Source: @chartrdaily

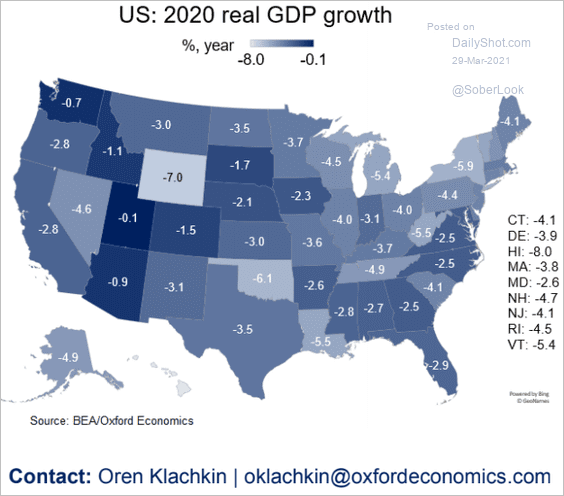

3. 2020 GDP growth, by state:

Source: Oxford Economics

Source: Oxford Economics

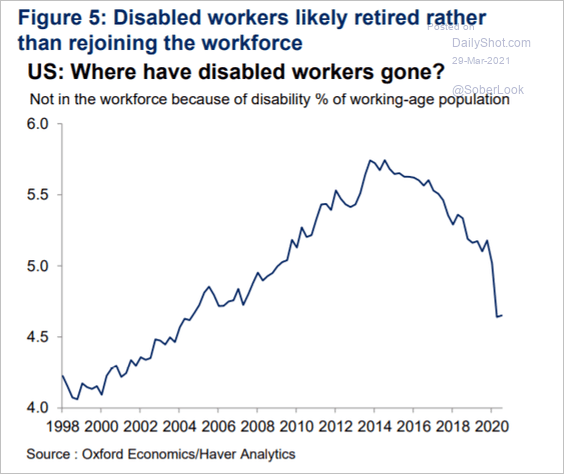

4. Retiring disabled workers:

Source: Oxford Economics

Source: Oxford Economics

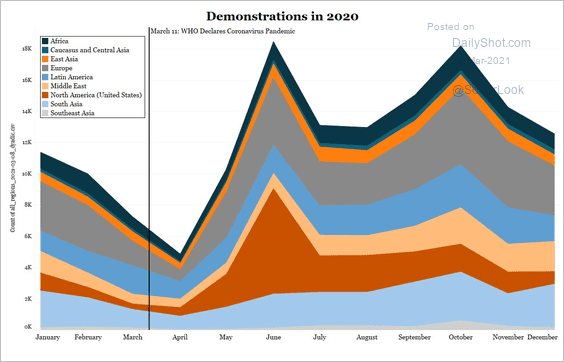

5. Demonstrations in 2020:

Source: ACLED Read full article

Source: ACLED Read full article

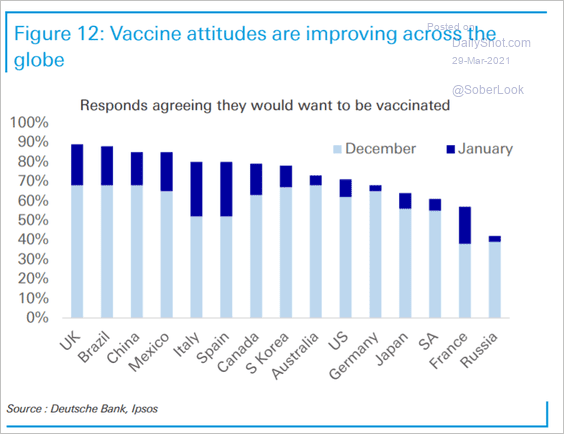

6. Vaccine attitudes:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

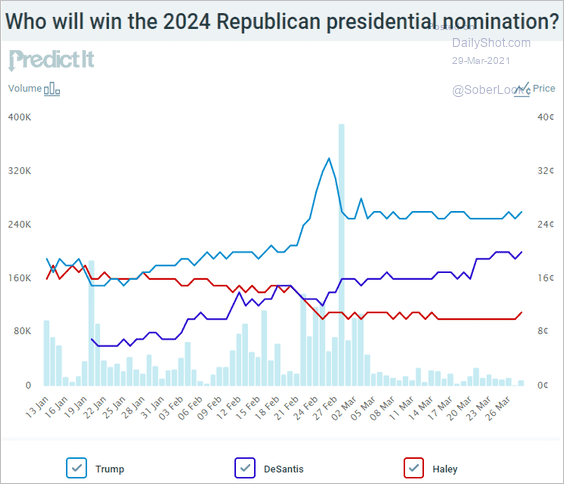

7. 2024 GOP presidential nomination odds in the betting markets:

Source: @PredictIt

Source: @PredictIt

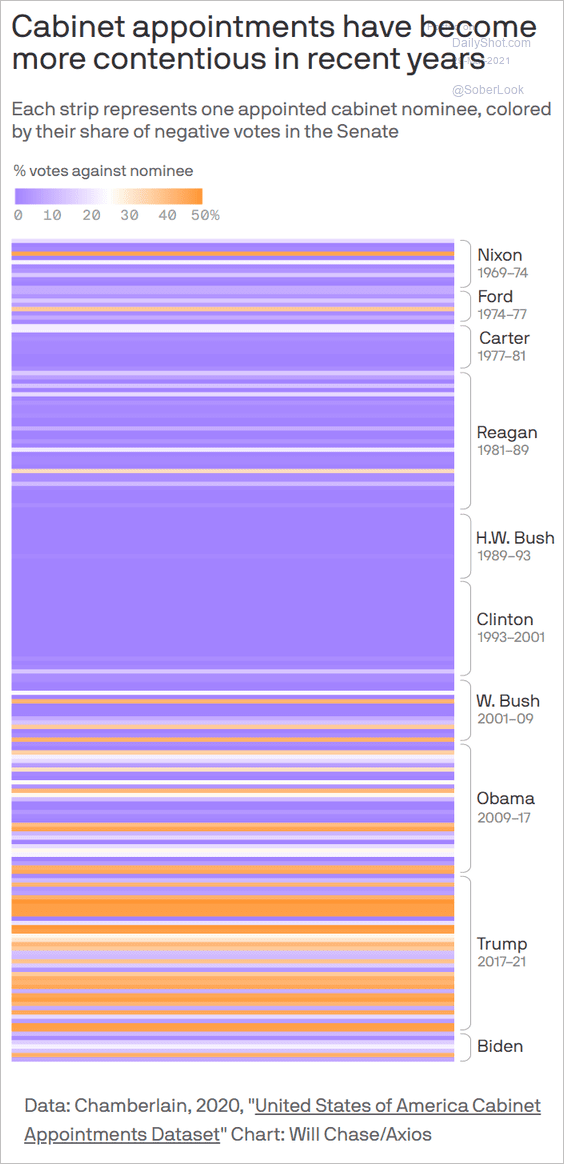

8. Share of negative votes in the Senate for appointed cabinet nominees:

Source: @axios Read full article

Source: @axios Read full article

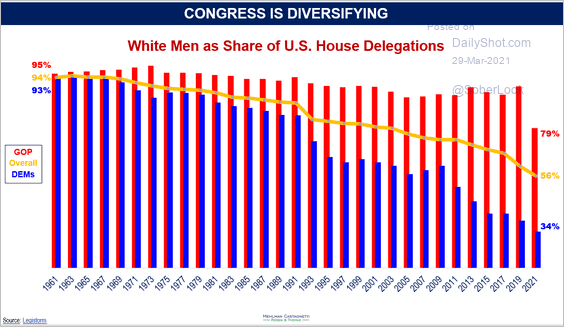

9. White men as a share of US House delegations:

Source: Mehlman Castagnetti Rosen & Thomas

Source: Mehlman Castagnetti Rosen & Thomas

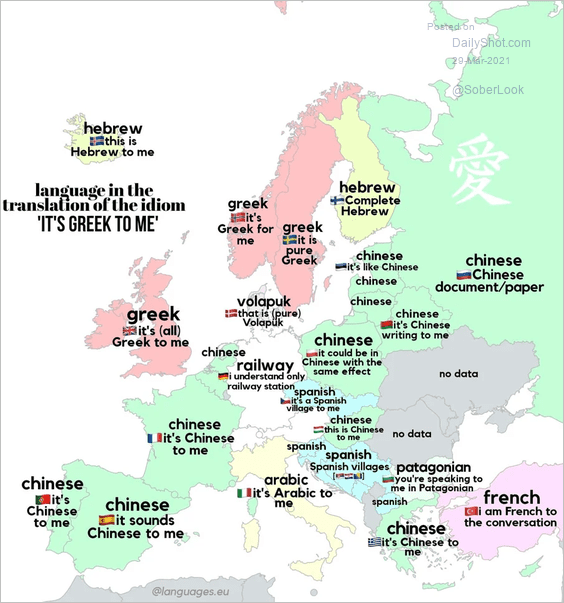

10. Cultural variations on the saying, “It’s all Greek to me”:

Source: r/europe

Source: r/europe

——————–

Back to Index