The Daily Shot: 26-Aug-21

• The United States

• Canada

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

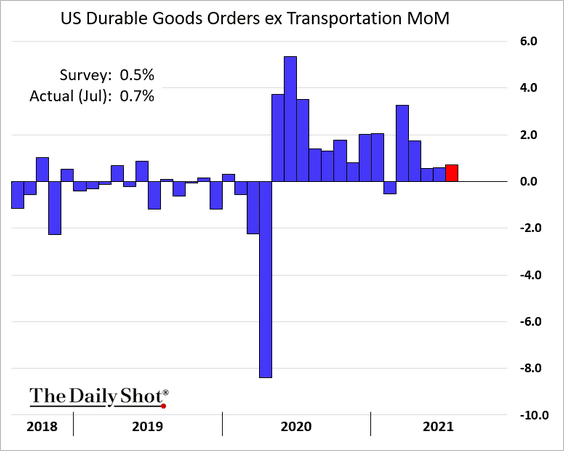

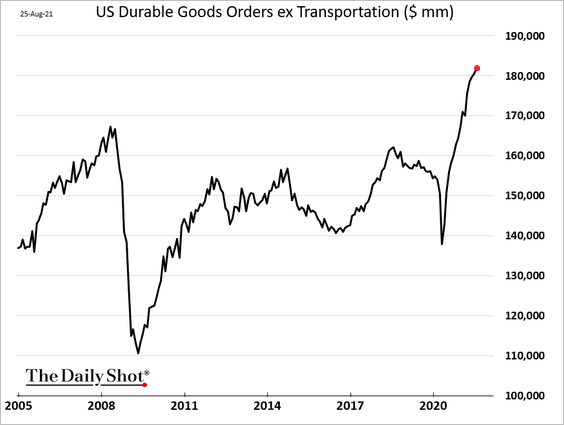

1. Outside of some weakness in aircraft parts, US durable goods orders improved further in July.

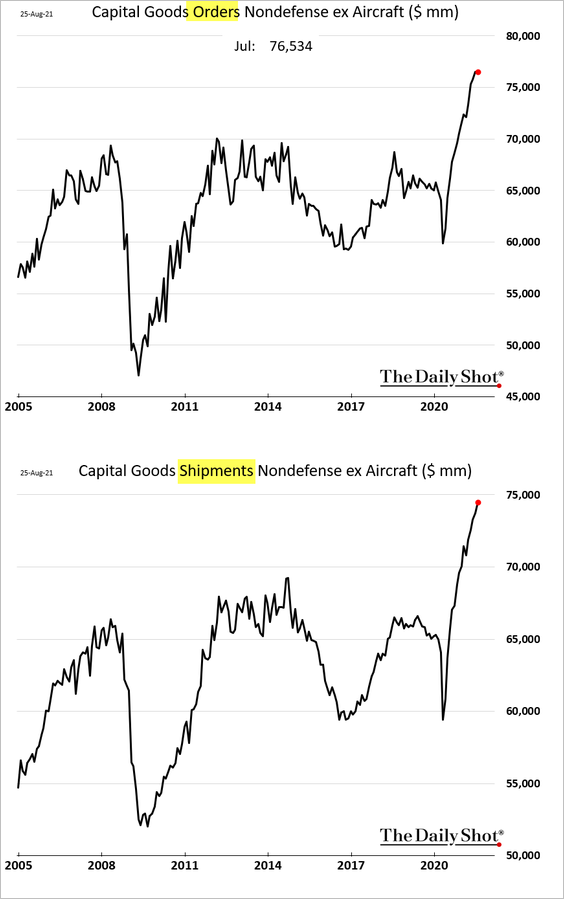

Capital goods orders were flat (at elevated levels), but shipments continued to march higher.

——————–

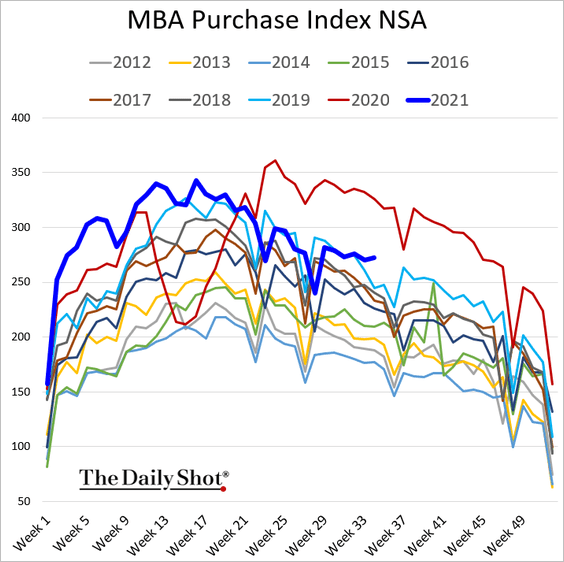

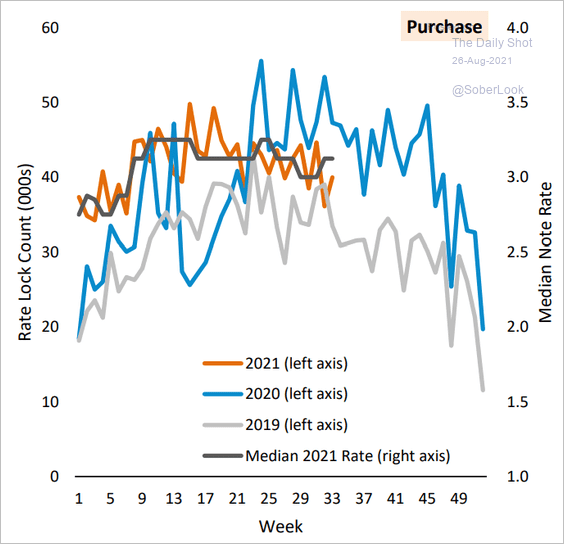

2. Mortgage applications to buy a home typically decline this time of the year. Instead, we got an increase, with the purchase index now well above 2019 levels.

Rate locks moved higher as well.

Source: AEI Center on Housing Markets and Finance

Source: AEI Center on Housing Markets and Finance

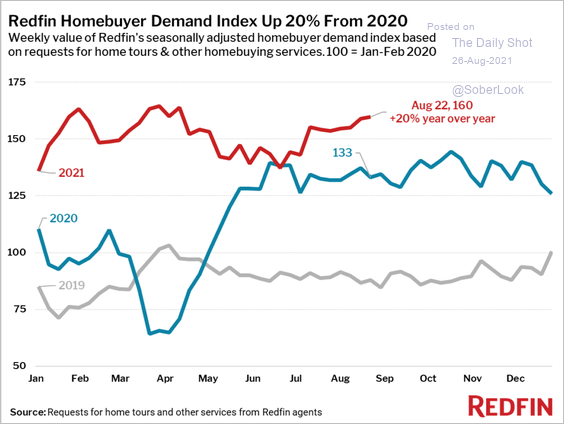

Housing demand remains exceptionally strong.

Source: Redfin

Source: Redfin

——————–

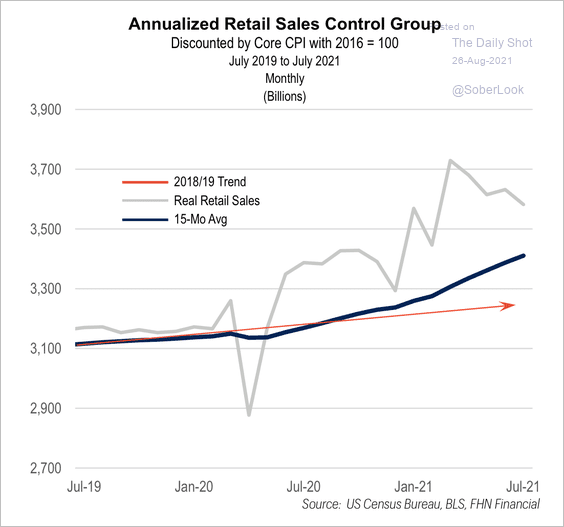

3. Retail sales have been running well above average levels.

Source: FHN Financial

Source: FHN Financial

Adjusted for inflation, retail sales have been moderating from record highs. We are likely to see further easing toward the pre-pandemic trend.

Source: MRB Partners

Source: MRB Partners

——————–

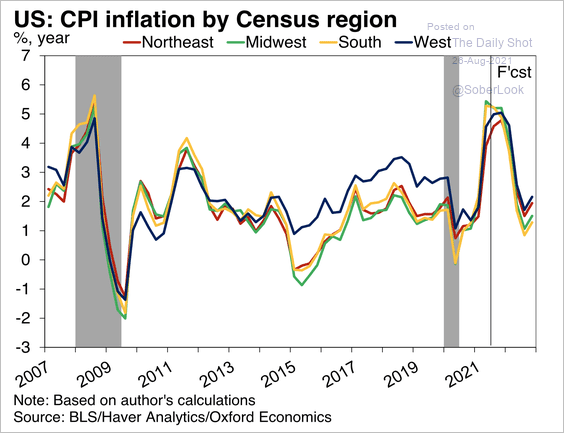

4. Oxford Economics expects inflation to cool next year, driven by a gradual unwind of supply constraints and moderating demand growth.

Source: Oxford Economics

Source: Oxford Economics

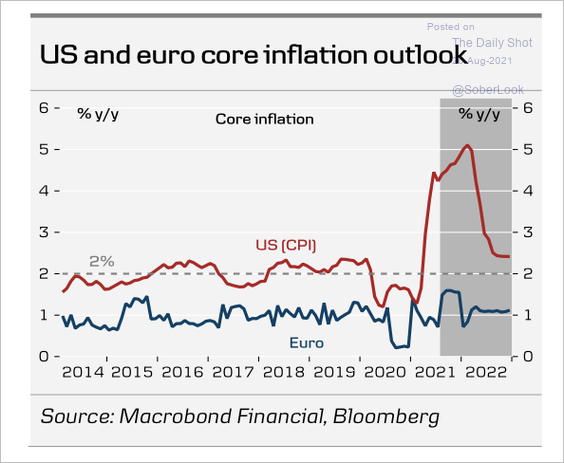

Danske Bank also expects US inflation to moderate and converge with Europe next year.

Source: Danske Bank

Source: Danske Bank

——————–

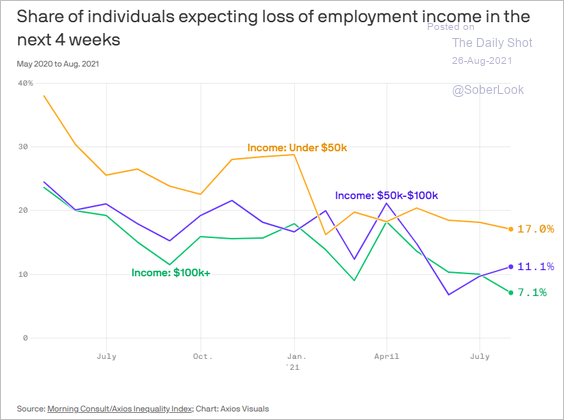

5. Despite the COVID spike, Americans don’t seem to be too concerned about losing their job.

Source: @axios Read full article

Source: @axios Read full article

Back to Index

Canada

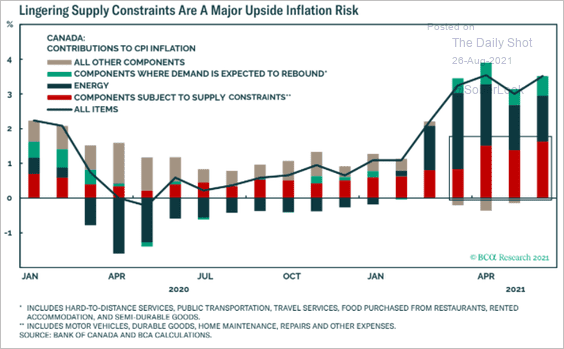

1. According to BCA Research, supply constraints pose a lingering upside risk for inflation.

Source: BCA Research

Source: BCA Research

2. The Oxford Economics Recovery Tracker is off the highs due to an increase in COVID cases.

![]() Source: Oxford Economics

Source: Oxford Economics

3. This chart shows Canada’s poll tracker.

![]() Source: Scotiabank Economics

Source: Scotiabank Economics

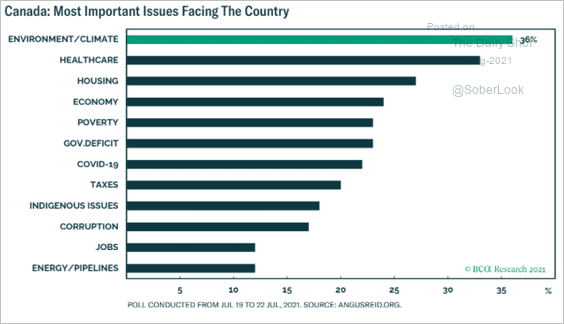

What do Canadians see as the most important issues facing their country?

Source: BCA Research

Source: BCA Research

Back to Index

The Eurozone

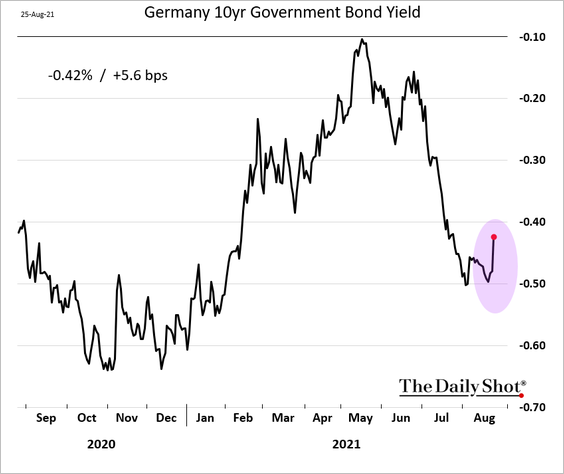

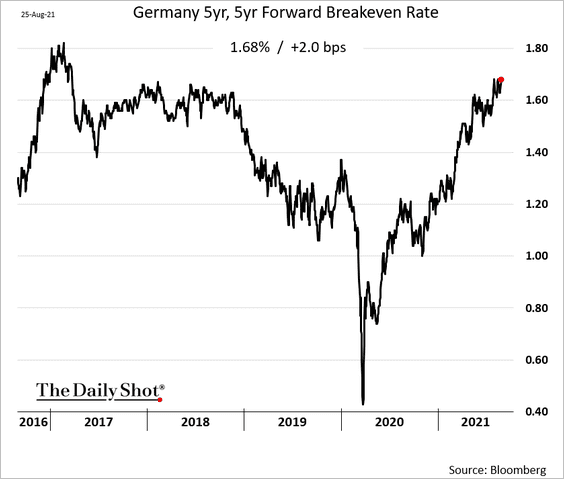

1. Bund yields jumped on Wednesday.

Longer-term inflation expectations are grinding higher.

——————–

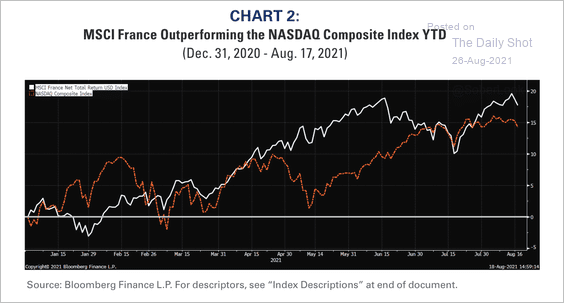

2. French equities have been outperforming the Nasdaq Composite this year.

Source: Richard Bernstein Advisors

Source: Richard Bernstein Advisors

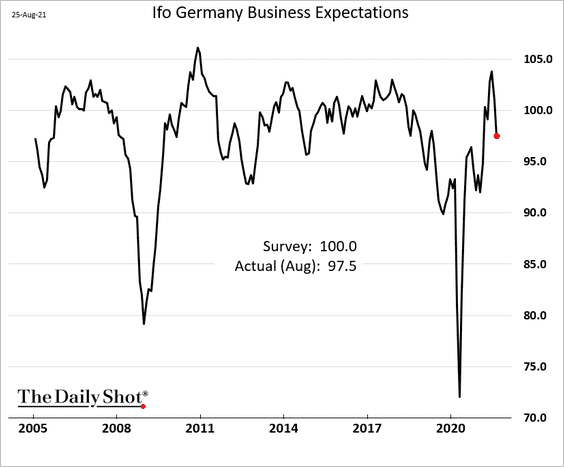

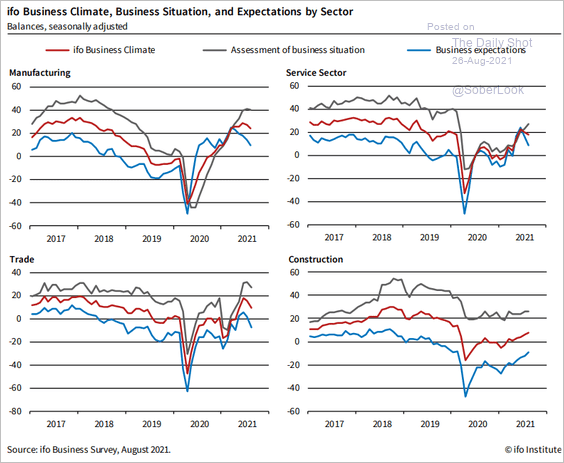

3. Germany’s Ifo Business Expectations index slumped this month. Supply constraints are taking a toll on the nation’s industry.

Source: Reuters Read full article

Source: Reuters Read full article

Source: ifo Institute

Source: ifo Institute

Back to Index

Europe

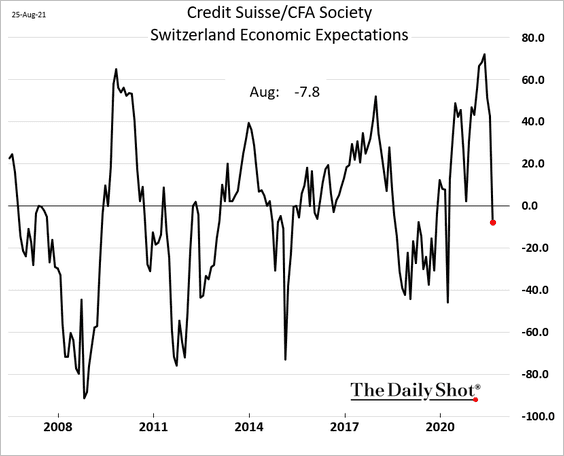

1. Swiss economic expectations plunged in August.

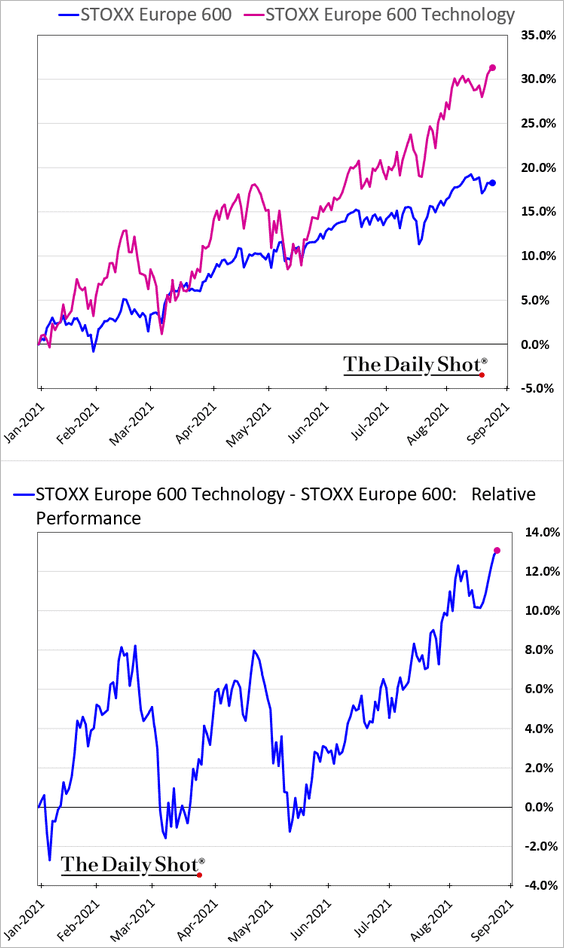

2. European tech firms continue to outperform the broader market.

h/t @_kitrees

h/t @_kitrees

Back to Index

Asia – Pacific

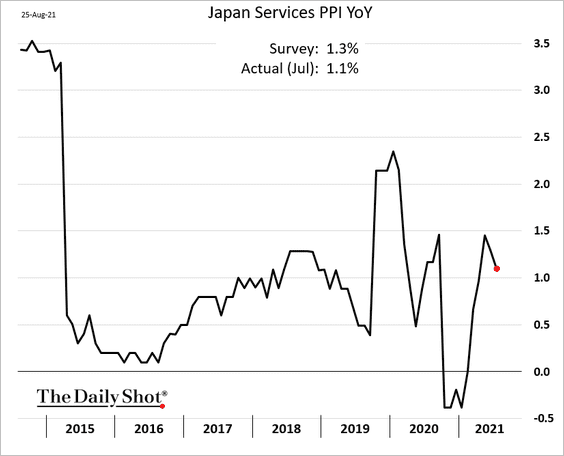

1. Japan’s service-sector PPI declined last month.

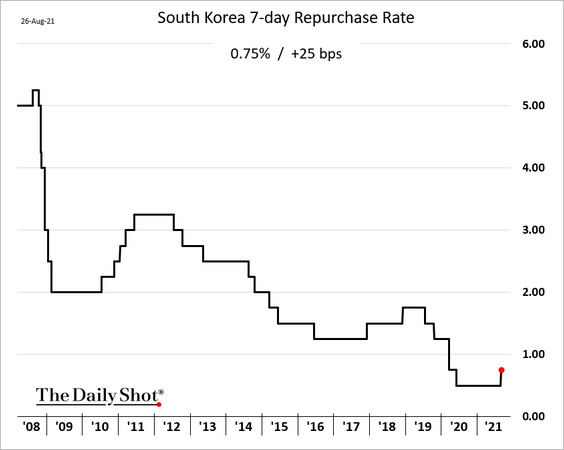

2. South Korea’s central bank hiked rates (from record lows) for the first time since 2018. This was a surprise to many economists who expected tightening to come later this year.

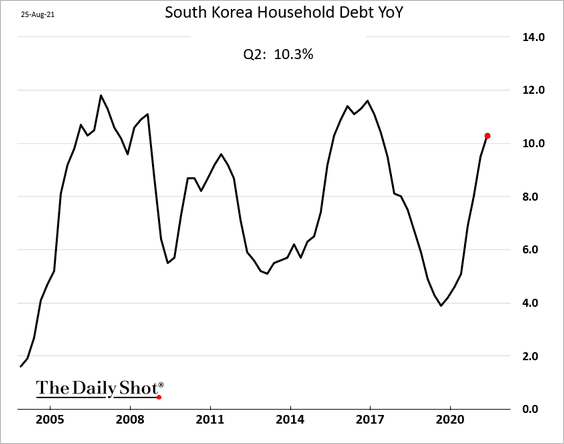

The central bank is concerned about rising household debt, …

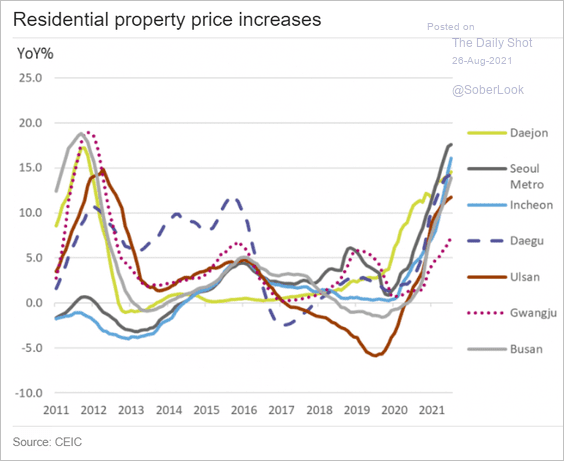

… and surging housing prices.

Source: ING

Source: ING

The central bank Governor Lee Ju-yeol indicated that policy remains highly accommodative. The won declined.

——————–

3. Asian investment-grade bond spreads continue to tighten.

Source: Kyungji Cho

Source: Kyungji Cho

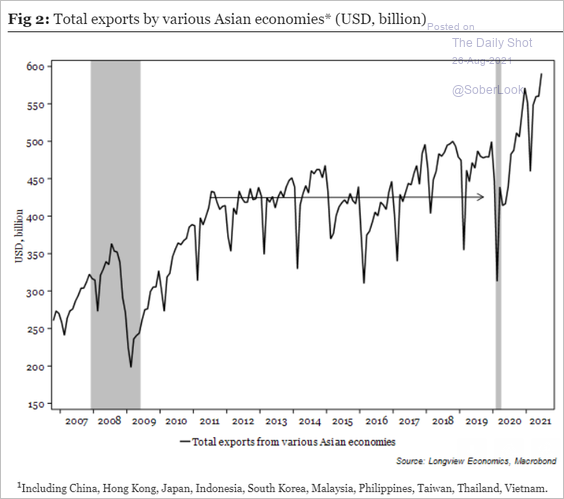

4. Exports from Asia surged since the start of the pandemic.

Source: Longview Economics

Source: Longview Economics

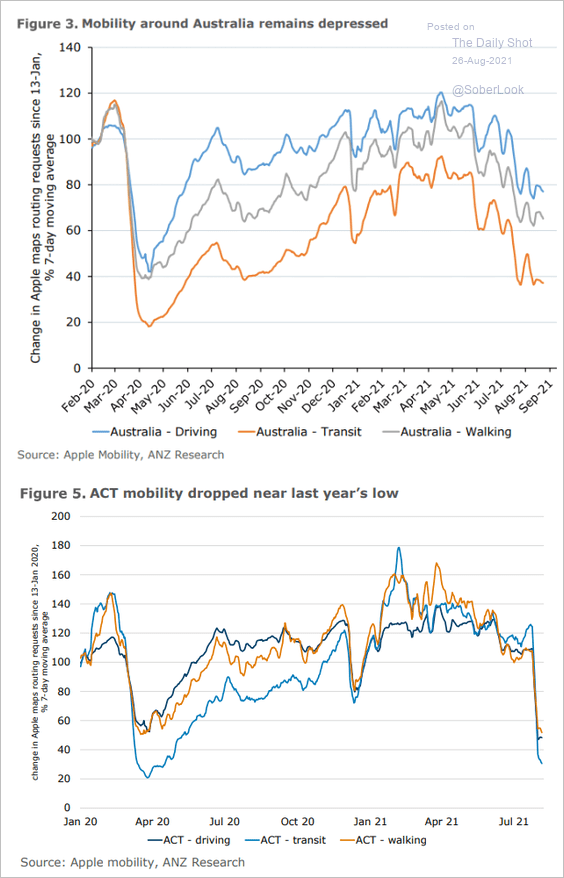

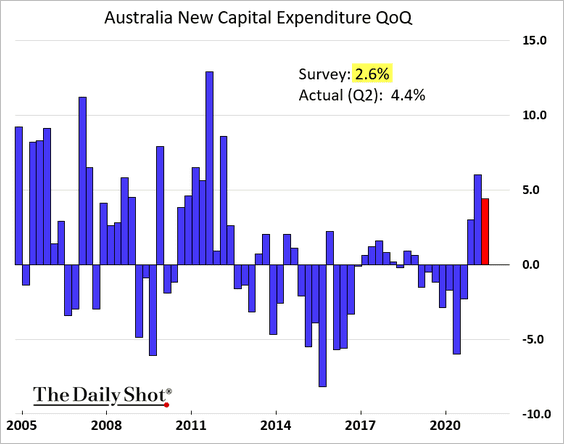

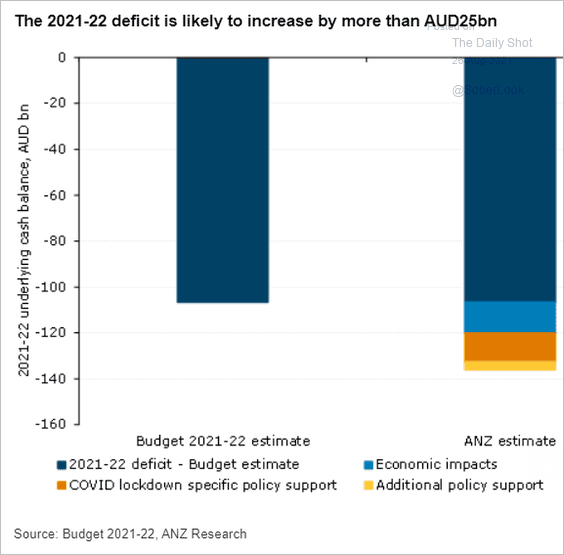

5. Next, we have some updates on Australia.

• Mobility has been deteriorating.

Source: ANZ Research

Source: ANZ Research

• Business investment was stronger than expected last quarter.

• According to ANZ, the budget deficit is likely to be much worse than the government’s projection.

Source: ANZ Research

Source: ANZ Research

Back to Index

China

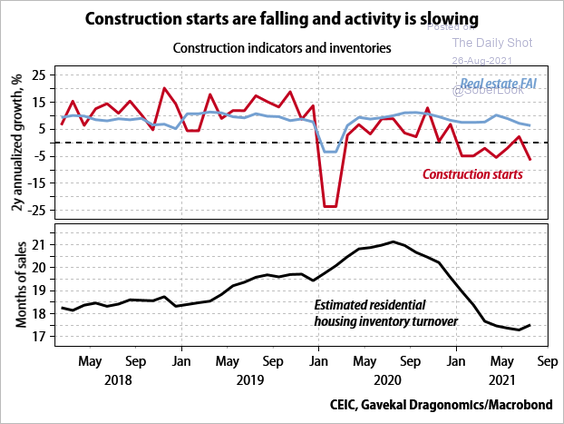

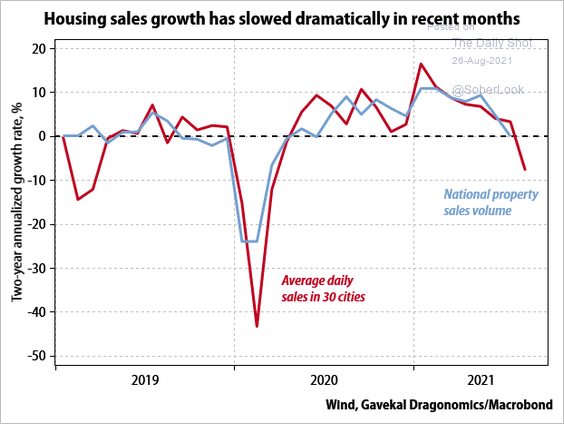

1. Construction activity has been moderating,

Source: Gavekal Research

Source: Gavekal Research

Housing sales growth has slowed.

Source: Gavekal Research

Source: Gavekal Research

——————–

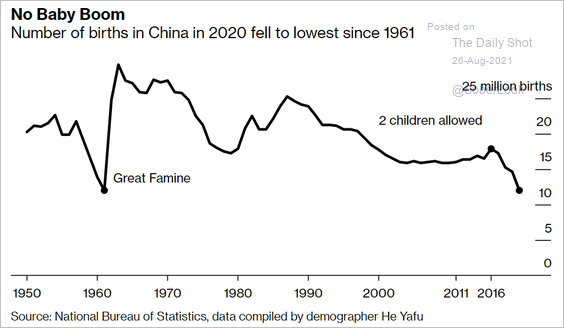

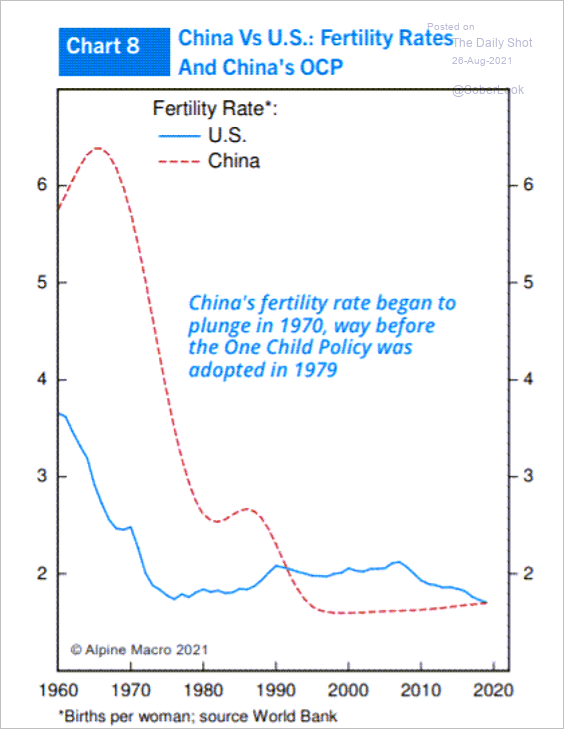

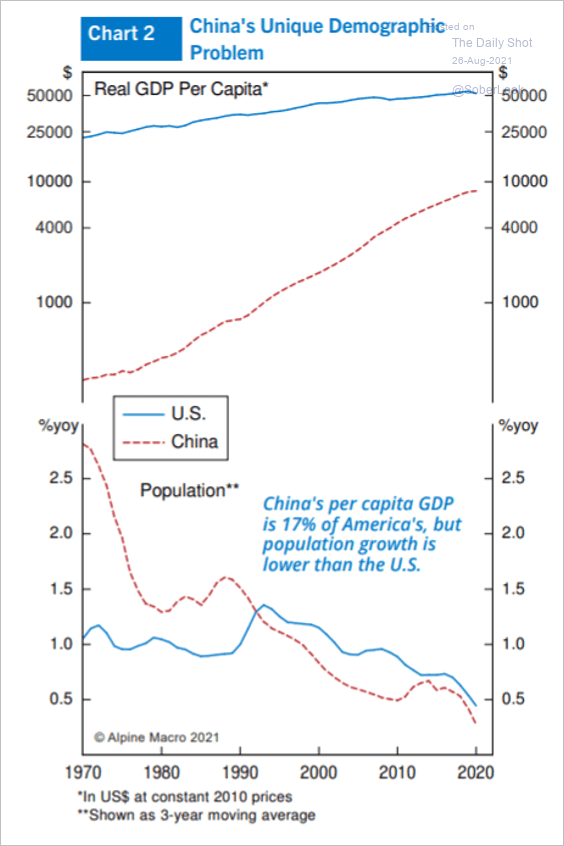

2. Next, we have some updates on China’s demographics.

• Number of births:

Source: @business Read full article

Source: @business Read full article

• Fertility rate:

Source: Alpine Macro

Source: Alpine Macro

• GDP per capita and population growth:

Source: Alpine Macro

Source: Alpine Macro

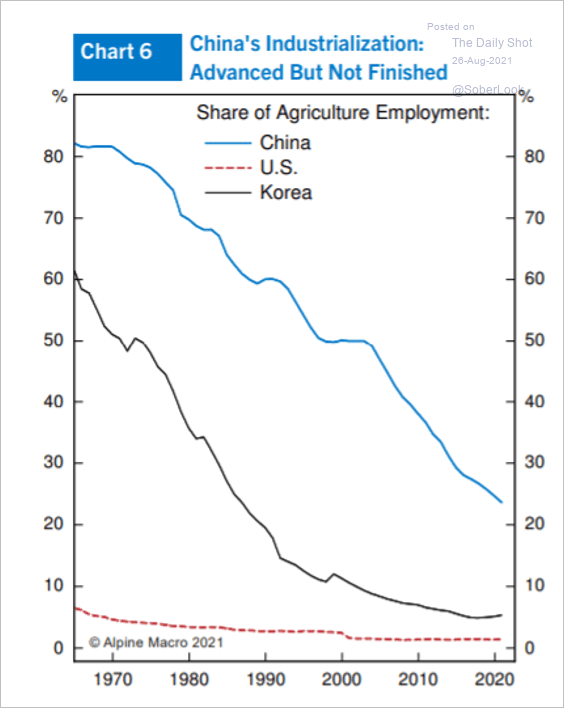

• Agriculture employment:

Source: Alpine Macro

Source: Alpine Macro

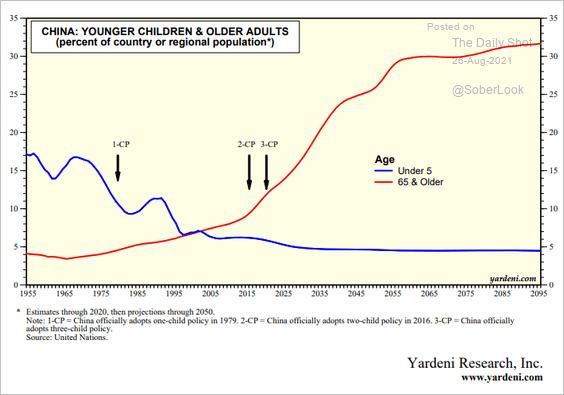

• Younger children and older adults:

Source: Yardeni Research

Source: Yardeni Research

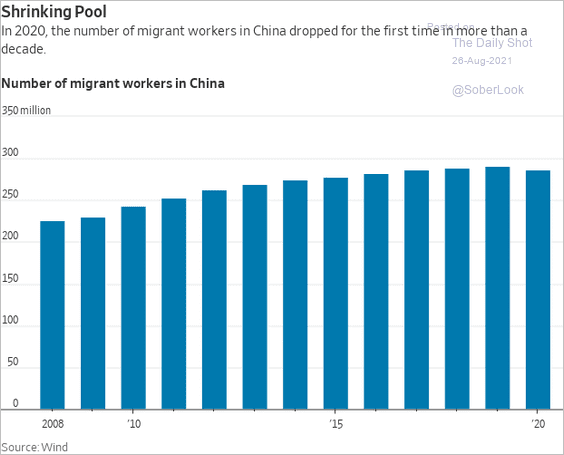

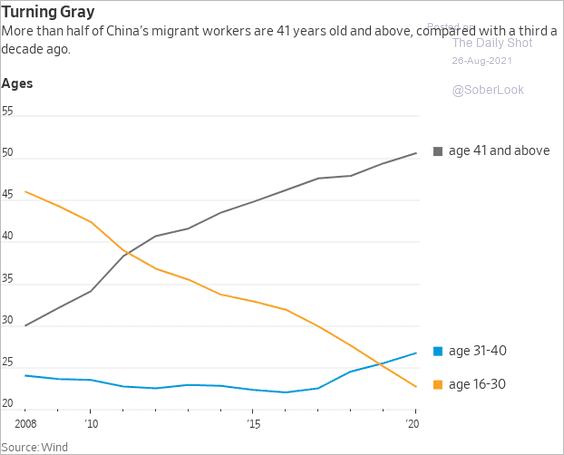

• Migrant workers (numbers and age trends):

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

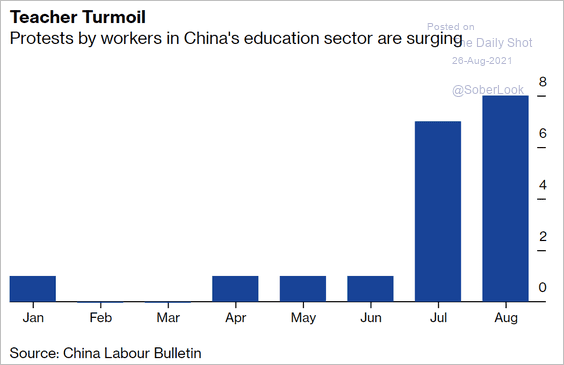

3. Protests by workers in the education sector have been rising.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

Back to Index

Emerging Markets

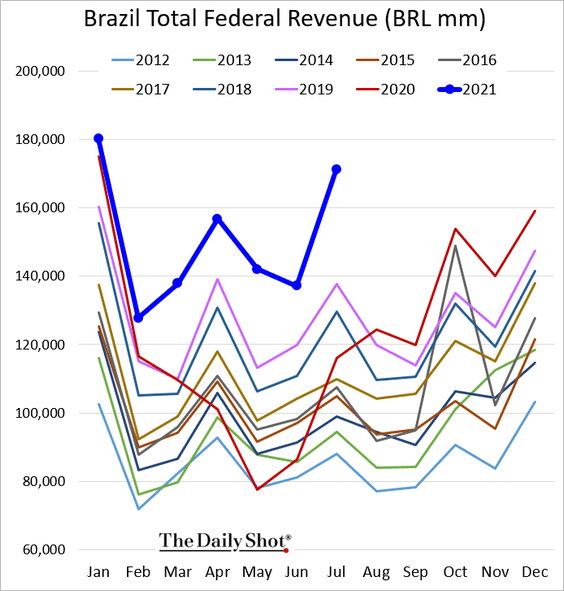

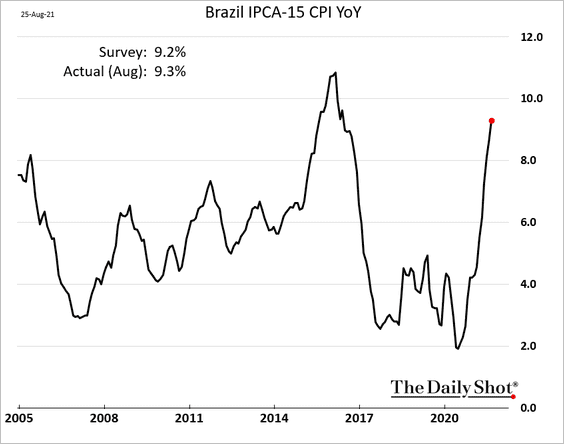

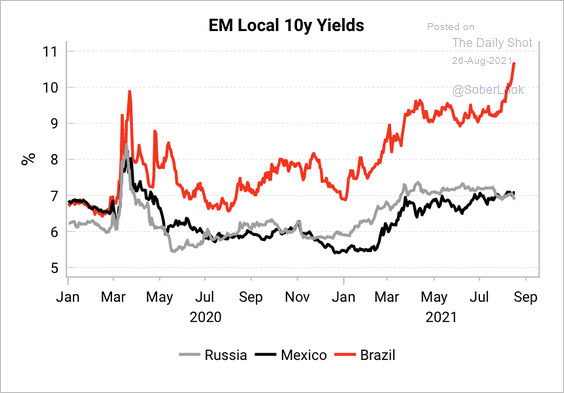

1. Let’s begin with Brazil.

• Federal revenue surged this year.

• Inflation continues to climb.

• Brazil’s 10-year yield has risen significantly this year, more so than in Russia and Mexico. The market is pricing in sustained rate hikes ahead.

Source: Variant Perception

Source: Variant Perception

——————–

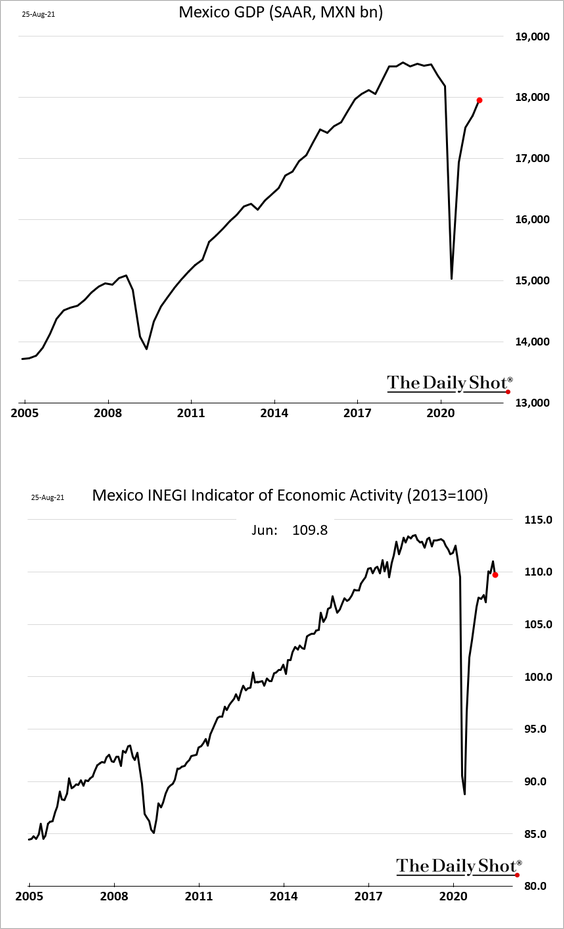

2. Mexico had a strong second quarter, but there was a pullback in June.

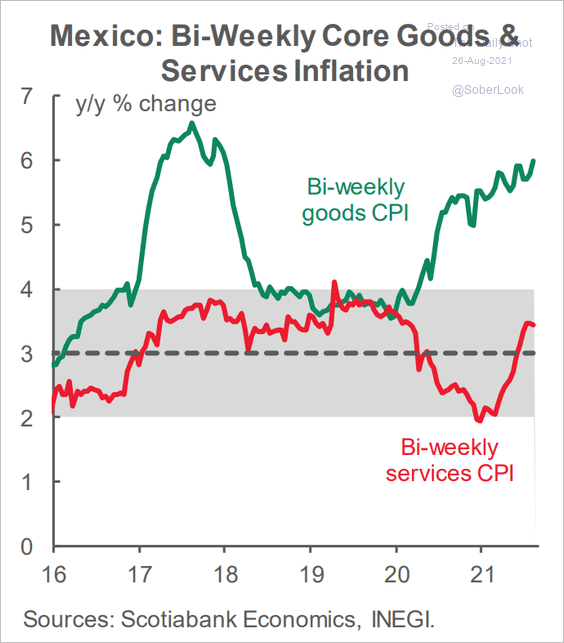

This chart shows Mexico’s goods and services CPI trends.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

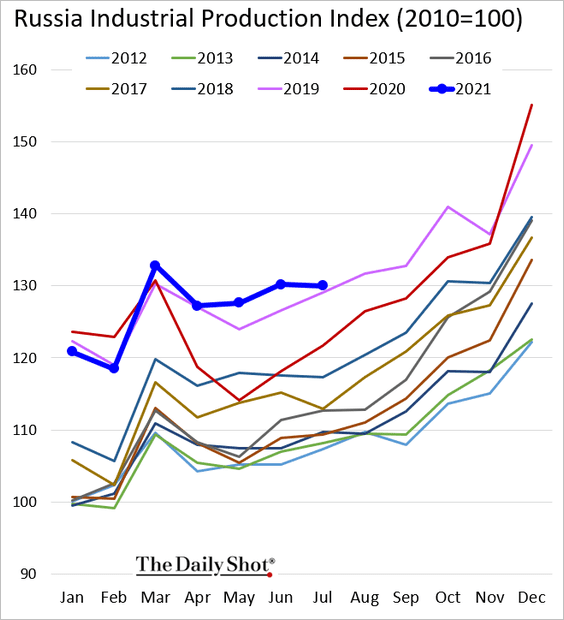

3. Russia’s industrial production weakened in July.

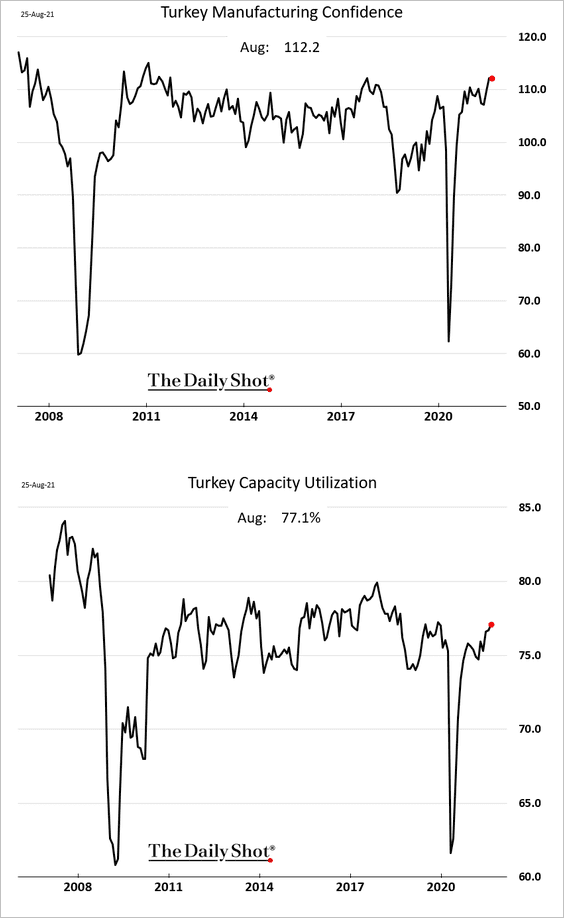

4. Turkey’s manufacturing confidence and capacity utilization remain resilient.

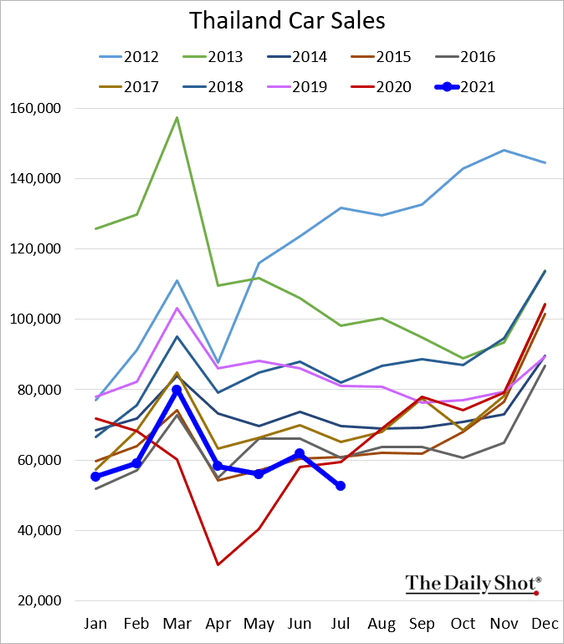

5. Thailand’s car sales hit a multi-year low in July (for this time of the year).

Source: Bangkok Post Read full article

Source: Bangkok Post Read full article

——————–

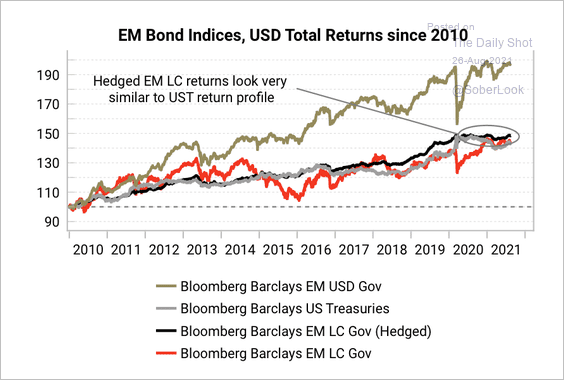

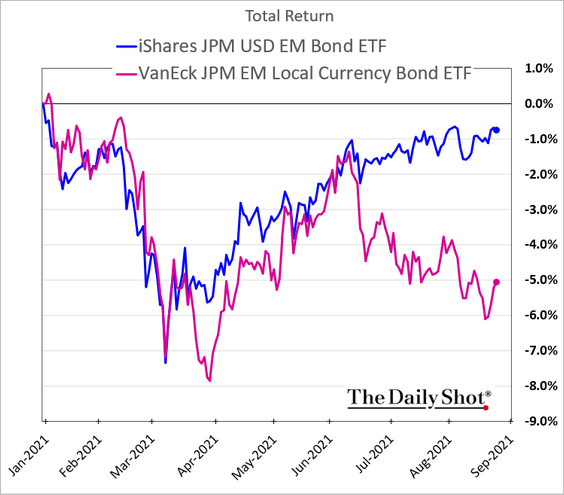

6. The return profile of hedged EM local currency debt is similar to Treasuries.

Source: Variant Perception

Source: Variant Perception

As the dollar rebounded, local-currency bonds underperformed USD-denominated debt (in dollar terms).

Back to Index

Cryptocurrency

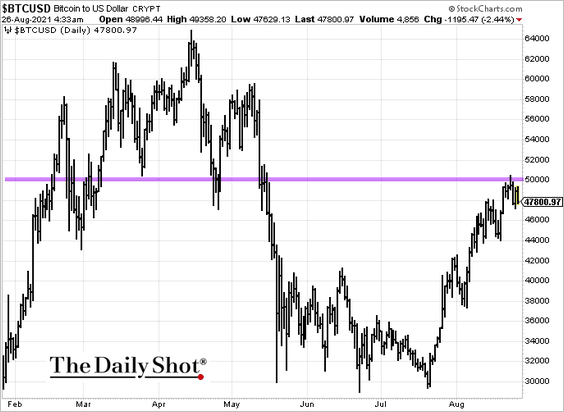

1. Bitcoin’s move above 50k was not sustained.

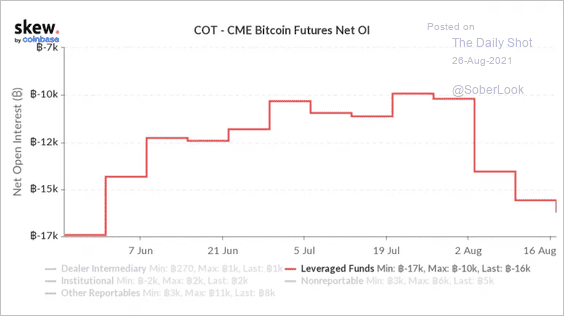

2. Leveraged funds piled into bearish bets on bitcoin last week, most likely to hedge long spot positions.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

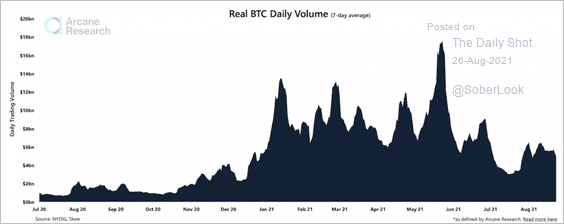

3. Bitcoin’s spot trading volume remains subdued and is roughly half of what the market experienced the last time BTC traded around $50K, according to Arcane Research.

Source: Arcane Research Read full article

Source: Arcane Research Read full article

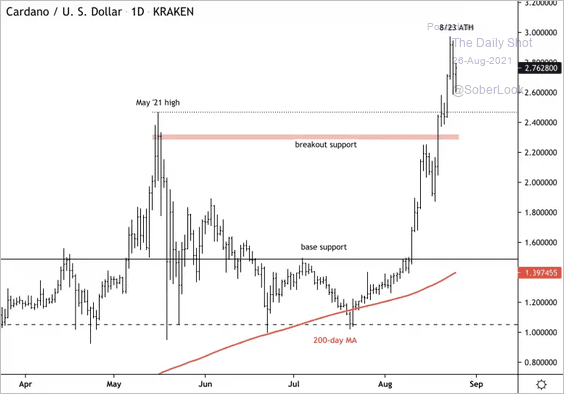

4. Cardano’s ADA appears overbought after a strong breakout to all-time highs.

Source: Dantes Outlook

Source: Dantes Outlook

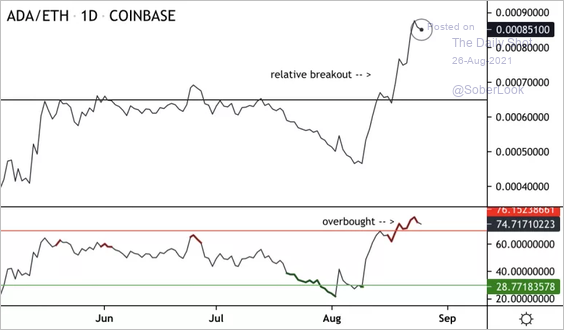

ADA has also broken out relative to ETH (viewed as direct competitors).

Source: Dantes Outlook

Source: Dantes Outlook

The article below provides an overview of the situation.

Source: WCCF TECH Read full article

Source: WCCF TECH Read full article

——————–

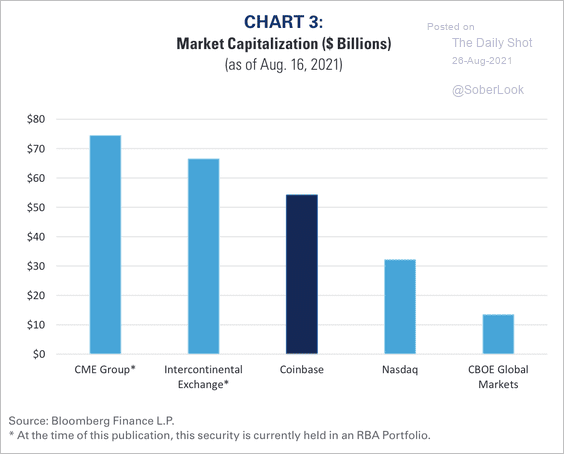

5. Here is Coinbase’s market cap alongside other leading exchanges.

Source: Richard Bernstein Advisors

Source: Richard Bernstein Advisors

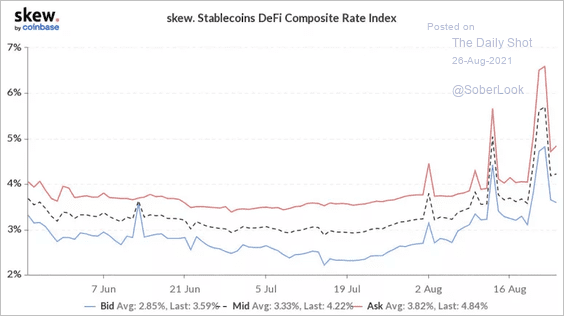

6. DeFi stablecoin lending rates are rising.

Source: Skew

Source: Skew

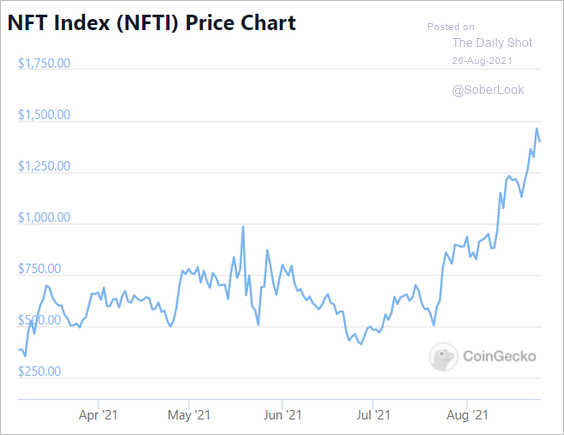

7. NFT sales are surging.

Source: Reuters Read full article

Source: Reuters Read full article

Source: CoinGecko

Source: CoinGecko

Back to Index

Commodities

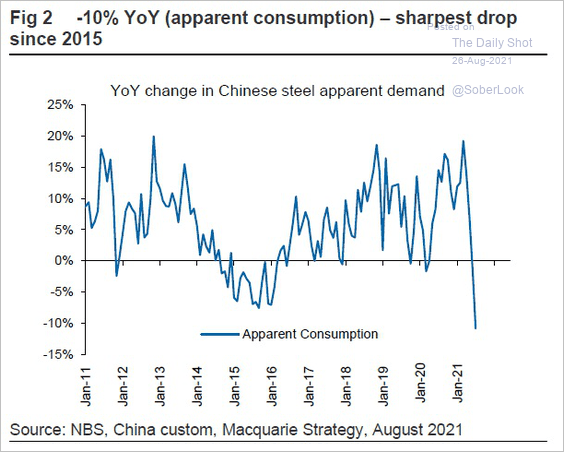

1. China’s steel demand saw a substantial drop recently, pressuring iron ore prices.

Source: Macquarie; @Scutty

Source: Macquarie; @Scutty

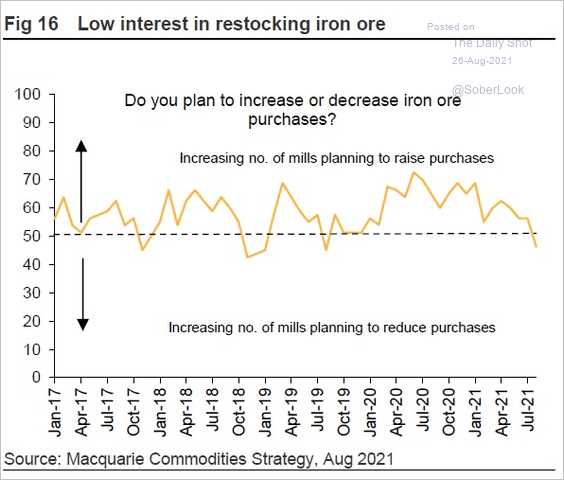

Mills are not planning to raise their iron ore purchases.

Source: Macquarie; @Scutty

Source: Macquarie; @Scutty

——————–

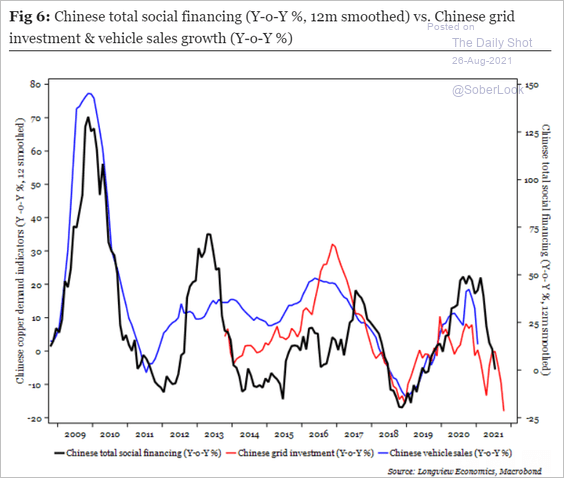

2. China’s fundamentals don’t bode well for copper.

Source: Longview Economics

Source: Longview Economics

Back to Index

Energy

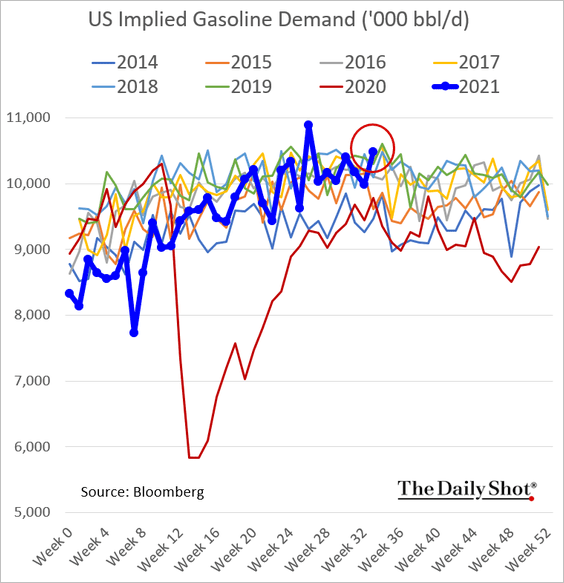

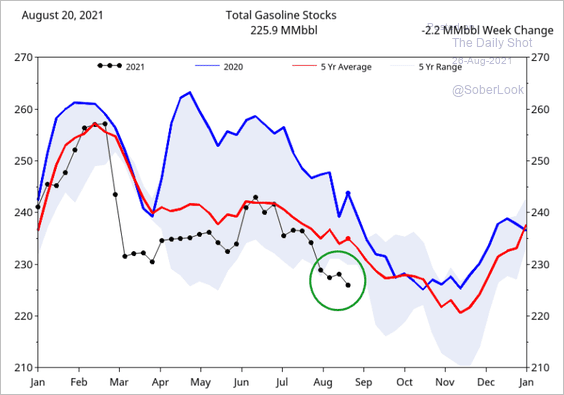

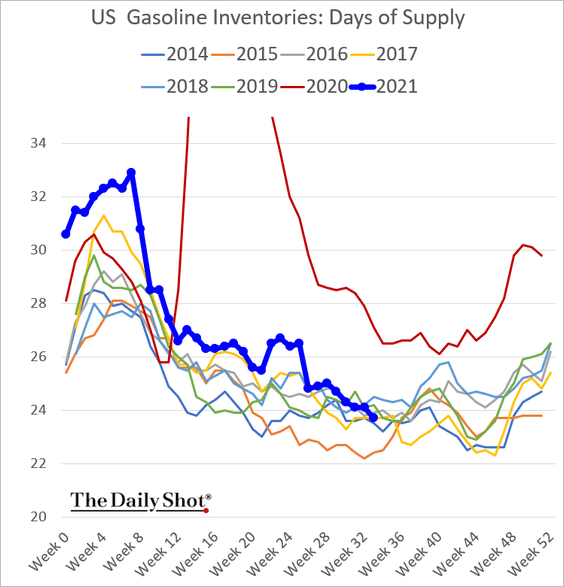

1. US gasoline demand is back at the top of the seven-year range.

Gasoline inventories continue to shrink (2 charts).

Source: Fundamental Analytics

Source: Fundamental Analytics

——————–

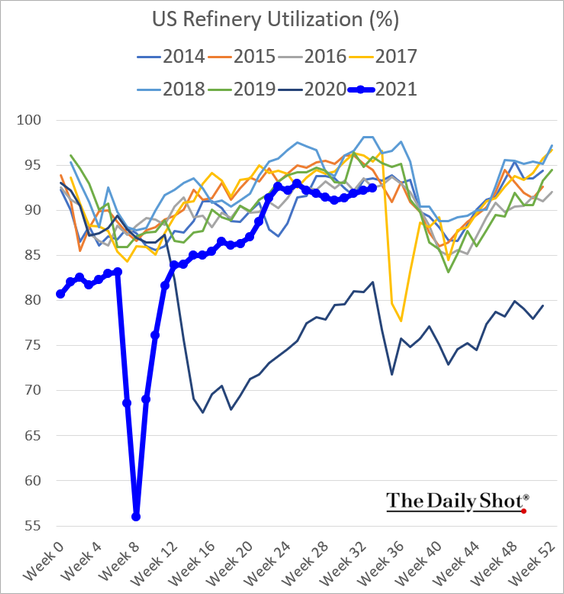

2. Refinery utilization remains at the low end of the seven-year range.

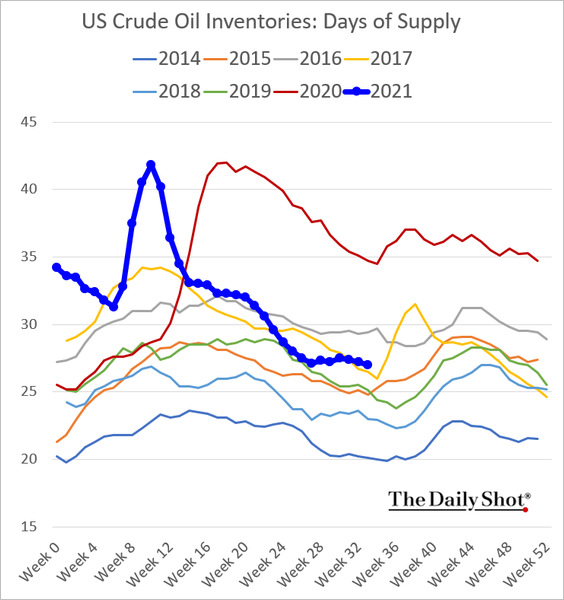

3. Measured in days of supply, US oil inventories are holding near 2017 levels.

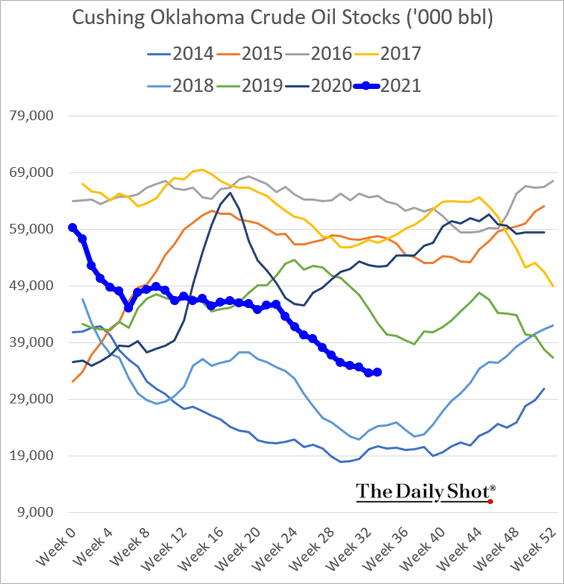

This chart shows oil stocks at Cushing, OK (the settlement hub for NYMEX crude).

——————–

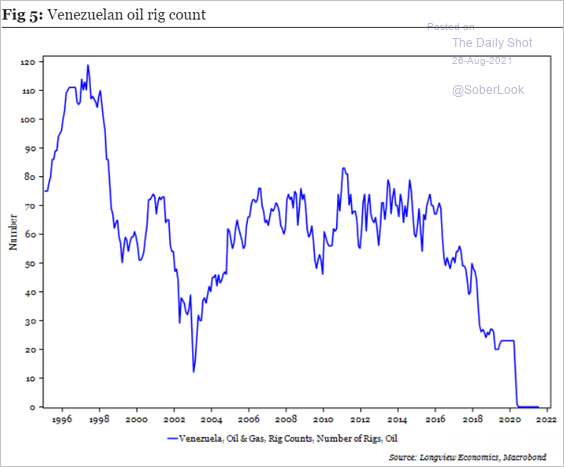

4. There is no more oil drilling in Venezuela.

Source: Longview Economics

Source: Longview Economics

Back to Index

Equities

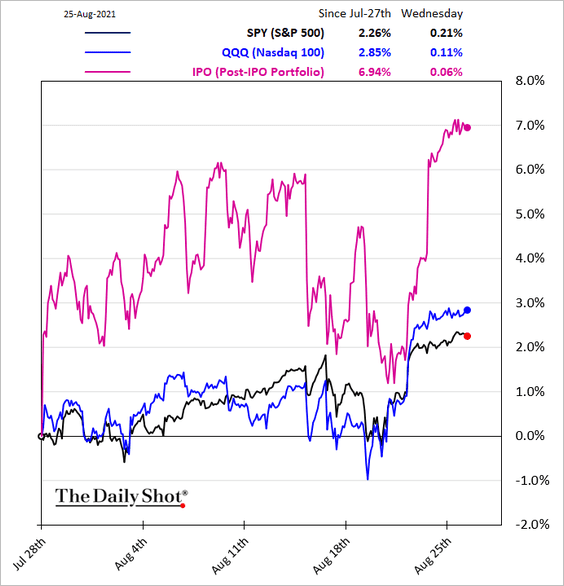

1. Post-IPO stocks surged this week.

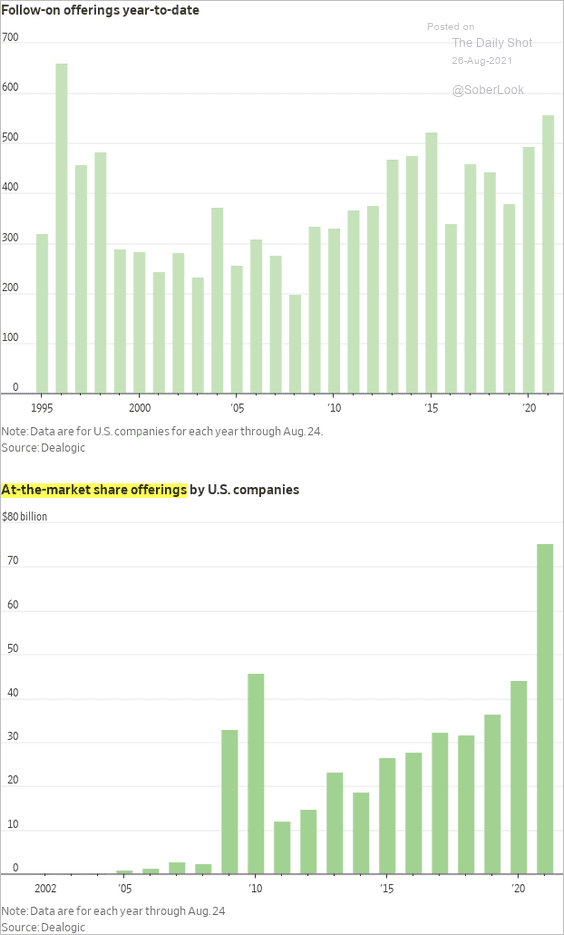

2. Follow-on stock offerings hit the highest level since 1996. This article describes the process of “at-the-market share offerings.”

Source: @WSJ Read full article

Source: @WSJ Read full article

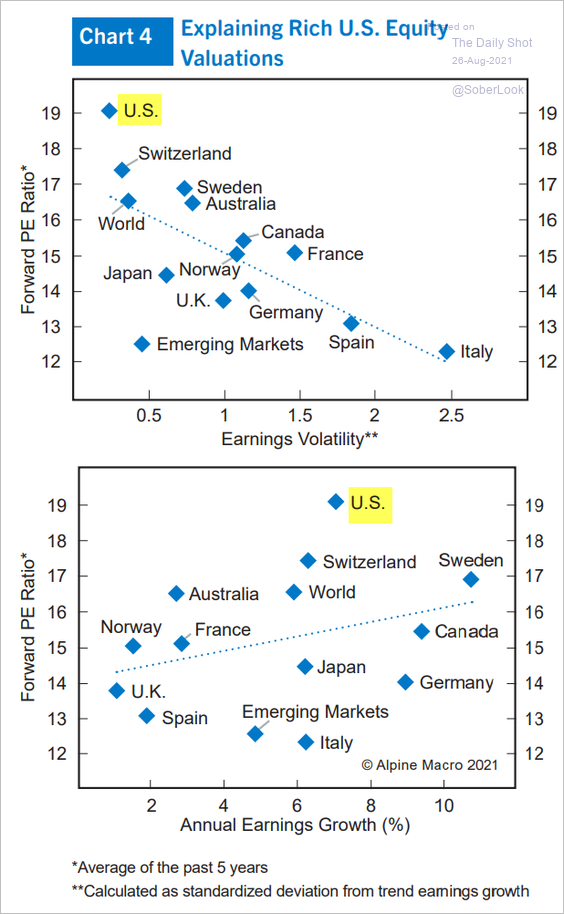

3. Strong and stable earnings growth helps explain higher valuations on US shares relative the rest of the world.

Source: Alpine Macro

Source: Alpine Macro

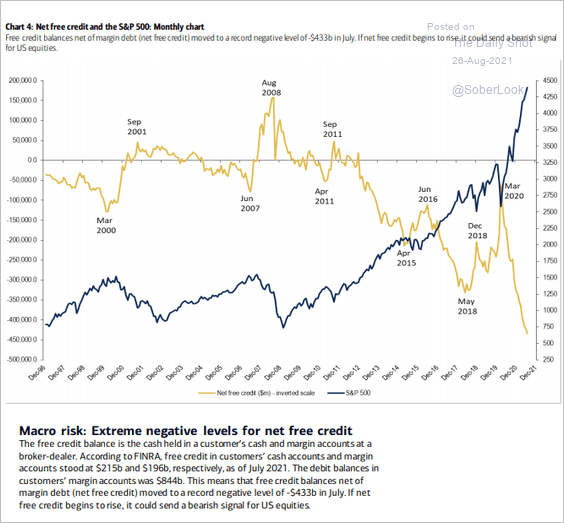

4. Low levels of free credit balances (unlevered accounts) pose a risk for the market, according to BofA.

Source: BofA Global Research

Source: BofA Global Research

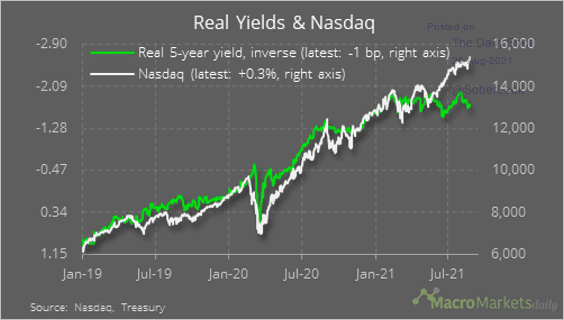

5. Growth companies remain exposed to an increase in real rates.

Source: @macro_daily

Source: @macro_daily

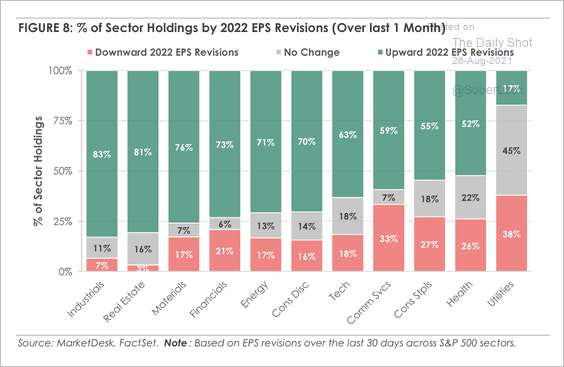

6. Cyclical sectors have seen upward earnings revisions in Q2.

Source: MarketDesk Research

Source: MarketDesk Research

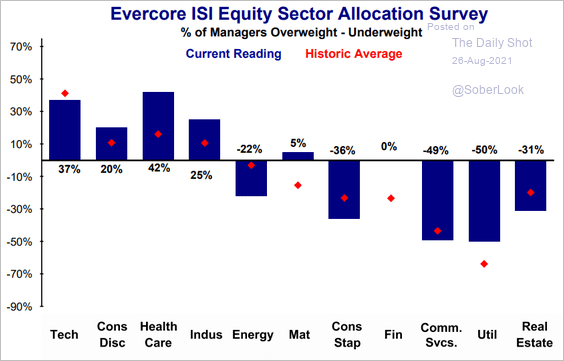

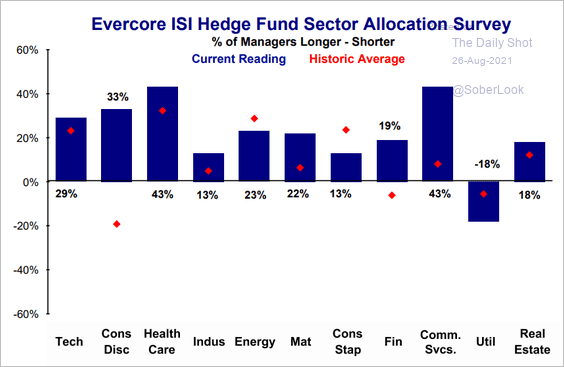

The following two charts show sector positioning (from Evercore ISI).

• Institutional equity managers:

Source: Evercore ISI

Source: Evercore ISI

• Hedge fund managers:

Source: Evercore ISI

Source: Evercore ISI

——————–

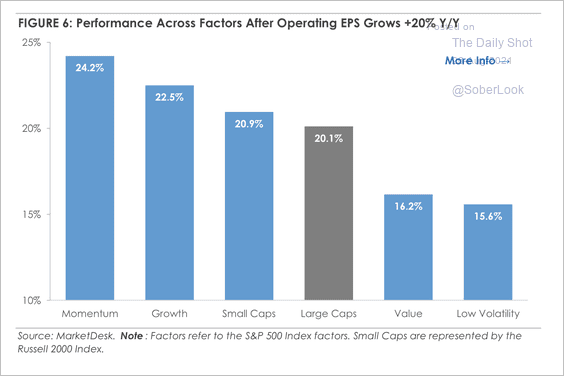

7. Momentum and growth factors tend to outperform when operating earnings per-share grow more than 20% year-over-year.

Source: MarketDesk Research

Source: MarketDesk Research

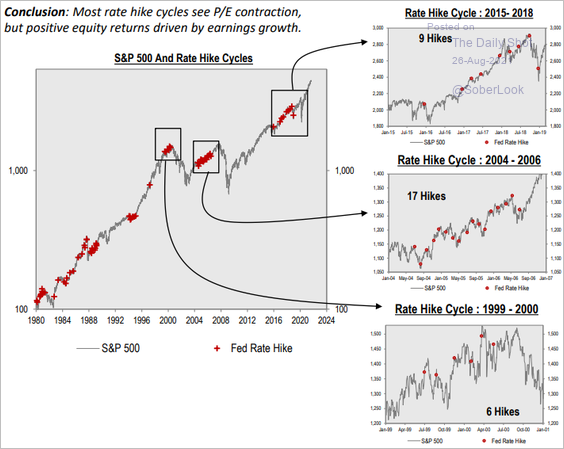

8. Rate hike cycles tend to see P/E contraction but positive stock returns, according to Cornerstone Macro.

Source: Cornerstone Macro

Source: Cornerstone Macro

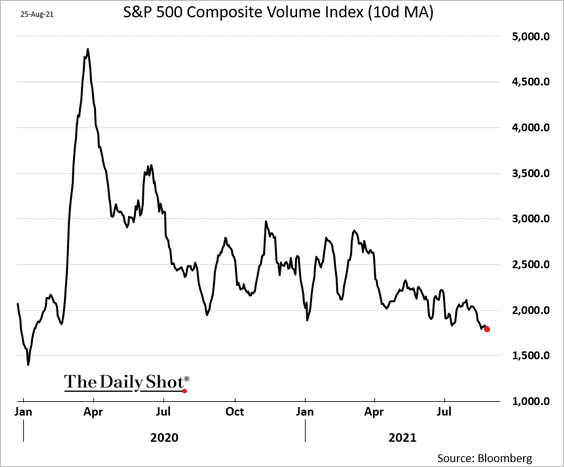

9. Trading volumes are near the lowest levels since the start of the pandemic.

h/t @Matt_Turnerr

h/t @Matt_Turnerr

Back to Index

Rates

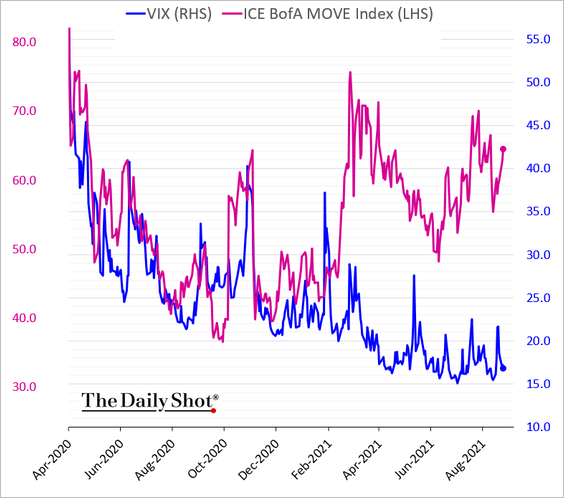

1. Treasury market implied volatility remains elevated relative to equity vol.

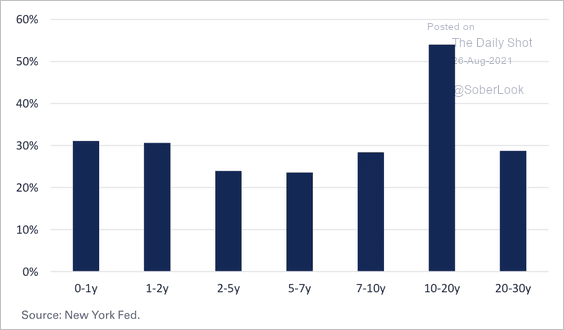

2. This chart shows the Fed ownership of Treasuries as a percentage of outstanding (by maturity, as of July).

Source: Richard Bernstein Advisors

Source: Richard Bernstein Advisors

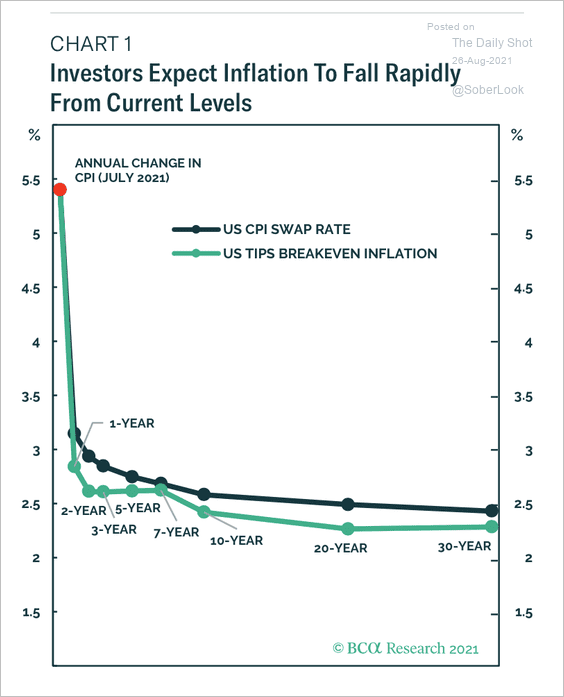

3. The market expects inflation to decline over the long term, which is one reason bond yields remain depressed, according to BCA Research. By the way, the deep backwardation in crude oil also contributes to the inflation curve inversion.

Source: BCA Research

Source: BCA Research

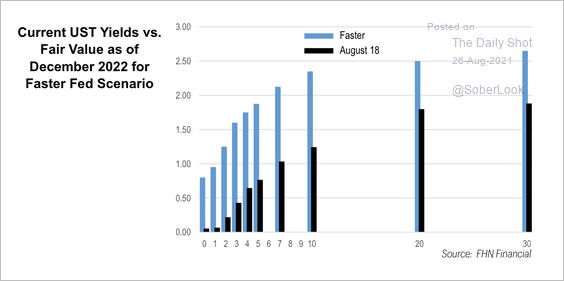

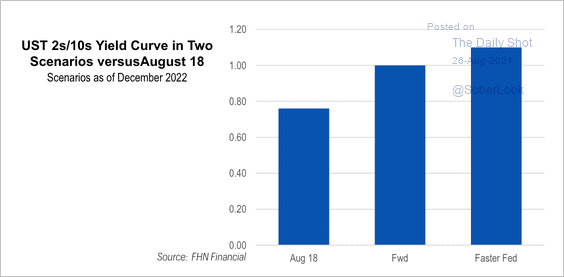

4. Here is FHN Financial’s yield forecast under a faster Fed hiking scenario (2 charts).

Source: FHN Financial

Source: FHN Financial

Source: FHN Financial

Source: FHN Financial

Back to Index

Global Developments

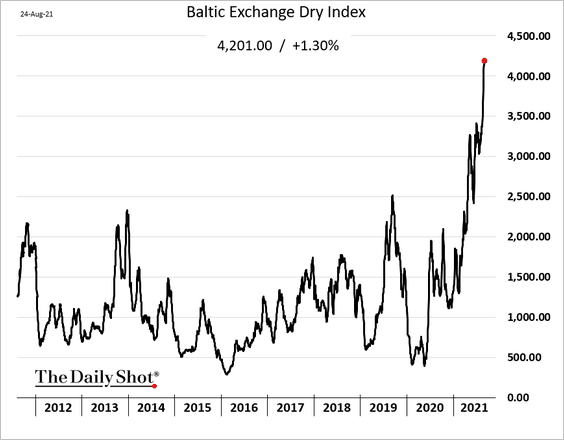

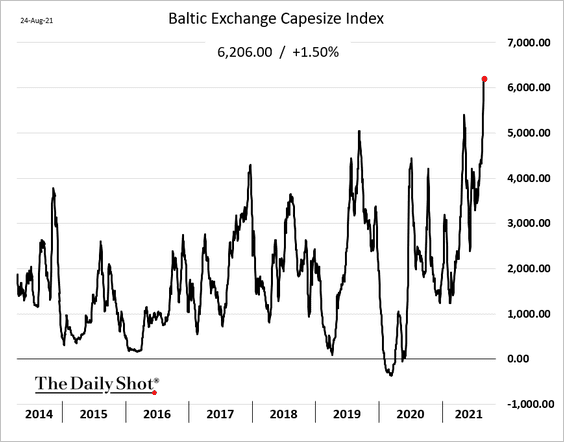

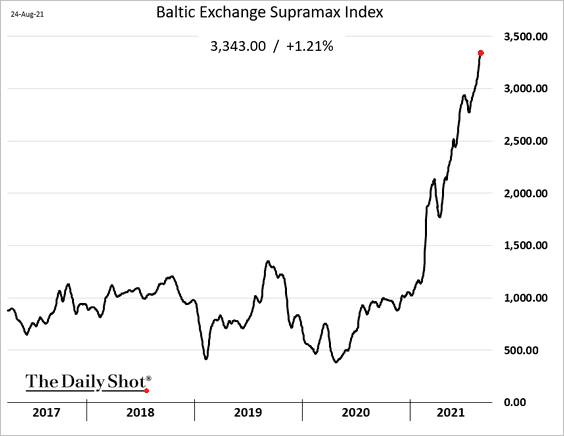

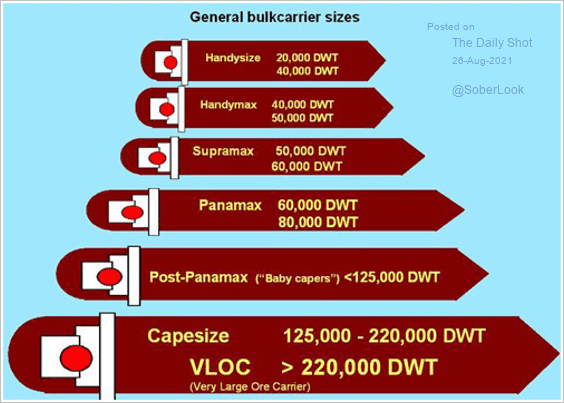

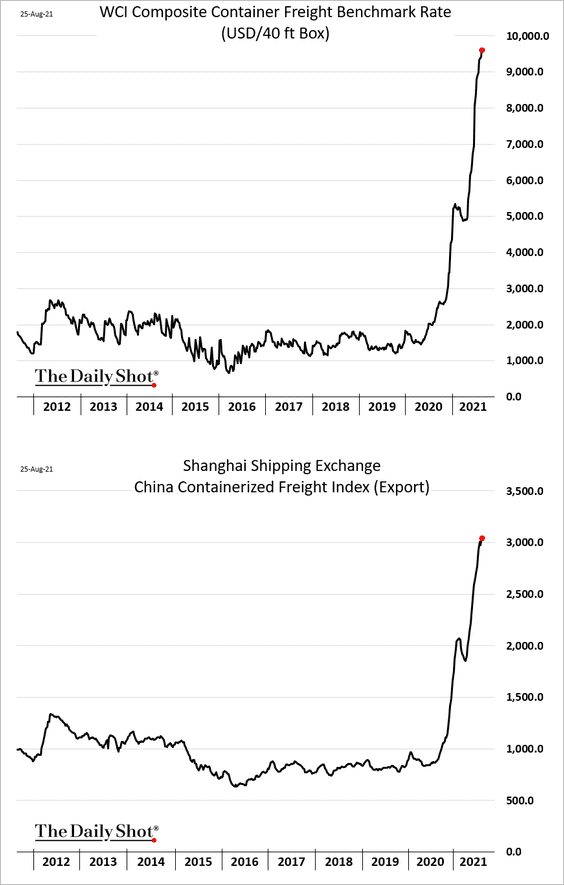

1. Shipping costs continue to surge.

• Dry bulk shipping costs:

– Capesize vessels:

Source: TradeWinds Read full article

Source: TradeWinds Read full article

– Smaller ships:

– As a reference, here is an illustration of bulk carrier sizes.

• Container rates:

——————–

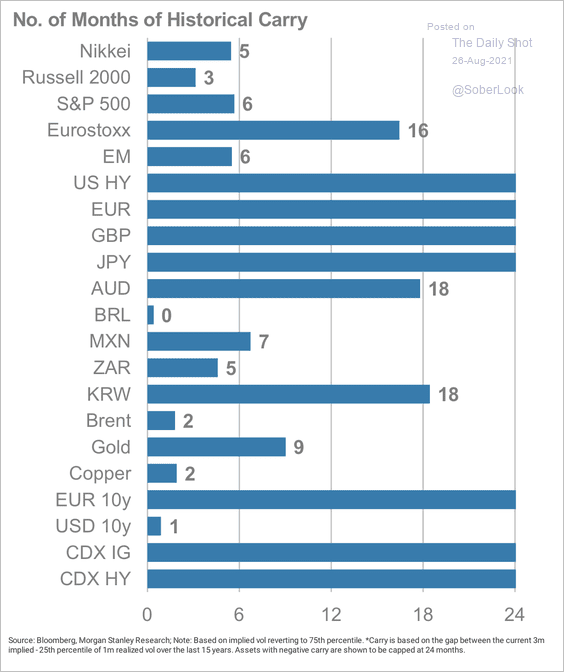

2. How many months of carry are needed to withstand a vol shock?

Source: Morgan Stanley Research

Source: Morgan Stanley Research

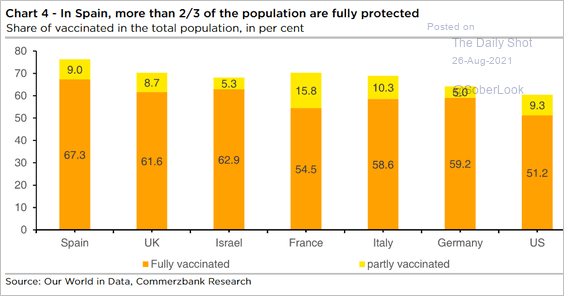

3. Finally, we have the vaccinated population share in select economies.

Source: Commerzbank Research

Source: Commerzbank Research

——————–

Food for Thought

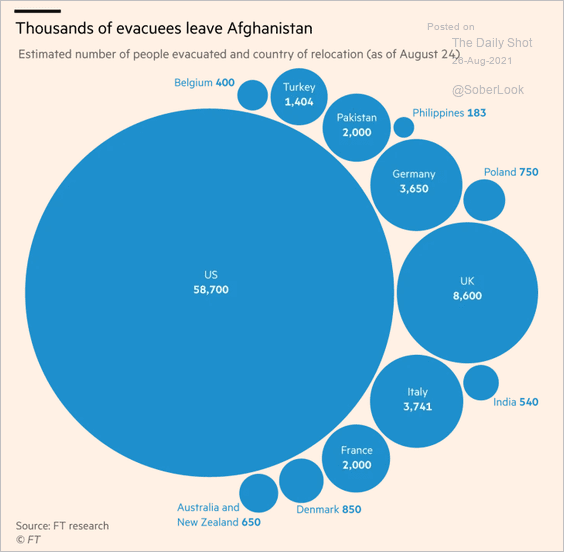

1. Evacuations from Afghanistan:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

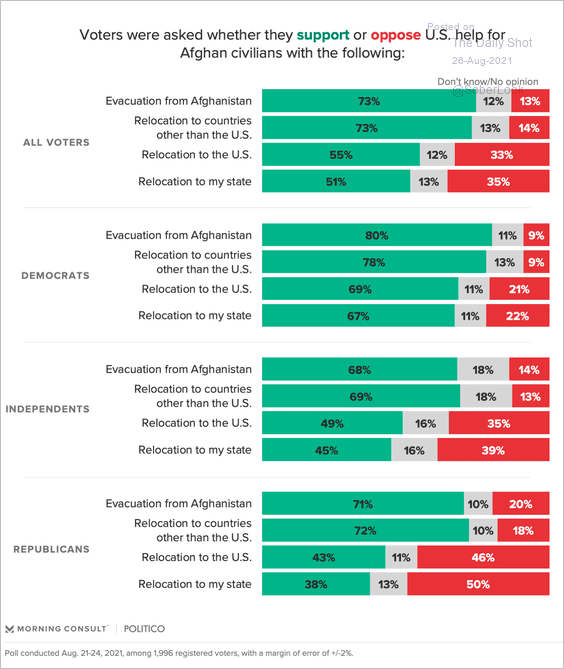

2. Relocating Afghans to the US or elsewhere:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

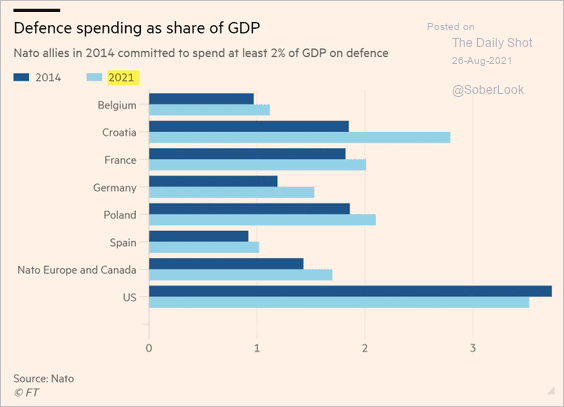

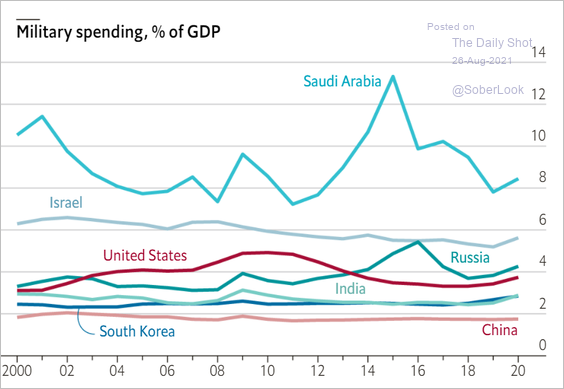

3. Defense spending in select economies (2 charts):

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: The Economist Read full article

Source: The Economist Read full article

——————–

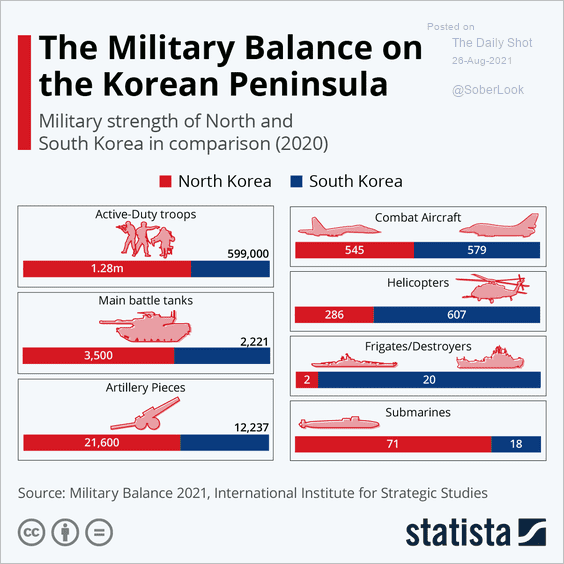

4. The military balance of power between North and South Korea:

Source: Statista

Source: Statista

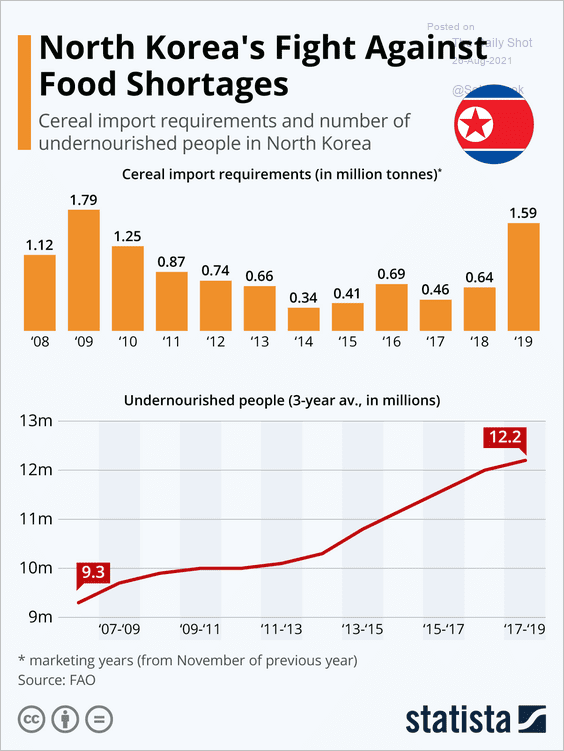

5. Food shortages in North Korea:

Source: Statista

Source: Statista

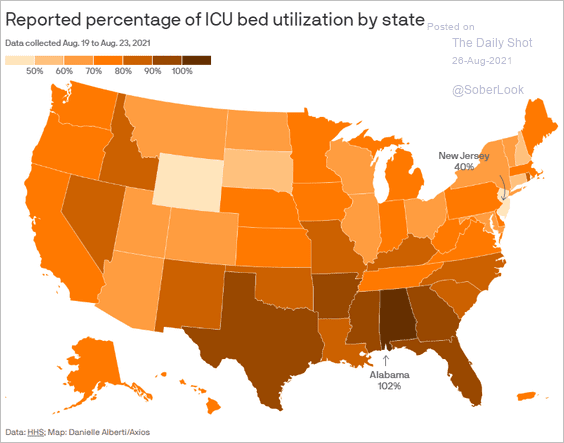

6. ICU bed utilization in the US:

Source: @axios Read full article

Source: @axios Read full article

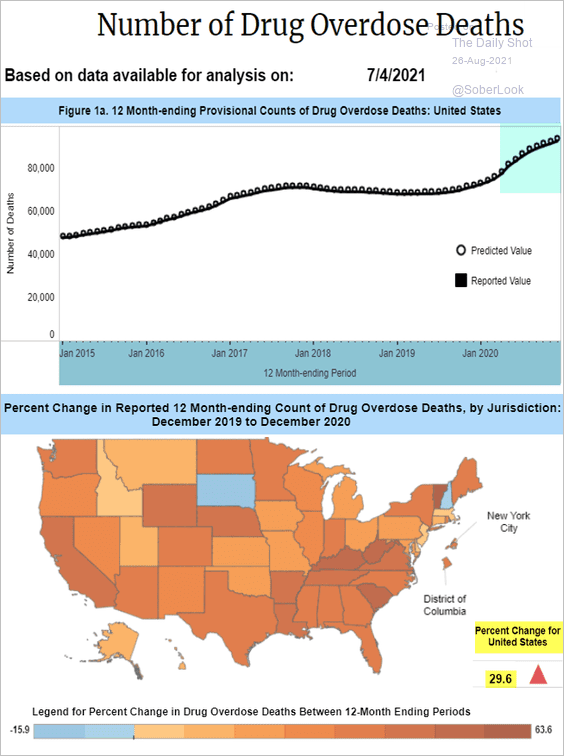

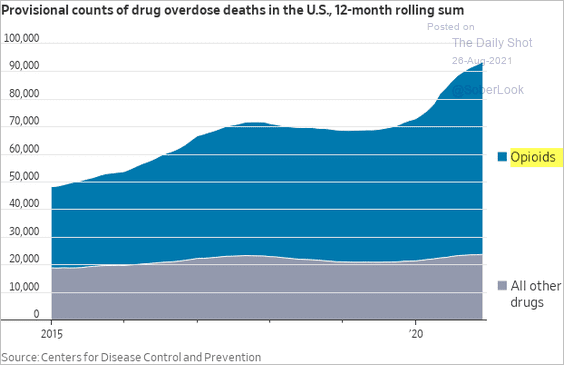

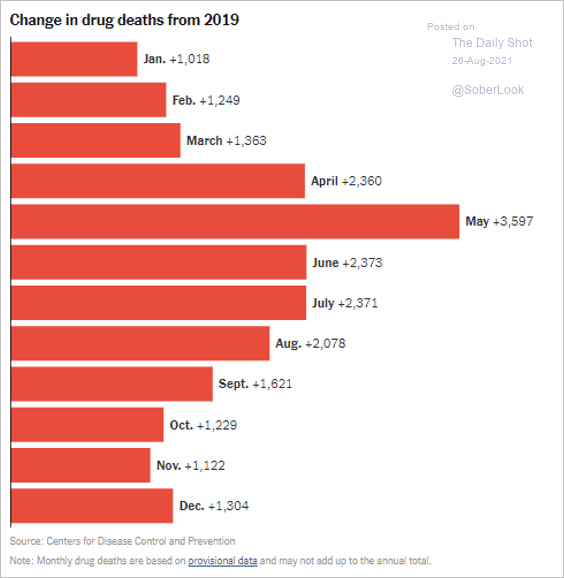

7. The number of drug overdose deaths surged during the pandemic (3 chats).

Source: National Center for Health Statistics

Source: National Center for Health Statistics

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: The New York Times Read full article

Source: The New York Times Read full article

——————–

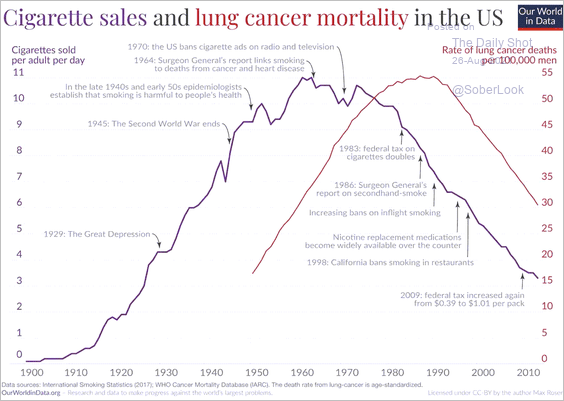

8. US cigarette sales vs. lung cancer mortality:

Source: Our World in Data; @TheBrowser

Source: Our World in Data; @TheBrowser

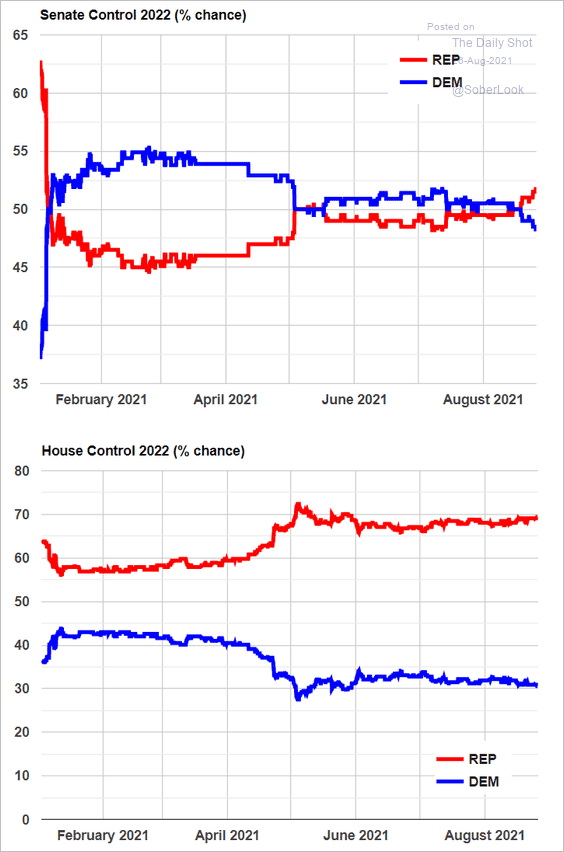

9. 2022 Senate and House control odds in the betting markets:

Source: Election Betting Odds; @bespokeinvest

Source: Election Betting Odds; @bespokeinvest

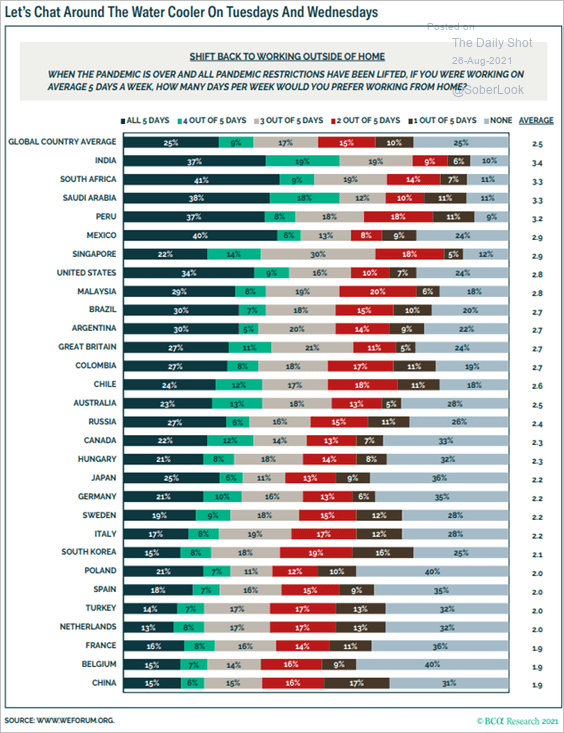

10. Back to working outside of the home:

Source: BCA Research

Source: BCA Research

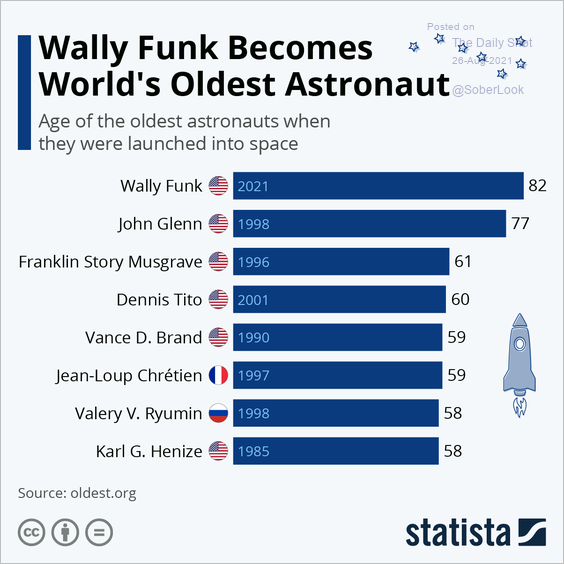

11. World’s oldest astronauts:

Source: Statista

Source: Statista

——————–

Back to Index