The Daily Shot: 14-Sep-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Rates

• Food for Thought

The United States

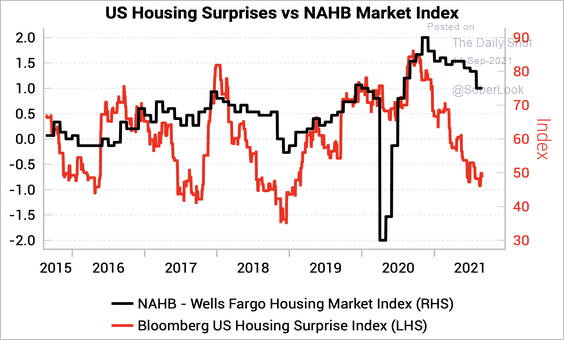

1. There are signs of moderation in the US housing market.

Source: Variant Perception

Source: Variant Perception

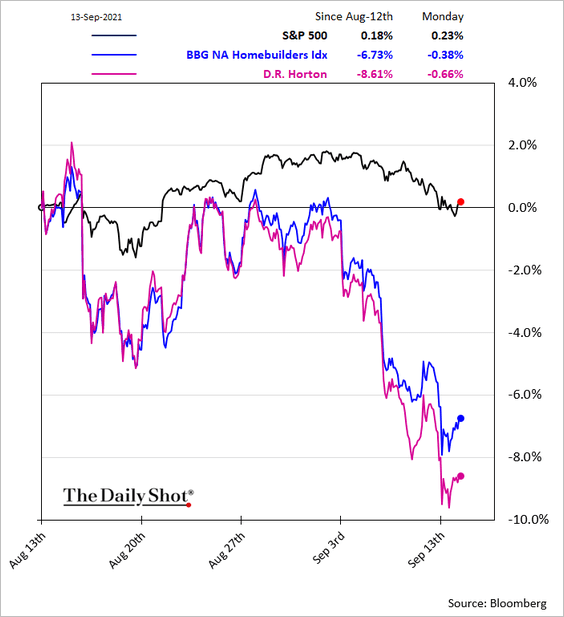

Homebuilder shares have been underperforming this month.

——————–

2. Next, we have some updates on the labor market.

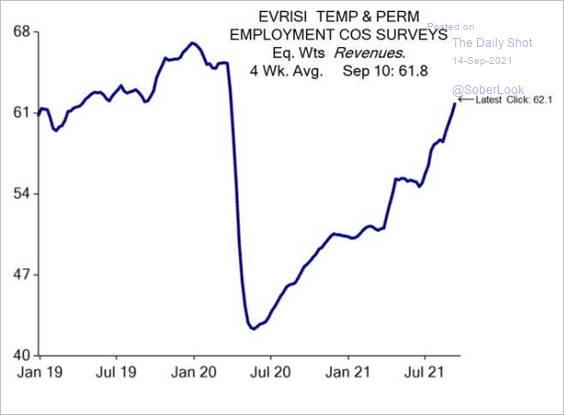

• The Evercore ISI business survey points to a rapid recovery in private-sector employment.

Source: Evercore ISI

Source: Evercore ISI

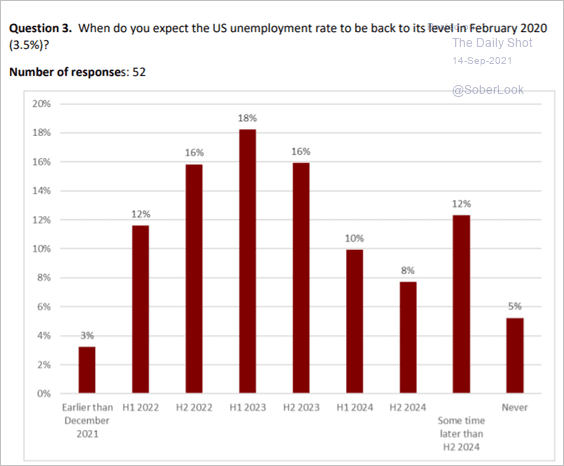

• When will the unemployment rate return to pre-COVID levels? Here is a survey of economists.

Source: IGM Forum

Source: IGM Forum

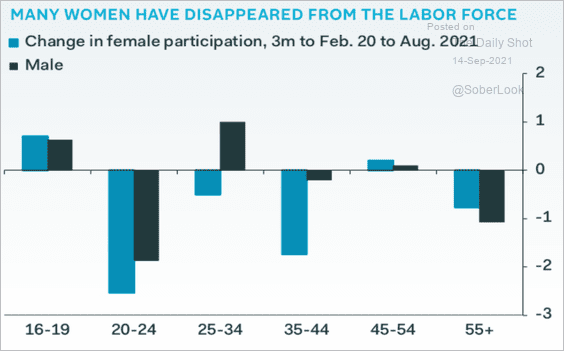

• Many prime-age women have exited the labor force since the start of the pandemic.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

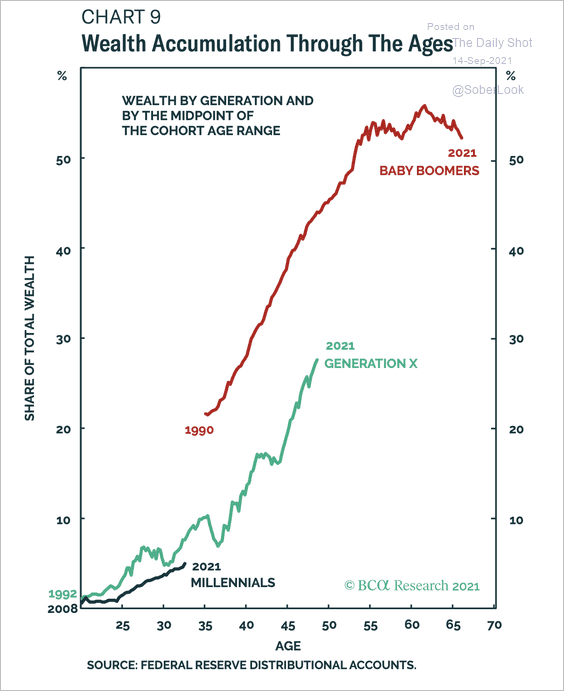

3. Baby boomers, who control more than half of household wealth in the US, are starting to retire and shift into dissaving.

Source: BCA Research

Source: BCA Research

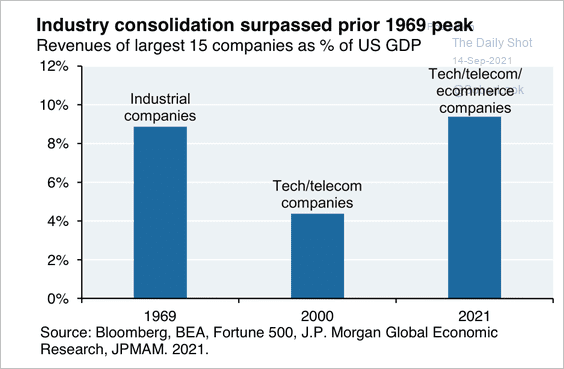

4. Current industry concentration in the tech sector is similar to industrials in the late 1960s.

Source: Michael Cembalest; J.P. Morgan Asset Management

Source: Michael Cembalest; J.P. Morgan Asset Management

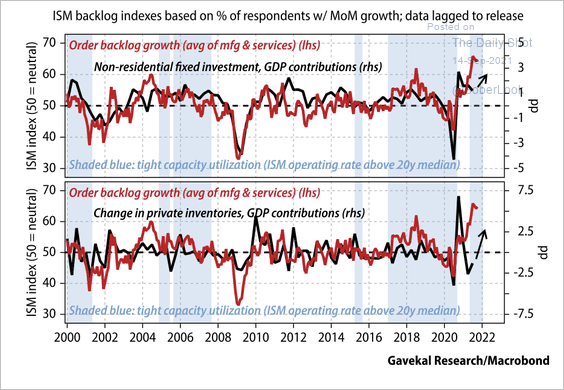

5. Backlogs and tight capacity point to more capital expenditures and inventory rebuilding ahead.

Source: Gavekal Research

Source: Gavekal Research

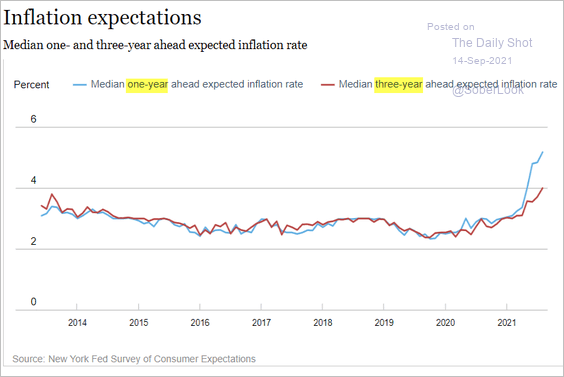

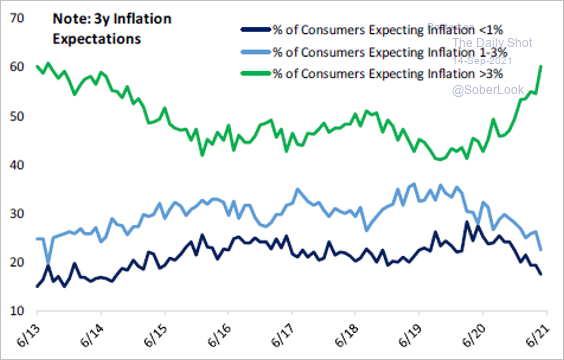

6. Next, we have some updates on inflation.

• Consumer inflation expectations continue to rise (2 charts).

Source: NY Fed

Source: NY Fed

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

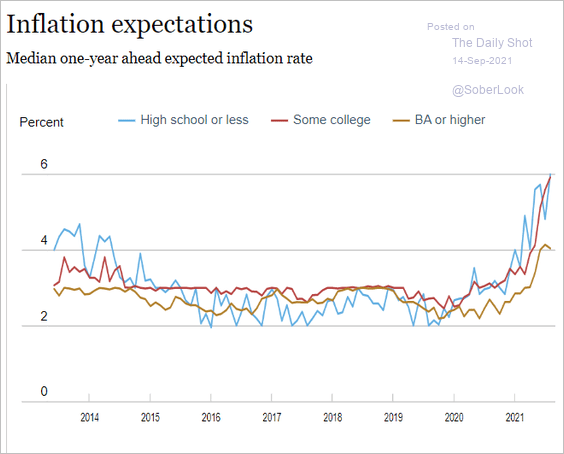

There is some disconnect between Americans with and without a college degree.

Source: NY Fed

Source: NY Fed

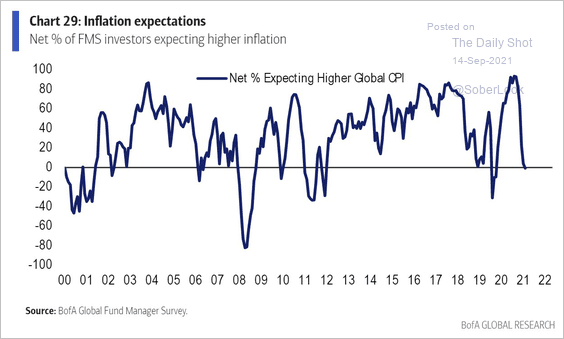

• Professional investors are not expecting higher inflation ahead.

Source: BofA Global Research; @Callum_Thomas

Source: BofA Global Research; @Callum_Thomas

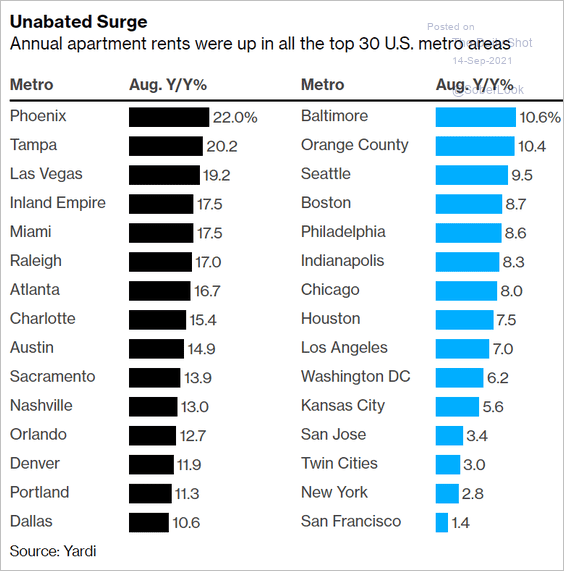

• Rental costs have rebounded sharply from the 2020 lows.

Source: @markets Read full article

Source: @markets Read full article

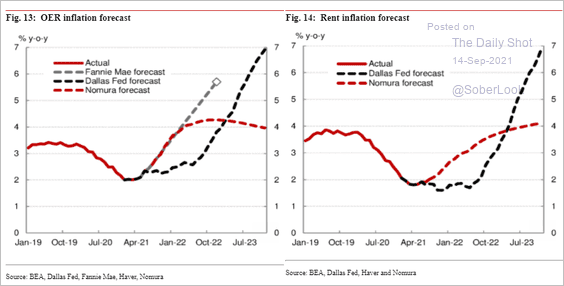

Here are some forecasts for rent and owners’ equivalent rent (OER) inflation.

Source: Nomura Securities

Source: Nomura Securities

——————–

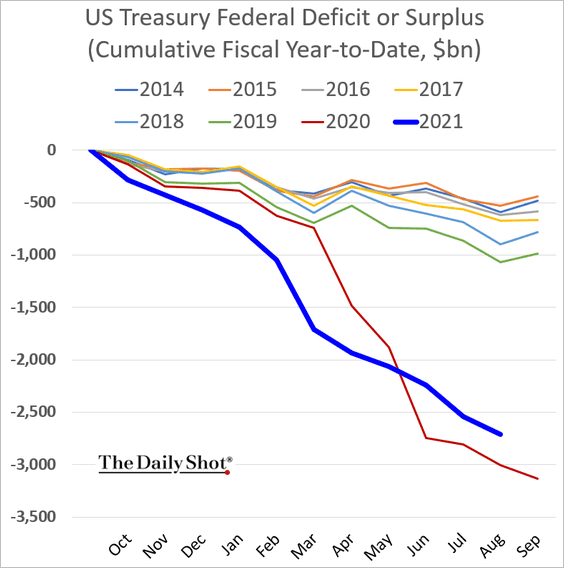

7. Finally, we have the year-to-date federal deficit, which has been less severe in 2021 than economists were expecting.

Back to Index

Canada

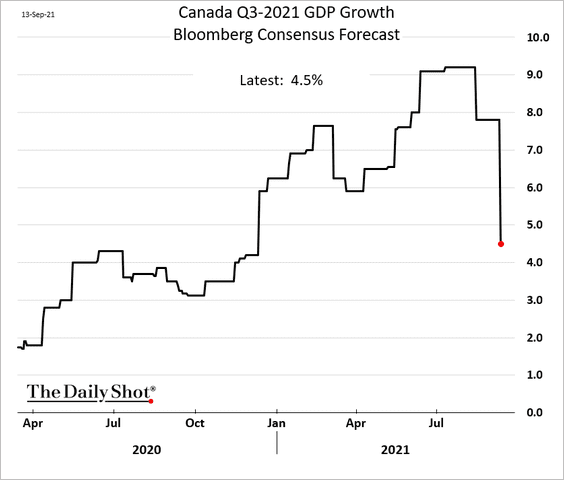

1. Economists have sharply downgraded their forecasts for Canada’s Q3 GDP growth.

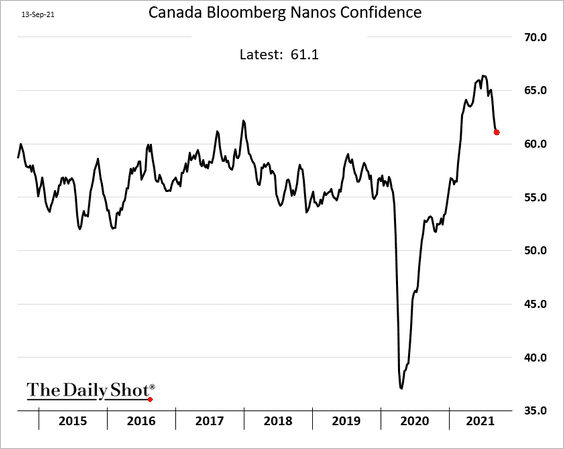

2. Consumer confidence should begin to stabilize.

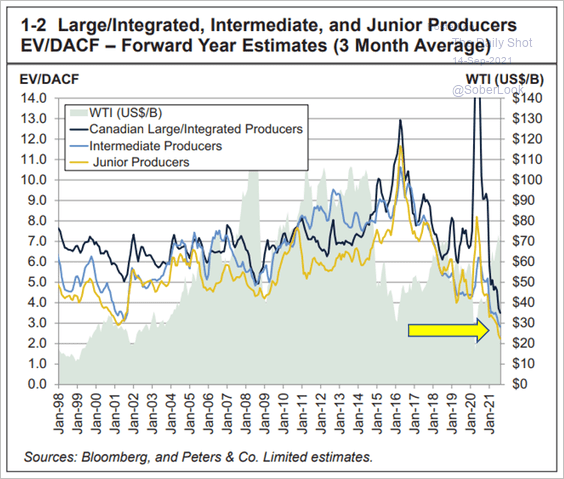

3. Energy share valuations are lowest in 20 years despite stronger oil & gas prices.

Source: @ericnuttall

Source: @ericnuttall

Back to Index

The United Kingdom

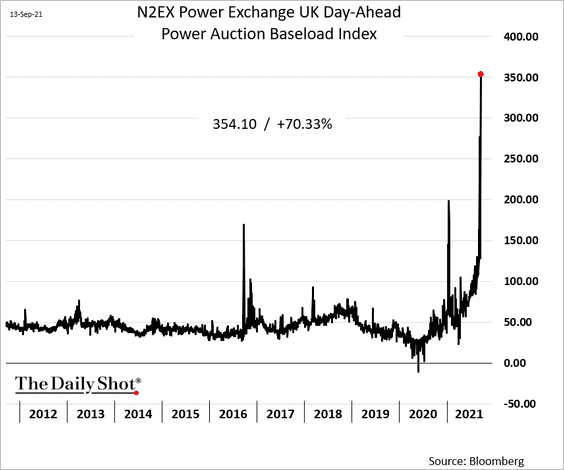

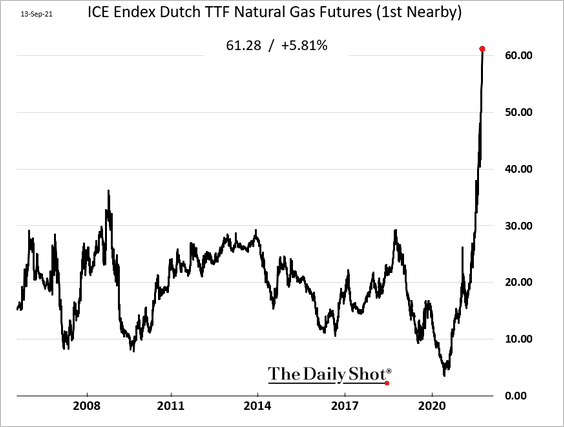

1. UK electricity prices continue to surge, …

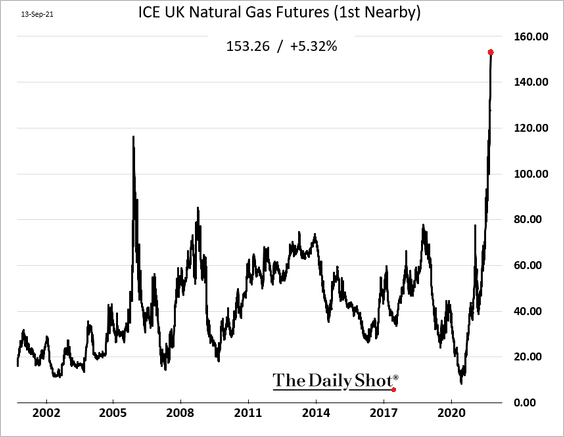

… as natural gas prices hit new records.

——————–

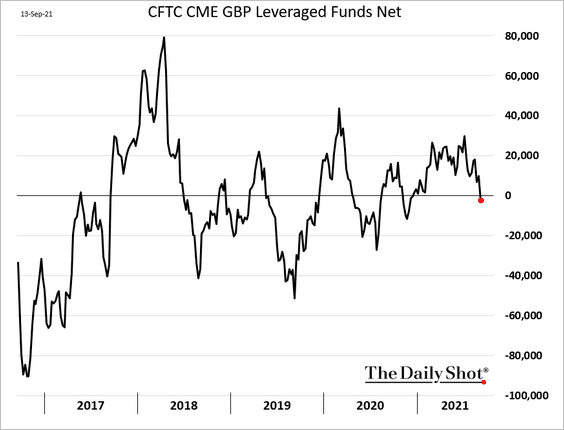

2. Hedge funds have turned bearish on the pound.

h/t @CormacMullen1

h/t @CormacMullen1

Back to Index

The Eurozone

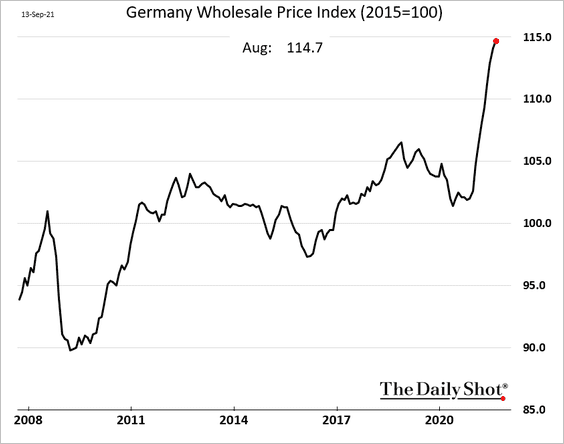

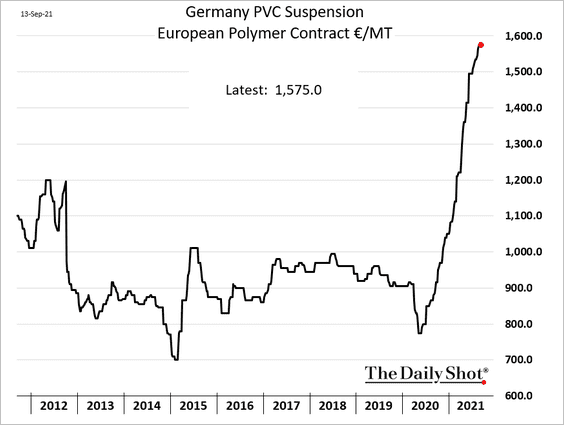

1. German wholesale prices continue to climb.

• Petrochemicals’ costs have been soaring, pushing prices of plastics to new highs.

h/t @JLeeEnergy

h/t @JLeeEnergy

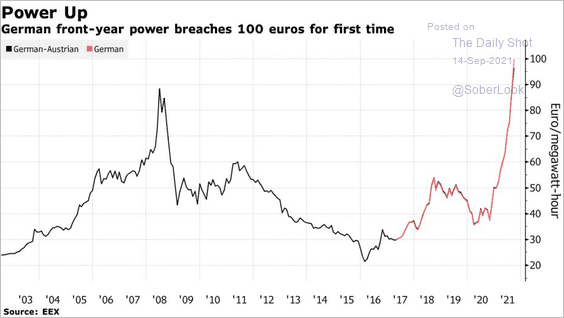

• Surging electricity costs, …

Source: @markets Read full article

Source: @markets Read full article

… driven by record-high natural gas prices, are exacerbating producer price inflation.

——————–

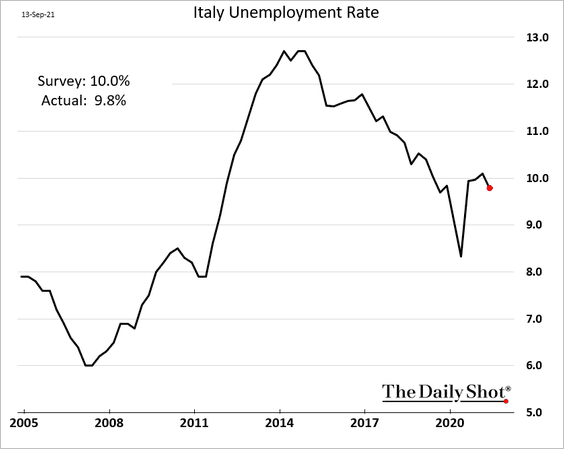

2. Italian unemployment ticked lower last quarter.

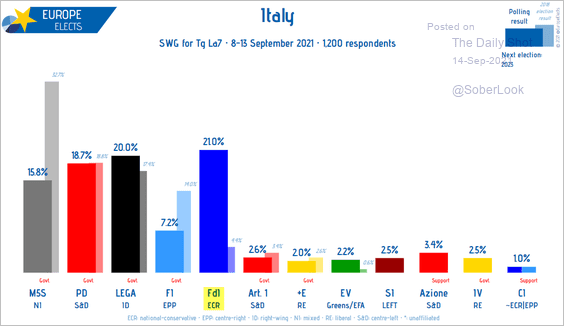

Separately, this chart shows the latest polls, with Brothers of Italy showing massive gains.

Source: @EuropeElects

Source: @EuropeElects

——————–

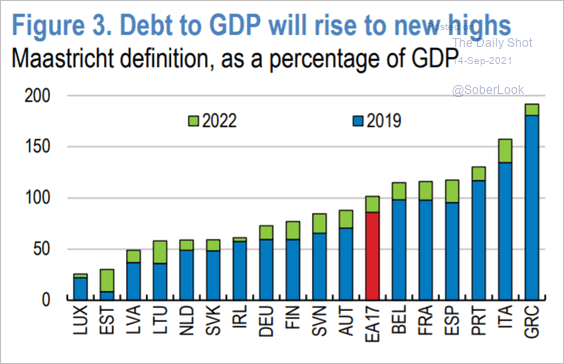

3. This chart shows the OECD’s forecast for debt-to-GDP ratios in the Eurozone.

Source: OECD Read full article

Source: OECD Read full article

Back to Index

Europe

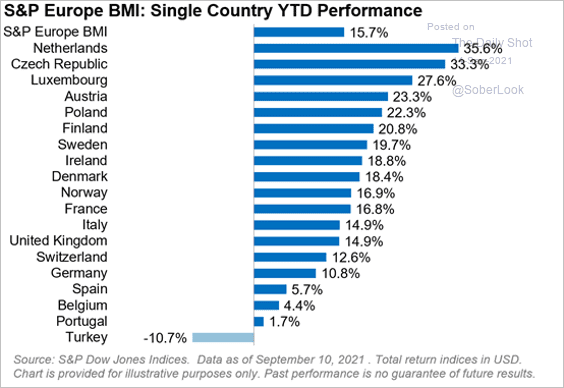

1. Here are the year-to-date stock market returns, by country.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

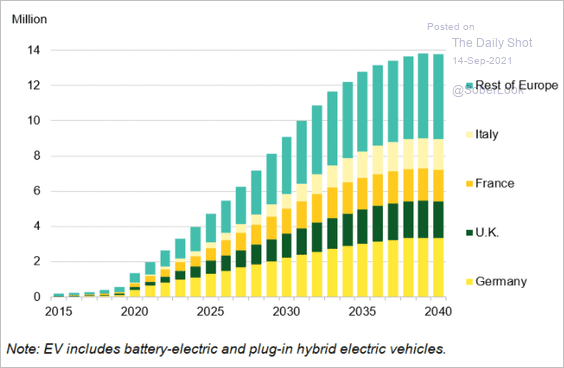

2. Europe is expected to lead in global EV adoption.

Source: @BloombergNEF Read full article

Source: @BloombergNEF Read full article

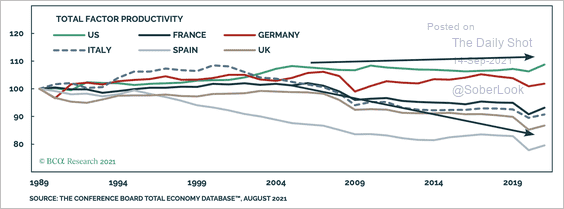

3. European total factor productivity has lagged the US for nearly two decades.

Source: BCA Research

Source: BCA Research

Back to Index

Asia – Pacific

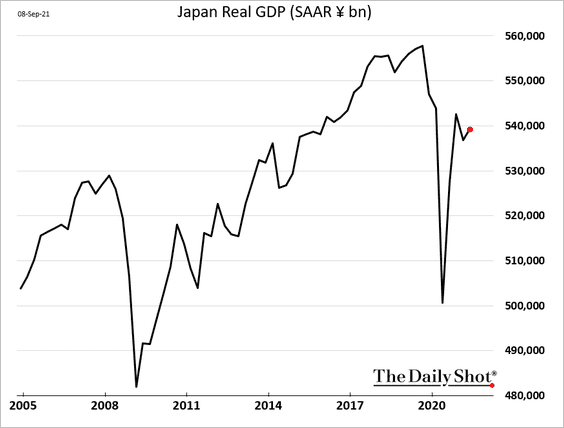

1. Japan’s GDP remains well below pre-COVID levels.

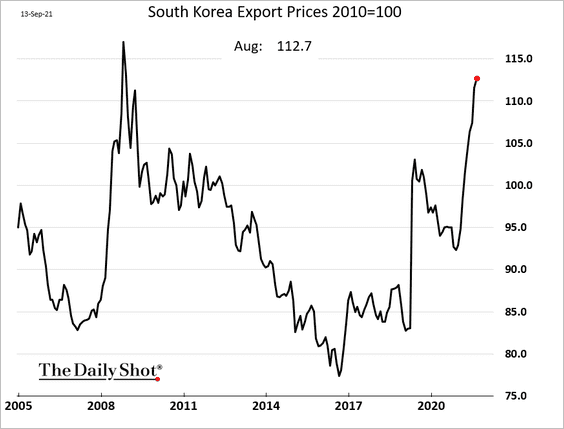

2. South Korea’s export prices continue to surge.

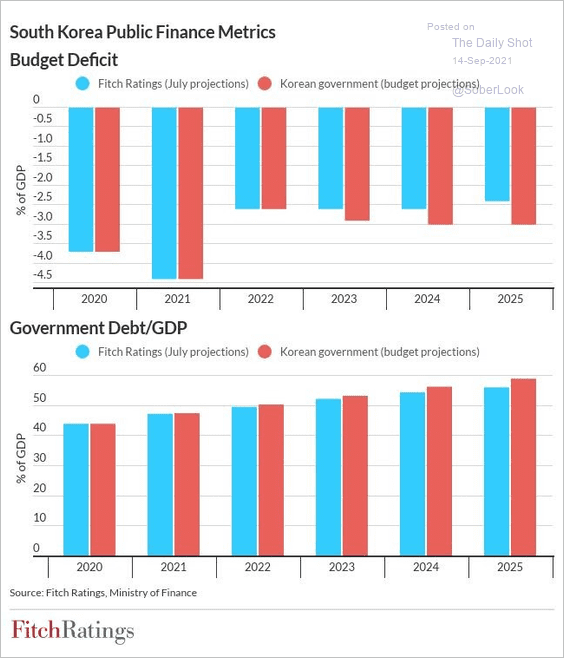

Separately, below is a forecast for South Korea’s budget deficit and debt (from Fitch Ratings).

Source: Fitch Ratings

Source: Fitch Ratings

——————–

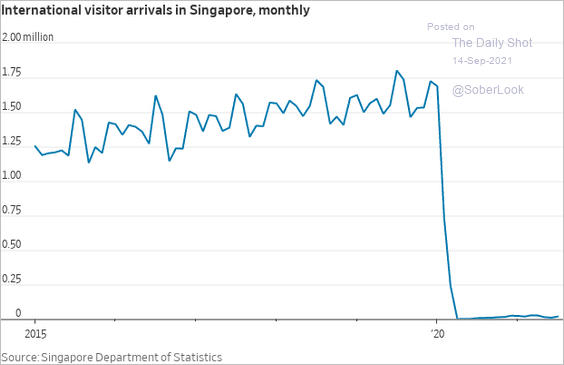

3. Here are Singapore’s visitor arrivals over time.

Source: @WSJ Read full article

Source: @WSJ Read full article

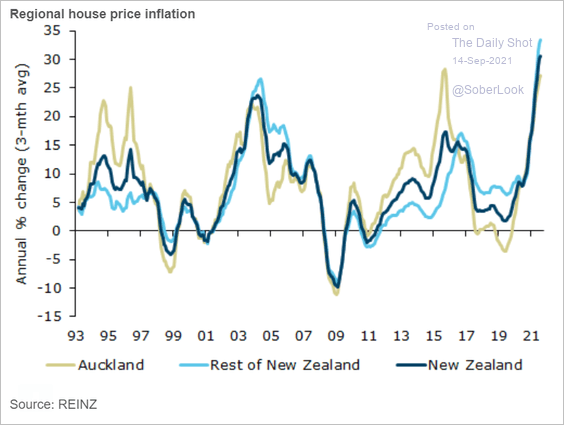

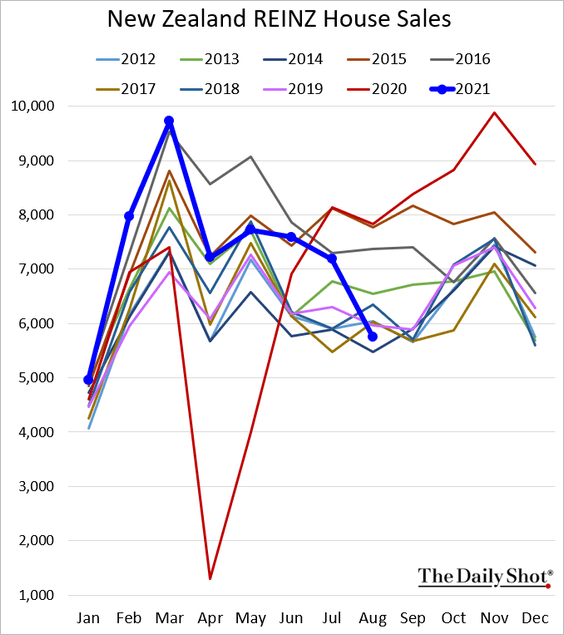

4. New Zealand’s home price appreciation has been hitting record highs.

Source: ANZ Research

Source: ANZ Research

But home sales slowed rapidly last month, amid COVID concerns.

——————–

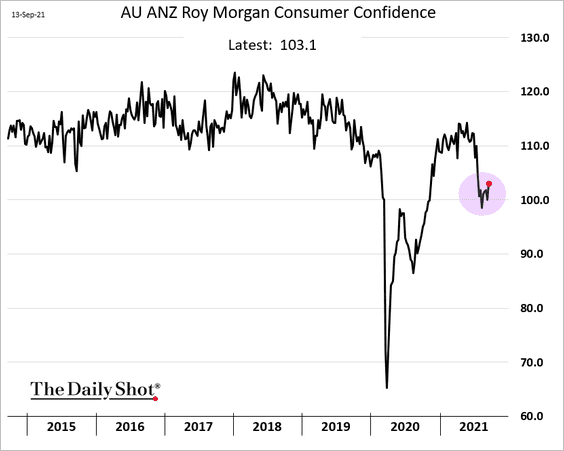

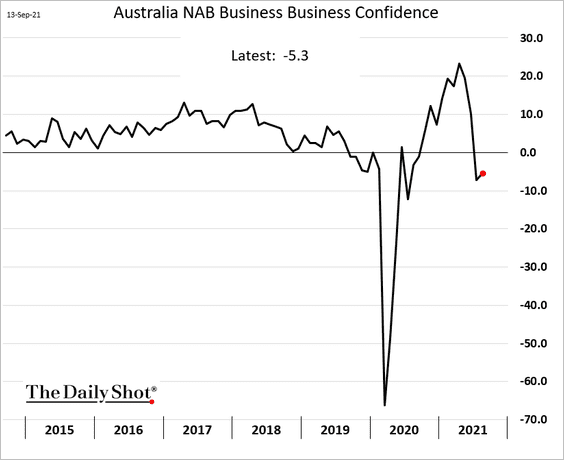

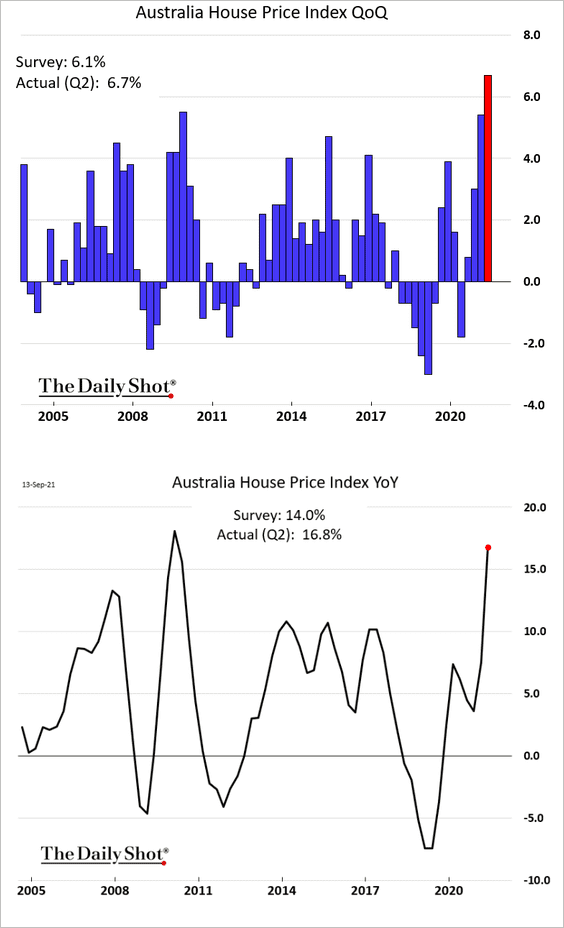

5. Next, we have some updates on Australia.

• Consumer and business confidence indicators have bottomed.

• The second-quarter increase in home prices was the highest on record.

Back to Index

China

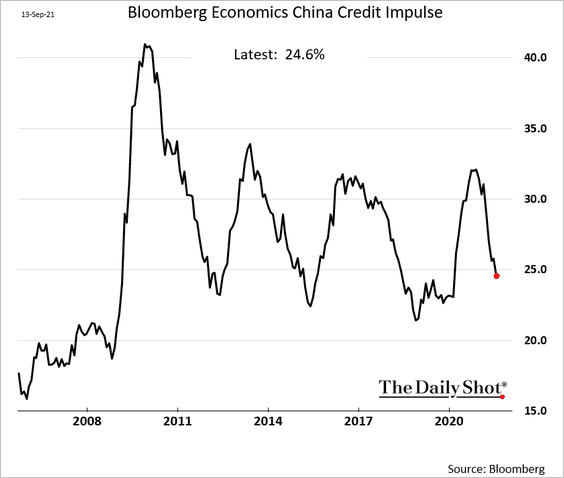

1. The nation’s credit impulse has been weakening.

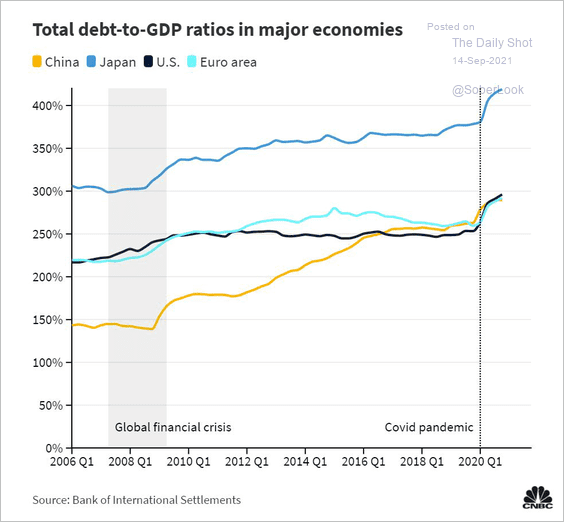

Nonetheless, the total debt-to-GDP ratio keeps climbing.

Source: @dlacalle_IA

Source: @dlacalle_IA

——————–

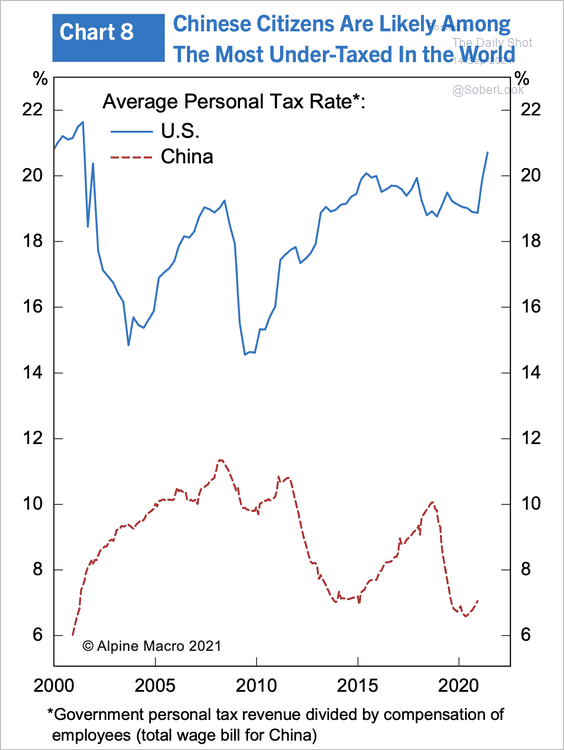

2. Chinese economy is under-taxed, with no property tax or capital gains tax and an effective personal tax rate of just 7%, far behind the US.

Source: Alpine Macro

Source: Alpine Macro

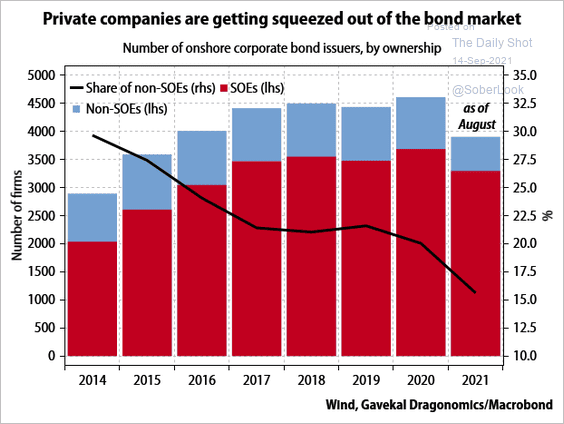

3. The bond market is increasingly dominated by state-owned companies.

Source: Gavekal Research

Source: Gavekal Research

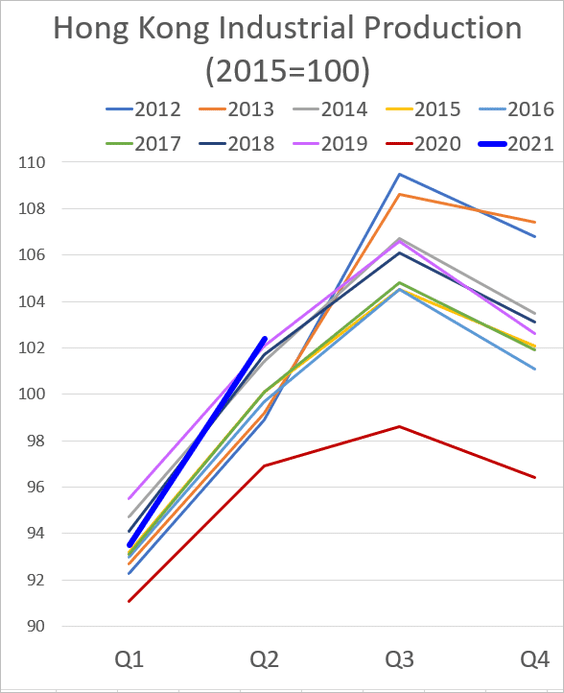

4. Hong Kong’s industrial production was above 2019 levels in Q2.

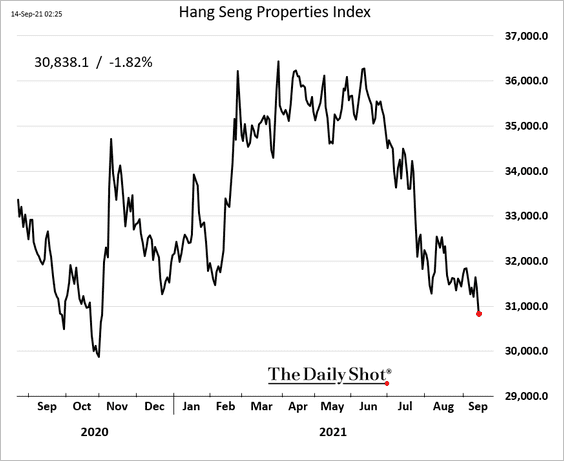

5. Shares of property developers are tumbling.

Back to Index

Emerging Markets

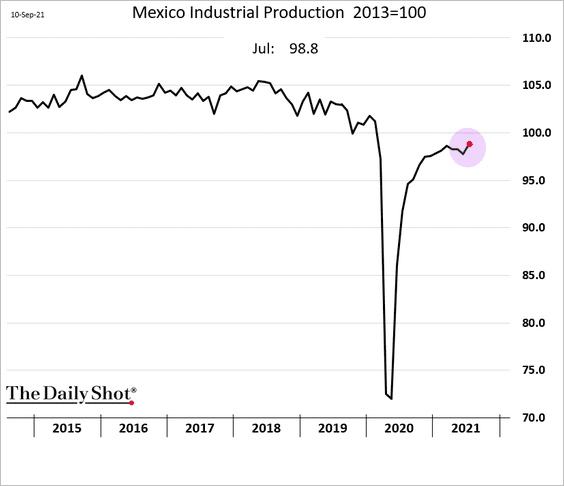

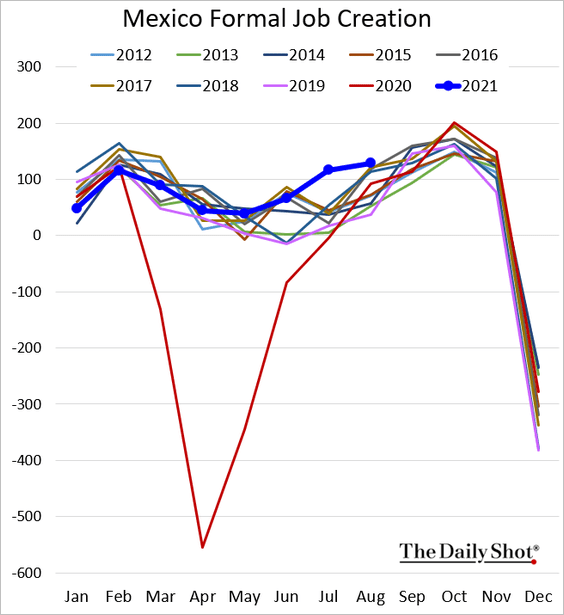

1. Mexico’s industrial production improved in July.

Job creation remains robust.

——————–

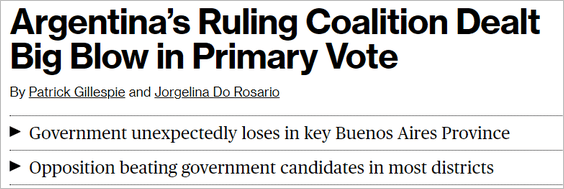

2. Argentina’s markets cheered the ruling coalition’s election loss.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

——————–

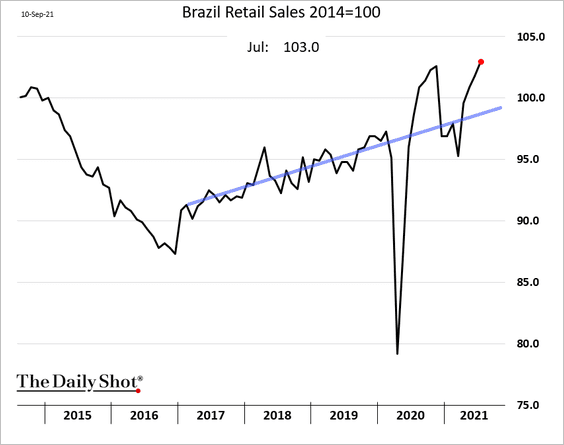

3. Brazil’s retail sales kept climbing in July.

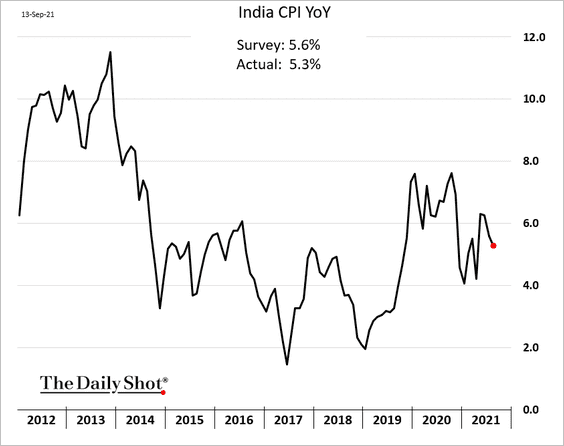

4. India’s CPI report was softer than expected.

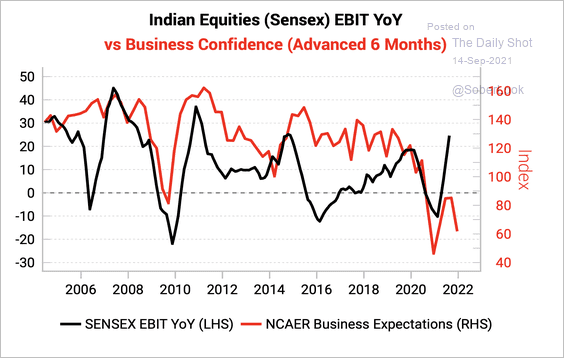

Separately, the drop in business confidence, hurt by rising raw material prices, does not bode well for corporate profits.

Source: Variant Perception

Source: Variant Perception

——————–

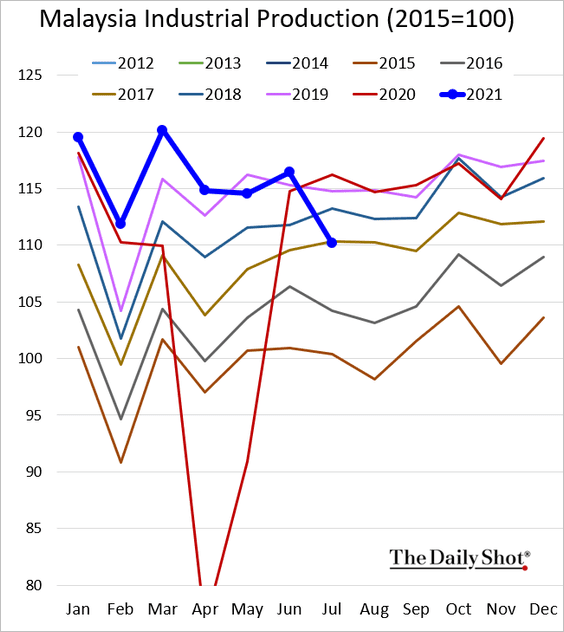

5. Malaysia’s industrial production declined sharply in July (pressured by the pandemic).

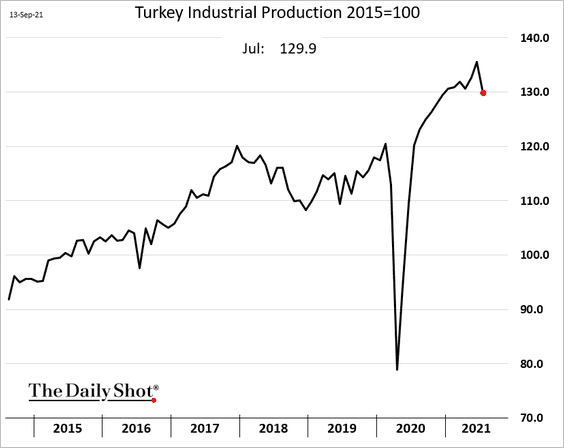

6. Turkey’s industrial production also declined.

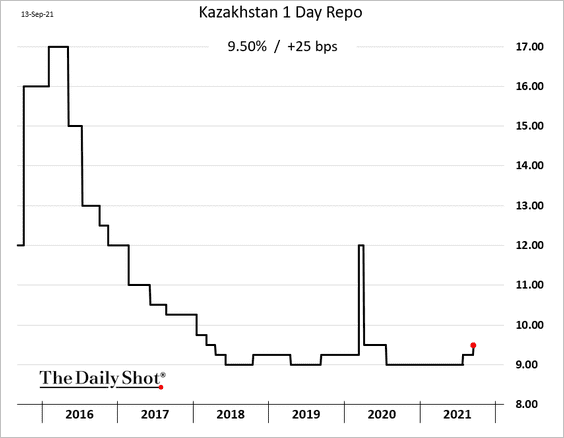

7. Kazakhstan’s central bank hiked rates again.

Back to Index

Cryptocurrency

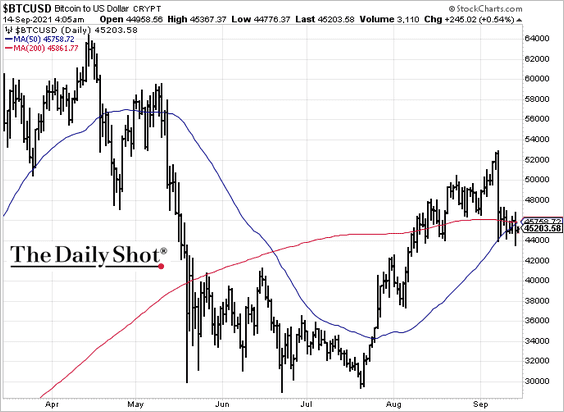

1. The Golden Cross formation is a bullish sign for bitcoin.

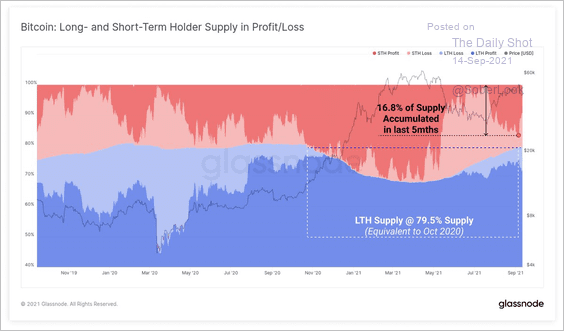

2. Blockchain data shows a large accumulation of bitcoin occurred between the $29K and $50K price levels.

Source: Glassnode Read full article

Source: Glassnode Read full article

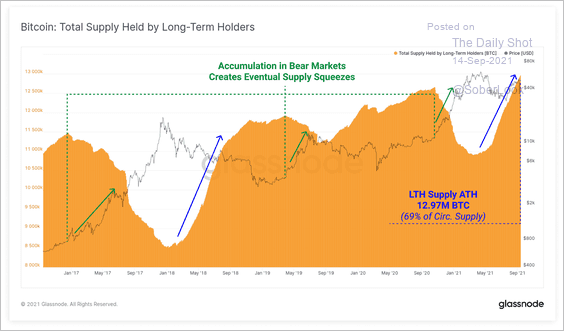

• A rise in long-term bitcoin holder supply typically occurs near the end of a bear market.

Source: Glassnode Read full article

Source: Glassnode Read full article

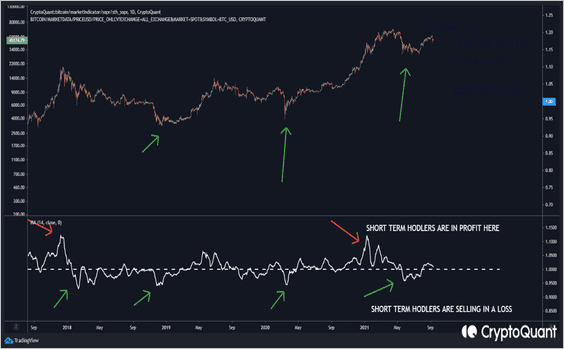

• Blockchain data also shows short-term holders selling at a loss (below their cost basis), which typically coincides with price recoveries.

Source: CryptoQuant Read full article

Source: CryptoQuant Read full article

——————–

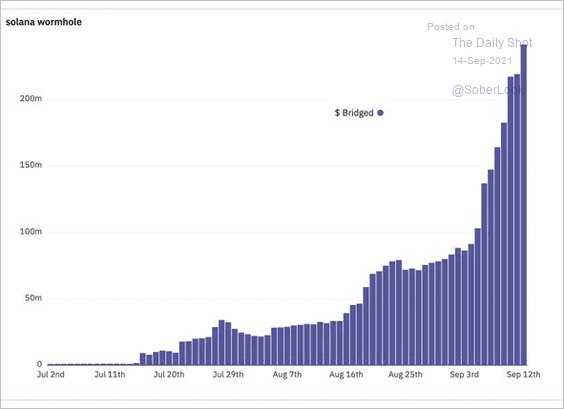

3. This chart shows the amount of ETH assets being transferred to Solana to facilitate DeFi activities.

Source: @chasedevens, @wormholecrypto

Source: @chasedevens, @wormholecrypto

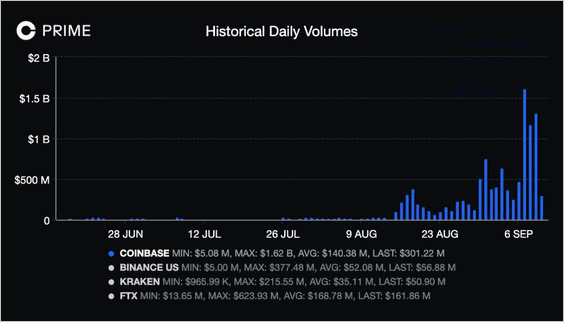

4. Solana’s (SOL) trading volume on Coinbase surged last month. SOL, the token for the open-source token used to facilitate decentralized applications, is up about 42% over the past month compared to a 9% decline in BTC.

Source: @CoinbaseInsto

Source: @CoinbaseInsto

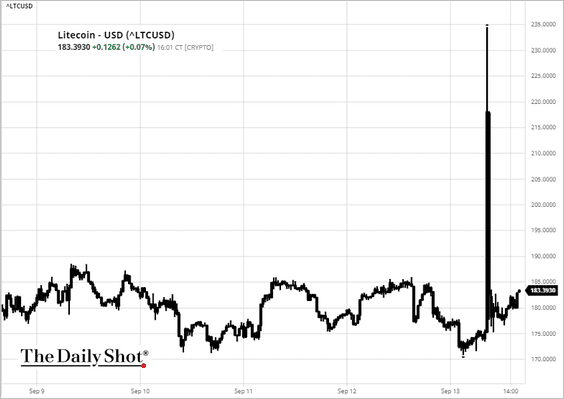

5. Crypto markets were whipsawed on fake news on Monday.

Source: Reuters Read full article

Source: Reuters Read full article

Source: barchart.com

Source: barchart.com

Back to Index

Energy

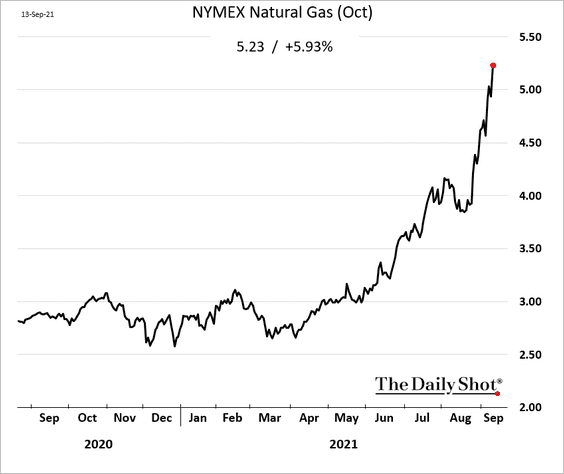

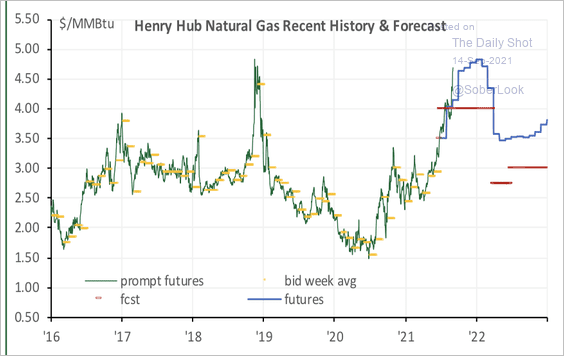

1. US natural gas futures continue to surge.

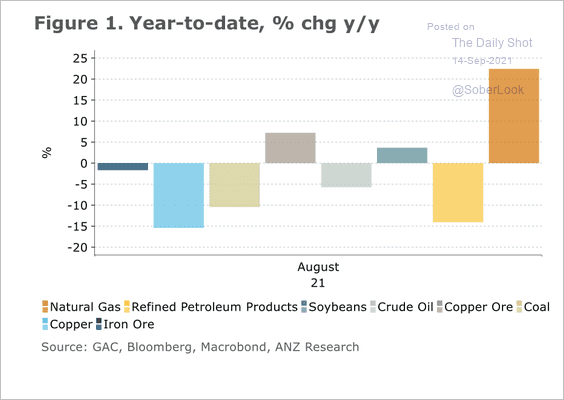

In terms of price change, natural gas has been a standout in the commodity space this year.

Source: ANZ Research

Source: ANZ Research

US natural gas prices could remain elevated into the winter.

Source: Cornerstone Macro

Source: Cornerstone Macro

——————–

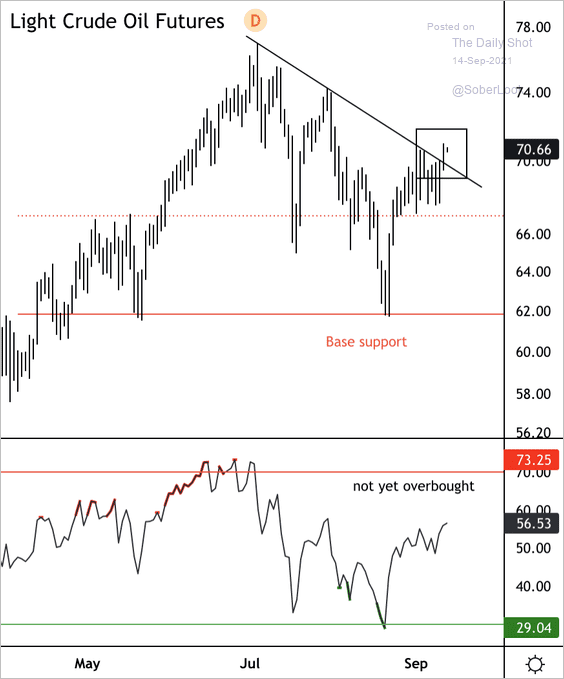

2. The front-month WTI crude oil contract has broken above a two-month downtrend.

Source: Dantes Outlook

Source: Dantes Outlook

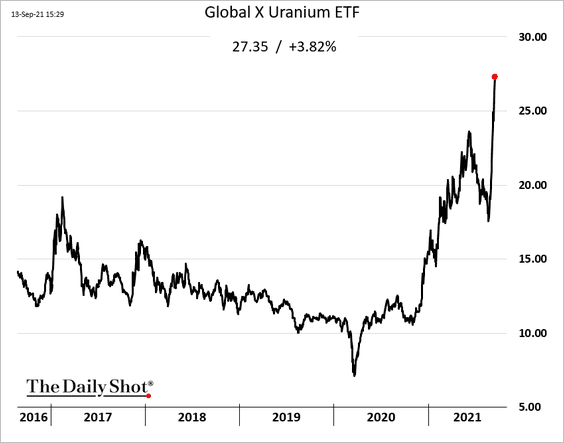

3. Shares of uranium miners are hitting multi-year highs.

Back to Index

Equities

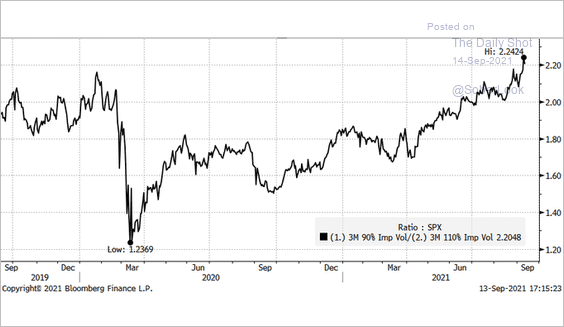

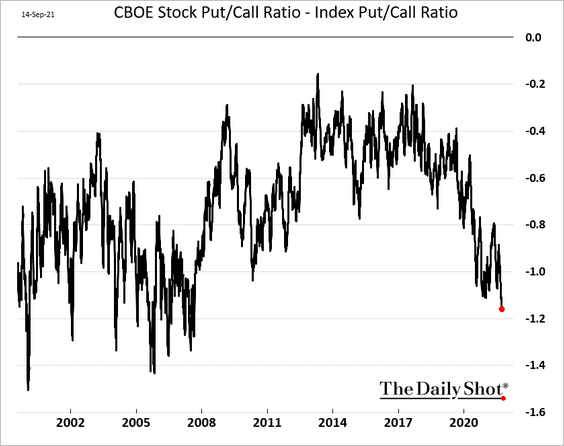

1. The Reddit vigilantes made shorting single stocks a dangerous endeavor. Traders are using index put options to offset/hedge their portfolio exposure. Here is the S&P 500 90/110 skew.

Source: @danny_kirsch

Source: @danny_kirsch

With traders staying away from single-stock put options and focusing on index products instead, the spread between stock and index put-call ratios hit a multi-year low.

h/t @TheOneDave

h/t @TheOneDave

——————–

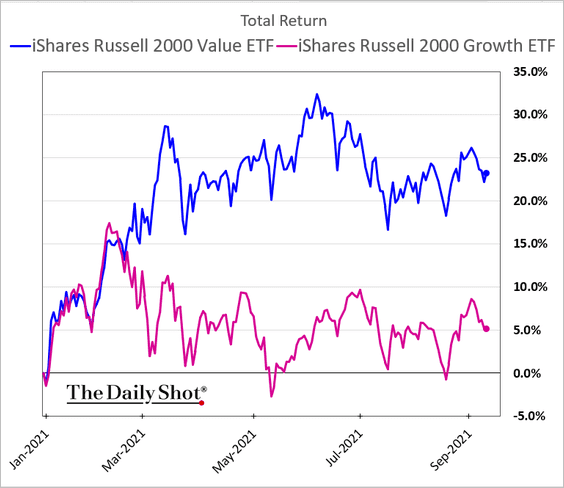

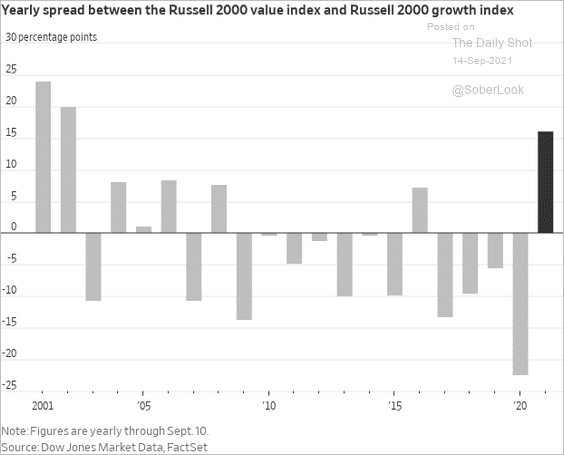

2. Small-cap value stocks have outperformed growth this year, driven by meme stocks (2 charts).

Source: @WSJ Read full article

Source: @WSJ Read full article

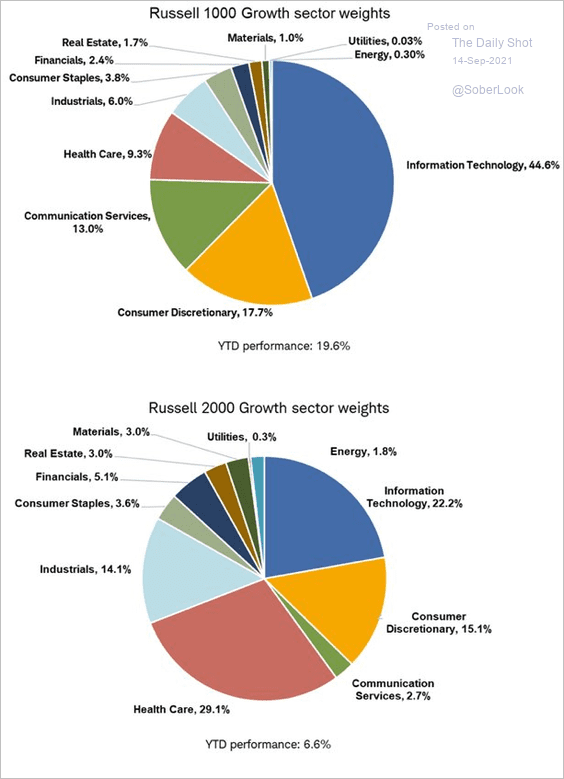

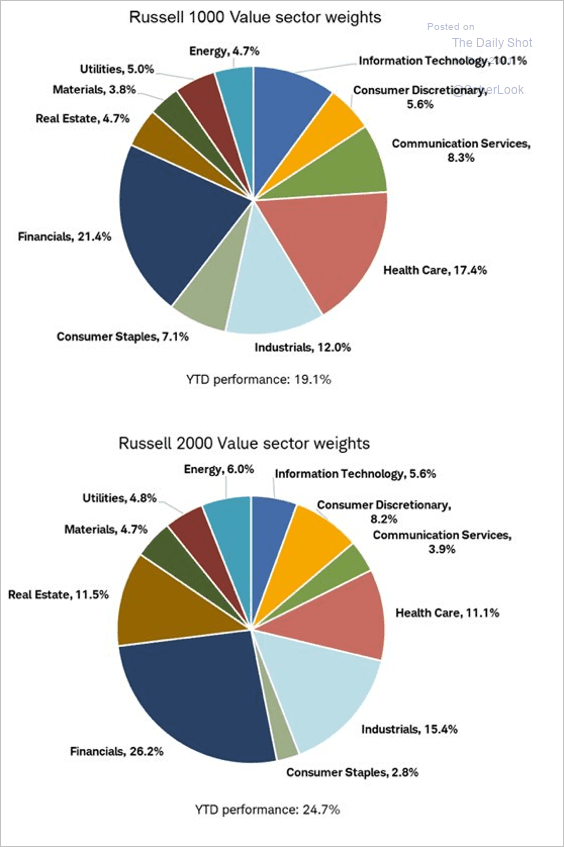

Separately, here is the sector breakdown for large-cap (Russell 1000) and small-cap (Russell 2000) indices.

• Growth:

Source: @LizAnnSonders

Source: @LizAnnSonders

• Value:

Source: @LizAnnSonders

Source: @LizAnnSonders

——————–

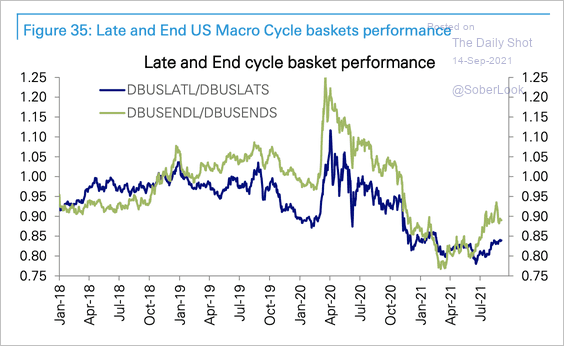

3. Late-cycle stocks, which tend to be defensive, gained over the past few months.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

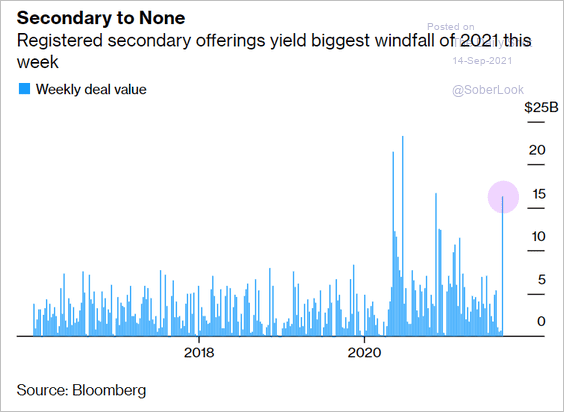

4. It’s been a good few days for secondary share offerings.

Source: @markets Read full article

Source: @markets Read full article

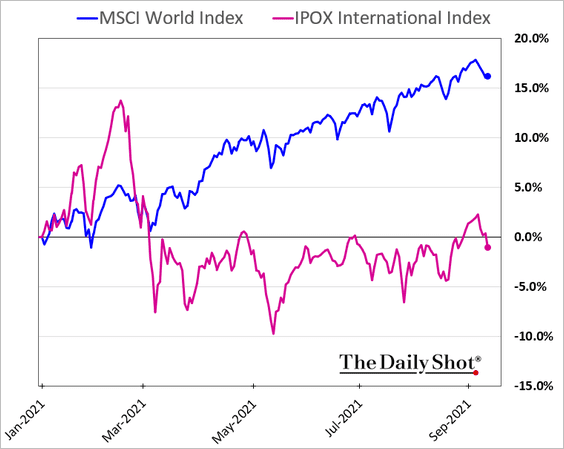

5. 2021 hasn’t been a good year for IPO performance globally.

h/t @Schuldensuehner

h/t @Schuldensuehner

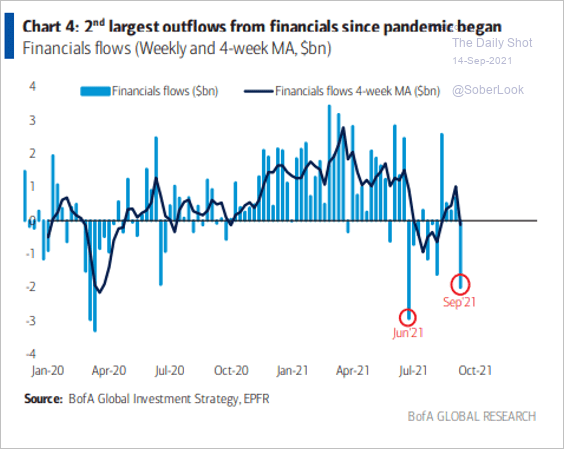

6. Financials saw some outflows recently.

Source: BofA Global Research

Source: BofA Global Research

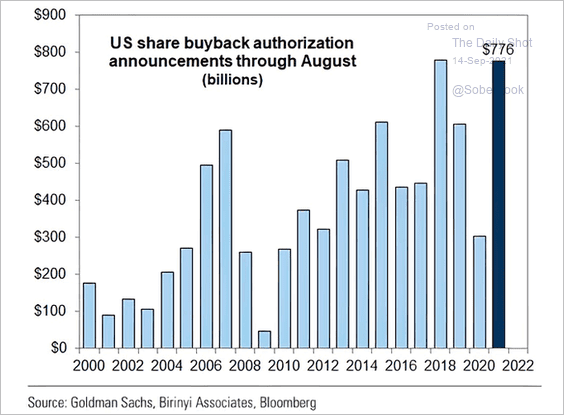

7. Share buyback activity remains robust.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

Back to Index

Rates

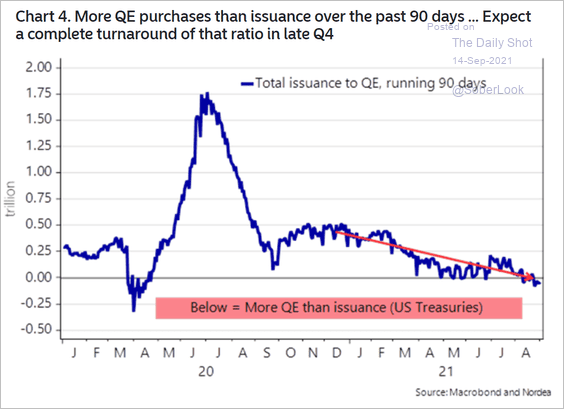

There have been more QE purchases than Treasury issuance. The situation will reverse once the debt ceiling is lifted.

Source: Nordea Markets

Source: Nordea Markets

——————–

Food for Thought

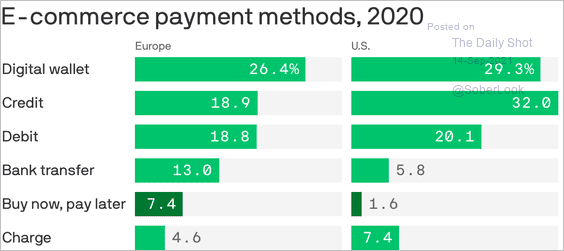

1. E-commerce payment methods in the US and Europe.

Source: @axios Read full article

Source: @axios Read full article

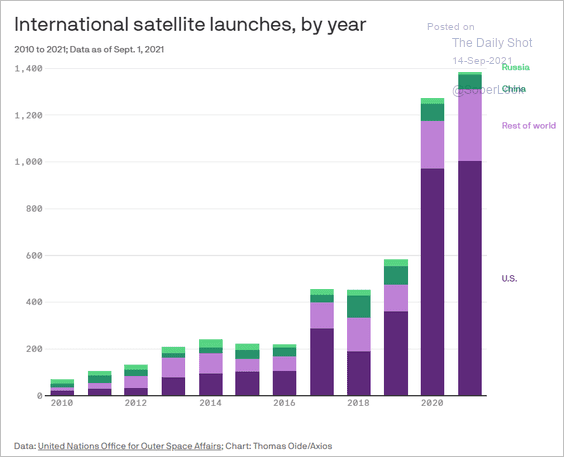

2. Satellite launches by year:

Source: @axios Read full article

Source: @axios Read full article

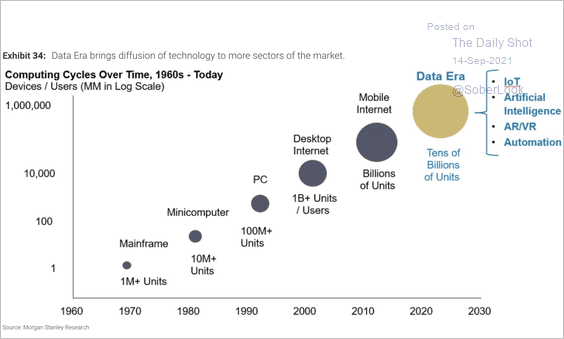

3. The data era:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

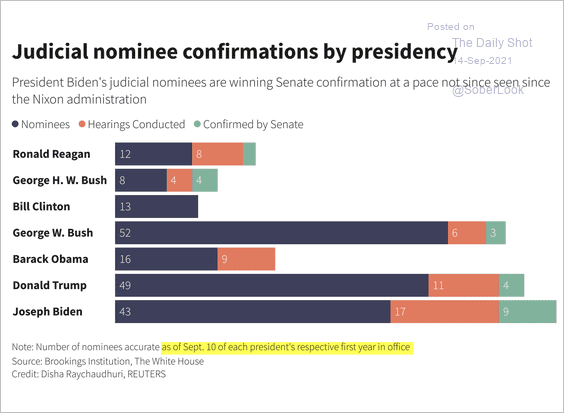

4. US judicial nominations:

Source: Reuters Read full article

Source: Reuters Read full article

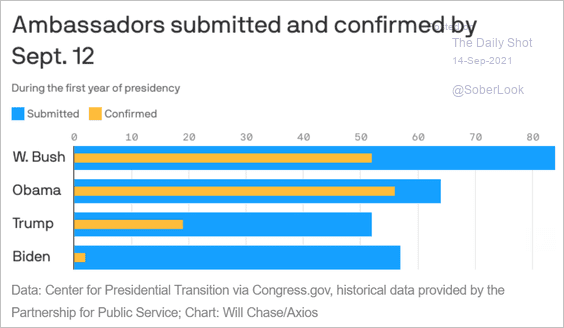

• US ambassadorial nominations:

Source: @axios Read full article

Source: @axios Read full article

——————–

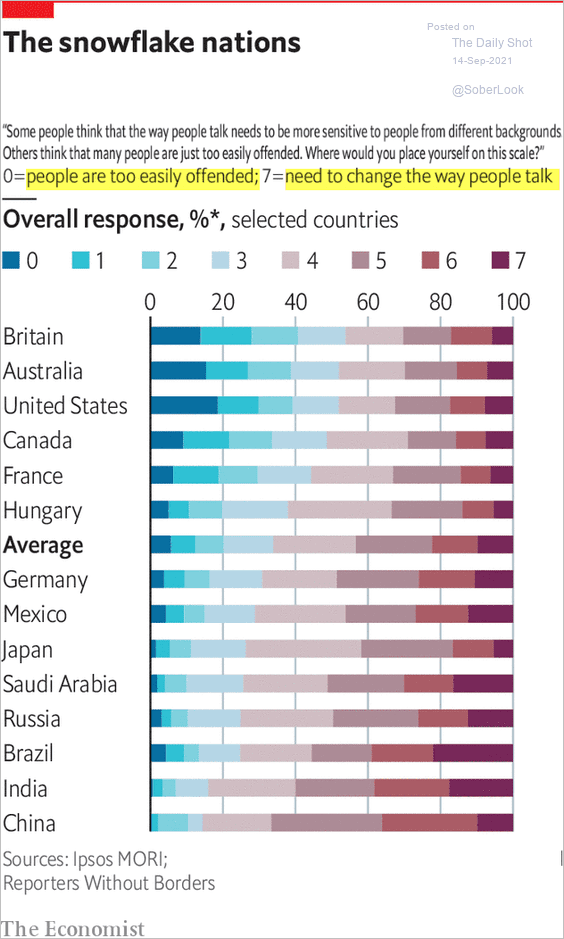

5. Are people too easily offended?

Source: The Economist Read full article

Source: The Economist Read full article

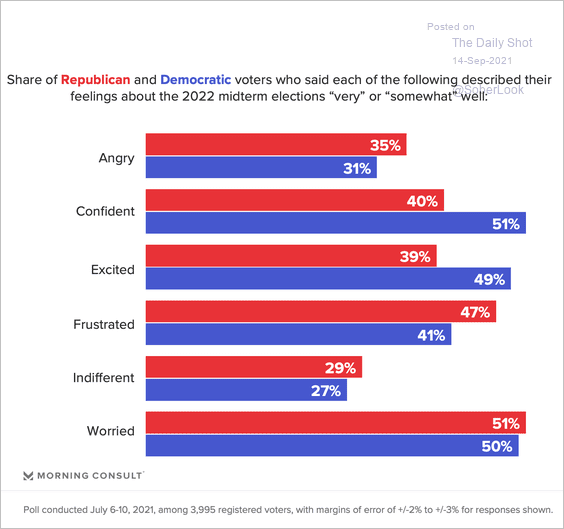

6. Feelings about the US 2022 midterm elections:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

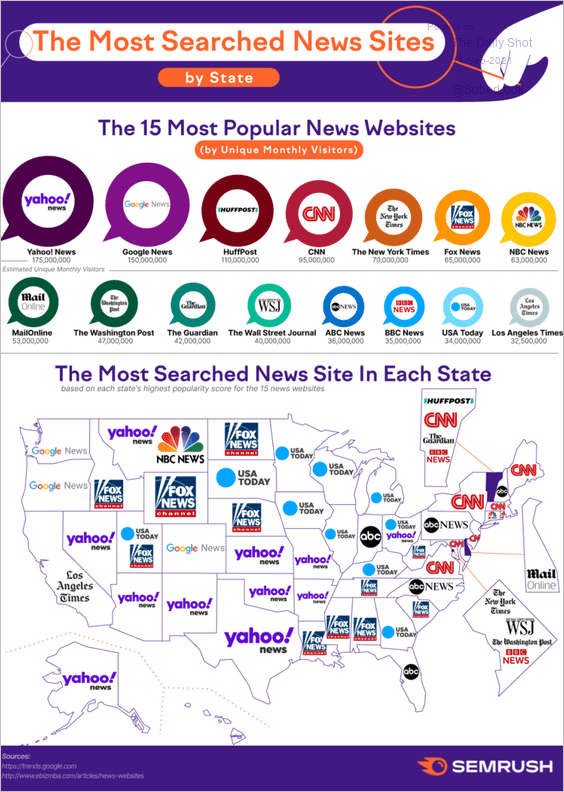

7. The most searched and visited news websites:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

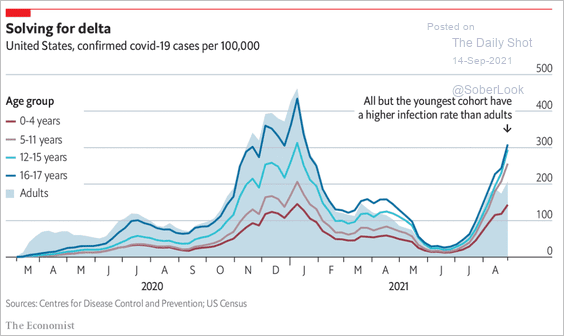

8. COVID cases among US children:

Source: The Economist Read full article

Source: The Economist Read full article

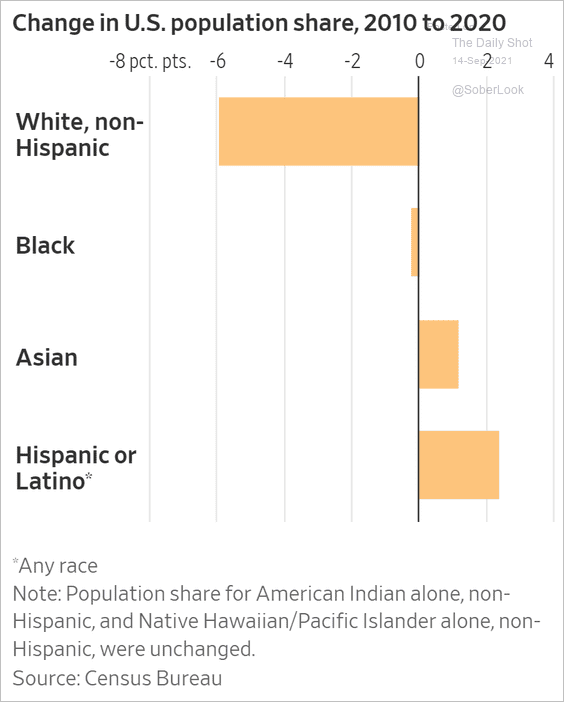

9. Change in US population share:

Source: @WSJ Read full article

Source: @WSJ Read full article

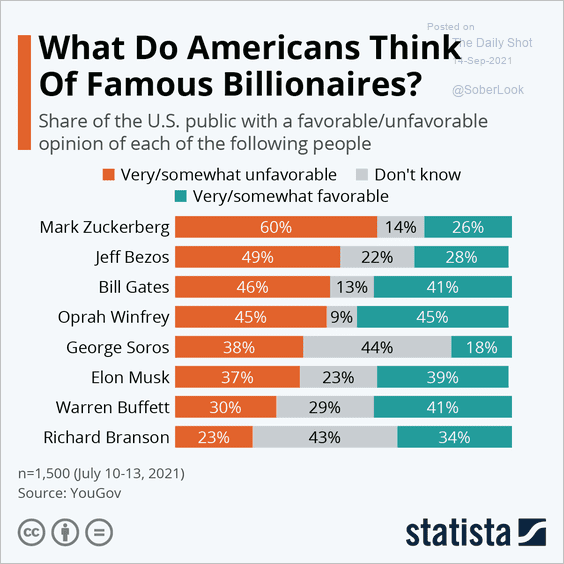

10. Americans’ views on famous billionaires:

Source: Statista

Source: Statista

——————–

Back to Index