The Daily Shot: 16-Sep-21

• China

• Asia – Pacific

• The Eurozone

• Europe

• The United Kingdom

• Canada

• The United States

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

China

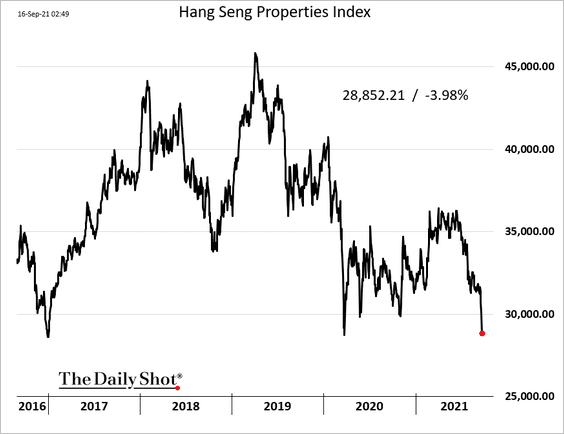

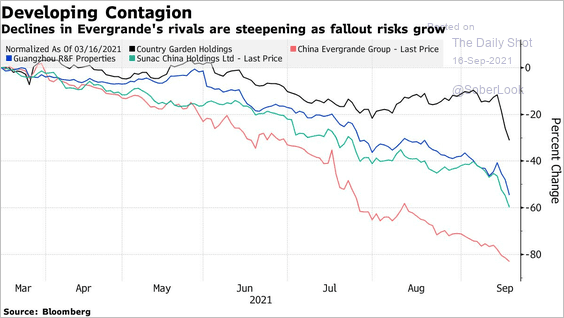

1. Investors in shares of property developers are in capitulation mode.

Source: @tracyalloway, @SofiaHC1 Read full article

Source: @tracyalloway, @SofiaHC1 Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

• Investors have been concerned that the sector’s credit risks will spread beyond Evergrande.

Source: Reuters Read full article

Source: Reuters Read full article

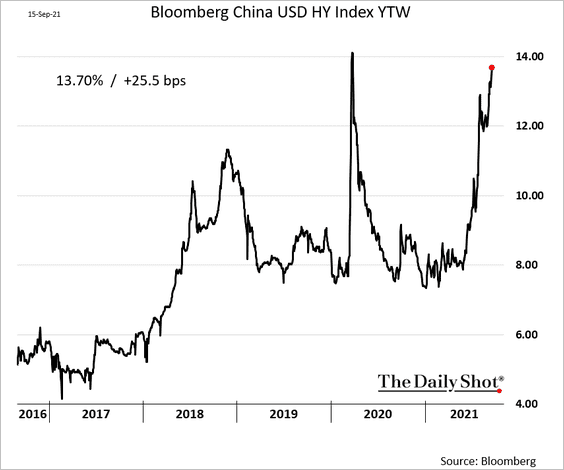

• Bloomberg’s index tracking lower-rated USD-denominated debt shows yields surging.

——————–

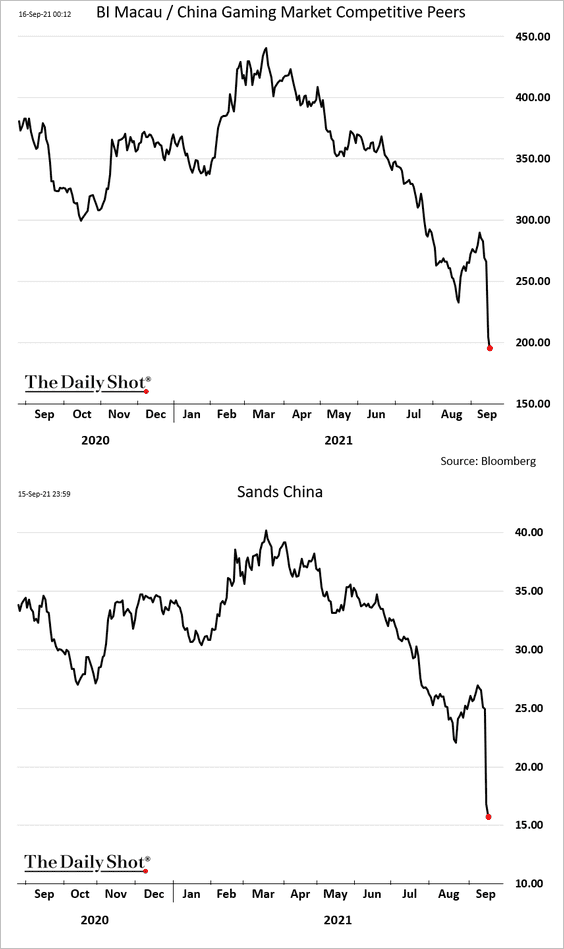

2. The authorities are initiating a regulatory overhaul of the gaming industry in Macau.

Source: Reuters Read full article

Source: Reuters Read full article

Casino stocks plummetted.

——————–

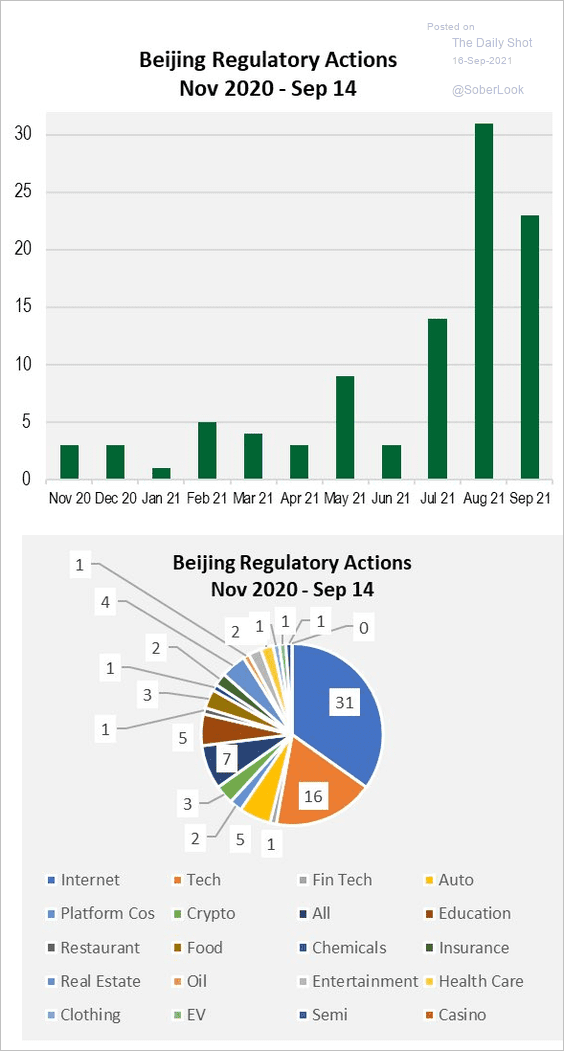

3. The number of regulatory actions coming out of Beijing has been climbing. China’s capital markets will be scarred by these actions for years to come, with substantial valuation discounts becoming a permanent feature.

Source: @MichaelKantro, @NancyRLazar1

Source: @MichaelKantro, @NancyRLazar1

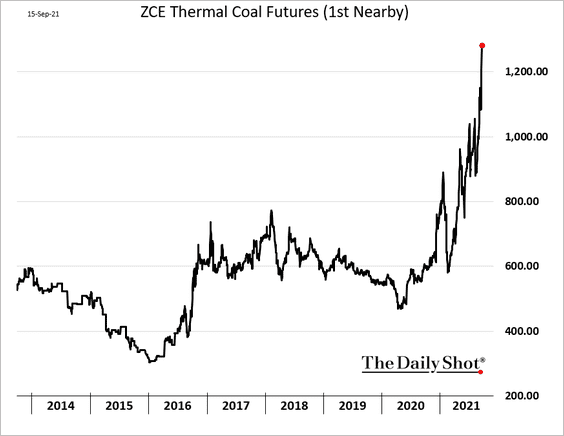

4. Thermal coal futures continue to surge amid shortages and soaring LNG prices.

5. China’s benchmark equity index is at support.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

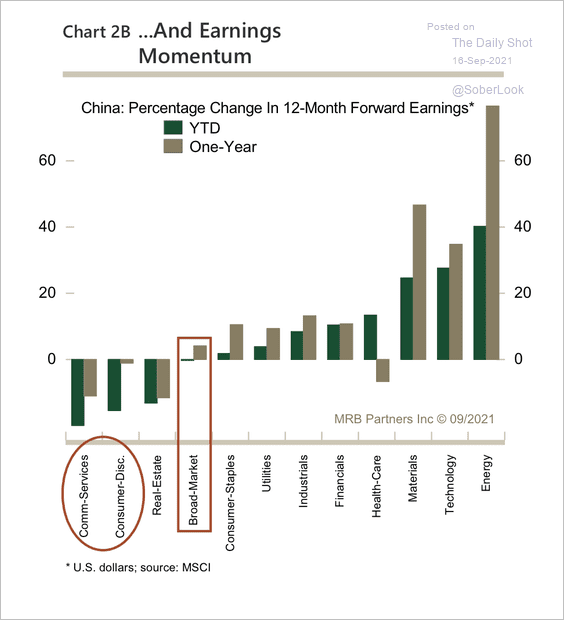

Consumer and real estate stocks have contributed to lower earnings momentum this year.

Source: MRB Partners

Source: MRB Partners

——————–

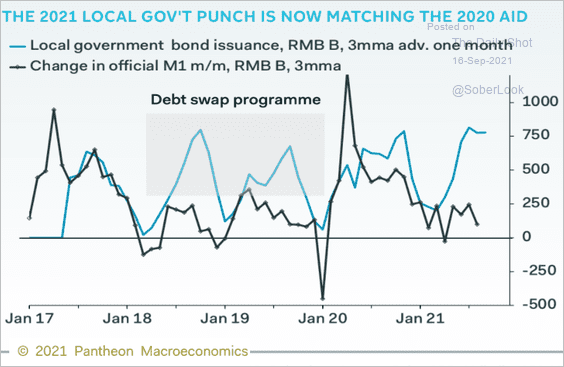

6. Local government bond issuance strengthened in recent months.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

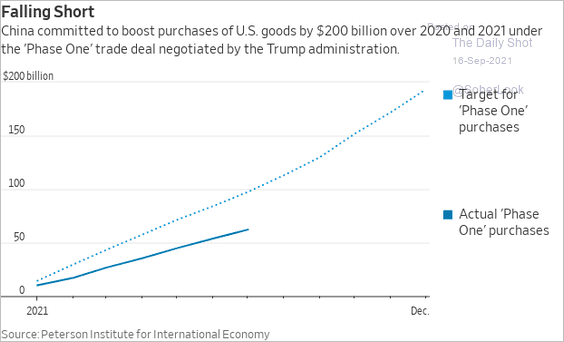

7. The “phase-1” trade deal with the US is in bad shape.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Asia – Pacific

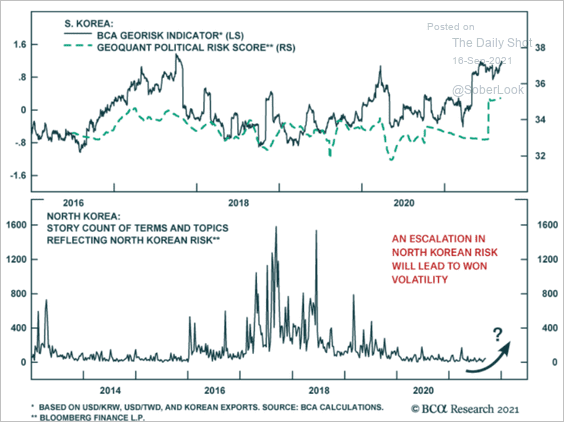

1. North Korea’s renewed missile testing will boost the won’s volatility.

Source: BCA Research

Source: BCA Research

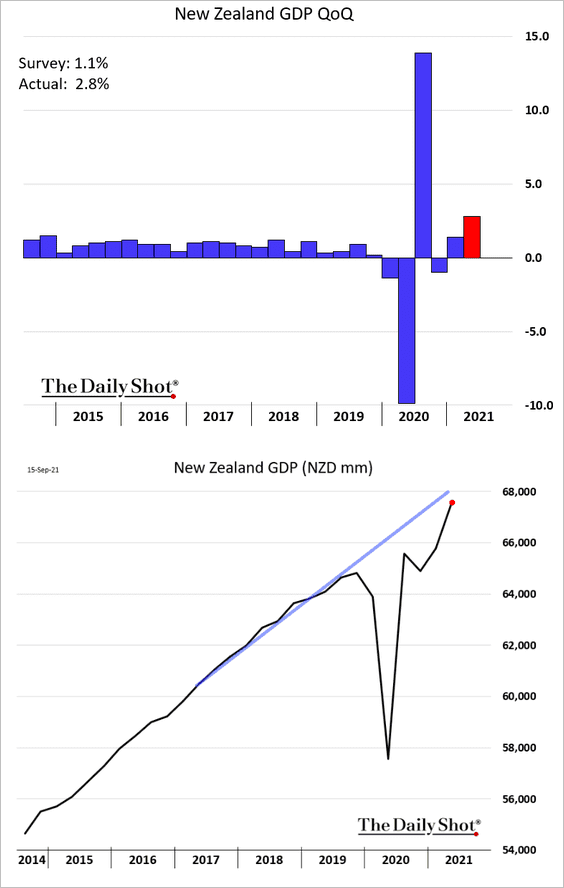

2. New Zealand’s second-quarter growth surprised to the upside. The GDP was nearing its pre-pandemic trend before the latest infection scare.

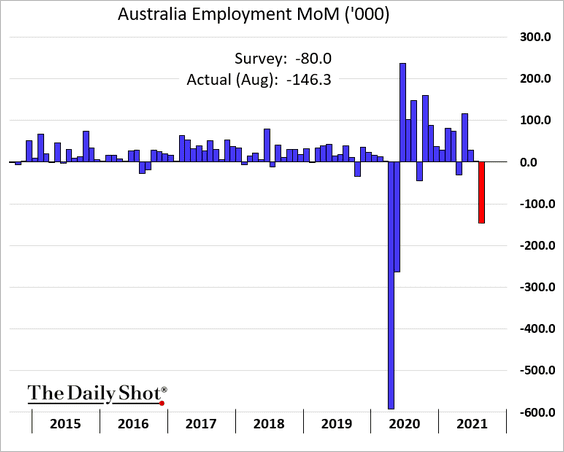

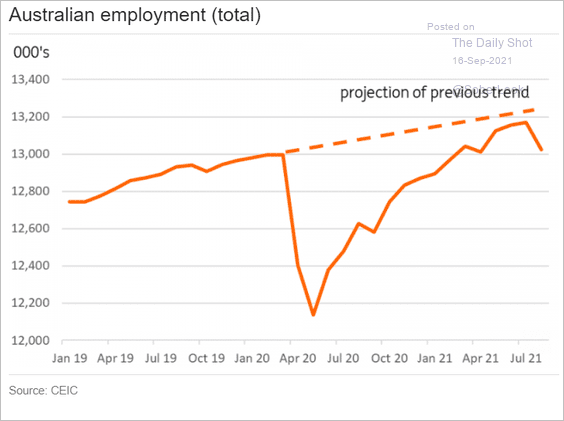

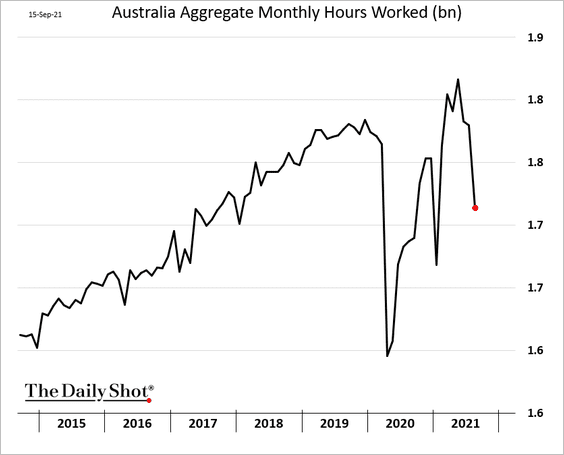

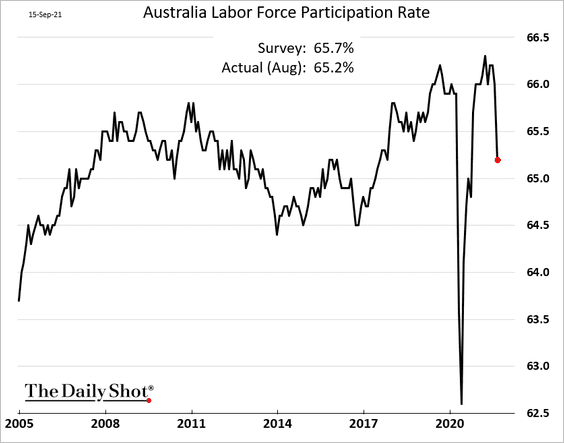

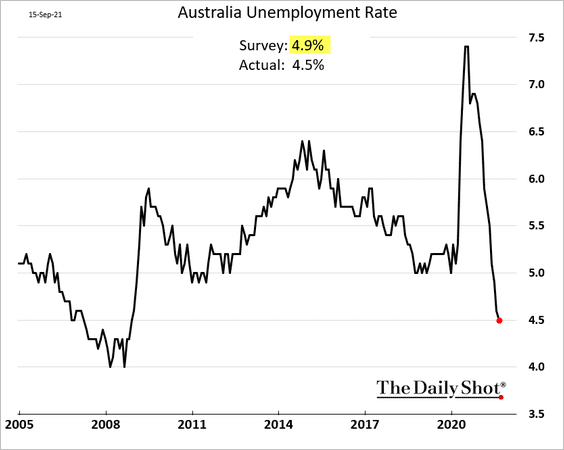

3. Australia’s labor market was hit by the lockdowns.

Source: ING

Source: ING

• Hours worked declined.

• The labor force participation rate dropped sharply.

• With fewer Australians looking for work, the unemployment rate declined more than expected.

Back to Index

The Eurozone

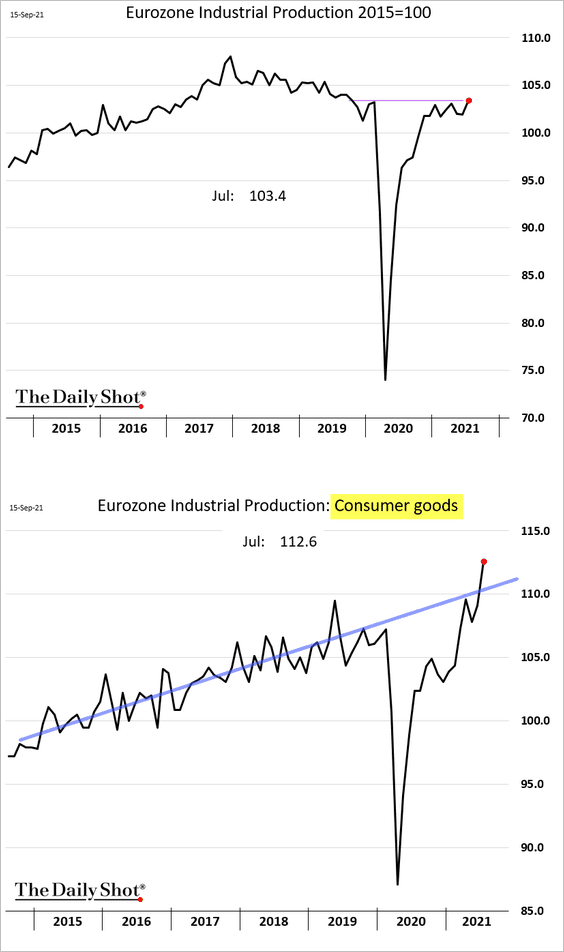

1. Industrial production climbed above pre-COVID levels in July.

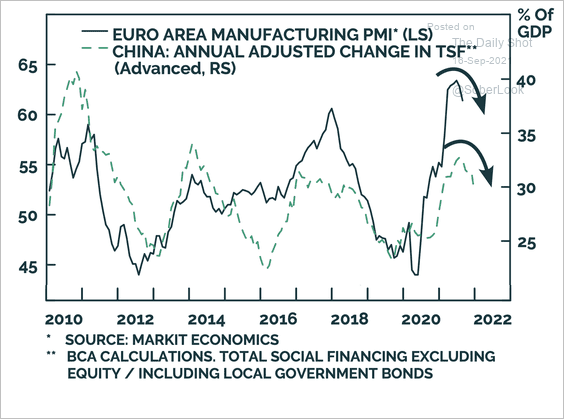

2. European manufacturing is strongly linked to China. The Chinese credit impulse leads by about nine months, signaling a slowdown ahead.

Source: BCA Research

Source: BCA Research

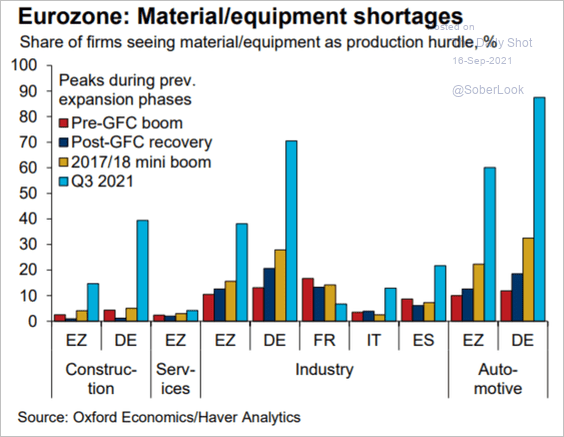

3. Material/equipment shortages are most acute in Germany.

Source: Oxford Economics

Source: Oxford Economics

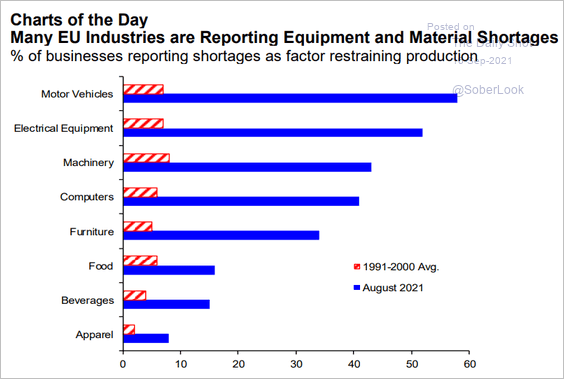

Here is the breakdown by sector (for the EU).

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

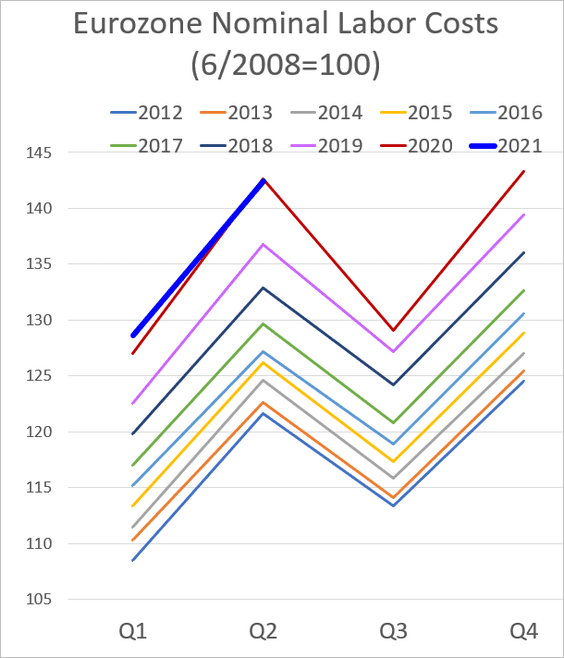

4. Labor costs continue to trend higher, but the year-over-year figures were distorted by last year’s “noisy” data.

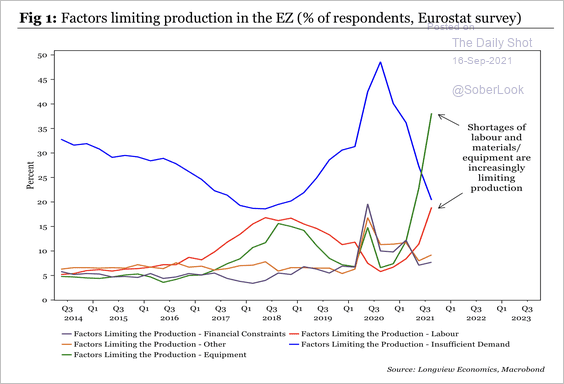

5. Eurozone labor and supply strains continue to affect many industries.

Source: Longview Economics

Source: Longview Economics

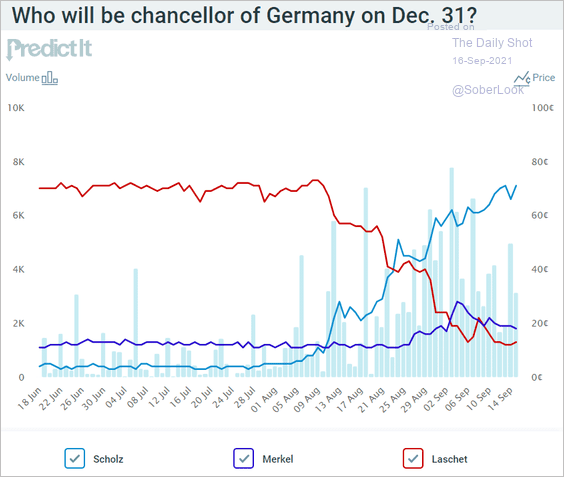

6. Here are the latest betting market odds for Germany’s upcoming election.

Source: @PredictIt

Source: @PredictIt

Back to Index

Europe

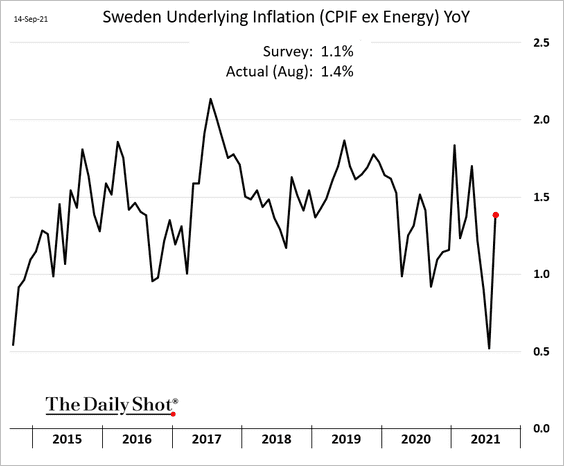

1. Sweden’s CPI rebounded last month.

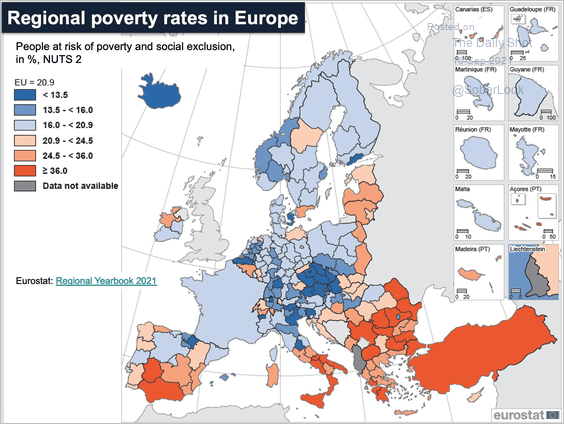

2. Here is a look at poverty rates in Europe.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

The United Kingdom

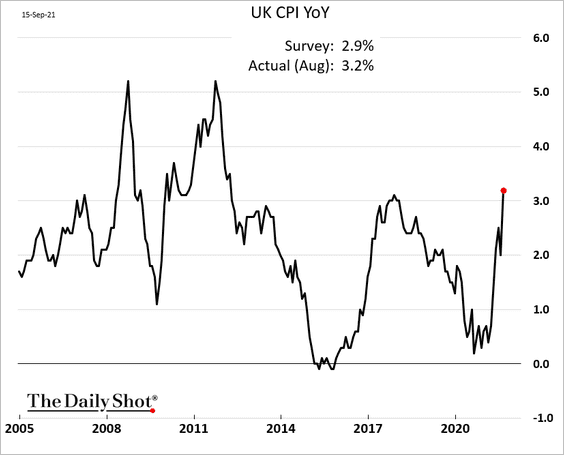

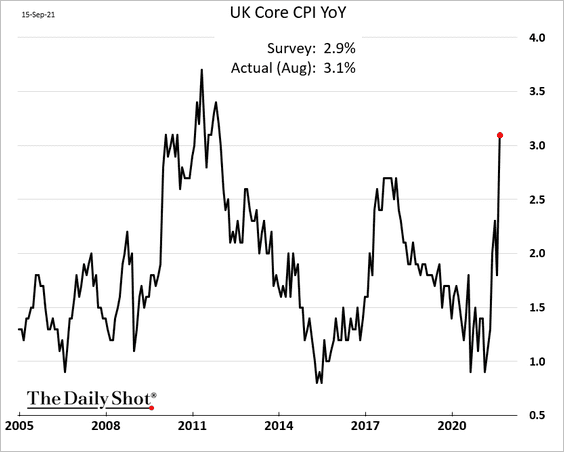

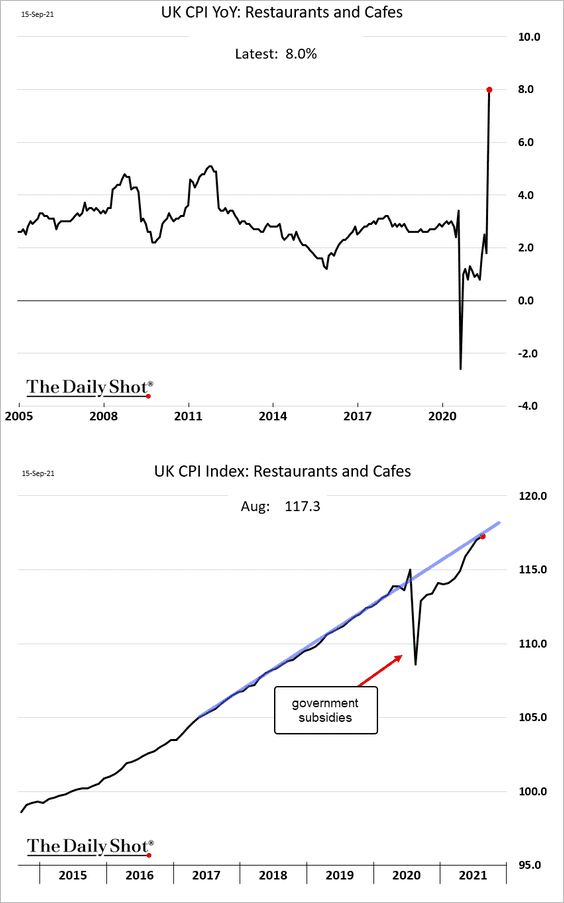

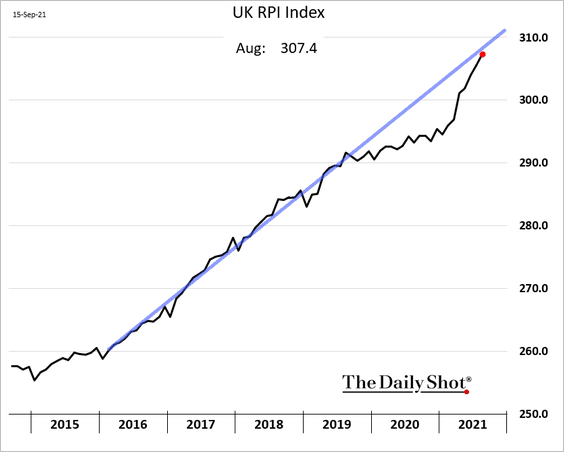

1. The CPI report surprised to the upside.

The biggest year-over-year gains were due to base effects in the restaurant sector (reversal of the government subsidies effect).

The retail price index is just returning to the pre-COVID trend.

——————–

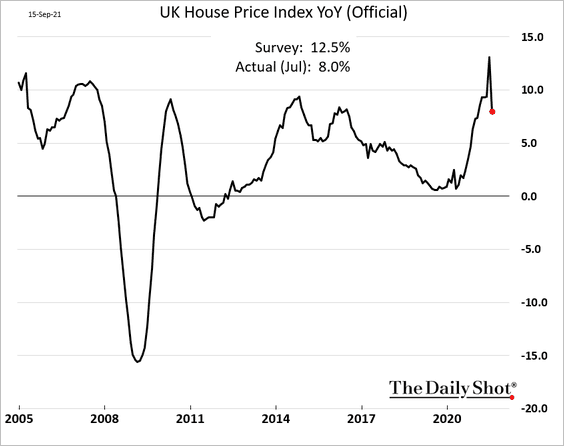

2. Home price appreciation retreated in July after the stamp duty holiday on high-end properties ended.

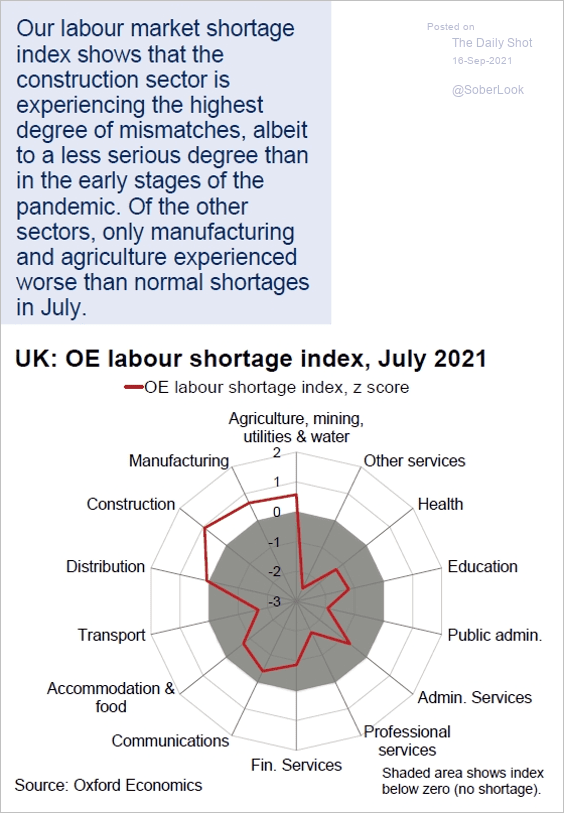

3. Here is a summary of labor shortages in the UK.

Source: @OxfordEconomics Read full article

Source: @OxfordEconomics Read full article

Back to Index

Canada

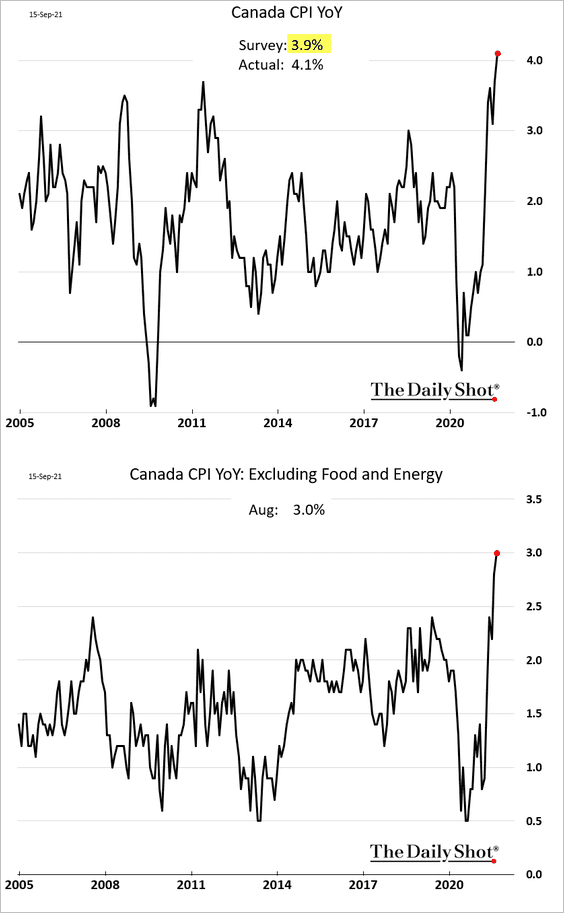

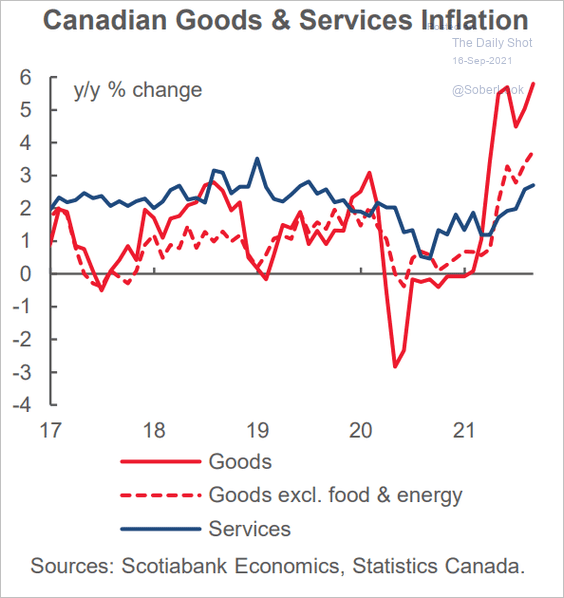

1. Inflation continues to surge.

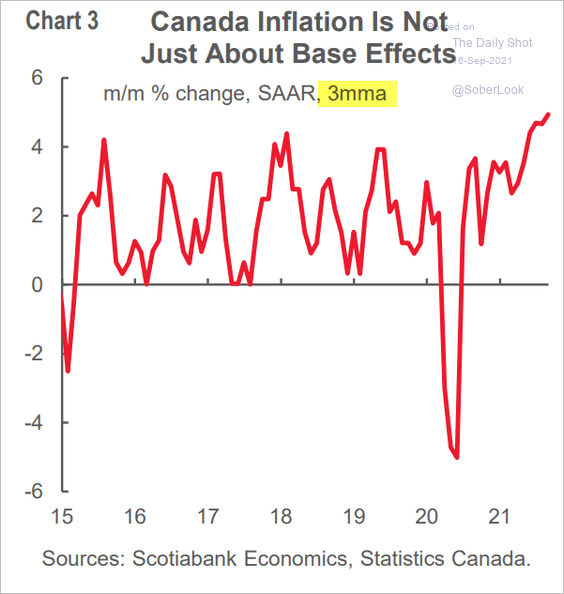

And it’s not just due to base effects. This chart shows the monthly changes (3-month average).

Source: Scotiabank Economics

Source: Scotiabank Economics

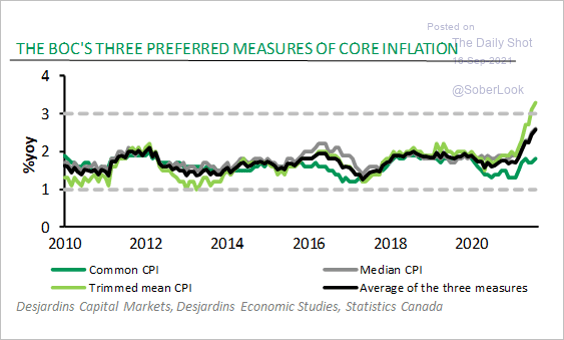

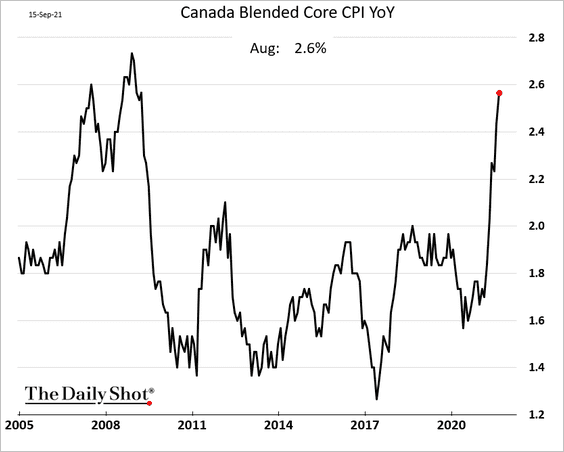

• Core inflation has been accelerating as well.

Source: Desjardins

Source: Desjardins

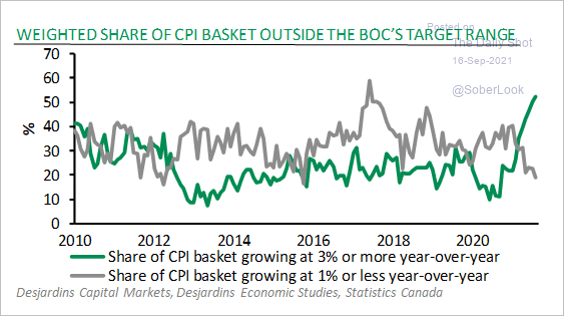

• Inflation breadth is on the rise.

Source: Desjardins

Source: Desjardins

• This chart shows goods vs. services CPI.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

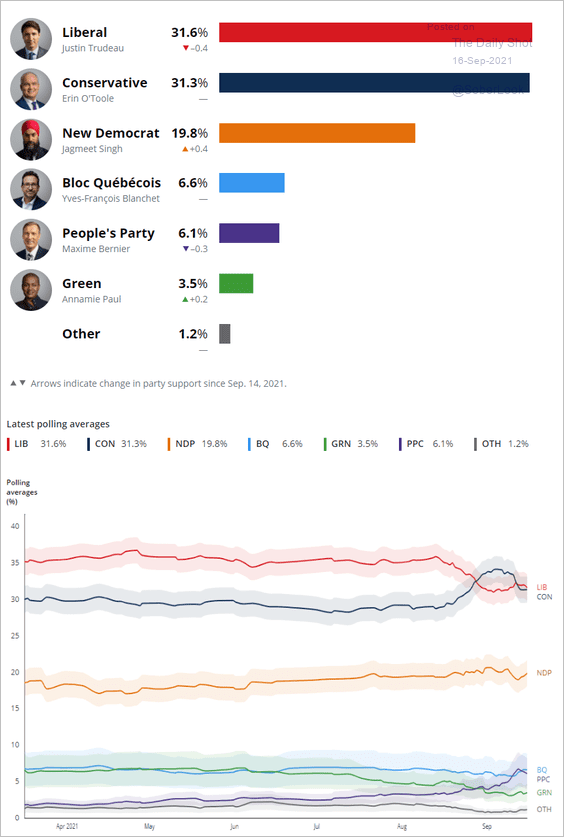

2. Will the CPI report impact the elections?

Source: Reuters Read full article

Source: Reuters Read full article

• The latest polls:

Source: CBC/Radio-Canada

Source: CBC/Radio-Canada

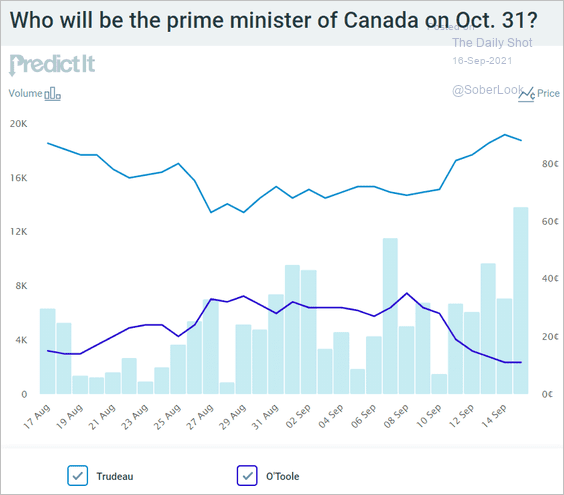

• The betting markets:

Source: @PredictIt

Source: @PredictIt

——————–

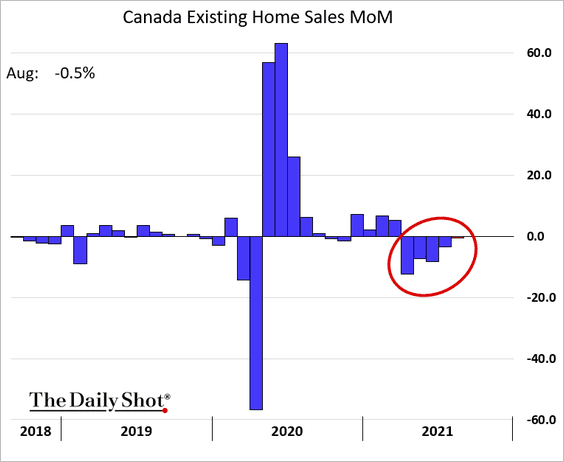

3. We’ve had five months of consecutive declines in existing home sales, as massive price gains take their toll.

Back to Index

The United States

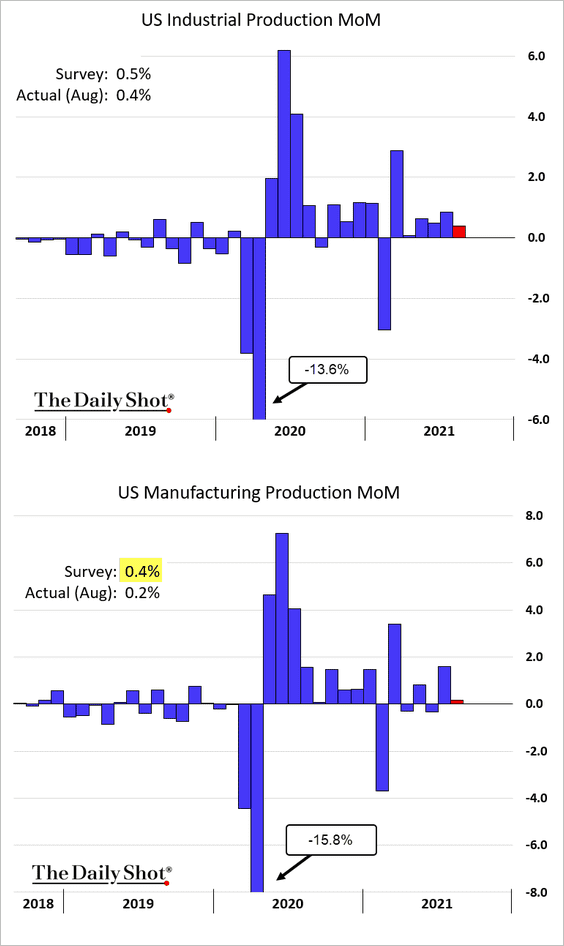

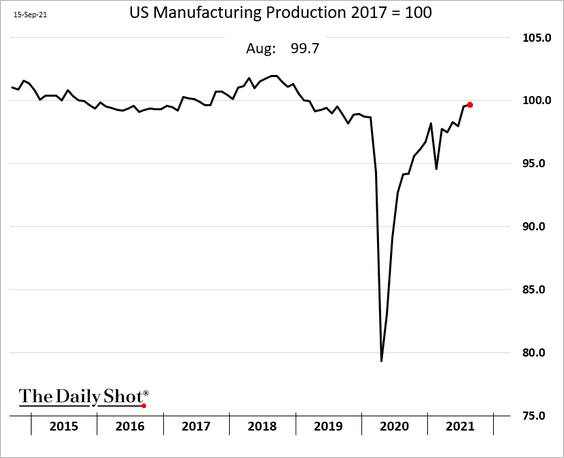

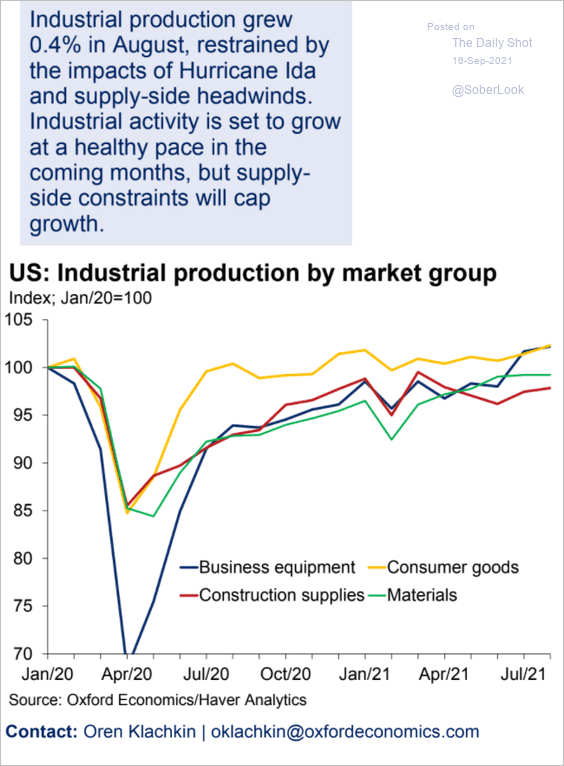

1. Industrial production was weaker than expected last month, partially due to Hurricane Ida.

Manufacturing output remains above pre-COVID levels.

Source: Oxford Economics

Source: Oxford Economics

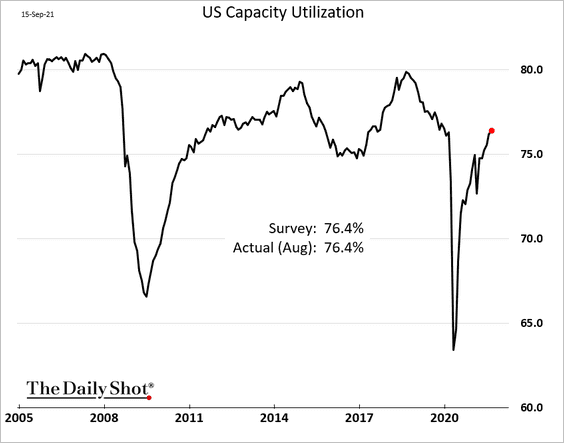

Here is the capacity utilization.

——————–

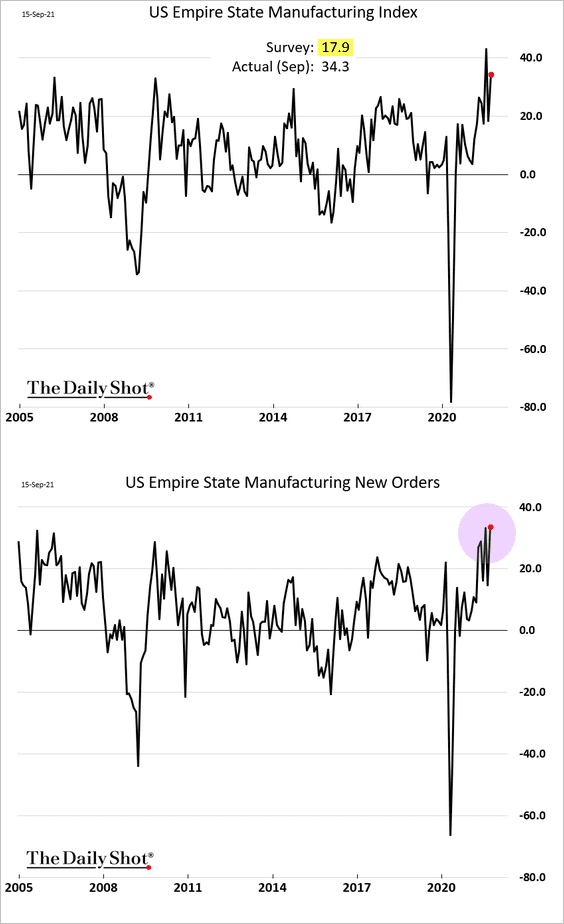

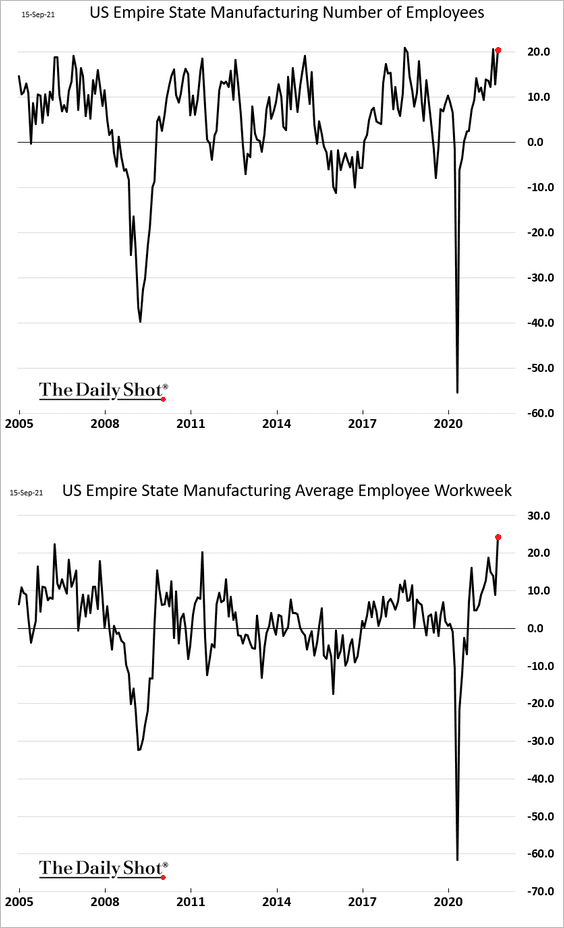

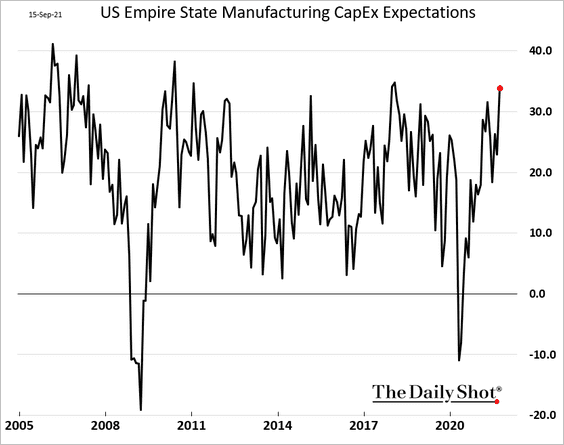

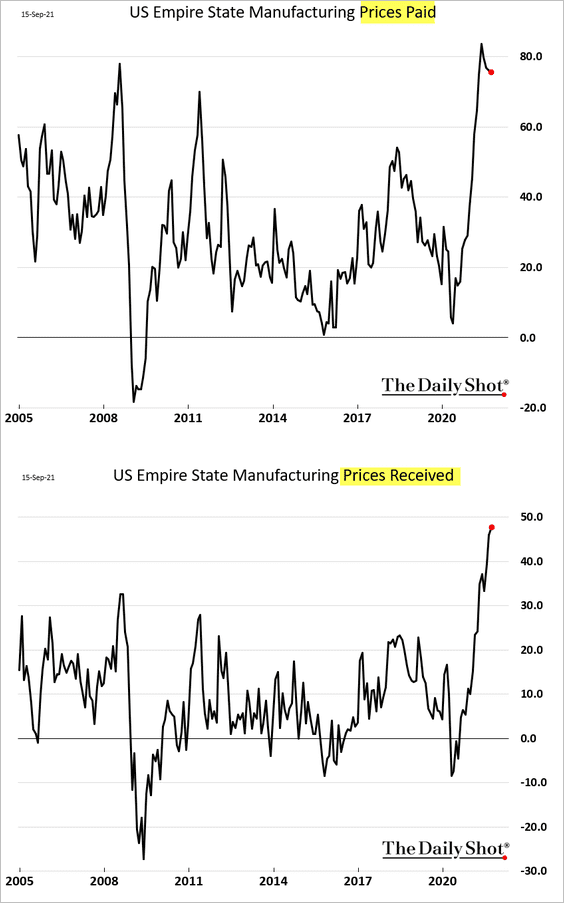

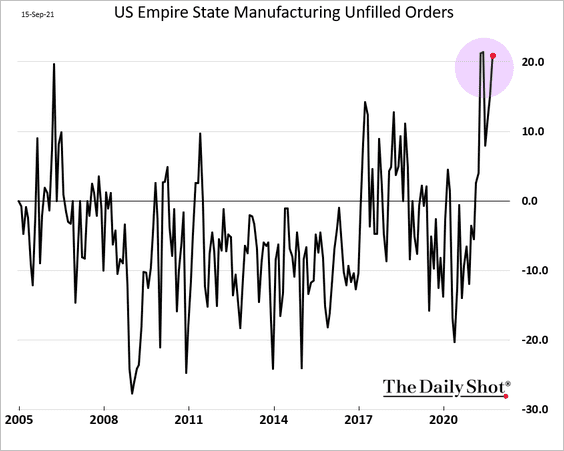

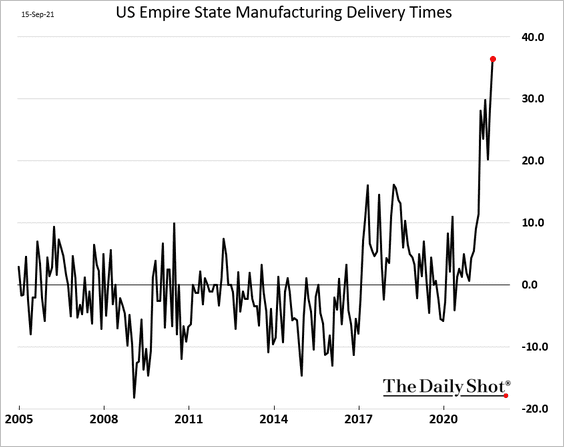

2. The first regional manufacturing report of the month (from the NY Fed) was remarkably strong.

– Employment and hours worked indicators:

– CapEx expectations:

• Factories are using their pricing power.

• Supply-chain bottlenecks remain acute.

– Unfilled orders:

– Supplier delivery times:

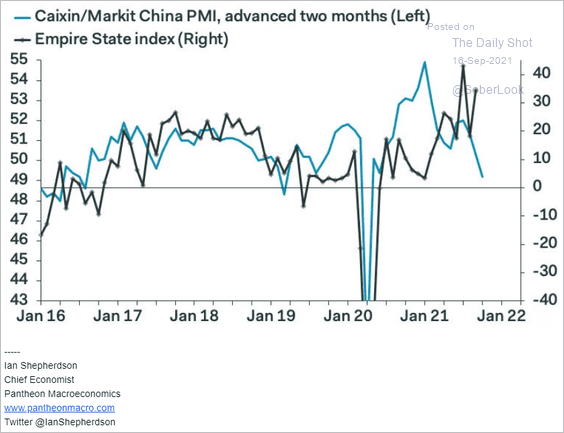

Given the weakness in China, the region’s factory activity is likely to moderate.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

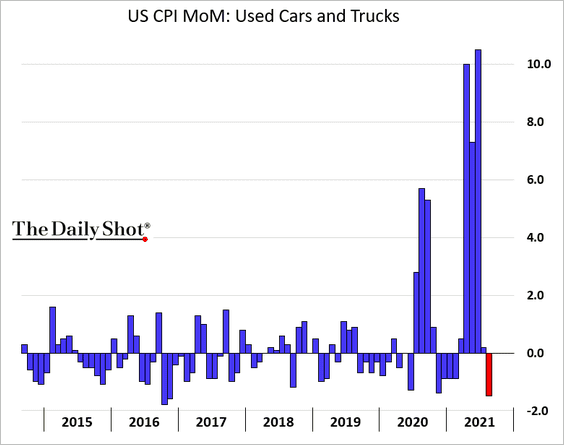

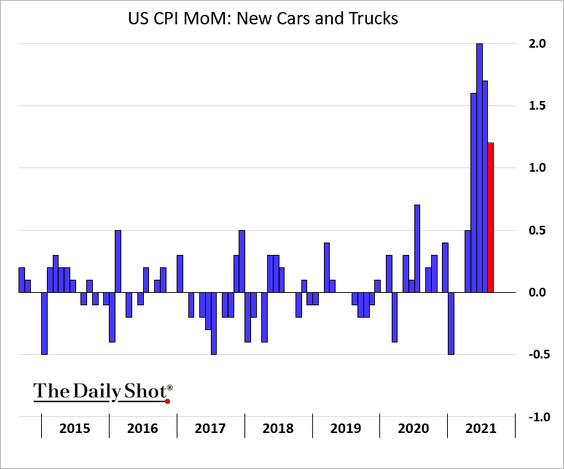

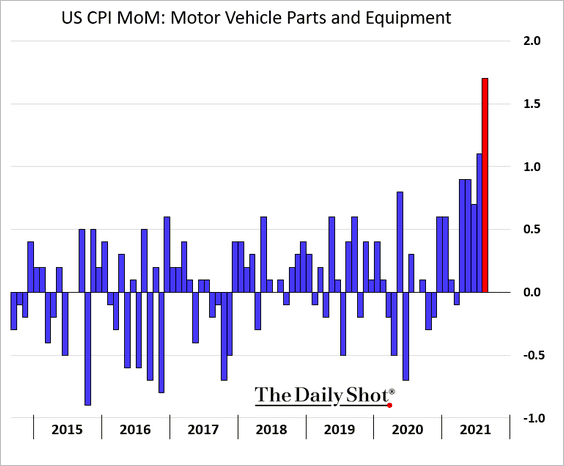

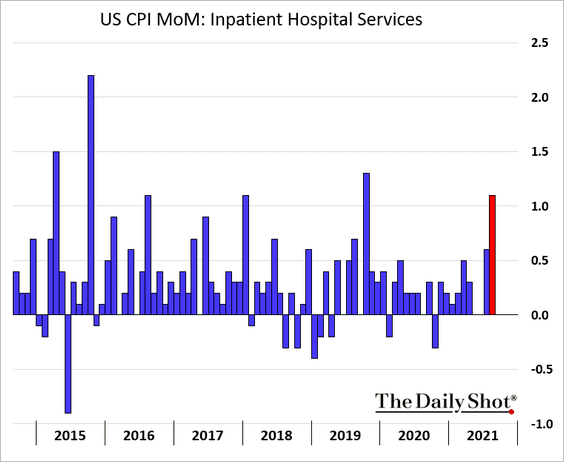

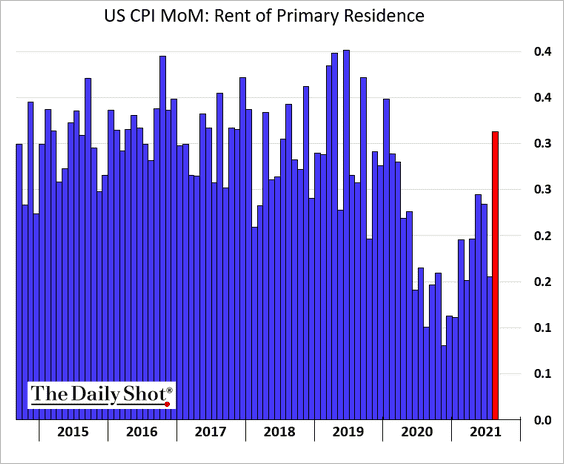

3. Next, we have some additional data from the CPI report.

– Used and new cars CPI (month-over-month):

– Car parts:

– Hospital services:

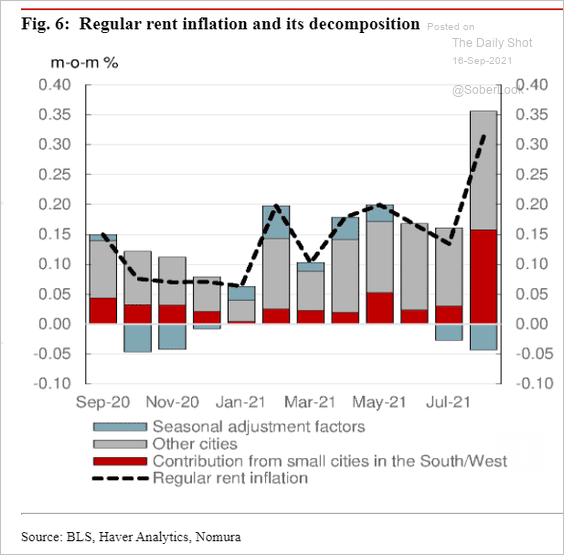

– Rent:

Source: Nomura Securities

Source: Nomura Securities

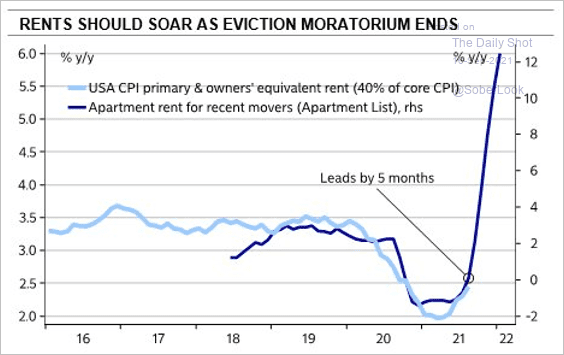

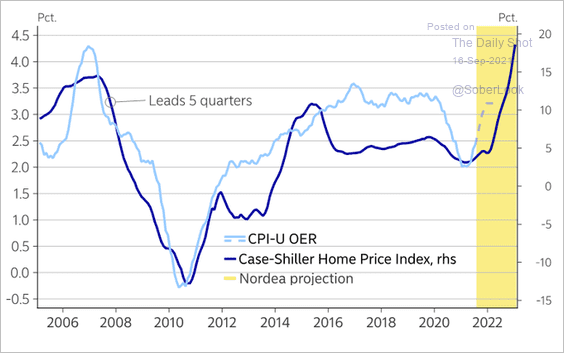

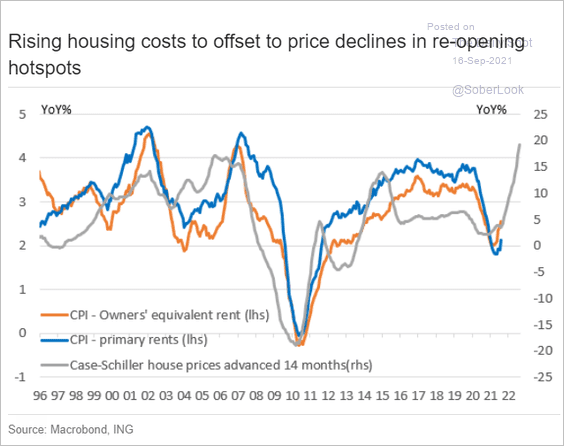

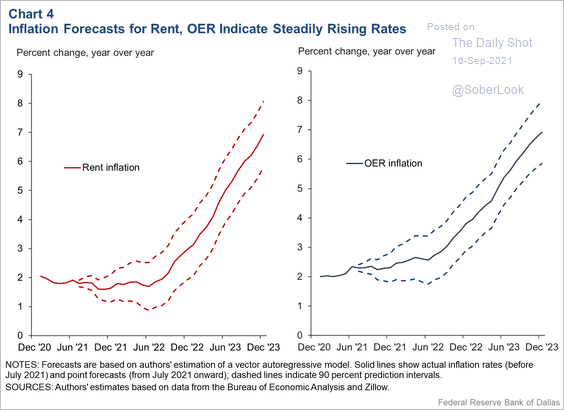

Economists expect housing-related inflation – rent and owners’ equivalent rent (OER) – to surge going forward.

– Apartment rent data:

Source: @MikaelSarwe

Source: @MikaelSarwe

– Housing prices:

Source: @AndreasSteno

Source: @AndreasSteno

Source: ING

Source: ING

– Forecasts:

Source: Dallas Fed Read full article

Source: Dallas Fed Read full article

——————–

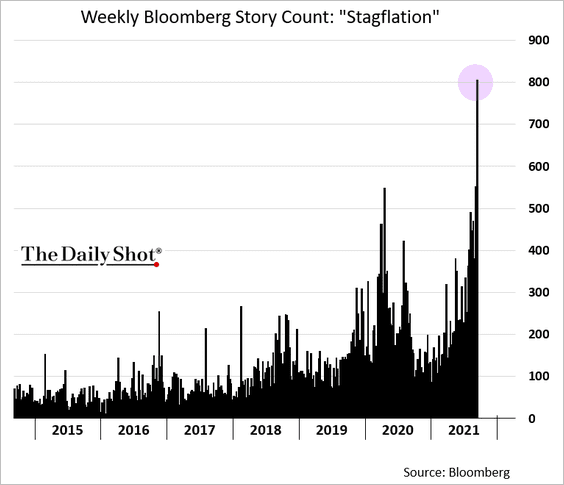

4. There is a great deal of talk about stagflation in the news.

Back to Index

Emerging Markets

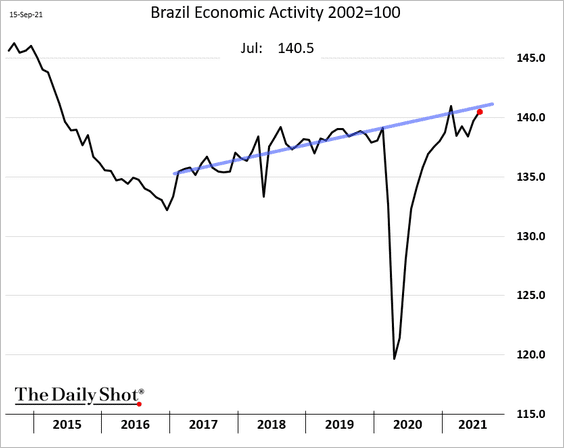

1. Brazil’s economic activity is back on its pre-COVID trend.

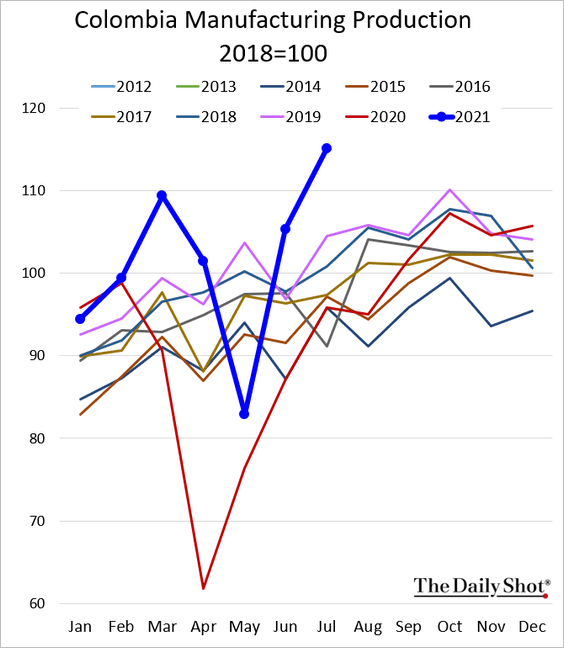

2. Colombia’s manufacturing output hit a new high.

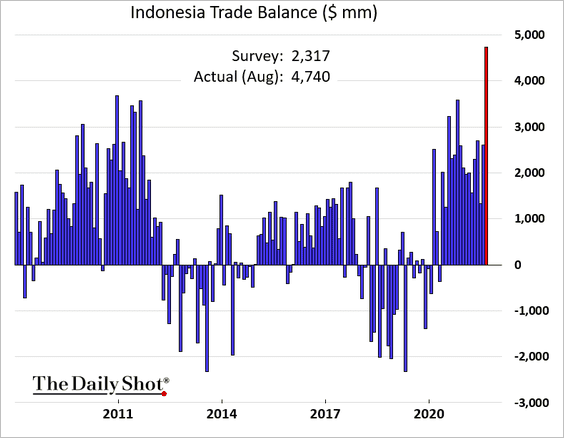

3. Indonesia’s trade surplus rose to a new record last month.

Source: Hellenic Shipping News Read full article

Source: Hellenic Shipping News Read full article

——————–

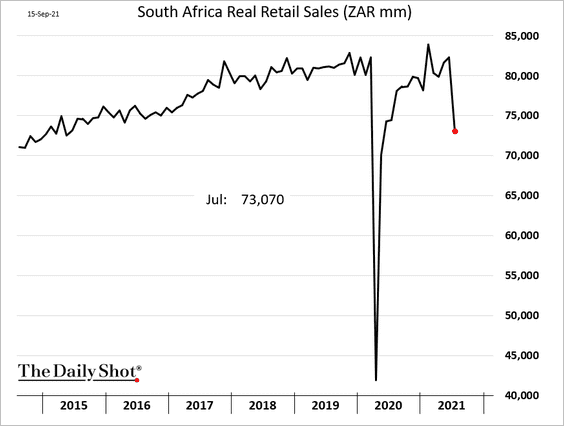

4. South Africa’s retail sales tumbled in July amid riots and tight COVID restrictions.

Back to Index

Cryptocurrency

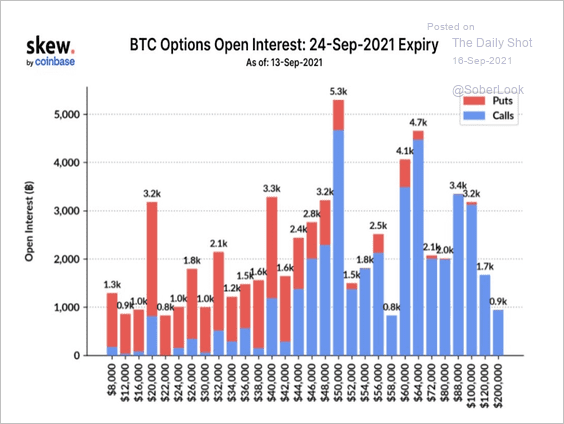

1. The $50K BTC strike price, a key resistance level, has the largest options open interest ahead of next week’s quarterly expiration.

Source: Skew

Source: Skew

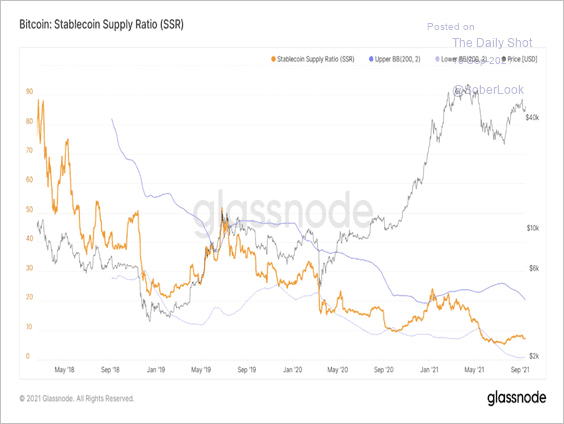

2. Bitcoin’s stablecoin supply ratio (SSR), which measures the cryptocurrency’s supply relative to the total supply of stablecoins denoted in BTC, is starting to rise. Some analysts believe a low/rising SSR means stablecoins have increasing buying power, used to acquire more BTC.

Source: Glassnode

Source: Glassnode

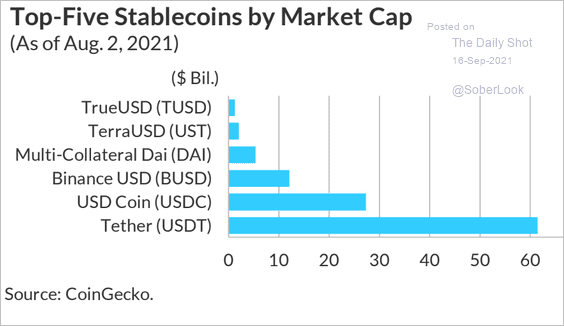

3. Here are the largest stablecoins by market value.

Source: Fitch Ratings

Source: Fitch Ratings

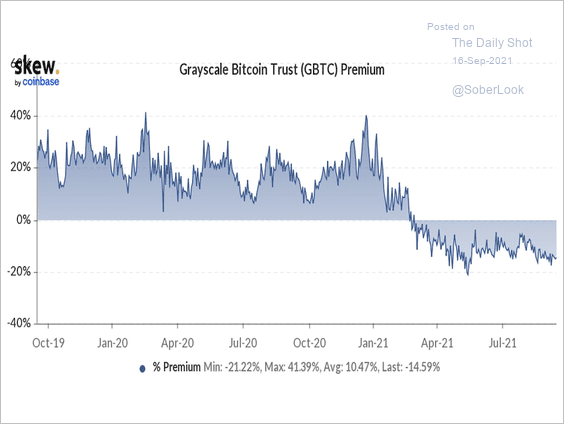

4. Grayscale’s Bitcoin Trust (GBTC) discount continues to widen amid dim hopes of a spot bitcoin ETF approval.

Source: Skew

Source: Skew

Source: CoinDesk Read full article

Source: CoinDesk Read full article

——————–

5. Insider trading was spotted at OpenSea, an NFT marketplace, as employees allegedly purchased items that they knew were set to display on the front page before publication.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Back to Index

Commodities

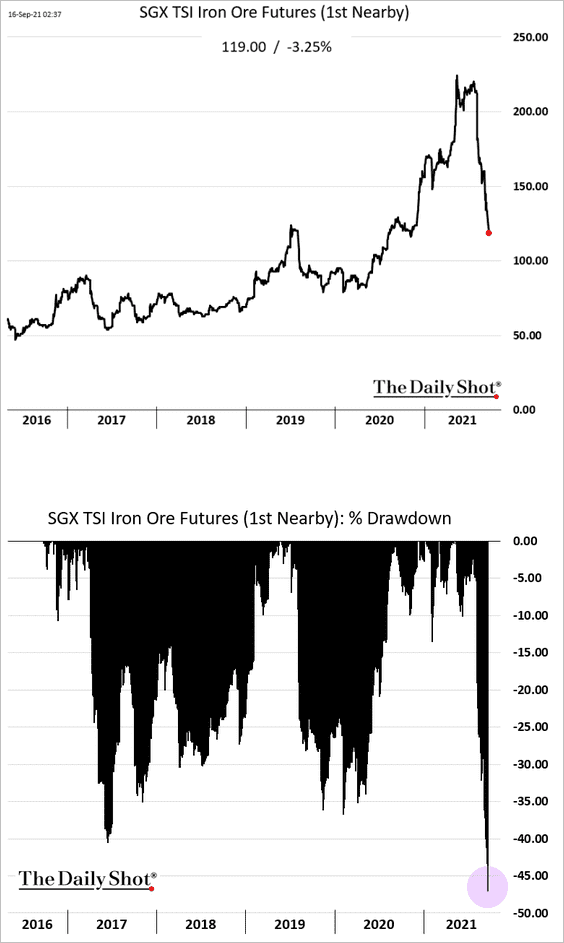

1. The iron ore drawdown is approaching 50%.

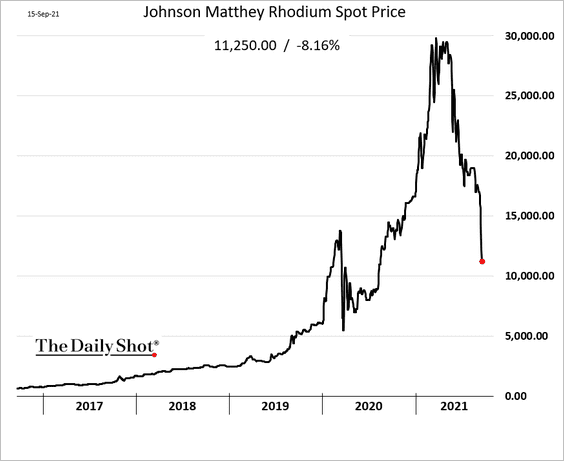

2. Rhodium prices tumbled this week.

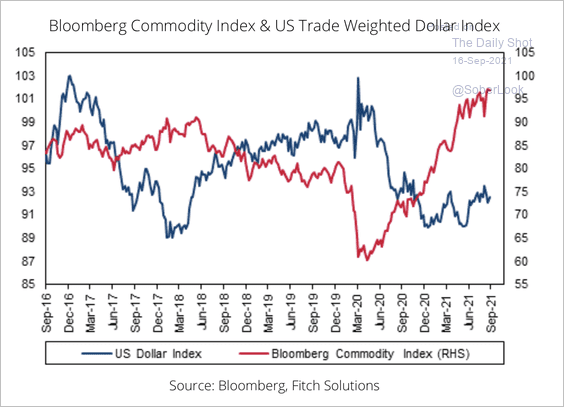

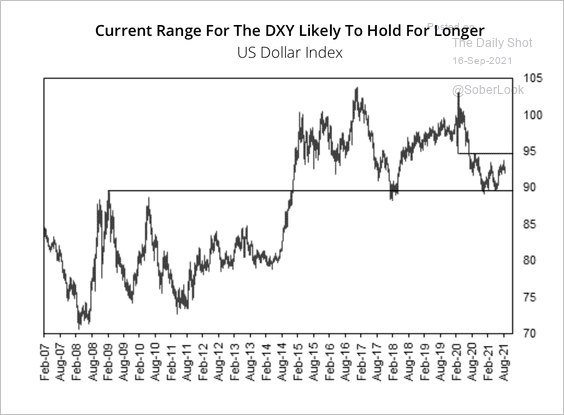

3. A recovery in the dollar could lead to a pullback or consolidation in commodities (2 charts).

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Back to Index

Energy

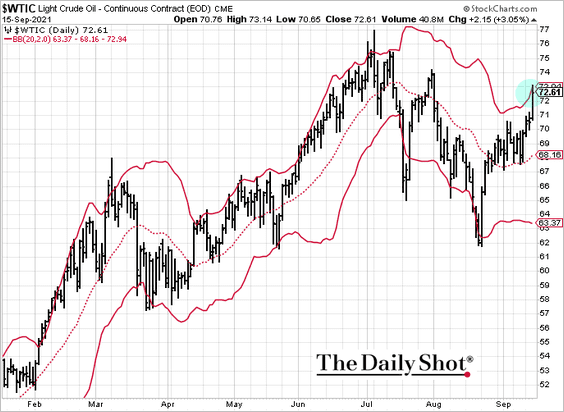

1. Crude oil futures (both Brent and WTI) are at the upper Bollinger Band.

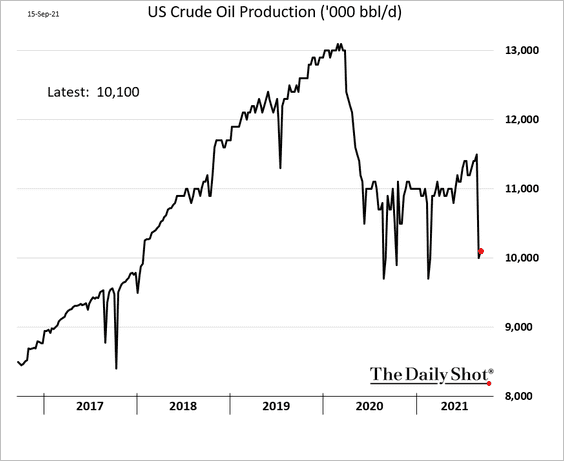

2. US oil output remained depressed last week.

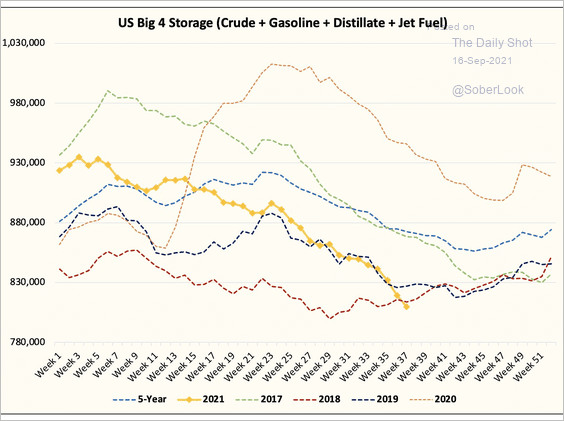

3. Total oil and products in storage continue to trend lower.

Source: @HFI_Research

Source: @HFI_Research

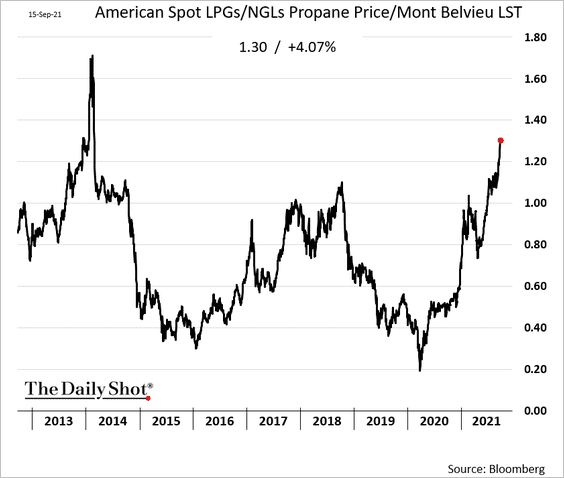

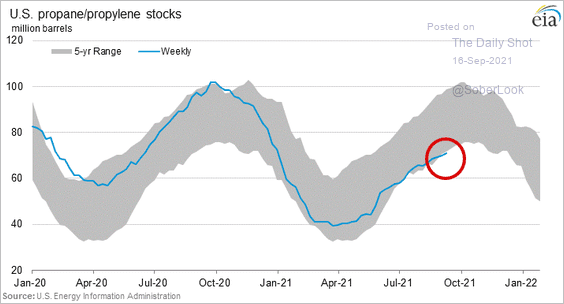

4. Heating is going to be expensive this winter as propane prices surge.

Back to Index

Equities

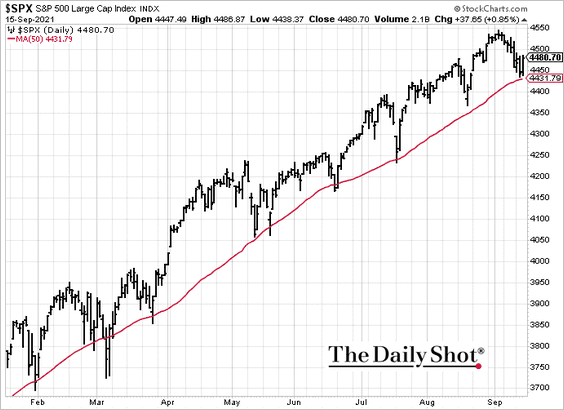

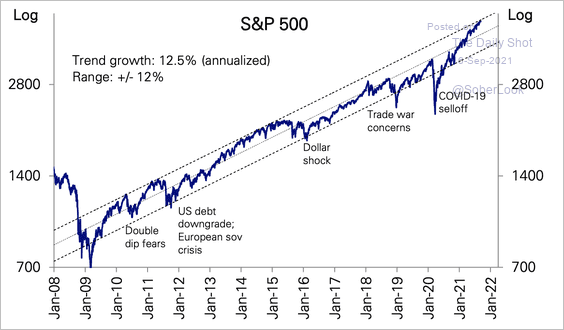

1. Once again, the S&P 500 held support at the 50-day moving average.

The S&P 500 is near the top end of its long-term trend channel.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

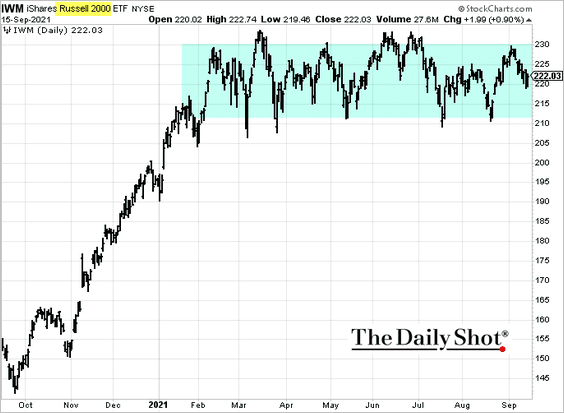

2. Small caps have been stuck in a range.

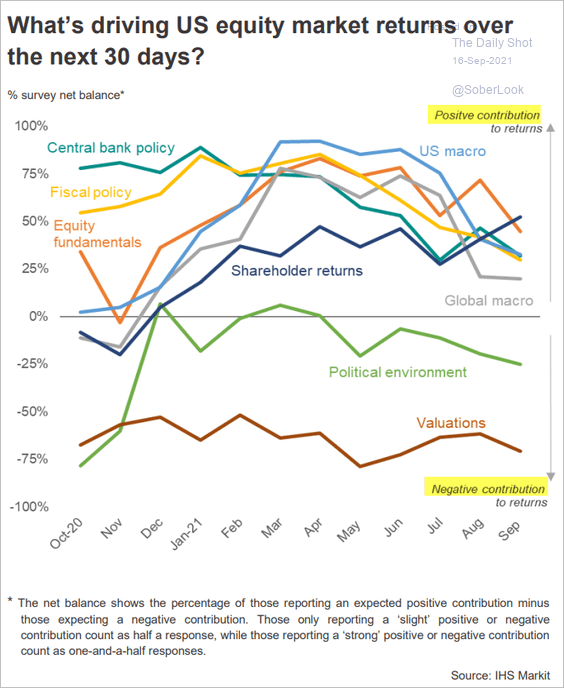

3. Which factors will drive returns in the next 30 days?

Source: @IHSMarkitPMI

Source: @IHSMarkitPMI

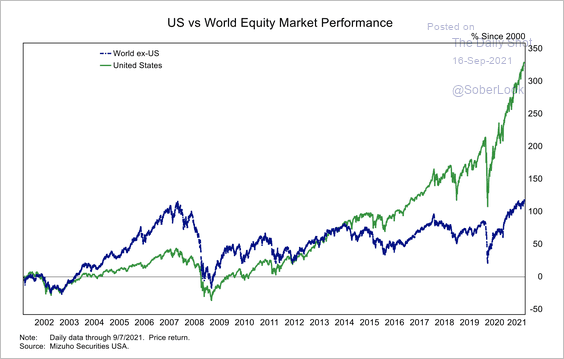

4. US equities have significantly outperformed global peers in recent years.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

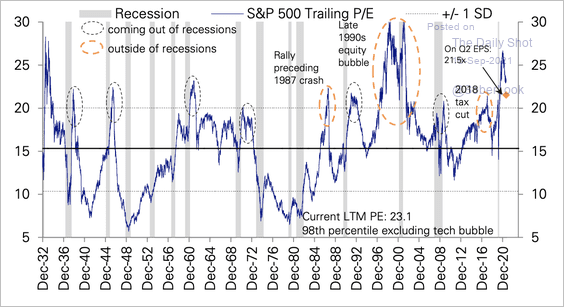

5. Valuations are typically high coming out of recessions but compress as the cycle continues.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

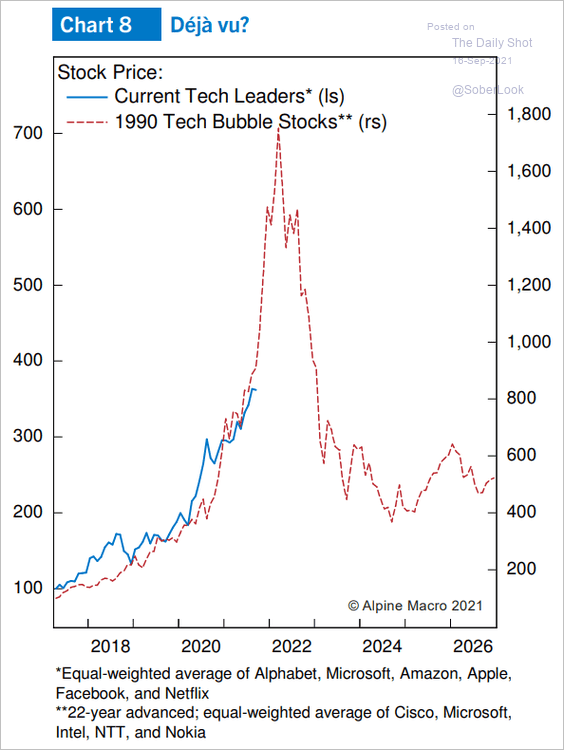

6. Will the tech sector price gains accelerate?

Source: Alpine Macro

Source: Alpine Macro

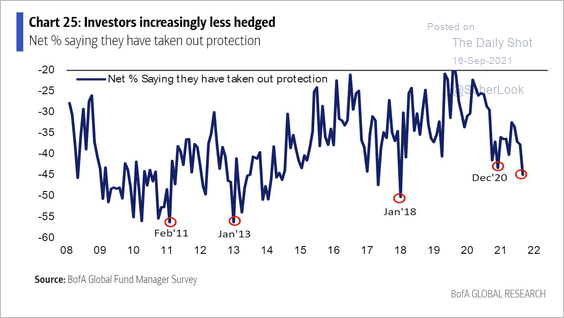

7. Fund managers are less hedged.

Source: BofA Global Research; @Callum_Thomas

Source: BofA Global Research; @Callum_Thomas

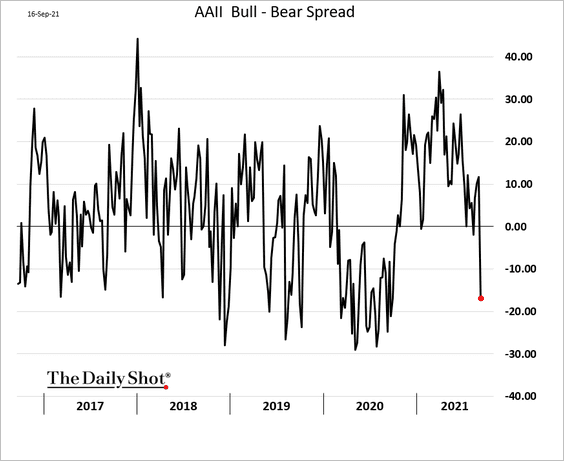

8. Retail investors appear to be turning cautious.

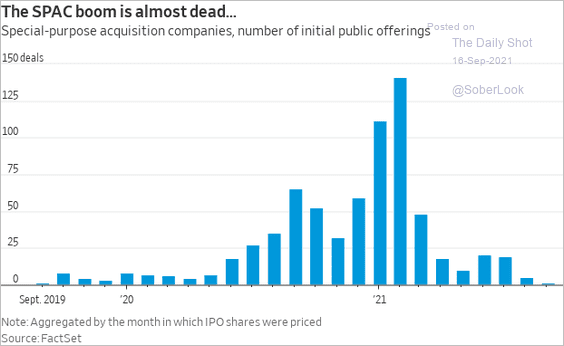

9. The SPAC boom is over for now.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Rates

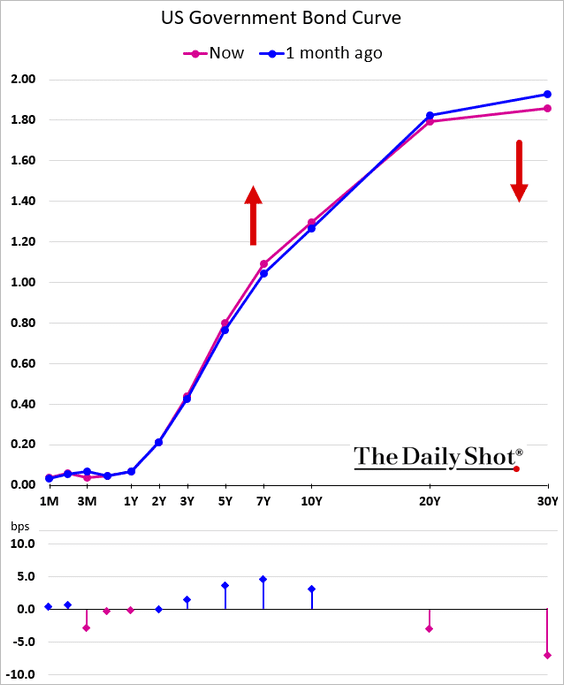

1. The longer end of the Treasury curve has been flattening.

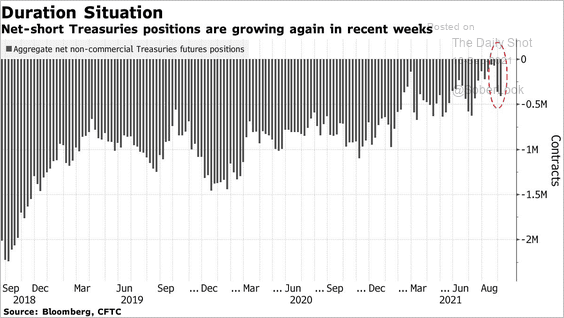

2. Hedge funds have started shorting Treasuries again.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

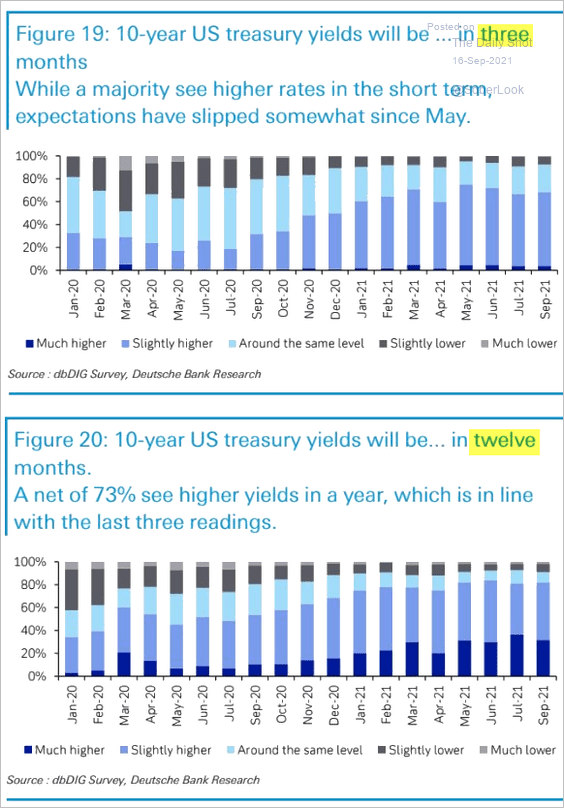

3. Where will the 10yr Treasury yield be in three months? Twelve months?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

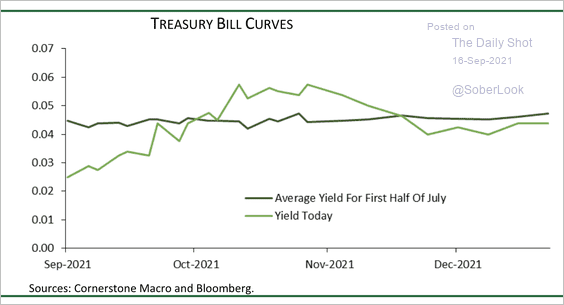

4. Treasury bills that mature in October and November yield more than bills maturing in September or December, but the difference is small. This suggests investors perceive some risk of US default as the deadline to extend the debt ceiling approaches next month.

Source: Cornerstone Macro

Source: Cornerstone Macro

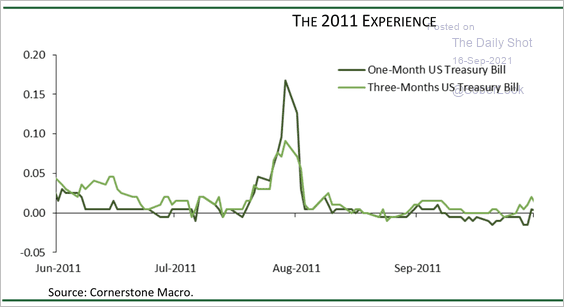

Treasury bill yields rose by almost 20 basis points during the 2011 debt ceiling debacle.

Source: Cornerstone Macro

Source: Cornerstone Macro

——————–

Food for Thought

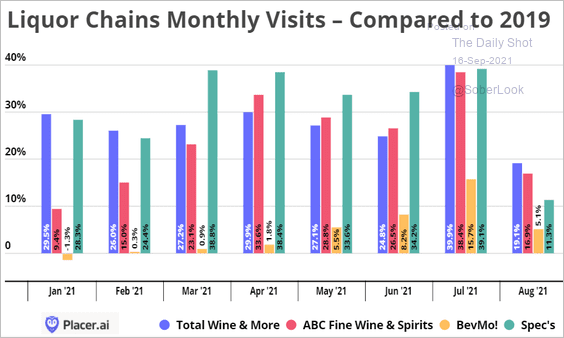

1. The US liquor store boom:

Source: Placer.ai

Source: Placer.ai

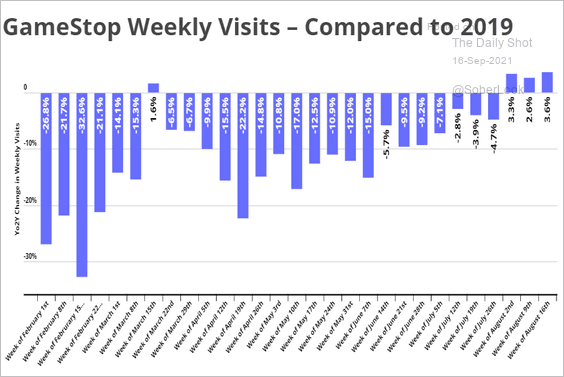

2. GameStop weekly visits:

Source: Placer.ai

Source: Placer.ai

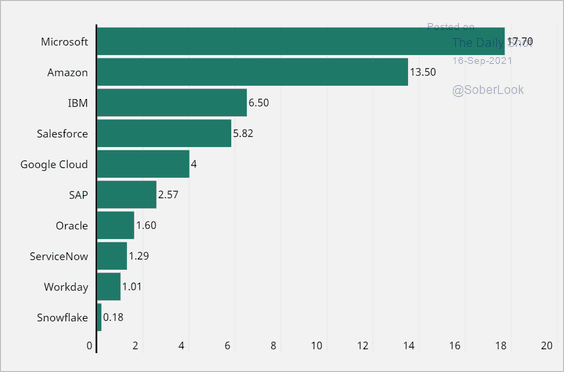

3. Top 10 cloud vendors globally by total revenue (Q1 2021):

Source: stockapps.com Read full article

Source: stockapps.com Read full article

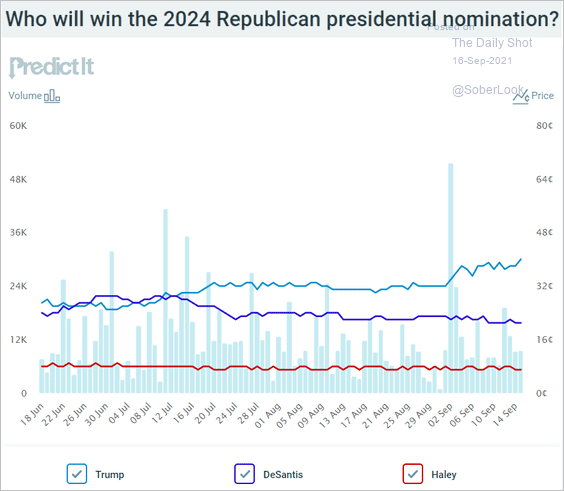

4. The 2024 Republican presidential nomination odds in the betting markets:

Source: @PredictIt

Source: @PredictIt

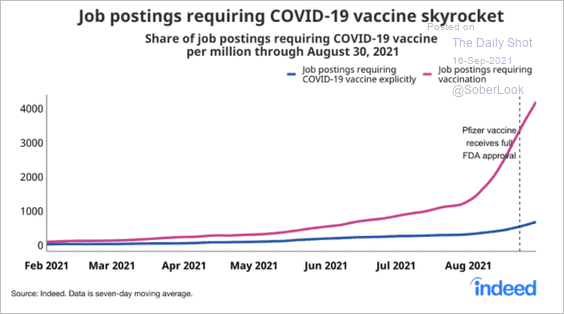

5. Job postings requiring vaccinations:

Source: @GregDaco, @Indeed, @AE_Konkel Read full article

Source: @GregDaco, @Indeed, @AE_Konkel Read full article

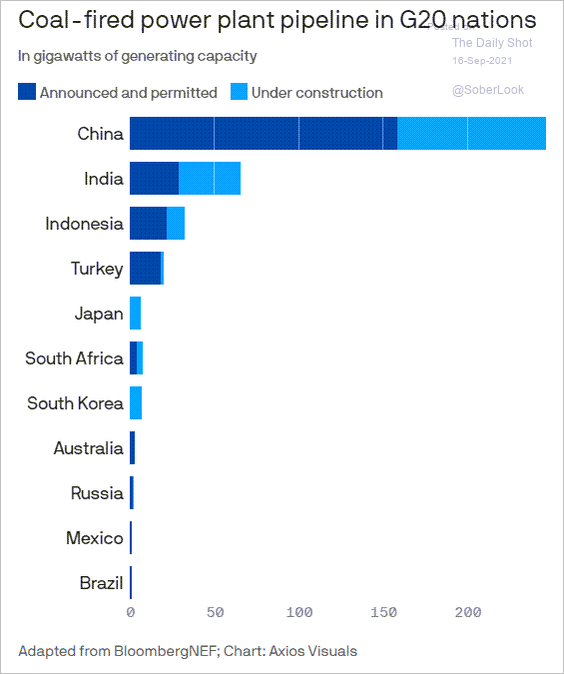

6. Coal-fired power plant pipeline:

Source: @axios Read full article

Source: @axios Read full article

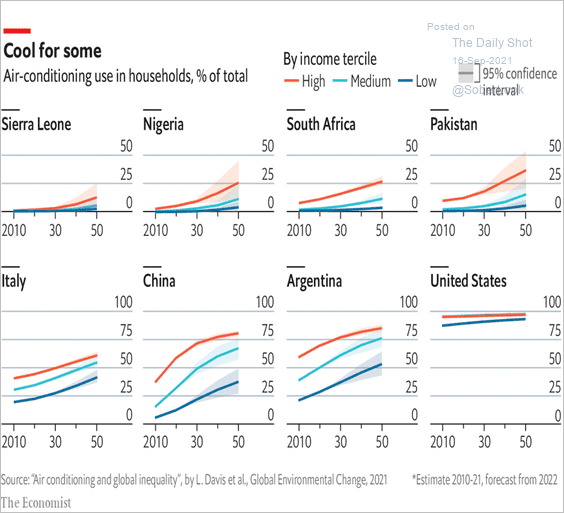

7. Air-conditioning use in select countries:

Source: The Economist Read full article

Source: The Economist Read full article

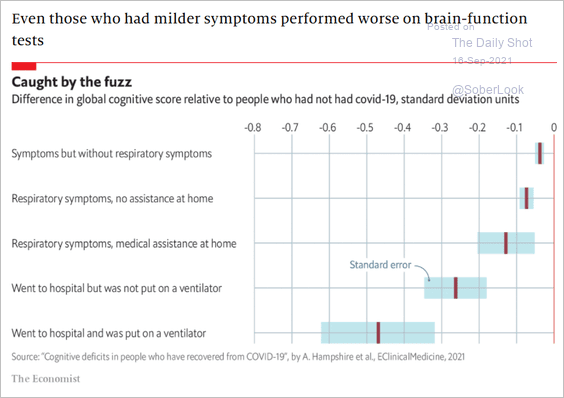

8. Long-lasting cognitive impairments among some COVID patients:

Source: The Economist Read full article

Source: The Economist Read full article

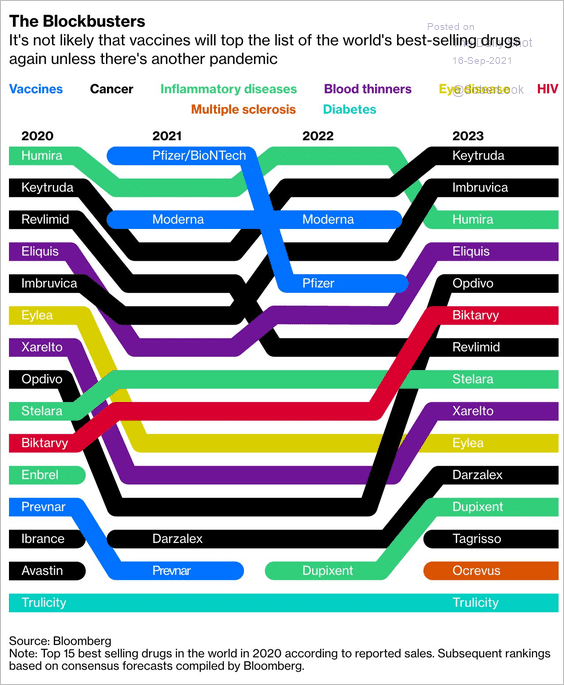

9. The world’s best-selling drugs:

Source: @bopinion Read full article

Source: @bopinion Read full article

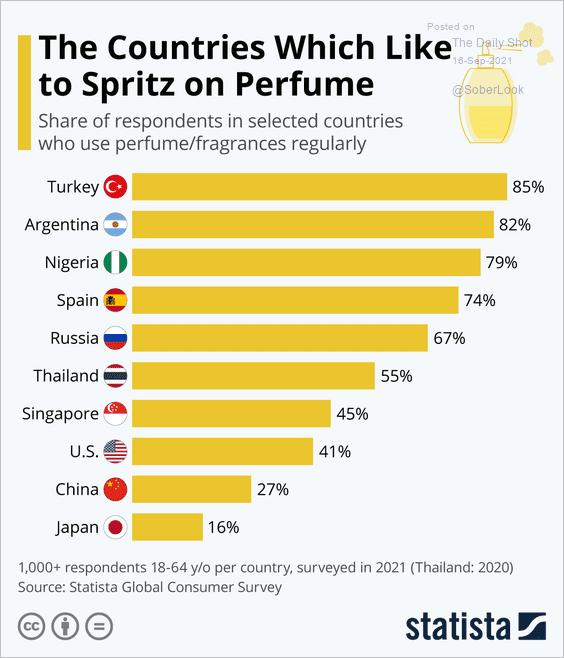

10. Using perfume regularly:

Source: Statista

Source: Statista

——————–

Back to Index