The Daily Shot: 07-Oct-20

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Australia

• China

• Emerging Markets

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

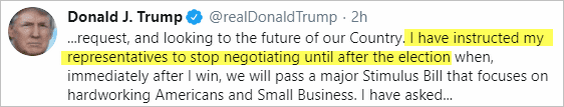

1. The negotiations to implement another stimulus package appear to be over for now.

Source: Twitter

Source: Twitter

The stock market did not react well to the news.

Source: @TheStalwart Read full article

Source: @TheStalwart Read full article

Economists are concerned about the looming “income cliff” as the LWSPA program expires.

Source: Oxford Economics

Source: Oxford Economics

Source: @WSJ Read full article

Source: @WSJ Read full article

To be sure, more stimulus is coming in the next few months. In the meantime, however, the loss of income will be a drag on growth.

——————–

2. Next, we have some updates on the labor market.

• The rebound in job openings paused in August.

Not all sectors registered declines. Here is manufacturing, for example.

• Permanent unemployment is rising faster than in previous recessions.

Source: Oxford Economics

Source: Oxford Economics

• Here is the employment recovery by educational attainment …

Source: @WSJ Read full article

Source: @WSJ Read full article

… and by wage category.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

3. The nation’s trade gap, excluding petroleum, hit a new high (second chart).

The trade deficit with Mexico is the largest on record amid increased US demand for automobiles.

By the way, Mexico has now undercut China for low-cost manufacturing.

Source: @adam_tooze, @KathrinHille Read full article

Source: @adam_tooze, @KathrinHille Read full article

——————–

4. The consensus for the Q3 GDP rebound is 25% (annualized). Nonetheless, the nation’s economic output will remain below the pre-crisis trend, according to JP Morgan.

Source: @ISABELNET_SA, @JPMorganAM

Source: @ISABELNET_SA, @JPMorganAM

5. While vehicle miles have seen a V-shaped recovery thus far, rail and air passenger miles have barely registered an uptick.

Source: St. Louis Fed

Source: St. Louis Fed

6. Will political uncertainty put further downward pressure on the US dollar?

Source: BCA Research

Source: BCA Research

7. Here is the evolution of mortgage delinquencies compared to regional post-hurricane trends.

Source: Black Knight

Source: Black Knight

Below is the current status of COVID-19 related mortgage forbearances.

Source: Black Knight

Source: Black Knight

Canada

1. Value stocks continue to underperform growth. But this could change if the Canadian 10-year yield starts to rise.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Currently, the 10-year yield is holding support. Will it break above the 200-day moving average?

Source: Dantes Outlook Read full article

Source: Dantes Outlook Read full article

——————–

2. Canada-focused ETF short sellers continued to cover their positions through the September selloff.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

3. The rebound in trade has stalled.

Source: Scotiabank Economics

Source: Scotiabank Economics

4. This chart shows the recovery in home prices compared to previous downturns.

Source: Desjardins

Source: Desjardins

The United Kingdom

1. Construction activity expanded rapidly last month.

Demand for build-to-rent homes has accelerated.

Source: @business Read full article

Source: @business Read full article

——————–

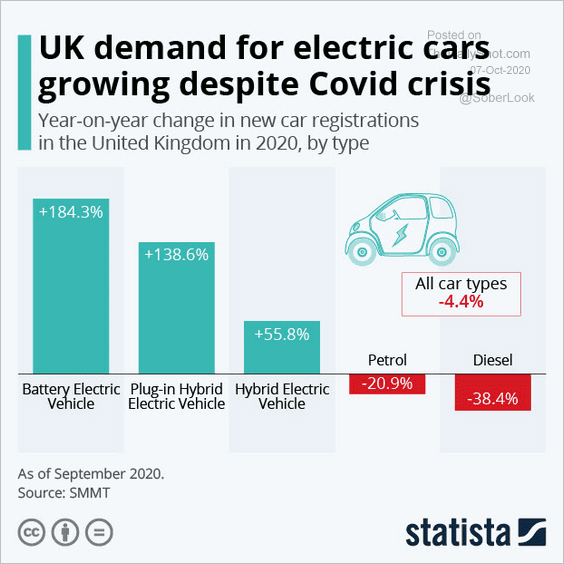

2. EV sales are up sharply.

Source: Statista

Source: Statista

The Eurozone

1. Let’s begin with Germany.

• Factory orders were quite strong in August.

But the rebound in industrial production appears to be losing momentum.

– Manufacturing sentiment suggests that there are further improvements ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

– Will we see a sharp increase in equipment investment?

Source: @OliverRakau

Source: @OliverRakau

• Construction activity slowed last month.

——————–

2. Spanish banks are most exposed to Turkey.

Source: TS Lombard

Source: TS Lombard

3. Euro-area disposable income is set to decline.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

4. Here is the Eurozone’s share of the global GDP.

Source: ECB Read full article

Source: ECB Read full article

Australia

1. Service sector activity deteriorated at a faster pace last month.

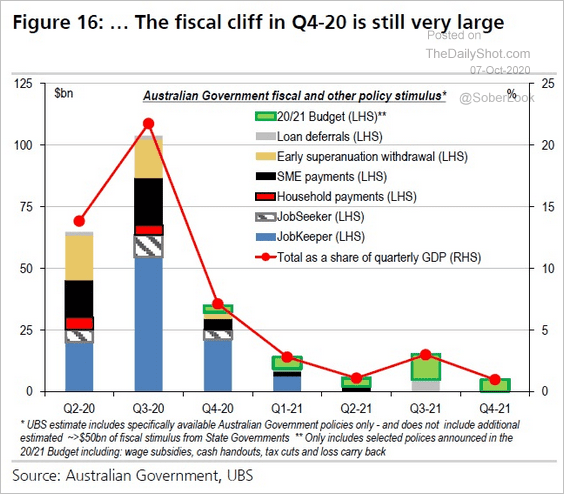

2. Australia is facing a fiscal cliff.

Source: UBS, @Scutty

Source: UBS, @Scutty

3. Here is the 3-year government bond yield (record low).

China

1. Many China-focused funds are domiciled in Luxembourg.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

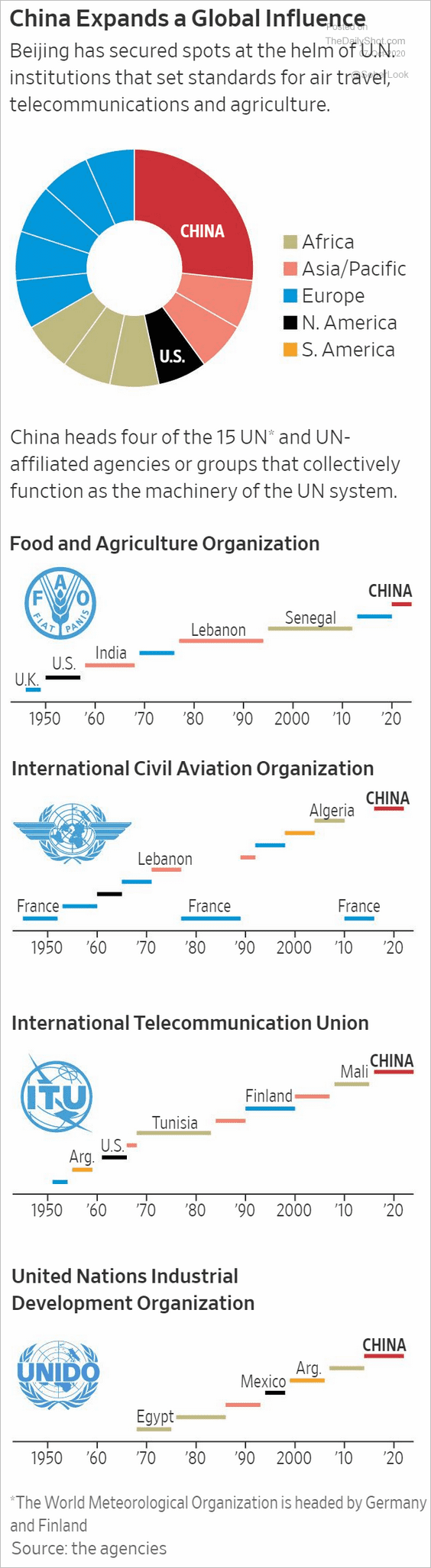

2. China continues to expand its influence through international organizations.

Source: @WSJ Read full article

Source: @WSJ Read full article

3. Hong Kong’s business activity is yet to stabilize.

Emerging Markets

1. Let’s begin with Mexico.

• Consumer confidence:

• Vehicle production:

• CapEx (through July):

——————–

2. Brazil’s economic uncertainty is moderating.

Source: Goldman Sachs

Source: Goldman Sachs

The nation’s service sector has stabilized.

Source: IHS Markit Read full article

Source: IHS Markit Read full article

——————–

3. Next, we have some updates on Russia.

• Consumer confidence:

• Inflation:

• The ruble (USD/RUB is testing resistance at 80):

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

4. EM currencies continue to lag.

Source: @AndreasSteno

Source: @AndreasSteno

5. Short interest in one of the largest local-currency bond ETFs (EMLC) has been climbing.

h/t @SriniSivabalan

h/t @SriniSivabalan

6. Outflows from EM accelerated during the final weeks of September.

Source: IIF

Source: IIF

Commodities

1. Despite the stalled rally, ETF holdings of gold continue to climb.

h/t @krystalchia

h/t @krystalchia

2. This chart shows the ratio of Goldman’s broad commodities index to the Dow.

Source: Die Incrementum AG

Source: Die Incrementum AG

3. US wheat prices are higher due to drought conditions and strong international demand.

Here is Bloomberg’s grains index.

——————–

4. Sugar futures continue to rally.

But supply is expected to increase substantially next year.

Source: @WSJ Read full article

Source: @WSJ Read full article

Equities

1. Shares of smaller companies have been outperforming in recent days.

• The S&P 500 equal-weight index:

• Small caps:

By the way, the Russell 2000 index held resistance at the upper Bollinger band.

Source: barchart.com

Source: barchart.com

——————–

2. This market recovery has been “unloved.”

Source: Market Ethos, Richardson GMP

Source: Market Ethos, Richardson GMP

3. Will we see a recovery in fund flows after the elections?

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

4. Analysts expect a sharp rebound in earnings in Q3.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

But year-over-year earnings growth, excluding loan loss provisions and energy, remains depressed.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

5. Next, we have some sector performance updates.

• Banks:

• Utilities:

• REITs:

• Consumer Staples:

• Semiconductors:

• Tech and Communication Services:

Source: @WSJ Read full article

Source: @WSJ Read full article

• Biotech:

• US healthcare sector ETF flows have been trending lower.

Source: MarketDesk Research

Source: MarketDesk Research

Credit

1. Most of the US high-yield issuance last quarter was to refinance existing debt.

Source: @lcdnews, @JakemaLewis

Source: @lcdnews, @JakemaLewis

2. Here is the quarterly loan issuance by region.

Source: @LPCLoans, @refinitiv

Source: @LPCLoans, @refinitiv

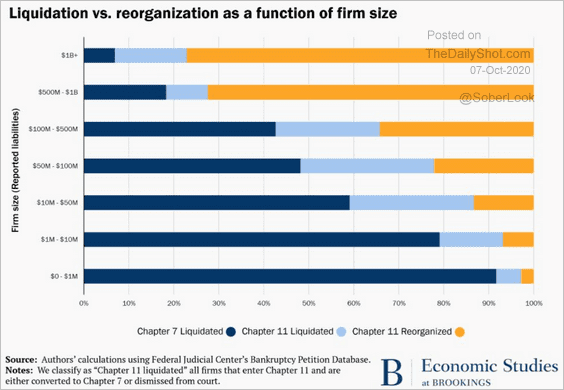

3. This chart shows liquidations vs. reorganizations by firm size.

Source: Brookings Economic Studies

Source: Brookings Economic Studies

Rates

1. Treasury implied volatility rose sharply on Tuesday.

2. Swaption skew shows a bias toward higher yields.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

3. The longer end of the yield curve has been steepening (perhaps driven by inflation concerns).

Source: @lisaabramowicz1

Source: @lisaabramowicz1

4. According to Arbor Data Science, FOMC members have been in agreement lately.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Global Developments

1. Here is Goldman’s estimate of the lockdowns’ impact on the GDP.

Source: Goldman Sachs

Source: Goldman Sachs

2. How long will it take these economies to fully recover?

Source: Barclays Research

Source: Barclays Research

3. The US, Japan, and China are the biggest sources of GDP-weighted private debt.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

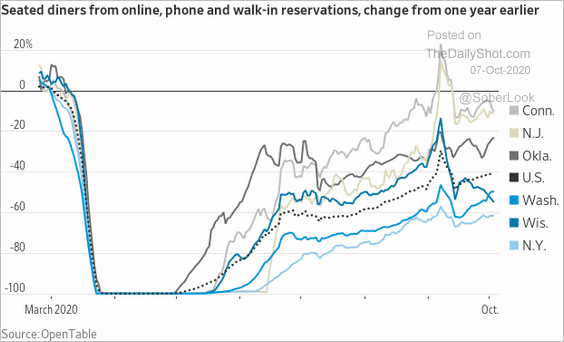

1. Restaurant reservations by state:

Source: @WSJ Read full article

Source: @WSJ Read full article

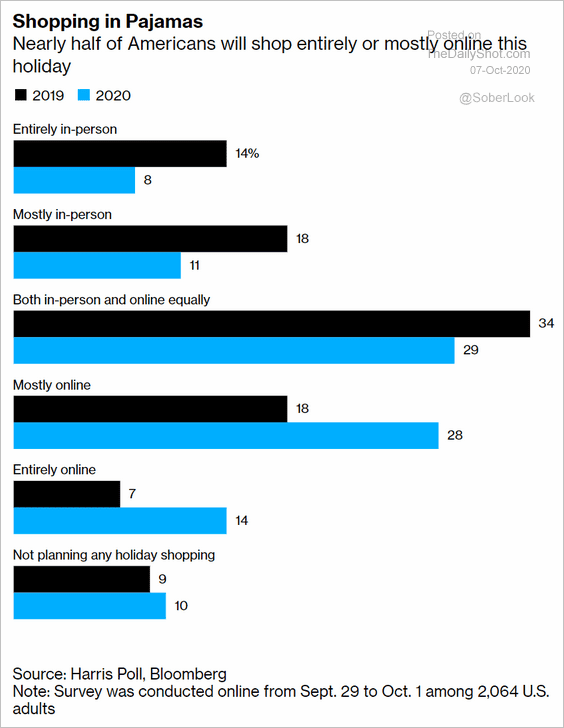

2. Holiday shopping online vs. in person:

Source: @business Read full article

Source: @business Read full article

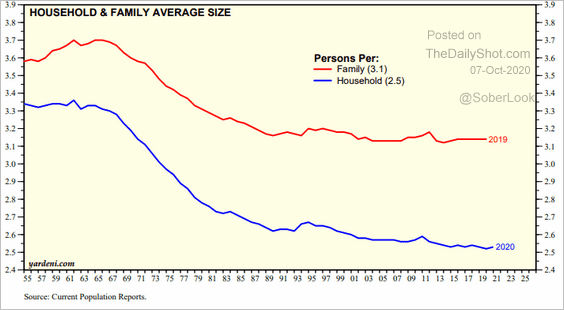

3. US household and family size over time:

Source: Yardeni Research

Source: Yardeni Research

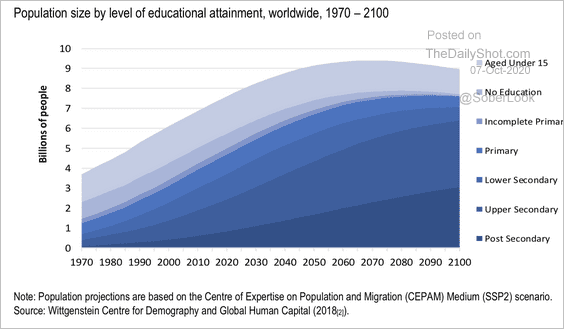

4. Global educational attainment forecasts:

Source: OECD Read full article

Source: OECD Read full article

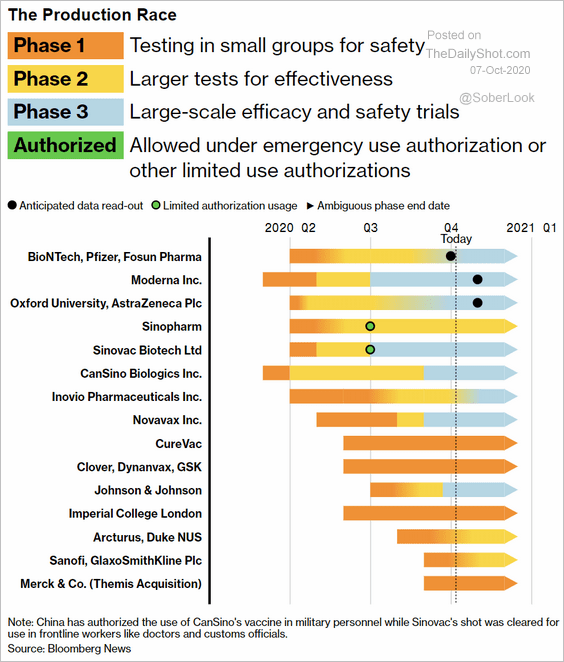

5. Vaccine status:

Source: @business Read full article

Source: @business Read full article

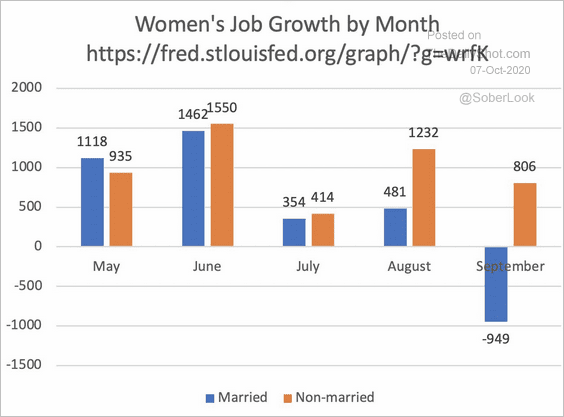

6. Employment among US women by marital status (impacted by school closures?):

Source: @mikemadowitz

Source: @mikemadowitz

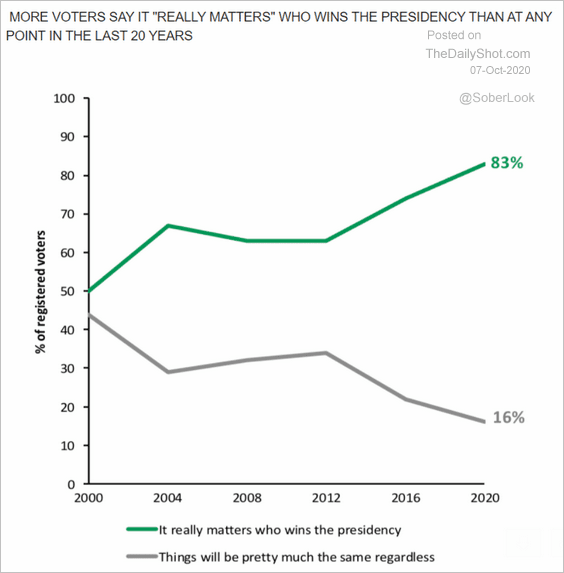

7. How much does the 2020 US presidential election matter?

Source: Desjardins

Source: Desjardins

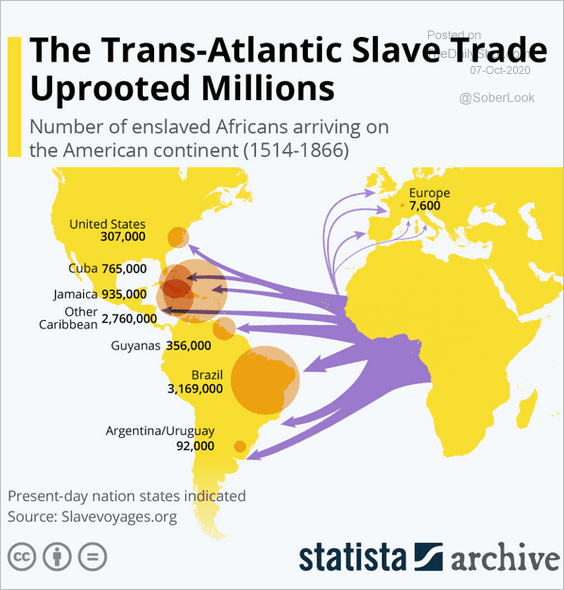

8. Enslaved Africans (1514-1866):

Source: Statista

Source: Statista

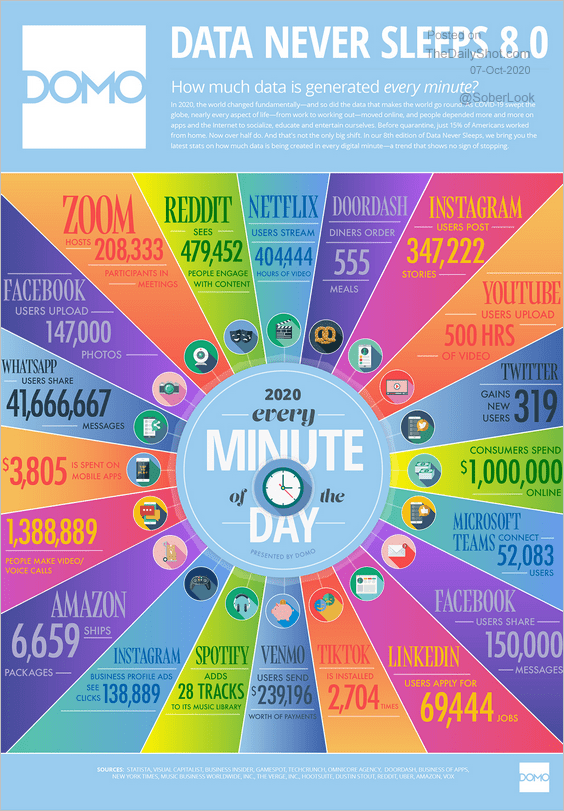

9. What happens in an internet minute?

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–