The Daily Shot: 08-Sep-21

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Global Developments

• Food for Thought

The United States

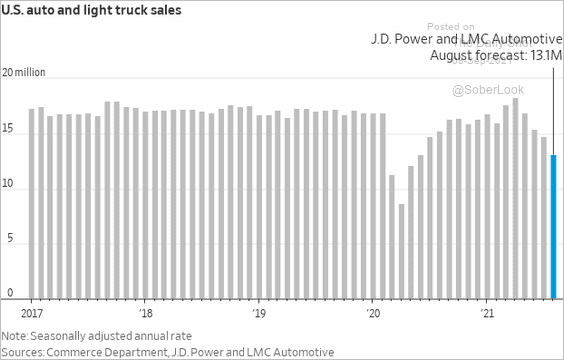

1. Automobile sales continue to weaken, with factories cutting output due to supply shortages.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

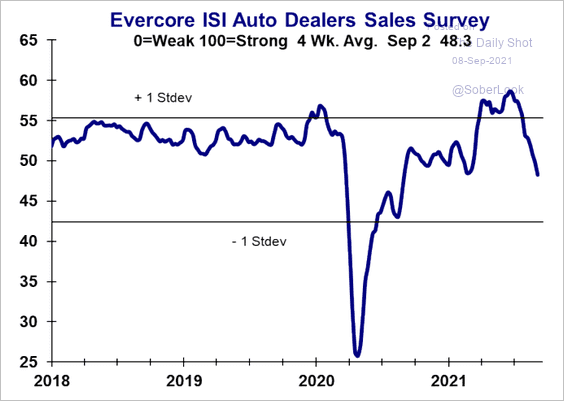

• Here is the Evercore ISI auto dealer sales survey.

Source: Evercore ISI

Source: Evercore ISI

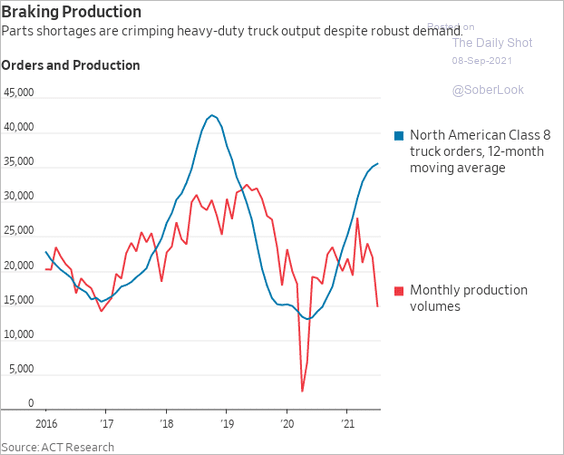

• Heavy truck sales are also slumping despite robust demand.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

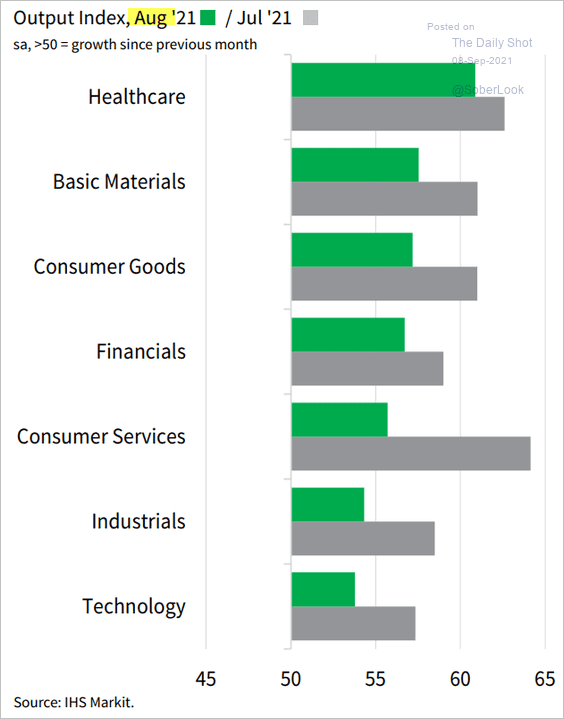

2. This chart shows output PMI indicators by sector (August vs. July).

Source: IHS Markit

Source: IHS Markit

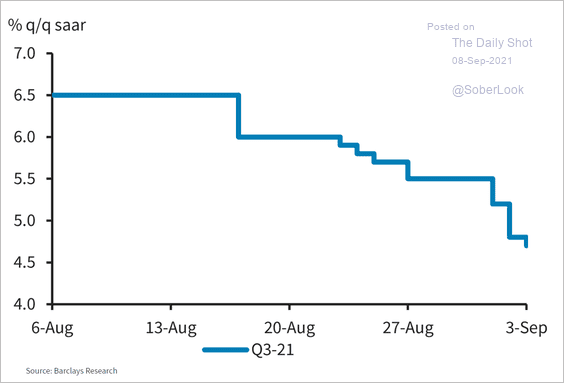

3. Economists have been downgrading their forecasts for the current quarter’s GDP growth.

Source: Barclays Research

Source: Barclays Research

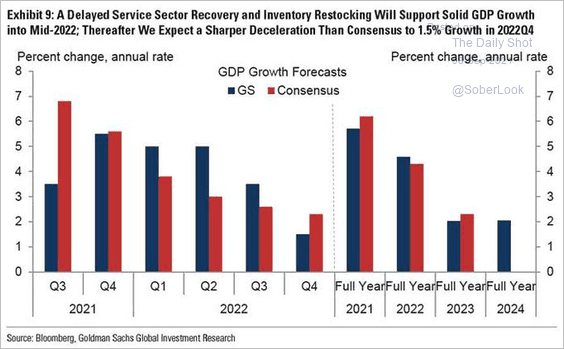

Goldman expects growth to remain robust through the middle of next year, driven by pent-up demand. But the bank sees deterioration after that point.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

——————–

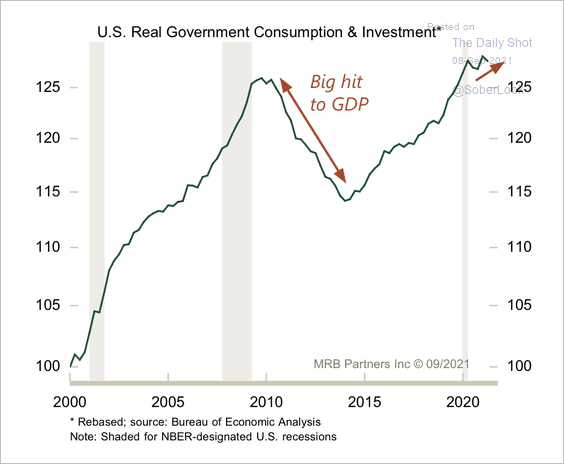

4. Fiscal austerity is unlikely to be repeated in future cycles (no matter which party is in charge).

Source: MRB Partners

Source: MRB Partners

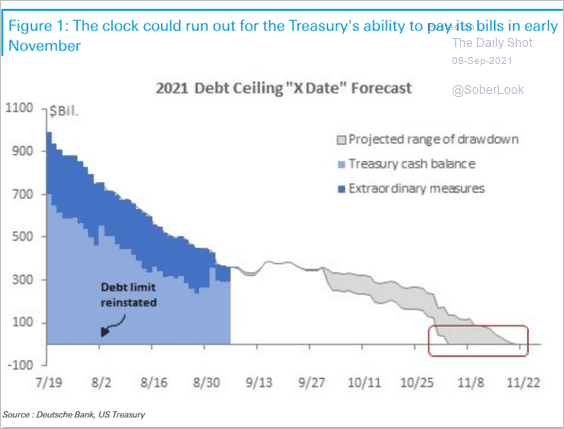

5. Without an increase in the debt ceiling, the US Treasury is expected to lose the ability to pay its bills by early November (the “X date”). Here is a forecast from Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

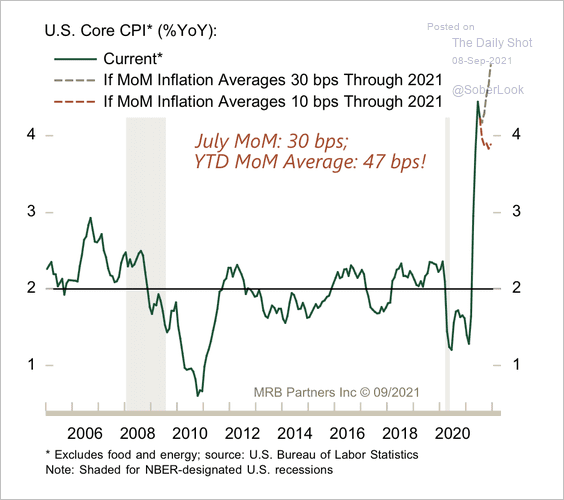

6. Next, we have a couple of updates on inflation.

• MRB Partners expects core inflation to end the year near 4%.

Source: MRB Partners

Source: MRB Partners

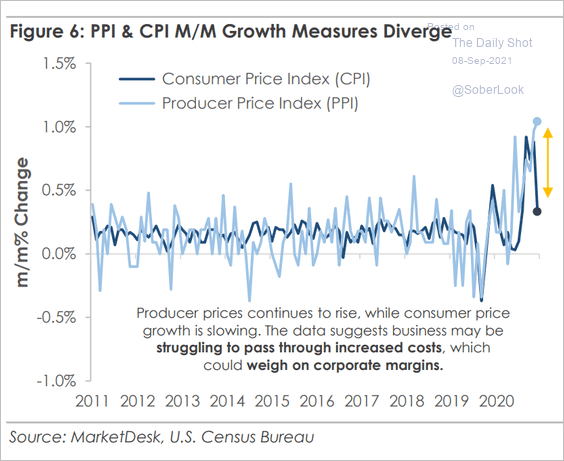

• The recent PPI-CPI divergence is not sustainable.

Source: MarketDesk Research

Source: MarketDesk Research

——————–

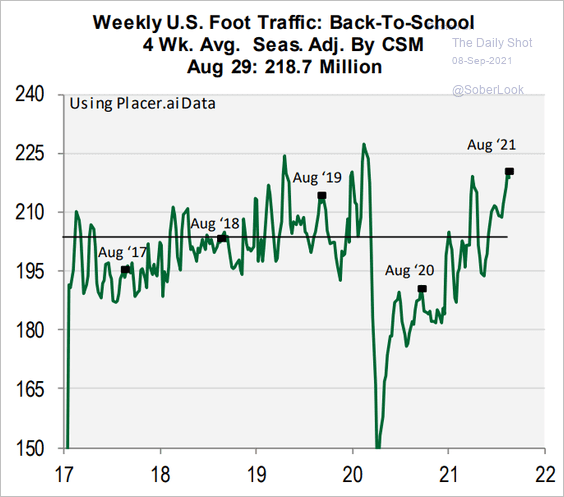

7. Back-to-school retail traffic has been robust.

Source: Cornerstone Macro

Source: Cornerstone Macro

Back to Index

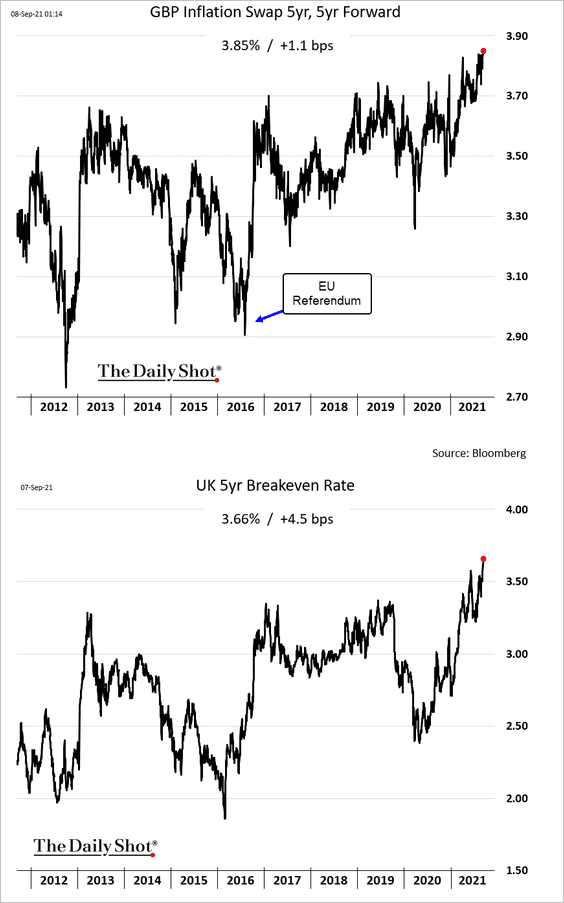

The United Kingdom

1. Market-based inflation expectations are at multi-year highs.

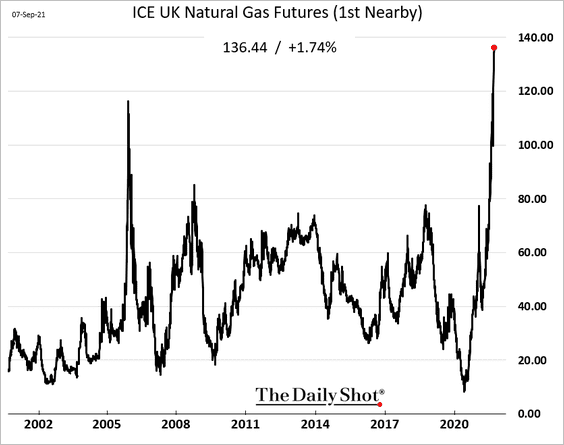

2. The relentless surge in natural gas prices (to record highs) will be a drag on economic growth.

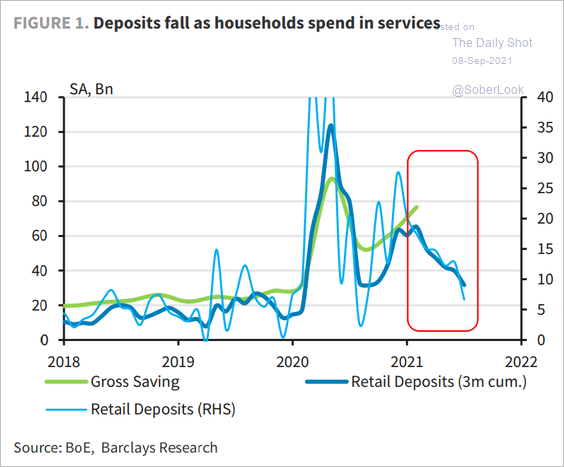

3. Retail deposit levels suggest that saving is slowing (pointing to stronger spending).

Source: Barclays Research

Source: Barclays Research

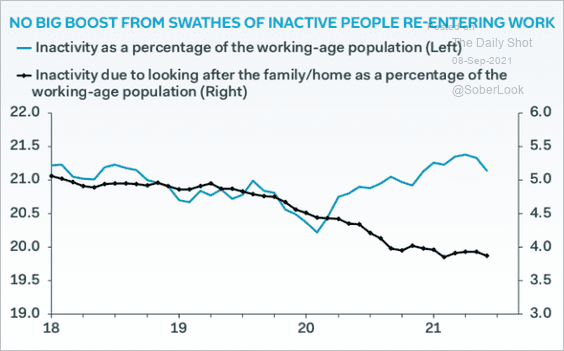

4. Staying out of the labor force since the start of the pandemic doesn’t seem to be linked to childcare challenges.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

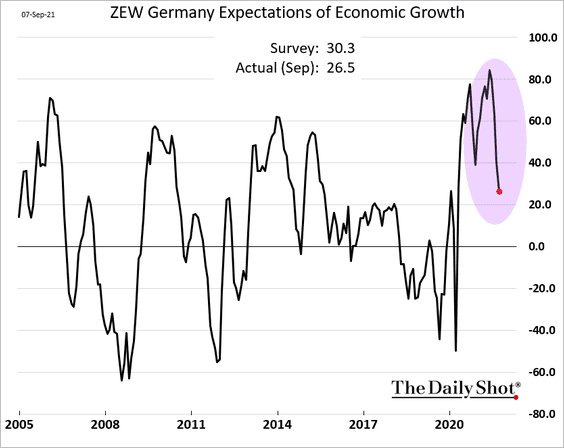

1. Germany’s ZEW expectations index declined further, pointing to a pullback in economic activity this month.

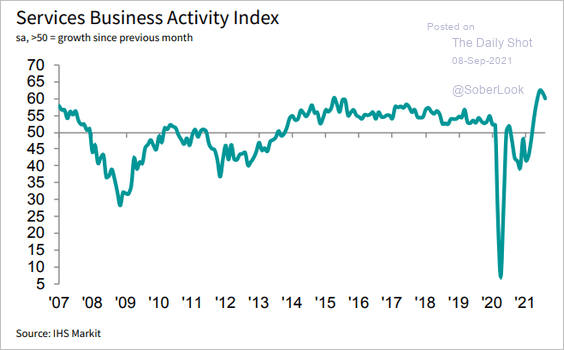

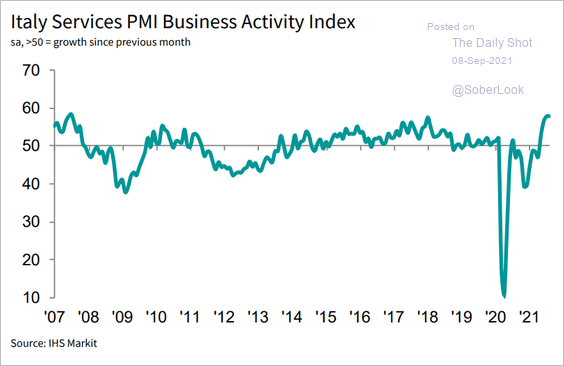

2. Service-sector growth remained robust in Spain and Italy last month.

Source: IHS Markit

Source: IHS Markit

Source: IHS Markit

Source: IHS Markit

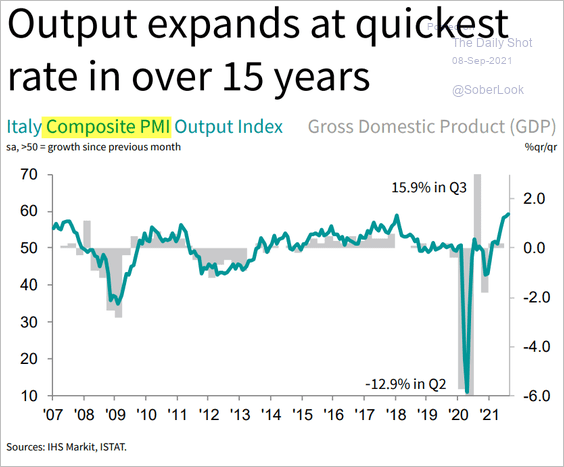

Here is Italy’s composite PMI.

Source: IHS Markit

Source: IHS Markit

——————–

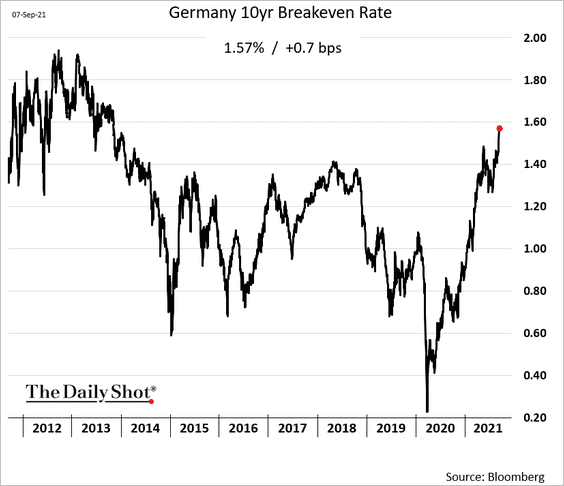

3. Next, we have some updates on inflation.

• Germany’s 10yr breakeven rate (inflation expectations) hit the highest level since 2013.

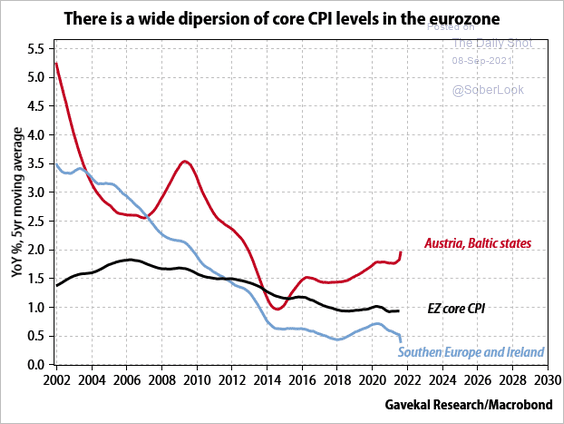

• Inflation trends across the euro area have diverged.

Source: Gavekal Research

Source: Gavekal Research

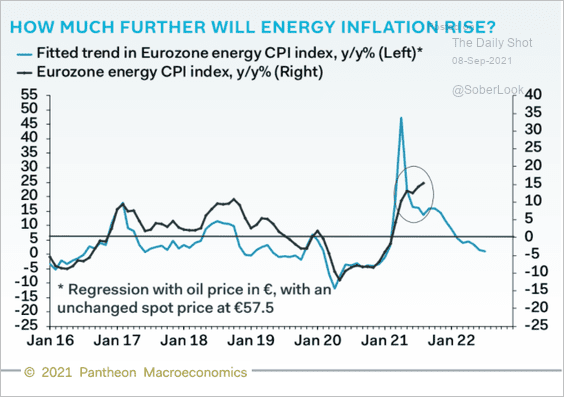

• Energy CPI should begin moderating. Of course, the massive spike in natural gas prices isn’t helping the situation (#2 here).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

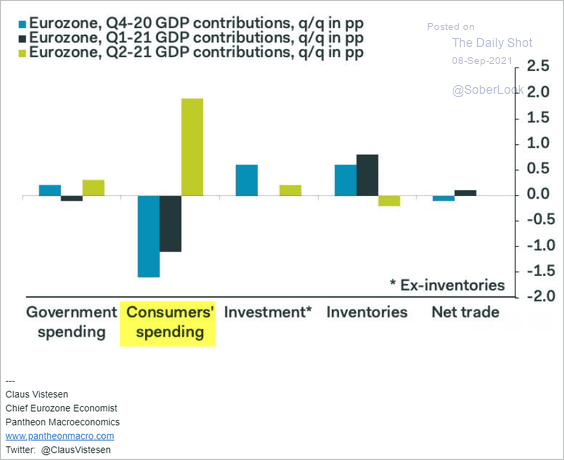

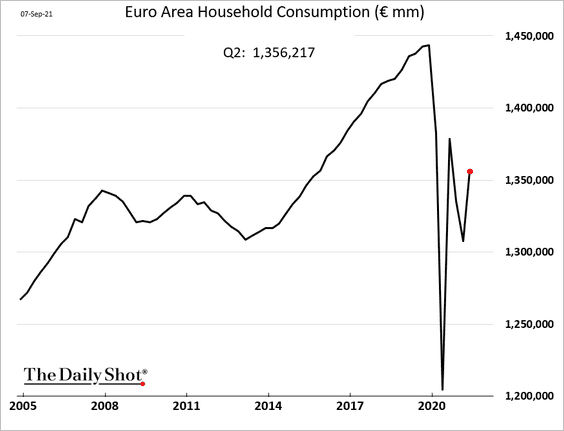

4. Consumer spending boosted the second-quarter growth.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

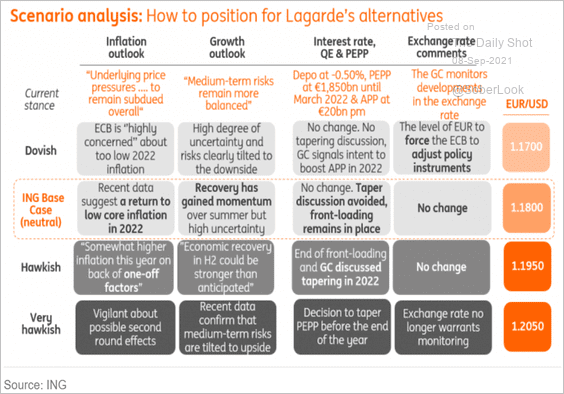

5. How will potential outcomes from this week’s ECB meeting impact the euro?

Source: ING

Source: ING

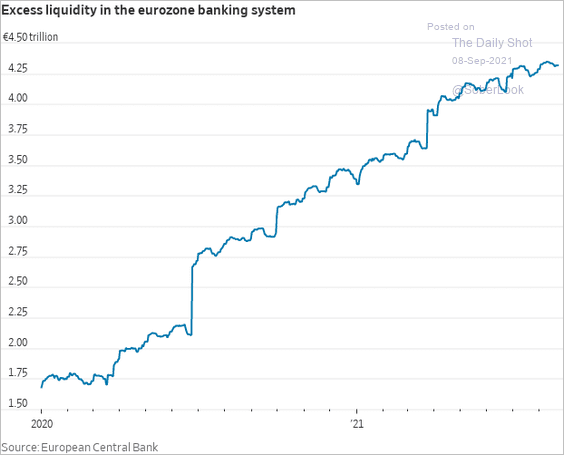

6. Excess reserves are approaching €4.5 trillion (due to QE).

Source: @WSJ Read full article

Source: @WSJ Read full article

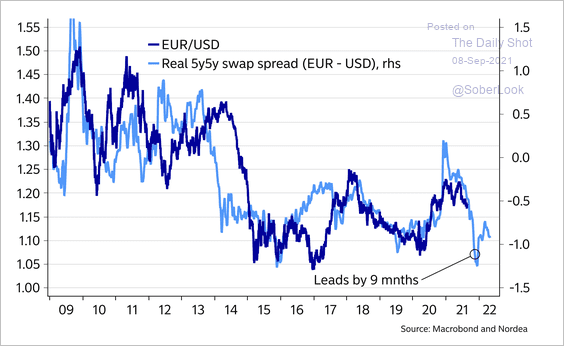

7. Real interest differentials between the US and the euro area will keep the USD well bid vs. EUR.

Source: Nordea Markets

Source: Nordea Markets

Back to Index

Europe

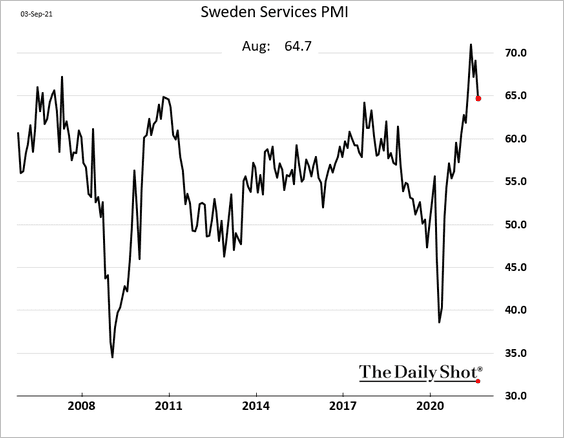

1. Sweden’s service-sector growth moderated in August but remains healthy.

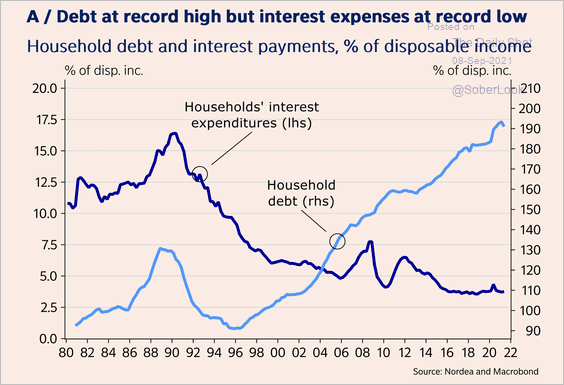

• Sweden looks very similar to other regions – record-high household debt compared to disposable income but record low-interest burden. Households are very sensitive to interest rates.

Source: Nordea Markets

Source: Nordea Markets

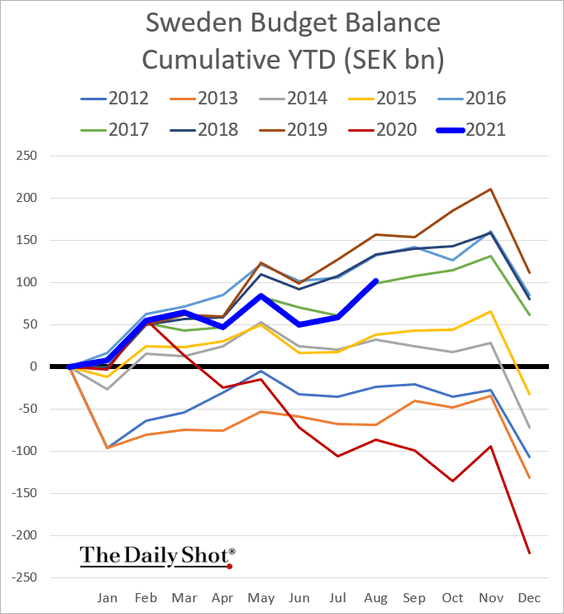

• Sweden’s government budget is in surplus this year.

——————–

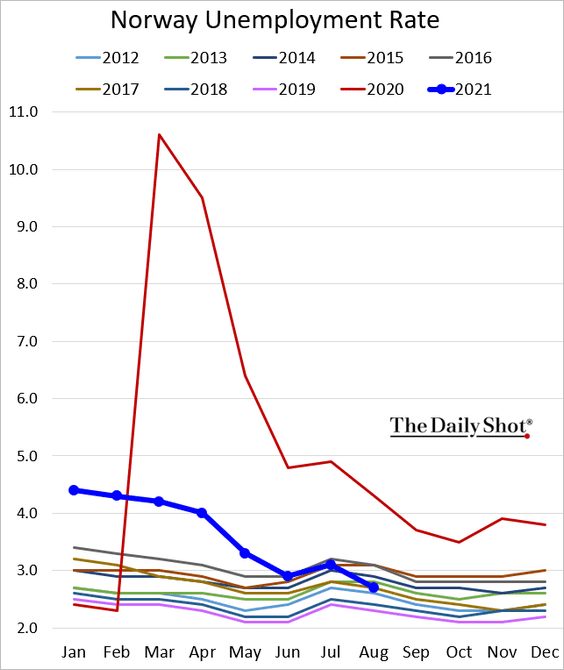

2. Norway’s unemployment rate continues to fall.

3. Next, we have some updates on Switzerland.

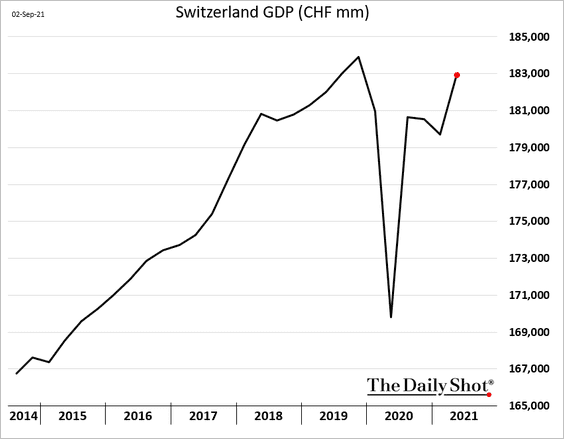

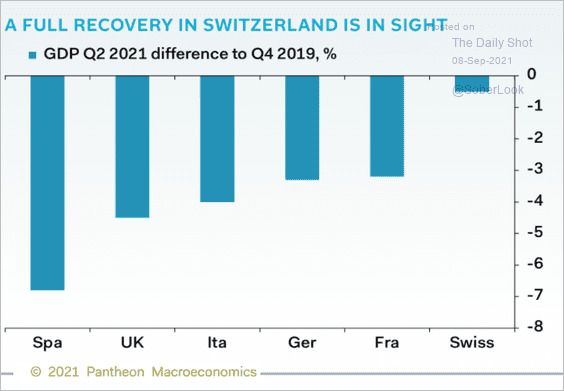

• Unlike other Europan economies, the Swiss GDP has almost recovered (2 charts).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

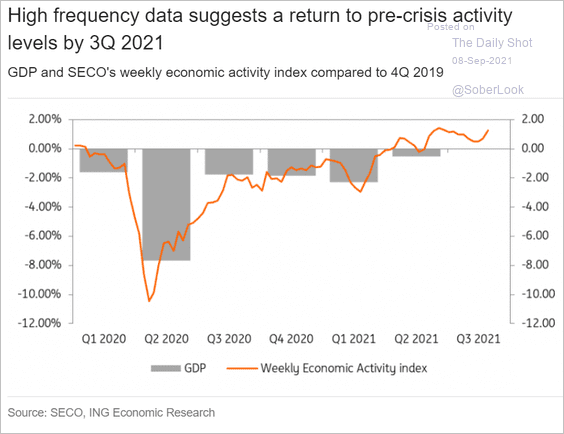

• High-frequency indicators suggest a return to pre-crisis growth this quarter.

Source: ING

Source: ING

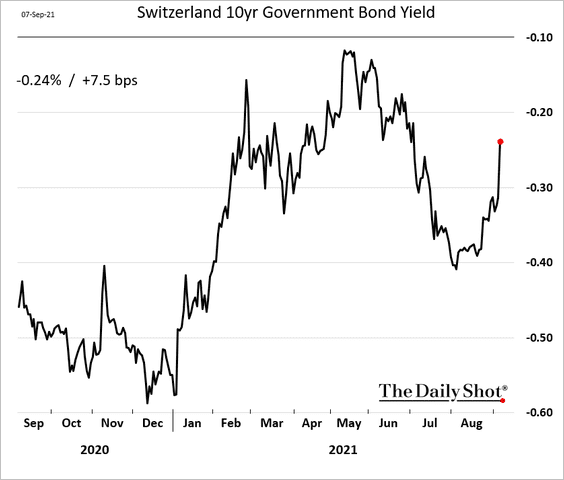

• Bond yields are rebounding.

——————–

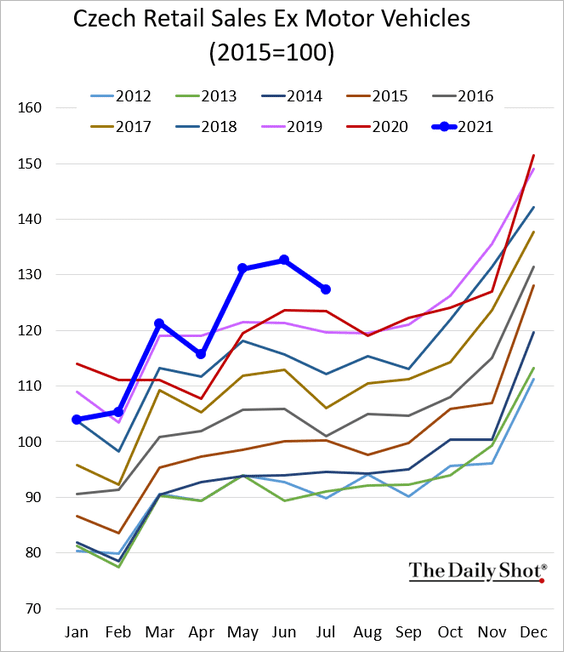

4. Czech retail sales remained strong in July.

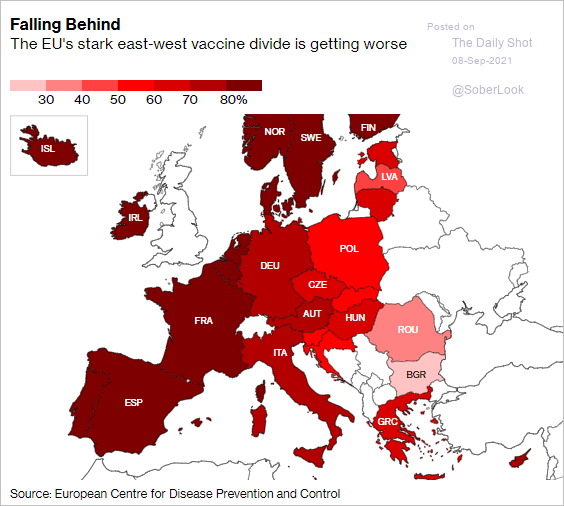

5. This map shows vaccination rates across Europe.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

Back to Index

Asia – Pacific

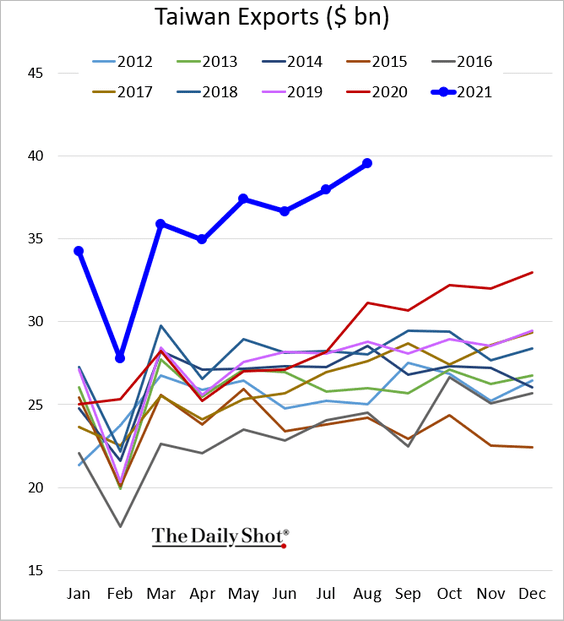

1. Taiwan’s exports continue to surge, hitting record highs.

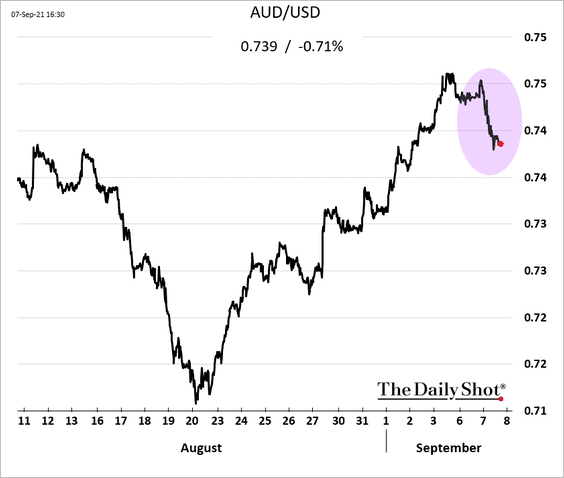

2. The Aussie dollar weakened after the RBA announced that it will maintain its bond purchases until at least mid-February, rather than potentially starting taper in November of this year.

Back to Index

China

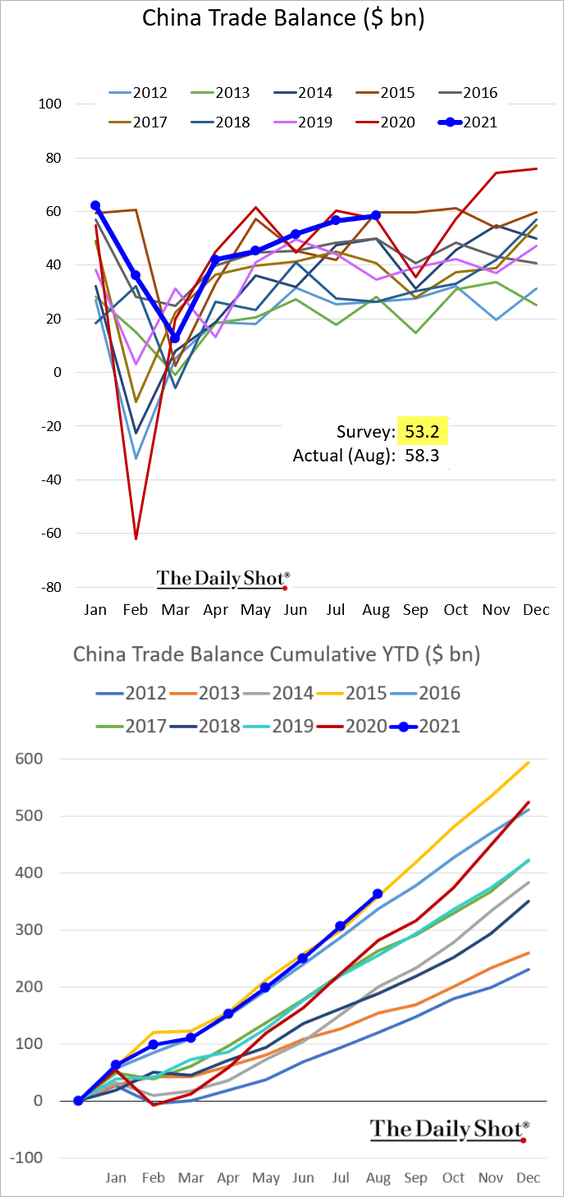

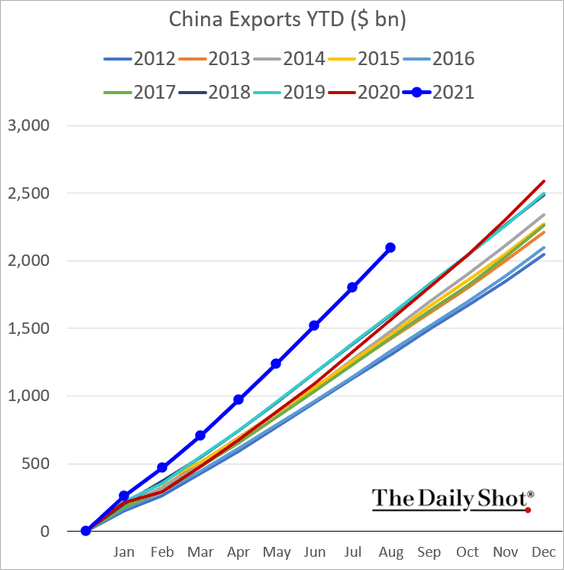

1. China’s trade surplus was stronger than expected last month.

Export growth remains robust.

——————–

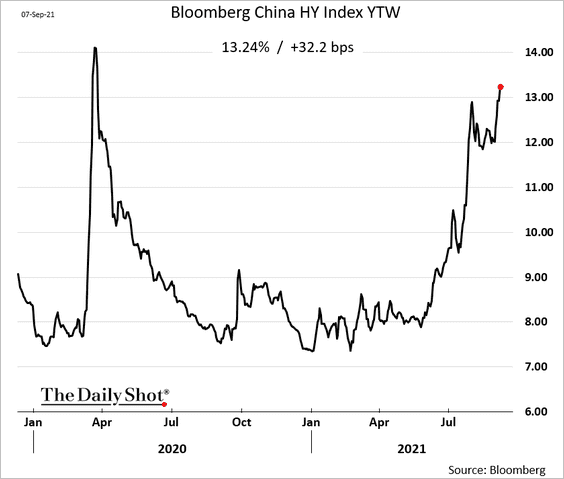

2. The high-yield index yield broke above 13%.

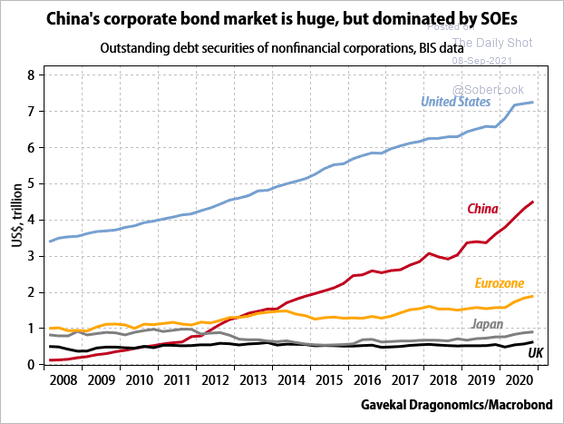

3. China’s corporate bond market has been growing rapidly, dominated by state-owned borrowers.

Source: Gavekal Research

Source: Gavekal Research

4. Evergrande’s share price is now below the IPO offering.

Source: @markets Read full article

Source: @markets Read full article

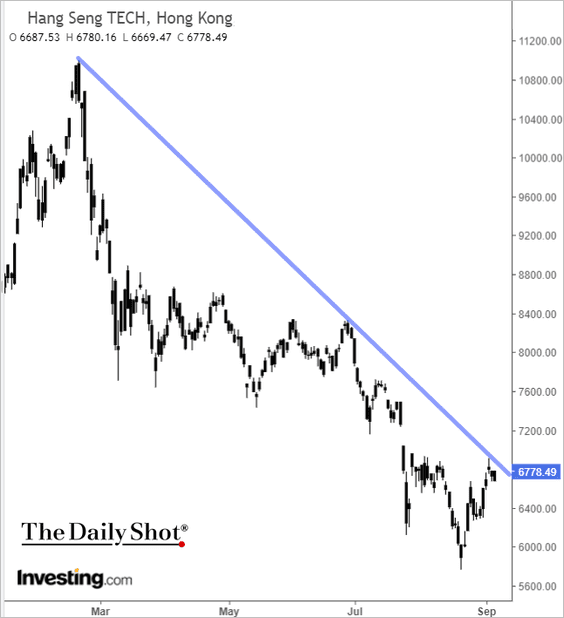

5. The Hang Seng TECH index is at resistance.

h/t @VishnoiSays Read full article

h/t @VishnoiSays Read full article

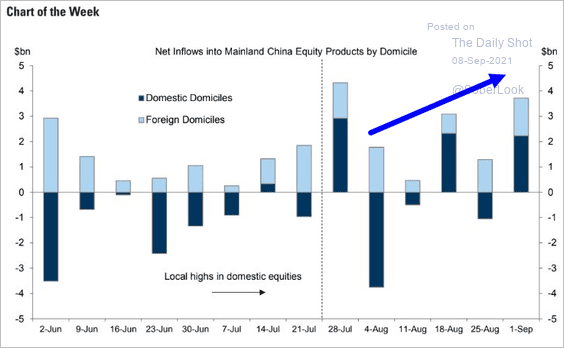

6. Equity flows are trending higher.

Source: Goldman Sachs

Source: Goldman Sachs

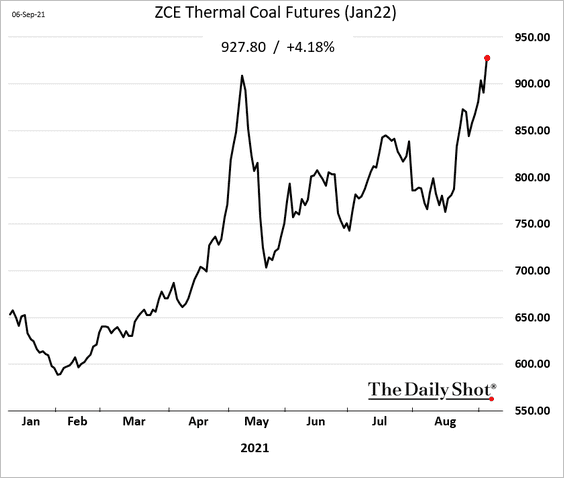

7. Coal prices continue to surge amid shortages.

Source: Reuters Read full article

Source: Reuters Read full article

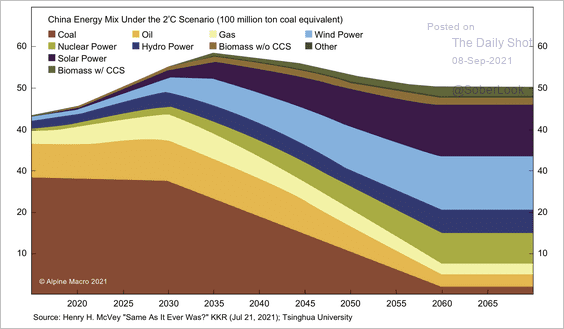

The nation’s dependence on coal will remain high for decades.

Source: Alpine Macro

Source: Alpine Macro

——————–

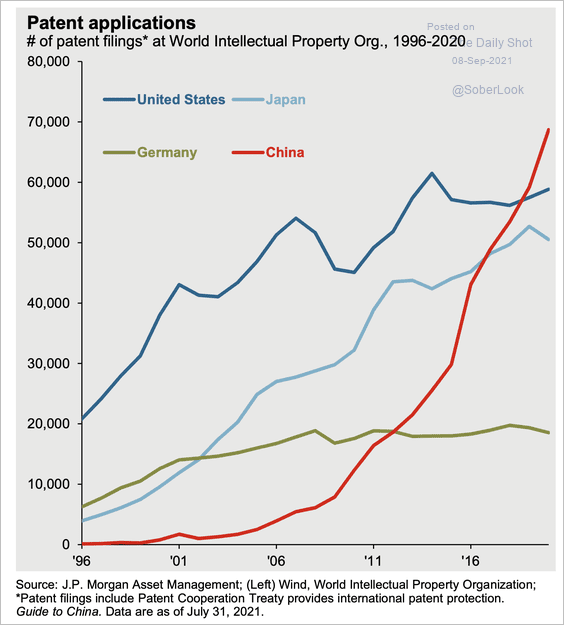

8. China’s patent applications now surpass major developed economies.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Back to Index

Emerging Markets

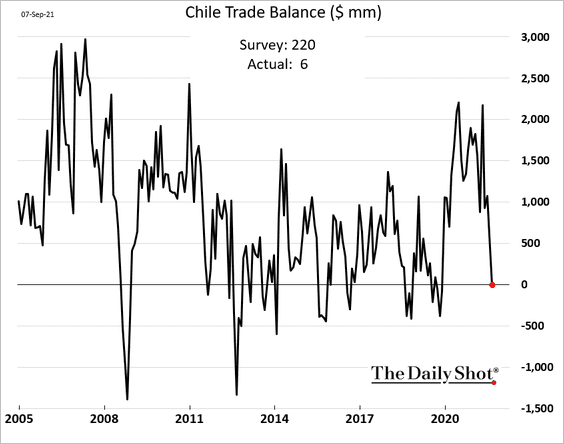

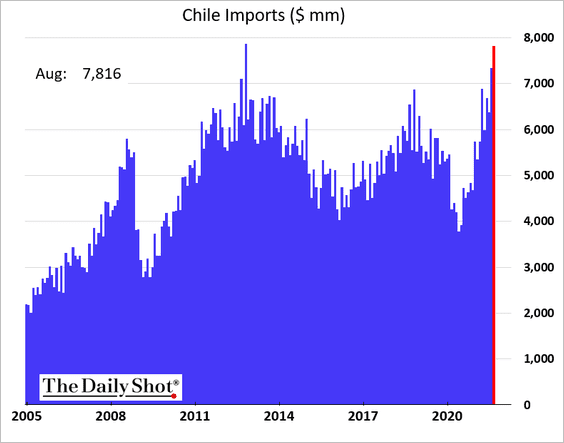

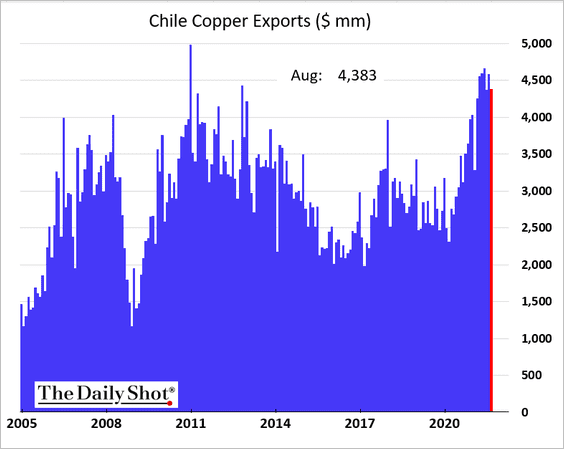

1. Let’s begin with Chile.

• The trade surplus deteriorated …

… amid robust imports.

Copper exports appear to have peaked for now.

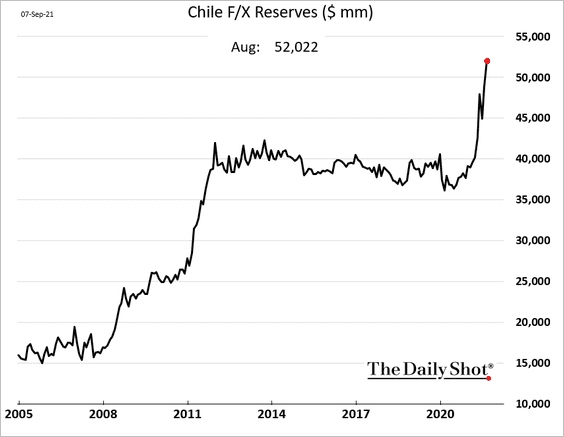

• F/X reserves are surging.

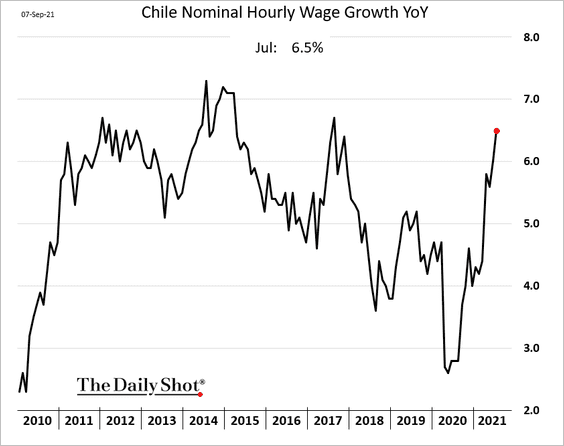

• Wage growth has accelerated.

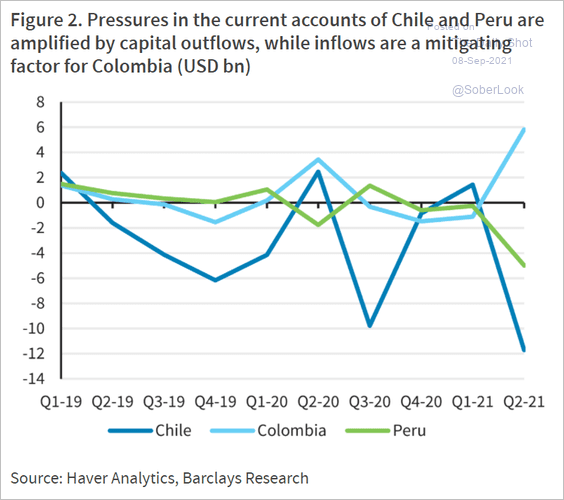

• Capital outflows were massive in Q2.

Source: Barclays Research

Source: Barclays Research

——————–

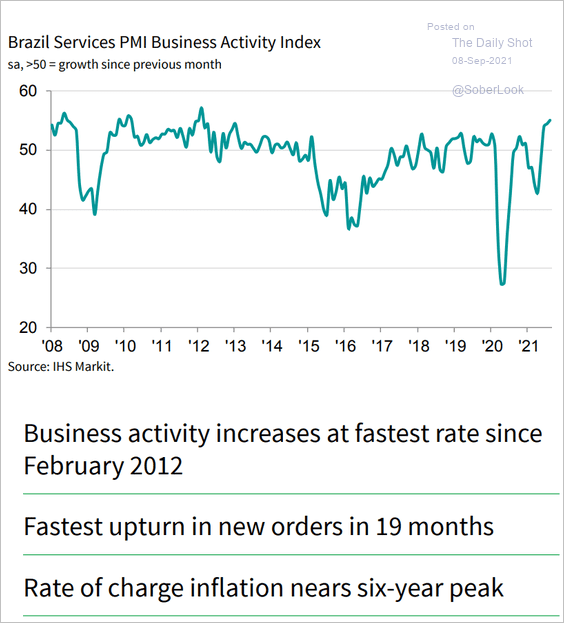

2. Brazil’s service-sector growth hit a multi-year high last month.

Source: IHS Markit

Source: IHS Markit

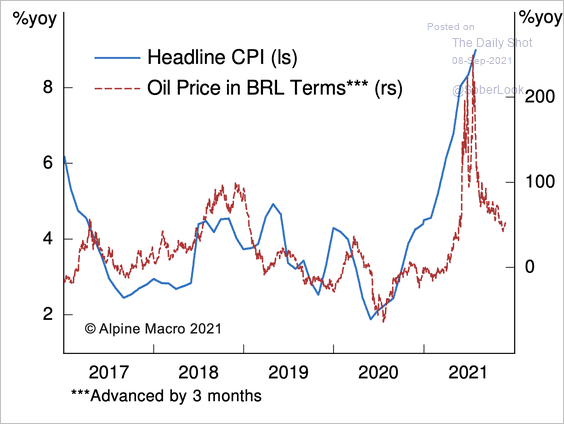

Driven up by energy and food costs, inflation in Brazil may be peaking.

Source: Alpine Macro

Source: Alpine Macro

——————–

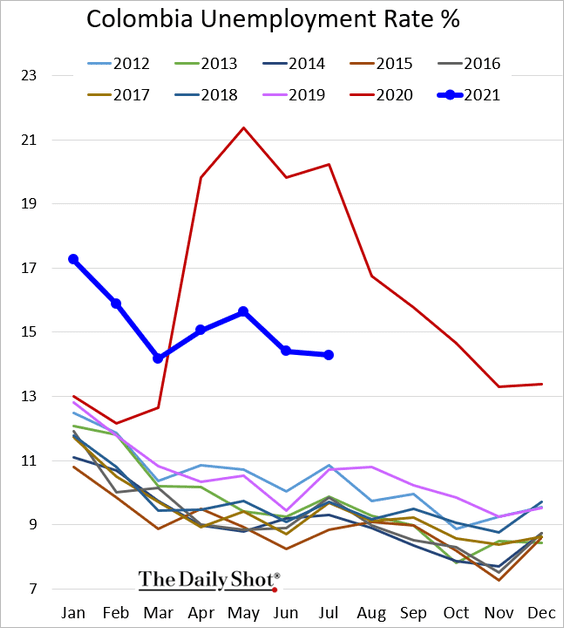

3. Colombia’s unemployment rate remains elevated.

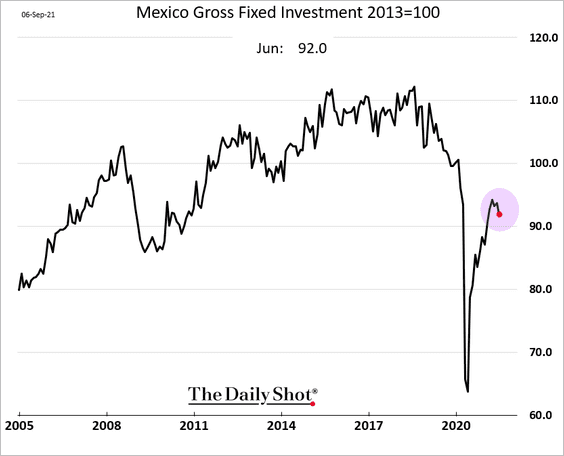

4. Mexico’s business investment slowed in June, holding well below pre-COVID levels.

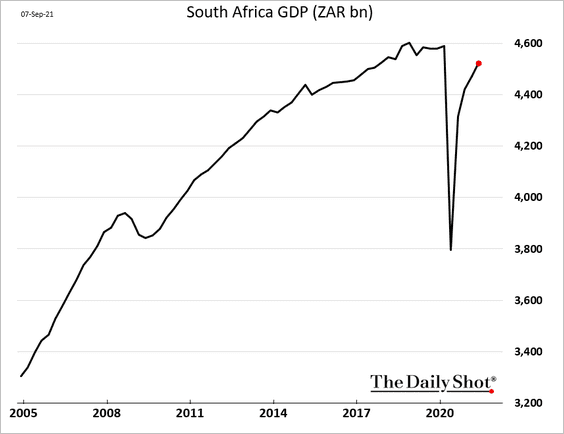

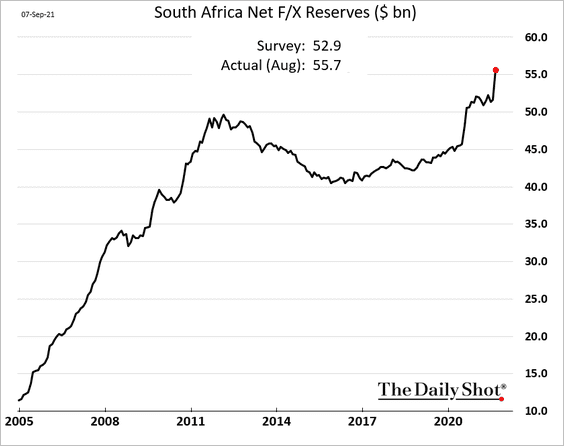

5. South Africa’s GDP is approaching a full recovery.

F/X reserves increased sharply last month.

——————–

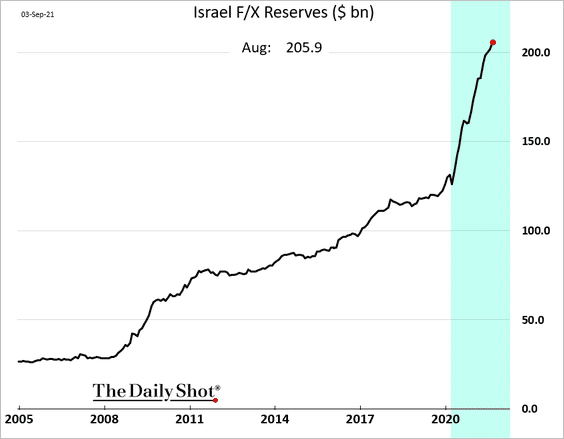

6. Israel’s F/X reserves are above $200 bn.

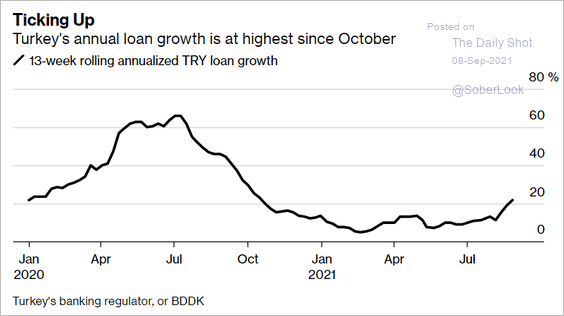

7. Turkey’s loan growth is rebounding.

Source: @markets Read full article

Source: @markets Read full article

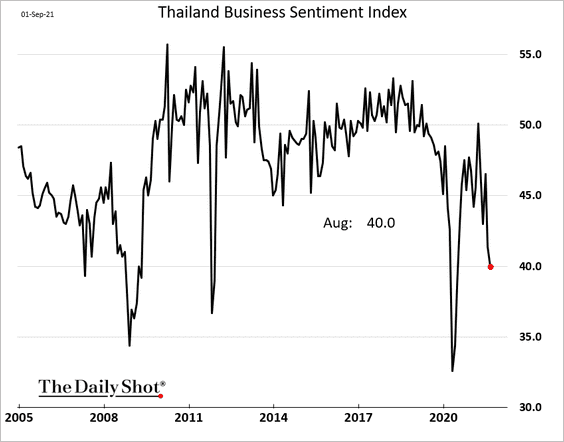

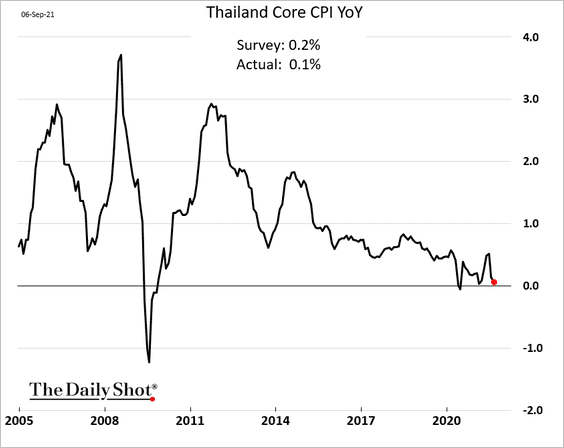

8. Thailand’s business sentiment tumbled in recent months.

Inflation is back near zero.

——————–

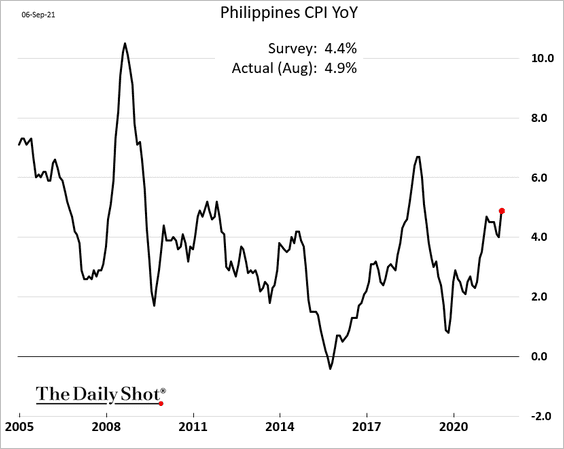

9. Inflation is approaching 5% in the Philippines.

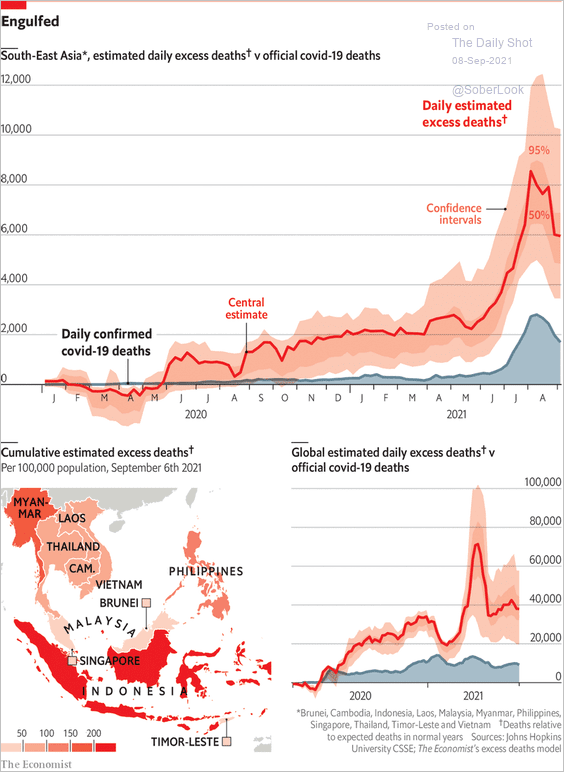

10. South-East Aisa’s COVID death toll has been devastating this summer

Source: The Economist Read full article

Source: The Economist Read full article

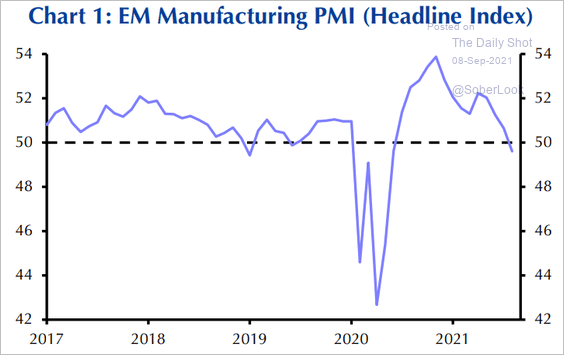

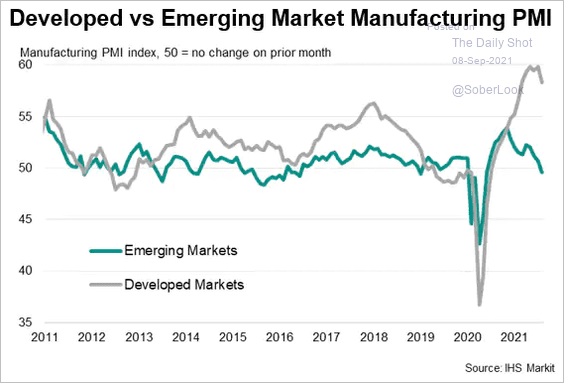

11. EM factory activity is in contraction mode, driven by Asian economies (2 charts).

Source: Capital Economics

Source: Capital Economics

Source: IHS Markit

Source: IHS Markit

Back to Index

Cryptocurrency

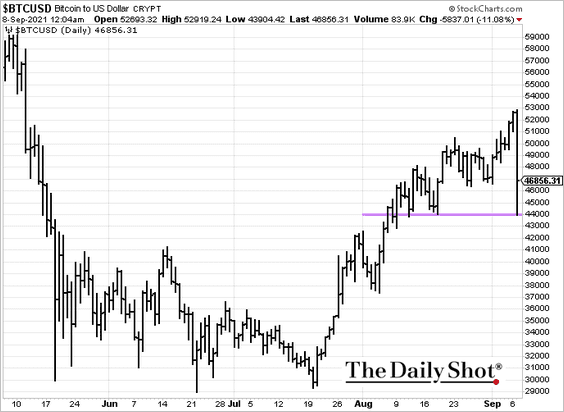

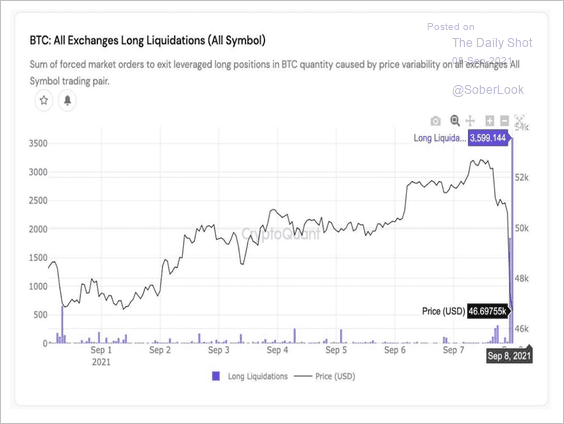

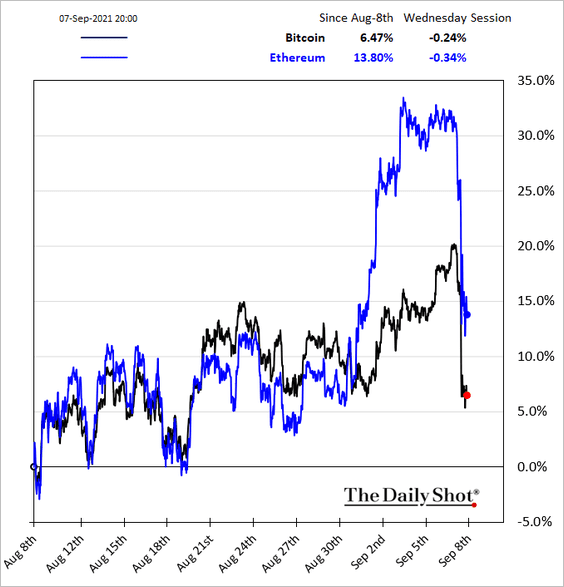

1. Bitcoin experienced a flash crash on Tuesday, finding support at $44k, as El Salvador accepted the cryptocurrency as legal tender.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

• Long positions were quickly liquidated as traders faced margin calls.

Source: CryptoQuant

Source: CryptoQuant

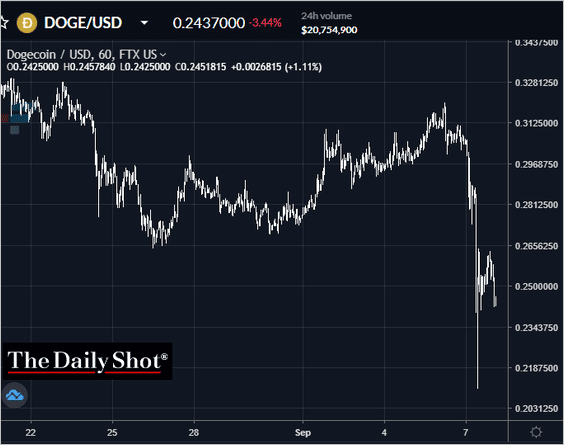

• Other cryptos followed.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

Dogecoin is trading below 25c.

• Exchanges ran into technical difficulties again.

Source: Fox Business Read full article

Source: Fox Business Read full article

——————–

2. El Salvador’s President Nayib Bukele appeared to be unphased.

Source: @nayibbukele

Source: @nayibbukele

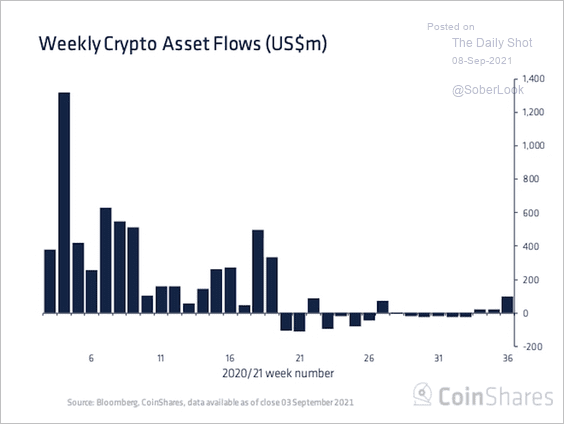

3. Digital asset investment funds saw inflows for the third consecutive week as of September 3.

Source: CoinShares

Source: CoinShares

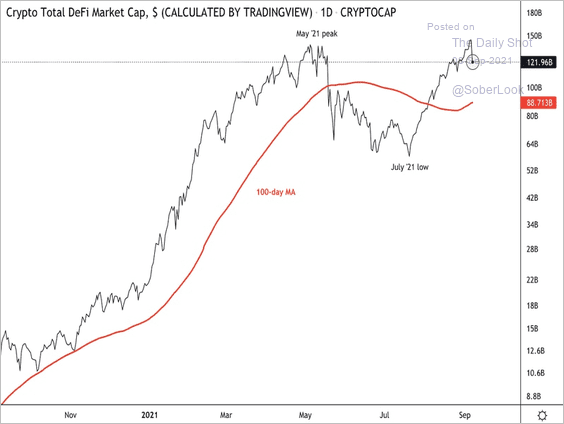

4. The total market value of decentralized finance (DeFi) reached an all-time high near $140 billion shortly before the crypto sell-off.

Source: Dantes Outlook

Source: Dantes Outlook

Back to Index

Commodities

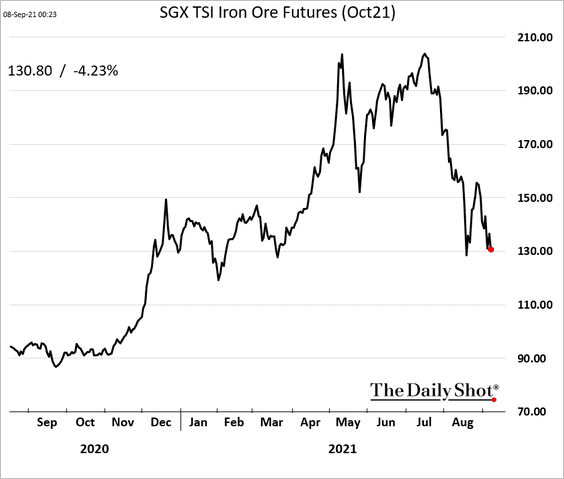

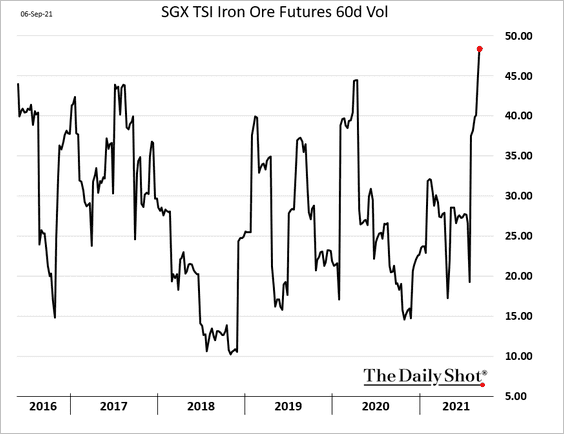

1. Iron ore remains under pressure, …

… as volatility spikes.

h/t @krystalchia

h/t @krystalchia

——————–

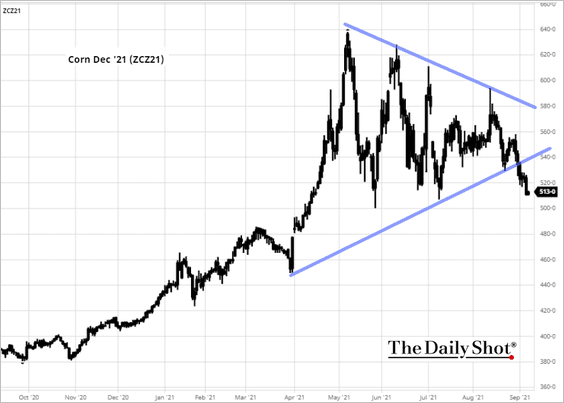

2. The December US corn contract broke below support as crop outlook improves.

Source: barchart.com

Source: barchart.com

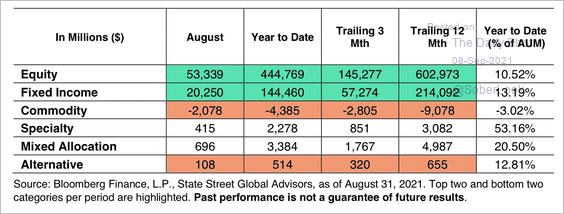

3. Investors continued to pull money out of commodity ETFs, mostly from gold funds, according to State Street.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

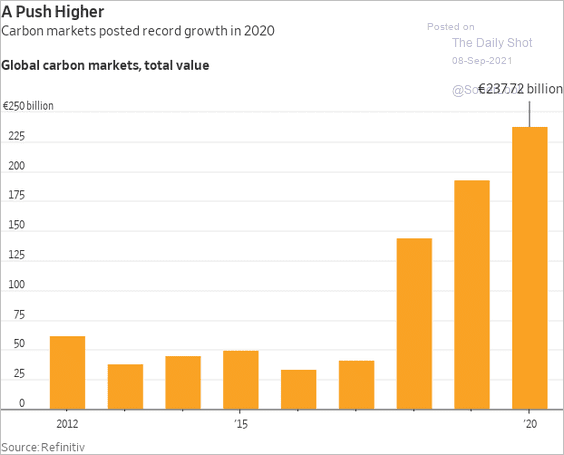

4. Carbon markets’ growth has been impressive.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Energy

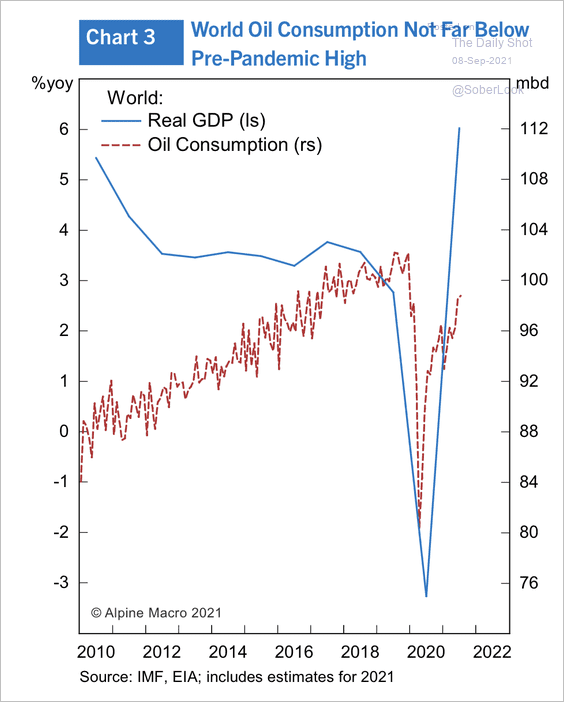

1. Global oil consumption is approaching pre-pandemic levels.

Source: Alpine Macro

Source: Alpine Macro

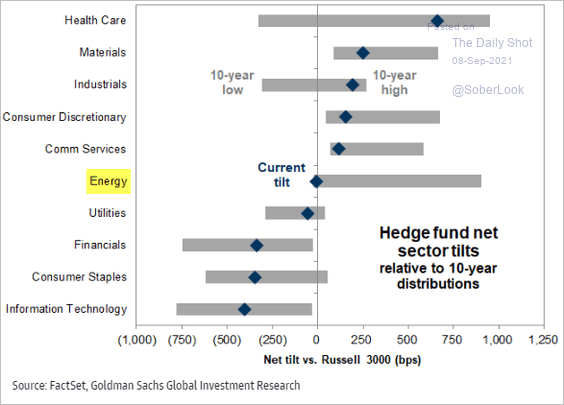

2. Hedge funds’ energy-sector (equities) exposure is the lowest in ten years.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Equities

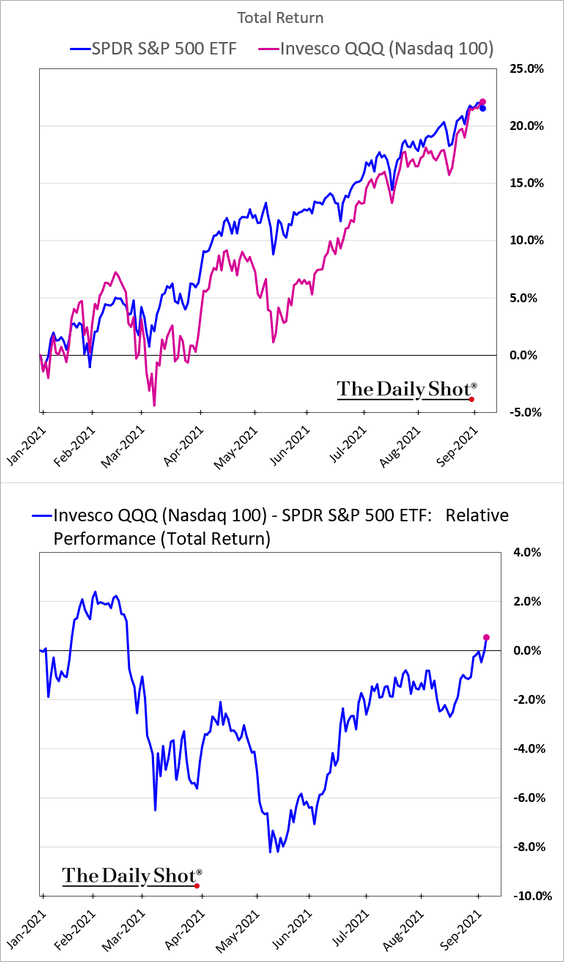

1. Year-to-date, the Nasdaq 100 is now outperforming the S&P 500 (on a total-return basis).

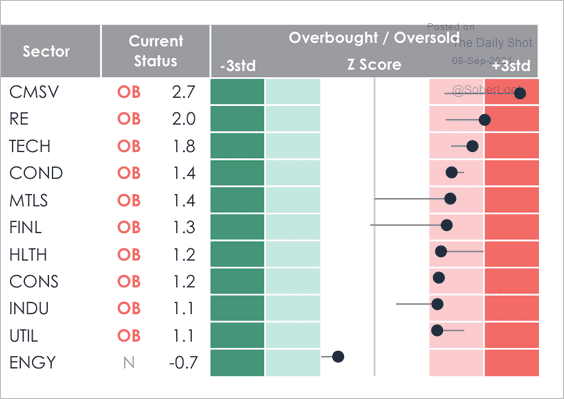

2. All sectors except energy appear to be overbought relative to their 50-day moving averages.

Source: MarketDesk Research

Source: MarketDesk Research

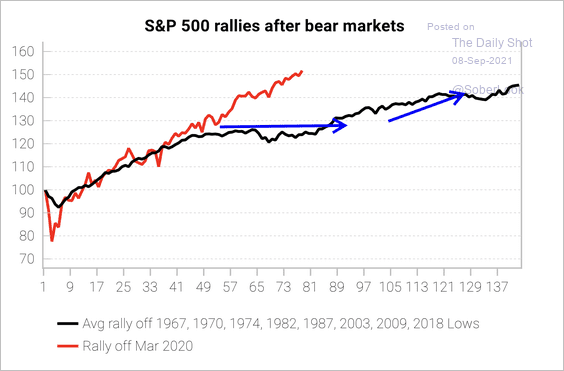

3. It has been a record-breaking rally off the lows, with historic patterns calling for flattening from here.

Source: Variant Perception

Source: Variant Perception

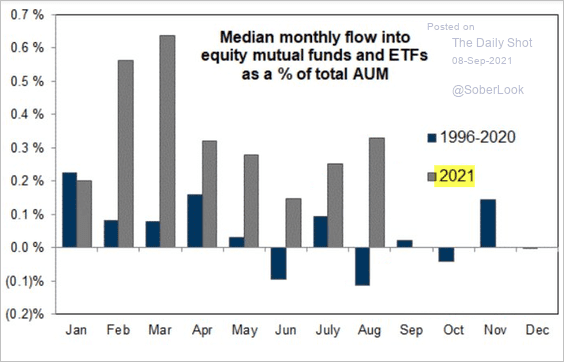

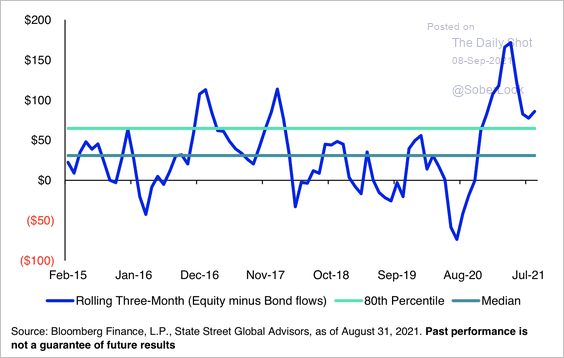

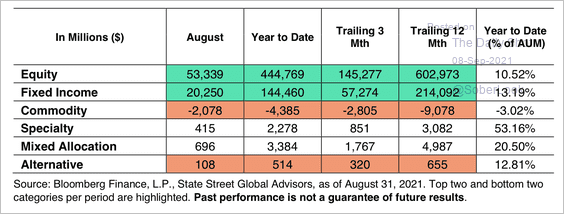

4. Flows remain well above historical averages.

Source: Goldman Sachs

Source: Goldman Sachs

• But equity ETF flows have declined relative to fixed income lately (chart shows rolling 3-month flows equities-bonds in billions).

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

• Developed markets’ ex-US equity ETFs registered inflows in August for the 14th month in a row.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

——————–

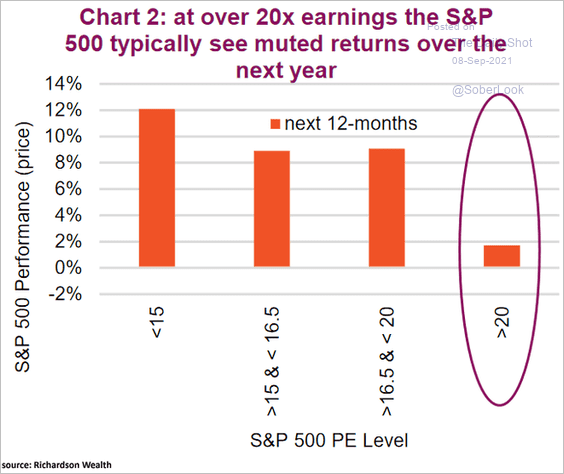

5. Historically, given the current valuations, returns over the next 12 months are expected to be poor.

Source: Market Ethos, Richardson GMP

Source: Market Ethos, Richardson GMP

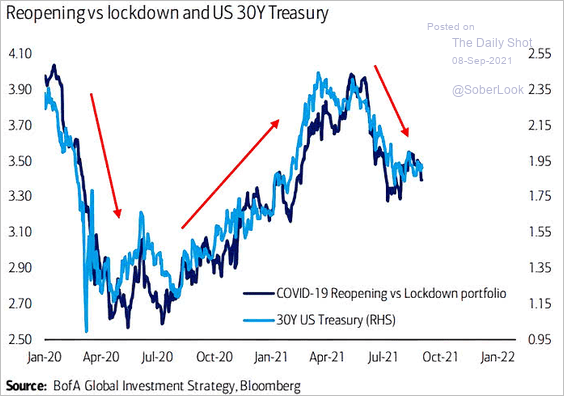

6. The relative performance of “reopening” vs. “lockdown” stocks tracks the 30yr Treasury yield.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

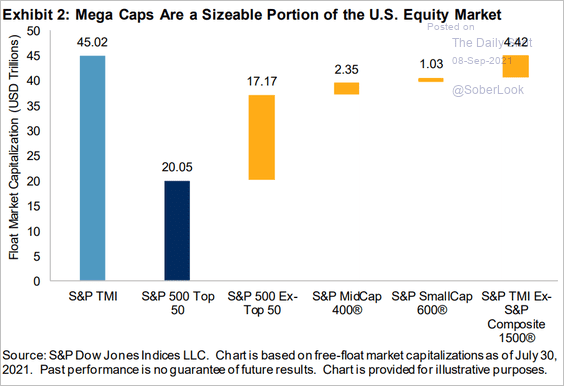

7. The 50 largest stocks represent 20% of the S&P Total Market Index.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

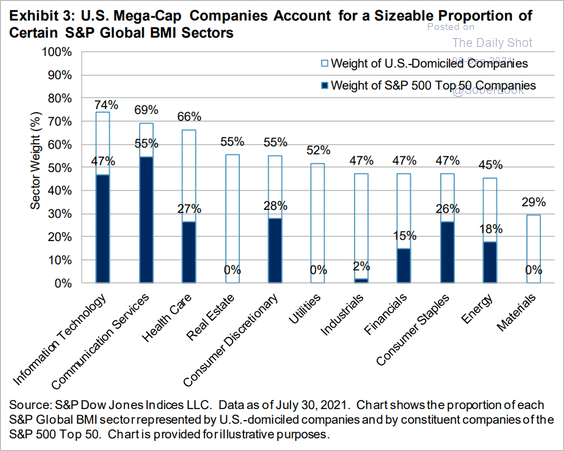

Here are the concentrations by sector.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Alternatives

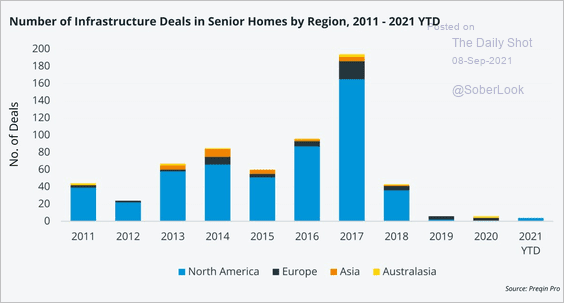

1. Nobody wants to invest in senior homes.

Source: @Preqin Read full article

Source: @Preqin Read full article

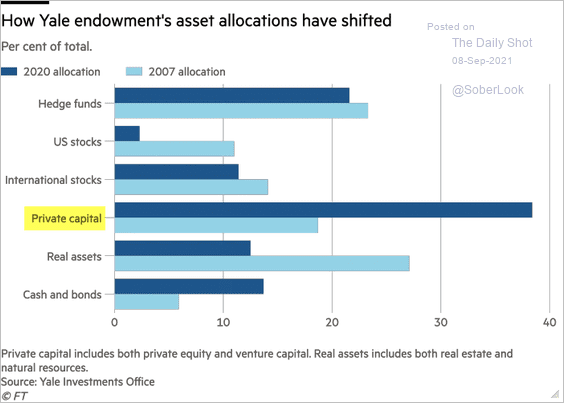

2. Yale’s endowment is betting heavily on private markets.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Credit

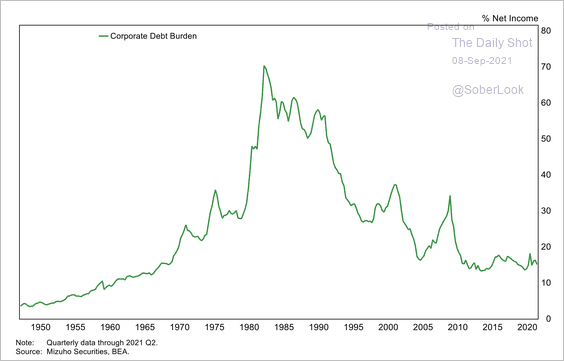

1. The US corporate debt burden is at multi-decade lows (amid depressed corporate bond yields).

Source: Mizuho Securities USA

Source: Mizuho Securities USA

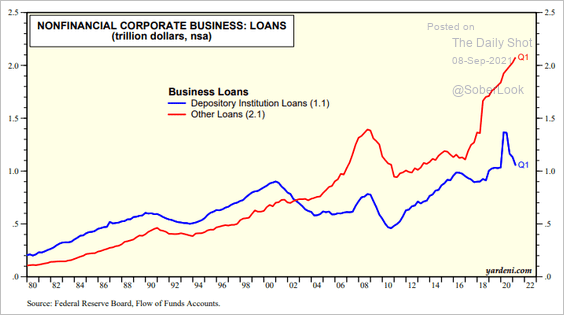

2. Corporate lending is increasingly dominated by “shadow banks” (funds, CLOs, etc.).

Source: Yardeni Research

Source: Yardeni Research

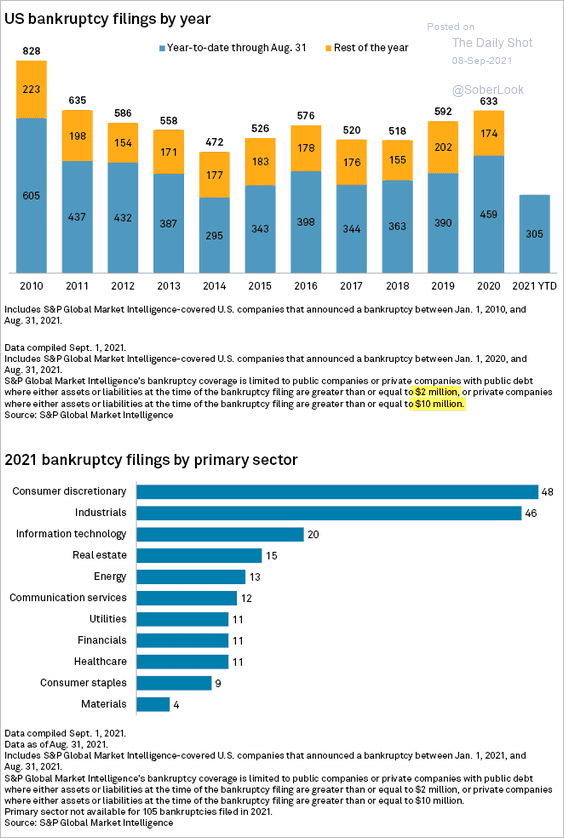

3. Next, we have some data on US bankruptcy filings from S&P Global.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

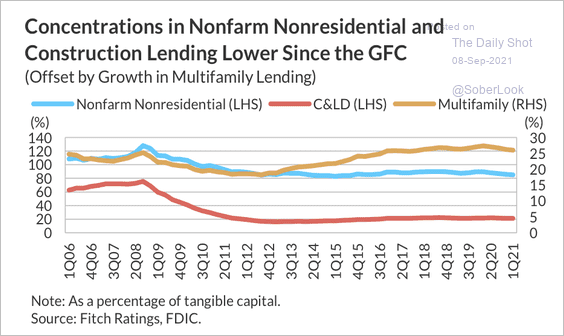

4. Growth in multifamily lending has offset bank concentrations in non-residential and construction lending.

Source: Fitch Ratings

Source: Fitch Ratings

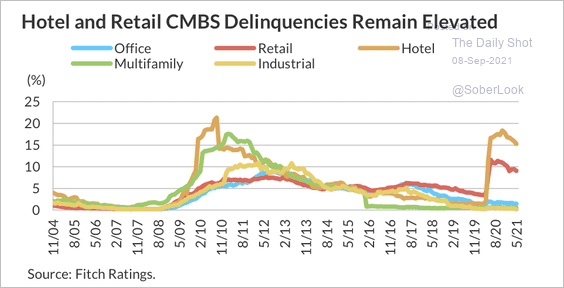

5. Hotel and retail property commercial mortgage-backed securities (CMBS) delinquencies remain elevated.

Source: Fitch Ratings

Source: Fitch Ratings

Back to Index

Global Developments

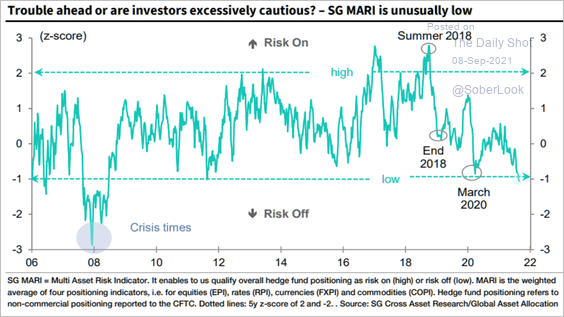

1. Incredibly, despite all-time highs in stock markets, Soc Gen’s Multi-Asset Risk indicator is flashing caution equivalent to March 2020.

Source: Soc Gen, The Market Ear, Snippet.Finance

Source: Soc Gen, The Market Ear, Snippet.Finance

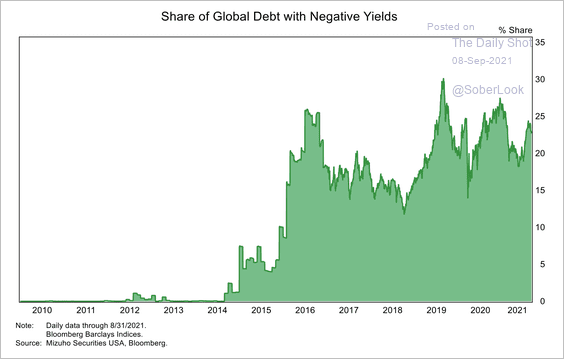

2. The share of global debt with negative yields remains elevated.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

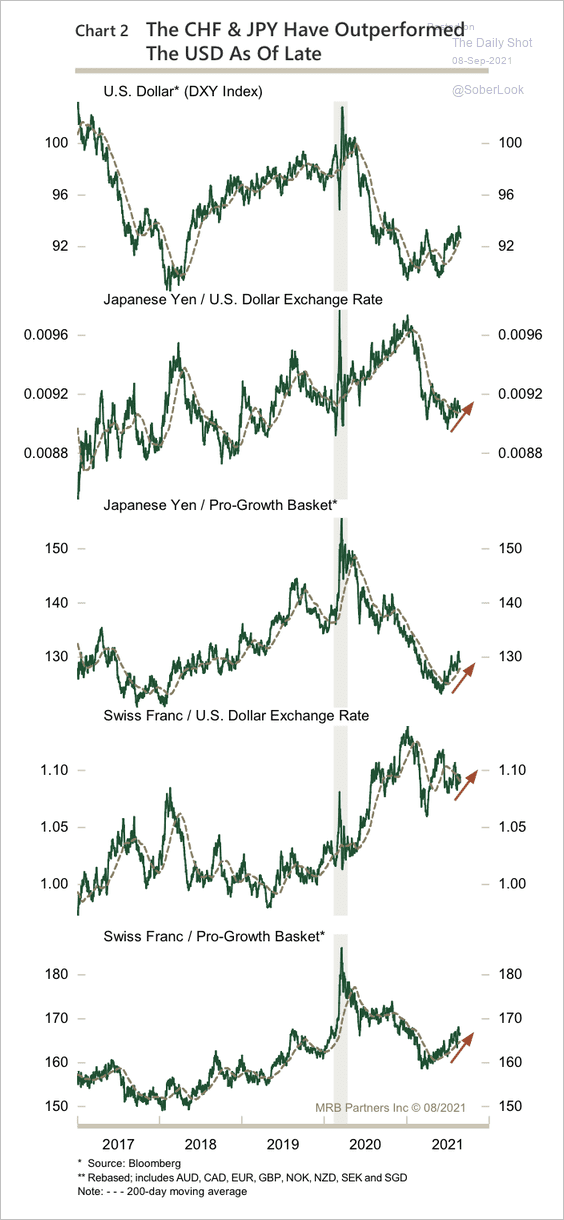

3. The Swiss franc and Japanese yen have outperformed the dollar and risk-on “growth” currencies lately.

Source: MRB Partners

Source: MRB Partners

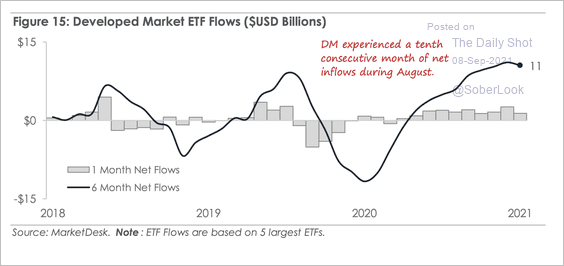

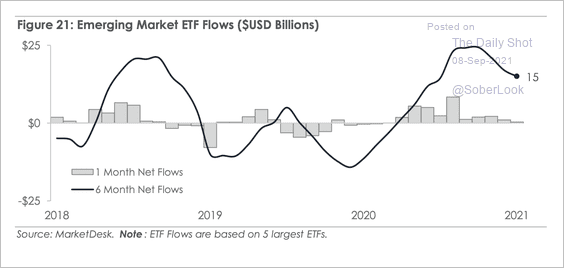

4. Developed markets’ ETFs have seen consistently higher net flows than emerging markets, where flows have been rolling over (2 charts).

Source: MarketDesk Research

Source: MarketDesk Research

Source: MarketDesk Research

Source: MarketDesk Research

——————–

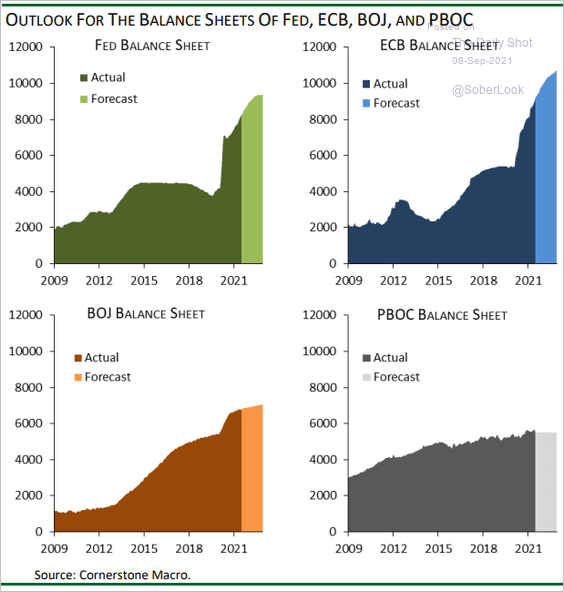

5. Next, we have a forecast for central banks’ balance sheets from Cornerstone Macro.

Source: Cornerstone Macro

Source: Cornerstone Macro

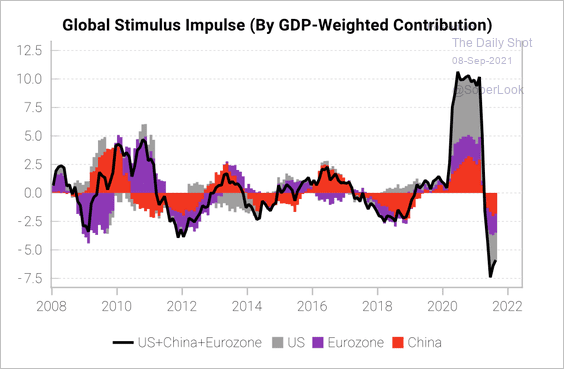

6. The global stimulus impulse has been negative.

Source: Variant Perception

Source: Variant Perception

——————–

Food for Thought

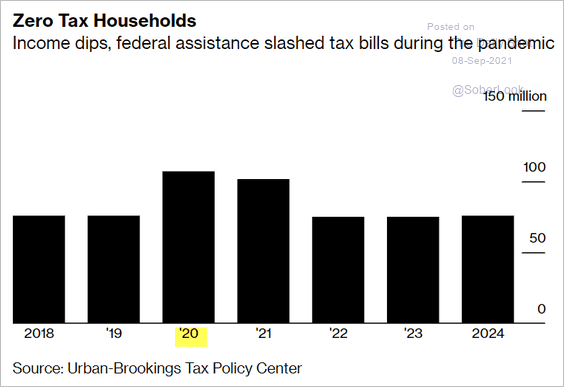

1. 61% of US households paid no income tax last year.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

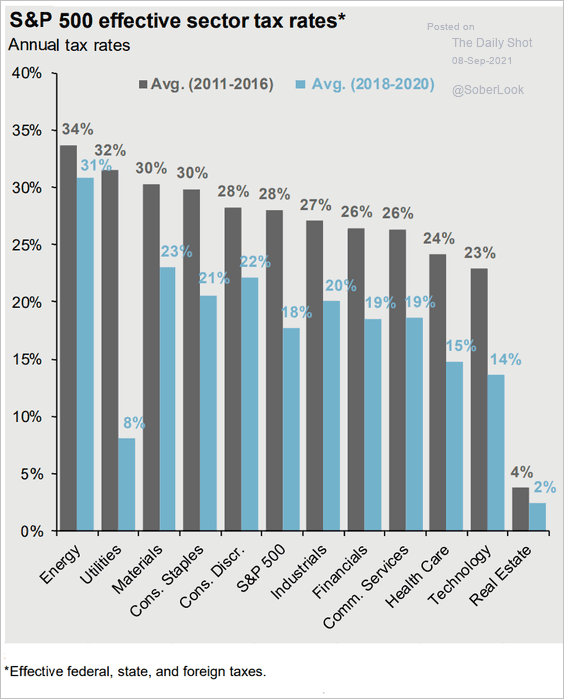

2. S&P 500 effective corporate tax rates by sector:

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

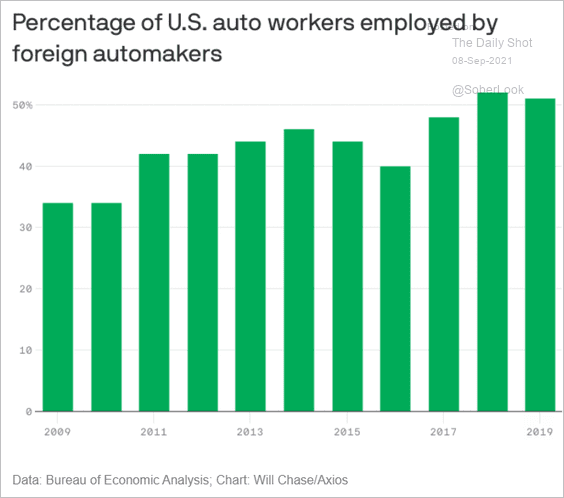

3. US auto workers employed by foreign firms:

Source: @axios Read full article

Source: @axios Read full article

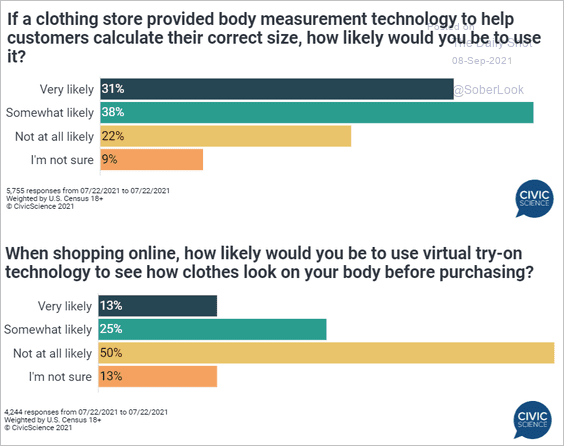

4. Using virtual try-on technology:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

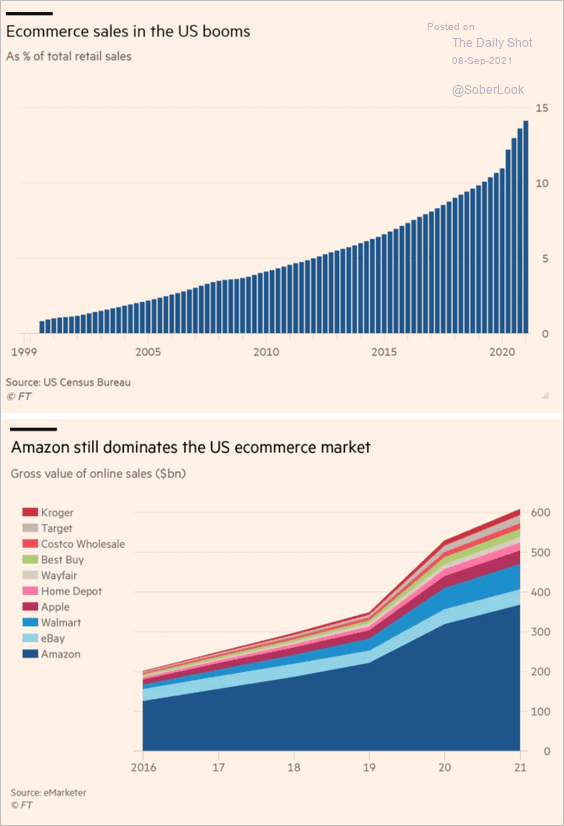

5. The US e-commerce market:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

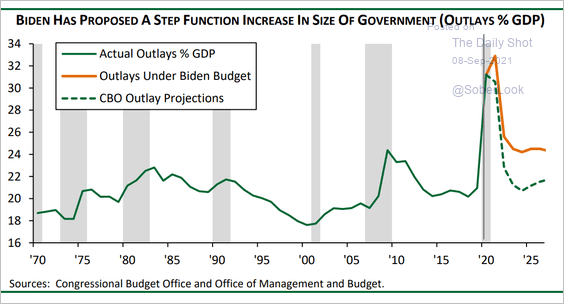

6. Proposed US federal government outlays as a percent of GDP:

Source: Cornerstone Macro

Source: Cornerstone Macro

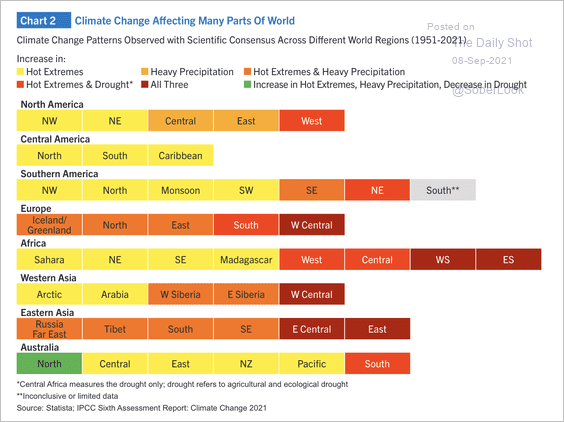

7. Extreme weather patterns:

Source: Alpine Macro

Source: Alpine Macro

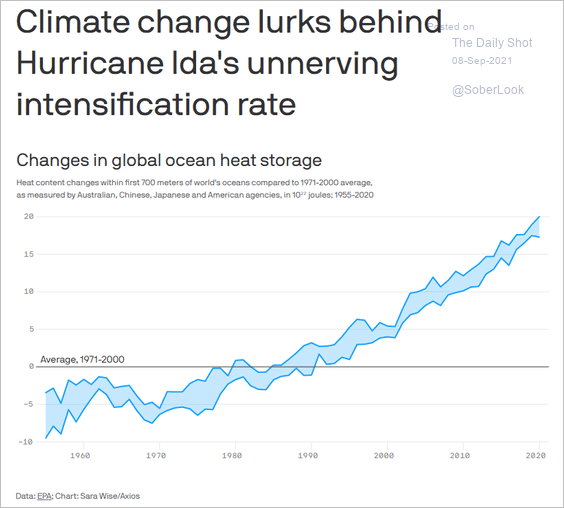

8. Warmer ocean water powering stronger hurricanes:

Source: @axios Read full article

Source: @axios Read full article

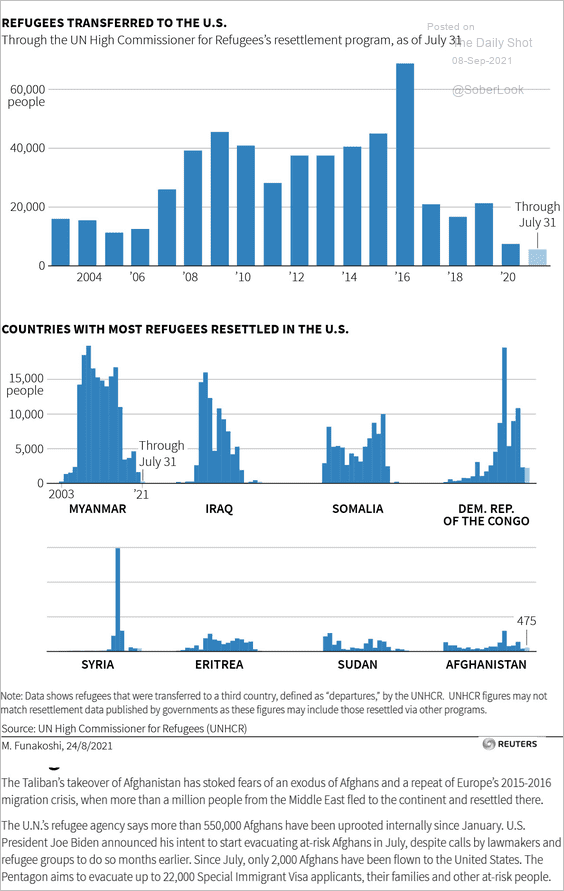

9. Refugees resettled in the US:

Source: @ReutersGraphics Read full article

Source: @ReutersGraphics Read full article

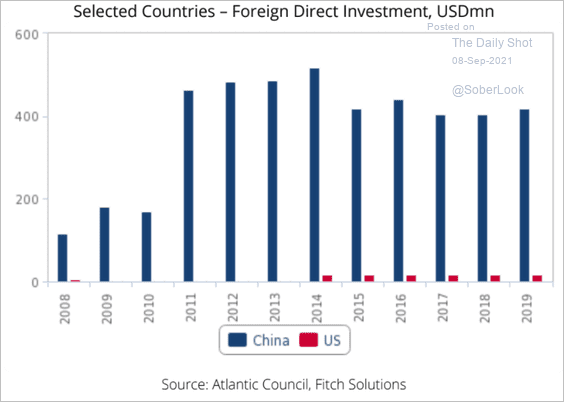

10. Foreign investment in Afghanistan:

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

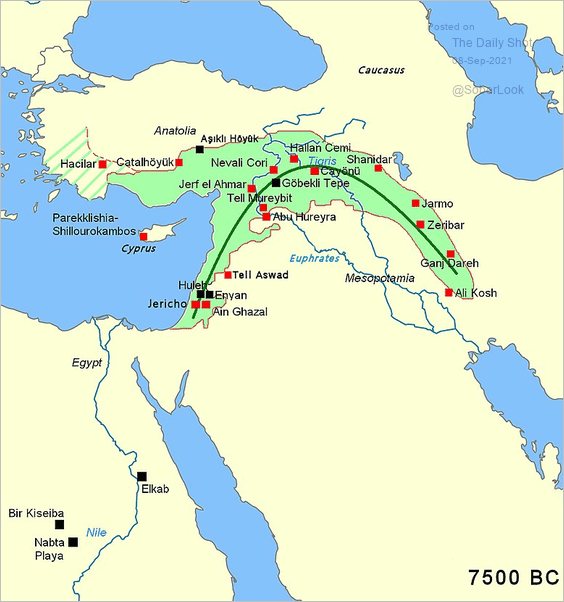

11. Archaeological sites of the Pre-Pottery Neolithic period (7500 BCE):

Source: Wikipedia Read full article

Source: Wikipedia Read full article

——————–

Back to Index