The Daily Shot: 11-Feb-22

• The United States

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Equities

• Credit

• Rates

• Food for Thought

The United States

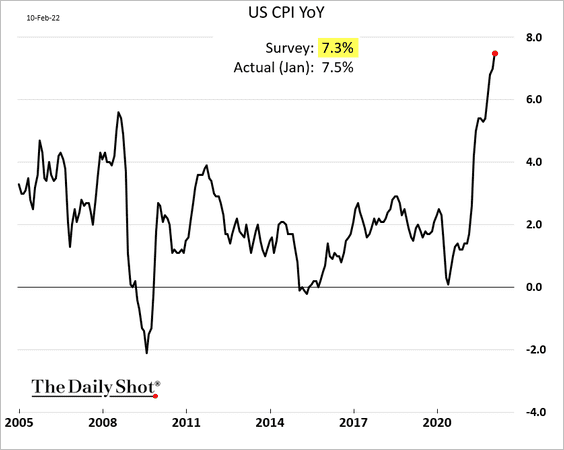

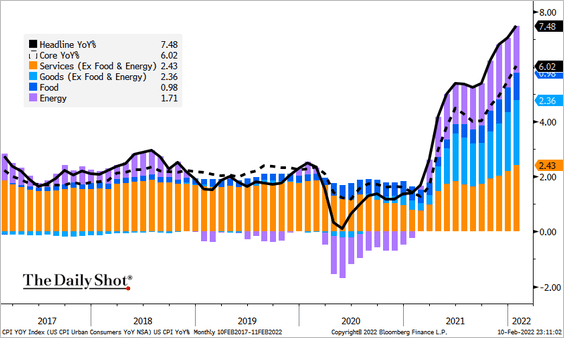

1. The CPI report surprised to the upside, with inflation hitting multi-decade highs.

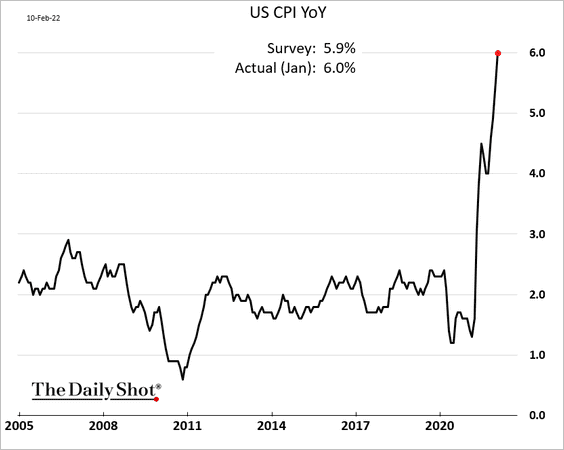

The core inflation also topped forecasts.

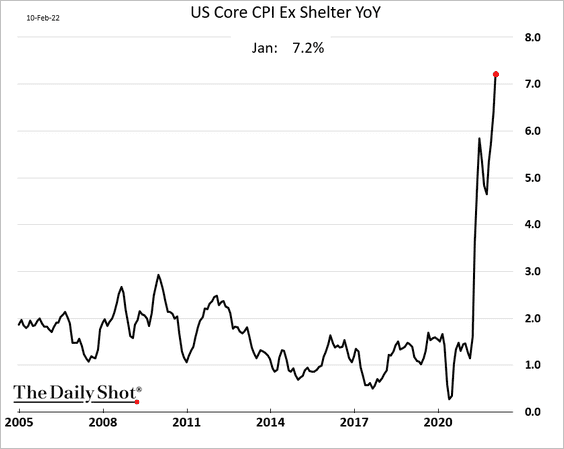

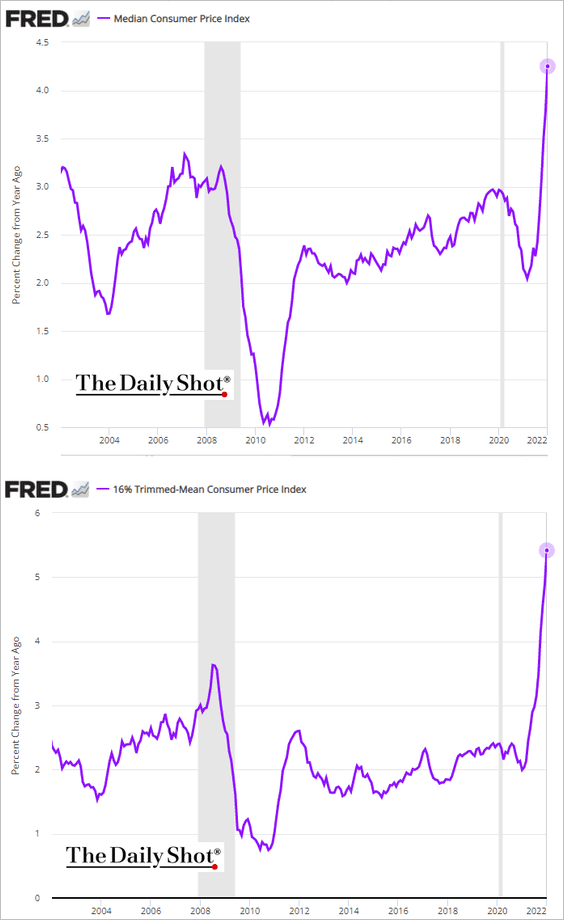

Other measures of core inflation have been accelerating.

• Core CPI ex shelter:

• Median and trimmed-mean CPI:

Services inflation has been picking up momentum.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

We will have more detail on the CPI report next week. We will also have some updates on wage growth.

——————–

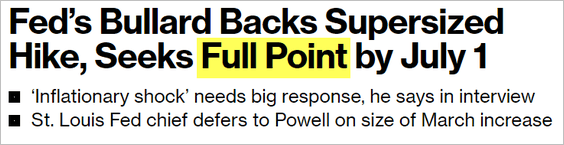

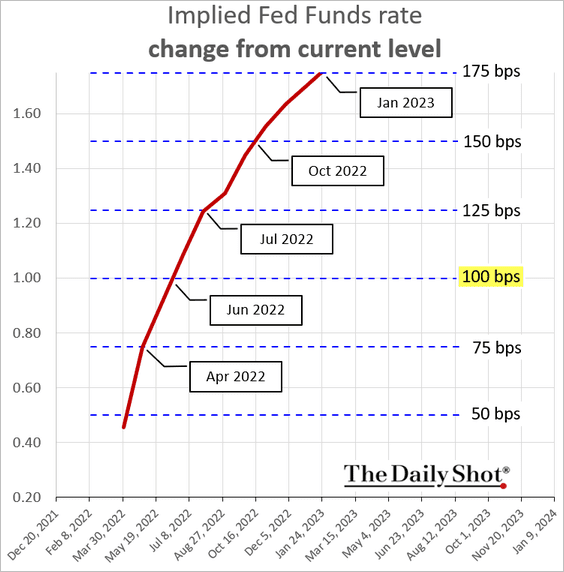

2. With inflation surging, we got some very hawkish comments from the Fed’s James Bullard, suggesting a full 100 bps rate increase before the start of July.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Many Fed officials now see the central bank being well “behind the curve” and would like to move faster.

Bullard: – There was a time when the committee would have reacted to something like this to having a meeting right now and doing 25 basis points right now. … I think we should be nimble and considering that kind of thing.

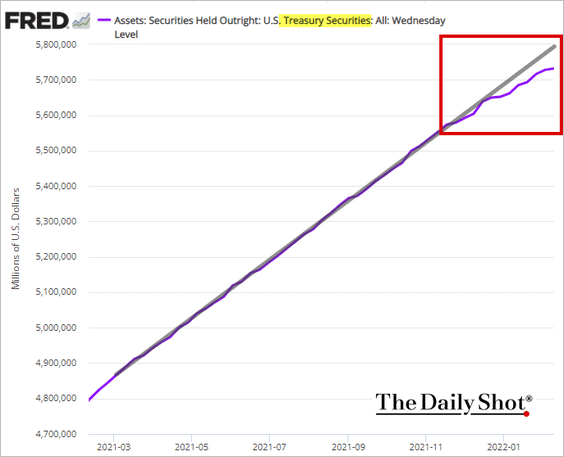

Moving on rates before the March meeting is challenging since taper is not yet complete (makes no sense to raise rates while still buying bonds). It’s unfortunate that the Fed didn’t give itself more room by starting to taper earlier.

——————–

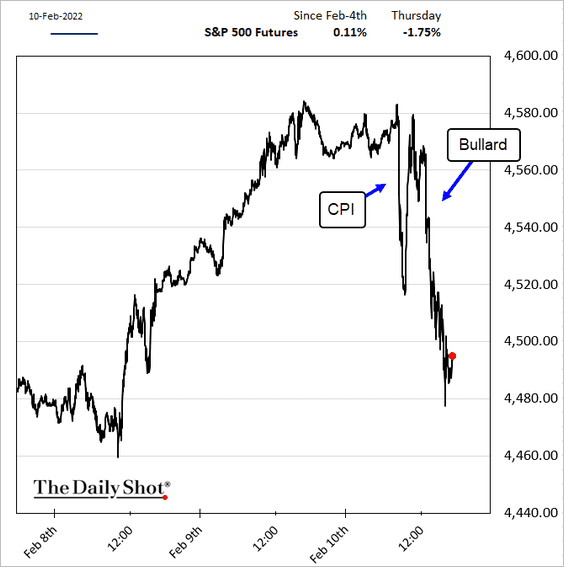

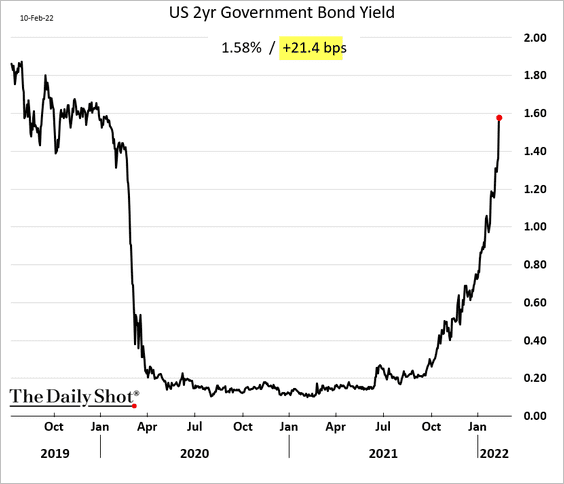

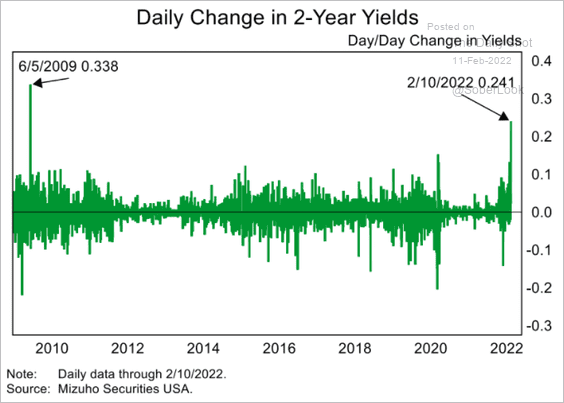

3. The markets’ reaction to Bullard’s comments was more intense than the CPI report.

• Equities:

• The 2-year Treasury yield:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

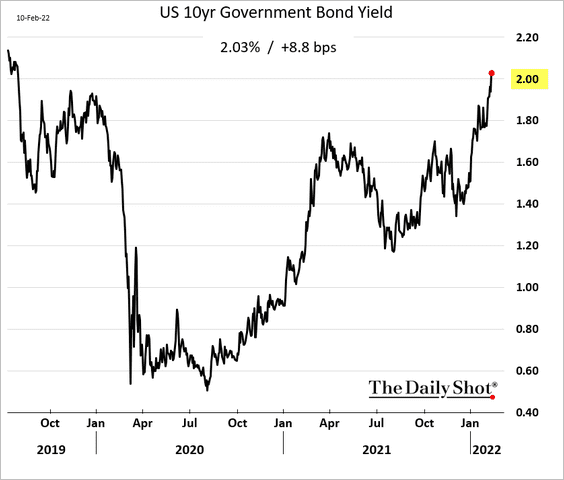

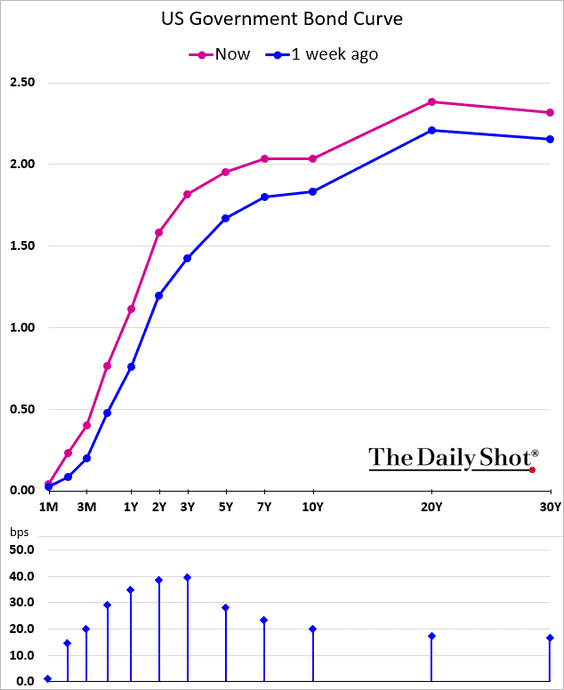

• The 10yr Treasury (above 2%):

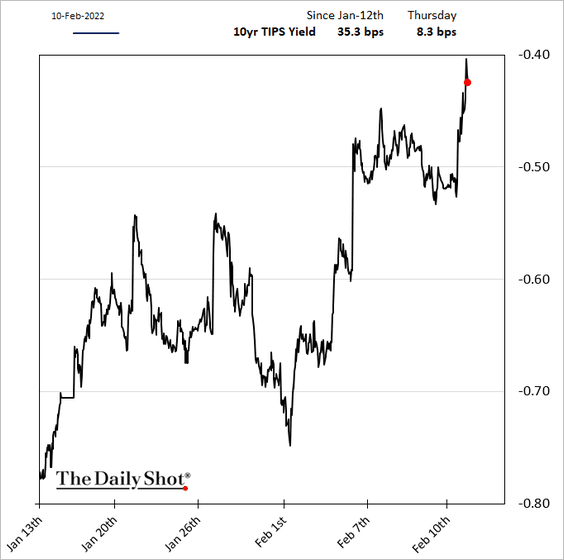

• The 10yr real yield (can be a headwind for growth stocks):

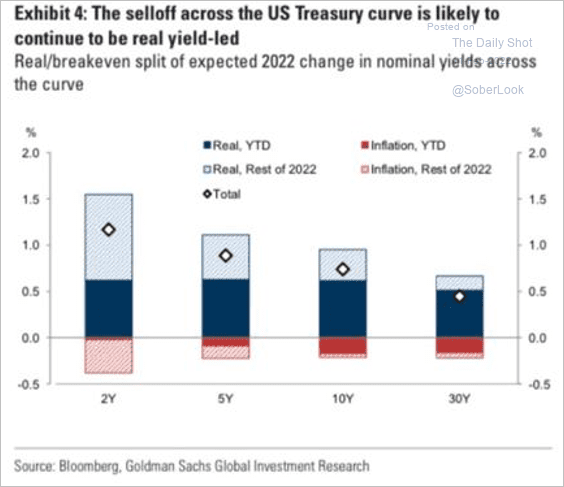

By the way, Goldman sees further gains in Treasury yields in 2022 driven by real yields, not inflation expectations.

Source: Goldman Sachs

Source: Goldman Sachs

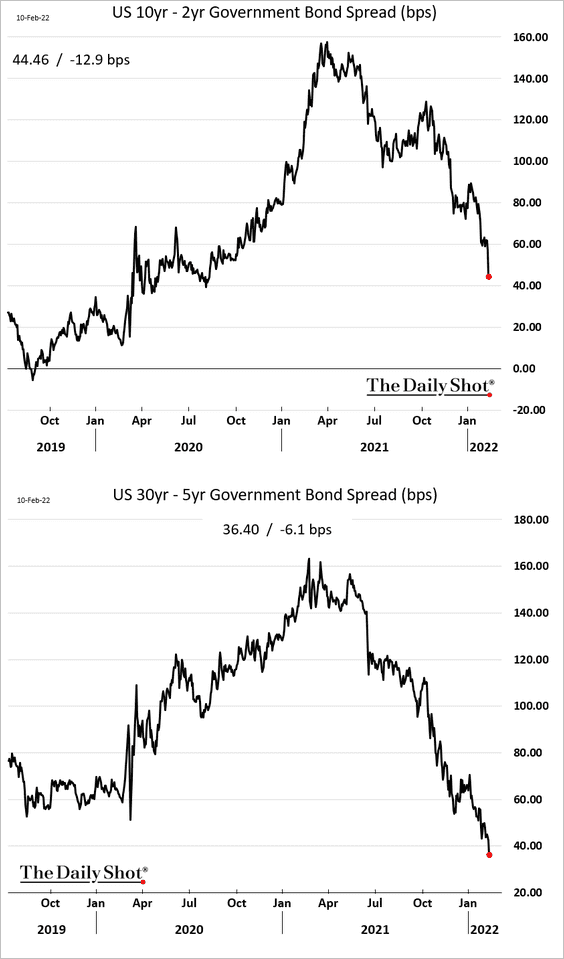

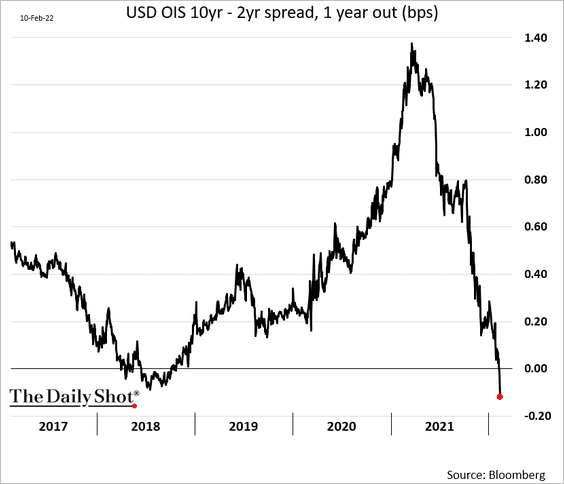

• The yield curve is flattening rapidly.

Moreover, the market now expects the yield curve to be inverted within a year. Will the Fed continue to hike when the curve inverts?

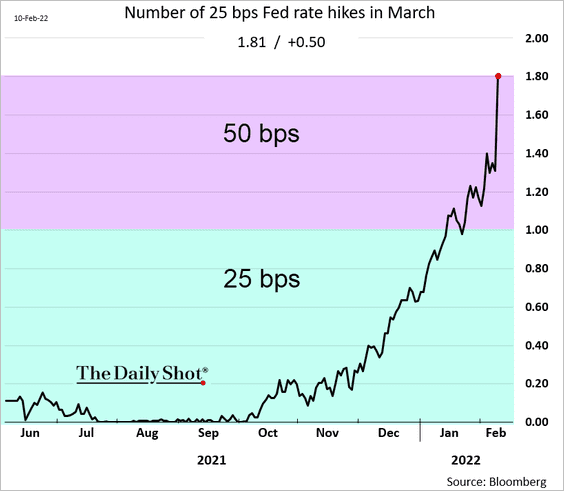

4. A 50 bps rate hike in March is increasingly likely.

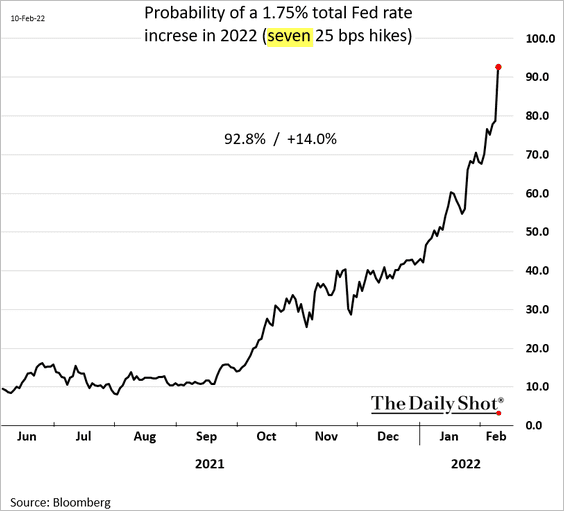

And there is a very high probability of a 1.75% rate increase this year (seven 25 bps hikes).

Here is what’s fully priced in.

——————–

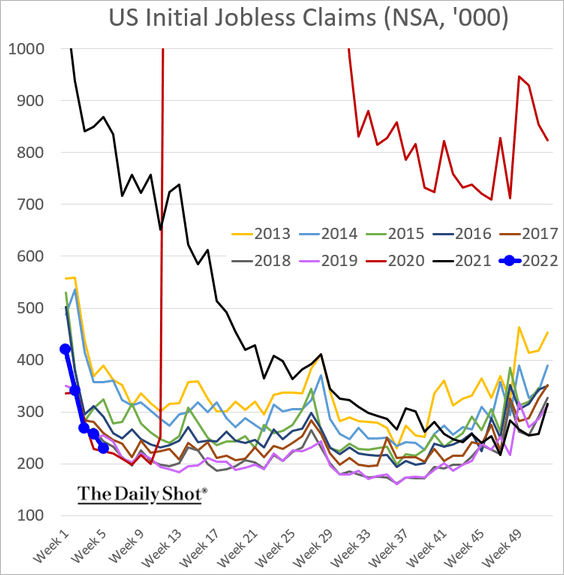

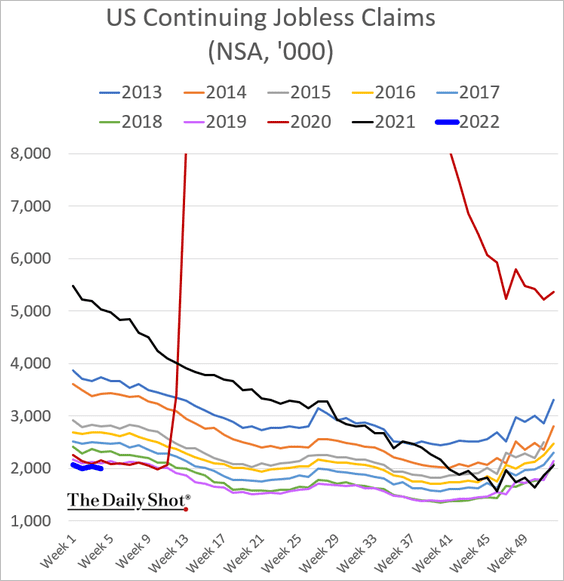

5. Initial jobless claims remain exceptionally low for this time of the year.

This chart shows the continuing jobless claims.

——————–

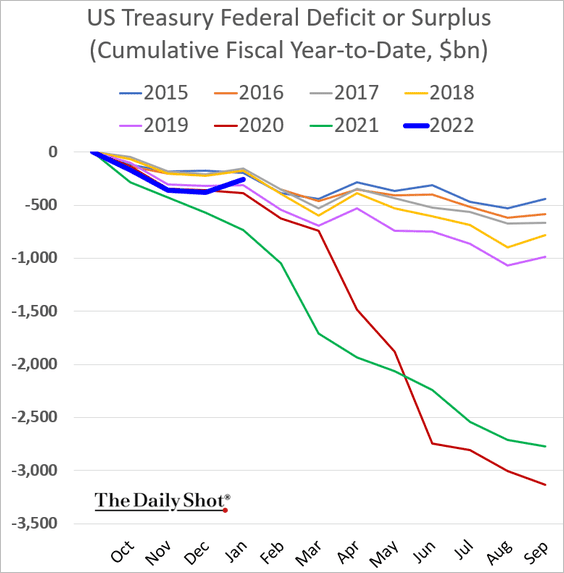

6. The federal budget improved markedly in January as revenues picked up.

Back to Index

Europe

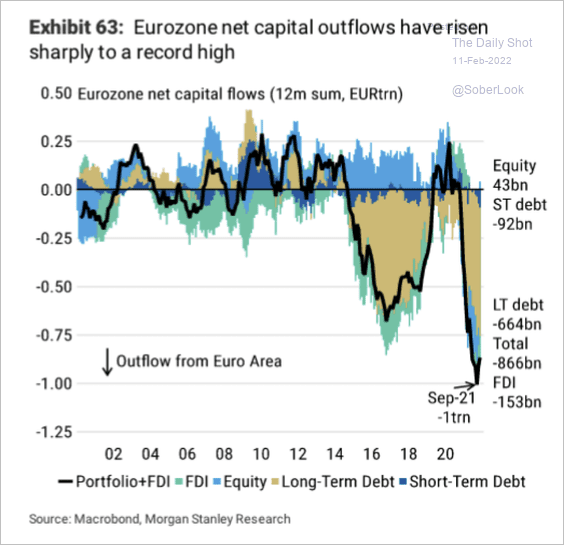

1. The Eurozone has seen a significant increase in capital outflows over the past year (driven by bonds).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

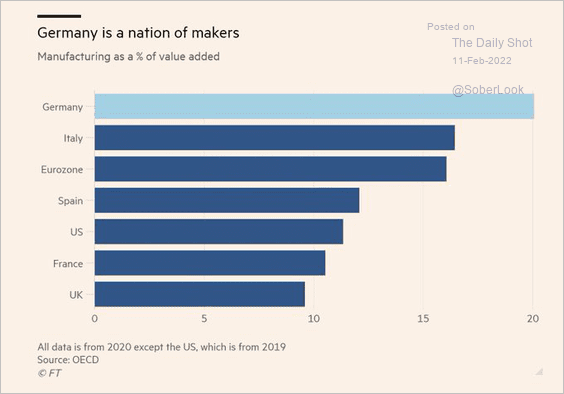

2. Germany’s economy is very exposed to the automobile sector.

Source: @acemaxx, @FT Read full article

Source: @acemaxx, @FT Read full article

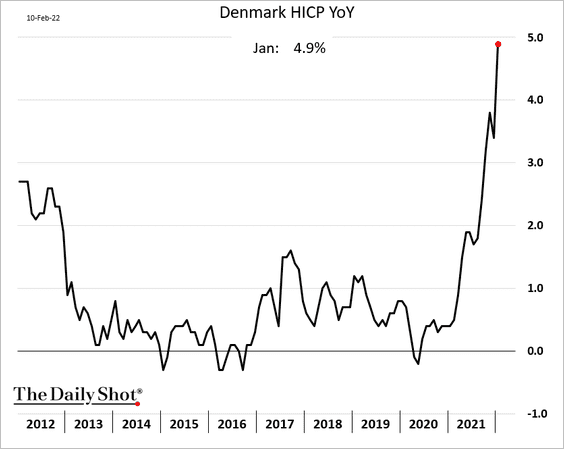

3. Denmark’s CPI is surging, …

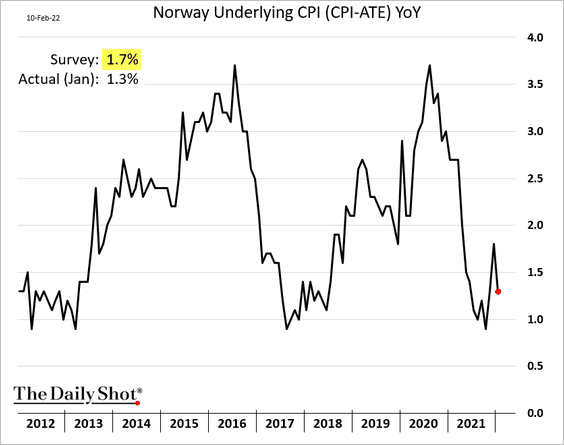

.. but Norway’s inflation slowed last month.

——————–

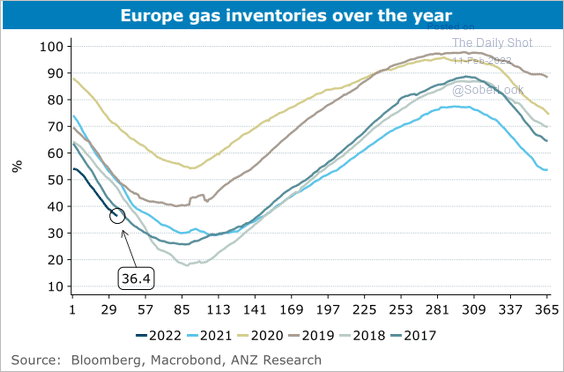

4. European natural gas supplies remain low.

Source: ANZ Research

Source: ANZ Research

Back to Index

Asia – Pacific

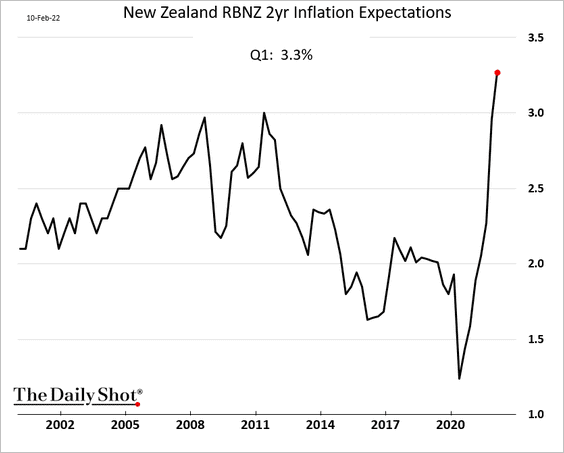

1. New Zealand’s inflation expectations climbed further this quarter.

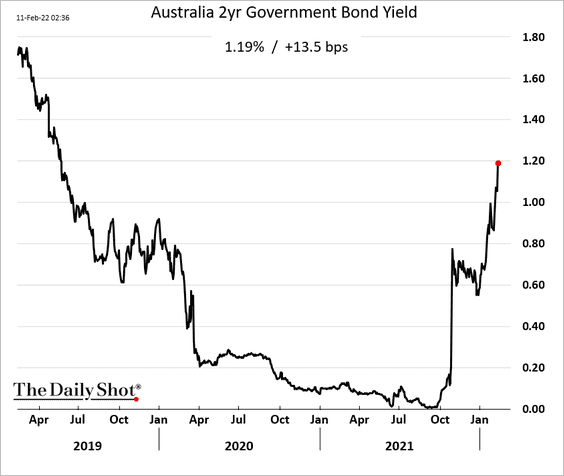

2. Here is Australia’s 2yr yield.

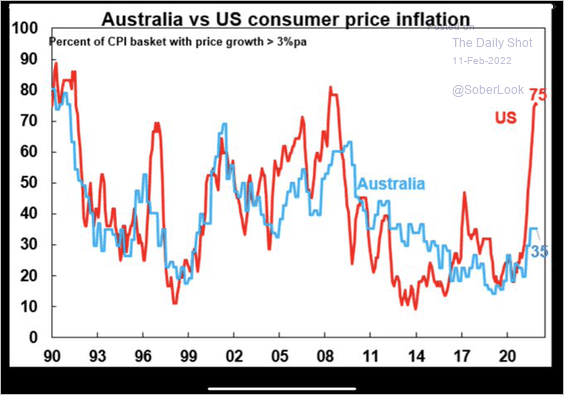

This chart shows the percentage of CPI items with prices rising faster than 3% for Australia vs. the US.

Source: @ShaneOliverAMP

Source: @ShaneOliverAMP

Back to Index

China

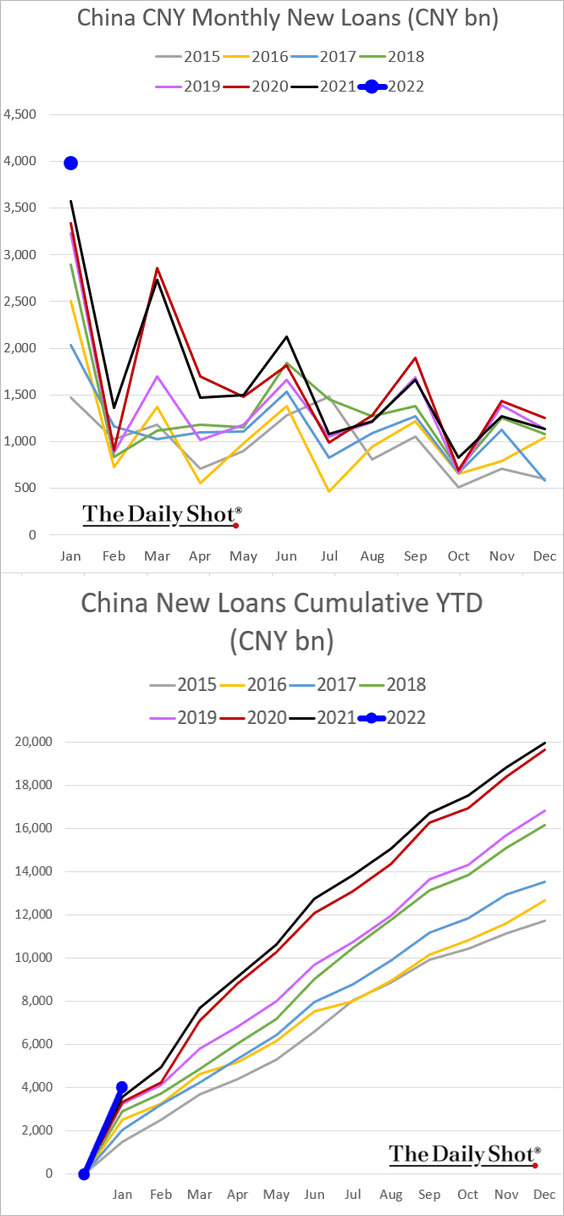

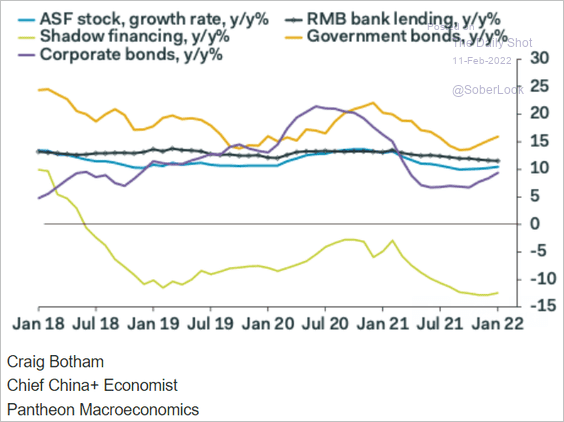

1. Credit expansion was robust in January.

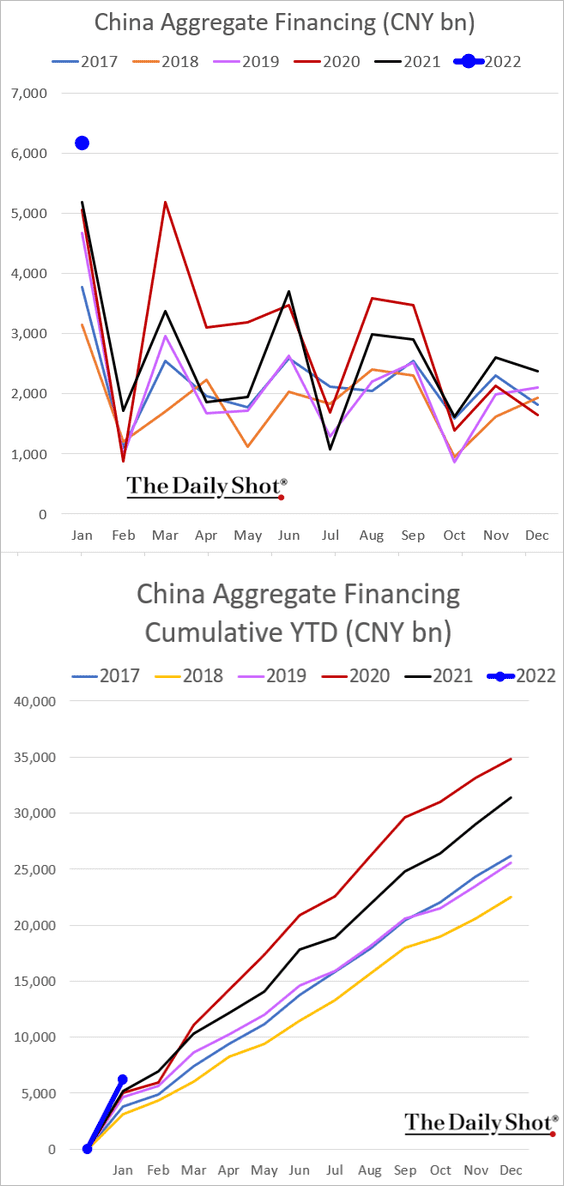

Here is China’s aggregate financing, …

… which got a boost from government and corporate issuance.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

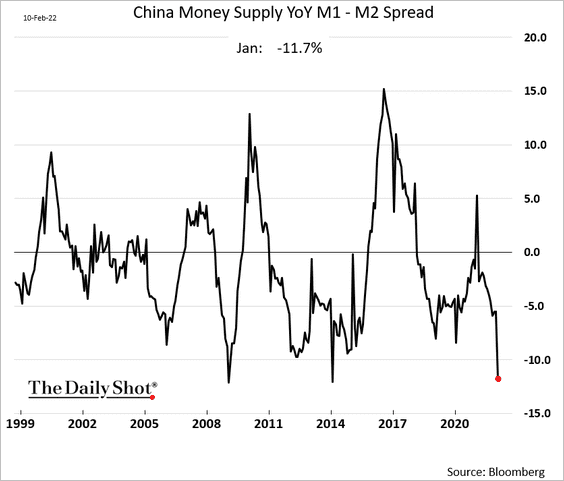

2. The narrow money supply unexpectedly contracted, even as the broad measure improved. While there are seasonal effects at play here, the M1 decline is highly unusual.

Here is the spread between M1 and M2 growth rates. In the past, Beijing boosted stimulus efforts when this spread was near the lows.

——————–

3. China’s growth stock index ChiNext is at support.

Back to Index

Emerging Markets

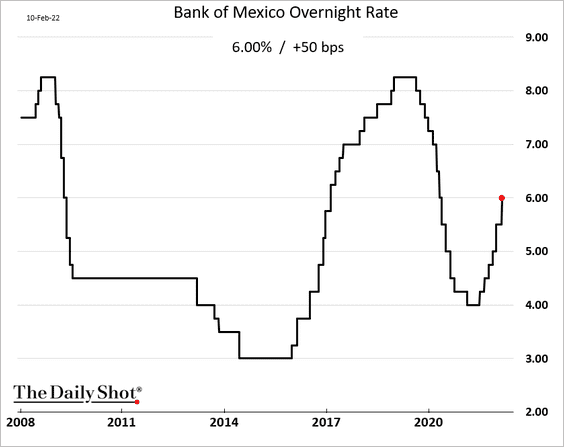

1. With prices surging, Banxico hiked rates again (as expected).

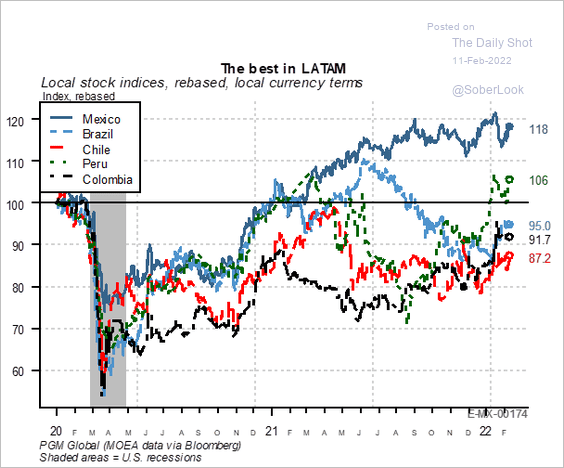

By the way, Mexican stocks have been outperforming LatAm peers.

Source: PGM Global

Source: PGM Global

——————–

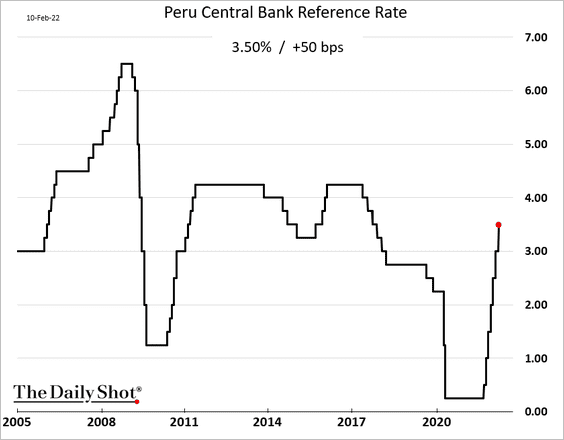

2. Peru’s central bank also raised rates.

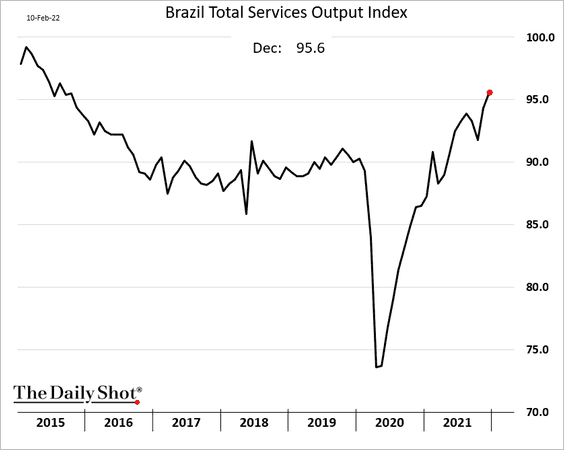

3. Brazil’s service-sector output continues to rise.

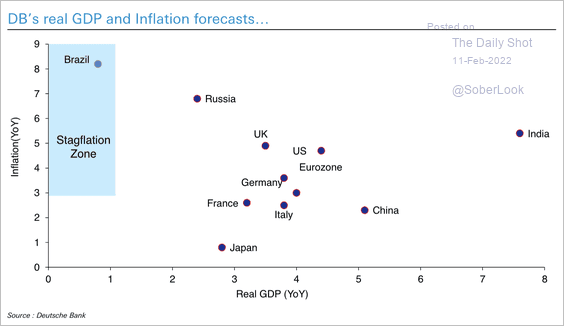

But the nation’s overall economy is firmly in stagflation territory.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

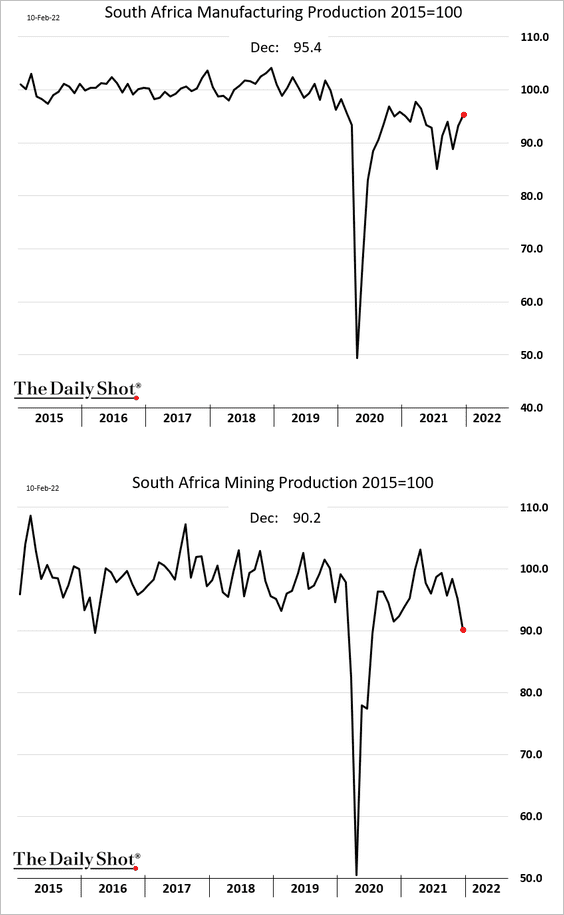

4. South Africa’s manufacturing and mining sectors are moving in opposite directions.

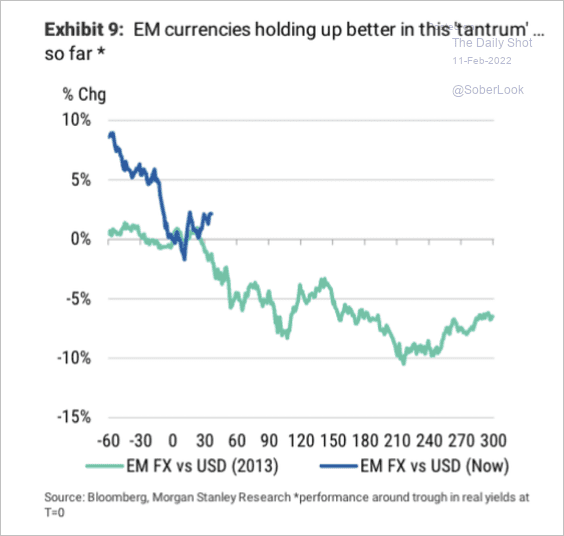

5. So far, EM currencies are holding up better than the 2013 taper tantrum.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Commodities

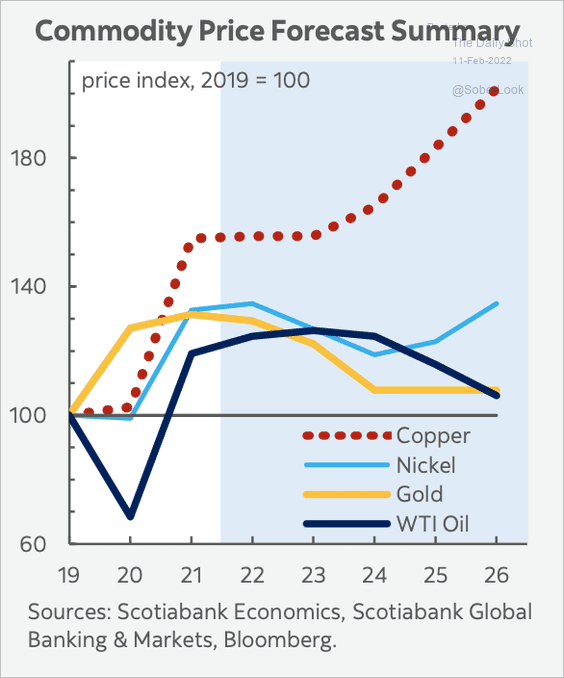

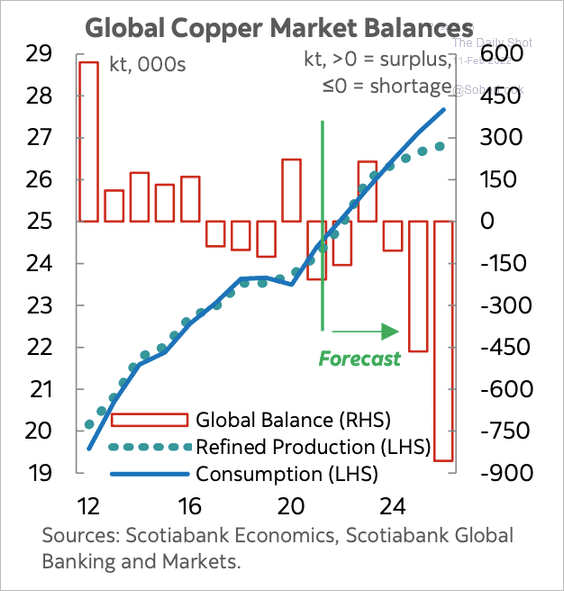

1. Scotiabank expects a record high in copper prices over the next few years, driven by weak supply growth (2 charts).

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

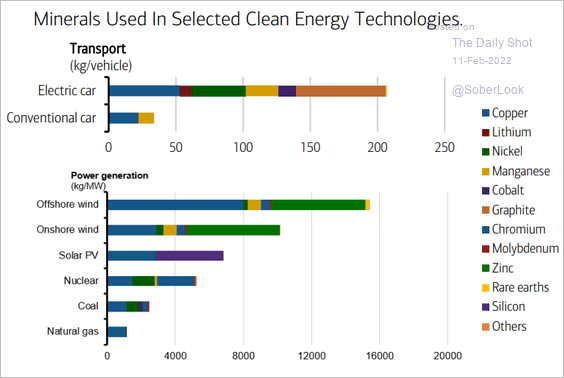

2. Here is a better chart of minerals used by clean energy technologies.

Source: Bank of America Merrill Lynch

Source: Bank of America Merrill Lynch

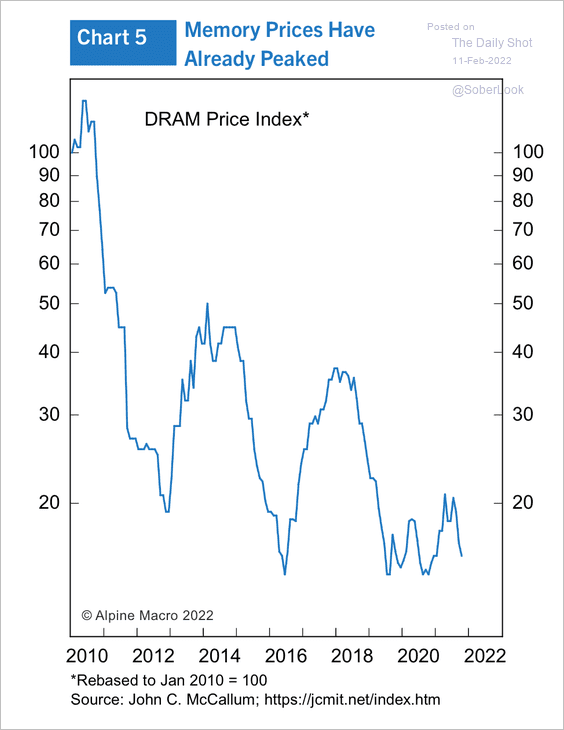

3. DRAM prices are declining.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

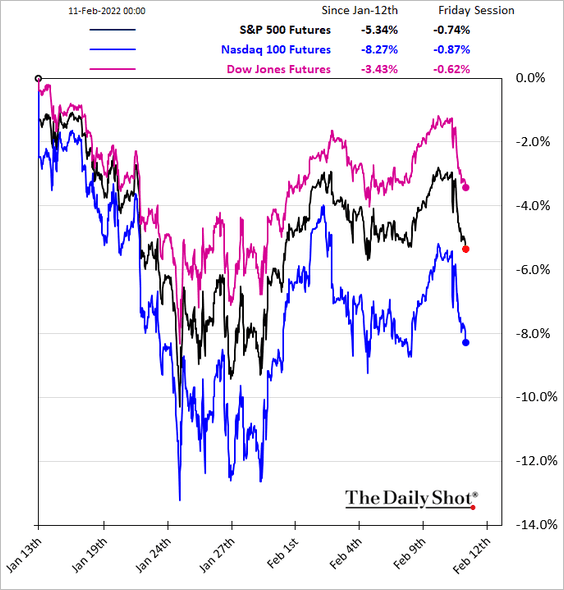

Equities

1. Stock futures are softer this morning after the CPI/Bullard selloff (see the US section).

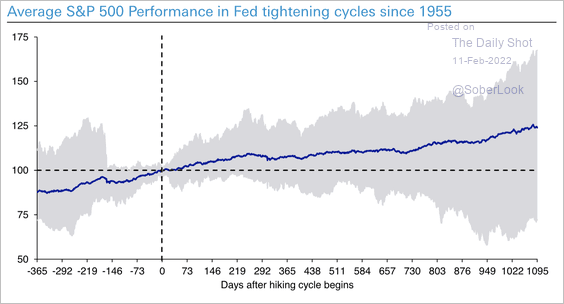

2. Since 1955, the S&P 500 has returned on average 25% in the three years after the start of a tightening cycle.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

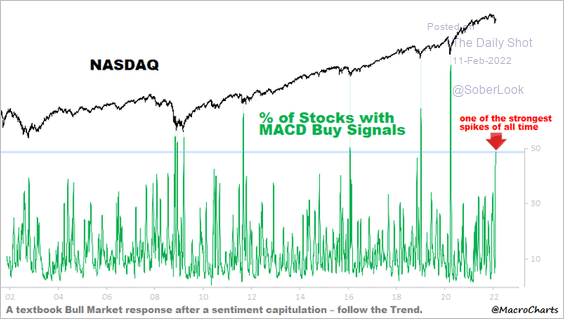

3. A buy signal for Nasdaq shares?

Source: @MacroCharts

Source: @MacroCharts

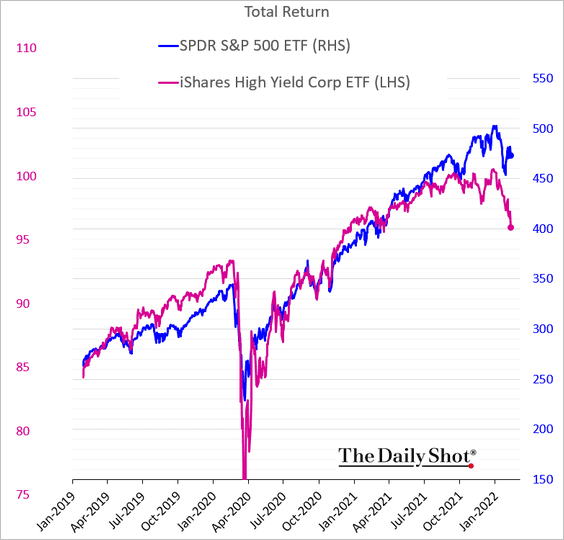

4. Equities and high-yield bonds continue to diverge.

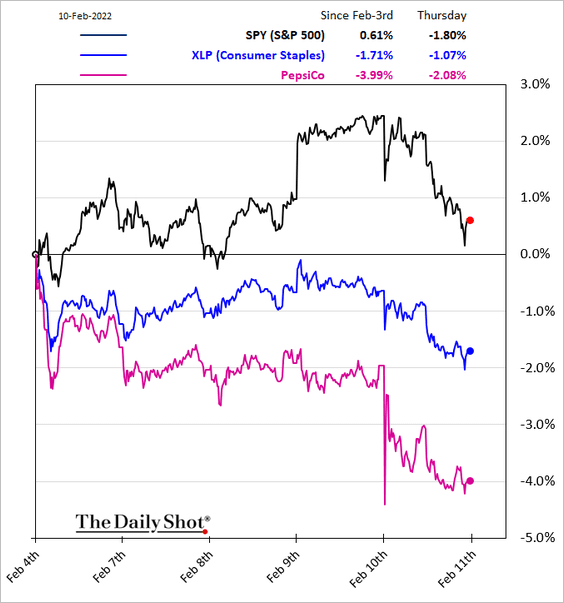

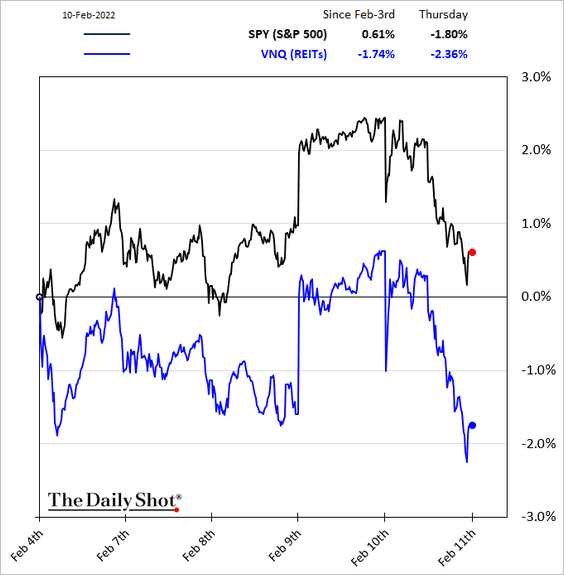

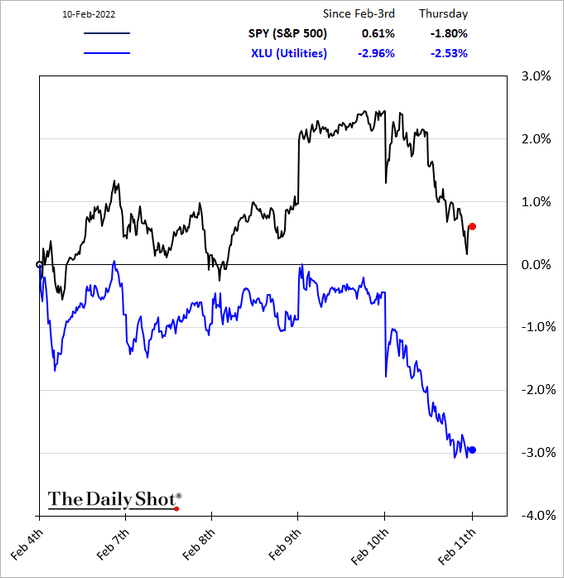

5. Hit by surging bond yields, defensive/high-dividend stocks aren’t offering protection.

• Consumer staples:

• REITs:

• Utilities:

Here are some additional sector updates.

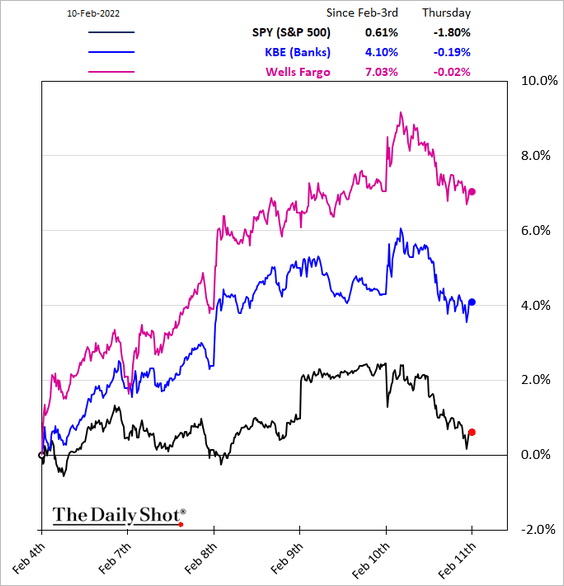

• Banks:

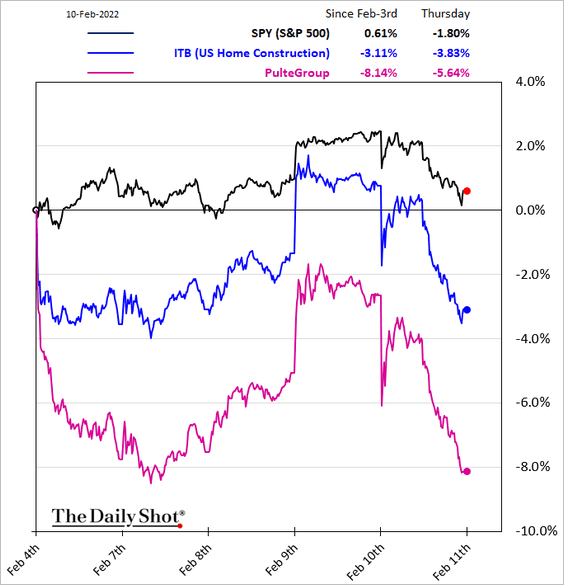

• Housing:

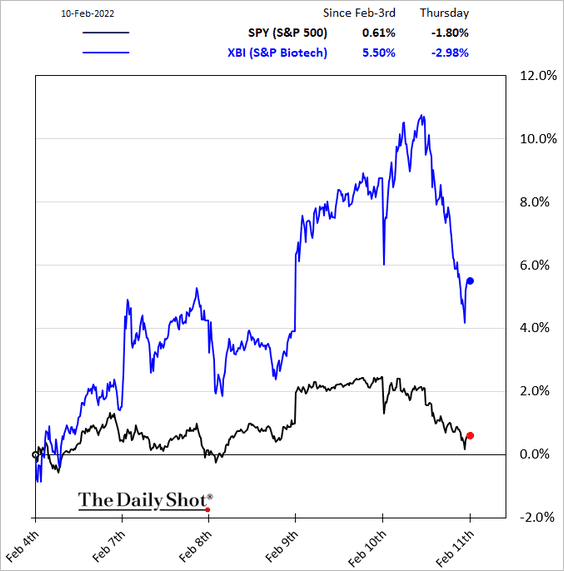

• Biotech:

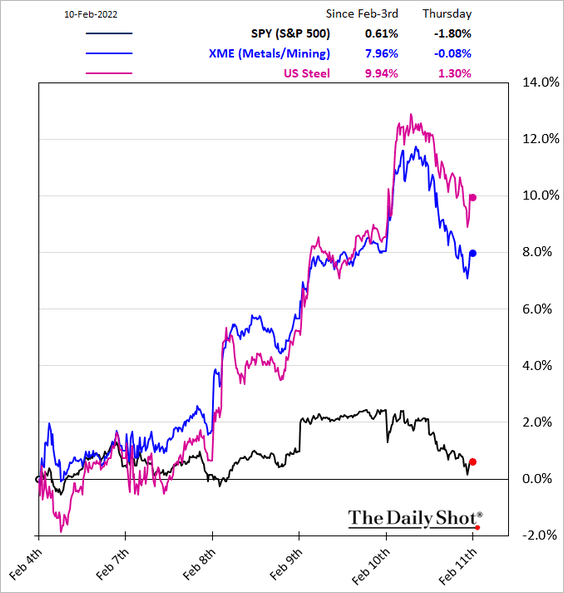

• Metals & Mining:

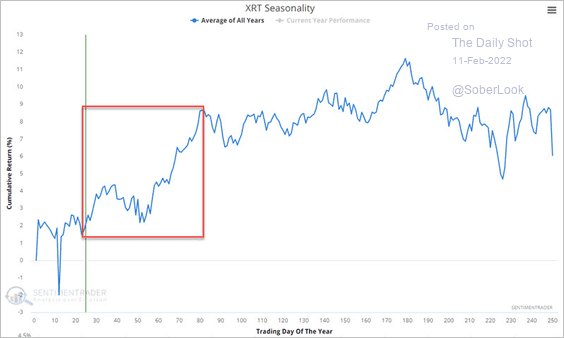

• Retail stocks are entering a seasonally strong period.

Source: SentimenTrader

Source: SentimenTrader

——————–

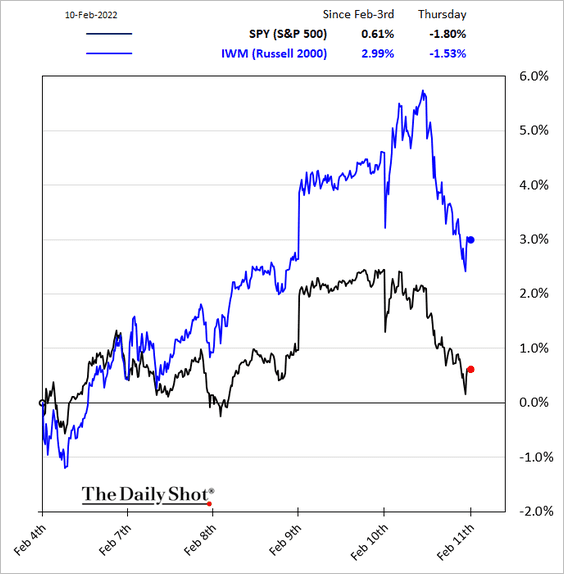

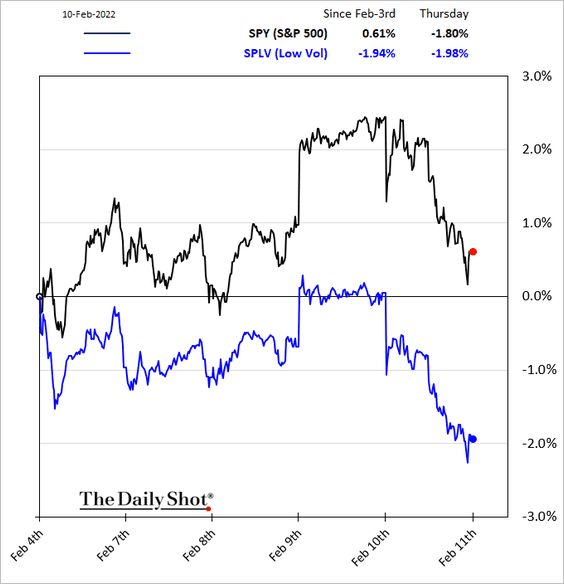

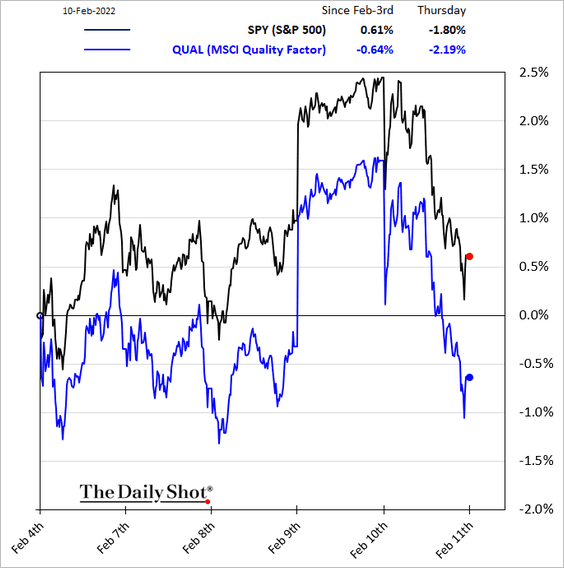

6. Finally, we have some equity factor trends over the past five days.

• Small caps:

• Low vol:

• Quality:

Back to Index

Credit

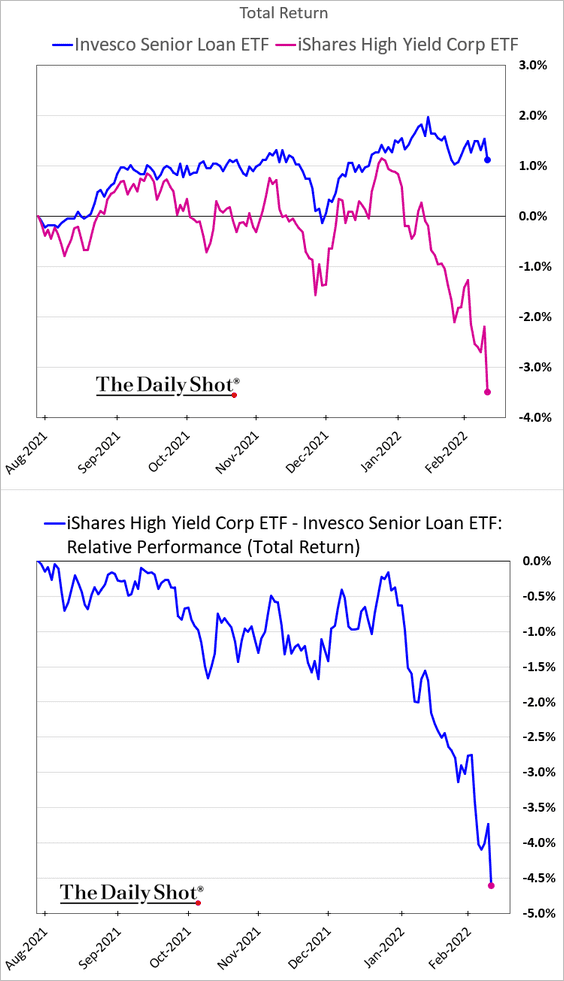

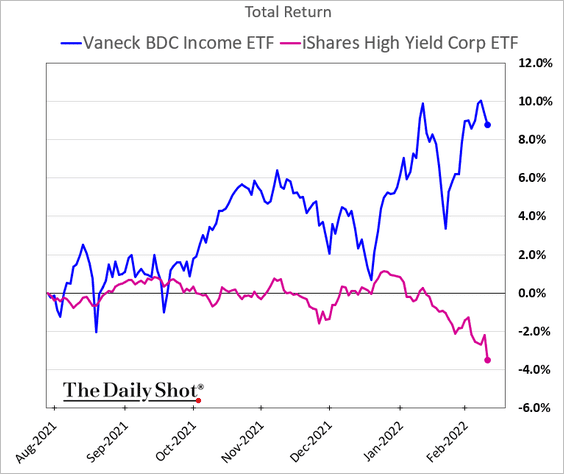

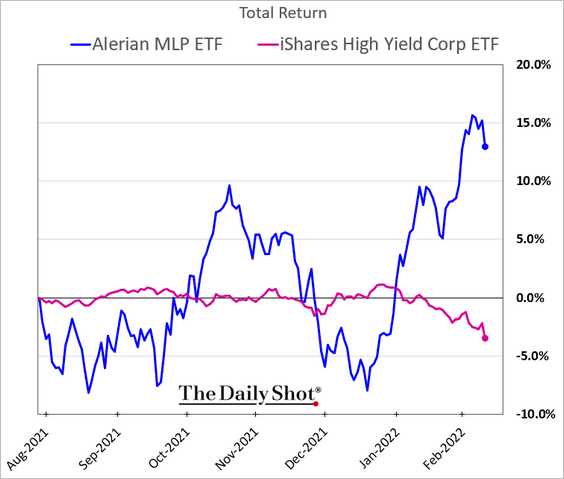

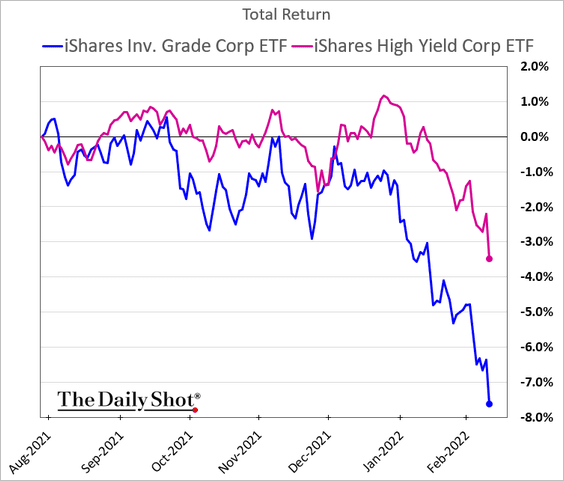

1. Let’s take a look at some relative performance charts over the past few months.

• Leveraged loans vs. HY bonds:

• BDCs vs. HY bonds (many BDCs hold floating-rate loans):

• MLPs vs. HY bonds (pipeline firms got a boost from higher energy prices):

• Investment-grade vs. HY bonds:

——————–

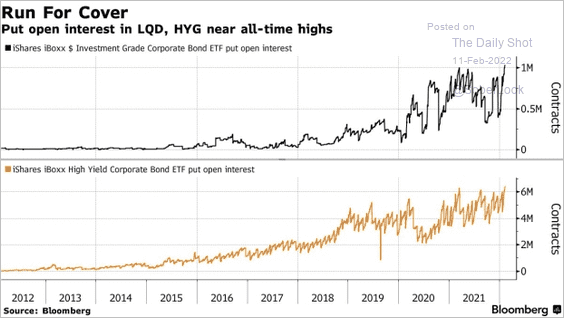

2. Demand for put options on credit ETFs has been rising.

Source: @kgreifeld, @markets Read full article

Source: @kgreifeld, @markets Read full article

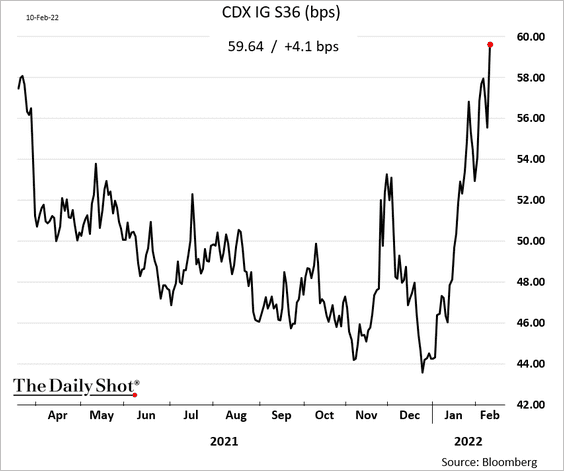

3. Investment-grade corporate credit default swap spreads continue to widen.

Back to Index

Rates

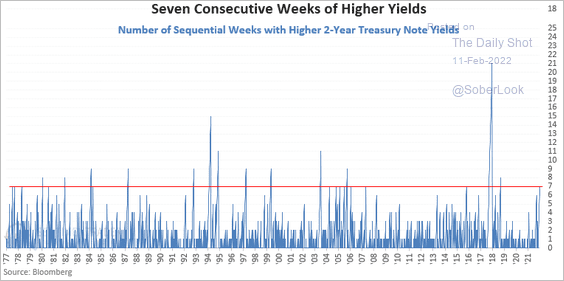

1. The 2-year Treasury yield has increased for seven consecutive weeks, which typically precedes a pause.

Source: SentimenTrader

Source: SentimenTrader

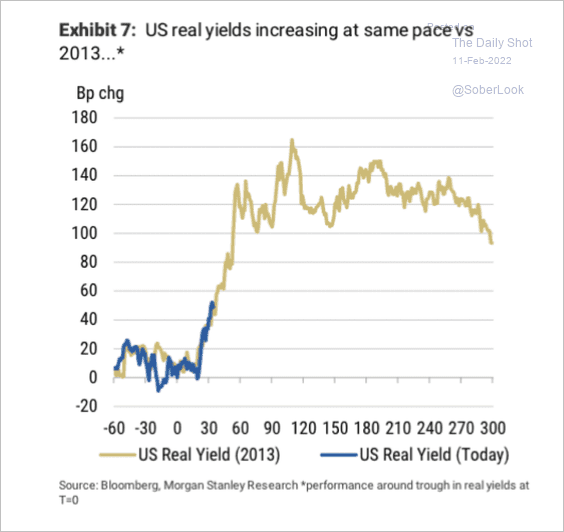

2. US real yields are following a similar path to what occurred during the 2013 taper tantrum.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

Food for Thought

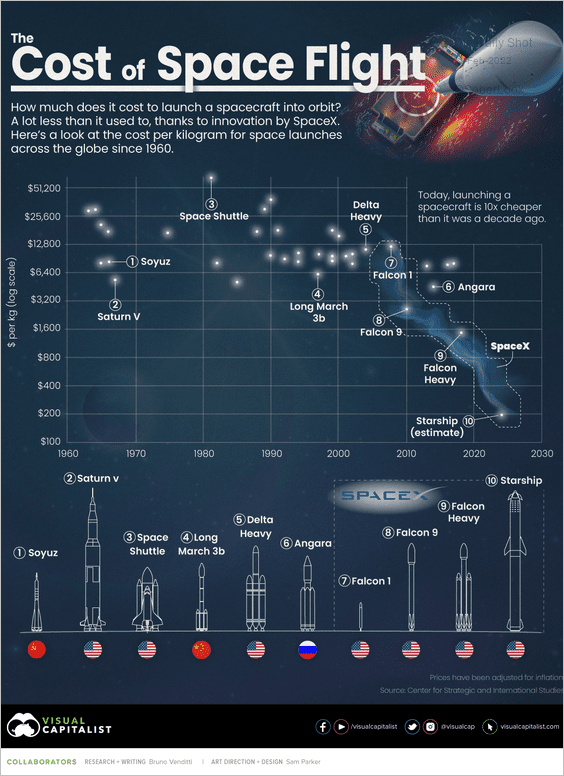

1. The cost of space flight:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

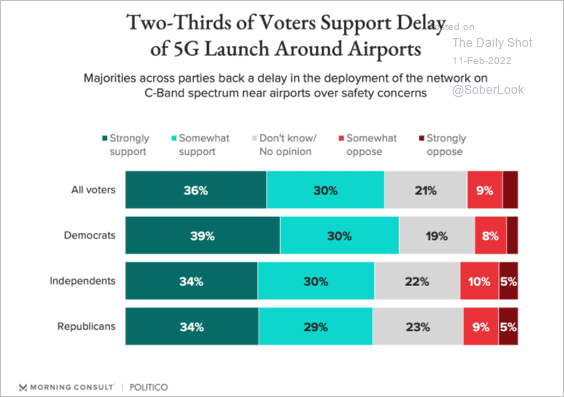

2. Delaying the 5G launch around airports:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

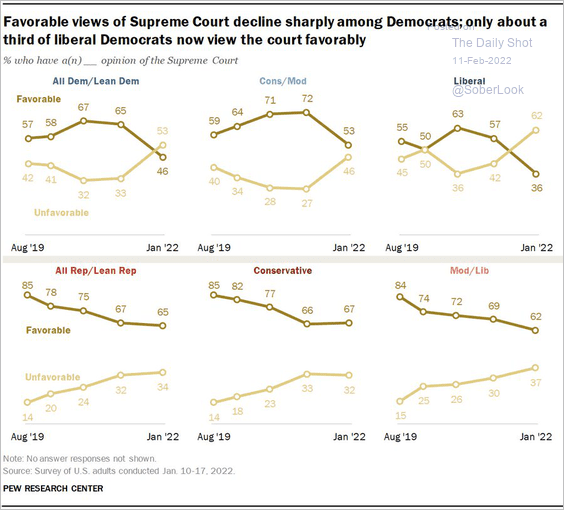

3. Views of the US Supreme Court:

Source: @tedvangreen, @pewresearch Read full article

Source: @tedvangreen, @pewresearch Read full article

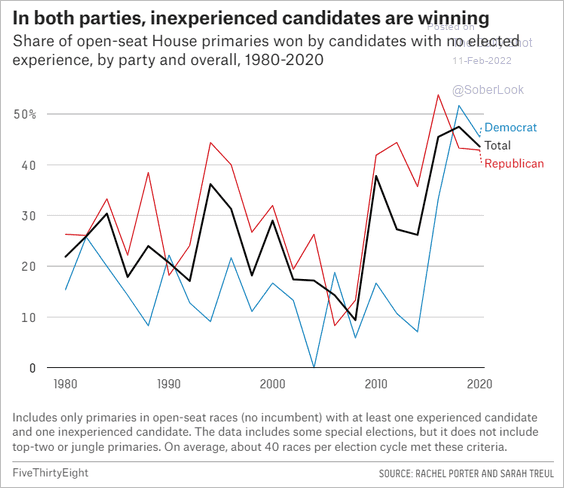

4. Electing inexperienced candidates:

Source: 538

Source: 538

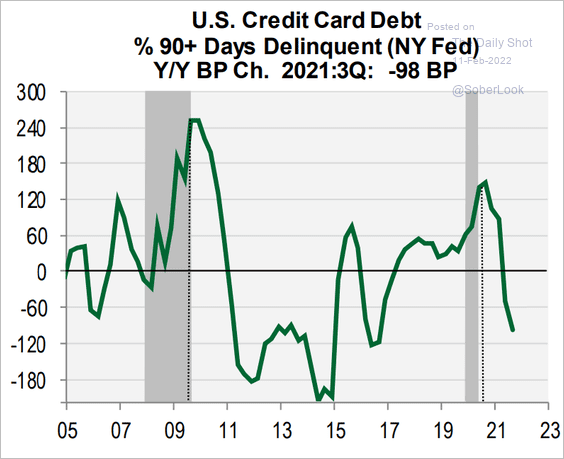

5. US credit card delinquencies:

Source: Cornerstone Macro

Source: Cornerstone Macro

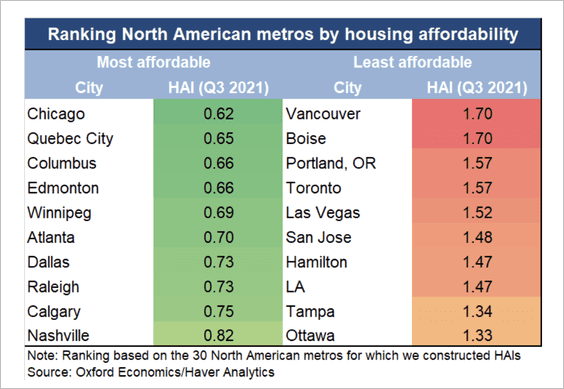

6. Housing affordability in North American cities:

Source: Oxford Economics

Source: Oxford Economics

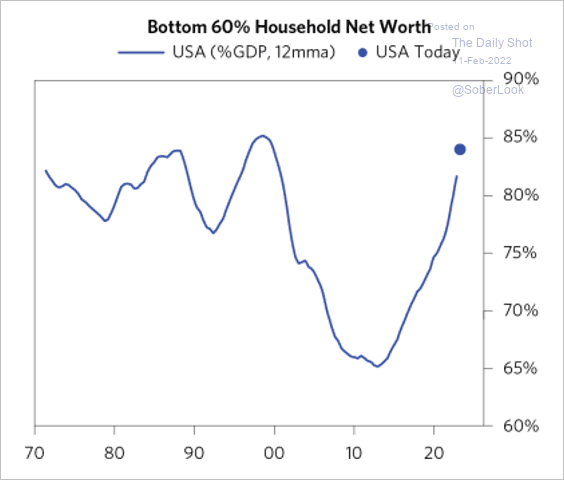

7. Bottom 50% of households’ net worth as a share of GDP:

Source: Bridgewater

Source: Bridgewater

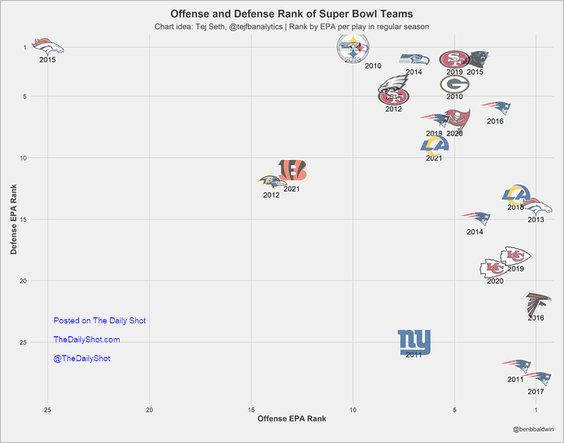

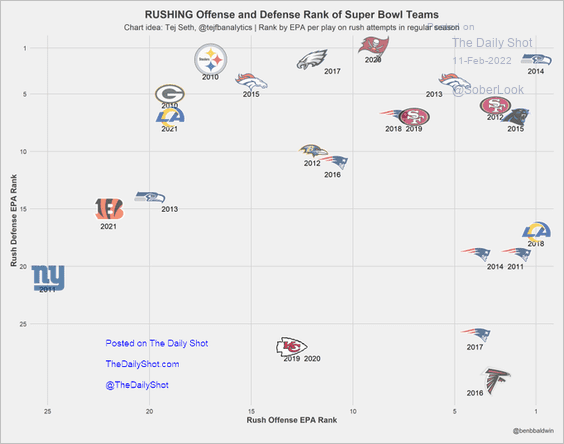

8. Offense and defense rank of Super Bowl teams:

Source: @benbbaldwin, @tejfbanalytics

Source: @benbbaldwin, @tejfbanalytics

Rushing offense and defense rank of Super Bowl teams:

Source: @benbbaldwin, @tejfbanalytics

Source: @benbbaldwin, @tejfbanalytics

——————–

Have a great weekend!

Back to Index