The Daily Shot: 21-Oct-20

• Rates

• Equities

• Commodities

• Cryptocurrencies

• Emerging Markets

• China

• Asia – Pacific

• Europe

• The United States

• Global Developments

• Food for Thought

Rates

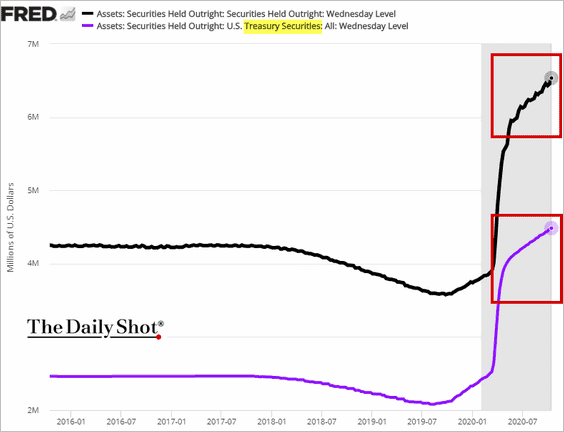

Markets are preparing for another massive US stimulus bill and the Treasury debt issuance spike that will follow. The Fed has been steadily buying Treasuries and MBS bonds, but that’s not enough to absorb all the new supply.

Is there sufficient appetite at the FOMC to repeat the April buying blitz?

Source: CNBC Read full article

Source: CNBC Read full article

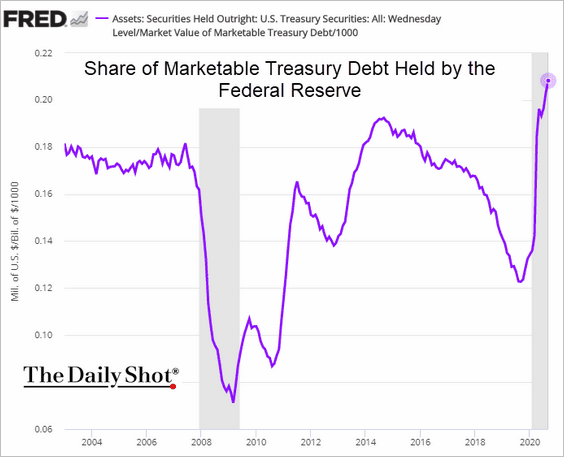

After all, the Fed’s ownership of the Treasury market is now at record highs.

h/t @LizAnnSonders

h/t @LizAnnSonders

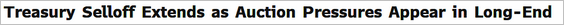

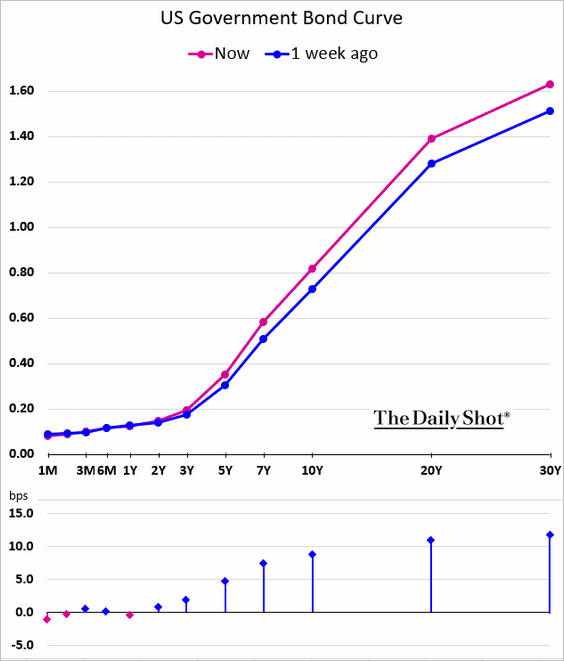

• Longer-dated Treasury yields climbed further this morning amid concerns about supply.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

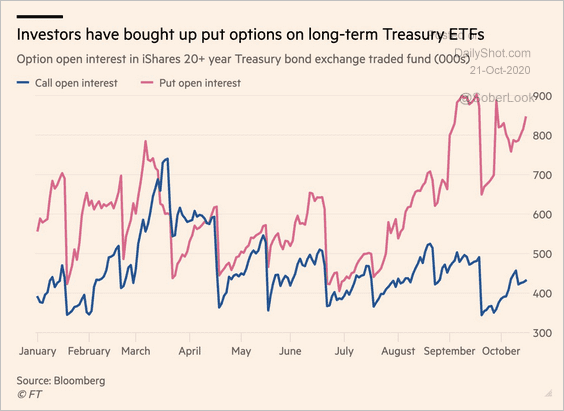

• Investors have been betting on a selloff in bonds.

Source: @jessefelder Read full article

Source: @jessefelder Read full article

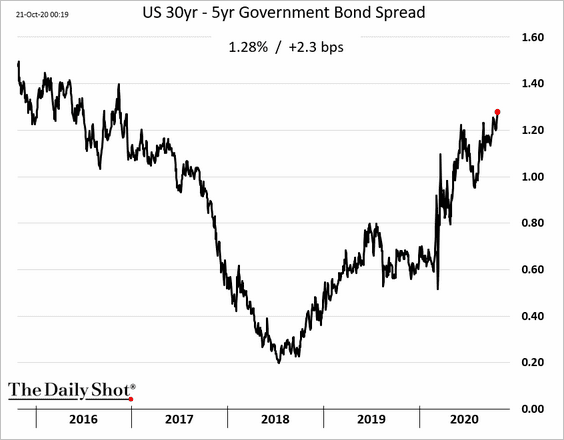

• The yield curve is steepening.

The longer end of the curve has been steepening for some time.

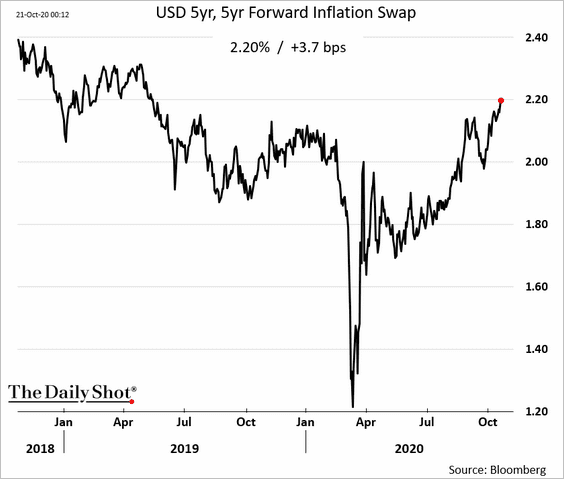

• Moreover, longer-dated inflation expectations have been rising, putting additional pressure on bonds.

Equities

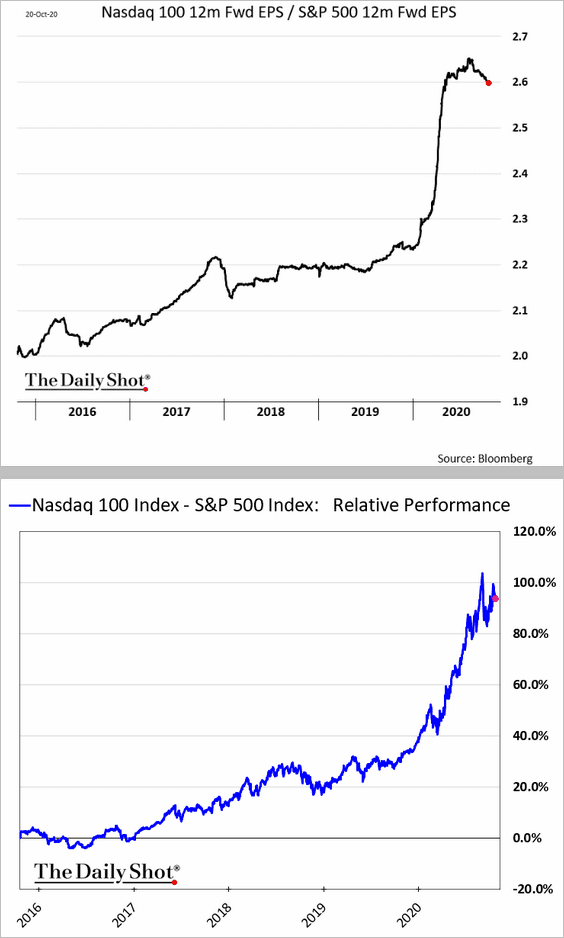

1. The Nasdaq 100 projected EPS has peaked relative to the S&P 500. Will performance follow?

h/t Cormac Mullen

h/t Cormac Mullen

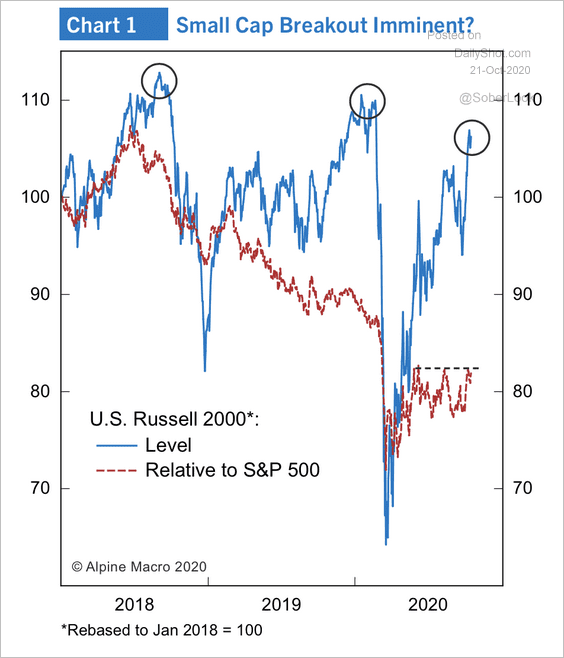

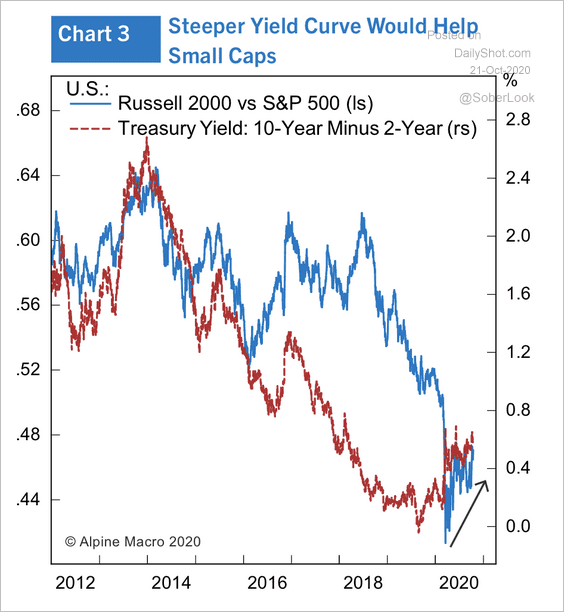

2. Will we see a breakout in US small-caps? (two charts)

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

——————–

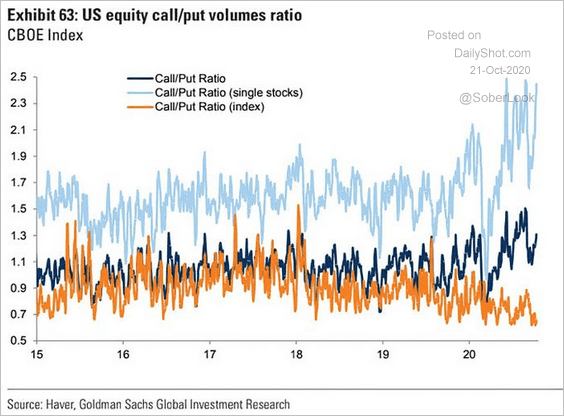

3. This year’s call option trading frenzy has been mostly focused on single-stock options. Index options have been used more for downside protection.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

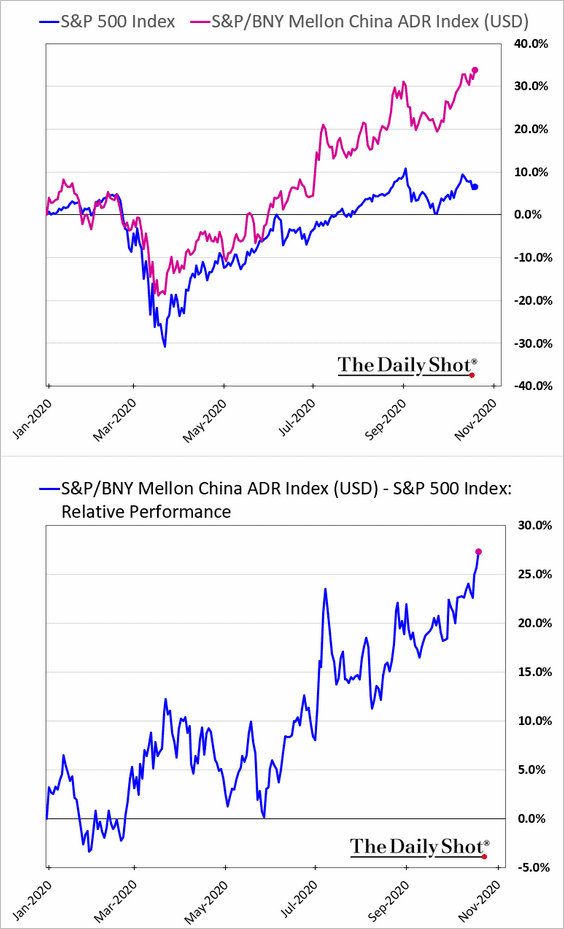

4. Chinese ADRs (traded in the US) have sharply outperformed the S&P 500 this year.

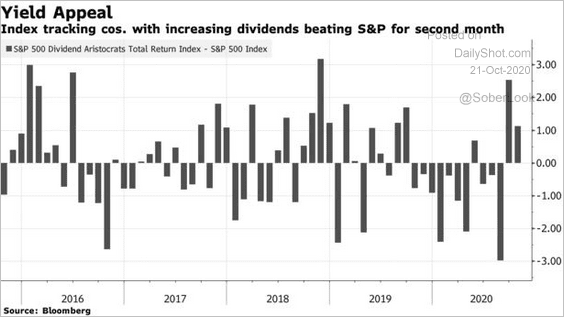

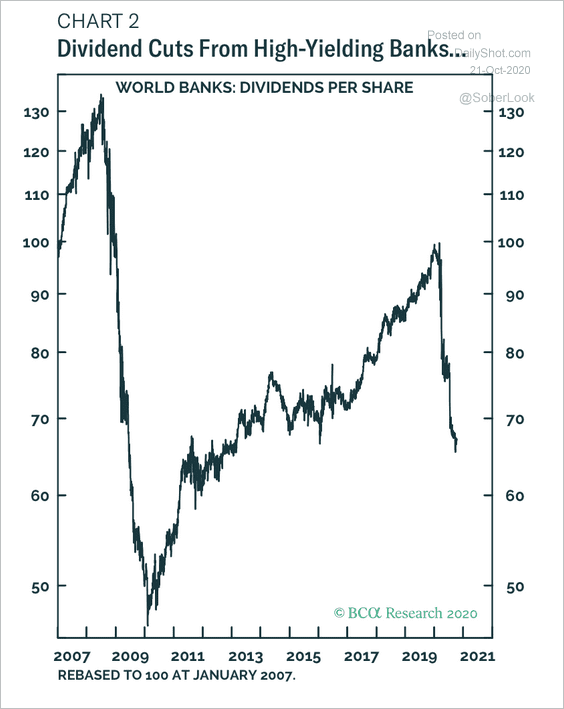

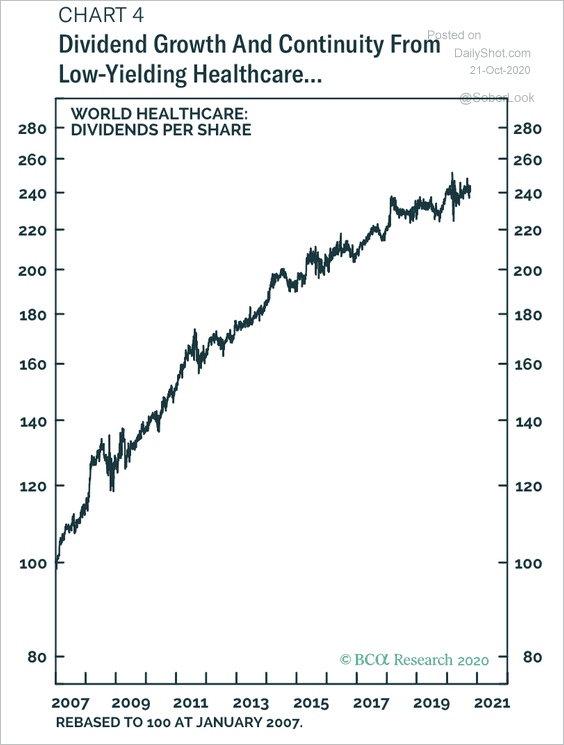

5. Next, we have some updates on dividend trends.

• Dividend Aristocrats have done well in recent weeks.

Source: @markets Read full article

Source: @markets Read full article

• Banks have substantially cut dividends this year.

Source: BCA Research

Source: BCA Research

• Healthcare has maintained its dividend per share growth, …

Source: BCA Research

Source: BCA Research

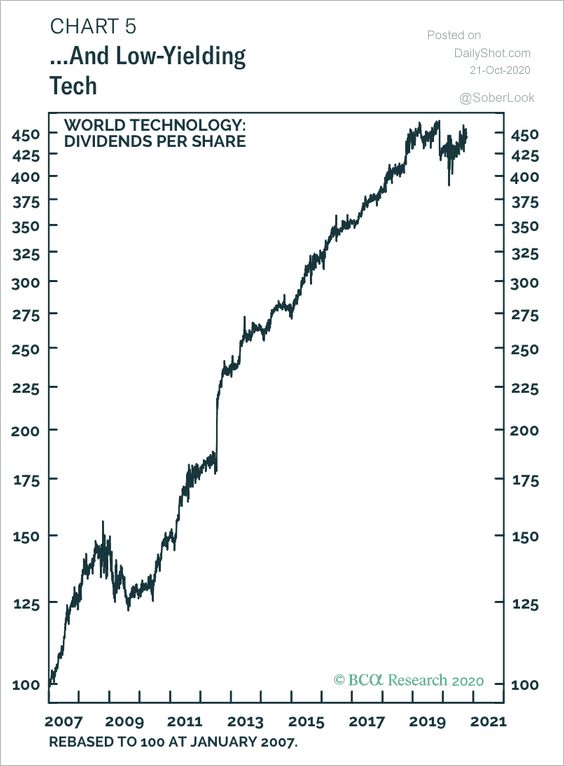

… and tech dividends have been stable.

Source: BCA Research

Source: BCA Research

——————–

6. Finally, here are some sector updates.

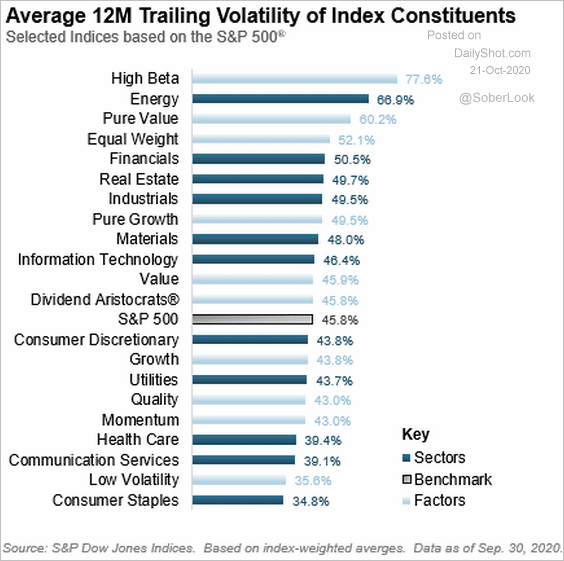

• Historical volatility by sector and equity factor:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

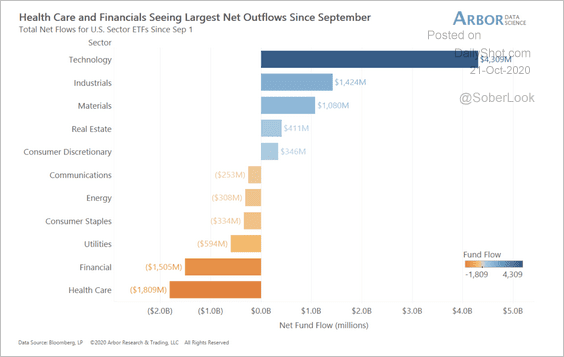

• ETF flows since September:

Source: Arbor Research & Trading

Source: Arbor Research & Trading

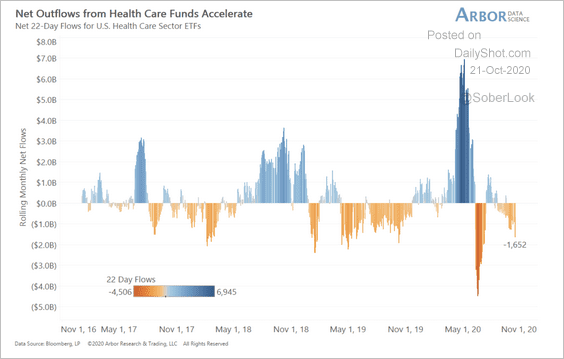

Healthcare outflows:

Source: Arbor Research & Trading

Source: Arbor Research & Trading

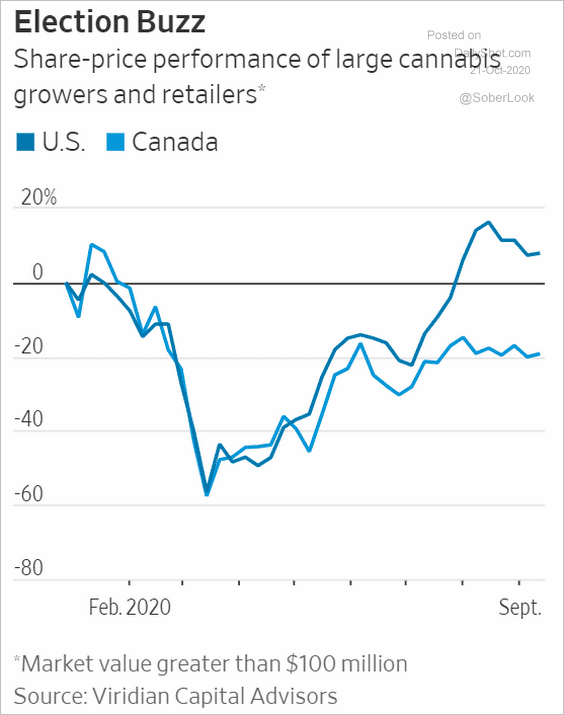

• Cannabis stocks (a bet on Democratic sweep):

Source: @WSJ Read full article

Source: @WSJ Read full article

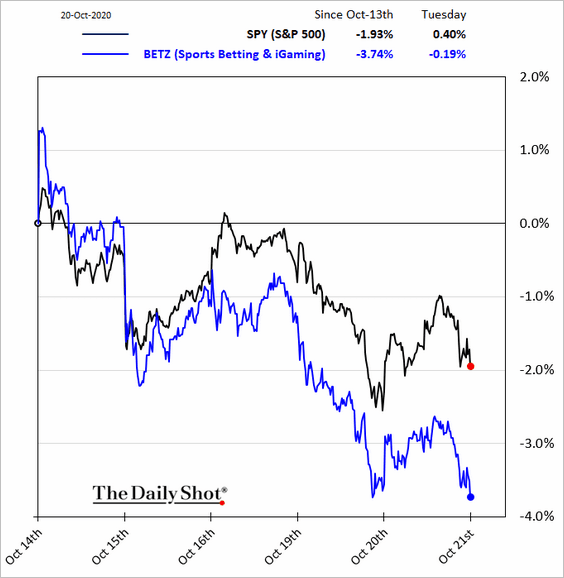

• Gaming stocks:

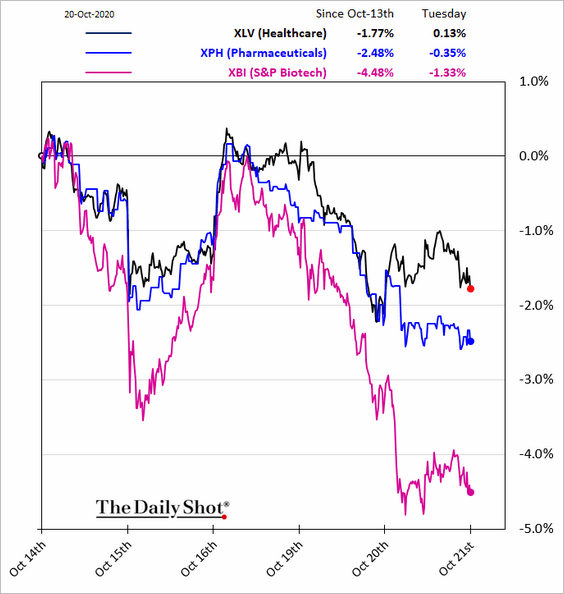

• Biotech:

Commodities

1. Let’s begin with some updates on gold.

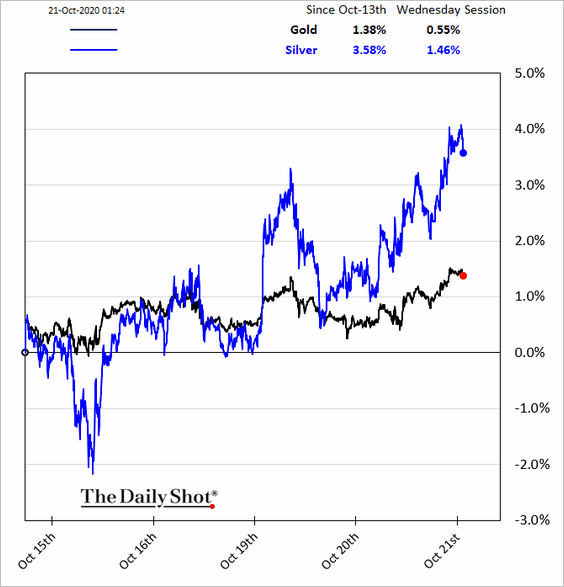

• Precious metals are higher on stimulus bets.

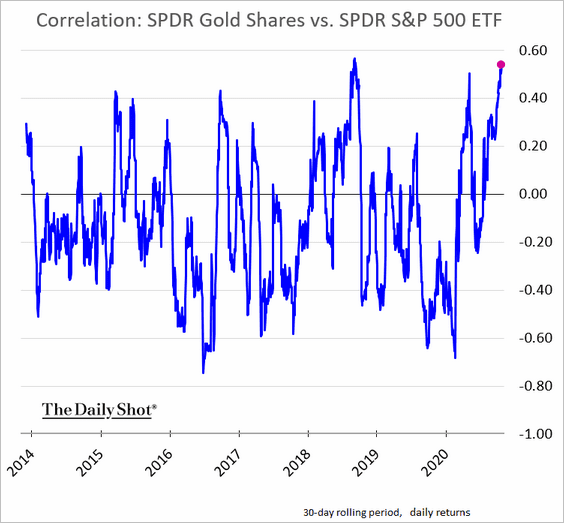

• The correlation between gold and stocks remains elevated (both benefit from government stimulus).

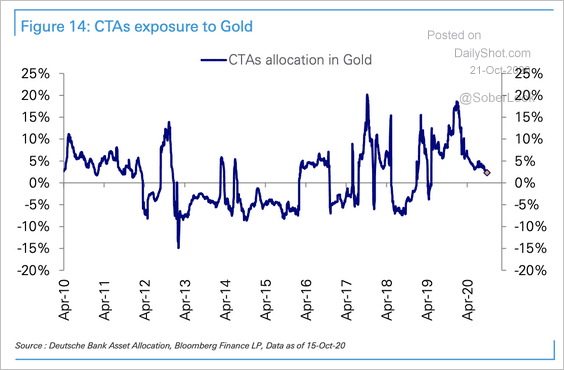

• CTAs have reduced their allocation to gold this year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

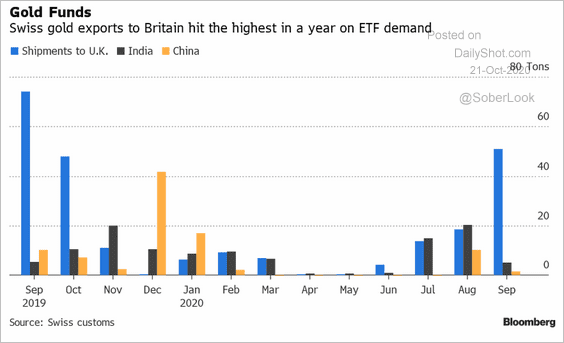

• Swiss gold exports to the UK climbed, driven by ETF demand.

Source: @Edspencive, Bloomberg Finance L.P.

Source: @Edspencive, Bloomberg Finance L.P.

——————–

2. Copper hit the highest price since June 2018.

Source: @lisaabramowicz1, @theterminal

Source: @lisaabramowicz1, @theterminal

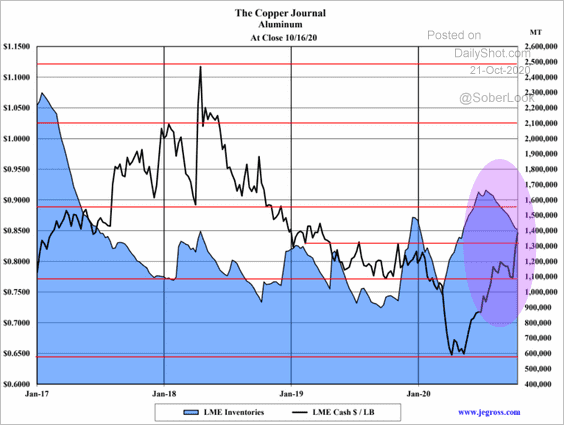

3. Aluminum prices have been surging on demand from China as inventories shrink.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: The Copper Journal

Source: The Copper Journal

——————–

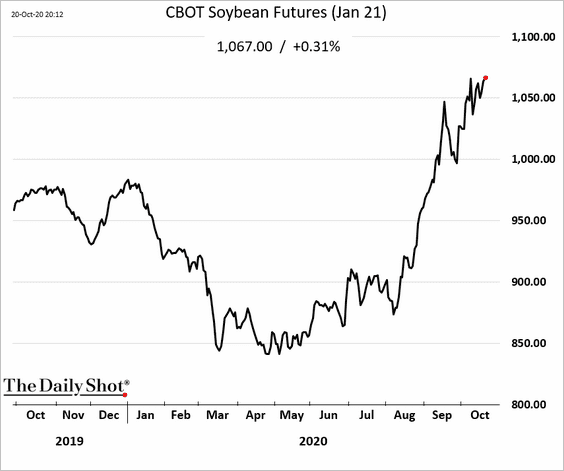

4. US soybean futures are grinding higher.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

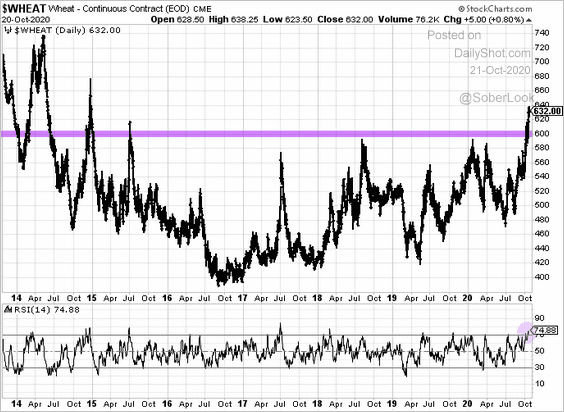

5. Chicago soft red winter wheat futures are now firmly above $6/bu.

h/t @ToddHultman1

h/t @ToddHultman1

Cryptocurrencies

Bitcoin is above $12k as the dollar weakens.

Emerging Markets

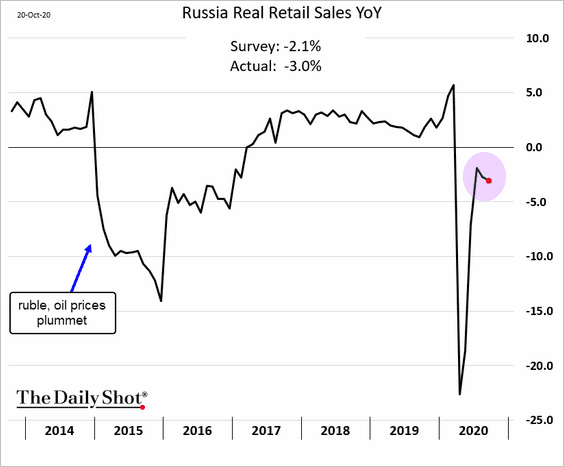

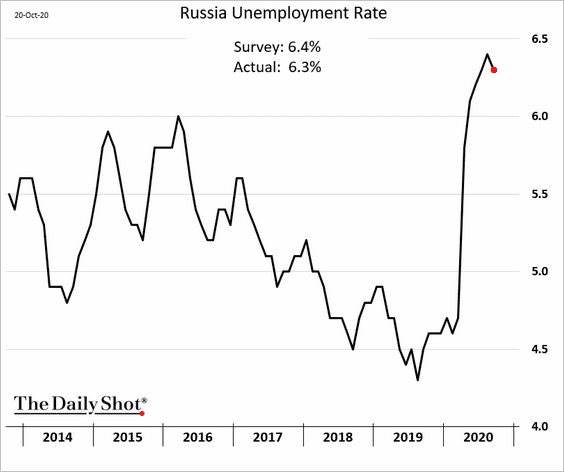

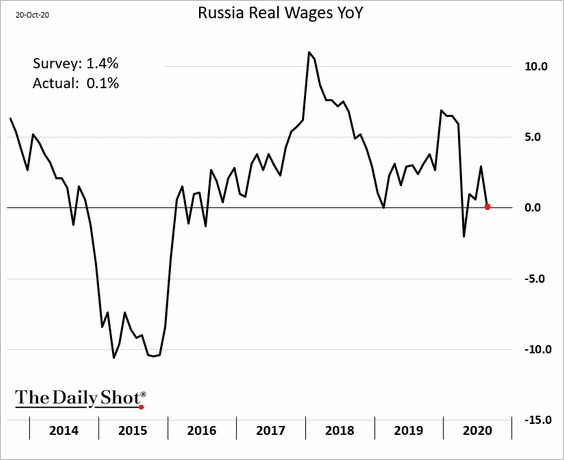

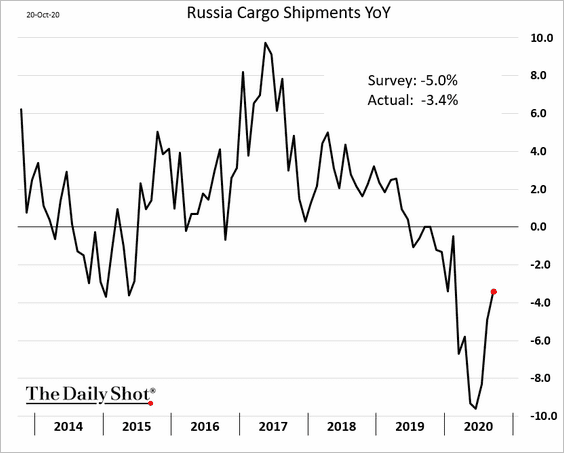

1. Here are some updates on Russia.

• Retail sales:

• Unemployment:

• Wage growth:

• Cargo shipments:

——————–

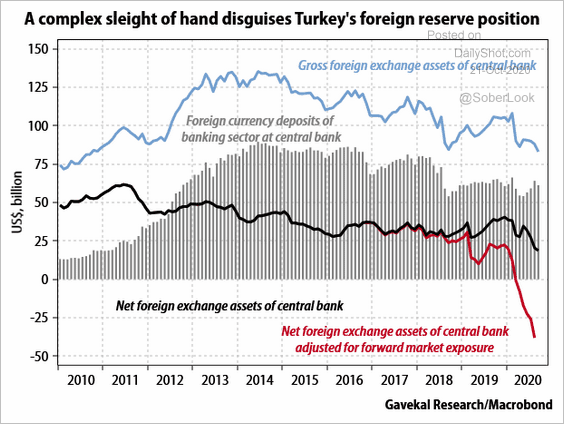

2. Turkey’s foreign reserves have been deteriorating. The central bank may be forced to hike rates again to strengthen the lira.

Source: Gavekal

Source: Gavekal

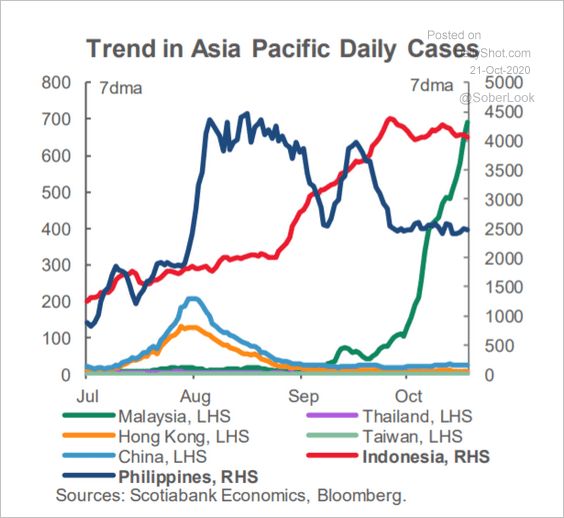

3. COVID is spreading rapidly in Malaysia.

Source: Scotiabank Economics

Source: Scotiabank Economics

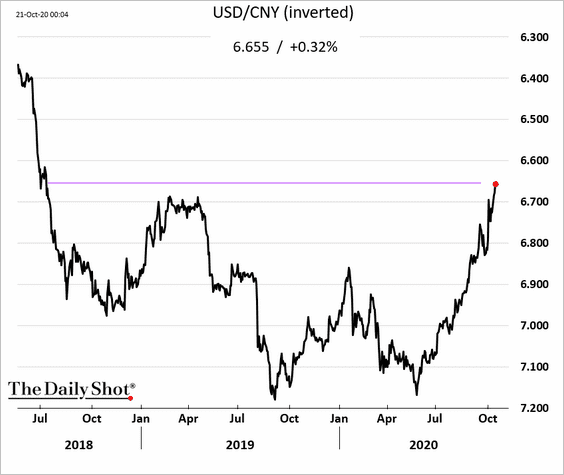

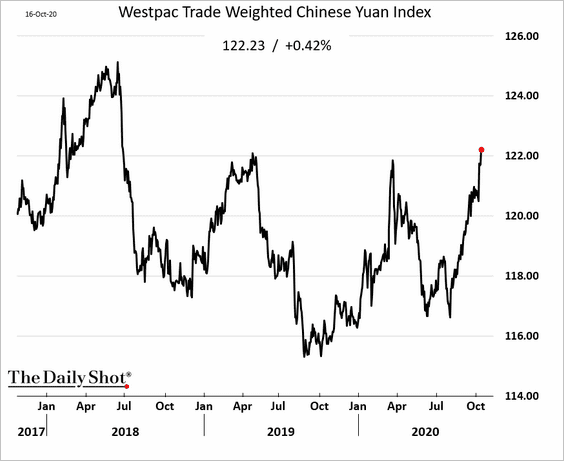

China

1. The currency continues to strengthen.

And the gains are not just about the US dollar weakness.

——————–

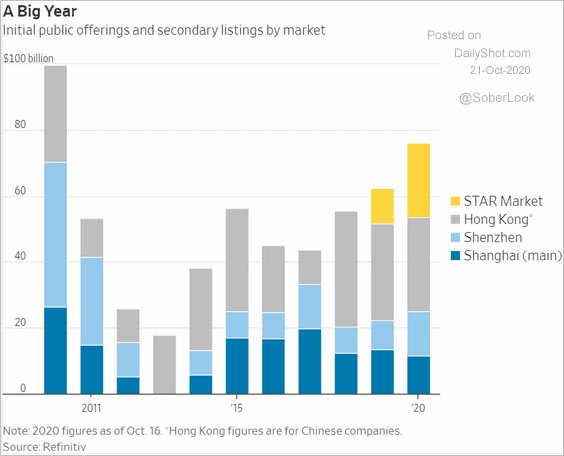

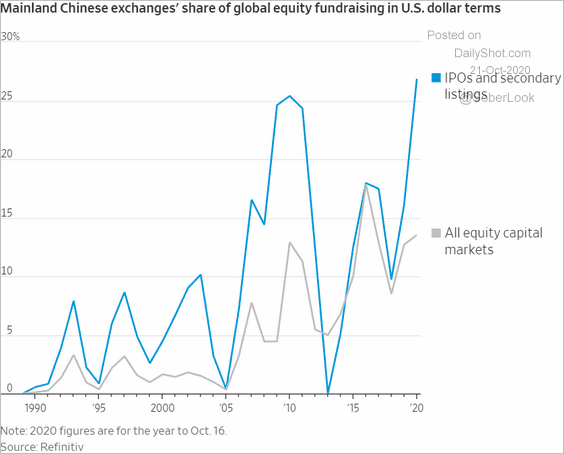

2. It’s been a good year for equity fundraising, with mainland exchanges taking market share.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

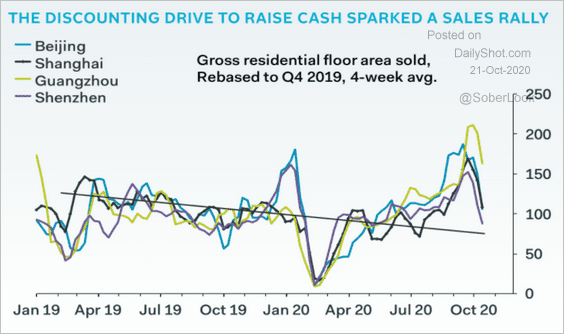

3. Residential sales are moderating.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

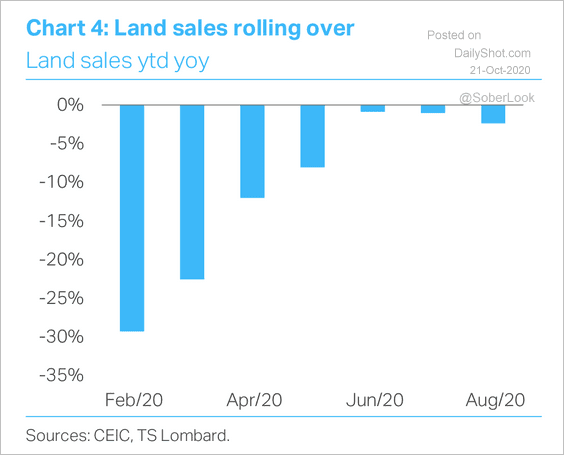

4. Land sales are starting to roll over, which typically leads fixed asset investment by five months, according to TS Lombard. Will the government inject capital to delay an investment slowdown?

Source: TS Lombard

Source: TS Lombard

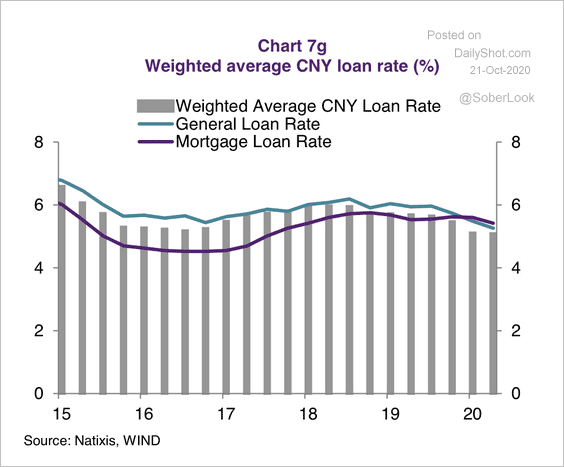

5. Main-street loan rates have been drifting lower.

Source: Natixis

Source: Natixis

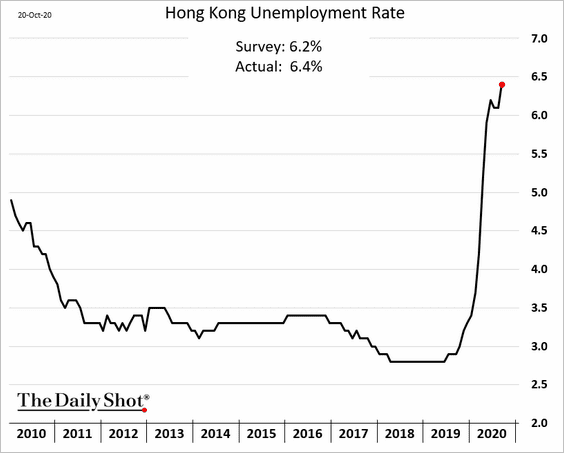

6. Hong Kong’s unemployment rate keeps climbing.

Asia – Pacific

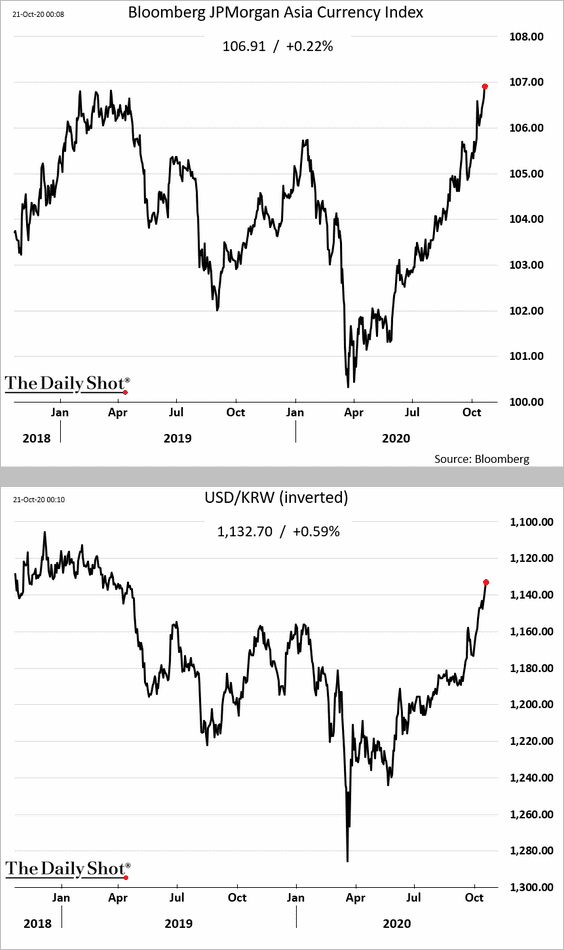

1. Asian currencies continue to rally vs. USD.

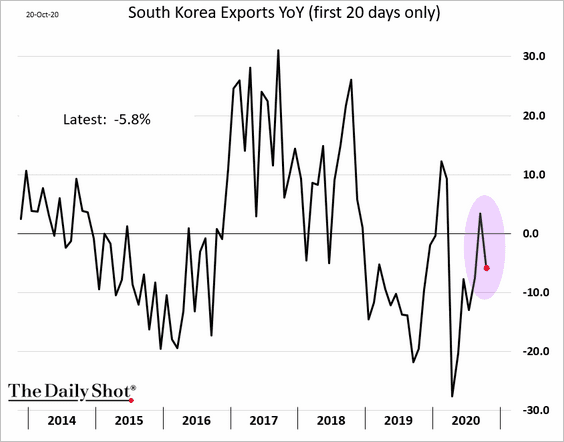

2. South Korean exports declined this month.

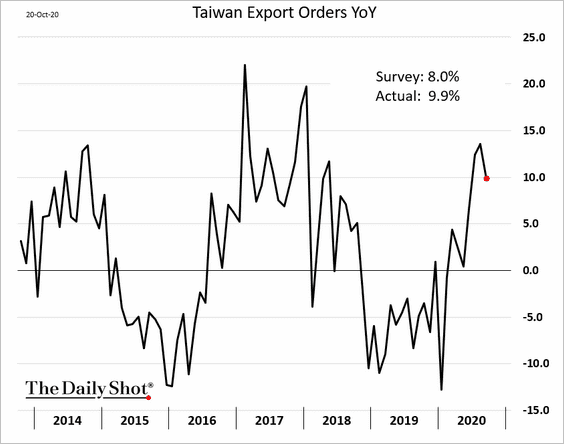

3. Taiwan’s export orders continue to surprise to the upside.

Europe

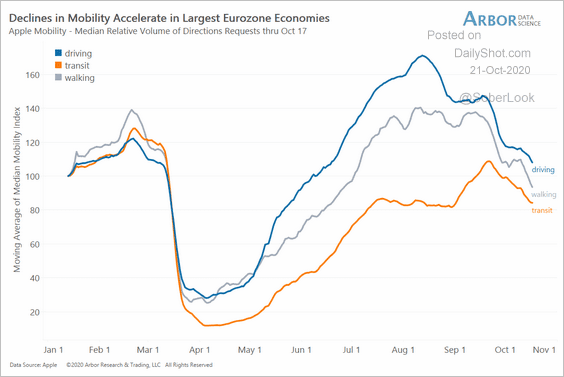

1. Mobility trends have been deteriorating.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

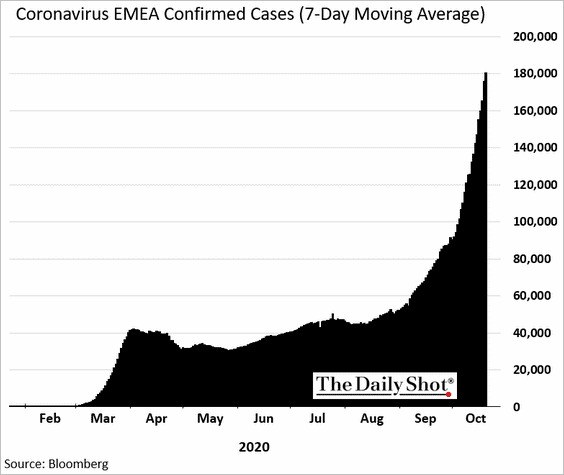

2. COVID cases across Europe and the Middle East have exploded.

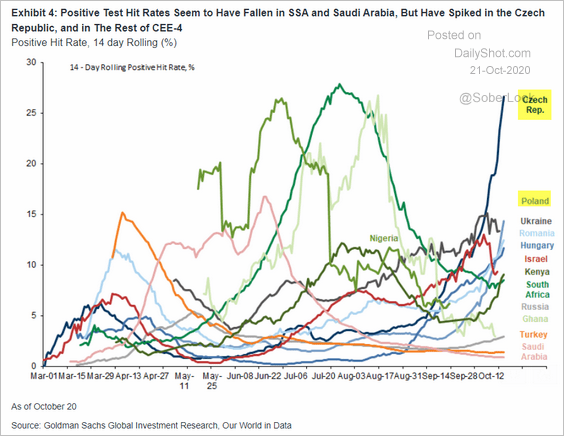

• Central Europe’s infections are accelerating.

Source: Goldman Sachs

Source: Goldman Sachs

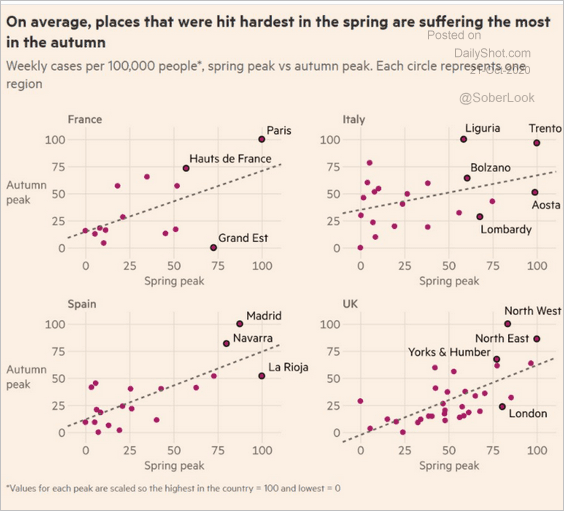

• Places hit hardest in the spring are impacted the most by the second wave.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

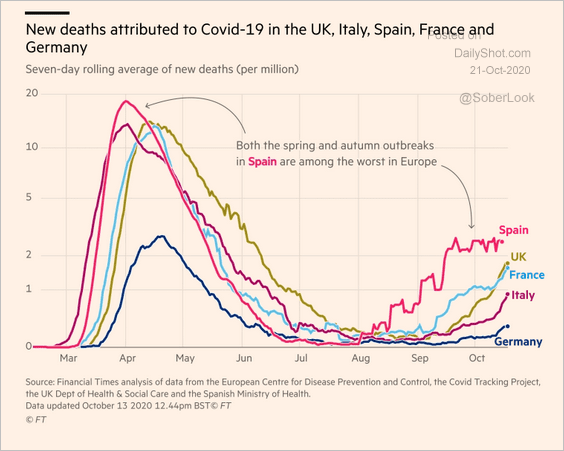

• New deaths are climbing as well.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

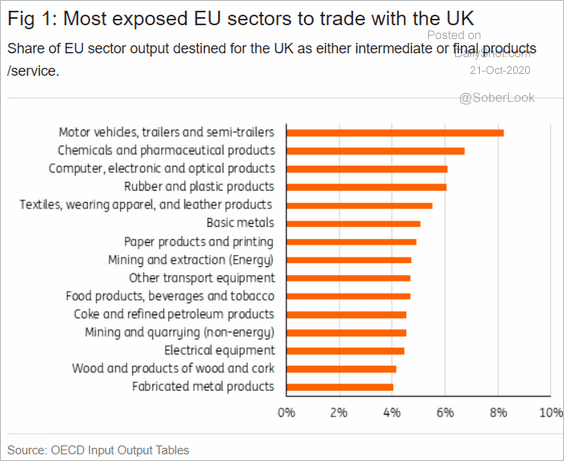

3. Which EU sectors are most exposed to Brexit?

Source: ING

Source: ING

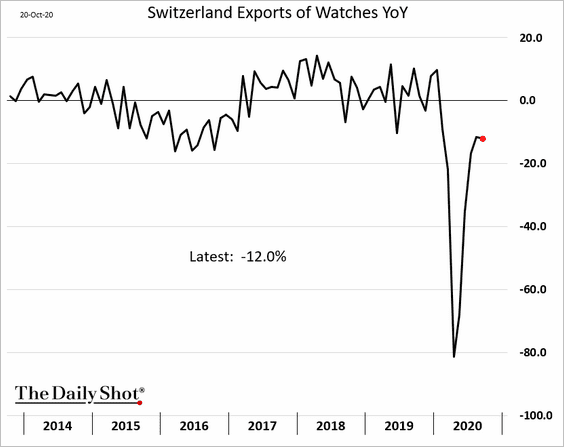

4. Swiss watch export recovery has stalled.

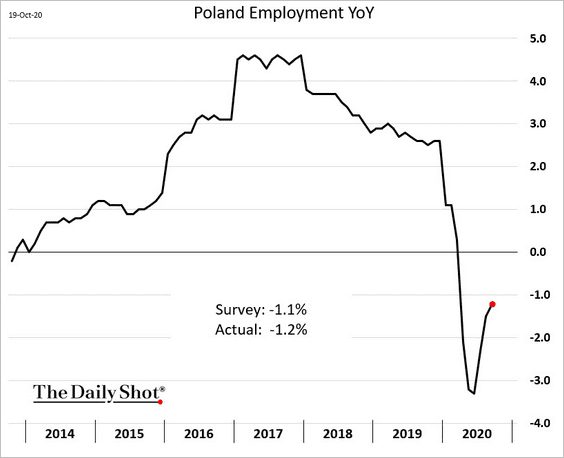

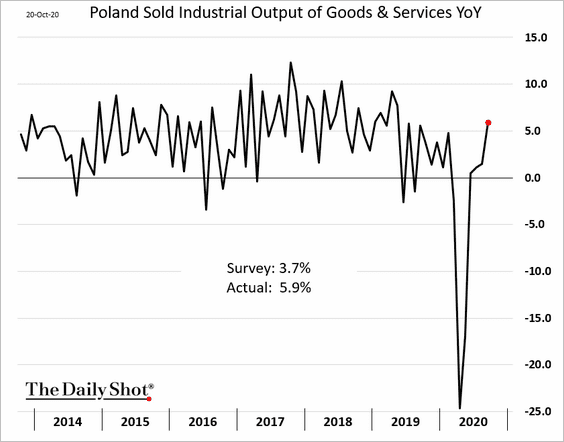

5. Finally, we have a couple of updates on Poland.

• Employment growth:

• Sold industrial output (before the second wave):

The United States

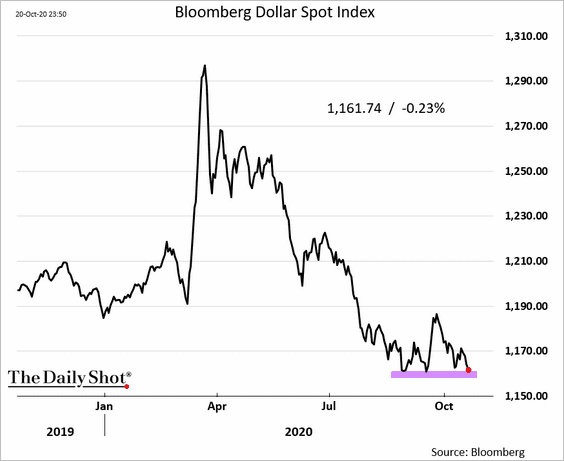

1. Stimulus expectations are pressuring the US dollar.

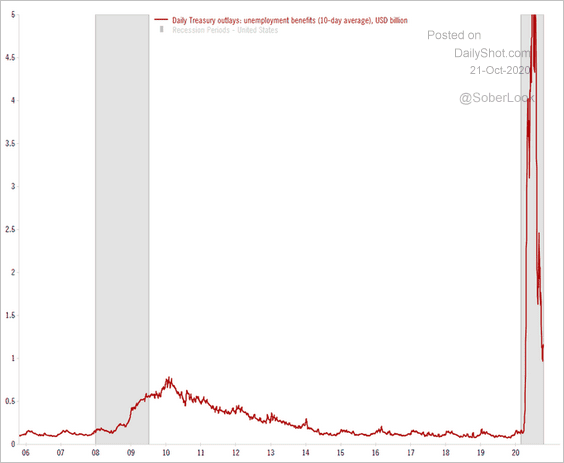

2. The federal government’s spending on unemployment benefits has declined sharply.

Source: @TCosterg

Source: @TCosterg

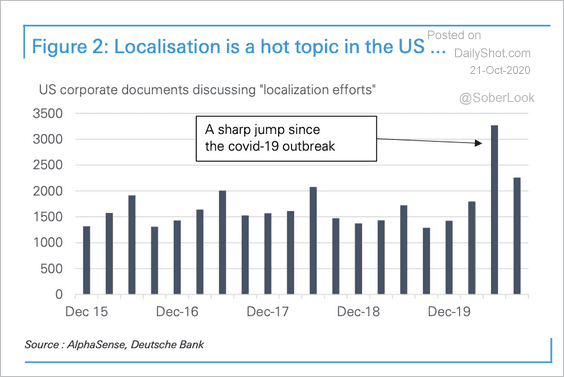

3. Companies are increasingly discussing localization efforts – a shift from globalization.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

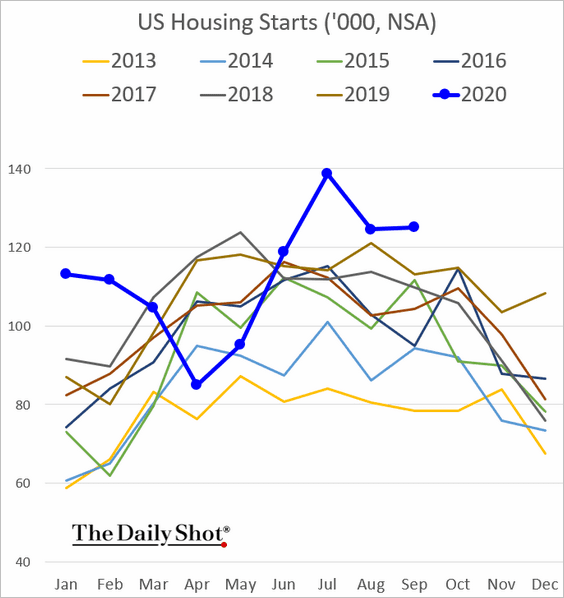

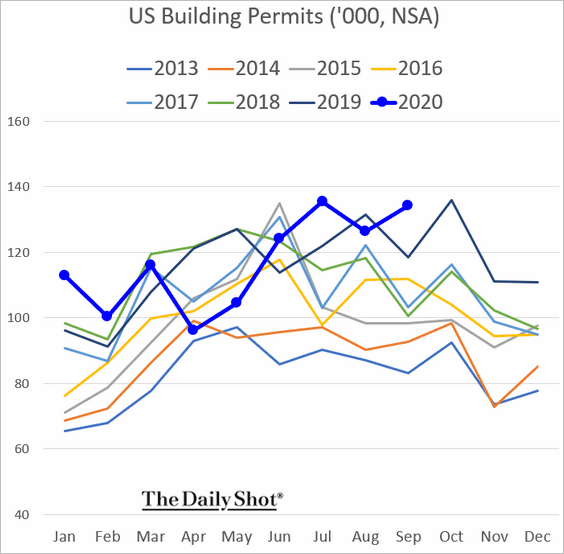

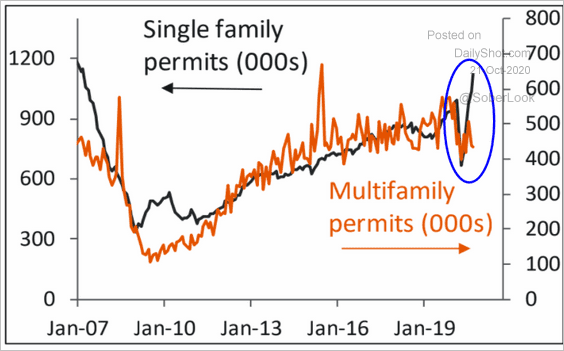

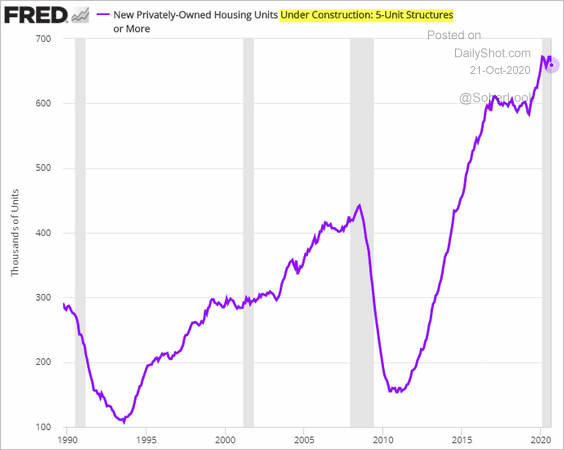

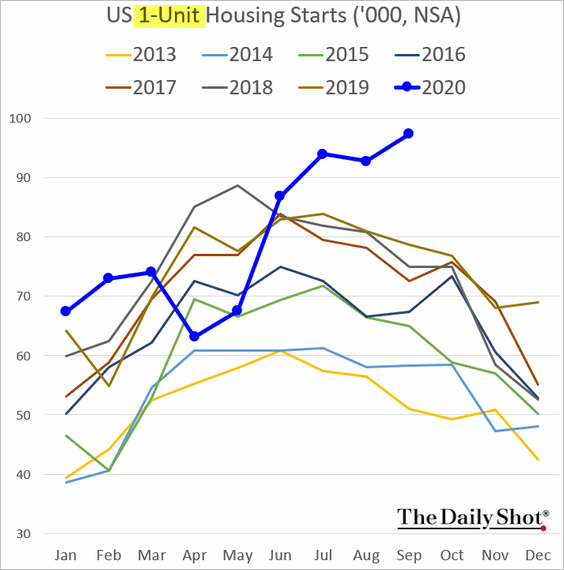

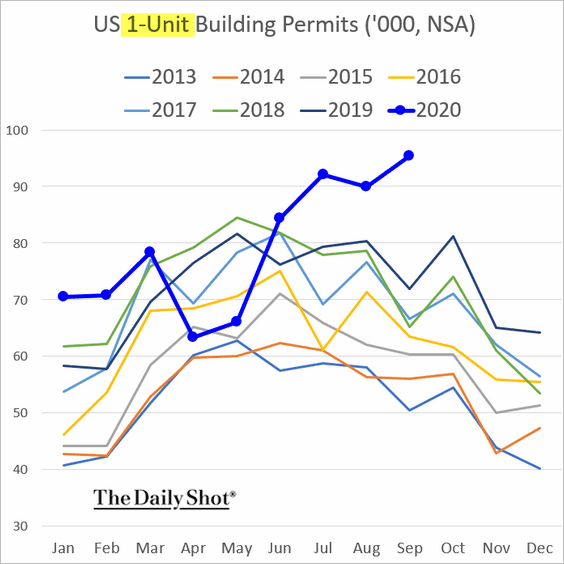

4. Next, we have some updates on new residential construction, which remained robust last month.

– Housing starts:

– Building permits:

There was a substantial divergence between single-family and multi-family housing. The need for more space and less crowded areas has widened the demand gap between apartments and houses.

Source: Piper Sandler

Source: Piper Sandler

Moreover, there is a substantial backlog of apartments under construction.

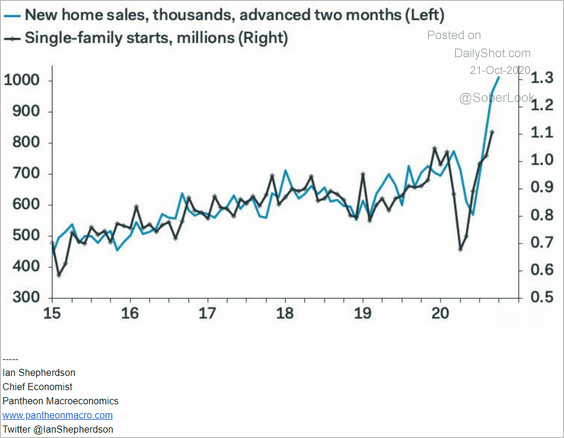

Single-family starts and permits hit a multi-year high.

Given the recent spike in new home sales, single-family construction is expected to accelerate further.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Global Developments

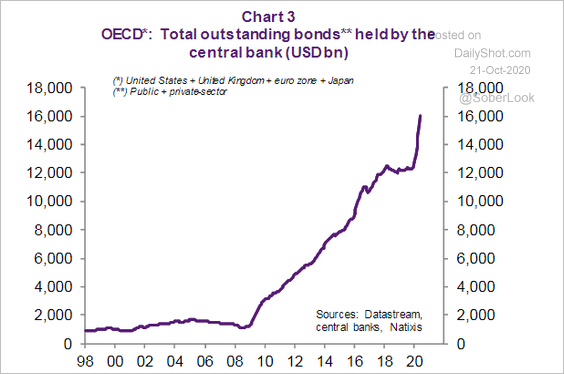

1. Central banks now own some $16 trillion worth of bonds.

Source: Natixis

Source: Natixis

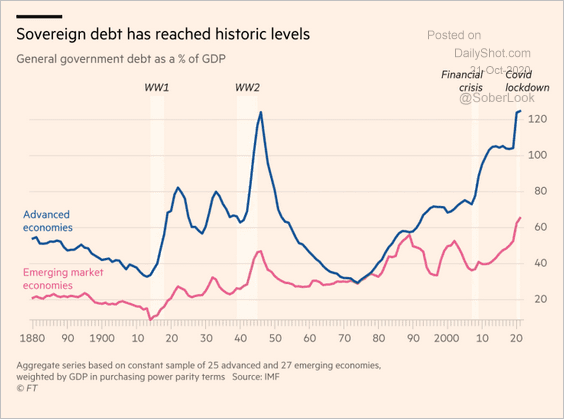

2. Sovereign debt-to-GDP ratios are at record highs.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

Food for Thought

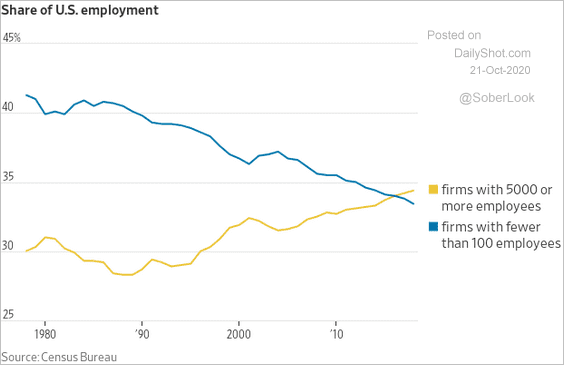

1. Employment at small vs. large firms over time:

Source: @WSJ Read full article

Source: @WSJ Read full article

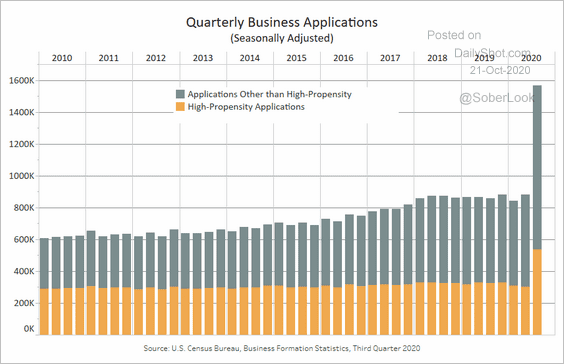

2. Business applications in the US:

Source: @uscensusbureau

Source: @uscensusbureau

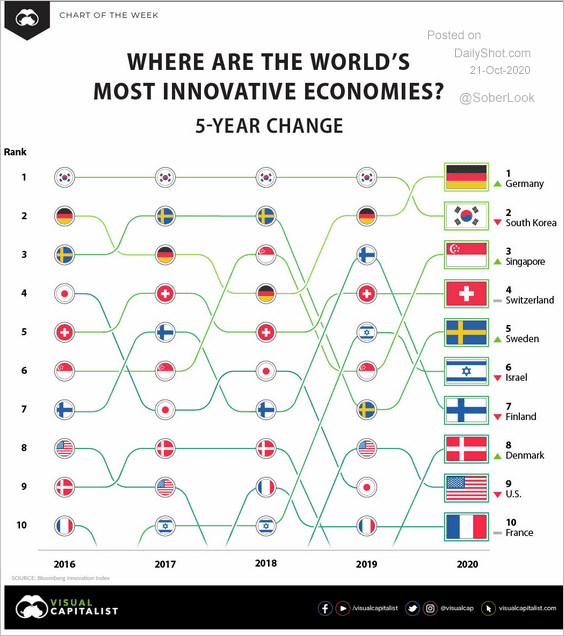

3. Most innovative economies:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

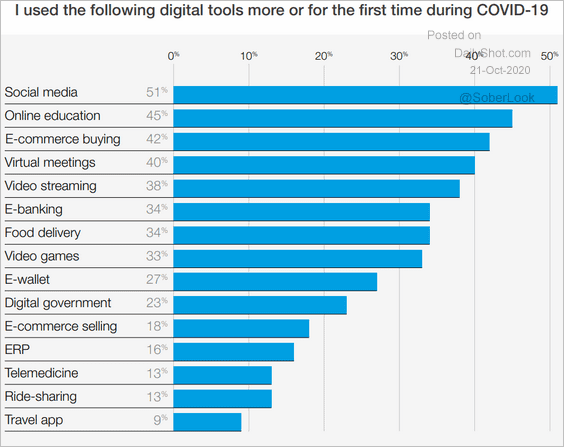

4. The increase in digital tool usage during COVID:

Source: @wef Read full article

Source: @wef Read full article

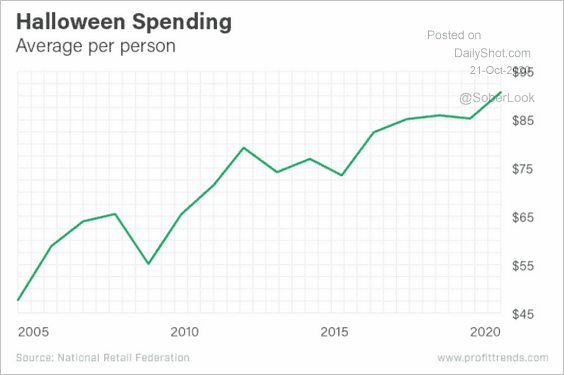

5. Halloween spending:

Source: Investment U Read full article

Source: Investment U Read full article

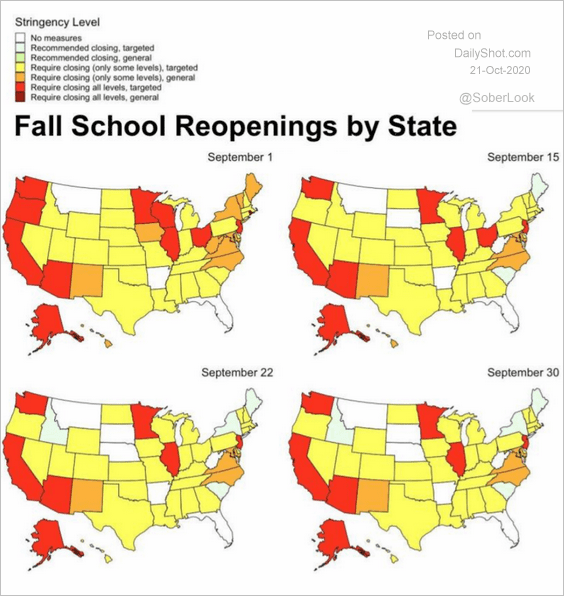

6. School reopenings by state:

Source: Oxford Read full article

Source: Oxford Read full article

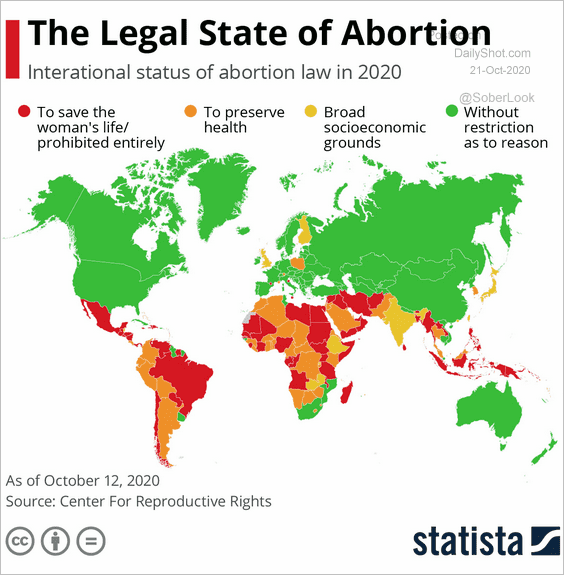

7. Abortion legal status globally:

Source: Statista

Source: Statista

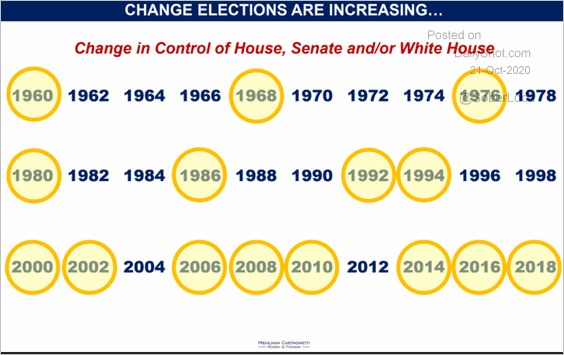

8. Change in control of House, Senate, or White House:

Source: Mehlman Castagnetti Rosen & Thomas

Source: Mehlman Castagnetti Rosen & Thomas

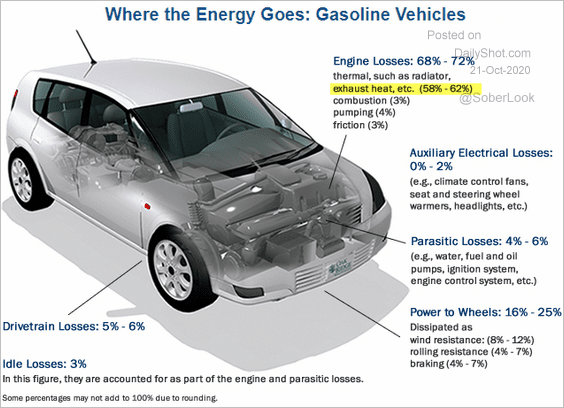

9. Energy loss in gasoline vehicles:

Source: fueleconomy.gov

Source: fueleconomy.gov

——————–