The Daily Shot: 19-Jun-20

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

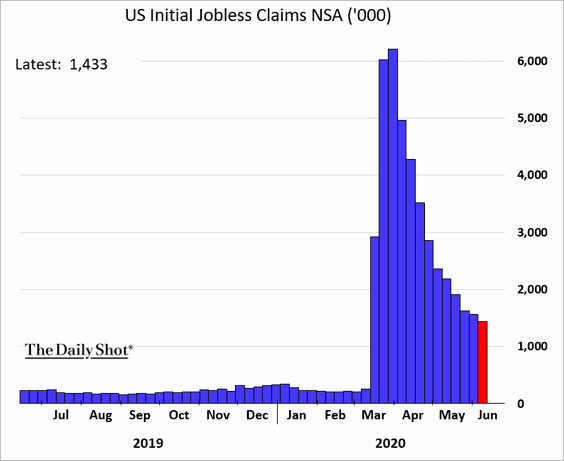

1. Initial jobless claims declined from last week, but the latest figure was above economists’ estimates.

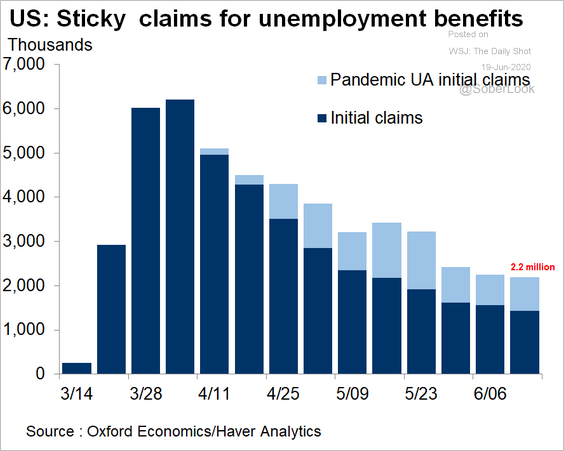

Combined with the Pandemic Unemployment Assistance (PUA) program, new unemployment applications topped 2 million again.

Source: @GregDaco

Source: @GregDaco

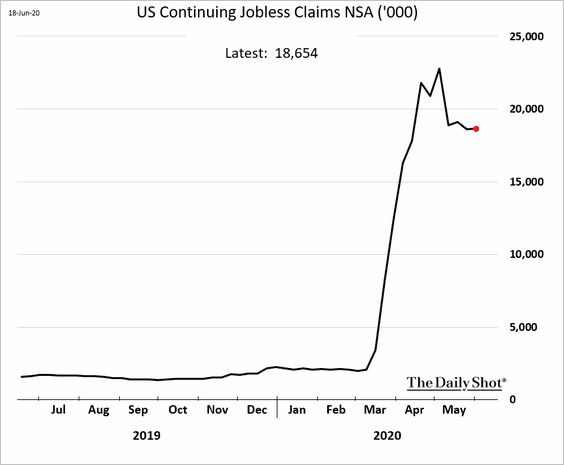

Continuing claims are holding above 18 million. The labor market is facing a long recovery.

——————–

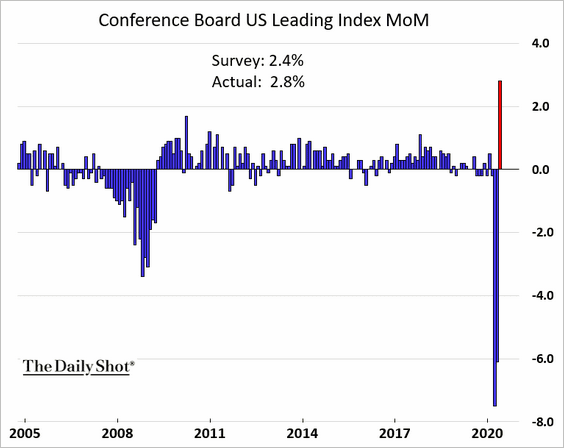

2. The May index of leading indicators rebounded after severe declines in March and April.

3. Next, let’s take a look at some high-frequency indicators of economic activity.

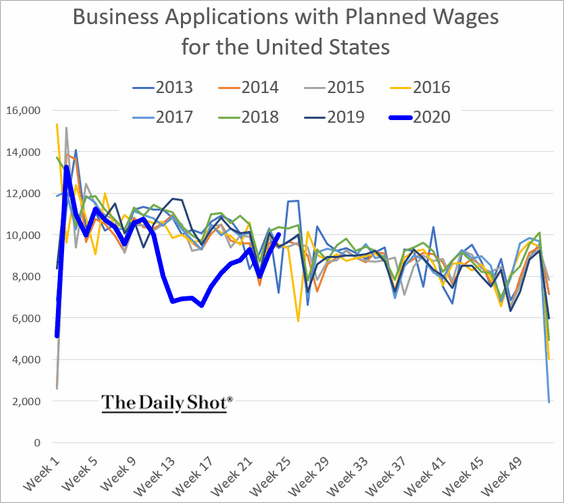

• Business applications (fully recovered):

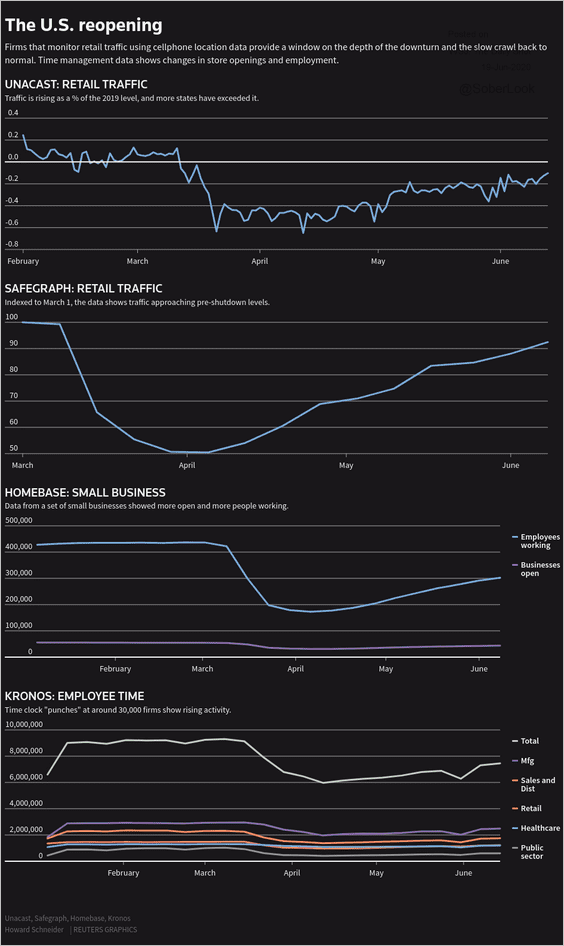

• Retail traffic, small business activity, and hourly employees:

Source: Reuters Read full article

Source: Reuters Read full article

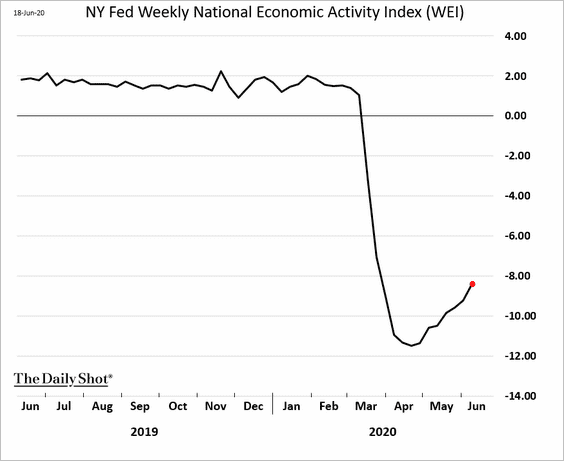

• The NY Fed’s national activity indicator (WEI):

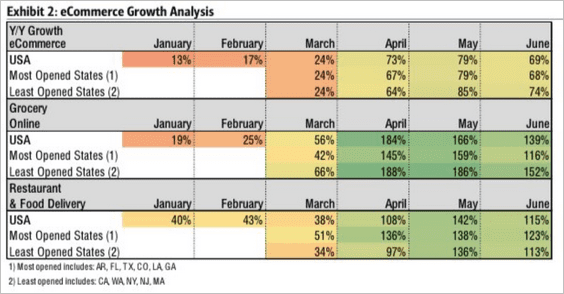

• E-commerce:

Source: BofA Merrill Lynch Global Research

Source: BofA Merrill Lynch Global Research

——————–

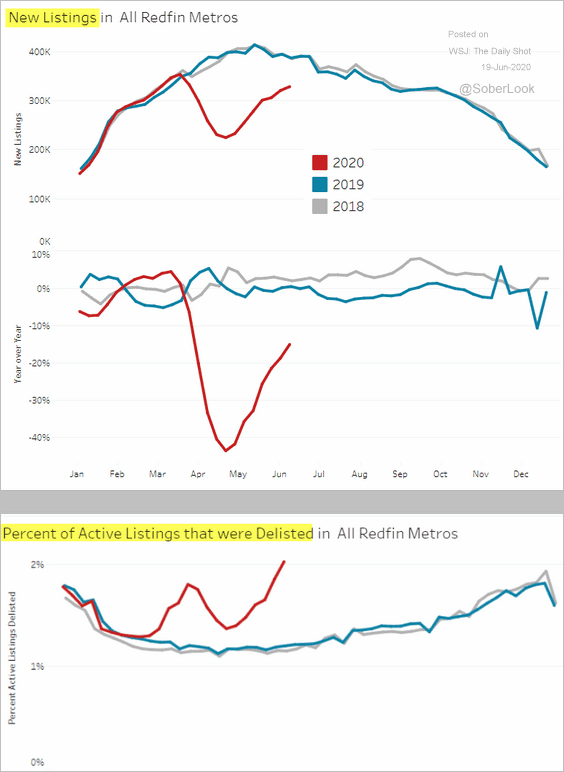

4. New home listings are rebounding.

Source: Redfin

Source: Redfin

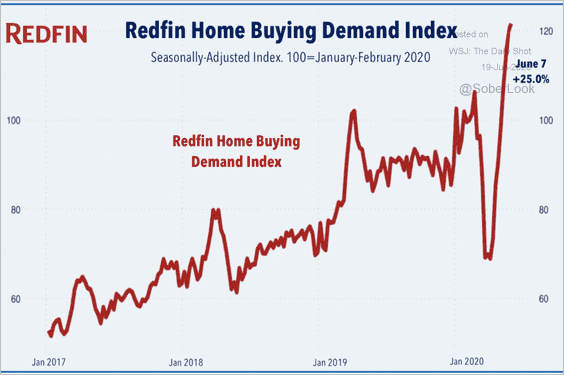

Here is the Redfin Home Buying Demand Index.

Source: Redfin, Hoya Capital Real Estate

Source: Redfin, Hoya Capital Real Estate

——————–

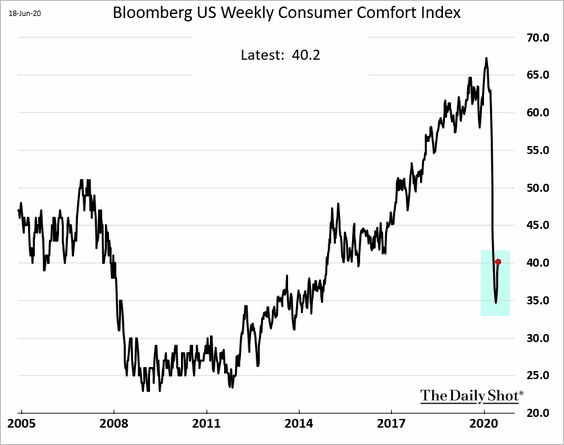

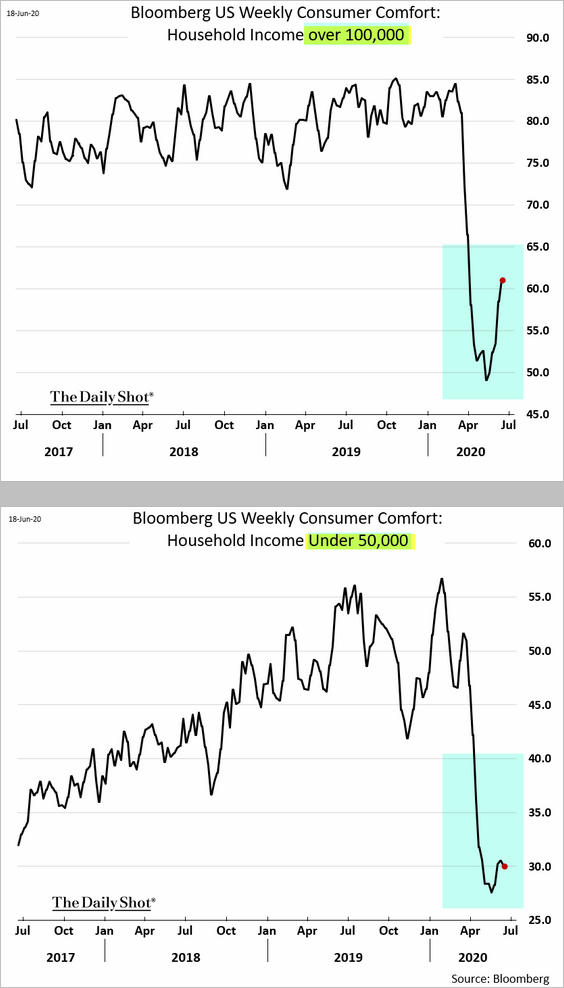

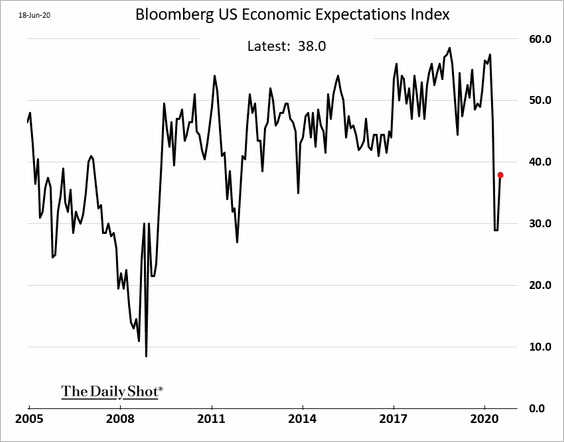

5. Bloomberg’s weekly consumer sentiment index continues to recover.

But the improvement has been uneven, with optimism among wealthier households rebounding quicker.

Here is the monthly economic expectations index.

——————–

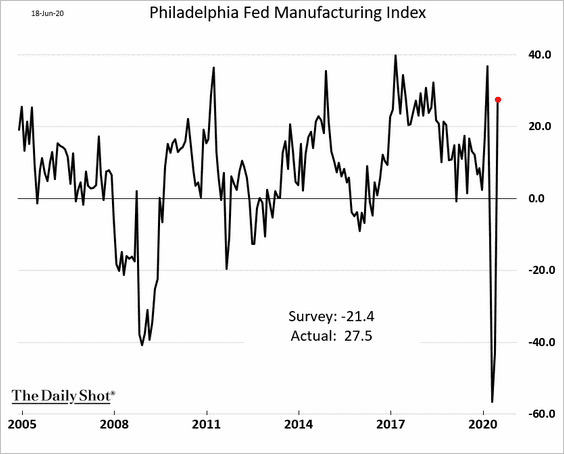

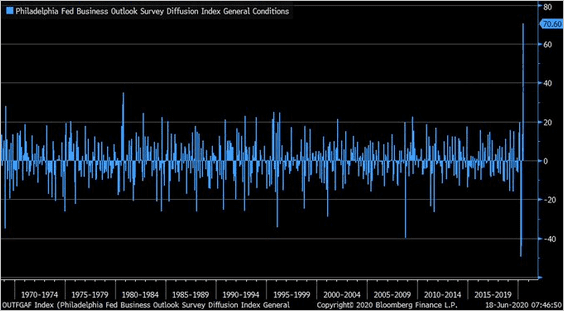

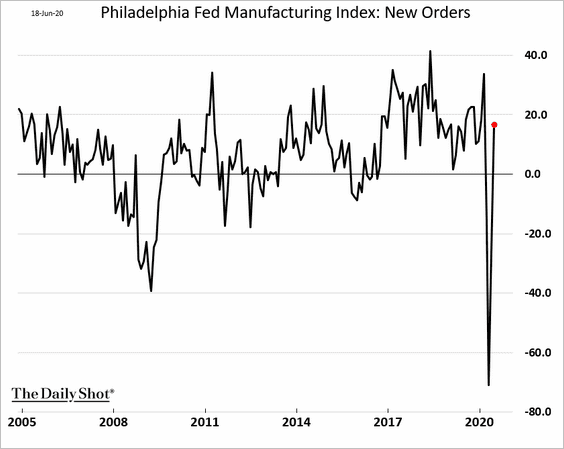

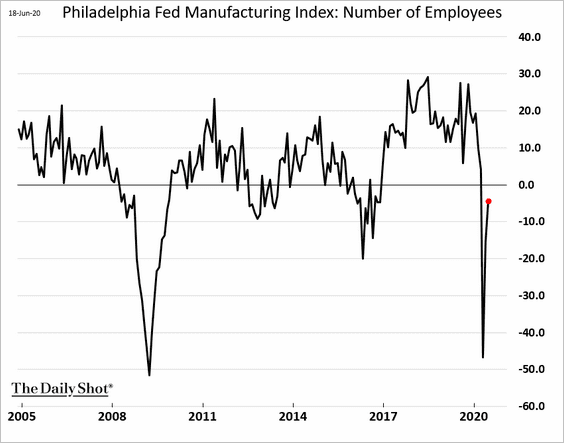

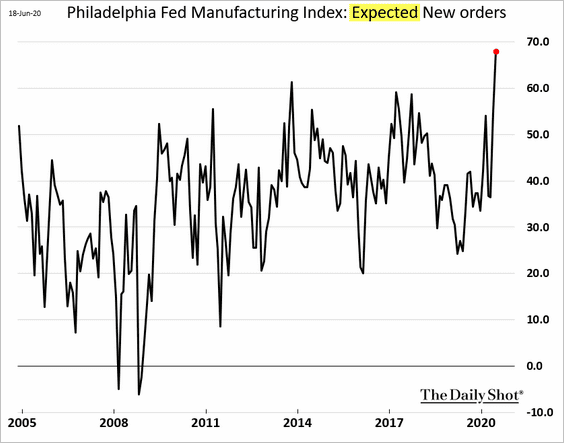

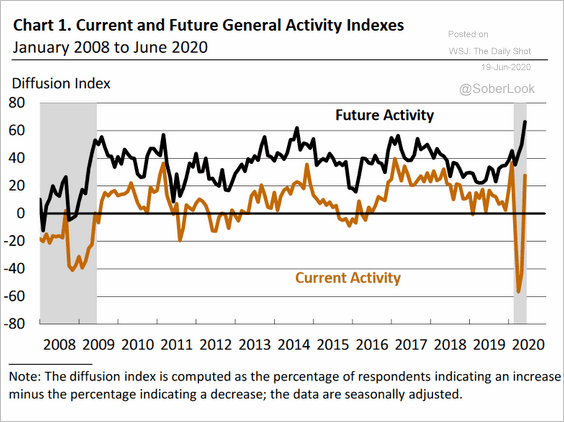

6. The Philly Fed’s factory activity indicator registered a sharp rebound in June. The second chart shows monthly changes.

Source: @LizAnnSonders

Source: @LizAnnSonders

• New orders:

• Employment:

Forward-looking indicators were exceptionally strong.

Here is a summary.

Source: @GregDaco

Source: @GregDaco

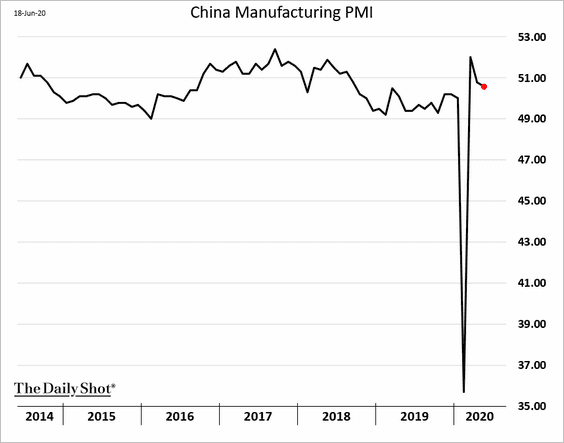

It’s worth noting that China also saw a sharp rebound in factory activity after reopening (in March), as manufacturers rushed to meet pent-up demand. However, momentum has since slowed.

——————–

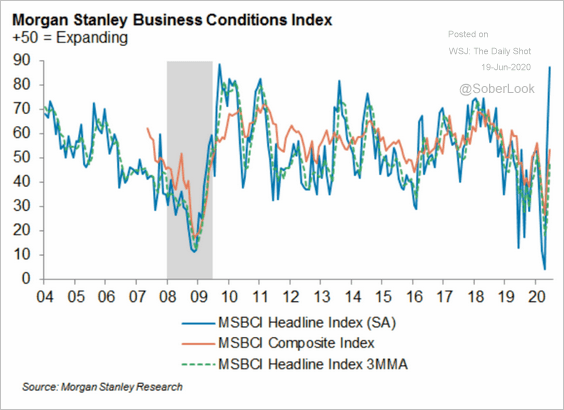

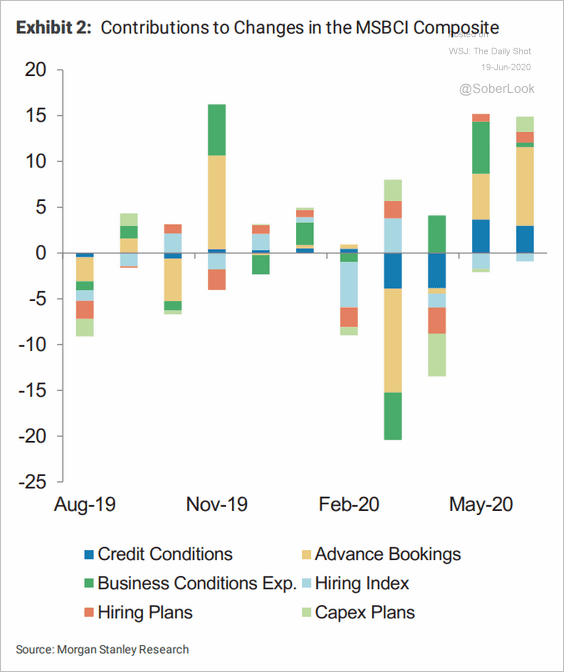

7. The Morgan Stanley Business Conditions Index rose significantly this month.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Here are the index components.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

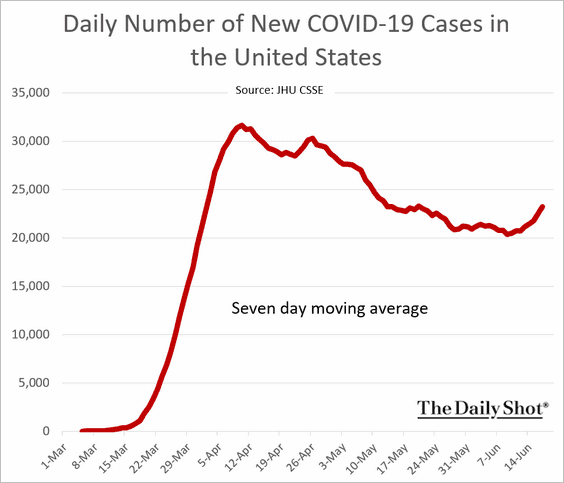

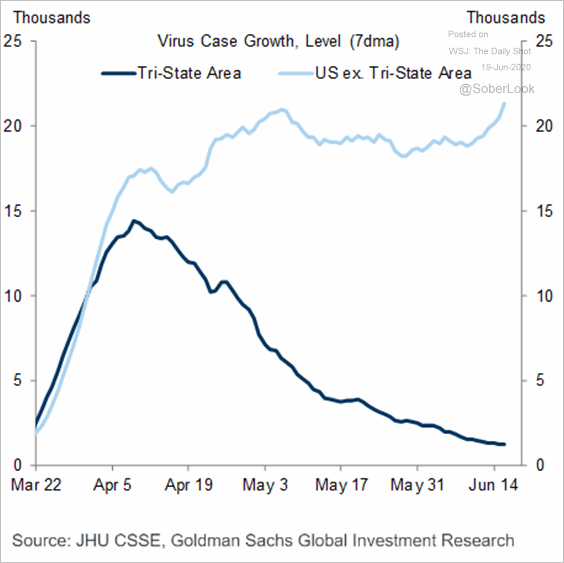

8. The number of new COVID-19 cases in the US started to climb again as progress remains painfully slow. Some hospital systems are concerned about becoming overwhelmed.

Outside of the New York City tri-state area, the number of daily infections hit a record.

Source: Goldman Sachs

Source: Goldman Sachs

The United Kingdom

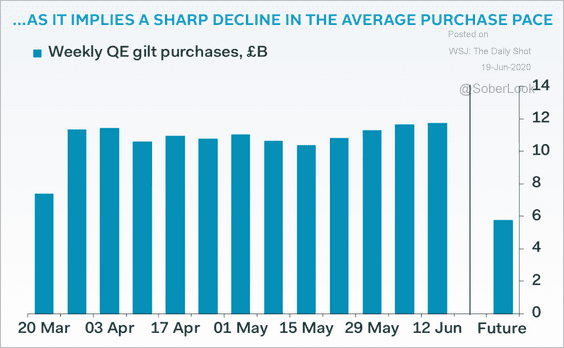

1. The Bank of England added a total of GBP 100 billion of securities purchases to its QE program. That was less than expected.

Source: CNBC Read full article

Source: CNBC Read full article

The weekly gilt purchases will be substantially smaller going forward.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

The pound (chart below) and bond yields (second chart) jumped in response.

Source: @samueltombs

Source: @samueltombs

Source: @markets Read full article

Source: @markets Read full article

——————–

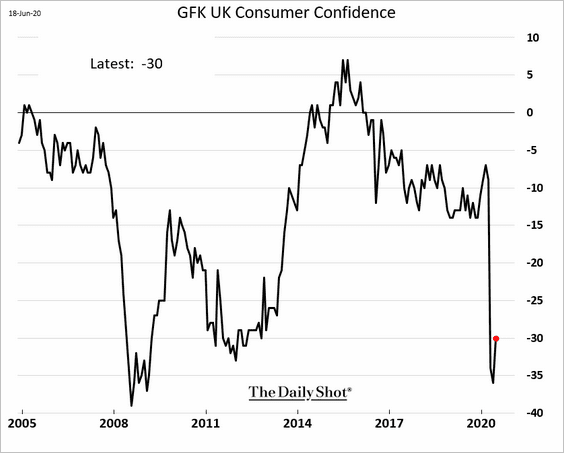

2. Consumer confidence is starting to recover.

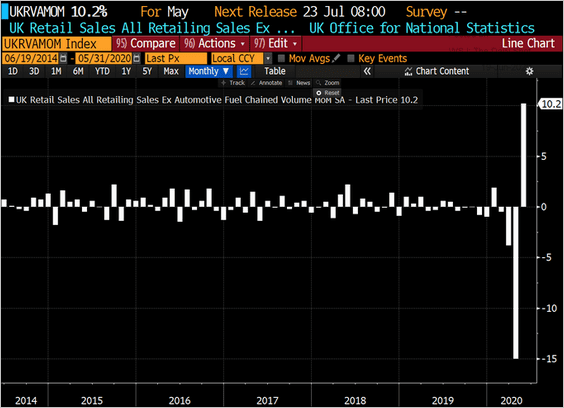

3. The May rebound in retail sales topped economists’ forecasts (10.2% vs. 4.1% expected).

Source: @jsblokland

Source: @jsblokland

The Eurozone

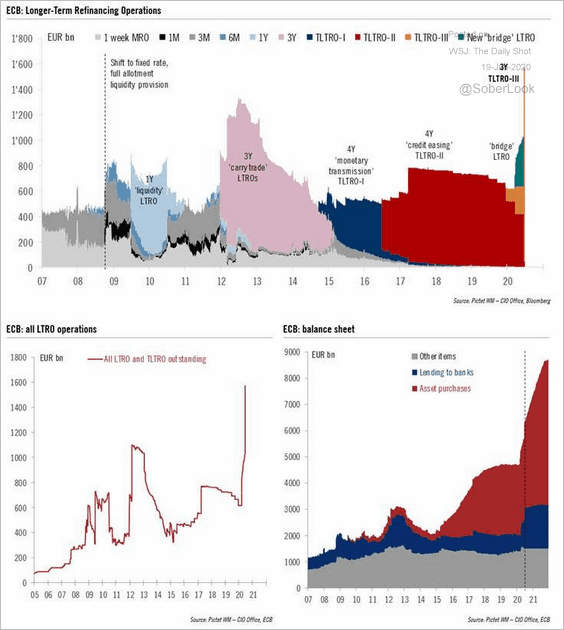

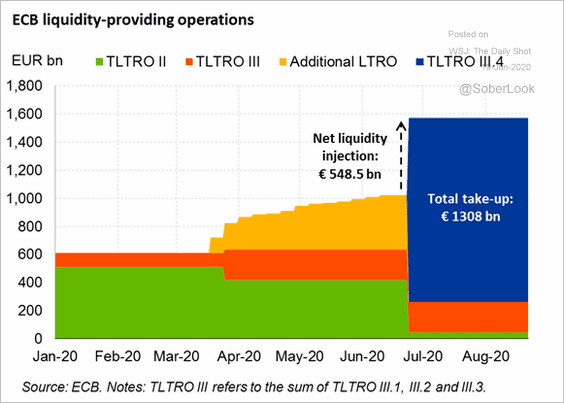

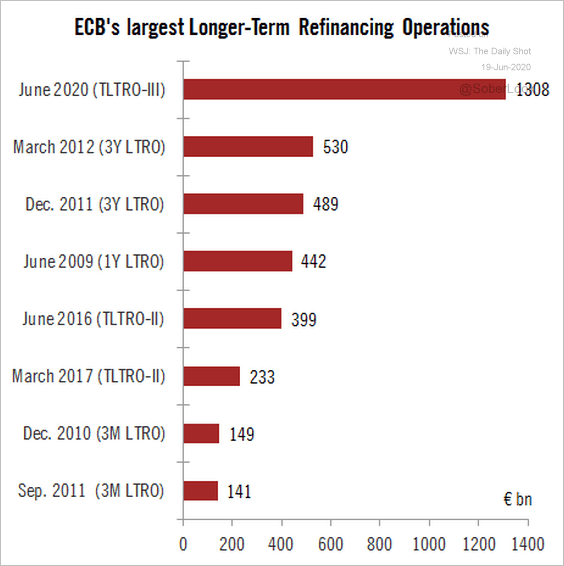

1. The demand for the latest tranche of TLTRO financing was remarkably strong (€1.3 trillion). When your central bank offers you a loan and pays you up to 1% in interest to take their money, it’s hard to refuse. It’s going to increase the ECB’s balance sheet and bank reserves significantly.

Source: @fwred

Source: @fwred

Source: @Isabel_Schnabel

Source: @Isabel_Schnabel

Source: @fwred

Source: @fwred

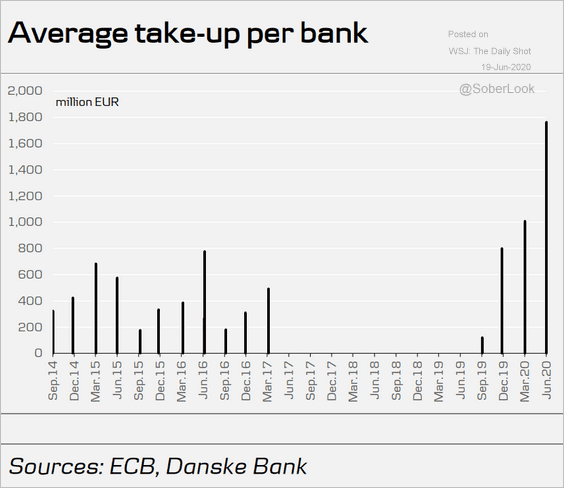

Here is the average LTRO take-up per bank.

Source: Danske Bank

Source: Danske Bank

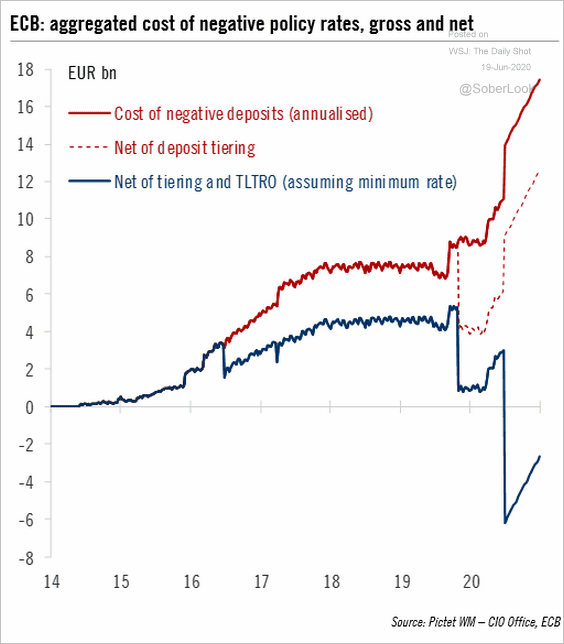

Not only did the ECB fully offset the impact of negative rates on the banking system, but banks will now generate net profits from the ECB’s operations.

Source: @fwred

Source: @fwred

——————–

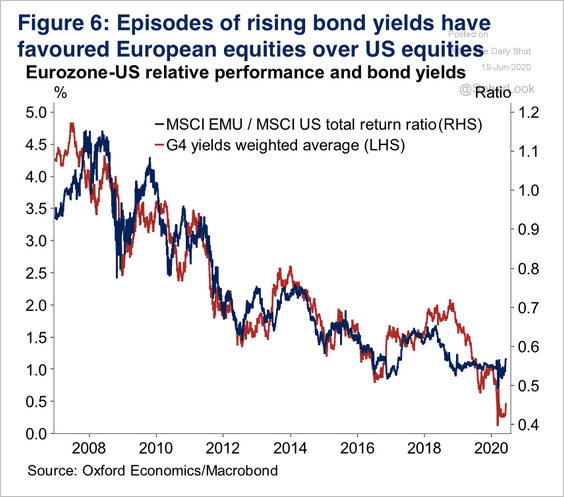

2. To the extent that expansionary fiscal policy globally puts upward pressure on bond yields, it should be good for European equities too, according to Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

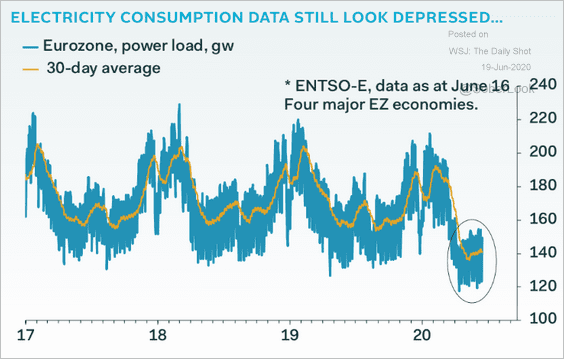

3. Despite the recent rebound in activity, electricity consumption in the Eurozone remains depressed.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Asia – Pacific

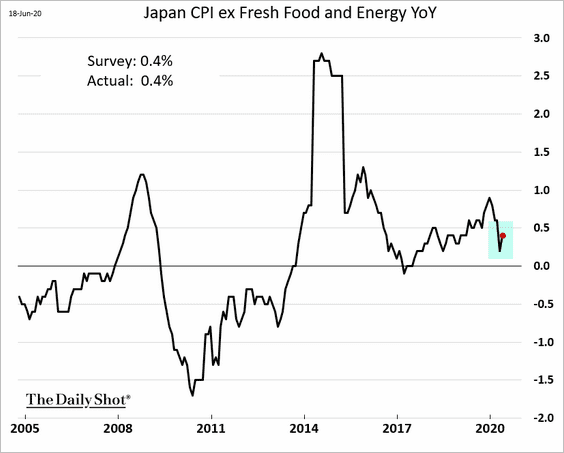

1. Japan’s CPI ticked higher.

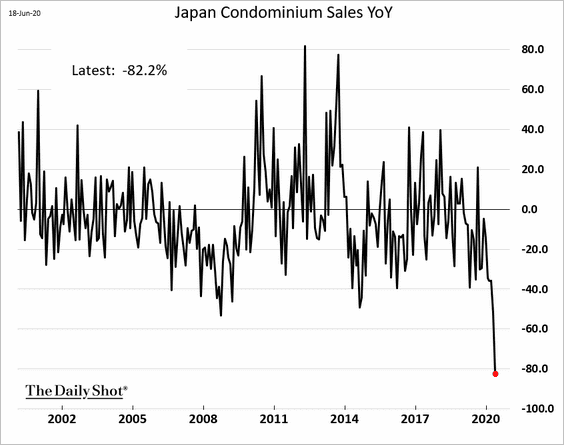

The nation’s condo sales collapsed in May.

——————–

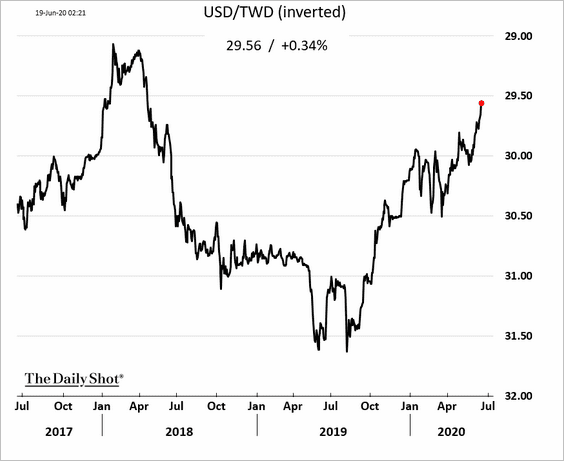

2. The Taiwan dollar continues to advance.

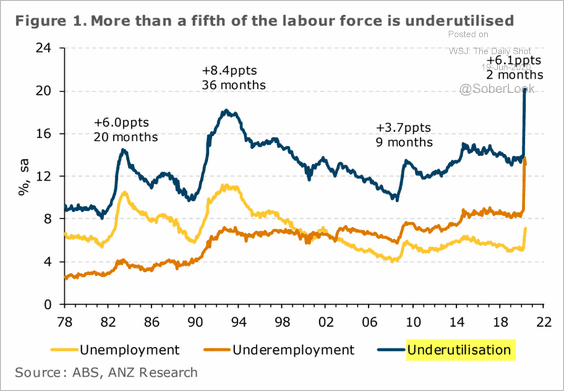

3. Australia’s labor underutilization hit 20% last month.

Source: ANZ Research

Source: ANZ Research

China

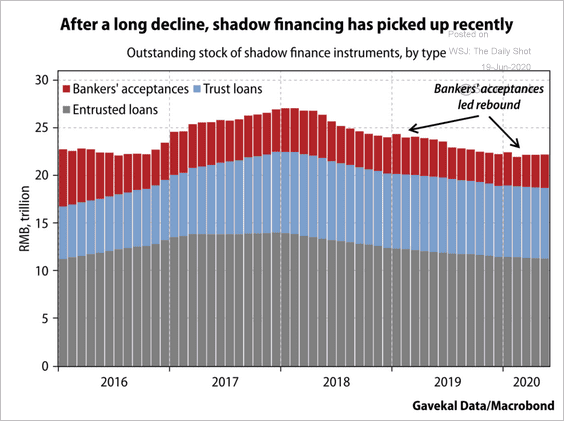

1. After two years of declines, shadow financing has stabilized.

Source: Gavekal

Source: Gavekal

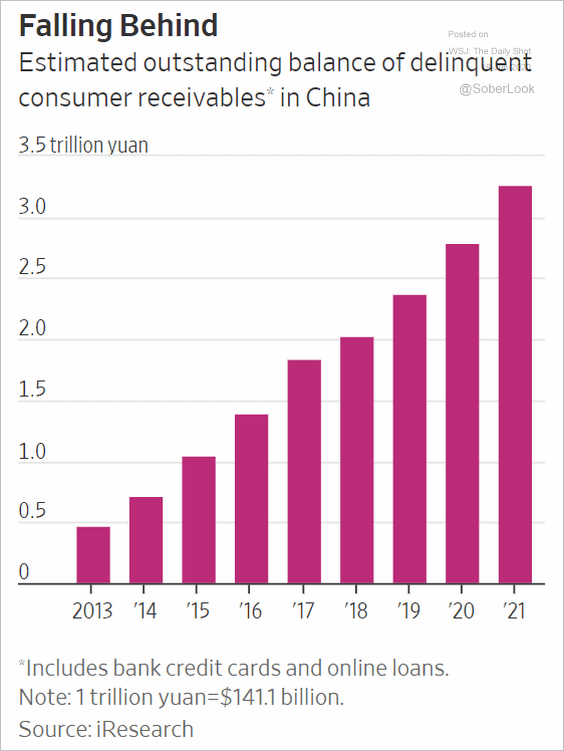

2. The amount of delinquent short-term consumer debt keeps climbing.

Source: @WSJ Read full article

Source: @WSJ Read full article

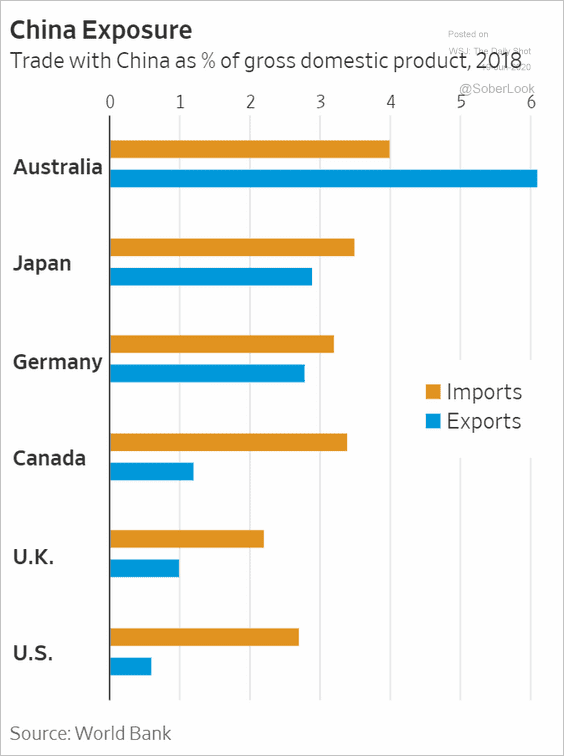

3. Here is each country’s trade with China as a percentage of GDP.

Source: @WSJ Read full article

Source: @WSJ Read full article

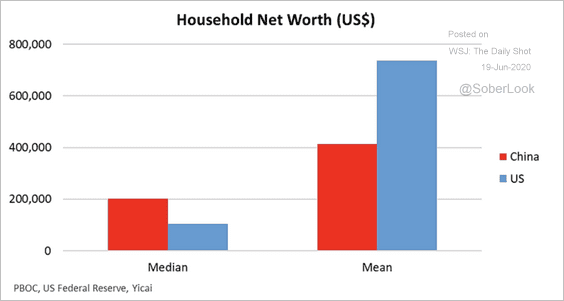

4. The chart below compares the household net worth for China and the US (mean and median).

Source: @adam_tooze Read full article

Source: @adam_tooze Read full article

Emerging Markets

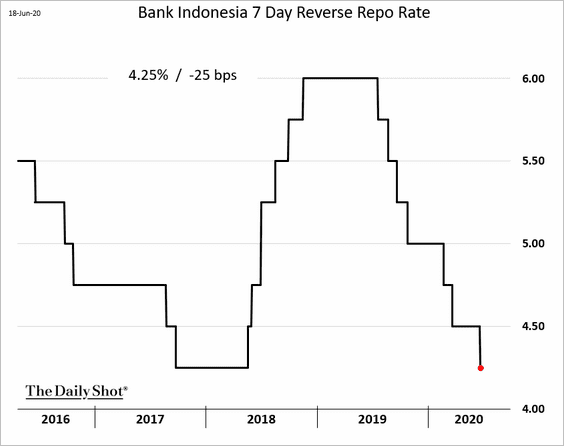

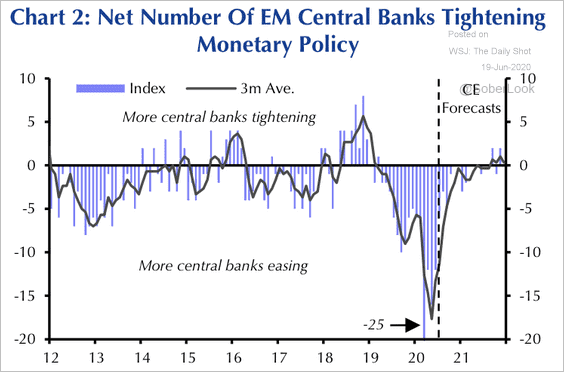

1. Indonesia’s central bank cut rates again.

According to Capital Economics, after rapid-fire easing since the start of the crisis, rate cuts will slow going forward.

Source: Capital Economics

Source: Capital Economics

——————–

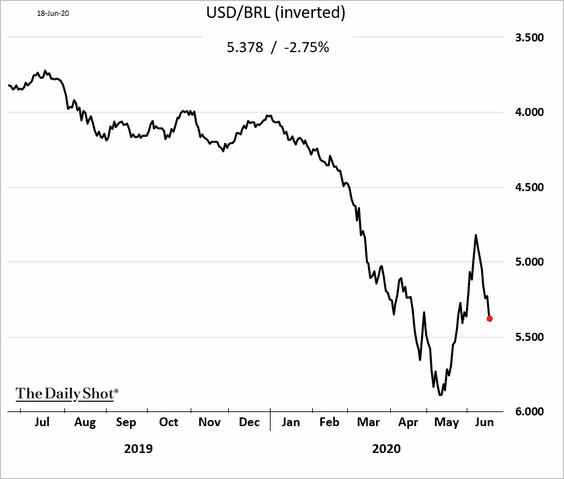

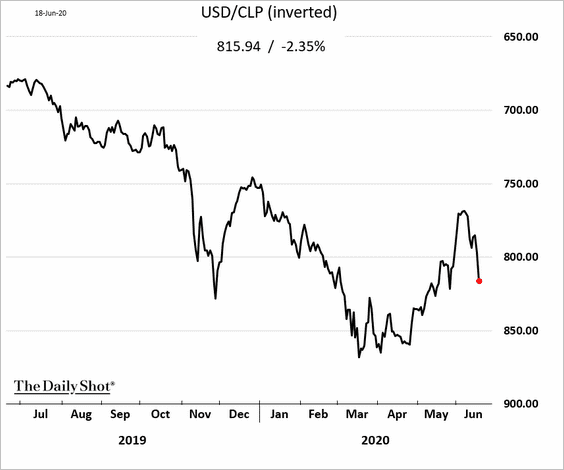

2. The rebound in LatAm currencies is fading.

• The Brazilian real:

• The Chilean peso:

This story didn’t help the situation.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

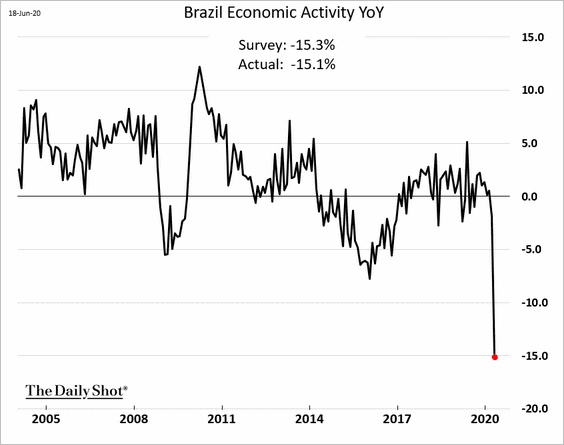

3. Brazil’s economy contracted 15% in April.

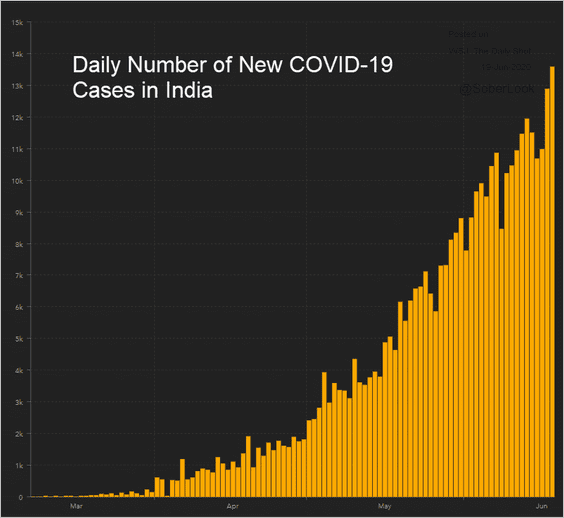

4. The number of new COVID-19 infections in India shows no signs of slowing.

Source: JHU CSSE

Source: JHU CSSE

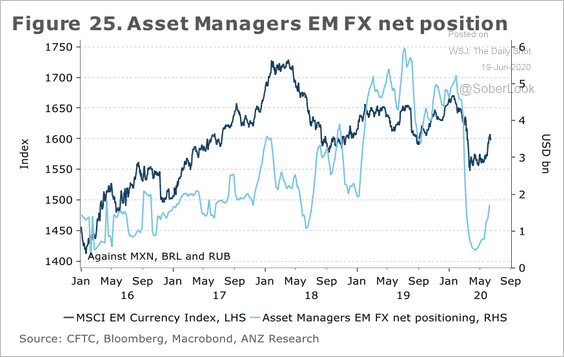

5. Asset managers have increased their long positions in EM currencies over the past month.

Source: ANZ Research

Source: ANZ Research

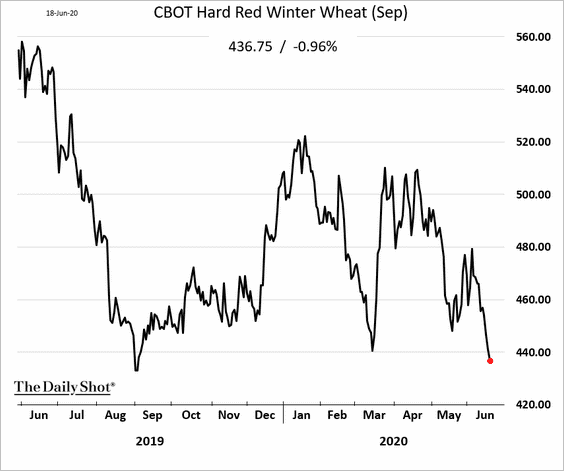

Commodities

US winter wheat futures have been under pressure lately, amid signs of a stronger US harvest and expectations for increased output in Europe.

Equities

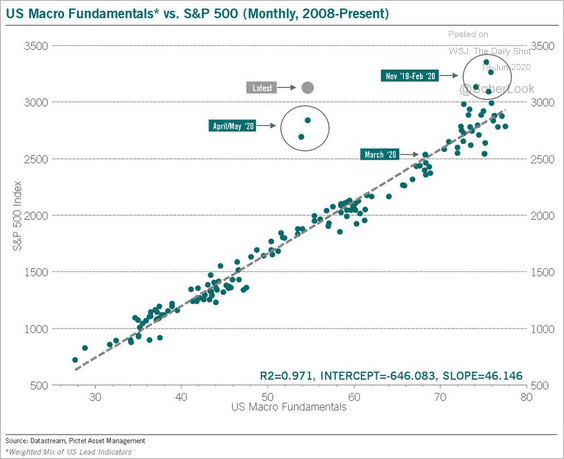

1. The S&P 500 has diverged from macro fundamentals.

Source: @BittelJulien

Source: @BittelJulien

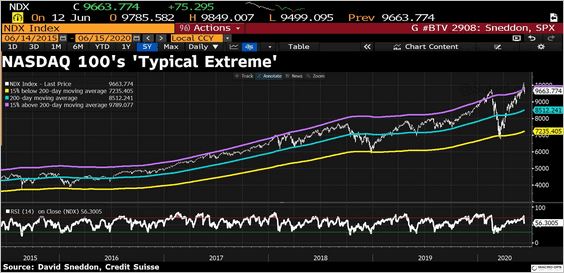

2. The Nasdaq 100 index has deviated dramatically from its 200-day moving average.

Source: @MacroOps

Source: @MacroOps

——————–

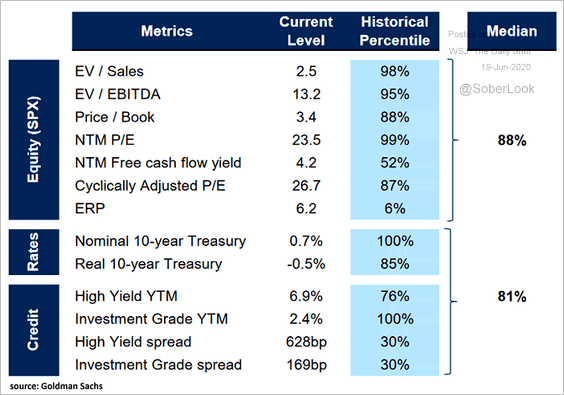

3. Below is a summary of market valuation metrics.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

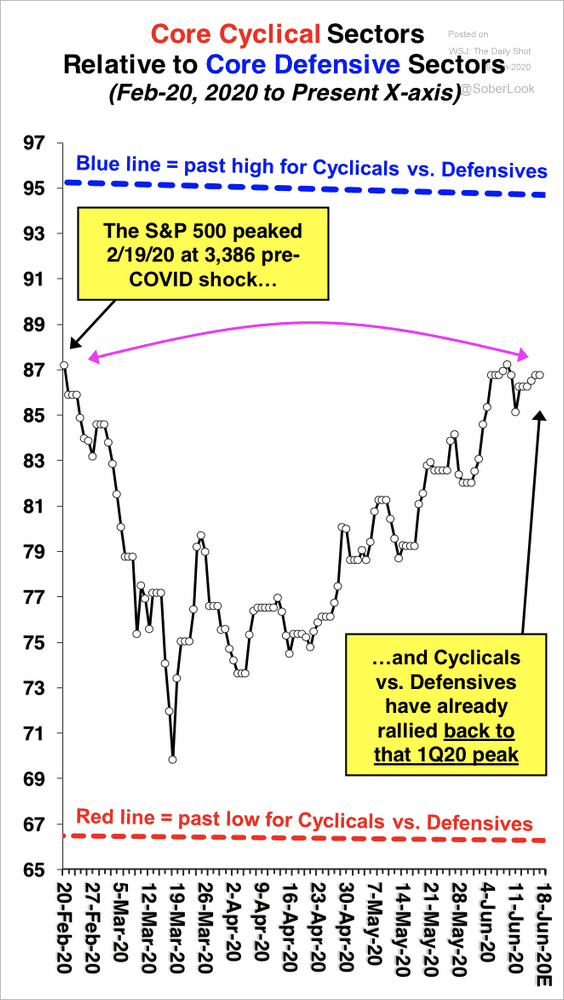

4. Cyclicals vs. defensive stocks have erased their crisis slump.

Source: Stifel

Source: Stifel

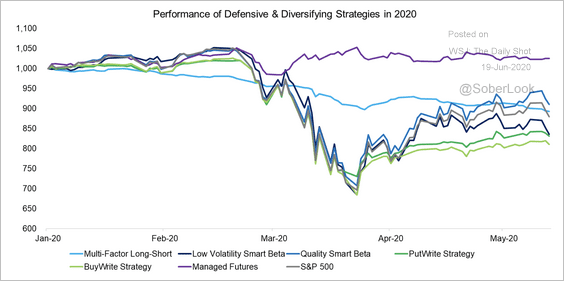

5. Here is the year-to-date performance of various defensive/diversified strategies.

Source: Factor Research

Source: Factor Research

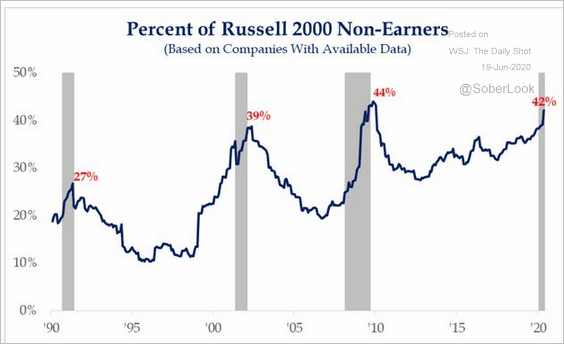

6. The percentage of money-losing small-cap firms is at an extreme.

Source: @DiMartinoBooth, @StrategasRP

Source: @DiMartinoBooth, @StrategasRP

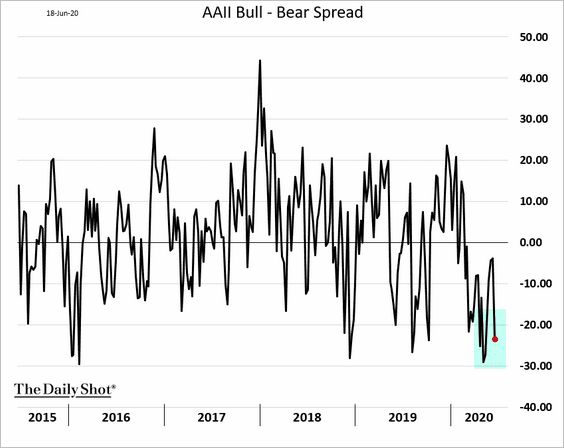

7. The AAII survey suggests that investors are relatively cautious.

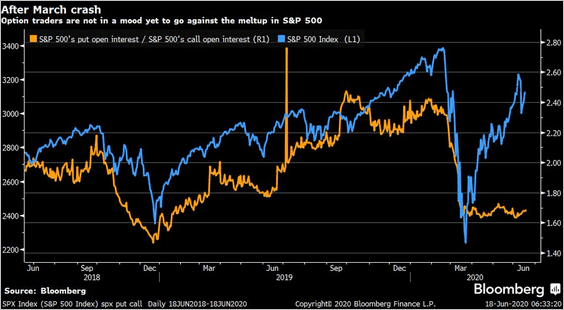

8. This chart shows the ratio of open interest in S&P 500 put options vs. call options.

Source: @LizAnnSonders, @Bloomberg

Source: @LizAnnSonders, @Bloomberg

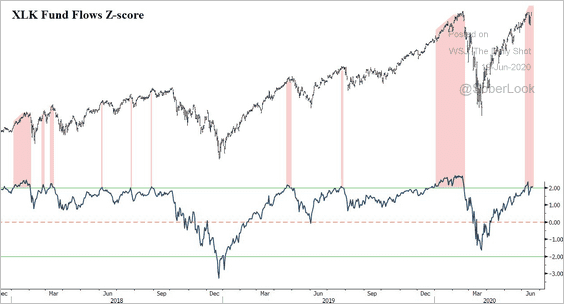

9. Flows into the SPDR tech sector ETF (XLK) are at an extreme.

Source: @MacroOps

Source: @MacroOps

Rates

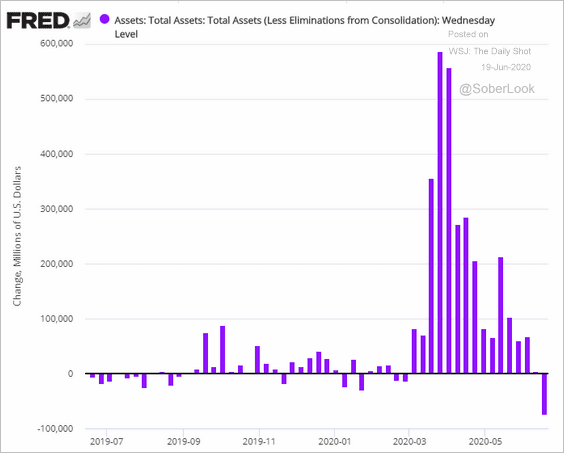

1. The Fed’s balance sheet declined this week.

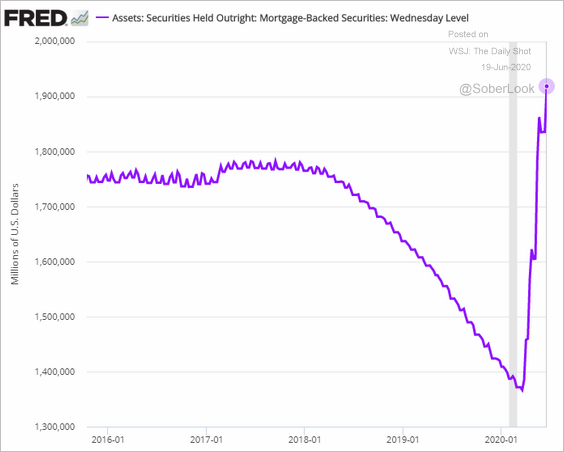

While the central bank continues to boost its securities holdings (MBS balances shown below), …

… some of the facilities see declining demand as funding pressures subside.

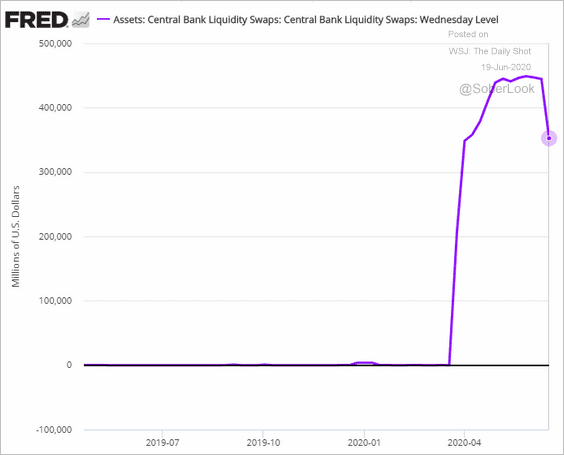

• Liquidity swaps with other central banks:

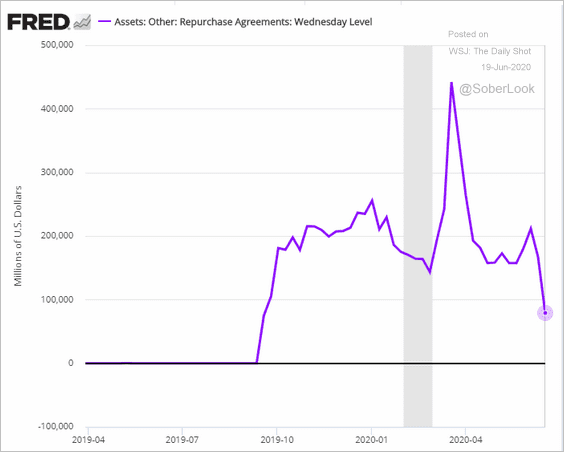

• Repo financing:

——————–

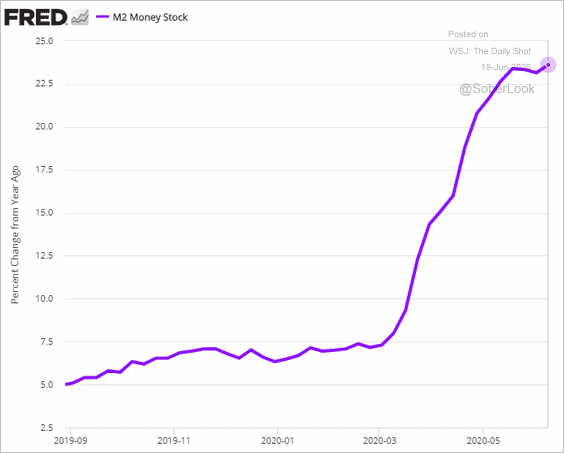

2. The M2 money supply is up 23% from a year ago.

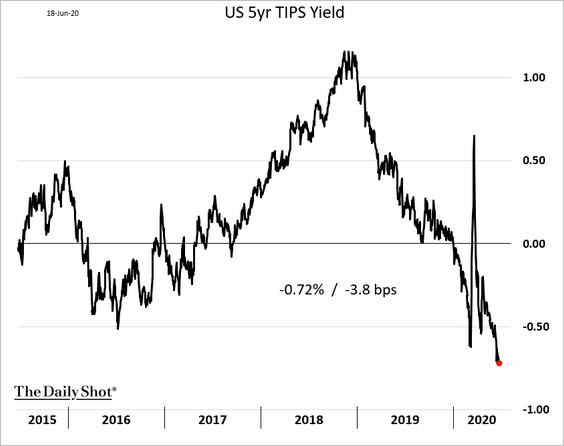

3. US real rates continue to sink. Here is the 5yr inflation-linked Treasury (TIPS) yield.

Global Developments

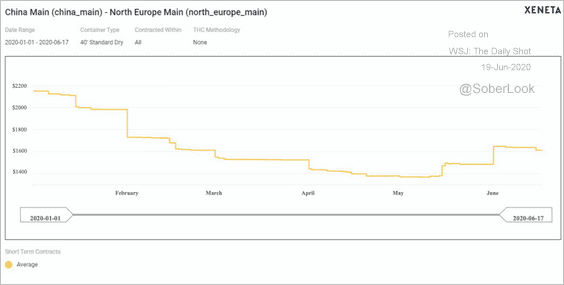

1. Global freight rates are rebounding.

Source: Xeneta

Source: Xeneta

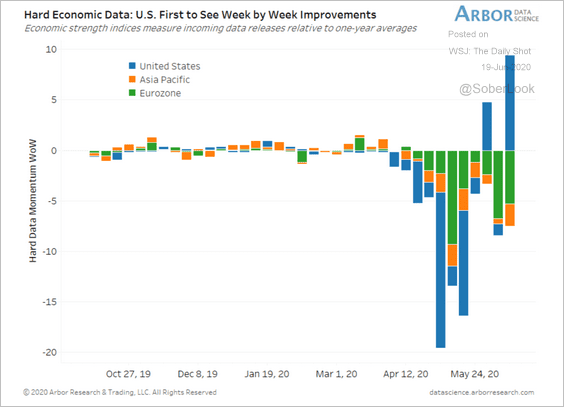

2. The US is leading the way in economic data momentum improvements.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

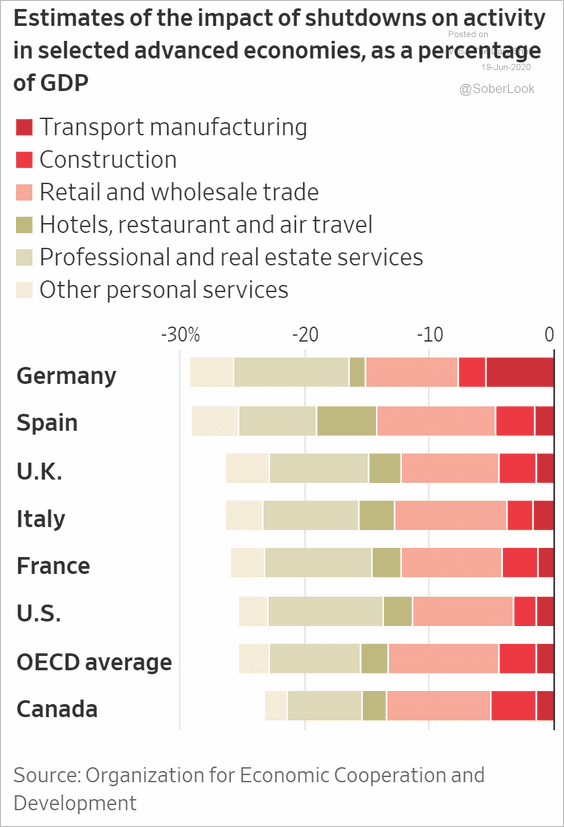

3. How did the shutdowns impact business activity in various sectors?

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Food for Thought

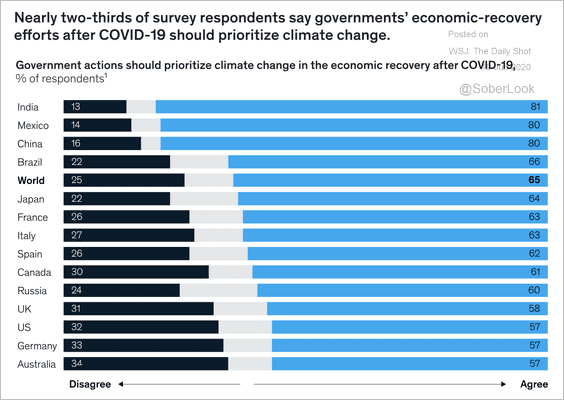

1. Prioritizing climate change:

Source: McKinsey Insights Read full article

Source: McKinsey Insights Read full article

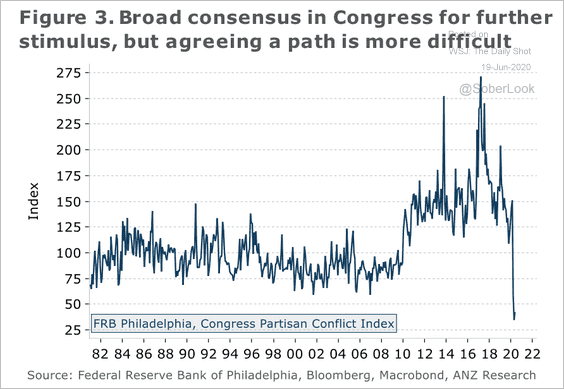

2. Bipartisan support for the stimulus bills sent the Philly Fed’s congressional partisan conflict index to a new low.

Source: ANZ Research

Source: ANZ Research

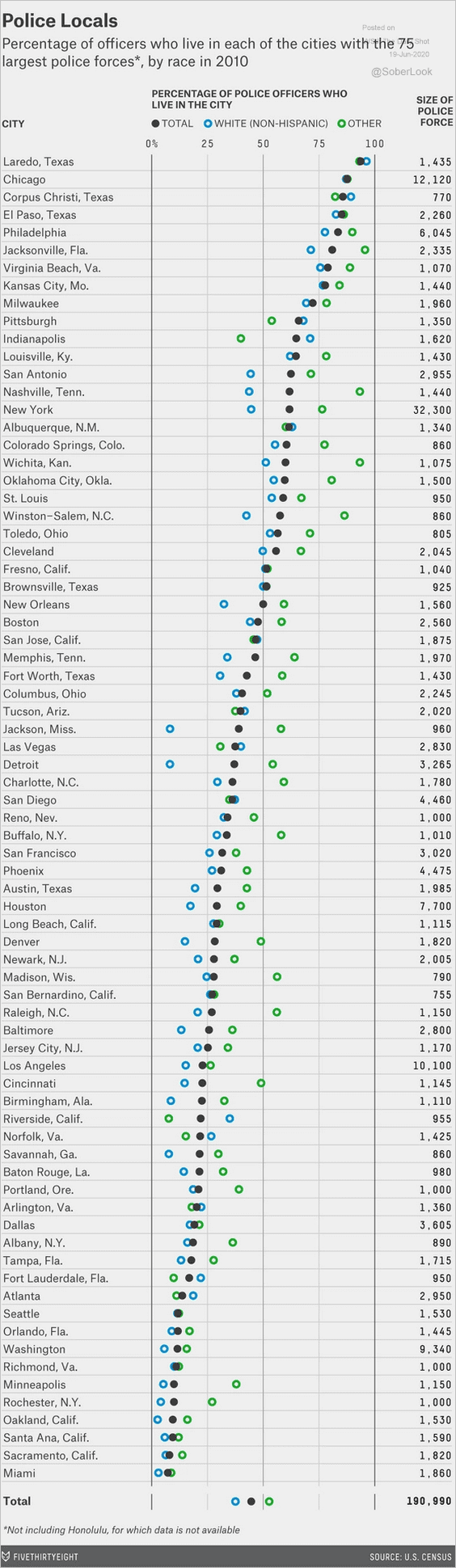

3. The percentage of police officers who live in the city where they work:

Source: FiveThirtyEight Read full article

Source: FiveThirtyEight Read full article

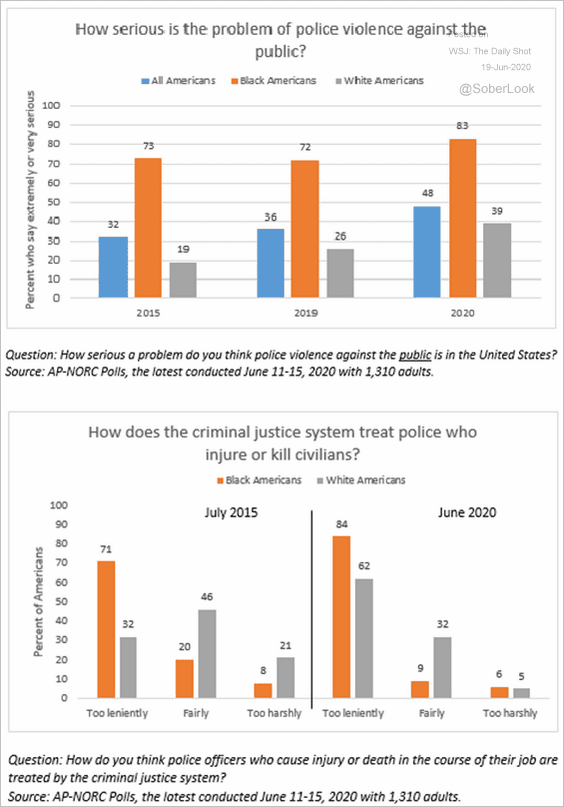

4. Views on police violence against the public:

Source: The Associated Press and NORC Read full article

Source: The Associated Press and NORC Read full article

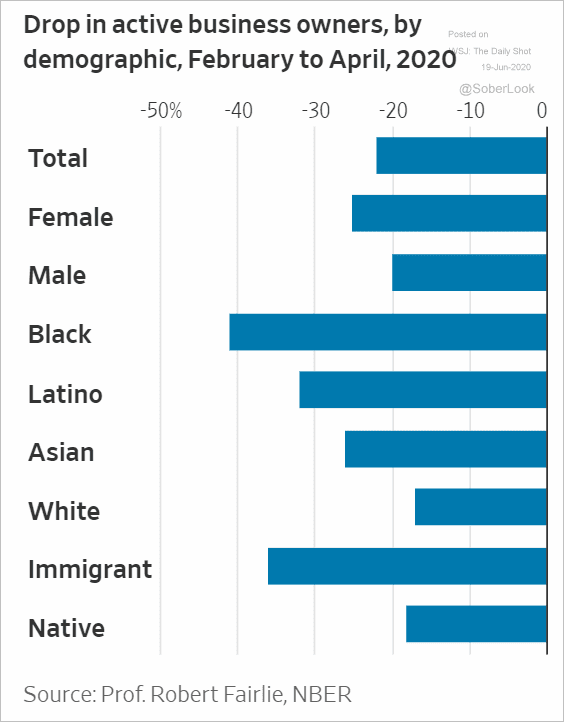

5. The slump in the number of active businesses:

Source: @WSJ Read full article

Source: @WSJ Read full article

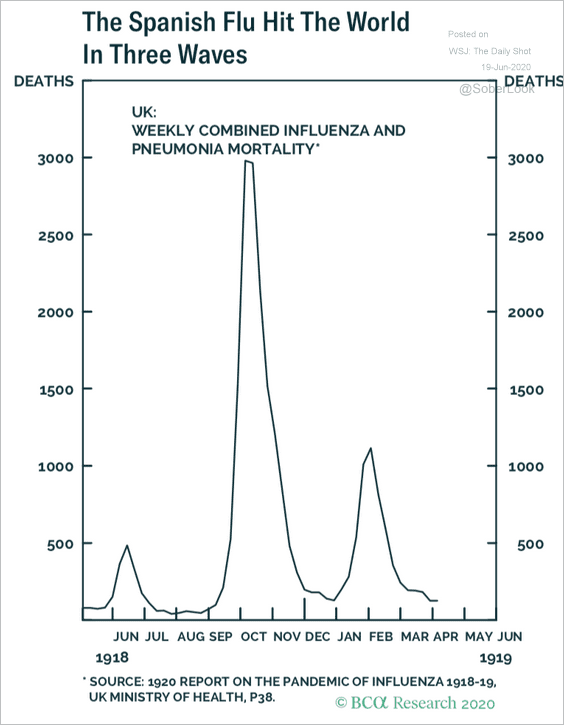

6. The three waves of the Spanish Flu.

Source: BCA Research

Source: BCA Research

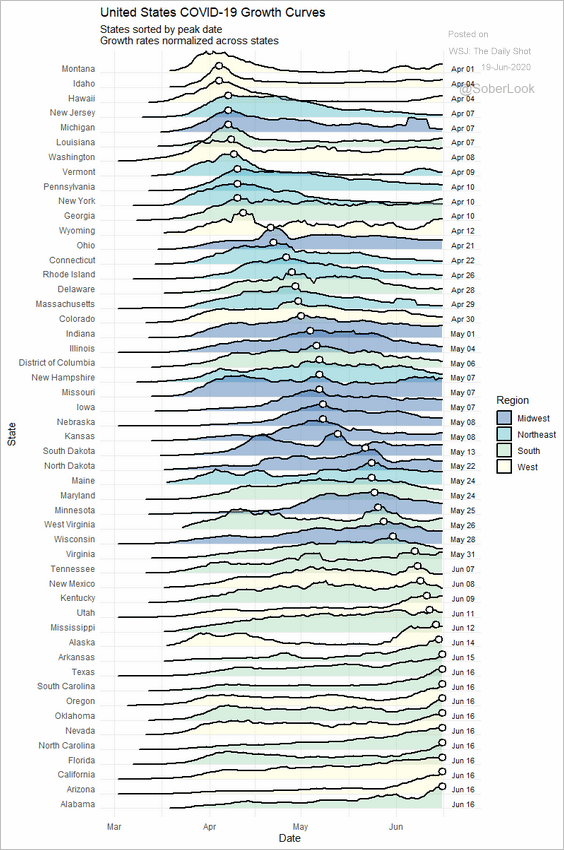

7. New daily COVID-19 cases by state:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

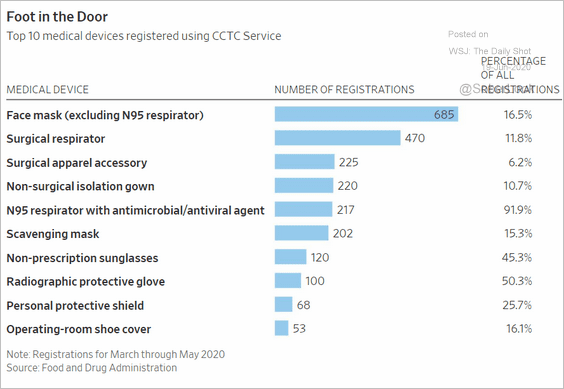

8. Fraudulent US registrations of Chinese medical device suppliers:

Source: @WSJ Read full article

Source: @WSJ Read full article

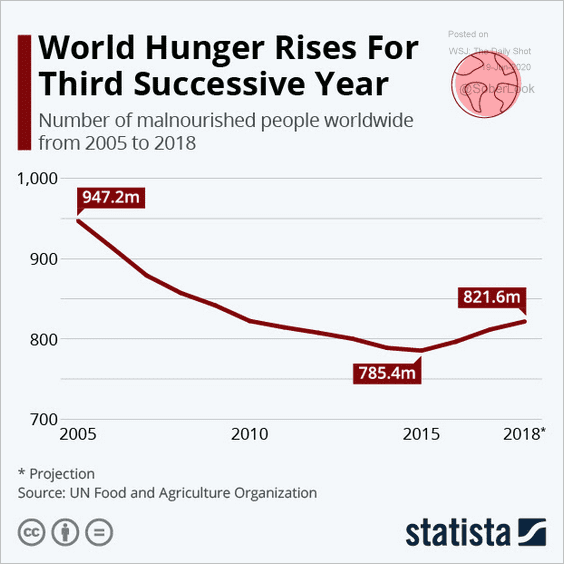

9. Malnourished people worldwide:

Source: Statista

Source: Statista

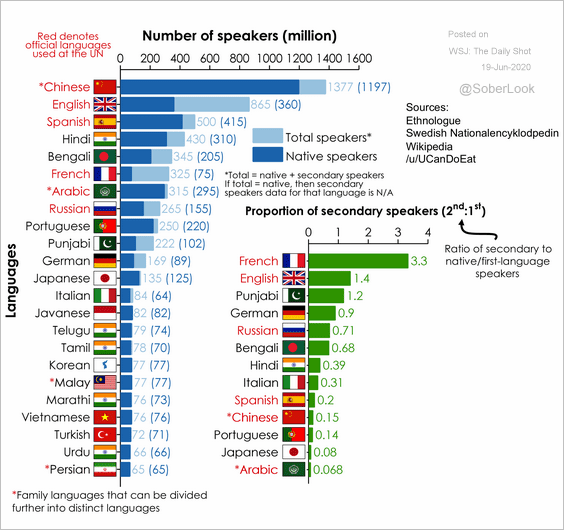

10. Most widely spoken languages in the world:

Source: Unique World Read full article

Source: Unique World Read full article

——————–

Have a great weekend!