The Daily Shot: 20-Dec-21

• Administrative Update

• Equities

• Credit

• Rates

• Commodities

• Energy

• Cryptocurrency

• Emerging Markets

• China

• Asia – Pacific

• The Eurozone

• Europe

• The United Kingdom

• Canada

• The United States

• Global Developments

• Food for Thought

Administrative Update

The Daily Shot will not be published the week of January 27th.

Back to Index

Equities

1. Last week, the Federal Reserve confirmed that it will be rapidly removing monetary stimulus next year. Now the fiscal spigot is getting shut off as well.

Source: Reuters Read full article

Source: Reuters Read full article

Source: @business Read full article

Source: @business Read full article

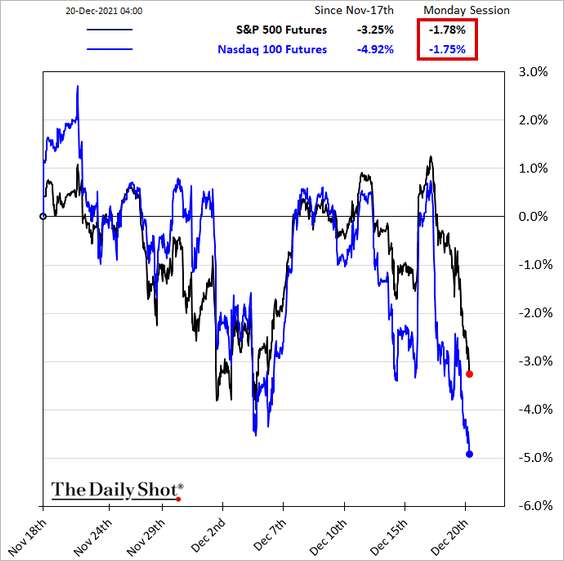

Stock futures are heavy this morning.

——————–

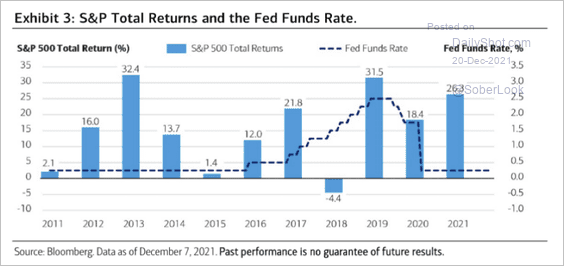

2. The only down year for the S&P 500 this decade was when the Fed raised rates above 1%.

Source: BofA Global Research

Source: BofA Global Research

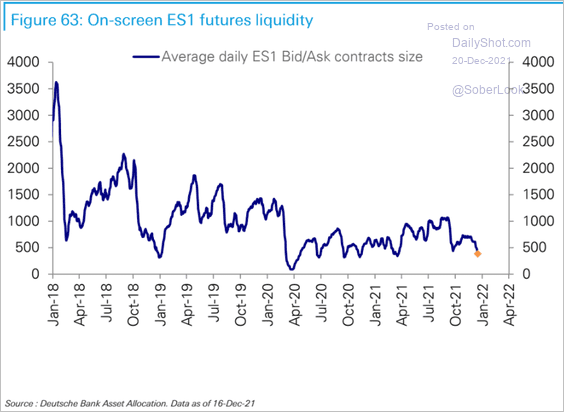

3. The S&P 500 futures liquidity declined this month.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

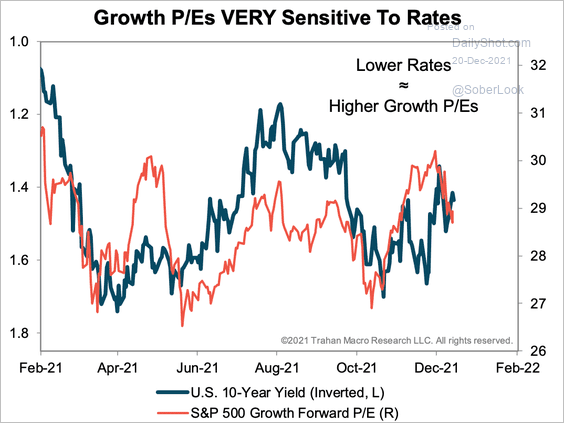

4. This year, the valuation of growth companies has been very sensitive to the movement in rates.

Source: Trahan Macro Research

Source: Trahan Macro Research

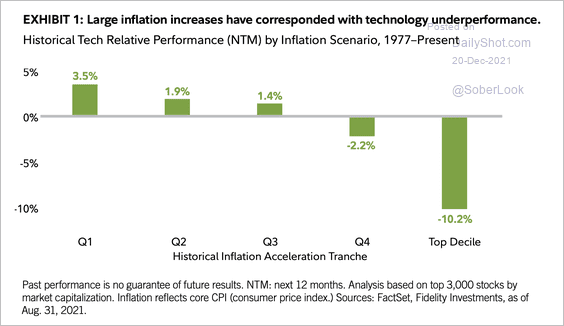

5. Tech stocks tend to underperform during periods of high inflation.

Source: Denise Chisholm, Fidelity Investments Read full article

Source: Denise Chisholm, Fidelity Investments Read full article

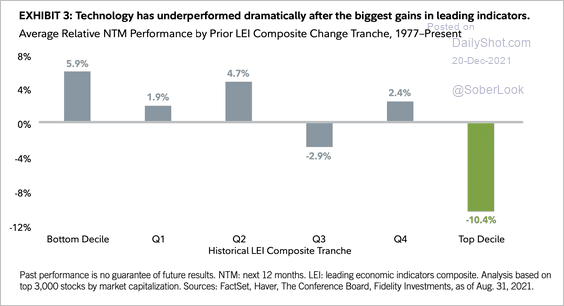

• Tech stocks have often lagged after the leading economic indicator (LEI) peaked.

Source: Denise Chisholm, Fidelity Investments Read full article

Source: Denise Chisholm, Fidelity Investments Read full article

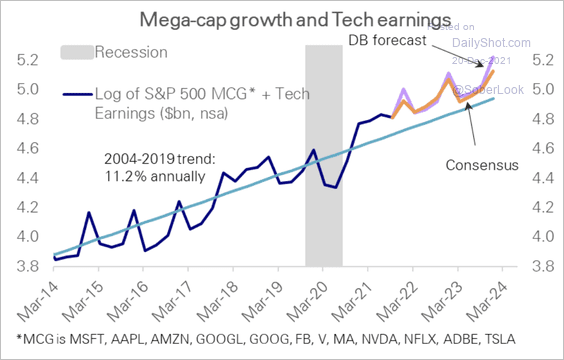

• Mega-cap growth and tech earnings are well above their prior trend.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

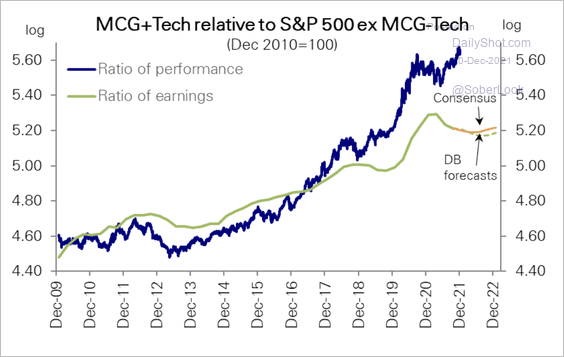

However, relative earnings have not grown as fast this year, and Deutsche Bank expects further flattening.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

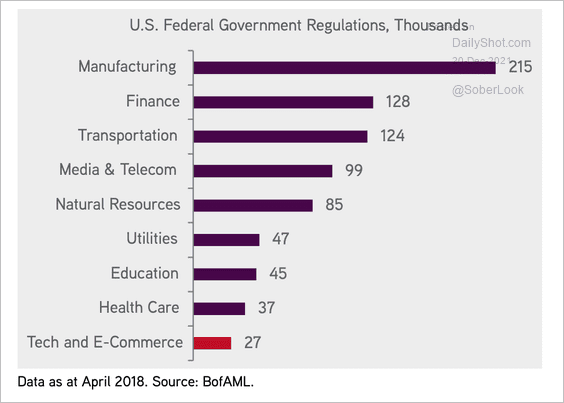

• Tech still lags all other sectors in terms of pages of federal regulation.

Source: KKR

Source: KKR

——————–

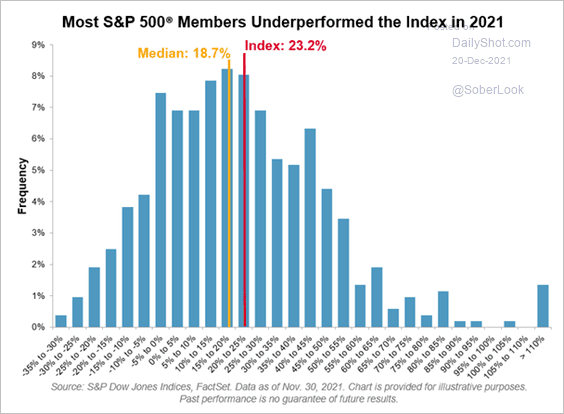

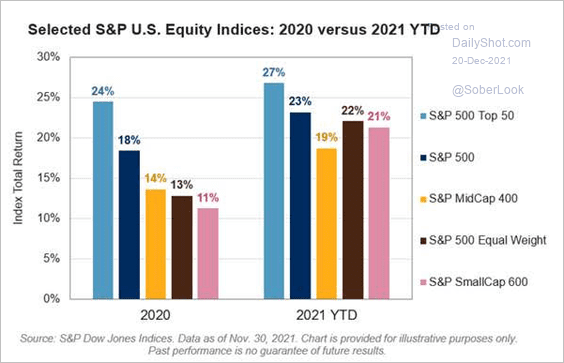

6. This chart shows the S&P 500 members’ performance distribution for 2021.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Equity returns have been broader this year than in 2020.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

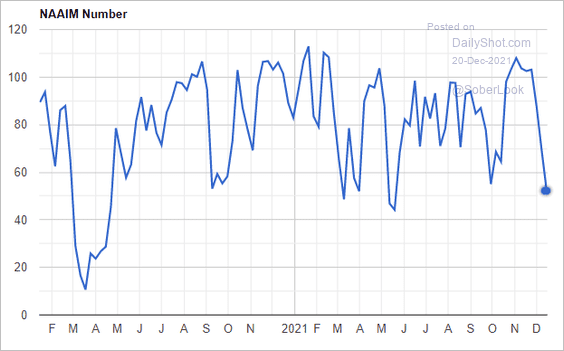

7. Investment managers have become more cautious this month, reducing their average exposure to US stocks.

Source: NAAIM

Source: NAAIM

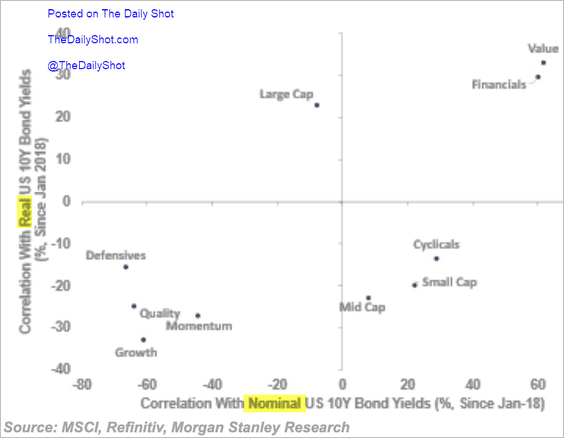

8. This scatterplot depicts how different equity factors correlate to real vs. nominal Treasury yields.

Source: @acemaxx, @MorganStanley

Source: @acemaxx, @MorganStanley

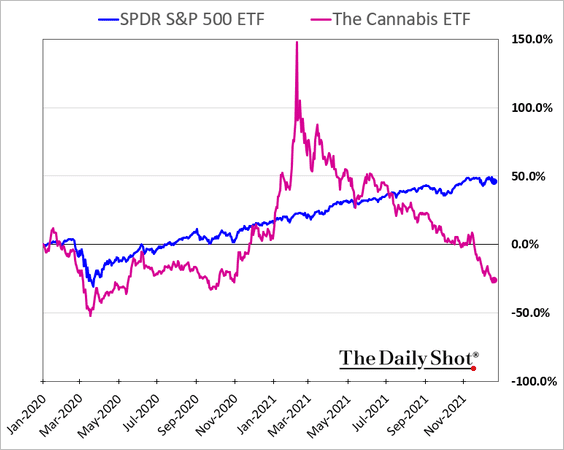

9. The 2021 cannabis bubble continues to deflate.

Back to Index

Credit

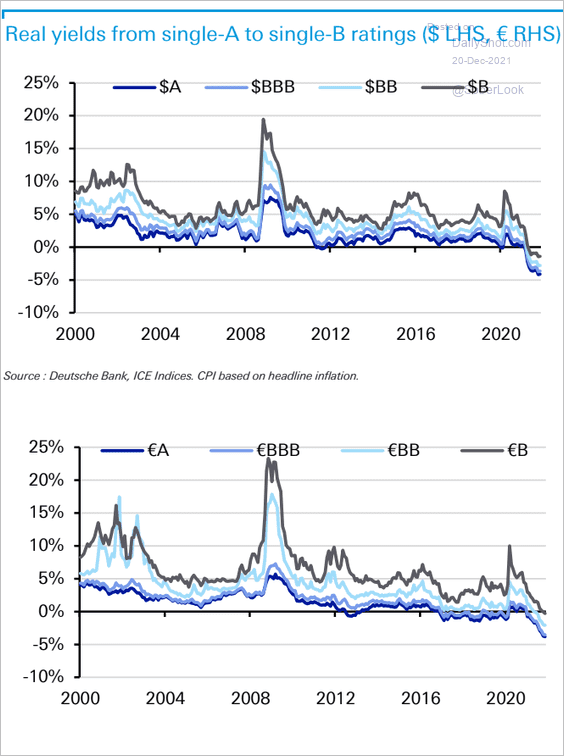

1. Most US and European corporate bonds now have negative real yields.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

2. Corporate loans with 6x and higher leverage found plenty of buyers in 2021.

Source: @jessefelder, @FT Read full article

Source: @jessefelder, @FT Read full article

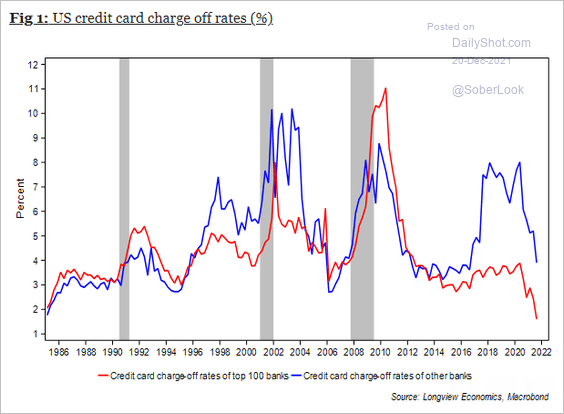

3. With household excess savings surging, US credit card charge-off rates tumbled this year.

Source: Longview Economics

Source: Longview Economics

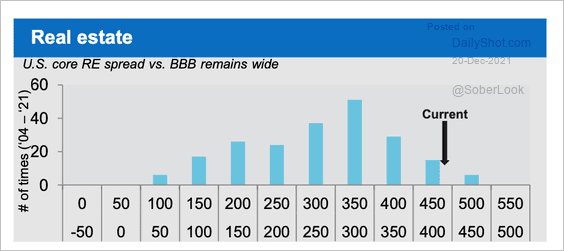

4. Real estate spreads are still attractive relative to corporate credit.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

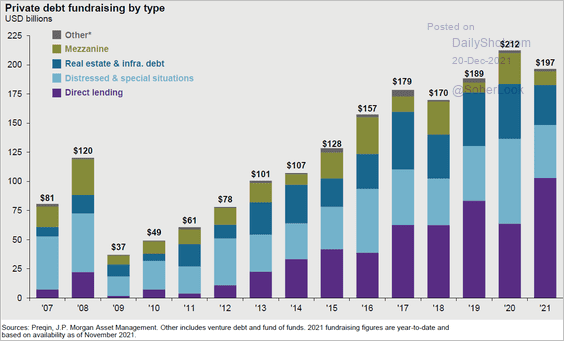

5. Finally, this chart shows private credit fundraising by type.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Back to Index

Rates

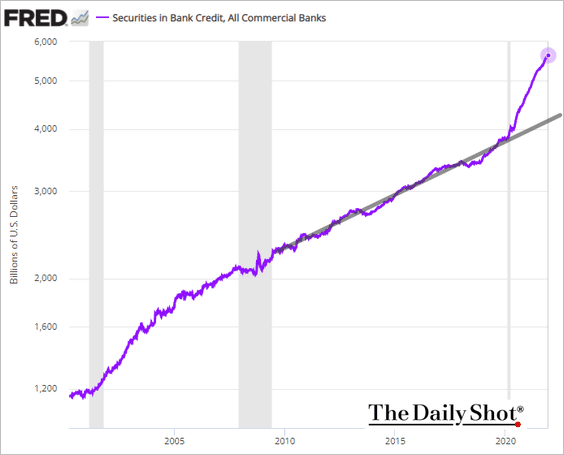

1. US banks’ securities holdings surged since the start of the pandemic (log scale).

h/t Deutsche Bank Research

h/t Deutsche Bank Research

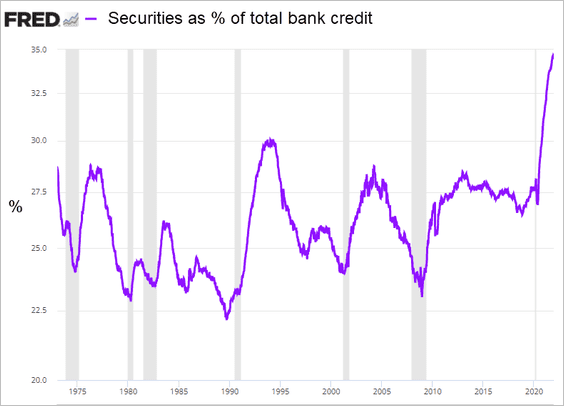

This chart shows securities as a share of total bank credit.

h/t Deutsche Bank Research

h/t Deutsche Bank Research

——————–

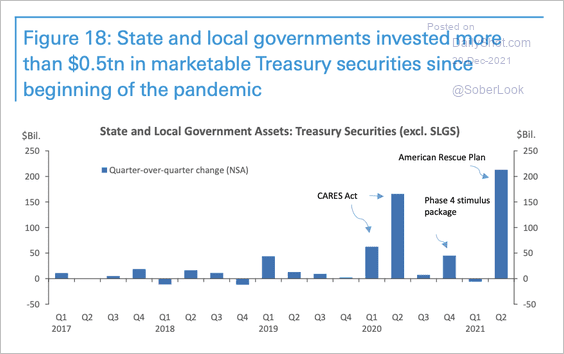

2. Next, we have the recent accumulation of Treasuries by state and local governments.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Commodities

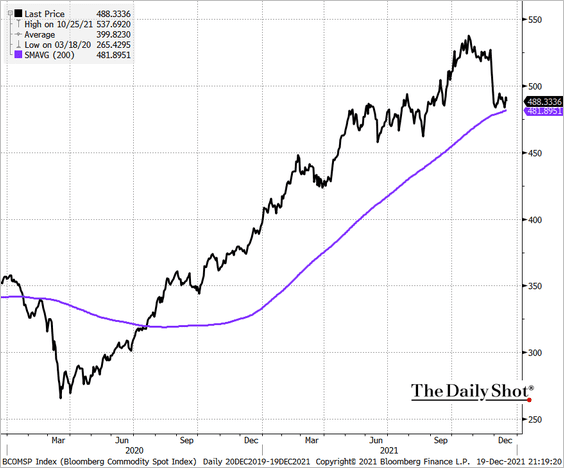

1. Bloomberg’s broad commodity index is testing support at the 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

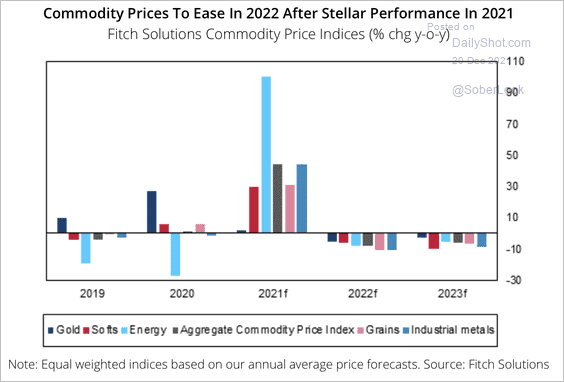

2. Fitch expects lower commodity prices in 2022 due to rising supply and fading demand growth.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

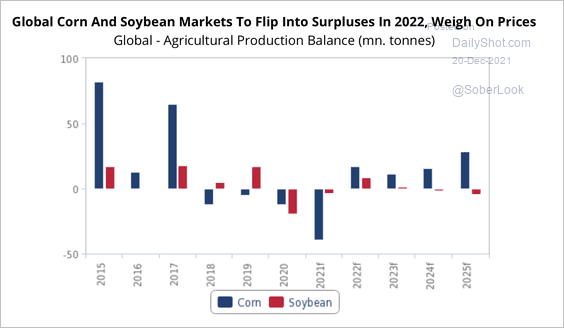

Corn and soybean markets are expected to flip into surpluses next year, which could weigh on prices.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

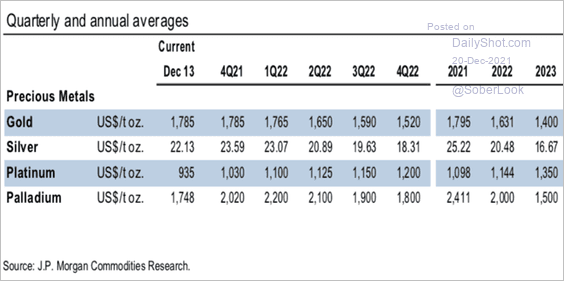

3. This table shows JP Morgan’s price forecasts for precious metals.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

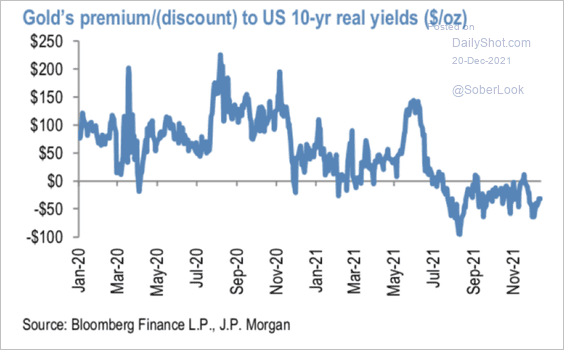

• Gold has been trading at a discount to US 10-year real yields for most of the year.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

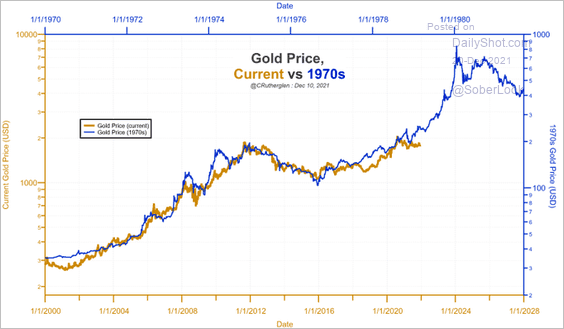

• Gold has been following the 1970s trajectory.

Source: @CRutherglen Read full article

Source: @CRutherglen Read full article

Back to Index

Energy

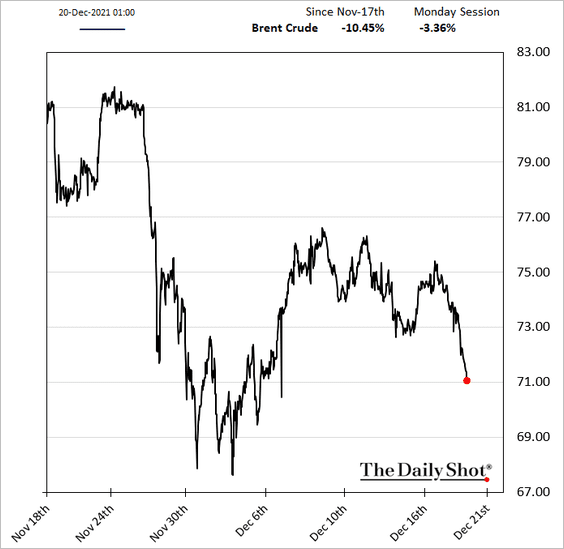

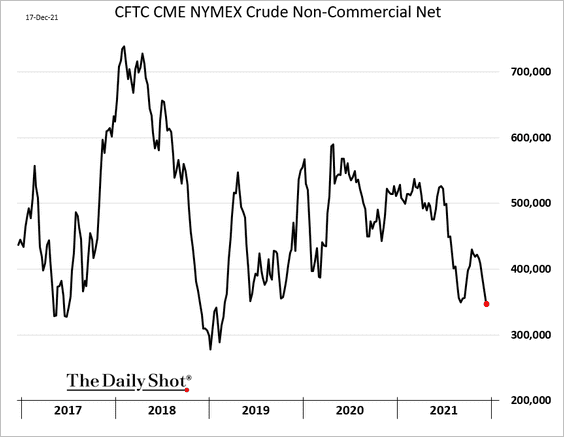

1. Crude oil is down this morning as fiscal and monetary stimulus in the US is removed (which could weigh on demand). COVID is also a concern.

Speculative accounts have been reducing their bets on oil.

——————–

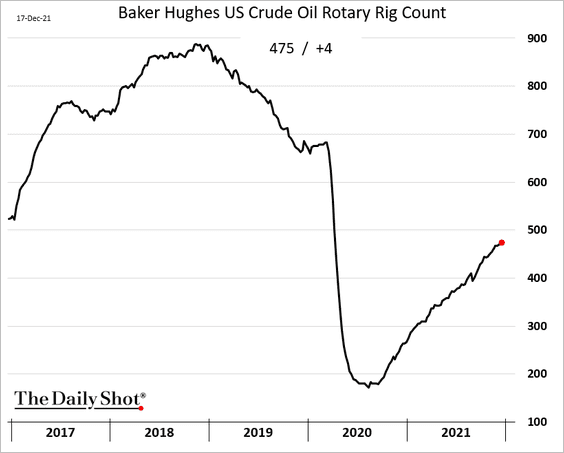

2. US rig count continues to grind higher.

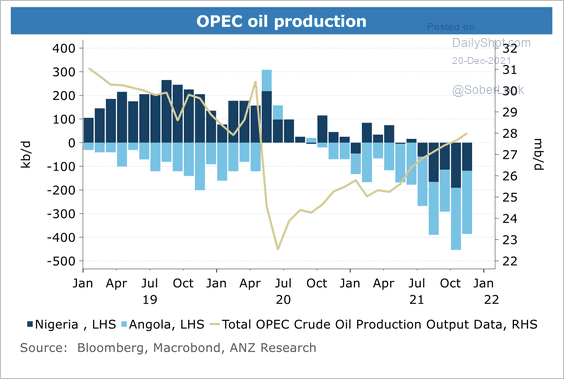

3. OPEC+ could fall short of its production target as Angola and Nigeria have been coming under quota over the past few months, according to ANZ Research.

Source: ANZ Research

Source: ANZ Research

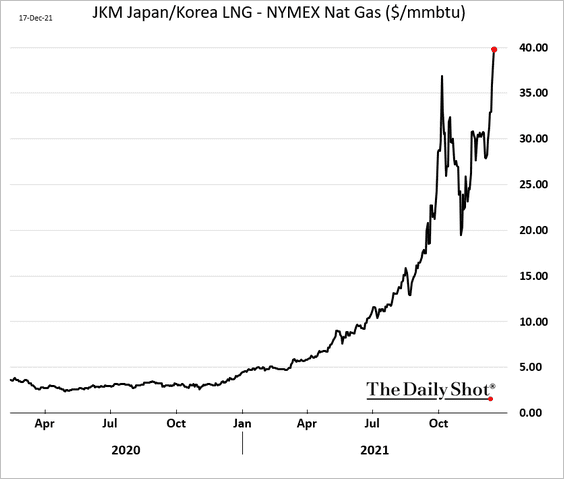

4. The spread between US natural gas and global LNG prices has blown out.

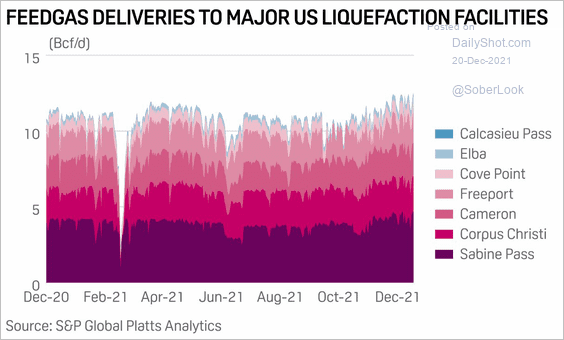

• US liquefaction facilities are seeing growing demand for natural gas as exports surge.

Source: @HMgmt1999, @PlattsLNG Read full article

Source: @HMgmt1999, @PlattsLNG Read full article

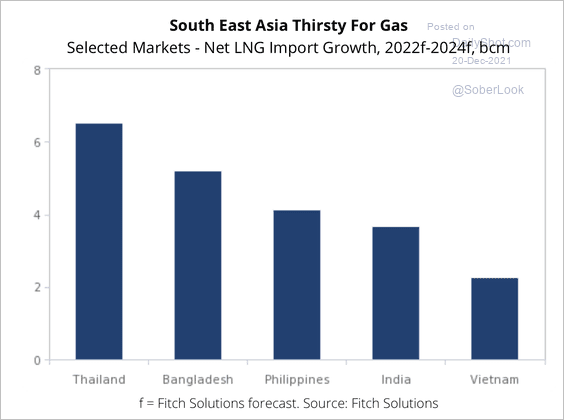

• Southeast Asia’s net LNG imports are expected to rise over the next few years, …

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

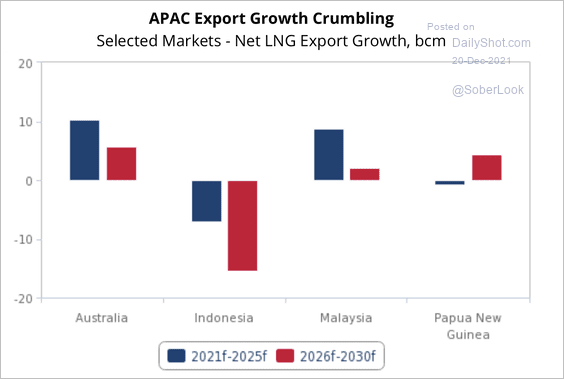

… as the region’s LNG exports shrink.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Back to Index

Cryptocurrency

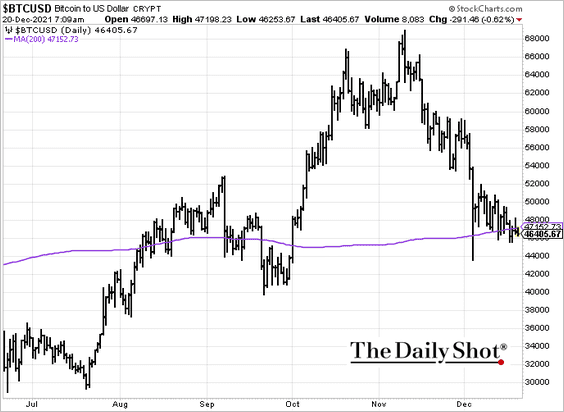

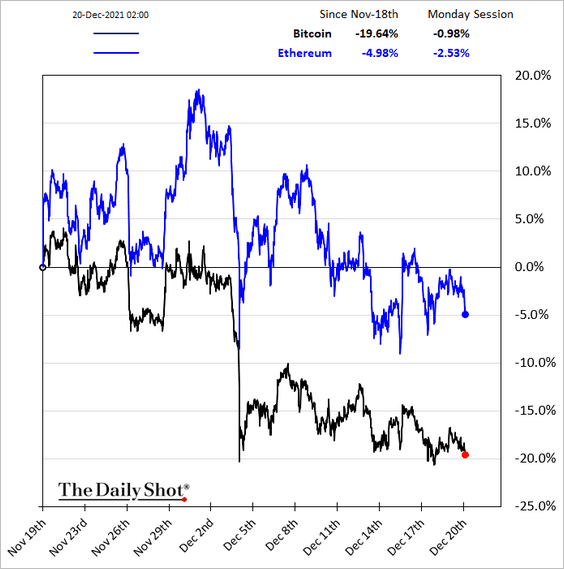

1. Bitcoin remains near the 200-day moving average, …

… as it continues to lag ether.

——————–

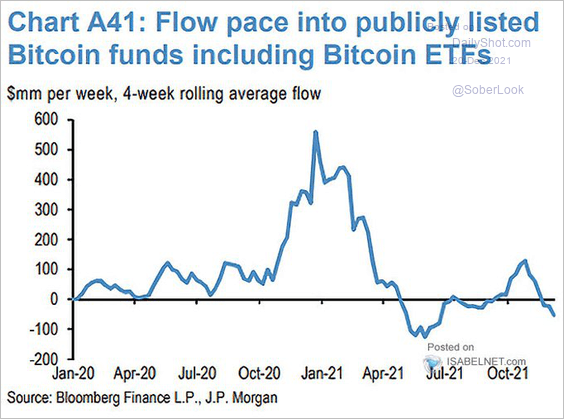

2. Bitcoin fund flows have been negative.

Source: @ISABELNET_SA, @jpmorgan

Source: @ISABELNET_SA, @jpmorgan

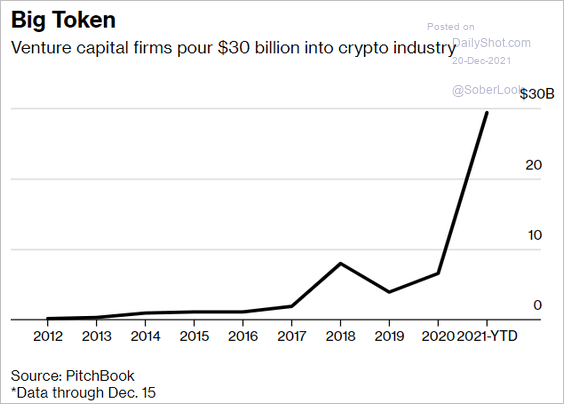

3. VCs pumped quite a bit of money into the crypto industry this year.

Source: @business Read full article

Source: @business Read full article

Back to Index

Emerging Markets

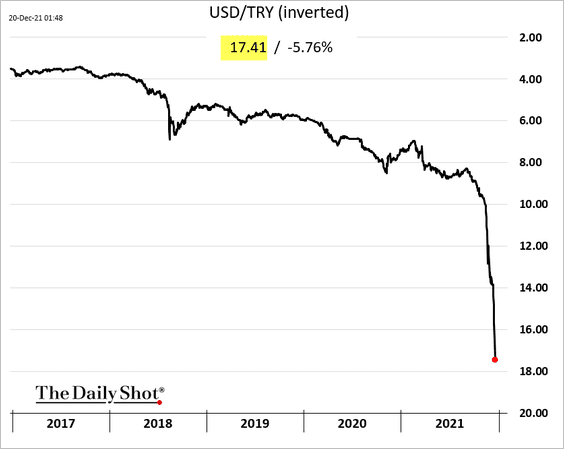

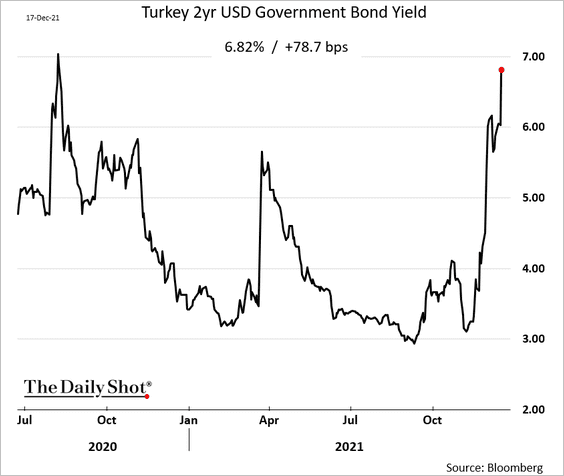

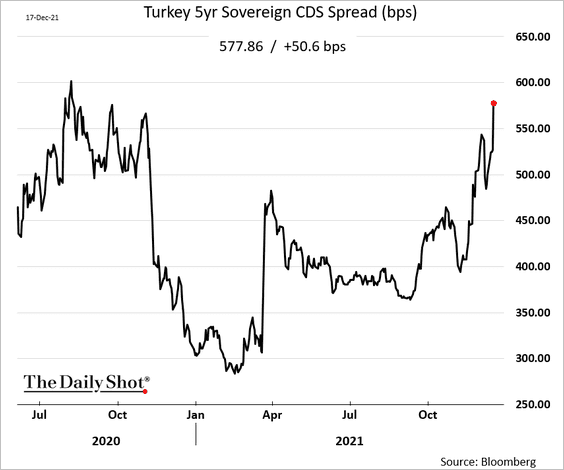

1. The Turkish lira continues to plummet. Inflation will hit new highs, putting pressure on Erdogan’s government.

Dollar bond yields and CDS spreads have been climbing.

——————–

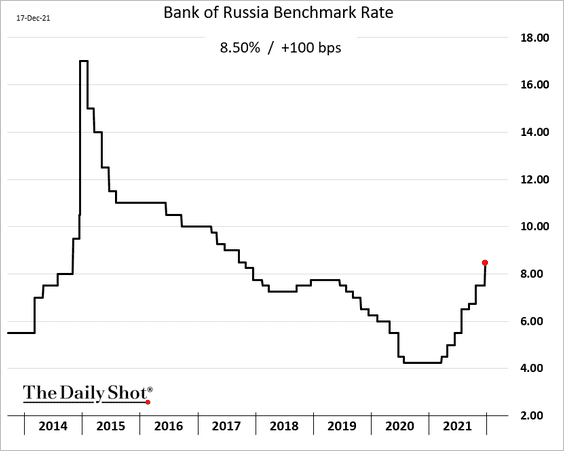

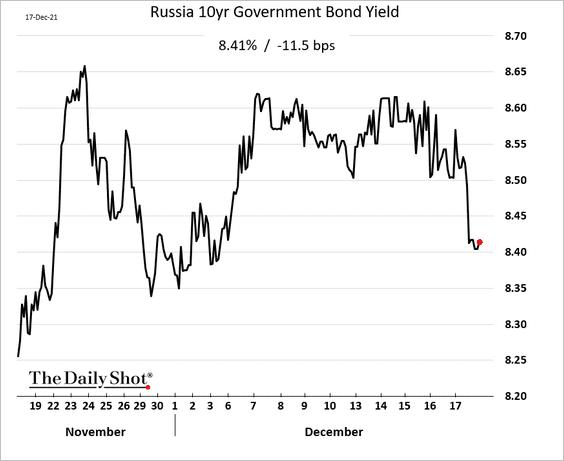

2. Russia’s central bank hiked rates again by 100 bps. The hiking cycle is probably nearing completion for now.

Russian bond yields declined.

——————–

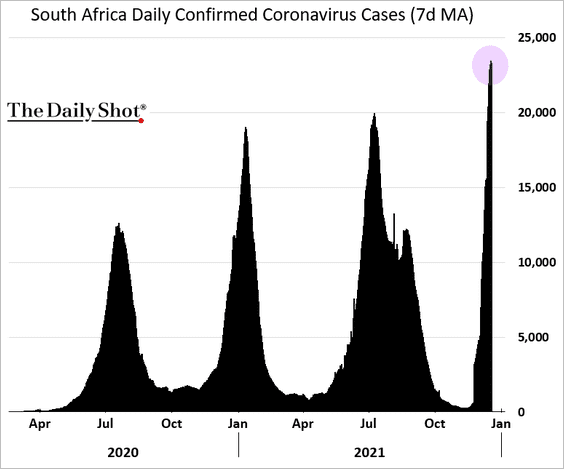

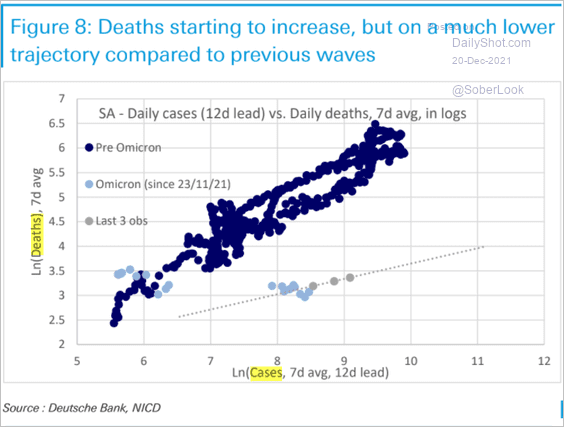

3. South Africa’s COVID cases have been surging.

But COVID-related deaths have been relatively low.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

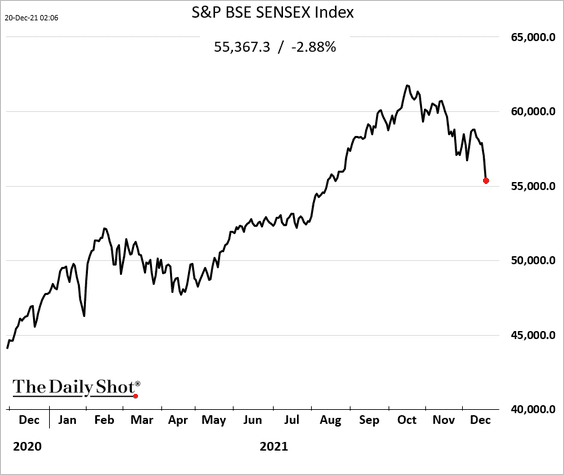

4. Indian shares are rolling over.

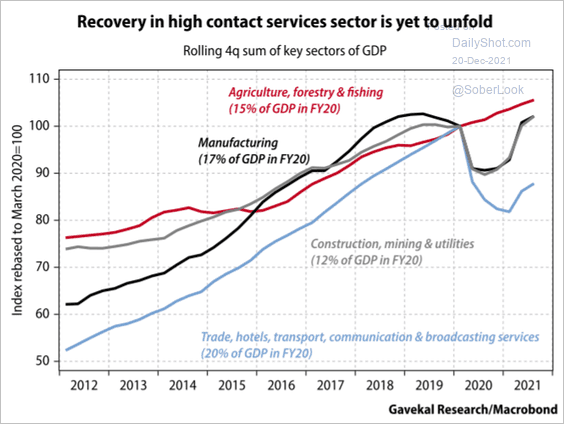

India’s high-contact services sector recovery has a long way to go.

Source: Gavekal Research

Source: Gavekal Research

——————–

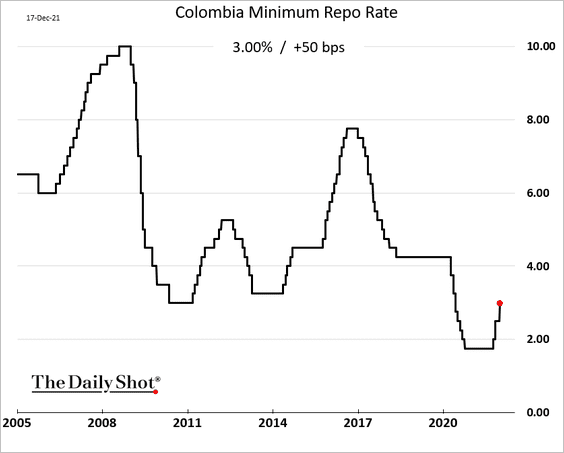

5. Colombia’s central bank hiked rates again.

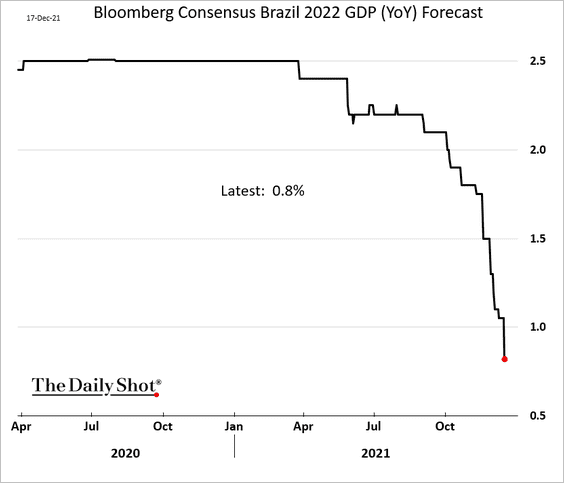

6. Economists have accelerated their downgrades for Brazil’s 2022 GDP growth (now below 1%).

Back to Index

China

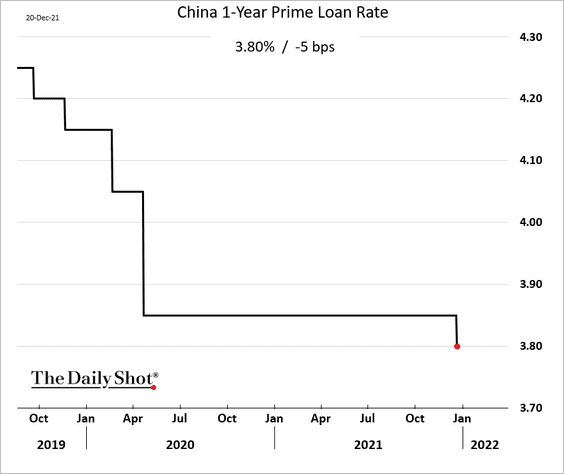

1. The PBoC unexpectedly cut the 1-year prime loan rate, indicating that Beijing is increasingly concerned about slowing economic growth.

Source: South China Morning Post Read full article

Source: South China Morning Post Read full article

——————–

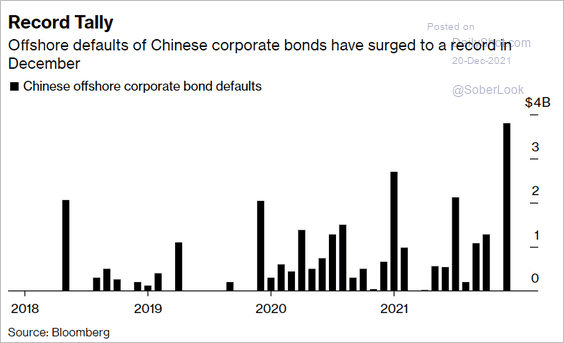

2. Offshore debt defaults hit a record high this year.

Source: @markets Read full article

Source: @markets Read full article

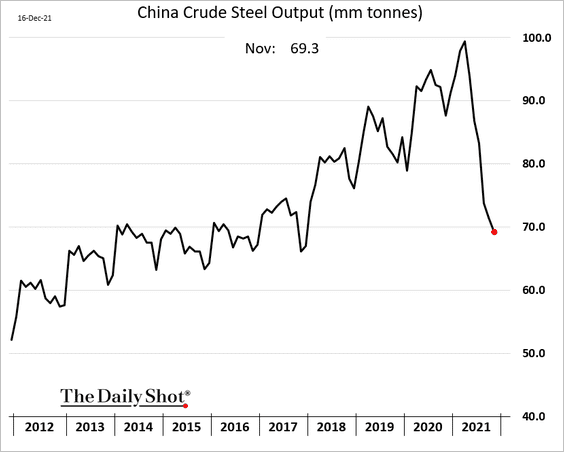

3. Steel output tumbled in 2021.

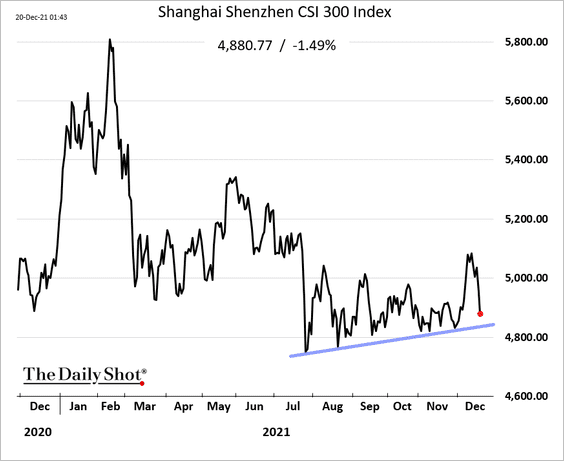

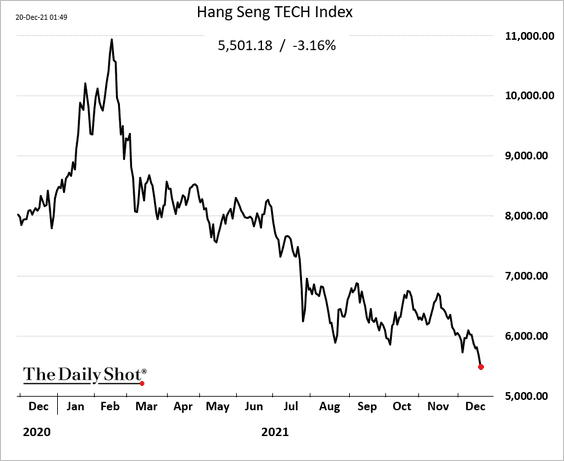

4. The Shanghai Shenzhen CSI 300 index is back near support.

Shares in Hong Kong remain under pressure.

Back to Index

Asia – Pacific

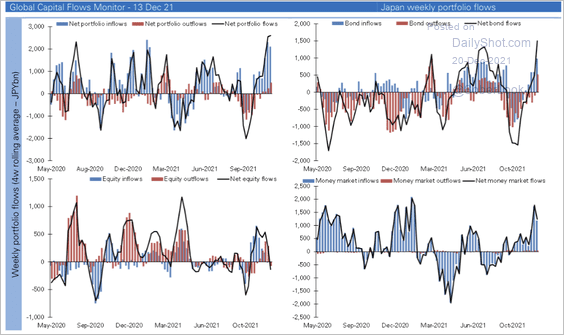

1. Japan is seeing net inflows into the bonds and outflows from equities.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

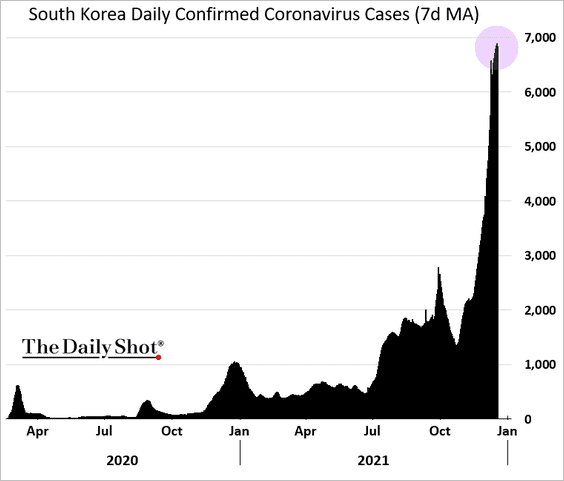

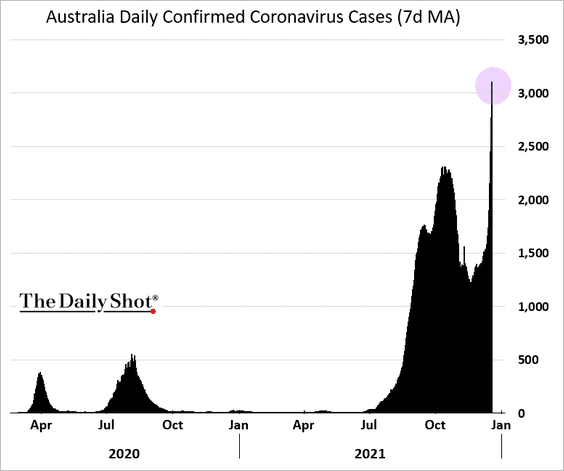

2. COVID cases are hitting record highs in South Korea and Australia.

——————–

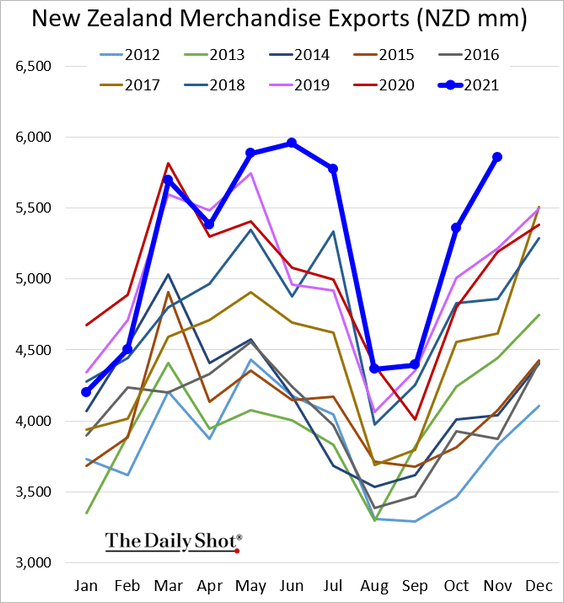

3. New Zealand’s exports strengthened further in November.

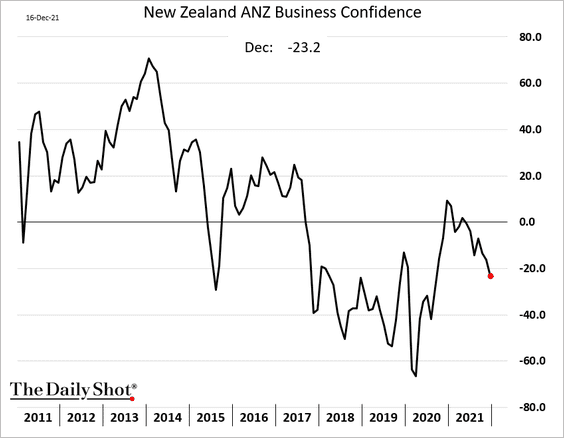

Business confidence continues to deteriorate.

Back to Index

The Eurozone

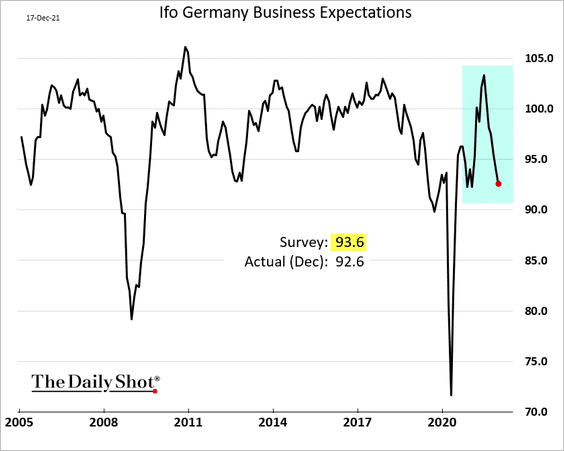

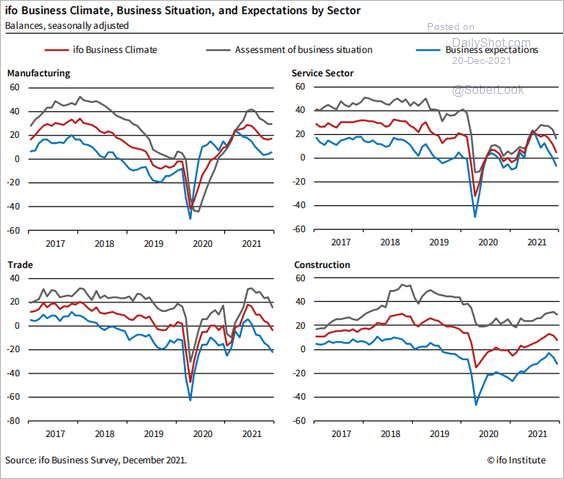

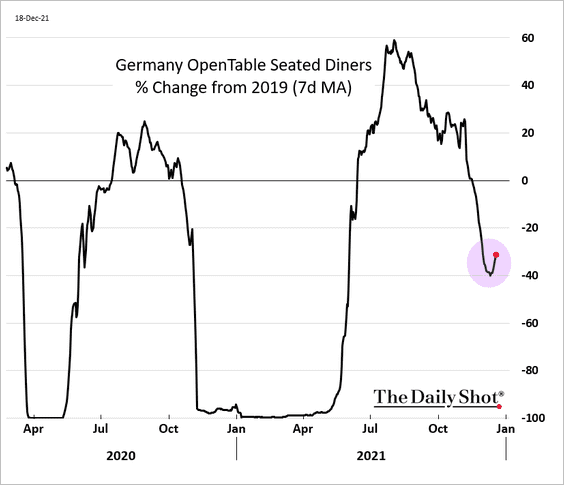

1. Germany’s Ifo business expectations index keeps sinking as the pandemic takes a toll.

Source: ifo Institute

Source: ifo Institute

But restaurant visits appear to be bottoming.

——————–

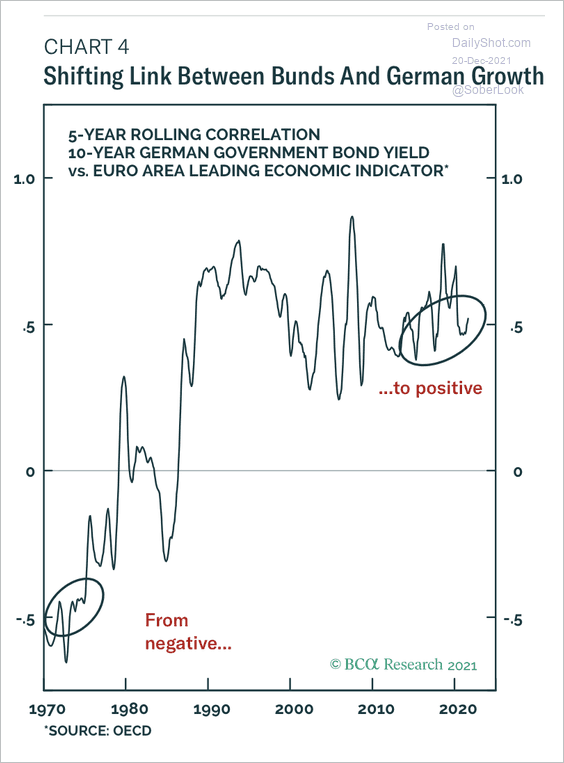

2. Bund yields and German growth have been moving in tandem.

Source: BCA Research

Source: BCA Research

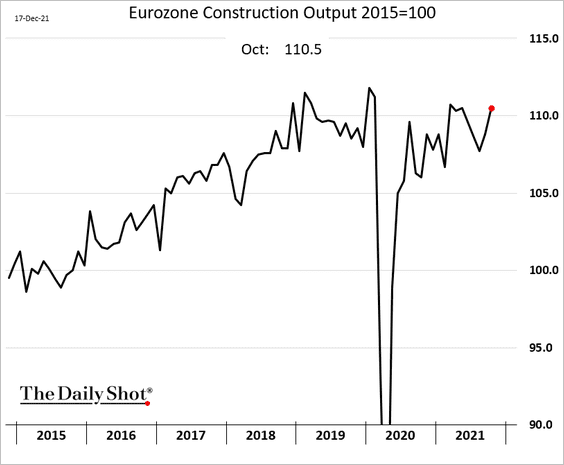

3. Euro-area construction output strengthened in October.

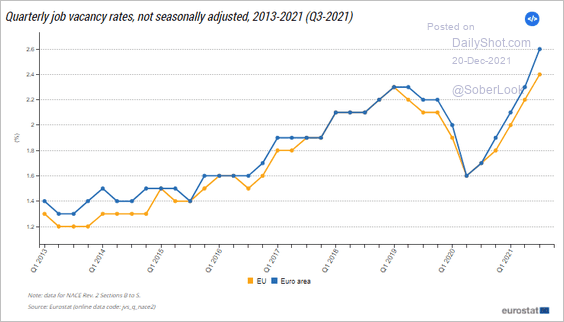

4. Job vacancy rates have been climbing.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Europe

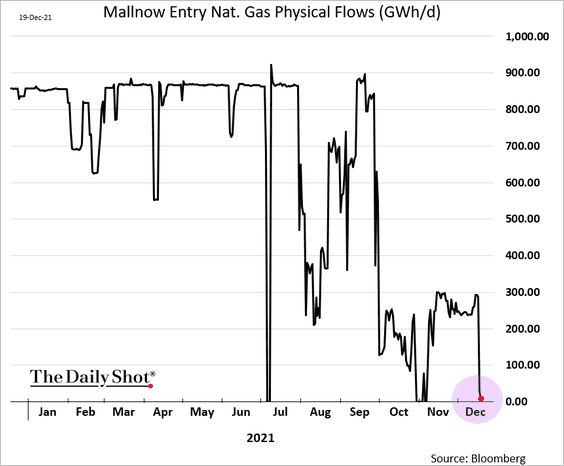

1. Russian natural gas flows to the EU have been shut off again.

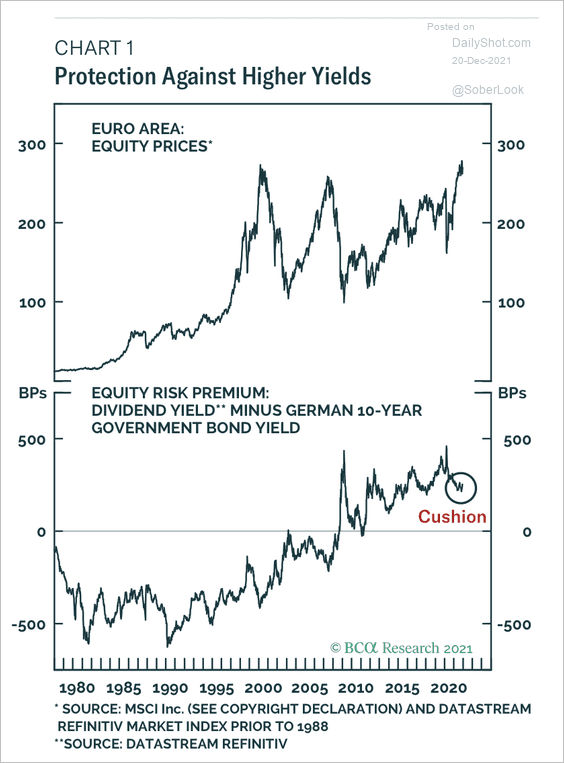

2. European equities have a significant premium in their dividend yield relative to Bund yields.

Source: BCA Research

Source: BCA Research

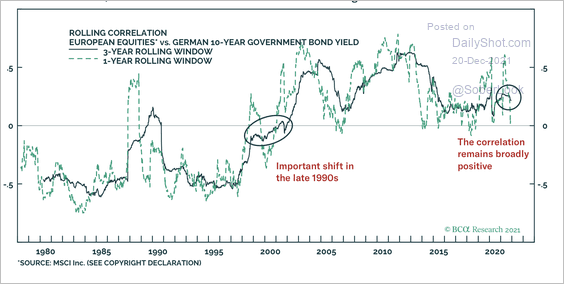

3. Bund yields and European stock prices typically move together.

Source: BCA Research

Source: BCA Research

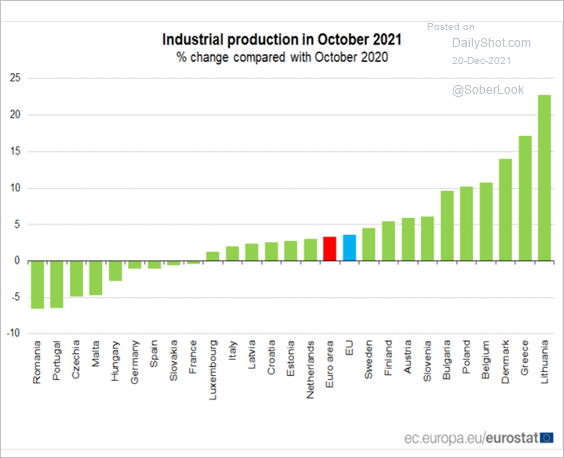

4. This chart shows industrial production growth across the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

The United Kingdom

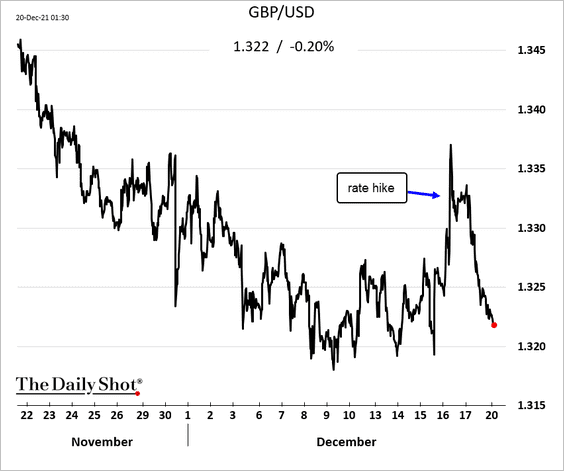

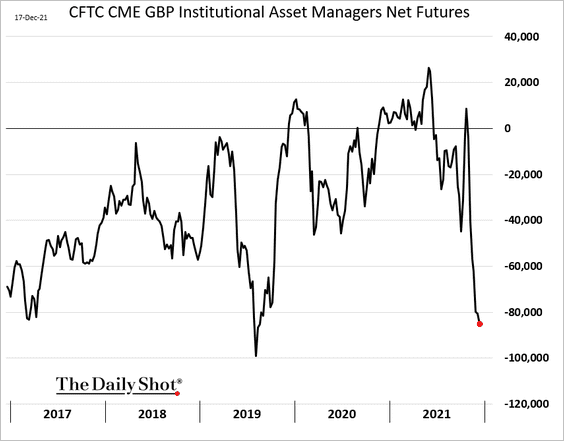

1. The pound has given up its BoE rate-hike gains.

Asset managers have been boosting their bets against the pound.

——————–

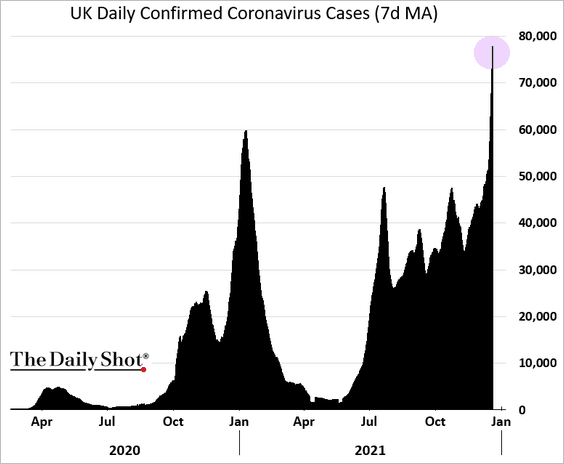

2. COVID cases are surging.

Mobility has been slipping.

——————–

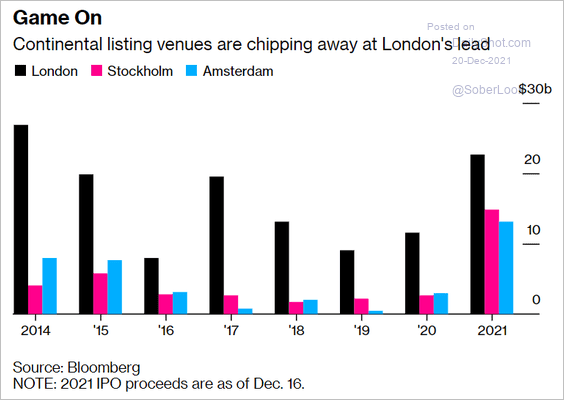

3. London still leads European IPOs.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Canada

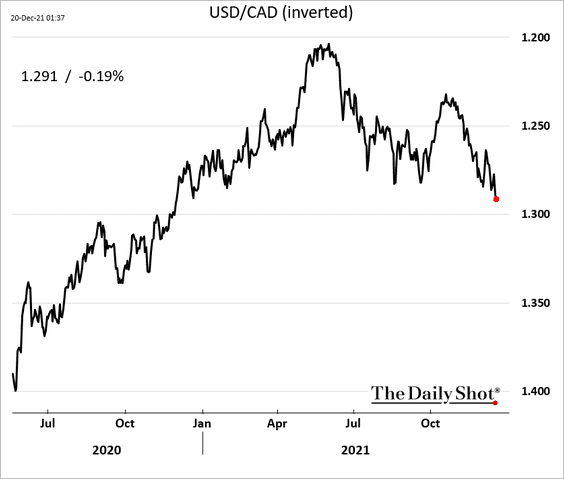

1. The Canadian dollar is at the lowest level in a year.

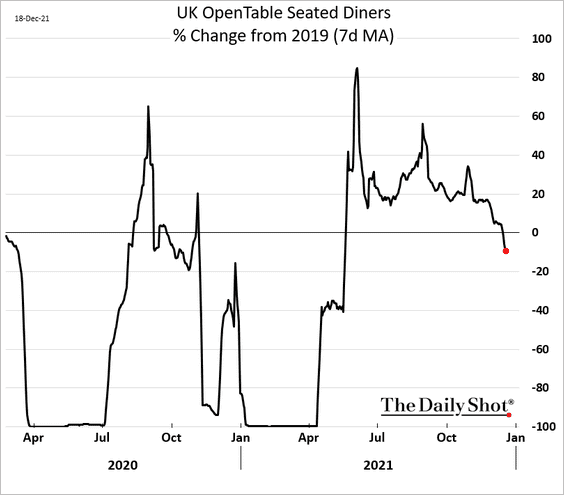

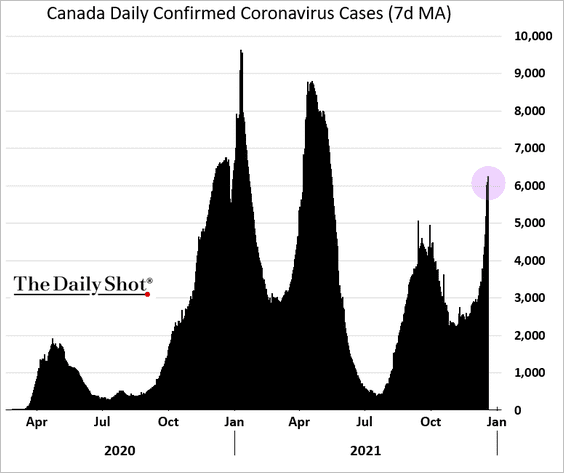

2. COVID cases are rising, …

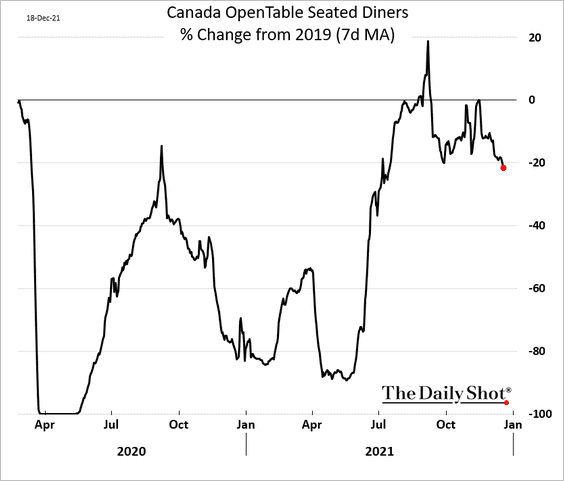

… and restaurant activity is slowing.

——————–

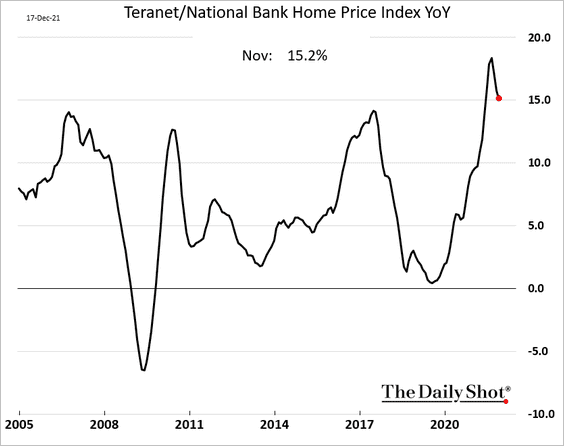

3. Home price appreciation has peaked.

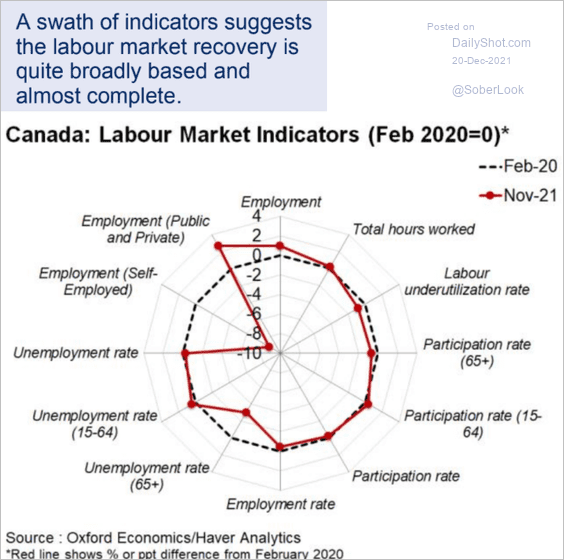

4. The labor market recovery has been broad.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

The United States

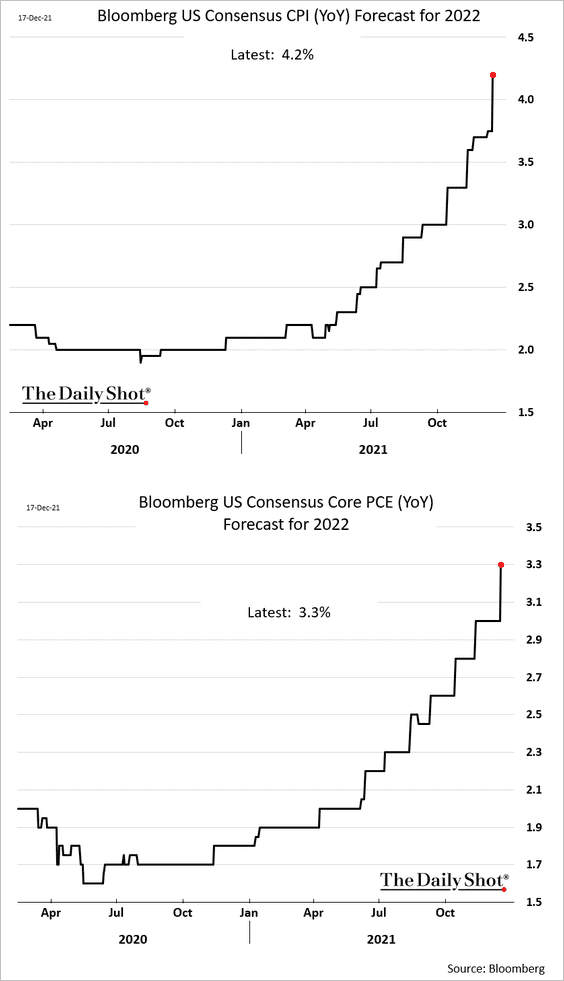

1. Economists sharply raised their inflation forecasts for next year, …

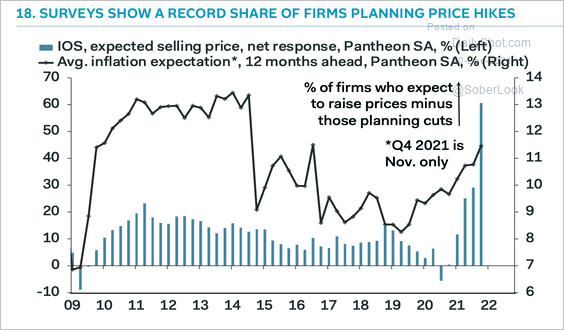

… as a record share of firms plan price hikes.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

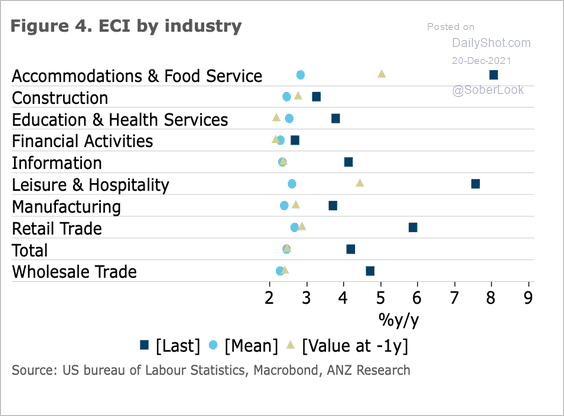

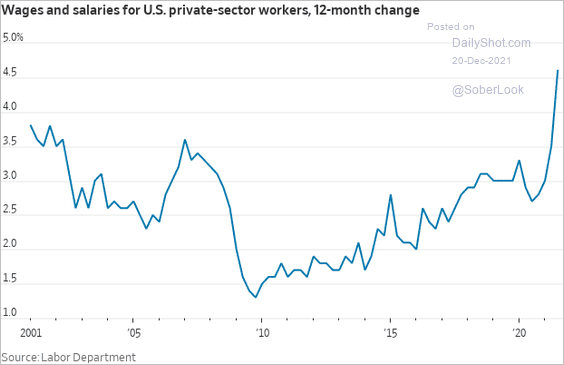

2. Wage pressures, measured by the employment cost index (ECI), are broad and at levels not consistent with the Fed’s mandate.

Source: ANZ Research

Source: ANZ Research

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

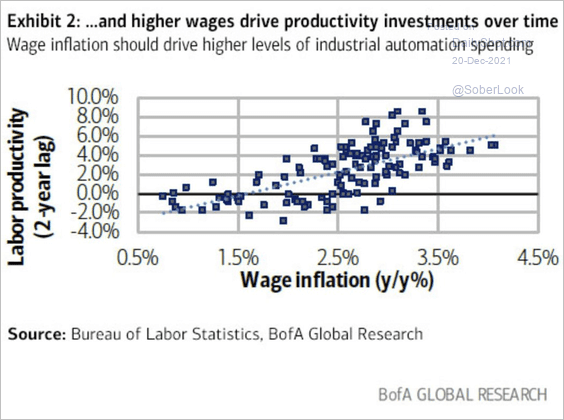

3. Will wage pressures drive improvements in productivity?

Source: BofA Global Research; @acemaxx

Source: BofA Global Research; @acemaxx

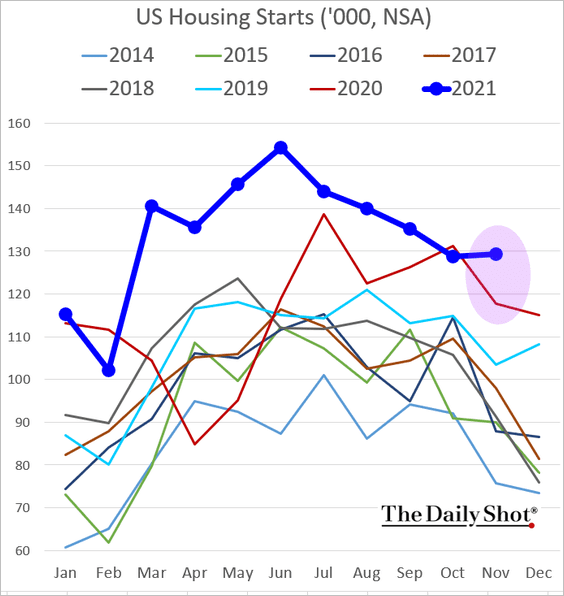

4. Residential construction activity was strong in November.

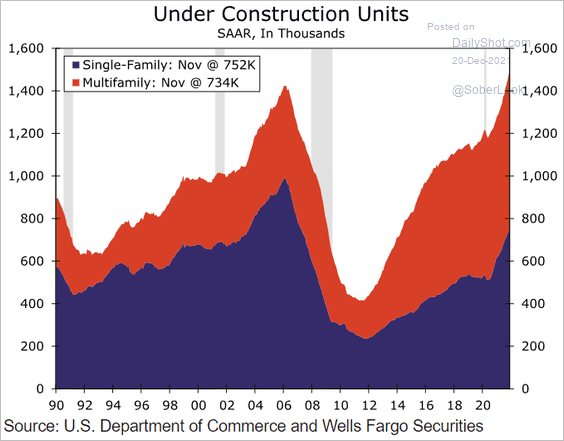

• There are a lot of units currently under construction.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

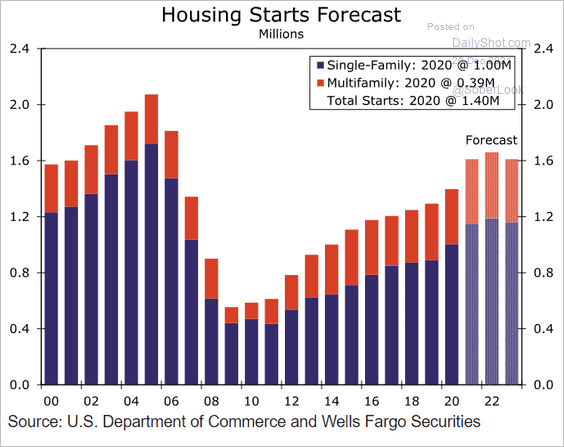

• Here is a forecast for housing starts from Wells Fargo.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

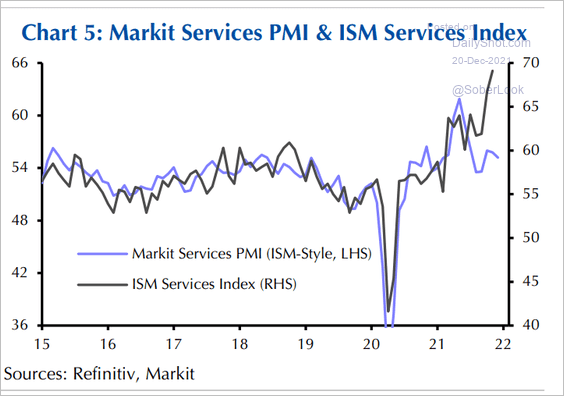

5. The disconnect between ISM and Markit services PMI measures has blown out. Economists see the ISM measure, which was distorted by supply shortages, moving lower in the months ahead.

Source: Capital Economics

Source: Capital Economics

Back to Index

Global Developments

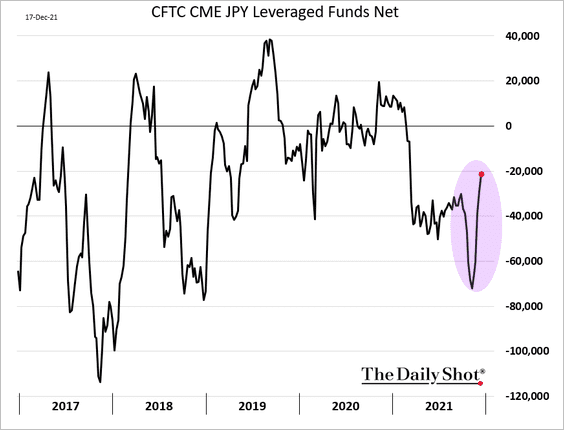

1. Hedge funds have reduced their bets against the yen as risk appetite wanes.

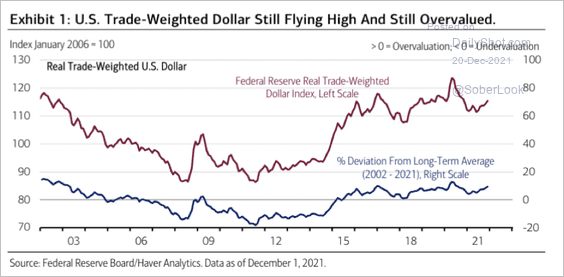

2. The trade-weighted dollar is overvalued relative to its long-term average.

Source: BofA Global Research

Source: BofA Global Research

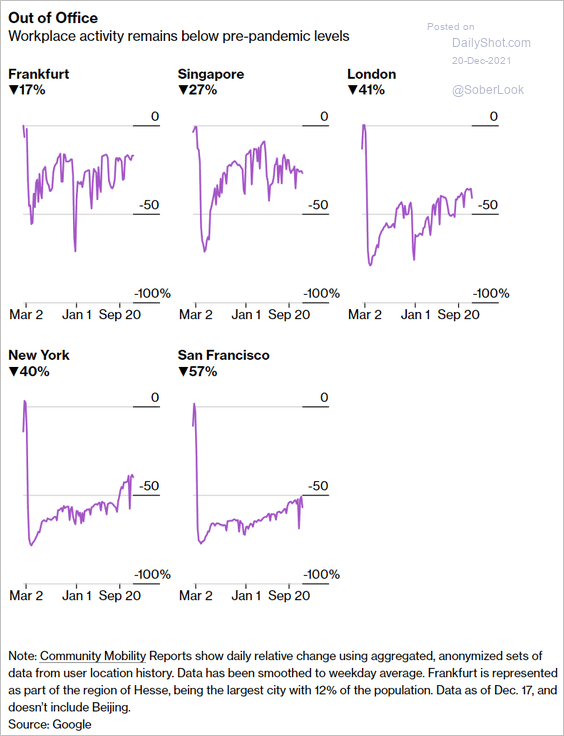

3. Return to the office will stall again.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

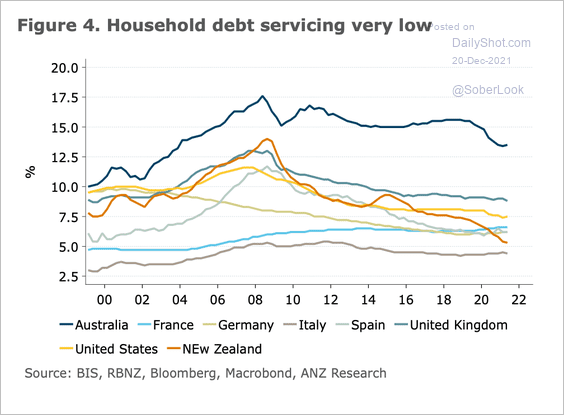

4. Debt service ratios in some economies are at generational lows.

Source: ANZ Research

Source: ANZ Research

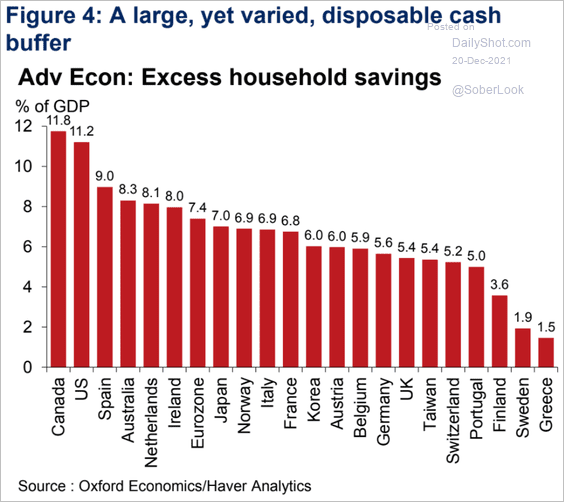

This chart shows excess household savings in select economies.

Source: Oxford Economics

Source: Oxford Economics

——————–

Food for Thought

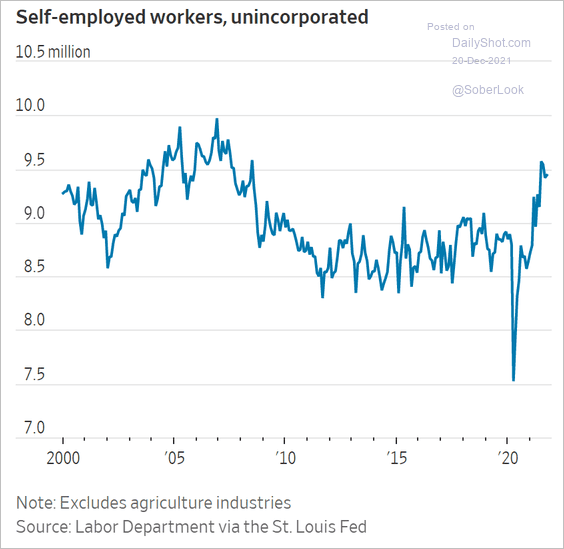

1. Self-employed workers in the US:

Source: @WSJ Read full article

Source: @WSJ Read full article

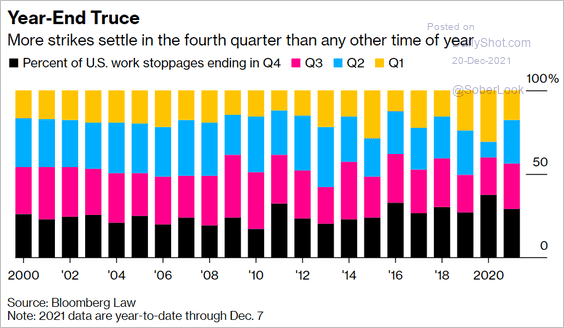

2. Work stoppages ending in each quarter:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

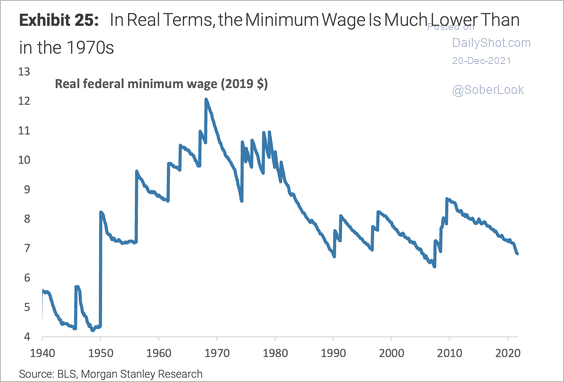

3. Inflation-adjusted minimum wage in the US:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

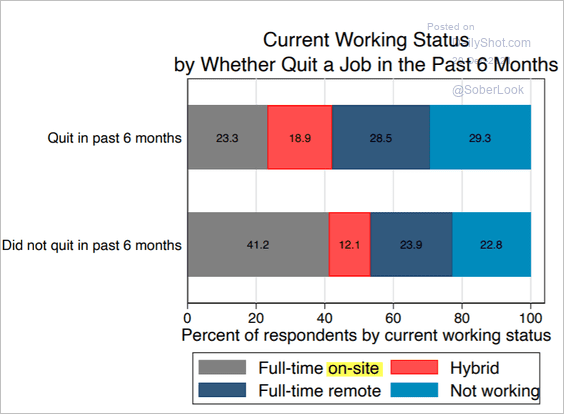

4. Changing jobs to work from home:

Source: WFH Research Read full article

Source: WFH Research Read full article

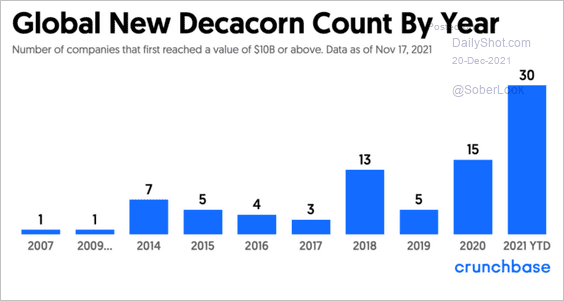

5. New startups valued at $10 billion or more (decacorns):

Source: Crunchbase Read full article

Source: Crunchbase Read full article

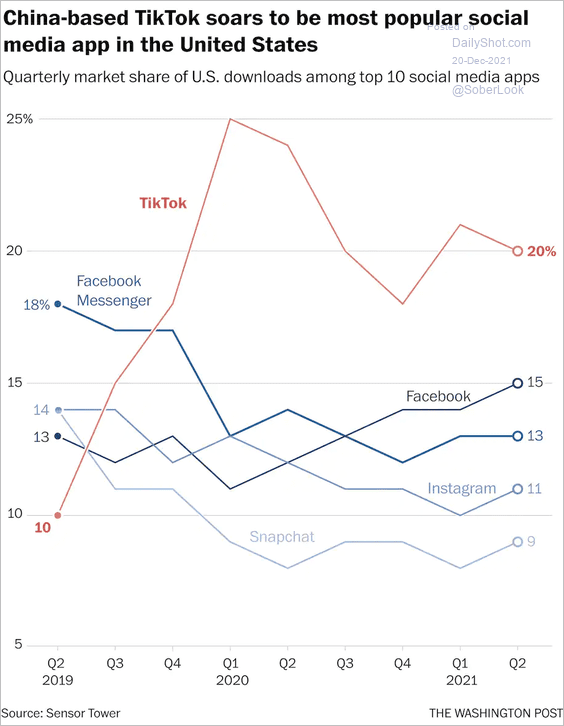

6. Most popular social media apps in the US:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

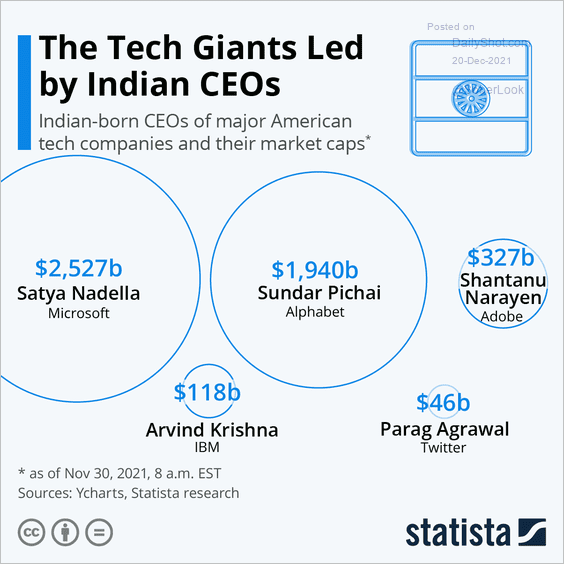

7. Indian-born US tech CEOs:

Source: Statista

Source: Statista

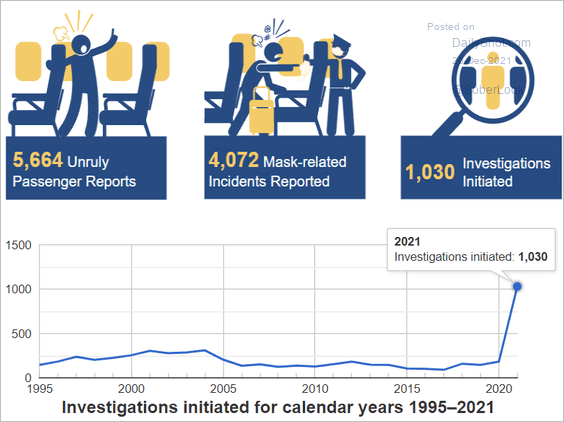

8. Unruly passengers:

Source: FAA Read full article

Source: FAA Read full article

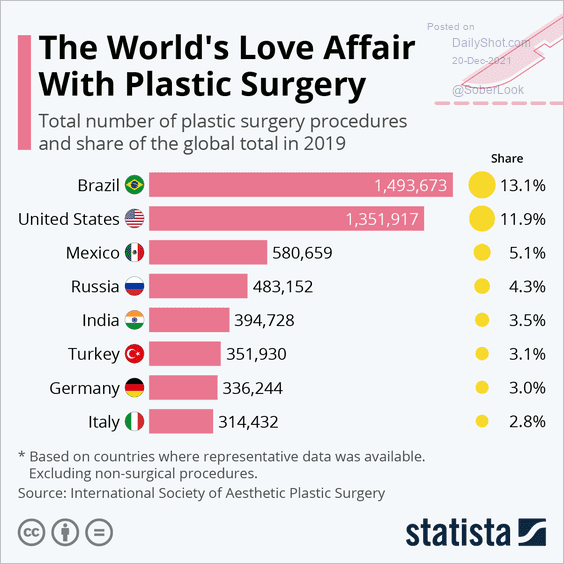

9. Plastic surgery procedures:

Source: Statista

Source: Statista

——————–

Back to Index