The Daily Shot: 18-Jul-22

• Administrative Update (Important)

• The United States

• Canada

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

Administrative Update (Important)

1. Your renewal notice may not show the renewal amount. All 2022 auto-renewing yearly subscriptions will be charged at the rate of $135/year.

2. To cancel your recurring subscription to The Daily Shot, please log into your account and click “cancel.” More information is available here.

3. We are currently in the process of deactivating accounts that share/redistribute The Daily Shot.

Back to Index

The United States

1. Let’s begin with some updates on inflation.

• The U. Michigan 1-year consumer inflation expectations index edged lower this month, …

… as gasoline prices eased.

But it was the longer-dated inflation expectations drop that got the markets’ attention. The concerns about inflation expectations becoming unanchored have eased (here is a similar trend from the NY Fed’s national consumer survey).

The combination of the above result and some comments from Federal Reserve officials reset the expectations for the July rate hike back near 75 bps. Stocks jumped.

It’s worth noting that given the persistent tightness in crude oil markets, US gasoline prices could bounce from here, reversing the downtick in inflation expectations.

• Import prices (ex petroleum) declined again last month, helped by a stronger US dollar.

• Core inflation is yet to peak, according to HSBC.

Source: HSBC; @patrick_saner

Source: HSBC; @patrick_saner

• What portion of the CPI growth is driven by COVID-related factors?

Source: TD Securities; @WallStJesus

Source: TD Securities; @WallStJesus

——————–

2. Next, we have some labor market data.

• Labor costs are rising at the fastest pace in 40 years.

Source: BCA Research

Source: BCA Research

Here is the Atlanta Fed’s wage growth tracker.

Source: @AtlantaFed

Source: @AtlantaFed

– Pay growth for hourly workers still outpaces the overall workforce.

Source: @AtlantaFed

Source: @AtlantaFed

– Job hopping remains lucrative.

Source: @AtlantaFed

Source: @AtlantaFed

• Cracks are starting to appear in the labor market (2 charts).

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

• Consumers increasingly expect unemployment to rise in the months ahead.

——————–

3. US retail sales edged higher last month.

But the picture looks different when adjusted for inflation.

——————–

4. The U. Michigan consumer sentiment index ticked up this month.

But the expectations index continues to hit multi-year lows.

——————–

5. US manufacturing output declined again last month.

The rebound in vehicle production has stalled.

——————–

6. The first regional manufacturing report of the month (from the NY Fed) bounced this month.

However, forward-looking indicators are crashing.

– Expected employee workweek:

– CapEx expectations:

– Expected new orders:

– Expected business conditions:

• Supply issues are giving way to demand weakness.

– Supplier delivery times:

– Unfilled orders:

• Price pressures persist, but there are signs of moderation.

Moreover, price expectations are tumbling.

——————–

7. The pullback in manufacturing is taking place after a long period of expansion.

Source: MarketDesk Research

Source: MarketDesk Research

8. The GDPNow model continues to show an economic contraction in Q2.

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

• The Treasury curve remains heavily inverted.

• The Fed’s Beige Book sentiment looks recessionary.

Source: Evercore ISI Research

Source: Evercore ISI Research

• Economists have sharply downgraded their forecasts for US GDP growth in 2023. Inflation projections continue to move higher.

——————–

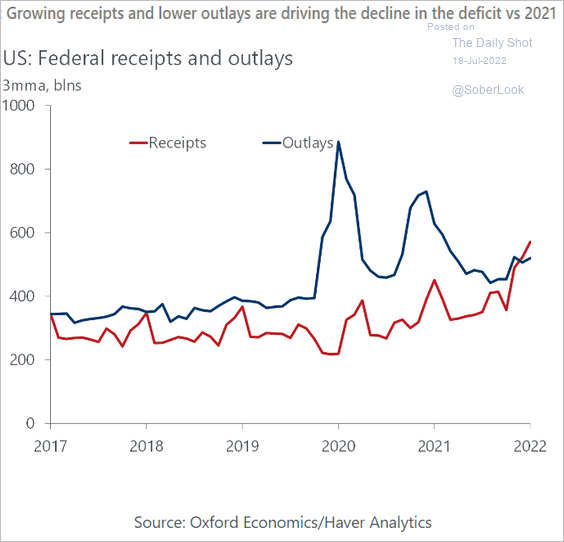

9. The federal budget deficit is running in line with 2017 levels, …

… as receipts rebound.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Canada

1. Existing home sales were down for the fourth month in a row in June.

2. Next, we have some data on Canada’s energy markets.

• Total energy consumption:

Source: @EIAgov

Source: @EIAgov

• Electricity generation by fuel type:

Source: @EIAgov

Source: @EIAgov

Back to Index

The Eurozone

1. Italian bond yields and spreads are higher amid political uncertainty.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Source: Reuters Read full article

Source: Reuters Read full article

• The Five-Star Movement party should be highly incentivized to avoid early elections.

Source: Barclays Research

Source: Barclays Research

• Will Italian funding costs rise further, boosting fragmentation risks?

Source: ECB Further reading

Source: ECB Further reading

——————–

2. The euro-area recession could be massive if Russia cuts off natural gas flows.

Source: Barclays Research

Source: Barclays Research

3. The gap between business and consumer confidence remains wide.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

4. The spread between PMI orders and inventories indices points to further economic weakness ahead.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

Back to Index

Europe

1. What are the betting markets telling us about Boris Johnson’s replacement?

Source: @PredictIt

Source: @PredictIt

2. Natural gas flows to the EU are down sharply. Will we see a rebound after the Gazprom pipeline maintenance?

Source: @JosephPolitano

Source: @JosephPolitano

3. It’s been hot across Europe.

Source: @MikeZaccardi

Source: @MikeZaccardi

4. EU house prices have been outpacing rents.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia – Pacific

1. Japan’s new COVID cases hit a record high. Infections are spiking around the world.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

2. Singapore’s exports (value) hit a record high.

3. New Zealand’s Q2 CPI was firmer than expected.

Bond yields are higher.

Back to Index

China

1. The renminbi’s strength vs. the yen is hurting China’s competitiveness.

2. Developers’ funding headaches are not going away.

Source: Gavekal Research

Source: Gavekal Research

Home prices are declining broadly.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Beijing is trying to help.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

3. State-owned firms still dominate the corporate sector in revenue terms.

Source: VOX EU Read full article

Source: VOX EU Read full article

4. Fertilizer prices have steadily increased, which will boost food inflation.

Source: USDA Read full article

Source: USDA Read full article

Back to Index

Emerging Markets

1. The Chilean peso bounced from the lows as the central bank stepped in and the US dollar rally paused.

2. Brazil’s economic activity eased again in May.

Retail sales remained robust.

——————–

3. Colombia’s economic activity was strong in May.

4. Latin America exhibits the sharpest spread widening in EM.

Source: S&P Global Ratings

Source: S&P Global Ratings

5. South Africa’s retail sales slowed in May.

6. Here is a forecast for EM Asia EV production.

Source: McKinsey & Company

Source: McKinsey & Company

7. Next, we have some performance data from last week.

• Currencies:

• Equity ETFs:

• Domestic bond yields:

Back to Index

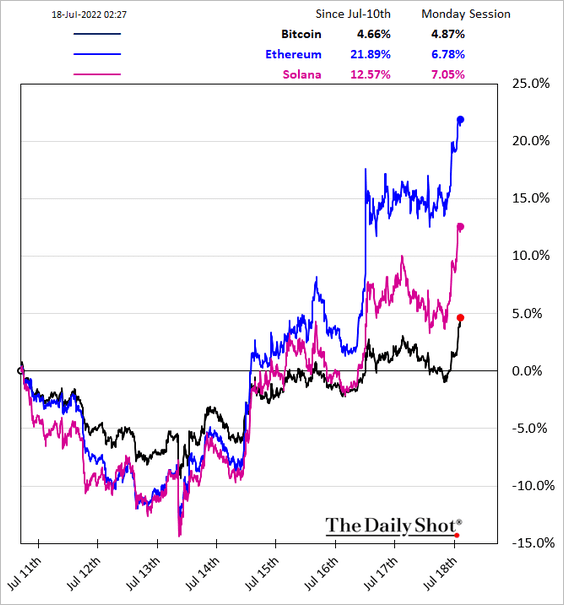

Cryptocurrency

1. Cryptos are rallying as stocks rebound.

2. Holding overnight exposure in bitcoin is no longer working.

Source: Bespoke Investment Group; Bloomberg Read full article

Source: Bespoke Investment Group; Bloomberg Read full article

3. The adoption of cryptocurrency closely tracks the price of bitcoin, driven by users’ willingness to take on significant risk.

Source: BIS

Source: BIS

4. Here is a look at TerraUSD’s implosion and the fragility of certain stablecoins that are governed by algorithms, often undercollateralized.

Source: BIS

Source: BIS

5. Speculators are jumping back into CryptoPunks NFTs.

Source: NFT Price Floor, h/t JC Parets

Source: NFT Price Floor, h/t JC Parets

Back to Index

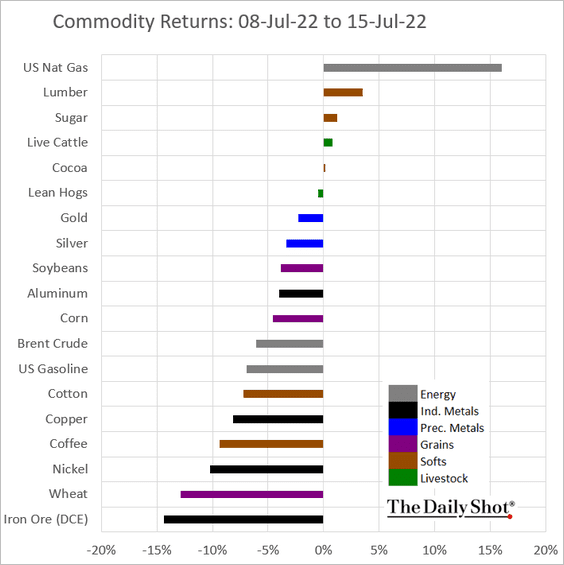

Commodities

1. Will we see a pause in the commodities selloff as the US dollar rally slows?

2. Below is a comparison of today’s commodity trends to those of the 1970s oil crises.

Source: BIS

Source: BIS

3. Here is last week’s performance data across key commodity markets.

Back to Index

Energy

1. US natural gas is rebounding as the heatwave broadens.

Source: NOAA

Source: NOAA

The Freeport outage should boost US natural gas inventories.

Source: @BloombergNEF, @TheTerminal, Bloomberg Finance L.P. Read full article

Source: @BloombergNEF, @TheTerminal, Bloomberg Finance L.P. Read full article

——————–

2. WTI crude oil held support at around $94/bbl.

Fitch expects the Brent oil price to stay higher for longer.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

3. Middle Eastern countries are pumping at near full capacity.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

• OPEC+ continues to fall short of its monthly production targets.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

• OPEC+ exports have been slowing.

Source: @HFI_Research

Source: @HFI_Research

——————–

4. It’s becoming more expensive to build solar panels.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Equities

1. Equity market sentiment remains depressed.

• GS sentiment indicator:

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

• US consumers:

By the way, consumer confidence has a significant impact on earnings.

Source: Trahan Macro Research

Source: Trahan Macro Research

——————–

2. Here is Variant Perception’s business cycle indicator vs. S&P 500 earnings growth.

Source: Variant Perception

Source: Variant Perception

3. US corporate profit margins are significantly above trend.

Source: MarketDesk Research

Source: MarketDesk Research

4. Small-cap earnings revisions are typically more negative than large-caps when the ISM manufacturing PMI declines.

Source: MarketDesk Research

Source: MarketDesk Research

5. The S&P 500 value/growth ratio held the downtrend resistance.

6. The weekly streak of more new lows vs. new highs continues.

Source: All Star Charts

Source: All Star Charts

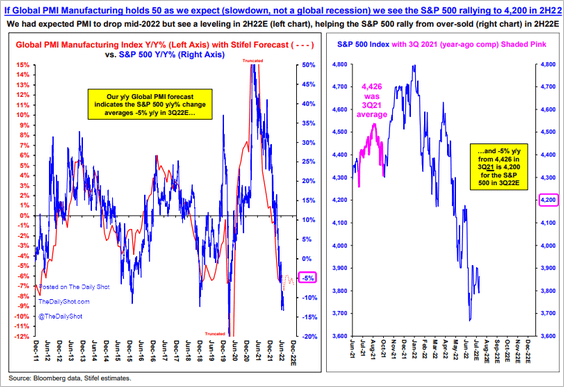

7. Could we get a strong bounce in stocks if global PMIs stabilize (no recession)?

Source: Stifel

Source: Stifel

Stifel sees a possibility of such an outcome.

Source: Stifel

Source: Stifel

——————–

8. Hedgers are most exposed to stocks than speculators, which typically precedes a rise in the S&P 500 index.

Source: SentimenTrader

Source: SentimenTrader

9. Next, we have last week’s performance data.

• Sectors:

• Factors:

• Thematic ETFs:

• Largest US tech firms:

Back to Index

Credit

1. The recent uptick in “weak links” (issuers rated B- or lower with negative outlooks by S&P) points to an increase in defaults.

Source: S&P Global Ratings

Source: S&P Global Ratings

2. So far, market stresses have not led to significantly higher default rates.

Source: S&P Global Ratings

Source: S&P Global Ratings

3. Spreads on senior securitized bonds rated AAA have widened toward levels last seen during the initial pandemic shock in 2020. These moves have been driven by broader risk-off sentiment rather than changes in credit quality, according to PIMCO.

Source: PIMCO Read full article

Source: PIMCO Read full article

4. Leveraged loan prices have been under pressure.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

5. Here is last week’s performance by asset class.

Back to Index

Rates

According to Deutsche Bank, the 10-year Treasury yield should be below 2%, given the decline in cross-asset proxies.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

1. Global consumer confidence dipped below the weakest point of the financial crisis.

Source: Merrill Lynch

Source: Merrill Lynch

2. According to BIS, “… front-loaded rate hikes were historically more likely to result in soft landings.”

Source: @BIS_org, @HyunSongShin Read full article

Source: @BIS_org, @HyunSongShin Read full article

3. The US dollar rally has been broad.

Source: @jessefelder, @WSJ Read full article

Source: @jessefelder, @WSJ Read full article

The dollar jumped 10% from its level a year ago, which typically points to a pullback.

Source: SentimenTrader

Source: SentimenTrader

——————–

4. Finally, we have some performance data for advanced economies (for last week).

• Trade-weighted currency indices:

• Sovereign yields:

——————–

Food for Thought

1. US car loan payments of $1,000 or more:

Source: @WSJ Read full article

Source: @WSJ Read full article

2. Gradual recovery in office visits:

Source: Placer.ai

Source: Placer.ai

3. Change in the population younger than 10:

Source: USAFacts

Source: USAFacts

4. The most populous countries:

Source: @axios Read full article

Source: @axios Read full article

5. Countries with the largest oil reserves:

Source: Statista

Source: Statista

6. Fertility rate projections:

Source: United Nations

Source: United Nations

7. Support for access to legal abortion:

Source: @WSJ Read full article

Source: @WSJ Read full article

8. Uber’s popularity around the world:

Source: Statista

Source: Statista

9. Wimbledon ticket price by tournament day:

Source: OpenAxis Read full article

Source: OpenAxis Read full article

——————–

Back to Index