The Daily Shot: 11-Aug-22

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

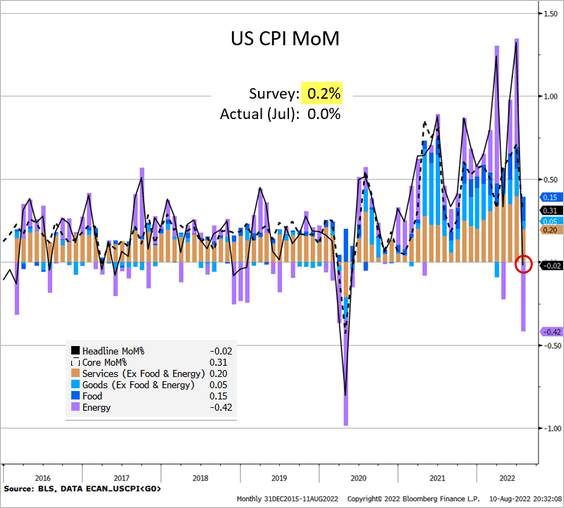

1. The July CPI report surprised to the downside. The decline in gasoline prices offset most of the gains elsewhere.

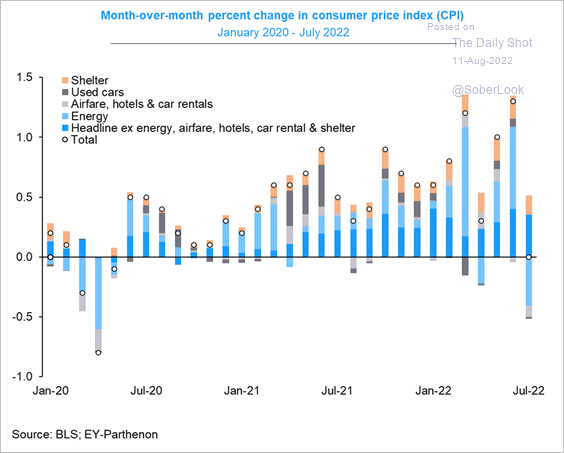

Below is a different breakdown of the CPI components.

Source: @GregDaco

Source: @GregDaco

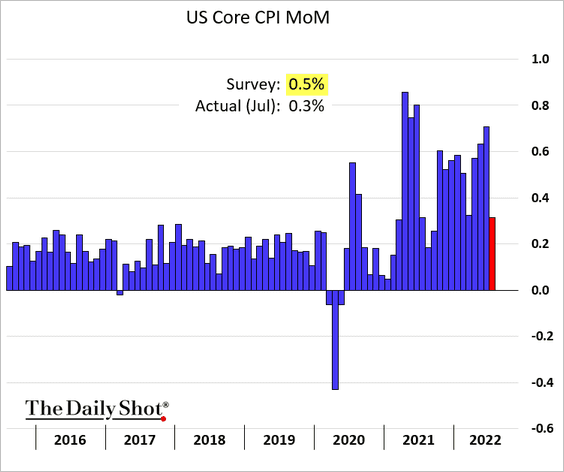

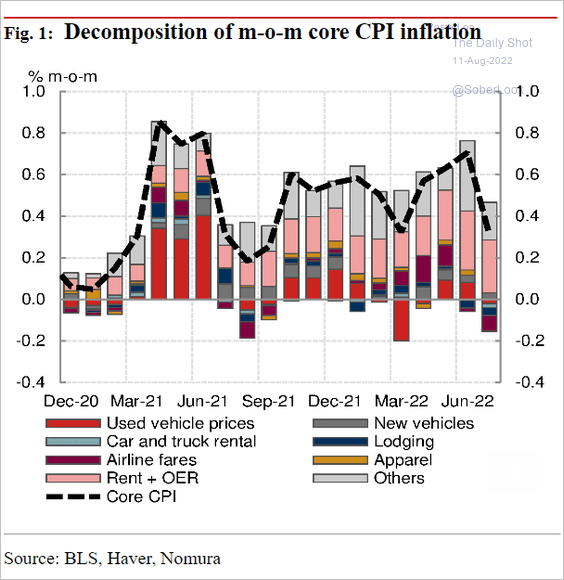

The core inflation print was also below forecasts (2 charts).

Source: Nomura Securities

Source: Nomura Securities

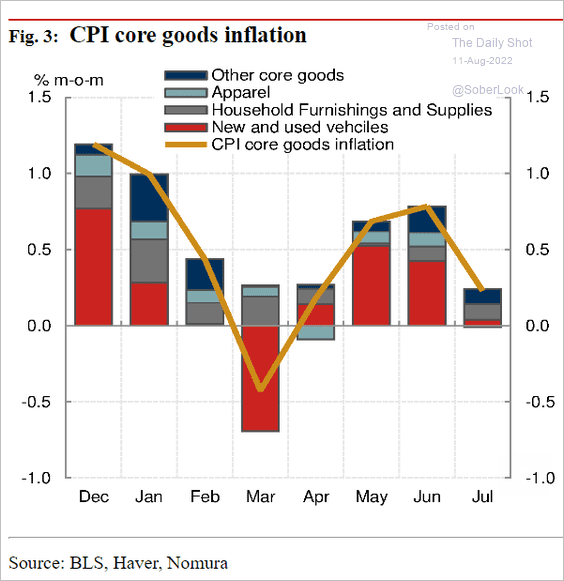

This chart shows the components of the core goods CPI.

Source: Nomura Securities

Source: Nomura Securities

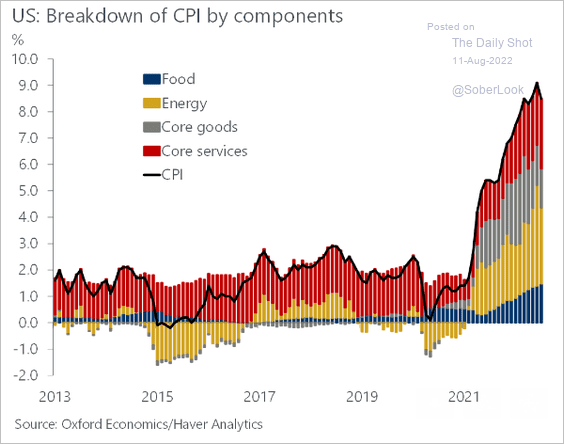

• Next, we have the year-over-year CPI attribution.

Source: Oxford Economics

Source: Oxford Economics

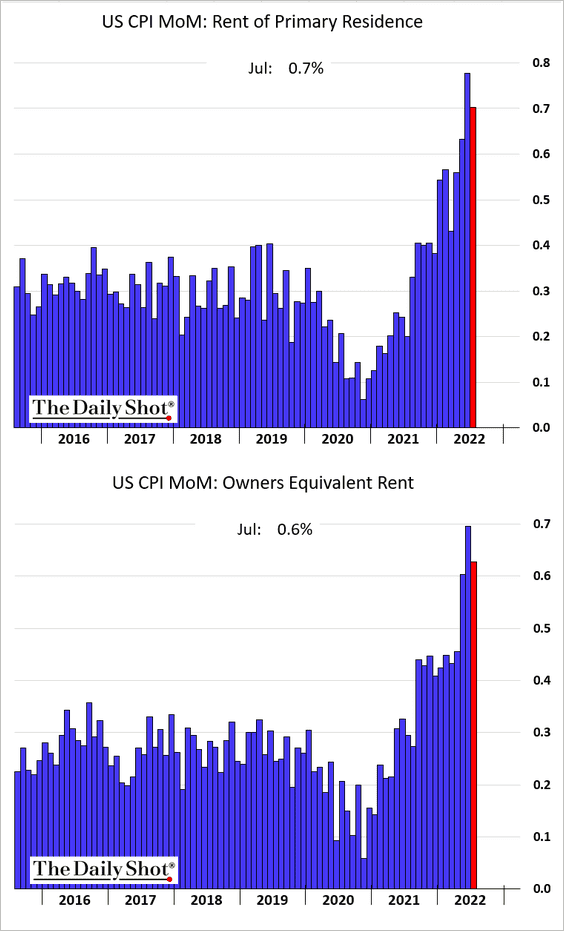

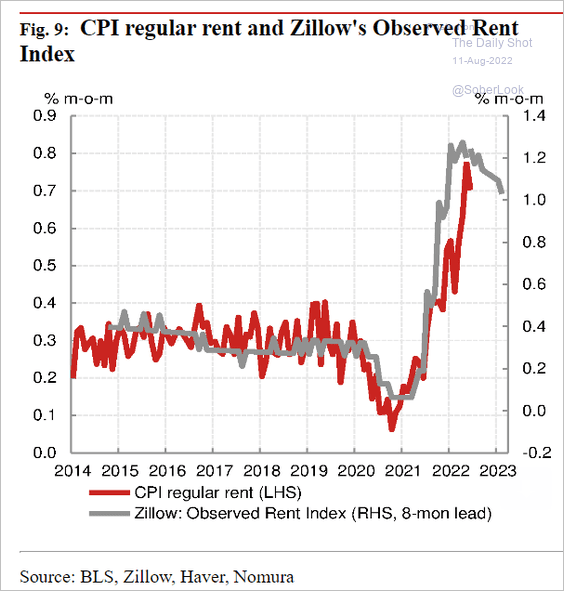

• Despite the positive news on inflation, shelter CPI remains very high.

Rents are expected to keep climbing at a much faster pace than what we saw in the pre-COVID era.

Source: Nomura Securities

Source: Nomura Securities

• We will have more on the CPI report tomorrow (including some forecasts).

——————–

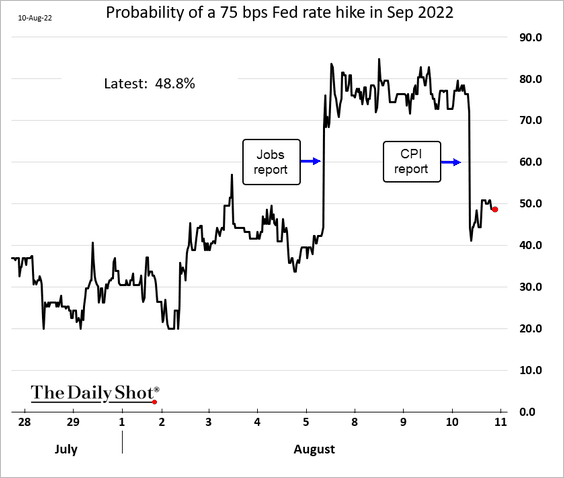

2. The probability of a 75 bps Fed rate hike in September dipped back below 50% in response to the softer-than-expected CPI report.

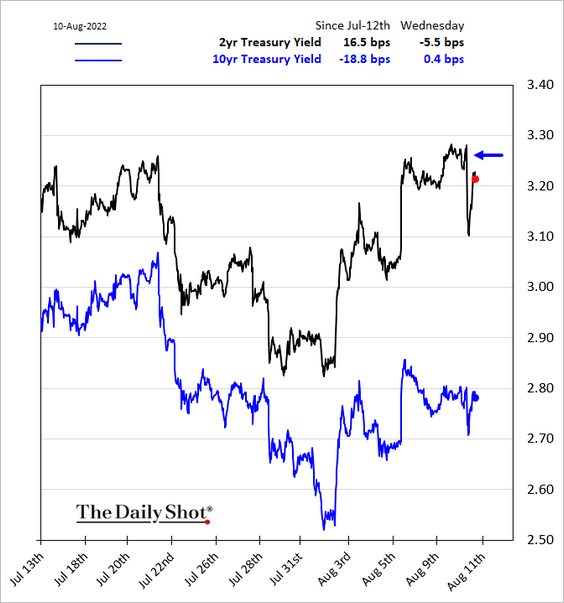

• Treasury yields didn’t change much.

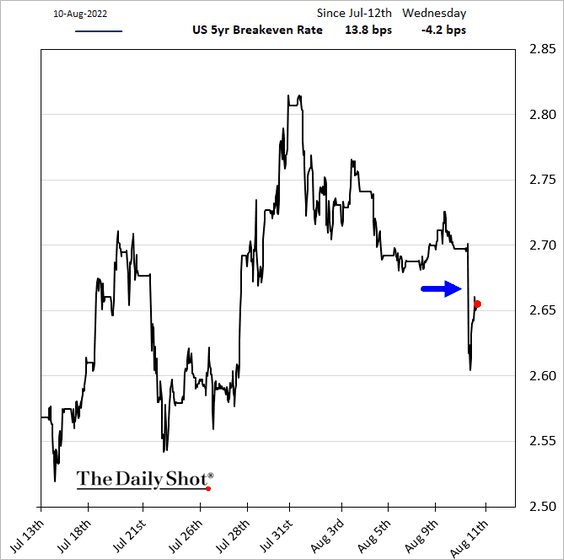

• Inflation expectations declined.

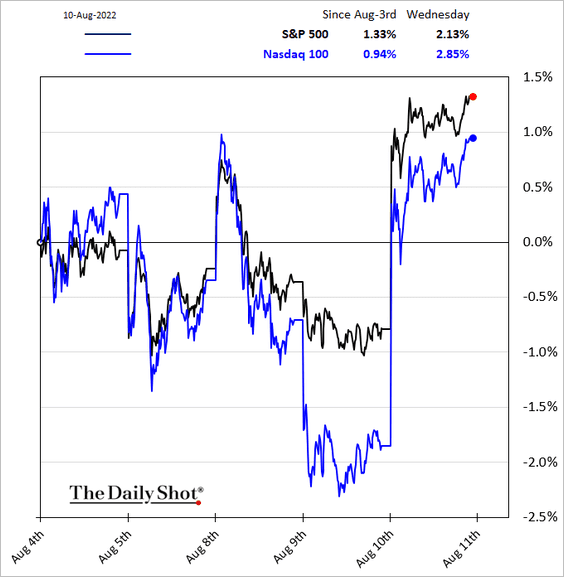

• Risk assets cheered the possibility of smaller rate hikes.

– Equities:

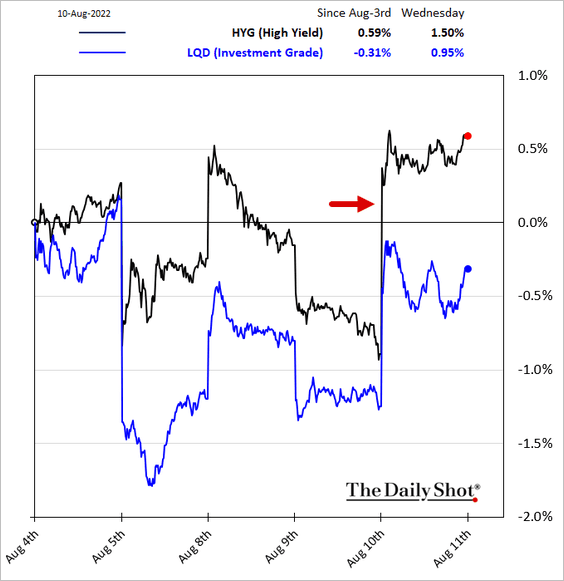

– Corporate bonds:

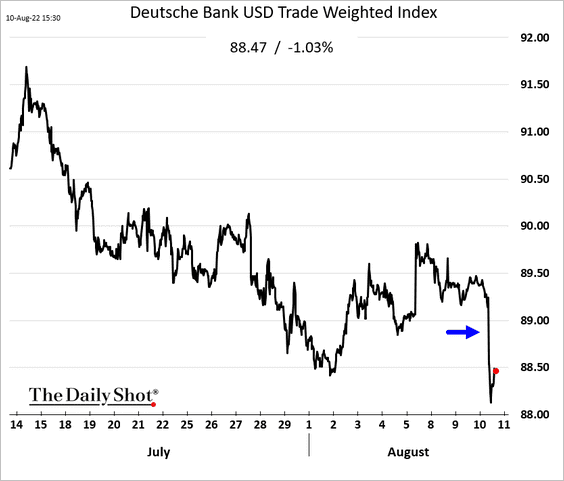

• The dollar dropped.

——————–

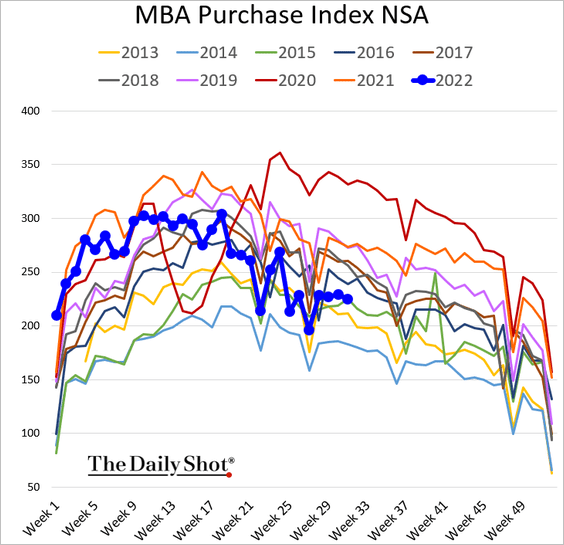

3. Mortgage applications are running at levels we saw in 2015.

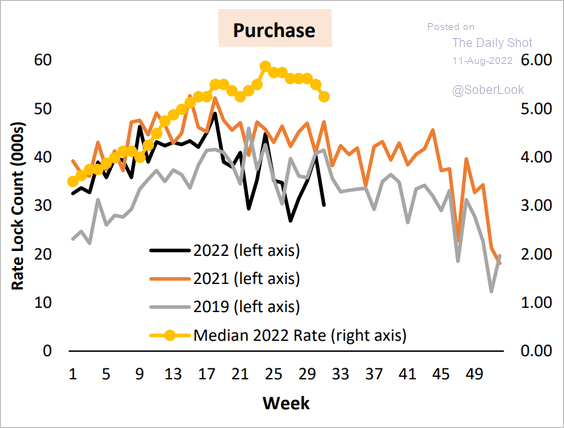

Here is the trend for rate locks.

Source: AEI Center on Housing Markets and Finance

Source: AEI Center on Housing Markets and Finance

——————–

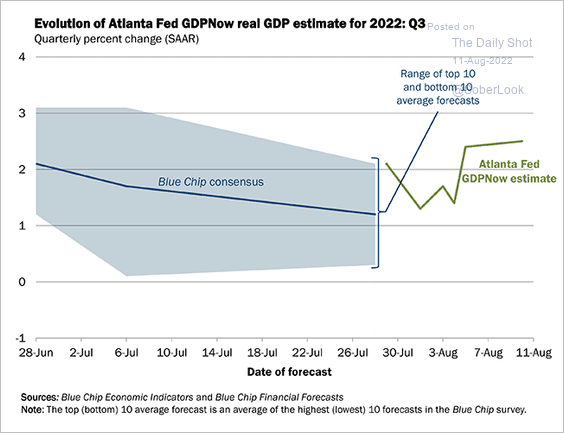

4. The Atlanta Fed’s GDPNow (nowcast) model has the Q3 GDP growth at 2.5% (annualized).

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

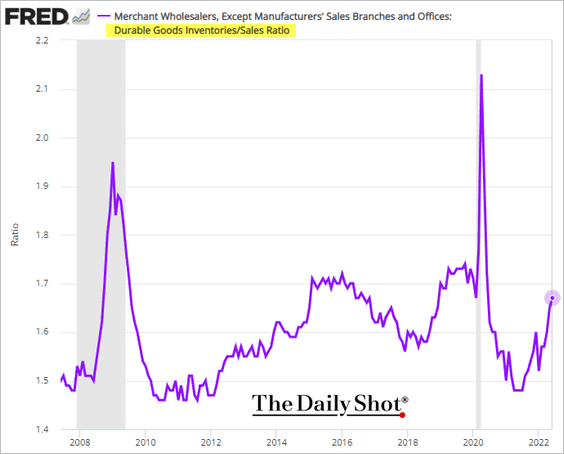

5. Durables inventories-to-sales ratio continues to climb (2 charts).

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

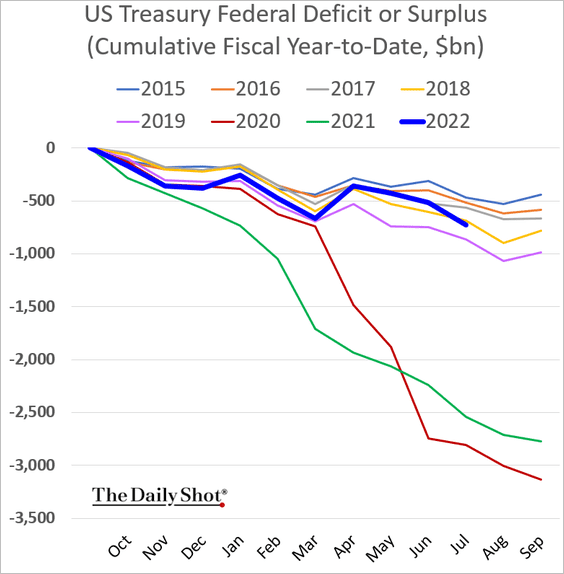

6. The federal budget deficit was worse than expected in July.

Back to Index

The United Kingdom

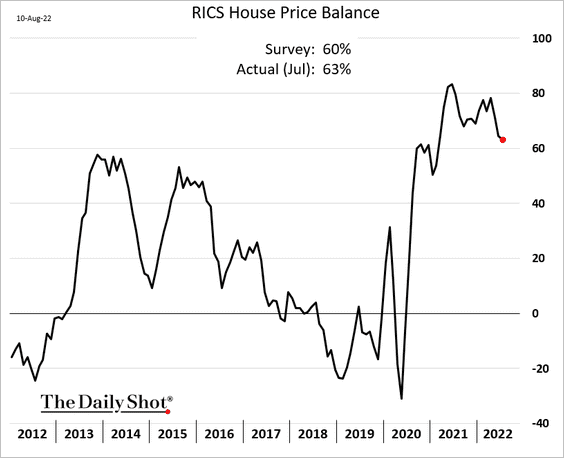

1. The housing market held up well last month.

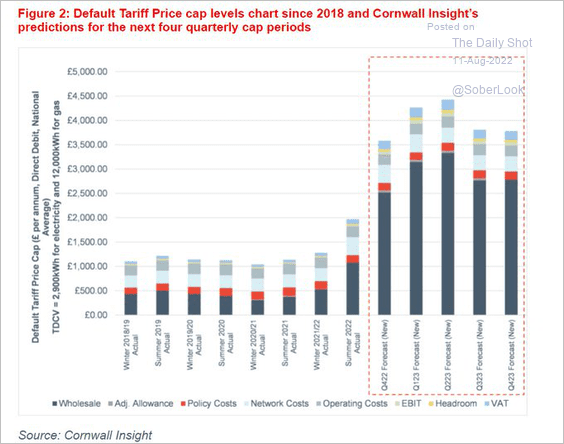

2. Retail electricity and natural gas prices are expected to surge.

Source: @JavierBlas, @CornwallInsight

Source: @JavierBlas, @CornwallInsight

Back to Index

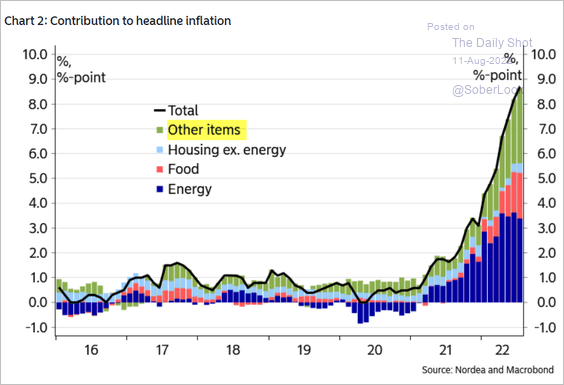

The Eurozone

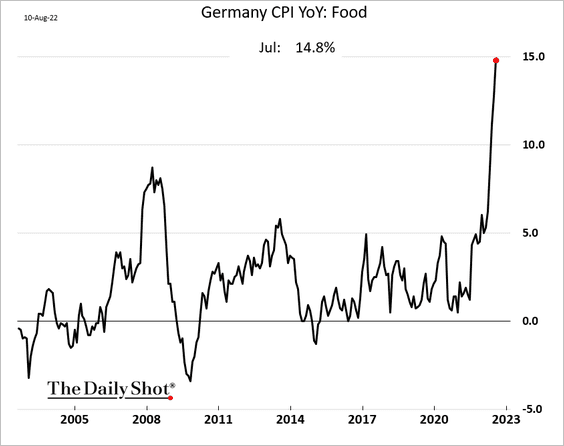

1. German food inflation is nearing 15%.

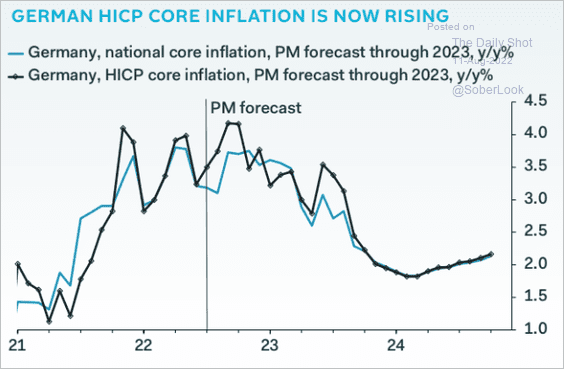

Core inflation is expected to remain elevated.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

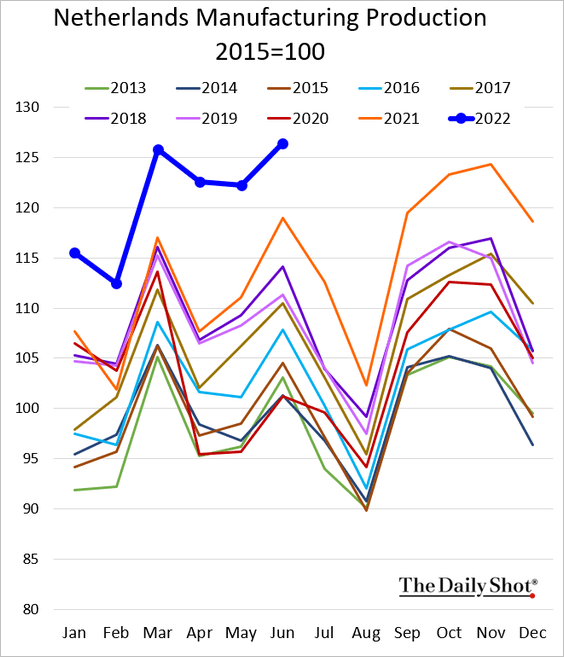

2. Dutch factory output remains robust.

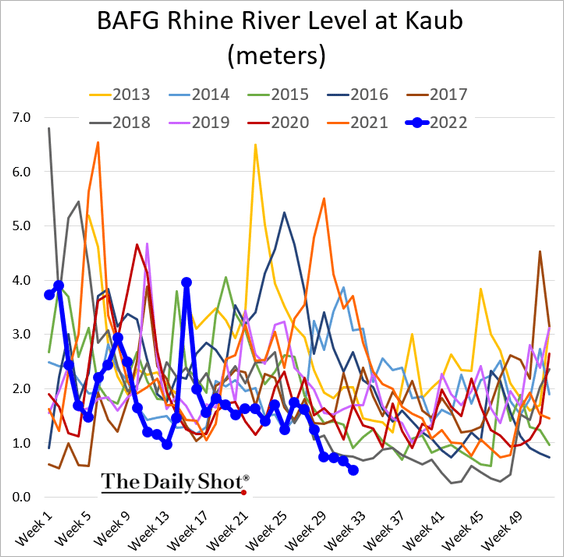

3. The Rhine river situation is very precarious.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Source: Reuters Read full article

Source: Reuters Read full article

——————–

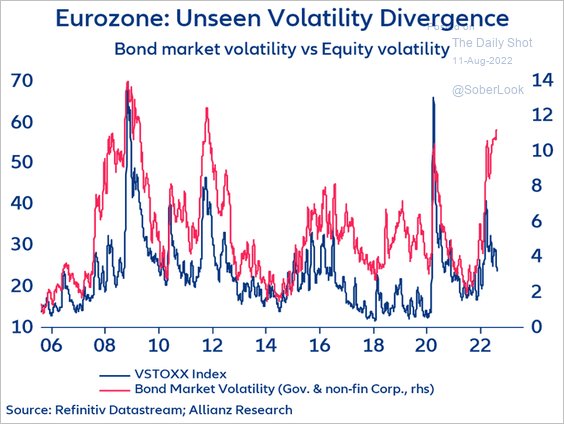

4. The bond/equity volatility gap continues to widen.

Source: @PatrickKrizan

Source: @PatrickKrizan

Back to Index

Europe

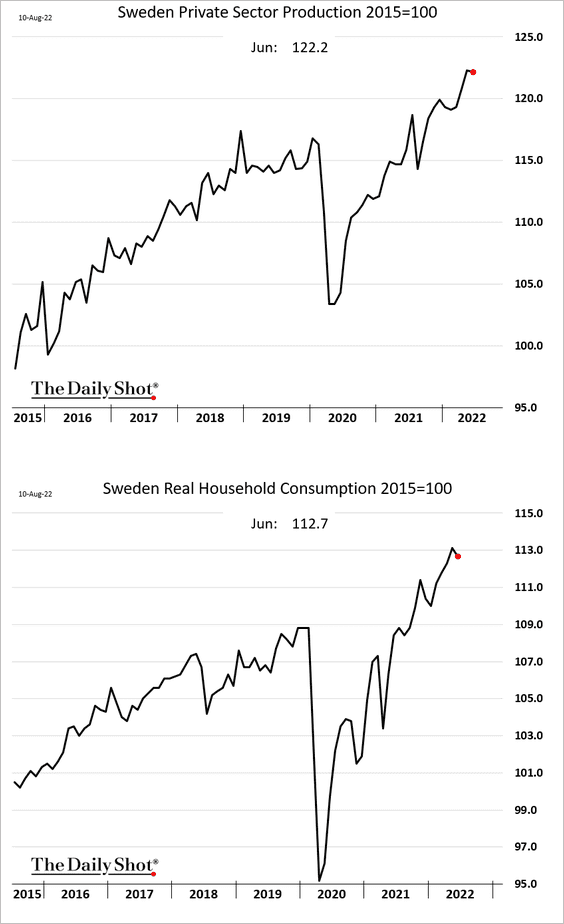

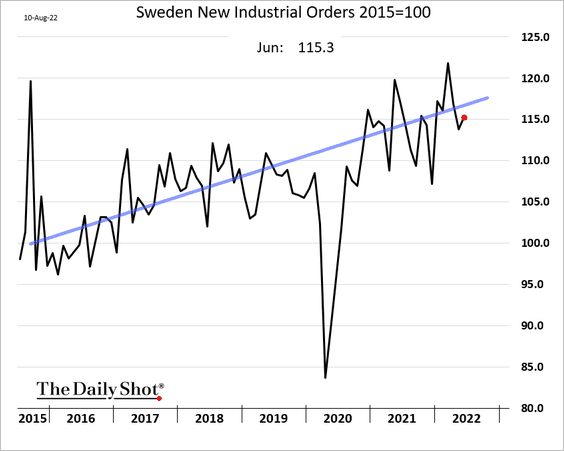

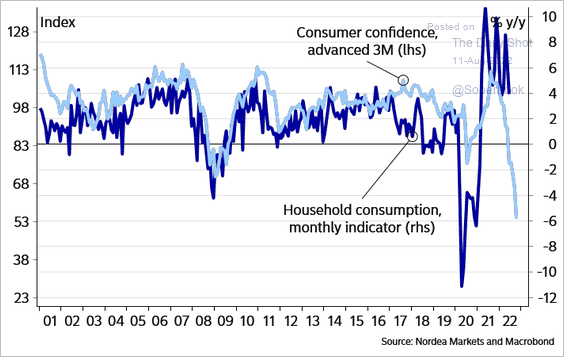

1. Sweden’s economic activity remains strong.

Will record low consumer sentiment drag down consumption?

Source: Nordea Markets

Source: Nordea Markets

——————–

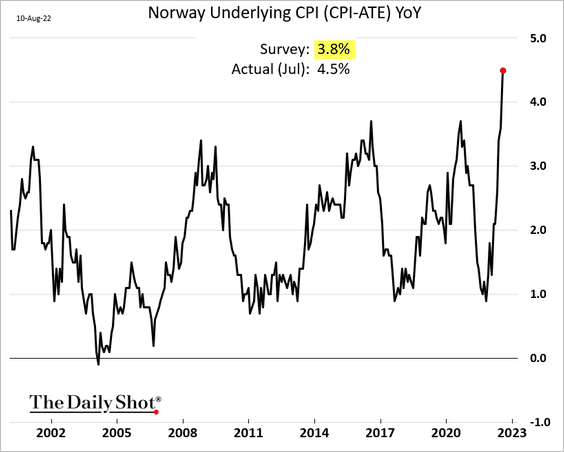

2. Norway’s CPI surprised to the upside.

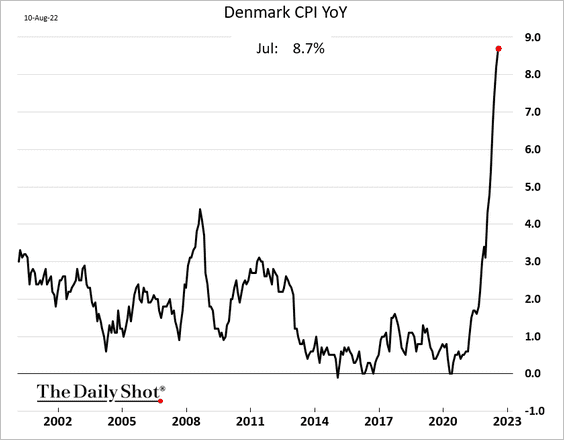

3. Denmark’s CPI continues to surge, increasingly driven by core inflation (2 charts).

Source: Nordea Markets

Source: Nordea Markets

——————–

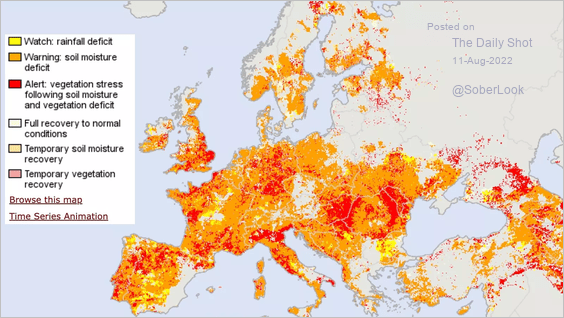

4. Drought conditions are affecting about 60% of the EU and the UK, according to Axios.

Source: @axios Read full article

Source: @axios Read full article

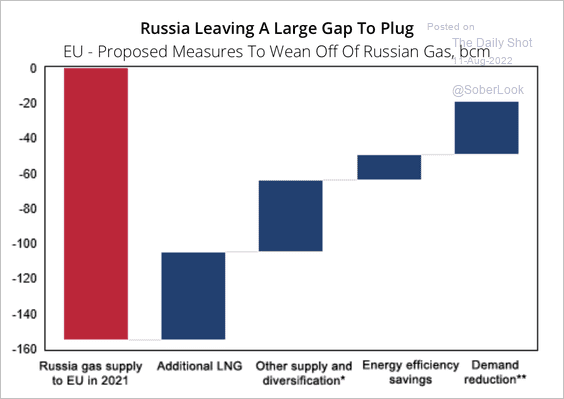

5. Can Europe substantially reduce its dependence on Russian gas?

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Back to Index

Asia – Pacific

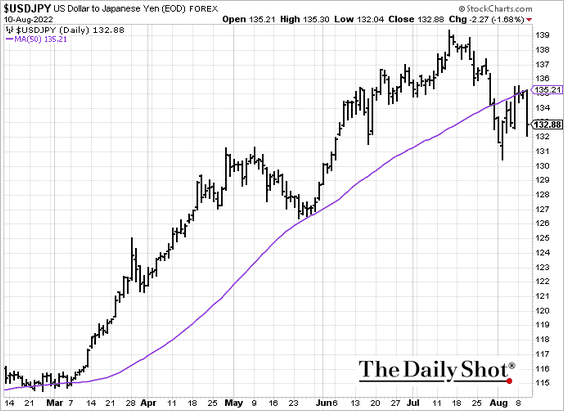

1. Dollar-yen held resistance at the 50-day moving average.

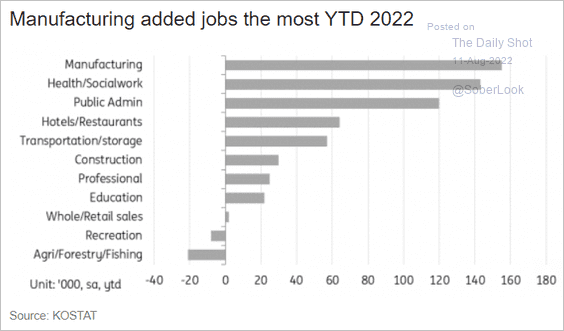

2. Thie chart shows the drivers of South Korea’s job gains in 2022.

Source: ING

Source: ING

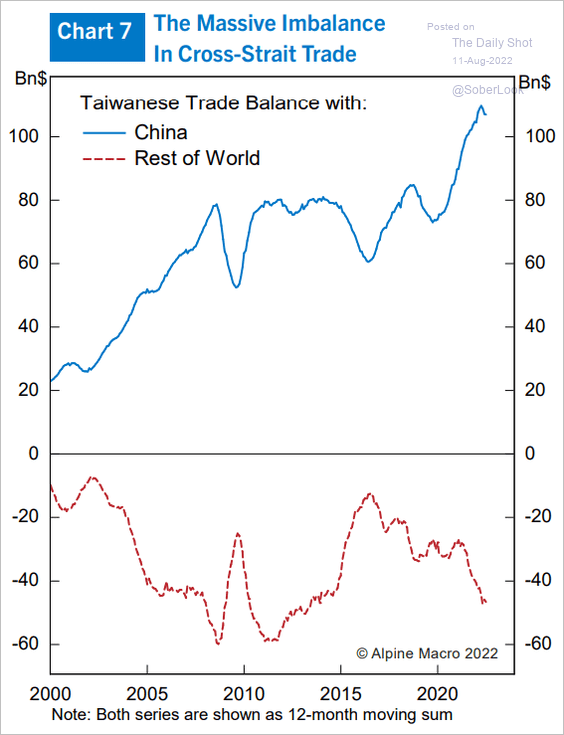

3. Here is Taiwan’s trade balance with China and the rest of the world.

Source: Alpine Macro

Source: Alpine Macro

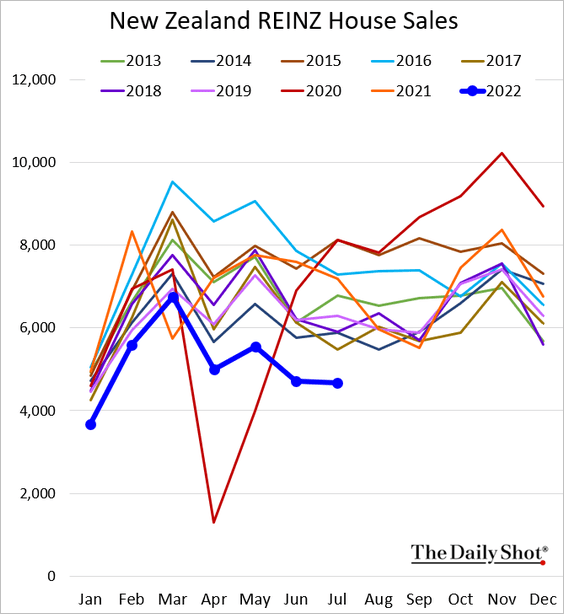

4. New Zealand’s home sales are at multi-year lows.

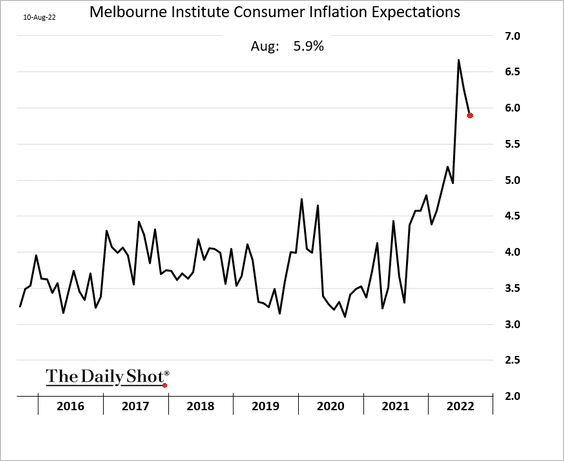

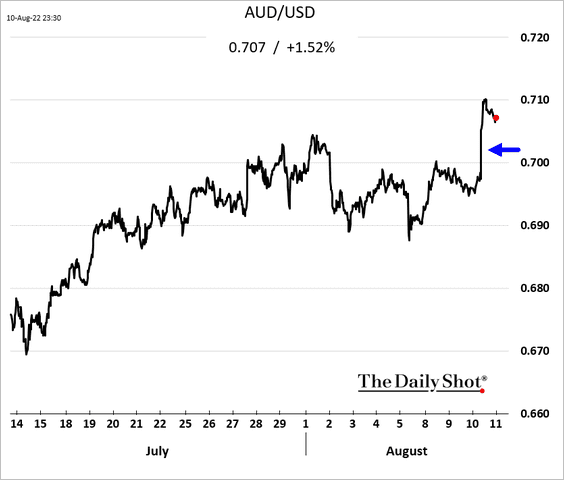

5. Australia’s consumer inflation expectations are off the highs.

The Aussie dollar jumped by 1.5% in response to the US CPI miss.

Back to Index

China

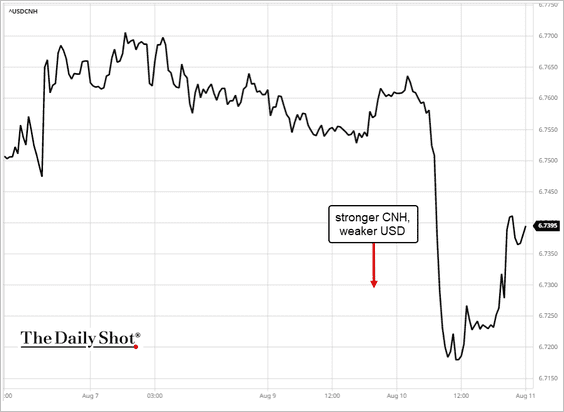

1. The renminbi strengthened on the US CPI report but gave up half the gains today.

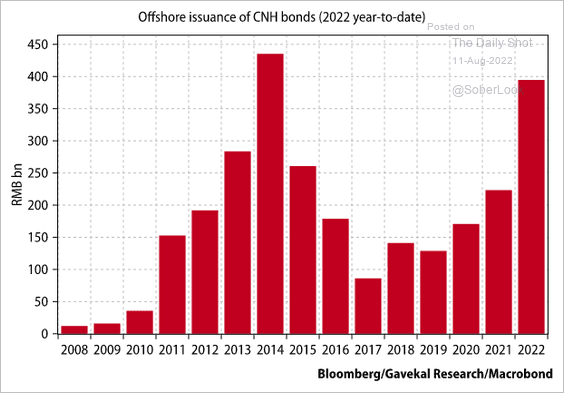

2. Offshore renminbi bond issuance has accelerated.

Source: Gavekal Research

Source: Gavekal Research

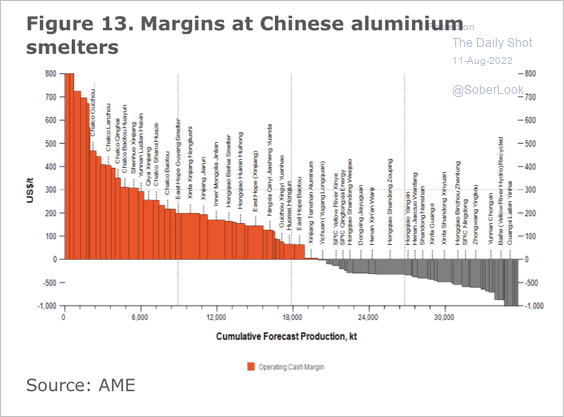

3. Roughly 56% of China’s aluminum smelters are operating at below cash costs, mainly because of rising energy prices, according to ANZ.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Emerging Markets

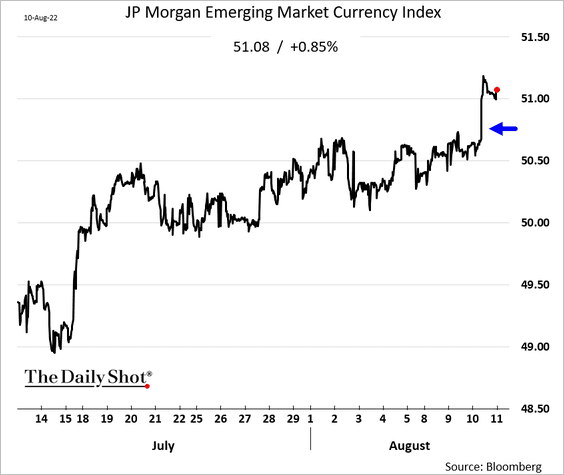

1. EM currencies climbed in response to the US CPI report.

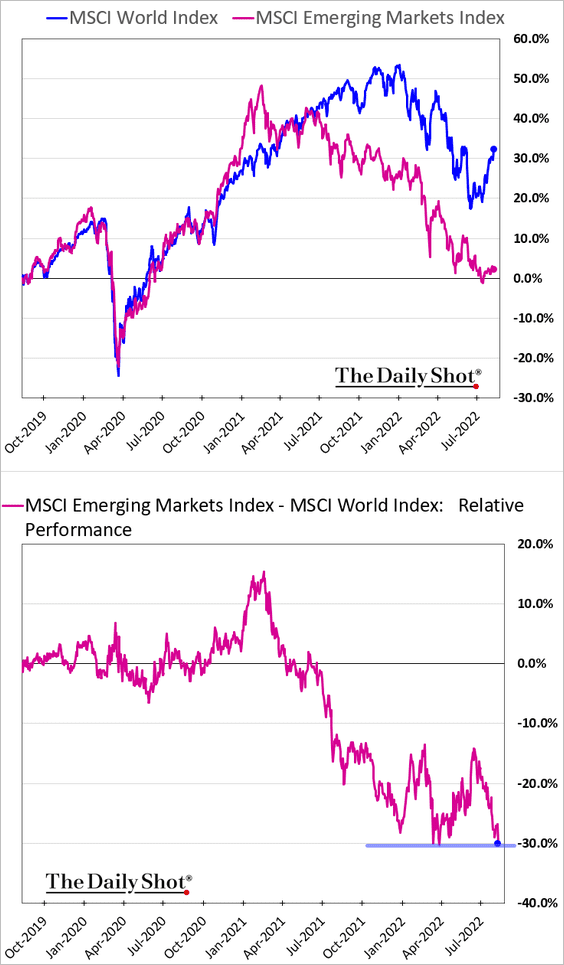

2. EM equities have been underperforming advanced economies.

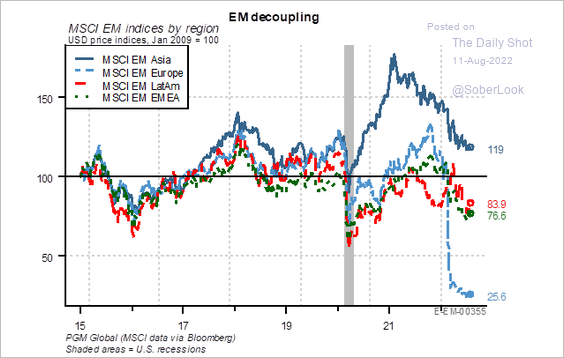

Here is the regional performance.

Source: PGM Global

Source: PGM Global

——————–

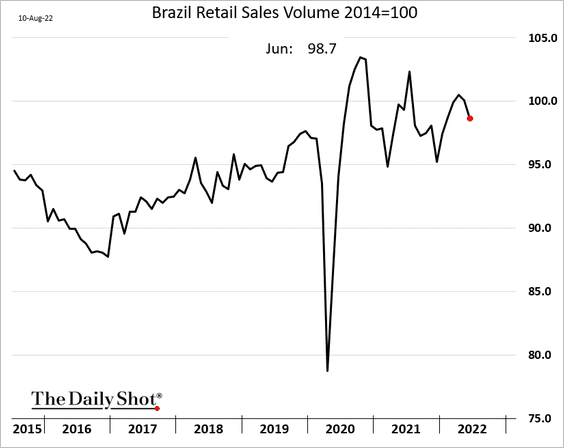

3. Brazil’s retail sales have been holding up well.

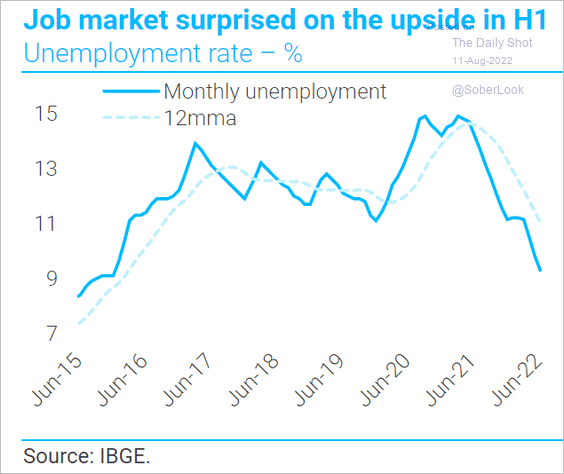

The nation’s job market has been stronger than expected this year.

Source: TS Lombard

Source: TS Lombard

——————–

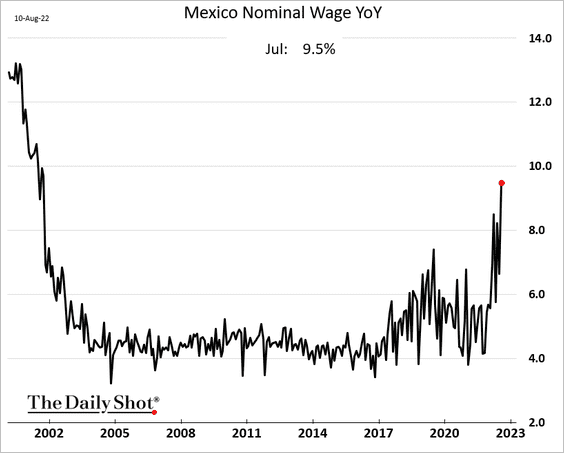

4. Mexican nominal wage growth hit a two-decade high.

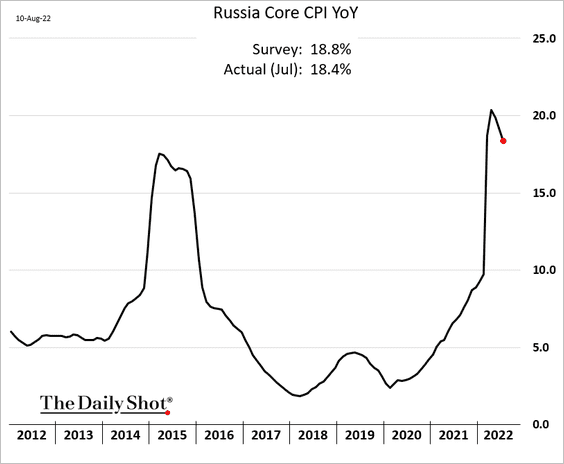

5. Russia’s inflation has peaked. Once again, data from the Federal Service of State Statistics should be taken with a grain of salt.

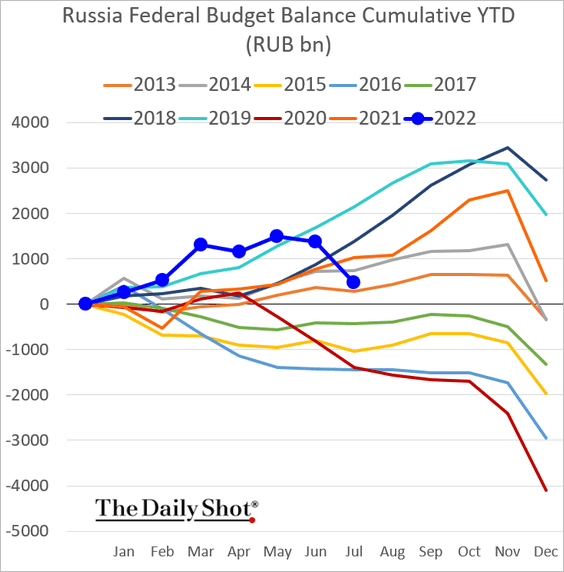

The budget (reported by the Russian Ministry of Finance) appears to be deteriorating.

——————–

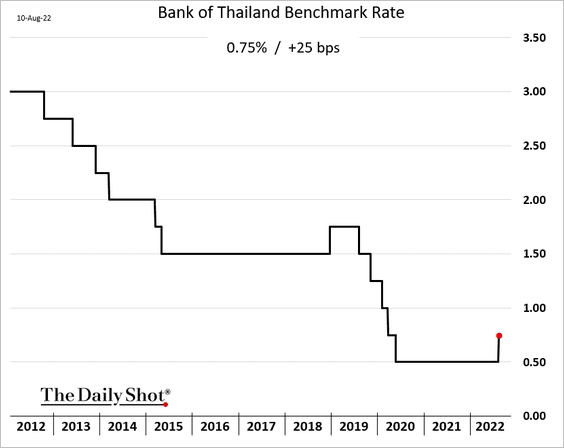

6. Thailand’s central bank finally raised rates.

Back to Index

Cryptocurrency

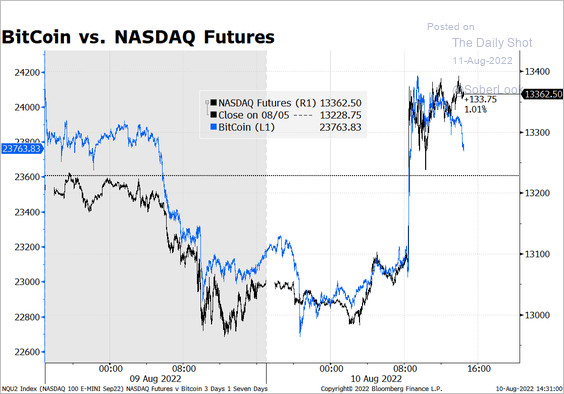

1. Bitcoin remains highly correlated to growth stocks

Source: @M_McDonough

Source: @M_McDonough

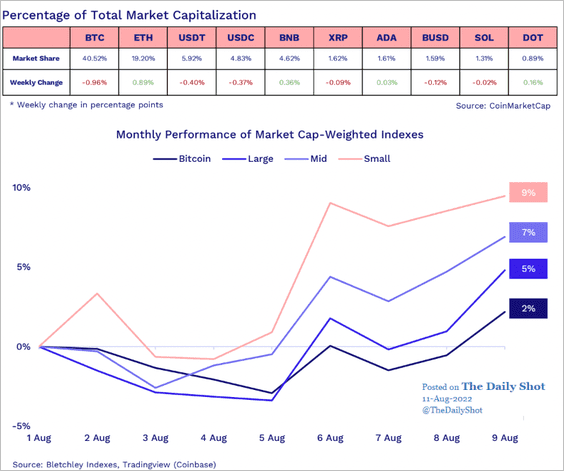

2. Small-cap tokens have been outperforming bitcoin over the past two weeks.

Source: Bietchley Indexes Read full article

Source: Bietchley Indexes Read full article

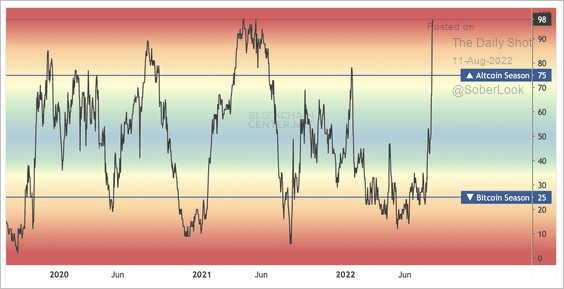

3. 98% of the top 50 coins have outperformed bitcoin over the past three months. It’s officially “altcoin season.”

Source: Blockchain Center

Source: Blockchain Center

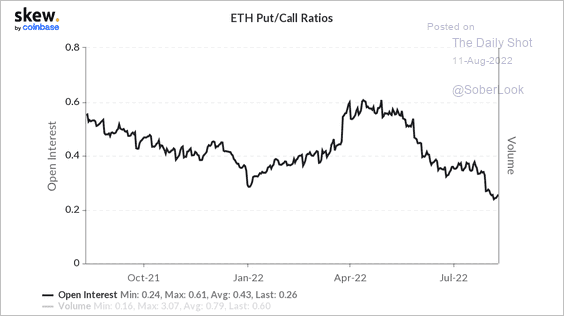

4. Ether’s put/call ratio is trending lower.

Source: Skew

Source: Skew

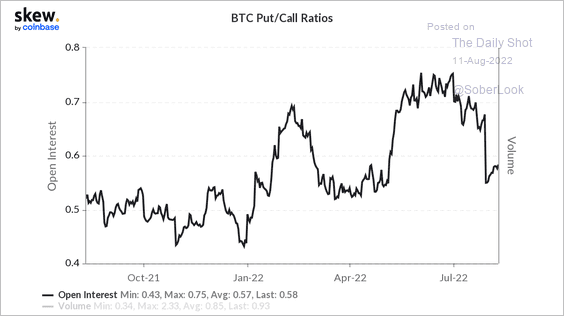

Bitcoin’s put/call ratio is starting to tick higher again.

Source: Skew

Source: Skew

Back to Index

Commodities

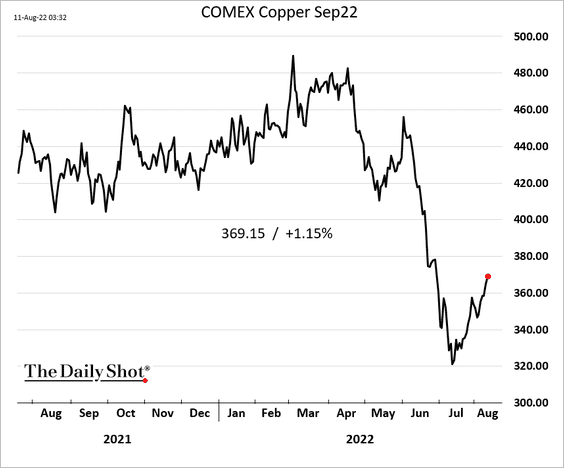

1. Copper is rebounding with other risk assets.

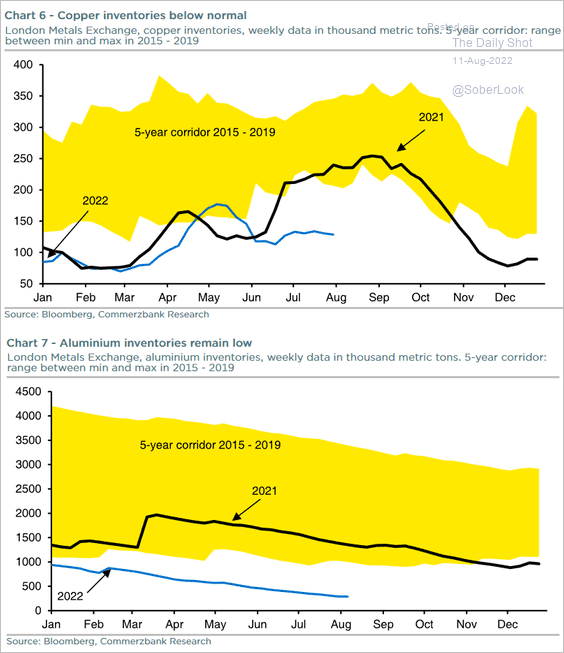

• LME copper and aluminum inventories remain low for this time of the year.

Source: Commerzbank Research

Source: Commerzbank Research

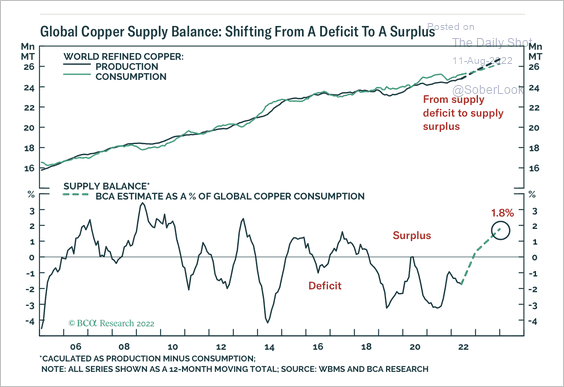

• But a surplus in the global copper market could weigh on prices.

Source: BCA Research

Source: BCA Research

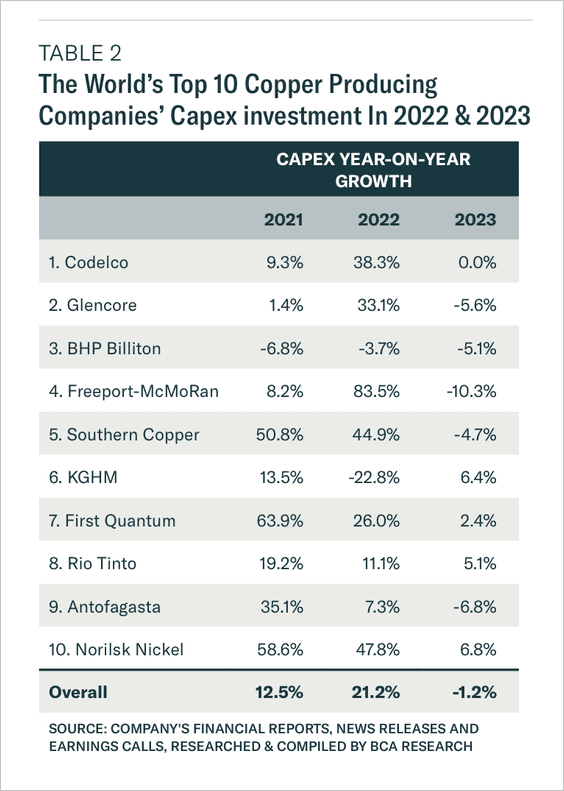

Copper miners plan to increase capital spending this year.

Source: BCA Research

Source: BCA Research

——————–

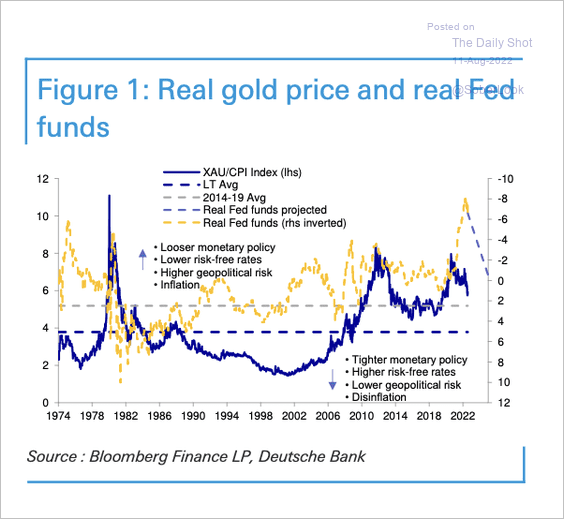

2. Gold is still trading above its long-term average relative to US CPI. However, tighter monetary policy and disinflation are headwinds for the precious metal.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

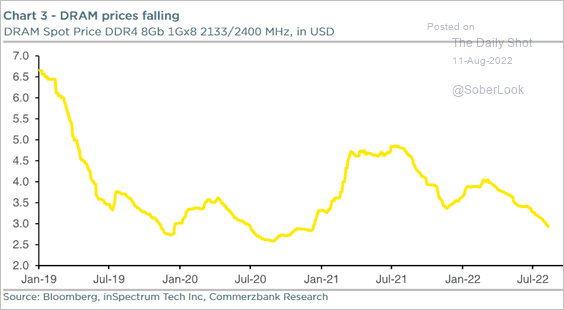

3. Memory chip prices have been falling.

Source: Commerzbank Research

Source: Commerzbank Research

Back to Index

Energy

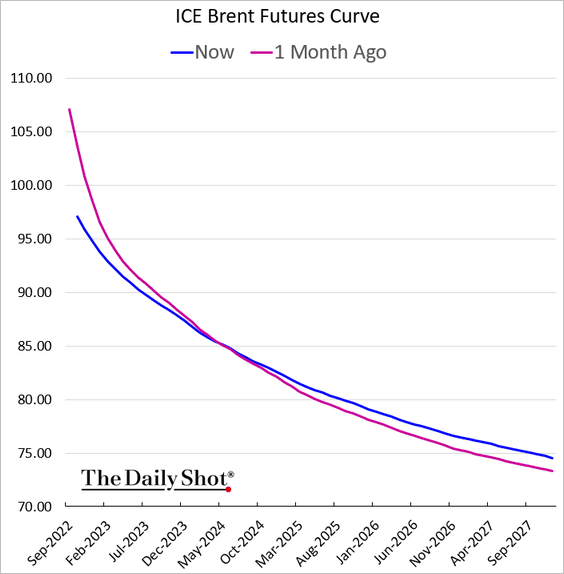

1. Crude oil backwardation continues to ease amid demand uncertainty.

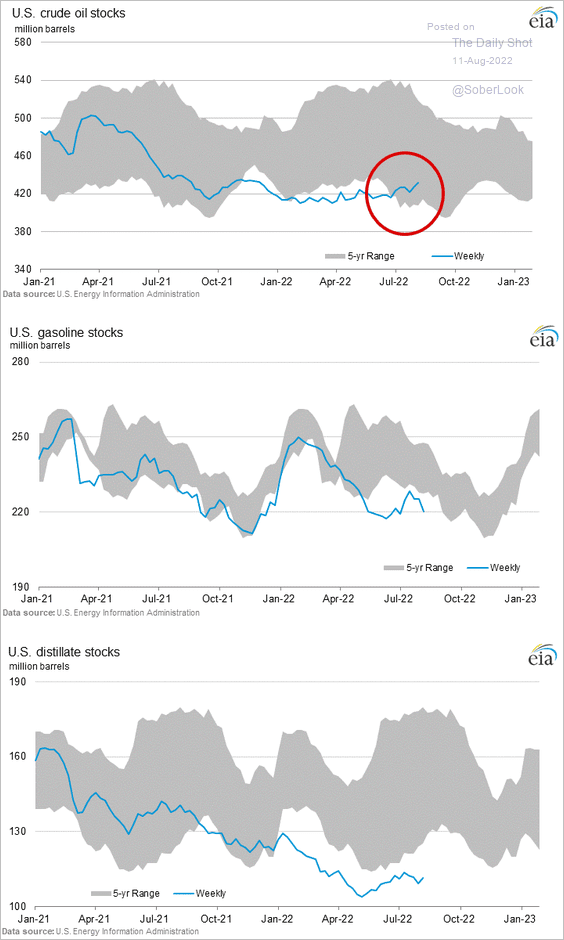

2. US crude oil inventories are moving deeper inside the five-year range. However, refined product stocks remain low.

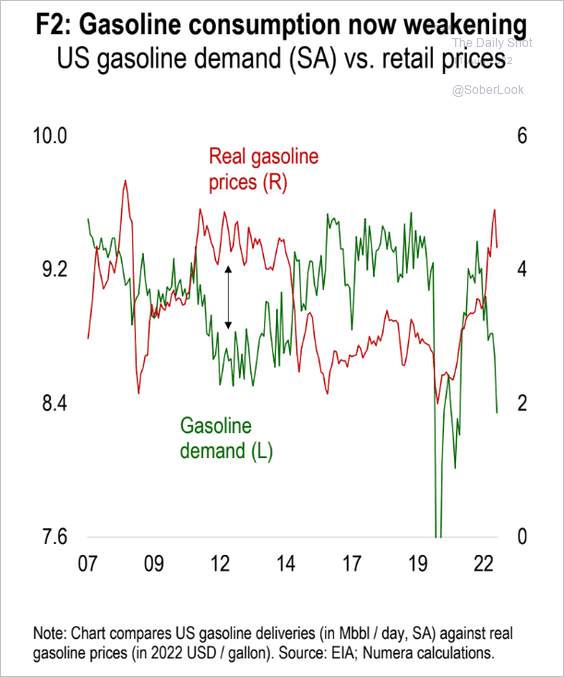

3. Will softer US gasoline demand keep a lid on prices (by pressuring refinery margins)?

Source: Numera Analytics

Source: Numera Analytics

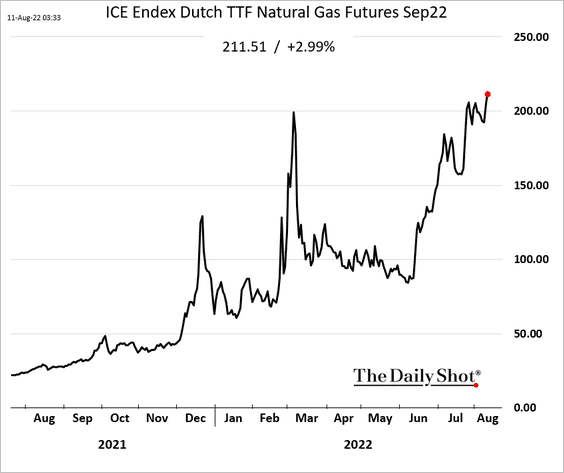

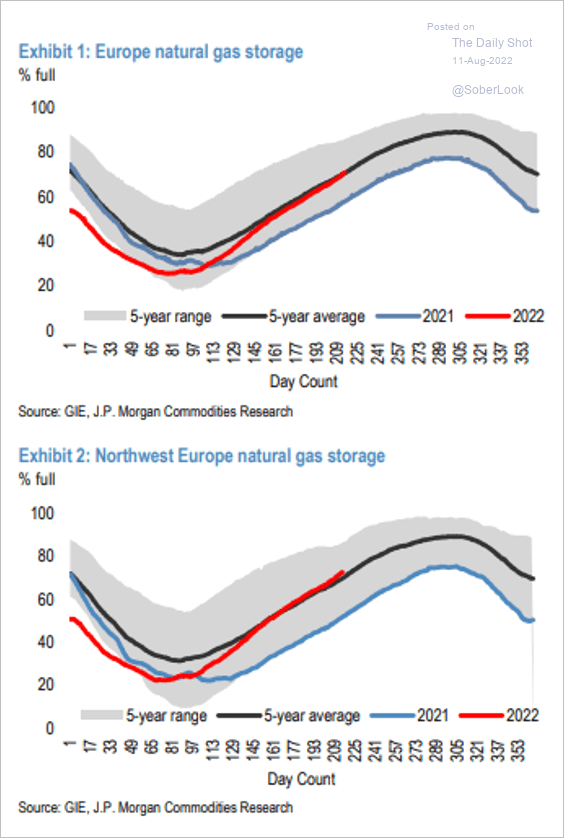

4. European natural gas futures are rallying, …

… despite improved storage levels.

Source: JP Morgan Research; @chigrl

Source: JP Morgan Research; @chigrl

——————–

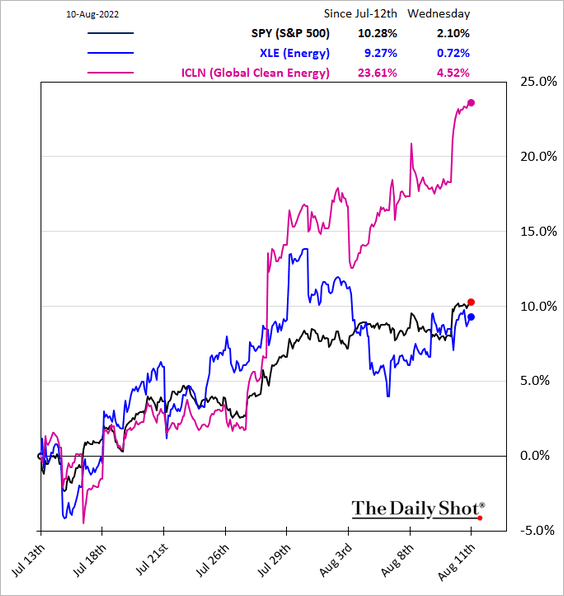

5. Clean energy shares have been surging.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

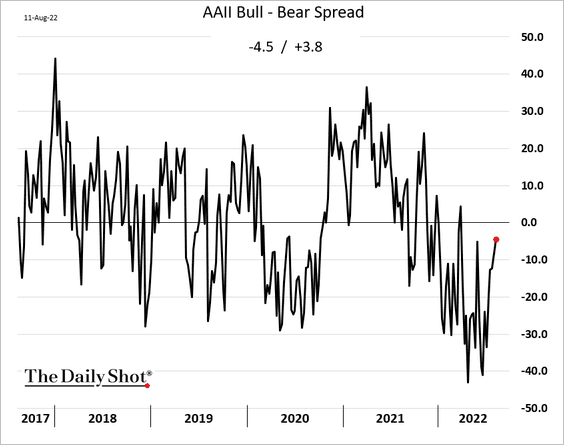

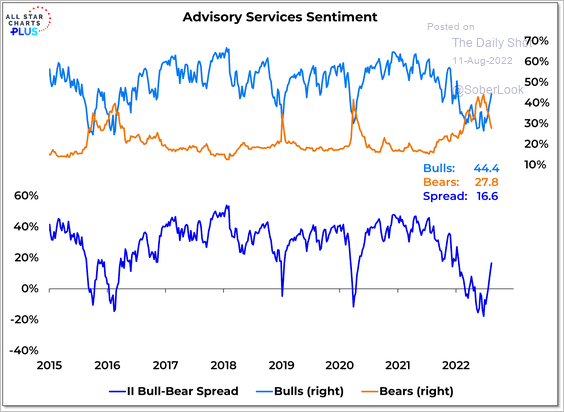

1. Investor sentiment is rebounding.

• AAII:

• Advisory services sentiment:

Source: @williedelwiche, h/t @pav_chartbook

Source: @williedelwiche, h/t @pav_chartbook

——————–

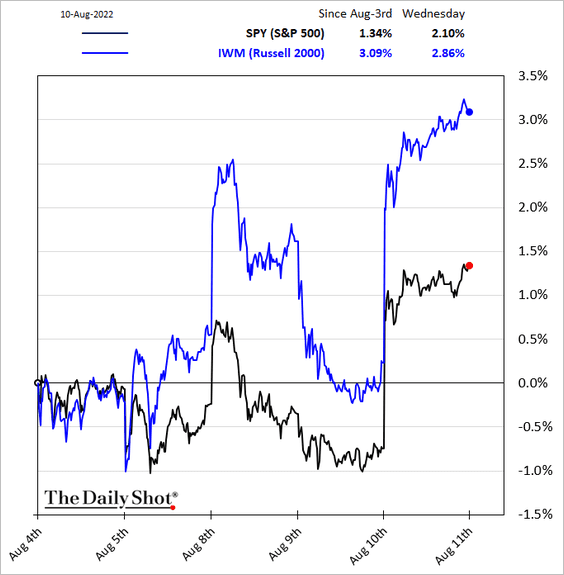

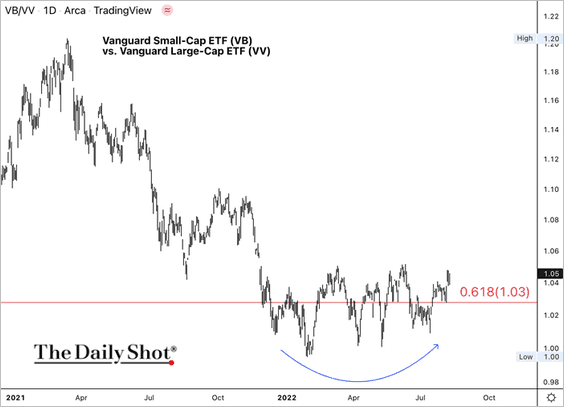

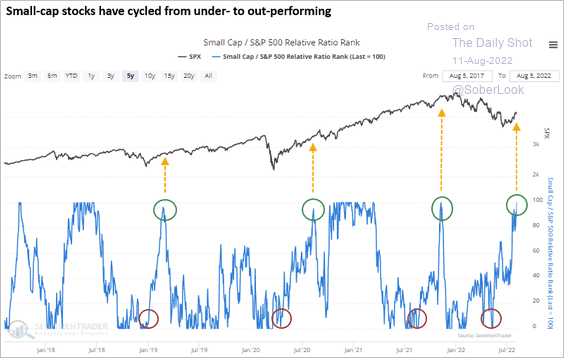

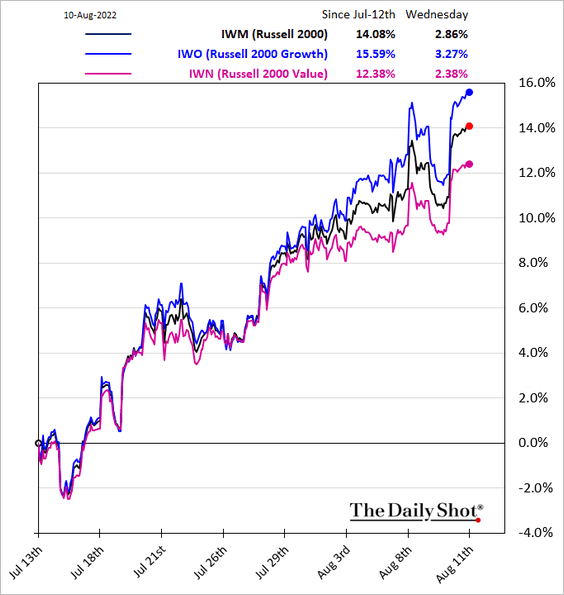

2. Small caps are outperforming (3 charts), …

Source: SentimenTrader

Source: SentimenTrader

… with small-cap growth stocks leading the way.

——————–

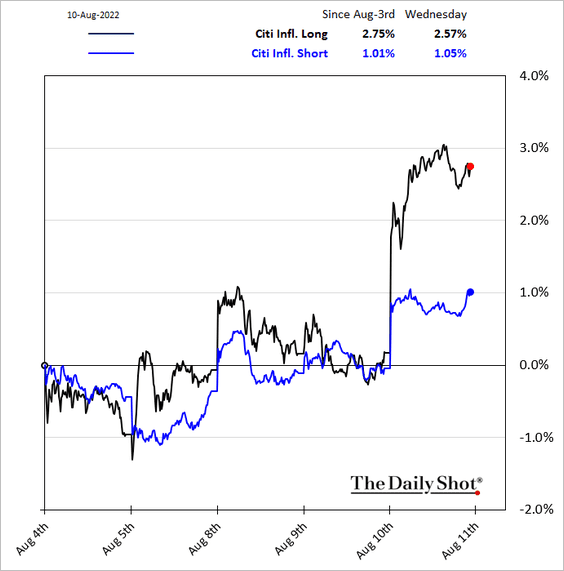

3. Inflation-sensitive stocks outperformed after the CPI report (boosted by the overall risk-on sentiment).

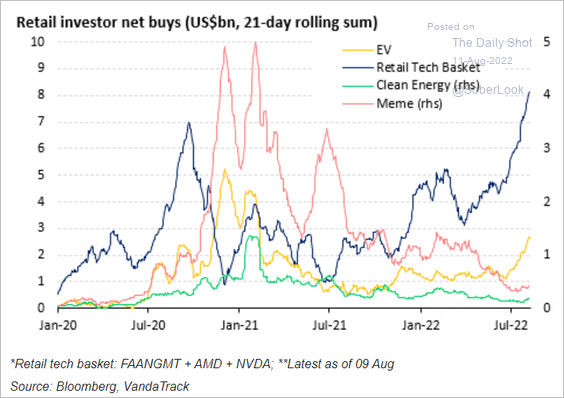

4. Retail investors have been buying tech for some time and recently started getting into EV stocks.

Source: Vanda Research

Source: Vanda Research

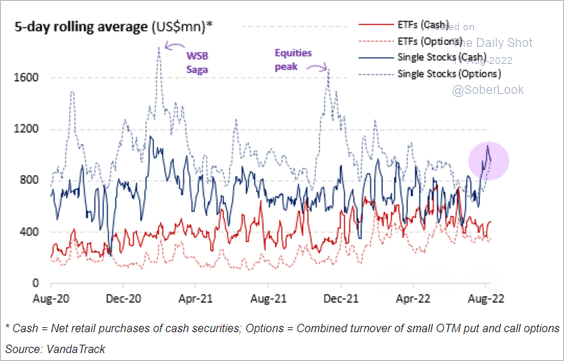

Retail investors’ options activity has picked up.

Source: Vanda Research

Source: Vanda Research

——————–

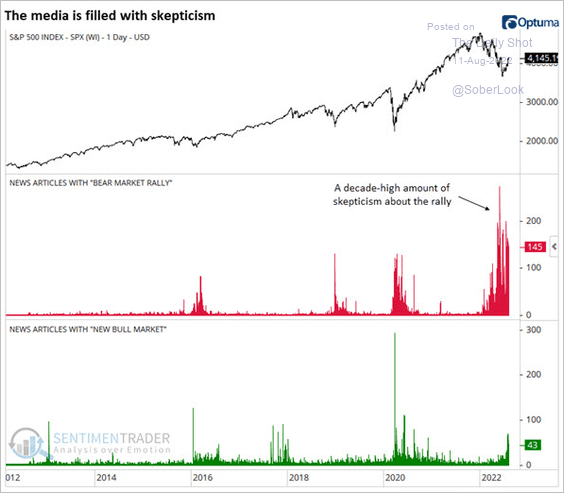

5. The current stock rally has been met with a great deal of skepticism.

Source: SentimenTrader

Source: SentimenTrader

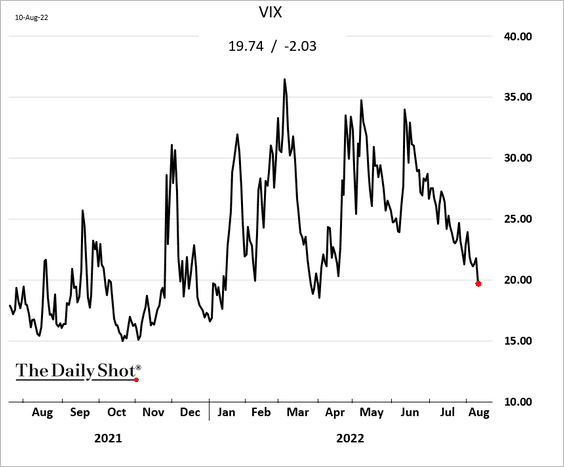

6. VIX is back below 20.

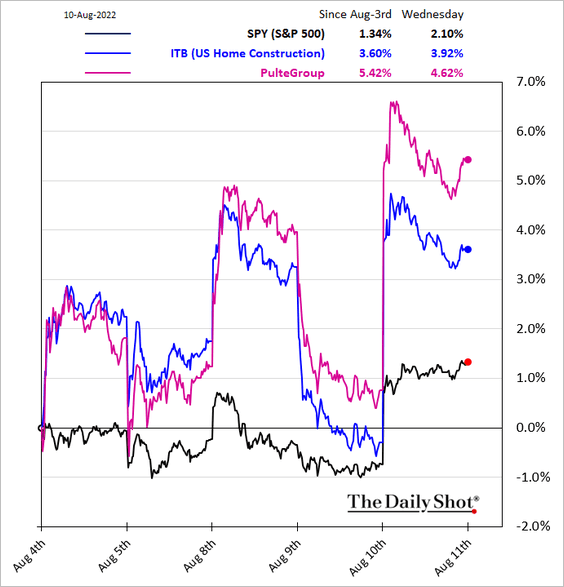

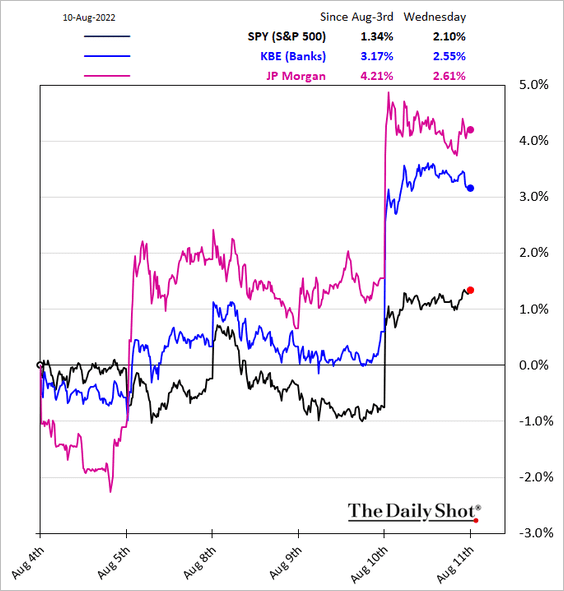

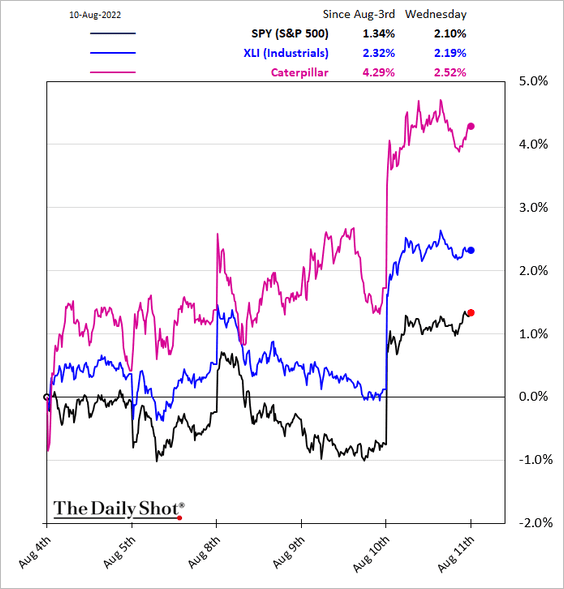

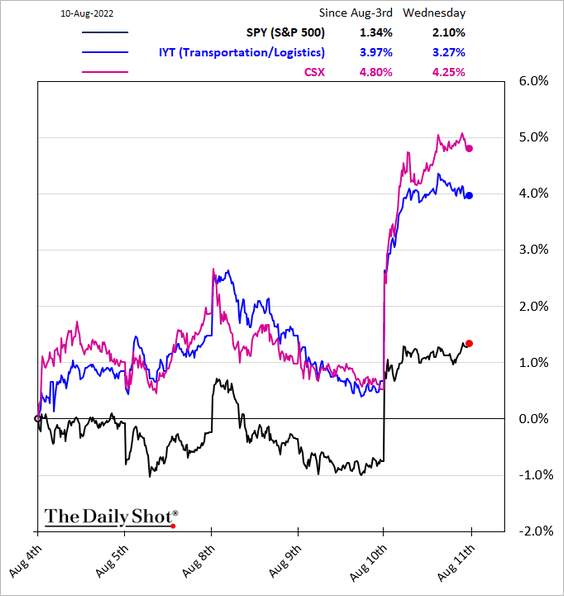

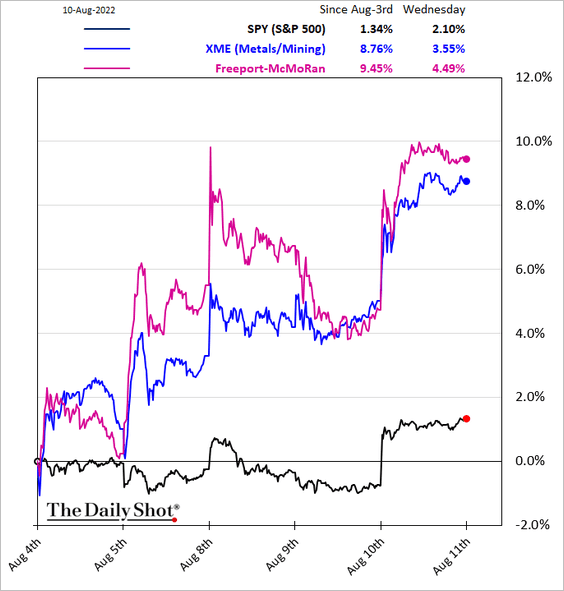

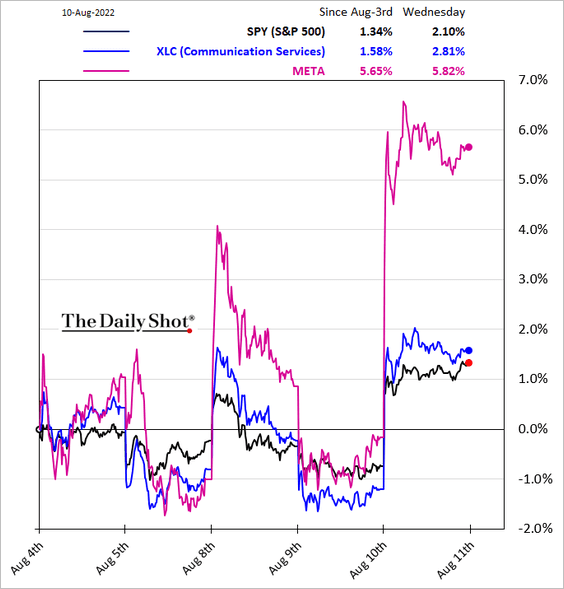

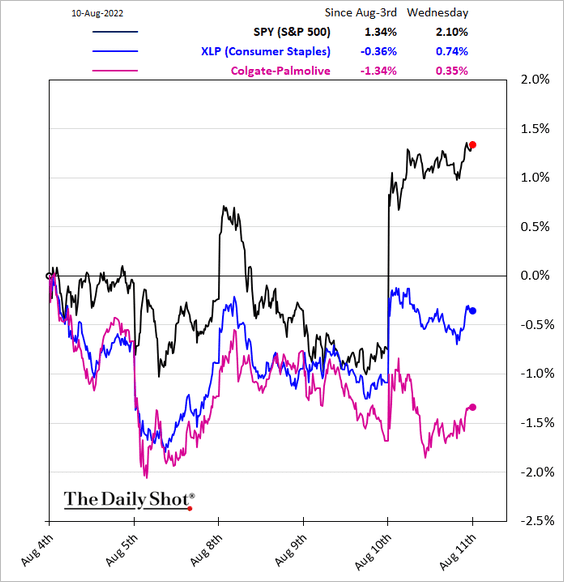

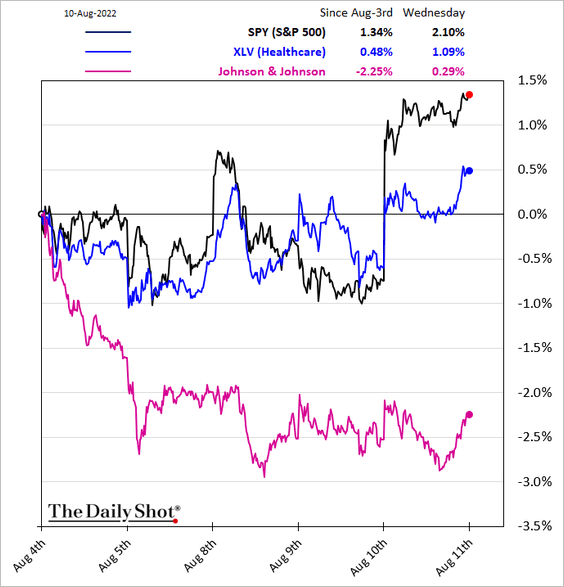

7. Finally, we have some sector updates (showing responses to the CPI report).

• Housing:

• Banks:

• Industrials:

• Transportation:

• Metals & Mining:

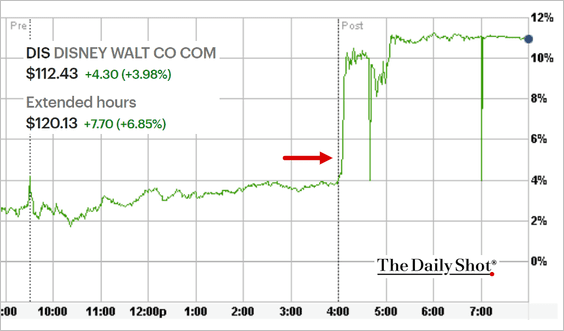

• Communication services:

The sector could get a boost from relatively strong Disney results after the close.

• Consumer Staples:

• Healthcare:

Back to Index

Credit

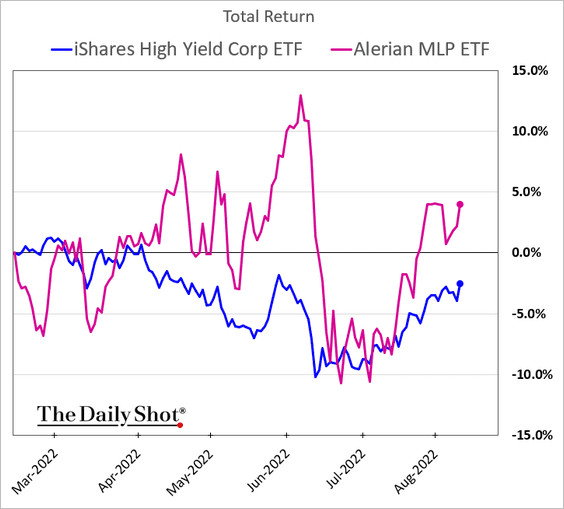

1. Energy pipeline MLPs remain highly volatile but are once again outperforming high-yield.

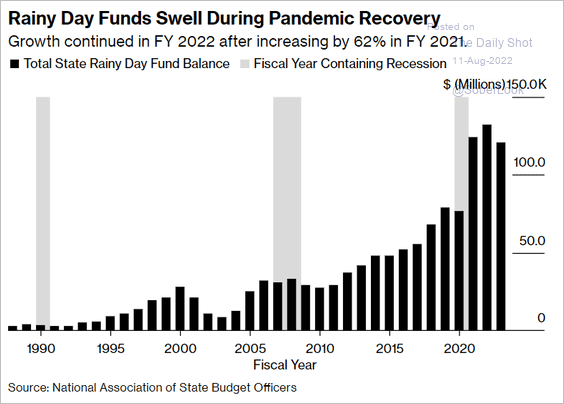

2. This chart shows US states’ rainy day funds growth.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Global Developments

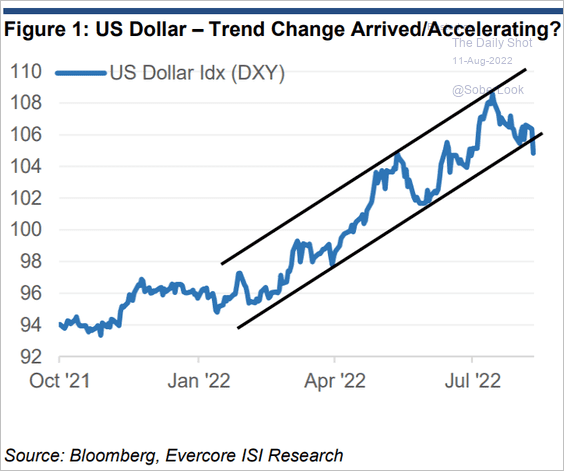

1. The US dollar broke below its uptrend channel.

Source: Evercore ISI Research

Source: Evercore ISI Research

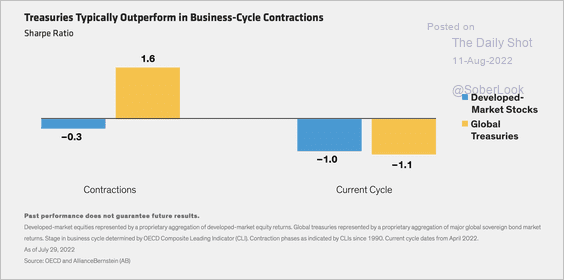

2. Sovereign bonds typically outperform stocks on a risk-adjusted basis during economic contractions.

Source: Alliance Bernstein Read full article

Source: Alliance Bernstein Read full article

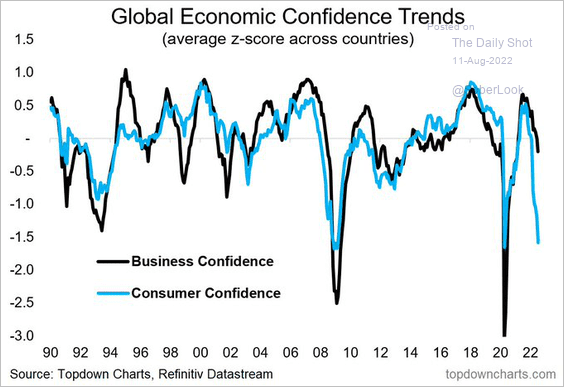

3. Business and consumer confidence indicators have diverged sharply.

Source: @Callum_Thomas, @topdowncharts

Source: @Callum_Thomas, @topdowncharts

——————–

Food for Thought

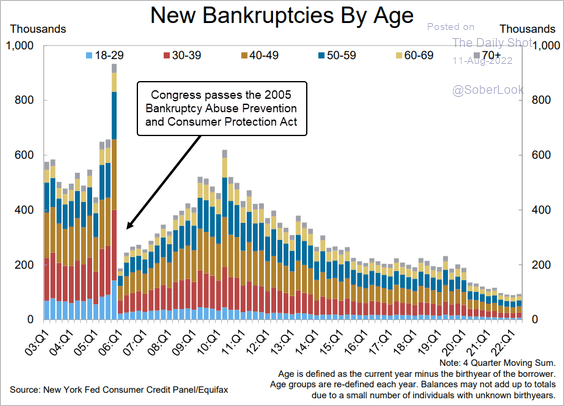

1. US personal bankruptcies by age:

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

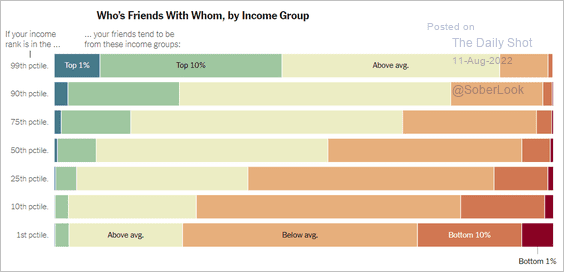

2. Your friends’ income bracket:

Source: The New York Times Read full article

Source: The New York Times Read full article

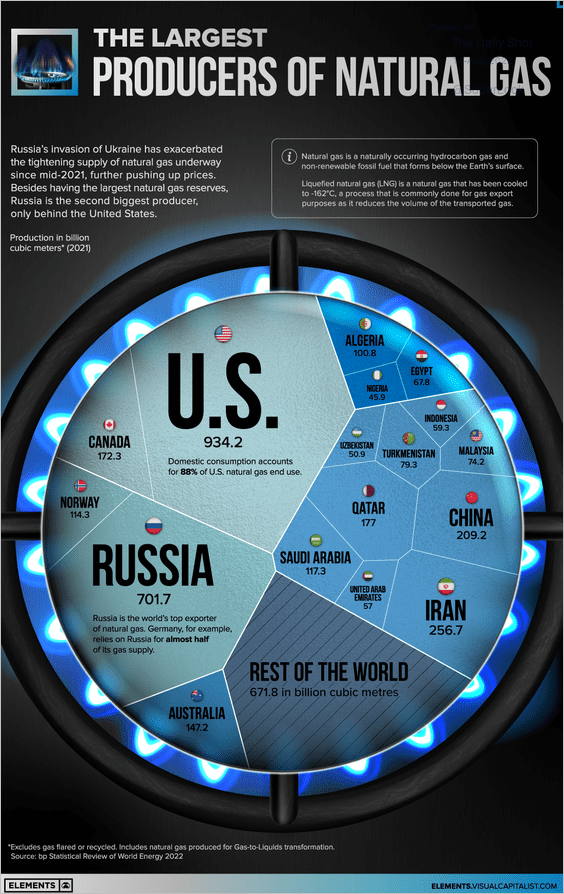

3. The largest producers of natural gas:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

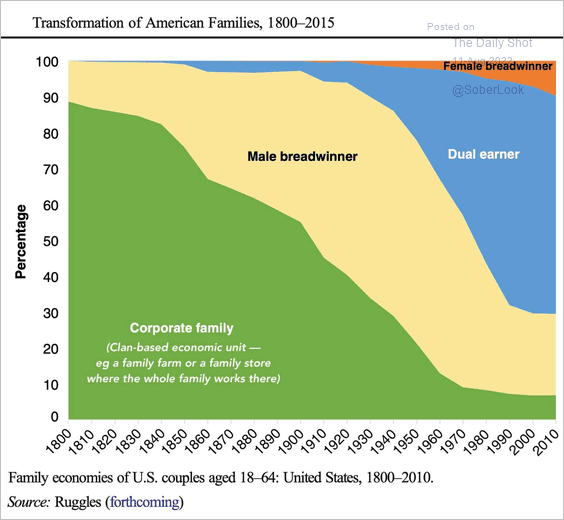

4. US family structure over time:

Source: @alyssamvance

Source: @alyssamvance

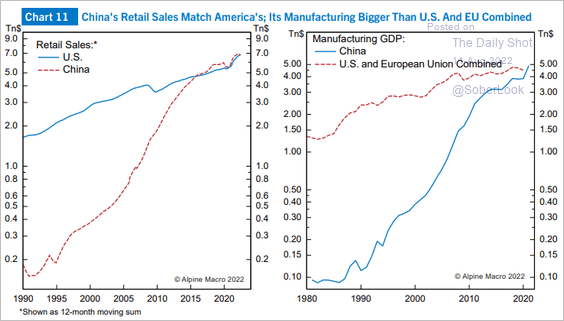

5. China’s retail sales and manufacturing in perspective:

Source: Alpine Macro

Source: Alpine Macro

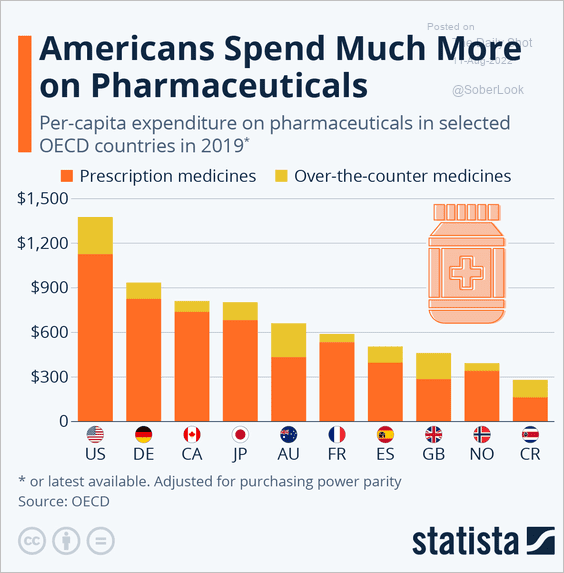

6. Spending on pharmaceuticals:

Source: Statista

Source: Statista

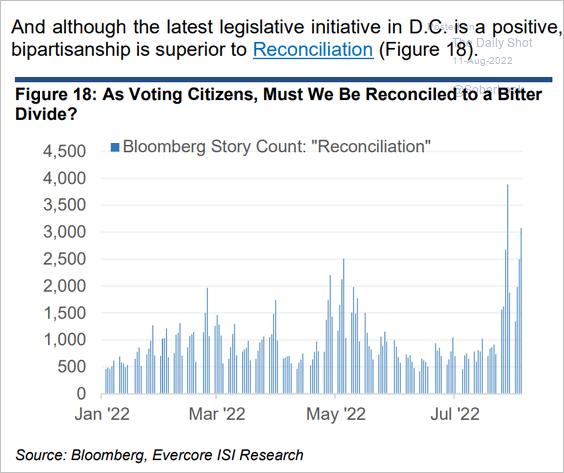

7. Passing legislation via Reconciliation:

Source: Evercore ISI Research

Source: Evercore ISI Research

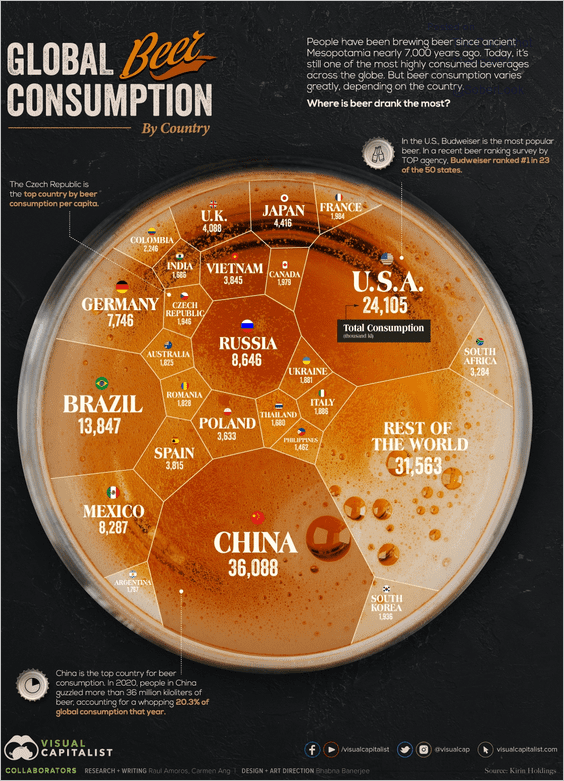

8. Global beer consumption:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Back to Index