The Daily Shot: 10-Aug-22

• The United States

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Global Developments

• Food for Thought

The United States

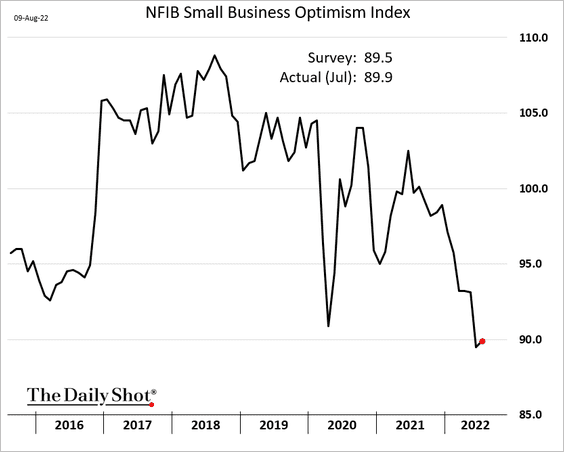

1. The NFIB small business sentiment index edged higher in July.

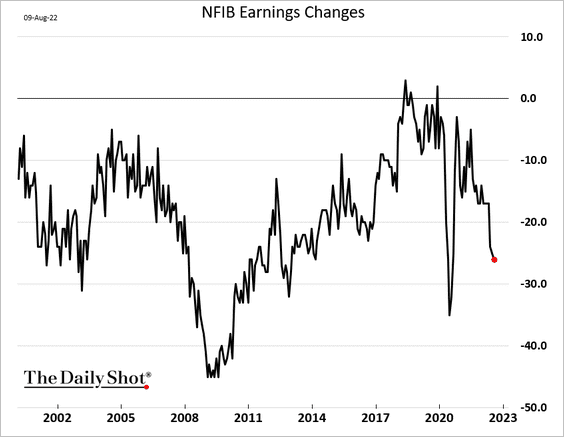

• But businesses are reporting deteriorating earnings.

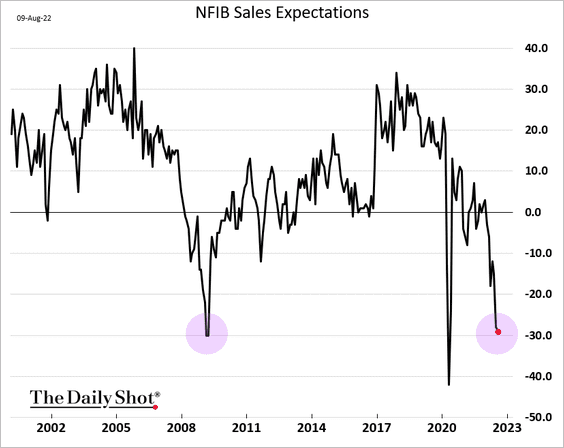

And sales expectations look recessionary.

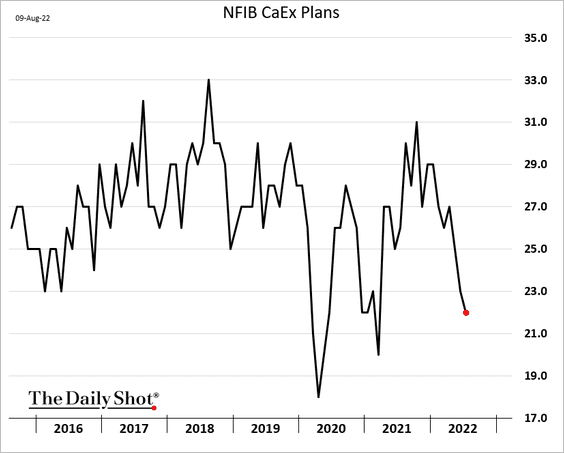

• CapEx expectations continue to move lower.

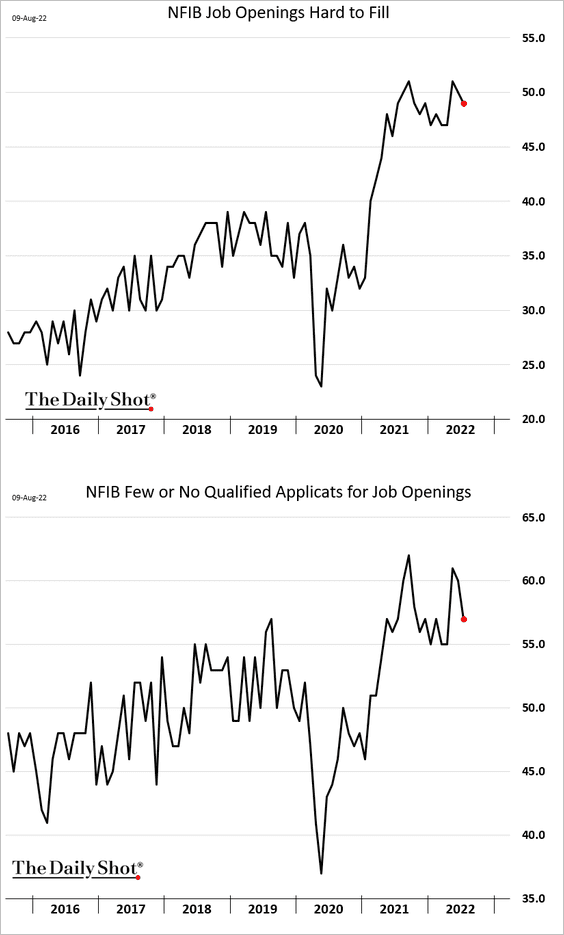

• Hiring remains a challenge.

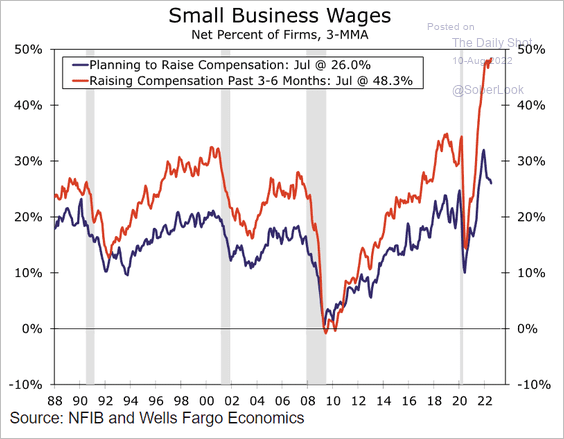

• Companies have been boosting wages but are now becoming more conservative with their compensation plans.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

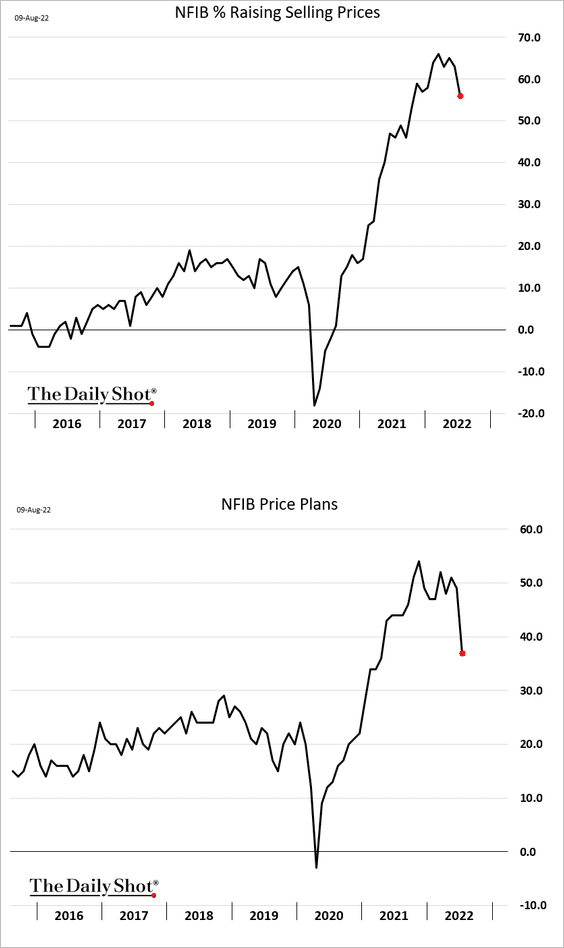

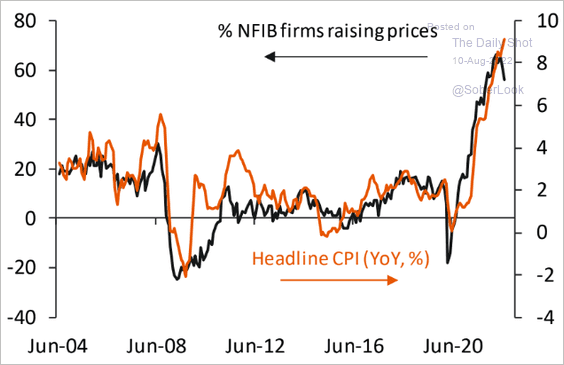

• Fewer firms are raising (or expect to be raising) prices, …

… which points to slower consumer price gains ahead.

Source: Piper Sandler

Source: Piper Sandler

——————–

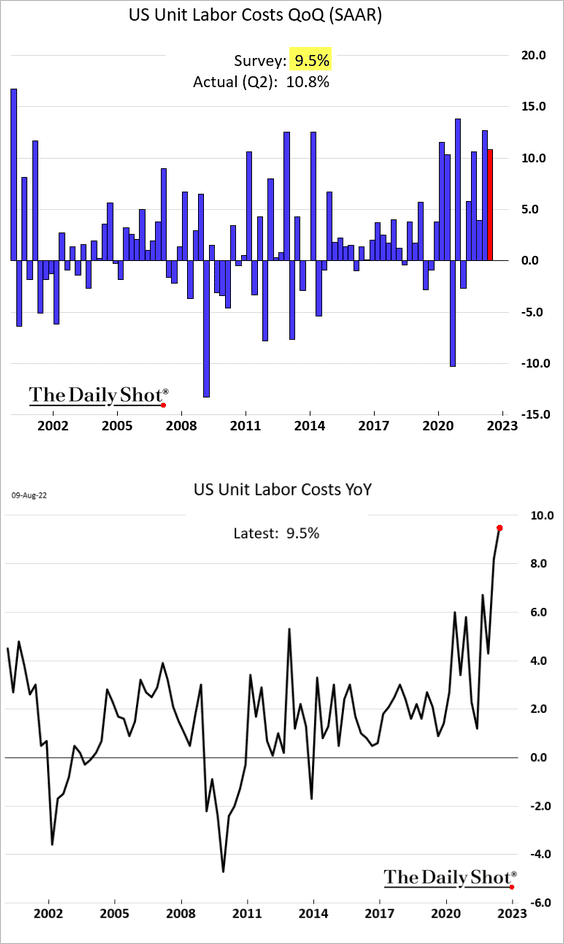

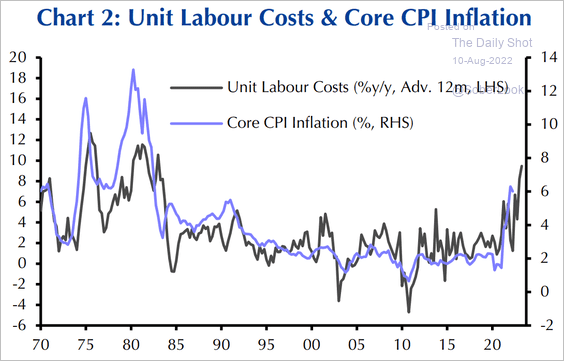

2. Unit labor costs are surging, …

… which could signal faster inflation.

Source: Capital Economics

Source: Capital Economics

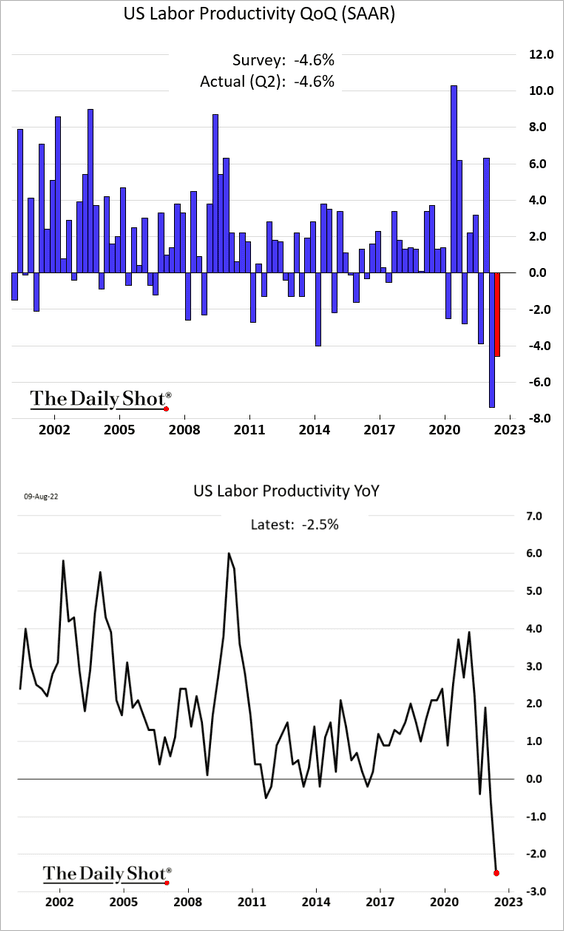

• Labor productivity tumbled this year. Some economists suspect that these productivity figures will be revised higher.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

——————–

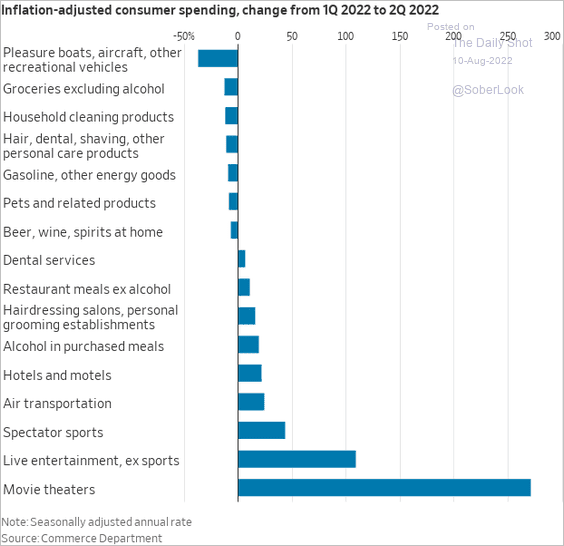

3. US consumers have shifted spending from goods to experiences.

Source: @WSJ Read full article

Source: @WSJ Read full article

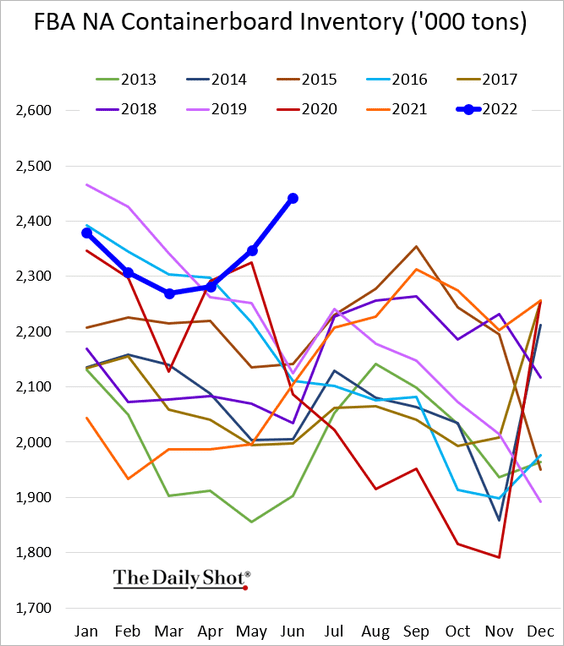

4. Related to the trend above, packaging supplies are surging as shipping demand slows.

Source: Richard Bourke, Ryan Fox, BI

Source: Richard Bourke, Ryan Fox, BI

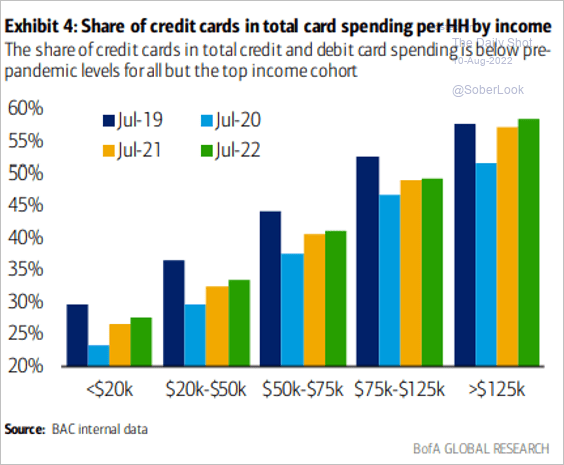

5. Except for the highest income bracket, households’ credit card spending is still below pre-COVID levels.

Source: BofA Global Research

Source: BofA Global Research

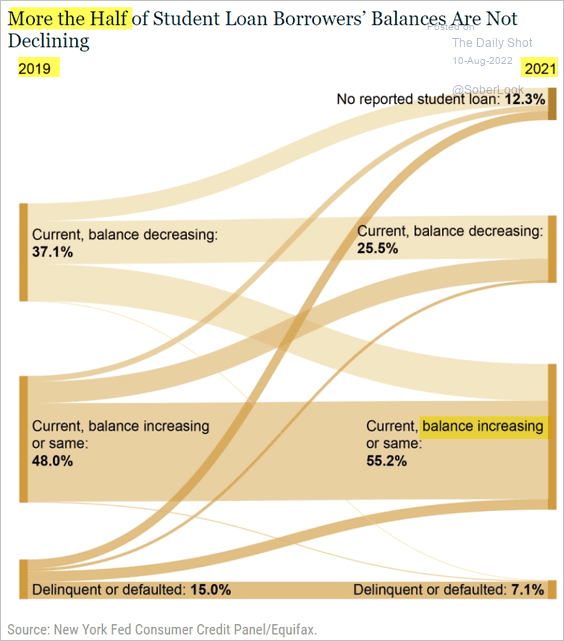

6. More than half of student loan borrowers made no progress in paying down their student debt since 2019.

Source: Federal Reserve Bank of New York Read full article

Source: Federal Reserve Bank of New York Read full article

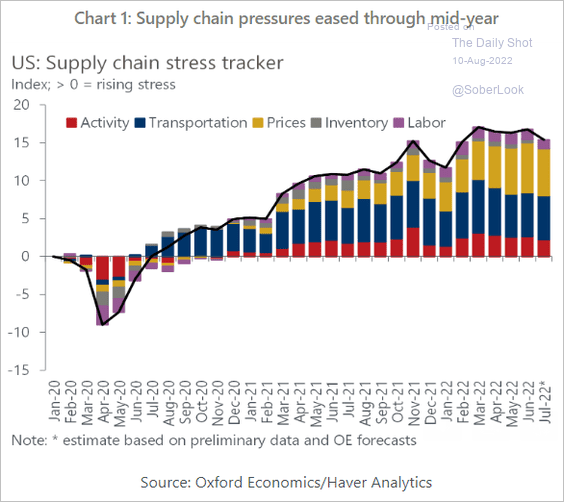

7. The Oxford Economics Supply Chain Stress Index eased modestly last month.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Europe

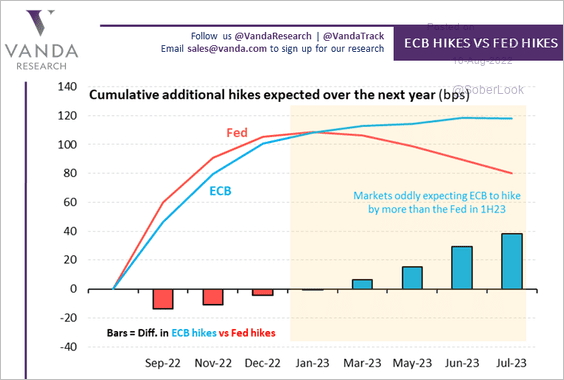

1. The ECB’s rate trajectory is expected to outpace the Fed next year.

Source: Vanda Research

Source: Vanda Research

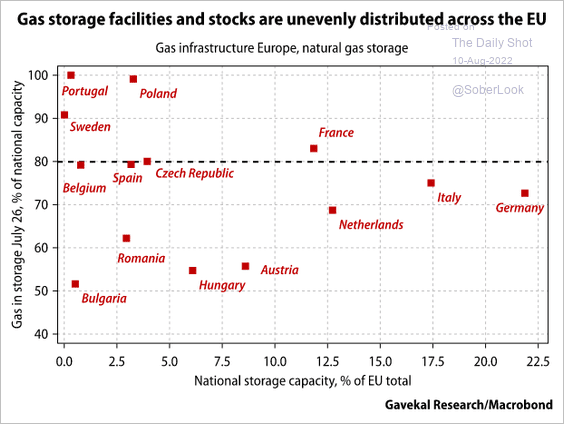

2. This scatterplot shows natural gas storage vs. storage capacity in the EU.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Japan

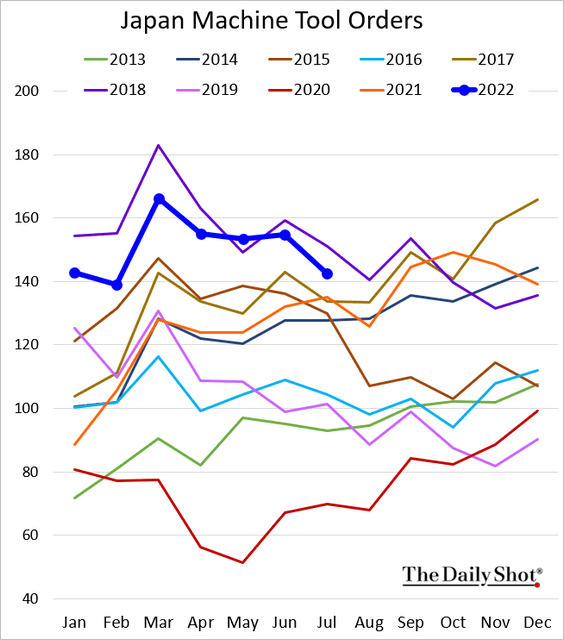

1. Machine tool orders are slowing.

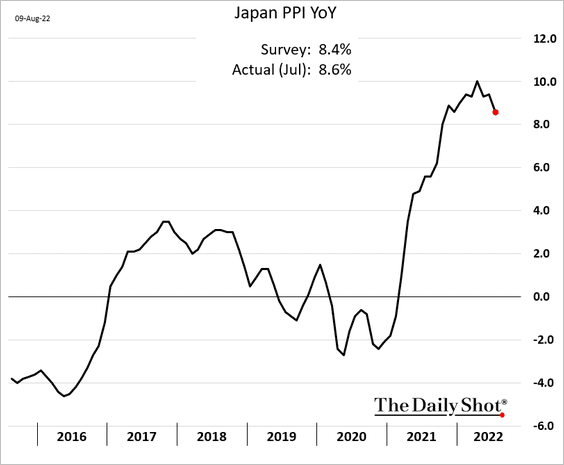

2. Producer price gains eased as subsidies cap energy prices.

Back to Index

Asia – Pacific

1. Taiwan’s stocks could come under further pressure as semiconductor demand slumps.

![]() Source: Alpine Macro

Source: Alpine Macro

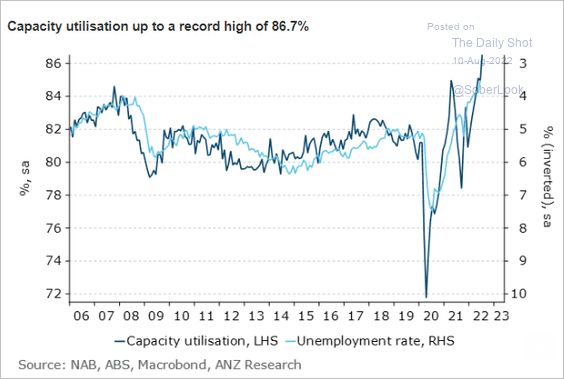

2. Australia’s capacity utilization hit a record high.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

China

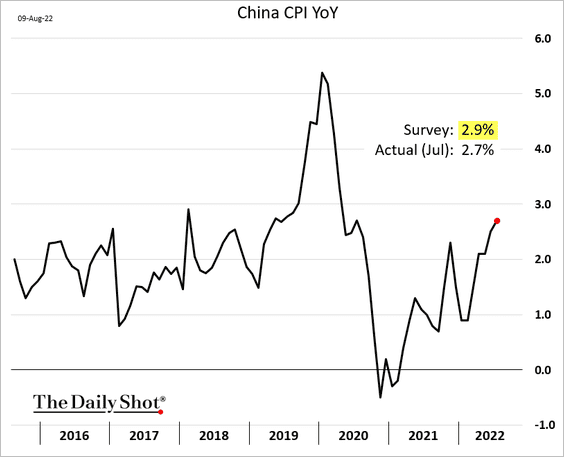

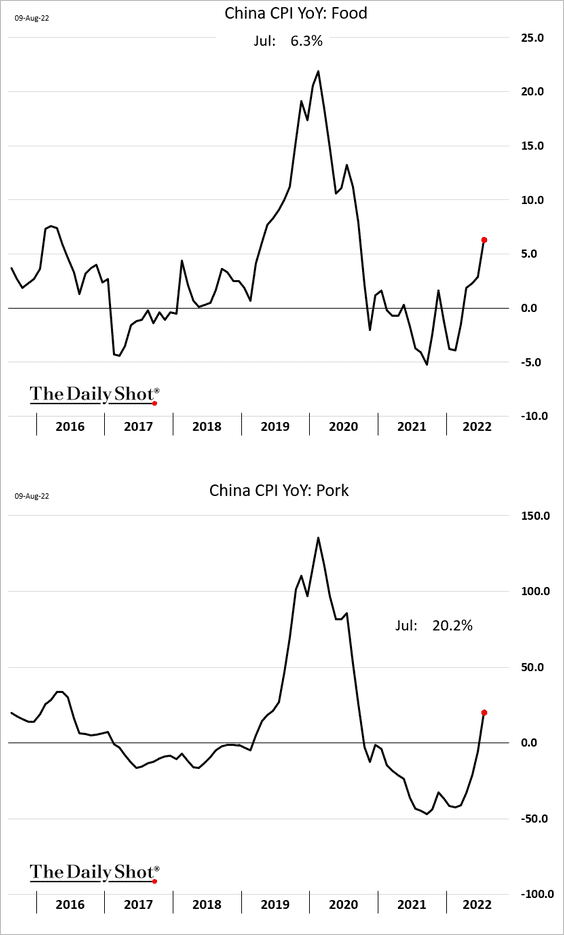

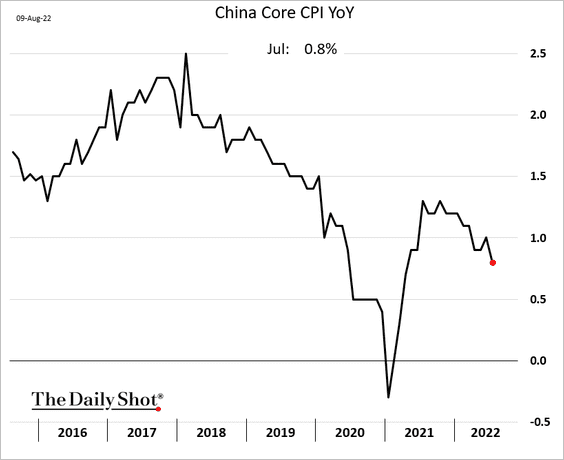

1. The CPI increase was softer than expected, …

… with gains driven by food prices.

The core inflation continues to moderate.

——————–

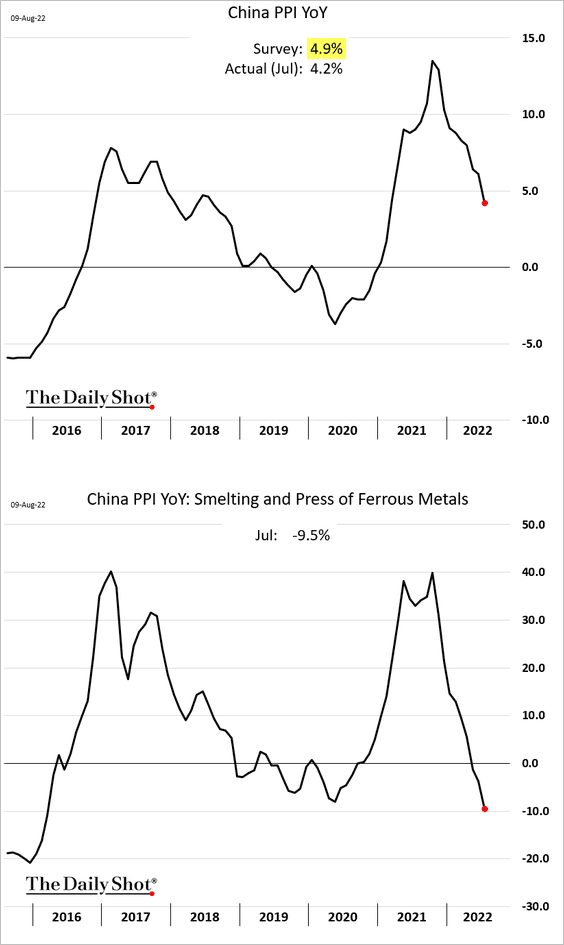

2. The PPI also surprised to the downside.

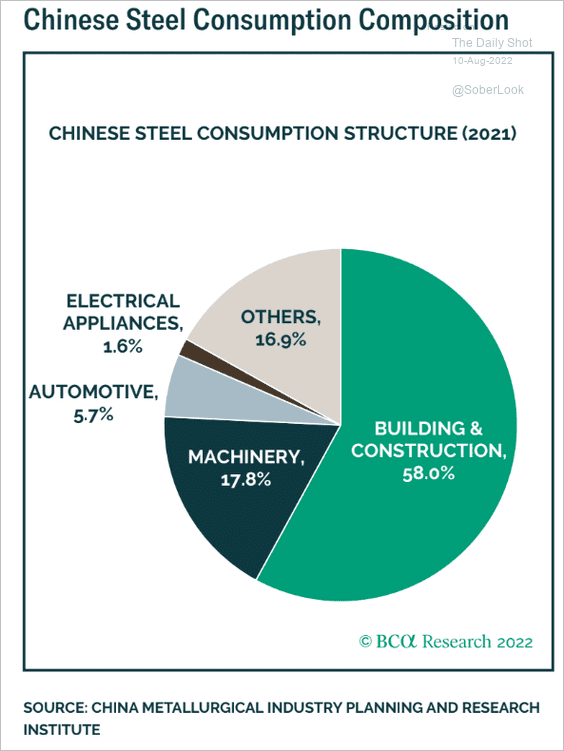

What’s going on with the ferrous metals sector (2nd chart above)? Here is the answer.

Source: BCA Research

Source: BCA Research

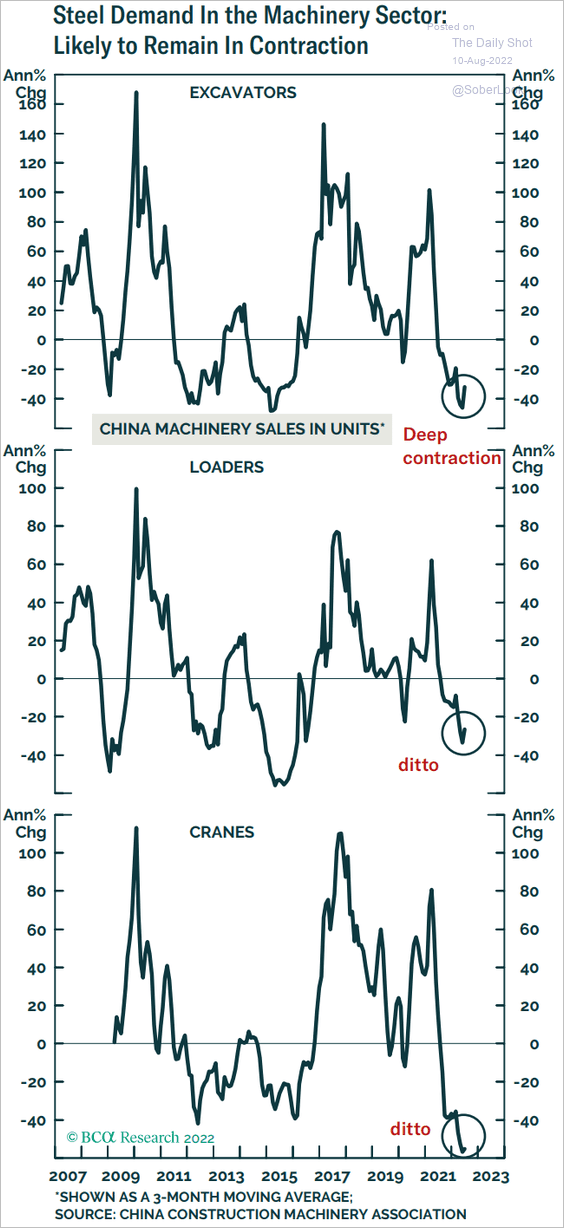

We know that building construction has been depressed. Machinery demand is also under pressure.

Source: BCA Research

Source: BCA Research

——————–

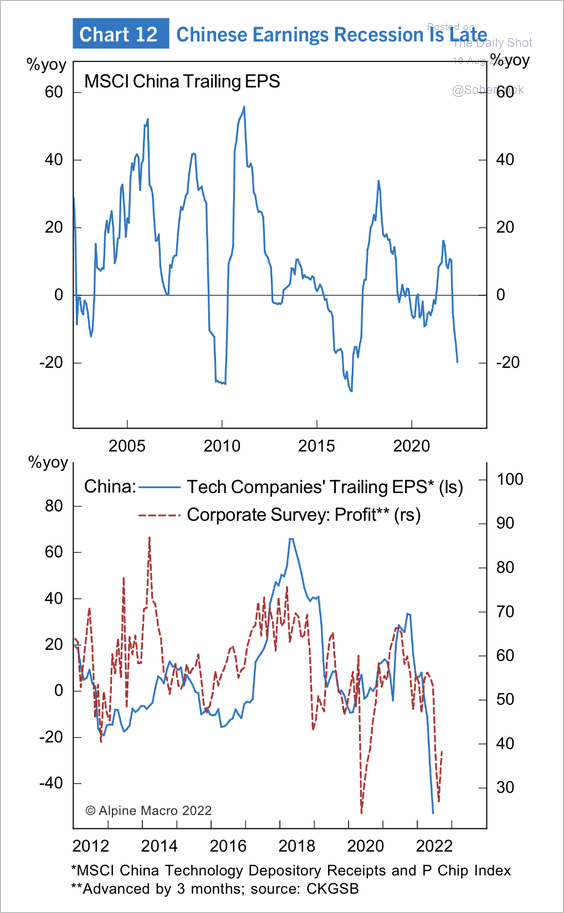

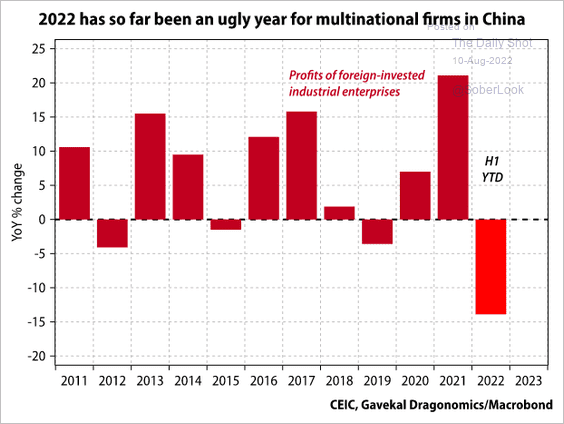

3. Earnings have dropped considerably, on par with some of the worst profit contractions in history.

Source: Alpine Macro

Source: Alpine Macro

• Multinationals took a hit in China this year.

Source: Gavekal Research

Source: Gavekal Research

——————–

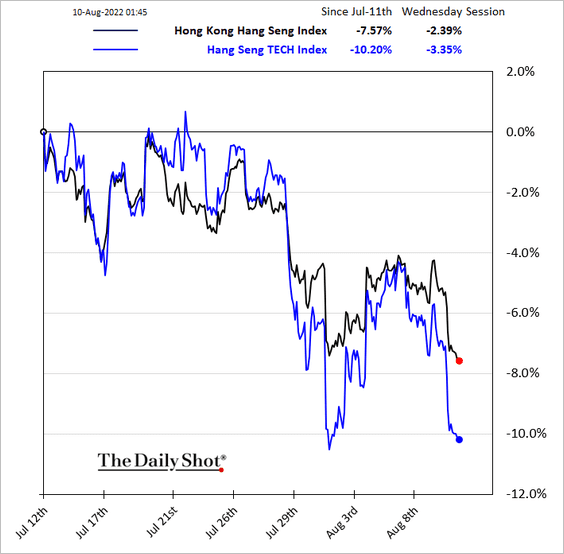

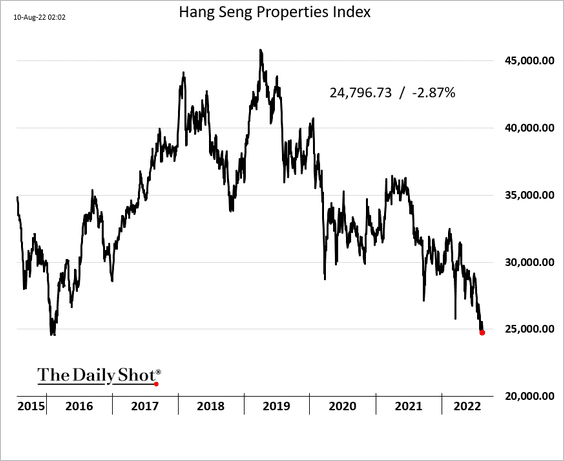

4. Stock prices are tumbling in Hong Kong.

The property developer stock index hit the lowest level since early 2016.

Back to Index

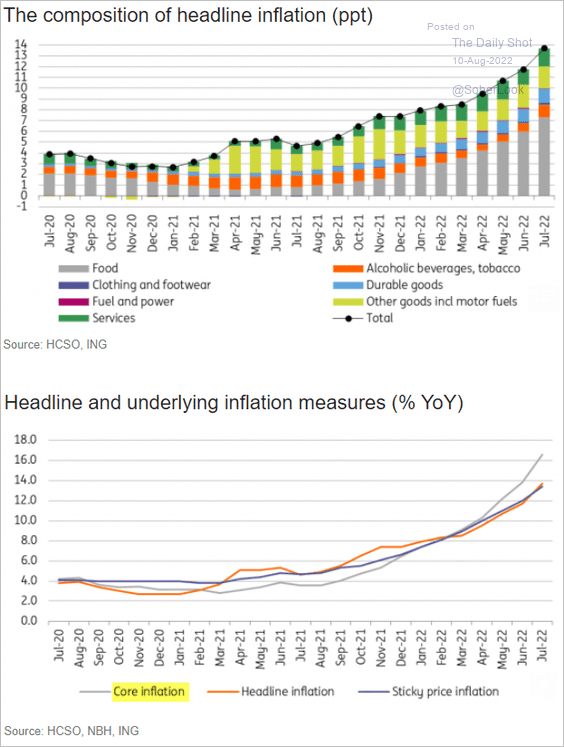

Emerging Markets

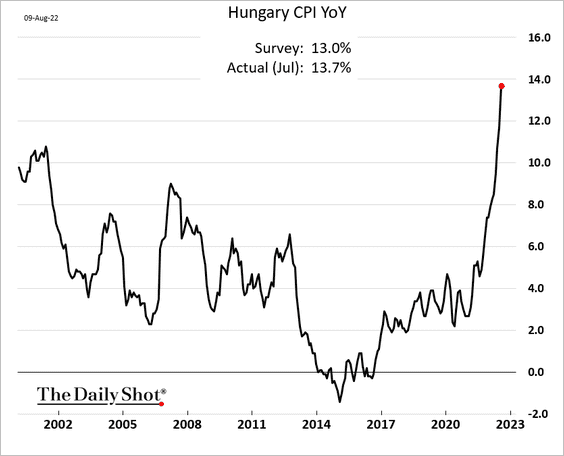

1. Hungarian inflation is surging.

Source: ING

Source: ING

——————–

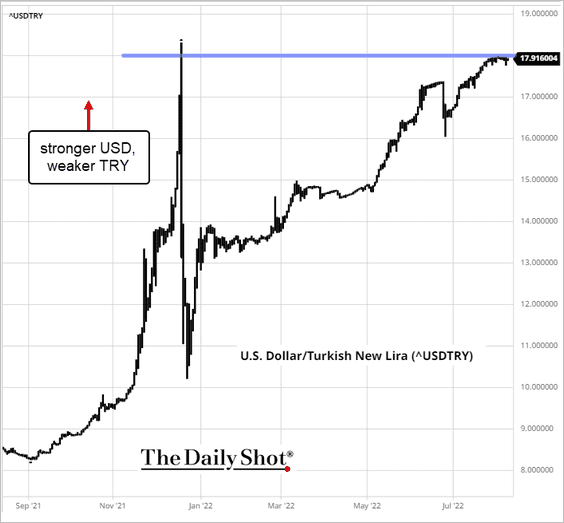

2. The Turkish lira continues to trade near 18 to the dollar.

Source: barchart.com

Source: barchart.com

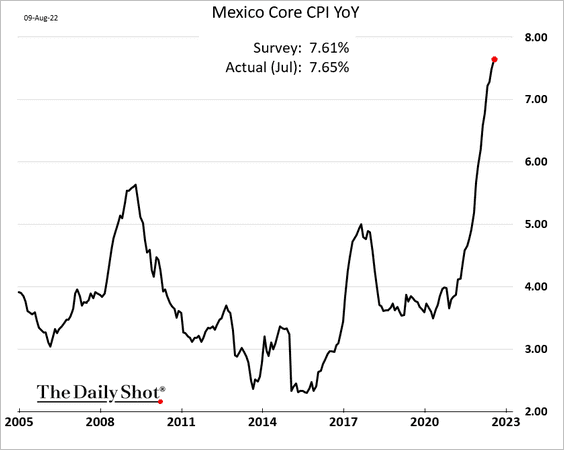

3. Mexican inflation keeps climbing.

Back to Index

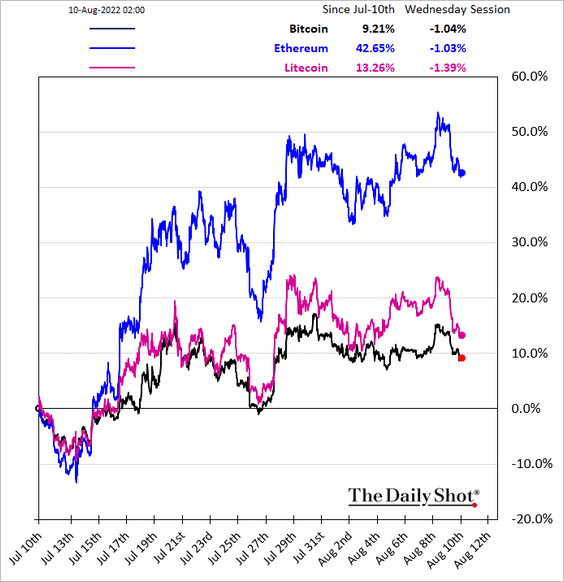

Cryptocurrency

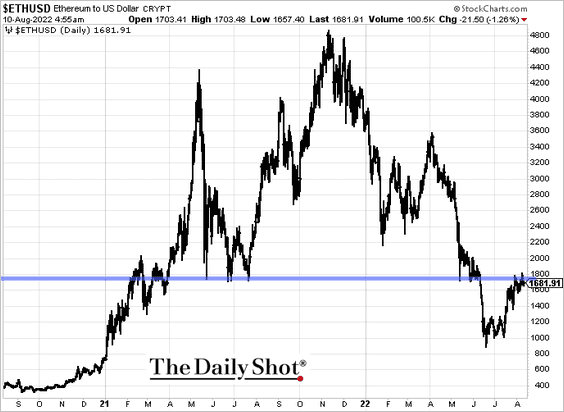

1. Ether continues to outperform, but it hit resistance (2nd chart).

——————–

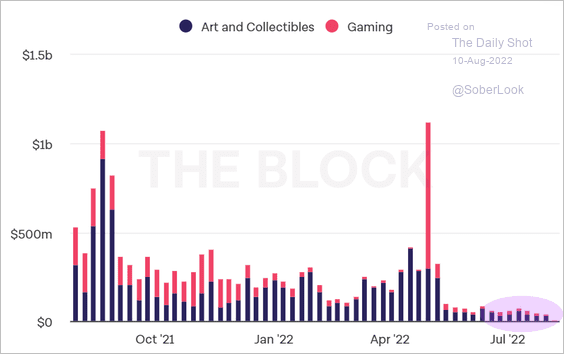

2. NFT trading volumes have slowed.

Source: The Block

Source: The Block

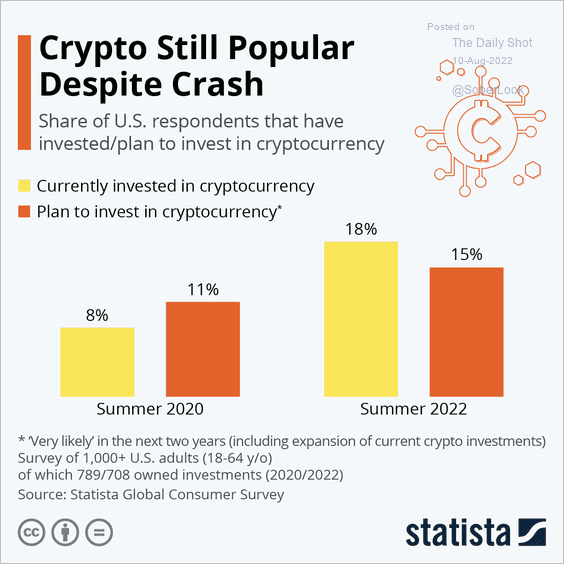

3. Despite the selloff, crypto remains popular.

Source: Statista

Source: Statista

Back to Index

Commodities

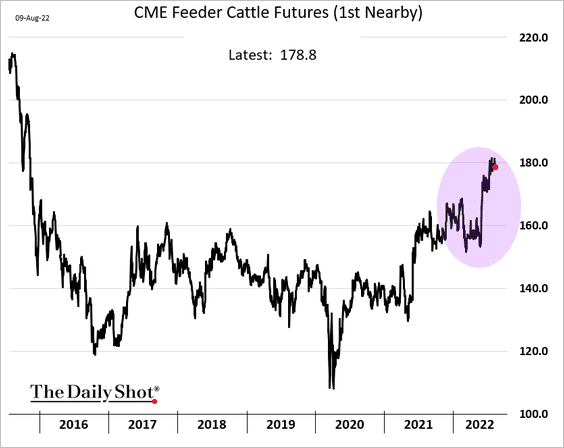

US feeder cattle futures rallied in recent weeks.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Energy

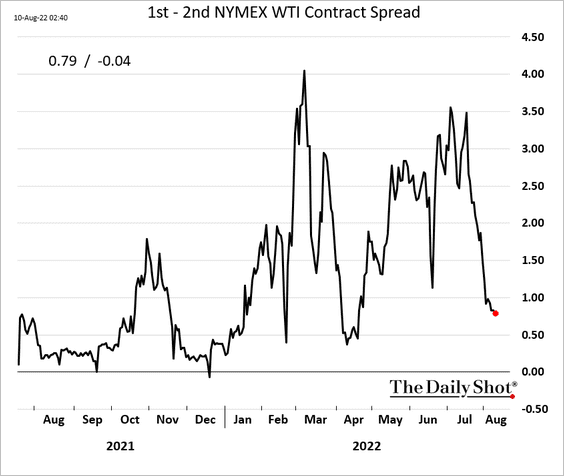

1. Crude oil backwardation has been easing.

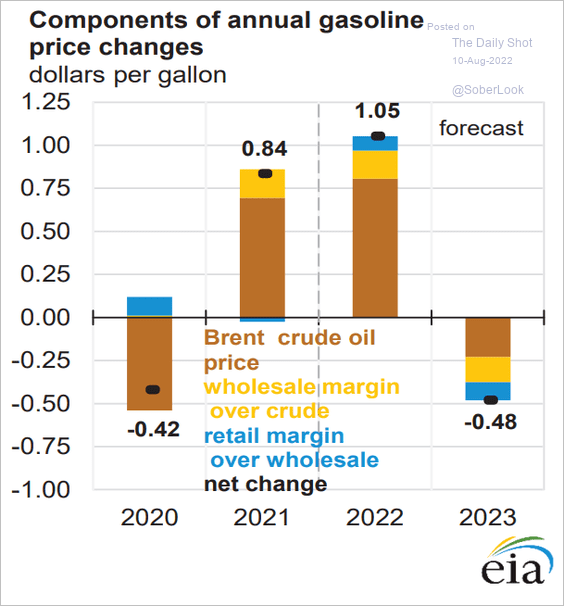

2. Here is the attribution of the expected US retail gasoline price decline next year.

Source: @EIAgov, h/t @pav_chartbook

Source: @EIAgov, h/t @pav_chartbook

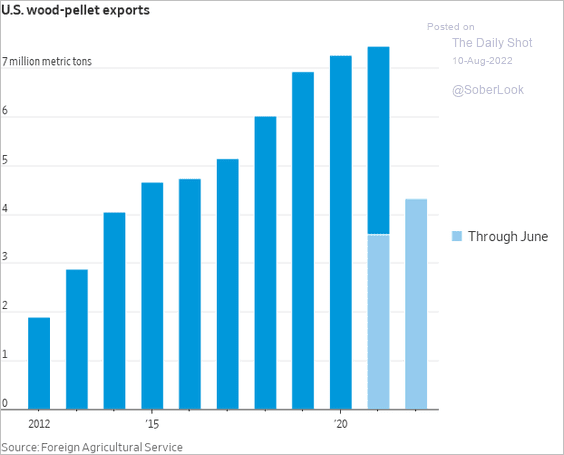

3. US wood-pellet exports have been rising quickly.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

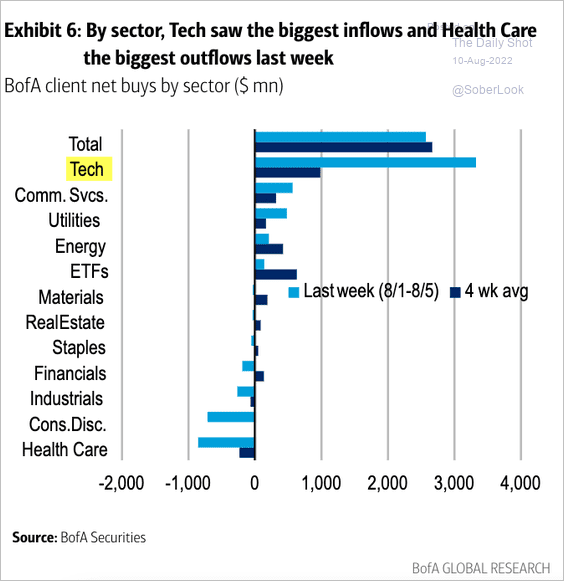

1. BofA’s clients jumped into tech last week.

Source: BofA Global Research

Source: BofA Global Research

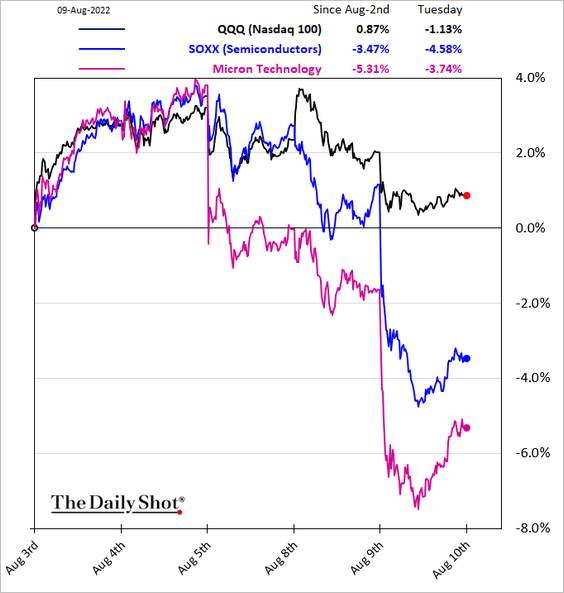

2. Semiconductor shares took a hit as demand wanes.

Source: IBD Read full article

Source: IBD Read full article

Semiconductor inventories have been rebounding.

![]() Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

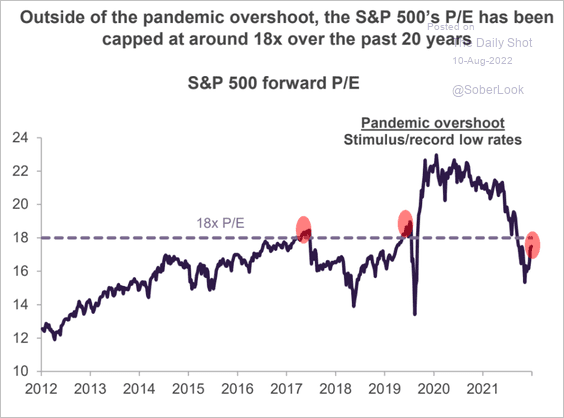

3. Will the S&P 500 hit resistance at the 18x P/E multiple?

Source: Truist Advisory Services

Source: Truist Advisory Services

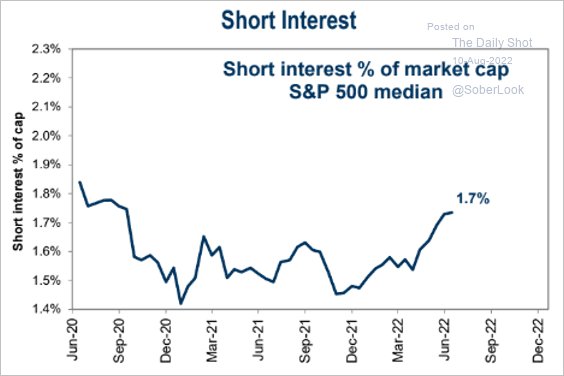

4. The recent rebound has been fueled by short-covering.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

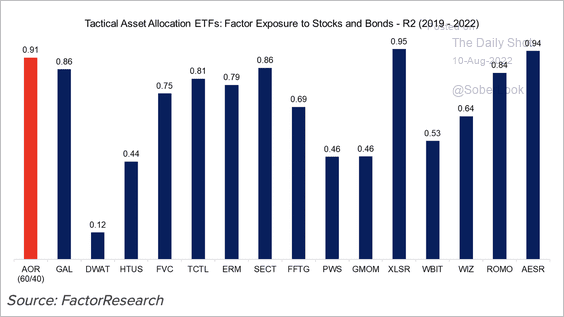

5. Many “tactical” ETFs have a fairly strong correlation to the standard 60% equity/40% bond portfolio.

Source: FactorResearch Read full article

Source: FactorResearch Read full article

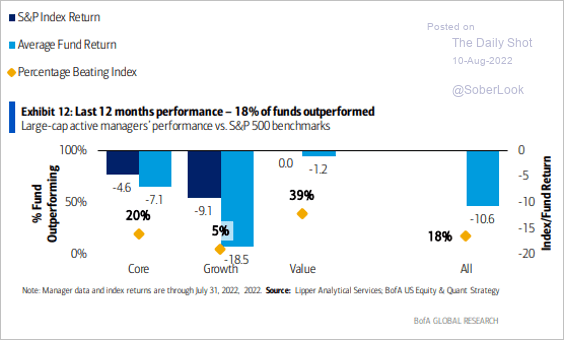

6. Only 18% of large-cap managers beat their benchmark over the past 12 months.

Source: BofA Global Research

Source: BofA Global Research

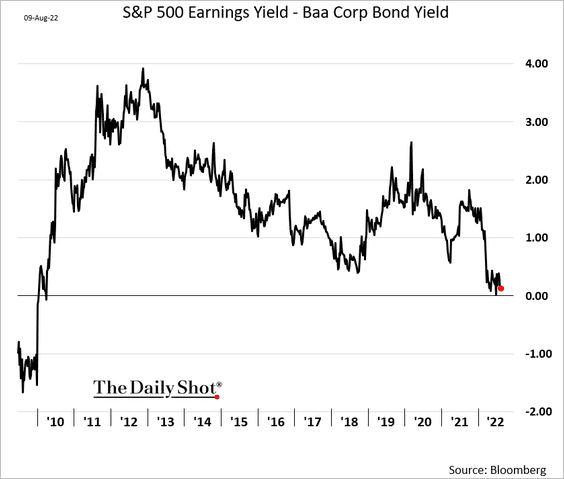

7. US stocks don’t look very attractive relative to corporate bonds.

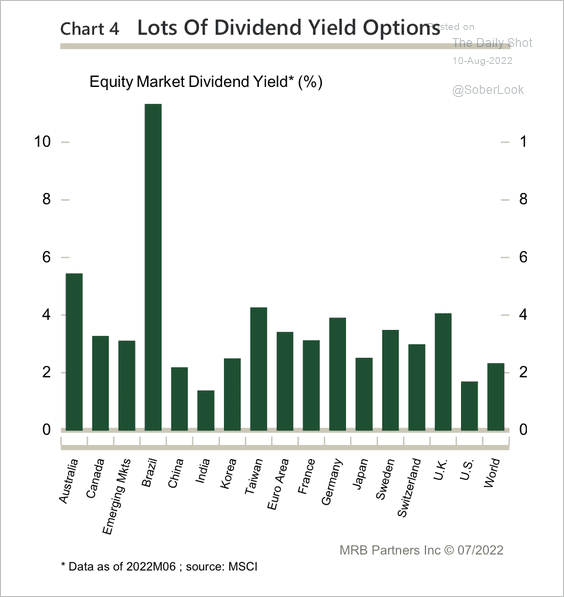

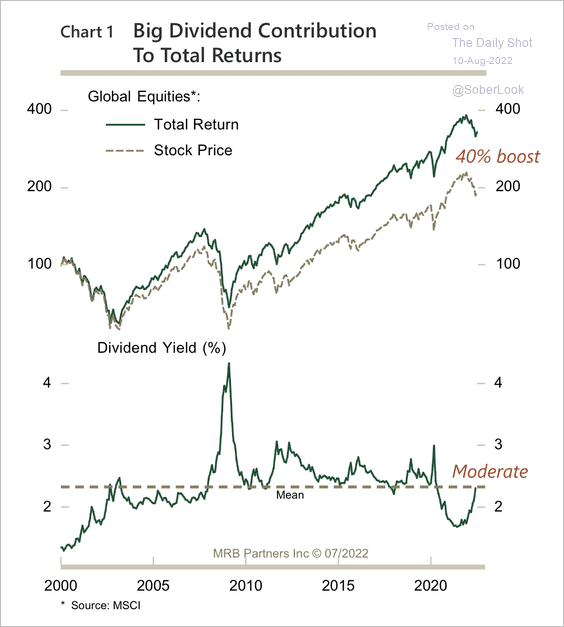

8. Dividend yields vary significantly across key emerging and developed markets.

Source: MRB Partners

Source: MRB Partners

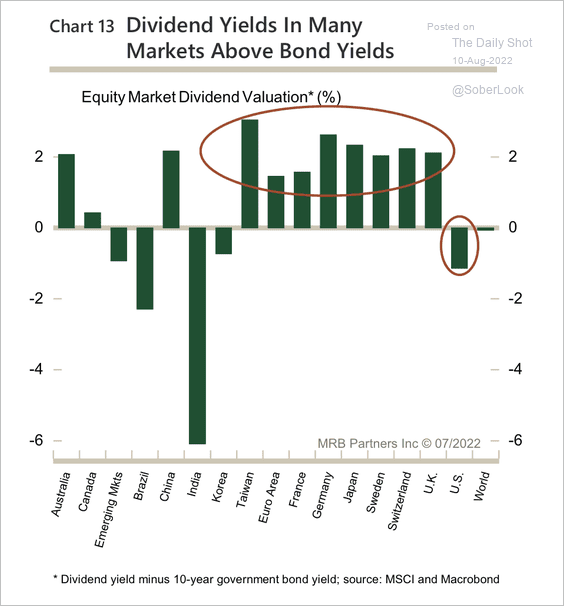

• Dividends are attractive relative to bonds in many markets (not the US).

Source: MRB Partners

Source: MRB Partners

• Dividends have played an important role in the total return of equities. Global dividend yields, however, are still below the long-term norm, consistent with historically low bond yields.

Source: MRB Partners

Source: MRB Partners

Back to Index

Global Developments

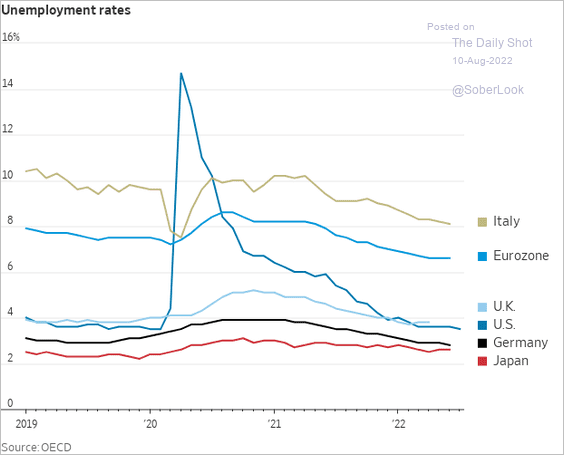

1. Here is a look at unemployment rates in the largest advanced economies.

Source: @WSJ Read full article

Source: @WSJ Read full article

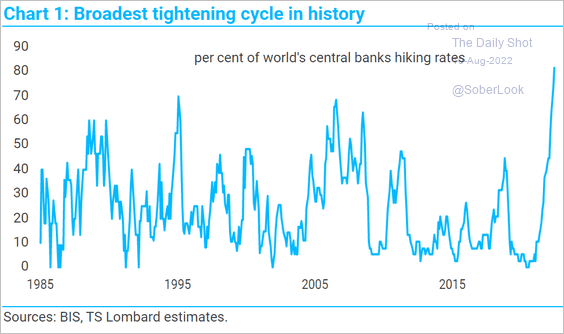

2. The current monetary tightening cycle is the broadest in history.

Source: TS Lombard

Source: TS Lombard

——————–

Food for Thought

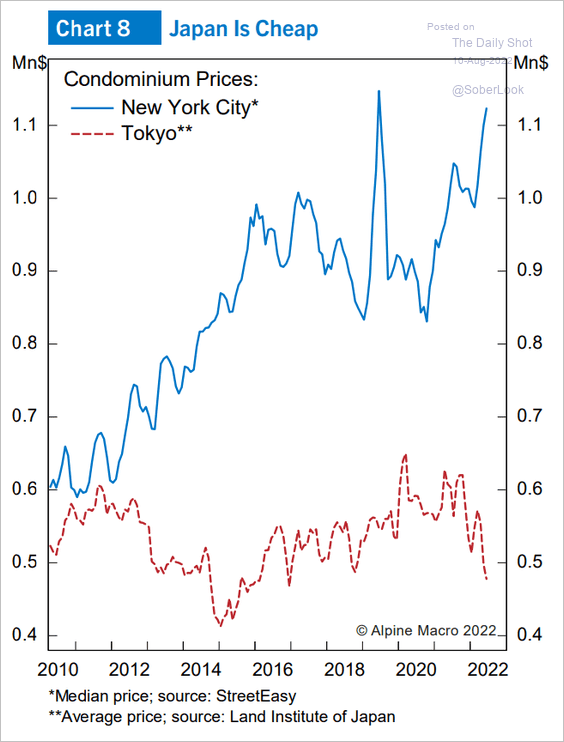

1. Condo prices in NYC and Tokyo (in USD terms):

Source: Alpine Macro

Source: Alpine Macro

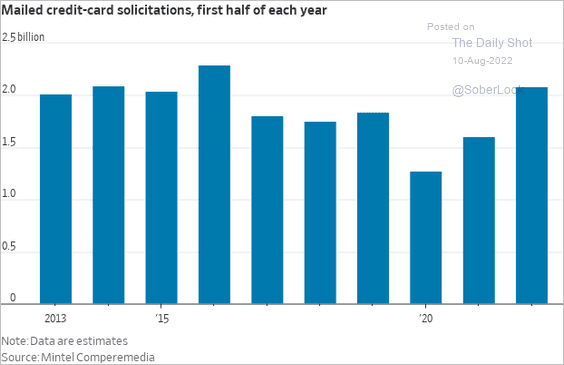

2. Credit card solicitations:

Source: @WSJ Read full article

Source: @WSJ Read full article

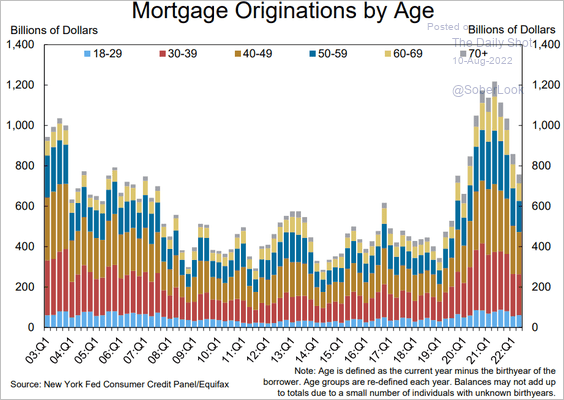

3. Mortgage originations by age:

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

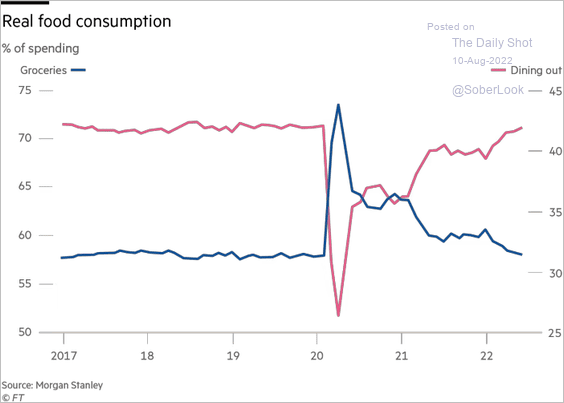

4. Spending on groceries vs. dining out:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

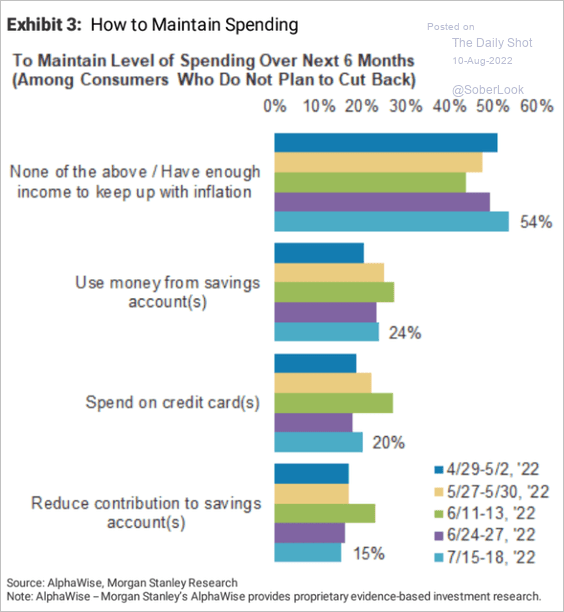

5. How households plan to maintain spending over the next 6 months:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

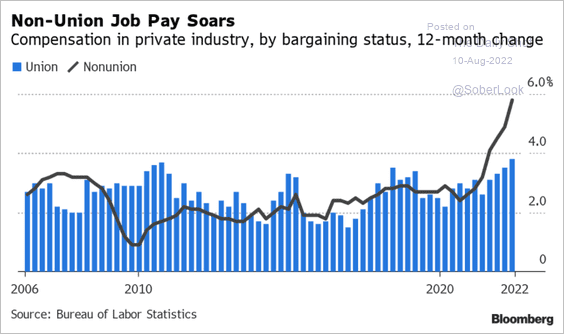

6. Union vs. non-union pay in the US:

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

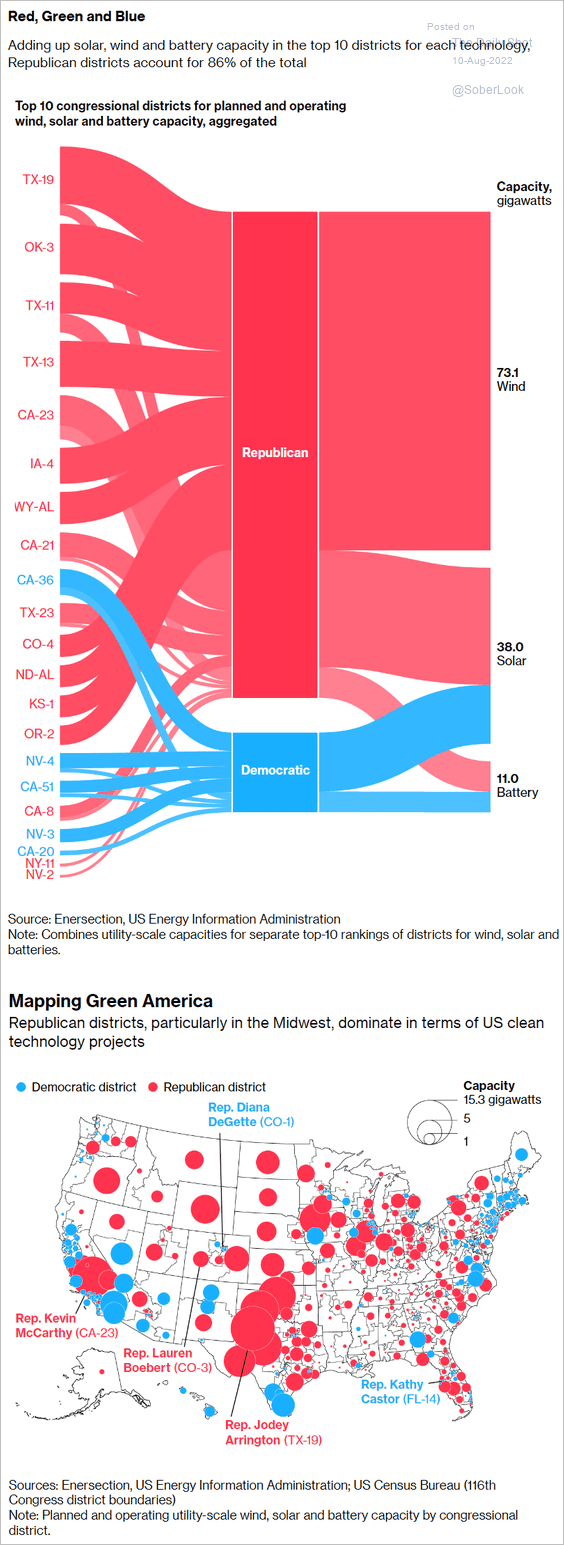

7. Congressional districts with the highest planned and operating renewables capacity:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

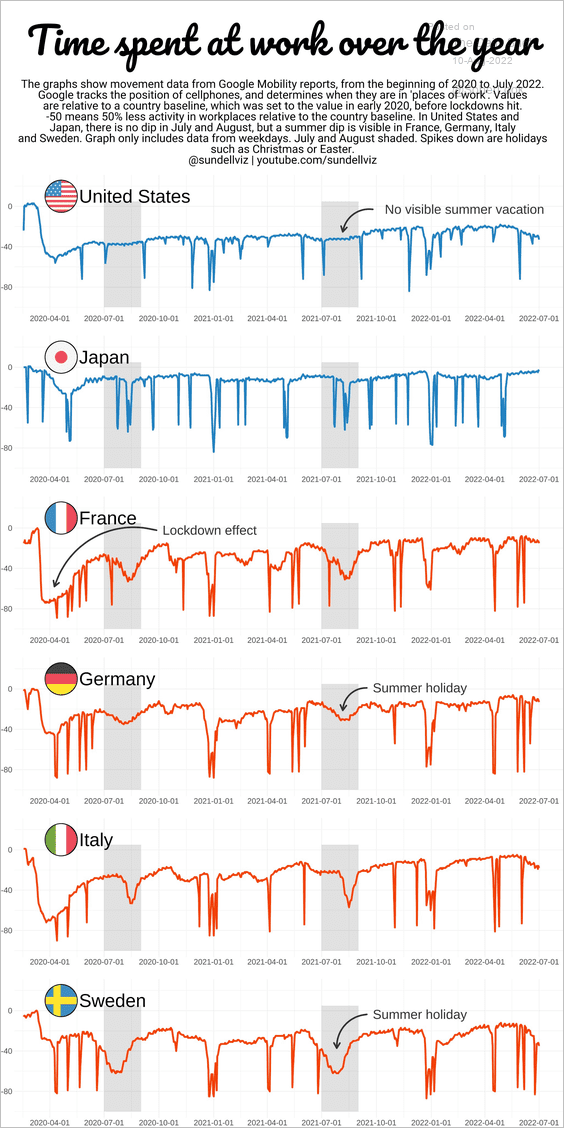

8. Seasonality of time spent at work in select economies:

Source: @sundellviz

Source: @sundellviz

——————–

Back to Index