The Daily Shot: 09-Aug-22

• The United States

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

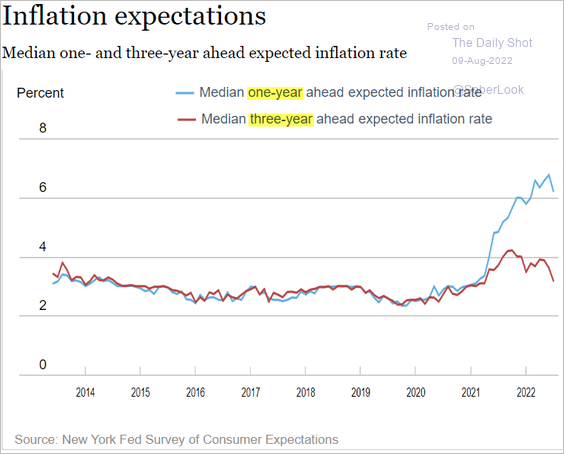

1. Let’s begin with some updates on inflation.

• Lower gasoline prices and, to a lesser extent, food prices sent inflation expectations sharply lower. While this is an important consideration for the Fed, it’s unlikely to deter the central bank from continuing with its tightening policy.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

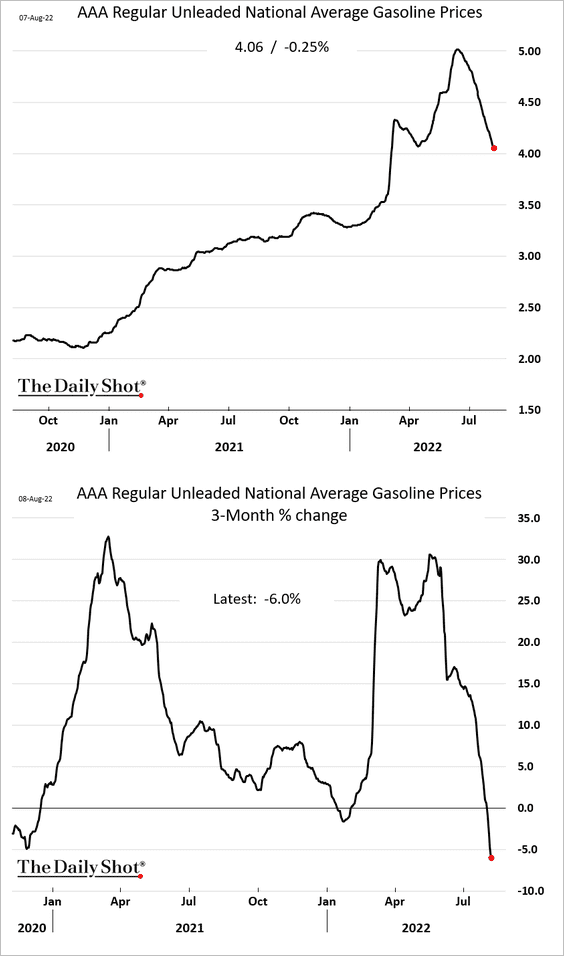

Source: Reuters Read full article

Source: Reuters Read full article

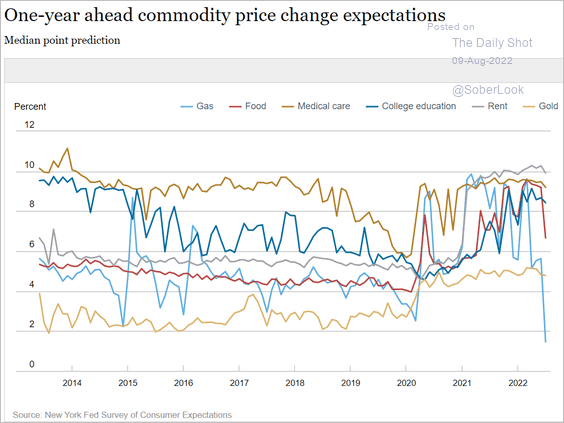

– This chart shows consumer expectations for commodity price changes (note the gasoline and food components).

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

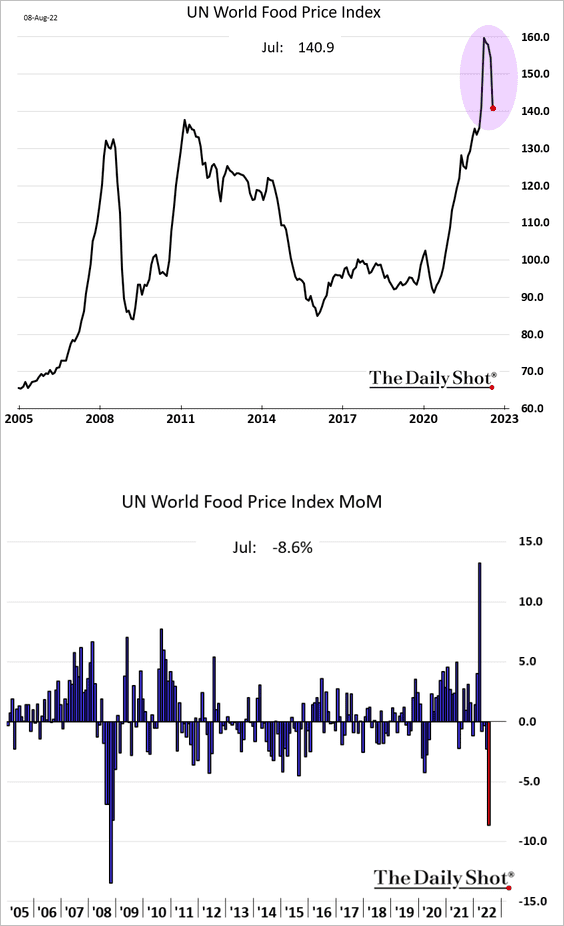

– Gasoline and food prices are still very elevated but have come off the highs (2 charts).

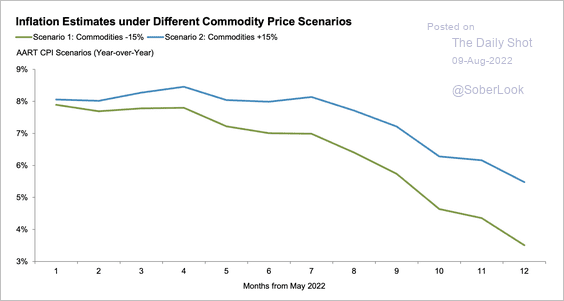

• Fidelity expects inflation to moderate over the next 12 months, although commodity prices remain a wildcard.

Source: Fidelity Investments Read full article

Source: Fidelity Investments Read full article

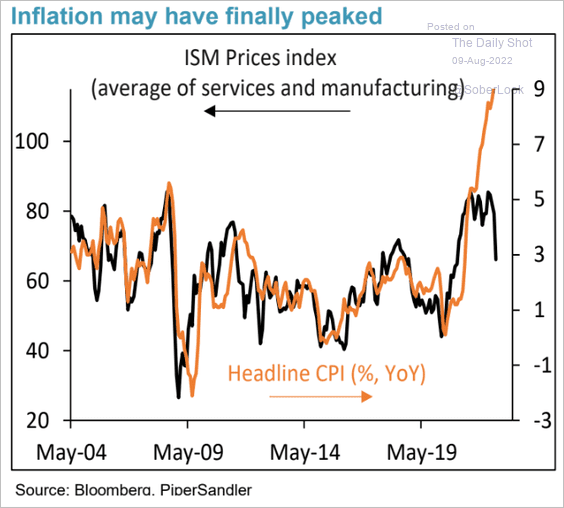

• The ISM PMI data indicate that inflation will slow in the months ahead.

Source: Piper Sandler

Source: Piper Sandler

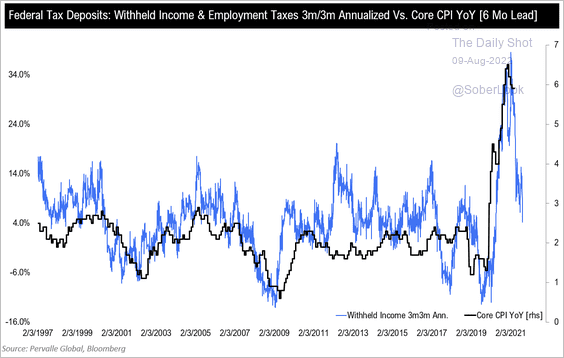

• Withheld federal income and employment tax growth also point to slower inflation going forward.

Source: @TeddyVallee

Source: @TeddyVallee

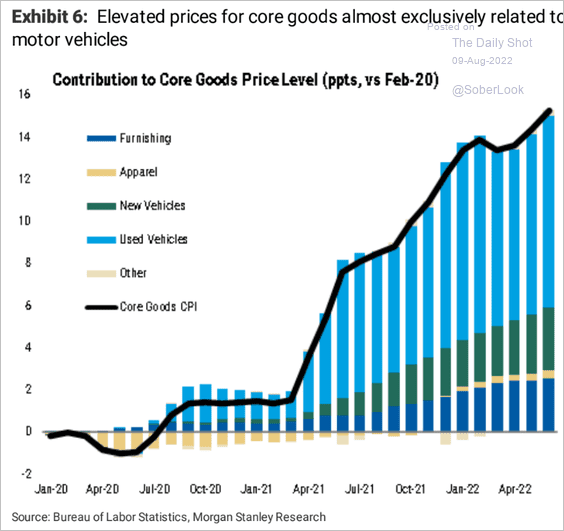

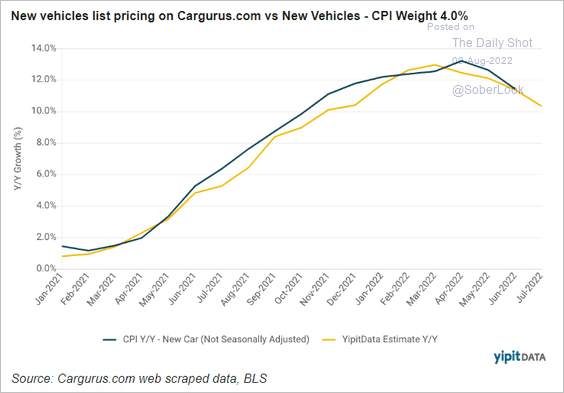

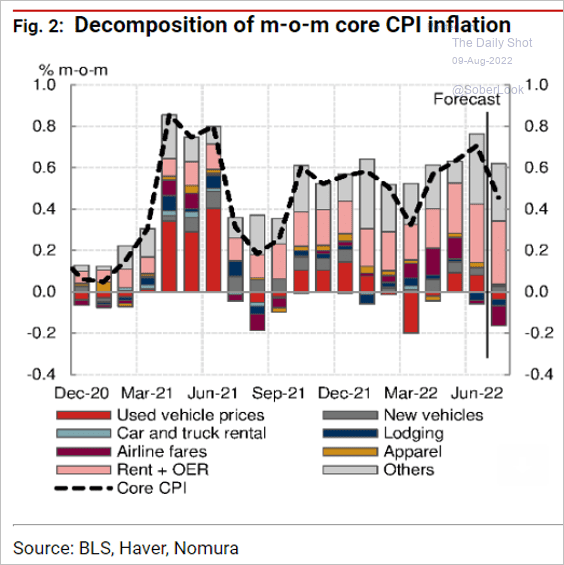

• Vehicle prices have been the main driver of the core goods CPI.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Real-time measurements from YipitData suggest that new car inflation is moderating.

Source: YipitData

Source: YipitData

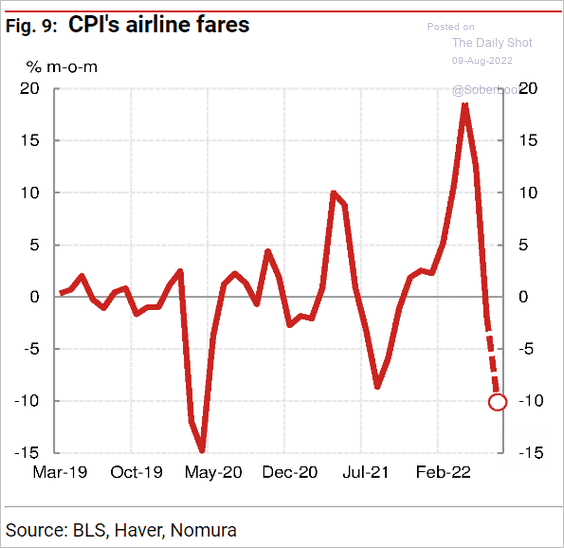

• Airline fares have eased.

Source: Nomura Securities

Source: Nomura Securities

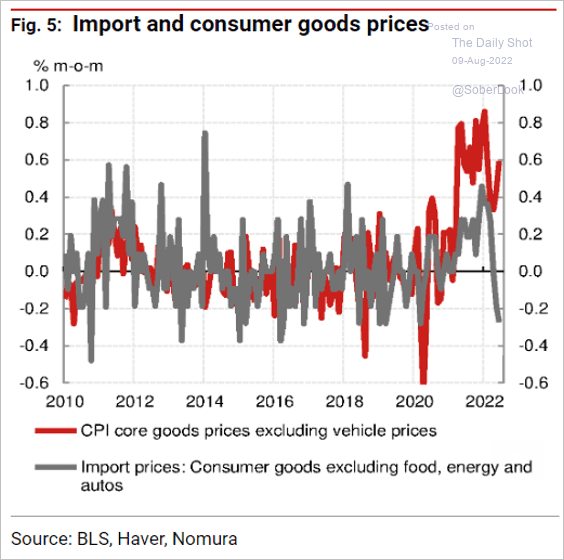

• The US dollar strength has been putting downward pressure on import prices, which should slow consumer goods inflation.

Source: Nomura Securities

Source: Nomura Securities

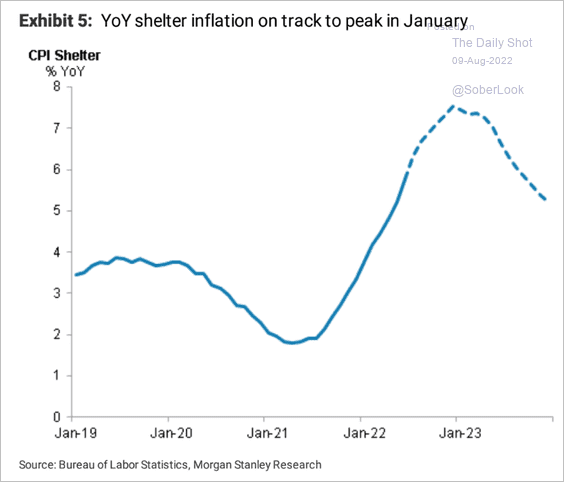

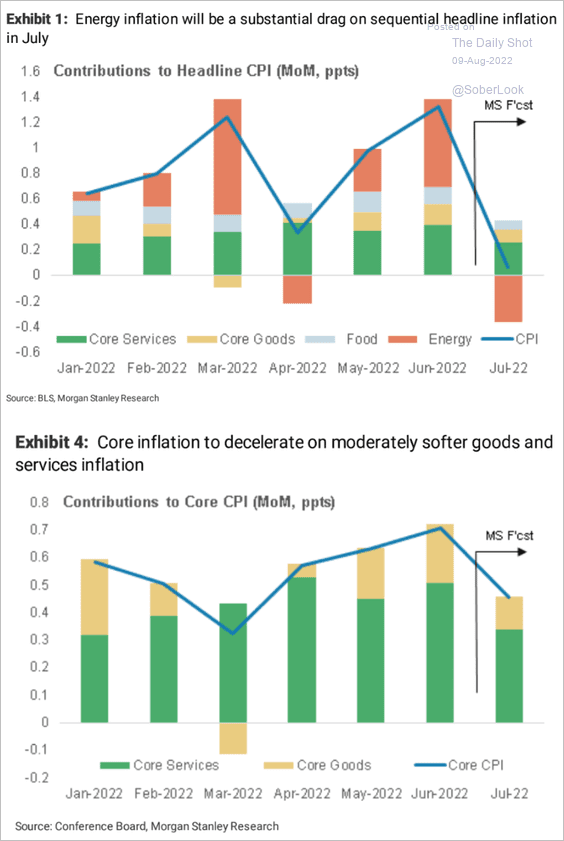

• Shelter inflation is yet to peak.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

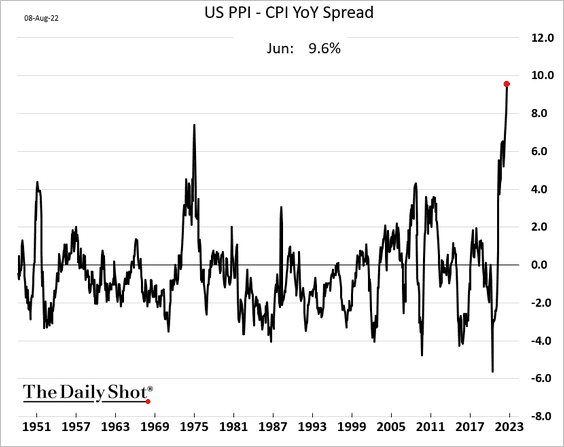

• The PPI – CPI spread hit a record high in June.

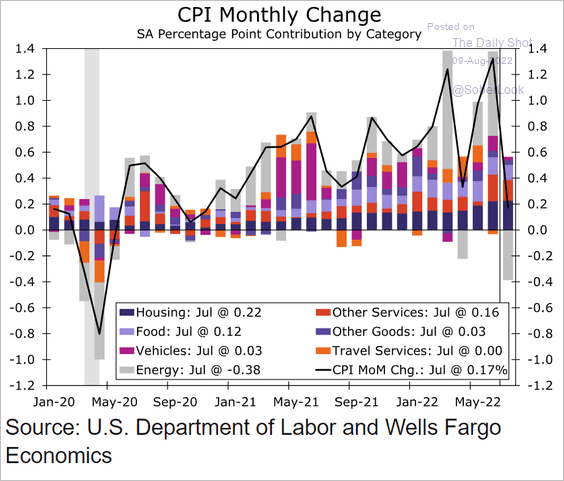

• Forecasts call for a small monthly increase in the headline CPI in July, with the core inflation remaining elevated, driven by shelter costs. The consensus estimates are 0.2% for the headline and 0.5% for the core CPI (month over month).

– Wells Fargo (headline CPI):

Source: Wells Fargo Securities

Source: Wells Fargo Securities

– Morgan Stanley (headline and core CPI):

Source: Morgan Stanley Research

Source: Morgan Stanley Research

– Nomura (core CPI):

Source: Nomura Securities

Source: Nomura Securities

——————–

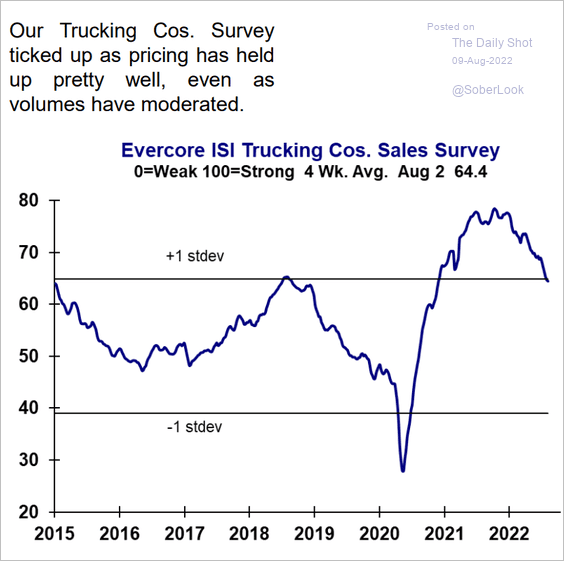

2. Truck freight demand is off the highs but remains elevated, according to a survey from Evercore ISI.

Source: Evercore ISI Research

Source: Evercore ISI Research

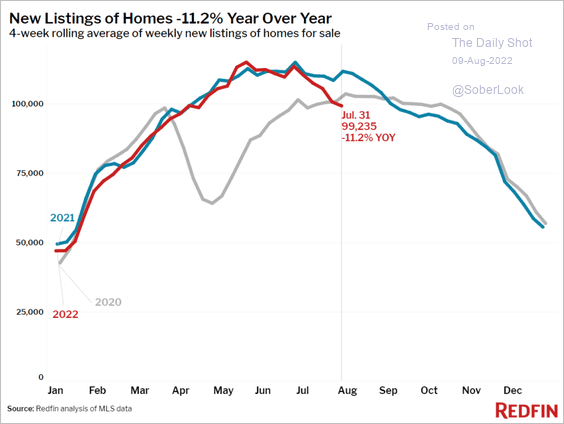

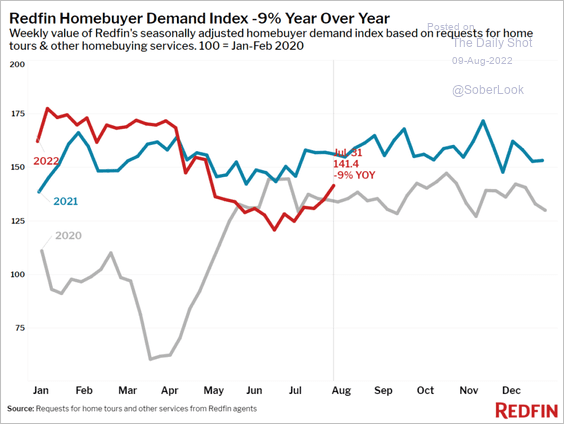

3. Next, we have some updates on the housing market.

• New listings are slowing.

Source: Redfin

Source: Redfin

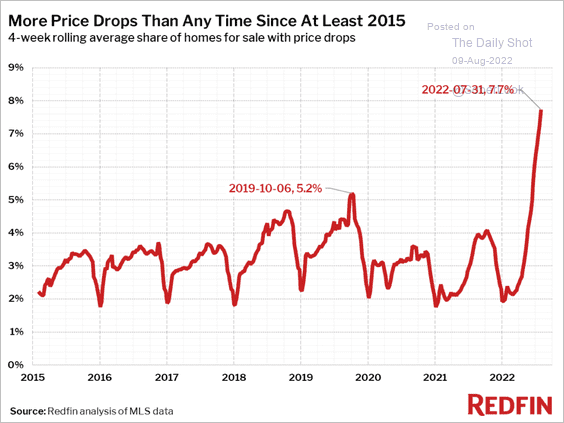

• More sellers have been dropping prices.

Source: Redfin

Source: Redfin

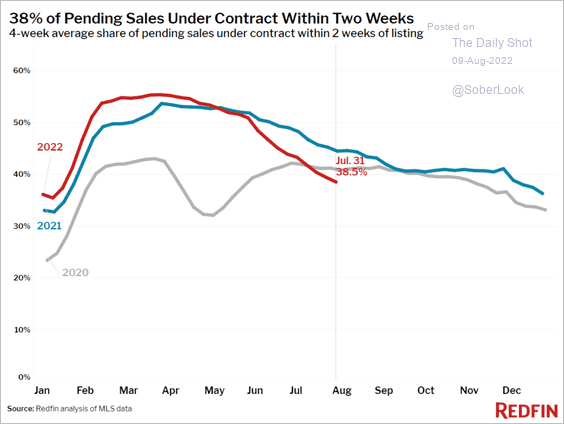

• It’s taking longer to sell homes.

Source: Redfin

Source: Redfin

• Despite affordability issues, demand for housing remains robust.

Source: Redfin

Source: Redfin

——————–

CORRECTION:

In yesterday’s US section, the description for this chart should be:

The market expects nearly 90 bps of rate cuts between next April and April of 2024.

Back to Index

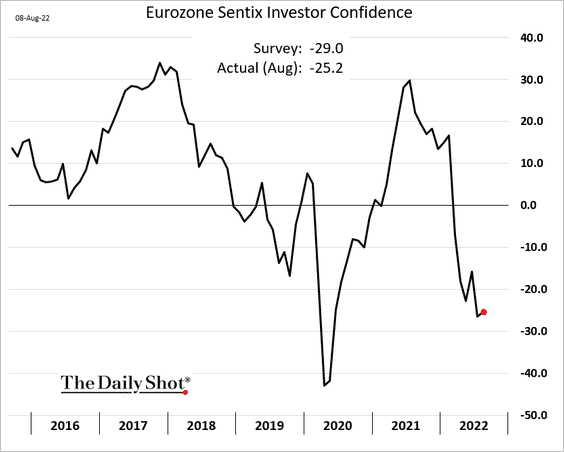

The Eurozone

1. The Sentix investor confidence index showed a slight improvement this month.

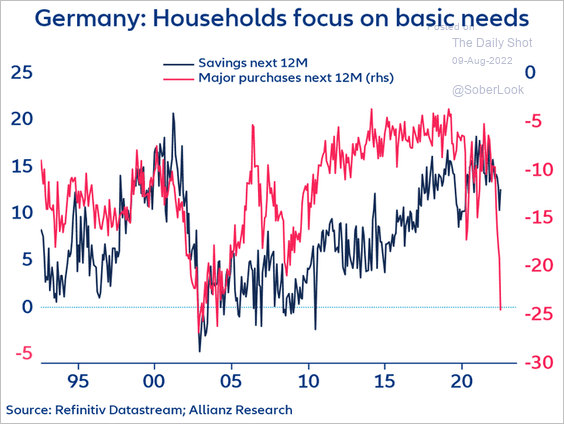

2. Germany’s depressed consumer sentiment points to weak spending ahead.

Source: @PatrickKrizan

Source: @PatrickKrizan

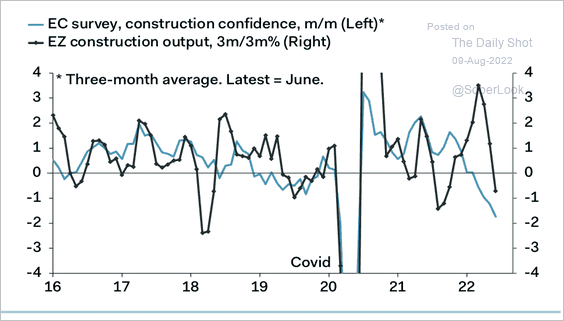

3. Construction output and confidence are sharply lower.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

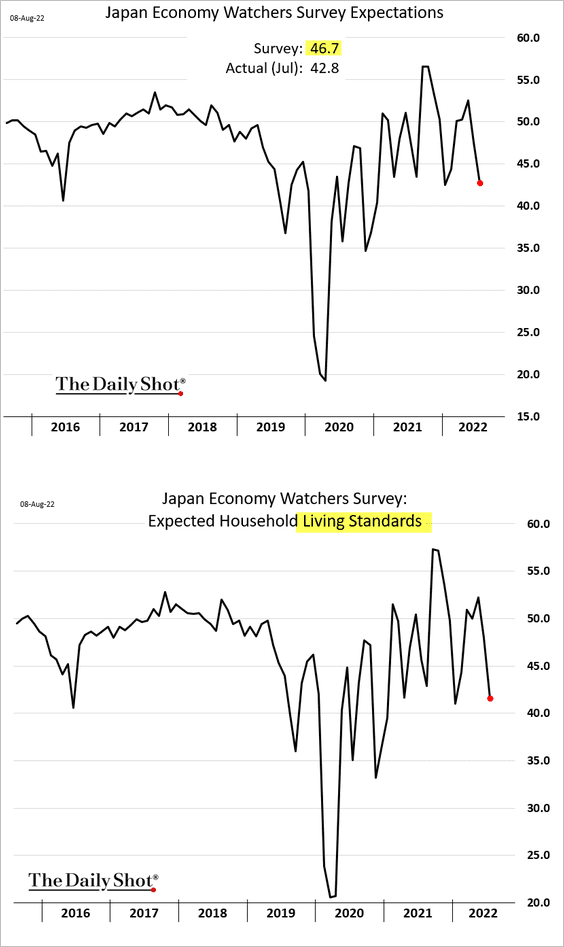

Asia – Pacific

1. Japan’s Economy Watchers index tumbled last month.

Source: @ynohara1, @business Read full article

Source: @ynohara1, @business Read full article

——————–

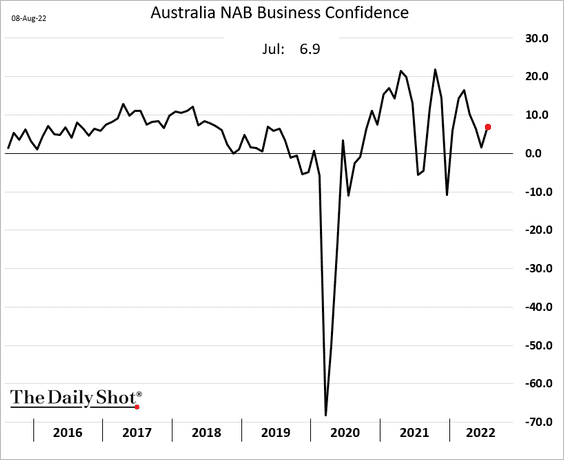

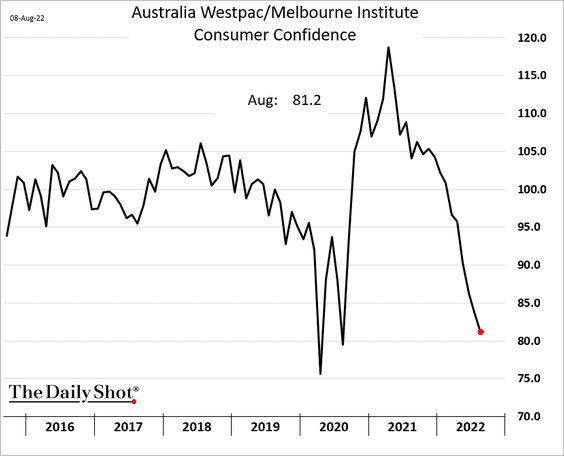

2. Australia’s business sentiment held up well last month, …

… but consumer sentiment is approaching the COVID-shock lows.

Back to Index

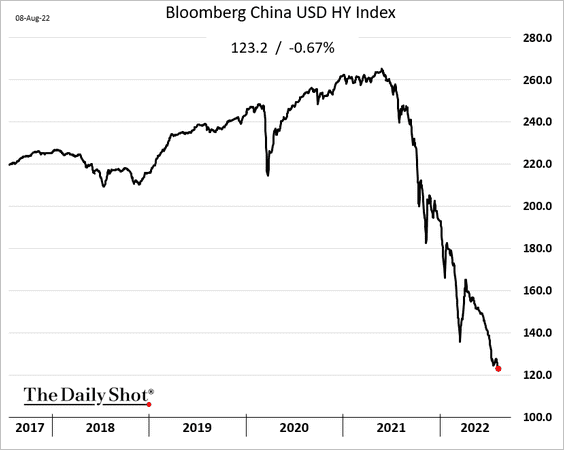

China

1. The dollar-denominated high-yield index continues to hit multi-year lows as leveraged developer stress persists.

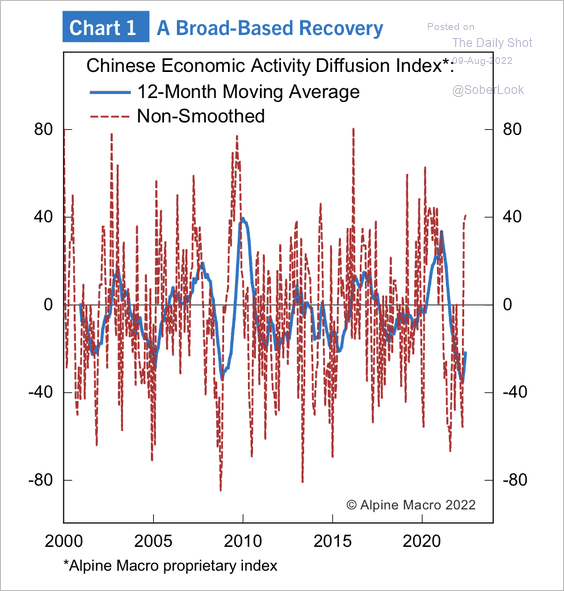

2. Some leading indicators suggest a growth recovery is near.

Source: Alpine Macro

Source: Alpine Macro

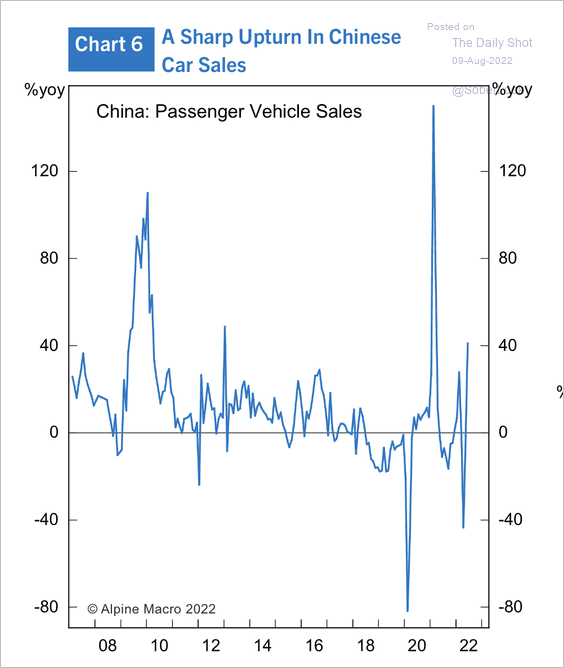

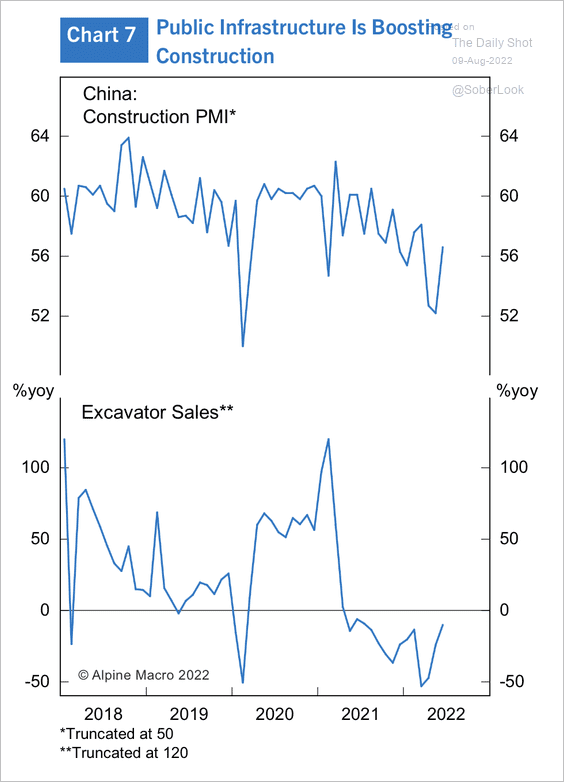

For example, car sales and construction activity are picking up. (2 charts)

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

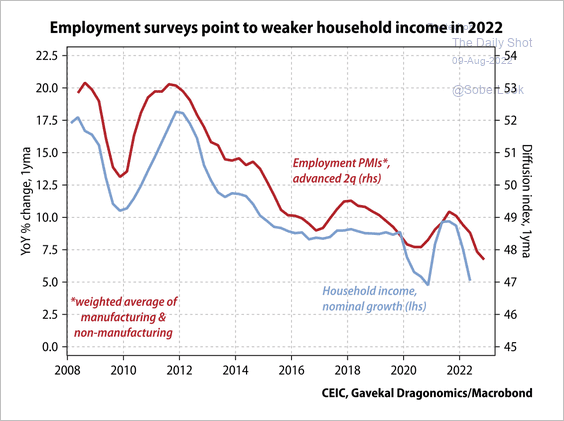

Still, employment and household income remain weak.

Source: Gavekal Research

Source: Gavekal Research

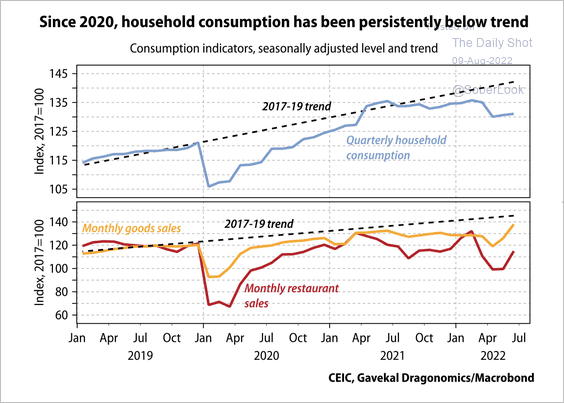

Household consumption continues to lag its pre-pandemic trend.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

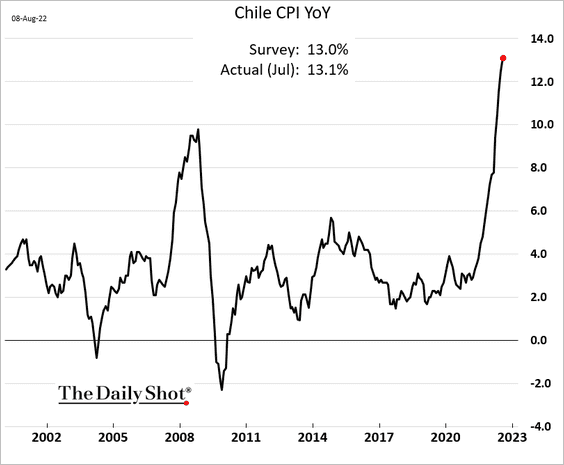

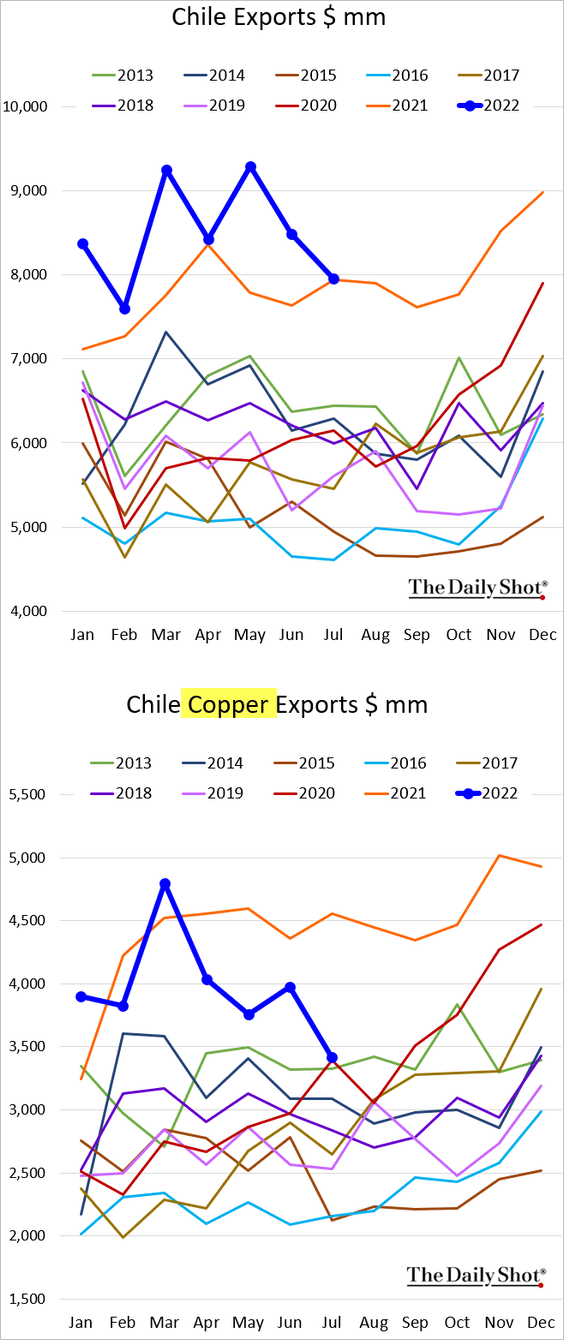

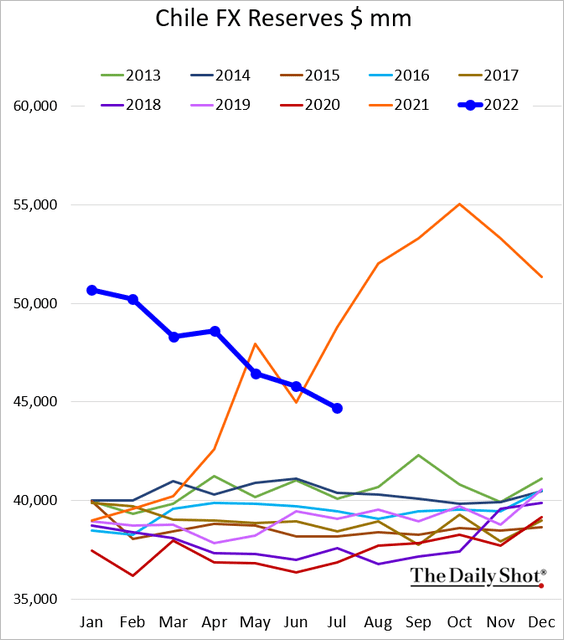

1. Let’s begin with Chile.

• Inflation continues to surge.

• Exports (value) declined as copper prices deteriorated.

• F/X reserves are moving toward pre-COVID levels.

——————–

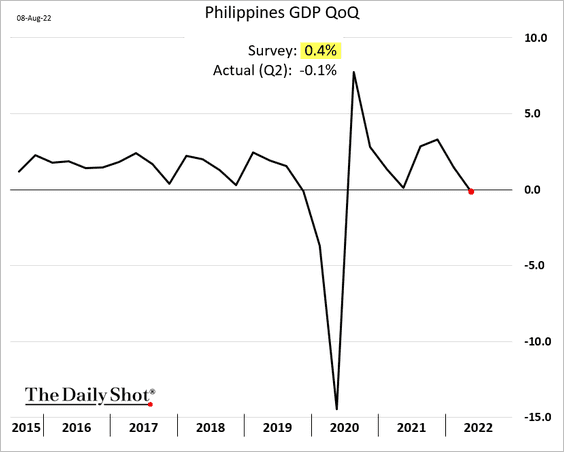

2. The Philippine economy unexpectedly contracted last quarter.

Source: Reuters Read full article

Source: Reuters Read full article

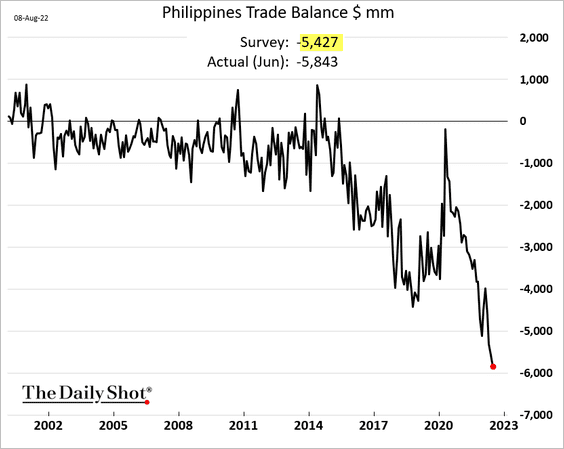

The trade deficit hit a record.

——————–

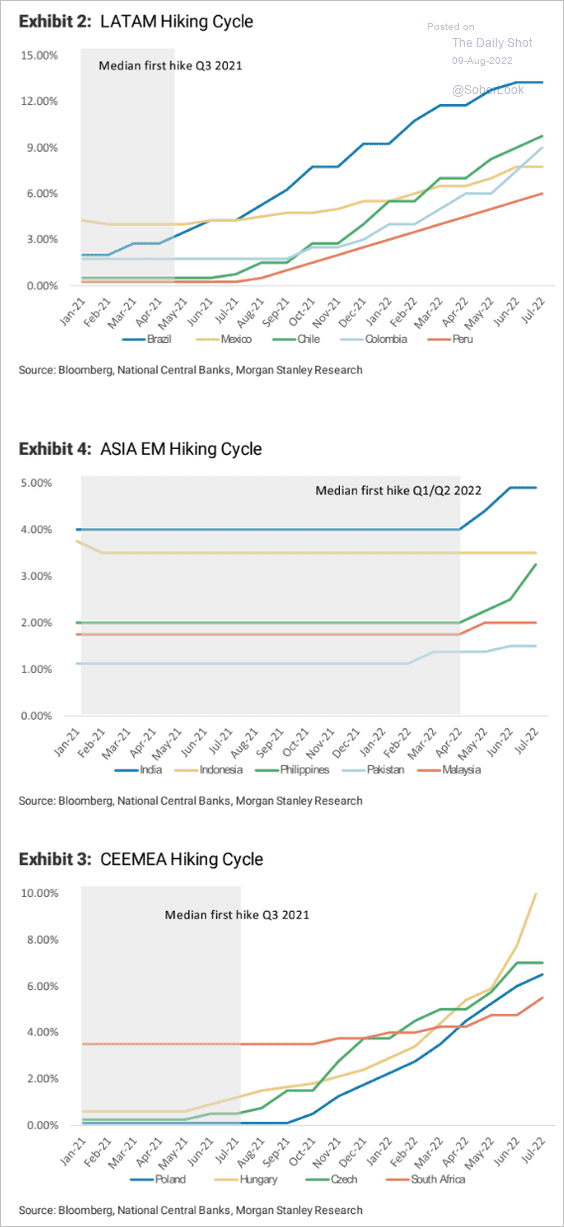

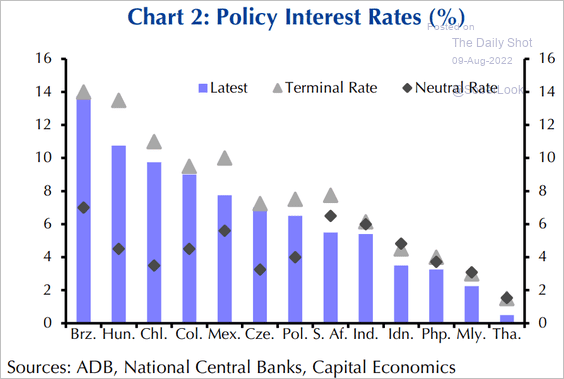

3. How far are EM central banks from completing their policy tightening?

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Capital Economics

Source: Capital Economics

——————–

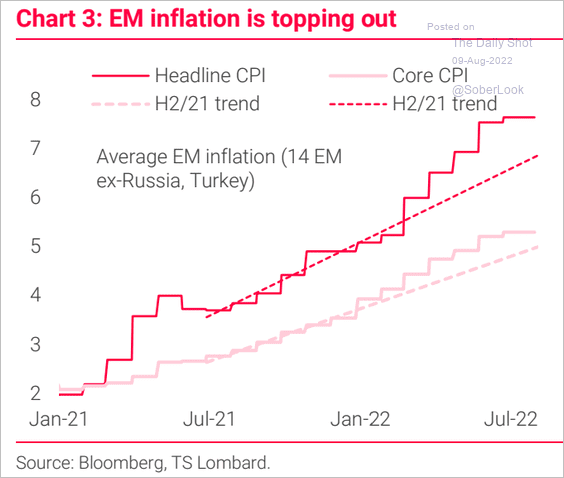

4. EM inflation appears to be peaking.

Source: TS Lombard

Source: TS Lombard

Back to Index

Cryptocurrency

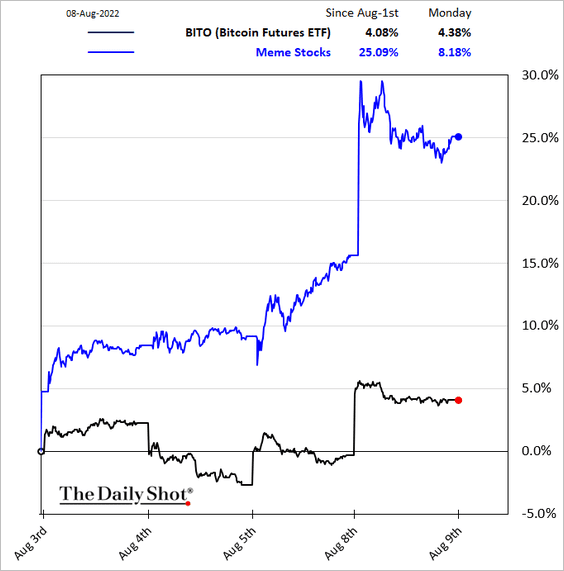

1. The Reddit crowd is back, giving cryptos a boost.

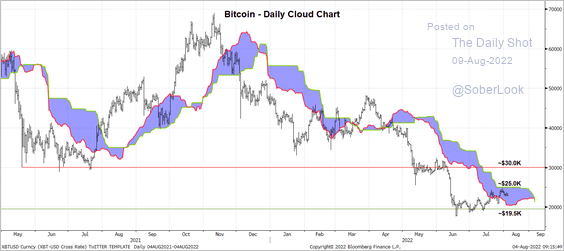

2. Bitcoin remains in an intermediate-term downtrend with resistance between $25K and $30K.

Source: @StocktonKatie

Source: @StocktonKatie

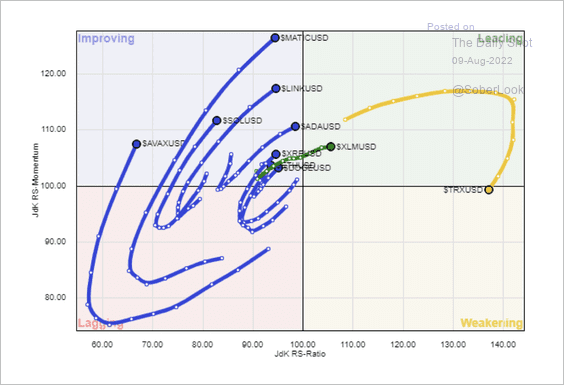

3. This chart shows the improvement in momentum of several altcoins (risk-on) relative to bitcoin over the past 12 weeks. That suggests the crypto relief rally could have staying power.

Source: @StocktonKatie

Source: @StocktonKatie

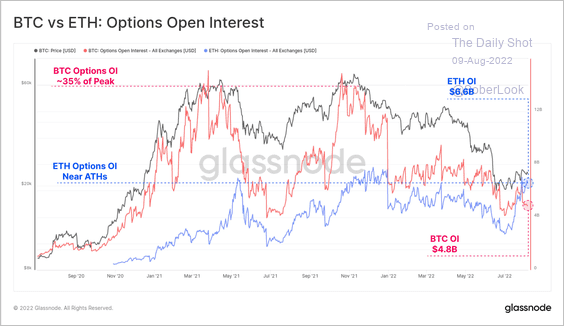

4. Ether’s (ETH) options open interest has surpassed bitcoin’s for the first time.

Source: @glassnode

Source: @glassnode

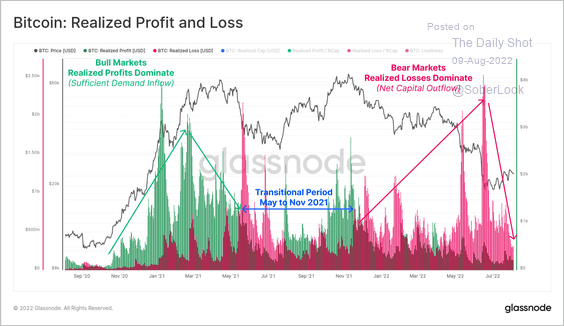

5. Realized losses have significantly increased among bitcoin holders over the past few months.

Source: @glassnode

Source: @glassnode

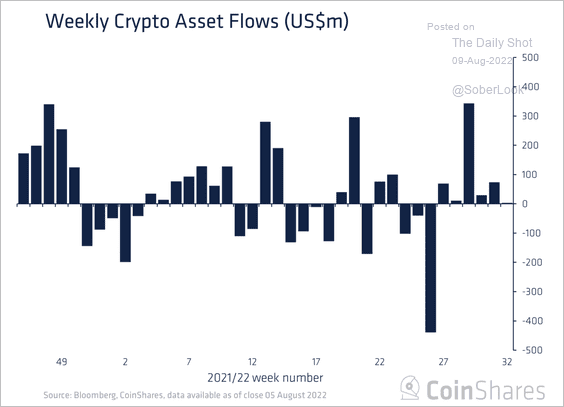

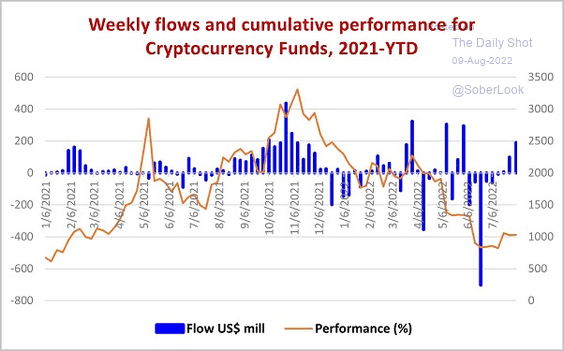

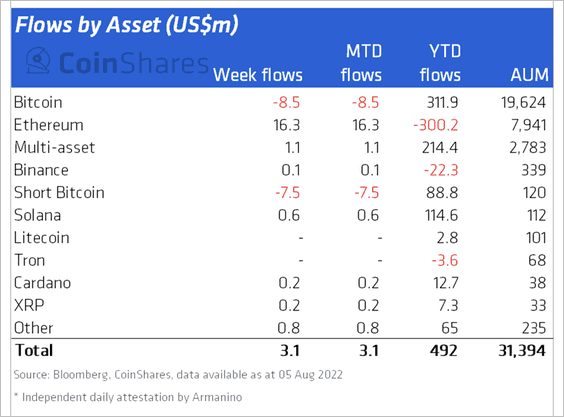

6. Crypto investment products registered six consecutive weeks of inflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: EPFR Global Navigator

Source: EPFR Global Navigator

Both long and short-bitcoin funds saw outflows last week, while Ethereum-focused funds saw inflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

By the way, the upcoming Ethereum Merge, scheduled for September, has been a major factor behind the recent ETH rally.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Back to Index

Commodities

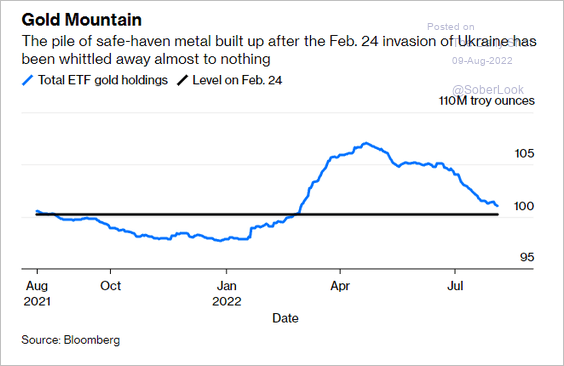

1. ETF gold holdings have been falling.

Source: @StuartLWallace, @davidfickling Read full article

Source: @StuartLWallace, @davidfickling Read full article

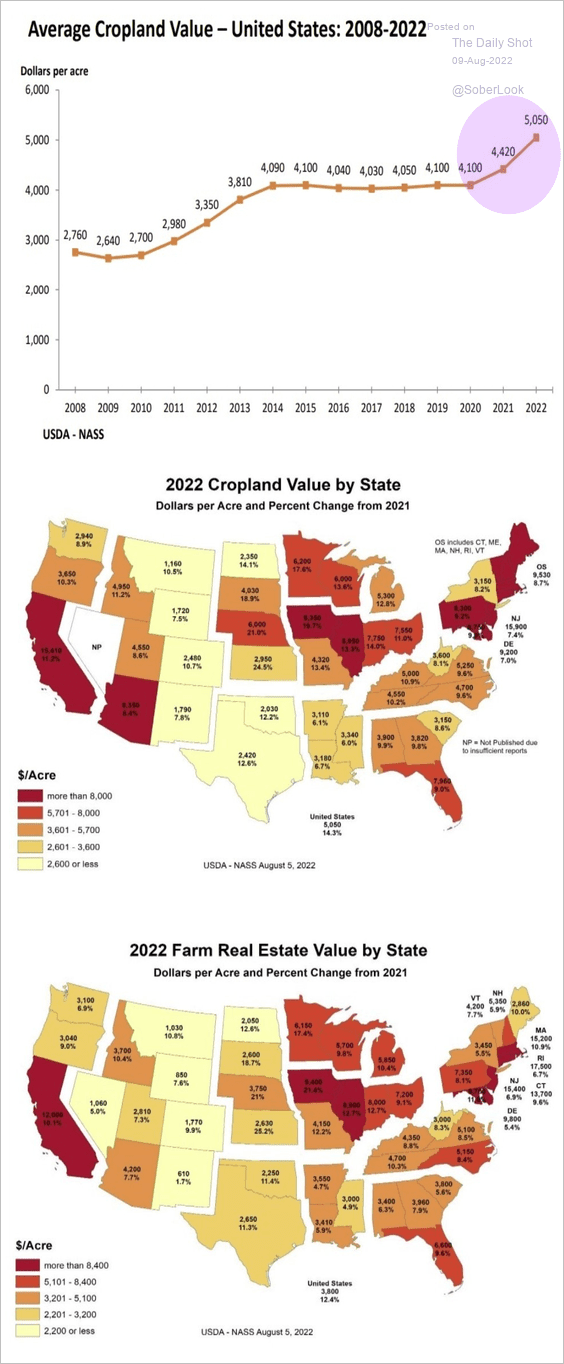

2. US farmland prices have been rallying with agricultural commodities.

Source: @chigrl Read full article

Source: @chigrl Read full article

Back to Index

Energy

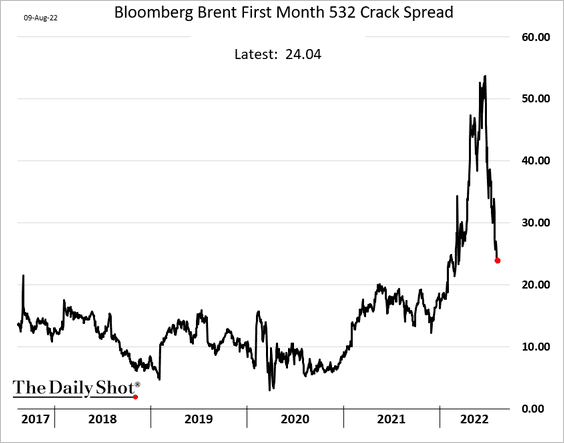

1. Crack spreads continue to tighten.

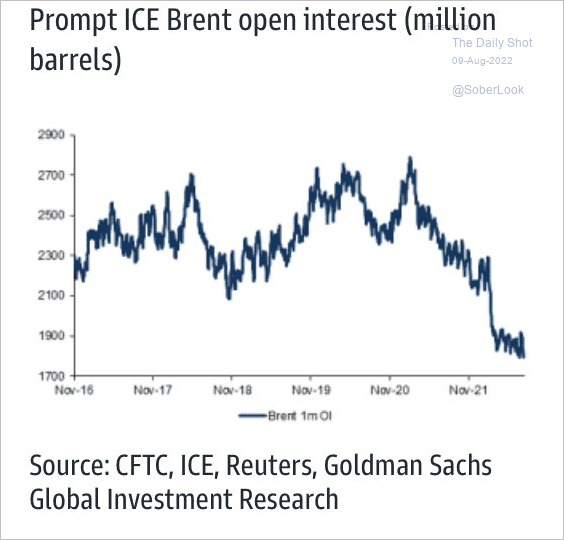

2. Open interest in front Brent futures has been shrinking.

Source: Goldman Sachs

Source: Goldman Sachs

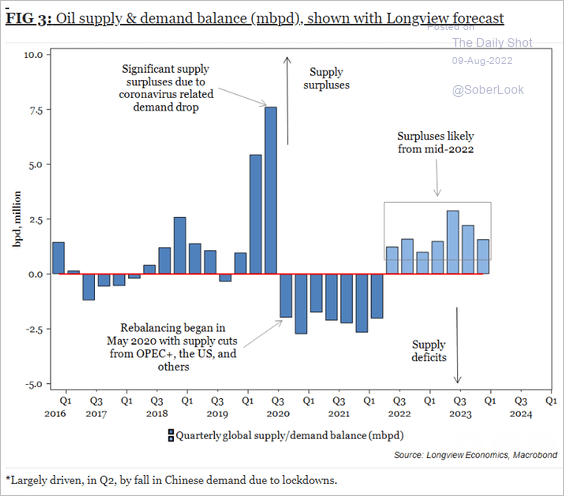

3. Is the global oil market in surplus?

Source: Longview Economics

Source: Longview Economics

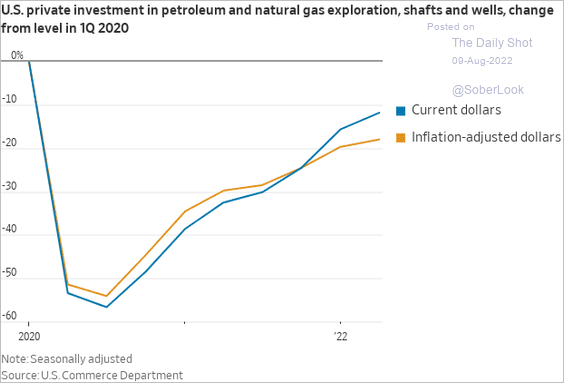

4. US energy CapEx is yet to recover from the COVID shock.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

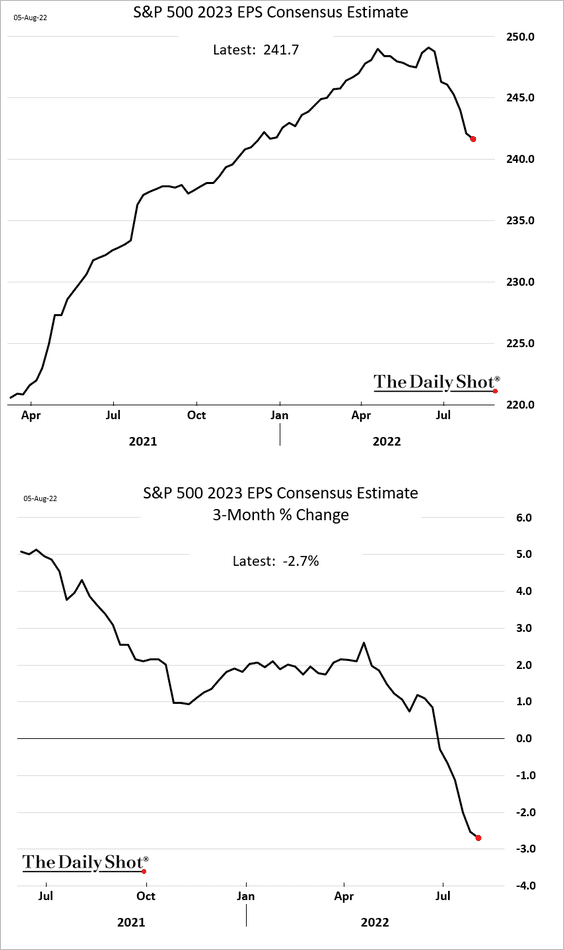

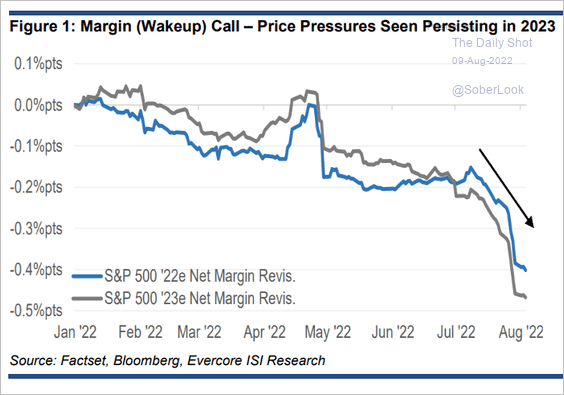

1. Analysts continue to downgrade their forecasts for the 2023 S&P 500 earnings.

Margin projections are also moving lower.

Source: Evercore ISI Research

Source: Evercore ISI Research

——————–

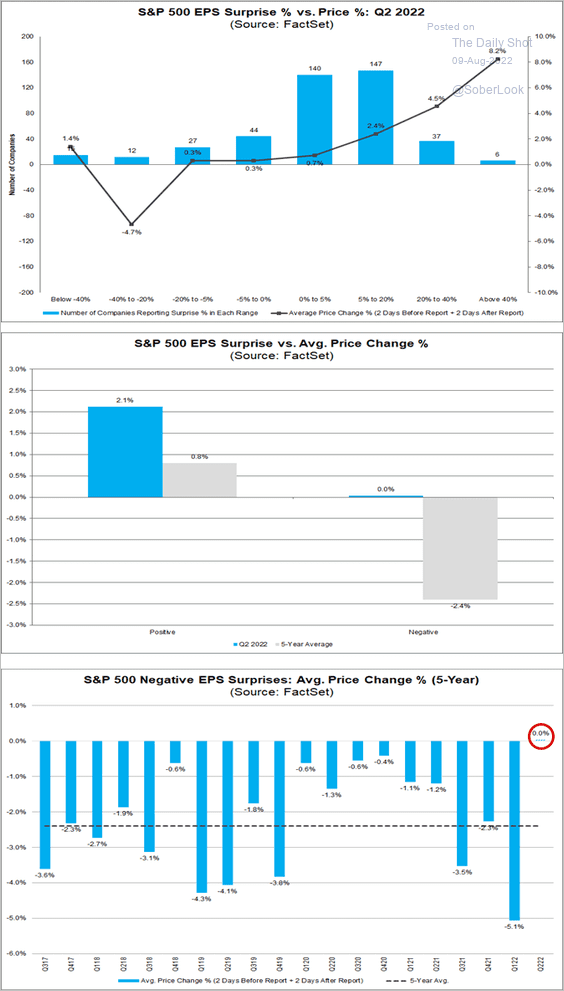

2. Next, we have some data on market response to earnings surprises. For now, there is a lot of forgiveness going on.

Source: @FactSet

Source: @FactSet

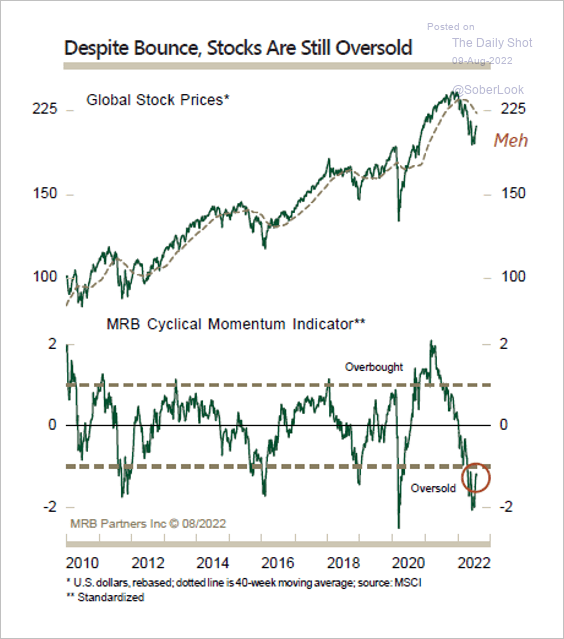

3. Global stocks are rising from extreme oversold levels.

Source: MRB Partners

Source: MRB Partners

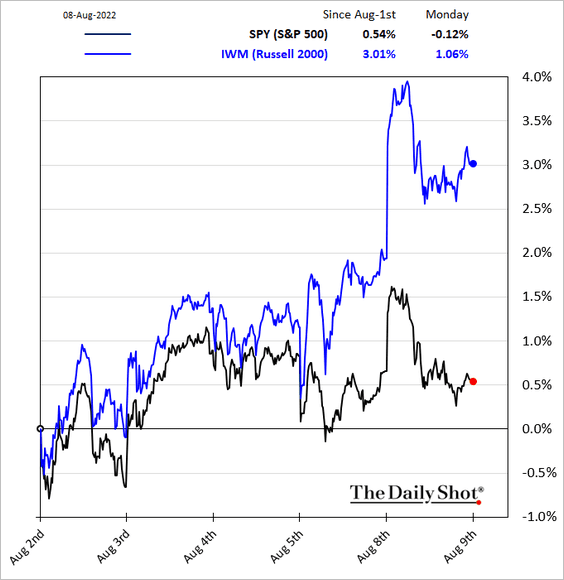

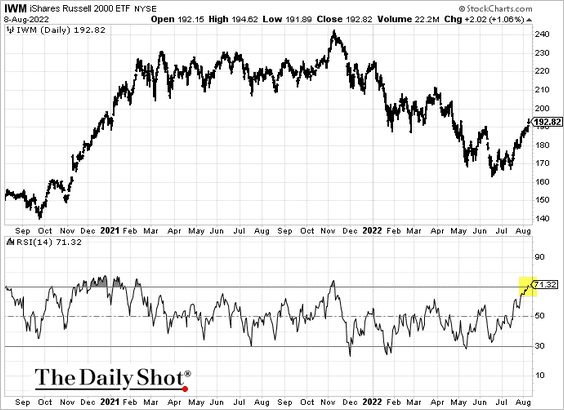

4. Small caps have been outperforming in recent days …

… and are now in overbought territory.

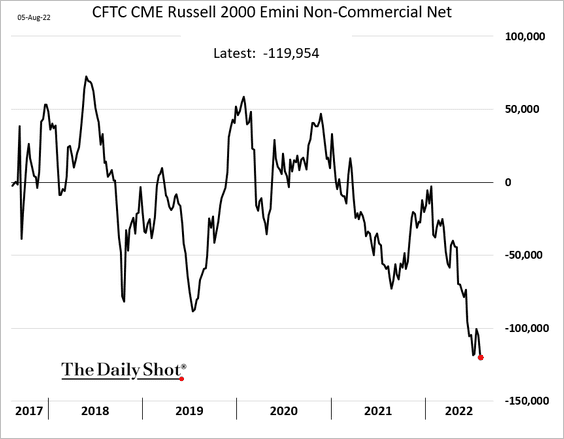

Positioning in small caps has been very bearish.

h/t @pav_chartbook

h/t @pav_chartbook

——————–

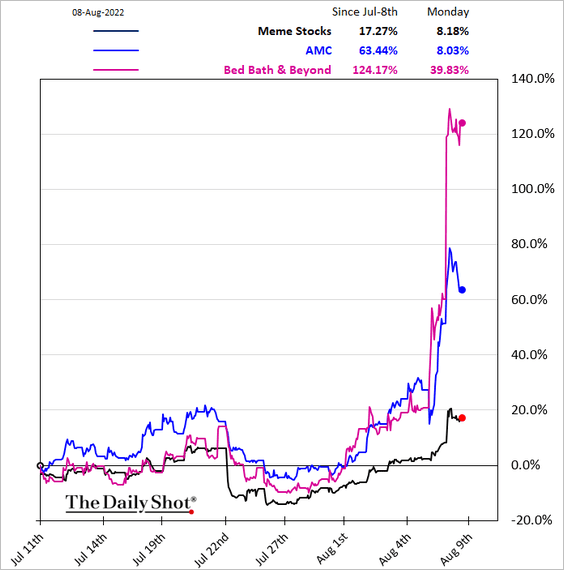

5. The Reddit crowd is back.

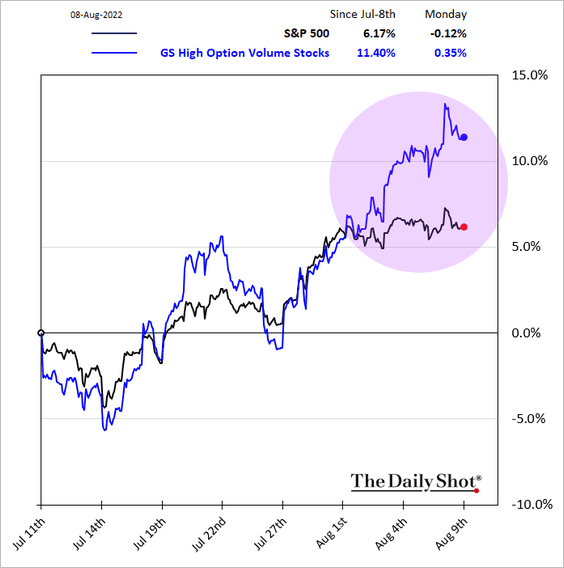

Stocks with high options volumes have been outperforming.

——————–

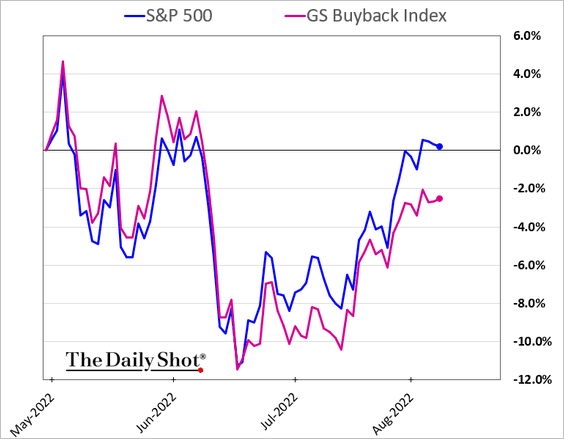

6. Companies that focus on share buybacks have been lagging.

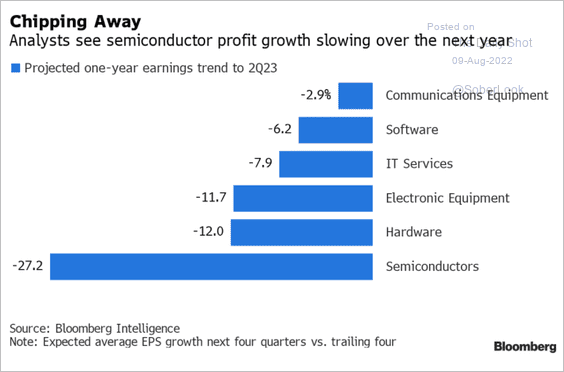

7. Semiconductor shares took a hit on NVIDIA.

![]()

![]() Source: @WSJ Read full article

Source: @WSJ Read full article

Semiconductor profits are expected to decline sharply.

Source: @technology Read full article

Source: @technology Read full article

——————–

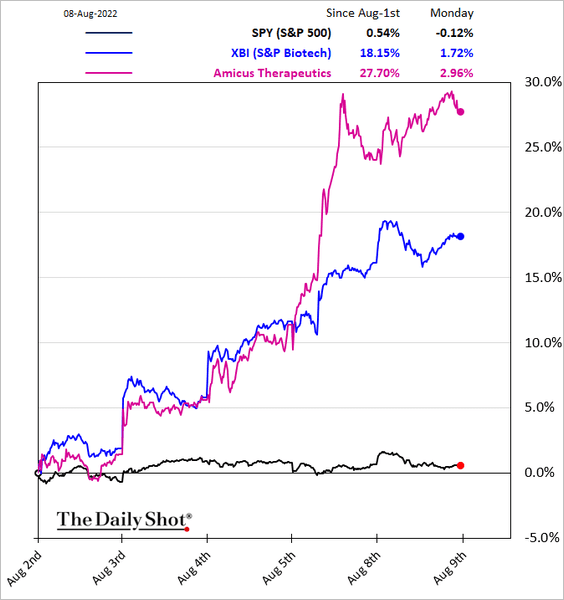

8. Biotech stocks have been surging on M&A activity.

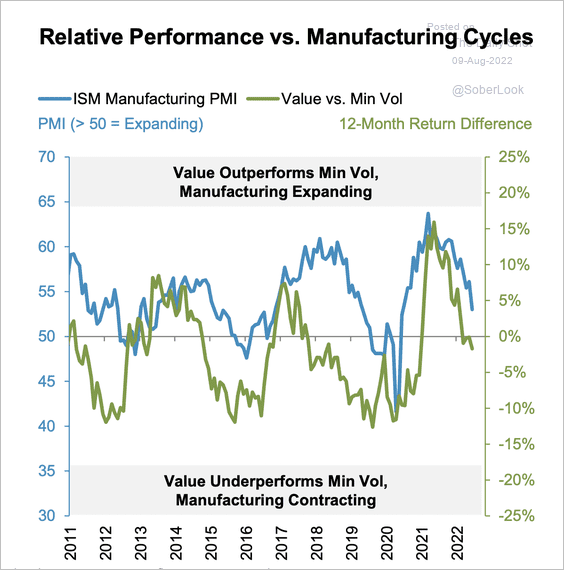

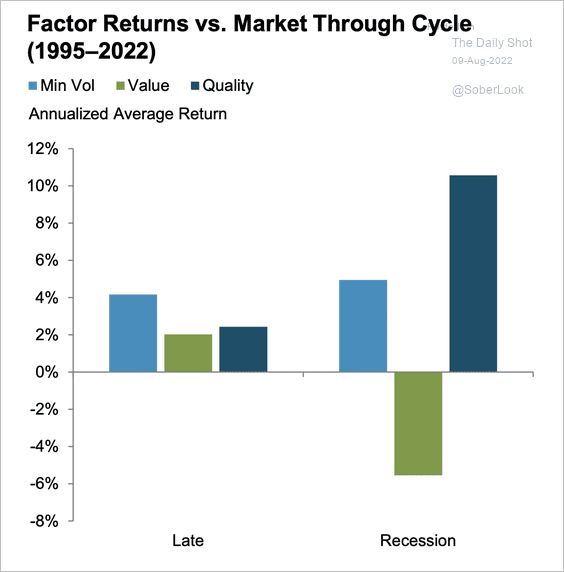

9. Value typically underperforms low-vol during manufacturing contractions.

Source: Fidelity Investment Read full article

Source: Fidelity Investment Read full article

Quality and minimum volatility factors typically outperform in late-cycle and recession phases.

Source: Fidelity Investment Read full article

Source: Fidelity Investment Read full article

——————–

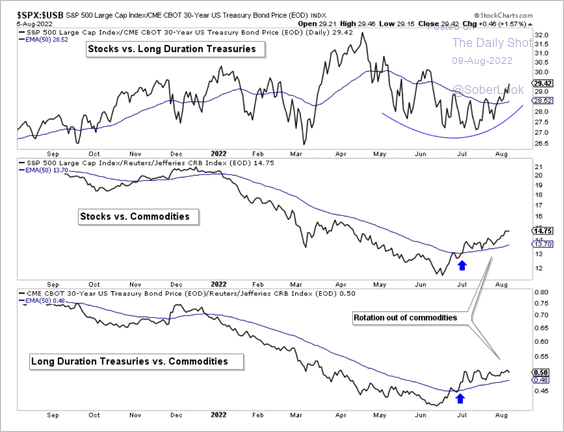

10. Stocks are gaining momentum relative to Treasuries and commodities.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

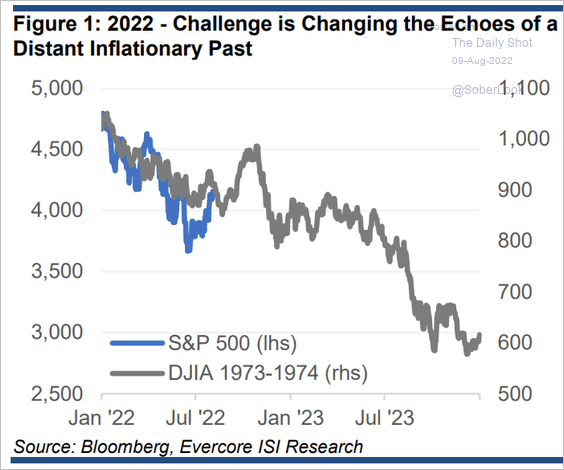

11. Are stocks following the 1970s pattern?

Source: Evercore ISI Research

Source: Evercore ISI Research

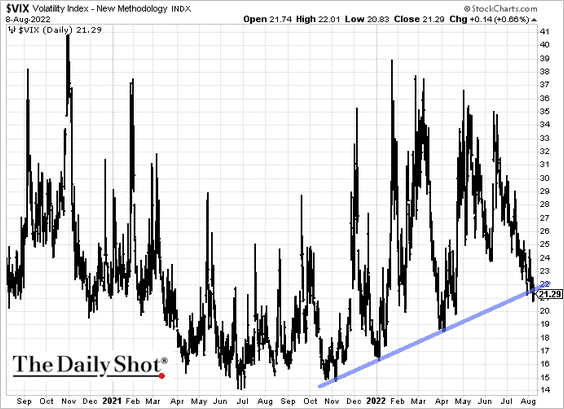

12. Will VIX hold support?

Back to Index

Credit

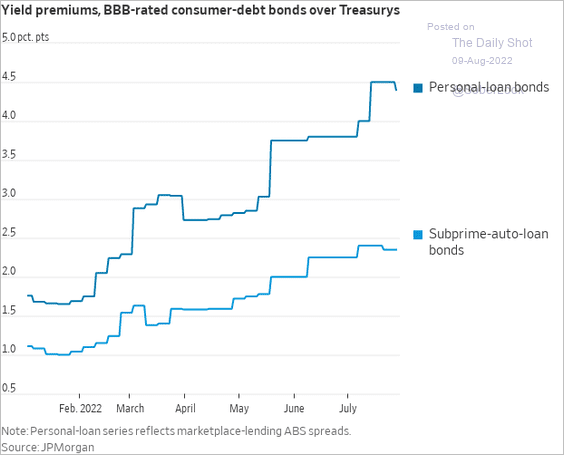

1. Lower-rated ABS spreads have risen substantially this year.

Source: @WSJ Read full article

Source: @WSJ Read full article

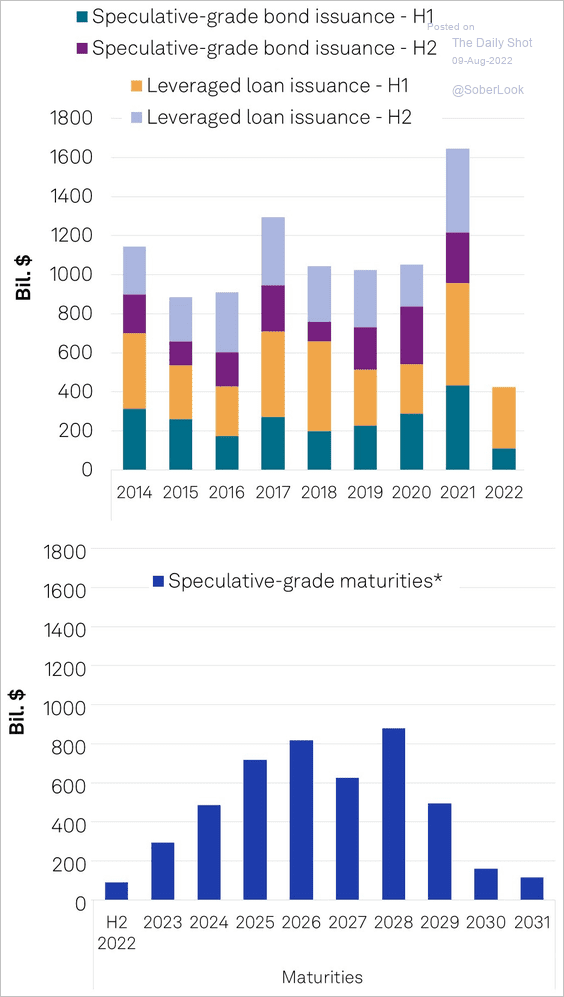

2. Next, we have some data on speculative-grade debt issuance and maturities.

Source: S&P Global Ratings

Source: S&P Global Ratings

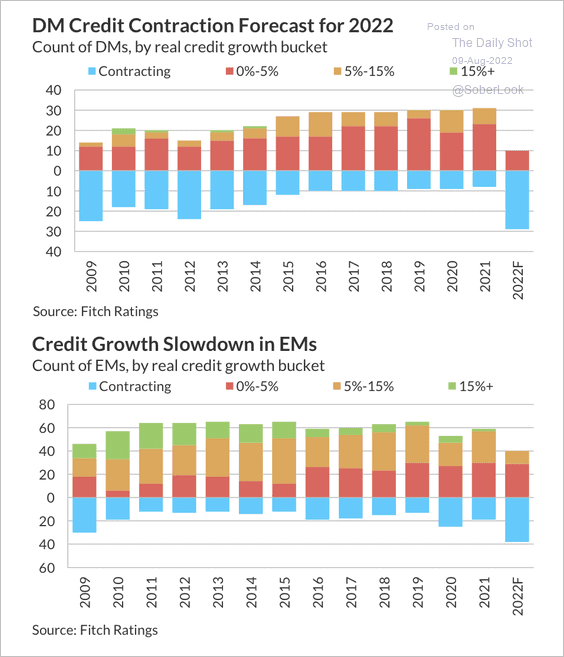

3. Fitch expects private credit to contract this year because of tighter monetary policy.

Source: Fitch Ratings

Source: Fitch Ratings

Back to Index

Rates

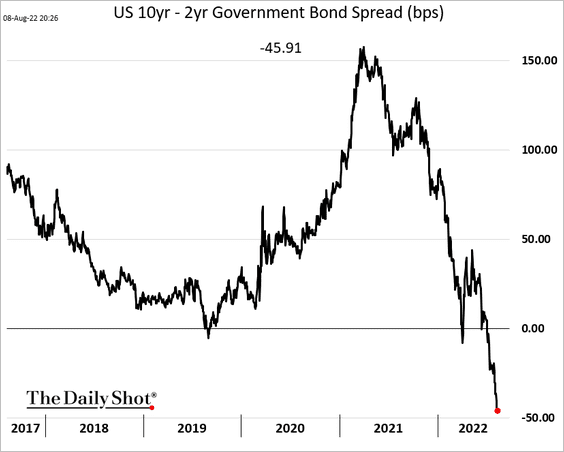

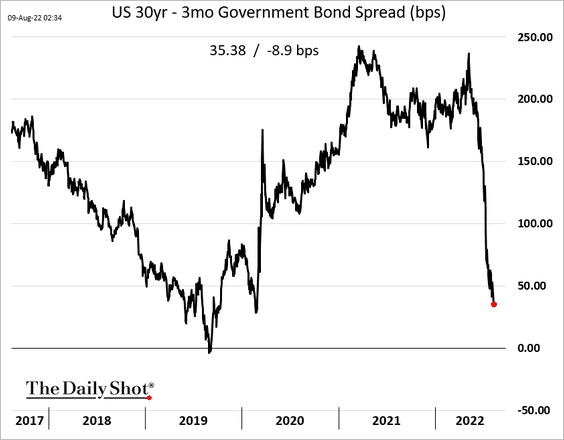

The Treasury curve continues to flatten/invert.

• 10-year – 2-year spread:

• 30-year – 3-month spread:

Back to Index

Global Developments

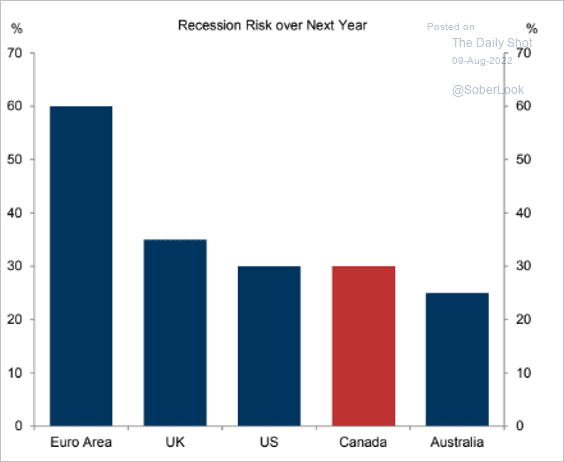

1. Here is a look at recession risks in select economies.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

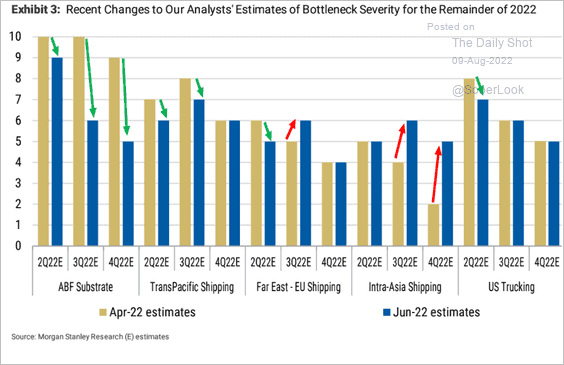

2. Next, we have the key supply bottleneck indicators from Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

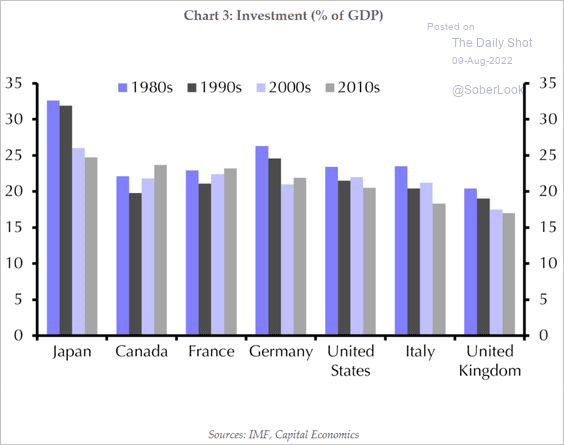

3. This chart shows business investment as a share of GDP over time.

Source: Capital Economics

Source: Capital Economics

——————–

Food for Thought

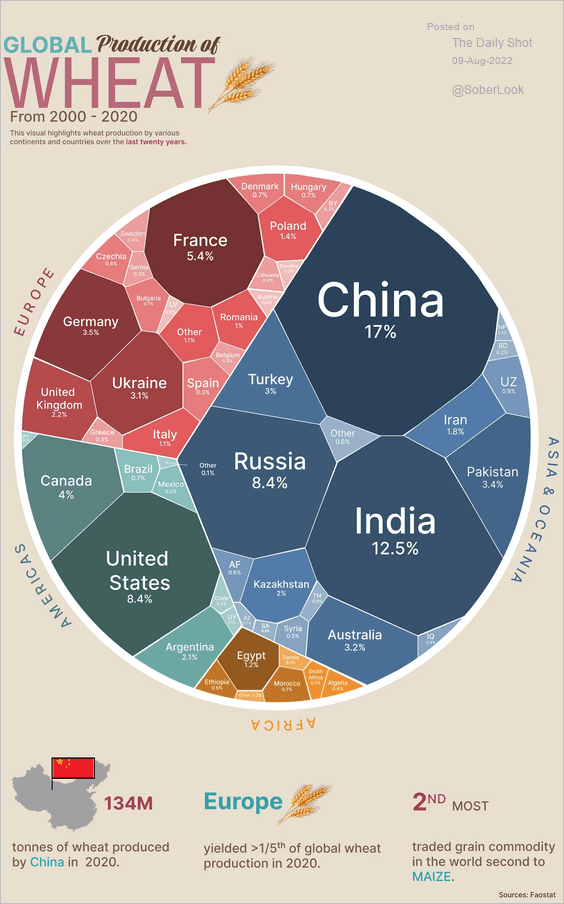

1. Global wheat production:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

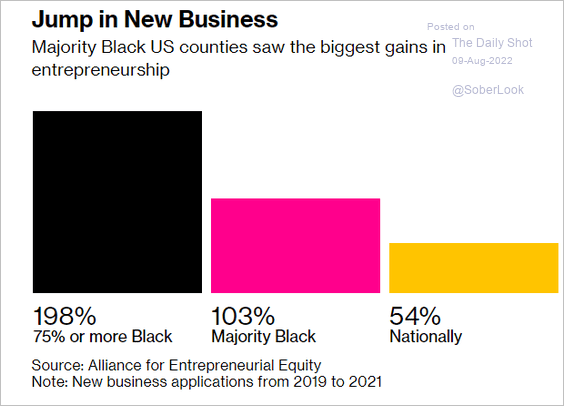

2. US startup surge in majority black areas:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

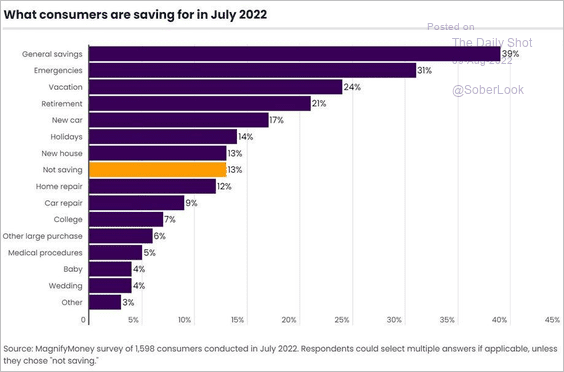

3. What are consumers saving for this year?

Source: @magnify_money Read full article

Source: @magnify_money Read full article

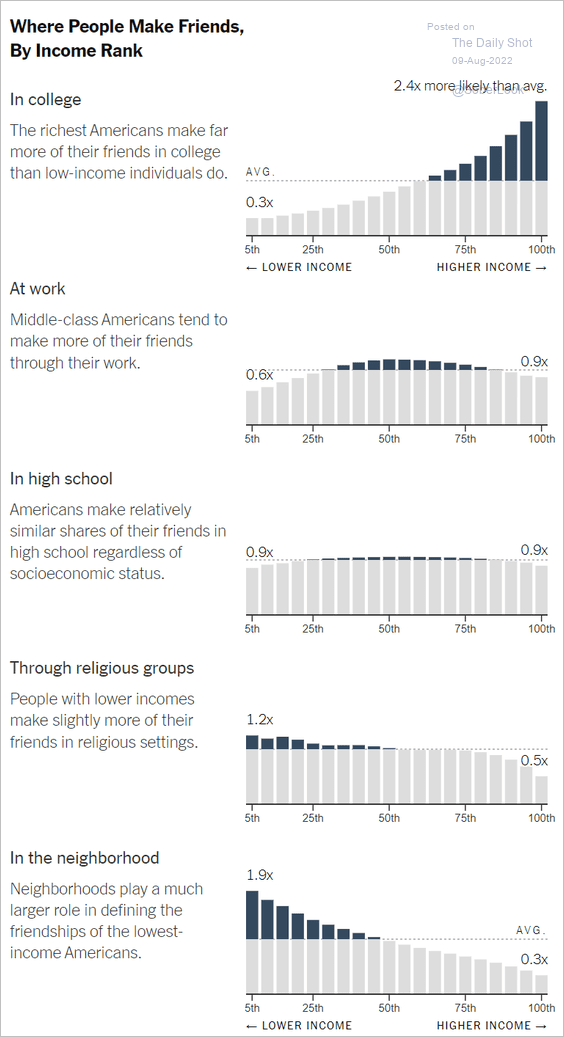

4. Where people make friends:

Source: The New York Times Read full article

Source: The New York Times Read full article

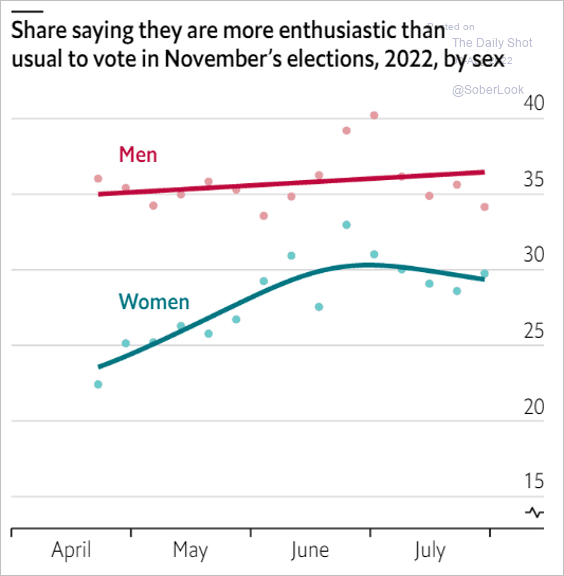

5. Voter enthusiasm in the US:

Source: The Economist Read full article

Source: The Economist Read full article

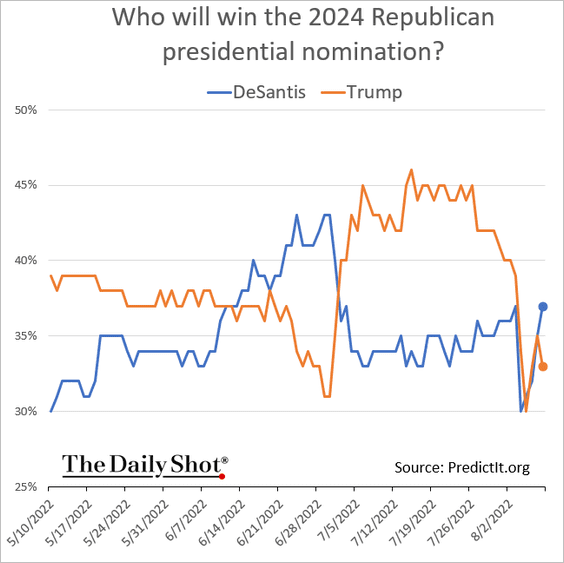

6. What are the betting markets telling us about the 2024 Republican presidential nomination?

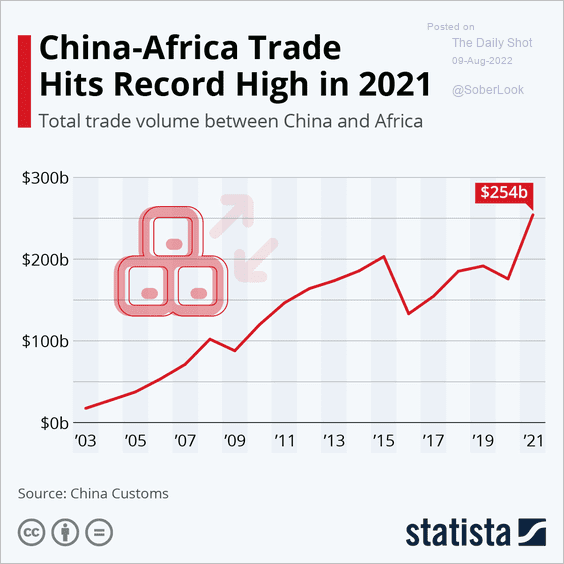

7. The China-Africa trade:

Source: Statista

Source: Statista

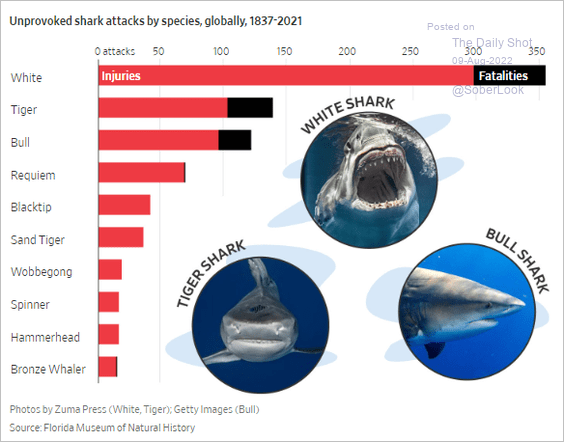

8. Shark attacks by species:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Back to Index