The Daily Shot: 16-Aug-22

• The United States

• The United Kingdom

• The Eurozone

• Europe

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

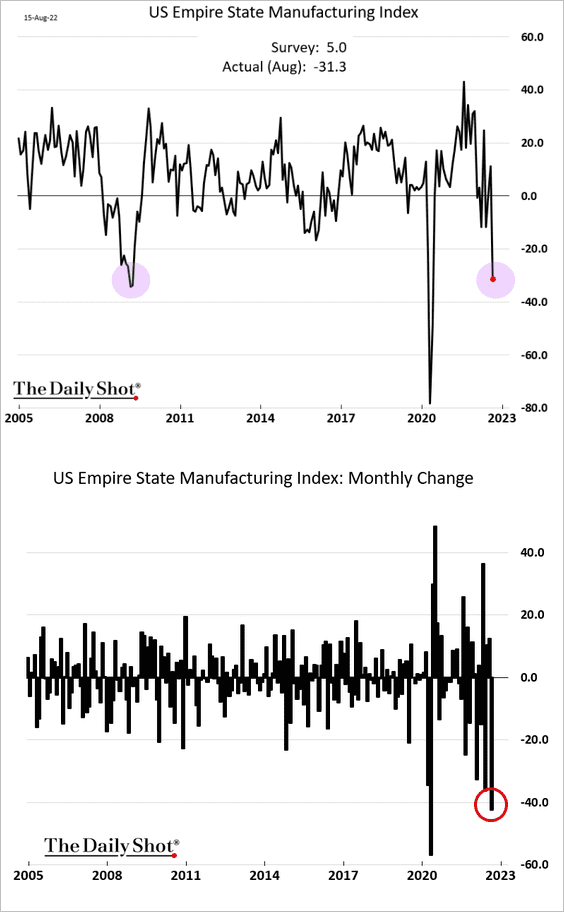

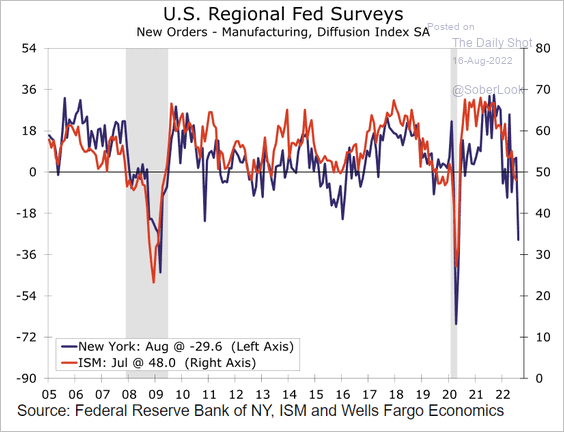

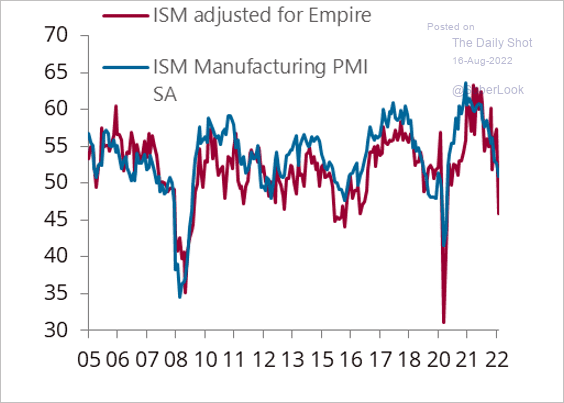

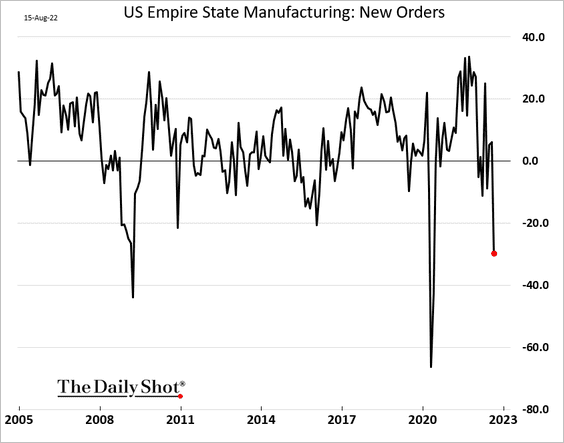

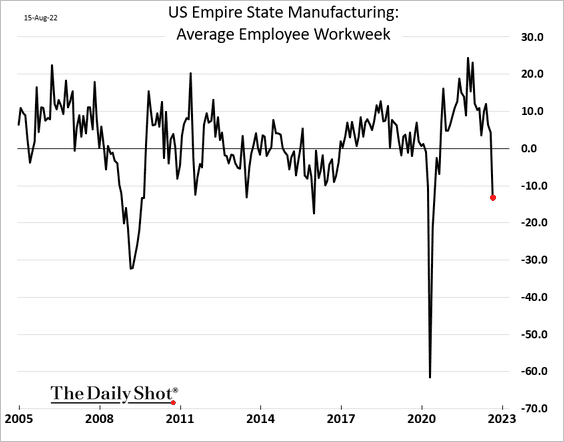

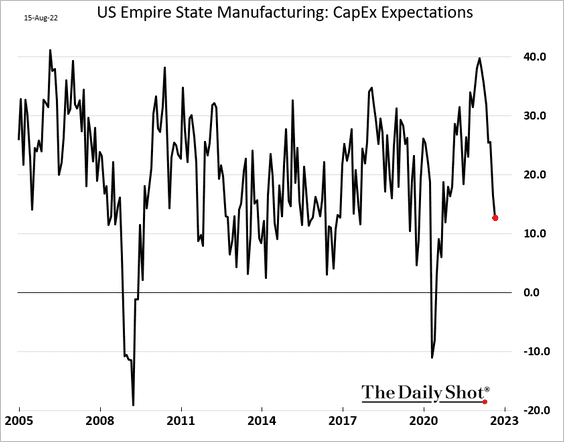

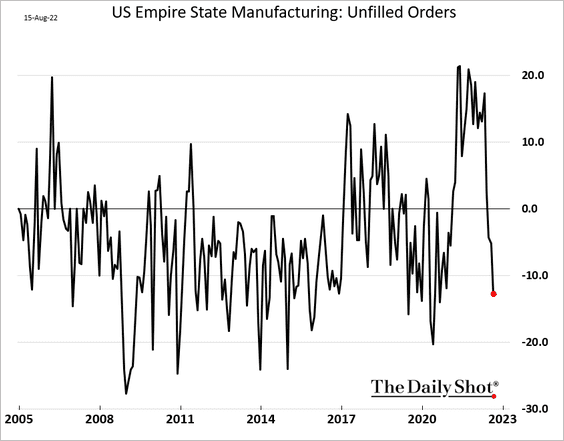

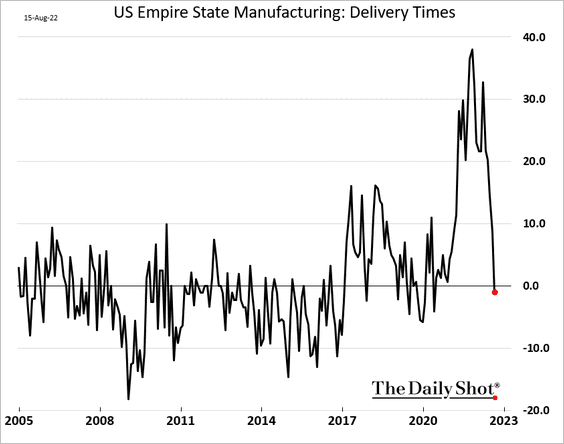

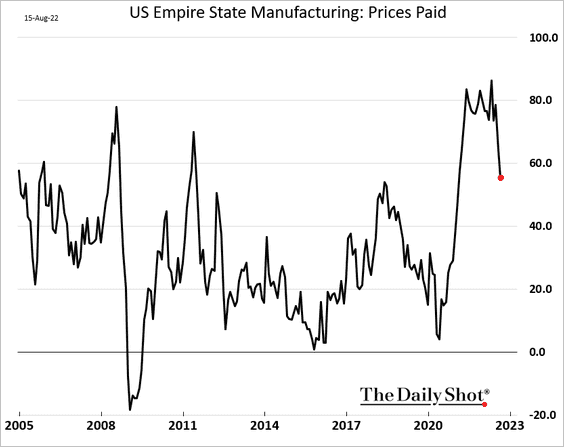

1. The NY Fed’s manufacturing report, the first regional indicator released in August, was shockingly weak.

It suggests that the manufacturing sector at the national level is in a recession (2 charts).

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Source: @Marcomadness2

Source: @Marcomadness2

• New orders plummetted.

• Factories have been cutting employee hours.

• CapEx expectations are slowing.

• Supply bottlenecks are no longer a problem as demand crashes.

– Unfilled orders:

– Supplier delivery times:

• Price pressures are starting to ease.

——————–

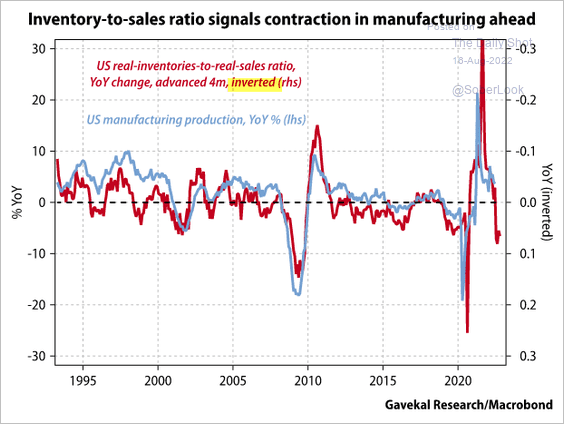

2. At the national level, the inventory-to-sales ratio also signals a manufacturing contraction.

Source: Gavekal Research

Source: Gavekal Research

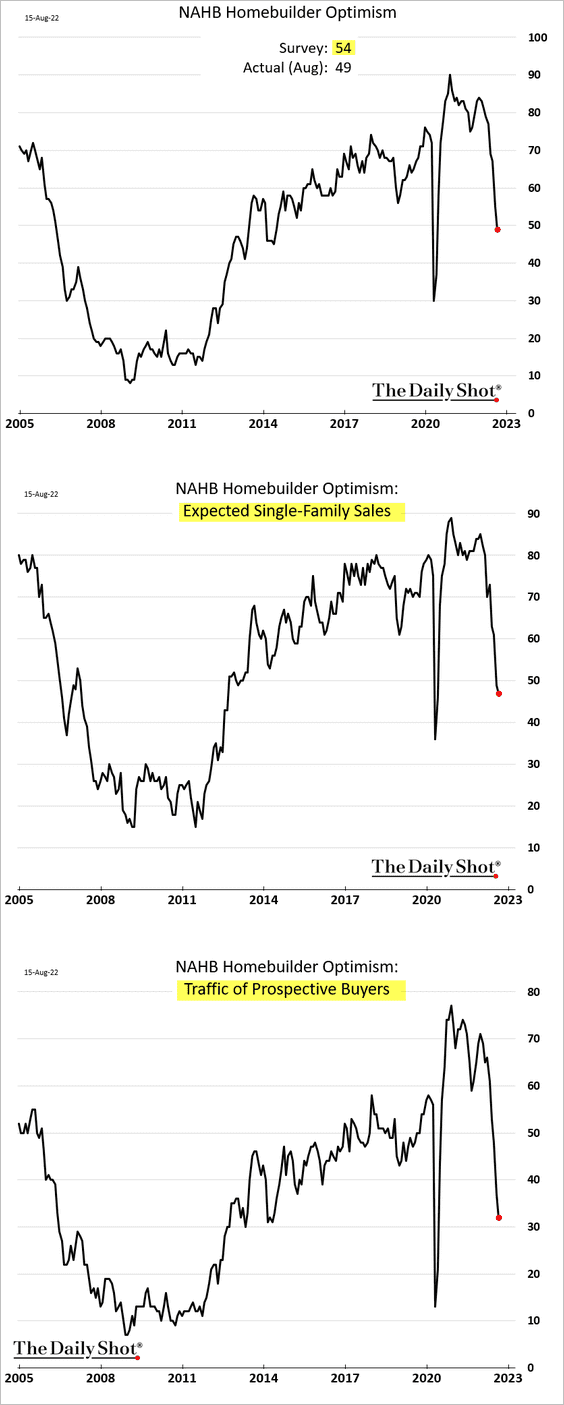

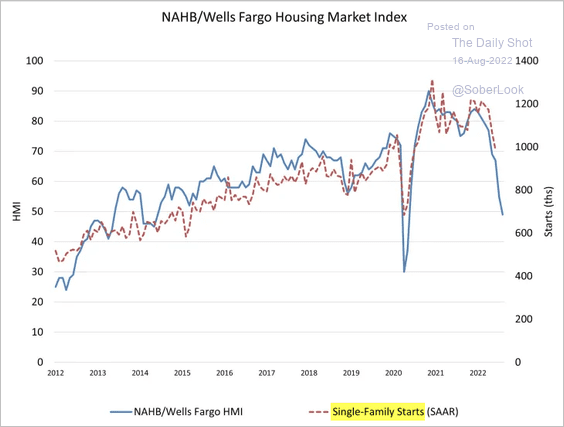

3. Next, we have some updates on the housing market.

• Homebuilders are under pressure, …

… signaling a sharp slowdown in residential construction.

Source: NAHB Read full article

Source: NAHB Read full article

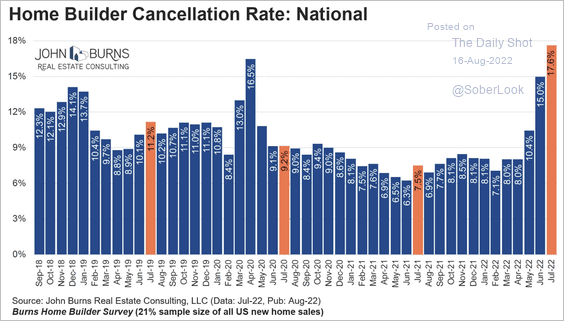

• Homebuilder cancellations jumped last month.

Source: @calculatedrisk

Source: @calculatedrisk

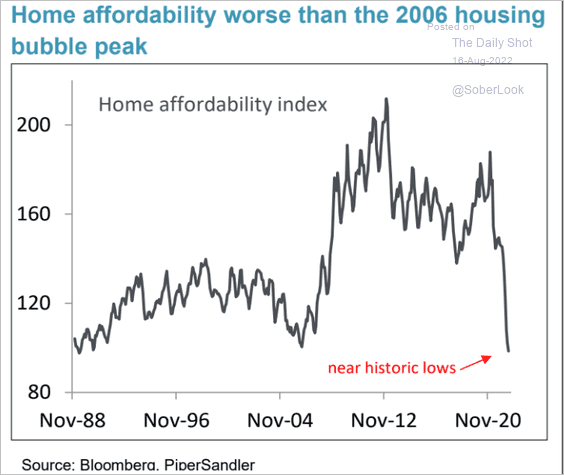

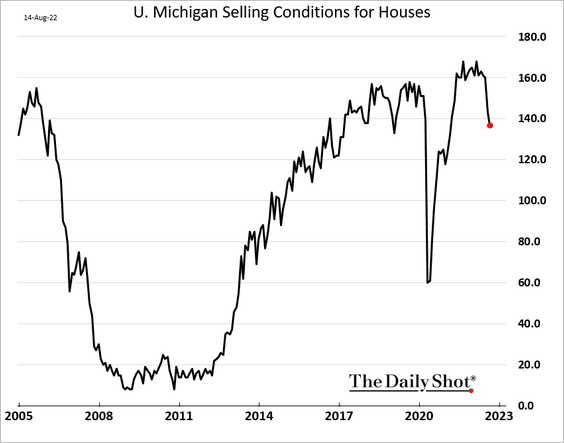

• Housing affordability has deteriorated further.

Source: Piper Sandler

Source: Piper Sandler

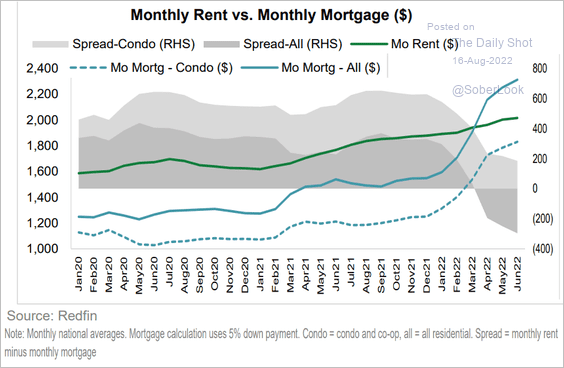

• The spread between rent and mortgage payments has been declining.

Source: SIFMA

Source: SIFMA

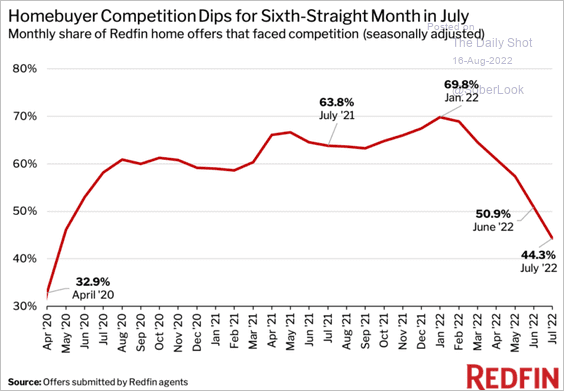

• Homebuyer competition eased further (fewer bidding wars).

Source: Redfin

Source: Redfin

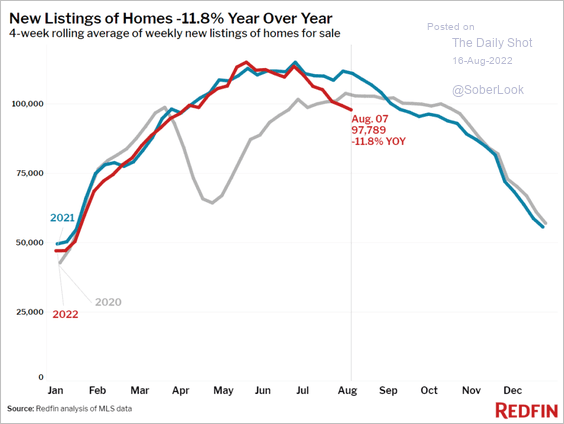

• New listings of homes are down almost 12% relative to last year, …

Source: Redfin

Source: Redfin

… as sellers pull back.

——————–

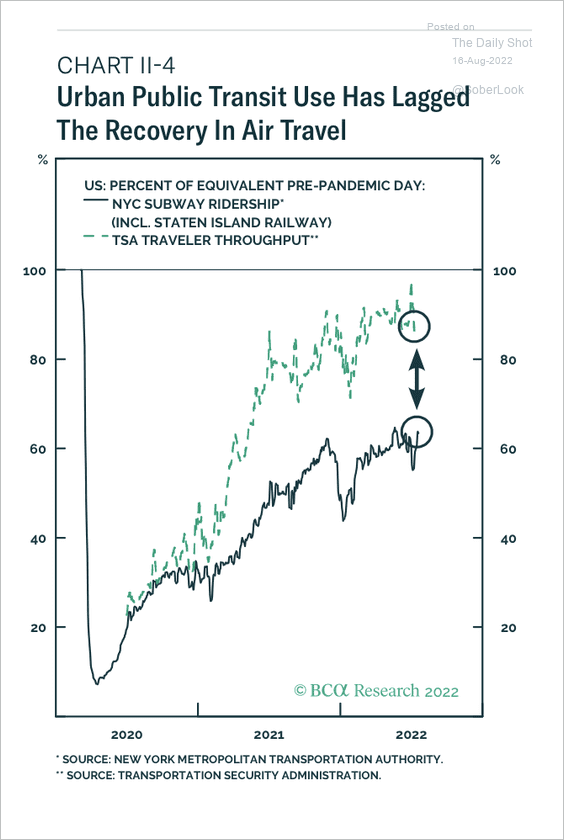

2. The recovery in air travel has outpaced urban transit use.

Source: BCA Research

Source: BCA Research

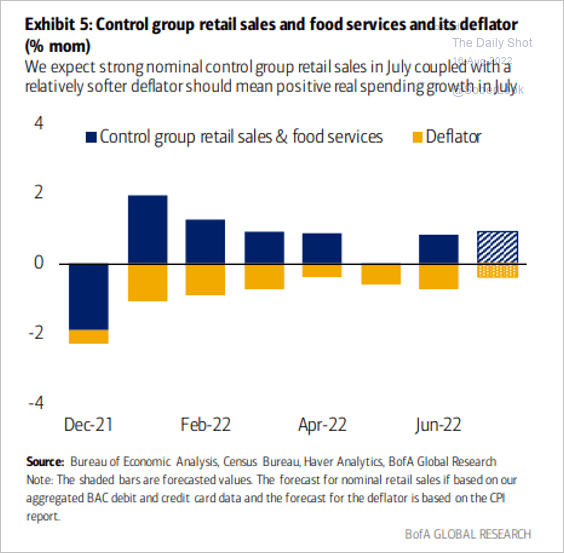

3. BofA expects robust real retail sales in July.

Source: BofA Global Research

Source: BofA Global Research

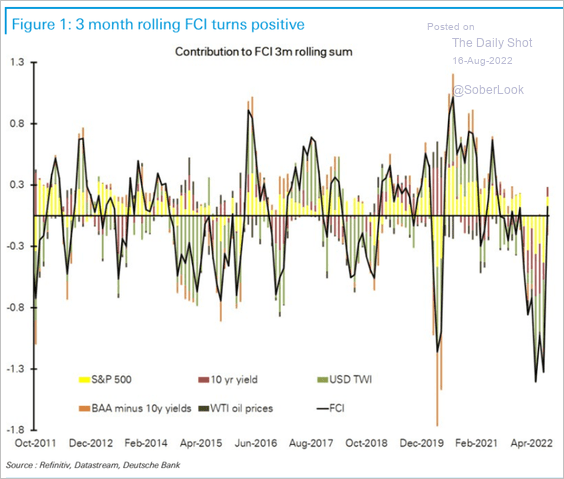

4. Financial conditions have eased recently. This should give the Fed room to keep tightening policy.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

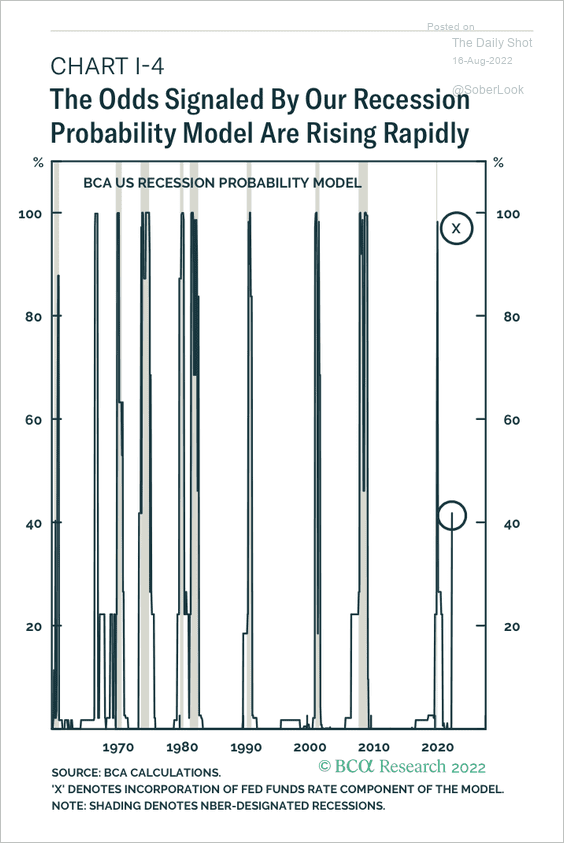

5. BCA Research’s recession probability model rose to 40%, mostly because of the decline in leading economic indicators.

Source: BCA Research

Source: BCA Research

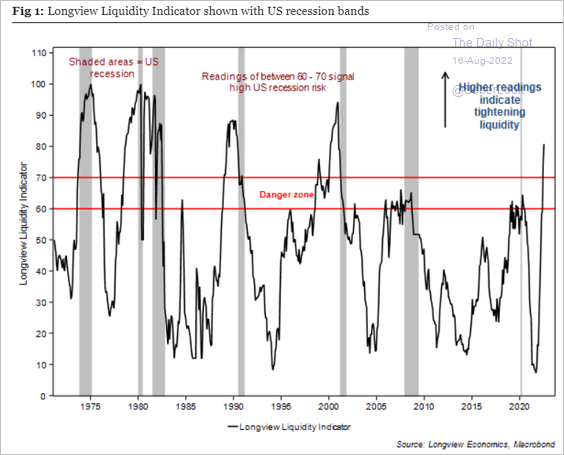

Tighter liquidity tends to precede recessions.

Source: Longview Economics

Source: Longview Economics

Back to Index

The United Kingdom

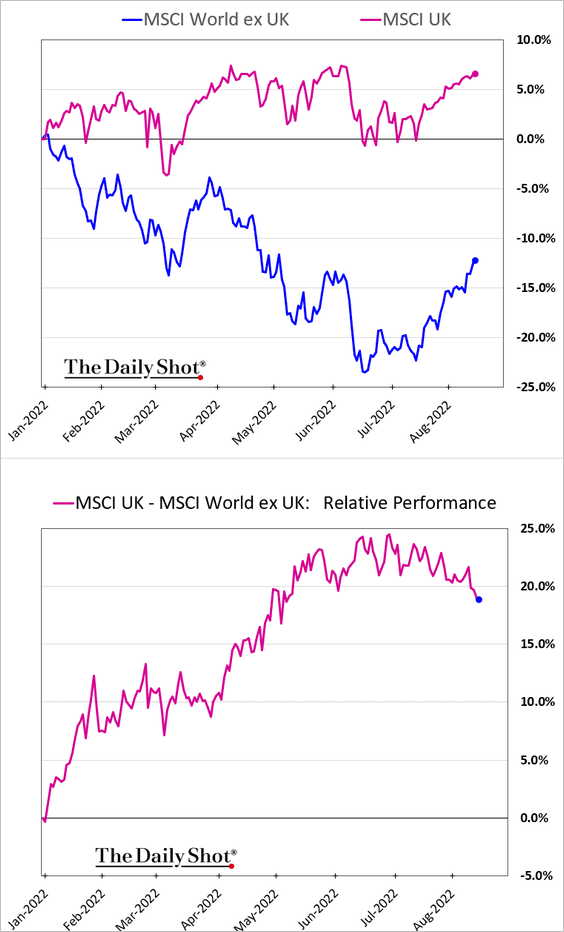

1. The UK stock market outperformance has stalled.

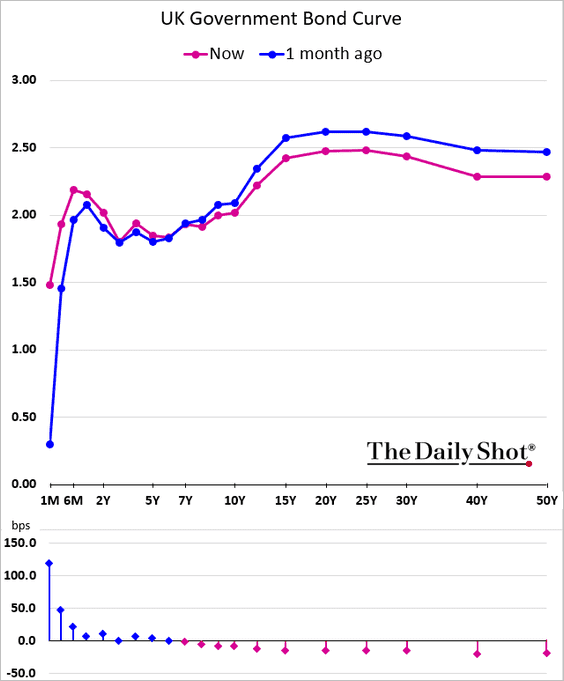

2. The gilt curve has flattened substantially in recent weeks.

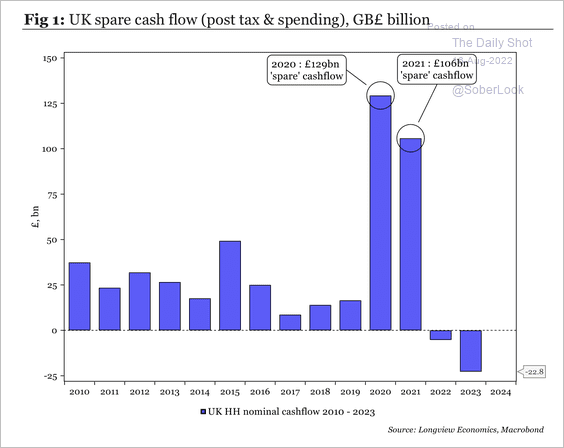

3. Spare cash flow among UK households is expected to shrink, which could negatively impact spending.

Source: Longview Economics

Source: Longview Economics

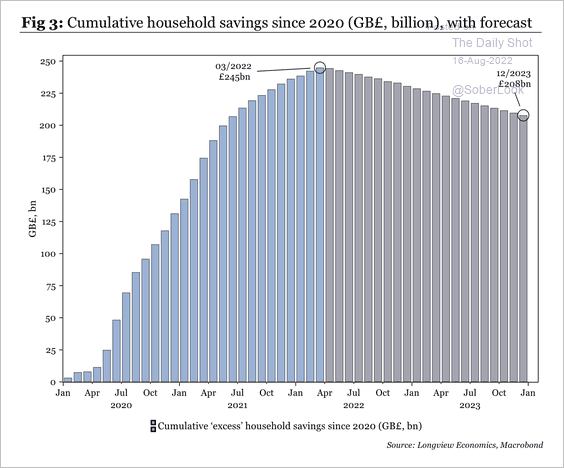

• Household savings are also forecasted to decline.

Source: Longview Economics

Source: Longview Economics

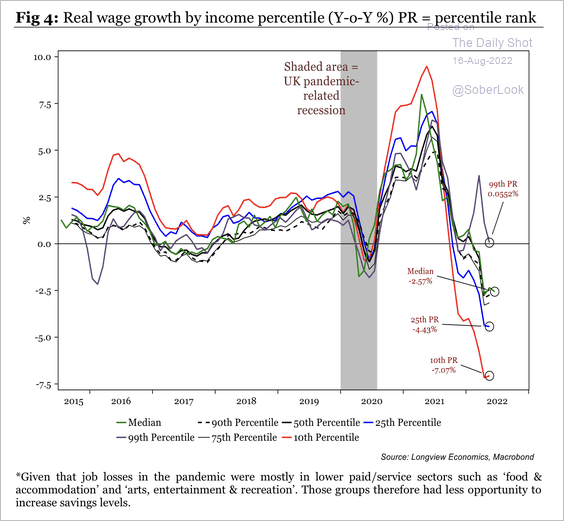

• The squeeze in real income growth has been concentrated among low-income groups.

Source: Longview Economics

Source: Longview Economics

——————–

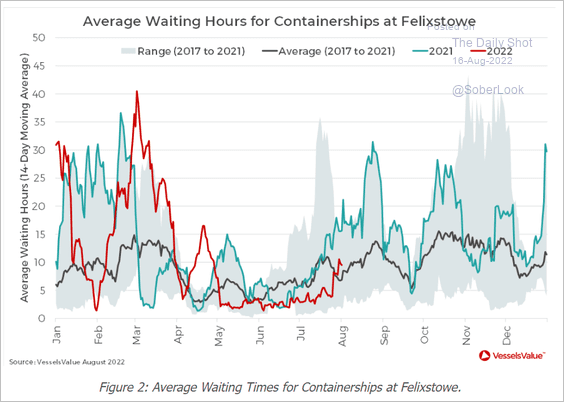

4. Container vessel waiting times are near their multi-year average.

Source: VesselsValue

Source: VesselsValue

Back to Index

The Eurozone

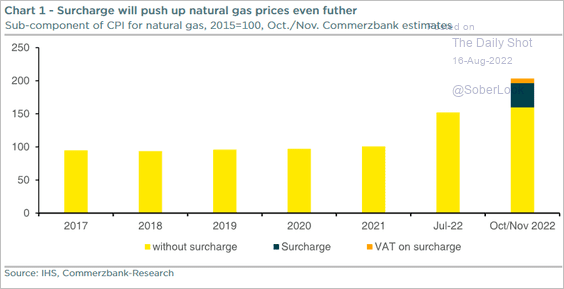

1. Germany’s natural gas surcharge will boost inflation.

Source: Commerzbank Research

Source: Commerzbank Research

Source: Bloomberg Read full article

Source: Bloomberg Read full article

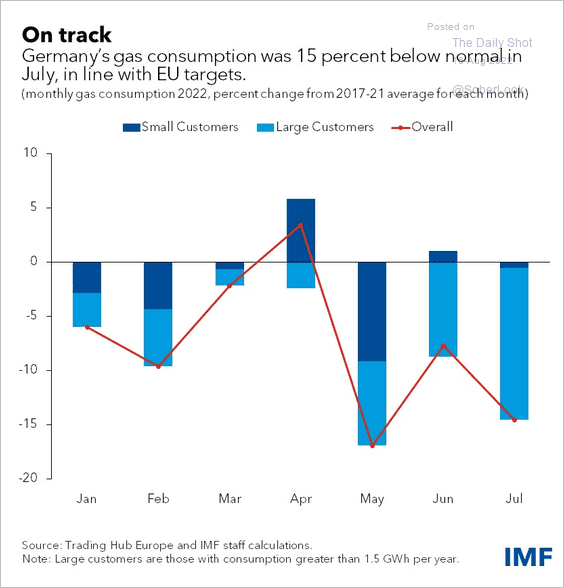

• Natural gas consumption has been lower than normal in recent months.

Source: IMF Read full article

Source: IMF Read full article

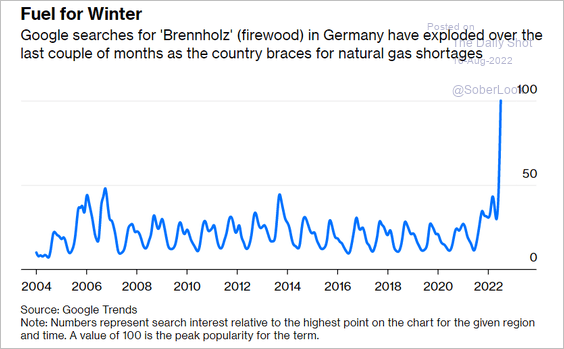

• Germany’s online search activity for firewood has been surging.

Source: @opinion Read full article

Source: @opinion Read full article

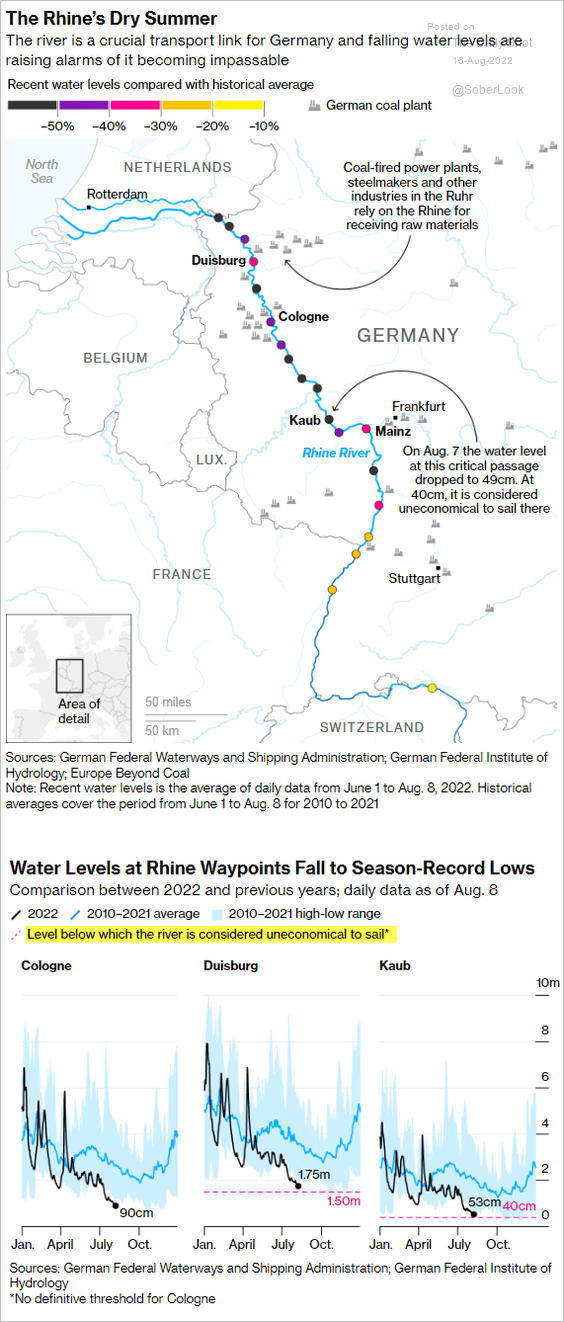

2. Next, we have some data on the Rhine river situation (from Bloomberg).

Source: Bloomberg Read full article

Source: Bloomberg Read full article

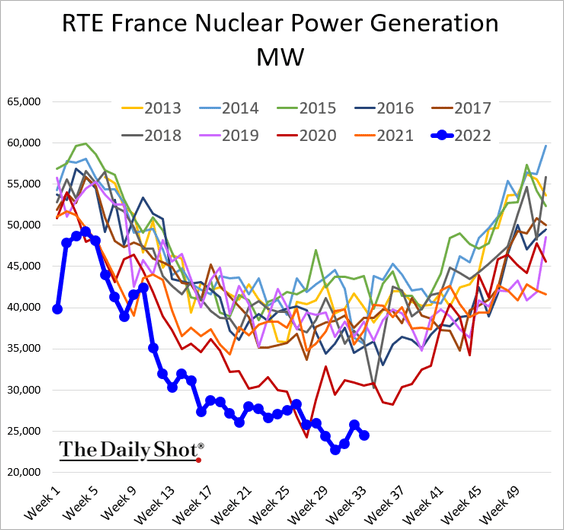

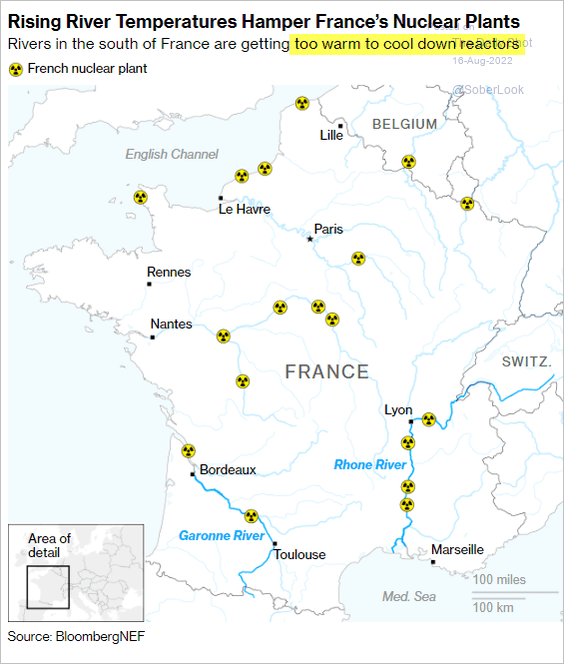

3. French nuclear power output is at multi-year lows for this time of the year.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

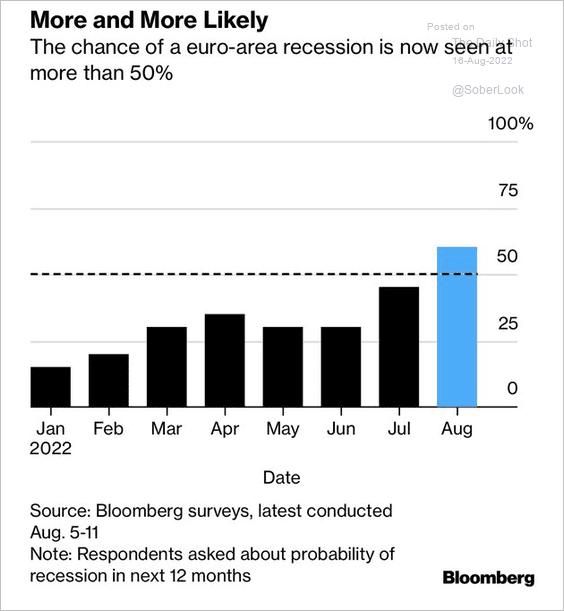

4. Economists increasingly see a recession in the Eurozone.

Source: @GregDaco, Bloomberg Read full article

Source: @GregDaco, Bloomberg Read full article

Back to Index

Europe

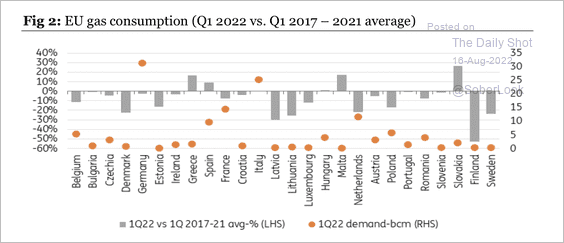

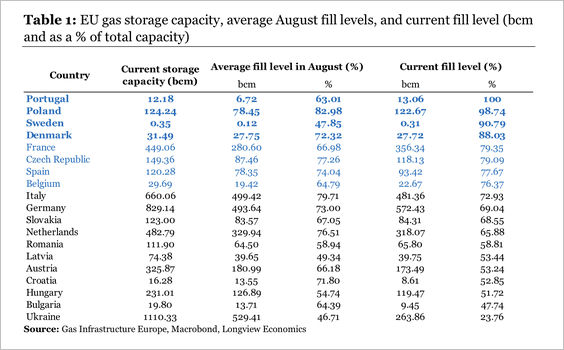

1. Many EU member countries have reduced gas demand to target levels.

Source: ING; {h/t} Longview Economics

Source: ING; {h/t} Longview Economics

At least four member states have already reached their November gas storage targets, while another four are close behind.

Source: Longview Economics

Source: Longview Economics

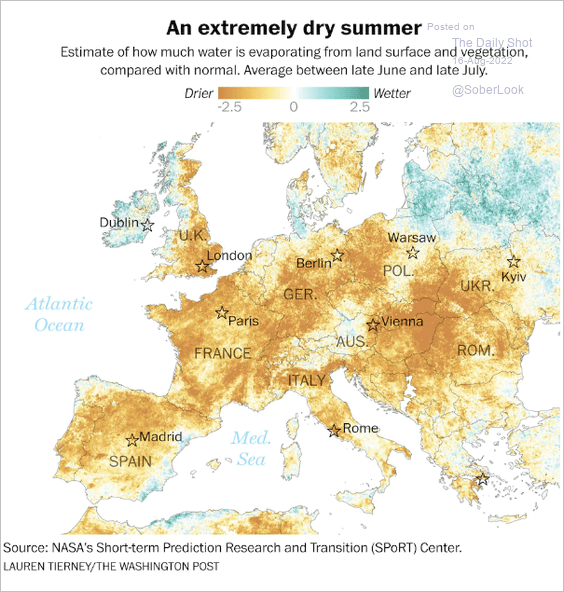

2. It’s been a very dry summer.

Source: The Washington Post Read full article

Source: The Washington Post Read full article

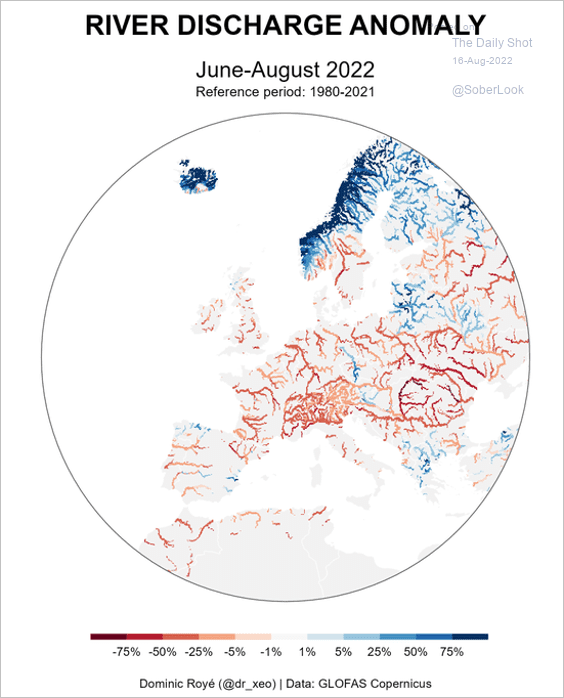

Rivers are running dry.

Source: @dr_xeo

Source: @dr_xeo

Back to Index

China

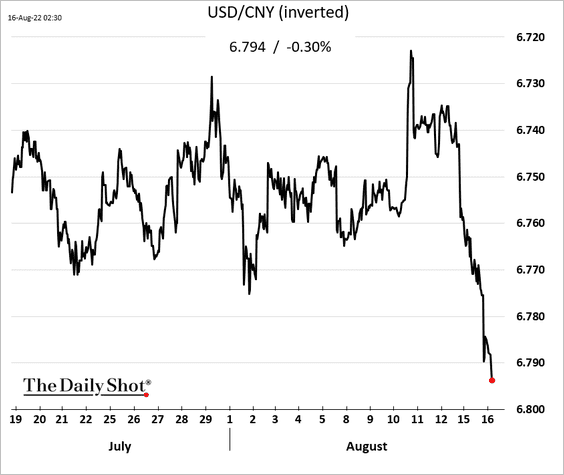

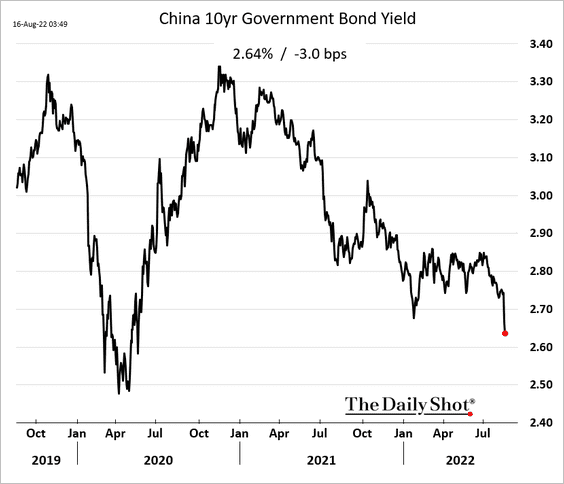

1. The renminbi weakened further after the PBoC rate cut.

Bond yields continue to fall.

——————–

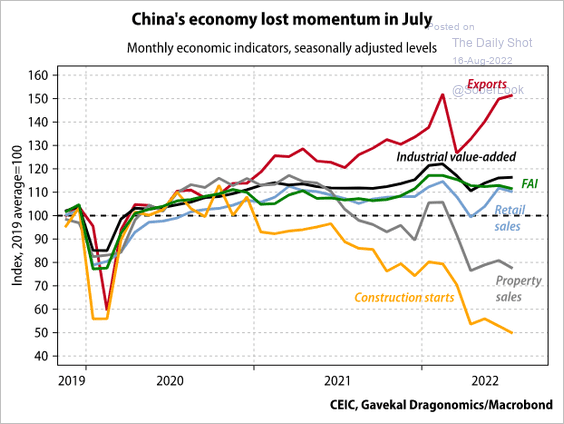

2. Here are China’s key economic indicators.

Source: Gavekal Research

Source: Gavekal Research

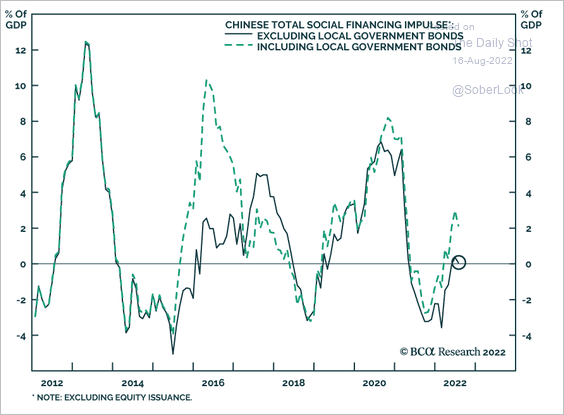

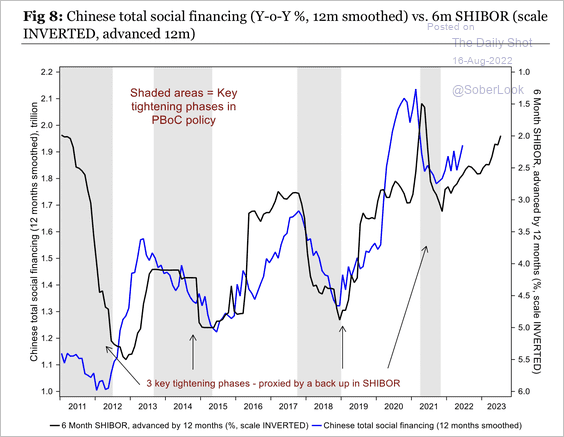

3. Excluding local government debt, China’s credit rebound has been tepid.

Source: BCA Research

Source: BCA Research

But the decline in interbank lending rates points to an increase in aggregate credit (typically a 12-month lead).

Source: Longview Economics

Source: Longview Economics

Back to Index

Emerging Markets

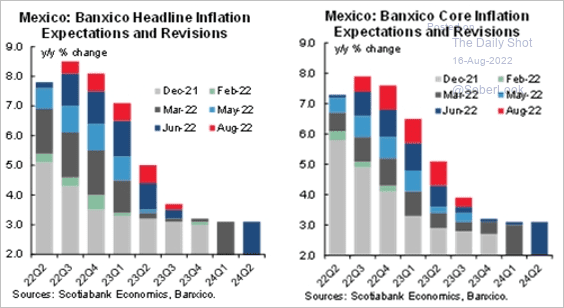

1. Banxico keeps boosting its inflation forecasts.

Source: Scotiabank Economics

Source: Scotiabank Economics

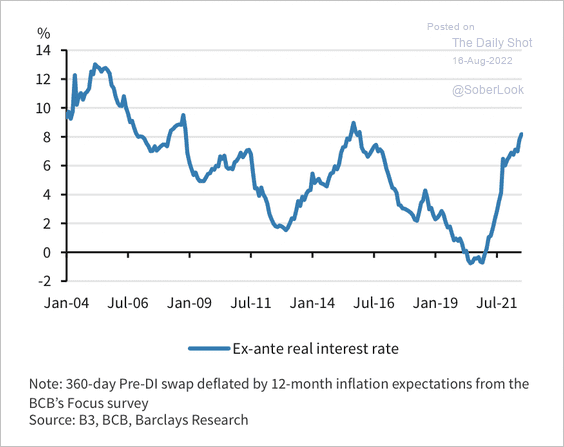

2. In Brazil, real interest rates are approaching a seven-year high, north of 8% year-over-year.

Source: Barclays Research

Source: Barclays Research

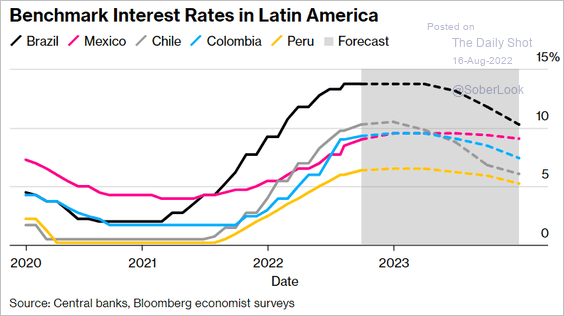

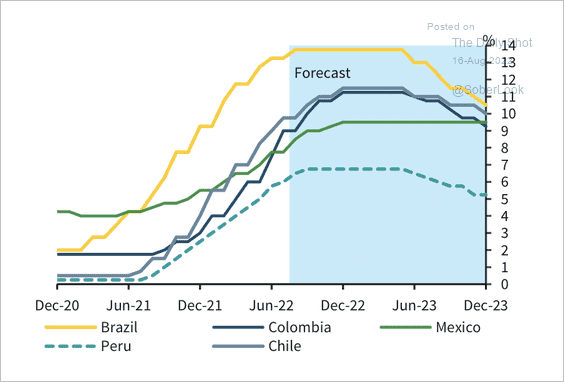

3. Are policy rates near their peak in most LatAm economies?

Source: @EloMdeo, @markets Read full article

Source: @EloMdeo, @markets Read full article

Barclays expects most tightening cycles in Latin America to extend into the fourth quarter of this year.

Source: Barclays Research

Source: Barclays Research

——————–

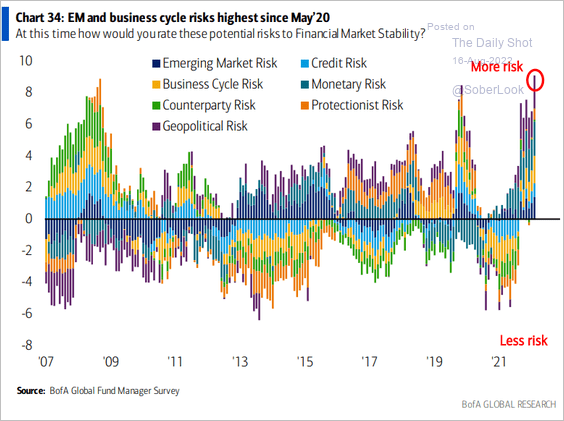

4. When it comes to emerging markets, risk aversion among global fund managers remains very high.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Cryptocurrency

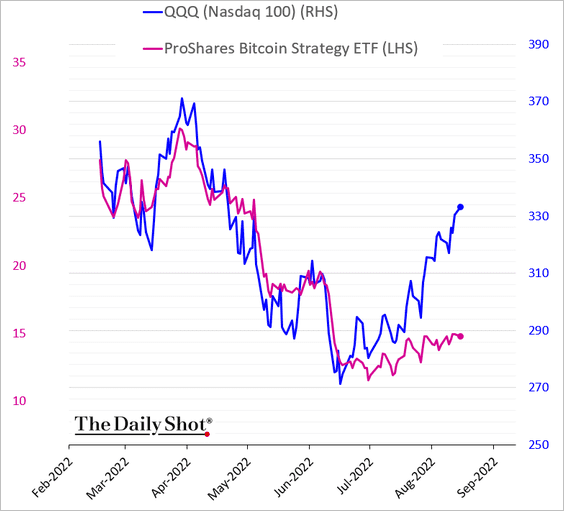

1. Bitcoin continues to lag growth stocks.

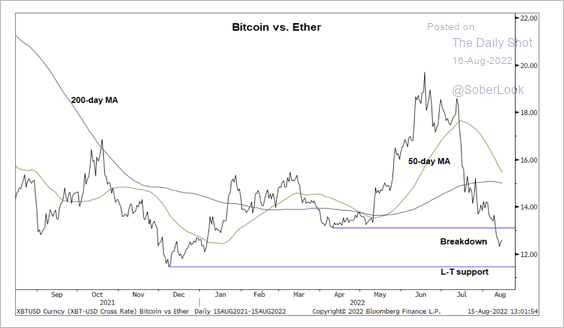

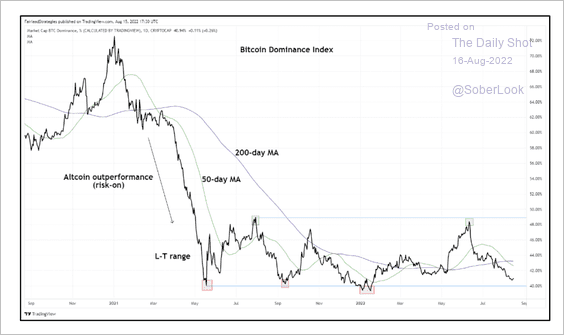

2. The BTC/ETH price ratio is approaching long-term support, similar to the bitcoin dominance index. Could we see a pause in the risk-on rally? (2 charts)

Source: @StocktonKatie

Source: @StocktonKatie

Source: @StocktonKatie

Source: @StocktonKatie

——————–

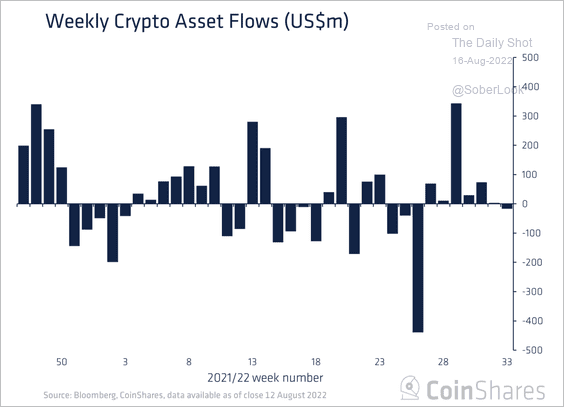

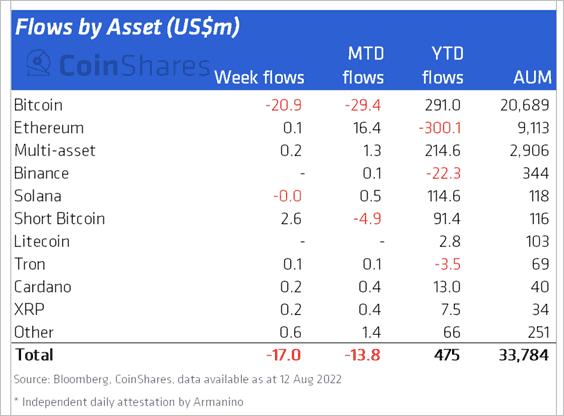

3. Crypto funds saw minor outflows last week, driven by bitcoin-focused products. (2 charts)

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

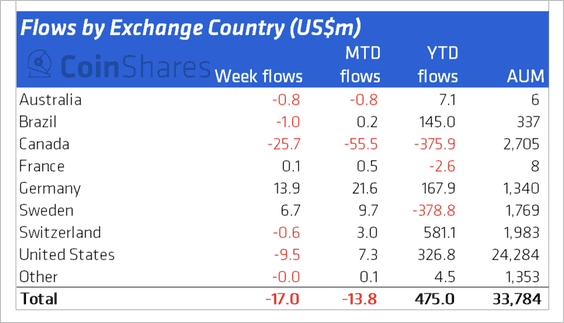

4. Canadian crypto ETFs saw the most outflows last week, while German funds continued to see inflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

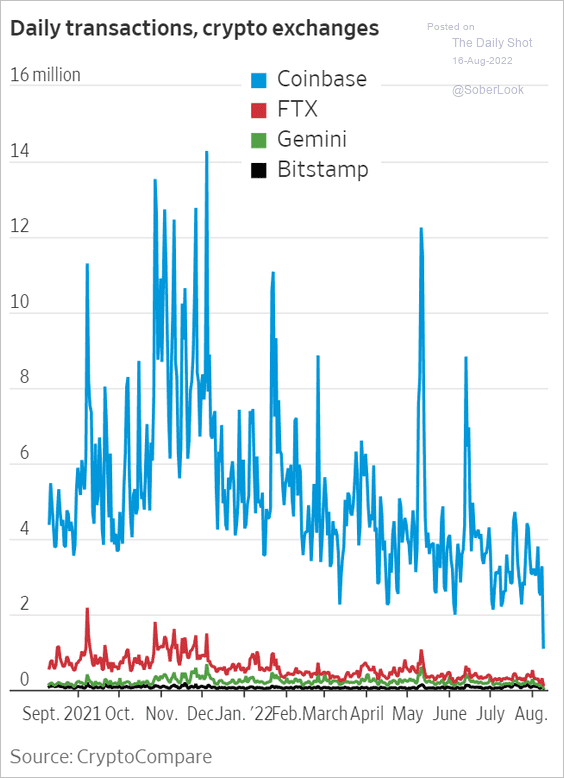

5. Coinbase daily transactions declined sharply in recent months.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Commodities

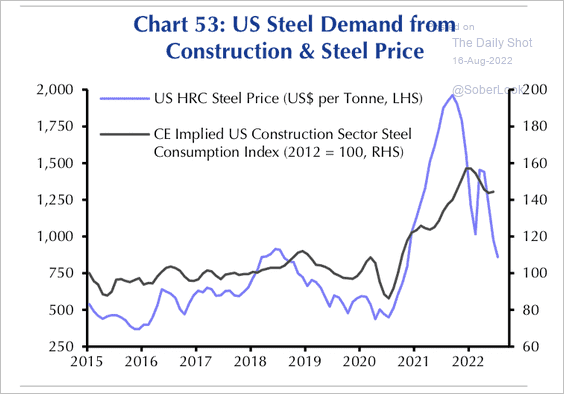

1. The decline in US steel prices points to weaker construction-related demand, especially on the back of higher borrowing costs, according to Capital Economics.

Source: Capital Economics

Source: Capital Economics

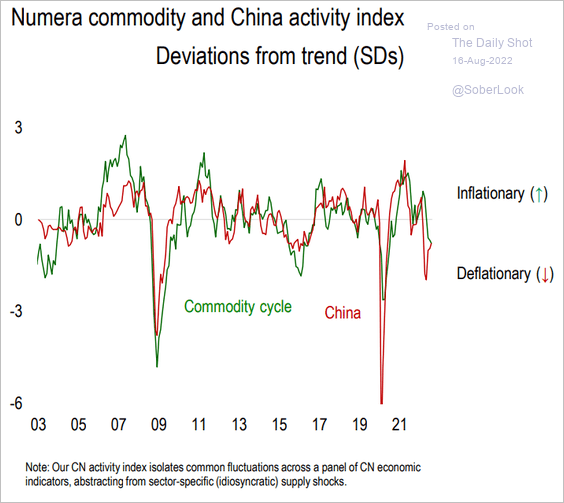

2. The commodity cycle is highly correlated to China’s economic activity.

Source: Numera Analytics

Source: Numera Analytics

Back to Index

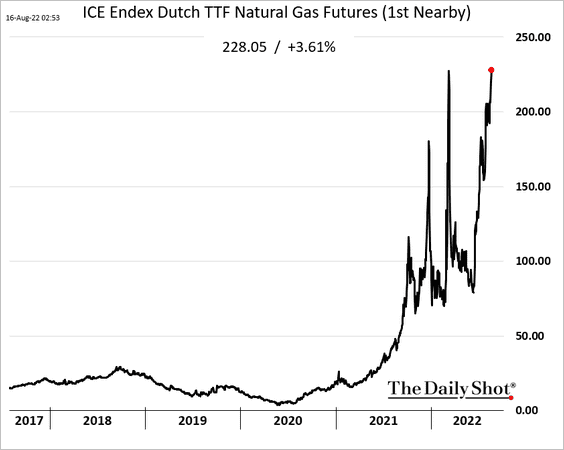

Energy

1. European natural gas futures hit a new high.

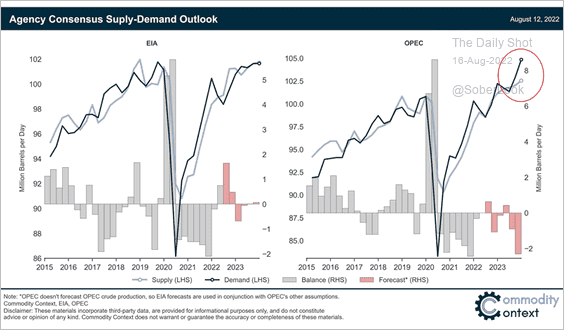

2. OPEC seems to have a lot of faith in global economic strength driving oil demand higher.

Source: @rory_johnston, h/t @pav_chartbook

Source: @rory_johnston, h/t @pav_chartbook

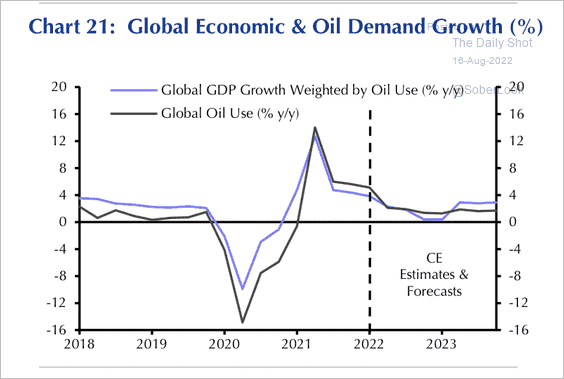

Capital Economics expects a decline in oil consumption growth in the coming quarters.

Source: Capital Economics

Source: Capital Economics

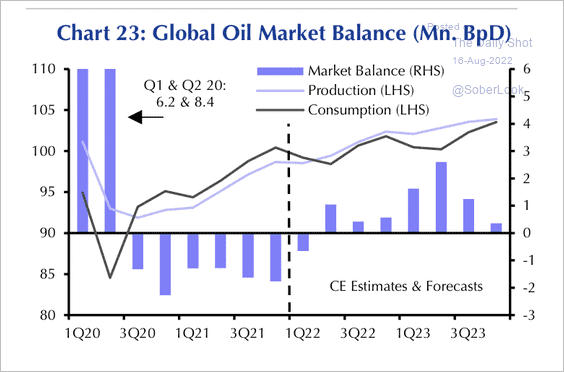

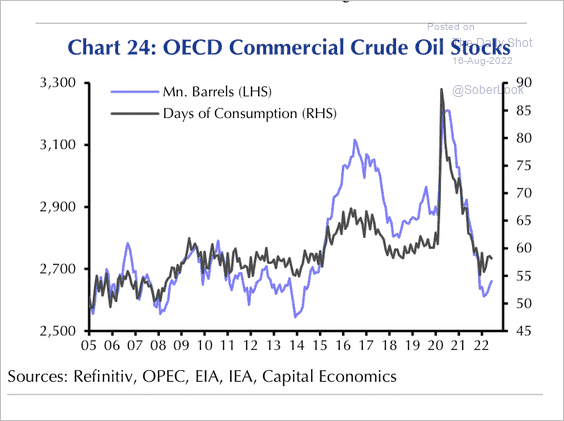

The crude oil market surplus is expected to increase, which could lead to a recovery in commercial stocks in advanced economies (2 charts).

Source: Capital Economics

Source: Capital Economics

Source: Capital Economics

Source: Capital Economics

Back to Index

Equities

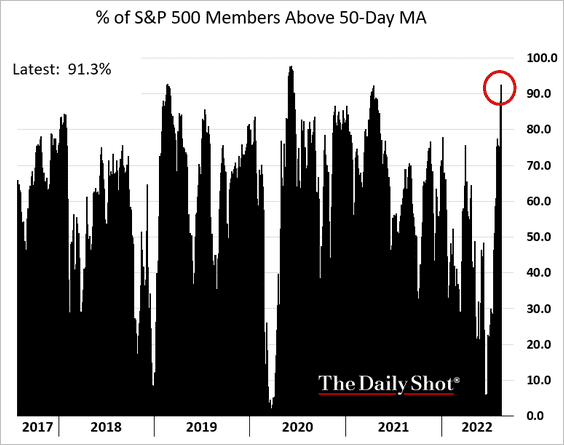

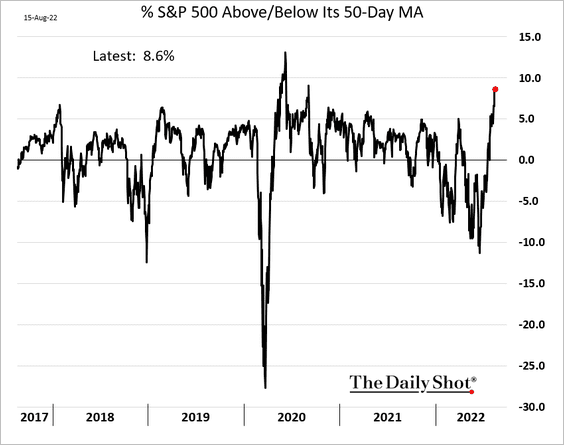

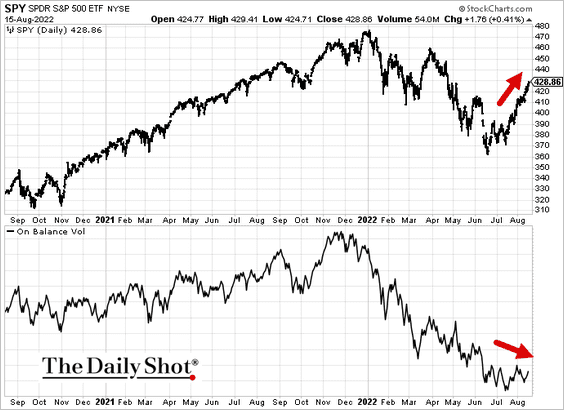

1. Over 90% of S&P 500 members trade above their 50-day moving average.

The S&P 500 is almost 9% above its 50-day moving average. Time for a pullback?

——————–

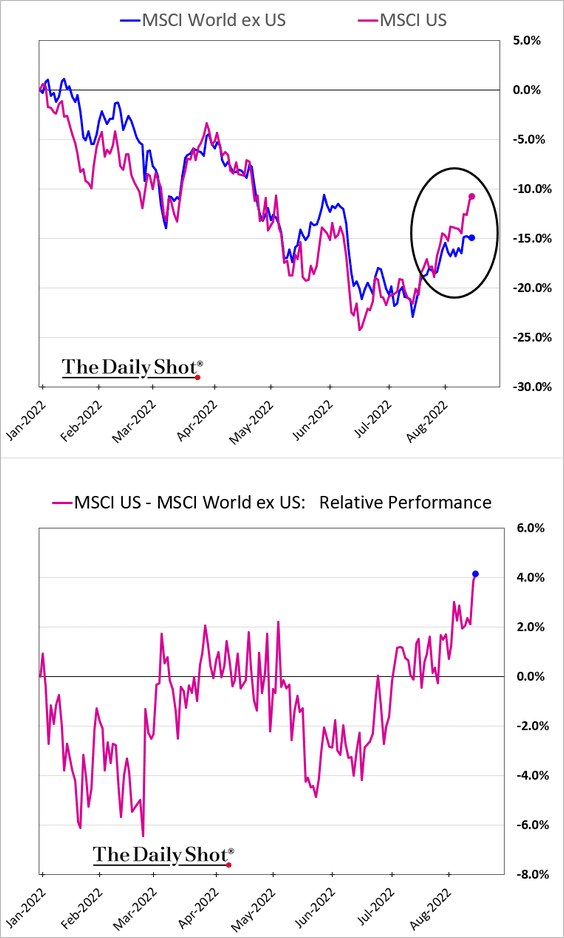

2. The US market rebound has been outpacing the rest of the world.

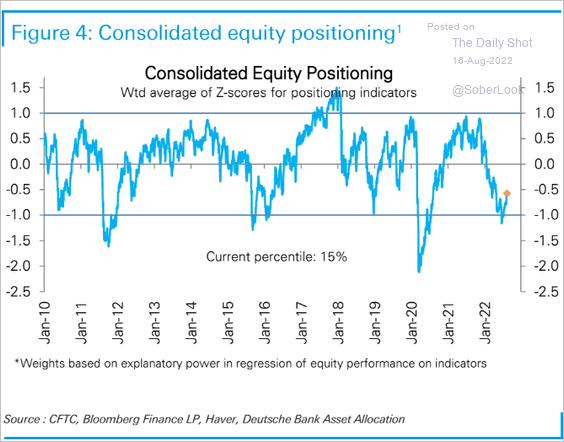

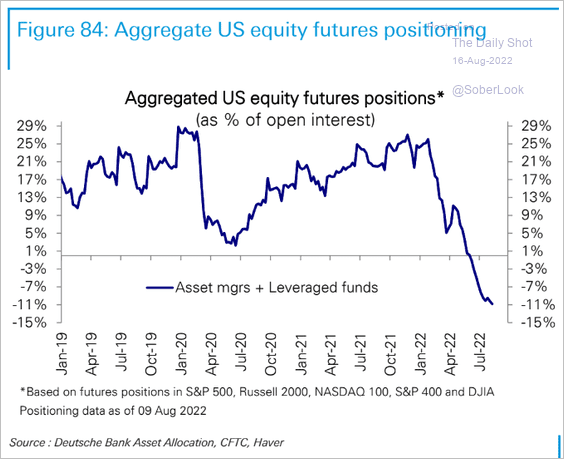

3. Deutsche Bank’s consolidated positioning indicator increased last week.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

But equity futures positioning remains exceptionally bearish.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

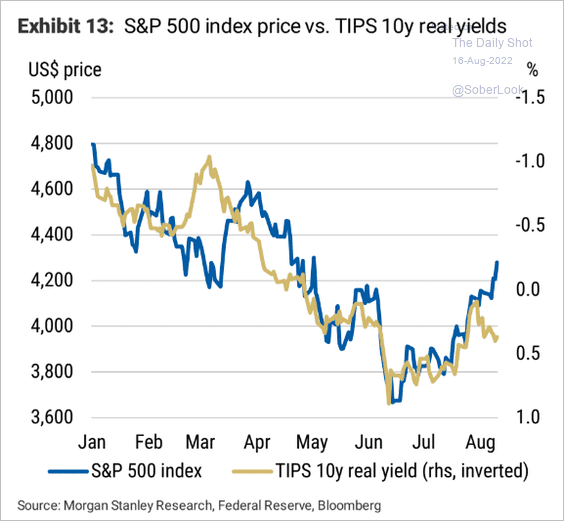

4. The stock market has diverged from real yields, which is not sustainable.

Source: Morgan Stanley Research; @WallStJesus

Source: Morgan Stanley Research; @WallStJesus

5. The On-Balance Volume indicator has not been signaling a rebound.

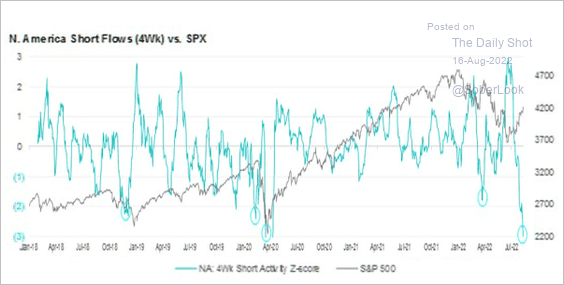

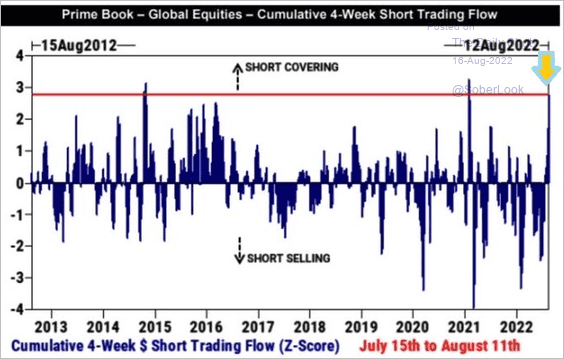

6. Short-covering has been extreme in recent weeks (2 charts).

Source: JP Morgan Research; @themarketear

Source: JP Morgan Research; @themarketear

Source: @Mayhem4Markets

Source: @Mayhem4Markets

——————–

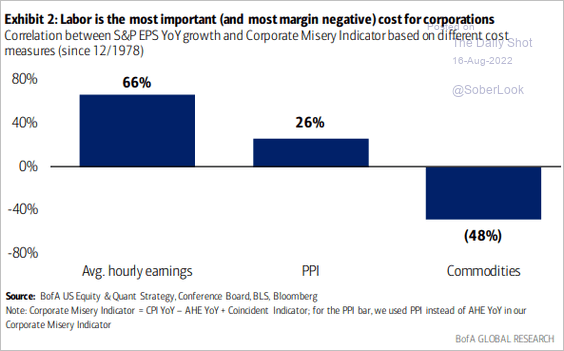

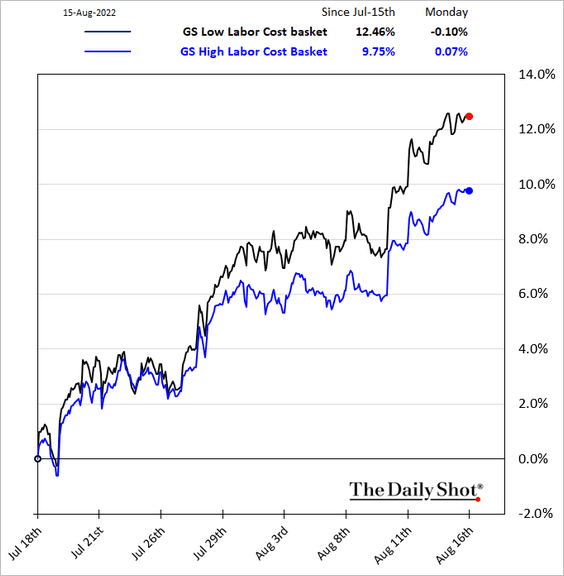

7. Rising labor costs will be a drag on margins.

Source: BofA Global Research

Source: BofA Global Research

Companies with traditionally high labor costs have been underperforming this month.

——————–

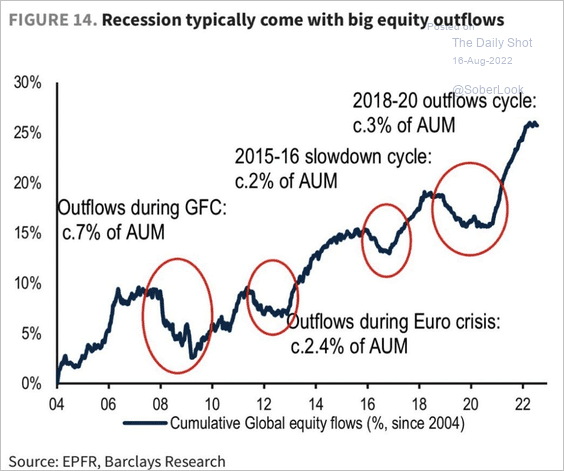

8. We didn’t see the usual fund outflows during this year’s selloff (no capitulation?).

Source: Barclays Research

Source: Barclays Research

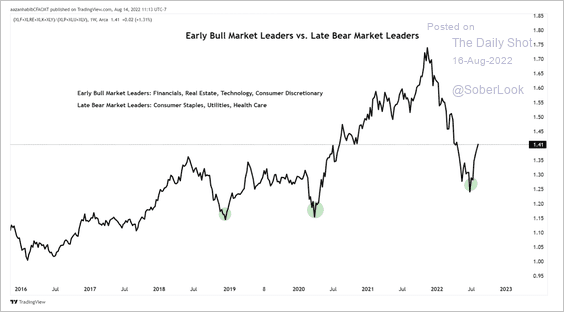

9. Cyclical sectors are starting to outperform defensives.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

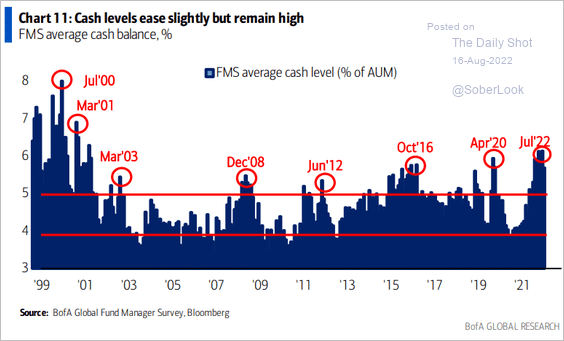

10. Fund managers’ cash holdings are off the highs but remain elevated.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Credit

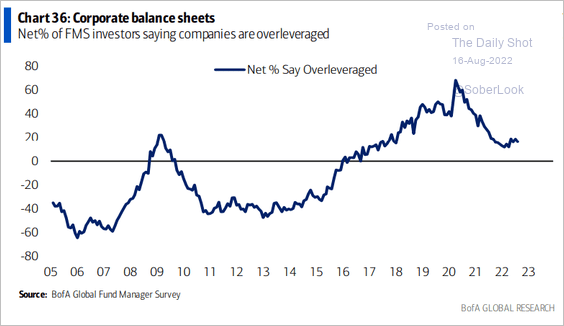

1. Investors are not very concerned about corporate leverage.

Source: BofA Global Research

Source: BofA Global Research

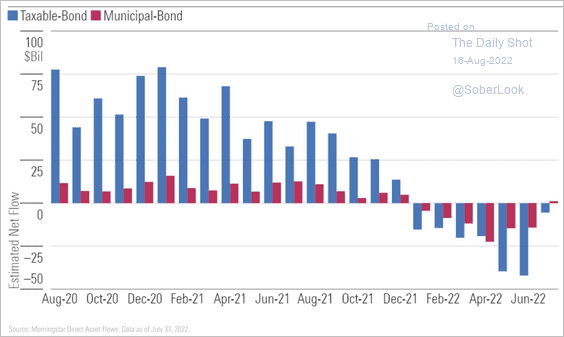

2. Muni bond fund flows turned positive last month (slightly).

Source: Morningstar

Source: Morningstar

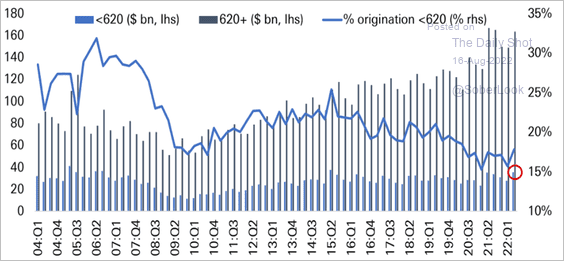

3. According to Deutsche Bank, subprime auto loan originations reached the highest level since 2015 in Q2.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Rates

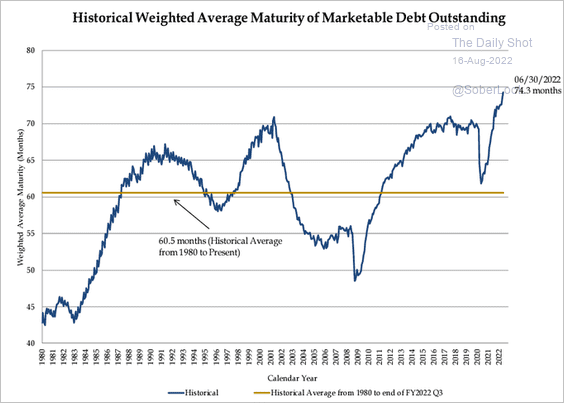

1. Is this the peak for the US Treasury’s average debt maturity?

Source: @FedGuy12 Read full article

Source: @FedGuy12 Read full article

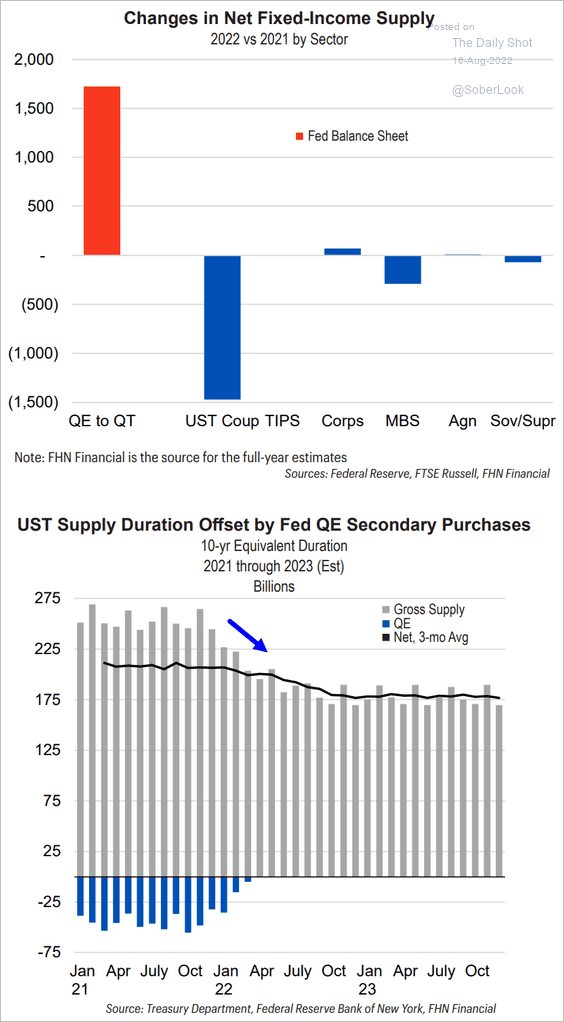

2. The QT-driven increase in fixed-income supply has been offset by lower debt issuance (“UST Coup” = coupon-paying Treasuries).

Source: FHN Financial

Source: FHN Financial

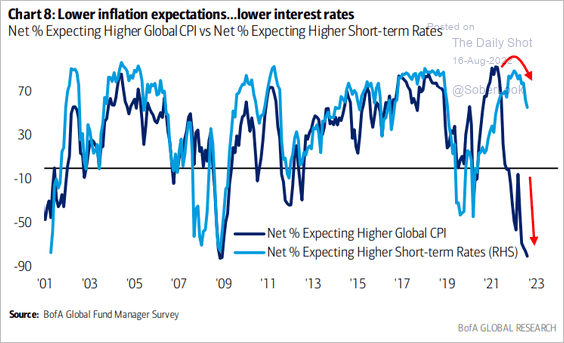

3. Will investors’ rate expectations follow inflation expectations lower.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Global Developments

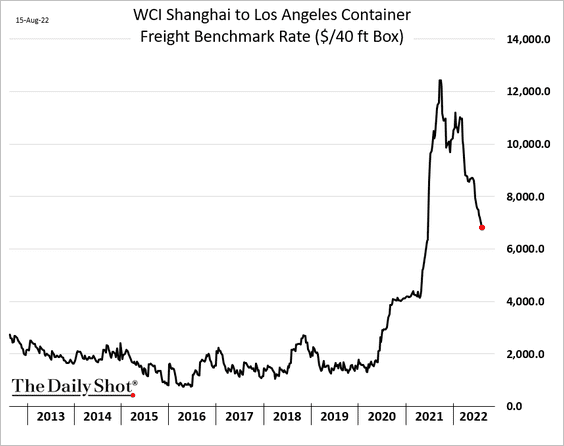

1. Container freight costs continue to ease.

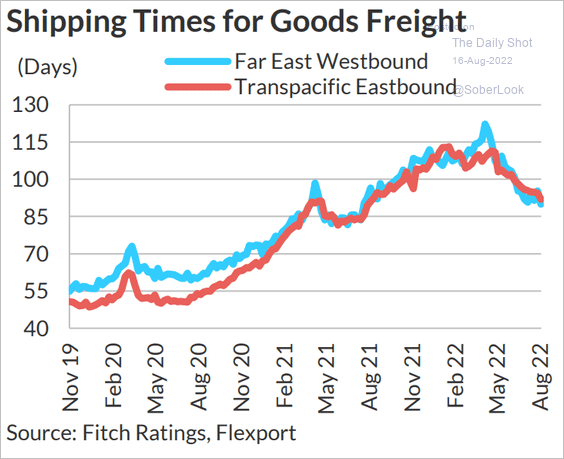

Shipping times are moderating but remain elevated.

Source: Fitch Ratings

Source: Fitch Ratings

——————–

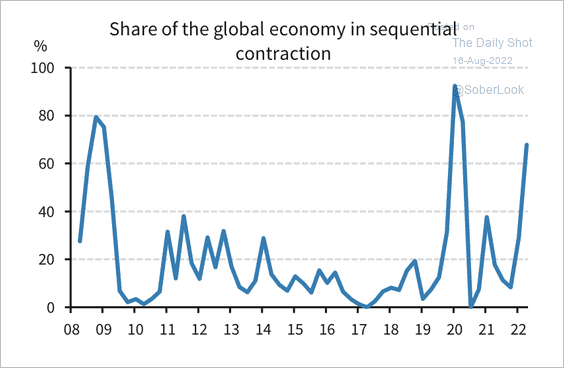

2. Economic growth is weakening globally.

Source: Barclays Research

Source: Barclays Research

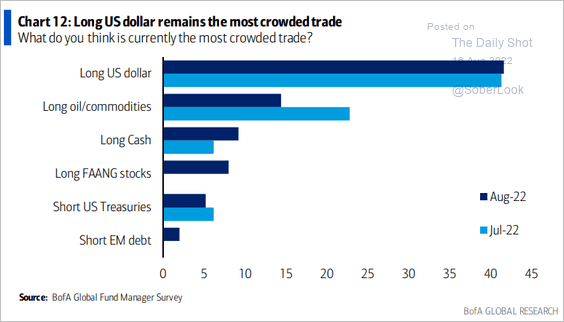

3. Long the US dollar is still viewed as the most crowded trade.

Source: BofA Global Research

Source: BofA Global Research

——————–

Food for Thought

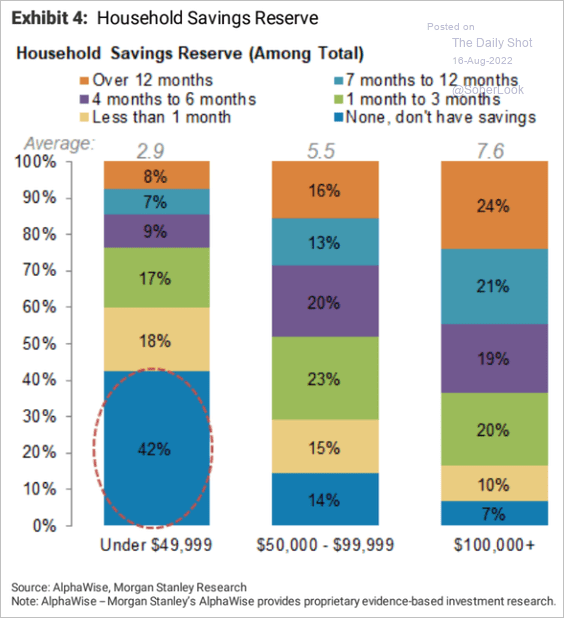

1. US household savings reserve:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

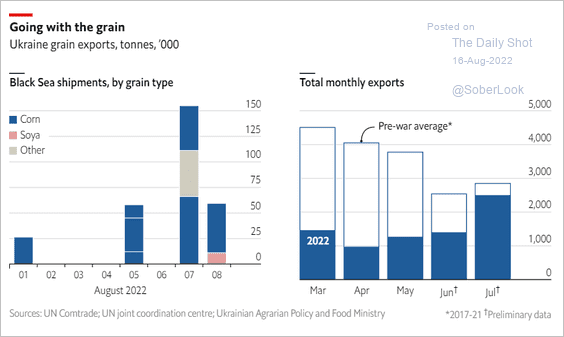

2. Ukraine’s grain shipments:

Source: The Economist Read full article

Source: The Economist Read full article

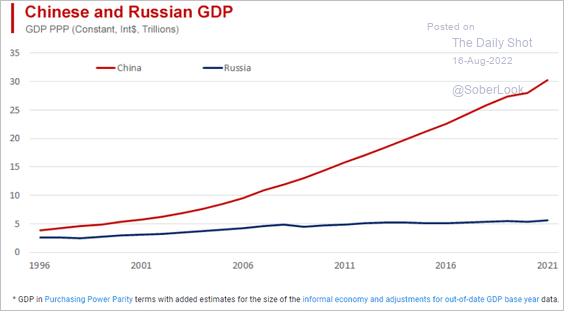

3. Chinese and Russian GDP trends:

Source: World Economics

Source: World Economics

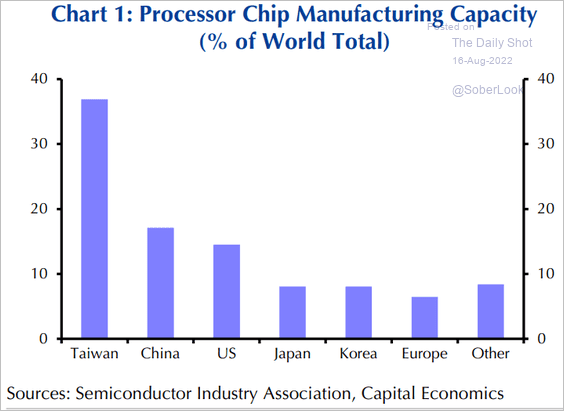

4. Processor chip manufacturing capacity:

Source: Capital Economics

Source: Capital Economics

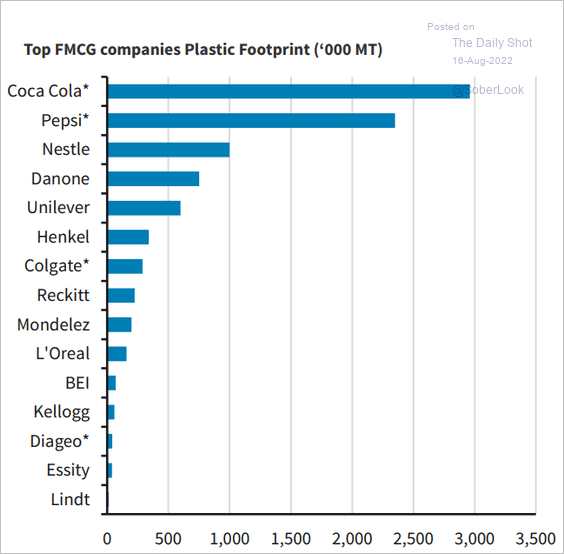

5. Plastics footprint of top fast-moving consumer goods (FMCG) companies:

Source: Barclays Research

Source: Barclays Research

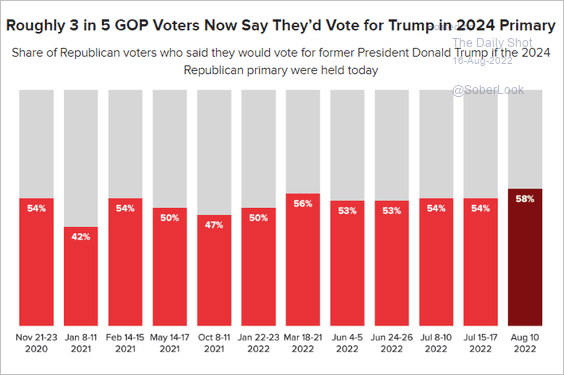

6. GOP voters’ support for Trump:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

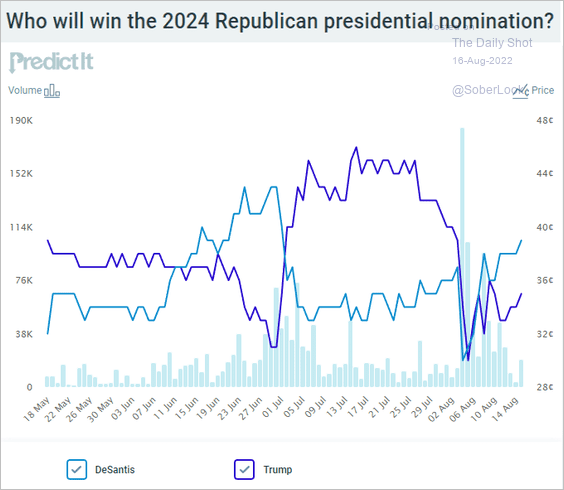

• GOP 2024 presidential nomination probabilities (according to the betting markets):

Source: @PredictIt

Source: @PredictIt

——————–

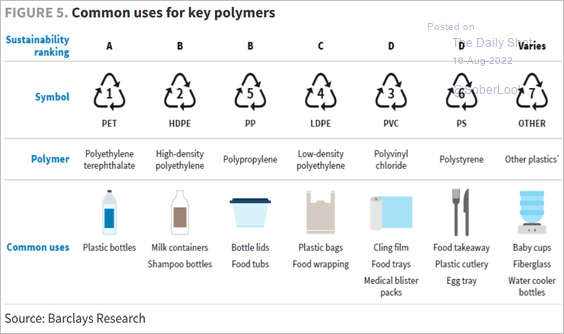

7. Common uses for key polymers:

Source: Barclays Research

Source: Barclays Research

——————–

Back to Index