The Daily Shot: 18-Aug-22

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

1. The FOMC minutes show that the US central bank is fully committed to getting inflation under control.

FOMC: – Participants concurred that, in expeditiously raising the policy rate, the Committee was acting with resolve to lower inflation to 2 percent and anchor inflation expectations at levels consistent with that longer-run goal.

And there is little indication of the so-called “pivot” in the Fed’s policy.

Participants agreed that there was little evidence to date that inflation pressures were subsiding.

The market interpreted the minutes as being a bit on the dovish side because of this language.

Participants judged that, as the stance of monetary policy tightened further, it likely would become appropriate at some point to slow the pace of policy rate increases while assessing the effects of cumulative policy adjustments on economic activity and inflation. Some participants indicated that, once the policy rate had reached a sufficiently restrictive level, it likely would be appropriate to maintain that level for some time to ensure that inflation was firmly on a path back to 2 percent.

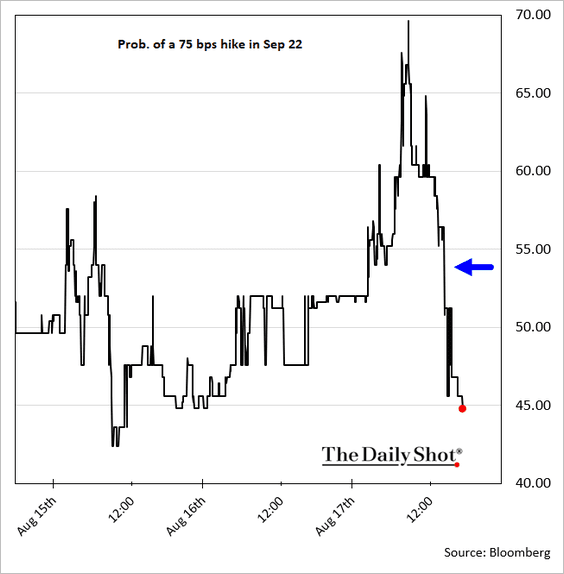

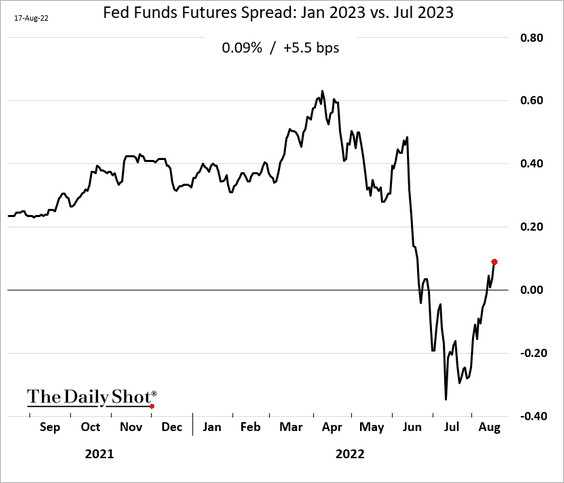

• The probability of a 75 bps rate hike in September, which was climbing on Wednesday morning, dropped below 50% after the FOMC minutes.

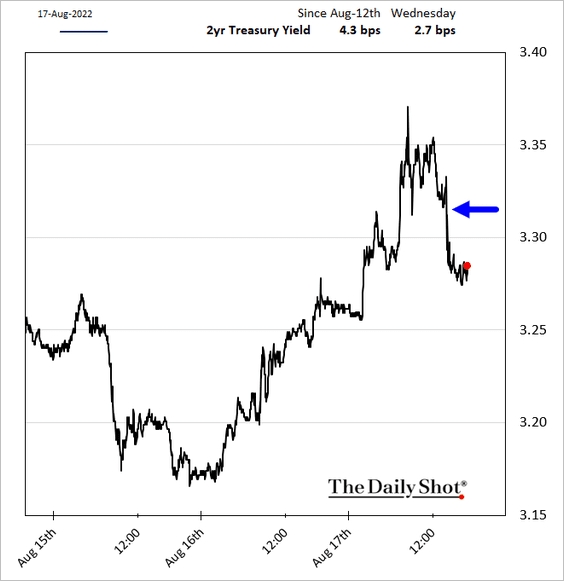

Short-term Treasury yields declined as well (but are rising this morning).

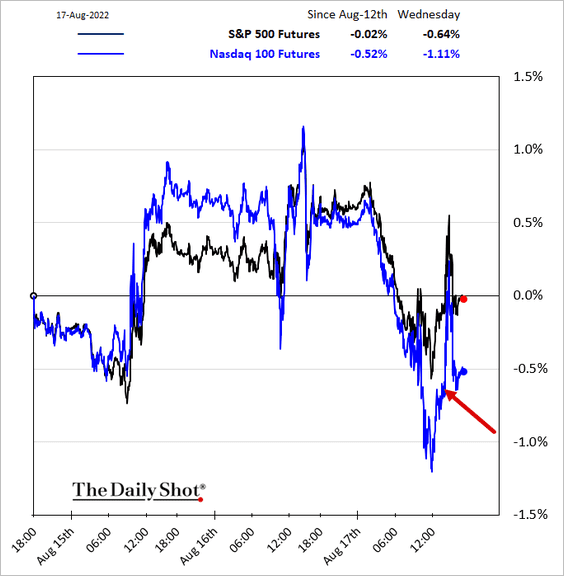

• Equities jumped but retreated shortly after.

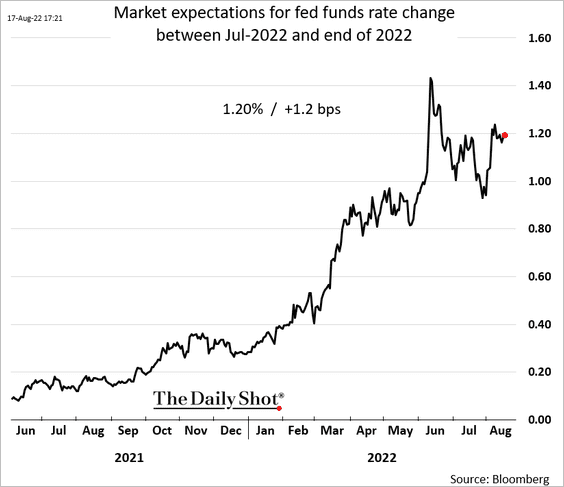

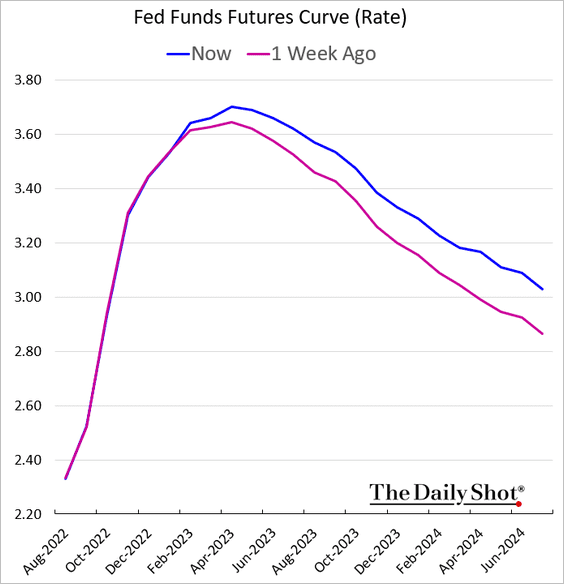

• The market expects the Fed to hike rates by an additional 120 bps before the end of the year, …

… with the fed funds rate peaking at 3.7% early next year.

• The market no longer expects rate cuts in the first half of next year.

——————–

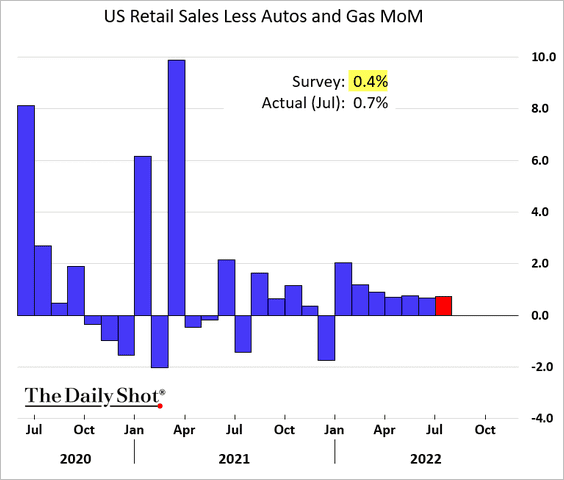

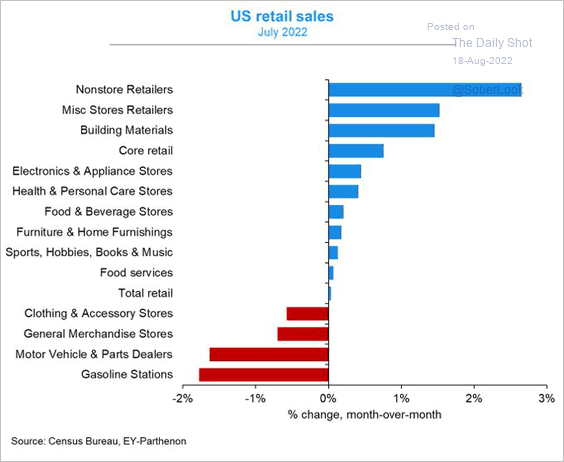

2. Last month’s retail sales surprised to the upside.

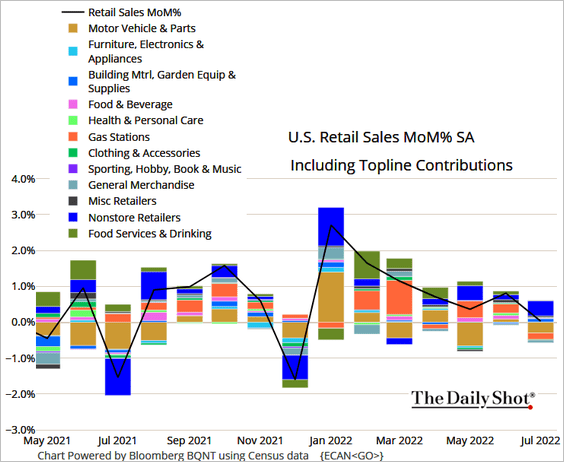

• The two charts below show the contributions to the headline figure, with gasoline pulling spending lower. Note that Americans did not reduce gasoline purchases in July. They just paid less for it because prices were lower.

Source: @GregDaco

Source: @GregDaco

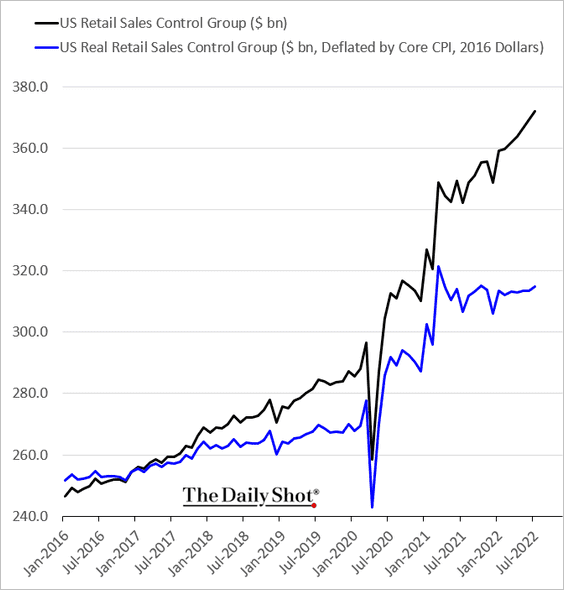

• This chart shows the retail sales control group (“core” retail sales), including the inflation-adjusted trend.

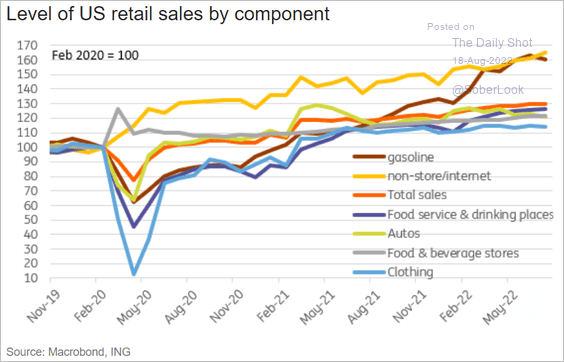

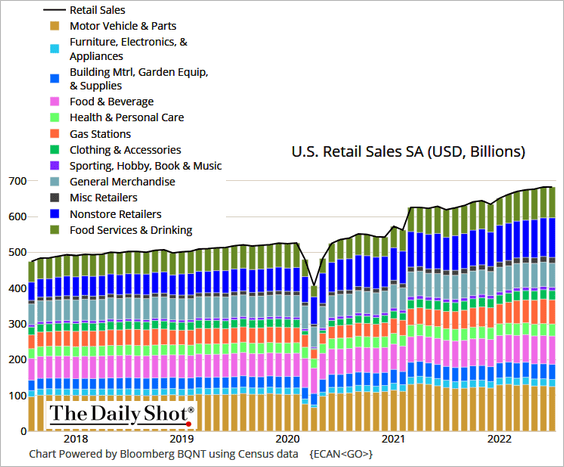

• Here are the trends by sector.

Source: ING

Source: ING

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

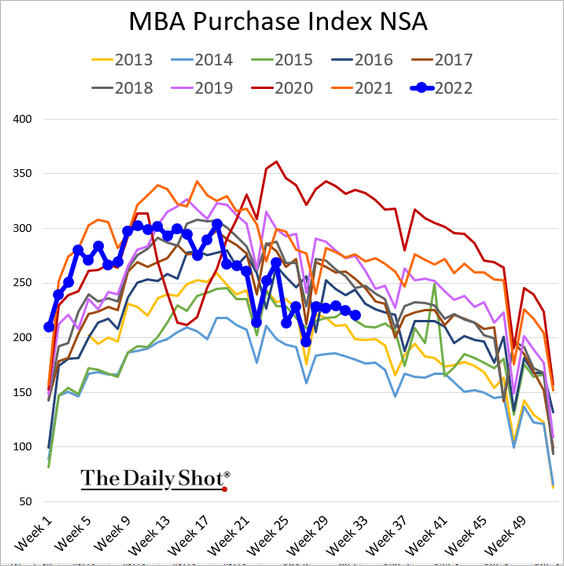

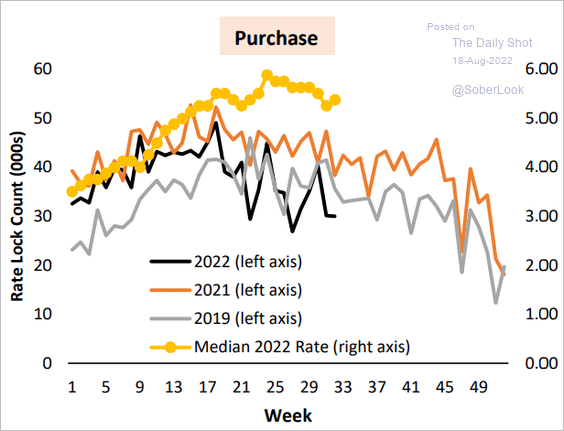

3. Next, we have some updates on the housing market.

• Mortgage applications remain about 18% below last year’s levels.

Here is the trend for rate locks.

Source: AEI Center on Housing Markets and Finance

Source: AEI Center on Housing Markets and Finance

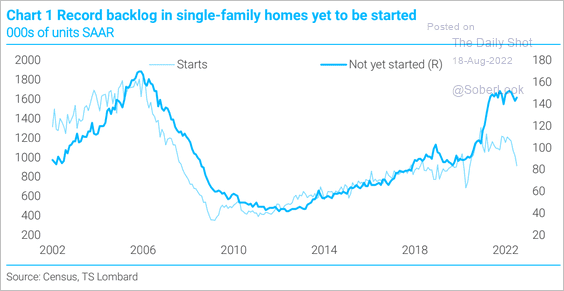

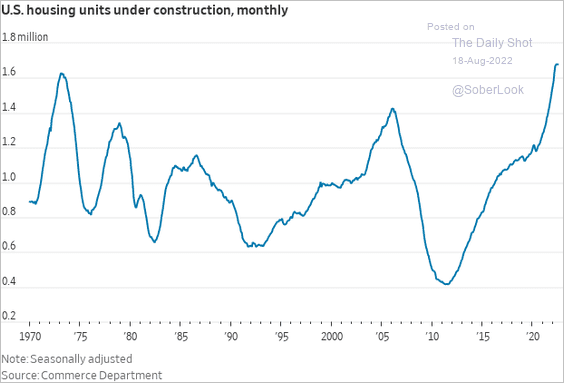

• While new residential construction slumped in recent months, there is a massive backlog that will drive construction activity for some time to come.

Source: TS Lombard

Source: TS Lombard

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

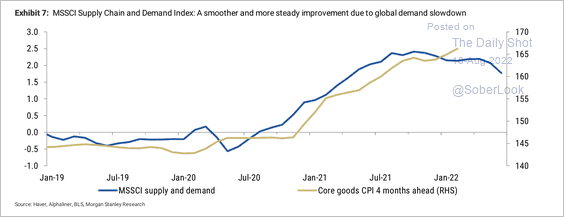

4. The reduction in supply chain bottlenecks points to lower CPI.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

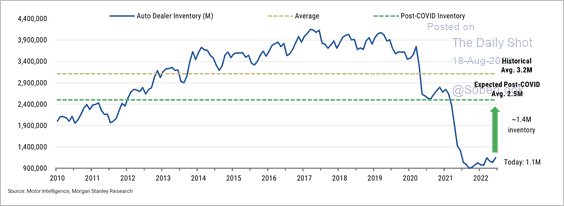

Auto dealer inventories are starting to improve as supply chain pressures ease.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

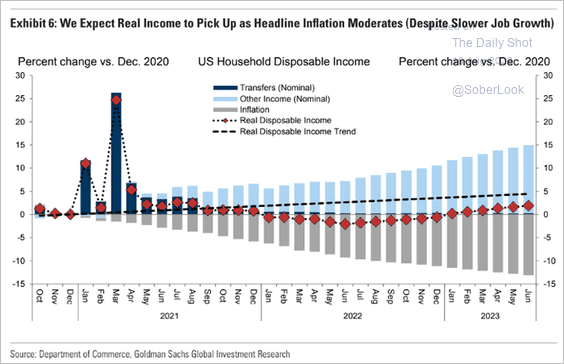

5. Real incomes should begin to move into positive territory as inflation moderates.

Source: Goldman Sachs; @MikeZaccardi, h/t @pav_chartbook

Source: Goldman Sachs; @MikeZaccardi, h/t @pav_chartbook

Back to Index

The United Kingdom

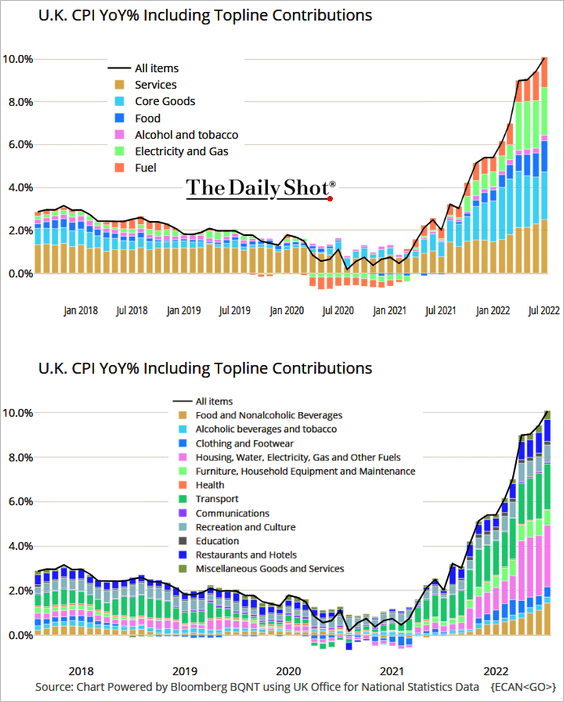

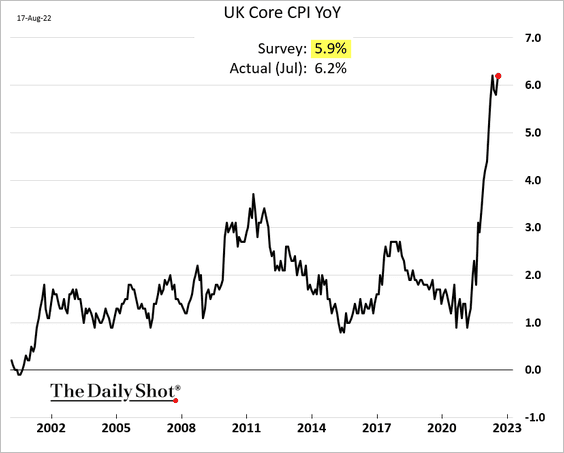

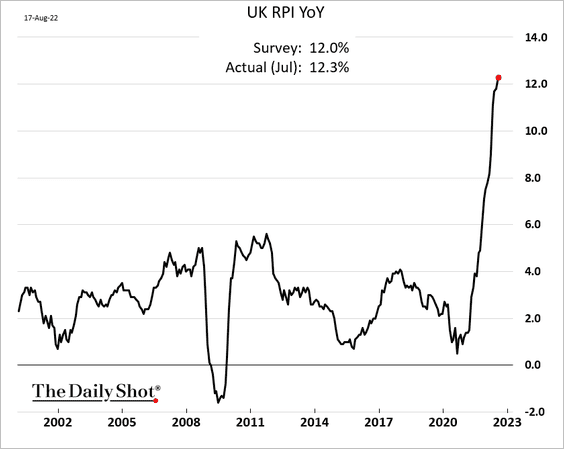

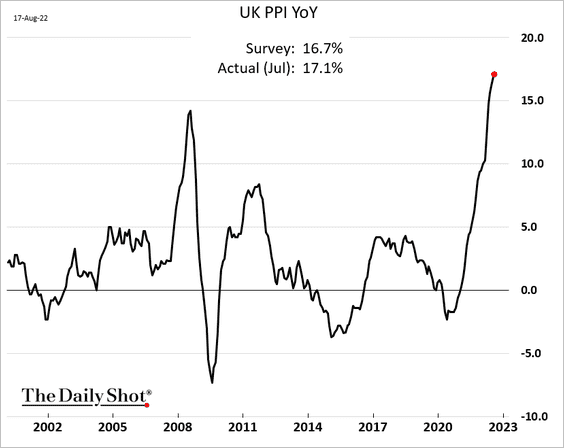

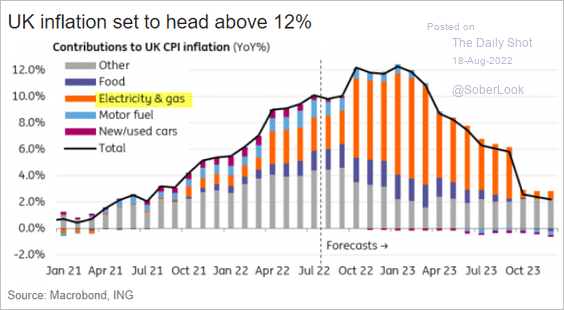

1. As we saw yesterday (chart), UK inflation exceeded forecasts. Here are some additional updates on the report.

• Contributions to inflation:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• The core CPI also topped forecasts.

• Retail inflation breached 12% on a year-over-year basis.

• And gains in producer prices exceeded 17%.

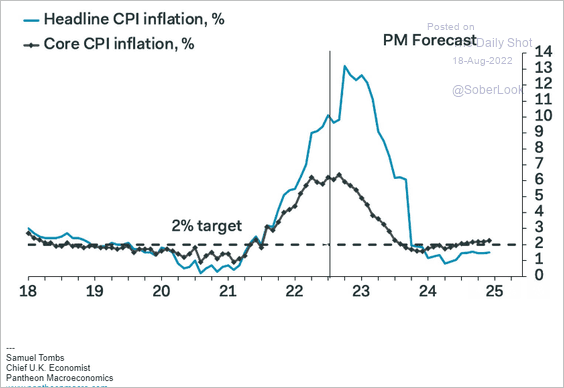

Moreover, inflation is yet to peak as natural gas and electricity prices surge. Here are a couple of forecasts.

• Pantheon Macroeconomics:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• ING:

Source: ING

Source: ING

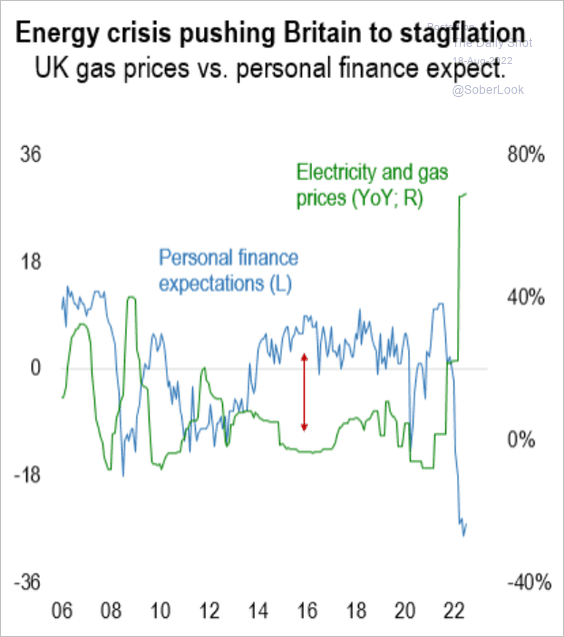

Stagflation is here.

Source: Numera Analytics

Source: Numera Analytics

——————–

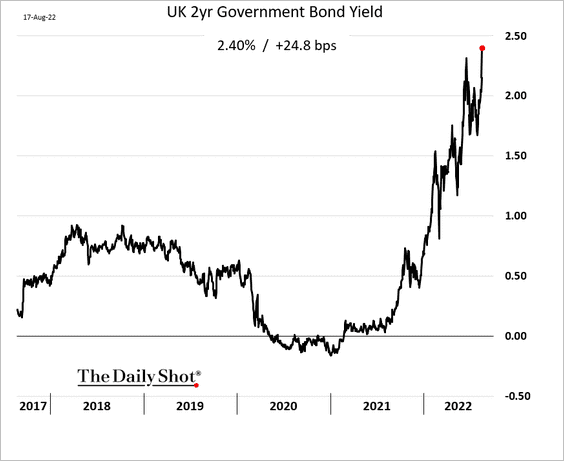

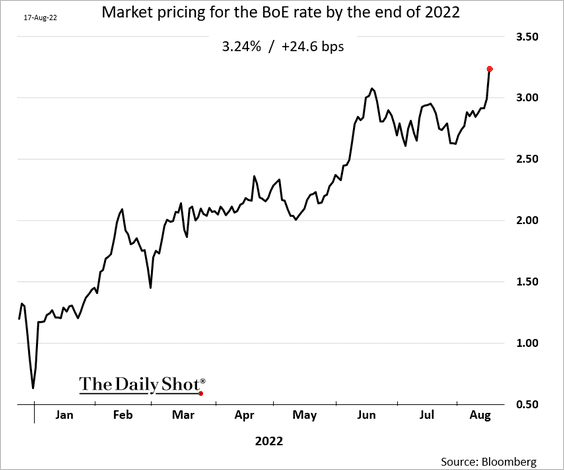

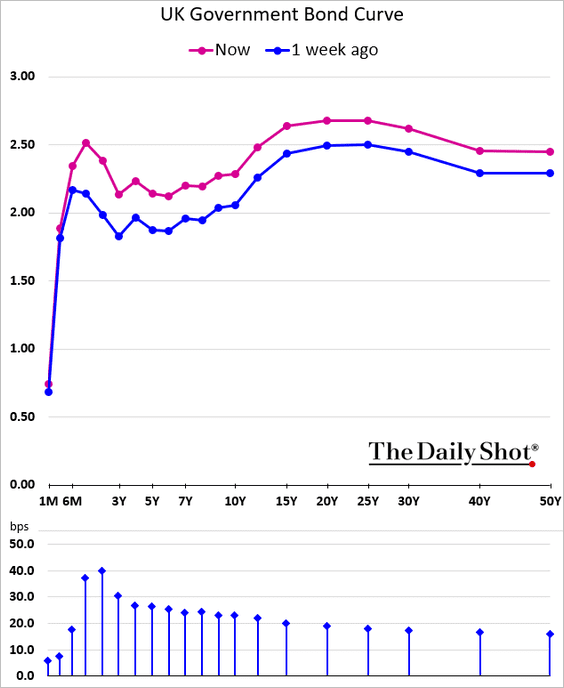

2. Gilt yields surged.

• The BoE is now expected to hike the benchmark rate to 3.24% by the end of the year.

• The yield curve is becoming increasingly inverted.

——————–

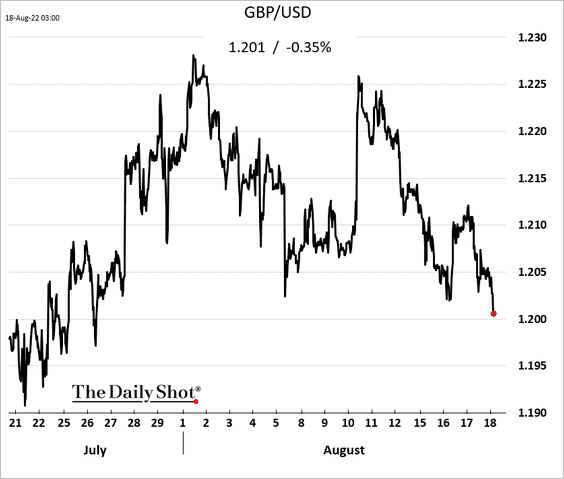

3. The pound has been moving lower vs. USD.

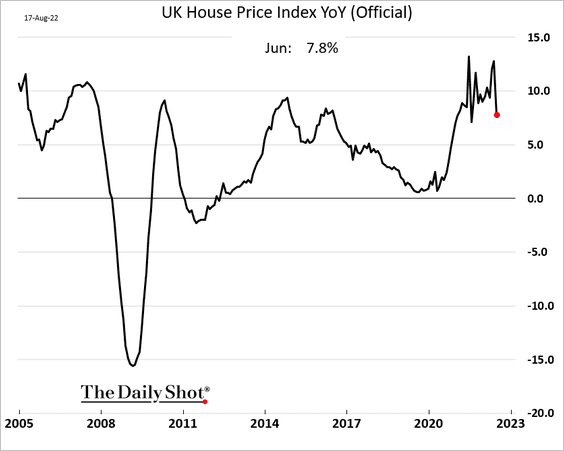

4. Home price appreciation slowed in June, according to official data.

Back to Index

The Eurozone

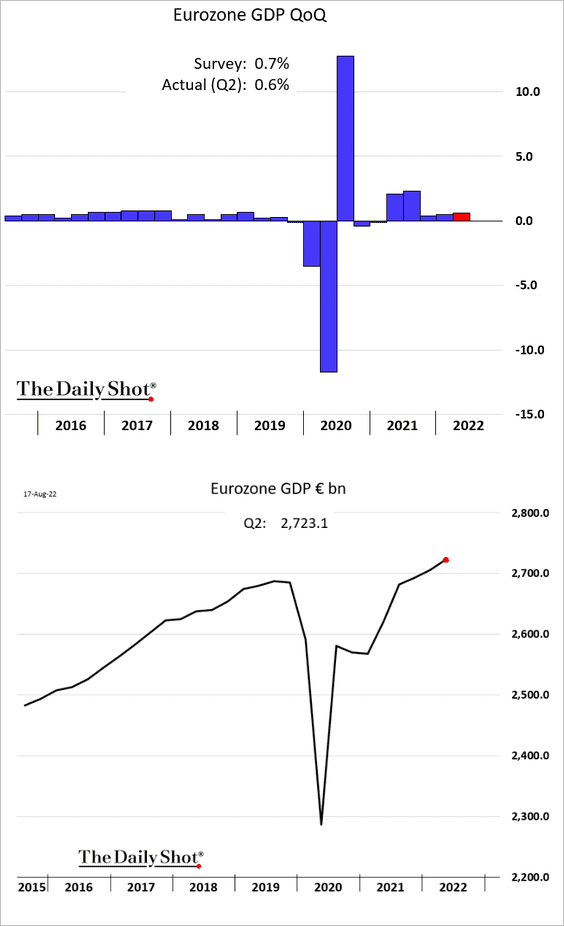

1. The second-quarter GDP growth was a bit slower than expected.

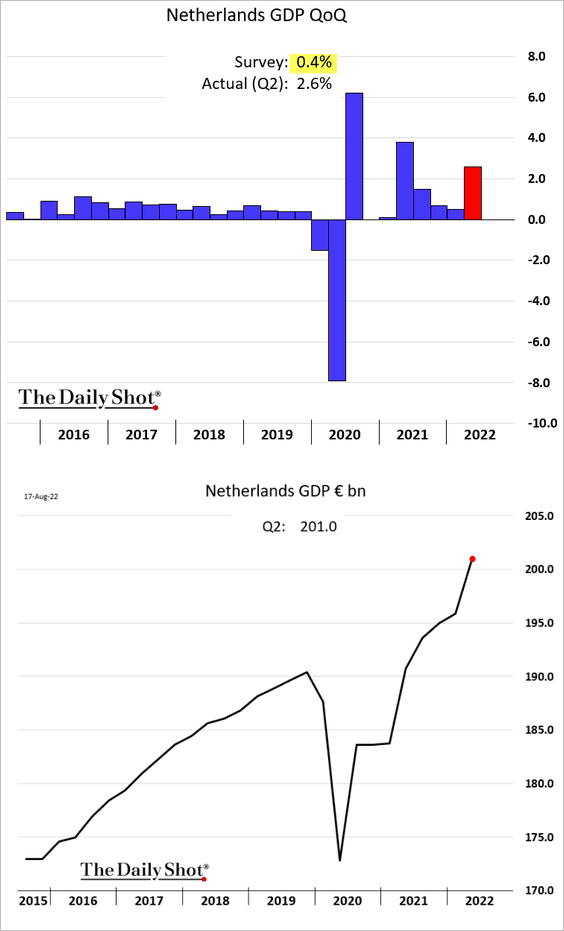

2. The Dutch GDP growth surprised to the upside.

Source: ING Read full article

Source: ING Read full article

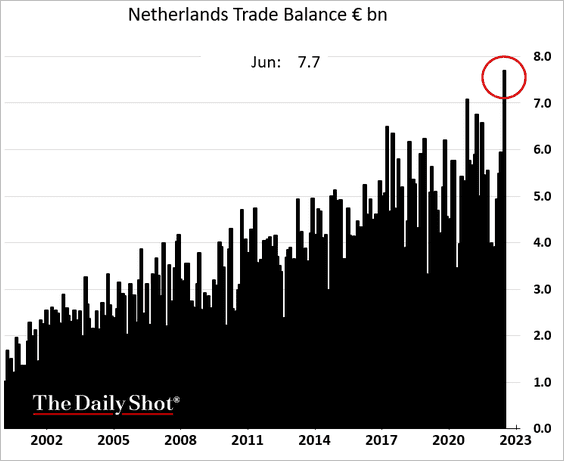

The nation’s record trade surplus has been helpful for GDP growth.

——————–

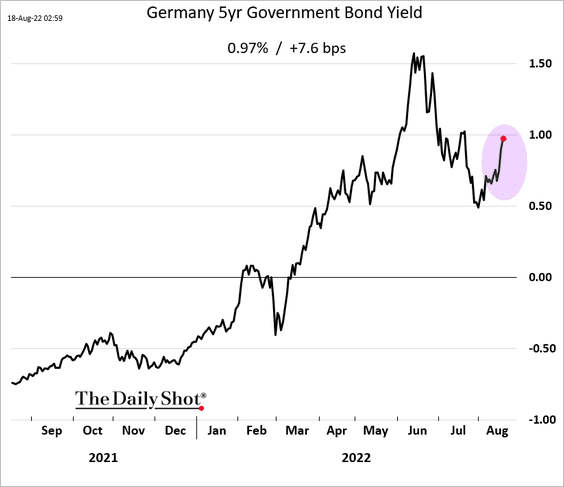

3. Bund yields are rising again.

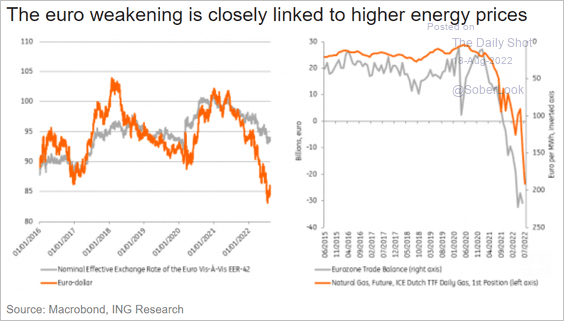

4. When it comes to trade, the euro’s weakness is no longer an advantage.

Source: ING

Source: ING

Back to Index

Asia – Pacific

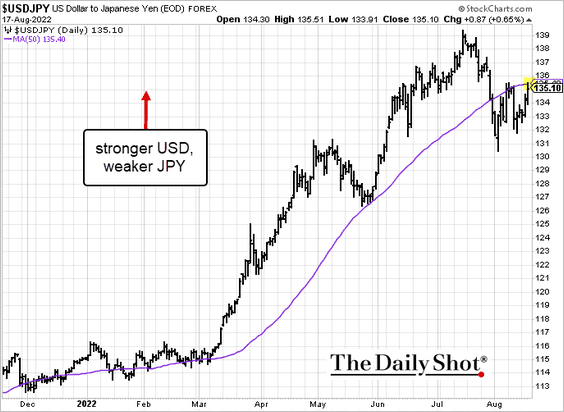

1. Dollar-yen is testing resistance at the 50-day moving average.

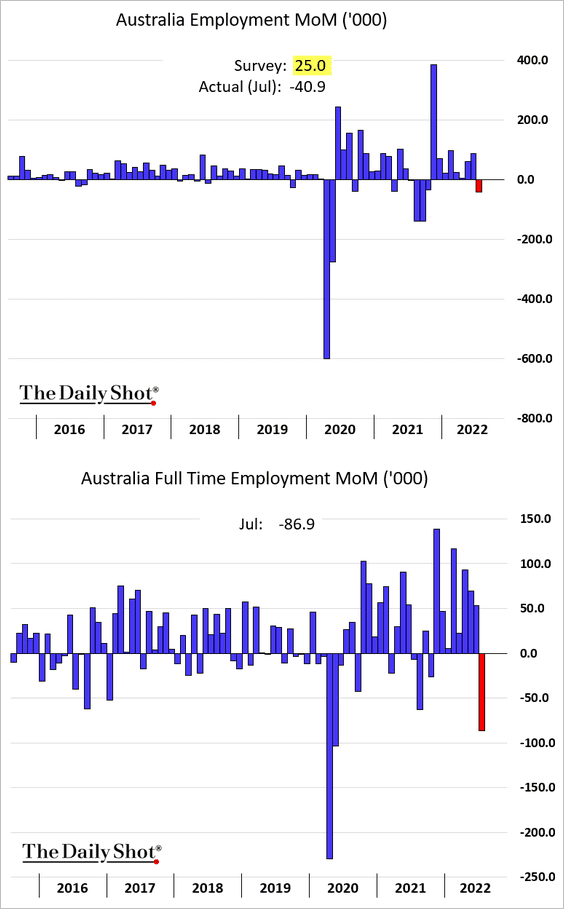

2. Australia unexpectedly registered job losses last month (for the first time in nine months).

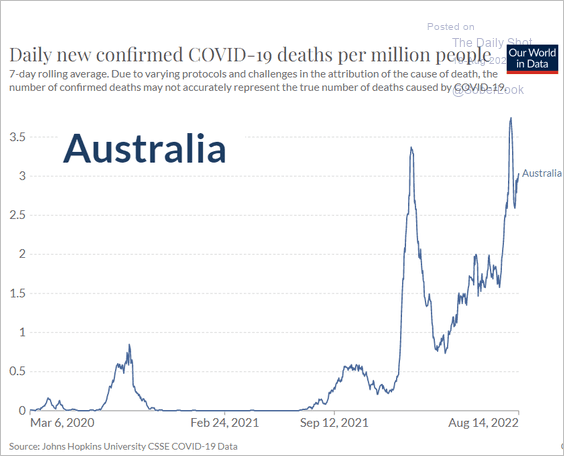

The surge in COVID cases is taking a toll.

Source: Our World in Data

Source: Our World in Data

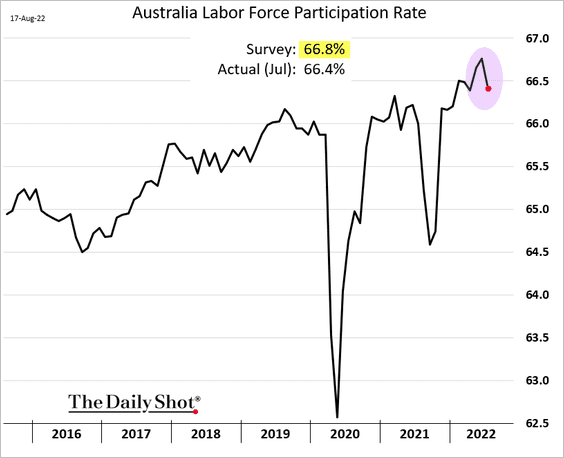

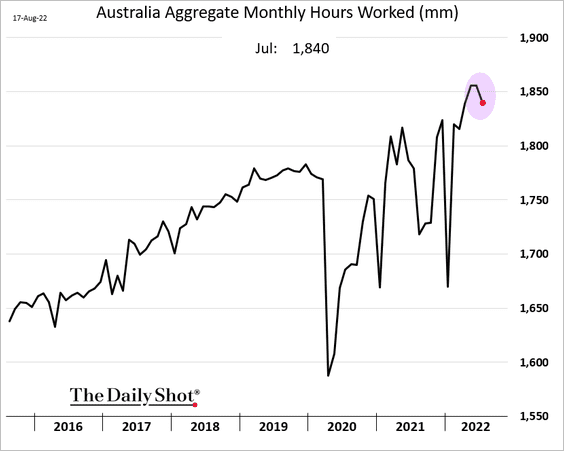

The participation rate and hours worked dropped.

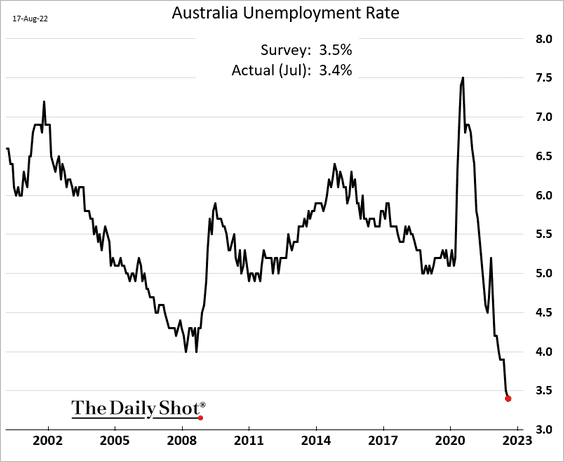

But the unemployment rate hit a multi-decade low.

Source: Reuters Read full article

Source: Reuters Read full article

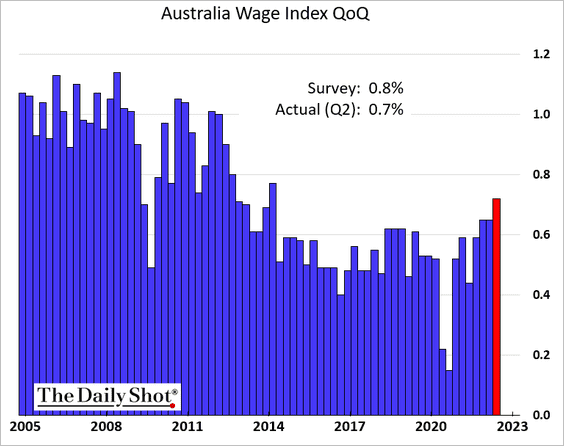

• Wage growth has been picking up momentum.

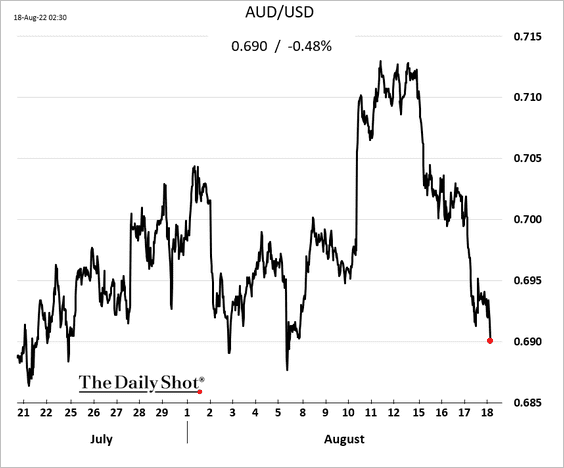

• The Aussie dollar is moving lower.

Back to Index

China

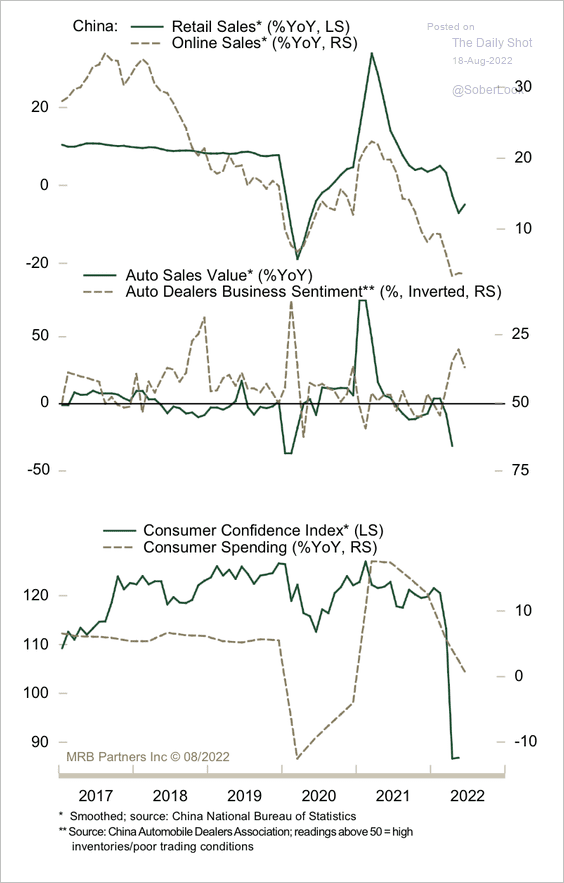

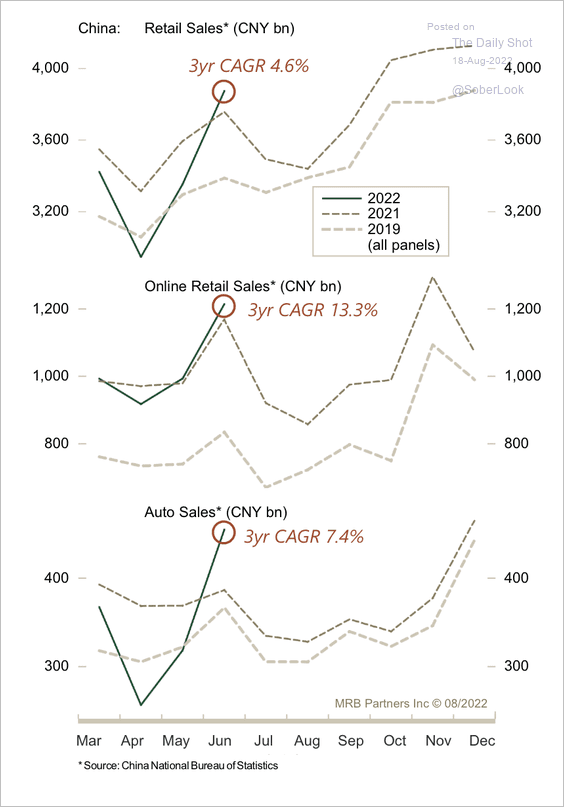

1. Consumption remains weak.

Source: MRB Partners

Source: MRB Partners

When viewed in seasonal terms, the bounce in auto sales is more of a catch-up from extreme lows.

Source: MRB Partners

Source: MRB Partners

——————–

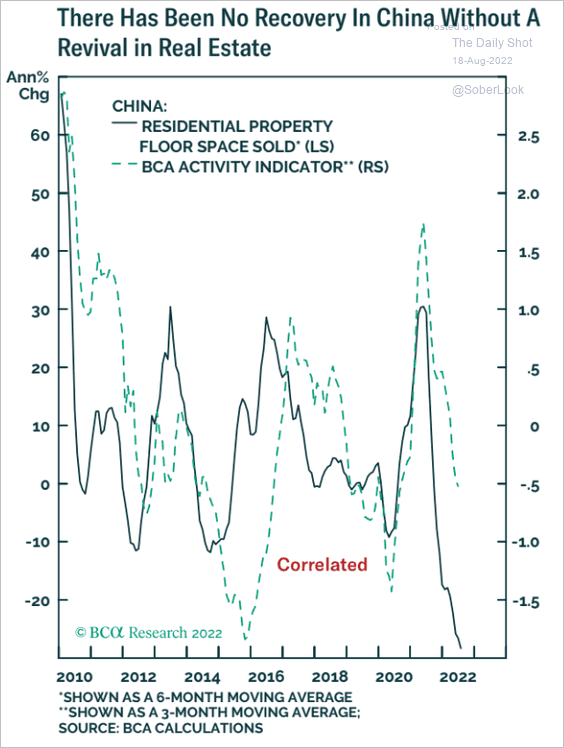

2. The property market needs to rebound to see a full recovery in China.

Source: BCA Research

Source: BCA Research

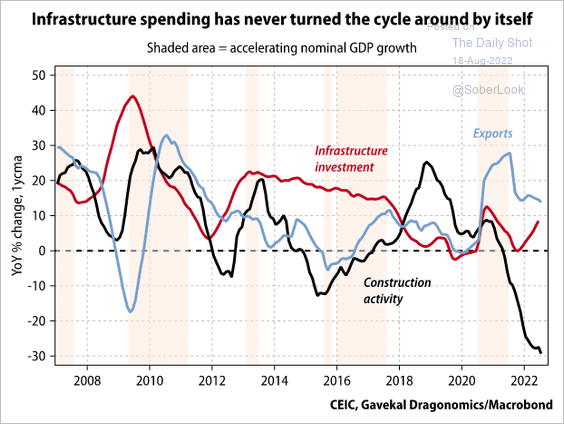

And infrastructure spending is not enough.

Source: Gavekal Research

Source: Gavekal Research

——————–

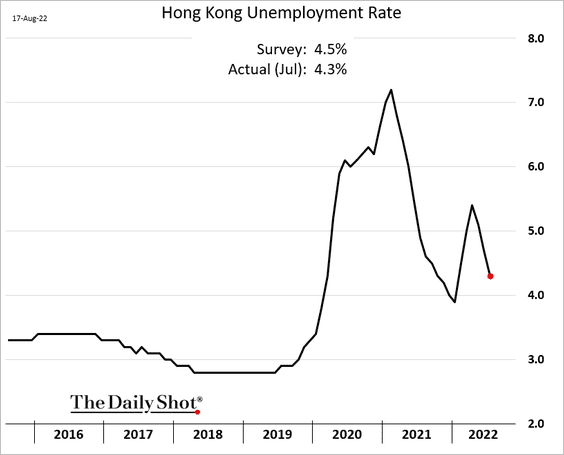

3. Hong Kong’s unemployment rate is moving lower.

Back to Index

Emerging Markets

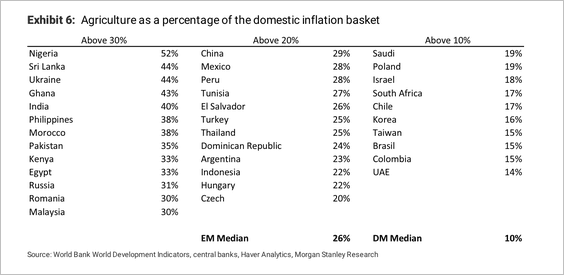

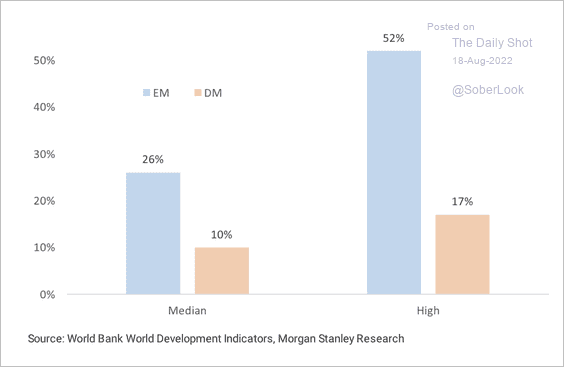

1. This table shows the weight of agriculture in the inflation basket across EM countries.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Food as a percentage of CPI baskets is considerably higher in emerging markets.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

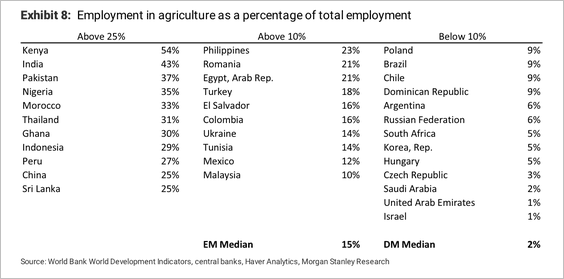

Agriculture is a key source of employment in many countries.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

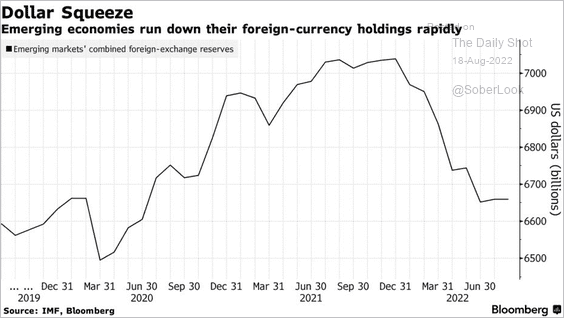

2. F/X reserves across EM economies have declined sharply.

Source: @SriniSivabalan, @karllesteryap, @Ruth_Liew10, @markets Read full article

Source: @SriniSivabalan, @karllesteryap, @Ruth_Liew10, @markets Read full article

Back to Index

Cryptocurrency

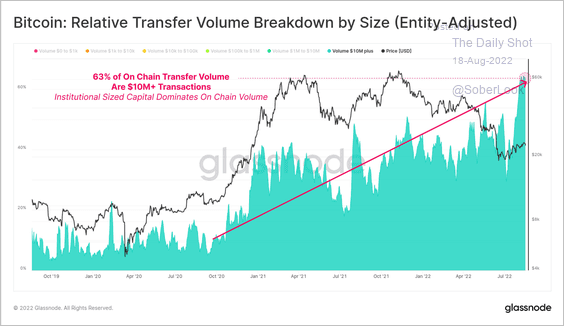

1. Bitcoin’s relative transfer volume has been dominated by entities with large capital.

Source: @glassnode

Source: @glassnode

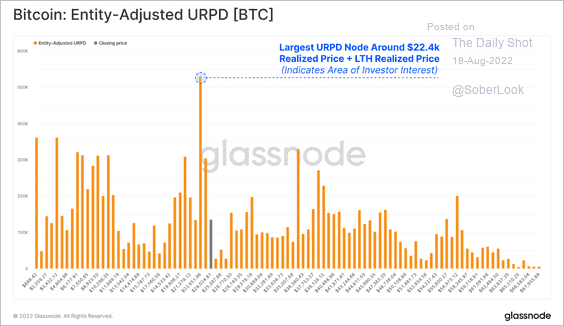

2. A large amount of BTC price volume occurred around $22,400, which could be a potential area of support (or liquidation zone).

Source: @glassnode

Source: @glassnode

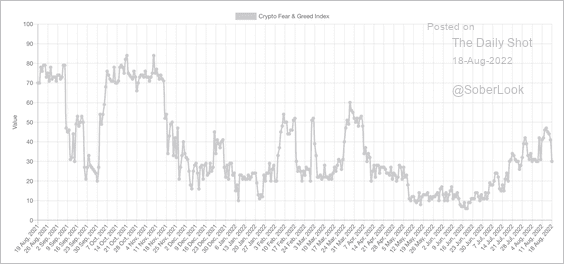

3. The Crypto Fear & Greed Index returned to “fear” territory as bullish sentiment waned.

Source: Alternative.me

Source: Alternative.me

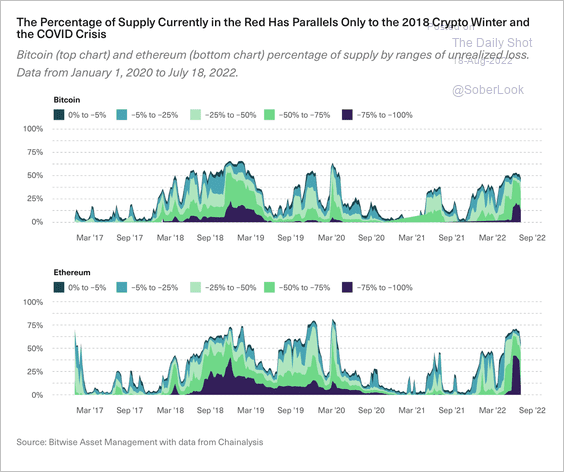

4. A majority of bitcoin and ether supply is held at a loss, similar to what occurred in previous bear markets.

Source: Bitwise Asset Management Read full article

Source: Bitwise Asset Management Read full article

Back to Index

Commodities

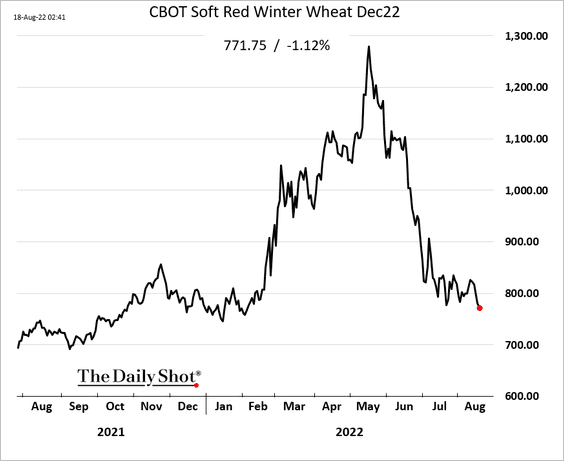

1. US wheat futures have been sinking as Ukraine shipments gather pace.

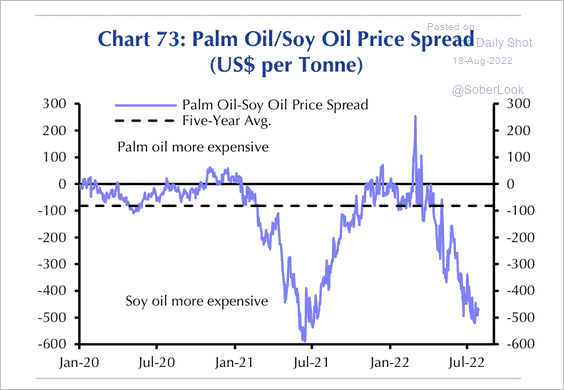

2. The spread between palm oil and soy oil appears stretched.

Source: Capital Economics

Source: Capital Economics

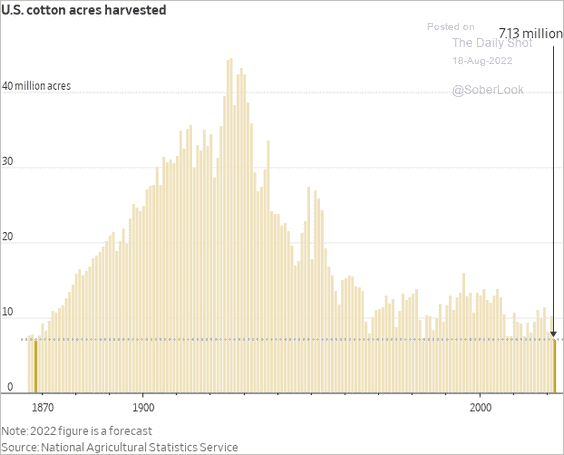

3. Here is the reason US cotton futures have been surging.

Source: @WSJ Read full article

Source: @WSJ Read full article

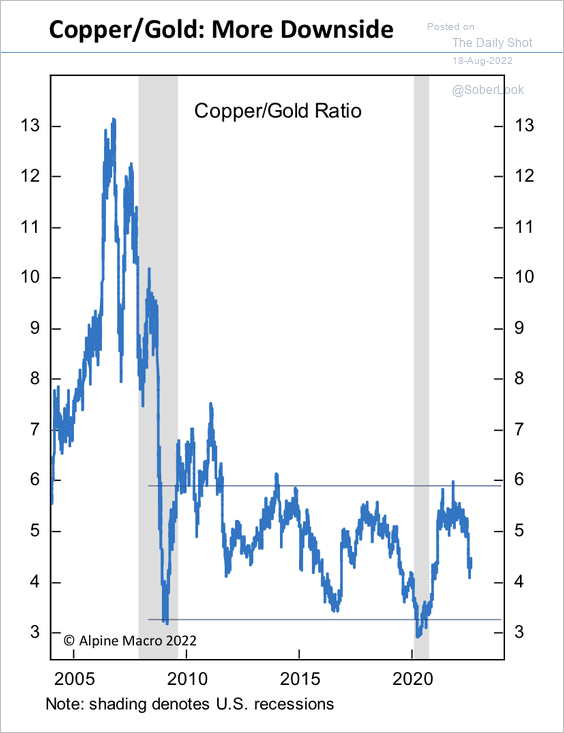

4. The copper/gold ratio continues to decline from resistance, signaling risk-off conditions.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Energy

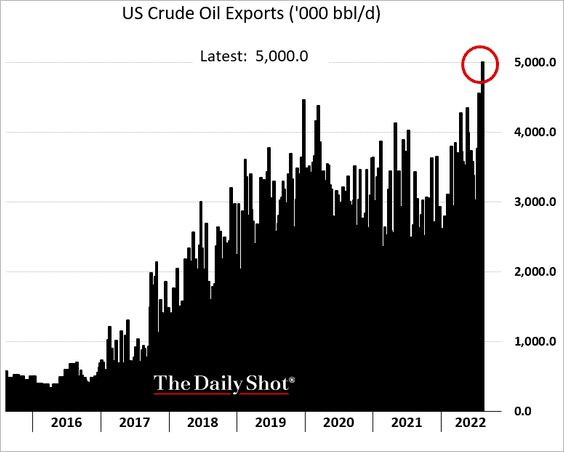

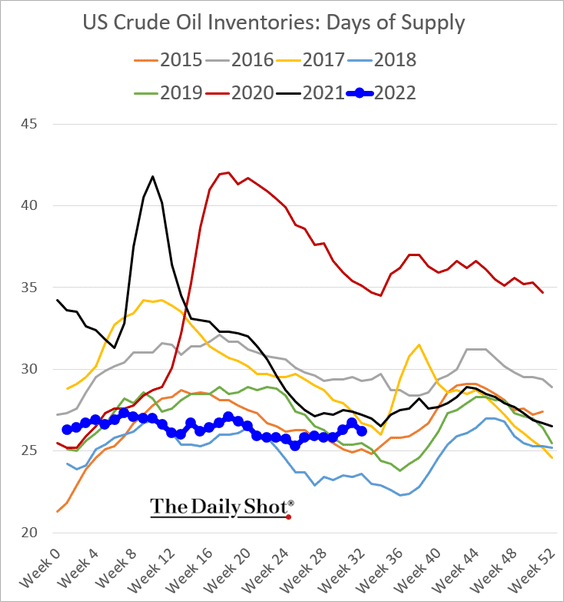

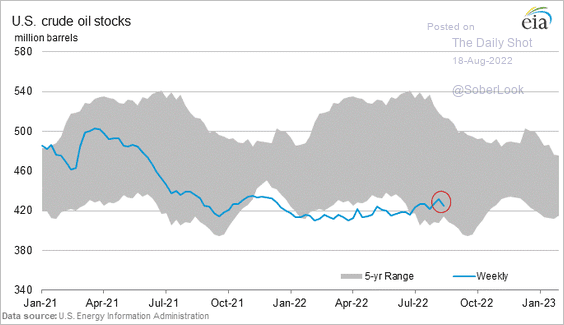

1. US (gross) crude oil exports hit a record high.

As a result, US oil inventories turned lower last week (2 cgarts).

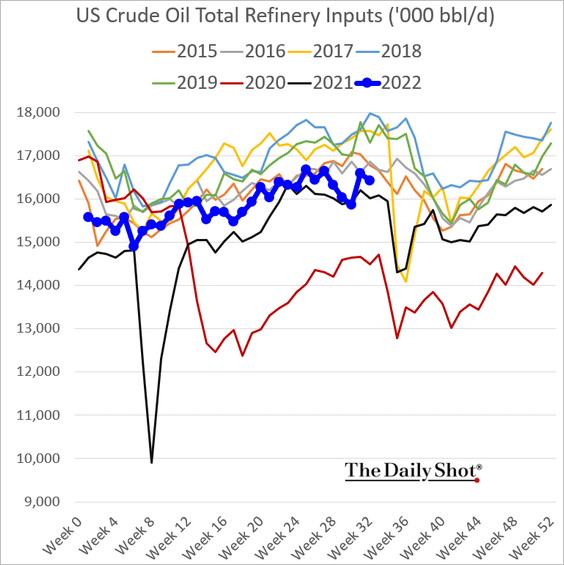

2. US refinery runs remain well below pre-COVID levels.

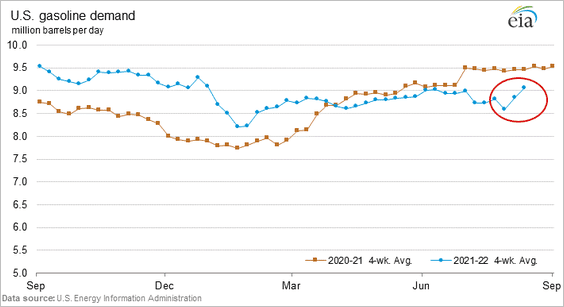

3. Gasoline demand is rebounding amid a pullback in prices.

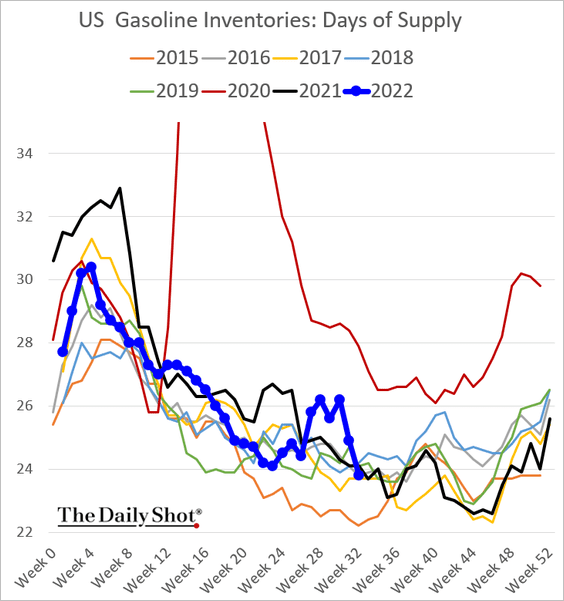

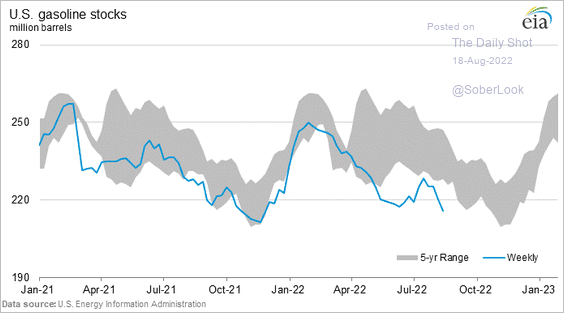

US gasoline inventories moved sharply lower over the past two weeks (2 charts).

——————–

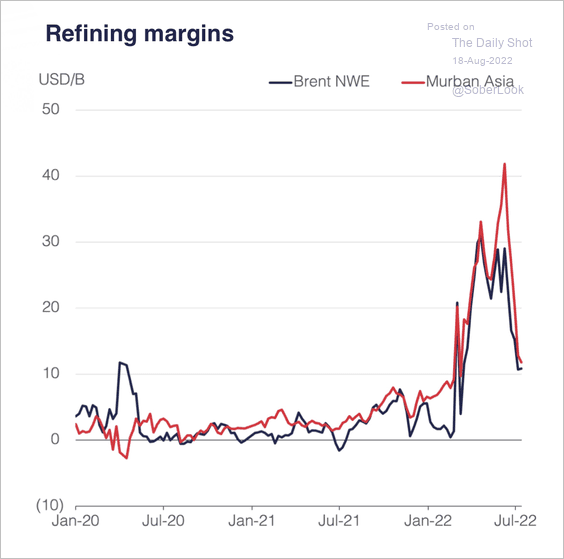

4. Refining margins have fallen off their highs in recent weeks.

Source: Oxford Institute for Energy Studies

Source: Oxford Institute for Energy Studies

Back to Index

Equities

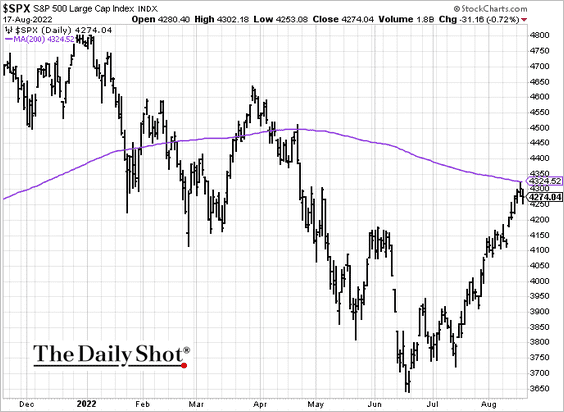

1. The S&P 500 held resistance at the 200-day moving average.

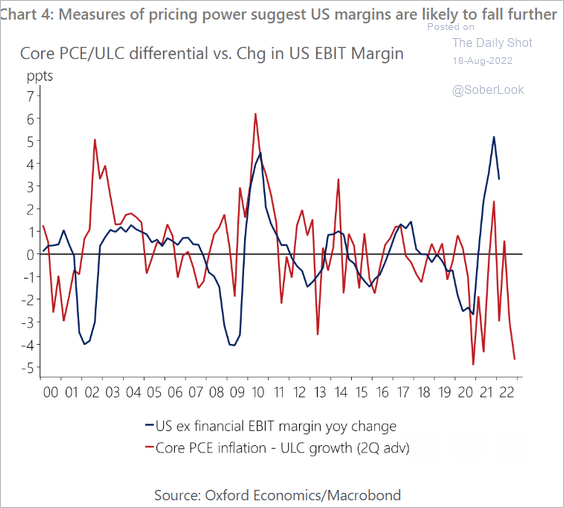

2. Corporate margins are under pressure.

Source: Oxford Economics

Source: Oxford Economics

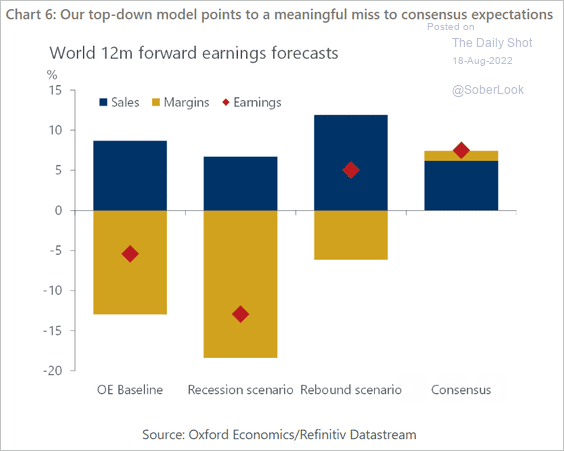

Consensus earnings expectations are much too optimistic, according to Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

——————–

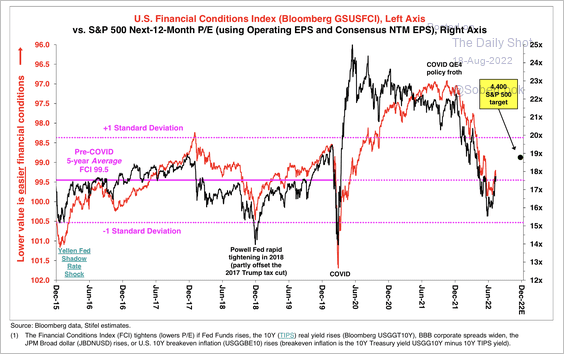

3. The improvement in financial conditions suggests higher equity valuations (assuming the improvement holds).

Source: Stifel

Source: Stifel

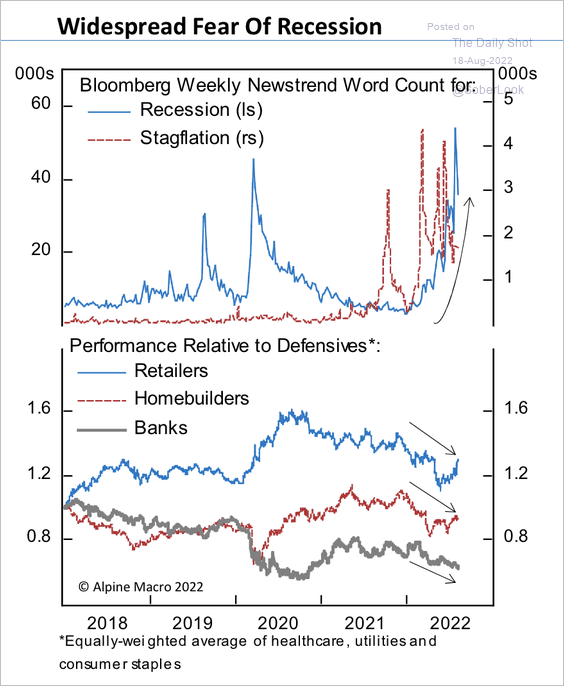

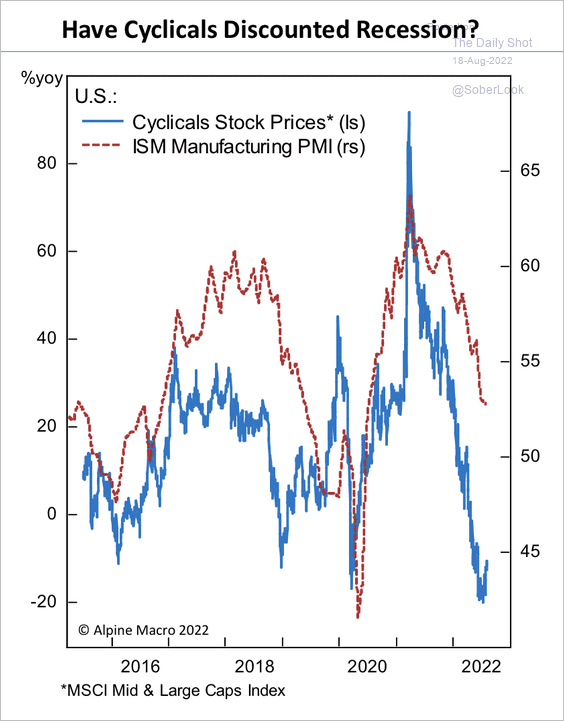

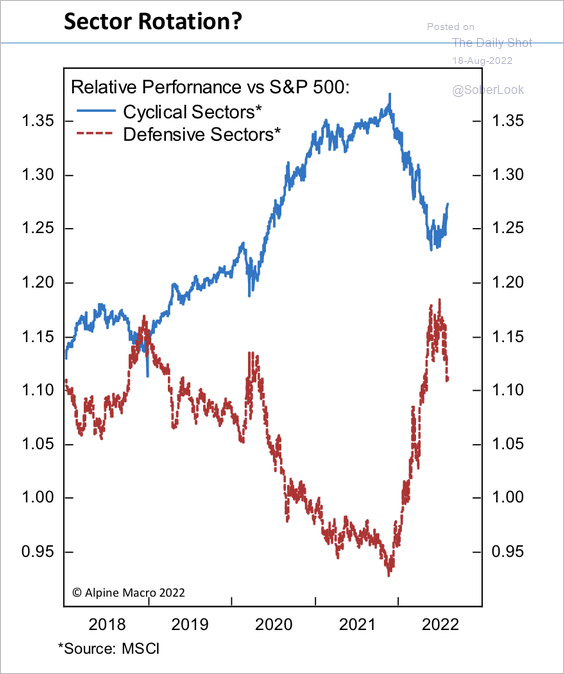

4. Cyclical sectors have underperformed as recession and stagflation risks increased (2 charts).

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

However, defensives have started to underperform cyclicals recently.

Source: Alpine Macro

Source: Alpine Macro

——————–

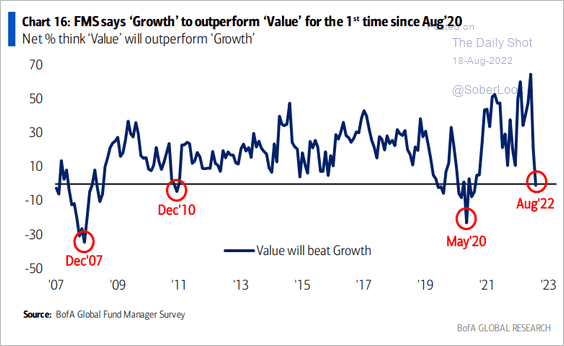

5. Fund managers now expect growth to outperform value.

Source: BofA Global Research

Source: BofA Global Research

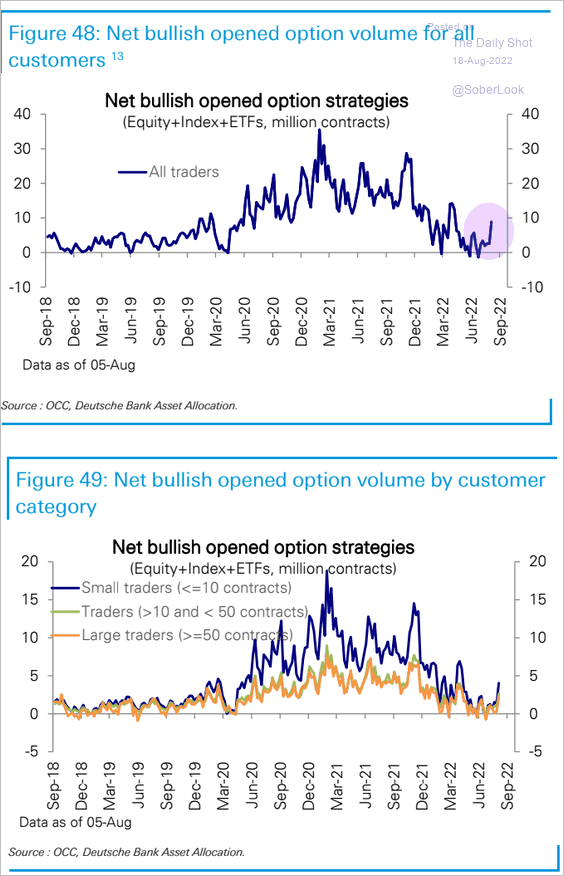

6. Call options activity is rebounding as the Reddit crowd returns.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

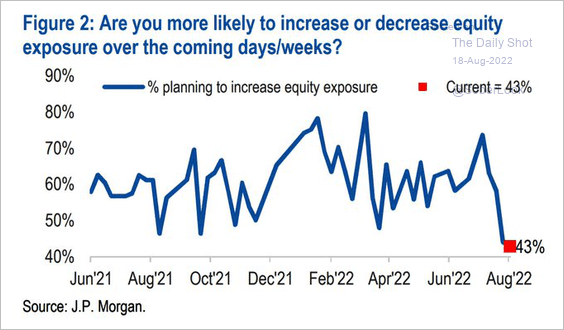

7. How do JP Morgan’s clients feel about changing their equity exposure?

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

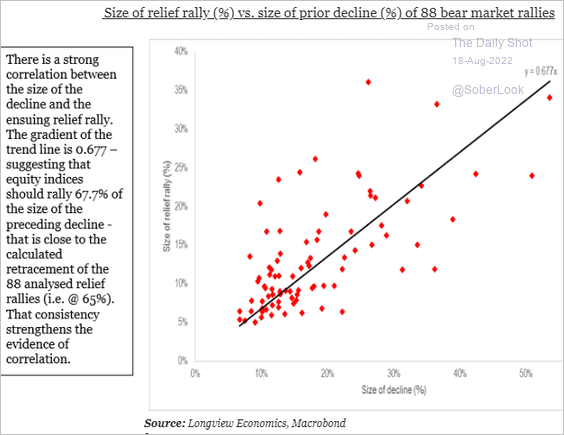

8. How much should we expect the market to rebound in a relief rally?

Source: Longview Economics

Source: Longview Economics

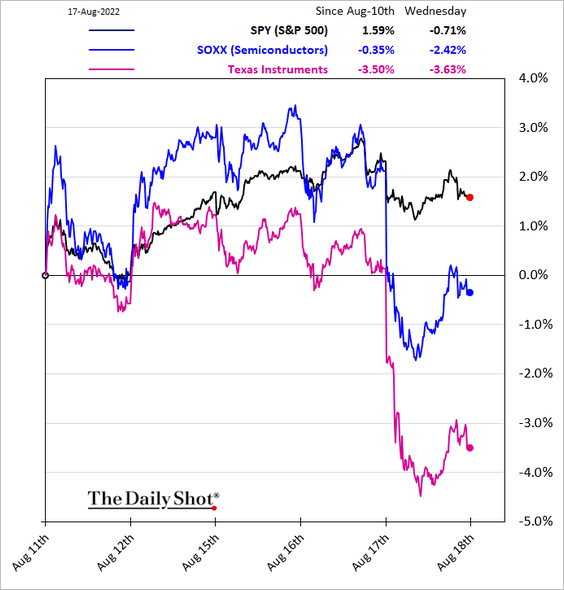

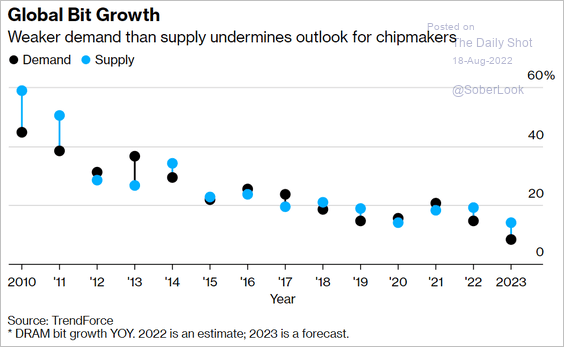

9. Semiconductor shares are under pressure as demand softens.

Source: @technology Read full article

Source: @technology Read full article

Back to Index

Credit

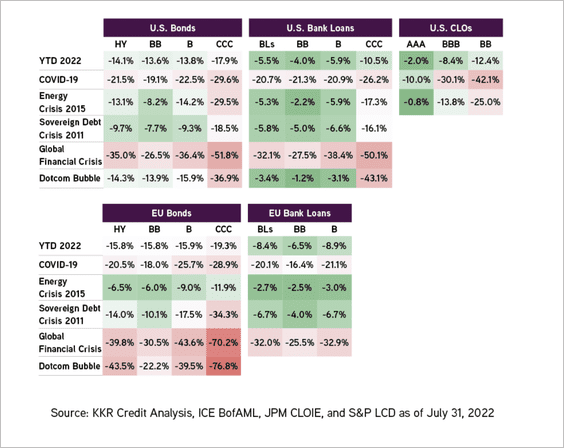

1. Here is a look at comparative drawdowns across the credit spectrum since the 2000s.

Source: KKR Read full article

Source: KKR Read full article

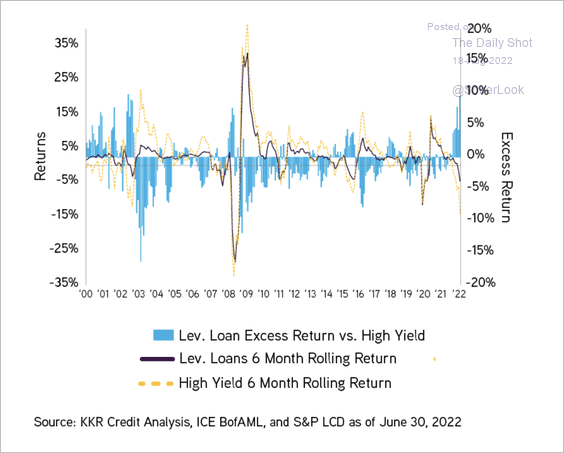

2. Leveraged loans typically outperform high yield during times of elevated interest rate volatility.

Source: KKR Read full article

Source: KKR Read full article

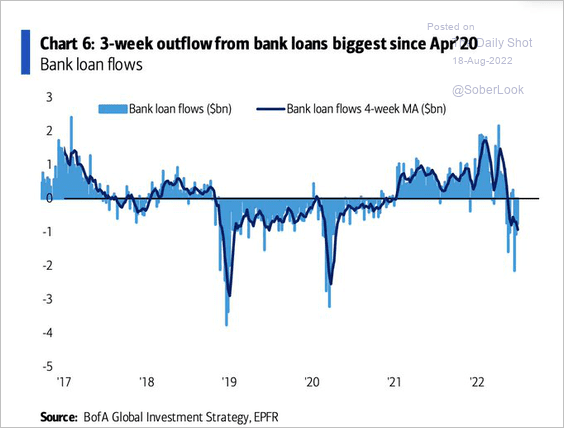

Leveraged loans have been registering outflows recently.

Source: @DiMartinoBooth, @BankofAmerica

Source: @DiMartinoBooth, @BankofAmerica

Back to Index

Global Developments

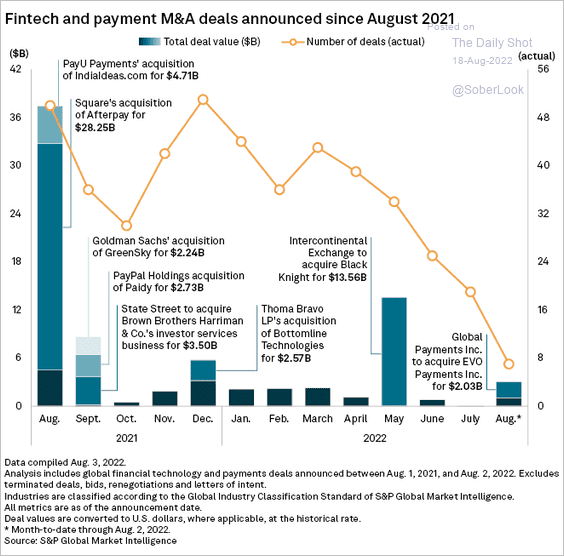

1. Fintech M&A activity has slowed.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

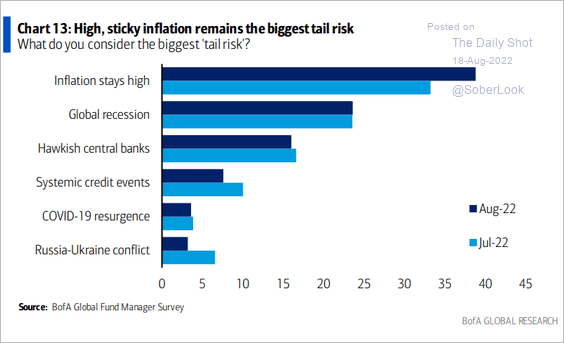

2. Investors still view elevated inflation as the biggest tail risk.

Source: BofA Global Research

Source: BofA Global Research

——————–

Food for Thought

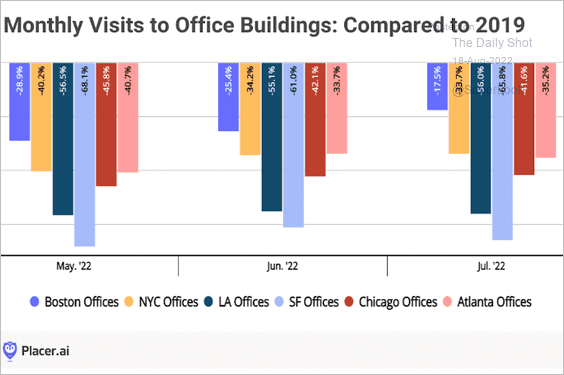

1. Office visits in select US cities:

Source: Placer.ai

Source: Placer.ai

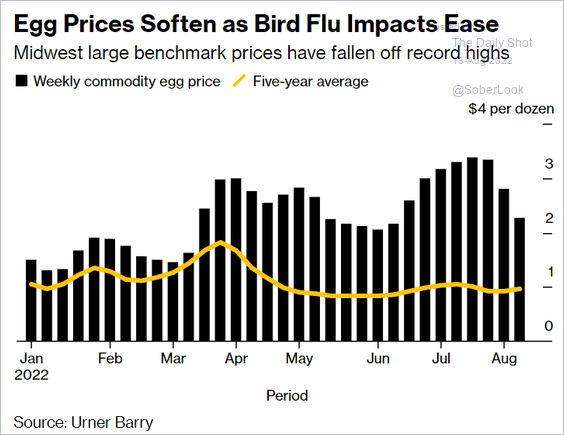

2. US egg prices:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

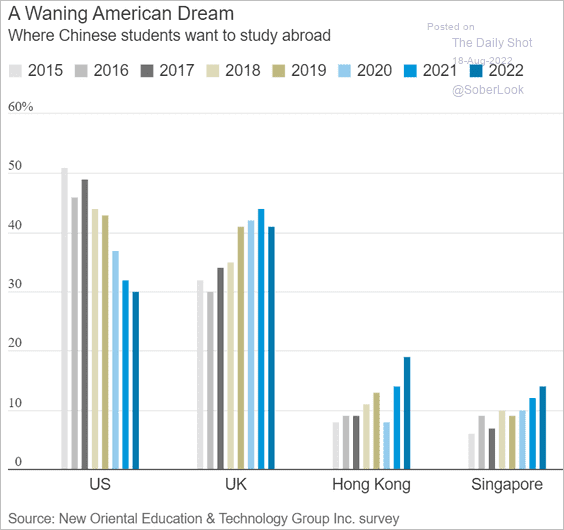

3. Chinese students’ preferences for studying abroad:

Source: @WSJ Read full article

Source: @WSJ Read full article

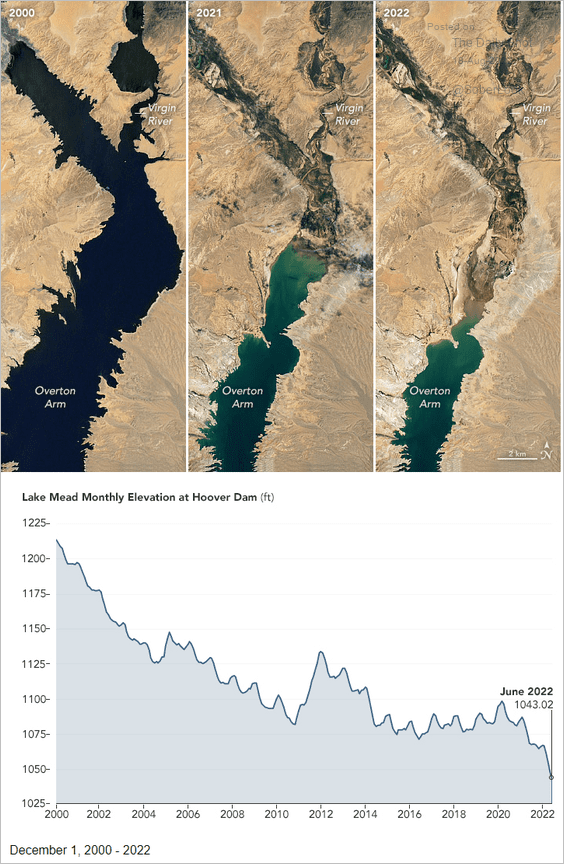

4. NASA satellite imagery of Lake Mead:

Source: NASA Read full article

Source: NASA Read full article

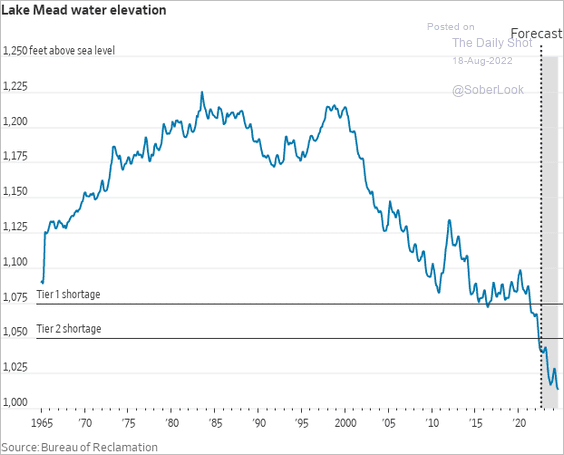

• Lake Mead water elevation forecast:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

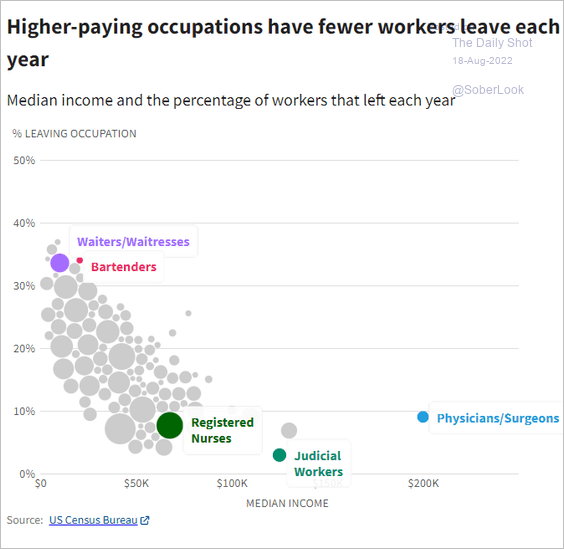

5. Americans leaving their occupations:

Source: USAFacts Read full article

Source: USAFacts Read full article

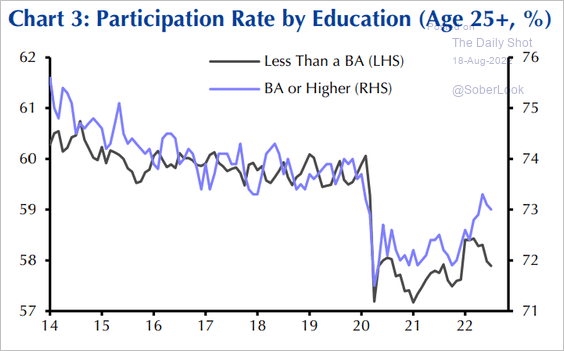

6. US labor force participation by education:

Source: Capital Economics

Source: Capital Economics

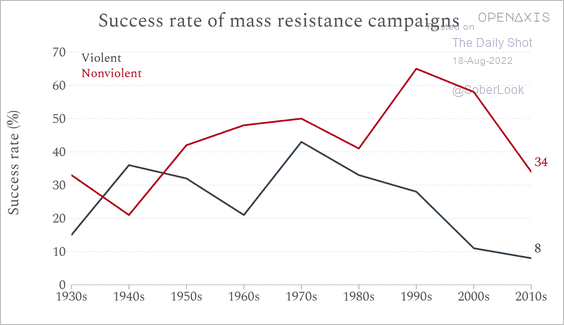

7. Success rate of mass-resistance campaigns:

Source: @OpenAxisHQ Read full article

Source: @OpenAxisHQ Read full article

——————–

Back to Index