The Daily Shot: 19-Aug-22

• The United States

• Canada

• The United Kingdom

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

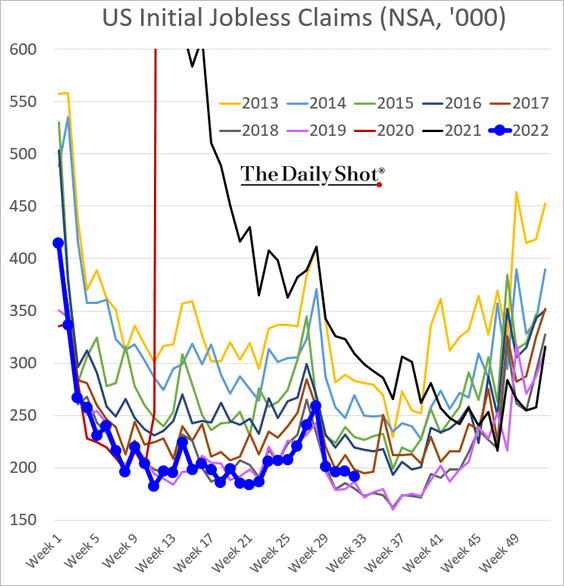

1. Let’s begin with the labor market.

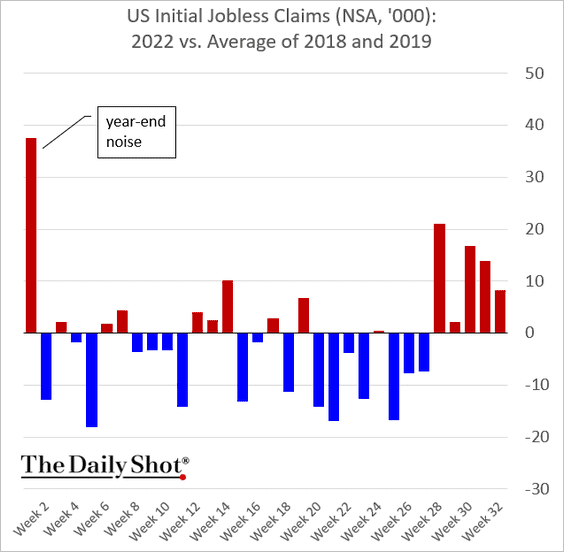

• Initial jobless claims are holding above pre-COVID levels, …

… although the spread is tightening.

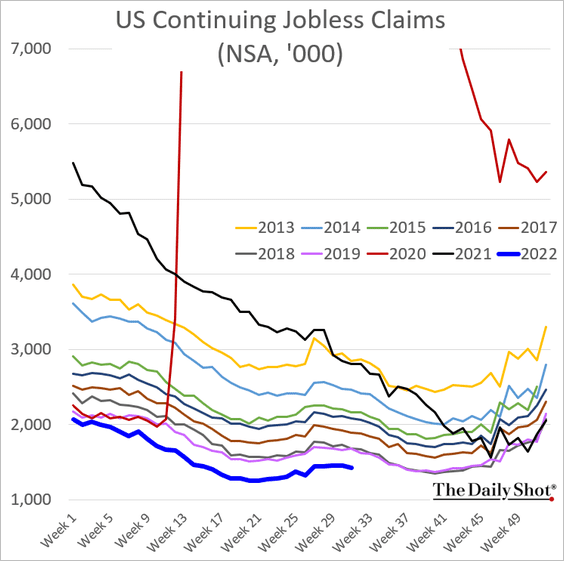

Continuing claims remain at multi-year lows for this time of the year.

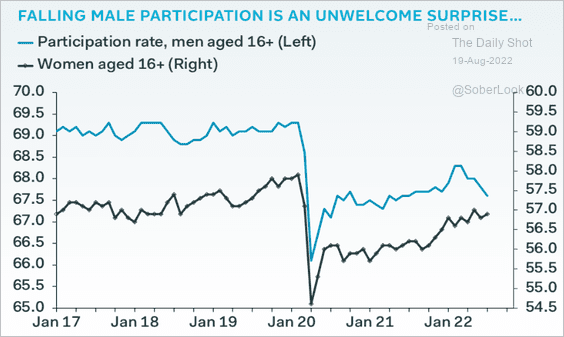

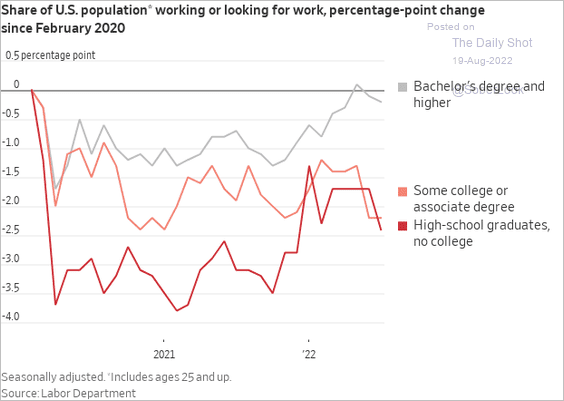

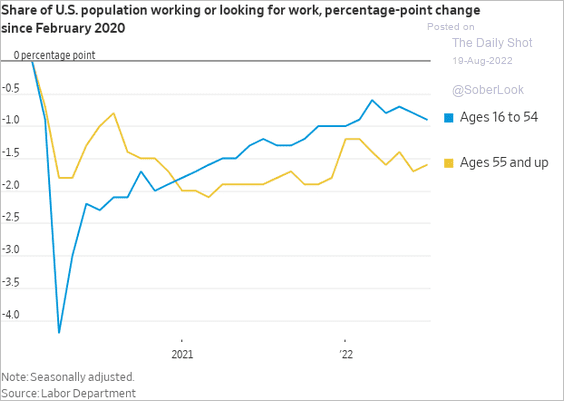

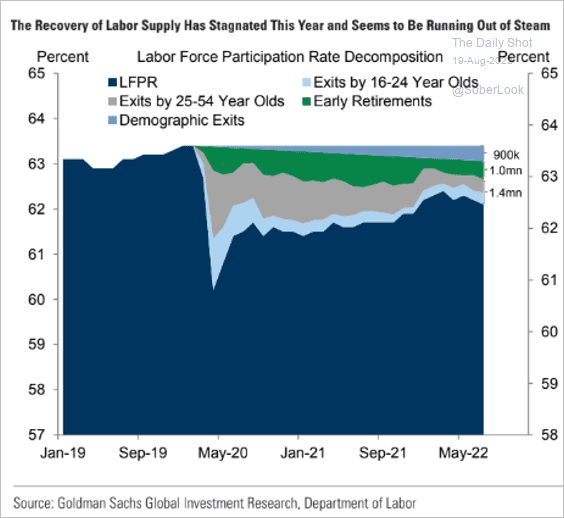

• Next, we have some labor force participation trends.

– Female and male participation:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

– By education level:

Source: @WSJ Read full article

Source: @WSJ Read full article

– By age category:

Source: @WSJ Read full article

Source: @WSJ Read full article

– Contributions to the participation gap relative to pre-COVID levels:

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

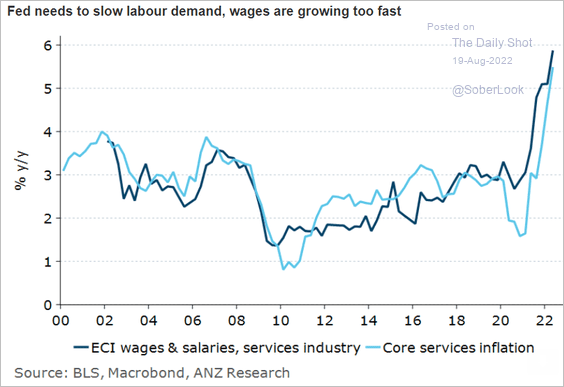

• The Fed wants to slow labor demand to get inflation under control.

Source: @ANZ_Research

Source: @ANZ_Research

——————–

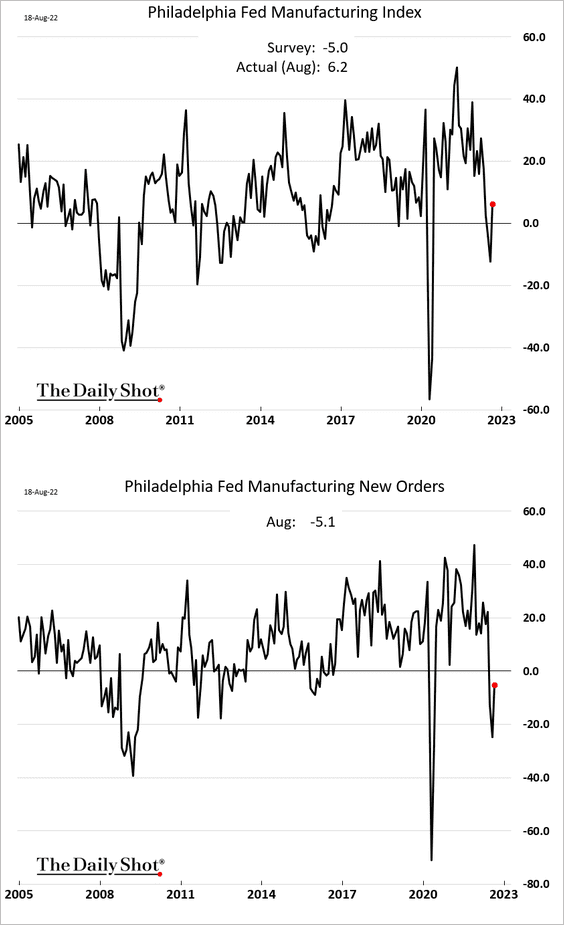

2. The Philly Fed’s regional manufacturing index unexpectedly jumped this month, diverging from the NY Fed’s dreadful report.

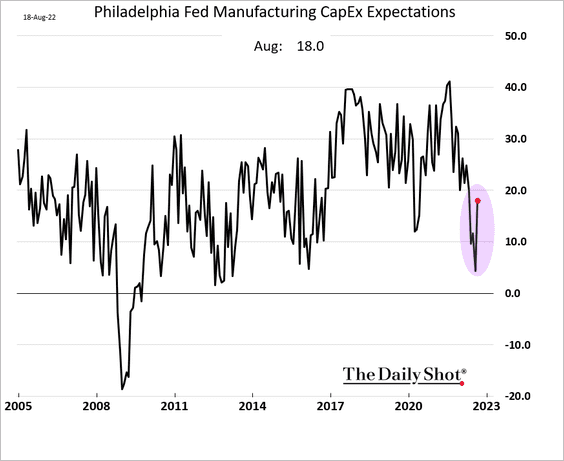

• CapEx expectations improved.

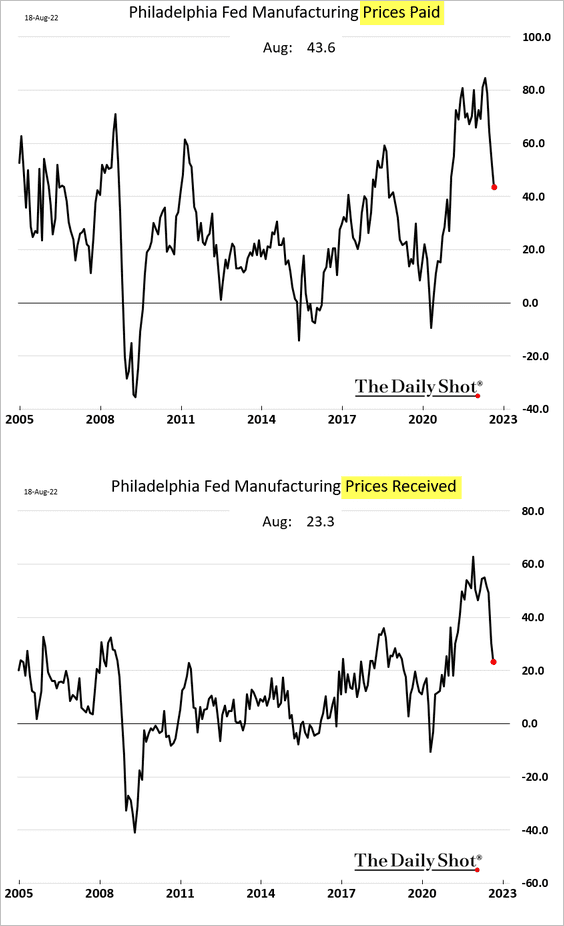

• Price pressures continue to moderate.

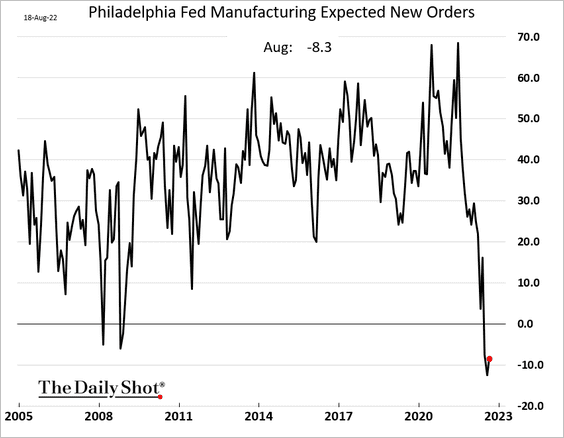

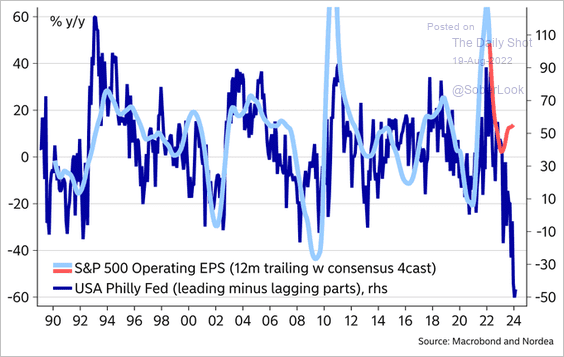

• Forward-looking components of the Philly Fed’s report remain depressed, …

… which doesn’t bode well for corporate earnings.

Source: @MikaelSarwe

Source: @MikaelSarwe

——————–

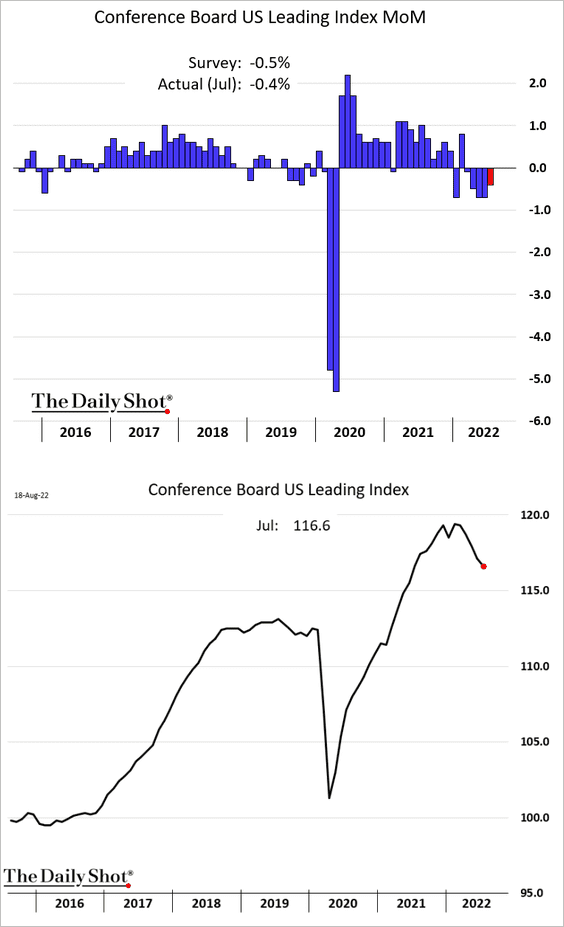

3. The Conference Board’s index of leading economic indicators was down for the 5th month in a row in July.

4. Next, we have some updates on the housing market.

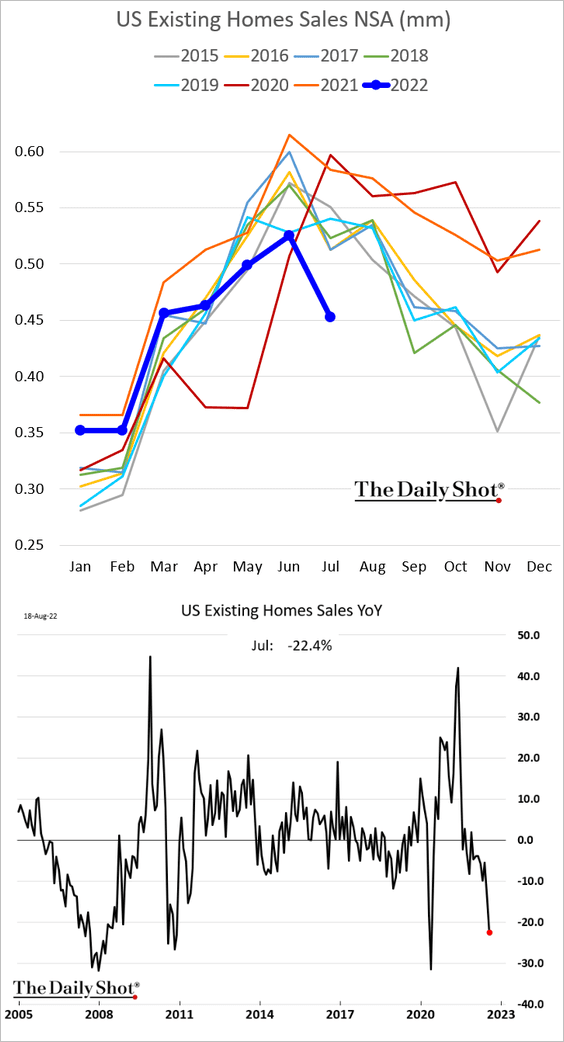

• Existing home sales slumped in July, and are now down 22% vs. last year (2nd panel).

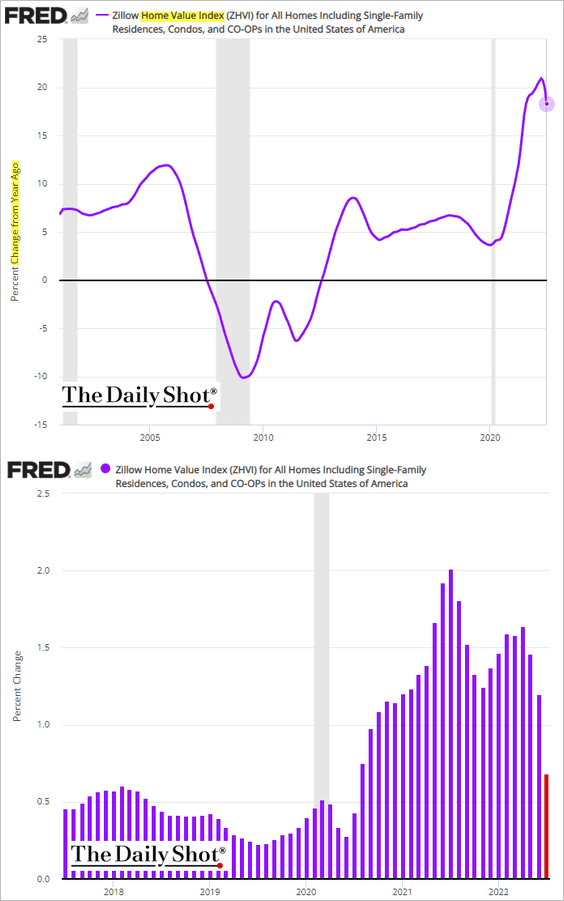

• Home price appreciation slowed last month but remains above pre-COVID levels (the second panel shows monthly price changes).

——————–

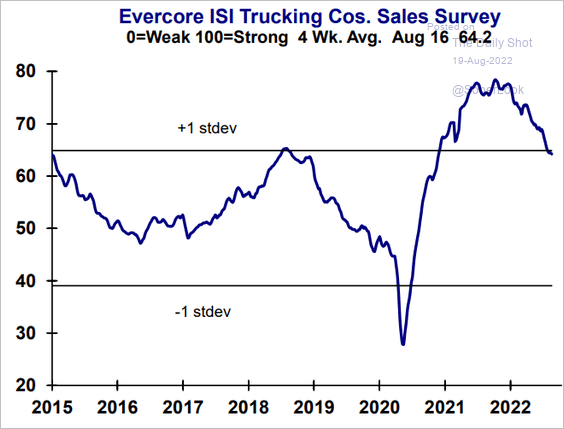

5. Trucking companies’ revenues continue to moderate as demand slows.

Source: Evercore ISI Research

Source: Evercore ISI Research

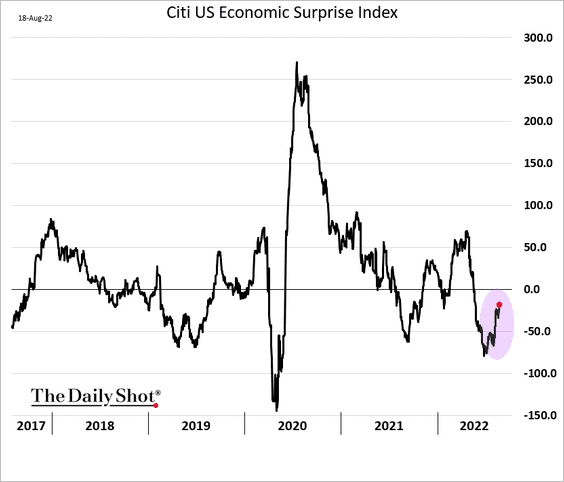

6. The Citi Economic Surprise Index is rebounding.

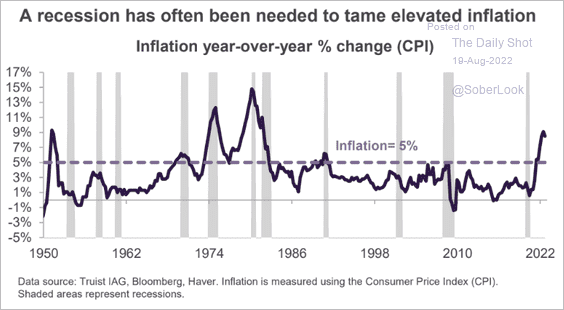

7. Will the US need a recession to tame inflationary pressures?

Source: Truist Advisory Services

Source: Truist Advisory Services

Back to Index

Canada

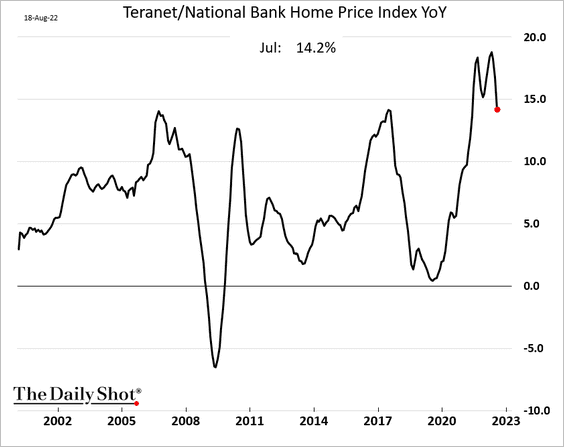

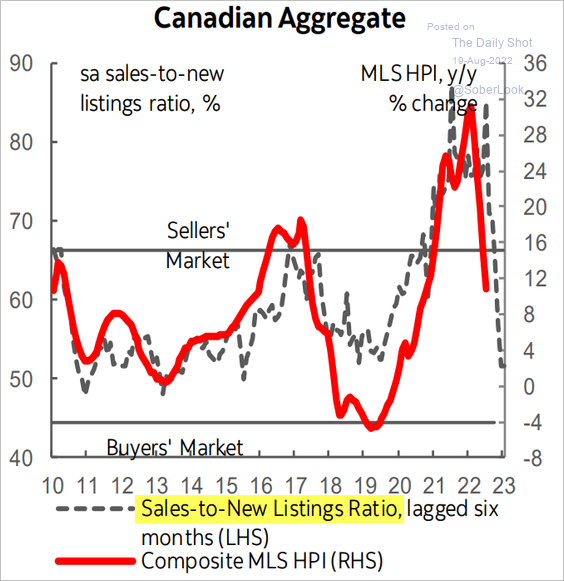

1. Home price appreciation is back below 15% but still above previous peaks.

• Housing appreciation is expected to slow sharply by the end of the year.

Source: Scotiabank Economics

Source: Scotiabank Economics

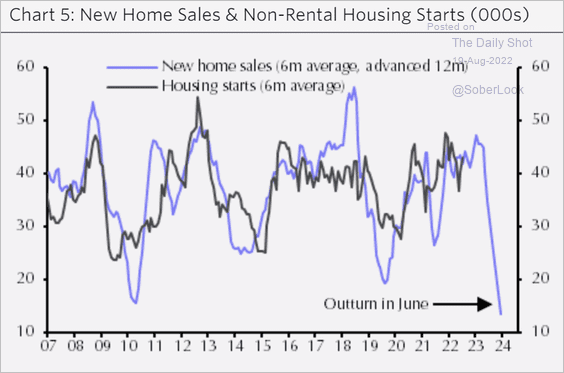

• Will housing starts crater next year?

Source: Capital Economics

Source: Capital Economics

——————–

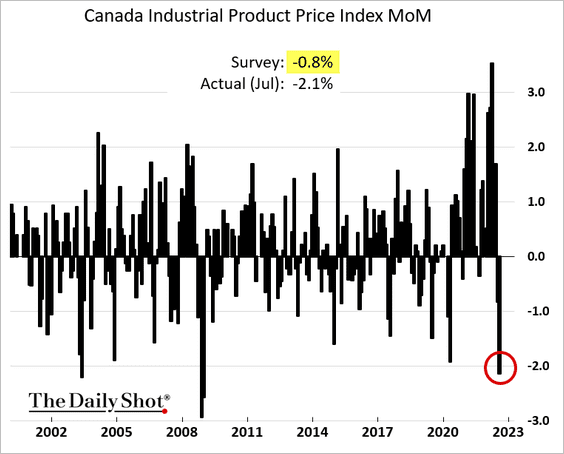

2. Upstream inflation is slowing.

Back to Index

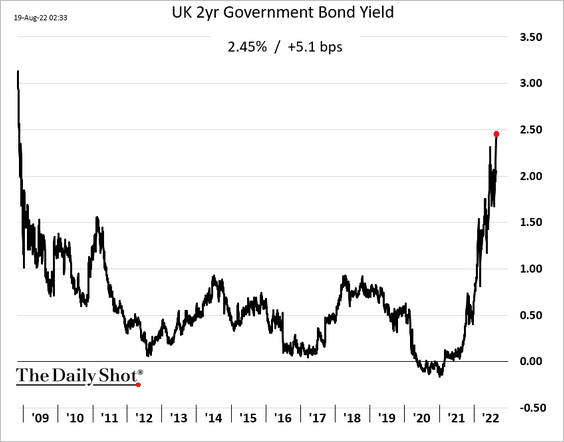

The United Kingdom

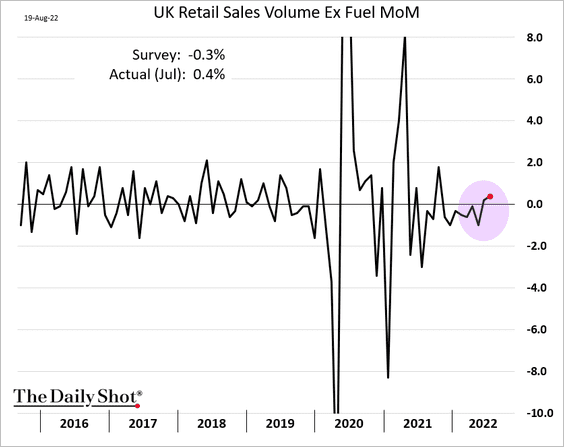

1. Retail sales unexpectedly increased last month, …

… sending gilt yields higher again.

——————–

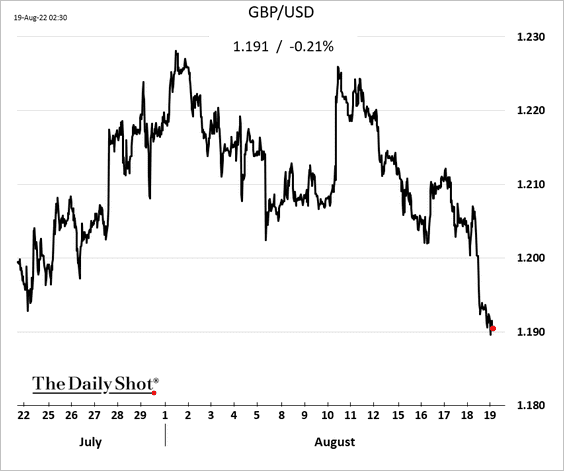

2. The pound continues to drift lower vs. USD.

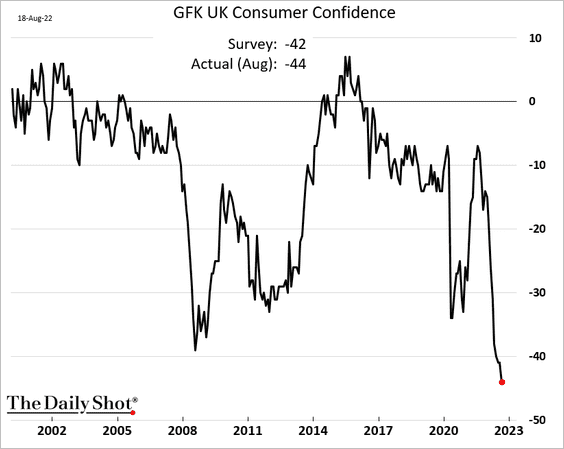

3. Consumer confidence hit a new low this month, …

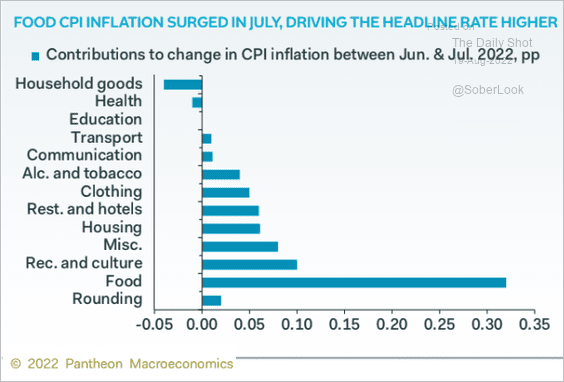

… as food inflation surges.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

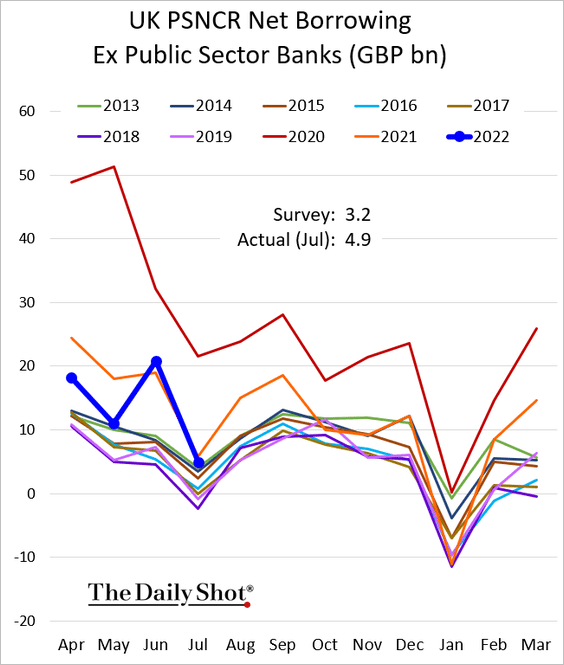

4. Government borrowing is back below last year’s levels.

Back to Index

Europe

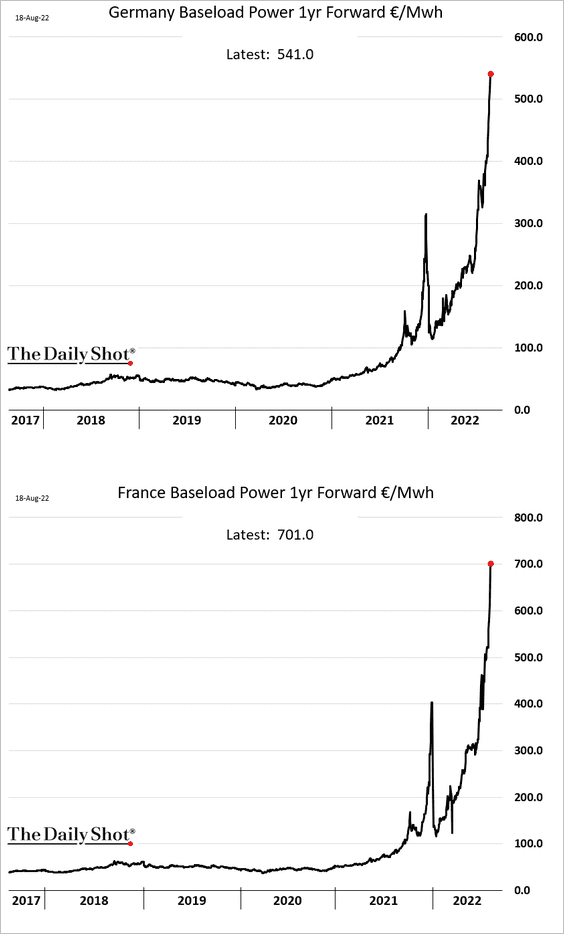

1. Electricity prices continue to surge.

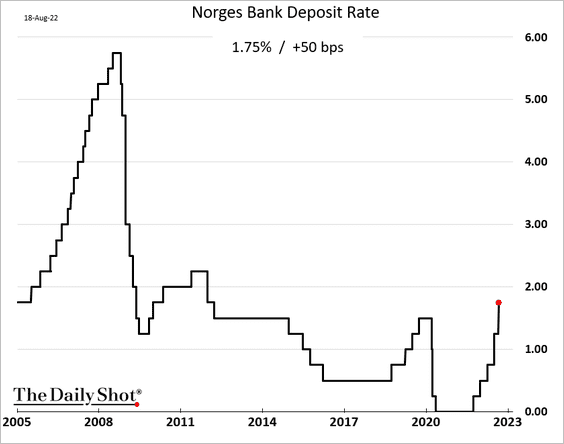

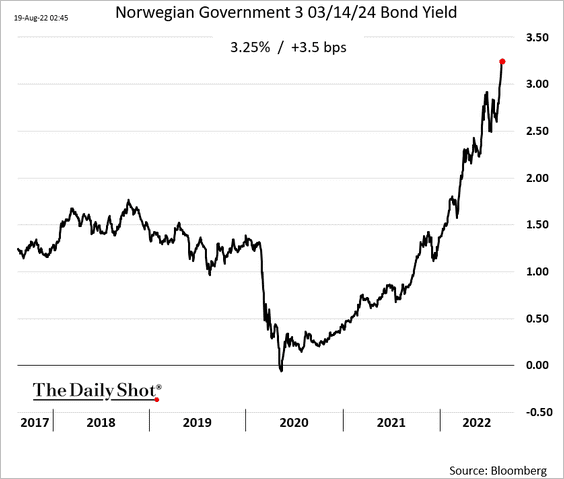

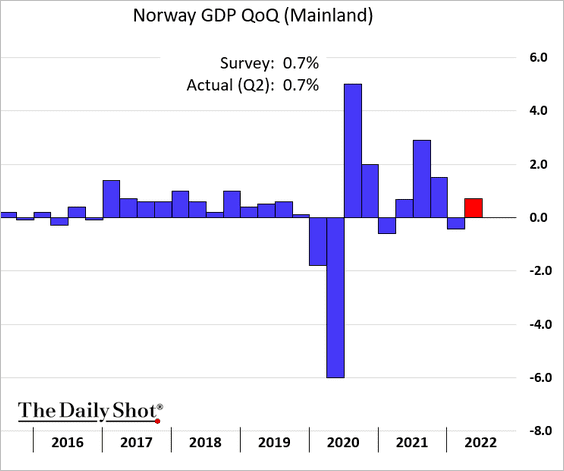

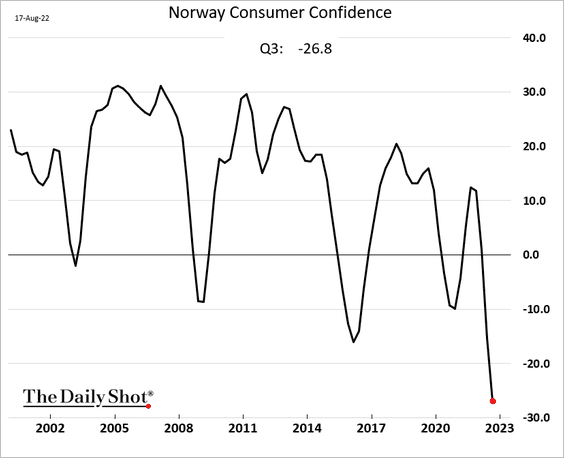

2. Next, we have some updates on Norway.

• The central bank hiked rates by 50 bps (as expected).

• Bond yields keep climbing.

• The Q2 GDP growth was in line with forecasts.

• Consumer confidence hit a new low.

——————–

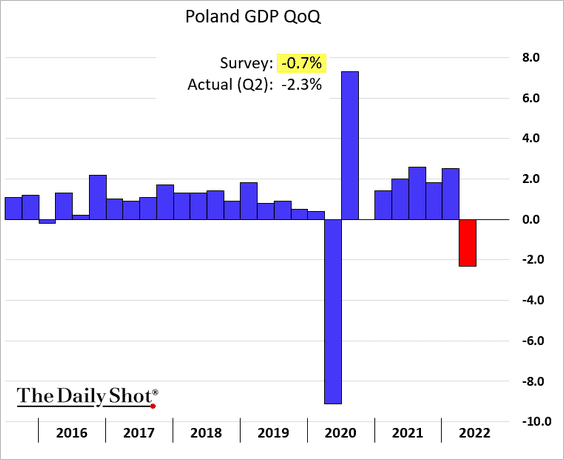

2. Poland’s GDP sank last quarter.

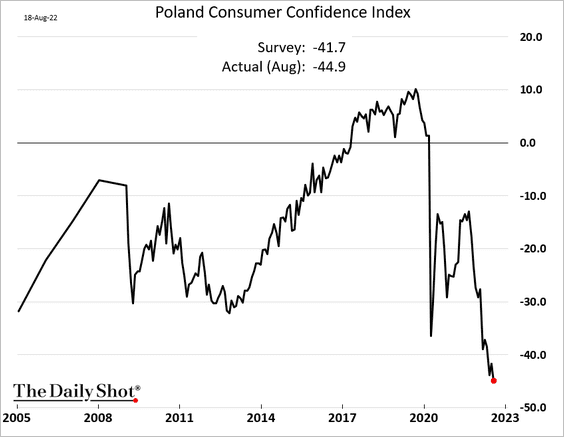

Consumer confidence has collapsed.

——————–

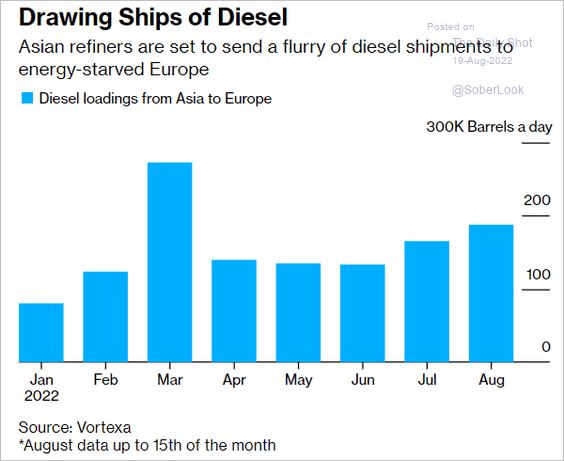

3. Asian refiners are increasingly supplying Europe with diesel.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

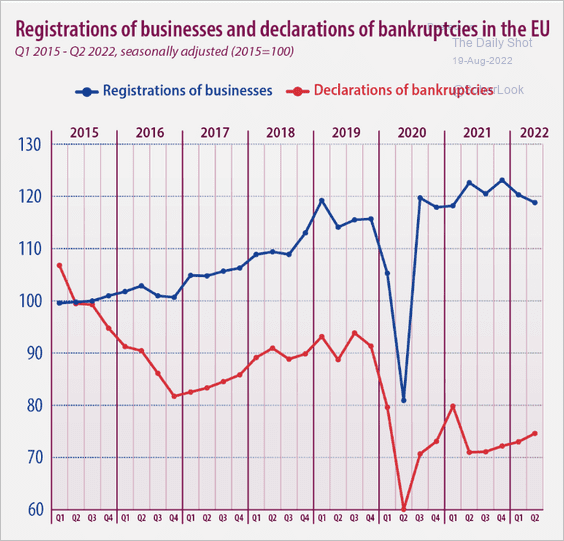

4. This chart shows business formation and bankruptcies in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia – Pacific

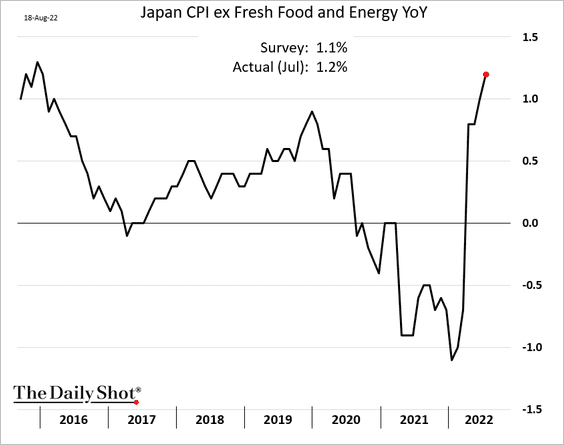

1. Japan’s inflation was a bit higher than expected last month, with the core CPI hitting 1.2% for the first time since 2016.

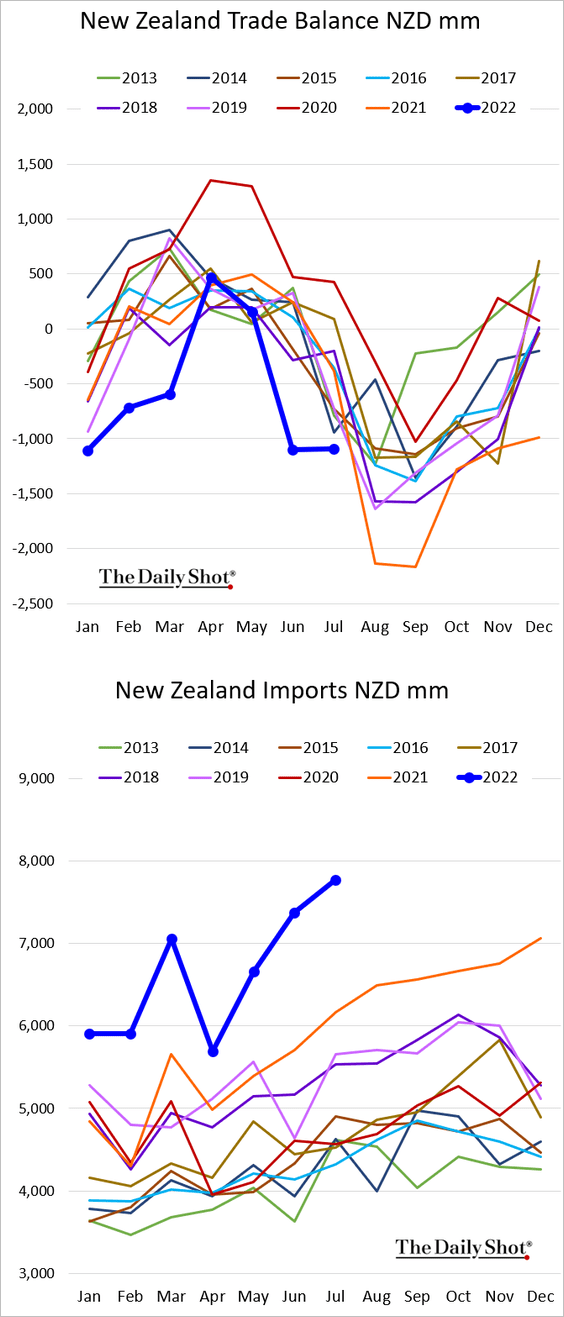

2. New Zealand continues to run a higher than normal trade deficit for this time of the year as imports surge.

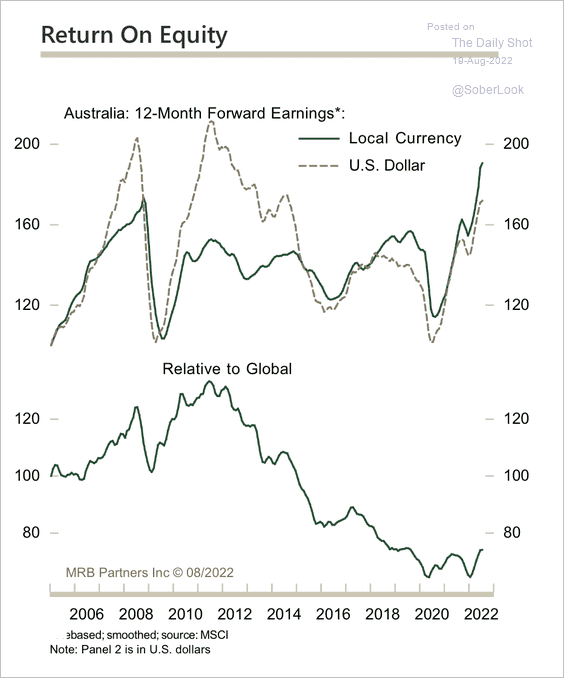

3. Australia’s equity valuations are starting to improve relative to the rest of the world.

Source: MRB Partners

Source: MRB Partners

Back to Index

China

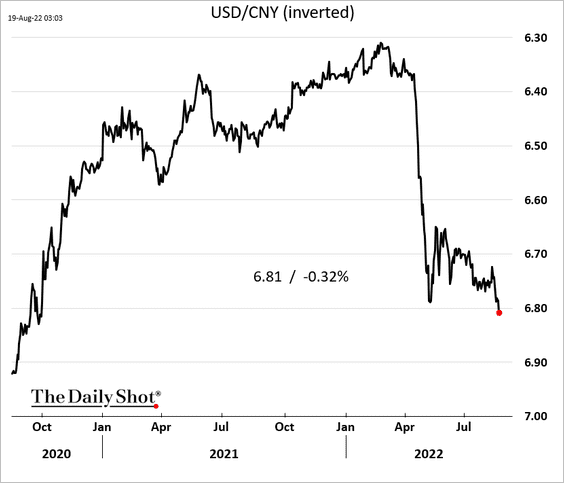

1. The renminbi hit the lowest level since 2020 on PBoC policy easing.

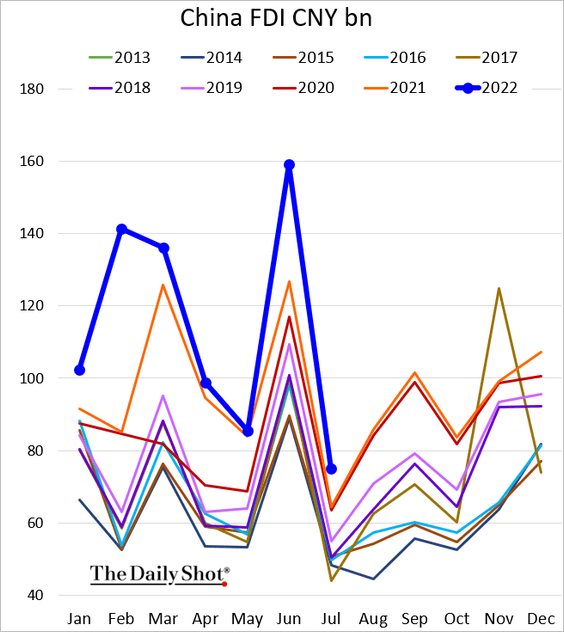

2. Foreign direct investment is holding up well (above last year’s levels).

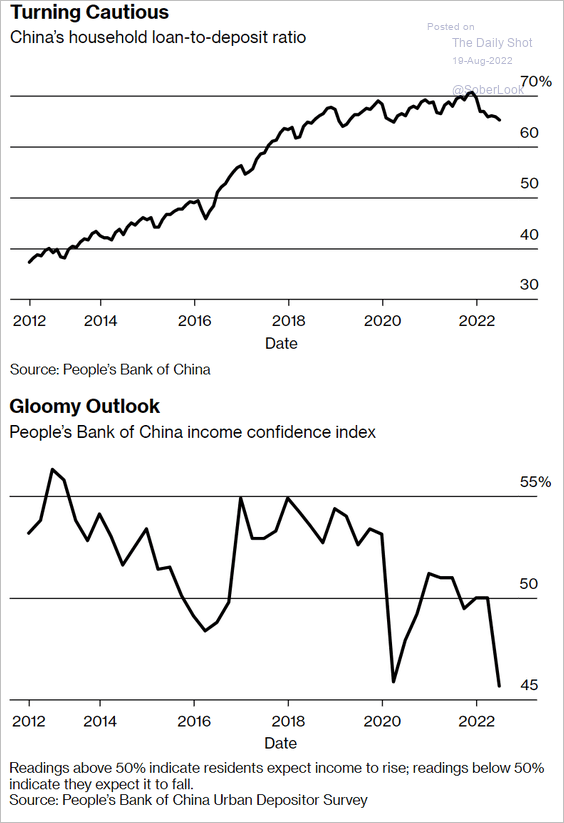

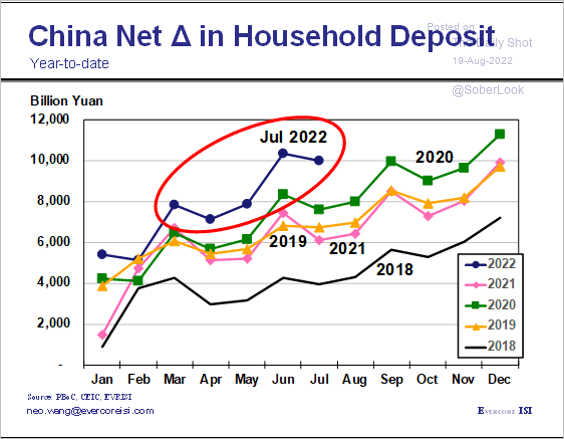

3. Risk aversion among China’s households has increased as income confidence slumps.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Households have been boosting savings.

Source: Evercore ISI Research

Source: Evercore ISI Research

——————–

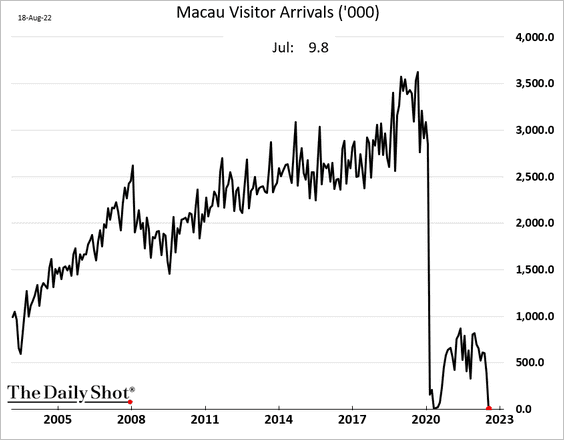

4. Visits to Macau have collapsed.

Back to Index

Emerging Markets

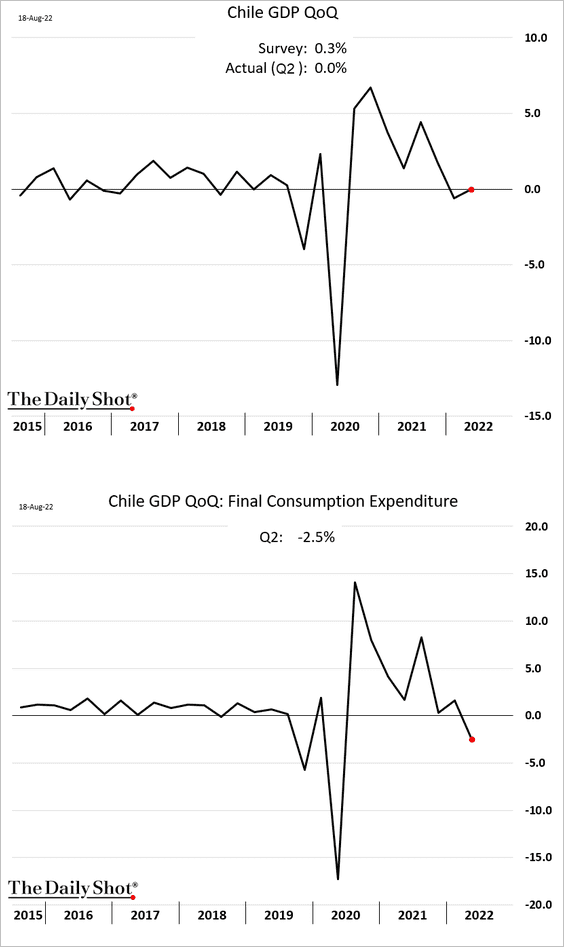

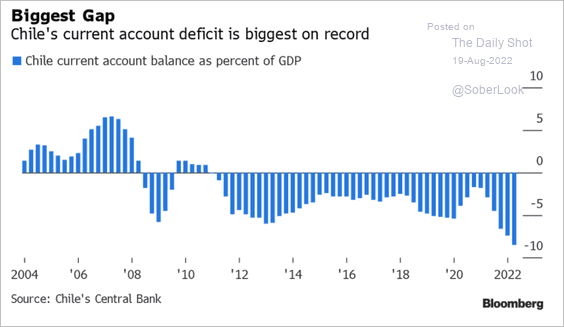

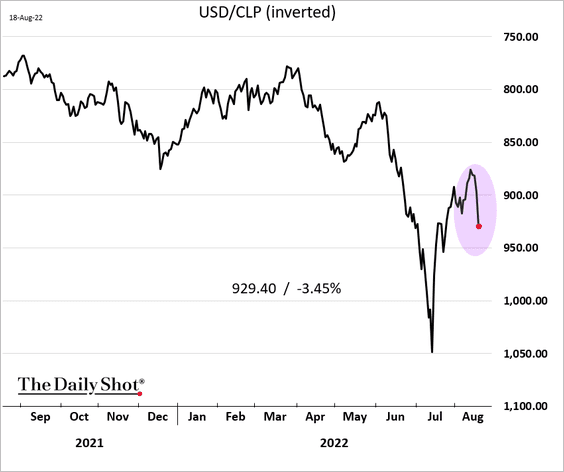

1. Let’s begin with Chile.

• Growth stalled this year as consumption declined.

• The current account deficit hit a record as a share of GDP, …

Source: @PNSanders Read full article

Source: @PNSanders Read full article

… sending the peso sharply lower.

——————–

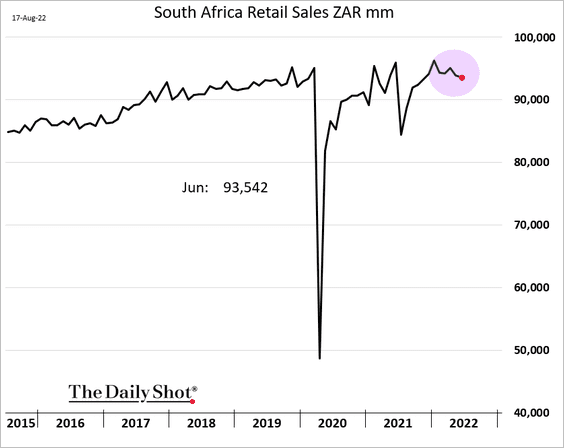

2. South Africa’s retail sales are trending down.

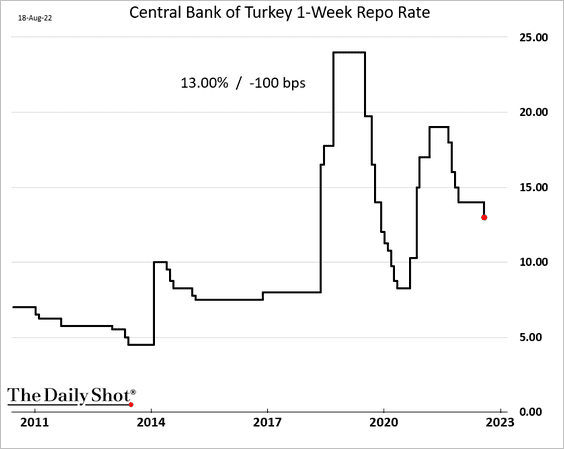

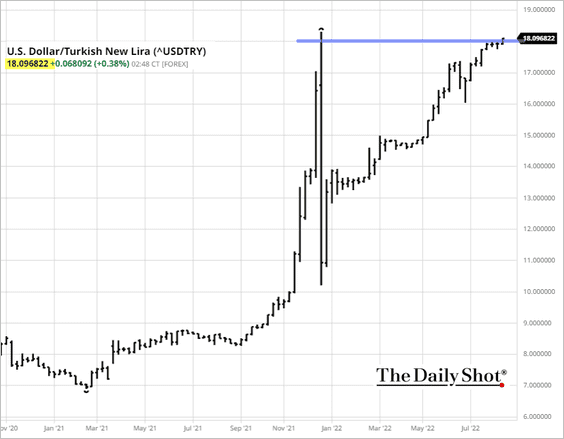

3. Turkey’s central bank unexpectedly cut rates despite hyperinflation.

The Turkish lira weakened further, with USD/TRY breaching 18.0.

Back to Index

Cryptocurrency

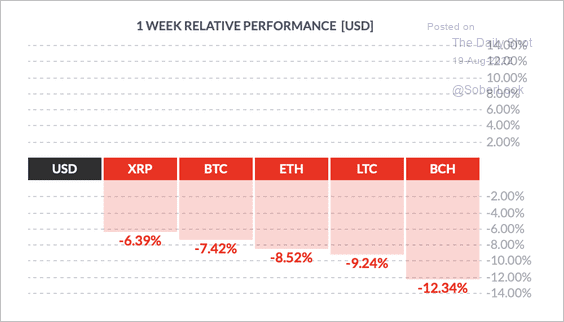

1. It’s been a tough week for cryptos.

Source: FinViz

Source: FinViz

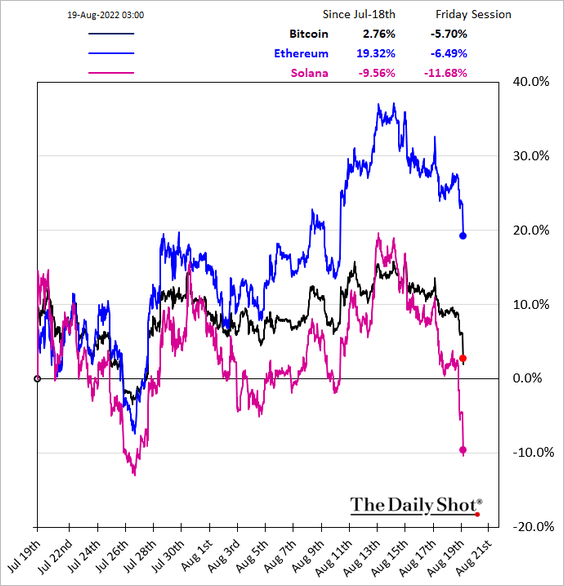

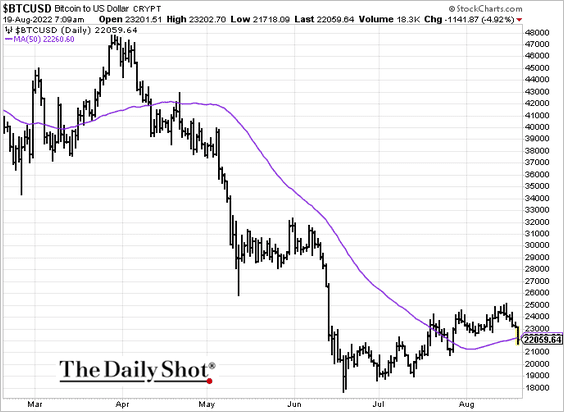

The market is tanking this morning, …

… as bitcoin dips below the 50-day moving average.

——————–

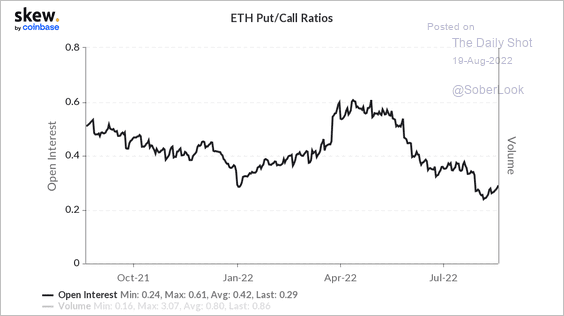

2. Ether’s put/call ratio ticked higher over the past week.

Source: Skew

Source: Skew

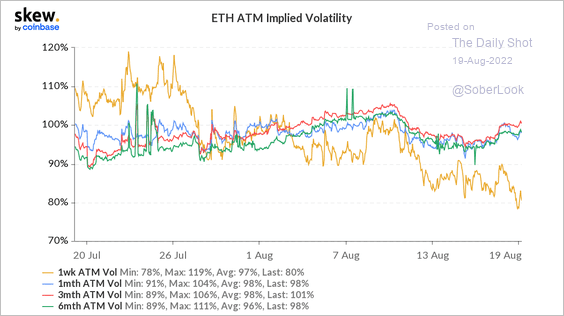

• Ether’s near-term implied volatility is trending lower, while longer-term vols are rising.

Source: Skew

Source: Skew

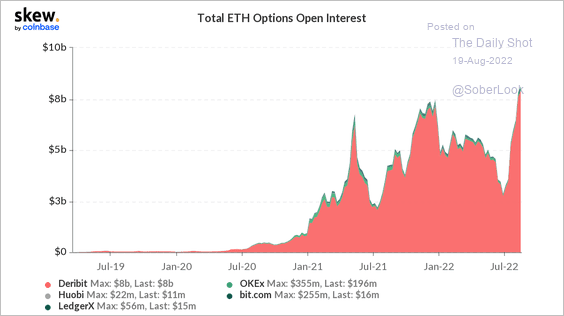

• Ether options open interest spiked over the past month.

Source: Skew

Source: Skew

Back to Index

Commodities

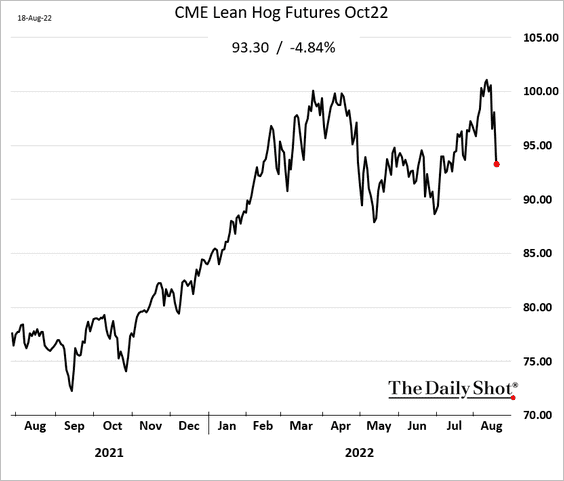

1. Chicago hog futures declined sharply on weaker US exports.

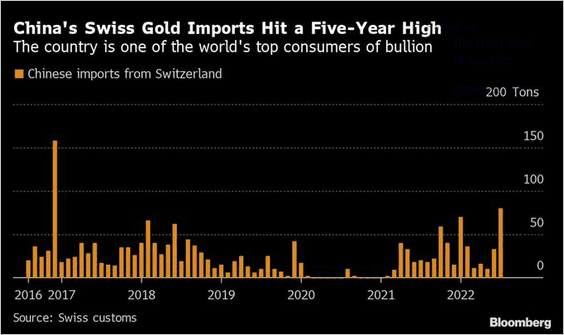

2. Swiss gold imports hit a five-year high.

Source: @acemaxx, @YahooFinance Read full article

Source: @acemaxx, @YahooFinance Read full article

Back to Index

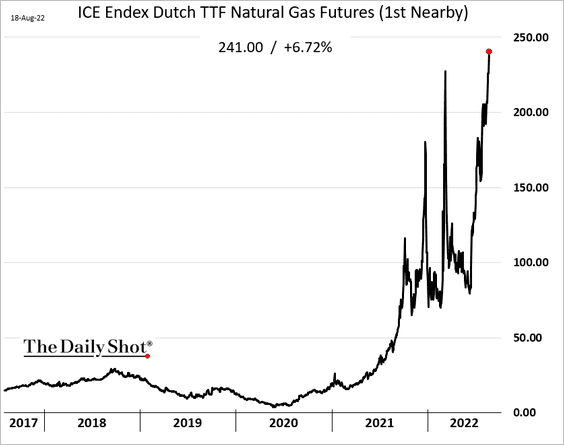

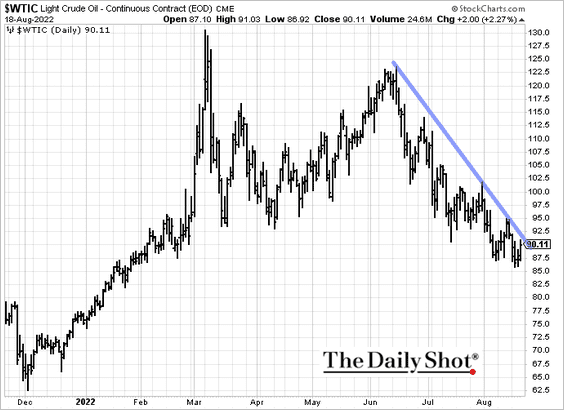

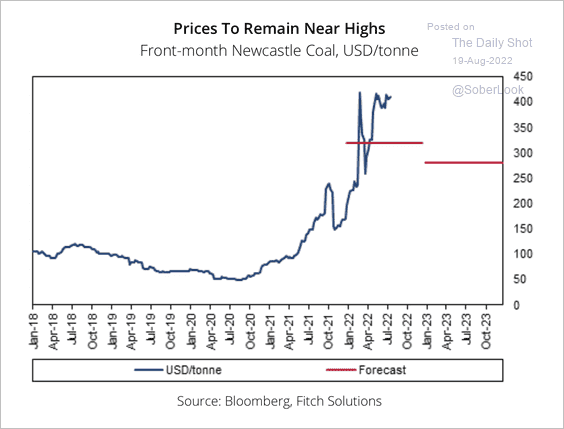

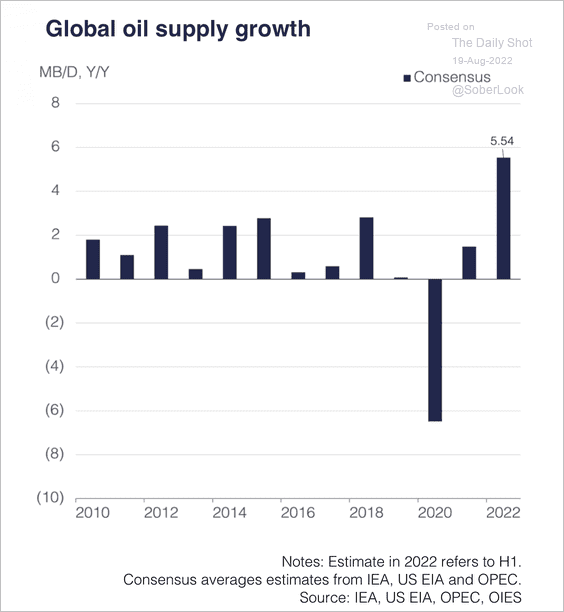

Energy

1. European natural gas prices continue to hit record highs.

2. NYMEX WTI crude oil futures are holding their downtrend resistance.

3. Fitch Solutions expects thermal coal prices to remain elevated over the next year.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

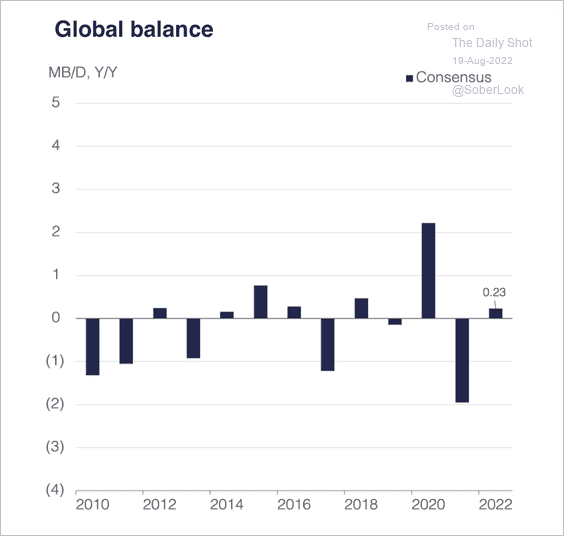

4. Preliminary estimates suggest that global oil supplies grew during the first half of the year, supported by the US strategic petroleum reserve release.

Source: Oxford Institute for Energy Studies

Source: Oxford Institute for Energy Studies

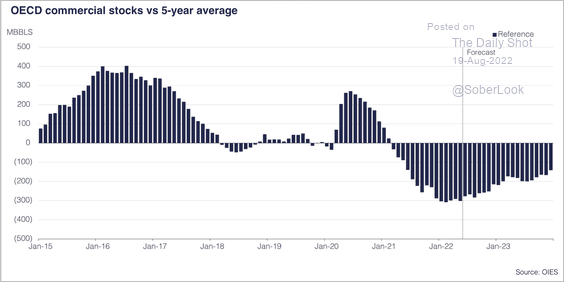

The oil market appears to have shifted to a small surplus during the first half of the year, although commercial stocks remain tight (2 charts).

Source: Oxford Institute for Energy Studies

Source: Oxford Institute for Energy Studies

Source: Oxford Institute for Energy Studies

Source: Oxford Institute for Energy Studies

——————–

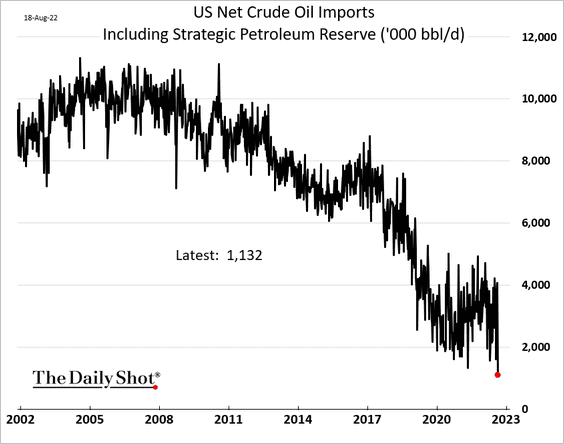

5. US net crude oil imports hit a multi-decade low.

Back to Index

Equities

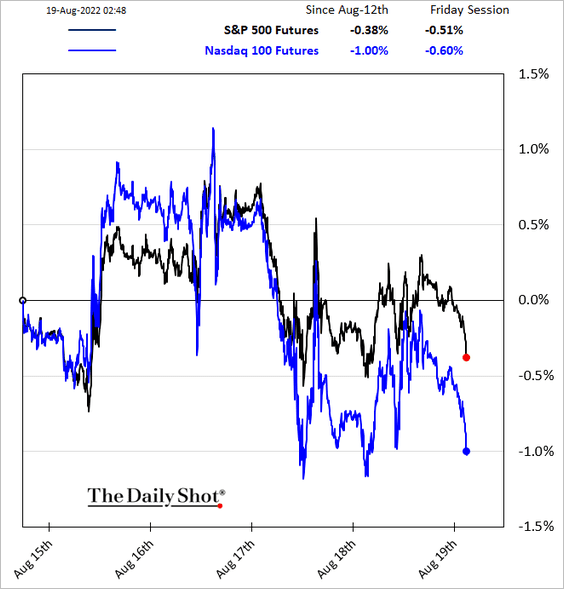

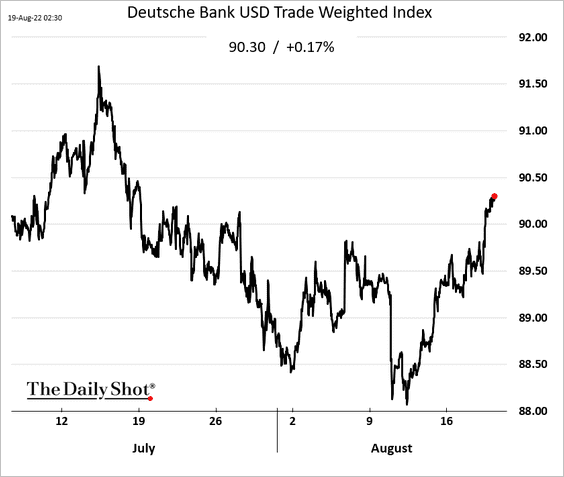

1. Stock futures are lower this morning, …

… as the US dollar rebounds.

——————–

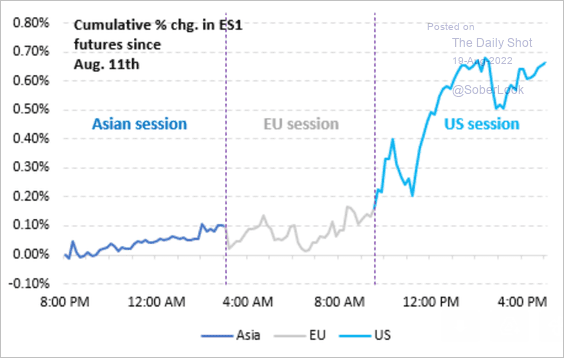

2. S&P 500 futures saw most of the recent gains during the US trading session, …

Source: Vanda Research

Source: Vanda Research

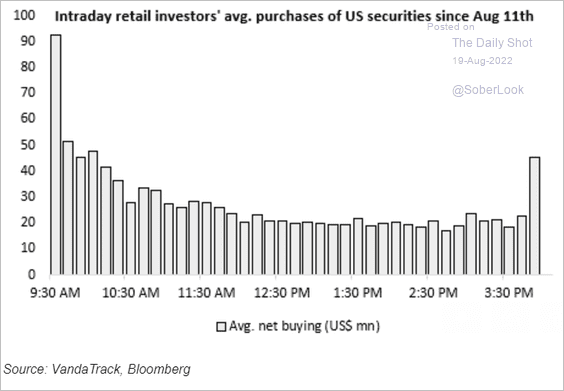

… with retail investors jumping into stocks at the open.

Source: Vanda Research

Source: Vanda Research

——————–

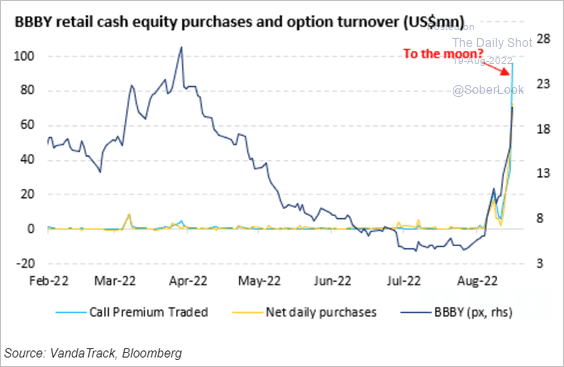

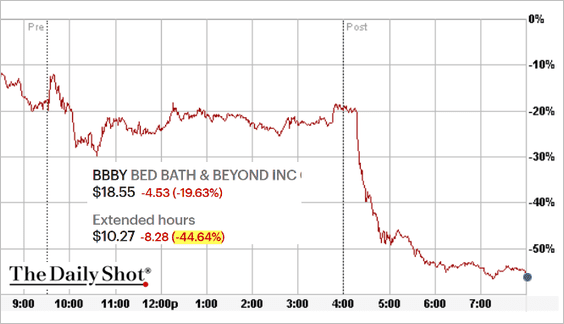

3. Bed Bath & Beyond was “going to the moon” as the Reddit crowd piled in with cash and call option purchases.

Source: Vanda Research

Source: Vanda Research

And then … another Reddit pump-and-dump episode.

Source: CNBC Read full article

Source: CNBC Read full article

——————–

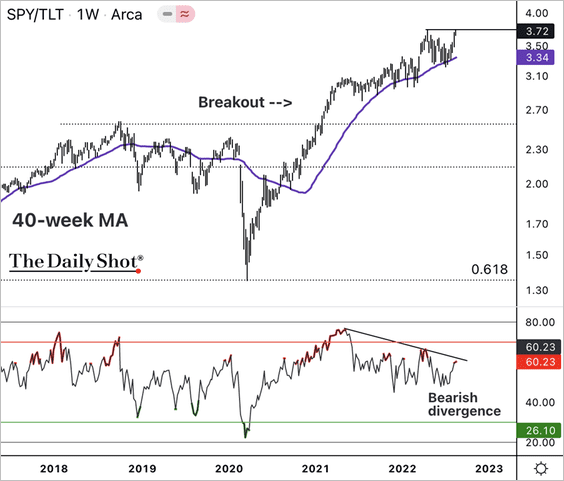

4. The stock/bond ratio is approaching a new all-time high, although upside momentum has slowed over the past year.

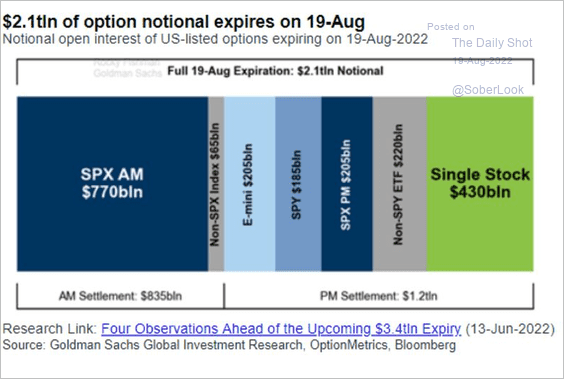

5. A lot of options expire today.

Source: @luwangnyc, @markets Read full article

Source: @luwangnyc, @markets Read full article

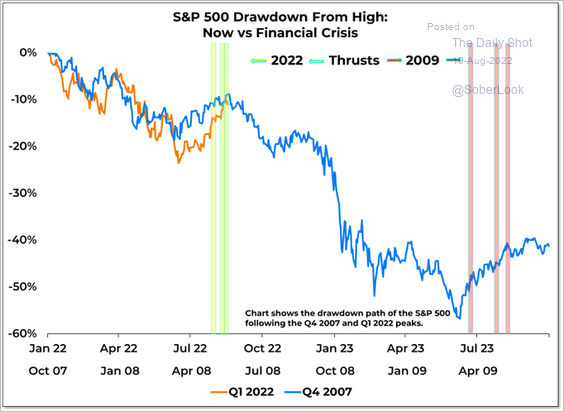

6. A repeat of 2009?

Source: @WillieDelwiche Read full article

Source: @WillieDelwiche Read full article

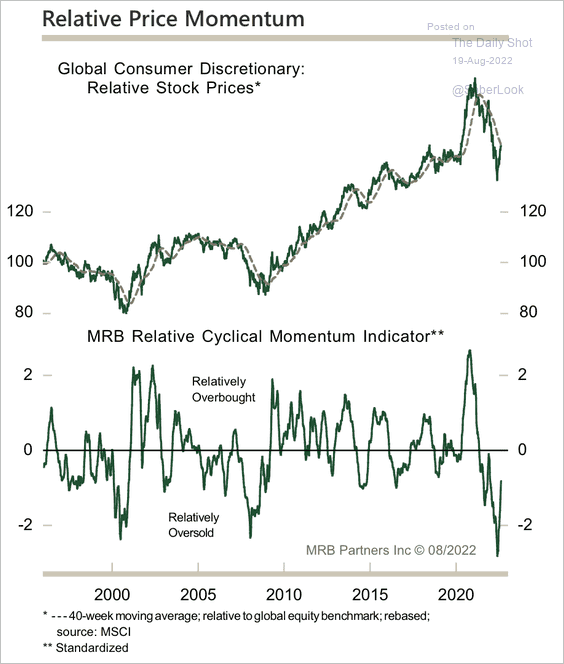

7. Consumer discretionary stocks are rising from deeply oversold levels, …

Source: MRB Partners

Source: MRB Partners

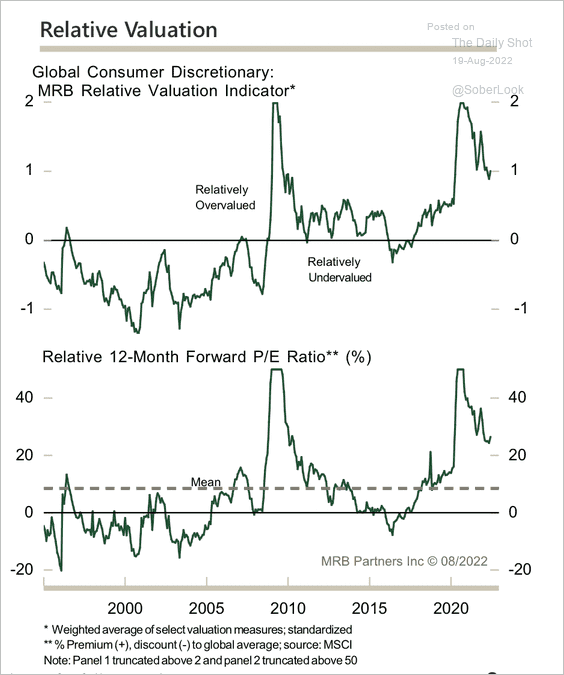

… although valuations remain elevated.

Source: MRB Partners

Source: MRB Partners

——————–

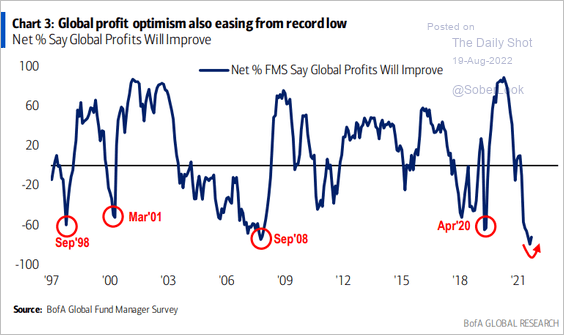

8. Fund managers’ sentiment on corporate profits appears to be bottoming.

Source: BofA Global Research

Source: BofA Global Research

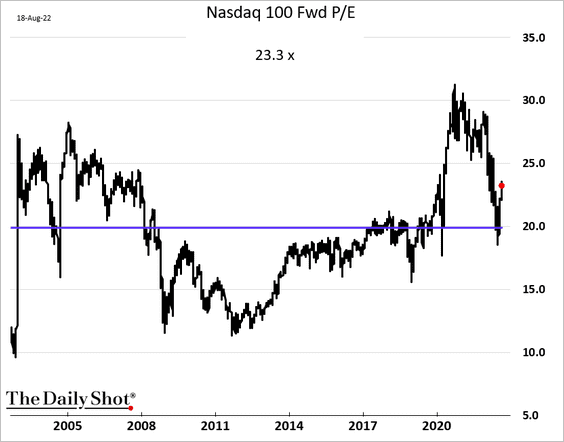

9. The Nasdaq 100 forward P/E ratio is back above the 20-year average.

h/t @farahesque

h/t @farahesque

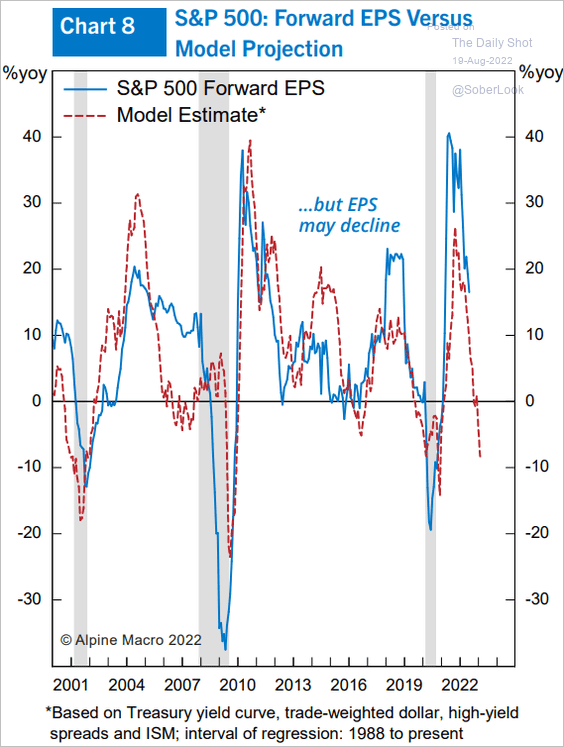

10. More pressure on earnings ahead?

Source: Alpine Macro

Source: Alpine Macro

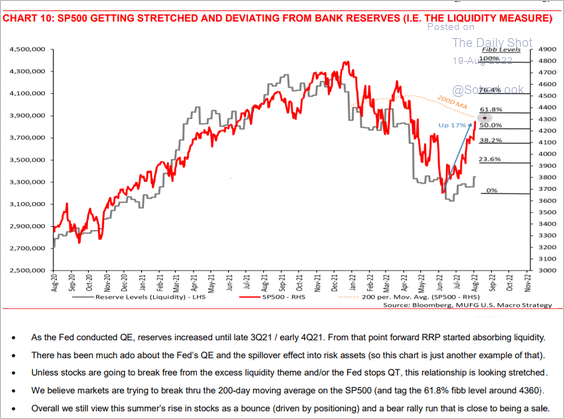

11. Stocks have diverged from bank reserves (liquidity) …

Source: MUFG Securities

Source: MUFG Securities

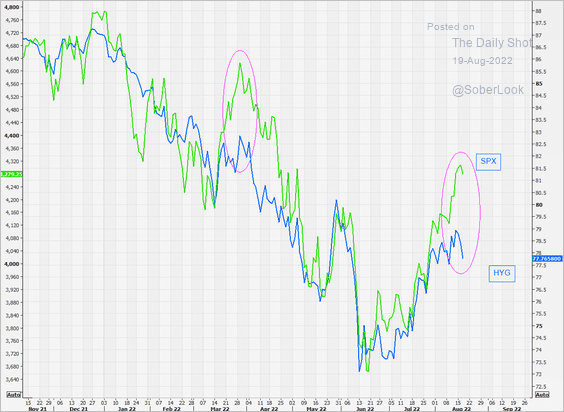

… and from credit.

Source: @themarketear

Source: @themarketear

Back to Index

Rates

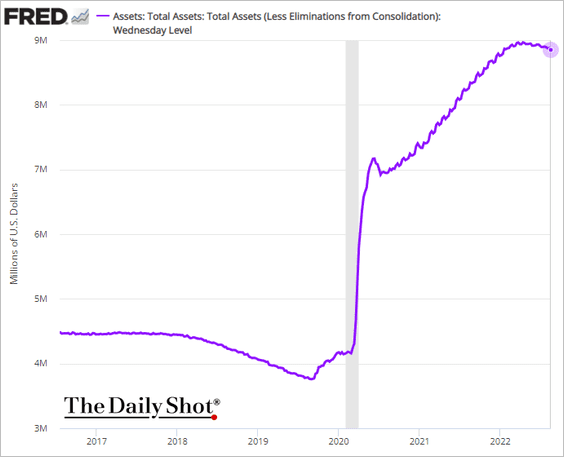

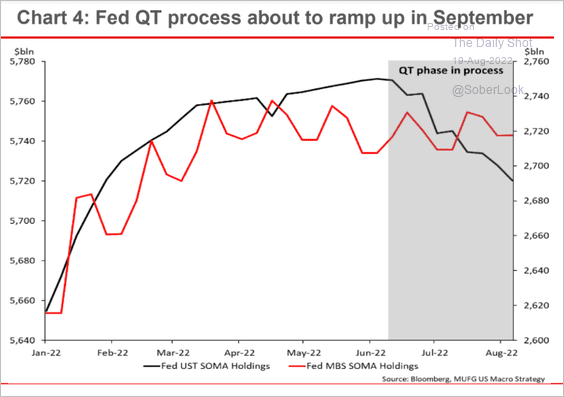

1. The Fed’s balance sheet has not declined much from the peak since the start of quantitative tightening (QT).

But QT will ramp up in September.

Source: MUFG Securities

Source: MUFG Securities

——————–

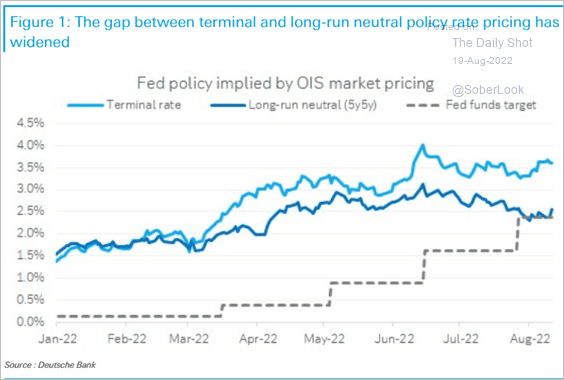

2. The market increasingly sees the Fed taking rates deeper into restrictive territory.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

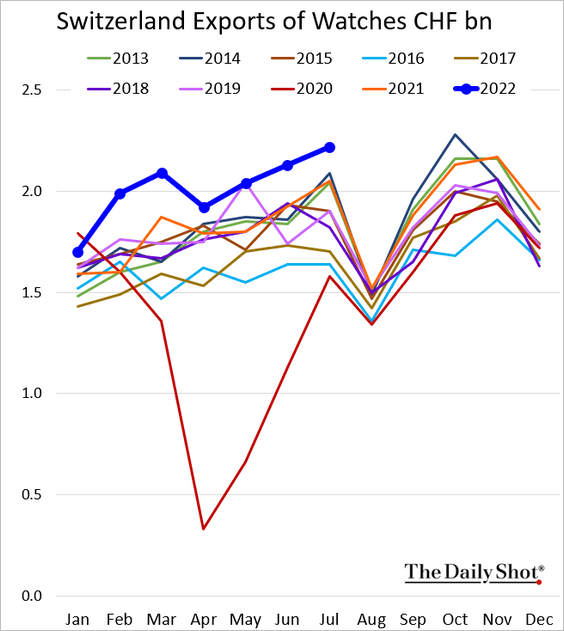

1. Swiss watch exports are holding up well despite the slowing global economic activity.

2. The dollar held support at its 50-day moving average.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

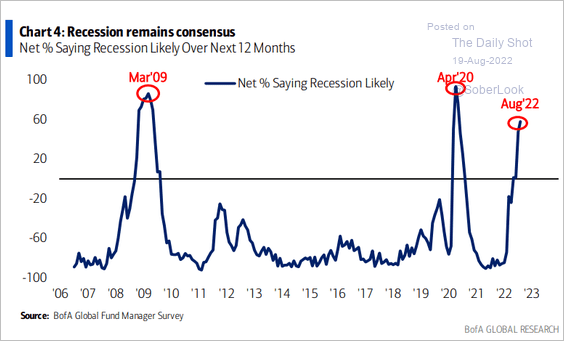

3. Investors’ recession expectations remain elevated.

Source: BofA Global Research

Source: BofA Global Research

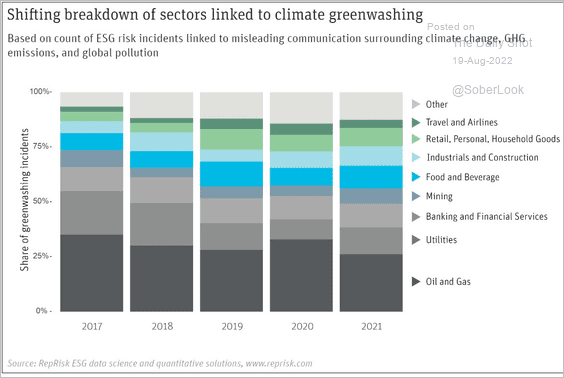

4. This chart shows greenwashing incidents (share) by sector.

Source: @FactSet, @RepRisk Read full article

Source: @FactSet, @RepRisk Read full article

——————–

Food for Thought

1. Shareholders resisting executive pay bumps:

Source: @BLaw Read full article

Source: @BLaw Read full article

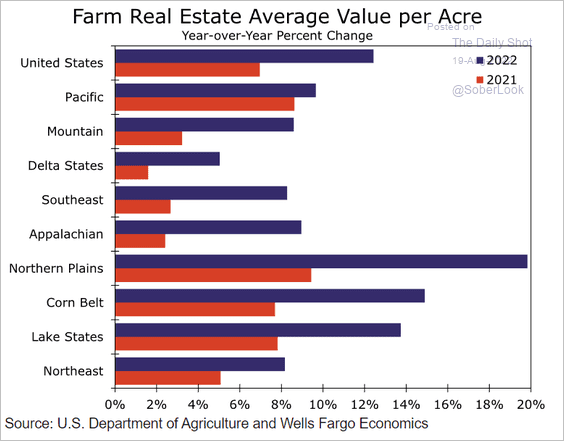

2. Farmland price gains:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

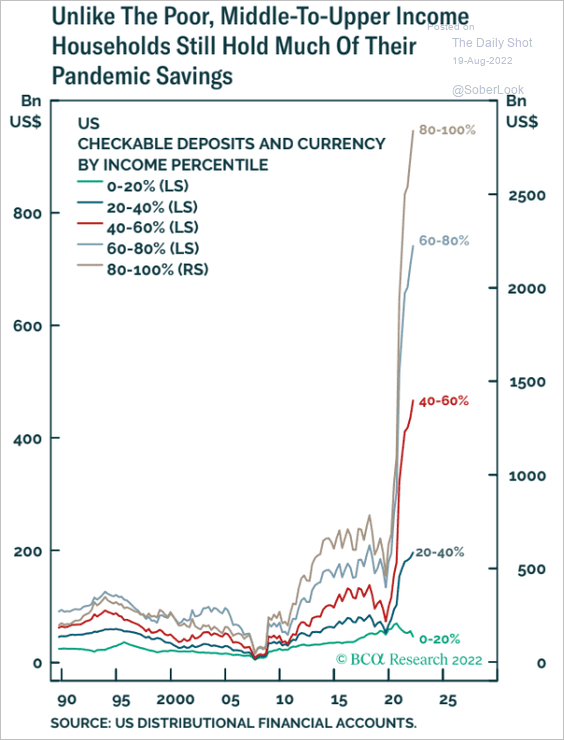

3. US household cash holdings by income percentile:

Source: BCA Research

Source: BCA Research

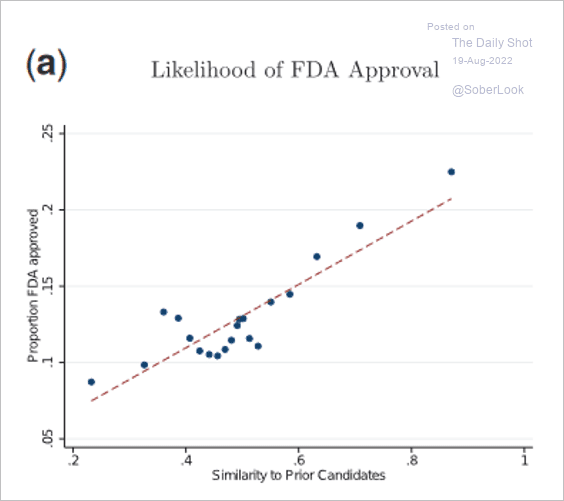

4. FDA approval rates vs. drug’s similarity to prior candidates:

Source: @emollick Read full article

Source: @emollick Read full article

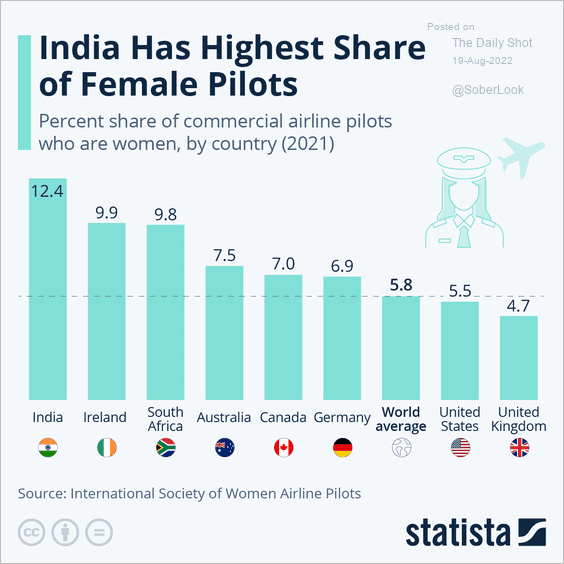

5. Female pilots by country:

Source: Statista

Source: Statista

6. Semiconductor market share by the type of production:

![]() Source: @financialtimes Read full article

Source: @financialtimes Read full article

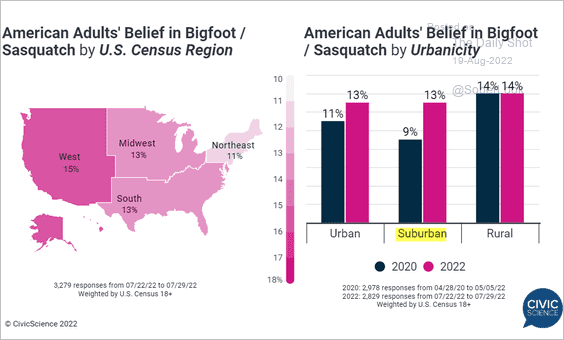

7. Belief in Bigfoot:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

——————–

Have a great weekend!

Back to Index