The Daily Shot: 06-Apr-23

• The United States

• The United Kingdom

• The Eurozone

• China

• Emerging Markets

• Cryptocurrency”>

Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

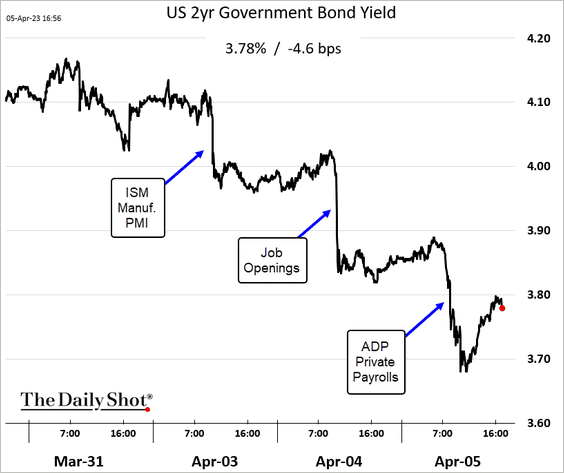

1. The March ADP private payrolls index surprised to the downside.

Source: CNBC Read full article

Source: CNBC Read full article

• The Midwest registered gains, but …

….the South saw substantial job losses.

Here are some ADP sector trends.

• Manufacturing:

• Construction (surprisingly resilient):

• Leisure and hospitality:

• Professional and business services:

——————–

2. The ISM Services PMI was also lower than expected.

Source: Reuters Read full article

Source: Reuters Read full article

• Here are the contributions.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

• Hiring and new orders growth slowed.

• With demand weakening, supplier delivery times are shrinking rapidly.

• Inventories are rising at a faster pace now.

• Input price inflation continues to moderate, …

… which points to lower consumer inflation, …

Source: Oxford Economics

Source: Oxford Economics

… and weaker wage growth.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

3. Treasury yields declined again, …

… as the Citi economic surprise index rolls over.

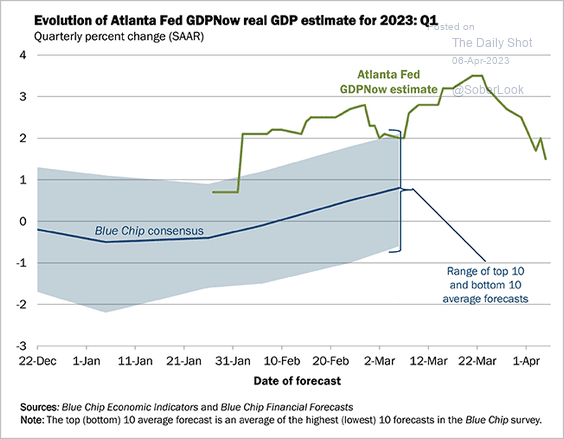

• The Atlanta Fed’s GDPNow estimate was adjusted downward again.

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

• The 10-year/3-month portion of the Treasury curve is the most inverted in decades.

Here is the Treasury curve.

——————–

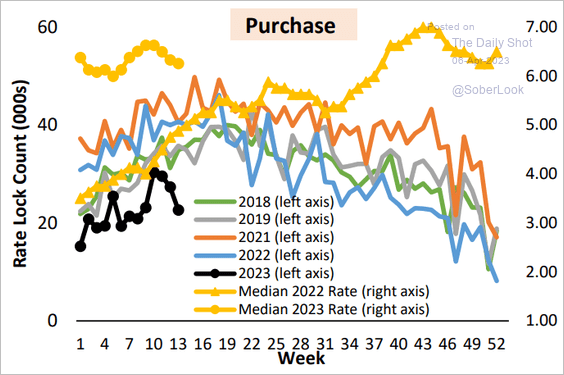

4. Next, we have some updates on the housing market.

• Mortgage applications hit a multi-year low.

Here is the rate-lock count.

Source: AEI Housing Center

Source: AEI Housing Center

• Mortgage rates are falling.

• Below is Freddie Mac’s home price index through February.

• Homes are still selling relatively quickly.

Source: Realtor.com

Source: Realtor.com

And sellers are not in a hurry.

Source: Realtor.com

Source: Realtor.com

——————–

5. The trade gap widened in February.

Both imports and exports declined.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @readep, @economics Read full article

Source: @readep, @economics Read full article

Here is a look at US trading partners.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

Back to Index

The United Kingdom

1. Car registrations are holding well above last year’s levels.

2. The passthrough of higher rates in the UK is significantly lower than other rate-sensitive economies.

Source: RBA

Source: RBA

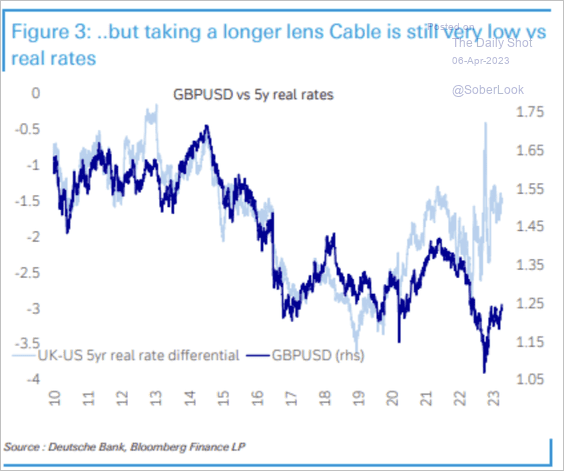

3. GBP/USD has underperformed real rate differentials.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• But the pound outperformed other currencies in Q1.

Source: TS Lombard

Source: TS Lombard

• Will the near-term resistance hold?

Back to Index

The Eurozone

1. Geman manufacturing orders and industrial production topped expectations, pointing to a rebound in economic activity.

• Factory orders:

Source: ABC News Read full article

Source: ABC News Read full article

• Industrial production:

Source: Reuters Read full article

Source: Reuters Read full article

——————–

2. French industrial production continues to climb but remains below pre-COVID levels.

3. Spain’s industrial production edged higher in February.

4. Euro-area services growth strengthened last month.

• Italy:

Source: World Economics

Source: World Economics

• Spain:

Source: S&P Global PMI

Source: S&P Global PMI

• The Eurozone:

——————–

5. Rapid declines in the narrow money supply is a headwind for European banks.

Source: Truist Advisory Services

Source: Truist Advisory Services

Back to Index

China

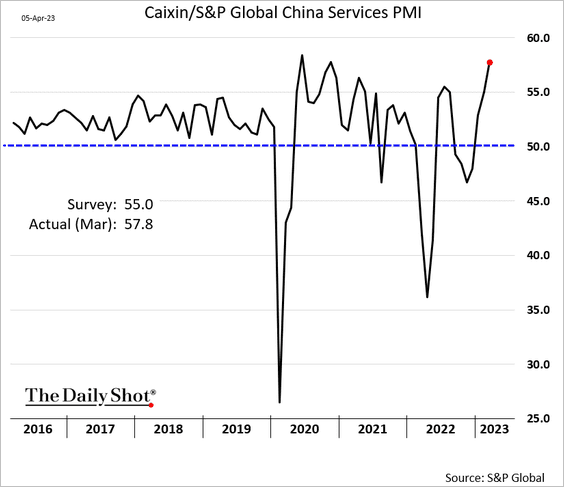

1. China’s services PMI (from S&P Global) was remarkably strong last month.

2. Hong Kong also registered robust growth in business activity.

Source: World Economics

Source: World Economics

3. China’s sales revenue and profit margins ticked higher over the past quarter.

Source: China Beige Book

Source: China Beige Book

Back to Index

Emerging Markets

1. India’s service-sector activity continues to show strength.

2. South Africa’s vehicle sales were robust in March.

South Africa remains one of the largest underweights across EM funds.

Source: Variant Perception

Source: Variant Perception

——————–

3. Mexico’s core inflation has peaked but remains elevated.

Consumer confidence is holding up despite high inflation.

——————–

4. Colombia’s core inflation continues to surge.

5. Argenitna’s vehicle sales are starting to recover.

Cryptocurrency”>Back to Index

Cryptocurrency

1. Bitcoin’s correlation with gold turned decisively positive late last year, although it has weakened a bit this year.

Source: @StocktonKatie

Source: @StocktonKatie

2. Only 6% of the top 50 altcoins have outperformed bitcoin over the past month, the lowest since October 2020. Traders have opted for BTC during the recent crypto rally, which is rare.

Source: Blockchain Center

Source: Blockchain Center

3. Ether’s put/call ratio is trending higher this year.

Source: The Block Research

Source: The Block Research

4. Volume and open interest in CME bitcoin futures are starting to recover.

Source: The Block Research

Source: The Block Research

Back to Index

Commodities

1. Copper is outperforming the broad commodity index.

Source: PGM Global

Source: PGM Global

• Managed money pared back their exposure to copper (now net short), possibly reacting to China’s lackluster reopening.

Source: PGM Global

Source: PGM Global

• PGM Global expects a large copper deficit over the next few years.

Source: PGM Global

Source: PGM Global

——————–

2. European coffee futures are rallying.

3. Sugar futures have been surging, driven by supply jitters from the lower-than-expected output in some countries.

Back to Index

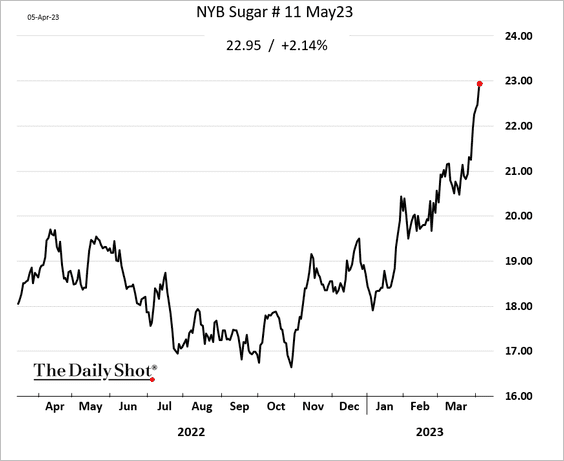

Energy

1. US crude oil and product inventories declined more than expected.

• Week-over-week changes:

– Oil:

– Gasoline:

– Distillates:

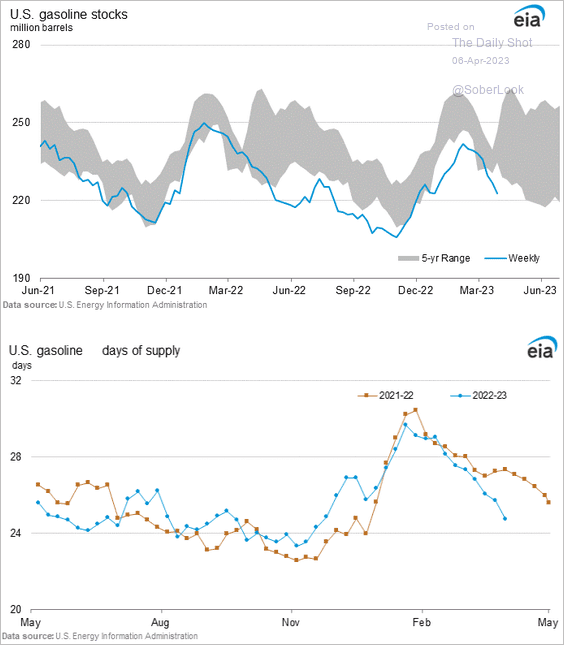

• Inventory levels and days of supply:

– Oil:

– Gasoline

:

:

– Distillates:

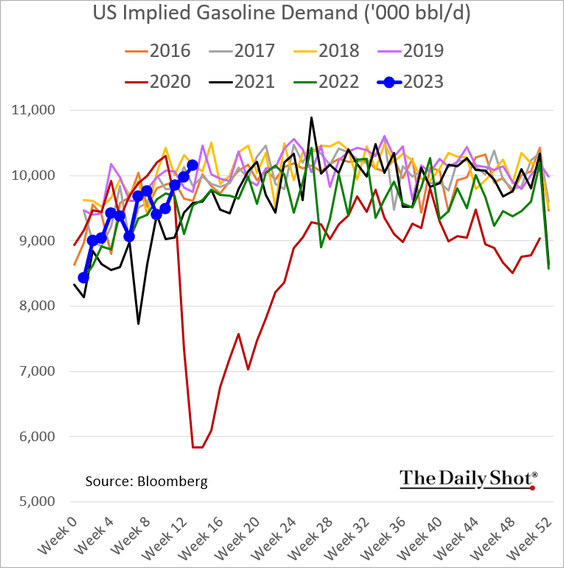

• US gasoline demand is approaching multi-year highs.

——————–

2. The Brent crude oil price benchmark will soon include US crude (WTI Midland crude).

EIA: – Declining production of the five North Sea crude oil grades in the Dated Brent benchmark has prompted the price reporting agency S&P Global Commodity Insights (previously called Platts) to add West Texas Intermediate (WTI) Midland crude oil to the basket of crude oil grades that determine Dated Brent prices, beginning with the June 2023 delivery.

Source: @EIAgov

Source: @EIAgov

Back to Index

Equities

1. US diversified banks’ forward earnings have been resilient compared to regional banks.

Source: MRB Partners

Source: MRB Partners

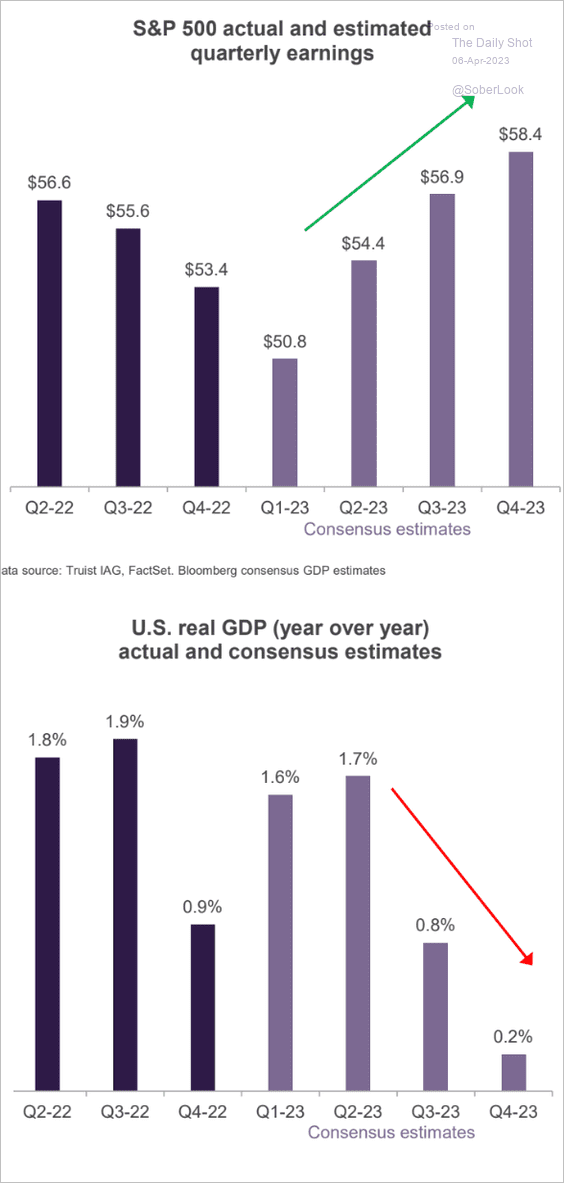

2. The disconnect between earnings and GDP projections remains a concern.

Source: Truist Advisory Services

Source: Truist Advisory Services

3. Office REITs continue to widen their underperformance.

4. Next, we have share buybacks by sector.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

5. How did different sectors perform in the 1970s (during high inflation)?

Source: BofA Global Research

Source: BofA Global Research

6. Recent tech stock outperformance has been driven by multiple expansion.

Source: MRB Partners

Source: MRB Partners

7. This chart shows the percentage of S&P 500 members outperforming the index.

Source: Truist Advisory Services

Source: Truist Advisory Services

Back to Index

Credit

1. Credit markets have been volatile in response to earnings releases.

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

2. European investment-grade fund flows continue to hold up despite some selling in high-yield.

Source: Goldman Sachs

Source: Goldman Sachs

• North American investment grade net-debt to EBITDA ratios (leverage) finished flat last year, while Europe declined.

Source: Goldman Sachs

Source: Goldman Sachs

• Median interest coverage ratios for North American and European investment-grade issuers increased over the past year.

Source: Goldman Sachs

Source: Goldman Sachs

• US high-yield issuers with loan-only debt capital structures saw their average coupon increase substantially over the past year.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

3. Tech has been a substantial portion of leveraged loan issuance recently.

Source: @rachel_butt, @technology Read full article

Source: @rachel_butt, @technology Read full article

Back to Index

Rates

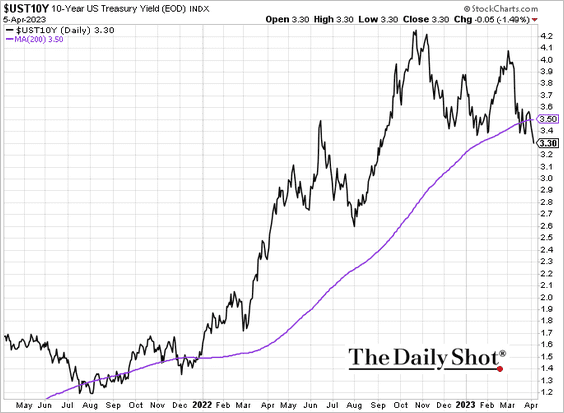

1. The 10-year Treasury yield is now well below the 200-day moving average.

The 20+ Year Treasury Bond ETF (TLT) broke above its 200-day moving average with positive momentum.

——————–

2. This chart shows the year-to-date contributions to the 10-year yield changes (based on Bloomberg’s model).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

3. Treasury yields remain elevated relative to the copper-to-gold ratio.

Back to Index

Global Developments

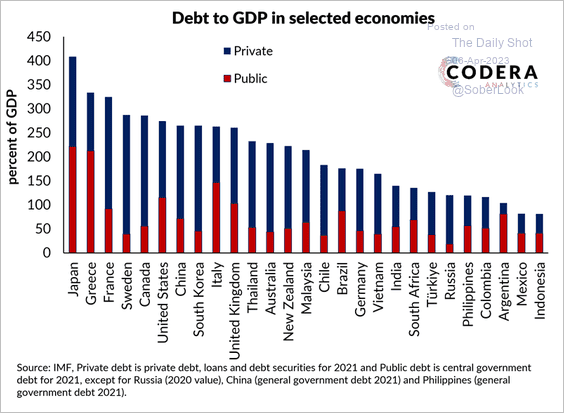

1. In most major economies, private debt exceeds public debt.

Source: Codera Analytics

Source: Codera Analytics

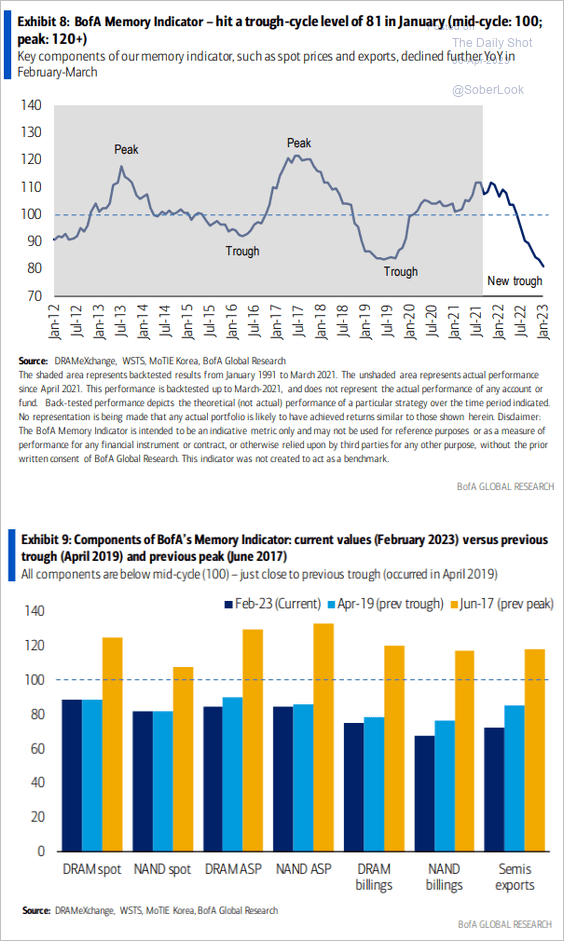

2. Global demand for memory chips has deteriorated

Source: BofA Global Research

Source: BofA Global Research

3. During previous housing bear markets, countries that were more sensitive to higher rates saw currency depreciations versus the dollar. These “weak link” economies include Canada, Norway, and the UK.

Source: MRB Partners

Source: MRB Partners

——————–

Food for Thought

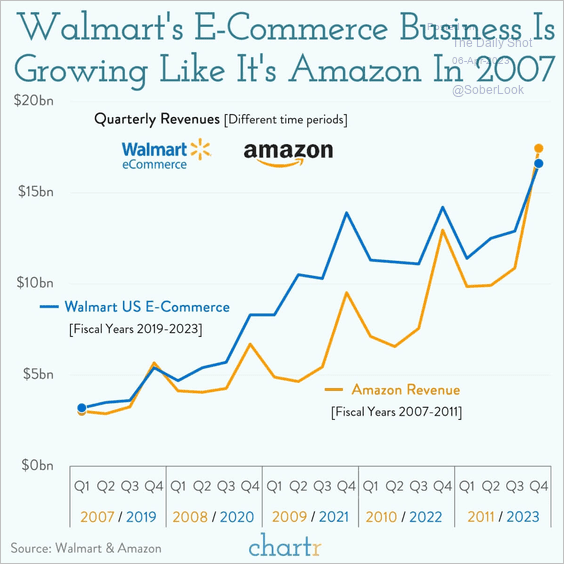

1. Walmart’s e-commerce business:

Source: @chartrdaily

Source: @chartrdaily

2. Office availability rates:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

3. Global EV sales:

Source: @WSJ Read full article

Source: @WSJ Read full article

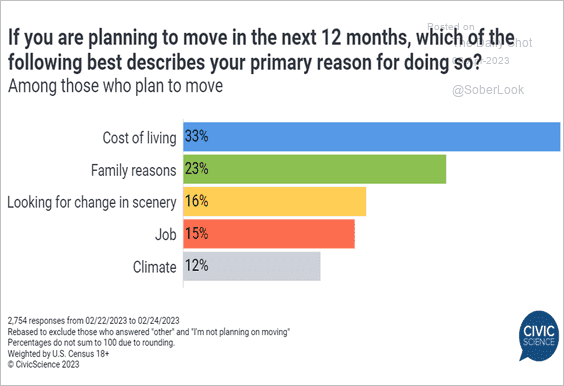

4. Reasons for moving:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

5. Inflation experience by household income percentile:

Source: The Economist Read full article

Source: The Economist Read full article

6. Russia’s attempts to ditch the US dollar in export settlements:

Source: @WSJ Read full article

Source: @WSJ Read full article

7. Cumulative mortality among individuals with post-COVID conditions:

Source: DeVries, Shambhu, Sloop Read full article

Source: DeVries, Shambhu, Sloop Read full article

8. The top 250 scorers in NBA history:

Source: The New York Times Read full article

Source: The New York Times Read full article

——————–

Back to Index