The Daily Shot: 05-Apr-23

• The United States

• Canada

• The Eurozone

• Europe

• Asia – Pacific

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Food for Thought

The United States

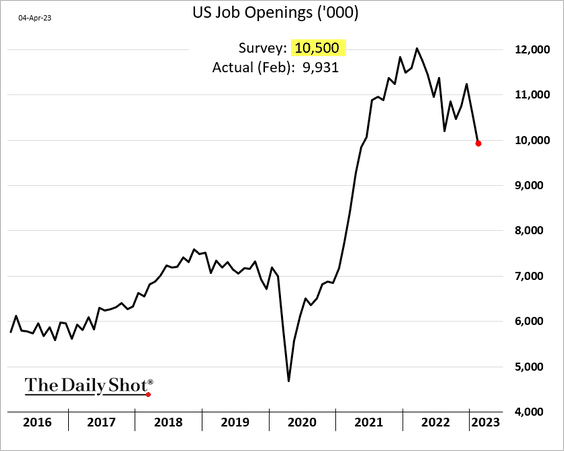

1. Job openings declined more than expected in February.

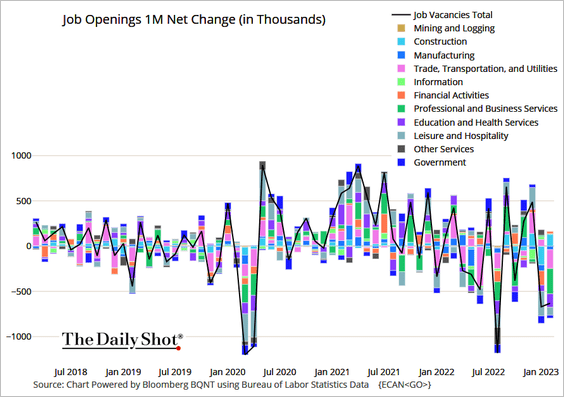

• Here are the monthly changes with contributions

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

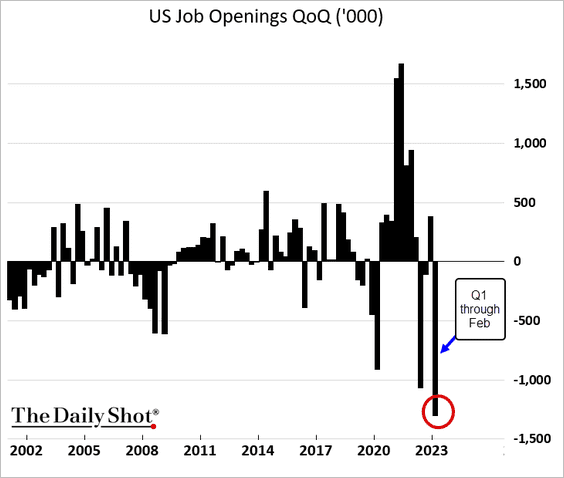

And this chart shows the quarterly changes in job openings over the past couple of decades.

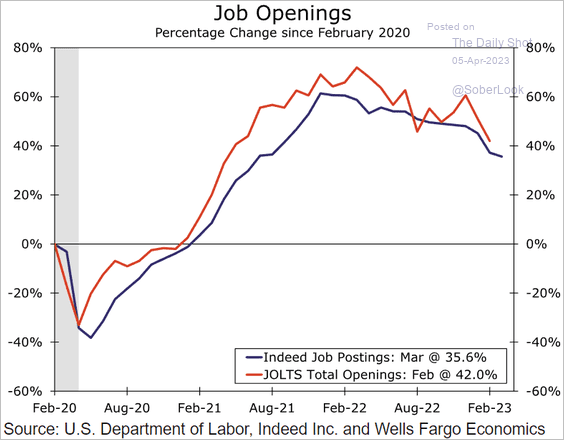

• Job vacancies are now more in line with postings on Indeed.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

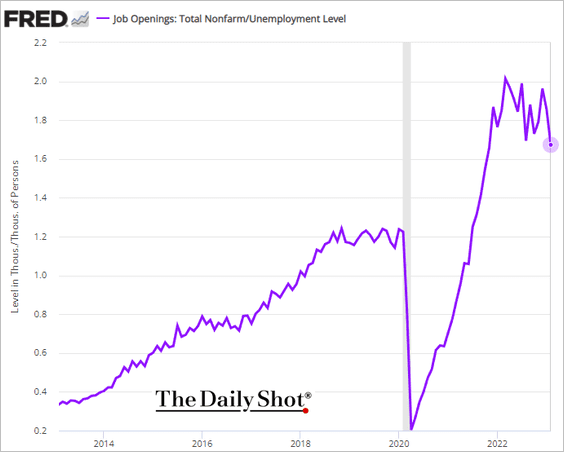

• Here is the number of openings per unemployed person, suggesting that the labor market imbalance persists.

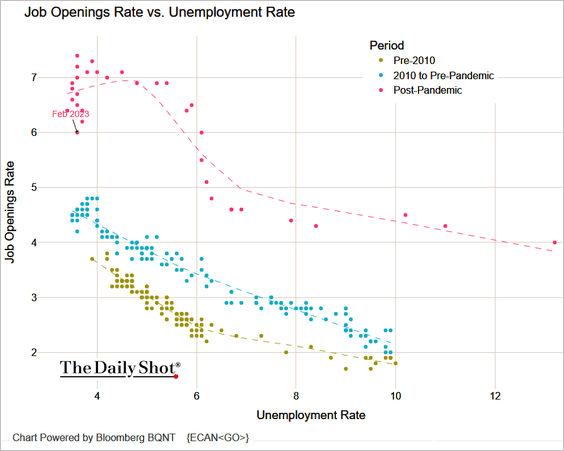

The Beveridge Curve also points to job market imbalances.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

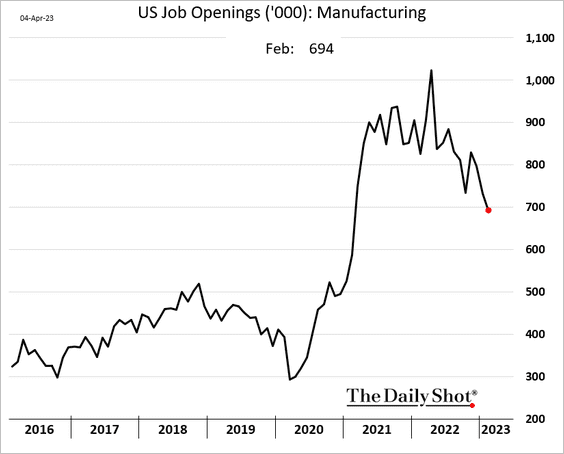

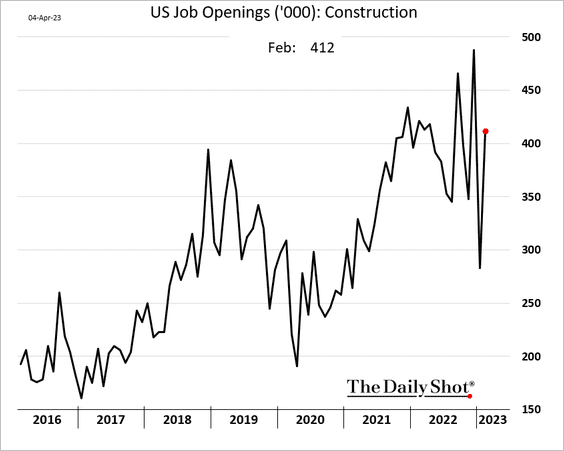

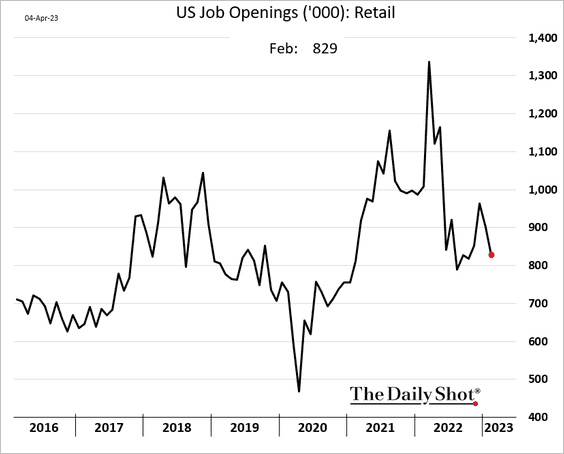

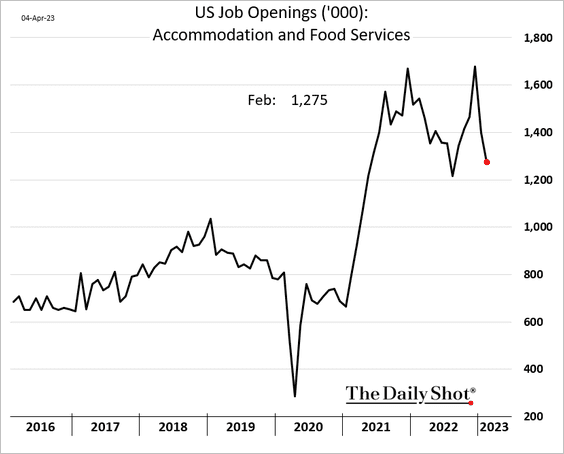

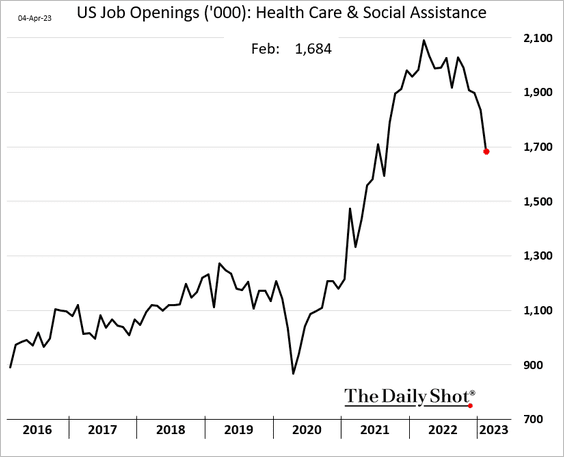

• Below are some trends by sector.

– Manufacturing:

– Construction (a surprise increase):

– Retail:

– Hotels and restaurants/bars:

– Healthcare:

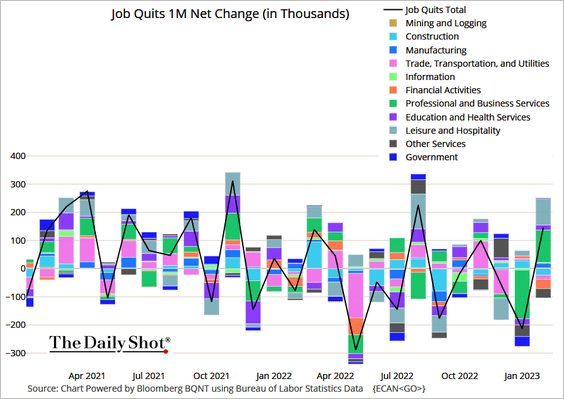

• Surprisingly, the number of voluntary resignations (quits) increased in February, signaling confidence in the job market.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

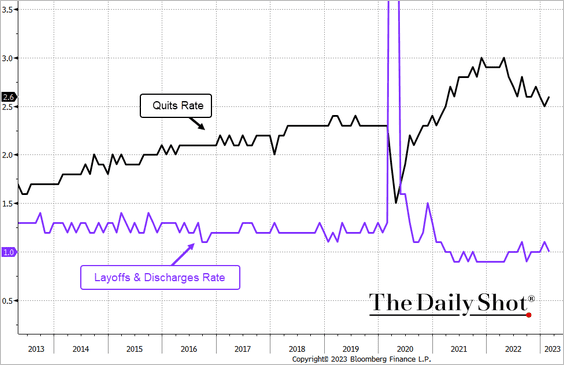

Here are the quits and the layoffs rates.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

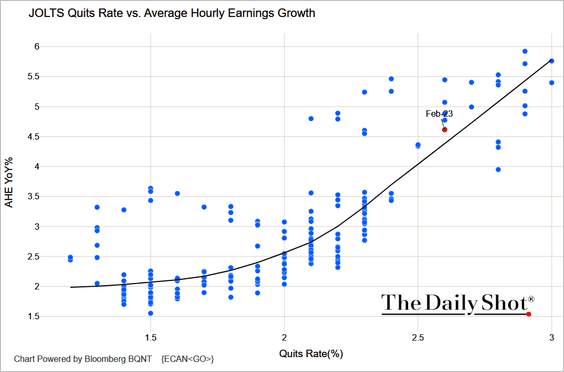

• Finally, this scatterplot shows the quits rate and wage growth.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

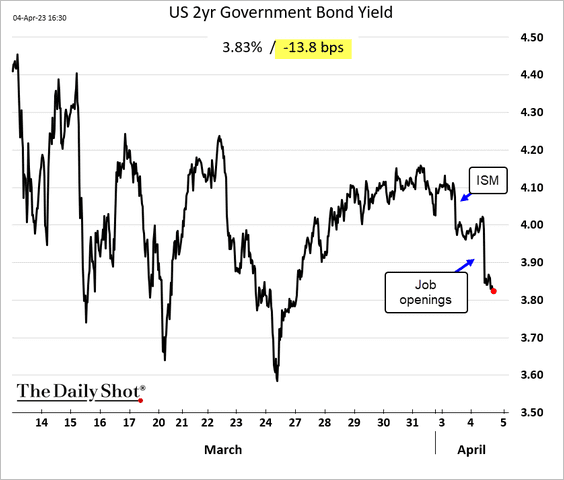

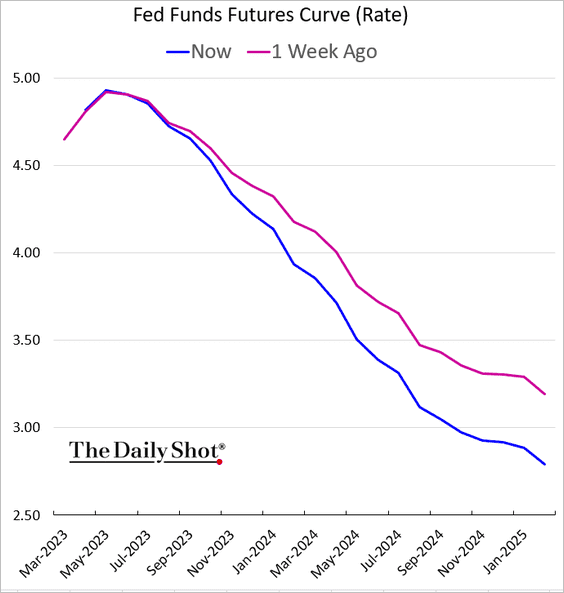

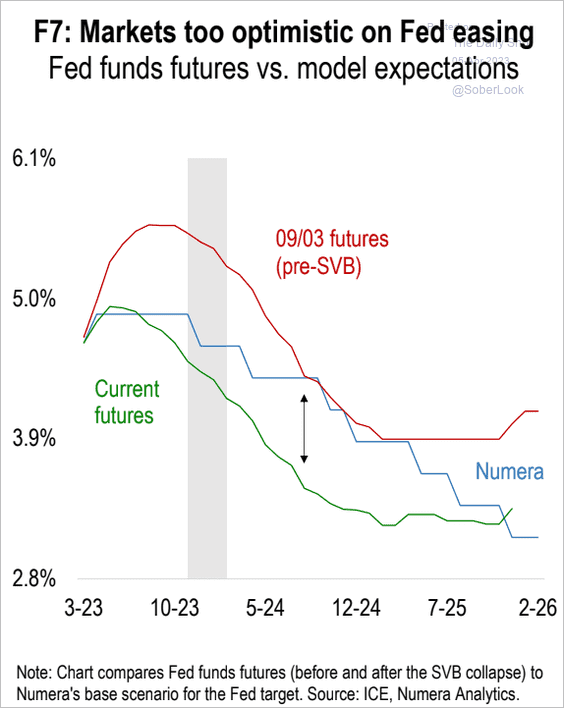

2. The faster-than-expected decline in job openings sent Treasury yields sharply lower.

• The market is pricing a faster pace of Fed rate cuts starting this summer.

Too much enthusiasm?

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

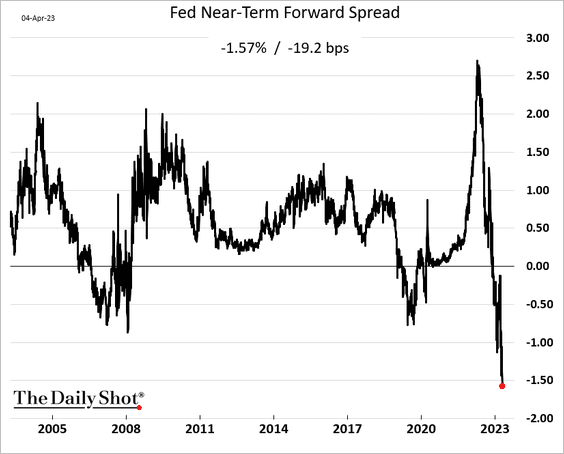

• This chart shows the near-term forward spread, the Fed’s preferred yield curve leading indicator. It is the expected three-month Treasury yield 18 months from now (market expectations) minus the current 3-month yield. Some Fed officials view this as a better indicator than the 10yr – 2yr spread (see research). The near-term forward spread is signaling a sharp economic downturn.

——————–

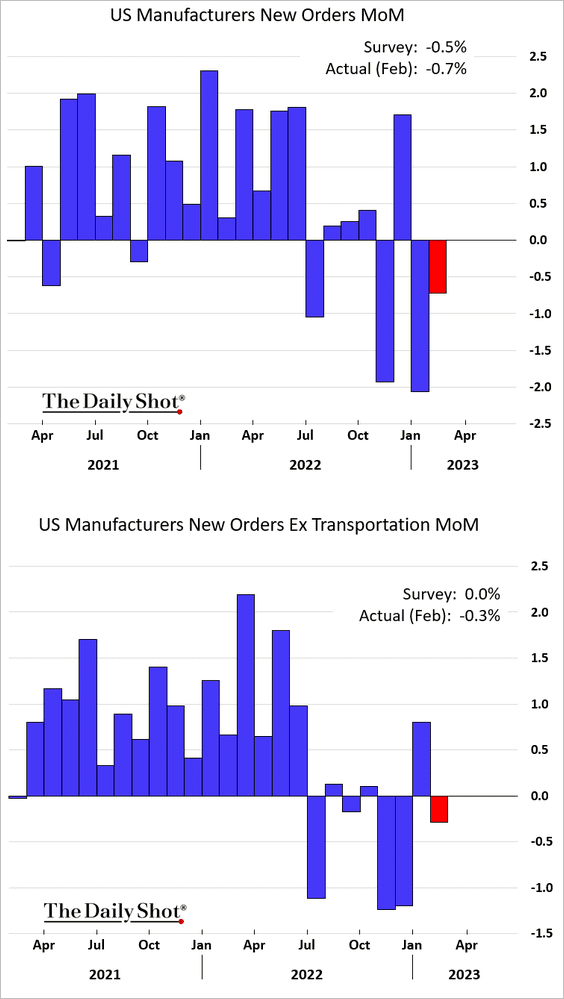

3. Factory orders declined in February.

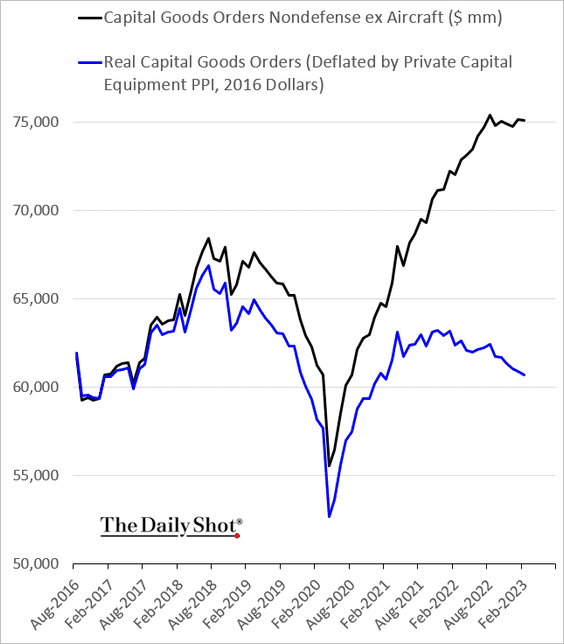

Real capital goods orders continue to fall, signaling slowing CapEx.

——————–

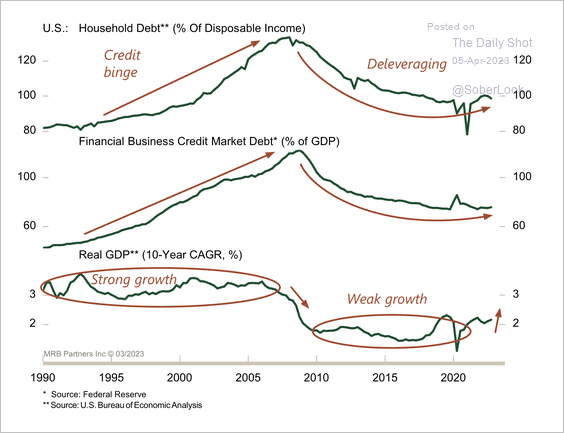

4. The economy is still coming off a long period of deleveraging following a credit binge in the 1990s/early-2000s.

Source: MRB Partners

Source: MRB Partners

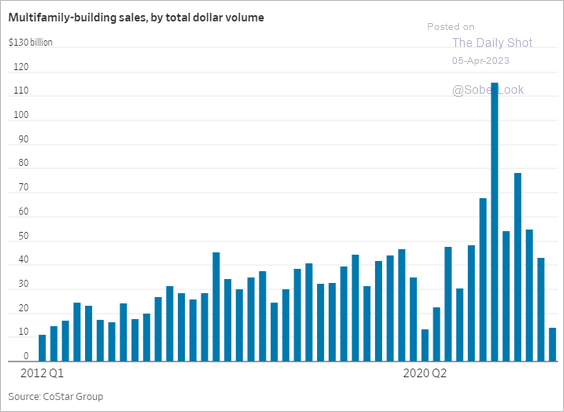

5. Multi-family (apartment) building sales are down sharply.

Source: @WSJ Read full article

Source: @WSJ Read full article

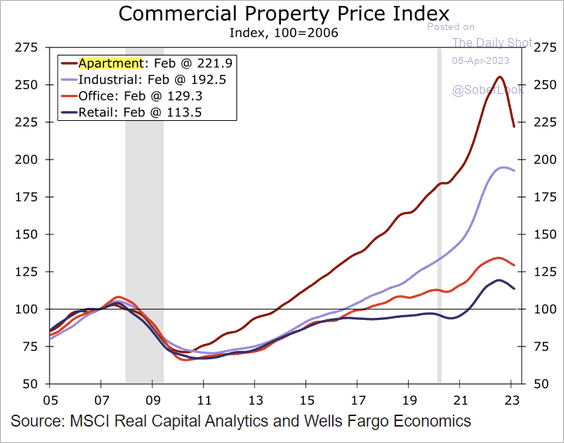

Prices have been falling recently.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

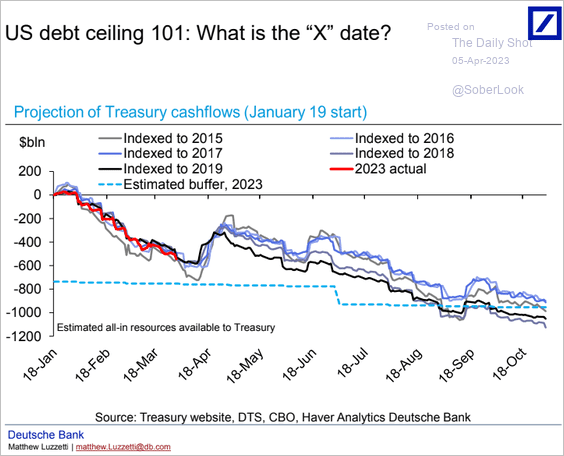

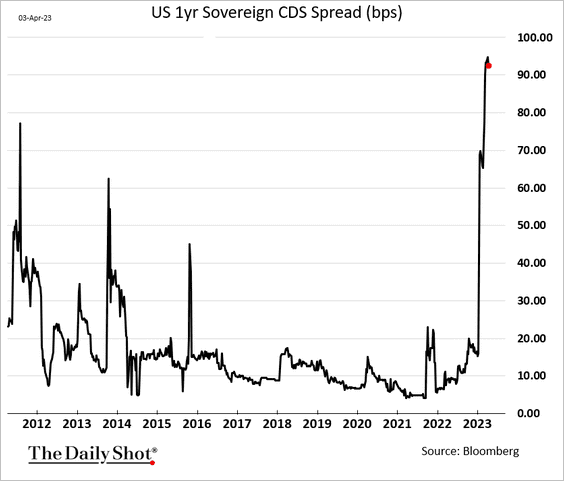

6. When is the X-date? Here are some scenarios based on the US Treasury’s cash flows in previous years.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

The market remains very concerned about the debt ceiling impasse.

Back to Index

Canada

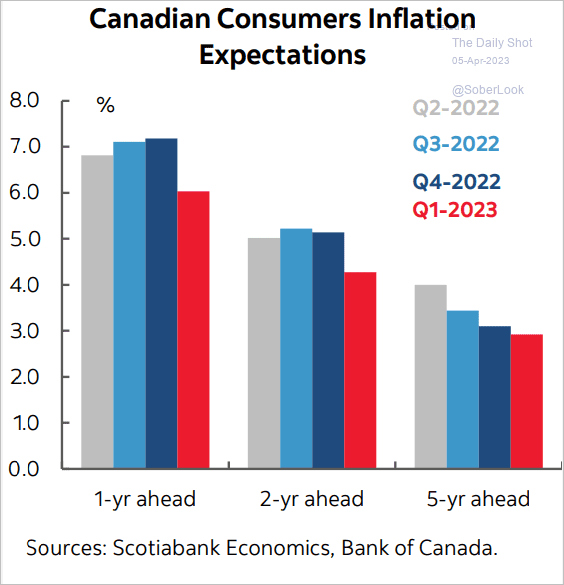

1. Consumer inflation expectations are moderating.

Source: Scotiabank Economics

Source: Scotiabank Economics

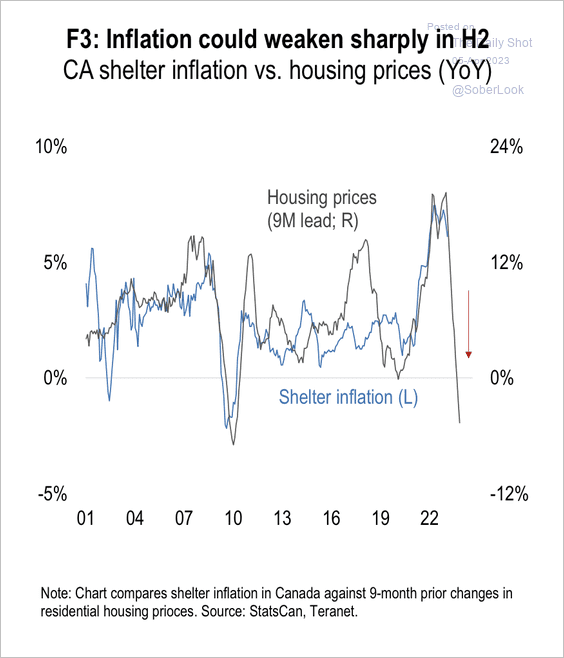

2. Lower inflation could take the pressure off the BoC, possibly leading to a pause/pivot.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

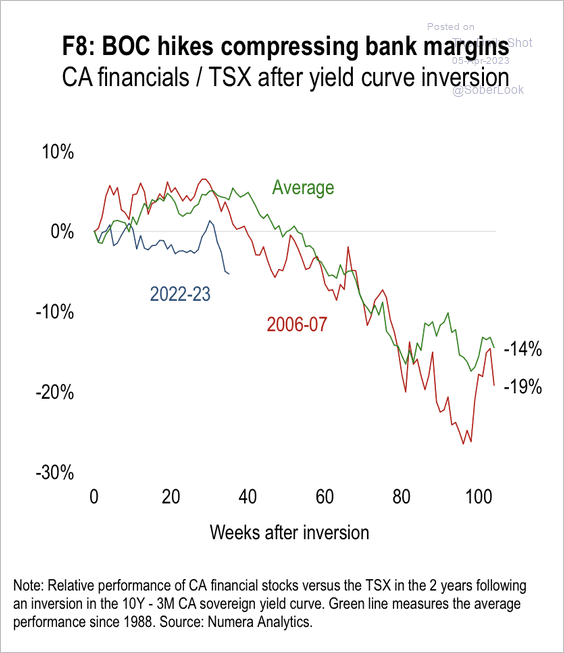

3. The inverted yield curve has been a drag on financial stocks, similar to previous occurrences.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

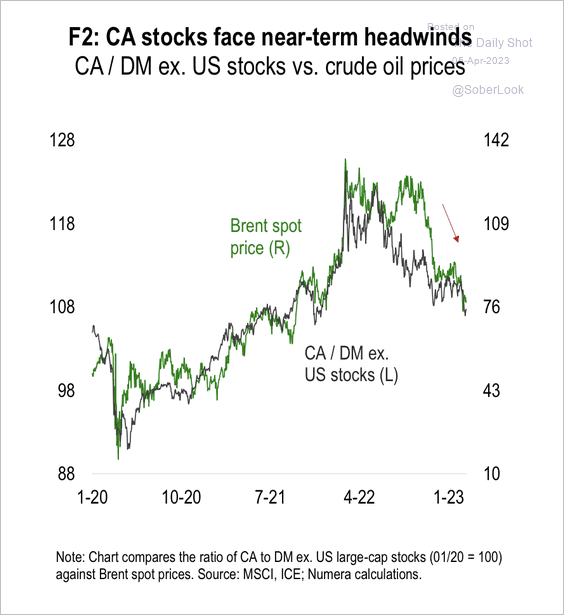

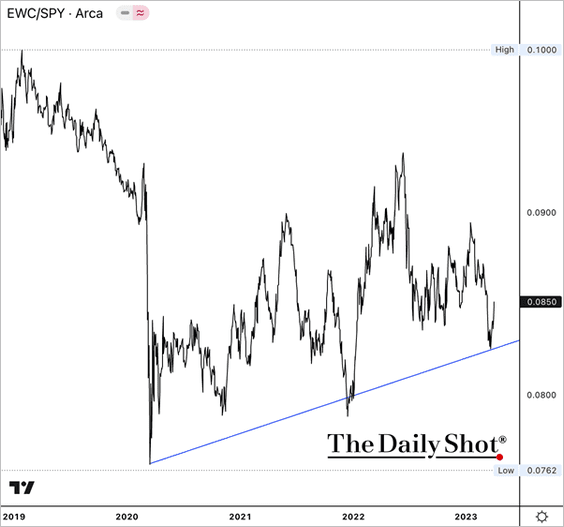

4. Canadian stocks have underperformed developed market peers during the recent correction in oil prices.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

However, the iShares Canada ETF (EWC) is holding long-term support relative to the S&P 500, aided by the recent bounce in crude prices.

Back to Index

The Eurozone

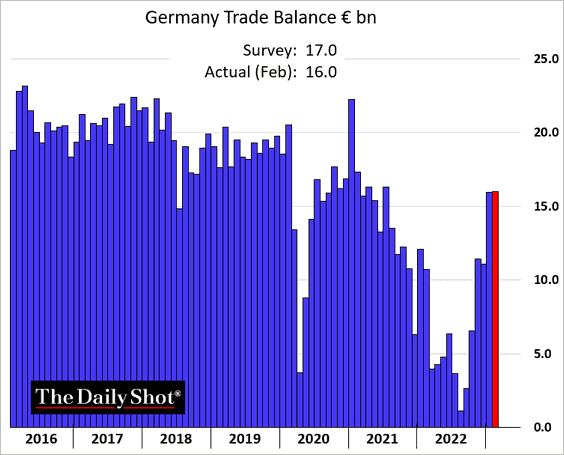

1. Germany’s trade surplus was a bit lower than expected.

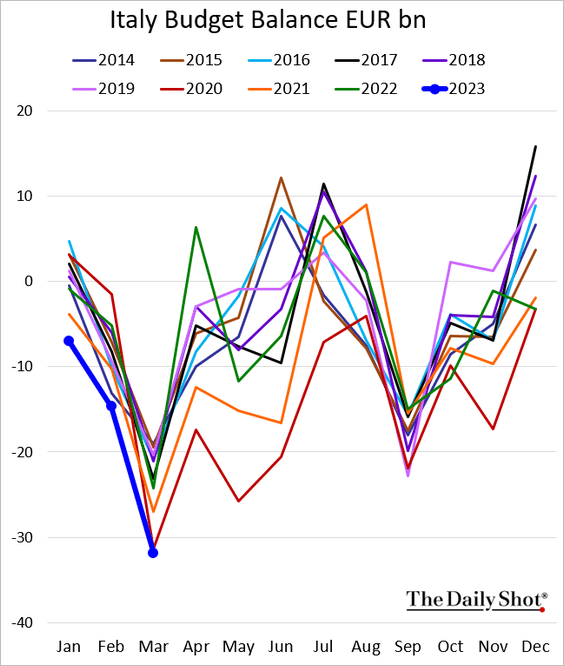

2. Italy’s budget deficit exceeded the 2020 levels in March.

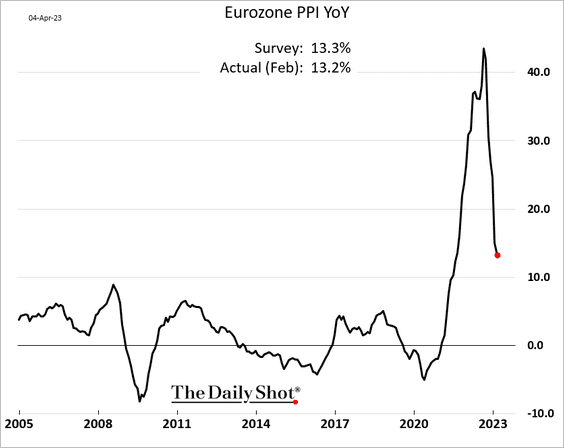

3. The euro-area PPI continues to moderate.

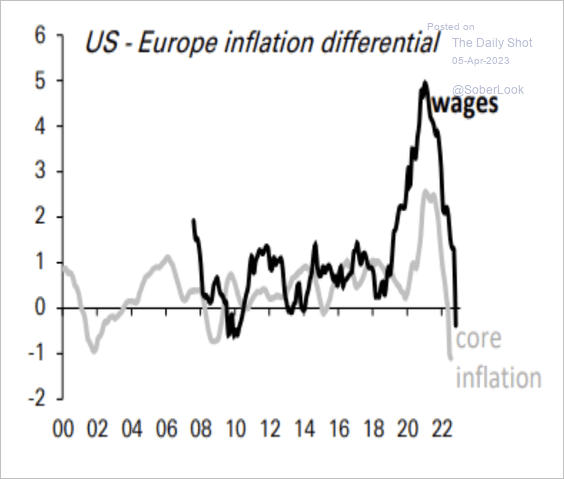

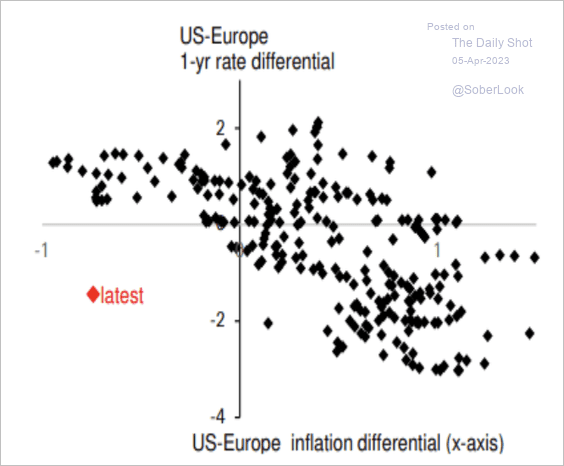

4. Wage growth and CPI are now higher in the Eurozone versus the US.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

The wide gap between Europe and US inflation points to a wider interest rate differential and a higher EUR/USD.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Europe

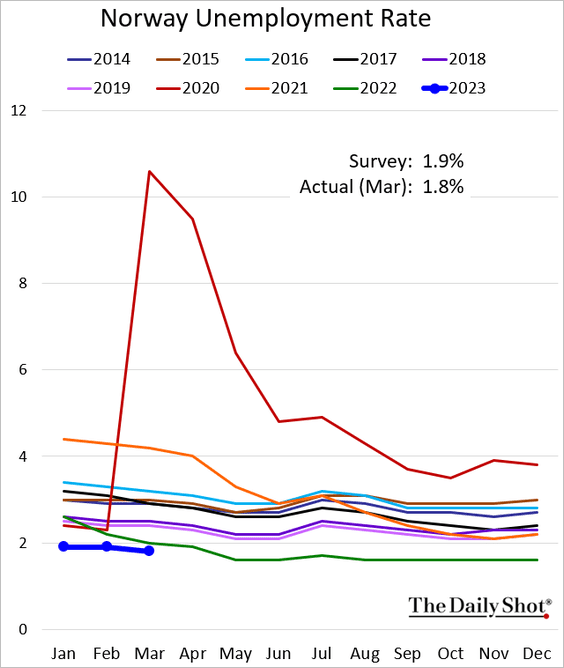

1. Norway’s unemployment rate remains very low for this time of the year.

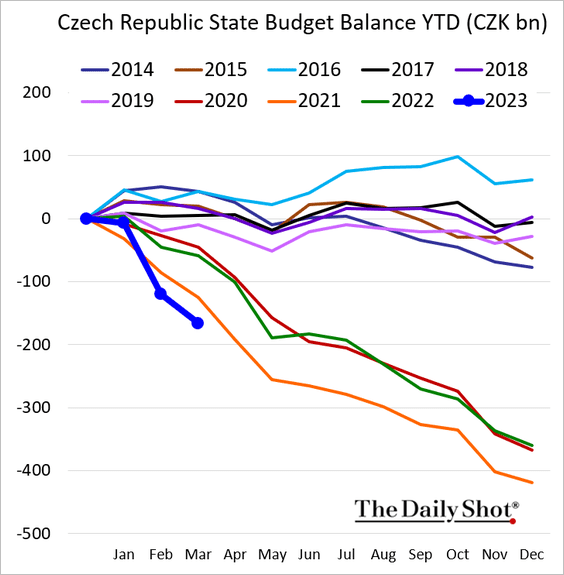

2. Here is the Czech Republic’s year-to-date budget deficit.

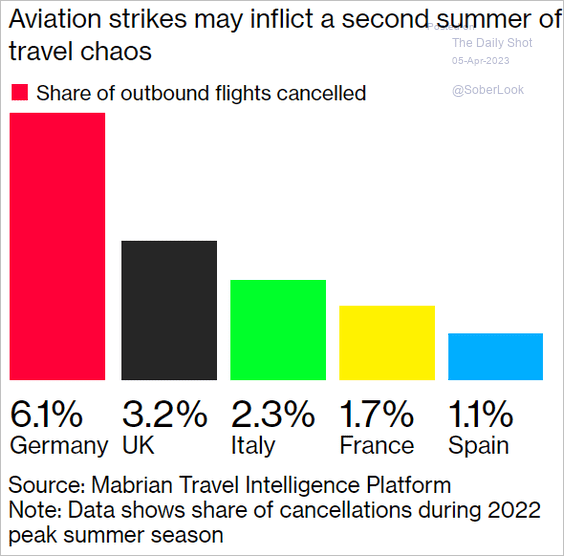

3. Below is a look at aviation strikes in Europe’s largest economies.

Source: @WillWilkesNews, @tomelleryrees, @eckldorna, @bpolitics Read full article

Source: @WillWilkesNews, @tomelleryrees, @eckldorna, @bpolitics Read full article

Back to Index

Asia – Pacific

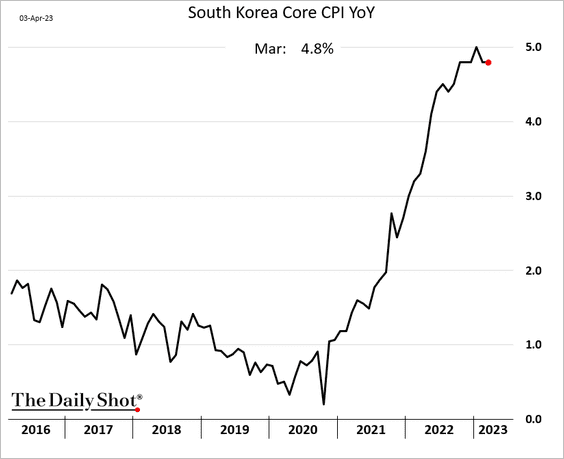

1. South Korea’s core CPI remains elevated.

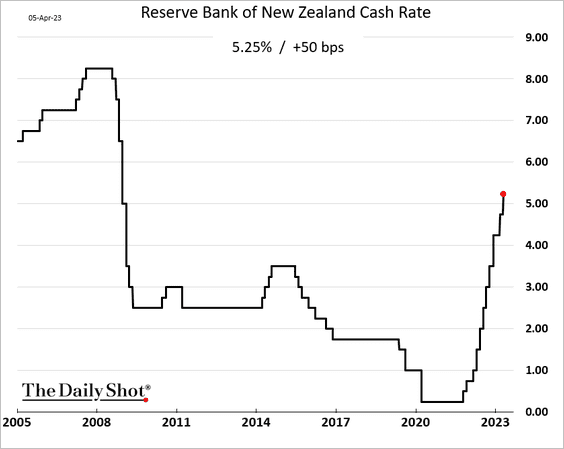

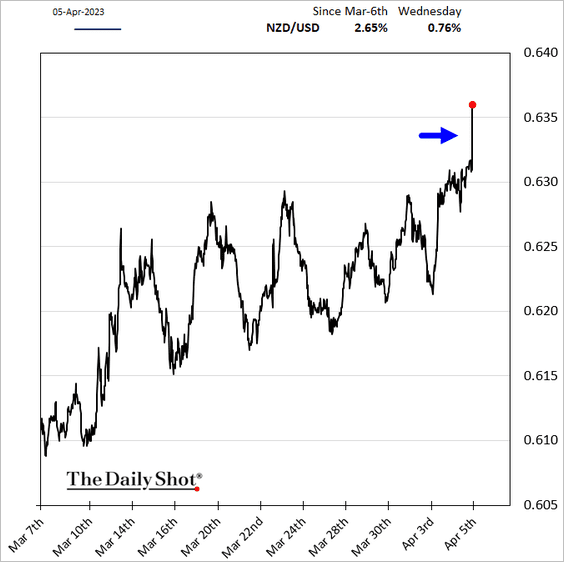

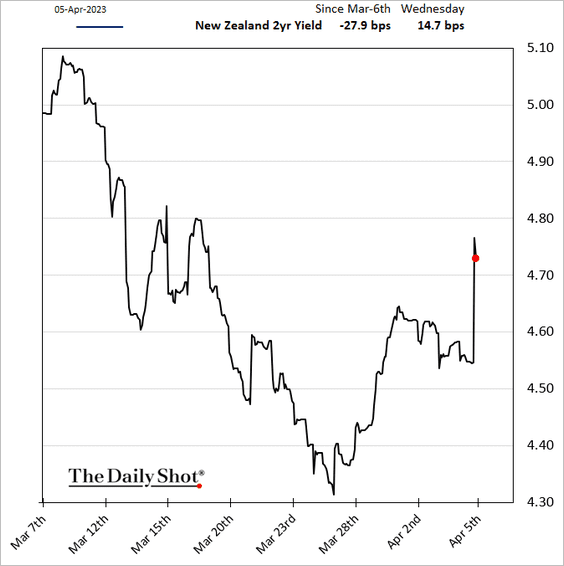

2. New Zealand’s central bank hiked rates by 50 bps, surprising the market.

The Kiwi dollar and bond yields jumped.

Source: @tracywwithers, @markets Read full article

Source: @tracywwithers, @markets Read full article

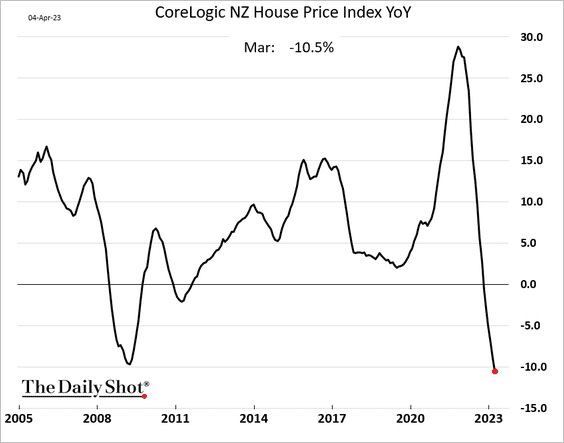

• Separately, New Zealand’s home price declines are now worse than during the GFC.

——————–

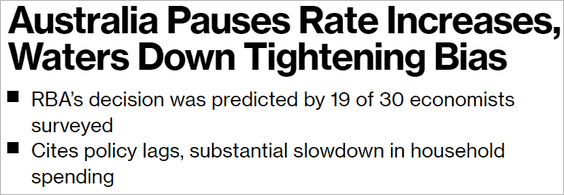

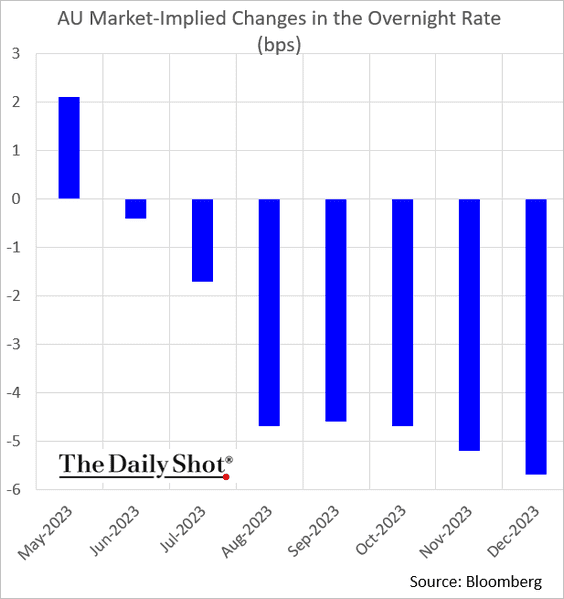

3. Australia’s central bank left rates unchanged.

Source: @Swatisays, @economics Read full article

Source: @Swatisays, @economics Read full article

Some analysts still expect a rate hike in May. The market is assigning less than a 10% chance of such an outcome.

Back to Index

Emerging Markets

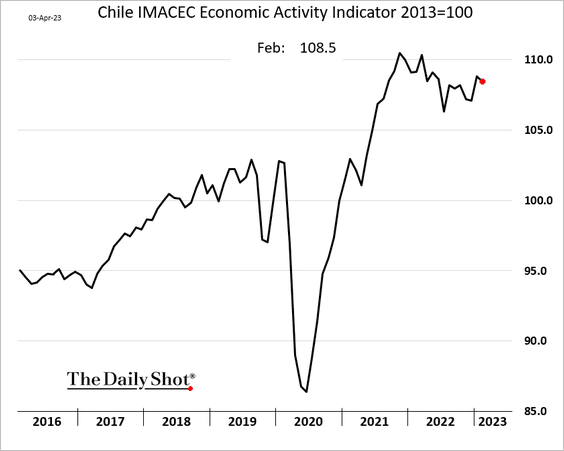

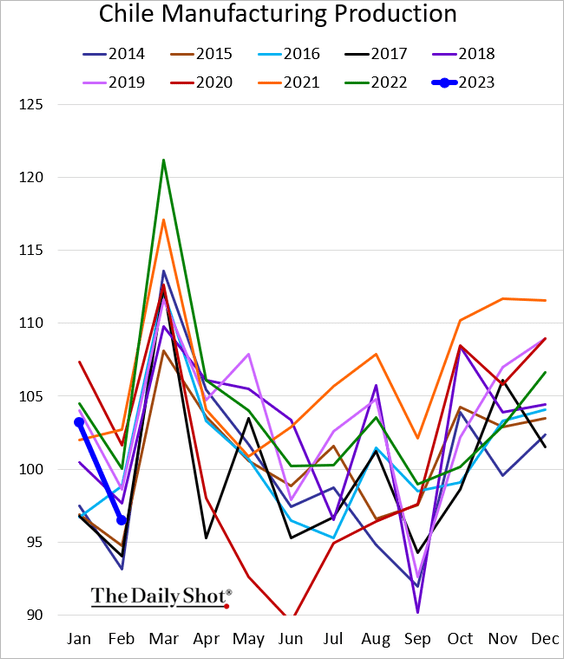

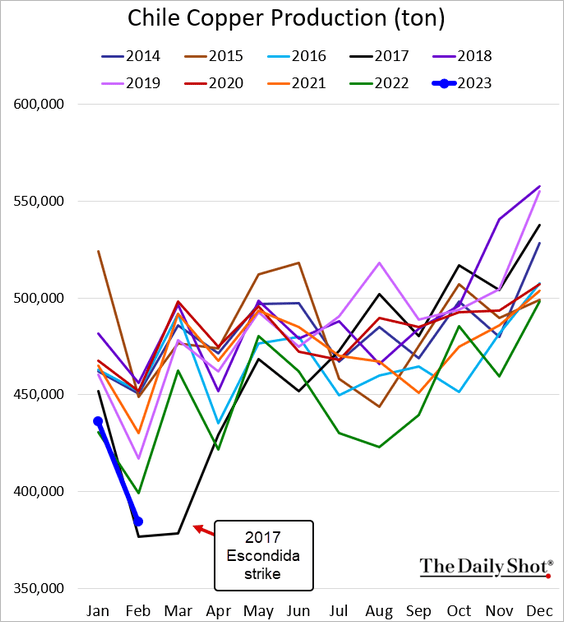

1. Let’s begin with Chile.

• Economic activity (a slight decline in February):

• Manufacturing production (well below last year’s levels):

• Copper production (very soft):

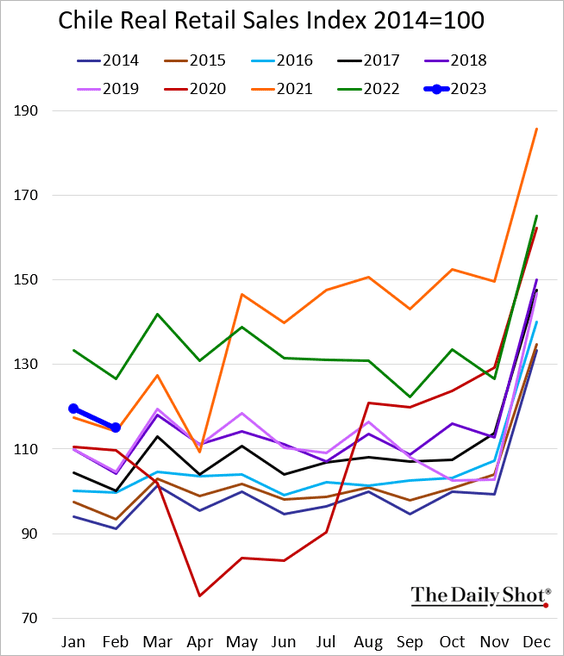

• Retail sales (in line with 2021 levels):

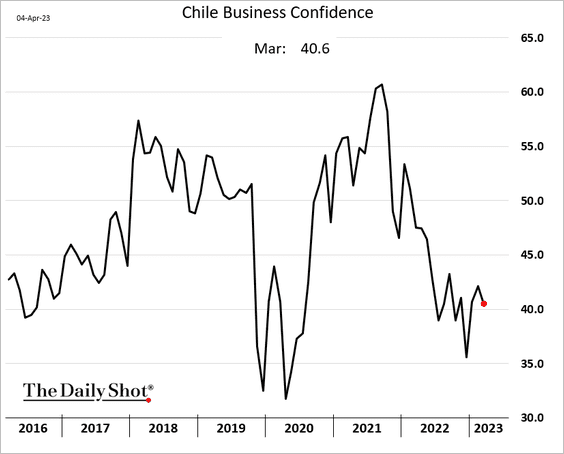

• Business sentiment (depressed):

——————–

2. Mexican vehicle sales are rebounding.

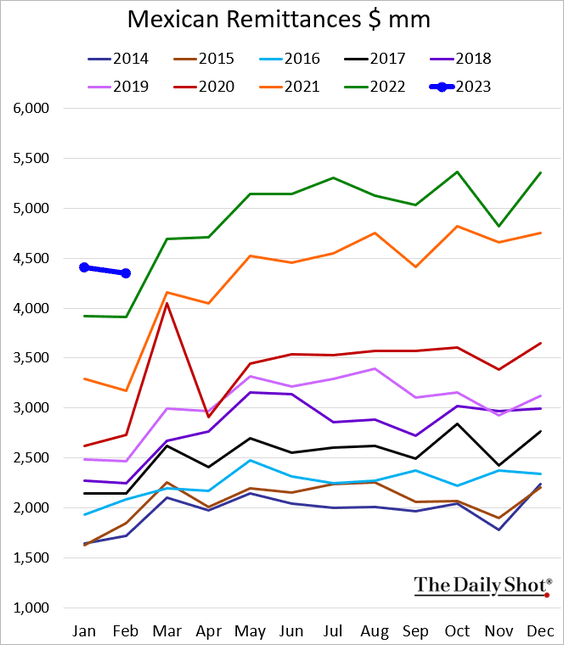

Remittances remain at record highs.

——————–

3. The gap between the official and the “blue-chip” USD/ARS (Argentine peso) rates continues to widen. This trend is not sustainable (amid reduced FX reserves).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

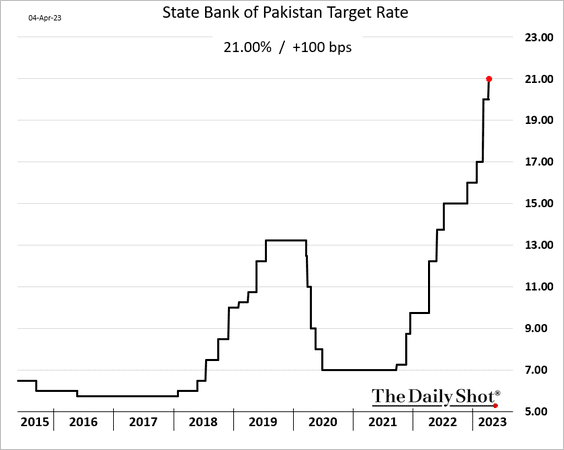

4. Pakistan’s central bank hiked rates again as inflation surges.

Back to Index

Commodities

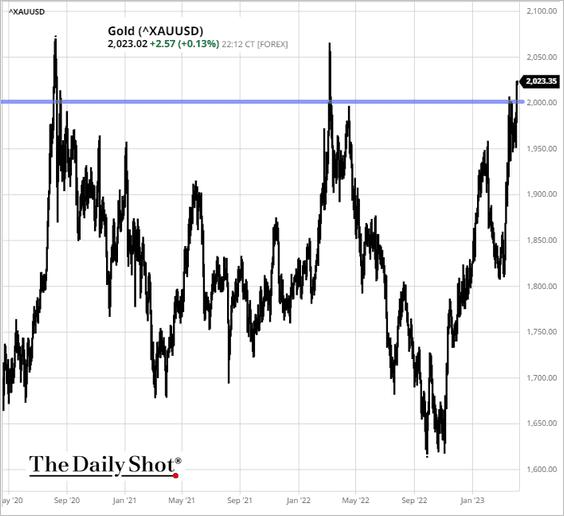

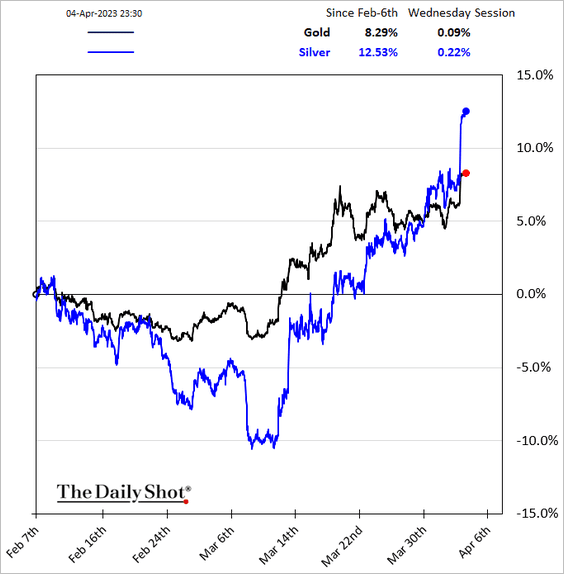

1. Gold blasted past $2,000/oz, as …

Source: barchart.com

Source: barchart.com

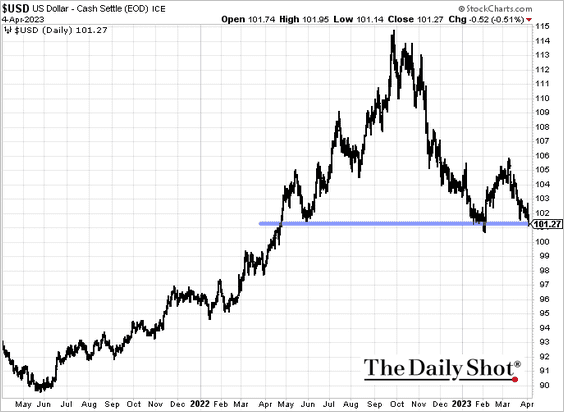

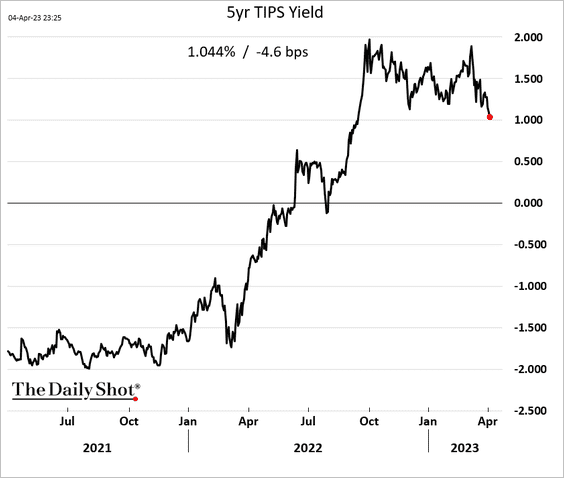

… the US dollar weakens and real yields decline.

• Silver has also been surging.

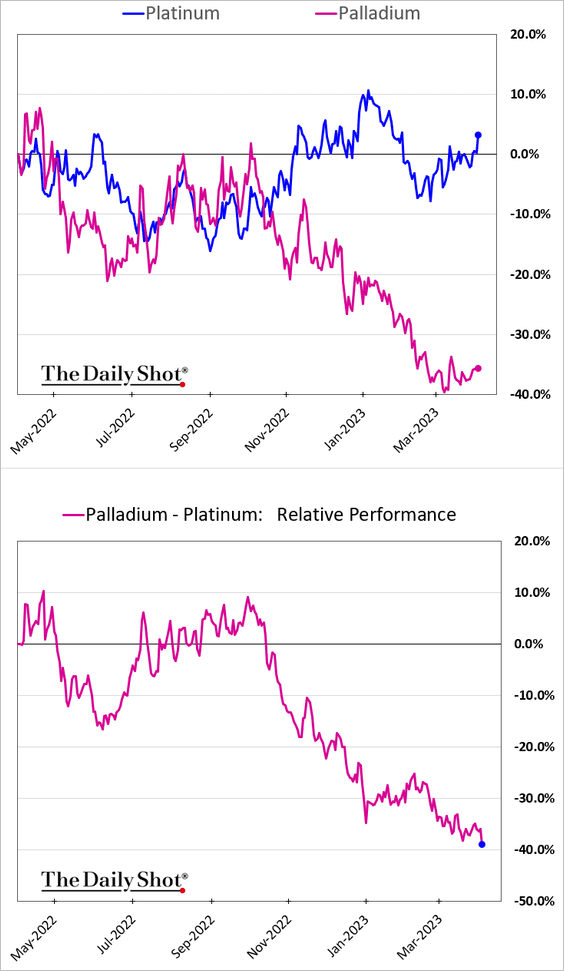

• Palladium’s underperformance widened further as platinum prices jumped.

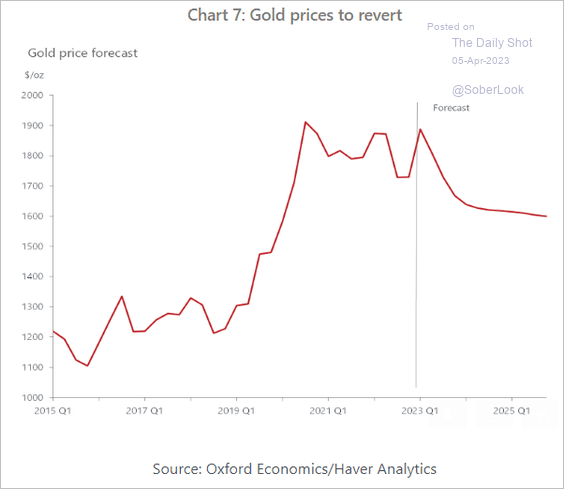

• Oxford Economics sees gold prices retreating in the months ahead.

Source: Oxford Economics

Source: Oxford Economics

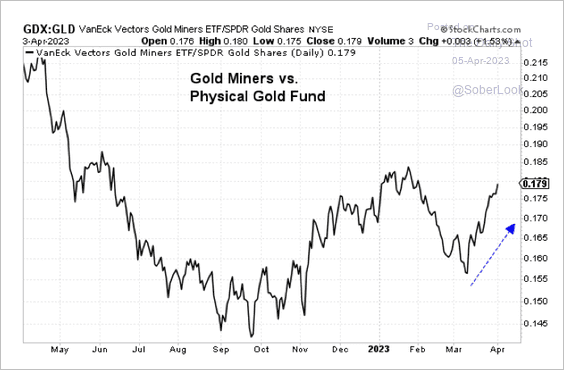

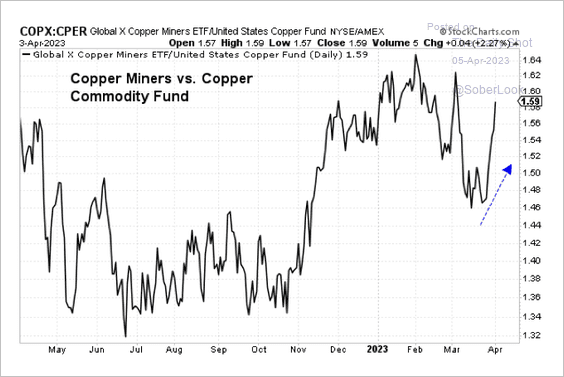

2. Gold and copper stocks have outperformed their respective physical commodity ETFs. (2 charts)

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

——————–

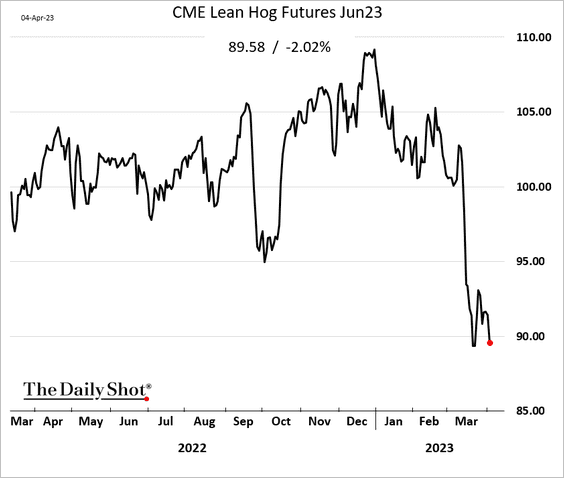

3. US hog futures remain under pressure amid ample supplies and weak cash prices.

Back to Index

Energy

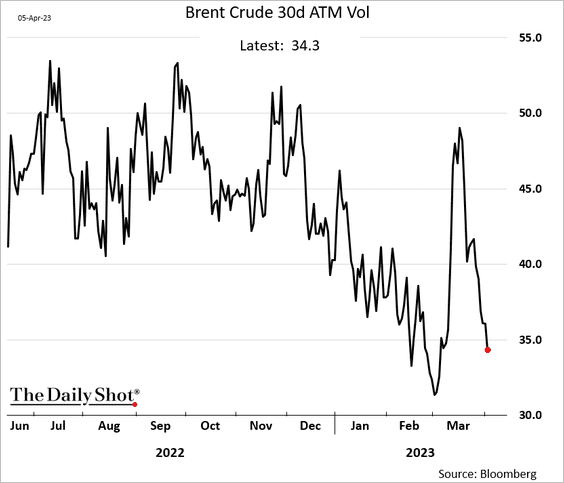

1. Despite a sharp increase in oil prices this week, oil implied vol has been declining.

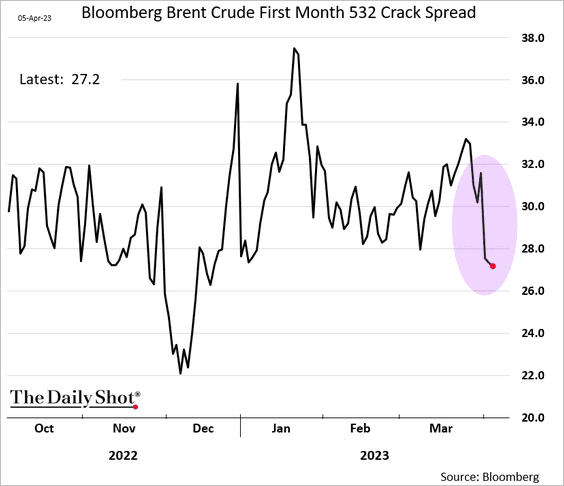

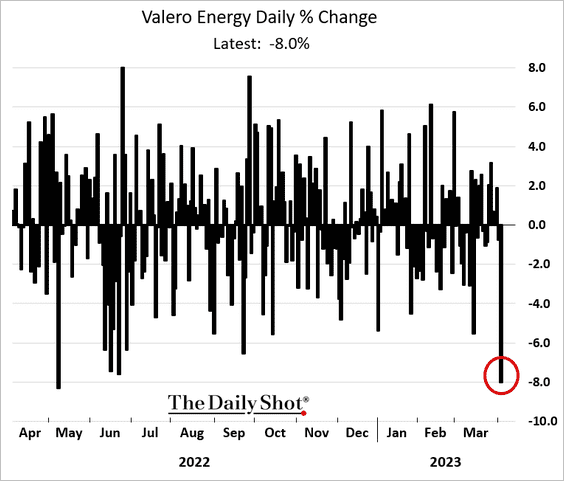

2. Crack spreads dropped this week, …

… which is a headwind for refiners.

——————–

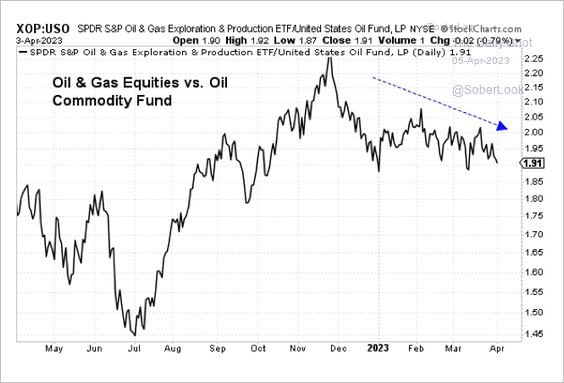

3. Oil and gas exploration & production stocks (XOP) have underperformed crude oil (USO).

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

Back to Index

Equities

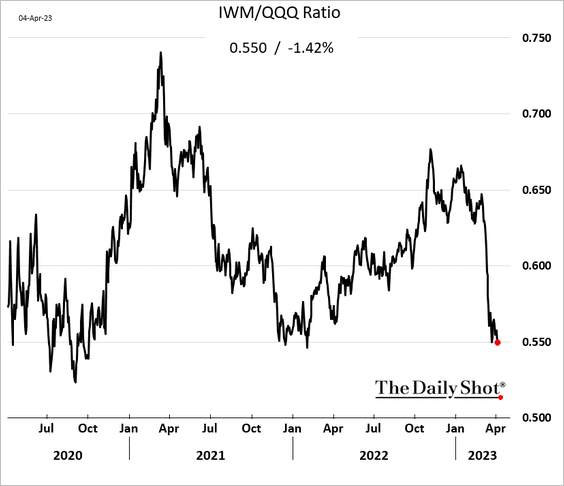

1. The recent Russell 2000 underperformance vs. the Nasdaq 100 has been remarkably rapid.

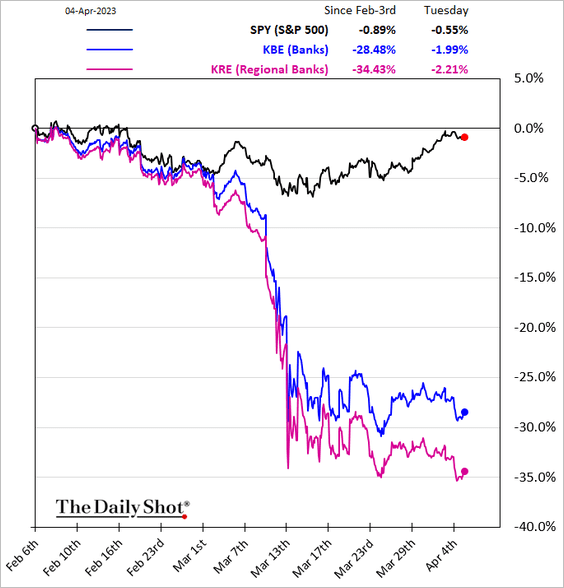

2. Bank shares continue to struggle.

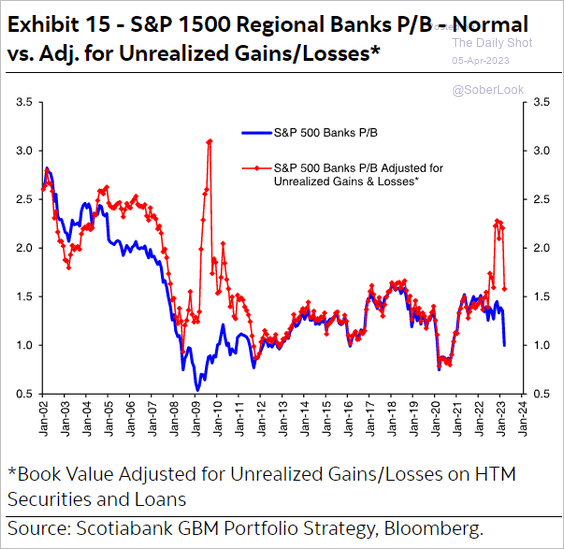

• Regional banks don’t look as cheap when the price-to-book ratio is adjusted for unrealized losses.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

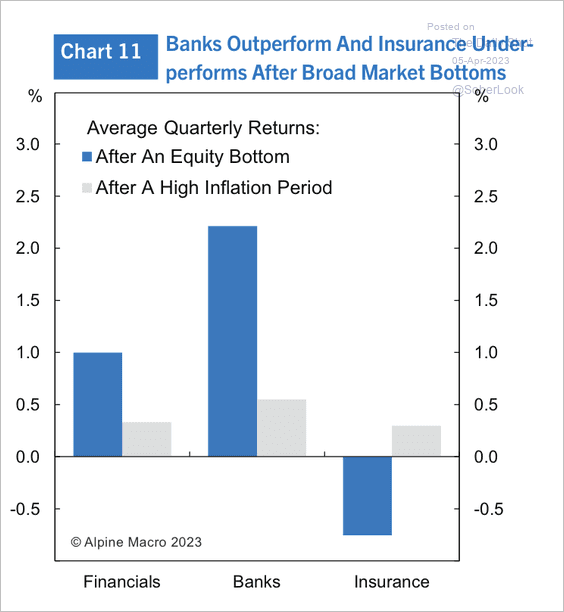

• Bank stocks typically outperform during the recovery phase, while insurance stocks underperform.

Source: Alpine Macro

Source: Alpine Macro

——————–

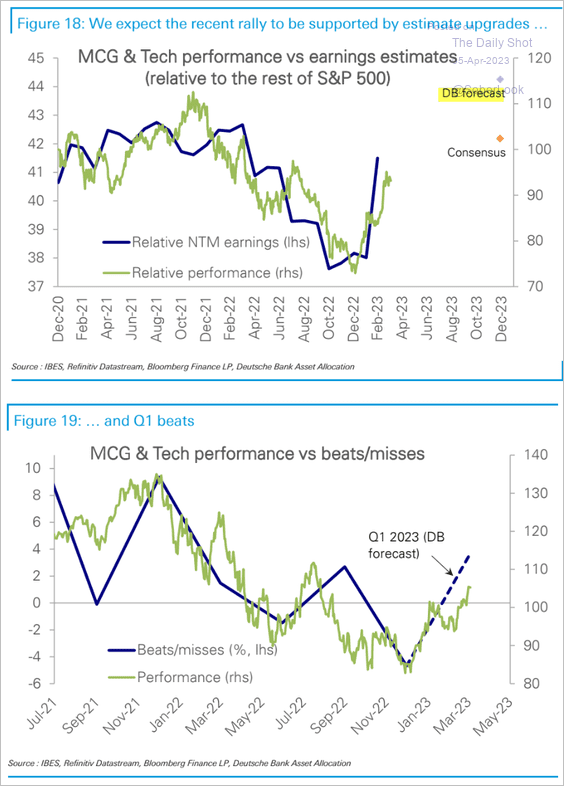

3. Deutsche Bank is bullish on mega-cap stocks (MCG & Tech = “mega-cap growth and tech”).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

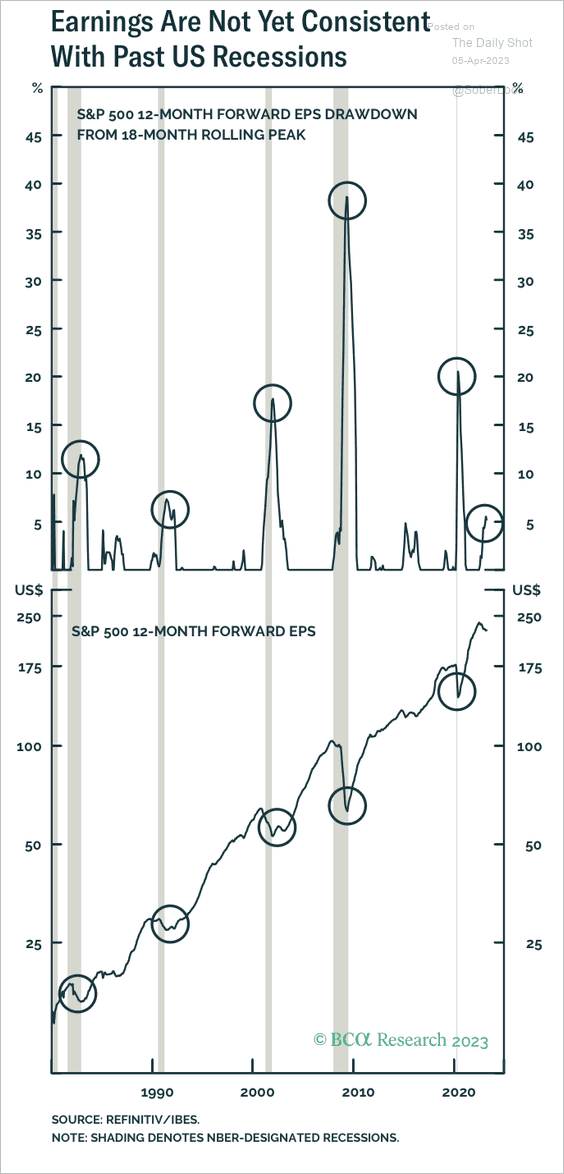

4. S&P 500 forward earnings have not fully priced in a recession.

Source: BCA Research

Source: BCA Research

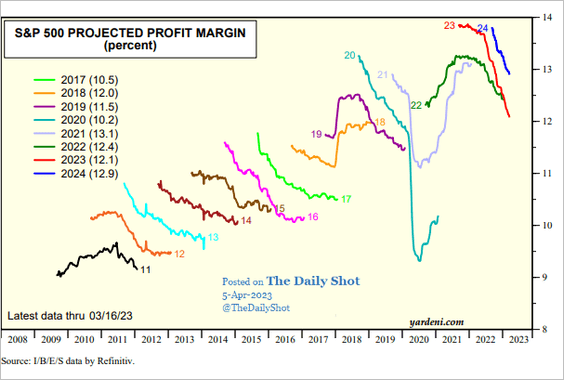

5. Analysts continue to downgrade profit margin projections.

Source: Yardeni Research

Source: Yardeni Research

Back to Index

Credit

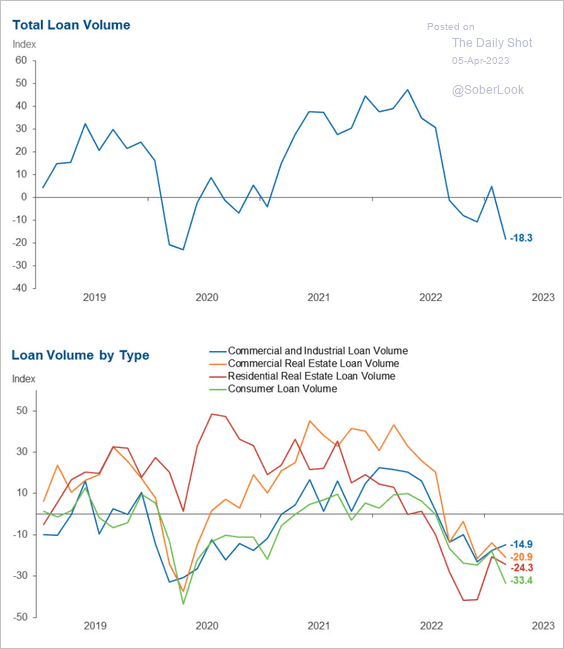

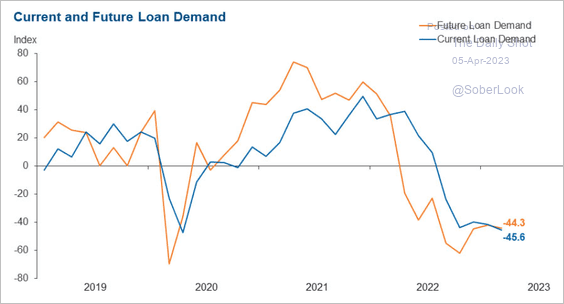

1. A survey from the Dallas Fed indicates deteriorating loan volumes and demand in March.

Source: Dallas Fed

Source: Dallas Fed

Source: Dallas Fed

Source: Dallas Fed

——————–

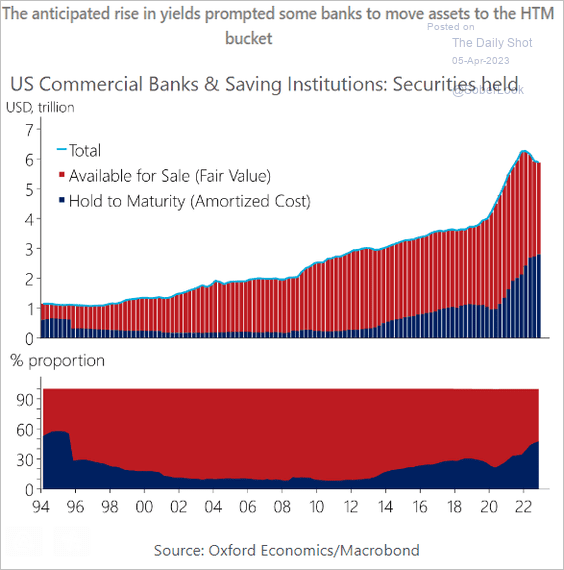

2. This chart shows the evolution of the hold-to-maturity portfolios in the banking system.

Source: Oxford Economics

Source: Oxford Economics

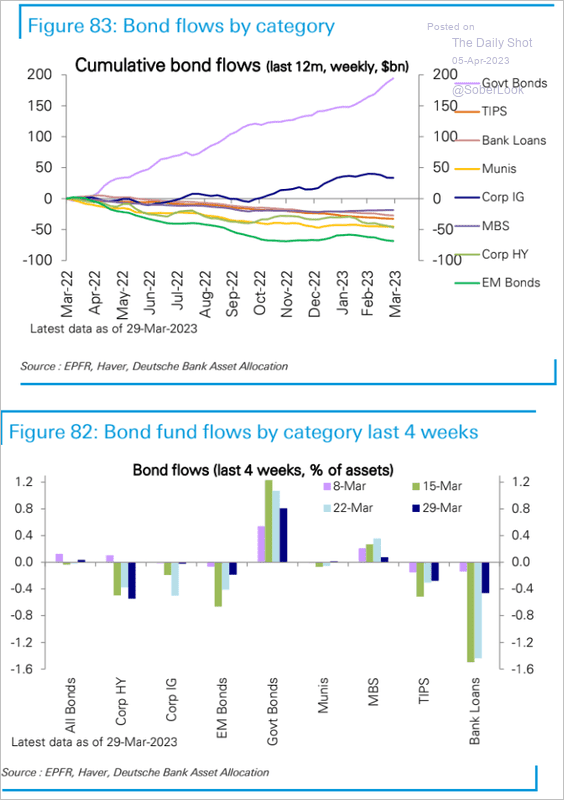

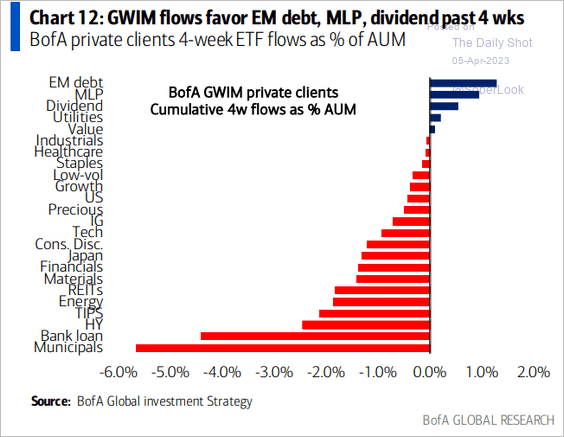

3. Leveraged loan and high-yield funds continue to see outflows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

BofA’s private clients have also been getting out of munis.

Source: BofA Global Research

Source: BofA Global Research

——————–

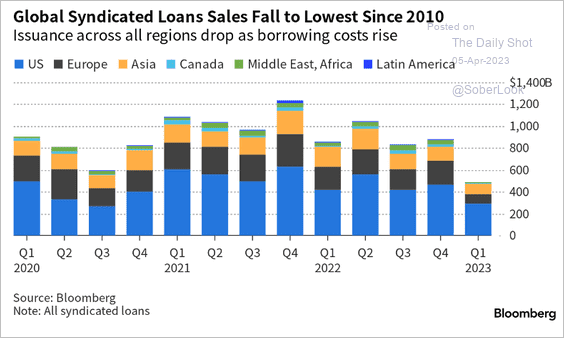

4. Leveraged loan sales slowed sharply in Q1.

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

——————–

Food for Thought

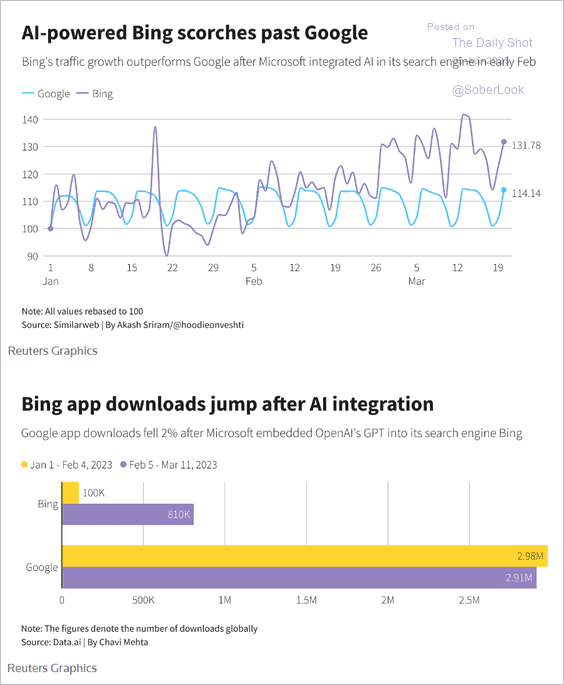

1. The AI feature helping Bing’s popularity:

Source: Reuters Read full article

Source: Reuters Read full article

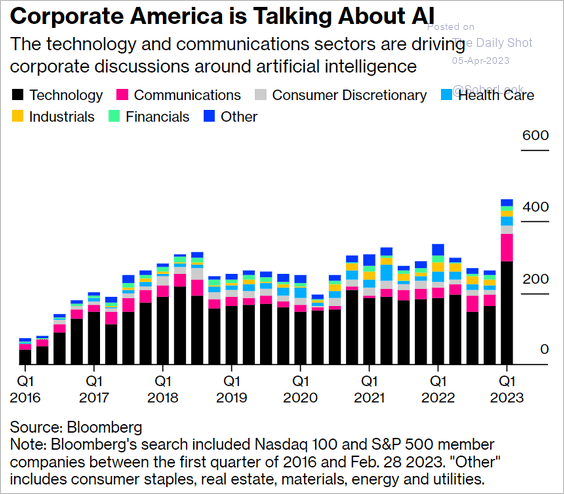

2. Companies discussing AI:

Source: @Subrat_Patnaik, @technology Read full article

Source: @Subrat_Patnaik, @technology Read full article

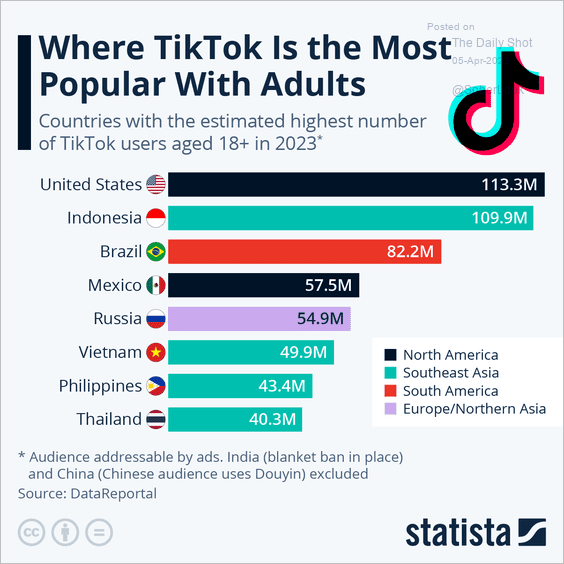

3. TikTok’s popularity with adults:

Source: Statista

Source: Statista

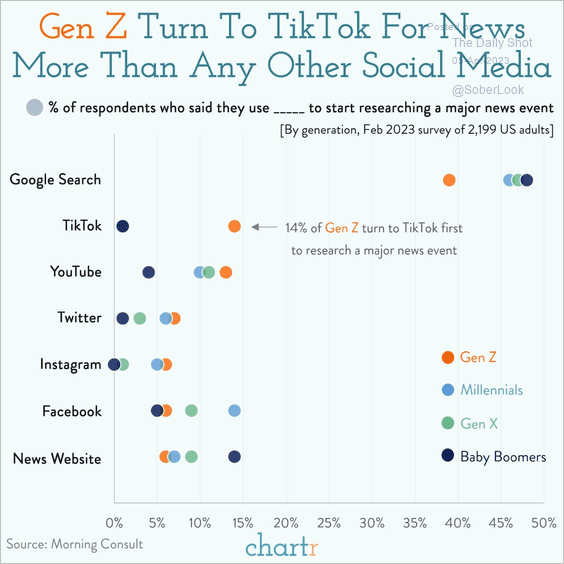

4. Researching a major news event:

Source: @chartrdaily

Source: @chartrdaily

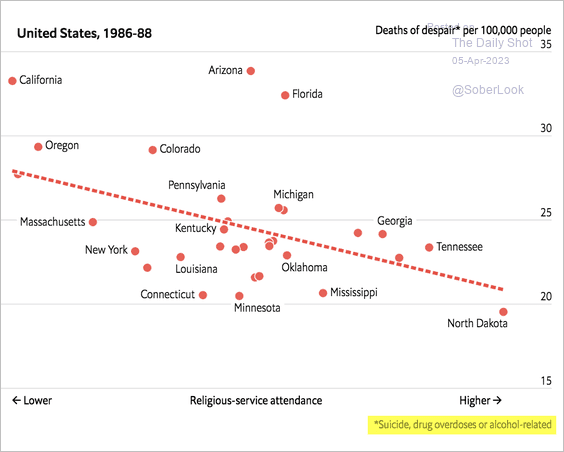

5. Religious participation and “deaths of despair”:

Source: The Economist Read full article

Source: The Economist Read full article

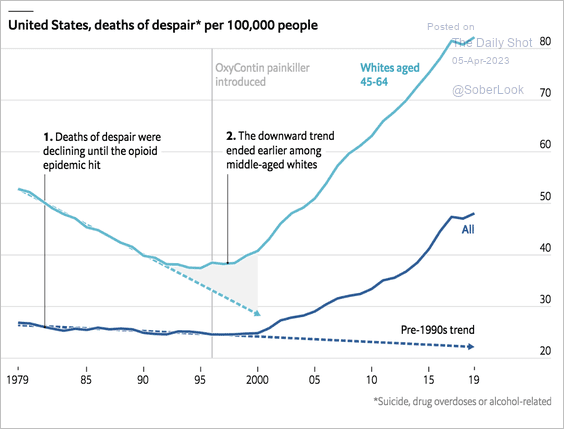

Deaths of despair over time:

Source: The Economist Read full article

Source: The Economist Read full article

——————–

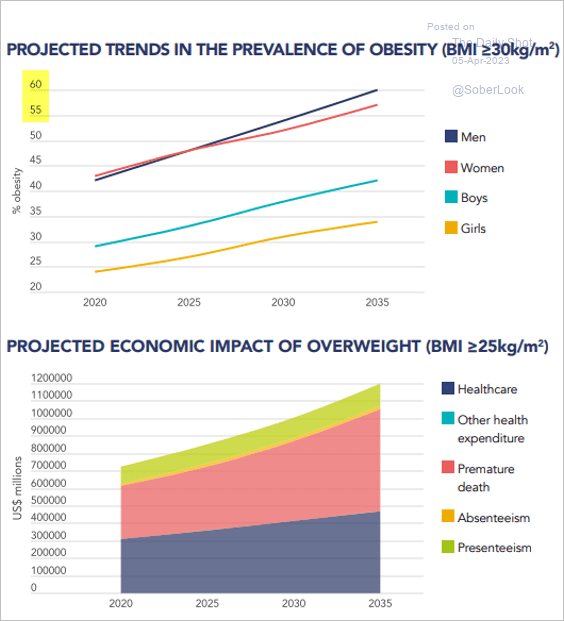

6. Projected prevalence of obesity in the US and its impact on the economy:

Source: World Obesity Day

Source: World Obesity Day

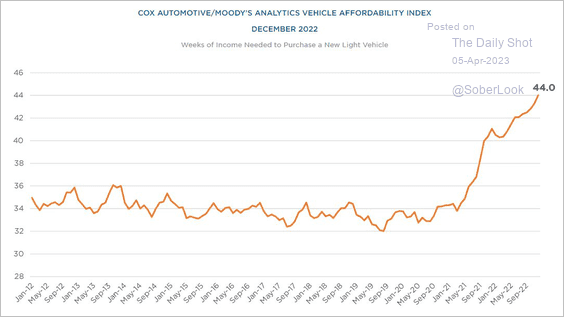

7. Weeks of income needed to purchase a new vehicle in the US:

Source: @KailashConcepts, @TheStreet Read full article

Source: @KailashConcepts, @TheStreet Read full article

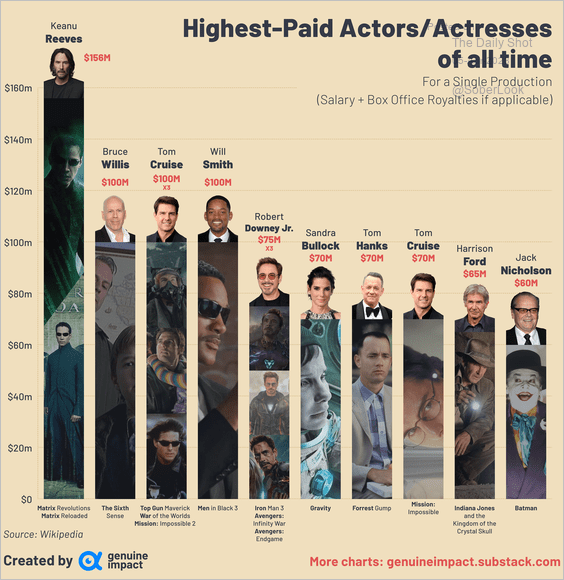

8. Highest-paid actors and actresses of all time:

Source: @genuine_impact

Source: @genuine_impact

——————–

Back to Index