The Daily Shot: 26-Jul-23

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

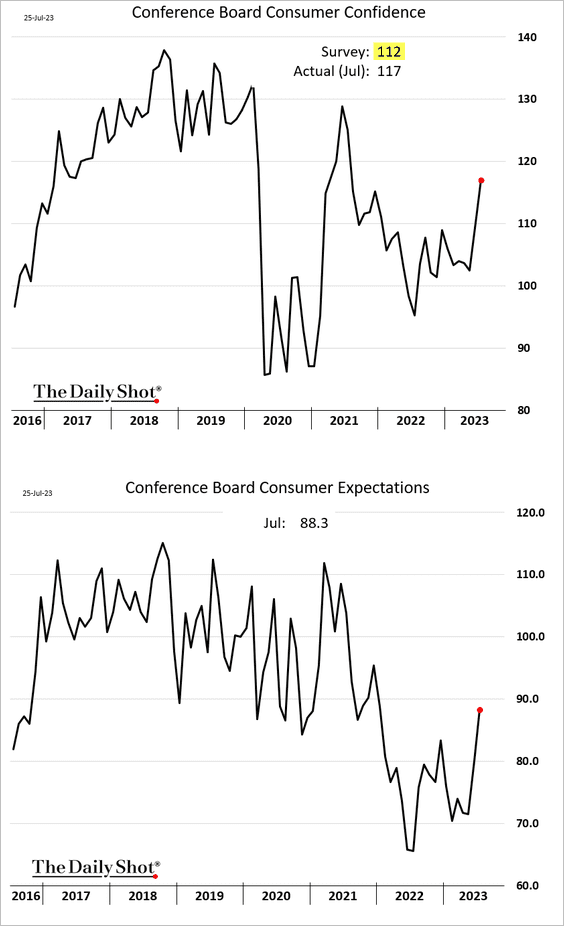

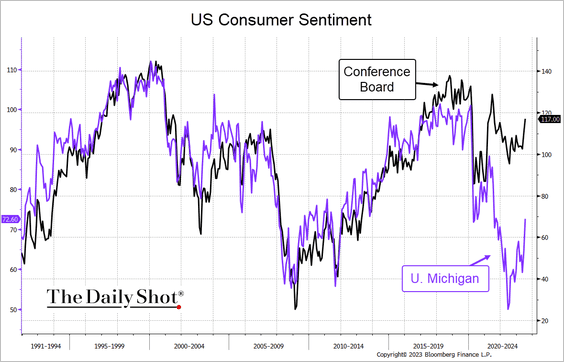

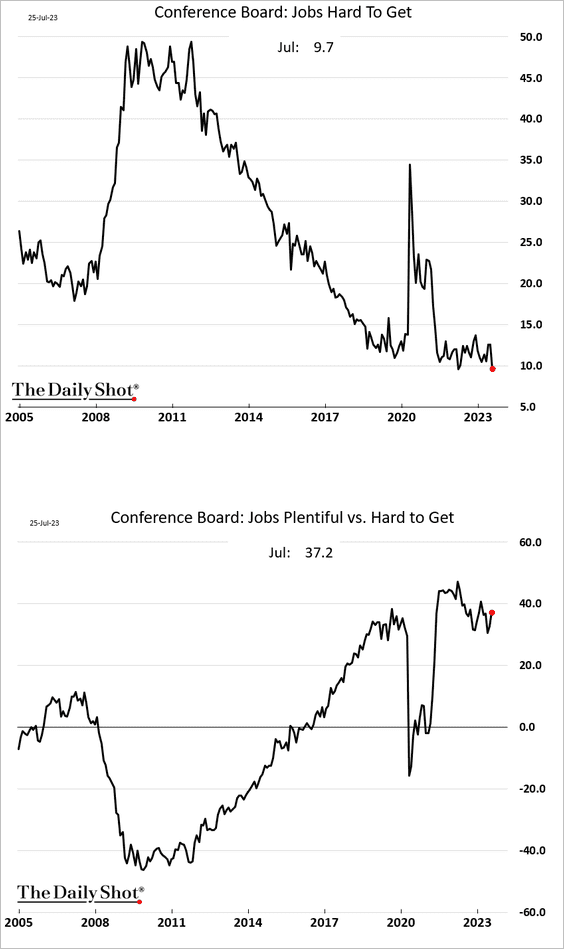

1. The Conference Board’s consumer confidence index confirmed the July gains we saw in the U. Michigan’s report.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

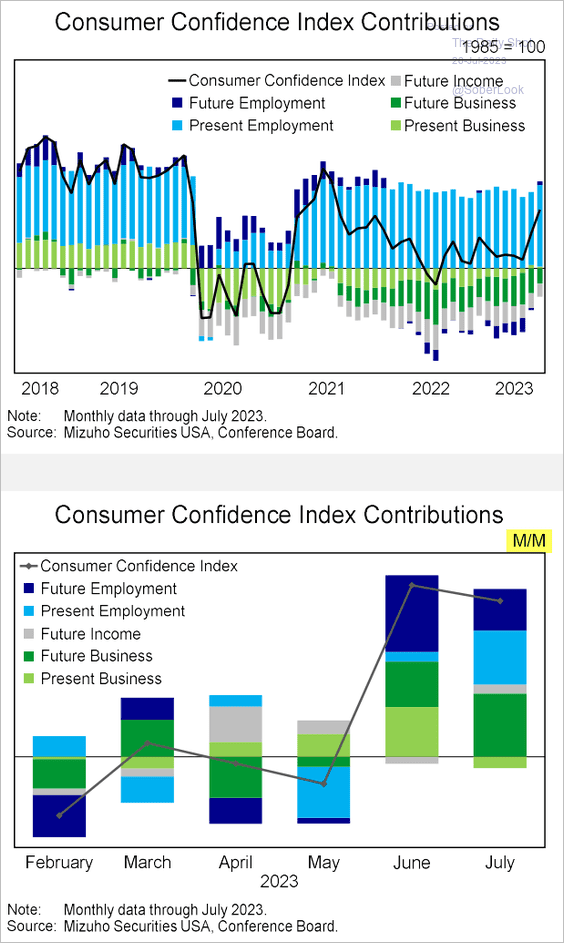

• Robust employment and stock market gains contributed to improving mood. Here are the contributions to the Conference Board’s index.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

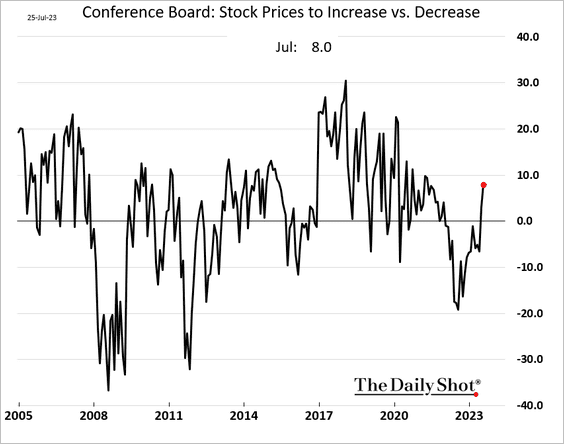

• The report showed a sharp gain in stock market sentiment.

• Confidence in the labor market strengthened.

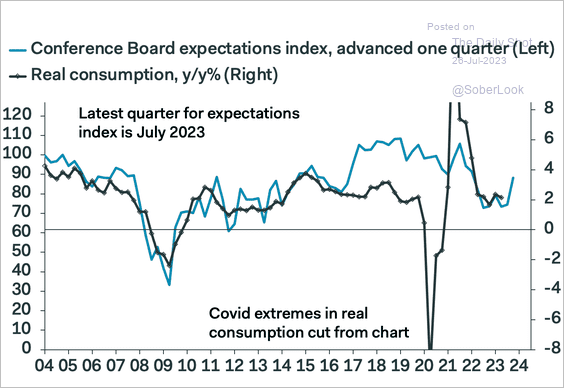

• Will we see a rebound in consumer spending growth?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

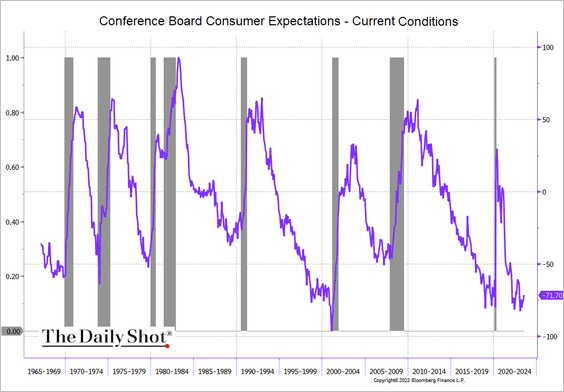

• The spread between consumer expectations and current conditions still signals a recession ahead.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

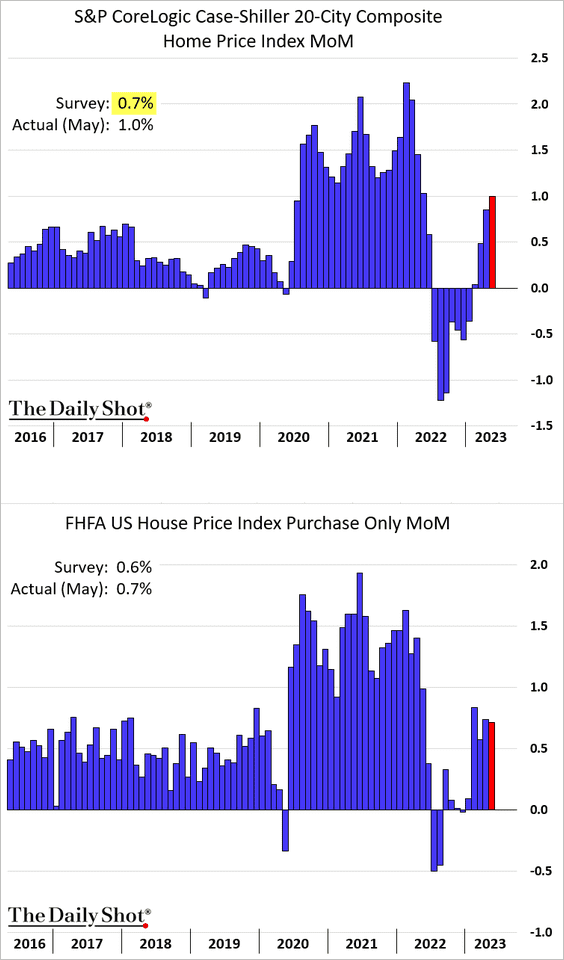

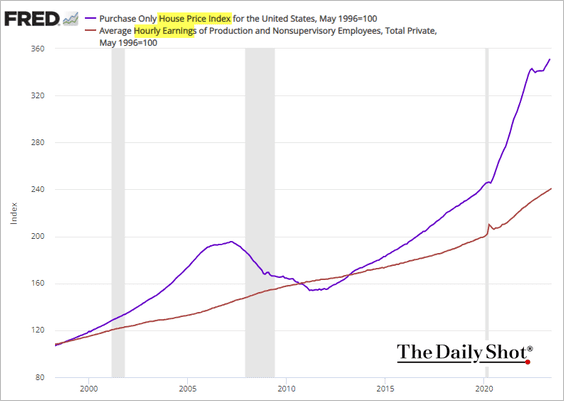

2. Home prices continued to rise in May amid depressed inventories.

• Housing prices keep outpacing wages.

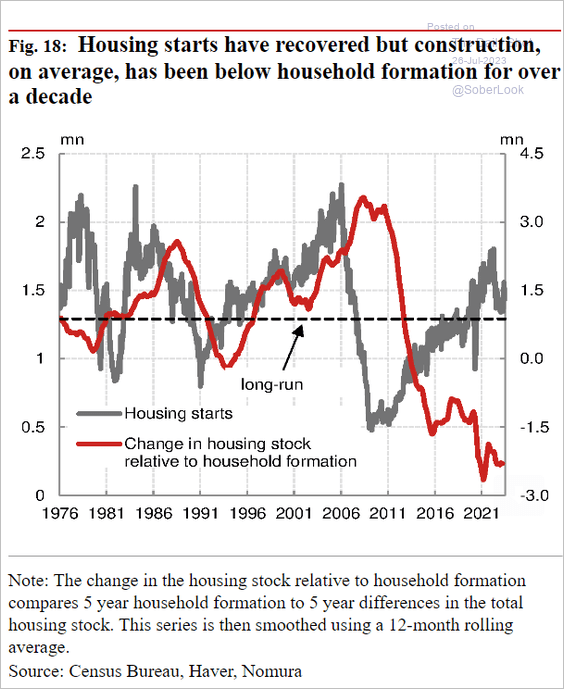

• By the way, residential construction has been running well below household formation for over a decade.

Source: Nomura Securities

Source: Nomura Securities

——————–

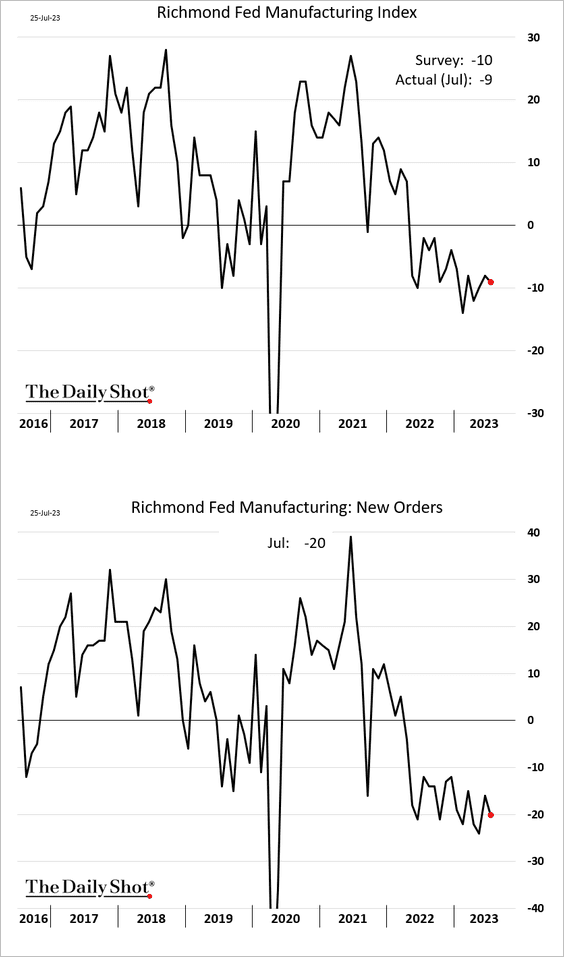

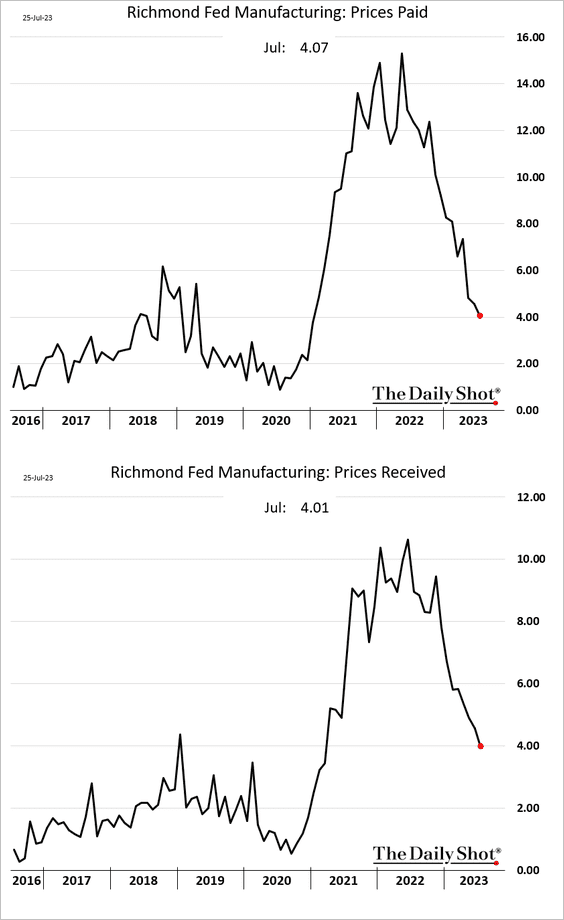

3. The Richmond Fed’s regional manufacturing index continues to show deteriorating factory activity, …

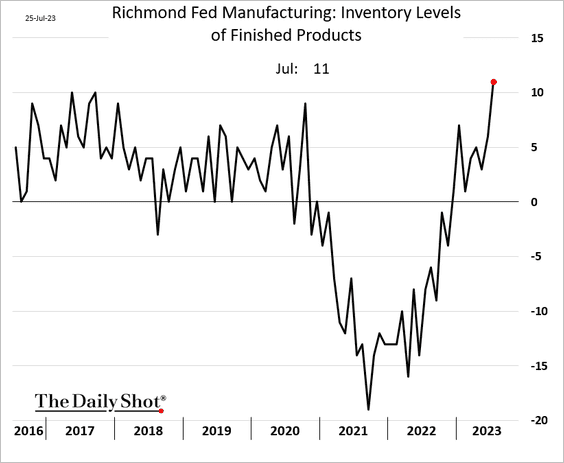

… as inventories climb.

Price pressures are easing.

——————–

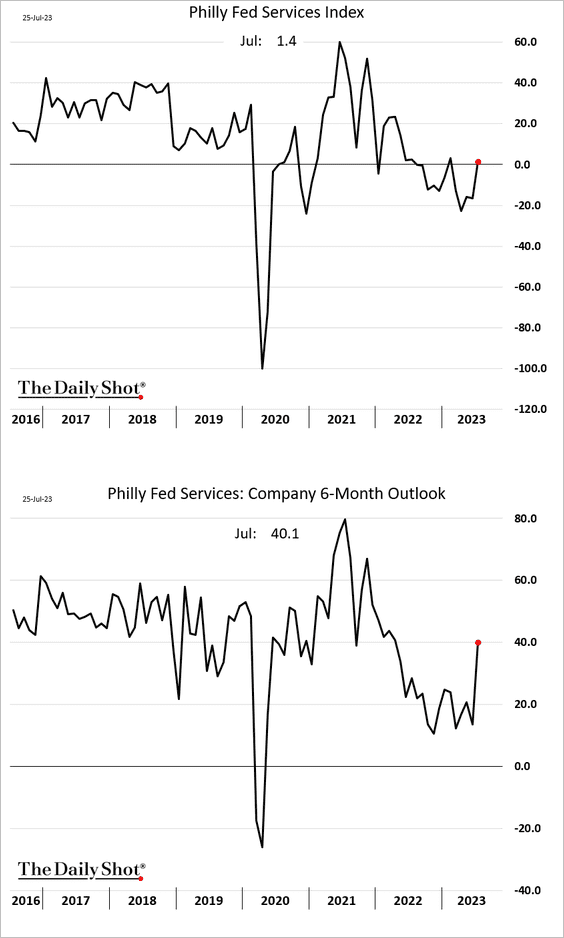

4. The Philly Fed’s regional services index signaled an improvement in July.

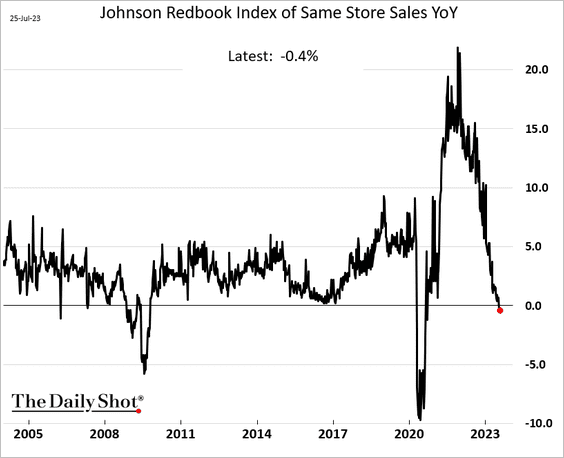

5. The Johnson Redbook index of same-store sales remains below last year’s levels.

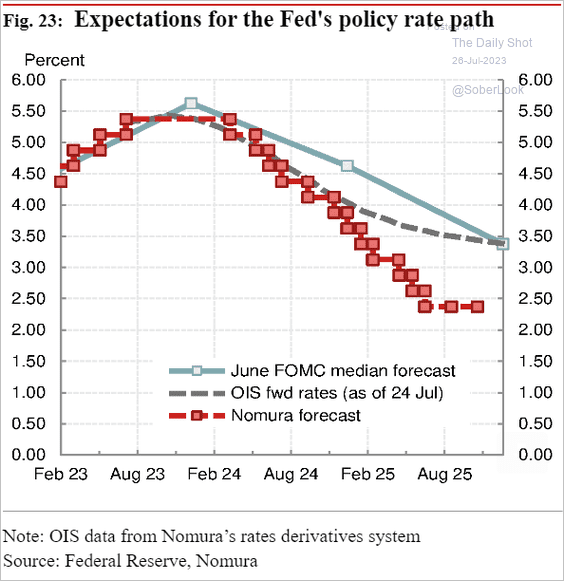

6. Nomura expects a sharper pace of Fed rate cuts than the market in 2025.

Source: Nomura Securities

Source: Nomura Securities

Back to Index

The United Kingdom

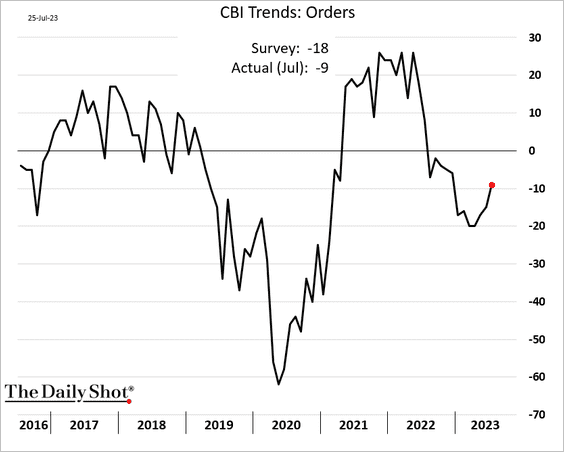

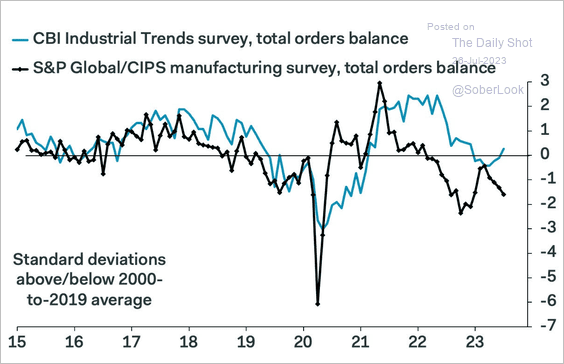

1. The CBI report points to some improvement in industrial orders, …

Source: Reuters Read full article

Source: Reuters Read full article

… contradicting the PMI data.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

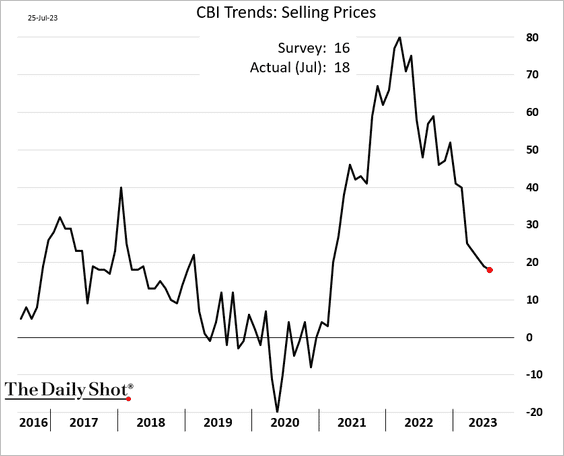

• Gains in selling prices have been moderating.

——————–

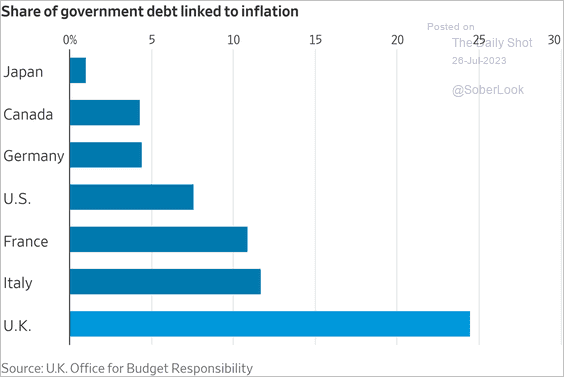

2. UK inflation-linked debt has been costly for the government.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

The Eurozone

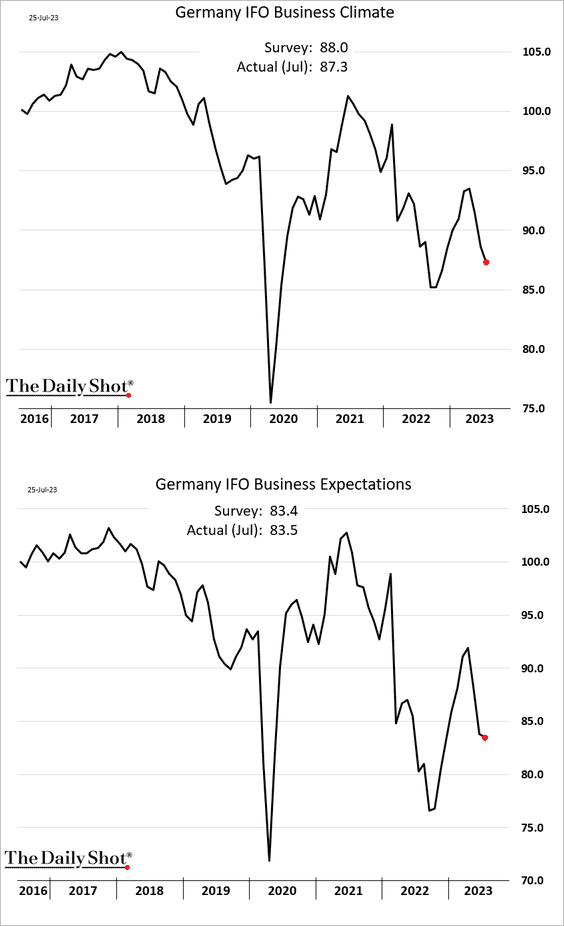

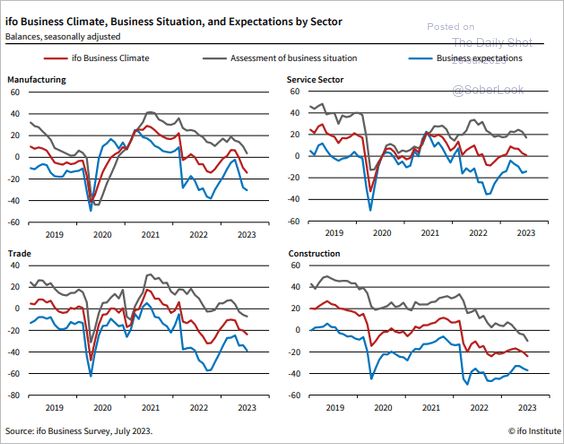

1. Germany’s Ifo index declined again this month.

Source: ifo Institute

Source: ifo Institute

——————–

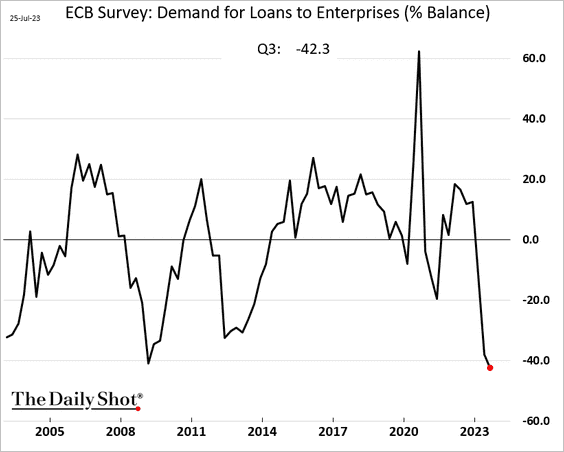

2. Euro-area demand for business loans is crashing.

Source: @economics Read full article

Source: @economics Read full article

——————–

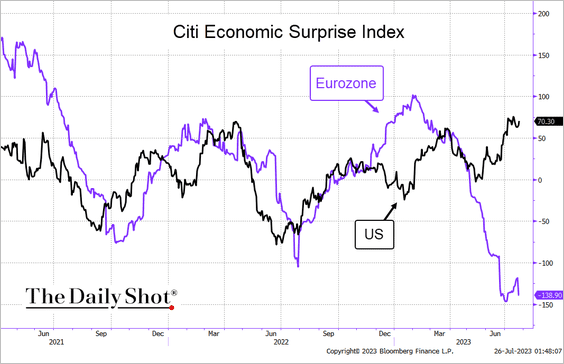

3. The Eurozone-US divergence in economic surprises persists.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

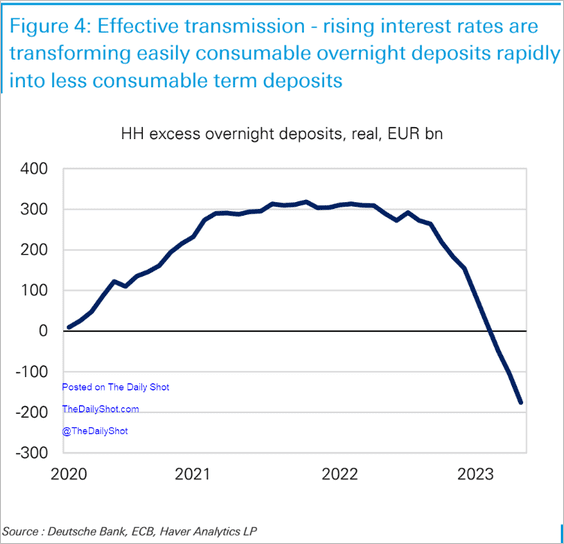

4. Households have been shifting cash from overnight deposits into higher-yielding products.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

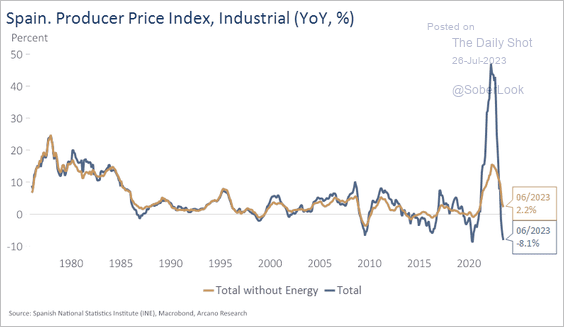

5. Here is Spain’s PPI.

Source: Arcano Economics

Source: Arcano Economics

Back to Index

Europe

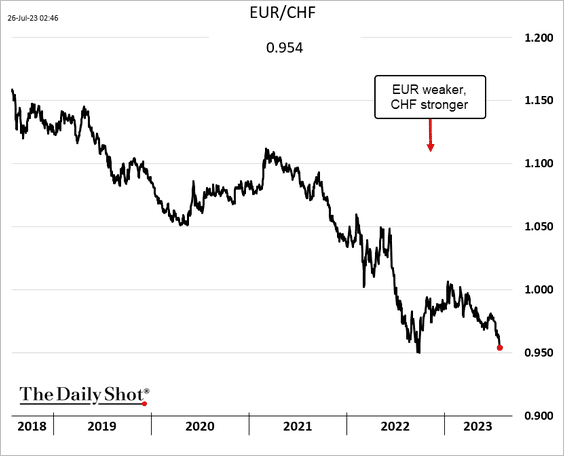

1. The Swiss franc has been surging, approaching a multi-year high versus the euro.

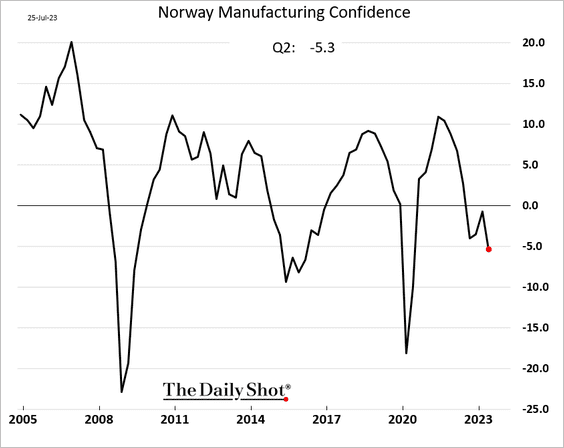

2. Norway’s manufacturing confidence hit the lowest level since the COVID shock.

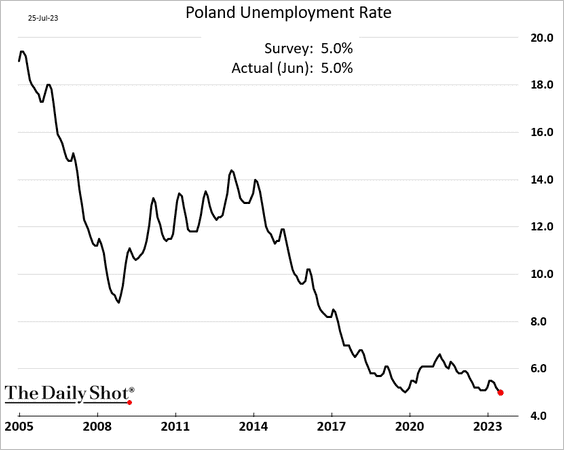

3. Poland’s unemployment rate continues to fall.

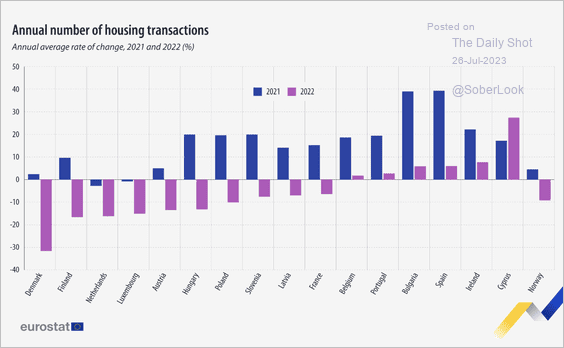

4. This chart shows the annual changes in housing transactions in 2021 and 2022.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

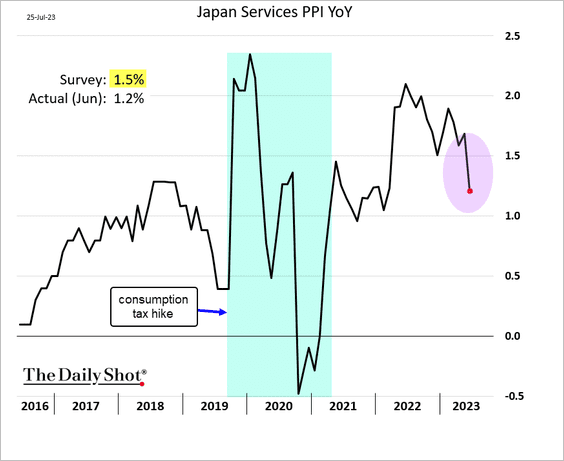

1. Services PPI declined sharply last month.

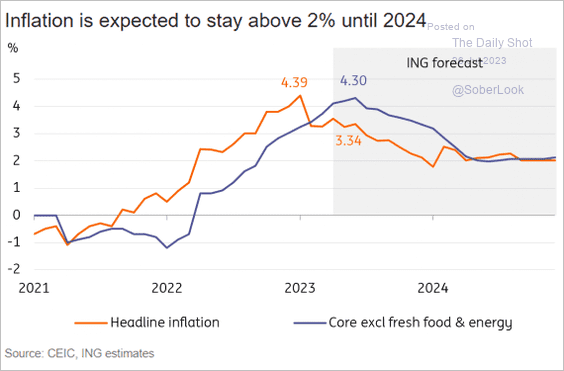

2. Here is the CPI forecast from ING.

Source: ING

Source: ING

Back to Index

Asia-Pacific

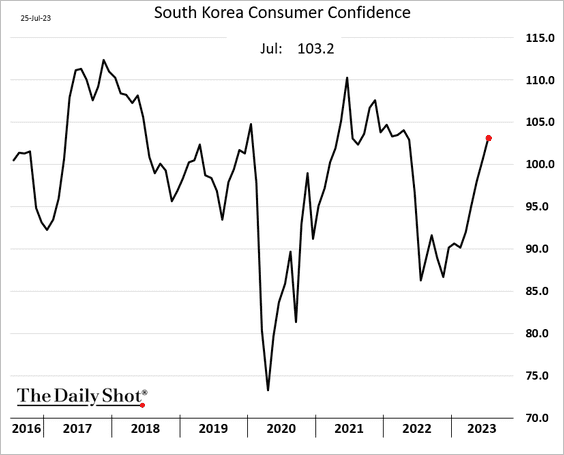

1. South Korea’s consumer confidence continues to improve.

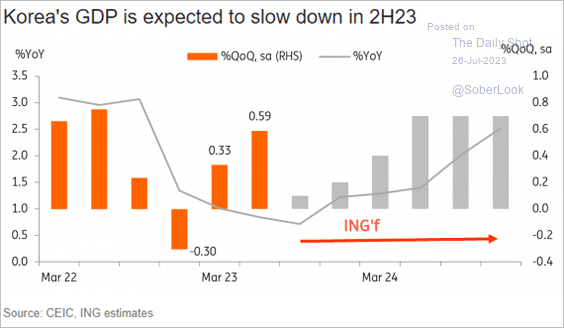

Separately, this chart shows South Korea’s GDP growth forecast from ING.

Source: ING

Source: ING

——————–

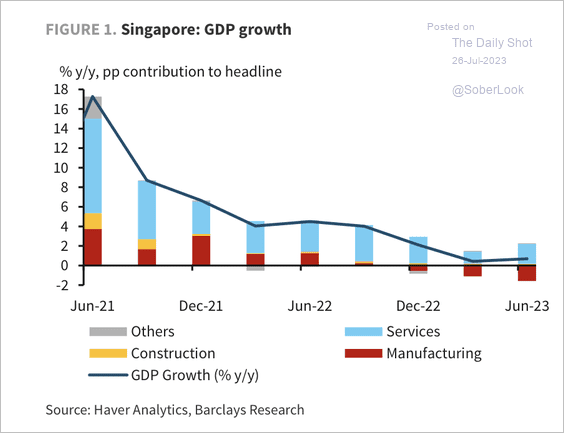

2. Singapore’s GDP growth has slowed, although sequential gains in services offset declines in manufacturing.

Source: Barclays Research

Source: Barclays Research

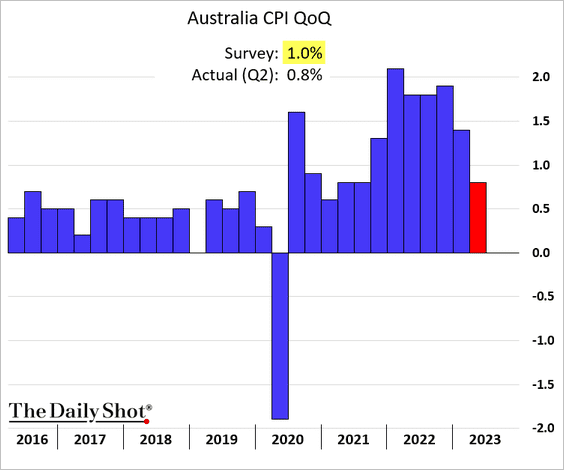

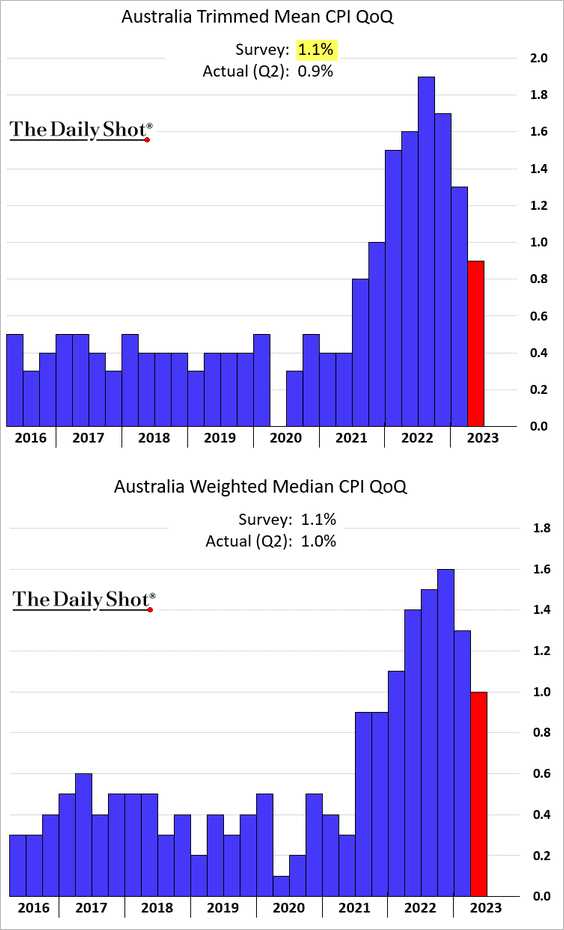

3. Australia’s CPI report surprised to the downside.

• Headline CPI:

• Core CPI:

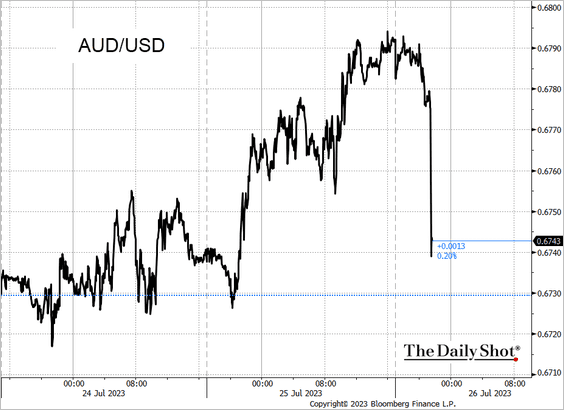

The Aussie dollar declined in response to the CPI print.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

China

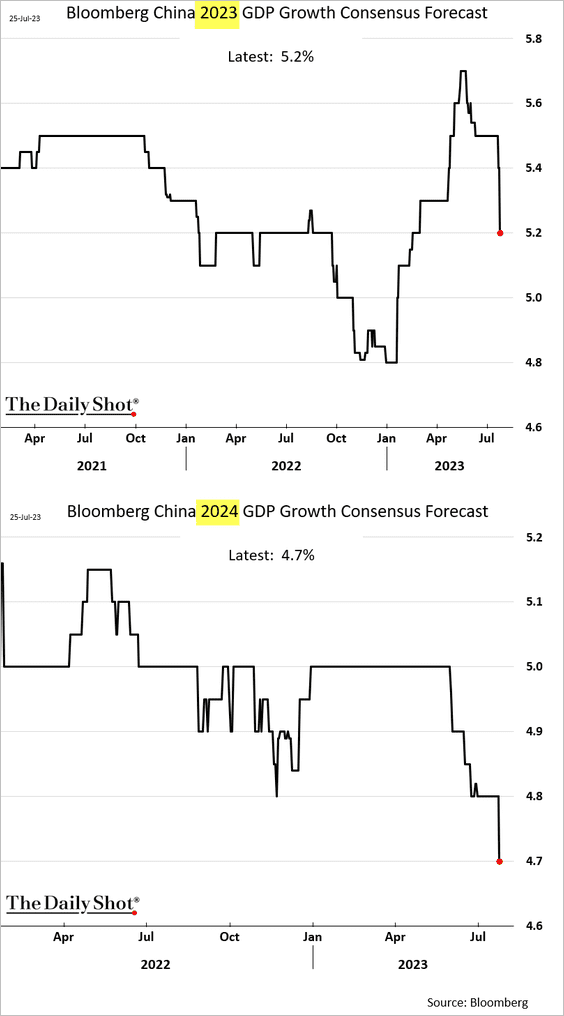

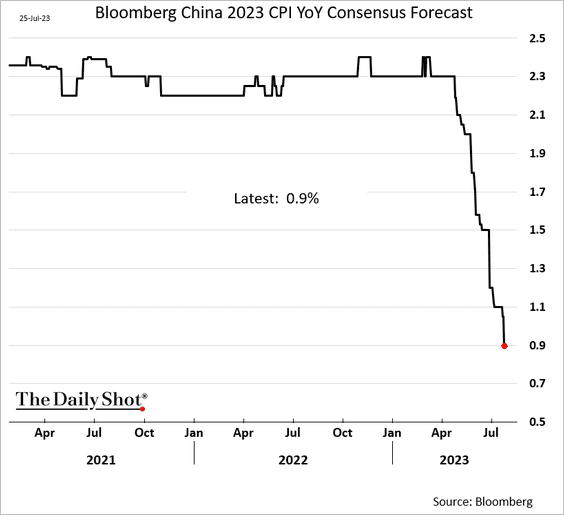

1. Economists are downgrading their GDP forecasts, …

… and lowering the CPI projections.

——————–

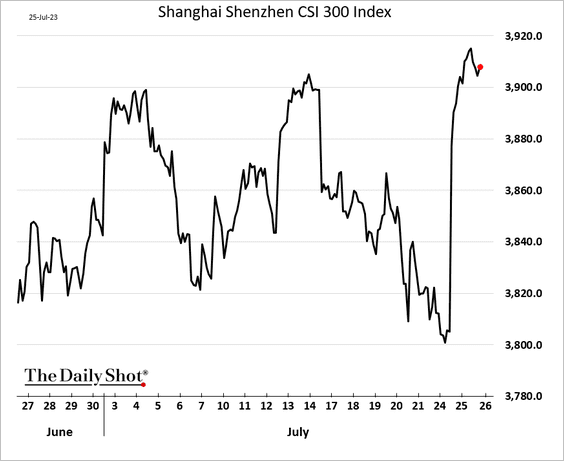

2. Stocks bounced this week on stimulus hopes.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

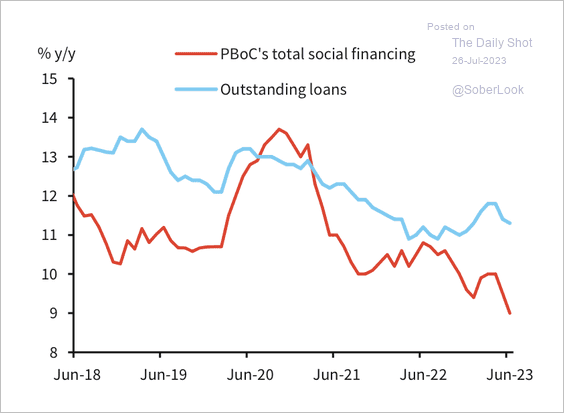

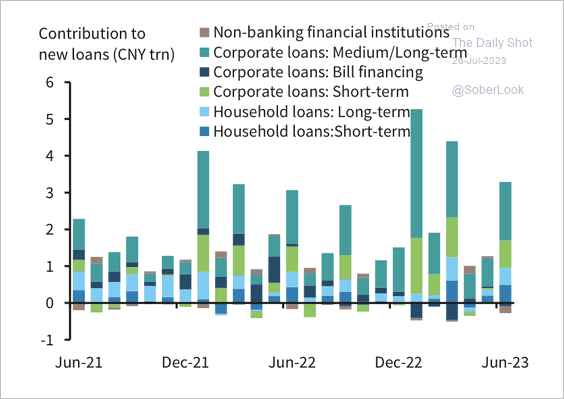

3. Aggregate financing growth slowed last month.

Source: Barclays Research

Source: Barclays Research

Corporate long-term loans and household loans improved in June.

Source: Barclays Research

Source: Barclays Research

——————–

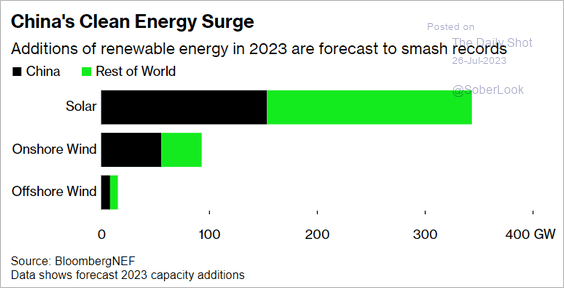

4. This chart shows China’s clean energy capacity additions.

Source: @climate Read full article

Source: @climate Read full article

Back to Index

Emerging Markets

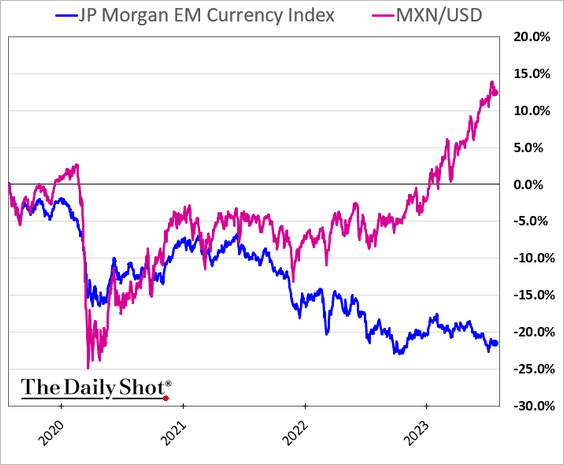

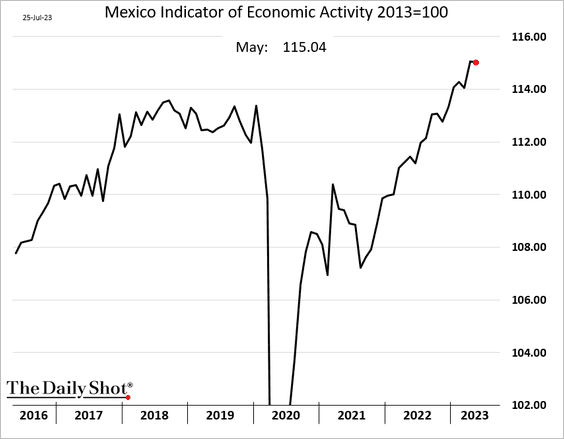

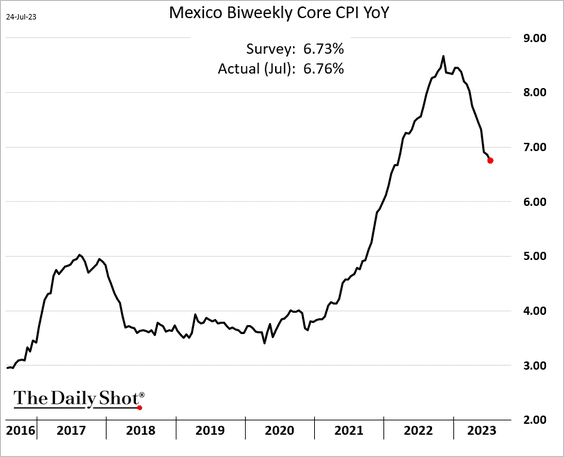

1. Let’s begin with Mexico.

• The peso has been surging.

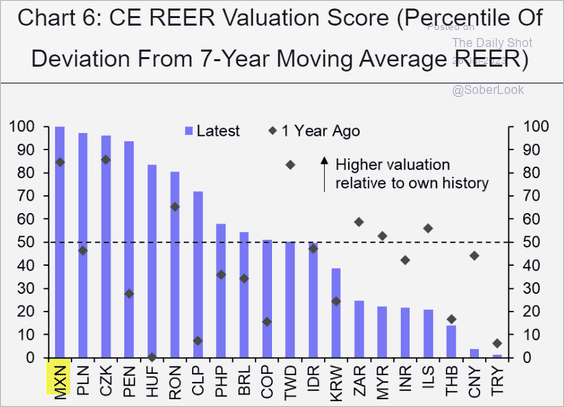

Is it overvalued?

Source: Capital Economics

Source: Capital Economics

• Economic activity was flat in May (but still robust).

• Inflation continues to ease.

——————–

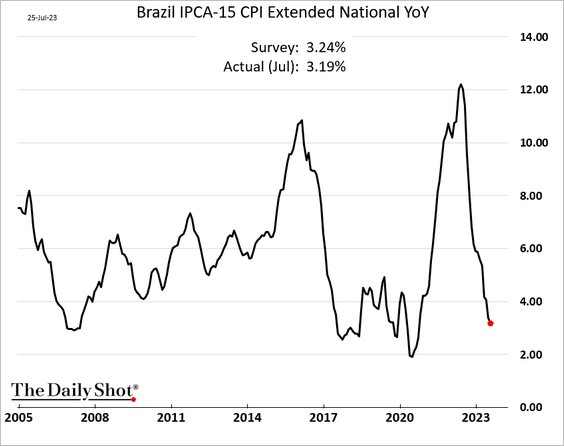

2. Brazil’s inflation has declined sharply.

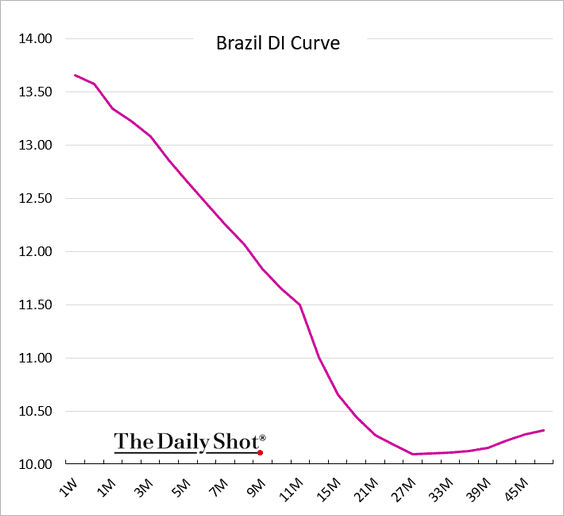

Rate cuts are coming. Here is the money market curve (%).

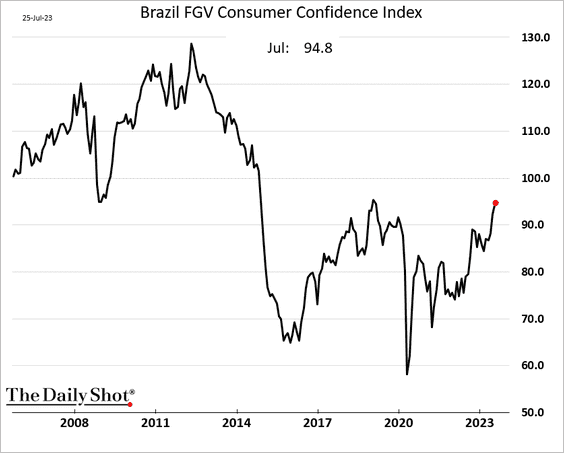

• Brazil’s consumer confidence continues to improve.

——————–

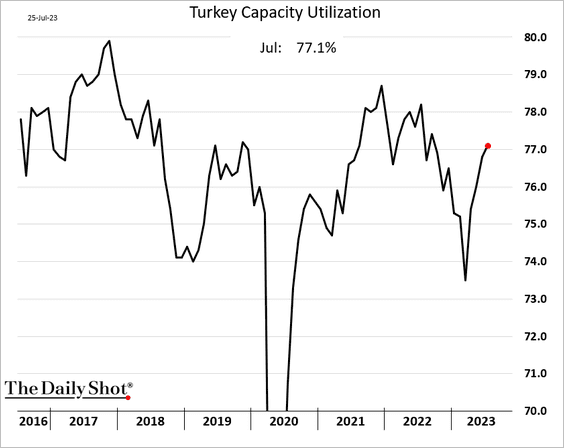

3. Turkey’s capacity utilization keeps rising.

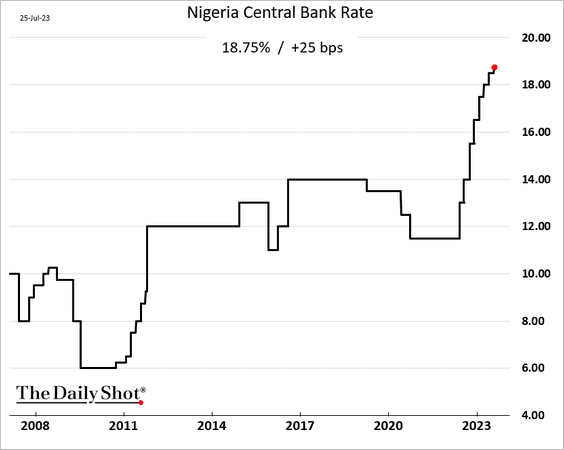

4. Nigeria’s central bank hiked rates again amid rising inflation.

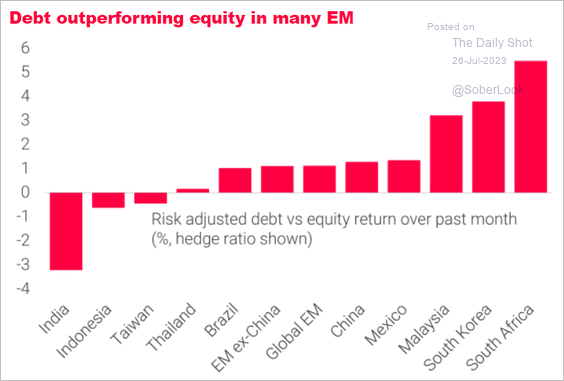

5. EM debt has been outperforming equities.

Source: TS Lombard

Source: TS Lombard

Back to Index

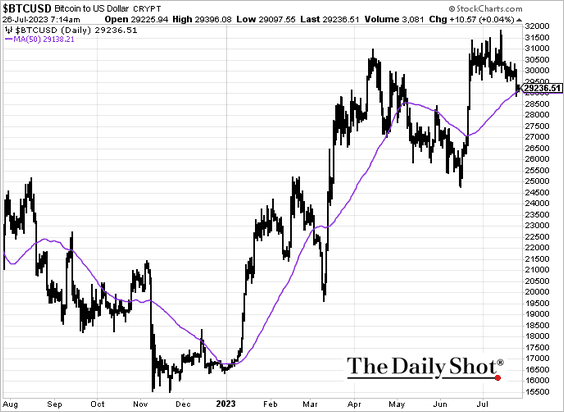

Cryptocurrency

Bitcoin is back below $30k and testing support at the 50-day moving average.

Back to Index

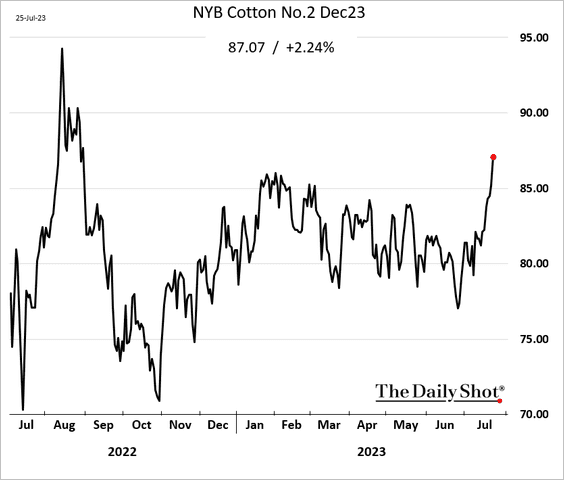

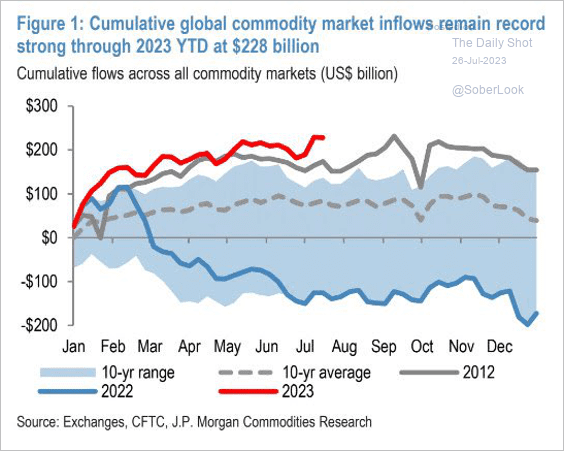

Commodities

1. US cotton futures have been surging due to dry conditions for the Southern Plains and Delta regions.

2. Global commodity flows remain robust.

Source: JP Morgan Research; @VolatilityMgmt

Source: JP Morgan Research; @VolatilityMgmt

Back to Index

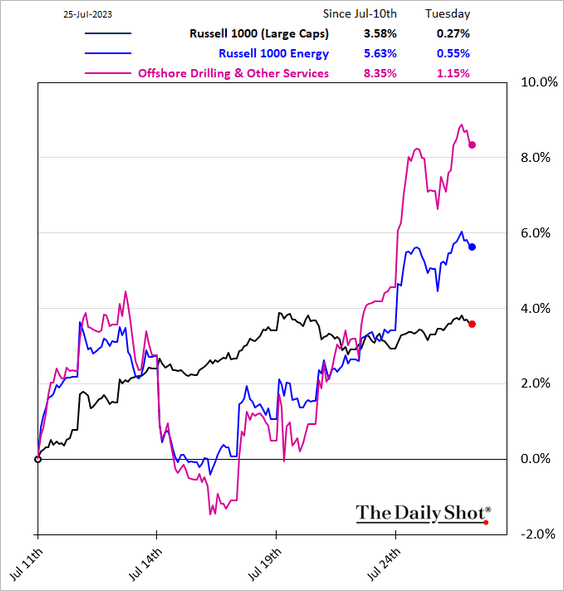

Energy

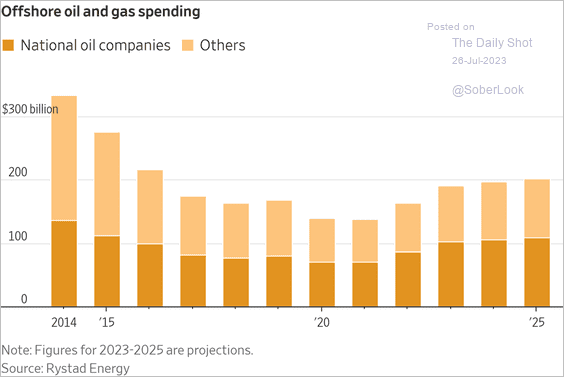

1. Investors are betting on offshore drillers.

Here is the offshore CapEx over time.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

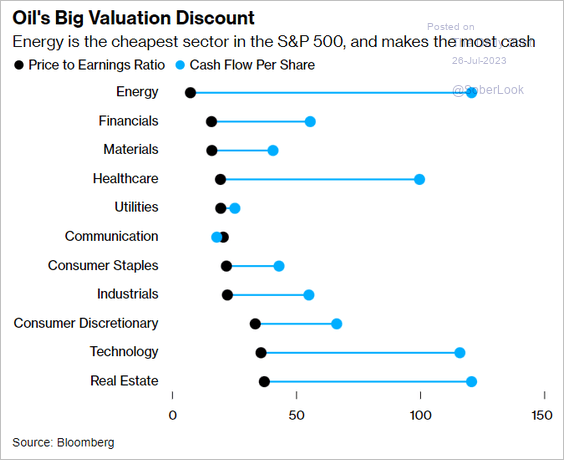

2. Based on current cash flow, energy companies look cheap.

Source: @markets Read full article

Source: @markets Read full article

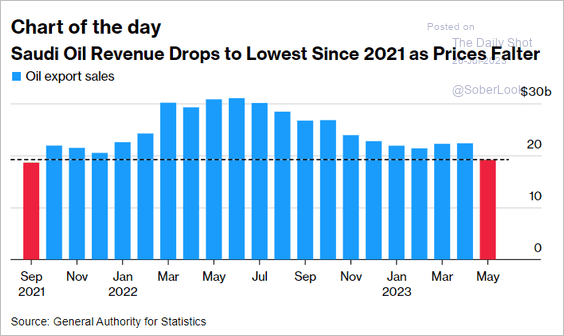

3. Saudi oil revenue hit the lowest level since 2021.

Source: @mburtonmetals, @markets Read full article

Source: @mburtonmetals, @markets Read full article

Back to Index

Equities

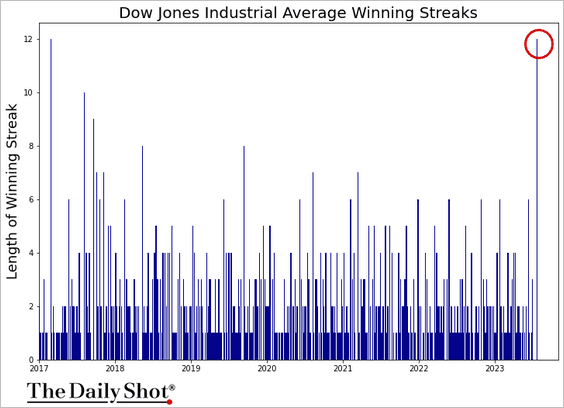

1. The Dow winning streak continues.

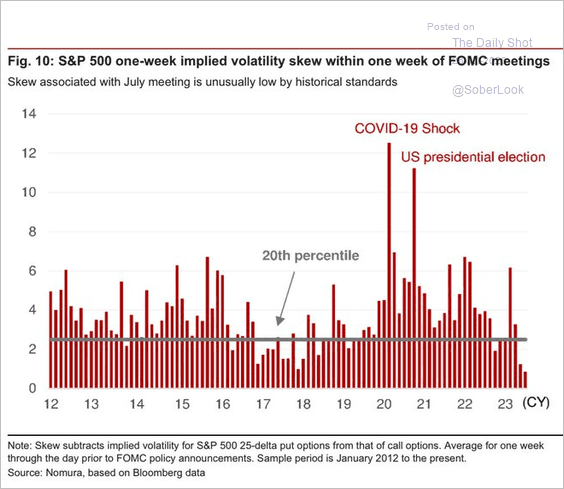

2. There isn’t much risk priced into this week’s FOMC meeting. The chart shows the S&P 500 one-week skew around FOMC meetings.

Source: Nomura Securities; @WallStJesus

Source: Nomura Securities; @WallStJesus

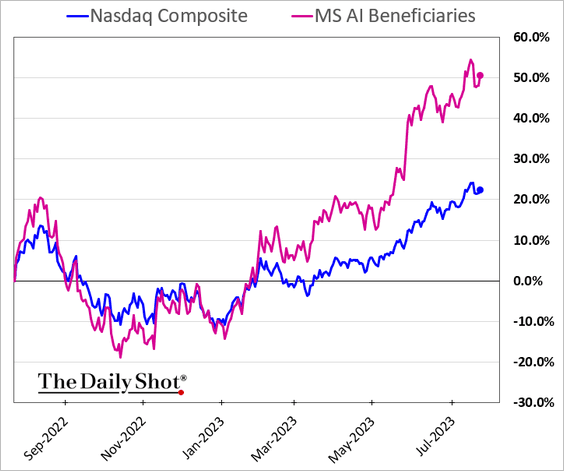

3. Stocks benefiting from AI advances continue to outperform.

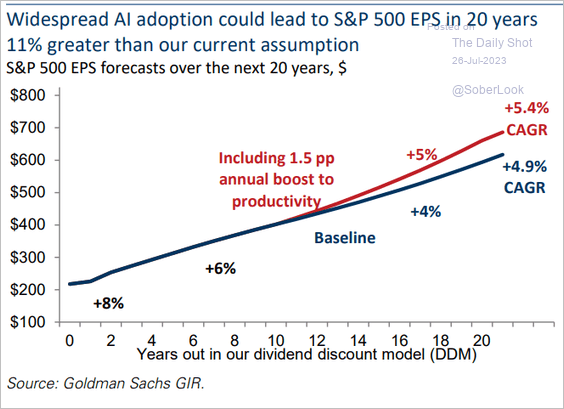

How much could AI adoption boost corporate earnings over the next two decades?

Source: Goldman Sachs

Source: Goldman Sachs

——————–

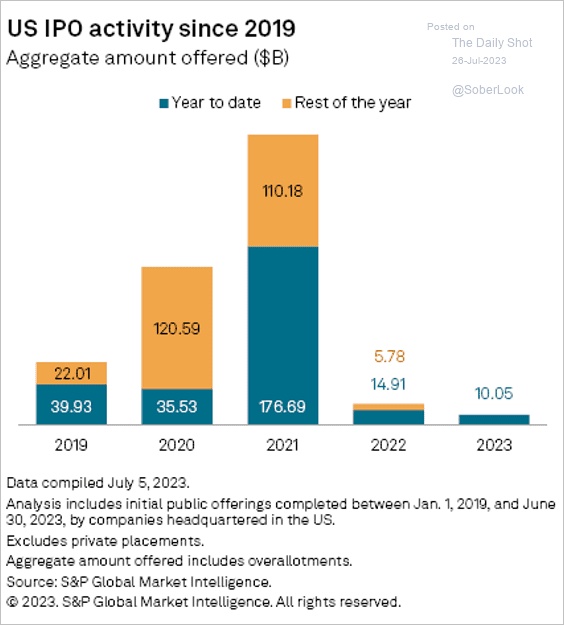

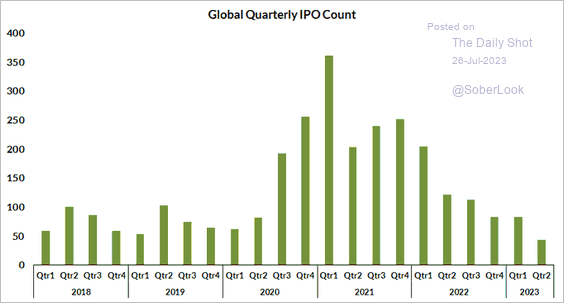

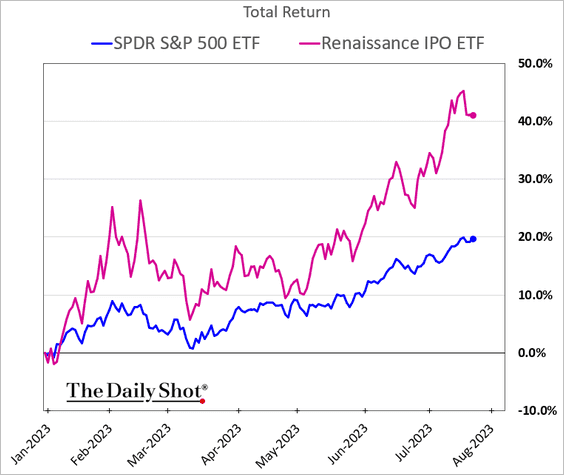

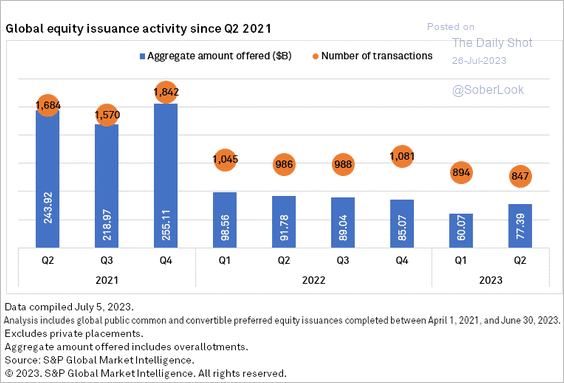

4. US IPO activity has been depressed this year.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Here is the global IPO activity by quarter.

Source: @MikeZaccardi, @WallStHorizon Read full article

Source: @MikeZaccardi, @WallStHorizon Read full article

Will post-IPO share outperformance boost IPO activity later this year?

h/t Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

h/t Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

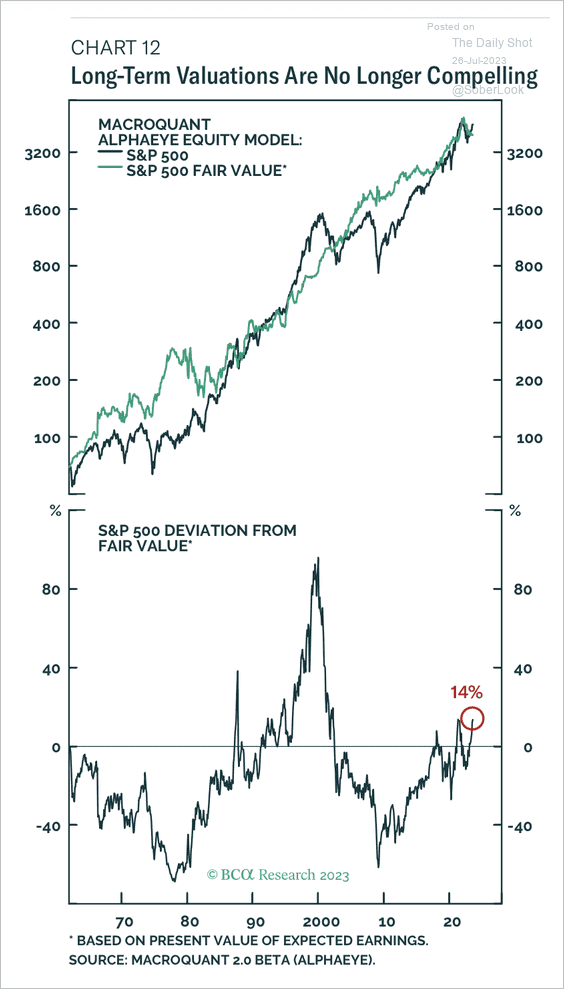

5. S&P 500 valuations are stretched, according to BCA Research.

Source: BCA Research

Source: BCA Research

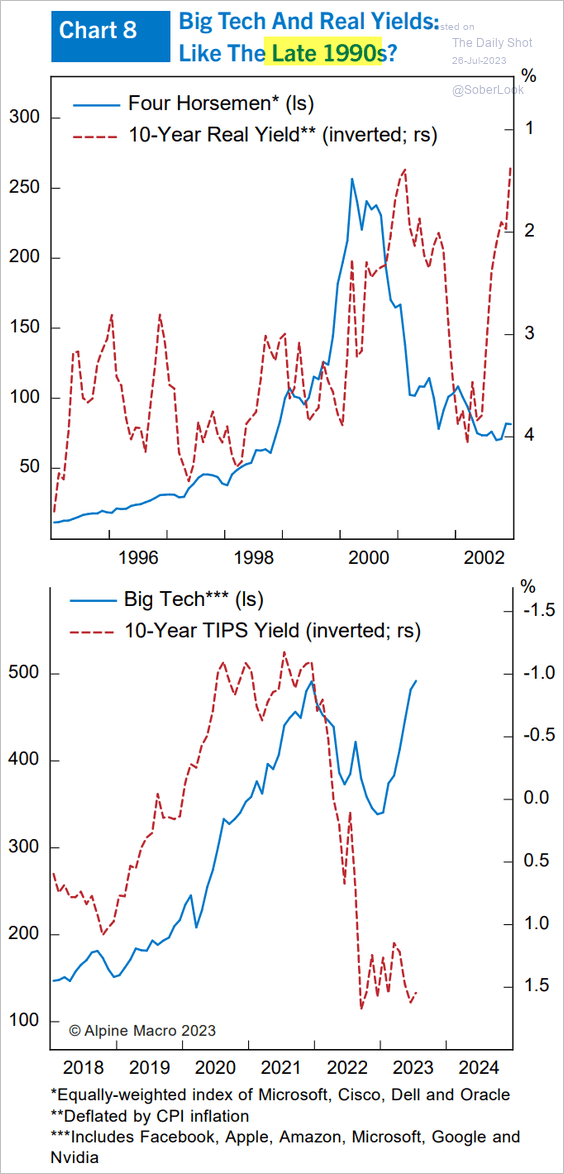

6. The divergence between big tech and real yields is similar to what we saw in the late 1990s.

Source: Alpine Macro

Source: Alpine Macro

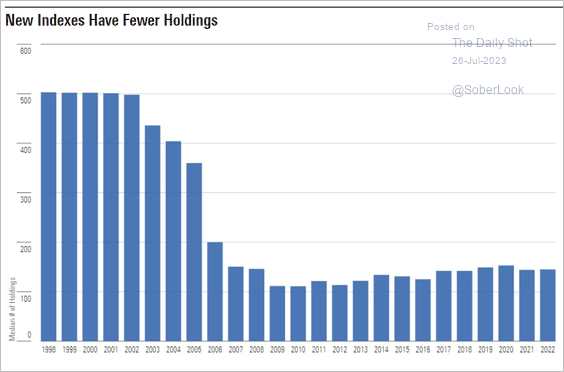

7. The median number of holdings among new indexes declined sharply between 2003 and 2007 before steadying over the most recent 15 years. According to Morningstar, most indexes have shifted away from market-cap weighting.

Source: Morningstar Read full article

Source: Morningstar Read full article

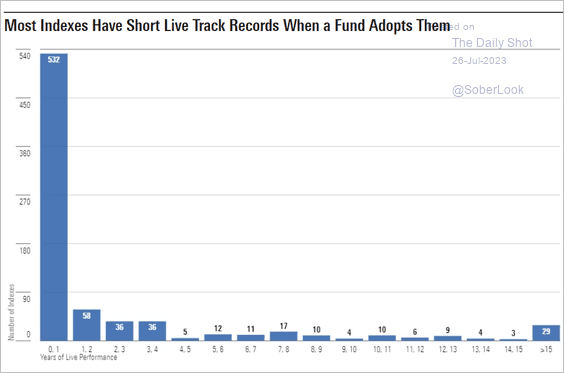

Most indexes do not have long track records when they become the target of a fund.

Source: Morningstar Read full article

Source: Morningstar Read full article

Back to Index

Credit

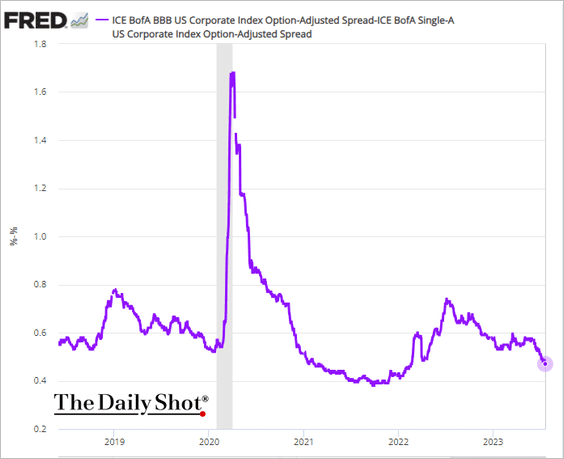

1. The spread between BBB and single-A corporate bonds has been tightening, an indication of growing risk appetite in the investment-grade market.

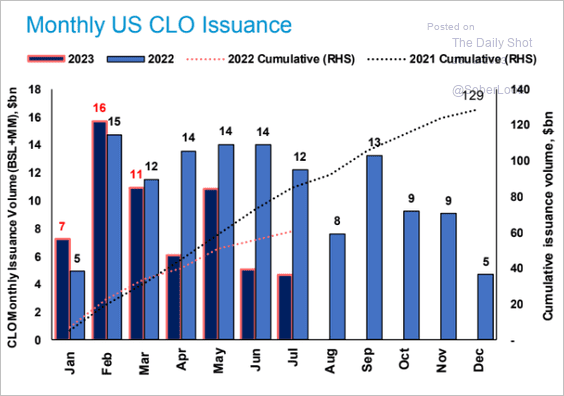

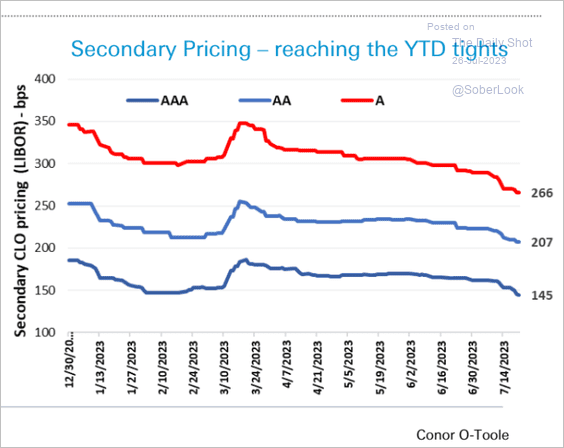

2. CLO issuance has been slow relative to last year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Secondary CLO spreads continue to tighten.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

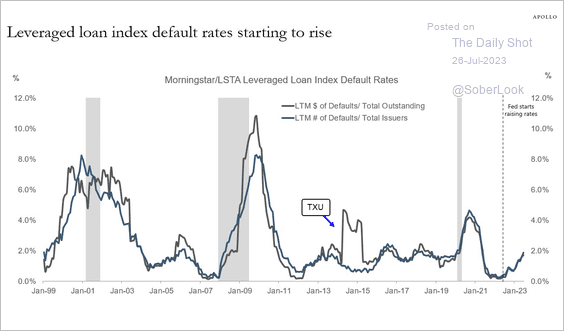

3. This chart shows leveraged loan defaults.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

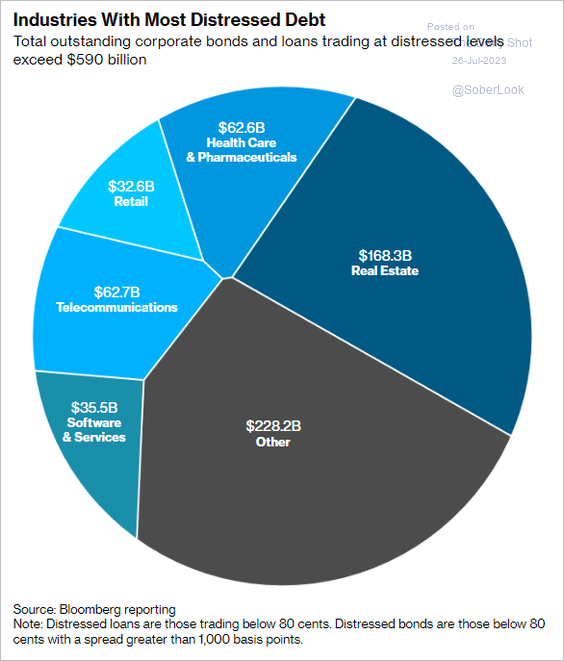

4. Here are the industries with the highest levels of distressed debt.

Source: @business Read full article

Source: @business Read full article

Back to Index

Rates

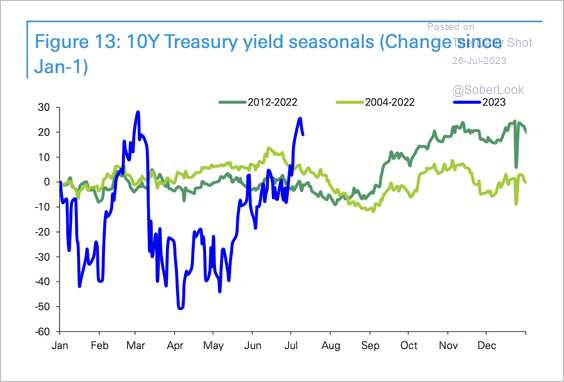

1. The 10-year Treasury yield is entering a seasonally weak period.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

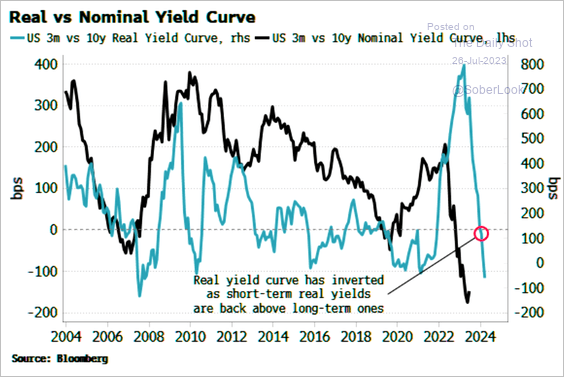

2. The real-yield curve has been inverting rapidly as short-term inflation expectations ease.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

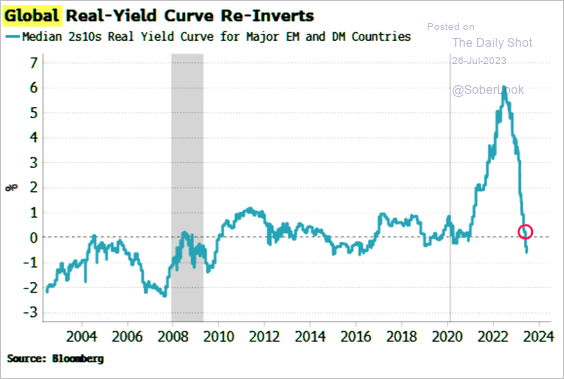

Here is the global real-yield curve.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

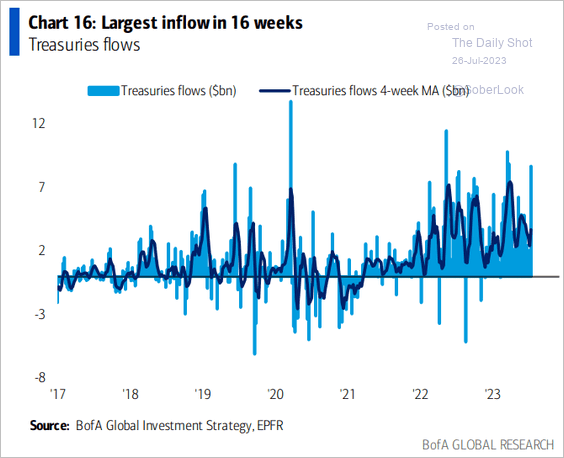

3. Treasury fund flows remain robust.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Global Developments

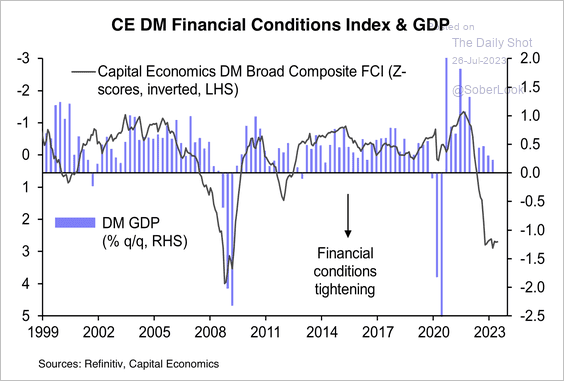

1. Financial conditions have tightened across developed markets, driven by higher borrowing costs and lower credit availability.

Source: Capital Economics

Source: Capital Economics

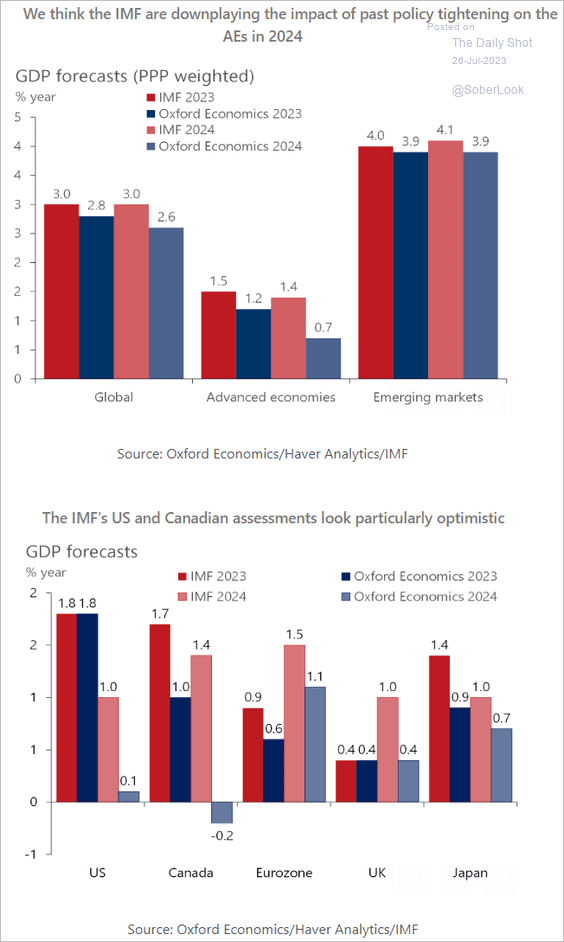

2. Is the IMF too optimistic about next year’s GDP growth in advanced economies?

Source: Oxford Economics

Source: Oxford Economics

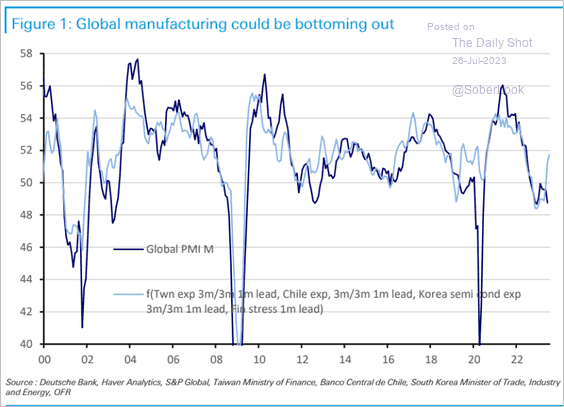

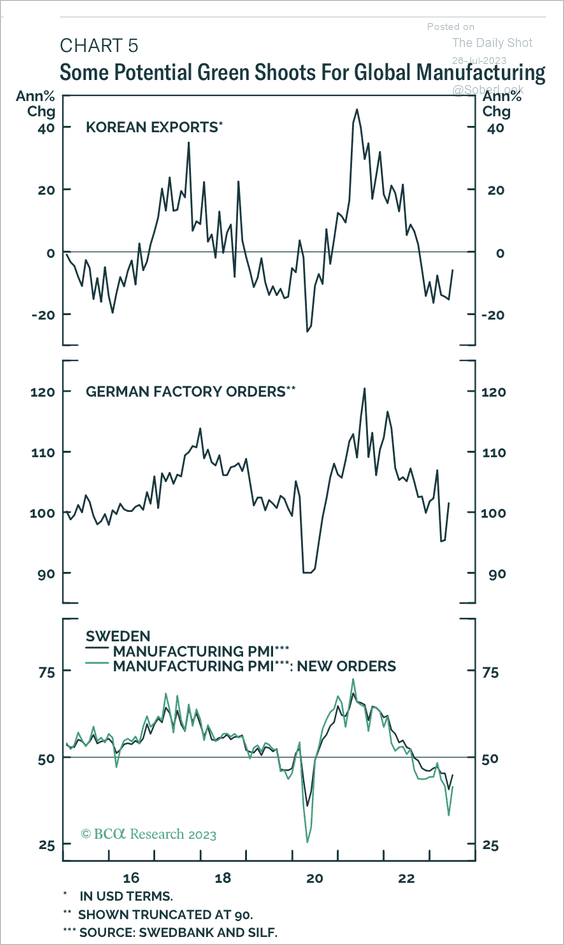

3. Leading indicators signal a rebound in global manufacturing activity (2 charts).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: BCA Research

Source: BCA Research

——————–

4. M&A activity remains soft.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

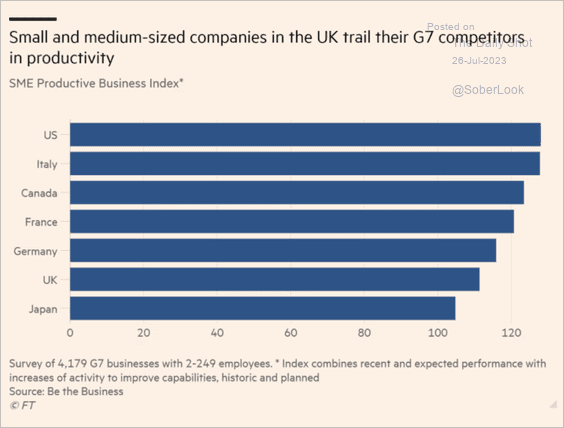

5. Next, we have the productivity of G7 small and medium-sized companies.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

Food for Thought

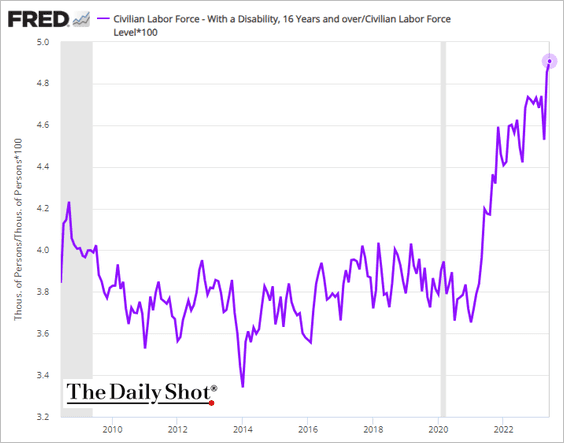

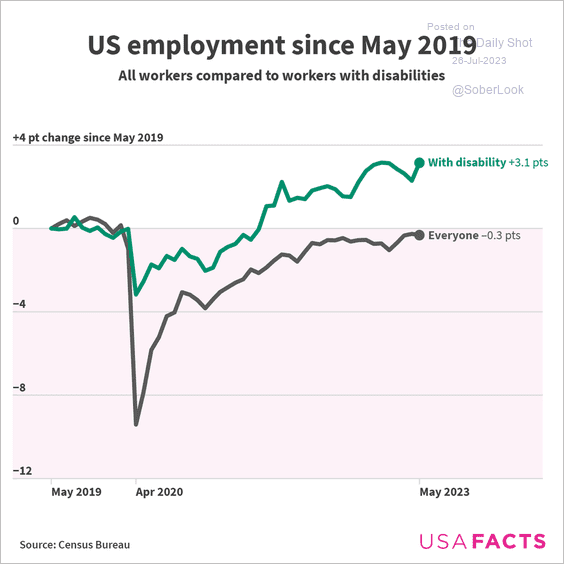

1. Labor force participation among Americans with disabilities:

• Employment growth:

Source: USAFacts

Source: USAFacts

——————–

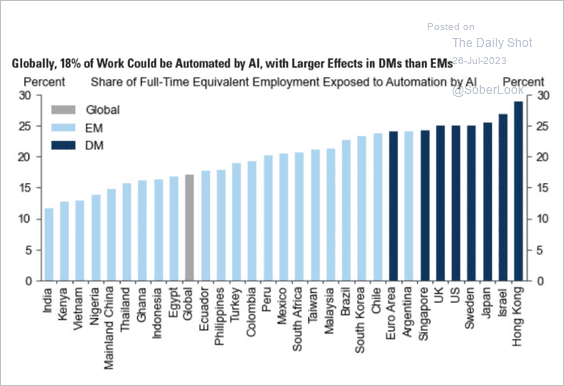

2. Employment share exposed to AI automation:

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

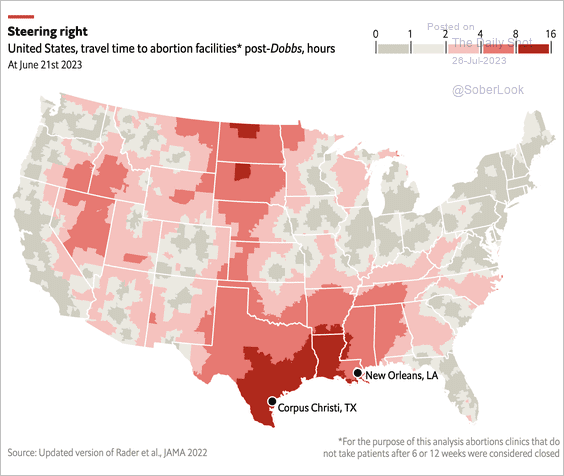

3. Travel time to abortion facilities:

Source: @WSJ Read full article

Source: @WSJ Read full article

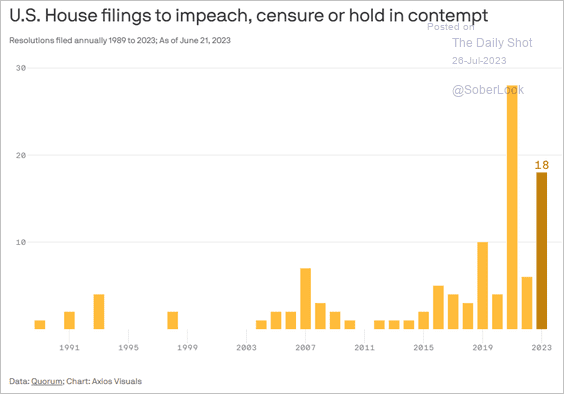

4. Impeachment censure and contempt fervor:

Source: @axios Read full article

Source: @axios Read full article

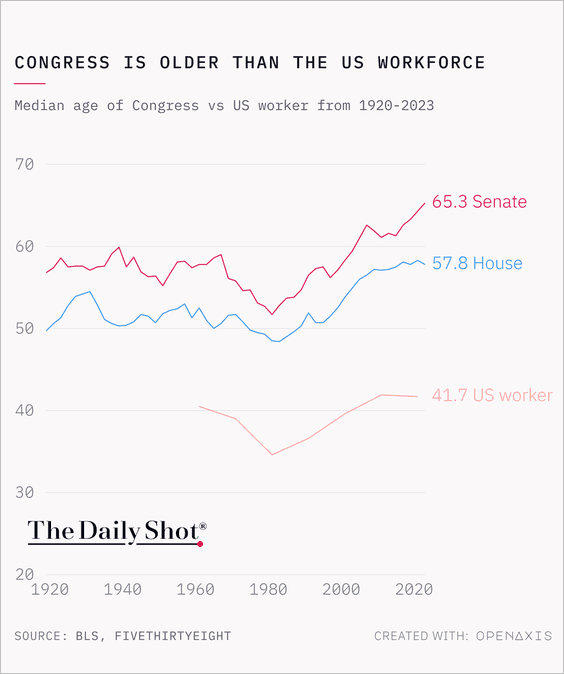

5. The US Congress is older than the US workforce:

Source: @TheDailyShot

Source: @TheDailyShot

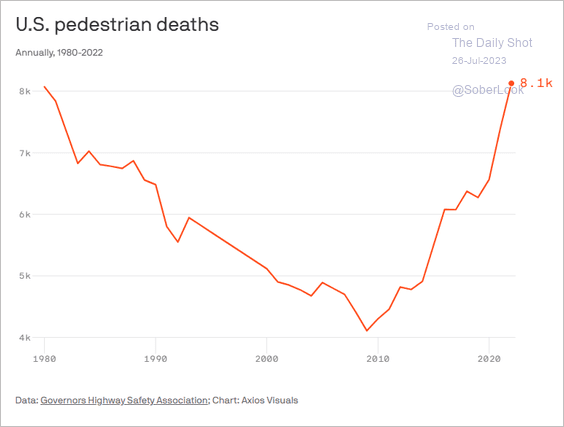

6. US pedestrian deaths:

Source: @axios Read full article

Source: @axios Read full article

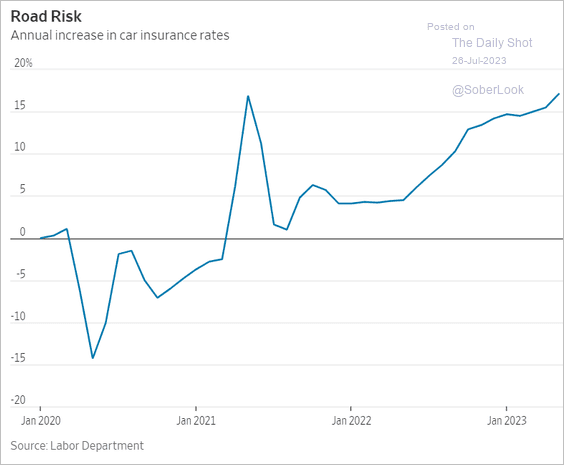

7. Auto insurance inflation in the US:

Source: @WSJ Read full article

Source: @WSJ Read full article

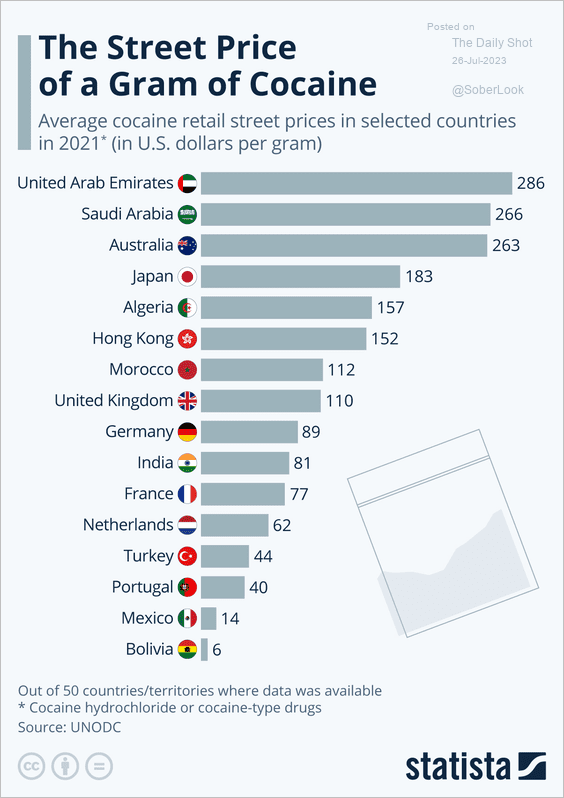

8. The street price of a gram of cocaine:

Source: Statista

Source: Statista

——————–

Back to Index