The Daily Shot: 27-Jul-23

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

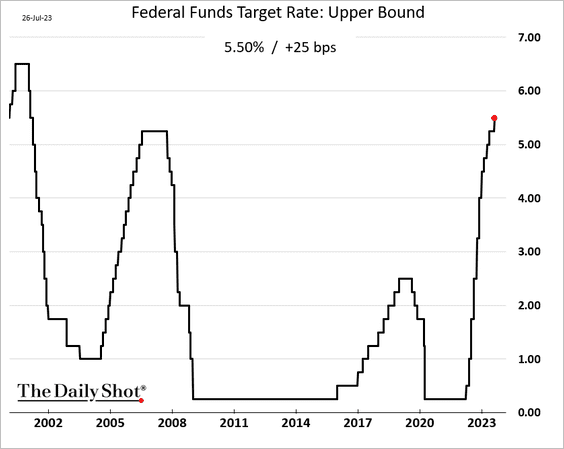

1. The Fed raised rates as expected and signaled readiness for additional increases.

Source: @economics Read full article

Source: @economics Read full article

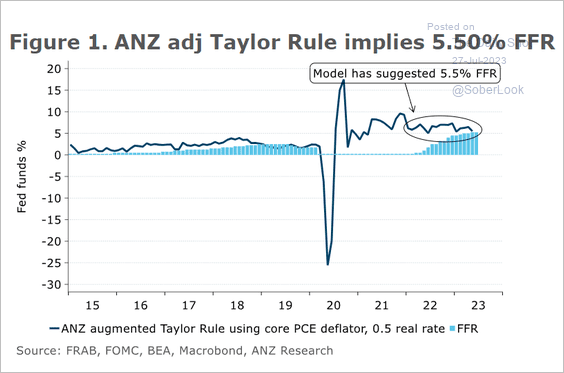

• Most economists now think this was the last increase of the cycle. ANZ’s adjusted Taylor Rule suggests that the current fed funds rate is optimal.

Source: @ANZ_Research

Source: @ANZ_Research

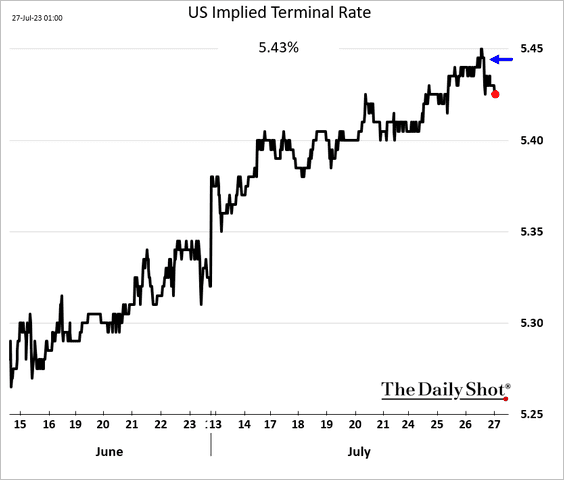

• Market reaction was muted, viewing the Fed’s action as marginally dovish. The implied terminal rate edged lower, …

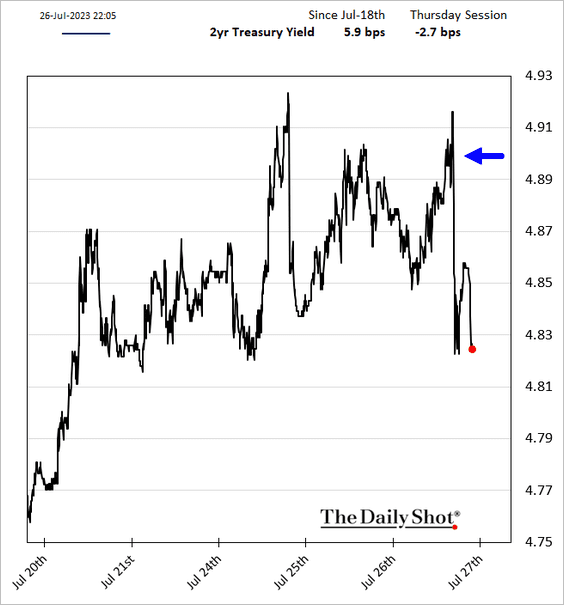

… and bond yields declined.

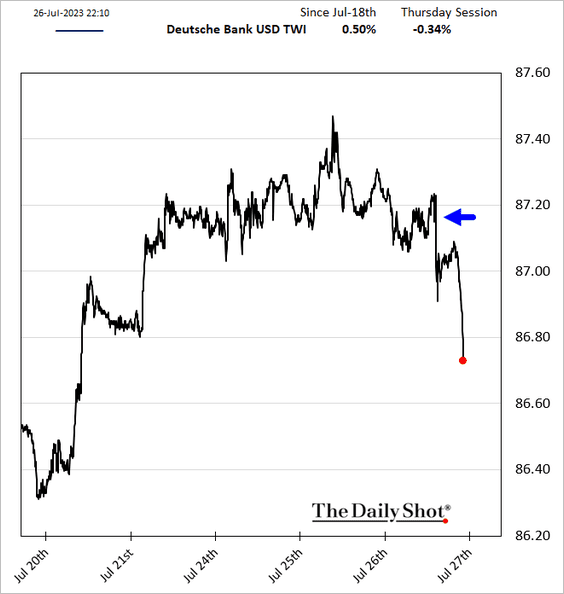

• The dollar sold off …

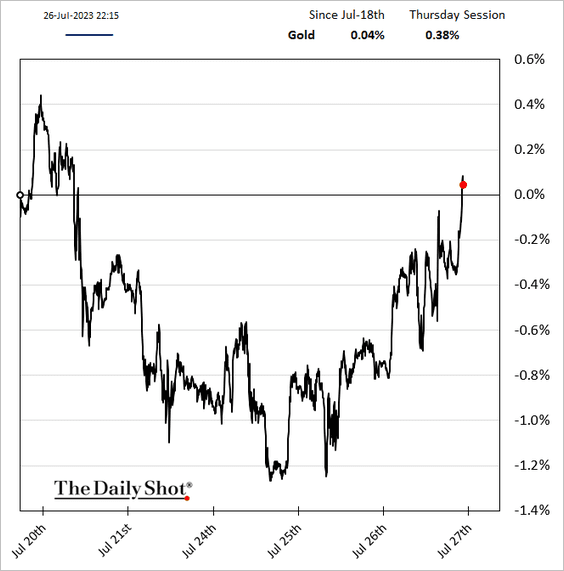

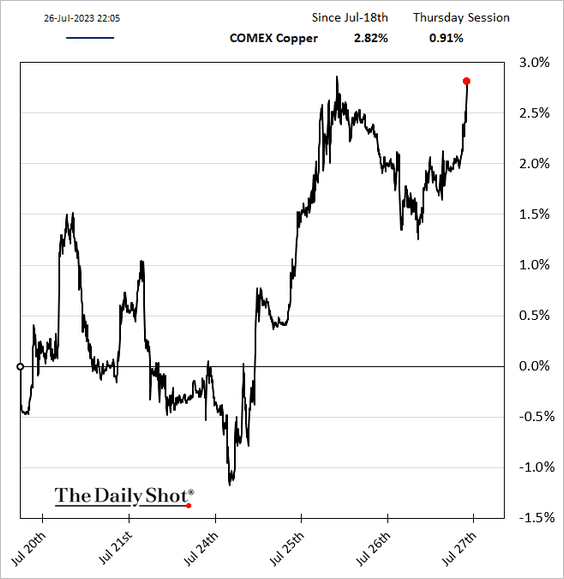

… sending commodity prices higher.

——————–

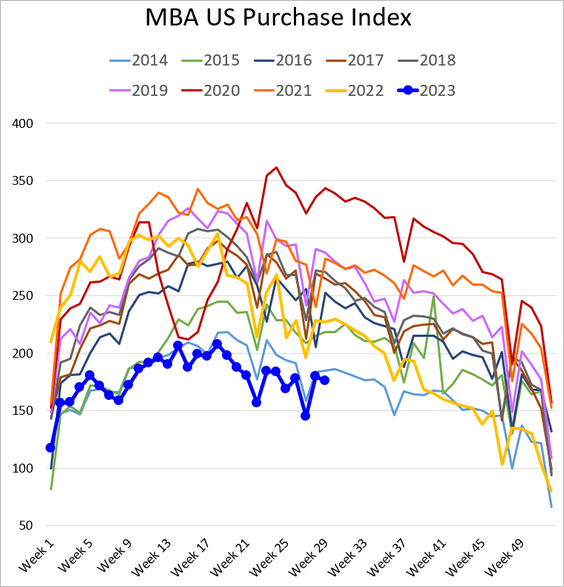

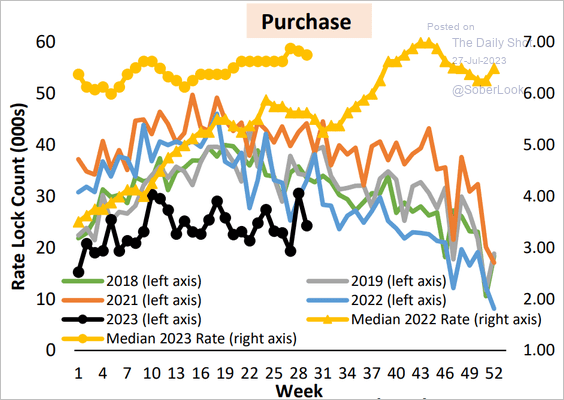

2. Mortgage application softened last week, …

… as did the rate lock count.

Source: AEI Housing Center

Source: AEI Housing Center

——————–

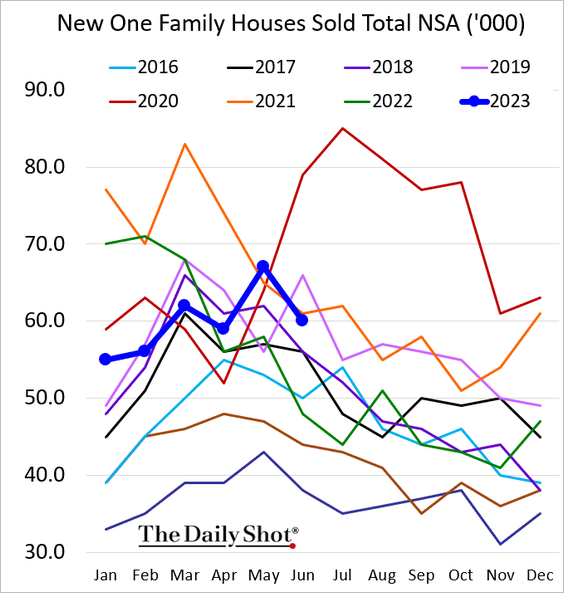

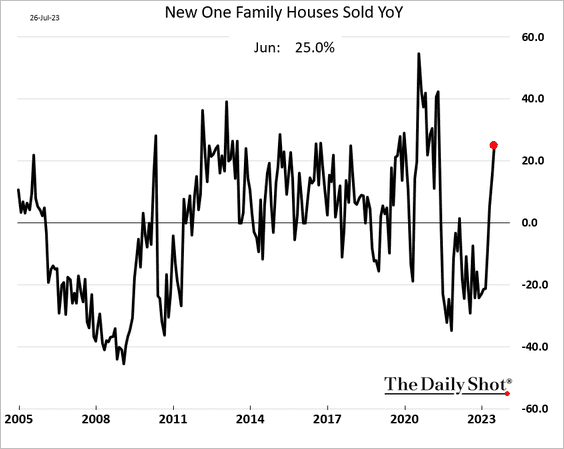

3. While new home sales saw a pullback in June, …

… they are still up 25% versus last year.

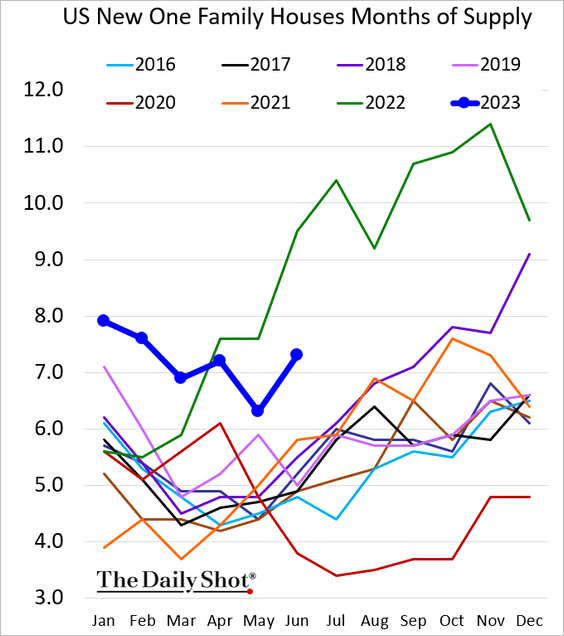

• Measured in months of supply, new home inventories climbed.

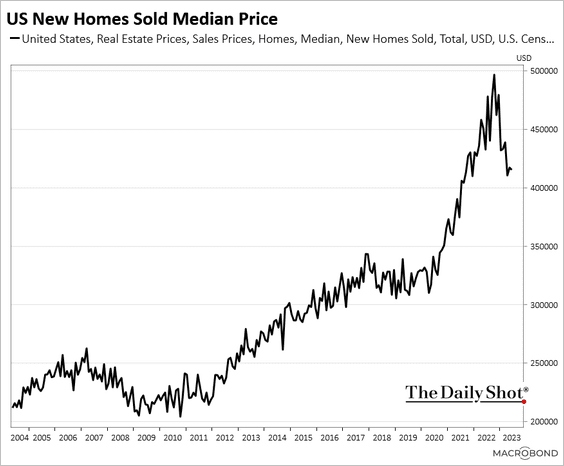

• This chart shows the median price of new houses sold.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

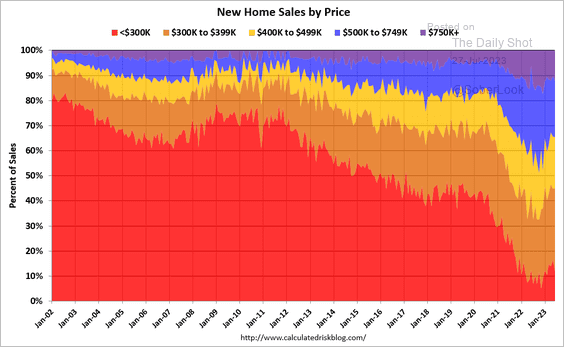

And here is the distribution of sales by price range.

Source: Calculated Risk

Source: Calculated Risk

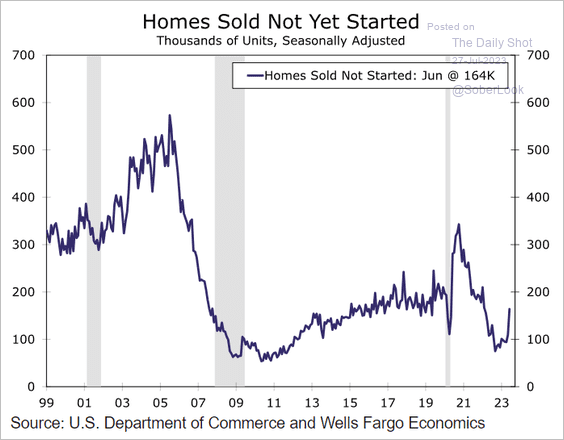

• The number of homes sold but not started increased in June.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

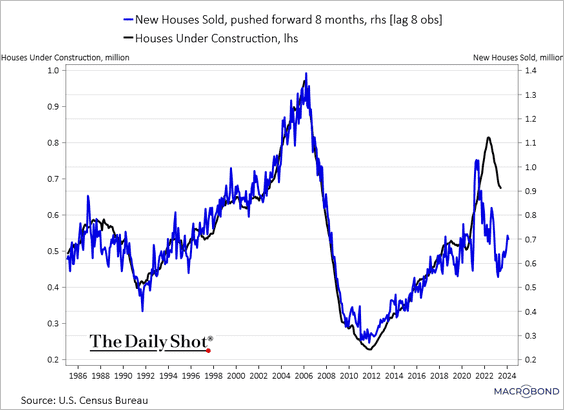

• The gap between houses sold and those under construction is narrowing.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

——————–

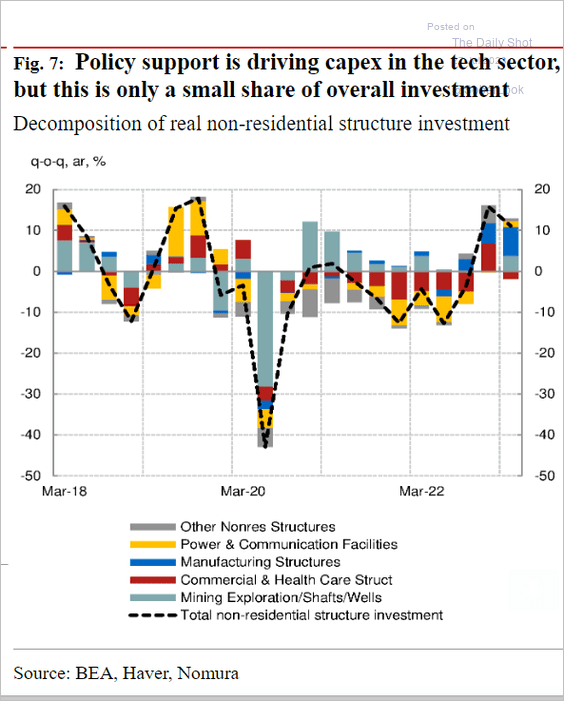

4. This chart shows the drivers of non-residential investment in structures.

Source: Nomura Securities

Source: Nomura Securities

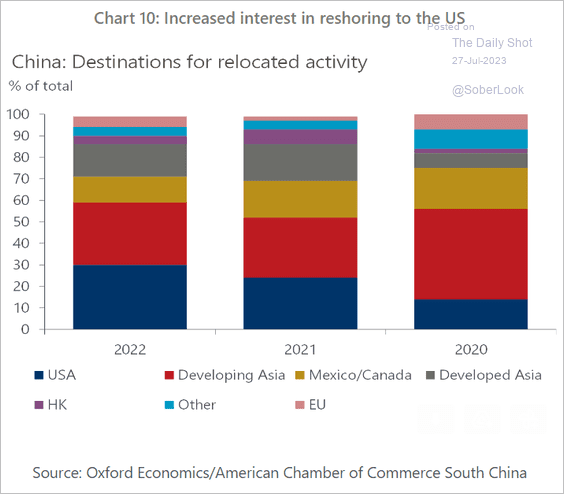

5. Finally, here are the destinations for US companies relocating activity out of China.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

The United Kingdom

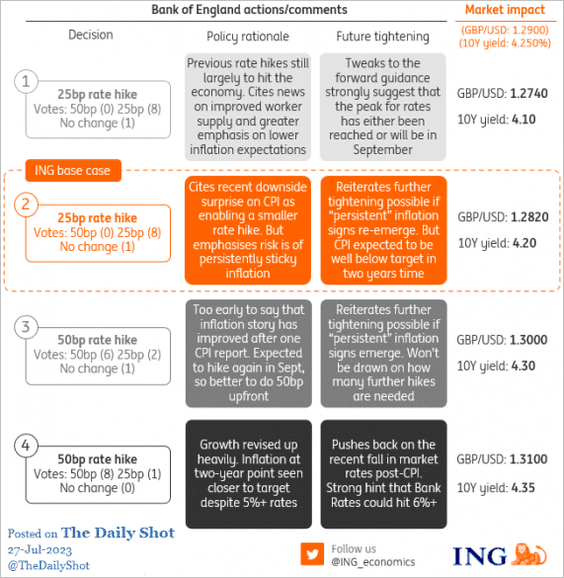

1. This graphic shows ING’s scenarios for the BoE decision this week.

Source: ING

Source: ING

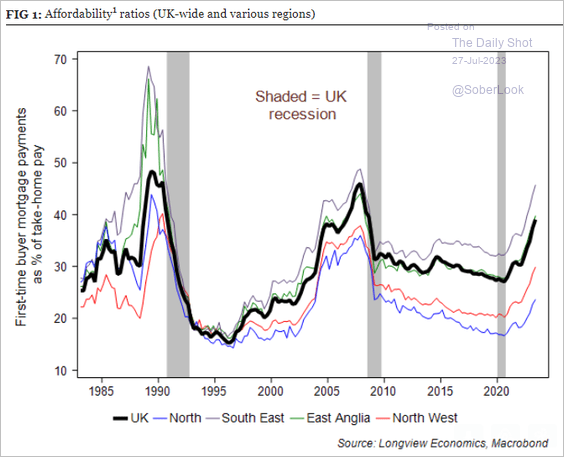

2. Housing affordability continues to deteriorate.

Source: Longview Economics

Source: Longview Economics

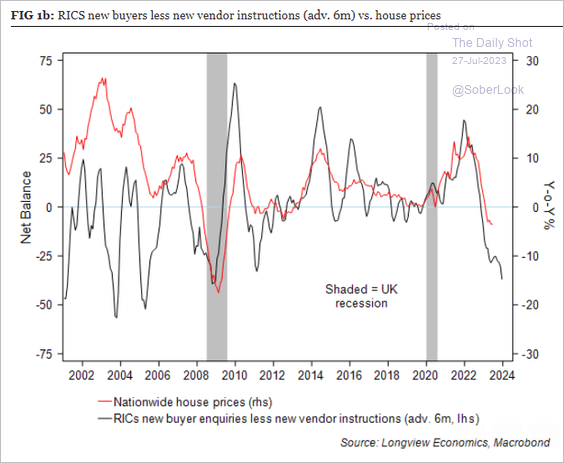

• House prices face significant downside risks as net demand slumps. “New buyer enquiries” is a proxy for buyers entering the market, and “vendor instructions” indicate sellers entering the market.

Source: Longview Economics

Source: Longview Economics

Back to Index

The Eurozone

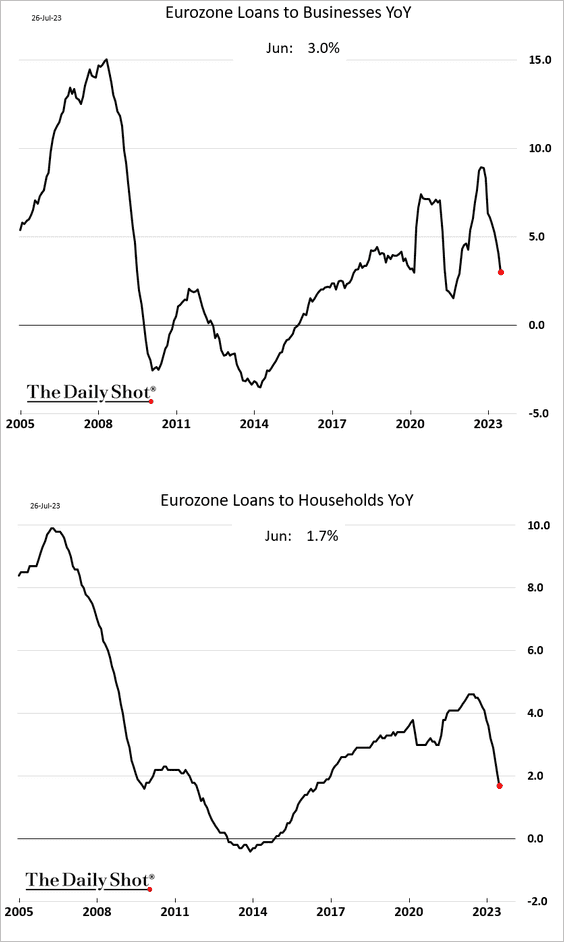

1. Loan growth continues to slow, …

Source: @WSJ Read full article

Source: @WSJ Read full article

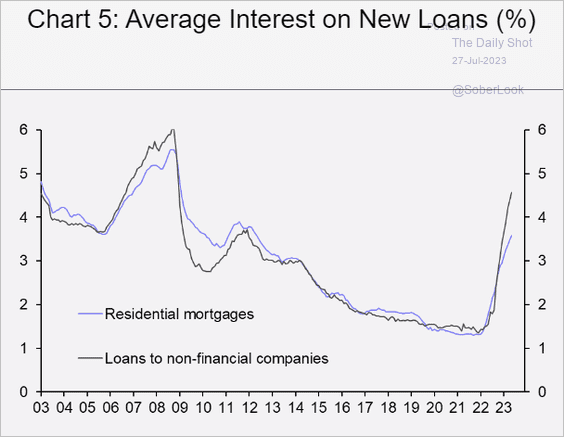

…. amid the recent spike in rates …

Source: Capital Economics

Source: Capital Economics

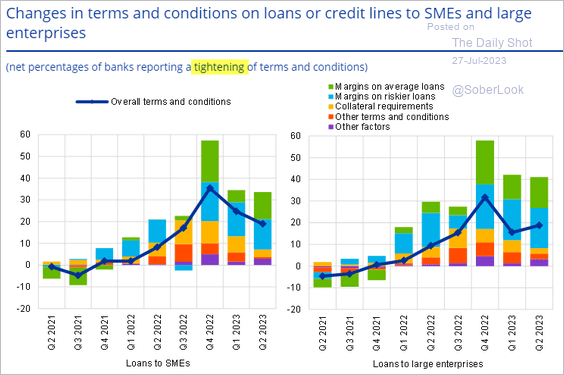

… and tighter bank lending standards.

Source: ECB

Source: ECB

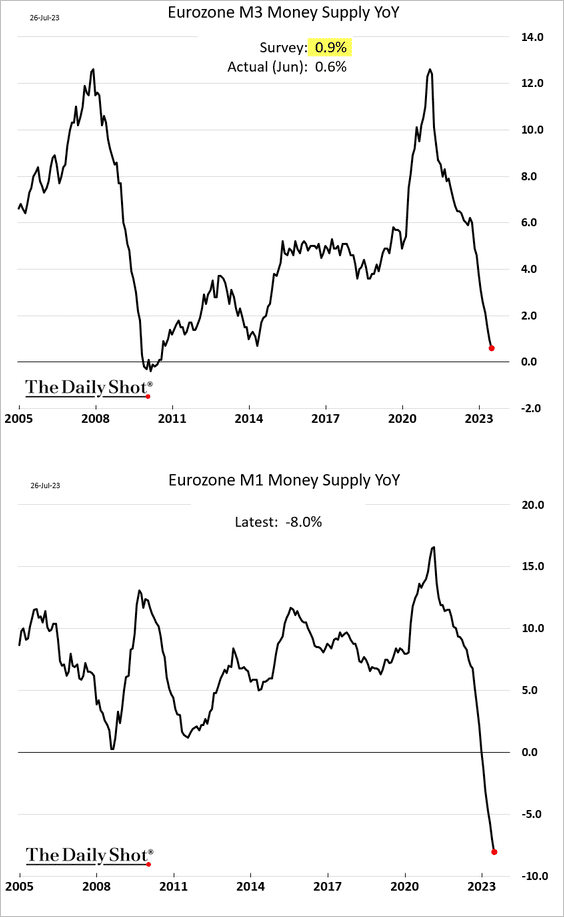

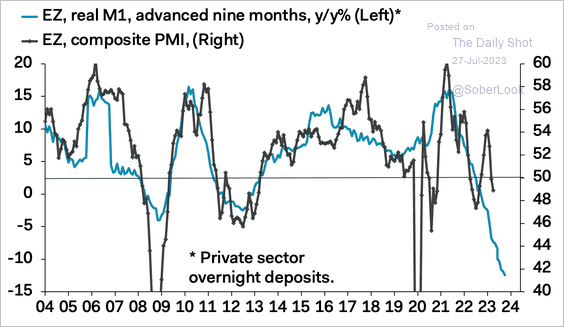

• Liquidity is deteriorating rapidly, …

… pointing to further weakness in business activity.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

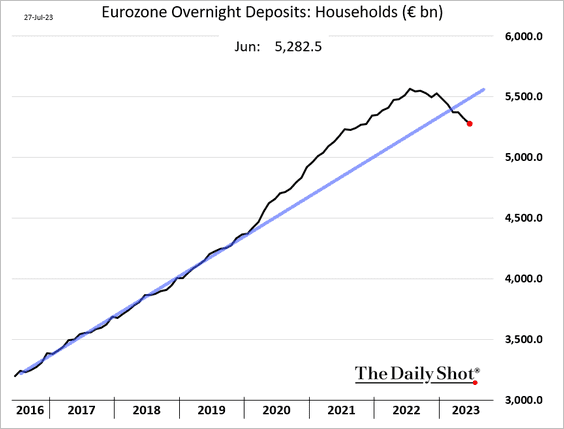

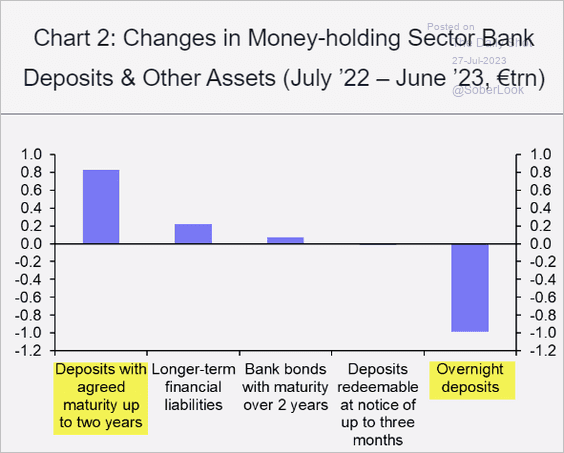

2. Households’ overnight deposits are falling, …

h/t Pantheon Macroeconomics

h/t Pantheon Macroeconomics

… partially due to the shift to term deposits (to get higher yields).

Source: Capital Economics

Source: Capital Economics

——————–

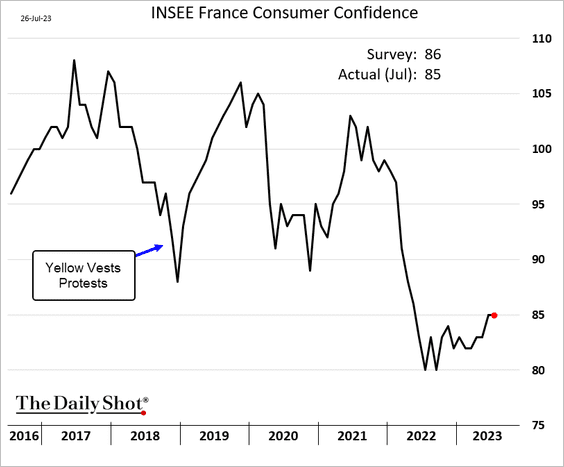

3. French consumer confidence held steady this month.

Back to Index

Europe

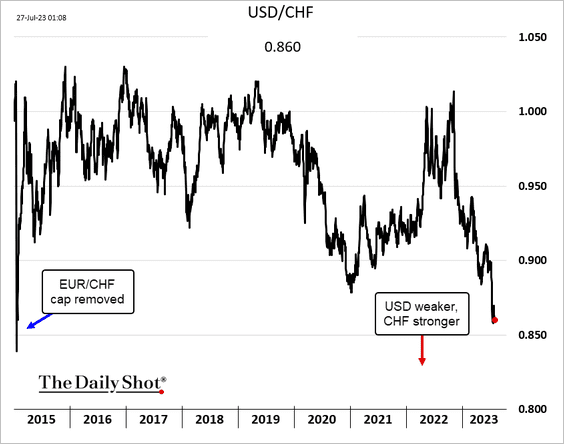

1. USD/CHF is near the lowest levels since the 2015 cap removal.

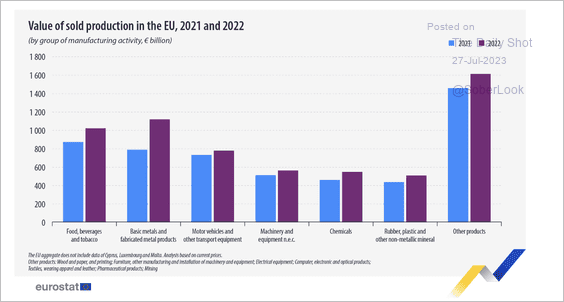

2. This chart shows the main components of industrial production in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

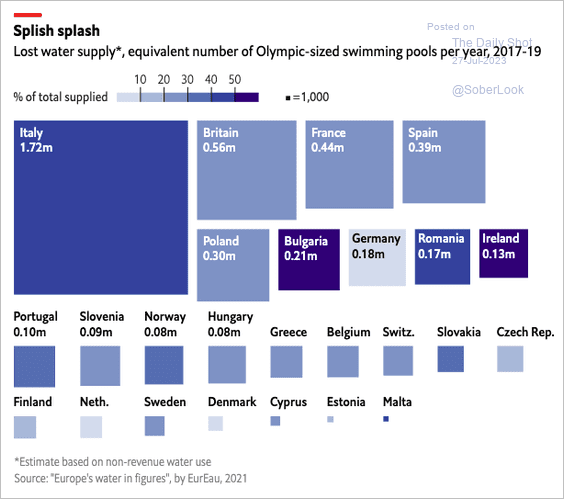

3. Water supplies are dwindling.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Japan

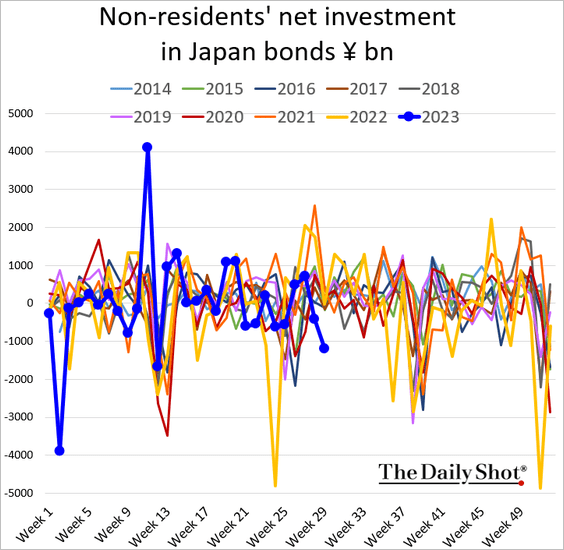

1. Foreigners dumped JGBs last week.

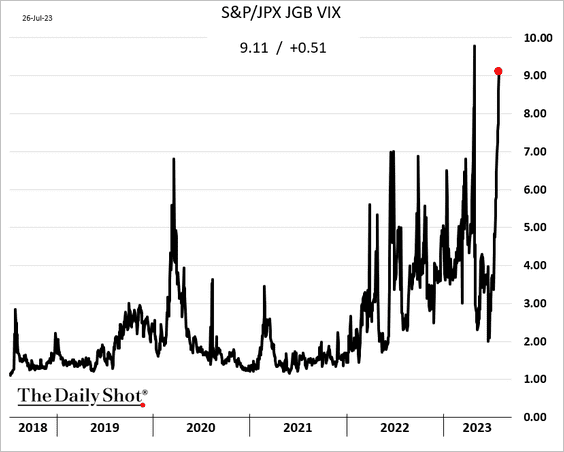

2. The JGB implied volatility continues its ascent as uncertainty surrounding BoJ policy lingers.

Back to Index

Asia-Pacific

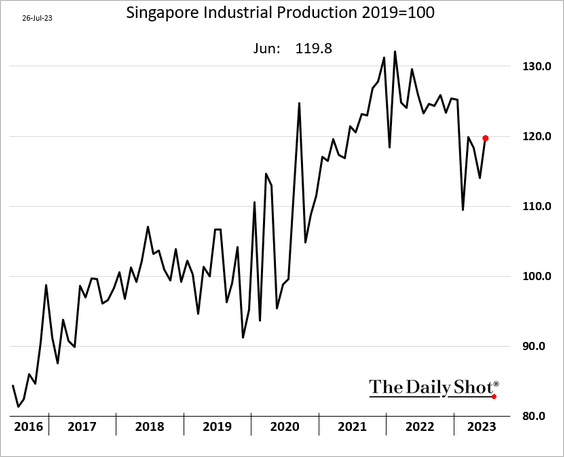

1. Singapore’s industrial production increased last month.

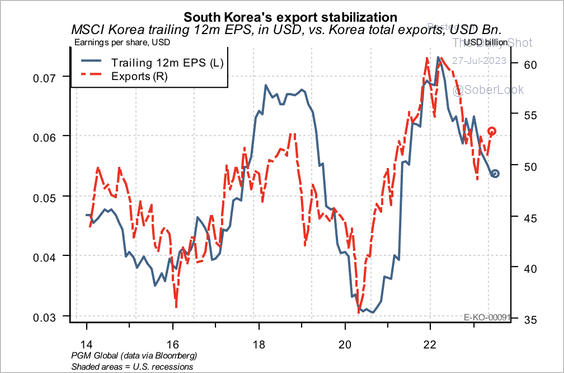

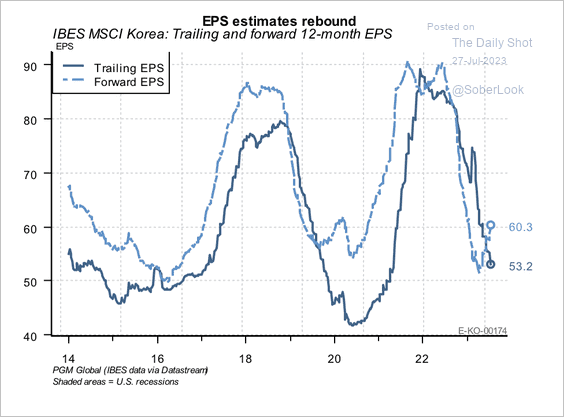

2. Rising exports in South Korea could bode well for earnings. (2 charts)

Source: PGM Global

Source: PGM Global

Source: PGM Global

Source: PGM Global

Back to Index

China

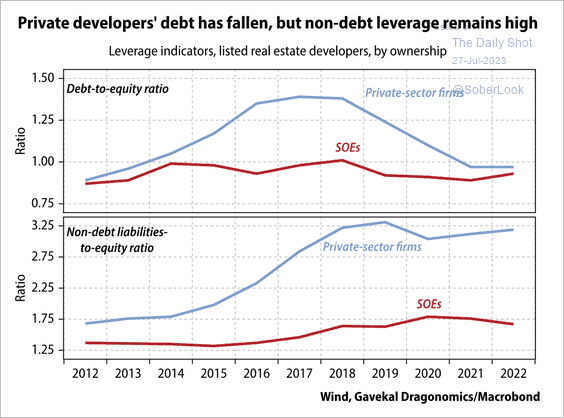

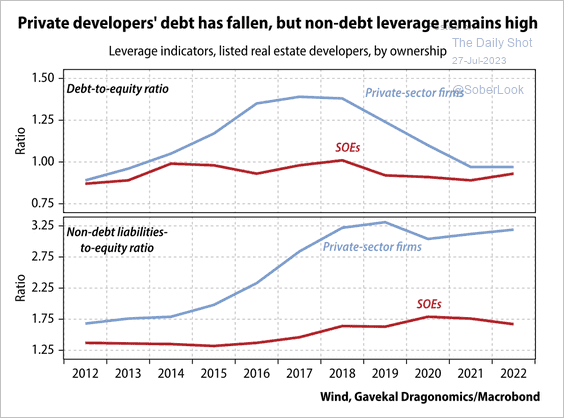

1. The real estate sector underwent forced deleveraging in recent years. According to Gavekal, this is mainly because of tighter financial regulation, although private developers have accumulated non-debt liabilities via pre-sales. (2 charts)

Source: Gavekal Research

Source: Gavekal Research

Source: Gavekal Research

Source: Gavekal Research

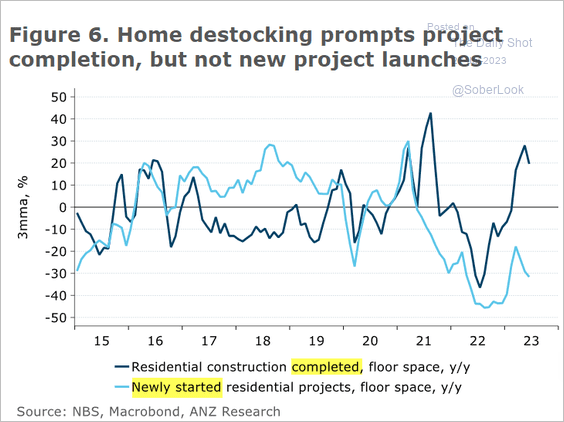

2. This chart shows developers’ completions versus starts.

Source: @ANZ_Research

Source: @ANZ_Research

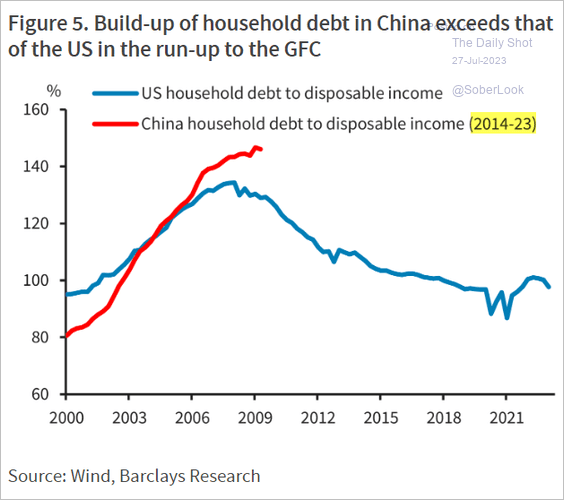

3. This figure compares China’s household leverage to that of the US in the run-up to the GFC.

Source: Barclays Research

Source: Barclays Research

Back to Index

Emerging Markets

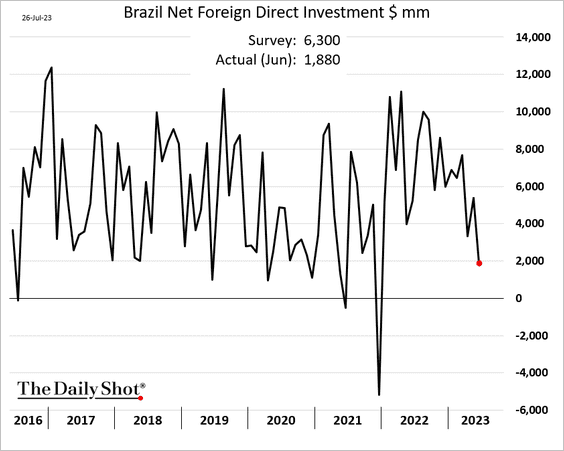

1. Brazil’s FDI has been dropping.

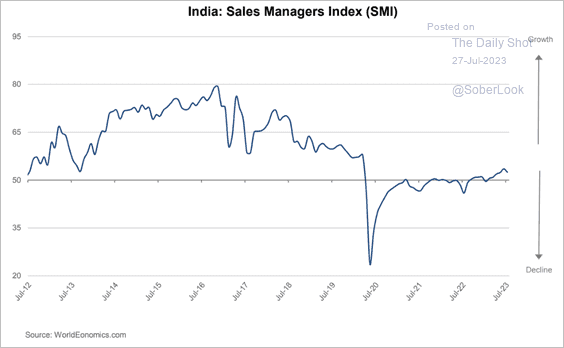

2. India’s business activity remained in growth mode this month, according to the World Economics SMI report.

Source: World Economics

Source: World Economics

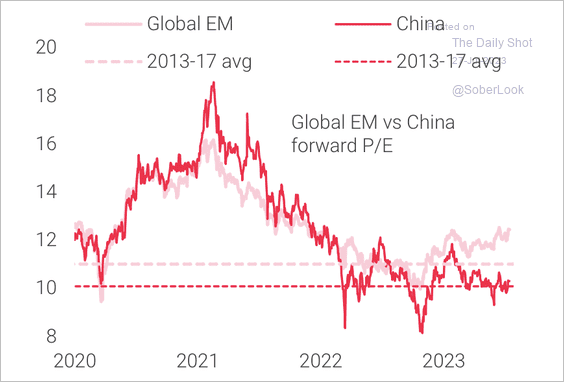

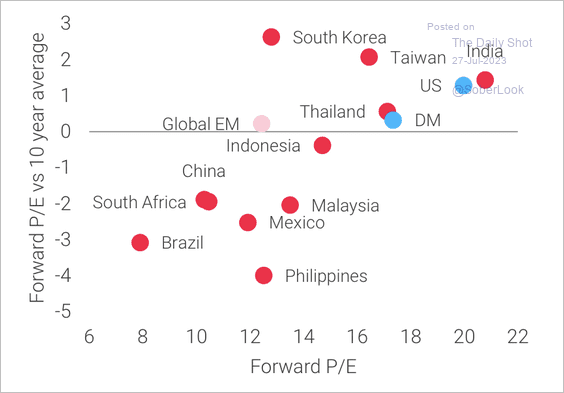

3. EM valuations are slightly above average, although many countries remain relatively cheap. (2 charts)

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

Back to Index

Cryptocurrency

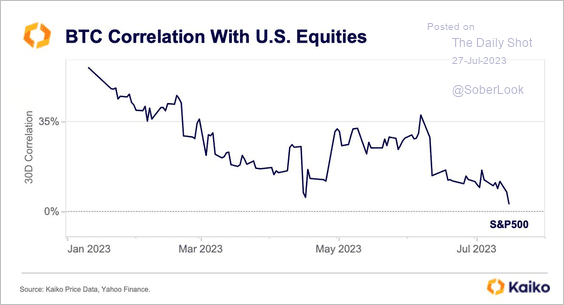

1. Bitcoin’s correlation with the S&P 500 continues to decline.

Source: @KaikoData

Source: @KaikoData

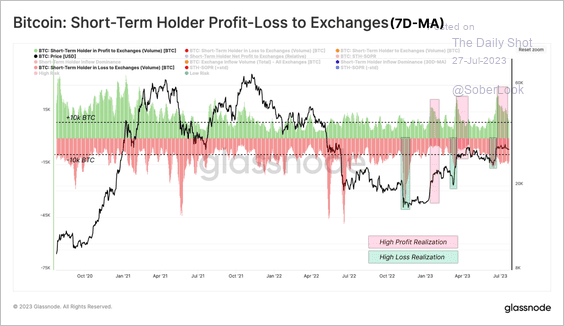

2. Each BTC rally and correction since the FTX fallout has seen an uptick in short-term holder profit or loss. This suggests that positions established in recent months experienced rapid price swings around the average cost basis.

Source: @glassnode

Source: @glassnode

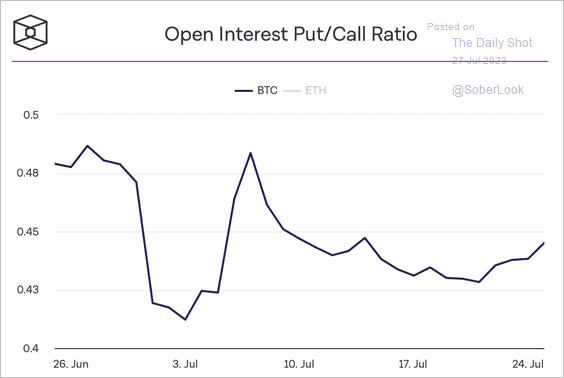

3. BTC’s put/call ratio ticked higher over the past week.

Source: The Block Research

Source: The Block Research

Back to Index

Commodities

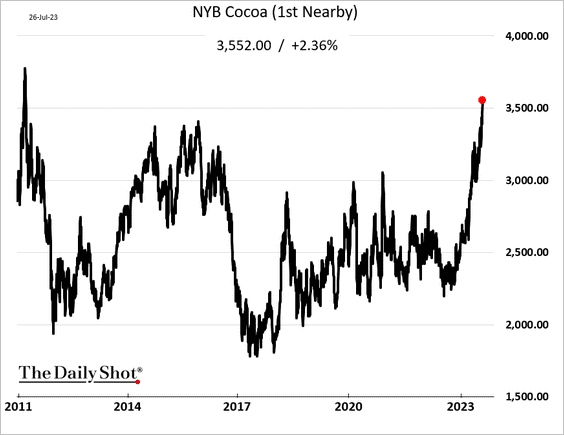

1. Cocoa prices are surging due to concerns about future production amid tight inventories.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

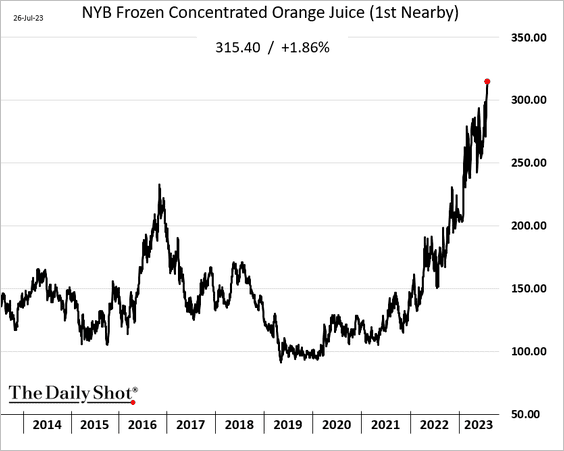

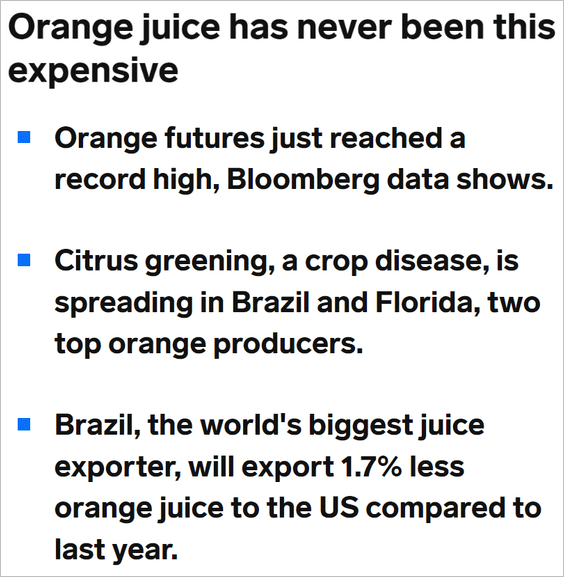

2. Orange juice futures hit another record high.

Source: Markets Insider Read full article

Source: Markets Insider Read full article

Back to Index

Energy

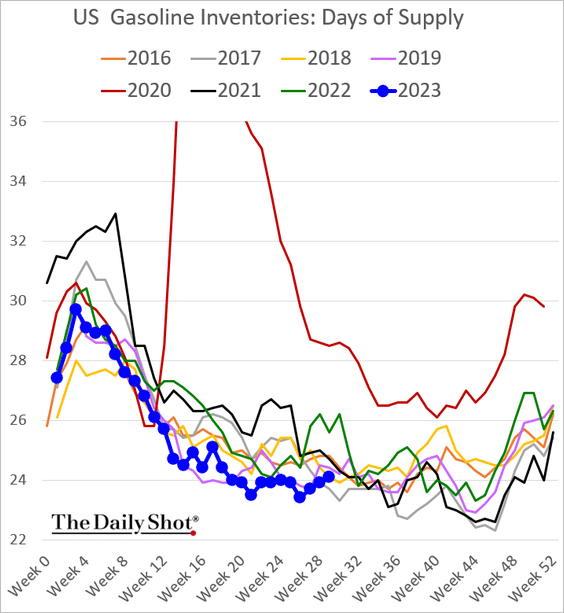

US gasoline inventories are rising.

Back to Index

Equities

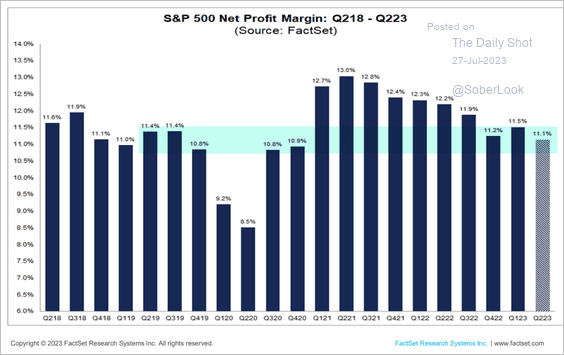

1. Profit margins are at pre-COVID levels and headed lower.

Source: FactSet Read full article

Source: FactSet Read full article

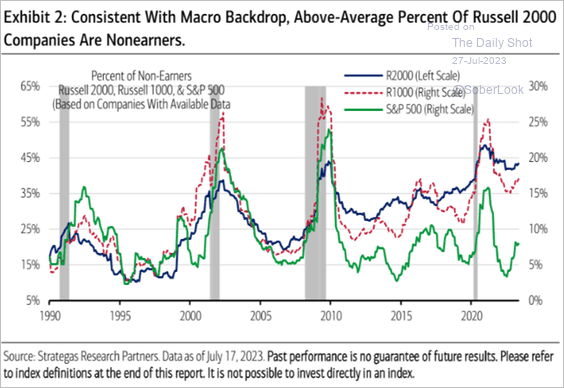

2. The share of unprofitable Russell 2000 companies remains elevated.

Source: Merrill Lynch

Source: Merrill Lynch

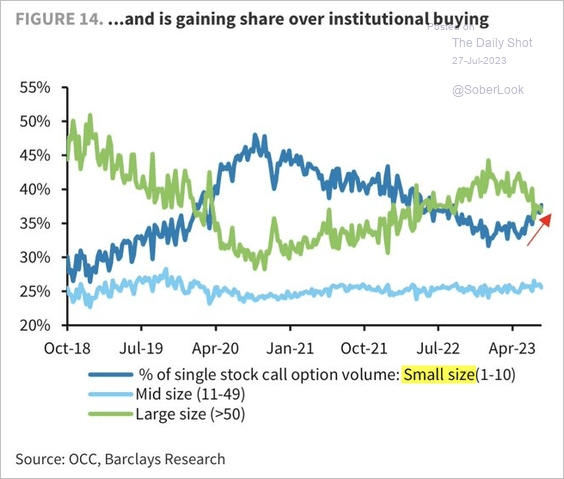

3. Retail investors are boosting their share of call option buying.

Source: Barclays Research

Source: Barclays Research

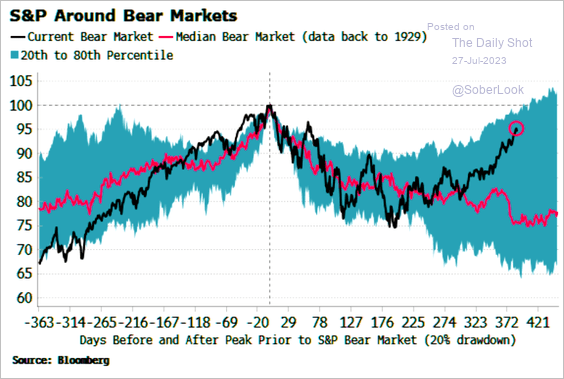

4. The recent market action does not look like a bear-market rally.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

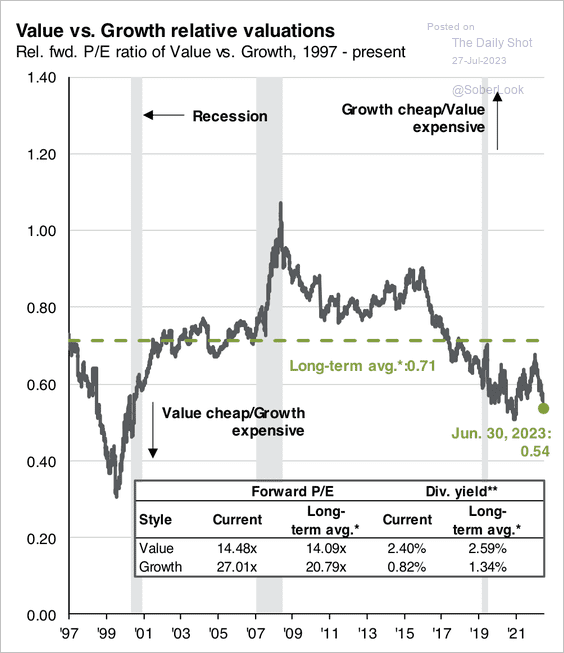

5. US value stock valuations are still below their long-term average relative to growth.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

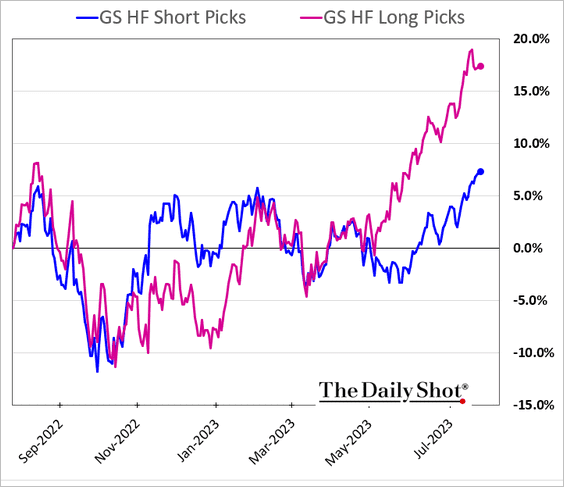

6. Hedge funds’ stock picks have been outperforming since May.

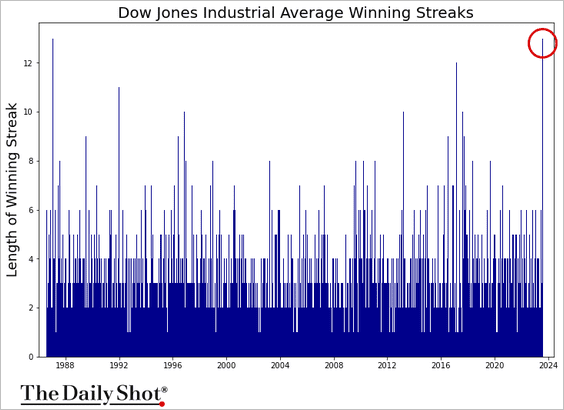

7. The Dow’s winning streak takes us back to 1987, a few months before Black Friday.

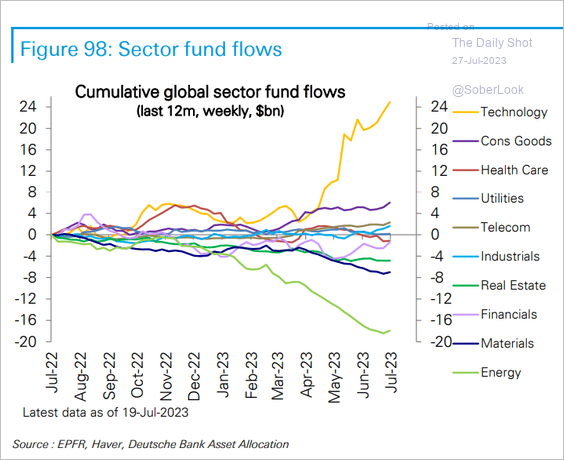

8. This chart shows cumulative fund flows by sector.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Credit

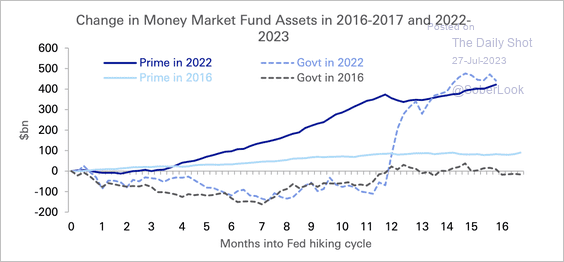

1. Prime money market funds experience inflows during rate hike cycles, while government funds face outflows. However, in March of this year, government money market funds became a haven for depositors.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

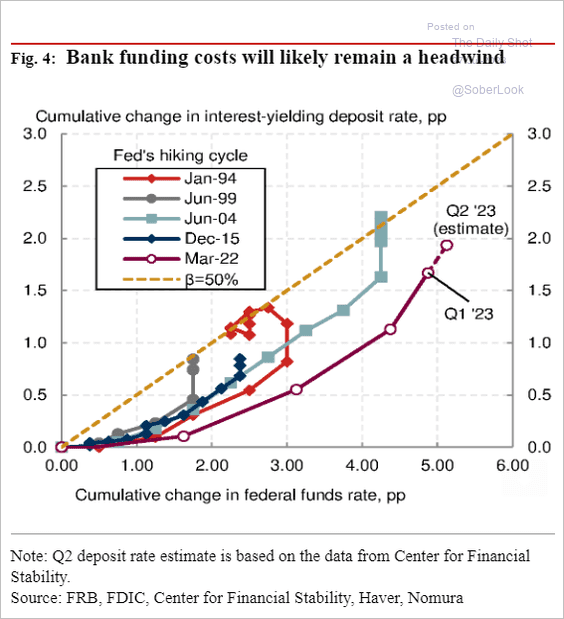

2. This chart shows cumulative Fed rate hikes versus changes in bank deposit rates.

Source: Nomura Securities

Source: Nomura Securities

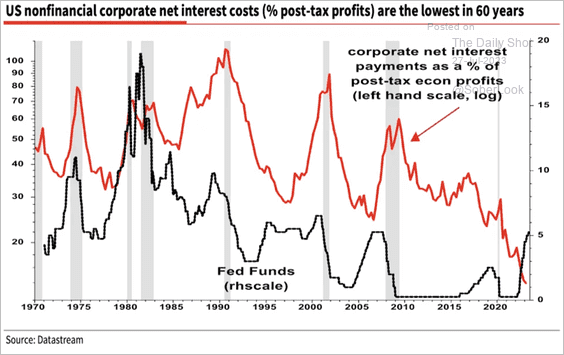

3. As a share of profits, corporate interest costs have been falling despite the recent surge in interest rates.

Source: @albertedwards99 Read full article

Source: @albertedwards99 Read full article

Back to Index

Global Developments

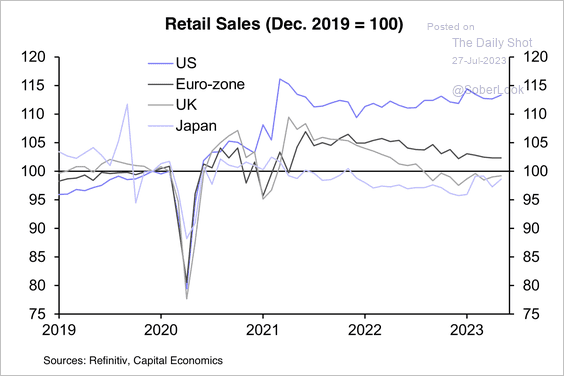

1. Retail sales have generally been weak in developed markets outside of the US over the past year.

Source: Capital Economics

Source: Capital Economics

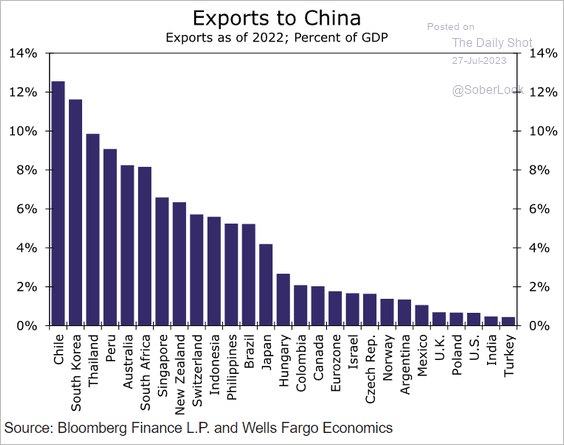

2. Which countries are most dependent on exports to China?

Source: Wells Fargo Securities

Source: Wells Fargo Securities

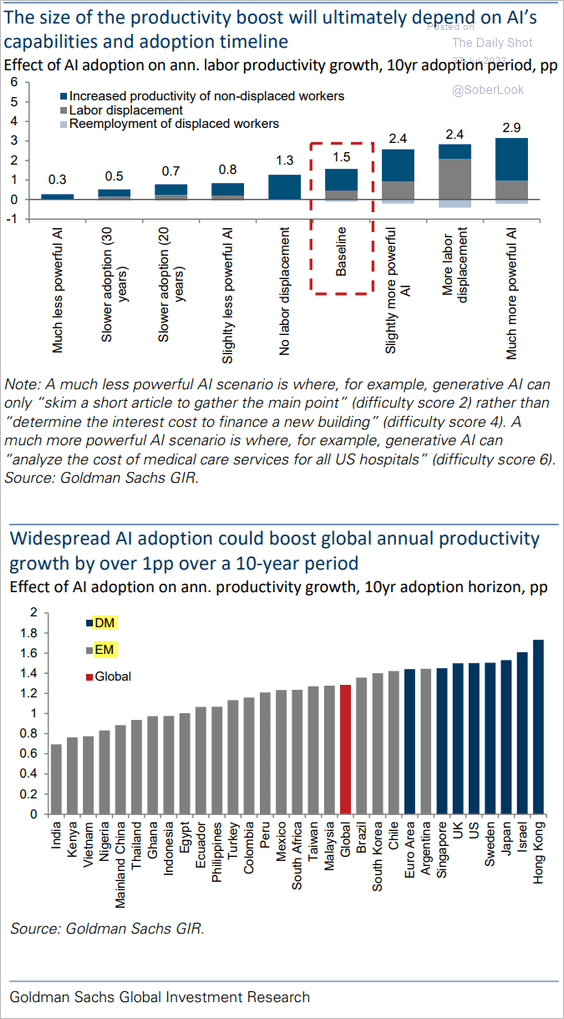

3. How much could AI adoption boost productivity over the next decade?

Source: Goldman Sachs

Source: Goldman Sachs

——————–

Food for Thought

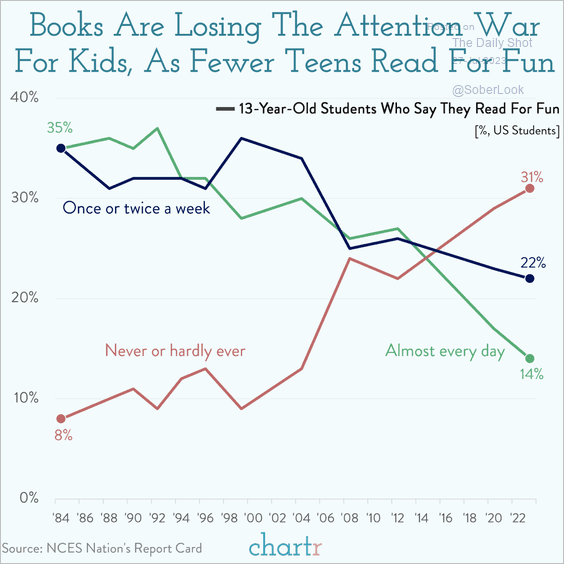

1. 13-year-old students reading for fun:

Source: @chartrdaily

Source: @chartrdaily

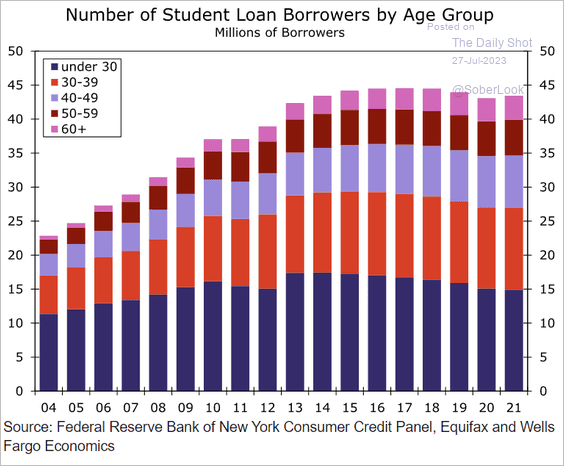

2. Student loan borrowers by age group:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

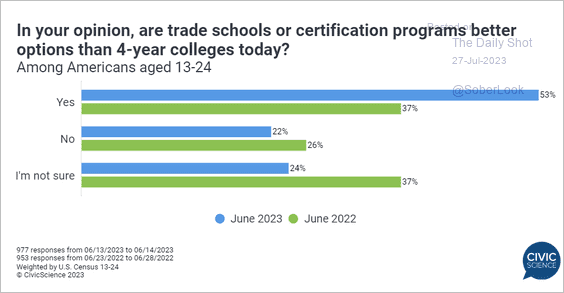

3. Trade school or a 4-year college?

Source: @CivicScience Read full article

Source: @CivicScience Read full article

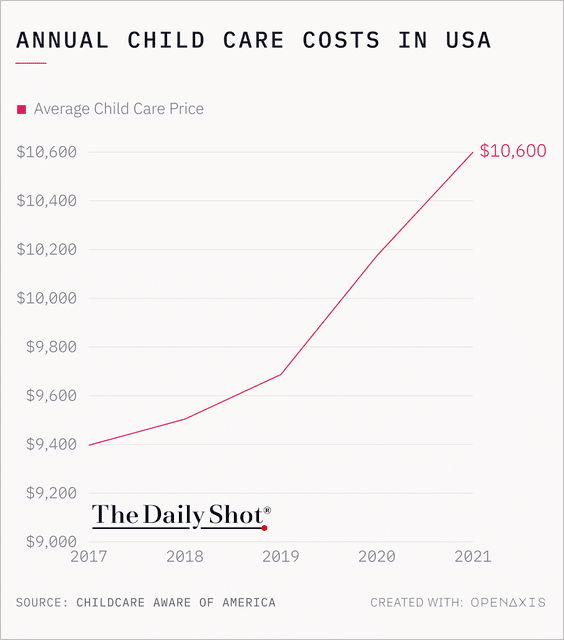

4. Annual childcare costs in the US:

Source: @TheDailyShot

Source: @TheDailyShot

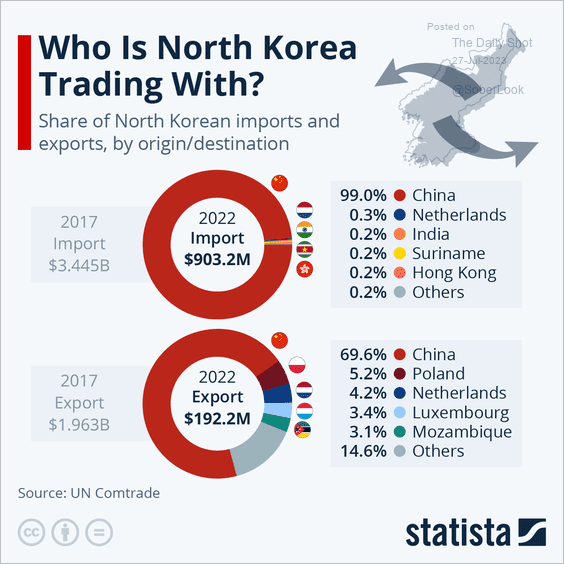

5. North Korea’s trading partners:

Source: Statista

Source: Statista

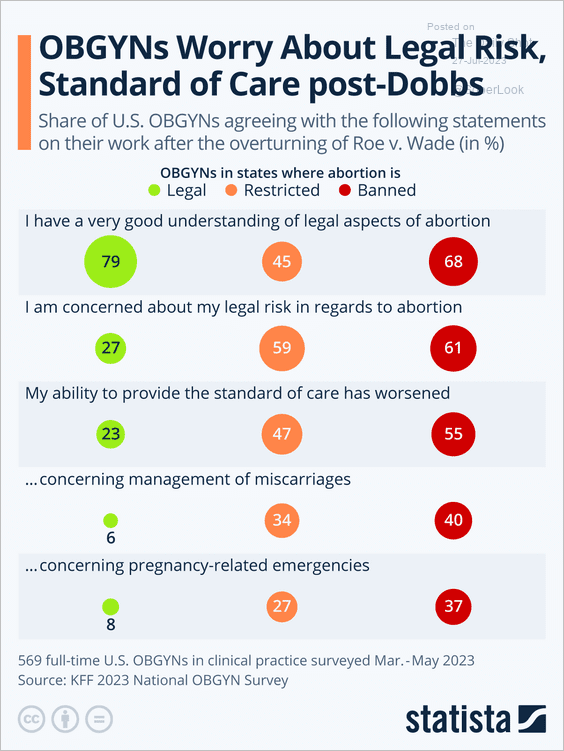

6. A survey of OBGYNs:

Source: Statista

Source: Statista

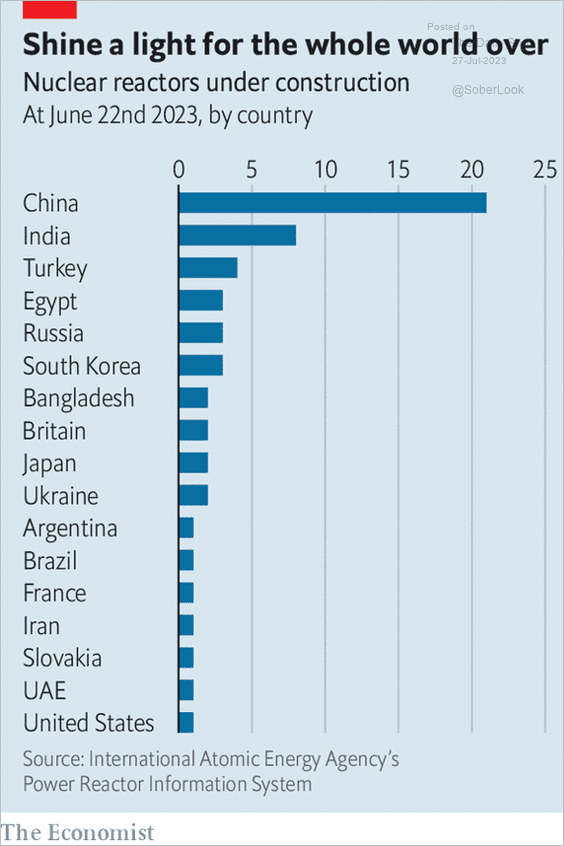

7. Nuclear reactors under construction:

Source: The Economist Read full article

Source: The Economist Read full article

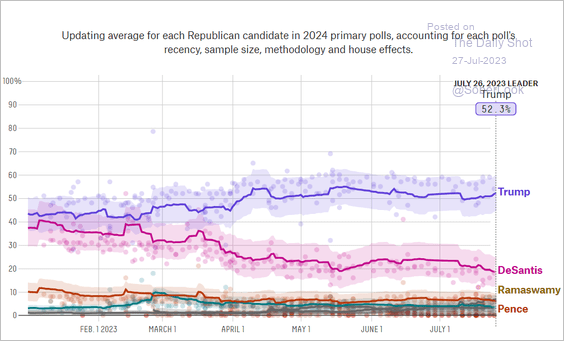

8. GOP presidential candidates’ primary polls:

Source: FiveThirtyEight

Source: FiveThirtyEight

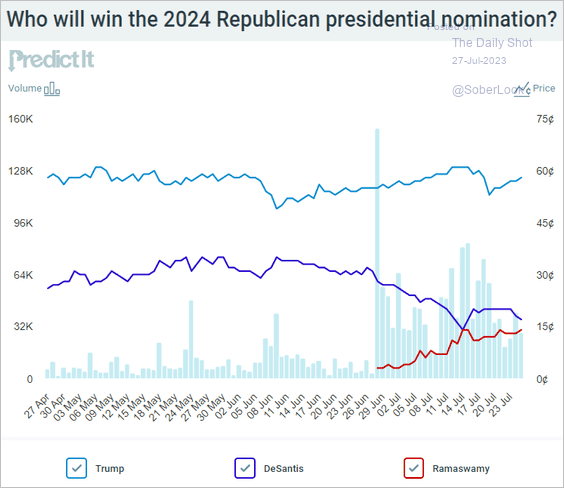

• Betting markets’ nomination probabilities:

Source: @PredictIt

Source: @PredictIt

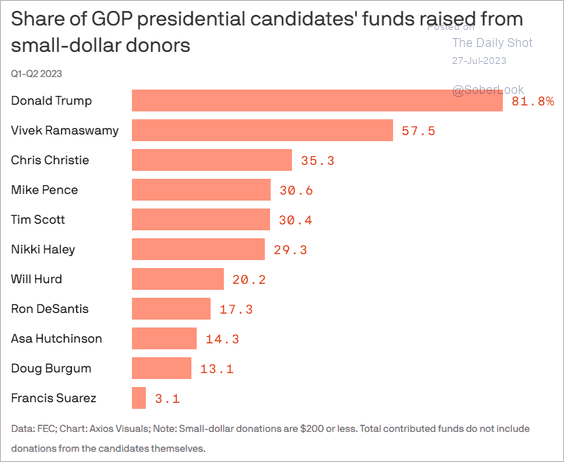

• Small-dollar donations:

Source: @axios Read full article

Source: @axios Read full article

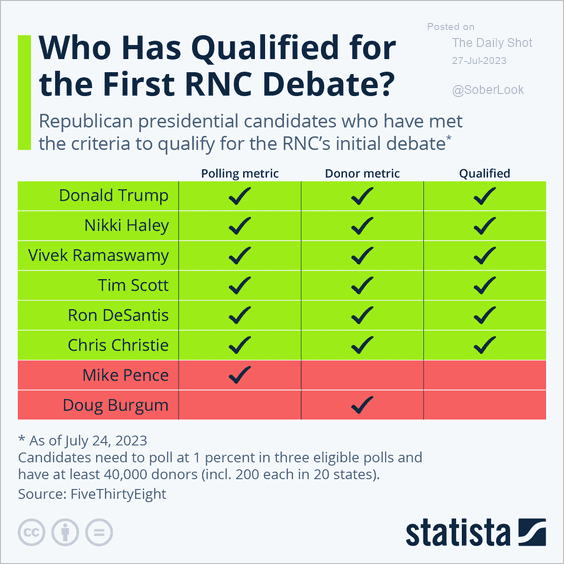

• Candidates who qualified for the first round of RNC debates:

Source: Statista

Source: Statista

——————–

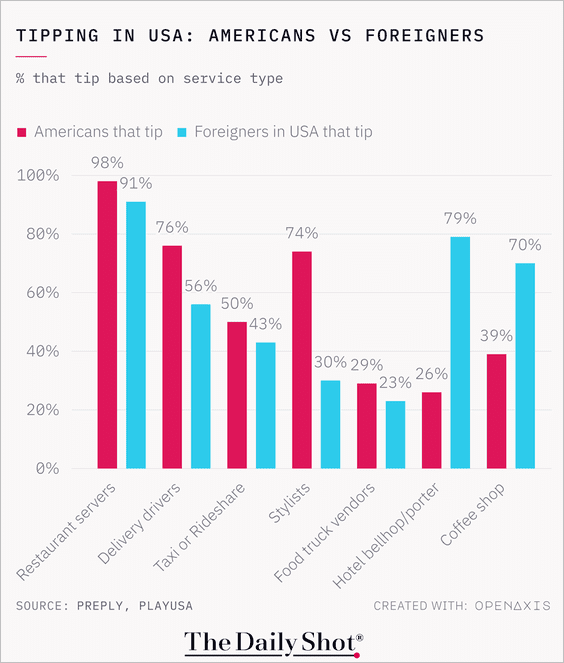

9. Tipping in US – Americans vs. foreigners:

Source: @TheDailyShot

Source: @TheDailyShot

——————–

Back to Index