The Daily Shot: 28-Jul-23

• The United States

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

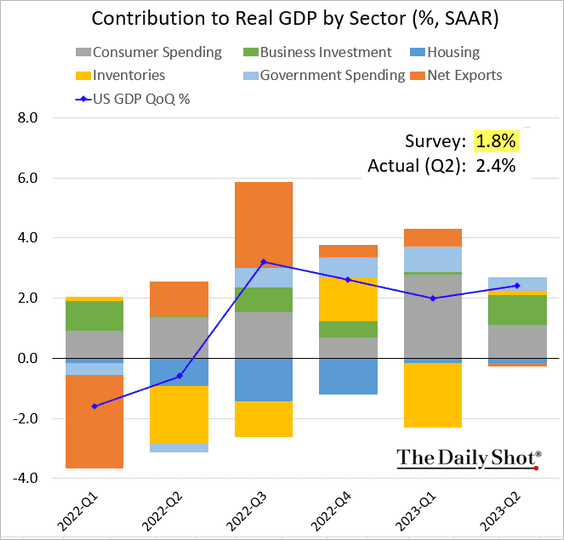

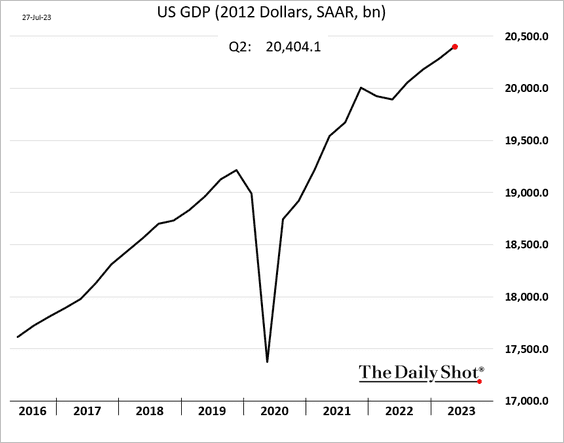

1. The GDP report topped expectations, signaling robust economic growth. The Atlanta Fed’s GDPNow model was much closer to the Q2 figure than the consensus forecast (see chart).

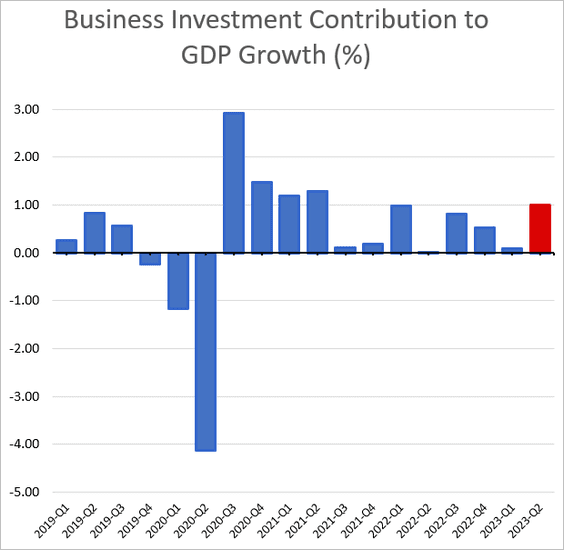

• Business investment growth was surprisingly strong.

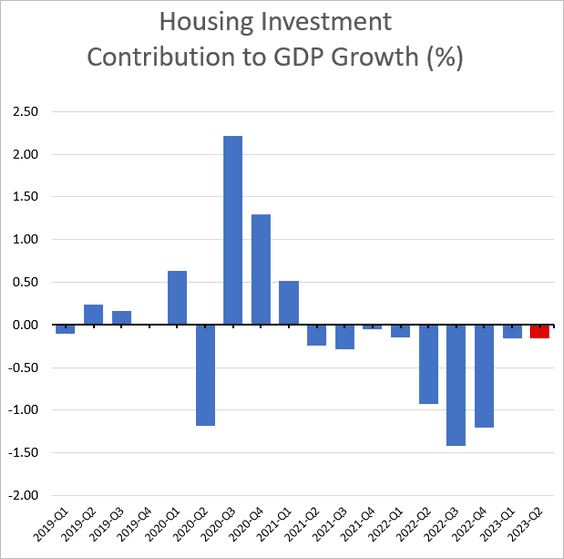

• The drag from housing investment has eased.

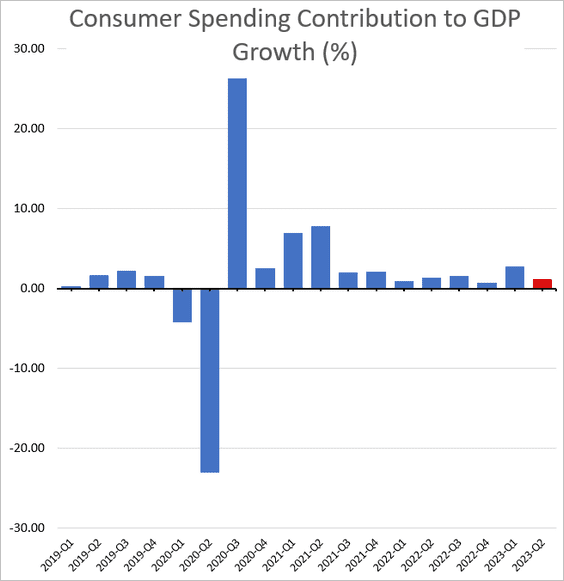

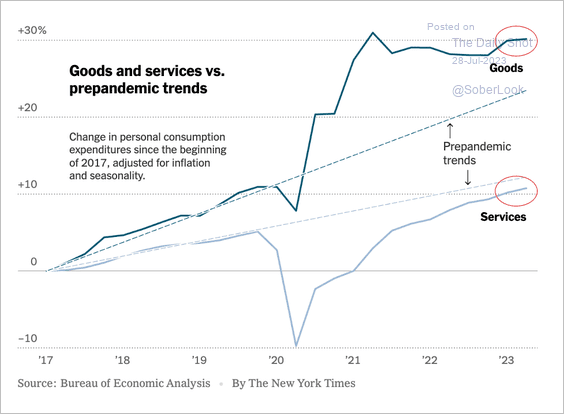

• Consumer spending continued to grow, …

… driven by services. Goods spending has leveled off.

Source: The New York Times Read full article

Source: The New York Times Read full article

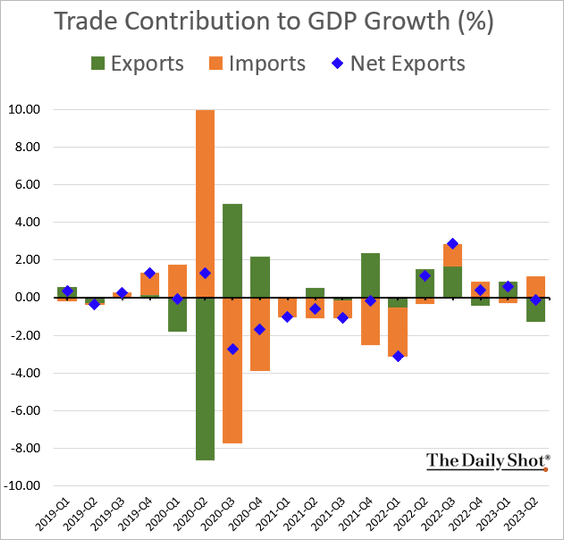

• The impact of trade was almost flat, with both imports and exports declining.

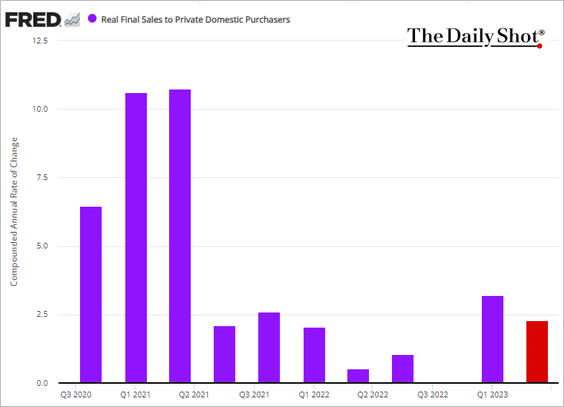

• The rise in both business and consumer spending has culminated in robust growth in real final sales to private domestic purchasers (the “core” GDP).

——————–

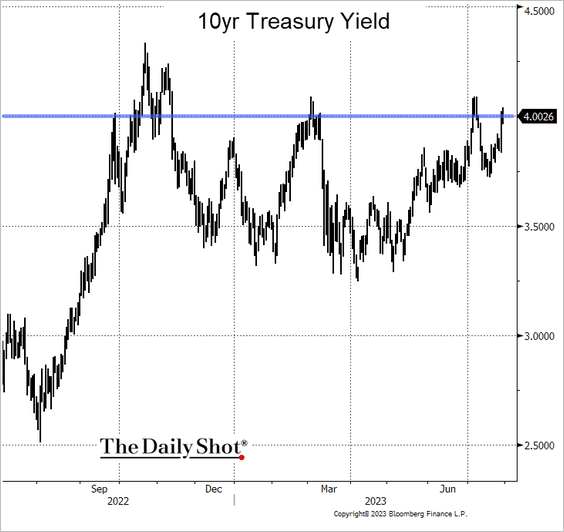

2. The 10-year Treasury yield climbed back above 4%.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

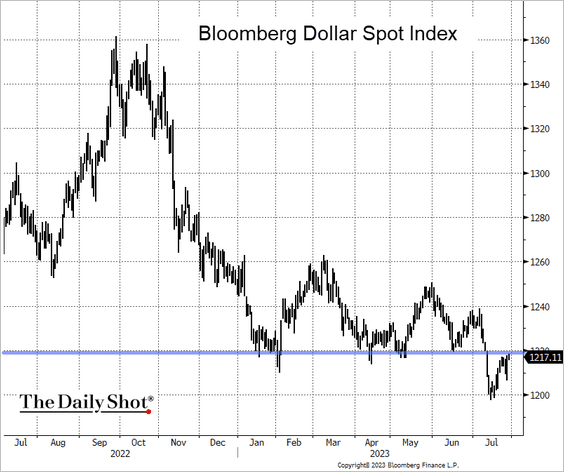

The dollar is off the lows amid robust US economic data.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

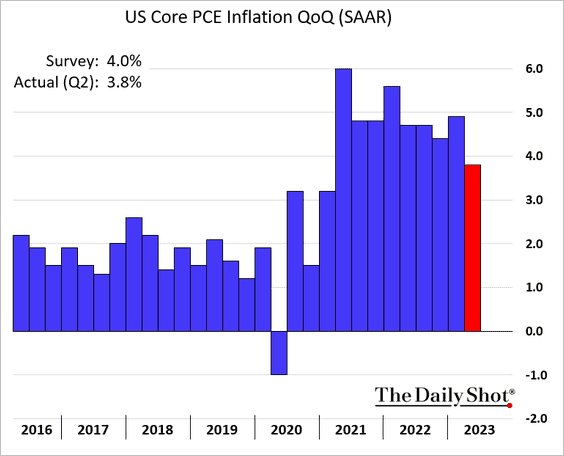

3. The quarterly core PCE inflation dipped below 4% (annualized) for the first time since the first quarter of 2021.

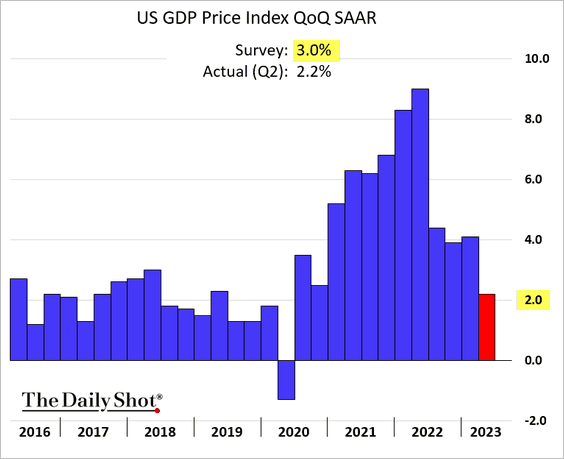

The overall GDP deflator was well below forecasts (lowest since the initial COVID shock) and nearing the Fed’s 2% target (annualized).

——————–

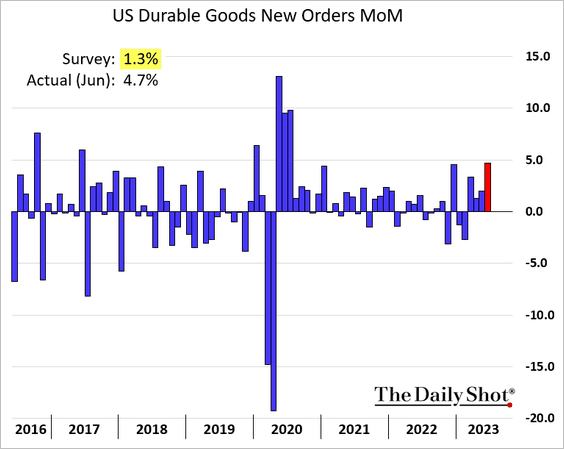

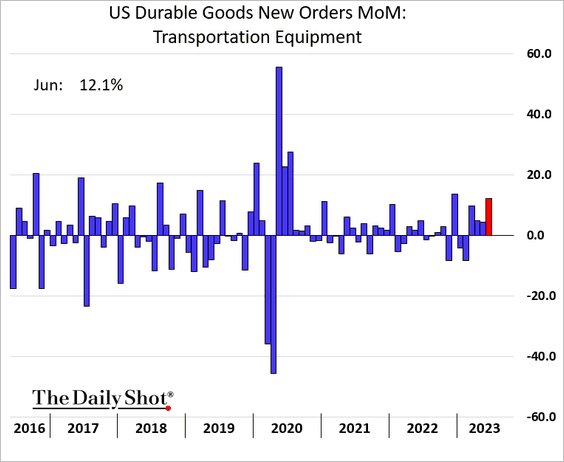

4. Durable goods orders surged in June, …

… boosted by aircraft orders.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

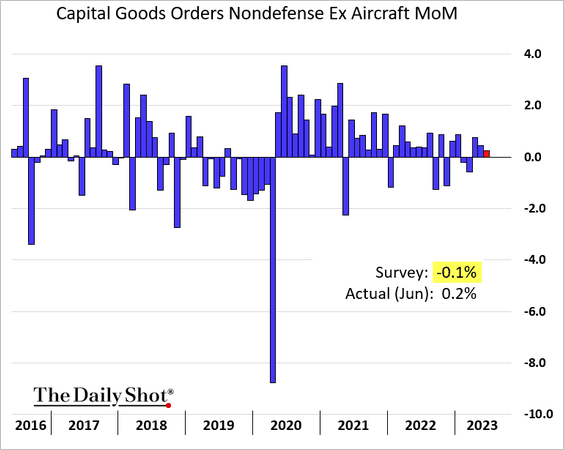

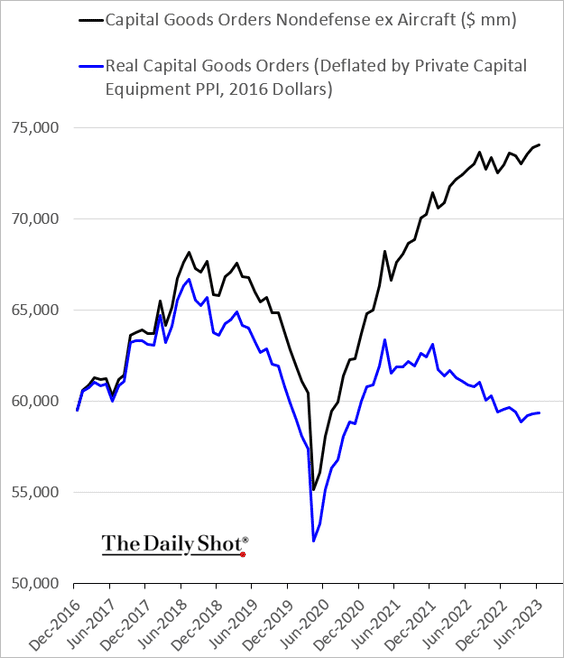

Capital goods orders, excluding aircraft, eked out a small gain.

This chart shows nominal and real capital goods orders (level).

——————–

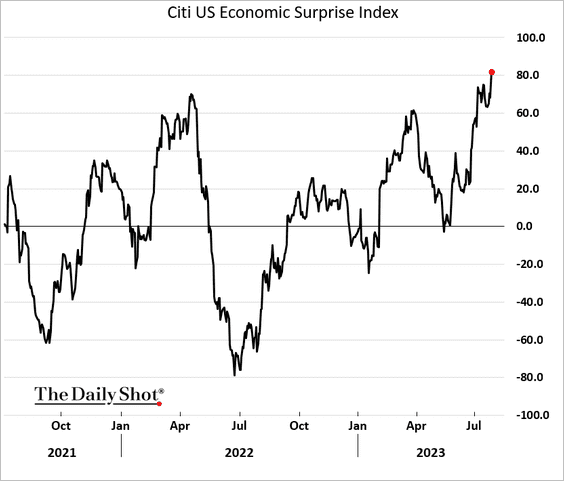

5. The GDP surprise and strong durable goods orders sent the Citi Economic Surprise Index higher.

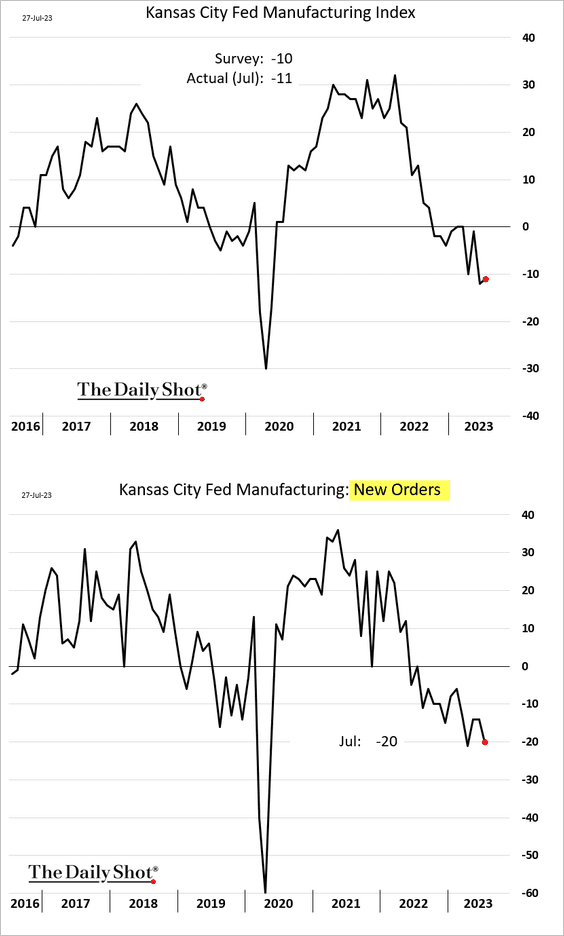

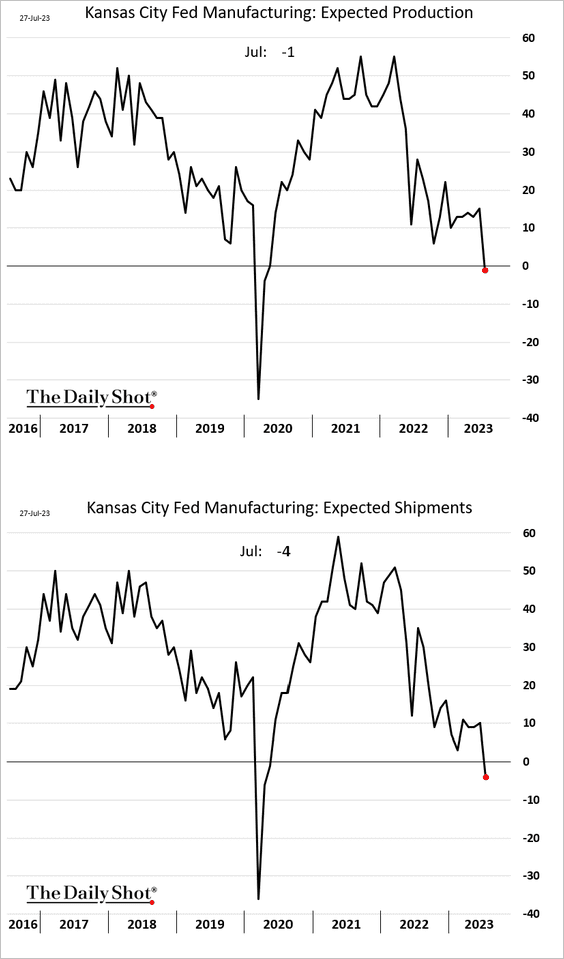

6. The manufacturing report from the Kansas City Fed still indicates ongoing challenges faced by the region’s industrial sector.

Manufacturers’ outlook deteriorated this month.

——————–

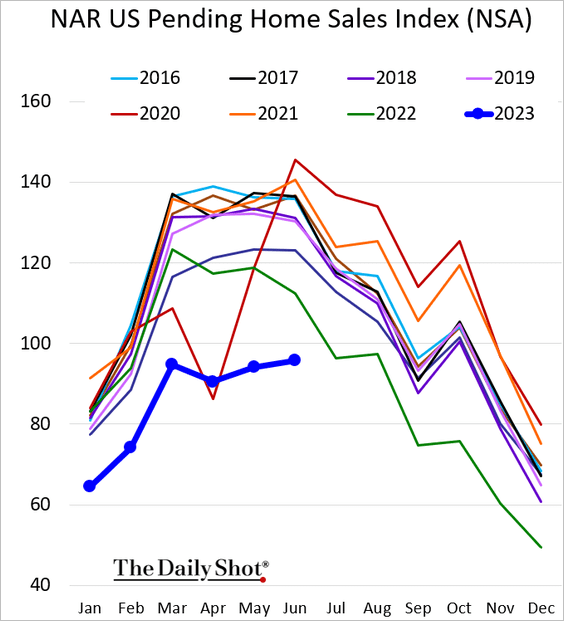

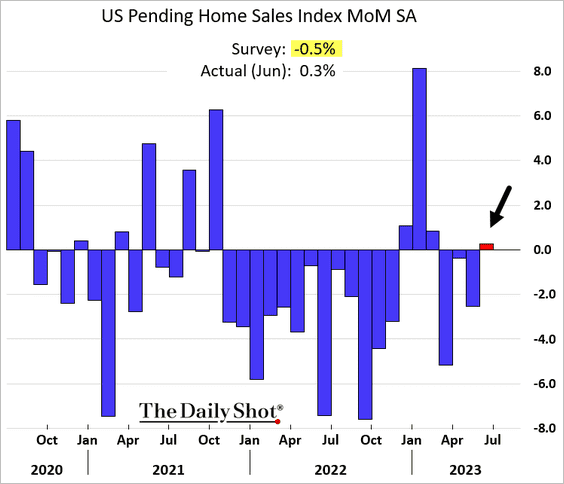

7. Pending home sales were stronger than expected.

Here are the changes in the seasonally-adjusted figures.

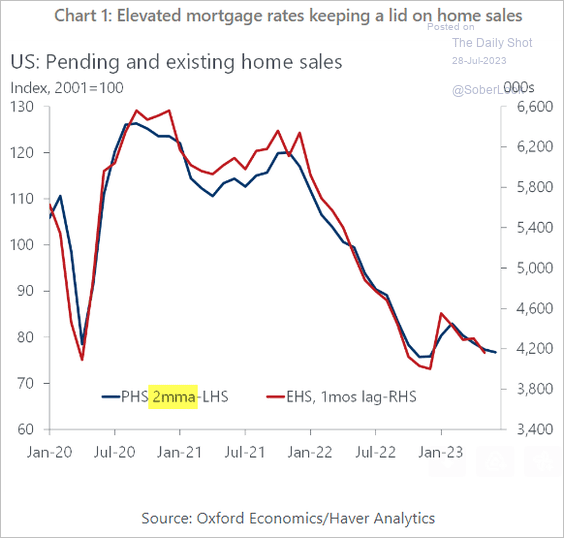

However, the overall trajectory in home sales continues to be unfavorable.

Source: Oxford Economics

Source: Oxford Economics

——————–

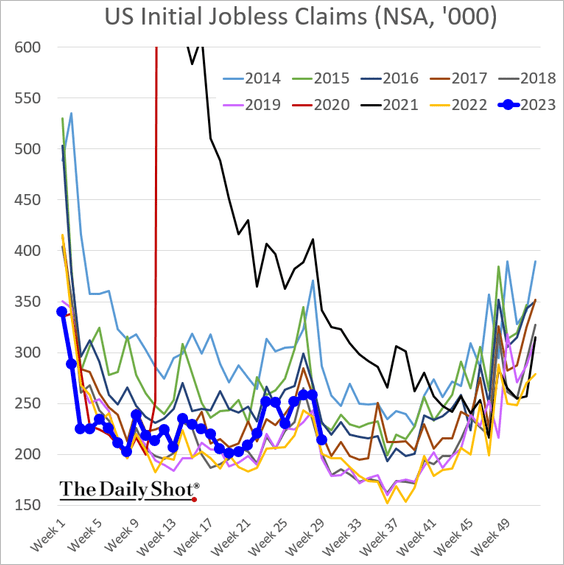

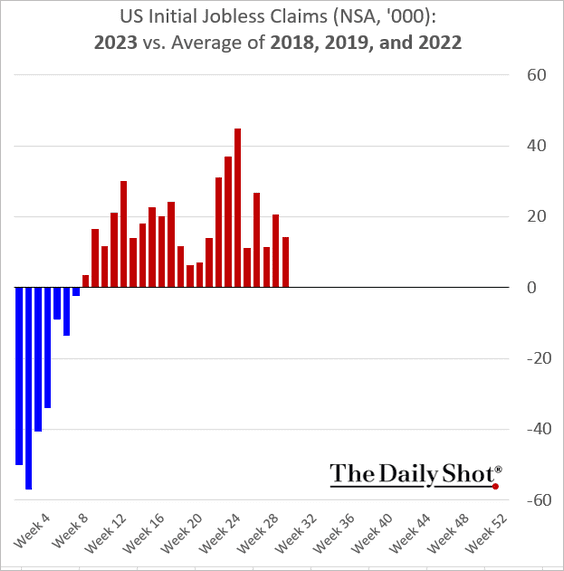

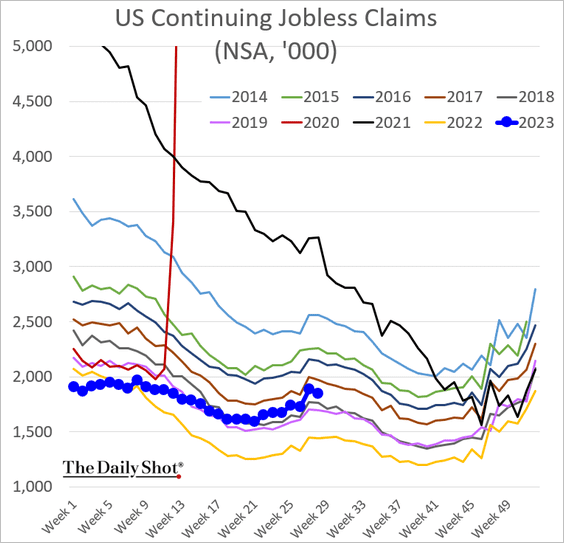

8. Initial jobless claims show no signs of significant deterioration in the labor market.

Here are the continuing jobless claims.

Back to Index

The Eurozone

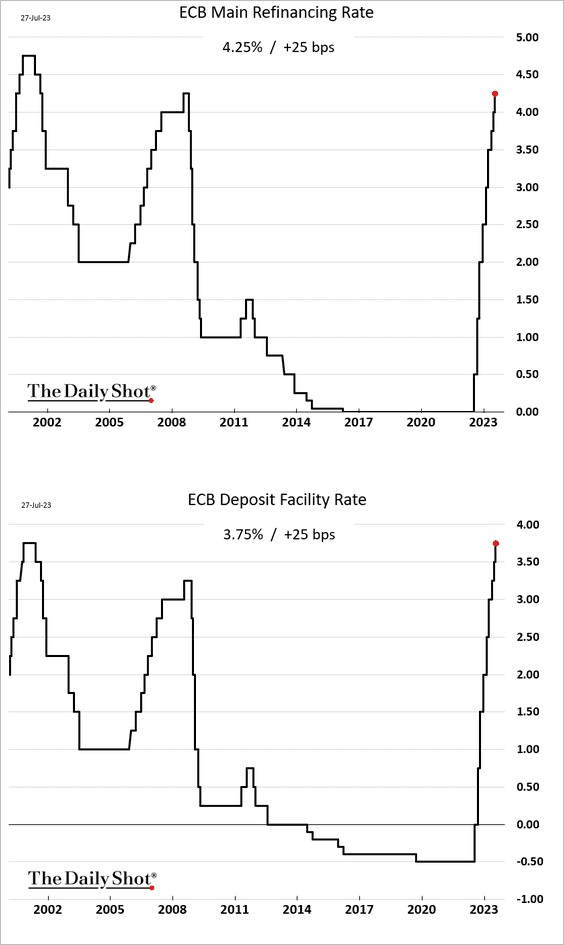

1. The ECB hiked rates by 25 bps, as expected.

Source: Reuters Read full article

Source: Reuters Read full article

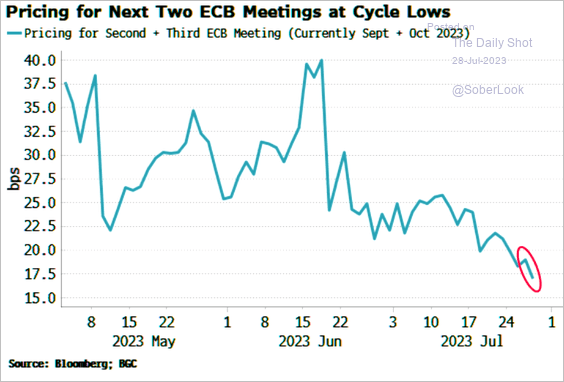

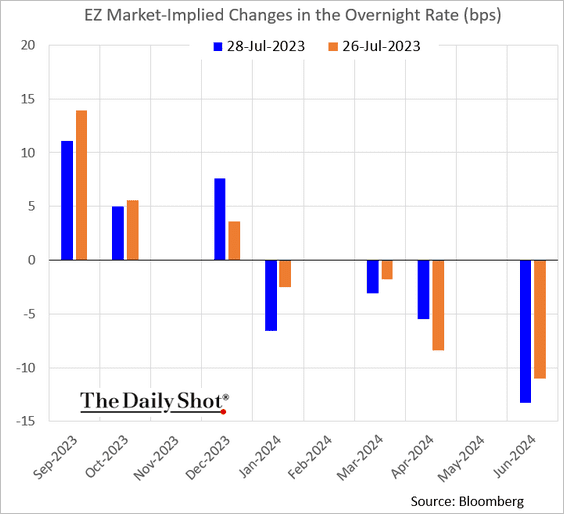

Christine Lagarde emphasized that the forthcoming ECB decisions will hinge on the interpretation of incoming data. Her comment regarding the September meeting – “There is the possibility of a hike. There is the possibility of a pause. It’s a decisive maybe.” – was interpreted by the markets as being a bit on the dovish side.

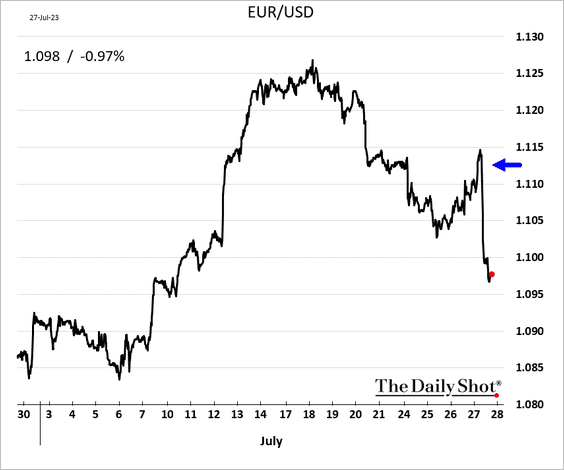

• The euro declined.

• Amid mounting economic challenges, market anticipation for further interest rate hikes softened further.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

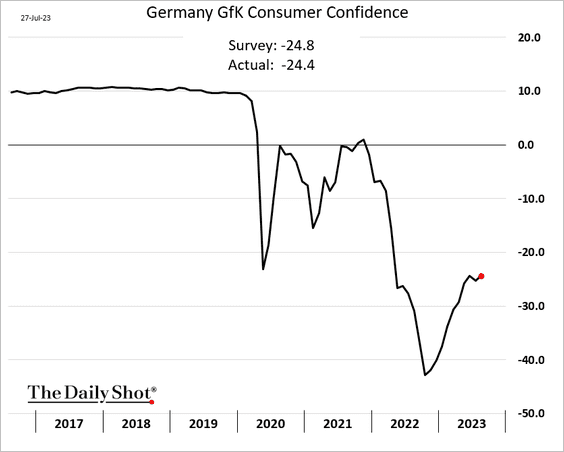

2. German consumer confidence edge higher this month.

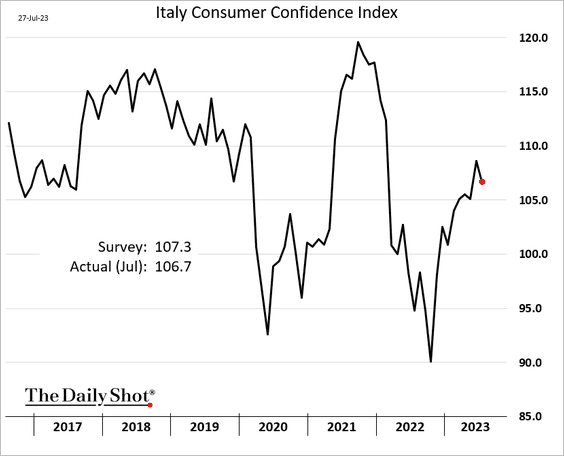

But Italian sentiment declined.

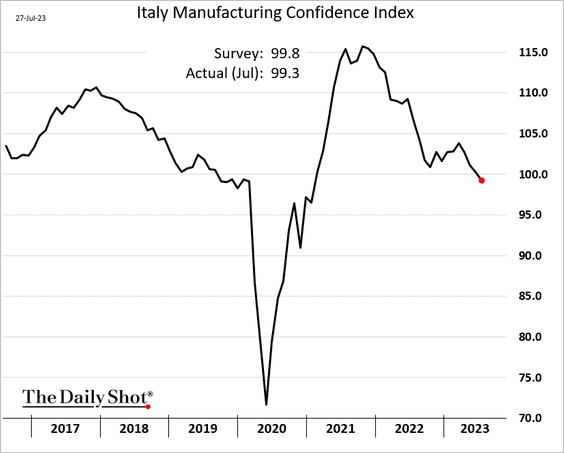

Italian manufacturing confidence continues to sink.

——————–

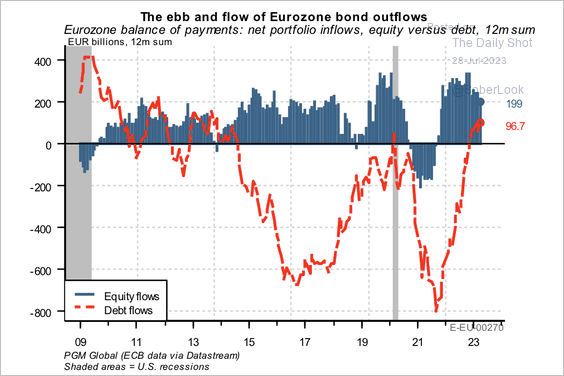

3. According to PGM Global, strong Eurozone bond inflows could be driven by expectations of higher real rates, which is a positive for EUR/USD.

Source: PGM Global

Source: PGM Global

Back to Index

Europe

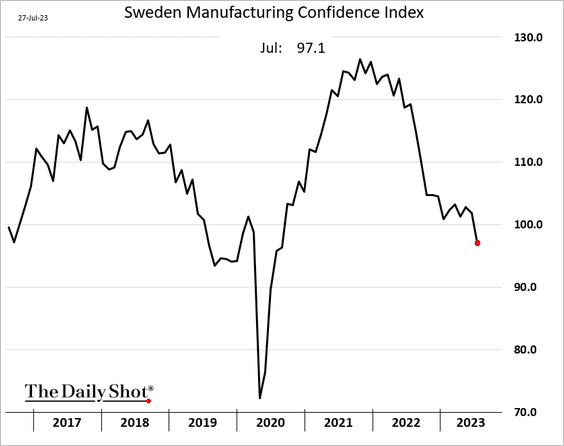

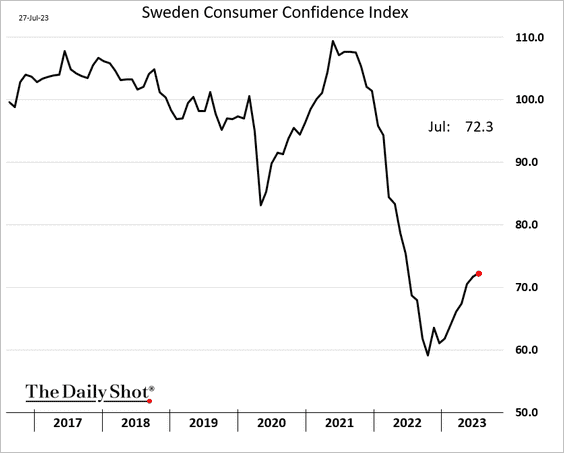

1. Here are some updates on Sweden.

• Manufacturing confidence:

• Consumer confidence:

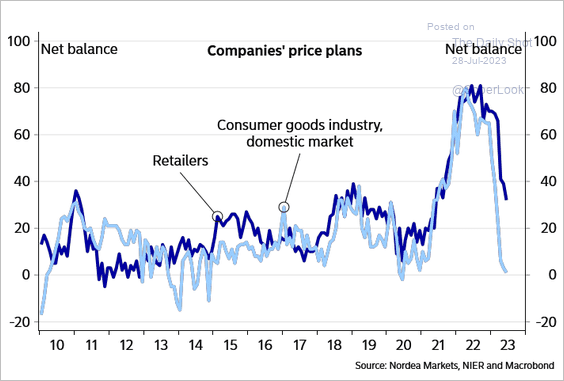

• Consumer companies’ price plans:

Source: Nordea Markets

Source: Nordea Markets

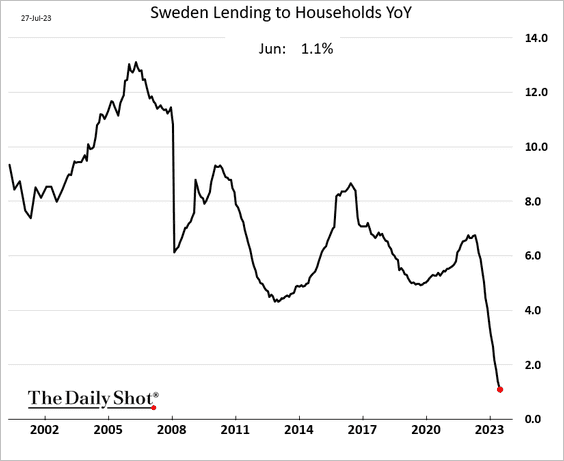

• Growth in bank lending to households:

——————–

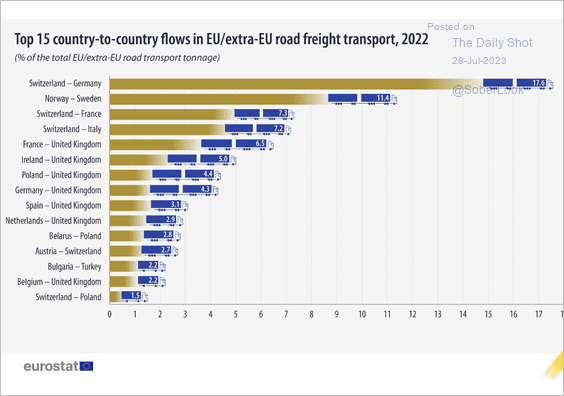

2. This chart shows road freight transport between EU and non-EU countries.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

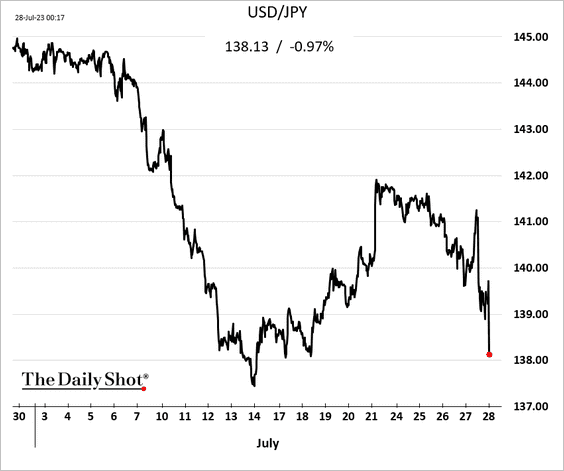

1. The BoJ signaled a “tweak” to its yield control policy.

Source: CNBC Read full article

Source: CNBC Read full article

The yen surged.

——————–

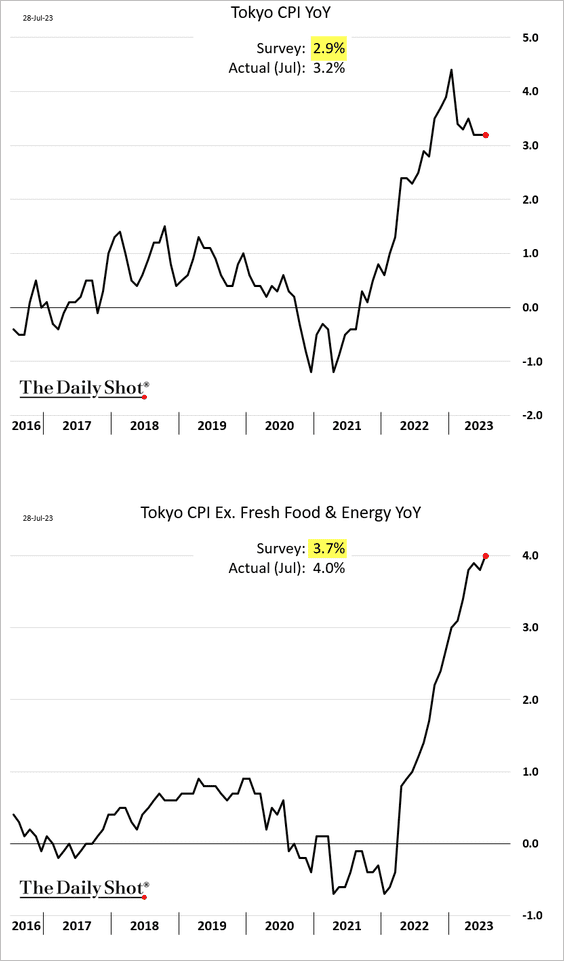

2. The July Tokyo CPI topped expectations, with “core” inflation hitting 4%.

Back to Index

Asia-Pacific

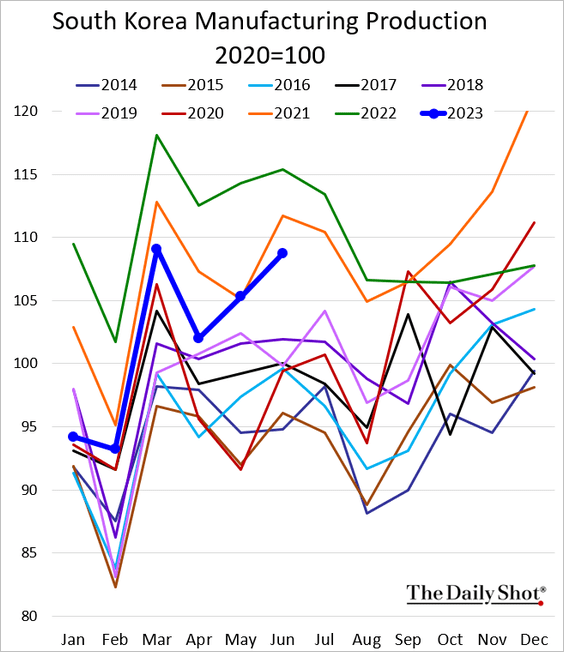

1. South Korea’s manufacturing output remains well below last year’s levels but is holding up well.

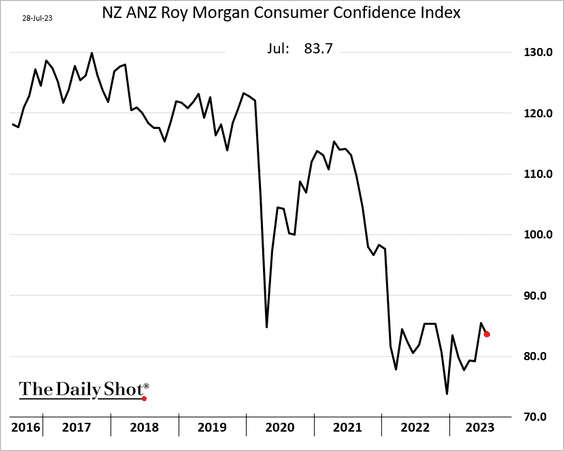

2. There are no signs of a rebound in New Zealand’s consumer confidence.

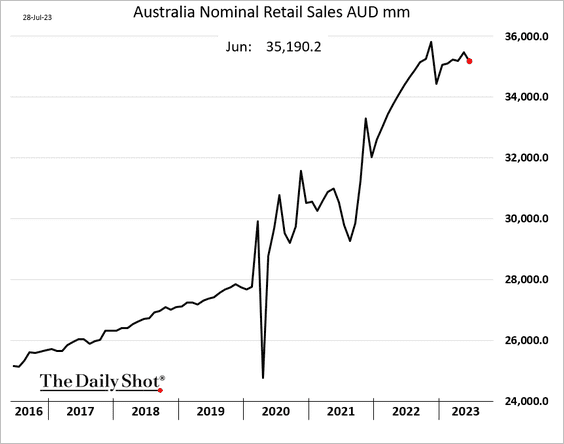

3. Australian retail sales declined in June.

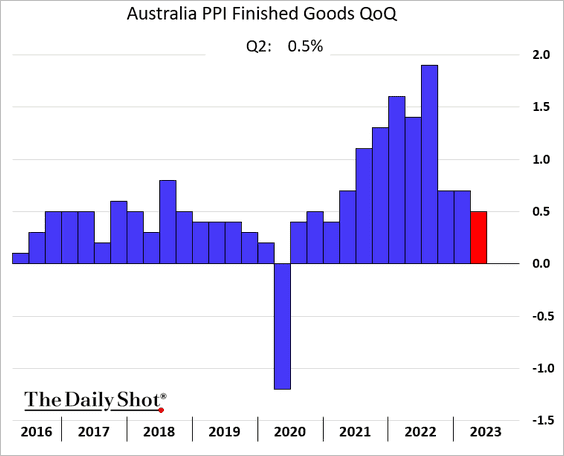

• The PPI continues to ease.

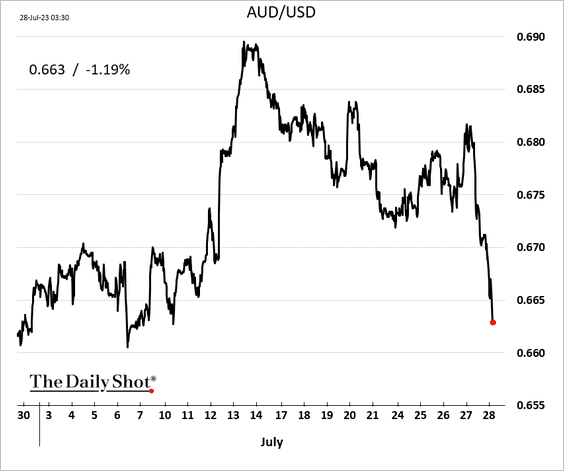

• The Aussie dollar is tumbling against USD.

Back to Index

China

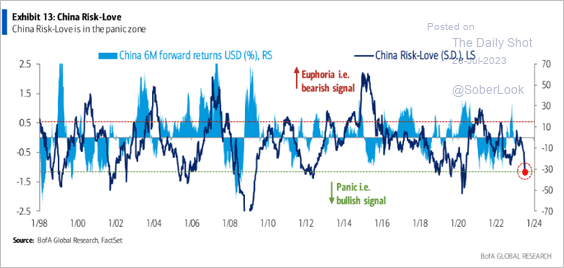

1. Investors’ sentiment on China’s stocks has been deteriorating.

Source: BofA Global Research; @dailychartbook

Source: BofA Global Research; @dailychartbook

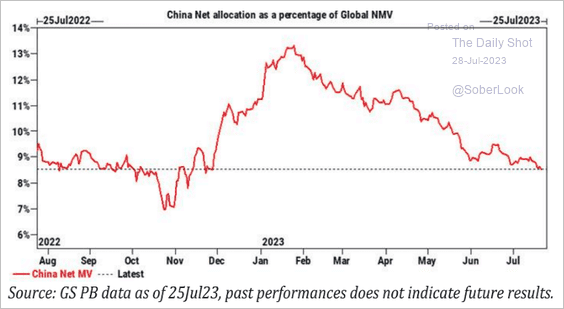

Hedge funds have been cutting their exposure.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

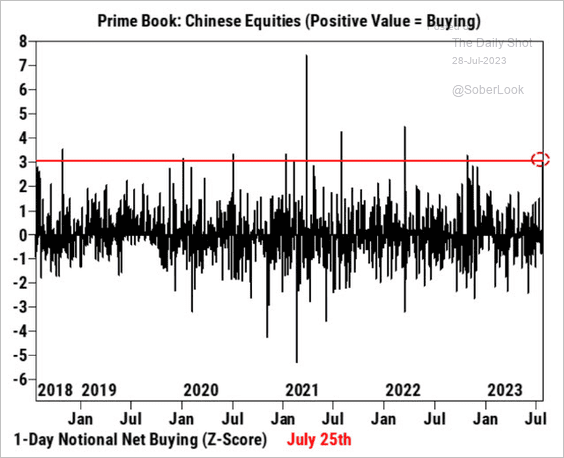

However, we saw some buying this week.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

——————–

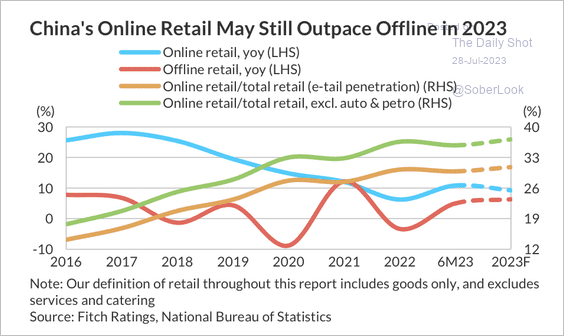

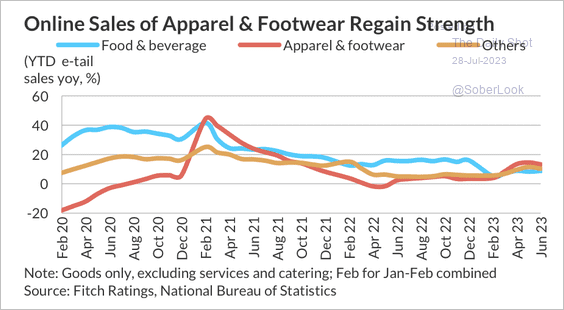

2. Online retail sales are holding up, particularly in apparel and footwear. (2 charts)

Source: Fitch Ratings

Source: Fitch Ratings

Source: Fitch Ratings

Source: Fitch Ratings

——————–

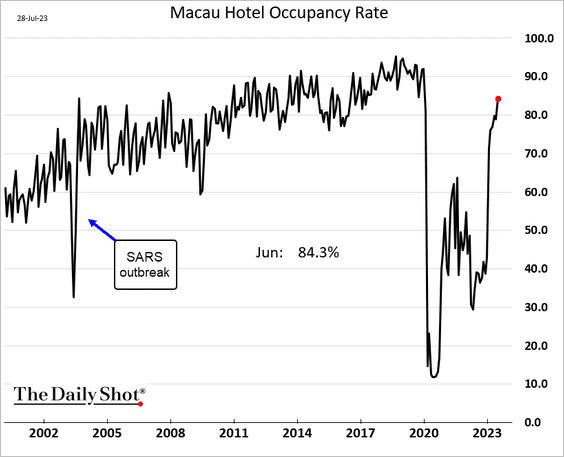

3. Macau hotel occupancy has almost fully recovered.

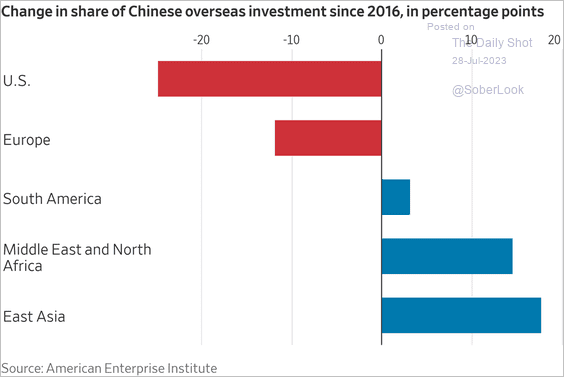

4. This chart shows the changes in China’s overseas investment since 2016.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Cryptocurrency

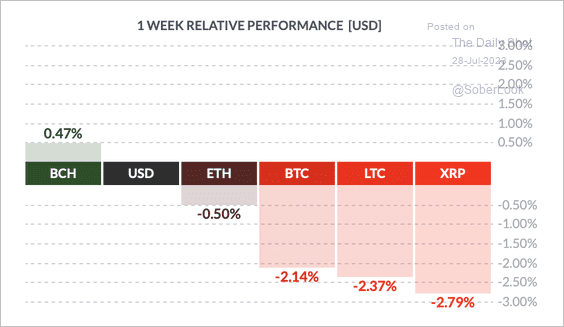

1. It has been a mixed week for cryptos, with XRP underperforming and bitcoin cash (BCH) outperforming top peers.

Source: FinViz

Source: FinViz

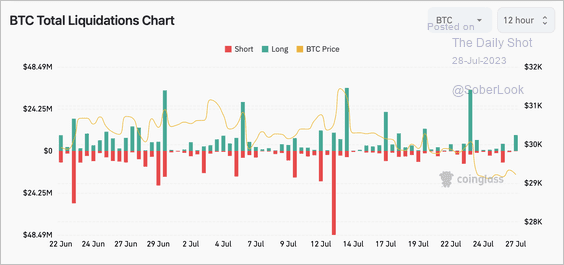

2. BTC saw a spike in long liquidations as the crypto dipped below $30K.

Source: Coinglass

Source: Coinglass

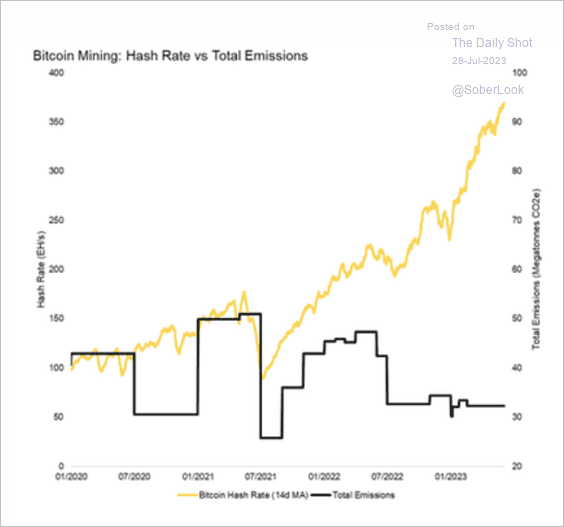

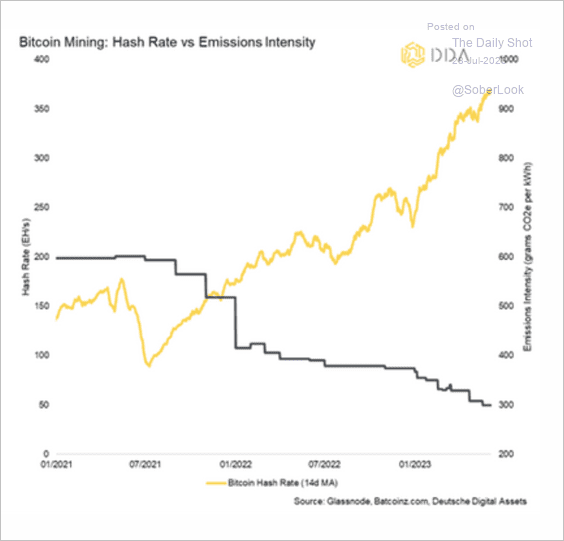

3. There has been a significant divergence between bitcoin’s hash rate and emissions, possibly due to advancements in computational efficiency. (2 charts)

Source: Deutsche Digital Assets

Source: Deutsche Digital Assets

Source: Deutsche Digital Assets

Source: Deutsche Digital Assets

——————–

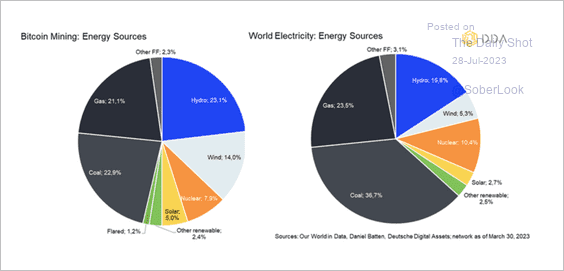

4. Here is a look at bitcoin mining energy sources versus global electricity.

Source: Deutsche Digital Assets

Source: Deutsche Digital Assets

Back to Index

Commodities

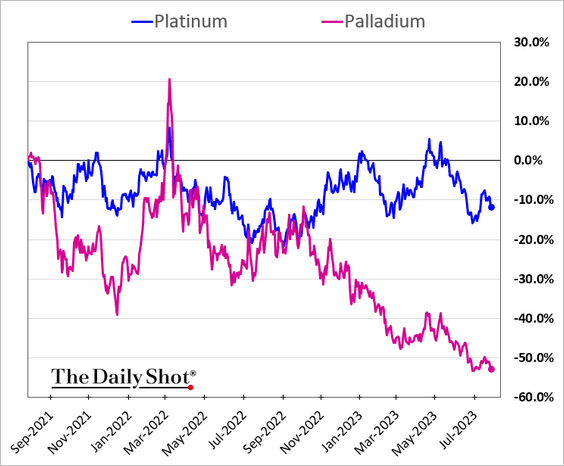

1. Palladium remains under pressure.

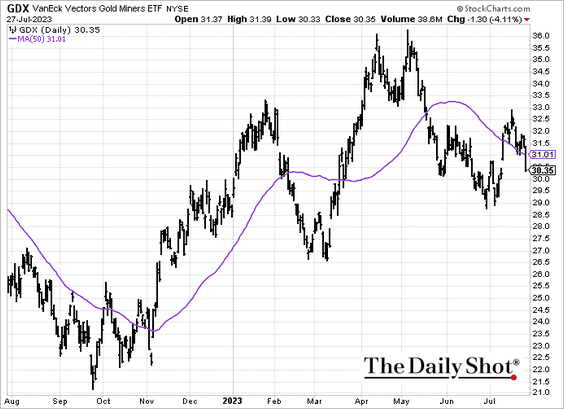

2. The rebound in gold miners’ shares is fading as the VanEck Gold Miners ETF dipped below its 50-day moving average.

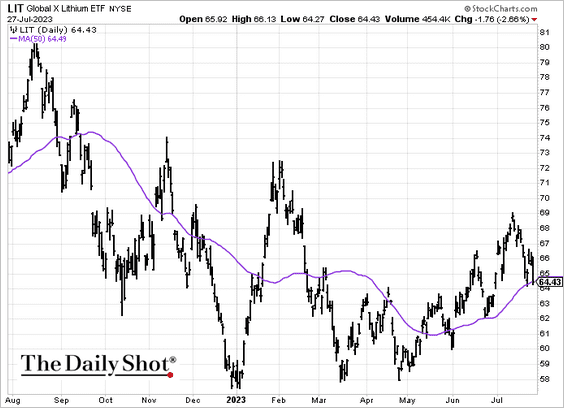

3. The Global X Lithium ETF is testing support at the 50-day moving average.

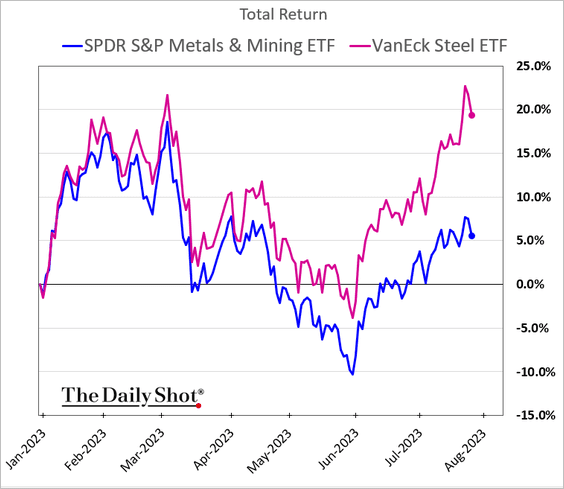

4. Steel producers have been outperforming.

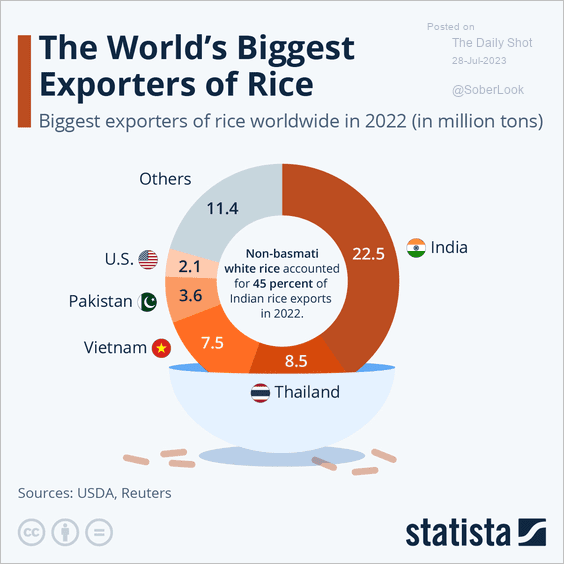

5. This graphic shows the largest exporters of rice.

Source: Statista

Source: Statista

Back to Index

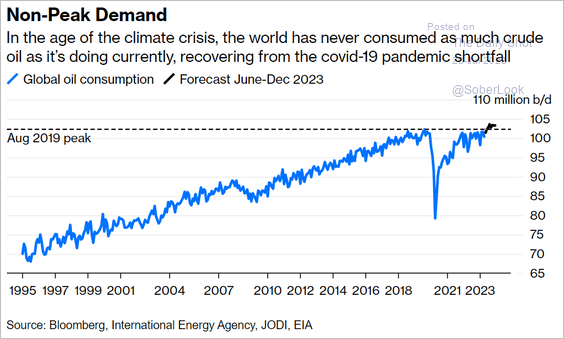

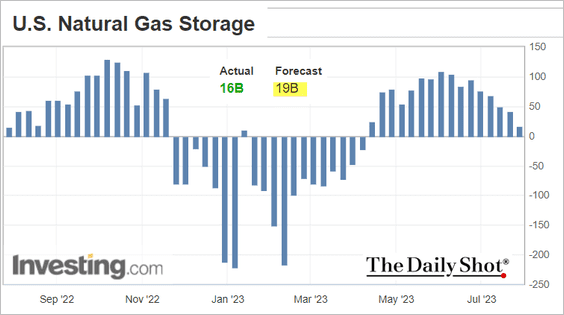

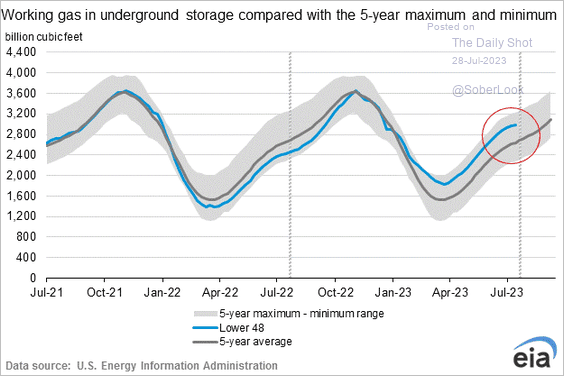

Energy

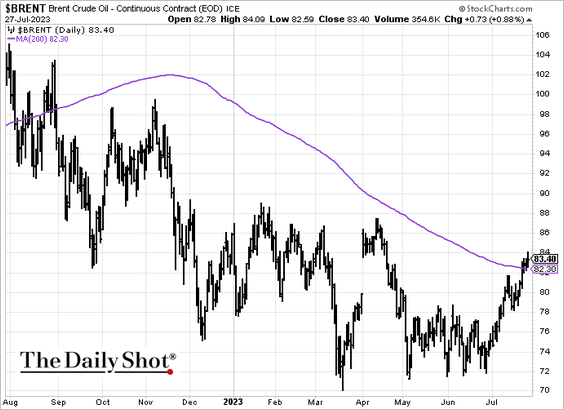

1. Crude oil continues to grind higher.

2. Global crude oil usage is climbing above its pre-COVID peak.

Source: @JavierBlas, @opinion Read full article

Source: @JavierBlas, @opinion Read full article

3. US natural gas inventory build was lower than expected last week amid robust demand.

Back to Index

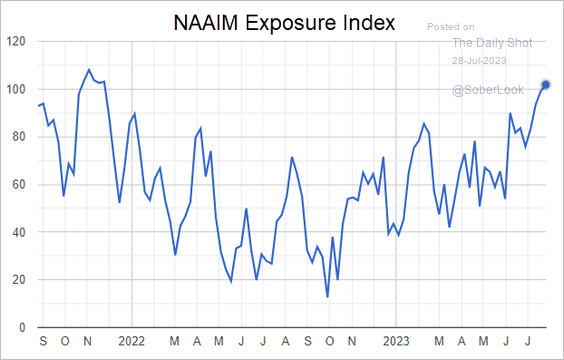

Equities

1. Investment managers are very bullish.

Source: NAAIM

Source: NAAIM

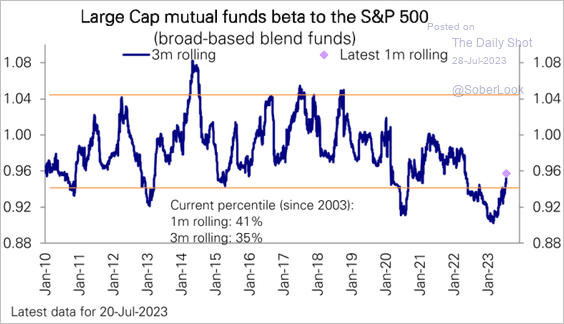

2. Large-cap mutual funds remain cautious.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

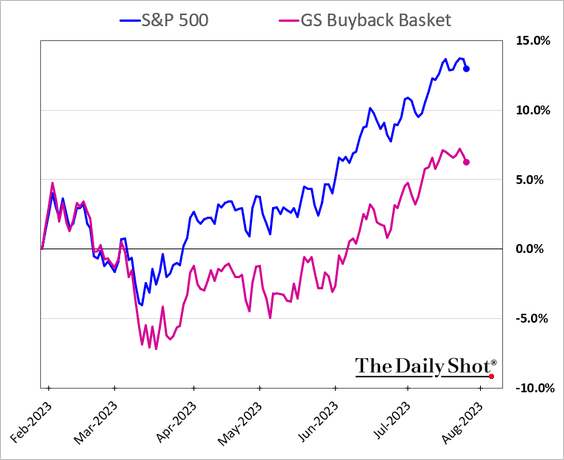

3. Firms recognized for their frequent share buy-back initiatives have been underperforming.

Back to Index

Credit

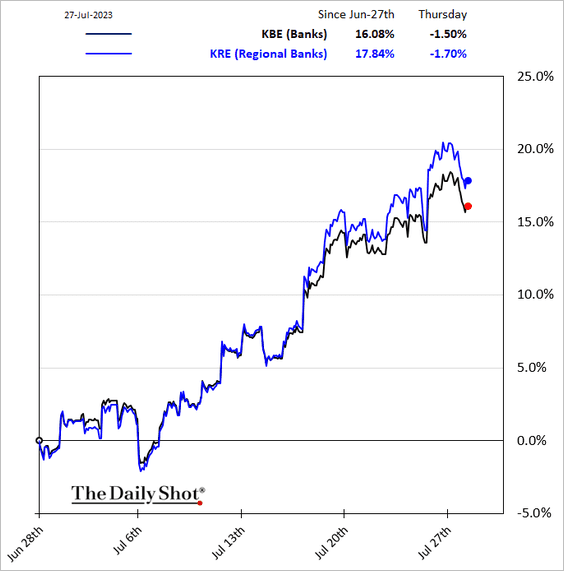

1. US regional banks have been outperforming in recent days, …

… as the biggest banks face higher capital requirements.

Source: Banking Law Read full article

Source: Banking Law Read full article

——————–

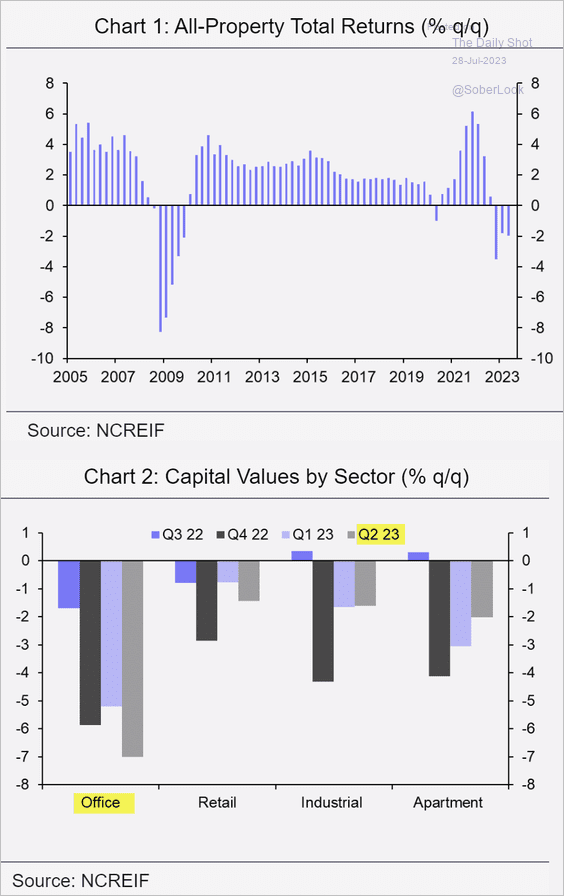

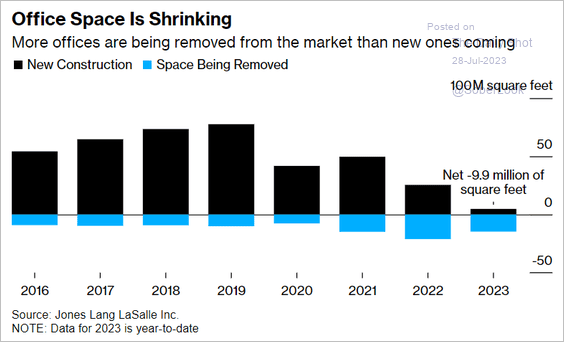

2. US commercial property prices continue to decline, with office properties bearing the brunt of this downward trend.

Source: Capital Economics

Source: Capital Economics

The overall US office space is shrinking.

Source: @business Read full article

Source: @business Read full article

——————–

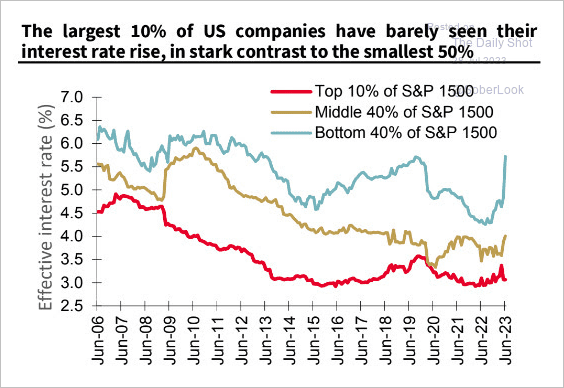

3. Smaller firms are feeling the impact of higher rates.

Source: @albertedwards99

Source: @albertedwards99

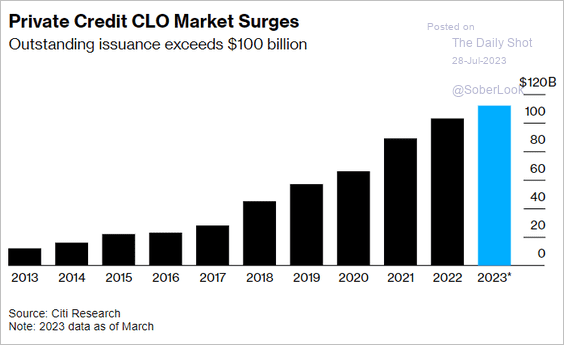

4. Private credit (direct lending) CLO issuance continues to climb.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Global Developments

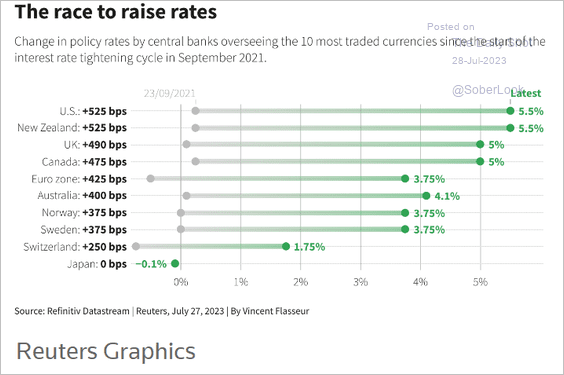

1. Here is a look at policy rate increases in advanced economies.

Source: Reuters Read full article

Source: Reuters Read full article

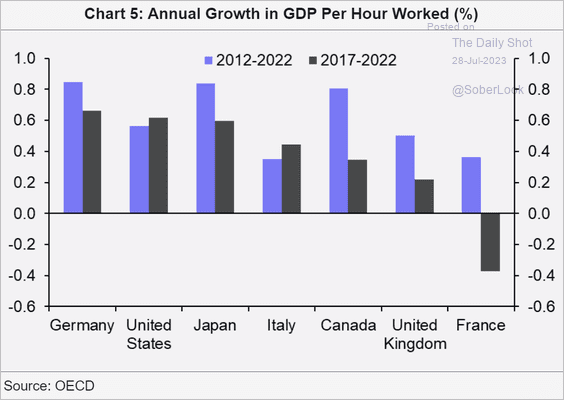

2. Next, we have the GDP growth per hour worked in select economies (productivity).

Source: Capital Economics

Source: Capital Economics

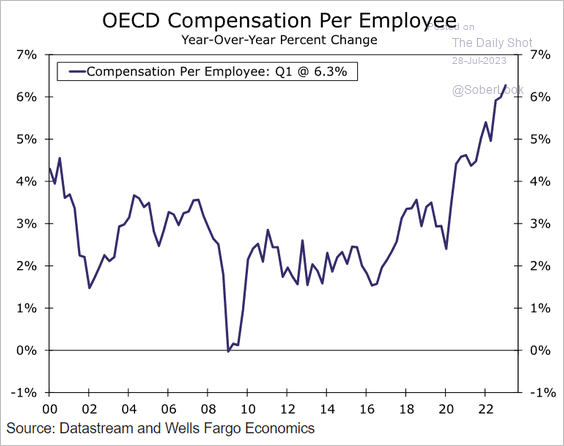

3. This chart shows compensation growth in OECD economies.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

Food for Thought

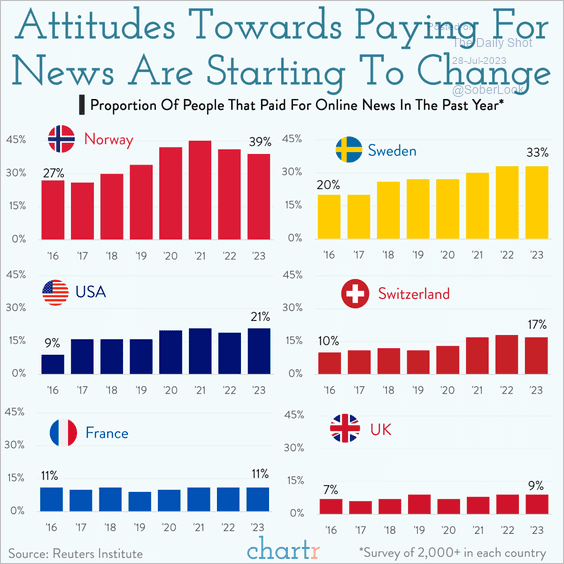

1. Paying for online news services:

Source: @chartrdaily

Source: @chartrdaily

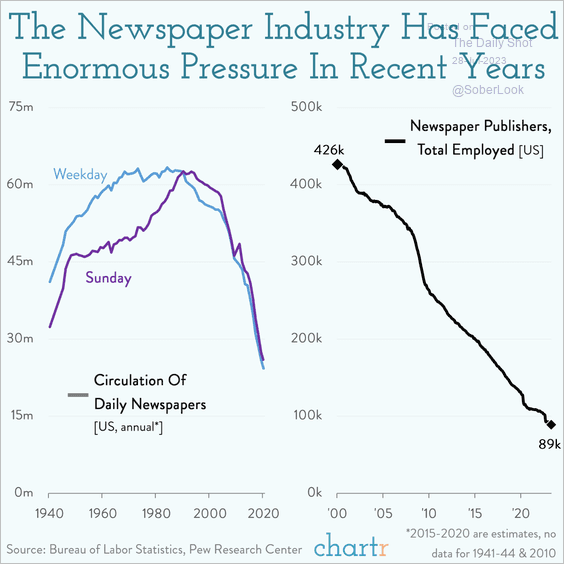

• The newspaper industry under pressure:

Source: @chartrdaily

Source: @chartrdaily

——————–

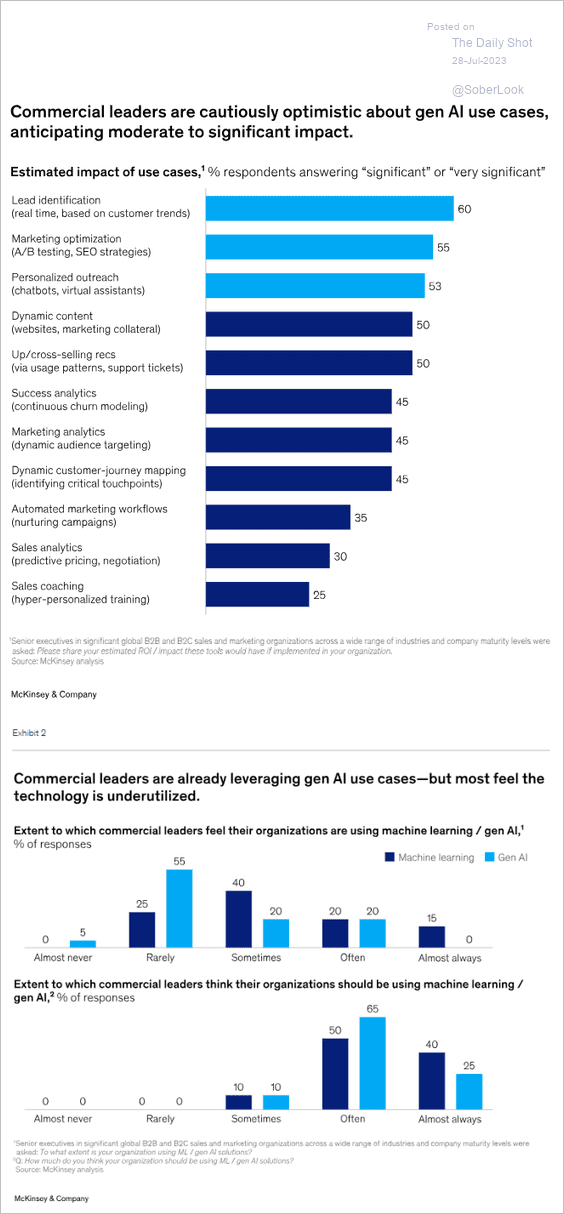

2. Using AI in marketing and sales:

Source: McKinsey & Company Read full article

Source: McKinsey & Company Read full article

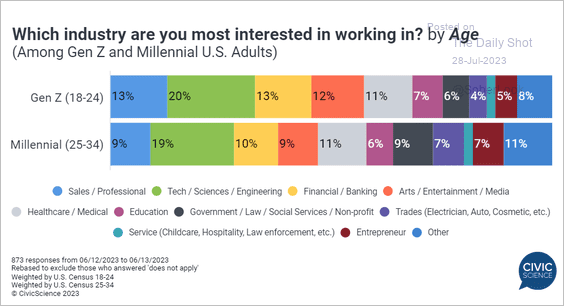

3. Gen-Z’s and Millennials’ industry preferences:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

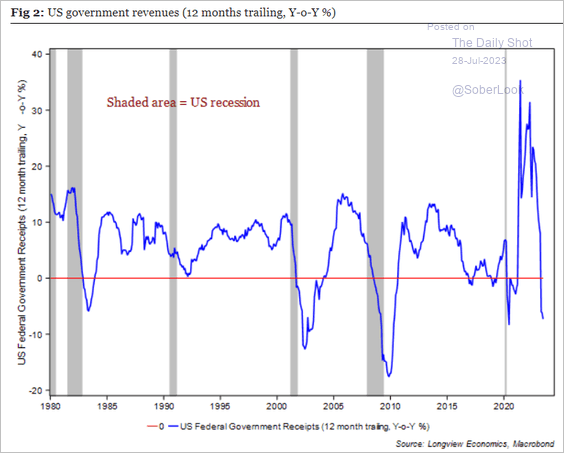

4. Year-over-year changes in US government revenues:

Source: Longview Economics

Source: Longview Economics

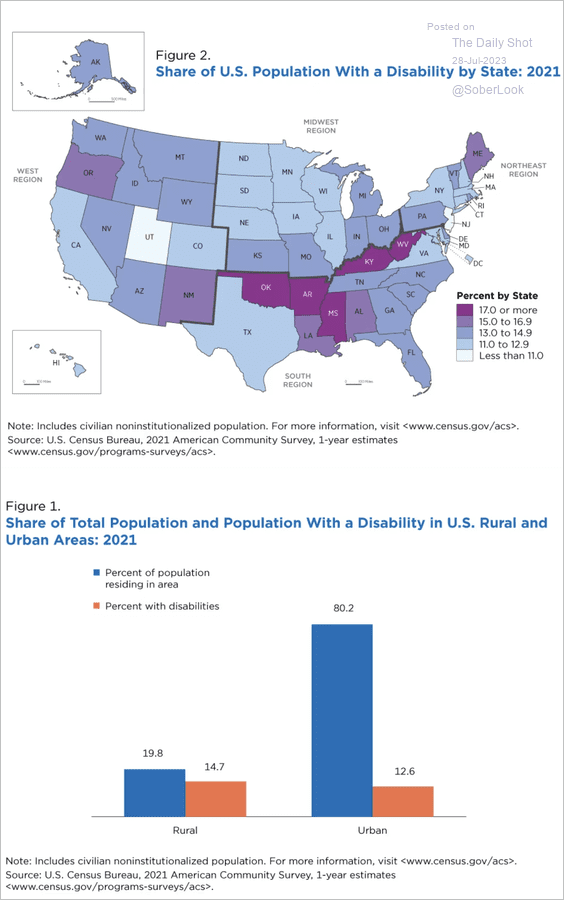

5. Disability rates:

Source: Census Bureau

Source: Census Bureau

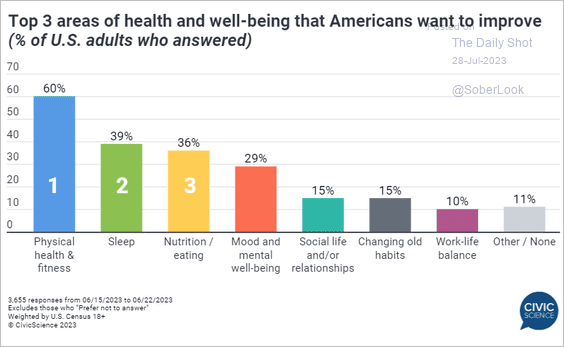

6. Improving health and well-being:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

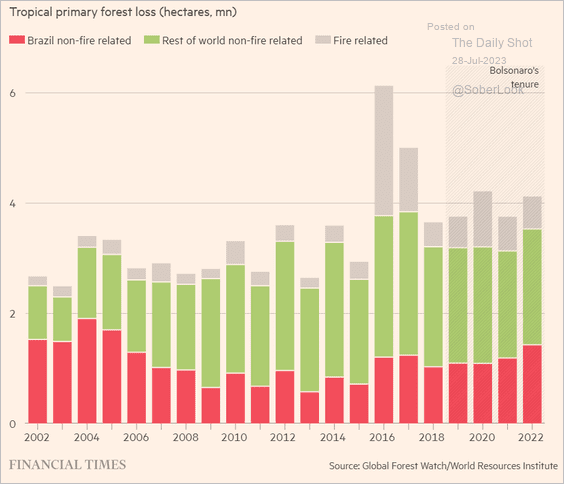

7. Deforestation in Brazil:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

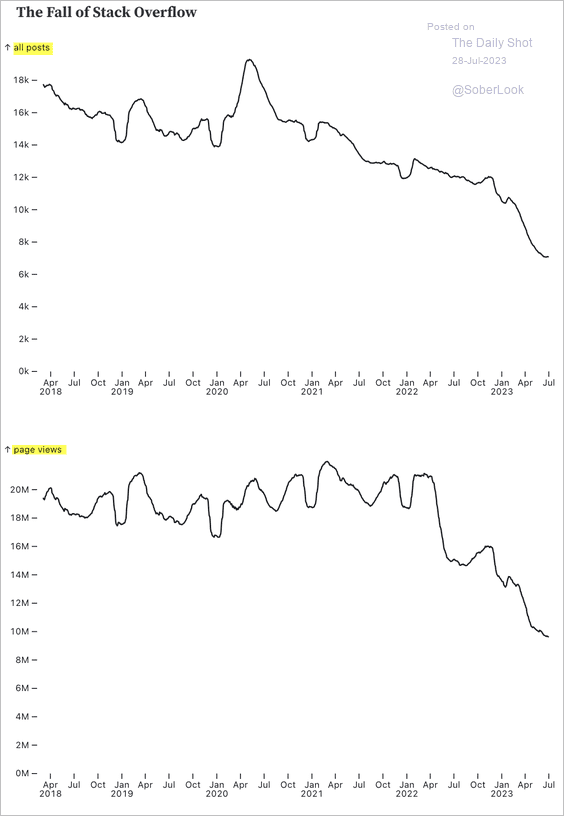

8. Why rely on sifting through Stack Overflow for your programming issues when you can just ask ChatGPT?

Source: Observable Read full article

Source: Observable Read full article

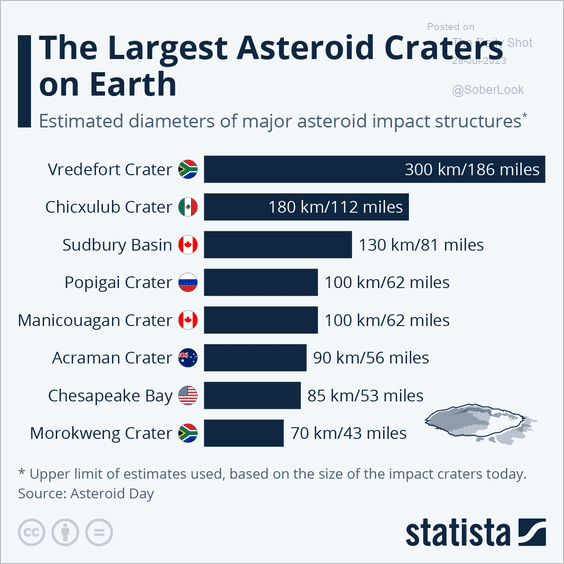

9. The largest asteroid craters on Earth:

Source: Statista

Source: Statista

——————–

Have a great weekend!

Back to Index