The Daily Shot: 31-Jul-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

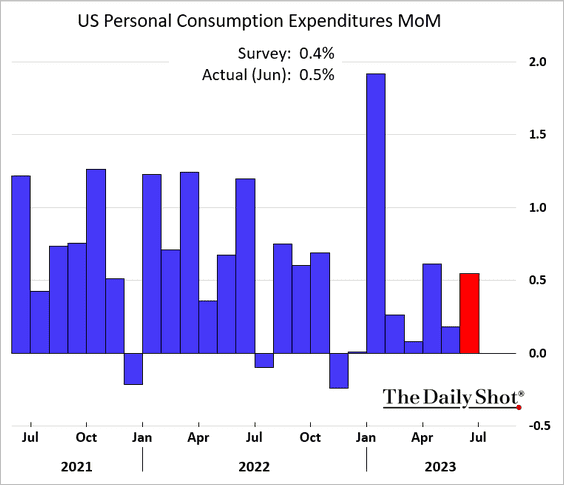

1. Consumer spending increased in June, …

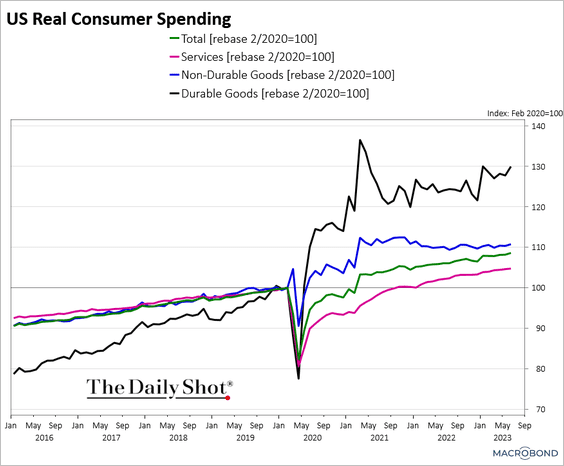

… with gains across goods and services.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

Source: MarketWatch Read full article

Source: MarketWatch Read full article

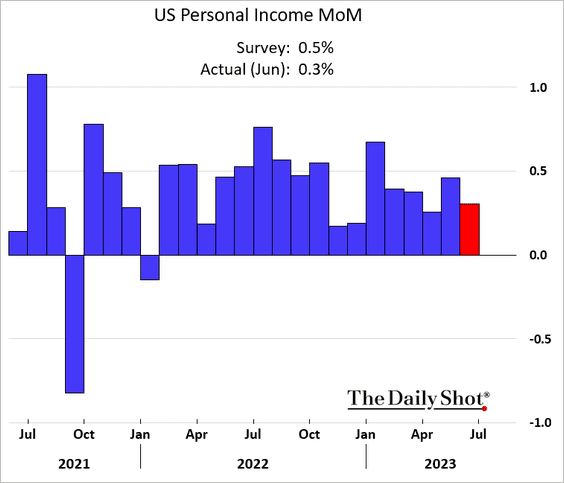

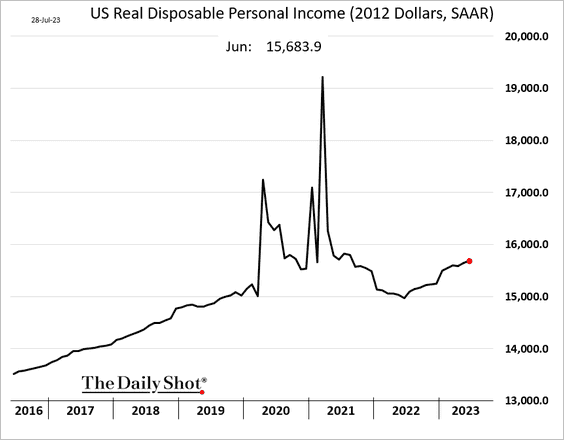

• Personal income increased less than expected.

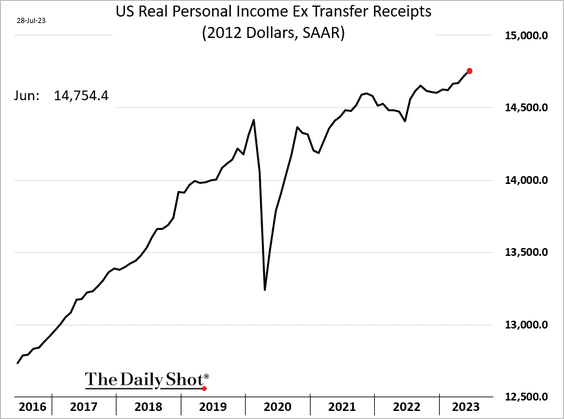

– This chart shows real personal income, excluding government payments (level).

– And here is real disposable income.

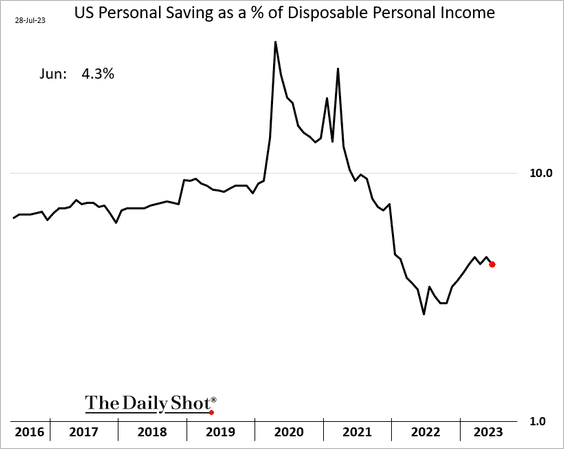

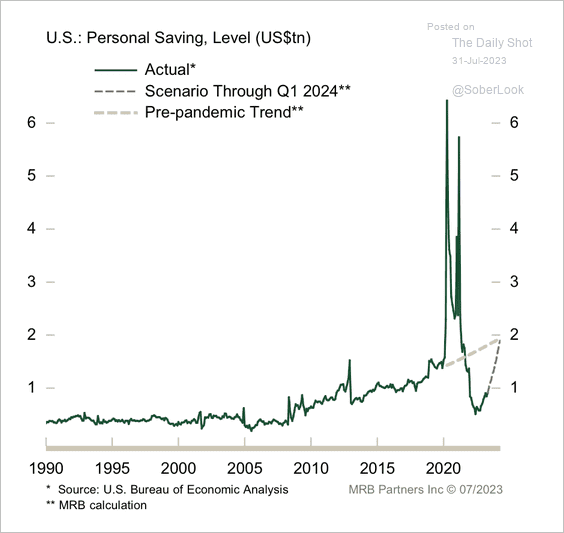

• The savings rate declined in June.

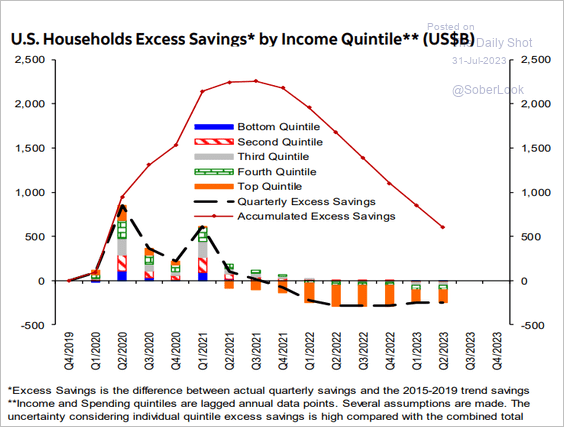

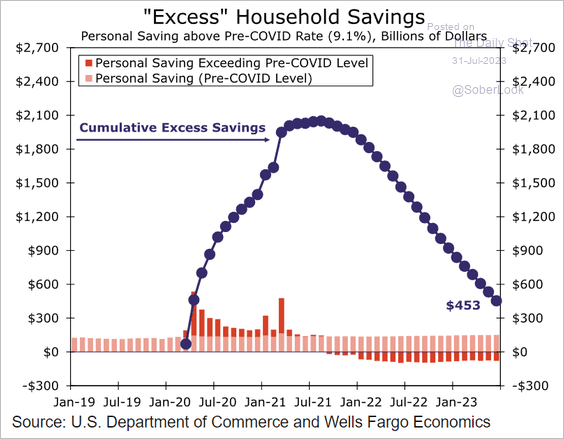

Estimates vary on the level of excess savings, but they continue to trend lower.

– Scotia Capital:

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

– Wells Fargo:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

– MRB Partners expects a complete drawdown of excess savings by Q1 2024.

Source: MRB Partners

Source: MRB Partners

——————–

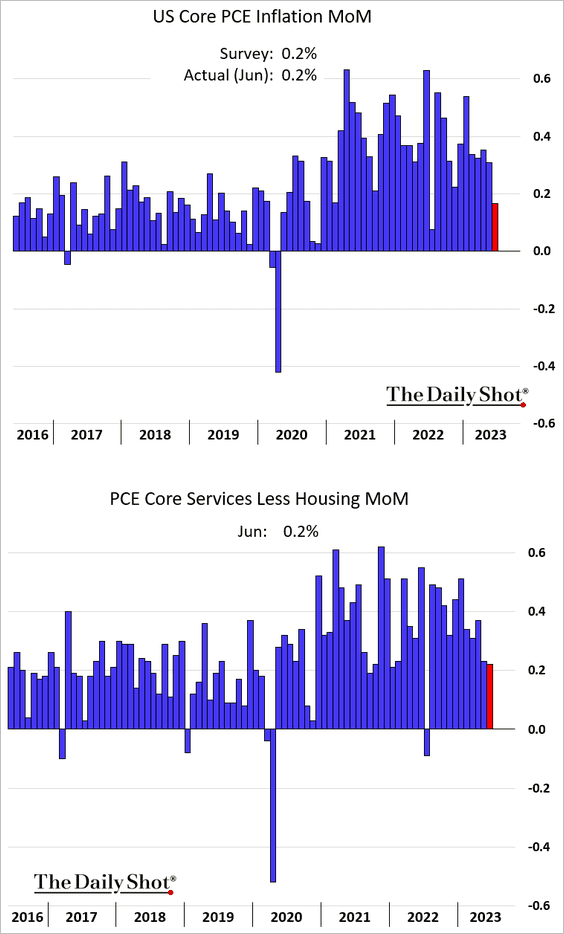

2. Core inflation eased in June. The second panel shows the “supercore” PCE inflation.

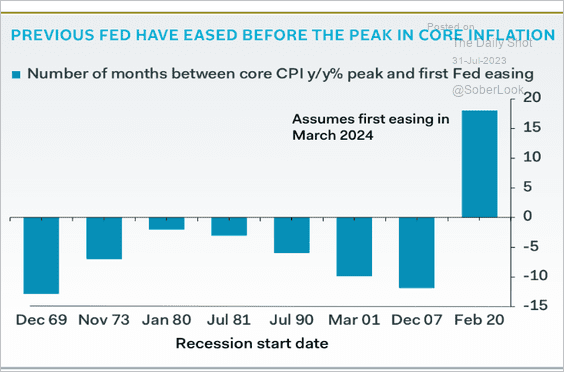

In this cycle, the peak in core inflation came long before the (expected) first Fed rate cut.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

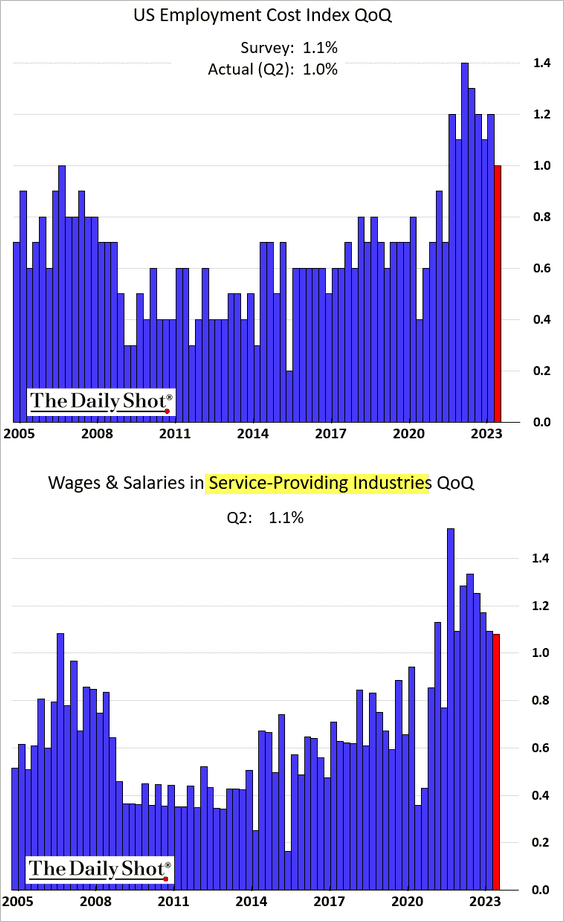

3. Gains in employment costs slowed in Q2 but remain elevated.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

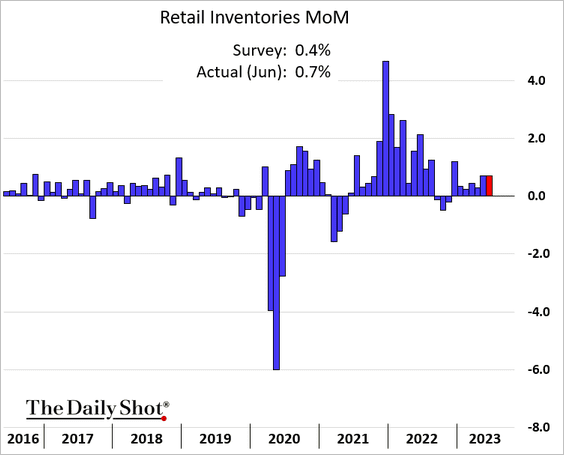

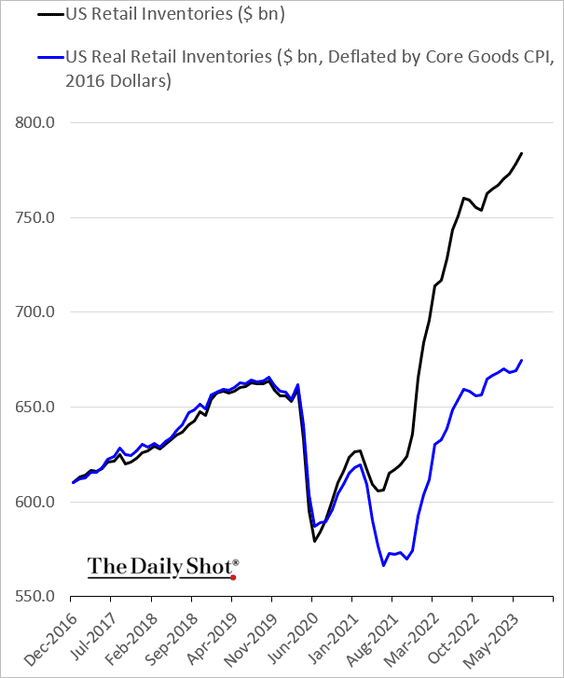

4. Retail inventories keep climbing.

The blue line below shows real retail inventories.

——————–

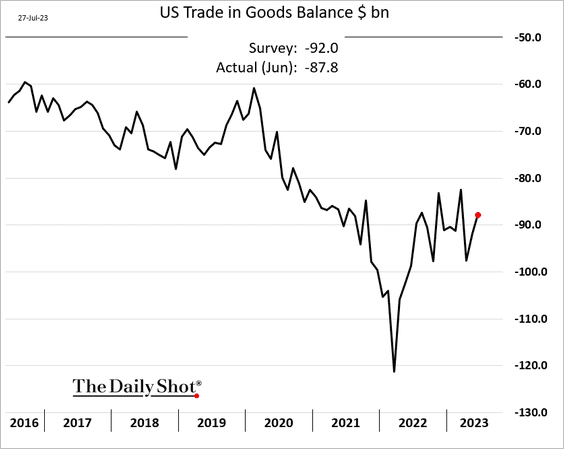

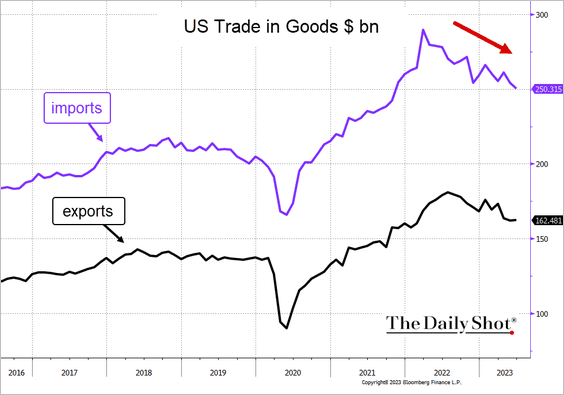

5. The trade deficit in goods narrowed in June, …

… as imports slowed.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

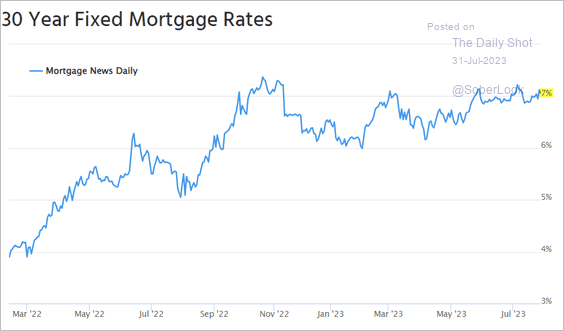

6. Mortgage rates are holding near 7%.

Source: Mortgage News Daily

Source: Mortgage News Daily

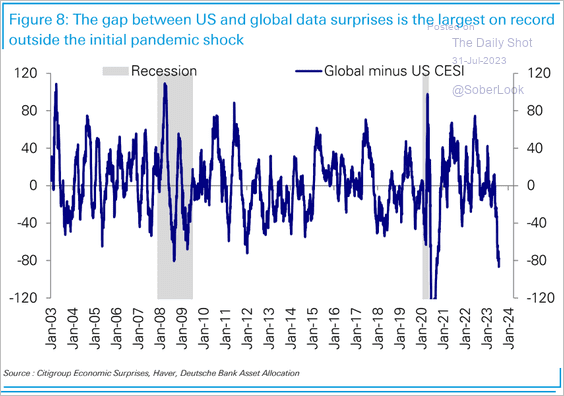

7. The US Citi Economic Surprise Index has massively outperformed economic data globally.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Canada

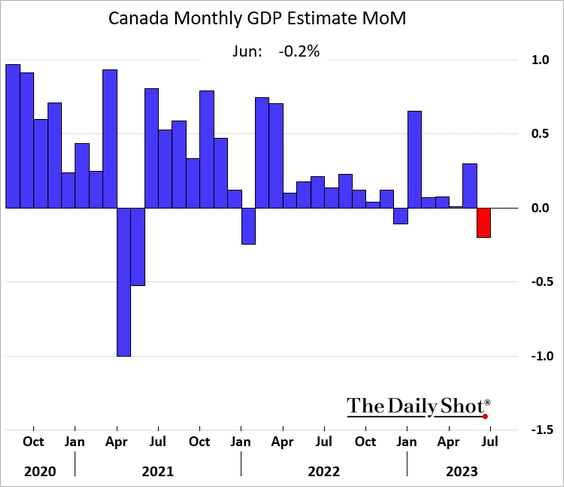

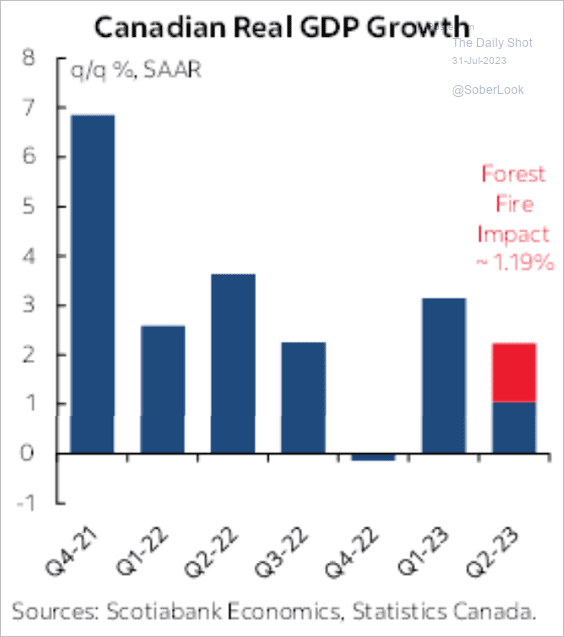

1. Canada’s economy contracted in June.

Forest fire depressed the Q2 GDP growth.

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: @economics Read full article

Source: @economics Read full article

——————–

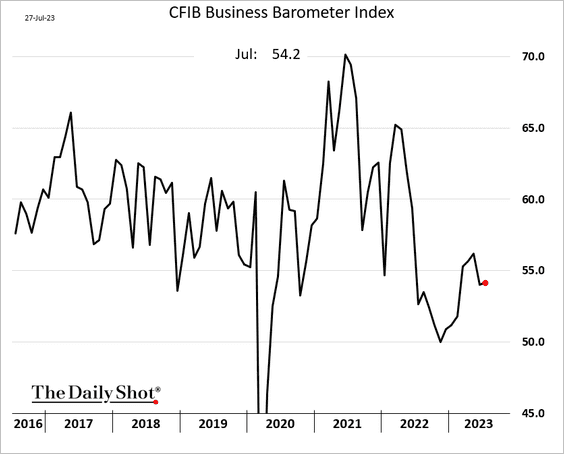

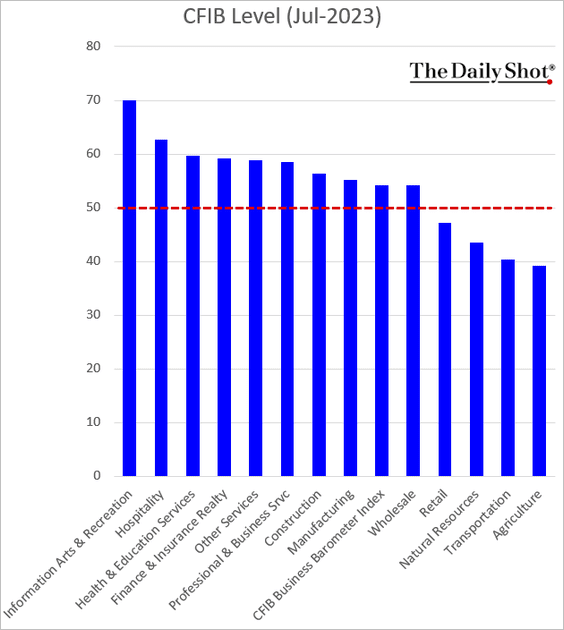

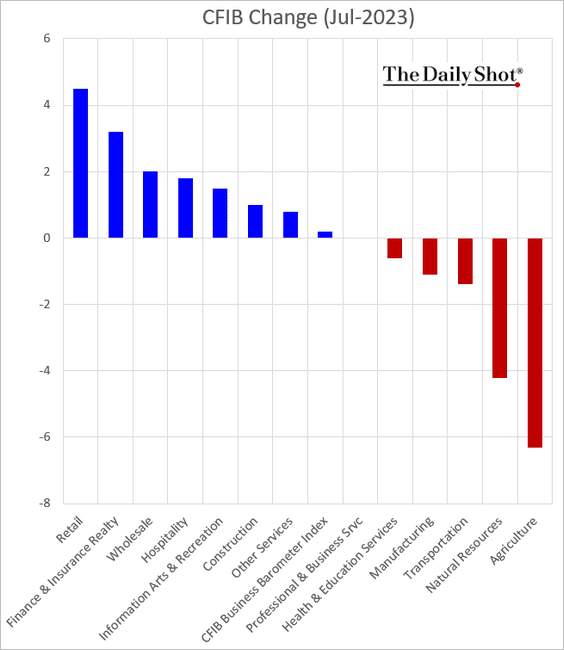

2. The CFIB small business index edged higher this month.

The charts below show the CFIB level and July changes by sector.

——————–

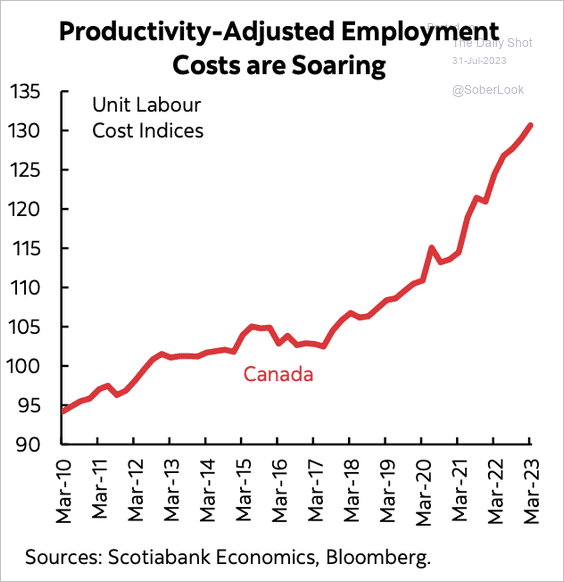

3. Unit labor costs have been rising quickly.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The United Kingdom

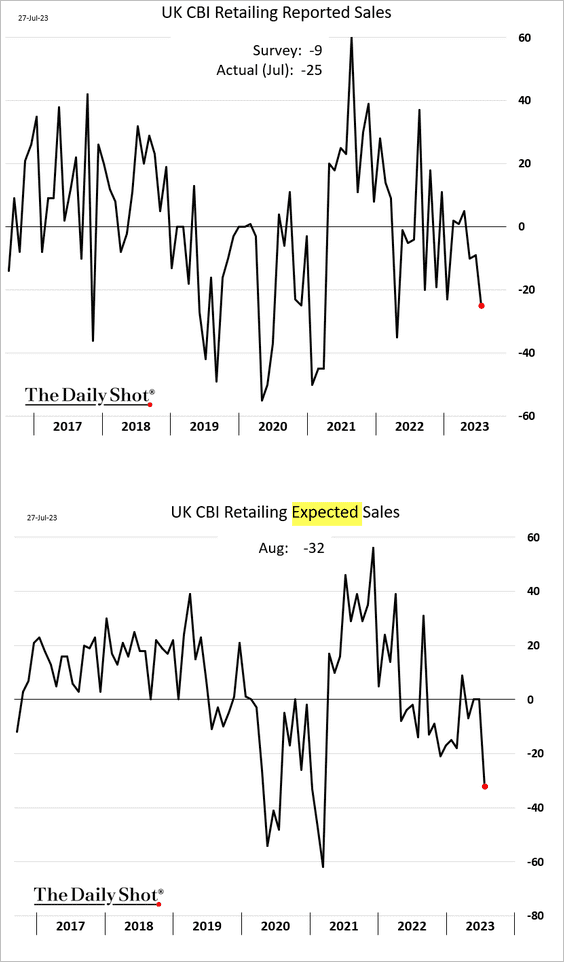

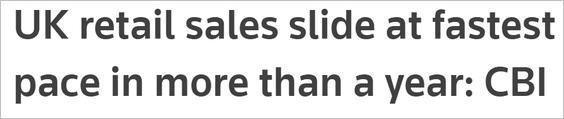

1. The CBI report showed a sharp pullback in retail sales this month.

Source: Reuters Read full article

Source: Reuters Read full article

Retailers are reducing their orders placed with suppliers due to changing market conditions.

——————–

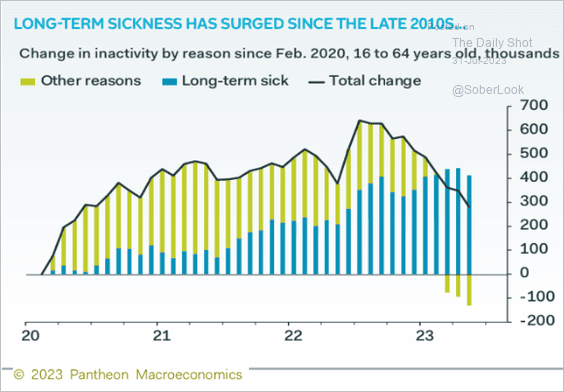

2. A large number of Britons are not working due to long-term sickness.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

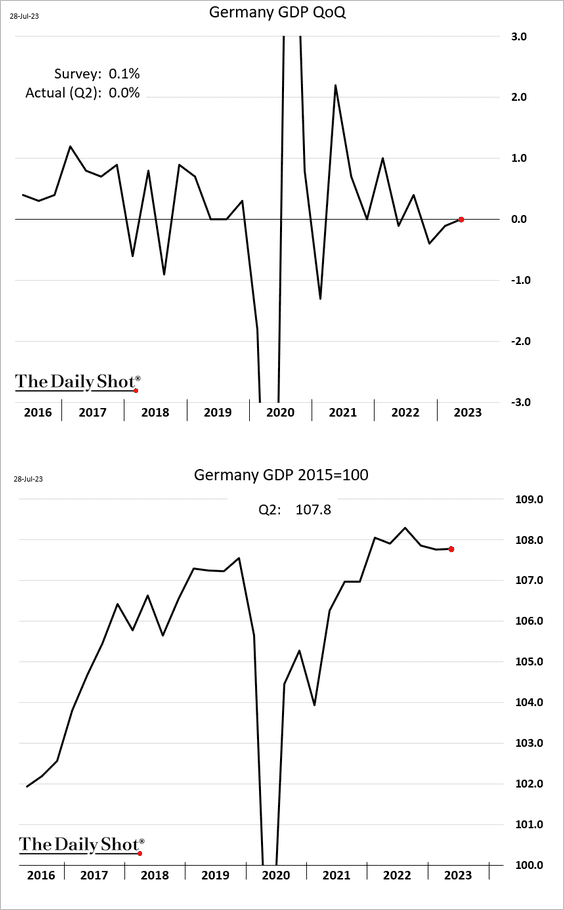

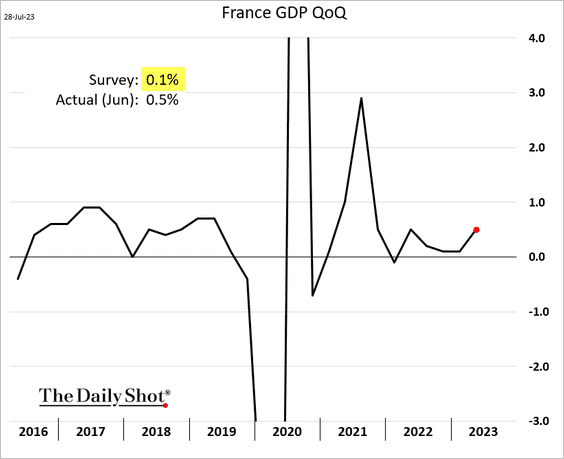

1. Let’s begin with the GDP reports.

• Germany’s GDP was flat in Q2.

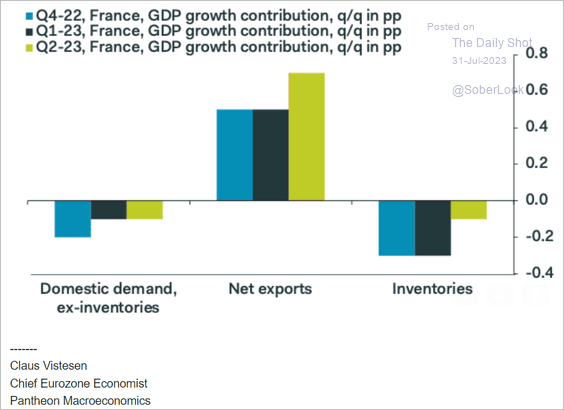

• French GDP growth surprised to the upside …

Source: @economics Read full article

Source: @economics Read full article

… driven by exports.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

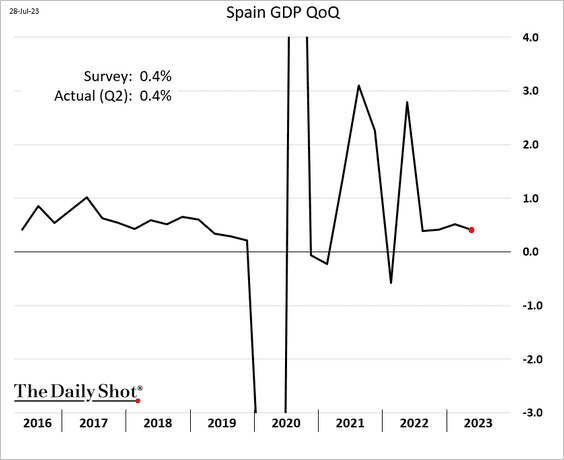

• Spain’s GDP growth remains robust.

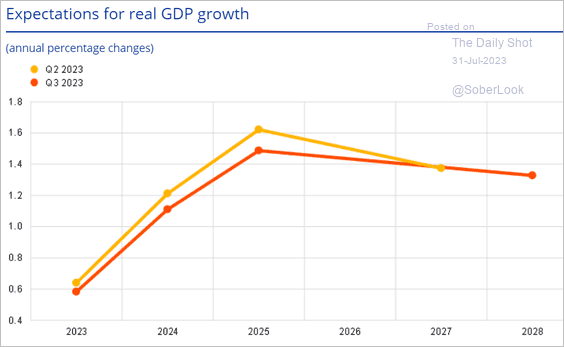

• Forecasters (ECB’s Survey of Professional Forecasters) downgraded their estimates for the euro-area GDP growth over the next few years.

Source: ECB

Source: ECB

——————–

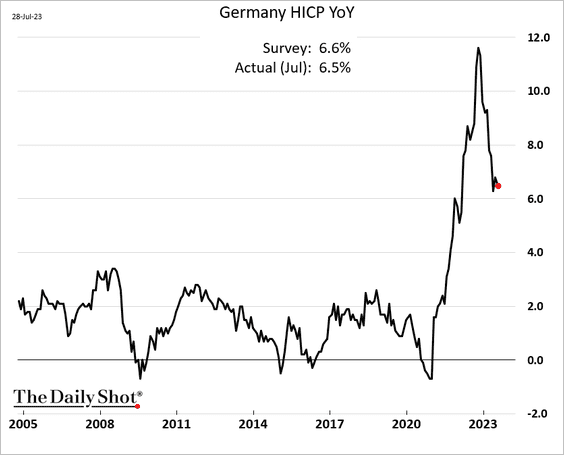

2. Next, let’s take a look at inflation reports.

• Germany (easing):

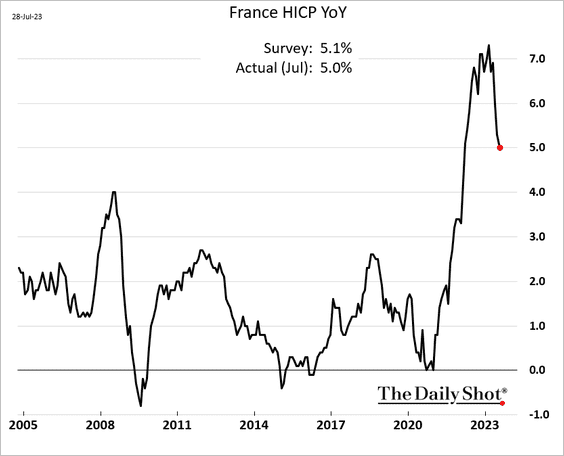

• France (easing):

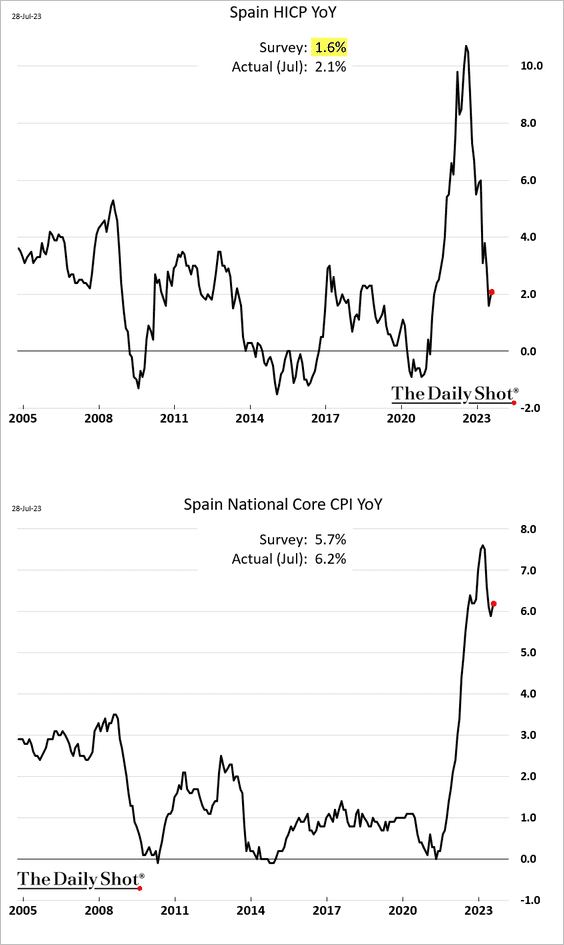

• Spain (a rebound):

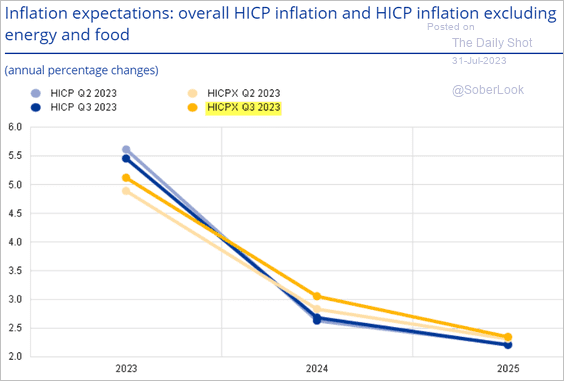

• Forecasters boosted their projections for euro-area core inflation.

Source: ECB

Source: ECB

——————–

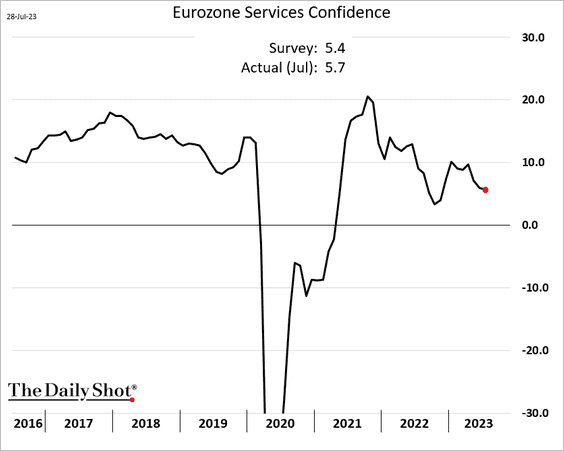

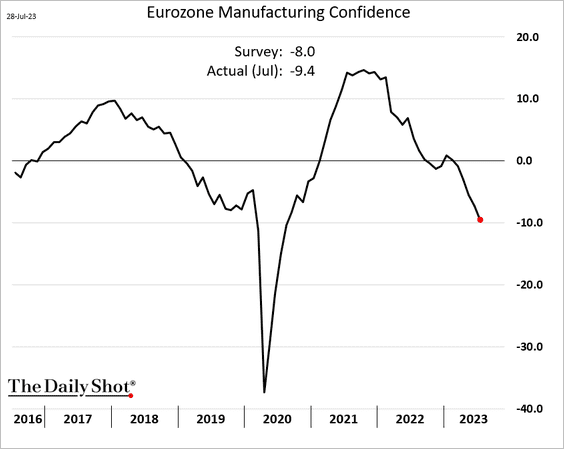

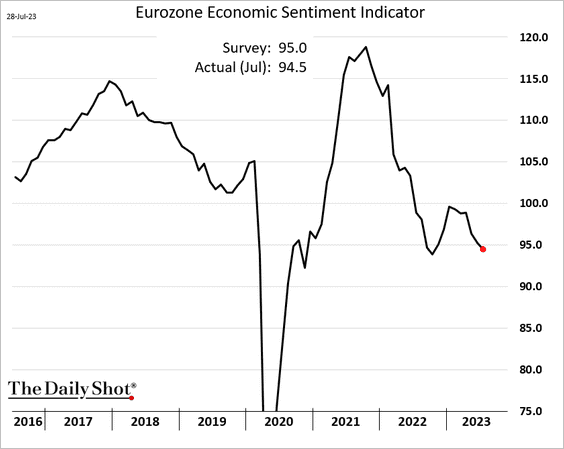

3. Sentiment among service companies held up well this month, topping expectations.

But manufacturing confidence is crashing.

This chart shows the aggregate economic sentiment (business and consumer confidence).

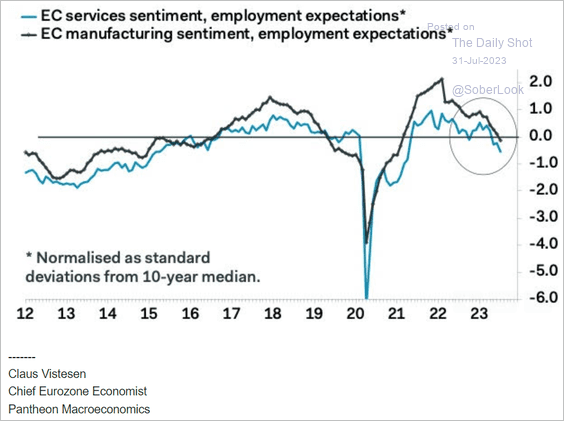

Employment expectations are deteriorating, according to Pantheon Macroeconomics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

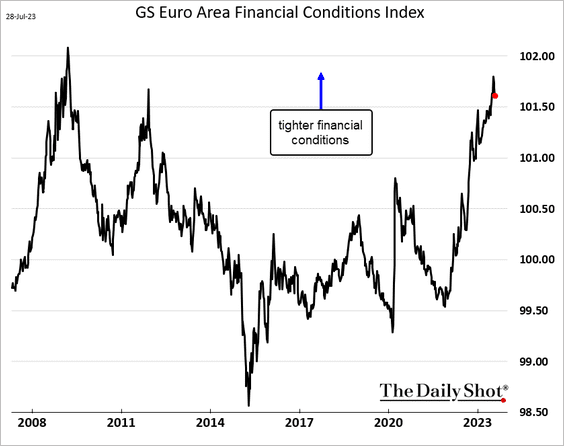

4. Euro-area financial conditions are near the tightest levels since the GFC.

Back to Index

Europe

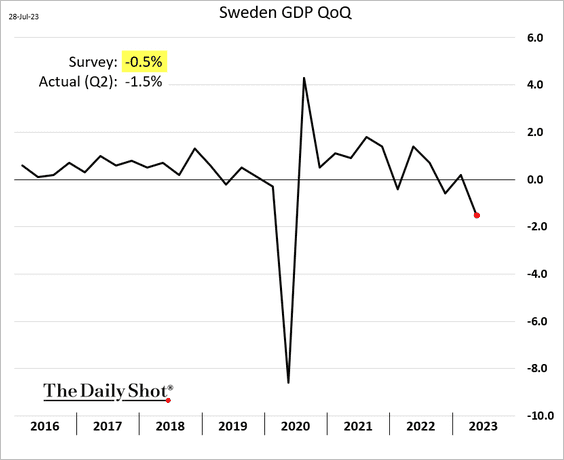

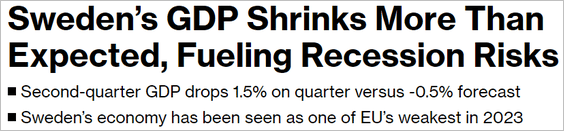

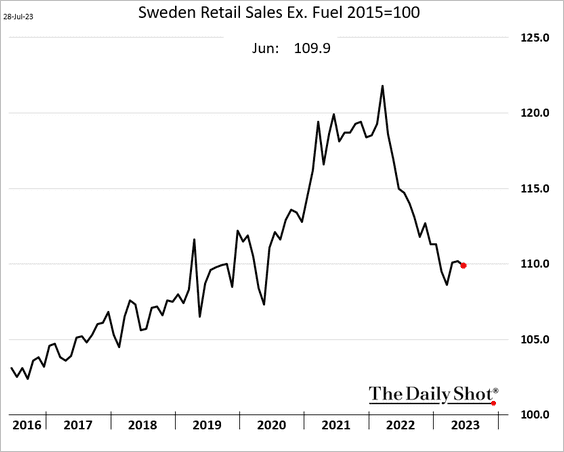

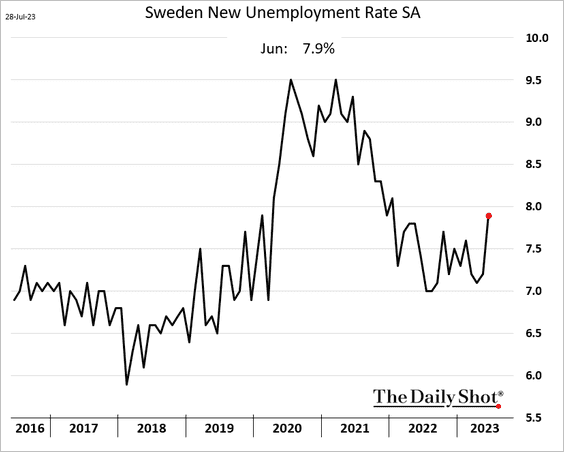

1. Let’s begin with Sweden.

• The economy contracted sharply last quarter.

Source: @economics Read full article

Source: @economics Read full article

• Retail sales edged lower in June.

• The unemployment rate jumped.

——————–

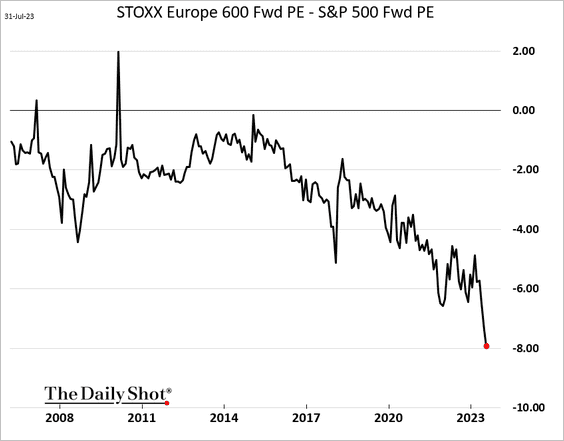

2. European companies are trading at a massive discount to US peers.

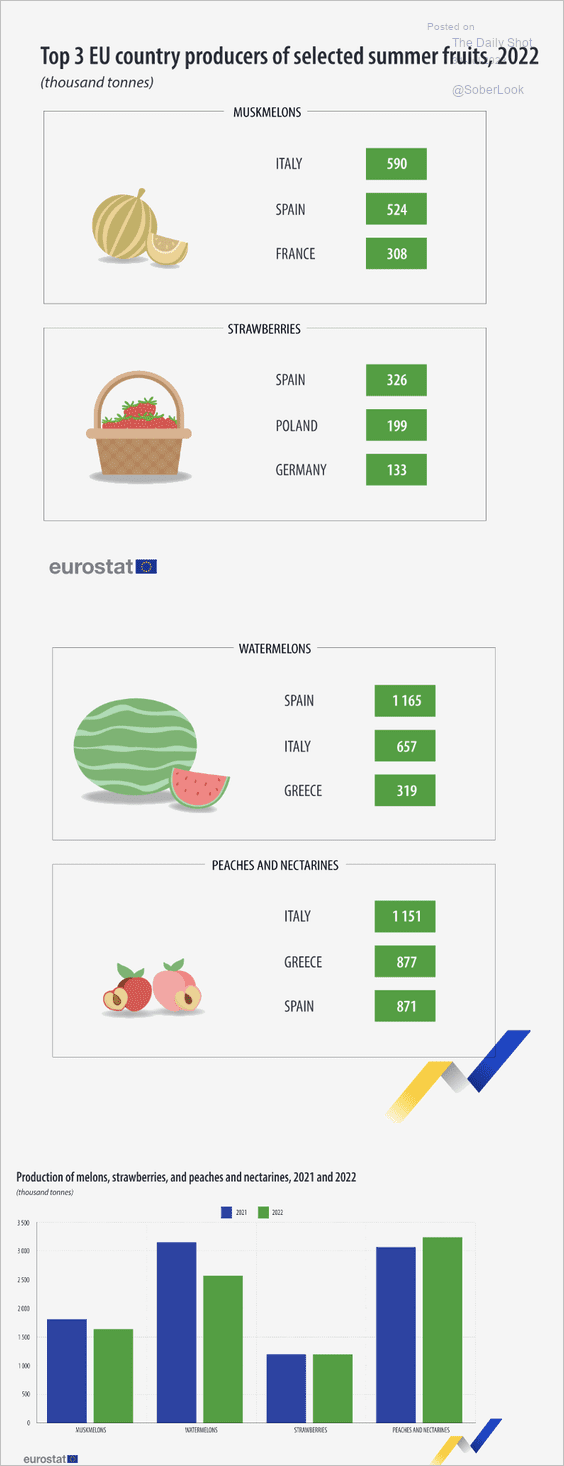

3. Here is a look at summer fruit production in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

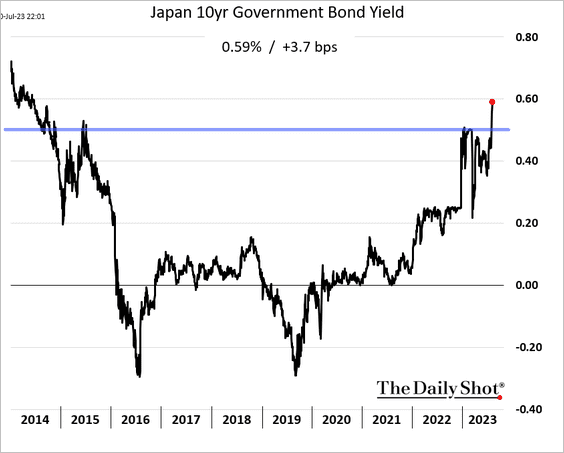

Japan

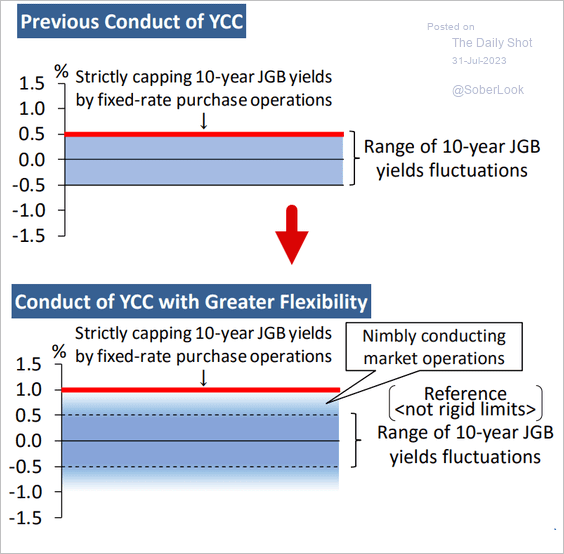

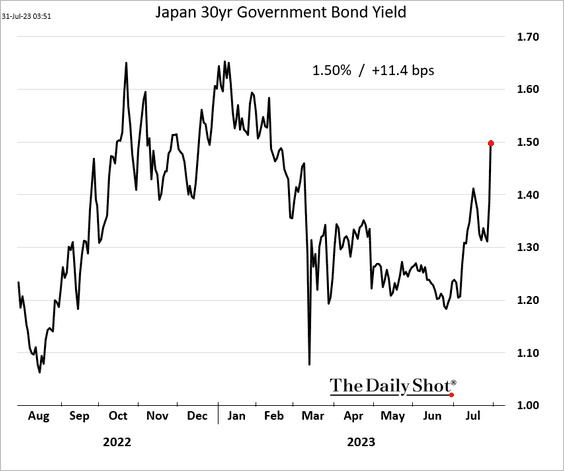

1. JGB yields surged to multi-year highs …

… as the BoJ adjusts the yield control policy.

Source: Reuters Read full article

Source: Reuters Read full article

Source: BoJ

Source: BoJ

But the central bank stepped in to buy JGBs today to arrest the selloff.

Source: forexlive Read full article

Source: forexlive Read full article

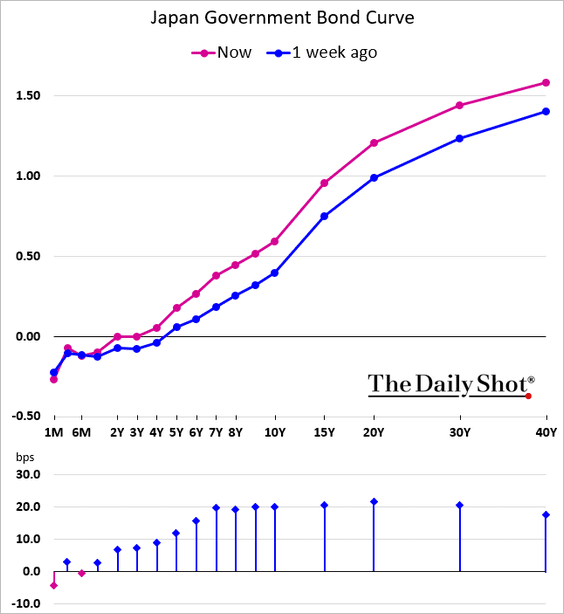

• Yields rose across the curve.

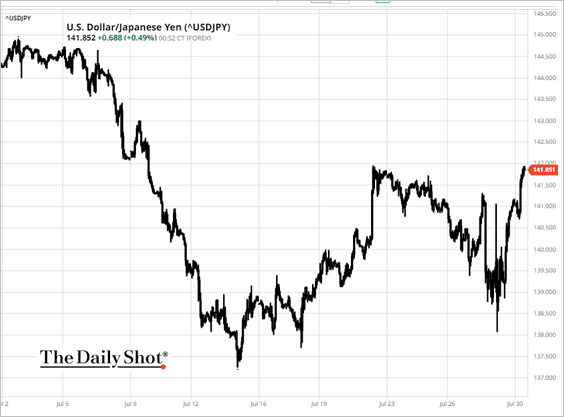

• The yen has been selling off.

Source: barchart.com

Source: barchart.com

——————–

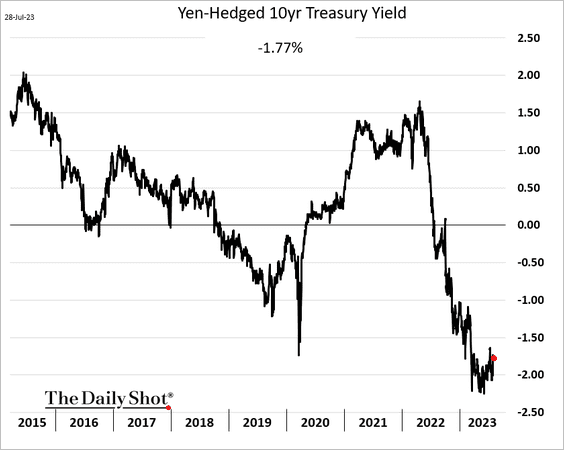

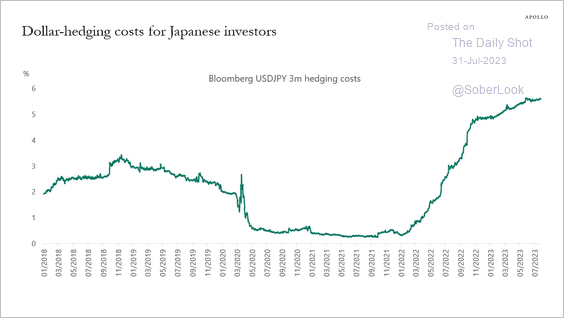

2. Treasuries hedged into yen look extremely unattractive.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

China

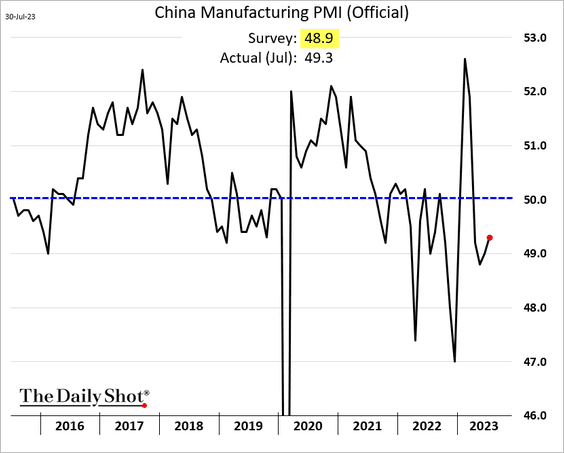

1. Manufacturing continues to contract, but at a slower pace, according to the official PMI report.

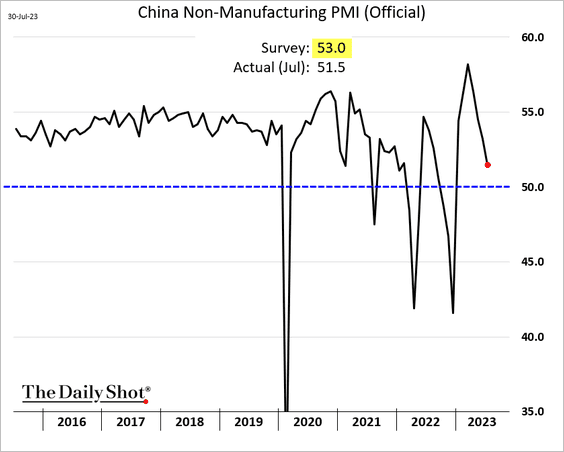

The expansion in services is slowing rapidly,

——————–

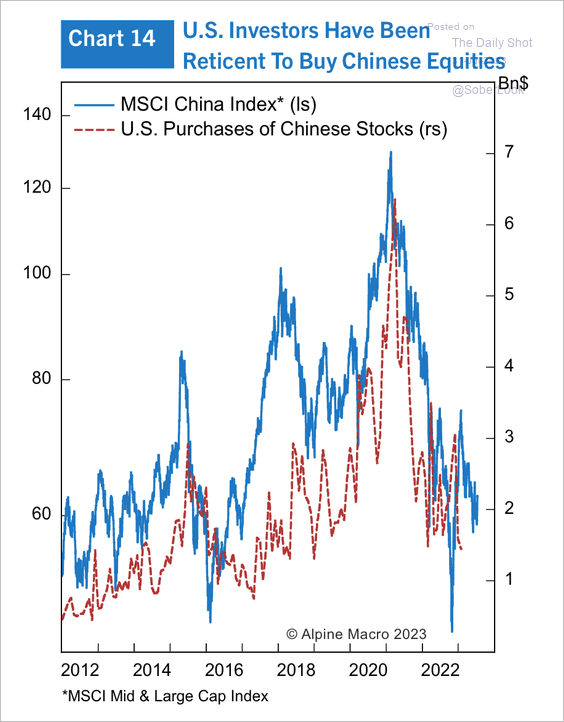

2. Chinese stocks remain unloved by US investors.

Source: Alpine Macro

Source: Alpine Macro

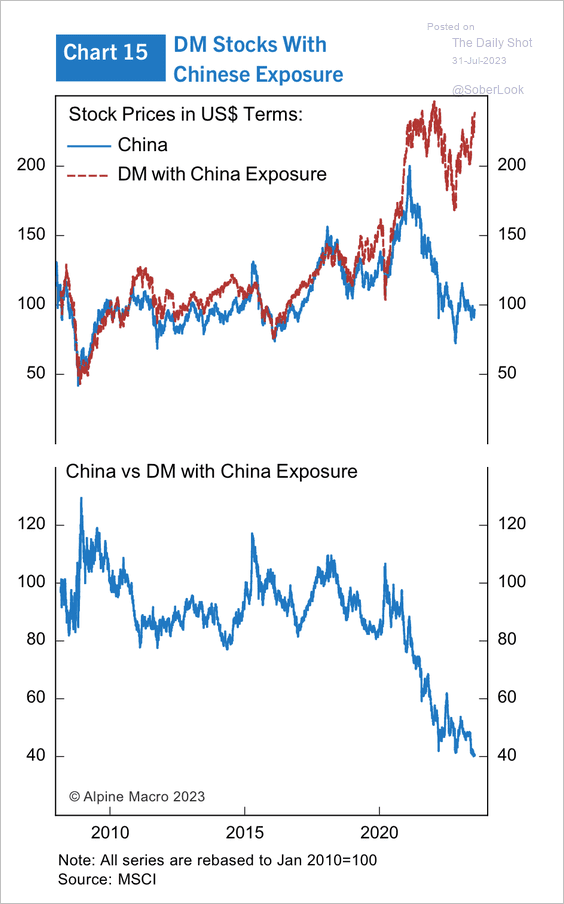

Developed-market stocks with Chinese exposure have significantly outperformed Chinese equities in recent years.

Source: Alpine Macro

Source: Alpine Macro

——————–

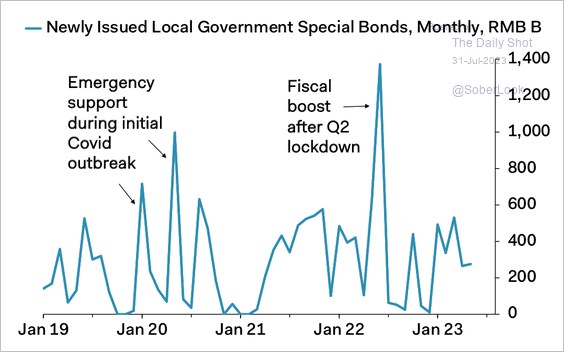

3. Local governments have front-loaded bond issuance.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Emerging Markets

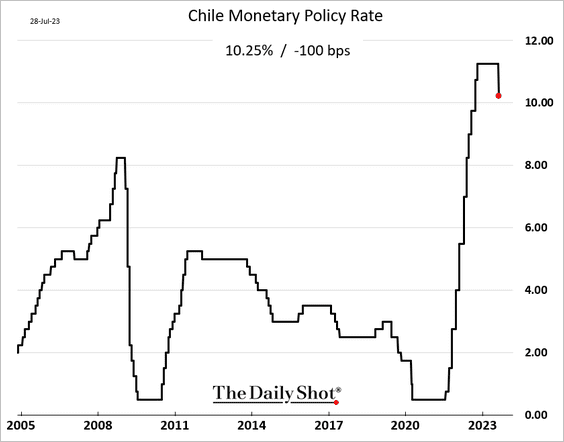

1. LatAm rate cuts have started, with Chile reducing rates by 100 bps (the market expected 75 bps).

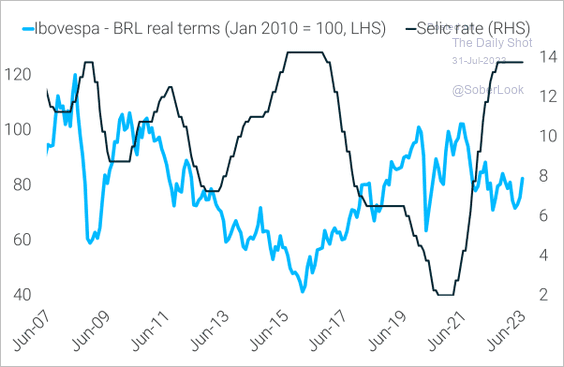

2. Brazil is next, which is a tailwind for stocks.

Source: TS Lombard

Source: TS Lombard

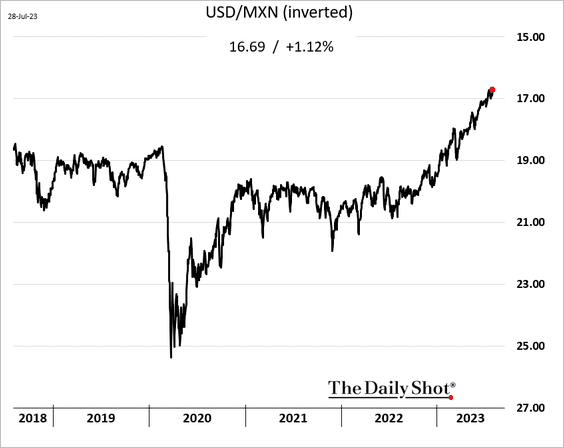

3. The Mexican peso continues to surge.

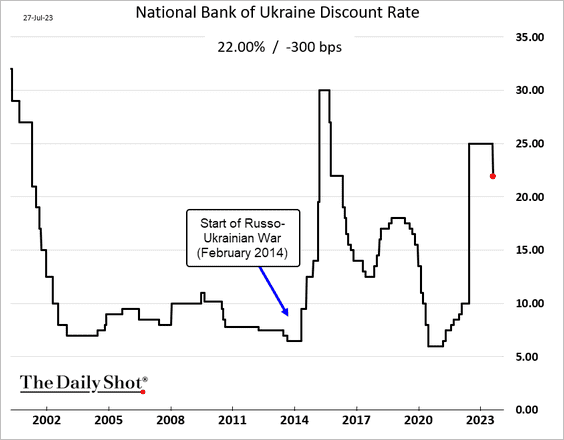

4. Ukraine’s central bank cut rates.

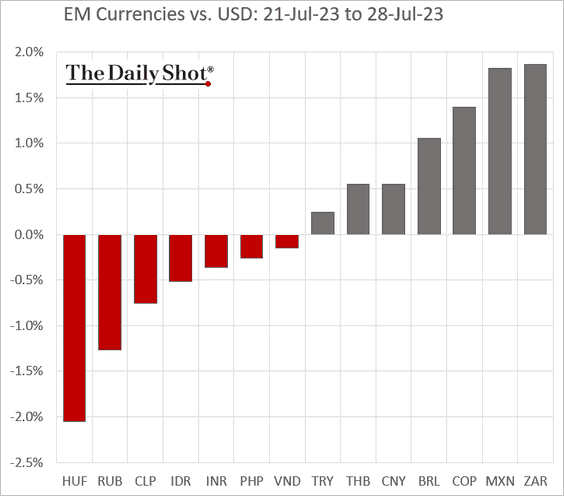

5. Next, we have some performance data from last week.

• Currencies:

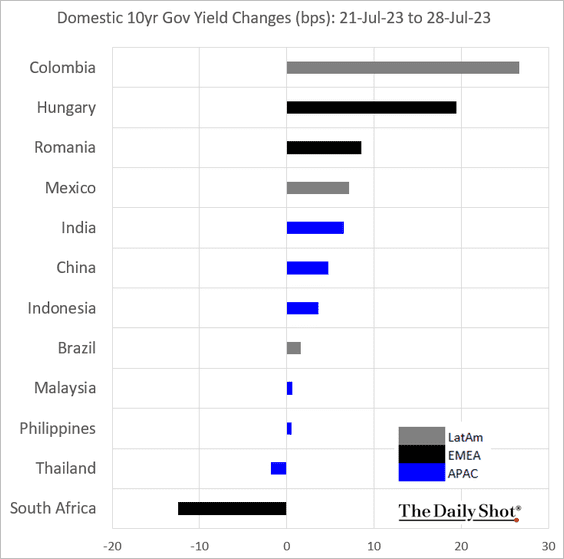

• Bond yields:

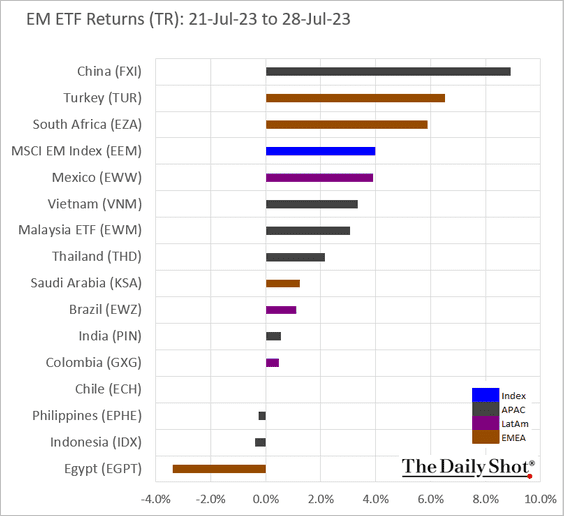

• Equity ETFs:

Back to Index

Cryptocurrency

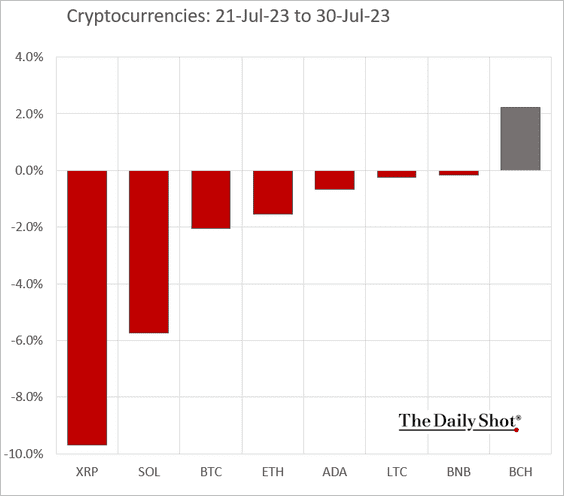

1. Let’s start with last week’s performance.

2. Curve Finance, a major stablecoin exchange, fell victim to an exploit.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

——————–

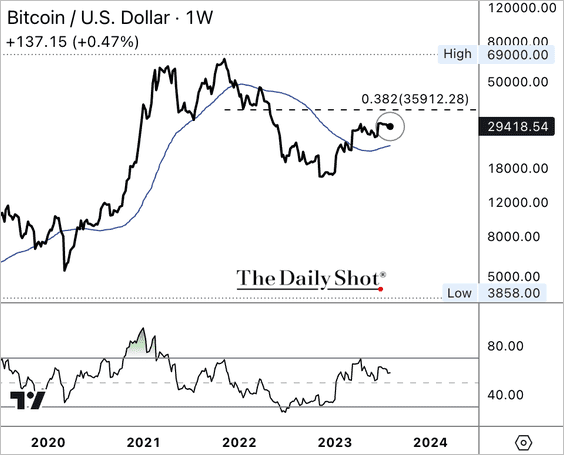

3. Bitcoin continues to stall below resistance.

Back to Index

Commodities

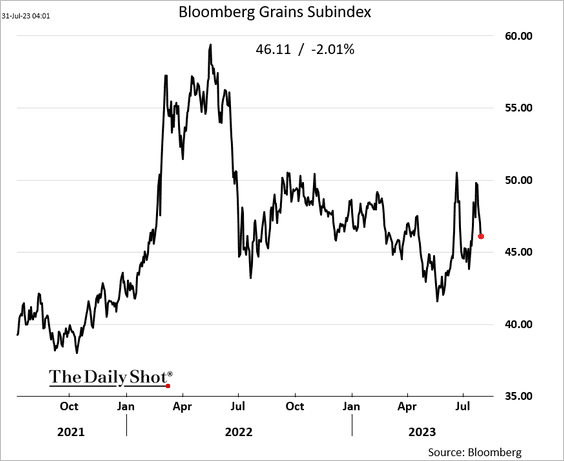

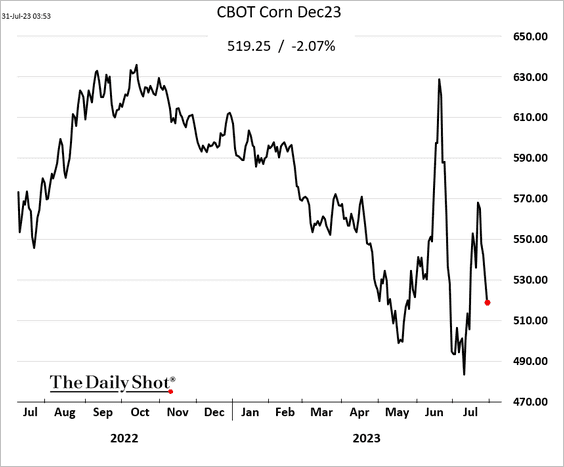

1. The recent bounce in grain prices is reversing.

——————–

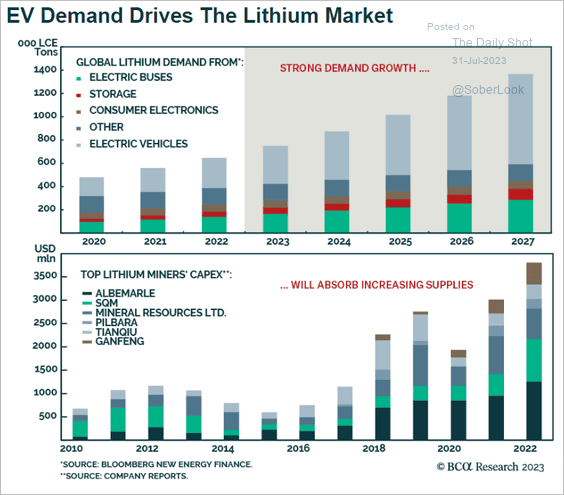

2. Below is a look at lithium demand and miners’ CapEx.

Source: BCA Research

Source: BCA Research

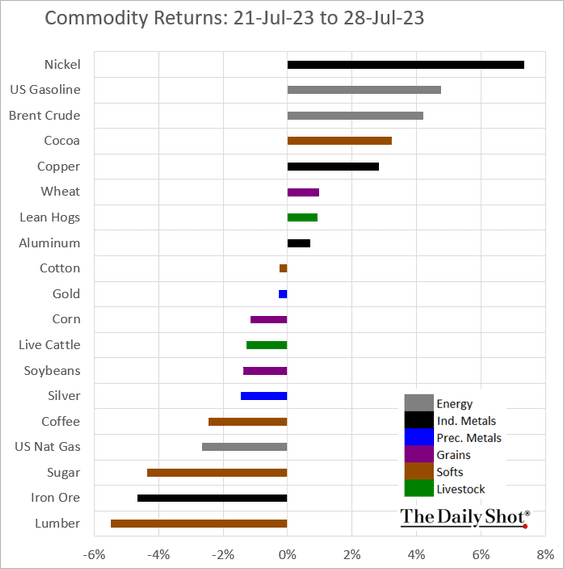

3. Here is last week’s performance across key commodity markets.

Back to Index

Equities

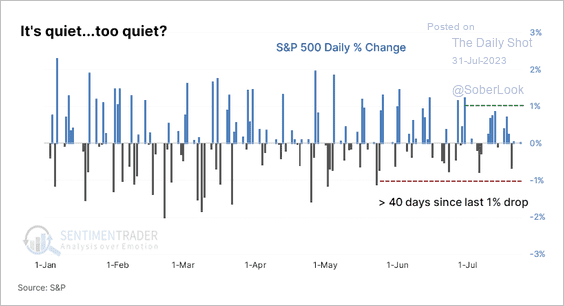

1. It has been a while since the S&P 500 experienced a 1%+ drop. According to SentimenTrader, this type of dynamic is almost exclusively witnessed during bull markets.

Source: SentimenTrader

Source: SentimenTrader

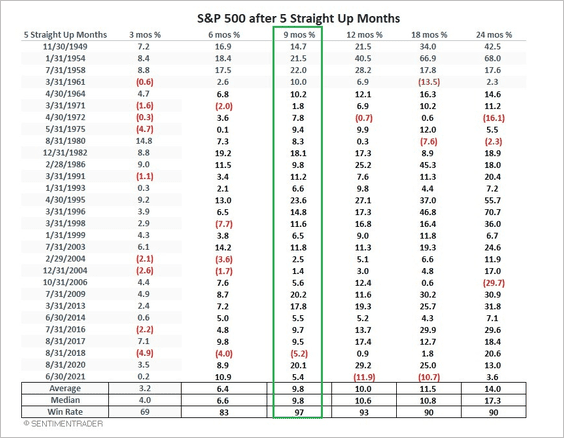

Five consecutive up months for the S&P 500 are rare and typically bullish.

Source: SentimenTrader

Source: SentimenTrader

——————–

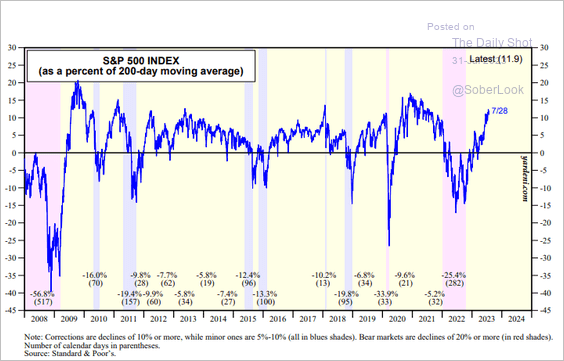

2. This chart shows the deviation of the S&P 500 from its 200-day moving average

Source: Yardeni Research

Source: Yardeni Research

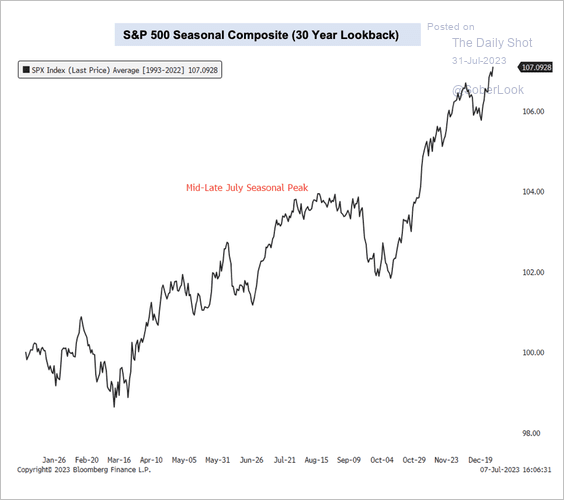

3. The S&P 500 is entering a seasonally weak period.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

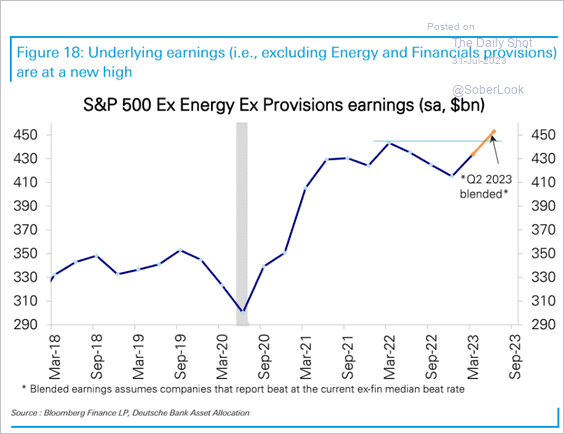

4. The underlying S&P 500 earnings hit a new high in Q2.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

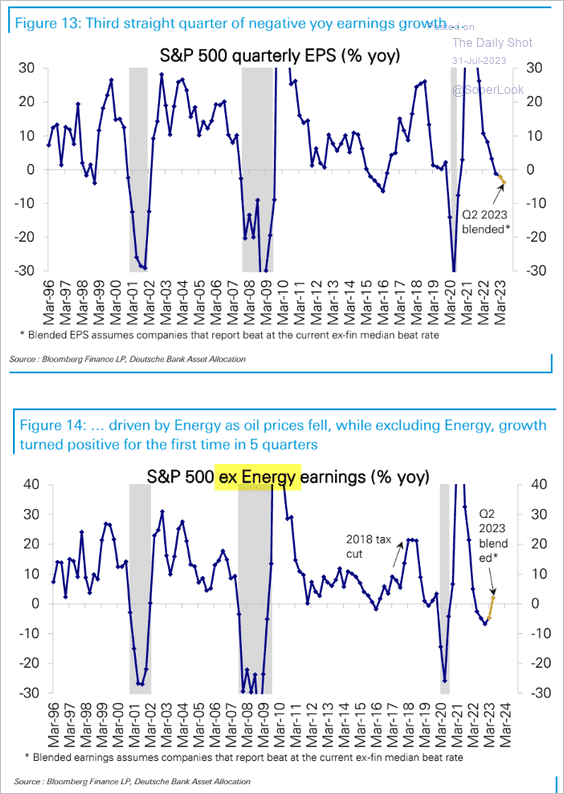

This chart shows the year-over-year EPS growth.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

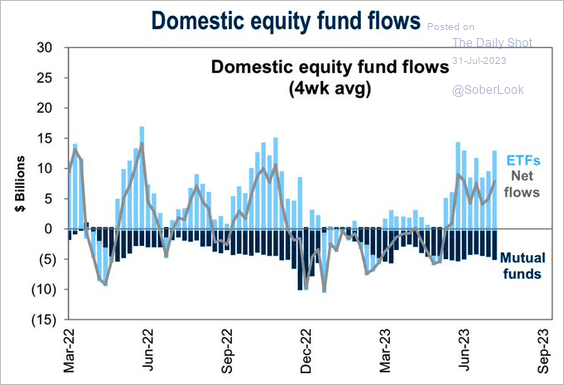

5. Fund flows remain robust.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

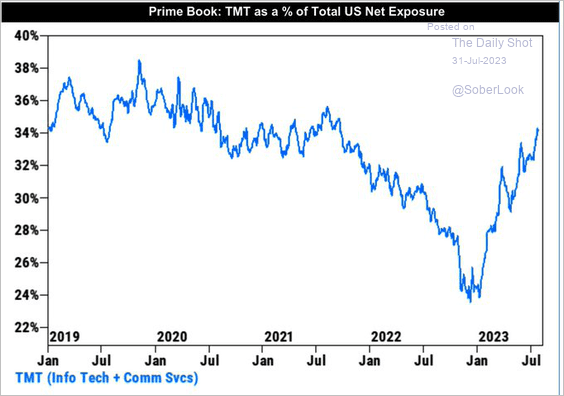

6. Hedge funds have been buying tech.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

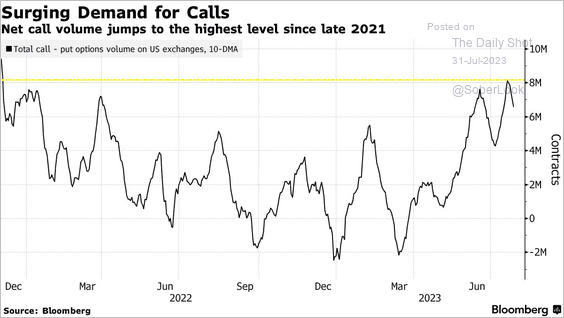

7. Demand for call options remains elevated.

Source: @markets Read full article

Source: @markets Read full article

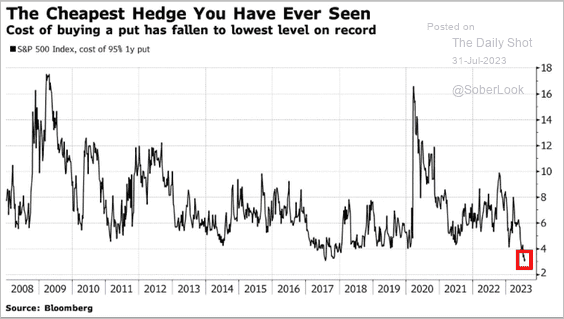

Put options are very cheap.

Source: Francois Trahan

Source: Francois Trahan

——————–

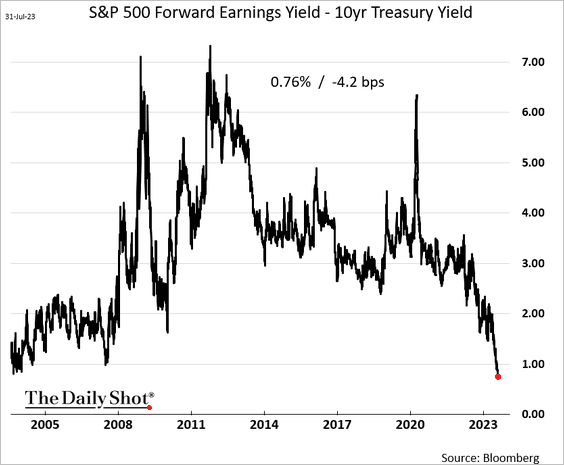

8. The S&P 500 equity risk premium continues to collapse.

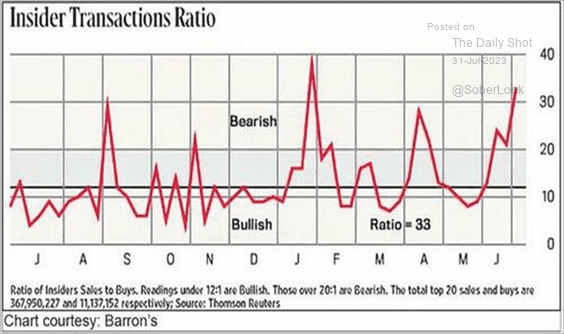

9. Insiders are very bearish.

Source: Barron’s

Source: Barron’s

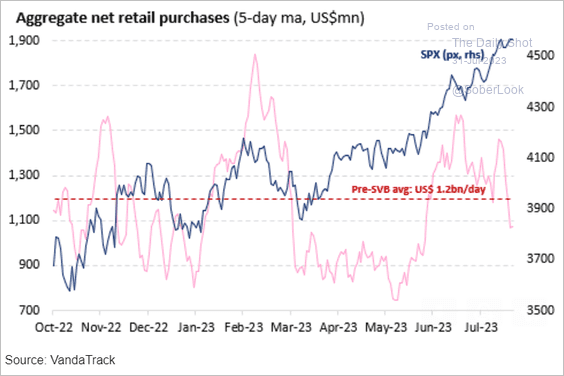

10. Retail investors have reduced their share purchases, …

Source: Vanda Research

Source: Vanda Research

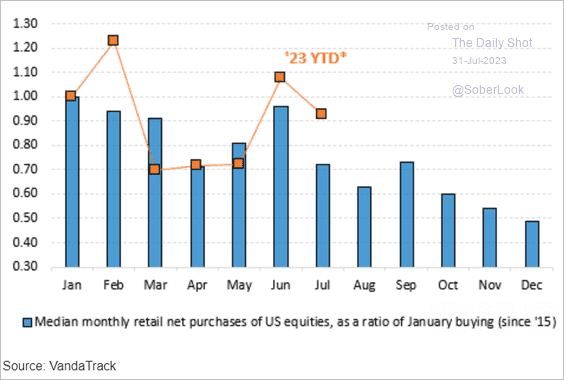

… which typically happens in July.

Source: Vanda Research

Source: Vanda Research

——————–

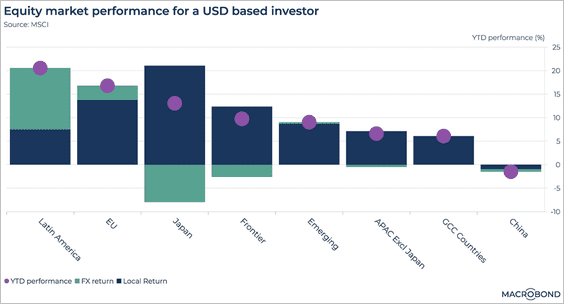

11. Here is the impact of currency fluctuations on international stock returns for US investors (year-to-date).

Source: Macrobond

Source: Macrobond

12. Next, we have some performance data from last week.

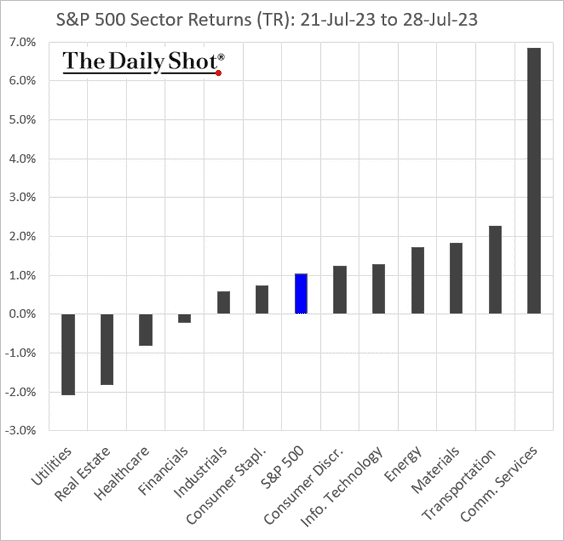

• Sectors:

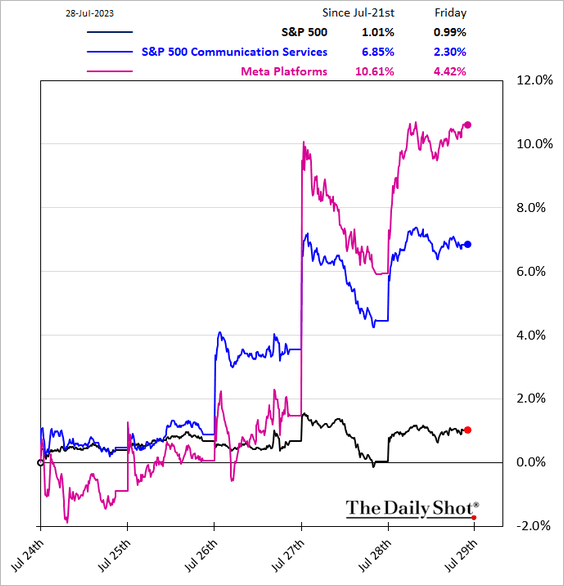

– Communication Services:

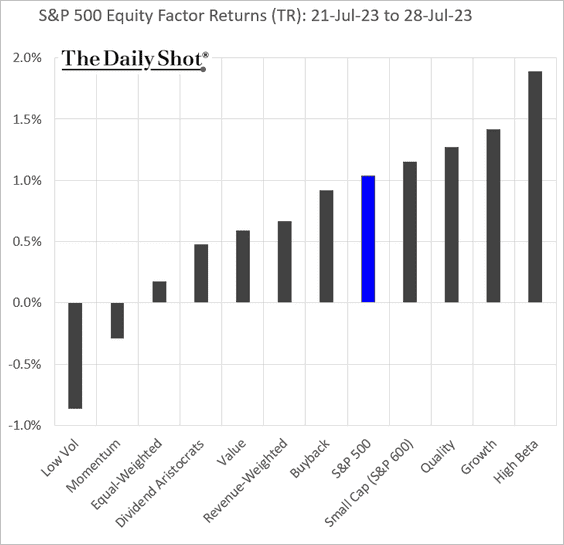

• Equity factors:

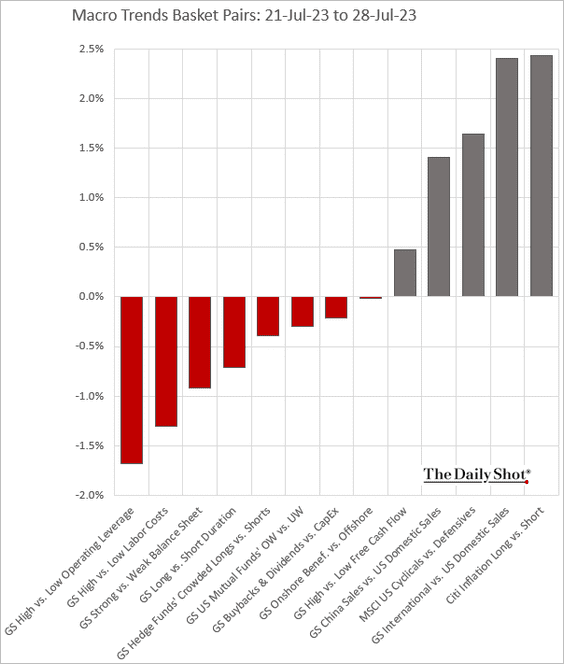

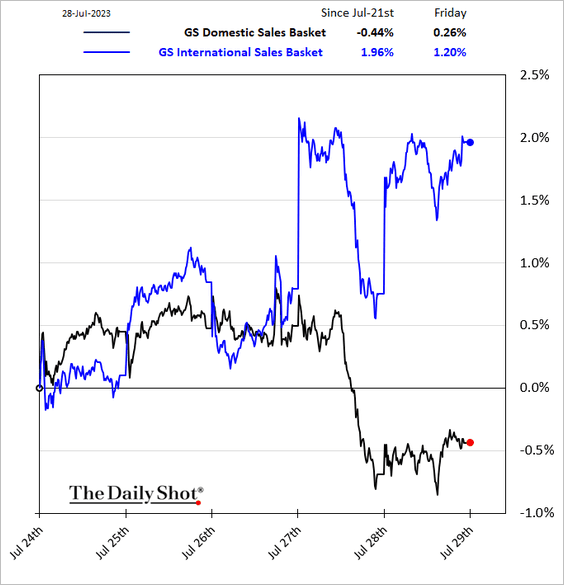

• Macro baskets’ relative performance:

– Companies with significant international sales outperformed last week.

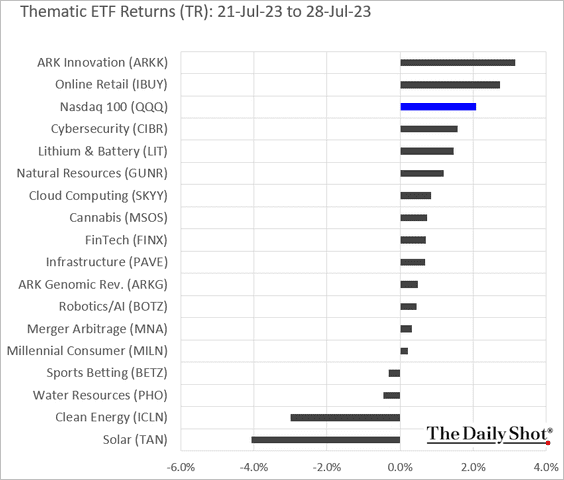

• Thematic ETFs:

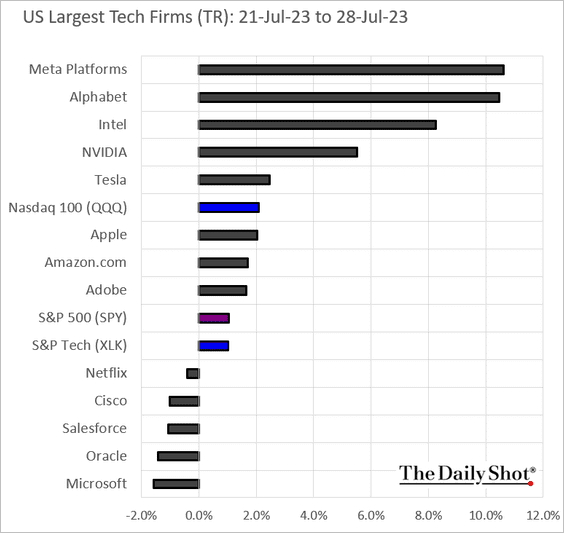

• Largest US tech firms:

Back to Index

Credit

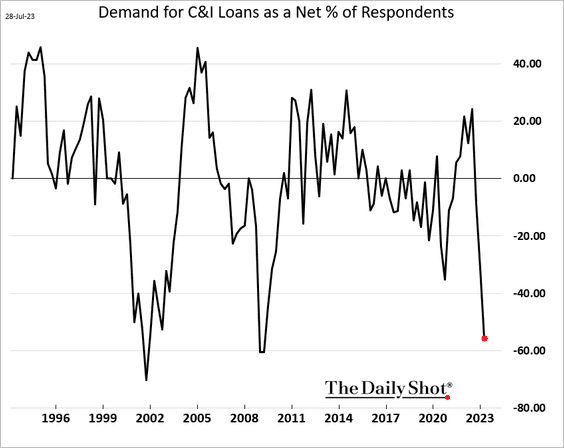

1. US business loan demand is crashing.

Further reading

Further reading

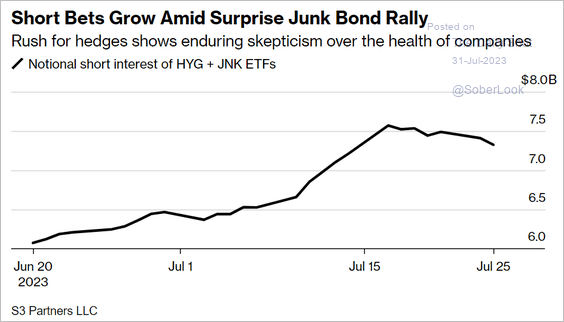

2. Short interest in HY ETFs has risen sharply.

Source: @markets Read full article

Source: @markets Read full article

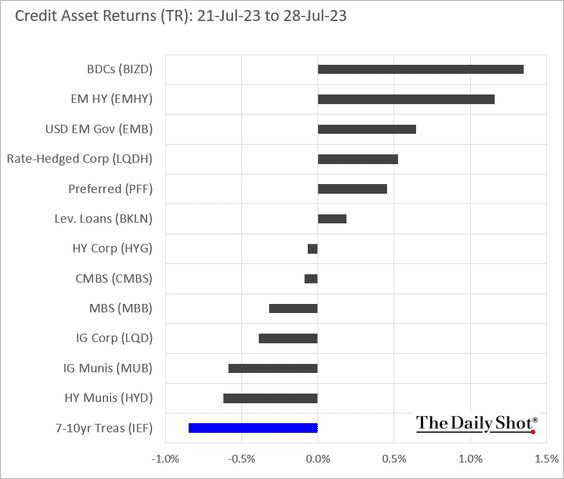

3. Here is last week’s performance across credit asset classes.

Back to Index

Global Developments

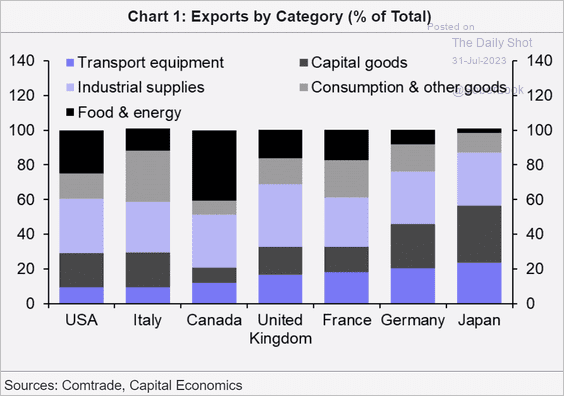

1. This chart shows the composition of exports in select economies.

Source: Capital Economics

Source: Capital Economics

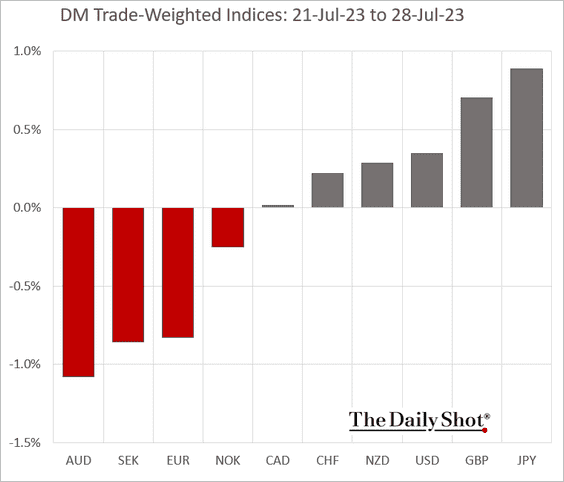

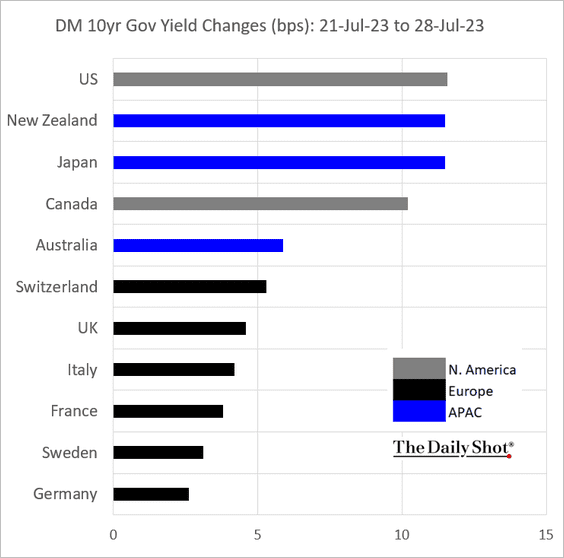

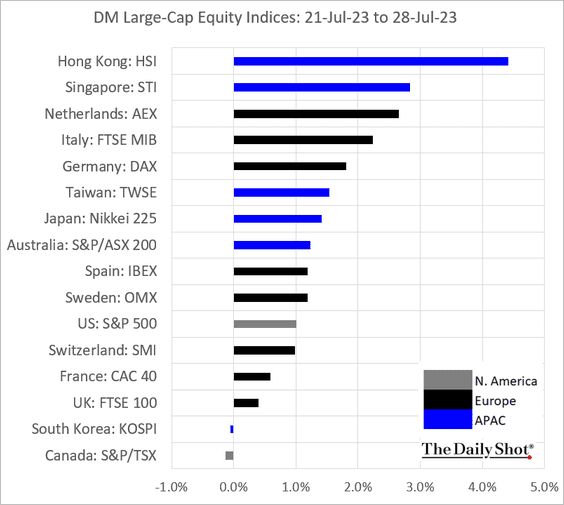

2. Here is a look at last week’s performance data for advanced economies.

• Currencies:

• Bond yields:

• Equities:

——————–

Food for Thought

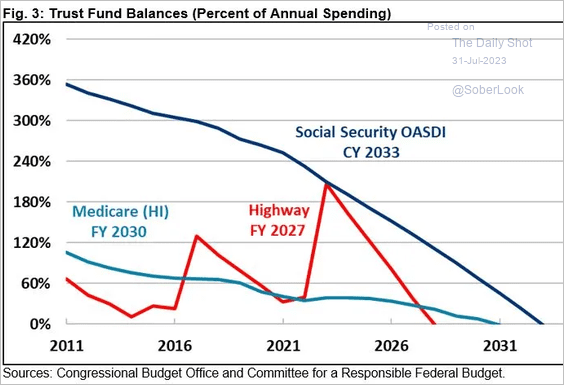

1. US trust funds are headed toward insolvency:

Source: Committee for a Responsible Federal Budget

Source: Committee for a Responsible Federal Budget

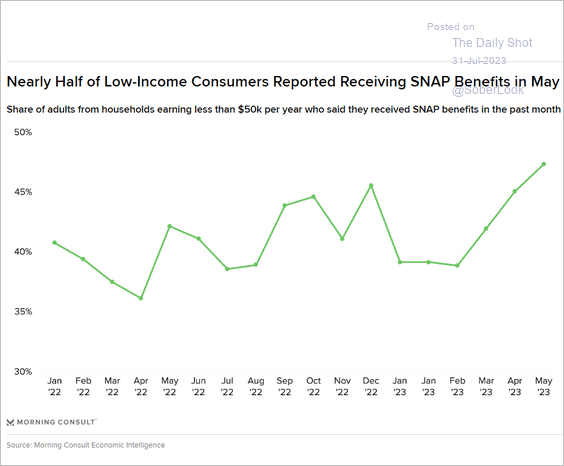

2. Low-income consumers using food stamps:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

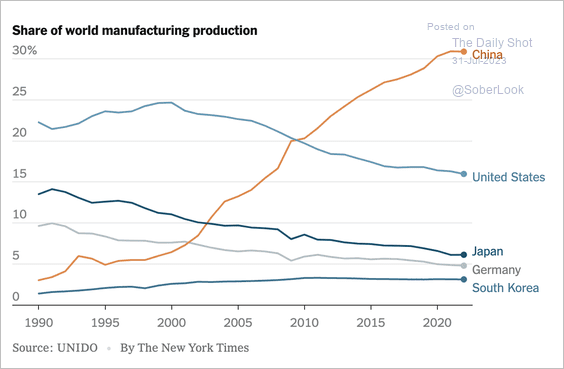

3. Share of global manufacturing output:

Source: The New York Times Read full article

Source: The New York Times Read full article

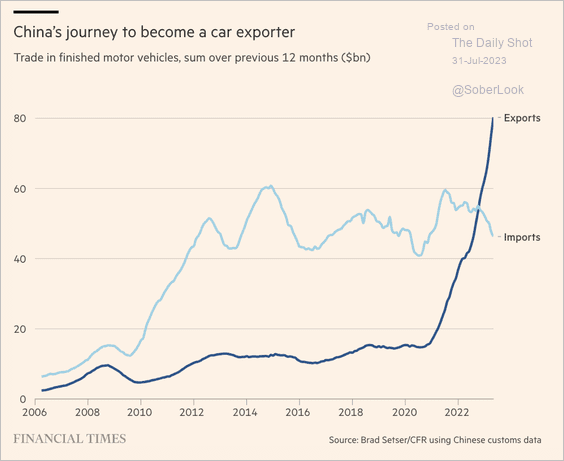

4. China’s vehicle imports and exports:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

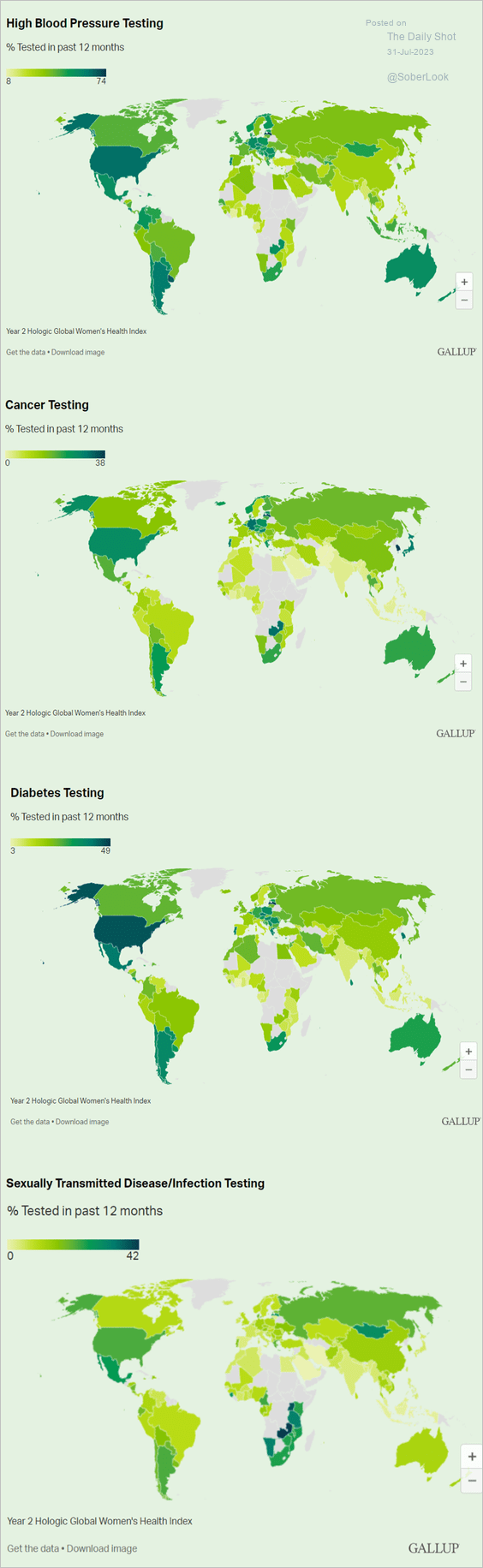

5. Percentage of women tested for various diseases:

Source: Gallup Read full article

Source: Gallup Read full article

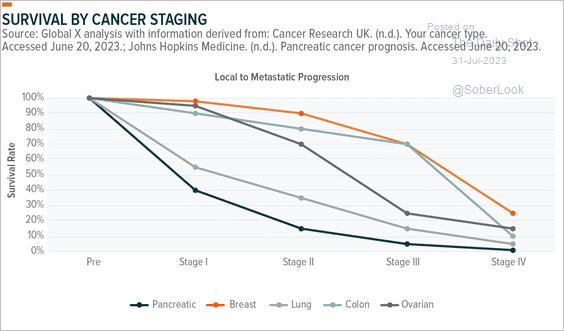

6. Survival rates by cancer staging:

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

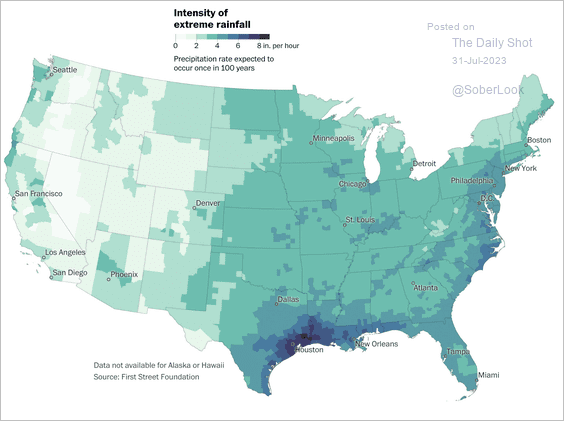

7. Intensity of extreme rainfall:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

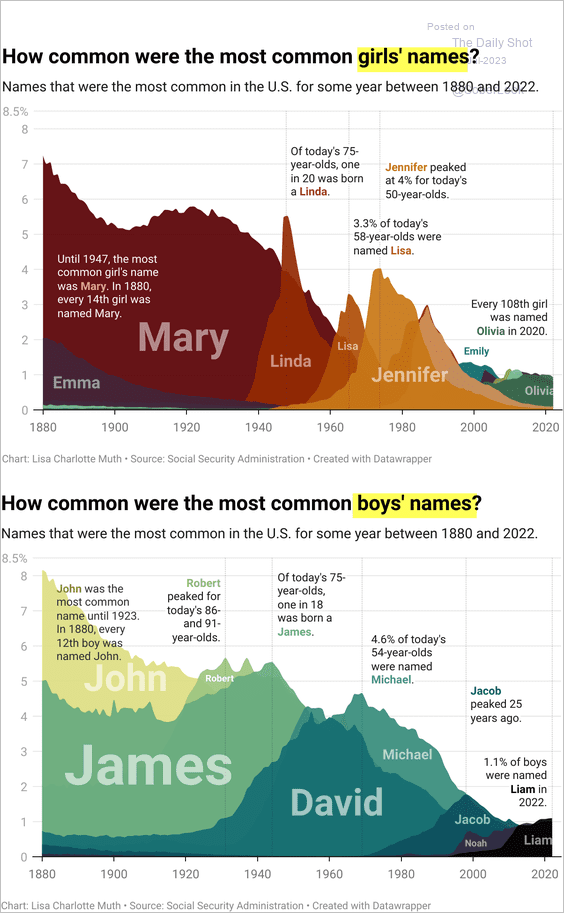

8. Most common baby names over time:

Source: @Datawrapper

Source: @Datawrapper

——————–

Back to Index