The Daily Shot: 02-Aug-23

• The United States

• Canada

• The Eurozone

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

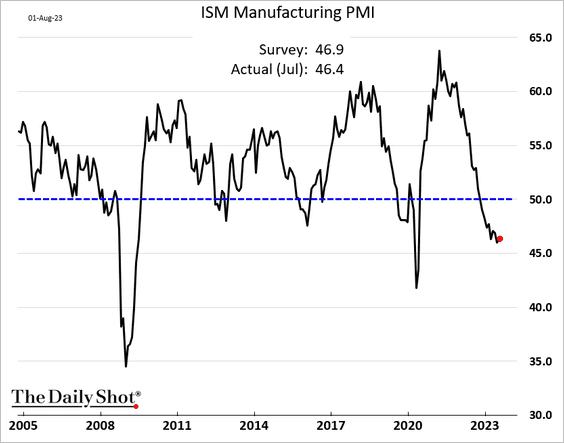

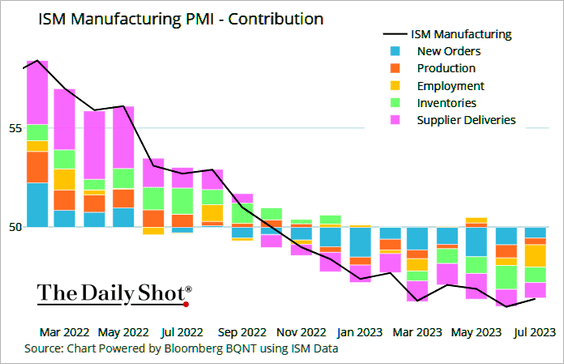

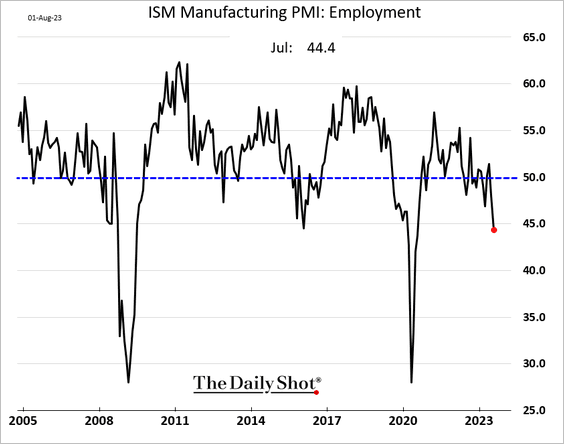

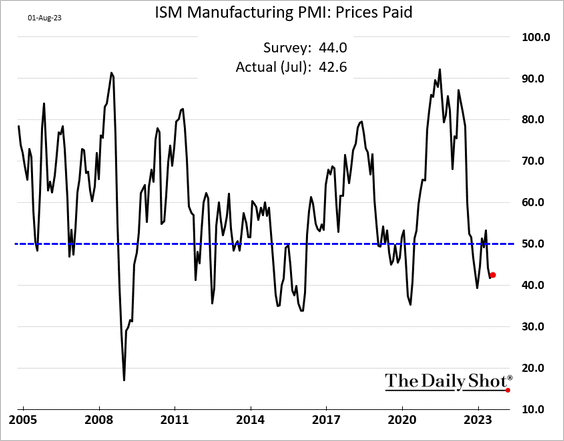

1. US (and global) factory activity remains depressed. Here is the ISM Manufacturing PMI.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

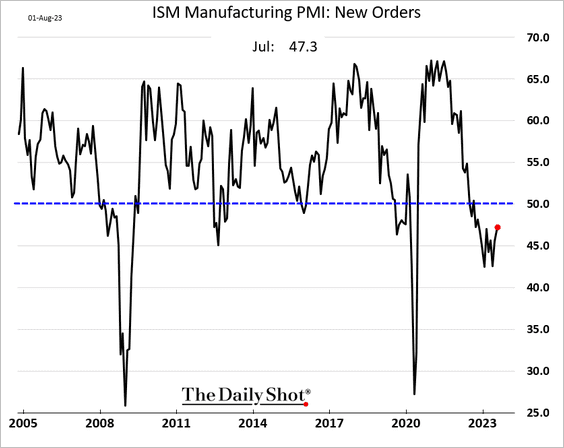

• The contraction in demand slowed somewhat in July, …

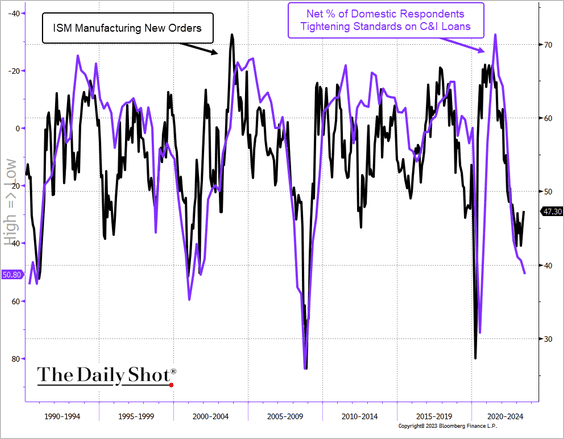

… but tightening credit conditions point to downside risks.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Factories are shedding jobs.

• Input prices keep falling (PMI < 50).

——————–

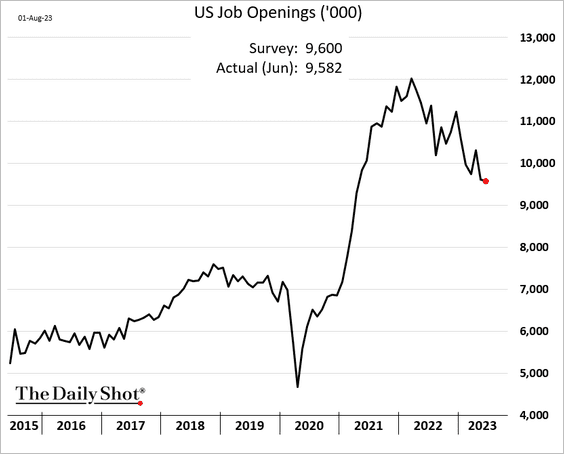

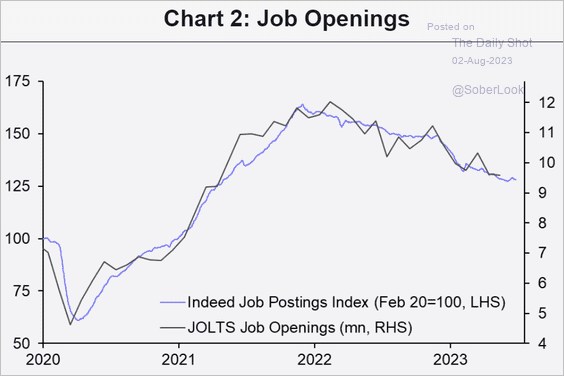

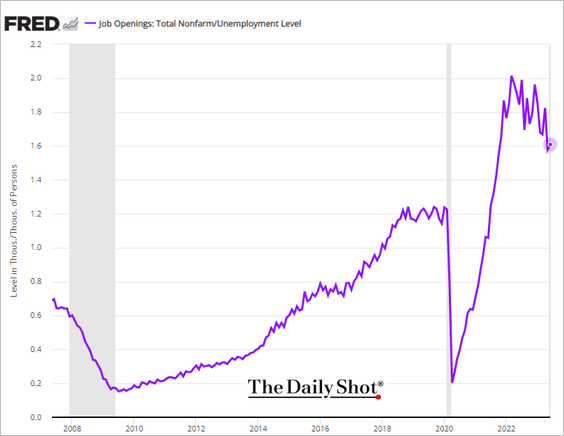

2. Job openings continue to trend lower (slowly).

Source: Reuters Read full article

Source: Reuters Read full article

• Data from Indeed points to a very gradual decline ahead.

Source: Capital Economics

Source: Capital Economics

• With 1.6 job openings for every unemployed American, the job market remains tight.

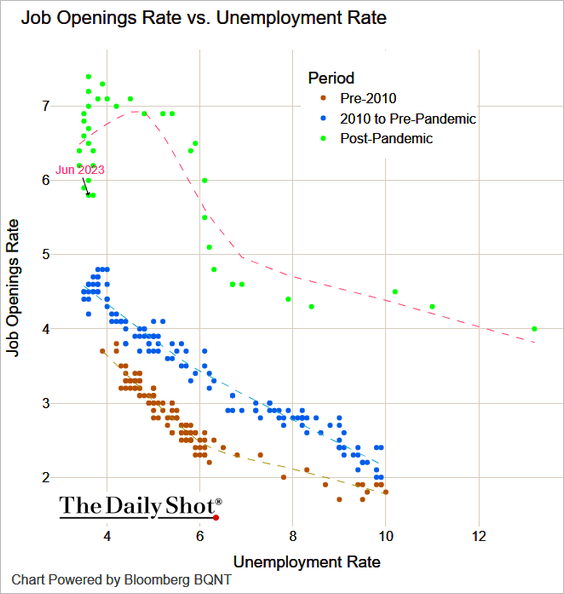

The Beveridge curve illustrates the labor market imbalance.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

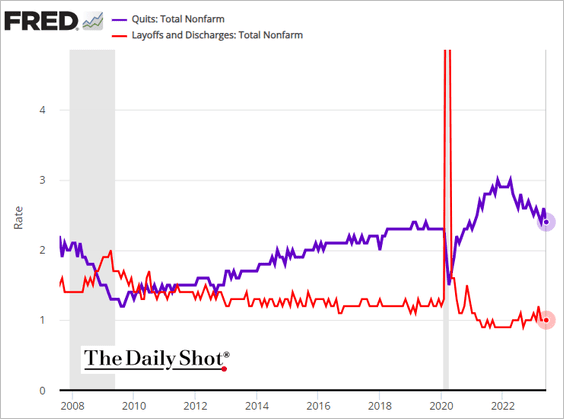

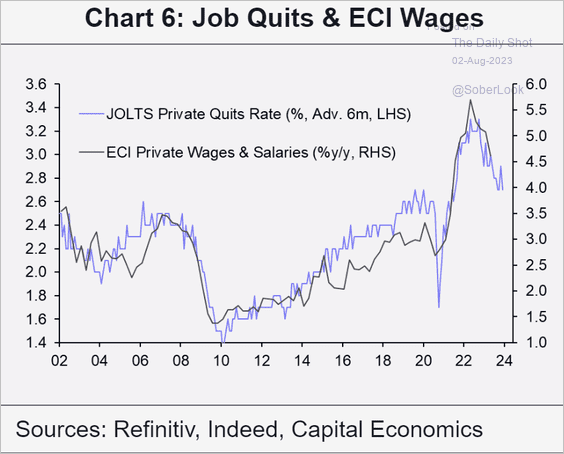

• However, the rate of voluntary resignations (quits) is declining.

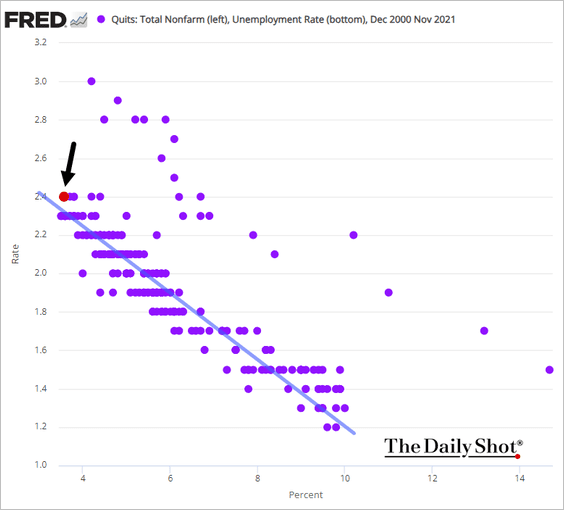

The plot of quits against the unemployment rate shows that we are back to the pre-COVID relationship.

– The declining quits rate signals slower growth in labor costs.

Source: Capital Economics

Source: Capital Economics

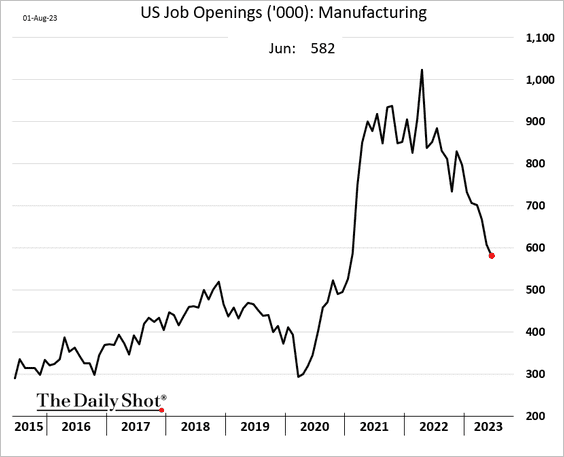

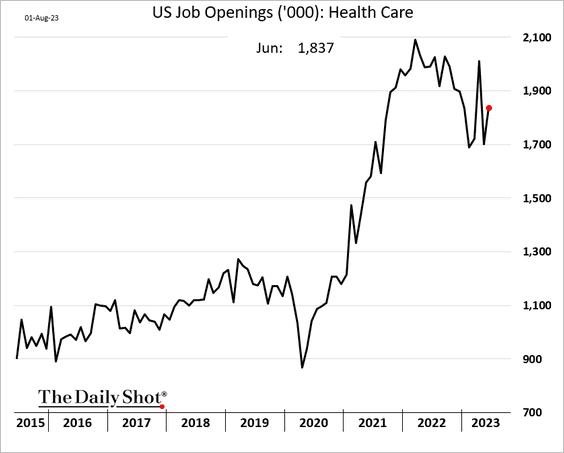

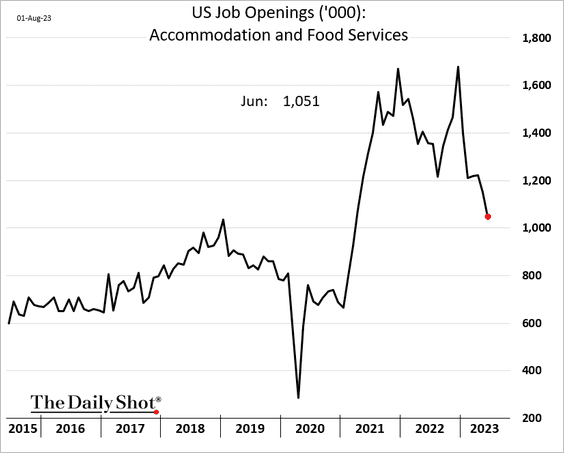

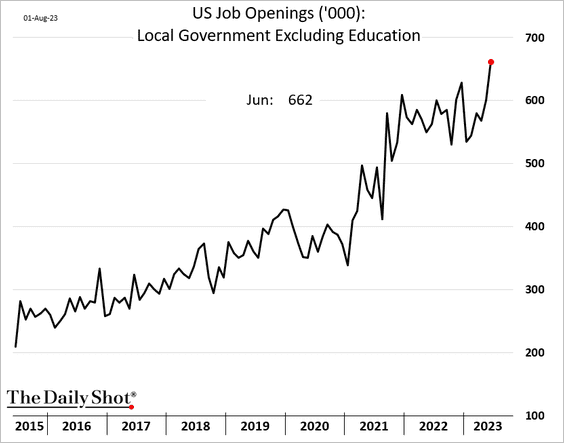

• Here are some selected trends in job openings.

– Manufacturing:

– Healthcare:

– Hotels and restaurants:

– Local government:

——————–

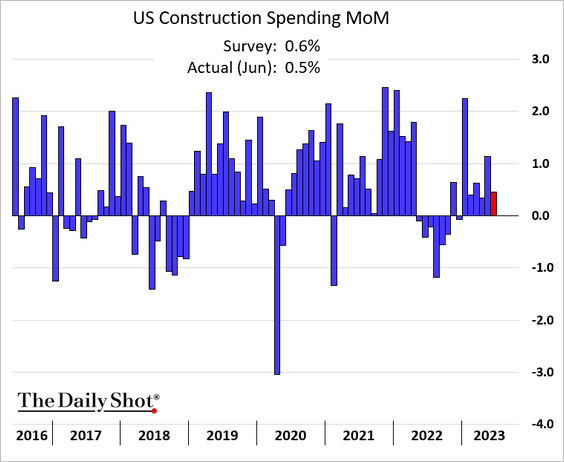

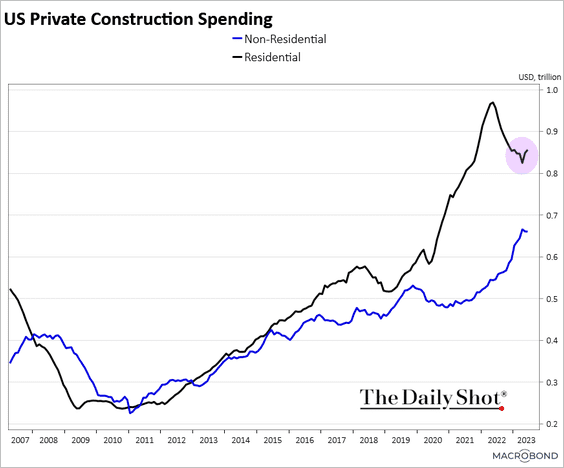

3. Construction spending increased again in June, …

… driven by gains in residential investment.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

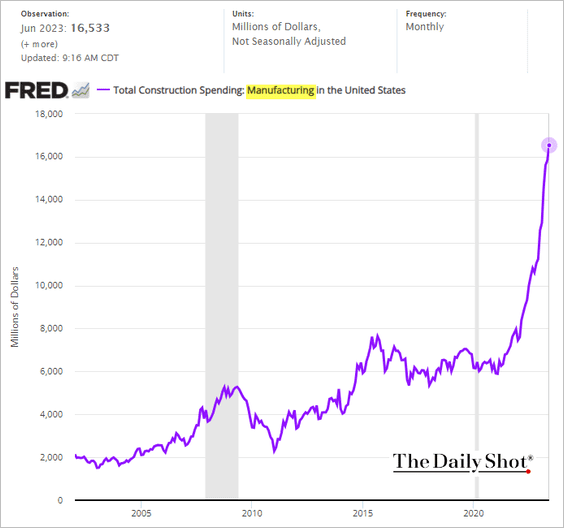

Manufacturing construction spending hit a new high.

——————–

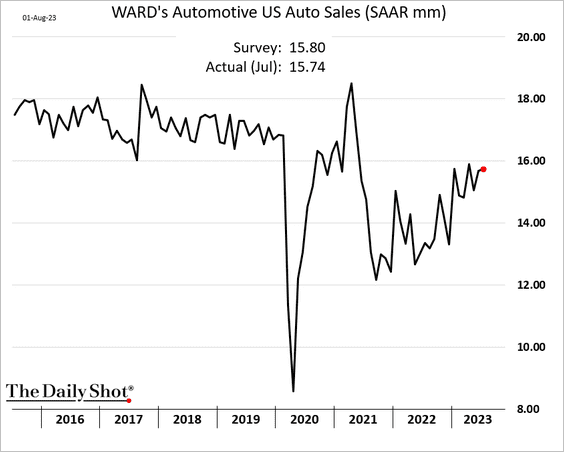

4. Automobile sales edged higher in July.

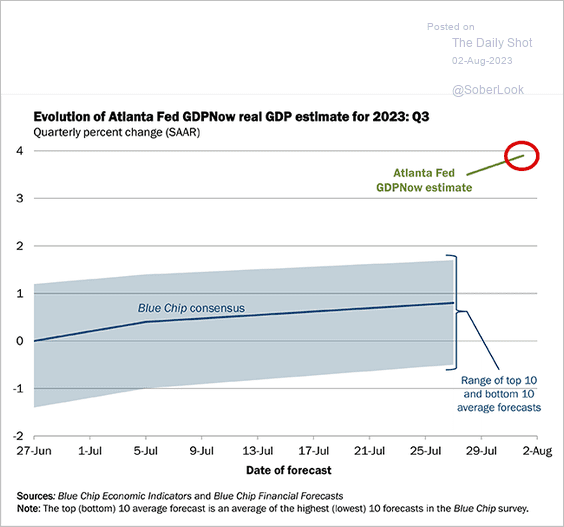

5. The Atlanta Fed’s GDPNow model’s third-quarter growth estimate is at 3.8% (annualized). We should see this measure move lower over time.

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

.

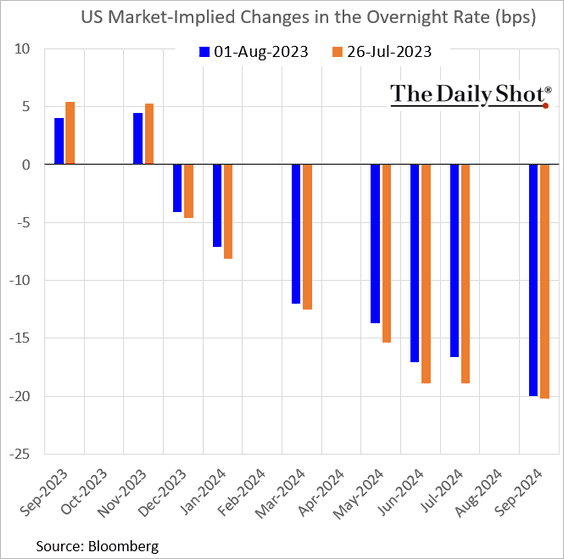

6. The market continues to assign a low probability to a September Fed rate hike.

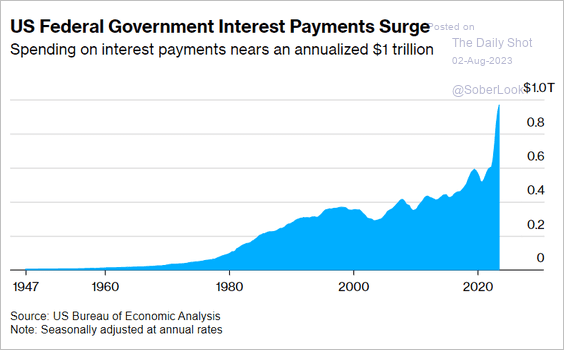

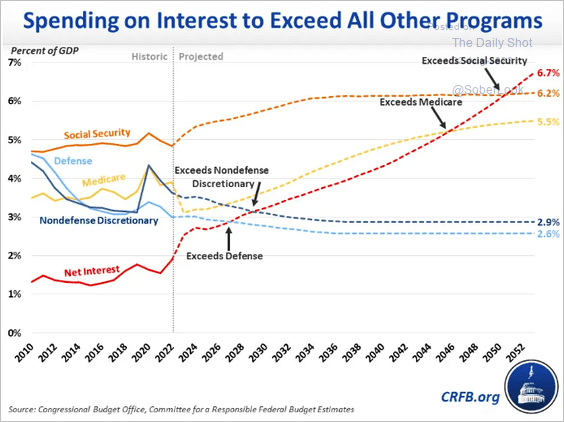

7. The US federal government’s net interest expense is surging, …

Source: @economics Read full article

Source: @economics Read full article

… and is expected to exceed all other programs in the next few decades.

Source: Committee for a Responsible Federal Budget

Source: Committee for a Responsible Federal Budget

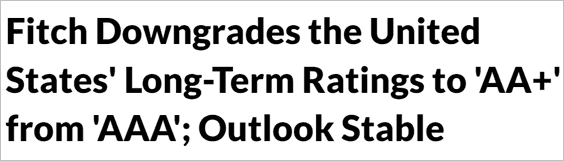

• Fitch downgraded US debt on debt-ceiling impasse risks.

Source: Fitch Ratings Read full article

Source: Fitch Ratings Read full article

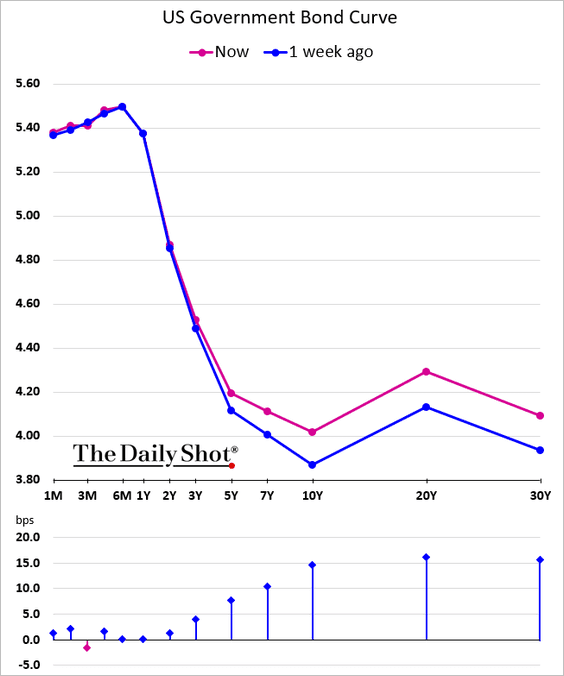

• The Treasury curve steepened.

Back to Index

Canada

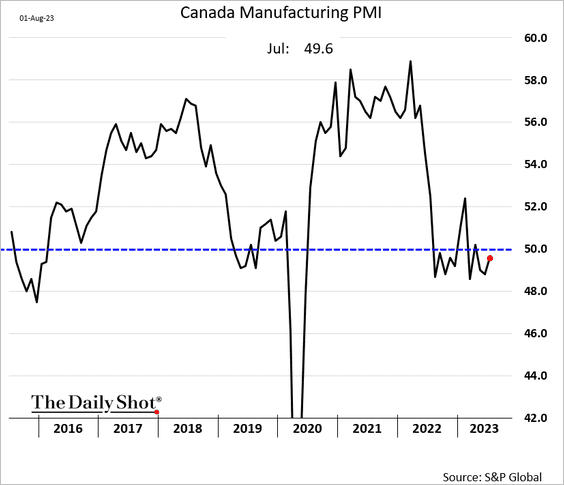

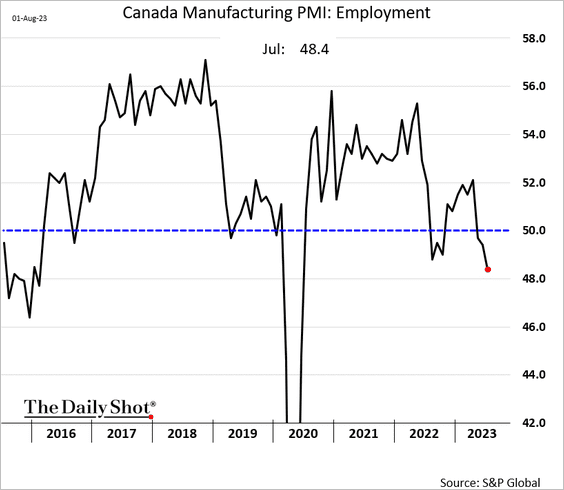

1. Factory activity remains in contraction mode.

Source: Reuters Read full article

Source: Reuters Read full article

Similar to the US, the PMI report showed factories shedding jobs.

——————–

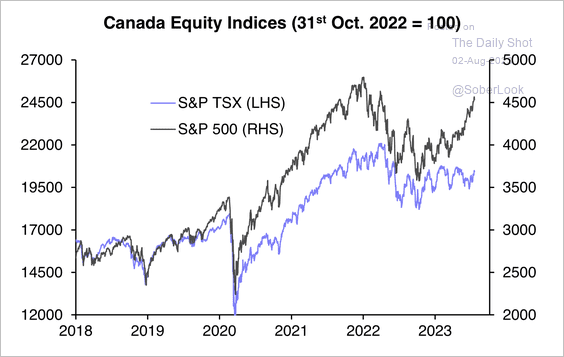

2. The lack of tech companies in the TSX index contributed to underperformance versus the S&P 500.

Source: Capital Economics

Source: Capital Economics

Back to Index

The Eurozone

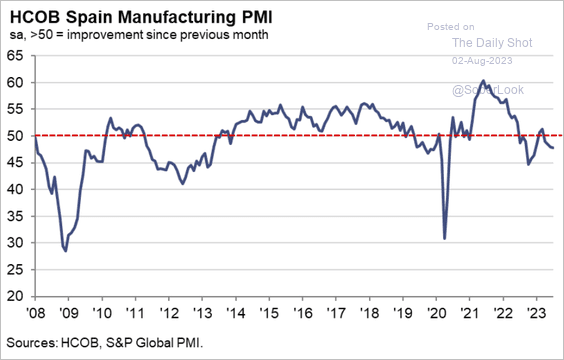

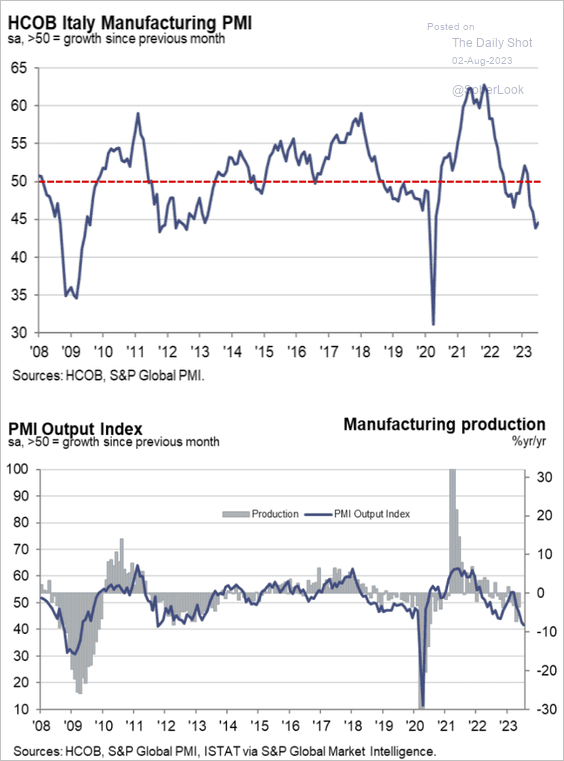

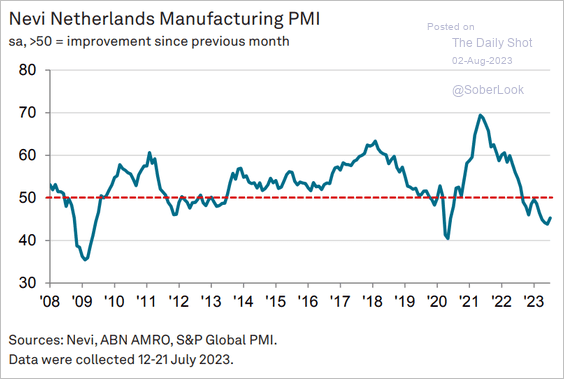

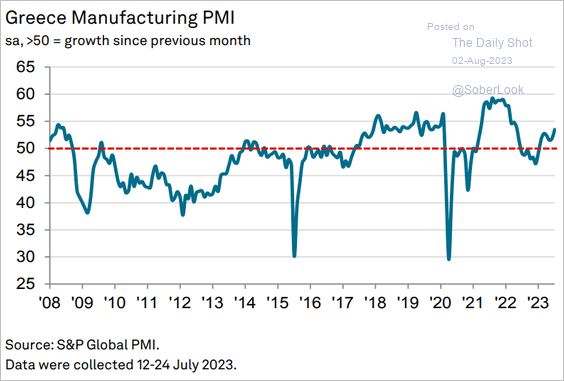

1. The PMI reports confirmed ongoing manufacturing contraction.

• Spain:

Source: S&P Global PMI

Source: S&P Global PMI

• Italy:

Source: S&P Global PMI

Source: S&P Global PMI

• The Netherlands:

Source: S&P Global PMI

Source: S&P Global PMI

Greece has been an outlier.

Source: S&P Global PMI

Source: S&P Global PMI

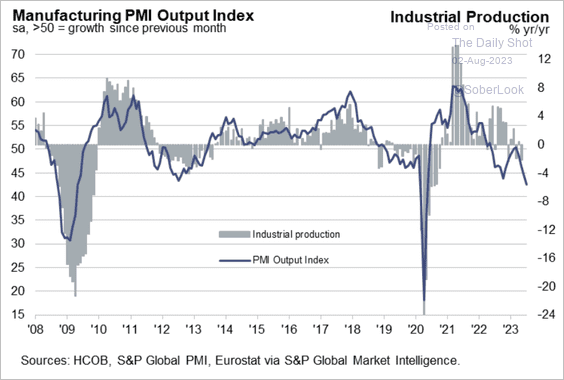

• Euro-area industrial production is headed lower.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

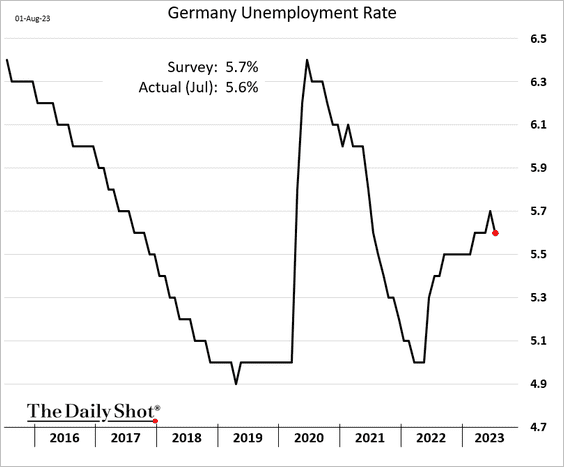

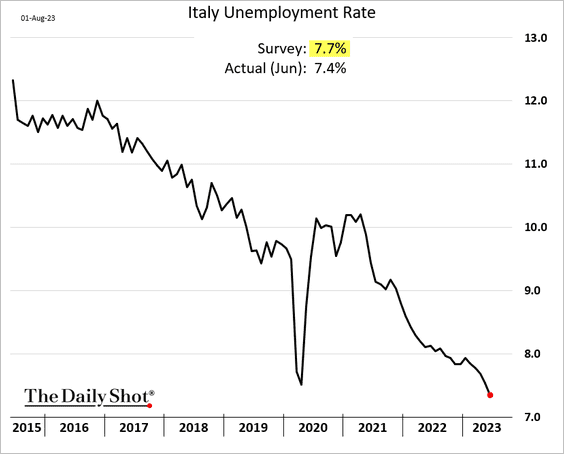

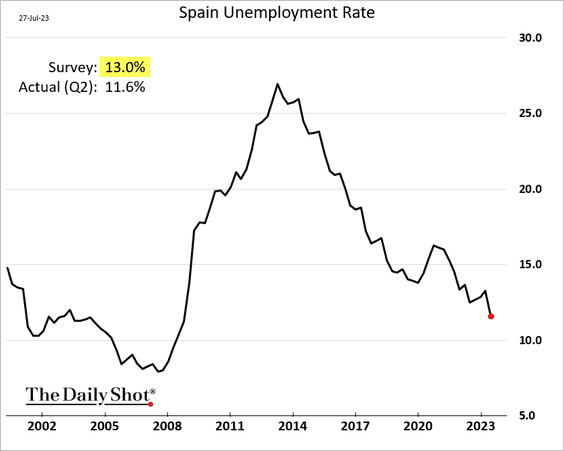

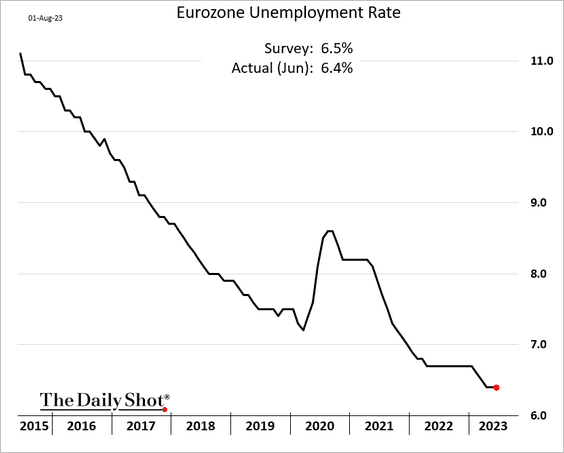

2. Euro-area labor markets remain robust, with unemployment surprising to the downside.

• Germany:

• Italy:

• Spain:

• The Eurozone:

——————–

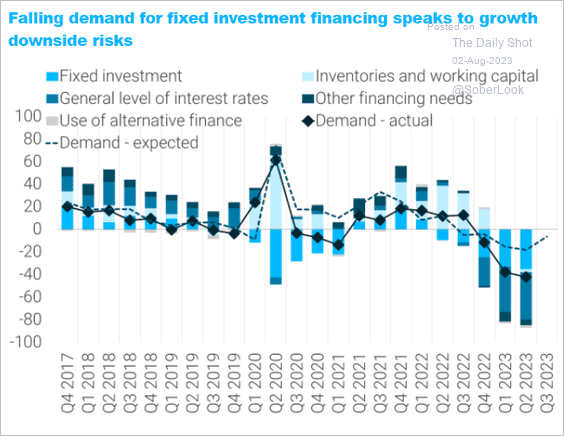

3. Demand for fixed-investment financing has deteriorated.

Source: TS Lombard

Source: TS Lombard

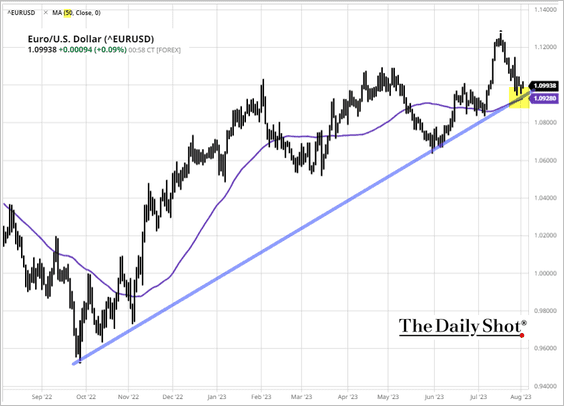

4. The euro is at support.

Source: barchart.com

Source: barchart.com

Back to Index

Asia-Pacific

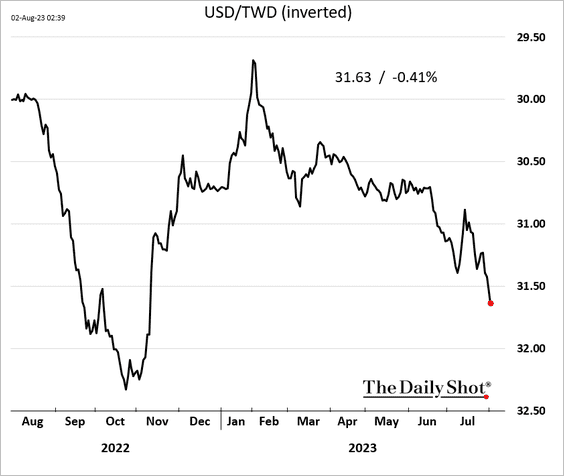

1. The Taiwan dollar is under pressure.

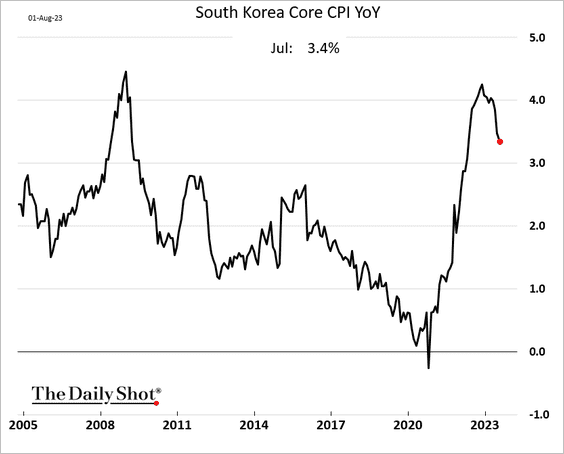

2. South Korea’s core inflation is slowing.

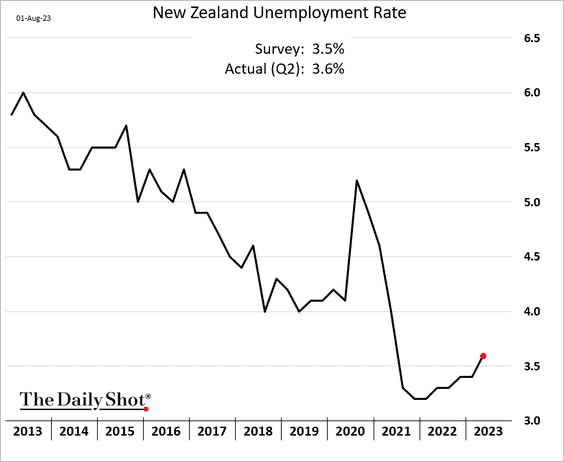

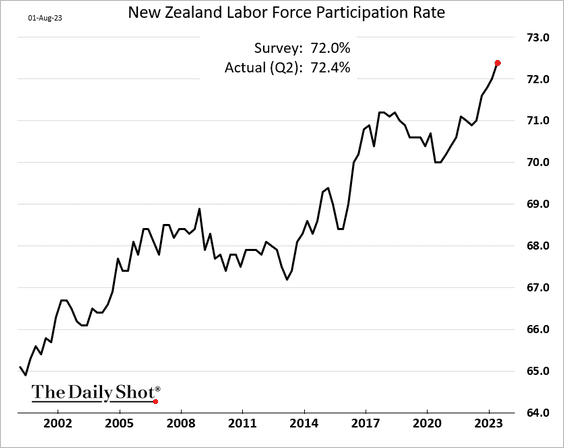

3. New Zealand’s unemployment rate climbed last quarter.

But labor-force participation is hitting new highs.

——————–

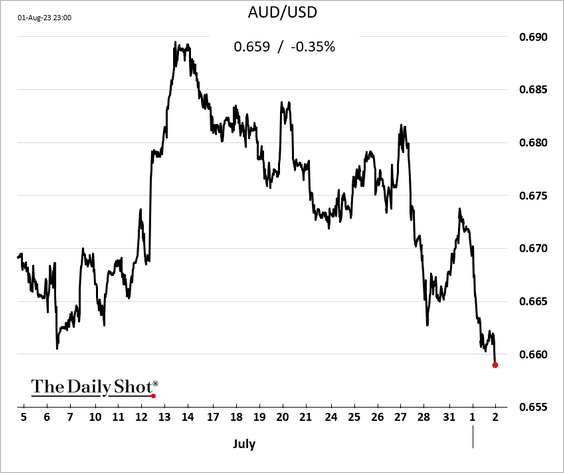

4. The Aussie dollar is selling off after the RBA left rates unchanged (the market was looking for another hike).

Source: CNBC Read full article

Source: CNBC Read full article

Back to Index

China

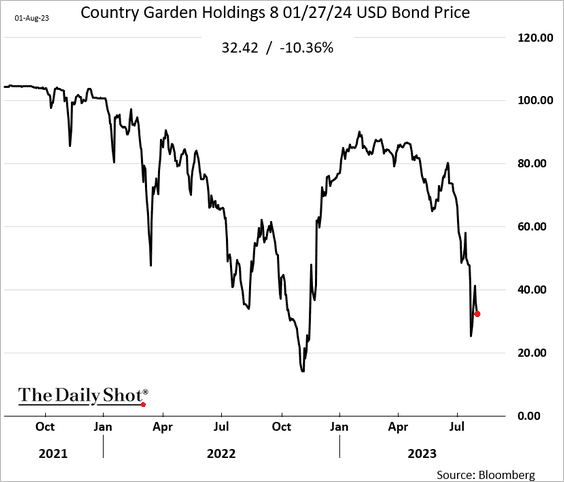

1. The property developer credit crisis continues to fester.

Source: South China Morning Post Read full article

Source: South China Morning Post Read full article

——————–

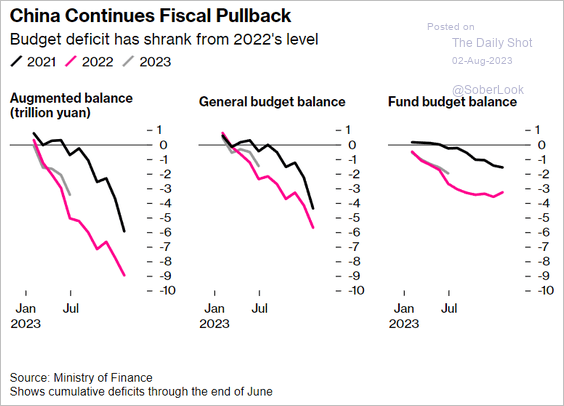

2. This chart shows fiscal deficit by year.

Source: @economics Read full article

Source: @economics Read full article

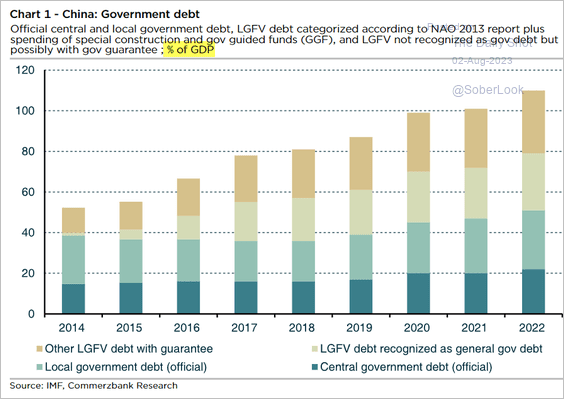

3. Here is the breakdown of government debt.

Source: Commerzbank Research

Source: Commerzbank Research

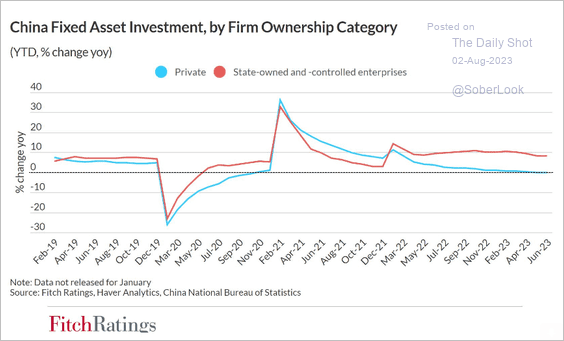

4. Fixed asset investment growth has been entirely driven by state-owned entities.

Source: Fitch Ratings

Source: Fitch Ratings

Back to Index

Emerging Markets

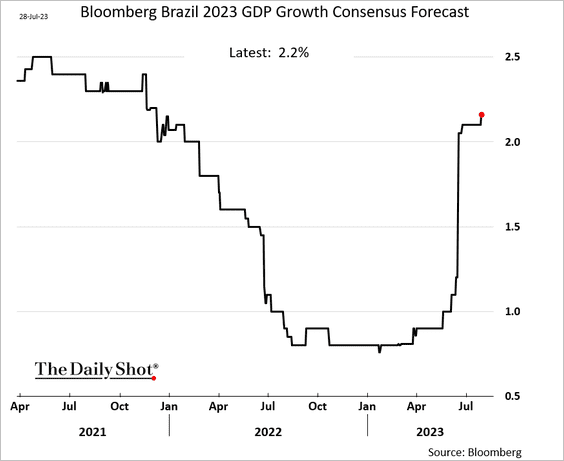

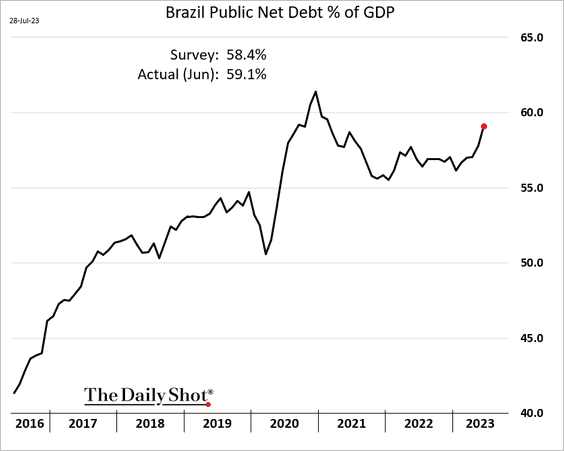

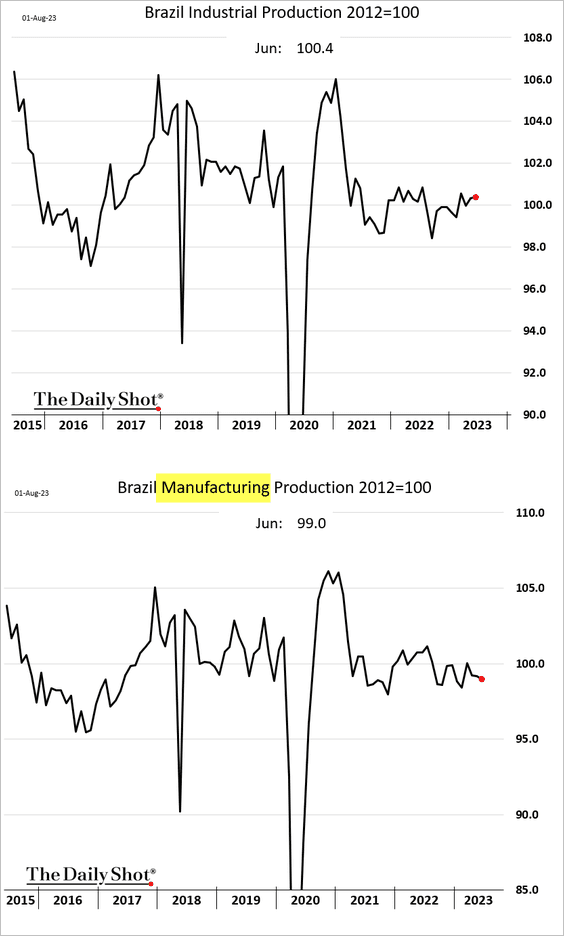

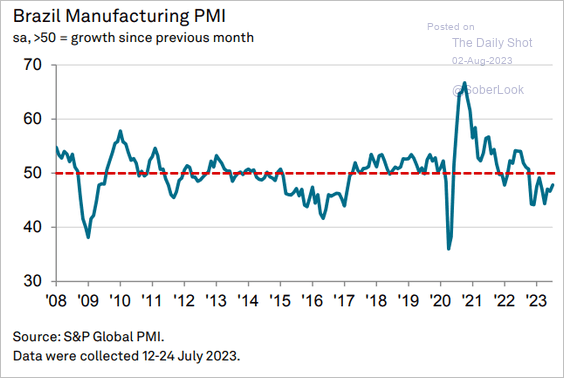

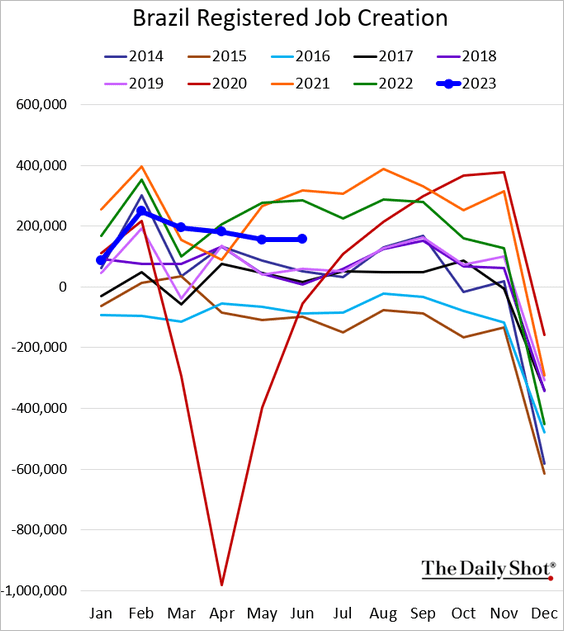

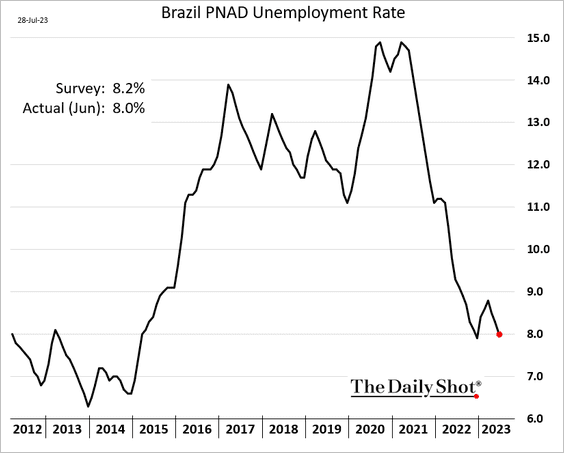

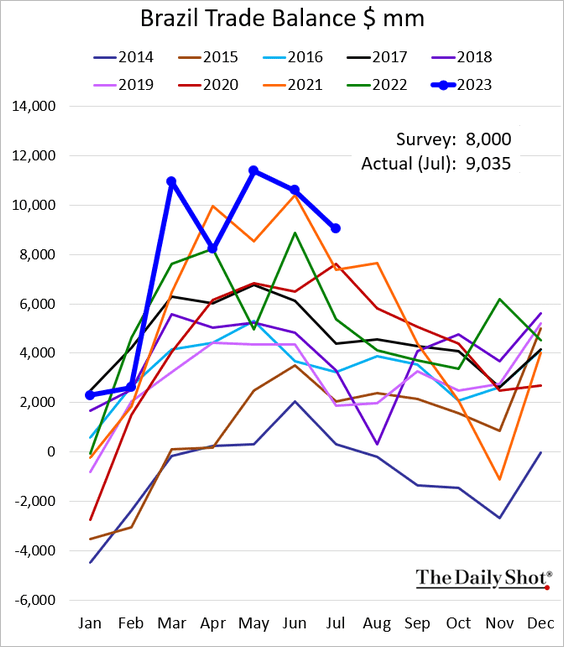

1. Here are some updates on Brazil.

• Consensus 2023 GDP growth estimate over time:

• The debt-to-GDP ratio (deteriorating fiscal picture):

• Industrial production:

• Manufacturing PMI (slower contraction):

Source: S&P Global PMI

Source: S&P Global PMI

• Formal job creation:

• The unemployment rate:

• The trade balance (elevated surplus for this time of the year):

——————–

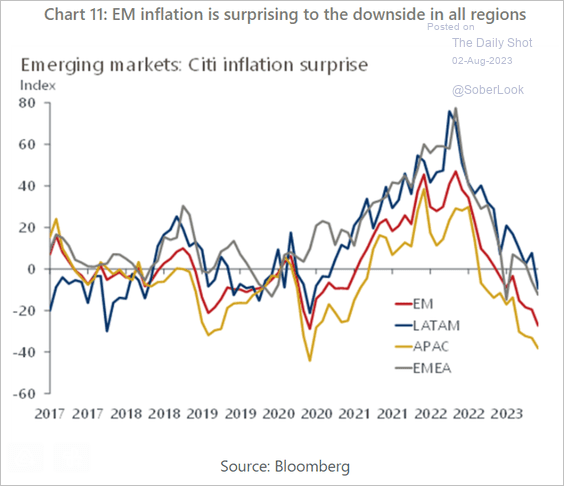

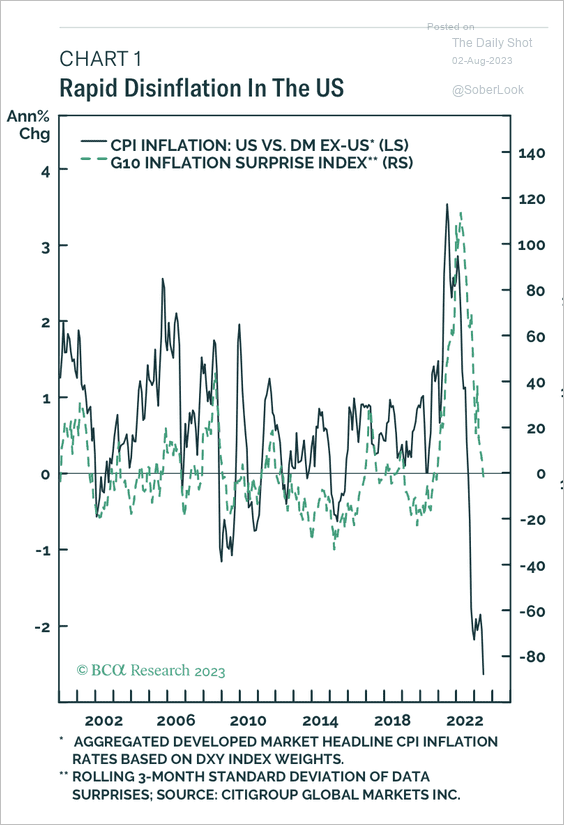

2. EM inflation has been surprising to the downside …

Source: Oxford Economics

Source: Oxford Economics

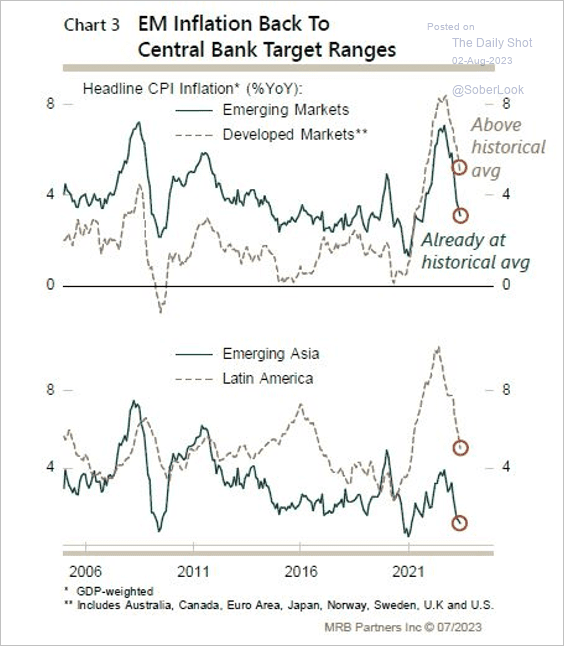

… and is back to central bank target ranges, which could pave the way for rate cuts.

Source: MRB Partners

Source: MRB Partners

——————–

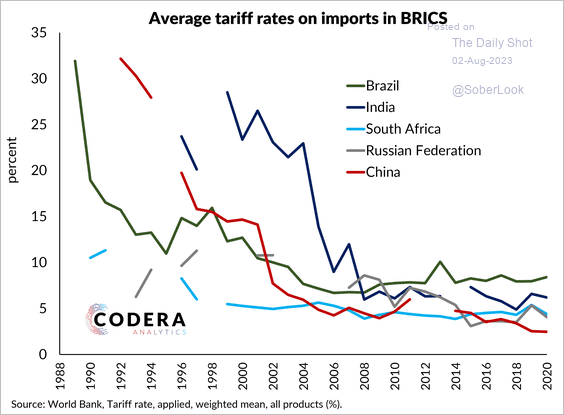

3. This chart shows the evolution of BRICS’ import tariffs.

Source: Codera Analytics Read full article

Source: Codera Analytics Read full article

Back to Index

Commodities

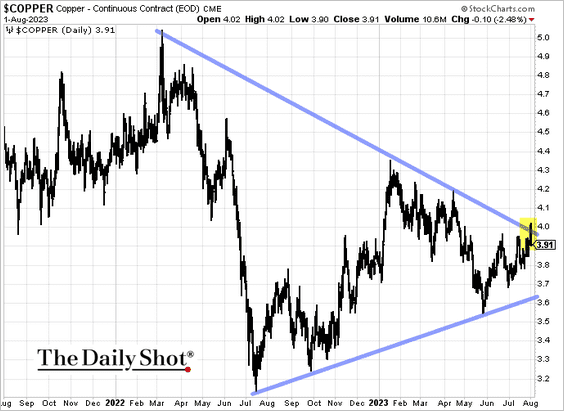

1. Copper is holding resistance.

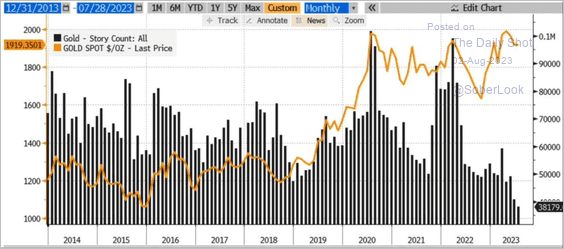

2. News mentions of gold declined in recent months despite prices hovering near all-time highs.

Source: @nicholastreece

Source: @nicholastreece

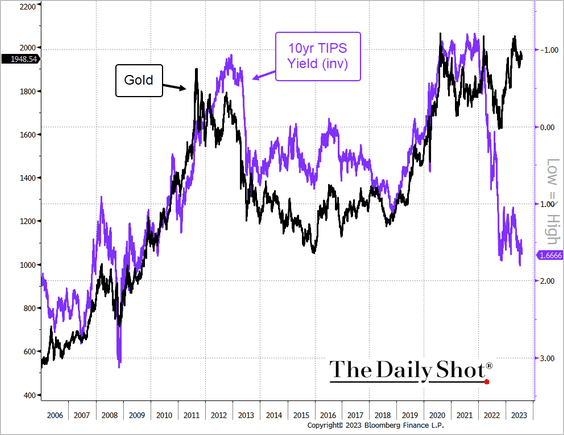

Elevated real yields point to downside risks for gold.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

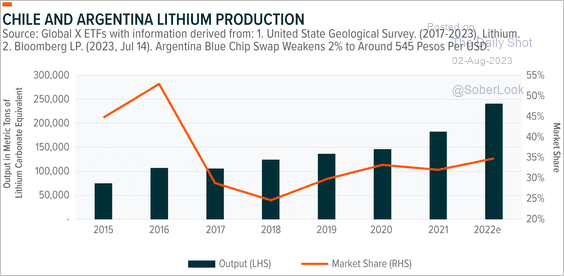

3. Chile and Argentina account for a growing share of lithium production.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

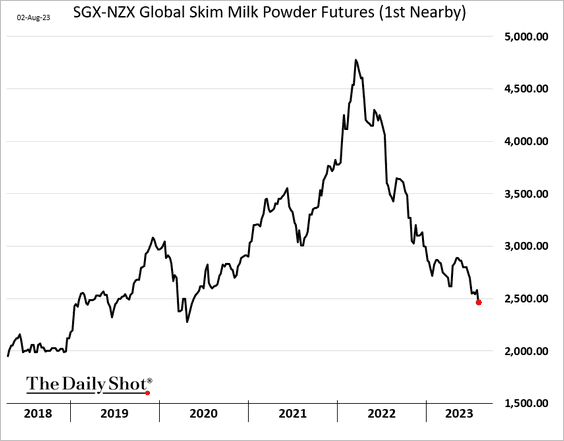

4. Milk prices are tumbling on weak China demand.

Back to Index

Energy

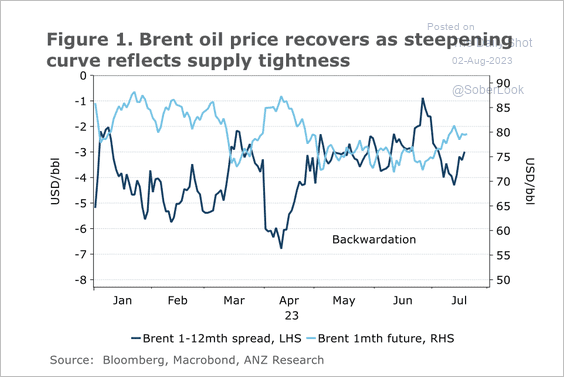

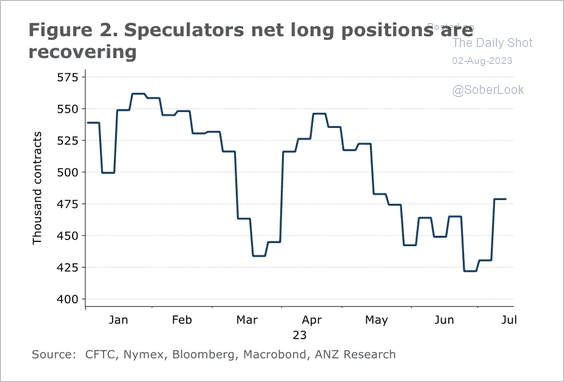

The rebound in oil prices occurred alongside tighter supplies and improving sentiment. (2 charts)

Source: @ANZ_Research

Source: @ANZ_Research

Source: @ANZ_Research

Source: @ANZ_Research

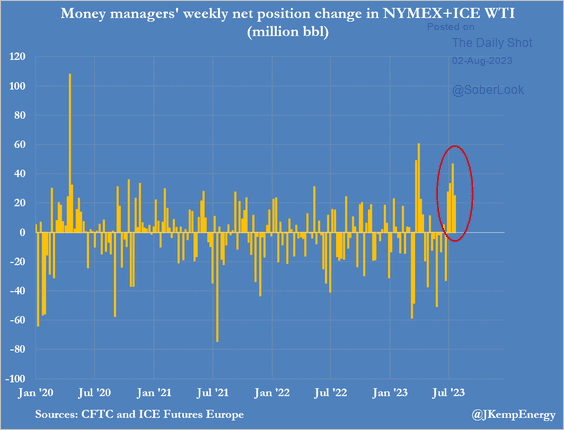

Prices got a boost from short-covering.

Source: @JKempEnergy

Source: @JKempEnergy

Back to Index

Equities

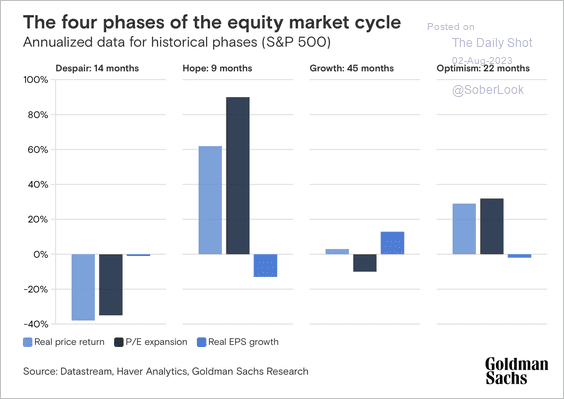

1. According to Goldman, the S&P 500 is currently in the optimism phase, which began in October 2022 and could precede a period of relatively low returns in a wide trading range.

Source: Goldman Sachs

Source: Goldman Sachs

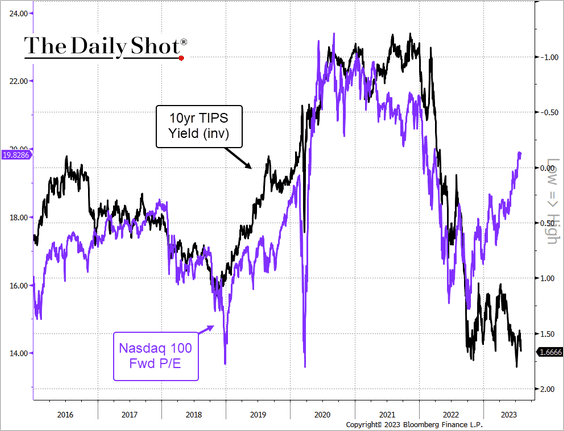

2. Growth stock valuations have diverged from real yields.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

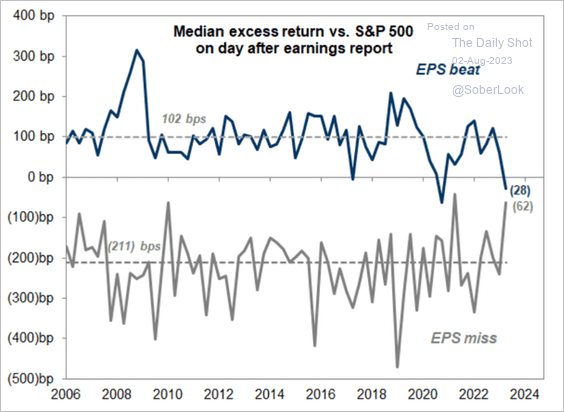

3. The Q2 earnings season exhibited little pain for companies that missed estimates but no reward for beating estimates.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

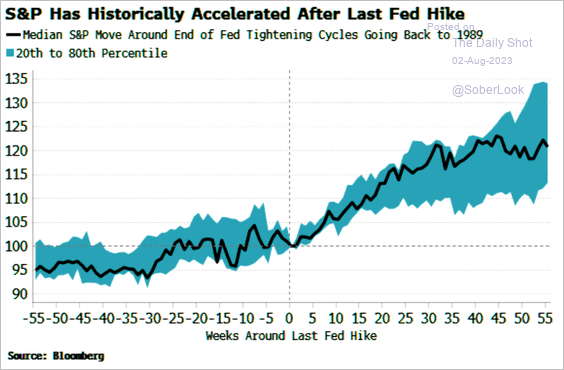

4. The market tends to perform well after the Fed’s last rate hike.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

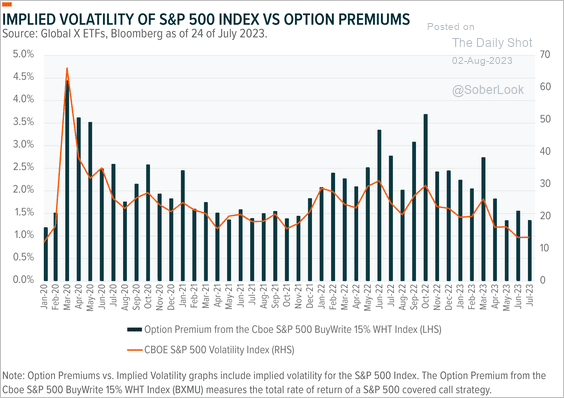

5. The S&P 500’s implied volatility and associated covered call option premiums are trending lower.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

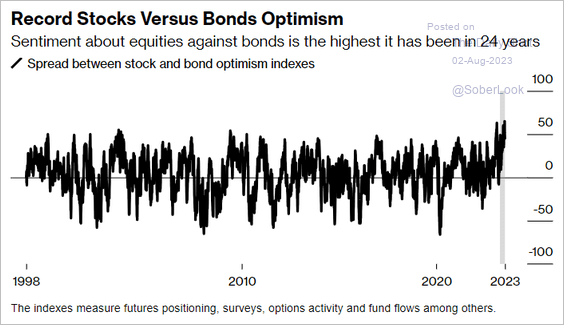

6. Stock optimism hasn’t been this strong relative to bonds in decades.

Source: @markets Read full article

Source: @markets Read full article

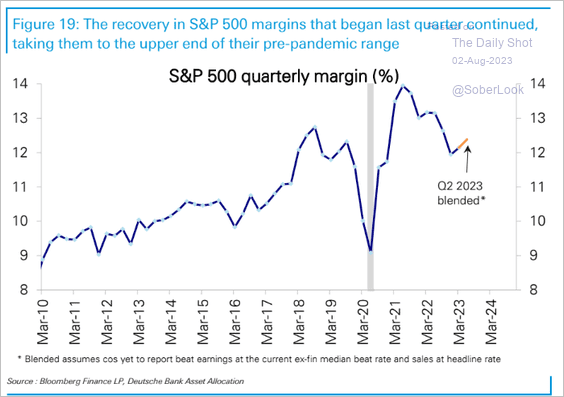

7. Margins appear to be rebounding, …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

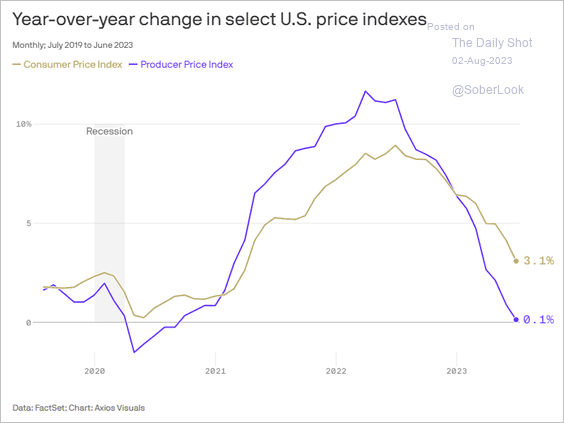

… despite the PPI-CPI divergence.

Source: @axios Read full article

Source: @axios Read full article

——————–

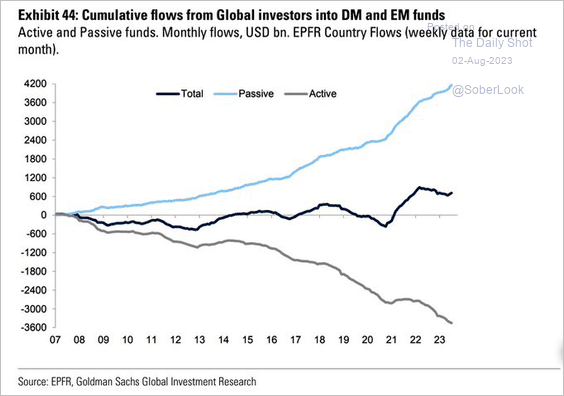

8. Passive fund flows continue to dominate.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

Back to Index

Credit

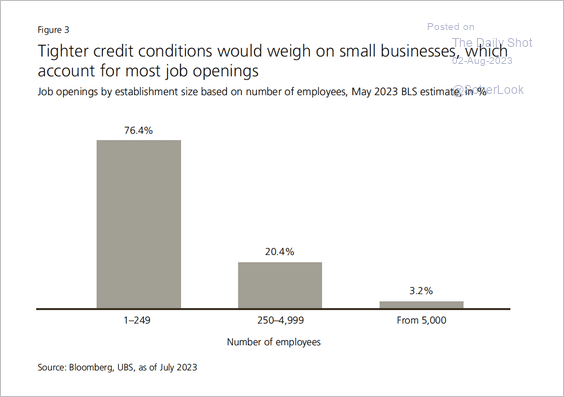

1. Small businesses face a difficult lending environment, which could limit their ability to hire and retain employees.

Source: UBS Research

Source: UBS Research

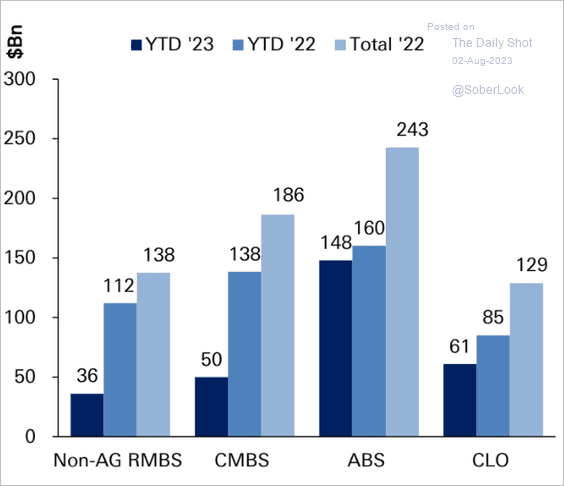

2. This chart shows US securitized product issuance vs. 2022.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Rates

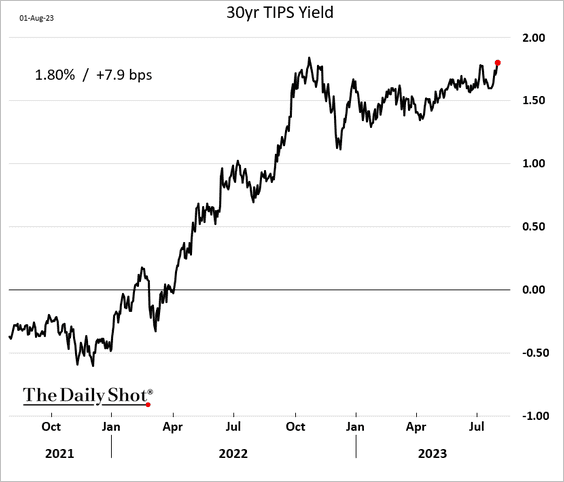

1. Longer-dated TIPS yields (real rates) are climbing.

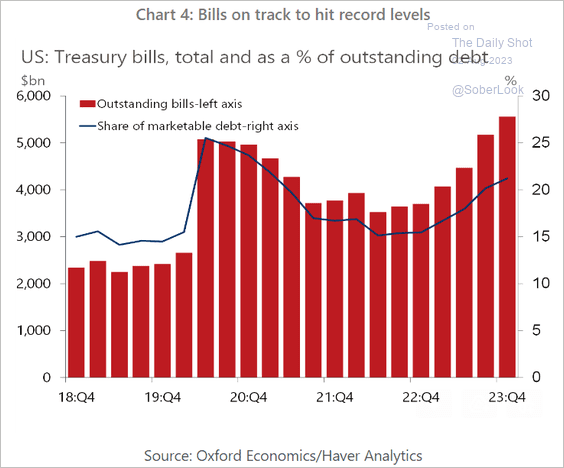

2. The amount of T-bills outstanding is surging.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Global Developments

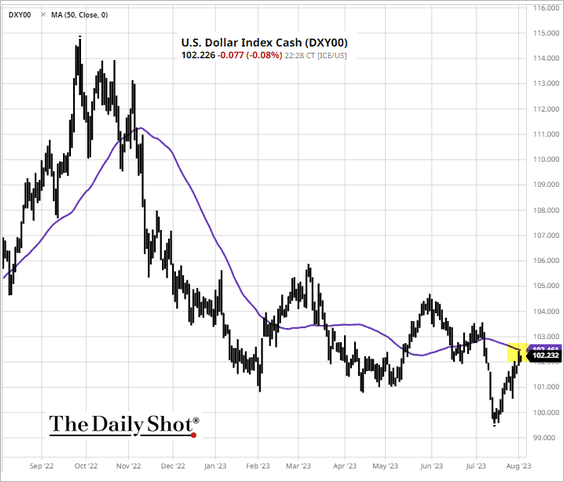

1. The dollar index (DXY) held resistance a the 50-day moving average.

Source: barchart.com

Source: barchart.com

• The dollar remains in a long-term downtrend.

Source: @nicholastreece

Source: @nicholastreece

——————–

2. According to BCA Research, a more dovish Fed could reverse carry trades that were betting on higher US rates. Carry trade unwinds typically trigger volatility shocks.

Source: BCA Research

Source: BCA Research

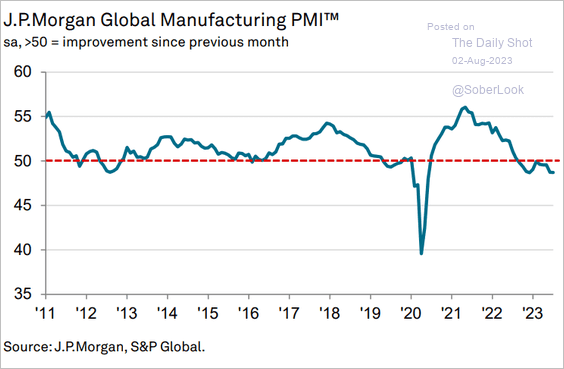

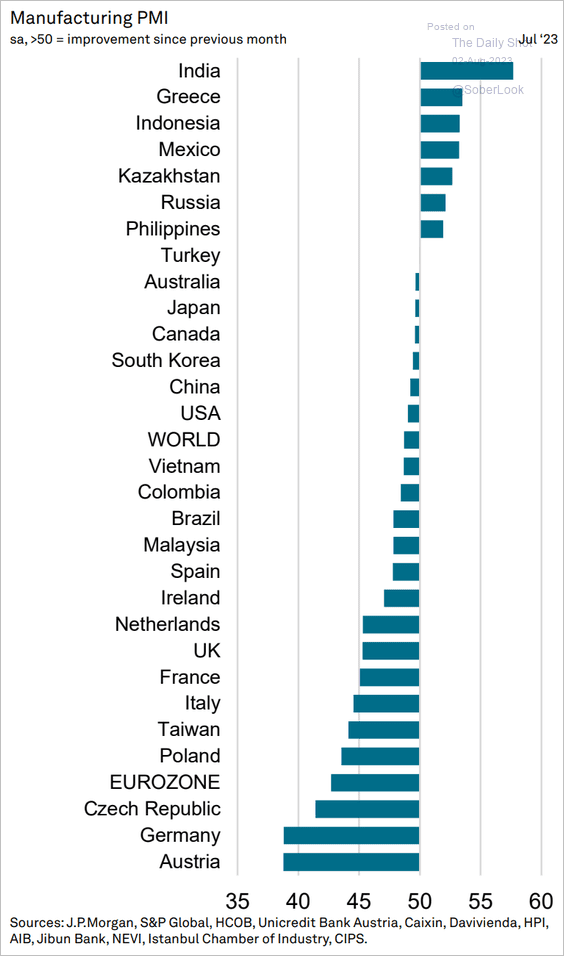

3. Global manufacturing activity continues to contract.

Source: S&P Global PMI

Source: S&P Global PMI

Source: Reuters Read full article

Source: Reuters Read full article

Here is the PMI breakdown by country/region.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

Food for Thought

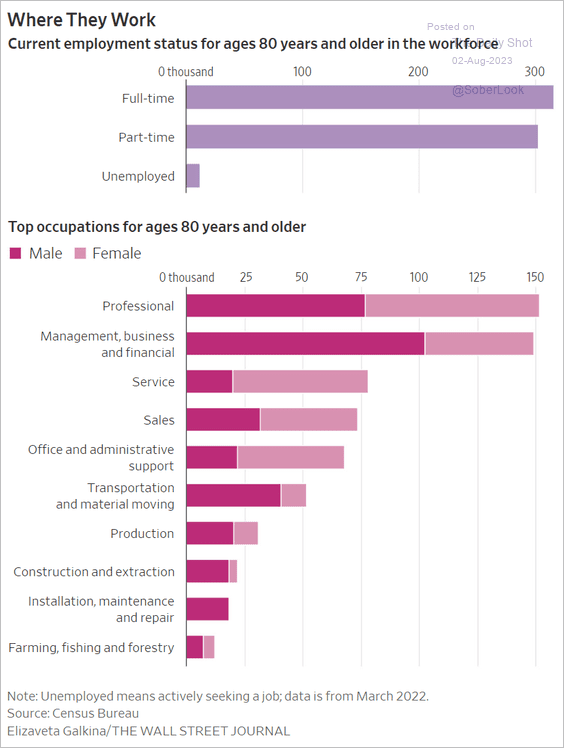

1. Americans aged 80 years and older in the workforce:

Source: @WSJ Read full article

Source: @WSJ Read full article

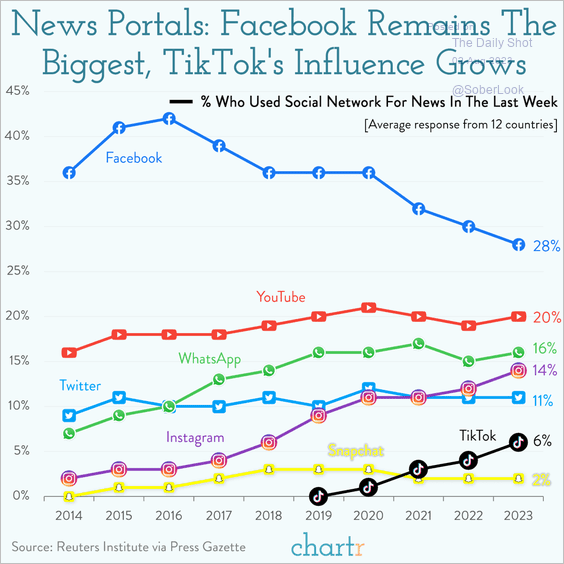

2. Social media platforms as news sources:

Source: @chartrdaily

Source: @chartrdaily

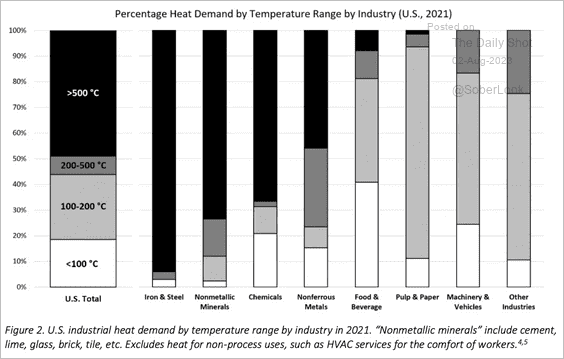

3. Industrial heat demand by temperature range:

Source: Canary Media Read full article

Source: Canary Media Read full article

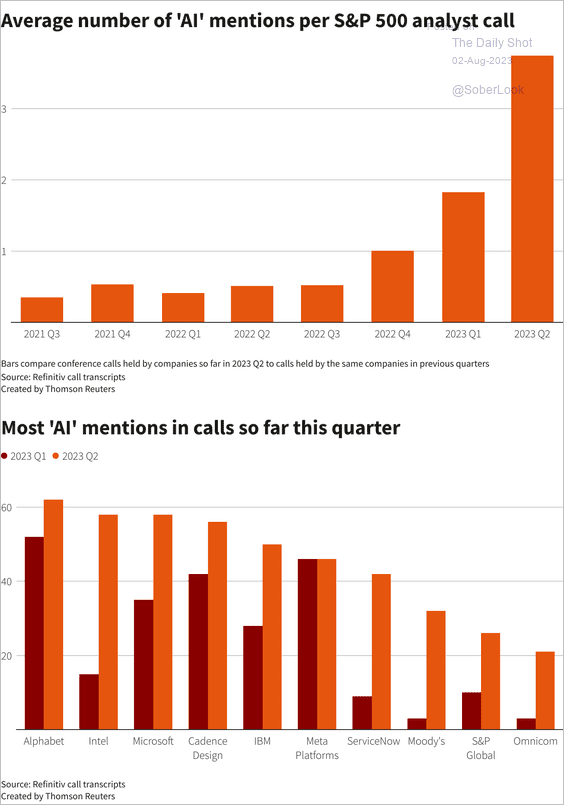

4. AI mentions on earnings calls:

Source: Reuters Read full article

Source: Reuters Read full article

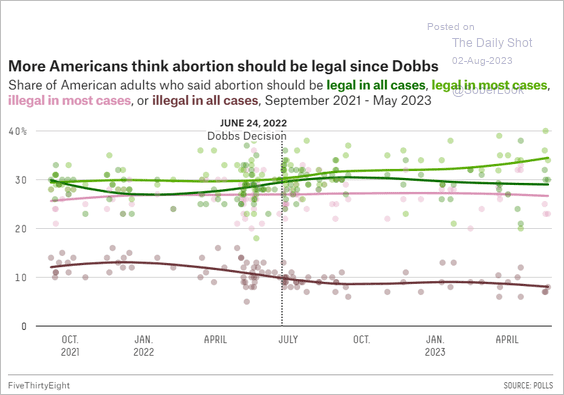

5. Views on abortion …

Source: FiveThirtyEight Read full article

Source: FiveThirtyEight Read full article

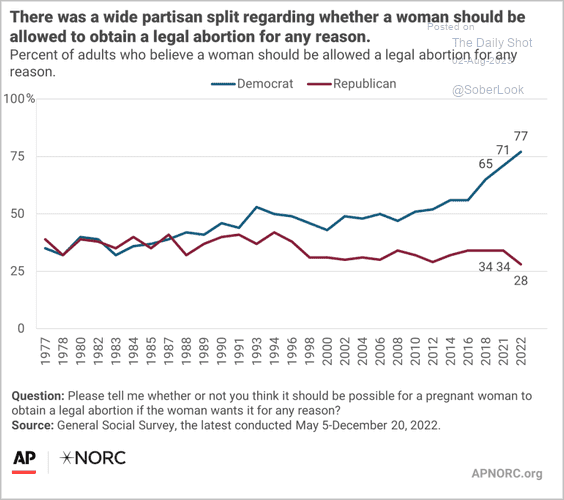

… by political affiliation:

Source: The Associated Press and NORC

Source: The Associated Press and NORC

——————–

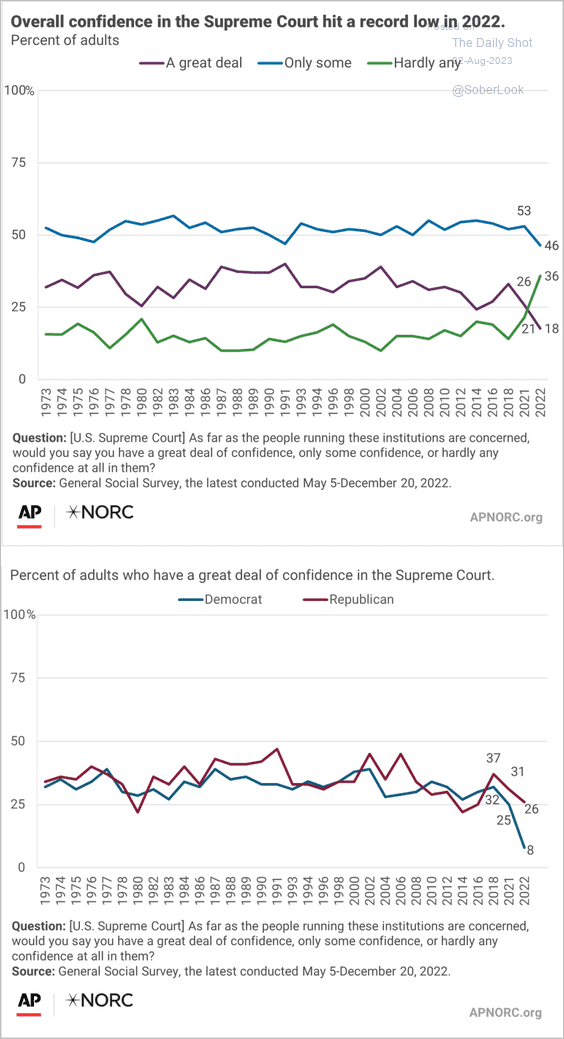

6. Public confidence in the US Supreme Court:

Source: The Associated Press and NORC

Source: The Associated Press and NORC

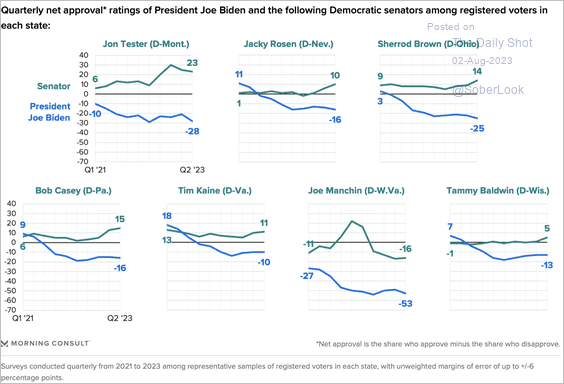

7. Vulnerable Democrats outperforming Biden’s approval rating:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

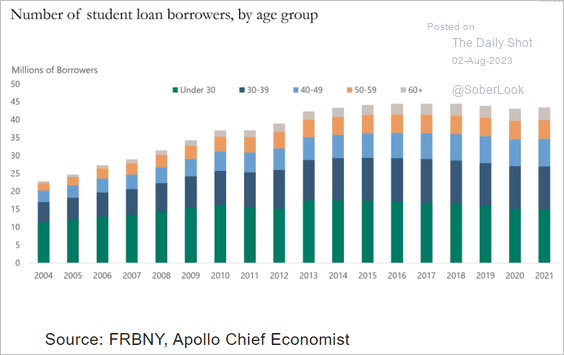

8. Student loan borrowers by age group:

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

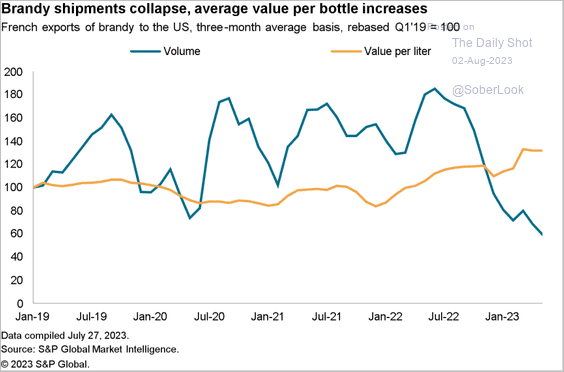

9. French exports of brandy to the US:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

Back to Index