The Daily Shot: 03-Aug-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Global Developments

• Food for Thought

The United States

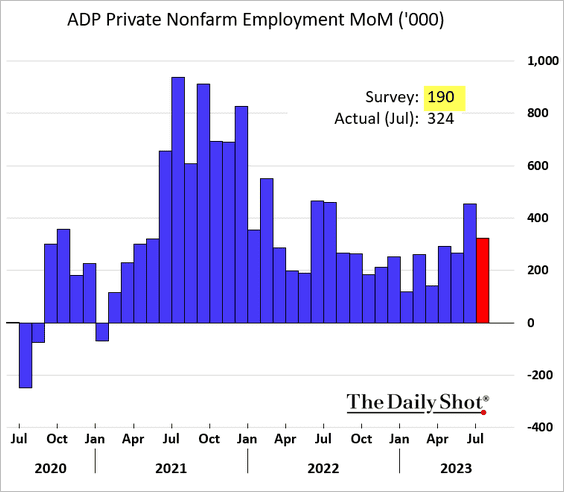

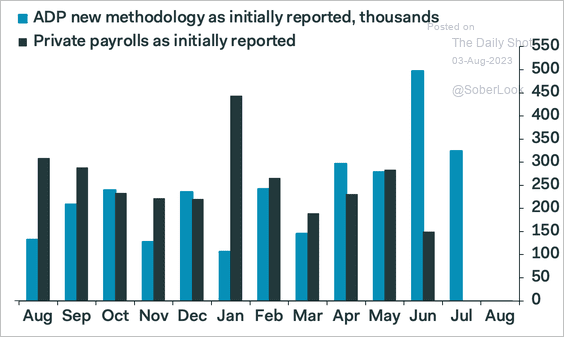

1. The ADP private payrolls index topped expectations – again.

• This upside surprise doesn’t say much about the official payrolls report this Friday.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

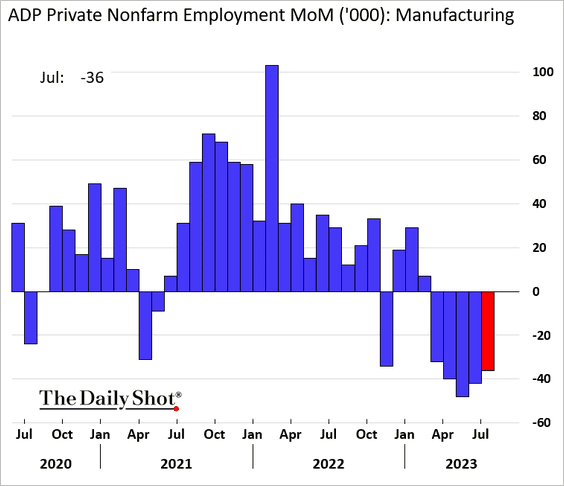

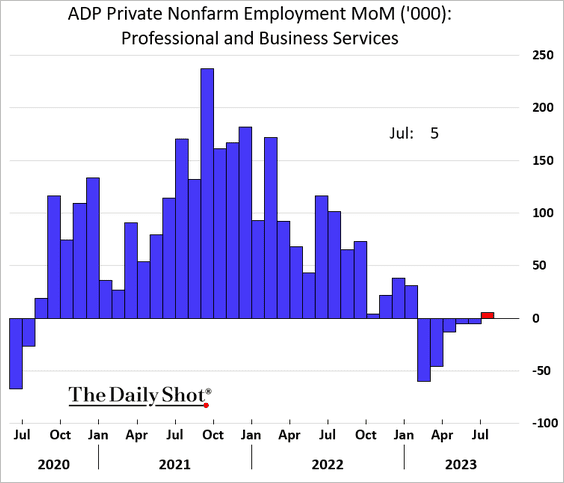

• Here are some trends by sector.

– Manufacturing (job losses continue):

– Professional & Business Services (first increase in six months):

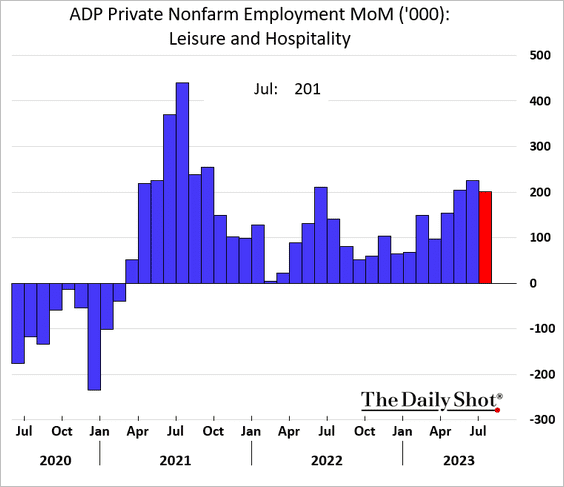

– Leisure & Hospitality:

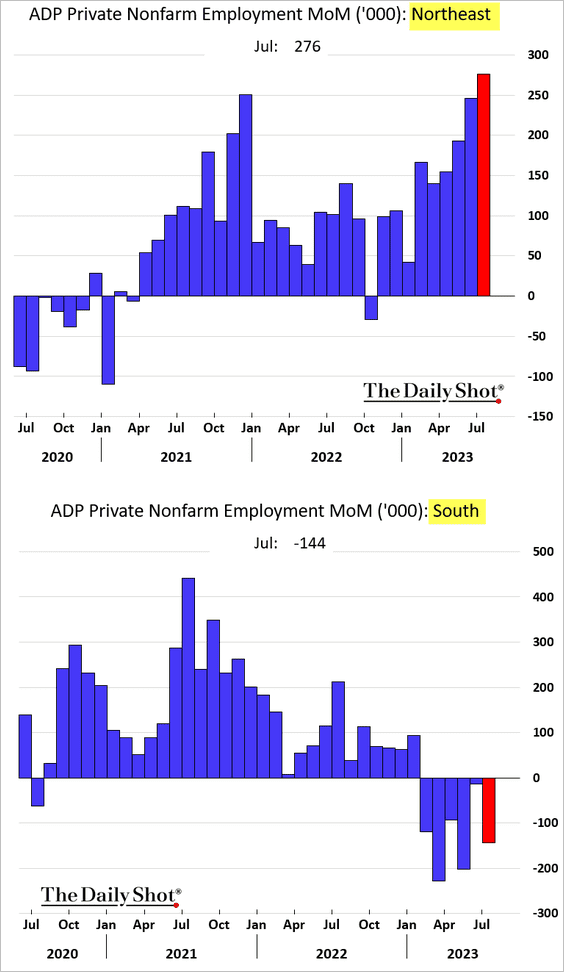

• Job gains have been uneven across US regions.

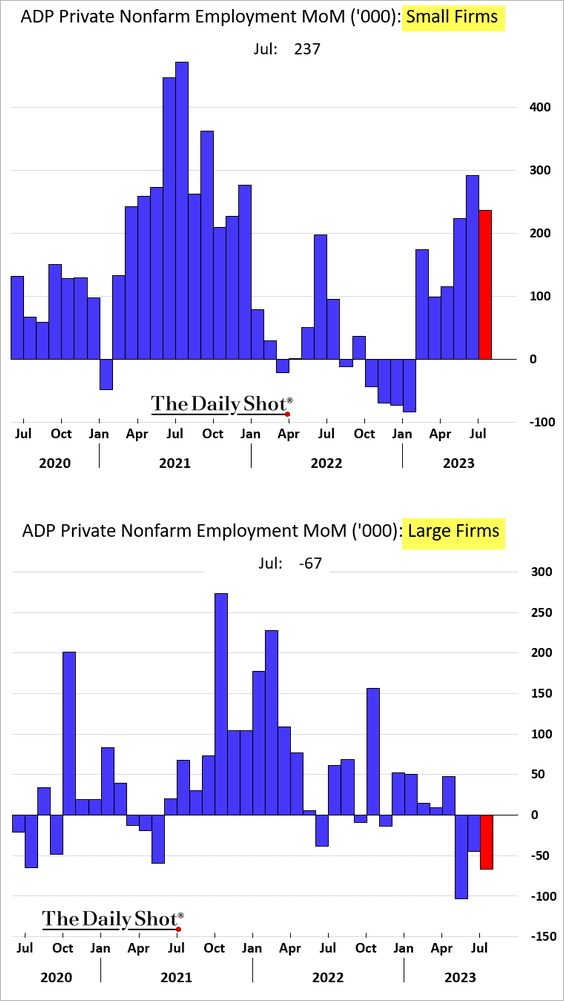

• Small businesses have been driving recent job growth.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

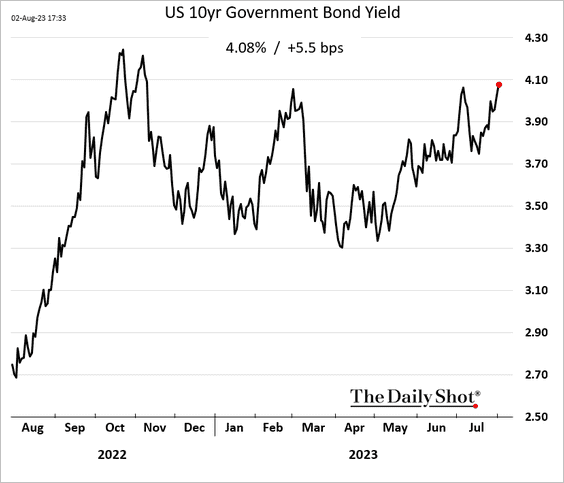

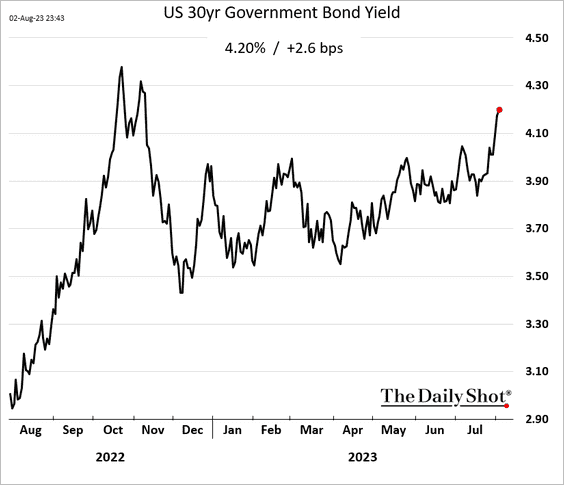

2. Longer-dated Treasury yields continue to climb, with the long bond reaching 4.2%.

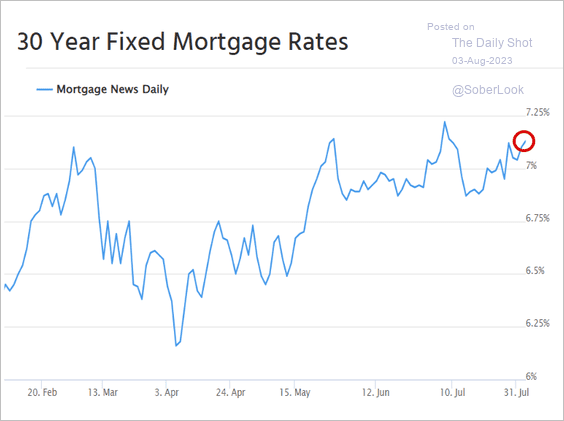

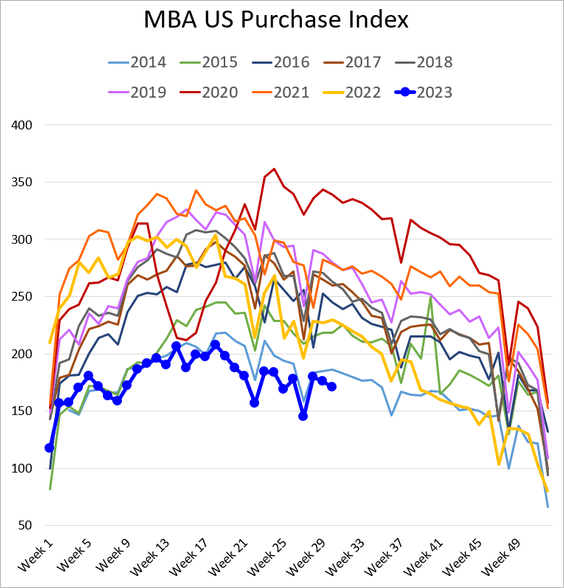

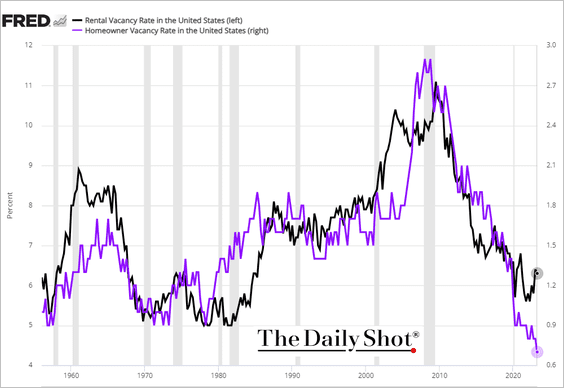

3. Next, we have some updates on the housing market.

• Mortgage rates have been climbing with Treasury yields.

Source: Mortgage News Daily

Source: Mortgage News Daily

Source: Mortgage News Daily Read full article

Source: Mortgage News Daily Read full article

• As a result, mortgage applications fell further.

• Rental vacancies are up this year, but homeowner vacancies hit a record low. The homeowner vacancy rate is defined as a proportion of homes that are for sale and vacant as a percentage of the total homeowner inventory.

Source: realtor.com Read full article

Source: realtor.com Read full article

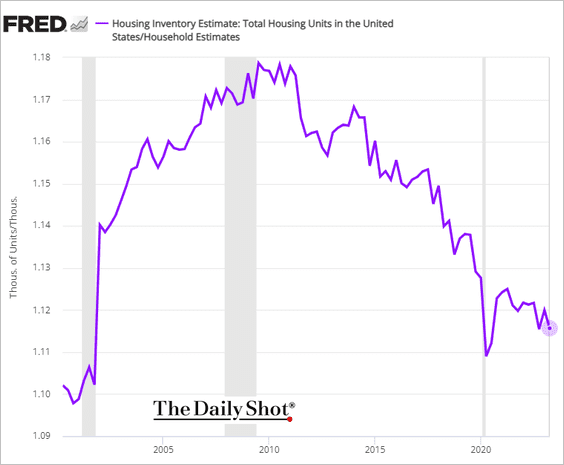

• The total housing inventory per household continues to trend lower.

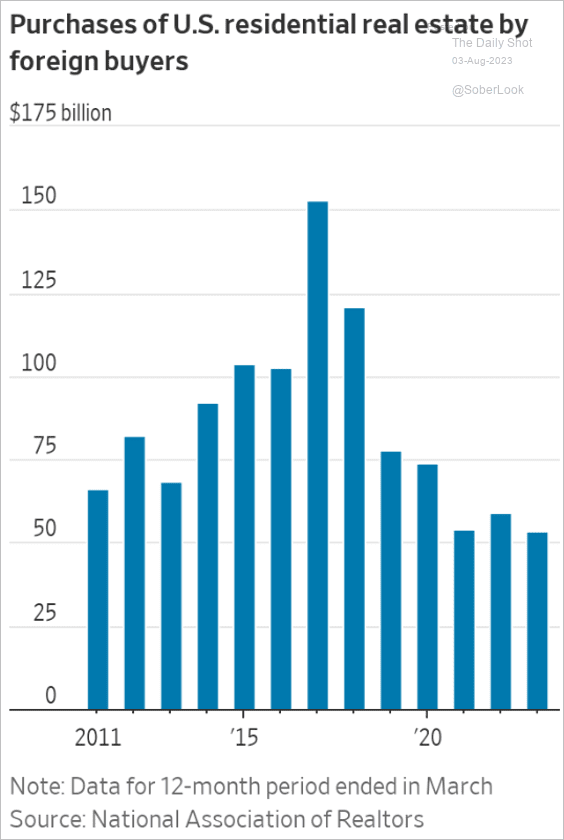

• International investors have reduced their acquisitions in the US residential real estate market.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

4. Here is a look at inflation trends.

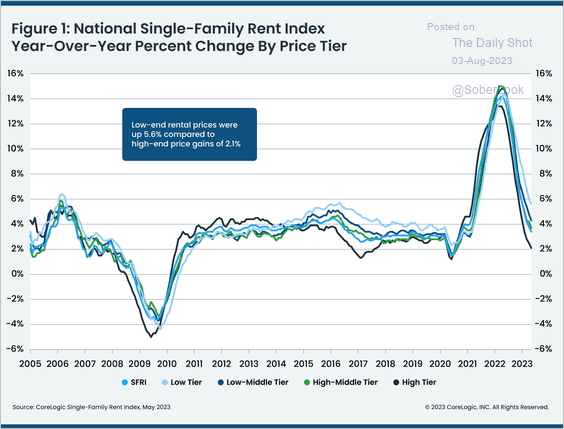

• Single-family rent inflation is slowing.

Source: CoreLogic

Source: CoreLogic

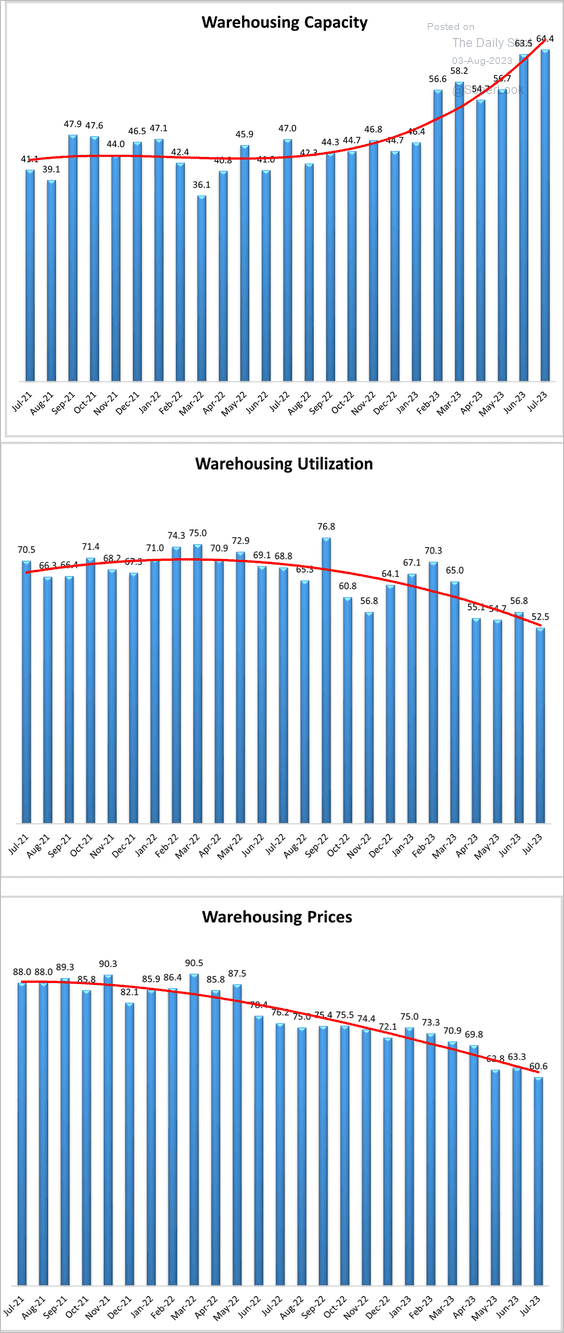

• Logistics bottlenecks continue to ease.

Source: Logistics Managers’ Index

Source: Logistics Managers’ Index

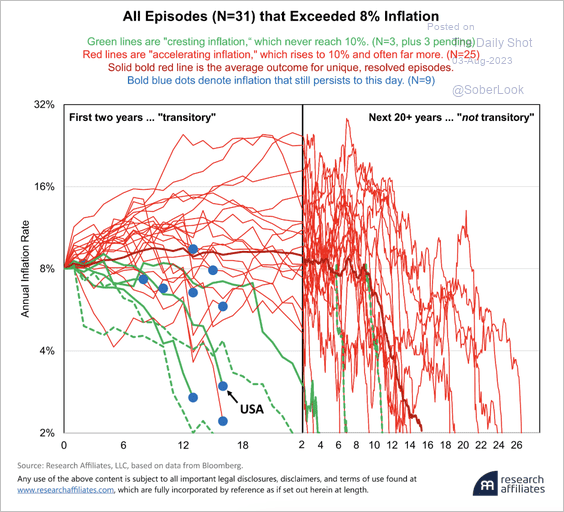

• Historically, when inflation crosses 8%, it takes years, not months, before it falls back below 2%.

Source: Research Affiliates Read full article

Source: Research Affiliates Read full article

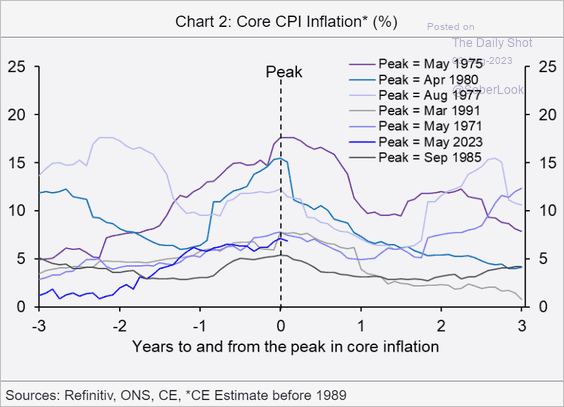

• Core inflation tends to be sticky following its peak.

Source: Capital Economics

Source: Capital Economics

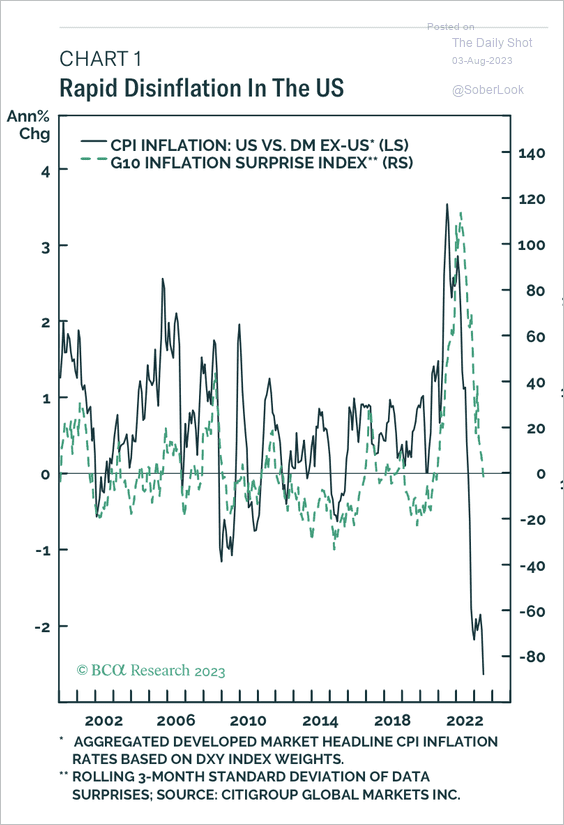

• The drop in US inflation has been faster than in other developed countries.

Source: BCA Research

Source: BCA Research

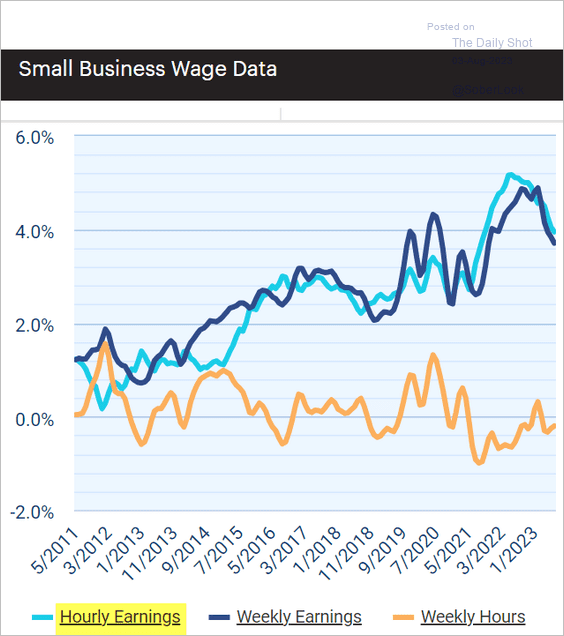

• Small business wage growth is still elevated.

Source: Paychex, IHS Markit

Source: Paychex, IHS Markit

——————–

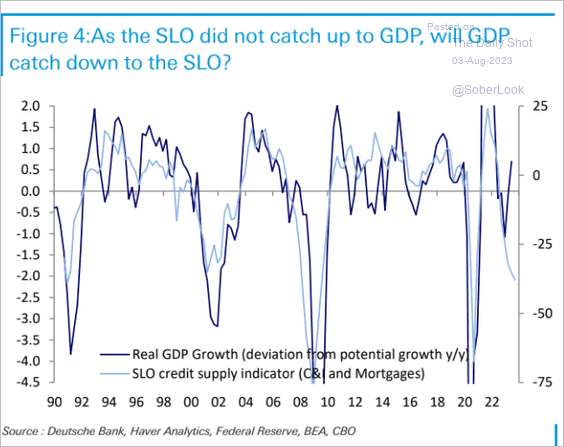

5. Tight credit conditions point to downside risks for the economy, …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

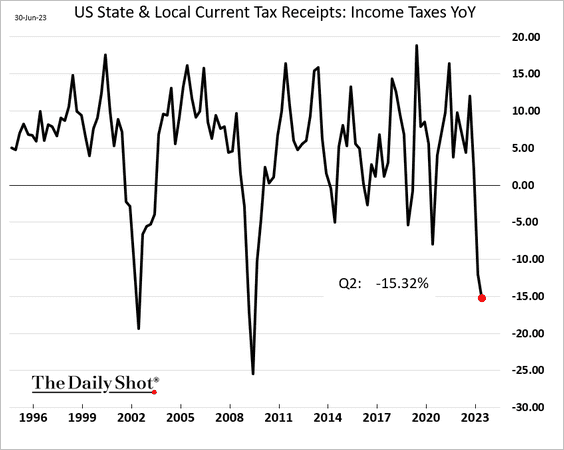

… and so do state and local tax receipts.

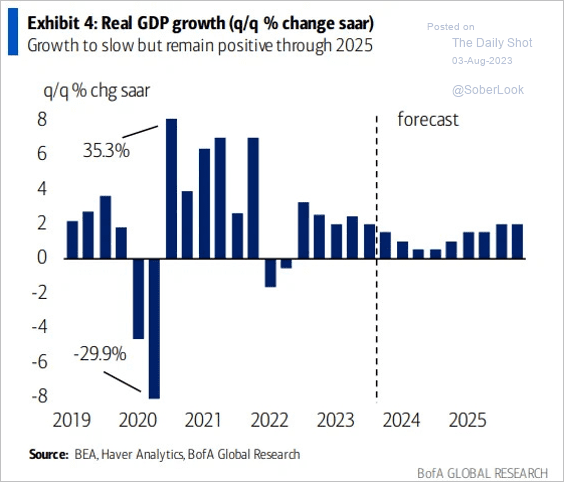

Nonetheless, BofA no longer sees a recession ahead (consistent with the FOMC).

Source: BofA Global Research; @mikezaccardi

Source: BofA Global Research; @mikezaccardi

——————–

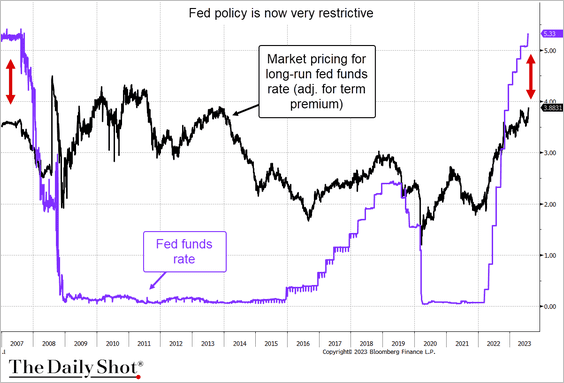

6. The last time the Fed’s monetary policy was this restrictive was in 2007.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Canada

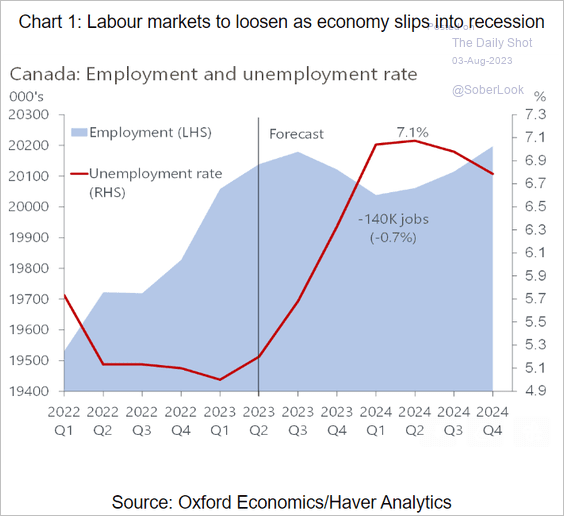

1. Oxford Economics sees Canada’s unemployment surging over the next few quarters, …

Source: Oxford Economics

Source: Oxford Economics

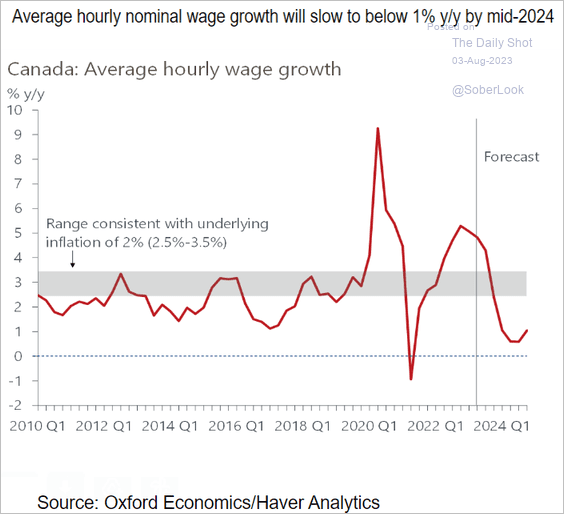

… and wage growth slowing.

Source: Oxford Economics

Source: Oxford Economics

——————–

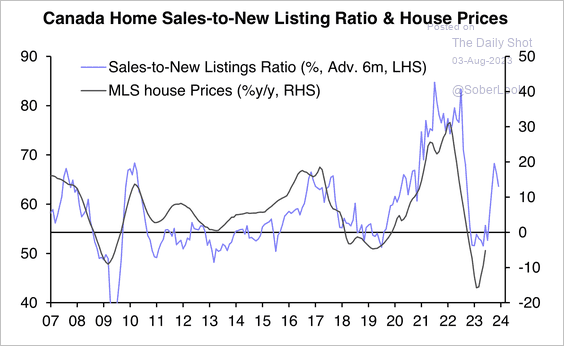

2. The rise in the sales-to-new listings ratio points to higher home prices.

Source: Capital Economics

Source: Capital Economics

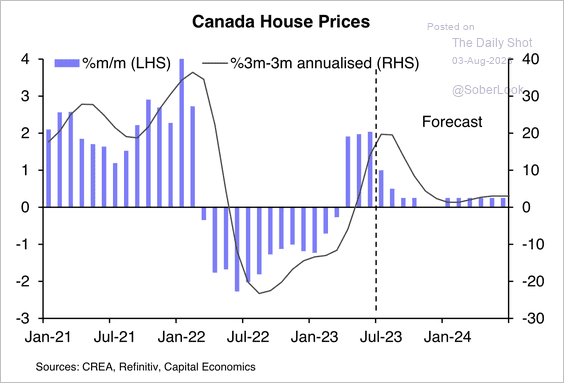

Capital Economics expects the pace of home price growth to slow as economic expansion eases and high mortgage rates take a toll.

Source: Capital Economics

Source: Capital Economics

Back to Index

The United Kingdom

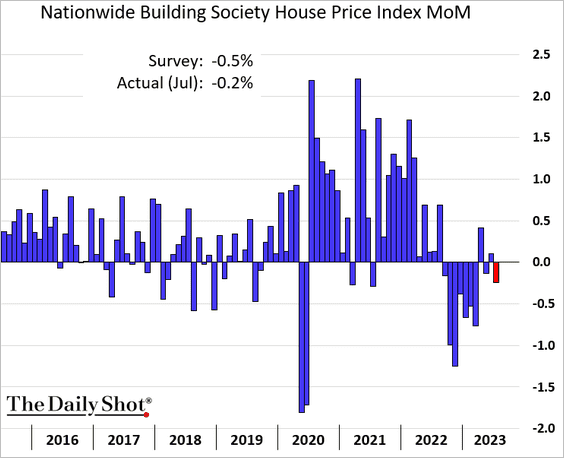

1. Home prices declined again last month.

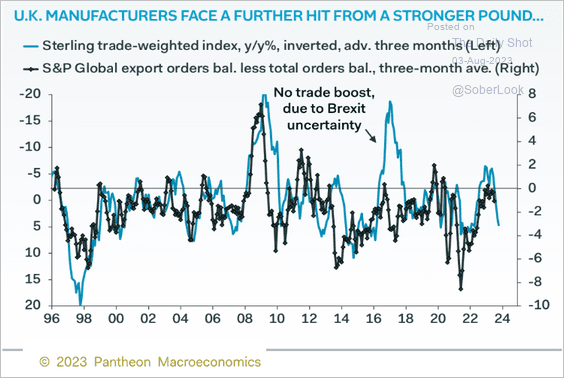

2. UK exporters face headwinds from the pound’s strength.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

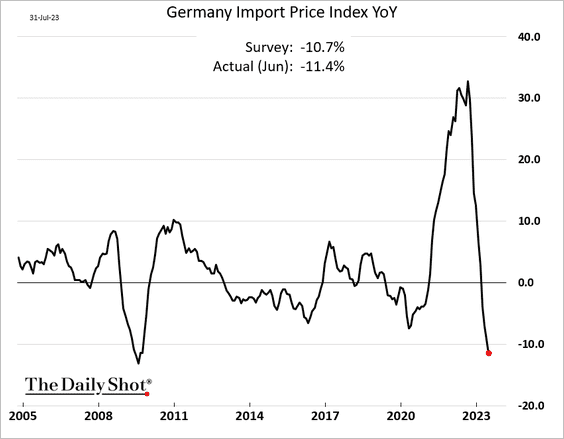

1. Germany’s import price declines haven’t been this severe since the GFC.

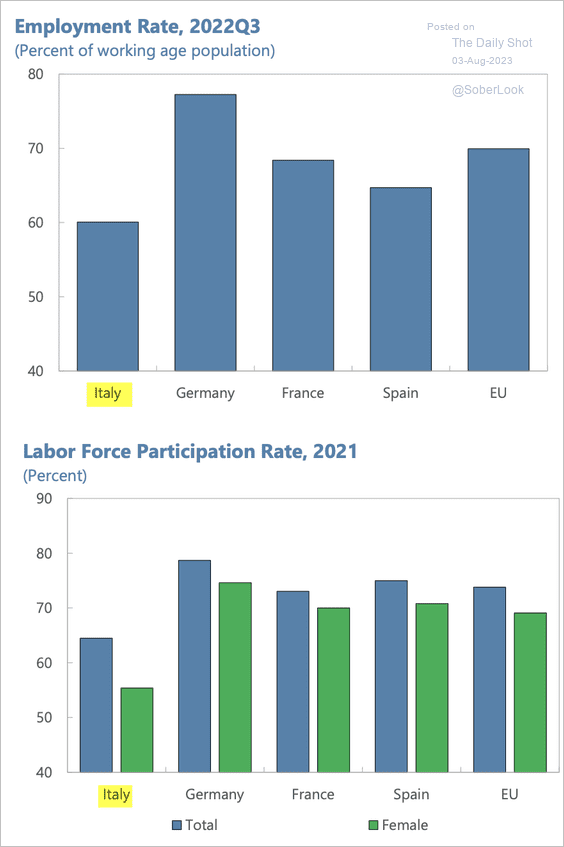

2. Next, we have a couple of updates on Italy.

– Employment and labor force participation rates vs. EU peers:

Source: IMF Read full article

Source: IMF Read full article

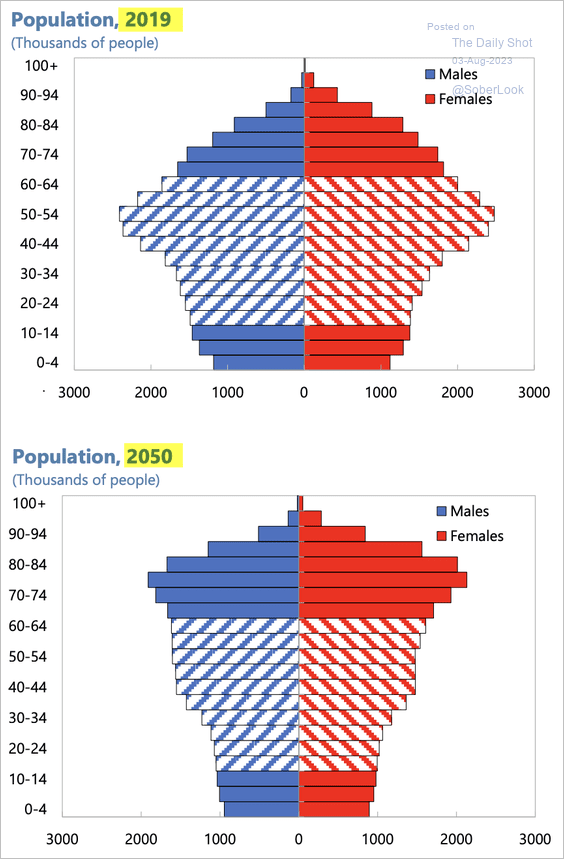

– Current and projected population pyramids:

Source: IMF Read full article

Source: IMF Read full article

——————–

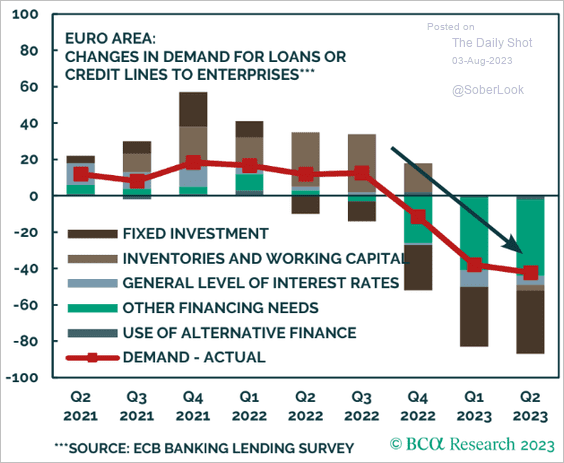

3. This chart shows the drivers of collapsing business loan demand.

Source: BCA Research

Source: BCA Research

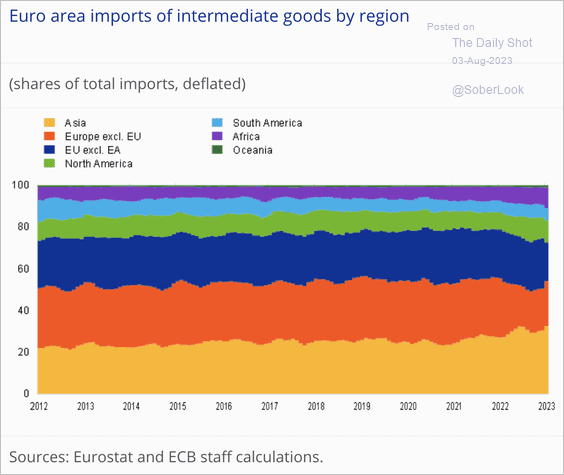

4. Finally, we have the distribution of intermediate goods imports by source.

Source: ECB Read full article

Source: ECB Read full article

Back to Index

Europe

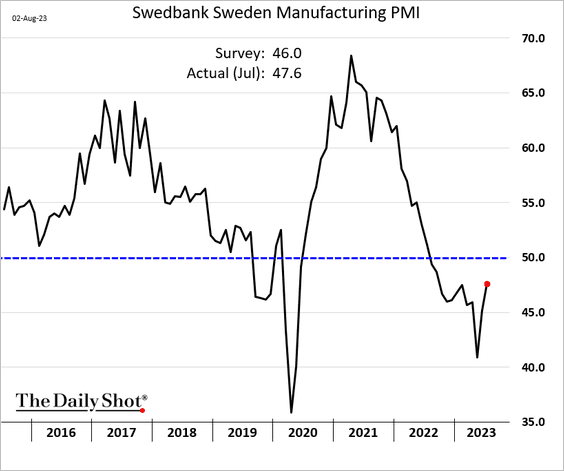

1. Sweden’s manufacturing contraction slowed last month.

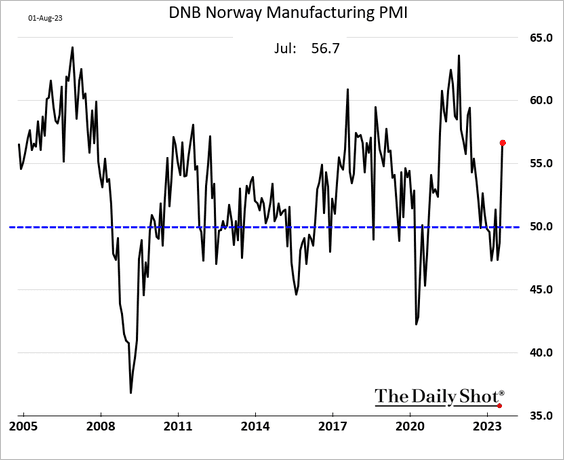

2. Norway’s factory activity surged in July.

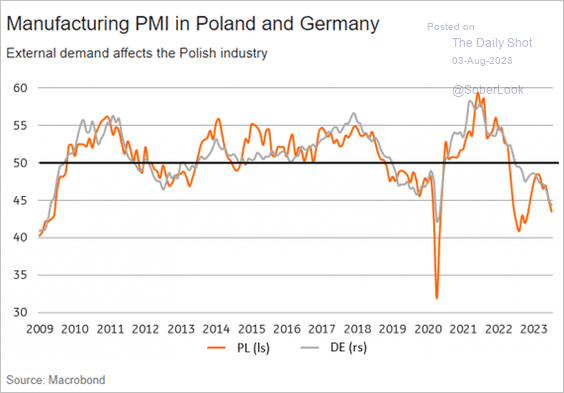

3. Poland’s manufacturing sector continued to weaken, mirroring the significant downturn in Germany’s factories.

Source: ING

Source: ING

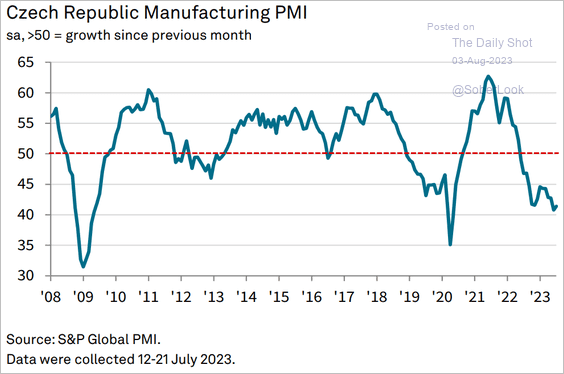

Factories in the Czech Republic are also struggling.

Source: S&P Global PMI

Source: S&P Global PMI

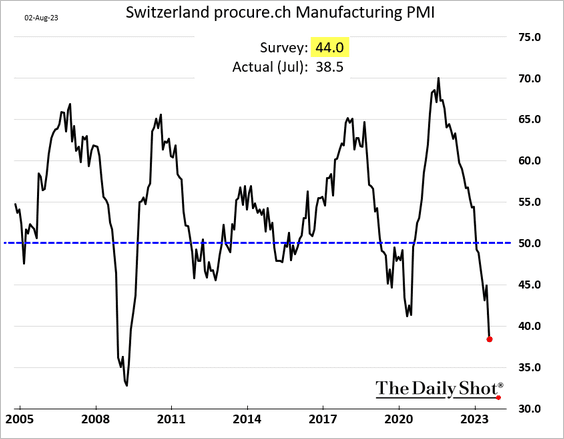

4. Swiss manufacturing contraction accelerated in July, with the PMI index hitting the lowest level since the GFC.

——————–

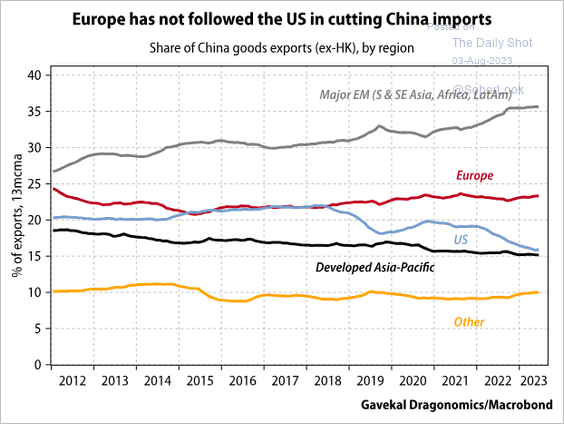

5. Unlike the US, Europe’s share of China’s exports has been stable.

Source: Gavekal Research

Source: Gavekal Research

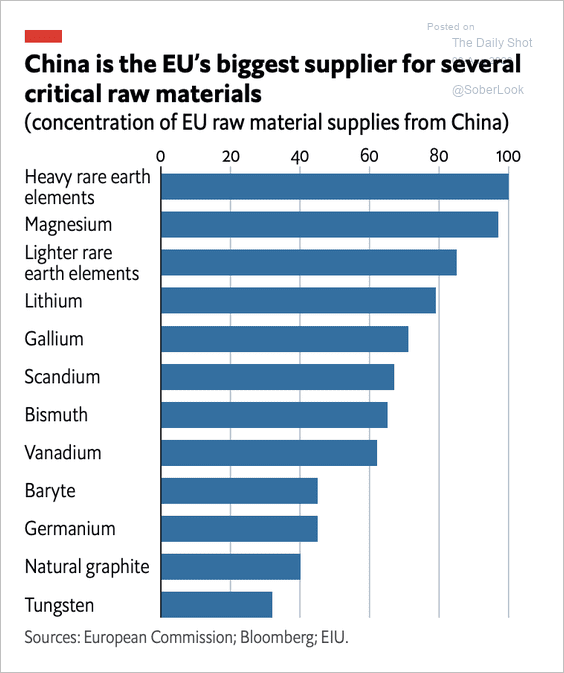

• Here is a look at the EU’s dependence on China for key raw materials.

Source: The Economist Intelligence Unit

Source: The Economist Intelligence Unit

Back to Index

Asia-Pacific

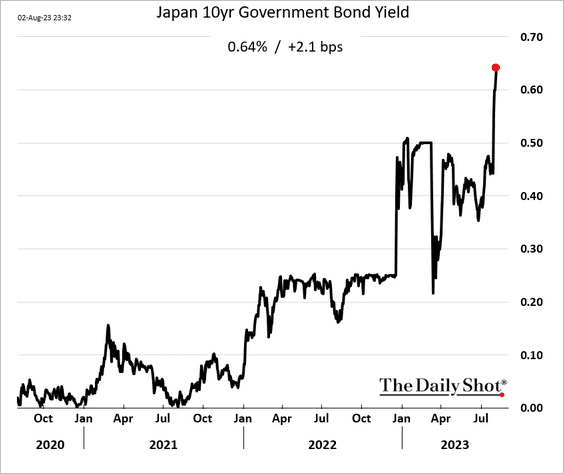

1. JGB yields continue to climb.

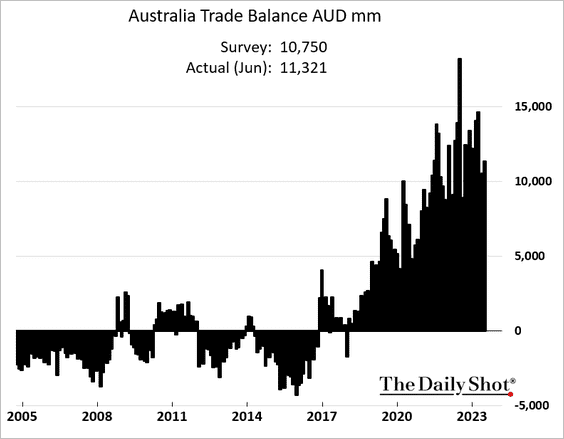

2. Australia’s trade surplus topped expectations.

Source: @economics Read full article

Source: @economics Read full article

Back to Index

China

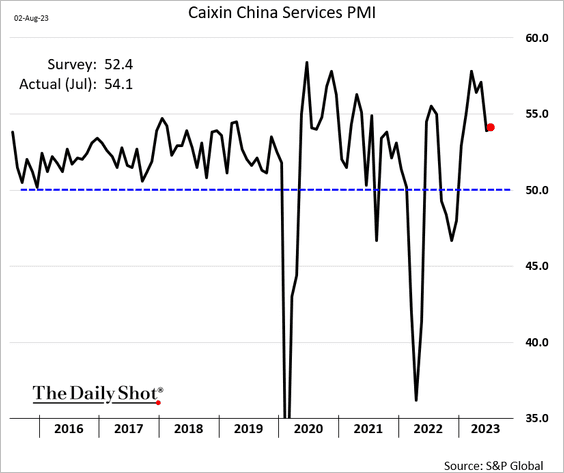

1. Growth in China’s service sector remains robust, with the PMI report topping expectations.

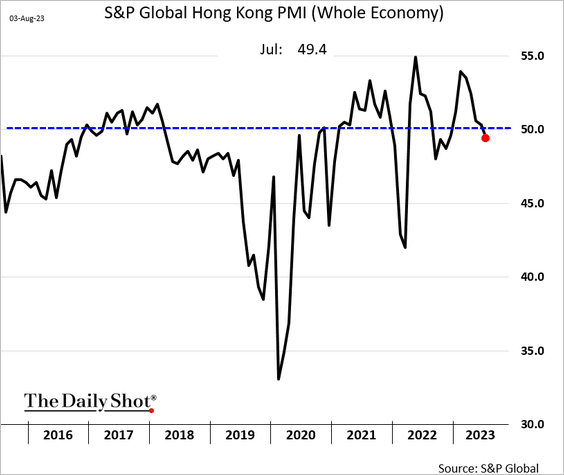

Hong Kong’s business sector is back in contraction mode.

——————–

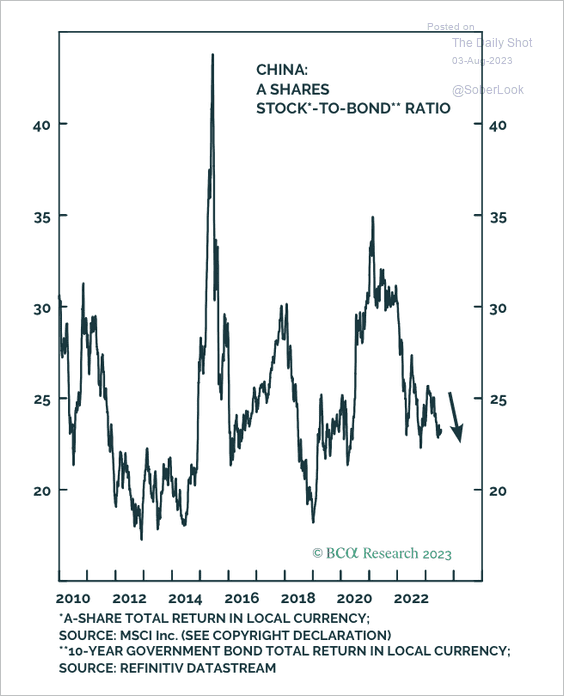

2. China’s stock/bond ratio is trending lower.

Source: BCA Research

Source: BCA Research

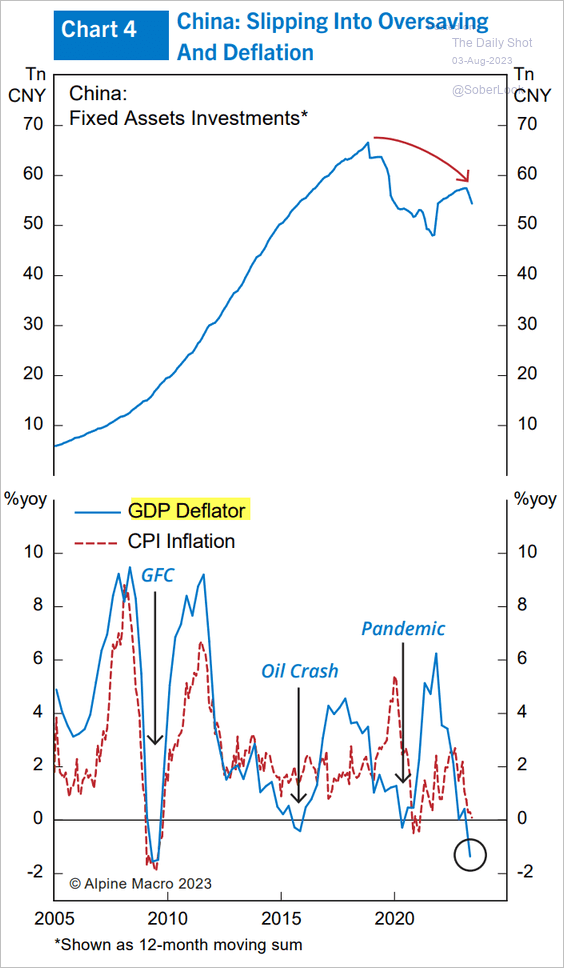

3. The nation is facing deflationary pressures.

Source: Alpine Macro

Source: Alpine Macro

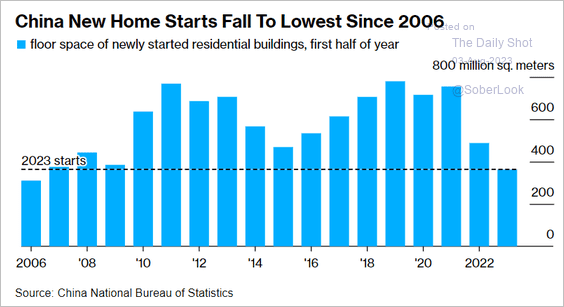

4. Here is a look at housing starts …

Source: @economics Read full article

Source: @economics Read full article

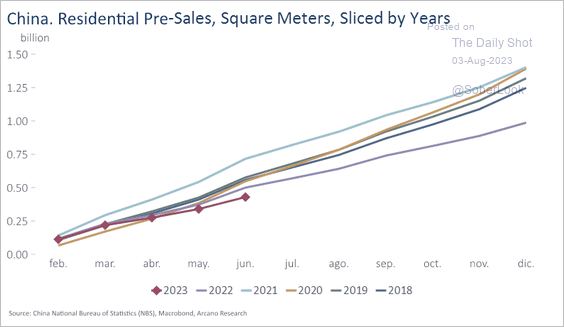

… and residential pre-sales.

Source: Arcano Economics

Source: Arcano Economics

——————–

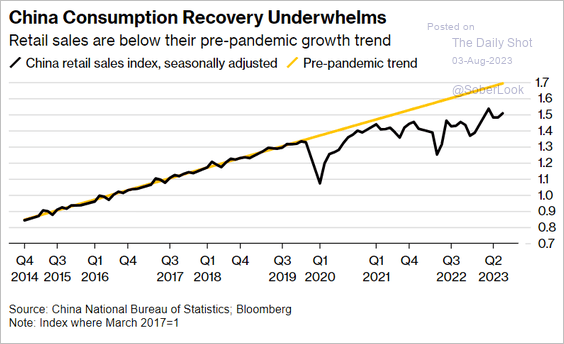

5. Finally, we have seasonally-adjusted retail sales relative to the pre-COVID trend.

Source: @economics Read full article

Source: @economics Read full article

Back to Index

Emerging Markets

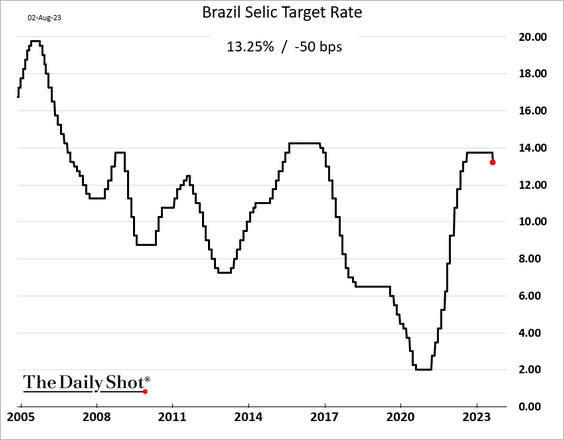

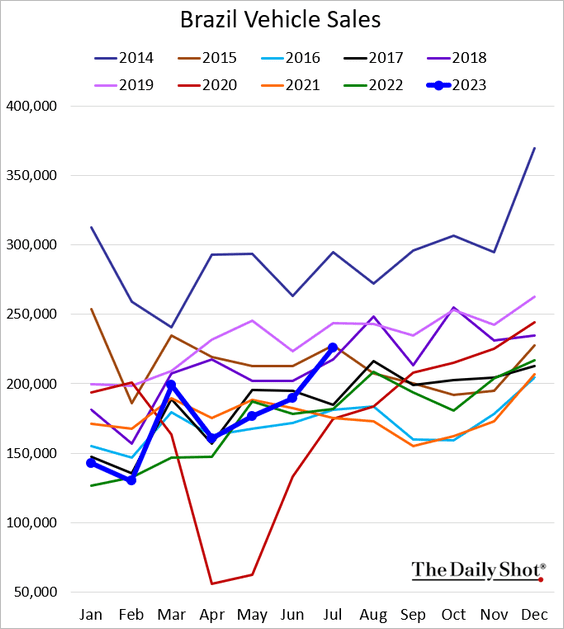

1. Brazil’s central bank cut the benchmark rate by 50 bps (the market was looking for 25 bps).

Separately, Brazil’s vehicle sales are rebounding.

——————–

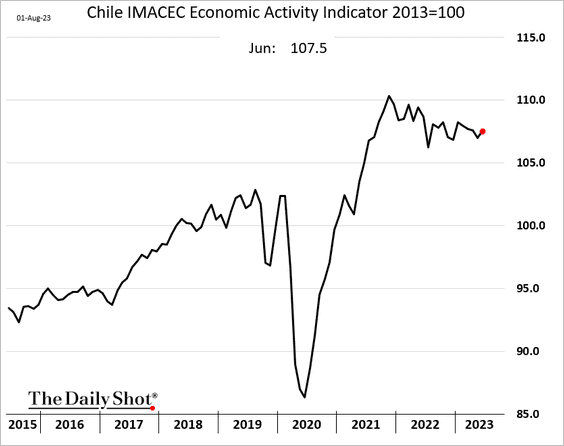

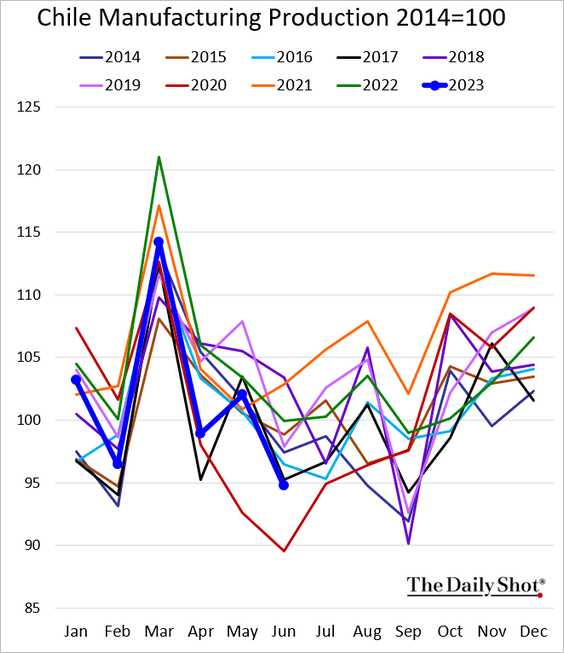

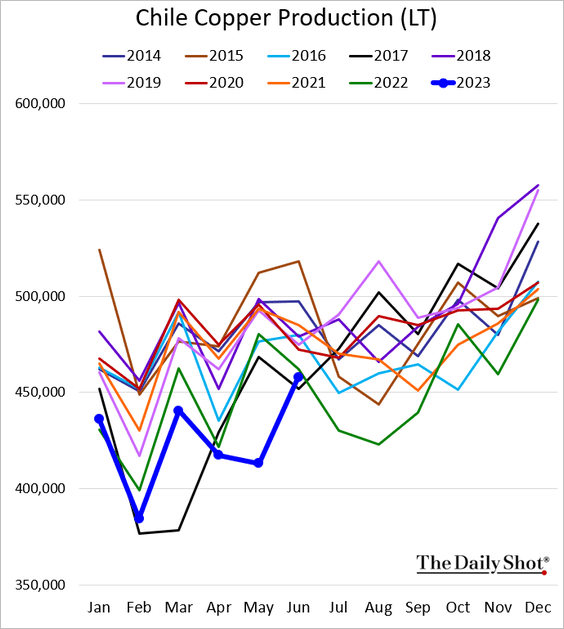

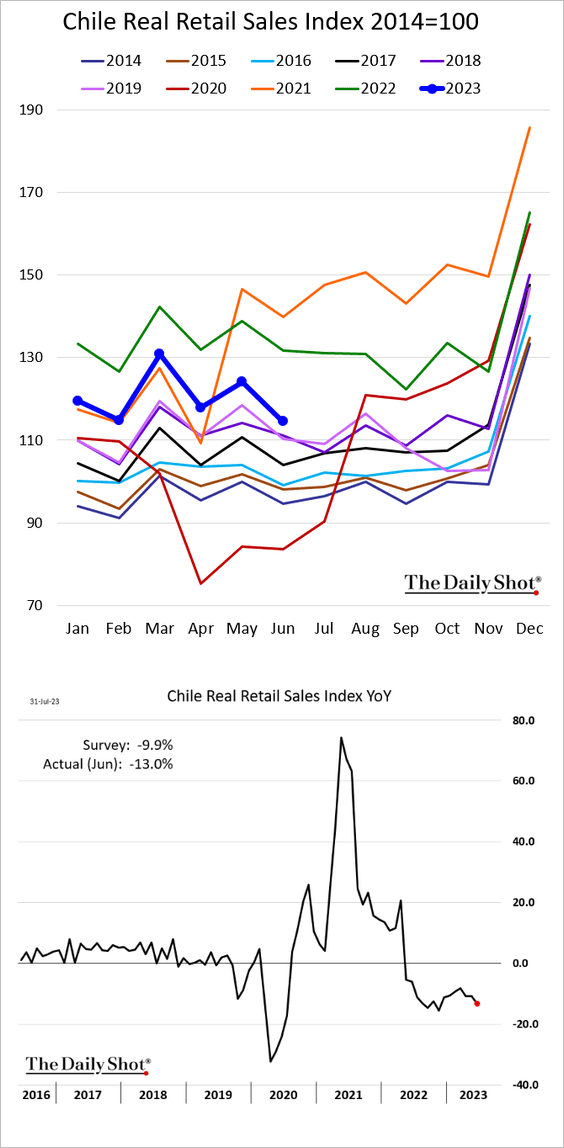

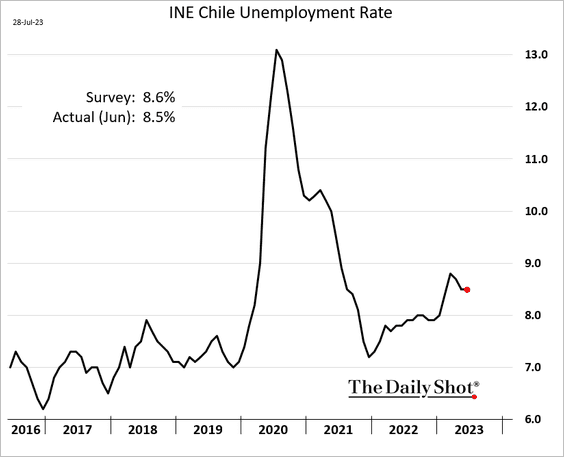

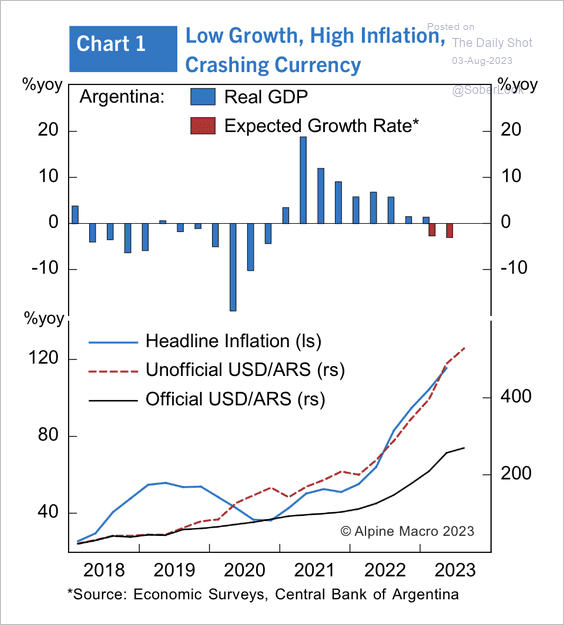

2. Next, we have some updates on Chile.

• Economic activity (an uptick in June):

• Manufacturing output (very soft):

• Copper production (a rebound):

• Retail sales (well below last year’s levels):

• Unemployment:

• Business confidence:

——————–

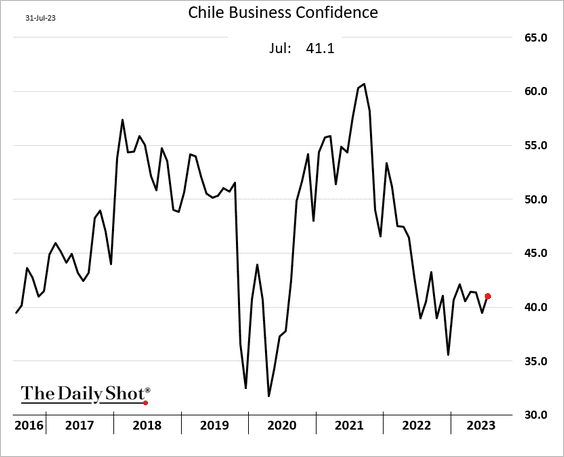

3. Here are some updates on Argentina.

• Argentina faces a deepening economic crisis. Will elections improve the country’s growth outlook?

Source: Alpine Macro

Source: Alpine Macro

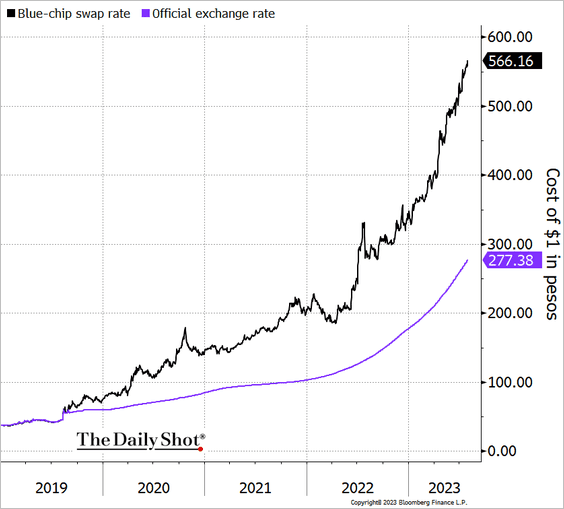

• The peso’s devaluation has accelerated.

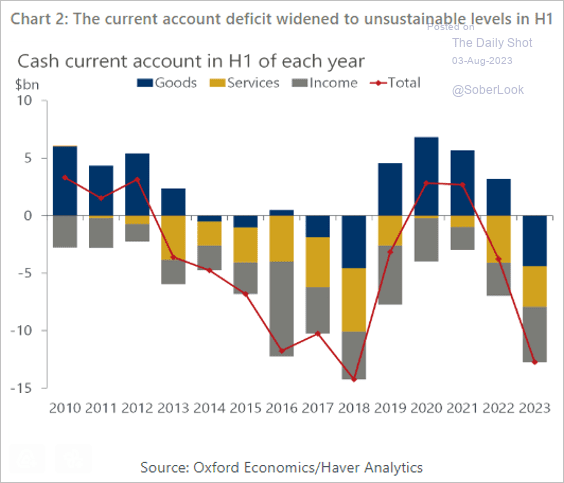

• The current account deficit widened further in H1.

Source: Oxford Economics

Source: Oxford Economics

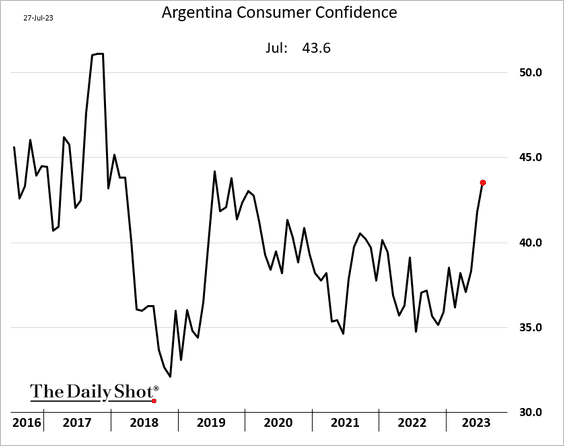

• Consumer confidence is rebounding.

——————–

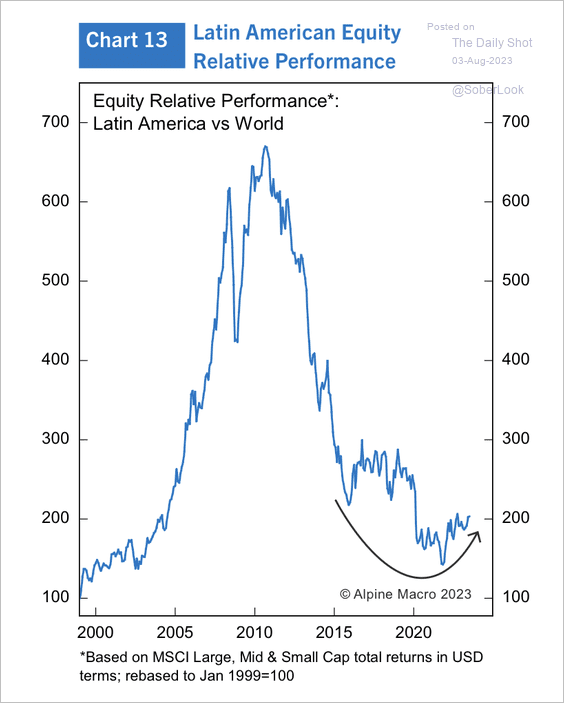

4. LatAm equities are improving relative to global equities.

Source: Alpine Macro

Source: Alpine Macro

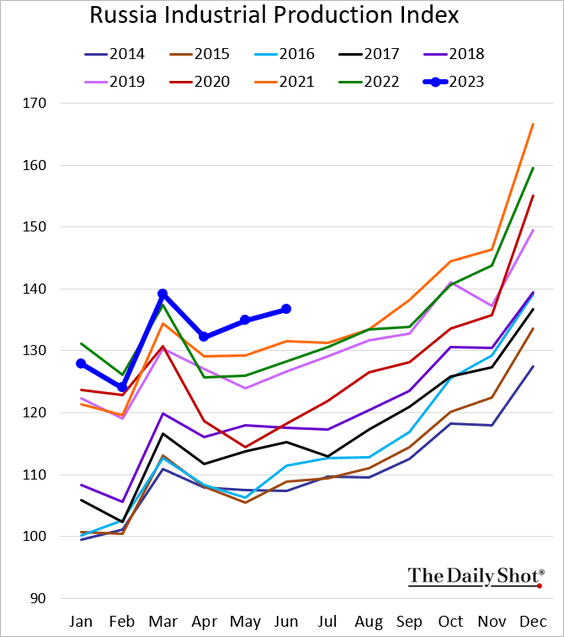

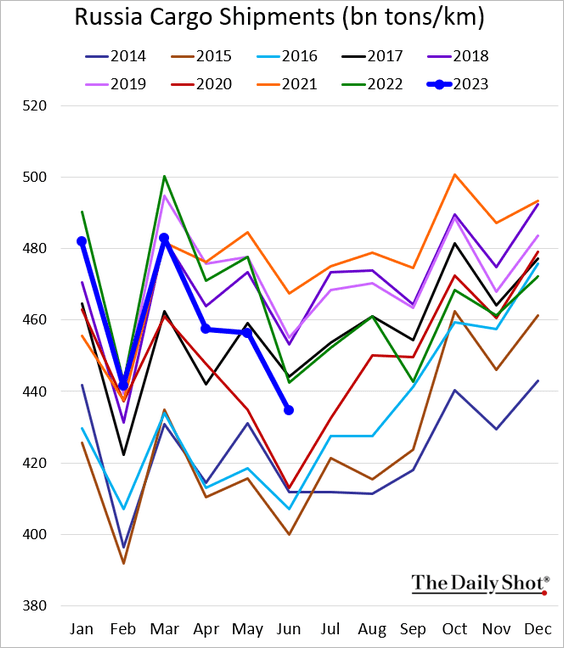

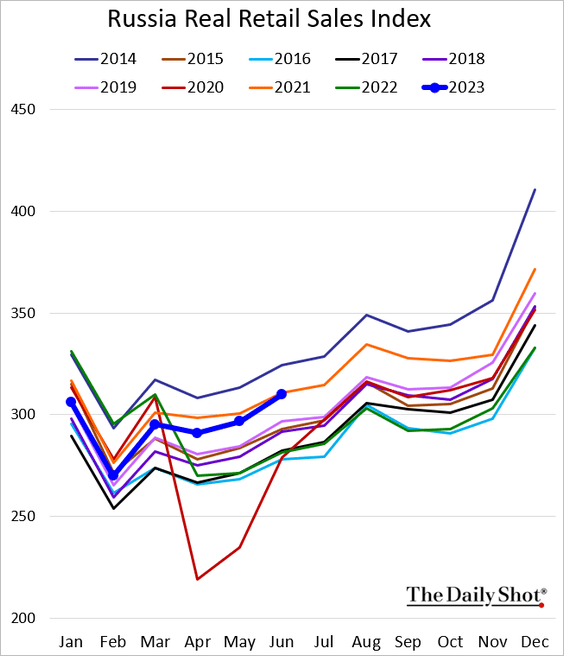

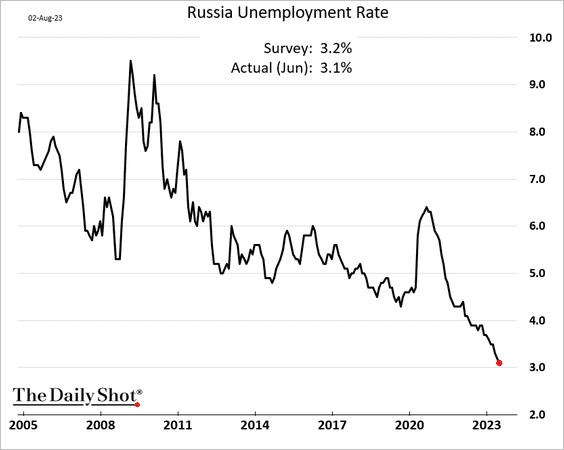

5. Next, we have some economic data from Russia. Please note that this rosy picture is brought to you by Russia’s Federal Service of State Statistics and should be taken with a pinch of salt.

• Industrial production:

• Cargo shipments:

• Retail sales:

• The unemployment rate:

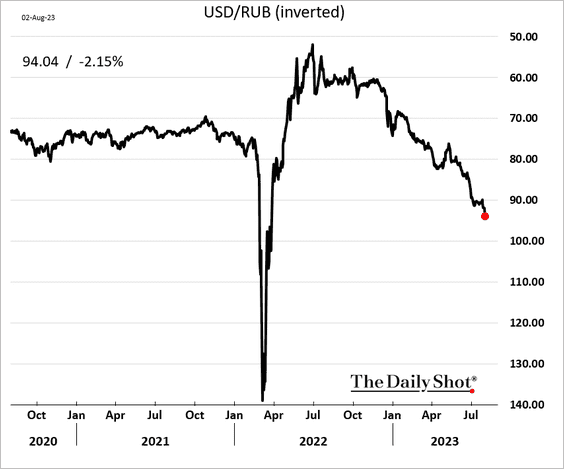

The ruble remains under pressure.

——————–

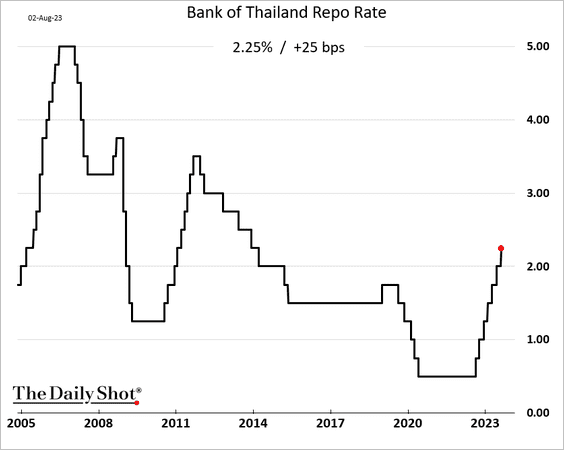

6. Thailand’s central bank hiked rates again.

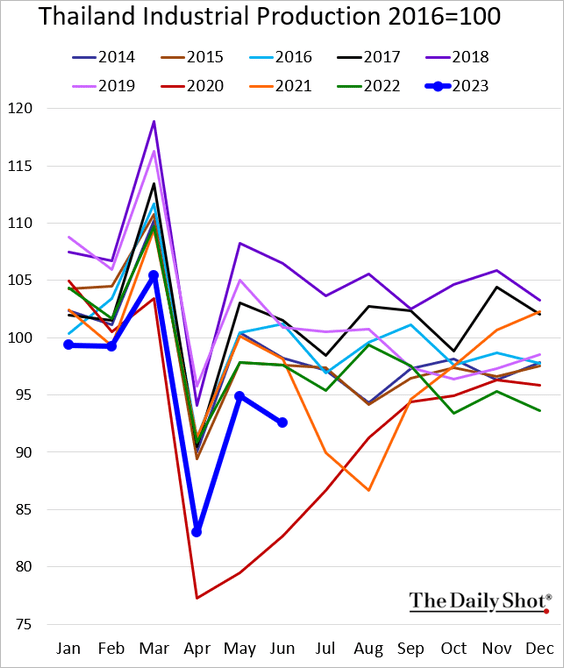

• Industrial production has been soft.

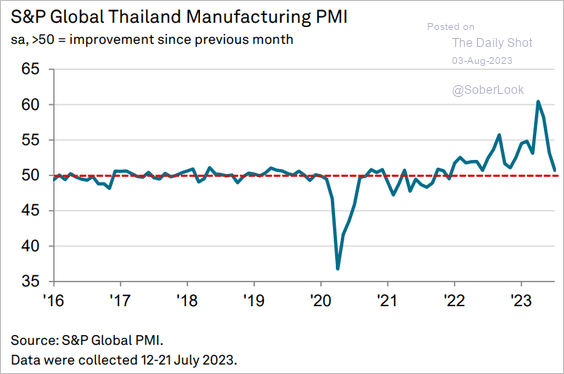

Manufacturing growth is stalling.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

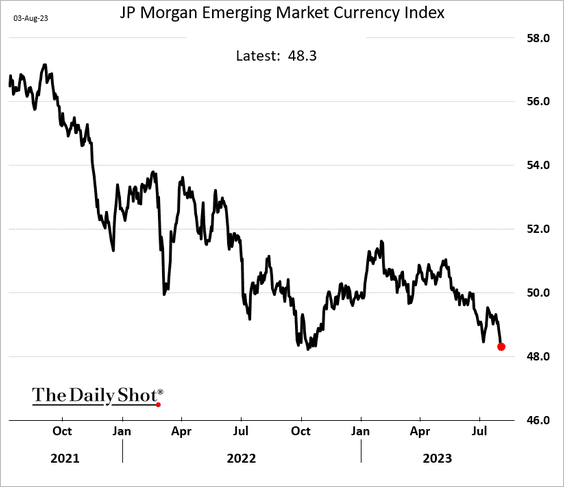

7. EM currencies are selling off as global sentiment shifts to risk-off.

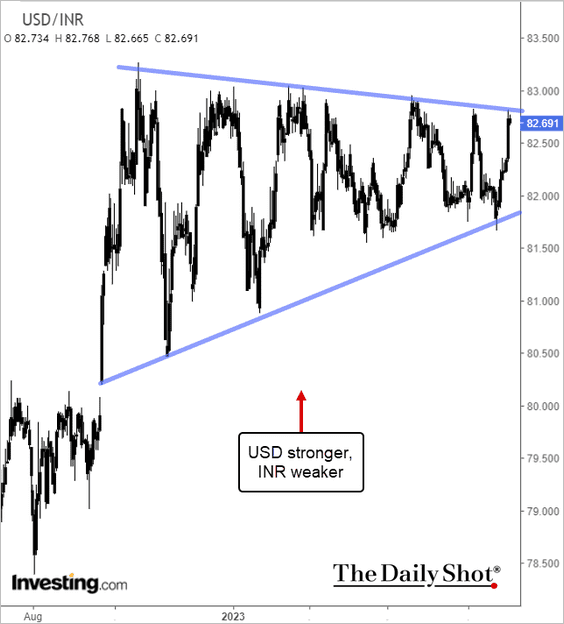

• USD/INR is at resistance.

——————–

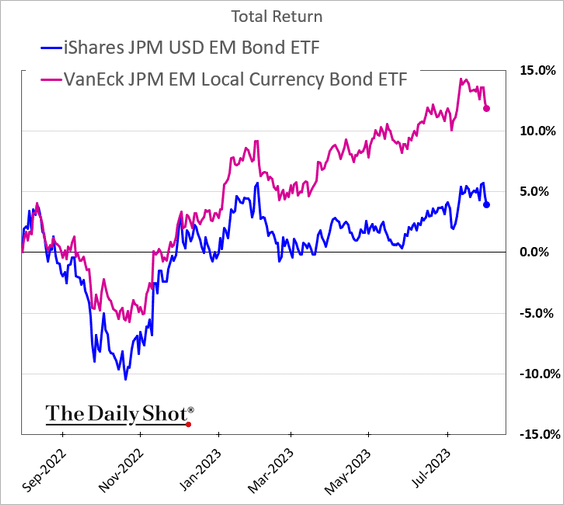

8. Dollar-denominated bonds have been outperforming local-currency debt (in dollar terms).

Back to Index

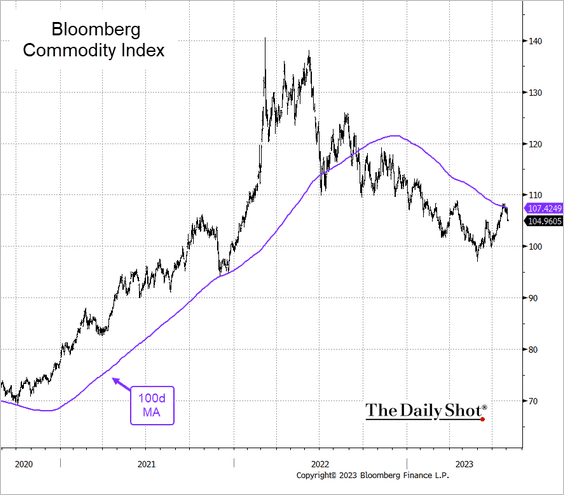

Commodities

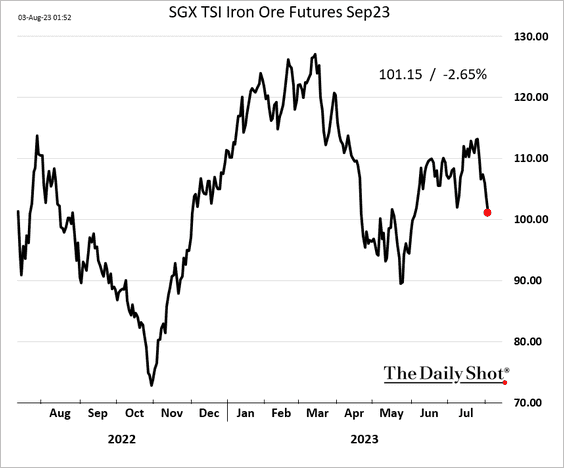

1. The iron ore rally is fading.

2. The commodity market rebound has stalled, with Bloomberg’s broad commodity index getting stopped at the 200-day moving average.

.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

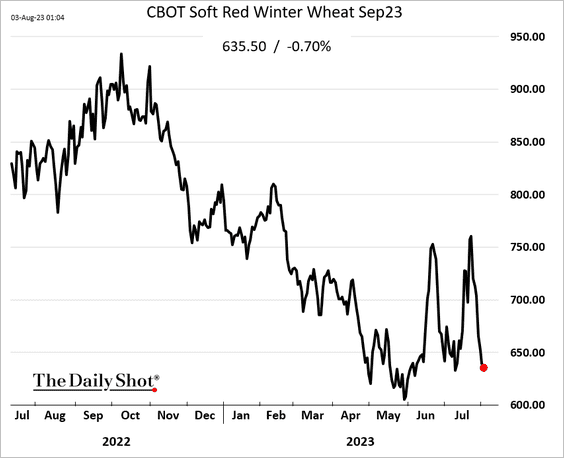

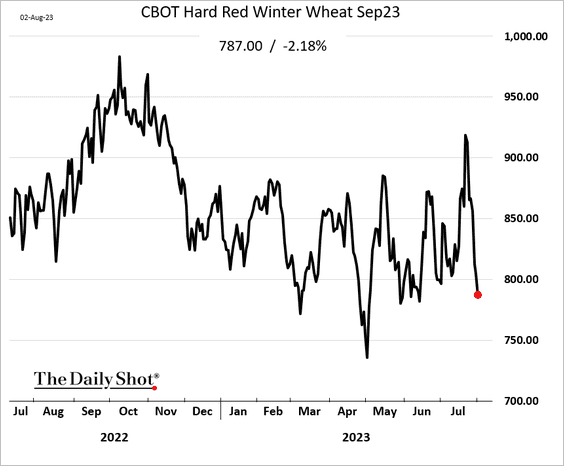

3. Wheat prices tumbled despite another Russian attack on Ukrainian grain infrastructure.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

Back to Index

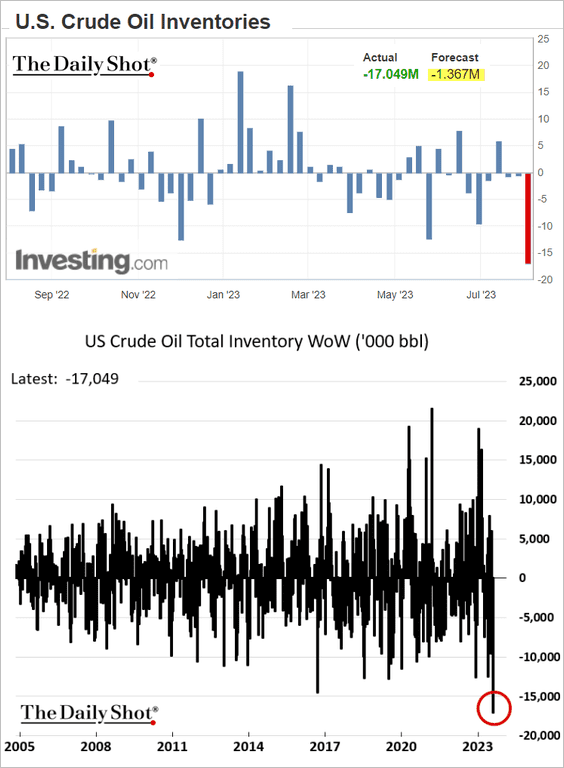

Energy

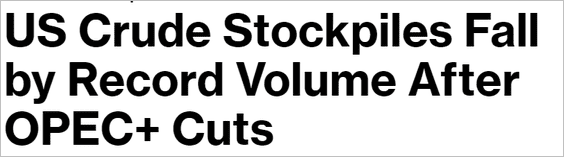

1. US oil inventories plummeted last week.

Source: @markets Read full article

Source: @markets Read full article

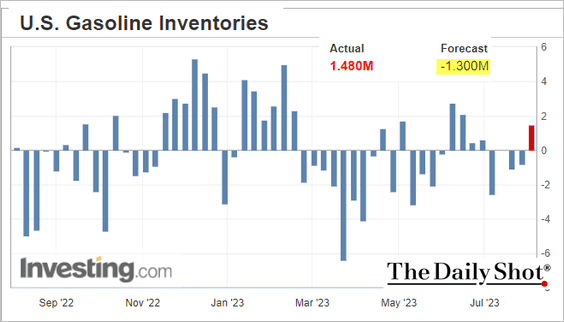

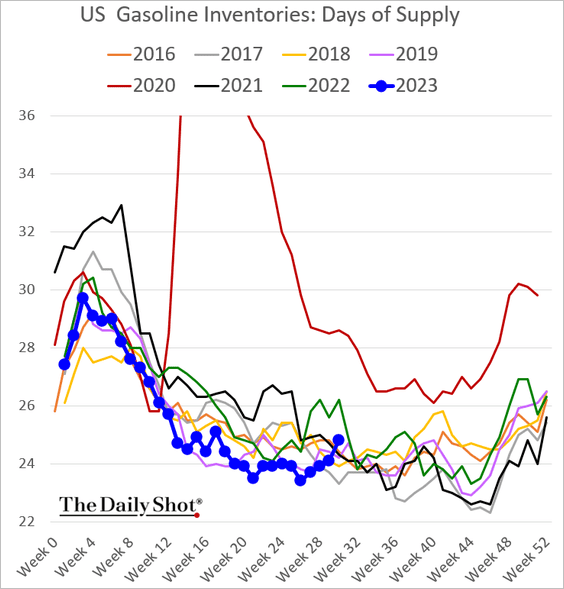

Gasoline inventories climbed …

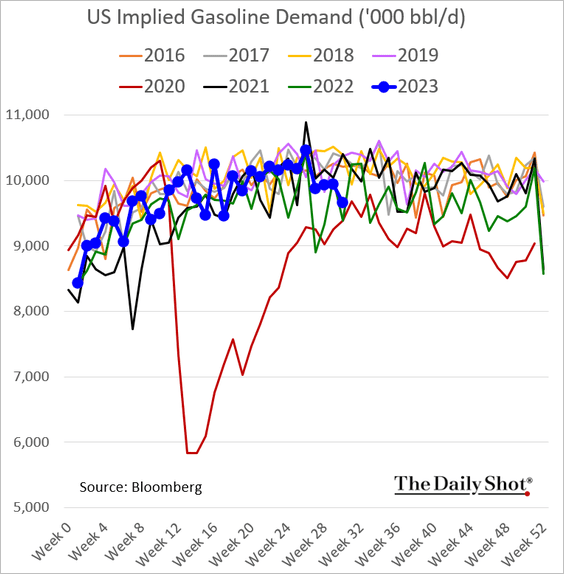

… due to softer demand.

——————–

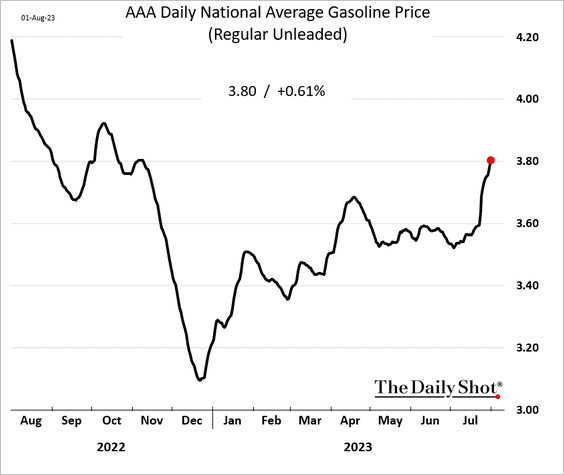

2. US retail gasoline prices surged in recent weeks.

Source: @axios Read full article

Source: @axios Read full article

——————–

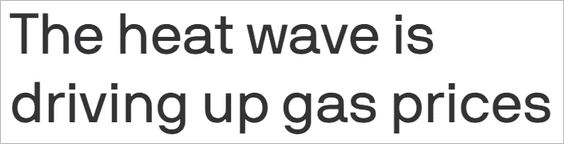

3. Russian oil discount to Brent has tightened.

Back to Index

Equities

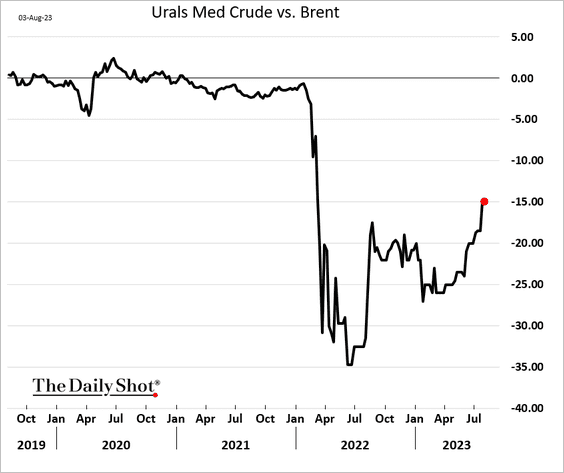

1. Time for a pause in the equity rally? Here is the share of S&P stocks above their 50-day moving average.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

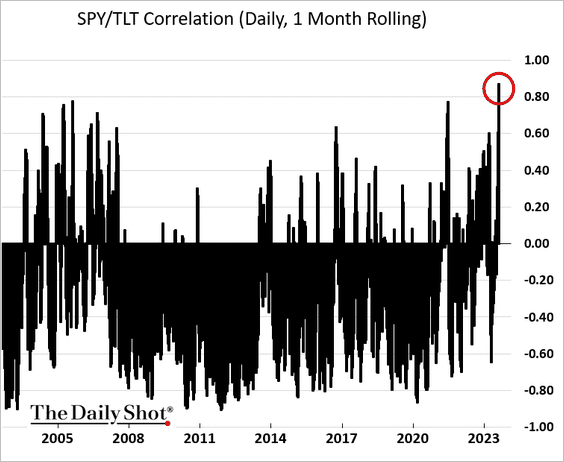

2. The stock-bond correlation surged in recent weeks.

h/t @lisaabramowicz1

h/t @lisaabramowicz1

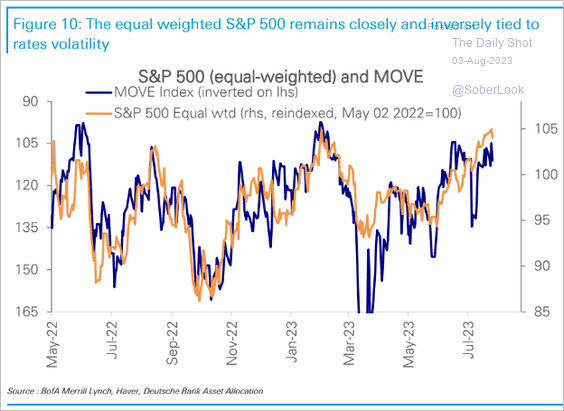

3. The S&P 500 equal-weight index has been correlated with the Treasury market implied vol (MOVE).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

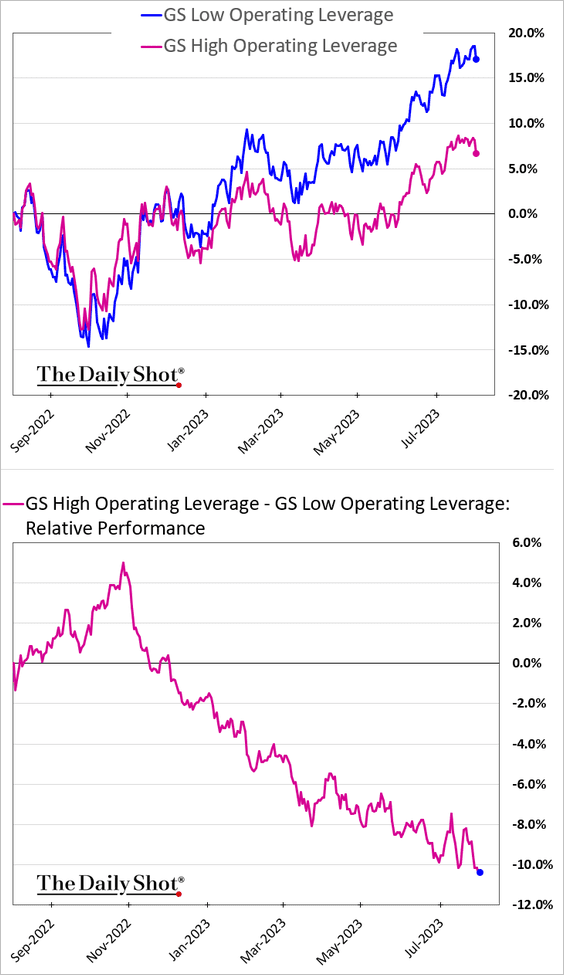

4. Companies with high operating leverage continue to widen their underperformance.

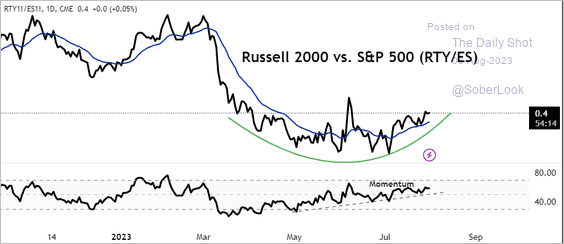

5. US small caps are improving relative to large caps – a sign of expanding breadth.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

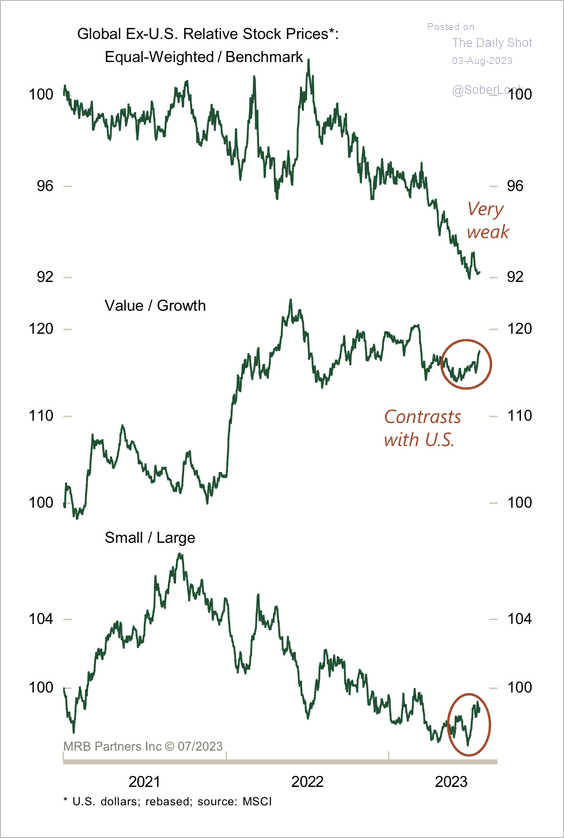

6. Value and small-cap stocks are holding up in equity markets outside of the US.

Source: MRB Partners

Source: MRB Partners

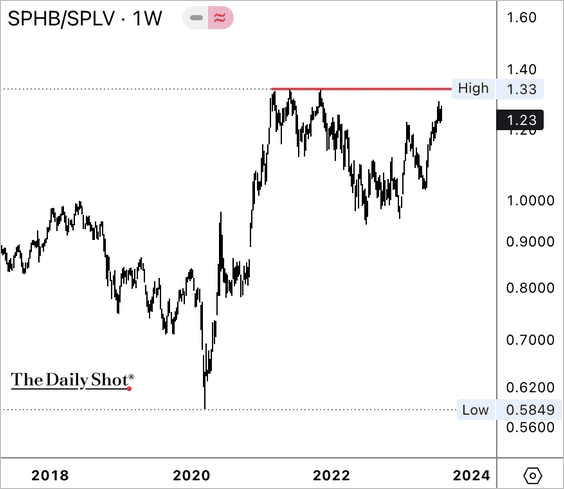

7. The Invesco S&P 500 High-Beta/Low-Vol (SPHB/SPLV) ratio is testing resistance.

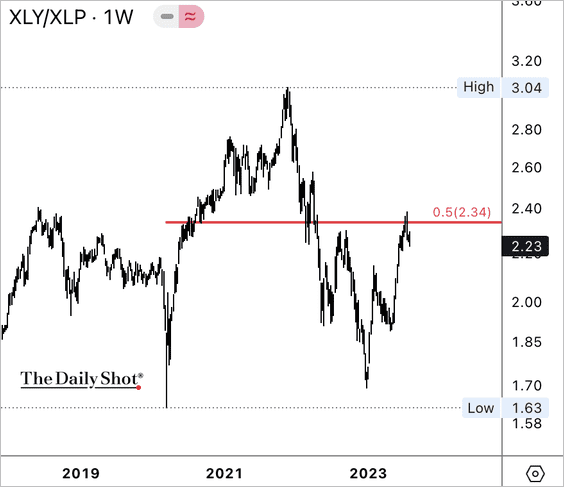

• The SPDR Consumer Discretionary/Consumer Staples (XLY/XLP) ratio is also testing resistance.

——————–

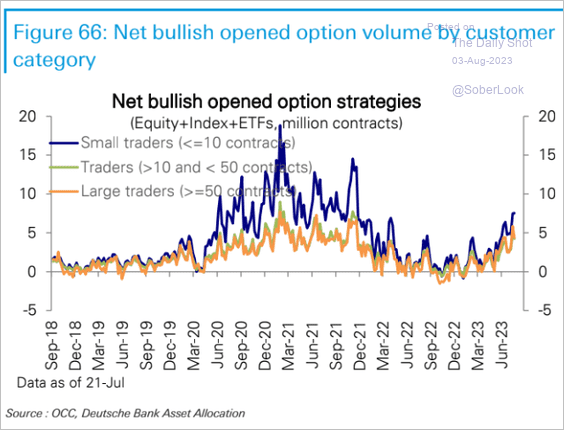

8. Retail investors have been embracing bullish options trades once again.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

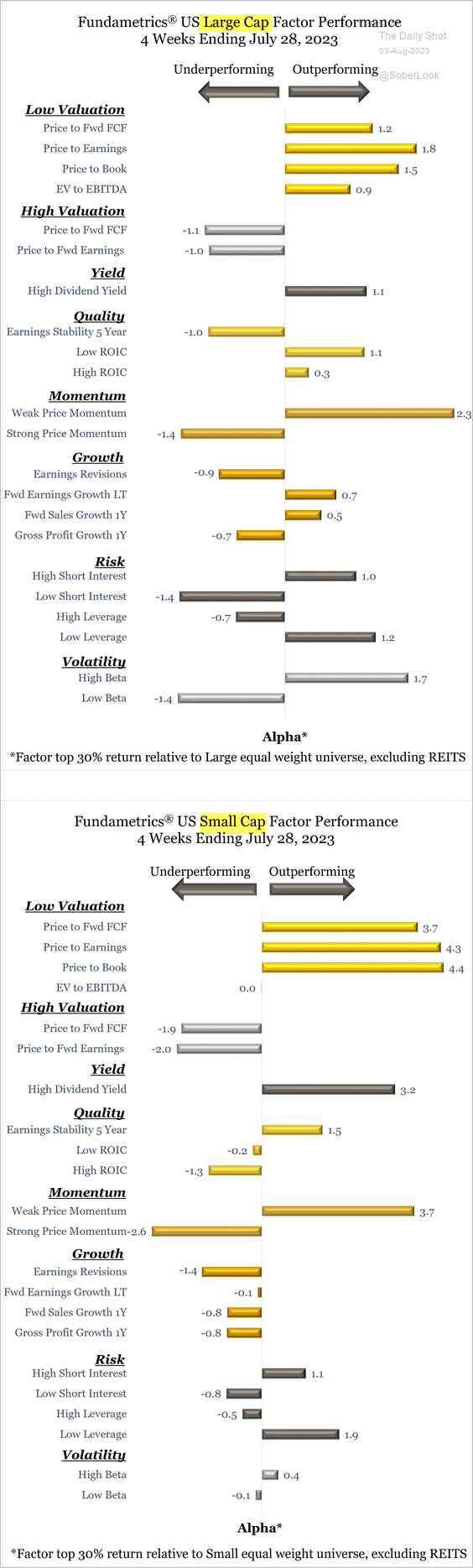

9. Finally, we have equity factor relative performance in July.

Source: CornerCap Institutional

Source: CornerCap Institutional

Back to Index

Global Developments

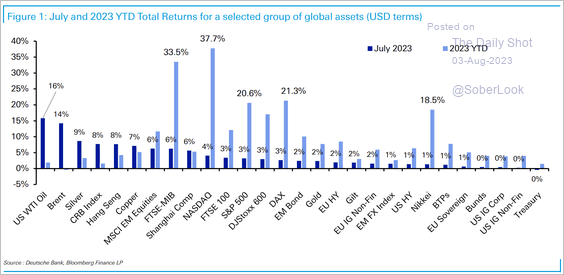

1. July was another good month for risk assets, including a bounce in oil prices and emerging market equities.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

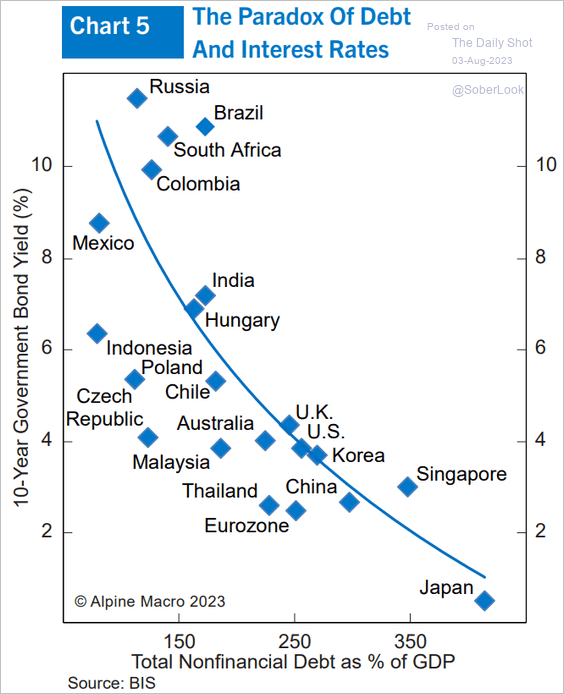

2. Countries with higher debt-to-GDP ratios tend to have lower bond yields.

Source: Alpine Macro

Source: Alpine Macro

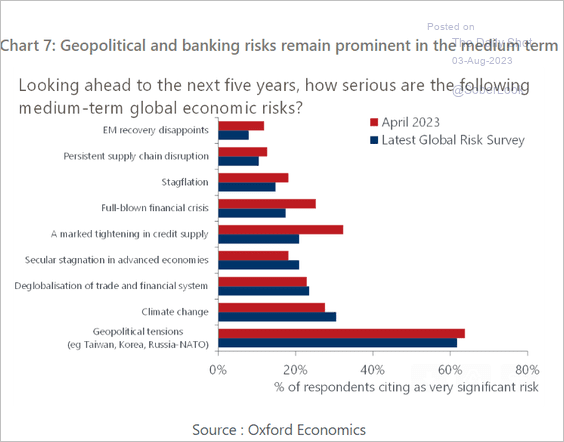

3. Where do businesses see global threats over the medium term?

Source: Oxford Economics

Source: Oxford Economics

——————–

Food for Thought

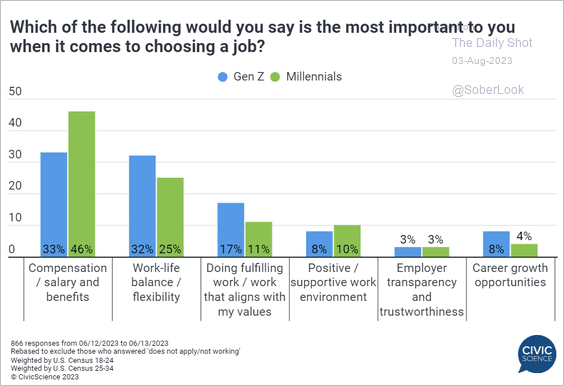

1. Key considerations when choosing a job:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

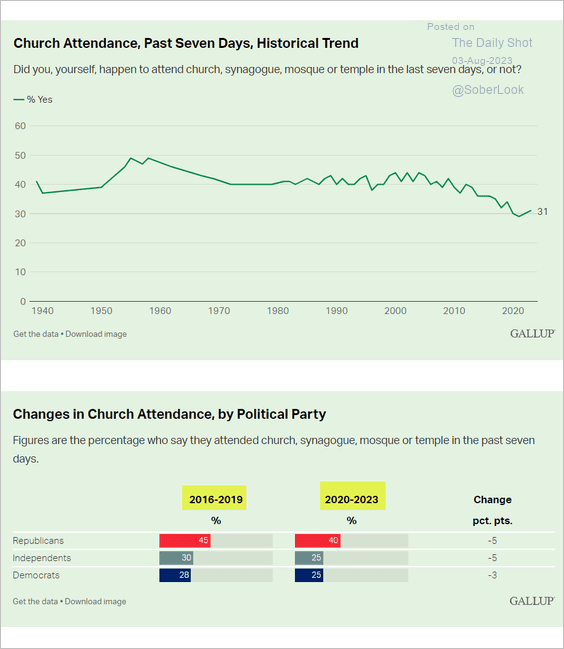

2. Church attendance:

Source: Gallup Read full article

Source: Gallup Read full article

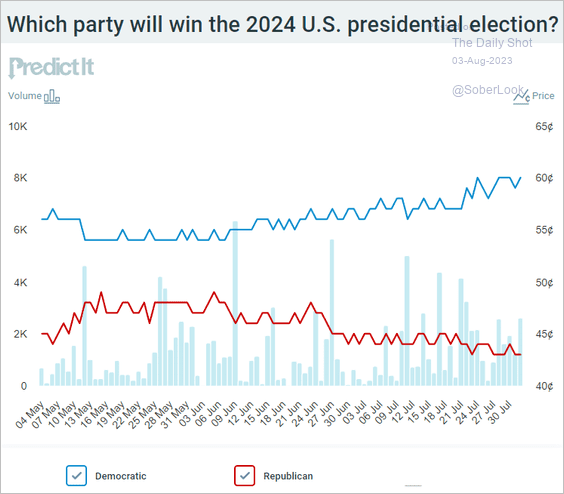

3. Betting market probabilities on which party wins the 2024 US presidential election:

Source: @PredictIt

Source: @PredictIt

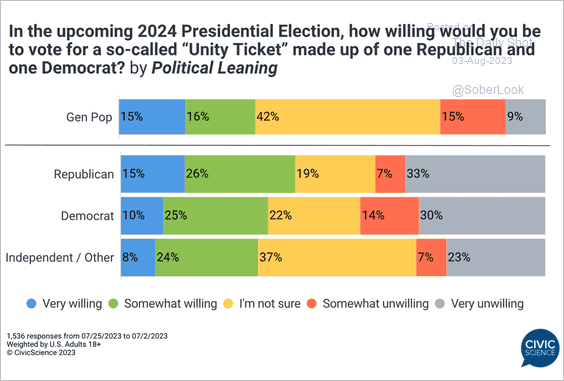

4. Interest in voting for a “Unity Ticket”:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

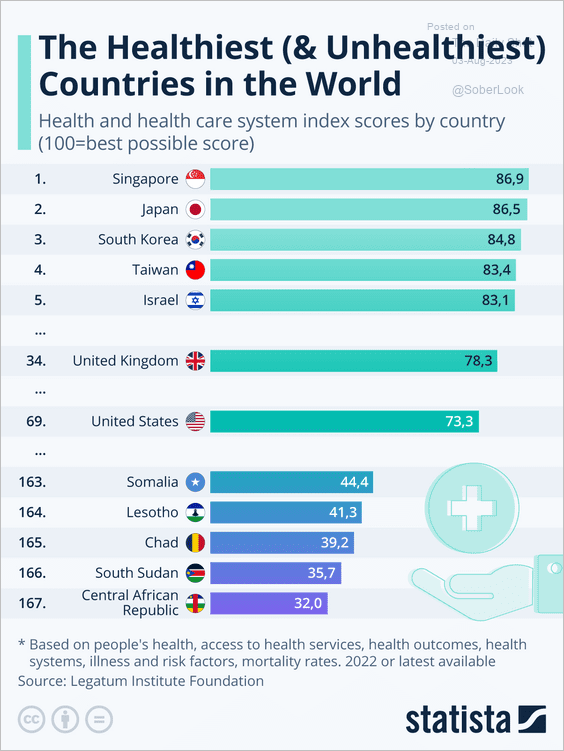

5. The healthiest and unhealthiest countries:

Source: Statista Read full article

Source: Statista Read full article

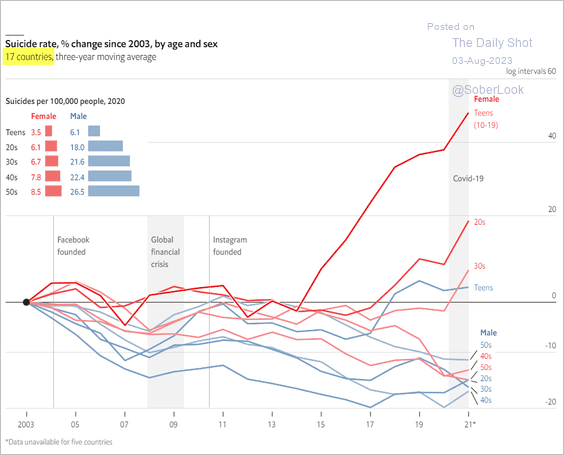

6. Suicide rates:

Source: The Economist Read full article

Source: The Economist Read full article

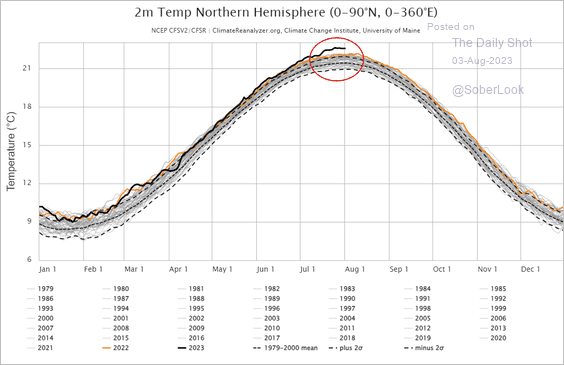

7. Air temperature in the northern hemisphere:

Source: Climate Reanalyzer Further reading

Source: Climate Reanalyzer Further reading

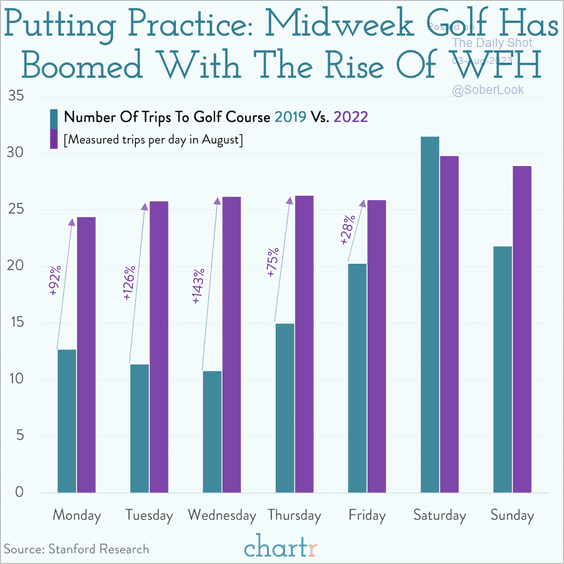

8. Midweek golf:

Source: @chartrdaily

Source: @chartrdaily

——————–

Back to Index