The Daily Shot: 04-Aug-23

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

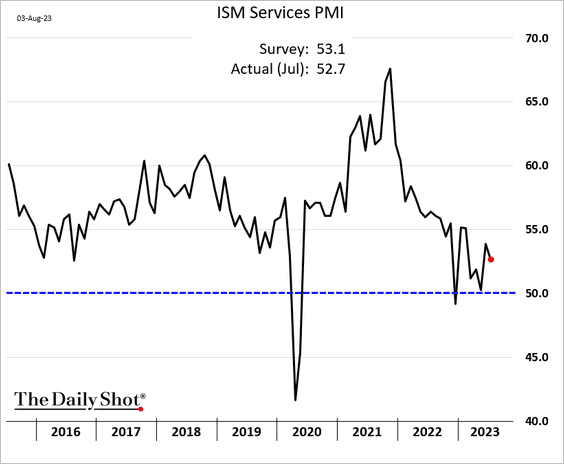

1. According to the ISM PMI report, service sector growth slowed in July.

Source: @TheTerminal, Bloomberg Finance L.P.

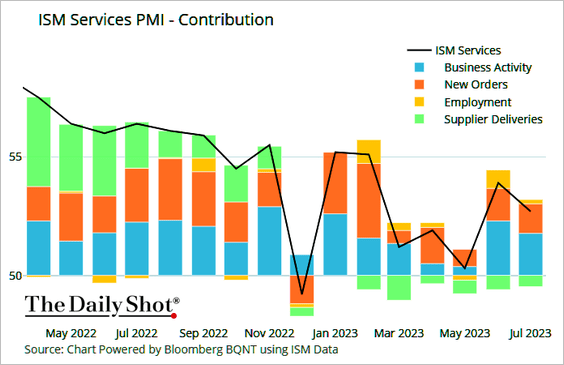

Source: @TheTerminal, Bloomberg Finance L.P.

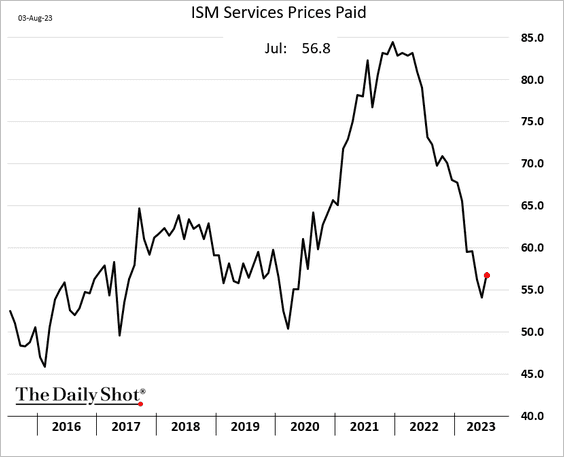

• More companies reported paying higher prices.

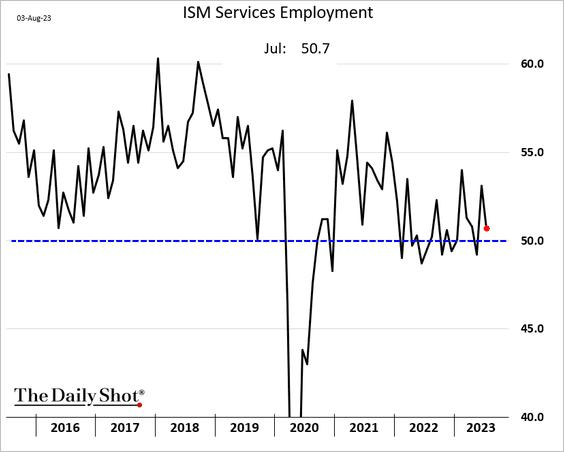

• Hiring slowed.

——————–

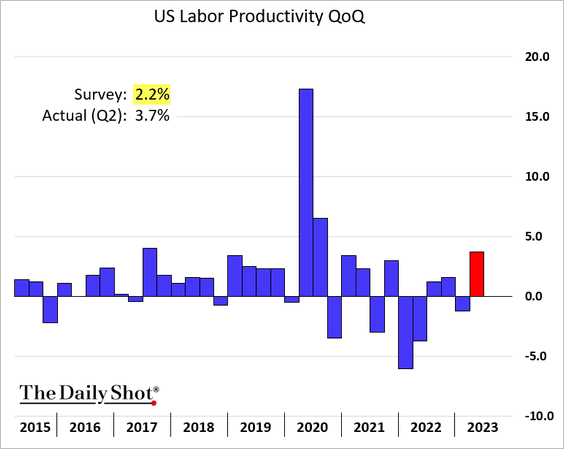

2. The second-quarter labor productivity growth was stronger than expected, …

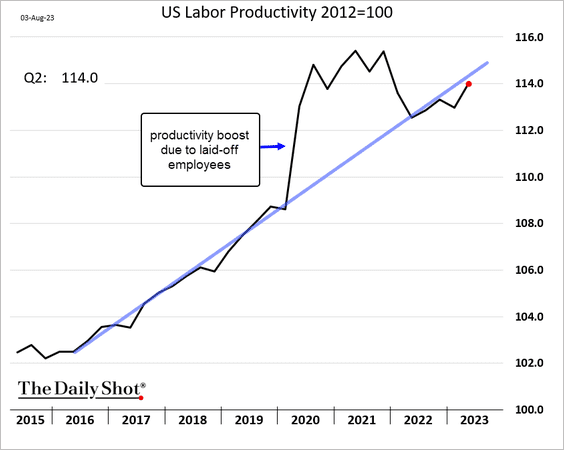

… returning to the pre-COVID trend.

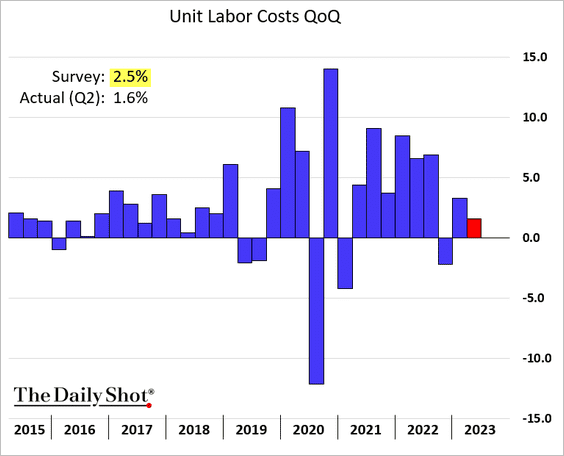

Unit labor costs eased. Some economists harbor doubts regarding the enduring nature of this deceleration in price pressures.

——————–

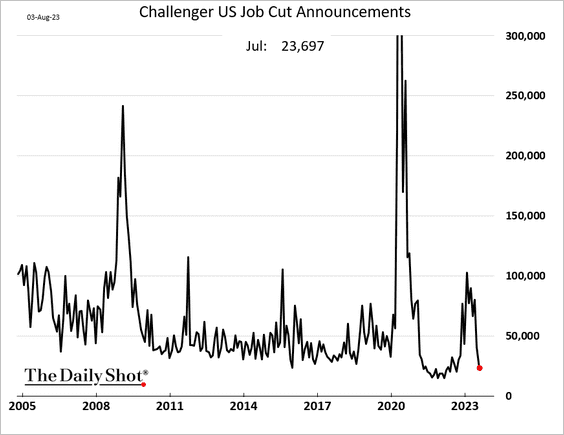

3. Job cut announcements slowed again last month and are now well below pre-COVID levels.

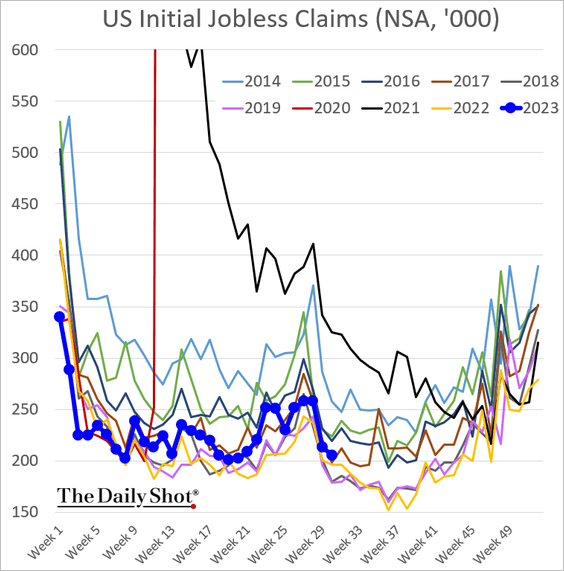

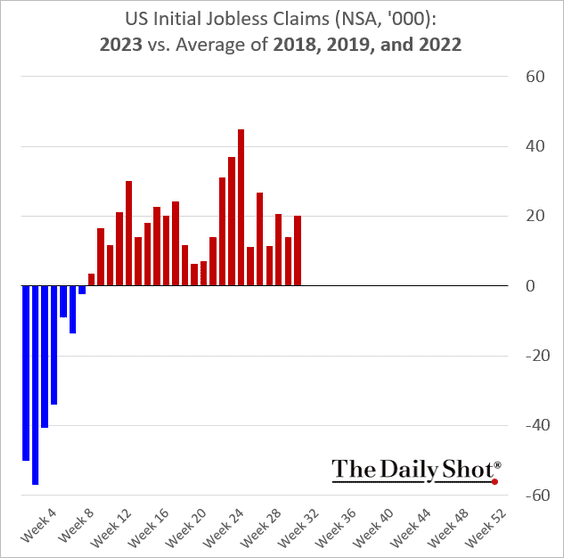

• Initial jobless claims show no signs of acceleration.

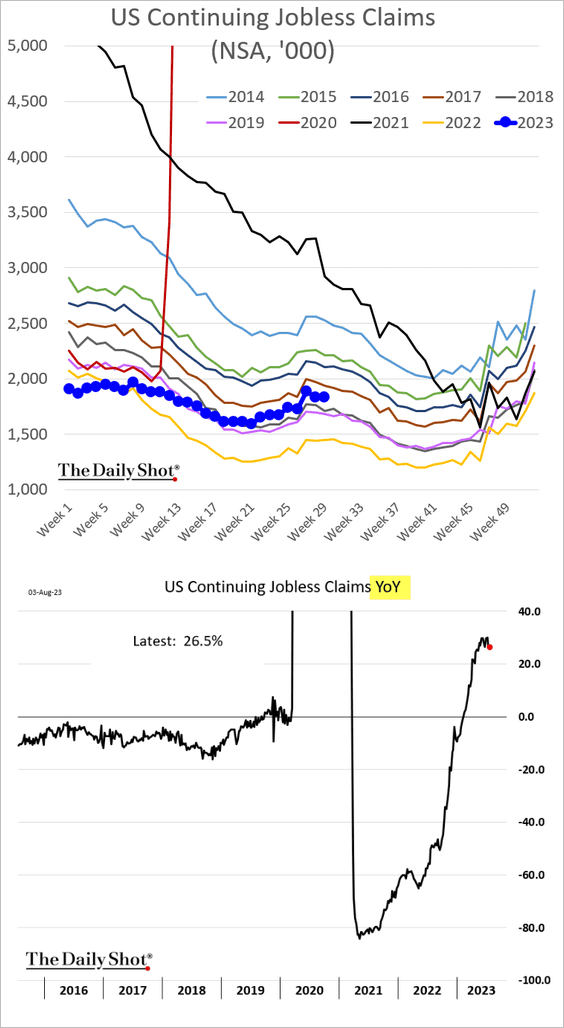

Continuing claims appear to have stabilized.

——————–

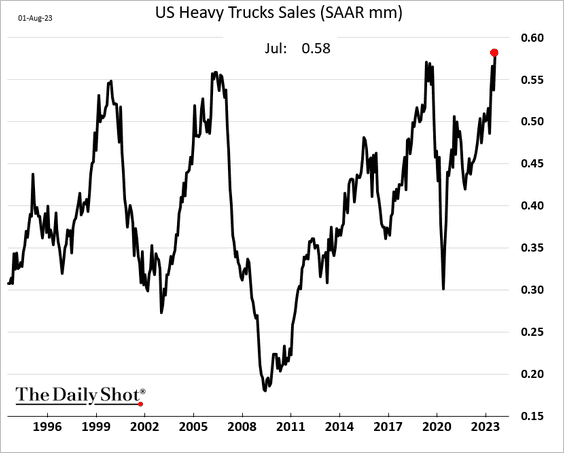

4. Heavy truck sales hit a record high.

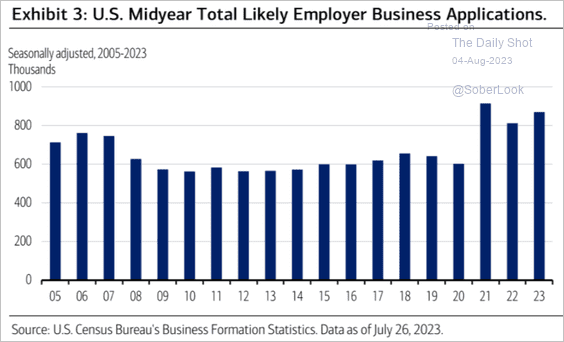

5. Business applications are holding well above pre-COVID levels.

Source: Merrill Lynch

Source: Merrill Lynch

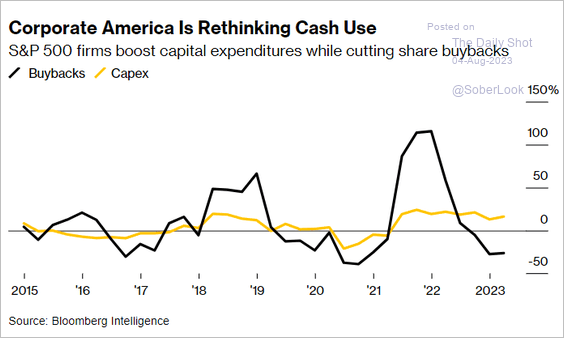

6. CapEx has been holding up well even as corporate share buybacks slow.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

The United Kingdom

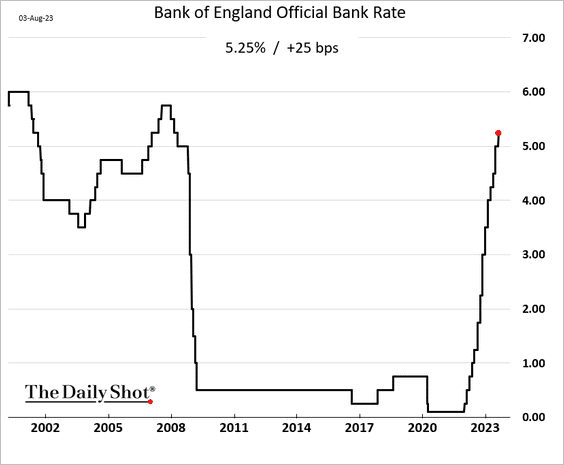

1. The BoE hiked rates by 25 bps.

Source: CNBC Read full article

Source: CNBC Read full article

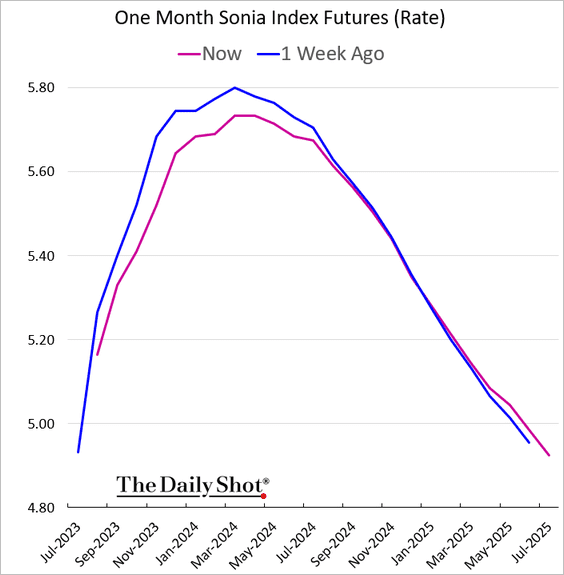

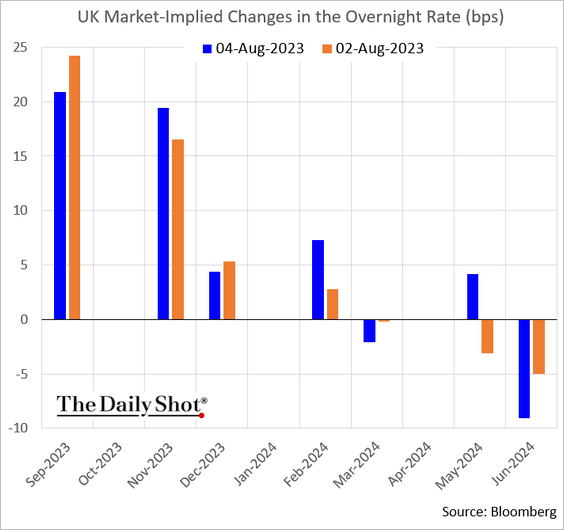

• The expected rate trajectory shifted lower.

But the market still sees a strong probability of another two rate increases before the peak.

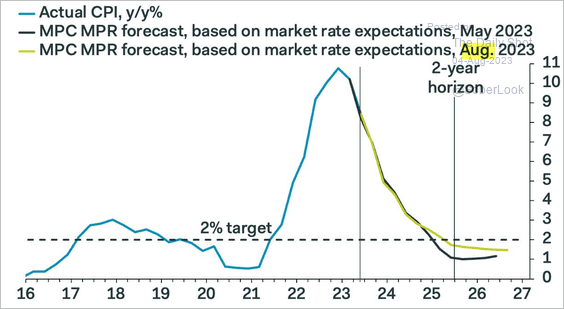

• The MPC’s longer-dated inflation trajectory shifted higher.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

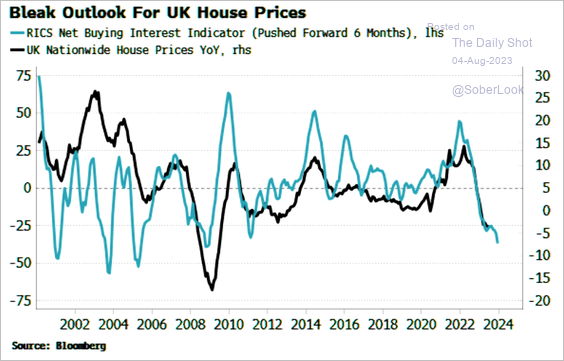

2. Home prices could decline further as demand slows.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

The Eurozone

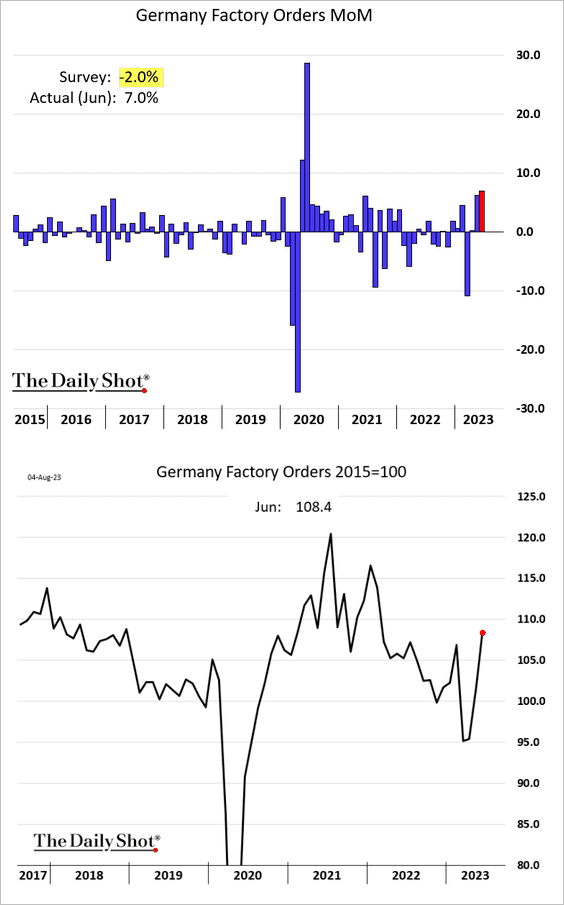

1. Germany’s factory orders were much stronger than expected in June.

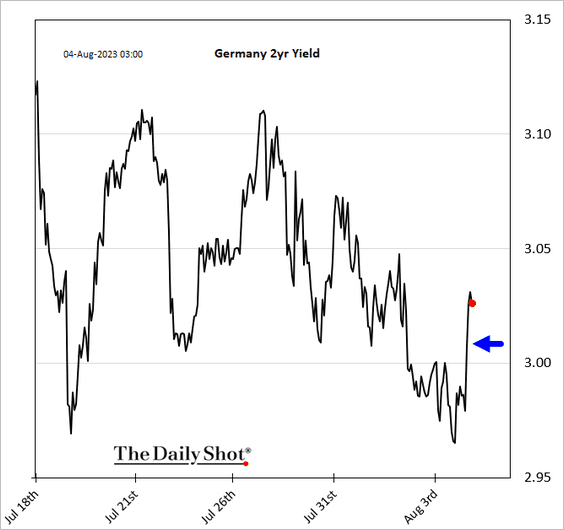

Bund yields jumped in response to the upbeat manufacturing orders report.

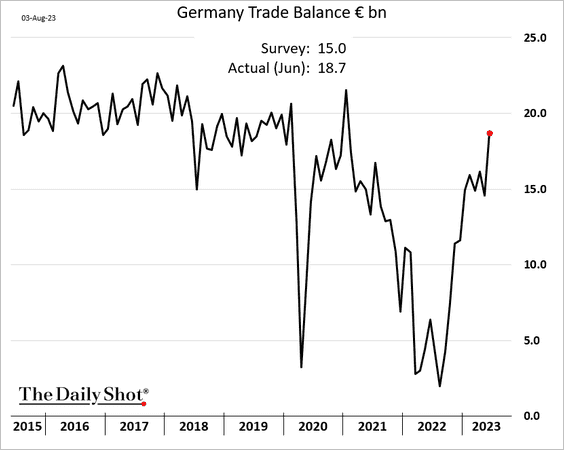

• Germany’s trade surplus surged in June, …

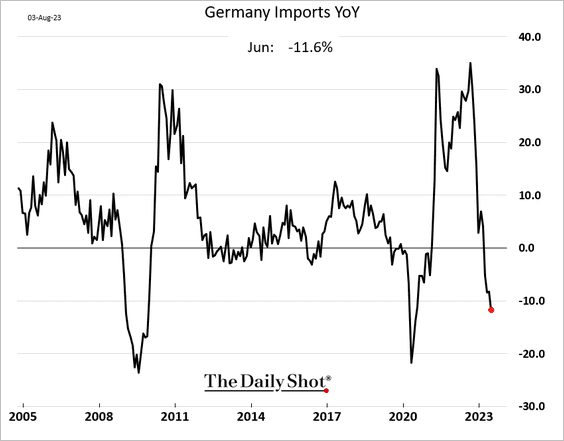

… as imports declined further.

——————–

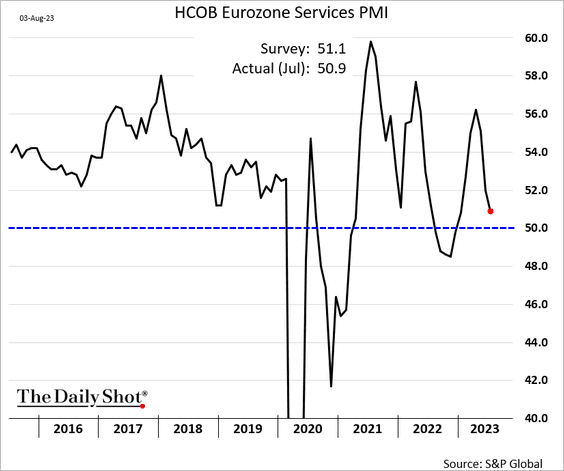

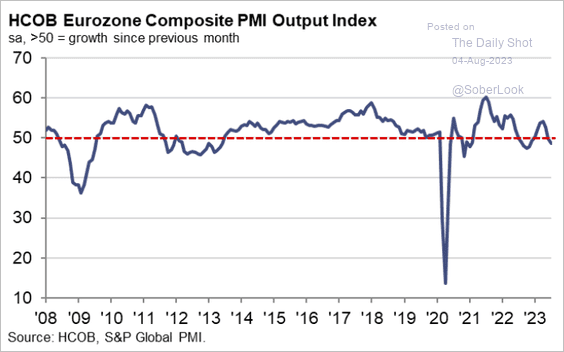

2. Euro-area services growth slowed again in July.

The composite PMI is below 50, indicating a contraction in business activity.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

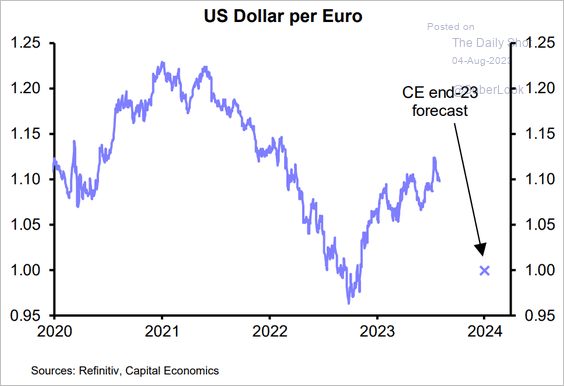

3. Capital Economics projects that the euro will reach parity with the dollar by the end of the year.

Source: Capital Economics

Source: Capital Economics

Back to Index

Europe

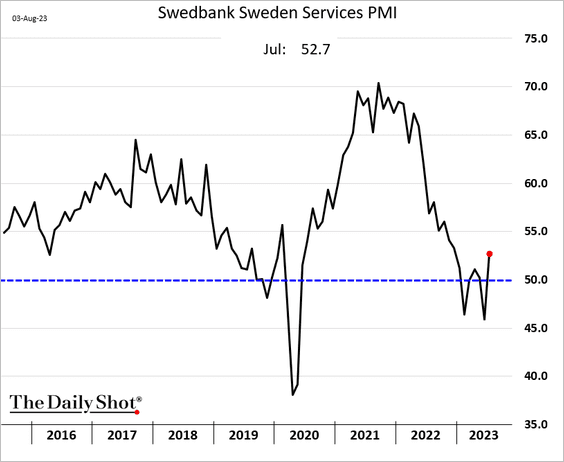

1. Sweden’s service sector returned to growth in July.

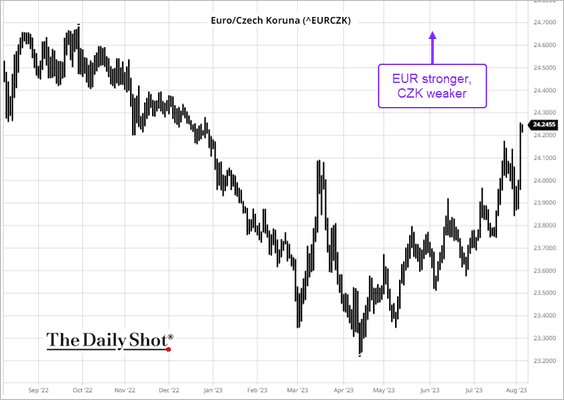

2. The Czech central bank left rates unchanged and stopped its support for the koruna. Rate cuts are coming.

Source: Reuters Read full article

Source: Reuters Read full article

The currency tumbled.

Source: barchart.com

Source: barchart.com

——————–

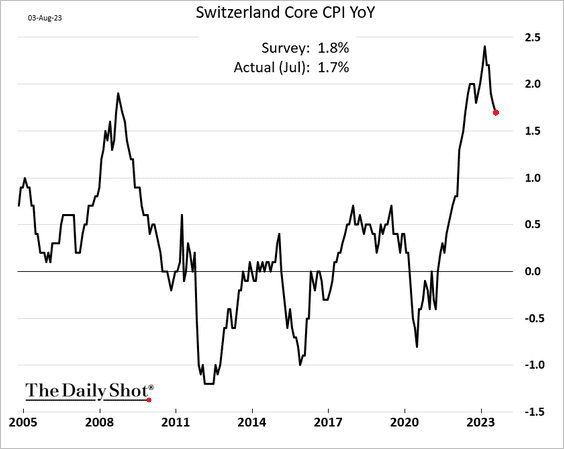

3. Swiss core inflation eased again in July.

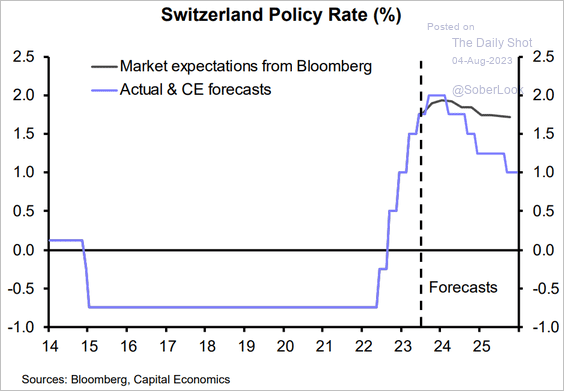

Here is a forecast for the policy rate trajectory from Capital Economics.

Source: Capital Economics

Source: Capital Economics

Back to Index

Asia-Pacific

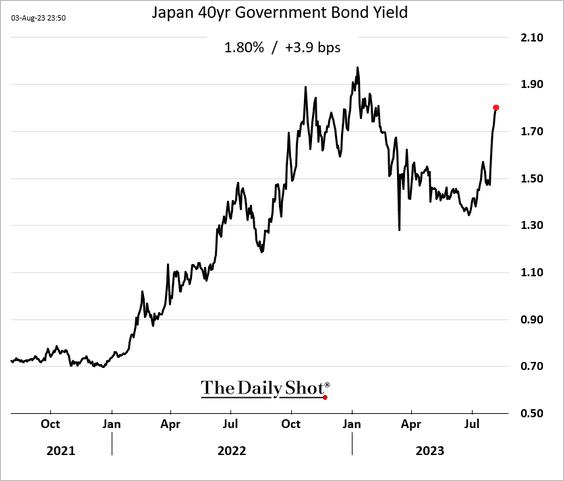

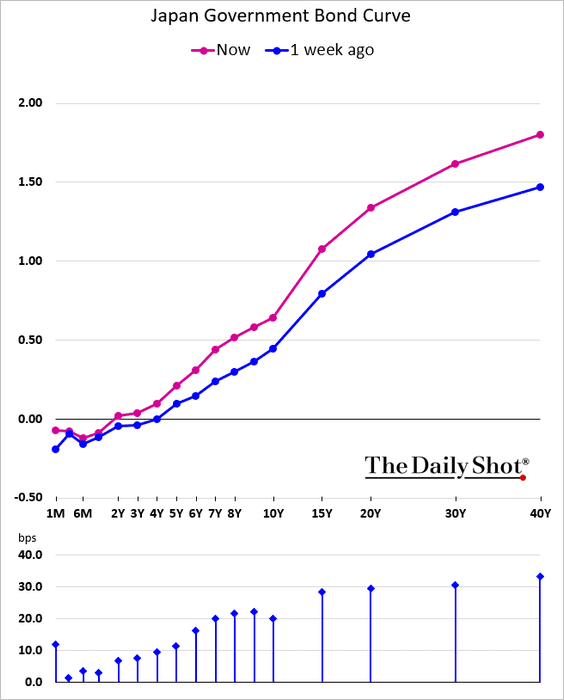

1. Japan’s bond yields climbed further as the BoJ’s policy “adjustment” put pressure on global debt markets.

——————–

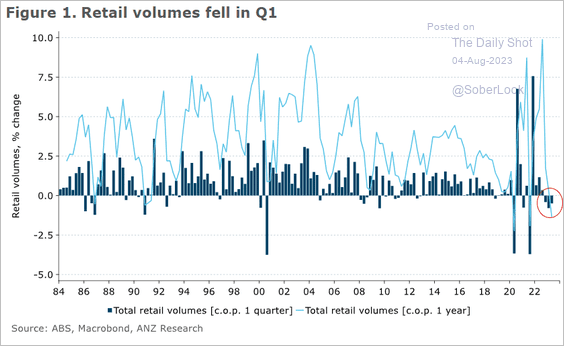

2. Australia’s retail trade has been slowing.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

China

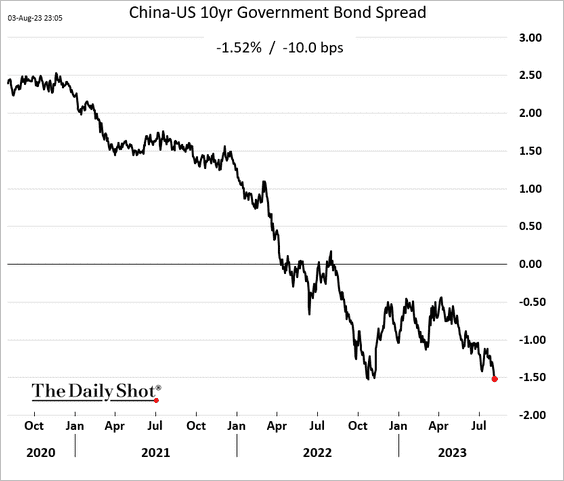

1. The spread between Treasuries and China’s government bonds is at multi-year lows.

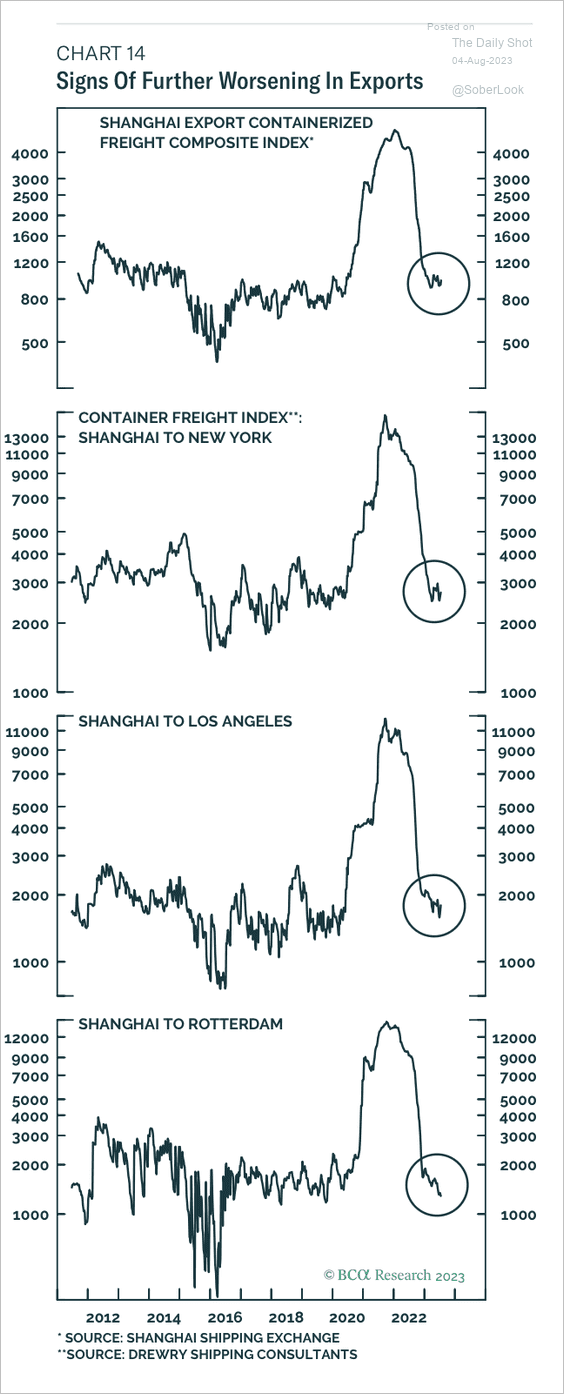

2. Container freight rates are falling again.

Source: BCA Research

Source: BCA Research

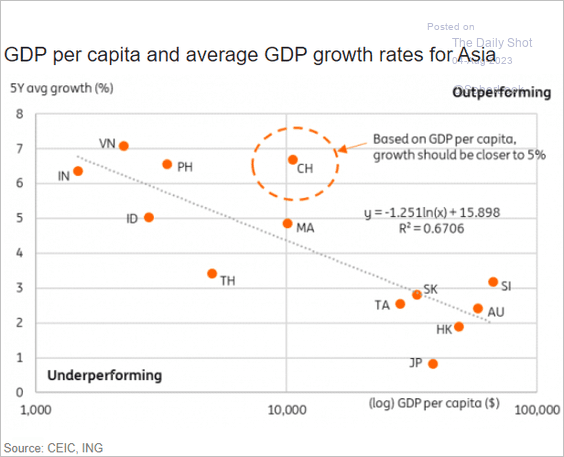

3. Given China’s GDP per capita, its economic growth should be slower.

Source: ING

Source: ING

Back to Index

Emerging Markets

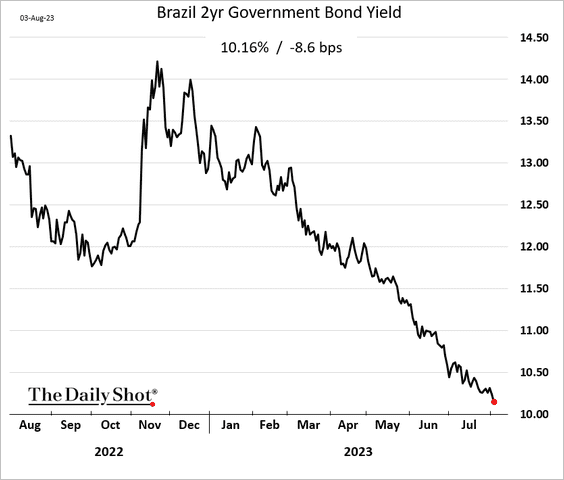

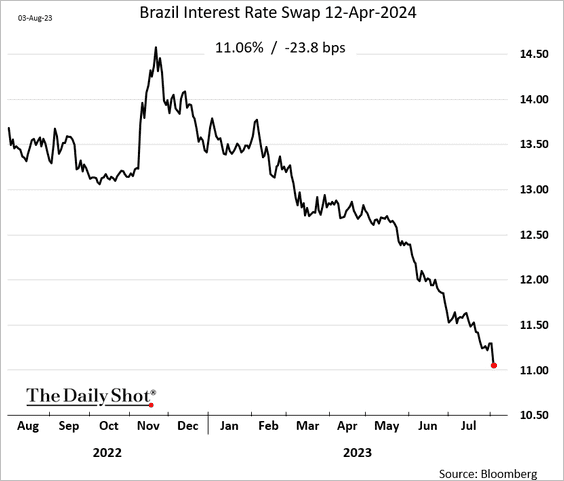

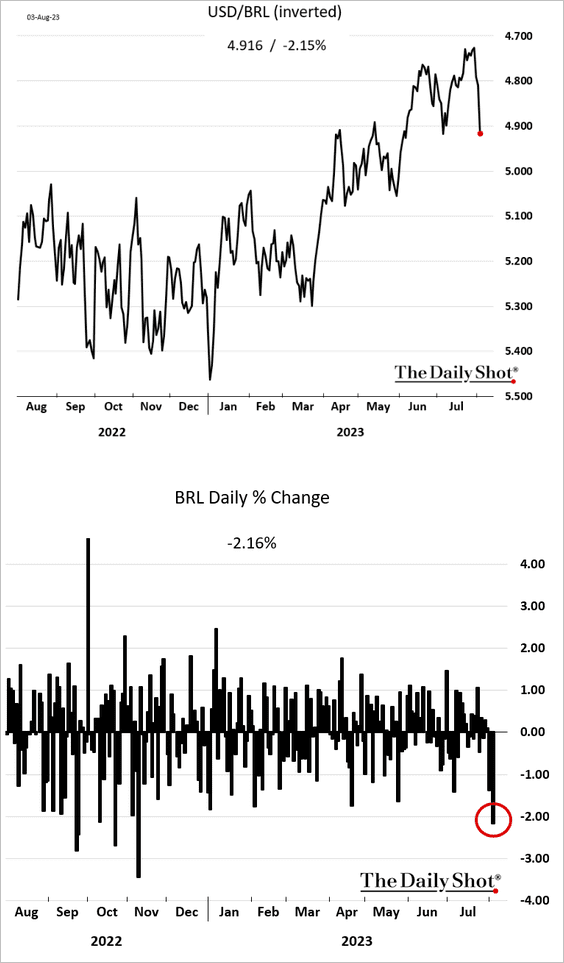

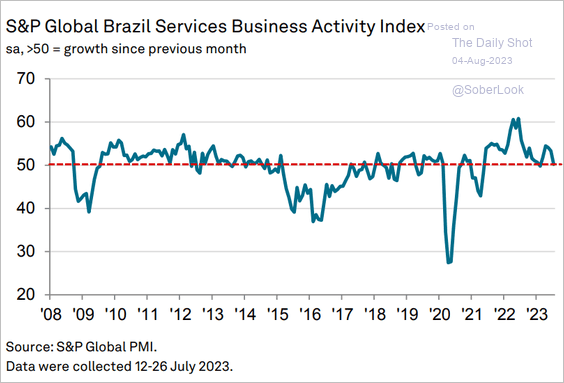

1. Let’s begin with Brazil.

• The central bank’s aggressive rate cut sent short-term yields and the real lower on Thursday.

Source: @markets Read full article

Source: @markets Read full article

• Growth in services is stalling.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

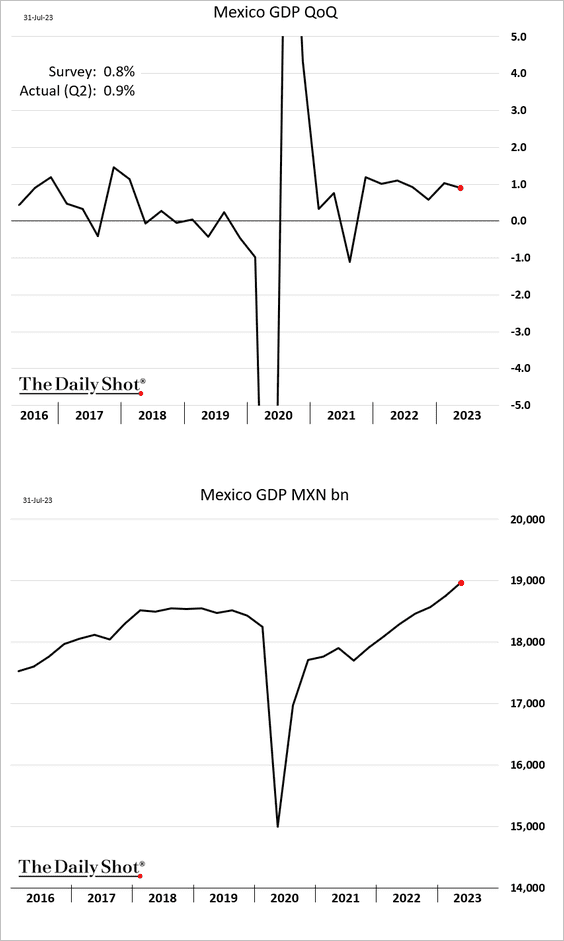

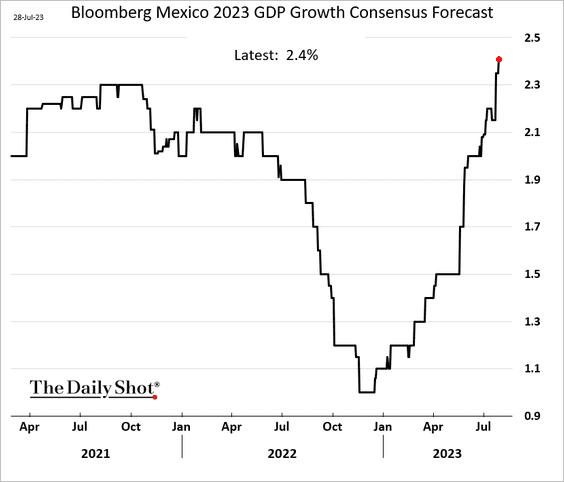

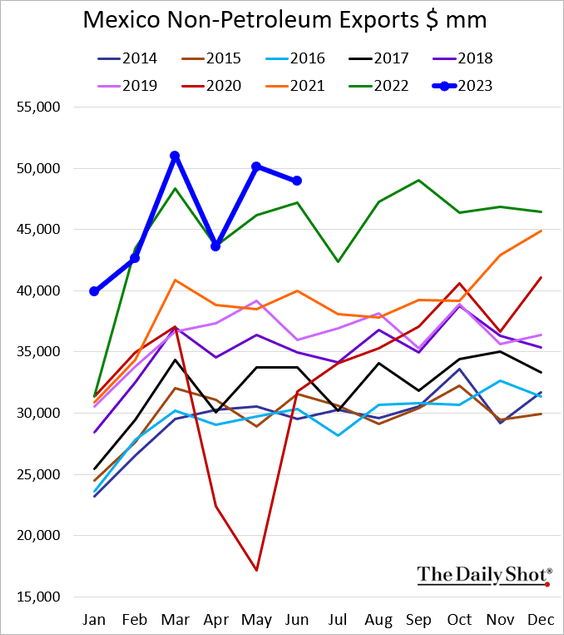

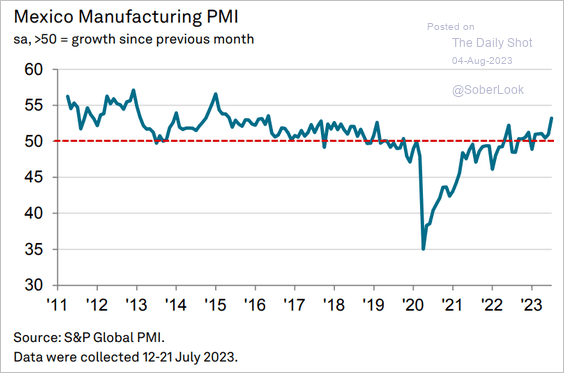

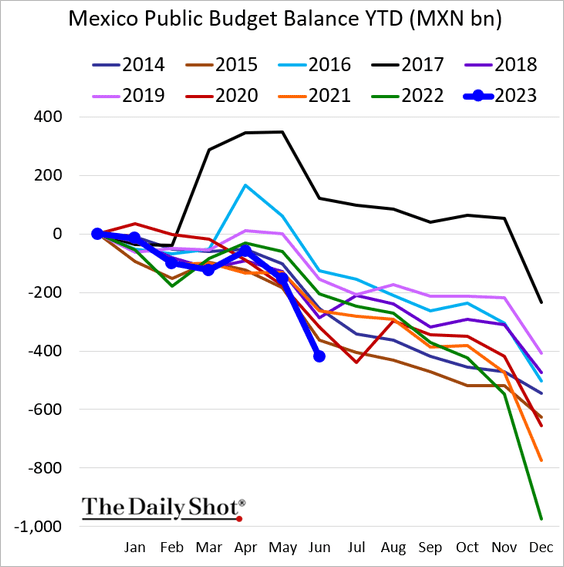

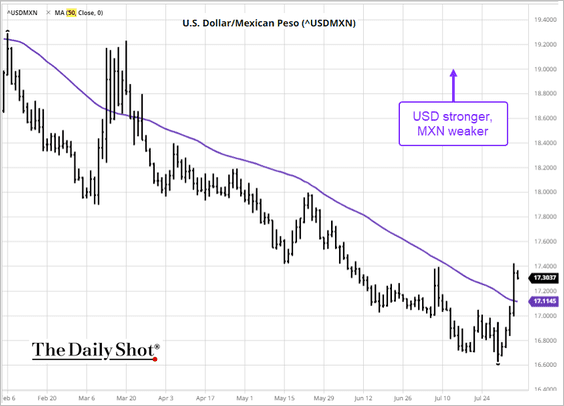

2. Next, we have some updates on Mexico.

• The GDP growth held up well in Q2.

• Economists have been rapidly upgrading this year’s growth projections.

• Exports have been strong.

• The manufacturing PMI hit the highest level in years.

Source: S&P Global PMI

Source: S&P Global PMI

• The government budget is deteriorating.

• The massive peso rally appears to be over.

Source: barchart.com

Source: barchart.com

——————–

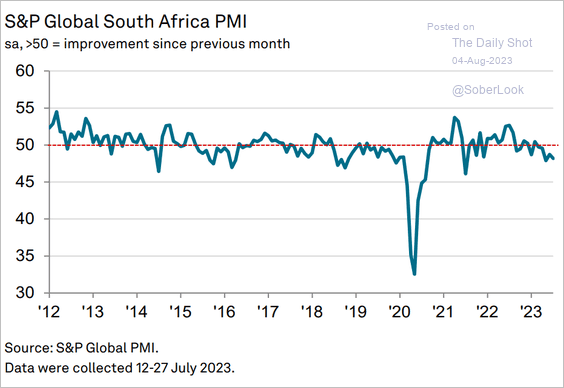

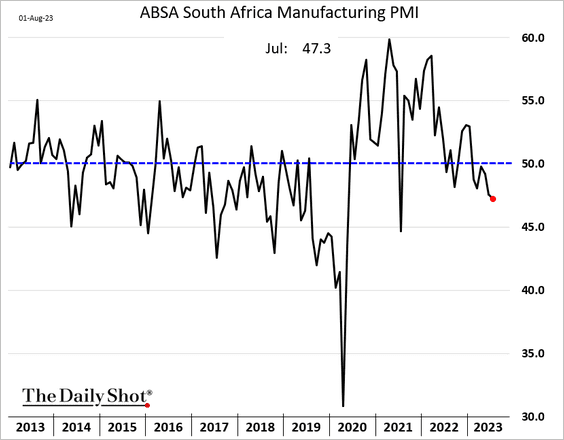

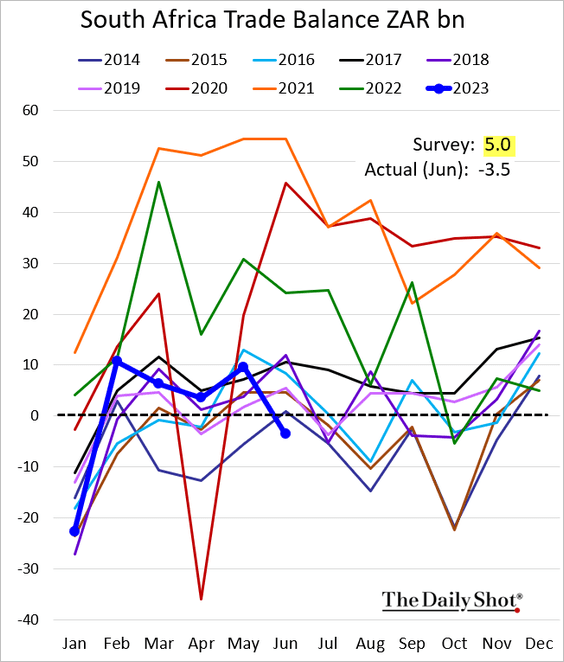

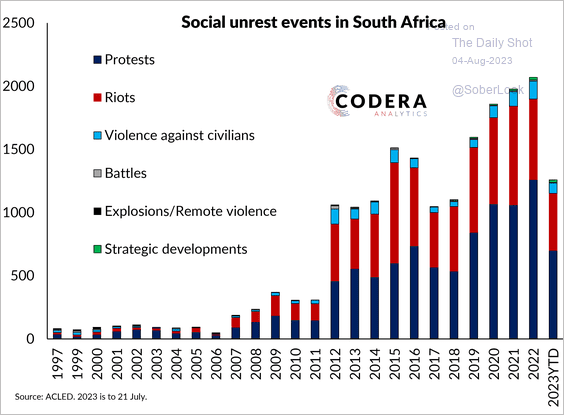

3. Here are some updates on South Africa.

• The contraction in manufacturing activity has accelerated, according to two independent PMI reports.

Source: S&P Global PMI

Source: S&P Global PMI

• The trade balance unexpectedly swung into deficit in June.

• Protest and riot event levels have increased dramatically over the recent decade and make up the bulk of social unrest events in South Africa.

Source: Codera Analytics Read full article

Source: Codera Analytics Read full article

——————–

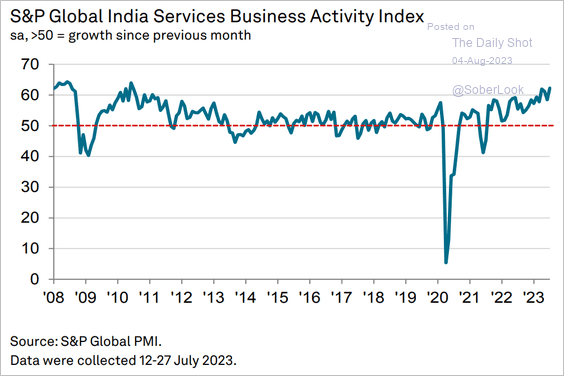

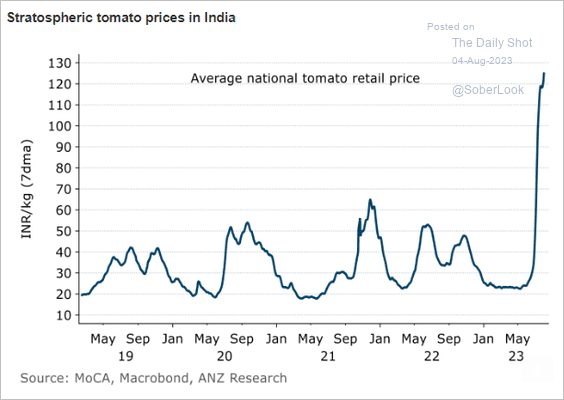

4. India’s services growth remains remarkably strong.

Source: S&P Global PMI

Source: S&P Global PMI

• The RBI could take a hawkish stance amid higher food costs and a rebound in oil prices.

Source: @ANZ_Research

Source: @ANZ_Research

——————–

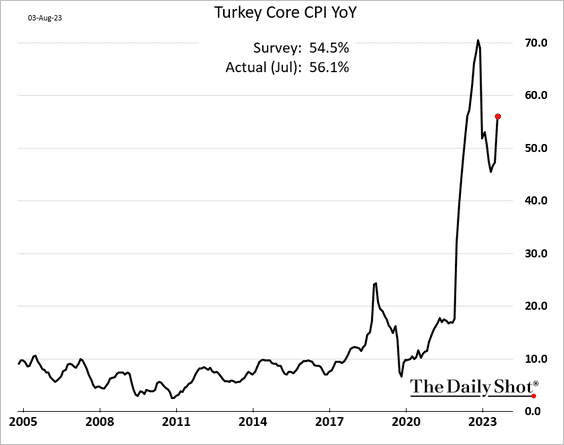

5. Turkey’s core inflation is accelerating again.

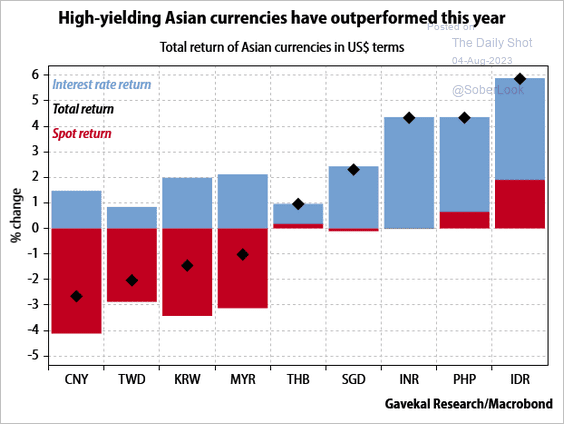

6. High-yielding Asian currencies have been a lucrative carry trade this year.

Source: Gavekal Research

Source: Gavekal Research

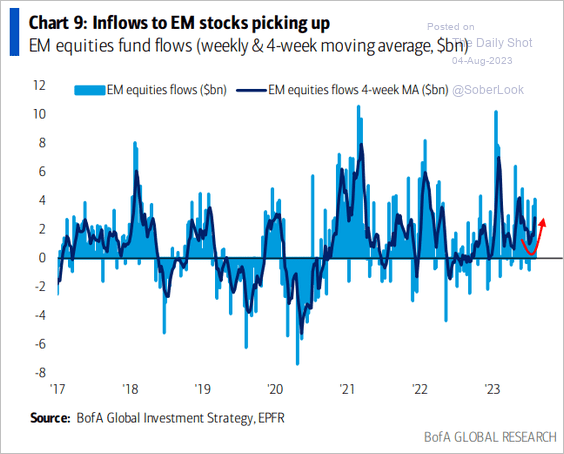

7. EM fund flows remain strong.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Commodities

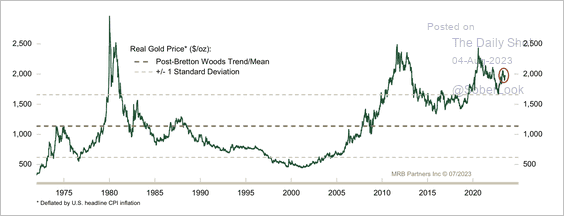

1. The real gold price appears stretched above its long-term average.

Source: MRB Partners

Source: MRB Partners

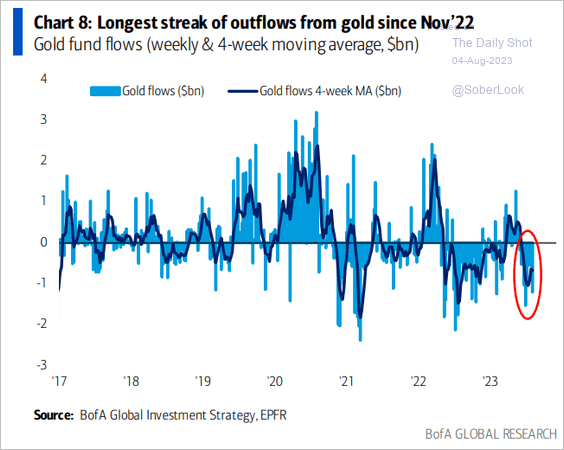

Gold fund outflows continue.

Source: BofA Global Research

Source: BofA Global Research

——————–

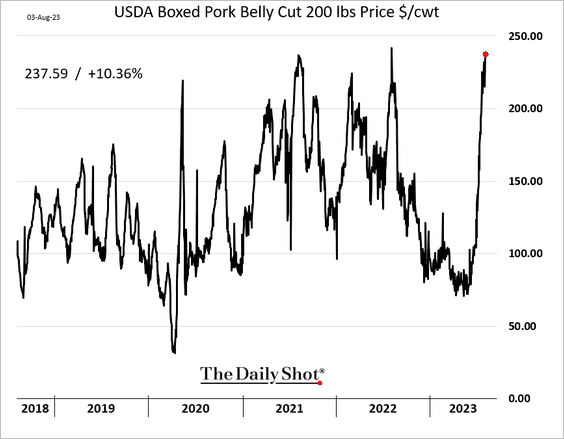

2. US pork belly prices are surging.

Source: Fortune Read full article

Source: Fortune Read full article

——————–

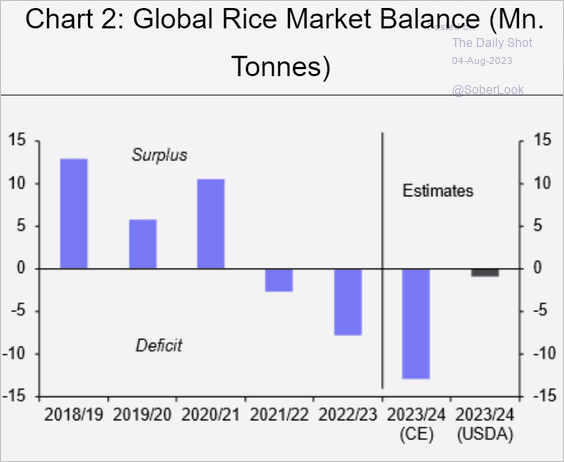

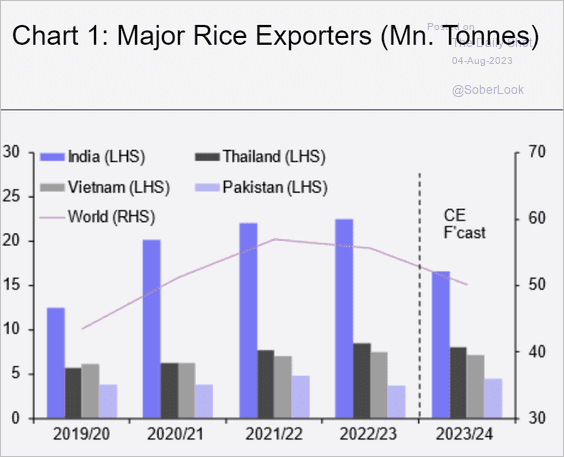

3. The rice market is in deficit, according to Capital Economics.

Source: Capital Economics

Source: Capital Economics

Here are the major rice exporters.

Source: Capital Economics

Source: Capital Economics

Back to Index

Energy

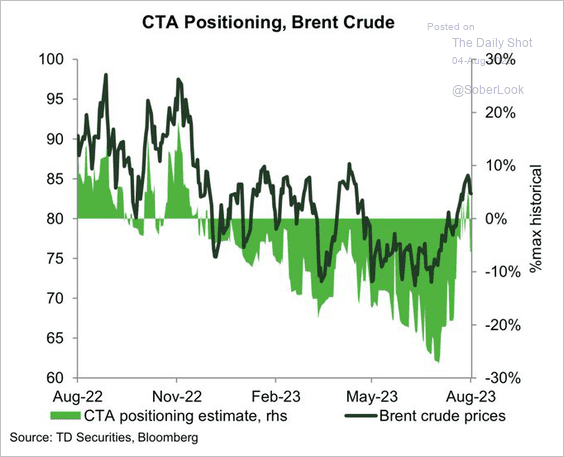

1. CTAs remain bullish on oil.

Source: TD Securities; @WallStJesus

Source: TD Securities; @WallStJesus

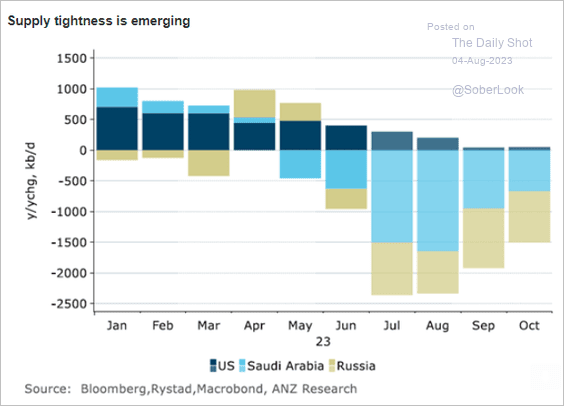

2. Global crude supplies are tightening.

Source: @ANZ_Research

Source: @ANZ_Research

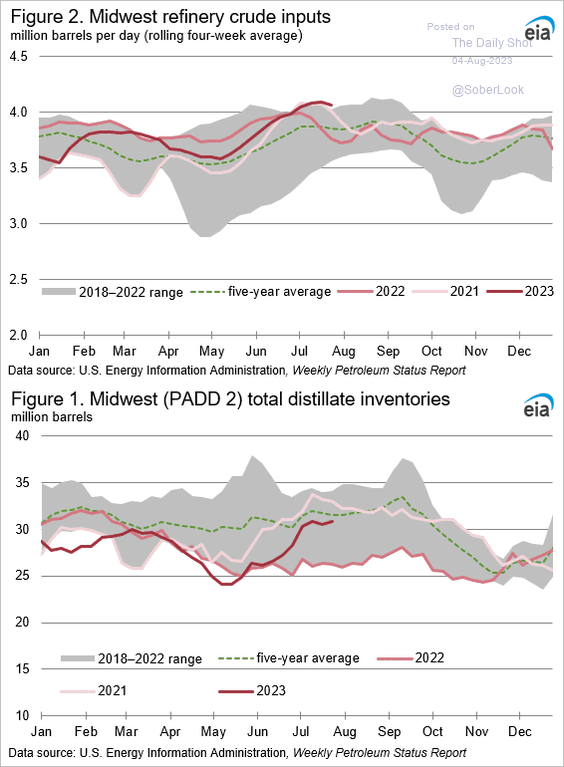

3. US Midwest refineries have been busy, boosting the region’s diesel inventories.

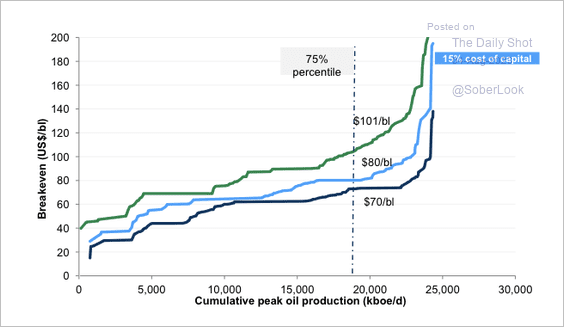

4. According to Goldman, significant postponements of energy investment led to a dramatic steepening of the oil cost curve. The incentive price is roughly $80/barrel at 15% hurdle rates.

Source: Goldman Sachs

Source: Goldman Sachs

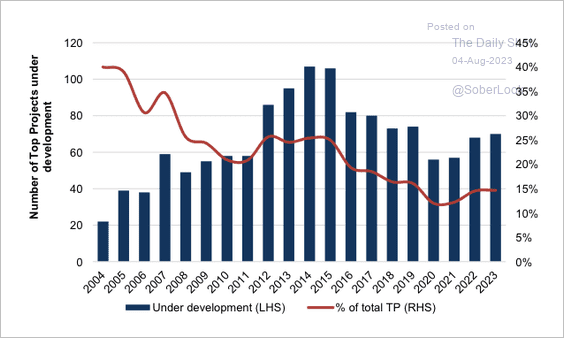

• The energy industry has about 70 giant projects under development, which is still far below 2014 levels.

Source: Goldman Sachs

Source: Goldman Sachs

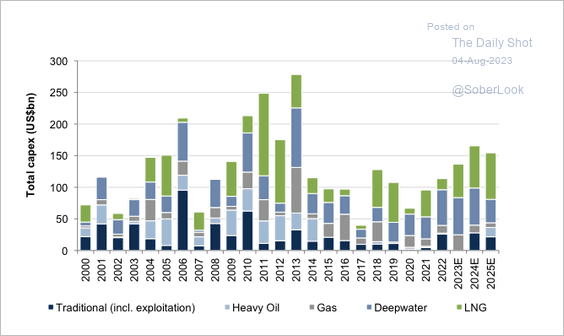

• Renewed focus on energy security jumpstarted oil and gas spending commitments.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

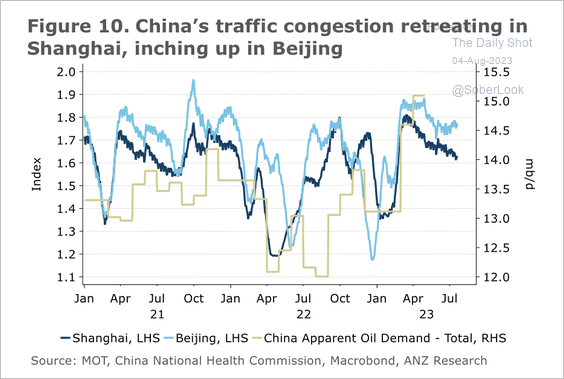

5. China’s road traffic levels are easing, suggesting mainland oil demand could retreat.

Source: @ANZ_Research

Source: @ANZ_Research

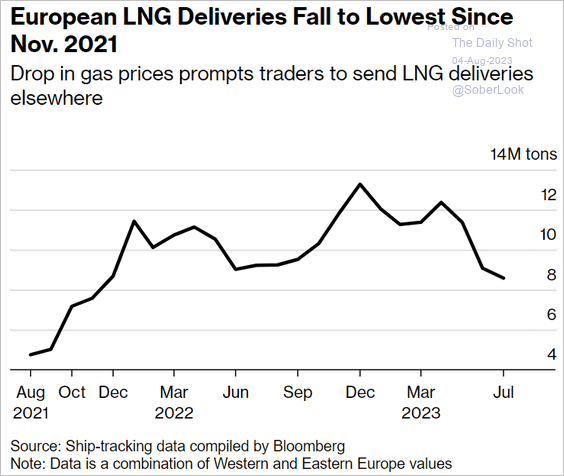

6. European LNG deliveries are slowing.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Equities

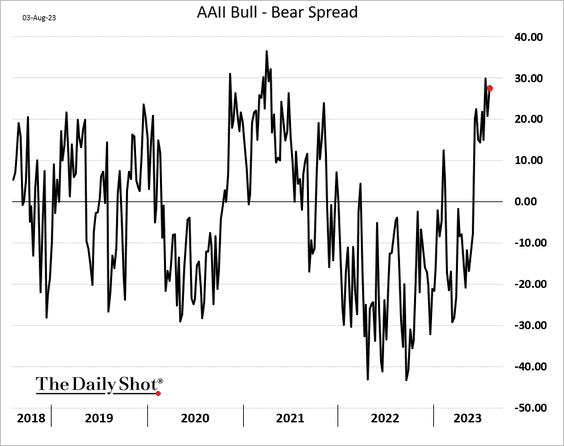

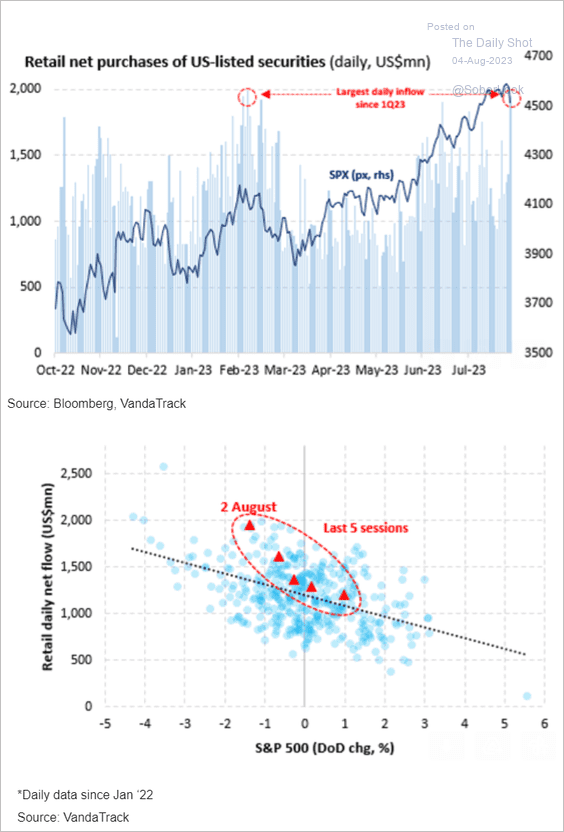

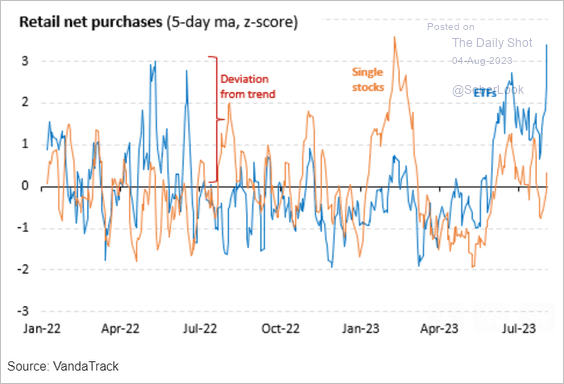

1. Retail investors remain bullish.

• Having missed some of the current rally, retail investors are getting more aggressive (1st panel) and buying the dip (2nd panel).

Source: Vanda Research

Source: Vanda Research

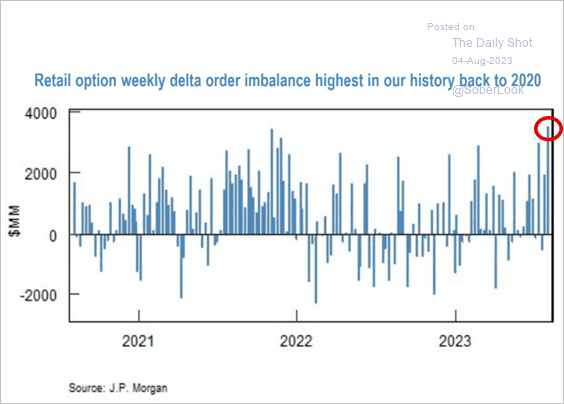

• Retail call-option buying has been extreme.

Source: JP Morgan Research; @dailychartbook

Source: JP Morgan Research; @dailychartbook

• Retail investors have been focused on ETFs.

Source: Vanda Research

Source: Vanda Research

——————–

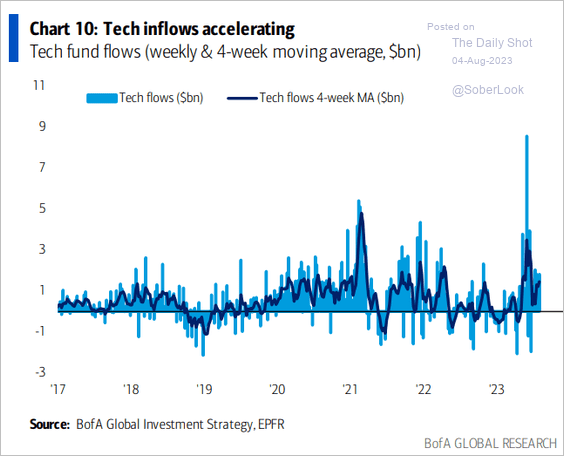

2. Tech flows remain robust.

Source: BofA Global Research

Source: BofA Global Research

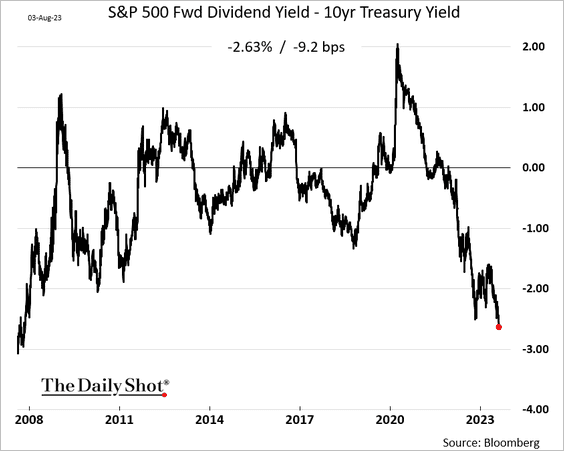

3. The S&P 500’s expected dividend yield is crashing relative to the 10-year Treasury yield.

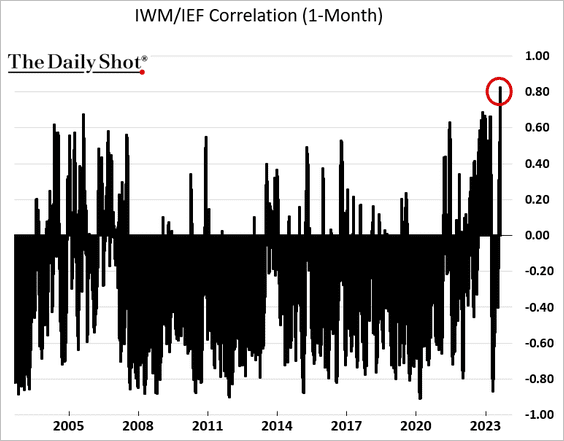

4. The surge in stock-bond correlation hasn’t been limited to large-caps. This chart shows the correlation of small caps (IWM) to the 7-10yr Treasuries (IEF).

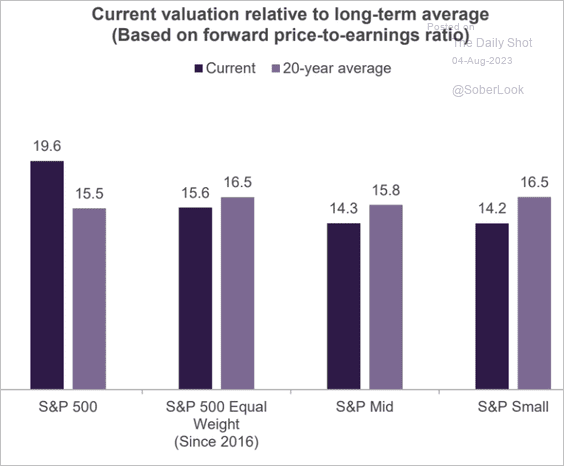

5. The S&P 500 valuation is elevated relative to the 20-year average. That’s not the case for mid-caps and small-caps.

Source: Truist Advisory Services

Source: Truist Advisory Services

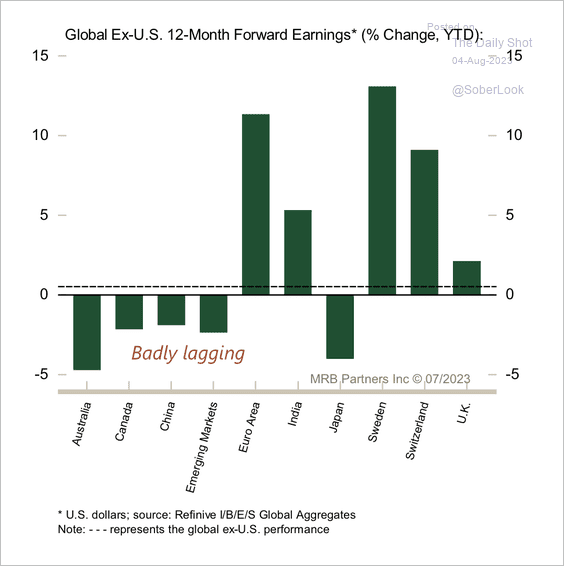

6. Earnings have diverged across non-US equity markets.

Source: MRB Partners

Source: MRB Partners

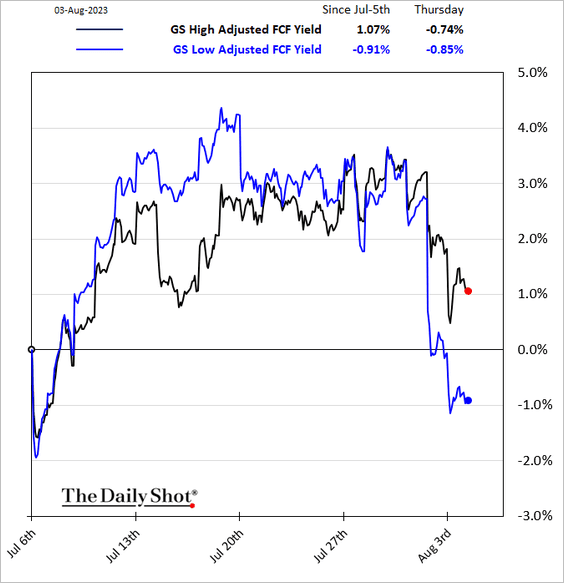

7. Companies with low free cash flow (FCF) underperformed this week.

Back to Index

Credit

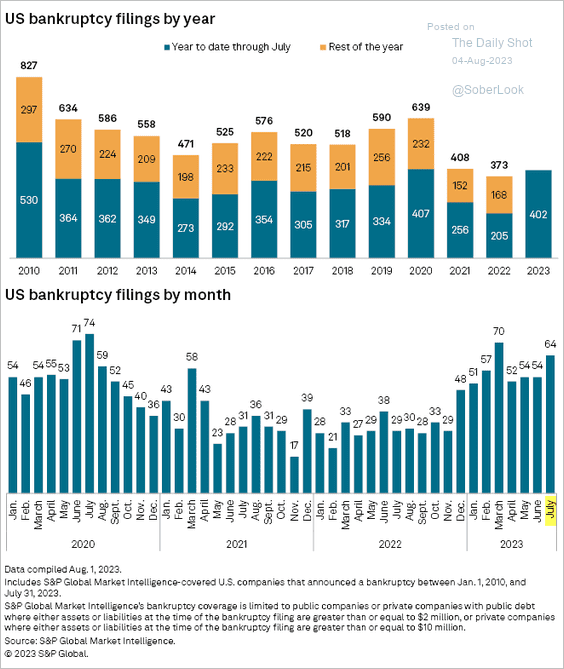

1. US bankruptcy filings remain elevated.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

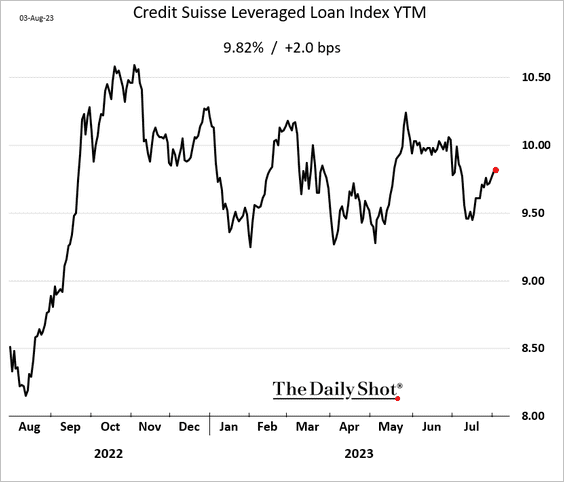

2. Leveraged loan yields are still near 10%.

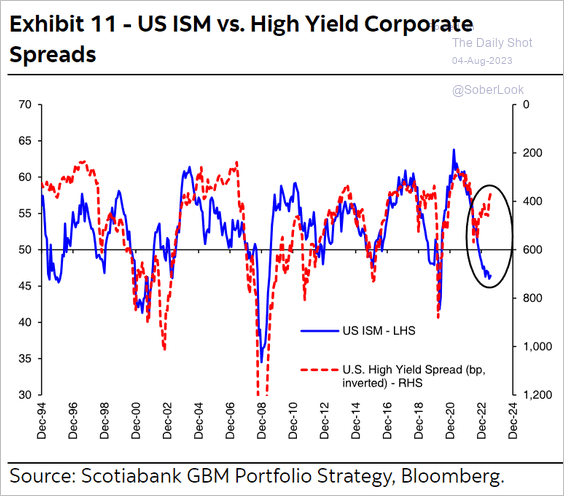

3. The ISM manufacturing PMI continues to point to downside risks for high-yield bonds.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

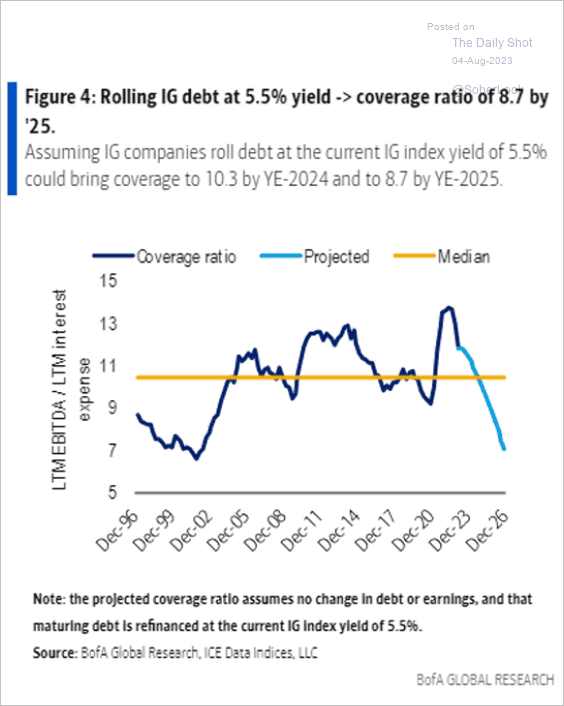

4. Coverage ratios will decline sharply if the Fed keeps rates elevated for a longer period.

Source: BofA Global Research

Source: BofA Global Research

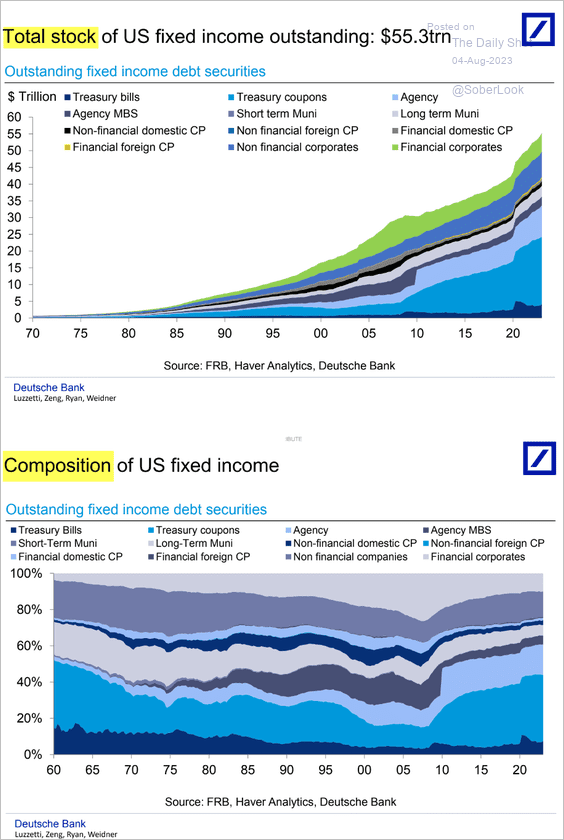

5. Here is a look at the overall US fixed-income market.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Rates

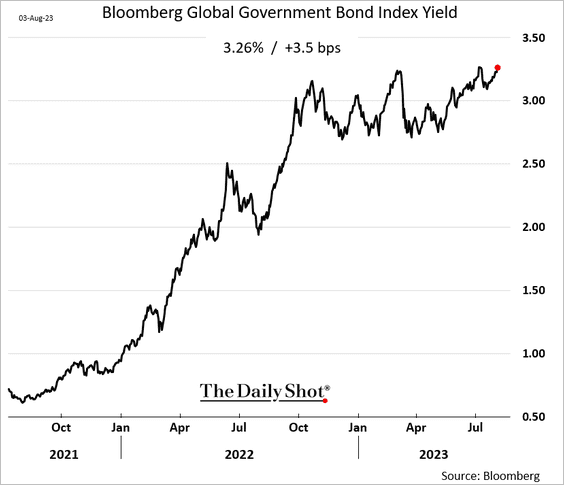

1. Global bond yields are near multi-year highs, with the latest increase driven by the BoJ’s yield-control policy adjustment.

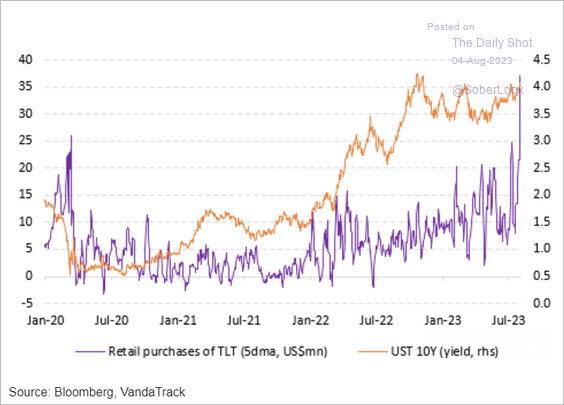

2. Retail investors are rapidly buying the iShares 20+Year Treasury Bond ETF (TLT).

Source: Vanda Research

Source: Vanda Research

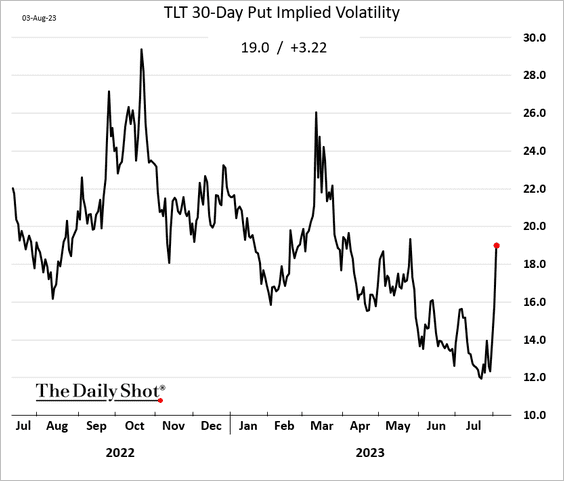

3. Longer-dated Treasuries’ (TLT) implied vol surged this week.

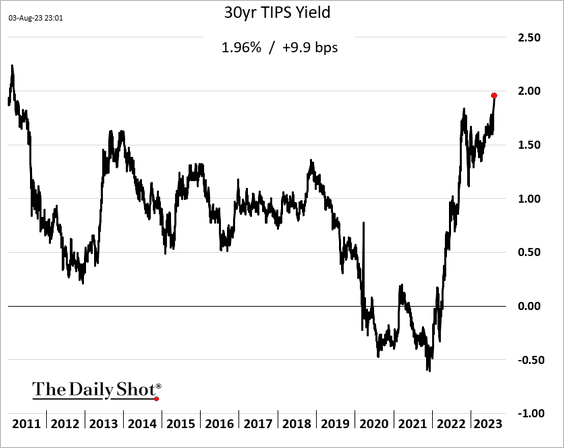

4. The 30-year TIPS yield (real rate) hit the highest level since 2011.

——————–

Food for Thought

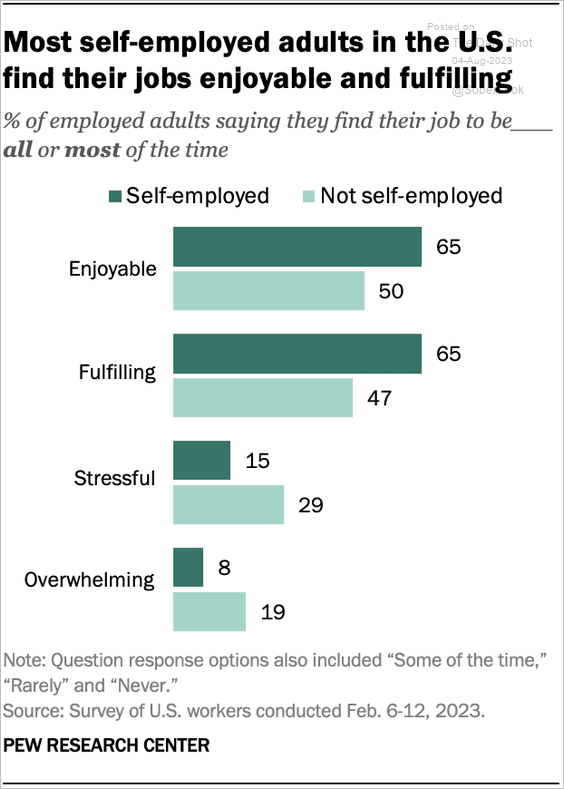

1. US self-employed individuals have higher job satisfaction than other workers.

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

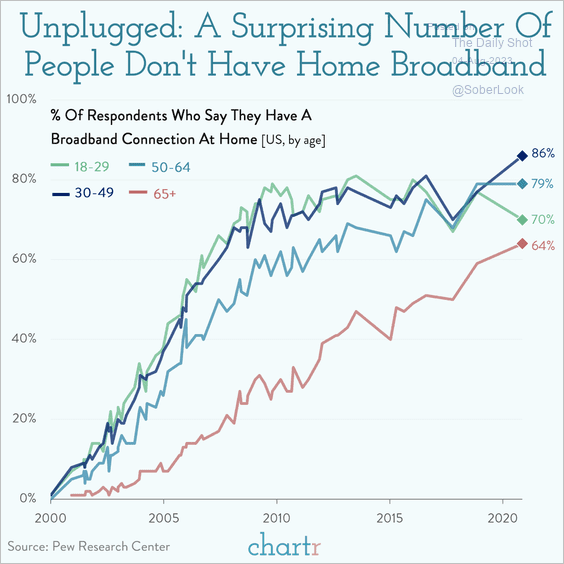

2. Access to high-speed internet:

Source: @chartrdaily

Source: @chartrdaily

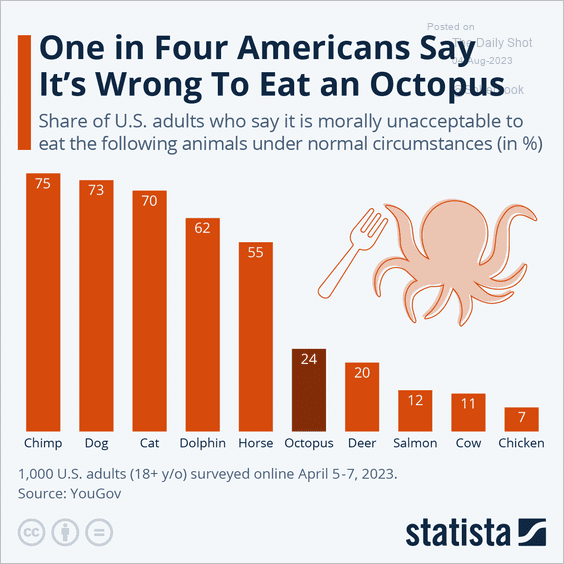

3. Views on eating animals:

Source: Statista

Source: Statista

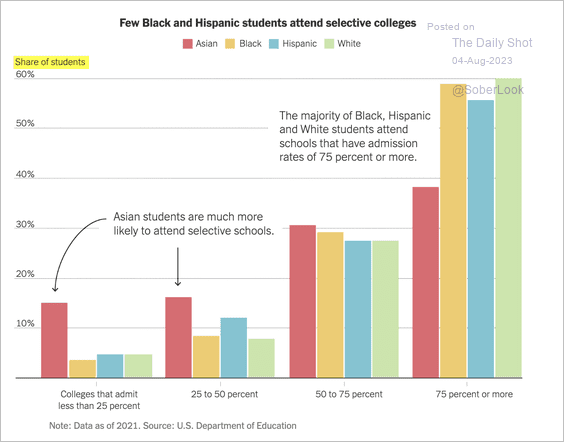

4. The racial breakdown of college attendance by admission rate for 2021:

Source: The New York Times Read full article

Source: The New York Times Read full article

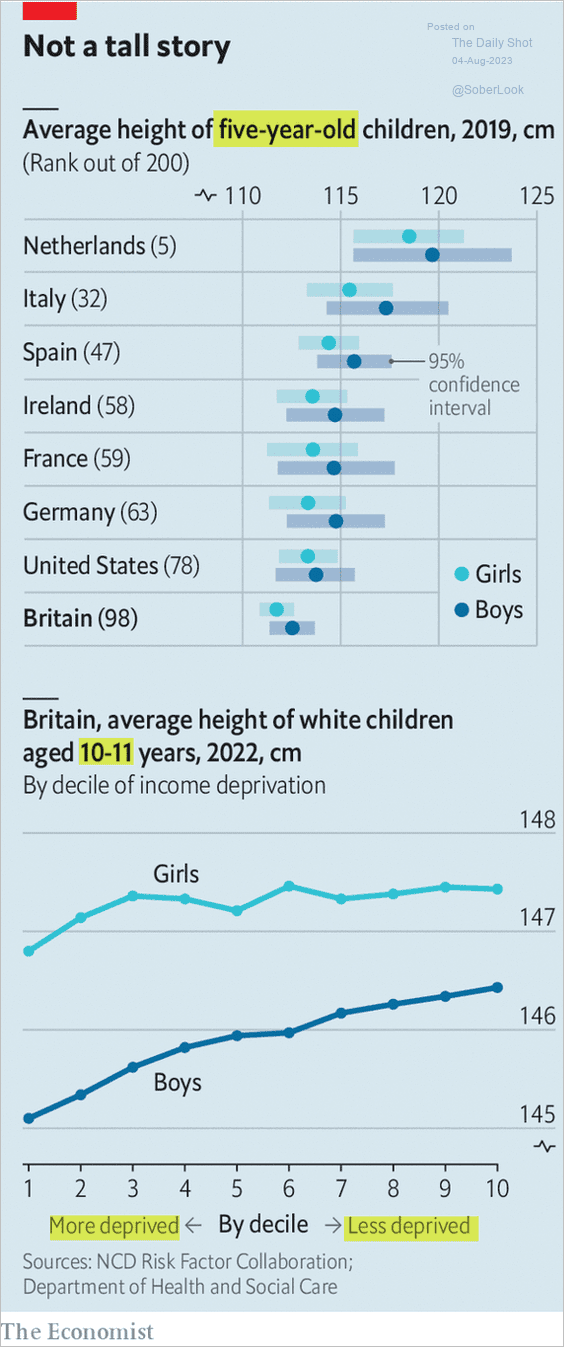

5. Poverty and children’s height:

Source: The Economist Read full article

Source: The Economist Read full article

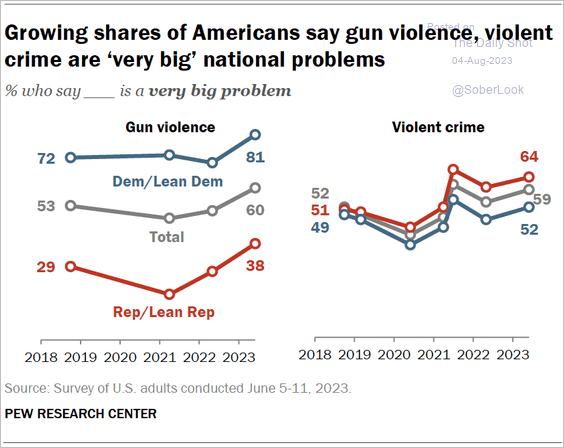

6. Views on gun violence and violent crime:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

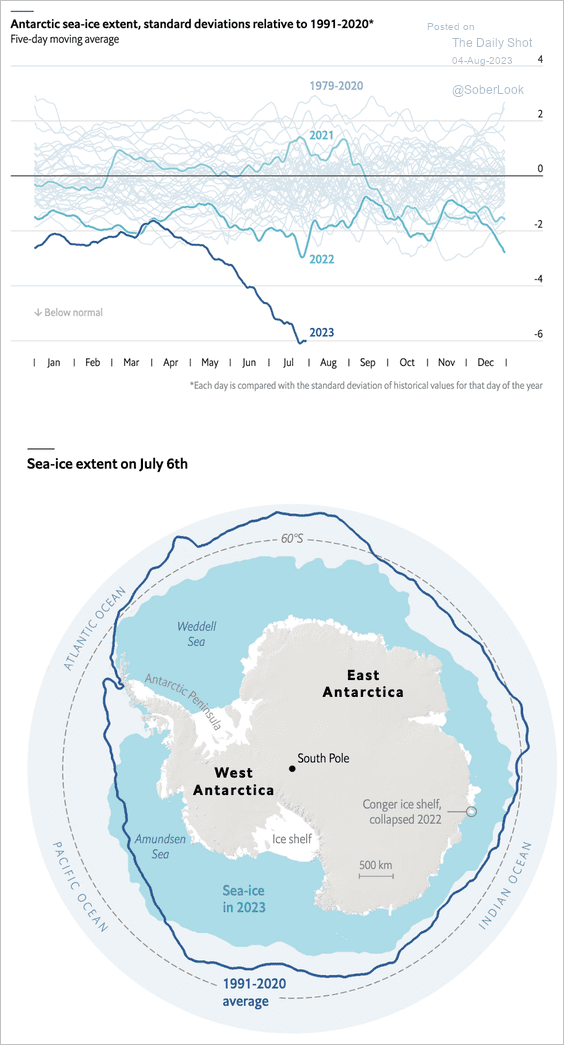

7. Antarctica is missing a lot of ice:

Source: The Economist Read full article

Source: The Economist Read full article

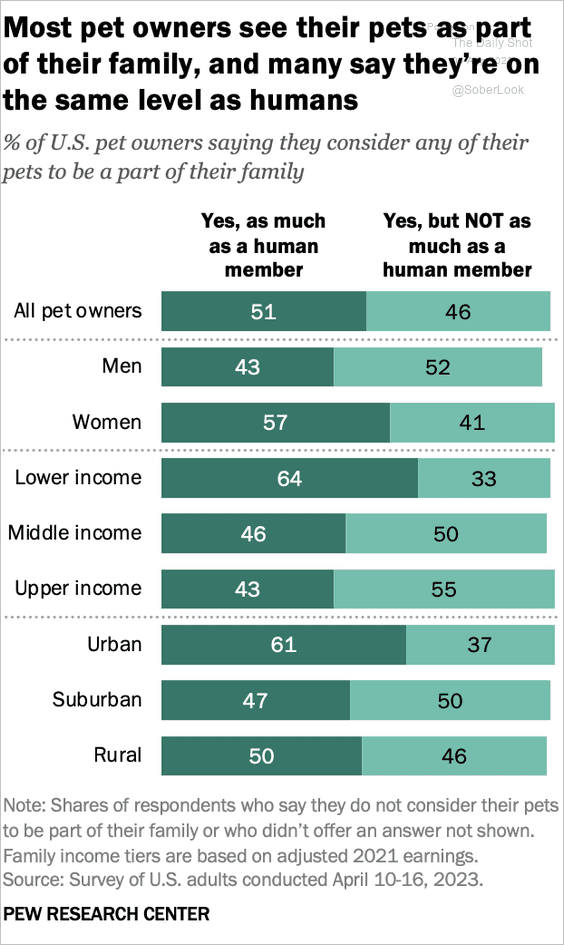

8. Pets are a part of the family:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

——————–

Back to Index