The Daily Shot: 23-Aug-23

• The United States

• The United Kingdom

• The Eurozone

• Japan

• Asia-Pacific

• China

• Commodities

• Equities

• Credit

• Rates

• Food for Thought

The United States

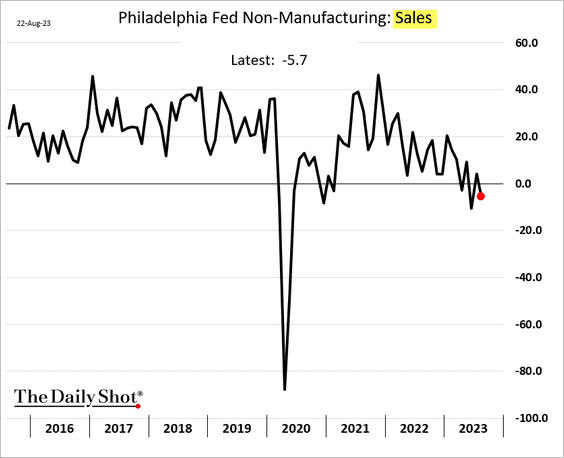

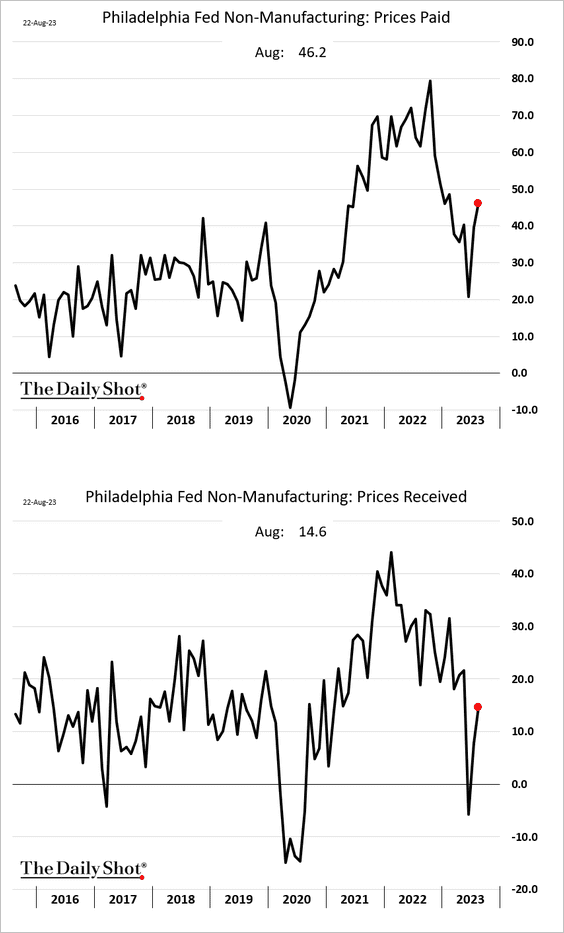

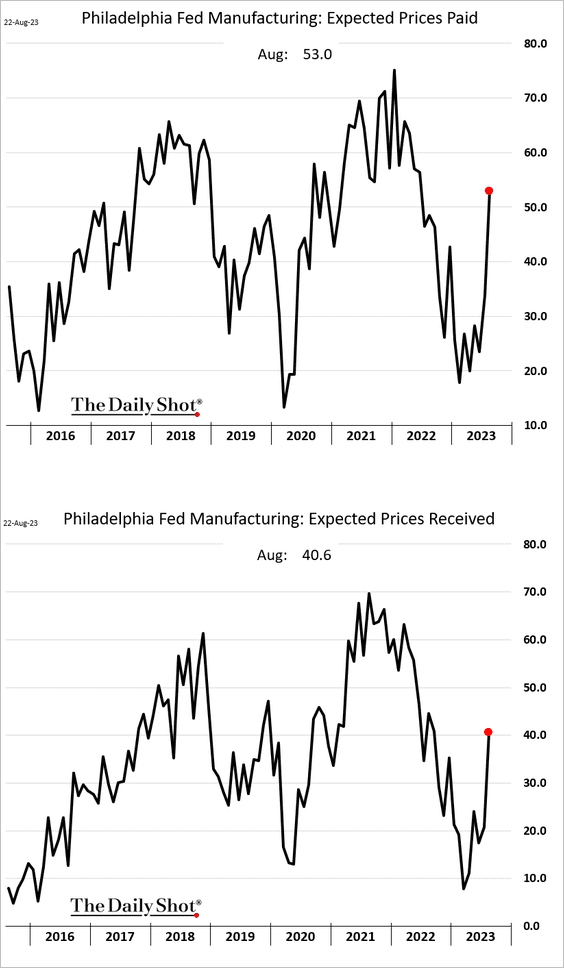

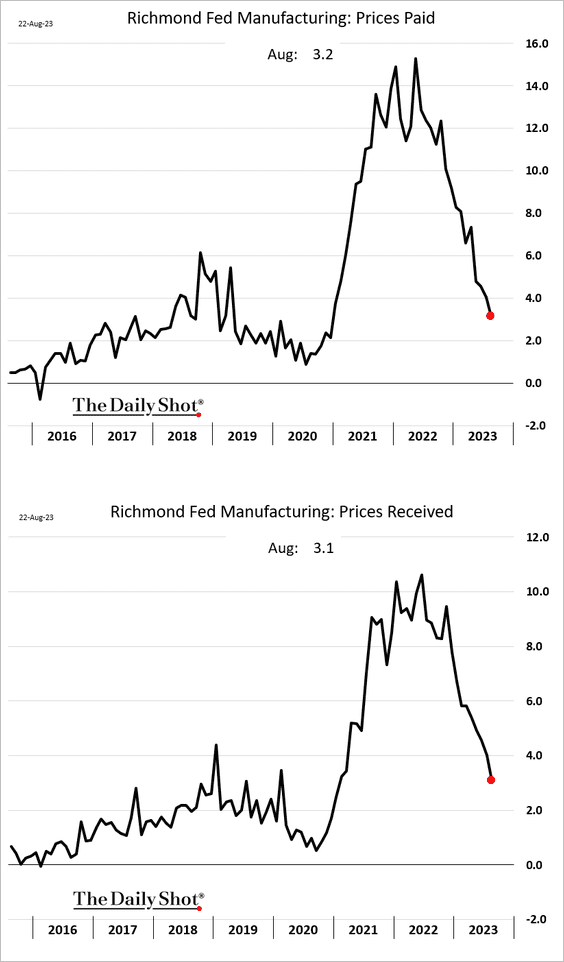

1. Despite soft demand, businesses are reporting an upturn in inflation.

• The Philly Fed’s non-manufacturing survey shows deteriorating sales, …

… and yet, gains in costs and prices charged have moved higher.

• The region’s manufacturers expect a reacceleration in inflation.

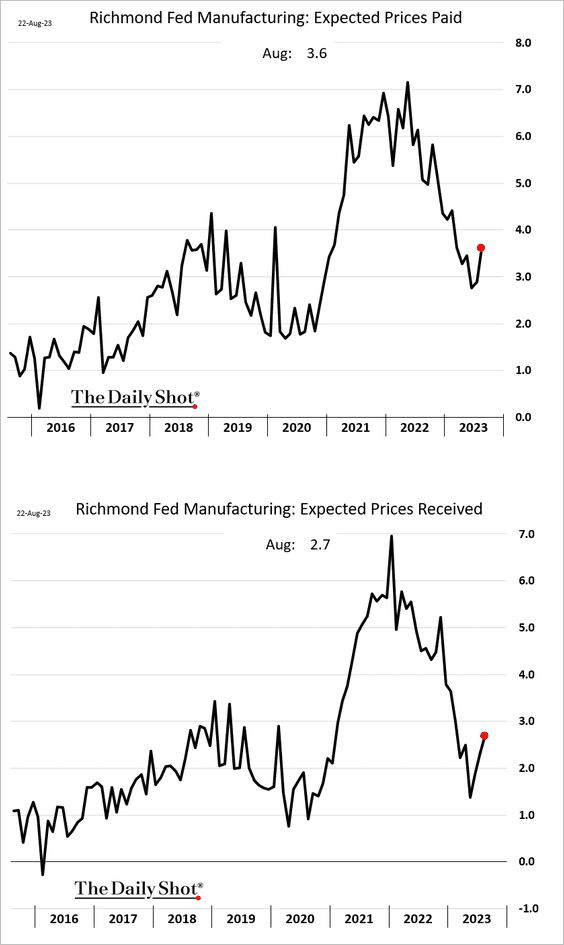

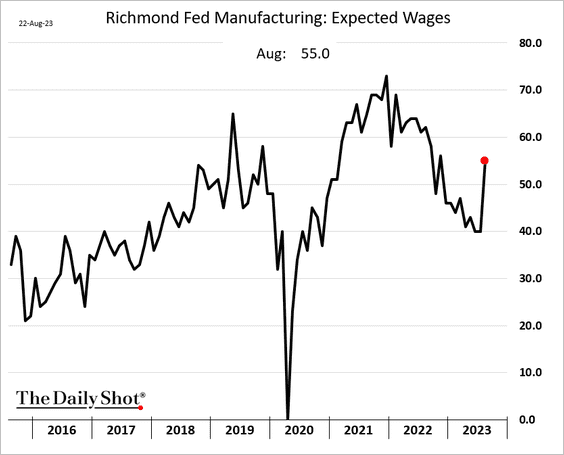

• Richmond Fed’s regional manufacturing survey shows slower current price increases, …

… but measures of expected prices have turned higher.

Factories also expect faster wage growth.

——————–

2. Next, we have some updates on the housing market.

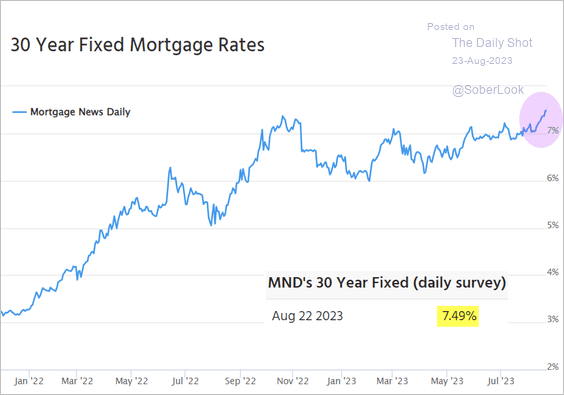

• Mortgage rates continue to hit multi-year highs, …

Source: Mortgage News Daily

Source: Mortgage News Daily

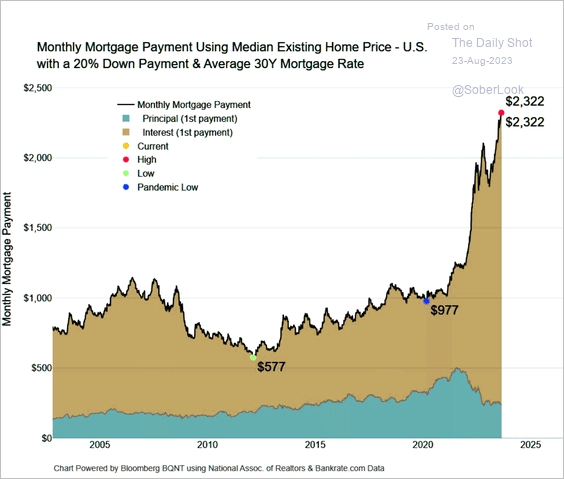

… pressuring affordability.

Source: @Barchart, @M_McDonough

Source: @Barchart, @M_McDonough

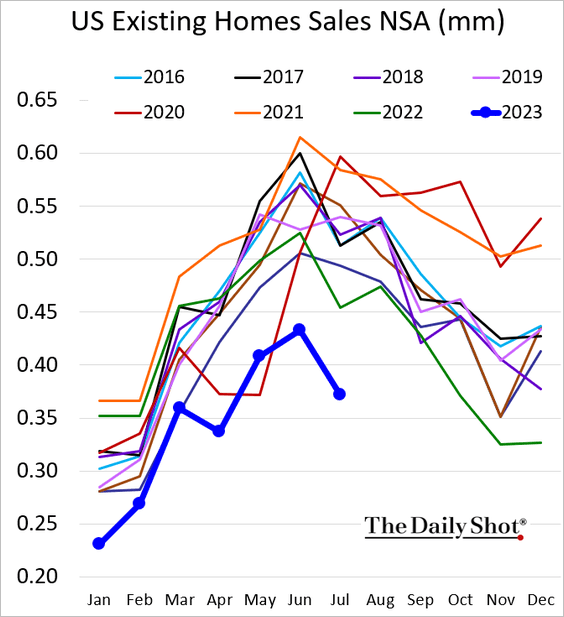

• Existing home sales were soft last month …

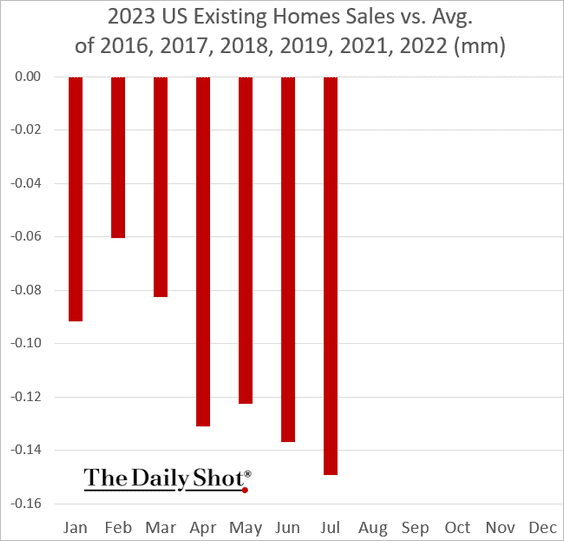

… dipping well below the average of recent years.

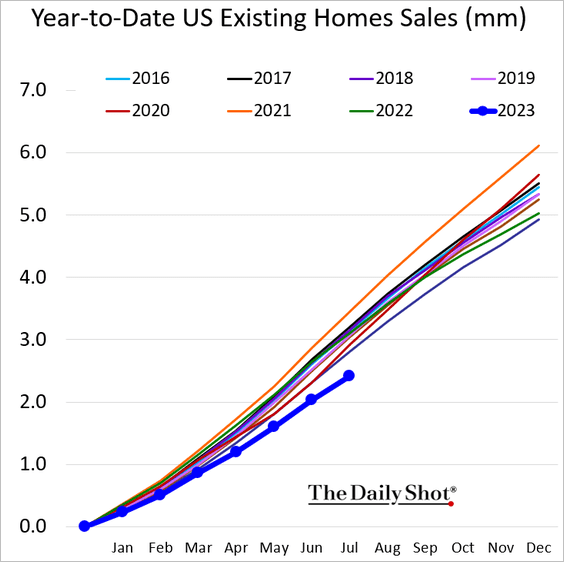

Here is the cumulative year-to-date trend.

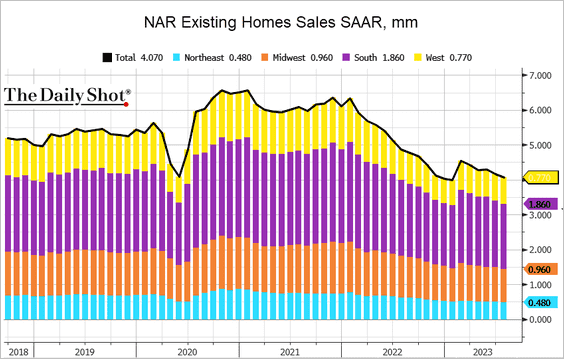

– This chart shows the seasonally-adjusted home sales index and its regional breakdown.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

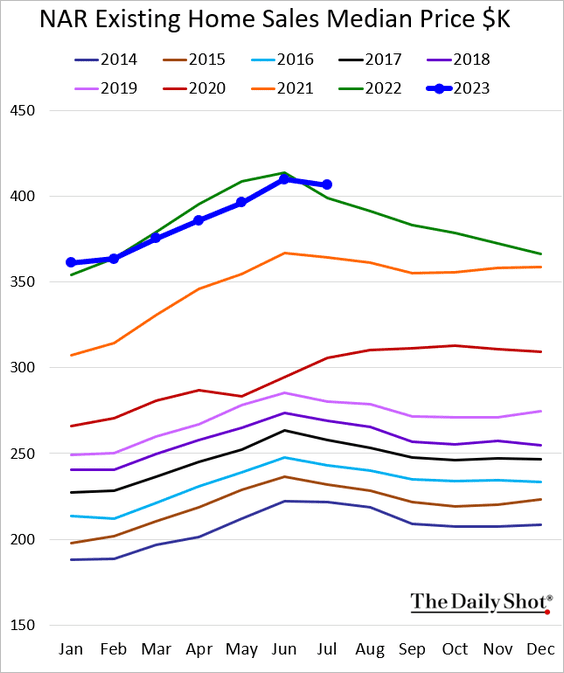

• The median sales price hit a new high for this time of the year, …

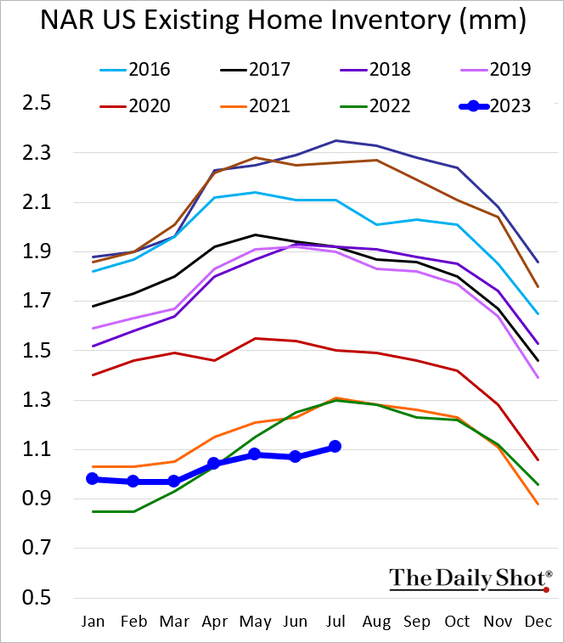

… as inventories slump.

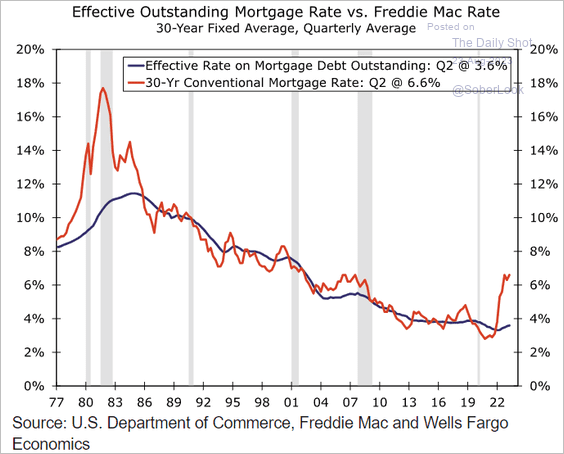

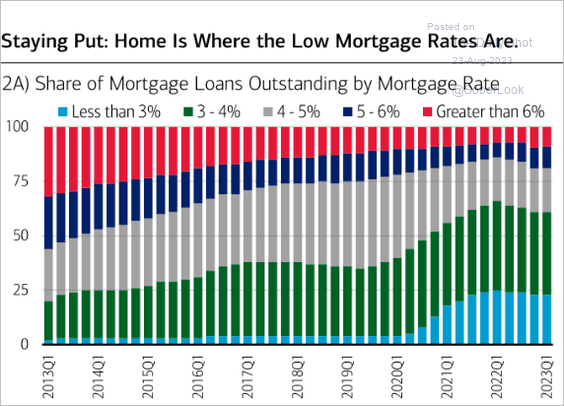

• With homeowners locked into low-rate mortgages (“effective rate”), there is little incentive to sell (2 charts).

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Source: Merrill Lynch

Source: Merrill Lynch

——————–

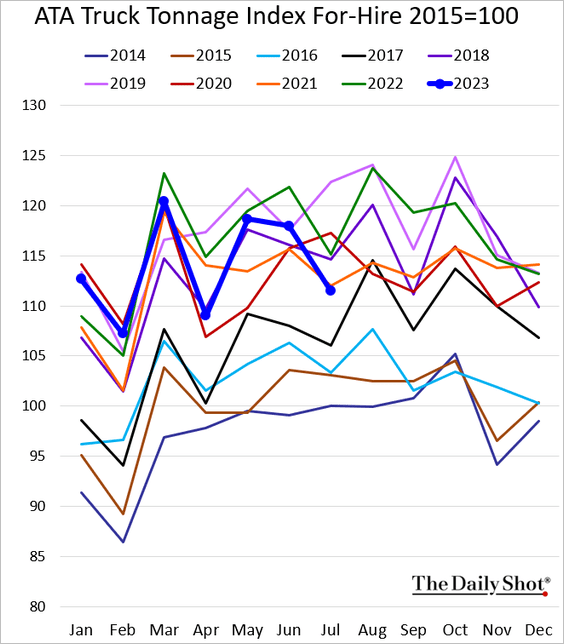

3. US truck tonnage dipped below 2021 levels last month.

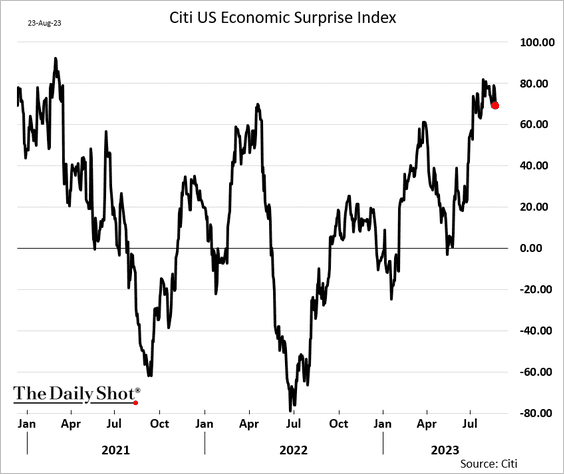

4. Has the Citi Economic Surprise Index peaked?

Back to Index

The United Kingdom

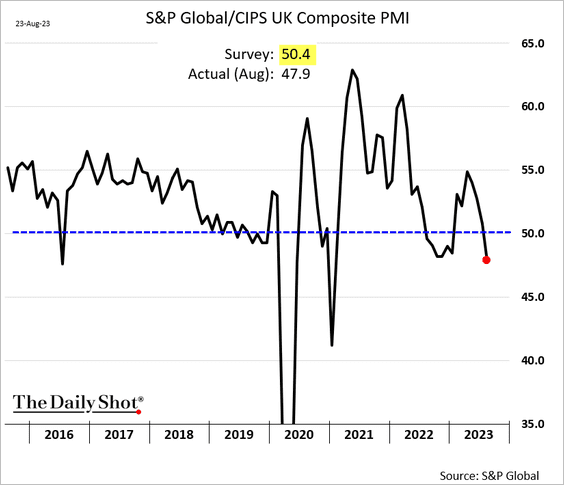

1. The PMI report unexpectedly signaled a contraction in business activity this month. We will have more on the PMI data tomorrow.

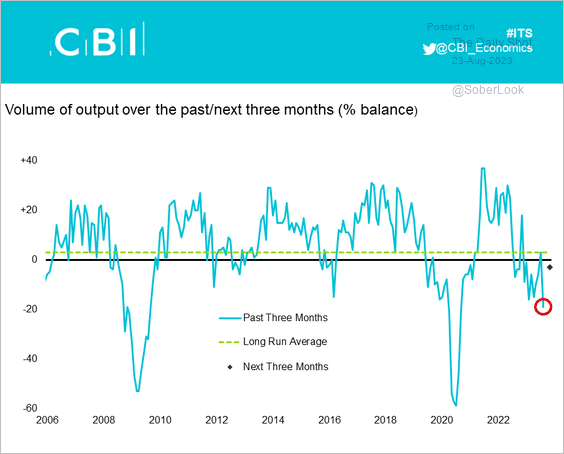

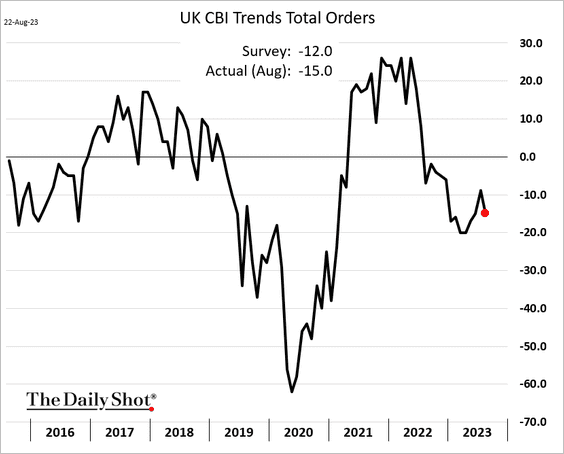

2. The CBI report showed factory orders and output weakening in August.

Source: CBI

Source: CBI

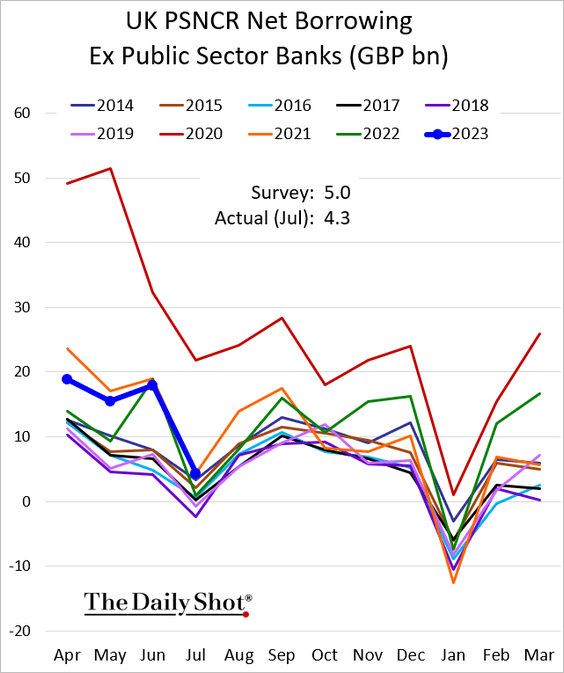

Source: Reuters Read full article

Source: Reuters Read full article

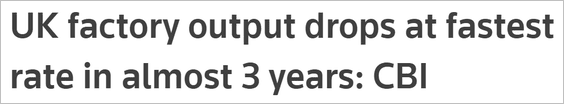

• Industrial price expectations continue to moderate.

——————–

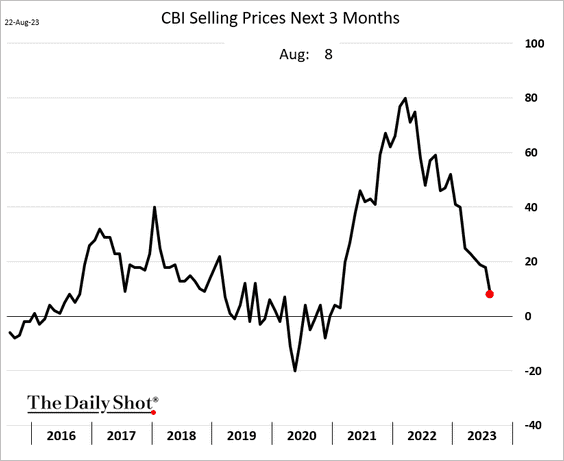

3. Government borrowing was lower than expected last month.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

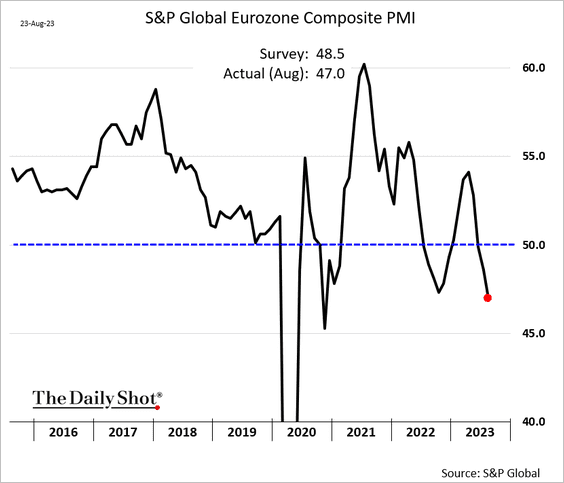

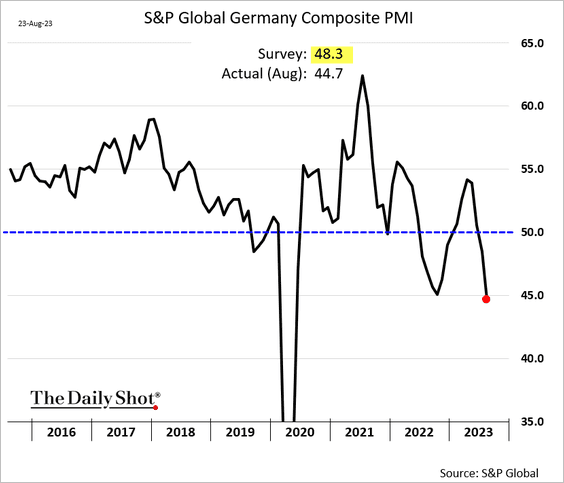

1. Business activity moved deeper into recessionary territory this month, according to S&P Global.

Germany’s composite PMI hit the lowest level since the 2020 COVID shock as services slumped. We will have more on the PMI report tomorrow.

——————–

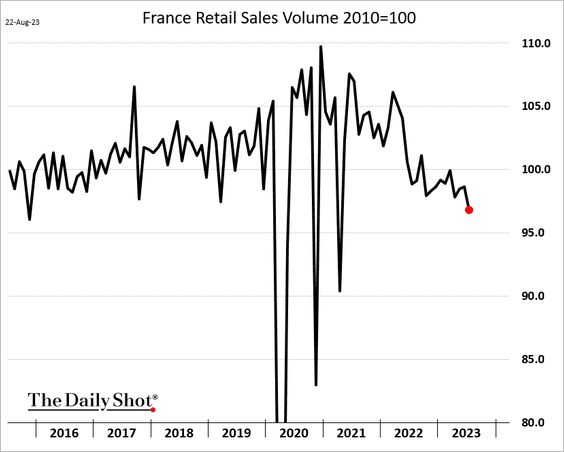

2. French retail sales continue to move lower.

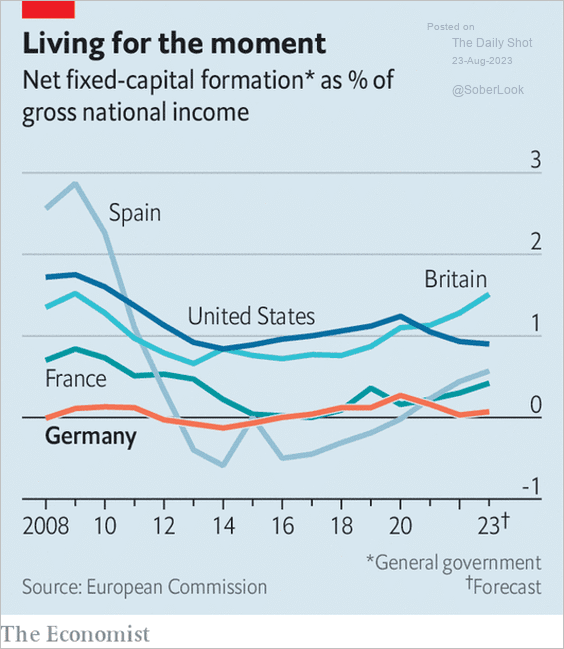

3. Germany’s public investment has lagged behind European peers.

Source: The Economist Read full article

Source: The Economist Read full article

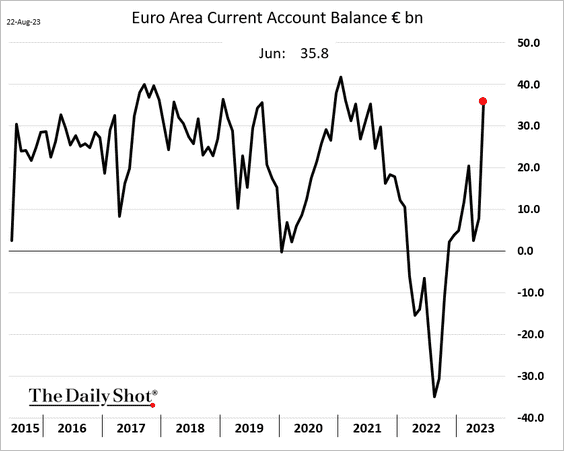

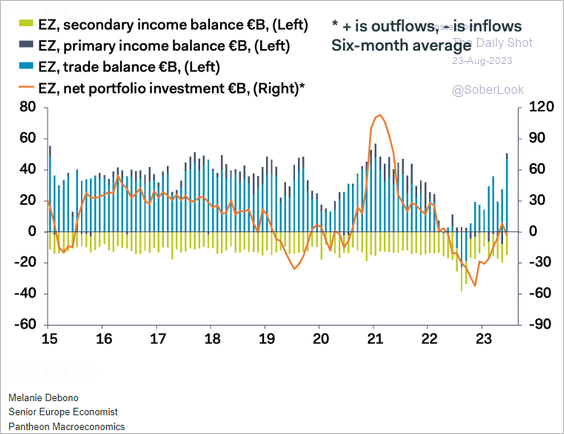

4. Euro-area current account rebounded sharply in June as energy prices eased (2 charts).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

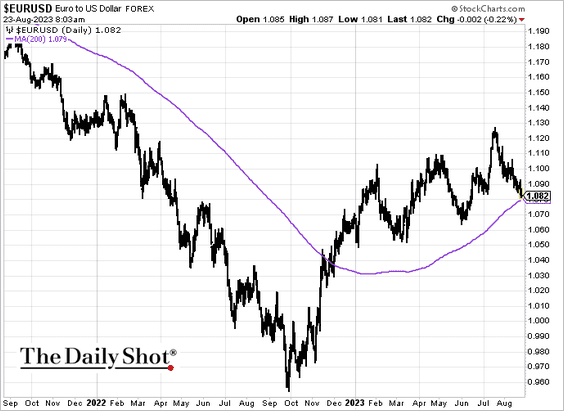

5. EUR/USD is going to test support at the 200-day moving average.

Back to Index

Japan

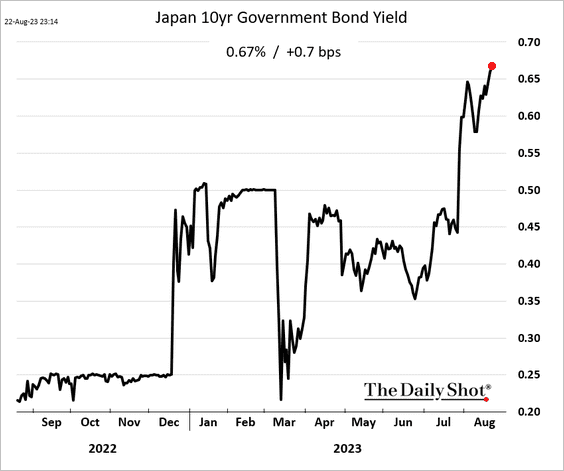

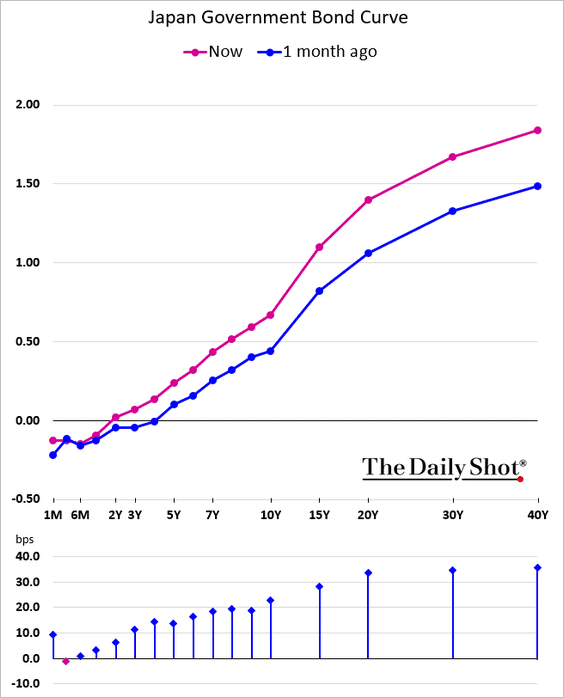

1. JGB yields are grinding higher, …

… as the curve steepens.

——————–

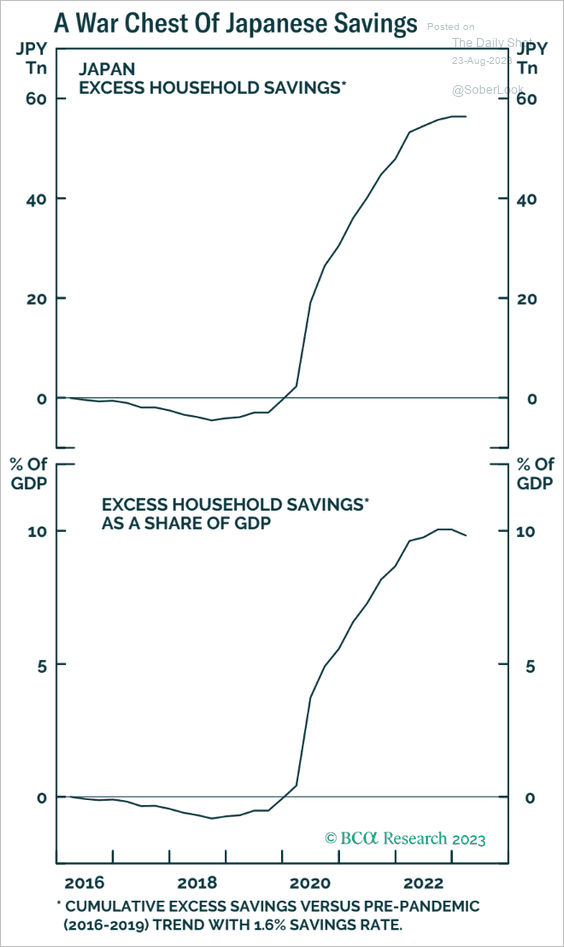

2. Excess savings remain elevated.

Source: BCA Research

Source: BCA Research

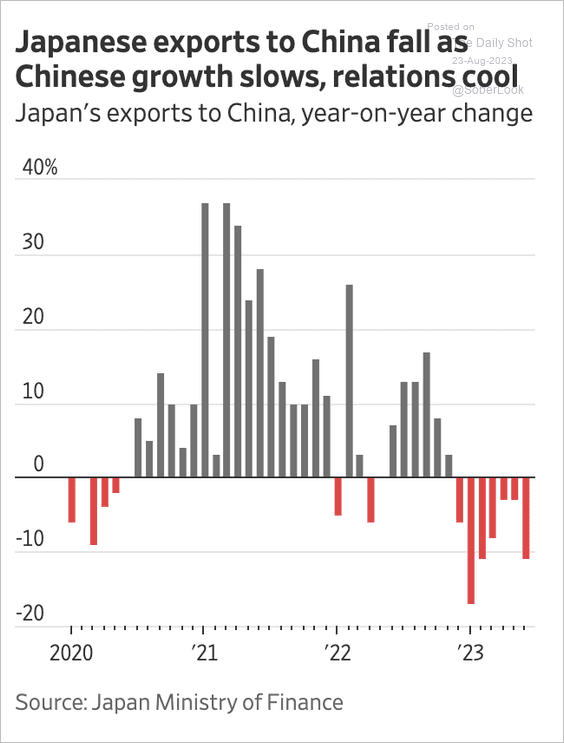

3. Exports to China are running below last year’s levels.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Asia-Pacific

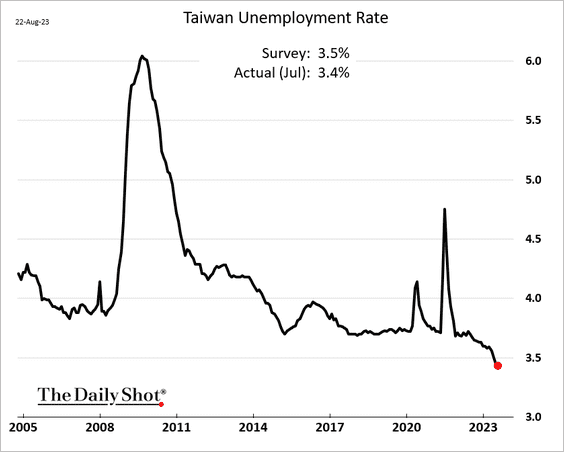

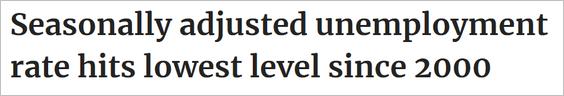

1. Taiwan’s unemployment rate hit a multi-year low.

Source: Focus Taiwan Read full article

Source: Focus Taiwan Read full article

——————–

2. Australia’s service-sector contraction accelerated this month.

Source: S&P Global PMI

Source: S&P Global PMI

Back to Index

China

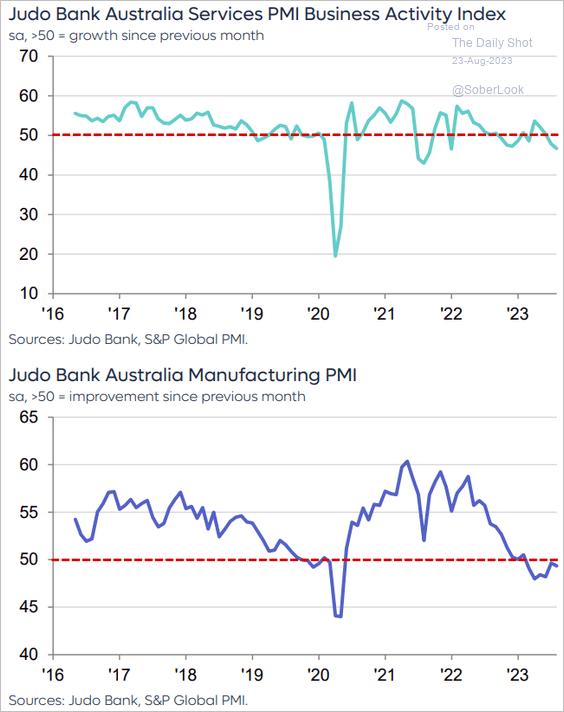

1. Mainland stocks remain under pressure.

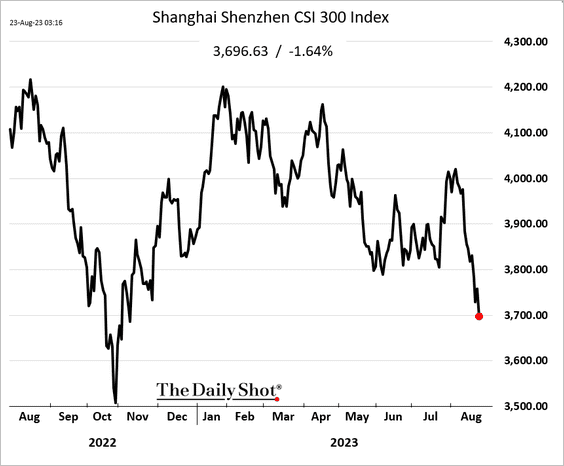

2. The August SMI report showed a slower contraction in manufacturing and a return to growth in services this month.

Source: World Economics

Source: World Economics

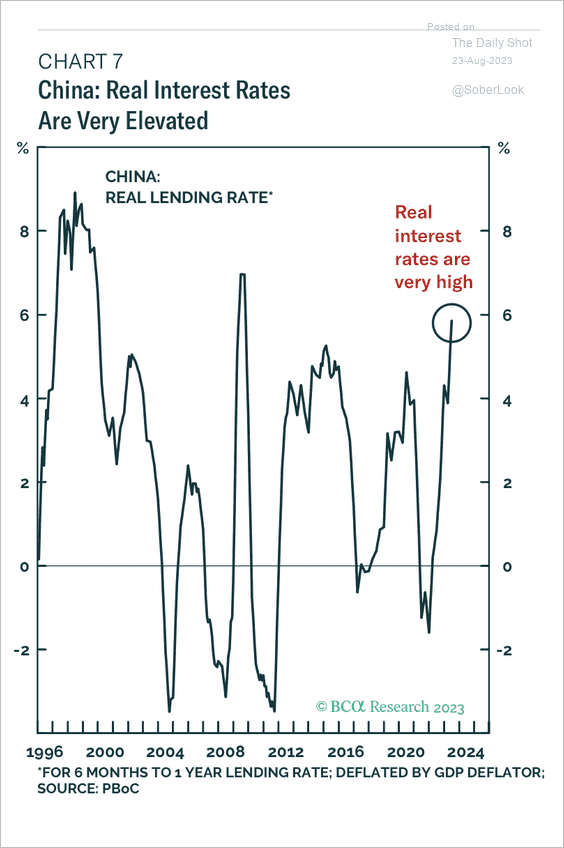

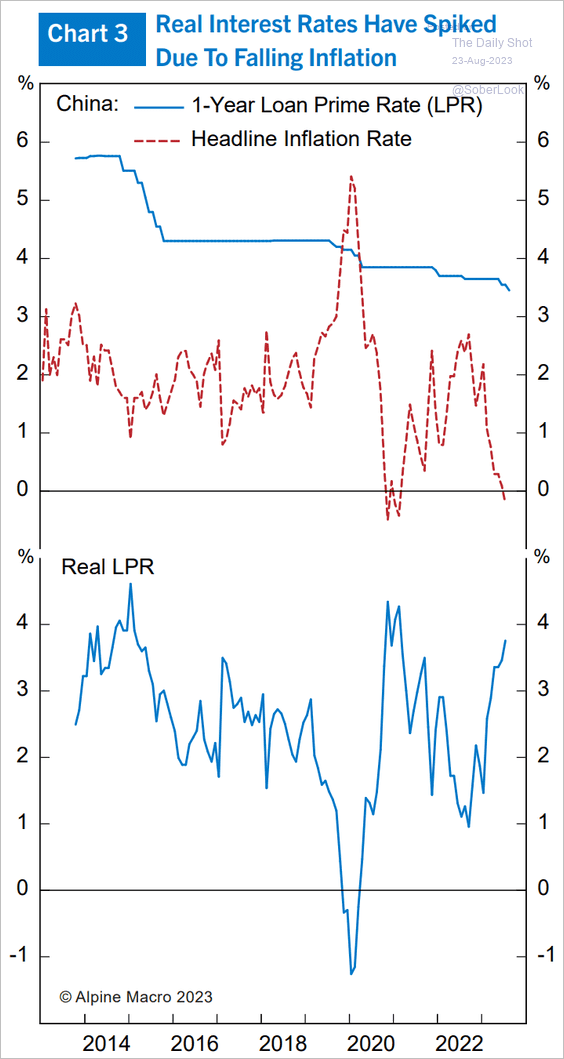

3. Real rates have risen sharply due to deflation, but for now, Beijing is unwilling to provide meaningful policy accommodation (2 charts).

Source: BCA Research

Source: BCA Research

Source: Alpine Macro

Source: Alpine Macro

——————–

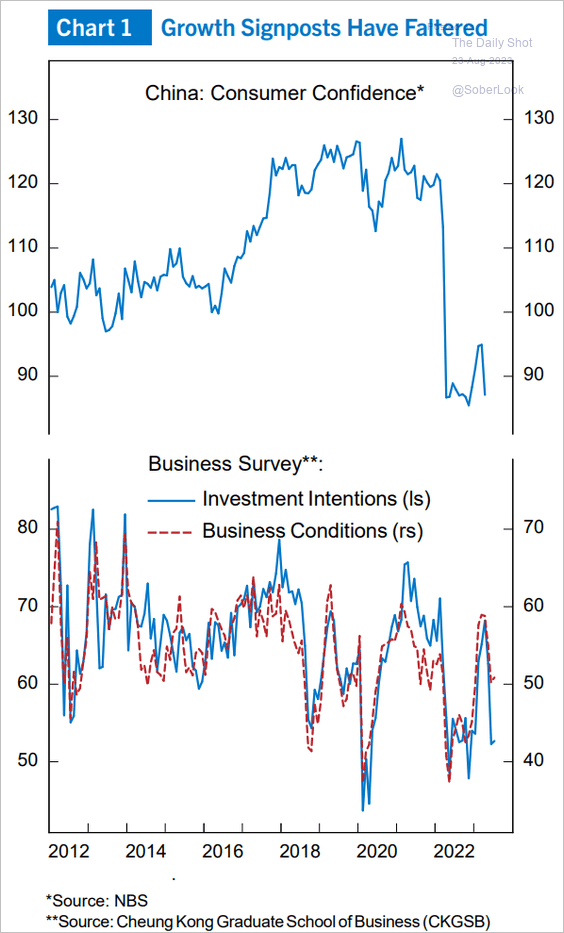

4. Consumer and business sentiment has been soft.

Source: Alpine Macro

Source: Alpine Macro

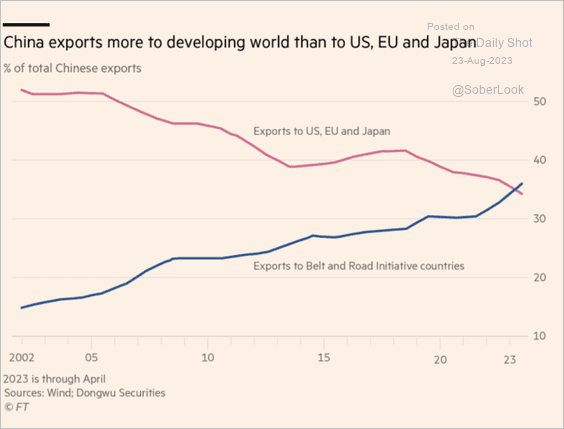

5. Here are China’s exports to Belt and Road Initiative countries.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

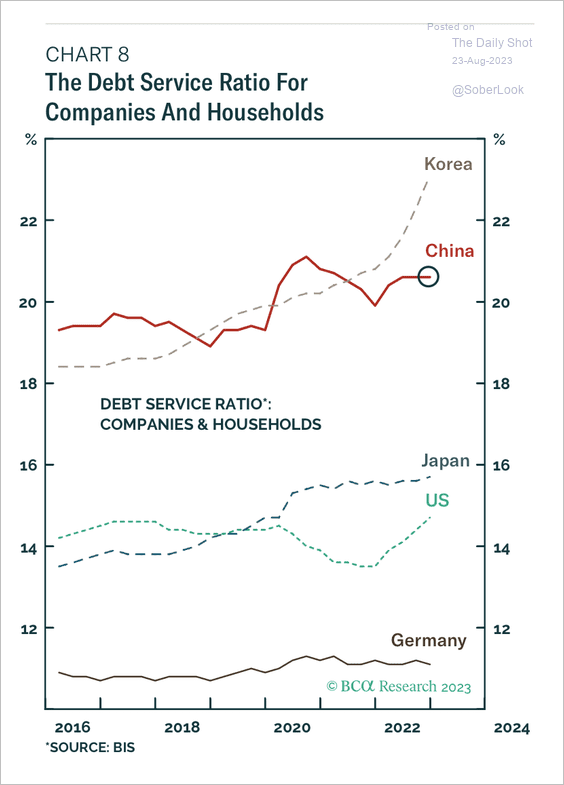

6. Debt servicing costs for households and companies are relatively high versus other major economies.

Source: BCA Research

Source: BCA Research

Back to Index

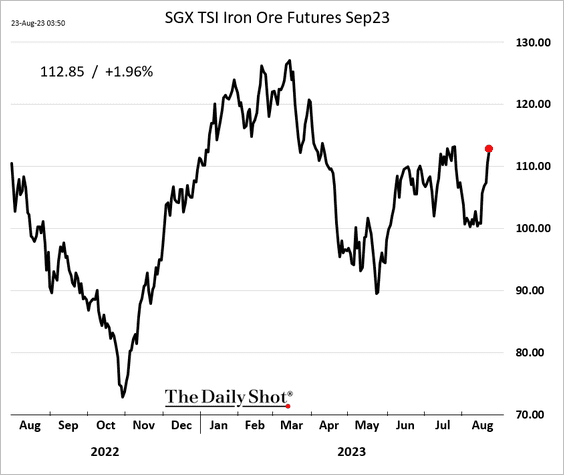

Commodities

1. Iron ore futures are rebounding.

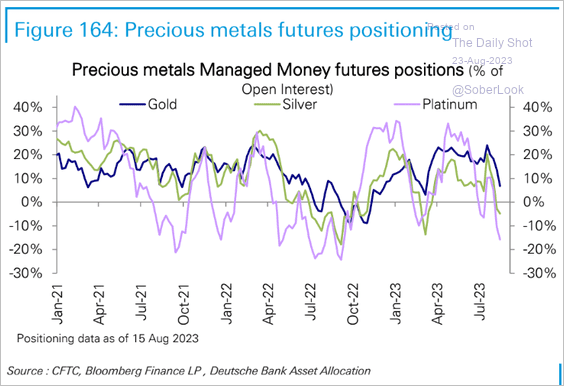

2. Hedge funds have reduced their exposure to precious metals.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

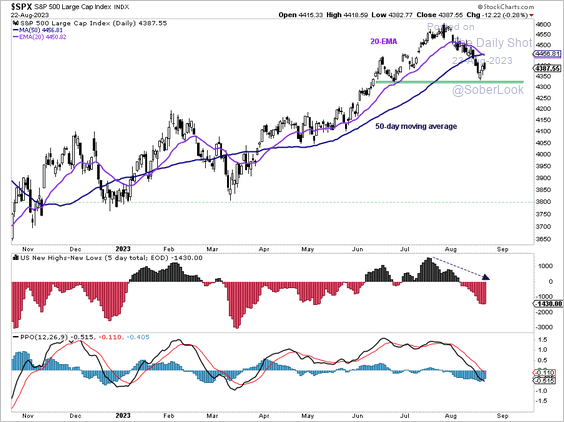

Equities

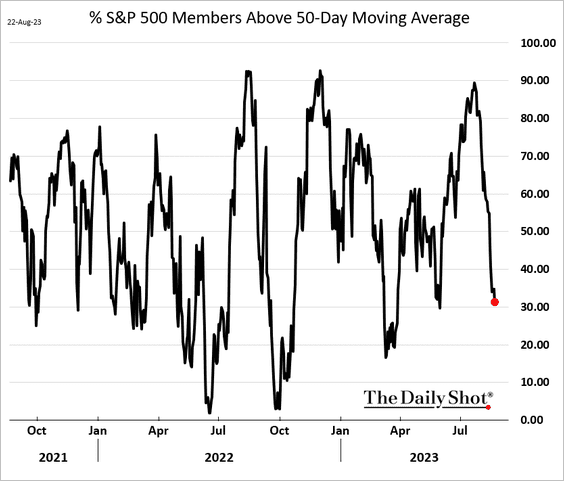

1. The S&P 500 held short-term support, although the decline in breadth and momentum suggests upside could be limited.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

Here is the percentage of S&P 500 members trading above their 50-day moving averages.

——————–

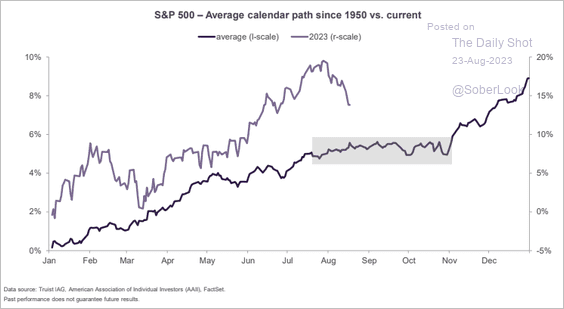

2. Sideways trading ahead?

Source: Truist Advisory Services

Source: Truist Advisory Services

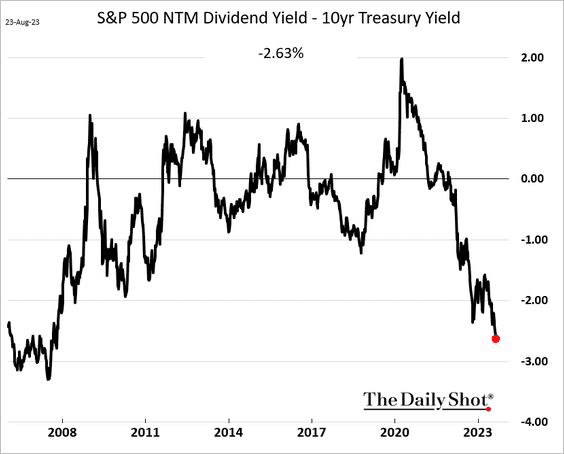

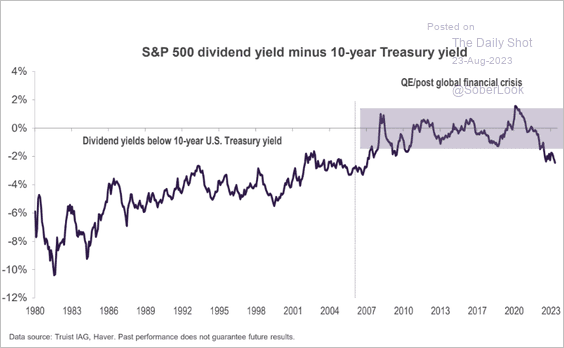

3. The S&P 500 expected dividend yield is well below the 10-year Treasury yield, …

… which was the norm before the GFC.

Source: Truist Advisory Services

Source: Truist Advisory Services

——————–

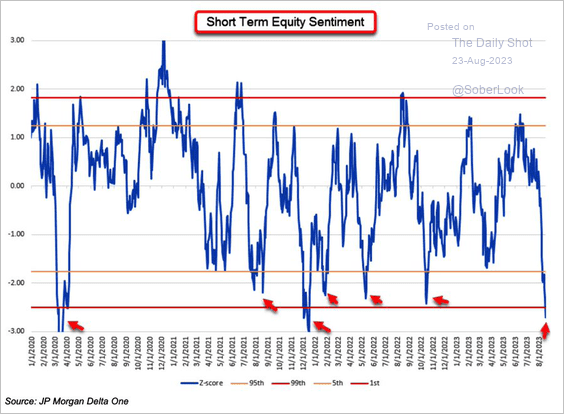

4. JP Morgan’s short-term sentiment index is at extreme lows …

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

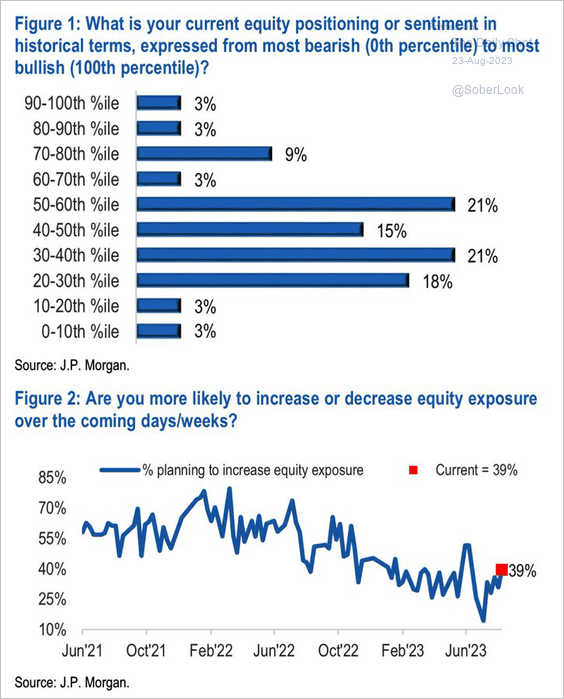

… but some of the firm’s clients are boosting their equity exposure.

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

——————–

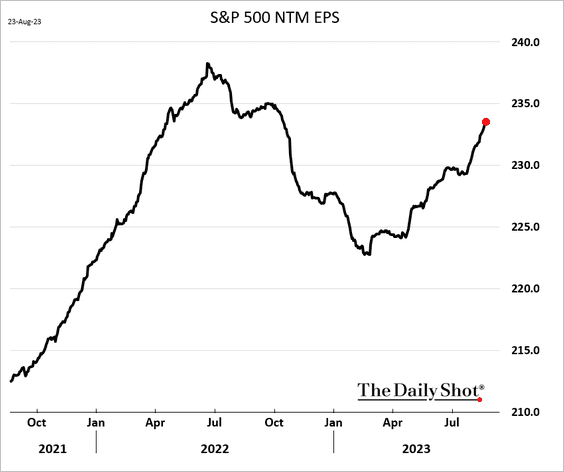

5. S&P 500 projected earnings per share over the next 12 months keep climbing.

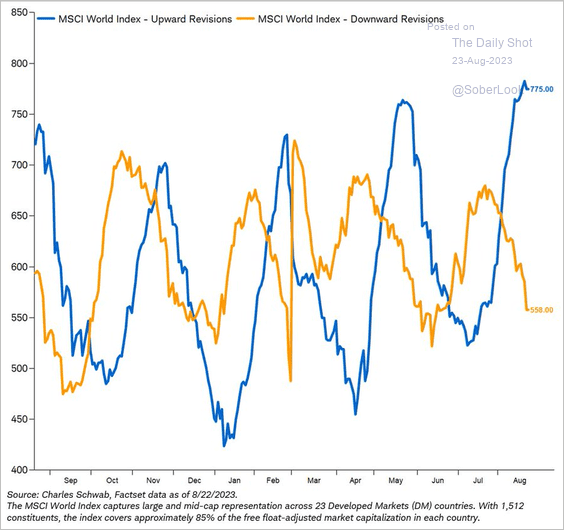

Globally, upward earnings revisions continue to outpace downgrades.

Source: @JeffreyKleintop

Source: @JeffreyKleintop

——————–

6. Next, we have some sector updates.

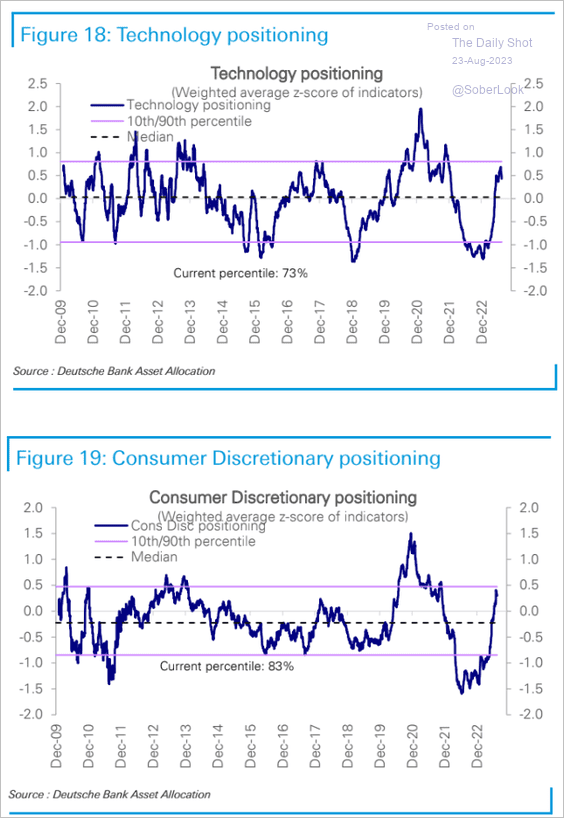

• Consumer discretionary and tech positioning remains bullish.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

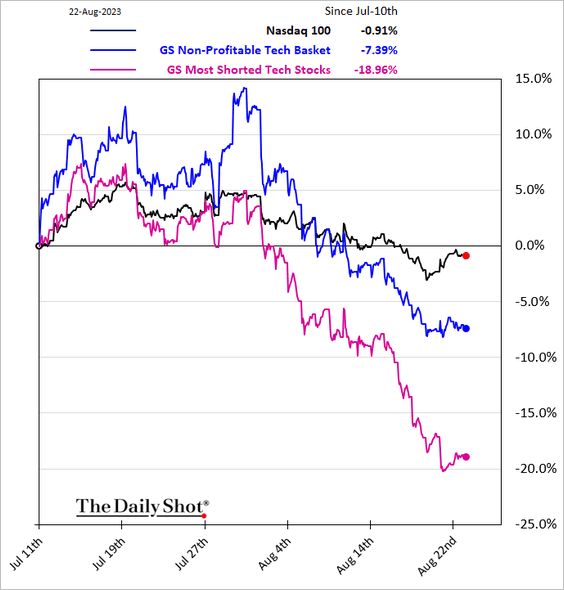

• Speculative tech shares have been underperforming.

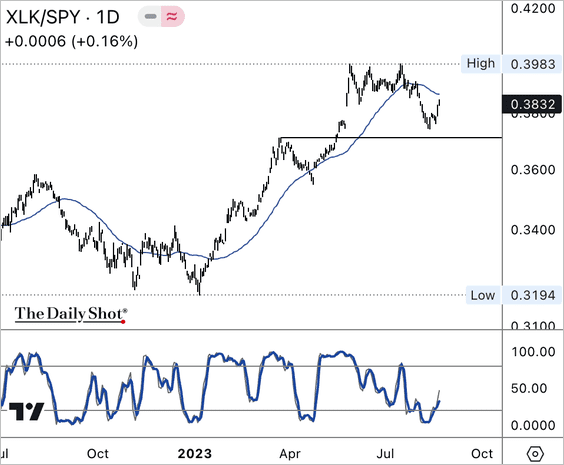

• The US tech sector bounced from short-term oversold levels relative to the S&P 500. However, resistance is nearby.

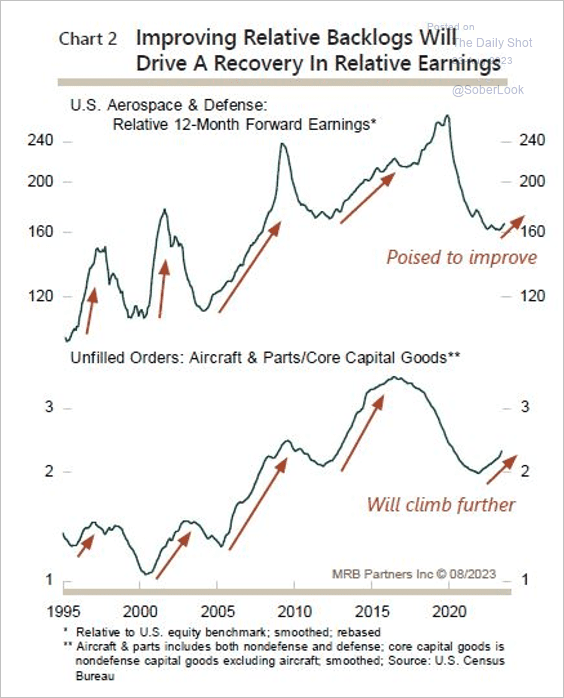

• Fundamentals are improving in the US Aerospace & Defense sector.

Source: MRB Partners

Source: MRB Partners

——————–

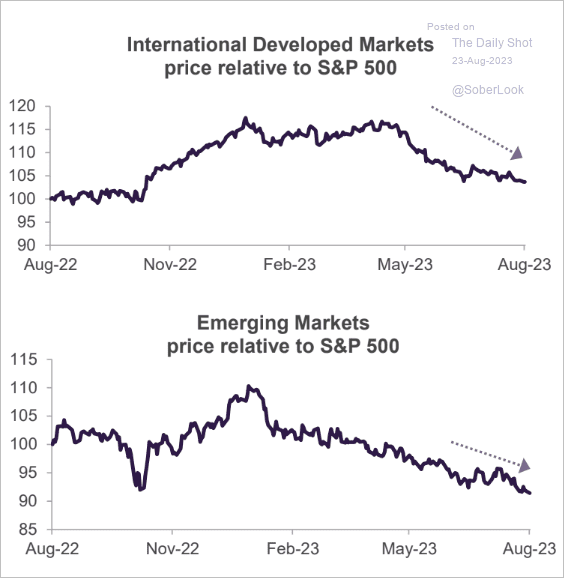

7. US shares continue to outperform international markets.

Source: Truist Advisory Services

Source: Truist Advisory Services

Back to Index

Credit

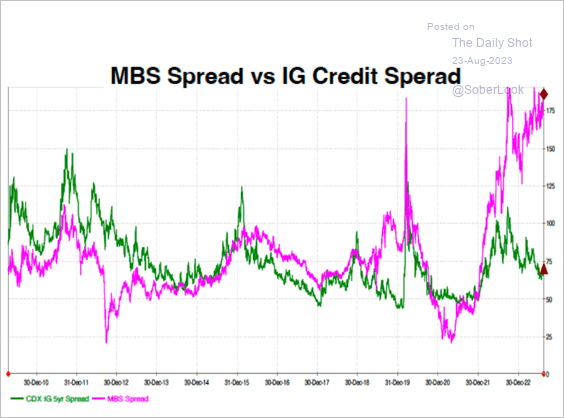

MBS spreads have diverged from investment-grade corporate credit.

Source: Convexity Maven

Source: Convexity Maven

Back to Index

Rates

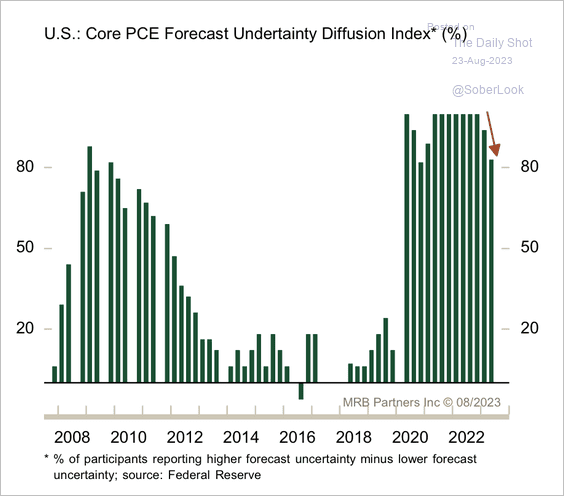

1. The Fed is less uncertain about forecasting lower inflation ahead.

Source: MRB Partners

Source: MRB Partners

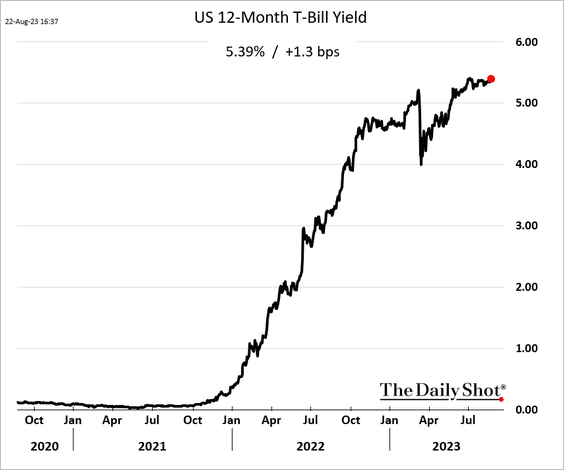

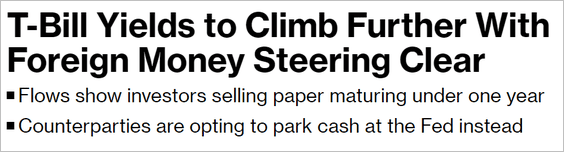

2. T-bill yields are grinding higher.

Source: @markets Read full article

Source: @markets Read full article

——————–

Food for Thought

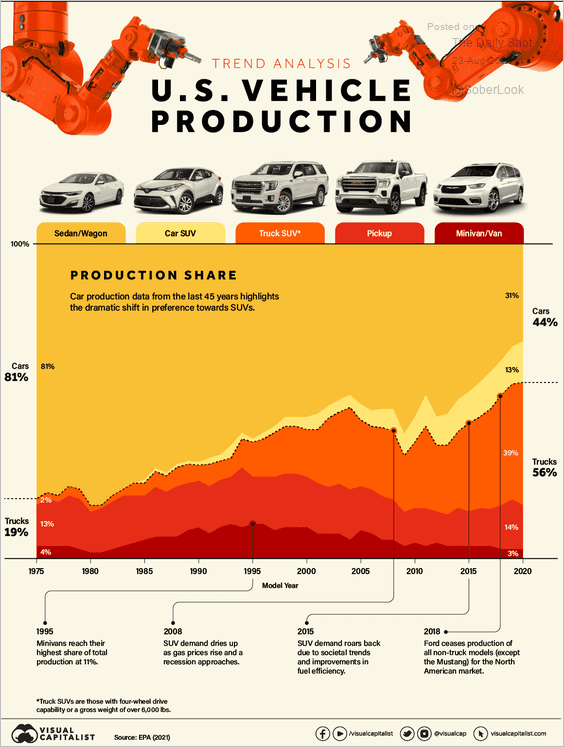

1. US vehicle production by type:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

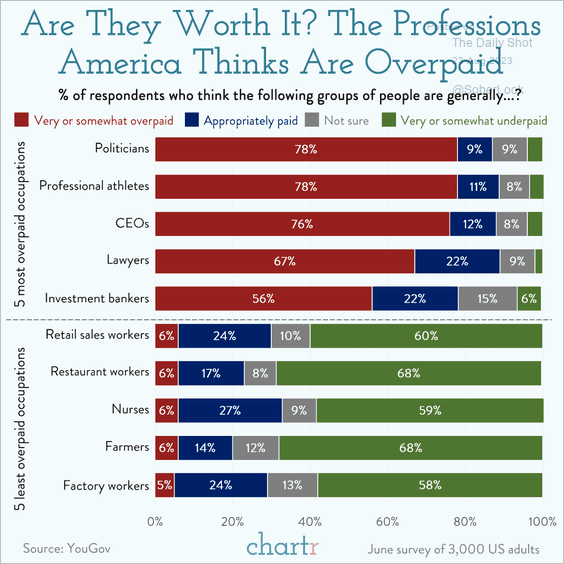

2. Overpaid and underpaid professions:

Source: @chartrdaily

Source: @chartrdaily

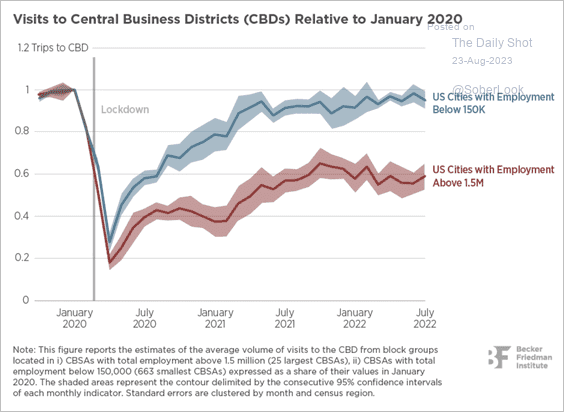

3. Back to the office in small cities but not so much in larger cities:

Source: The Economist Read full article

Source: The Economist Read full article

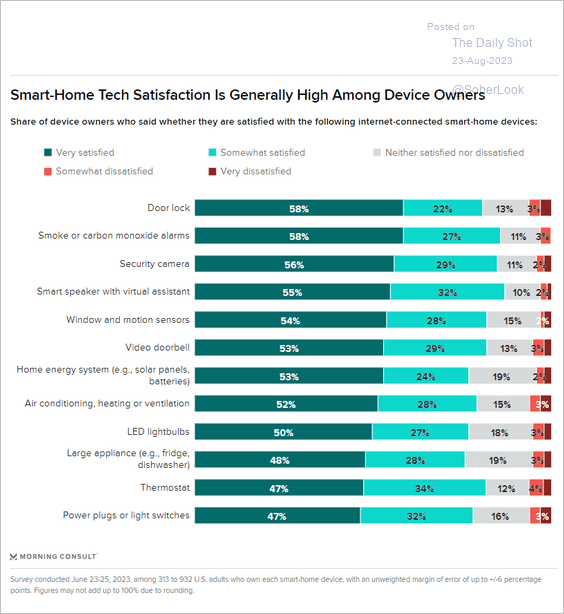

4. Satisfaction with smart-home tech:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

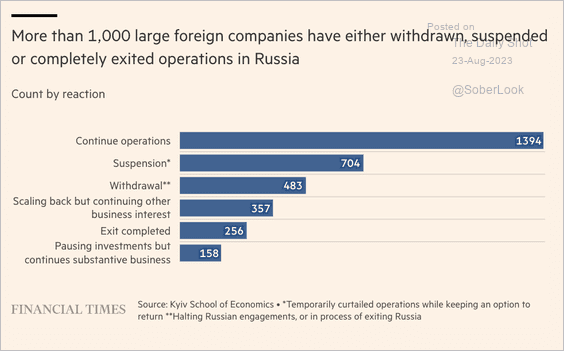

5. Foreign companies’ presence in Russia:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

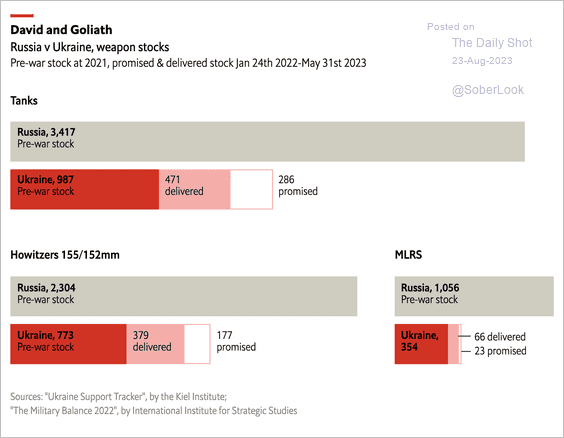

6. Russian vs. Ukrainian weapons stockpiles:

Source: The Economist Read full article

Source: The Economist Read full article

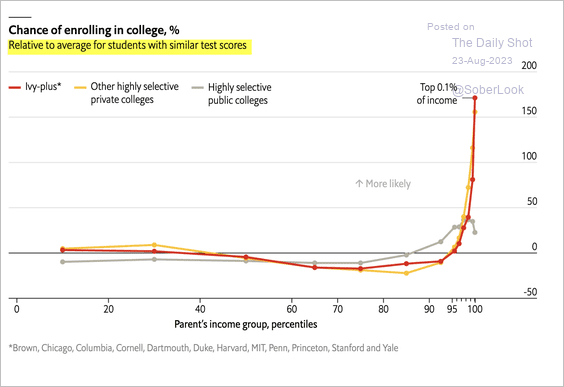

7. Relative chance of enrolling in highly selective colleges based on parents’ income group:

Source: The Economist Read full article

Source: The Economist Read full article

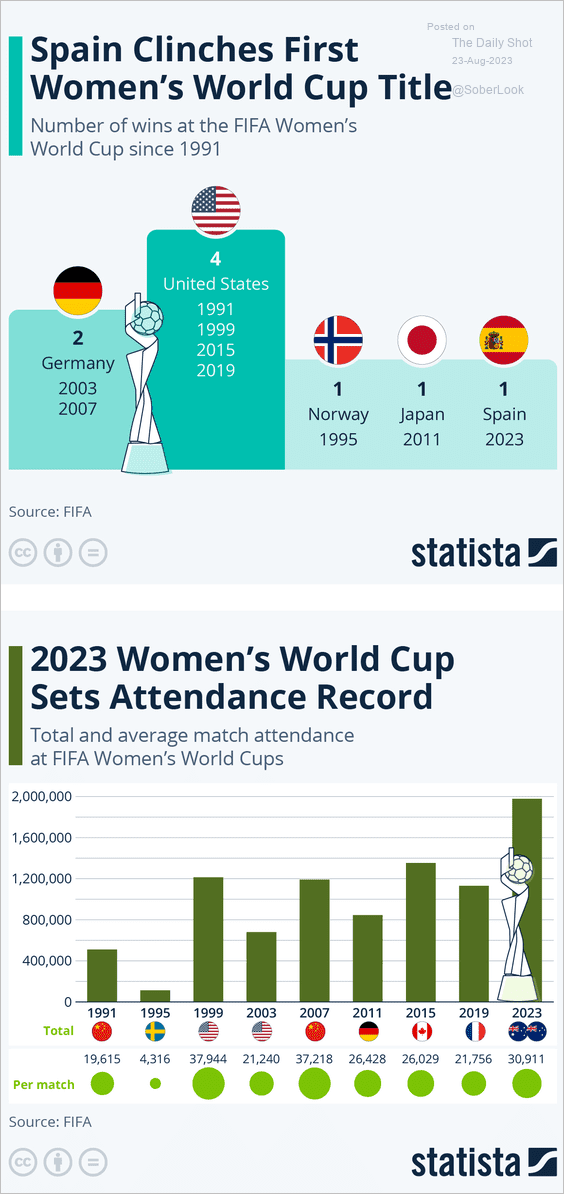

8. FIFA Women’s World Cup data:

Source: Statista

Source: Statista

——————–

Back to Index