The Daily Shot: 24-Aug-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Energy

• Equities

• Alternatives

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

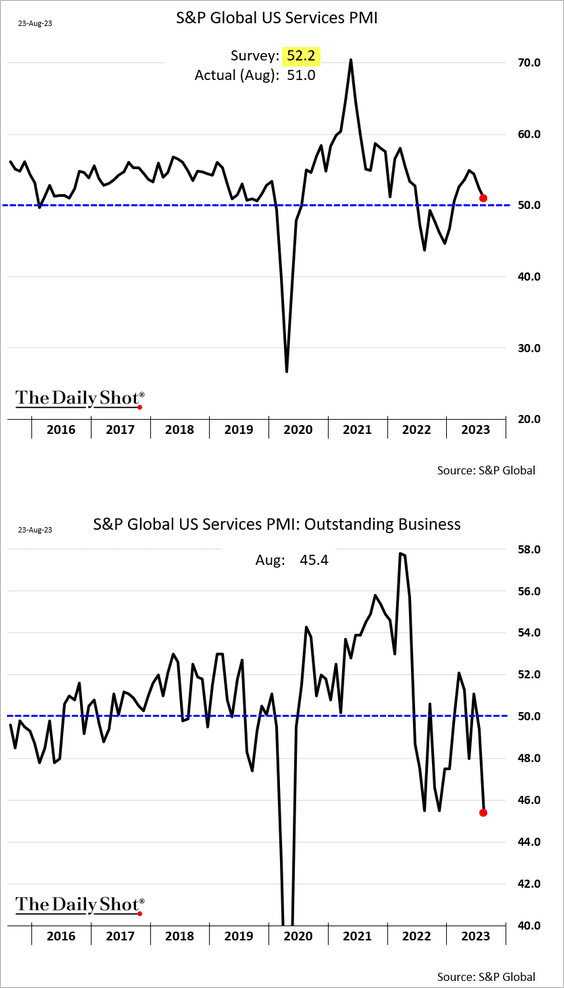

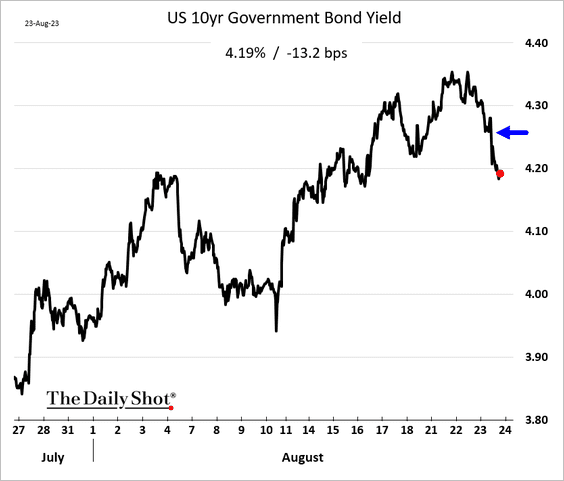

1. The August US PMI report from S&P Global showed growth stalling in services, …

Source: Reuters Read full article

Source: Reuters Read full article

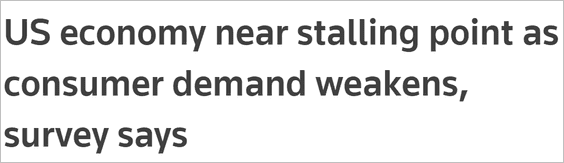

… and faster contraction in manufacturing. Both measures were below consensus estimates. The report suggests that a resurgence in economic growth is unlikely at this point.

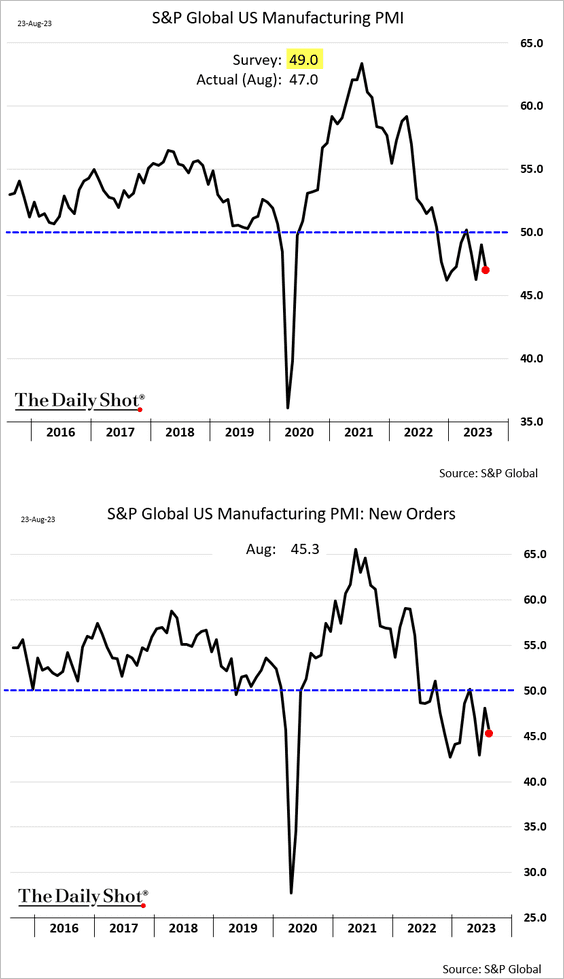

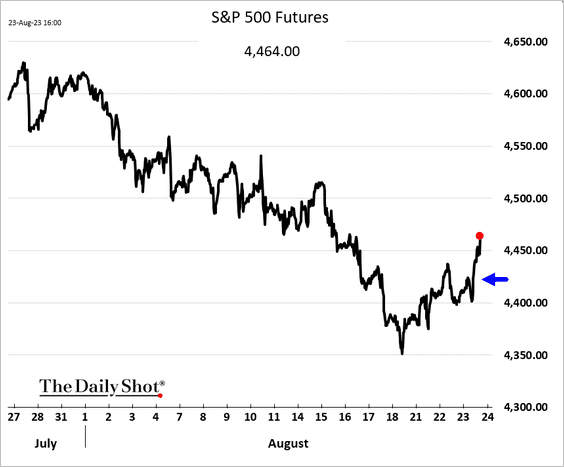

Treasury yields declined in response to the PMI report, …

… boosting stock prices.

——————–

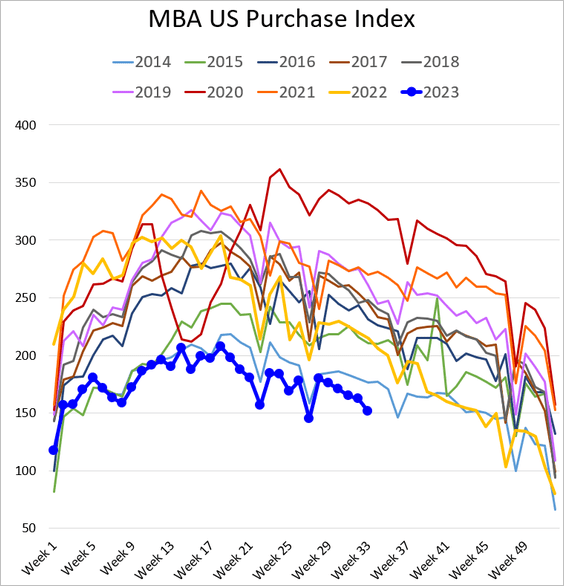

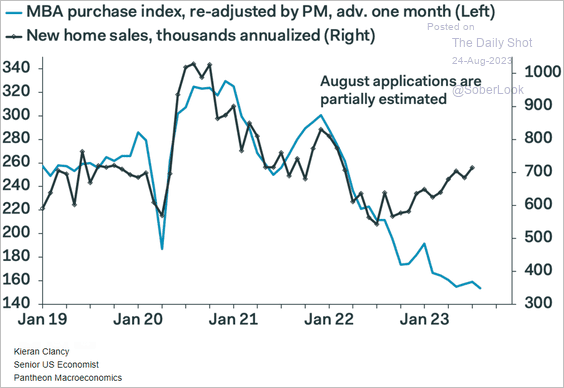

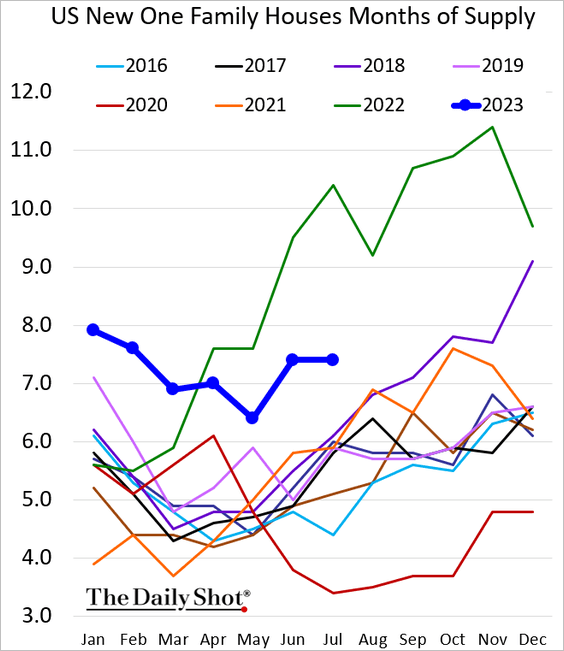

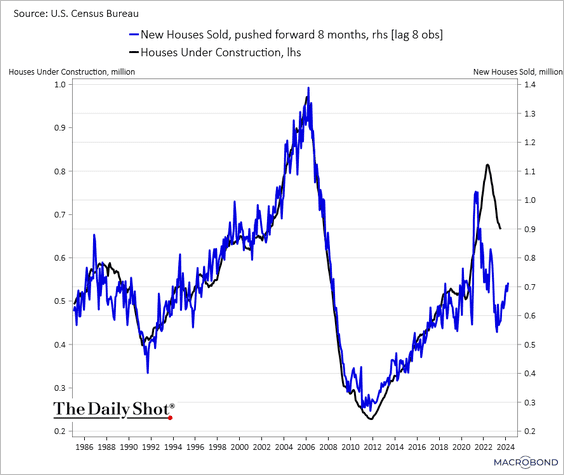

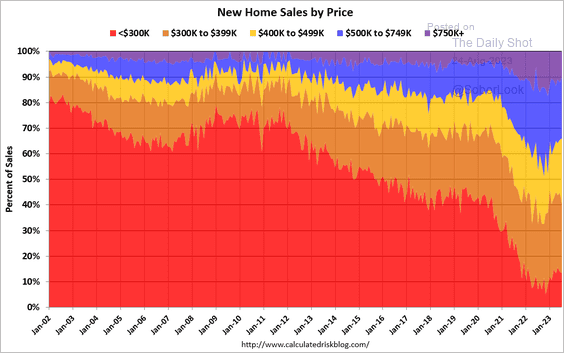

2. Next, we have some updates on the housing market.

• Loan applications weakened further last week as mortgage rates surged.

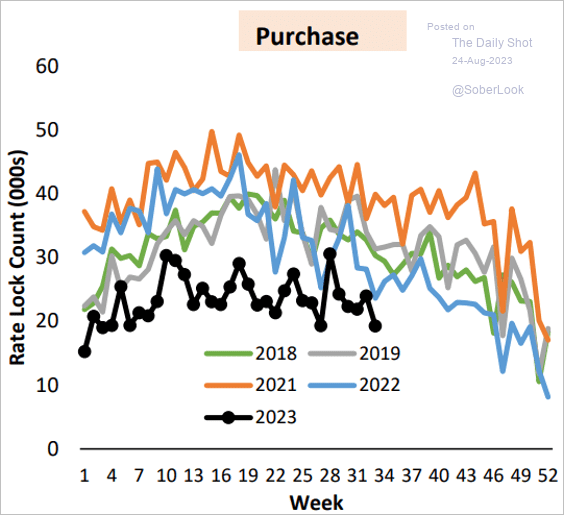

This chart shows the mortgage rate-lock count.

Source: AEI Housing Center

Source: AEI Housing Center

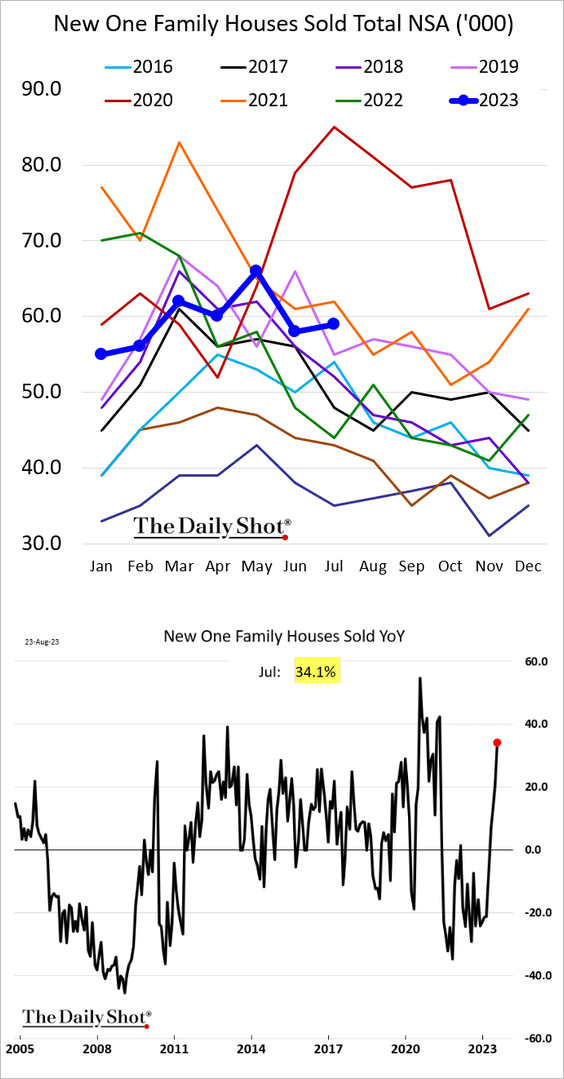

• New home sales were robust last month, up 34% vs. last year.

– However, weak mortgage applications point to downside risks for new residential sales.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

– Measured in months of supply, new house inventories remain elevated but are well below last year’s levels.

Here are a couple of additional trends in new home sales.

– Units under construction vs. new houses sold:

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

– The price distribution of new homes sold:

Source: Calculated Risk

Source: Calculated Risk

——————–

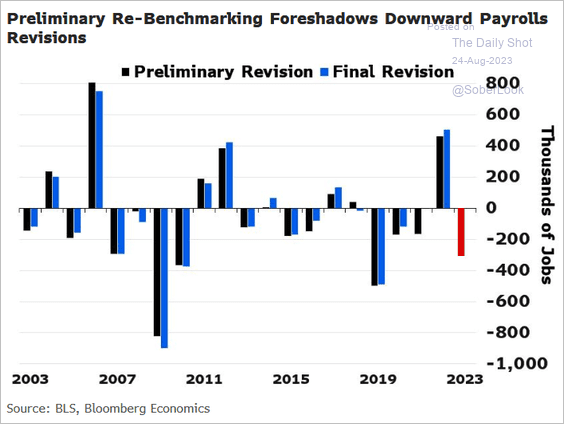

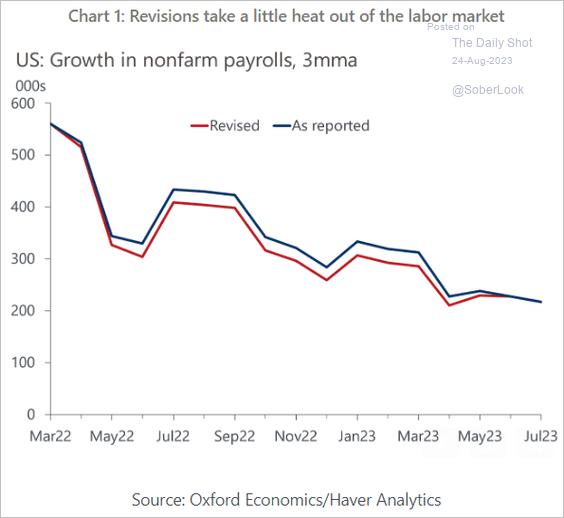

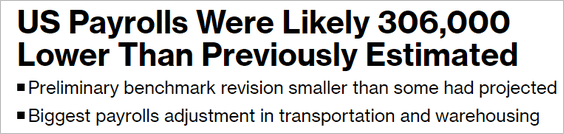

3. US payrolls were revised down, although the revision was smaller than expected.

Source: @stuartapaul, @TheTerminal, Bloomberg Finance L.P. Read full article

Source: @stuartapaul, @TheTerminal, Bloomberg Finance L.P. Read full article

Source: Oxford Economics

Source: Oxford Economics

Source: @economics Read full article

Source: @economics Read full article

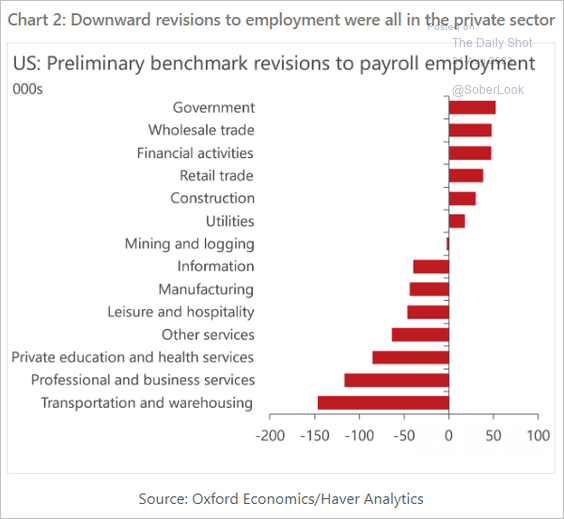

Here are the revisions by sector.

Source: Oxford Economics

Source: Oxford Economics

——————–

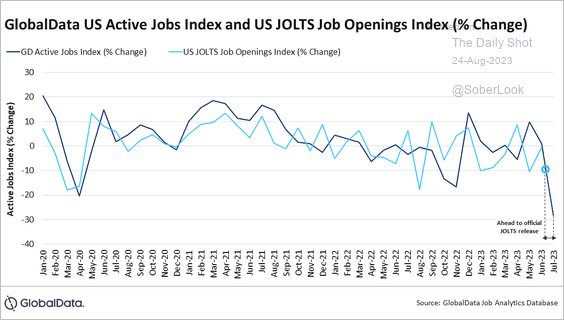

4. The Active Jobs Index points to further declines in job openings.

Source: GlobalData Read full article

Source: GlobalData Read full article

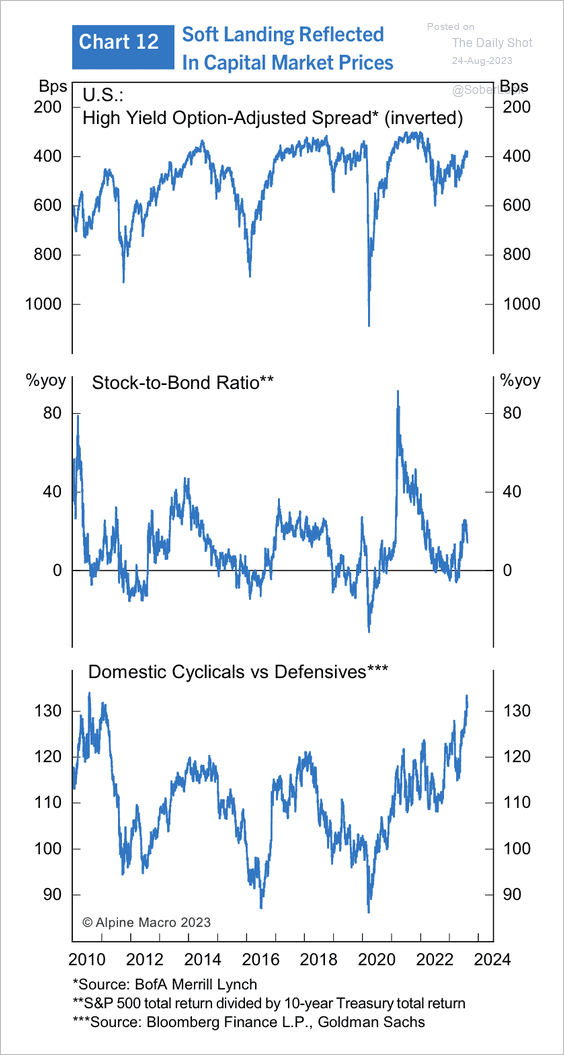

5. Markets are pricing in a soft-landing scenario.

Source: Alpine Macro

Source: Alpine Macro

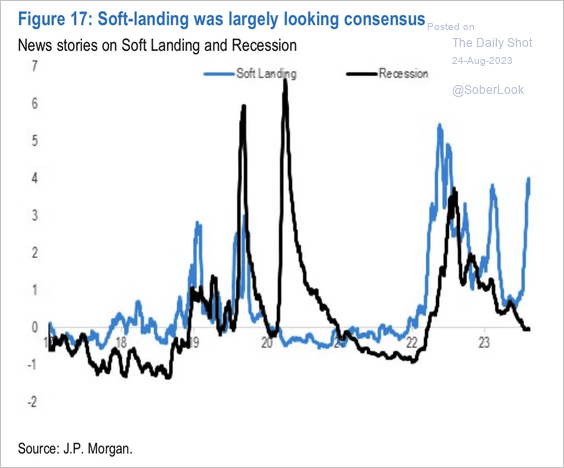

News stories of “soft landing” spiked.

Source: JP Morgan Research

Source: JP Morgan Research

Back to Index

Canada

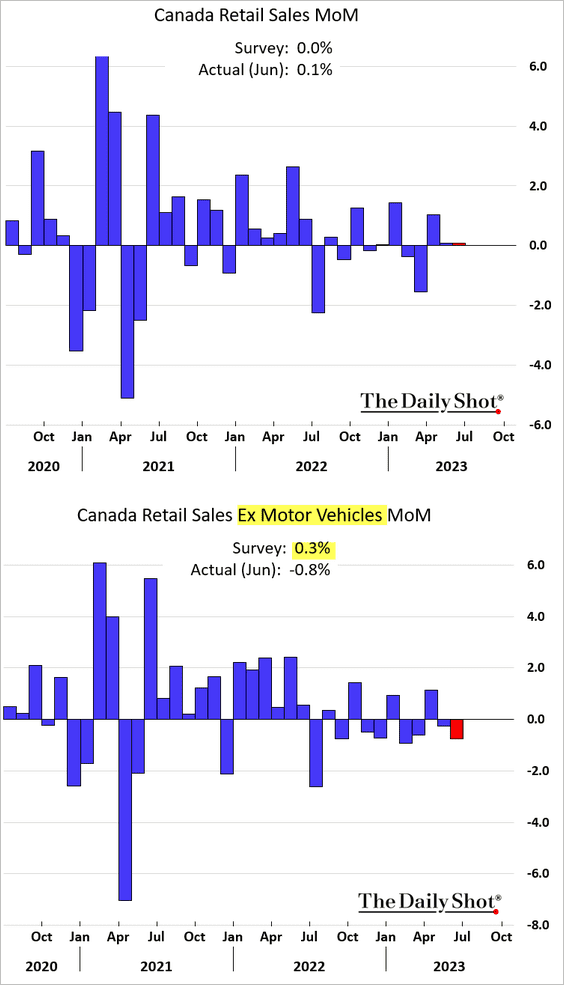

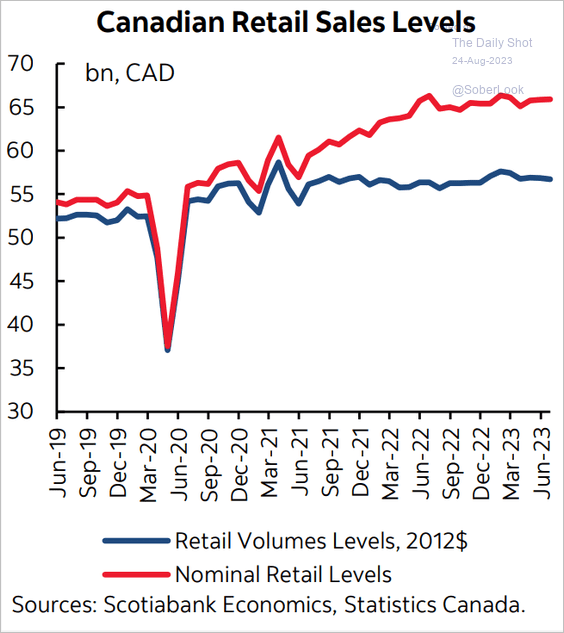

1. Retail sales edged higher in June, driven by vehicle purchases. Excluding autos, however, sales declined.

This chart shows the levels of nominal and real retail sales.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

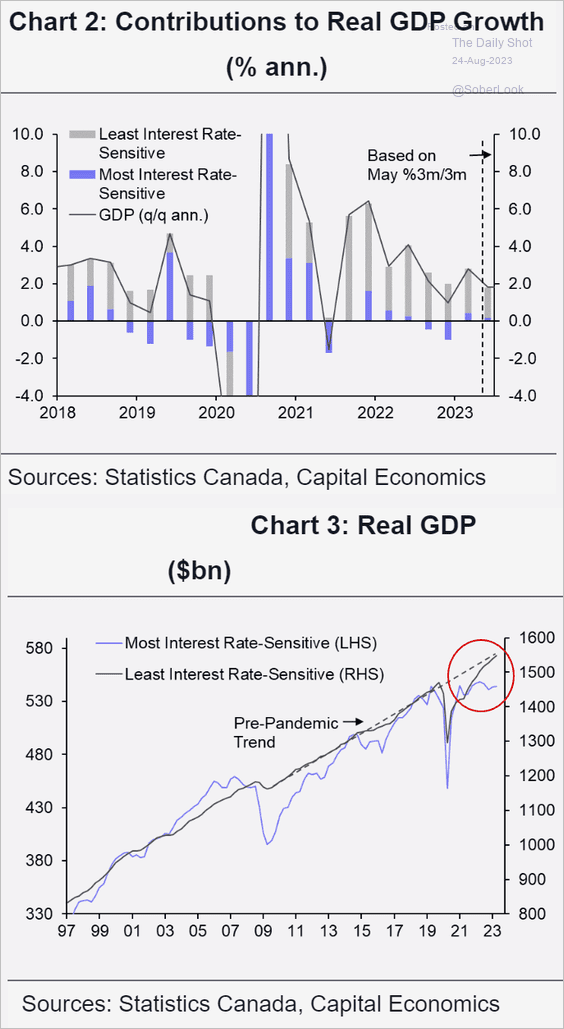

2. Canada’s economic growth has been supported by sectors that are less sensitive to interest rates.

Source: Capital Economics

Source: Capital Economics

Back to Index

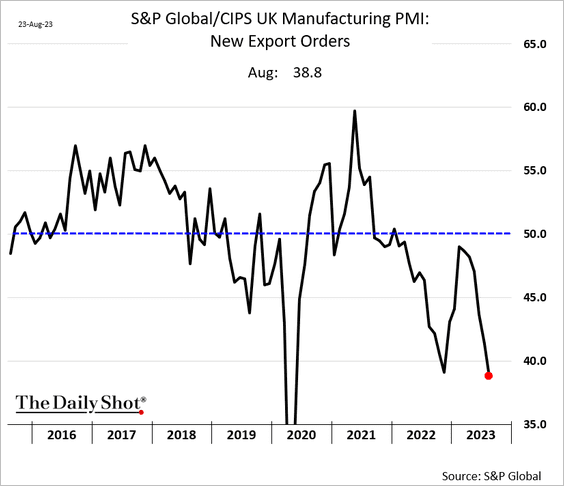

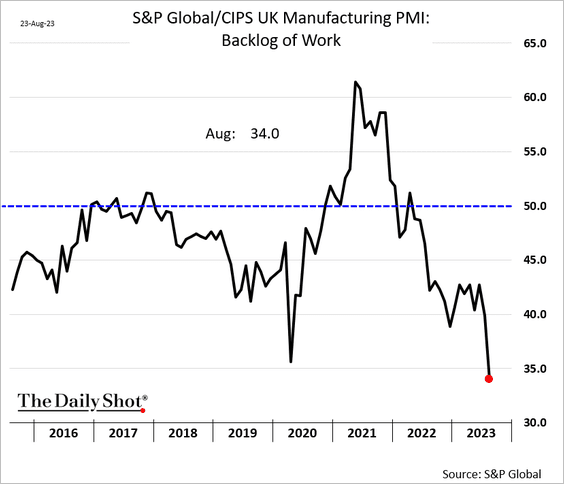

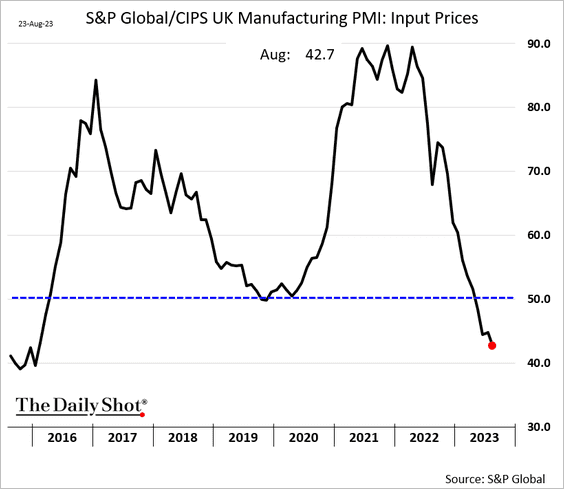

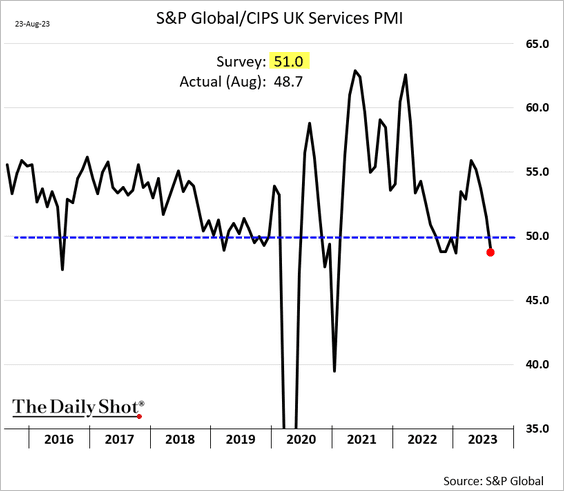

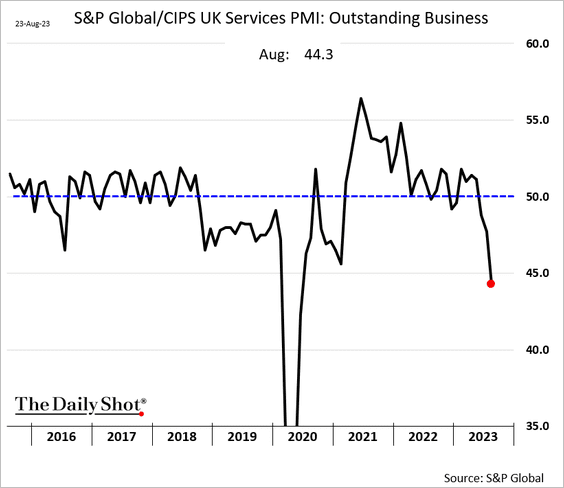

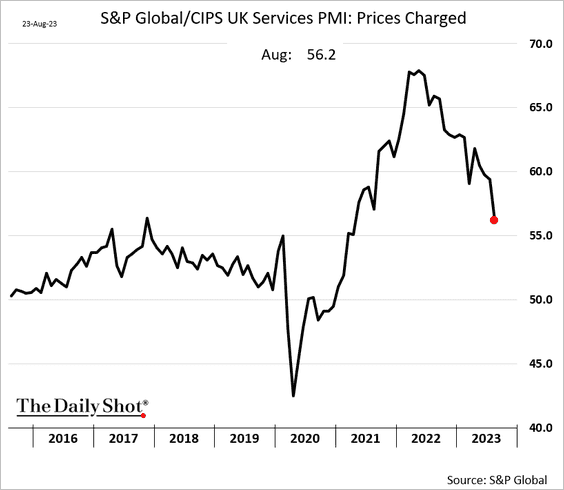

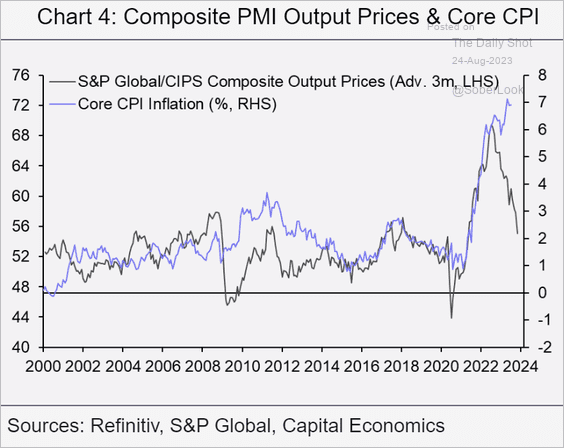

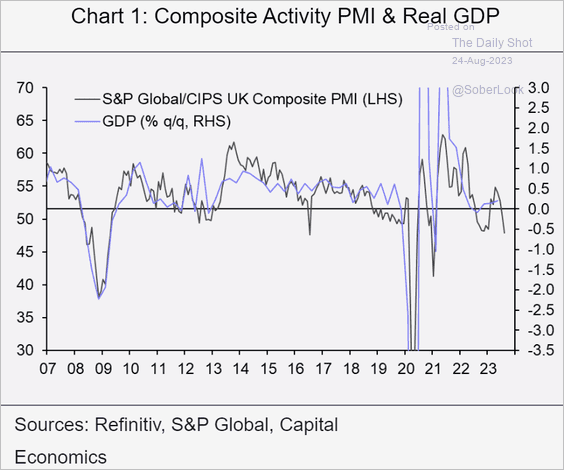

The United Kingdom

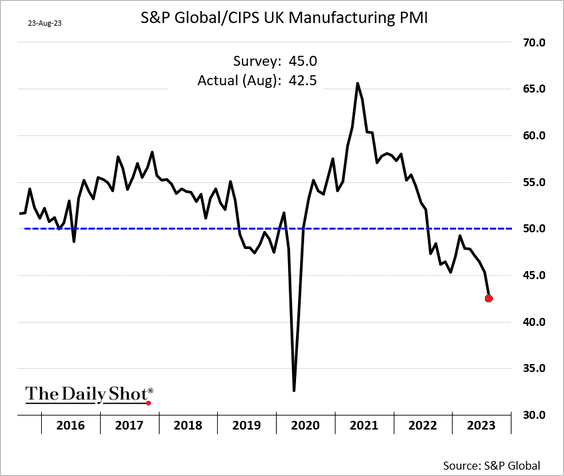

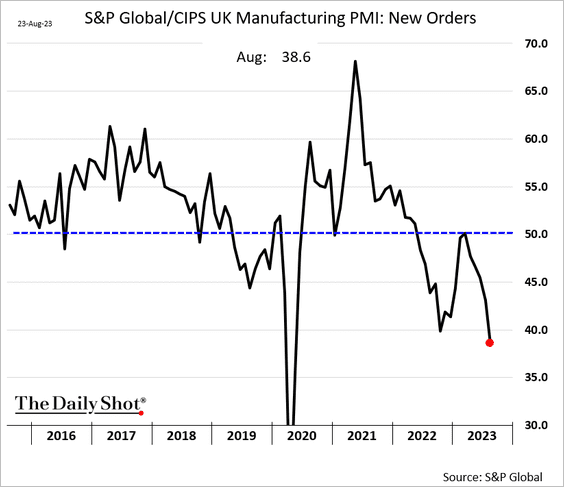

As we saw yesterday, the PMI report was disappointing, raising the risk of a recession in the UK.

Source: The Guardian Read full article

Source: The Guardian Read full article

Here are some details from the report.

• Manufacturing PMI:

– Manufacturing orders:

– Export orders:

– Manufacturing backlog:

– Input prices (falling faster):

• Services PMI:

– Services outstanding business:

– Services prices charged (rising at a slower pace):

• Composite PMI output prices vs. the core CPI:

Source: Capital Economics

Source: Capital Economics

• Composite PMI vs. GDP:

Source: Capital Economics

Source: Capital Economics

Back to Index

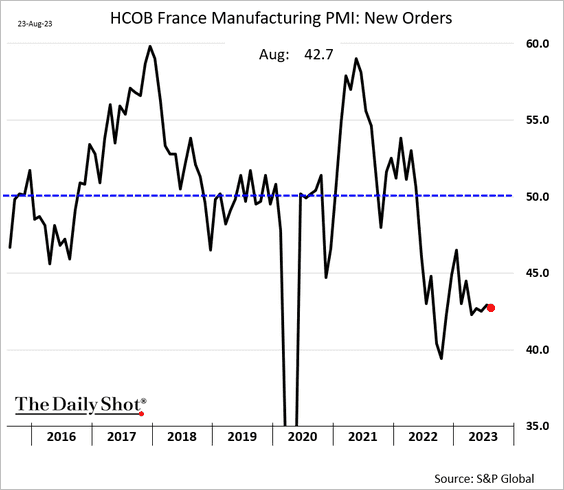

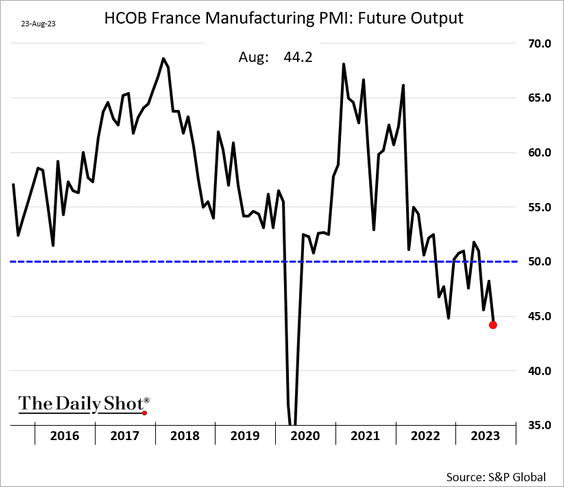

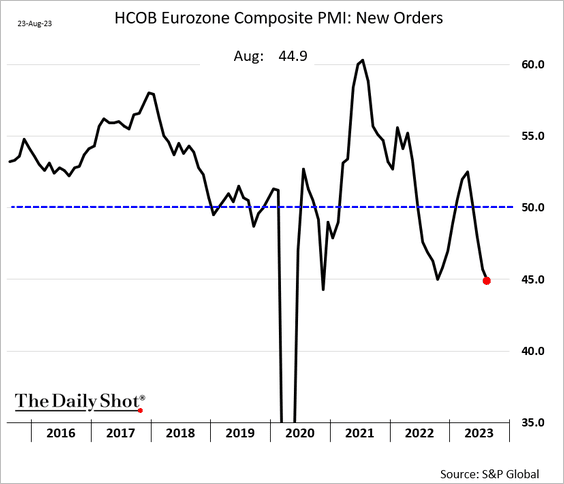

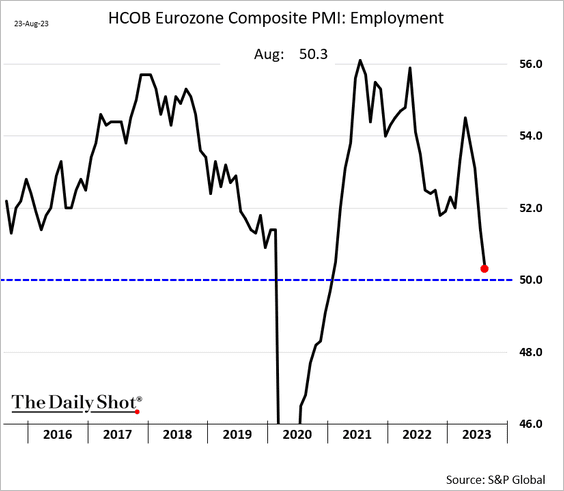

The Eurozone

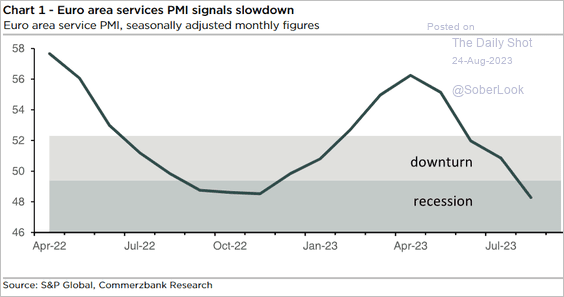

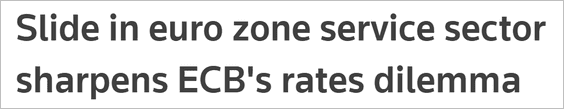

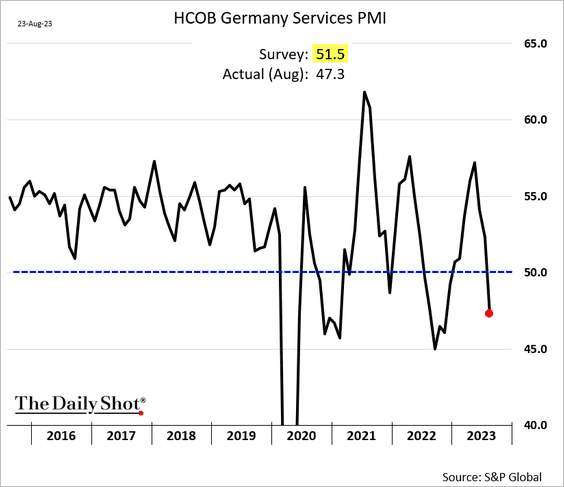

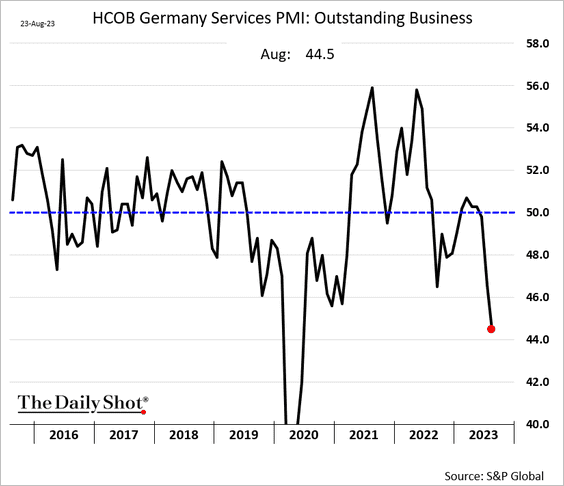

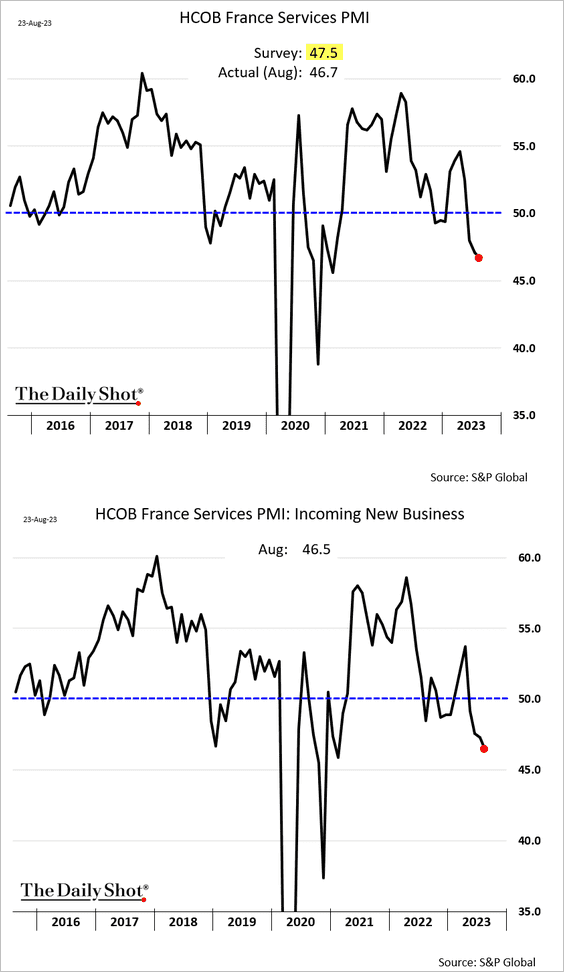

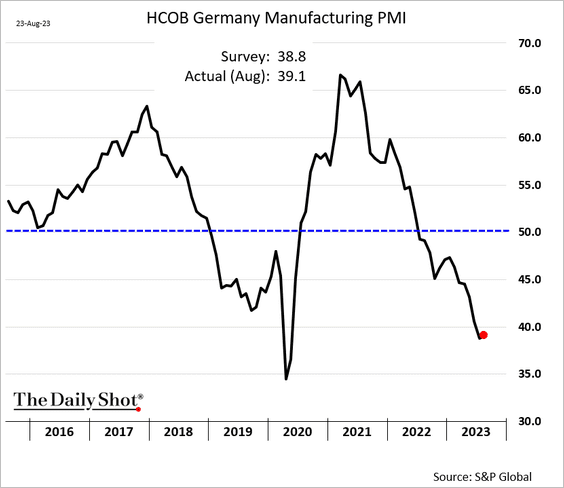

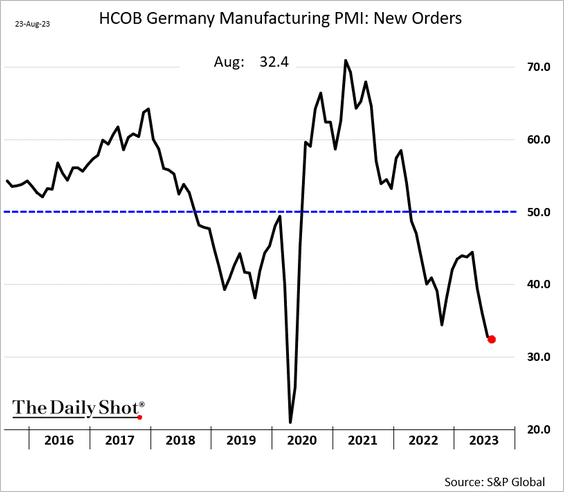

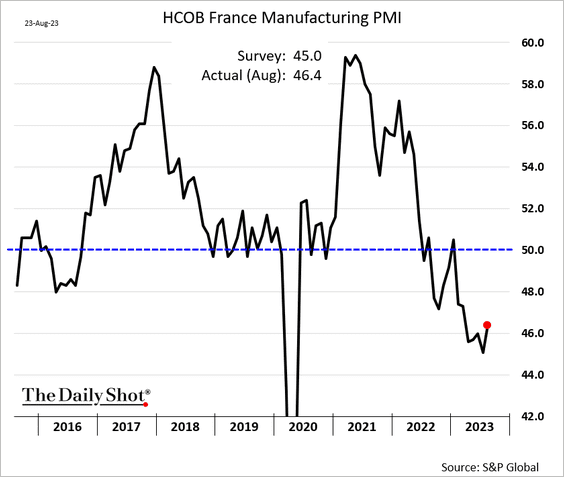

1. As we saw yesterday, the euro-area PMI reports signal a faster contraction in business activity. Recession looks increasingly likely.

Source: Commerzbank Research

Source: Commerzbank Research

• The deterioration in services is particularly concerning.

Source: Reuters Read full article

Source: Reuters Read full article

– Germany’s services PMI (2 charts):

– France services PMI:

• Manufacturing indices edged higher but remained in contraction territory.

– Germany (2 charts):

– France (3 charts):

• Here are some trends for the euro-area composite PMI.

– New orders:

– Employment:

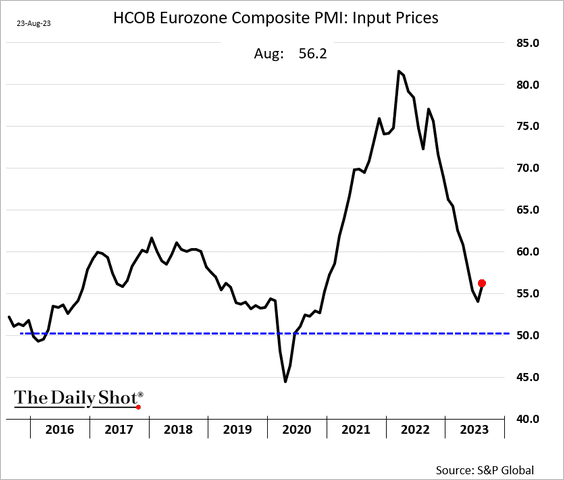

– Input prices (rising a bit faster):

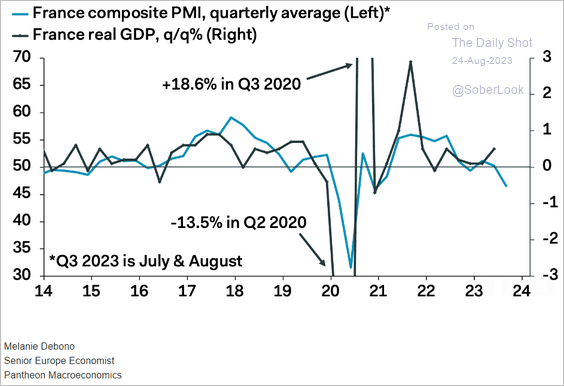

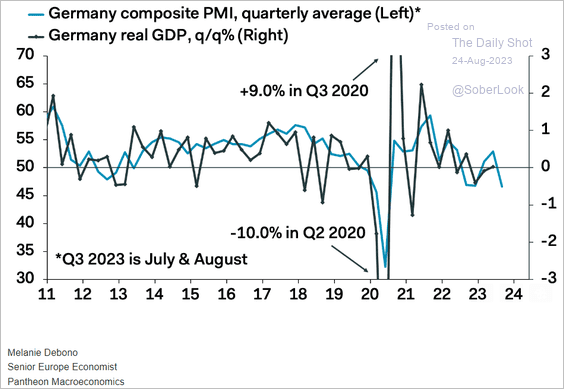

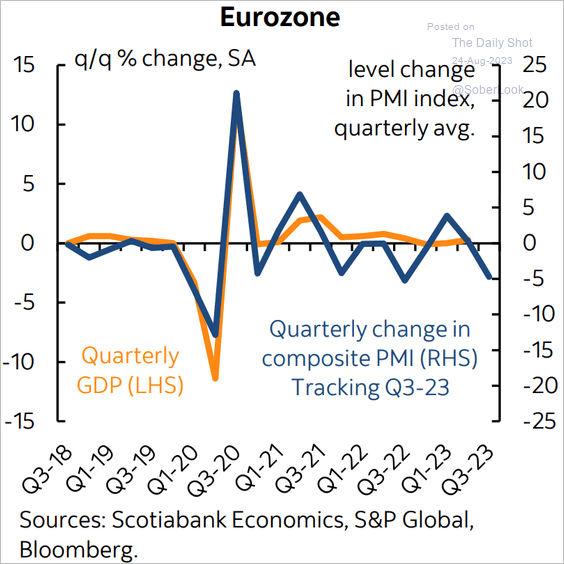

• Economic contraction looks likely.

– France:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

– Germany:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

– The Eurozone:

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

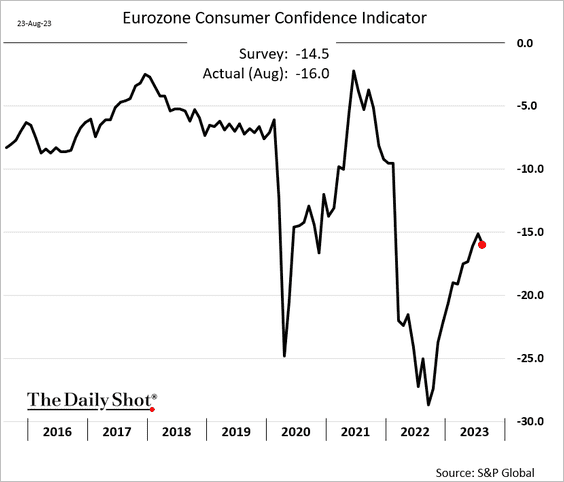

2. Consumer confidence unexpectedly turned lower this month.

Back to Index

Europe

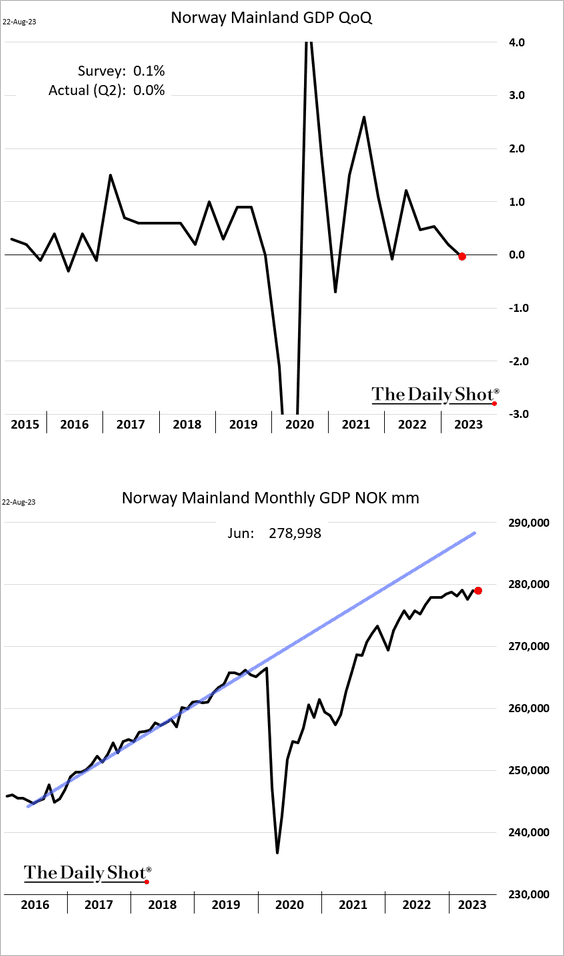

1. Norway’s economic growth stalled last quarter.

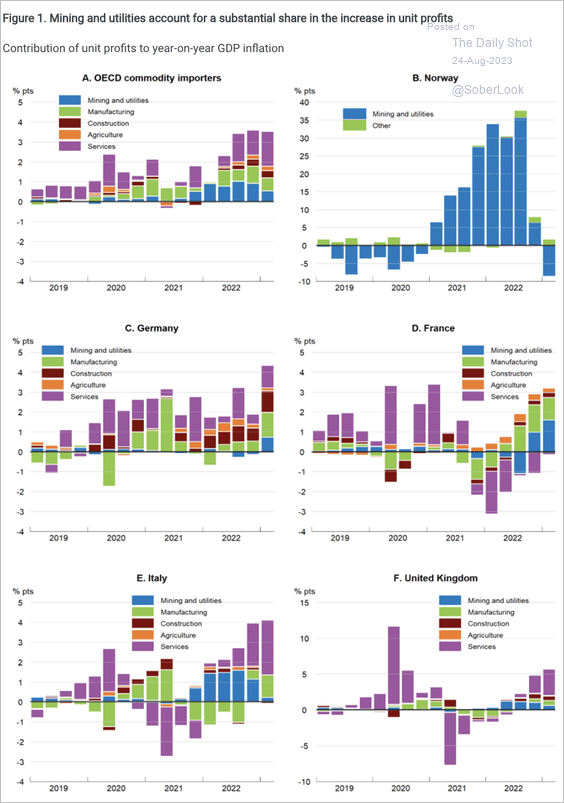

2. Here is a look at corporate profits and inflation.

Source: OECD Read full article

Source: OECD Read full article

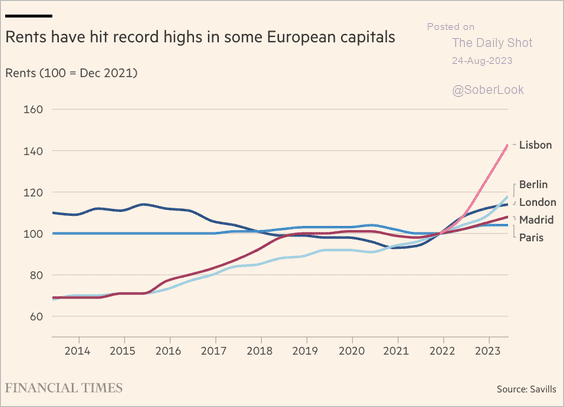

3. This chart shows rent growth in some European capitals.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Asia-Pacific

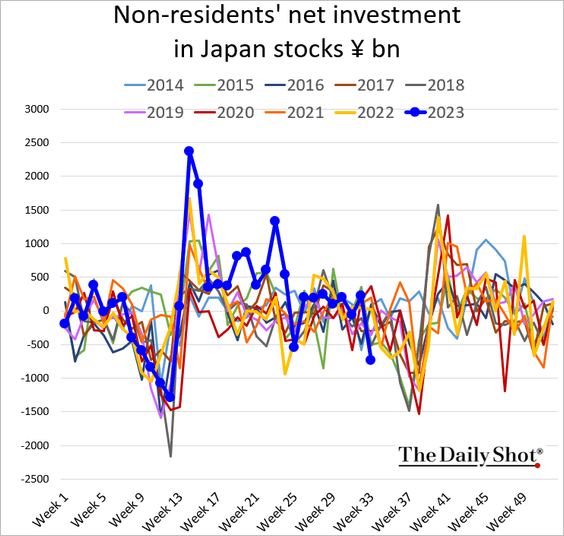

1. Foreigners are taking profits on Japanese shares.

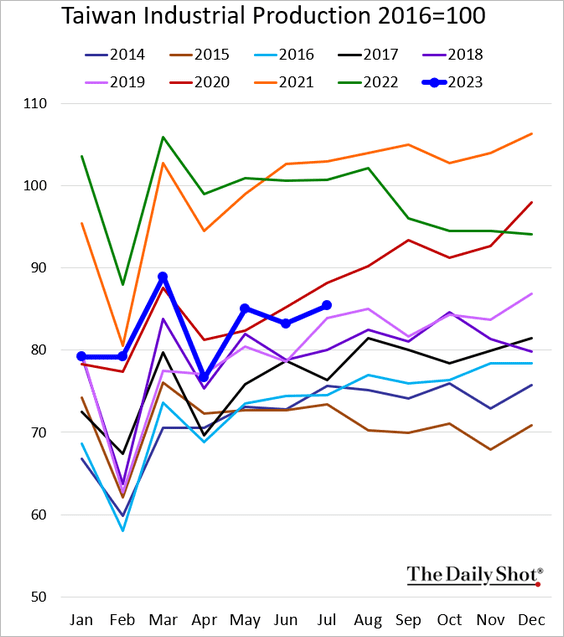

2. Taiwan’s industrial production is running well below last year’s levels.

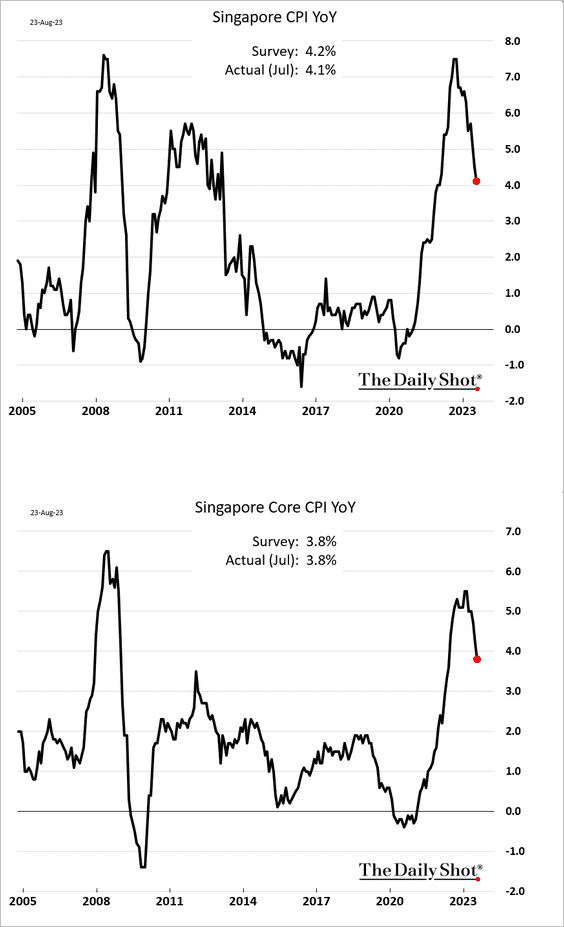

3. Singapore’s inflation is moderating.

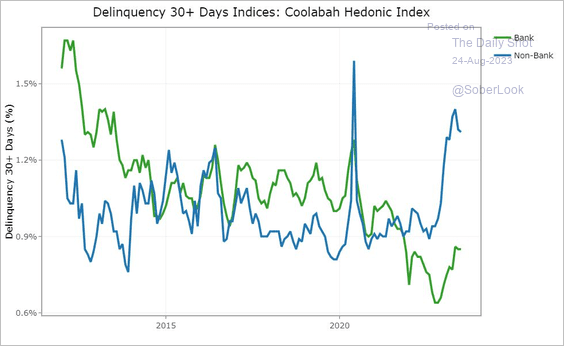

4. Australia’s non-bank lenders’ home loan portfolios are facing higher delinquency rates.

Source: Coolabah Capital Investments

Source: Coolabah Capital Investments

Back to Index

China

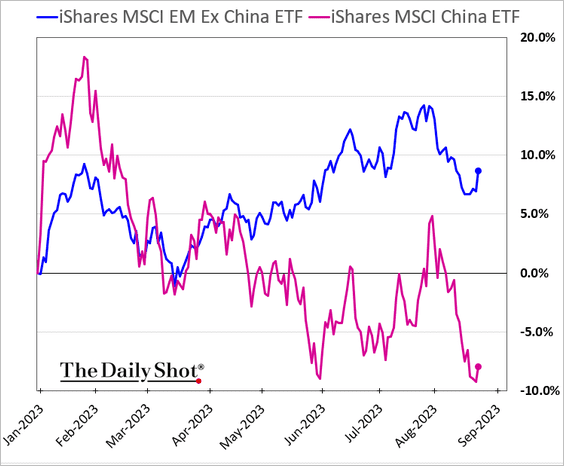

1. China’s stocks continue to underperform EM peers.

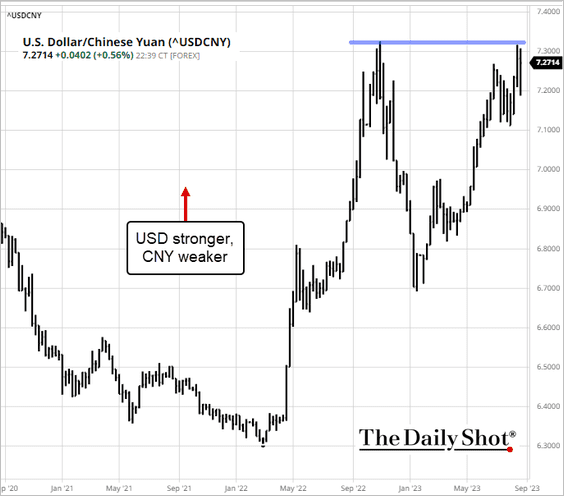

2. Beijing was able to halt the renminbi’s decline at around 7.3 to the dollar.

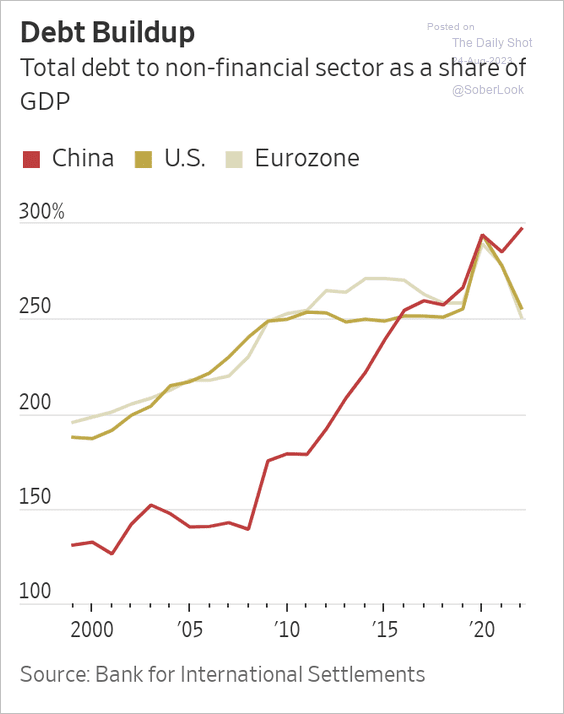

3. China’s total debt-to-GDP ratio has surpassed that of the US and the Eurozone.

Source: @WSJ Read full article

Source: @WSJ Read full article

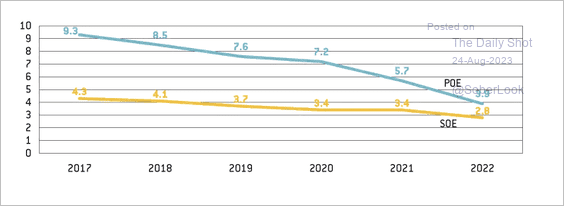

4. This chart shows Chinese corporations’ average return on assets.

Source: Bruegel Read full article

Source: Bruegel Read full article

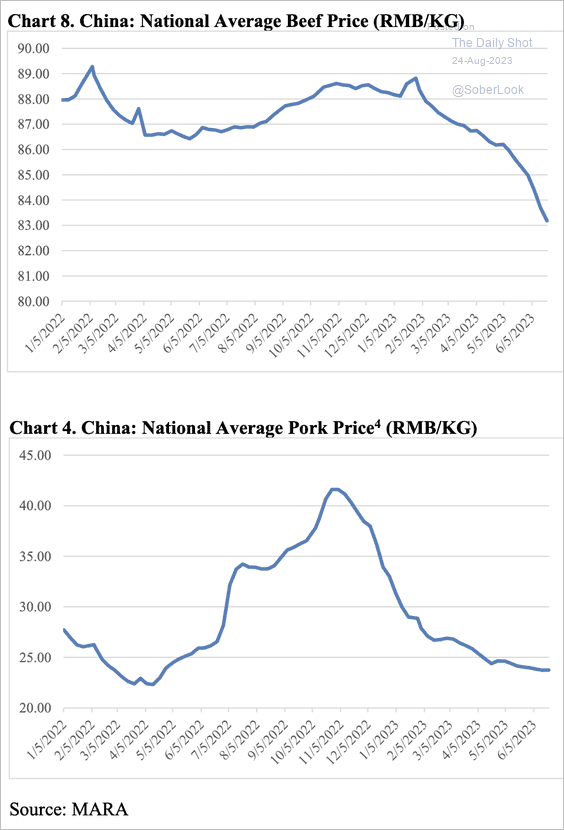

5. Meat prices have contributed to China’s disinflation.

Source: USDA Read full article

Source: USDA Read full article

Back to Index

Emerging Markets

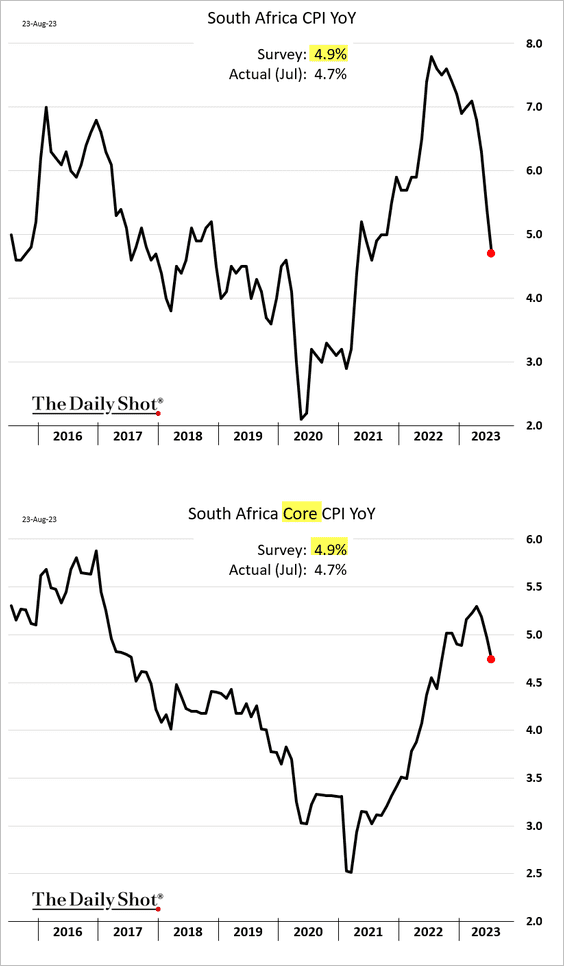

1. South Africa’s inflation was below forecasts.

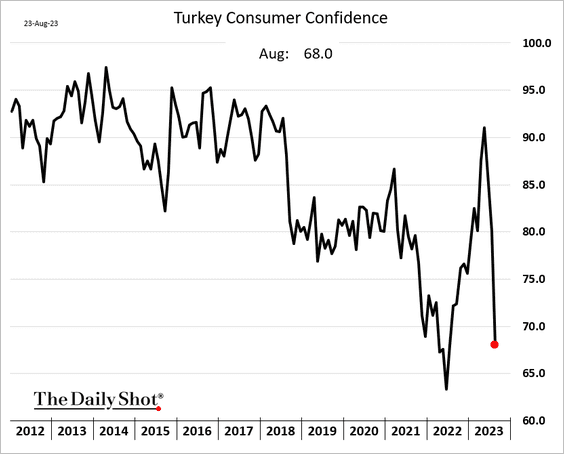

2. Turkey’s consumer confidence suddenly deteriorated this month.

Source: @economics Read full article

Source: @economics Read full article

——————–

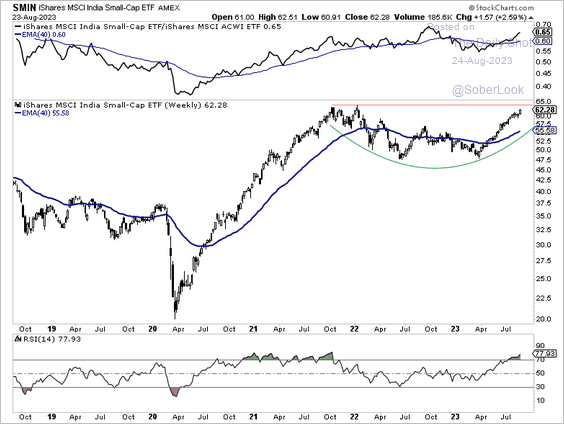

3. Indian small-cap stocks are approaching new highs while displaying relative strength versus global equities.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

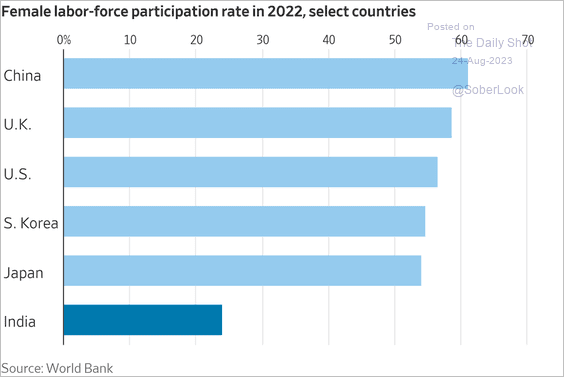

Separately, this chart illustrates the notably low participation of Indian women in the labor force compared to their counterparts in other countries.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

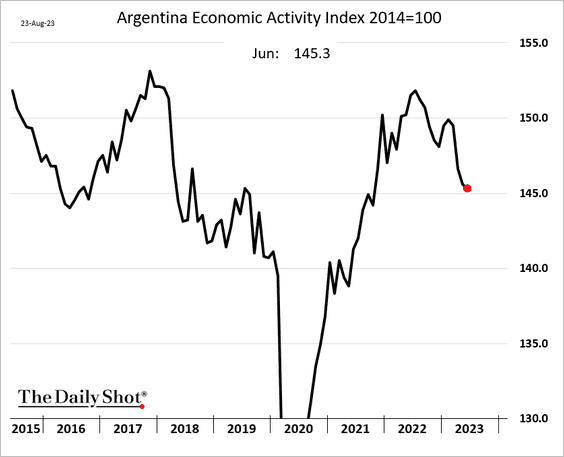

4. Argentina’s economic activity continues to contract.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

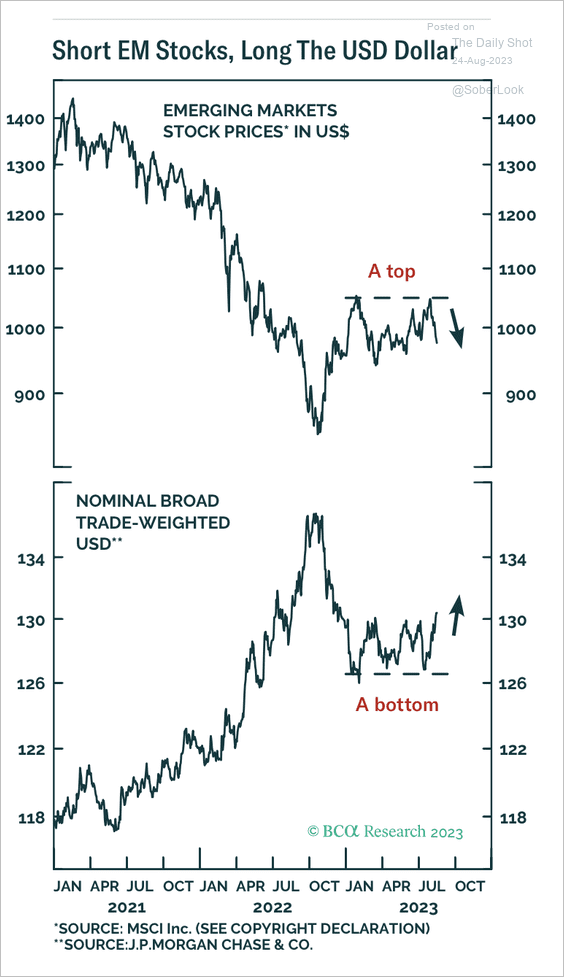

5. EM equities held resistance as the dollar strengthened.

Source: BCA Research

Source: BCA Research

Back to Index

Energy

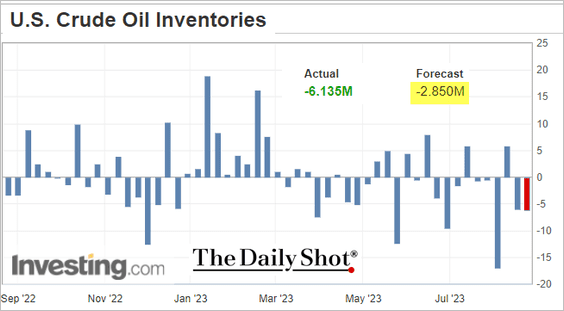

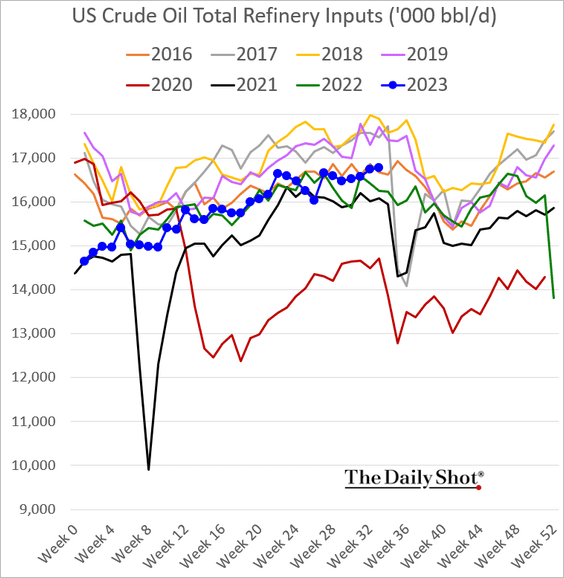

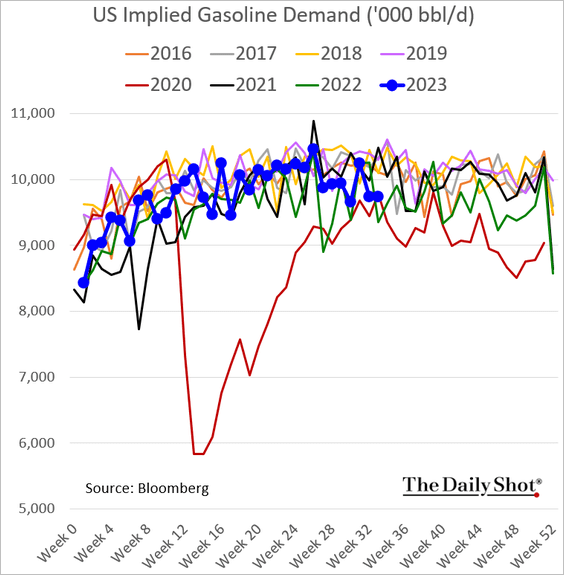

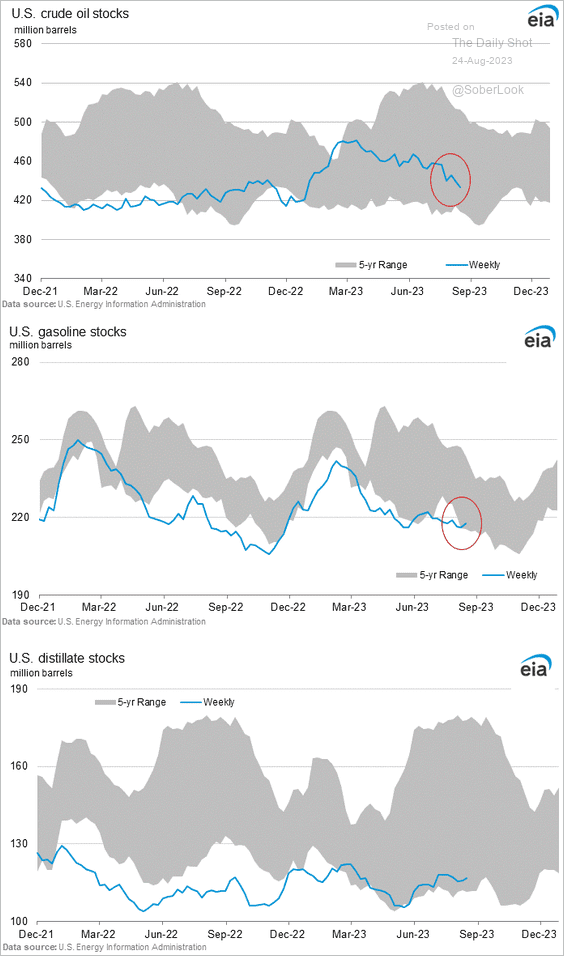

1. US oil inventories saw another sharp decline last week, …

… as refinery runs climbed.

Source: Reuters Read full article

Source: Reuters Read full article

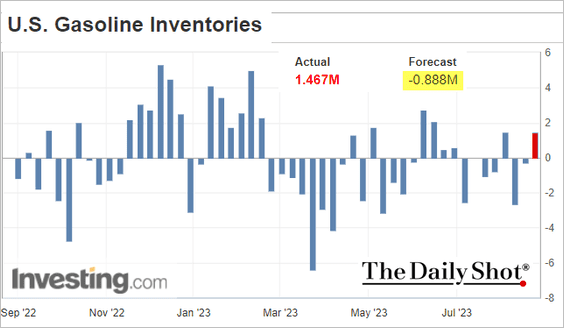

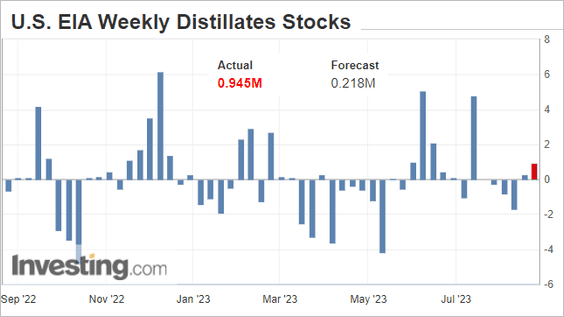

• However, refined product inventories increased.

Gasoline demand remains relatively soft.

• Here are the inventory levels.

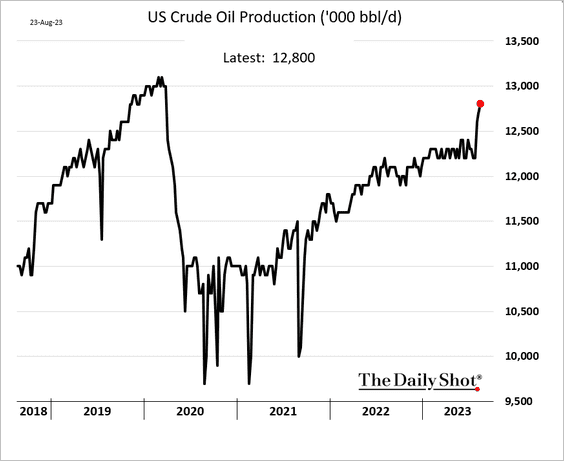

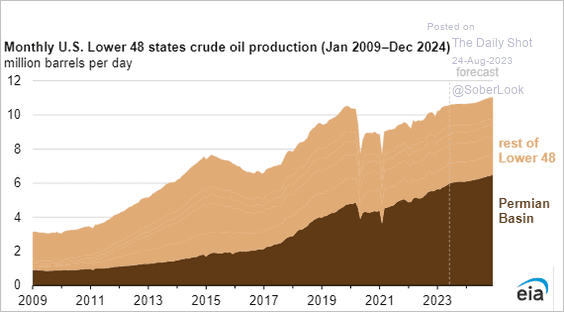

2. US crude oil production climbed again last week, …

… and is expected to clear the pre-COVID peak in the months ahead.

Source: @EIAgov

Source: @EIAgov

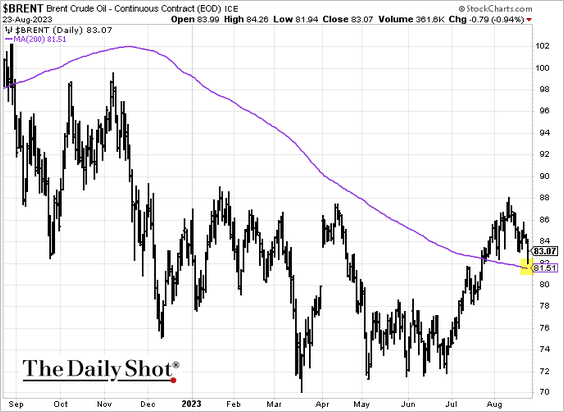

3. Brent crude declined on Wednesday but held support at the 200-day moving average.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

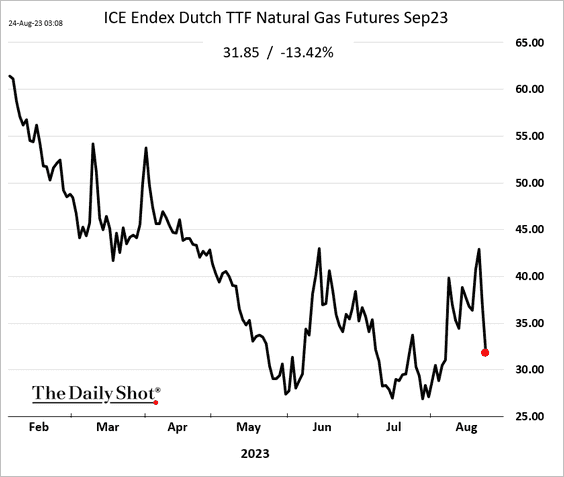

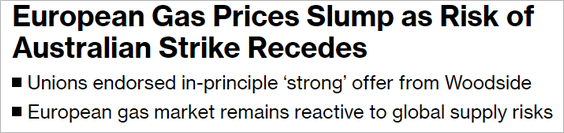

4. European natural gas futures dropped sharply this week.

Source: @markets Read full article

Source: @markets Read full article

——————–

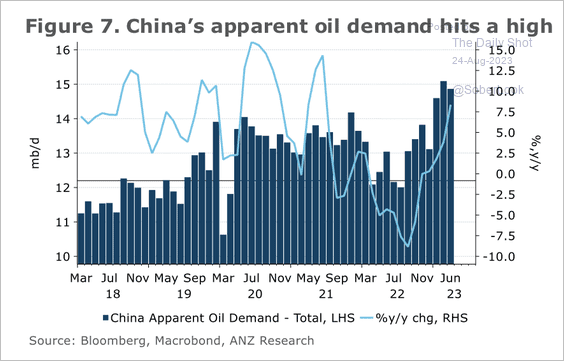

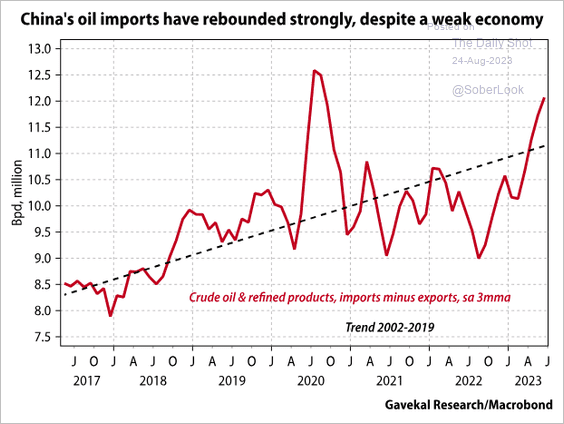

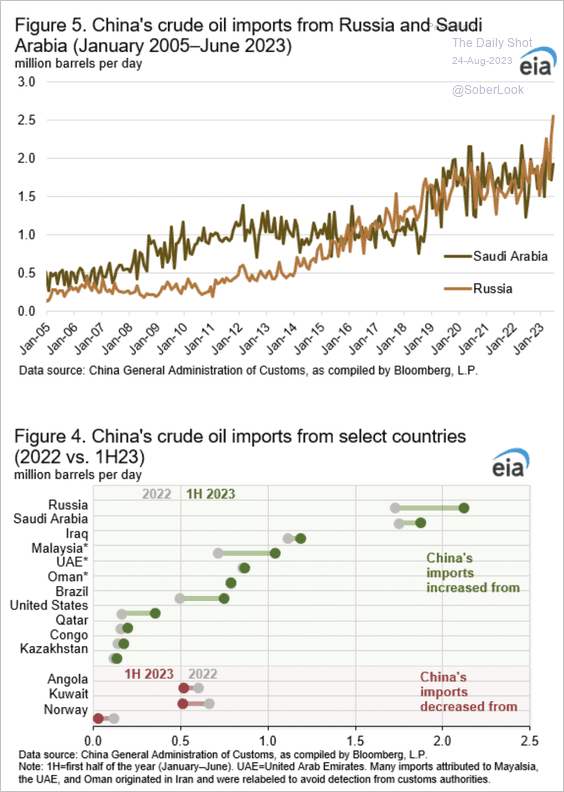

5. So far, China’s oil demand has been resilient despite the economic slowdown. (3 charts)

Source: @ANZ_Research

Source: @ANZ_Research

Source: Gavekal Research

Source: Gavekal Research

Source: @EIAgov

Source: @EIAgov

Back to Index

Equities

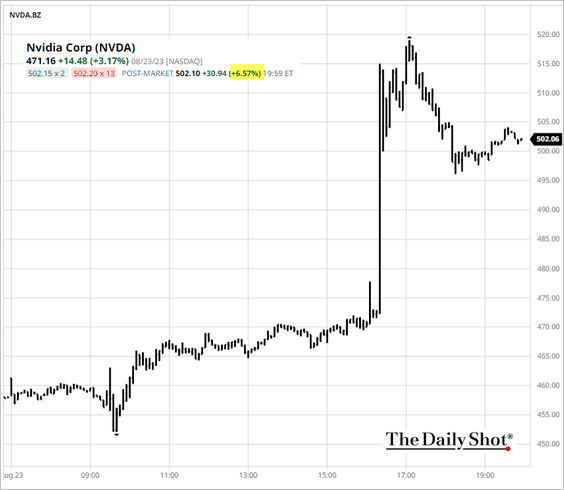

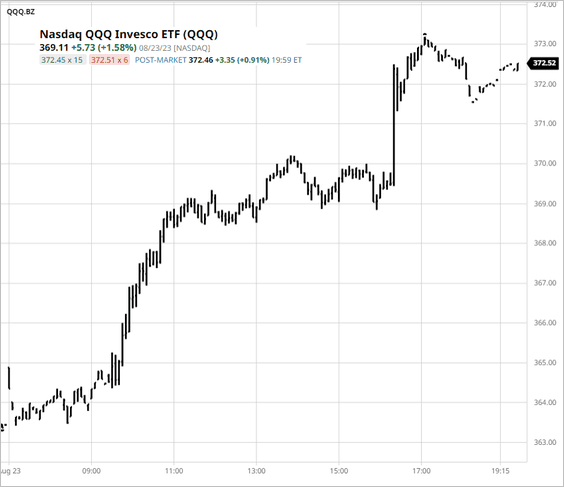

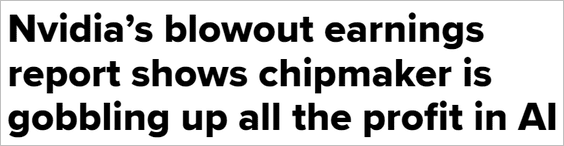

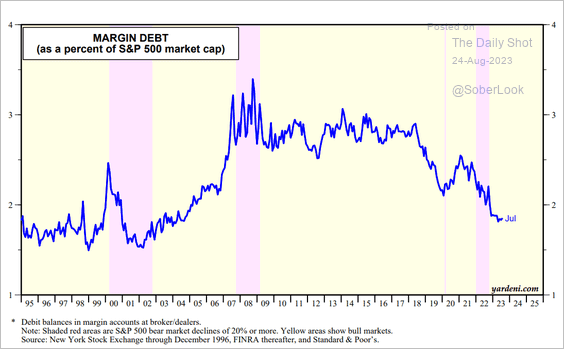

1. The market liked what it heard from Nvidia.

Source: barchart.com

Source: barchart.com

Source: barchart.com

Source: barchart.com

Source: CNBC Read full article

Source: CNBC Read full article

Stock futures are up sharply.

——————–

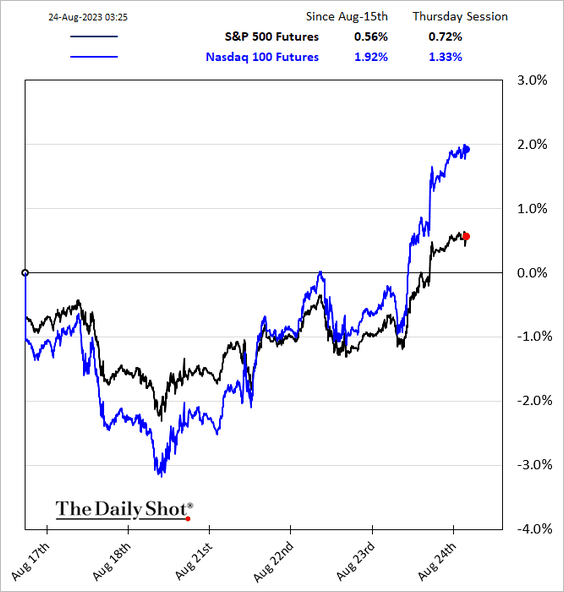

2. The Nasdaq Composite breadth has been weak during this year’s rally.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

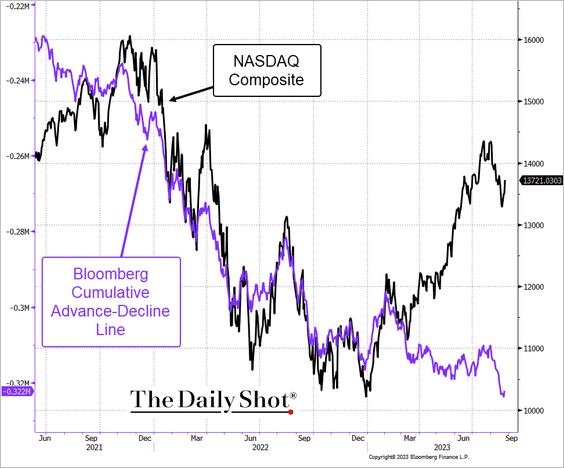

3. Margin debt has declined sharply as a percentage of market capitalization. Leverage has shifted from stock financing to using options.

Source: Yardeni Research

Source: Yardeni Research

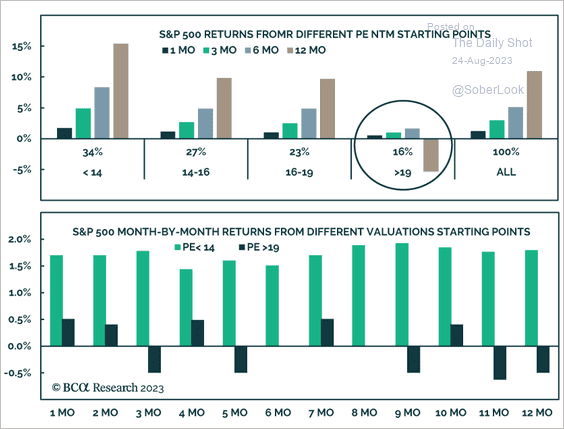

4. Lofty valuations typically mean lackluster returns.

Source: BCA Research

Source: BCA Research

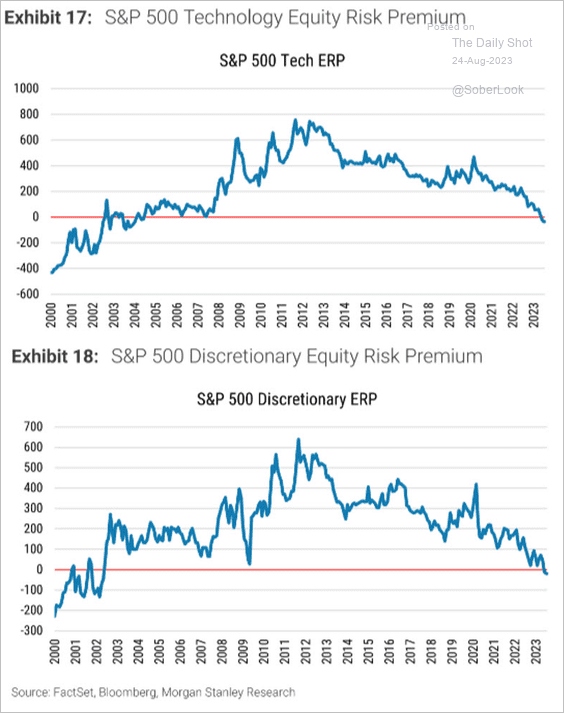

• Equity risk premia for tech and consumer discretionary sectors have turned negative for the first time in years.

Source: Morgan Stanley Research; @dailychartbook

Source: Morgan Stanley Research; @dailychartbook

——————–

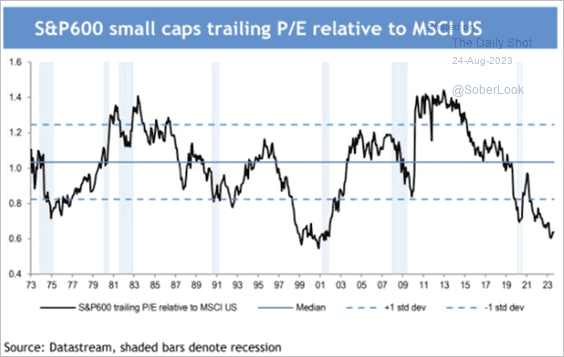

5. US small-cap stocks are trading at the widest discount to the overall market since coming out of the tech bubble.

Source: Tidal Financial Group

Source: Tidal Financial Group

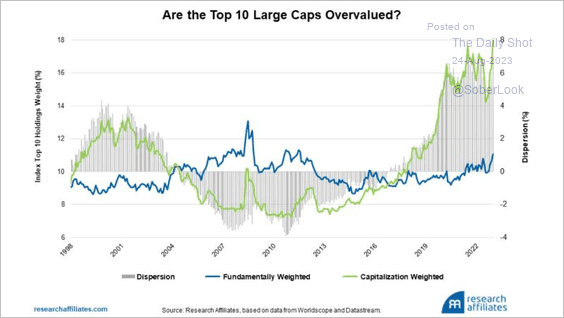

6. The top-10 US large-cap stocks may be significantly overvalued, according to Research Affiliates.

Source: Research Affiliates

Source: Research Affiliates

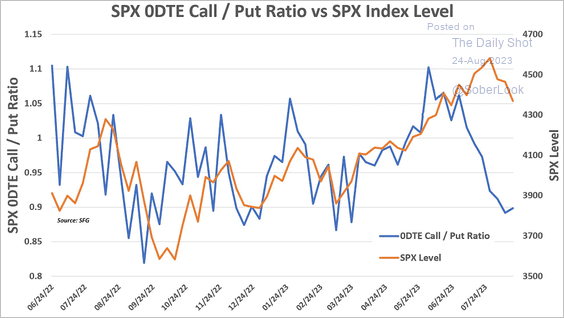

7. Overnight (zero-days-until-expiration) options traders became more cautious in recent weeks.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

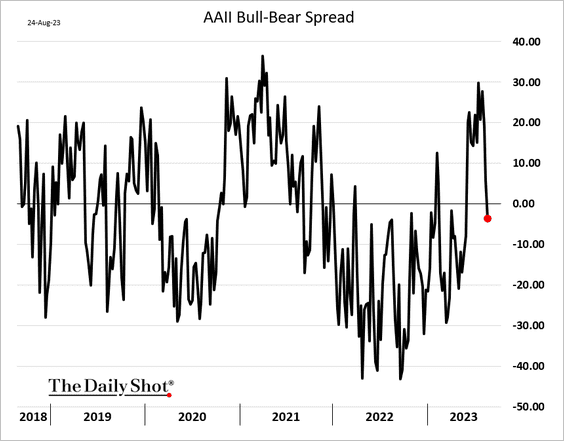

6. Retail investors have turned bearish.

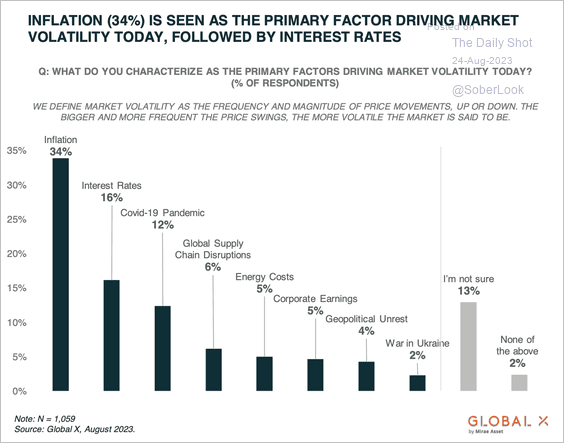

• Most retail investors view inflation as the main factor driving market volatility, according to a survey by Global X ETFs.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

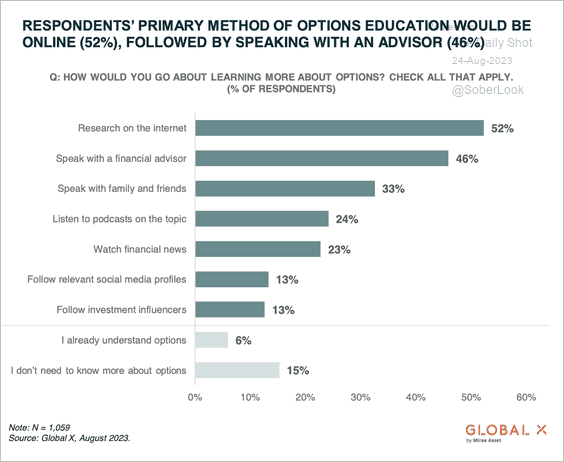

• Retail investors are most likely to research option strategies on the internet, while speaking with a financial advisor came in close second, according to a survey by Global X ETFs.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Back to Index

Alternatives

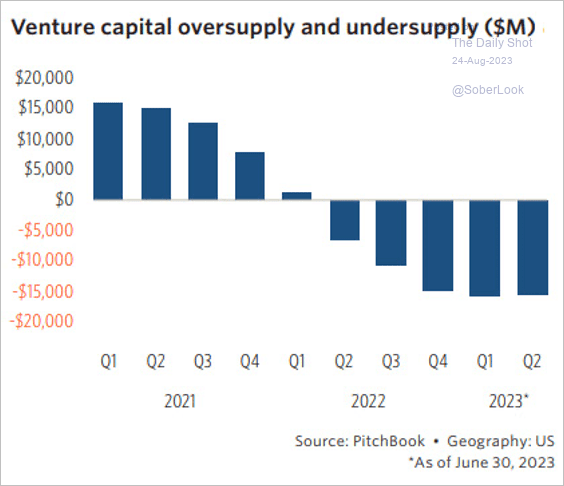

1. US late-stage venture capital companies need about three times more capital than is entering the market.

Source: PitchBook

Source: PitchBook

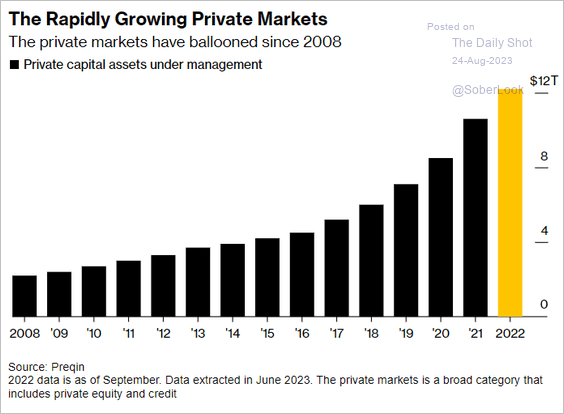

2. This chart shows the total private capital AUM.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Credit

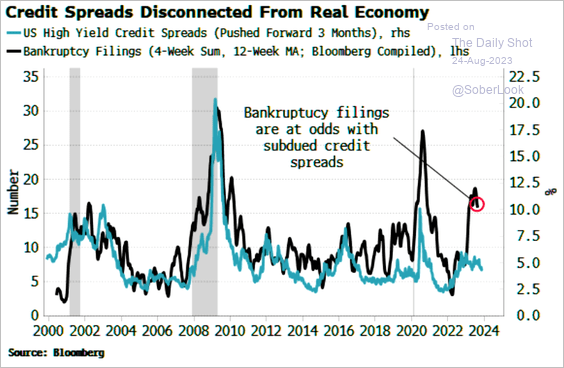

1. Bankruptcy filings suggest that high-yield spreads should be wider.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

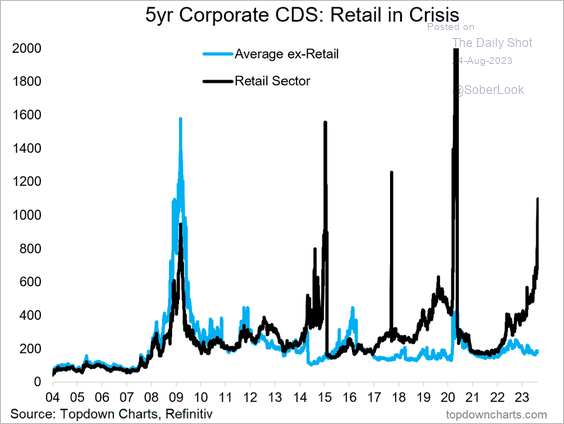

2. Retail-sector CDS spreads have been widening.

Source: @Callum_Thomas

Source: @Callum_Thomas

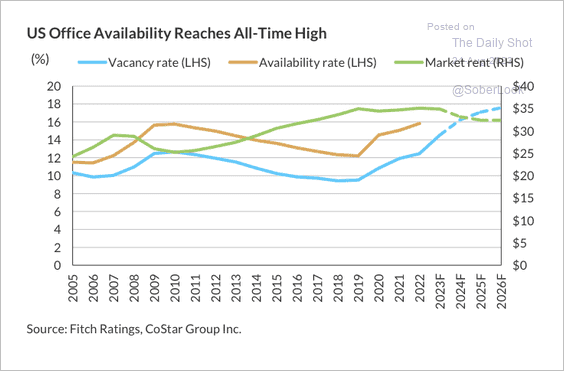

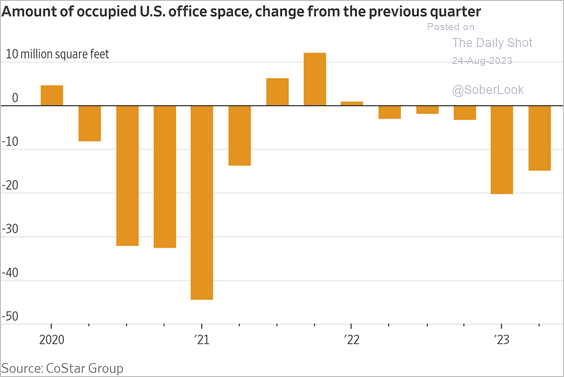

3. Office availability continues to rise, which could pressure rents.

Source: Fitch Ratings

Source: Fitch Ratings

Tenants are renewing their leases but for smaller spaces.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Rates

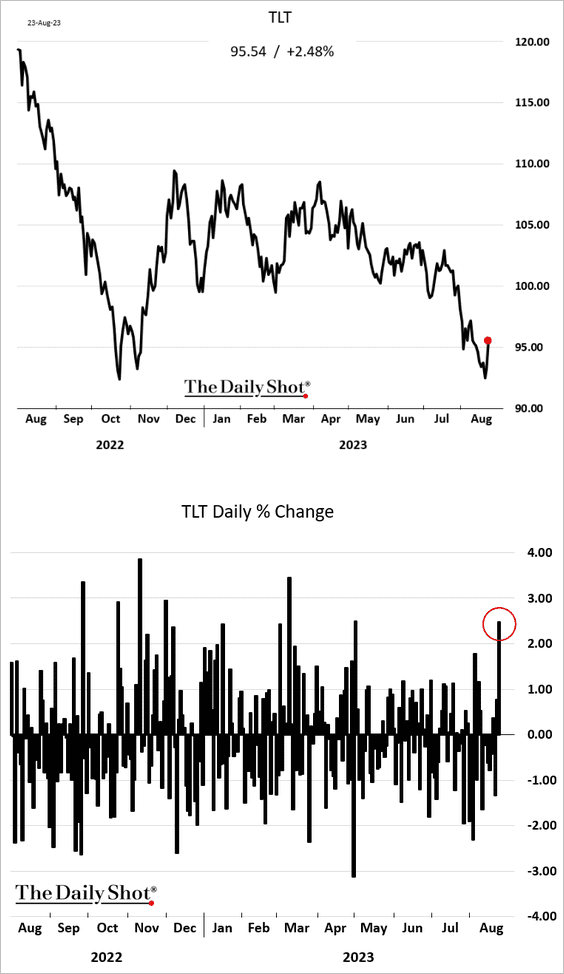

The iShares 20+ Year Treasury Bond ETF (TLT) rose sharply on Wednesday as investors bought longer-dated bonds.

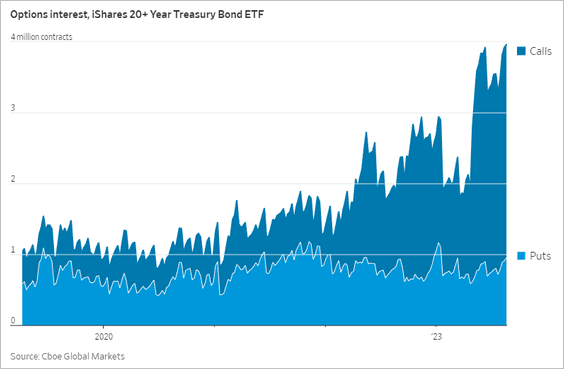

Options traders have been betting on a rebound in longer-dated Treasuries for some time.

Back to Index

Global Developments

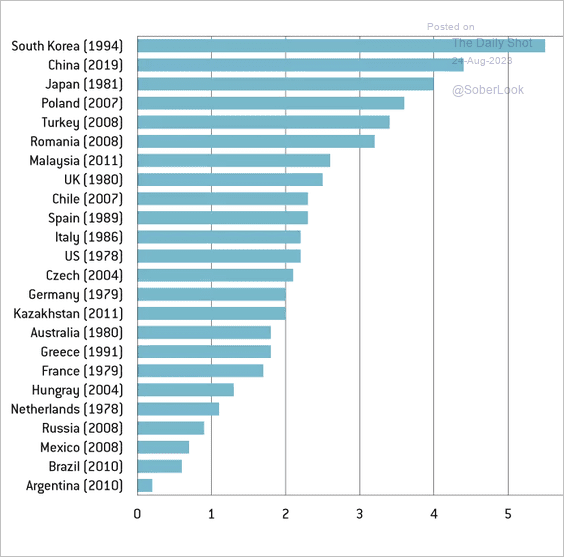

1. Here is a look at average economic growth rates during the ten years after crossing the $10,000 GDP per capita threshold.

Source: Bruegel Read full article

Source: Bruegel Read full article

2. Which countries are most exposed to China?

Source: The Economist Read full article

Source: The Economist Read full article

——————–

Food for Thought

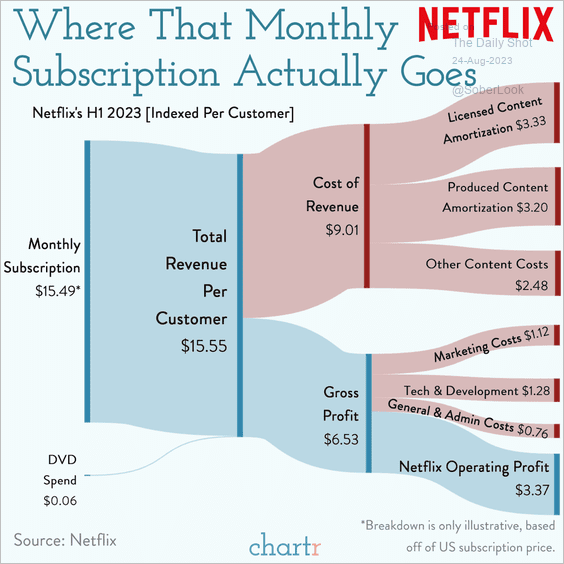

1. How Netflix uses its subscription revenue:

Source: @chartrdaily

Source: @chartrdaily

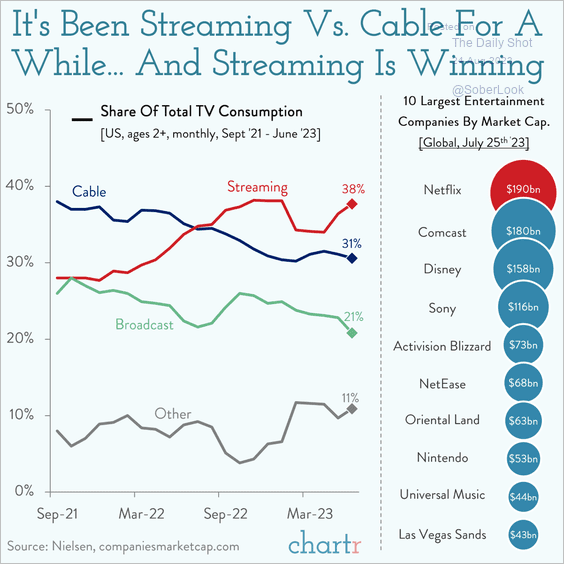

2. Streaming vs. cable:

Source: @chartrdaily

Source: @chartrdaily

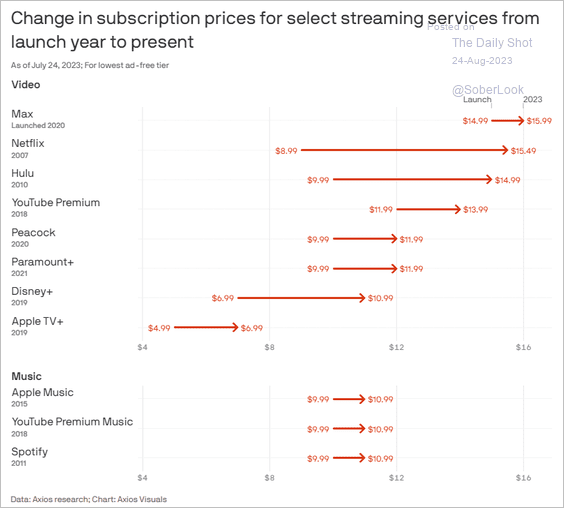

3. Streaming services price increases:

Source: @axios Read full article

Source: @axios Read full article

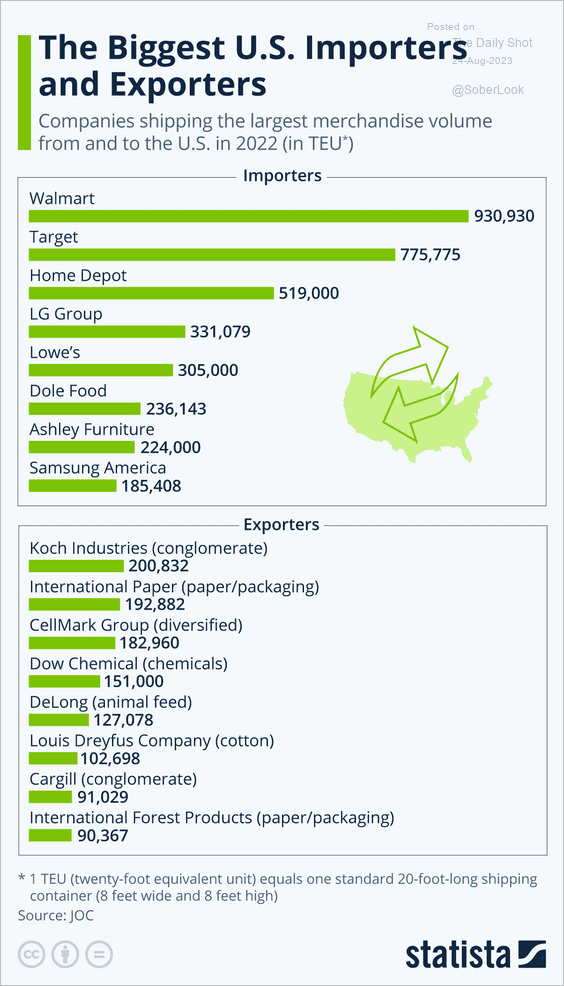

4. The biggest US importers and exporters:

Source: Statista

Source: Statista

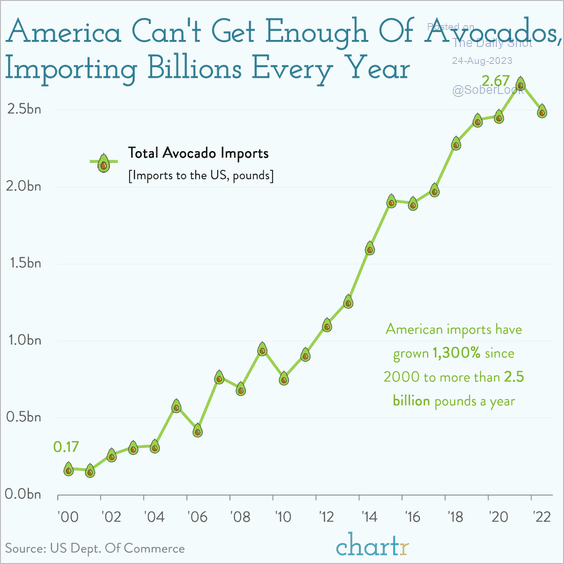

5. US avocado imports:

Source: @chartrdaily

Source: @chartrdaily

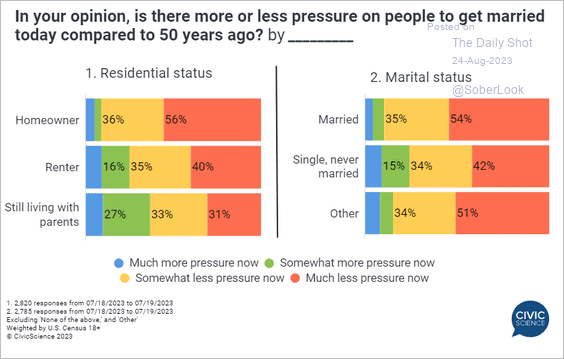

6. Pressure to marry:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

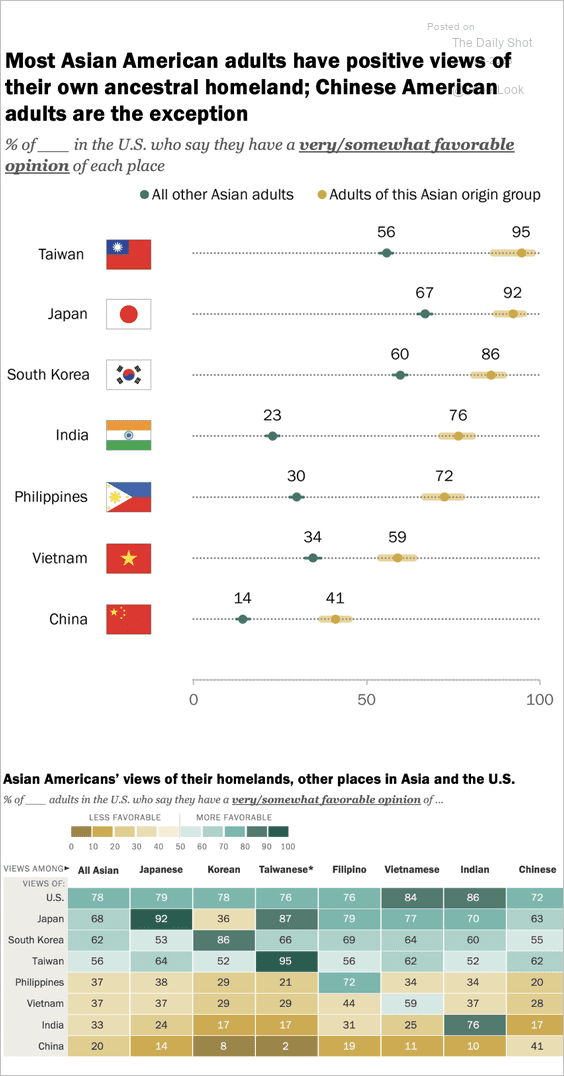

7. Asian Americans’ views on their ancestral homelands:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

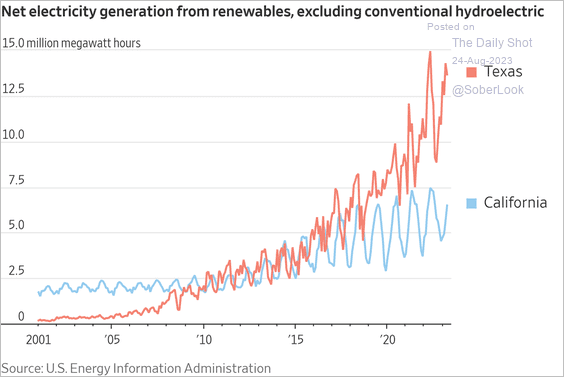

8. Renewables’ electricity generation in California and Texas:

Source: @WSJ Read full article

Source: @WSJ Read full article

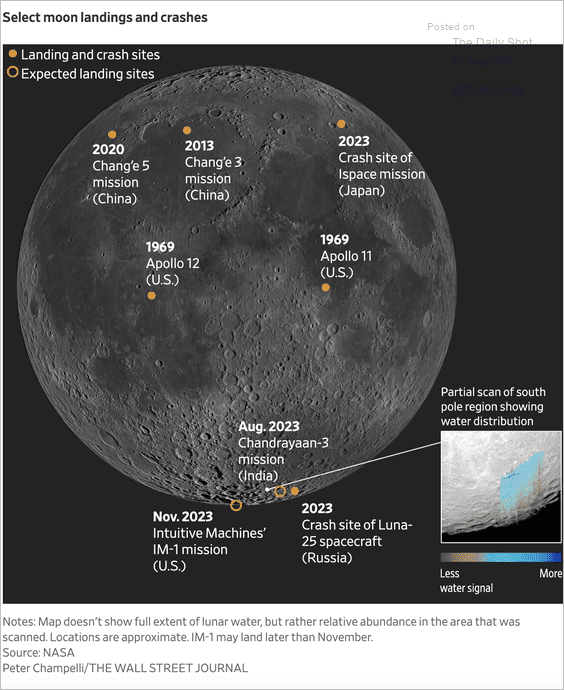

9. Moon landings and crashes:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Back to Index