The Daily Shot: 25-Aug-23

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

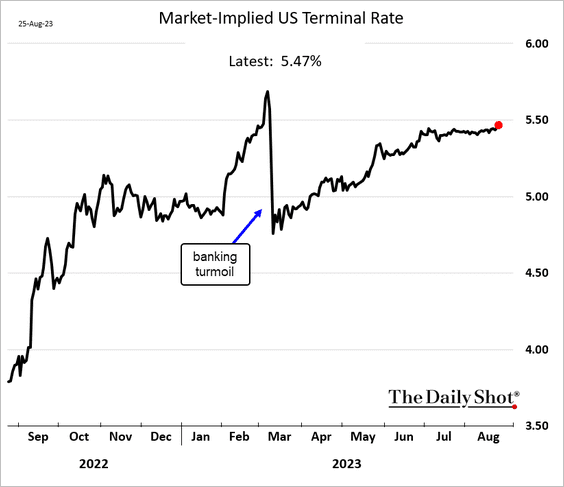

1. The market-implied terminal rate, which represents the maximum expected fed funds rate for the current cycle, reached its highest level since March ahead of the Jackson Hole meeting.

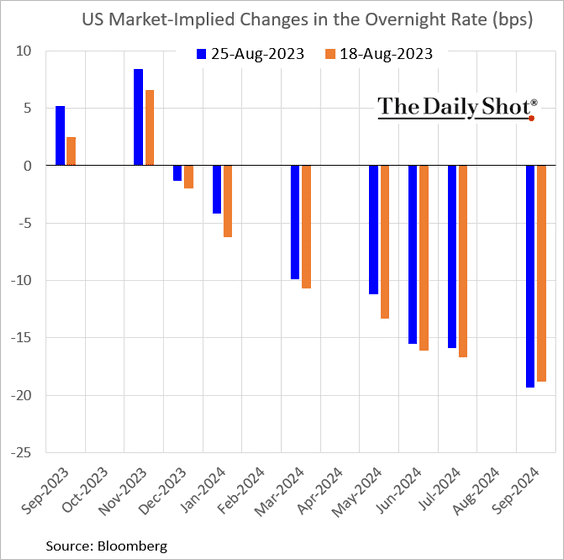

The market currently anticipates slightly more than a 50% chance of another Fed rate hike before shifting to a holding pattern.

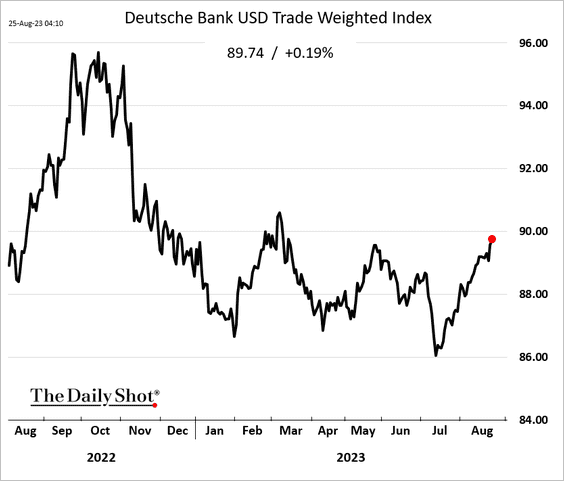

The dollar continues to climb.

——————–

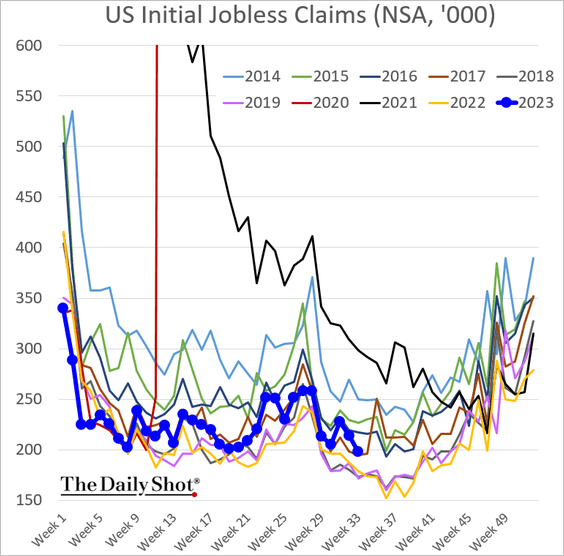

2. Initial jobless claims eased over the past couple of weeks.

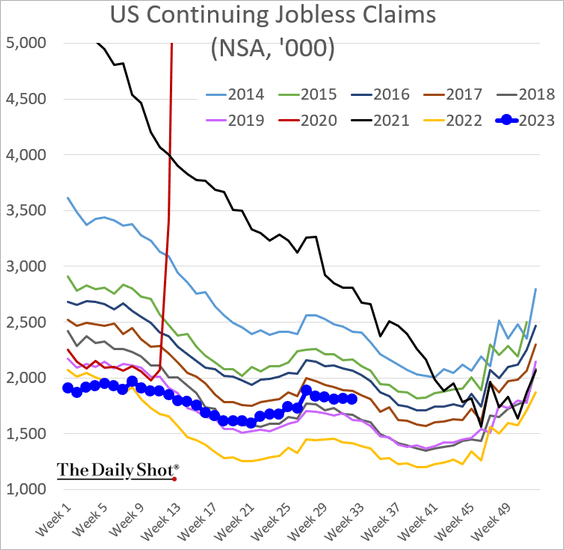

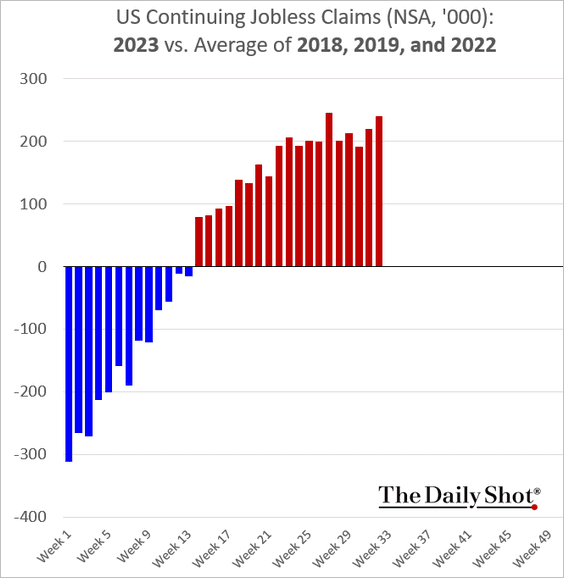

However, continuing jobless claims are still diverging from the usual seasonal pattern.

The trend is clear.

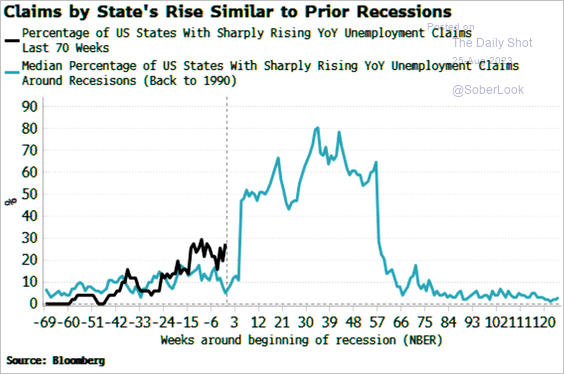

The percentage of states with substantial increases in unemployment claims has been rising.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

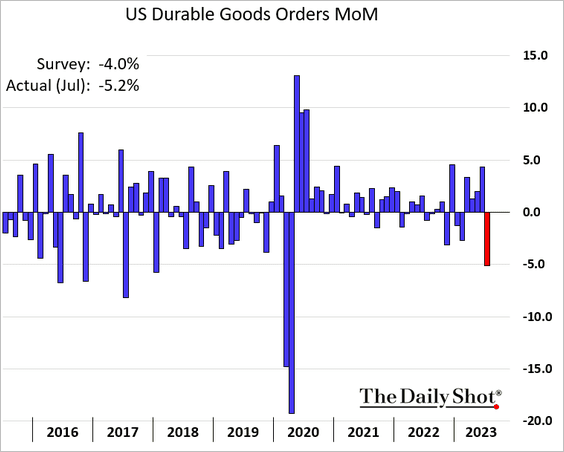

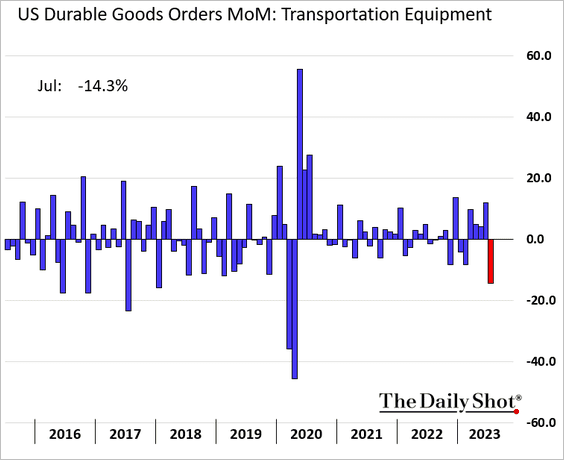

2. Durable goods orders dropped sharply last month, …

… driven by aircraft sales, which tend to be lumpy.

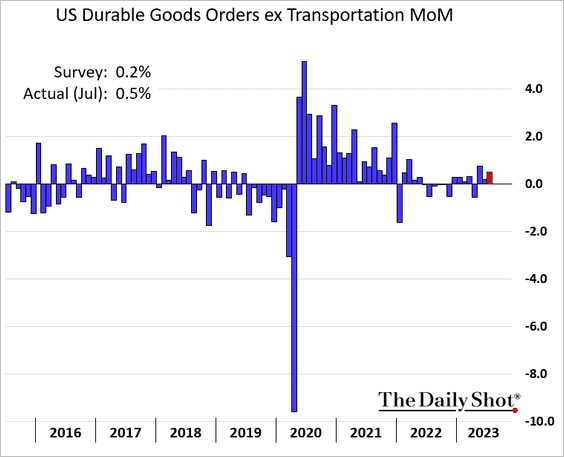

Excluding transportation, orders rose more than expected.

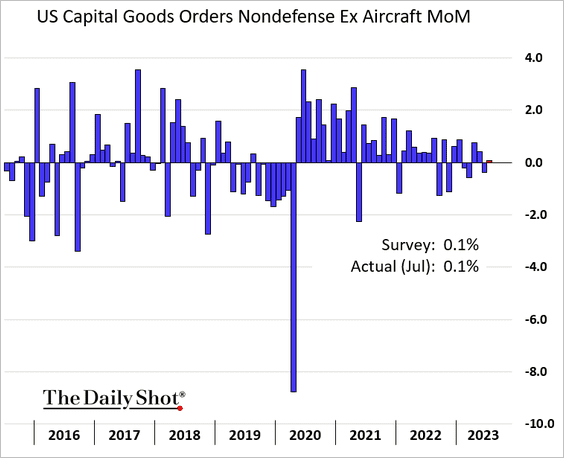

• Core capital goods orders edged higher.

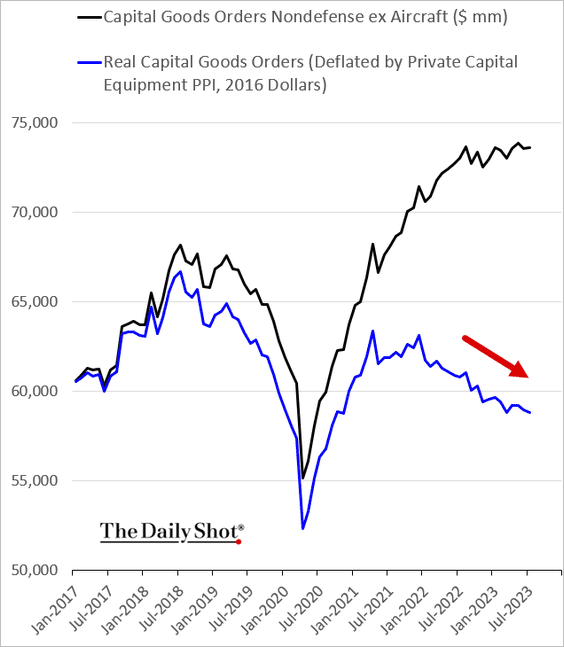

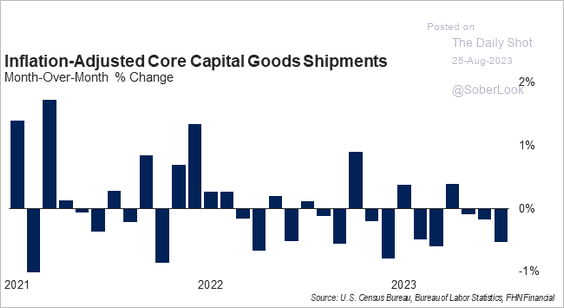

However, adjusted for inflation, capital goods orders continue to decline, suggesting that business investment is softening.

This chart shows the monthly changes in real capital goods shipments.

Source: FHN Financial

Source: FHN Financial

——————–

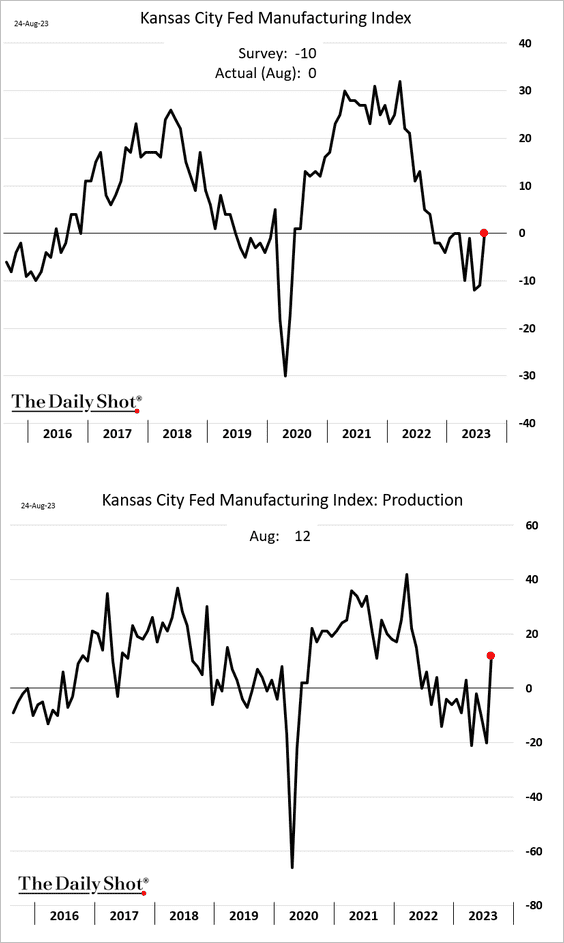

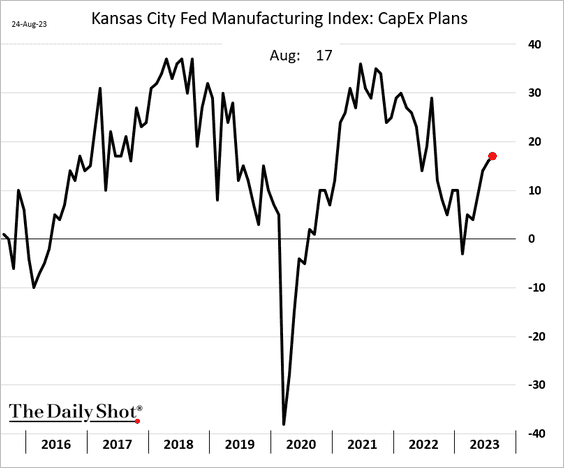

3. The Kansas City Fed’s regional manufacturing survey showed factory activity stabilizing this month. Production jumped.

More firms plan to boost business investment.

——————–

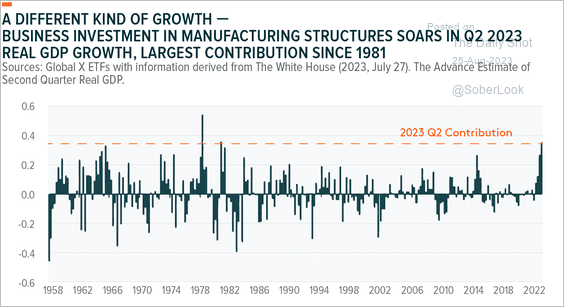

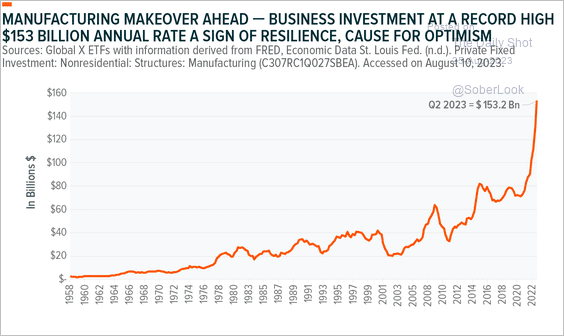

4. Business investment in manufacturing structures soared in Q2, which boosted GDP. (2 charts)

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

——————–

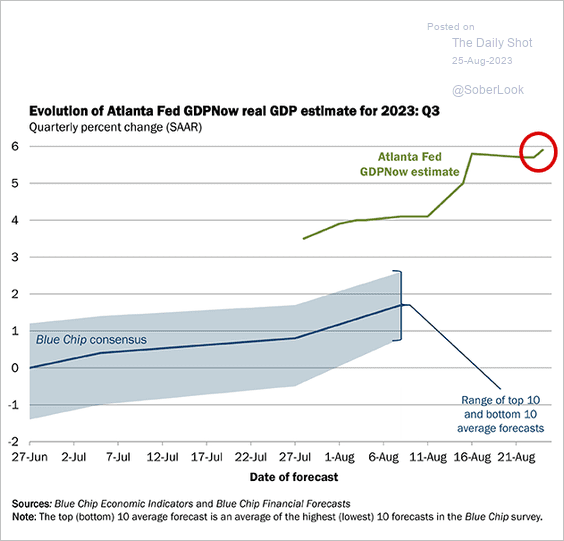

5. The Atlanta Fed’s GDPNow model is tracking the Q3 growth at nearly 6% (annualized). This measure is in sharp contrast with the PMI indicators.

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

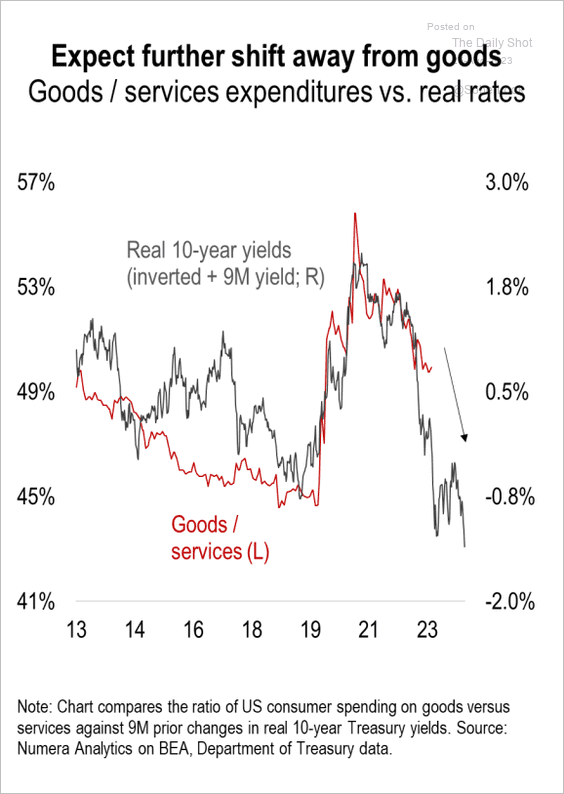

6. Elevated real rates suggest that the spending shift from goods to services will continue.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

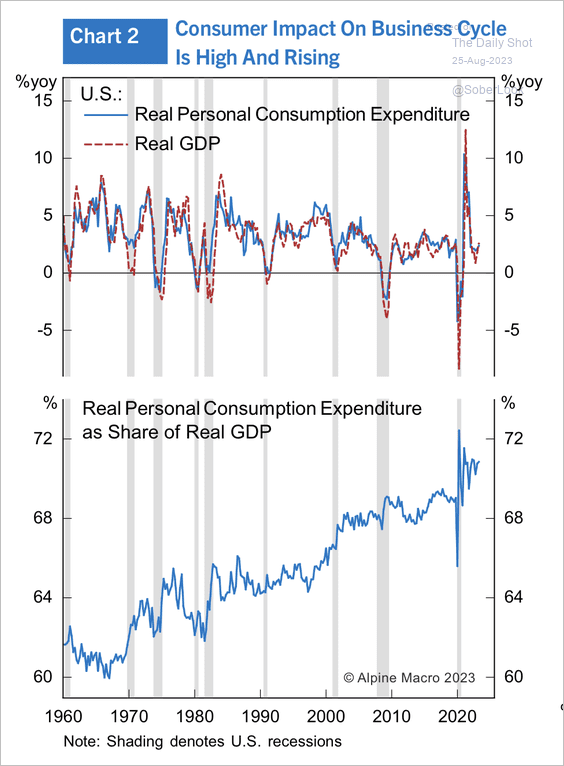

7. Consumption keeps growing as a share of US GDP.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

The United Kingdom

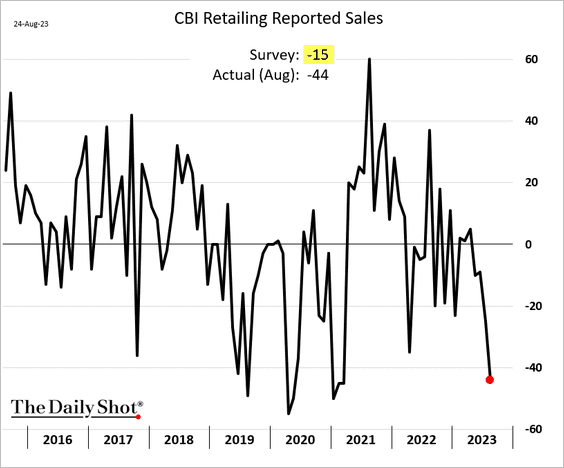

1. The CBI report showed deteriorating retail sales this month.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

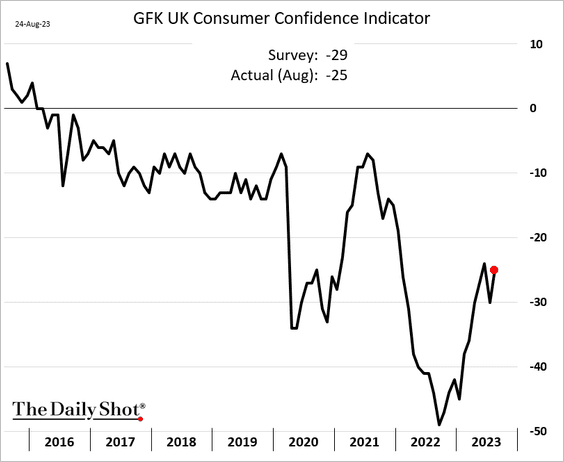

2. Consumer confidence unexpectedly improved in August.

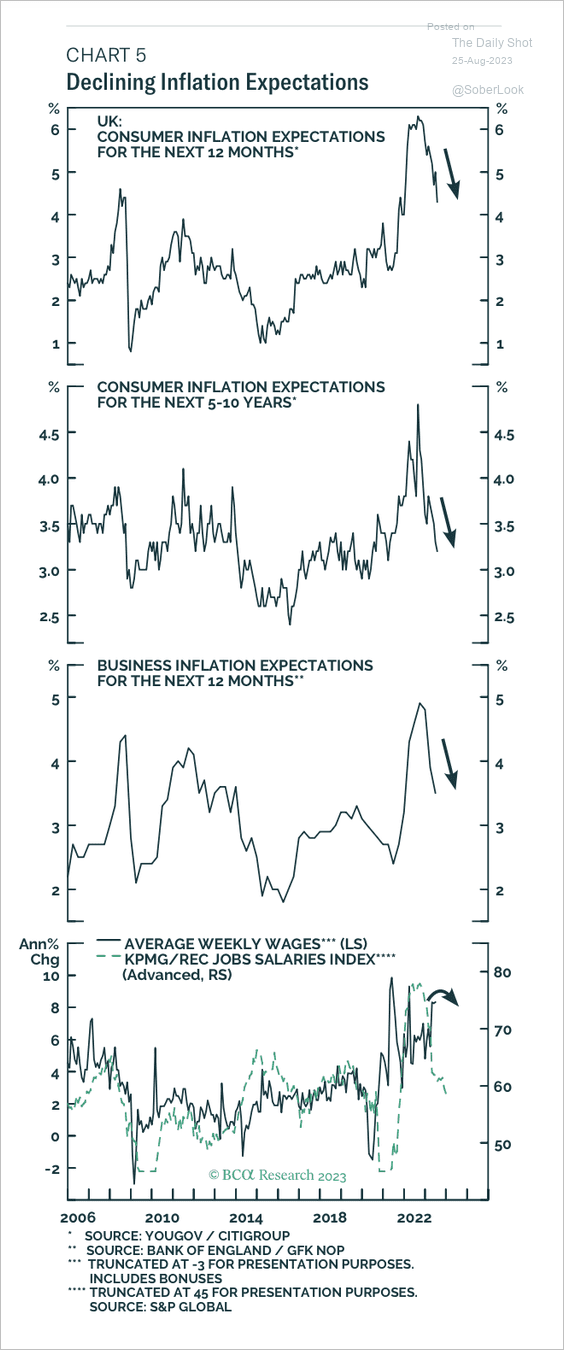

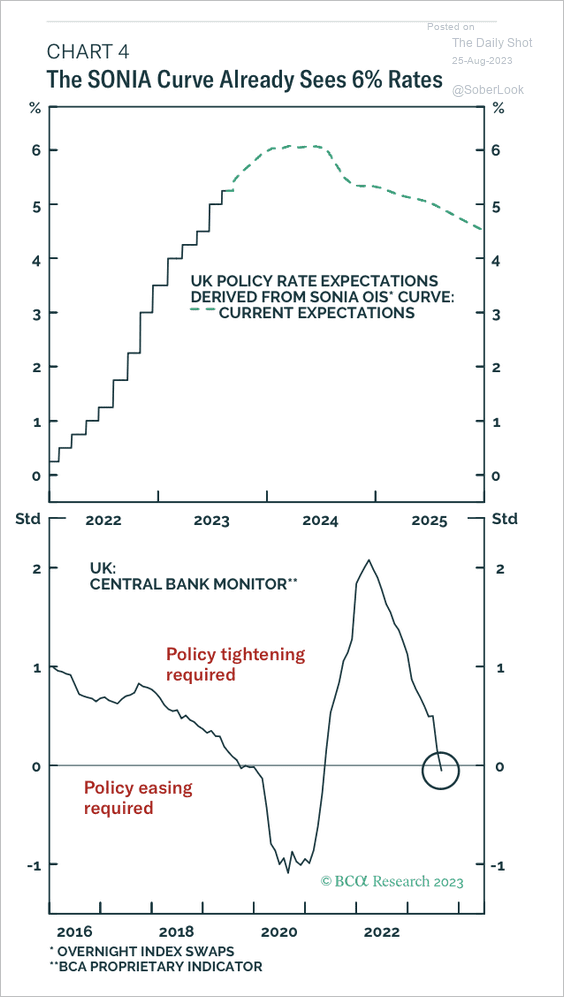

3. Inflation expectations are declining, although rates could peak at 6% and remain at elevated levels for some time. (2 charts)

Source: BCA Research

Source: BCA Research

Source: BCA Research

Source: BCA Research

——————–

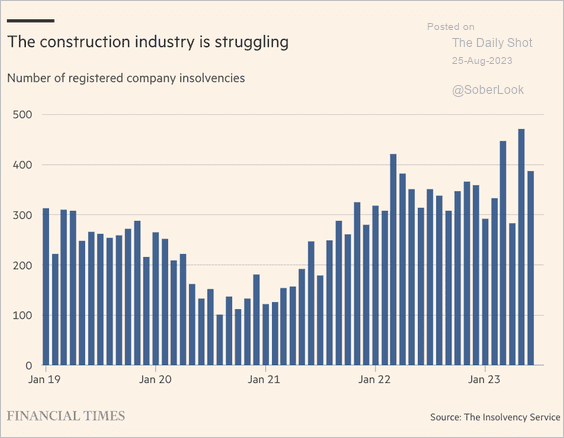

4. Construction sector insolvencies remain elevated.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

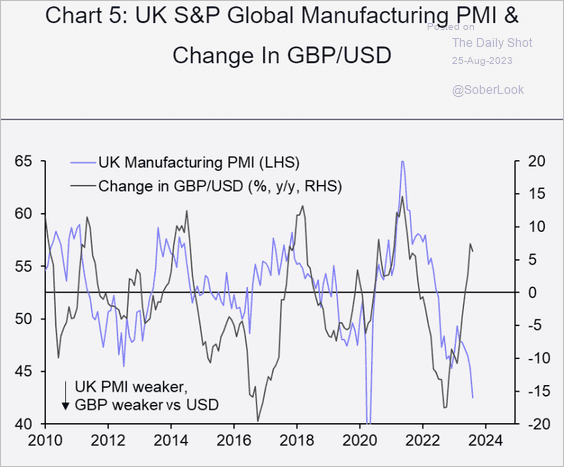

5. The manufacturing PMI weakness (see chart) signals downside risks for the pound.

Source: Capital Economics

Source: Capital Economics

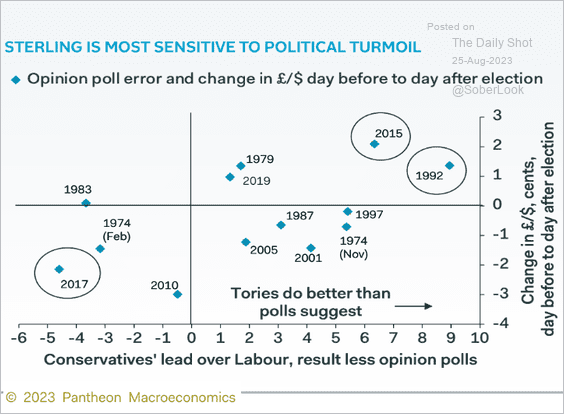

6. How does the pound respond to election surprises?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

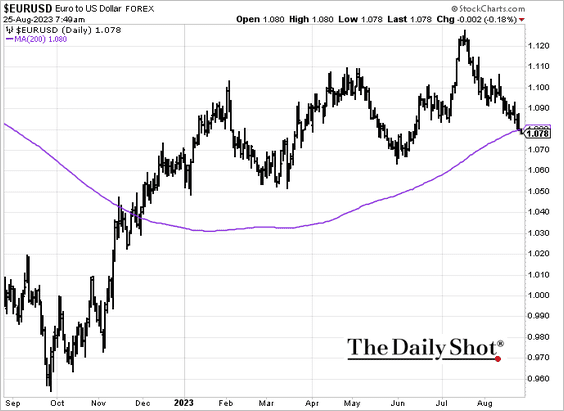

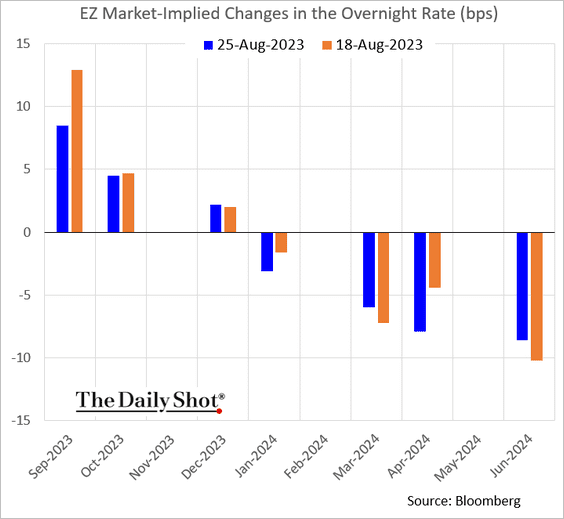

1. The euro dipped below its 200-day moving average, …

… as markets downshifted ECB rate hike expectations after the disappointing August PMI report (see chart).

——————–

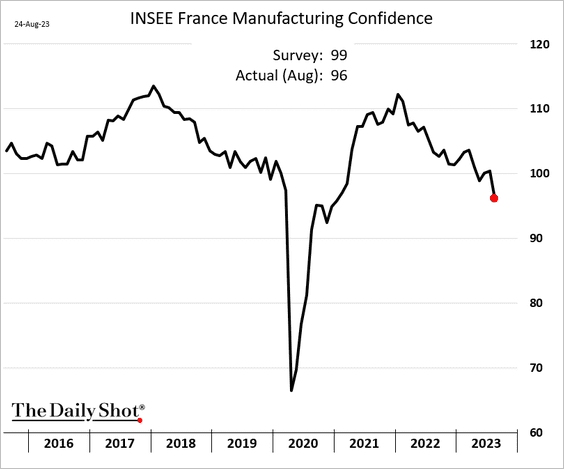

2. French manufacturing confidence surprised to the downside this month.

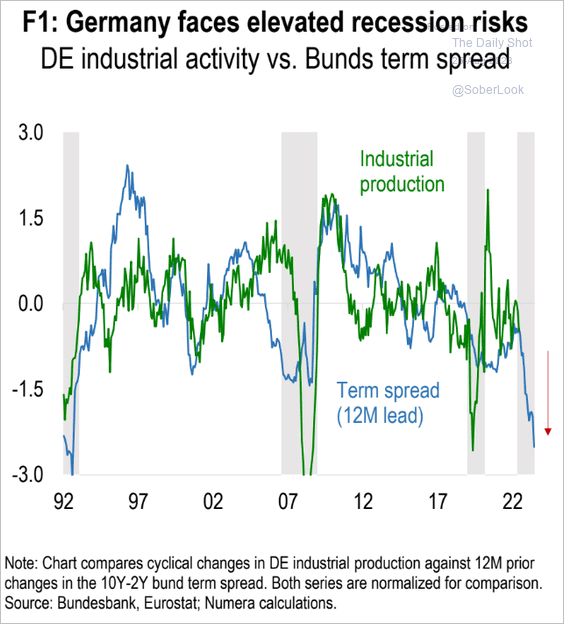

3. The Bund curve inversion signals headwinds for Germany’s industrial production.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

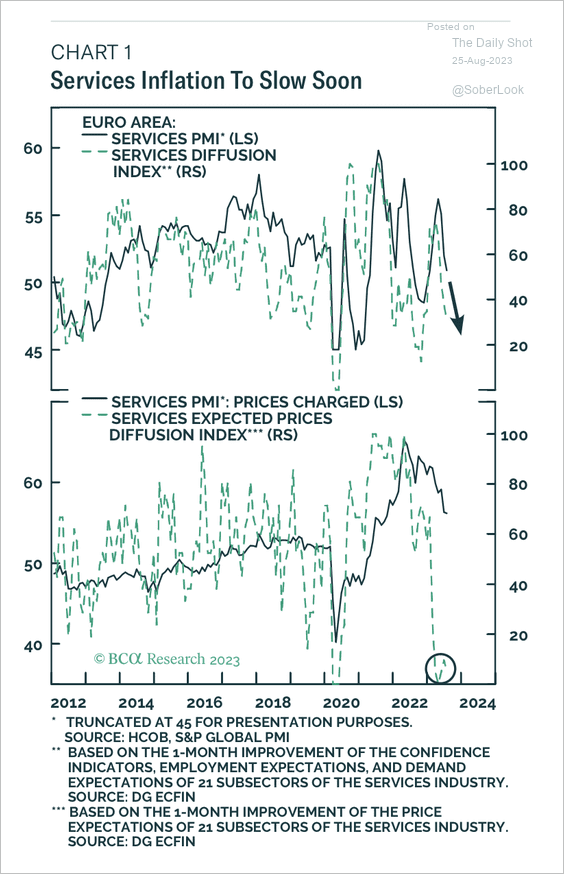

4. Euro-area services inflation will likely decline over the coming months.

Source: BCA Research

Source: BCA Research

Back to Index

Europe

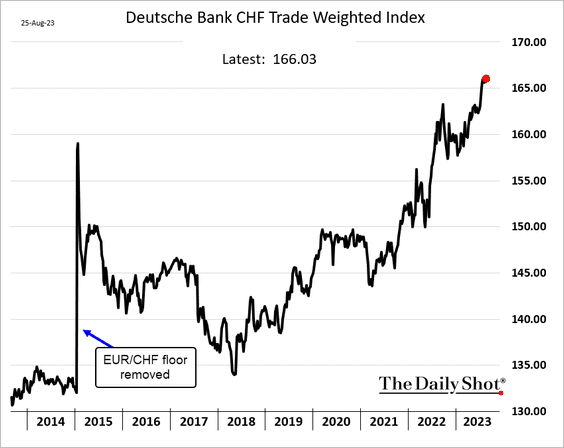

1. The Swiss franc trade-weighted index continues to surge.

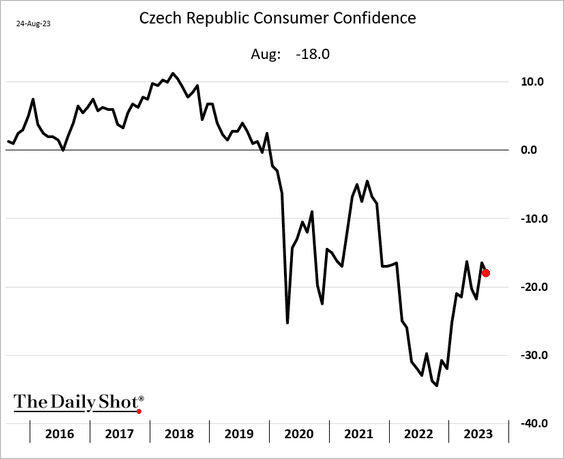

2. Czech consumer confidence edged lower this month, …

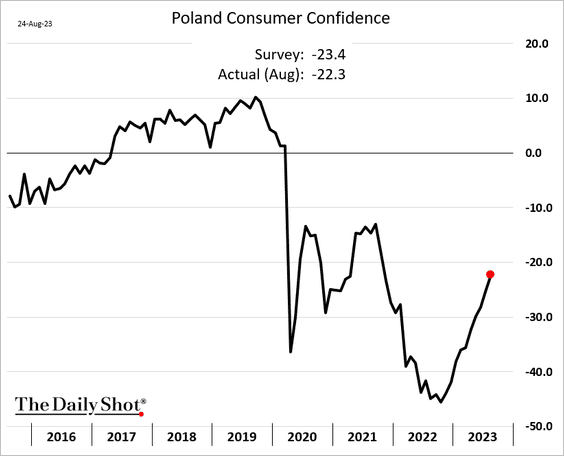

… but Poland’s sentiment keeps rising.

Back to Index

Japan

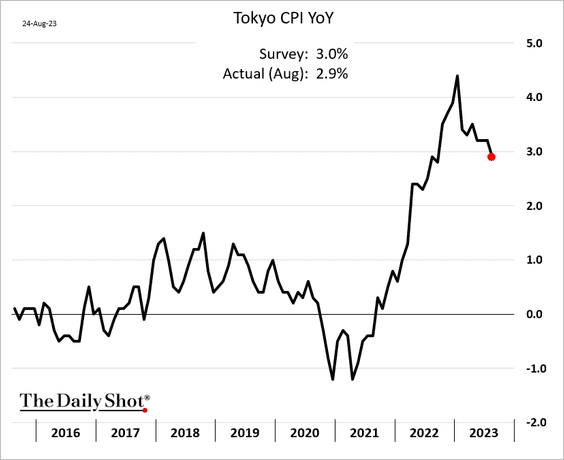

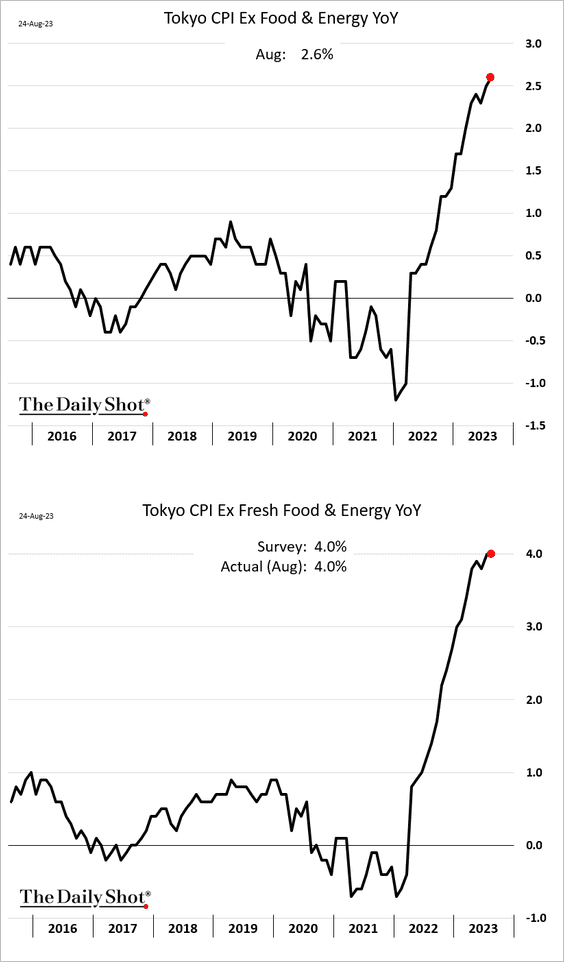

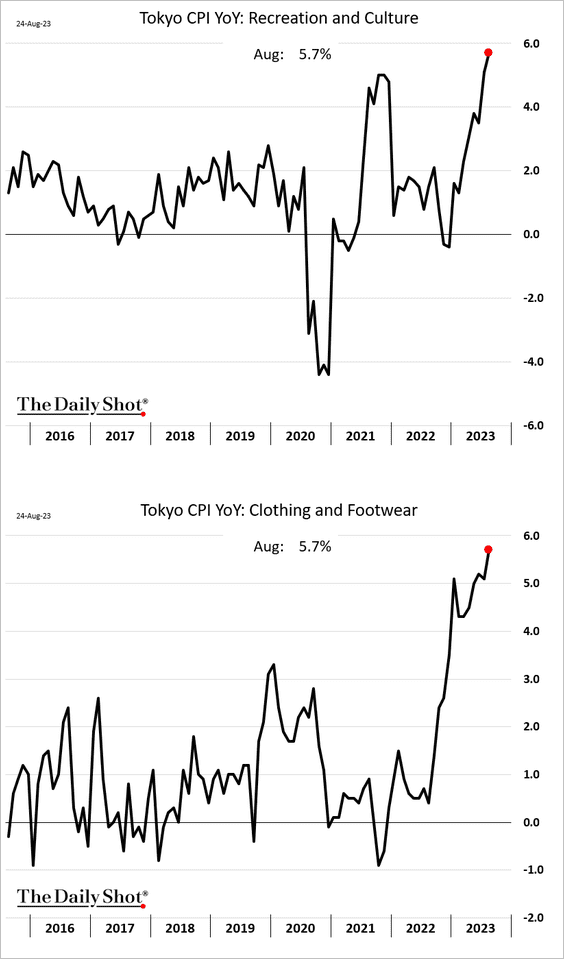

1. The Tokyo CPI continued to ease in August.

However, core inflation remains sticky.

Here are a couple of examples.

——————–

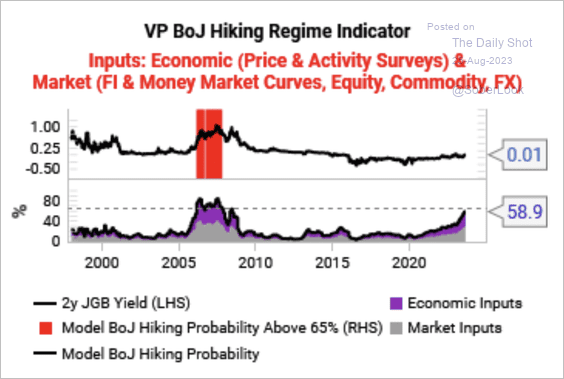

2. According to Variant Perception, a mix of elevated inflation and labor market data raises the chance of a BoJ hiking cycle.

Source: Variant Perception

Source: Variant Perception

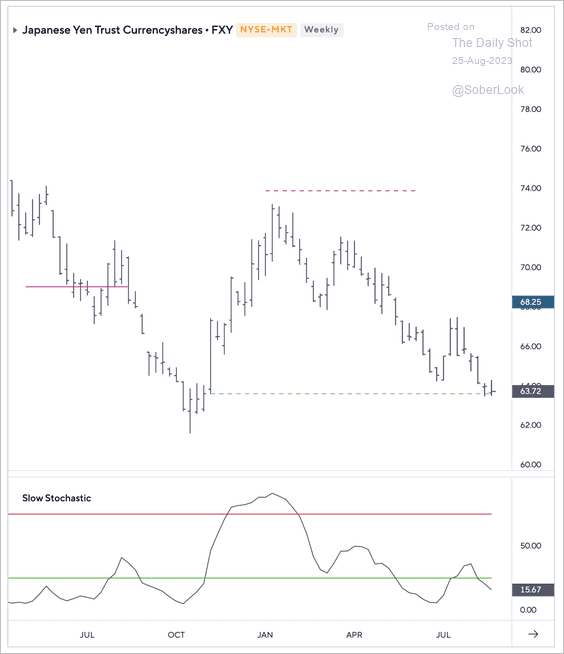

Could a BoJ rate hike trigger a yen short-squeeze? The Invesco CurrencyShares Japanese Yen ETF (FXY) is oversold and near long-term support.

Source: Symbolik

Source: Symbolik

Back to Index

Asia-Pacific

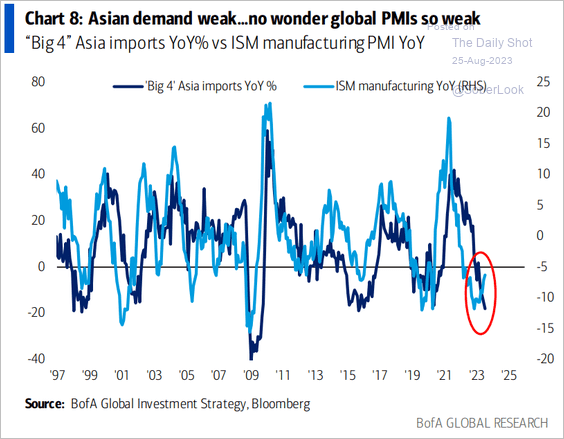

1. Asian imports have been soft, pressuring global manufacturing demand.

Source: BofA Global Research

Source: BofA Global Research

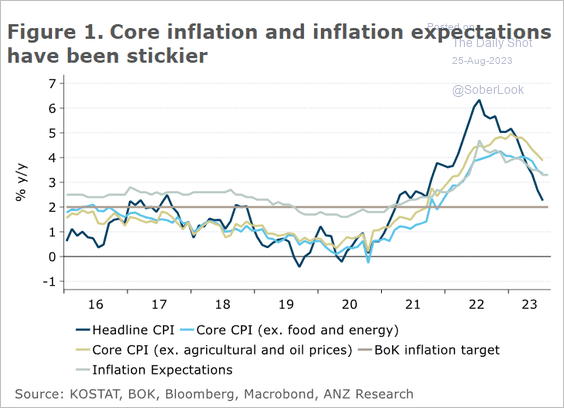

2. Next, we have some updates on South Korea.

• The BoK maintains its hawkish stance as core inflation and inflation expectations remain sticky.

Source: @ANZ_Research

Source: @ANZ_Research

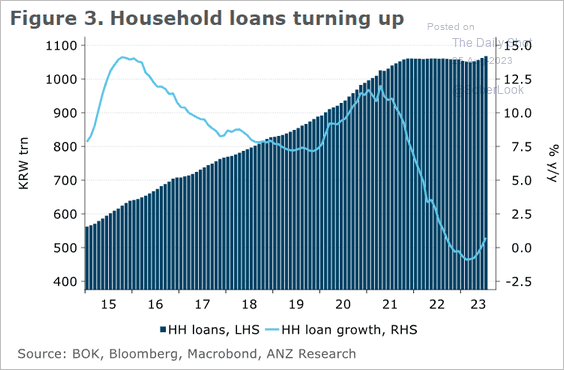

• Household loan balances are turning higher.

Source: @ANZ_Research

Source: @ANZ_Research

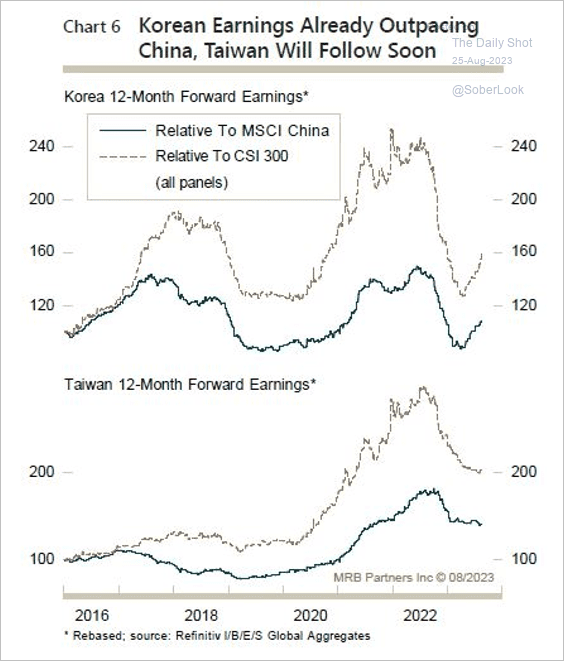

• South Korean corporate earnings are improving relative to China.

Source: MRB Partners

Source: MRB Partners

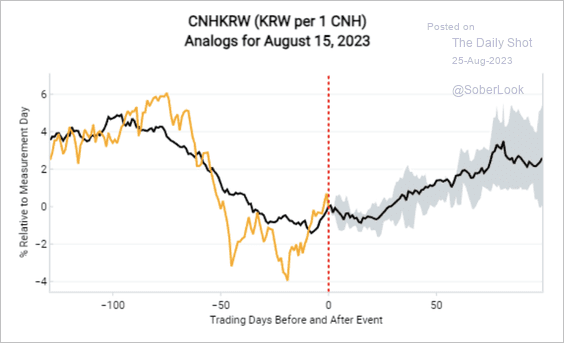

• Variant Perception’s model forecasts further upside for CNH/KRW, possibly indicating a more dovish Bank of Korea.

Source: Variant Perception

Source: Variant Perception

Back to Index

China

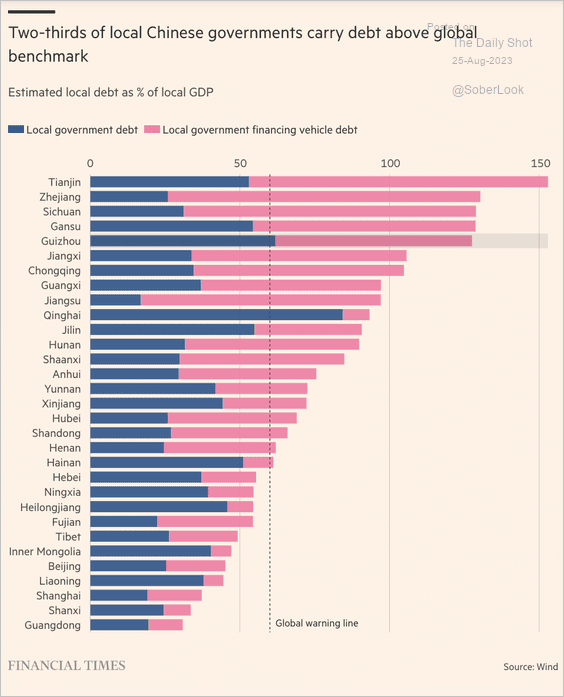

1. Let’s begin with some data on local government debt.

• Local governments are heavily leveraged:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

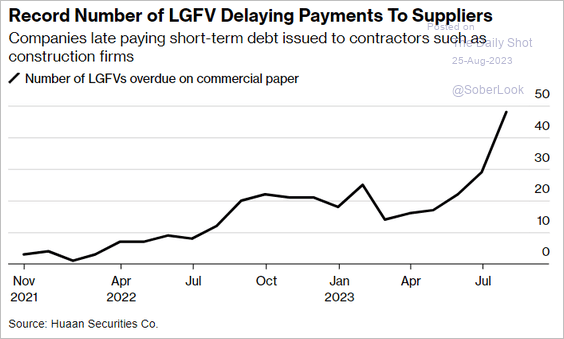

• Many LGFVs are behind on their debt payments, …

Source: @markets Read full article

Source: @markets Read full article

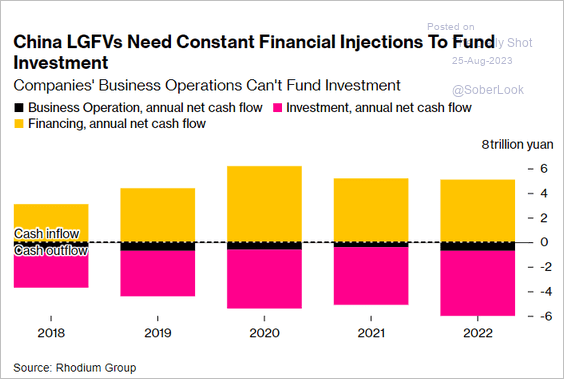

… and bleeding cash.

Source: @markets Read full article

Source: @markets Read full article

——————–

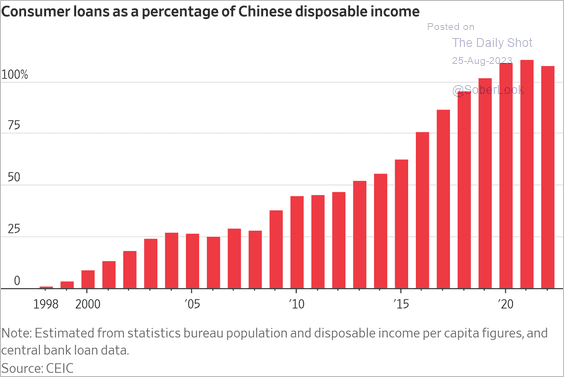

2. Consumers are leveraged, …

Source: @WSJ Read full article

Source: @WSJ Read full article

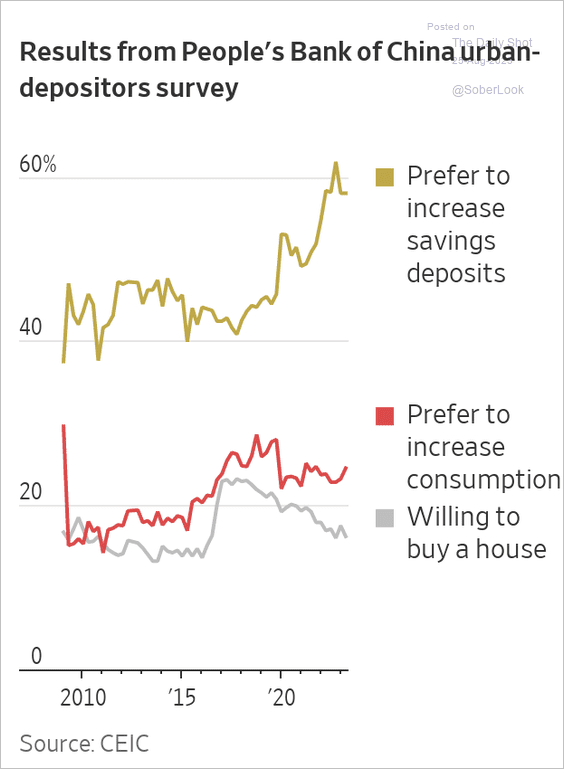

… and remain cautious.

Source: @WSJ Read full article

Source: @WSJ Read full article

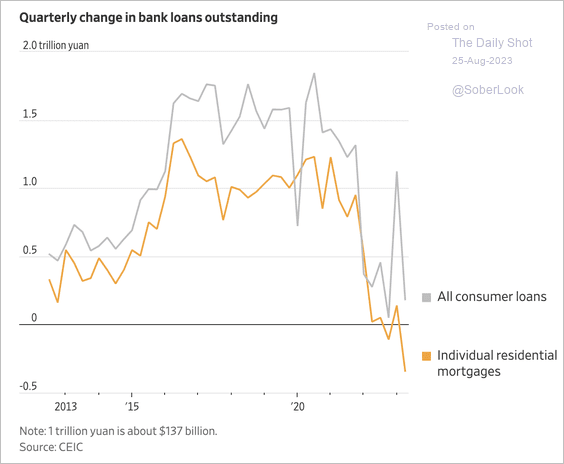

Households’ borrowing has slowed.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

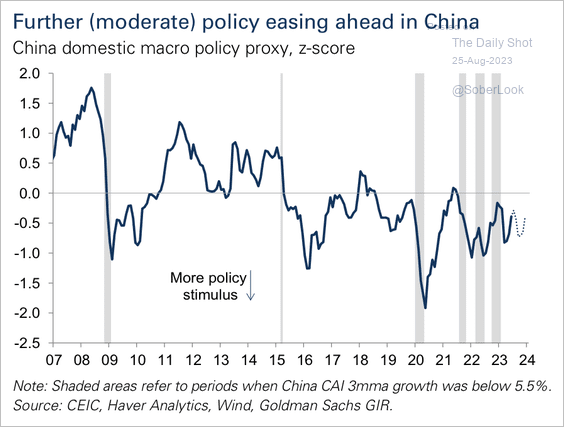

3. Goldman expects only moderate policy easing – a stark contrast from previous economic downturns.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Emerging Markets

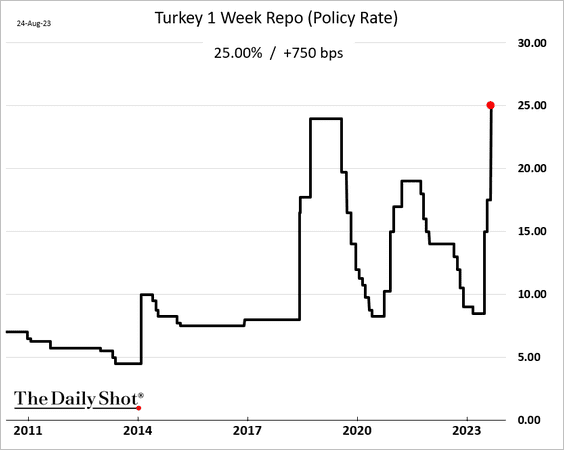

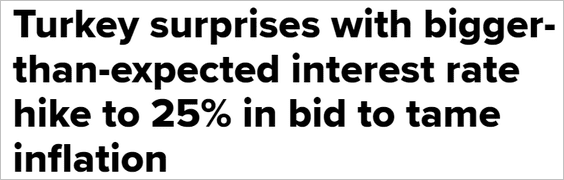

1. Turkey’s central bank surprised with a 750 bps rate hike, as Hafize Gaye Erkan pursues a more traditional monetary policy.

Source: CNBC Read full article

Source: CNBC Read full article

• The lira surged but is reversing some of the gains today.

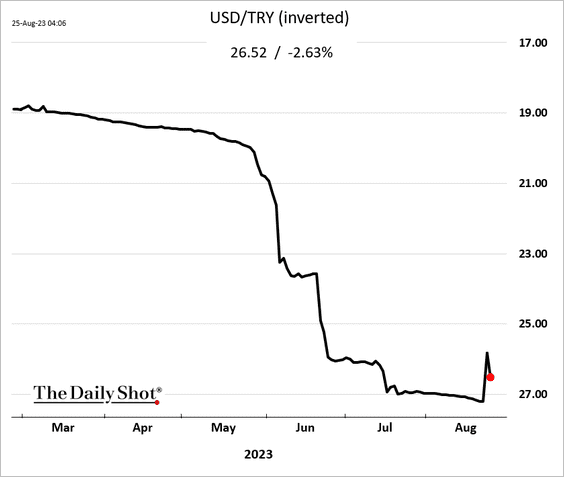

• The yield curve shifted sharply higher.

——————–

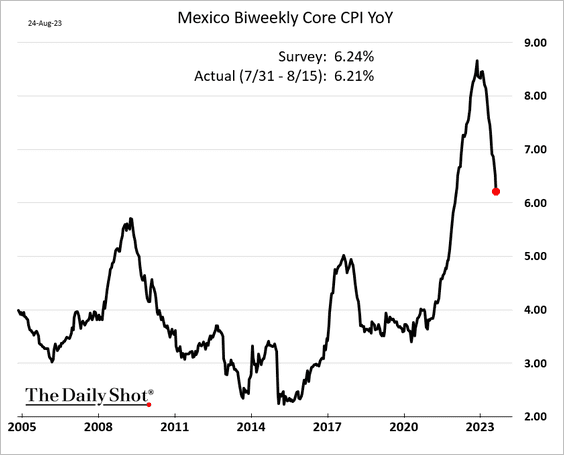

2. Mexico’s inflation continues to ease.

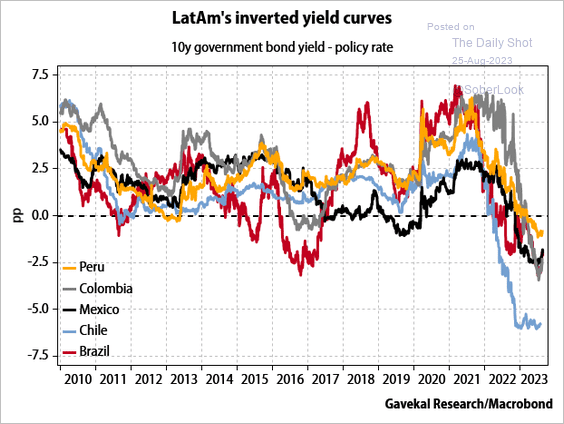

3. LatAm yield curves remain inverted.

Source: Gavekal Research

Source: Gavekal Research

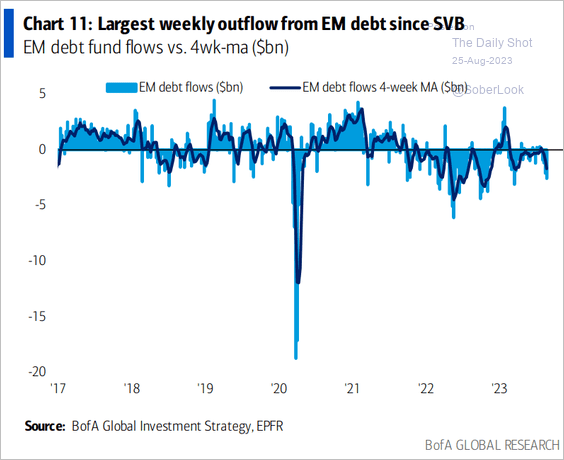

4. EM debt funds registered sharp outflows in recent days.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Cryptocurrency

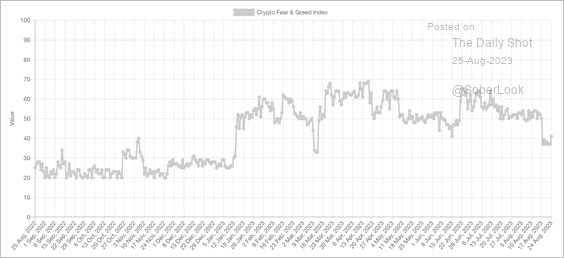

1. The Crypto Fear & Greed Index dipped into “fear” territory during last week’s sell-off.

Source: Alternative.me

Source: Alternative.me

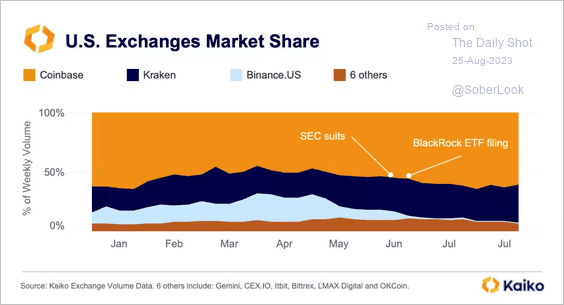

2. Coinbase and Kraken captured nearly all of the market share that Binance US lost in the past three months.

Source: @KaikoData

Source: @KaikoData

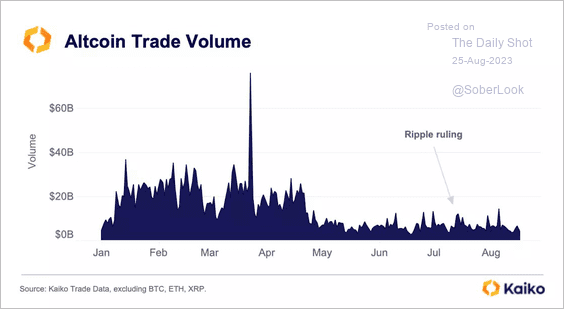

3. Trading volume among altcoins remains very low, struggling to reach levels from earlier this year.

Source: @KaikoData

Source: @KaikoData

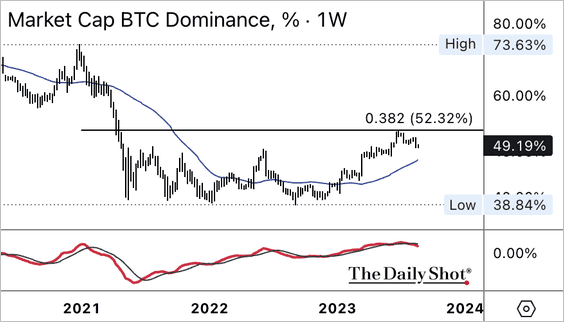

4. Bitcoin’s market cap relative to the total crypto market cap (dominance ratio) continues to fade from resistance.

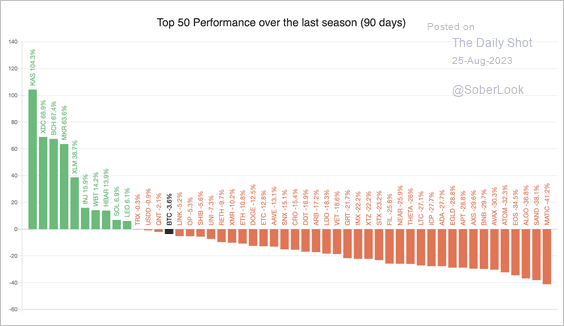

5. Still, only one-third of the top 50 altcoins outperformed BTC over the past 90 days.

Source: Blockchain Center

Source: Blockchain Center

Back to Index

Energy

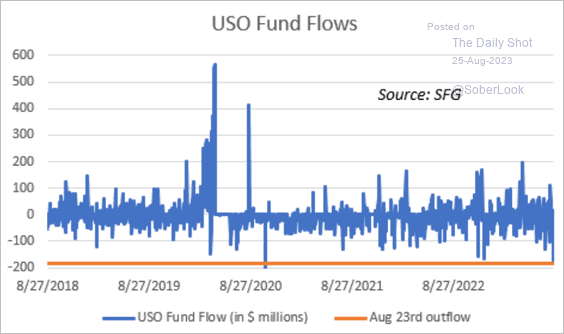

1. USO, the largest oil ETF, is seeing substantial outflows.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

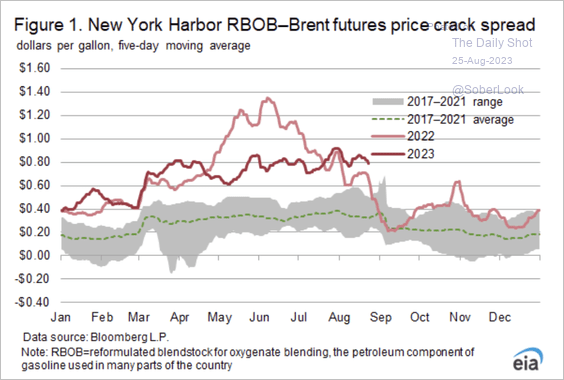

2. NYMEX gasoline crack spreads remain elevated.

Source: @EIAgov

Source: @EIAgov

Back to Index

Equities

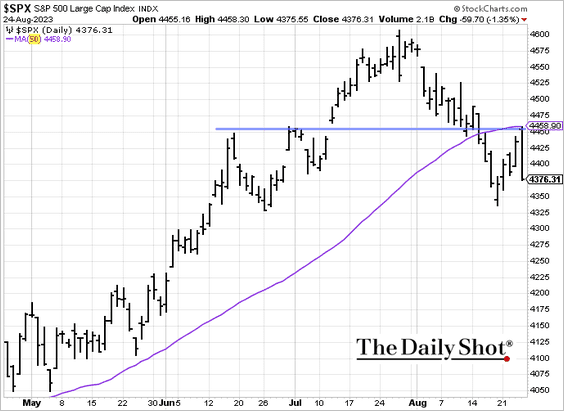

1. The S&P 500 hit resistance near 4450.

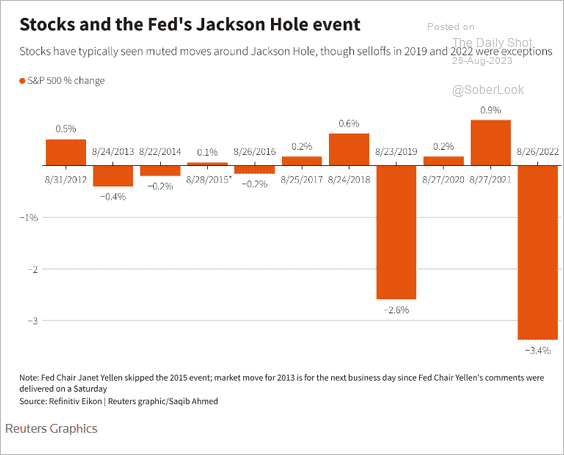

2. Here is how the S&P 500 performed around Jackson Hole events.

Source: Reuters Read full article

Source: Reuters Read full article

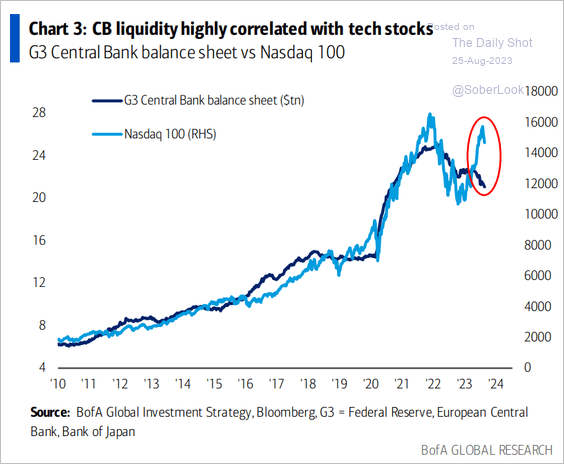

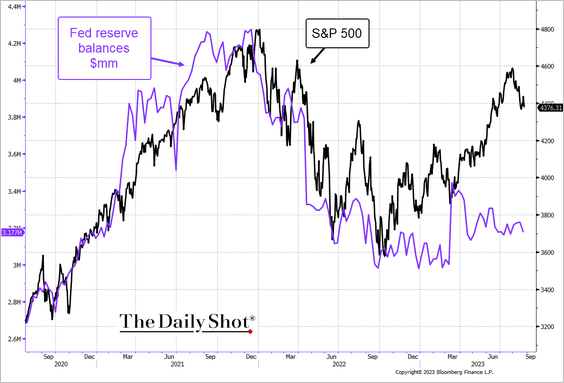

3. Stock prices have diverged from central bank liquidity trends (2 charts).

Source: BofA Global Research

Source: BofA Global Research

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

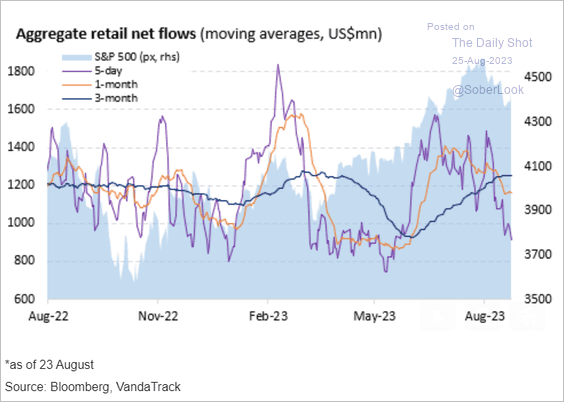

4. Retail investors have been slowing their stock purchases.

Source: Vanda Research

Source: Vanda Research

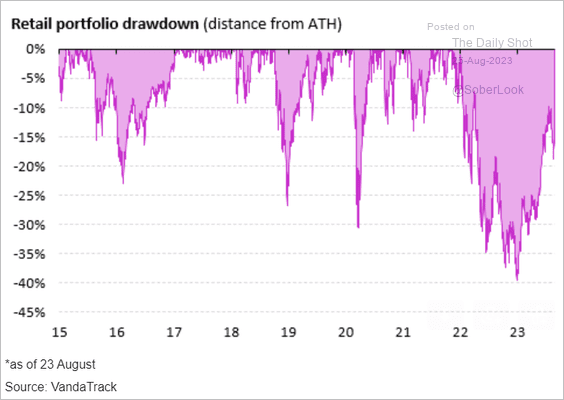

Despite this year’s rally, retail portfolios remain in the red.

Source: Vanda Research

Source: Vanda Research

——————–

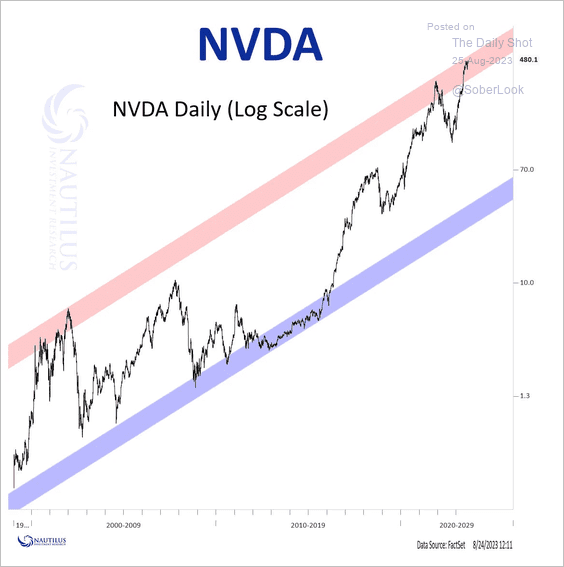

5. After an impressive earnings beat, Nvidia is testing resistance along its long-term uptrend.

Source: @NautilusCap

Source: @NautilusCap

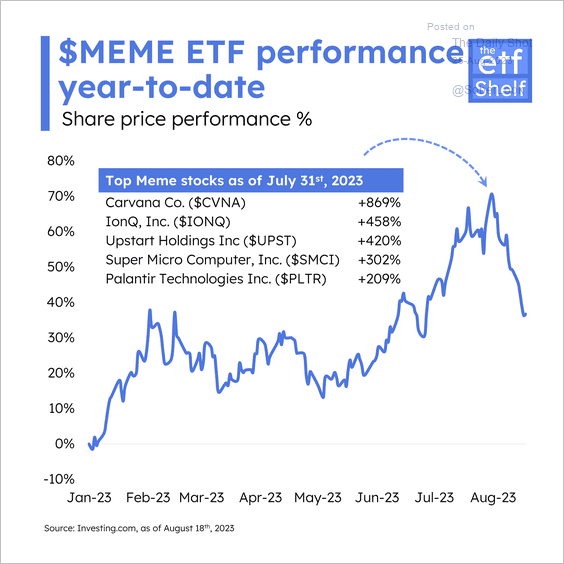

6. Meme stocks are under pressure, …

Source: The ETF Shelf

Source: The ETF Shelf

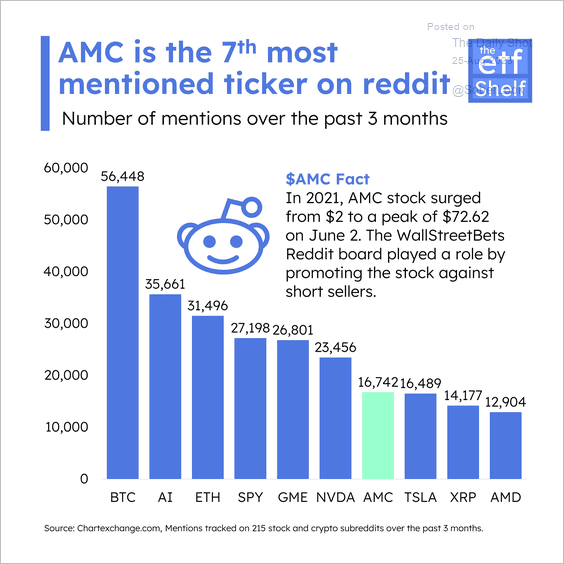

… although the Reddit crowd remains active.

Source: The ETF Shelf

Source: The ETF Shelf

——————–

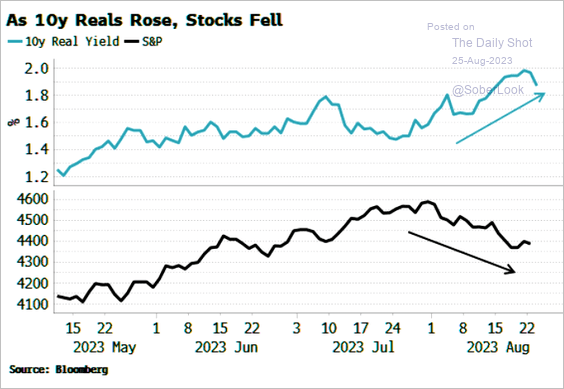

7. Elevated real rates remain a drag on stock prices.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

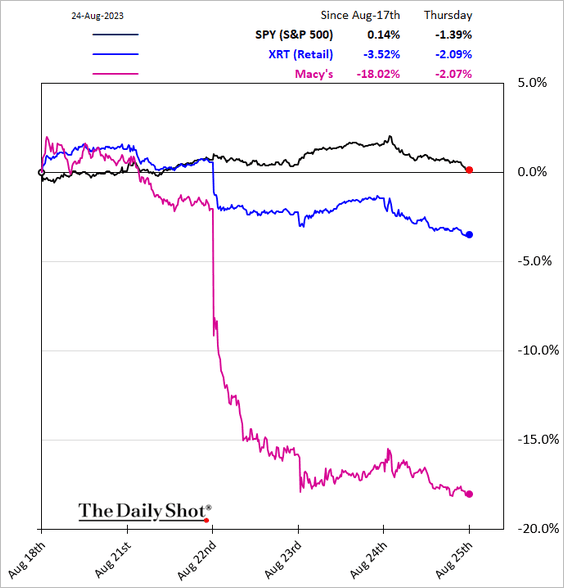

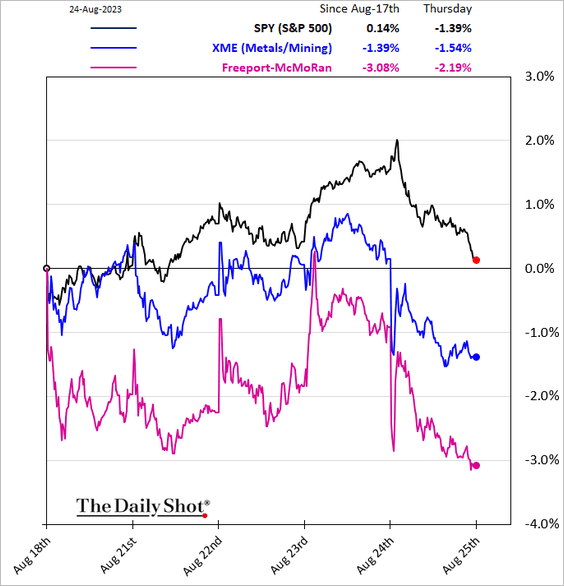

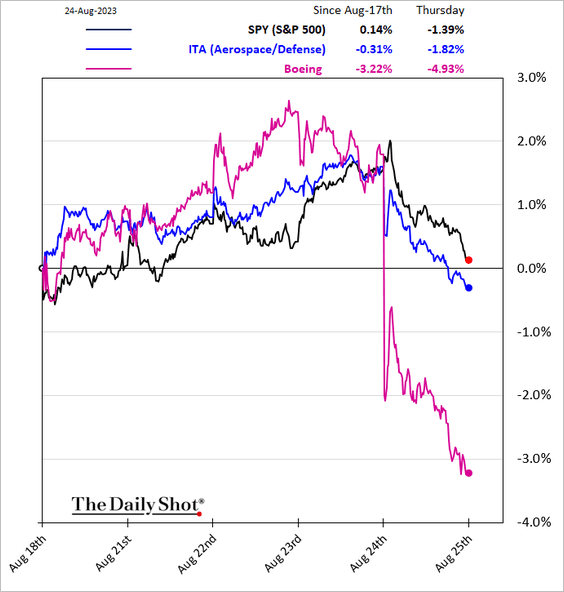

8. Next, we have some sector updates.

• Let’s start with three performance trends over the past five business days.

– Retail:

– Metals & Mining:

– Aerospace & Defense:

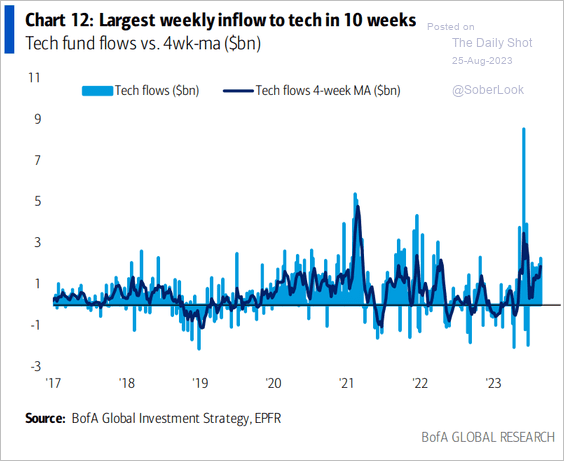

• Tech inflows remain robust.

Source: BofA Global Research

Source: BofA Global Research

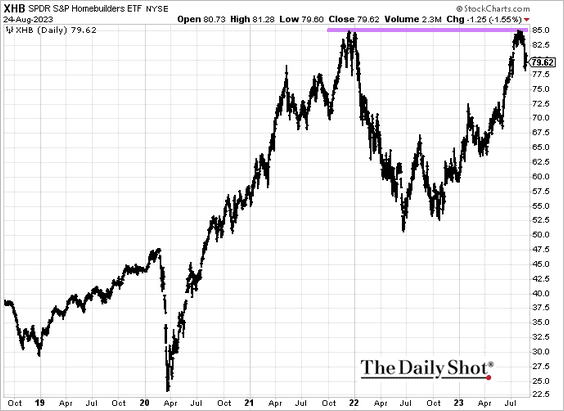

• XHB, the largest housing ETF, held resistance at 85.

Back to Index

Rates

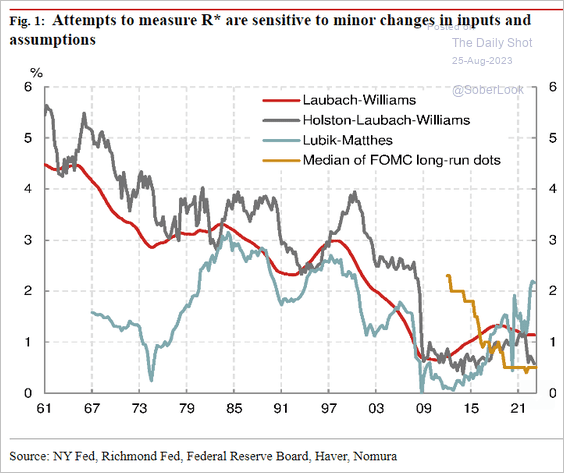

1. At the Jackson Hole meeting, there’s likely to be significant discussion about the long-run interest rate and whether the current US monetary policy is sufficiently tight.

Source: Barron’s Read full article

Source: Barron’s Read full article

Here are some estimates (real rates).

Source: Nomura Securities

Source: Nomura Securities

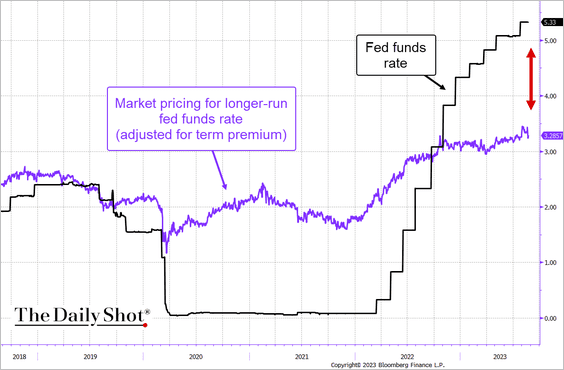

Markets place the nominal long-term rate at approximately 3.3%. Given this, the current rate set by the Federal Reserve might be fairly restrictive.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

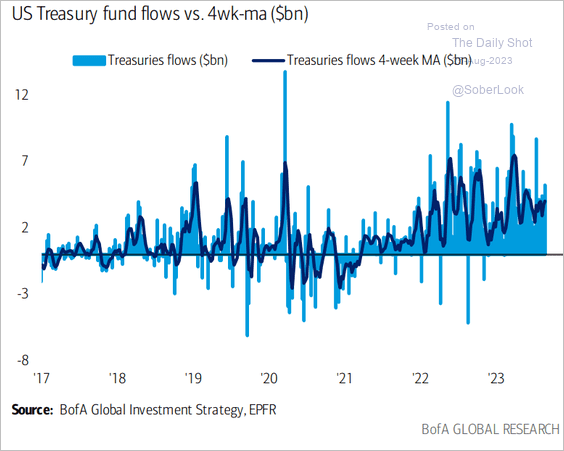

2. Flows into Treasury bond funds continue.

Source: BofA Global Research

Source: BofA Global Research

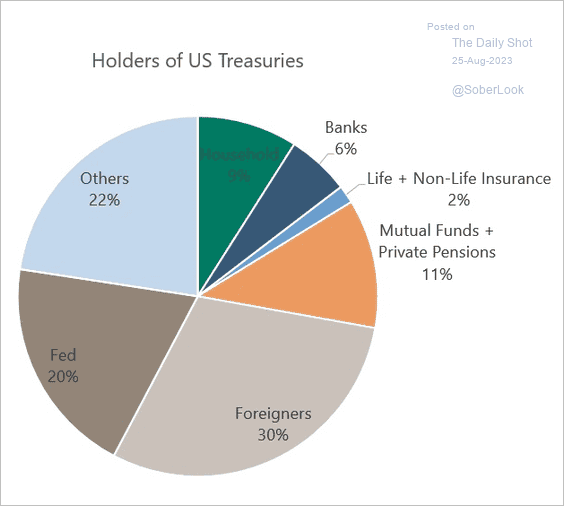

3. Who owns US Treasury securities?

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

Global Developments

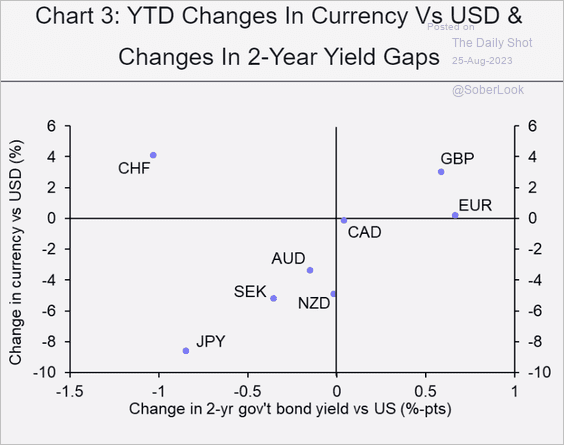

1. Bond yield differentials have been driving DM currency moves, except for the Swiss franc.

Source: Capital Economics

Source: Capital Economics

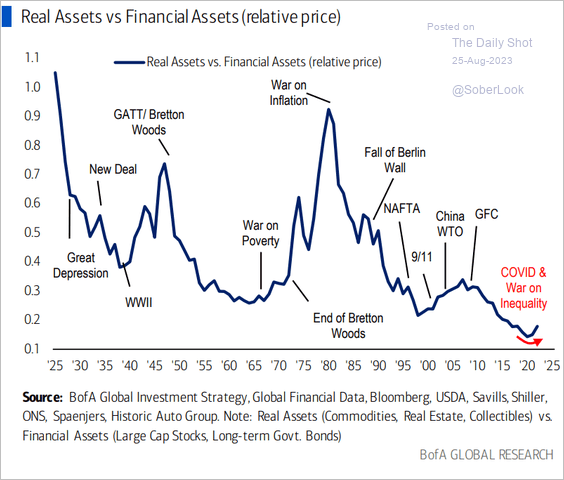

2. Have real asset prices bottomed relative to financial assets?

Source: BofA Global Research

Source: BofA Global Research

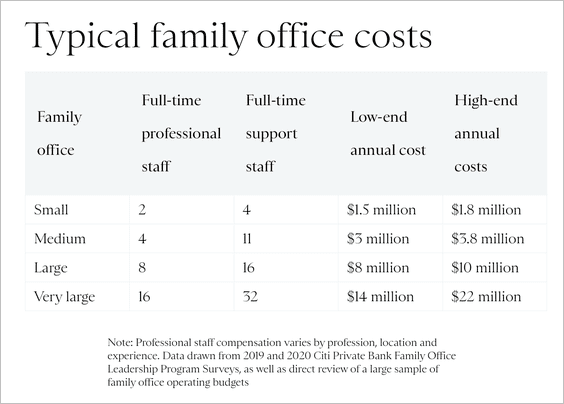

3. What does it cost to run a family office?

Source: Citi Private Bank Read full article

Source: Citi Private Bank Read full article

——————–

Food for Thought

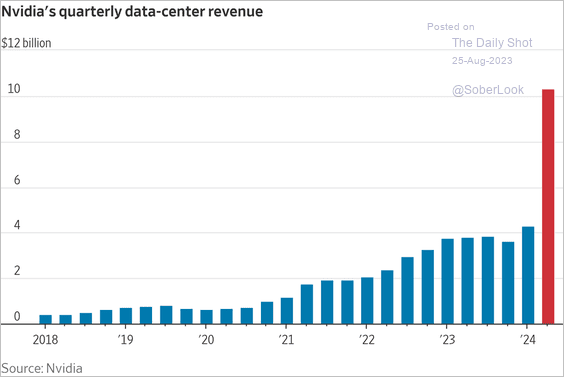

1. The AI gold rush:

Source: @WSJ Read full article

Source: @WSJ Read full article

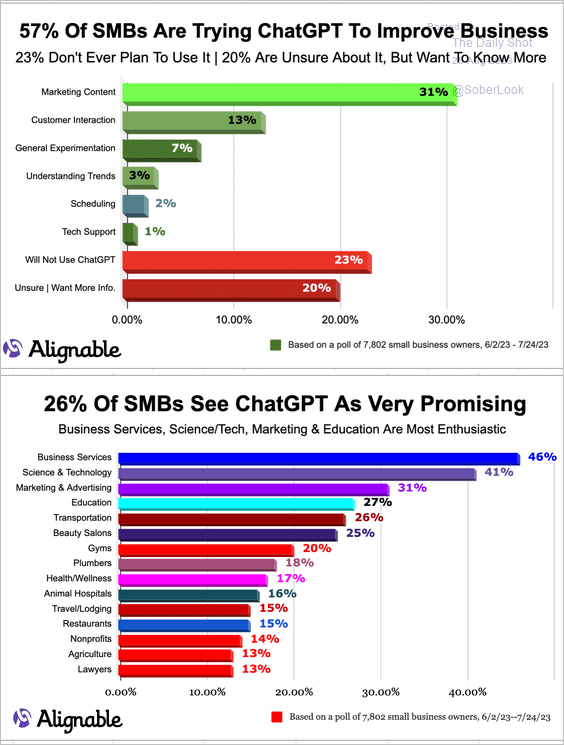

2. Small US firms trying ChatGPT:

Source: Alignable Read full article

Source: Alignable Read full article

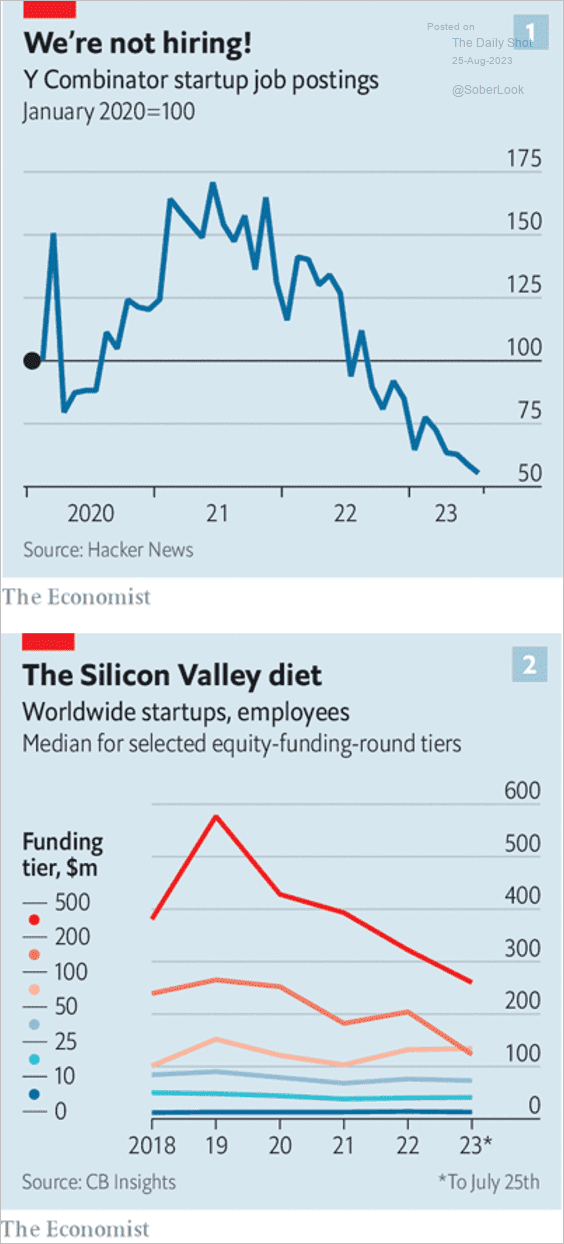

3. Slower hiring at startups:

Source: The Economist Read full article

Source: The Economist Read full article

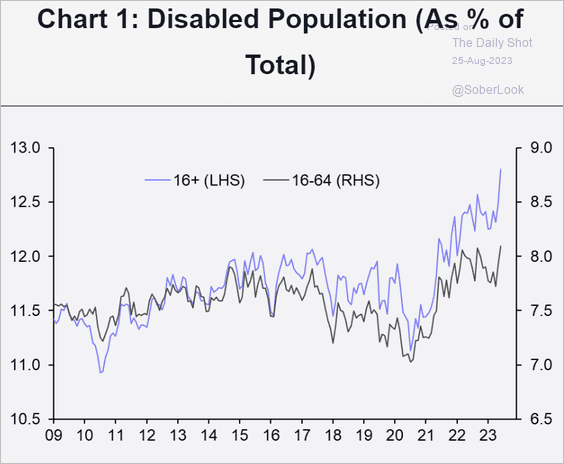

4. Share of US population with disabilities:

Source: Capital Economics

Source: Capital Economics

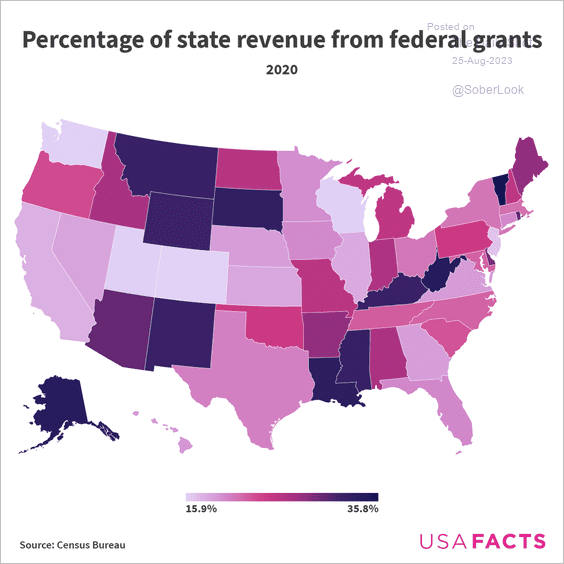

5. State revenues from federal grants:

Source: USAFacts

Source: USAFacts

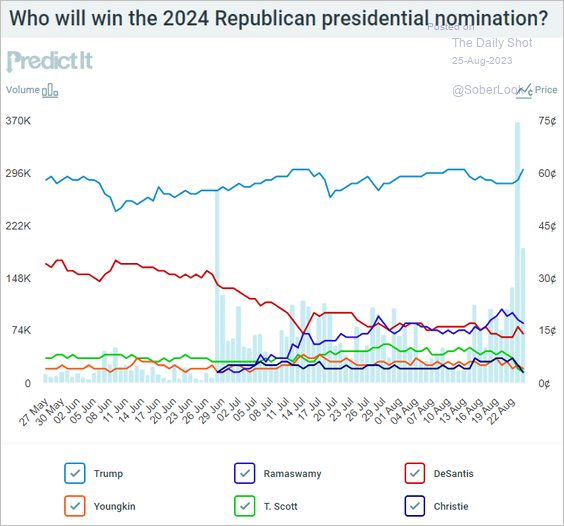

6. Betting market probabilities for the 2024 Republican presidential nomination:

Source: @PredictIt

Source: @PredictIt

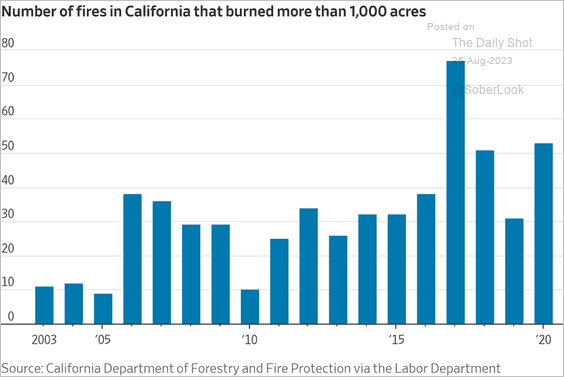

7. California fires:

Source: @jeffsparshott, @greg_ip, @JamesHookway

Source: @jeffsparshott, @greg_ip, @JamesHookway

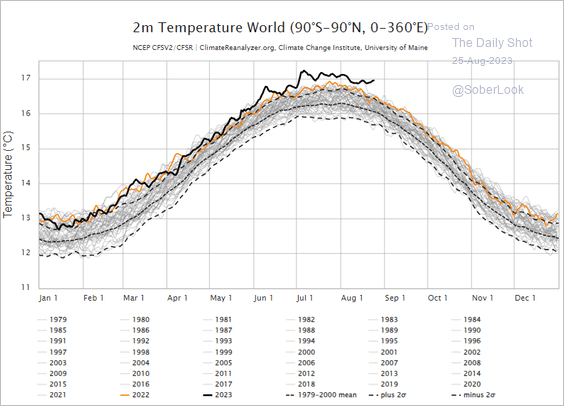

8. A warm August globally:

Source: Climate Reanalyzer Read full article

Source: Climate Reanalyzer Read full article

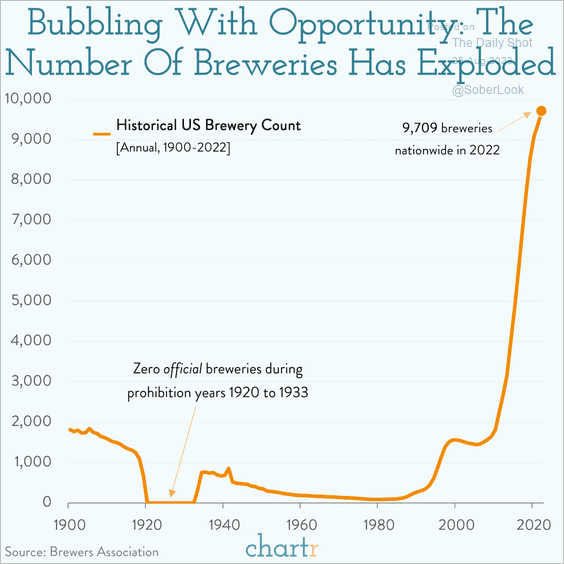

9. The number of US breweries over time:

Source: @chartrdaily

Source: @chartrdaily

——————–

Have a great weekend!

Back to Index