The Daily Shot: 28-Aug-23

• Administrative Update

• The United States

• Canada

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

Administrative Update

The Daily Shot will not be published on Monday, September 4th.

Back to Index

The United States

Chair Powell’s speech at Jackson Hole was measured and revealed little new insight. Although he recognized improvements on the inflation front, he emphasized the need for further progress, indicating that the central bank stands ready to tighten policy again.

Source: CNBC Read full article

Source: CNBC Read full article

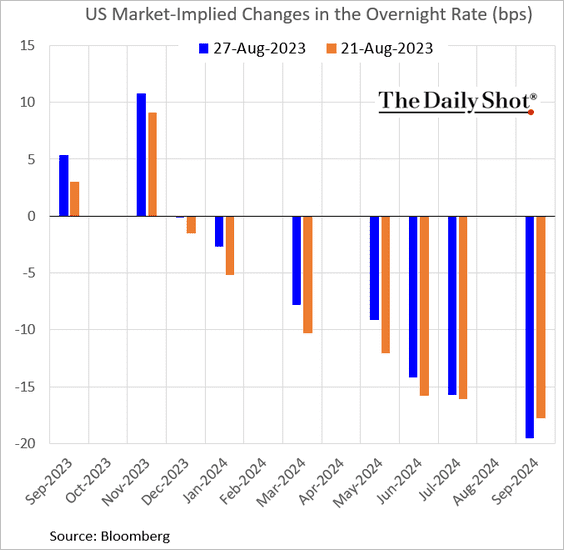

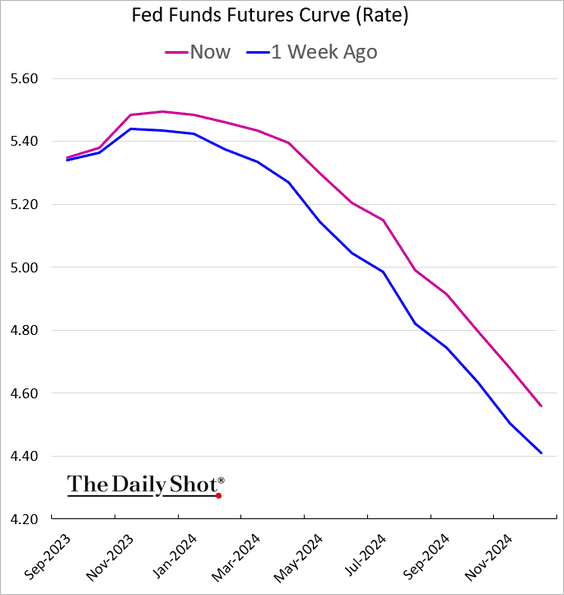

• The market interpreted Powell’s comments as being a bit on the hawkish side, pushing the probability of another rate hike to 65%.

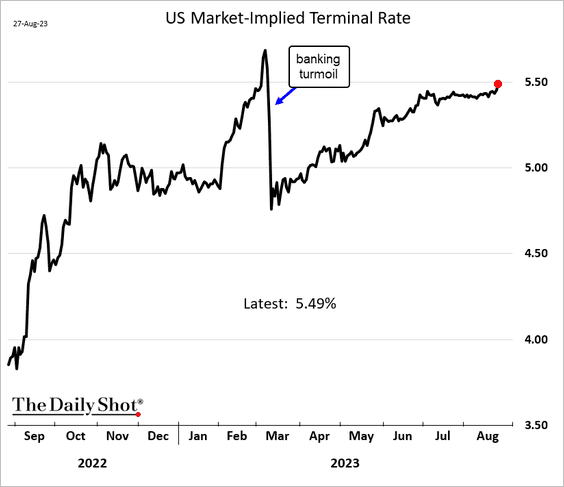

• The terminal rate hit the highest level since March.

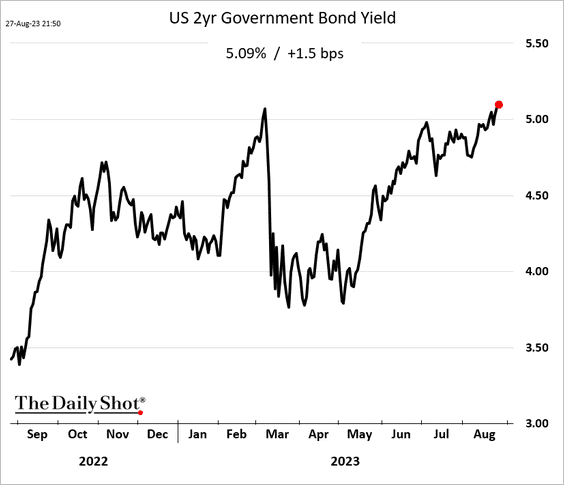

• Treasury yields climbed.

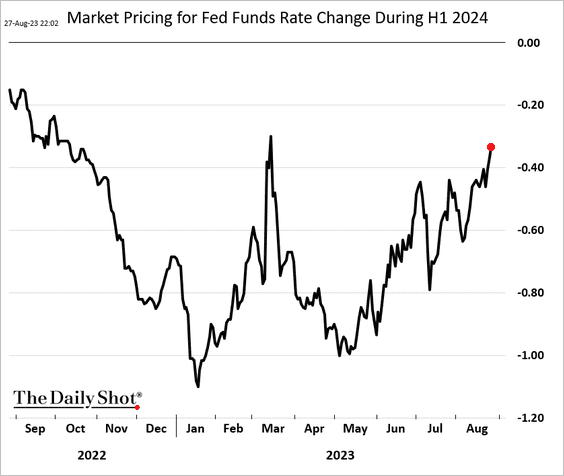

• Rate cut expectations in the first half of next year moderated further.

——————–

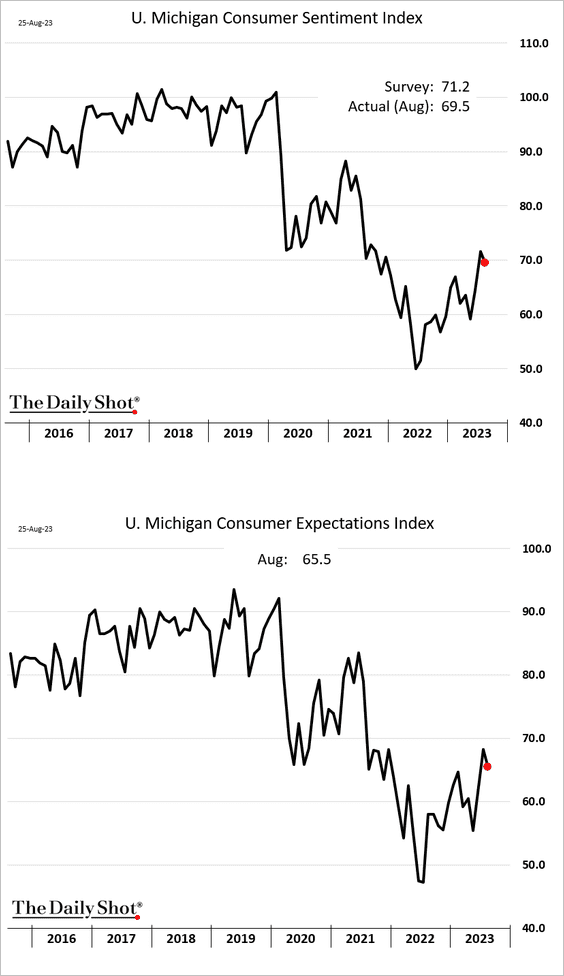

2. The updated consumer sentiment report from the University of Michigan indicated a decline in confidence during the latter half of August. This dip can be attributed in part to higher gasoline prices and stock market volatility.

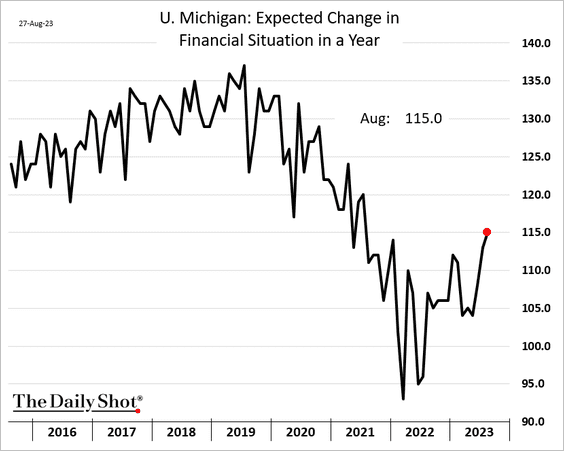

Households are more optimistic about their short-term financial prospects.

Inflation expectation metrics have risen slightly since the early August readings.

——————–

3. The Citi Economic Surprise Index appears to be rolling over.

4. Next, we have some updates on households’ financial situation.

• Credit card delinquencies are grinding higher as consumers face headwinds.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: Insider Read full article

Source: Insider Read full article

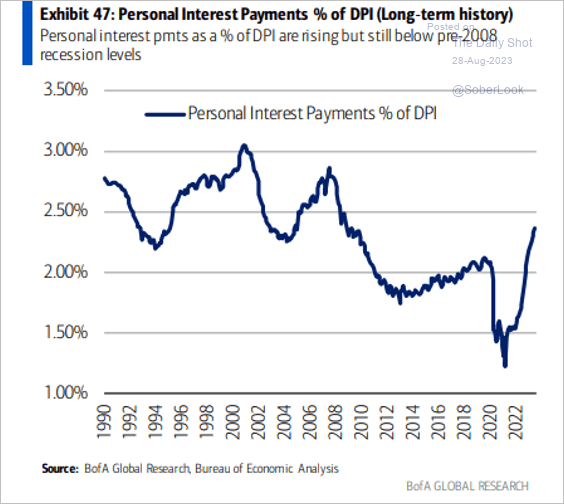

• Households’ interest payments as a share of personal disposable income have been rising.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

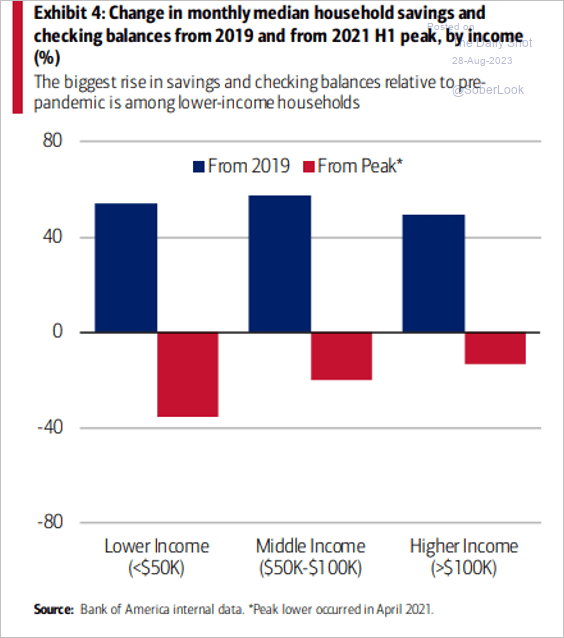

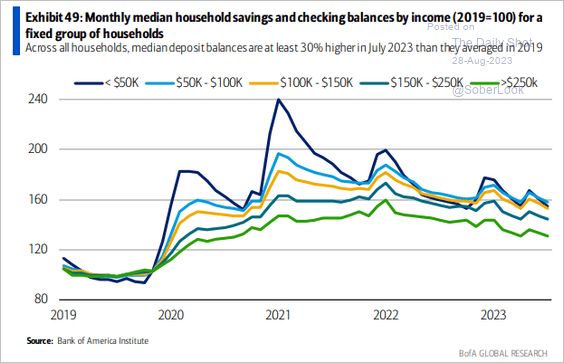

• Excess savings are still elevated (2 charts).

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

——————–

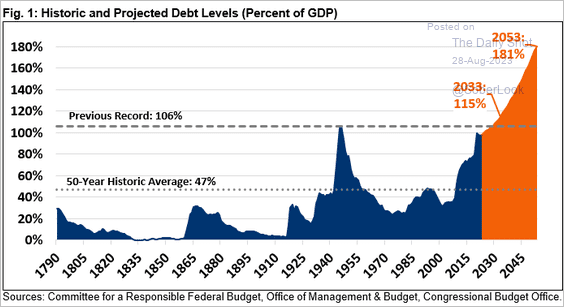

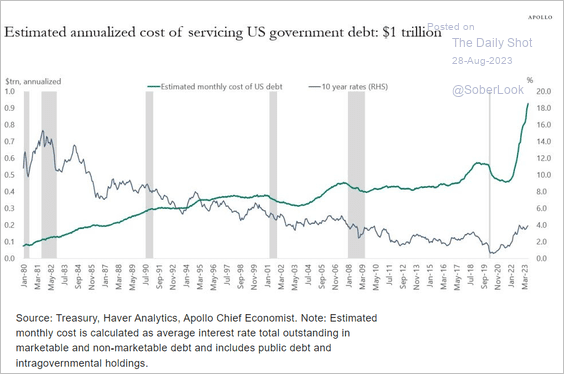

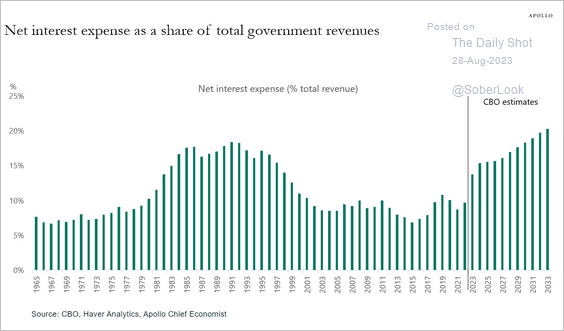

5. Here are some charts on US federal debt.

• The Congressional Budget Office projects federal debt as a percent of GDP to nearly double by 2053 if current tax and spending laws remain unchanged.

Source: Committee for a Responsible Federal Budget

Source: Committee for a Responsible Federal Budget

• Interest expense is expected to accelerate.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

Canada

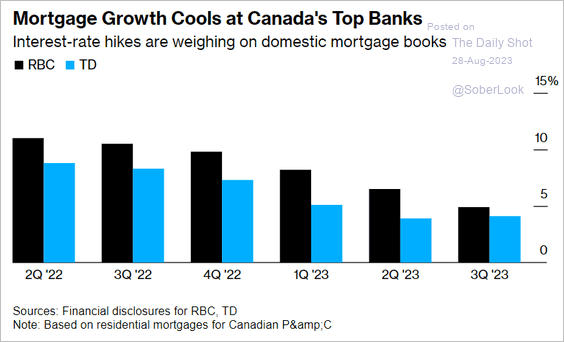

1. Growth in mortgage lending has been slowing.

Source: @markets Read full article

Source: @markets Read full article

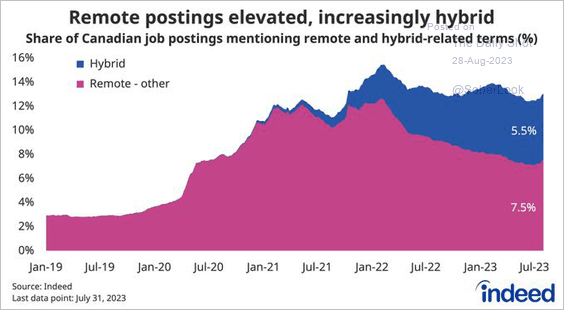

2. This chart shows remote and hybrid job postings on Indeed.

Source: @BrendonBernard_ Read full article

Source: @BrendonBernard_ Read full article

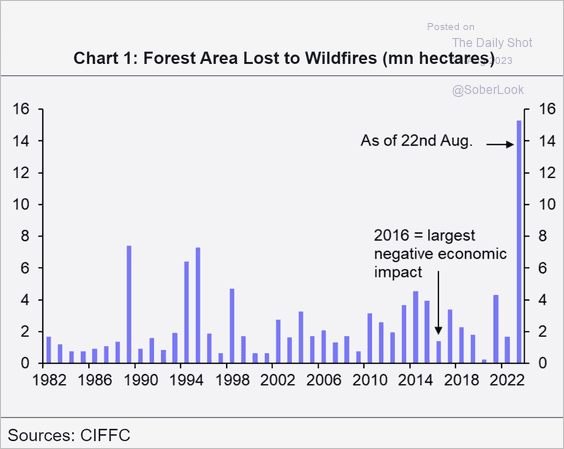

3. Canada’s forest fires have been devastating.

Source: Capital Economics

Source: Capital Economics

Back to Index

The Eurozone

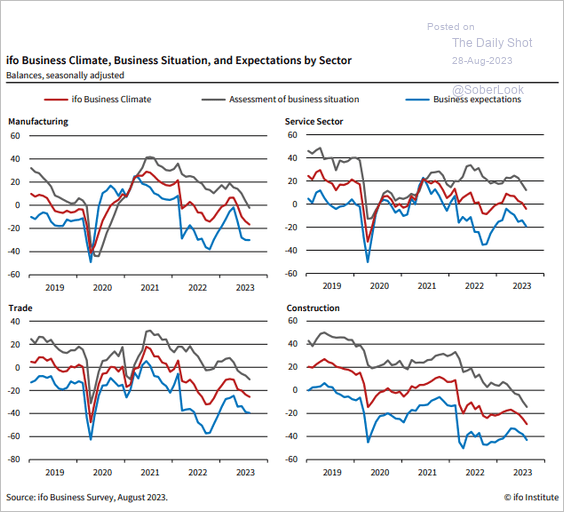

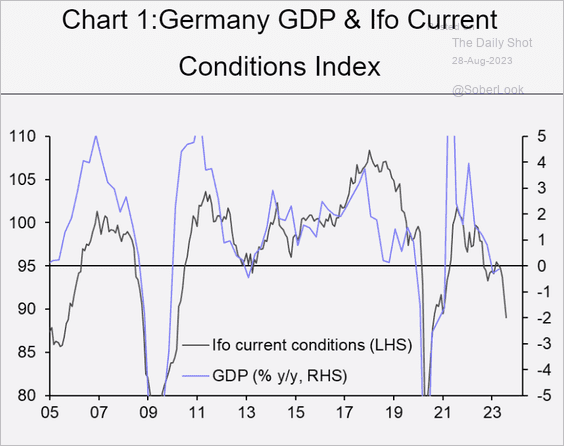

1. Germany’s Ifo sentiment index surprised to the downside, …

Source: ifo Institute Read full article

Source: ifo Institute Read full article

… signaling rising risks for economic growth.

Source: Capital Economics

Source: Capital Economics

Source: Reuters Read full article

Source: Reuters Read full article

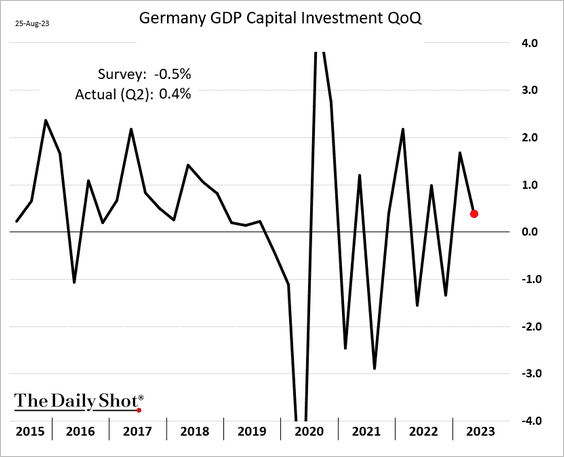

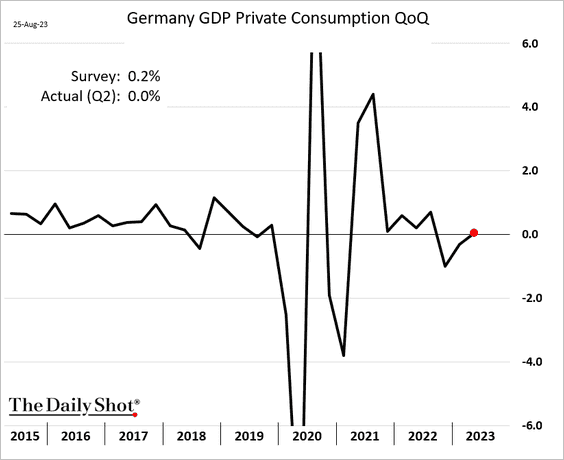

• Germany’s business investment was stronger than expected in the second quarter, …

… but there was no growth in consumer spending.

——————–

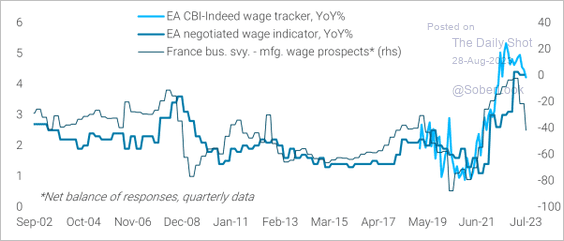

2. Has euro-area wage growth peaked?

Source: TS Lombard

Source: TS Lombard

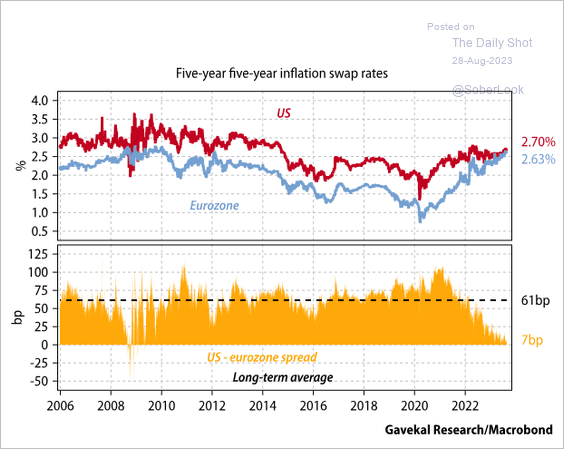

3. The Eurozone’s longer-dated inflation expectations are converging with those in the US, which is highly unusual.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Europe

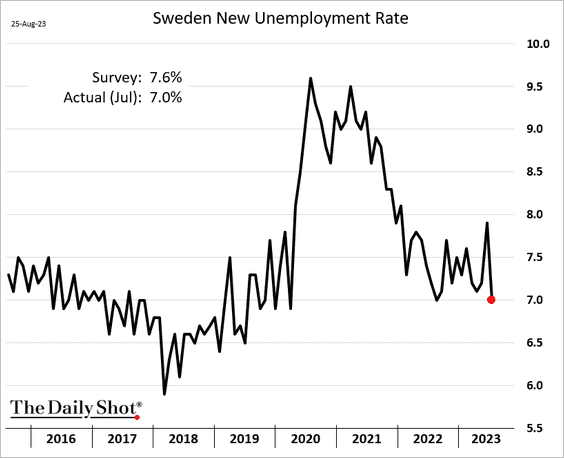

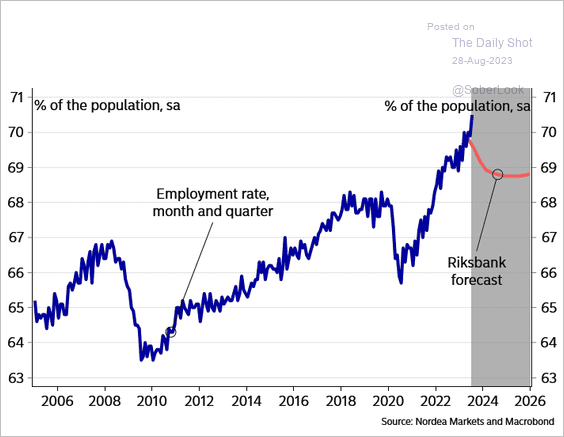

1. Sweden’s unemployment rate dropped sharply last month.

The employment rate continues to climb.

Source: Nordea Markets

Source: Nordea Markets

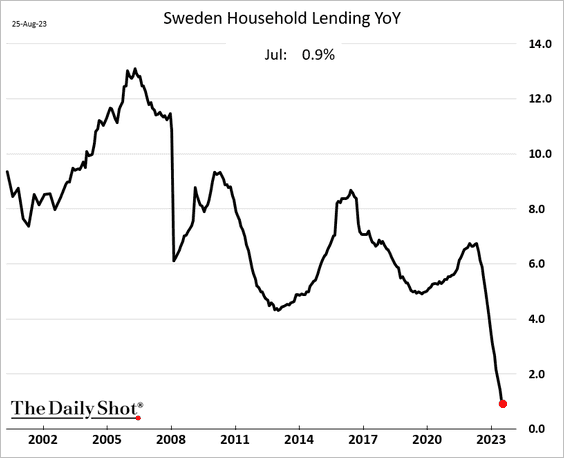

• Lending to households is slowing.

——————–

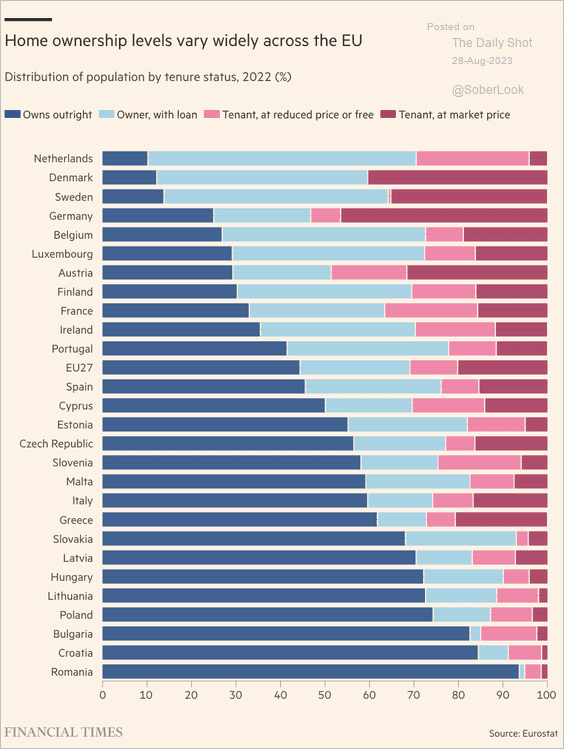

2. Here is a look at homeownership rates in the EU.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Asia-Pacific

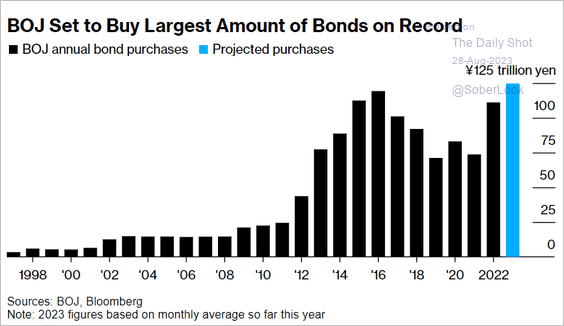

1. The BoJ’s JGB purchases are expected to hit a record high this year.

Source: @markets Read full article

Source: @markets Read full article

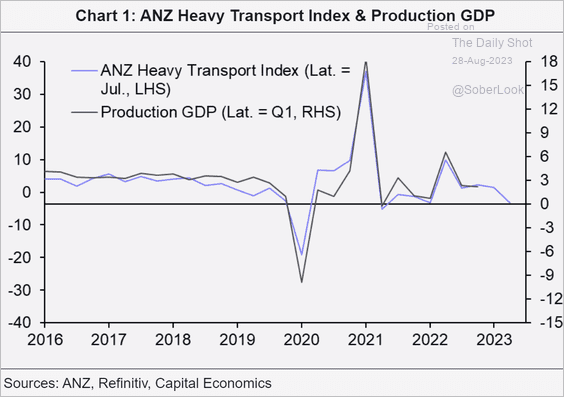

2. New Zealand’s economic growth is stalling.

Source: Capital Economics

Source: Capital Economics

Back to Index

China

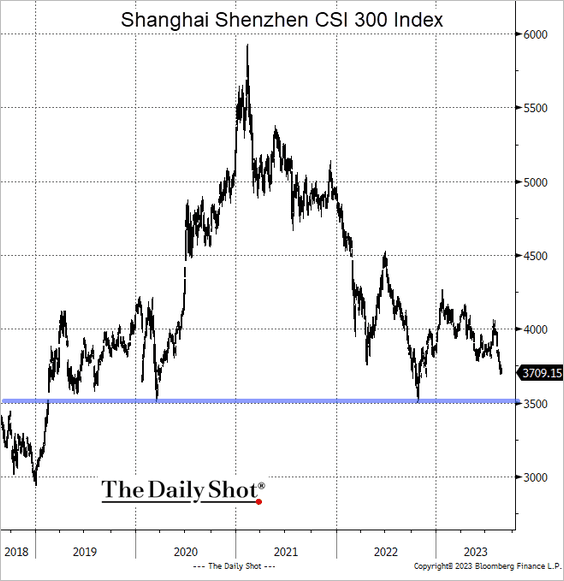

1. Beijing is attempting to mitigate the negative publicity stemming from the nation’s underperforming stock market. Will it work?

Source: @markets Read full article

Source: @markets Read full article

Source: @markets Read full article

Source: @markets Read full article

Source: @markets Read full article

Source: @markets Read full article

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

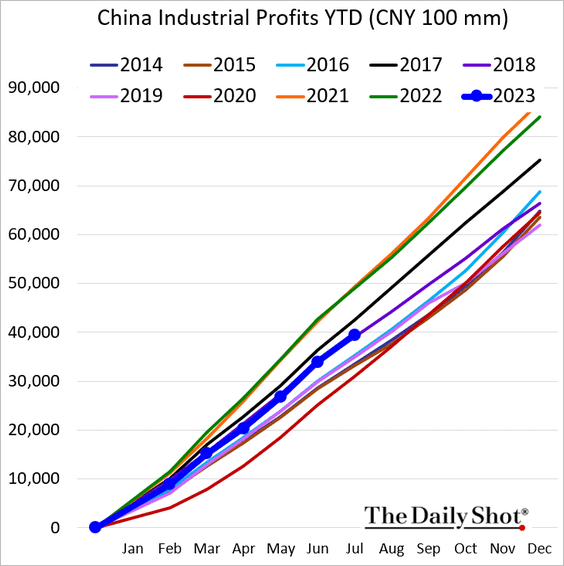

2. Industrial profits have been soft.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

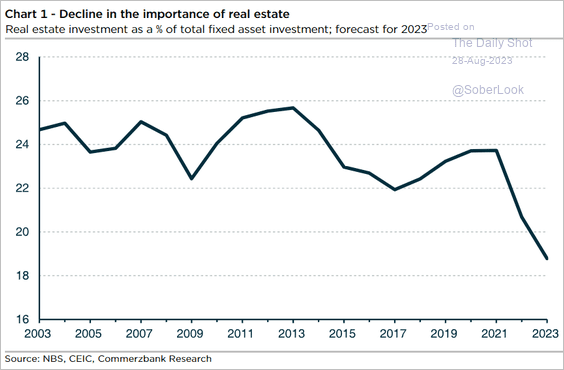

3. Real estate is becoming a smaller part of fixed asset investment.

Source: Commerzbank Research

Source: Commerzbank Research

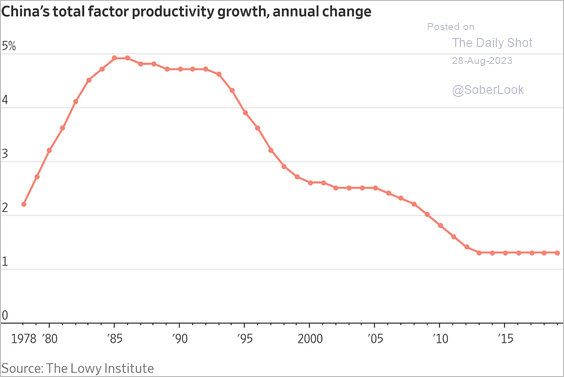

4. Productivity growth has slowed in recent decades.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Emerging Markets

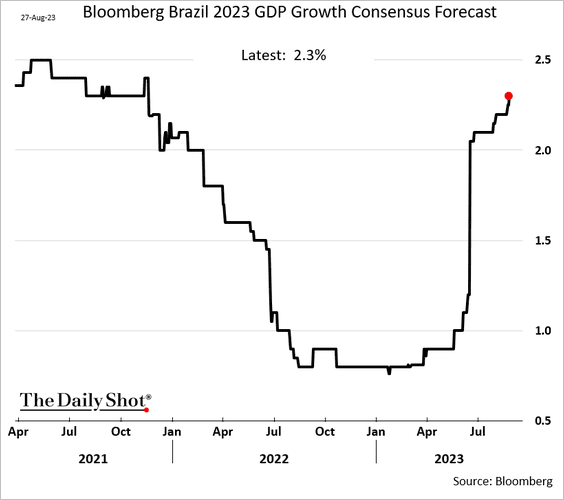

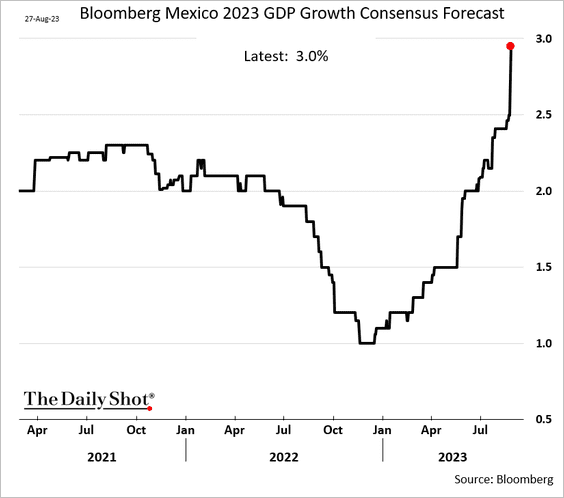

1. Economists have been upgrading their estimates for this year’s GDP growth in Brazil and Mexico.

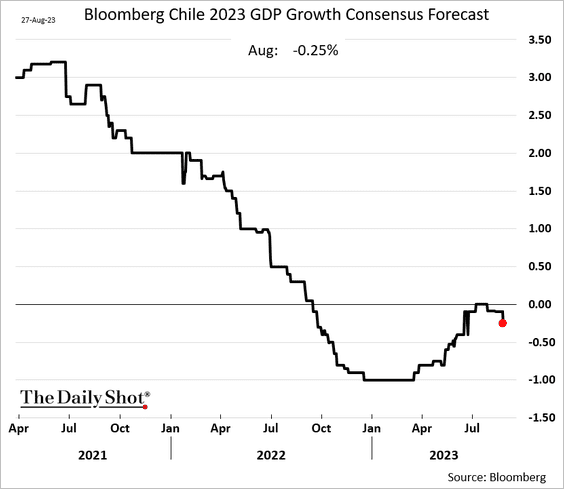

Chile’s economy is still expected to contract in 2023.

——————–

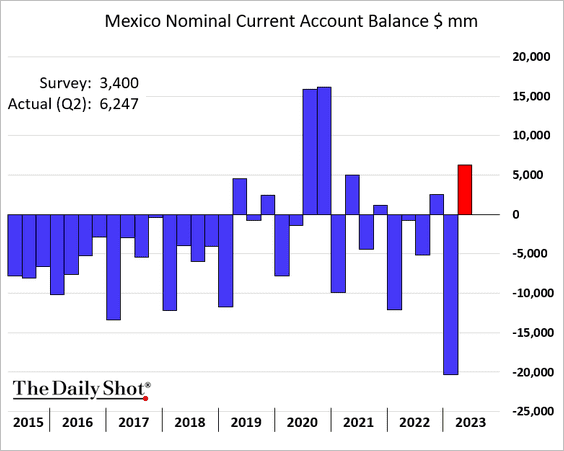

2. Mexico’s Q2 current account surplus topped expectations.

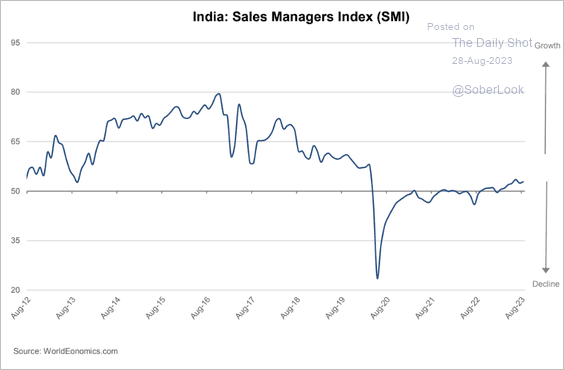

3. The World Economics SMI report for India shows ongoing expansion in business activity.

Source: World Economics

Source: World Economics

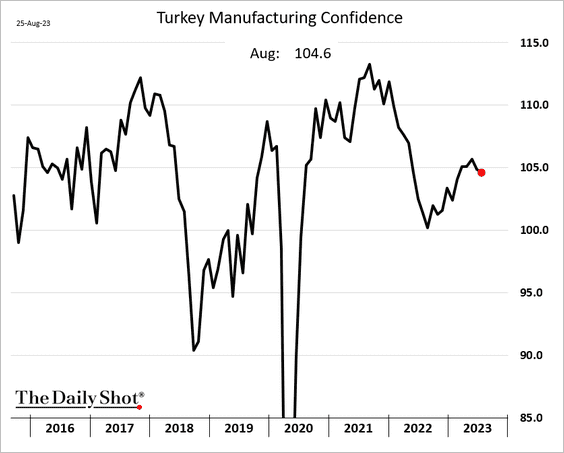

4. Turkey’s manufacturing confidence edged lower this month.

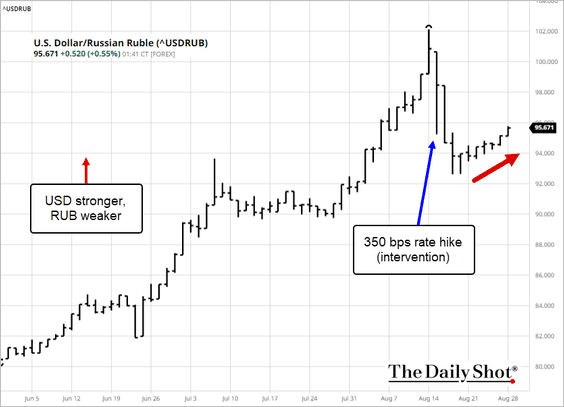

5. The ruble is weakening again.

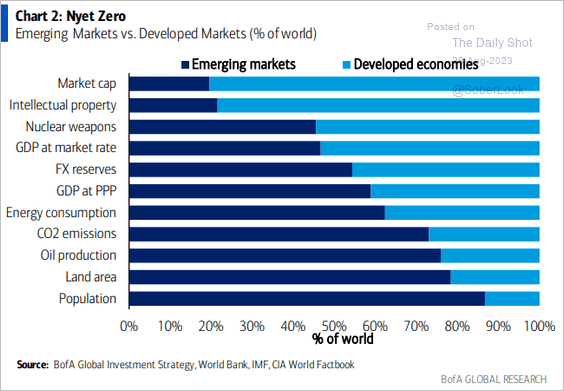

6. Here is a comparison of EM and DM countries across different metrics.

Source: BofA Global Research

Source: BofA Global Research

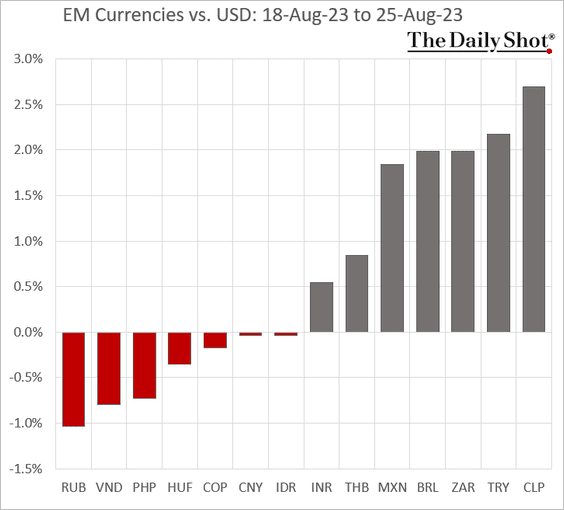

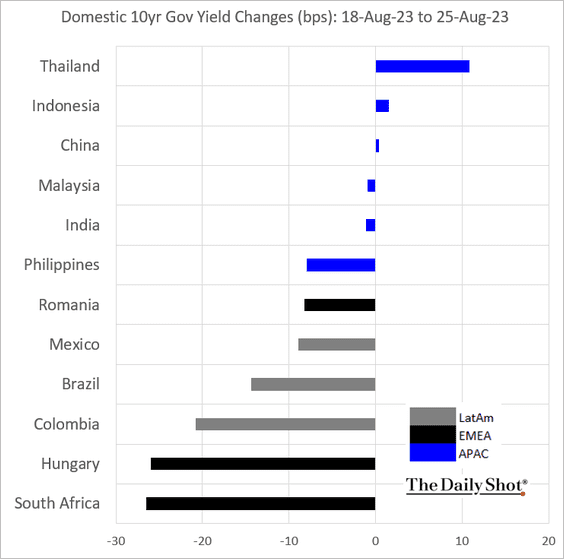

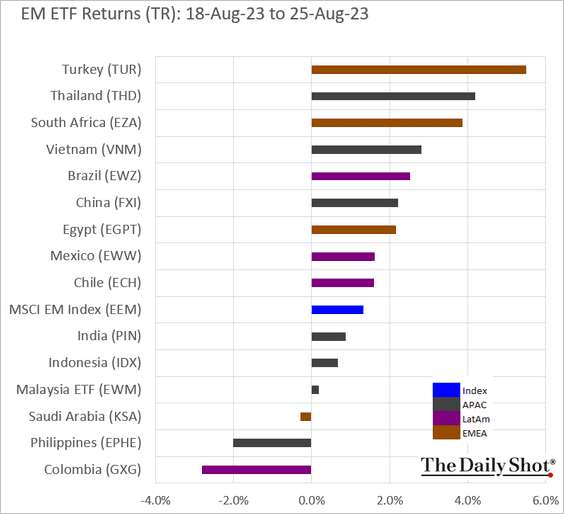

7. Finally, we have last week’s performance data.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

Commodities

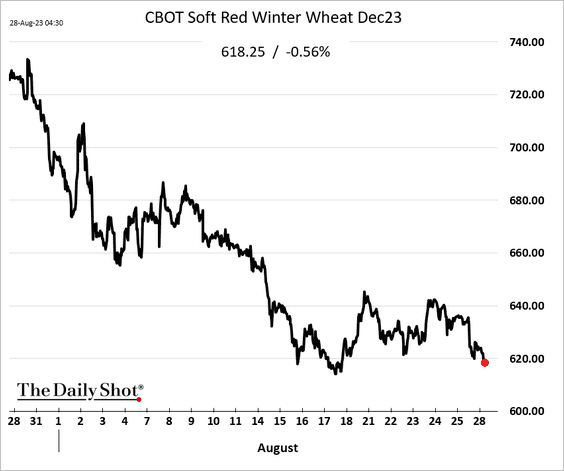

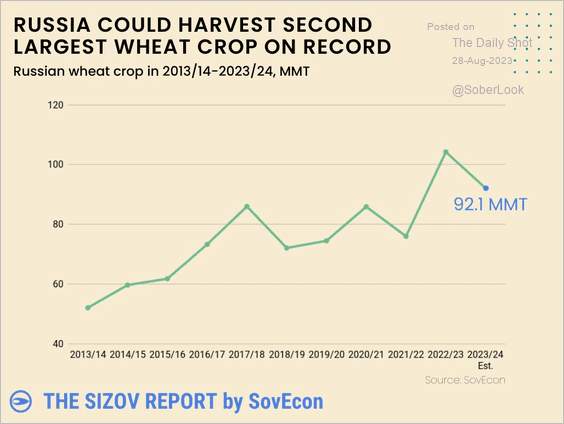

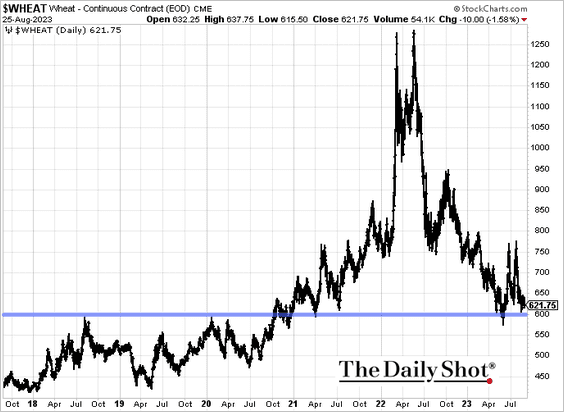

1. US soft red winter wheat is selling off, …

… pressured by robust Russian output.

Source: @sizov_andre Read full article

Source: @sizov_andre Read full article

Will wheat test support at $6 per bushel?

——————–

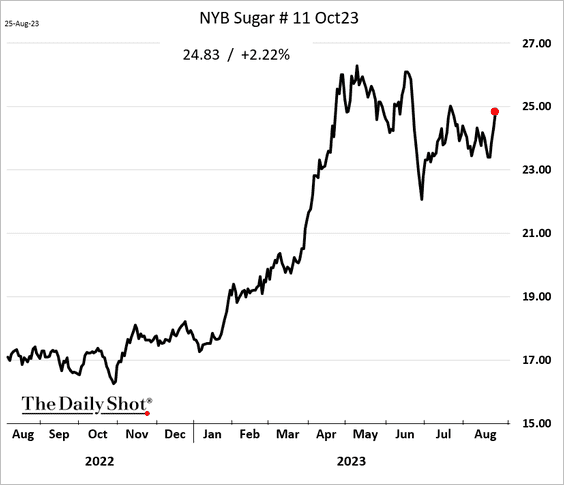

2. Sugar prices are higher.

Source: @markets Read full article

Source: @markets Read full article

——————–

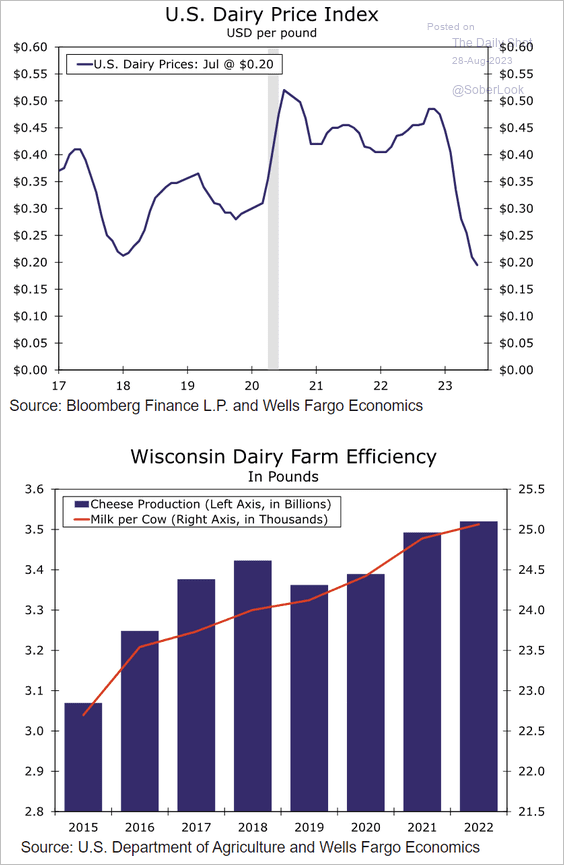

3. As the milk supply climbs, US dairy prices are steadily declining. Milk cow efficiency rates have reached new highs.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

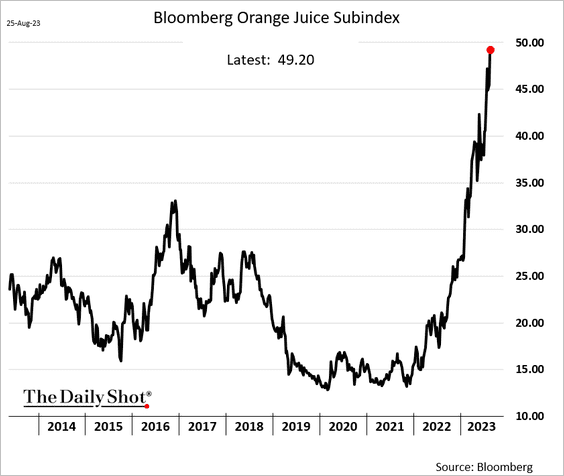

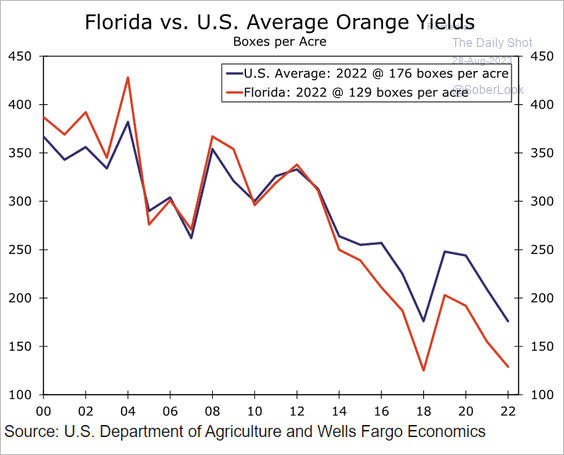

4. Orange juice prices continue to surge, …

… driven by depressed yields.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

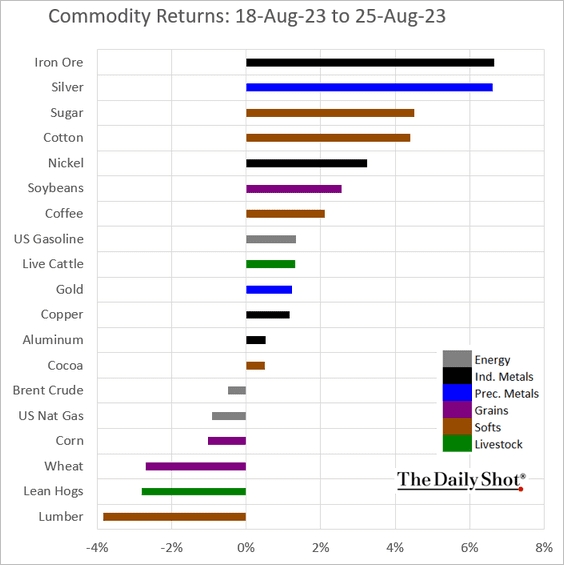

5. Here is last week’s performance across key commodity markets.

Back to Index

Energy

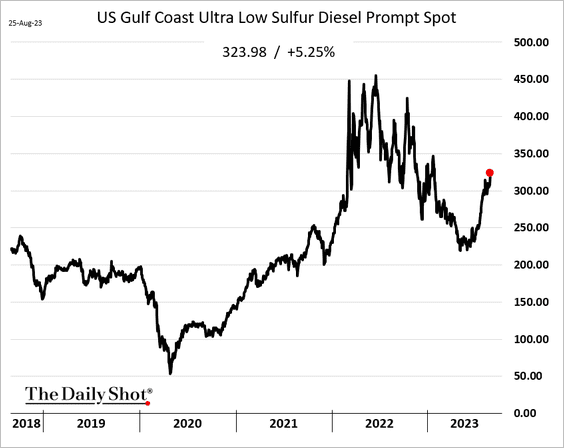

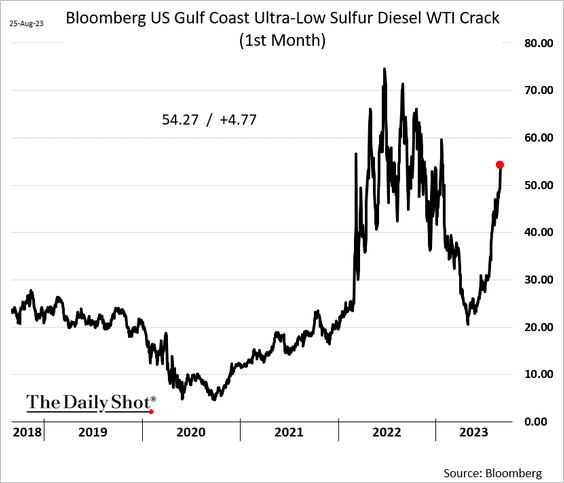

1. US diesel prices and crack spreads are sharply higher, …

… as Marathon shuts down the Garyville refinery.

Source: @markets Read full article

Source: @markets Read full article

——————–

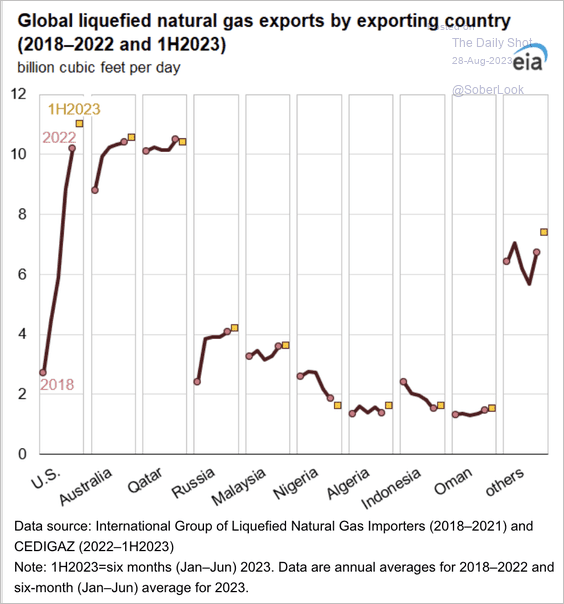

2. US LNG exports surpassed those of other countries in the first half of the year.

Source: @EIAgov

Source: @EIAgov

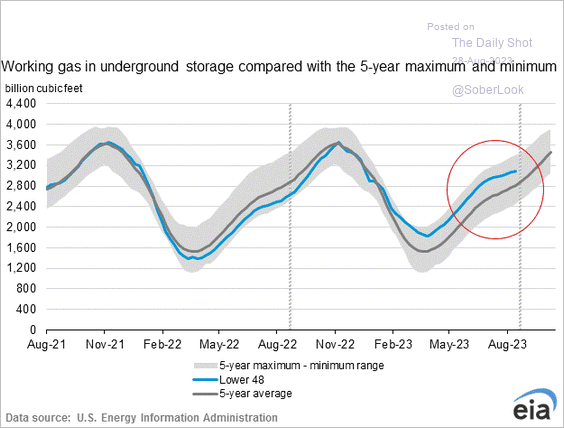

3. US natural gas injections into storage slowed, …

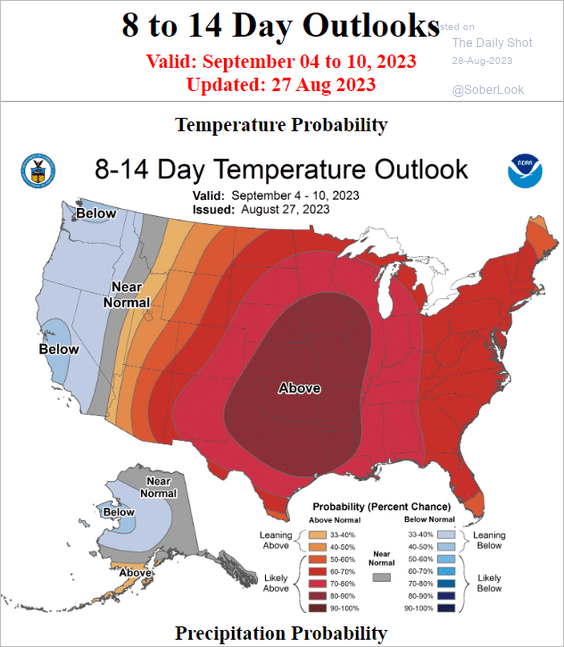

… as scorching heat in parts of the US boosts demand.

Source: NOAA

Source: NOAA

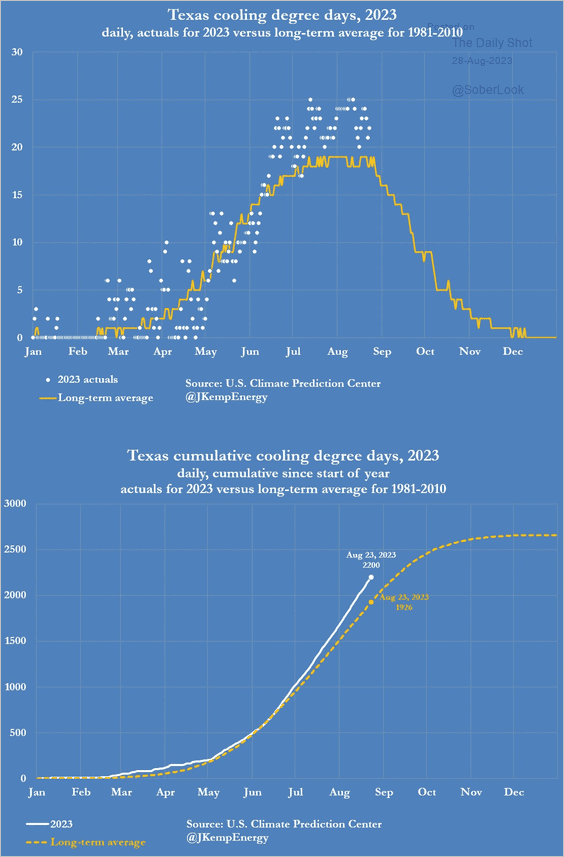

Here is the situation in Texas.

Source: @JKempEnergy

Source: @JKempEnergy

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Equities

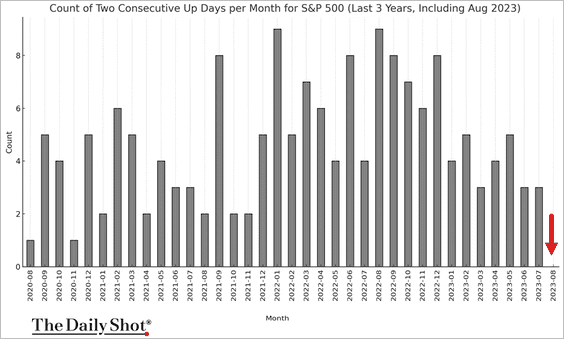

1. This month, the S&P 500 failed to achieve two consecutive daily gains – a phenomenon not seen in years.

Source: @markets Read full article

Source: @markets Read full article

——————–

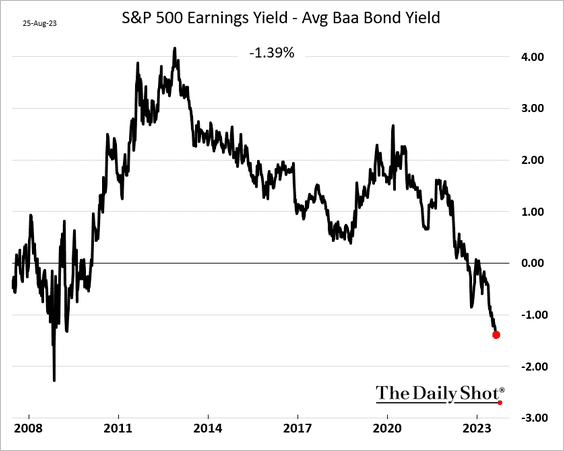

2. Stocks look increasingly expensive relative to corporate credit.

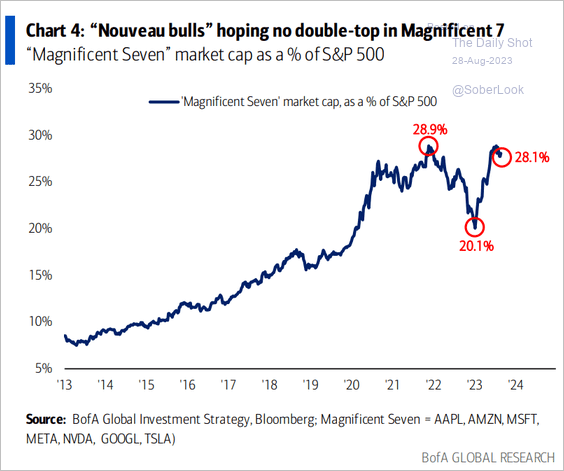

3. The S&P 500 remains concentrated.

Source: BofA Global Research

Source: BofA Global Research

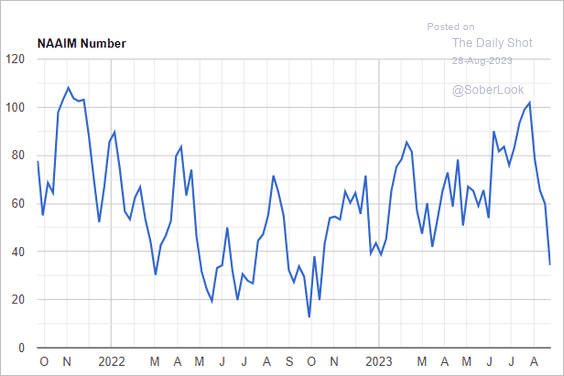

4. Investment managers have turned bearish.

Source: NAAIM

Source: NAAIM

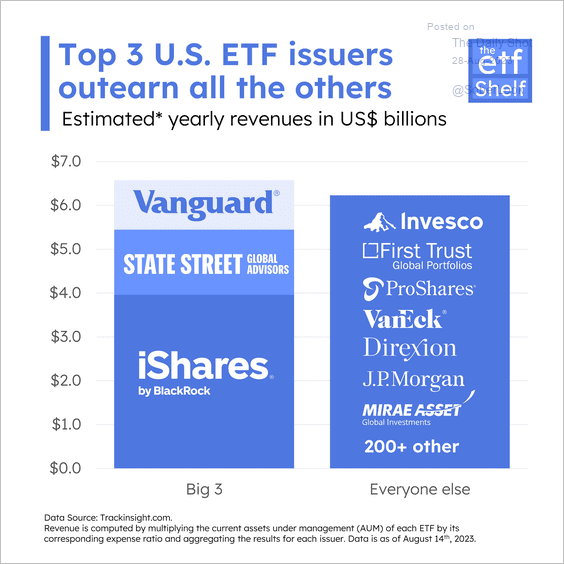

5. The top three largest US ETF issuers collectively generate more revenue than all other issuers combined.

Source: The ETF Shelf

Source: The ETF Shelf

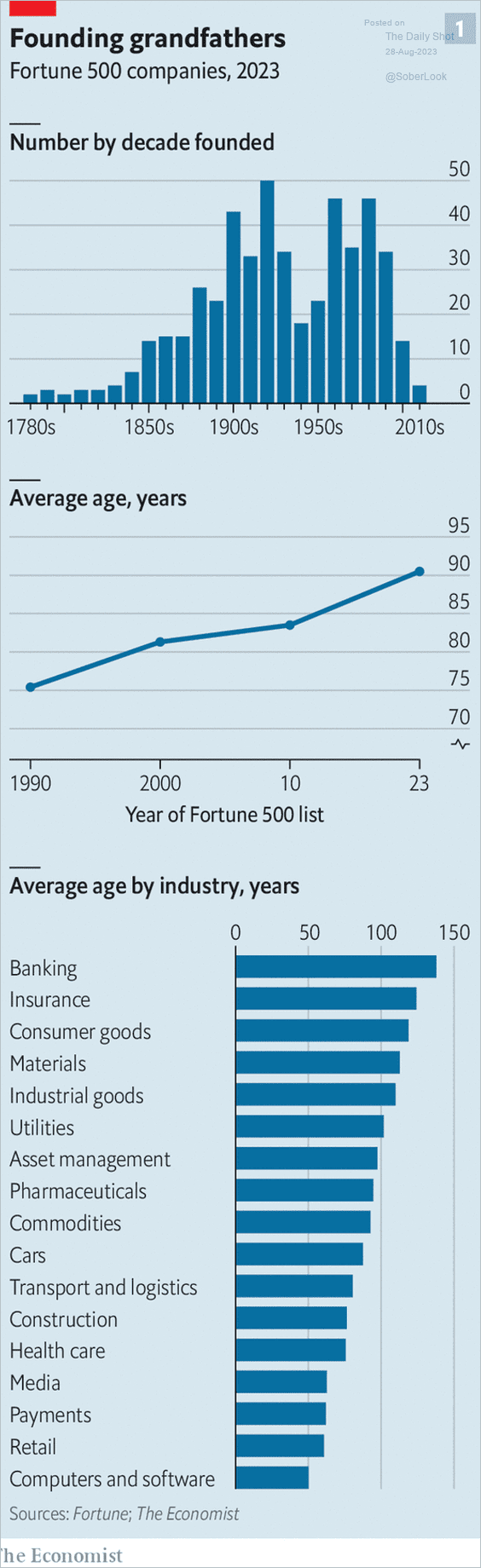

6. Here is a look at the Fortune 500 companies’ age.

Source: The Economist Read full article

Source: The Economist Read full article

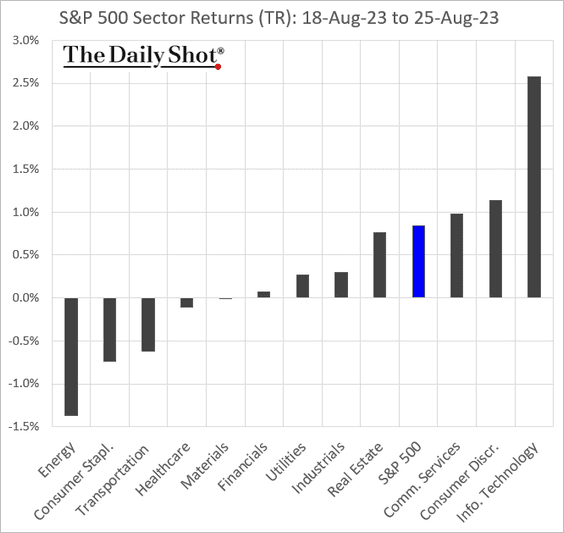

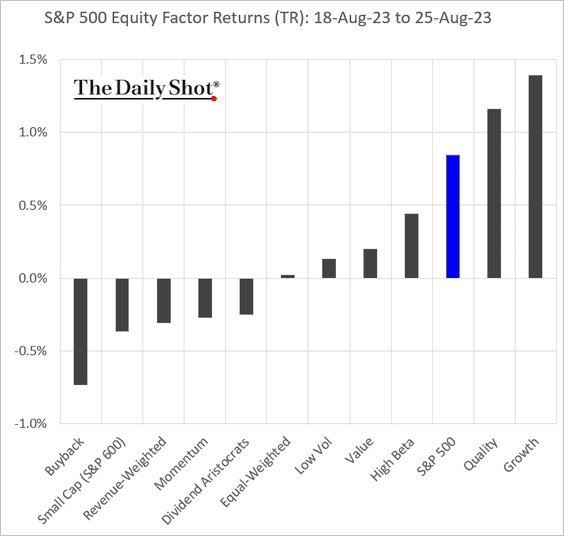

7. Finally, we have some performance data from last week.

• Sectors:

• Equity factors:

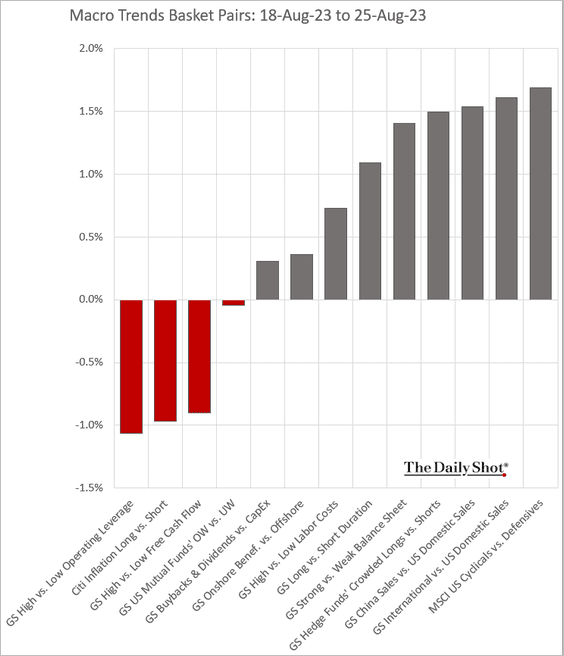

• Macro baskets’ relative performance:

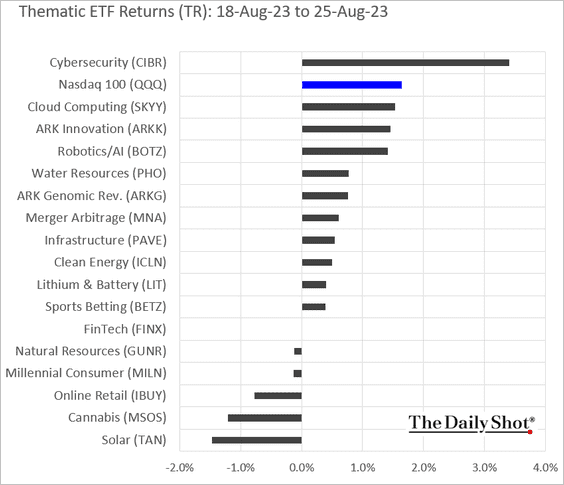

• Thematic ETFs:

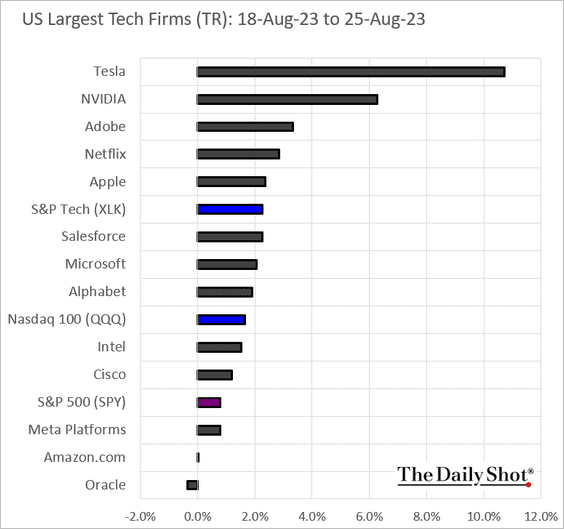

• Largest US tech firms:

Back to Index

Credit

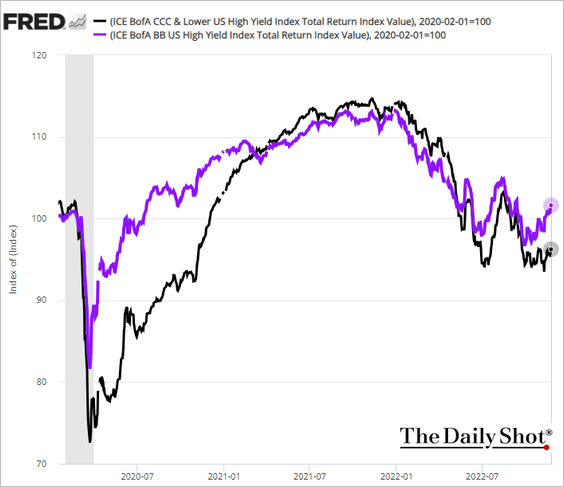

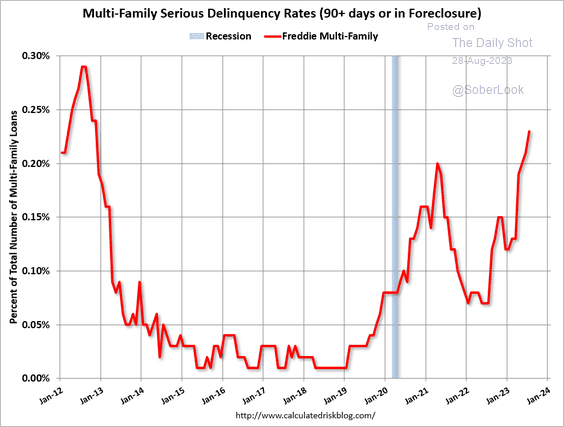

1. Stressed credits have been outperforming.

Source: @markets Read full article

Source: @markets Read full article

——————–

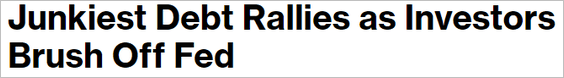

2. Leveraged loan recovery rates are crashing, offsetting the benefits of relatively low default rates.

Source: @markets Read full article

Source: @markets Read full article

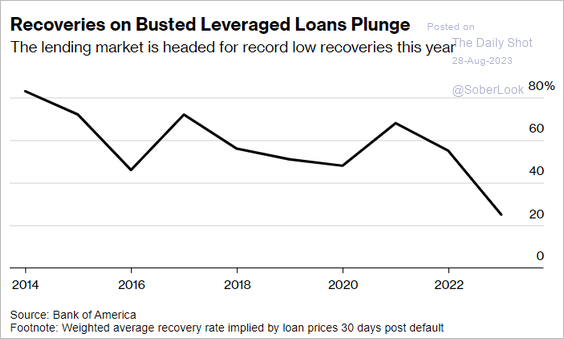

3. Multifamily housing delinquency rates continue to rise.

Source: Calculated Risk

Source: Calculated Risk

4. Here is last week’s performance across credit asset classes.

Back to Index

Global Developments

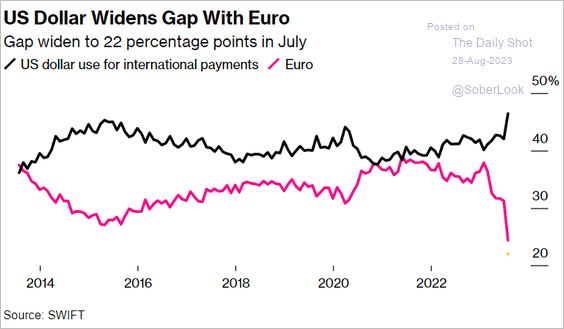

1. US dollar usage in global payments hit a record high.

Source: @markets Read full article

Source: @markets Read full article

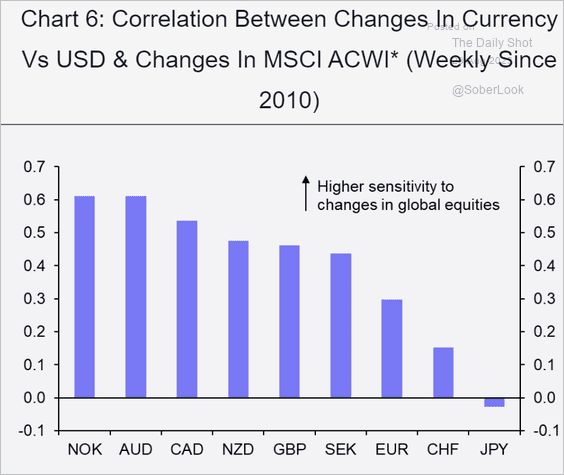

2. Which DM currencies are most correlated to stocks?

Source: Capital Economics

Source: Capital Economics

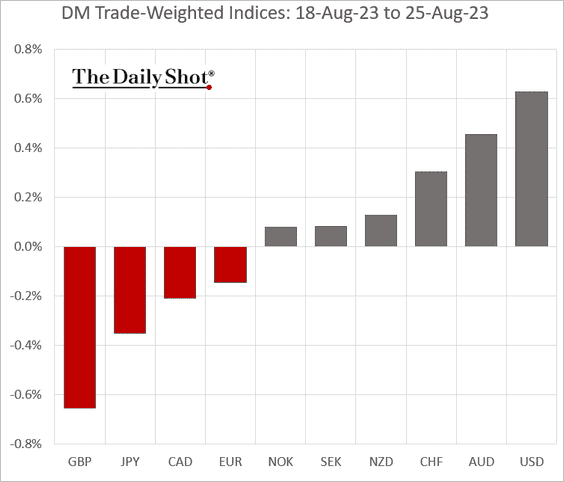

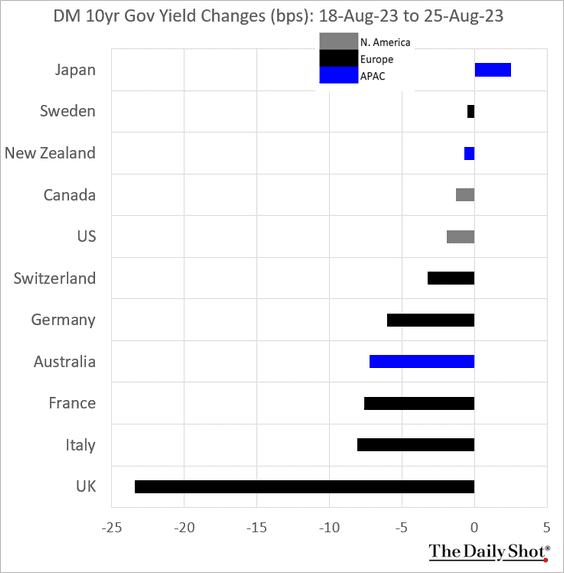

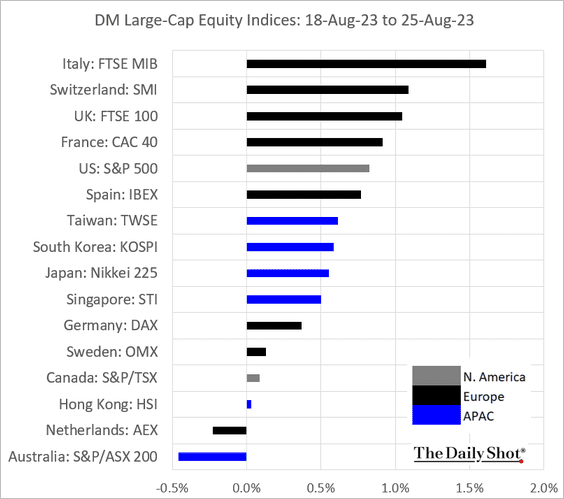

3. Next, we have some DM performance data from last week.

• Currencies:

• Bond yields:

• Equities:

——————–

Food for Thought

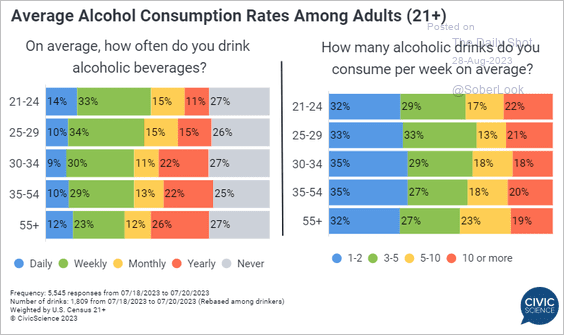

1. Alcohol consumption by age:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

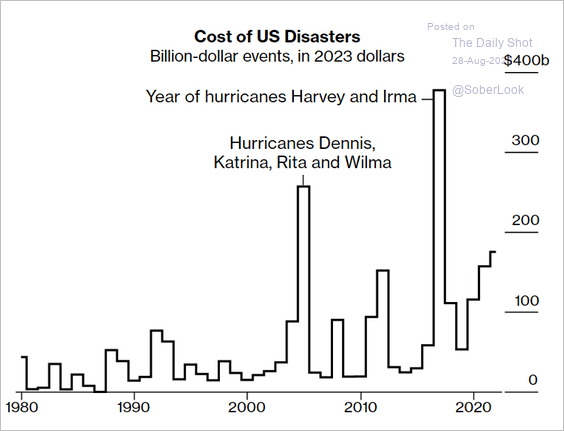

2. Inflation-adjusted cost of US disasters:

Source: @bbgvisualdata Read full article

Source: @bbgvisualdata Read full article

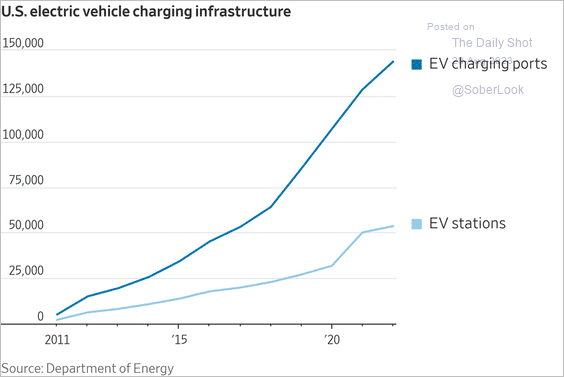

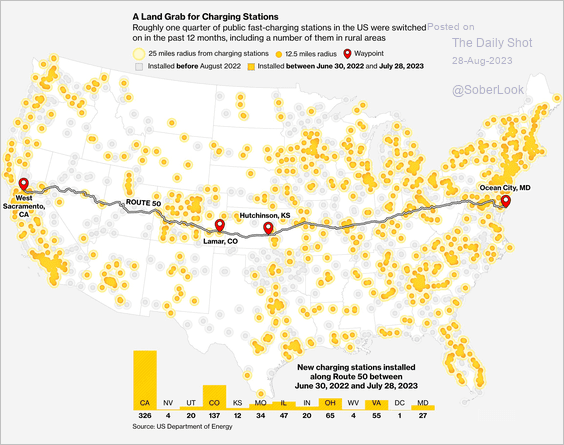

3. US EV charging infrastructure:

Source: @WSJ Read full article

Source: @WSJ Read full article

• Fast-charging stations:

Source: @bbgvisualdata Read full article

Source: @bbgvisualdata Read full article

——————–

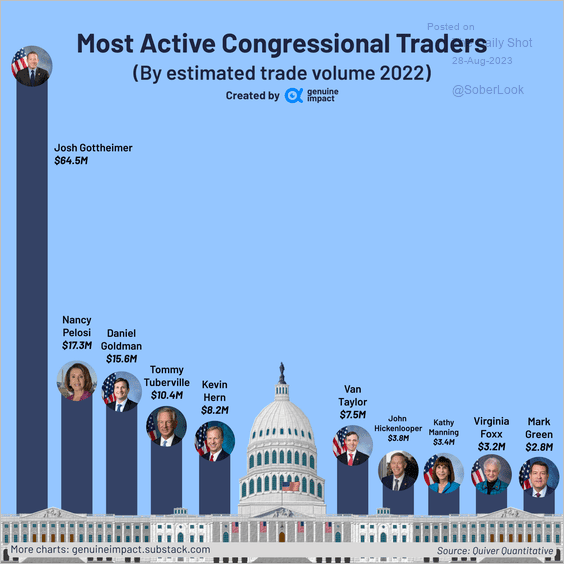

4. Active trading by members of Congress:

Source: @genuine_impact

Source: @genuine_impact

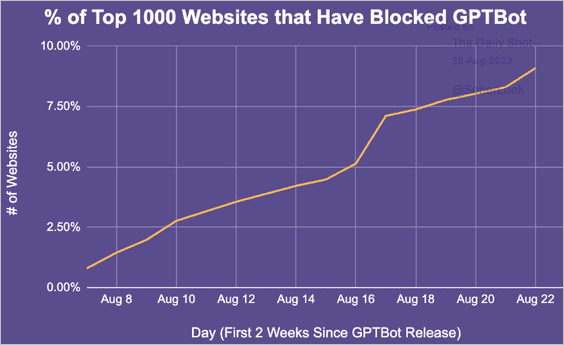

5. Websites blocking OpenAI’s web-scraping bots:

Source: Originality.AI Read full article

Source: Originality.AI Read full article

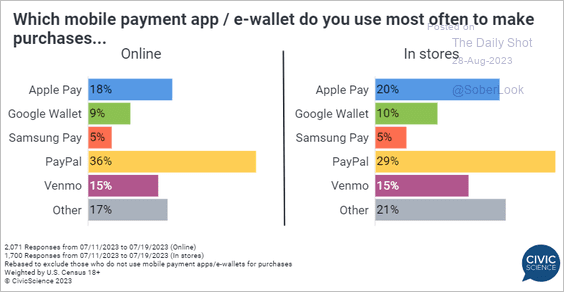

6. Preferred payment apps:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

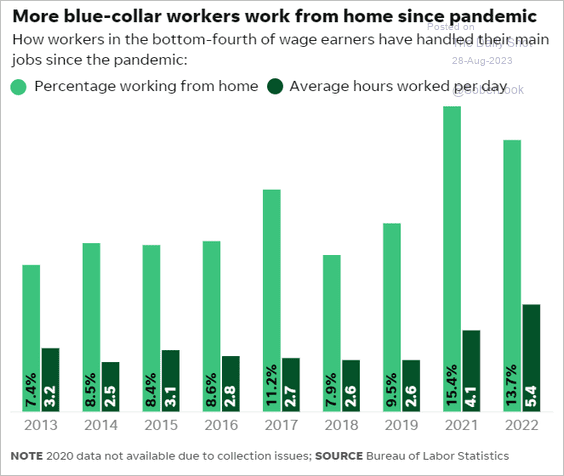

7. Blue-collar workers working from home:

Source: USA Today Read full article

Source: USA Today Read full article

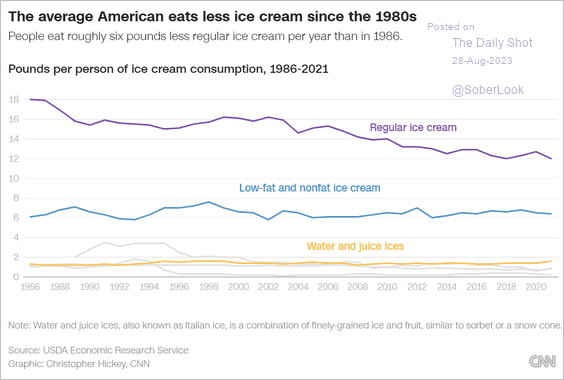

8. Ice cream consumption in the US:

Source: CNN Business Read full article

Source: CNN Business Read full article

——————–

Back to Index