The Daily Shot: 29-Aug-23

• The United States

• Europe

• Japan

• China

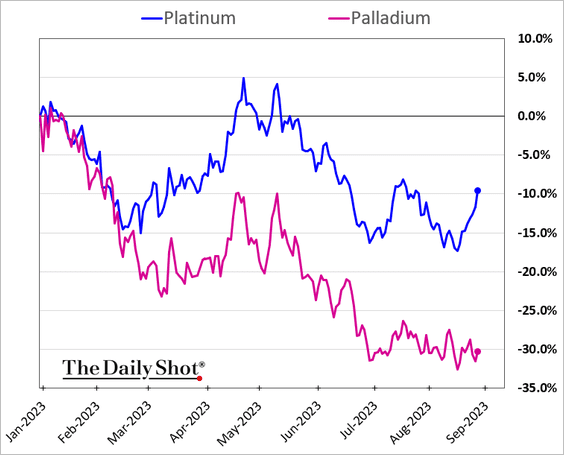

• Emerging Markets

• Commodities

• Equities

• Rates

• Food for Thought

The United States

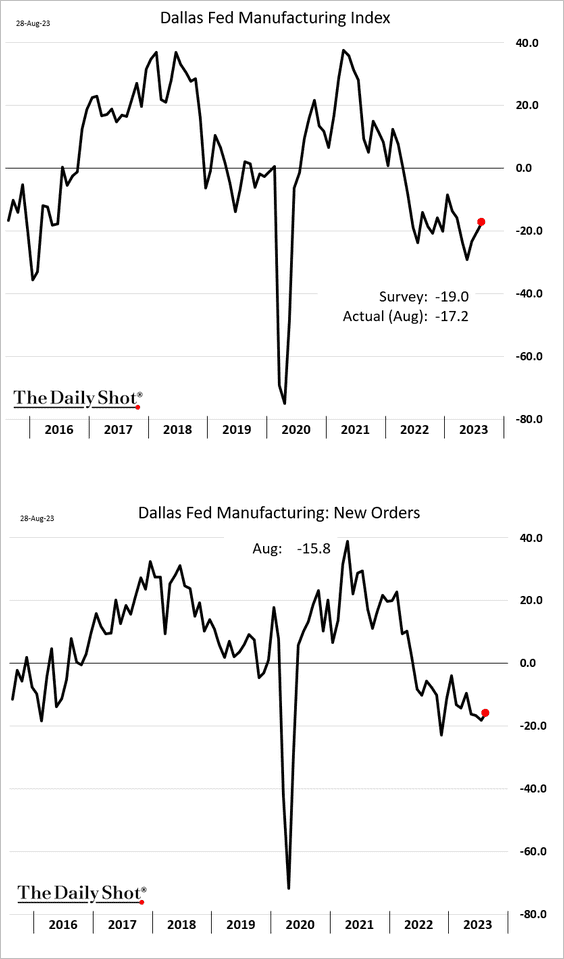

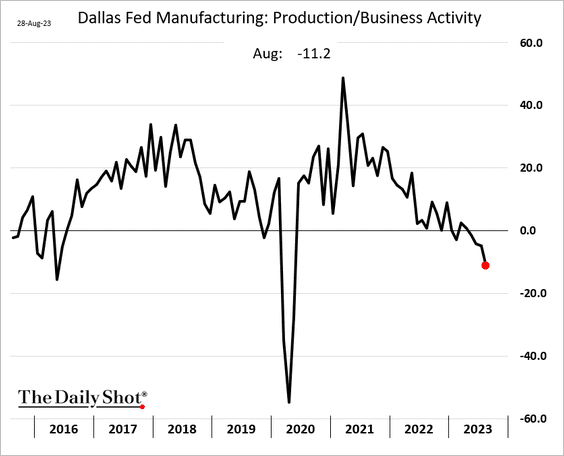

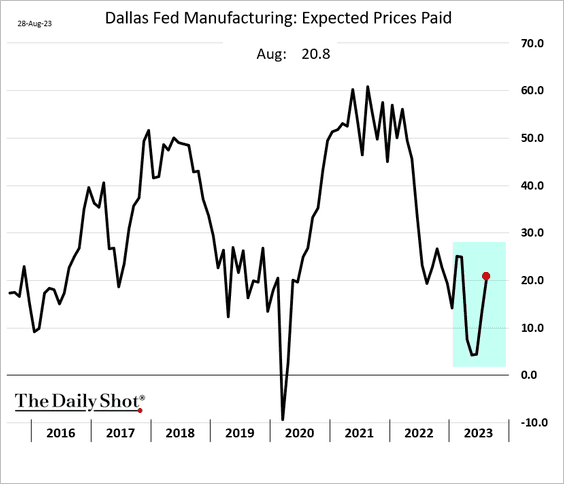

1. The Dallas Fed’s manufacturing survey shows persistent weakness in the region’s factory activity, …

… as the index of production deteriorates further.

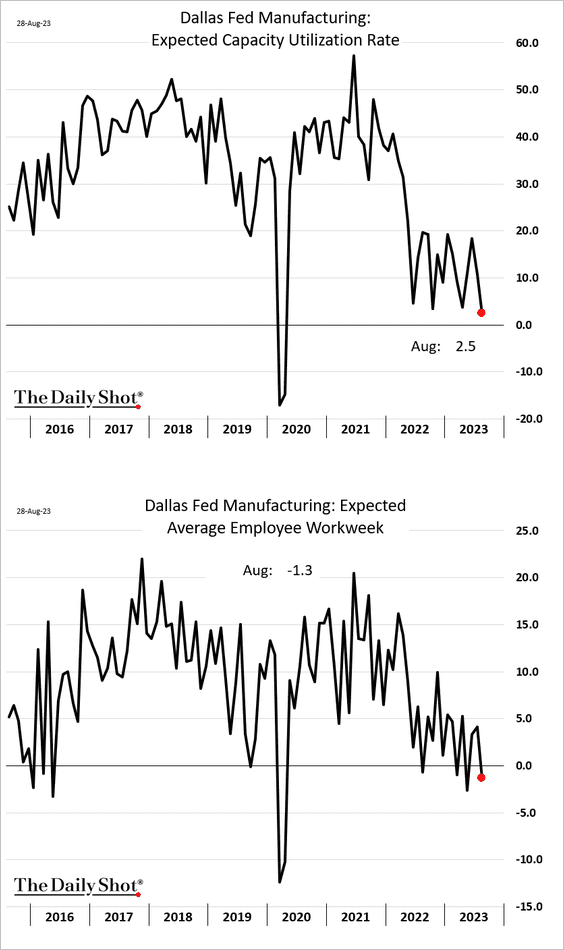

• Manufacturers don’t expect to be very busy in the months ahead.

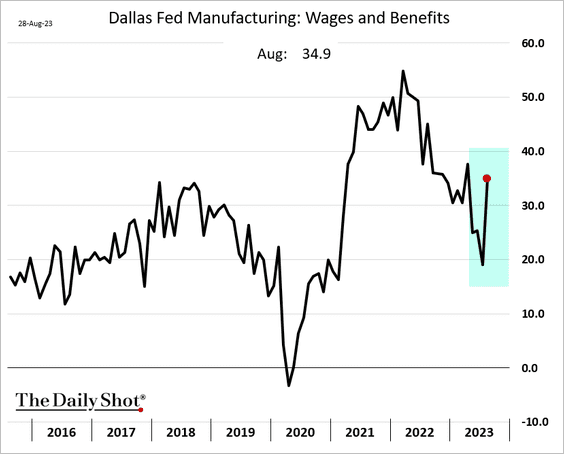

• Businesses boosted wages this month.

And more factories expect to pay higher prices for raw materials.

——————–

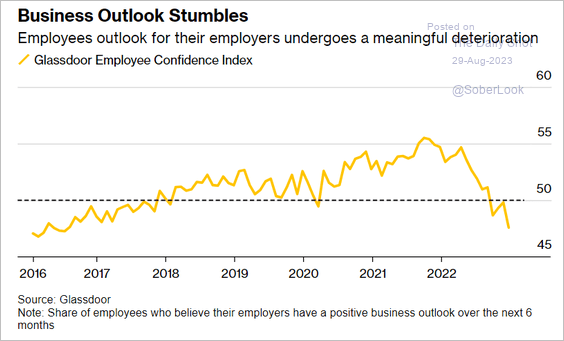

2. Next, let’s take a look at some labor market trends.

• Employee sentiment has been eroding.

Source: @economics Read full article

Source: @economics Read full article

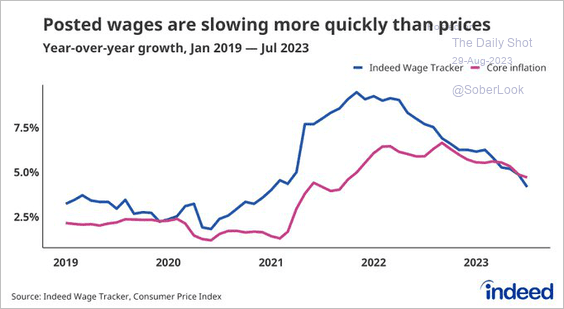

• The Indeed Wage Tracker points to slower wage growth.

Source: @nick_bunker Read full article

Source: @nick_bunker Read full article

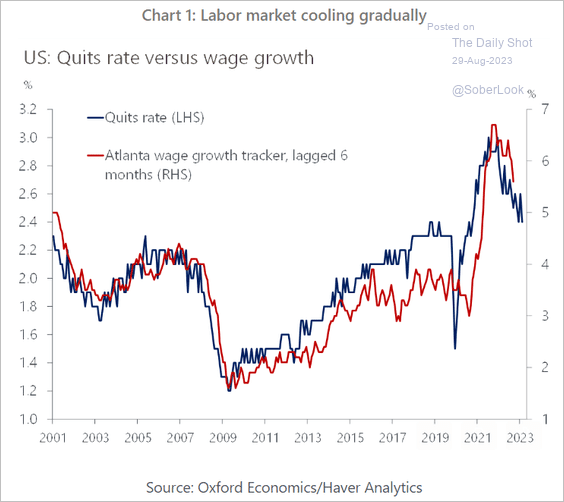

And so does the falling quits rate (voluntary resignations).

Source: Oxford Economics

Source: Oxford Economics

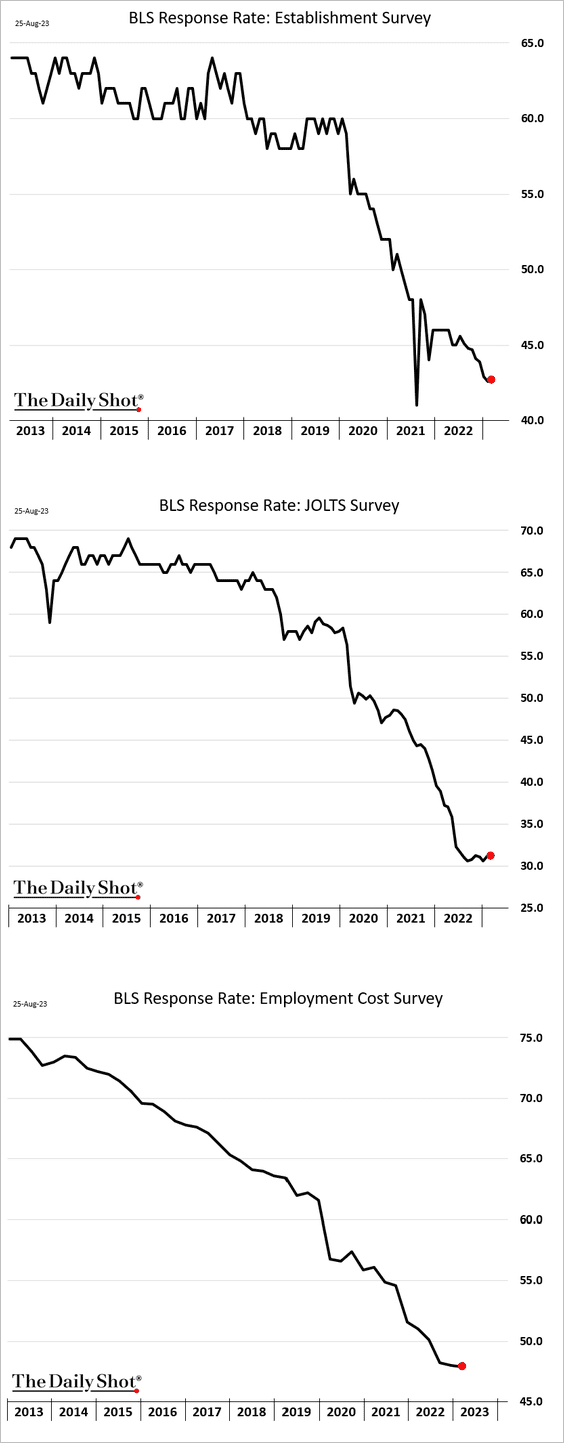

• Response rates on the Bureau of Labor Statistics’ employment surveys, including the official employment report (first panel), continue to drop.

h/t Felice Maranz

h/t Felice Maranz

——————–

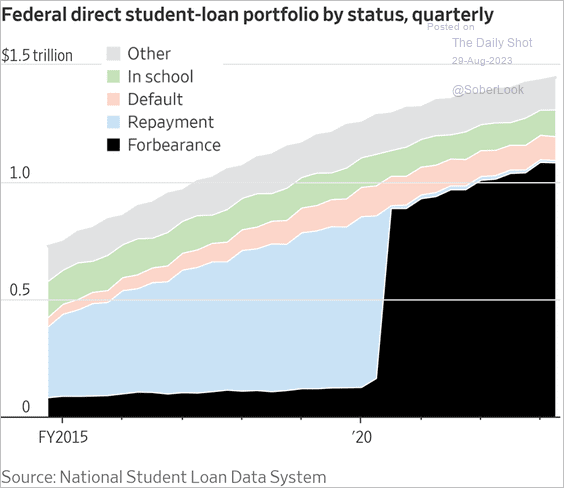

3. Some economists see a pullback in consumption later this year. Here is one catalyst: Interest on federal student loans will resume this Friday, with the initial payments scheduled for October. The amount of loans in forbearance is now above $1 trillion.

Source: @WSJ Read full article

Source: @WSJ Read full article

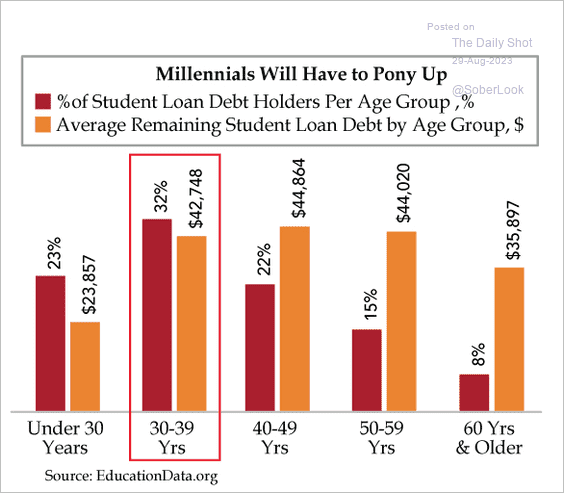

• Millennials are particularly exposed.

Source: Quill Intelligence

Source: Quill Intelligence

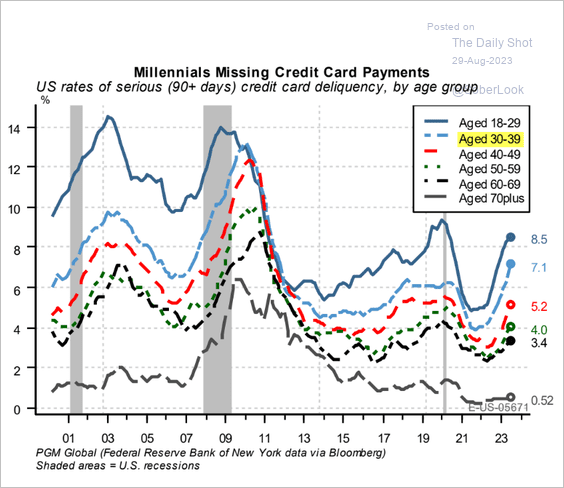

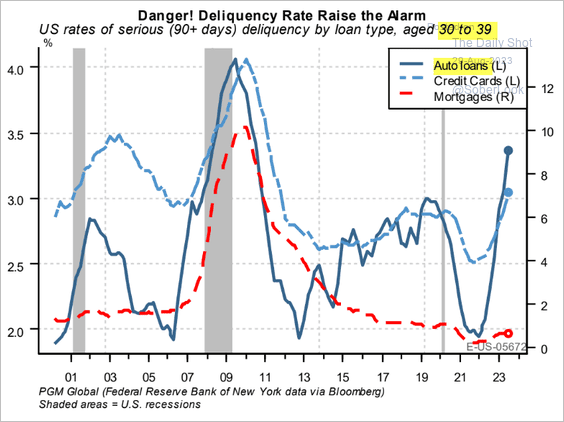

• Some Millennials are already struggling with credit card debt, as delinquencies hit the highest level since 2012.

Source: PGM Global

Source: PGM Global

And auto loan delinquencies are at their highest since 2011.

Source: PGM Global

Source: PGM Global

Back to Index

Europe

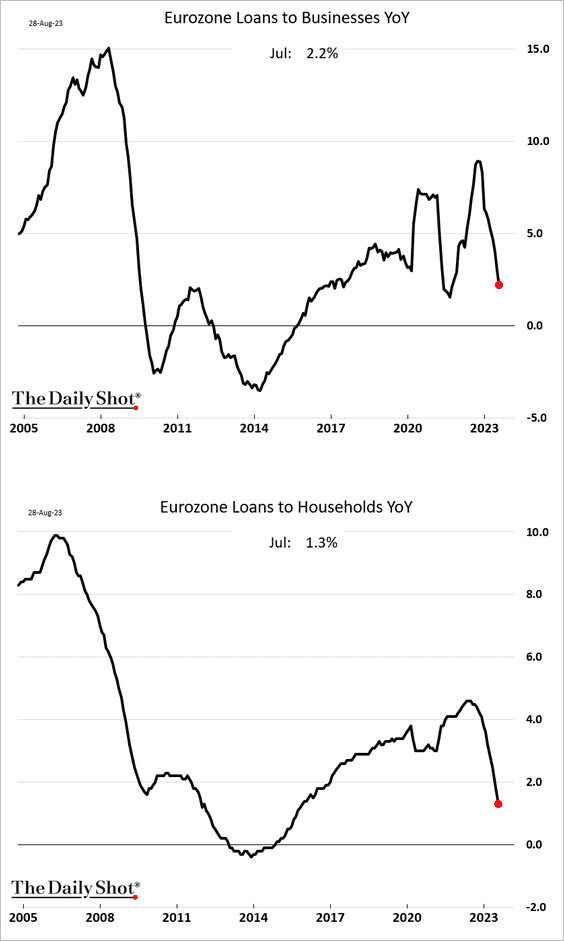

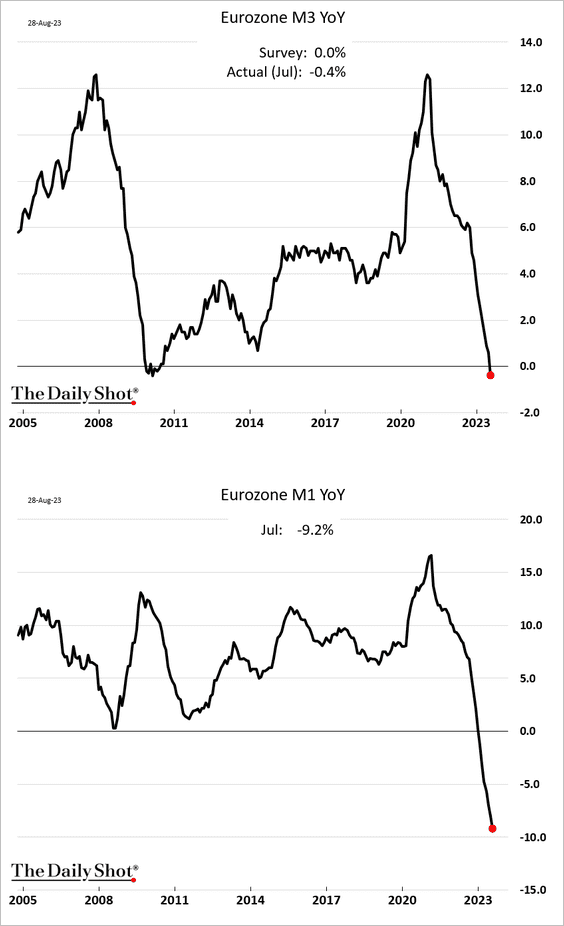

1. The Eurozone is facing a liquidity crunch.

• Growth in loans to companies and households:

• Growth in money supply metrics:

——————–

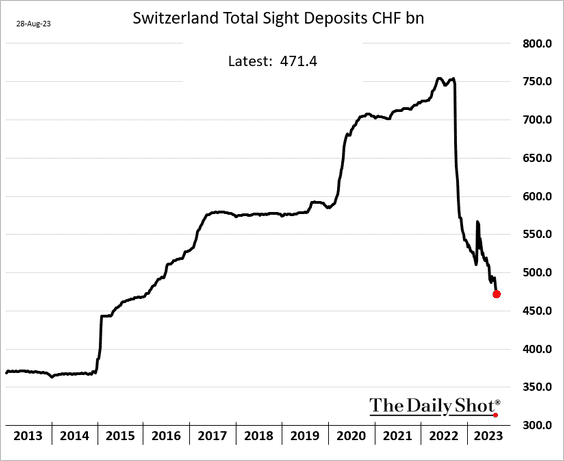

2. The Swiss National Bank’s quantitative tightening continues.

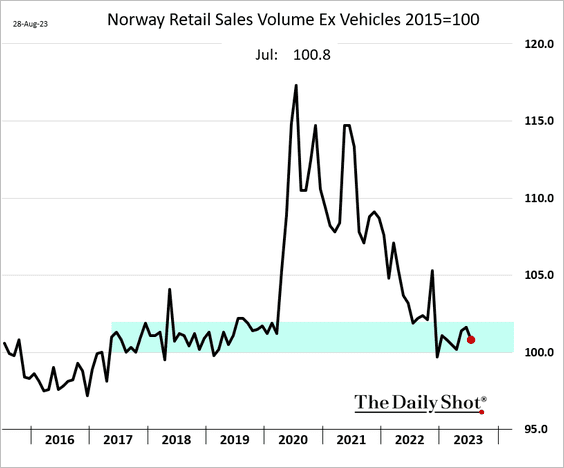

3. Norway’s retail sales are holding at pre-COVID levels.

Back to Index

Japan

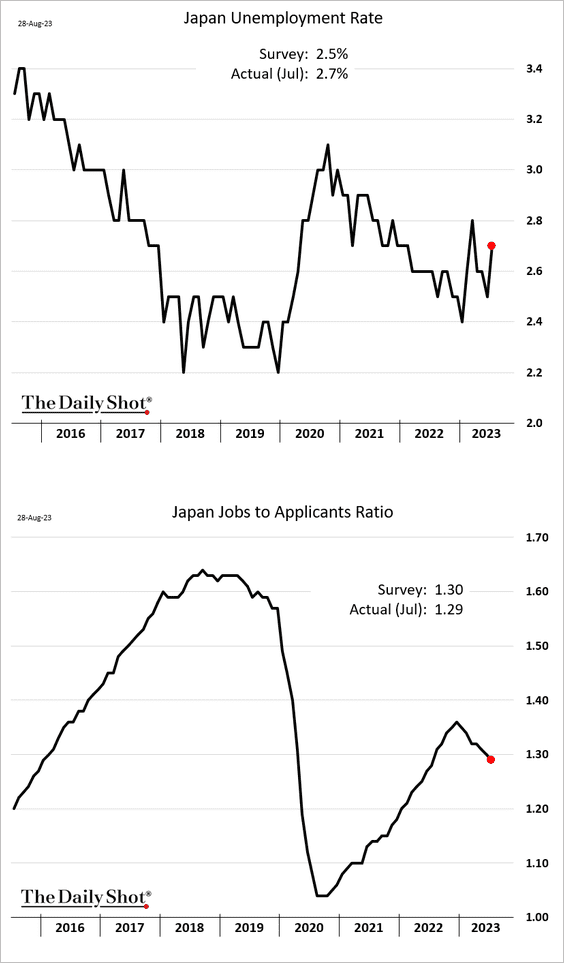

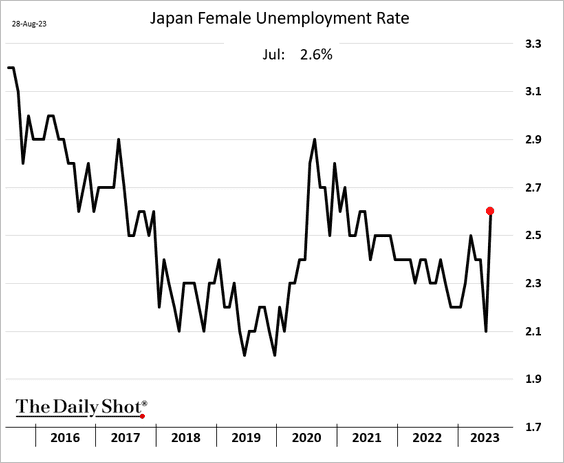

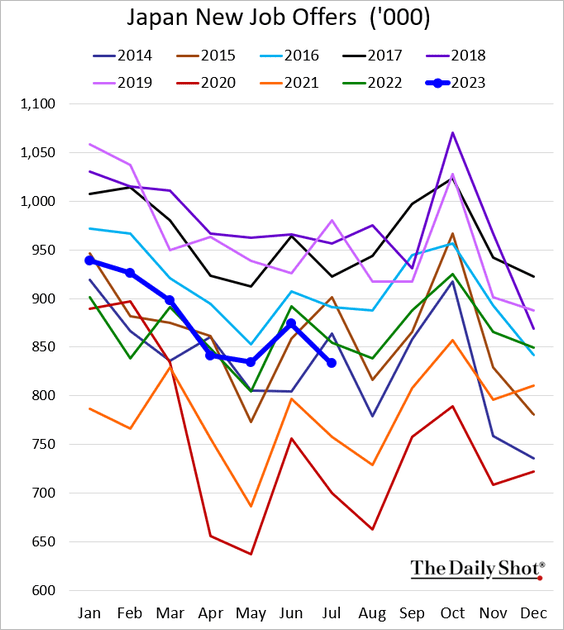

The labor market is showing signs of slowing down.

Source: @economics Read full article

Source: @economics Read full article

• The unemployment rate and jobs-to-applicants ratio:

• Unemployment among women:

• New job offers:

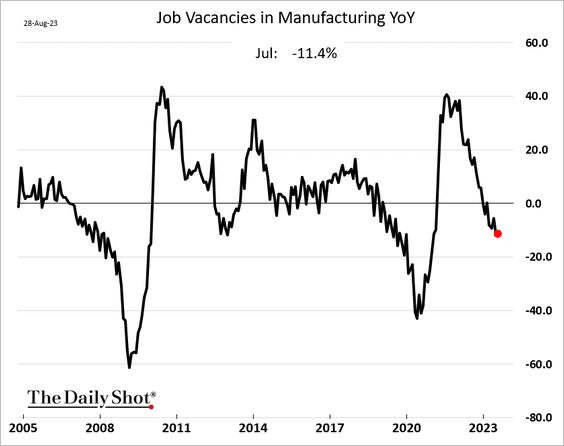

• Year-over-year growth in manufacturing job vacancies:

Back to Index

China

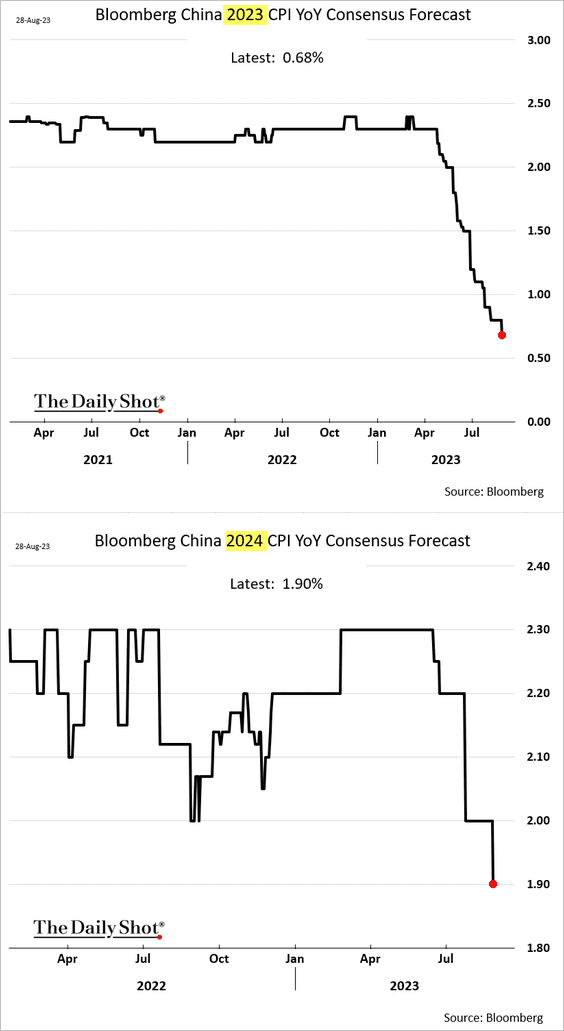

1. Economists continue to lower their projections for China’s GDP growth.

Source: @economics Read full article

Source: @economics Read full article

Inflation forecasts are also getting trimmed.

——————–

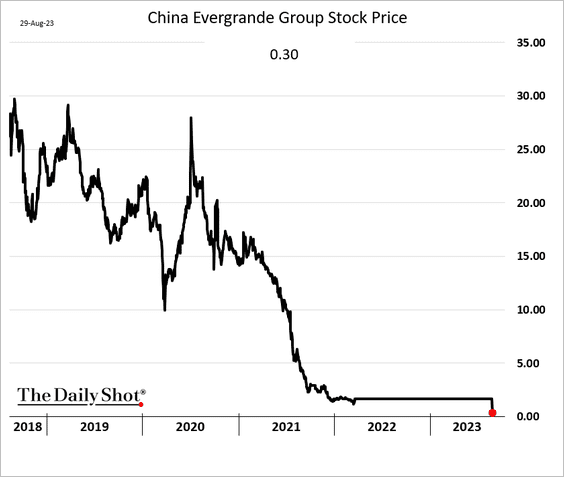

2. Evergrande’s share trading has resumed.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

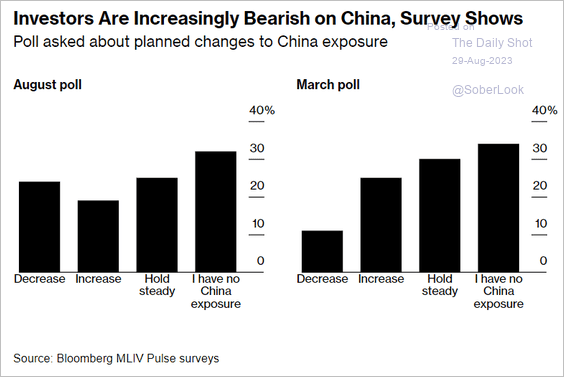

3. Investors are increasingly bearish on China.

Source: @markets Read full article

Source: @markets Read full article

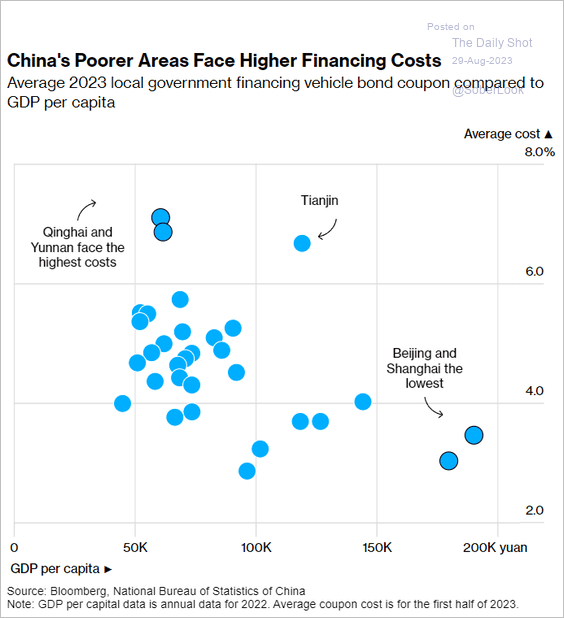

4. China’s local governments’ LGFV funding costs are highest for the poorer areas.

Source: @markets Read full article

Source: @markets Read full article

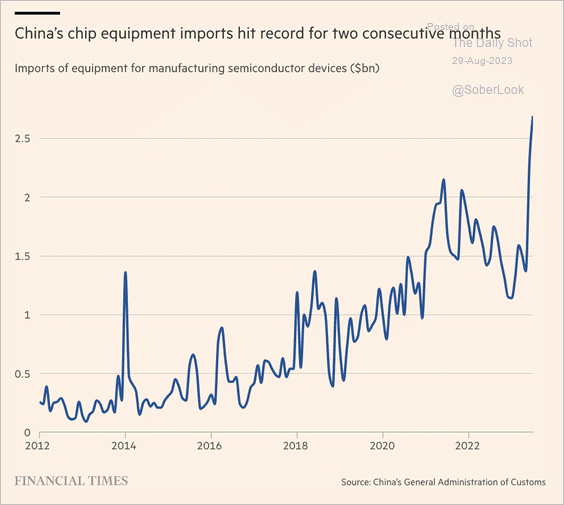

5. Chip equipment imports have been surging.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Emerging Markets

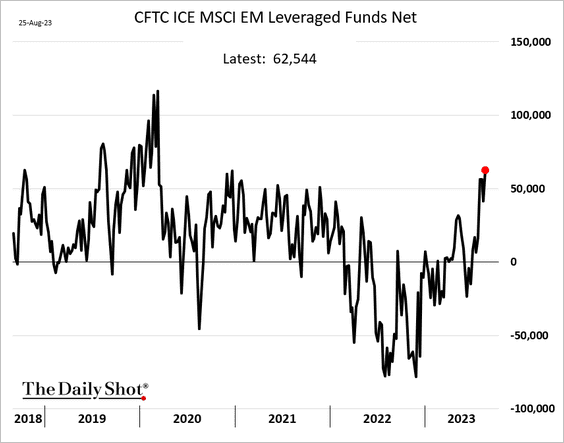

1. Hedge funds have been boosting their bets on EM equities.

Source: @markets Read full article

Source: @markets Read full article

——————–

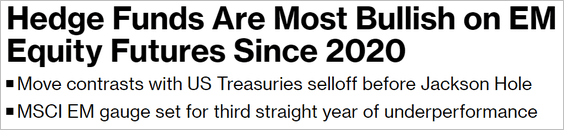

2. According to BCA Research, EM “cyclical and structural growth prospects are poor.”

Source: BCA Research

Source: BCA Research

Back to Index

Commodities

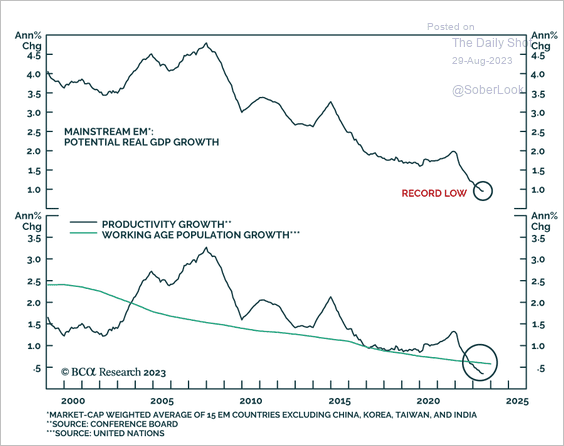

1. Platinum has been rebounding, widening its outperformance over palladium.

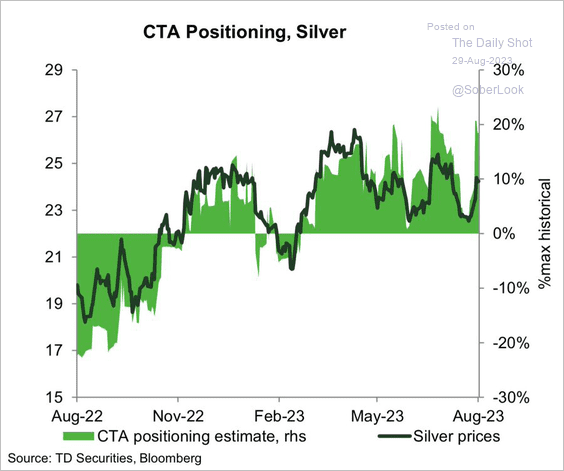

2. CTAs are betting on silver.

Source: TD Securities; @WallStJesus

Source: TD Securities; @WallStJesus

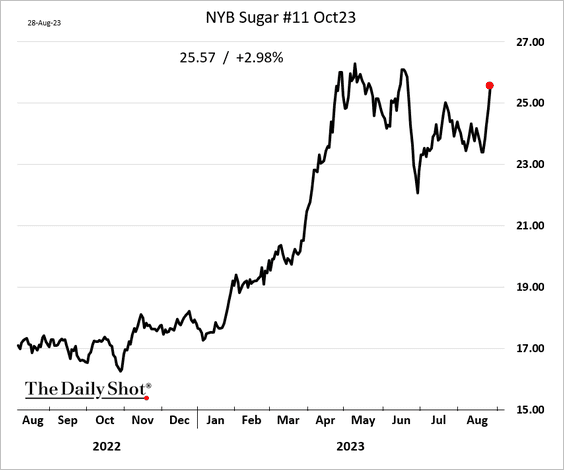

3. Sugar continues to rally.

Reuters: – Dealers said the market has been supported by news that India is expected to ban mills from exporting sugar in the season starting in October, halting shipments for the first time in seven years.

There were also concerns about the production in Thailand, where below-average rains were seen reducing sugarcane development.

Back to Index

Equities

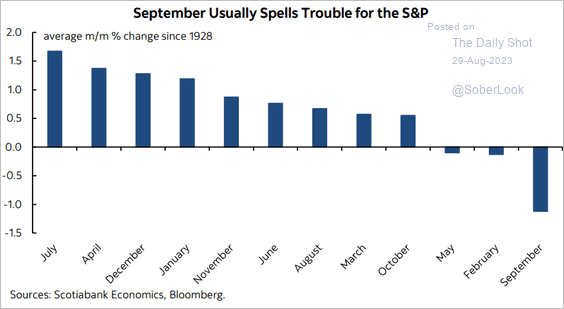

1. September tends to be the worst month for US stocks.

Source: Scotiabank Economics

Source: Scotiabank Economics

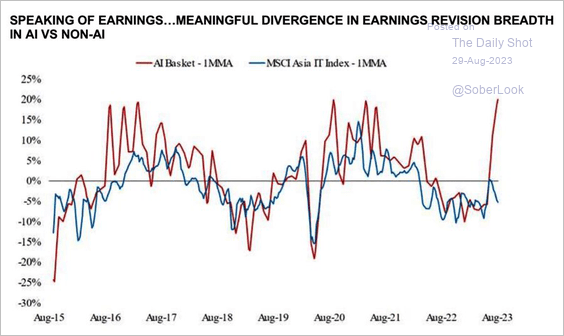

2. Earnings optimism has been all about AI-related businesses.

Source: Morgan Stanley; @WallStJesus

Source: Morgan Stanley; @WallStJesus

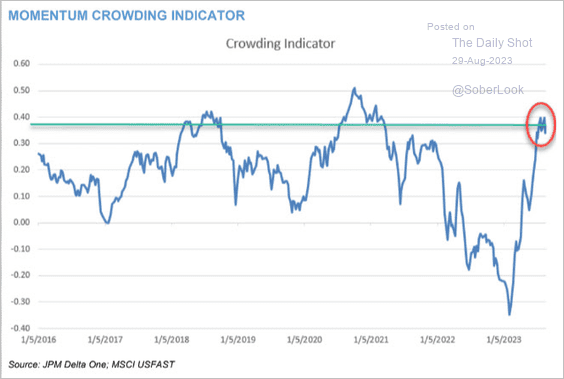

3. Everyone is piling into the same names.

Source: JP Morgan Research; @dailychartbook

Source: JP Morgan Research; @dailychartbook

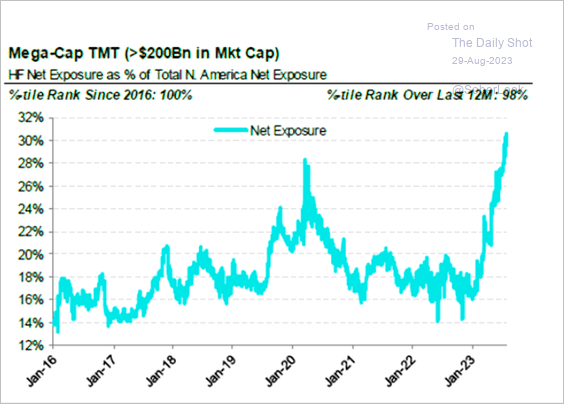

Hedge funds’ exposure to tech megacaps hit a new high.

Source: @themarketear

Source: @themarketear

——————–

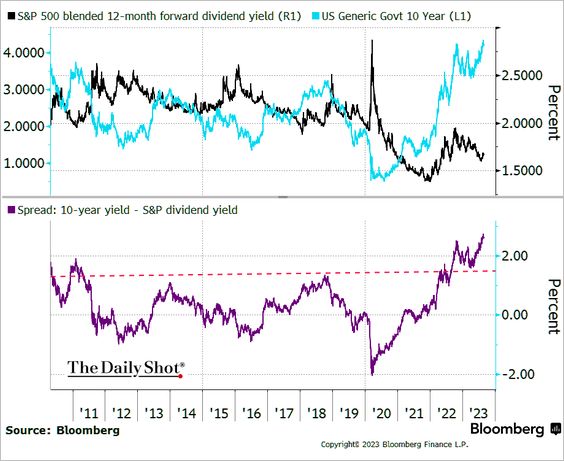

4. The S&P 500 expected dividend yield is now massively below the 10-year Treasury yield.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

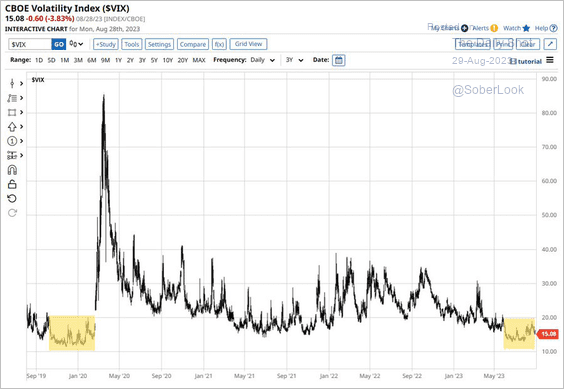

5. VIX has been below 19 for 64 consecutive sessions.

Source: @Barchart

Source: @Barchart

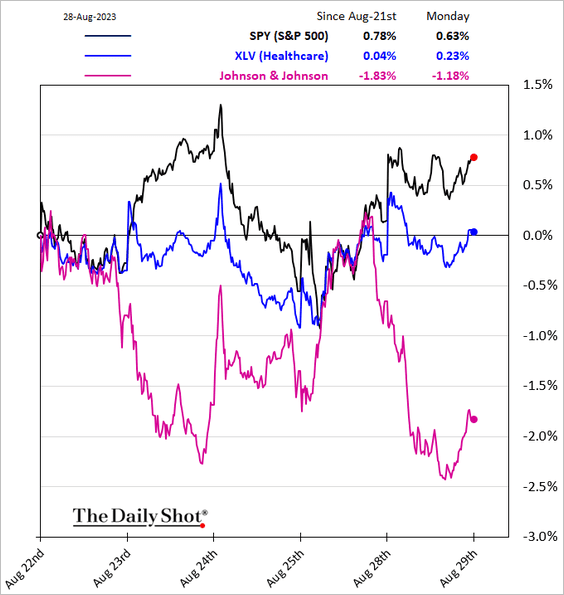

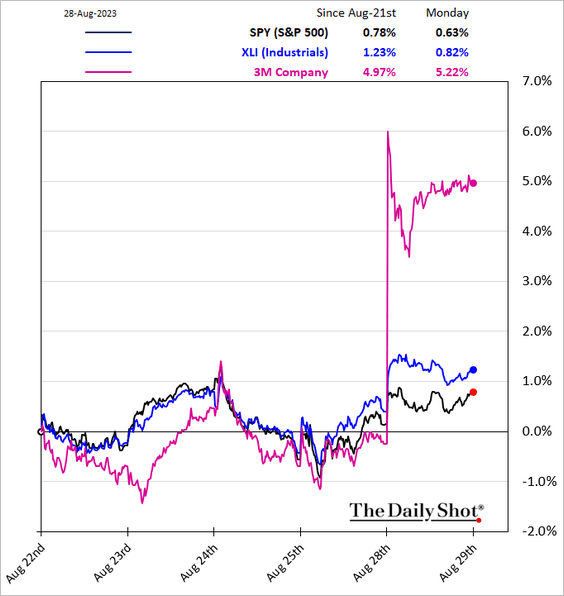

6. Here are a couple of sector trends.

• Healthcare:

• Industrials:

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Rates

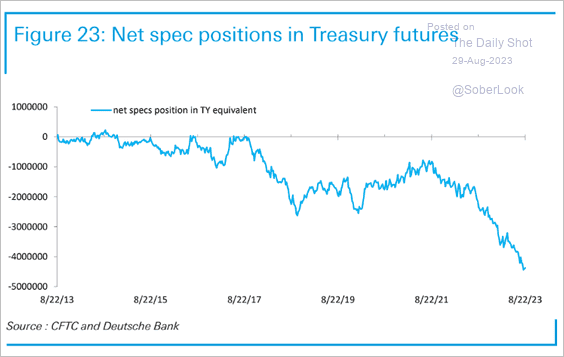

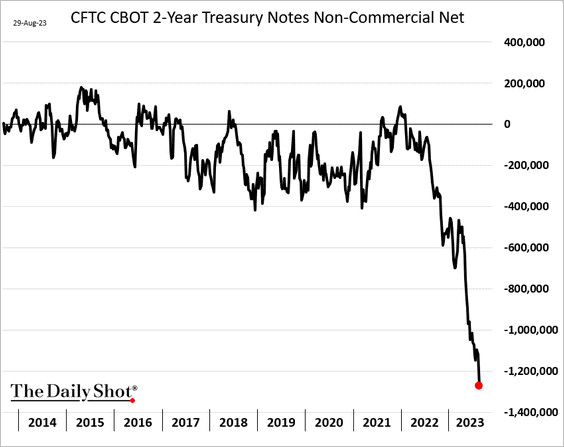

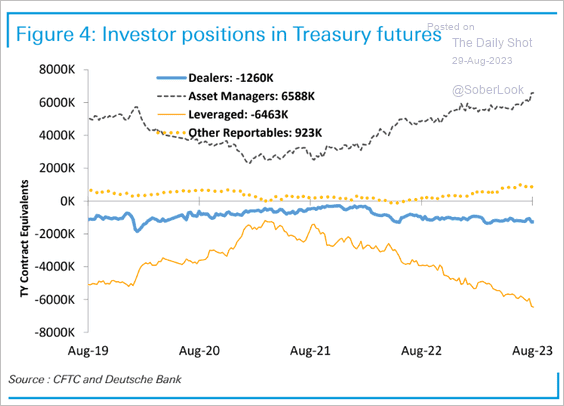

1. Speculative positioning in Treasury futures remains extraordinarily bearish.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

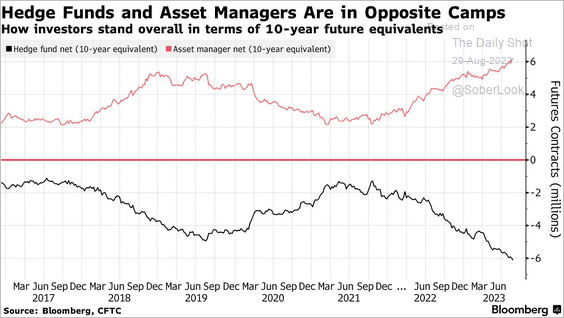

• Hedge funds’ Treasury positioning has diverged sharply from that of asset managers (2 charts).

Source: @markets Read full article

Source: @markets Read full article

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

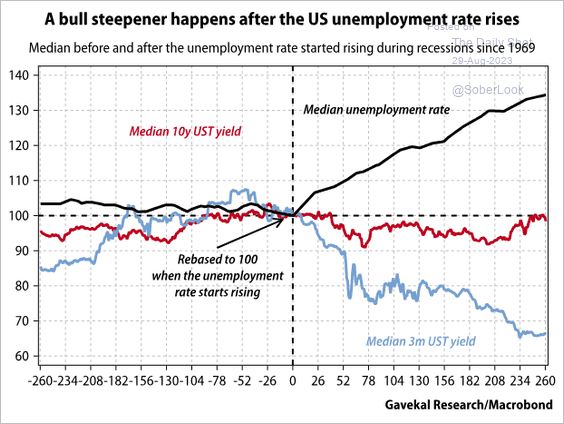

2. The Treasury curve undergoes a bull steepener when the unemployment rate starts rising.

Source: Gavekal Research

Source: Gavekal Research

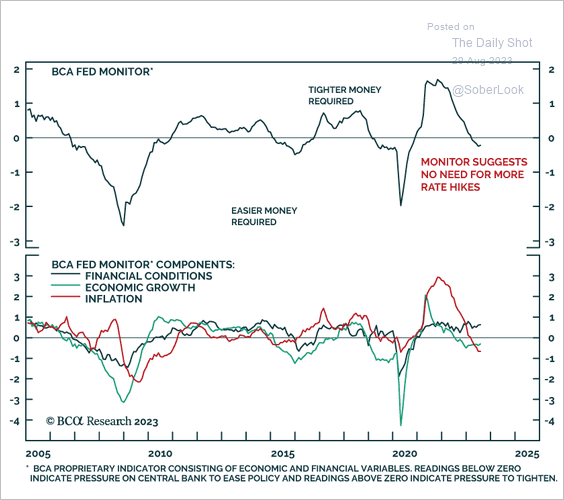

3. BCA’s Fed policy indicator suggests that no more rate hikes are needed.

Source: BCA Research

Source: BCA Research

——————–

Food for Thought

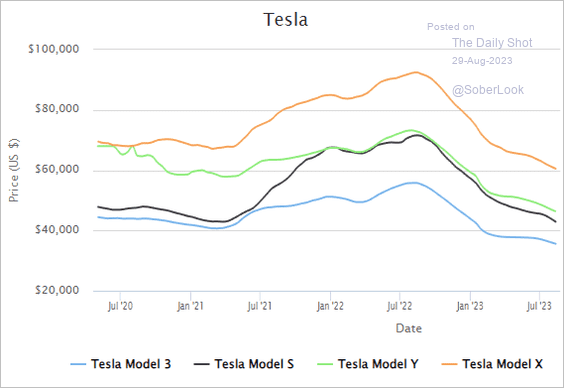

1. Used Tesla prices:

Source: CarGurus

Source: CarGurus

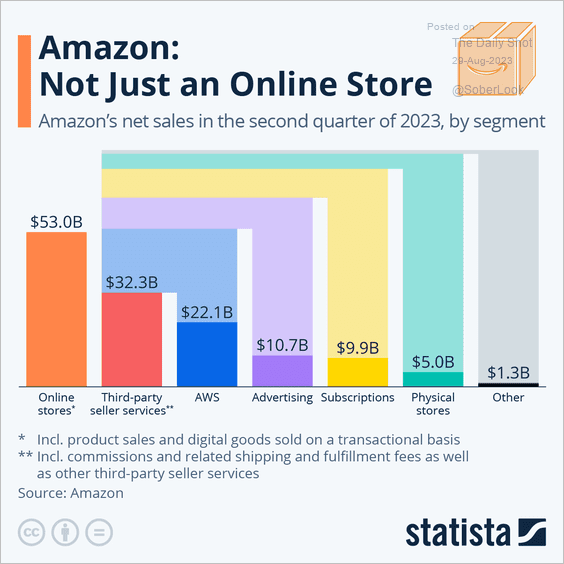

2. Amazon’s net sales by segment:

Source: Statista

Source: Statista

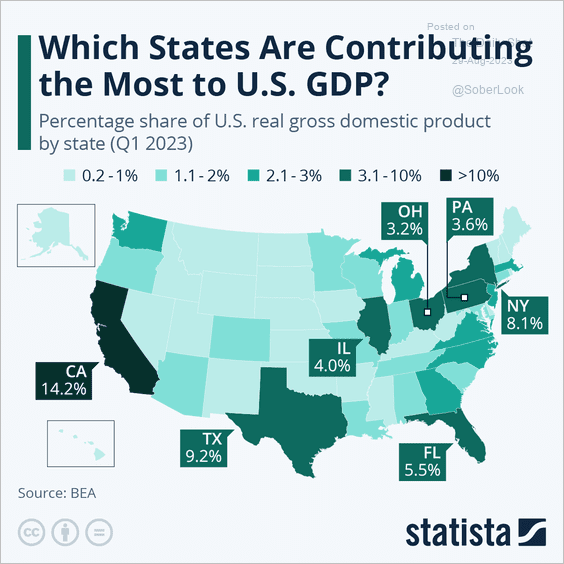

3. States’ contribution to US GDP:

Source: Statista

Source: Statista

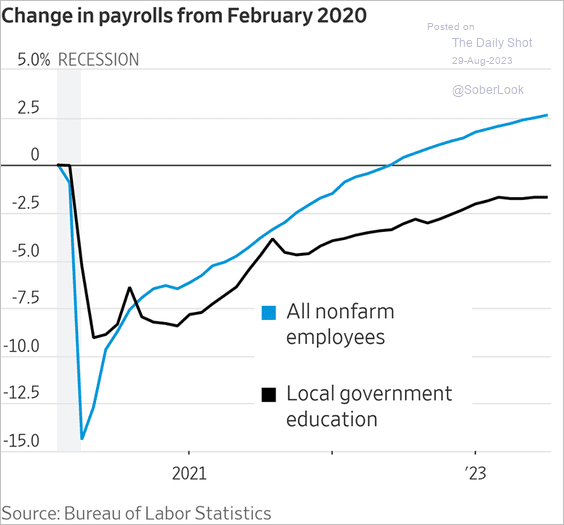

4. US school teacher numbers are yet to recover from the COVID losses.

Source: @WSJ Read full article

Source: @WSJ Read full article

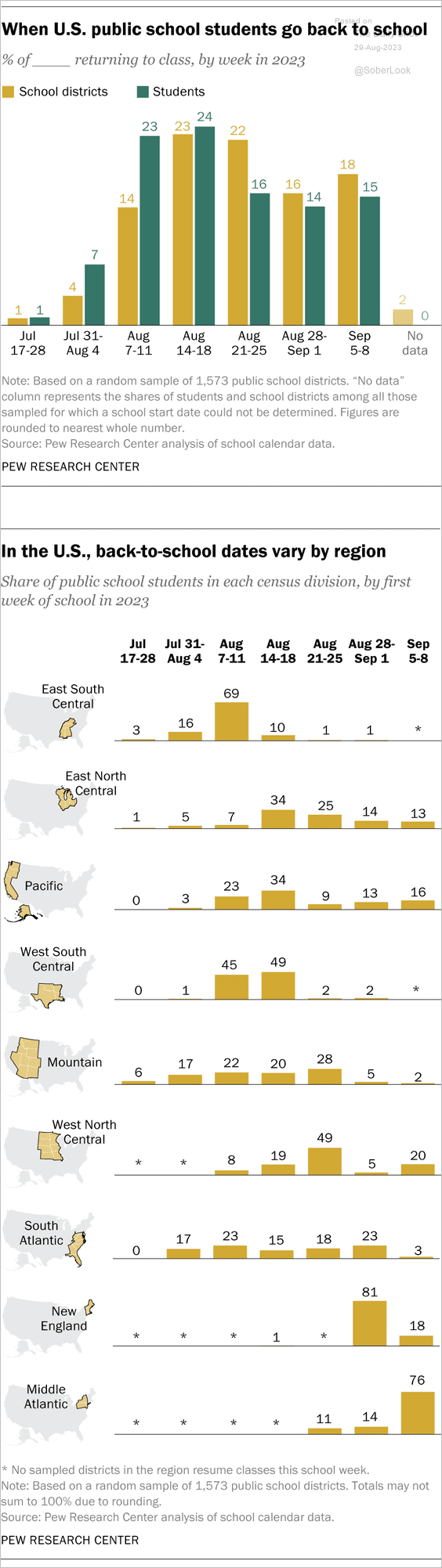

5. When do US public school students start their classes after the summer break?

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

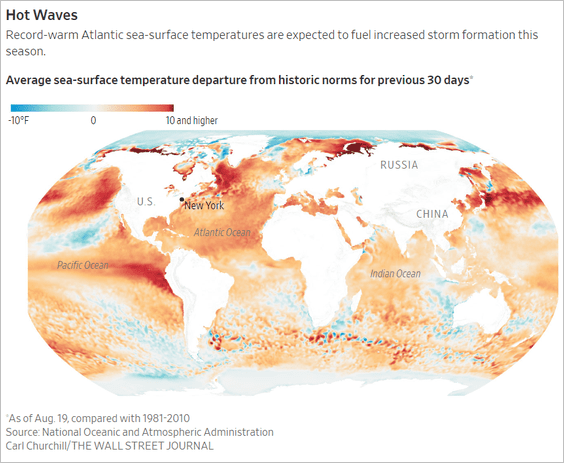

6. Hurricanes are coming:

Source: @WSJ Read full article

Source: @WSJ Read full article

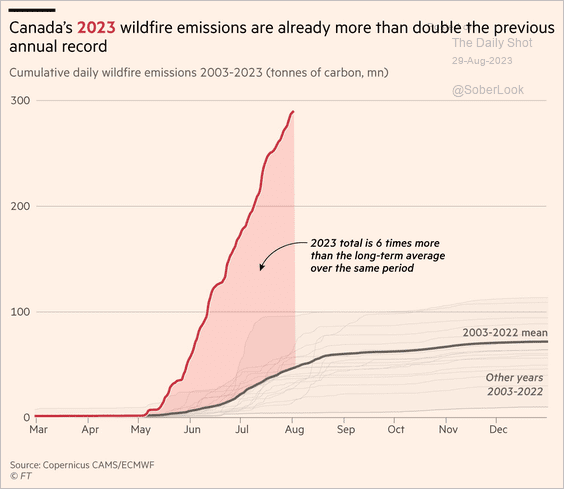

7. Canada’s 2023 wildfire emissions in perspective:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

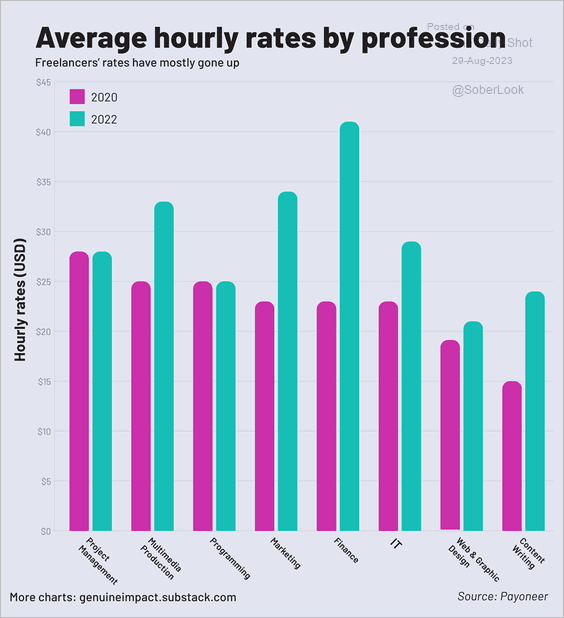

8. Freelancers’ rates by profession:

Source: @genuine_impact

Source: @genuine_impact

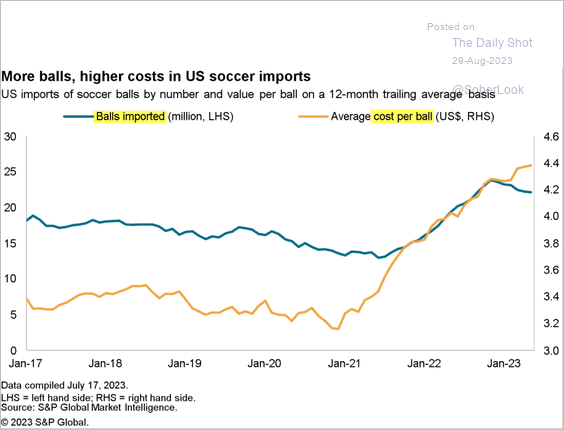

9. US imports of soccer balls:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

Back to Index