The Daily Shot: 30-Aug-23

• The United States

• The Eurozone

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Food for Thought

The United States

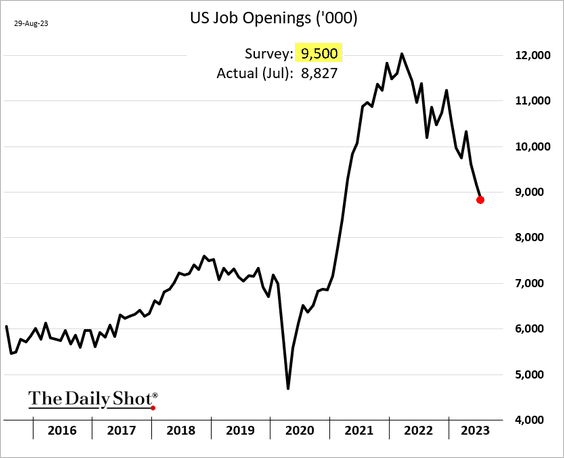

1. The July job openings print came in below forecasts, suggesting that the job market continues to loosen.

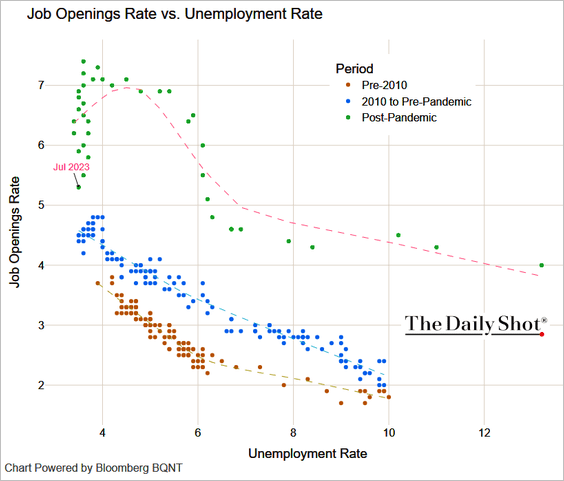

• The Beveridge Curve signals improvement in addressing imbalances in the labor market.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

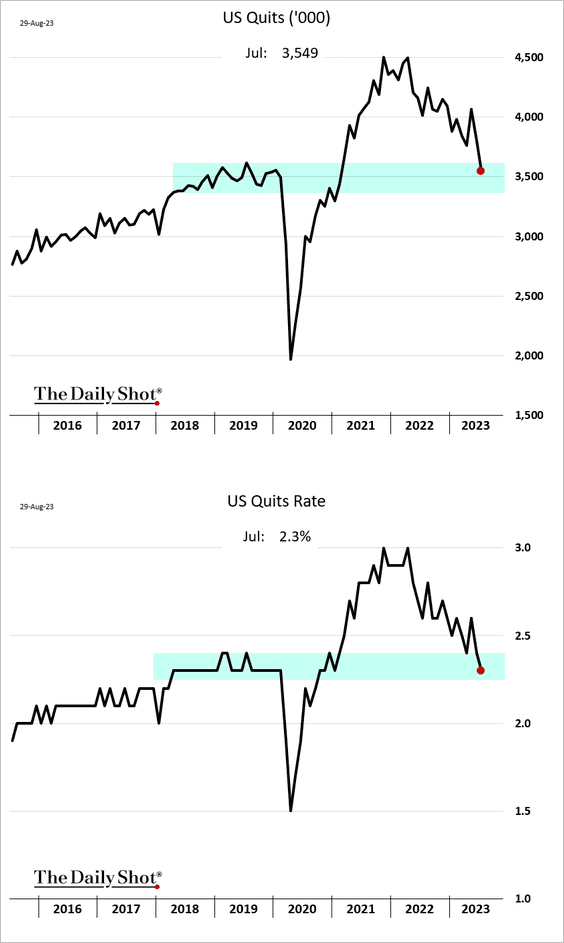

• Voluntary resignations (quits) are back at pre-COVID levels.

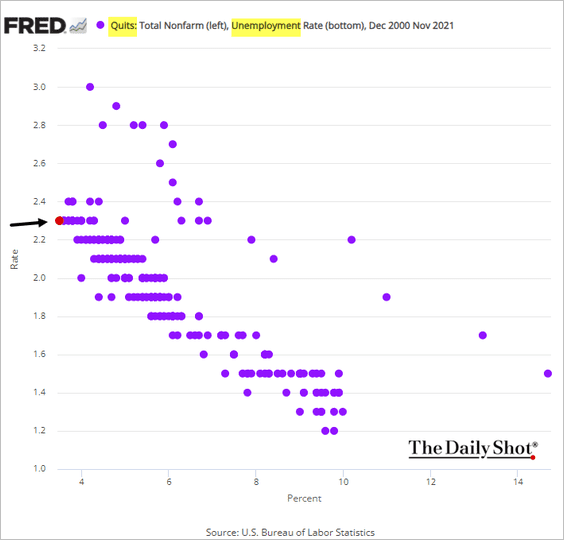

– The scatterplot comparing the quits rate to the unemployment rate also suggests normalization.

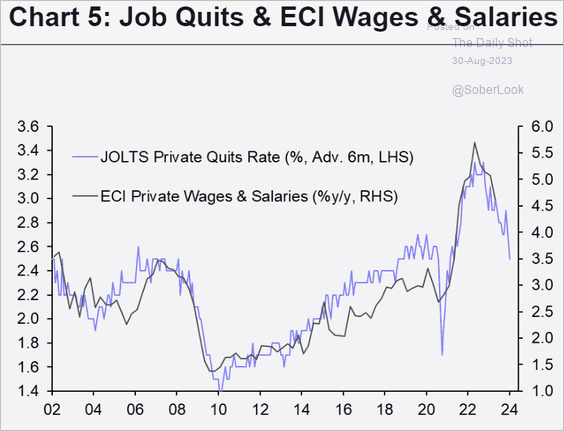

– The quits rate signals a sharp slowdown in wage growth ahead.

Source: Capital Economics

Source: Capital Economics

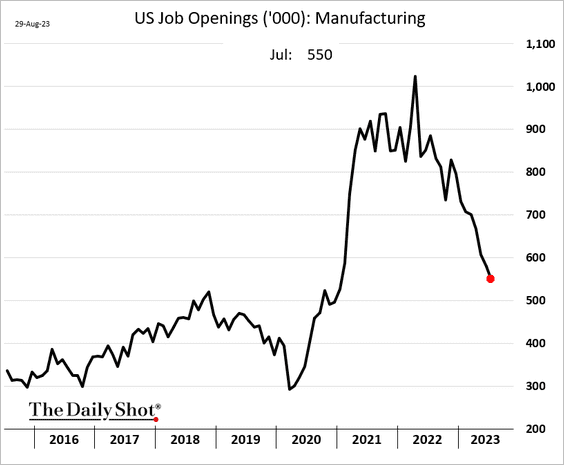

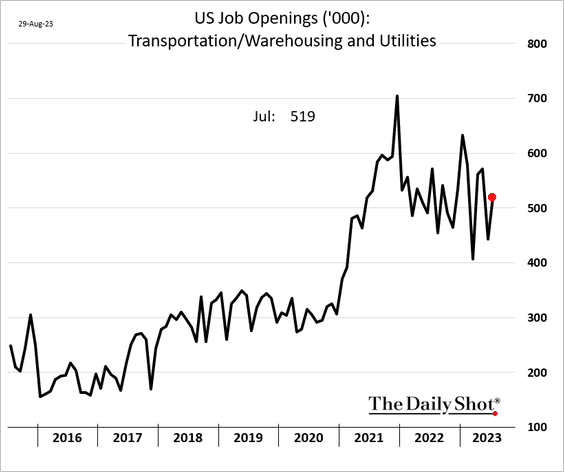

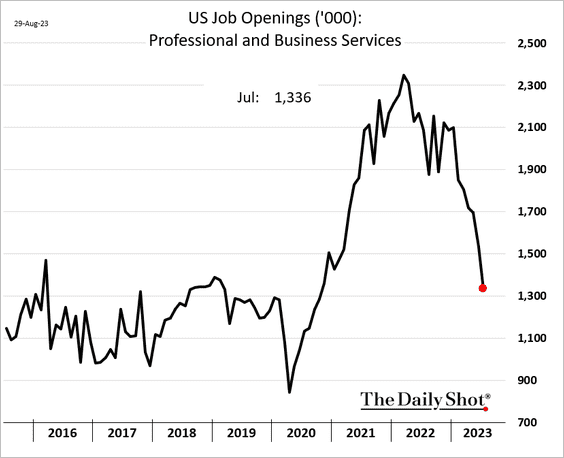

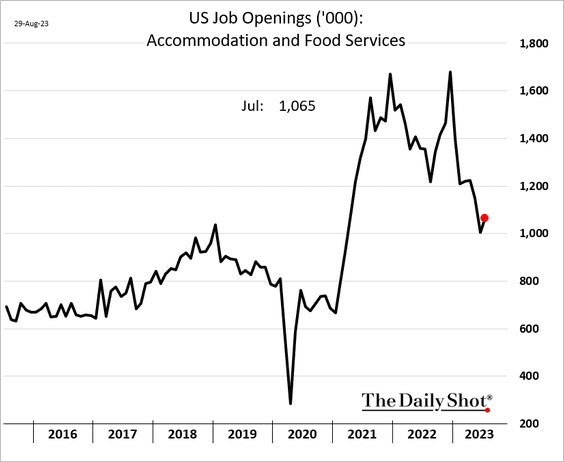

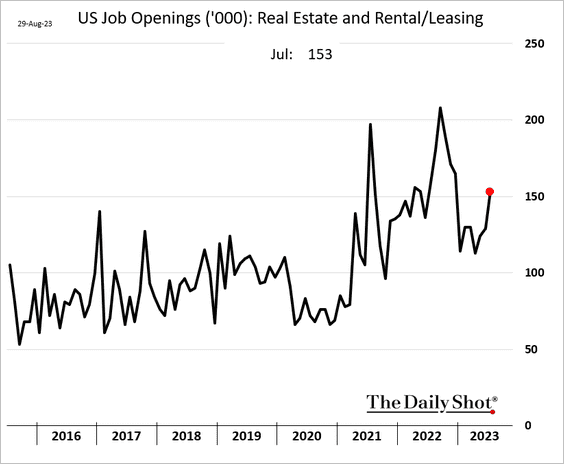

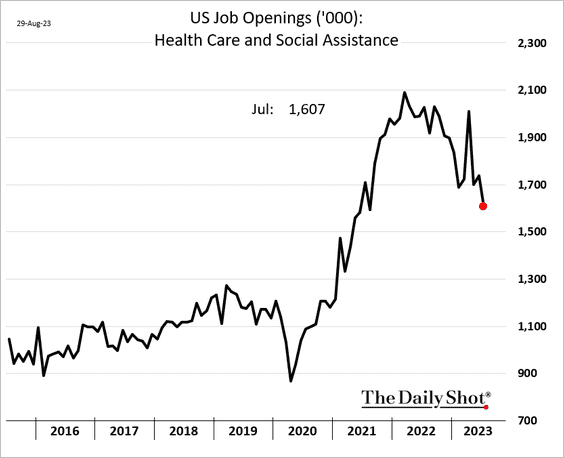

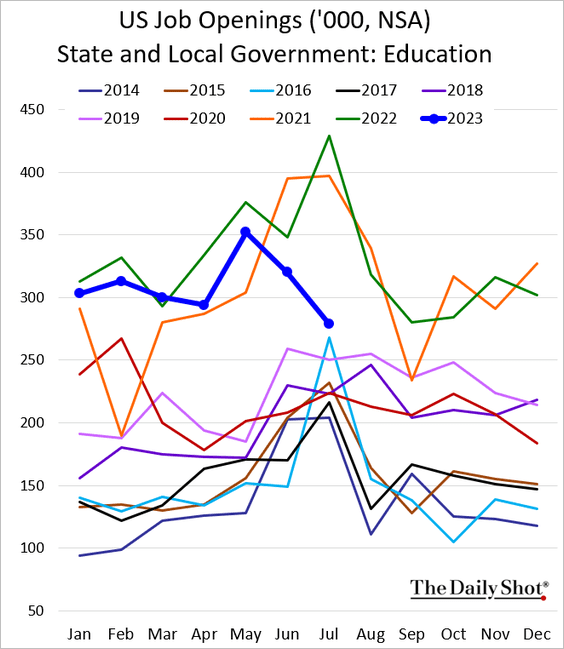

• Below are some job openings trends by sector.

– Manufacturing:

– Logistics:

– Professional and business services:

– Hotels and restaurants:

– Real estate services (surprisingly resilient):

– Healthcare:

– Public school teachers (a big drop):

——————–

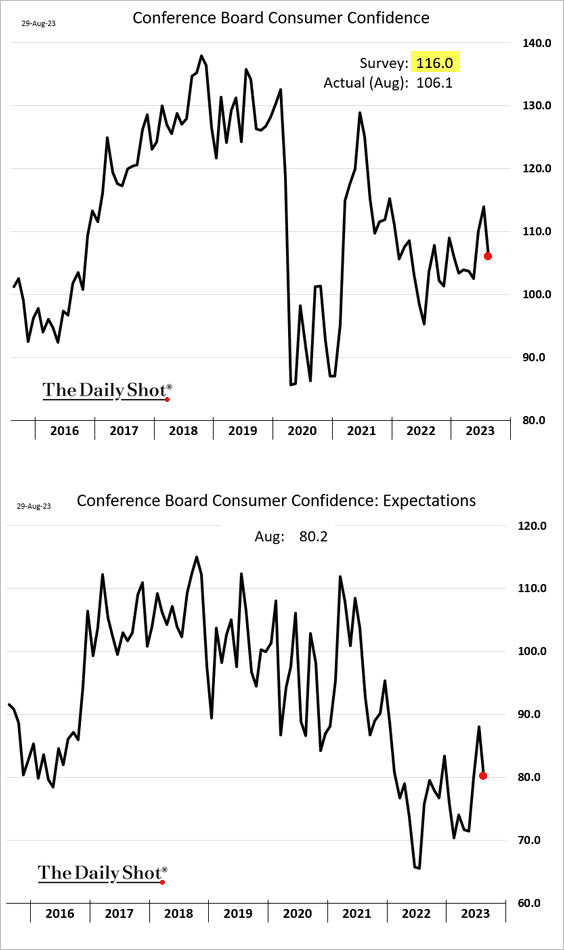

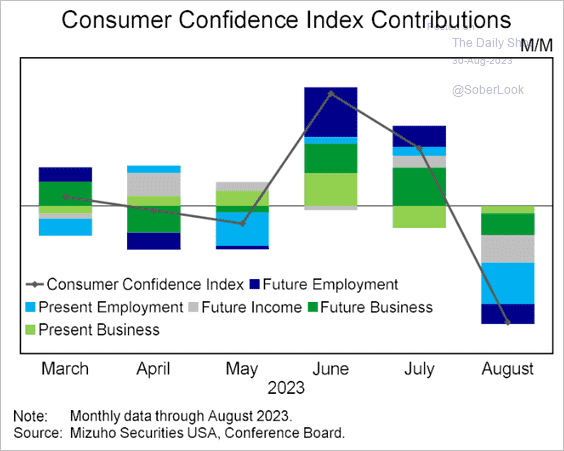

2. The Conference Board’s consumer sentiment index dropped this month amid higher gasoline prices and stock market volatility. The print was well below forecasts.

• All components of the Conference Board’s index declined.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

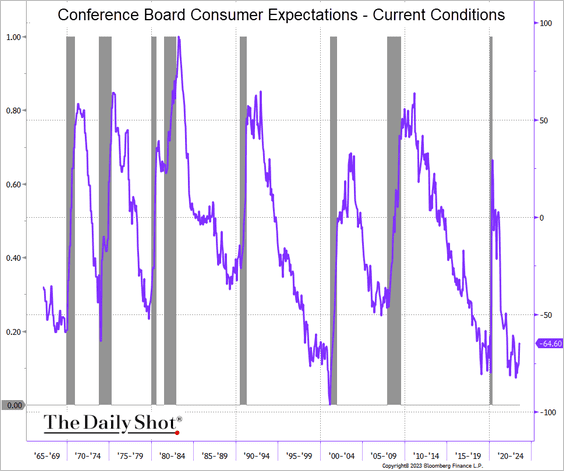

• The spread between expectations and current conditions continues to signal a recession ahead.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

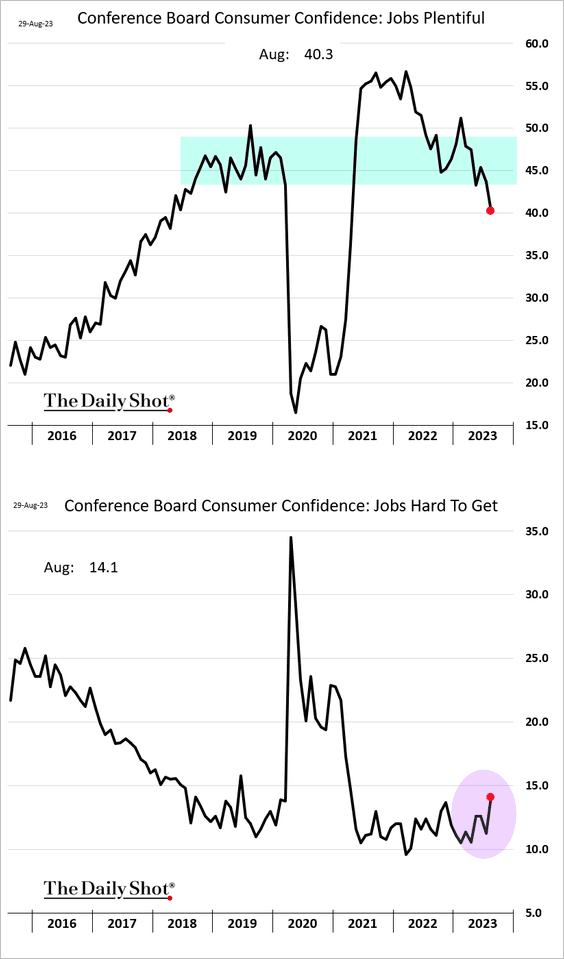

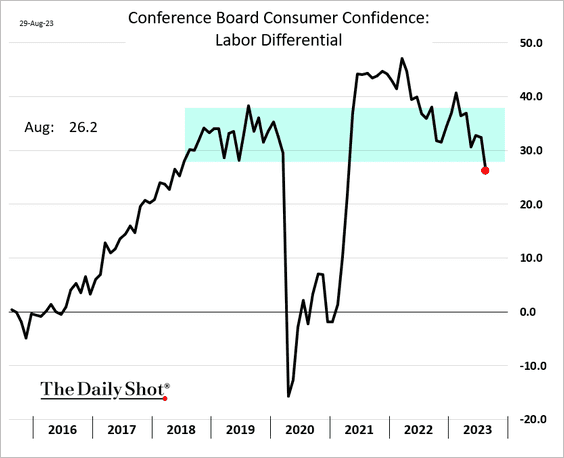

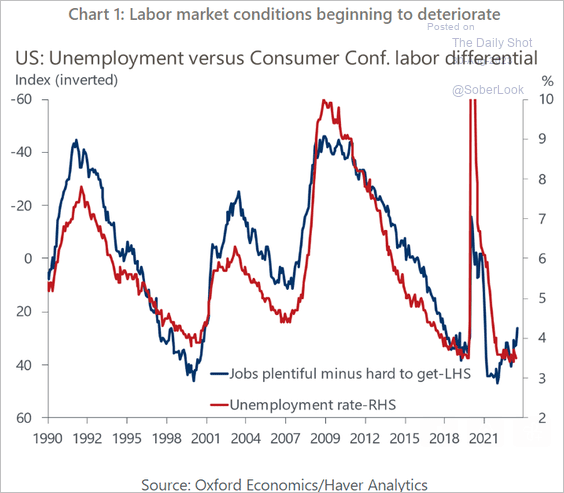

• Households are becoming nervous about the job market, which was reflected in last month’s quits rate drop (above).

– Here is the labor differential, the difference between “jobs plentiful” and “jobs hard to get” indicators, which is now below pre-COVID levels.

– The labor differential’s sharp decline signals higher unemployment ahead.

Source: Oxford Economics

Source: Oxford Economics

——————–

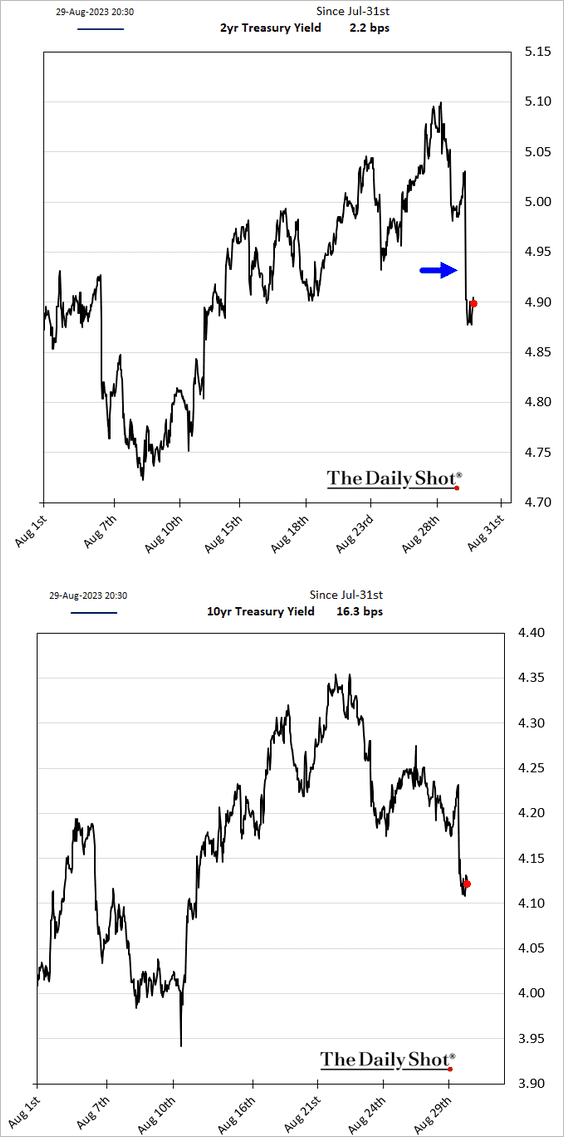

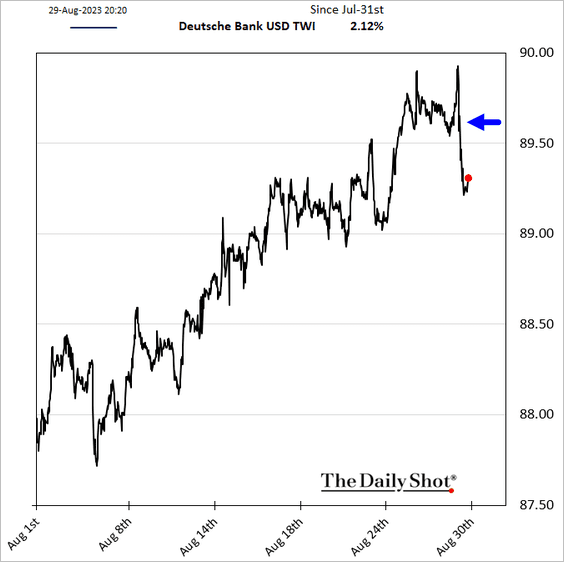

3. Treasury yields dropped sharply in response to signs of a cooling labor market.

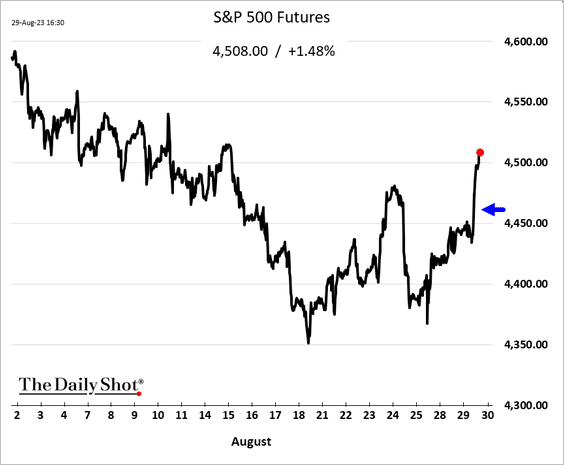

• Stocks surged on hopes that the Fed is done raising rates.

• The dollar declined.

——————–

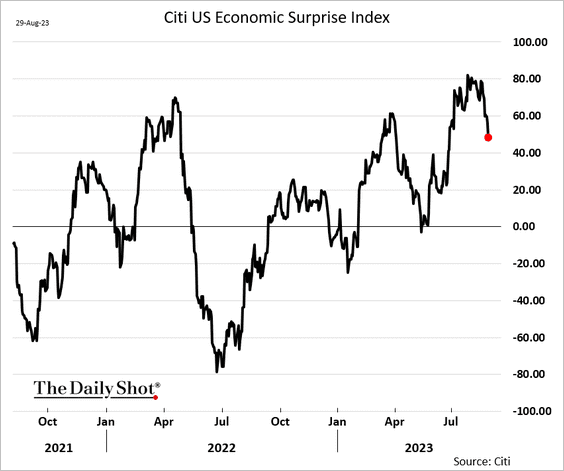

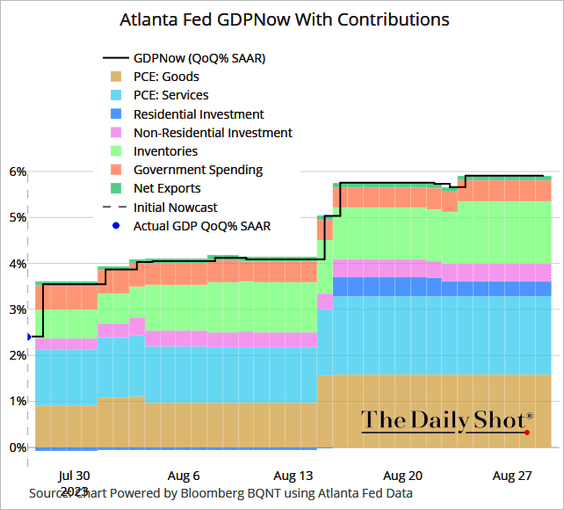

4. The Citi Economic Surprise Index is rolling over, …

… suggesting that the Atlanta Fed’s GDPNow estimate of the current quarter’s growth will be adjusted lower.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

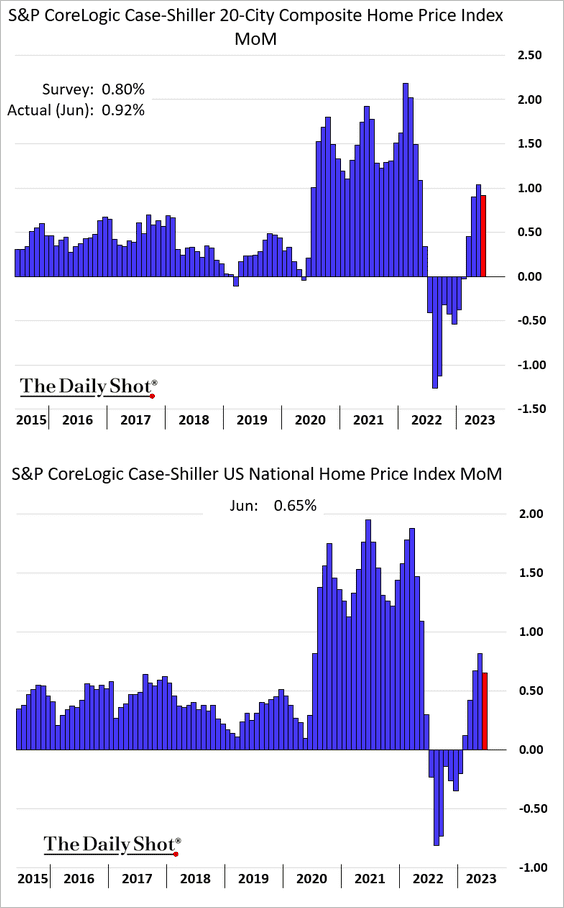

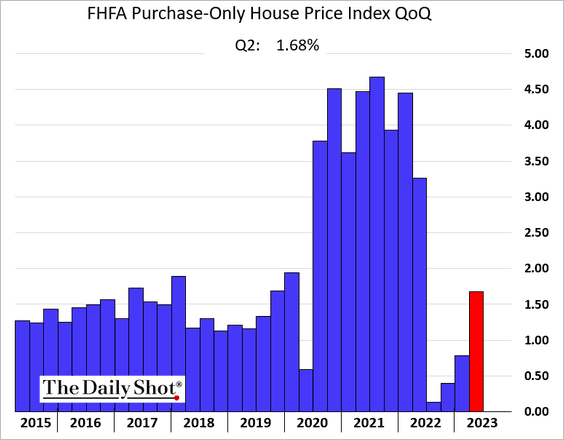

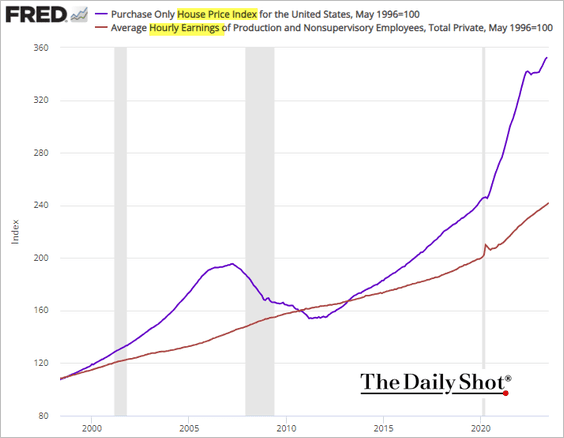

5. Home prices climbed again in June.

• The FHFA’s house price index has not had a down quarter in years.

• The gap between house prices and wages continues to widen.

Back to Index

The Eurozone

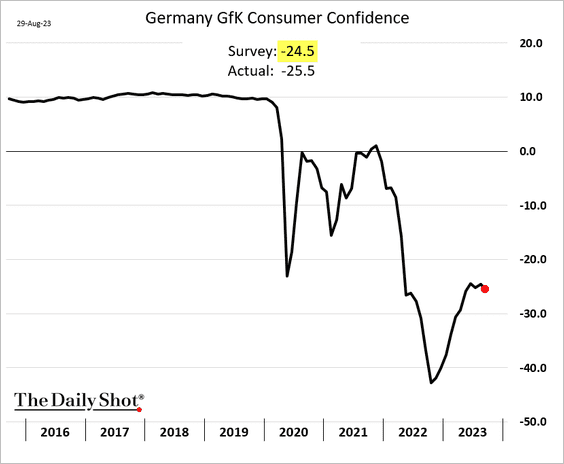

1. Germany’s consumer confidence appears to be rolling over.

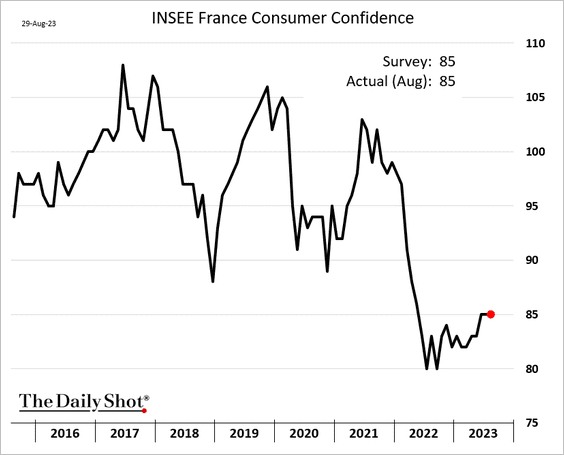

French sentiment held steady this month.

——————–

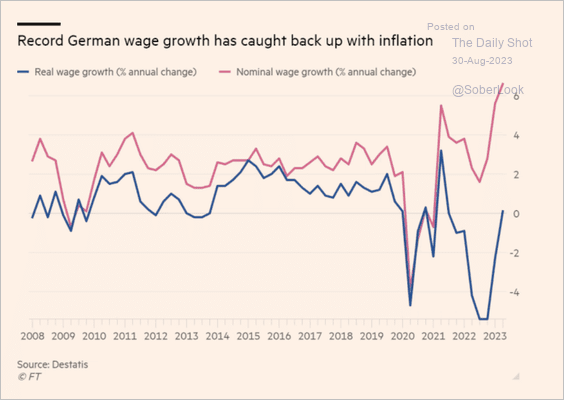

2. Germany’s real wage growth is back above zero.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

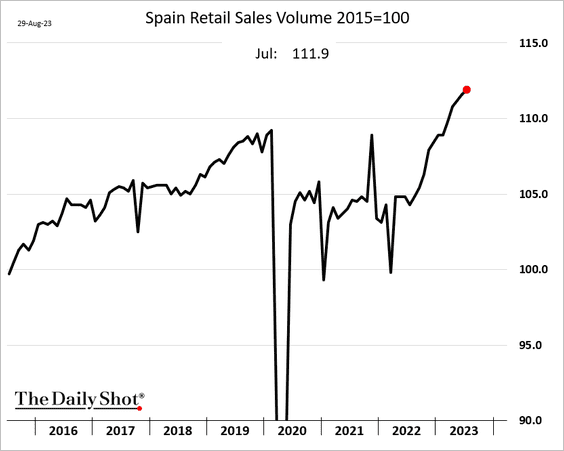

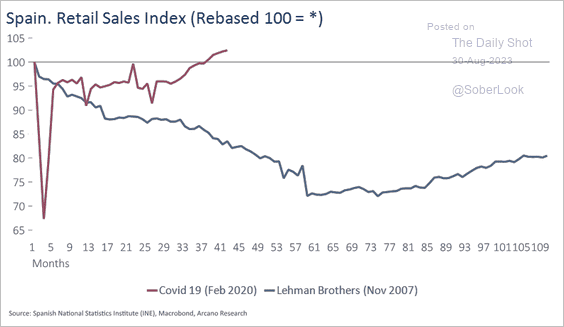

3. Spain’s real retail sales continue to surge.

Here is a comparison to the post-GFC recovery.

Source: Arcano Economics

Source: Arcano Economics

——————–

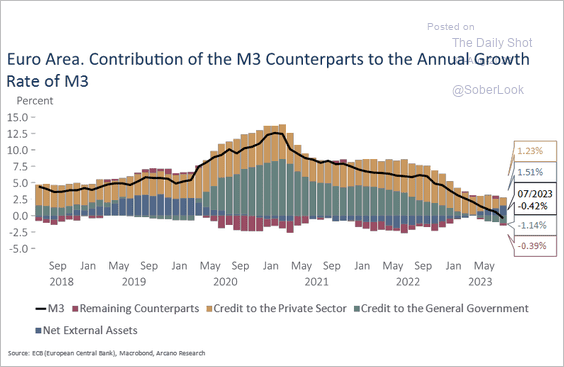

4. This chart shows the contributions to the euro-area board money supply growth, which is now negative on a year-over-year basis.

Source: Arcano Economics

Source: Arcano Economics

Back to Index

Asia-Pacific

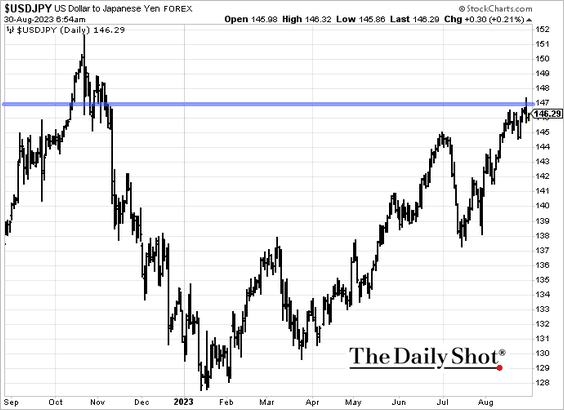

1. The yen remains under pressure.

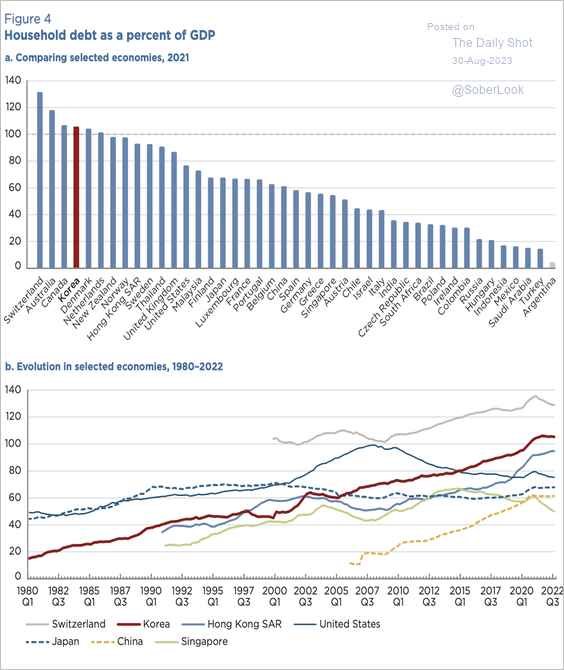

2. South Korea’s household debt is very high.

Source: Peterson Institute for International Economics Read full article

Source: Peterson Institute for International Economics Read full article

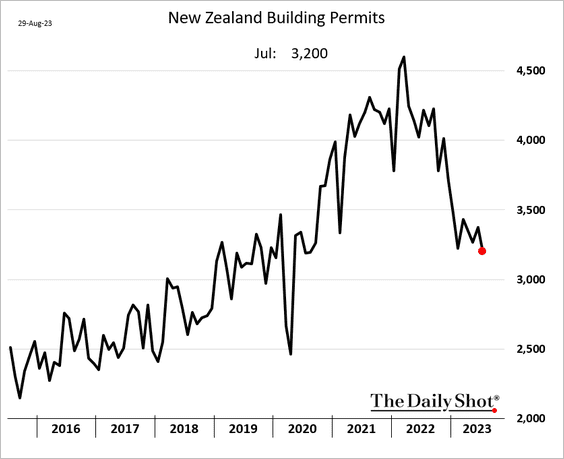

3. New Zealand’s building permits continue to sink.

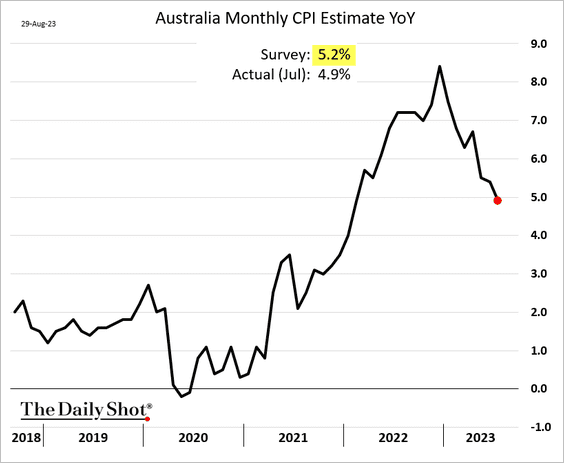

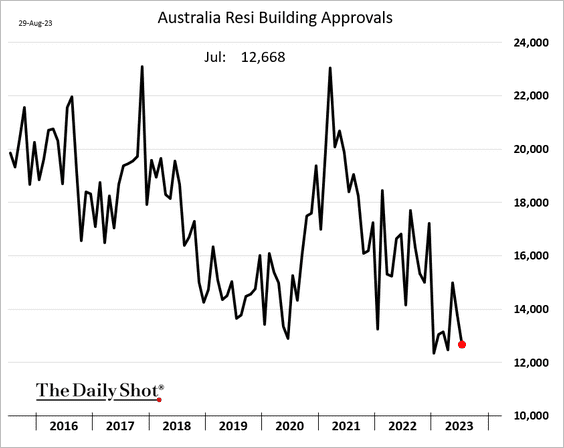

4. Next, we have some updates on Australia.

• The monthly inflation estimate surprised to the downside.

• Building permits are near multi-year lows.

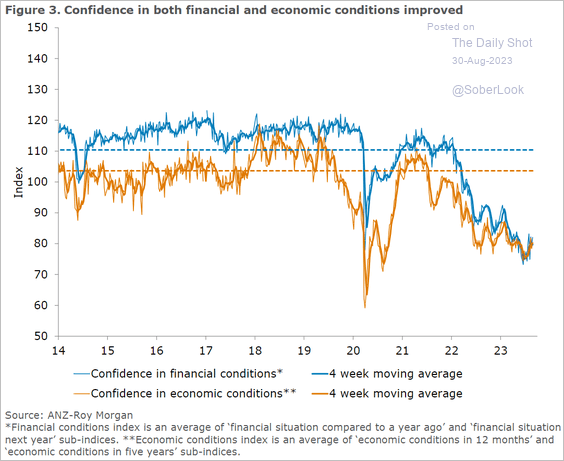

• Consumer sentiment appears to have stabilized.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

China

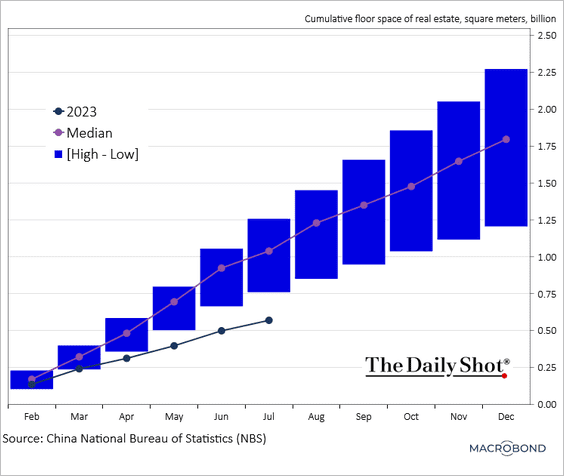

1. This chart displays the cumulative construction starts for 2023 in comparison to the trends observed from 2010 onwards.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

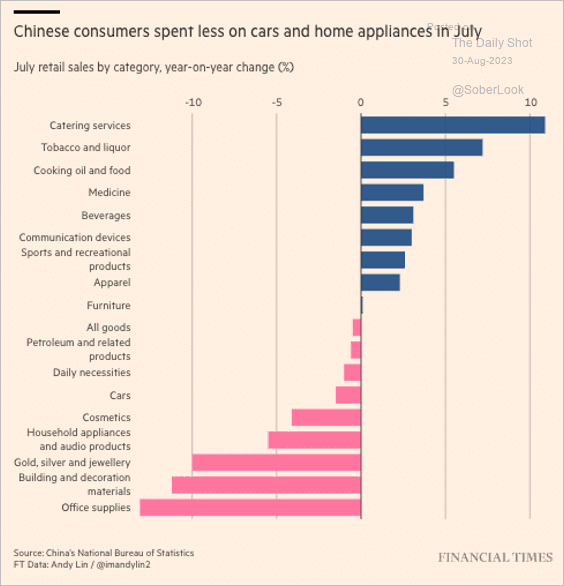

2. Here is a look at the changes in consumer spending last month.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

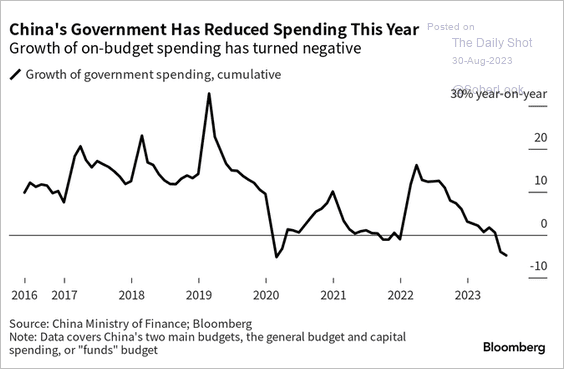

3. Government spending is down on a year-over-year basis.

Source: @hancocktom Read full article

Source: @hancocktom Read full article

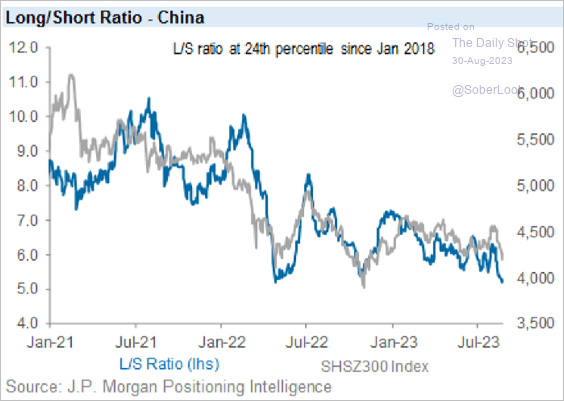

4. Investor positioning is increasingly cautious.

Source: JP Morgan Research; @AyeshaTariq

Source: JP Morgan Research; @AyeshaTariq

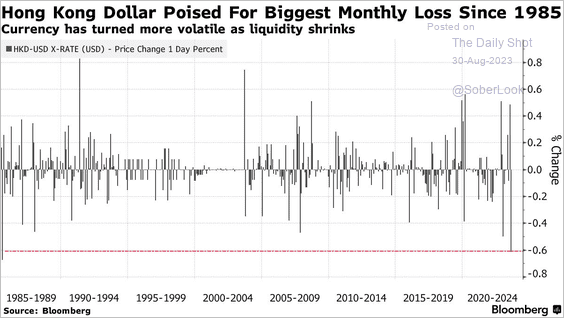

5. It has been a rough month for the Hong Kong dollar (2 charts). The USD/HKD volatility has risen amid weaker liquidity conditions.

Source: @markets Read full article

Source: @markets Read full article

——————–

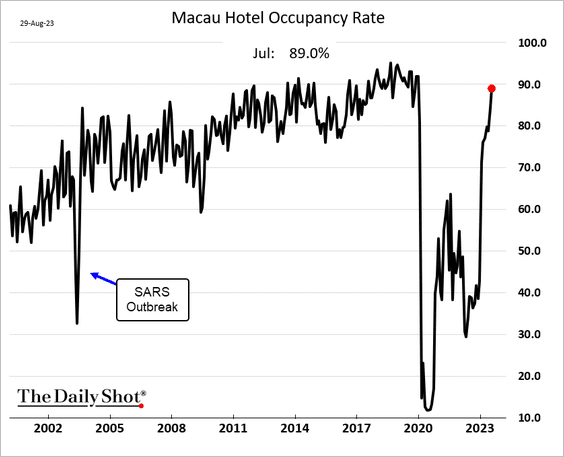

6. Macau’s hotel occupancy has almost fully recovered.

Back to Index

Emerging Markets

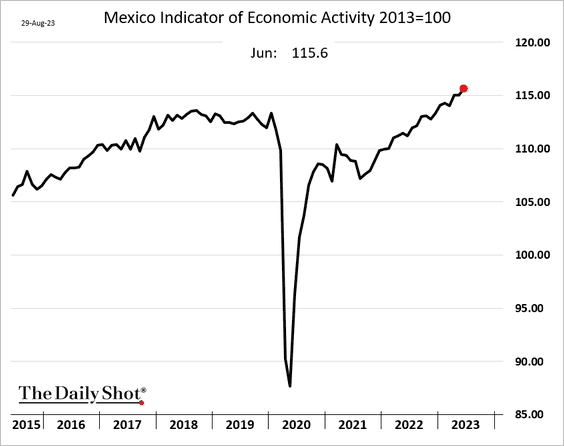

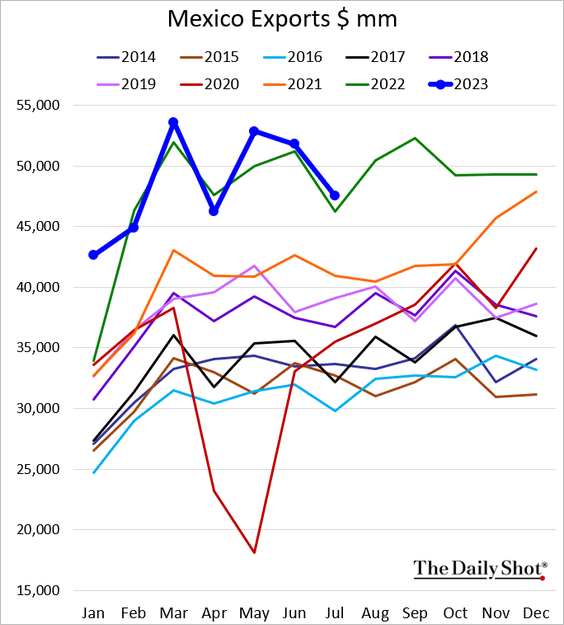

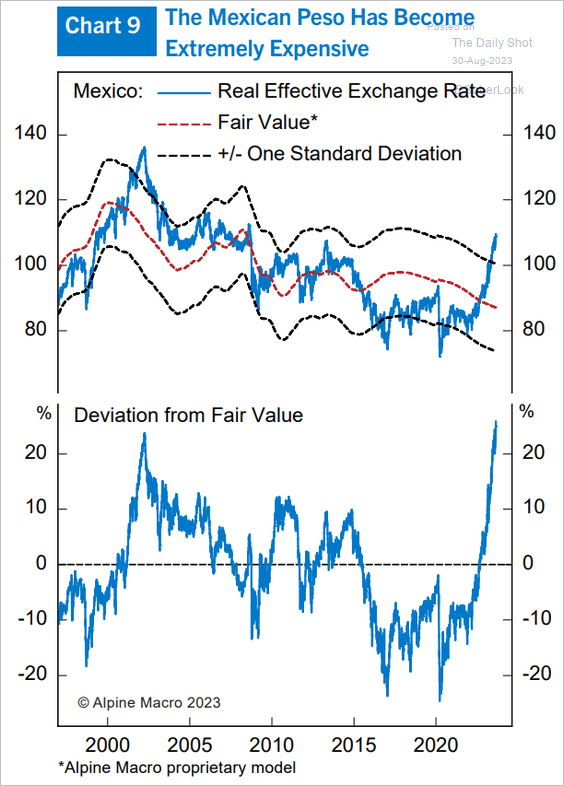

1. Let’s begin with Mexico.

• Economic activity (strong):

• Exports (still above last year’s levels):

• The peso (too expensive?):

Source: Alpine Macro

Source: Alpine Macro

——————–

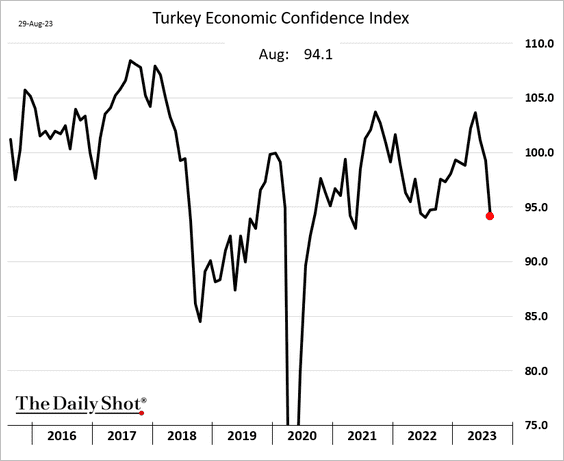

2. Turkey’s economic confidence is deteriorating.

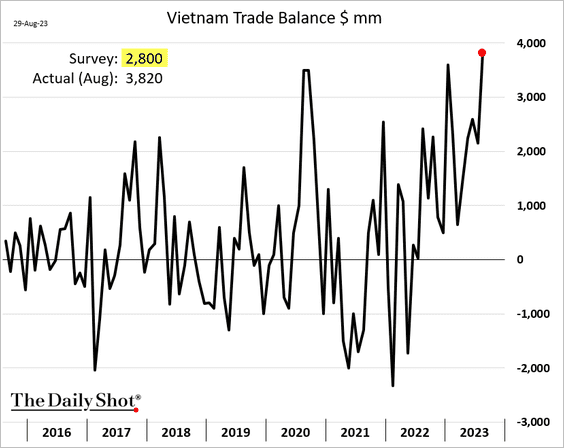

3. Vietnam’s trade surplus hit a record high.

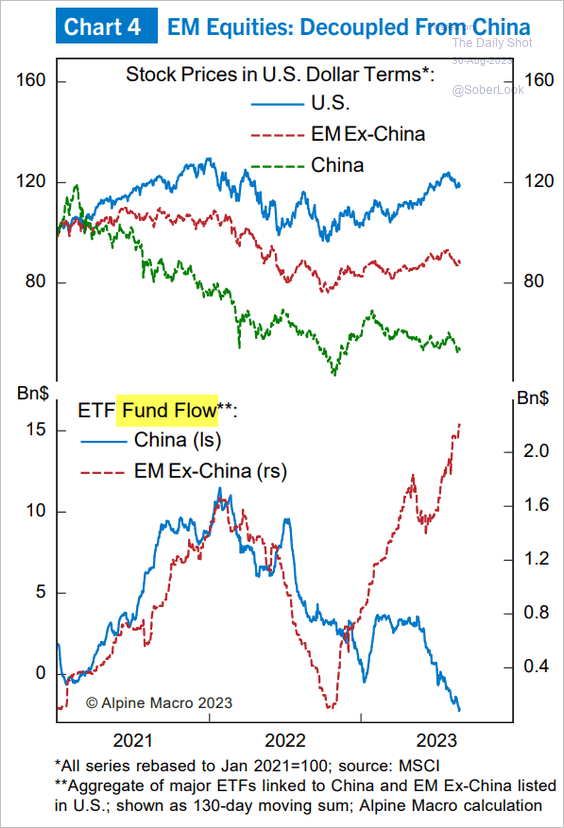

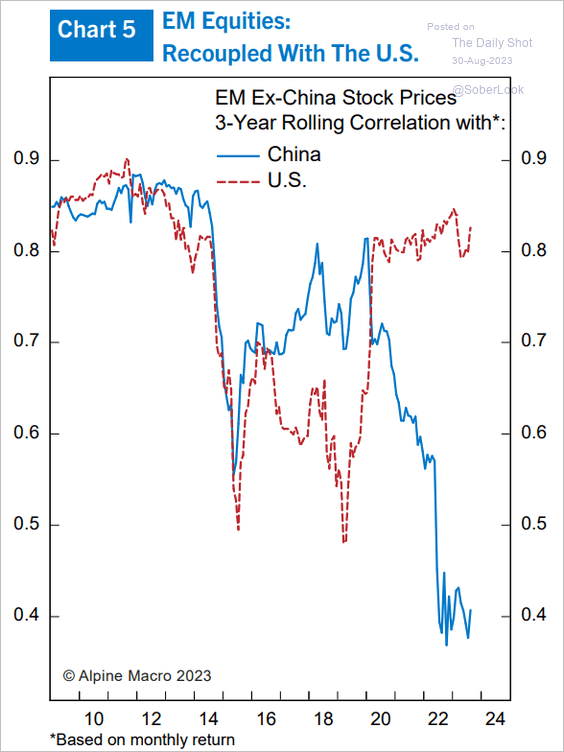

4. EM equities have decoupled from China (2 charts).

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Cryptocurrency

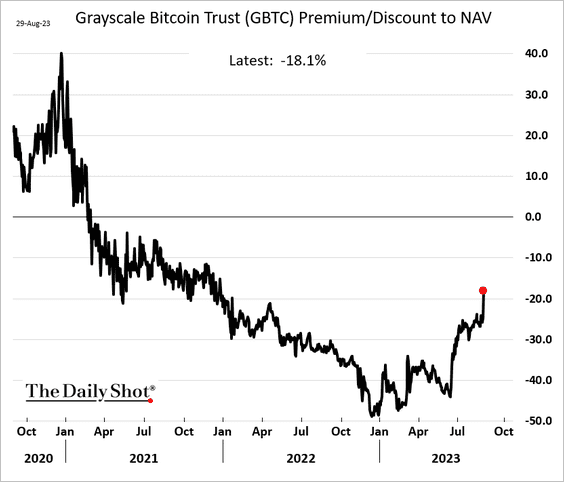

1. Grayscale prevailed in its battle with the SEC to turn GBTC into an ETF.

Source: CNBC Read full article

Source: CNBC Read full article

• The GBTC discount to NAV narrowed sharply.

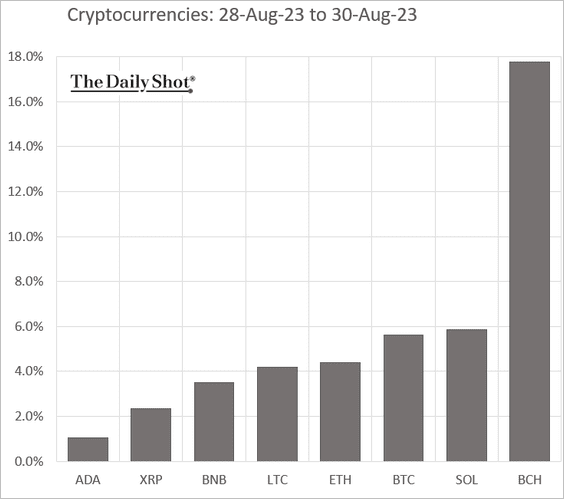

• Crypto assets rallied in response to the Grayscale news.

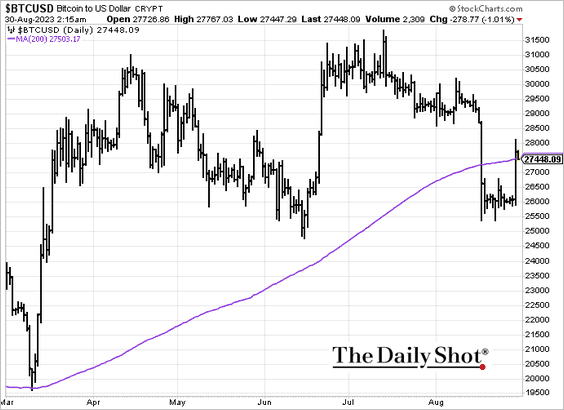

• Bitcoin climbed above its 200-day moving average.

——————–

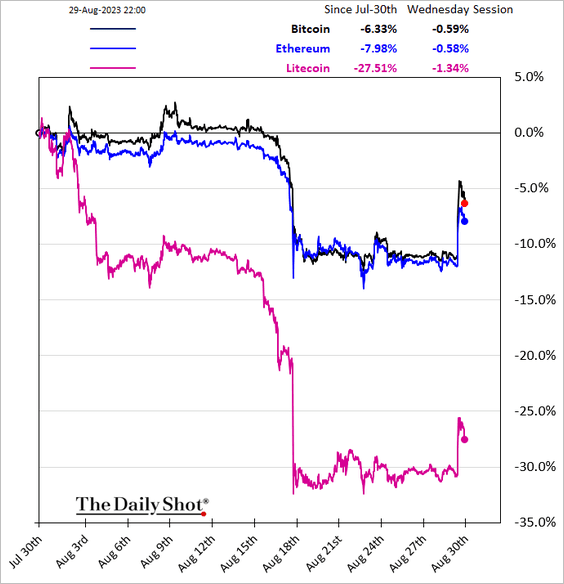

2. Litecoin has been underperforming.

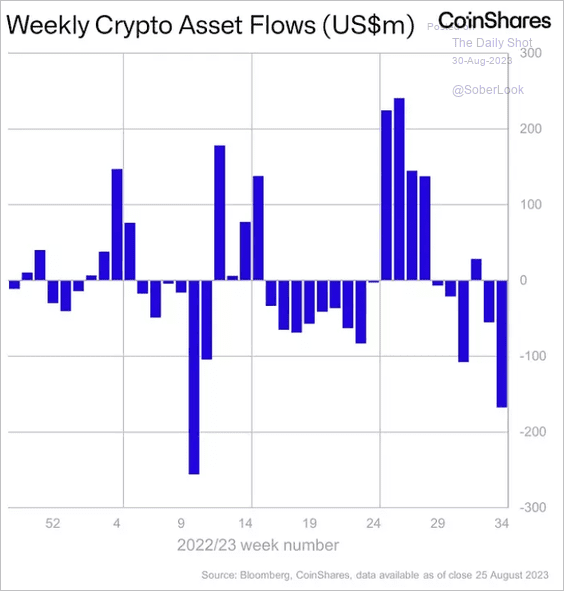

3. Crypto assets saw some outflows in recent days.

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

Commodities

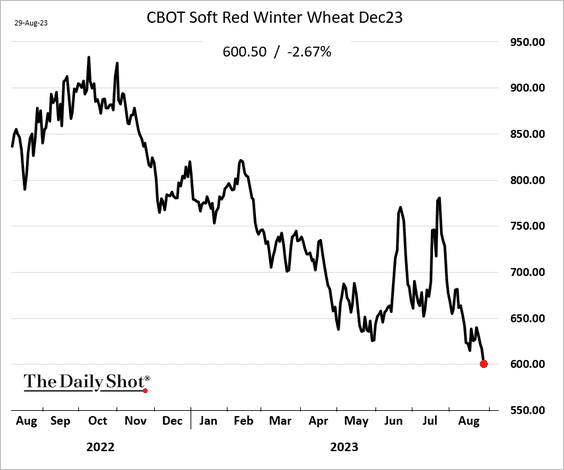

1. Wheat prices remain under pressure.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

——————–

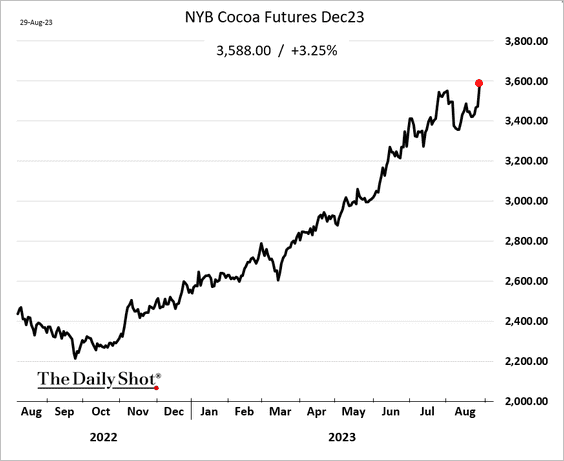

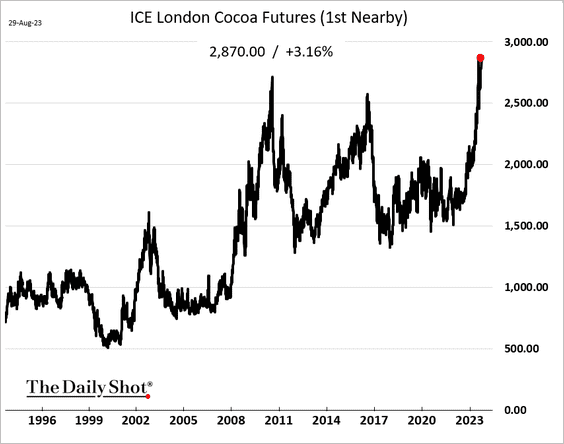

2. Cocoa prices continue to surge.

London cocoa futures hit a multi-decade high.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

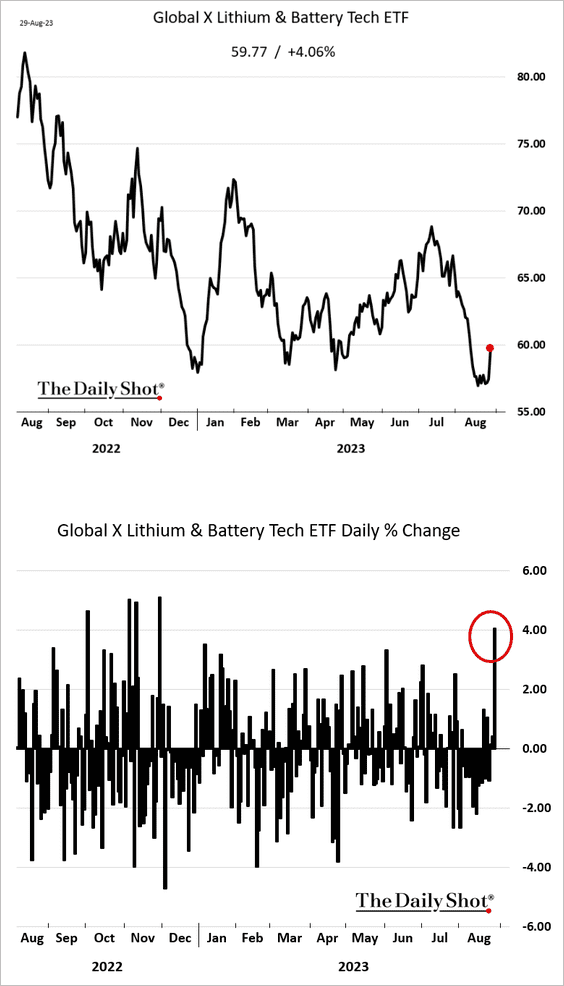

3. The Global X lithium ETF bounced from recent lows.

Back to Index

Equities

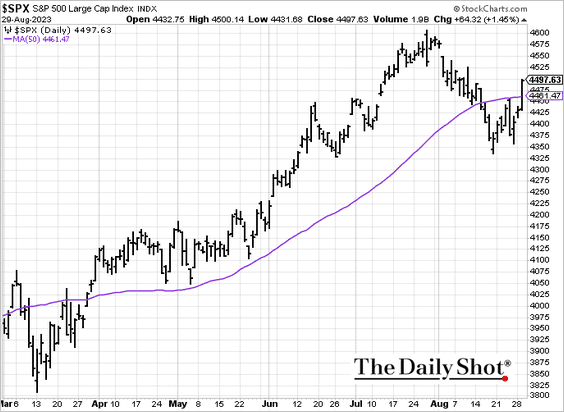

1. The S&P 500 cleared its 50-day moving average.

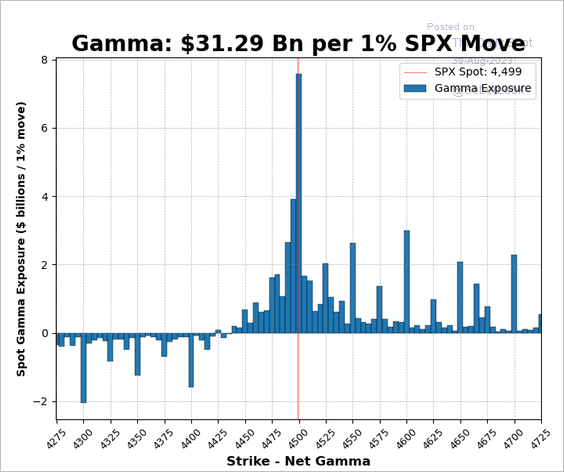

Given the gamma exposure, is 4500 the new resistance level?

Source: @Mayhem4Markets

Source: @Mayhem4Markets

——————–

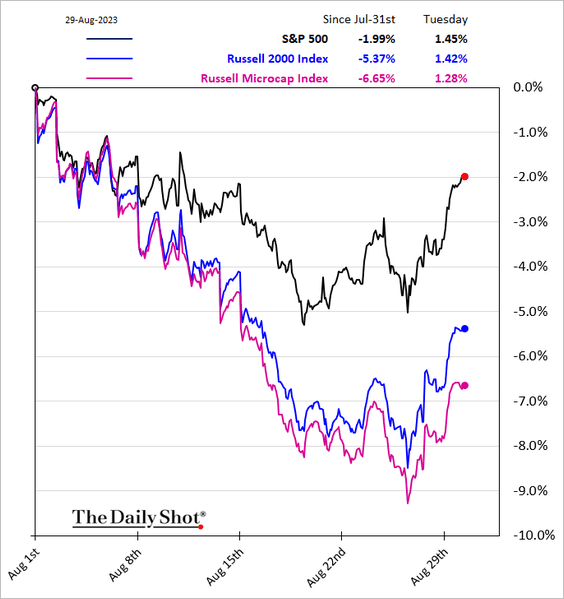

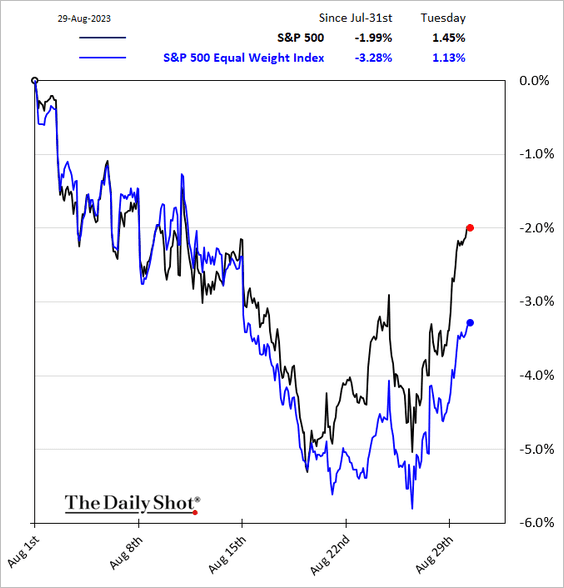

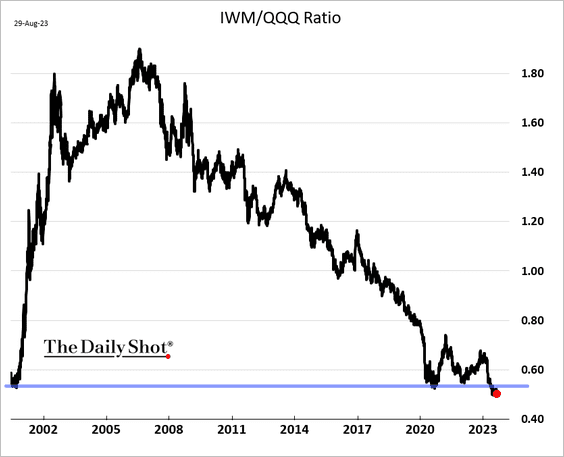

2. Small caps and microcaps underperformed significantly this month.

• Below is the S&P 500 equal-weight index.

• This chart shows the IWM/QQQ ratio (Russell 2000/Nasdaq 100).

——————–

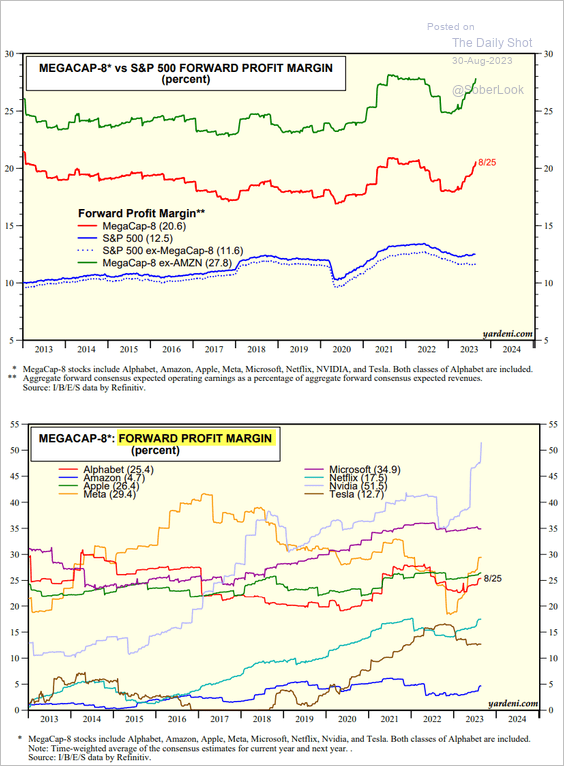

3. Here is a look at tech mega-caps’ forward profit margins.

Source: Yardeni Research

Source: Yardeni Research

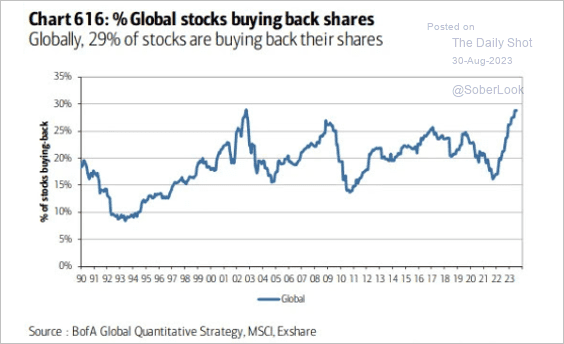

4. Globally, share buybacks haven’t been this popular in two decades.

Source: BofA Global Research

Source: BofA Global Research

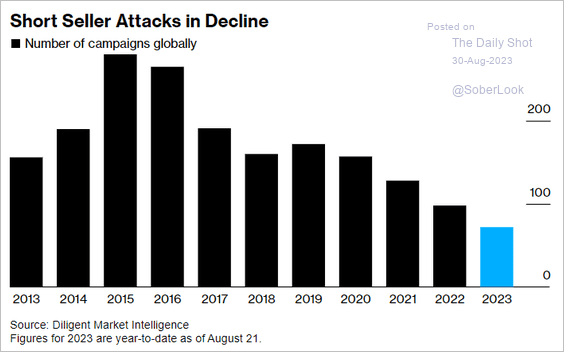

5. Short-seller attacks have slowed in recent years.

Source: @markets Read full article

Source: @markets Read full article

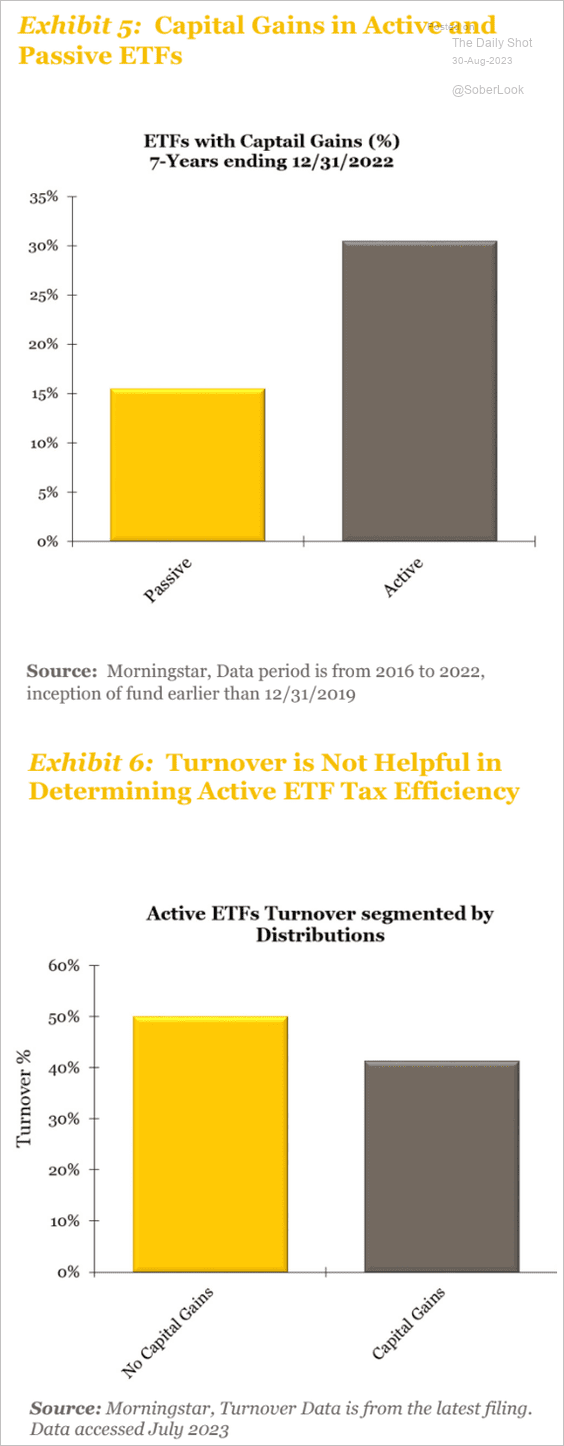

6. According to CornerCap Institutional, active ETFs are twice as likely to pay capital gains than passive ETFs.

Source: CornerCap Institutional

Source: CornerCap Institutional

Back to Index

Credit

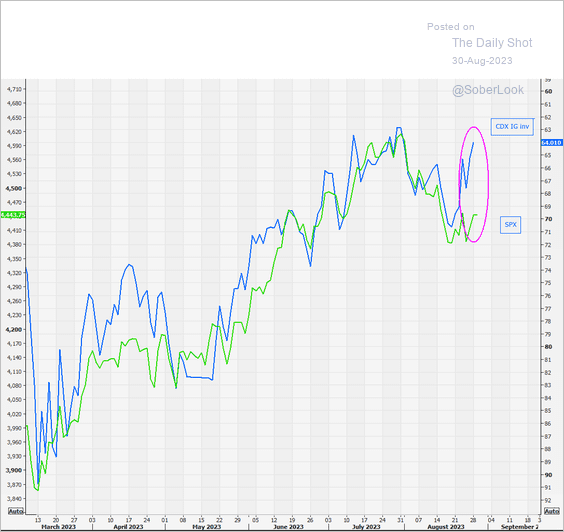

1. Investment-grade CDS spreads appear too tight relative to stock prices.

Source: @themarketear

Source: @themarketear

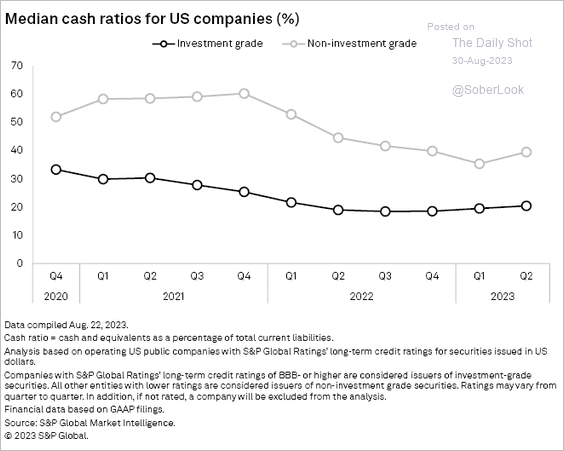

2. HY companies boosted their cash positions in Q2.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

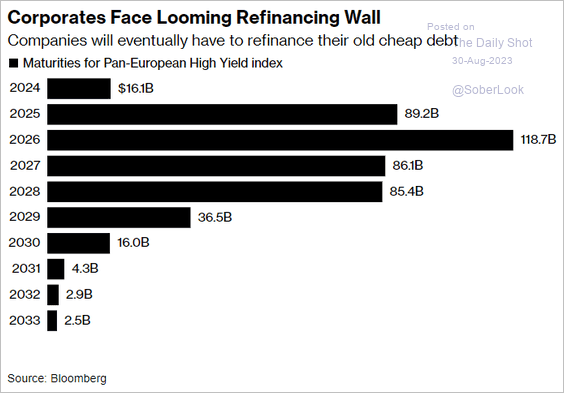

3. European HY issuers face some refinancing headwinds over the next few years.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Rates

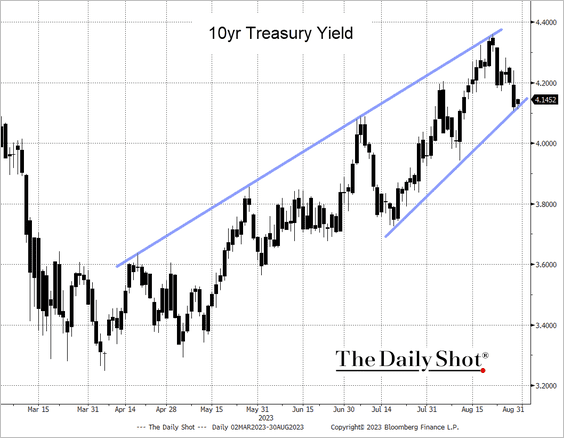

The 10-year Treasury yield is testing short-term uptrend support.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

Food for Thought

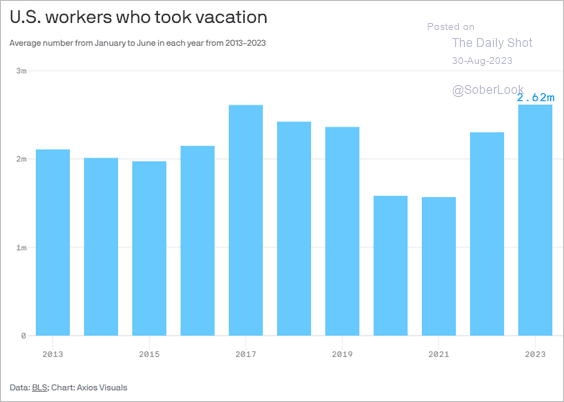

1. Vacations are back.

Source: @axios Read full article

Source: @axios Read full article

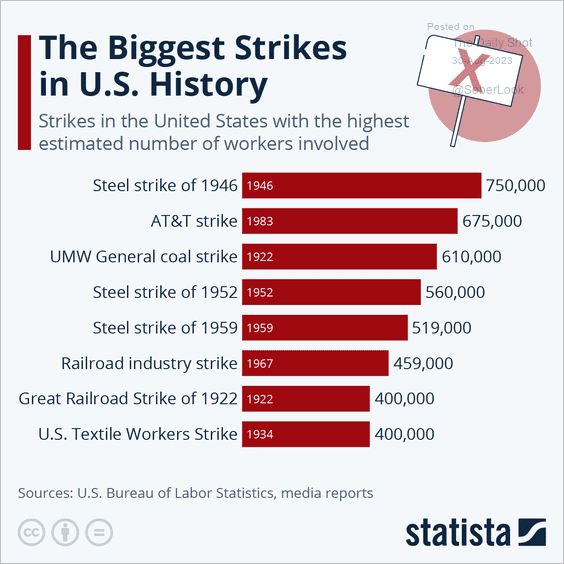

2. The biggest strikes in the US:

Source: Statista

Source: Statista

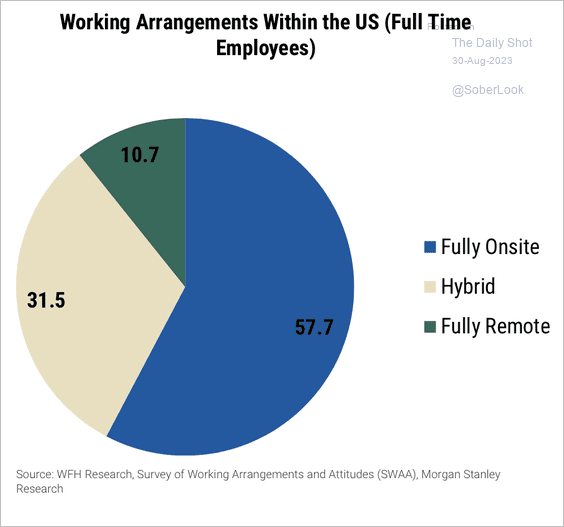

3. Roughly 40% of employees are either hybrid or fully remote, according to a survey by WFH Research.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

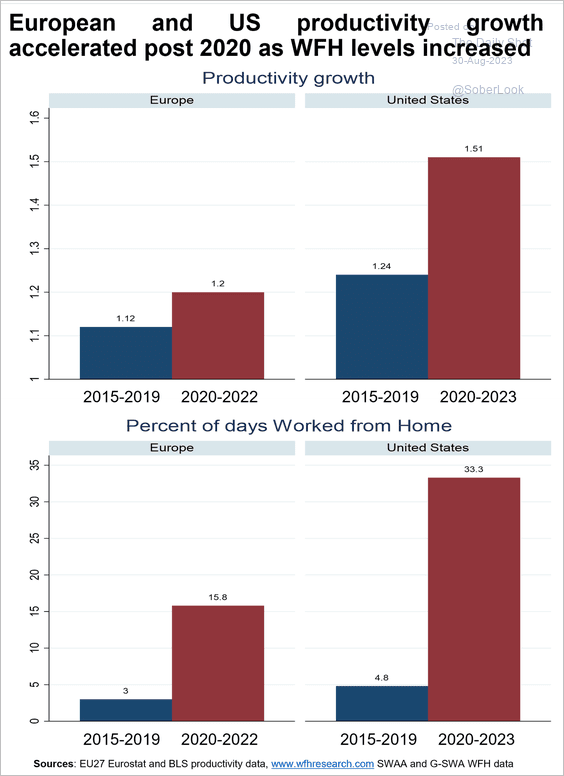

4. Is remote work boosting productivity?

Source: @I_Am_NickBloom

Source: @I_Am_NickBloom

5. Legal status of sports betting:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

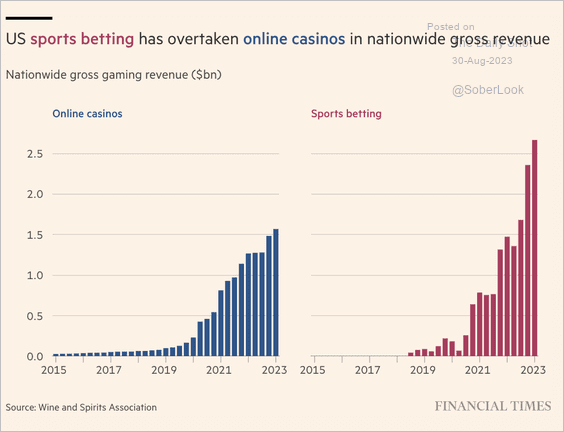

• Online casinos vs. sports betting (revenues):

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

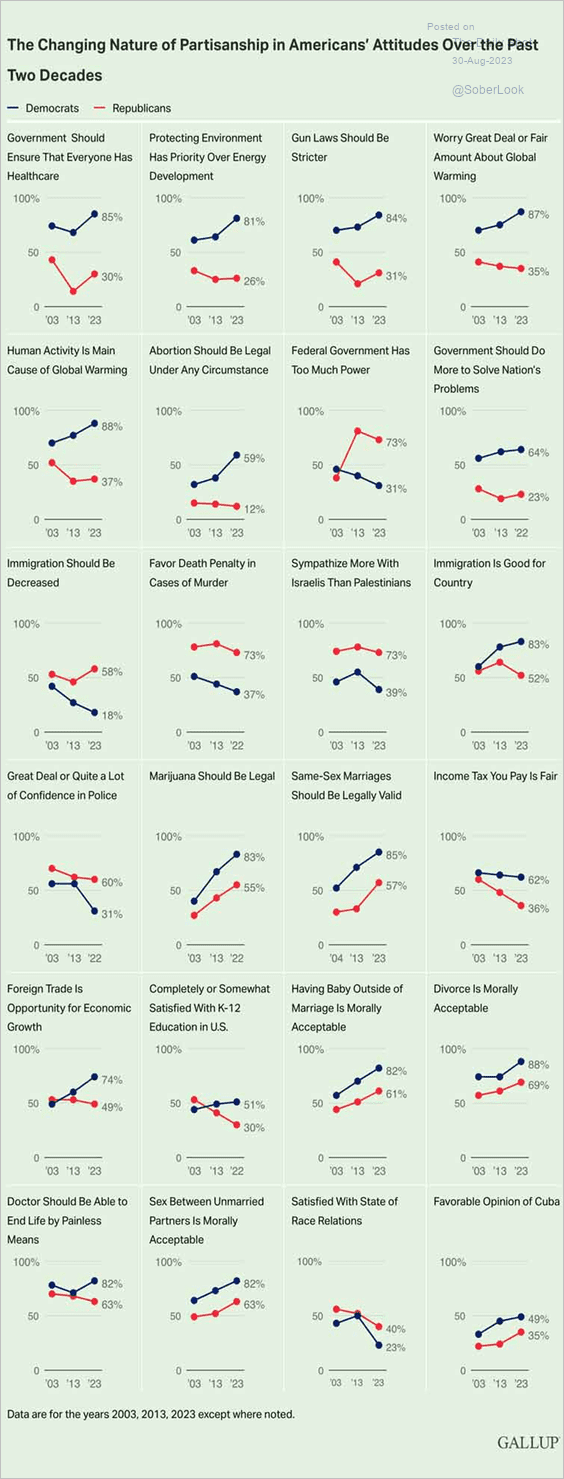

6. Changing US attitudes over the past two decades:

Source: Gallup Read full article

Source: Gallup Read full article

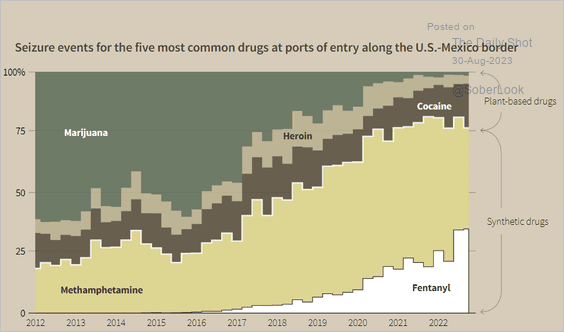

7. Drugs seized at ports of entry along the US-Mexico border:

Source: Reuters Read full article

Source: Reuters Read full article

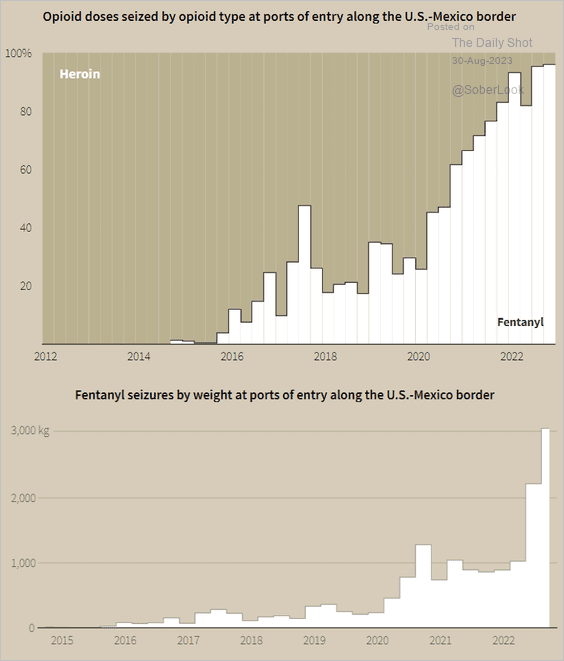

• Opioids seized:

Source: Reuters Read full article

Source: Reuters Read full article

——————–

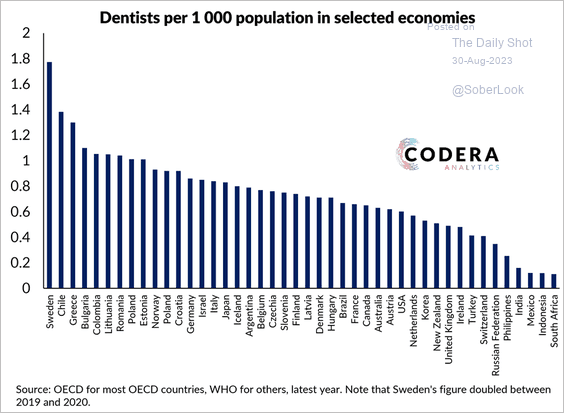

8. Number of dentists per thousand residents:

Source: Codera Analytics

Source: Codera Analytics

——————–

Back to Index