The Daily Shot: 31-Aug-23

• The United States

• The United Kingdom

• The Eurozone

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

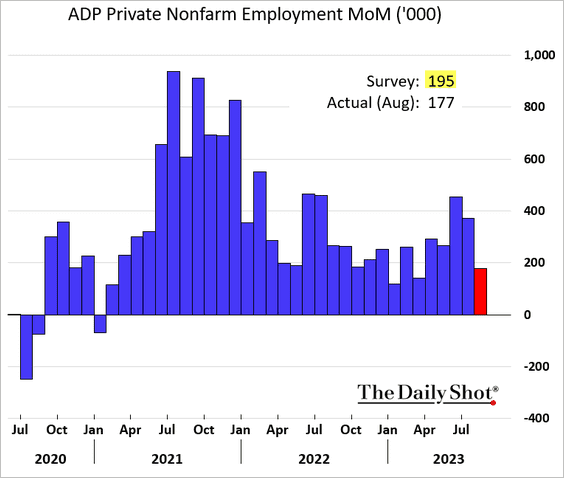

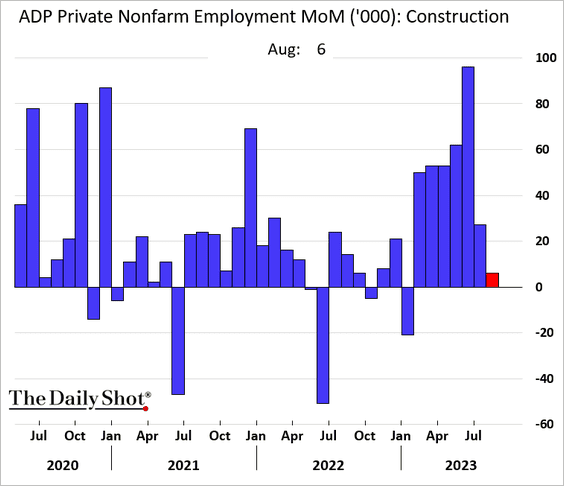

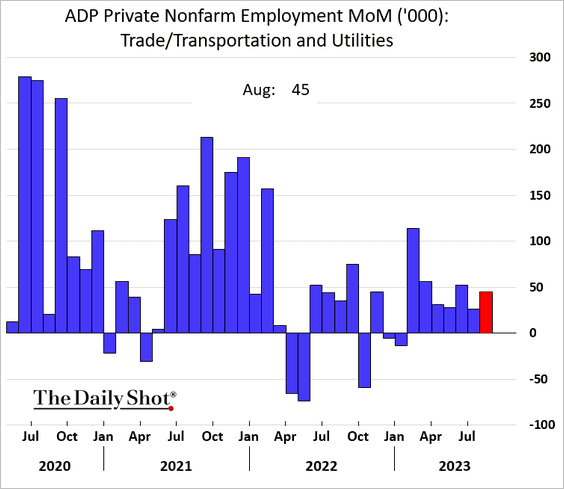

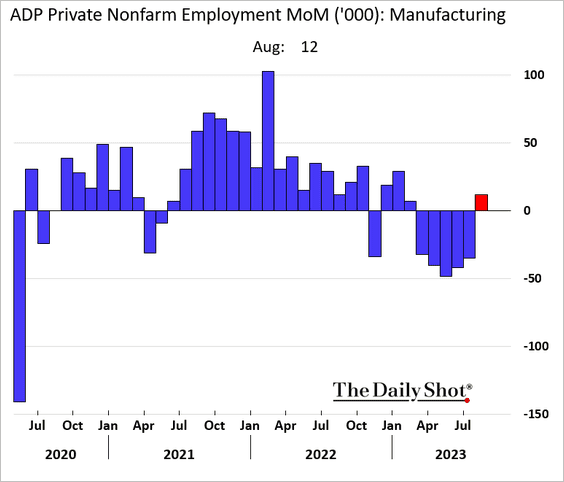

1. The ADP private payrolls report for August came in well below expectations. Although this metric isn’t a reliable forecaster of the official employment report, it suggests a potential slowdown in the job market.

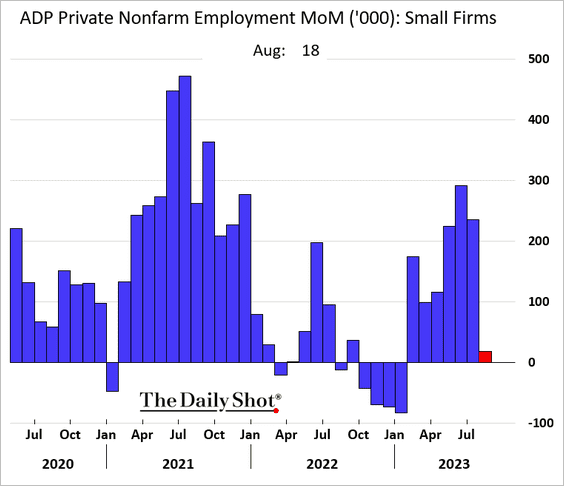

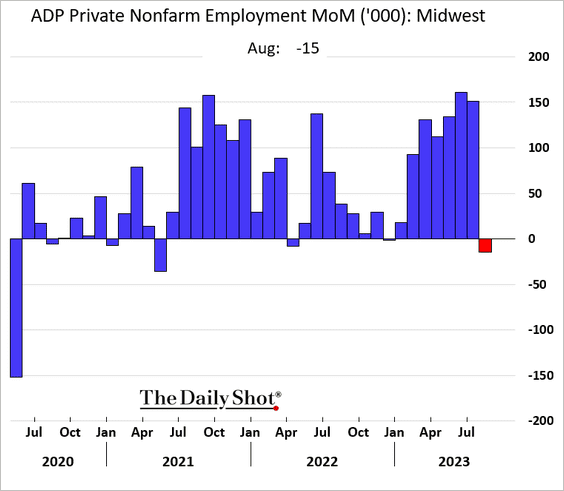

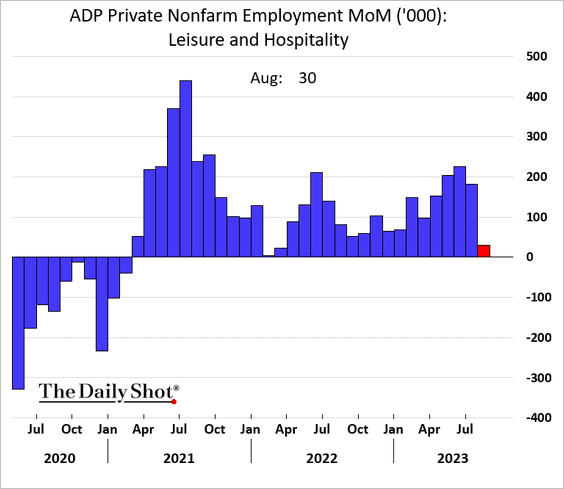

• Here are the key drivers of the decline.

– Small businesses:

– The Midwest region:

– Hotels, restaurants, bars:

• Below are some additional hiring trends.

– Construction:

– Logistics:

– Manufacturing (first increase in six months):

——————–

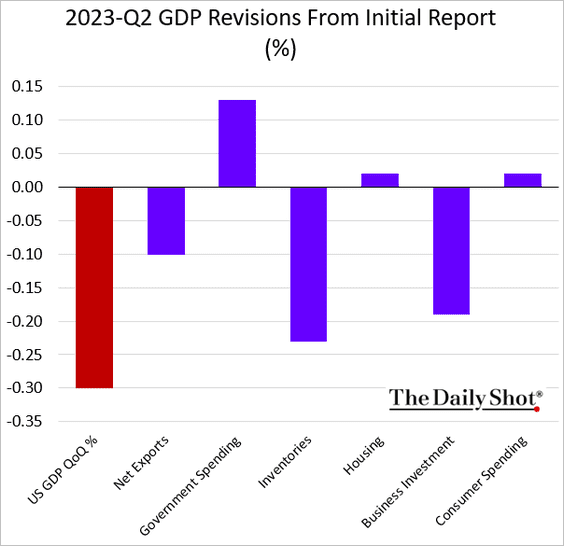

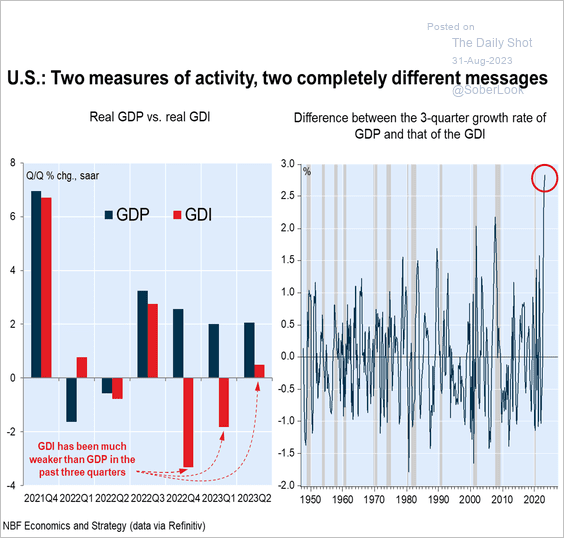

2. The Q2 GDP growth has been revised downward. Here are the drivers.

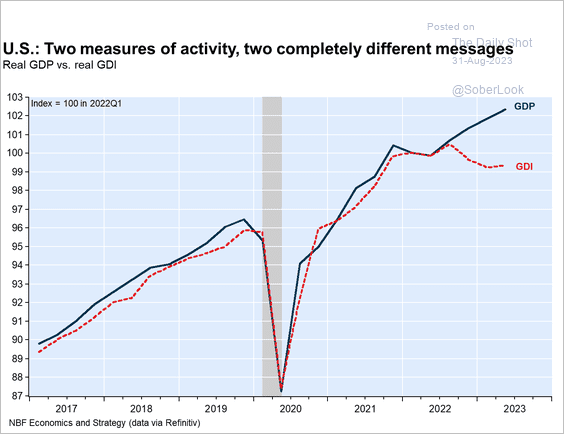

• The widening disparity between GDP and GDI indicates potential challenges for future GDP growth (2 charts).

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

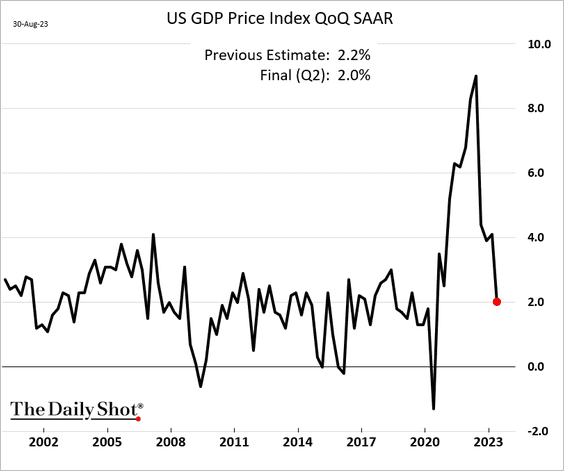

• The GDP deflator is back at 2%.

——————–

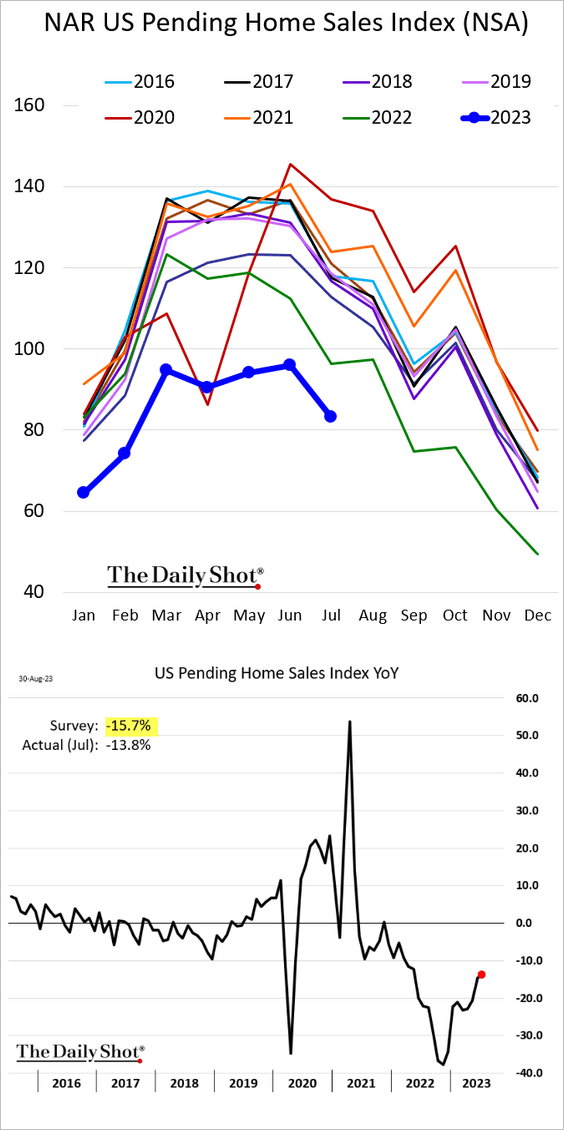

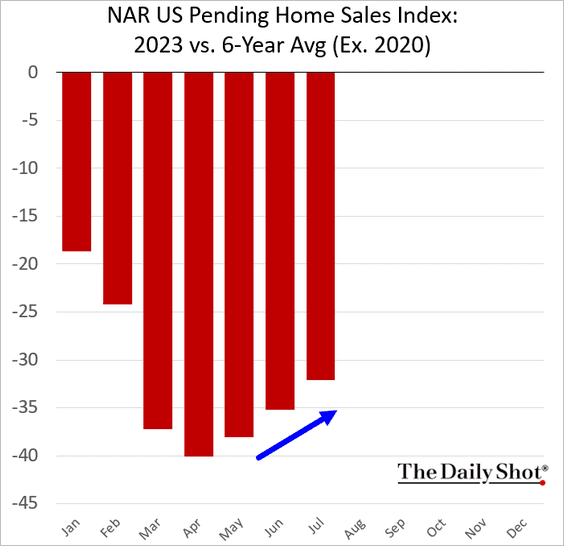

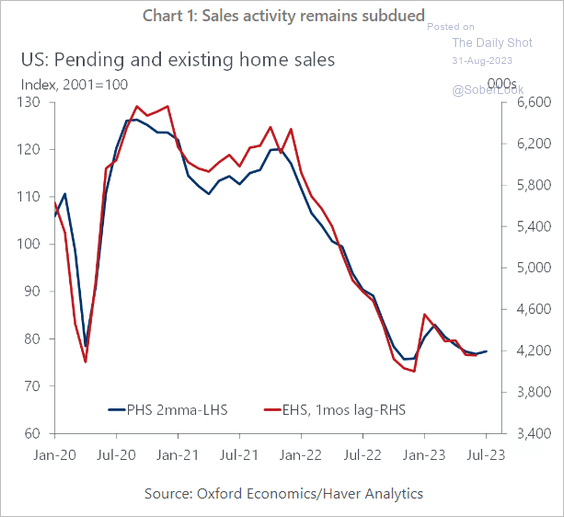

3. Next, we have some updates on the housing market.

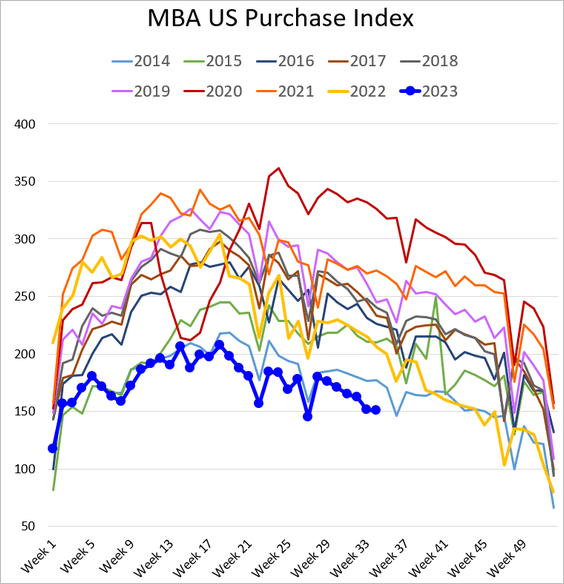

• Mortgage applications remain soft.

– While still at multi-year lows, pending home sales showed some improvement last month (topping expectations).

Here is the comparison of the 2023 pending home sales index versus the average of 2016-2022 (ex 2020).

– The uptick in pending sales is expected to manifest in September’s report on existing home sales.

Source: Oxford Economics

Source: Oxford Economics

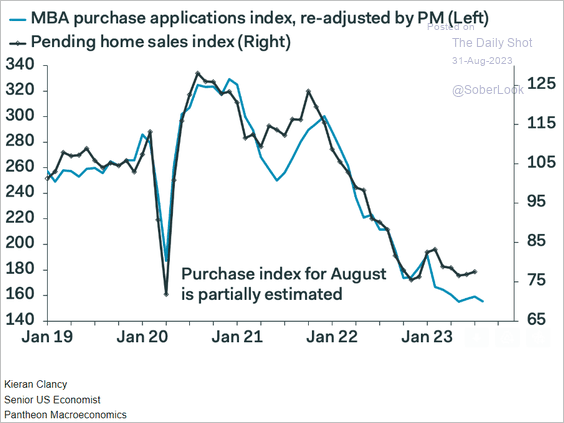

– Weak mortgage applications point to downside risks for home sales.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

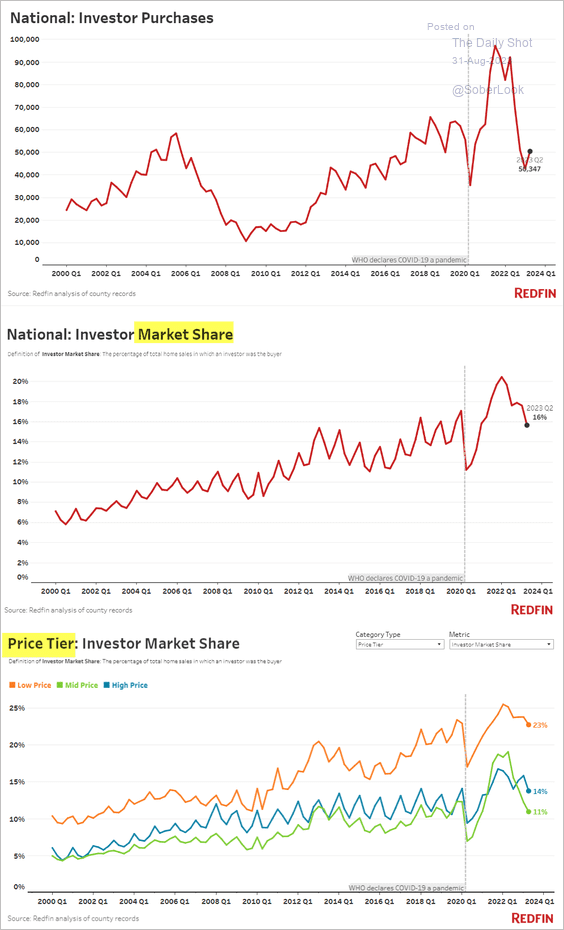

• Investors’ residential real estate purchases are well below last year’s levels, but their market share remains elevated.

Source: Redfin

Source: Redfin

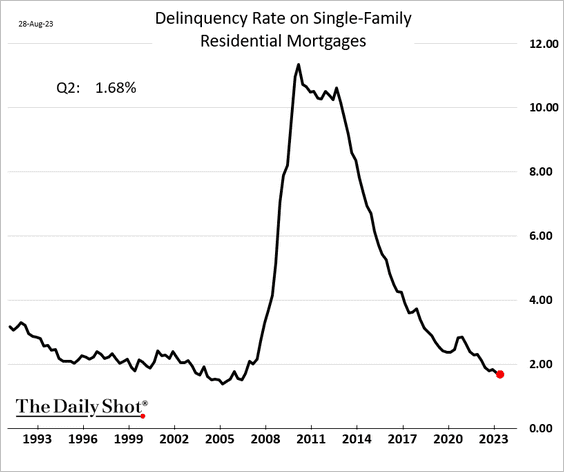

• Mortgage delinquencies continue to fall.

——————–

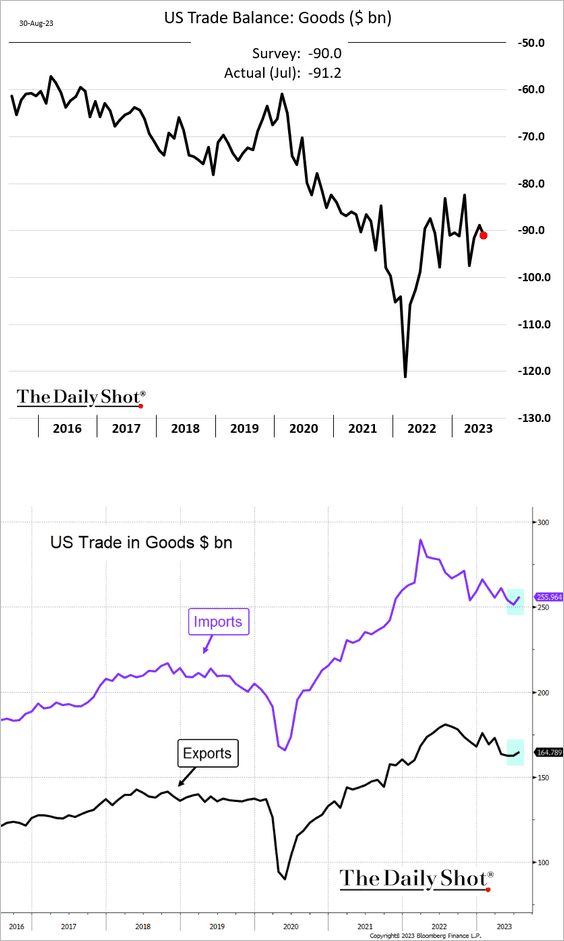

4. The trade deficit in goods widened last month as imports increased more than exports.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

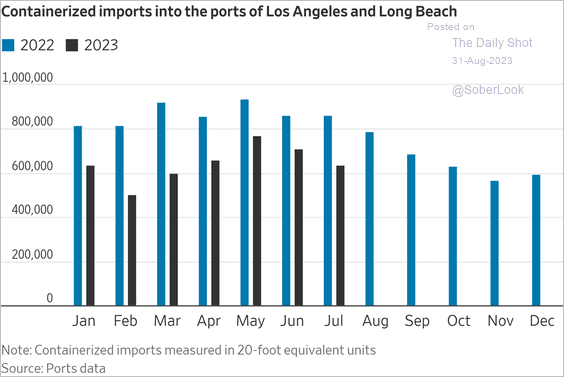

• This chart shows containers moving through the West Coast ports.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

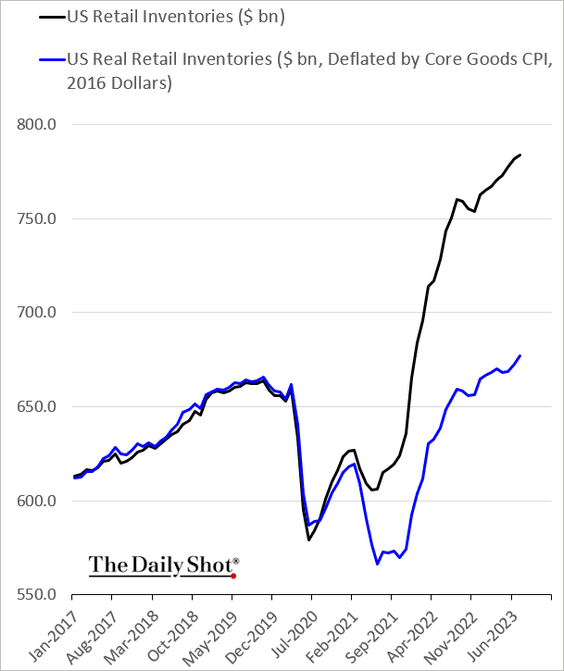

5. Real retail inventories are now well above pre-COVID levels.

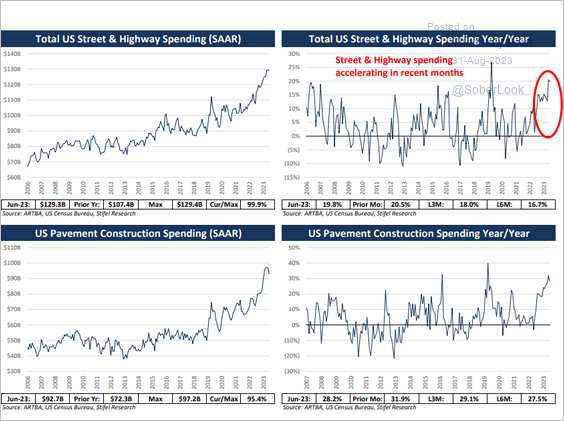

6. Federal spending on road construction has been rising.

Source: Stifel

Source: Stifel

Back to Index

The United Kingdom

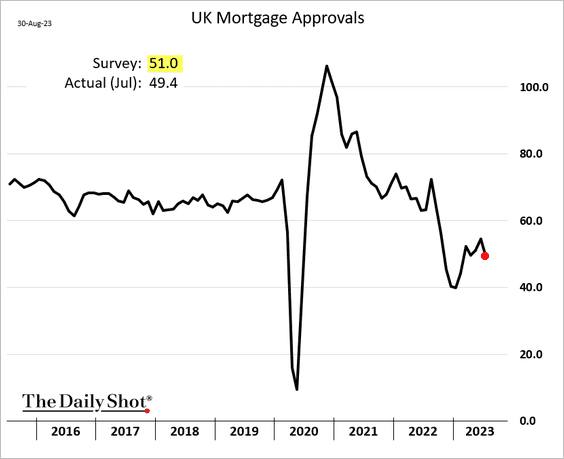

1. Mortgage approvals declined more than expected last month.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

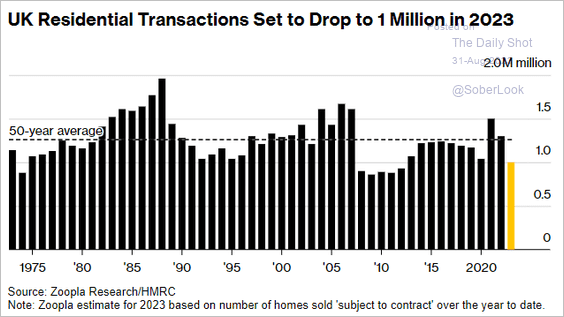

2. Home sales have been soft this year.

Source: @economics Read full article

Source: @economics Read full article

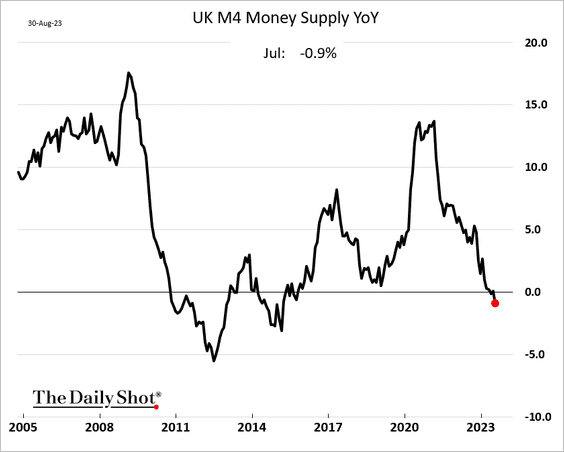

3. The broad money supply is now down on a year-over-year basis.

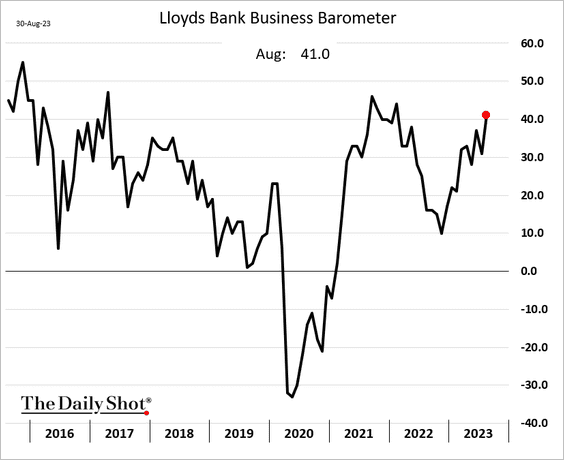

4. The Lloyds Bank business sentiment index continues to improve.

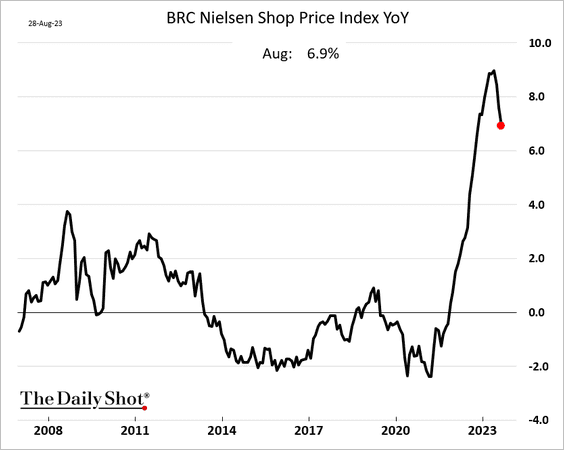

5. Shop price inflation has finally peaked.

Back to Index

The Eurozone

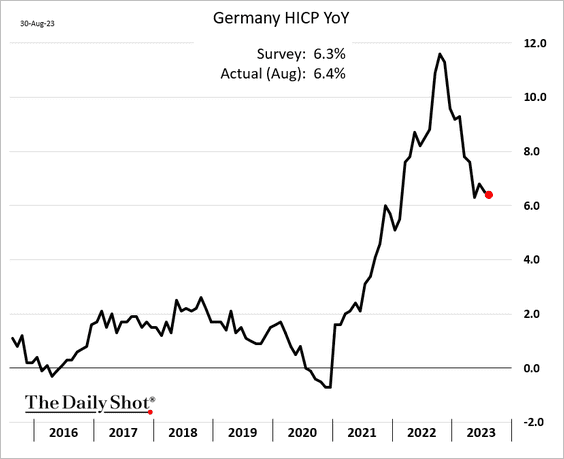

1. Germany’s CPI remained stubbornly high this month.

Source: @economics Read full article

Source: @economics Read full article

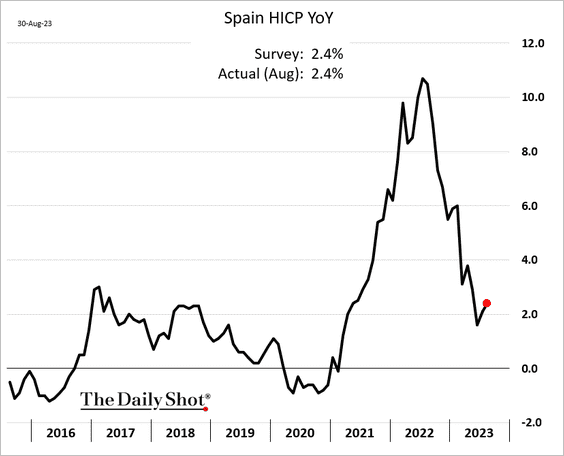

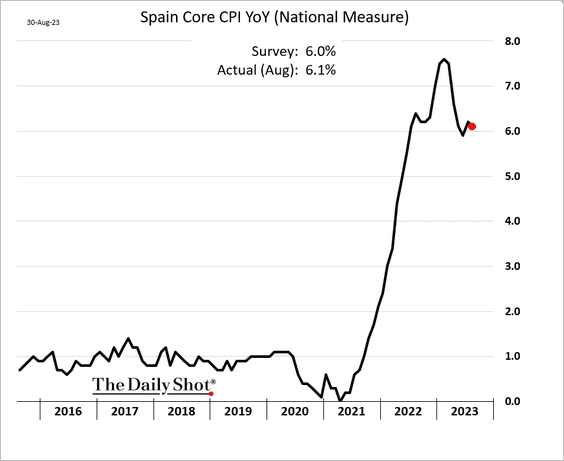

Spain’s CPI climbed again, …

… and core inflation was higher than expected.

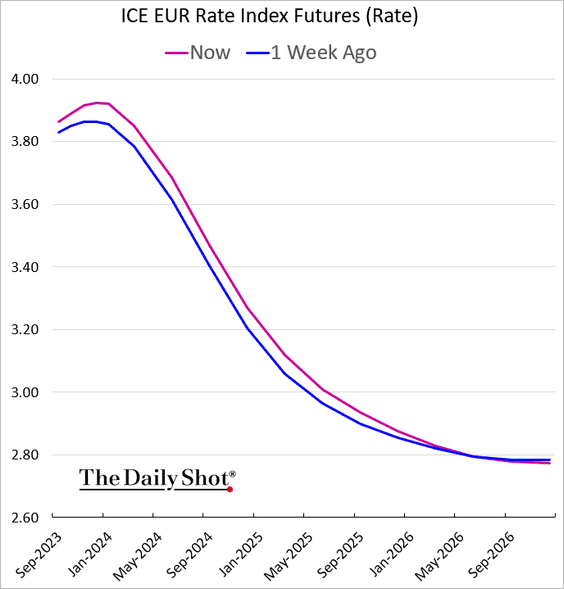

2. Rate hike expectations climbed in response to the CPI report.

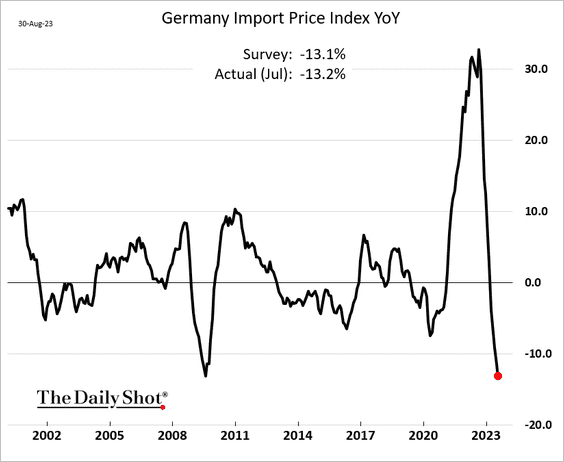

3. Leading indicators point to easing inflation in Germany.

• Import prices:

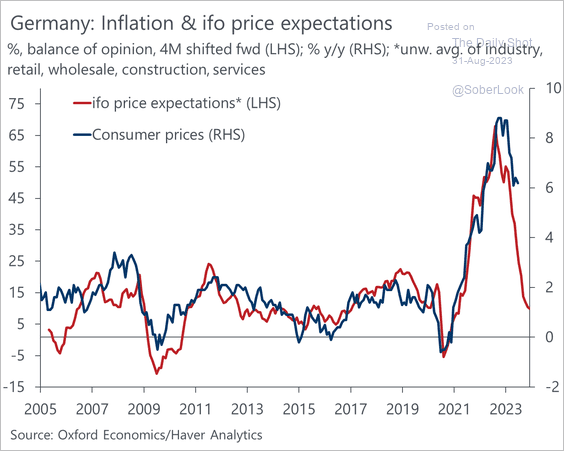

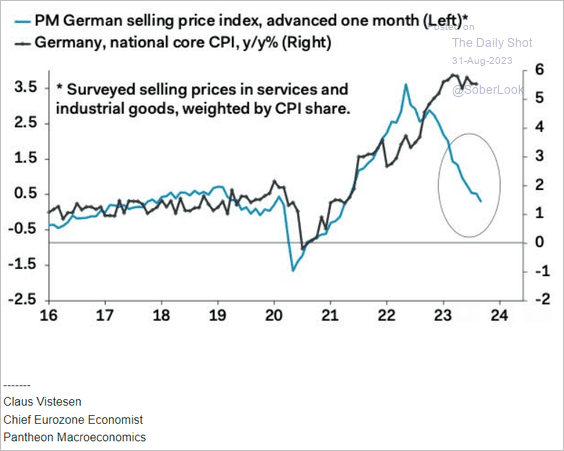

• Survey data (2 charts):

Source: @OliverRakau

Source: @OliverRakau

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

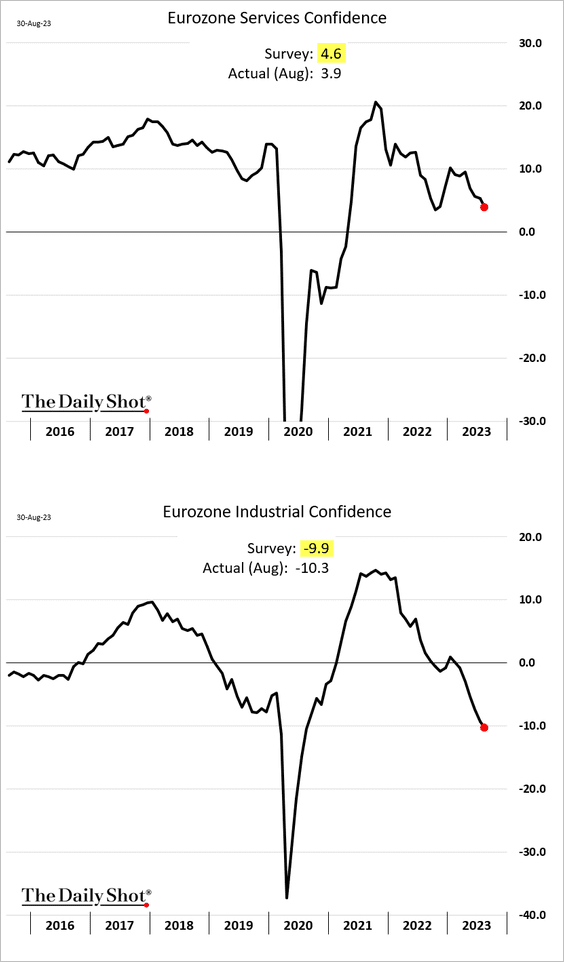

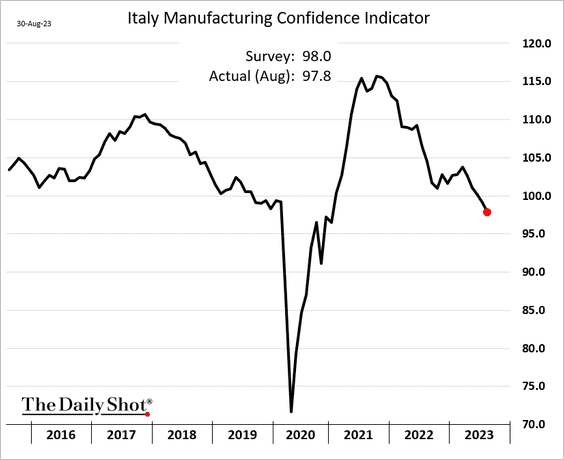

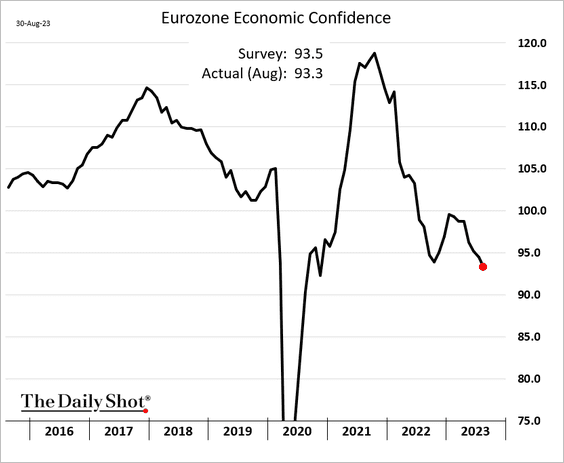

4. Euro-area business confidence deteriorated further in August.

Here is Italy’s manufacturing confidence.

This chart shows the economic confidence in the Eurozone, encompassing both business and consumer sentiment.

Back to Index

Japan

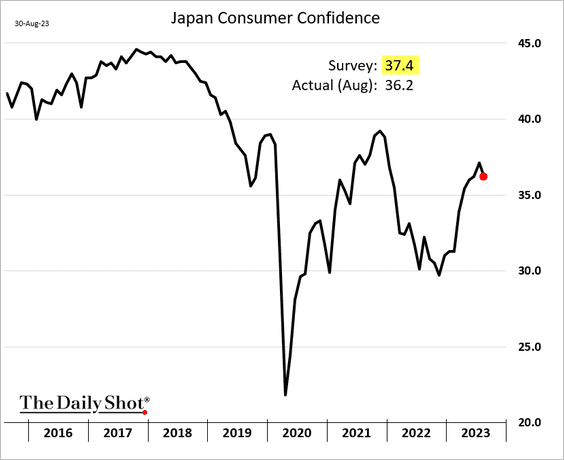

1. Consumer confidence eased this month.

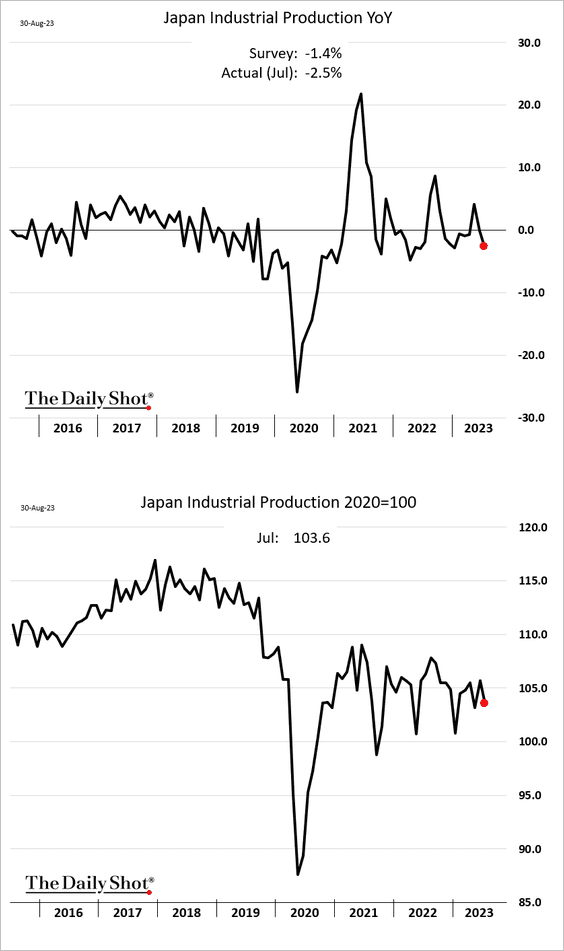

2. Industrial production declined more than expected in July.

Back to Index

Asia-Pacific

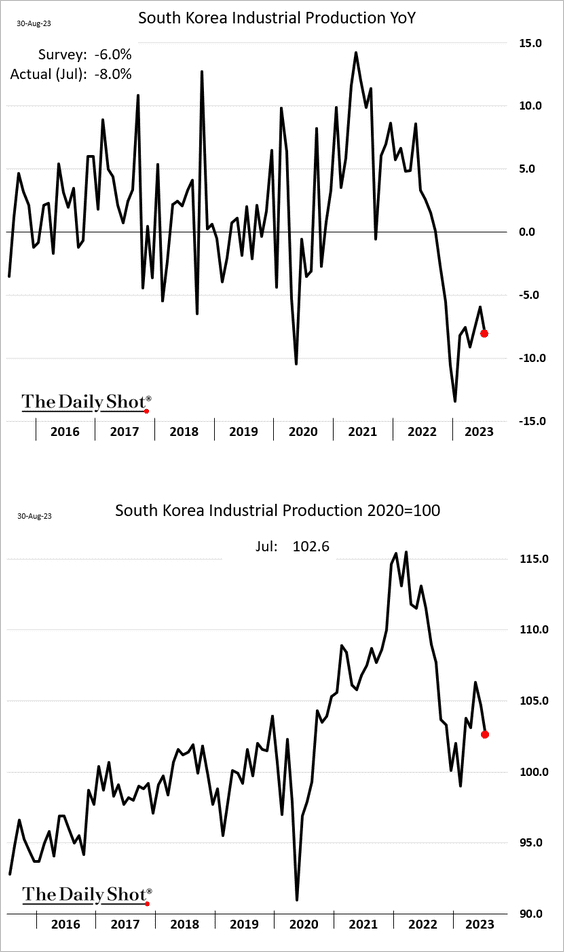

1. South Korea’s industrial production is down 8% vs. 2022.

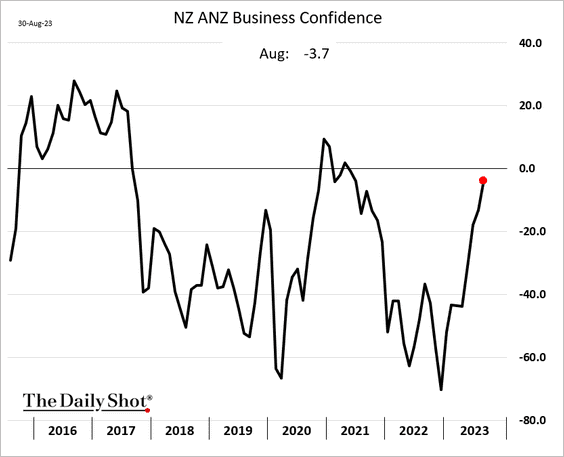

2. New Zealand’s business confidence is improving.

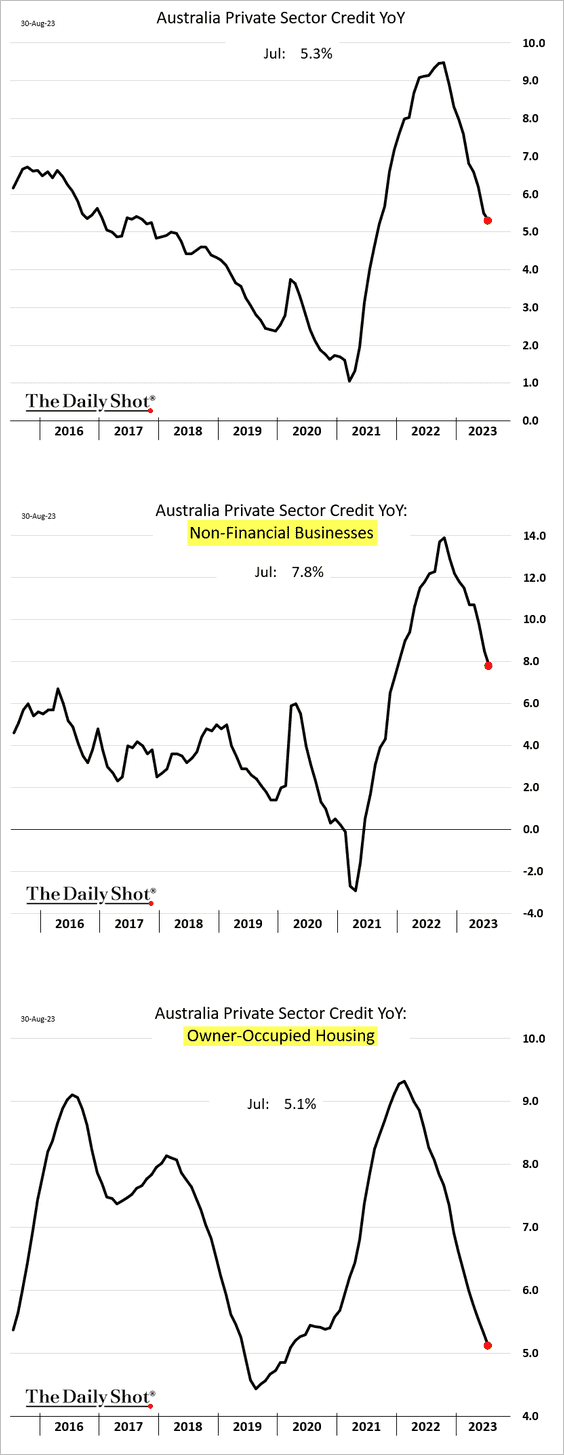

3. Australia’s credit growth is decelerating, yet it remains over 5% higher compared to the previous year.

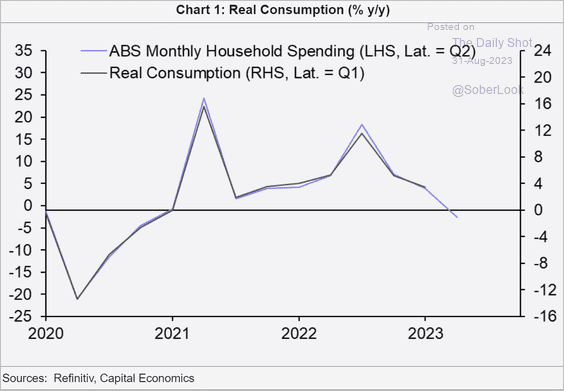

Australian household spending continues to slow.

Source: Capital Economics

Source: Capital Economics

Back to Index

China

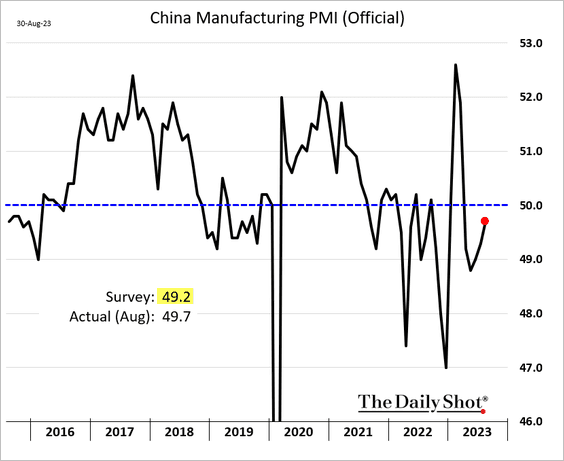

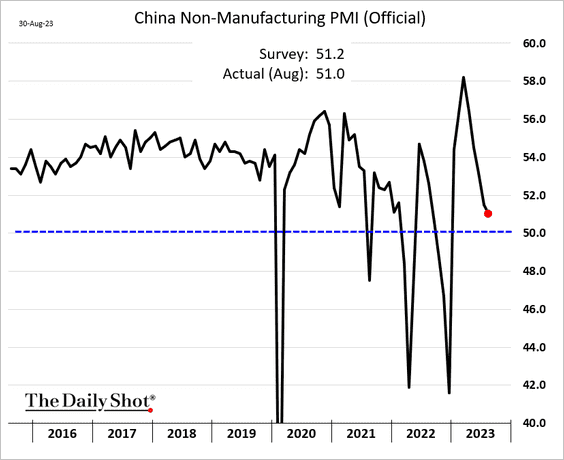

1. The official manufacturing PMI remained in the contractionary zone this month, though its pace has slowed.

Non-manufacturing growth eased further.

——————–

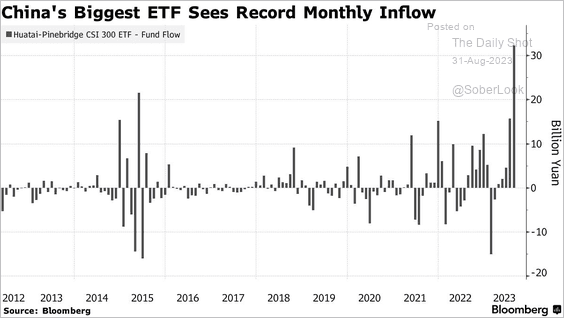

2. Investors have been buying the largest domestic equity ETF.

Source: @markets Read full article

Source: @markets Read full article

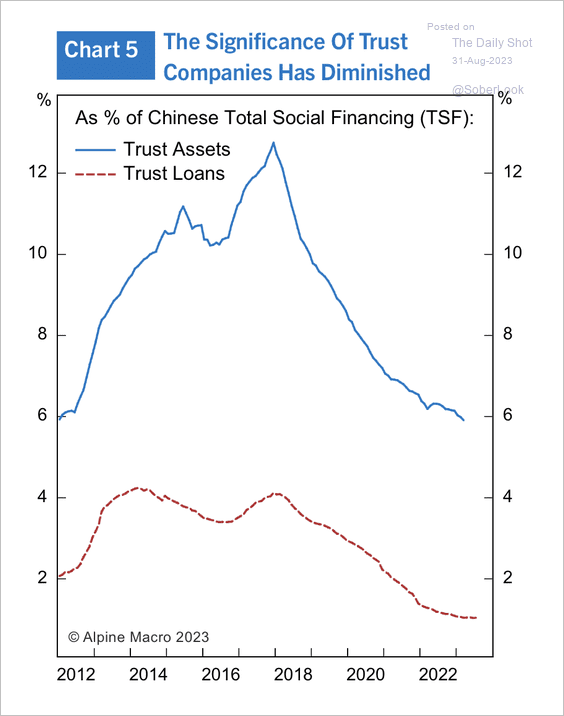

3. The significance of the trust sector in the overall economy has diminished due to heightened regulatory scrutiny, which could limit contagion risk.

Source: Alpine Macro

Source: Alpine Macro

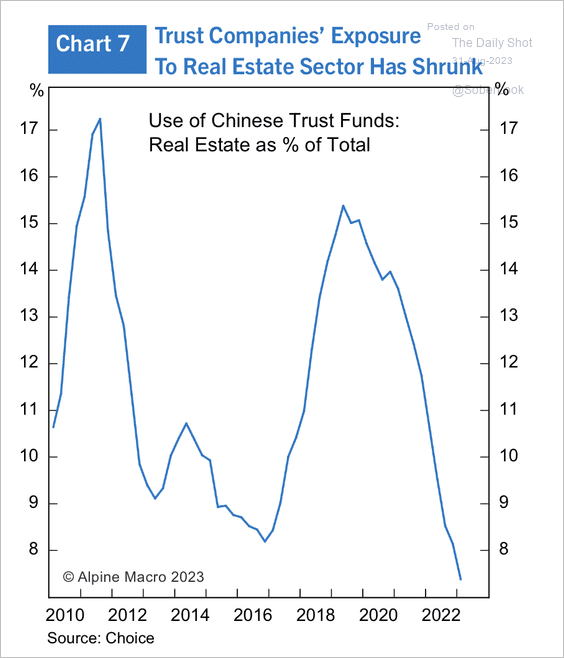

The real estate sector accounts for roughly 7% of all trust funds, down from 15% in 2020.

Source: Alpine Macro

Source: Alpine Macro

——————–

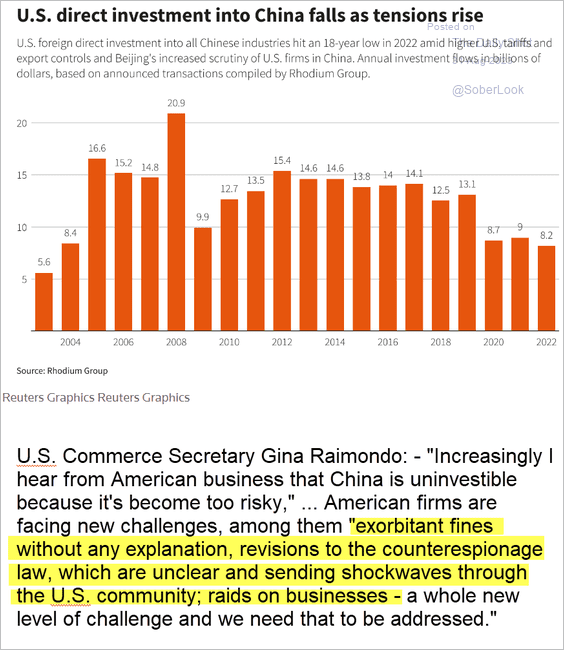

4. This chart shows US direct investment in China (see comment below).

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Emerging Markets

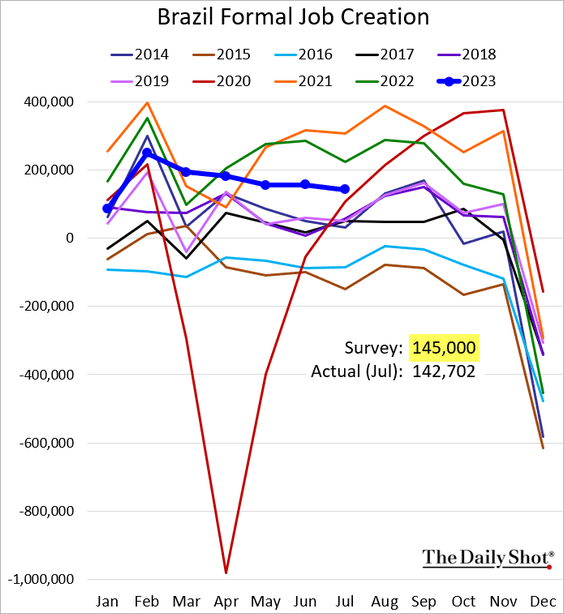

1. Brazil’s formal job creation is slowing.

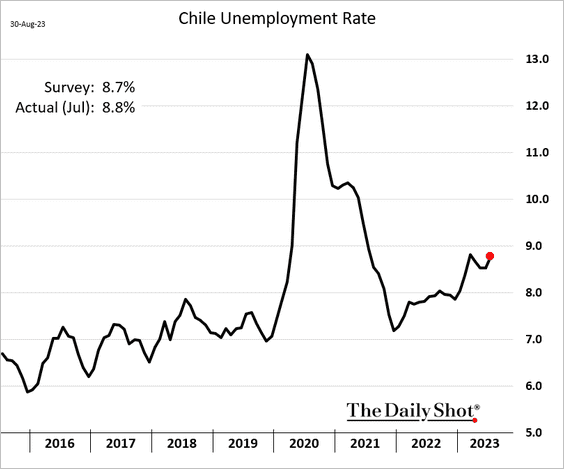

2. Chile’s unemployment rate continues to climb.

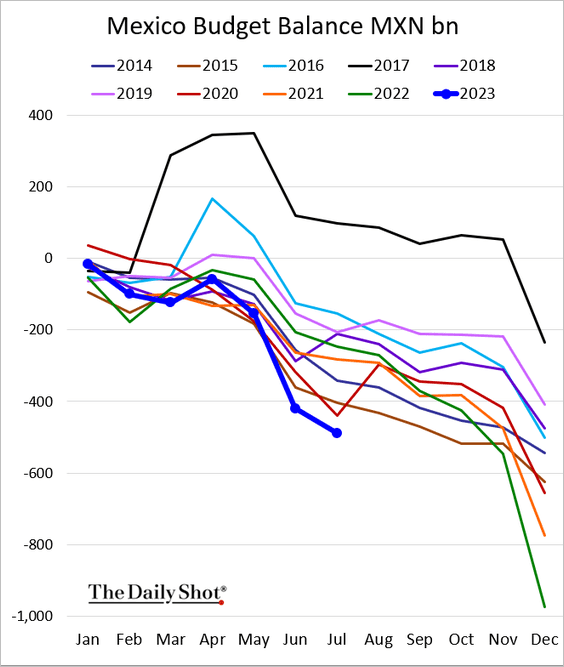

3. Here is Mexico’s cumulative budget deficit.

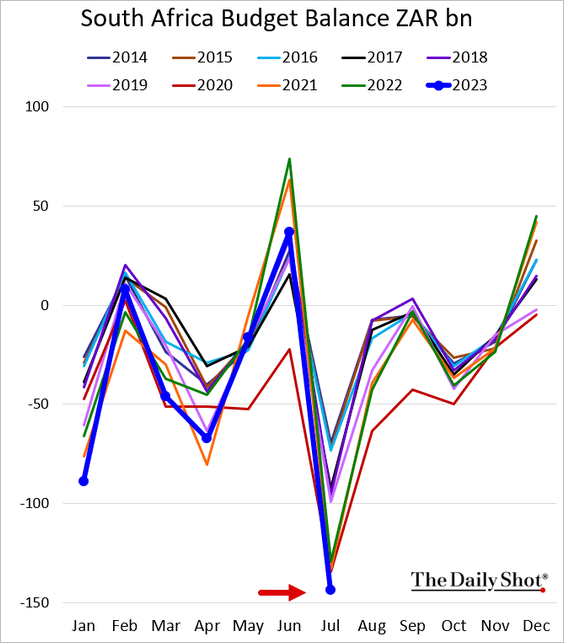

4. This chart shows South Africa’s budget deficit.

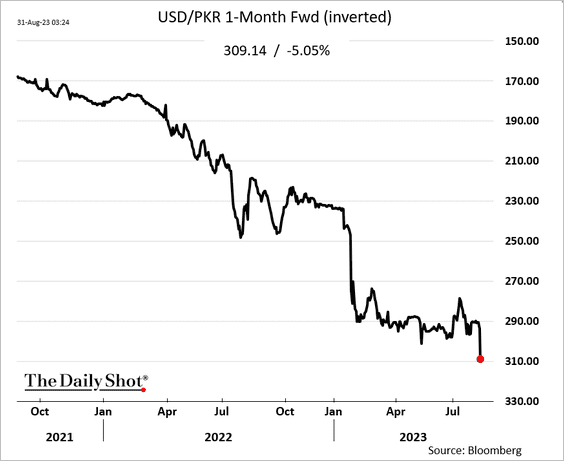

5. The Pakistani rupee remains under pressure.

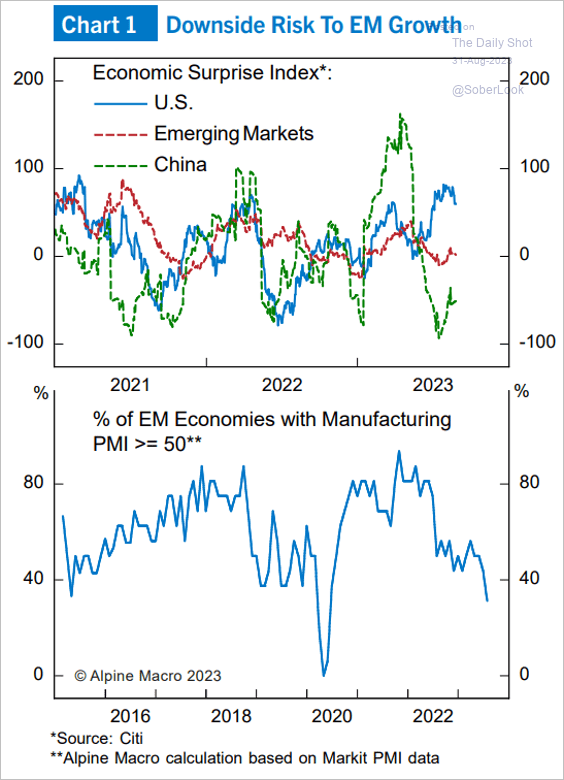

6. Softer demand from China poses growth risks for emerging markets.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Cryptocurrency

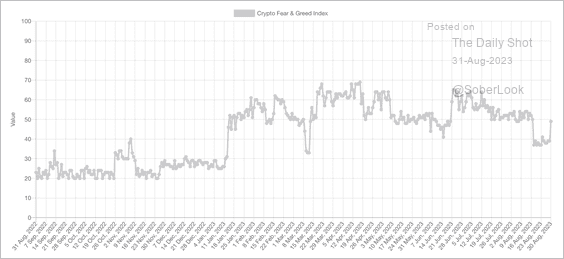

1. The Crypto Fear & Greed Index flipped back into “neutral” territory after reaching “fear” levels last week. News of Grayscale’s court victory versus the SEC boosted investor optimism.

Source: Alternative.me

Source: Alternative.me

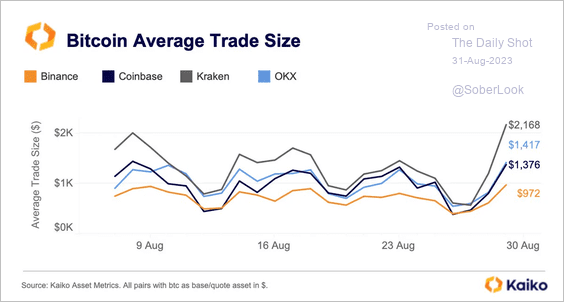

2. Bitcoin’s average trade size surged to its highest level since June.

Source: @KaikoData

Source: @KaikoData

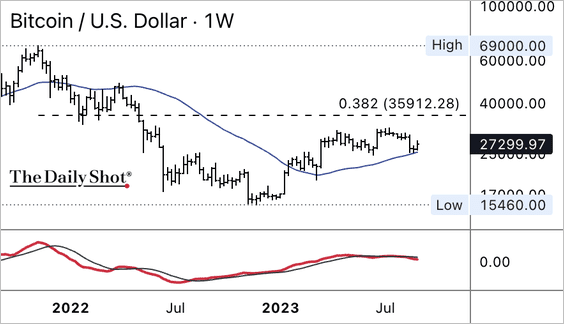

3. Bitcoin held support at its 40-week moving average, although negative momentum suggests upside could be limited.

4. The ETH/BTC price ratio continues to fade from long-term resistance.

Back to Index

Commodities

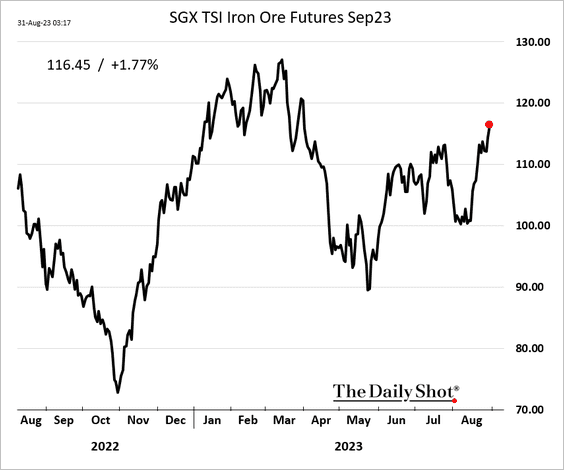

1. Iron ore futures continue to rally, suggesting that China’s economy has pockets of strength.

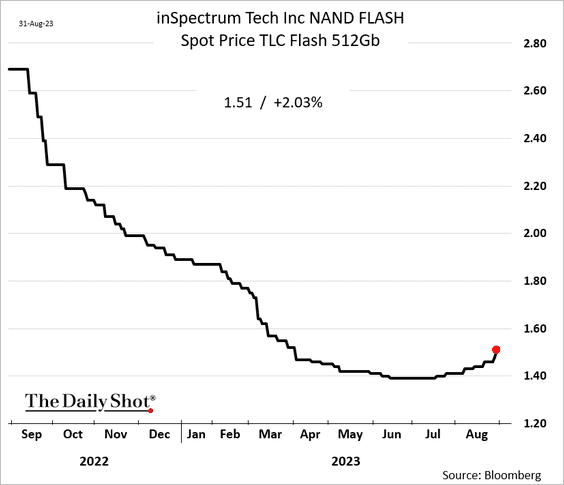

2. NAND memory prices appear to be rebounding.

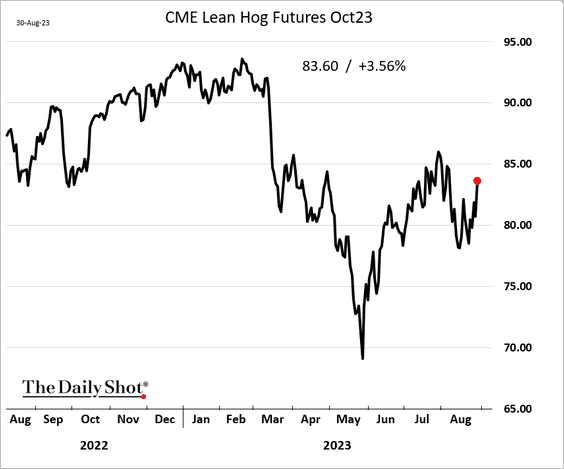

3. Chicago hog futures are up sharply.

Source: barchart.com Read full article

Source: barchart.com Read full article

——————–

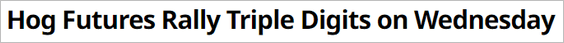

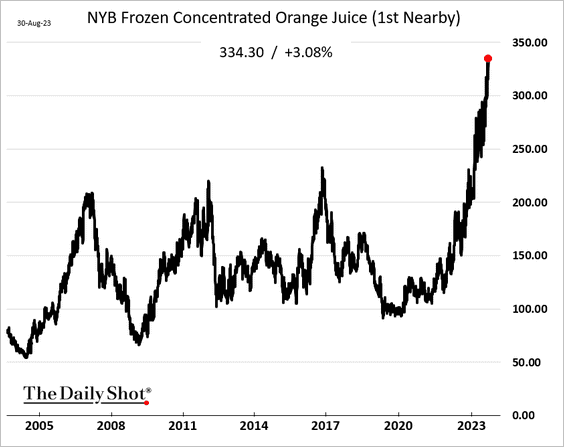

4. Orange juice futures hit a record high, …

… amid low supplies.

Source: @markets Read full article

Source: @markets Read full article

——————–

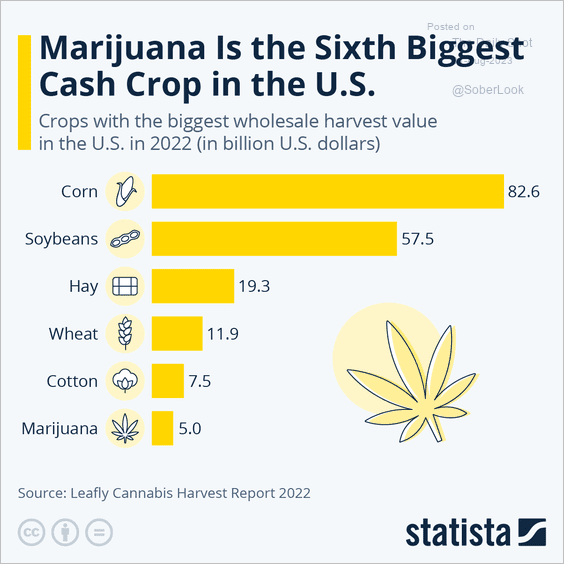

5. Marijuana is an important crop in the US.

Source: Statista

Source: Statista

Back to Index

Energy

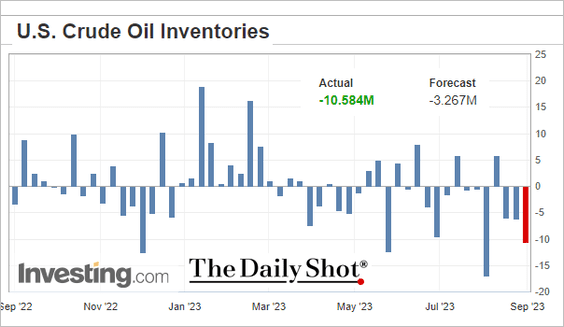

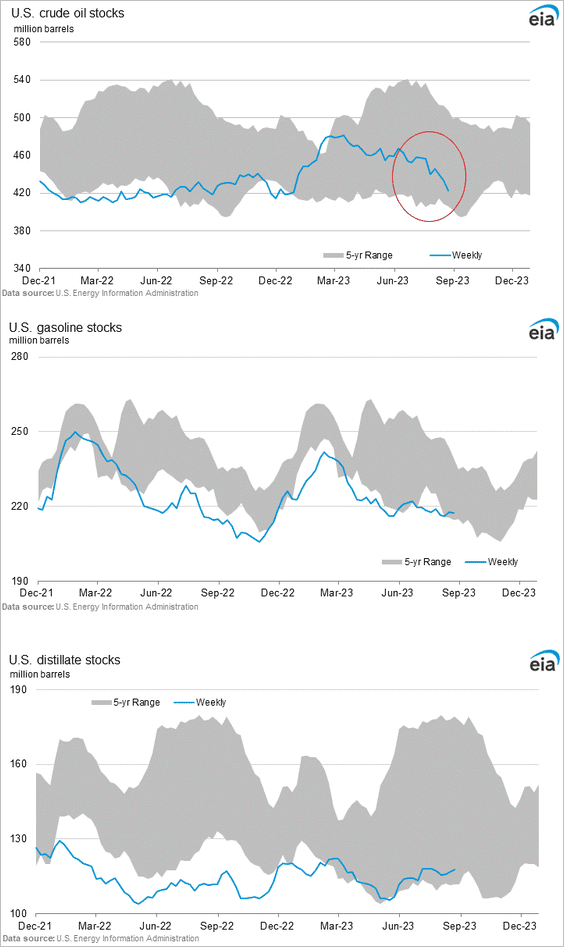

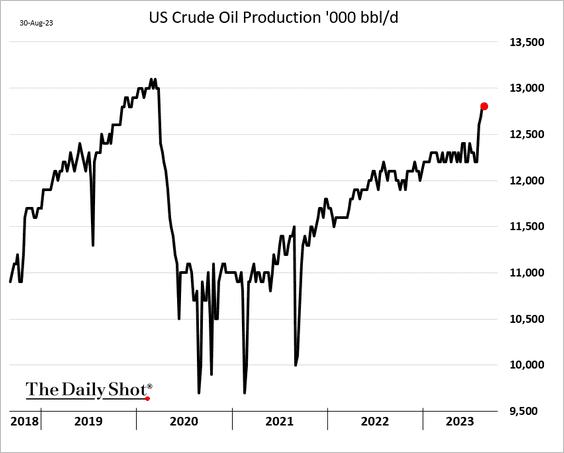

1. US crude oil inventories continue to fall, …

… even as production held at multi-year highs last week.

——————–

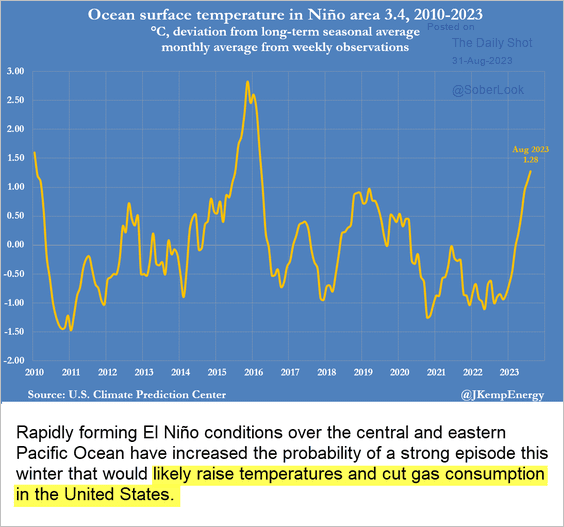

2. El Niño conditions will be a headwind for natural gas prices this winter.

Source: @JKempEnergy Read full article

Source: @JKempEnergy Read full article

Back to Index

Equities

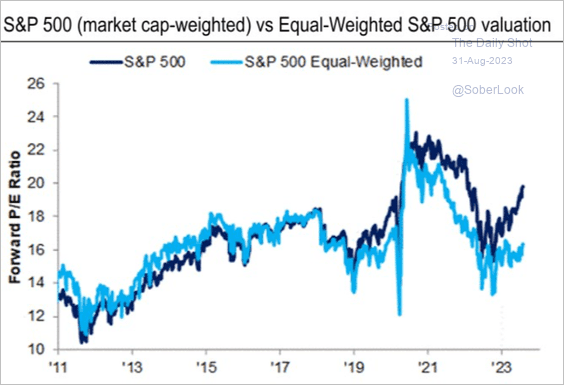

1. The S&P 500 valuations continue to diverge from that of the equal-weight index.

Source: Citi Private Bank

Source: Citi Private Bank

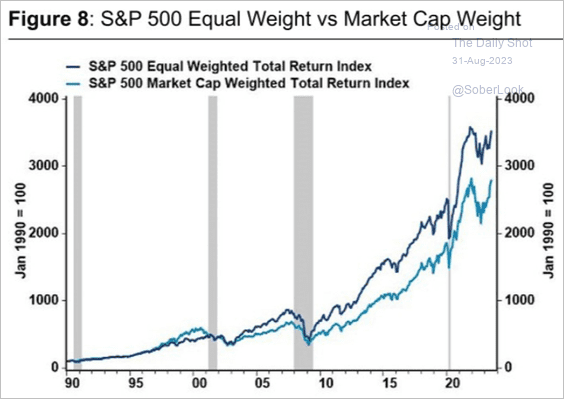

By the way, the S&P 500 equal-weight index outperformed the market-cap-weighted index over the long run.

Source: Citi Private Bank

Source: Citi Private Bank

——————–

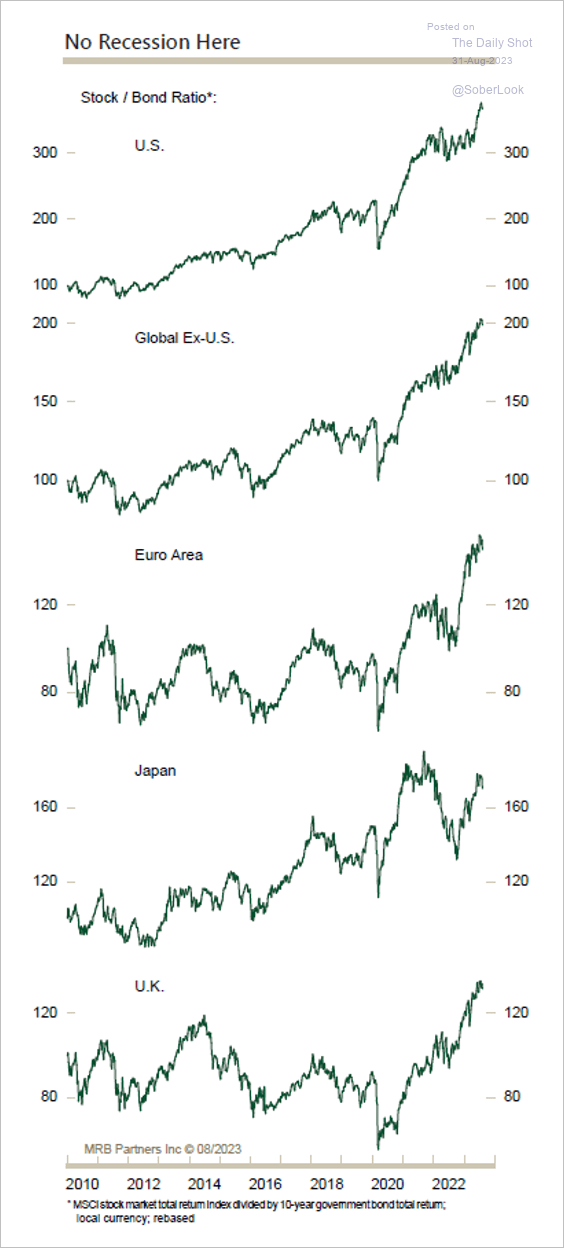

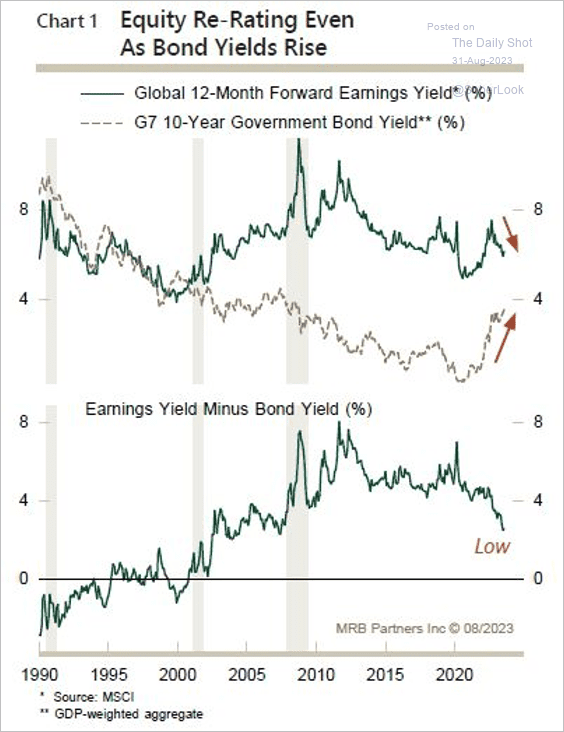

2. Developed market stock/bond ratios continue to climb. However, the declining equity risk premium suggests stocks are increasingly vulnerable to another rise in bond yields. (2 charts)

Source: MRB Partners

Source: MRB Partners

Source: MRB Partners

Source: MRB Partners

——————–

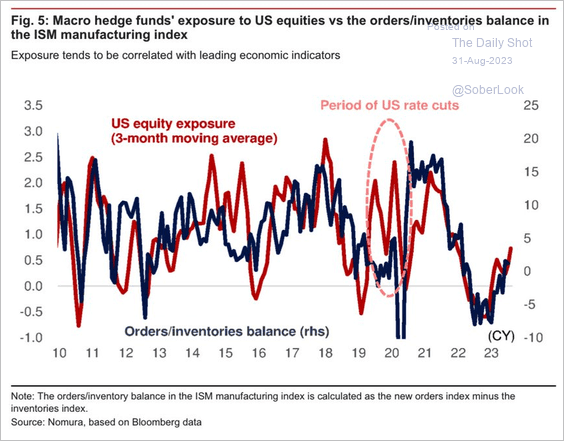

3. Macro hedge funds’ US equity exposure tends to be correlated to leading economic indicators.

Source: Nomura Securities; @WallStJesus

Source: Nomura Securities; @WallStJesus

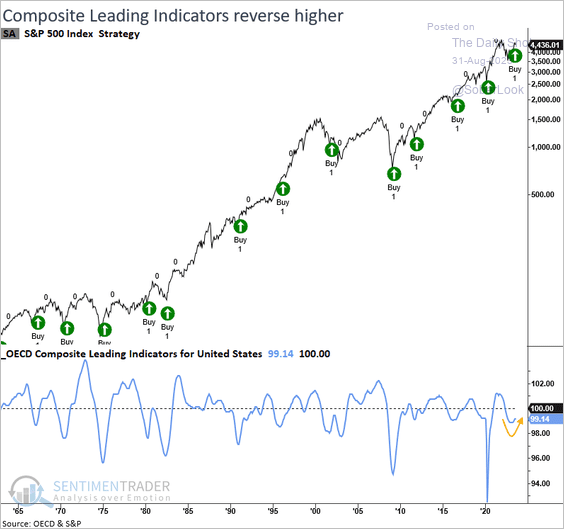

4. A potential trough in US leading indicators could bode well for stocks.

Source: SentimenTrader

Source: SentimenTrader

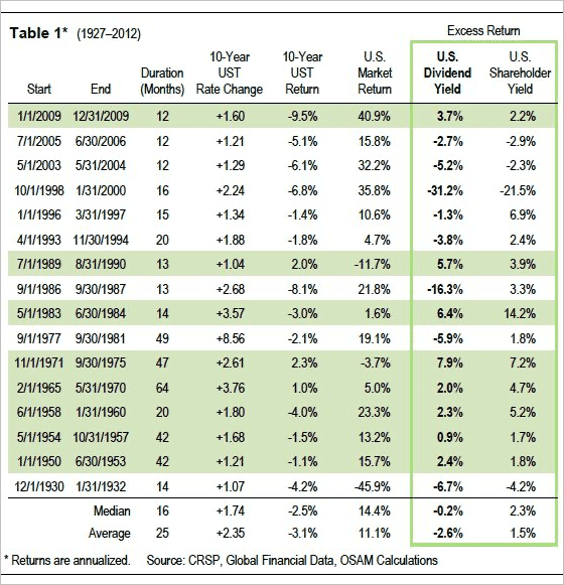

5. Historically, US high-dividend yield has underperformed in rising rate environments, while shareholder yield outperformed.

Source: O’Shaughnessy Asset Management; {h/t} @MebFaber

Source: O’Shaughnessy Asset Management; {h/t} @MebFaber

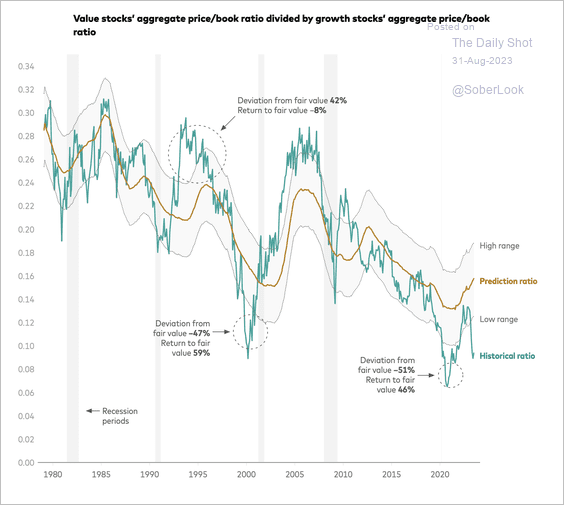

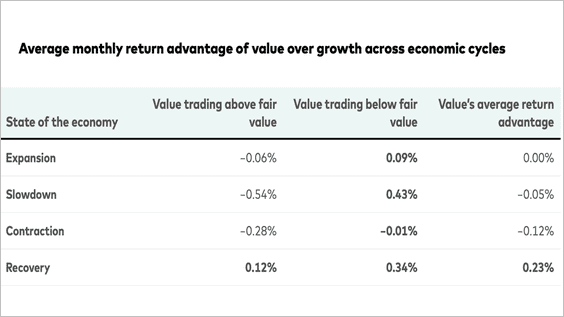

6. US value stocks appear depressed relative to their fair value.

Source: Vanguard Read full article

Source: Vanguard Read full article

Historically, value stocks have outperformed during economic recoveries.

Source: Vanguard Read full article

Source: Vanguard Read full article

——————–

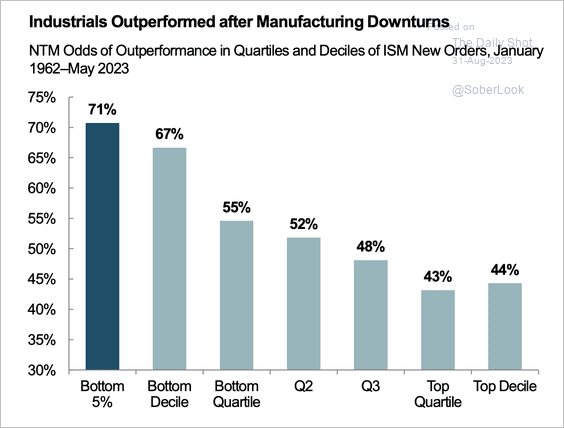

7. S&P 500 industrial stocks typically outperform after similar periods of manufacturing weakness.

Source: Fidelity Investments Read full article

Source: Fidelity Investments Read full article

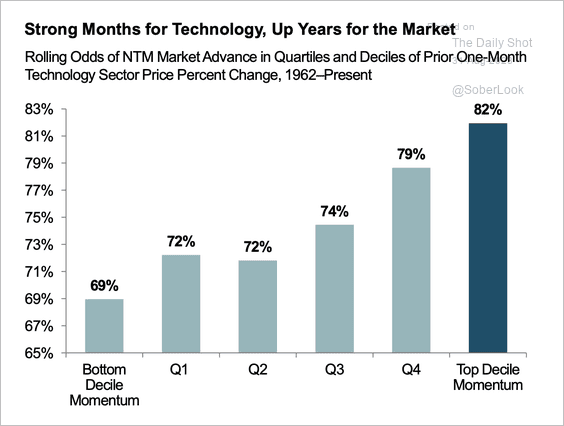

8. Top-decile monthly S&P 500 tech sector returns typically coincide with strong forward market returns.

Source: Fidelity Investments Read full article

Source: Fidelity Investments Read full article

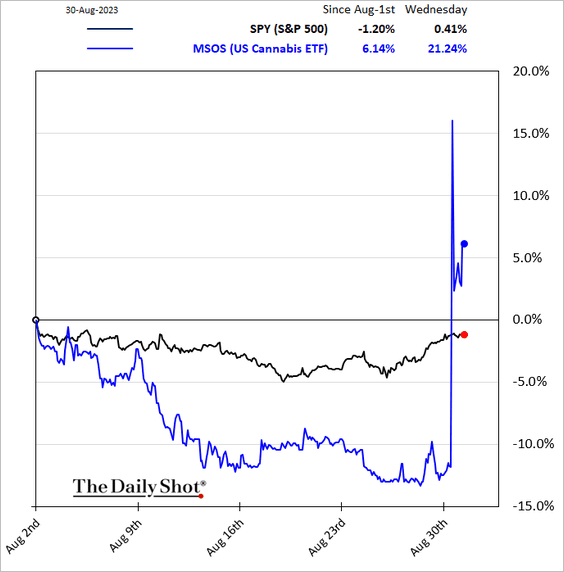

10. It was a good day for cannabis stocks.

Source: @axios Read full article

Source: @axios Read full article

Back to Index

Credit

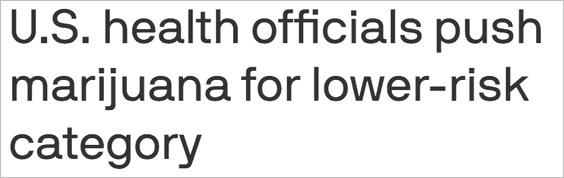

1. There is still robust demand for money market funds. According to PGM Global, healthy Treasury bill spreads to average money market fund (MMF) yields suggest that ongoing issuance of new supply will be funded with MMF inflows plus existing Fed Reverse Repo balances.

Source: PGM Global

Source: PGM Global

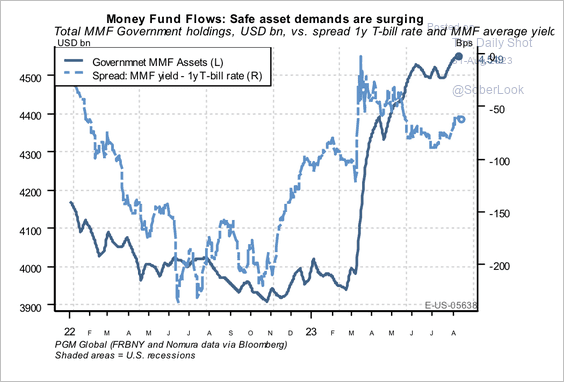

2. What are the sources of funding for US and European companies?

Source: ECB Read full article

Source: ECB Read full article

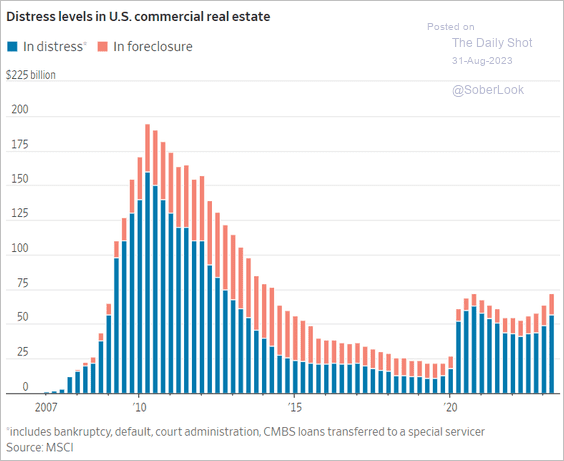

3. Here is a look at distressed commercial real estate over time.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Rates

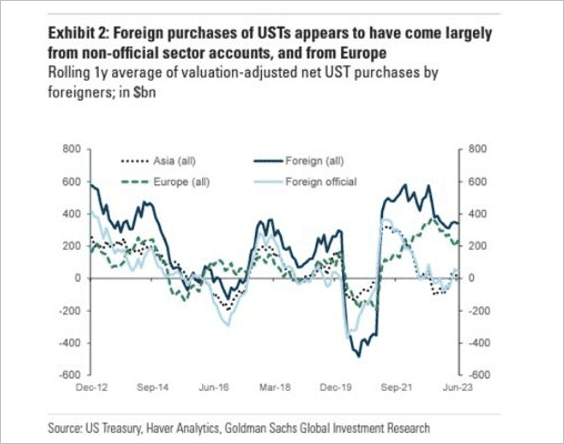

1. Private accounts in Europe have been big buyers of US Treasuries.

Source: Goldman Sachs

Source: Goldman Sachs

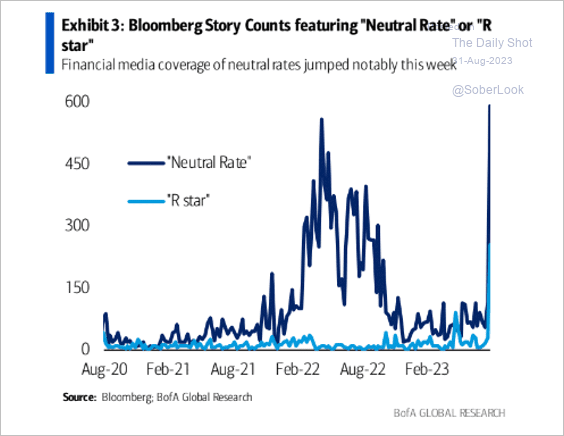

2. There is a lot of interest in the neutral rate.

Source: BofA Global Research; @dailychartbook

Source: BofA Global Research; @dailychartbook

Back to Index

Global Developments

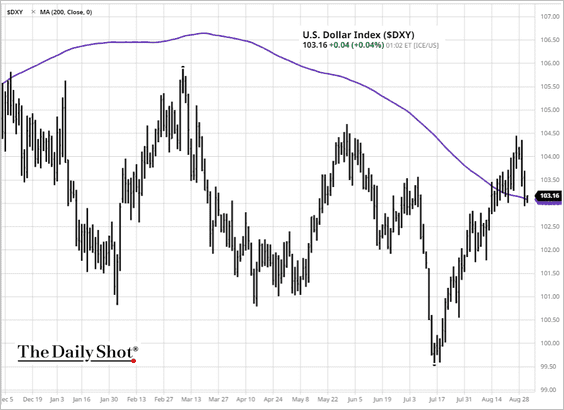

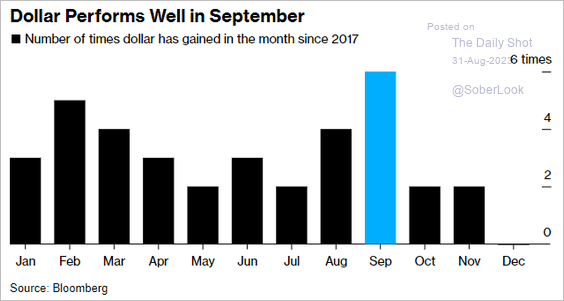

1. The US dollar index (DXY) is testing support at the 200-day moving average.

• September tends to be a good month for the US dollar.

Source: @markets Read full article

Source: @markets Read full article

——————–

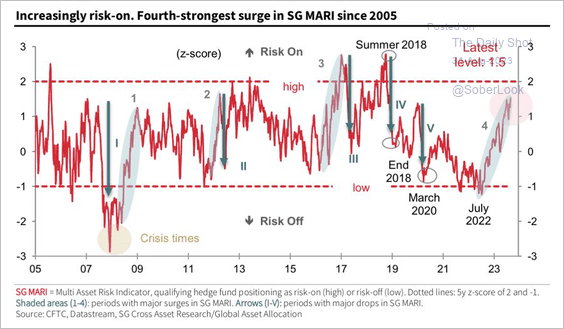

2. It’s risk-on …

Source: SG Markets Cross Asset Research; @WallStJesus

Source: SG Markets Cross Asset Research; @WallStJesus

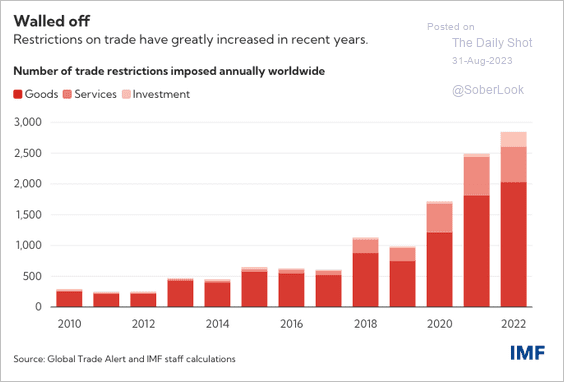

3. Trade restrictions are rising.

Source: IMF Read full article

Source: IMF Read full article

——————–

Food for Thought

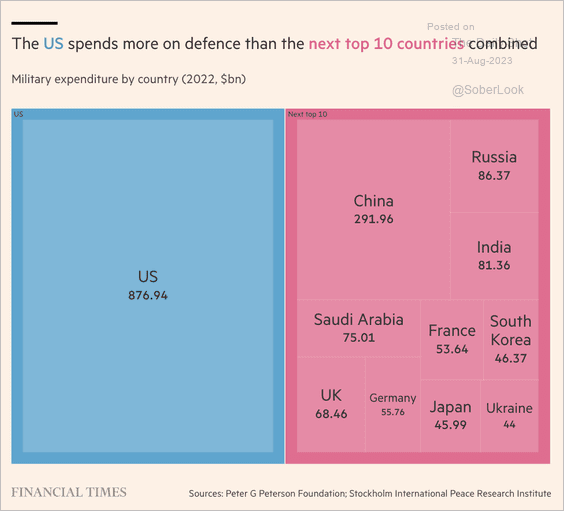

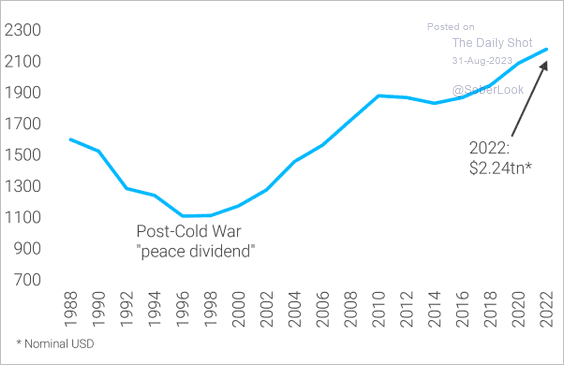

1. US defense spending in perspective:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

• Global military spending adjusted for inflation:

Source: TS Lombard

Source: TS Lombard

——————–

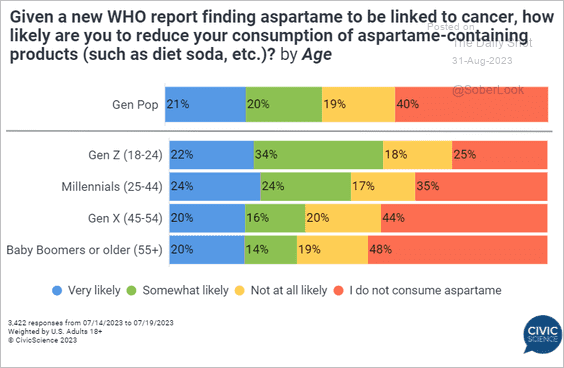

2. Cutting back on aspartame:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

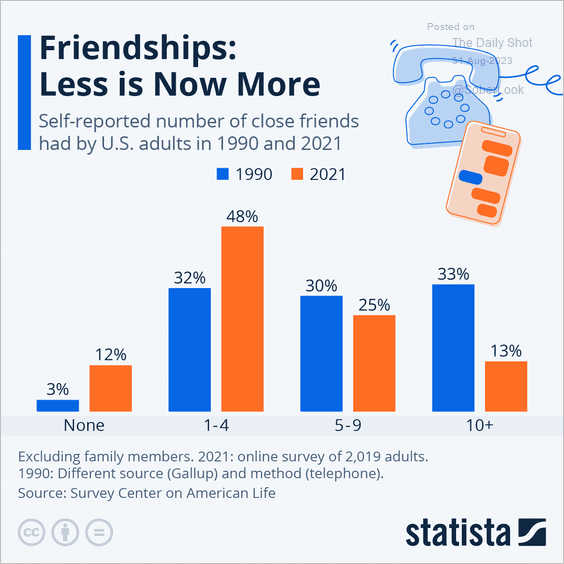

3. Self-reported number of close friends:

Source: Statista

Source: Statista

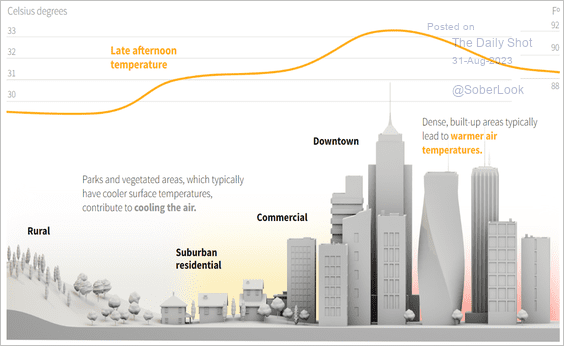

4. Cities tend to be warmer:

Source: Reuters Read full article

Source: Reuters Read full article

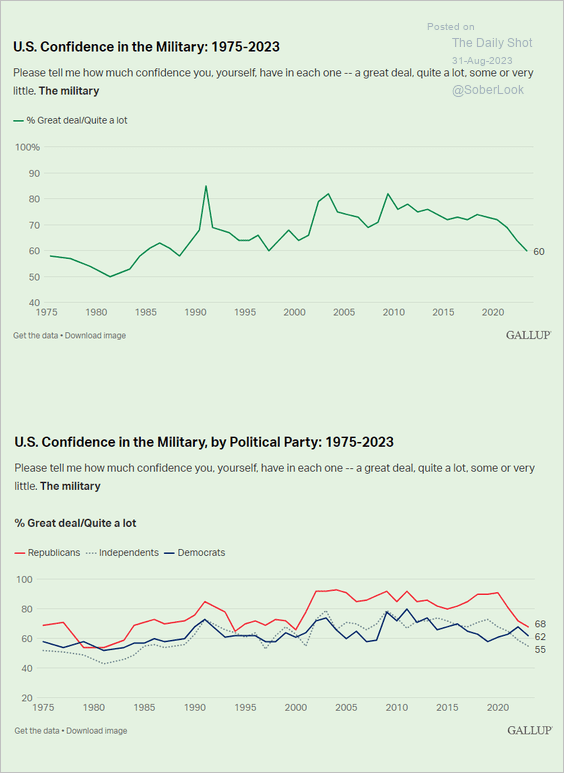

5. Confidence in the US military:

Source: Gallup Read full article

Source: Gallup Read full article

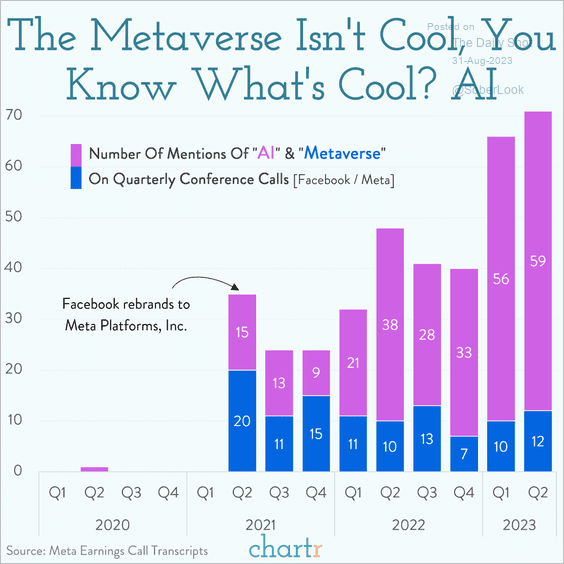

6. Metaverse vs. AI:

Source: @chartrdaily

Source: @chartrdaily

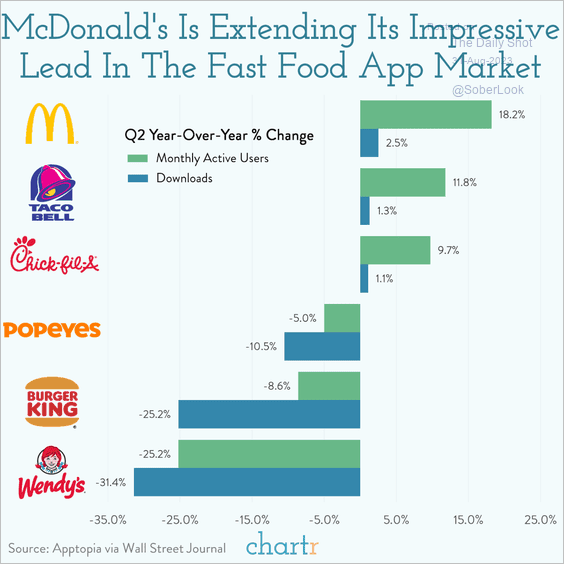

7. The fast food app market:

Source: @chartrdaily

Source: @chartrdaily

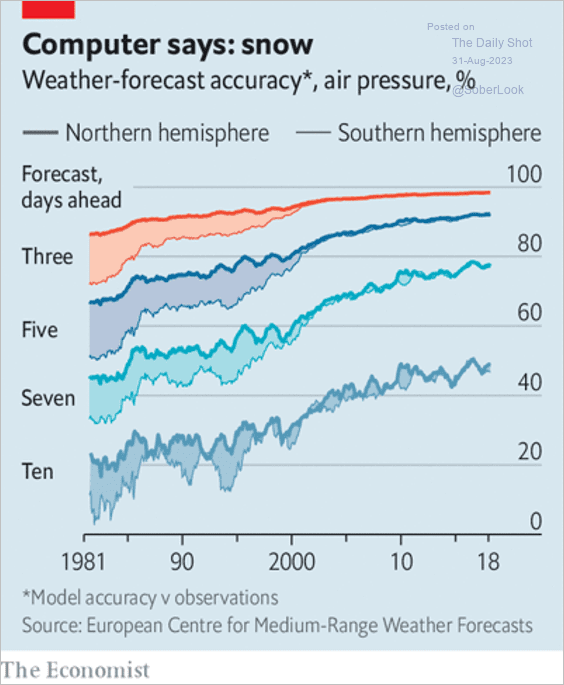

8. Weather-forecast accuracy over time:

Source: The Economist Read full article

Source: The Economist Read full article

——————–

Back to Index