The Daily Shot: 01-Sep-23

• The United States

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

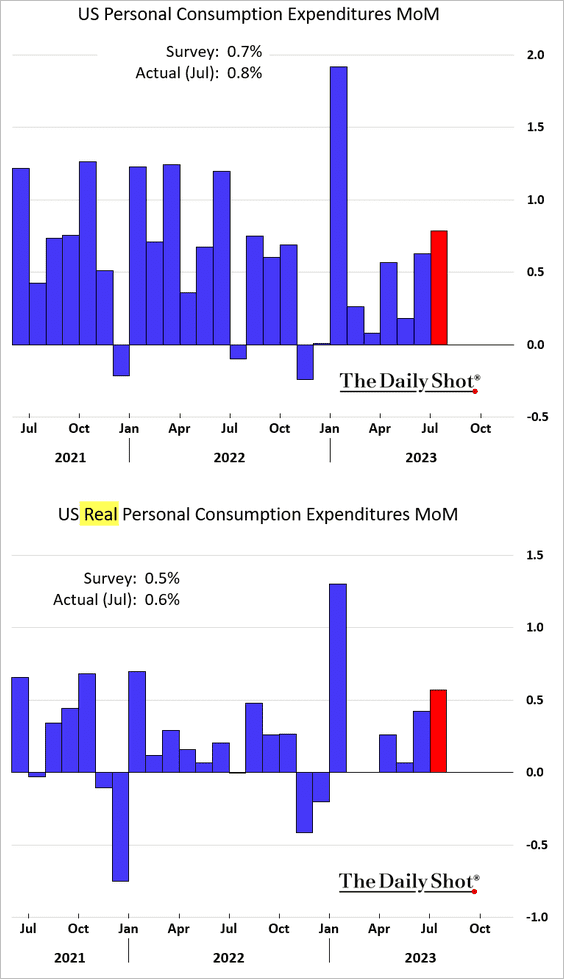

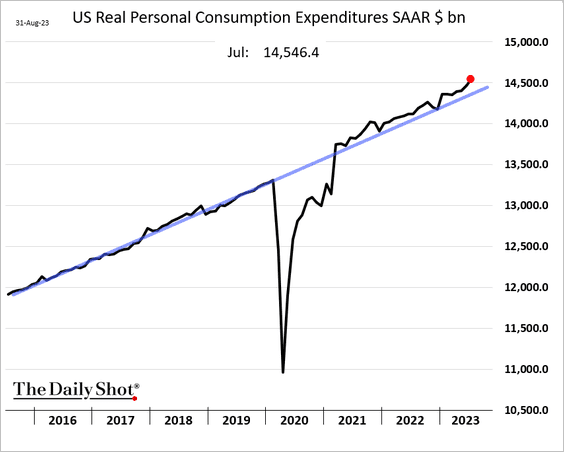

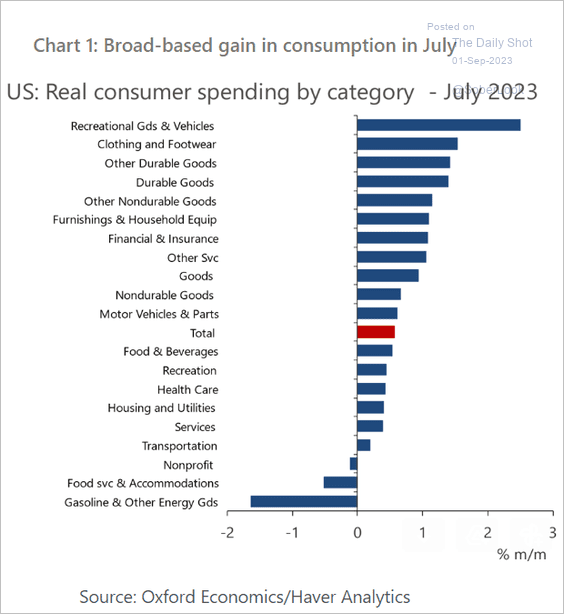

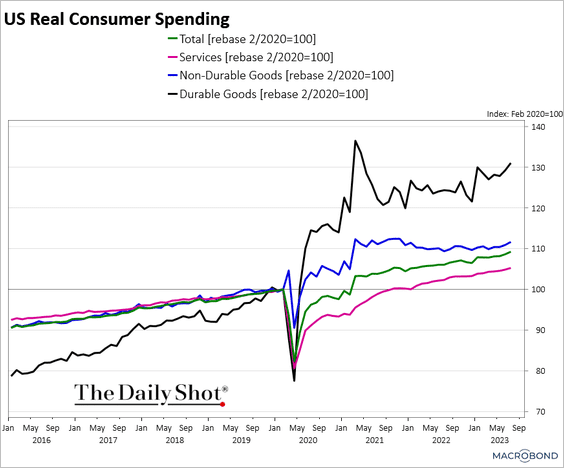

1. Consumer spending jumped in July, topping expectations.

Most sectors registered an increase in consumption (2 charts).

Source: Oxford Economics

Source: Oxford Economics

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

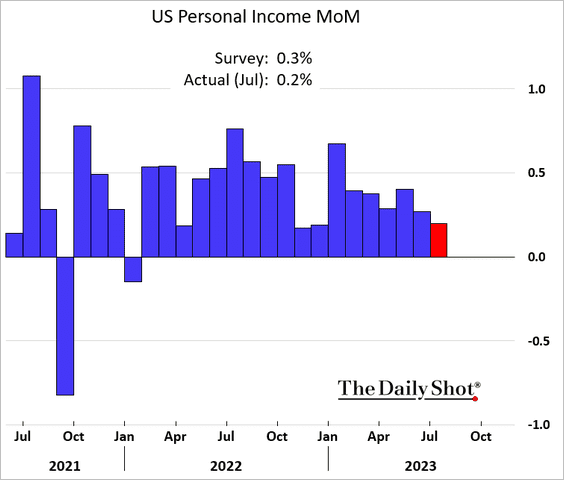

• Income growth slowed, with a lower-than-expected gain in July.

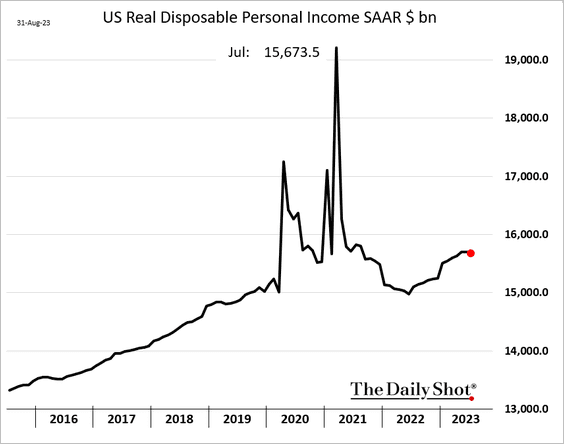

This chart shows real disposable income.

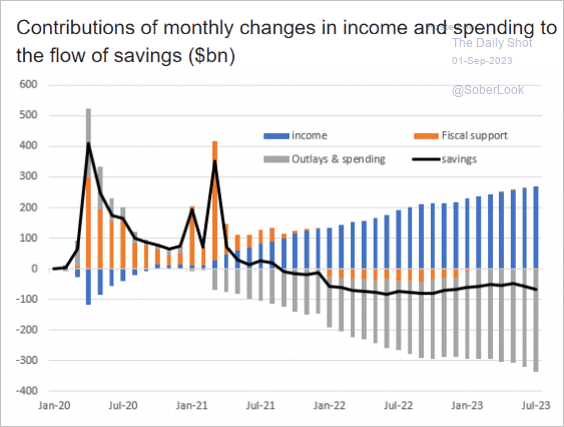

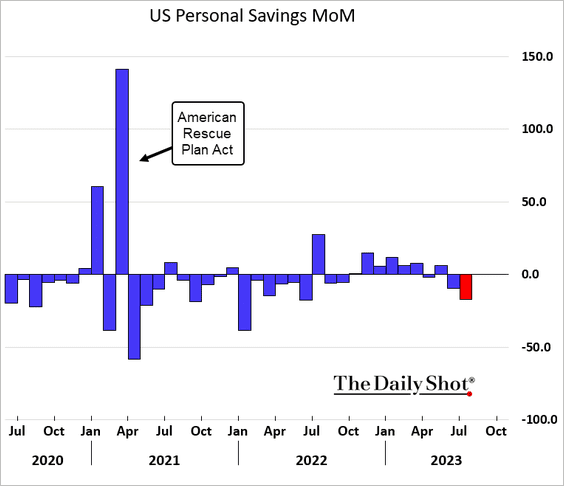

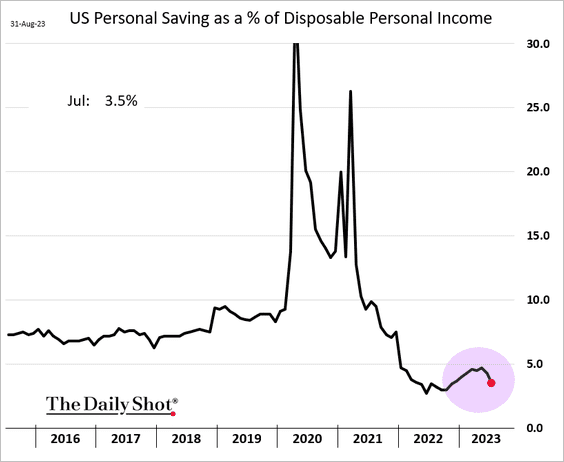

• Increased expenditures, coupled with sluggish income growth, have reduced the savings rate (3 charts).

Source: ING

Source: ING

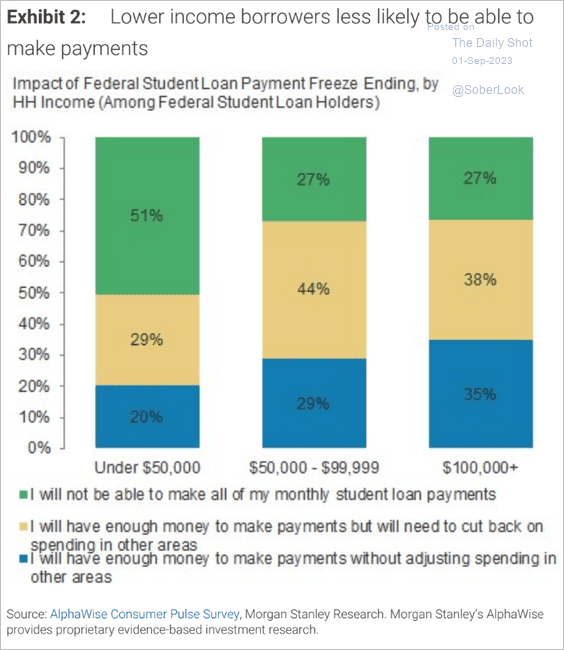

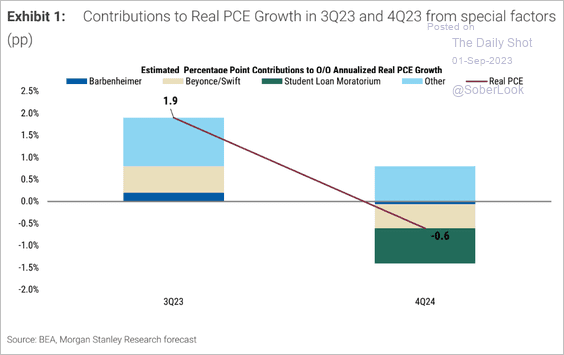

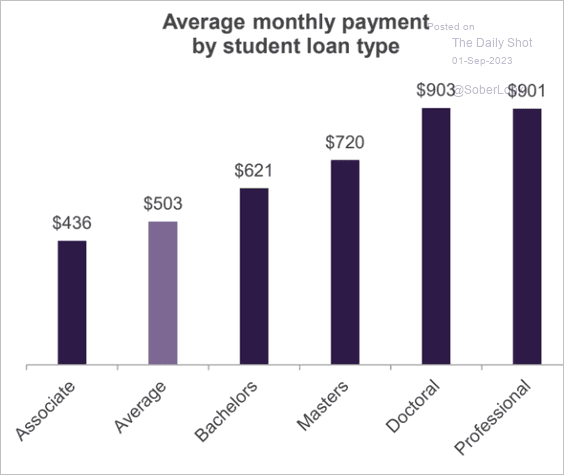

• With student debt payments kicking in shortly, …

Source: Morgan Stanley Research

Source: Morgan Stanley Research

… we are likely to see a sharp pullback in spending in the fourth quarter.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

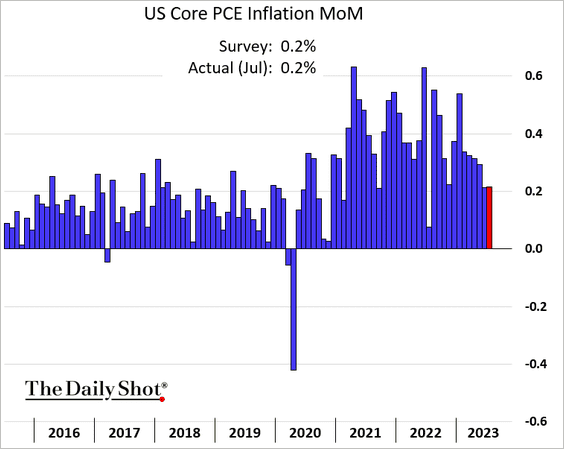

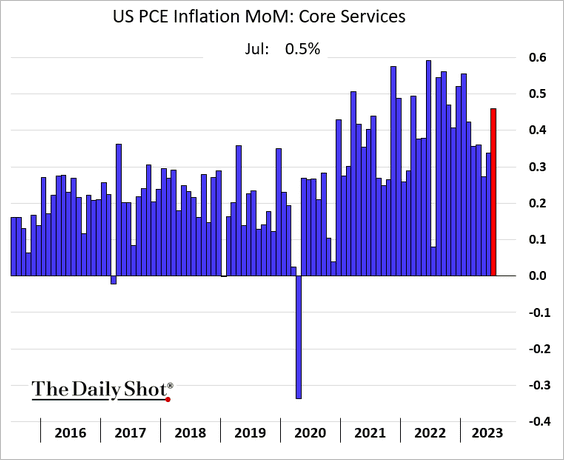

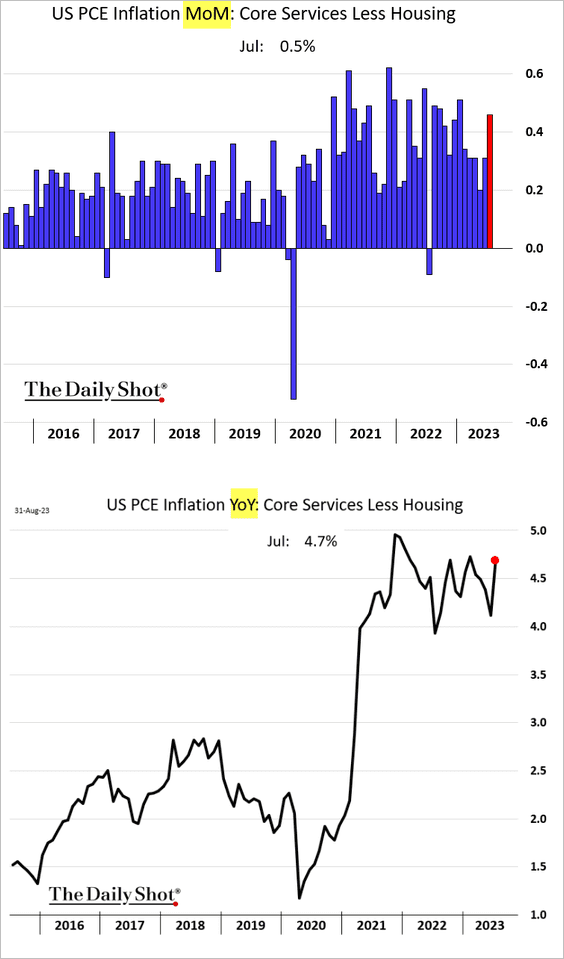

2. The core PCE inflation increased by 0.2% in July, the same as in June.

But core services inflation accelerated.

Here is the supercore PCE inflation, a measure closely tracked by the Fed.

——————–

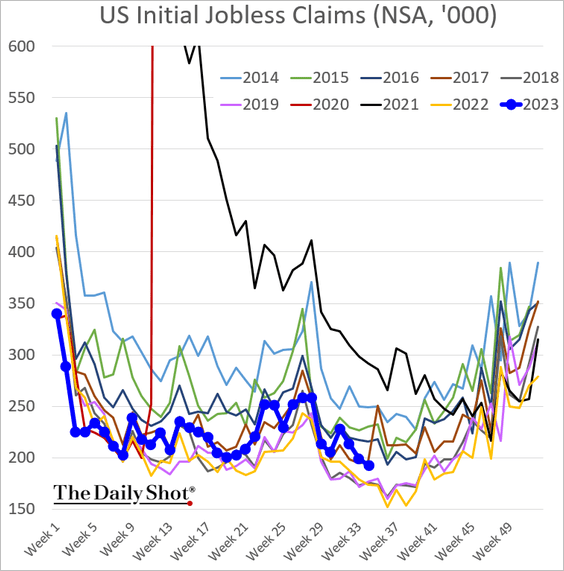

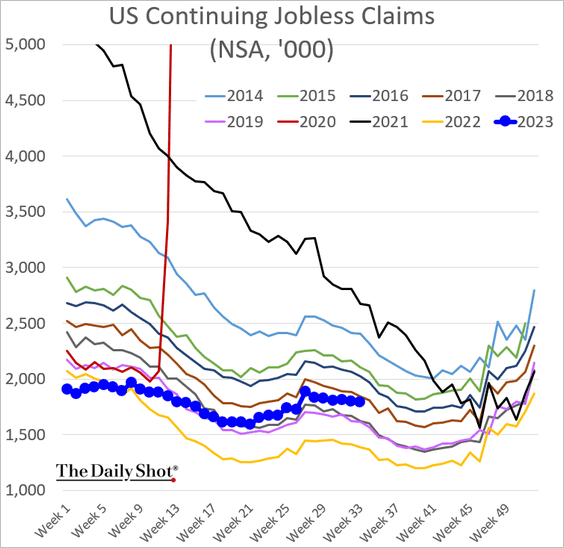

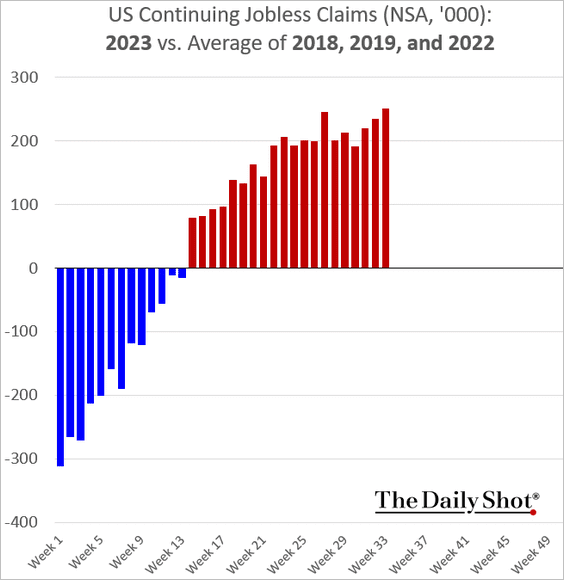

3. Initial jobless claims eased last week.

However, continuing claims keep diverging from their historical pattern.

This deviation clearly shows a softening in the labor market.

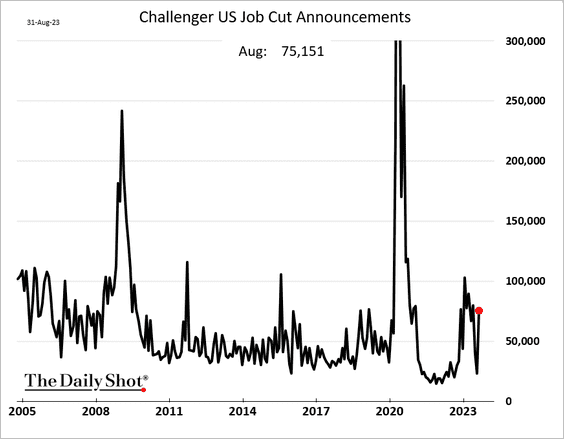

• Job cut announcements increased in August.

——————–

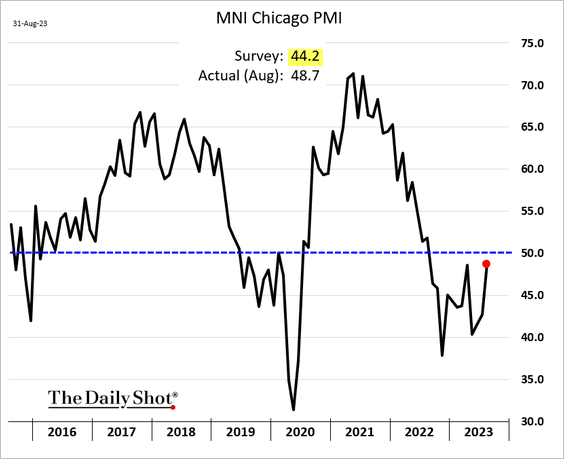

4. The Chicago PMI surprised to the upside, …

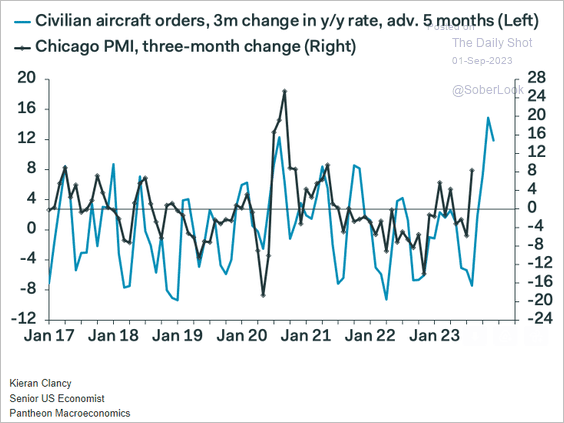

… boosted by Boeing’s orders.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

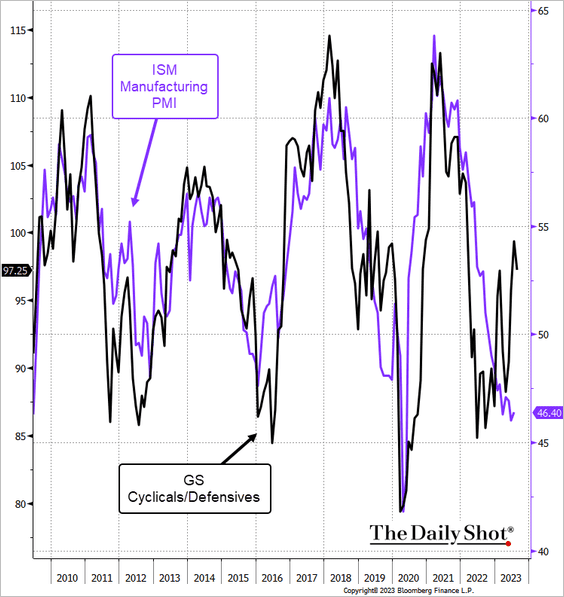

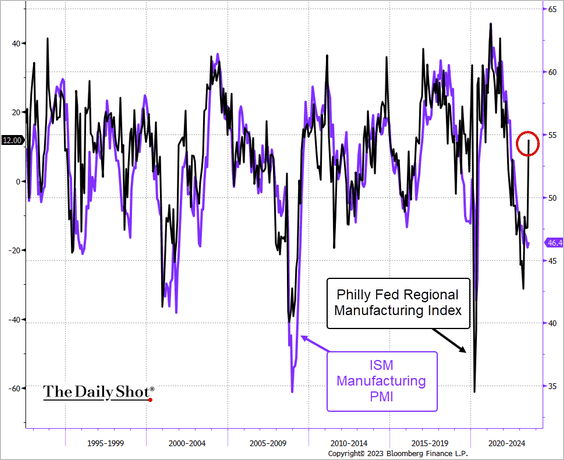

• Leading indicators point to some strengthening in US factory activity in August.

– The stock market:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

– The Philly Fed’s manufacturing index:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

The Eurozone

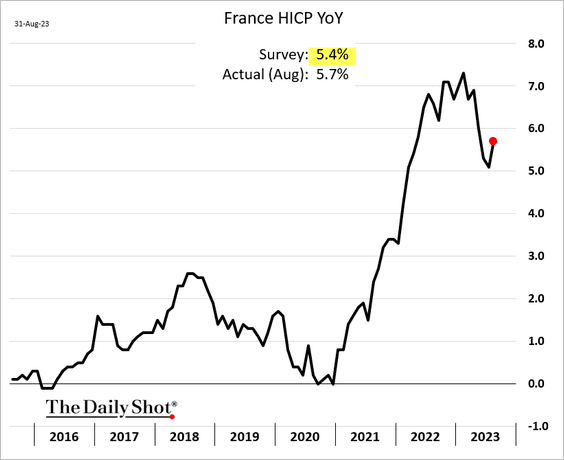

1. French inflation accelerated in August, boosted by higher energy prices.

Source: @economics Read full article

Source: @economics Read full article

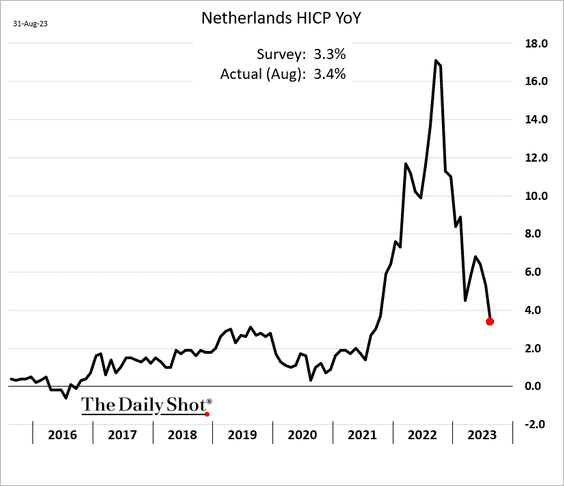

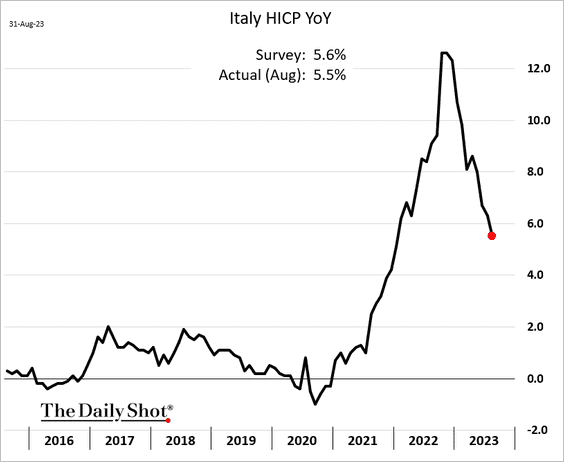

• Dutch and Italian inflation continued to ease.

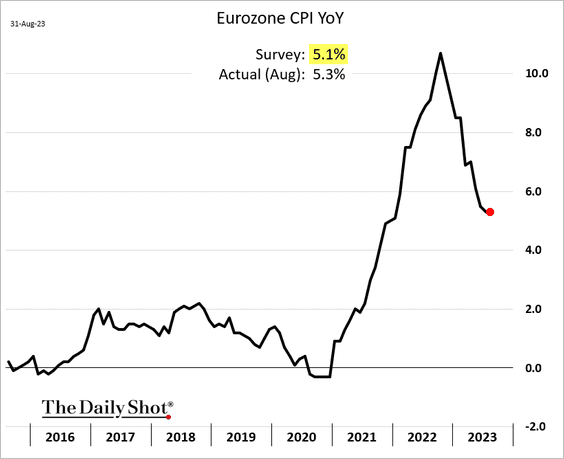

• At the Eurozone level, the CPI topped expectations, …

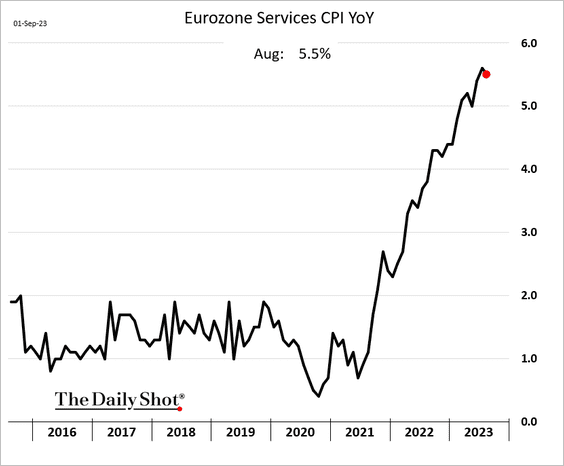

… as services inflation remains elevated.

Source: @economics Read full article

Source: @economics Read full article

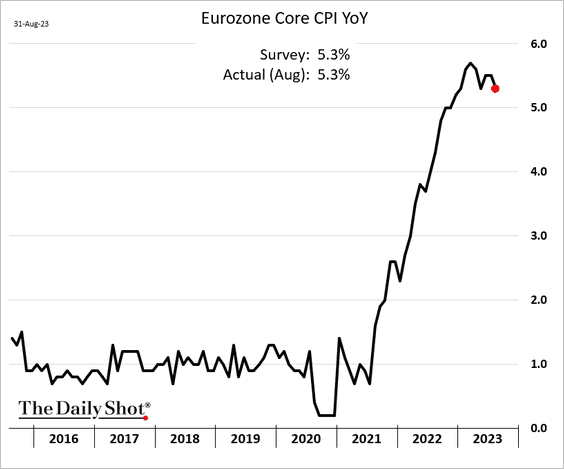

Here is the core CPI.

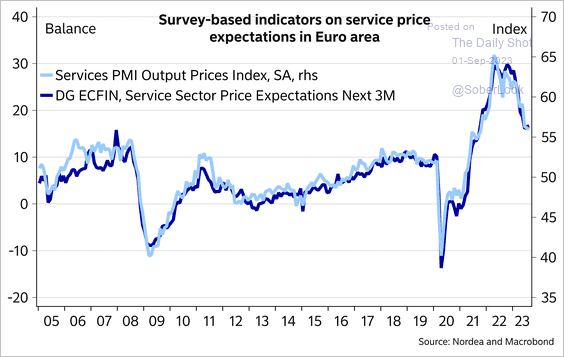

Survey data point to easing services inflation.

Source: Nordea Markets

Source: Nordea Markets

——————–

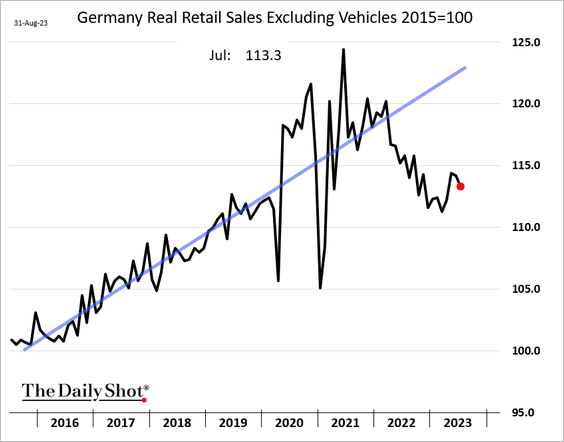

2. Germany’s retail sales declined in July.

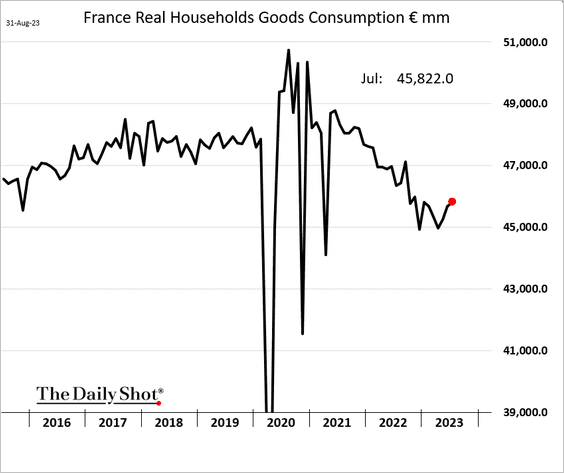

But French household spending on goods continued to increase.

——————–

3. Let’s take a look at some labor market trends.

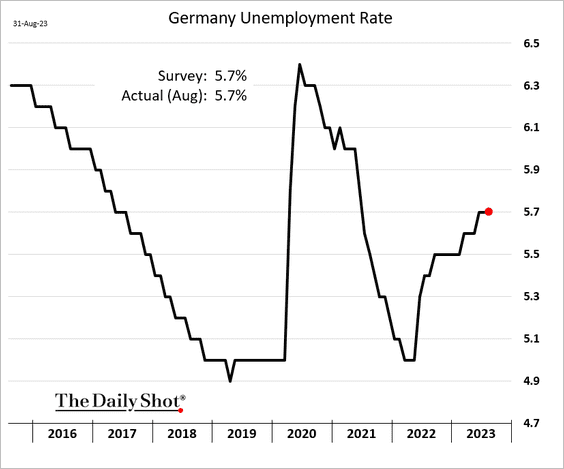

• Germany’s unemployment rate (steady):

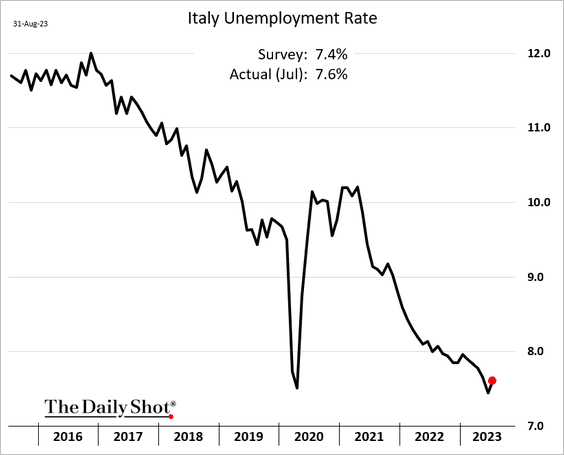

• Italian unemployment rate (unexpected increase in July):

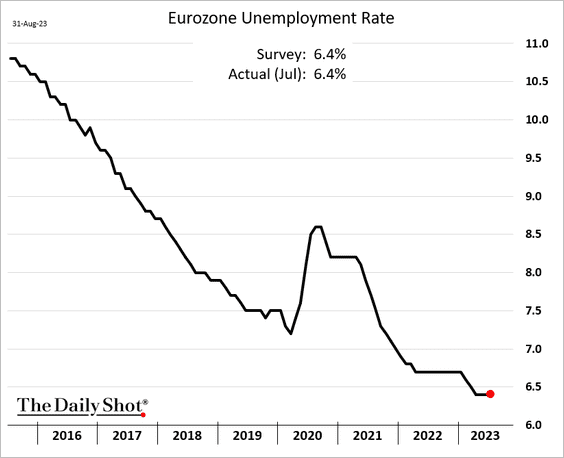

• Eurozone unemployment rate (steady):

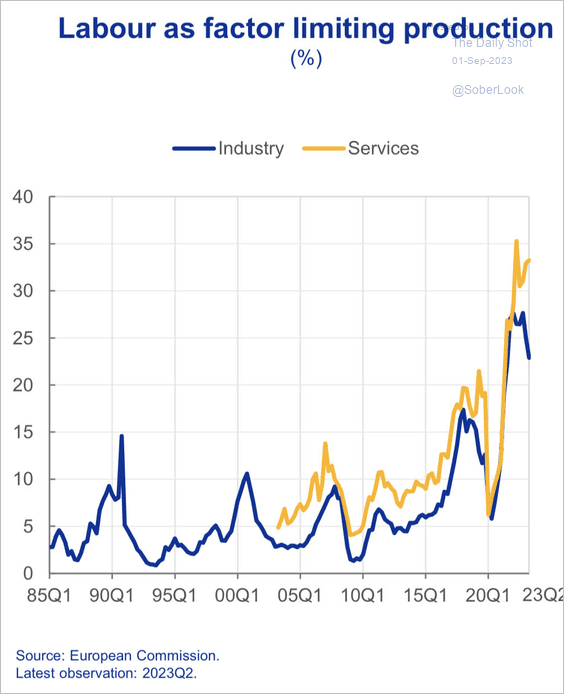

• Labor constraints continue to limit production for many firms.

Source: ECB

Source: ECB

——————–

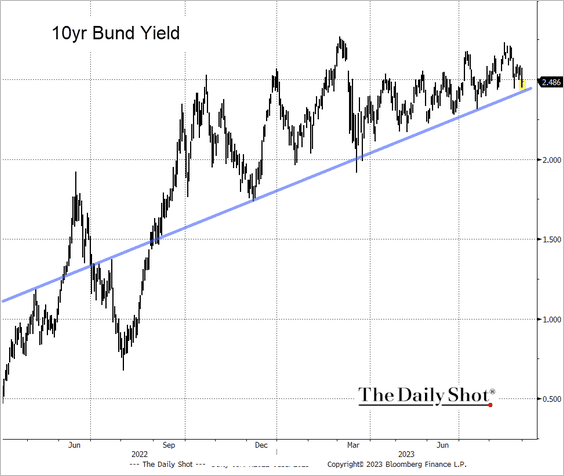

4. Will the 10-year Bund yield hold the uptrend support?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Europe

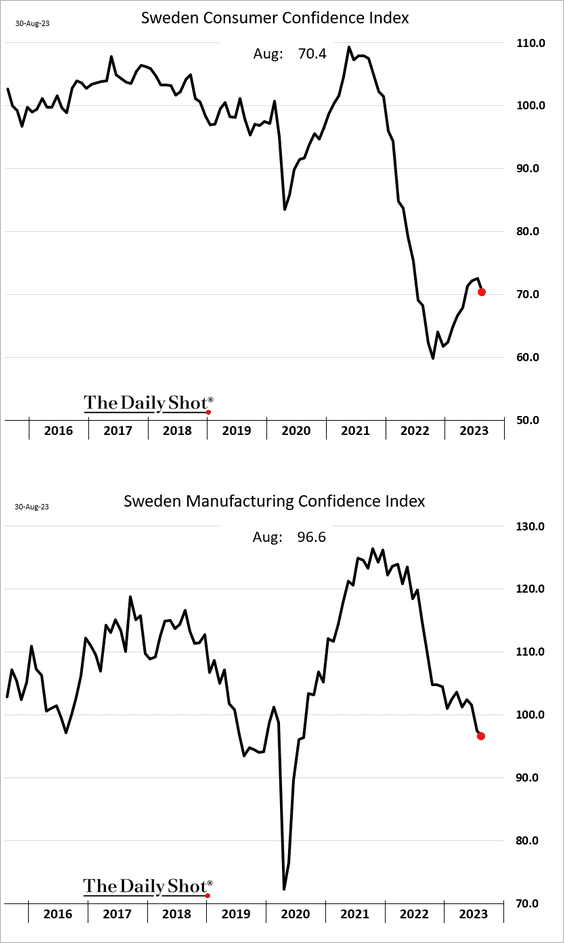

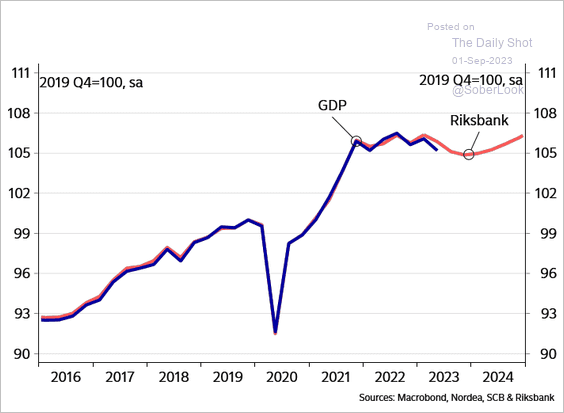

1. Sweden’s sentiment indicators softened in August.

The GDP has been running below Riksbank’s forecasts.

Source: Nordea Markets

Source: Nordea Markets

——————–

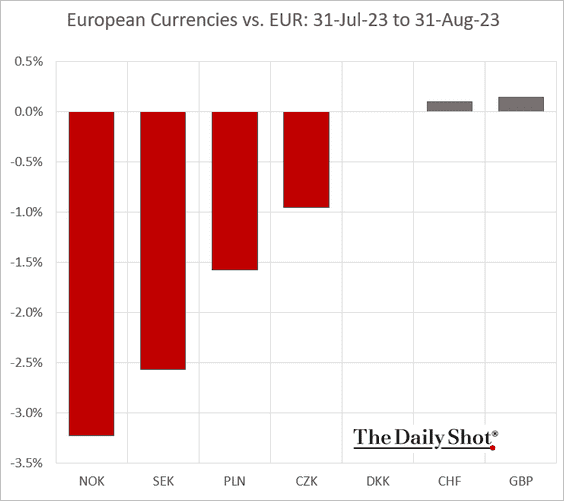

2. This chart shows how some European currencies performed against the euro in August.

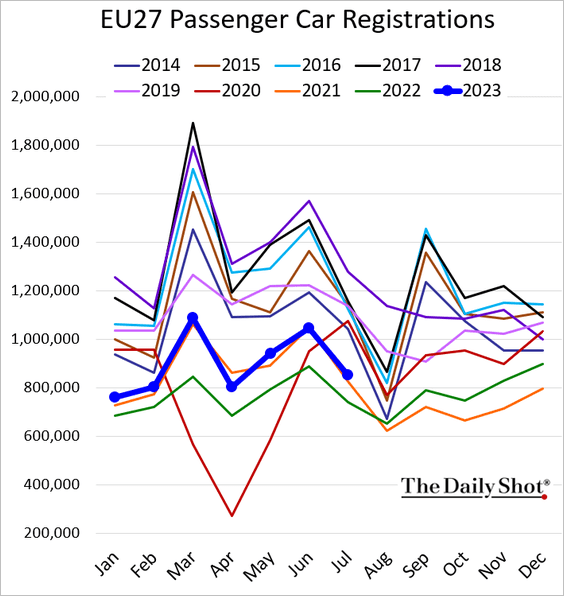

3. EU car registrations are following the 2021 trend.

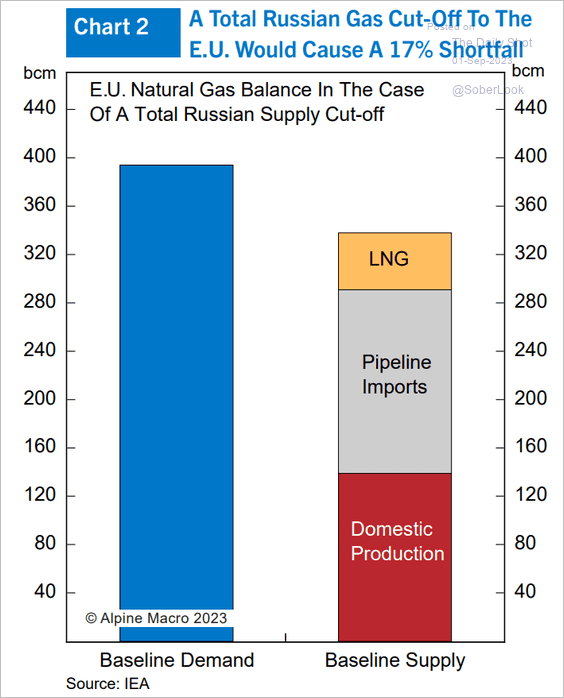

4. A shortfall in European natural gas supply remains a risk.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Japan

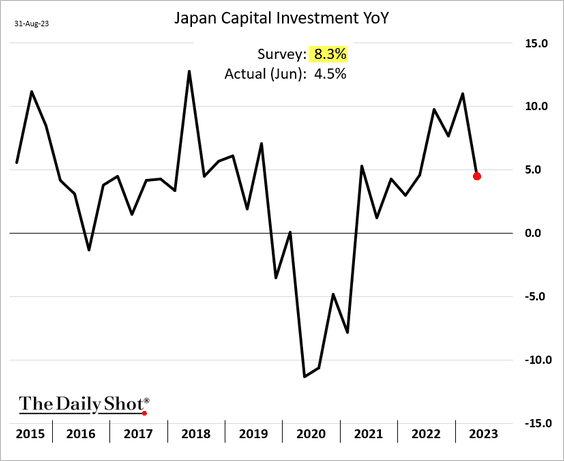

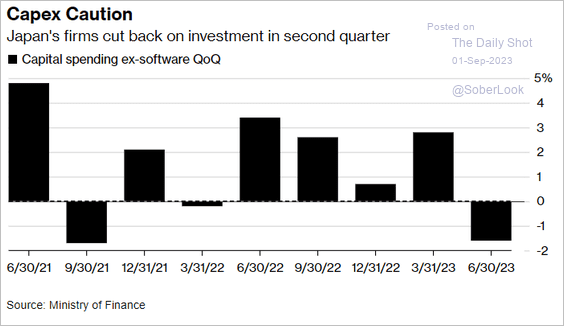

1. Business investment slowed in Q2.

Source: @economics Read full article

Source: @economics Read full article

——————–

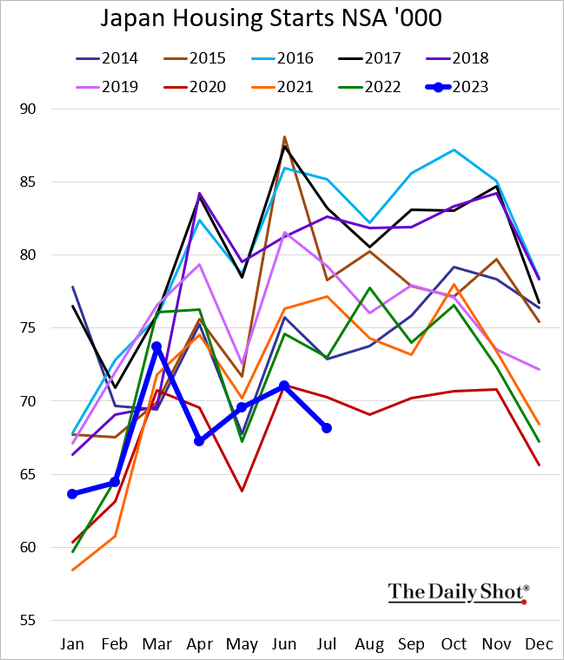

2. Housing starts hit a multi-year low in July.

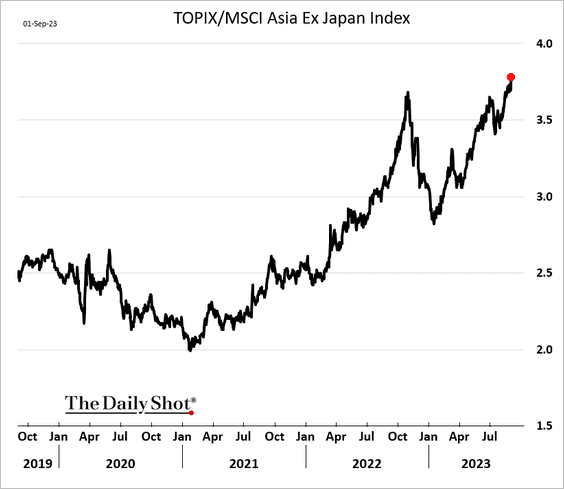

3. Japanese stocks continue to outperform Asian peers.

h/t Sungwoo Park, Bloomberg

h/t Sungwoo Park, Bloomberg

Back to Index

Asia-Pacific

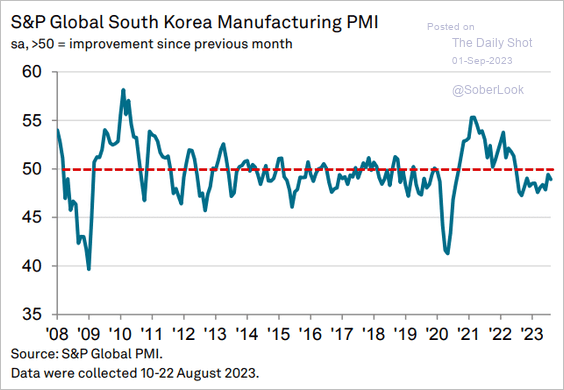

1. South Korea’s manufacturing activity remains sluggish.

Source: S&P Global PMI

Source: S&P Global PMI

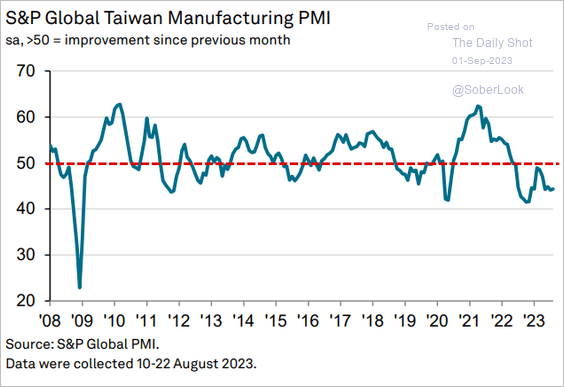

Taiwan’s manufacturing contraction continues.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

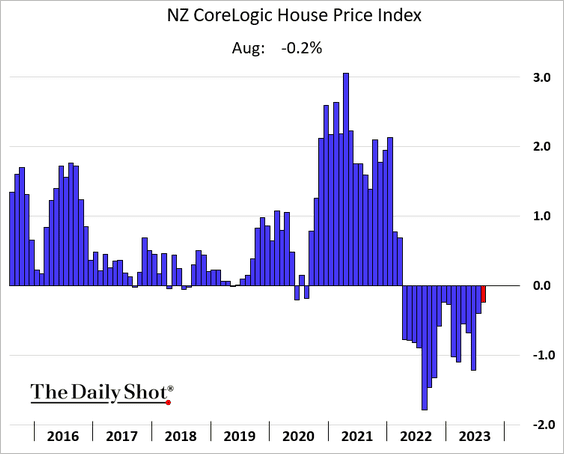

2. New Zealand’s home prices continue to fall.

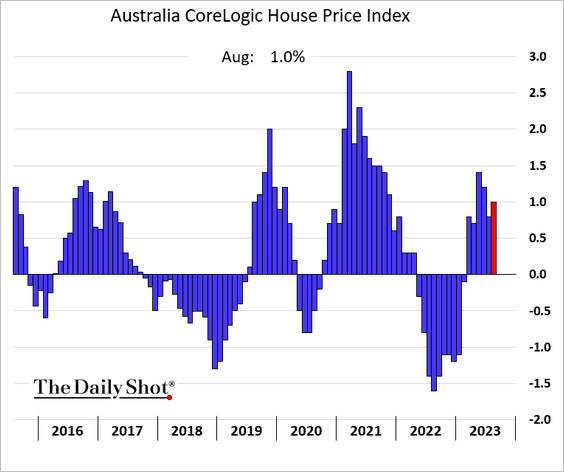

3. Australia’s housing prices were up again in August.

Source: ABC News Read full article

Source: ABC News Read full article

Back to Index

China

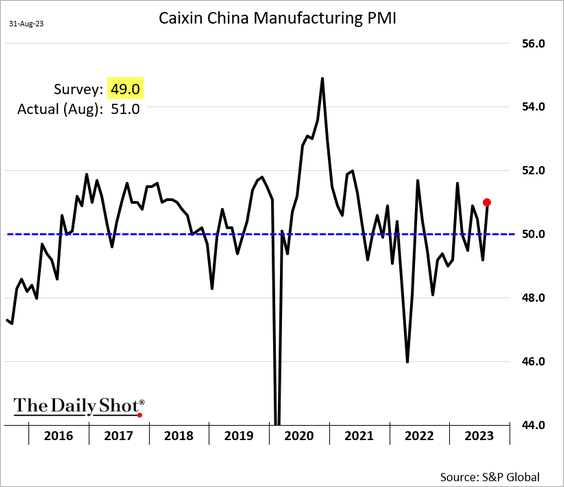

1. The manufacturing PMI from S&P Global showed factory activity expanding in August, topping forecasts.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

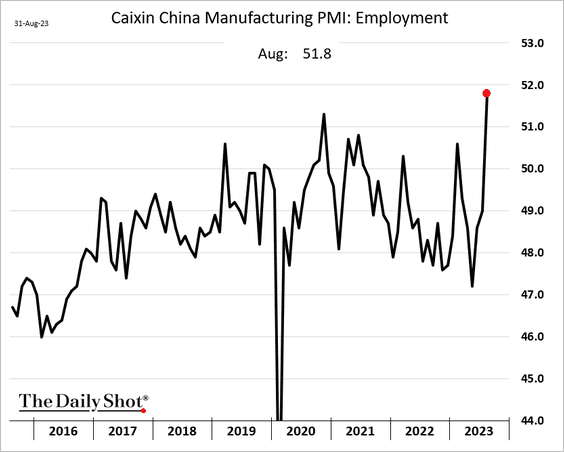

Hiring in the manufacturing sector accelerated.

——————–

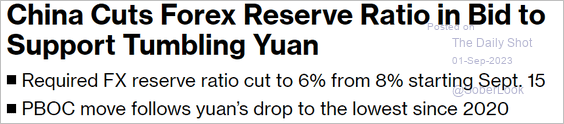

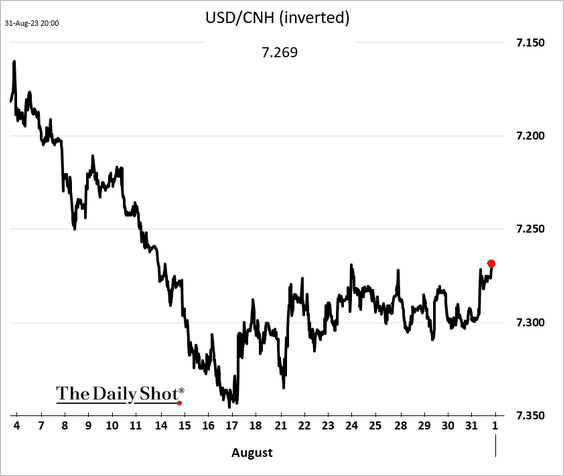

2. Beijing cut the forex reserve ratio, …

Source: @markets Read full article

Source: @markets Read full article

… boosting the renminbi.

Back to Index

Emerging Markets

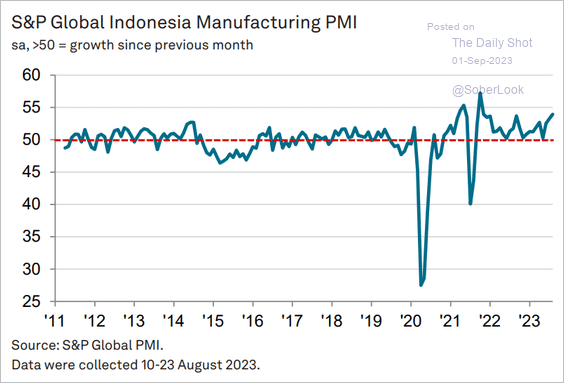

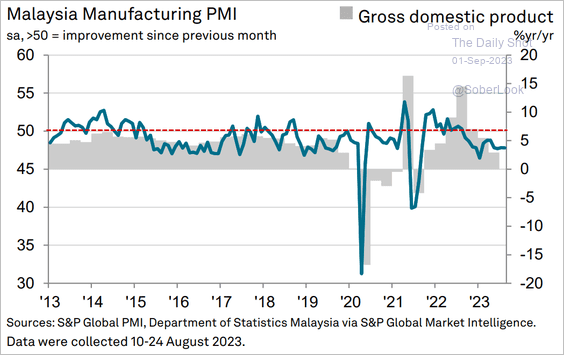

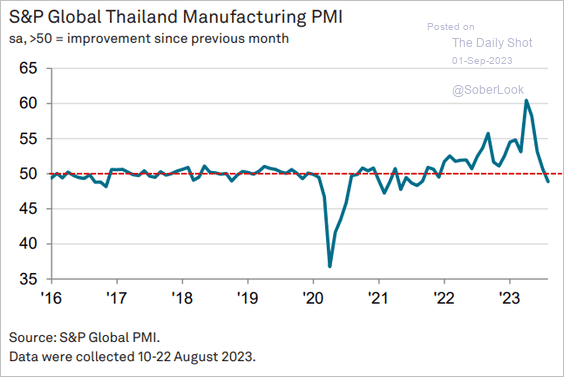

1. Let’s run through Asian manufacturing PMI trends.

• Indonesia (faster growth):

Source: S&P Global PMI

Source: S&P Global PMI

• Malaysia (sluggish):

Source: S&P Global PMI

Source: S&P Global PMI

• Thailand (sudden contraction):

Source: S&P Global PMI

Source: S&P Global PMI

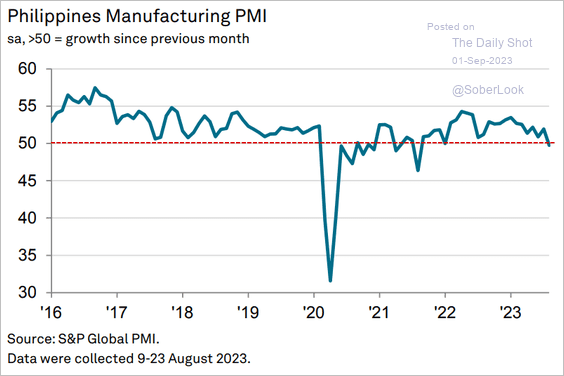

• The Philippines (also contracting):

Source: S&P Global PMI

Source: S&P Global PMI

——————–

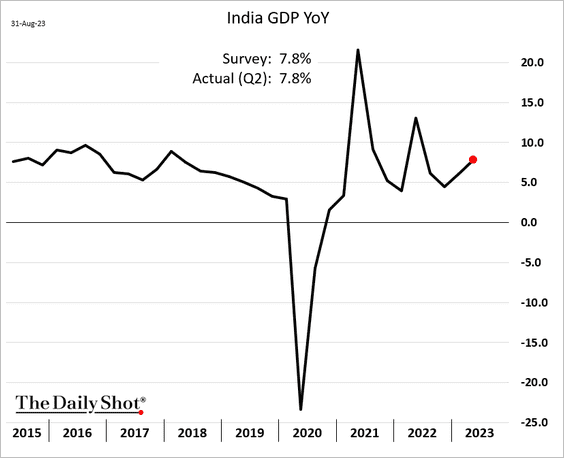

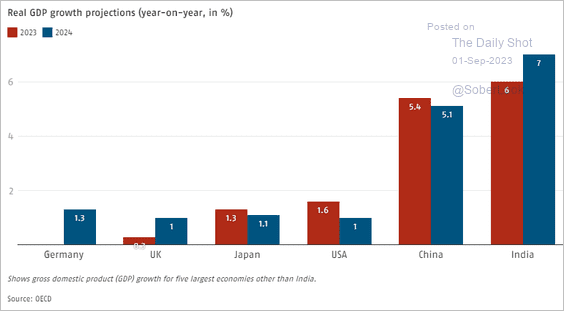

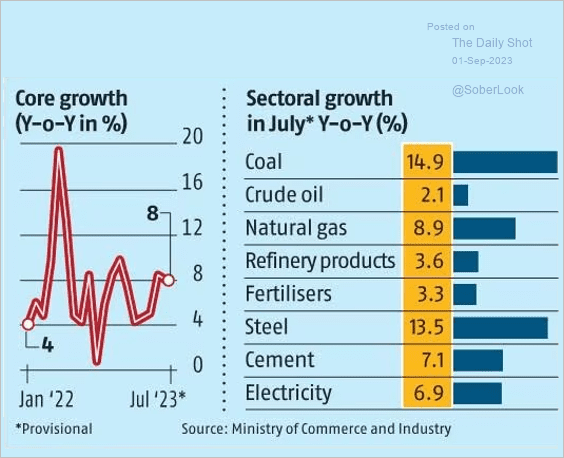

2. India’s GDP growth picked up in Q2.

Source: Business Standard Read full article

Source: Business Standard Read full article

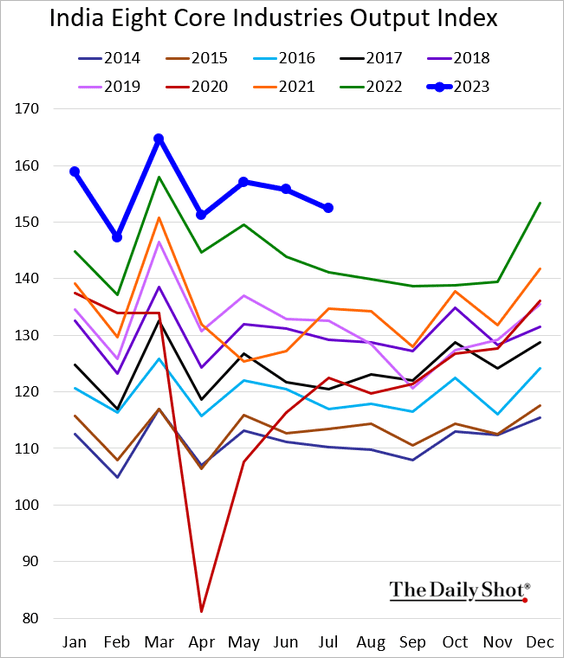

Core industries’ output remains robust.

Source: Business Standard Read full article

Source: Business Standard Read full article

——————–

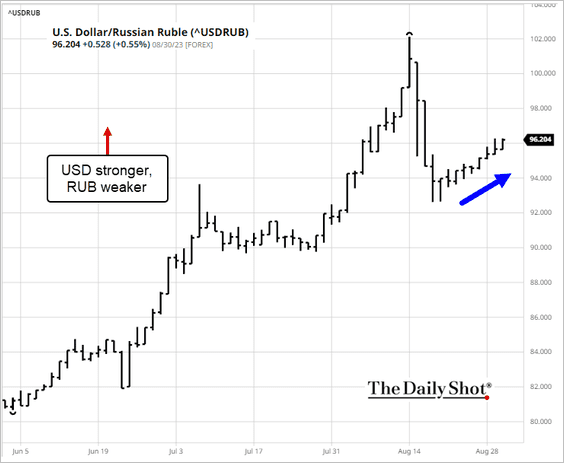

3. The ruble remains under pressure.

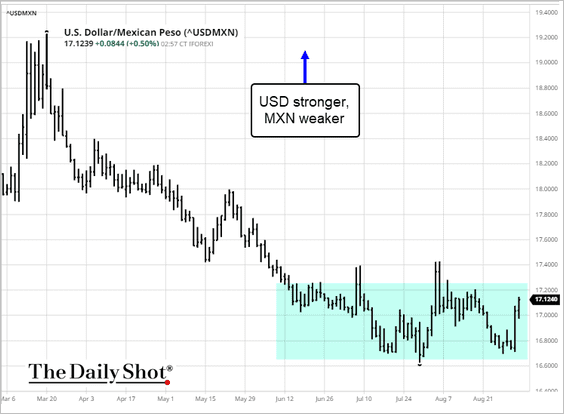

4. The Mexican peso’s rally is over.

Source: barchart.com

Source: barchart.com

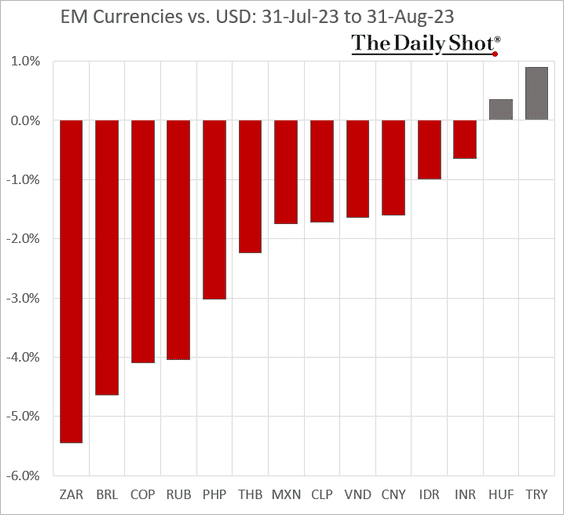

5. Next, we have some performance data for August.

• Currencies:

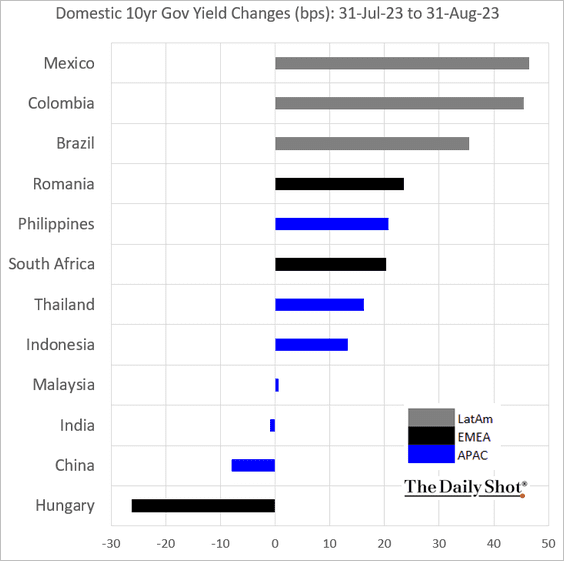

• Bond yields:

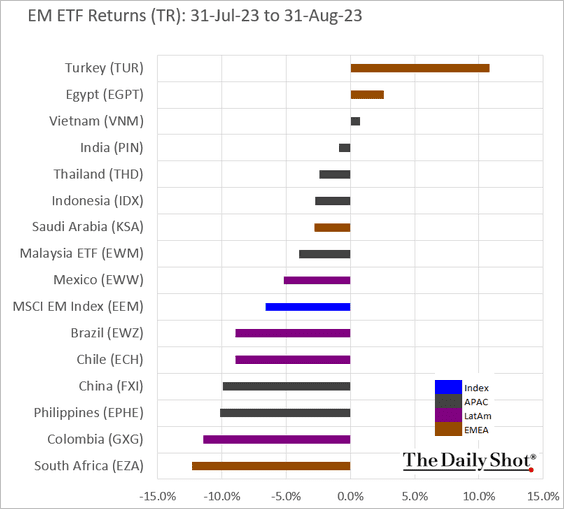

• Equity ETFs:

Back to Index

Commodities

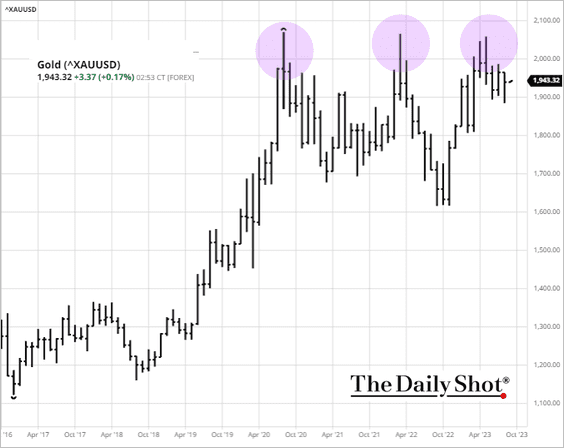

1. A triple top for gold?

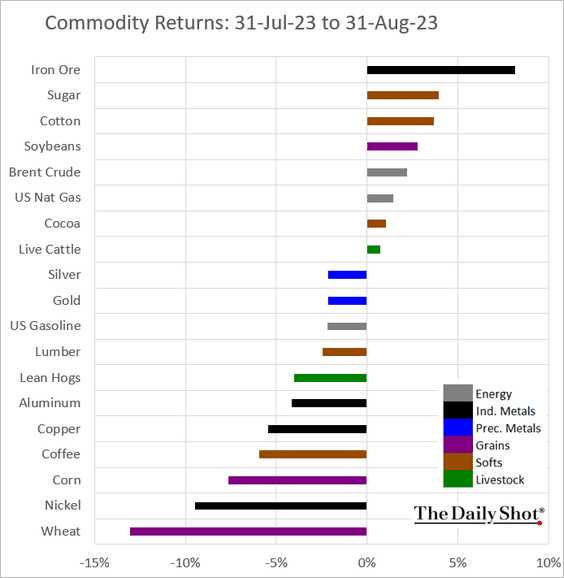

2. Here is last month’s performance across key commodity markets.

Back to Index

Energy

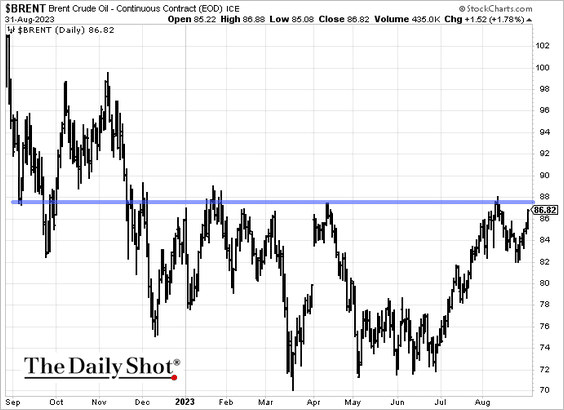

1. Brent is nearing resistance again.

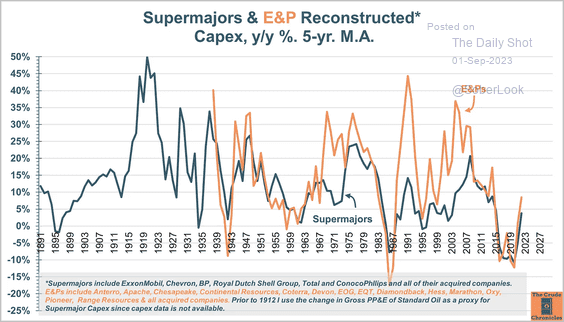

2. On a five-year smoothed basis, capex among oil producers turned positive for the first time since 2015.

Source: The Crude Chronicles Read full article

Source: The Crude Chronicles Read full article

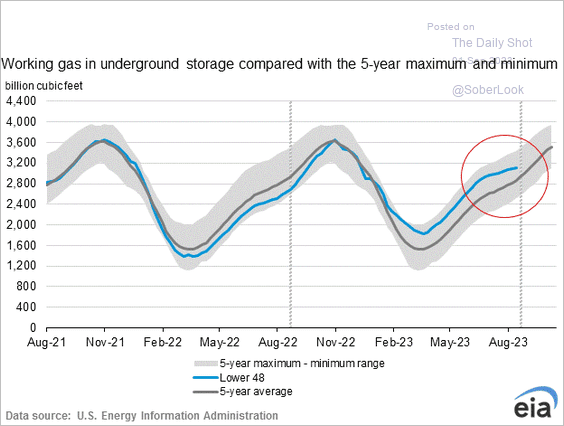

3. US natural gas in storage is rising slower than usual for this time of the year.

Back to Index

Equities

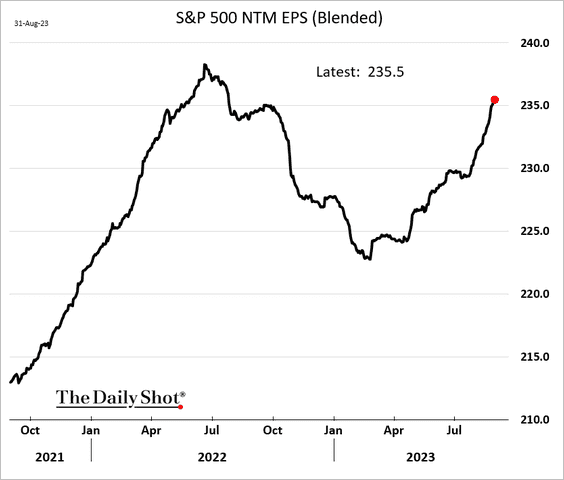

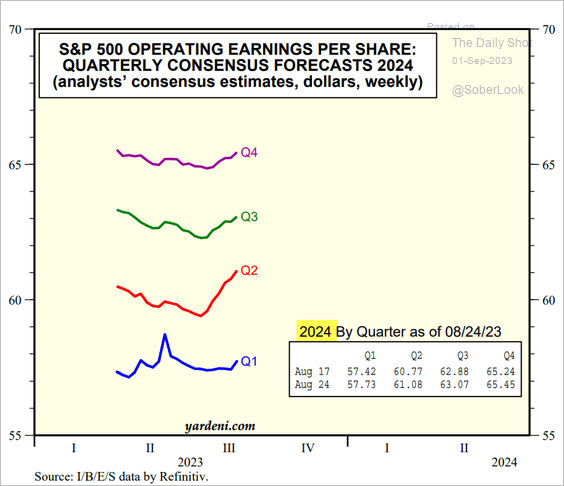

1. S&P 500 earnings expectations for the next 12 months continue to climb.

Here are the quarterly trends for 2024.

Source: Yardeni Research

Source: Yardeni Research

——————–

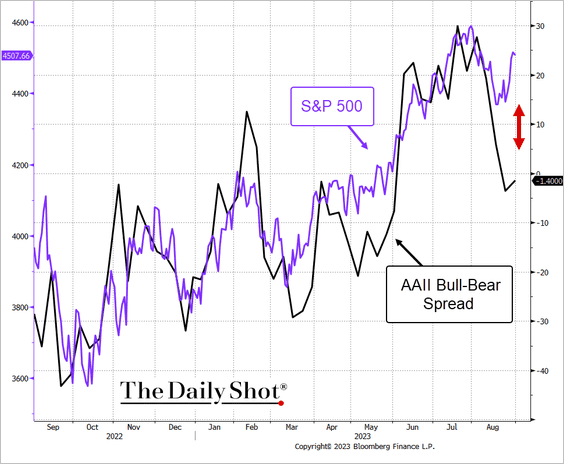

2. Retail investors were unprepared for the market rebound.

Source: @TheTerminal, Bloomberg Finance L.P.; h/t @themarketear

Source: @TheTerminal, Bloomberg Finance L.P.; h/t @themarketear

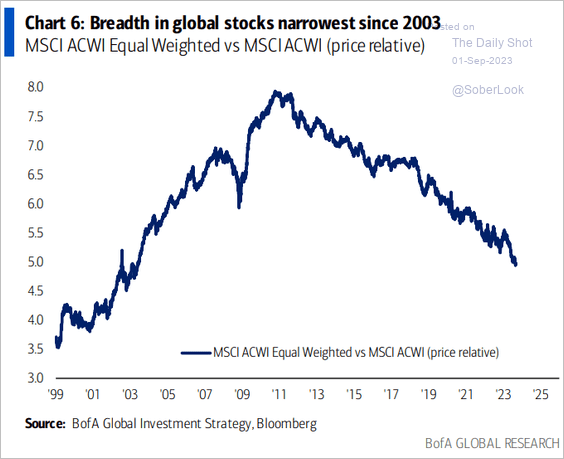

3. Breadth in global stocks has been narrowing for years.

Source: BofA Global Research

Source: BofA Global Research

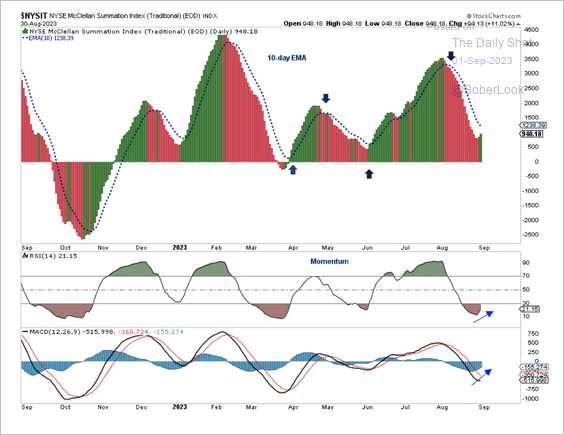

But short-term breadth is improving among NYSE-listed stocks.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

——————–

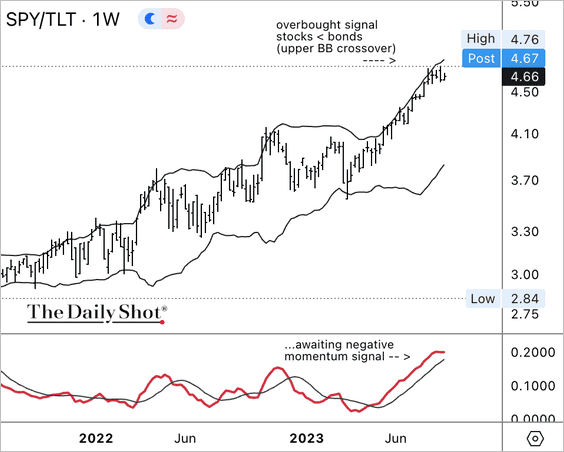

4. The SPY/TLT price ratio (stock/bond ratio) appears extended, although, for now, momentum is still positive.

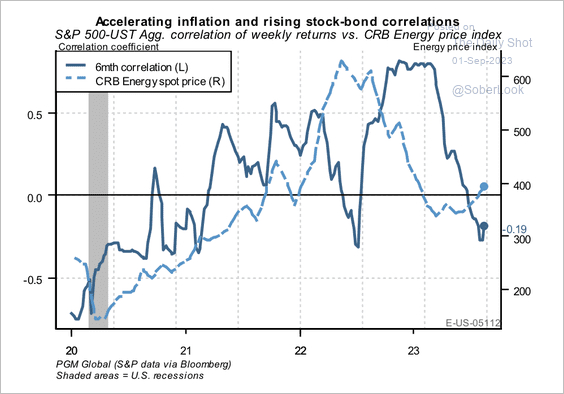

But higher energy-driven inflation could place upward pressure on yields, resulting in a positive correlation between US equity and bond returns – a potential headwind for both assets.

Source: PGM Global

Source: PGM Global

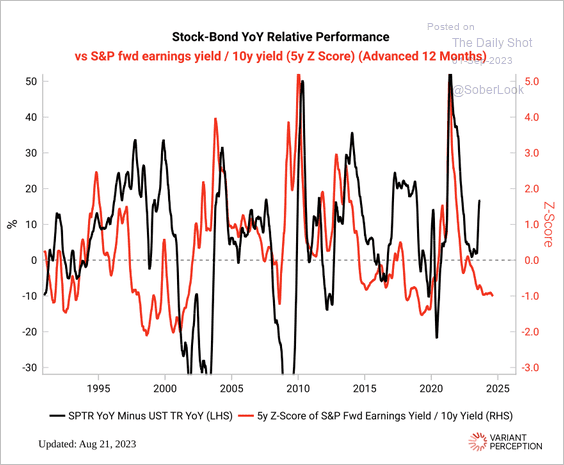

A depressed risk premium points to a pullback in the stock/bond ratio.

Source: Variant Perception

Source: Variant Perception

——————–

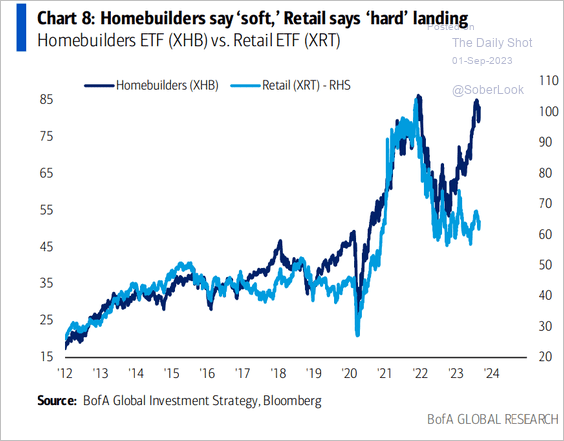

5. Housing and retail stocks have diverged.

Source: BofA Global Research

Source: BofA Global Research

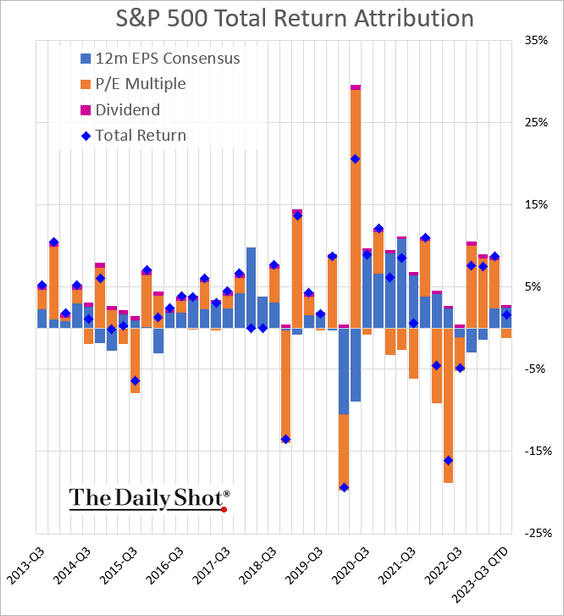

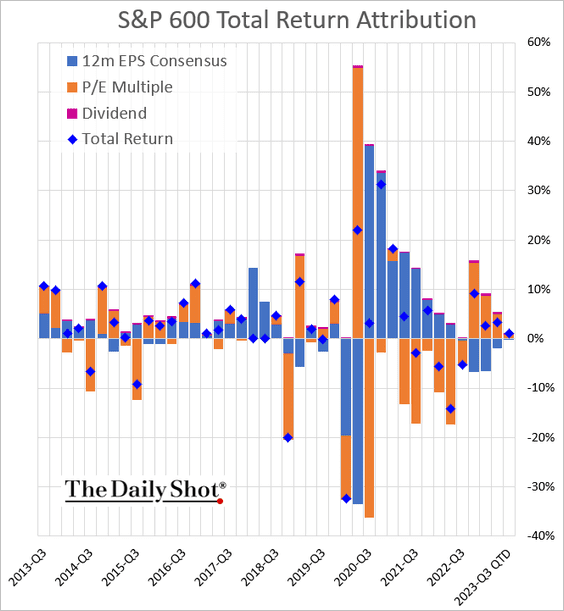

6. Next, let’s take a look at quarterly performance attribution.

• S&P 500 (this quarter’s gains have been driven by earnings expectations):

• S&P 600 (small caps are almost flat QTD):

——————–

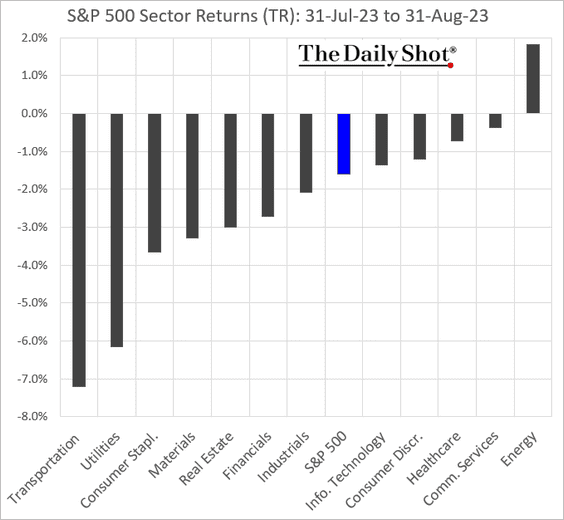

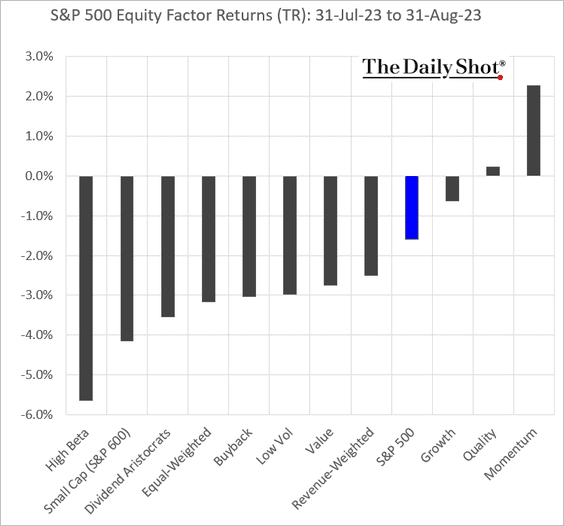

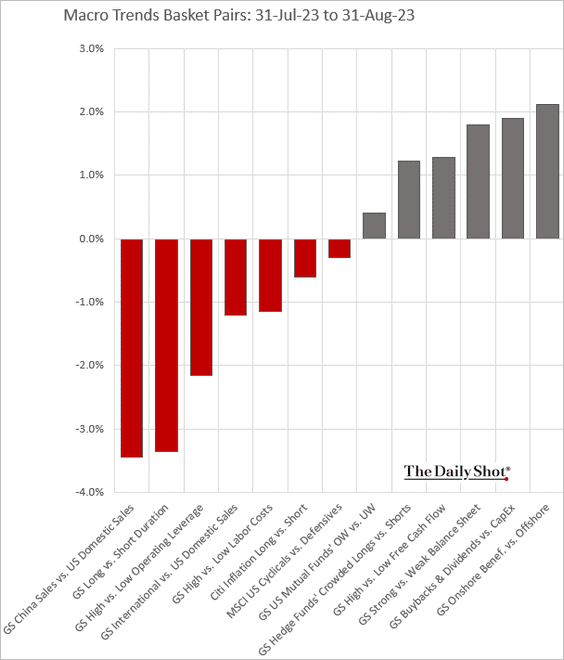

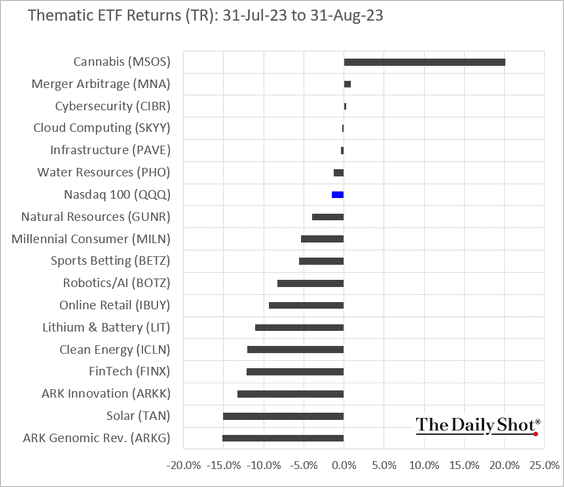

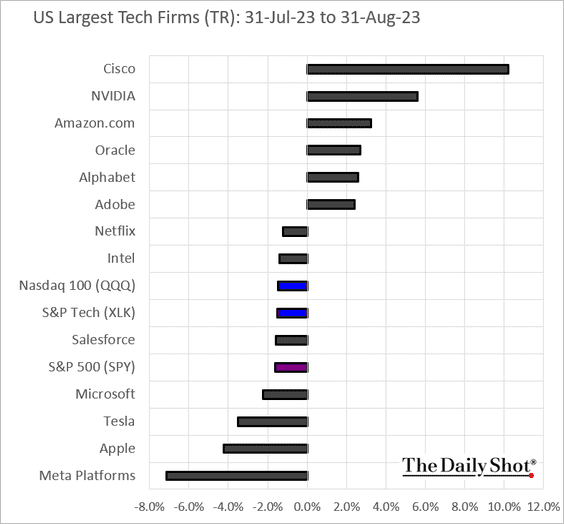

7. Finally, here are some performance metrics for August.

• Sectors:

• Equity factors:

• Macro basket pairs’ relative performance:

• Thematic ETFs:

• Largest US tech firms:

Back to Index

Credit

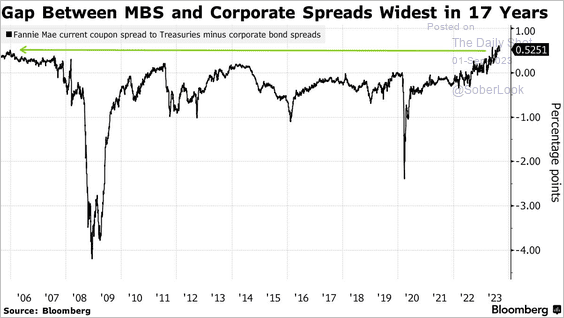

1. MBS spreads are elevated relative to corporate bonds.

Source: @markets Read full article

Source: @markets Read full article

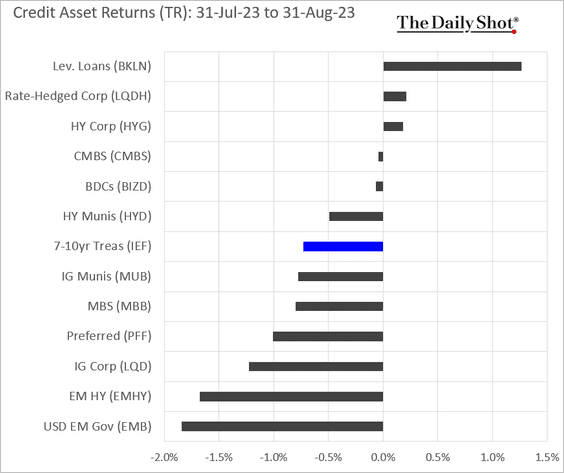

2. Here is last month’s performance across credit asset classes.

Back to Index

Rates

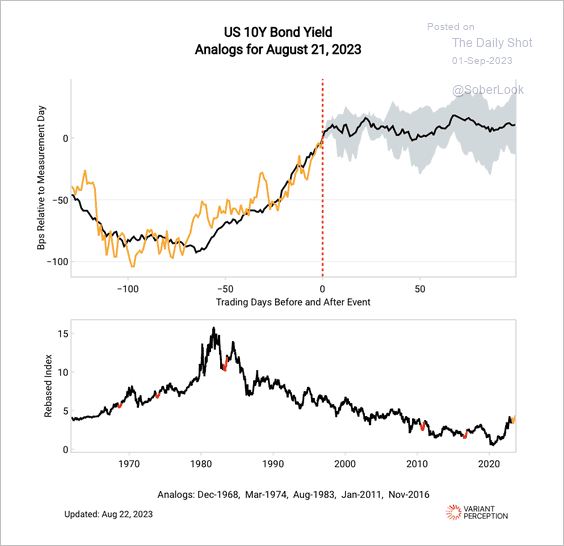

1. Variant Perception’s model shows the 10-year Treasury yield at a short-term peak, which coincides with extremes in the stock/bond ratio.

Source: Variant Perception

Source: Variant Perception

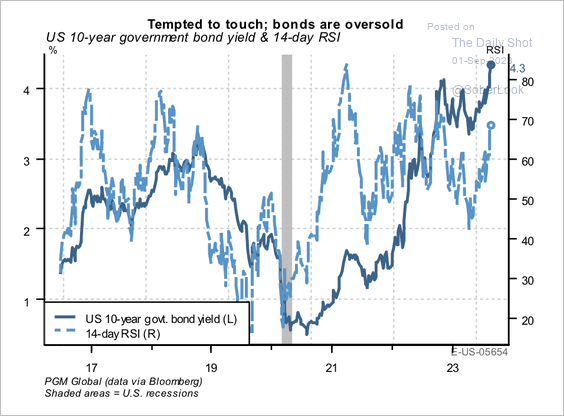

• Technicals suggest the 10-year Treasury note is oversold.

Source: PGM Global

Source: PGM Global

——————–

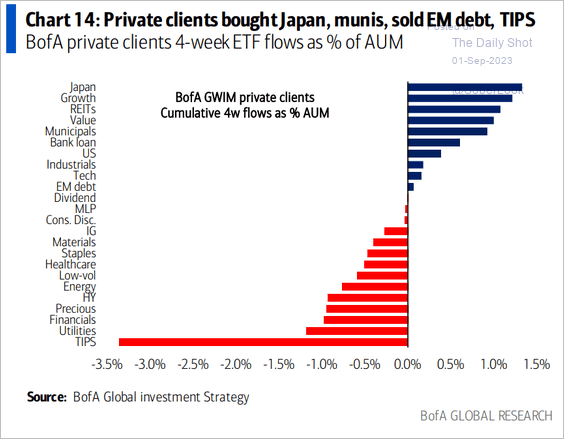

2. BofA’s private clients are dumping inflation-linked Treasuries again.

Source: BofA Global Research

Source: BofA Global Research

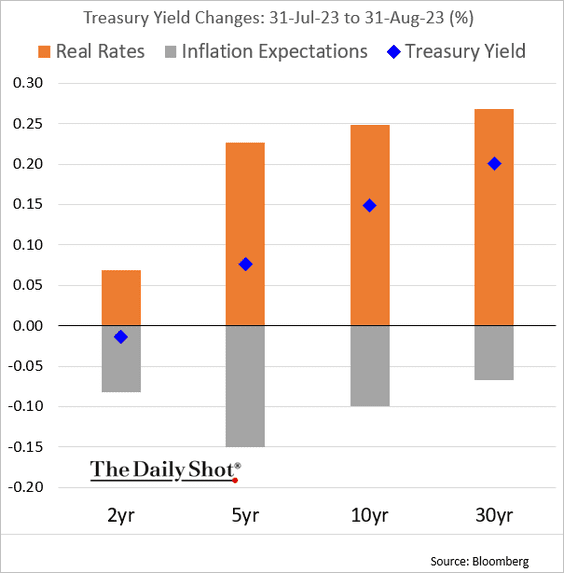

3. Here is the attribution of Treasury yield changes in August.

Back to Index

Global Developments

1. What do central bankers fear most?

Source: ING

Source: ING

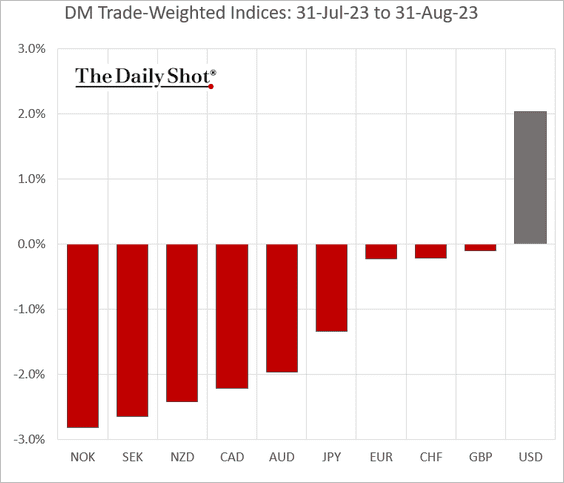

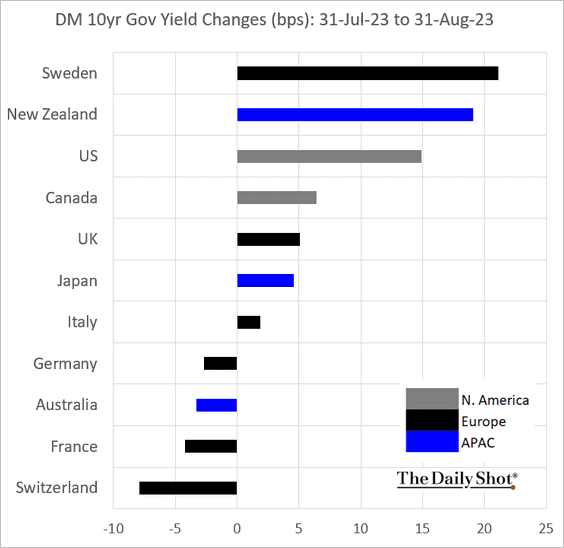

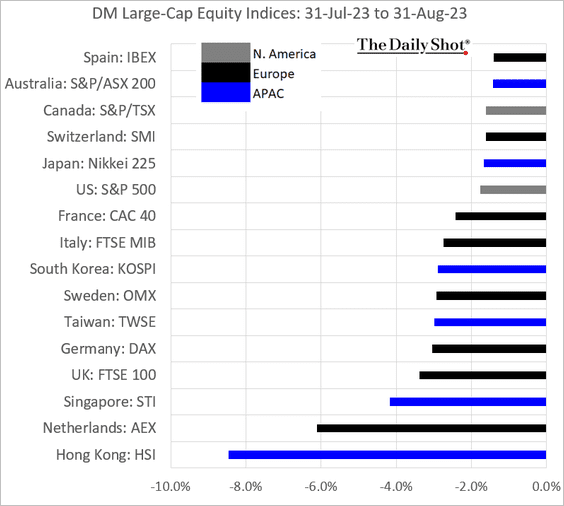

2. Here is last month’s market performance across advanced economies.

• Currencies:

• Bond yields:

• Equities:

——————–

Food for Thought

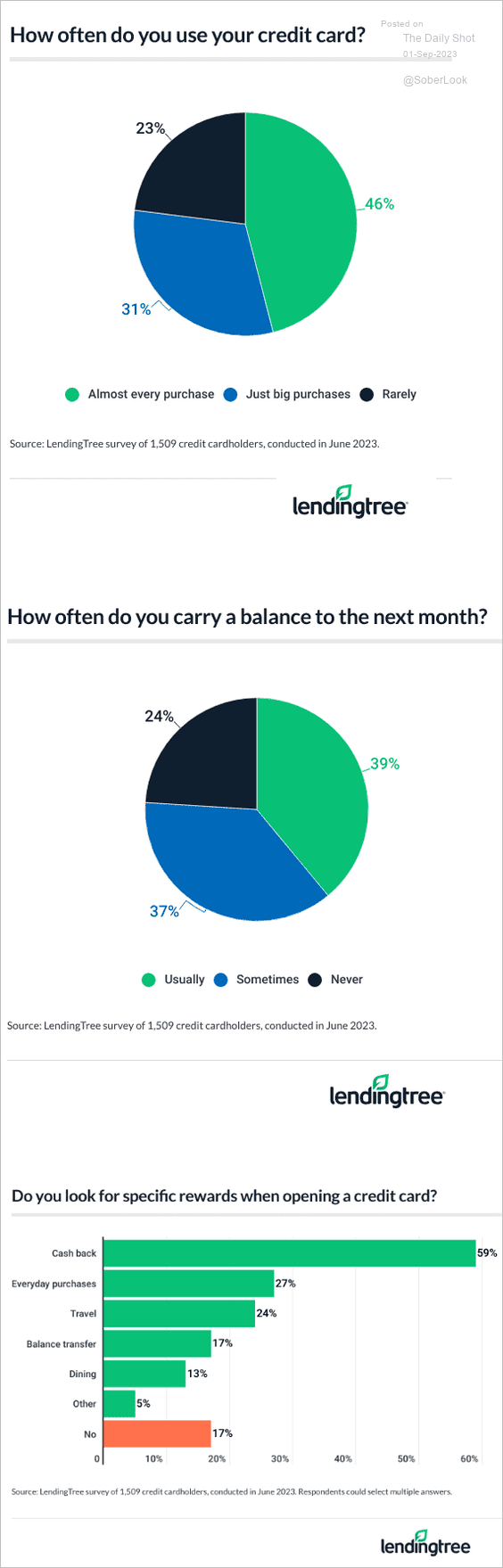

1. US credit card usage:

Source: LendingTree Read full article

Source: LendingTree Read full article

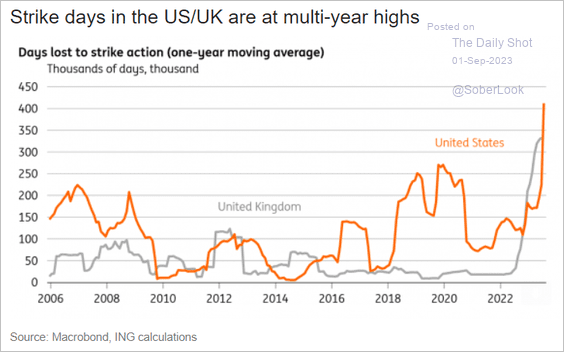

2. Days lost to strike action:

Source: ING

Source: ING

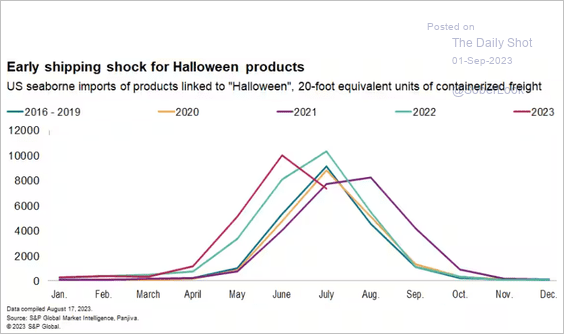

3. According to S&P Global, “retailers are preparing for Halloween sales earlier than ever.”

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

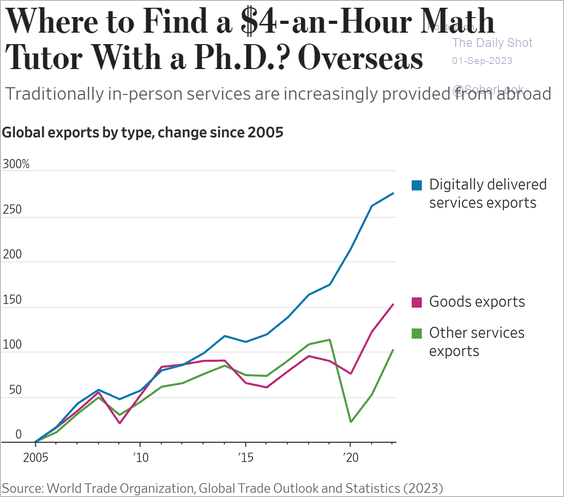

4. Growth in digitally-delivered service exports:

Source: @WSJ Read full article

Source: @WSJ Read full article

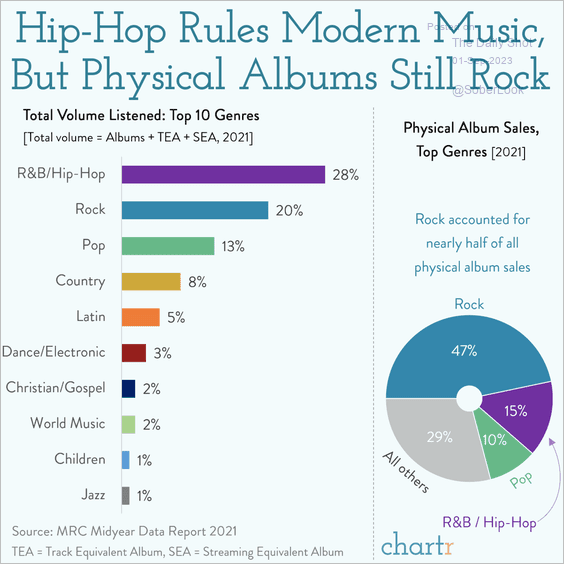

5. Music popularity by genre:

Source: @chartrdaily

Source: @chartrdaily

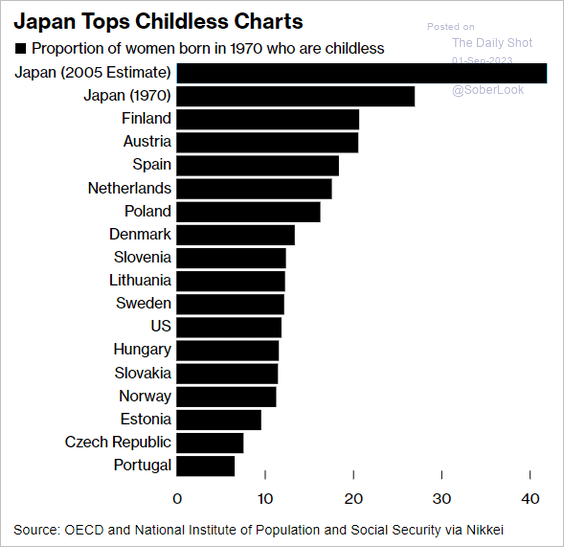

6. Proportion of women born in 1970 who are childless:

Source: @bbgequality Read full article

Source: @bbgequality Read full article

7. Average monthly payment on student debt:

Source: Truist Advisory Services

Source: Truist Advisory Services

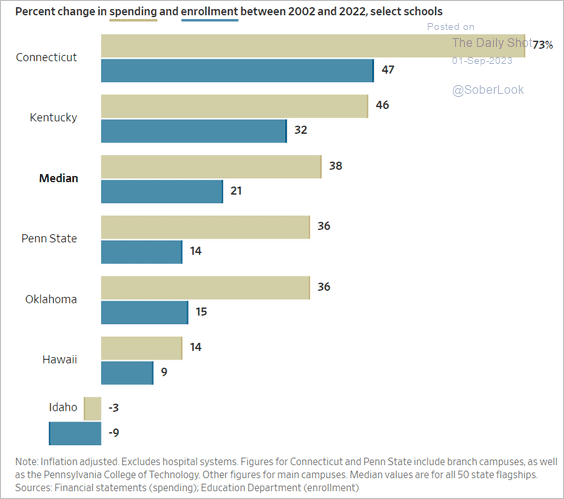

8. Changes in spending and enrollment at public universities:

Source: @WSJ Read full article

Source: @WSJ Read full article

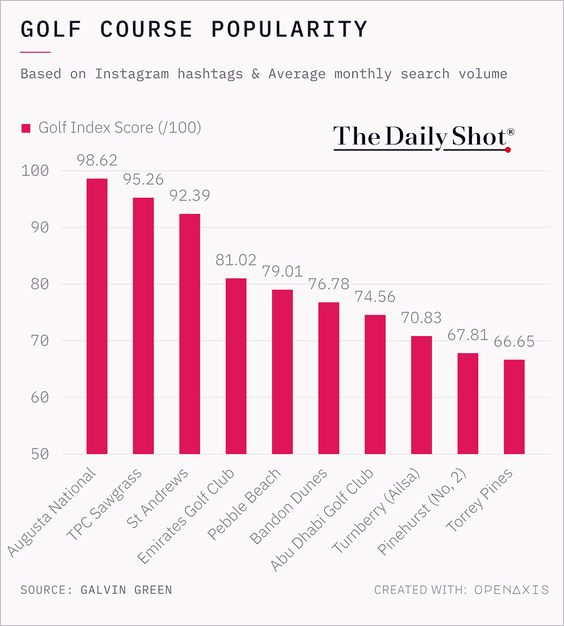

9. Golf course popularity:

——————–

The next Daily Shot will be published on Tuesday.

Have a great weekend!

Back to Index