The Daily Shot: 05-Sep-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

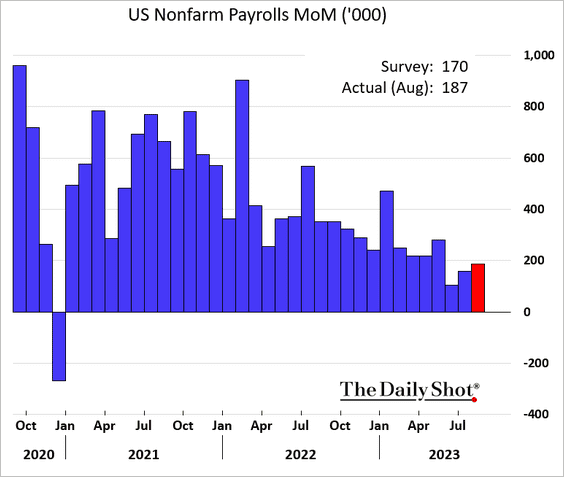

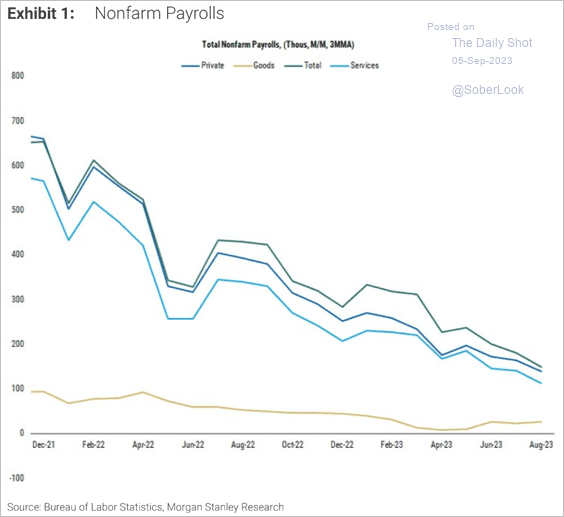

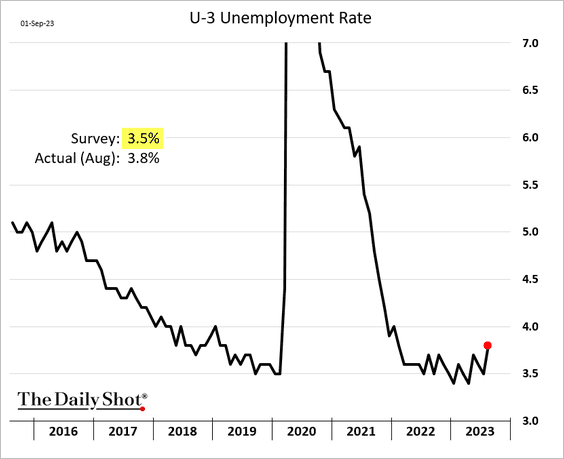

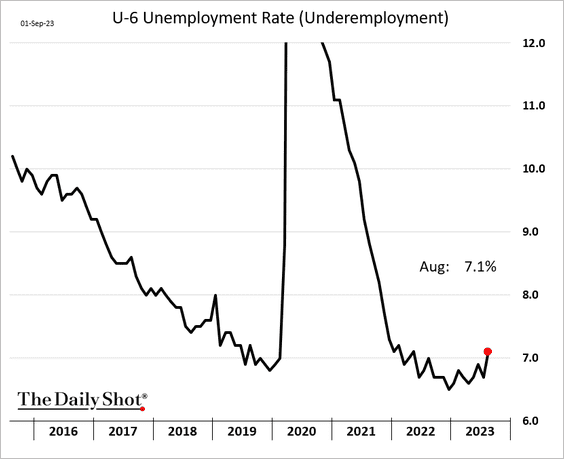

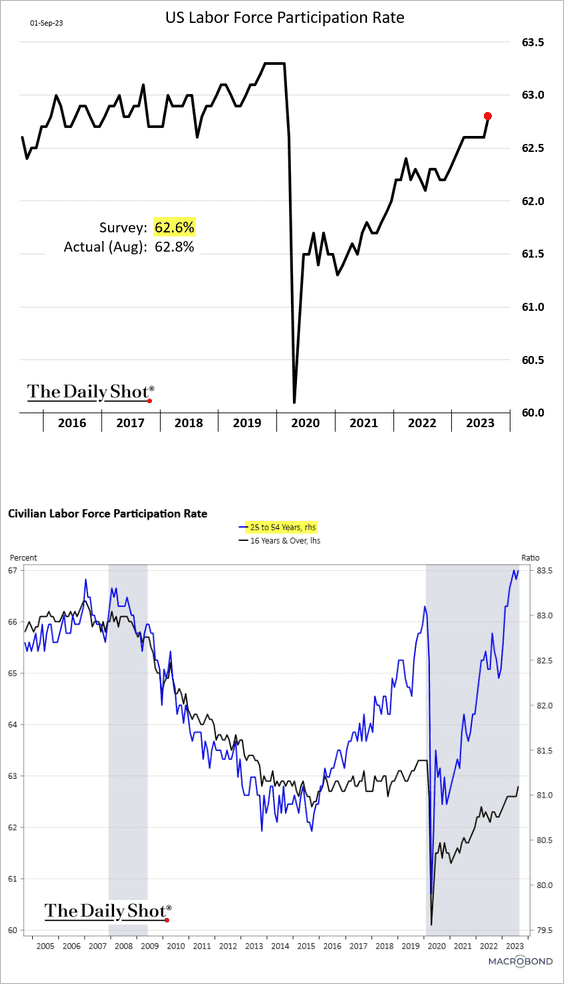

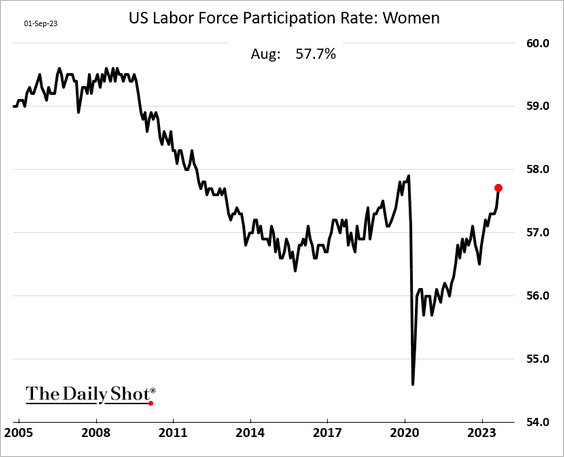

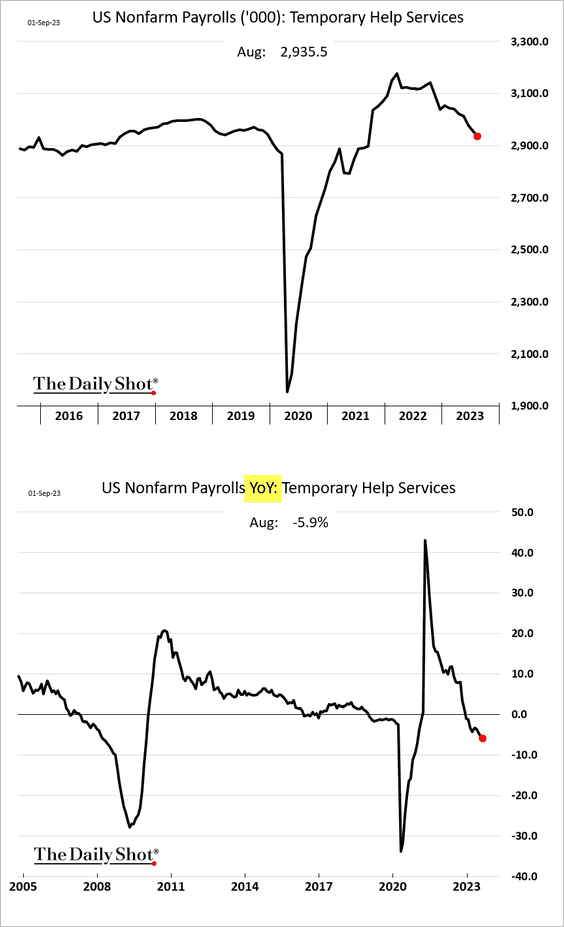

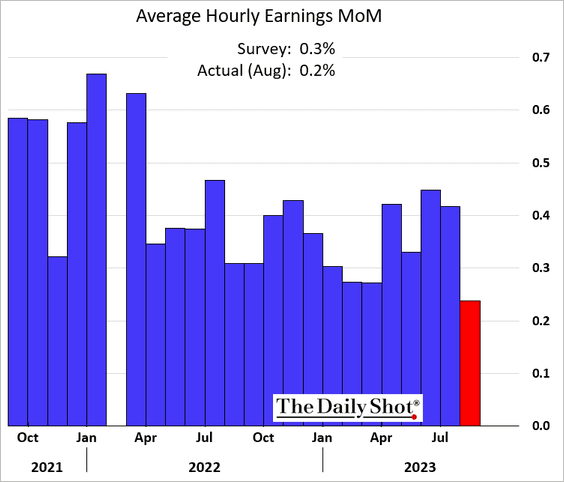

1. Hiring remained robust in August, but the labor market continues to soften.

Source: @economics Read full article

Source: @economics Read full article

The downward trend remains intact.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

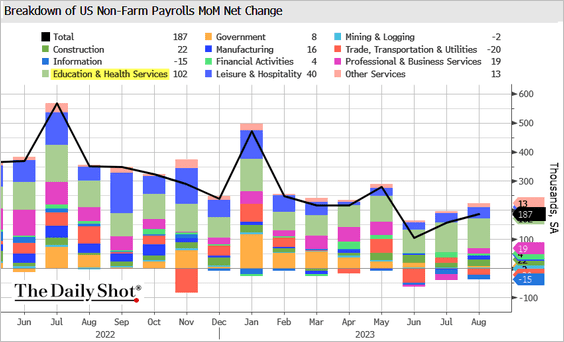

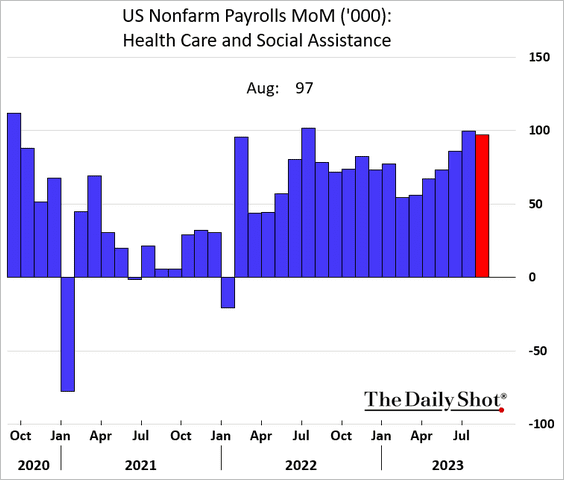

– Healthcare now represents a more dominant share of new job gains.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

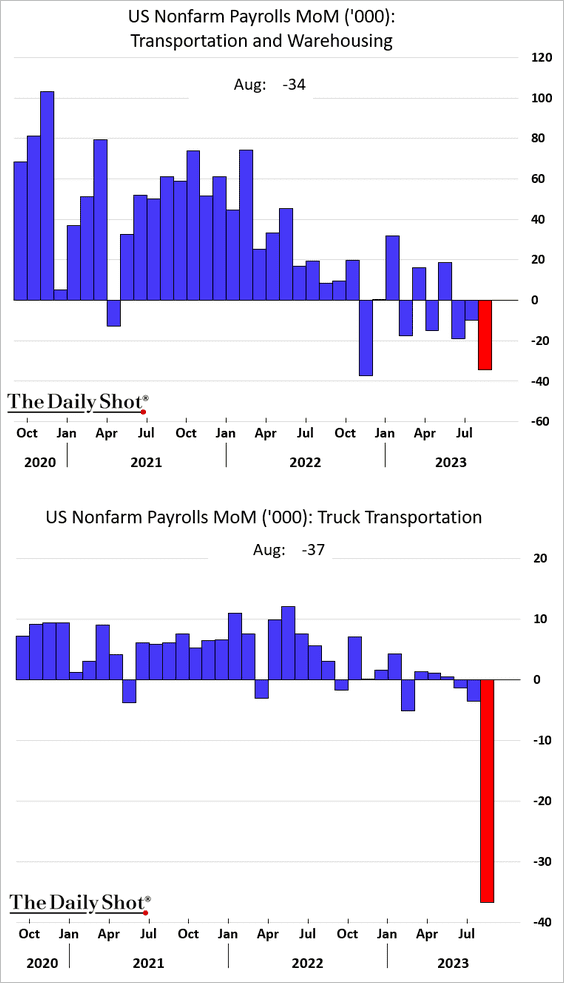

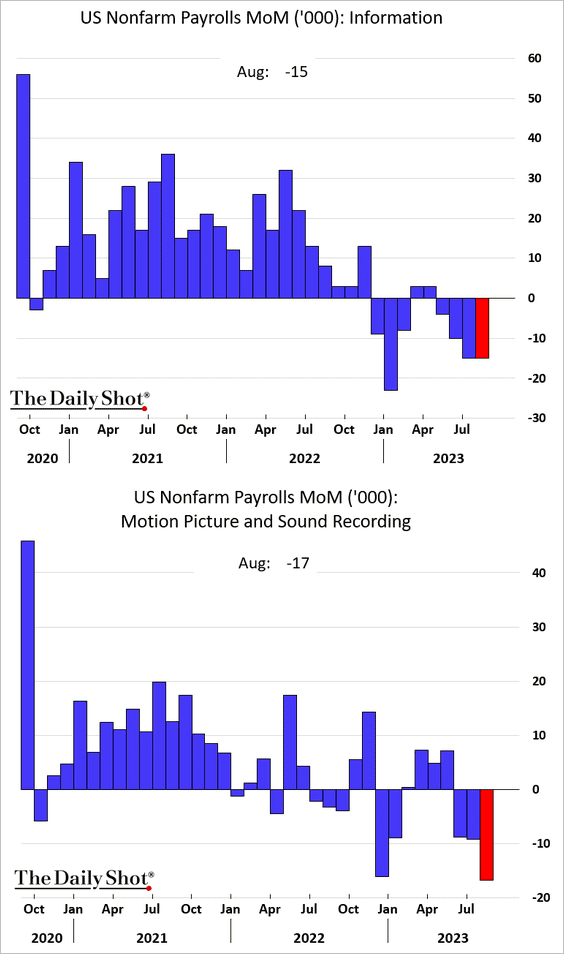

– The Yellow bankruptcy was a drag on payrolls in the logistics sector.

– And the Hollywood strike has been a drag on the information sector.

• The unemployment rate topped expectations.

• Labor force participation increased.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

• Temp help services jobs continue to trend lower.

• Wage growth slowed last month. These are the indicators the Fed has been monitoring for signs of labor market loosening.

We will have more updates on the labor market shortly.

——————–

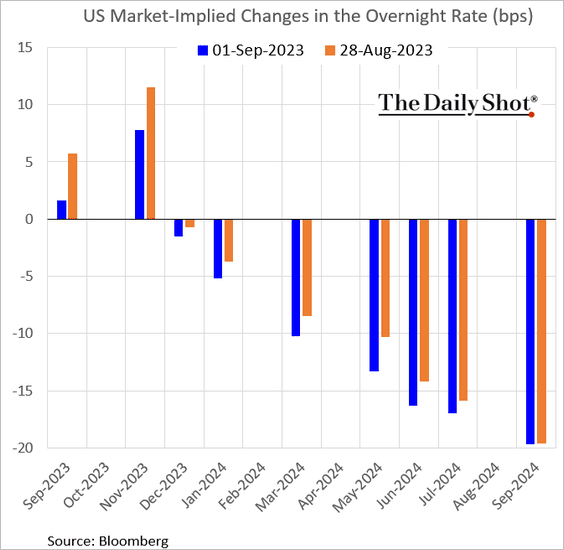

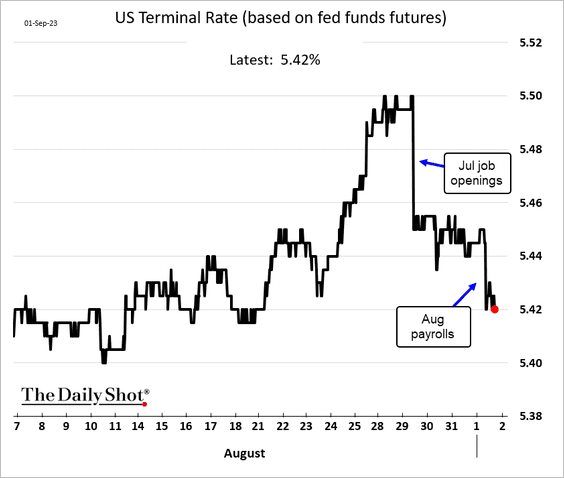

2. The jobs report reinforces the view that the Fed is likely done with rate hikes.

• The terminal rate dropped.

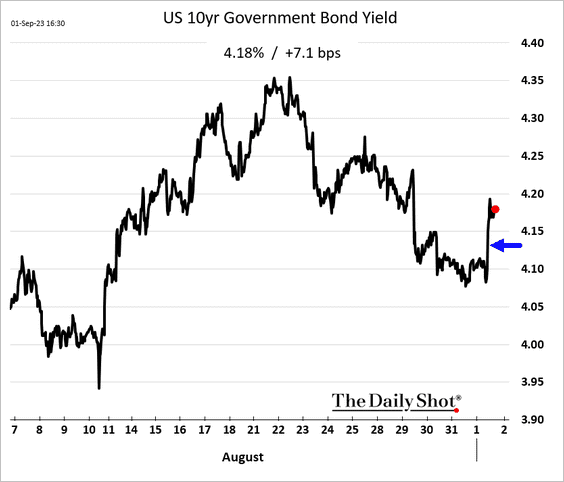

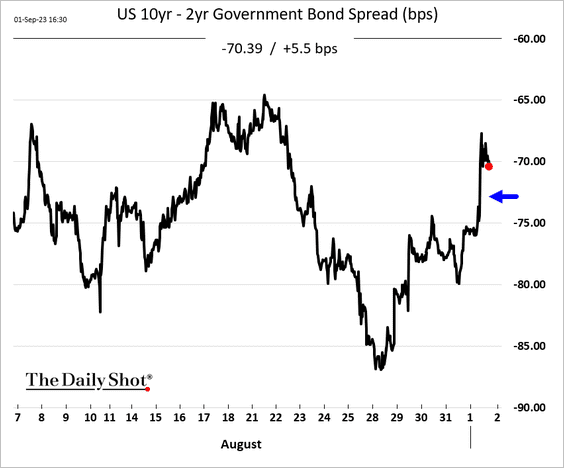

• But longer-dated Treasury yields moved higher as the curve steepened.

——————–

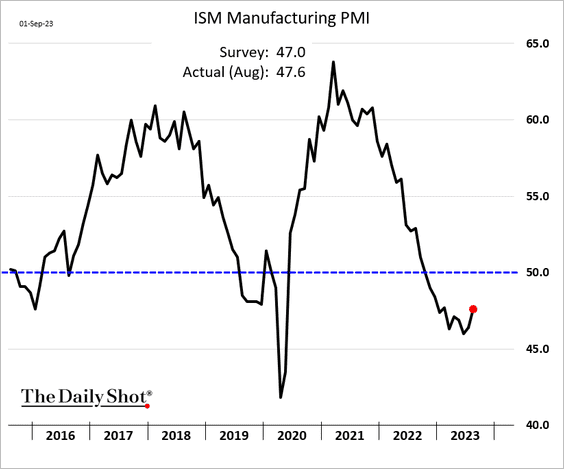

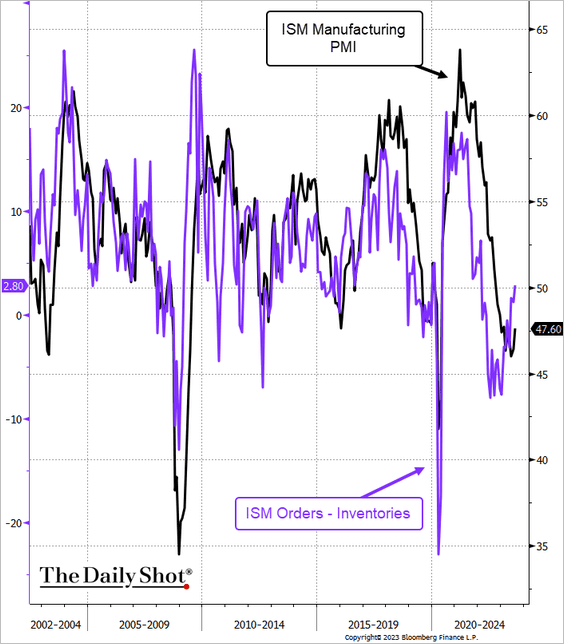

2. The ISM Manufacturing PMI indicated a continued decline in US manufacturing activity, but the pace of contraction seems to be slowing.

Source: Reuters Read full article

Source: Reuters Read full article

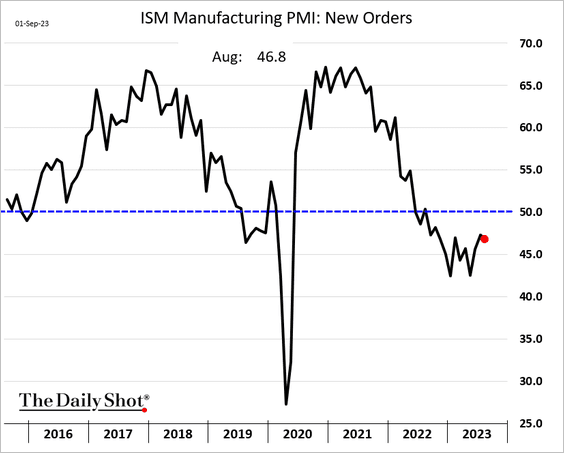

• Demand remains soft.

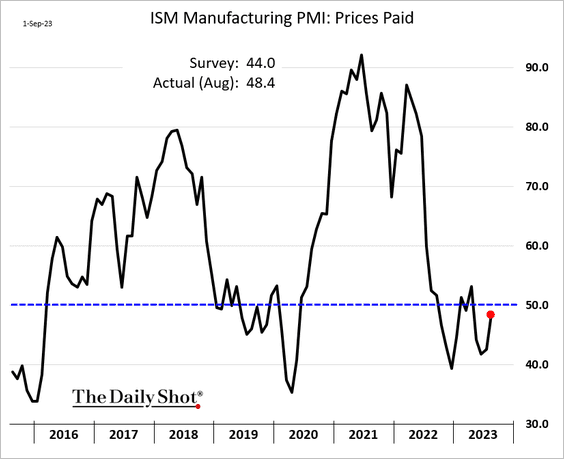

• Costs are not falling as quickly as in July.

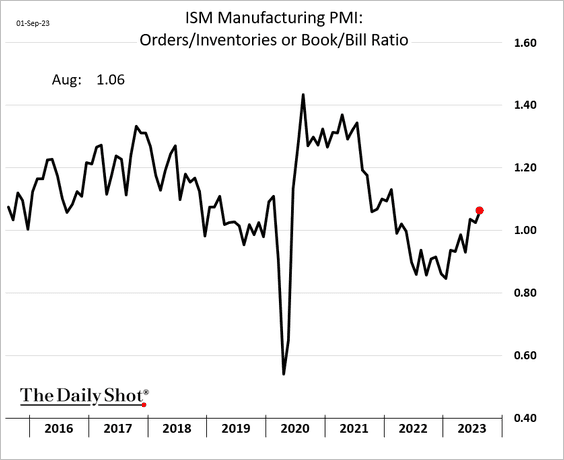

• The orders-to-inventories index is rebounding, …

… pointing to stronger factory activity ahead.

——————–

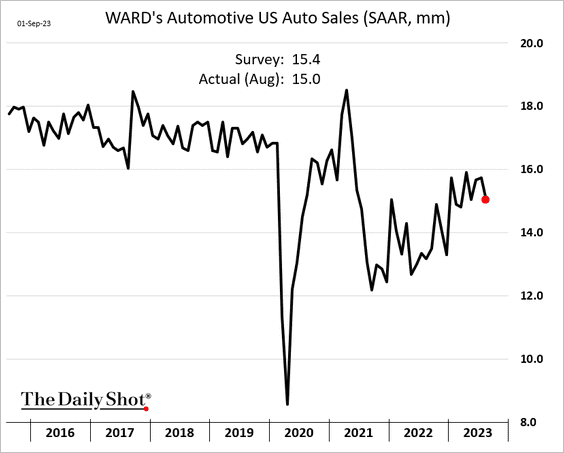

3. Automobile sales eased last month.

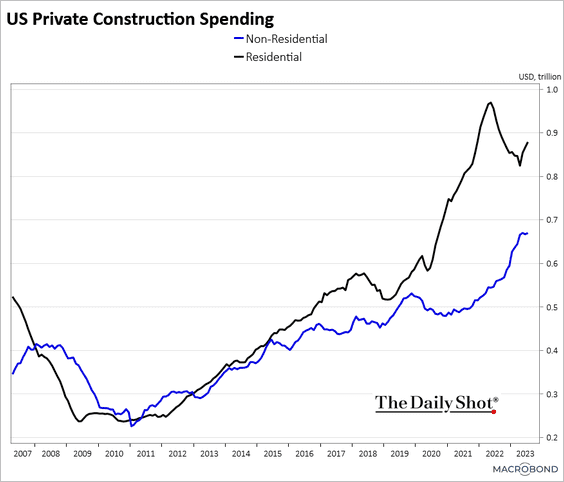

4. Residential construction spending continues to rebound.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

Source: Reuters Read full article

Source: Reuters Read full article

——————–

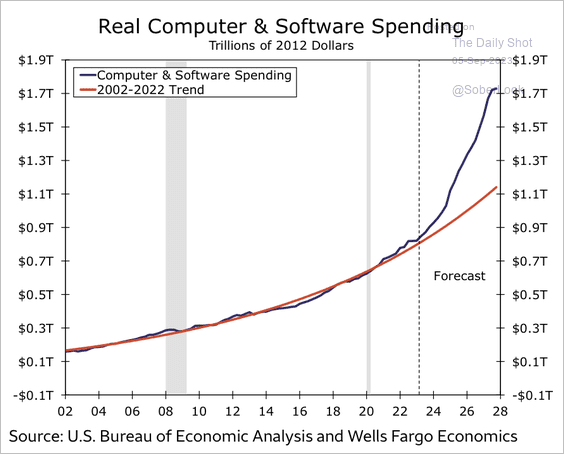

5. Total real spending on computers and software is expected to rise roughly 50% above its existing trend.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

Canada

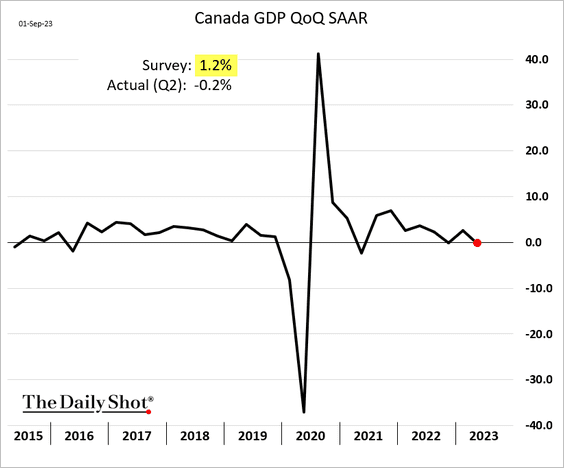

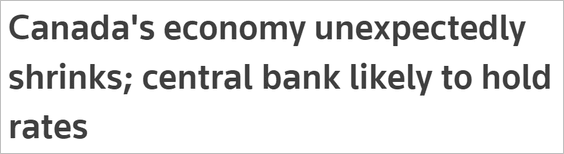

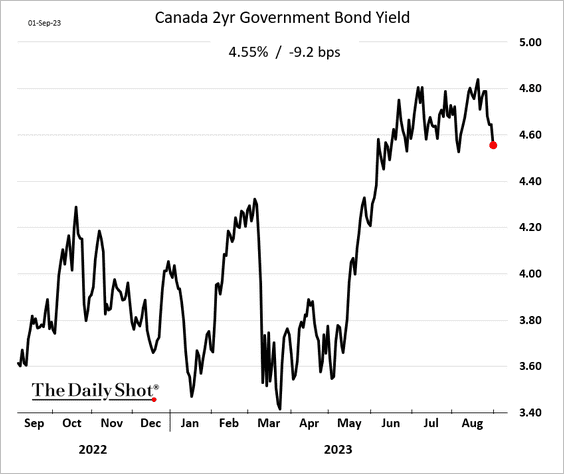

1. The GDP unexpectedly contracted last quarter. Is the economy in recession?

Source: Reuters Read full article

Source: Reuters Read full article

The market now anticipates the BoC to maintain rates steady this month, possibly extending into October.

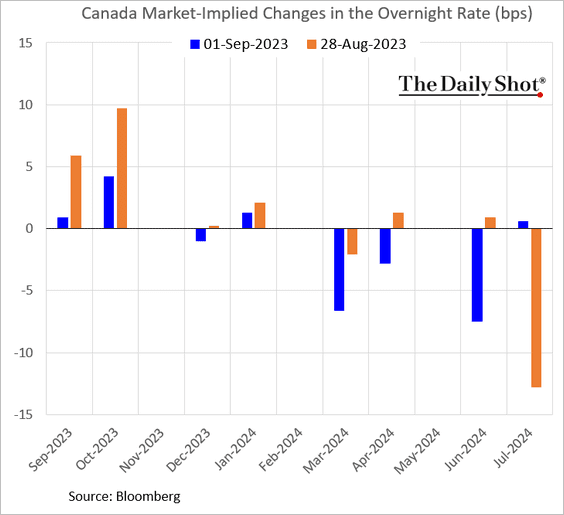

Short-term bond yields fell.

——————–

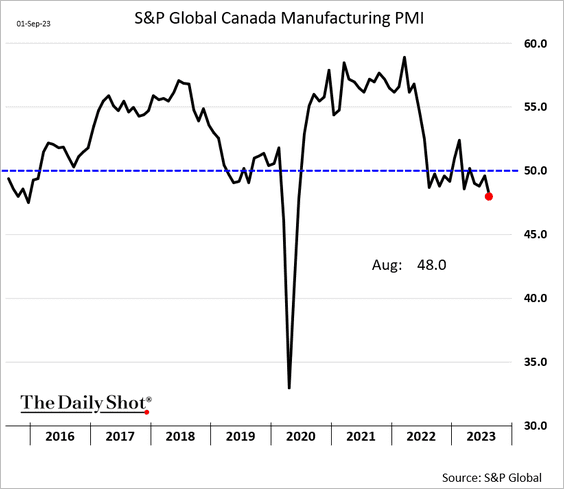

2. Manufacturing contraction accelerated in August.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

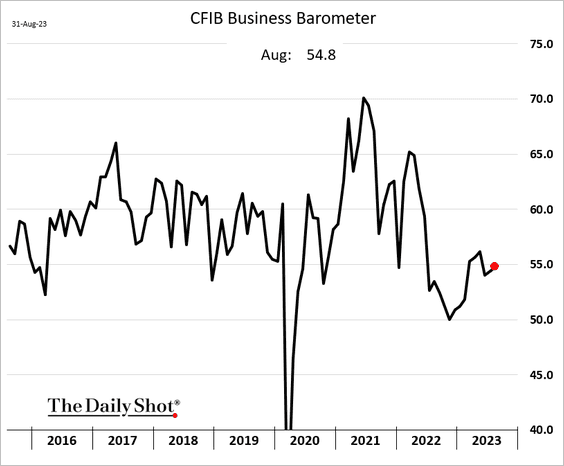

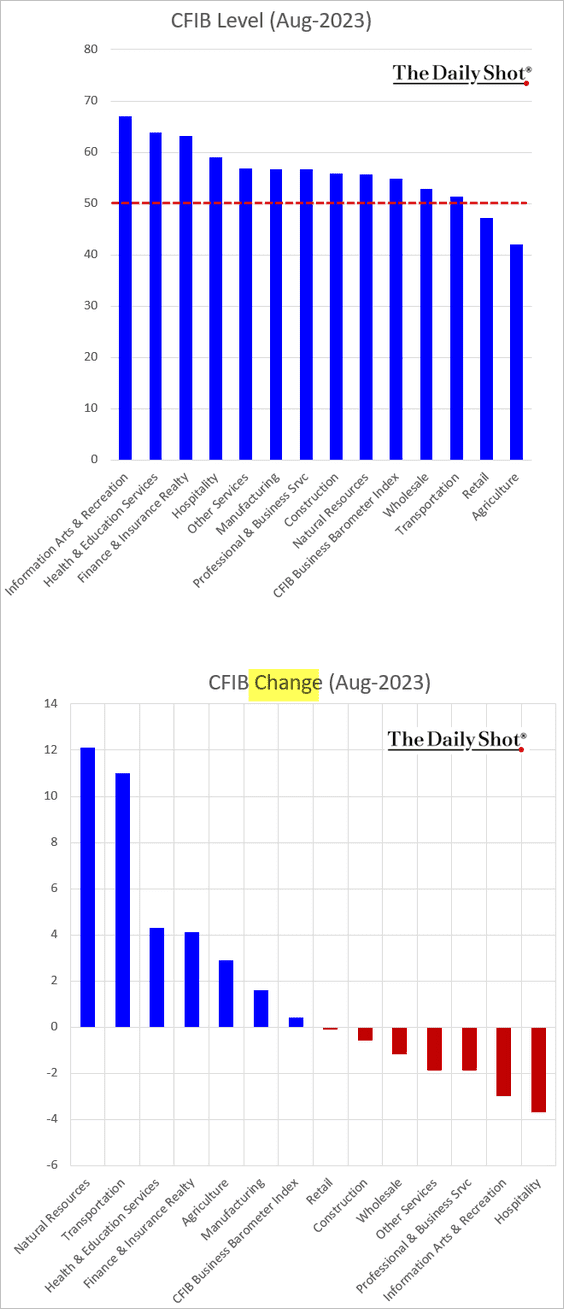

3. Small business activity edged higher in August.

Here are the components.

——————–

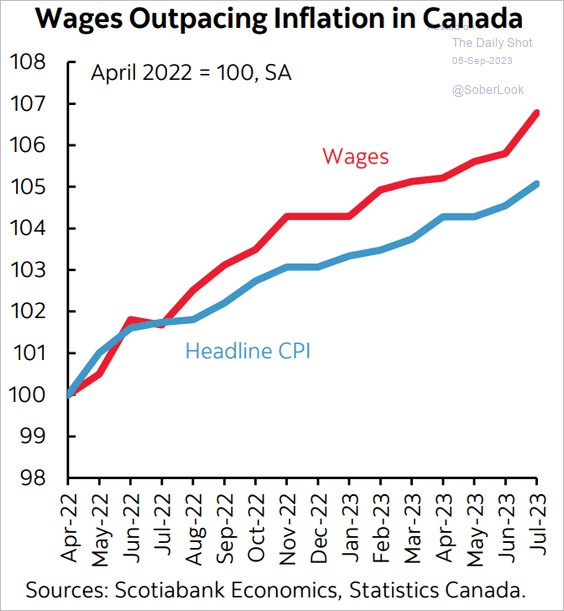

4. Wages continue to outpace inflation.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The United Kingdom

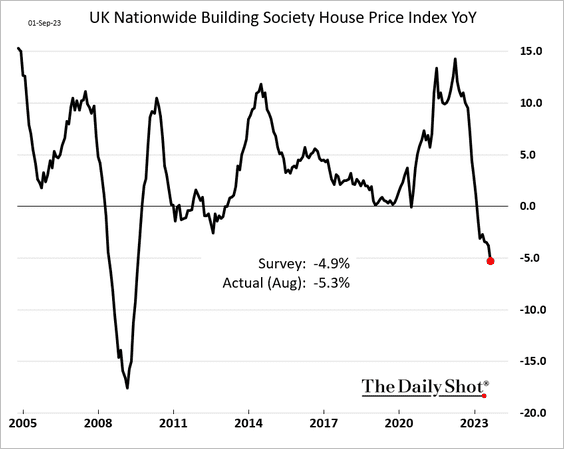

1. Home price declines haven’t been this severe since the GFC.

Source: @economics Read full article

Source: @economics Read full article

——————–

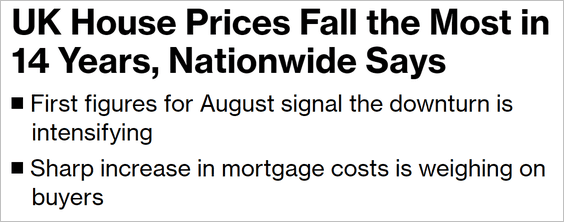

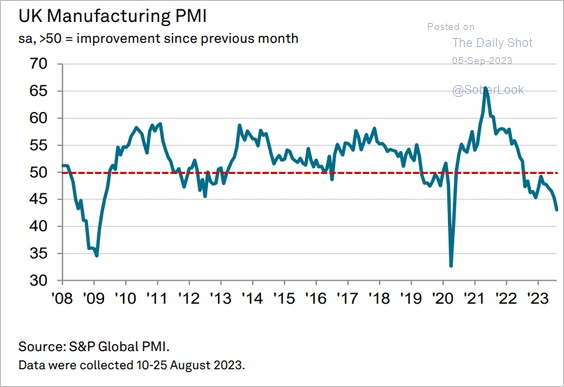

2. The manufacturing PMI weakness bodes poorly for industrial production.

Source: S&P Global PMI

Source: S&P Global PMI

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

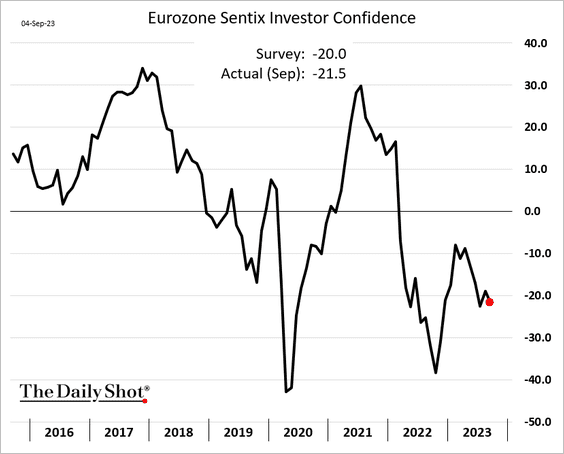

1. The Sentix Investor Confidence index declined more than expected.

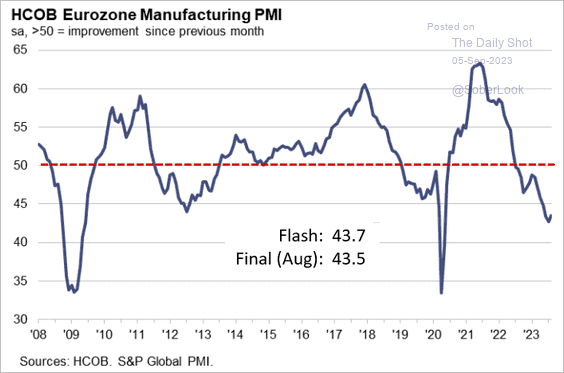

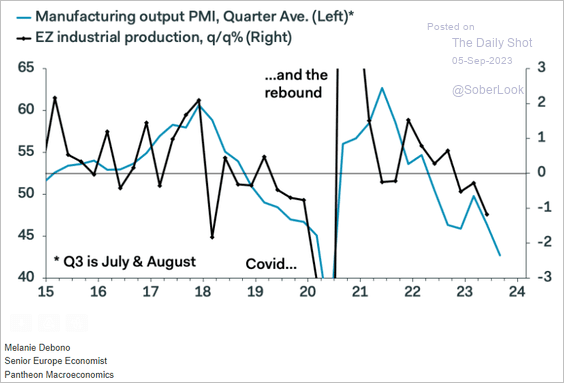

2. The updated manufacturing PMI measure shows euro-area factories still struggling.

Source: S&P Global PMI

Source: S&P Global PMI

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

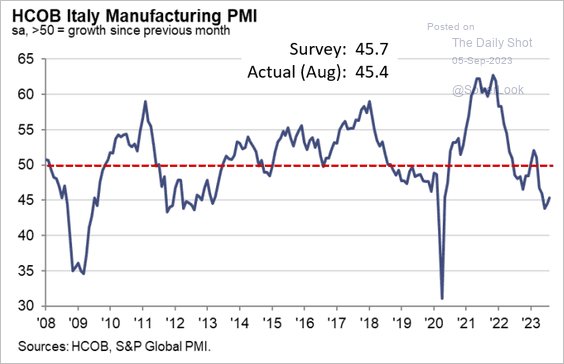

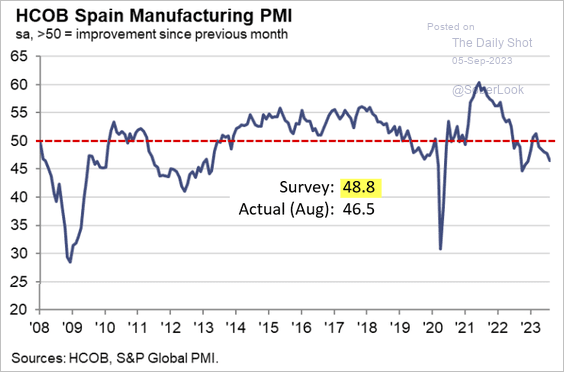

Here is Italy and Spain.

Source: S&P Global PMI

Source: S&P Global PMI

Source: S&P Global PMI

Source: S&P Global PMI

——————–

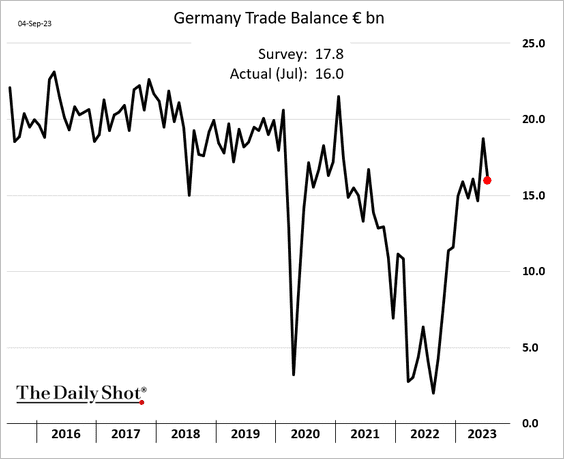

3. Germany’s trade surplus was lower than expected in July.

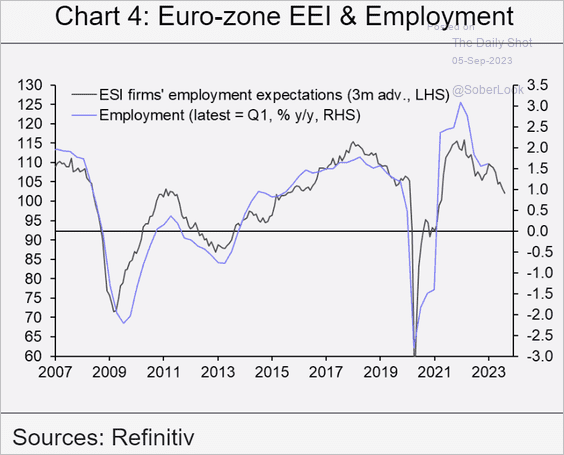

4. Employment growth is expected to slow.

Source: Capital Economics

Source: Capital Economics

Back to Index

Asia-Pacific

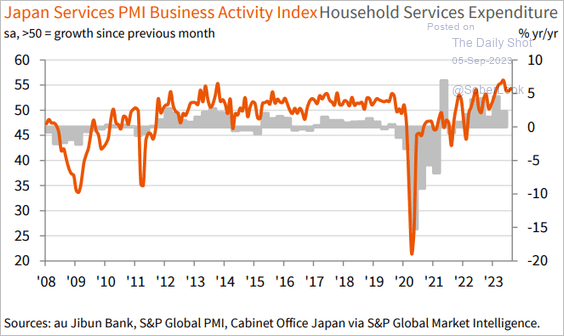

1. Japan’s services growth remains robust.

Source: S&P Global PMI

Source: S&P Global PMI

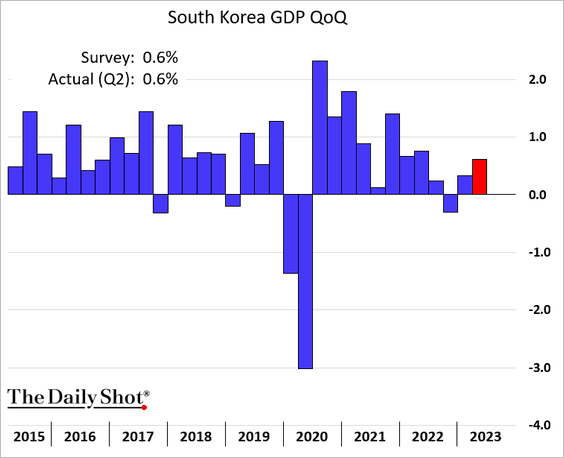

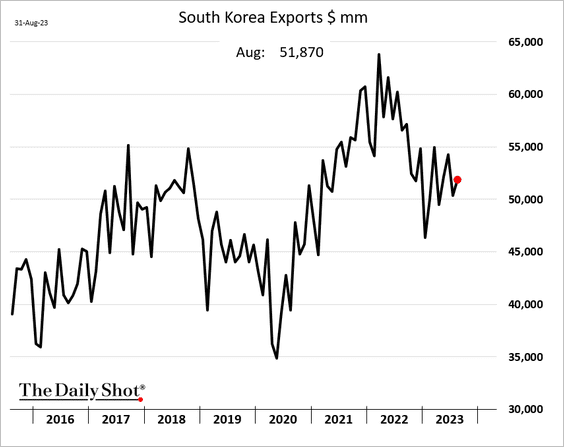

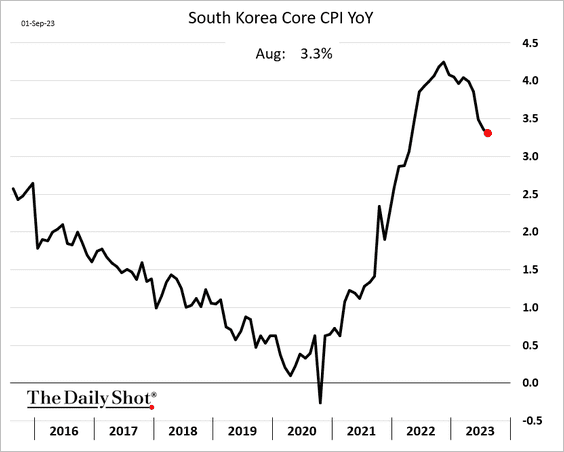

2. Next, we have some updates on South Korea.

• The GDP growth (a rebound):

• Exports (holding up):

• Inflation (moderating):

——————–

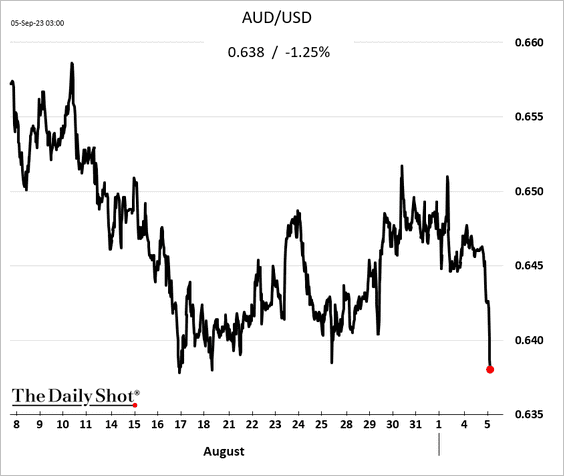

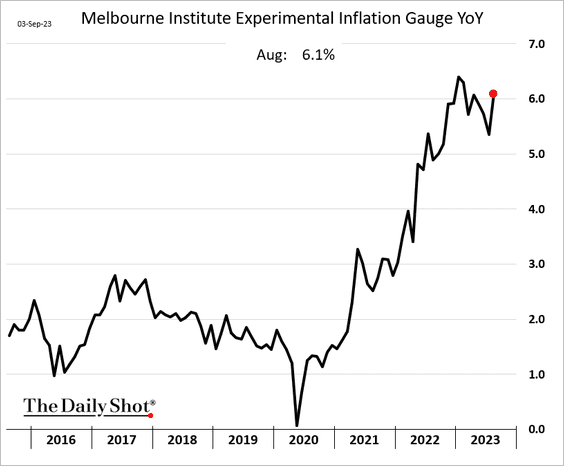

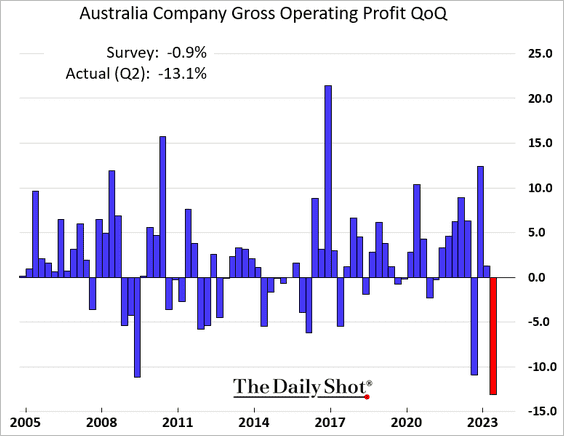

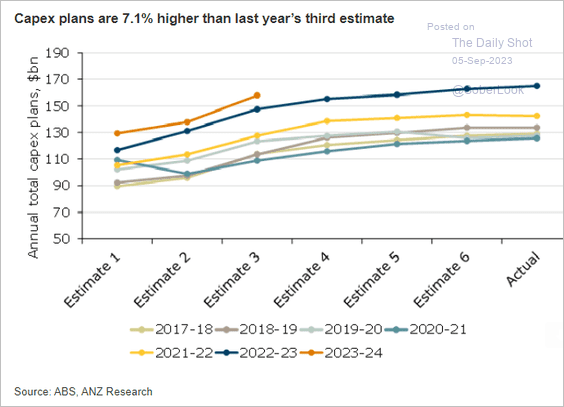

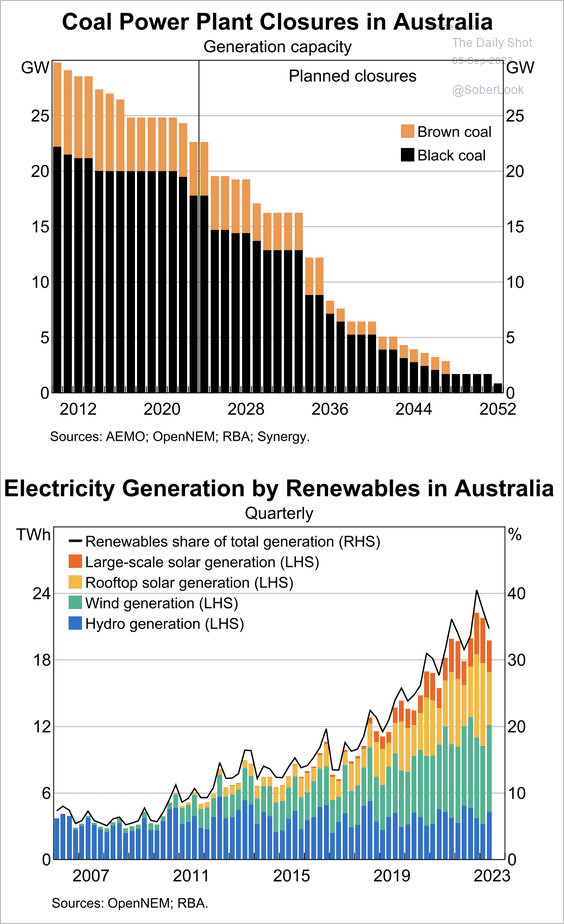

3. Here are some updates on Australia.

• The Aussie dollar is sharply lower after the RBA left rates unchanged again.

• Inflation remains high.

• Corporate profits took a hit in Q2.

• CapEx plans remain strong.

Source: @ANZ_Research

Source: @ANZ_Research

• Here is a look at the shift to renewables.

Source: RBA Read full article

Source: RBA Read full article

Back to Index

China

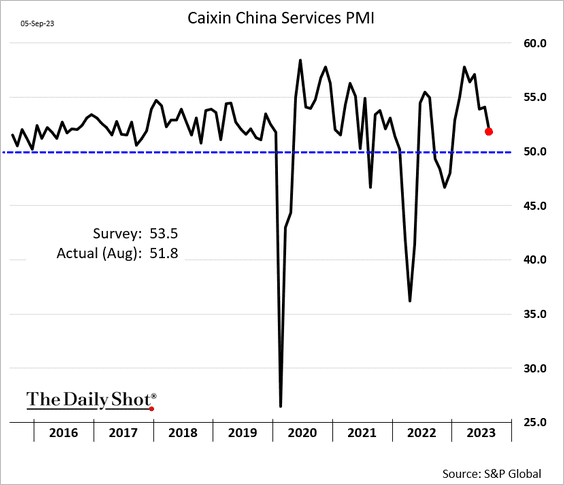

1. Growth in services slowed last month.

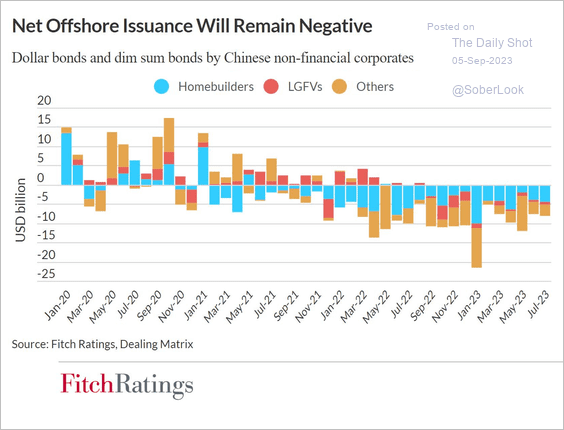

2. Offshore bond issuance remains depressed.

Source: Fitch Ratings

Source: Fitch Ratings

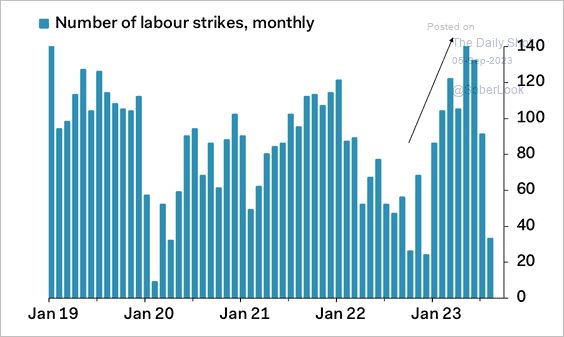

3. The number of labor strikes increased in Q1 as the economy reopened.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

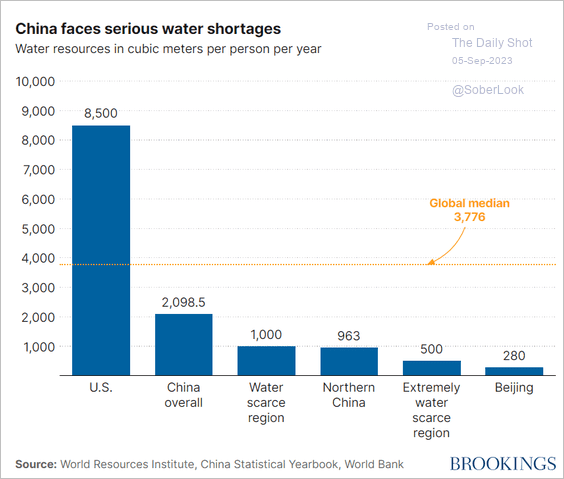

4. China faces water shortages.

Source: Brookings Read full article

Source: Brookings Read full article

Back to Index

Emerging Markets

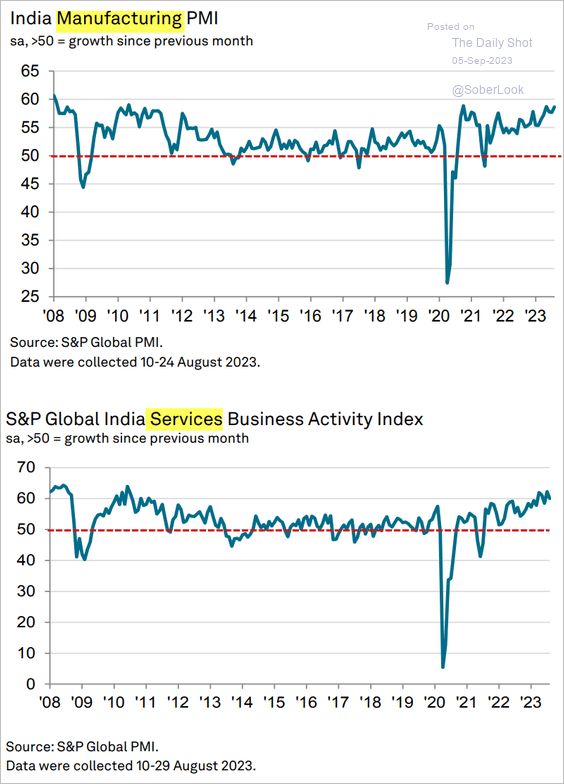

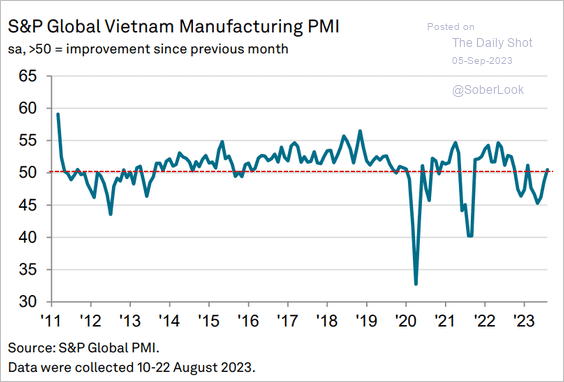

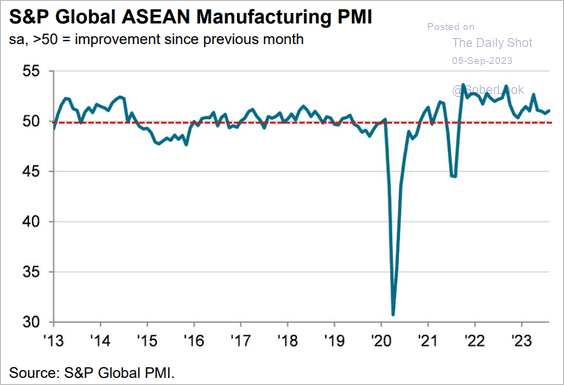

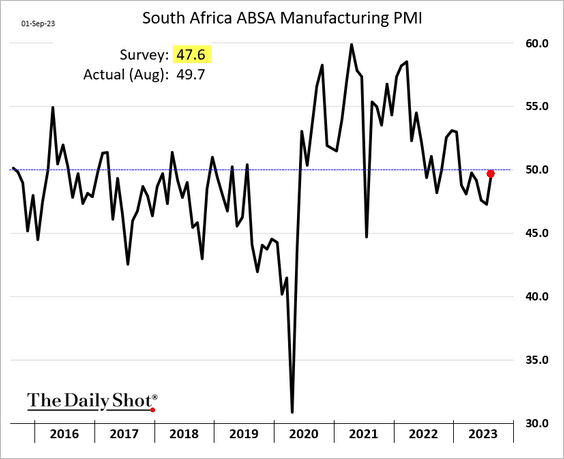

1. Let’s run through some PMI reports for August.

• India (remarkably strong):

Source: S&P Global PMI

Source: S&P Global PMI

• Vietnam (manufacturing back to growth):

Source: S&P Global PMI

Source: S&P Global PMI

• ASEAN (expansion continues):

Source: S&P Global PMI

Source: S&P Global PMI

• South Africa (stabilizing):

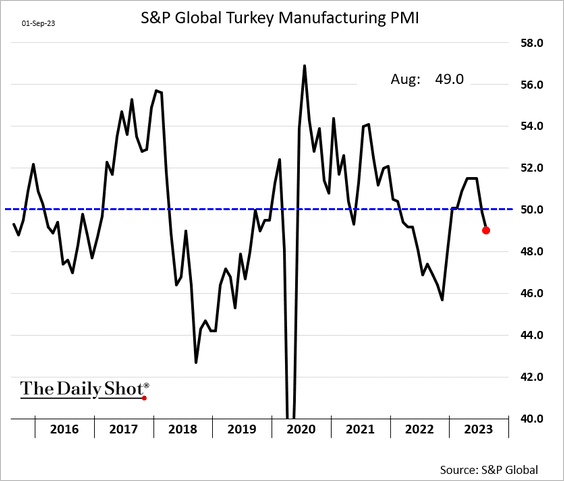

• Turkey (manufacturing back in contraction):

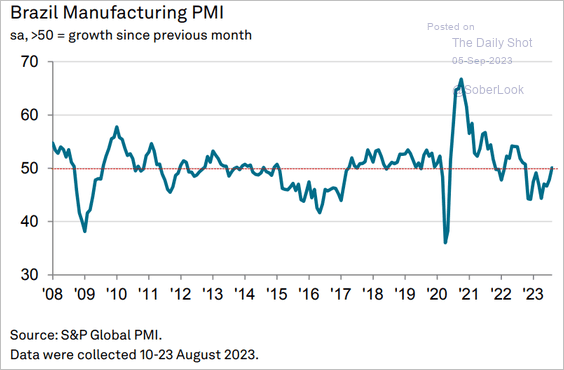

• Brazil (back to growth):

Source: S&P Global PMI

Source: S&P Global PMI

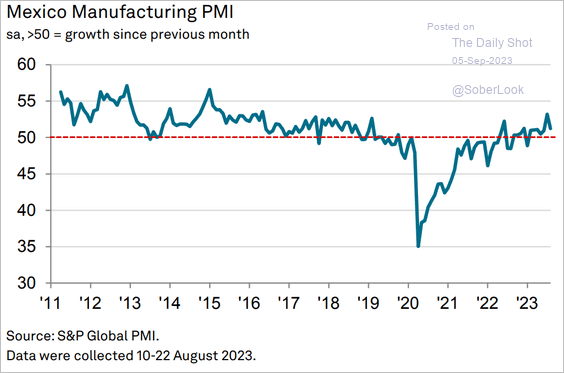

• Mexico (slower expansion):

Source: S&P Global PMI

Source: S&P Global PMI

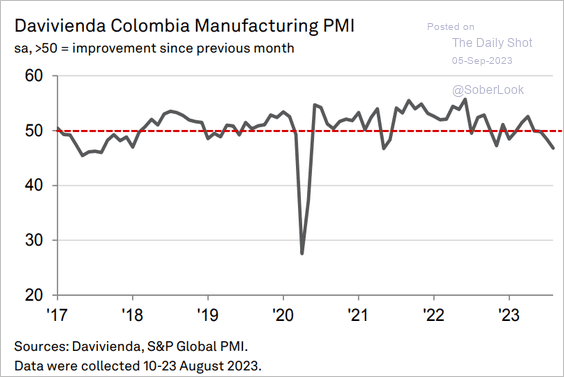

• Colombia (crashing):

Source: S&P Global PMI

Source: S&P Global PMI

——————–

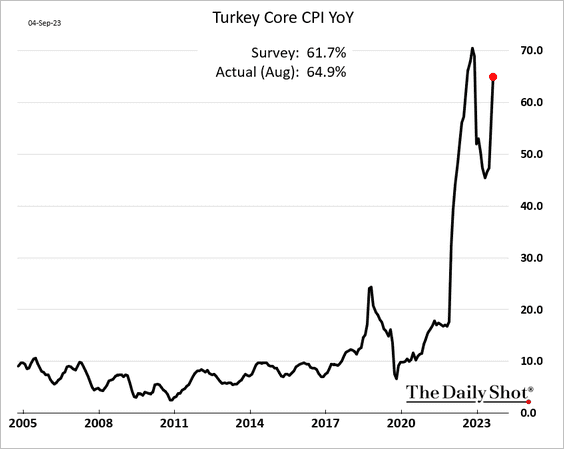

2. Turkey’s inflation is surging.

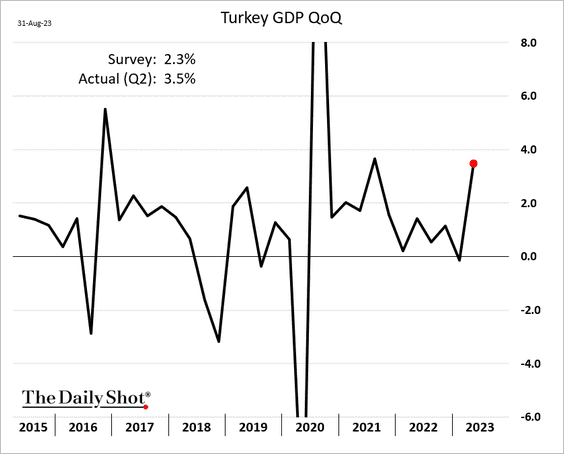

The Q2 GDP growth topped expectations.

——————–

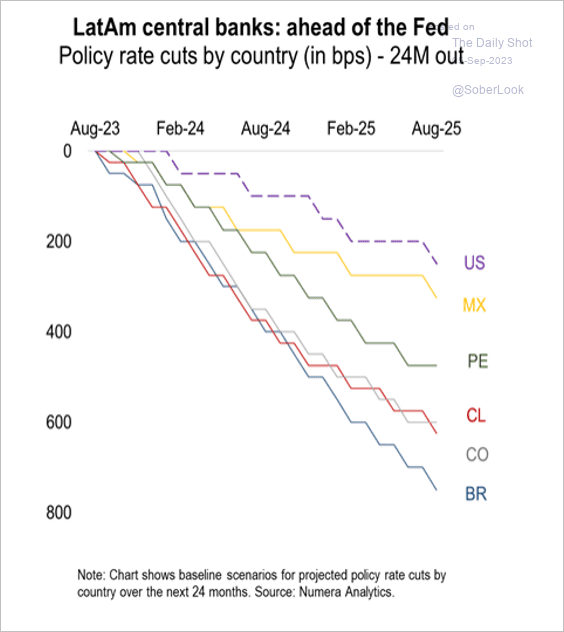

3. Here is a look at LatAm policy rate forecasts.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

Back to Index

Cryptocurrency

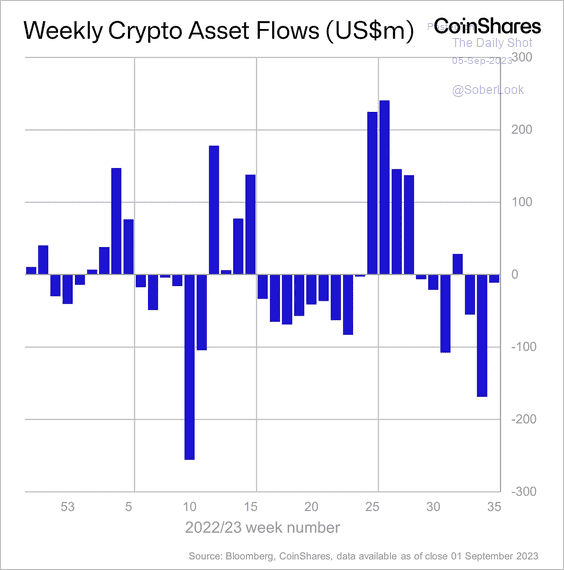

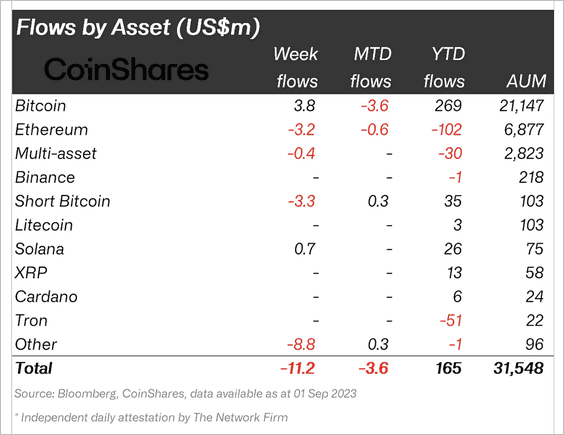

1. Crypto funds saw minor outflows last week, although long-bitcoin products attracted fresh capital. (2 charts)

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

2. The SEC delayed making a decision on spot-bitcoin ETF applications until October.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

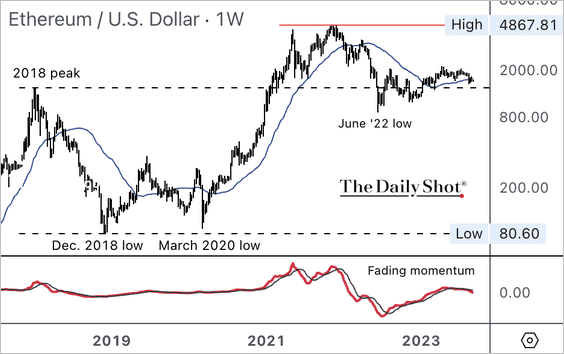

3. ETH/USD is testing support at its 40-week moving average, although upside momentum has slowed.

Back to Index

Commodities

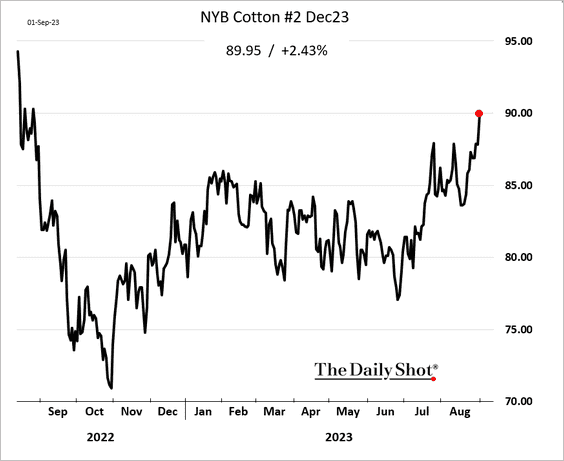

1. It’s been a good couple of months for cotton futures. Hopes for stronger demand from China and tighter supplies have been supporting prices.

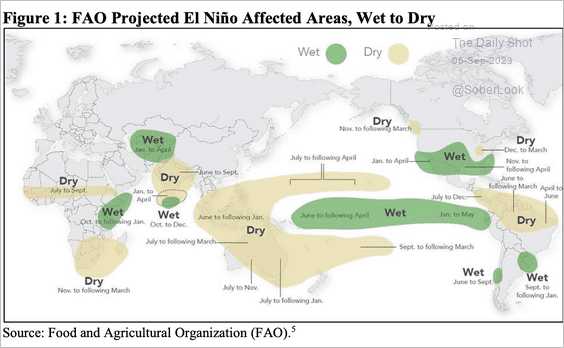

2. This map illustrates the areas expected to be impacted by El Niño.

Source: USDA

Source: USDA

Back to Index

Energy

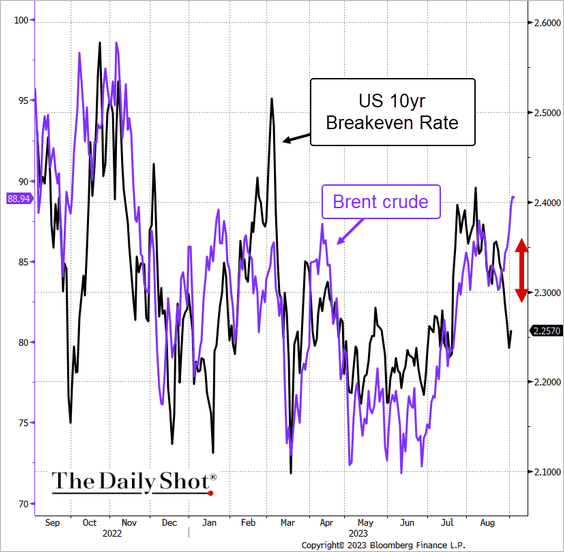

1. Crude oil prices have diverged from US market-based inflation expectations.

Source: @TheTerminal, Bloomberg Finance L.P.; h/t @themarketear

Source: @TheTerminal, Bloomberg Finance L.P.; h/t @themarketear

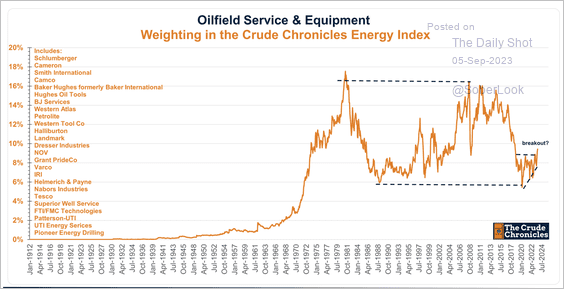

2. Oil service stocks are displaying relative strength.

Source: The Crude Chronicles

Source: The Crude Chronicles

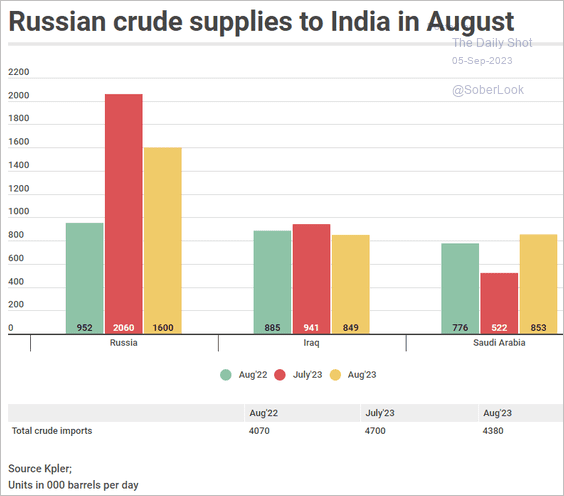

3. India continues to buy a lot of crude oil from Russia.

Source: Business Standard Read full article

Source: Business Standard Read full article

Back to Index

Equities

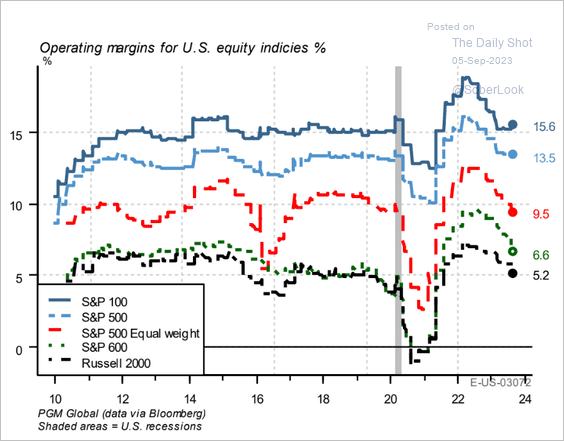

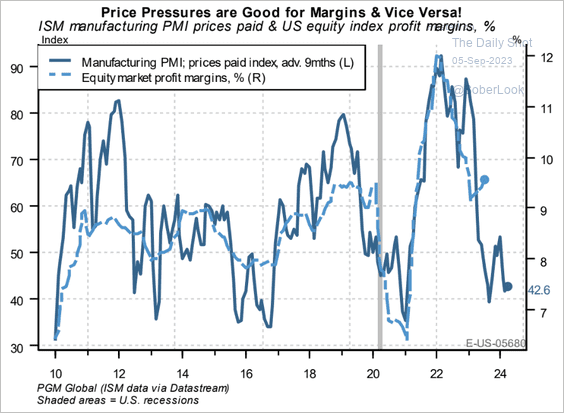

1. Here is a look at operating margins by company size.

Source: PGM Global

Source: PGM Global

Are margins headed lower?

Source: PGM Global

Source: PGM Global

——————–

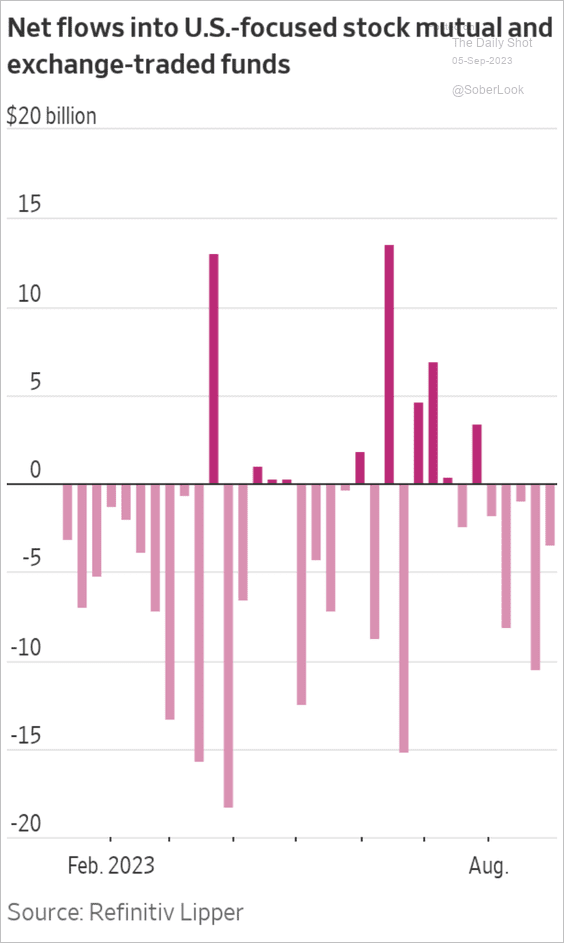

2. US funds saw some ouflows in August.

Source: @WSJ Read full article

Source: @WSJ Read full article

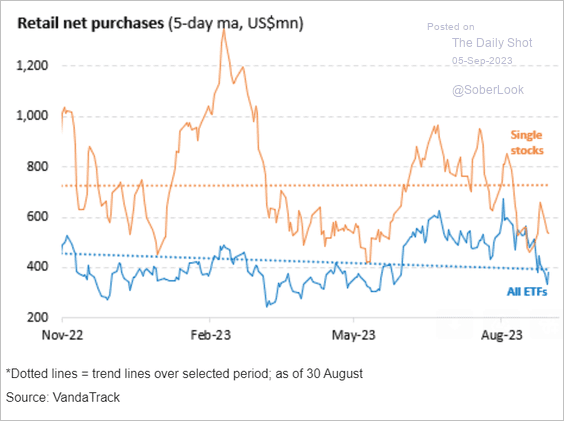

3. Retail purchases have slowed recently.

Source: Vanda Research

Source: Vanda Research

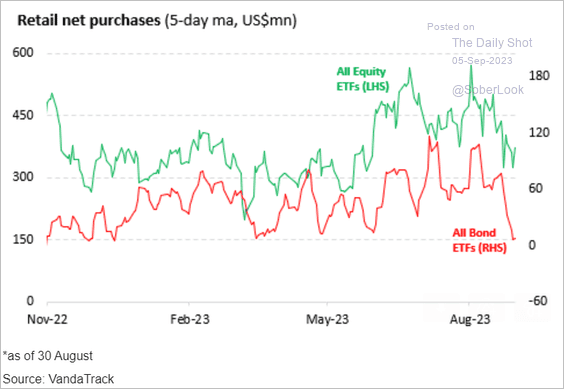

But softer ETF demand was more about fixed income than equities.

Source: Vanda Research

Source: Vanda Research

——————–

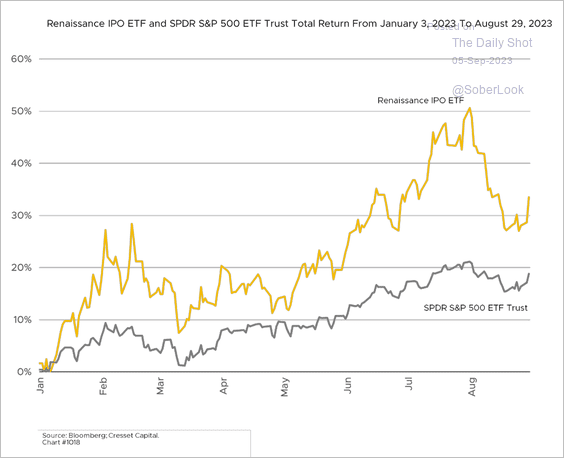

4. More IPOs on the way?

Source: Jack Ablin, Cresset Wealth Advisors

Source: Jack Ablin, Cresset Wealth Advisors

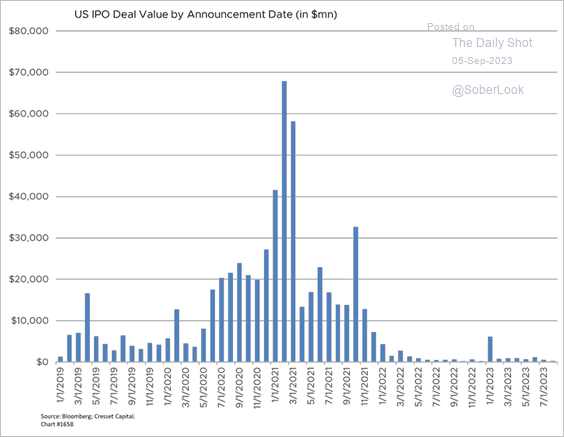

• US IPO deal value over time:

Source: Jack Ablin, Cresset Wealth Advisors

Source: Jack Ablin, Cresset Wealth Advisors

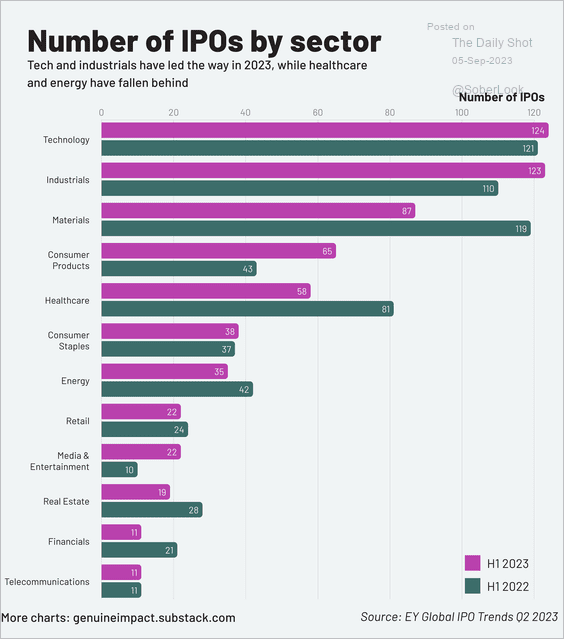

• Global IPOs by sector:

Source: @genuine_impact

Source: @genuine_impact

——————–

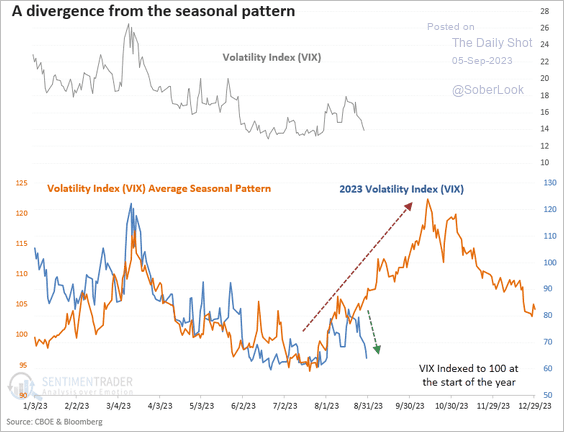

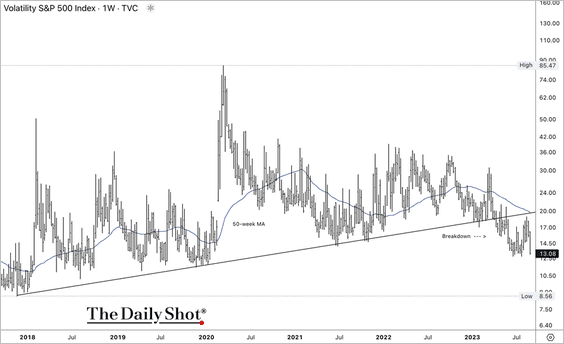

5. So far, VIX has diverged from its seasonal pattern.

Source: SentimenTrader

Source: SentimenTrader

VIX broke below its uptrend from 2018. Are we entering a low-vol regime?

Back to Index

Credit

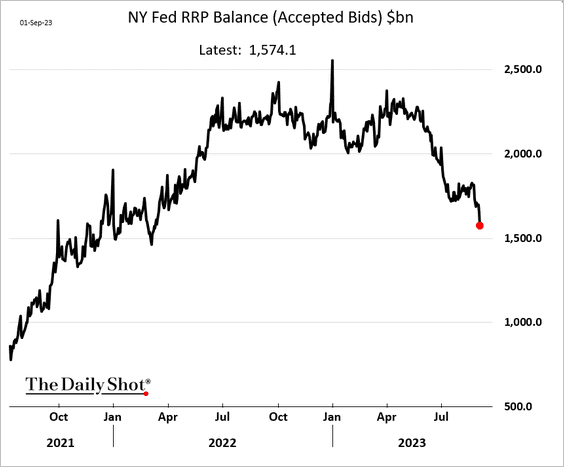

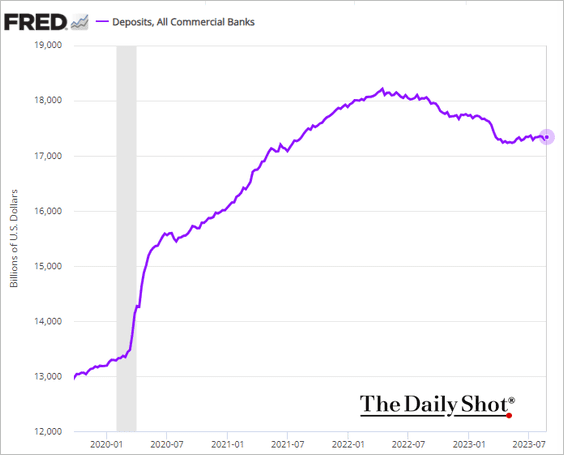

1. The Fed’s RRP (reverse repo program) balances declined sharply in recent days, ..

… which should boost bank deposits.

——————–

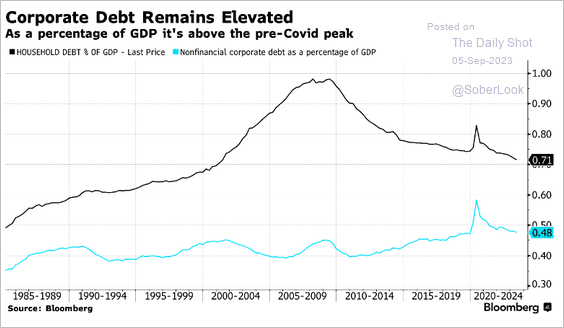

2. Corporate debt as a share of GDP has been trending higher even as household debt continues to decline.

Source: @5thrule, @TheTerminal, Bloomberg Finance L.P. Read full article

Source: @5thrule, @TheTerminal, Bloomberg Finance L.P. Read full article

Back to Index

Global Developments

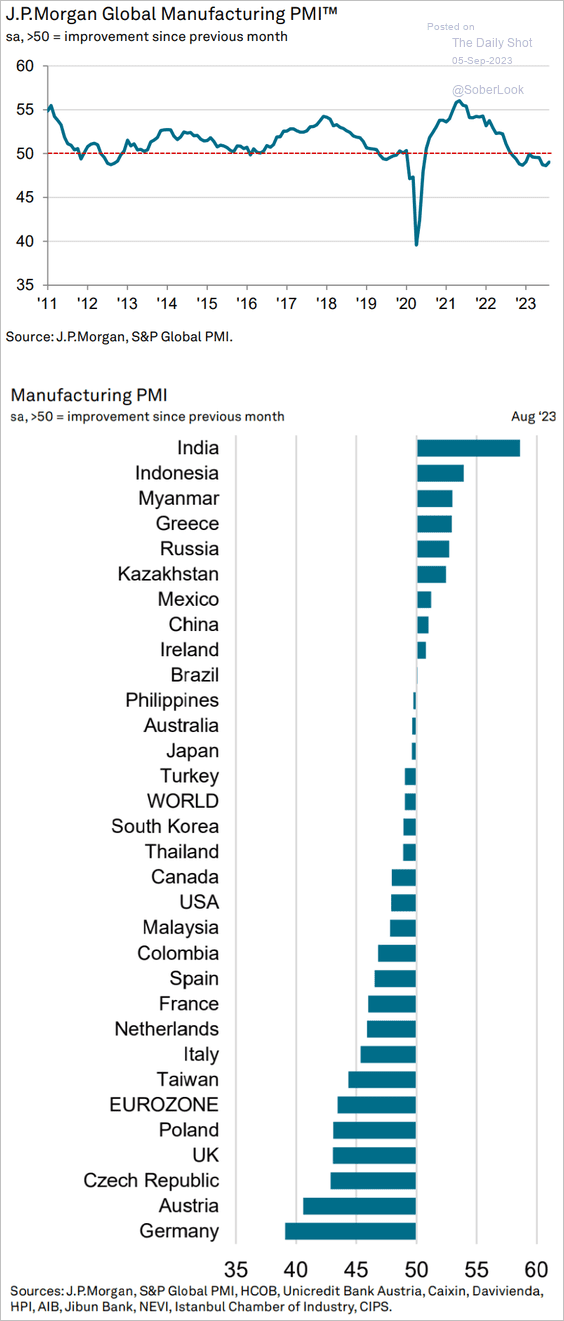

1. Global factory activity remains in contraction mode.

Source: S&P Global PMI

Source: S&P Global PMI

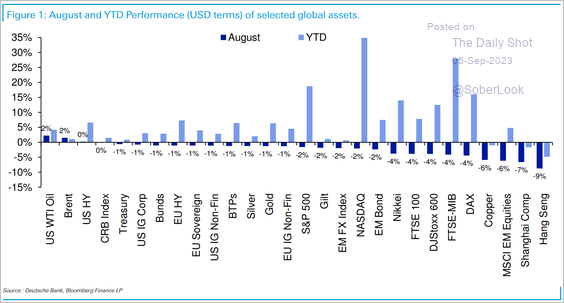

2. Most global assets were down in August, although oil prices saw a third consecutive monthly gain.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

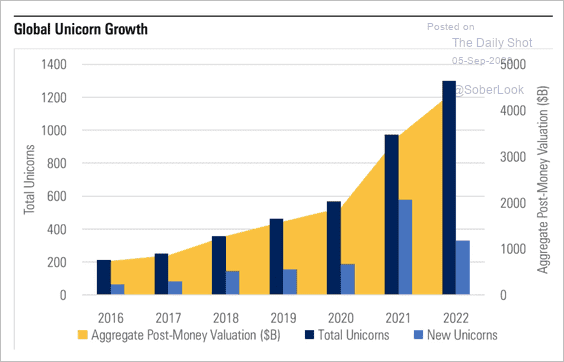

3. According to Morningstar, as a group, unicorns (startups valued > $1bn) are worth more than the publicly traded companies of all countries except the US, China, and Japan.

Source: Morningstar Read full article

Source: Morningstar Read full article

——————–

Food for Thought

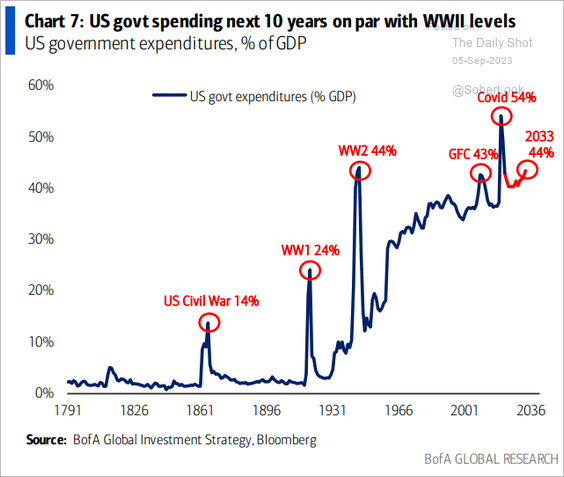

1. US federal government spending as a share of GDP:

Source: BofA Global Research

Source: BofA Global Research

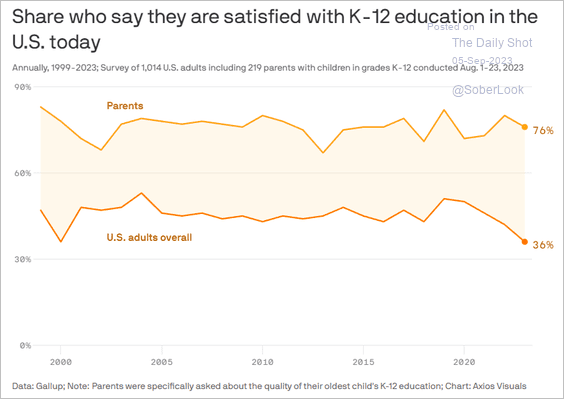

2. Satisfaction with K-12 education in the US:

Source: @axios Read full article

Source: @axios Read full article

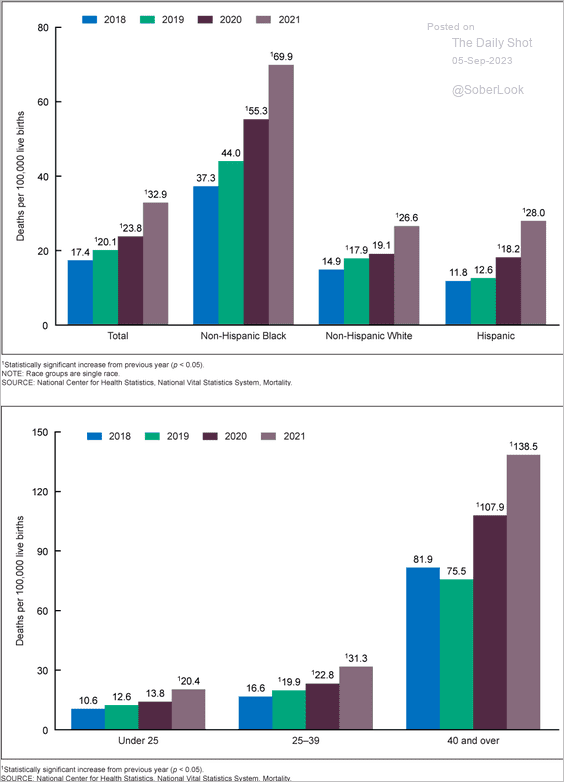

3. US maternal mortality rates:

Source: CDC

Source: CDC

Source: @axios Read full article

Source: @axios Read full article

——————–

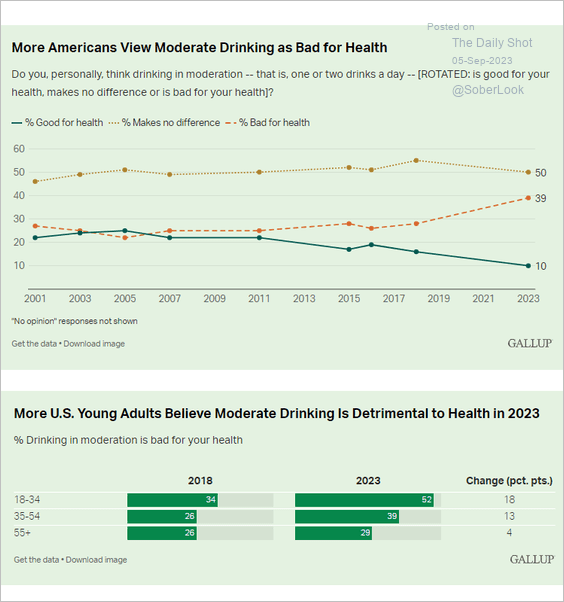

4. Views on moderate drinking:

Source: Gallup Read full article

Source: Gallup Read full article

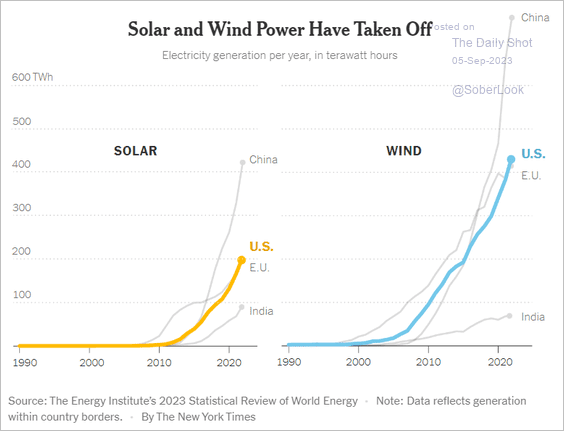

5. Electricity generated from solar and wind:

Source: The New York Times Read full article

Source: The New York Times Read full article

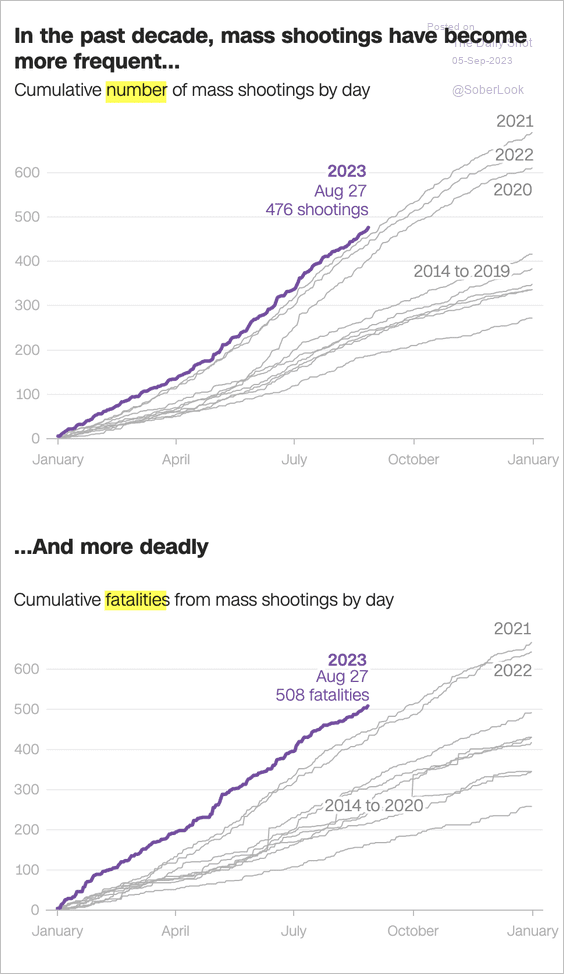

6. Mass shootings in the US:

Source: CNN Read full article

Source: CNN Read full article

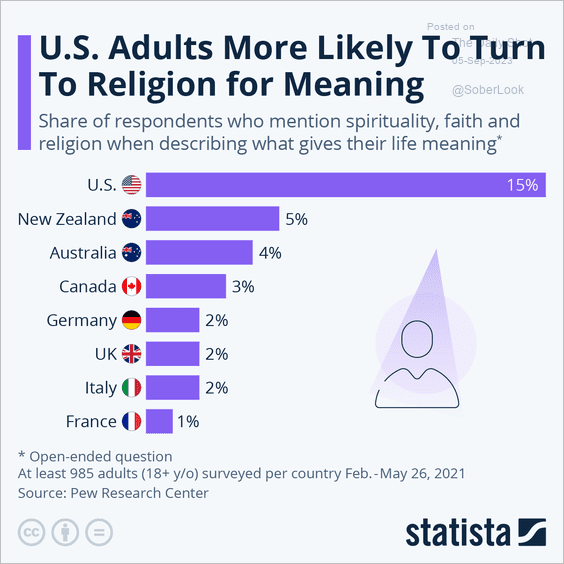

7. Turning to religion for meaning:

Source: Statista

Source: Statista

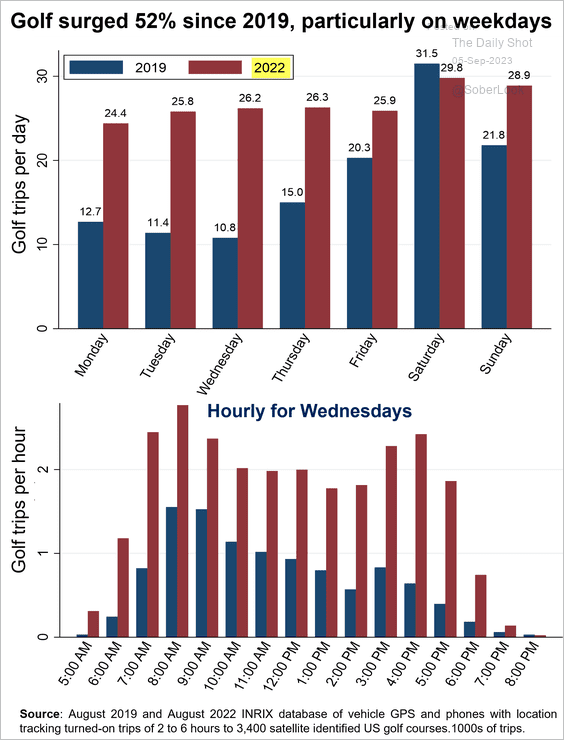

8. Working hard (from home) or playing golf?

Source: Alex Finan (Stanford and INRIX) and Nick Bloom (Stanford)

Source: Alex Finan (Stanford and INRIX) and Nick Bloom (Stanford)

——————–

Back to Index