The Daily Shot: 06-Sep-23

• The United States

• Canada

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Food for Thought

The United States

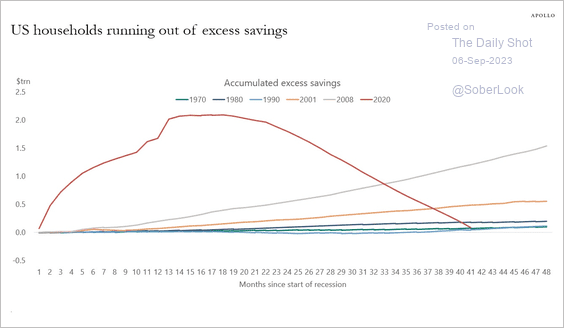

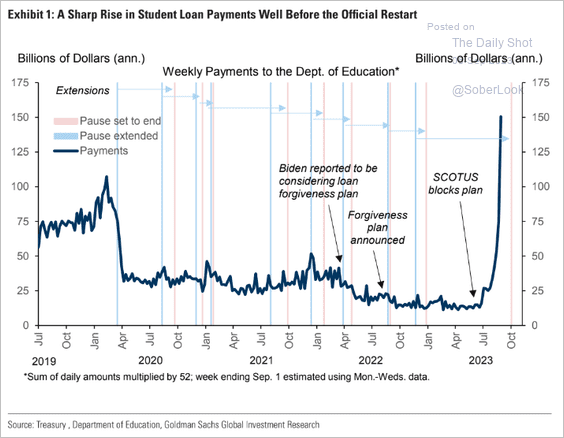

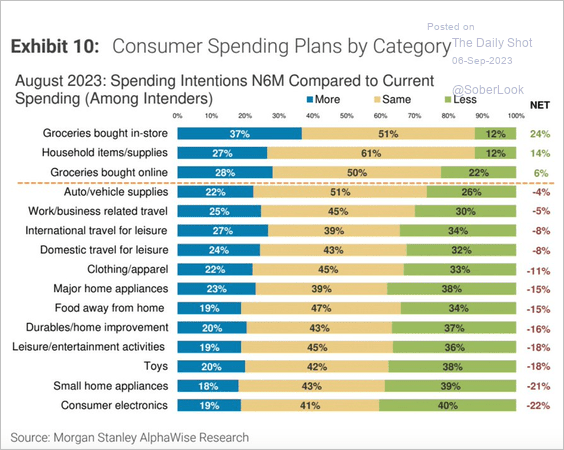

1. All signs point to a retreat in consumption in the months ahead.

• Shrinking excess savings:

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

• The resumption of student loan payments:

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

• Consumer spending intentions:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

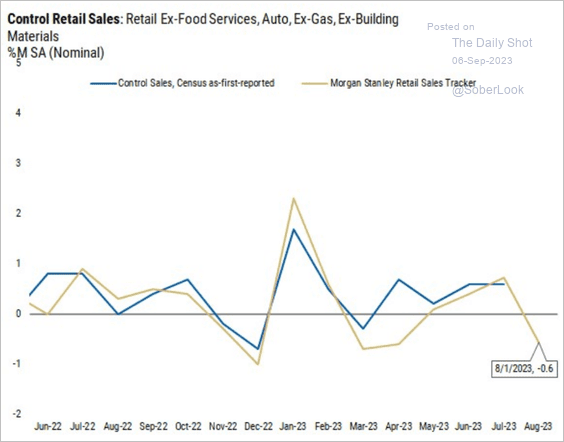

The pullback may have already started. Morgan Stanley sees core retail sales declining sharply in August.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

2. Next, we have some updates on the labor market.

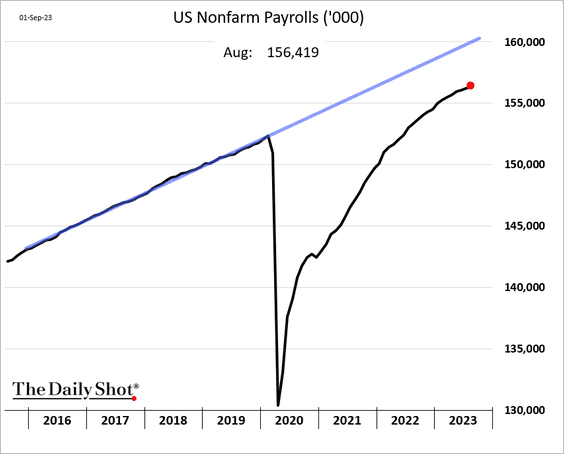

• Payrolls growth remains well below the pre-COVID trend.

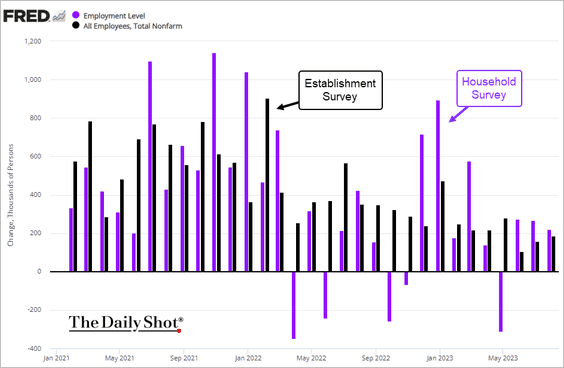

• The Household Survey for August once again reported higher job gains than the official figures from the Establishment Survey.

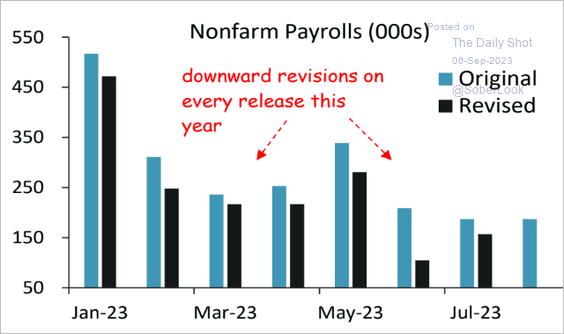

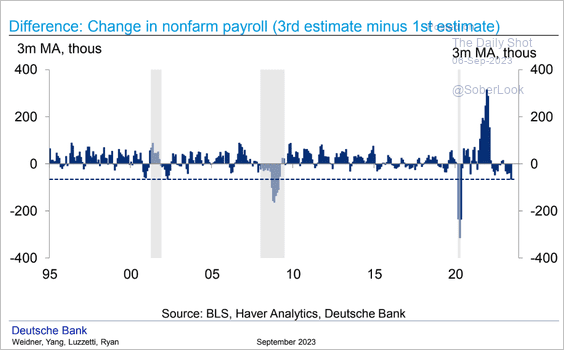

• Payrolls figures have been persistently revised down this year (2 charts).

Source: Piper Sandler

Source: Piper Sandler

Source: Deutsche Bank Research

Source: Deutsche Bank Research

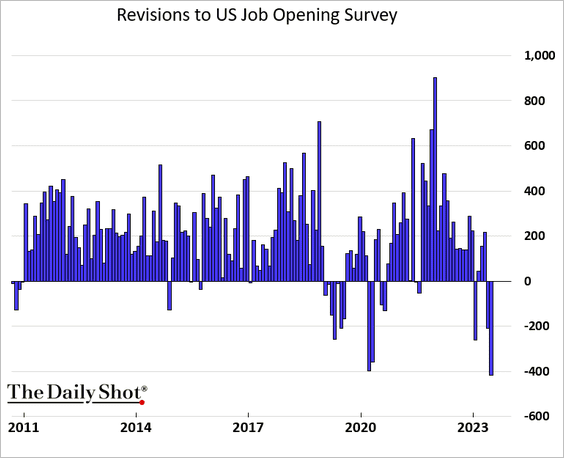

Job openings revisions have also been negative.

h/t @5thrule

h/t @5thrule

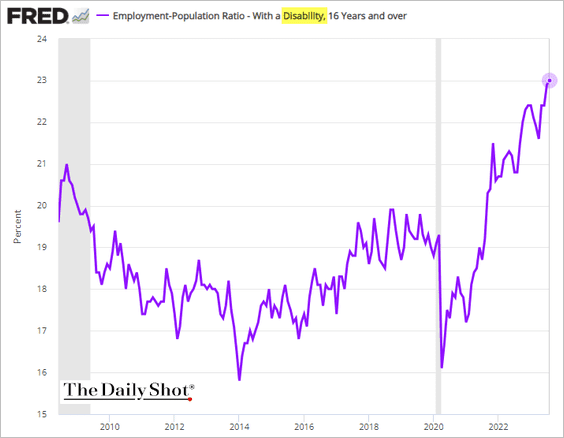

• Americans with disabilities increasingly participate in the labor force.

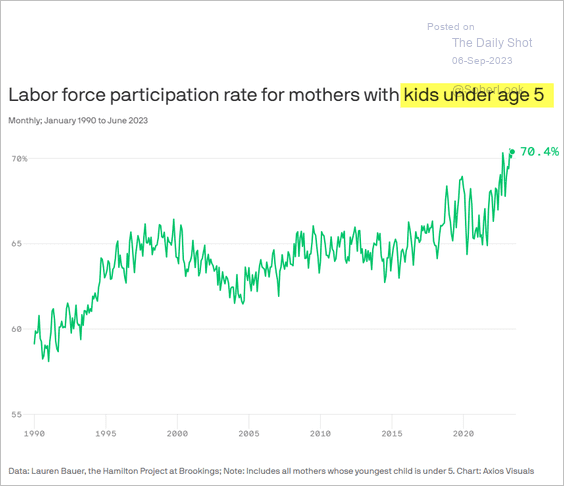

• This chart shows the labor force participation rate for mothers with children under five.

Source: @axios Read full article

Source: @axios Read full article

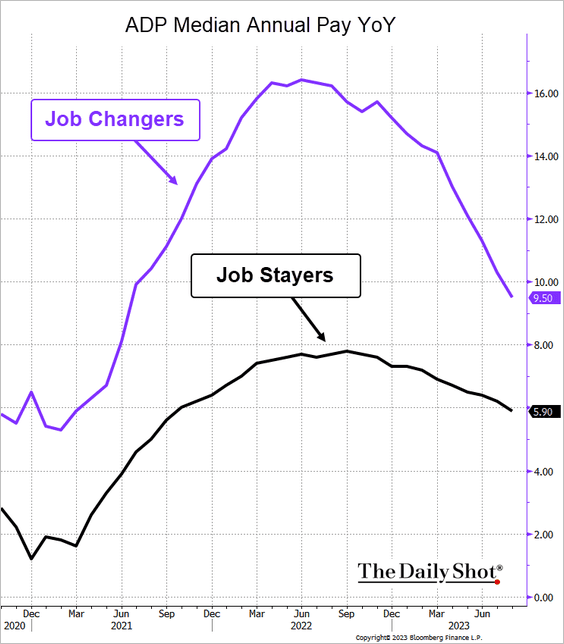

• Job hopping is losing its luster.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

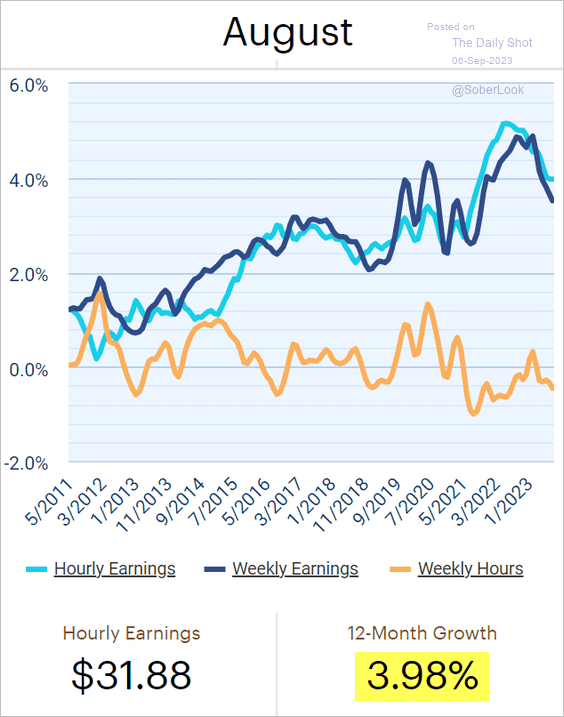

• Small business wage growth held near 4% in August.

Source: Paychex, IHS Markit

Source: Paychex, IHS Markit

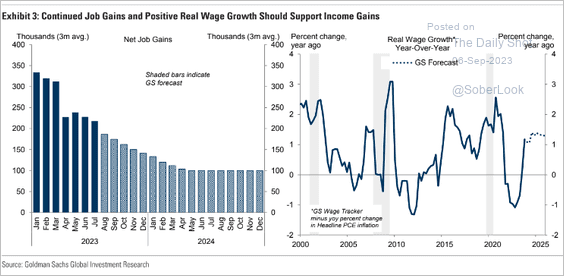

• Goldman sees job gains stabilizing near 100k per month.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

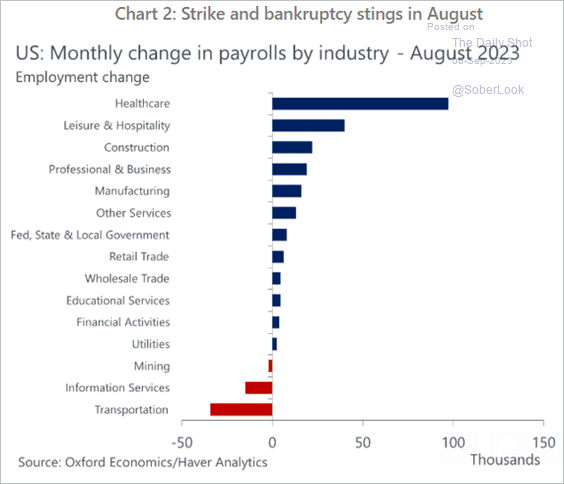

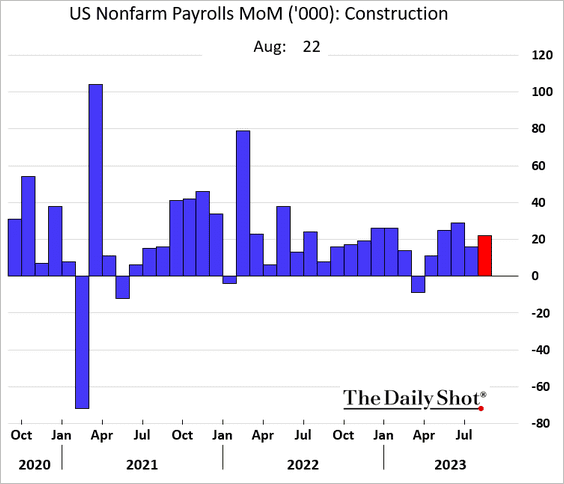

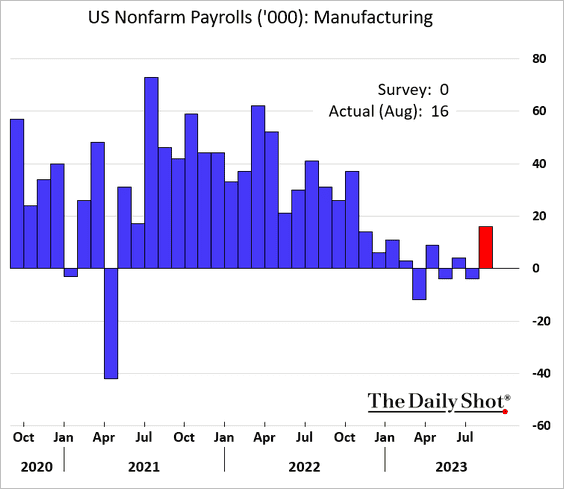

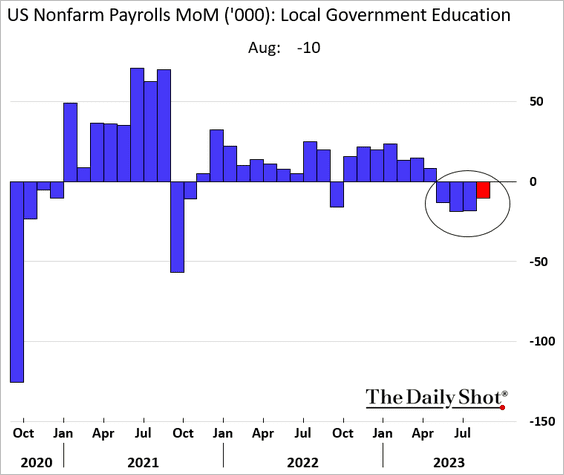

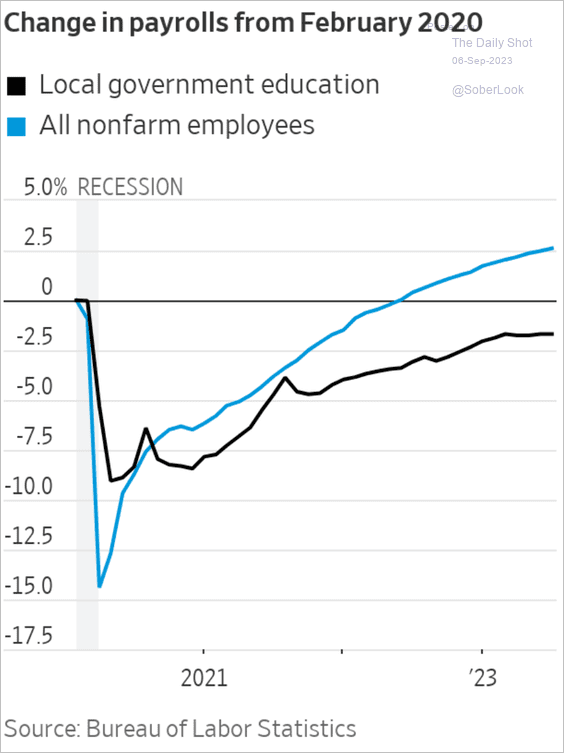

• Finally, we have some job growth trends by industry.

– August changes:

Source: Oxford Economics

Source: Oxford Economics

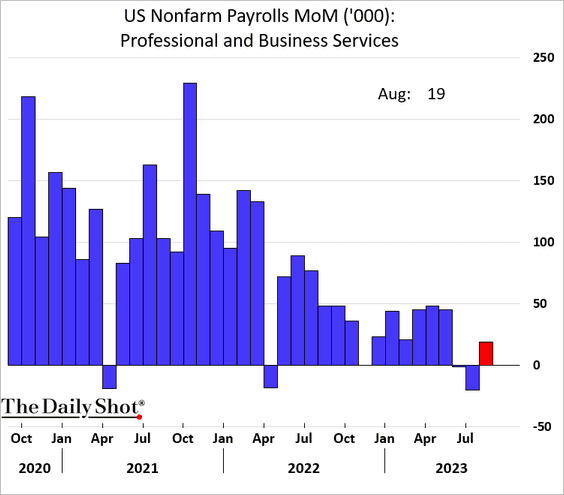

– Business services:

– Construction (resilient):

– Manufacturing (a rebound):

– Public school teachers (still challenging to recruit):

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

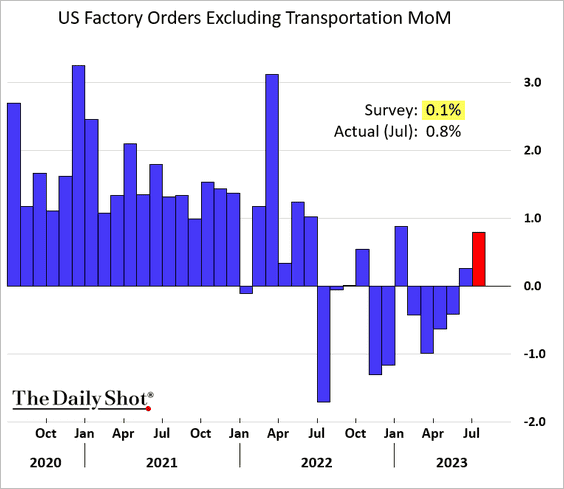

3. Excluding transportation, factory orders in July surpassed expectations.

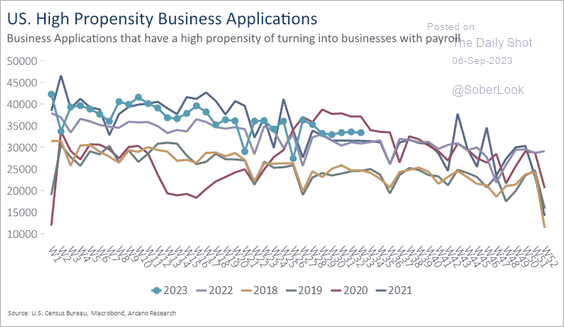

4. Business applications remain elevated.

Source: Arcano Economics

Source: Arcano Economics

Back to Index

Canada

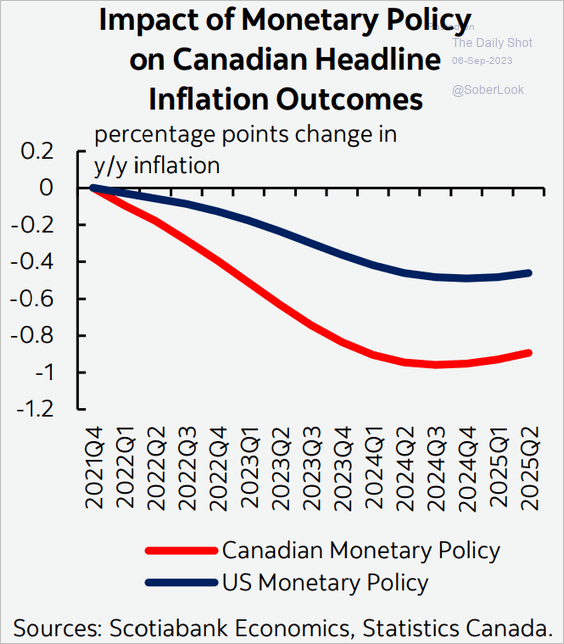

1. How much do rate hikes impact inflation?

Source: Scotiabank Economics

Source: Scotiabank Economics

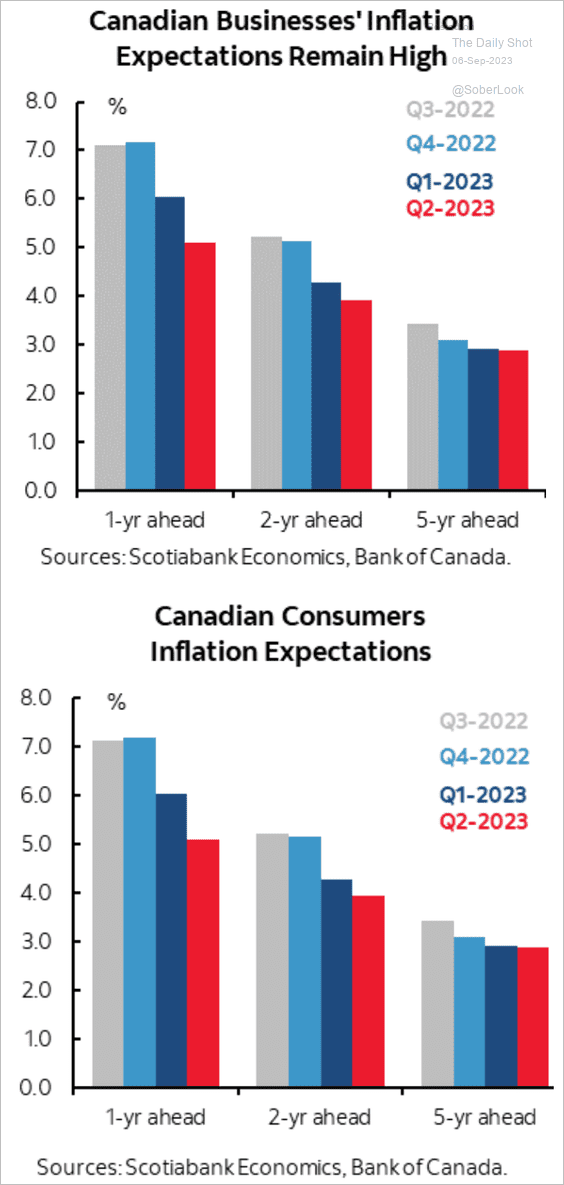

2. Inflation expectations remain elevated.

Source: Scotiabank Economics

Source: Scotiabank Economics

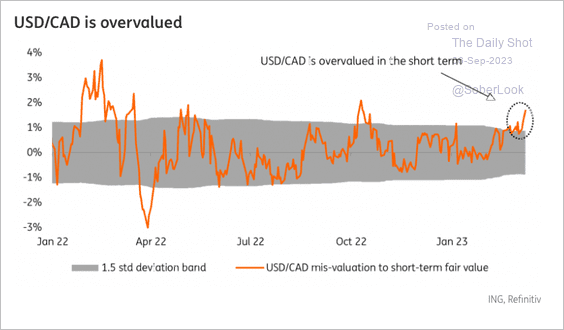

3. Is the loonie undervalued?

Source: ING

Source: ING

Back to Index

The Eurozone

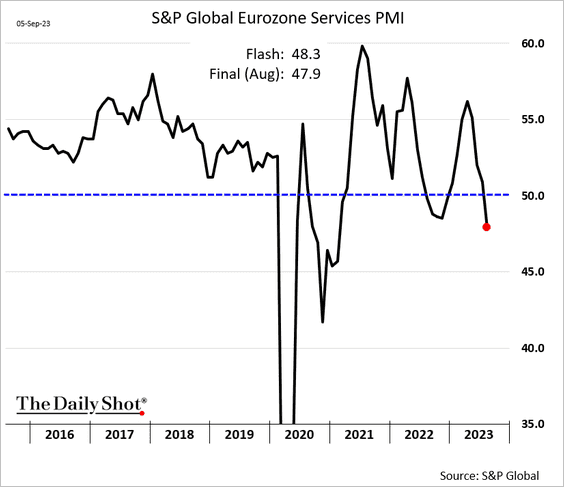

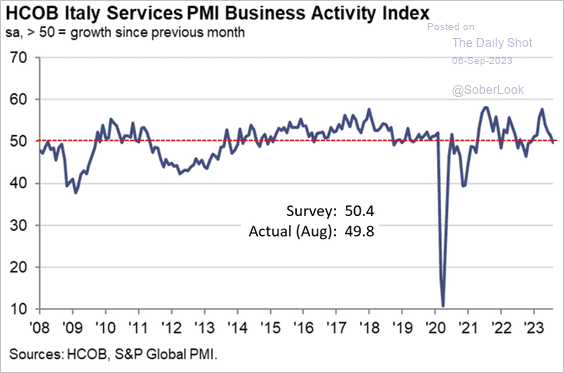

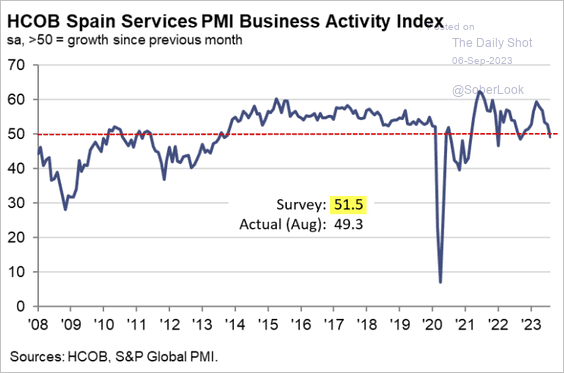

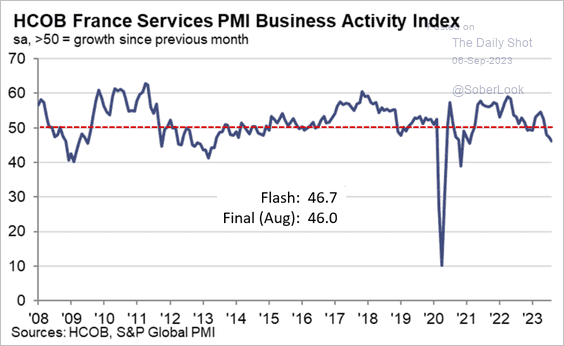

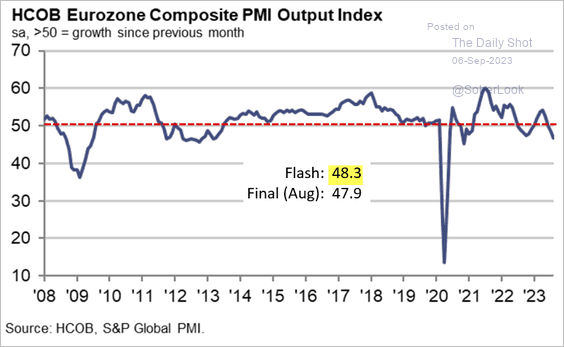

1. The final services PMI report for August was even worse than the flash figure.

– Italy:

Source: S&P Global PMI

Source: S&P Global PMI

– Spain:

Source: S&P Global PMI

Source: S&P Global PMI

– France:

Source: S&P Global PMI

Source: S&P Global PMI

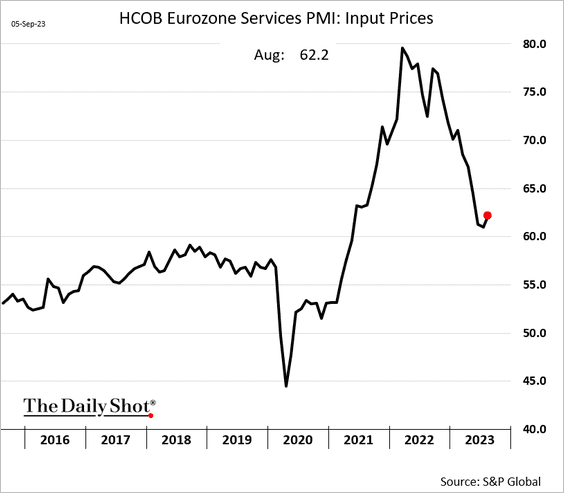

• Services input price gains accelerated last month.

• Here is the final Eurozone Composite PMI.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

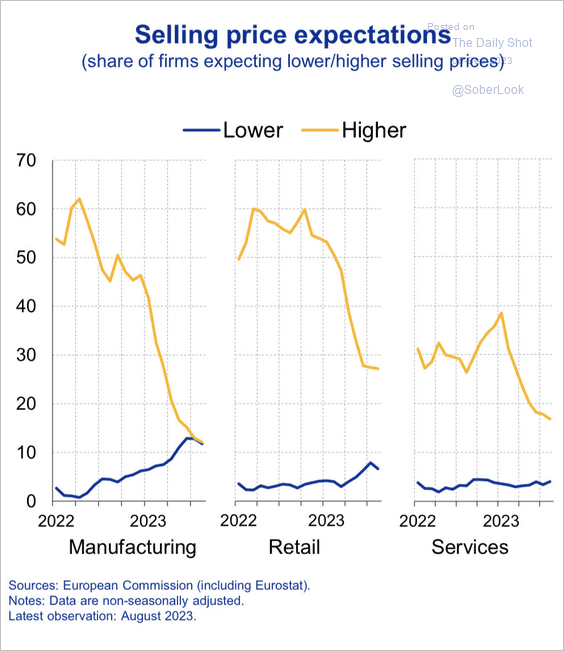

2. Fewer firms expect to be raising prices.

Source: ECB

Source: ECB

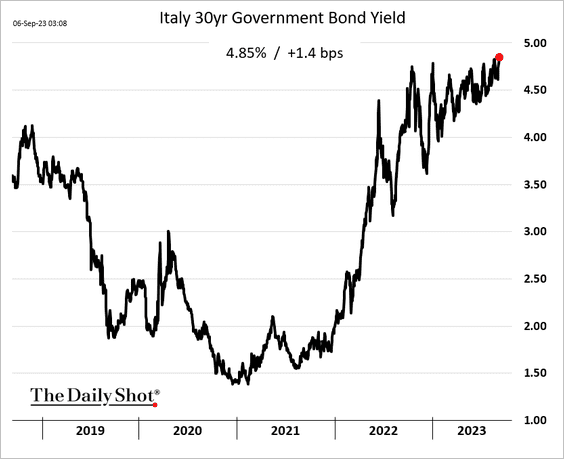

3. 30-year bond yields are grinding higher across the Eurozone.

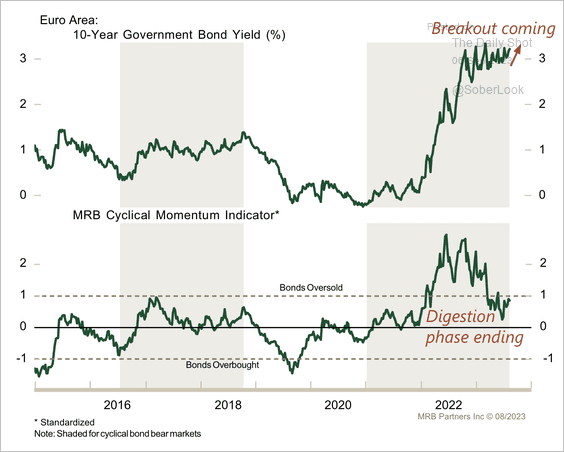

• Euro Area sovereign bonds are no longer extremely oversold, according to MRB Partners.

Source: MRB Partners

Source: MRB Partners

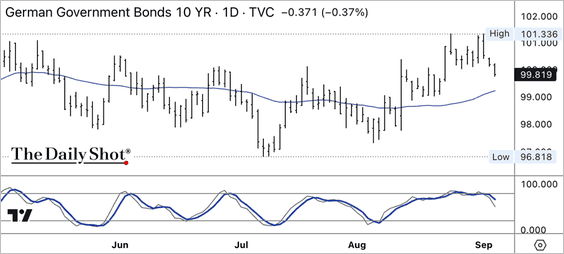

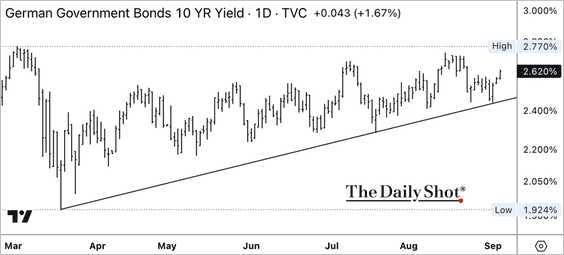

• German 10-year government bonds are stuck in a range, declining from short-term overbought levels. Will we see a breakout in yields? (2 charts)

——————–

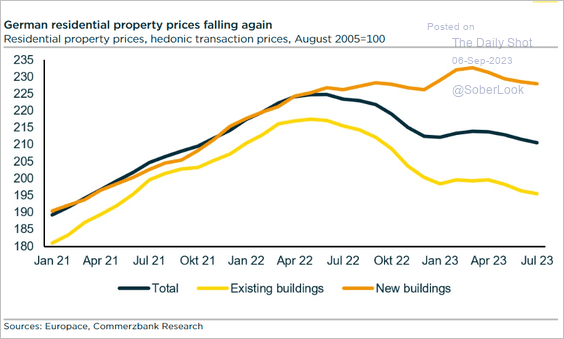

4. German home prices continue to trend down.

Source: Commerzbank Research

Source: Commerzbank Research

Back to Index

Europe

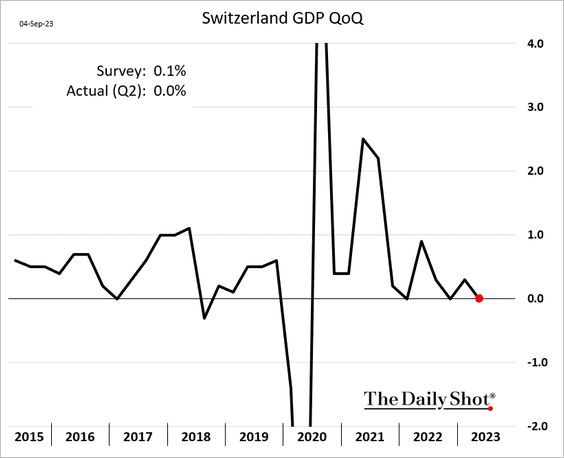

1. Swiss economic growth stalled last quarter.

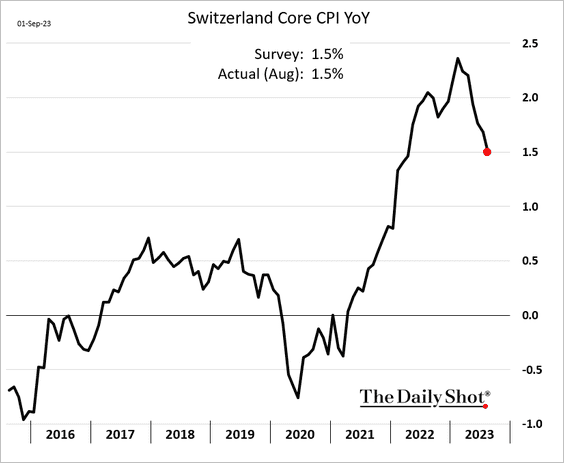

• Inflation is moderating.

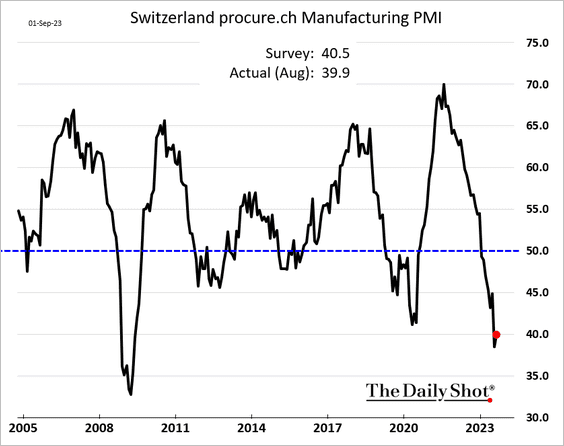

• Manufacturing contraction persists.

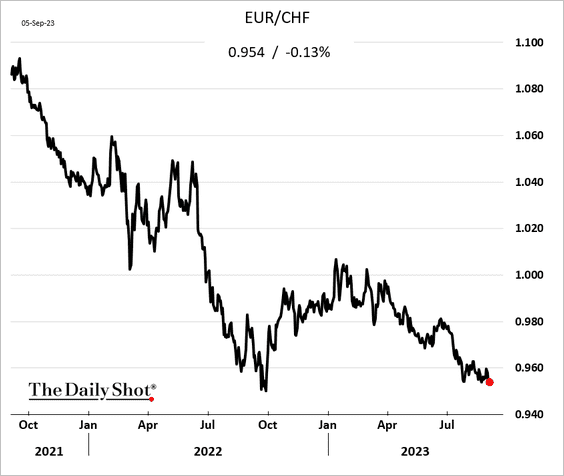

• The Swiss franc’s strength is squeezing exporters.

Source: @luxury Read full article

Source: @luxury Read full article

——————–

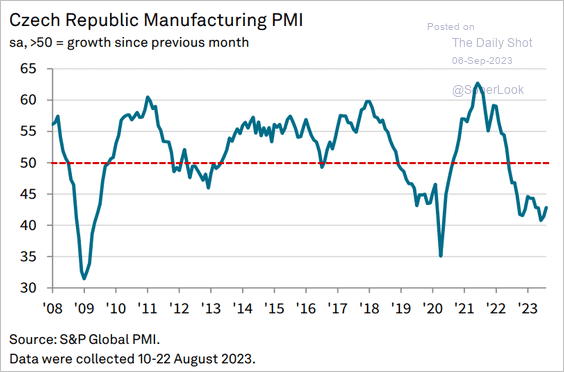

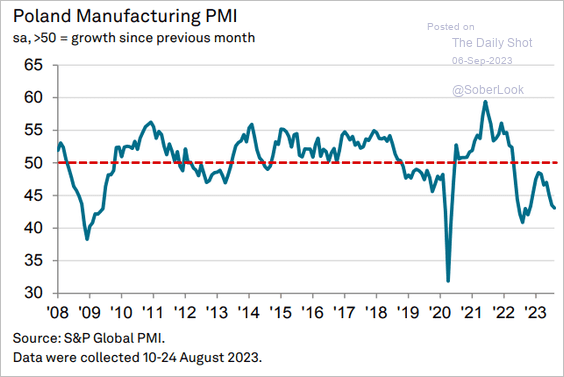

2. Central European manufacturing hubs continue to struggle.

Source: S&P Global PMI

Source: S&P Global PMI

Source: S&P Global PMI

Source: S&P Global PMI

——————–

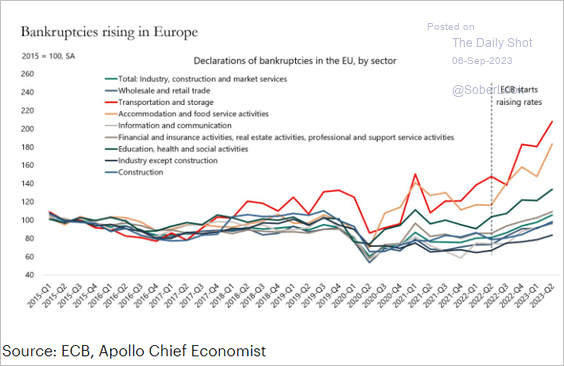

3. Bankruptcies keep climbing in the EU.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

Japan

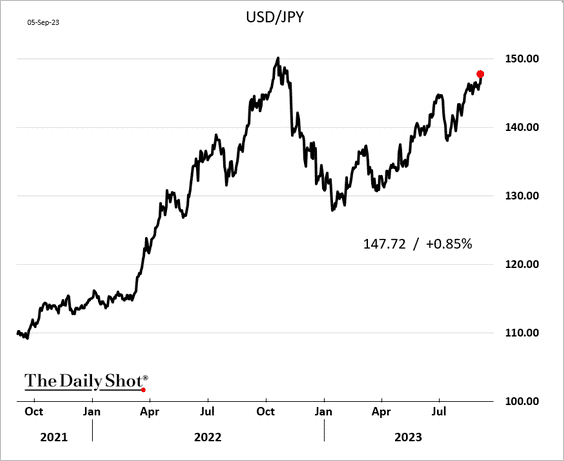

1. The yen continues to weaken. Will USD/JPY hit 150?

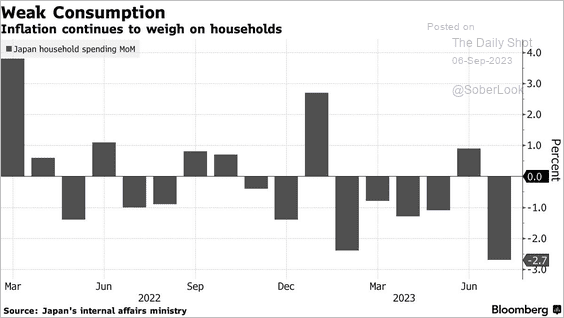

2. Households cut back on spending as inflation takes a toll.

Source: @economics Read full article

Source: @economics Read full article

Back to Index

China

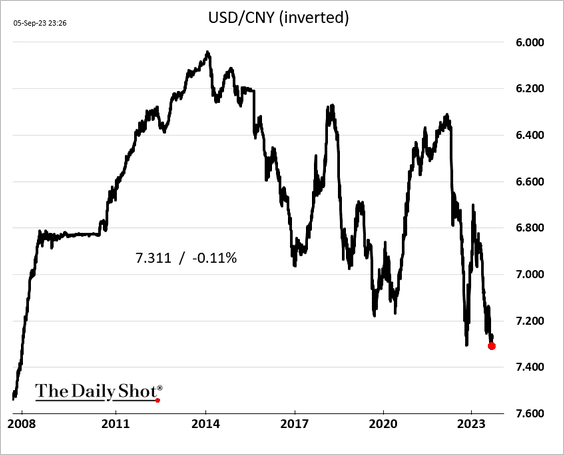

1. The renminbi hit the lowest level vs. USD since 2007.

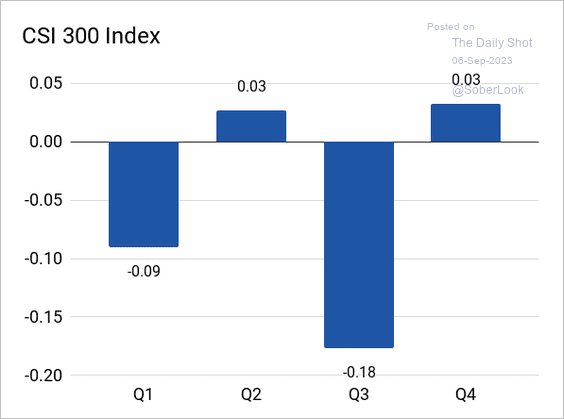

2. Over the past ten years, the CSI 300 Index has typically struggled in Q3.

Source: Kyaw Swar Ye Myint

Source: Kyaw Swar Ye Myint

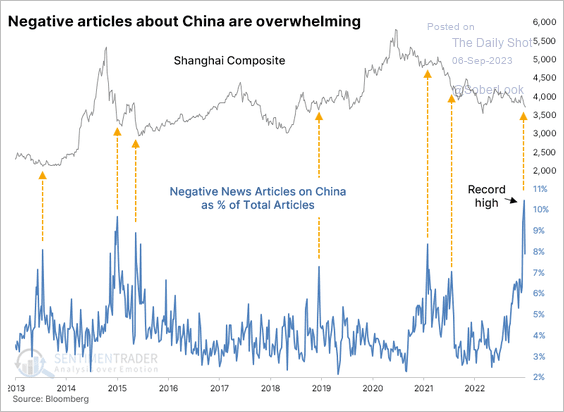

3. News sentiment is extremely negative regarding China.

Source: SentimenTrader

Source: SentimenTrader

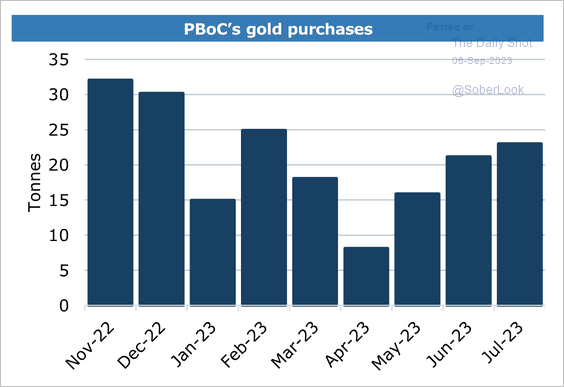

4. The PBoC increased its gold stash this year. According to ANZ, a reduction of Treasury holdings and efforts to reduce its exposure to the dollar may have been behind this move.

Source: @ANZ_Research

Source: @ANZ_Research

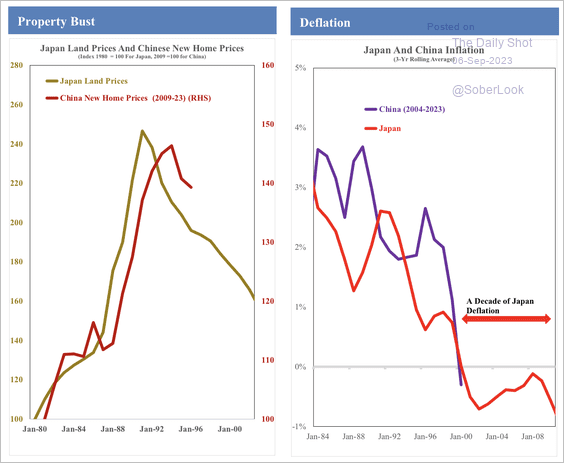

5. China’s property bust and deflation path look similar to Japan’s.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

Back to Index

Emerging Markets

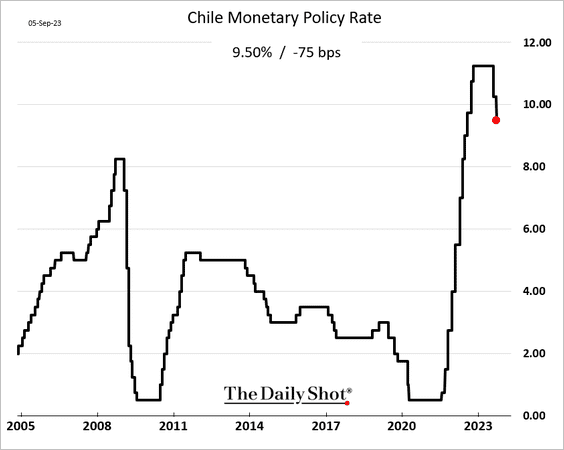

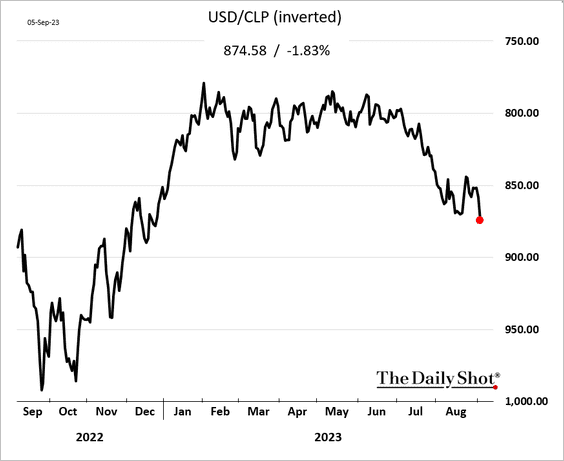

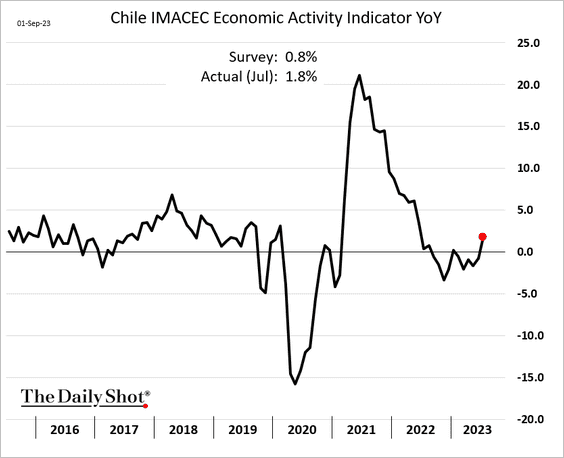

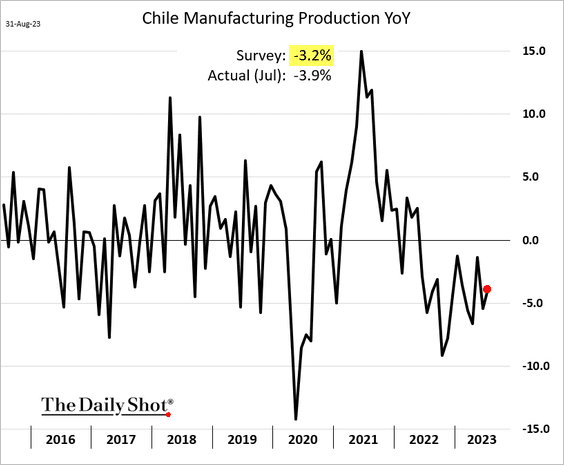

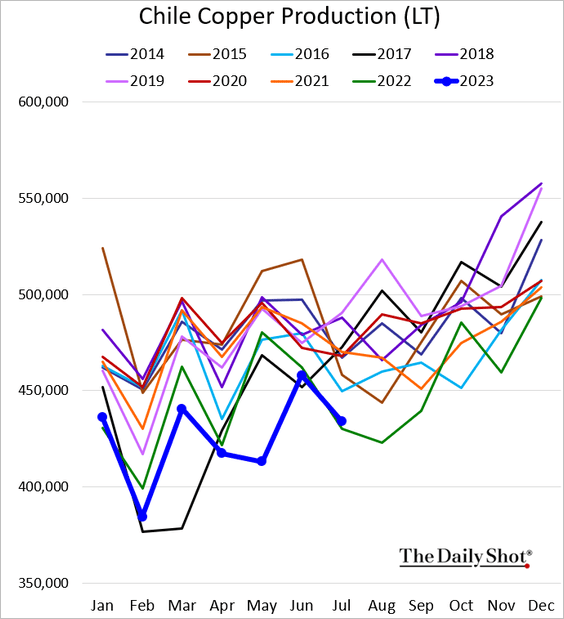

1. Let’s begin with Chile.

• Another aggressive rate cut:

• The Chilean peso (a sharp decline):

• Economic activity:

• Industrial production:

• Copper output (in line with 2022):

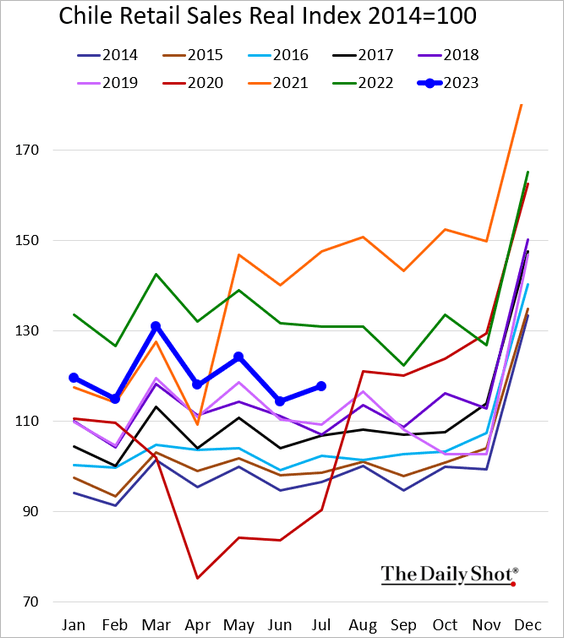

• Retail sales:

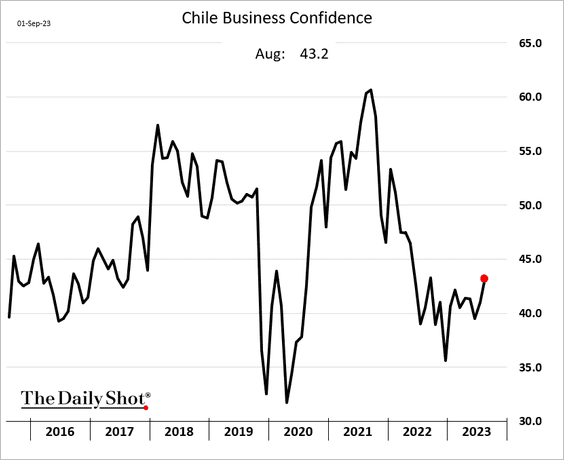

• Business confidence:

——————–

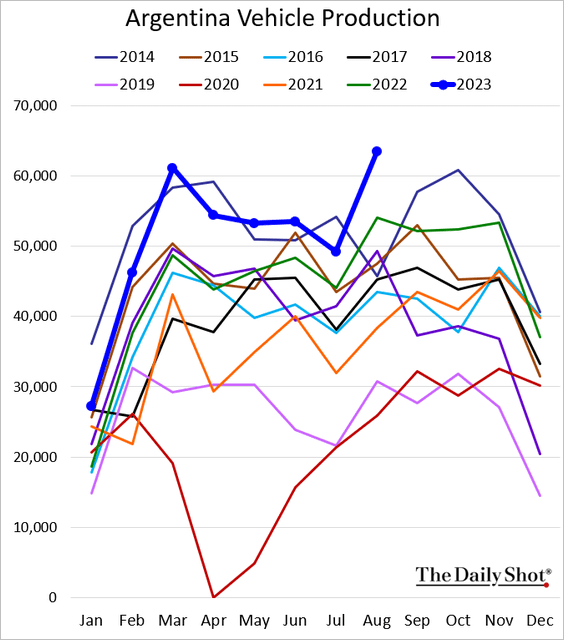

2. Argentina’s vehicle production hit a multi-year high.

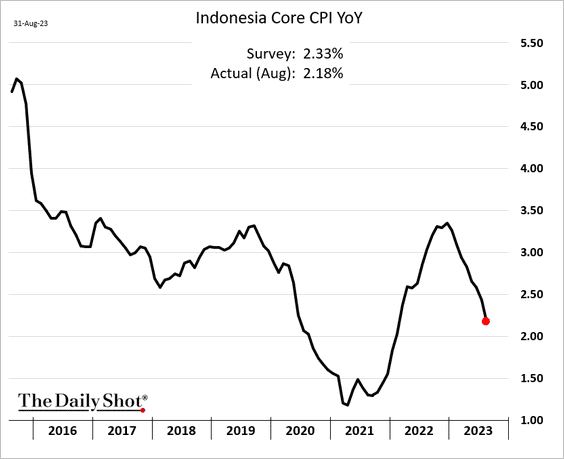

3. Indonesia’s CPI continues to moderate.

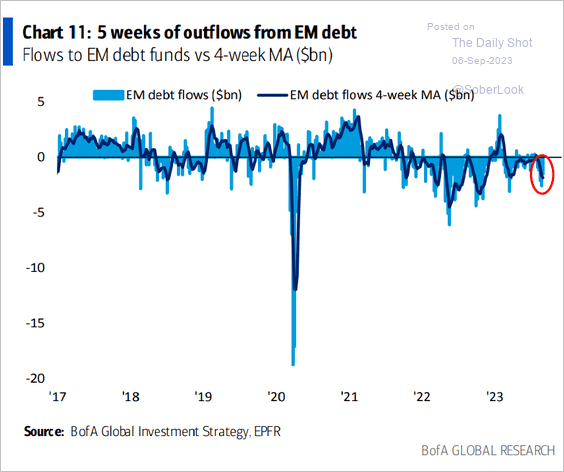

4. EM debt funds keep seeing outflows.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Commodities

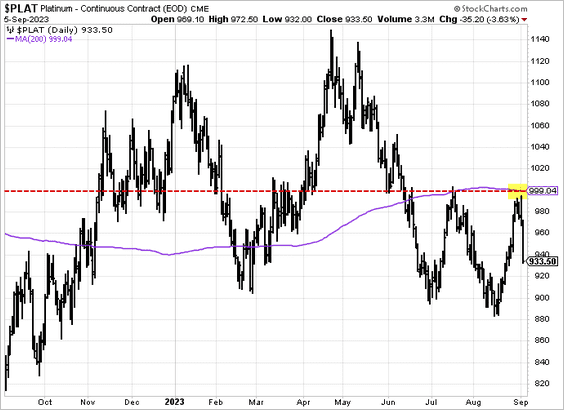

1. Platinum hit resistance near $1,000/oz.

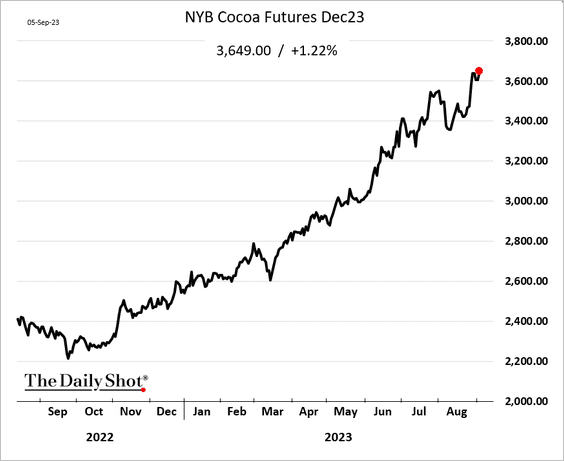

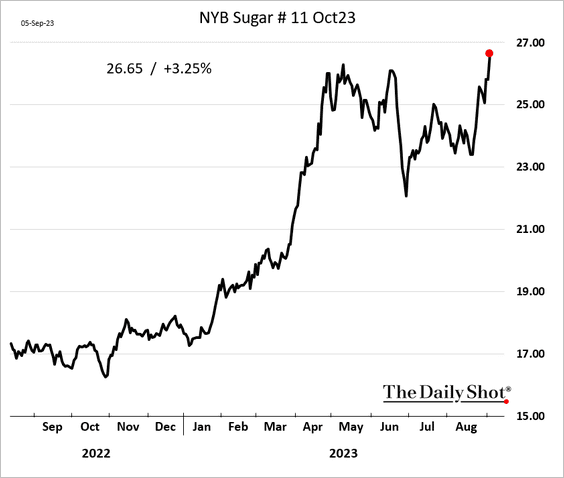

2. Get ready to pay up for Halloween candy (2 charts).

——————–

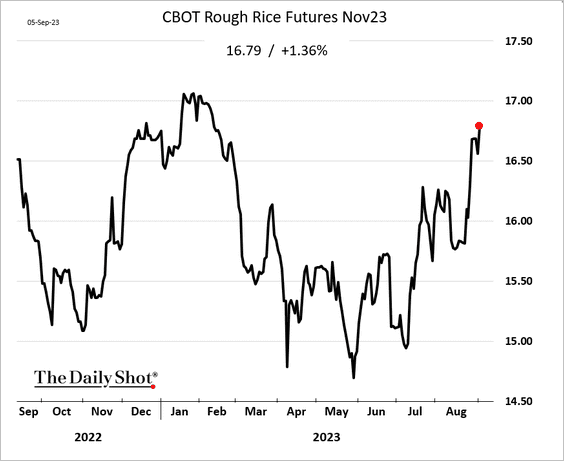

3. Rice futures keep climbing.

Source: @markets Read full article

Source: @markets Read full article

——————–

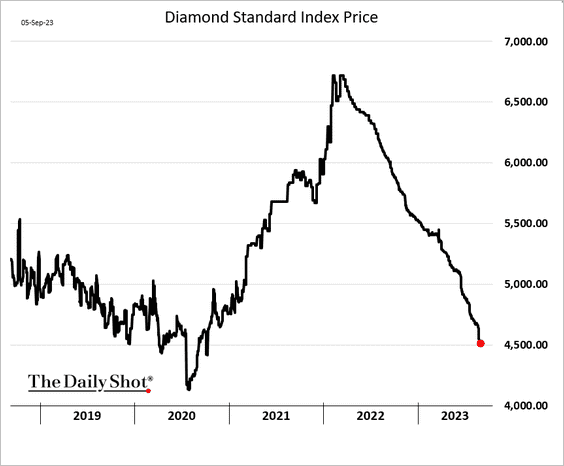

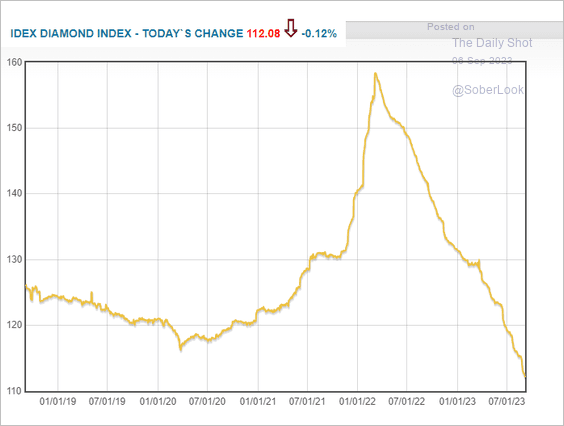

4. The diamond market has been under pressure.

Source: IDEX

Source: IDEX

Source: @luxury Read full article

Source: @luxury Read full article

Back to Index

Energy

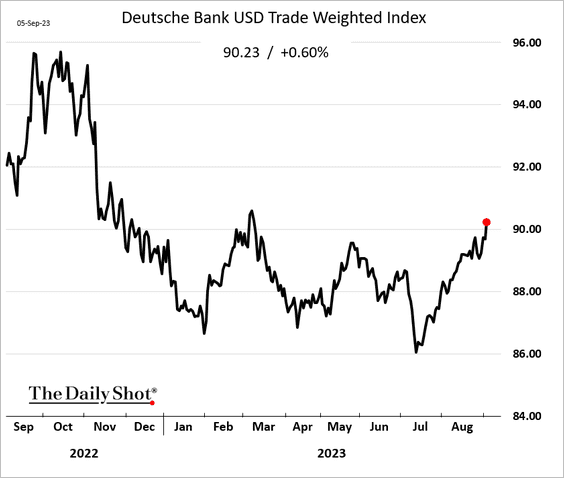

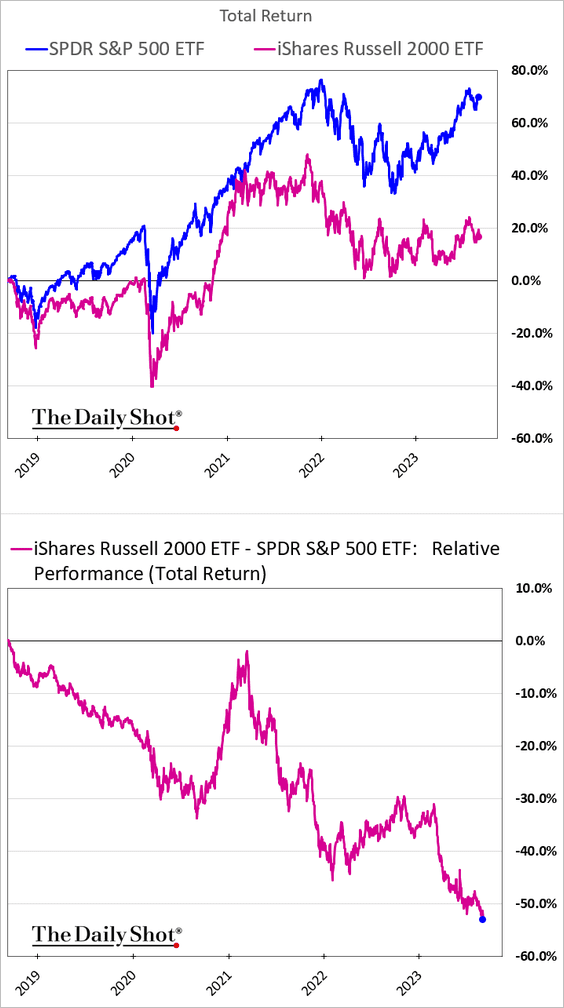

1. Brent futures broke above $90/bbl.

… despite the US dollar’s surge.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

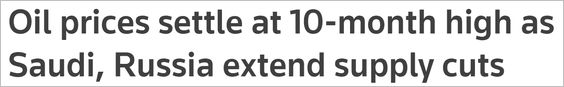

2. It was a good first half of the year for US crude oil and natural gas production.

Source: @JKempEnergy

Source: @JKempEnergy

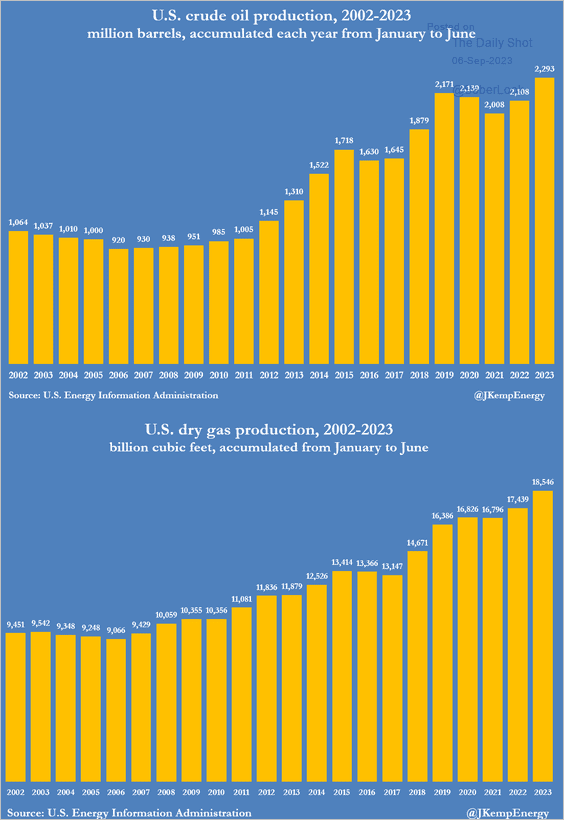

3. Energy capex is starting to rise outside of the US.

Source: The Crude Chronicles

Source: The Crude Chronicles

Back to Index

Equities

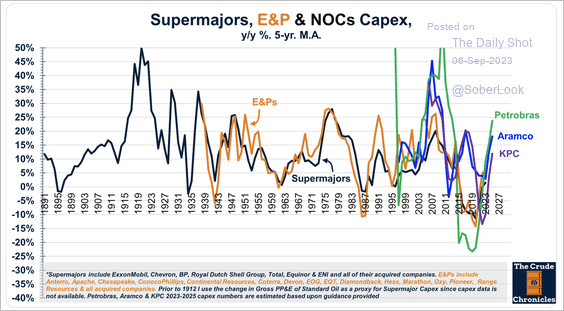

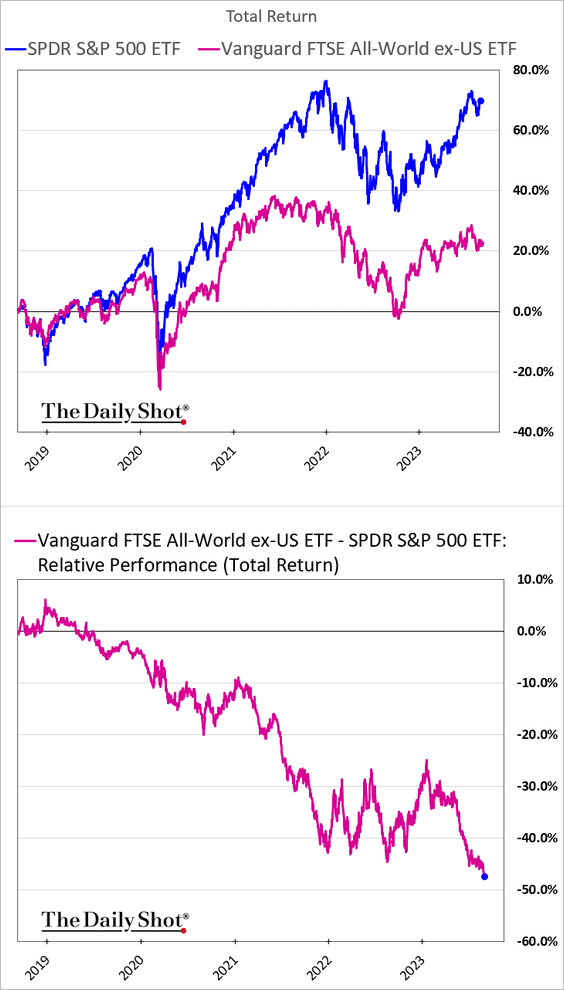

1. US small caps continue to lose ground to the S&P 500.

The same holds true for international shares.

h/t @MikeZaccardi

h/t @MikeZaccardi

——————–

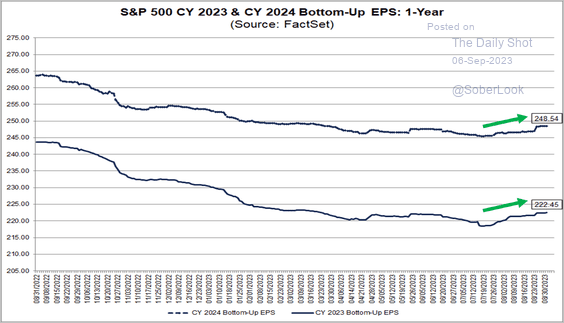

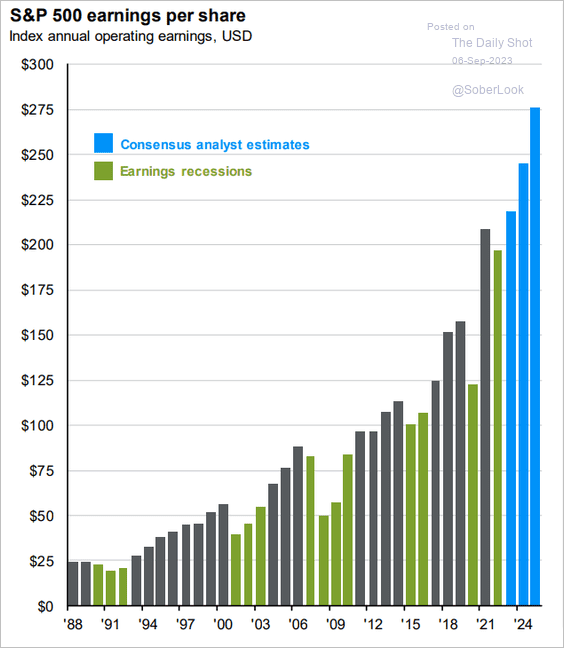

2. Analysts continue to upgrade earnings estimates.

Source: @FactSet Read full article

Source: @FactSet Read full article

Are the projections too optimistic?

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

——————–

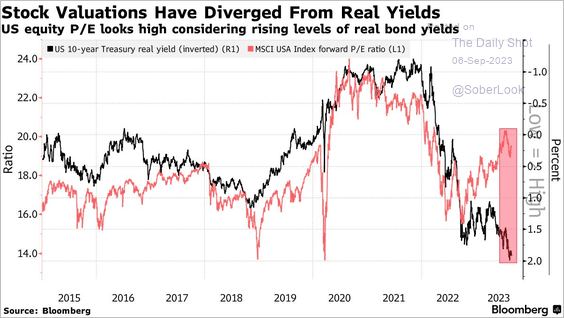

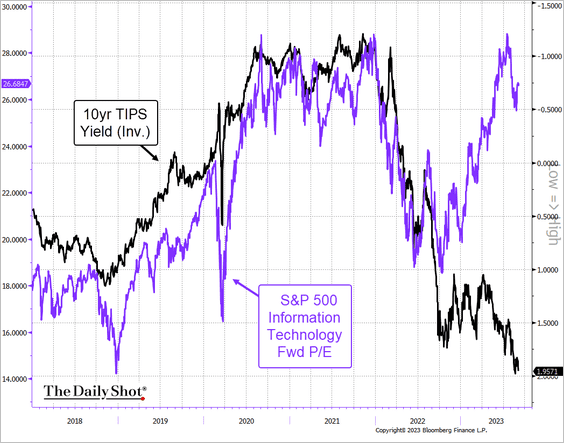

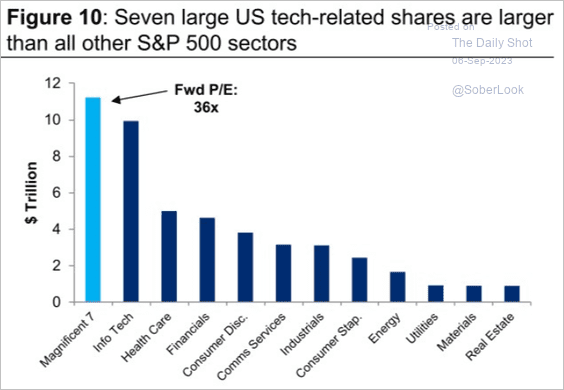

3. Elevated real rates suggest that valuations are stretched, …

Source: @markets Read full article

Source: @markets Read full article

… especially in tech.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

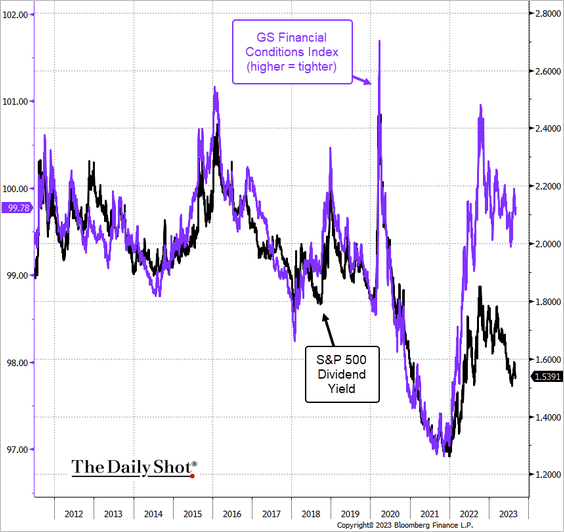

4. Tighter financial conditions typically correspond to higher dividend yields.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

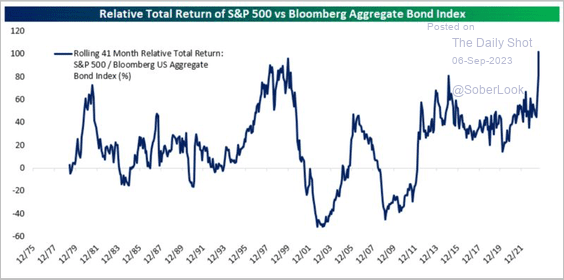

5. The total return of US stocks relative to bonds spiked since the pandemic low and is at the highest level since the dot-com bubble.

Source: @bespokeinvest

Source: @bespokeinvest

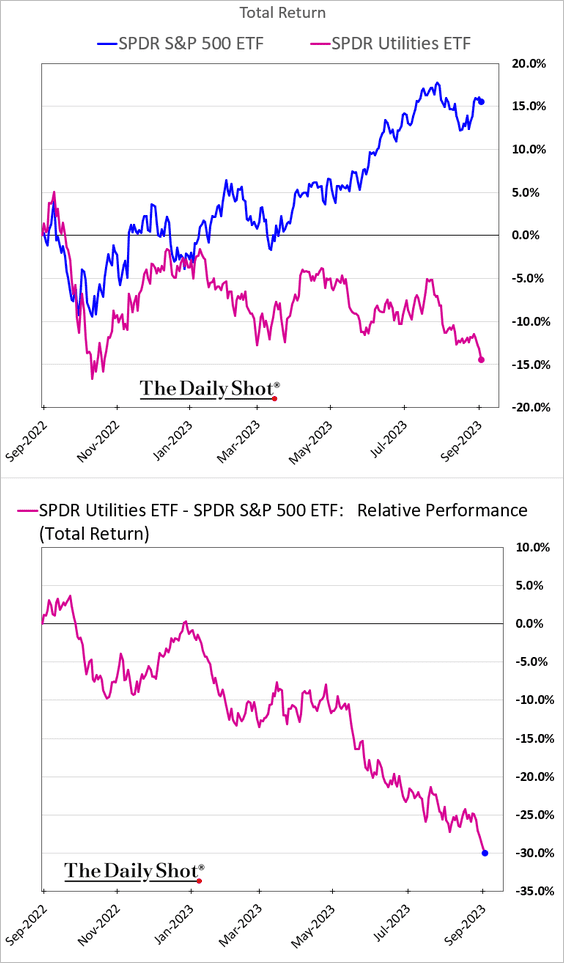

6. Next, we have some sector trends.

• Utilities:

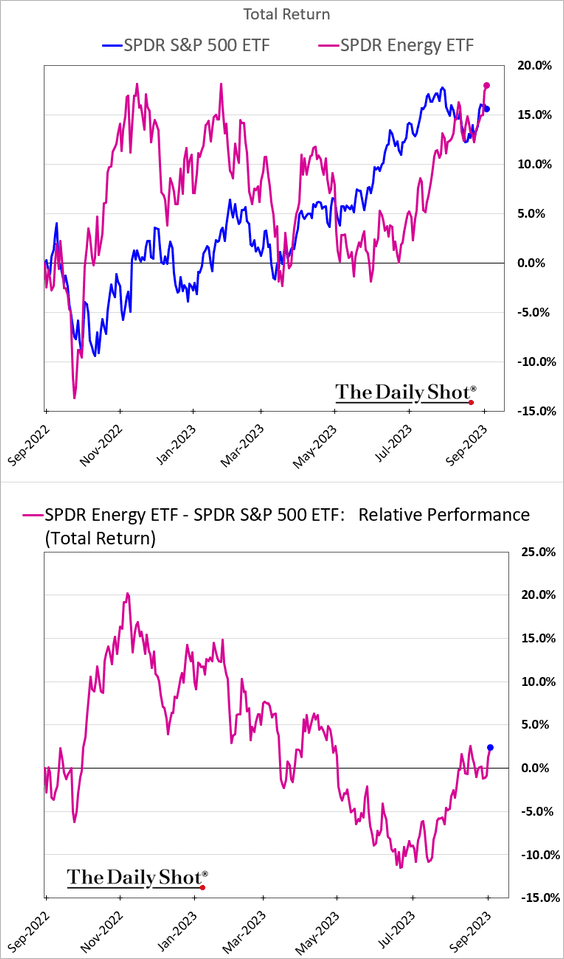

• Energy (leadership returns):

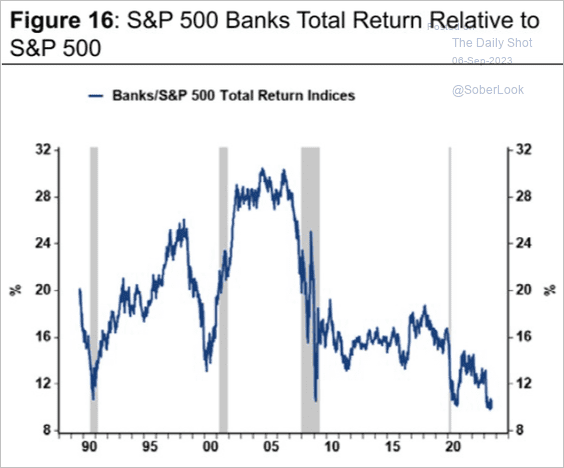

• Banks:

Source: Citi Private Bank

Source: Citi Private Bank

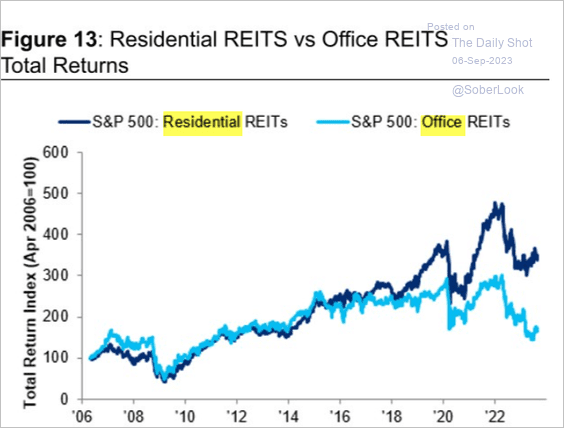

• REITs:

Source: Citi Private Bank

Source: Citi Private Bank

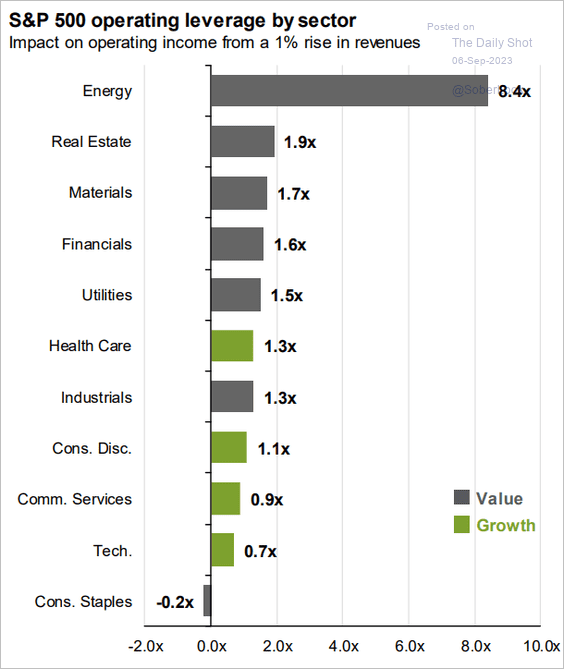

• Operating leverage by sector:

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

• Mega-caps in perspective:

Source: Citi Private Bank

Source: Citi Private Bank

Back to Index

Credit

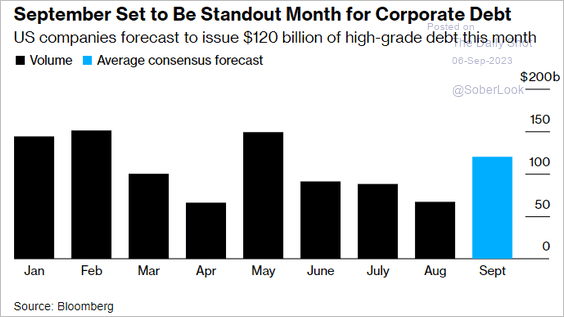

1. It’s going to be a busy month for corporate bond issuance, …

Source: @markets Read full article

Source: @markets Read full article

… which is pressuring the Treasury market.

Source: Yahoo Finance Read full article

Source: Yahoo Finance Read full article

——————–

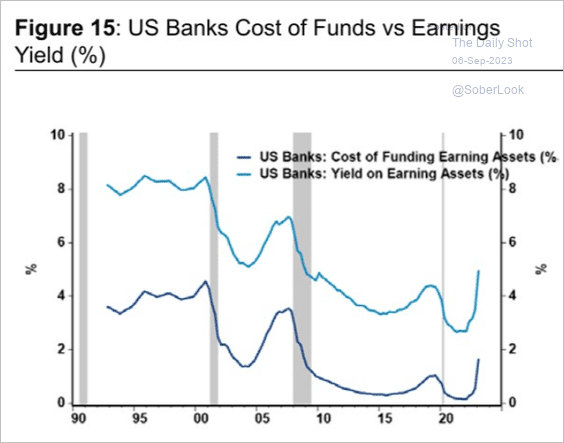

2. Banks’ cost of funds surged this year.

Source: Citi Private Bank

Source: Citi Private Bank

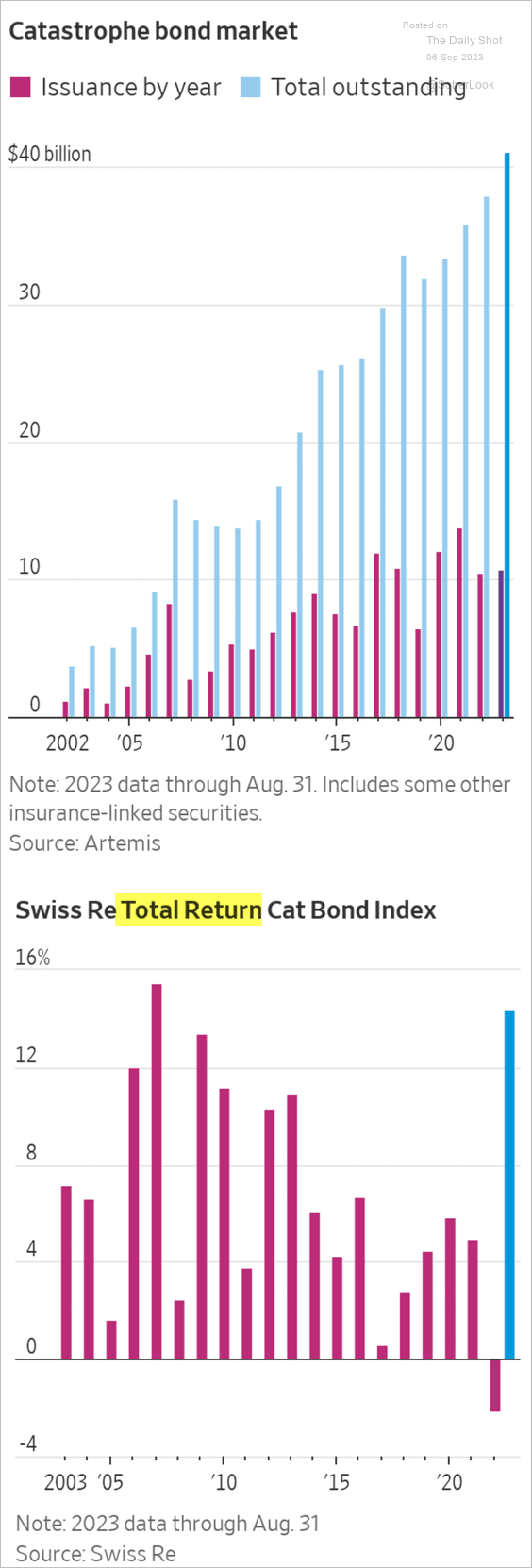

3. The cat bond market continues to expand.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Food for Thought

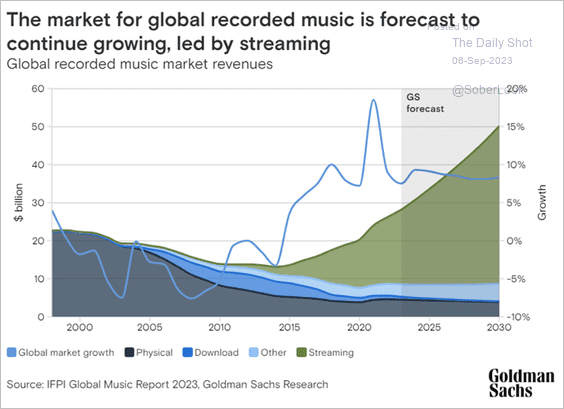

1. The market for recorded music:

Source: Goldman Sachs

Source: Goldman Sachs

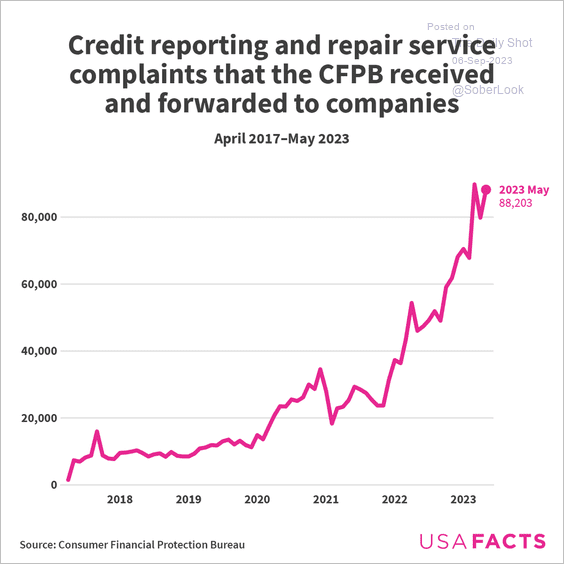

2. Complaints against credit reporting and repair service firms:

Source: USAFacts

Source: USAFacts

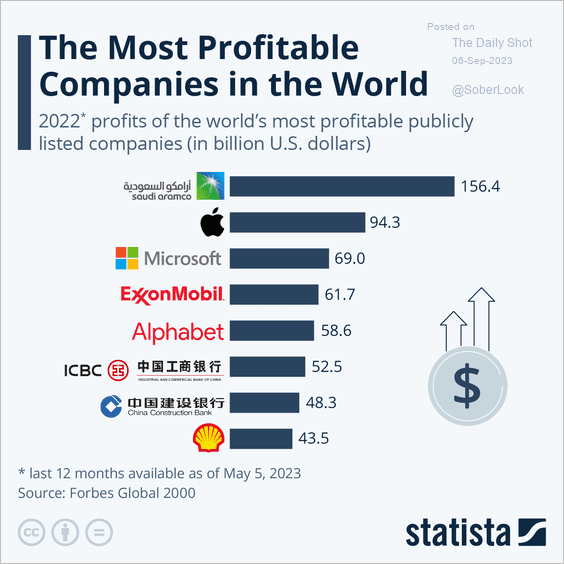

3. The most profitable companies:

Source: Statista

Source: Statista

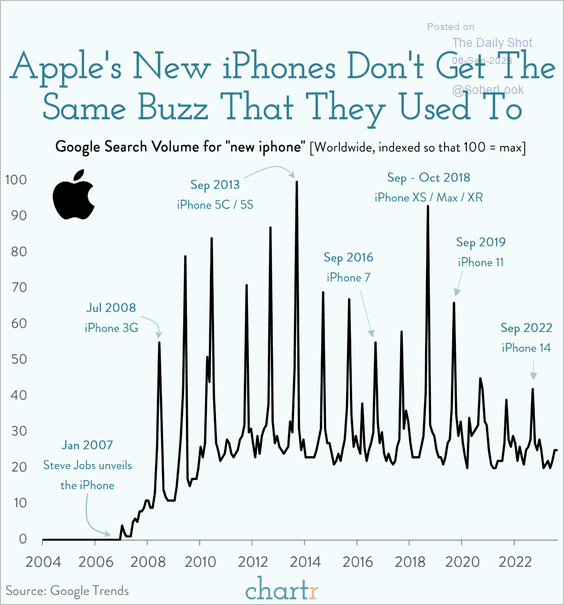

4. Search activity for “new iPhone”:

Source: @chartrdaily

Source: @chartrdaily

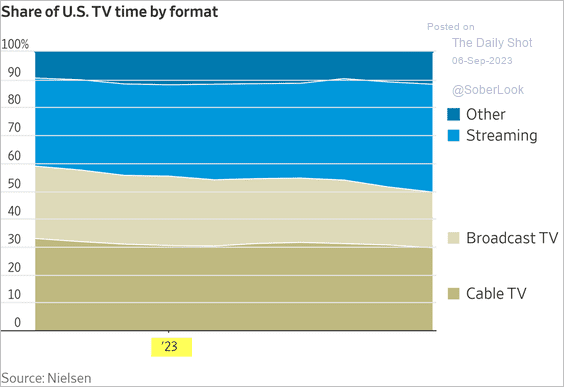

5. Viewing time by format:

Source: @WSJ Read full article

Source: @WSJ Read full article

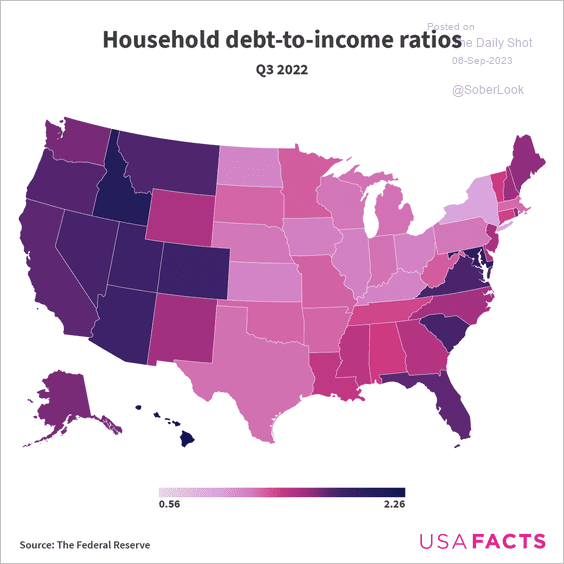

6. Debt-to-income ratios:

Source: USAFacts

Source: USAFacts

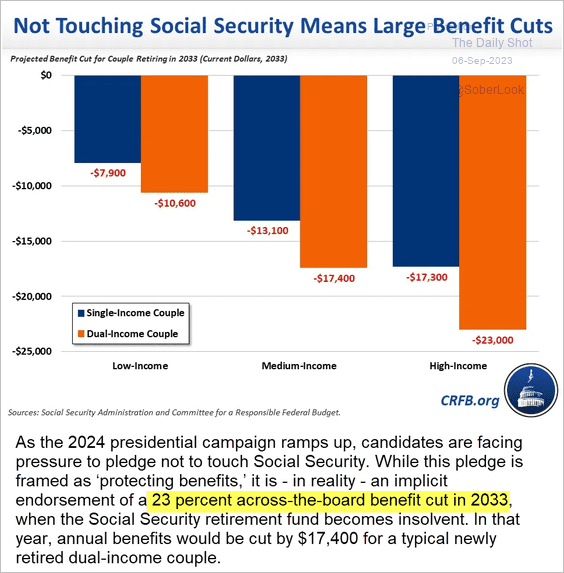

7. Automatic Social Security benefit cuts after the fund becomes insolvent in ten years:

Source: Committee for a Responsible Federal Budget

Source: Committee for a Responsible Federal Budget

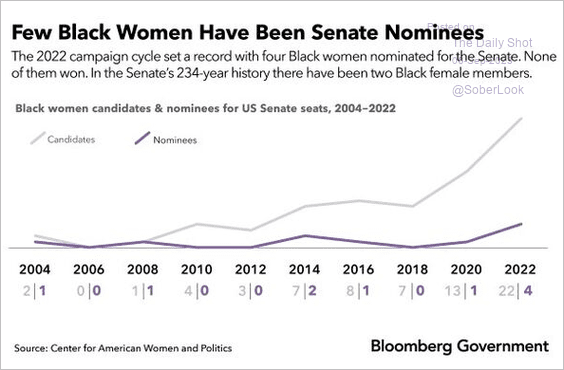

8. Black women candidates and nominees for the US Senate:

Source: Bloomberg Government Read full article

Source: Bloomberg Government Read full article

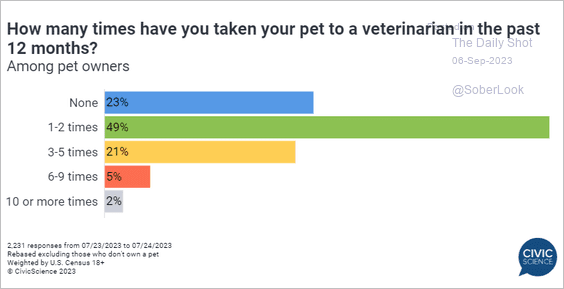

9. Trips to the veterinarian:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

——————–

Back to Index