The Daily Shot: 22-Aug-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

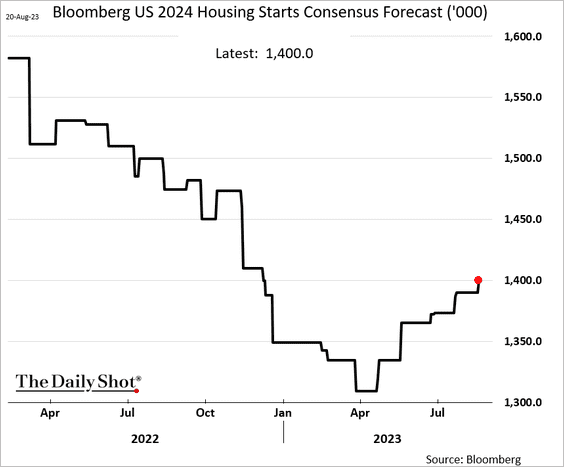

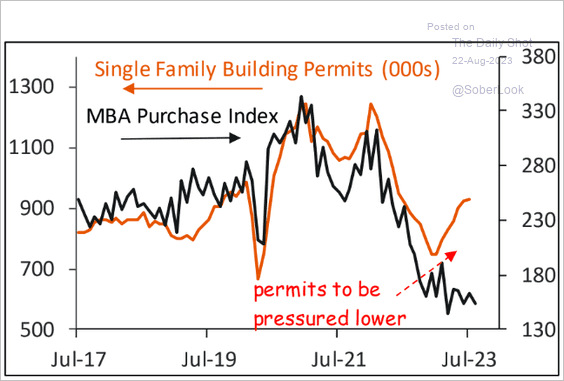

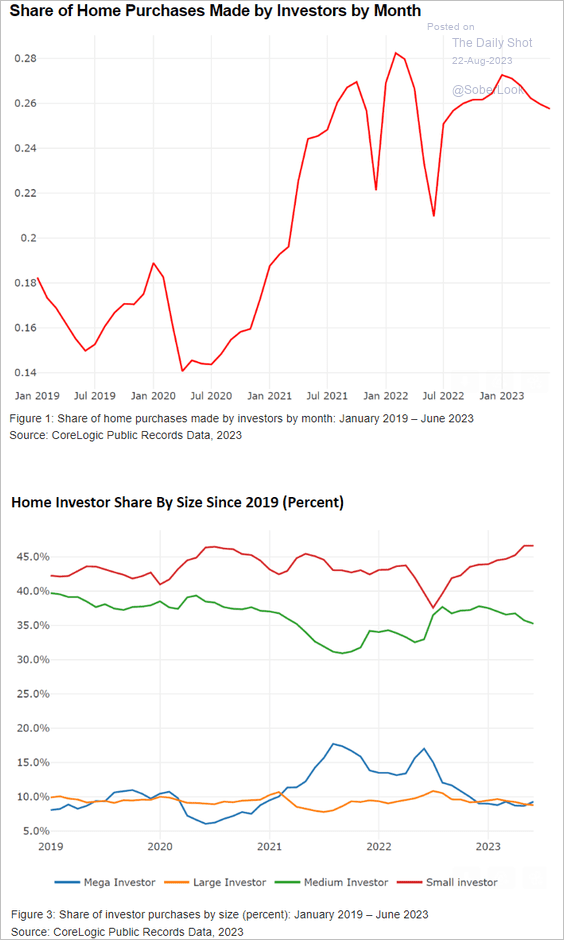

1. Let’s begin with some updates on the housing market.

• Economists have been upgrading their forecasts for next year’s housing starts.

• But residential construction is facing headwinds this year.

Source: Piper Sandler

Source: Piper Sandler

• The share of home purchases made by investors remains elevated.

Source: CoreLogic

Source: CoreLogic

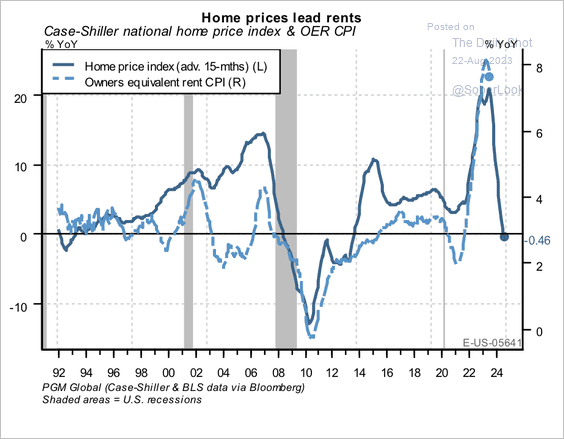

2. Home prices typically lead to the owner’s equivalent rent CPI by 18-24 months.

Source: PGM Global

Source: PGM Global

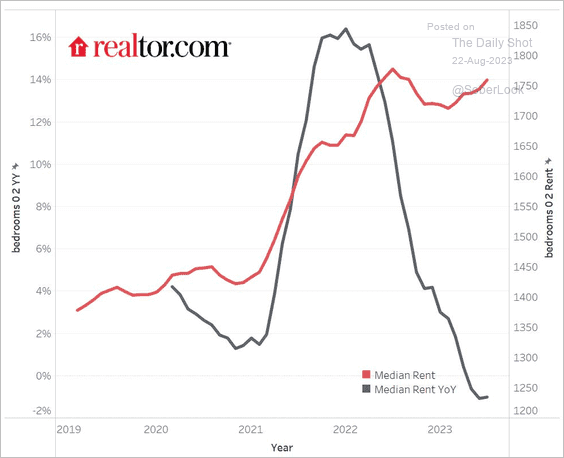

3. While rents are down on a year-over-year basis, they continue to rise.

Source: realtor.com

Source: realtor.com

——————–

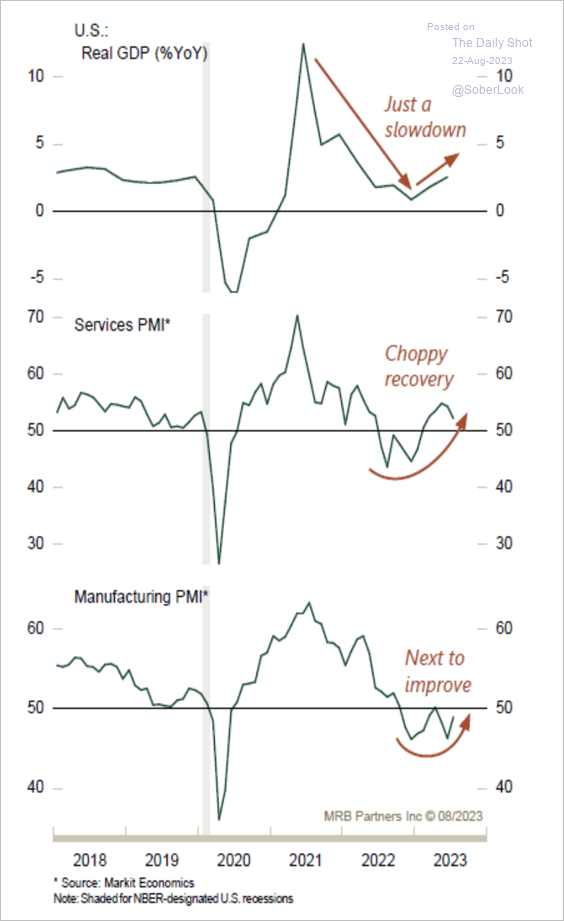

4. So far, the US economy has been resilient.

Source: MRB Partners

Source: MRB Partners

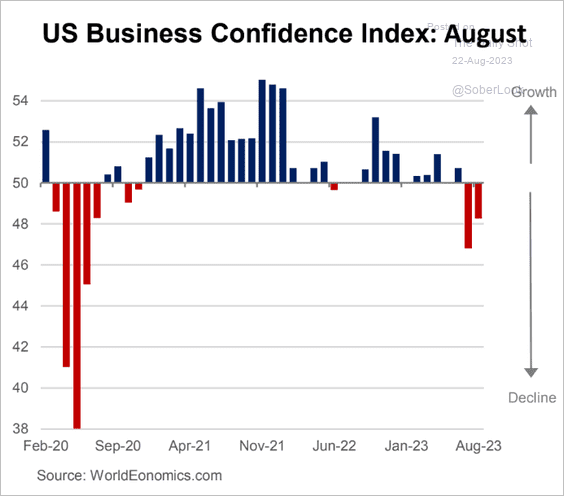

5. The World Economics SMI report shows that business confidence continued to deteriorate in August.

Source: World Economics

Source: World Economics

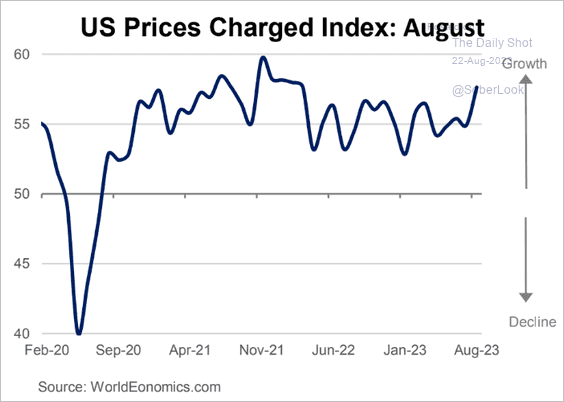

• Companies accelerated price hikes this month.

Source: World Economics

Source: World Economics

——————–

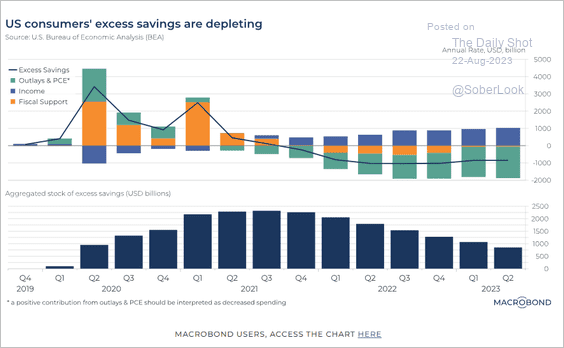

6. This chart shows the drivers of consumers’ excess savings.

Source: Macrobond

Source: Macrobond

Back to Index

Canada

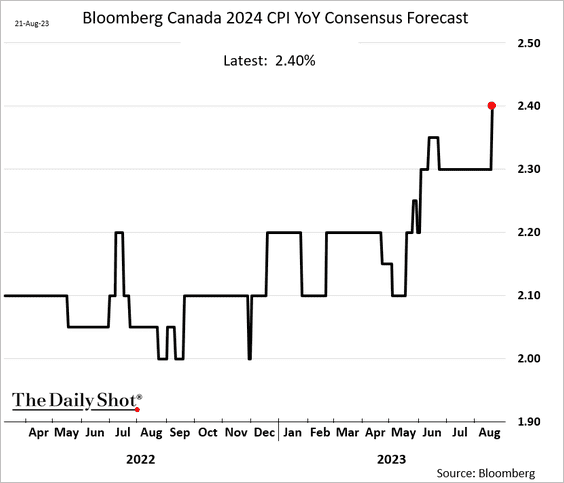

1. Economists are boosting their forecasts for next year’s CPI.

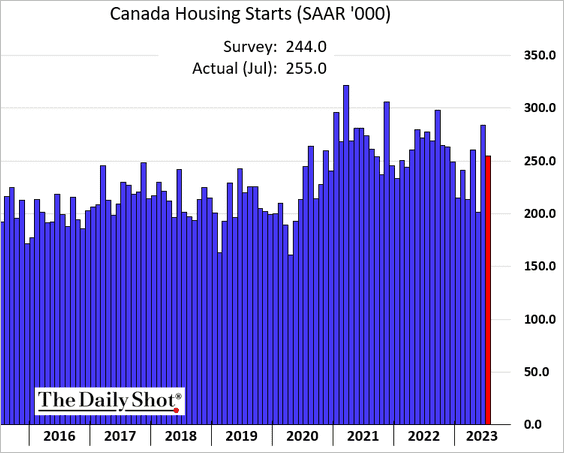

2. July housing starts were stronger than expected.

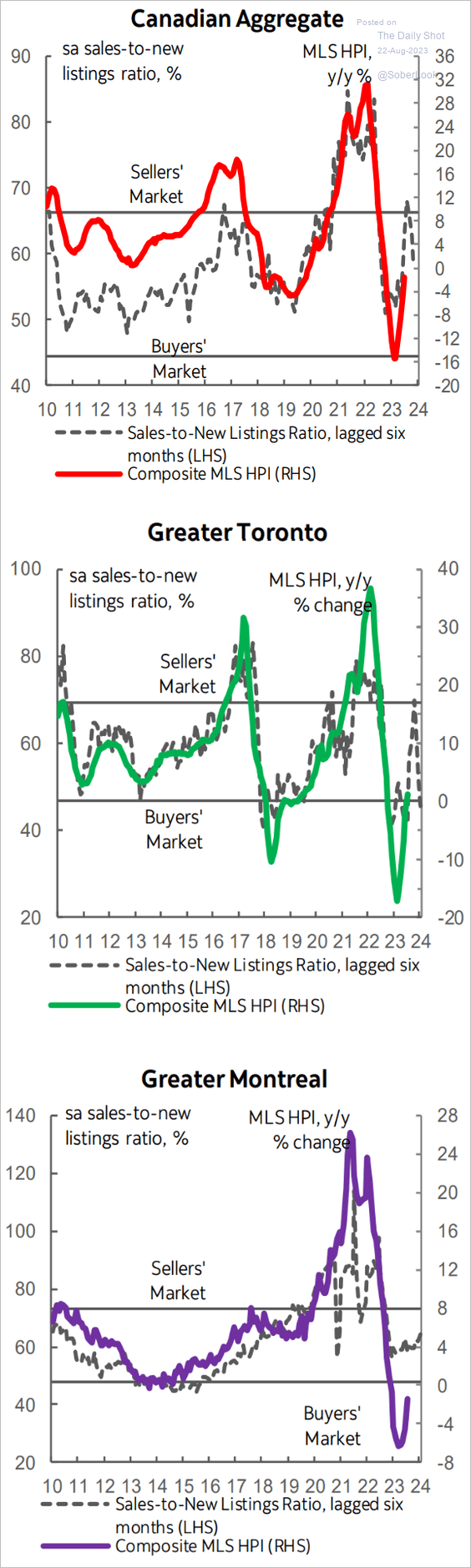

3. Home prices are rebounding.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

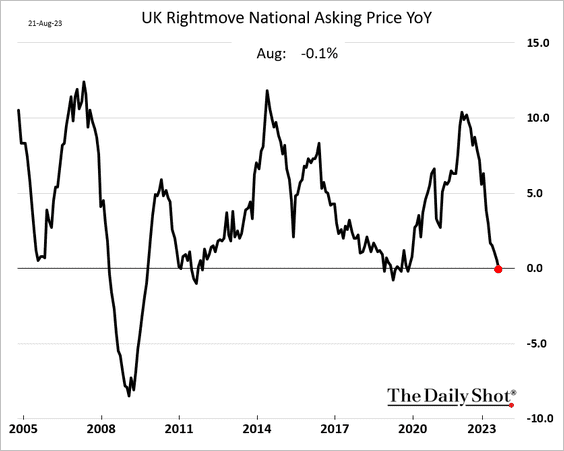

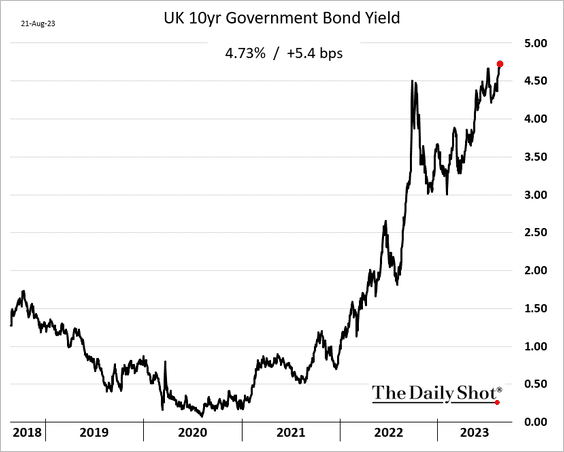

The United Kingdom

1. Housing asking prices are now down on a year-over-year basis.

2. Gilt yields continue to climb.

Back to Index

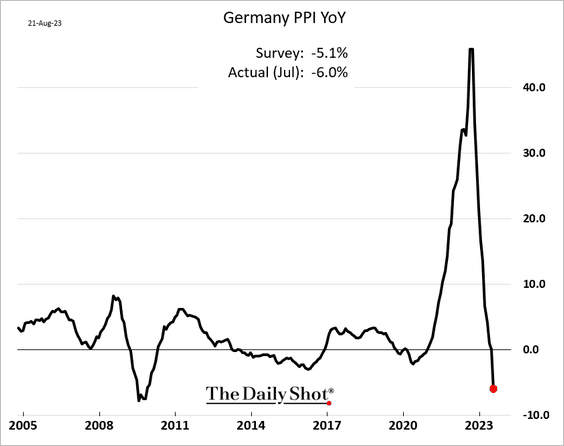

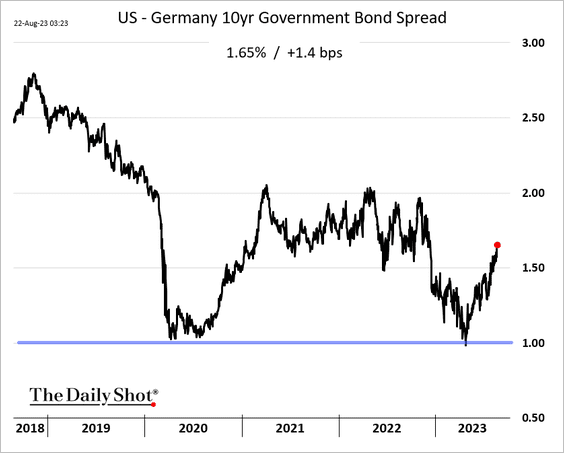

The Eurozone

1. Germany’s producer prices are falling rapidly.

2. The Treasury-Bund spread has been widening.

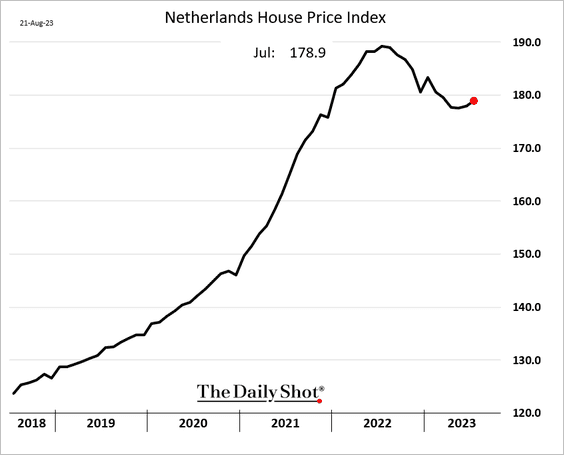

3. Dutch house prices appear to have bottomed.

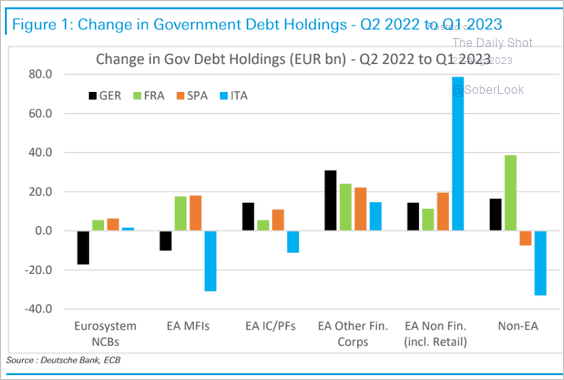

4. Who bought euro-area government debt during the ECB’s current policy tightening?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

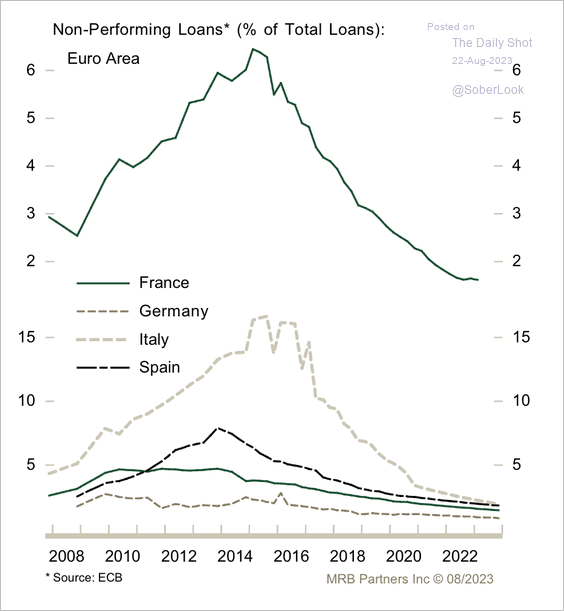

5. The health of the euro area banking system improved in recent years.

Source: MRB Partners

Source: MRB Partners

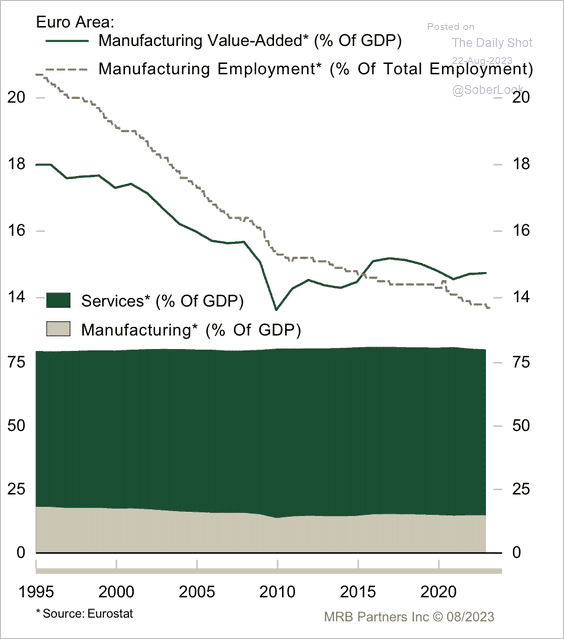

6. Manufacturing is a relatively small portion of the euro area economy.

Source: MRB Partners

Source: MRB Partners

Back to Index

Europe

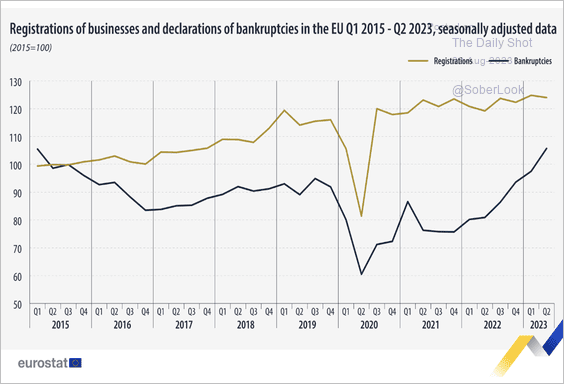

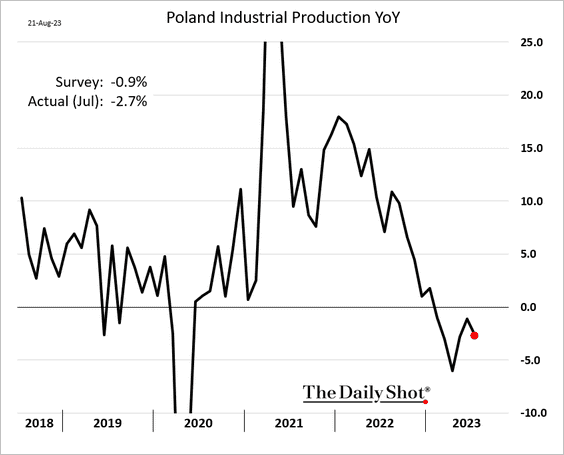

1. Bankruptcies have been rising in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Source: Eurostat Read full article

Source: Eurostat Read full article

——————–

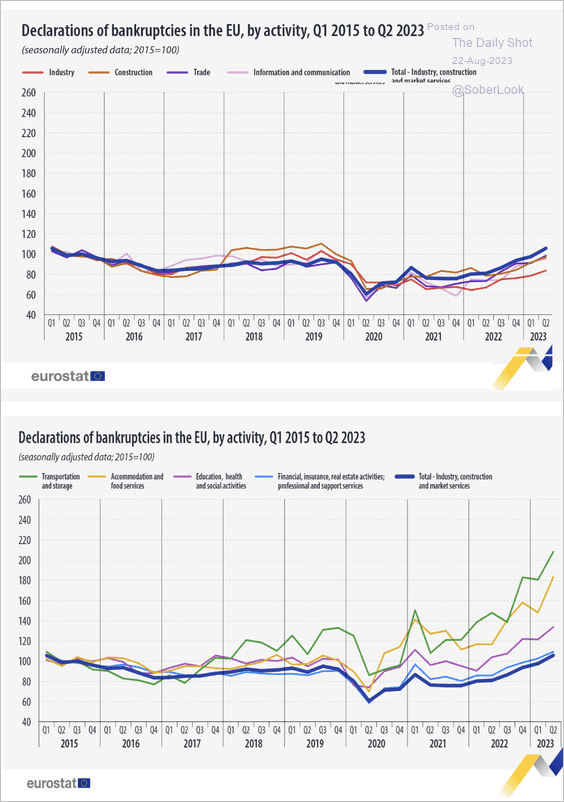

2. This chart shows the share of European electricity generation by source.

Source: @WSJ Read full article

Source: @WSJ Read full article

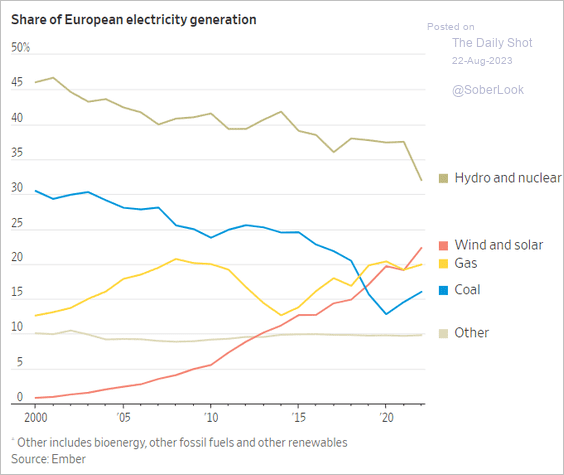

3. Poland’s industrial production remains below last year’s levels.

Back to Index

Asia-Pacific

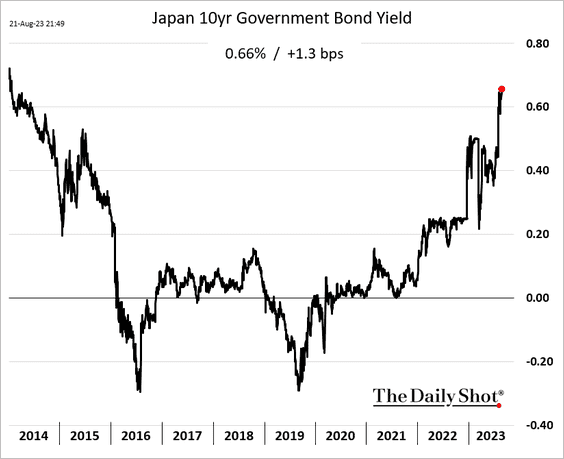

1. JGB yields continue to climb.

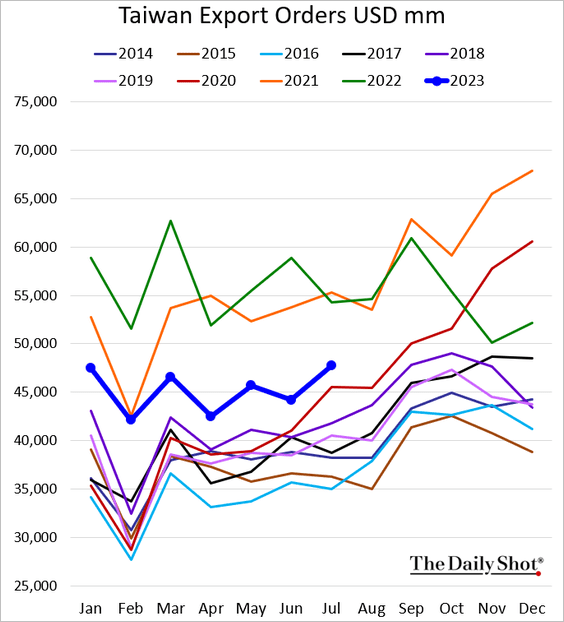

2. Taiwan’s export orders were firmer than expected last month.

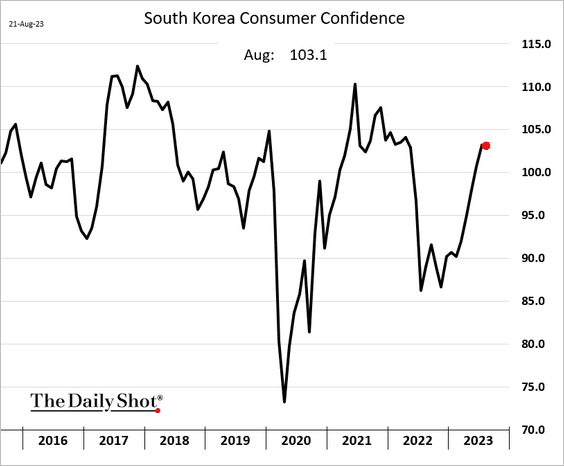

3. South Korea’s consumer confidence is holding up well.

Back to Index

China

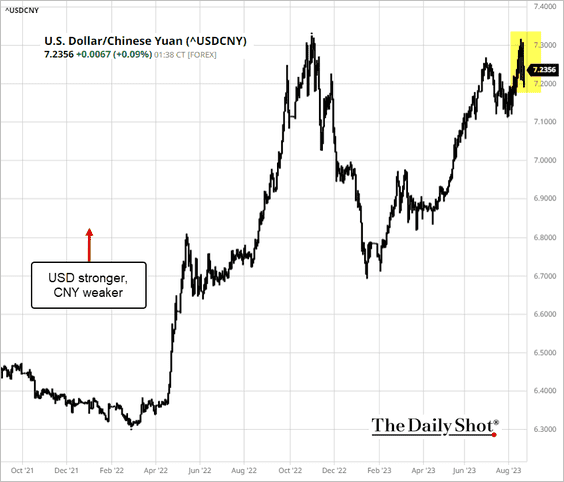

1. Beijing managed to stabilize the renminbi.

Source: barchart.com

Source: barchart.com

Source: @markets Read full article

Source: @markets Read full article

——————–

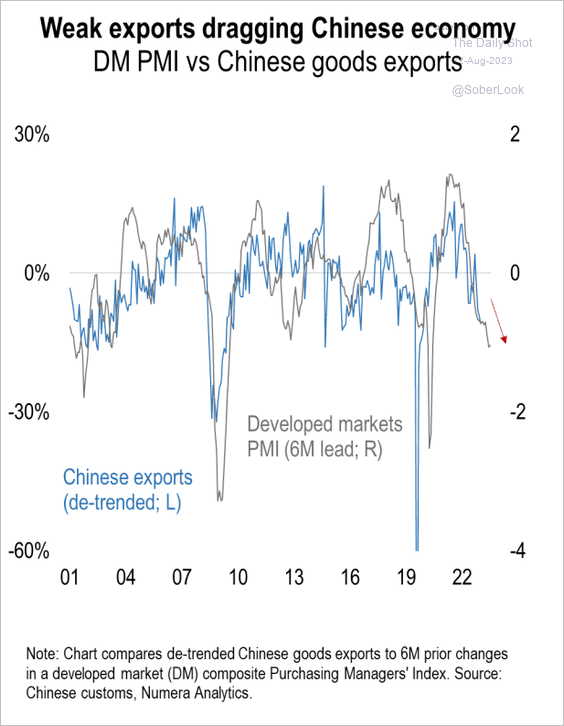

2. Soft business activity in advanced economies has been a drag on China’s exports.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

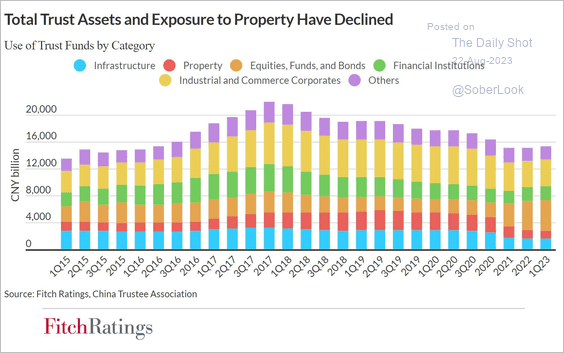

3. Here is a look at trust funds’ exposure to property.

Source: Fitch Ratings

Source: Fitch Ratings

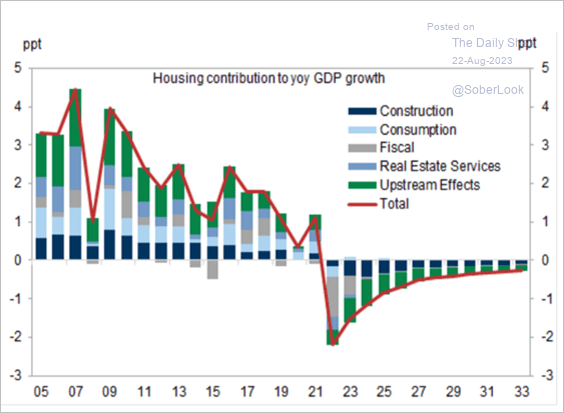

4. The housing shock will be a drag on growth for some time.

Source: Goldman Sachs; III Capital Management

Source: Goldman Sachs; III Capital Management

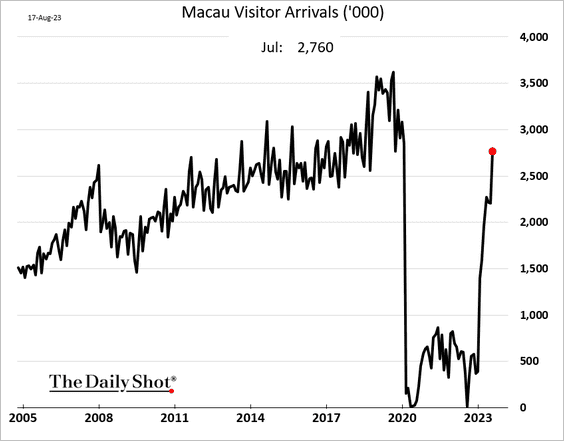

5. Macau visitor numbers continue to rebound.

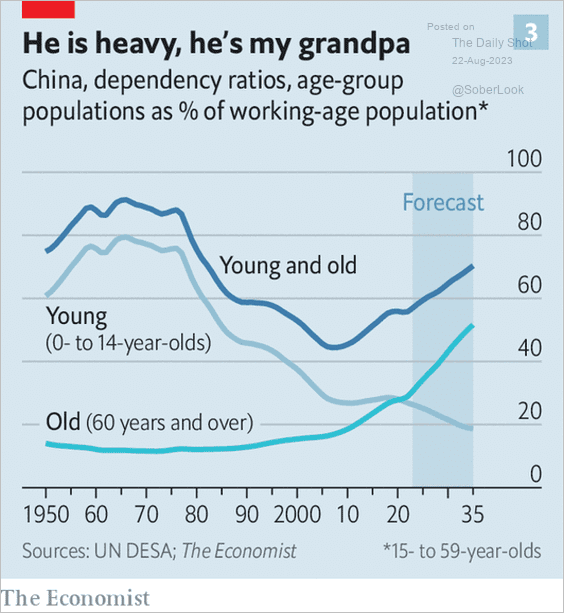

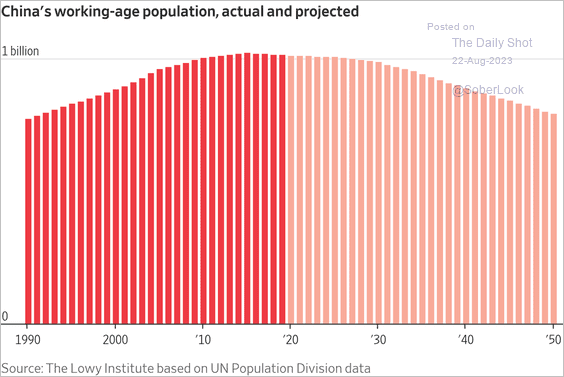

6. Next, we have a couple of demographic trends.

• Dependency ratio:

Source: The Economist Read full article

Source: The Economist Read full article

• Working-age population:

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Emerging Markets

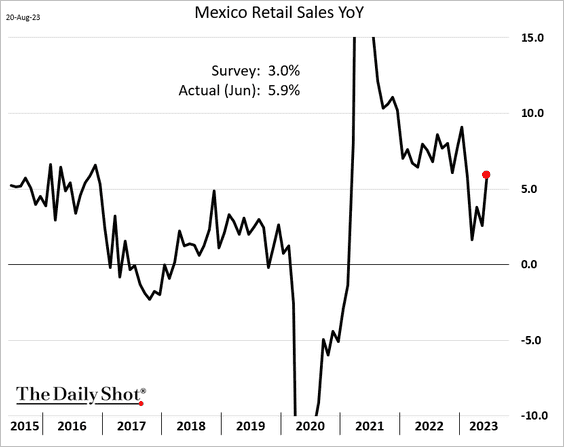

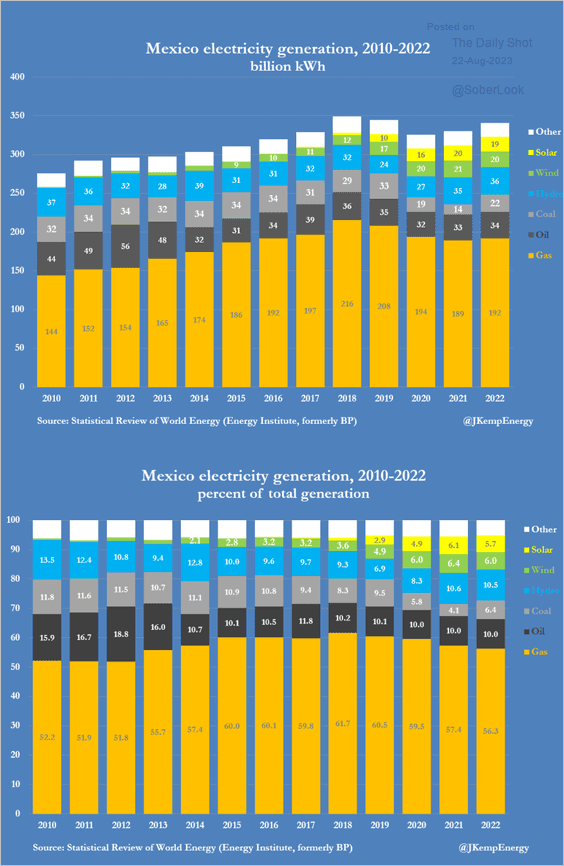

1. Mexican retail sales were stronger than expected in June.

• Here is a look at Mexico’s electricity generation by source.

Source: @JKempEnergy

Source: @JKempEnergy

——————–

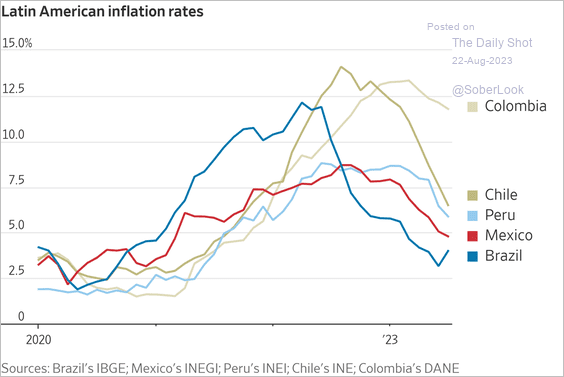

2. Colombia’s CPI decline is lagging behind other LatAm economies.

Source: @WSJ Read full article

Source: @WSJ Read full article

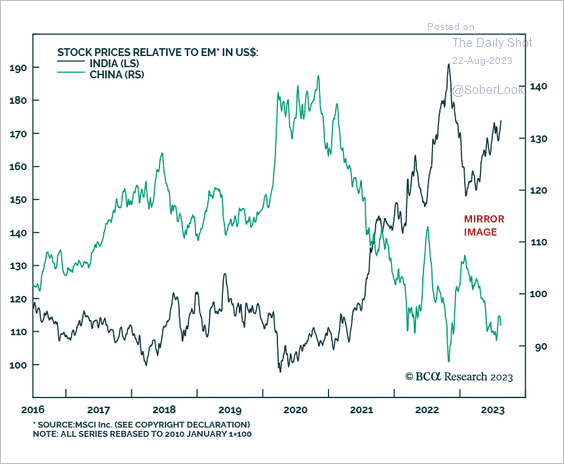

3. How long will equity investors keep rotating from China to India?

Source: BCA Research

Source: BCA Research

Back to Index

Cryptocurrency

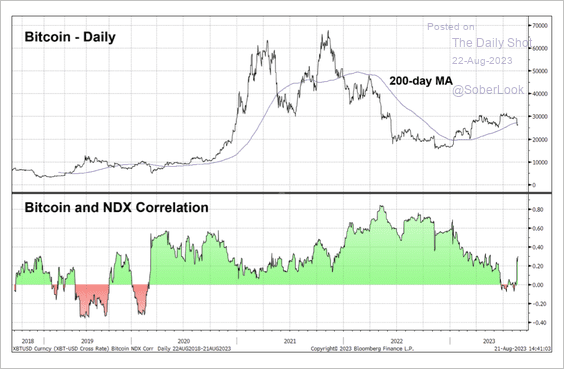

1. The correlation between bitcoin and the Nasdaq 100 Index spiked last week during the crypto sell-off.

Source: @StocktonKatie

Source: @StocktonKatie

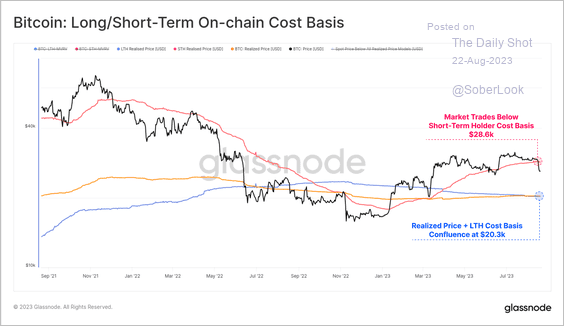

2. Bitcoin dipped below the average short-term holders’ cost basis.

Source: Glassnode Read full article

Source: Glassnode Read full article

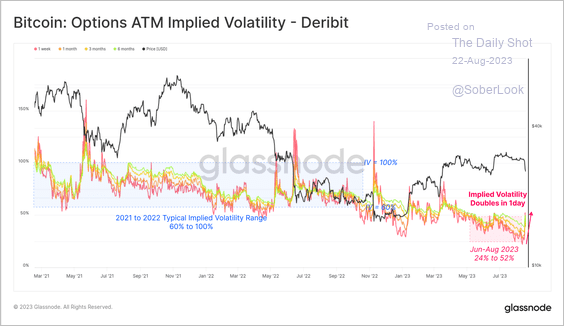

3. Implied volatility in the bitcoin options market spiked from historically low levels during last week’s sell-off.

Source: Glassnode Read full article

Source: Glassnode Read full article

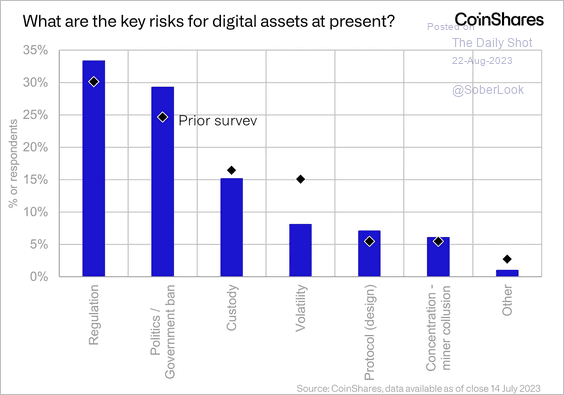

4. Fund managers are most concerned about crypto regulations, according to a survey by CoinShares.

Source: CoinShares Read full article

Source: CoinShares Read full article

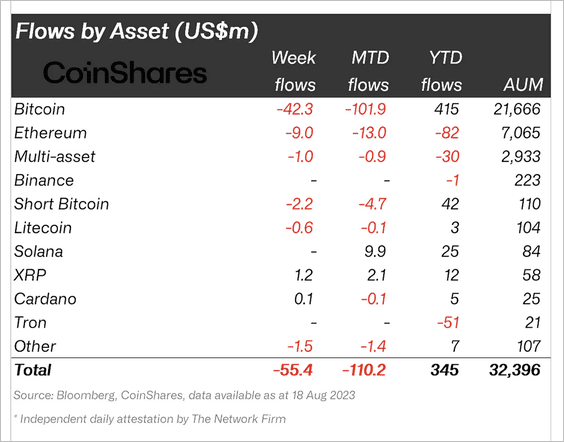

5. Crypto funds saw outflows last week, led by long-bitcoin products.

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

Energy

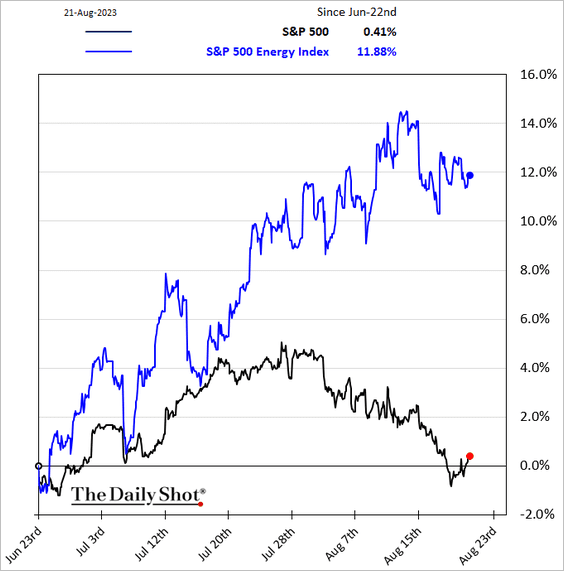

1. Energy shares have been outperforming.

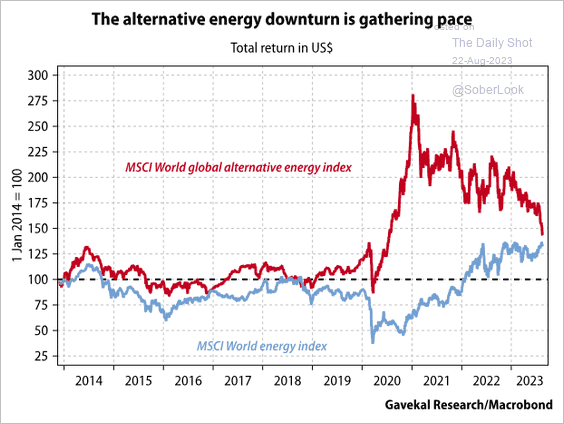

But the rout in alternative energy shares has accelerated.

Source: Gavekal Research

Source: Gavekal Research

——————–

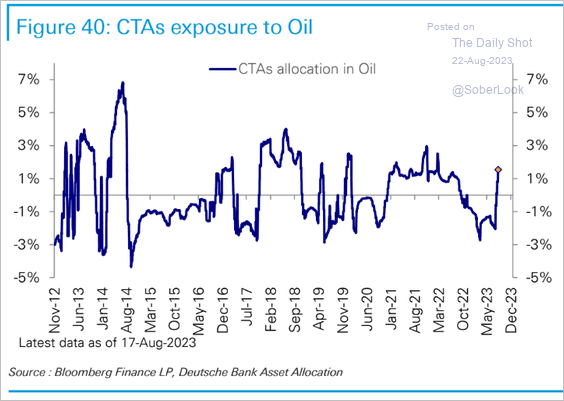

2. CTAs have warmed up to crude oil.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Equities

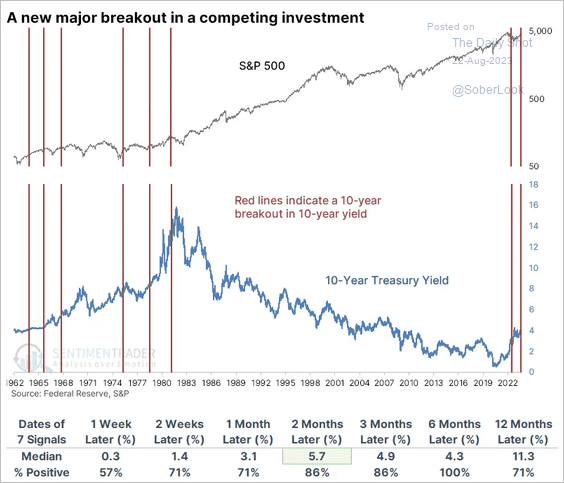

1. A breakout in the 10-year Treasury yield is not always bearish for stocks.

Source: @jasongoepfert

Source: @jasongoepfert

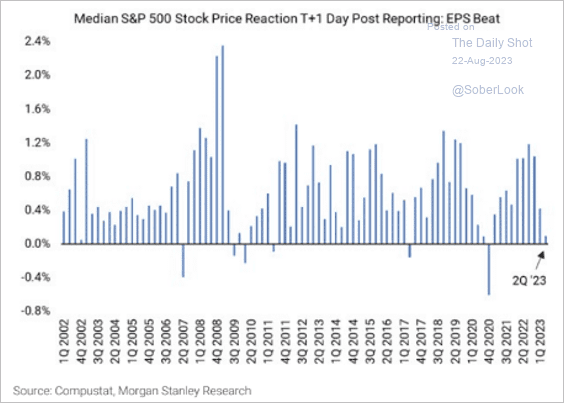

2. The market didn’t cheer the Q2 earnings beats the way it typically does.

Source: Morgan Stanley Research; @AyeshaTariq

Source: Morgan Stanley Research; @AyeshaTariq

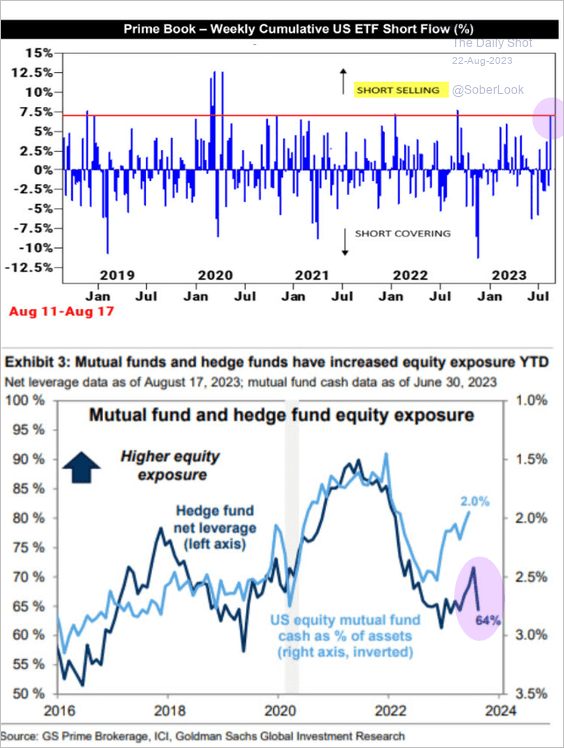

3. Hedge funds have been trimming their equity exposure.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

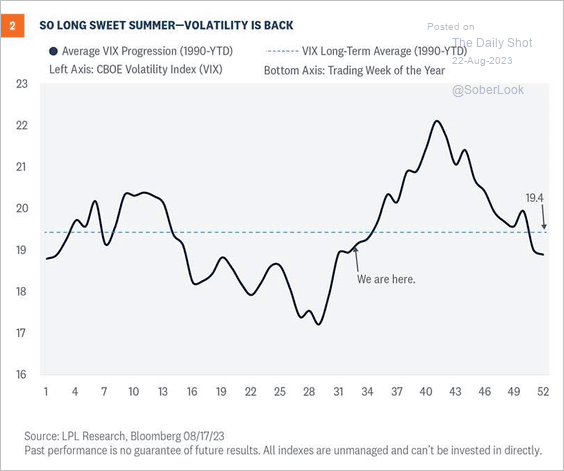

4. Volatility typically rises as summer ends.

Source: LPL Research

Source: LPL Research

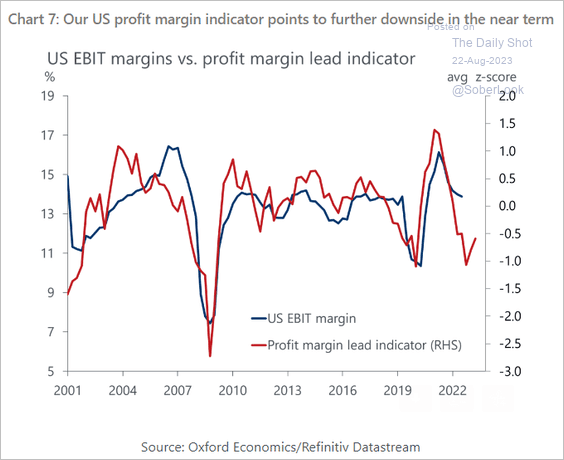

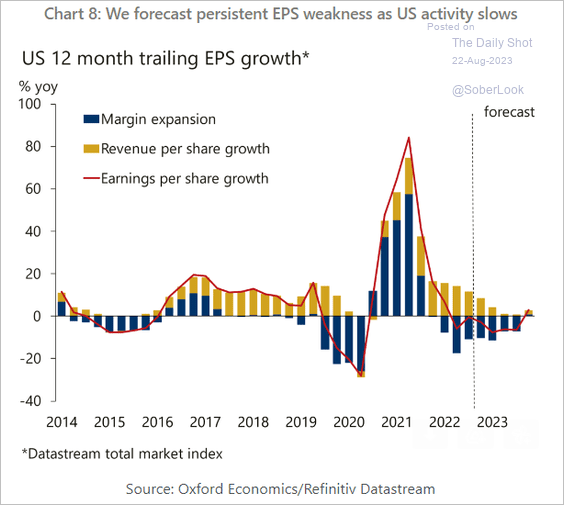

5. A model from Oxford Economics suggests that profit margins will decline from here, …

Source: Oxford Economics

Source: Oxford Economics

… pressuring earnings.

Source: Oxford Economics

Source: Oxford Economics

——————–

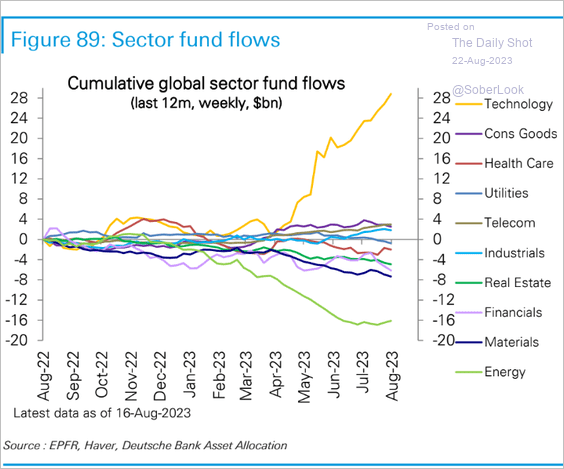

6. Tech fund flows remain strong.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

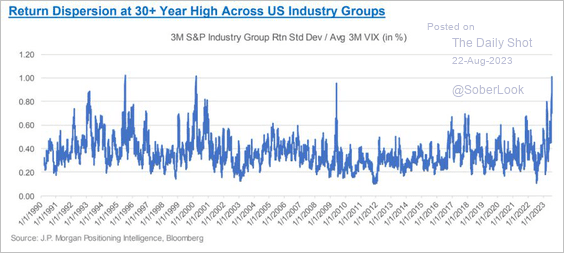

7. Return dispersion across US sectors has risen sharply this year.

Source: JP Morgan Research; @dailychartbook

Source: JP Morgan Research; @dailychartbook

Back to Index

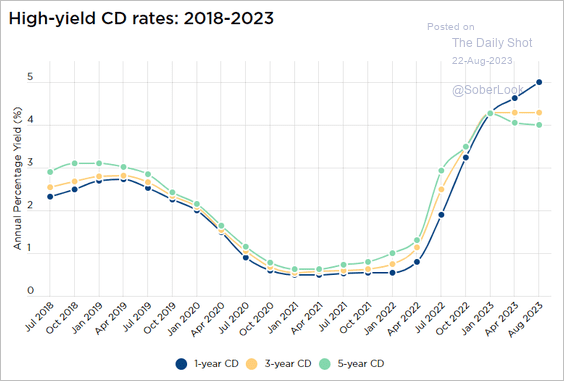

Credit

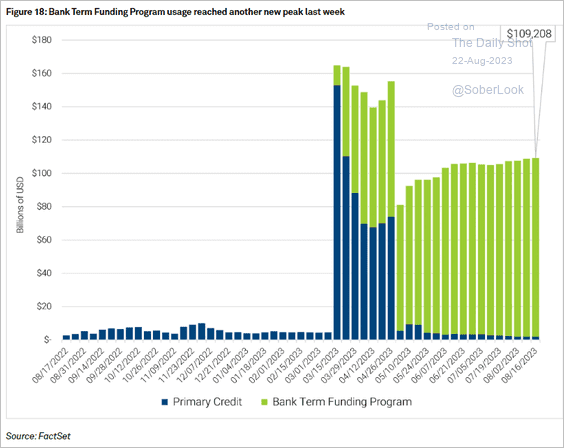

1. The Bank Term Funding Program usage keeps rising, suggesting that funding remains a challenge for some banks.

Source: @FactSet Read full article

Source: @FactSet Read full article

• Average short-term funding costs for smaller banks hit 5%.

Source: NerdWallet Read full article

Source: NerdWallet Read full article

• S&P followed Moody’s in downgrading a number of US banks.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

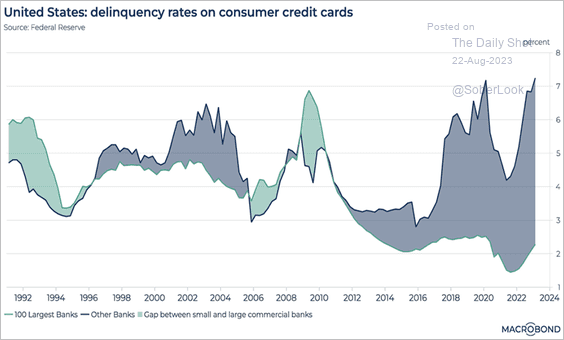

2. Smaller banks see much higher credit card delinquency rates than large lenders.

Source: Macrobond

Source: Macrobond

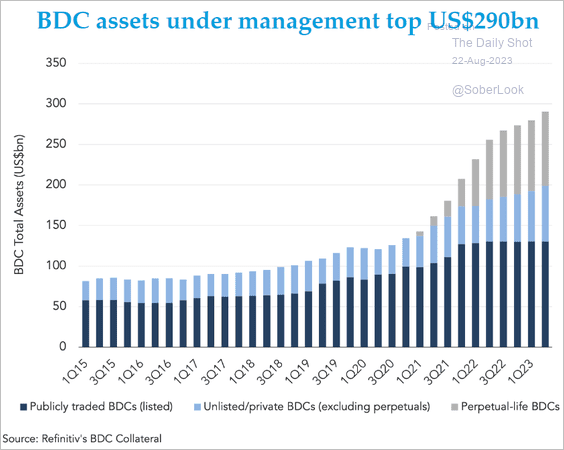

3. BDC assets under management continue to climb, boosted by private vehicles.

Source: @theleadleft

Source: @theleadleft

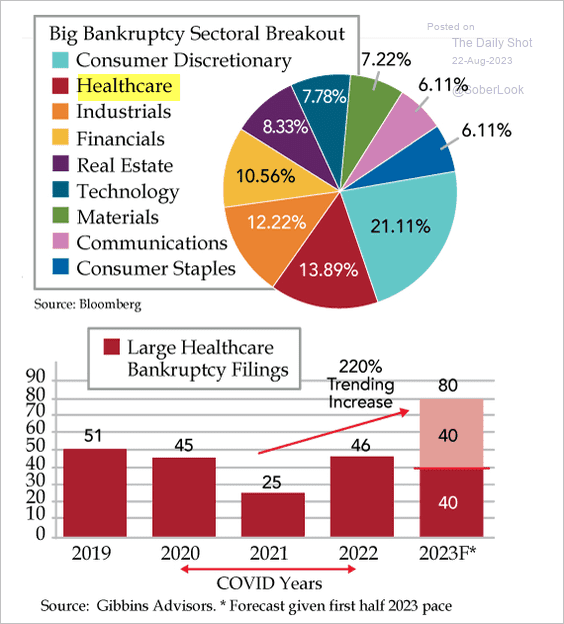

4. The healthcare sector has seen a surge in bankruptcies this year.

Source: Quill Intelligence

Source: Quill Intelligence

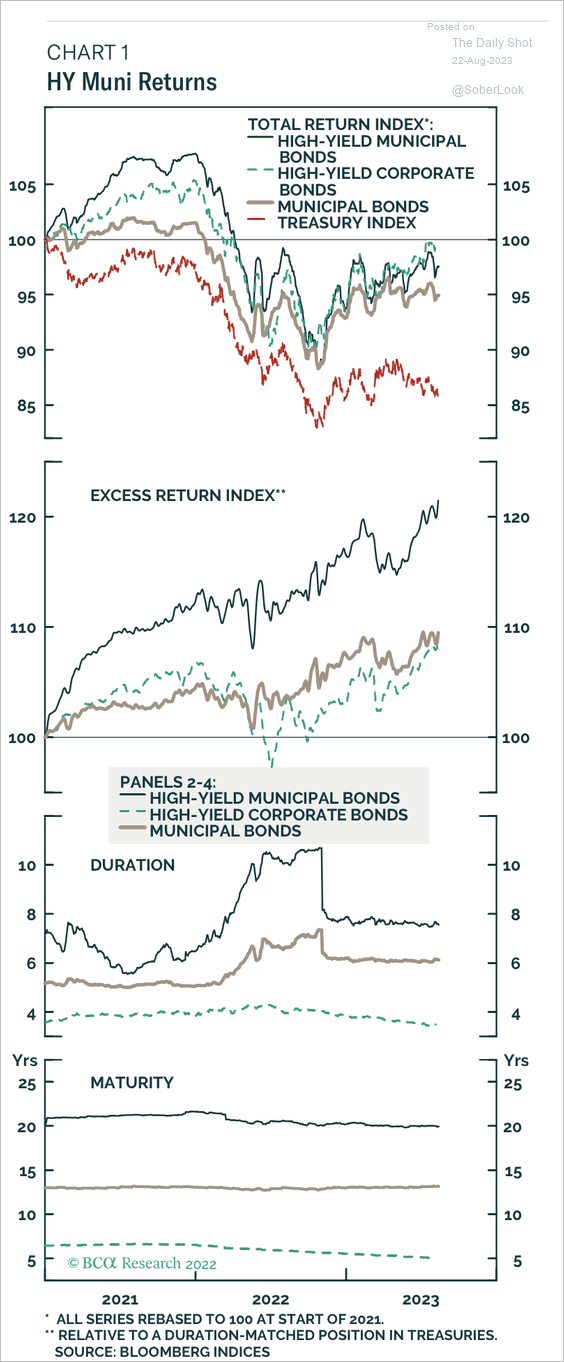

5. High-yield munis have been one of the top-performing US bond sectors over the past few years, …

Source: BCA Research

Source: BCA Research

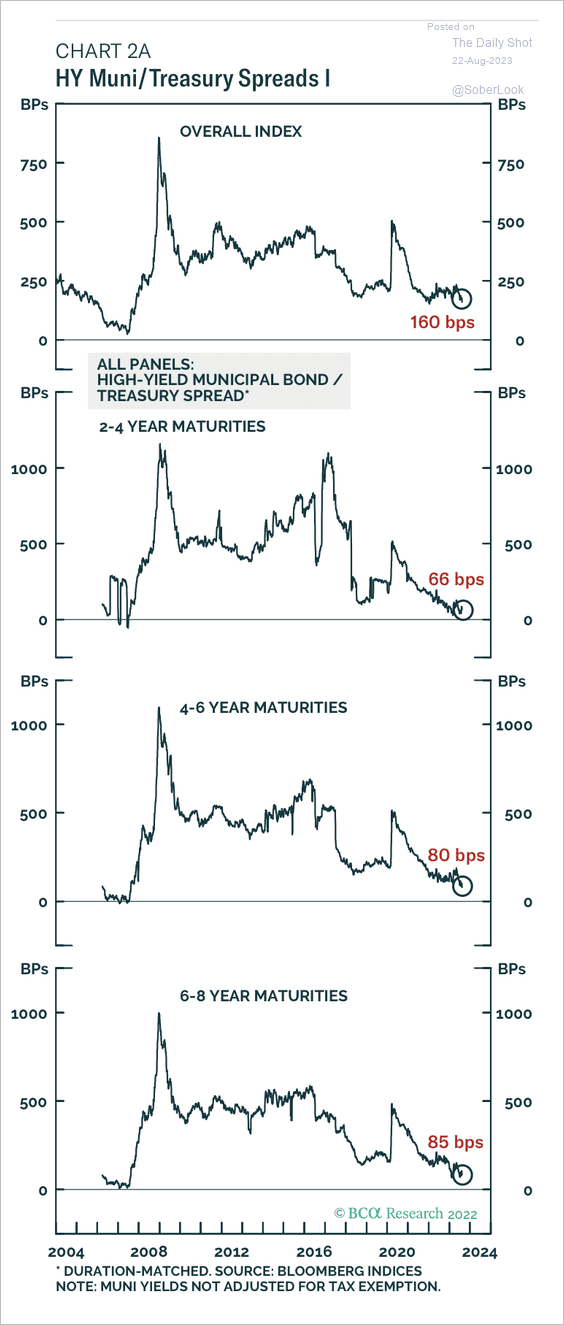

… although high-yield muni spreads versus duration-matched Treasuries have significantly tightened, appearing historically expensive.

Source: BCA Research

Source: BCA Research

Back to Index

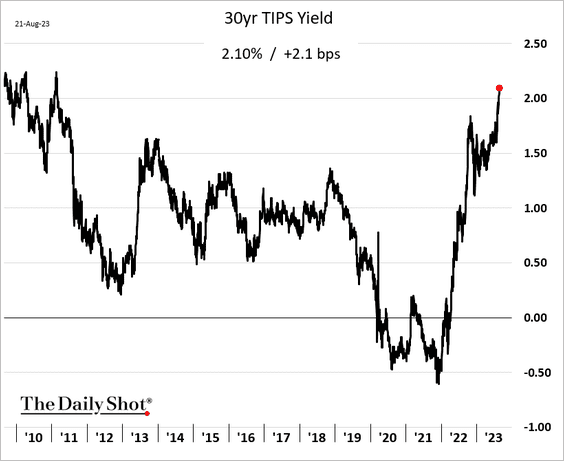

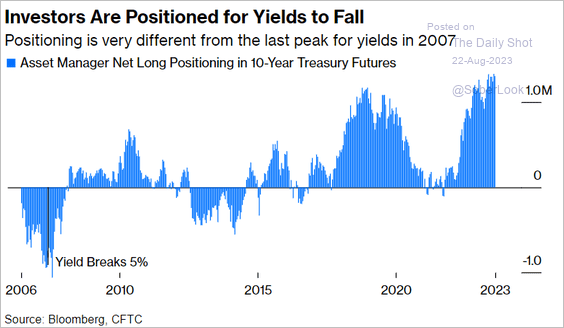

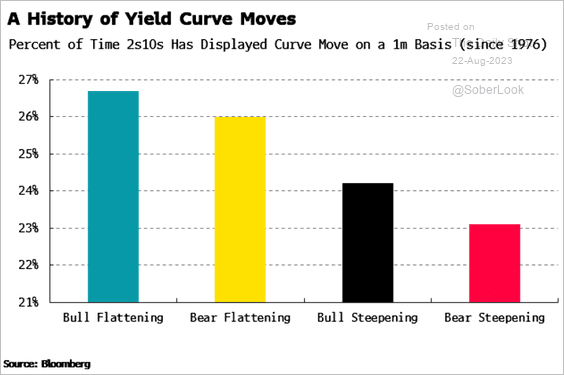

Rates

1. Technicals suggest that long-dated Treasuries are in oversold territory.

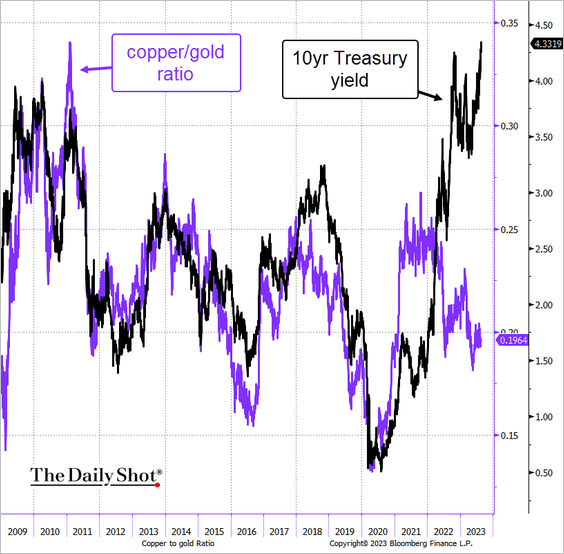

2. The gap between Treasury yields and the copper-to-gold ratio continues to widen.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

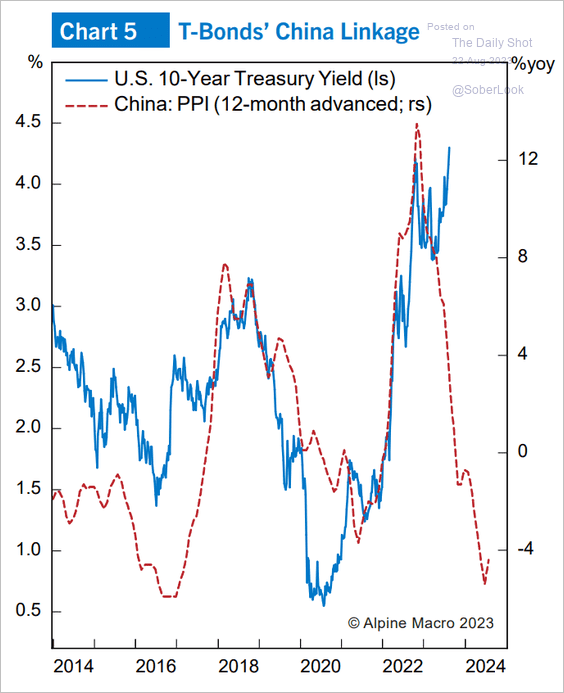

China’s PPI also points to lower Treasury yields.

Source: Alpine Macro

Source: Alpine Macro

——————–

3. The selloff in US inflation-linked bonds has been severe.

4. Asset managers have been taking a beating on the 10-year note futures.

Source: @johnauthers, @opinion Read full article

Source: @johnauthers, @opinion Read full article

5. Here is a look at historical Treasury curve moves by type.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

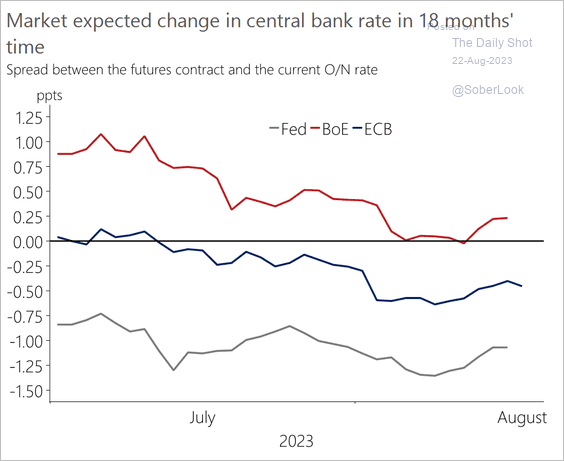

Global Developments

1. Rate expectations have declined more in the Eurozone and UK vs. the US.

Source: Oxford Economics

Source: Oxford Economics

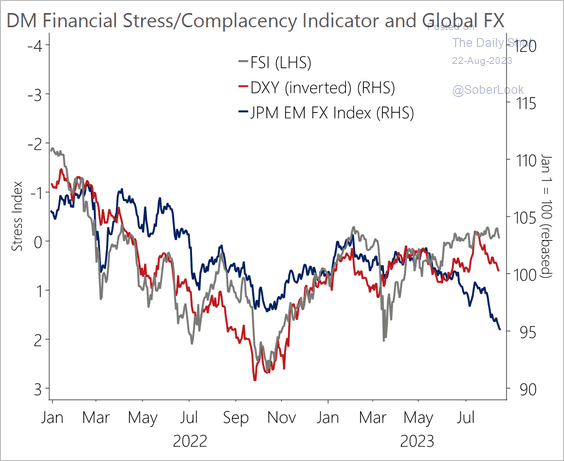

2. The dollar has moved higher despite financial stress remaining broadly stable.

Source: Oxford Economics

Source: Oxford Economics

——————–

Food for Thought

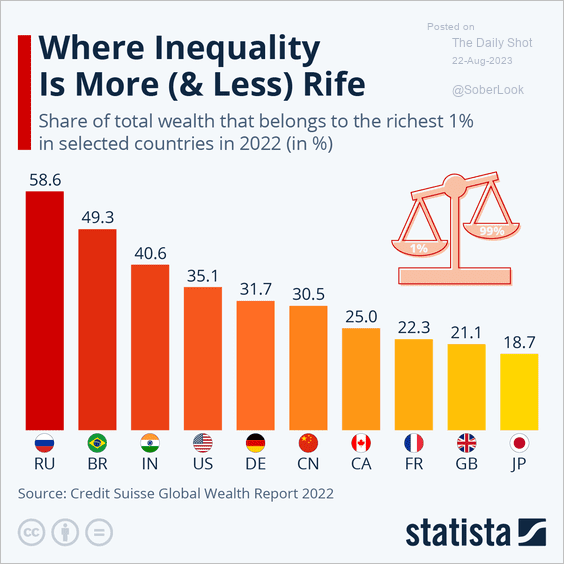

1. Share of wealth held by the top 1%:

Source: Statista

Source: Statista

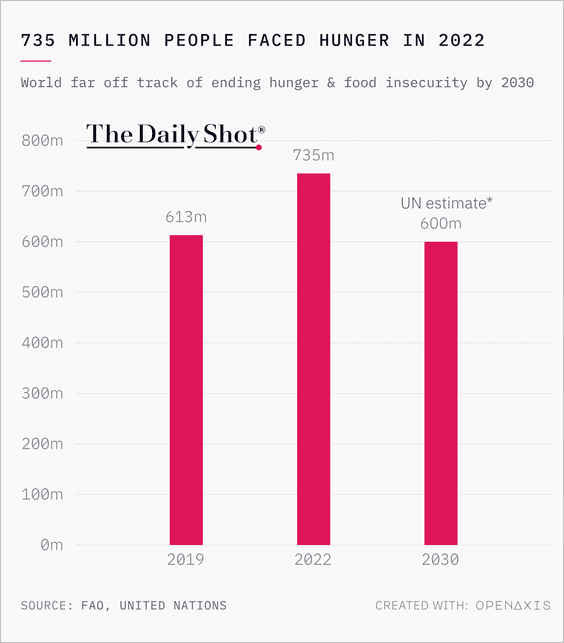

2. 735 million people are facing hunger.

Source: @TheDailyShot

Source: @TheDailyShot

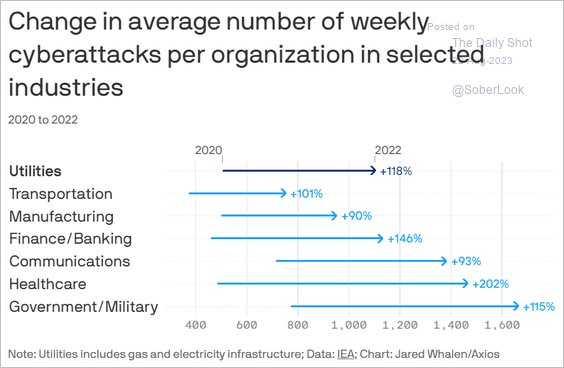

3. Growth in cyberattacks:

Source: @axios Read full article

Source: @axios Read full article

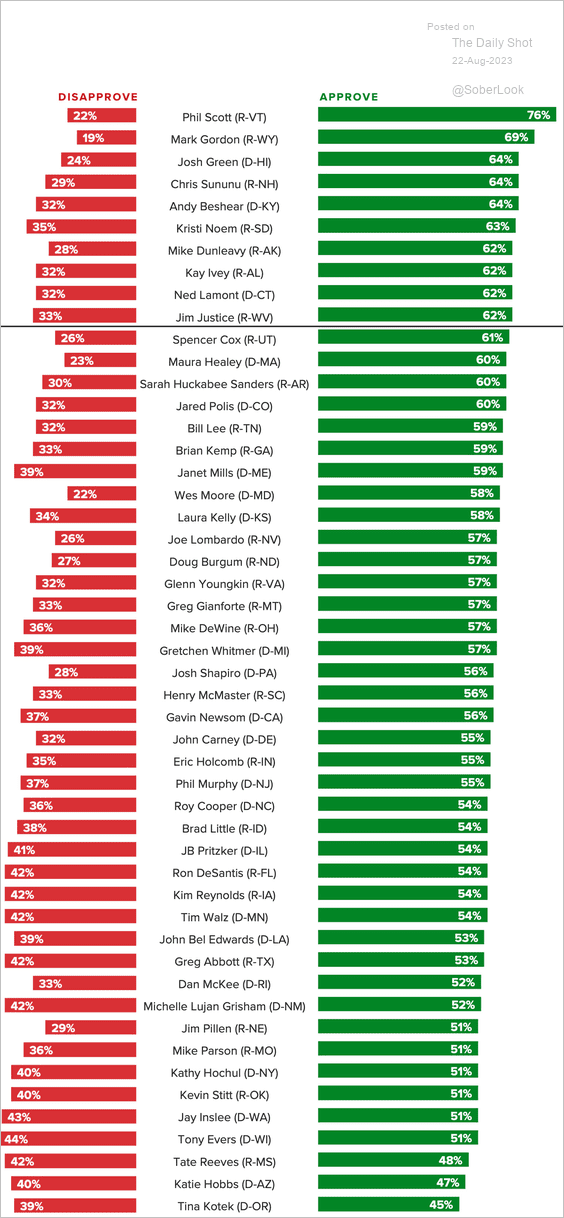

4. US governor rankings:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

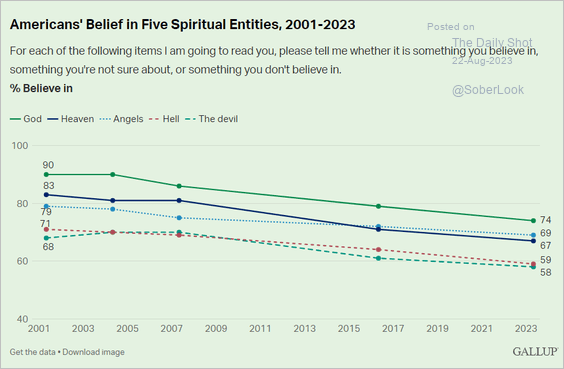

5. Belief in spiritual entities:

Source: Gallup Read full article

Source: Gallup Read full article

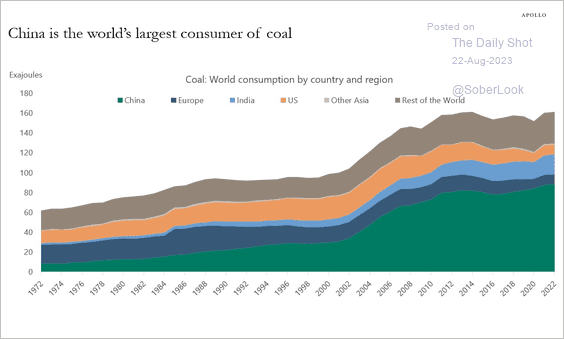

6. Global coal consumption:

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

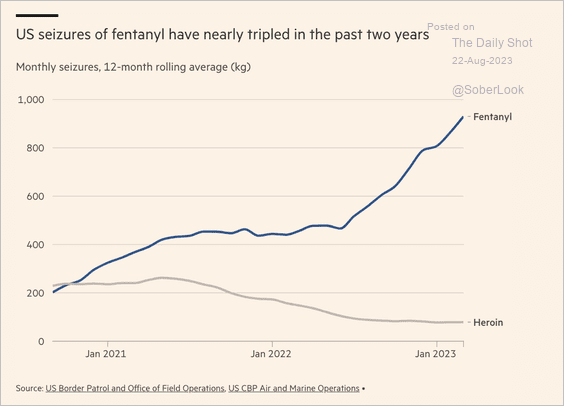

7. Seizures of fentanyl:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

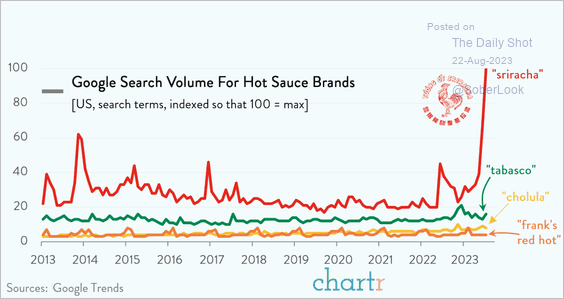

8. Google search volume for hot sauce brands:

Source: @chartrdaily

Source: @chartrdaily

——————–

Back to Index