The Daily Shot: 21-Aug-23

• China

• Asia-Pacific

• Europe

• The United Kingdom

• The United States

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

China

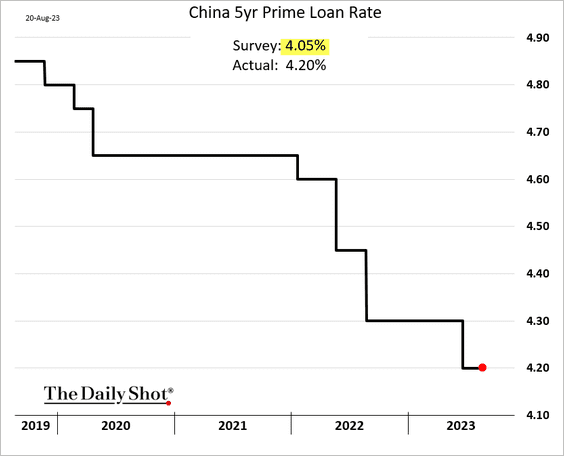

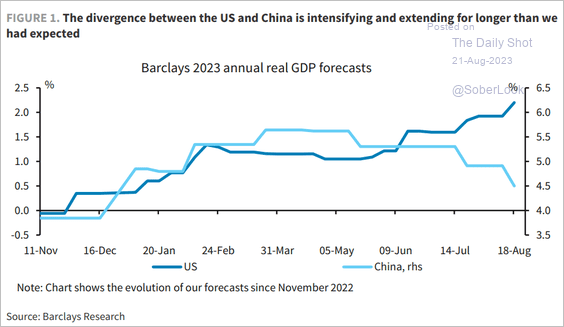

1. Despite the turmoil in its property markets, China unexpectedly left its 5-year mortgage benchmark rate unchanged (the market expected a 15 bps cut).

Source: Yahoo Finance Read full article

Source: Yahoo Finance Read full article

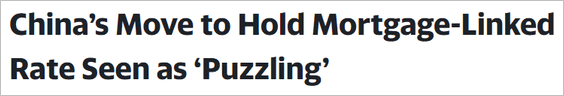

Beijing lowered the one-year rate by ten basis points, a smaller-than-expected cut.

——————–

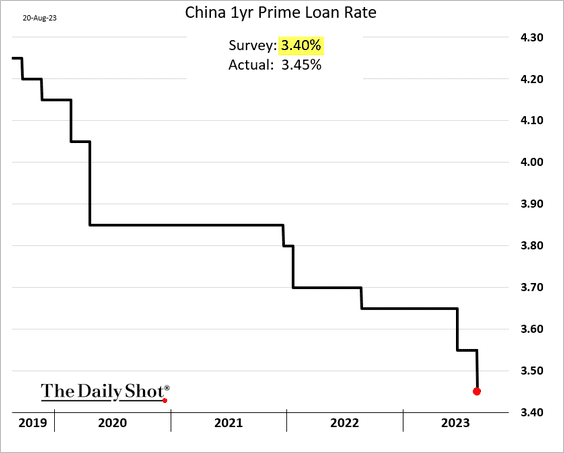

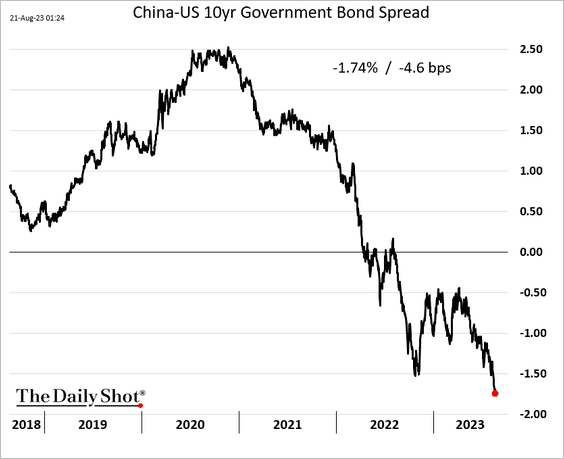

2. The expected economic growth trends in the US and China are diverging, putting pressure on the renminbi.

Source: Barclays Research

Source: Barclays Research

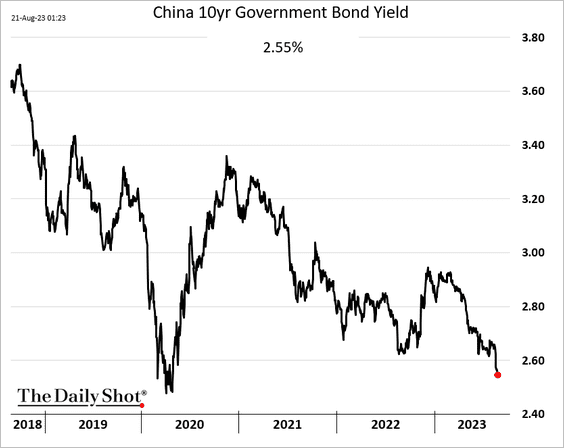

China’s bond yields continue to fall, …

… widening the differential with the US.

——————–

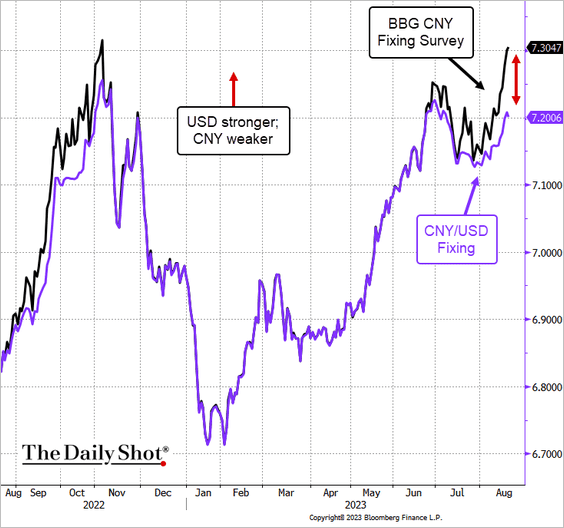

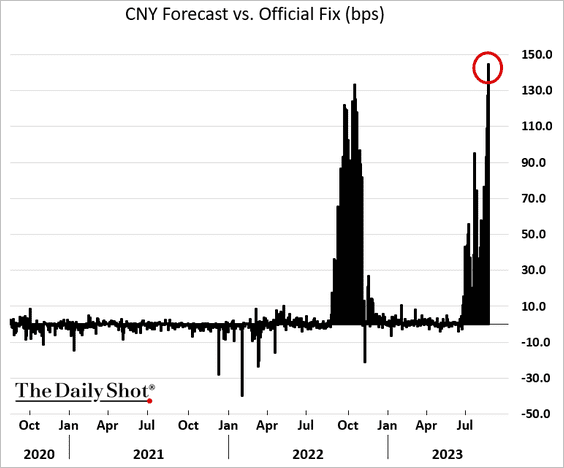

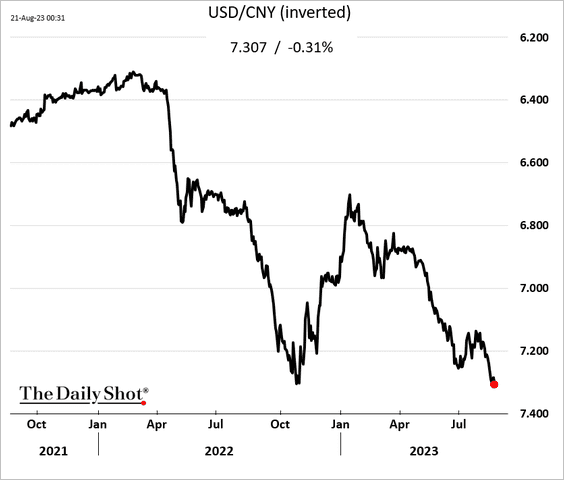

3. Despite Beijing’s forceful attempts to halt the RMB’s decline, …

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

… China’s currency continues to weaken vs. USD.

——————–

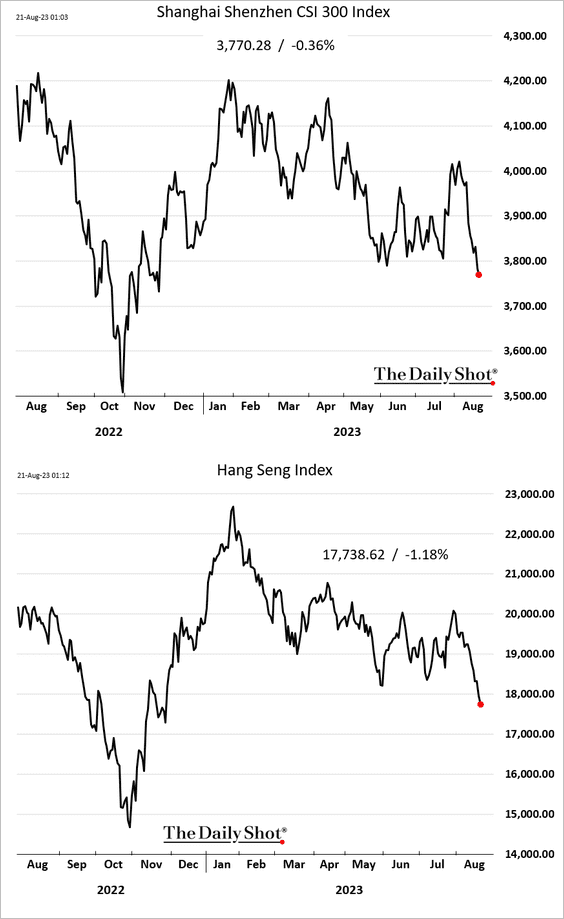

4 Both Mainland and Hong Kong-listed stocks are under pressure.

Source: @WSJ Read full article

Source: @WSJ Read full article

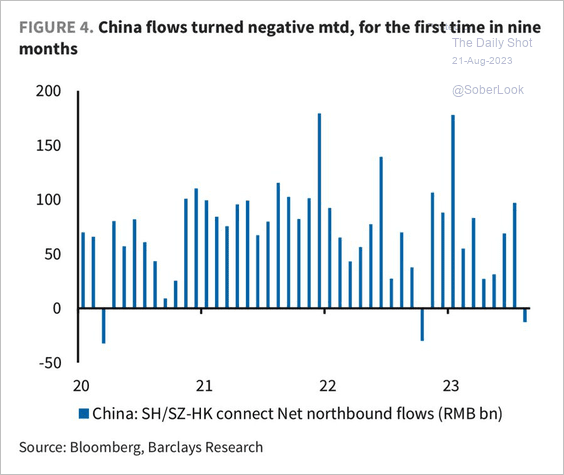

• Flows into Mainland stocks from Hong Kong-based and foreign investors have turned negative.

Source: Barclays Research

Source: Barclays Research

——————–

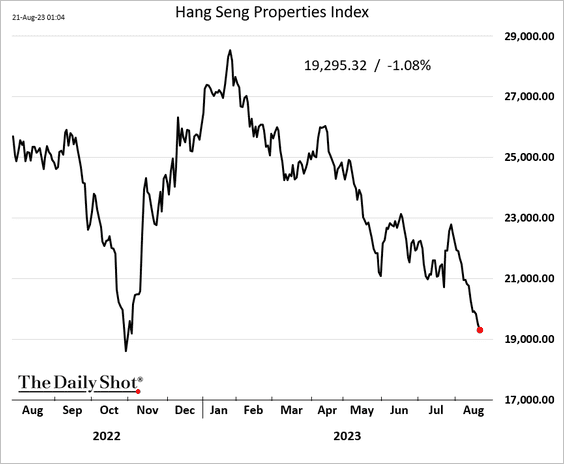

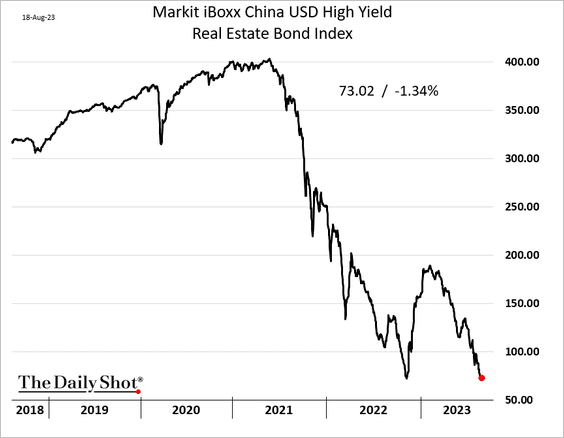

5. Developers’ stocks and bonds continue to struggle.

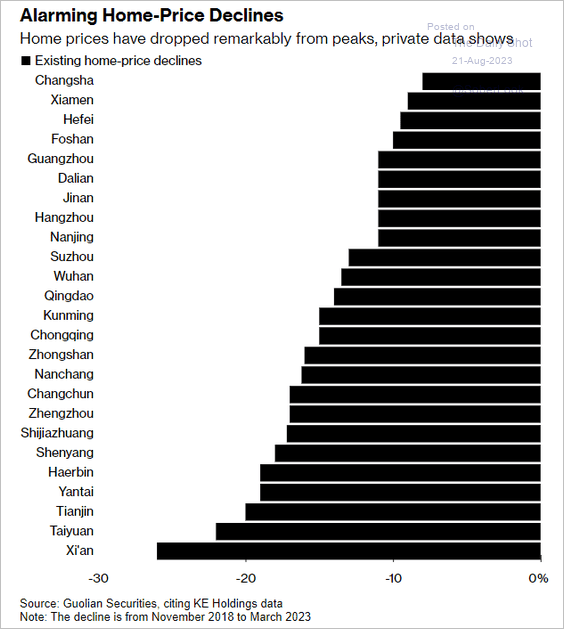

• Existing home prices are down sharply from peak levels.

Source: @economics Read full article

Source: @economics Read full article

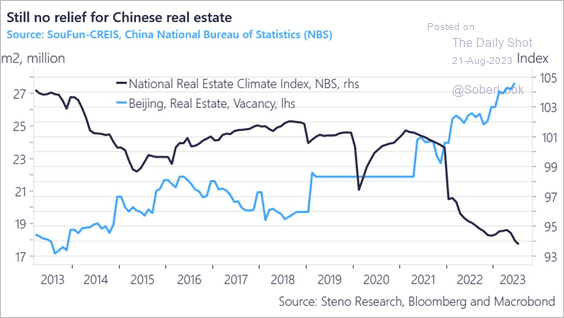

• Real estate sentiment continues to deteriorate as vacancies rise.

Source: @AndreasSteno Read full article

Source: @AndreasSteno Read full article

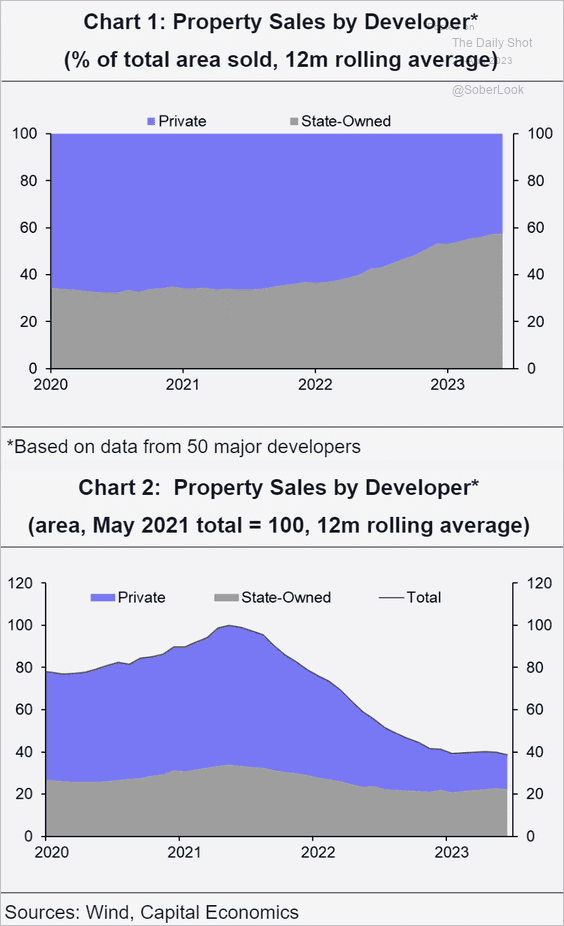

• China’s property sales are increasingly dominated by state-owned enterprises.

Source: Capital Economics

Source: Capital Economics

——————–

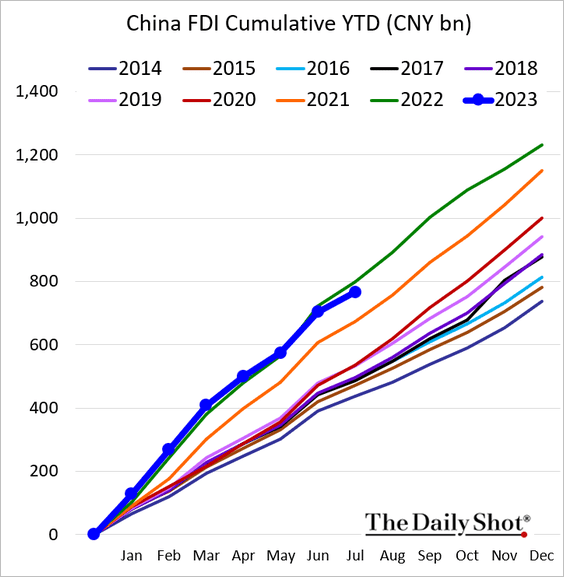

6. Foreign direct investment is now running below last year’s levels.

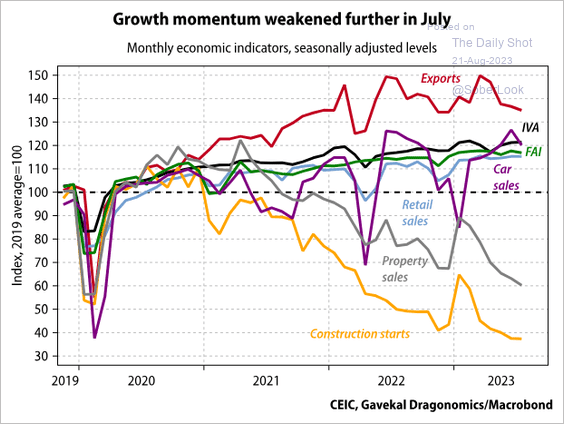

7. This chart shows China’s key economic indicators (seasonally adjusted by Gavekal).

Source: Gavekal Research

Source: Gavekal Research

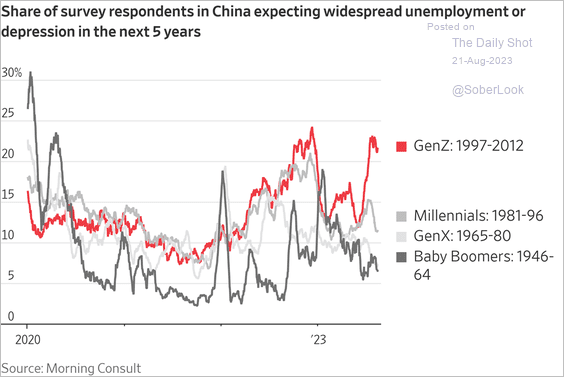

8. A growing number of young people are pessimistic about China’s economy.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Asia-Pacific

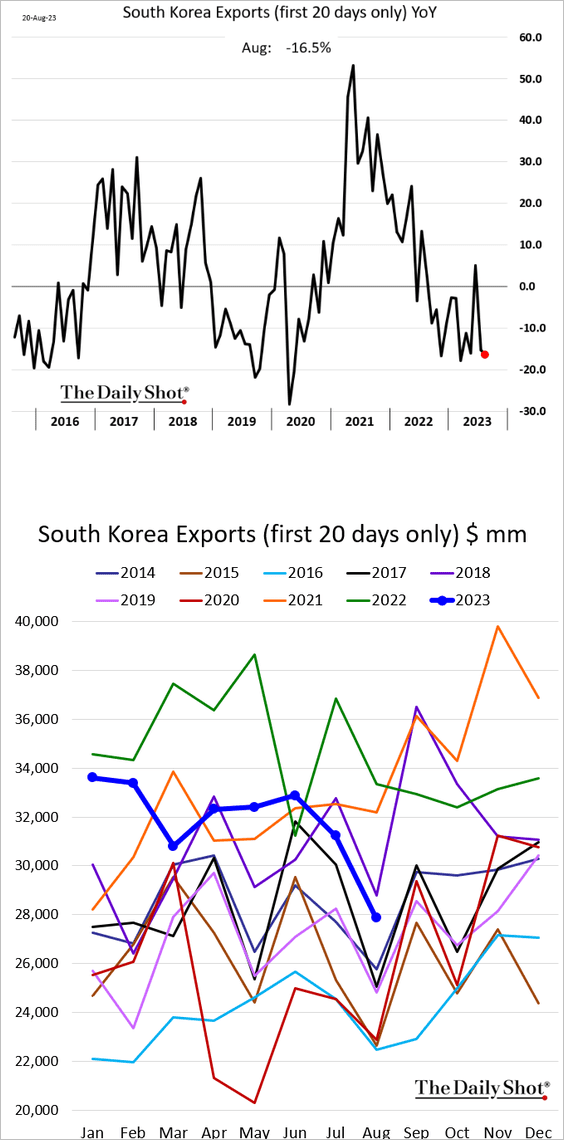

1. South Korea’s exports are down 16.5% from last year as China’s downturn weighs on demand.

Source: @economics Read full article

Source: @economics Read full article

——————–

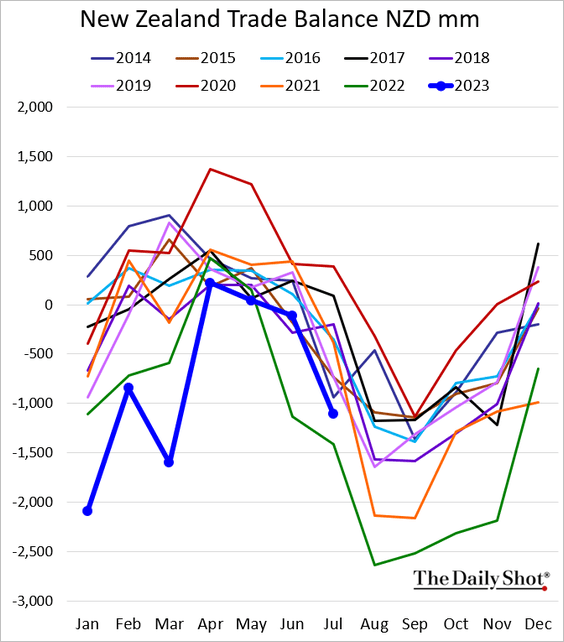

2. New Zealand’s trade deficit widened in July, …

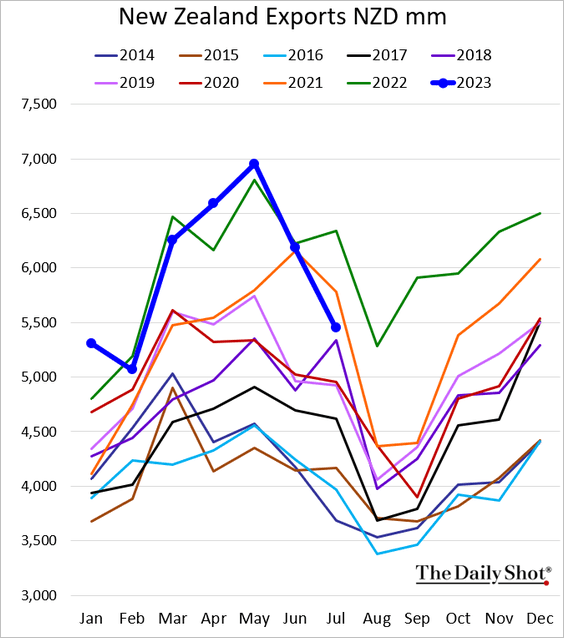

… as exports slump.

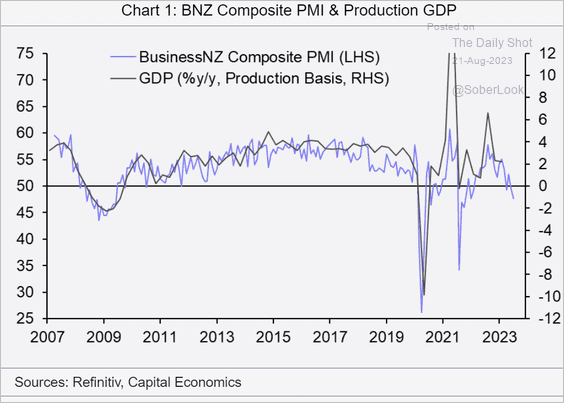

New Zealand’s PMI signals a sharp deterioration in economic growth.

Source: Capital Economics

Source: Capital Economics

——————–

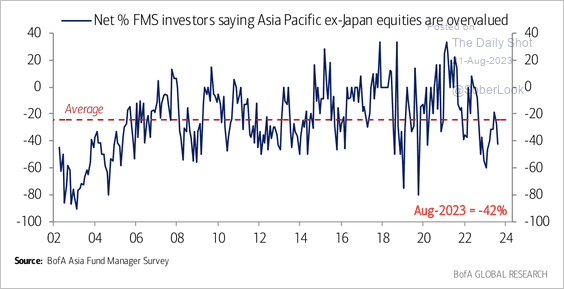

3. Fund managers continue to view Asia Pacific ex-Japan equities as undervalued, according to a BofA survey.

Source: BofA Global Research

Source: BofA Global Research

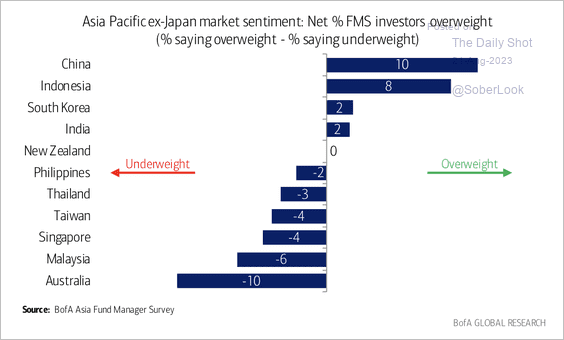

Regional investors have been overweight China and underweight Australia.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Europe

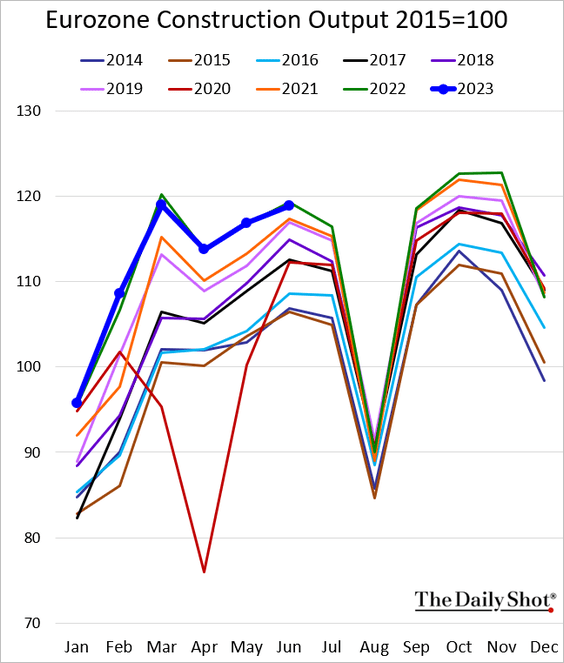

1. Euro-area construction output is running roughly in line with last year’s levels.

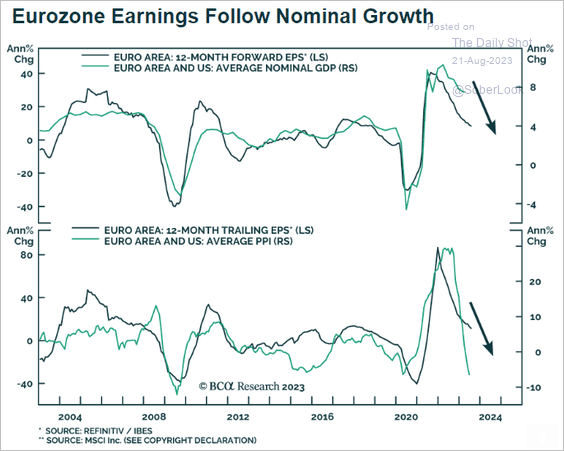

2. Eurozone corporate earnings are facing some headwinds.

Source: BCA Research

Source: BCA Research

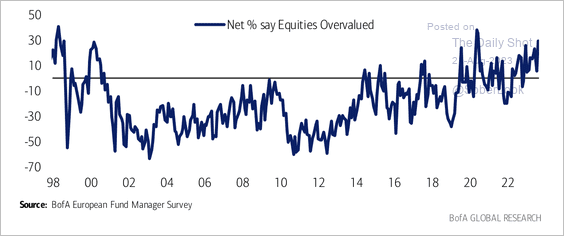

Investors surveyed by BofA increasingly view European equities as overvalued – a sharp rise over the past month and the highest level in three years.

Source: BofA Global Research

Source: BofA Global Research

——————–

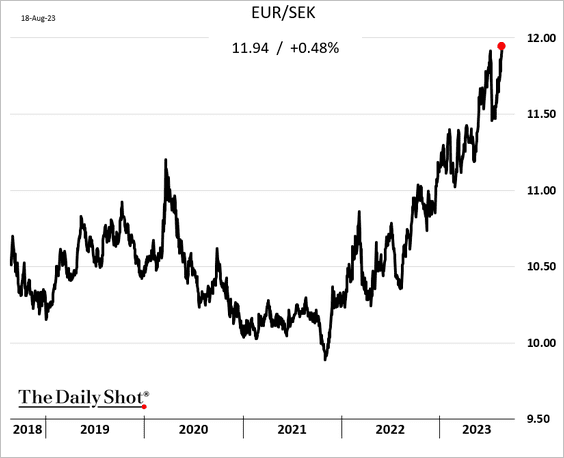

3. The Swedish krona hit a new low vs. the euro.

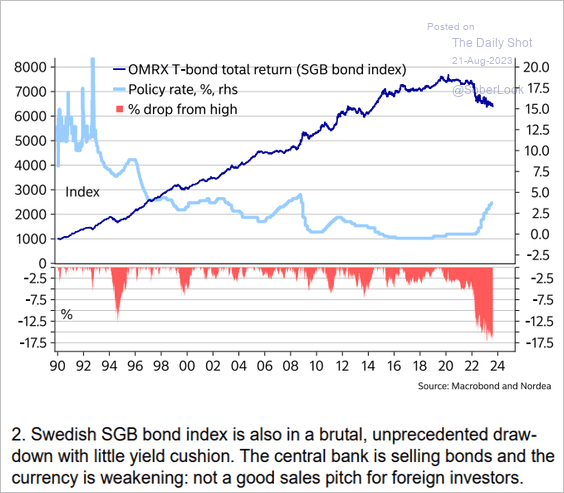

The drawdown in Swedish government bonds has been extreme.

Source: Nordea Markets

Source: Nordea Markets

——————–

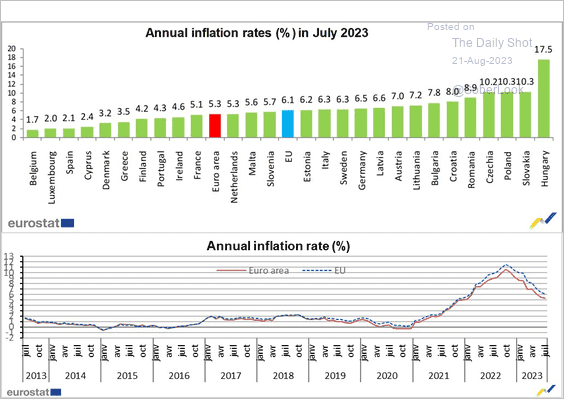

4. Here is a look at inflation rates across the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

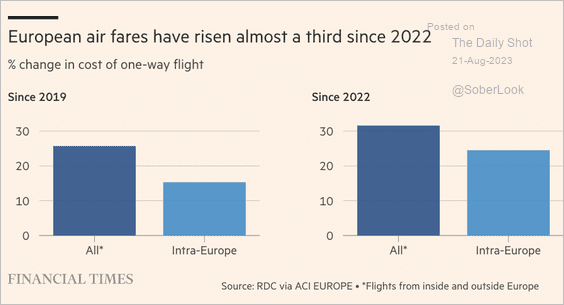

Airfares surged this year.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The United Kingdom

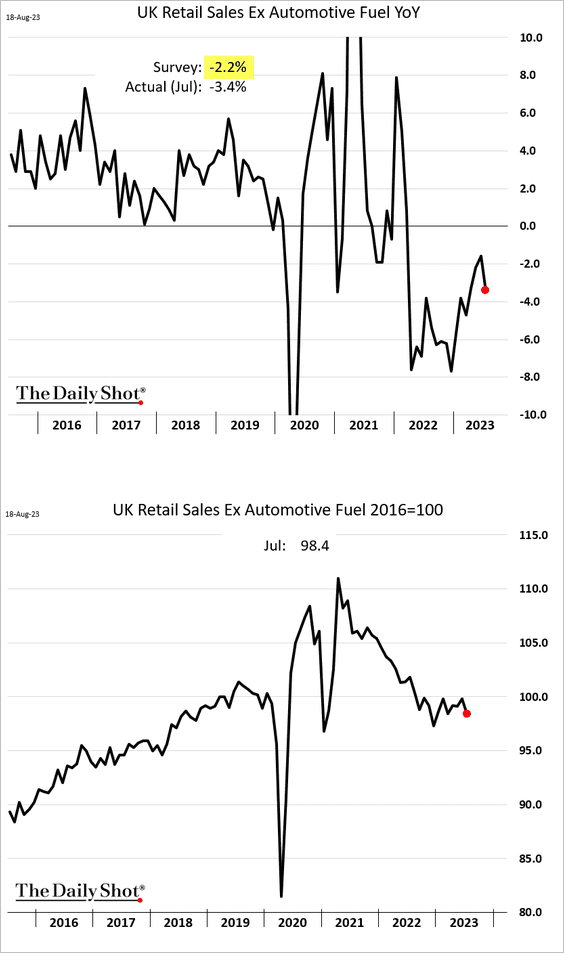

1. Retail sales declined more than expected in July.

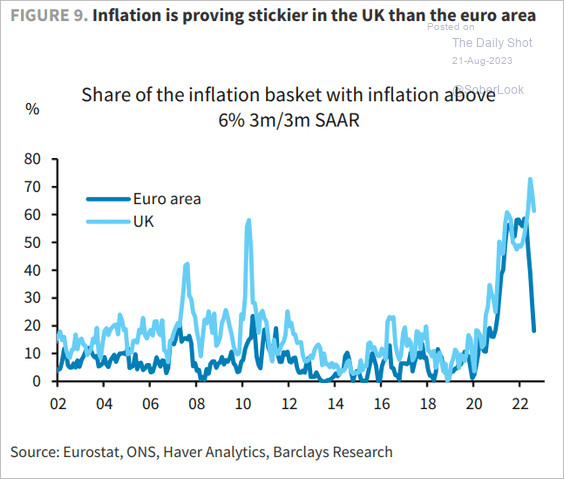

2. UK inflation has been more persistent than that in the Eurozone.

Source: Barclays Research

Source: Barclays Research

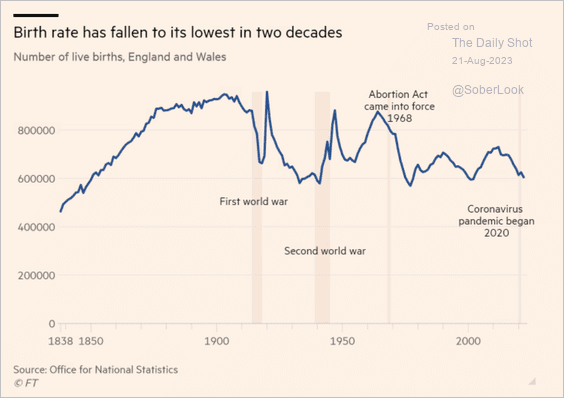

3. The nation’s birth rate has been falling.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The United States

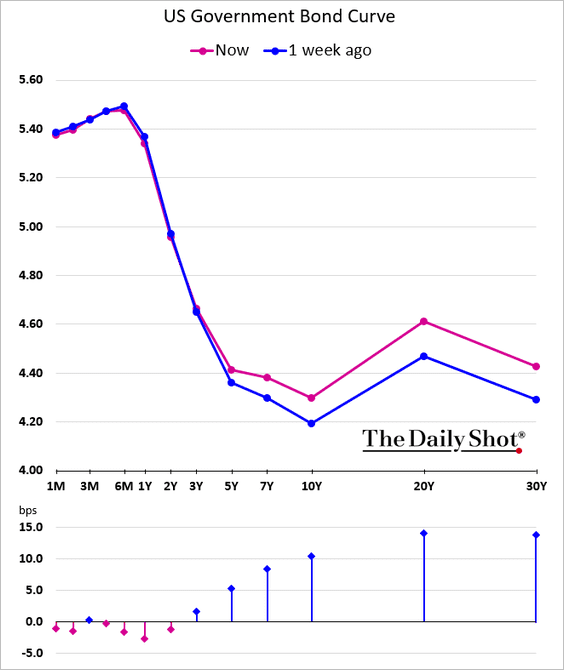

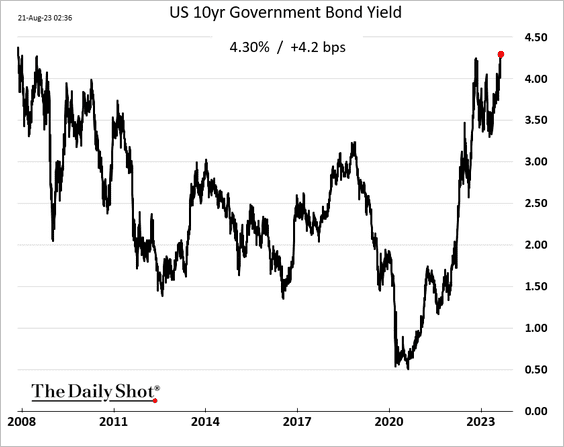

1. The Treasury curve bear steepening continues, pushing the 10-year yield to a multi-year high.

——————–

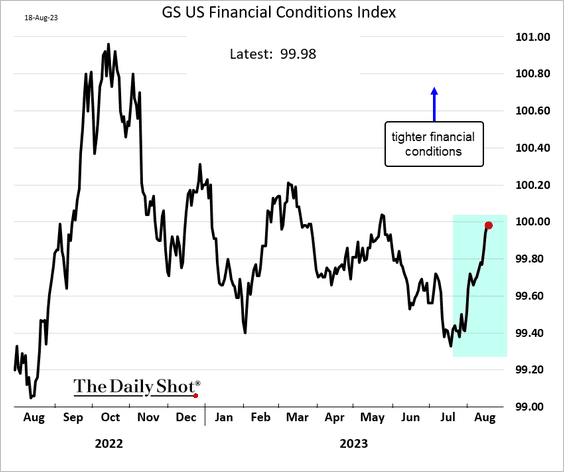

2. Tighter financial conditions have resulted from higher bond yields, recent gains in the dollar, and the stock market wobble.

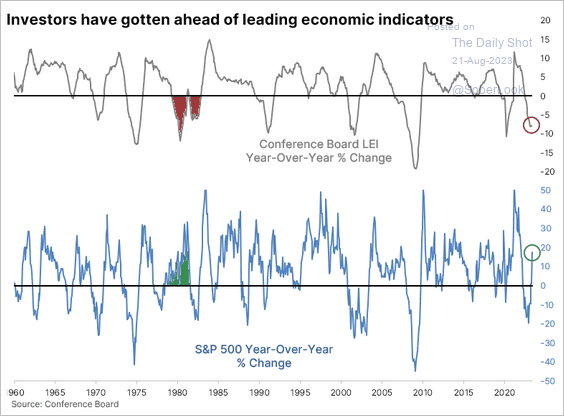

3. Is the stock market signaling a trough in US leading economic indicators?

Source: SentimenTrader

Source: SentimenTrader

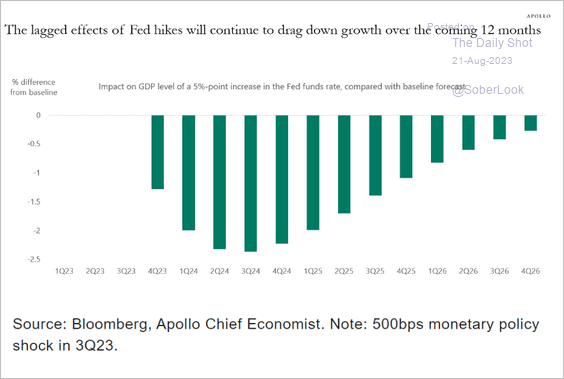

4. The full impact of the Fed’s policy tightening is yet to be felt.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

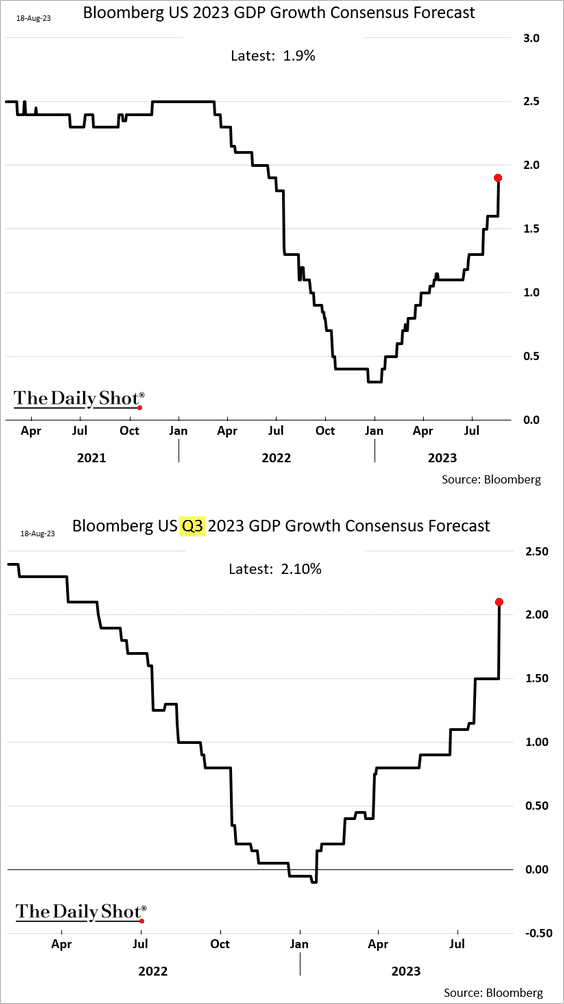

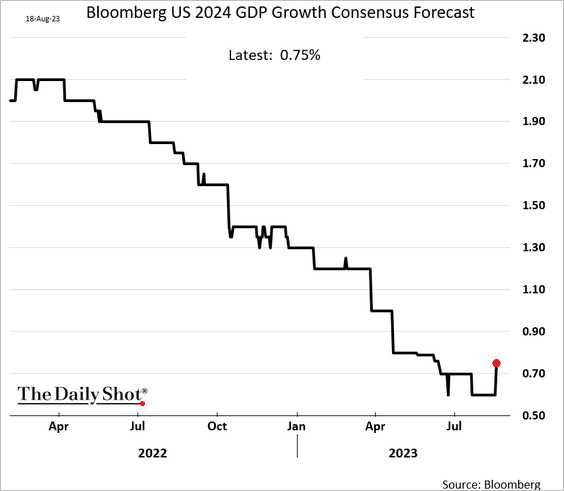

5. Economists have revised their economic growth forecasts upward for 2023 and 2024.

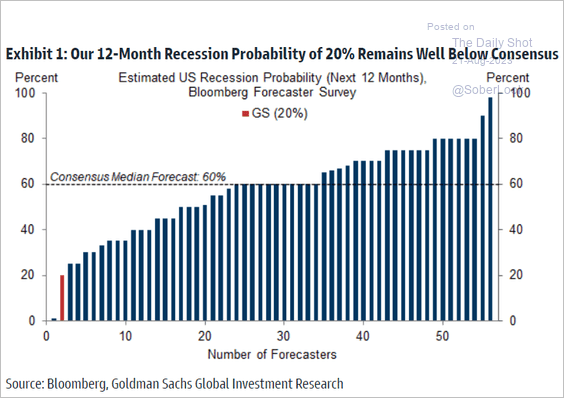

Goldman sees only a 20% chance of a recession over the next 12 months.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

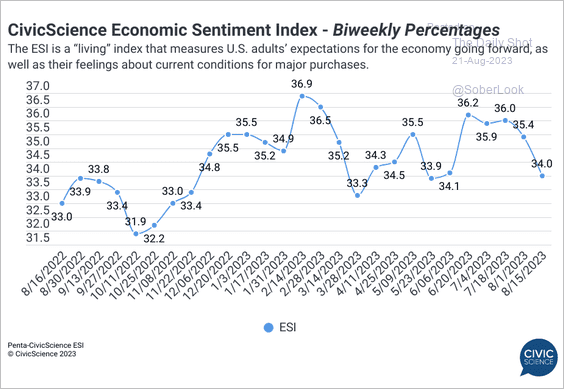

6. The recent decline in stock prices and higher gasoline prices are weighing on consumer sentiment.

Source: @CivicScience

Source: @CivicScience

Back to Index

Emerging Markets

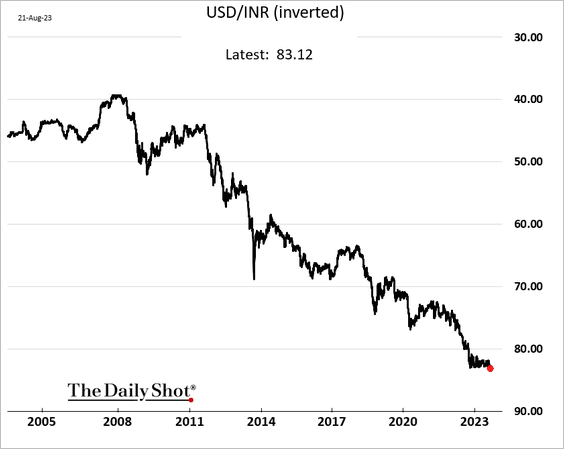

1. The Indian rupee hit a record low vs. USD.

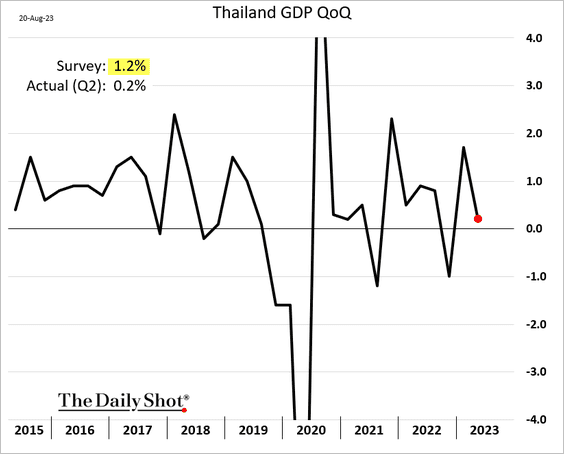

2. Thailand’s Q2 GDP growth was disappointing.

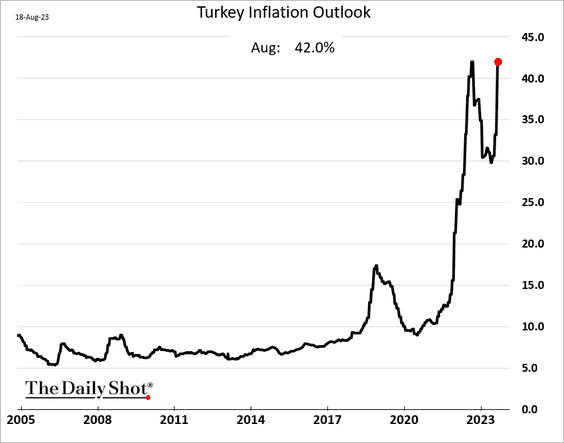

3. Turkey’s inflation outlook looks ugly.

Source: @economics Read full article

Source: @economics Read full article

——————–

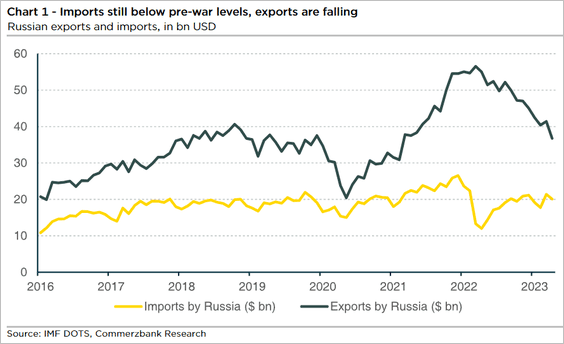

4. Russia’s exports have been falling.

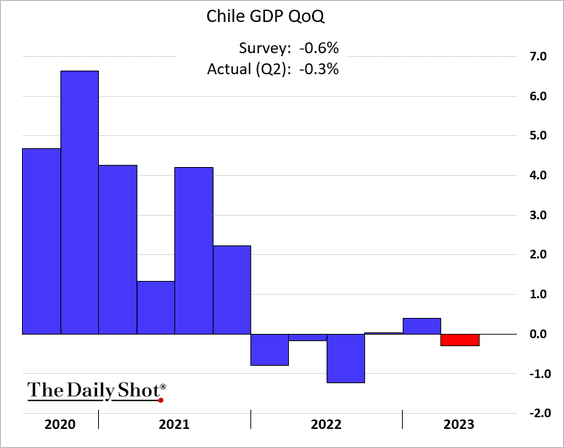

5. Chile’s GDP contracted less than expected last quarter.

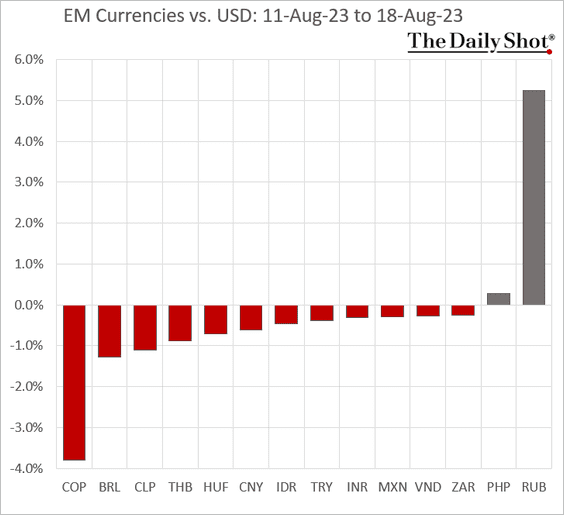

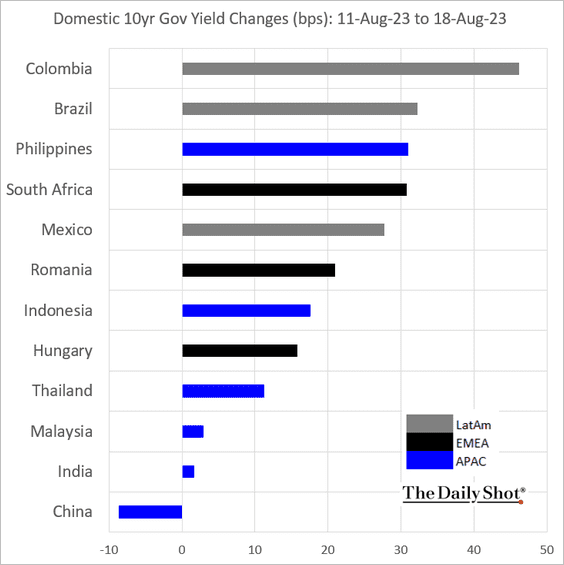

7. Next, we have some performance data from last week.

• Currencies:

• Bond yields:

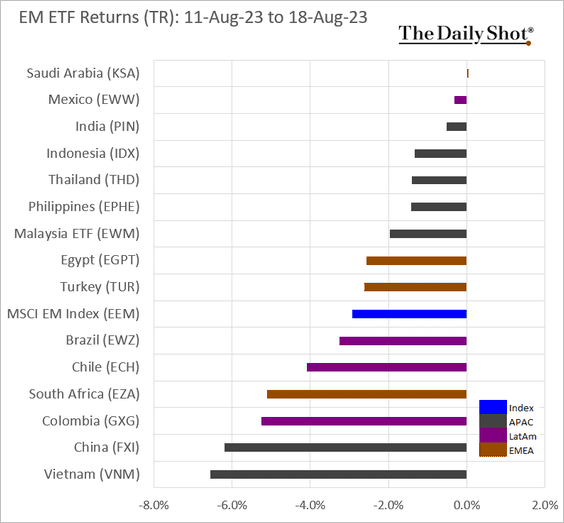

• Equity ETFs:

Back to Index

Commodities

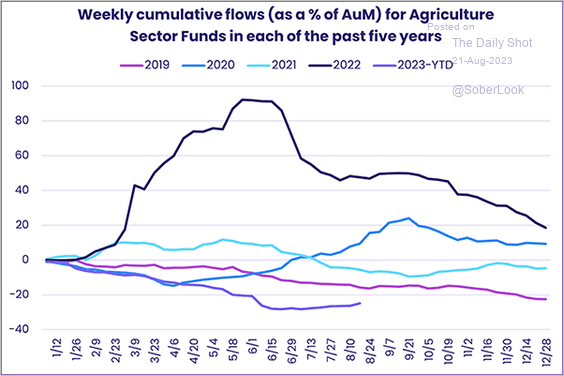

1. Have agriculture fund outflows finally ceased?

Source: EPFR

Source: EPFR

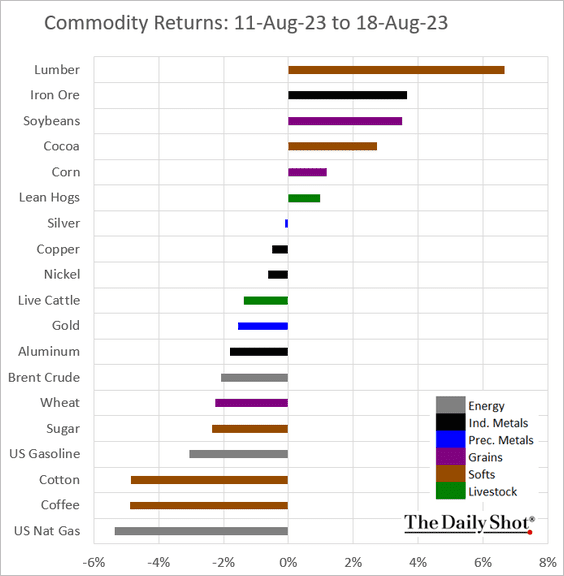

2. Here is last week’s performance across key commodity markets.

Back to Index

Energy

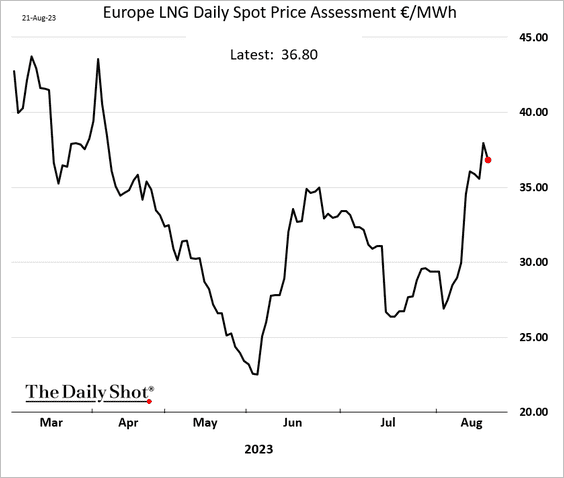

1. European LNG prices remain elevated amid labor uncertainty in Australia’s gas platforms.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

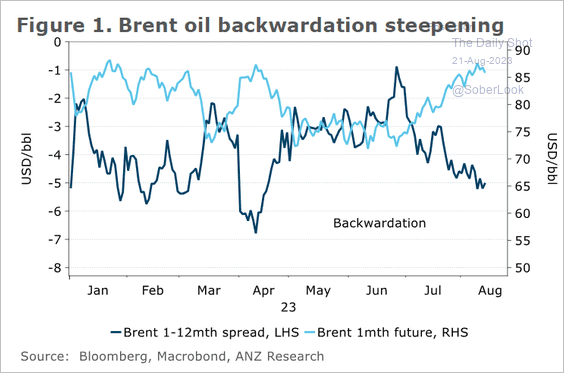

2. Brent crude backwardation deepened in recent months.

Source: @ANZ_Research

Source: @ANZ_Research

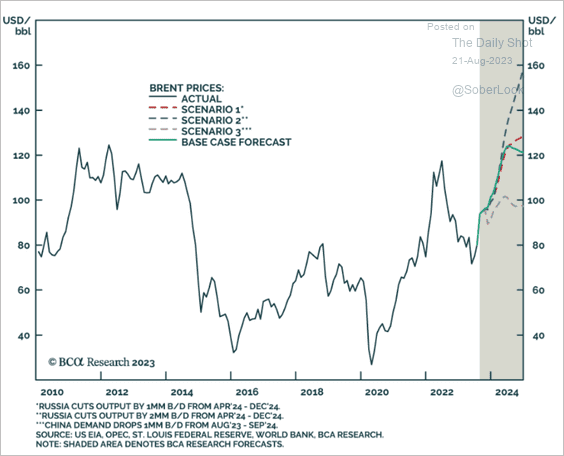

Here are some price forecasts from BCA Research.

Source: BCA Research

Source: BCA Research

Back to Index

Equities

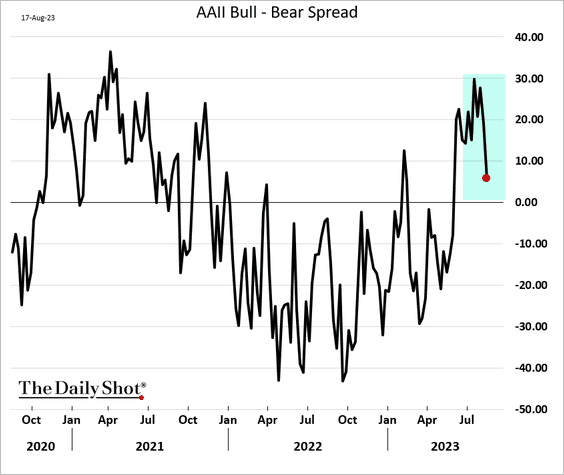

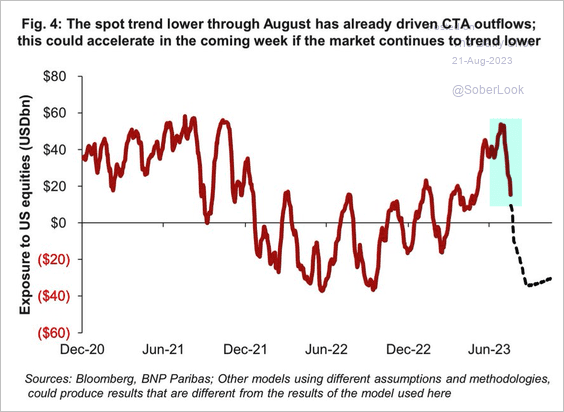

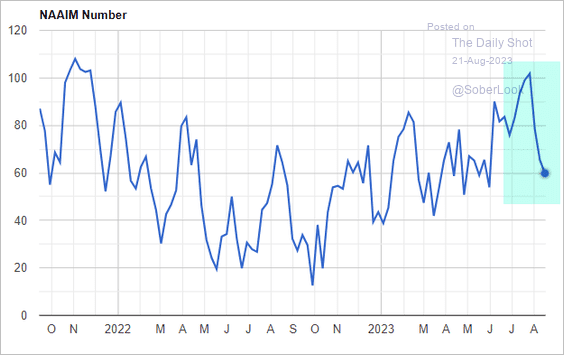

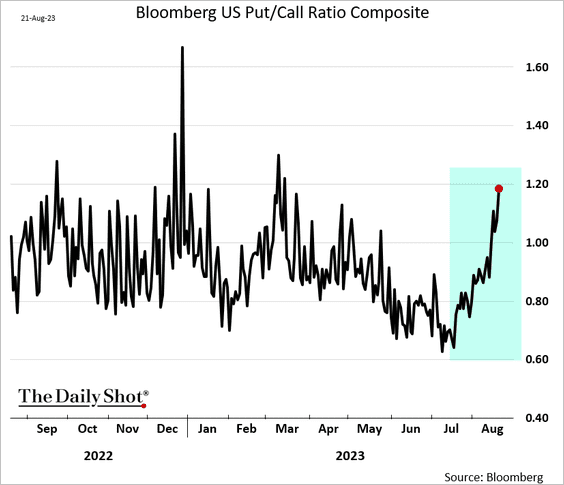

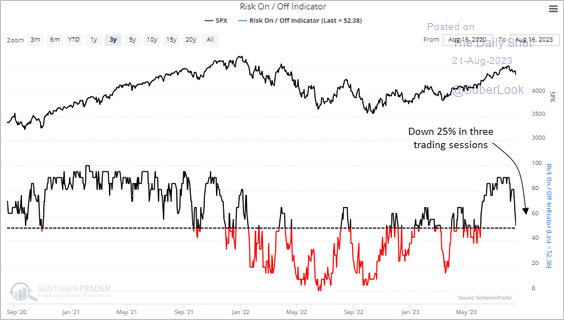

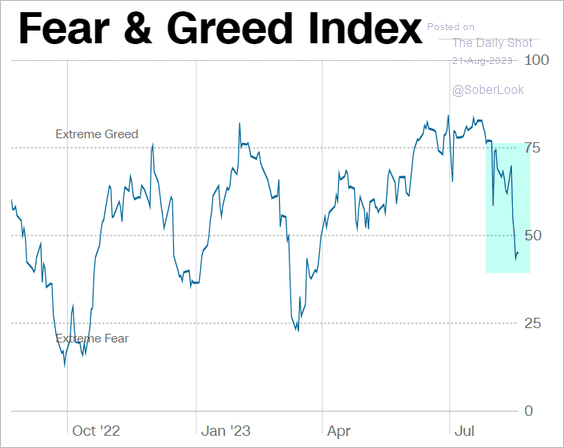

1. Sentiment deteriorated sharply in recent days.

• AAII bull-bear spread (retail investors):

• CTAs:

Source: BNP Paribas; @WallStJesus

Source: BNP Paribas; @WallStJesus

• Investment manager sentiment:

Source: NAAIM

Source: NAAIM

• The put/call ratio:

• SentimenTrader’s risk-on/risk-off indicator:

Source: SentimenTrader

Source: SentimenTrader

• CNN Fear/Greed index:

Source: CNN Business

Source: CNN Business

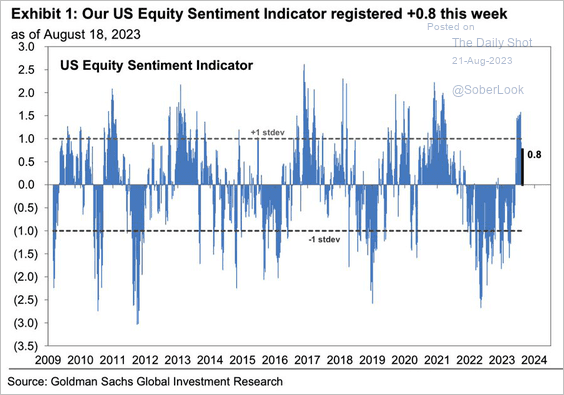

• Goldman’s sentiment index:

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

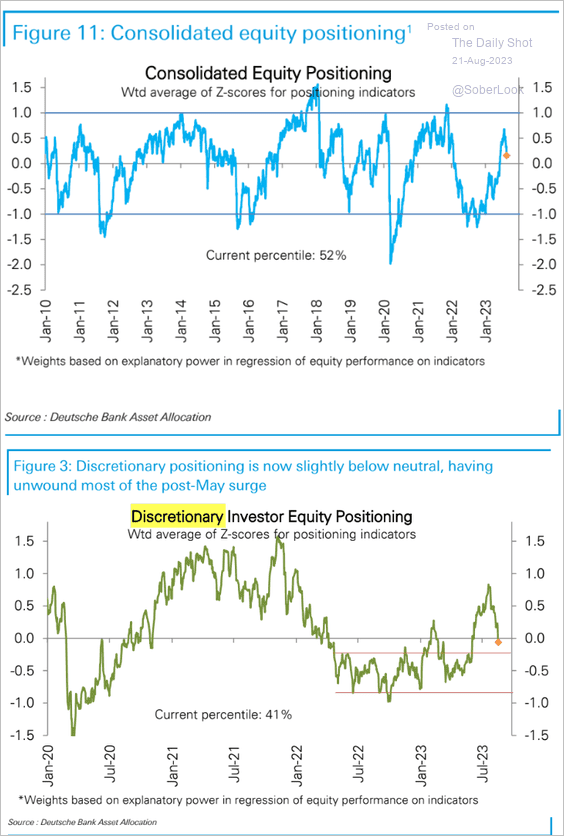

• Deutsche Bank’s positioning indicator (pulled lower by discretionary investors):

Source: Deutsche Bank Research

Source: Deutsche Bank Research

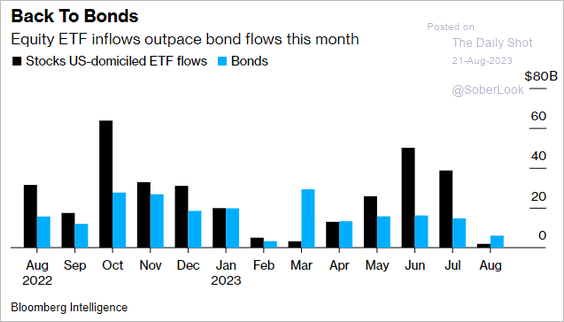

• ETF flows:

Source: @business Read full article

Source: @business Read full article

• VIX (firmly above its 50-day moving average):

Source: CNN Business

Source: CNN Business

——————–

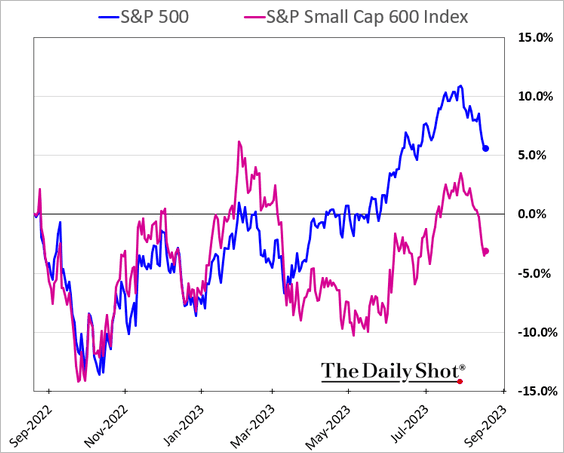

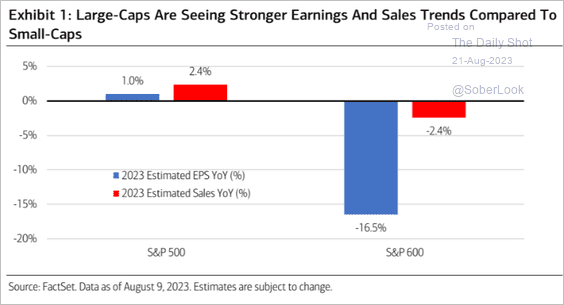

2. Small caps are lagging, …

… driven by fundamentals.

Source: Merrill Lynch

Source: Merrill Lynch

——————–

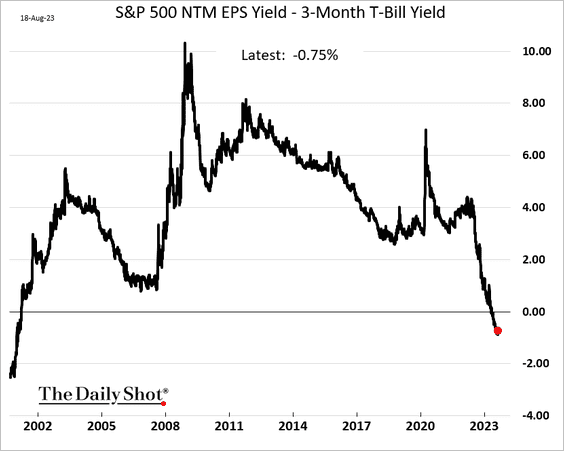

3. Cash yields are higher than the S&P 500 projected earnings yield.

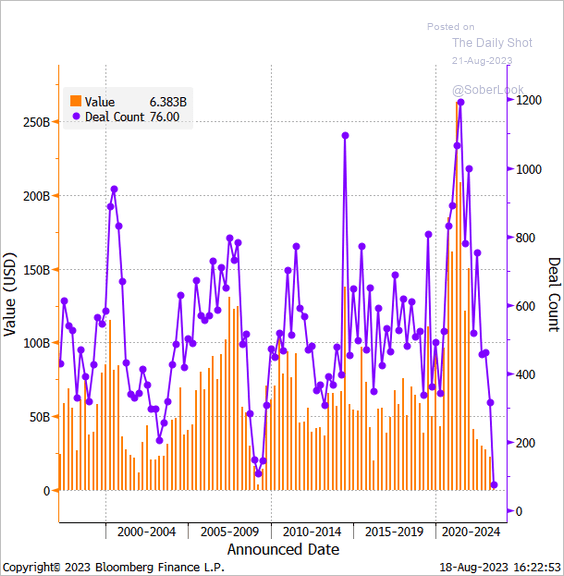

4. US IPO activity has been slow.

Source: @JeffreyKleintop

Source: @JeffreyKleintop

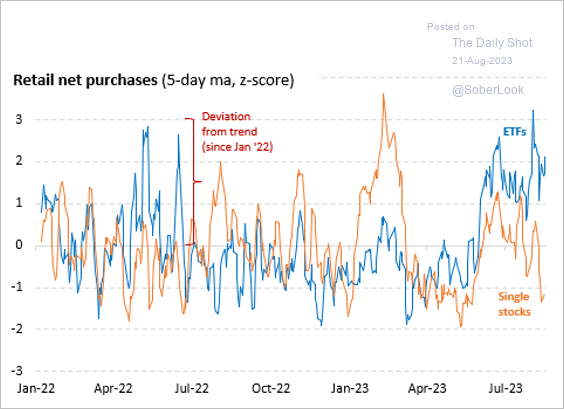

5. Retail investors have been less enthusiastic about individual stocks, but they boosted ETF purchases this summer.

Source: Vanda Research

Source: Vanda Research

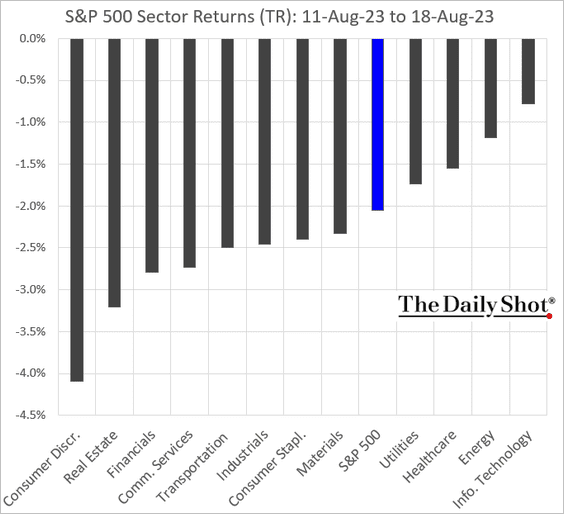

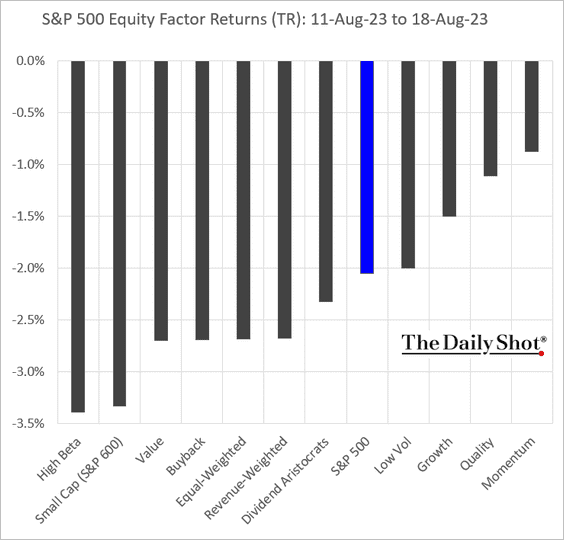

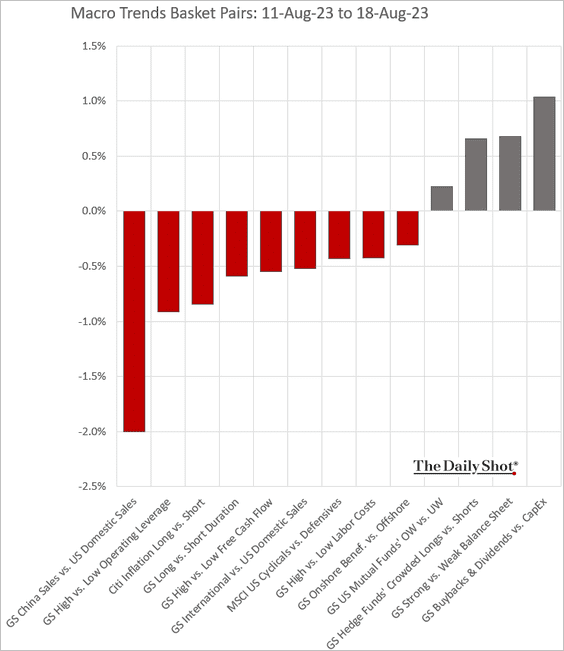

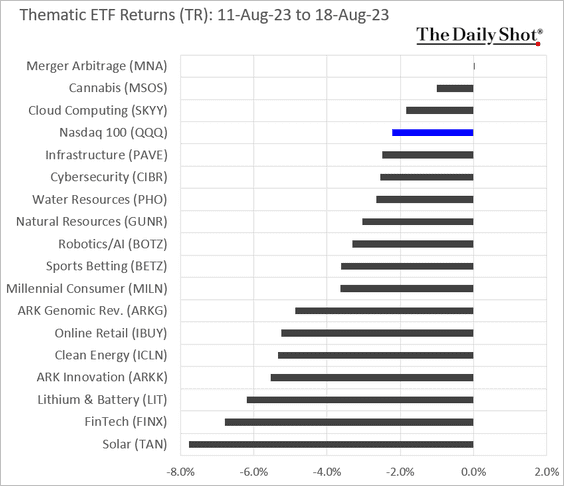

6. Next, we have some performance data from last week.

• Sectors:

• Equity factors:

• Macro baskets’ relative performance:

• Thematic ETFs:

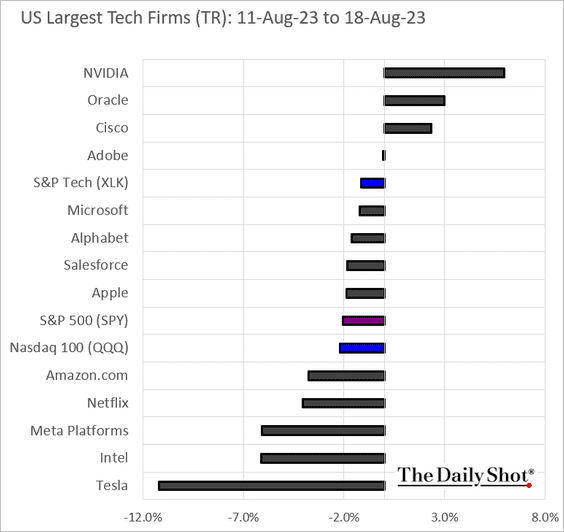

• Largest US tech firms:

Back to Index

Credit

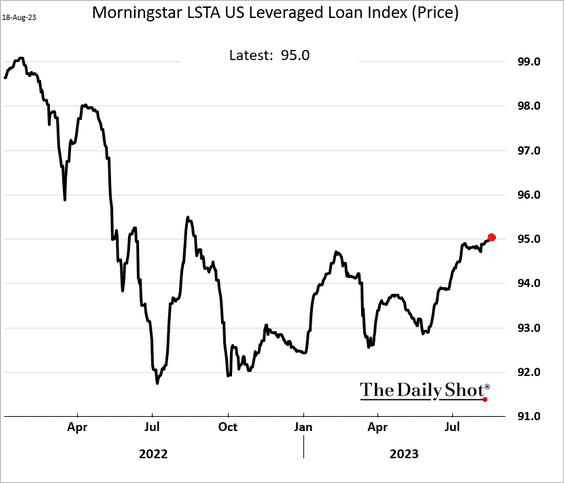

1. Leveraged loan prices have been recovering.

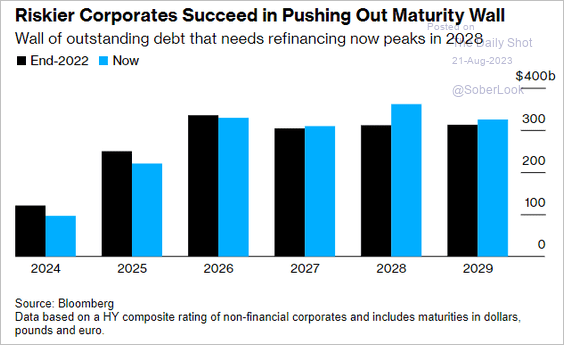

2. The maturity wall for high-yield debt was extended as risk appetite improved and bond issuance increased.

Source: @markets Read full article

Source: @markets Read full article

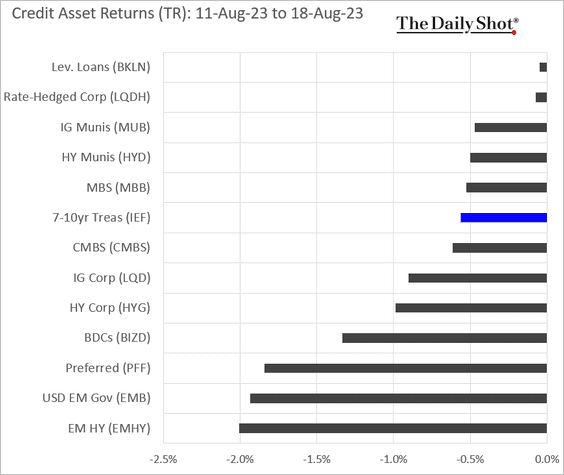

3. Here is last week’s performance across credit asset classes.

Back to Index

Rates

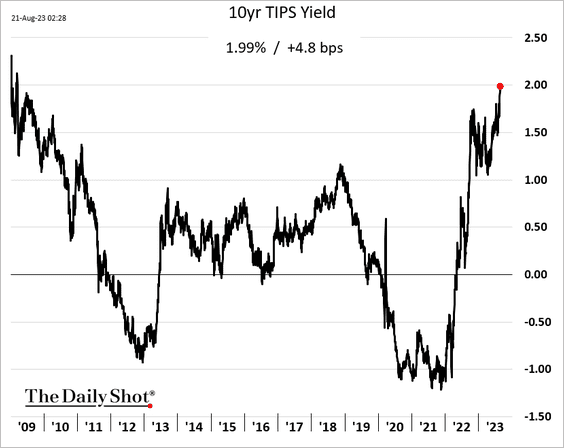

1. Real yields continue to surge, which is a headwind for growth equities. The 10-year TIPS yield is near 2% for the first time since 2009.

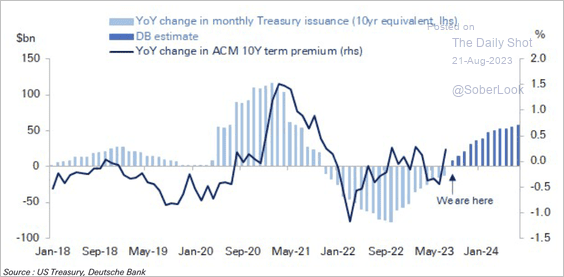

2. Treasury duration from monthly auctions is set to increase over the next few months.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

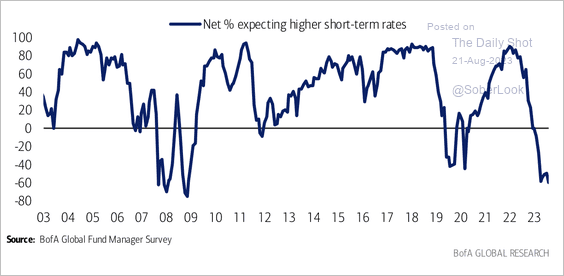

1. Most investors expect lower short-term rates over the next 12 months, according to a survey by BofA.

Source: BofA Global Research

Source: BofA Global Research

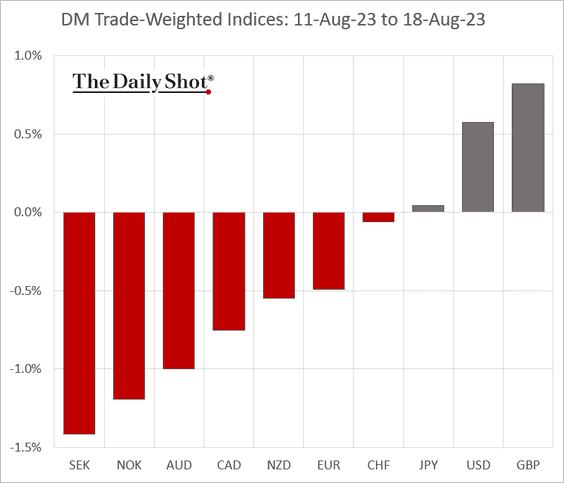

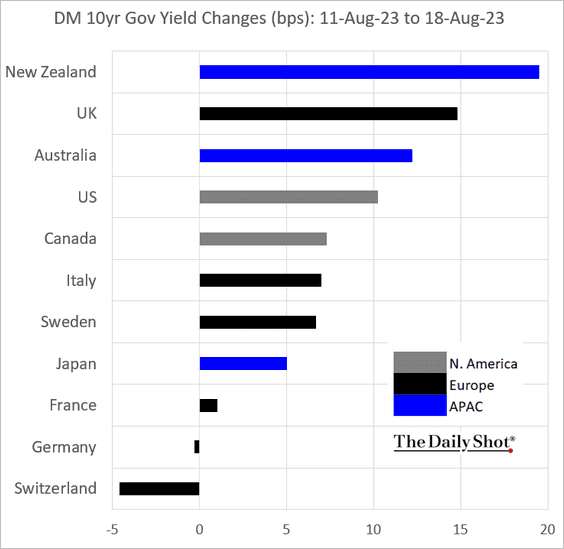

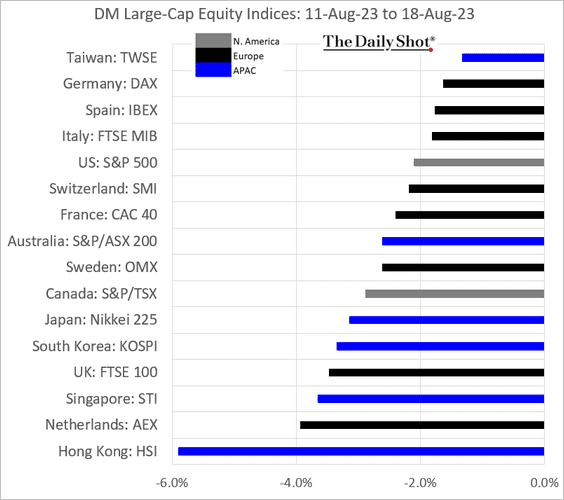

2. Here is last week’s market performance in advanced economies.

• Currencies:

• Bond yields:

• Equities:

——————–

Food for Thought

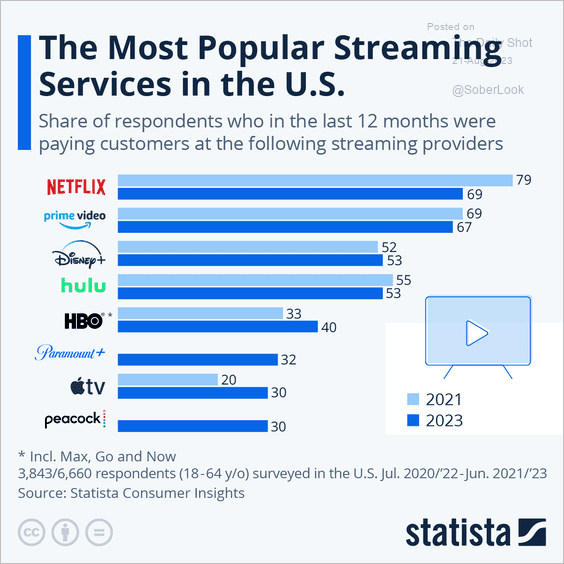

1. Popular streaming services:

Source: Statista

Source: Statista

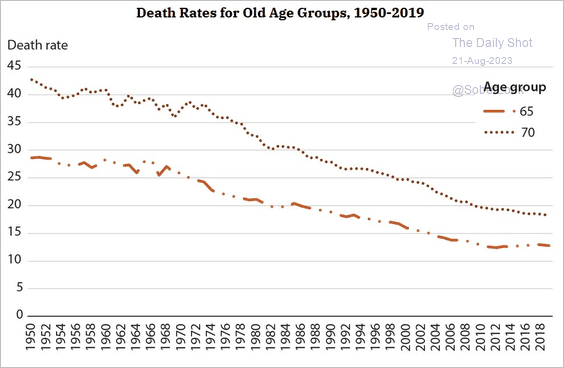

2. Death rates among older Americans:

Source: St. Louis Fed Read full article

Source: St. Louis Fed Read full article

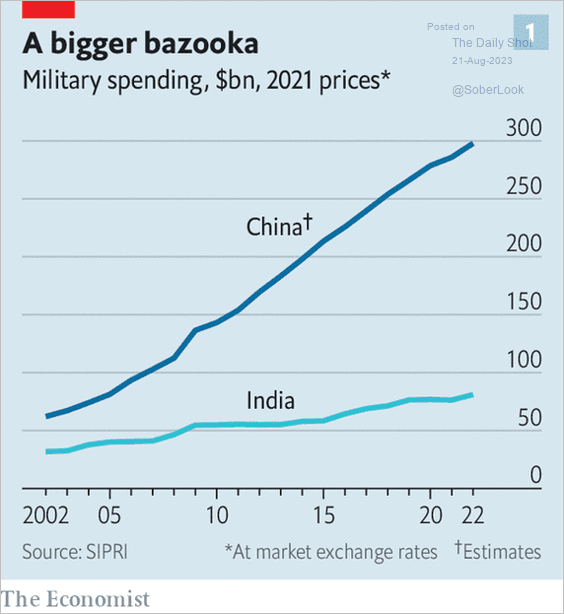

3. Military spending trends for China and India:

Source: The Economist Read full article

Source: The Economist Read full article

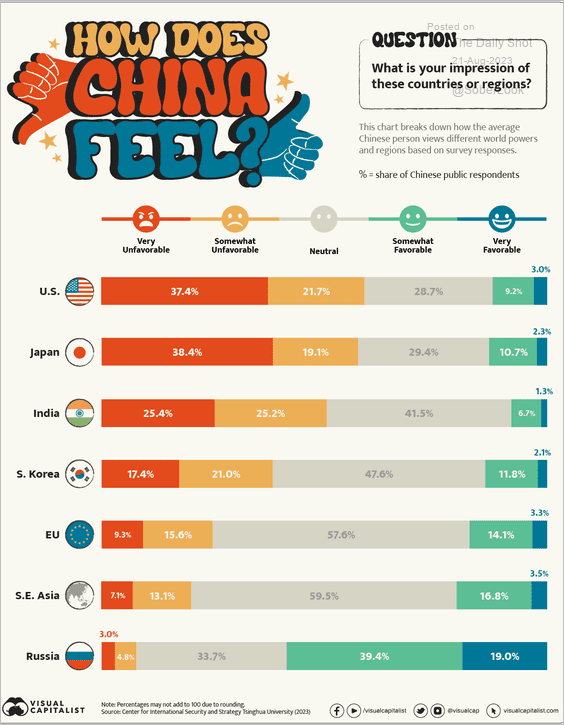

4. How do Chinese citizens feel about other countries?

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

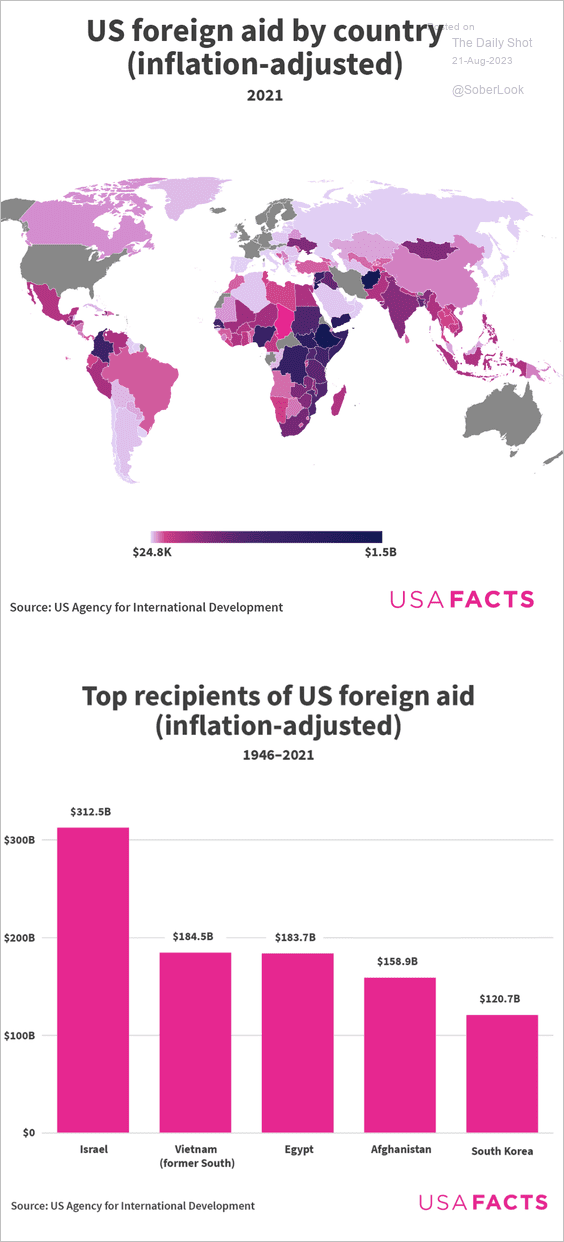

5. US foreign aid:

Source: USAFacts

Source: USAFacts

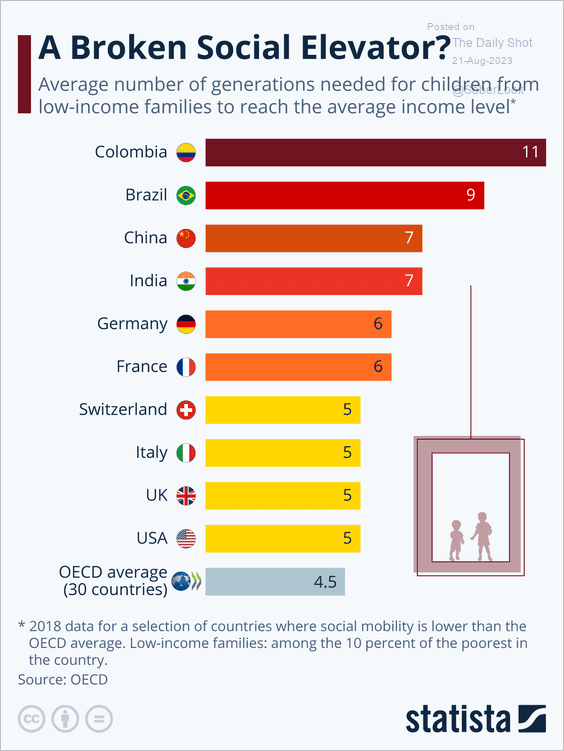

6. Upward mobility:

Source: Statista

Source: Statista

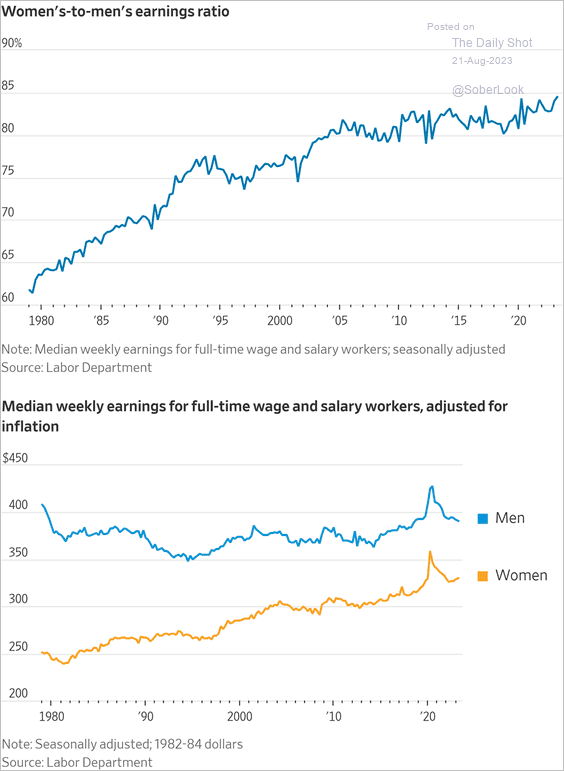

7. The US pay gap has been narrowing:

Source: @jeffsparshott, @WSJ

Source: @jeffsparshott, @WSJ

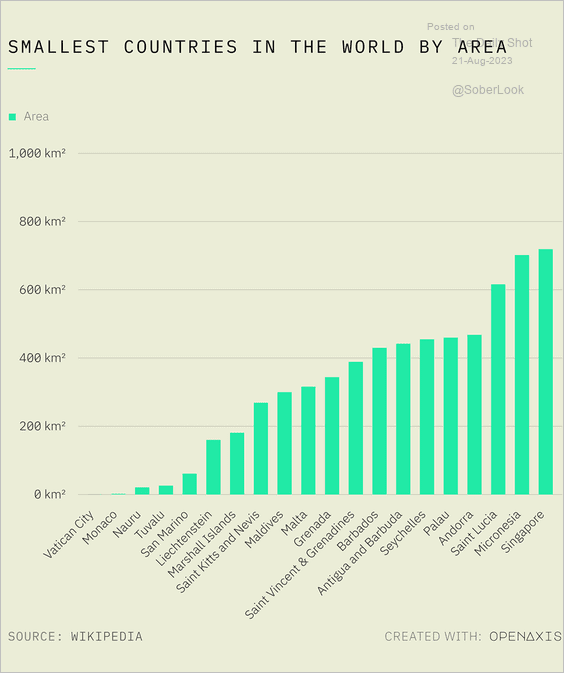

8. Smallest countries in the world (by area):

Source: @OpenAxisHQ

Source: @OpenAxisHQ

——————–

Back to Index