The Daily Shot: 18-Aug-23

• The United States

• Europe

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. The Conference Board’s leading index continues to signal an economic slowdown.

Here are the drivers of last month’s decline.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

2. Below are some updates on the labor market.

• Initial jobless claims increased in the past couple of weeks relative to previous years.

Continuing claims are also edging higher.

• Fewer Americans are concerned about unemployment.

• Small businesses fueled US job gains this year. But now small firms are reporting deteriorating sales.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

To put this in perspective, small businesses employ a lot of Americans.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

——————–

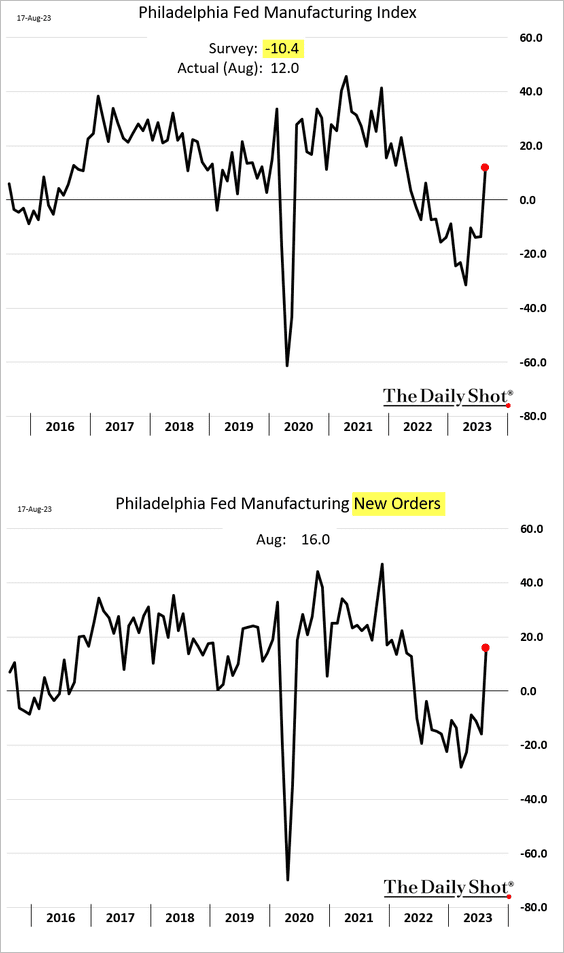

3. The Philly Fed’s regional manufacturing index points to improving factory activity this month.

• Factories are increasing workers’ hours as demand picks up.

• However, more companies are reporting rising costs.

• Manufacturers are cutting their CapEx plans.

——————–

4. Housing affordability hit its worst levels in decades last quarter.

Now, with mortgage rates at over two-decade highs, affordability has deteriorated even more.

Source: @wealth Read full article

Source: @wealth Read full article

——————–

5. Next, we have some updates on inflation.

• Disinflation appears to be intensifying.

Source: @ANZ_Research

Source: @ANZ_Research

• Import prices were flat last month.

• Inflation expectations continue to ease.

• Stifel expects headline inflation to settle near 3.5% later this year, which could keep monetary policy tight.

Source: Stifel

Source: Stifel

Back to Index

Europe

1. The euro area’s trade balance is back in surplus.

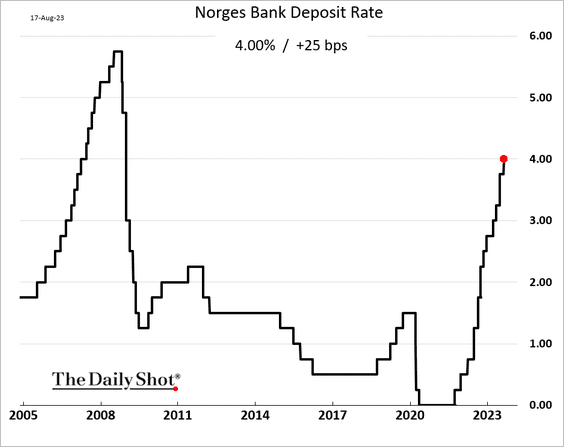

2. Norway’s central bank raised rates, as expected. Economists see one more increase in this cycle.

The yield curve has shifted up in recent days.

——————–

3. Poland’s GDP declined sharply last quarter.

Core inflation is starting to ease.

——————–

4. Who are the biggest ice cream exporters in the EU?

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

1. Core inflation continues to climb.

Here are some inflation trends.

• Food:

• Recreation and culture:

• Clothing and footwear:

——————–

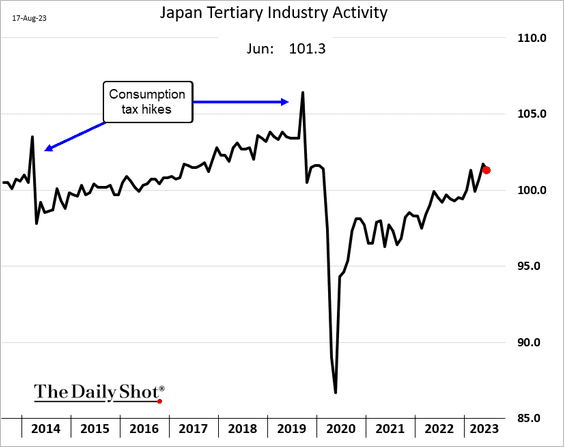

2. This chart shows Japan’s service-sector activity.

Back to Index

China

1. Beijing seems to have arrested the RMB’s decline.

Source: Barron’s Read full article

Source: Barron’s Read full article

Rate differentials with the US remain at multi-year wides.

——————–

2. China’s bond yields continue to fall, …

…as the yield curve flattens.

——————–

3. Property developers’ debt remains under pressure (2 charts).

Source: BofA Global Research

Source: BofA Global Research

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Developers’ stock prices are also falling.

——————–

4. Beijing’s focus shifts to shadow banking.

Source: @markets Read full article

Source: @markets Read full article

Source: @markets Read full article

Source: @markets Read full article

——————–

5. The Heng Seng TECH Index is at its 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @technology Read full article

Source: @technology Read full article

——————–

6. Hong Kong’s unemployment rate keeps dropping.

Back to Index

Emerging Markets

1. Prices are falling rapidly in Brazil.

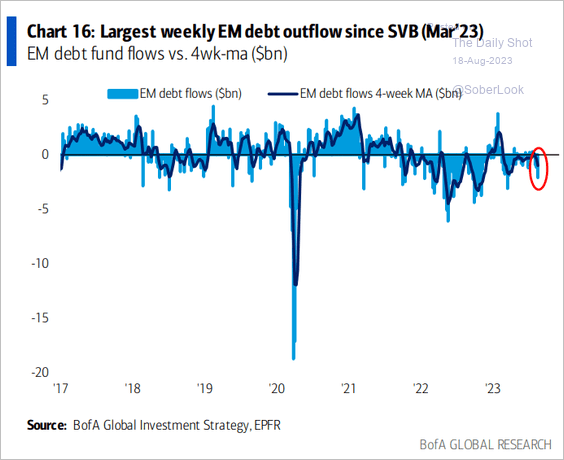

2. Colombia’s GDP contracted last quarter.

3. EM debt funds saw substantial outflows last week.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

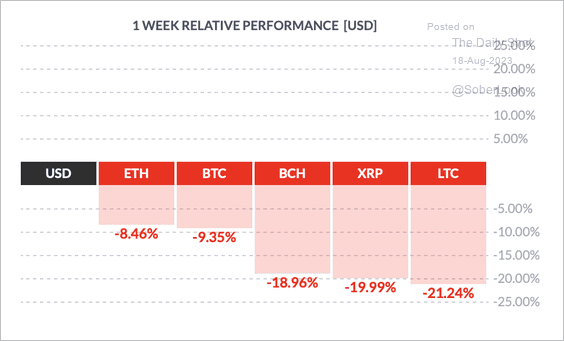

Cryptocurrency

1. It has been a difficult week for cryptos, with Litecoin’s LTC underperforming top peers.

Source: FinViz

Source: FinViz

Bitcoin dipped below $26k, crashing through the 200-day moving average. Here is one explanation for the drop.

2. The latest price correction triggered a sharp drop in the percentage of BTC supply in profit…

Source: @glassnode

Source: @glassnode

…and a significant spike in long liquidations.

Source: Coinglass

Source: Coinglass

Source: CoinDesk Read full article

Source: CoinDesk Read full article

——————–

3. Solana’s SOL token became one of the most liquid altcoins on Coinbase.

Source: @KaikoData

Source: @KaikoData

Back to Index

Commodities

1. China’s imports of commodities fell in July, although Capital Economics expects infrastructure spending to boost demand for metals over the next few months.

Source: Capital Economics

Source: Capital Economics

2. Here is a look at global steel production.

Source: Semafor

Source: Semafor

Who are the largest US steel producers?

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

1. US equity indices are nearing oversold territory.

• S&P 500:

• Nasdaq Composite:

• S&P 600 (small caps):

——————–

2. This trend is not sustainable.

Bonds have been dragging stocks lower this month, …

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

… as the stock-bond correlation remains in positive territory.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

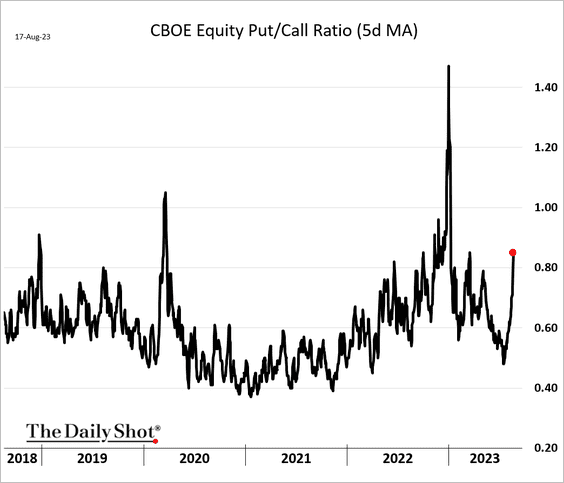

3. The single-stock put-call ratio has risen sharply in recent days as caution returns to the market.

4. US firms with substantial exposure to China are having a rough month.

5. Short interest continues to trend lower.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

6. How will the market react to the looming government shutdown?

Source: BCA Research

Source: BCA Research

7. Here is a look at buybacks as a share of the total cash returned across global equity markets.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Credit

1. Money market funds’ assets keep climbing.

Source: BofA Global Research

Source: BofA Global Research

——————–

2. So far, US high-yield credit spreads are not showing signs of stress.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

3. Private loan activity has accelerated.

Source: @technology Read full article

Source: @technology Read full article

Back to Index

Rates

1. The real US policy rate is well above the estimated long-run equilibrium real rate (R*). This restrictive stance is consistent with the deeply inverted yield curve.

Source: Alpine Macro

Source: Alpine Macro

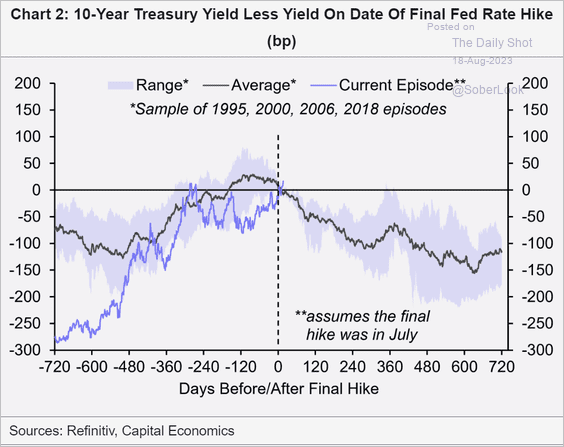

2. Either Treasury yields are heading lower, or the Fed isn’t done with rate hikes yet.

Source: Capital Economics

Source: Capital Economics

Back to Index

Global Developments

1. Narrower interest rate differentials could weigh on the dollar, especially during the late stage of the US hiking cycle.

Source: Alpine Macro

Source: Alpine Macro

However, recent weakness in China occurred alongside dollar strength, indicating a flight to safety.

Source: Alpine Macro

Source: Alpine Macro

——————–

2. Here is a look at potential growth in advanced economies.

Source: Fitch Ratings

Source: Fitch Ratings

3. Smartphone sales have been slowing.

Source: @technology Read full article

Source: @technology Read full article

<+>

——————–

Food for Thought

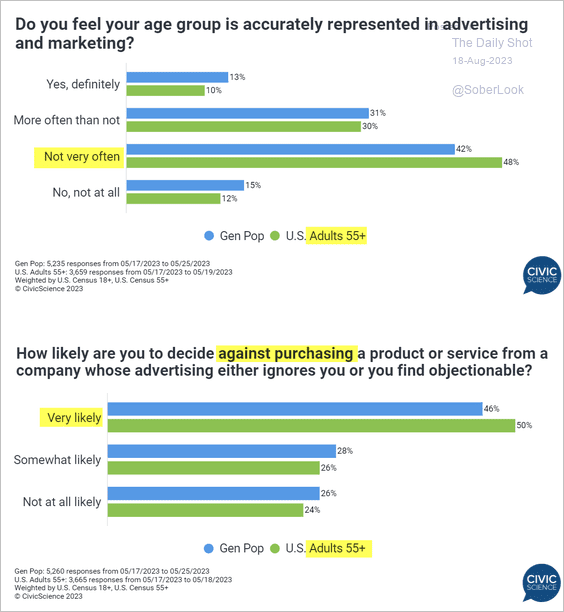

1. Are advertisers ignoring older Americans?

Source: @CivicScience Read full article

Source: @CivicScience Read full article

2. Taking on more work before student loan payments resume:

Source: Intelligent Read full article

Source: Intelligent Read full article

• Boycotting student loan payments?

Source: Intelligent Read full article

Source: Intelligent Read full article

——————–

3. The distribution of US college admission rates:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

4. Changes in COVID-related hospitalization rates:

Source: @axios Read full article

Source: @axios Read full article

5. Prescriptions for diabetes drugs:

Source: @chartrdaily

Source: @chartrdaily

6. US obesity rates:

Source: @chartrdaily

Source: @chartrdaily

7. Disaster funding sources:

Source: Brookings Read full article

Source: Brookings Read full article

8. Movie running times:

Source: @chartrdaily

Source: @chartrdaily

——————–

Have a great weekend!

Back to Index