The Daily Shot: 17-Aug-23

• The United States

• The United Kingdom

• The Eurozone

• Japan

• Australia

• China

• Emerging Markets

• Energy

• Equities

• Credit

• Food for Thought

The United States

1. The FOMC minutes showed a hawkish bias.

With inflation still well above the Committee’s longer-run goal and the labor market remaining tight, most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy.

But some FOMC members are becoming concerned about the impact of the increasingly restrictive policy, pointing to a growing divide on the Committee.

A number of participants judged that, with the stance of monetary policy in restrictive territory, risks to the achievement of the Committee’s goals had become more two sided, and it was important that the Committee’s decisions balance the risk of an inadvertent overtightening of policy against the cost of an insufficient tightening.

Source: @WSJ Read full article

Source: @WSJ Read full article

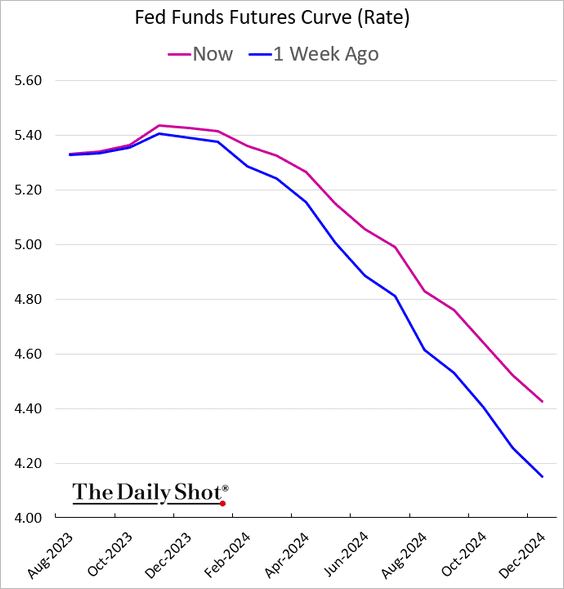

The market dialed back next year’s rate cut expectations.

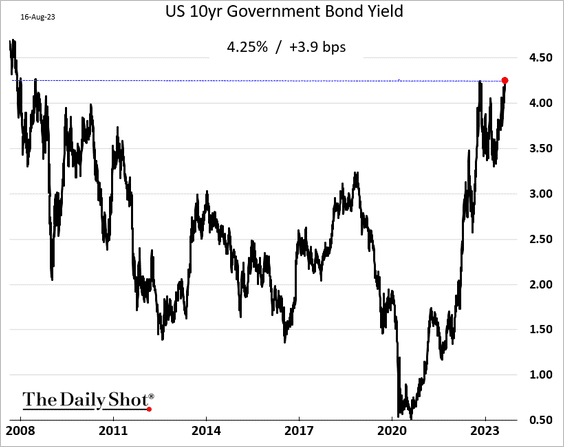

The 10-year Treasury yield hit a multi-year high.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

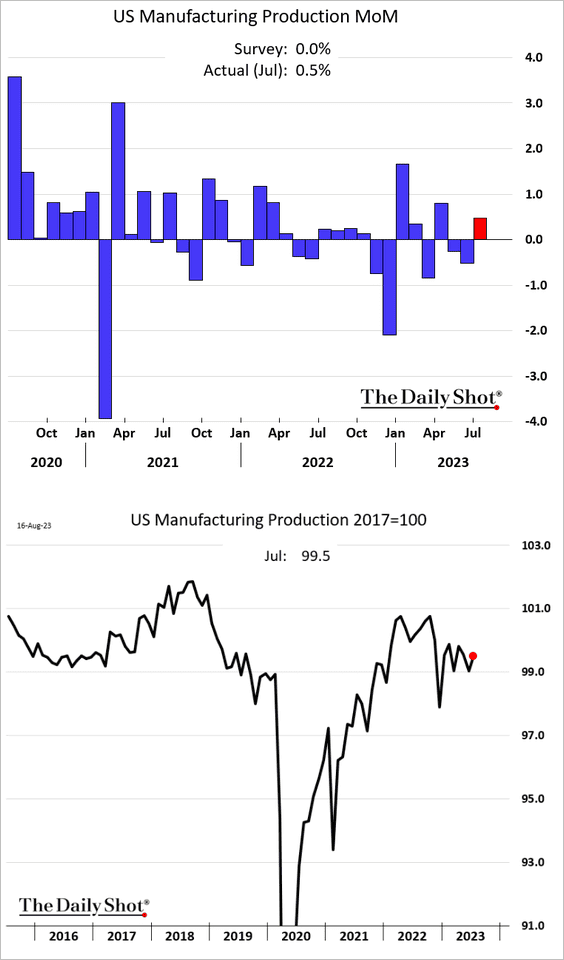

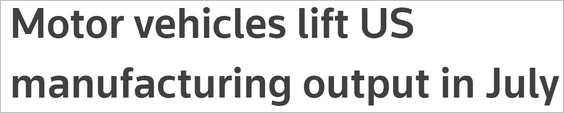

2. US manufacturing output topped expectations, …

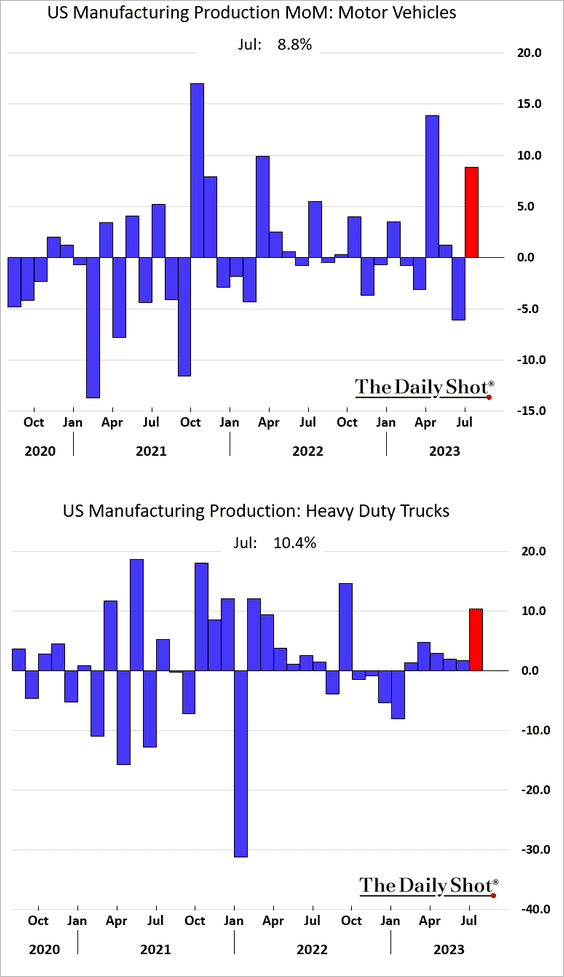

… boosted by vehicle production.

Source: Reuters Read full article

Source: Reuters Read full article

However, factory output has been slowing when vehicles are excluded.

Source: ING

Source: ING

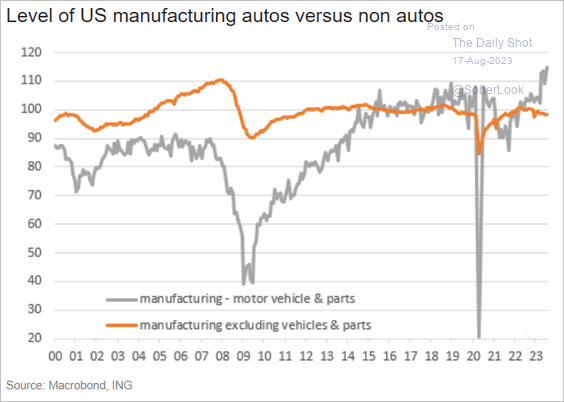

And automobile production is expected to decline over the next few months.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

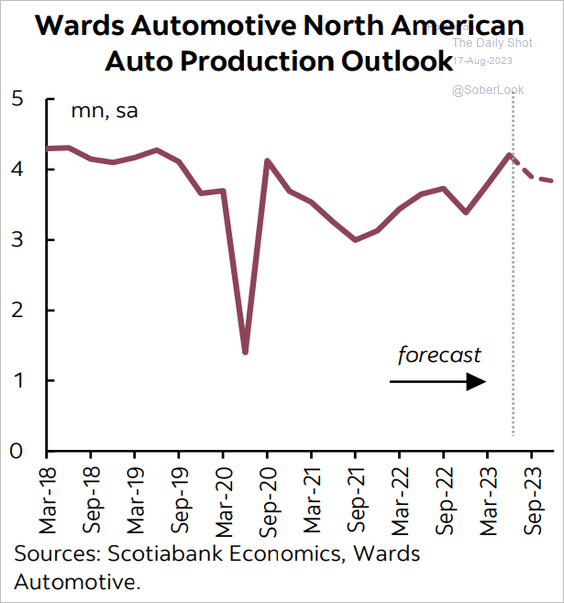

3. The GDPNow model keeps raising growth forecasts for the current quarter.

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

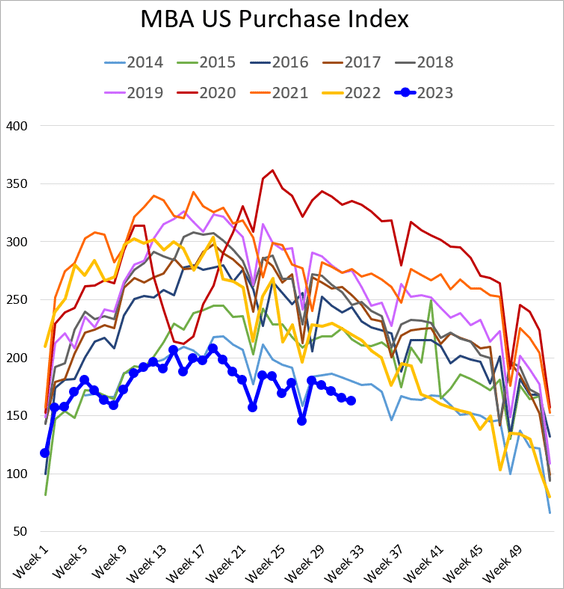

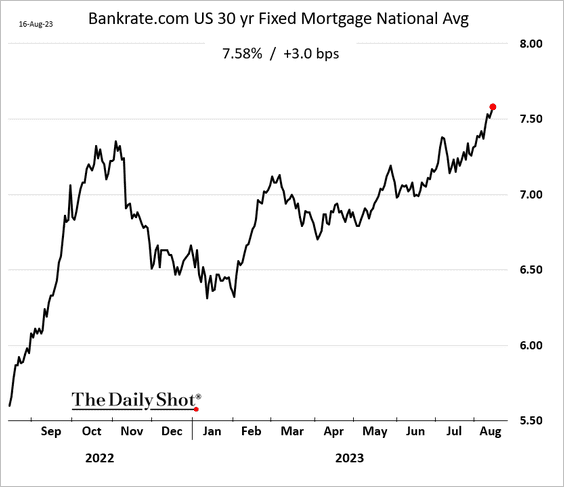

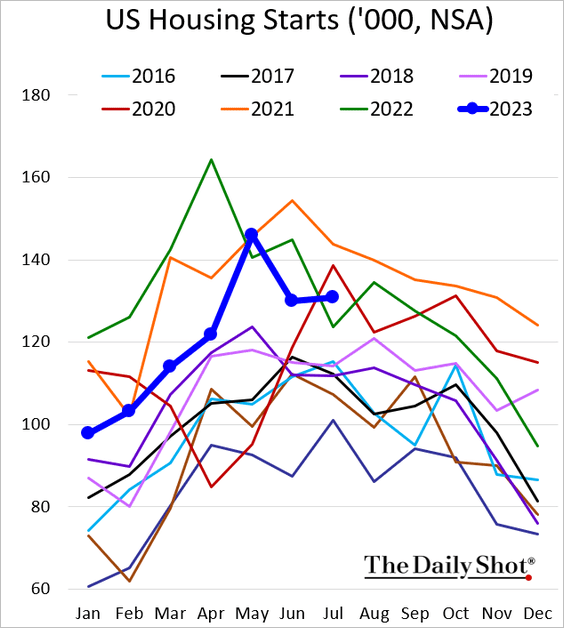

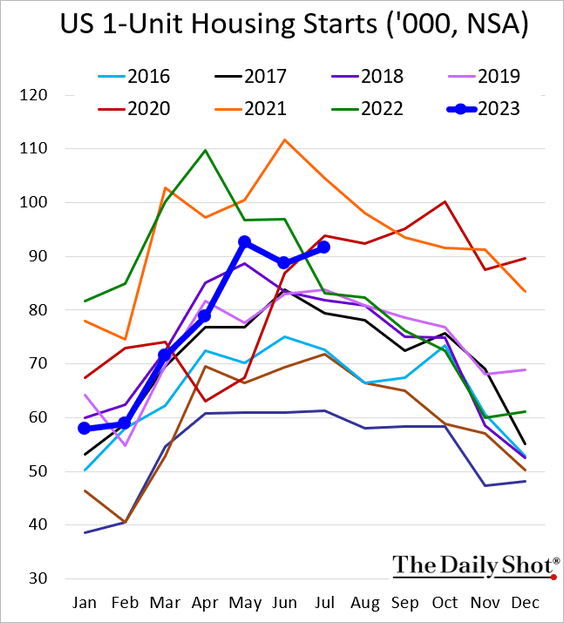

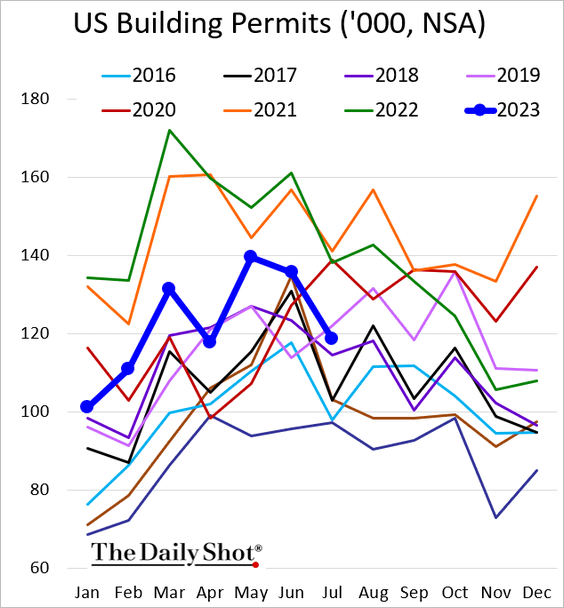

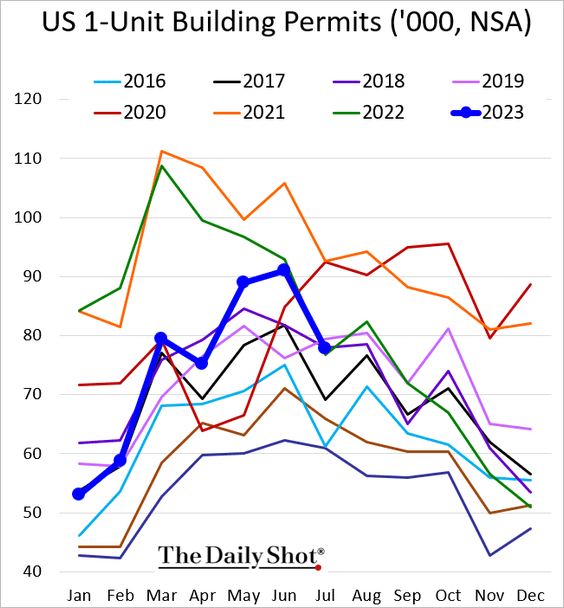

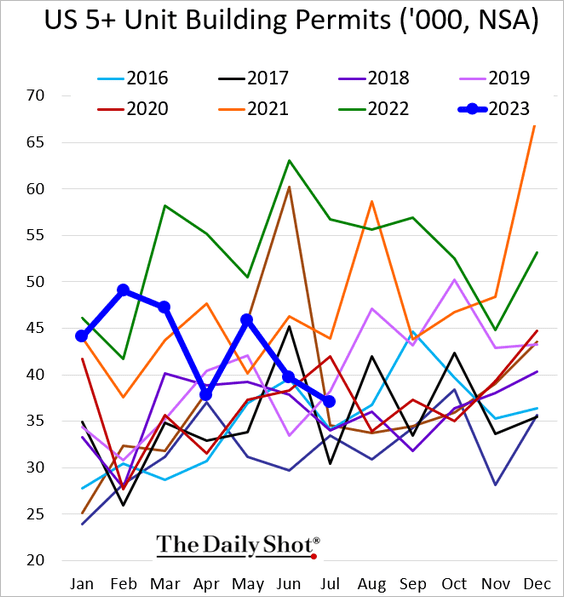

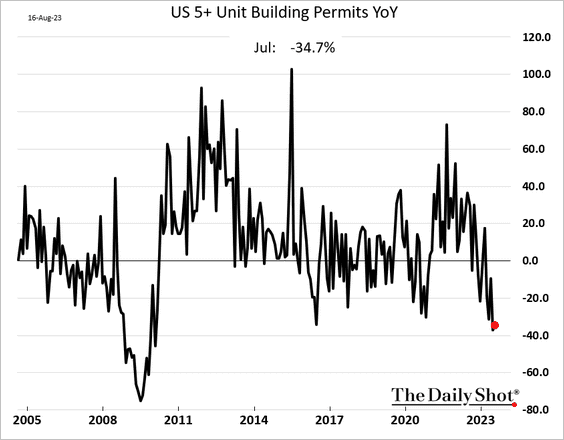

4. Next, we have some updates on the housing market.

• Mortgage applications are likely to keep slowing, …

… as mortgage rates surge.

• Last month’s housing starts were stronger than expected, climbing above 2022 levels.

Source: Reuters Read full article

Source: Reuters Read full article

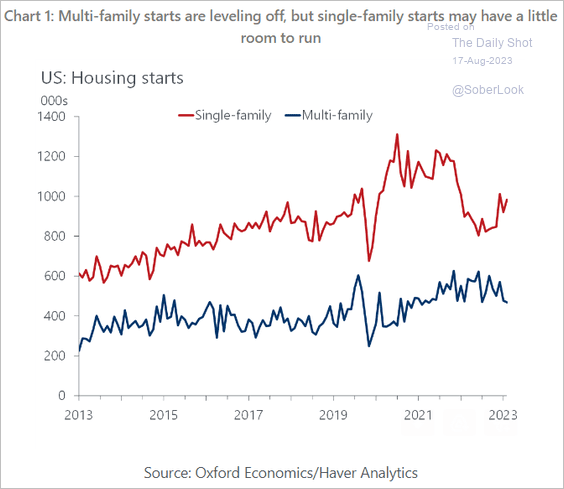

The strength in construction was fueled by single-family housing.

– Building permits were softer than expected (2 charts).

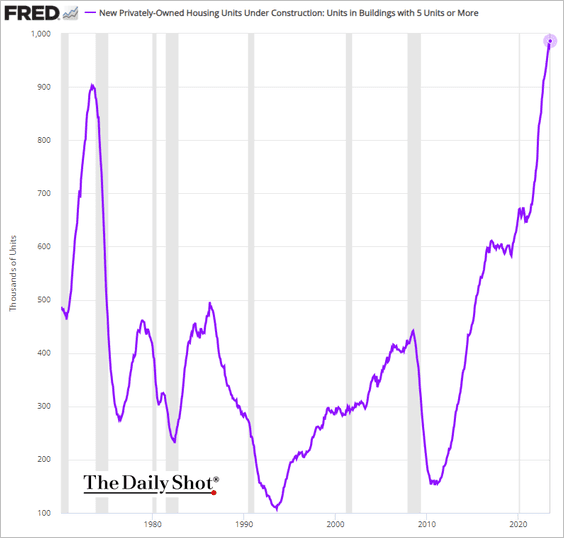

– Multifamily housing activity continues to slow …

… amid expanding pipeline. Multifamily units under construction hit a record high.

Here are the seasonally-adjusted trends for housing starts.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

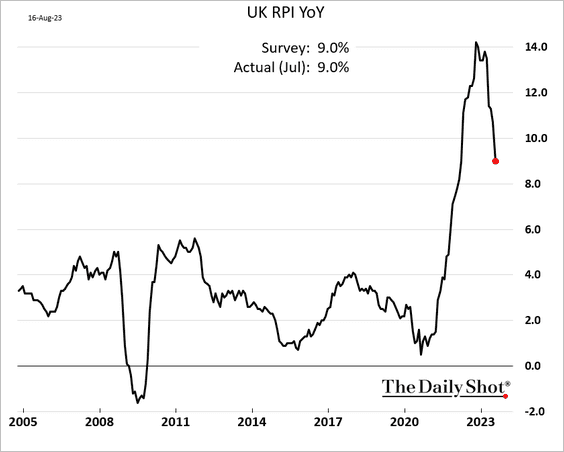

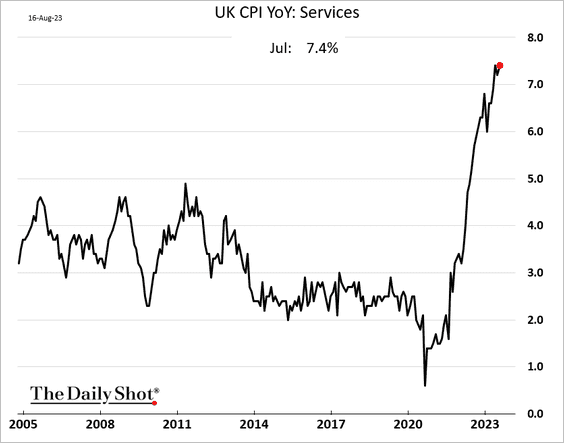

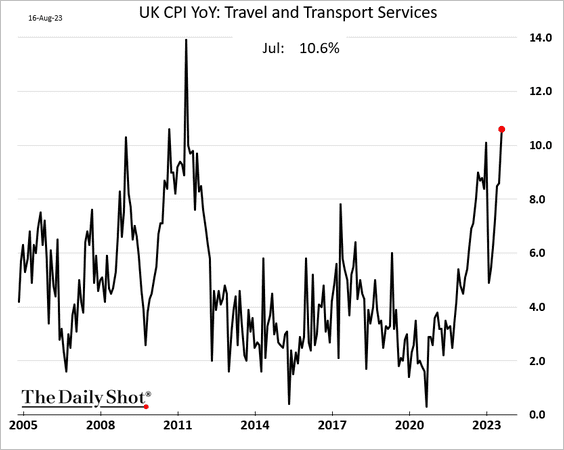

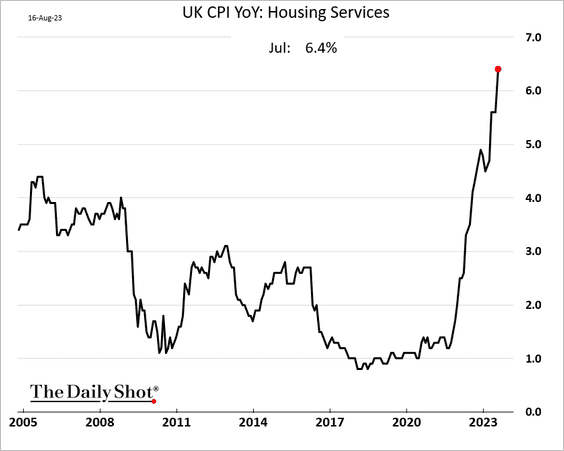

The United Kingdom

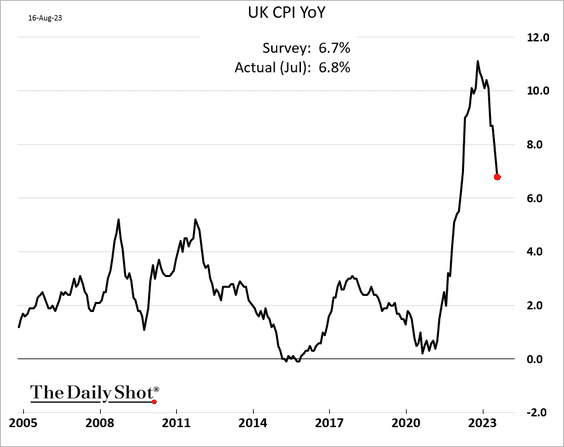

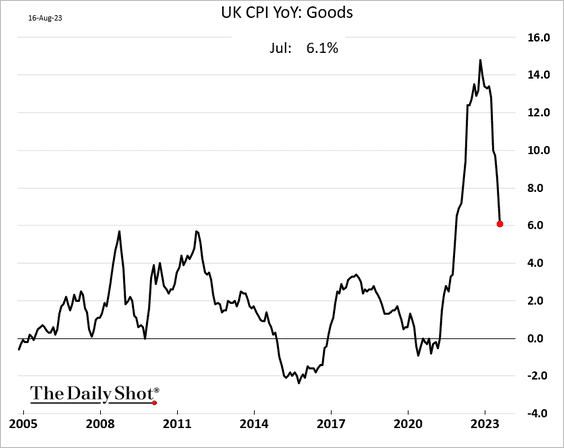

1. The headline CPI declined sharply last month.

But as we saw yesterday, core inflation remains stubbornly high (see chart).

• While goods inflation is easing rapidly, …

… which is showing up in retail prices, …

… services inflation is at a multi-year high (3 charts).

Source: Reuters Read full article

Source: Reuters Read full article

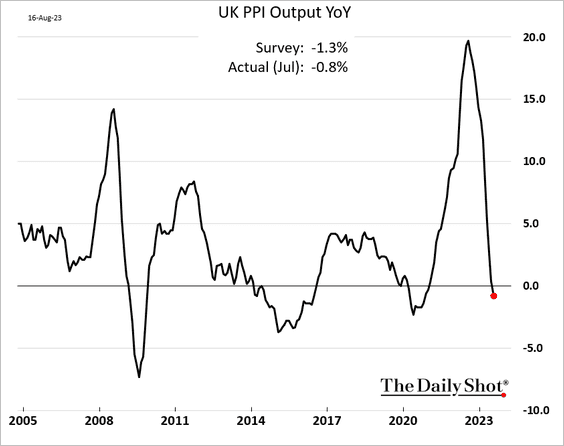

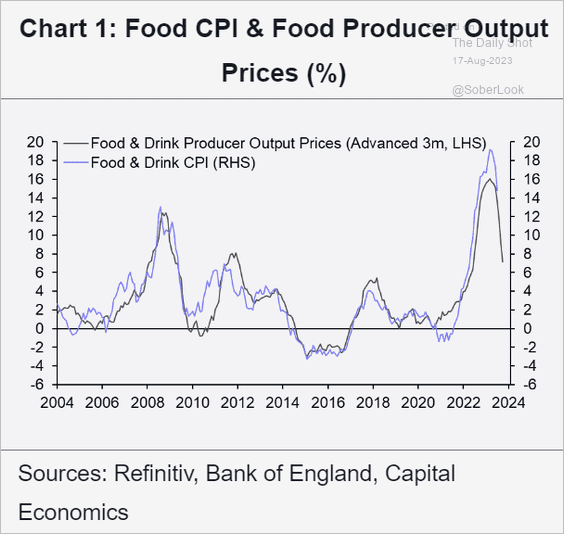

• Moderating producer prices …

… should ease food inflation.

Source: Capital Economics

Source: Capital Economics

——————–

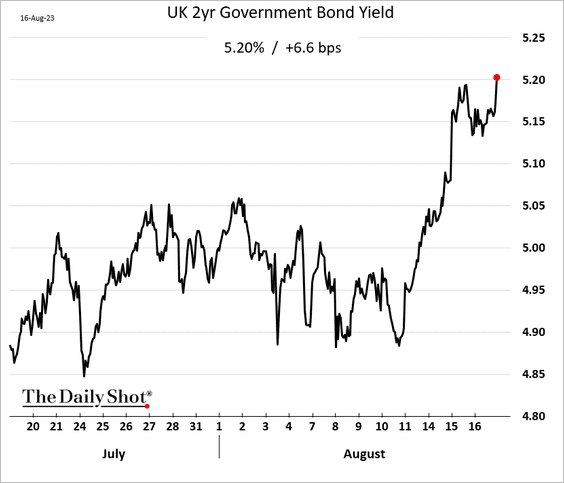

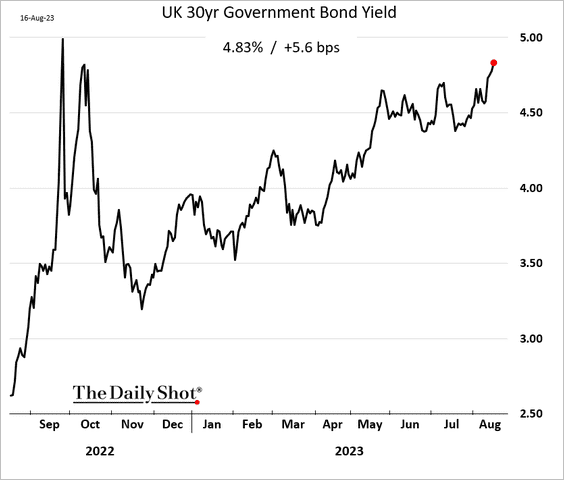

2. Gilt yields climbed further.

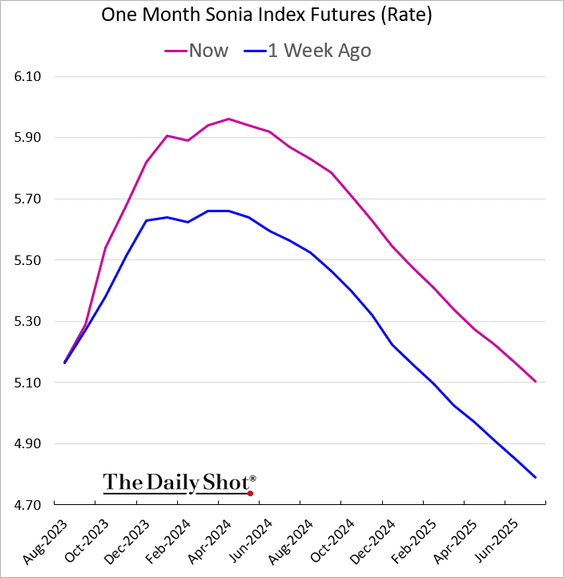

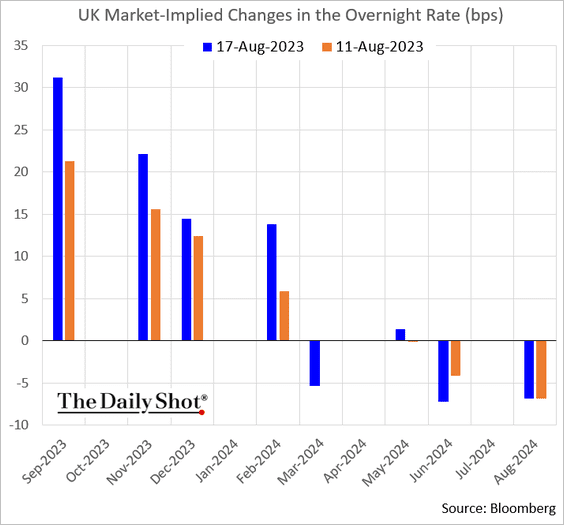

The market expects more tightening from the BoE, …

… with some 82 bps of additional rate hikes priced in for this cycle.

——————–

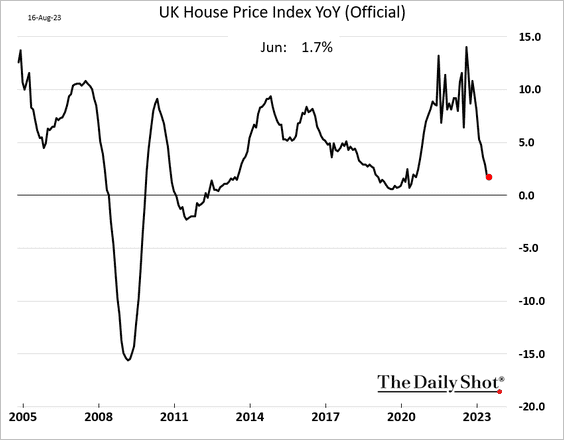

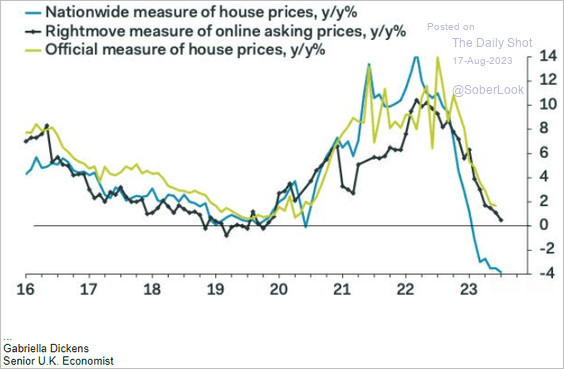

3. Home price appreciation continues to slow.

Private measures point to further weakness in the housing market.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

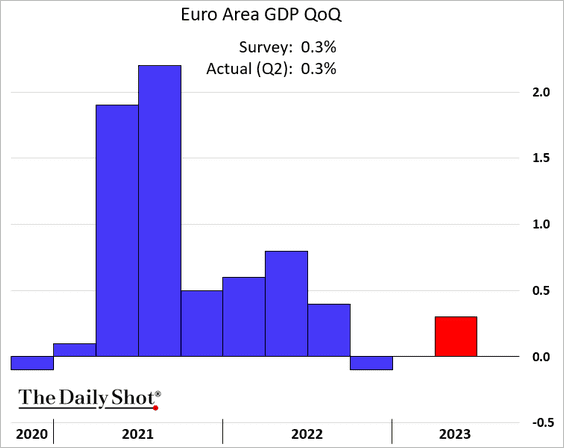

1. The euro-area GDP expanded by 0.3% last quarter, in line with forecasts.

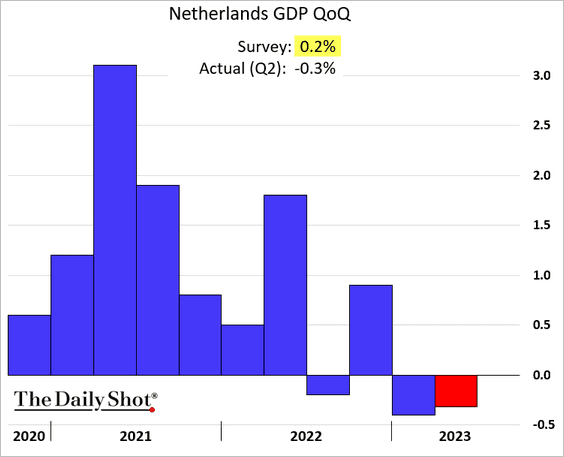

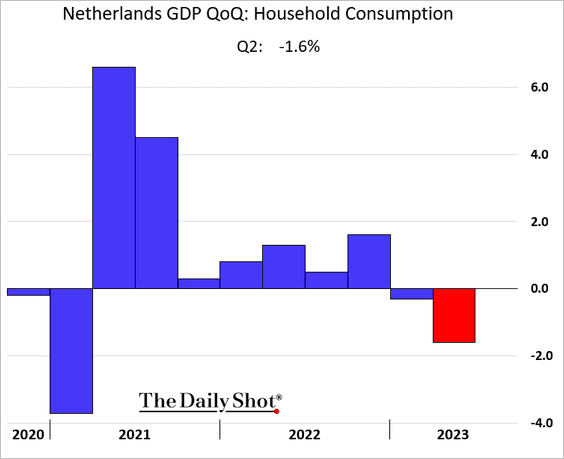

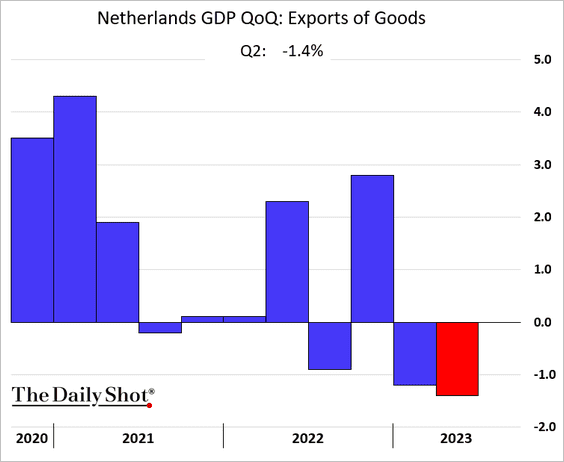

2. The Dutch economy unexpectedly entered a technical recession, …

… due to softer household consumption and weaker exports.

Source: @economics Read full article

Source: @economics Read full article

——————–

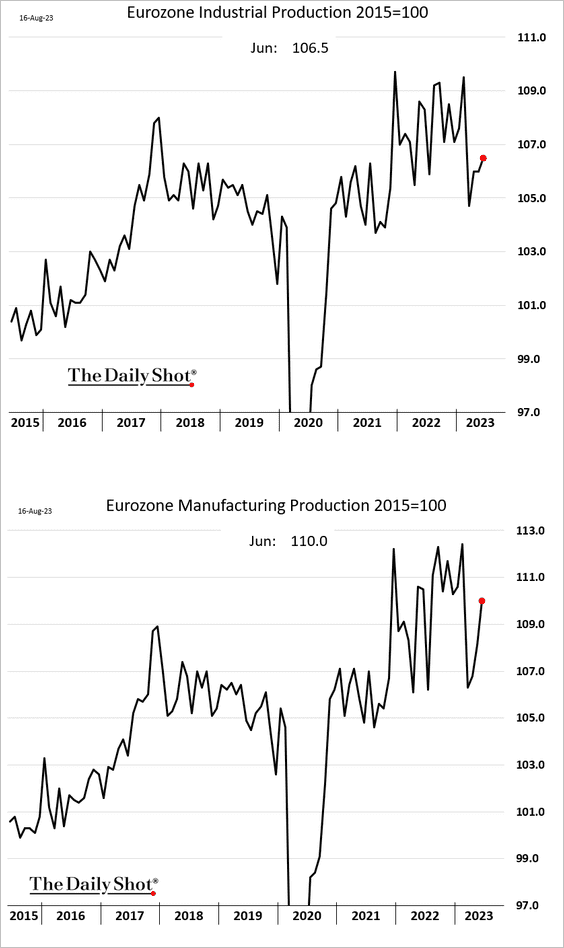

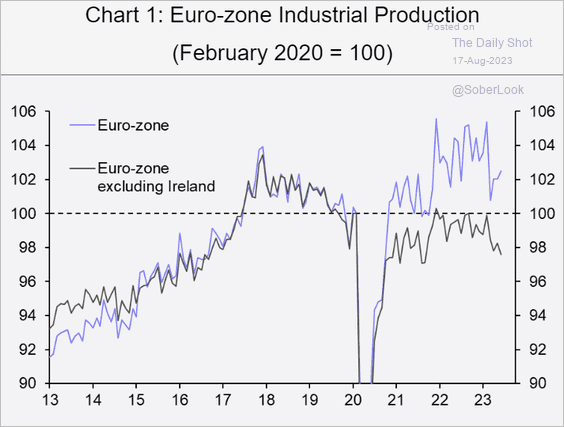

3. Euro-area industrial production increased in June, boosted by Ireland’s output.

Source: @WSJ Read full article

Source: @WSJ Read full article

Excluding Ireland’s contribution, the picture looks less rosy.

Source: Capital Economics

Source: Capital Economics

Back to Index

Japan

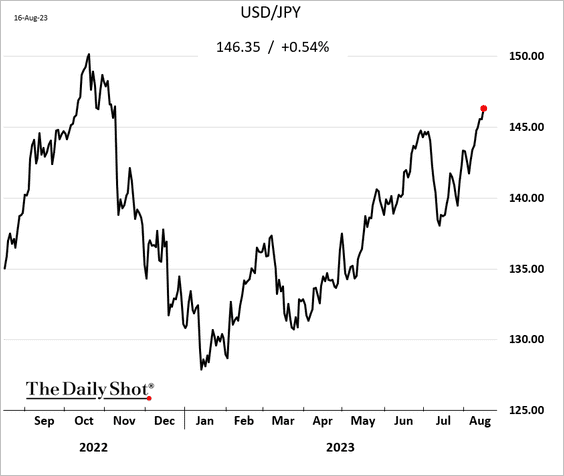

1. The yen continues to weaken (chart shows the dollar gaining against the yen).

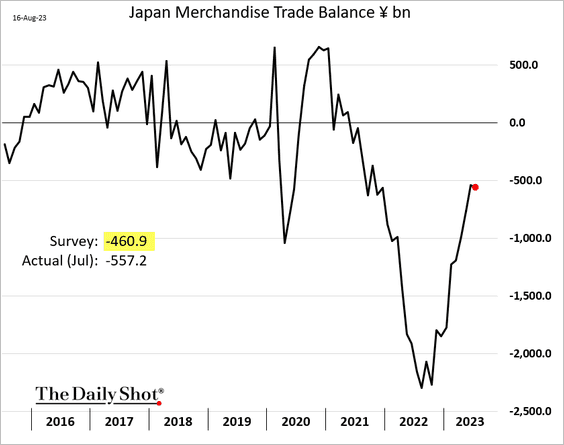

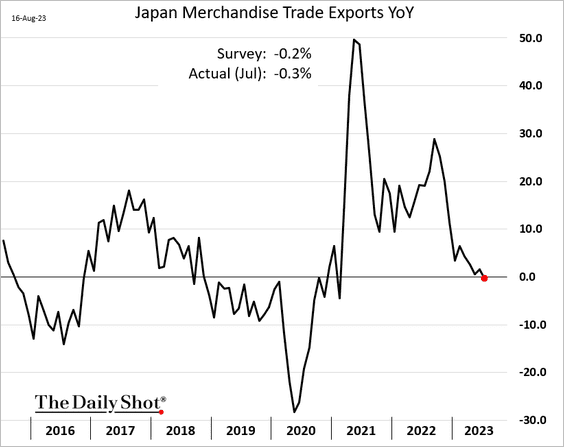

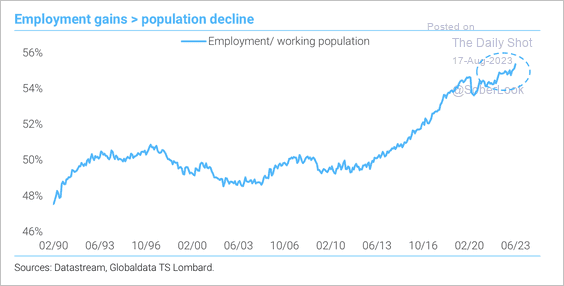

2. The trade deficit was wider than expected last month, …

… due to softer exports.

Source: @economics Read full article

Source: @economics Read full article

——————–

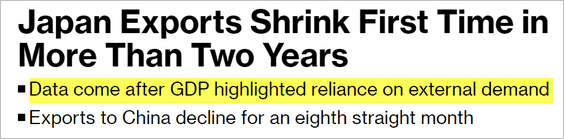

3. Elevated wage growth has become entrenched.

Source: Capital Economics

Source: Capital Economics

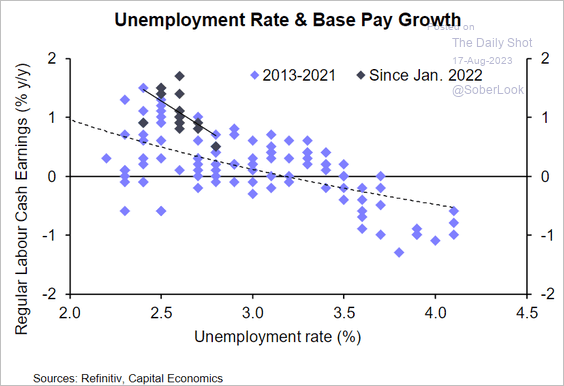

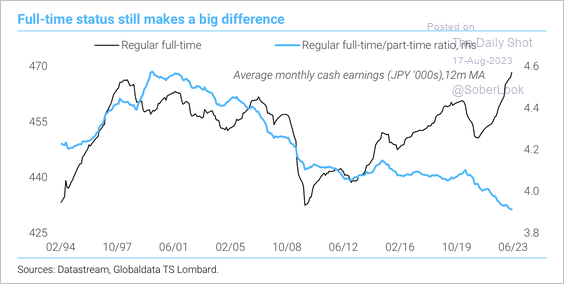

4. The employment-to-working-age-population ratio is rising, driven by full-time jobs. (2 charts)

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

Back to Index

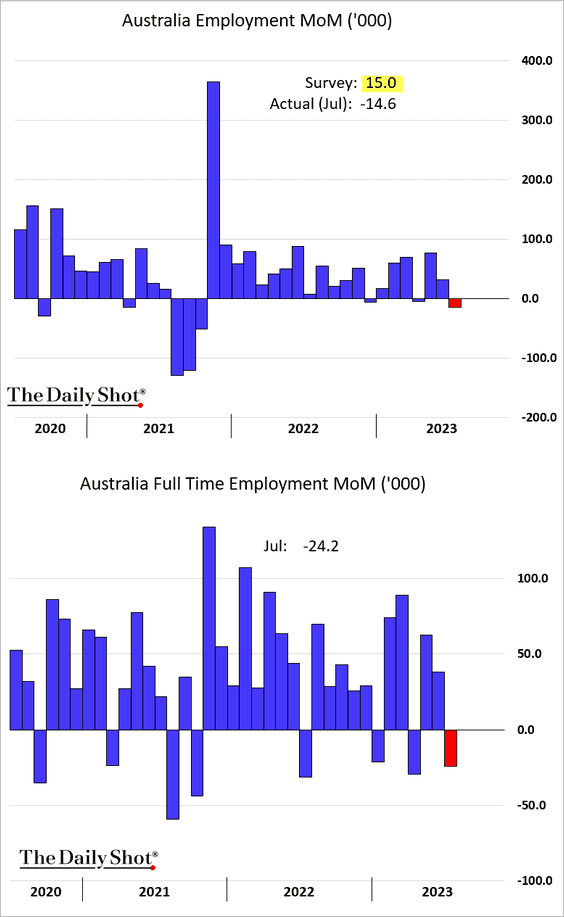

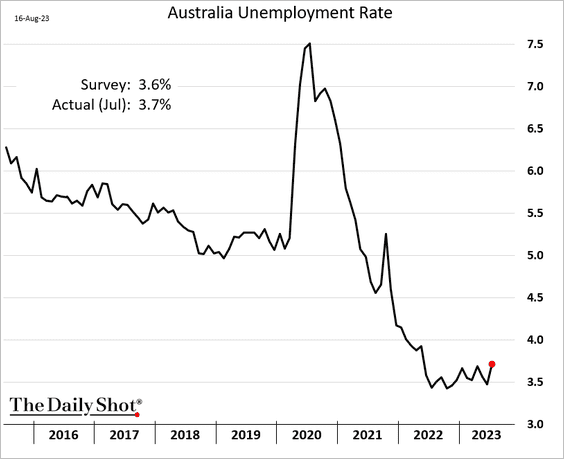

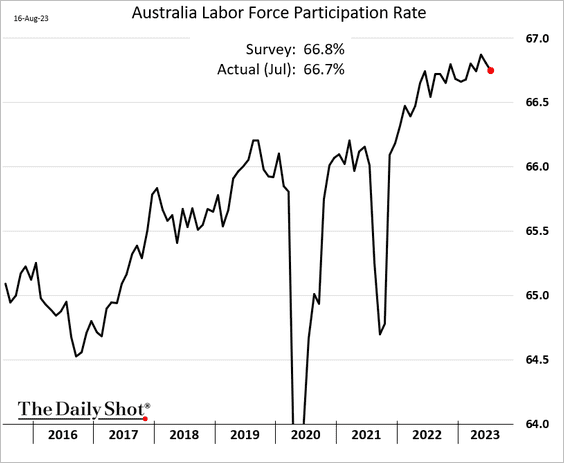

Australia

The labor market shows signs of sputtering, with unexpected job losses in July.

Source: @economics Read full article

Source: @economics Read full article

The unemployment rate ticked higher, …

… and the participation rate eased.

Back to Index

China

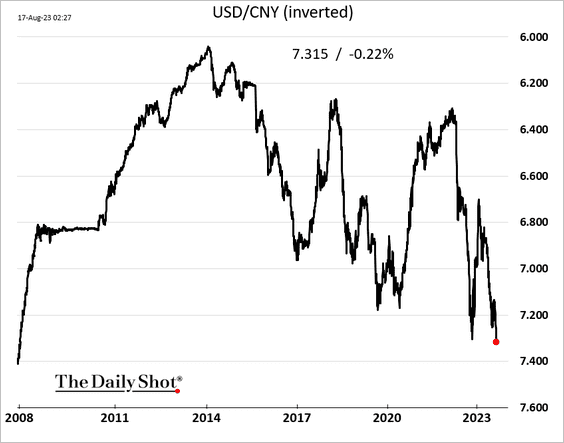

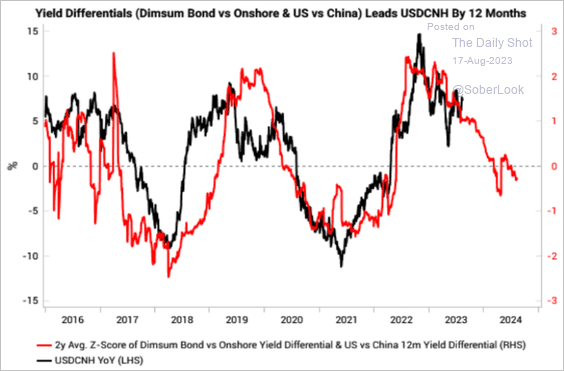

1. The renminbi hit the lowest level vs. USD since 2008, …

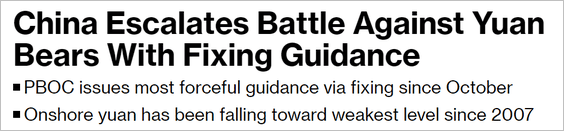

… and Beijing is trying to arrest the decline.

– By setting a stronger fixing guidance:

Source: @markets Read full article

Source: @markets Read full article

– And via direct intervention:

Source: Reuters Read full article

Source: Reuters Read full article

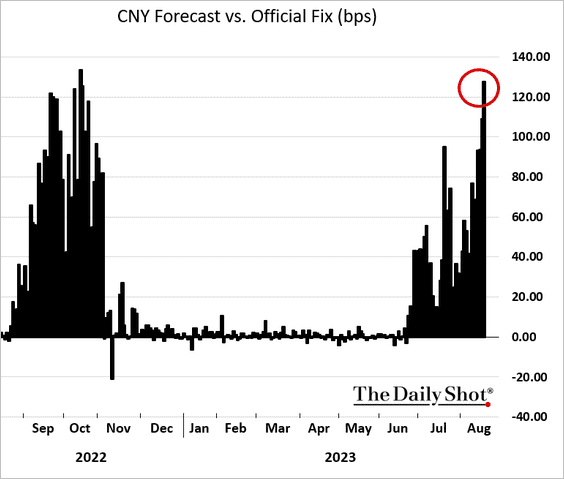

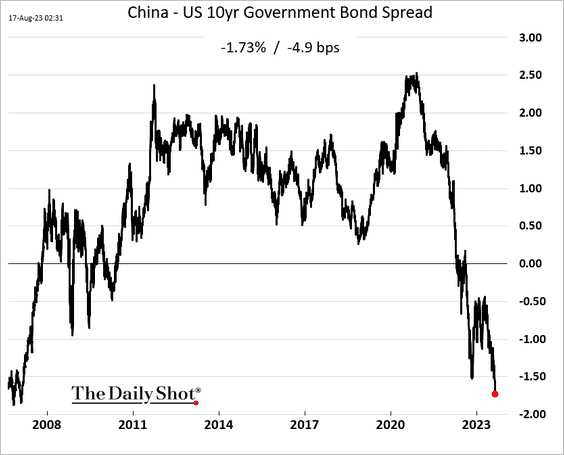

• The rate differential with the US continues to widen,…

… pressuring China’s currency.

Source: Variant Perception

Source: Variant Perception

——————–

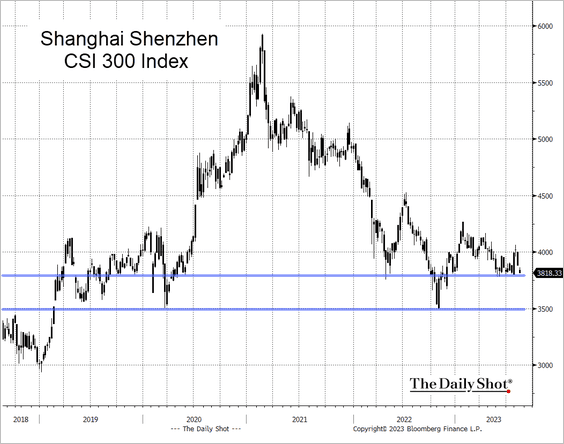

2. The Shanghai Shenzhen CSI 300 Index is at support. The next stop is 3,500.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

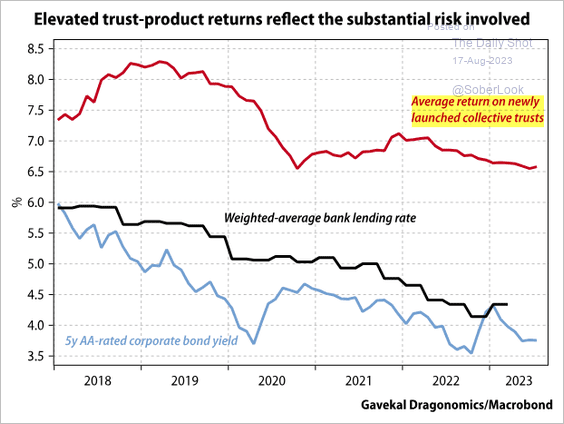

3. Concerns are growing around China’s trust assets.

Source: @markets Read full article

Source: @markets Read full article

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

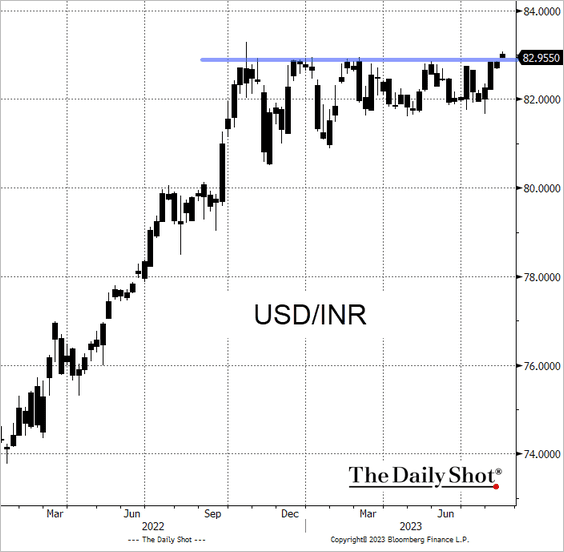

1. USD/INR (US dollar vs. Indian rupee) is testing resistance.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

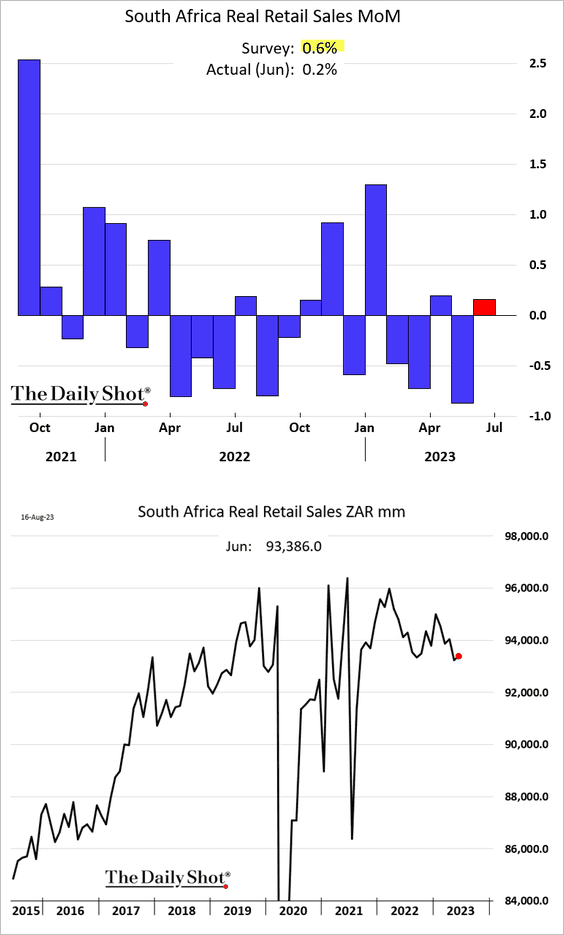

2. South Africa’s retail sales edged higher in June.

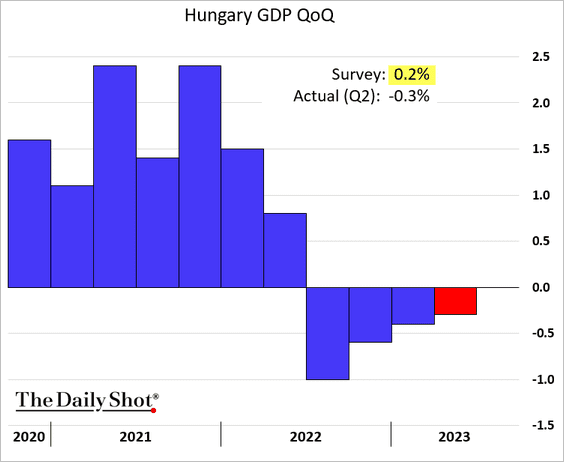

3. Hungary remains in recession.

Source: @economics Read full article

Source: @economics Read full article

Back to Index

Energy

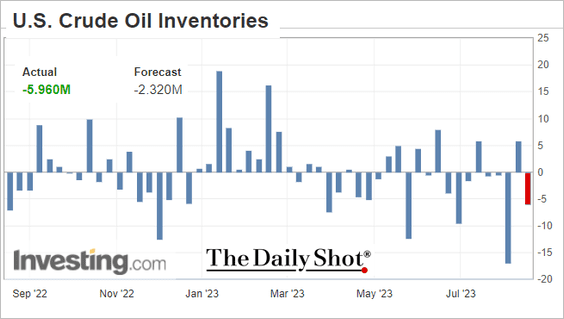

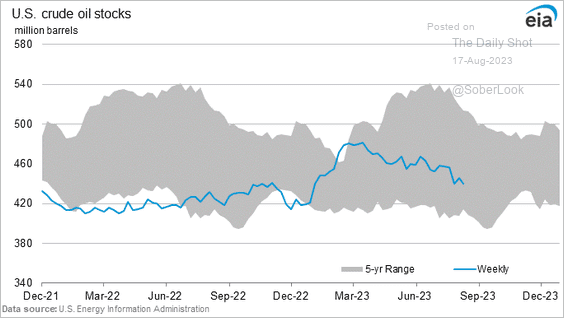

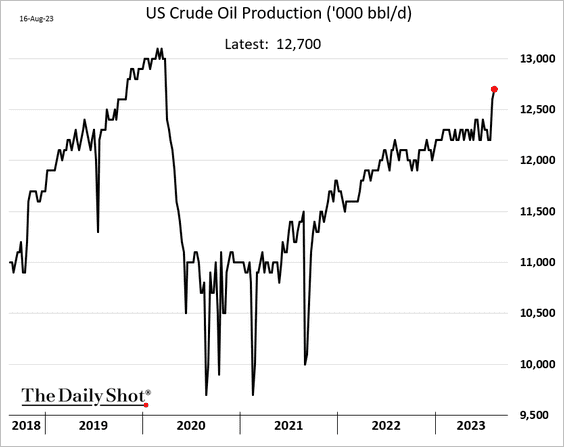

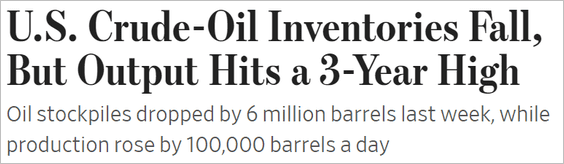

1. US crude oil inventories declined sharply last week, …

… but US production hit the highest level since the COVID shock.

Source: @WSJ Read full article

Source: @WSJ Read full article

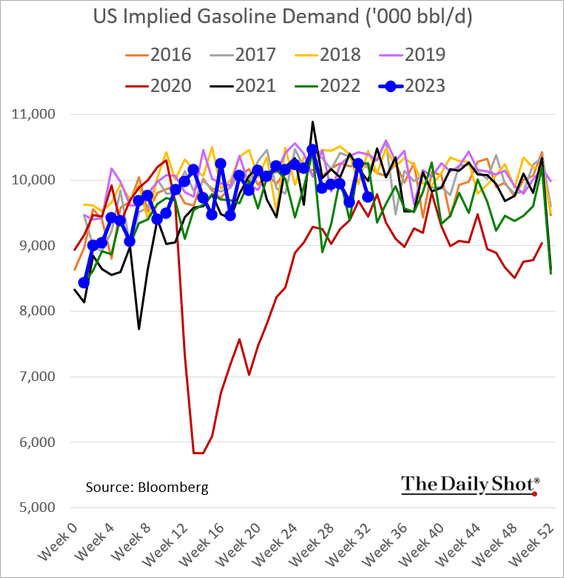

2. US gasoline demand eased last week.

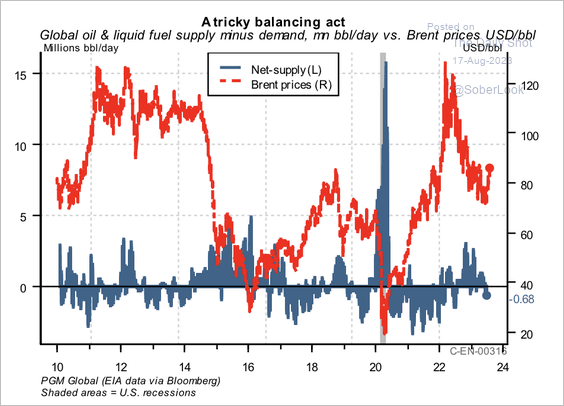

3. The global oil market is in a slight deficit.

Source: PGM Global

Source: PGM Global

——————–

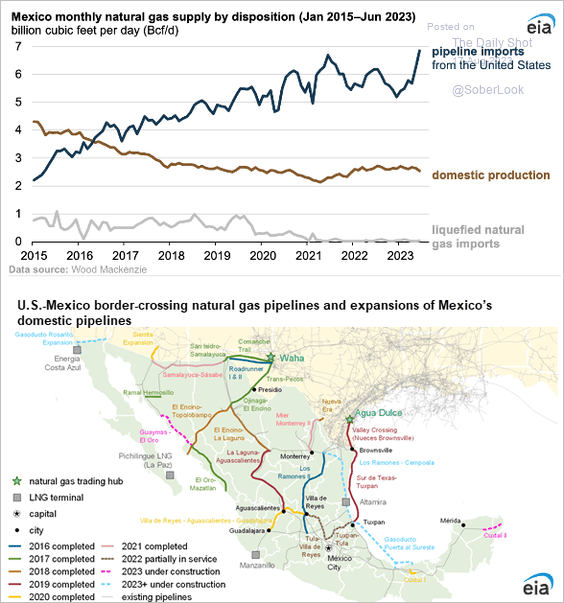

4. Mexico is importing a lot of natural gas from the US.

Source: @EIAgov

Source: @EIAgov

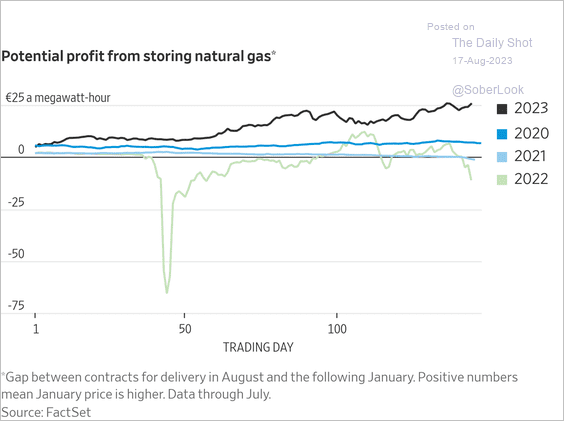

5. Storing natural gas in Ukraine presents both potential high rewards (carry profits) and risks for Western European energy traders.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

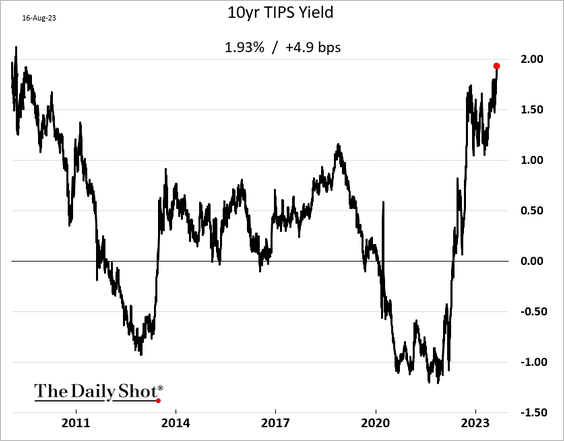

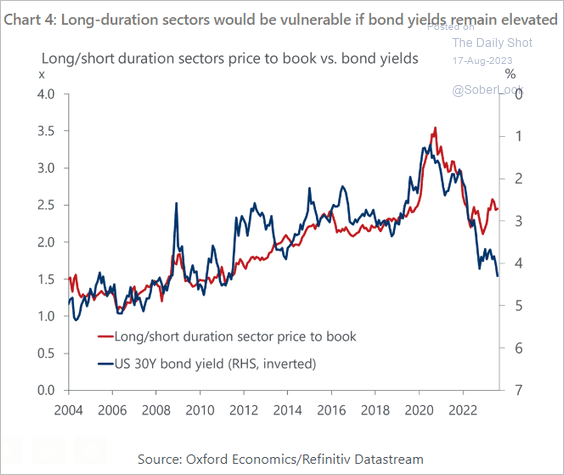

1. Surging real yields pose risks for growth stocks.

Long-duration equities are vulnerable.

Source: Oxford Economics

Source: Oxford Economics

——————–

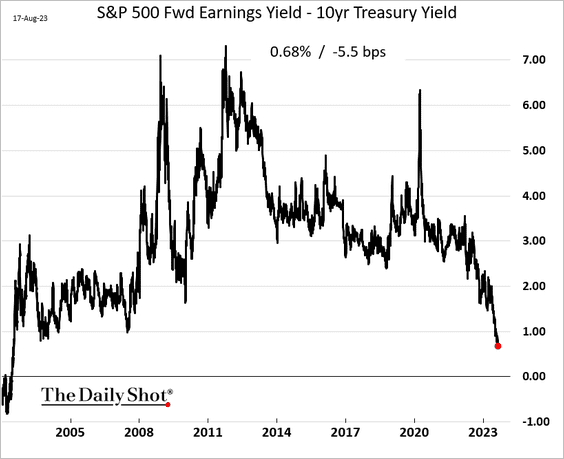

2. The S&P 500 risk premium continues to tumble.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

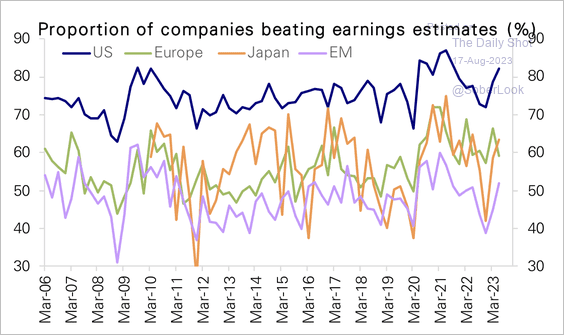

3. The proportion of companies that beat Q2 earnings estimates rose in all regions except Europe.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

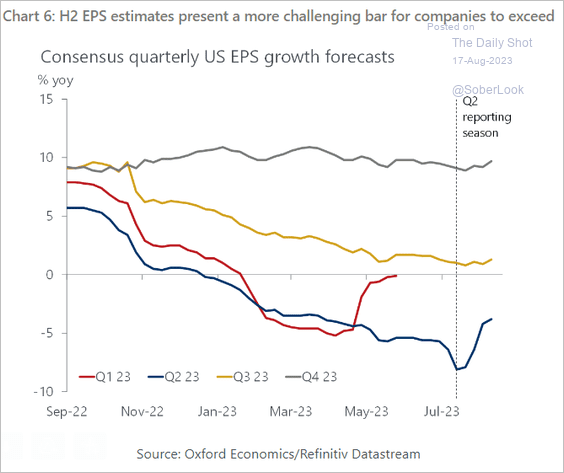

But second-half US earnings estimates will be harder to beat.

Source: Oxford Economics

Source: Oxford Economics

——————–

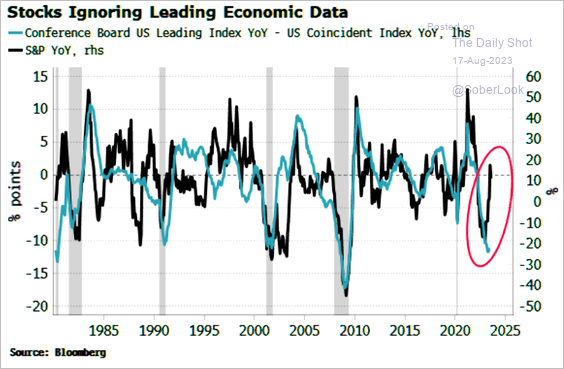

4. The leading economic index points to headwinds for stocks.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

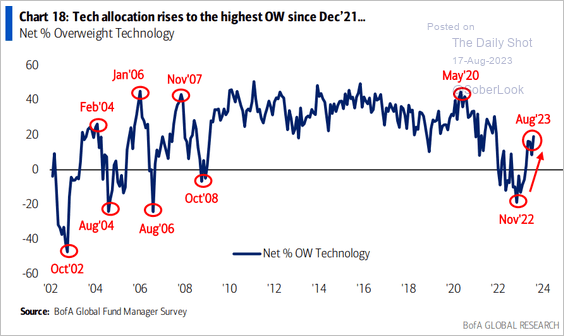

5. Fund managers have been boosting allocations to tech.

Source: BofA Global Research

Source: BofA Global Research

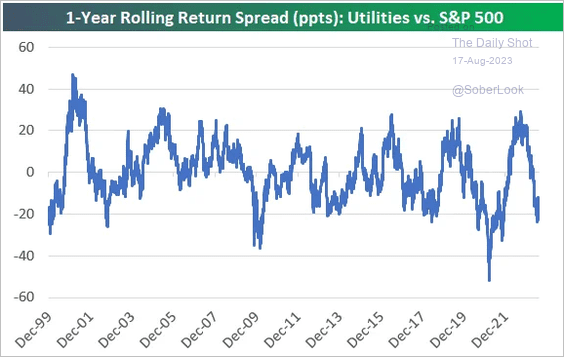

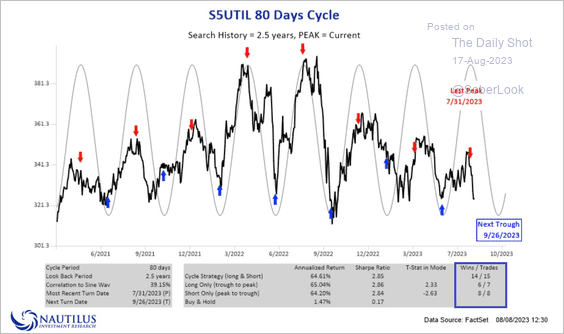

6. The S&P 500 utilities sector’s underperformance appears stretched and could approach a cycle trough next month. (2 charts)

Source: @bespokeinvest

Source: @bespokeinvest

Source: @NautilusCap

Source: @NautilusCap

——————–

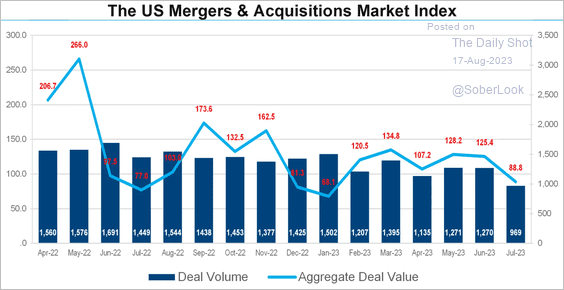

7. US M&A activity has been slowing.

Source: @FactSet Read full article

Source: @FactSet Read full article

Back to Index

Credit

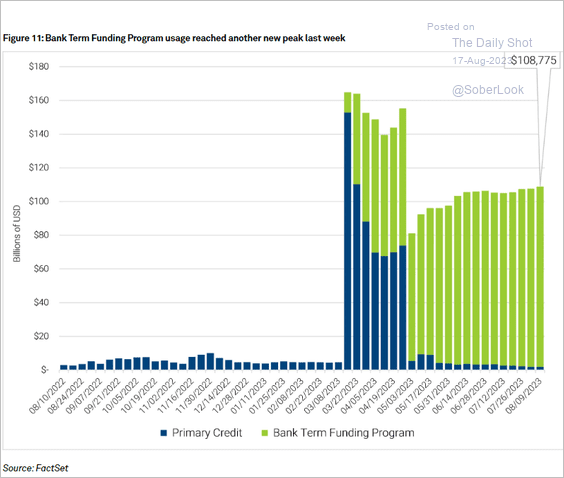

1. The Bank Term Funding Program usage keeps rising, suggesting that some smaller US banks are facing funding headwinds.

Source: @FactSet Read full article

Source: @FactSet Read full article

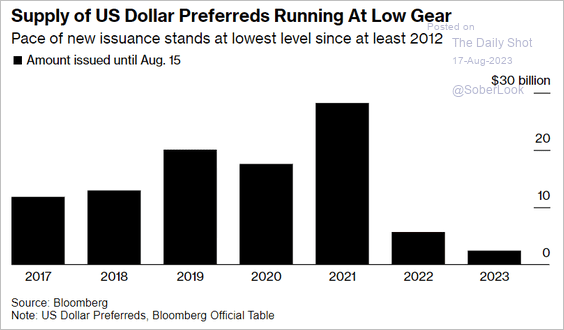

2. Preferred securities issuance has been slow due to the banking turmoil this year.

Source: @markets Read full article

Source: @markets Read full article

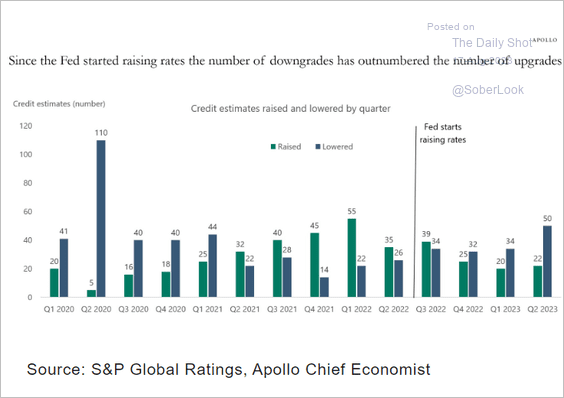

3. Ratings downgrades continue to outpace upgrades.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

——————–

Food for Thought

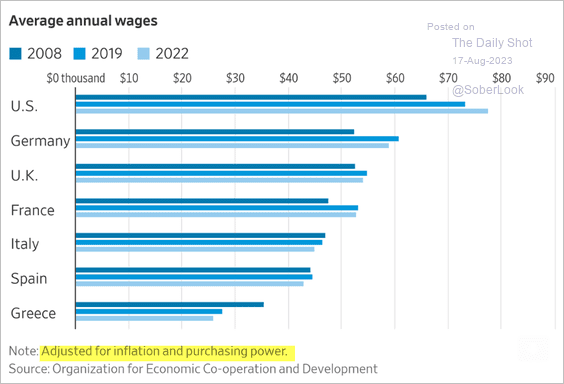

1. Average annual wages in the US and Western Europe:

Source: @WSJ Read full article

Source: @WSJ Read full article

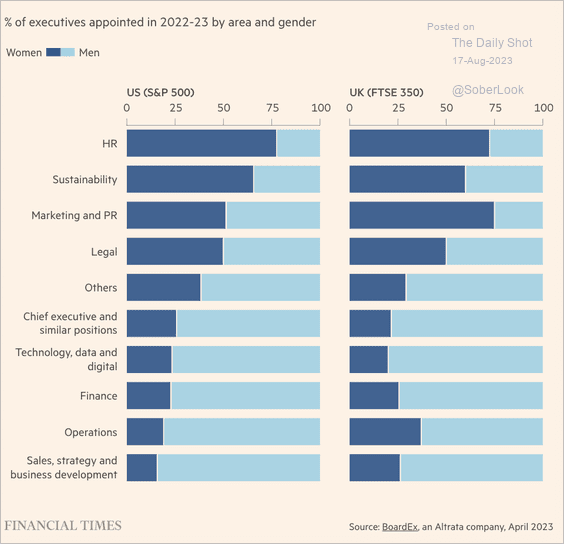

2. Women executives in the US and the UK:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

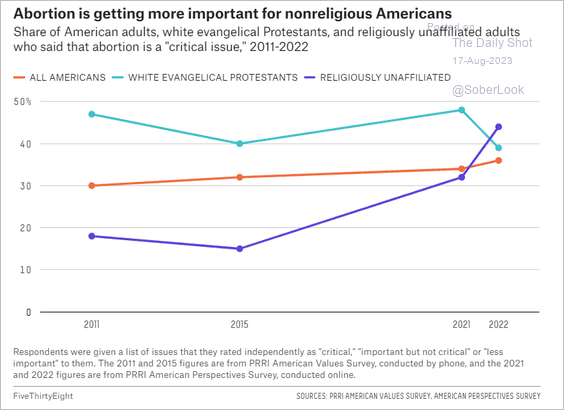

3. Religiously unaffiliated Americans’ attitudes towards abortion:

Source: FiveThirtyEight Read full article

Source: FiveThirtyEight Read full article

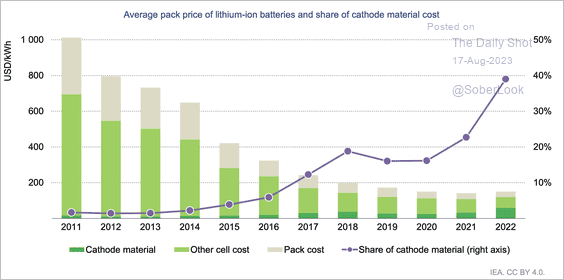

4. Commodity costs as a share of battery prices:

Source: IEA Read full article

Source: IEA Read full article

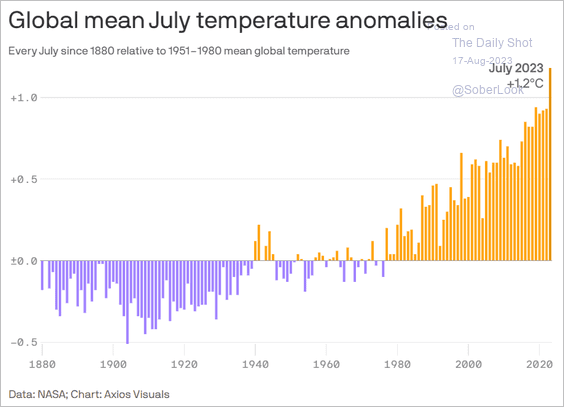

5. A warm July globally:

Source: @axios Read full article

Source: @axios Read full article

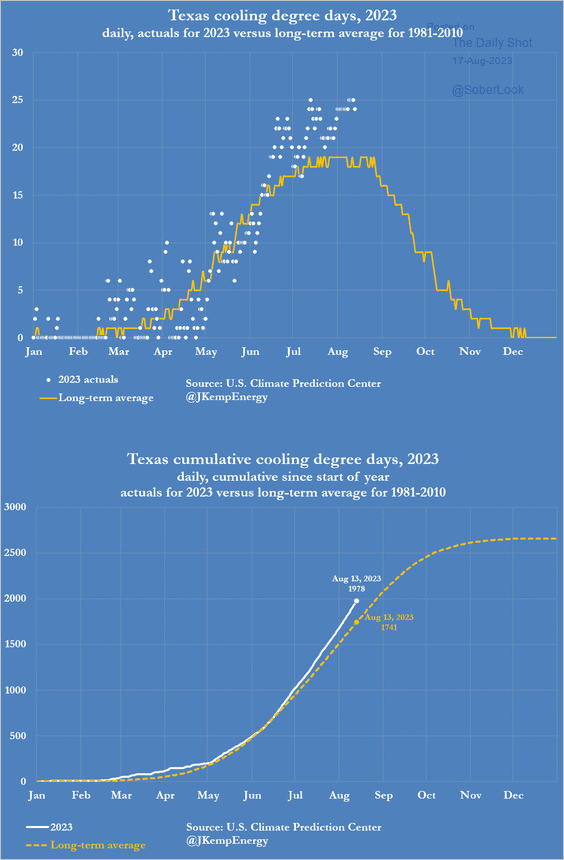

A warm summer in Texas:

Source: @JKempEnergy

Source: @JKempEnergy

——————–

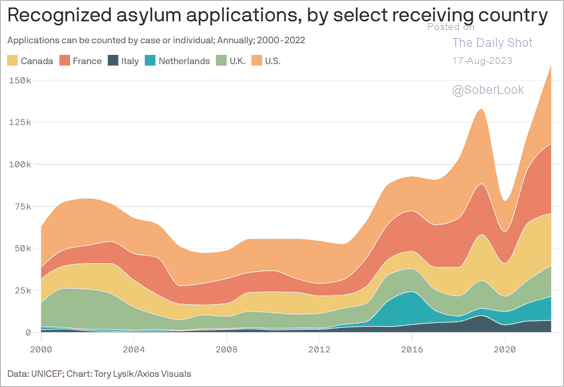

6. Recognized asylum applications in advanced economies:

Source: @axios Read full article

Source: @axios Read full article

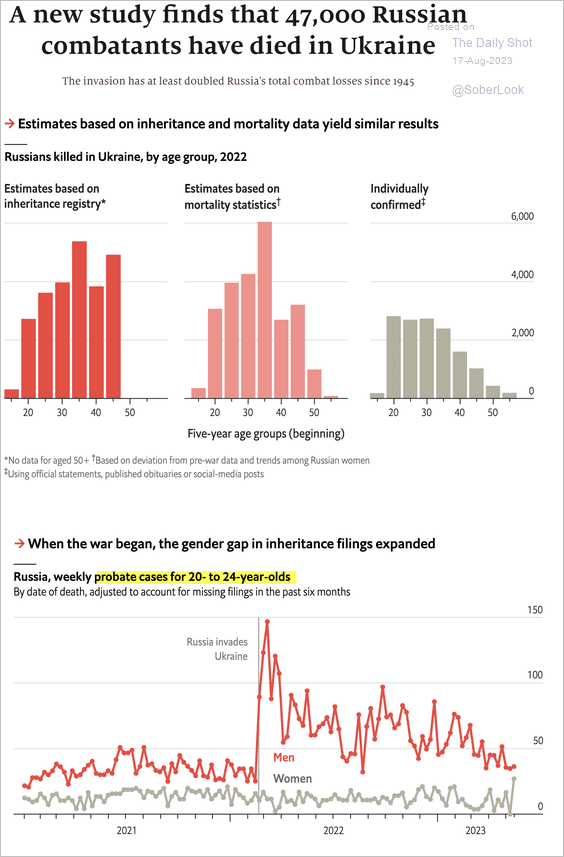

7. Russian soldiers dying in Ukraine:

Source: The Economist Read full article

Source: The Economist Read full article

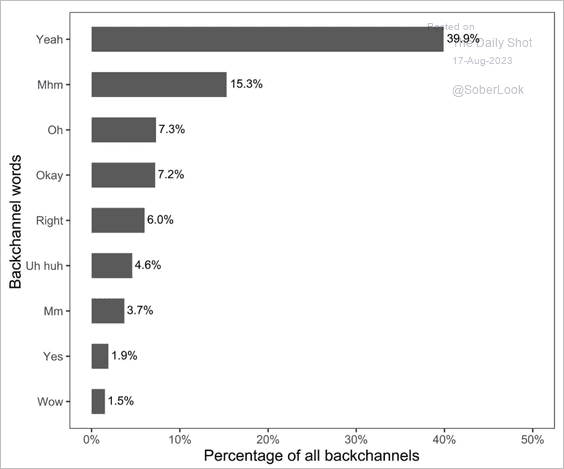

8. “Backchannel” word frequency in spoken English conversations:

Source: Science Advances Read full article

Source: Science Advances Read full article

——————–

Back to Index