The Daily Shot: 16-Aug-23

• The United States

• Canada

• The United Kingdom

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Energy

• Equities

• Rates

• Global Develpmetns

• Food for Thought

The United States

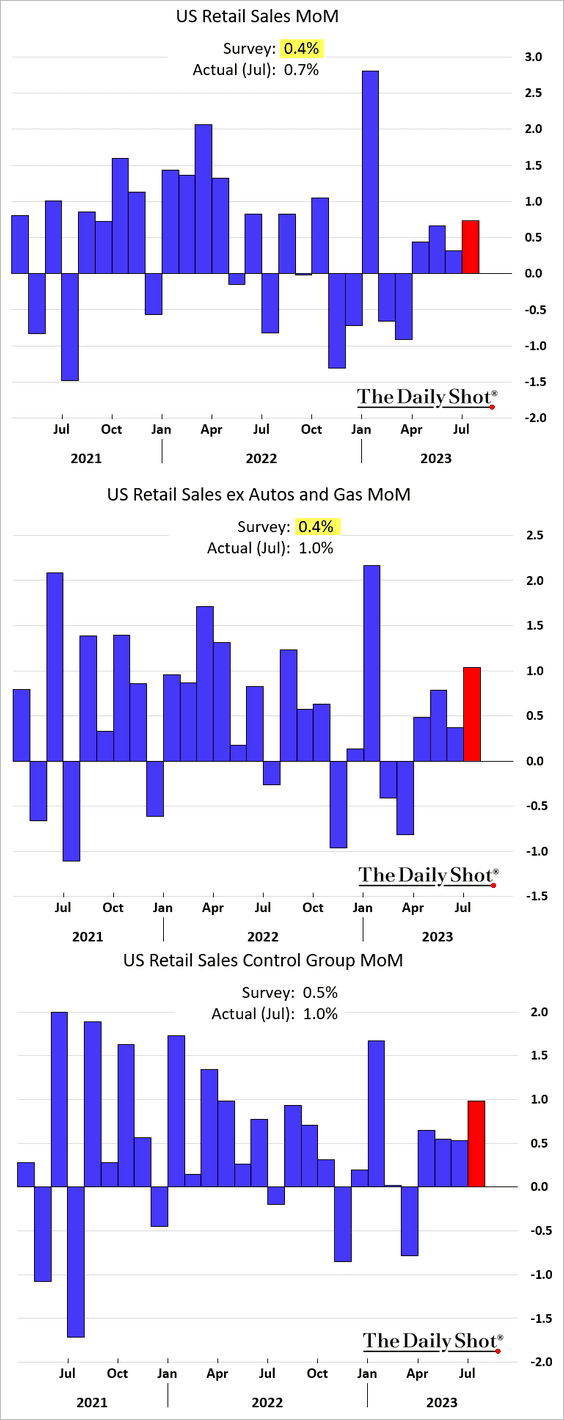

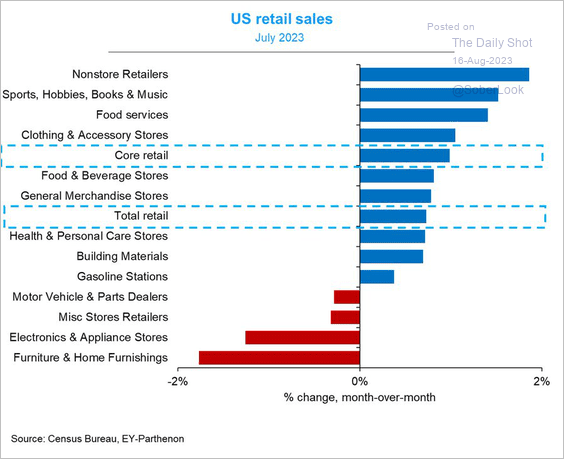

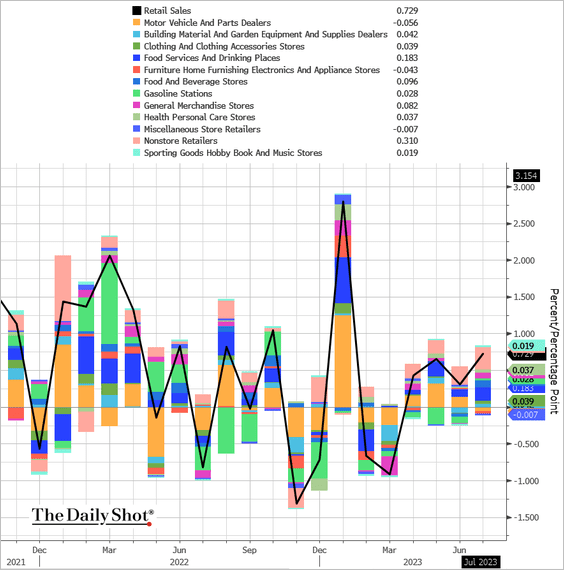

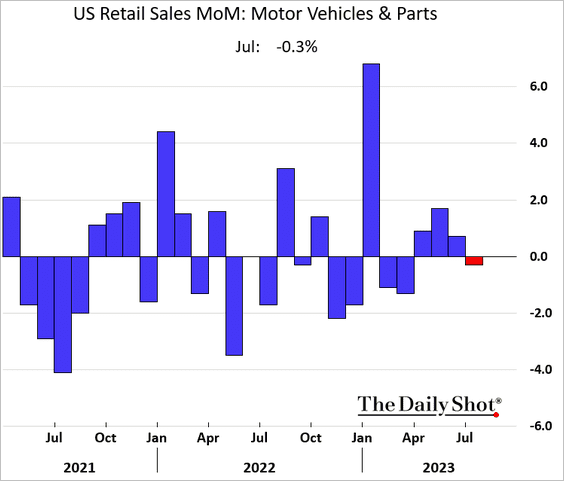

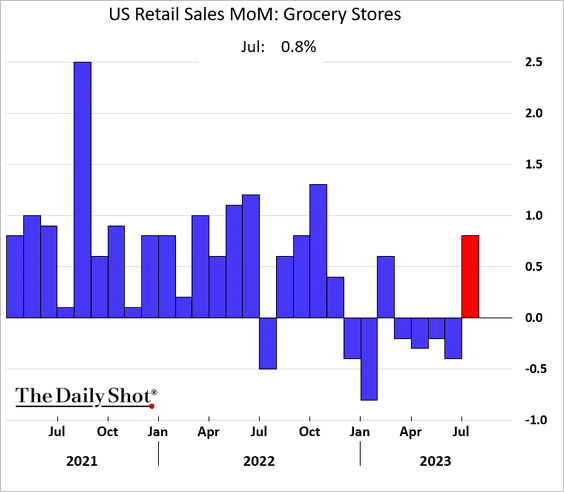

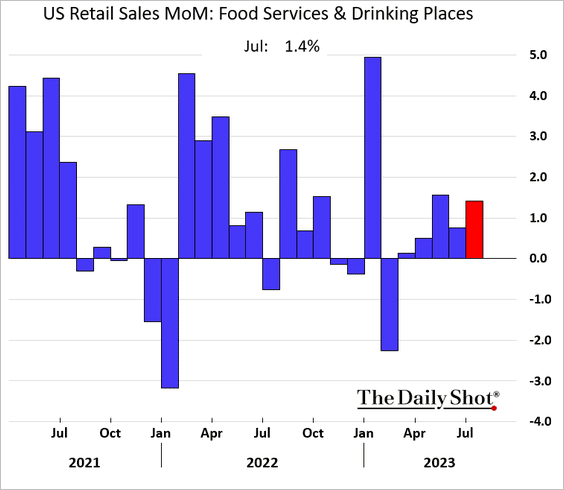

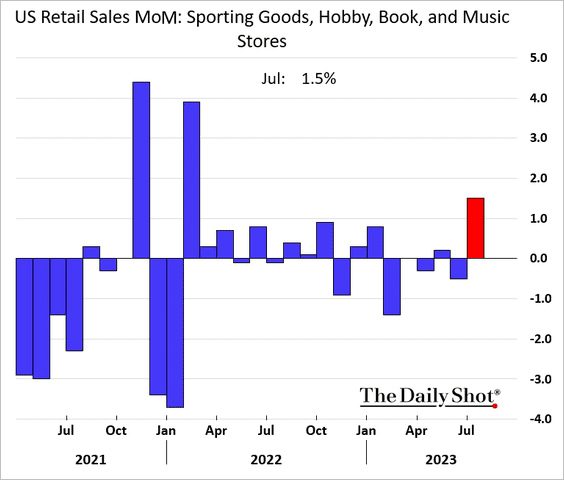

1. Last month’s retail sales topped expectations, suggesting that consumers are not retrenching.

Robust Amazon Prime Day and back-to-school sales contributed to the upside surprise. The charts below provide the breakdown by sector.

Source: @GregDaco

Source: @GregDaco

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Here are five graphs illustrating the month-over-month changes in various retail sectors.

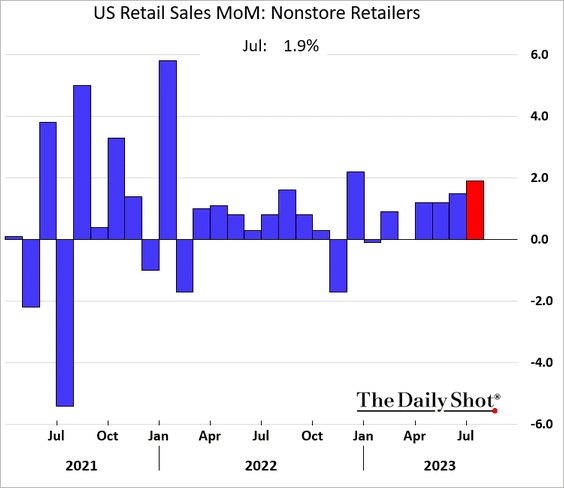

– Nonstore (online) retail sales:

– Vehicles:

– Grocery stores:

– Restaurants and bars:

– Sporting goods, etc.:

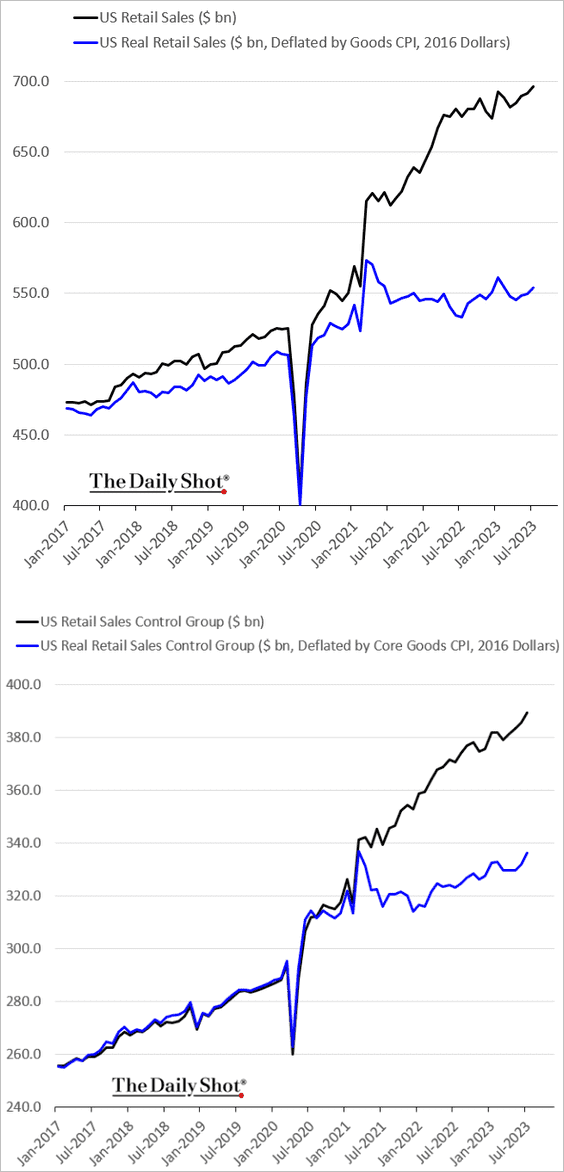

• The next chart shows nominal and real retail sales levels.

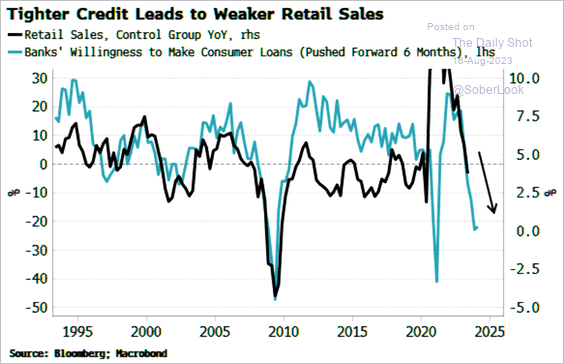

• Tight credit conditions suggest that retail sales will slow in the months ahead.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

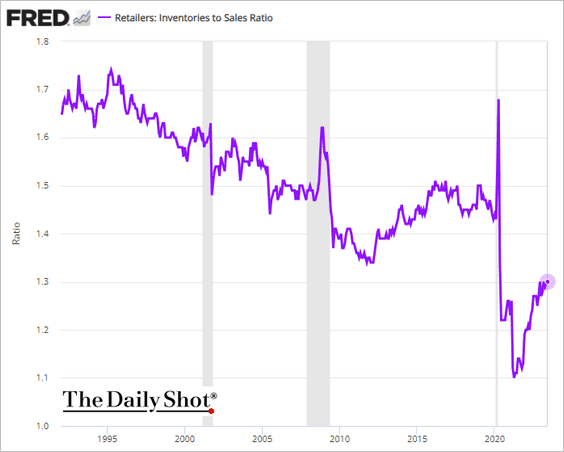

• Retailers’ inventories-to-sales ratio remains well below pre-COVID levels.

——————–

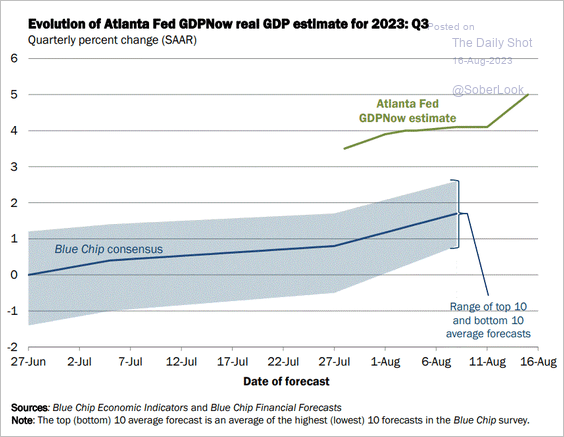

2. In response to the strong retail sales report, the Atlanta Fed’s GDPNow model showed a significant increase in the Q3 growth forecast.

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

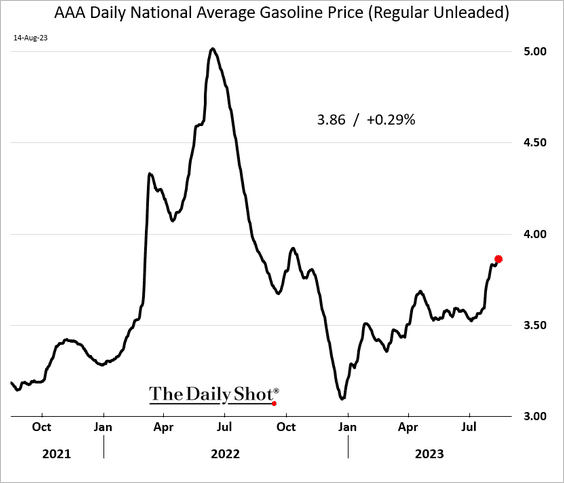

3. Gasoline prices continue to climb, which could dampen consumer sentiment and spending.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

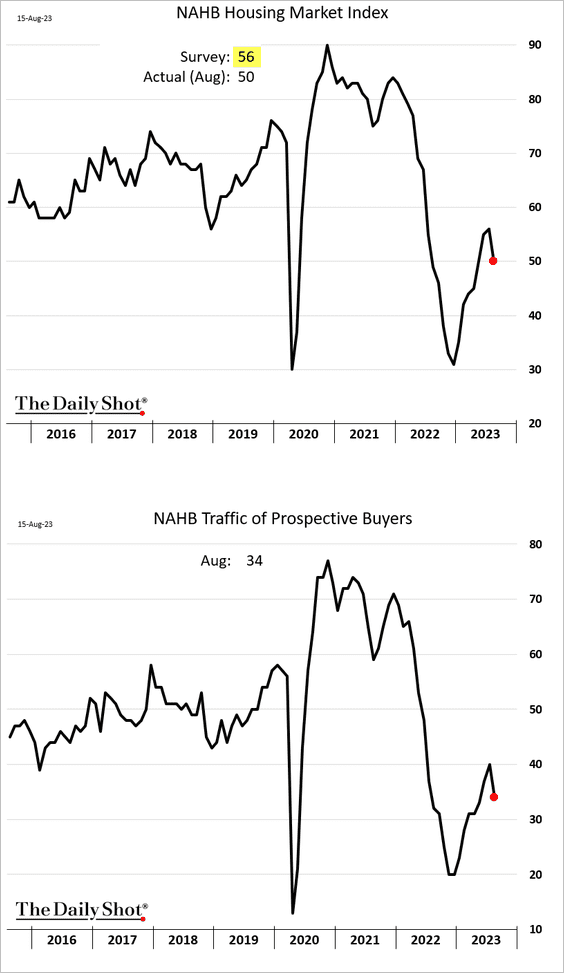

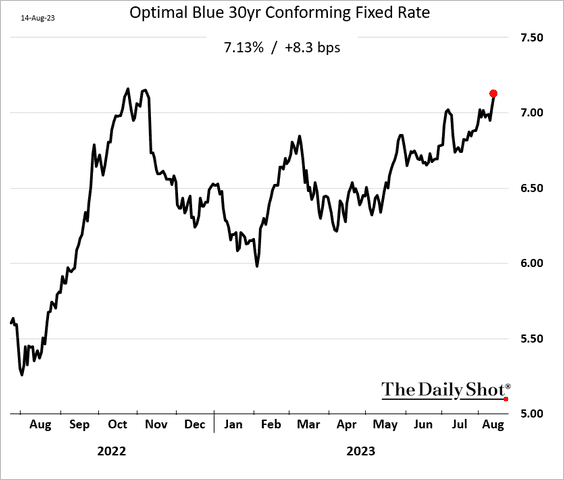

4. The NAHB homebuilder sentiment indicator unexpectedly declined this month, …

… as mortgage rates keep climbing.

——————–

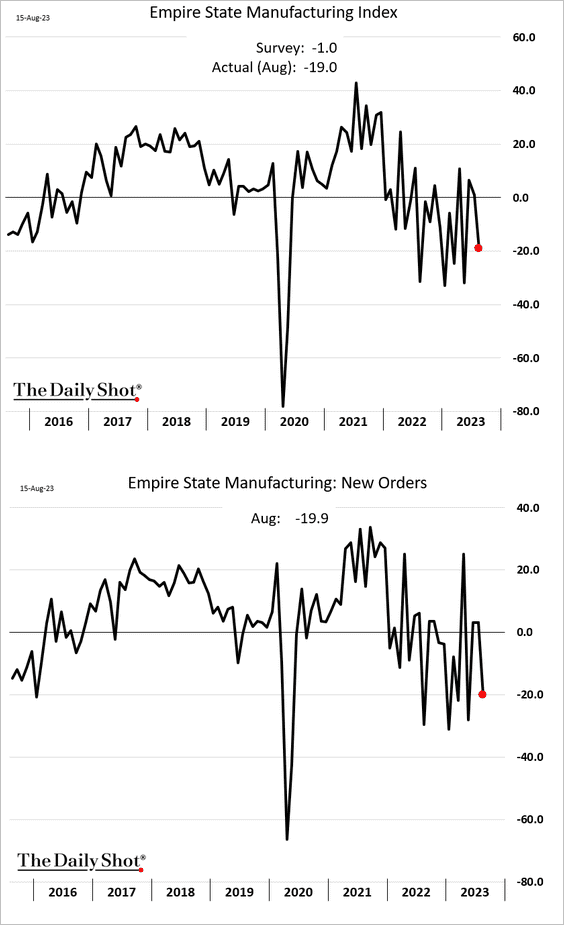

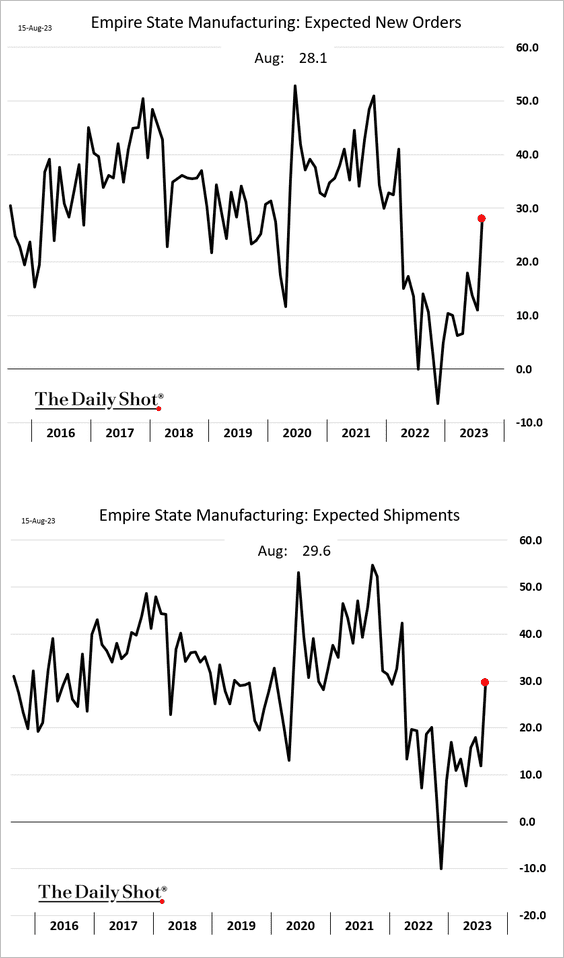

5. The month’s first regional manufacturing report from the NY Fed indicated a drop in factory activity.

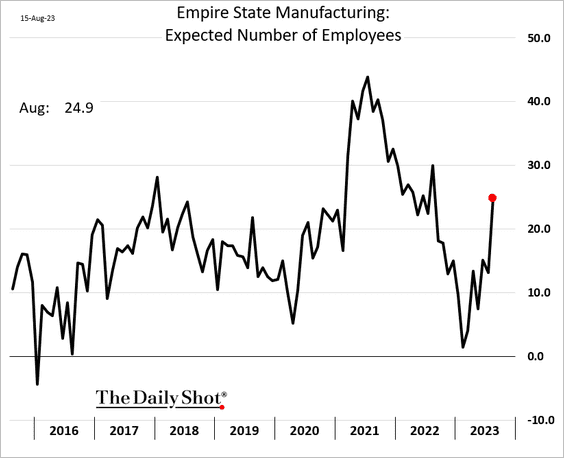

• But forward-looking indicators signaled an improving outlook.

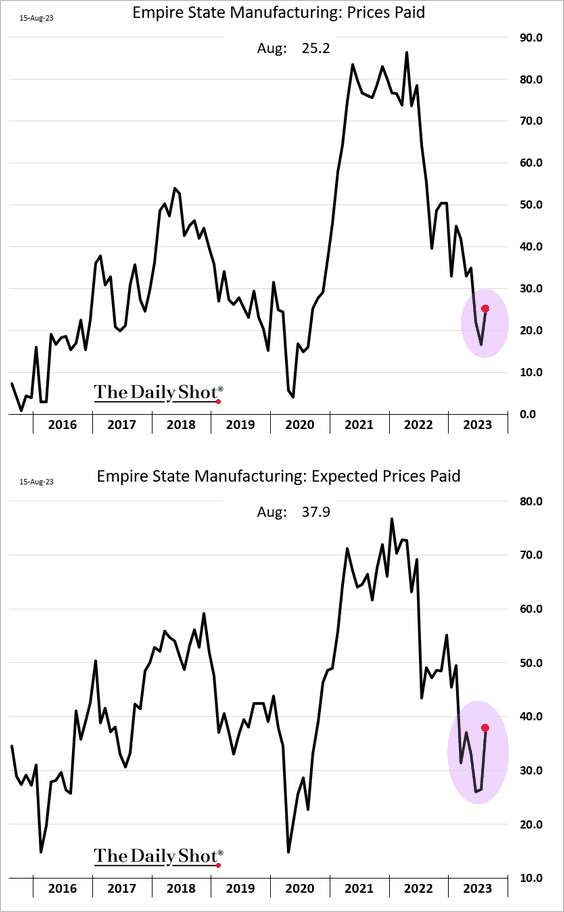

• More firms reported rising current and expected costs.

——————–

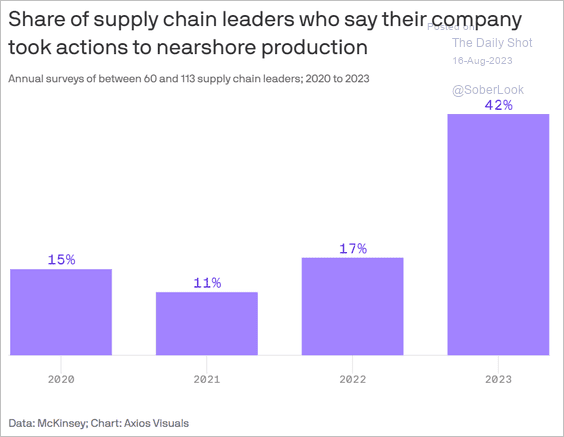

6. US firms are increasingly taking action on nearshoring.

Source: @axios Read full article

Source: @axios Read full article

Back to Index

Canada

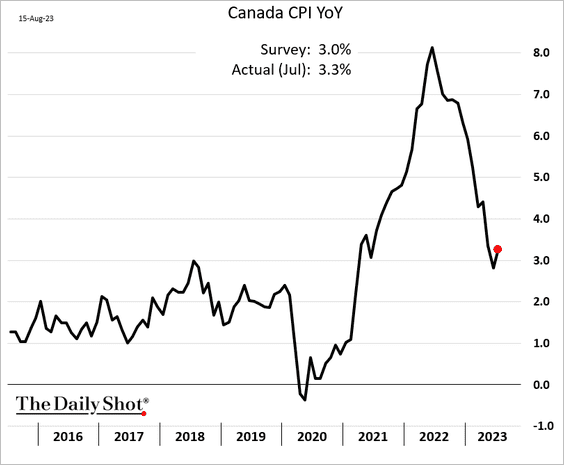

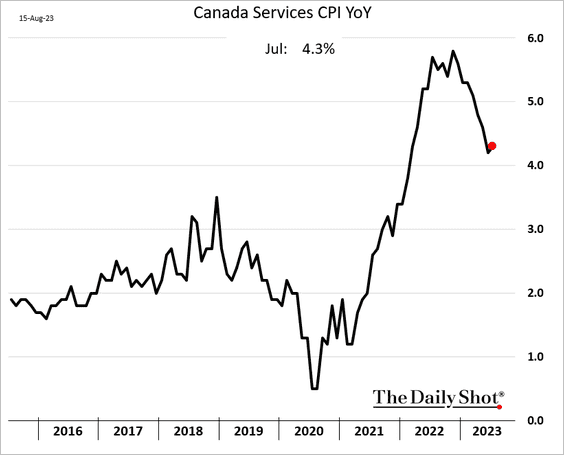

1. The headline CPI report topped expectations.

Source: Reuters Read full article

Source: Reuters Read full article

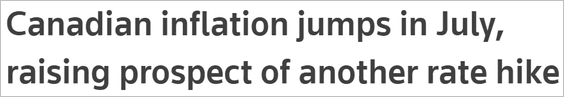

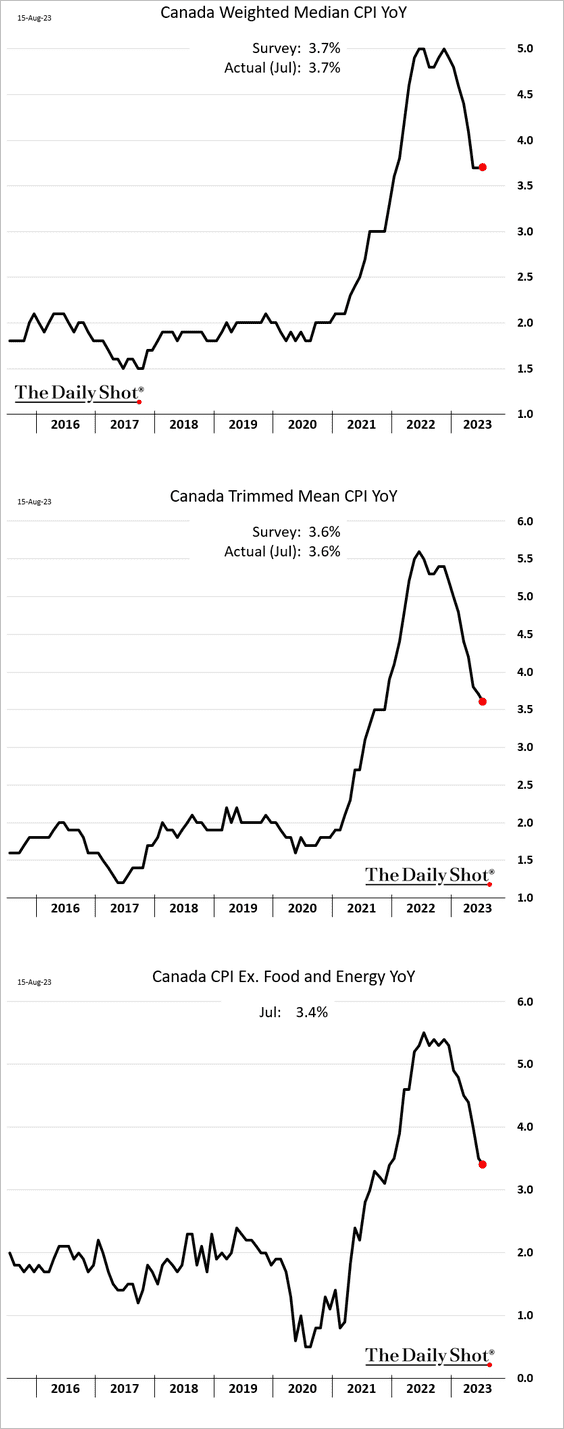

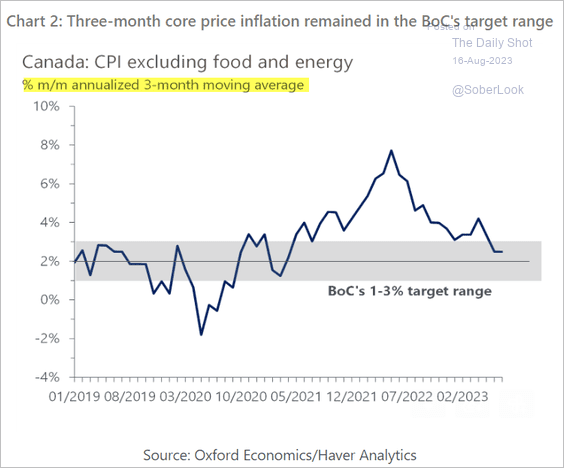

• However, core inflation measures were in line with forecasts.

Source: Capital Economics

Source: Capital Economics

• Services inflation has been stubbornly high.

——————–

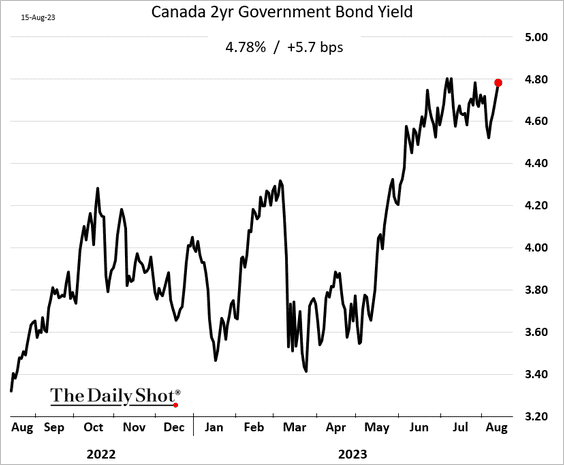

2. Bond yields are rising.

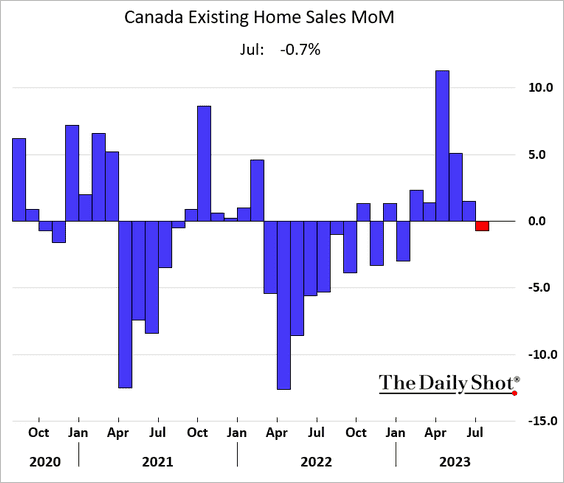

3. Home sales declined last month.

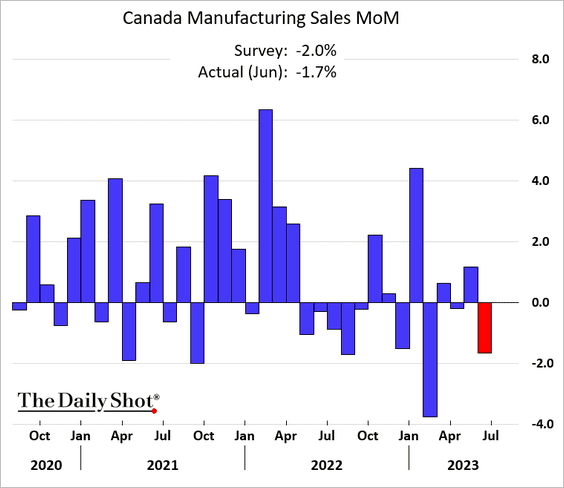

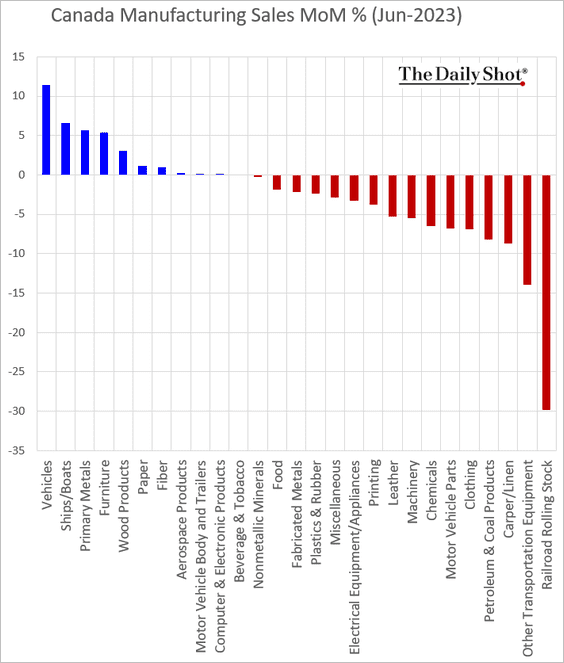

4. Manufacturing sales eased in June.

Auto sales jumped, but that wasn’t enough to offset weakness elsewhere.

Back to Index

The United Kingdom

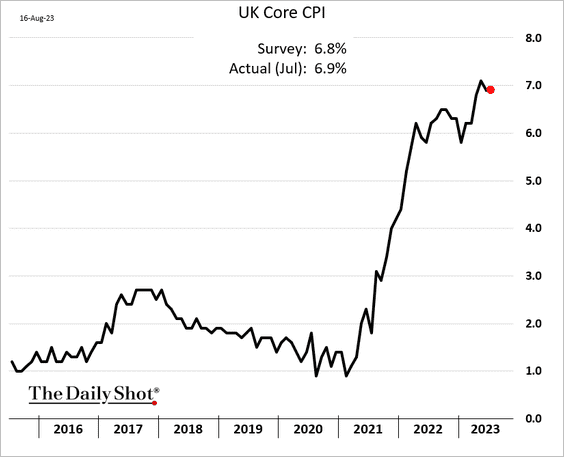

1. Inflation was higher than expected last month, with the core CPI remaining stubbornly high.

We will have more on the CPI report tomorrow.

——————–

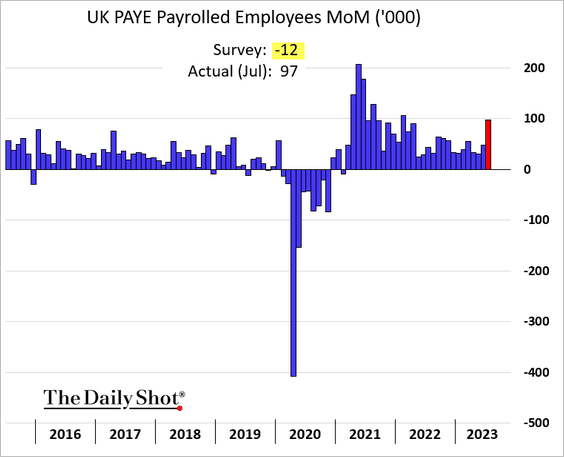

2. Payrolls increased sharply last month.

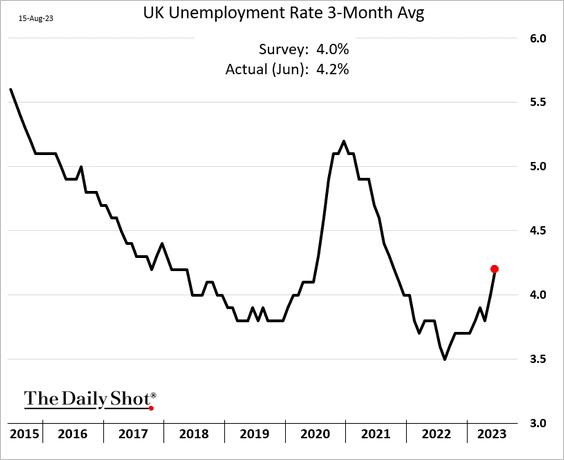

But the unemployment rate keeps rising. The last data point in the chart below is the average for April, May, and June.

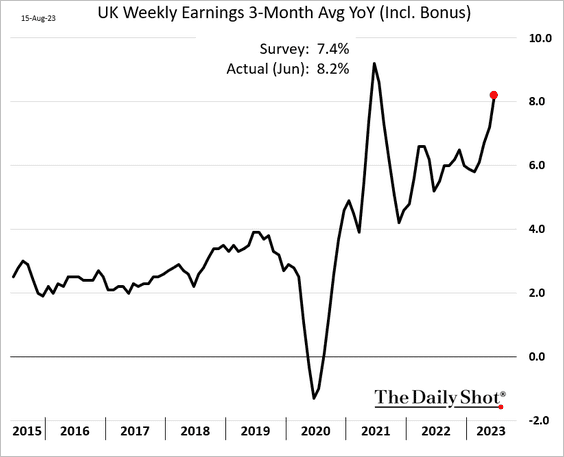

• As we saw yesterday, rapid wage growth is a concern.

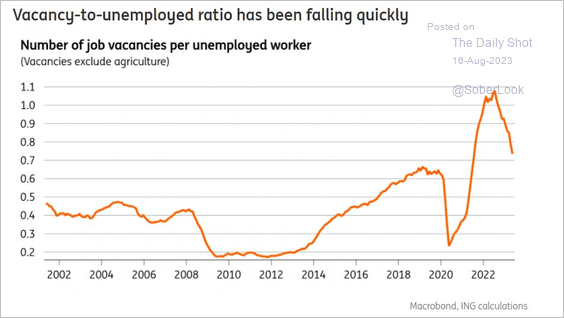

• Job vacancies per employee are falling.

Source: ING

Source: ING

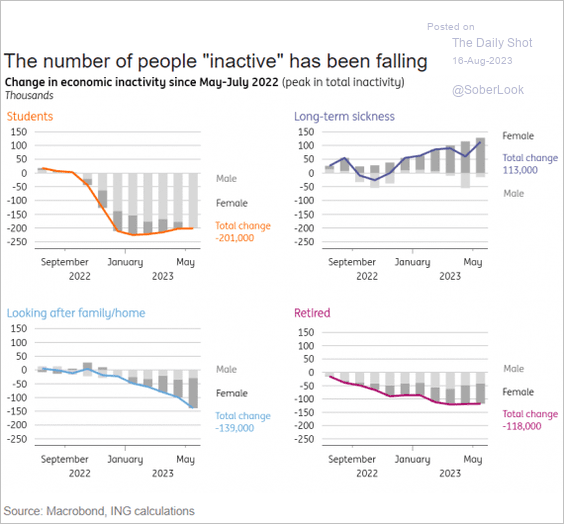

• Next, we have some trends in labor “inactivity” (from ING).

Source: ING

Source: ING

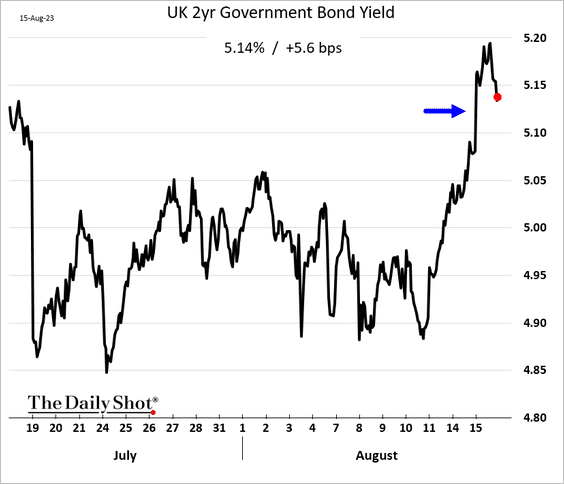

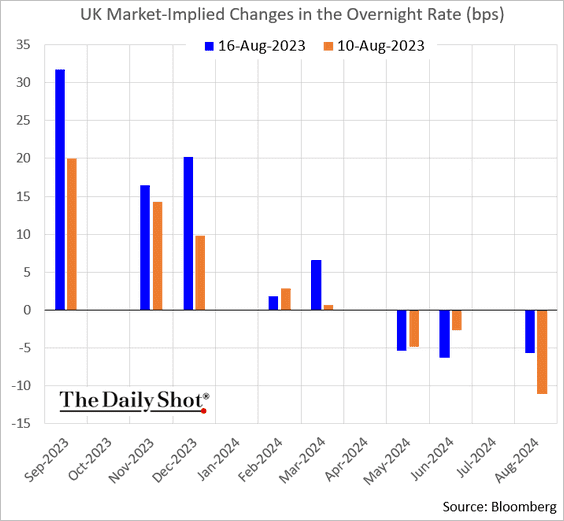

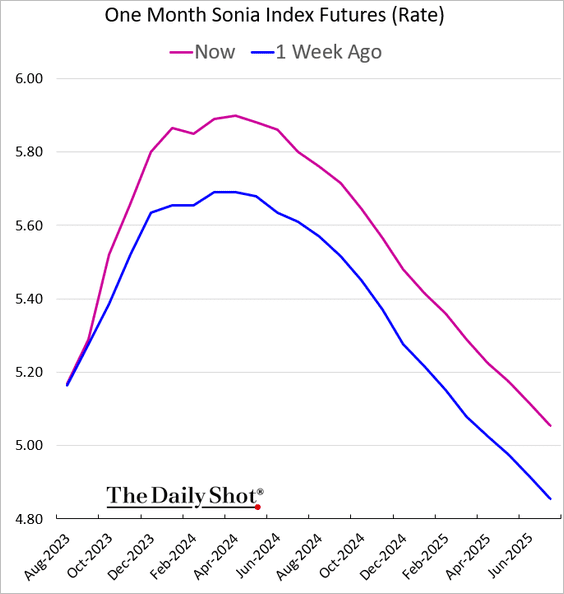

2. Gilt yields and rate-hike expectations jumped in response to stronger-than-expected wage data.

The market-implied overnight rate trajectory has shifted higher.

Back to Index

Europe

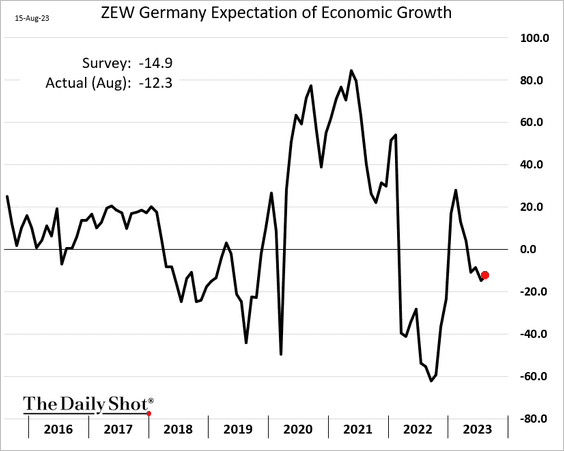

1. Germany’s ZEW index unexpectedly edged higher.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

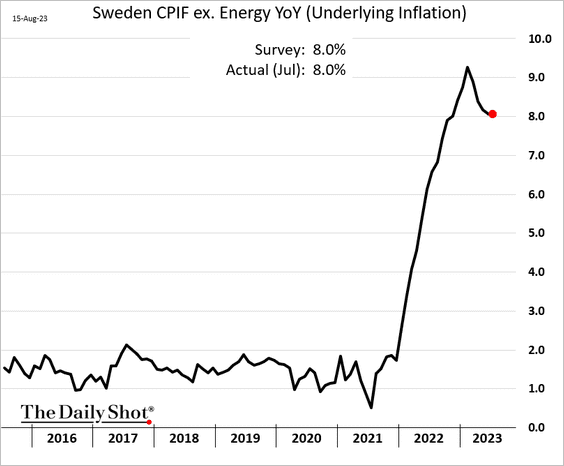

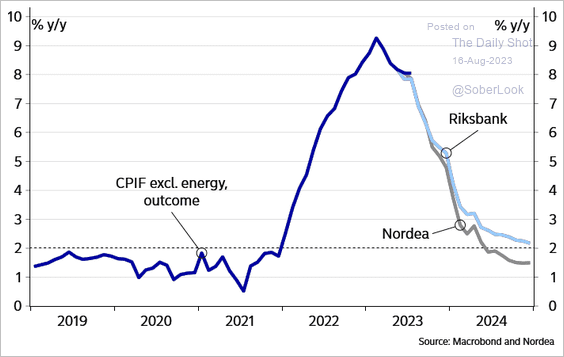

2. Sweden’s core inflation remains stubbornly high.

But forecasts call for rapid moderation in inflationary pressures.

Source: Nordea Markets

Source: Nordea Markets

——————–

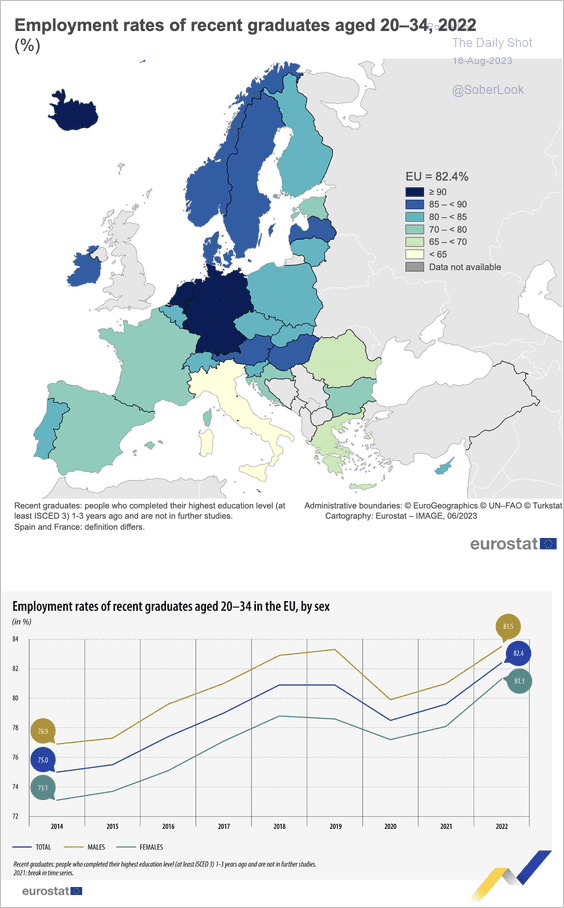

3. Here is a look at college graduates’ employment rates in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia-Pacific

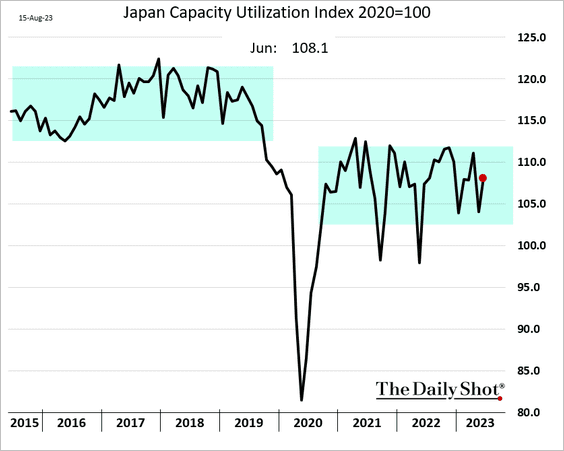

1. Japan’s capacity utilization never recovered to pre-COVID levels.

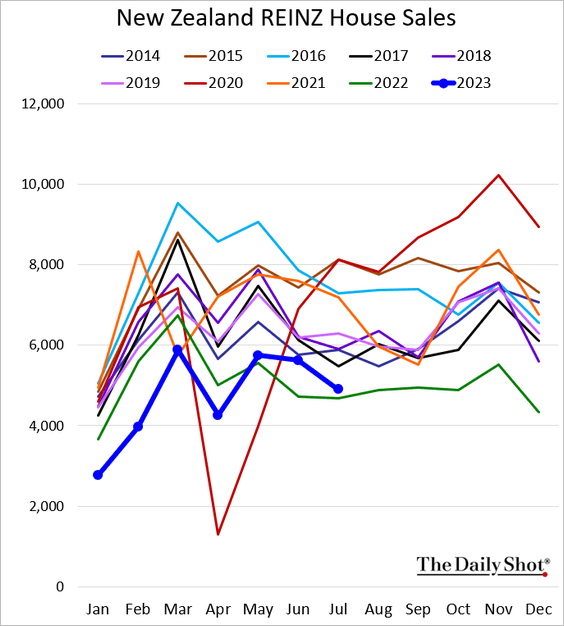

2. New Zealand’s house sales remain depressed.

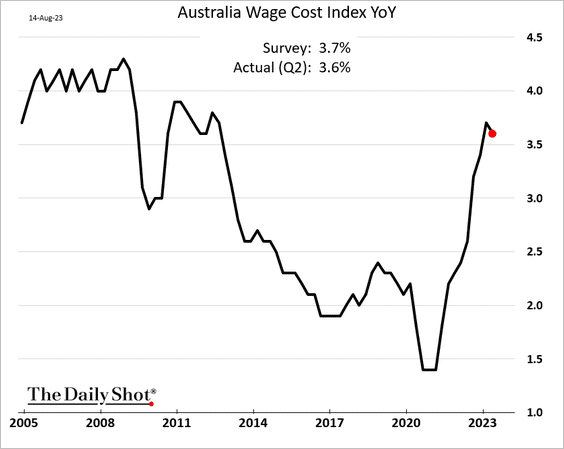

3. Growth in Australia’s wage costs appears to have peaked last quarter.

Back to Index

China

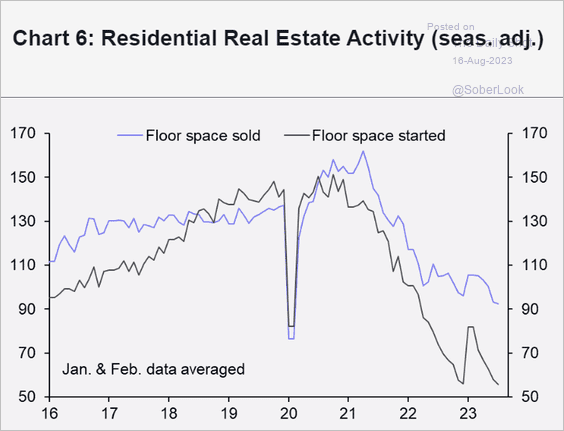

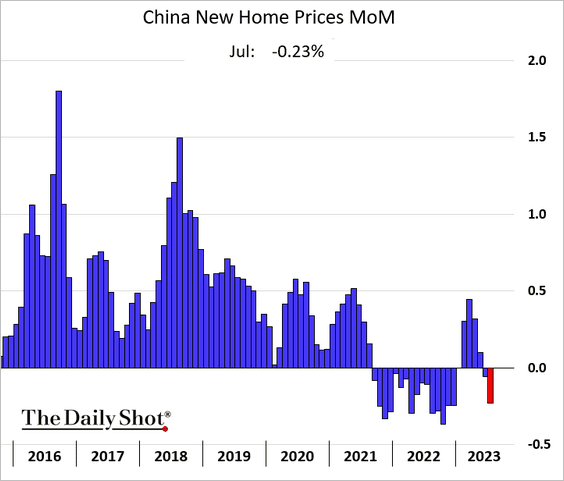

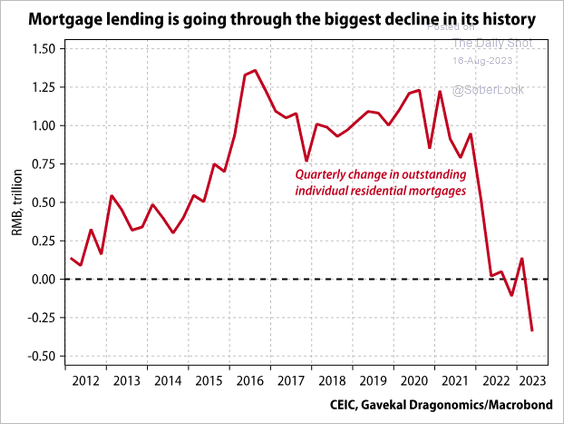

1. Let’s start with some updates on the housing market.

• Residential real estate activity:

Source: Capital Economics

Source: Capital Economics

• New home prices (falling again):

• Mortgage lending:

Source: Gavekal Research

Source: Gavekal Research

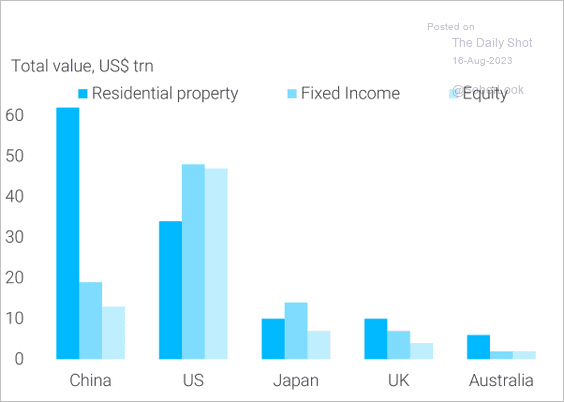

• China’s property market in perspective:

Source: TS Lombard

Source: TS Lombard

——————–

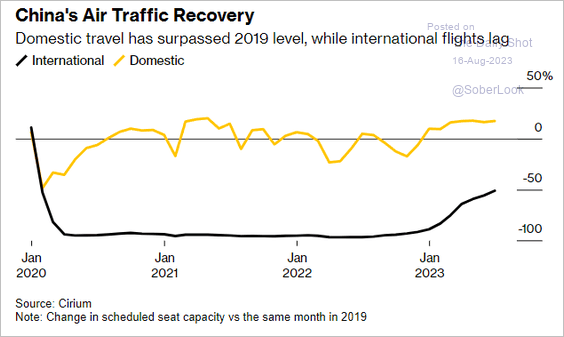

2. International air travel remains below pre-COVID levels.

Source: @JLeeEnergy, @markets Read full article

Source: @JLeeEnergy, @markets Read full article

Back to Index

Emerging Markets

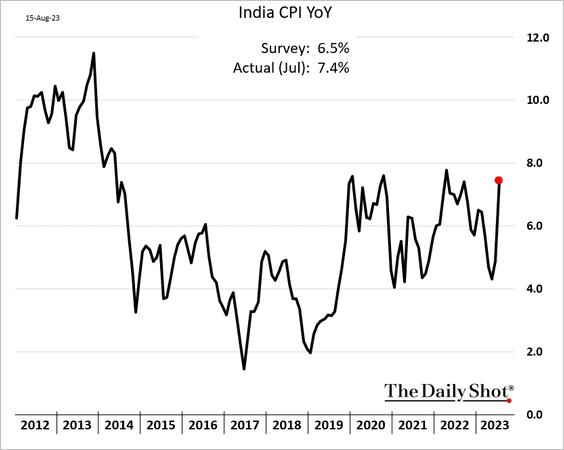

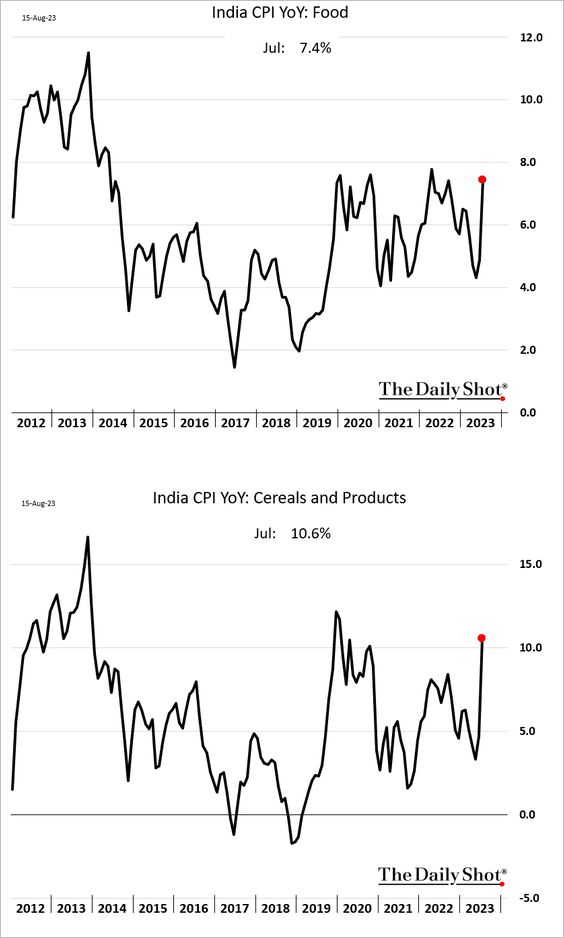

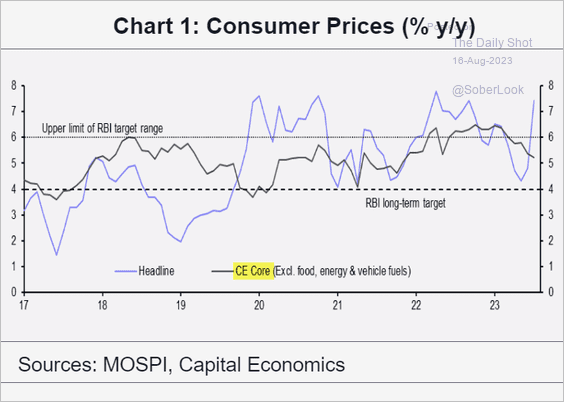

1. India’s consumer inflation surged unexpectedly last month, …

… boosted by food prices.

Core inflation has been slowing.

Source: Capital Economics

Source: Capital Economics

——————–

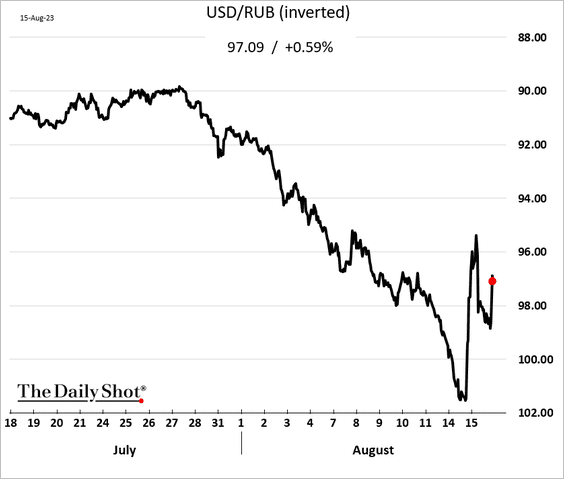

2. The ruble is holding up after the central bank’s massive rate hike.

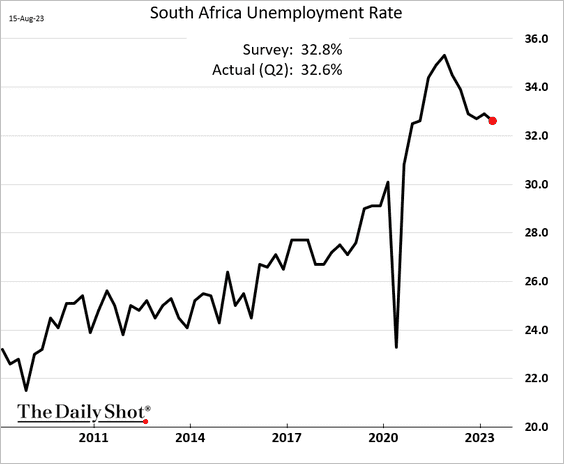

3. South Africa’s unemployment is easing but remains elevated.

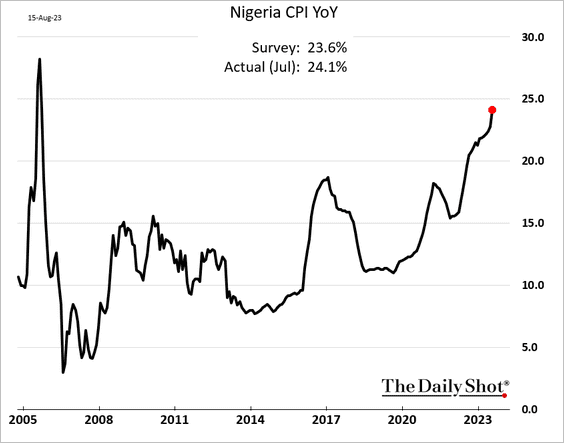

4. Nigeria’s CPI keeps climbing.

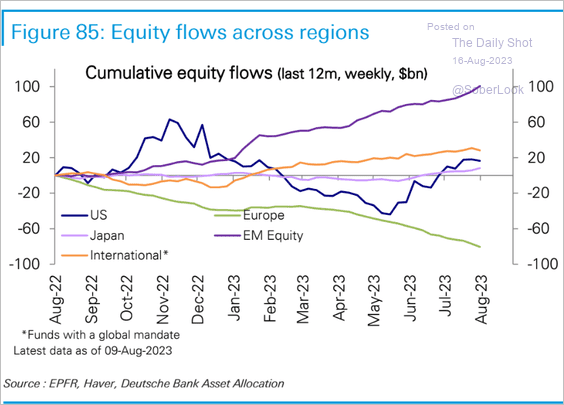

5. Fund flows show an ongoing rotation from European stocks to emerging markets.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Energy

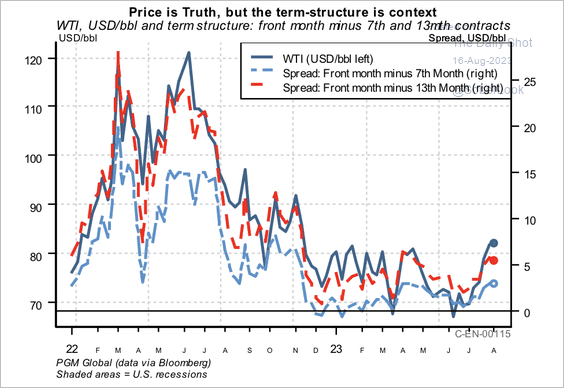

1. The backwardation of the WTI curve has increased, which is indicative of a tight physical market.

Source: PGM Global

Source: PGM Global

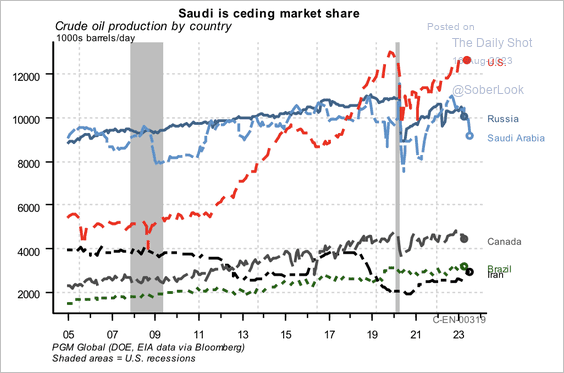

2. The US continues to lead in crude oil production.

Source: PGM Global

Source: PGM Global

Back to Index

Equities

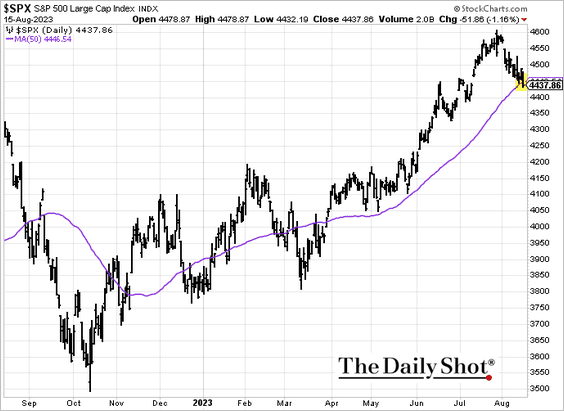

1. The S&P 500 closed below its 50-day moving average.

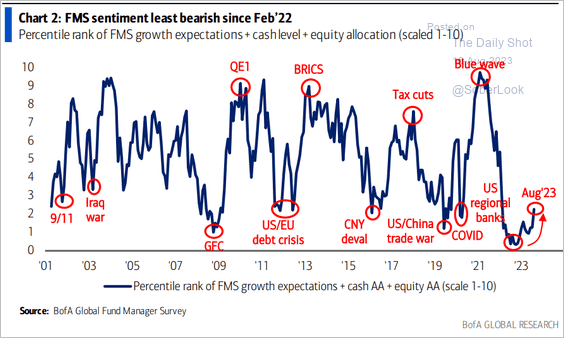

2. Global fund managers are becoming less bearish.

Source: BofA Global Research

Source: BofA Global Research

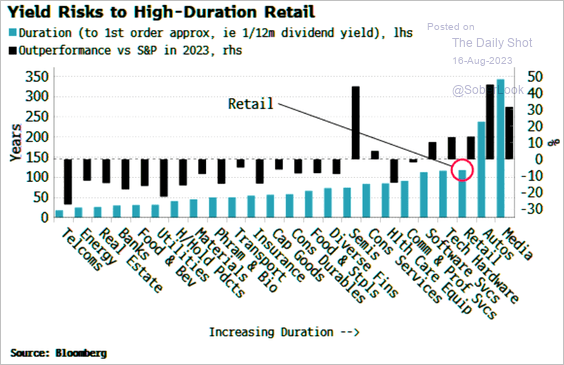

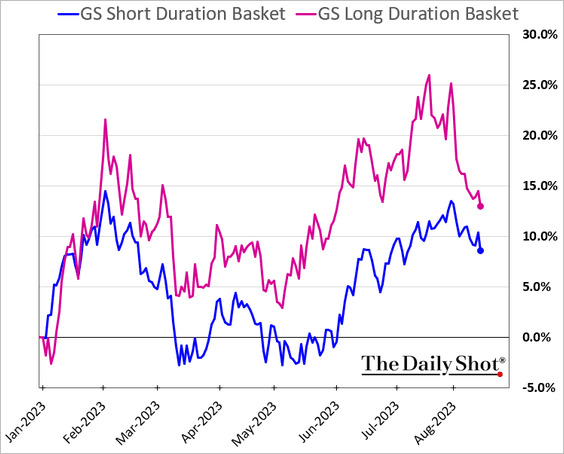

3. Long-duration sectors outperformed this year.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

But the outperformance is narrowing.

——————–

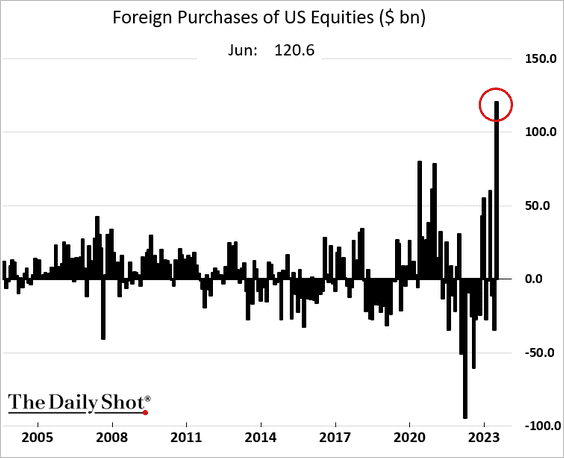

4. Foreigners bought a record amount of US shares in June, fueling the rally.

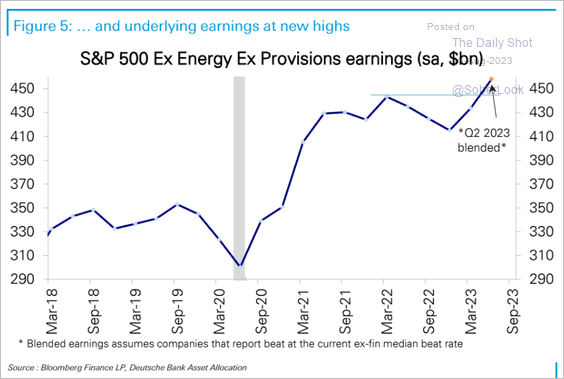

5. Excluding energy and provisions, earnings hit a new high in Q2.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

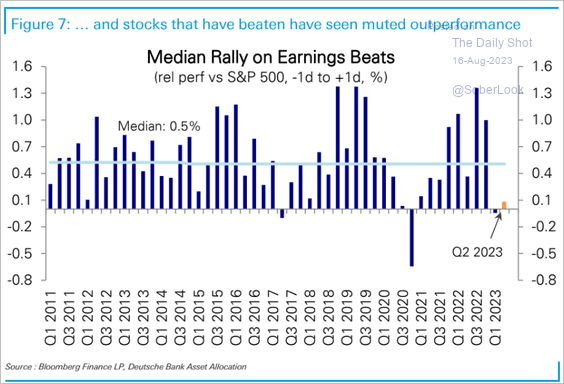

But there hasn’t been much enthusiasm for earnings beats.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

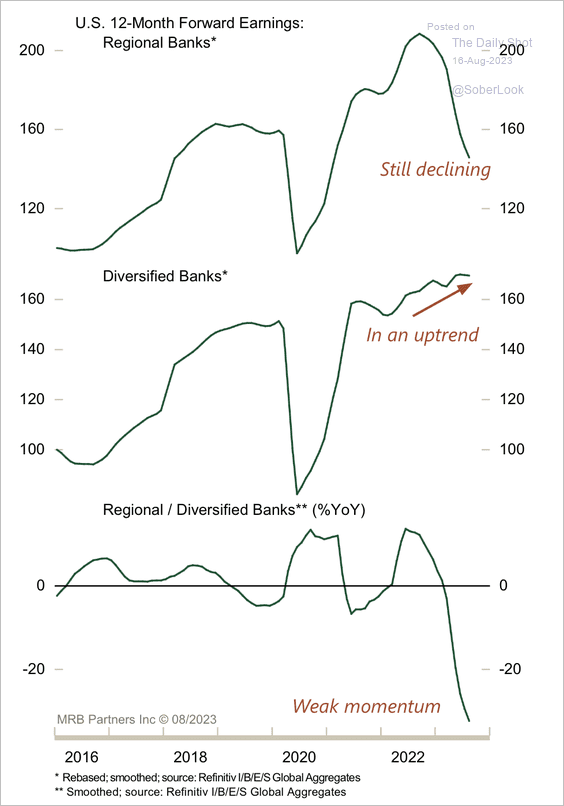

6. Forward earnings for regional banks have yet to bottom.

Source: MRB Partners

Source: MRB Partners

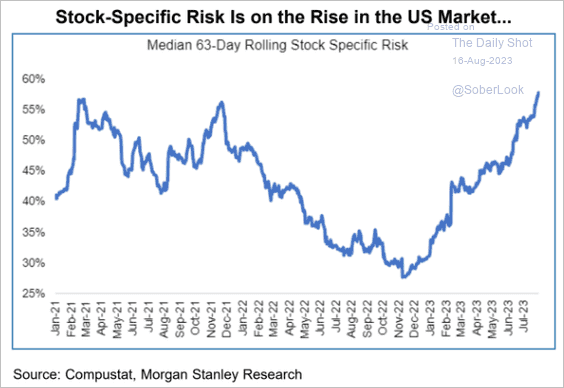

7. Stock-specific risk (as opposed to the overall market) has been rising, according to Morgan Stanley.

Source: Morgan Stanley Research; @dailychartbook

Source: Morgan Stanley Research; @dailychartbook

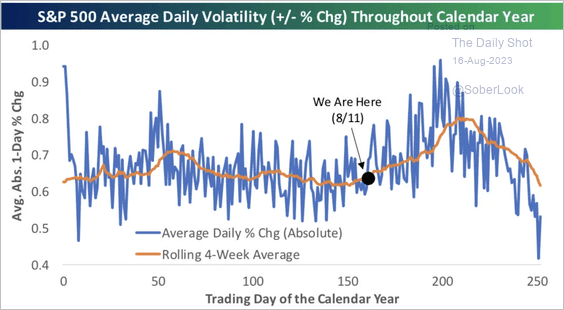

8. The S&P 500 is entering a historically volatile period.

Source: @bespokeinvest

Source: @bespokeinvest

Back to Index

Rates

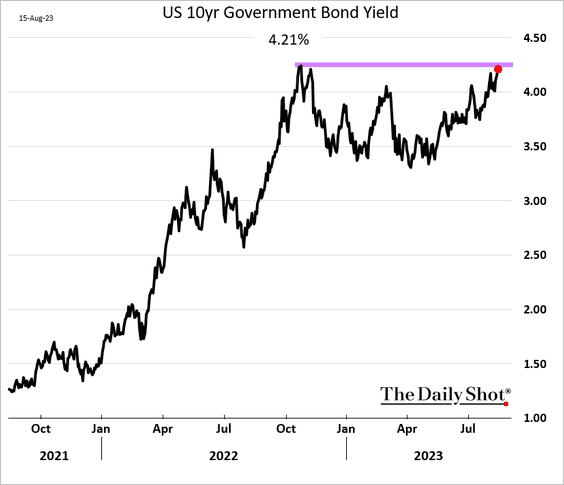

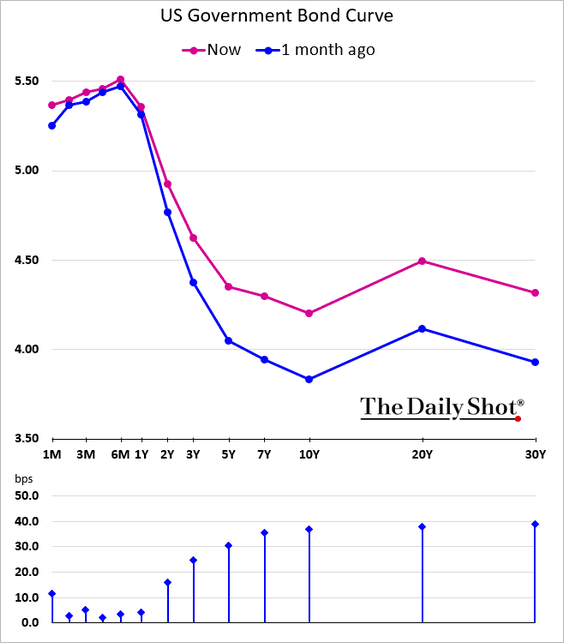

1. The 10-year Treasury yield is approaching its 2022 high, …

… in a bear steepening.

——————–

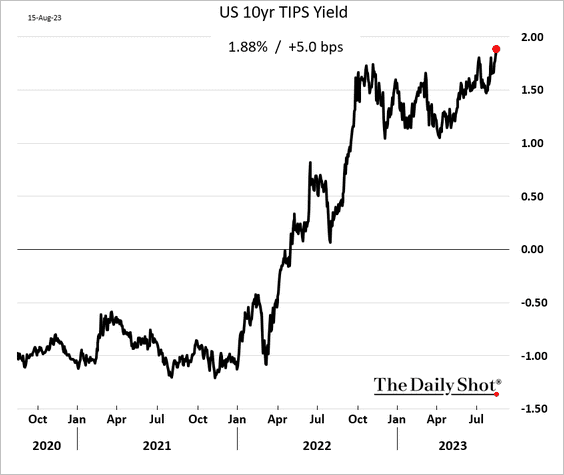

2. Real yields continue to surge.

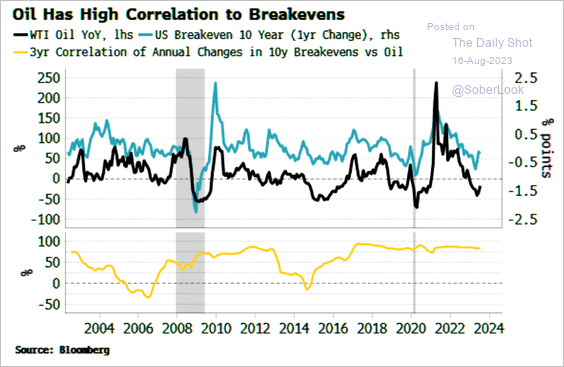

3. US breakeven rates (market-based inflation expectations) are highly correlated with crude oil …

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

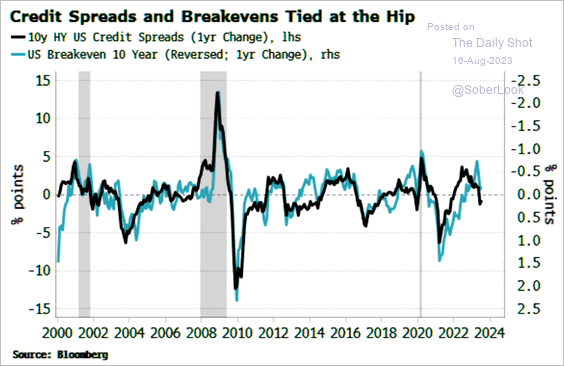

… and credit spreads.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

Global Develpmetns

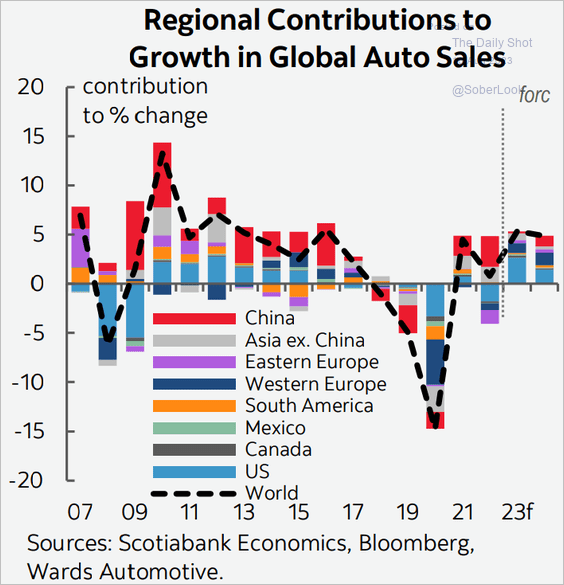

1. Global vehicle sales are expected to show an increase this year.

Source: Scotiabank Economics

Source: Scotiabank Economics

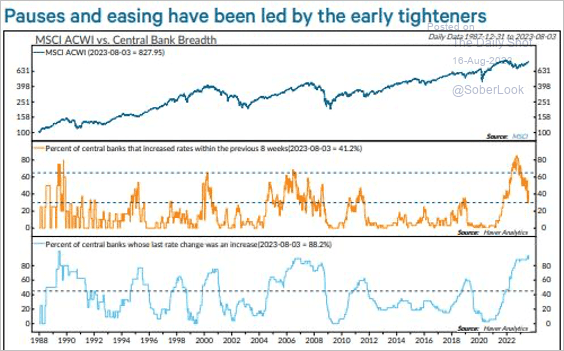

2. Fewer central banks are raising rates, which could support global liquidity.

Source: @NDR_Research

Source: @NDR_Research

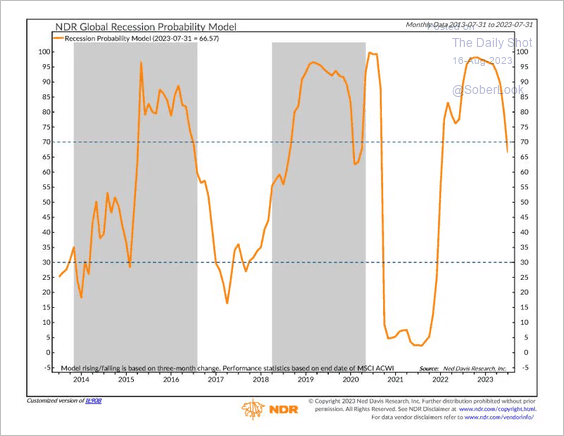

3. NDR’s global recession probability has declined.

Source: @NDR_Research

Source: @NDR_Research

——————–

Food for Thought

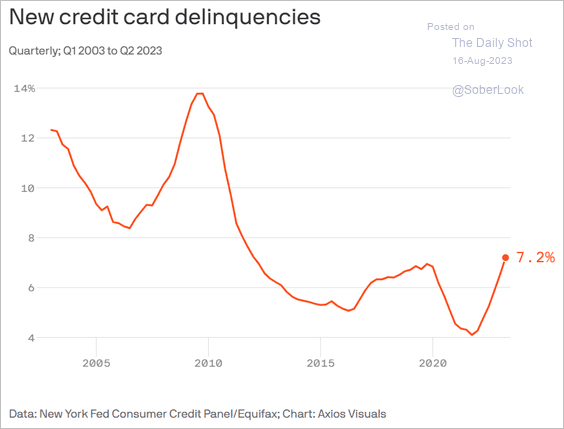

1. US credit card delinquencies:

Source: @axios Read full article

Source: @axios Read full article

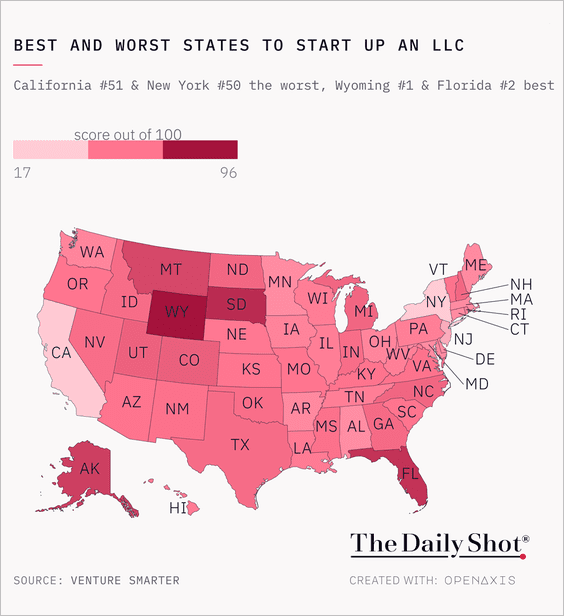

2. Best and worst states to start an LLC:

Source: @TheDailyShot

Source: @TheDailyShot

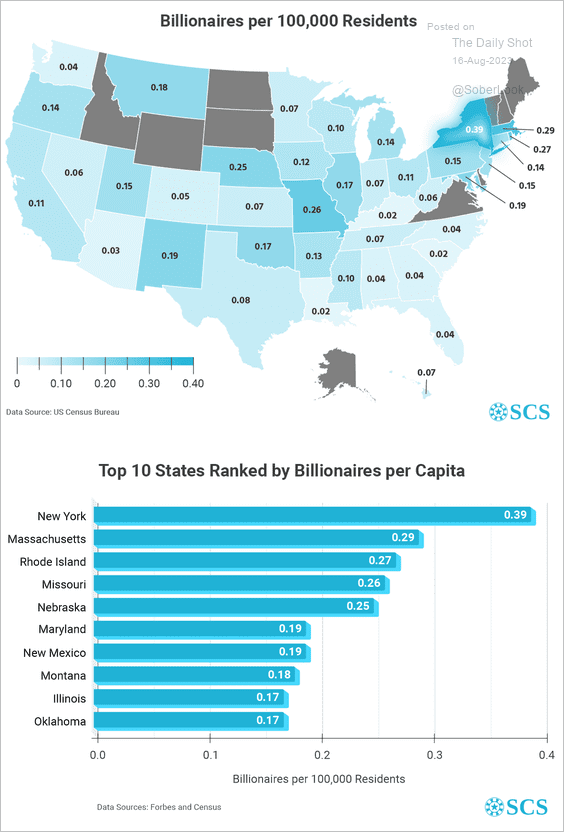

3. Billionaires per capita by state:

Source: Super Casino Sites Read full article

Source: Super Casino Sites Read full article

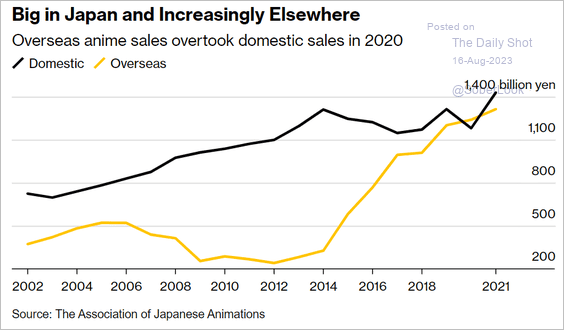

4. Anime sales:

Source: @soheefication, @technology Read full article

Source: @soheefication, @technology Read full article

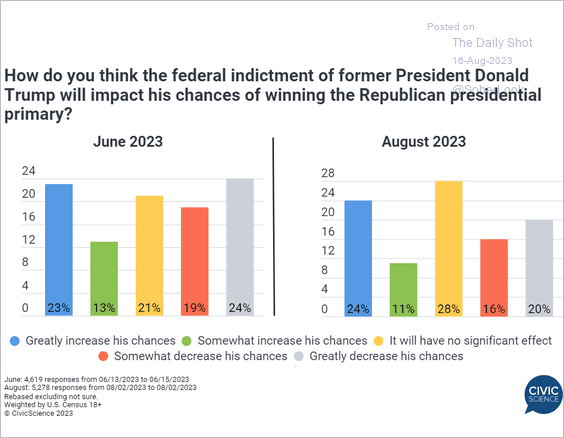

5. Donald Trump’s nomination chances:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

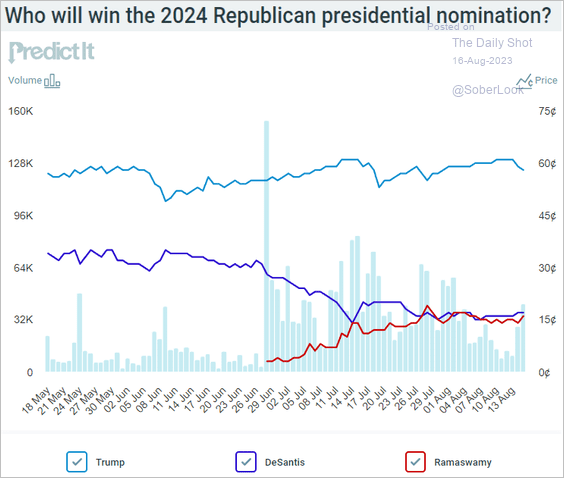

• GOP nomination probabilities in the betting markets:

Source: @PredictIt

Source: @PredictIt

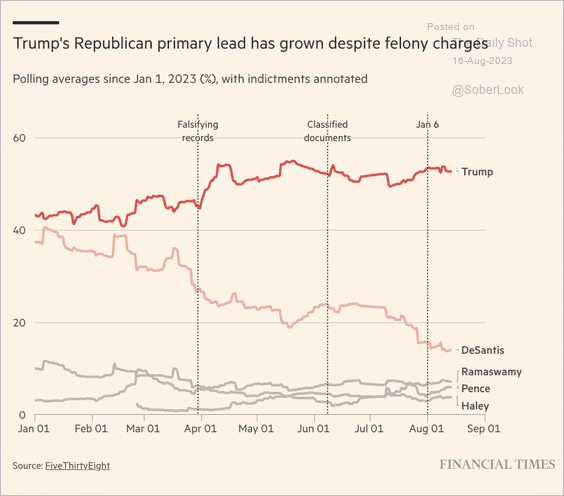

• GOP nomination polls:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

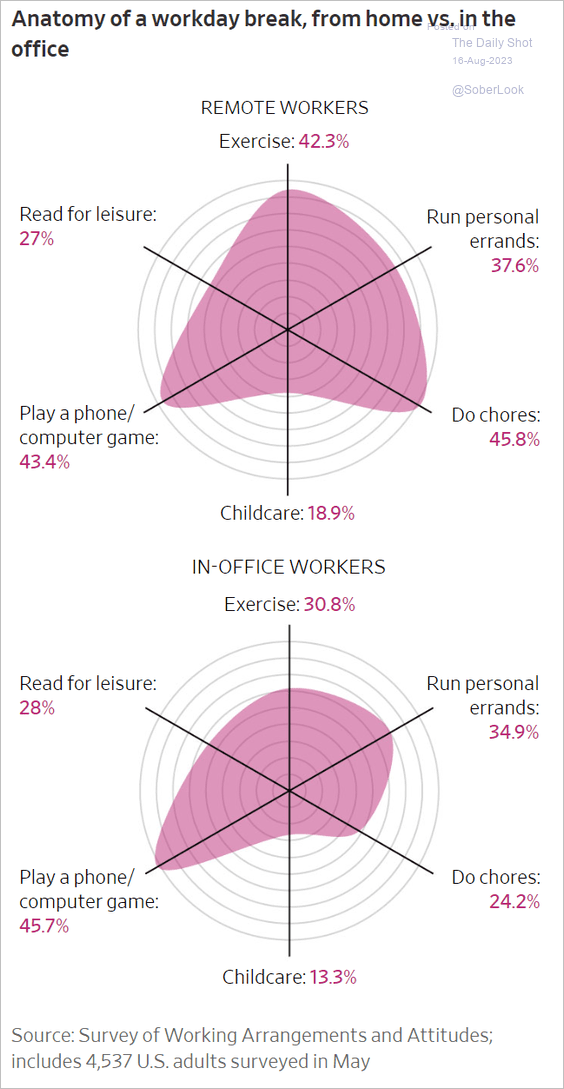

6. The workday break time allocation for remote and in-office workers:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Back to Index