The Daily Shot: 15-Aug-23

• China

• Japan

• Europe

• The United Kingdom

• Canada

• The United States

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Rates

• Global Developments

• Food for Thought

China

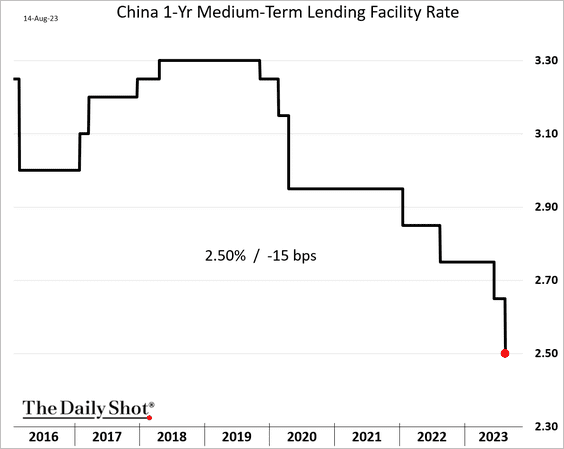

1. The PBoC unexpectedly cut its one-year benchmark rate as economic activity slumps, …

Source: Reuters Read full article

Source: Reuters Read full article

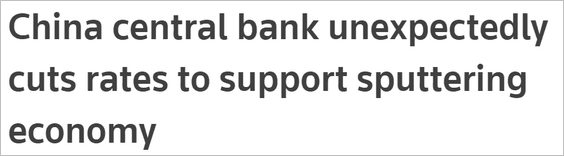

… and deflationary pressures push real rates higher.

Source: The Economist Read full article

Source: The Economist Read full article

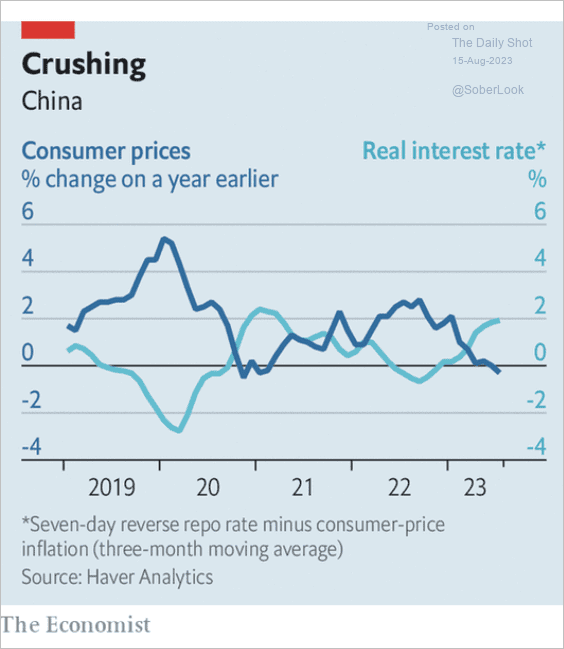

• Market-based rates slipped further.

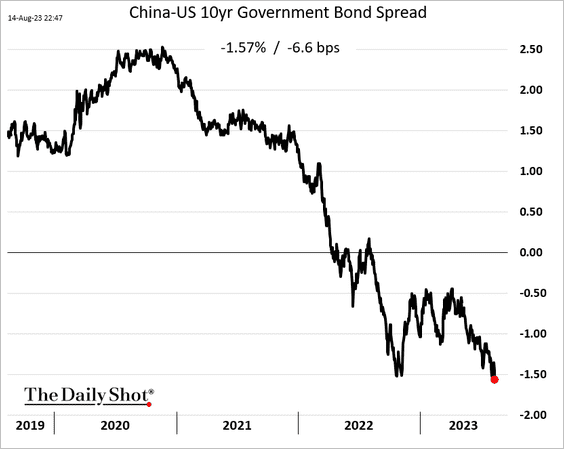

• The rate differential with the US keeps moving further into negative territory, which is pressuring the renminbi.

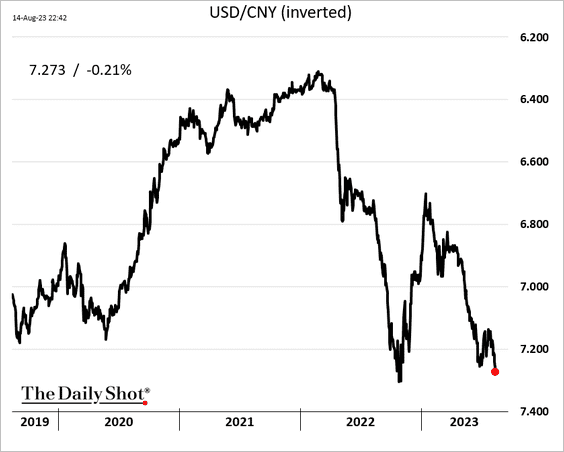

• China’s currency continues to weaken vs. the dollar, …

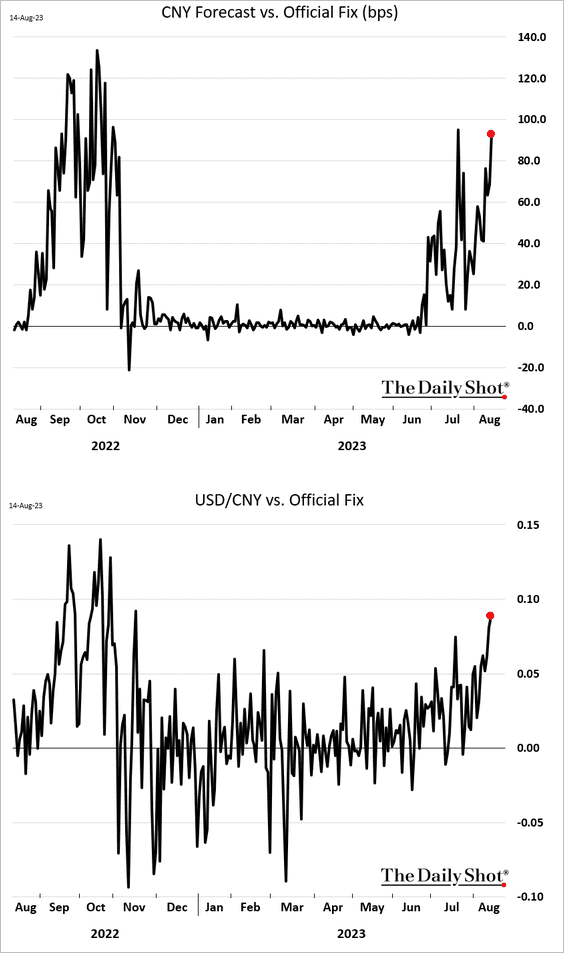

… even as Beijing attempts to drive it higher.

——————–

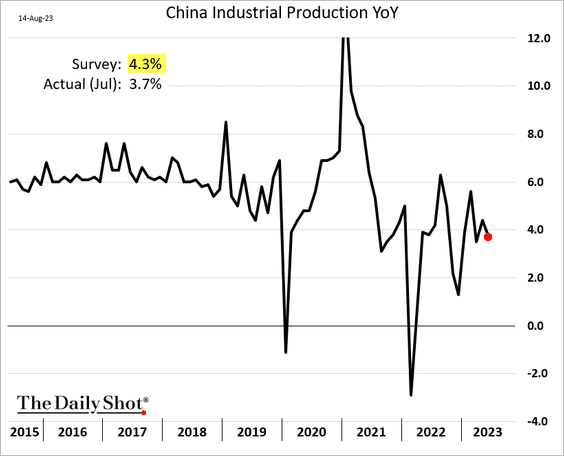

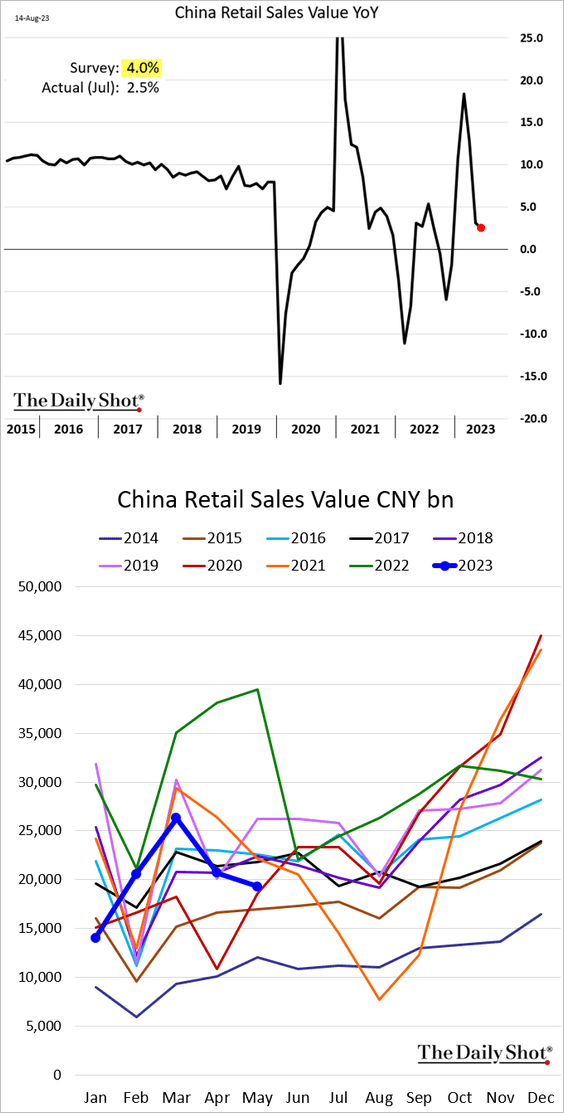

2. Economic activity in July was softer than expected.

• Industrial production:

• Retail sales:

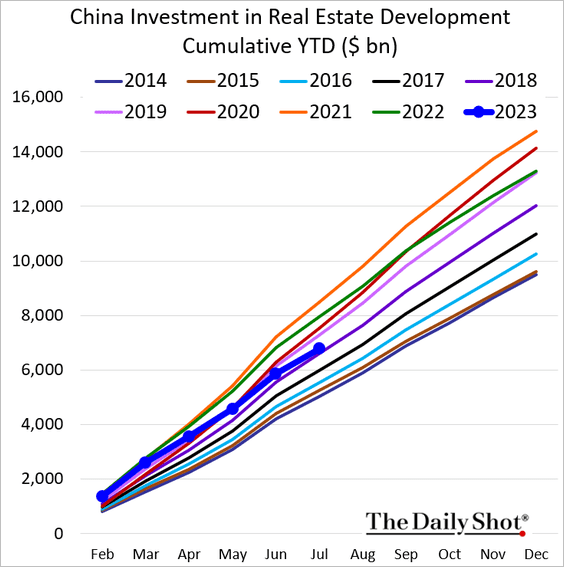

• Real estate investment:

China stopped reporting youth unemployment as the indicator created a PR nightmare for Beijing.

Source: @economics Read full article

Source: @economics Read full article

——————–

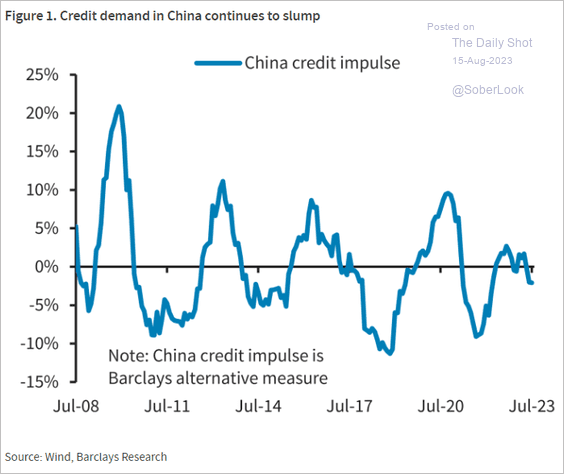

3. The credit impulse is rolling over.

Source: Barclays Research

Source: Barclays Research

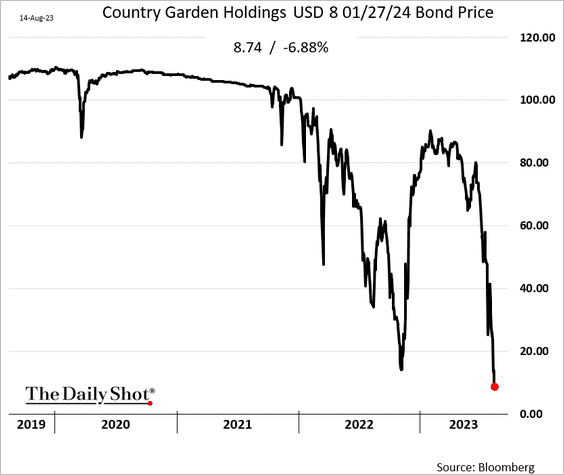

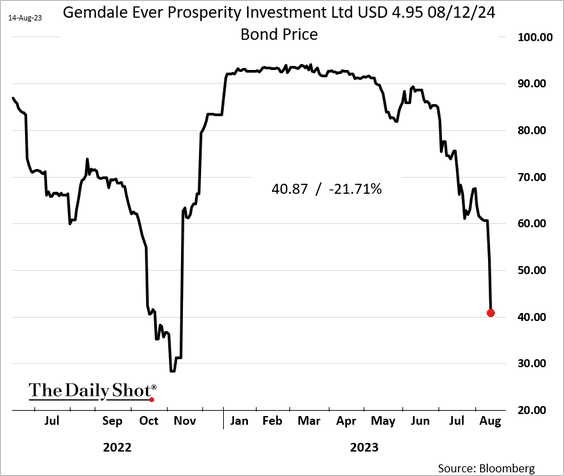

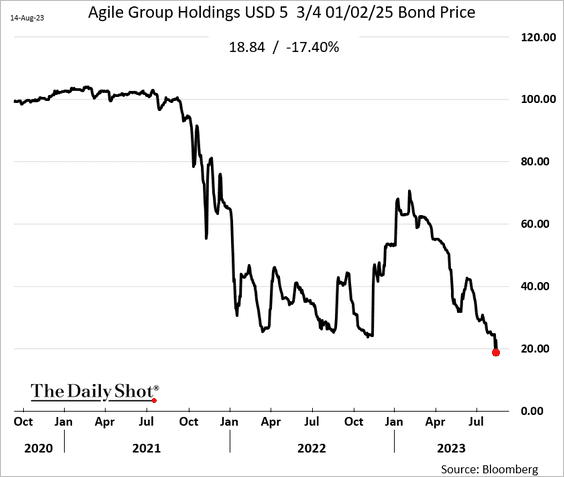

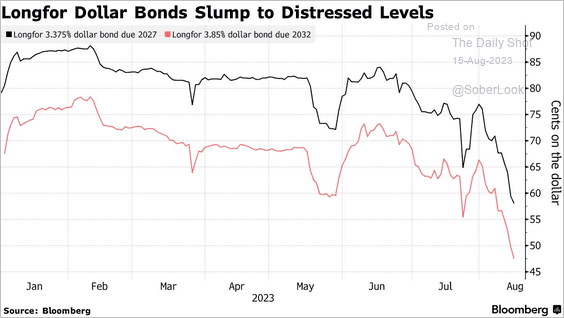

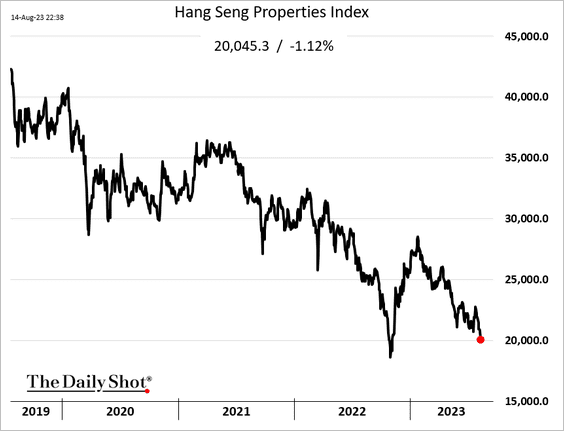

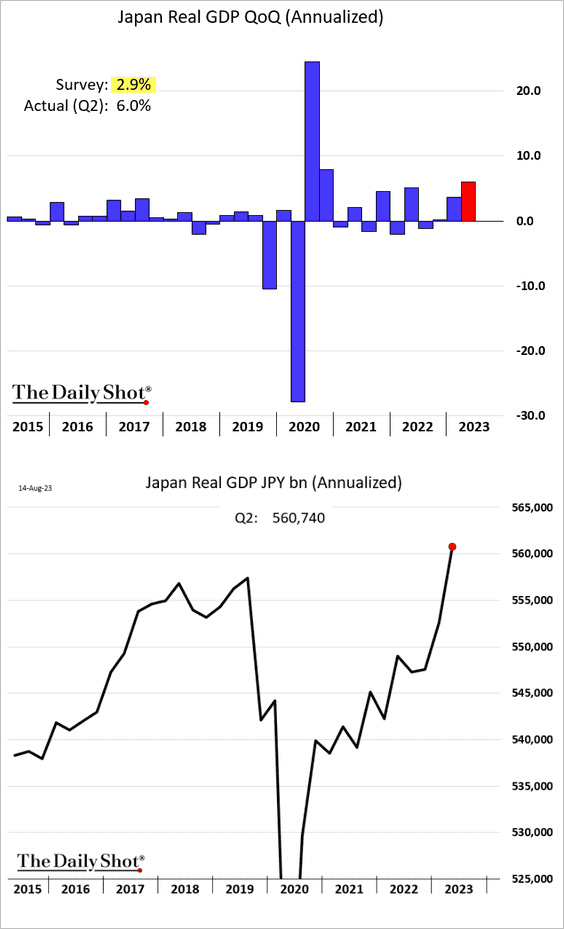

4. The property credit crisis is spreading, with dollar-denominated bonds tumbling.

Source: Reuters Read full article

Source: Reuters Read full article

• Country Garden bond price:

• Gemdale:

• Agile Group:

• Longfor:

Source: @markets Read full article

Source: @markets Read full article

• Developers’ share prices in Hong Kong:

• Could financial firms be next?

Source: @markets Read full article

Source: @markets Read full article

——————–

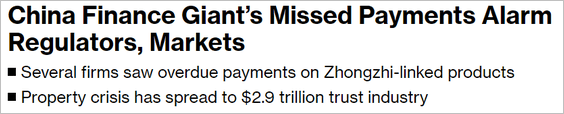

5. The EV price war is back, …

Source: @climate Read full article

Source: @climate Read full article

… pressuring automotive stocks.

——————–

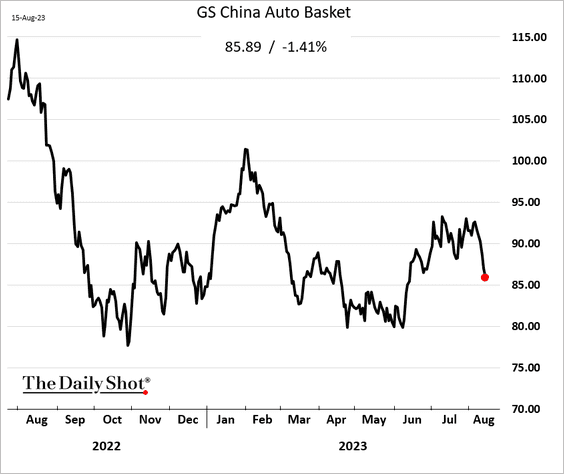

6. This chart shows forecasts for China’s GDP growth: Capital Economics vs. consensus.

Source: Capital Economics

Source: Capital Economics

Back to Index

Japan

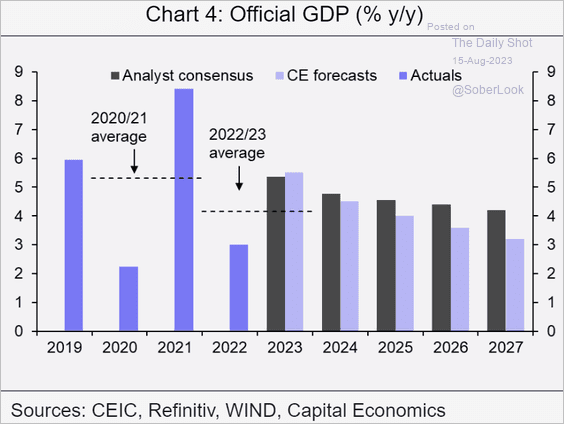

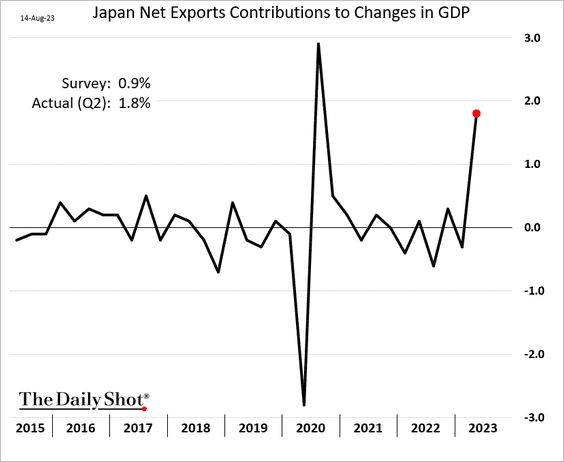

1. The GDP growth was shockingly strong in Q2, …

… boosted by net exports.

Source: CNBC Read full article

Source: CNBC Read full article

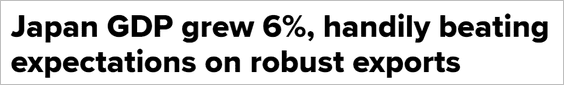

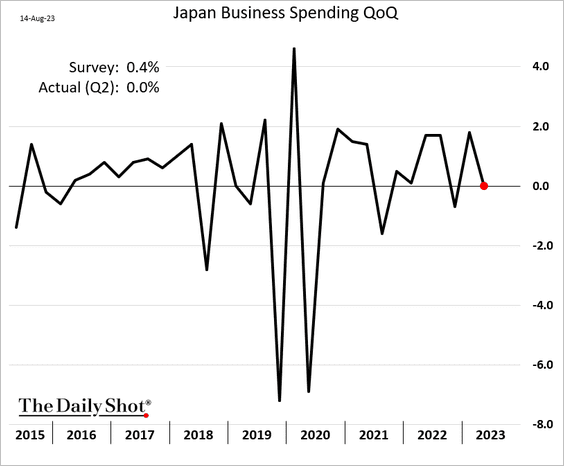

However, domestic demand softened.

• Business spending:

• Private consumption:

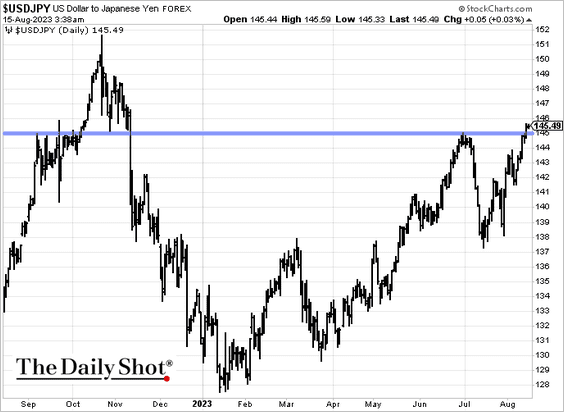

2. Dollar-yen is above 145 as pressure on the yen persists.

Back to Index

Europe

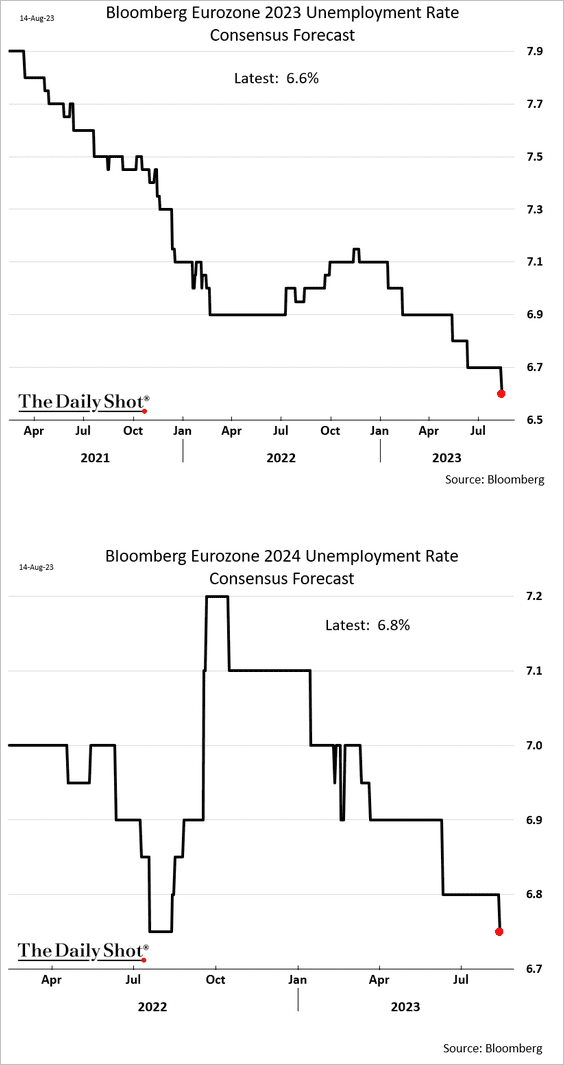

1. Economists have been lowering their unemployment forecasts for the euro area.

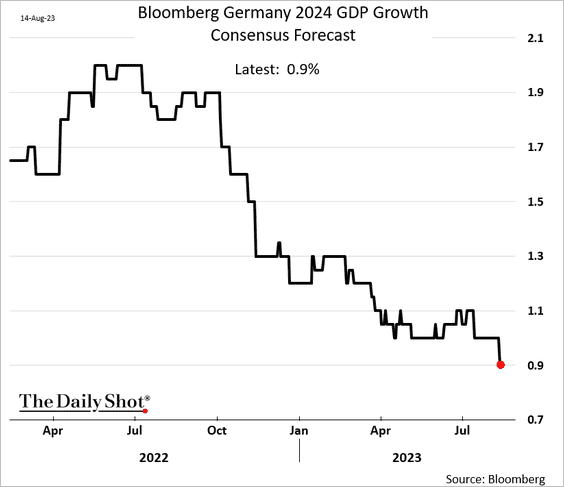

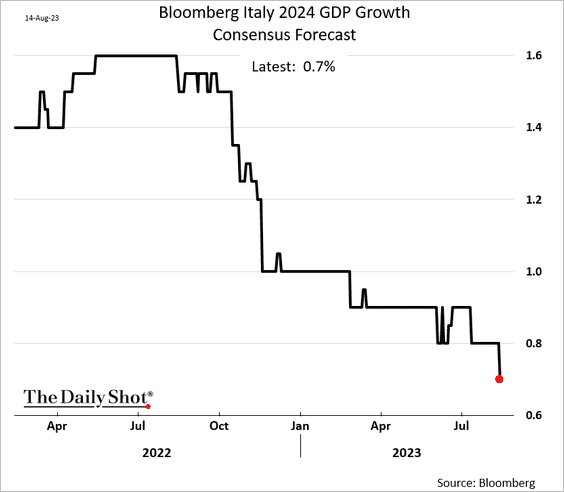

2. Projections for German and Italian economic growth in 2024 were revised lower.

——————–

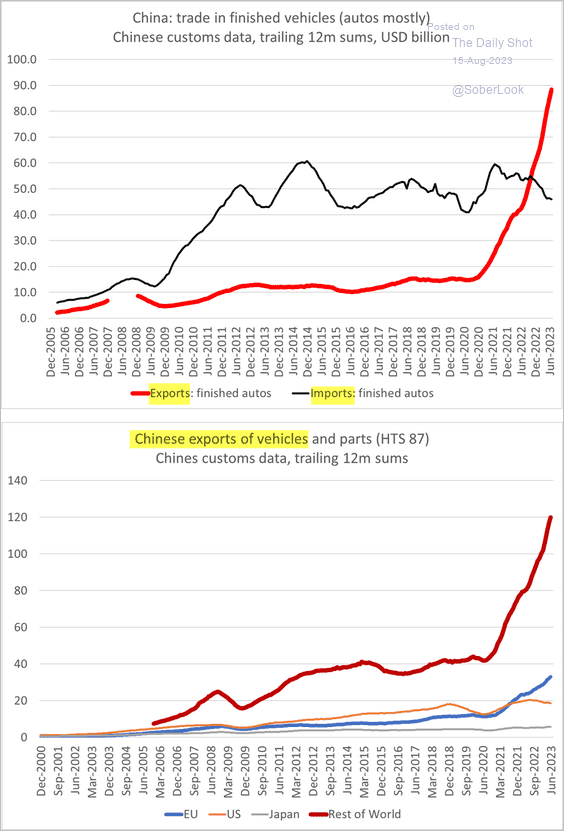

3. This is a nightmare scenario for Germany’s auto manufacturers.

Source: @Brad_Setser

Source: @Brad_Setser

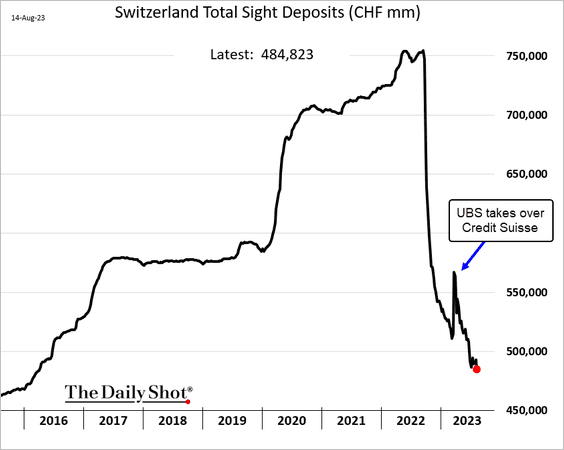

4. The Swiss central bank continues to reduce liquidity.

Back to Index

The United Kingdom

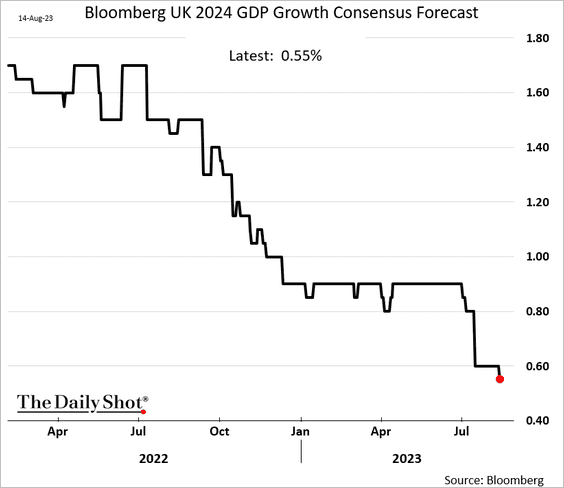

1. Economists keep lowering their projections for next year’s growth.

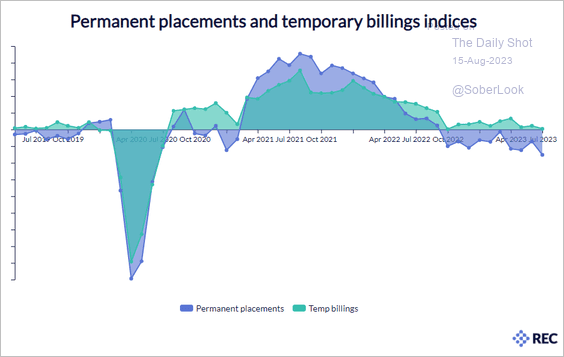

2. Permanent placements have been slowing, signaling some loosening in the labor market.

Source: REC

Source: REC

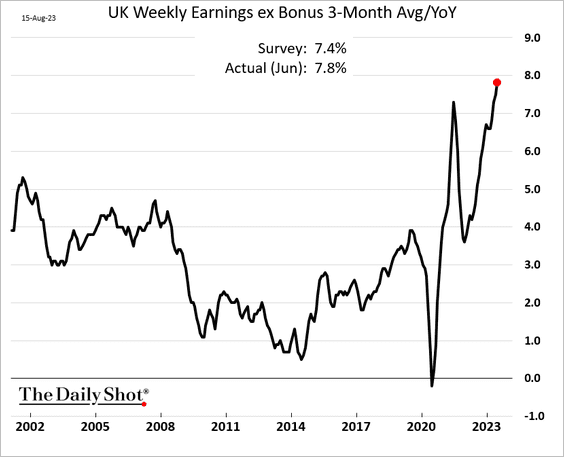

3. Wage growth accelerated in recent months.

Source: @economics Read full article

Source: @economics Read full article

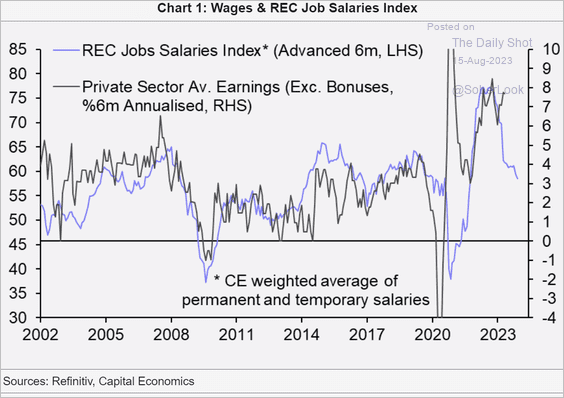

• But leading indicators suggest that wage growth should be easing.

Source: Capital Economics

Source: Capital Economics

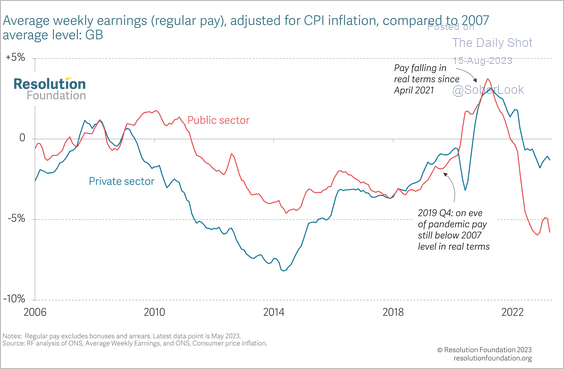

• Real wages in the UK fell more rapidly for public-sector employees, leading to a surge in strikes.

Source: @resfoundation, @nyecominetti, @hcslaughter_ Read full article

Source: @resfoundation, @nyecominetti, @hcslaughter_ Read full article

——————–

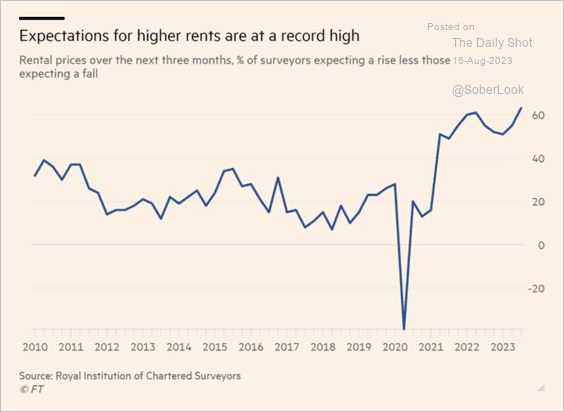

4. Surveys point to further gains in rental costs.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

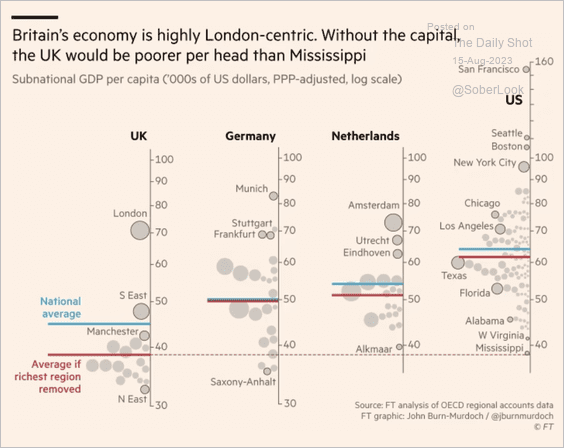

5. All the wealth is in London.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Canada

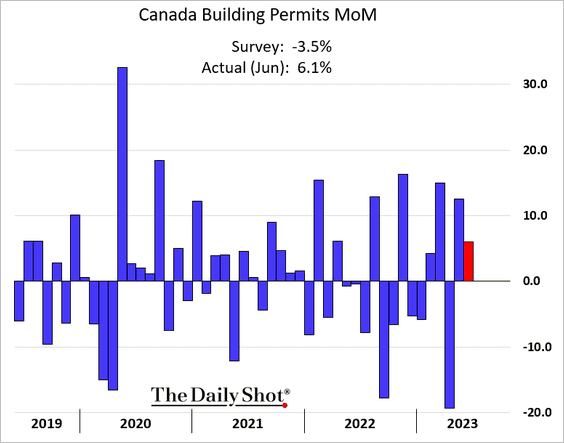

1. Building permits unexpectedly increased in June.

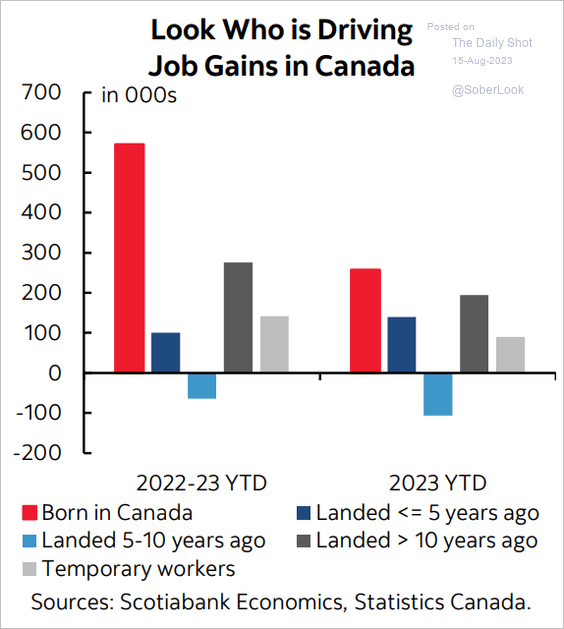

2. New immigrants have not been the driving force behind job gains.

Source: Scotiabank Economics

Source: Scotiabank Economics

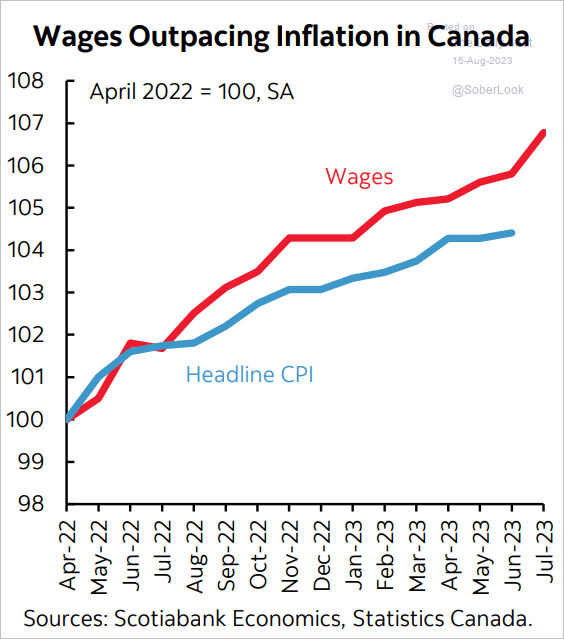

3. Wages have been rising faster than inflation.

Source: Scotiabank Economics

Source: Scotiabank Economics

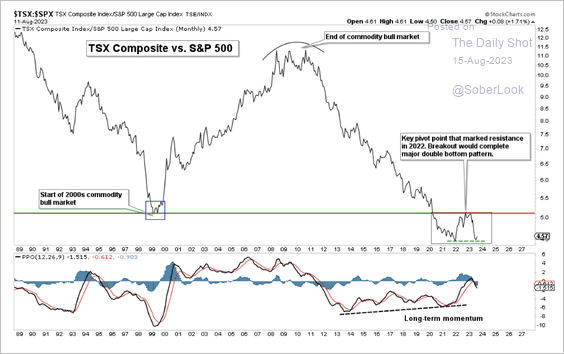

4. The TSX Composite is stabilizing relative to the S&P 500. Could we see a period of outperformance?

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

Back to Index

The United States

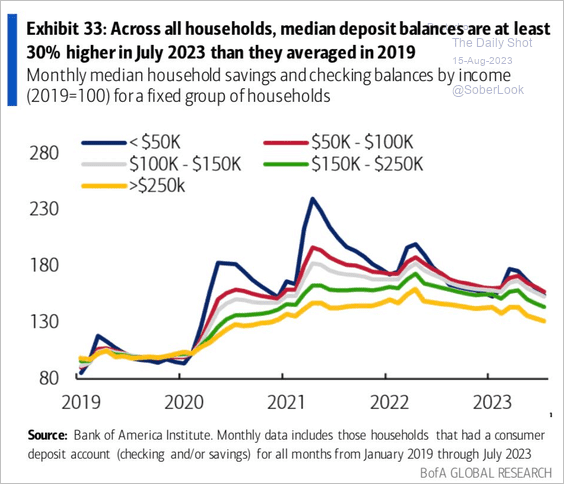

1. Let’s begin with some consumer trends.

• Household deposit balances remain elevated, according to BofA.

Source: BofA Global Research

Source: BofA Global Research

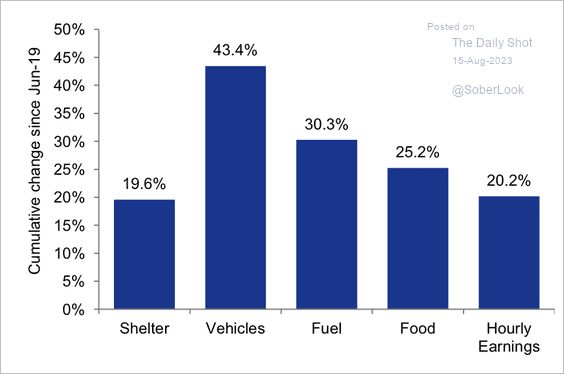

• Incomes are up, but higher prices are pressuring consumer balance sheets.

Source: Goldman Sachs

Source: Goldman Sachs

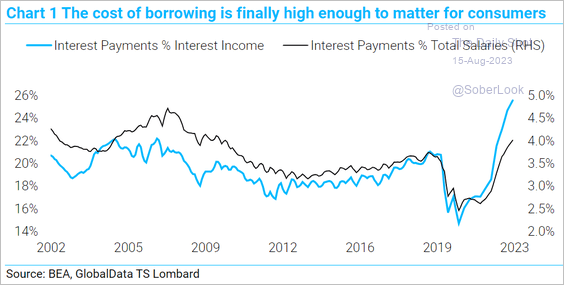

• Consumers are starting to feel the impact of higher rates.

Source: TS Lombard

Source: TS Lombard

——————–

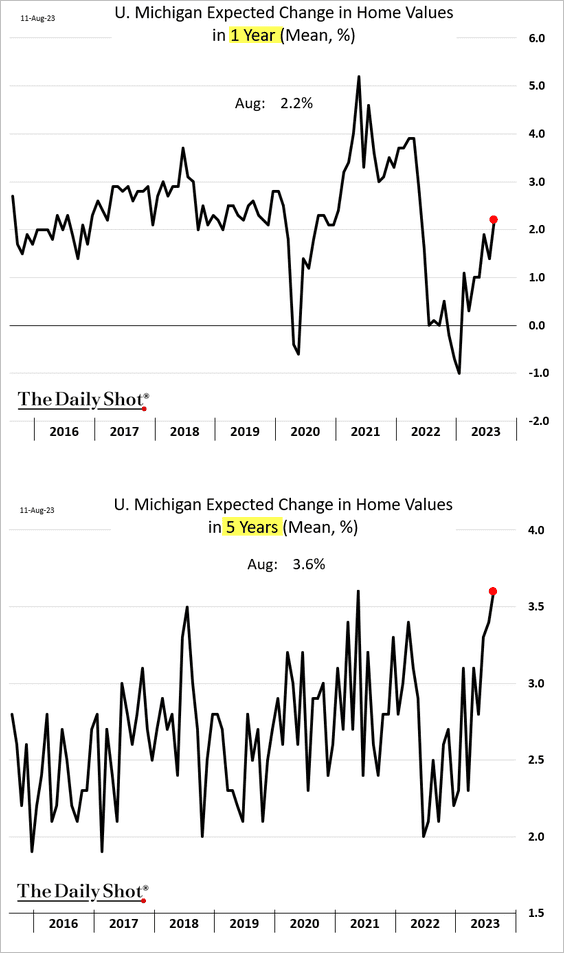

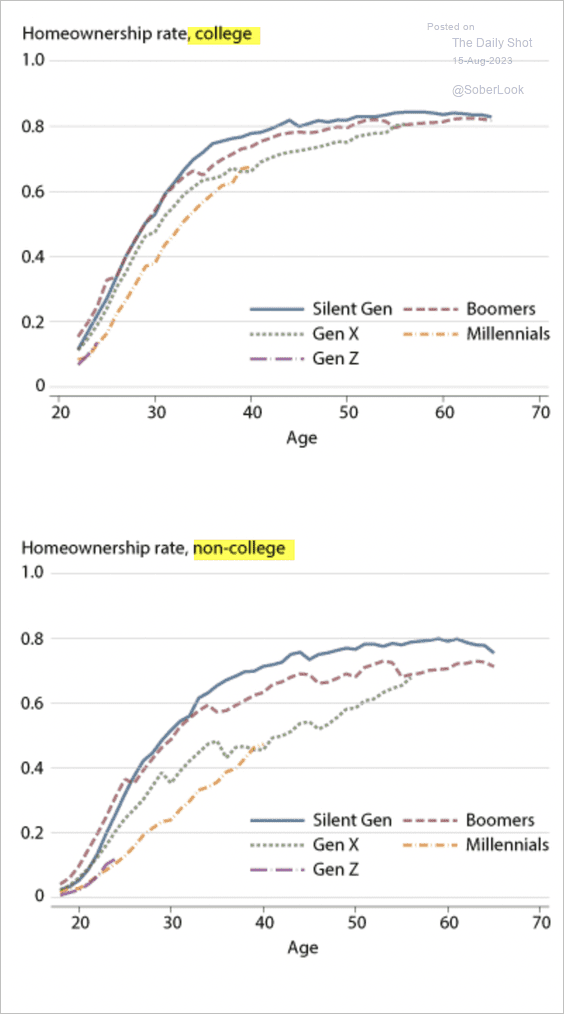

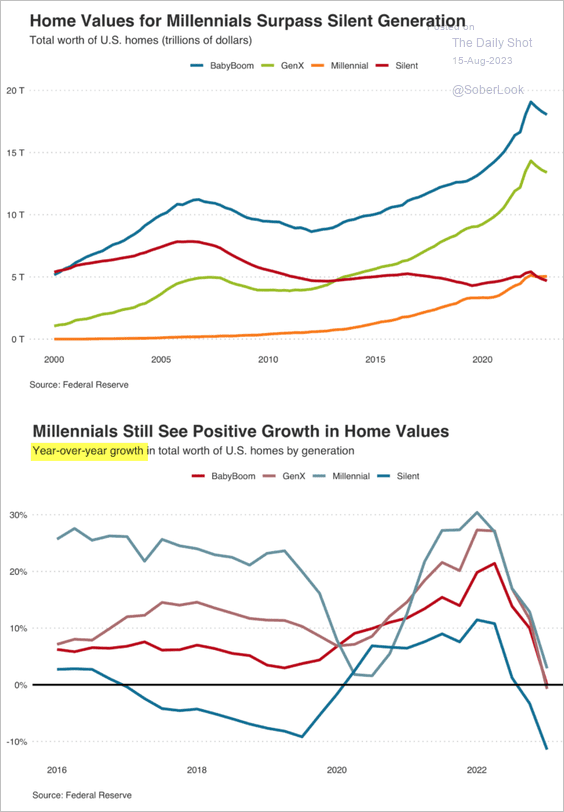

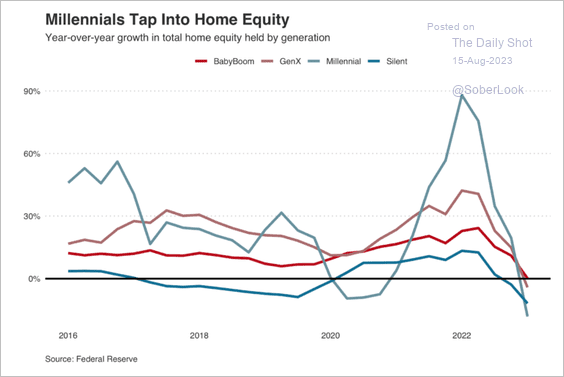

2. Next, we have some updates on the housing market.

• Consumers are growing more optimistic about the appreciation of home prices.

• This chart shows homeownership rates by age and generation.

Source: @stlouisfed Read full article

Source: @stlouisfed Read full article

• Next, we have the total housing value by generation.

Source: Redfin

Source: Redfin

– Here are the changes in total home equity.

Source: Redfin

Source: Redfin

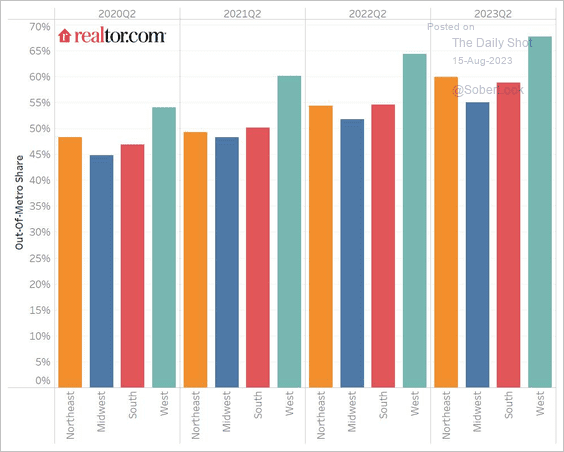

• According to Realtor.com, “more shoppers are looking for homes in areas other than where they live.”

Source: realtor.com

Source: realtor.com

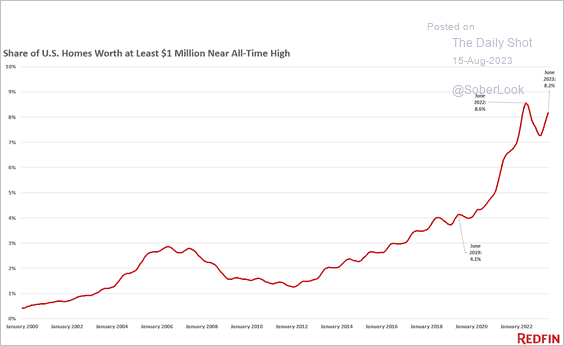

• The share of homes worth at least $1 million is approaching the recent peak.

Source: Redfin

Source: Redfin

——————–

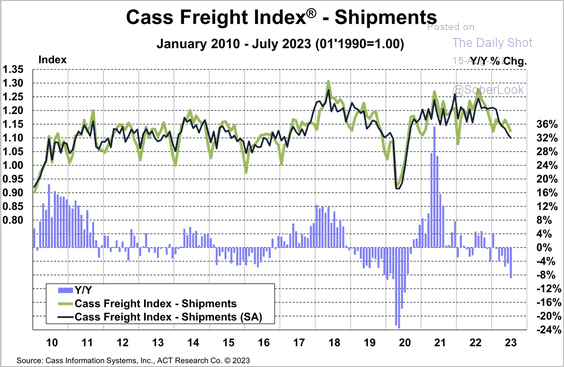

3. Freight activity is slowing, …

Source: Cass Information Systems

Source: Cass Information Systems

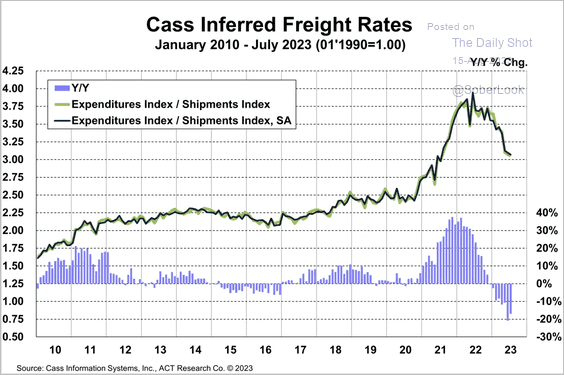

… pressuring freight rates.

Source: Cass Information Systems

Source: Cass Information Systems

Back to Index

Emerging Markets

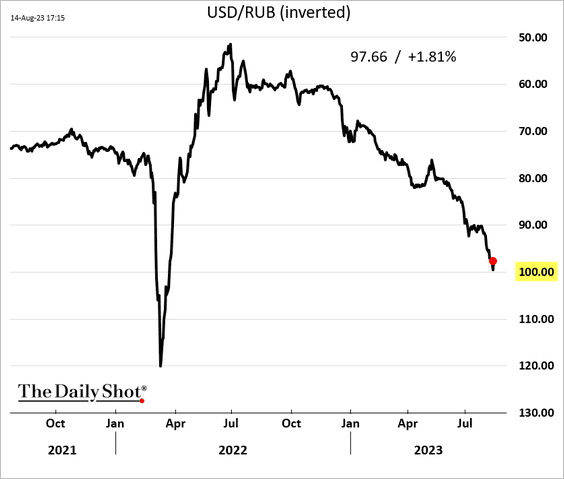

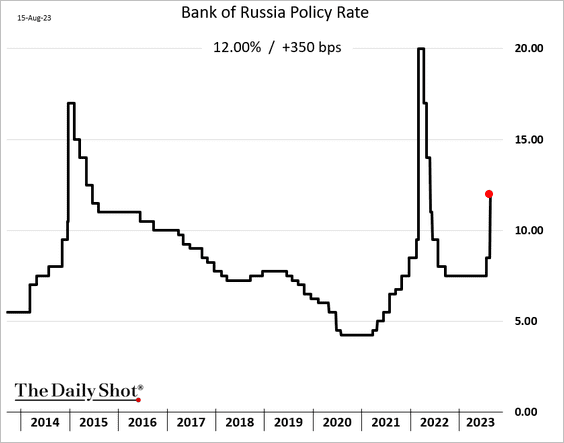

1. The Russian ruble bounced from the lows as the central bank hiked rates by 350 bps to stabilize the currency.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: CNBC Read full article

Source: CNBC Read full article

——————–

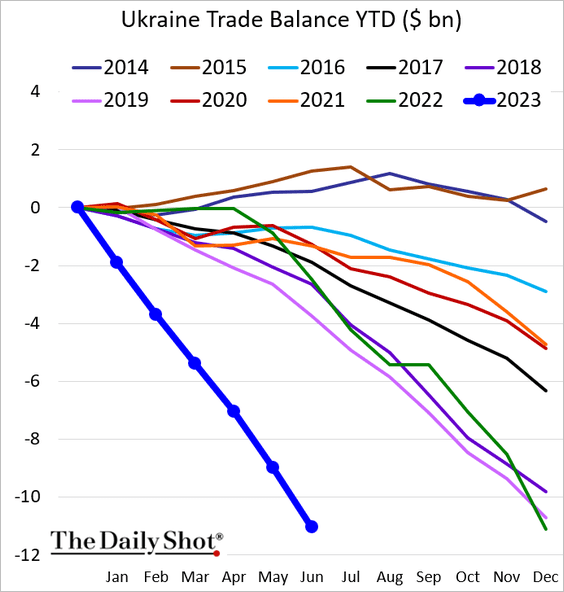

2. Ukraine’s trade deficit has blown out.

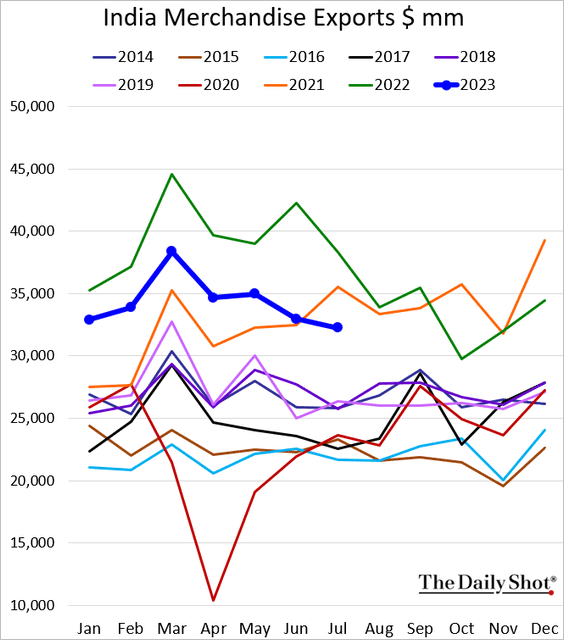

3. India’s exports slowed last month.

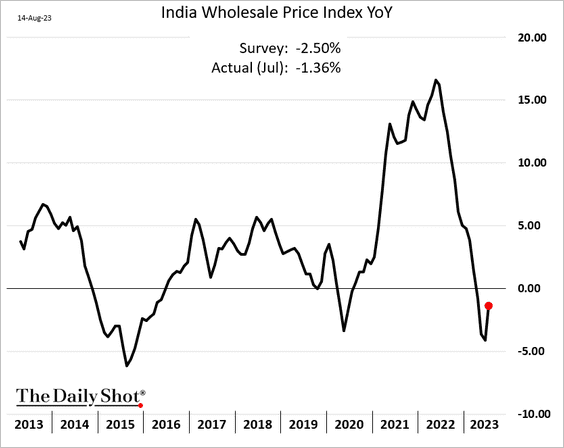

Wholesale price deflation eased in July.

——————–

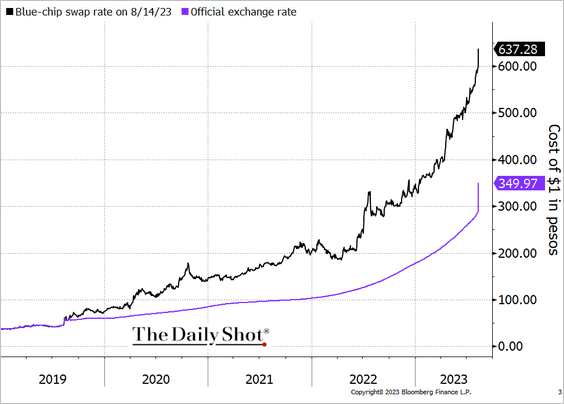

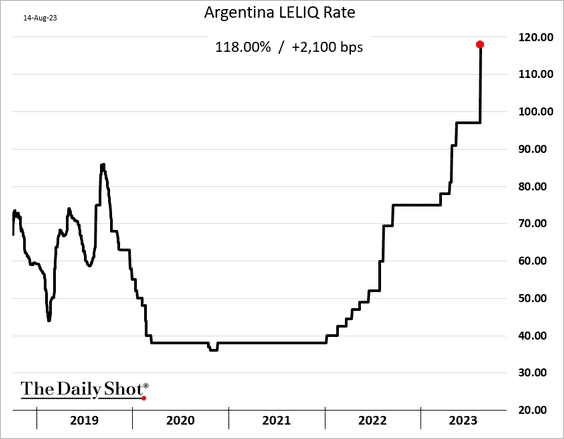

4. Argenitna’s election took an unexpected turn.

Source: Fox News Read full article

Source: Fox News Read full article

Capital outflows kicked in quickly. With insufficient foreign reserves to support the currency, Argentina permitted a significant depreciation of the peso, …

Source: @bpolitics Read full article

Source: @bpolitics Read full article

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

… and hiked rates by 21% to arrest further declines.

——————–

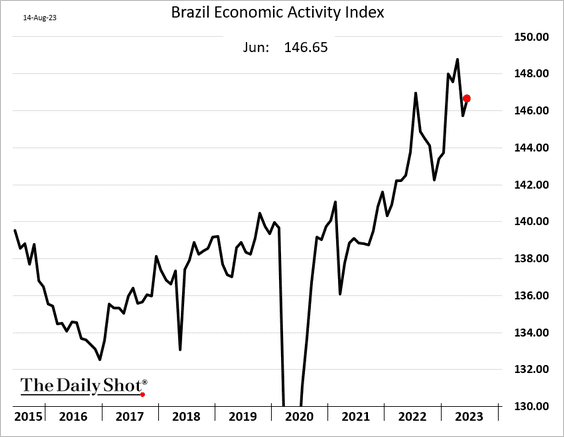

5. Brazil’s economic activity edged higher in June.

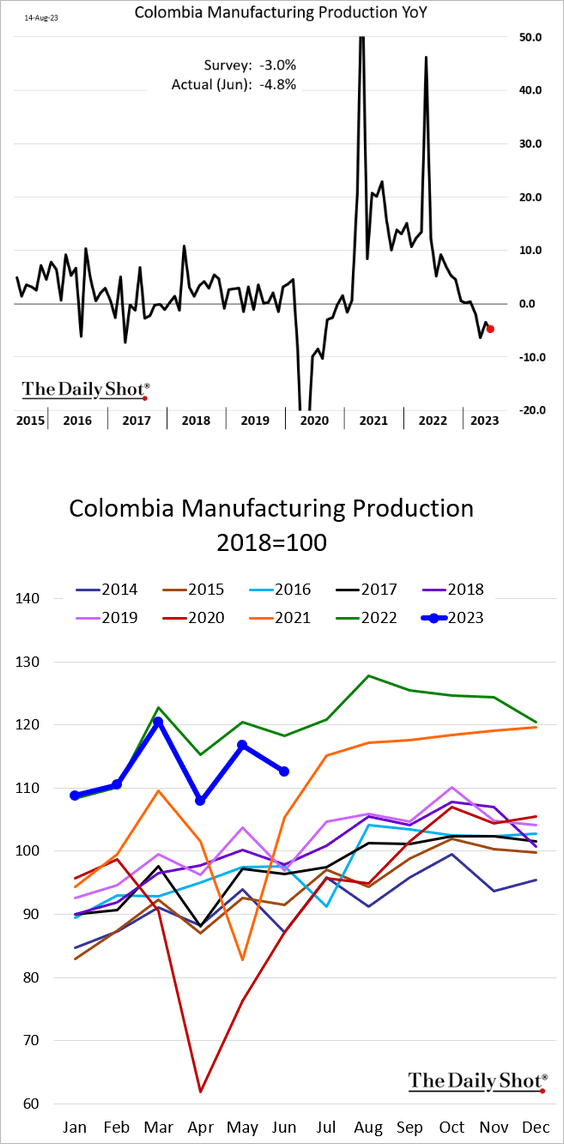

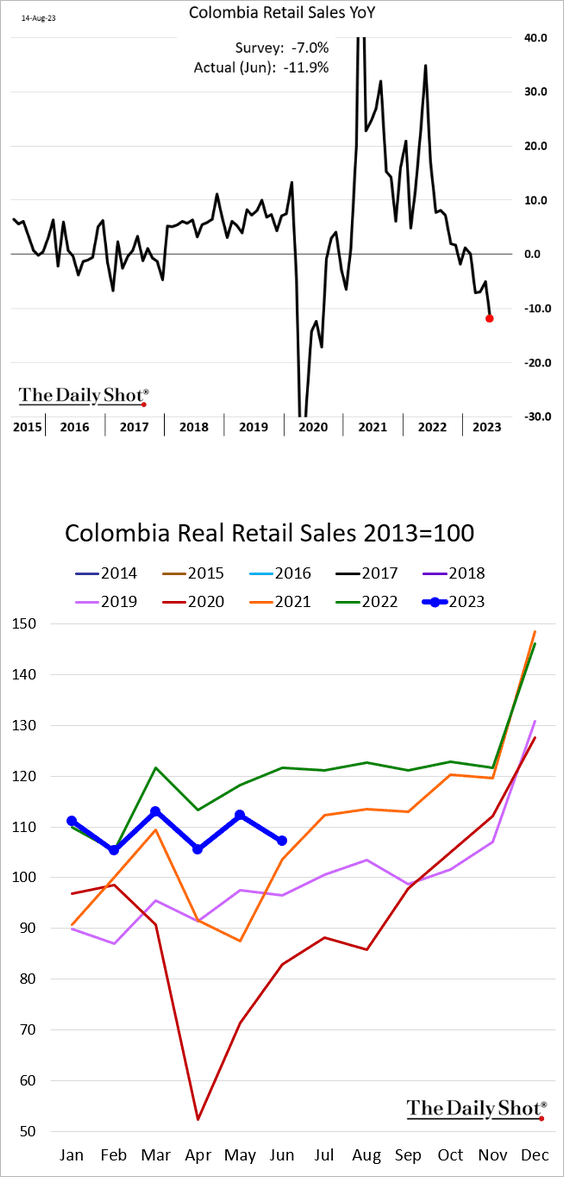

6. Colombia’s economic activity is slowing.

• Manufacturing:

• Retail sales:

——————–

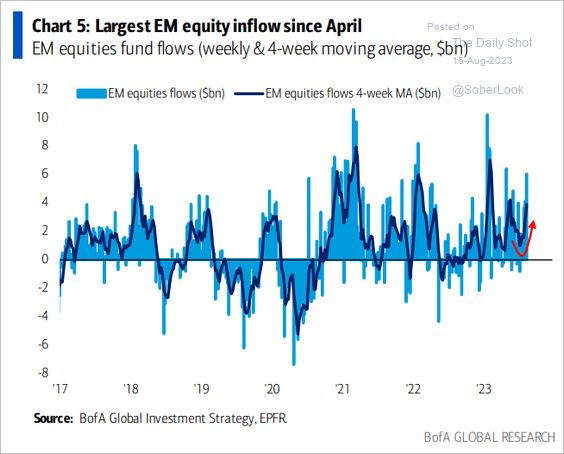

7. EM equity fund inflows accelerated in recent days.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Cryptocurrency

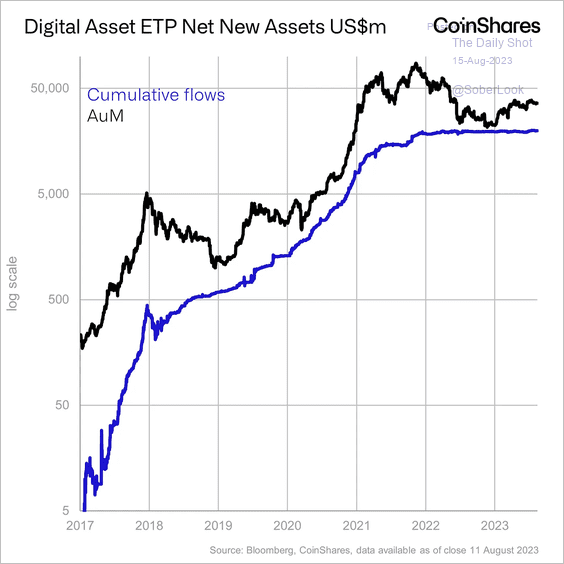

Bitcoin cumulative fund flows and assets under management have leveled off in recent years.

Source: CoinShares Read full article

Source: CoinShares Read full article

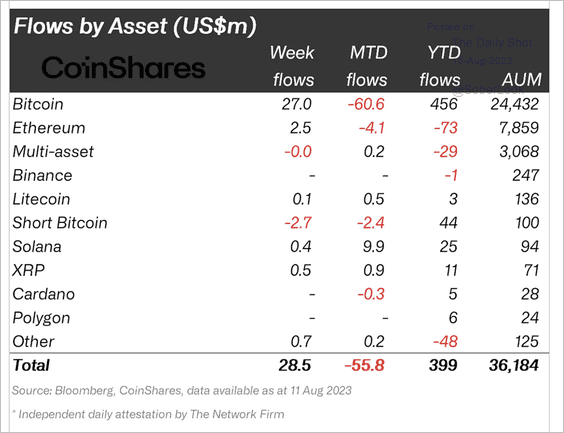

Crypto funds saw inflows last week after a three-week run of outflows. Long-bitcoin products attracted the most capital.

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

Commodities

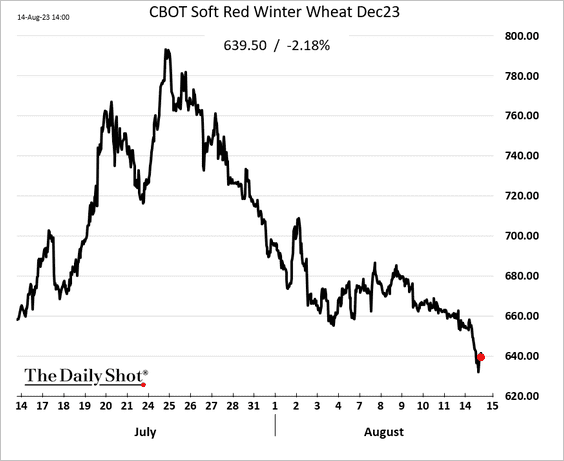

1. Wheat prices declined despite the Black Sea tensions.

Source: @markets Read full article

Source: @markets Read full article

——————–

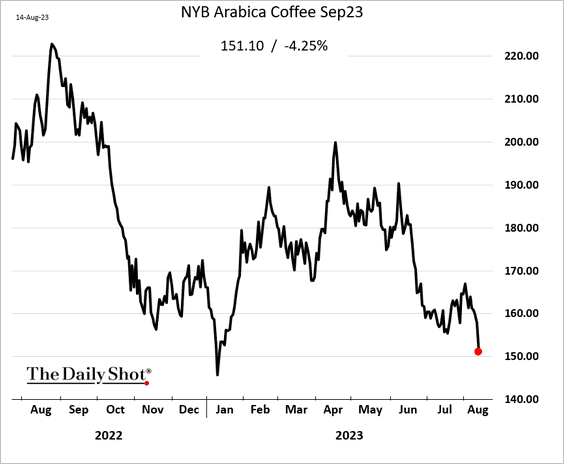

2. Coffee futures are sharply lower.

Source: barchart.com Read full article

Source: barchart.com Read full article

——————–

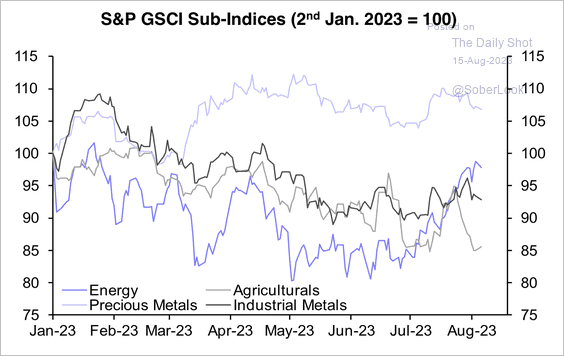

3. Over the past month, agriculture prices have generally fallen while energy prices rallied.

Source: Capital Economics

Source: Capital Economics

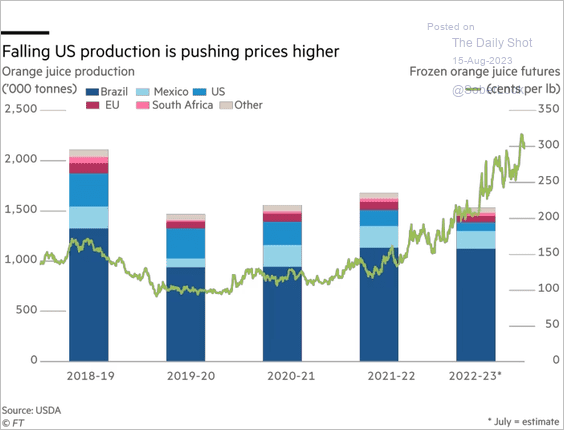

4. Falling US production has been putting upward pressure on orange juice futures.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

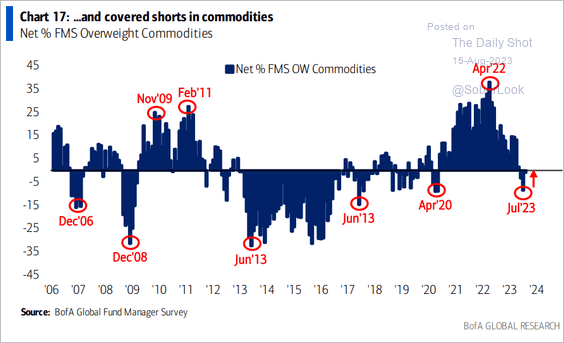

5. Global fund managers covered their bets against commodities.

Source: BofA Global Research

Source: BofA Global Research

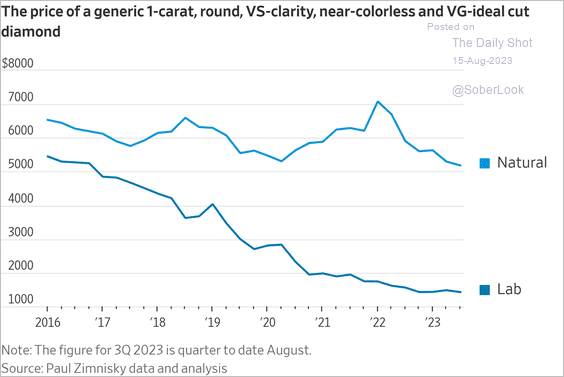

6. Diamond prices have been falling.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Energy

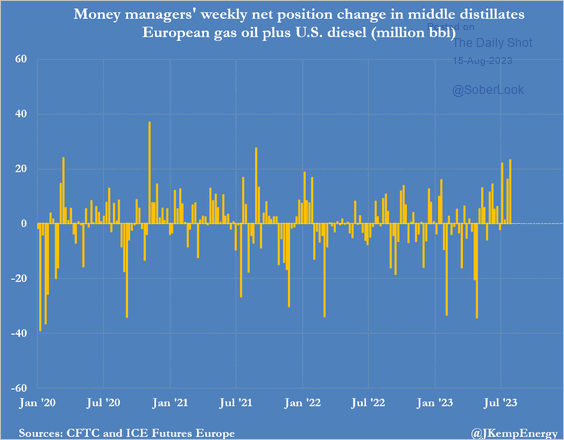

1. Fund managers are boosting their bets on diesel futures.

Source: @JKempEnergy

Source: @JKempEnergy

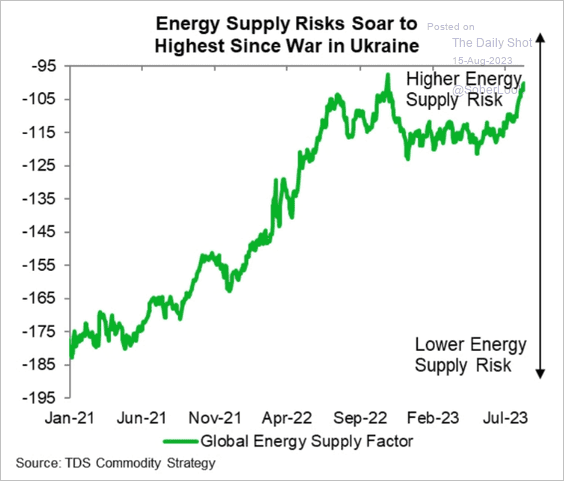

2. Energy supply risks remain elevated.

Source: TD Securities; @dailychartbook

Source: TD Securities; @dailychartbook

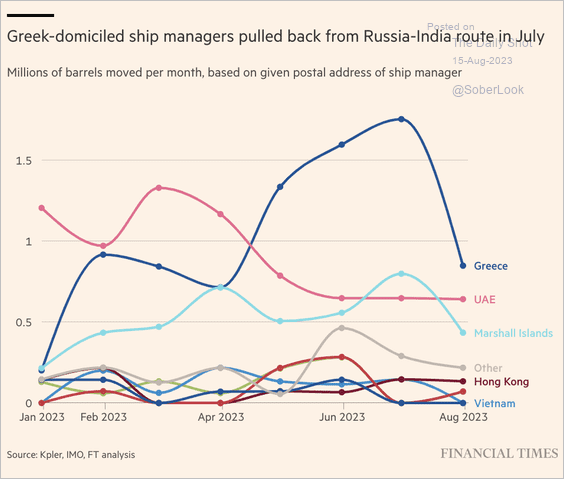

3. Who is moving Russian crude?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Equities

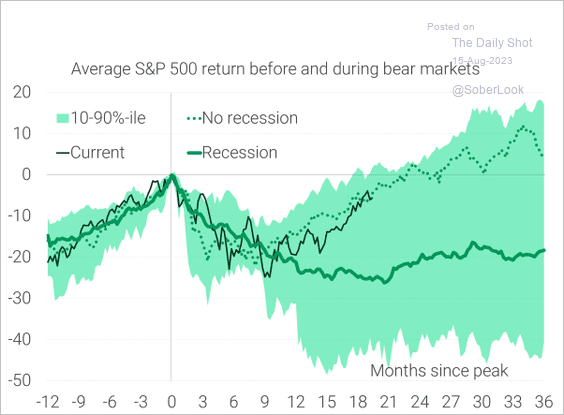

1. The market is pricing in a no-recession scenario.

Source: TS Lombard

Source: TS Lombard

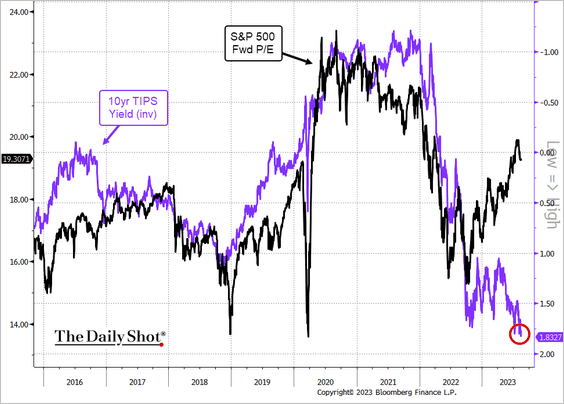

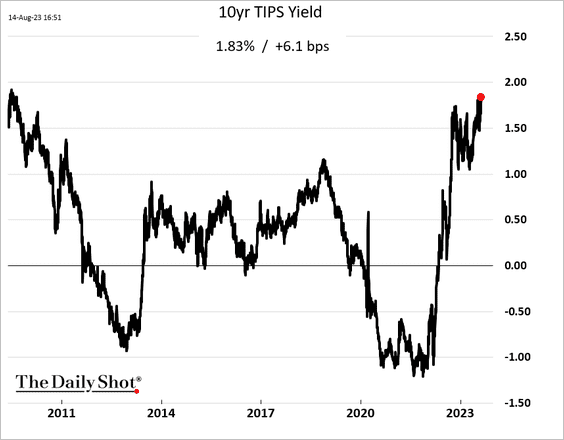

2. Rising real rates are a headwind for stock valuations.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

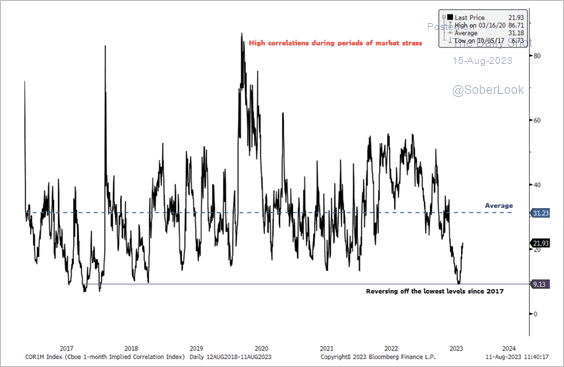

3. The one-month implied correlation between S&P 500 constituents is rising from its lowest level since 2017. This typically occurs during periods of market stress.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

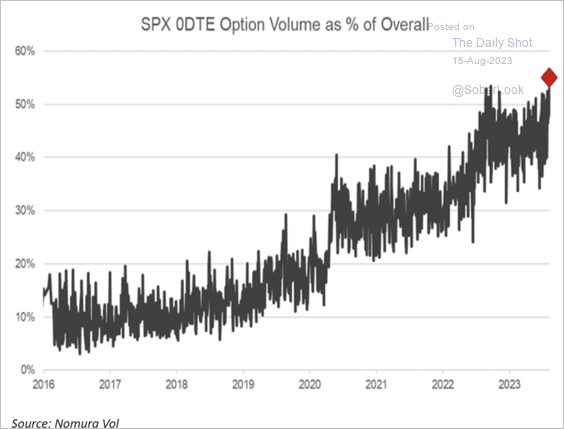

4. One-day options now make up over 50% of the overall volume.

Source: Nomura Securities; @markets Read full article

Source: Nomura Securities; @markets Read full article

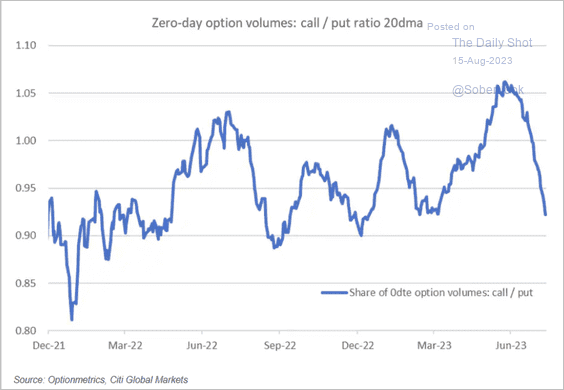

• Traders of one-day options have turned increasingly bearish.

Source: Citi; @markets Read full article

Source: Citi; @markets Read full article

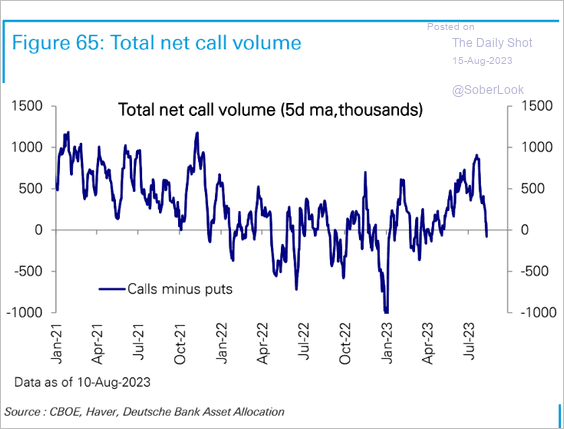

• The overall equity call volume dropped sharply in recent days.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

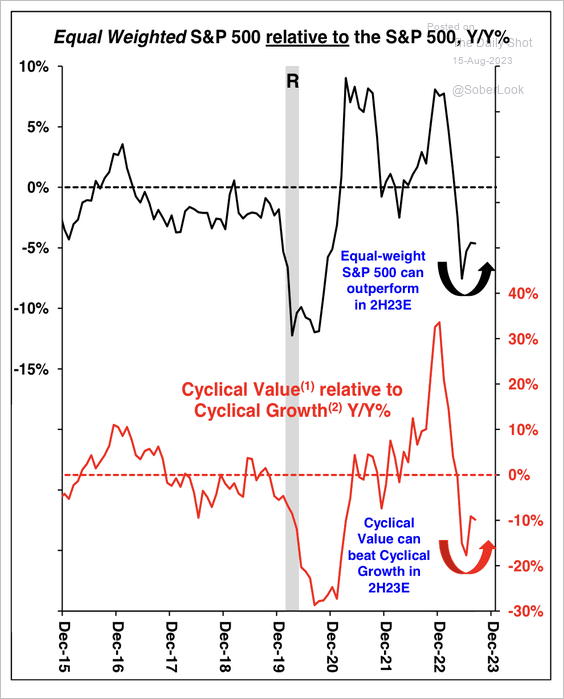

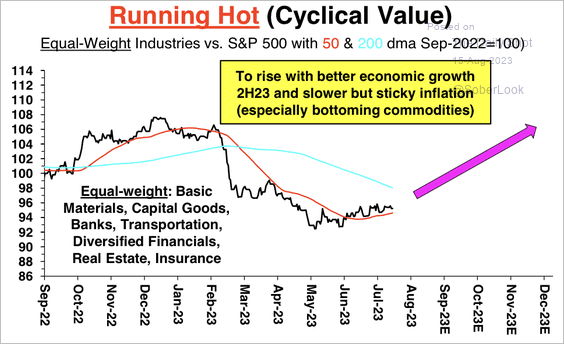

5. The equal-weighted S&P 500 has been improving relative to the cap-weighted S&P 500, especially among cyclical value stocks. (2 charts)

Source: Stifel

Source: Stifel

Source: Stifel

Source: Stifel

——————–

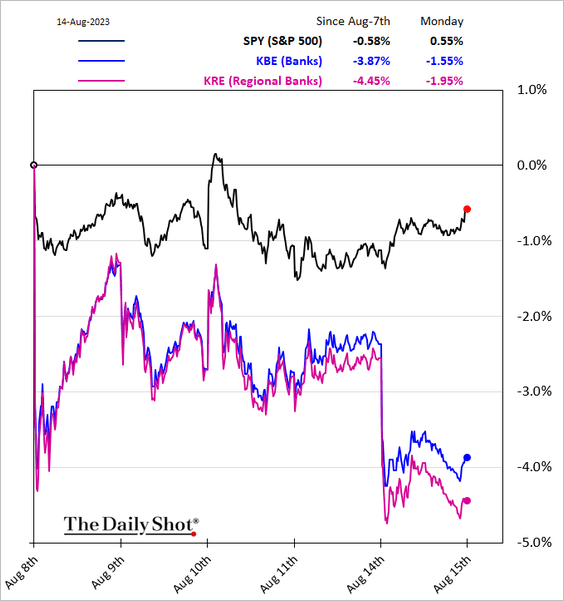

6. Next, we have some sector trends.

• Banks:

• Semiconductors:

![]()

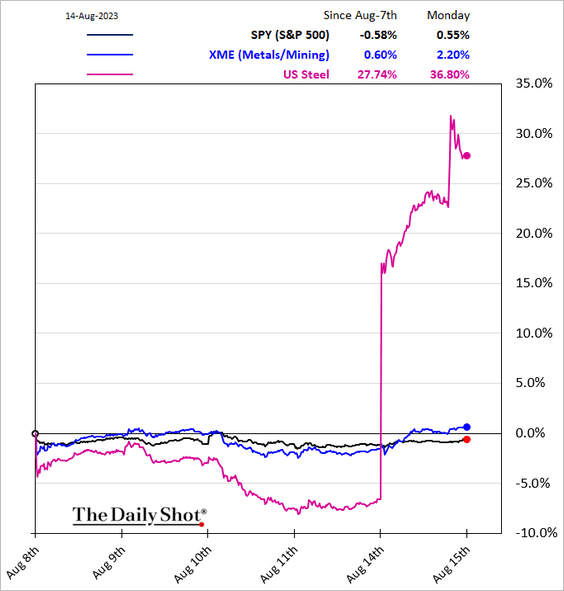

• Metals & Mining:

Source: @WSJ Read full article

Source: @WSJ Read full article

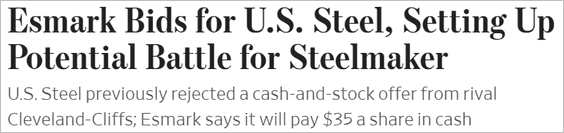

• Fund managers have been dumping REITs …

Source: BofA Global Research

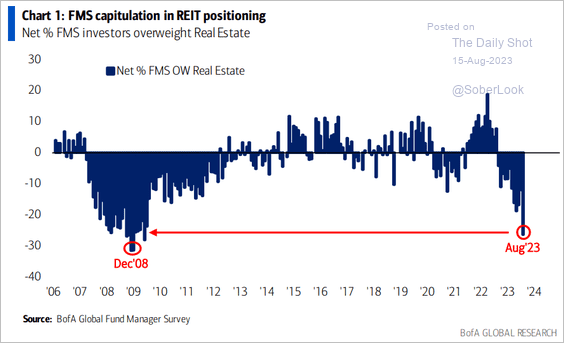

Source: BofA Global Research

… amid concerns about commercial real estate.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Alternatives

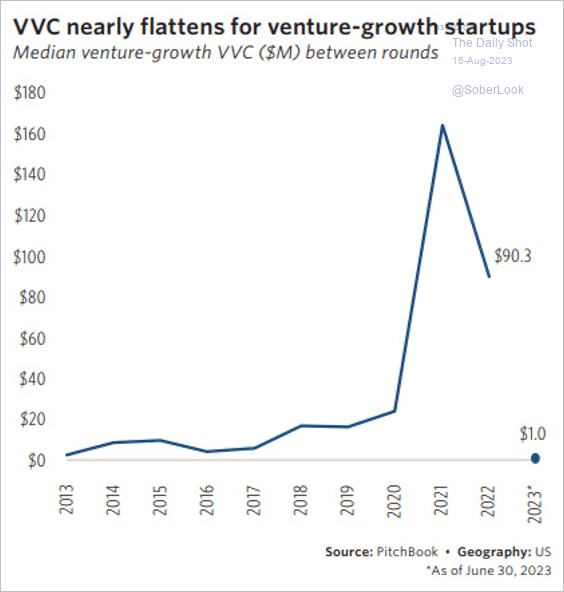

1. The velocity of US venture capital value creation (VVC) has fallen rapidly across all stages.

Source: PitchBook

Source: PitchBook

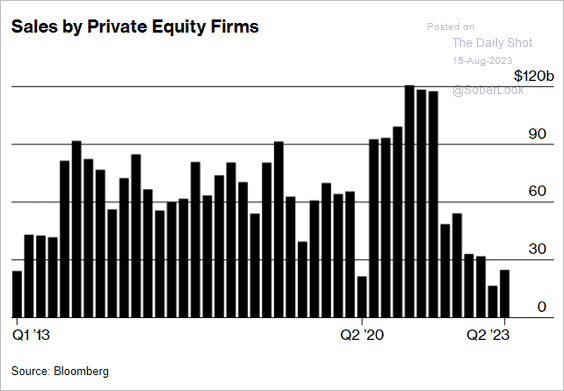

2. Sales by private equity (PE) funds have slowed.

Source: @BW Read full article

Source: @BW Read full article

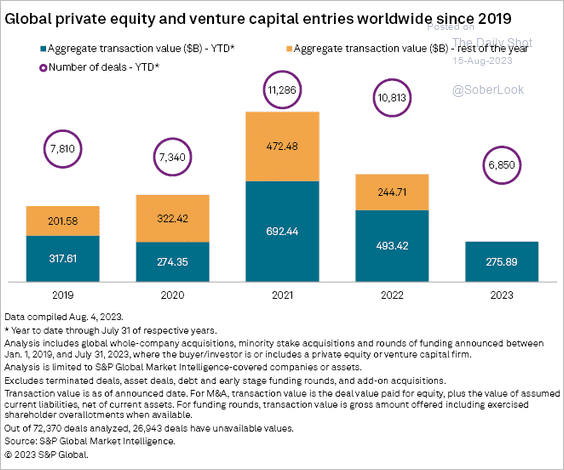

3. PE deal activity this year has been the slowest since the 2020 COVID shock.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Credit

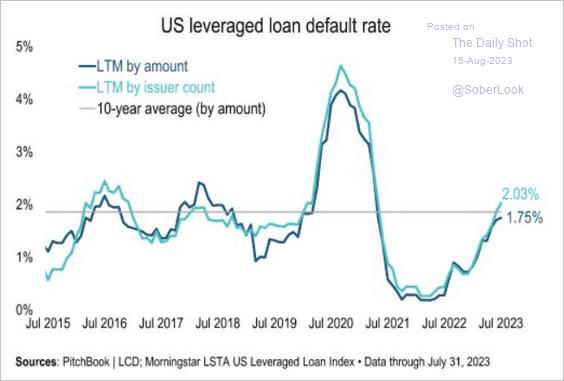

1. Leverage loan defaults have been rising.

Source: @lcdnews

Source: @lcdnews

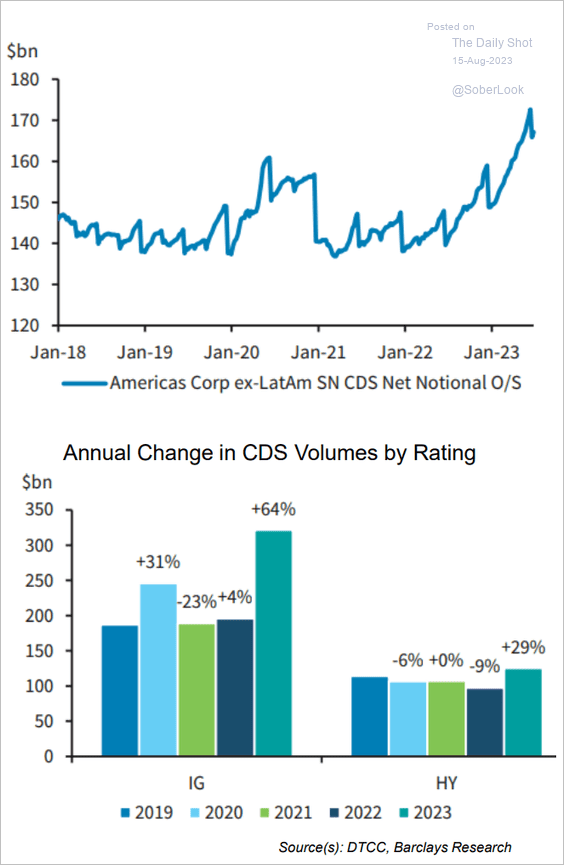

2. Single-name CDS volume surged over the past 12 months.

Source: Barclays Research; III Capital Management

Source: Barclays Research; III Capital Management

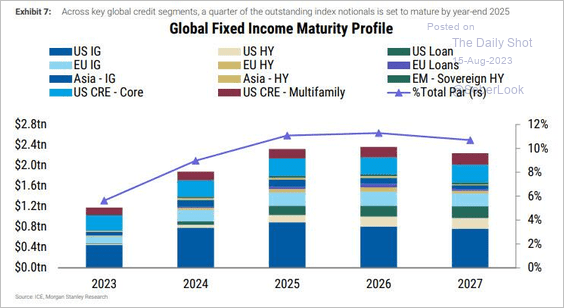

3. This chart shows the maturity profile by credit category.

Source: Morgan Stanley Research; @Mayhem4Markets

Source: Morgan Stanley Research; @Mayhem4Markets

Back to Index

Rates

1. The 10-year TIPS yield (real rates) hit a multi-year high.

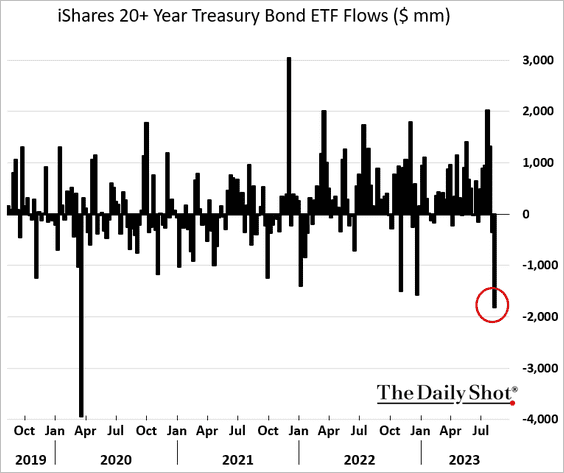

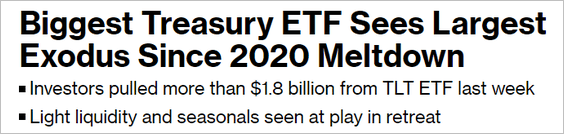

2. The largest long-dated Treasury ETF registered a significant outflow.

Source: @markets Read full article

Source: @markets Read full article

——————–

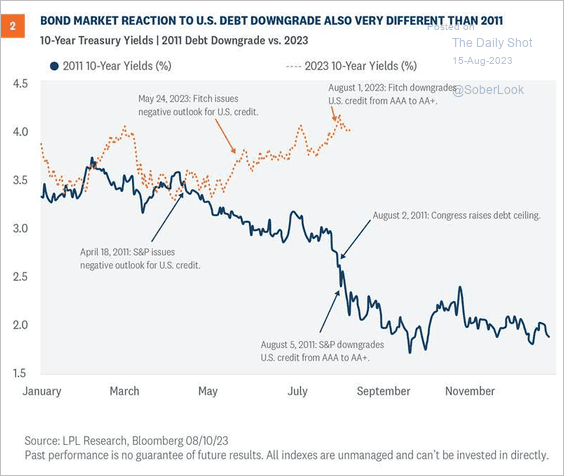

3. The market reaction to this year’s US debt downgrade has been quite different from the 2011 event.

Source: LPL Research

Source: LPL Research

Back to Index

Global Developments

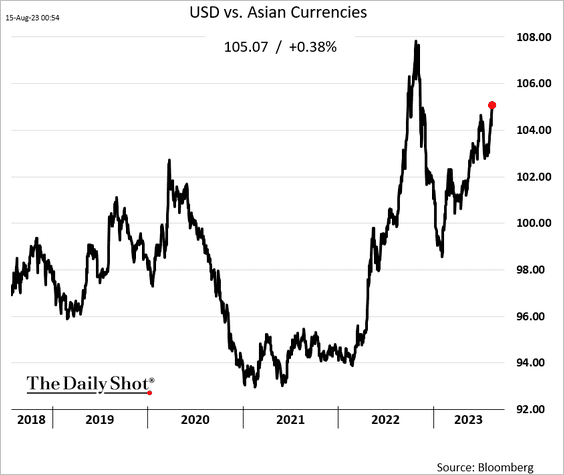

1. The dollar is rising against Asian currencies.

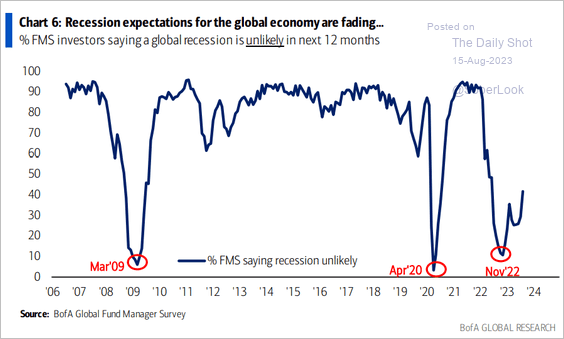

2. Fund managers are becoming less concerned about recession risks.

Source: BofA Global Research

Source: BofA Global Research

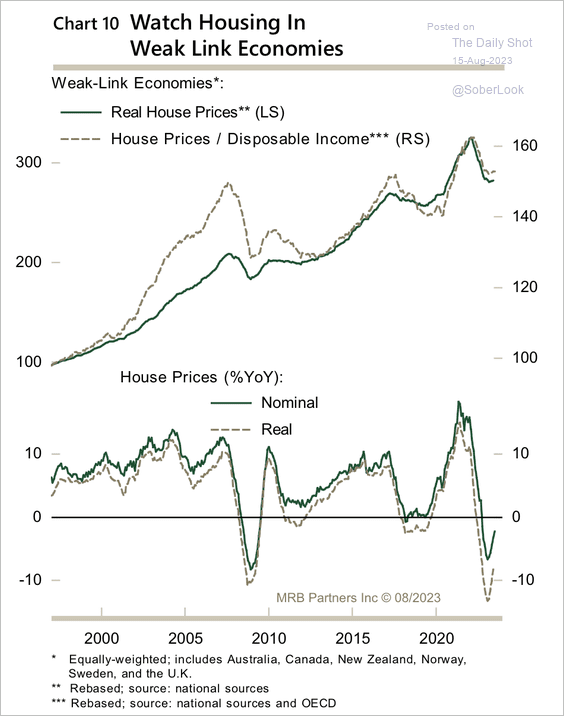

3. Housing prices are rebounding in interest-rate-sensitive economies like Canada and Australia.

Source: MRB Partners

Source: MRB Partners

——————–

Food for Thought

1. Semiconductor industry value added:

![]() Source: Statista

Source: Statista

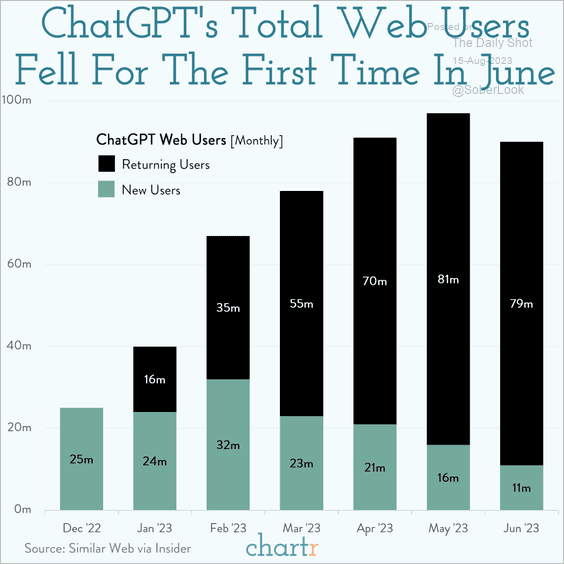

2. ChatGPT users:

Source: @chartrdaily

Source: @chartrdaily

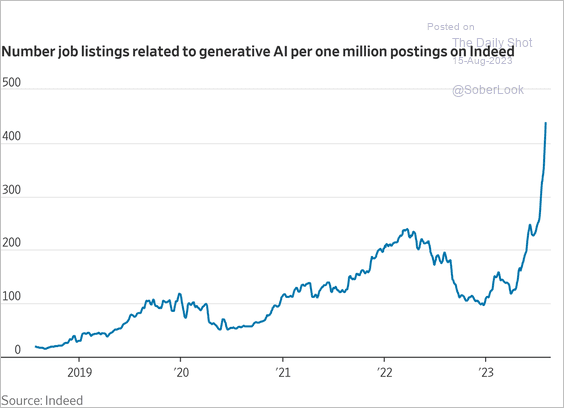

3. Generative AI job listings:

Source: @WSJ Read full article

Source: @WSJ Read full article

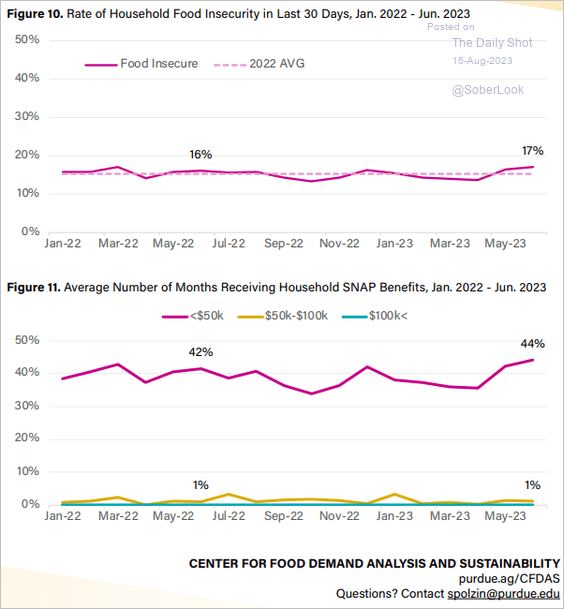

4. US food insecurity on the rise:

Source: Purdue Agriculture Read full article

Source: Purdue Agriculture Read full article

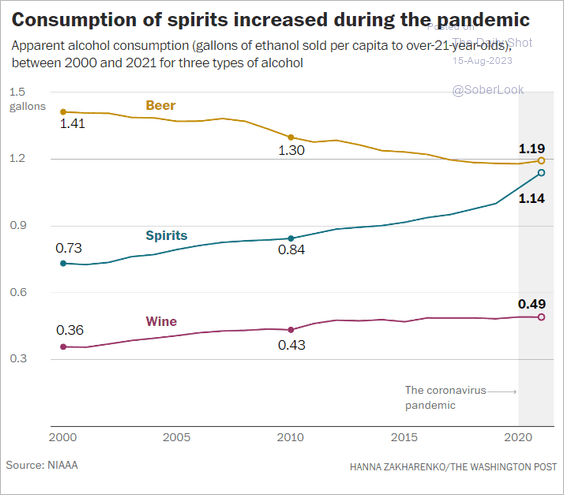

5. US consumption of spirits over time:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

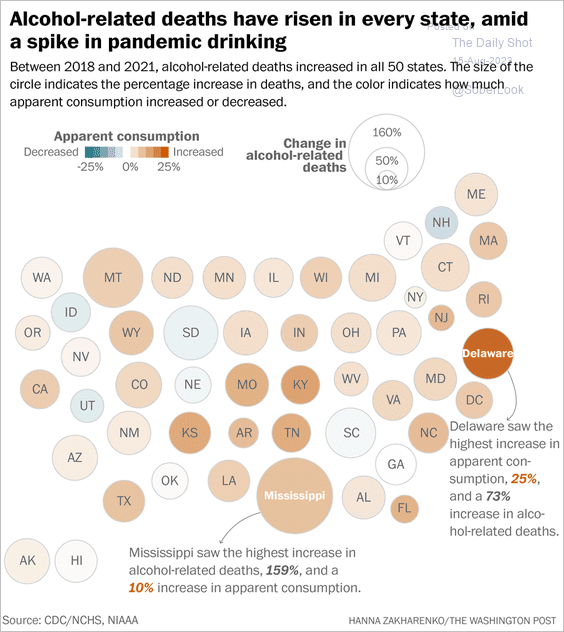

6. COVID-era changes in alcohol consumption and alcohol-related deaths:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

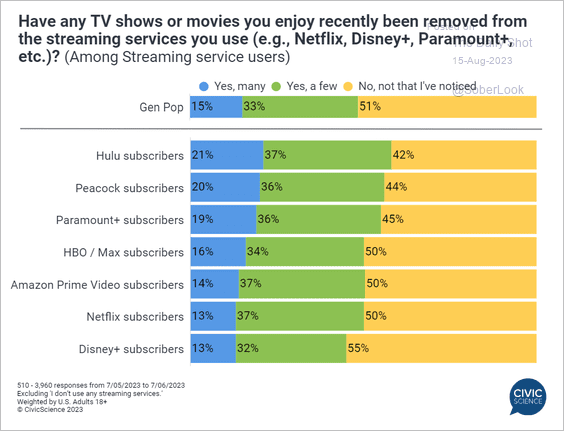

7. Removal of shows from streaming services:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

——————–

Back to Index