The Daily Shot: 12-Sep-23

• The United States

• The United Kingdom

• The Eurozone

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

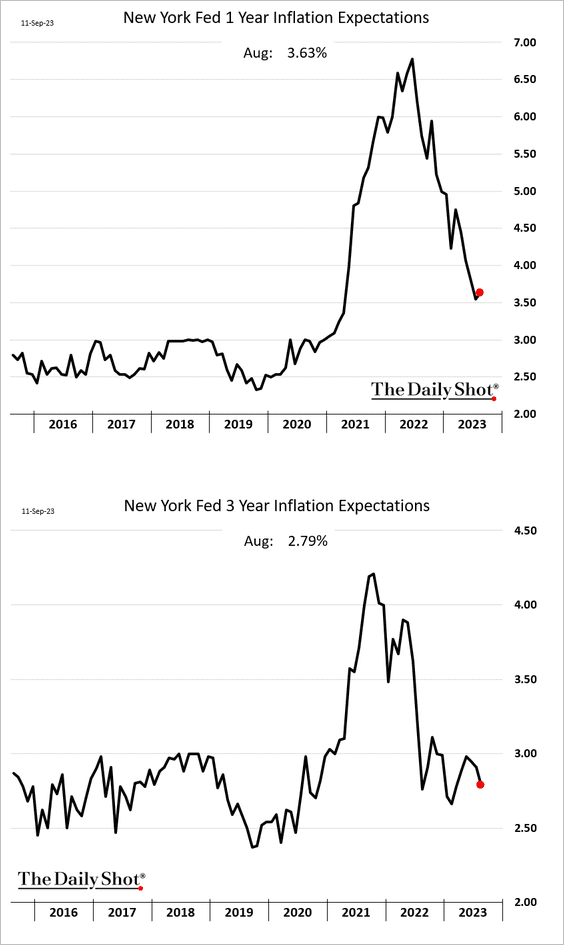

1. Let’s begin with some updates on inflation.

• The one-year consumer inflation expectations from the NY Fed’s latest survey edged higher last month, but the three-year index declined.

Source: Reuters Read full article

Source: Reuters Read full article

• Retail gasoline prices are now up on a year-over-year basis.

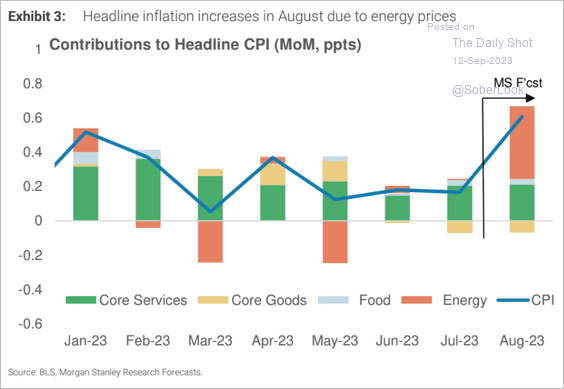

• Morgan Stanley estimates a sharp increase in the headline CPI in August, boosted by energy prices.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• Goldman sees the core CPI accelerating through January of next year.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

• Used car prices continue to fall.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

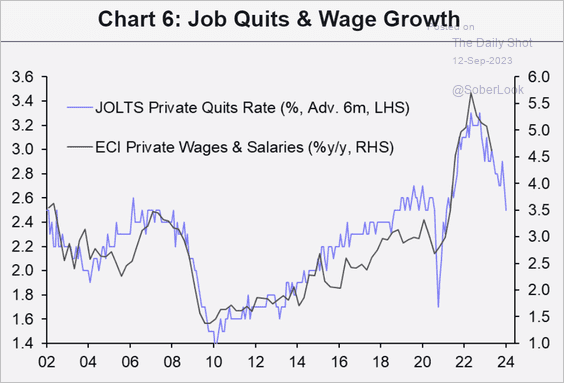

• Fewer resignations signal a sharp decline in wage growth.

Source: Capital Economics

Source: Capital Economics

• Is the Fed’s policy rate high enough to meaningfully bring inflation down to 2%, especially given resilient economic growth?

Source: MRB Partners

Source: MRB Partners

We will have more data on inflation ahead of tomorrow’s CPI report.

——————–

2. Next, let’s take a look at other aspects of the NY Fed’s consumer survey.

• Income and spending expectations continue to ease.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

• Workers with a high school diploma or less are increasingly concerned about job security.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

• Expectations for home price appreciation are back at pre-COVID levels.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

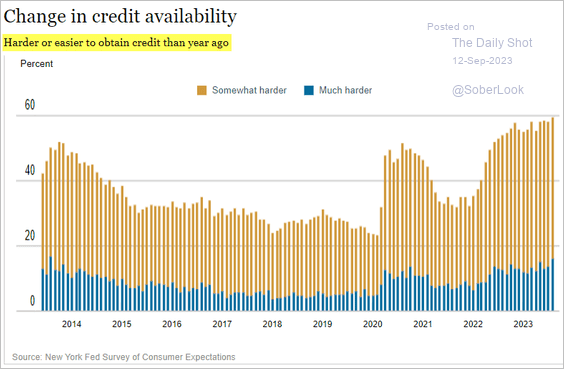

• Consumers increasingly report difficulties obtaining credit.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

——————–

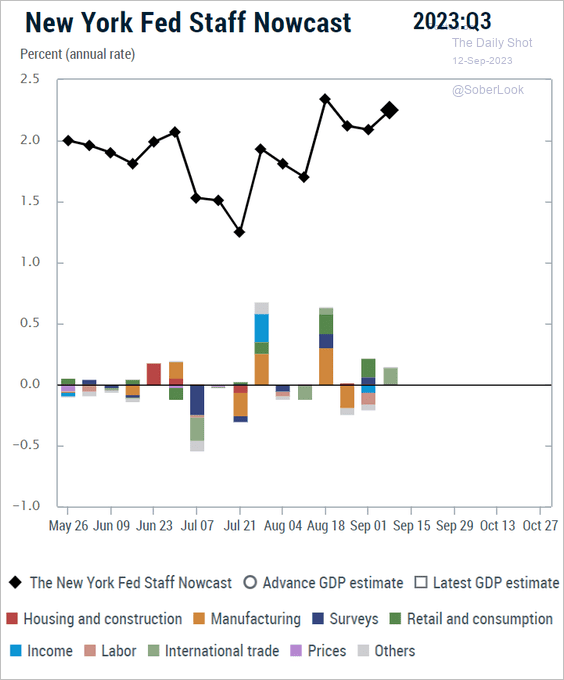

3. After a multi-year hiatus, the NY Fed’s GDP nowcast report is back, providing an alternative to Atlanta Fed’s GDPNow.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

Source: MarketWatch Read full article

Source: MarketWatch Read full article

——————–

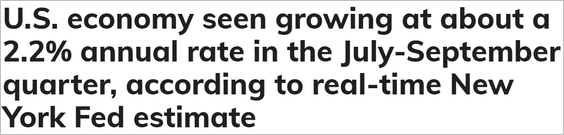

4. Transportation overcapacity is easing, pushing prices higher.

Source: Logistics Managers’ Index

Source: Logistics Managers’ Index

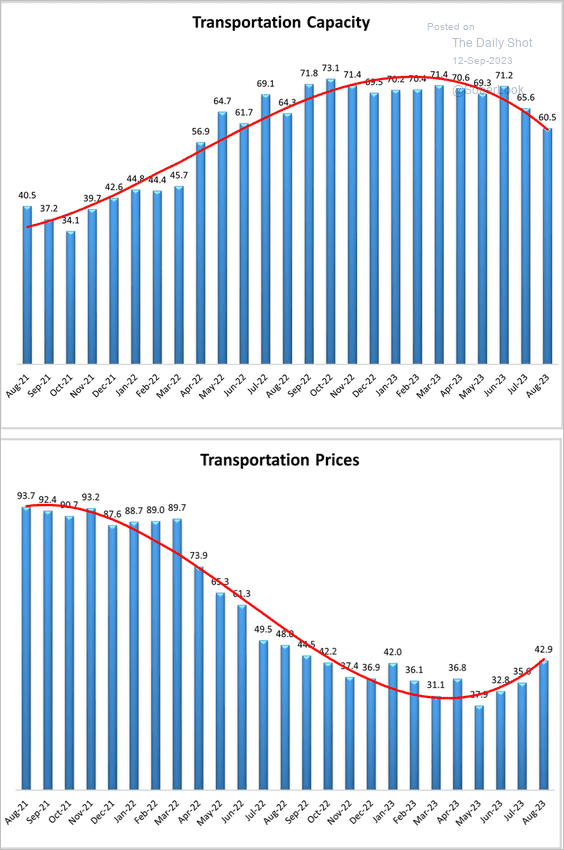

Here is the Logistics Manager’s Index. Is the freight sector recession finally over?

Source: tradingeconomics.com

Source: tradingeconomics.com

——————–

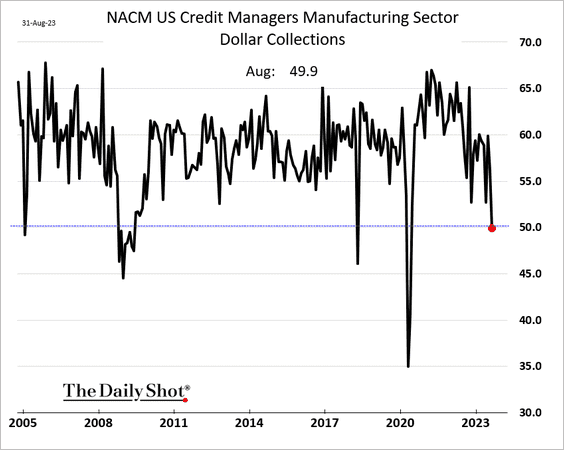

5. Manufacturing accounts receivables entered contraction last month. This could mean any of the following:

• Fewer sales on credit.

• More customers paying off their debts, reducing the outstanding accounts receivable.

• Write-offs of uncollectible accounts.

h/t Quill Intelligence

h/t Quill Intelligence

Back to Index

The United Kingdom

1. The housing market remains under pressure.

Source: tradingeconomics.com

Source: tradingeconomics.com

2. The UK REC (placement company) survey indicates a weakening labor market.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

3. Hiring challenges are easing.

Source: ING

Source: ING

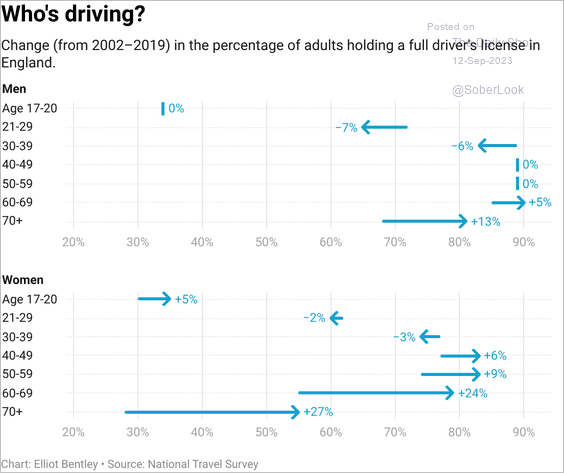

4. Who is getting their driver’s license?

Source: @Datawrapper

Source: @Datawrapper

Back to Index

The Eurozone

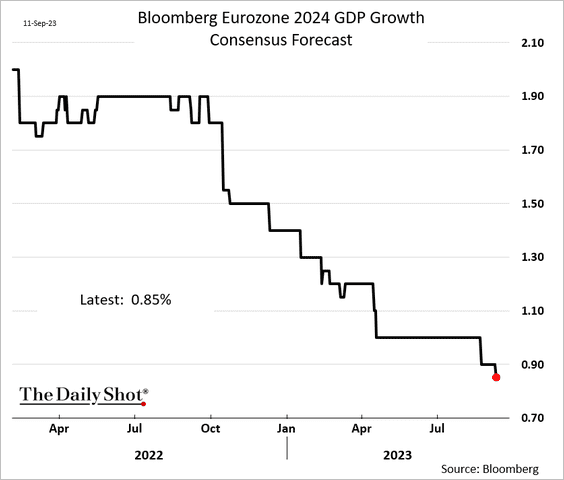

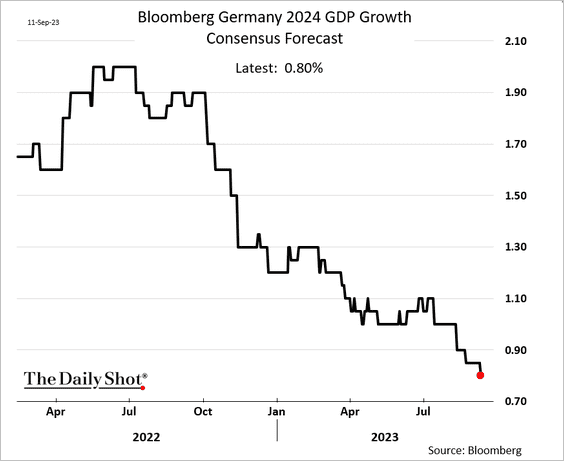

1. Economists continue to downgrade their estimates for the euro-area GDP growth next year. Much of the weakness is driven by Germany.

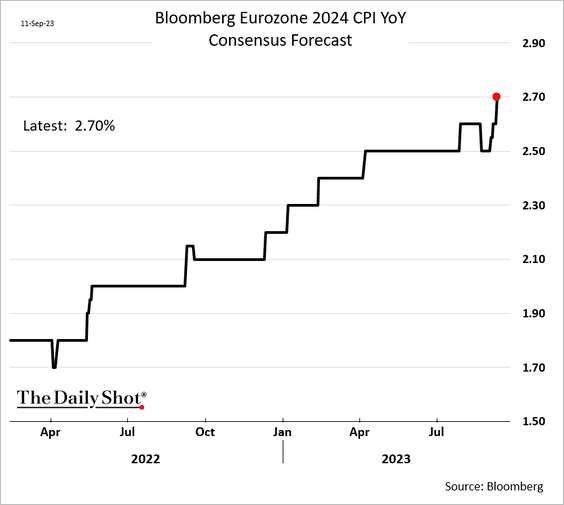

Forecasters also increasingly see higher inflation next year.

——————–

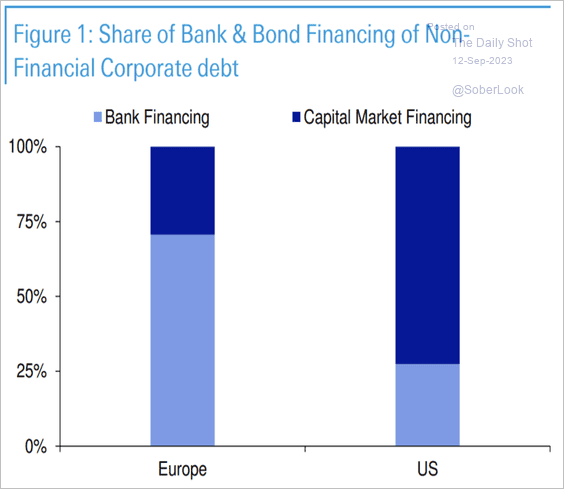

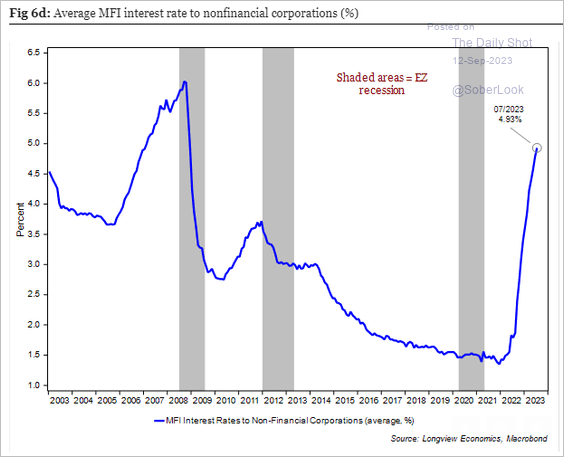

2. According to Deutsche Bank, 70% of Eurozone business debt is bank-based and, therefore, far more likely to be variable rate relative to the US.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

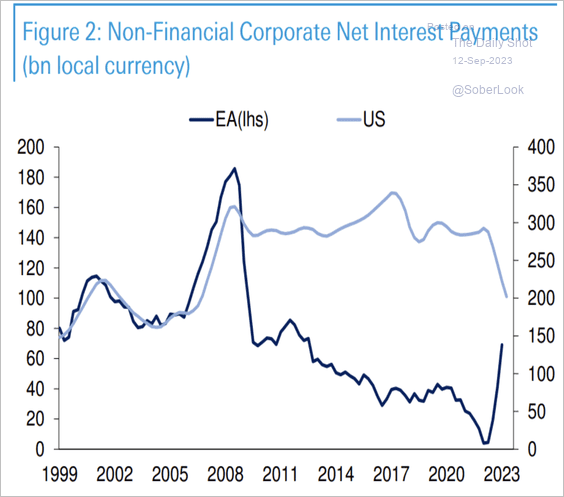

European corporate net interest payments rose sharply in contrast to a surprise decline in the US (2 charts).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Longview Economics

Source: Longview Economics

——————–

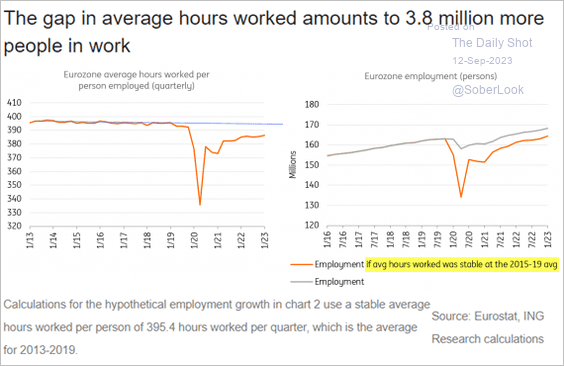

3. A key driver of labor shortages has been the reduction in hours worked (2 charts).

Source: ING

Source: ING

Source: ING

Source: ING

Back to Index

Japan

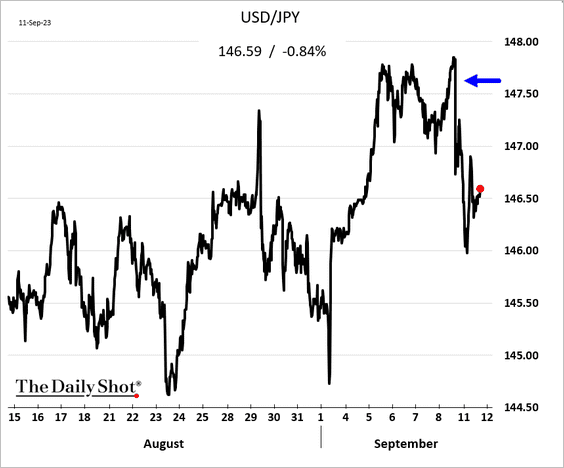

1. The yen strengthened this week as the BoJ signaled tighter policy ahead.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

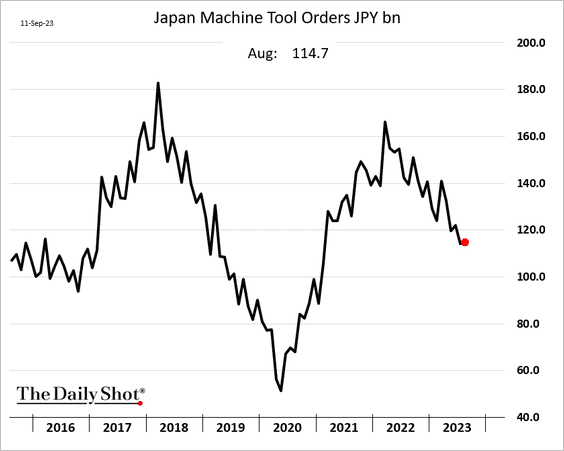

2. Machine tool orders were almost unchanged last month.

Back to Index

China

1. Loan growth picked upin August.

• Bank loans:

• Total credit:

The money supply growth continues to slow.

——————–

2. Consumption growth is holding up.

Source: MRB Partners

Source: MRB Partners

3. The rise in excess liquidity could support equities.

Source: Variant Perception

Source: Variant Perception

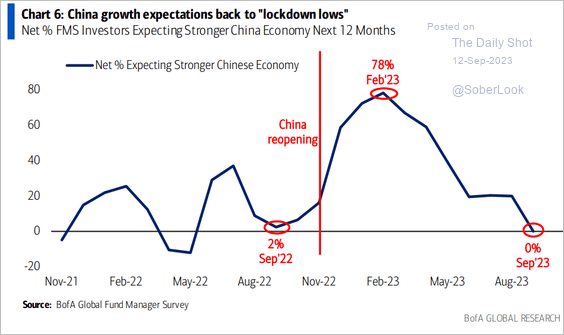

4. Are investors too gloomy on China?

Source: BofA Global Research

Source: BofA Global Research

5. This chart shows China’s projected vehicle exports.

Source: @WSJ Read full article

Source: @WSJ Read full article

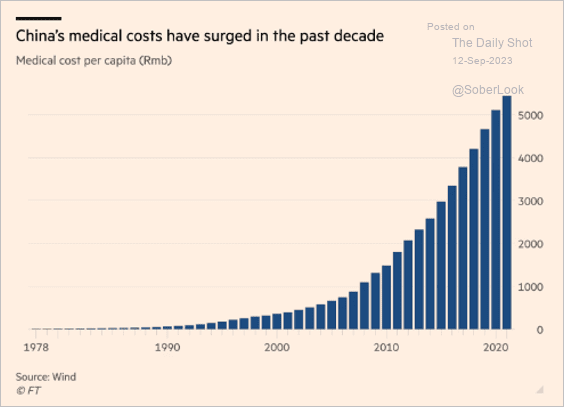

6. Medical costs have been surging.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Emerging Markets

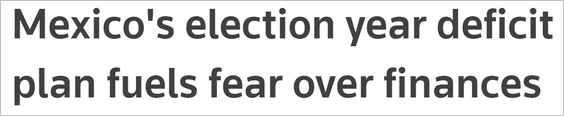

1. Let’s begin with Mexico.

• Concerns over rising budget deficit put upward pressure on bond yields.

Source: Reuters Read full article

Source: Reuters Read full article

• Higher yields boosted the peso.

Source: Reuters Read full article

Source: Reuters Read full article

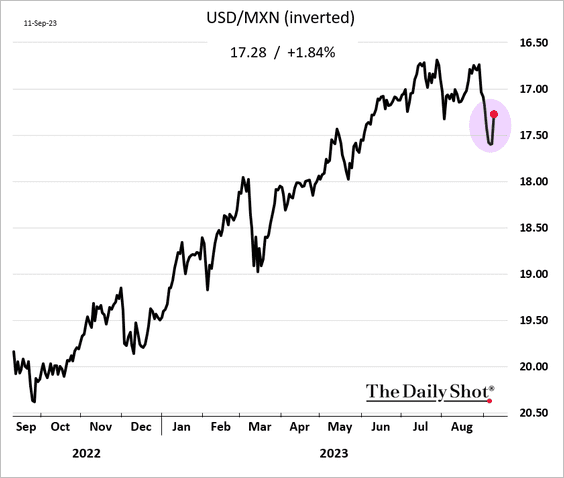

• The policy rate differential with the US is expected to tighten.

Source: Oxford Economics

Source: Oxford Economics

——————–

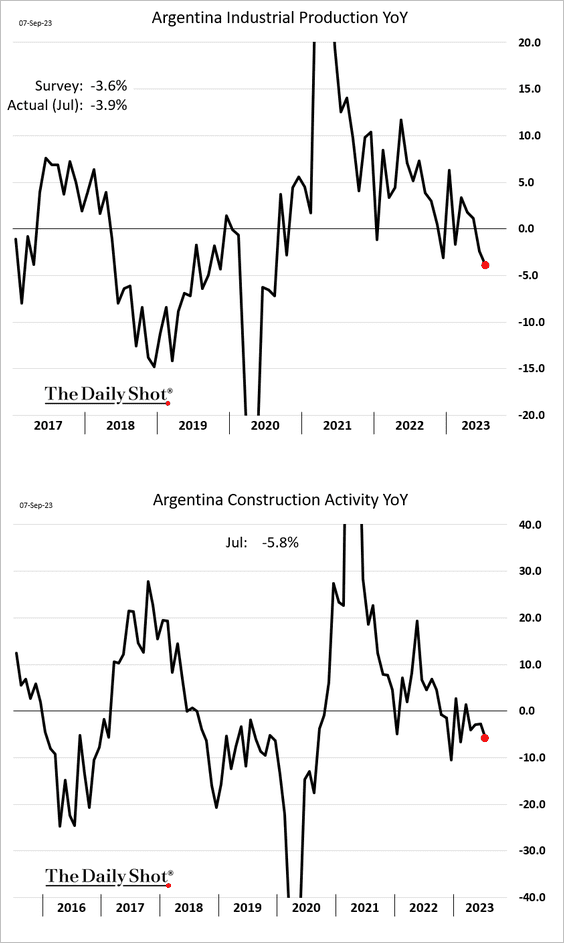

2. Argentina’s economic activity continues to slow.

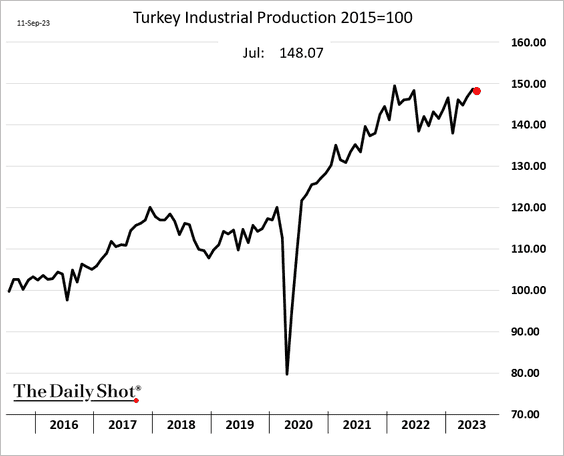

3. Turkey’s industrial production remains robust.

4. Hungary’s budget deficit has blown out.

5. India’s labor market sentiment has been improving over the past decade.

Source: Gallup Read full article

Source: Gallup Read full article

6. Here is a look at credit ratings and estimates of the neutral rate.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Cryptocurrency

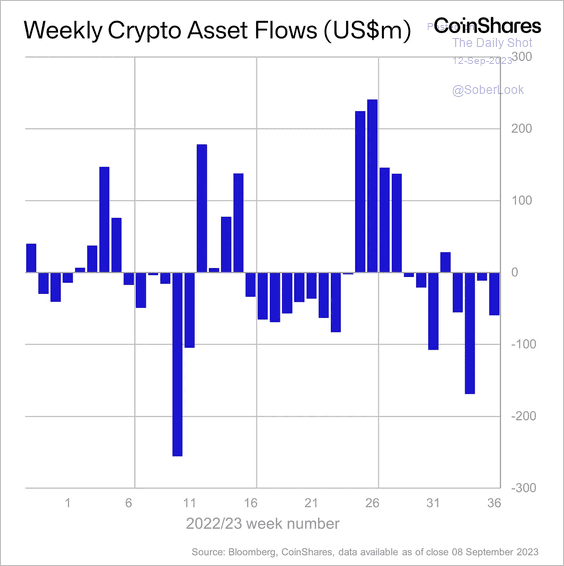

1. Crypto funds saw another week of outflows led by long-bitcoin funds. (2 charts)

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

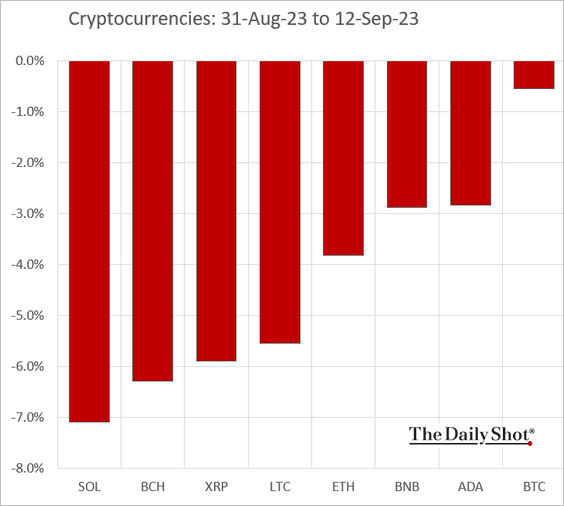

2. Bitcoin has outperformed month-to-date.

3. There is concern that FTX could shed its large holdings of digital assets, which could unleash selling pressure across altcoins. The news sent BTC briefly below the $25K support level.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Source: CoinDesk Read full article

——————–

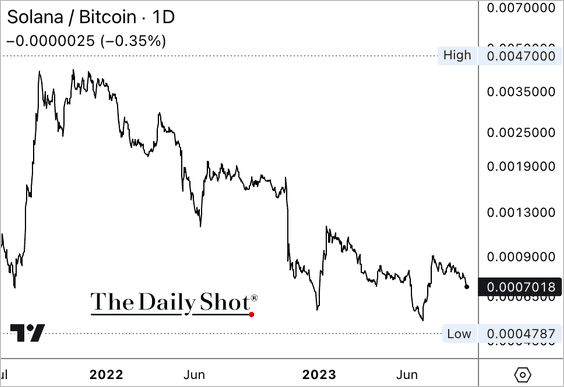

4. Solana’s SOL token remains in a steep downtrend relative to bitcoin.

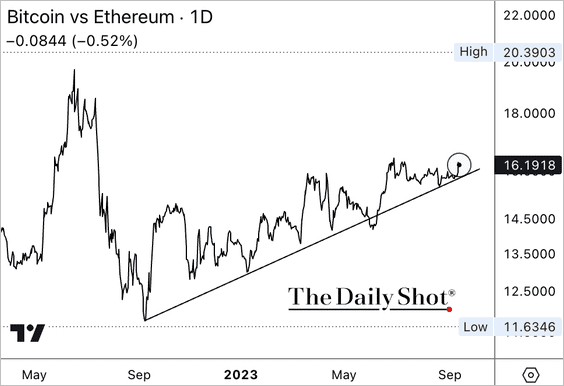

5. The BTC/ETH price ratio continues to trend higher.

Back to Index

Commodities

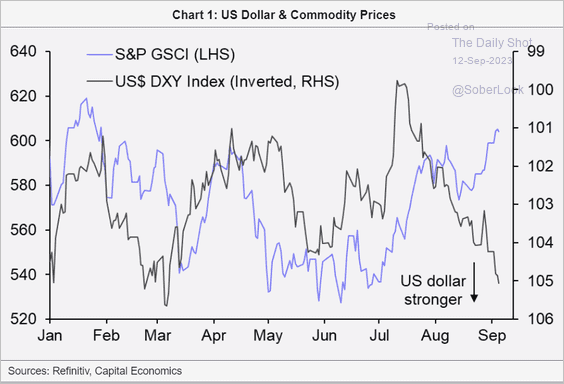

1. Commodity prices have risen despite the strengthening of the US dollar.

Source: Capital Economics

Source: Capital Economics

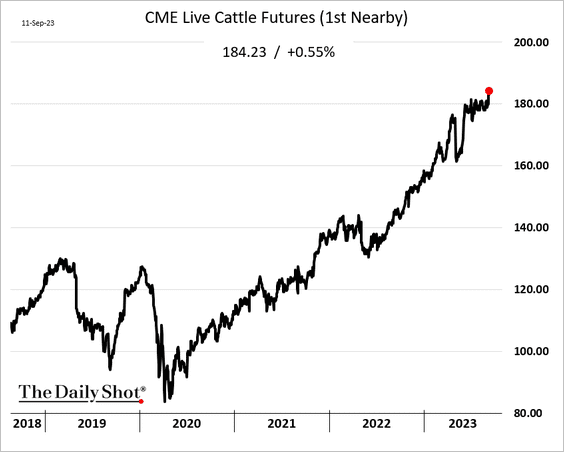

2. Chicago cattle futures hit a new high.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

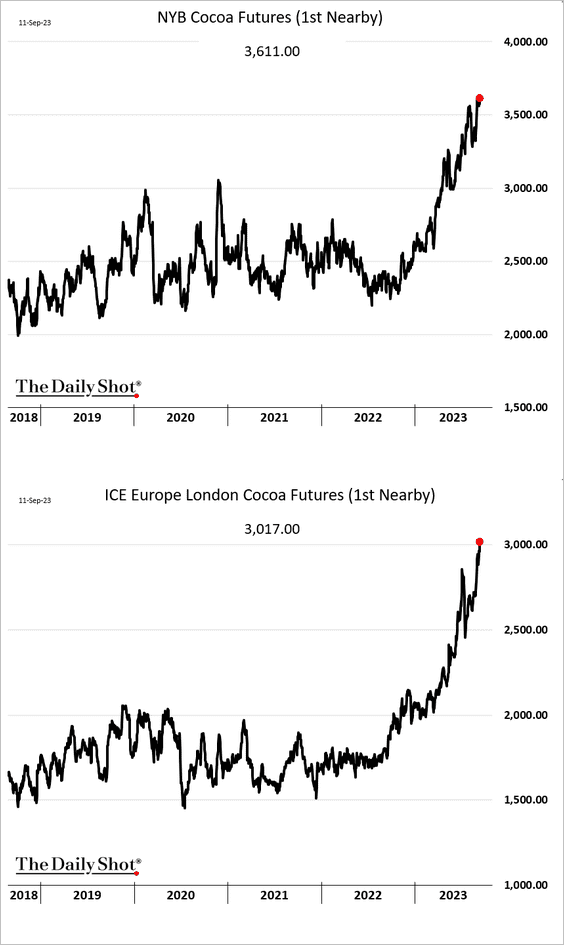

3. Cocoa futures continue to surge.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Energy

1. Oil implied vol has been tanking.

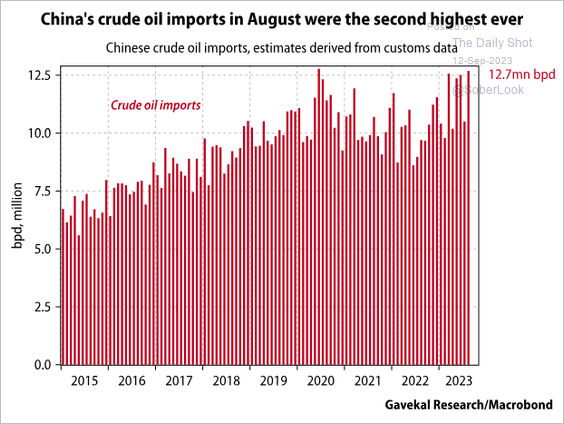

2. China’s oil imports remain elevated.

Source: Gavekal Research

Source: Gavekal Research

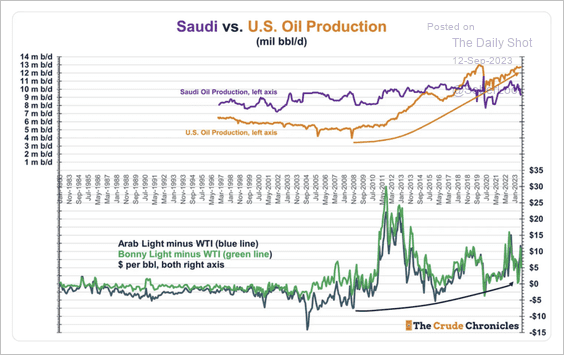

3. The rise in US shale production created wider disparities between the WTI oil price and other grades of oil across the world.

Source: The Crude Chronicles

Source: The Crude Chronicles

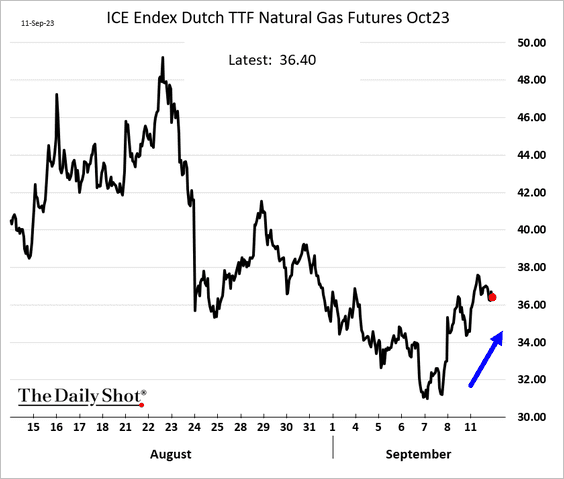

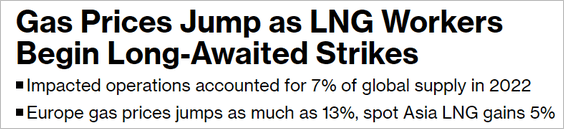

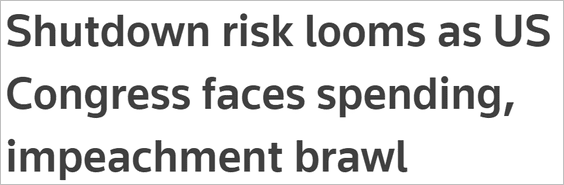

4. European natural gas prices are higher due to LNG worker strikes in Australia.

Source: @markets Read full article

Source: @markets Read full article

——————–

5. US solar investment is accelerating.

Source: @markchediak, @markets Read full article

Source: @markchediak, @markets Read full article

Back to Index

Equities

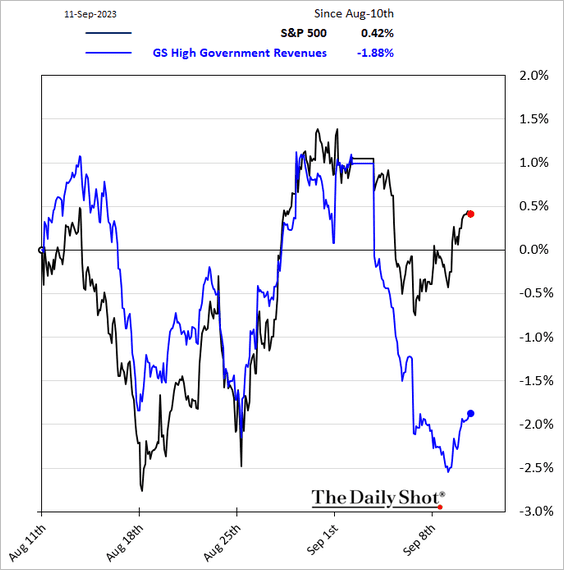

1. Companies with exposure to the US government have underperformed recently.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

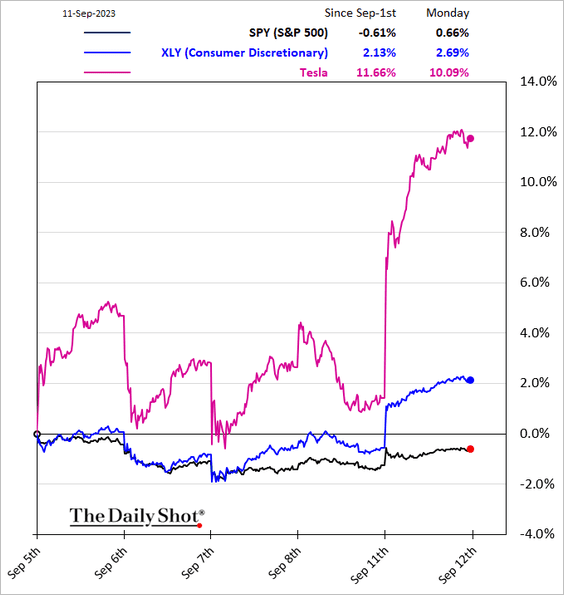

2. Next, we have some sector trends.

• Consumer Discretionary:

Source: @technology Read full article

Source: @technology Read full article

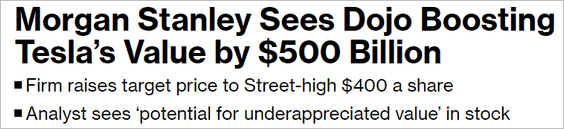

• Communication Services:

• Semiconductors:

• Consumer Staples:

• Banks:

——————–

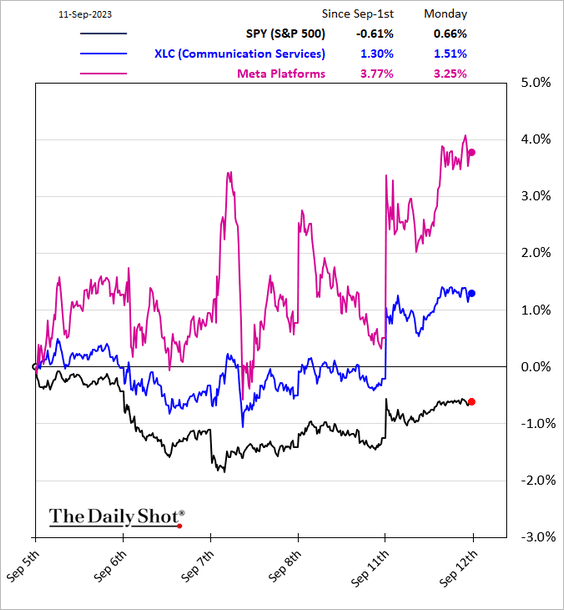

3. Hedge funds’ stock picks have been outperforming …

… as managers boosted exposure to mega-caps this year.

Source: Goldman Sachs

Source: Goldman Sachs

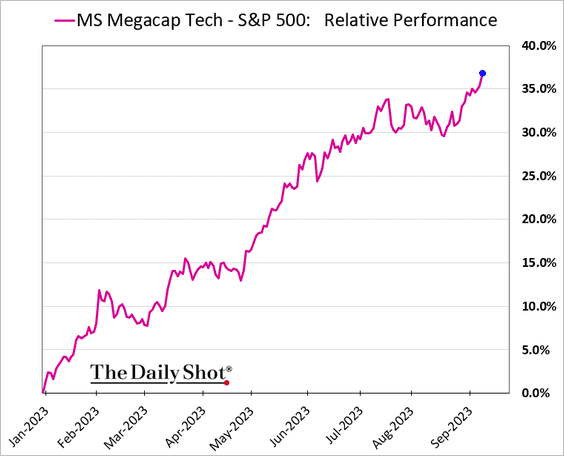

4. Hedge funds have also been boosting their short positions.

Source: Goldman Sachs; @Marlin_Capital

Source: Goldman Sachs; @Marlin_Capital

5. It’s been 95 trading sessions since the S&P 500 declined by 1.5% or more.

6. So far, the S&P 500 has benefitted from the compression in bond market volatility since the March peak in the MOVE Index.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

7. The average US stock has underperformed international shares over the past 12 months. Below is a comparison of equal-weighted indices.

Source: @JeffreyKleintop

Source: @JeffreyKleintop

——————–

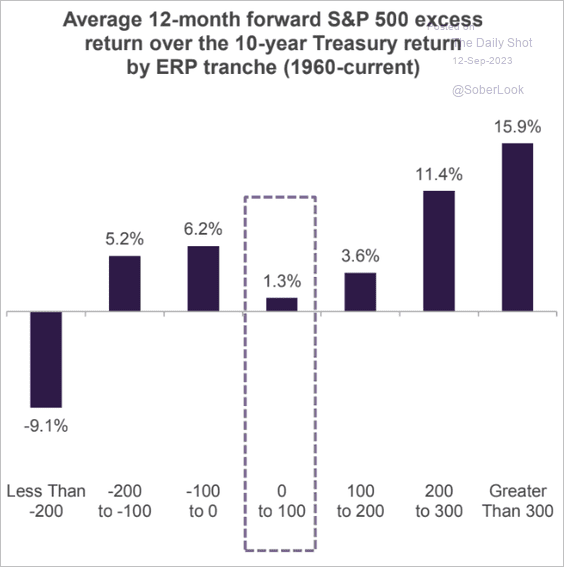

8. The depressed equity risk premium doesn’t bode well for S&P 500 performance relative to bonds.

Source: Truist Advisory Services

Source: Truist Advisory Services

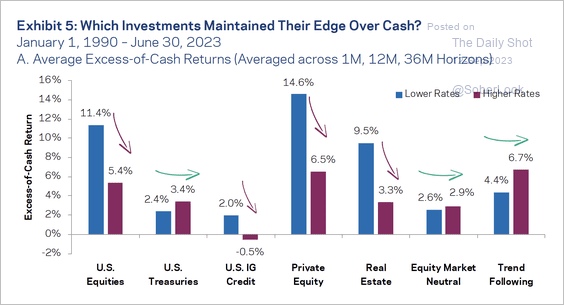

• Historically, equities, credit, private equity, and real estate exhibit smaller risk premia when rates are high. Liquid alternatives such as equity-neutral and trend-following strategies typically deliver on their “cash-plus” objective during high-rate environments.

Source: AQR Read full article

Source: AQR Read full article

Back to Index

Credit

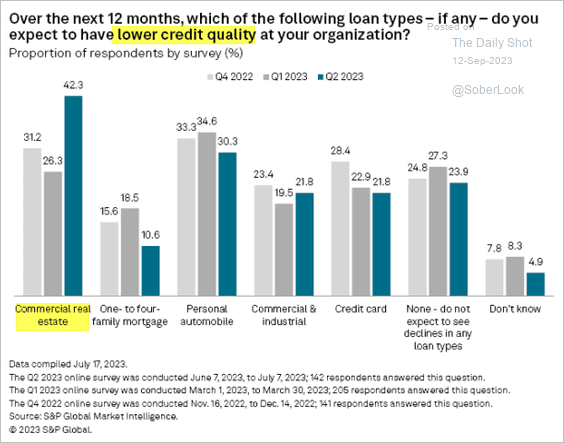

1. Bank deposits in the US, including those with smaller lenders, have remained relatively stable in recent months.

However, commercial real estate exposure at small banks remains a concern.

Source: @markets Read full article

Source: @markets Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

Here is the S&P Global US Bank Outlook Survey.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

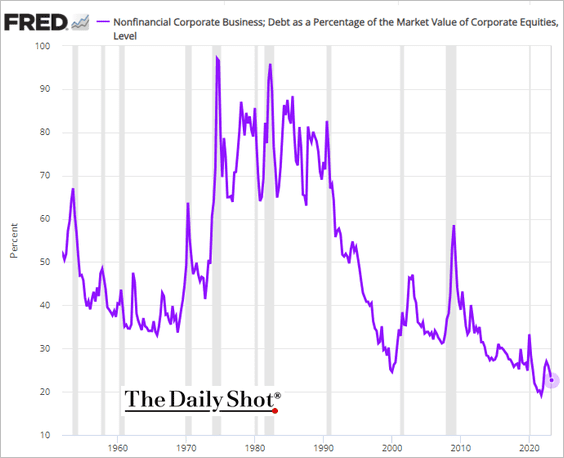

2. The corporate debt-to-equity ratio remains relatively low.

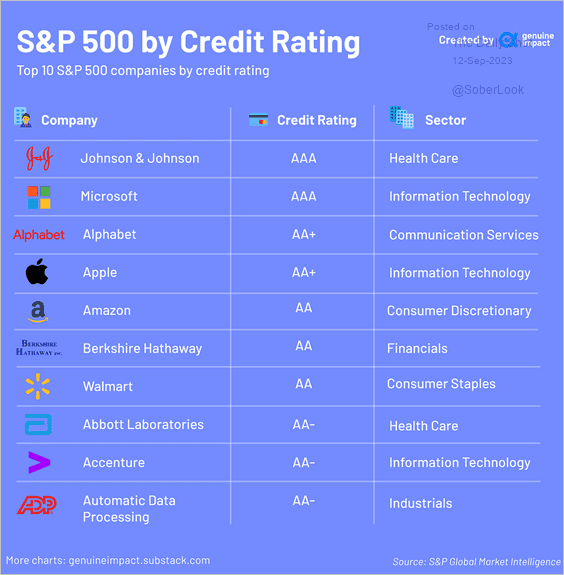

3. Here is a look at S&P 500 companies with the highest debt ratings.

Source: @genuine_impact

Source: @genuine_impact

Back to Index

Rates

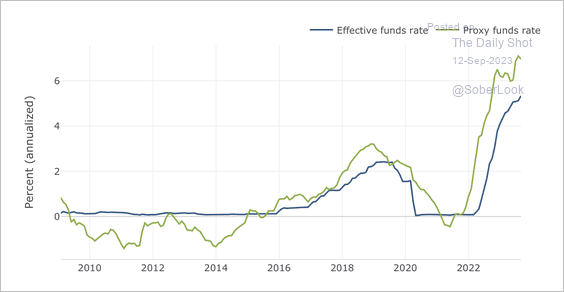

1. The San Francisco Fed’s proxy funds rate suggests that the broader monetary policy is more restrictive than the actual rate implies.

Source: SF Fed

Source: SF Fed

2. The average across all forecasts suggests the fed funds rate could average 330 basis points higher over the next decade than the previous 12 years.

Source: AQR Read full article

Source: AQR Read full article

3. Fund managers increasingly believe that the Fed has finished raising rates.

Source: BofA Global Research

Source: BofA Global Research

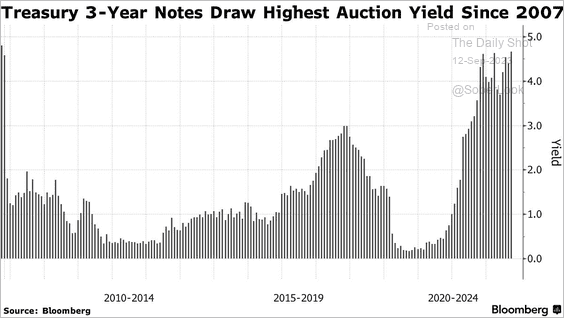

4. The 3-year note auction drew the highest yield since 2007.

Source: @markets Read full article

Source: @markets Read full article

——————–

Food for Thought

1. Unhappy employees:

Source: @axios Read full article

Source: @axios Read full article

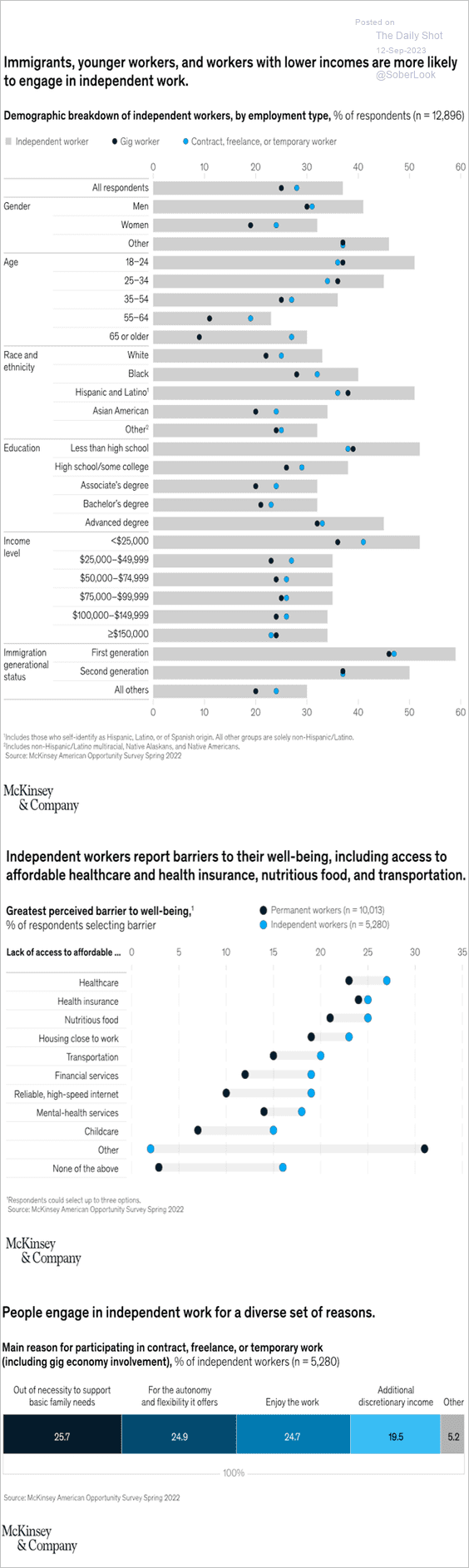

2. Data on US independent workers:

Source: McKinsey & Company Read full article

Source: McKinsey & Company Read full article

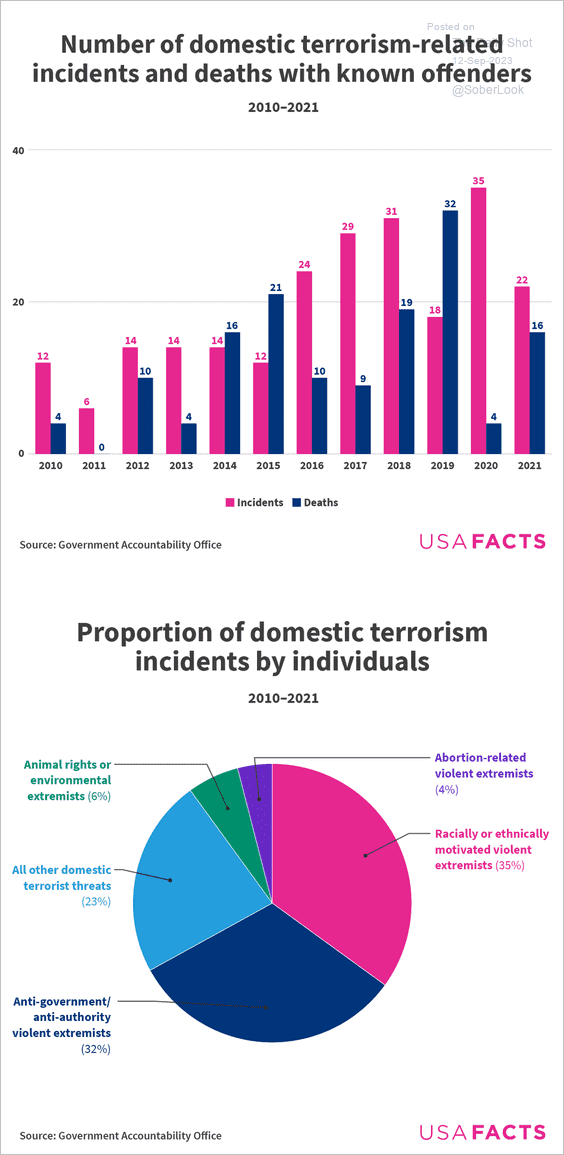

3. US domestic terrorism with known offenders:

Source: USAFacts

Source: USAFacts

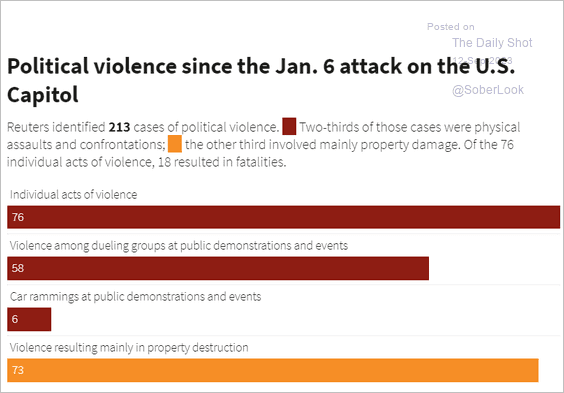

• Political violence in the US:

Source: Reuters Read full article

Source: Reuters Read full article

——————–

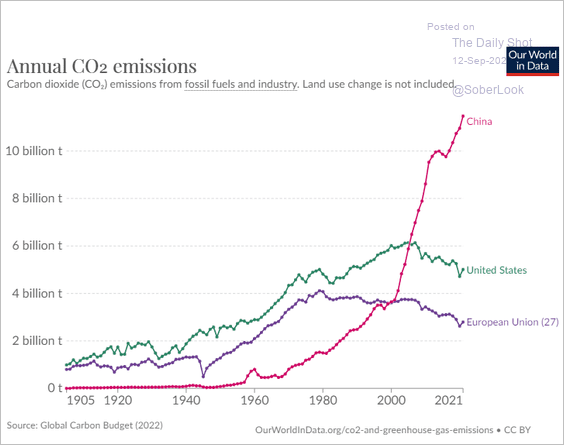

4. CO2 emissions:

Source: Our World in Data

Source: Our World in Data

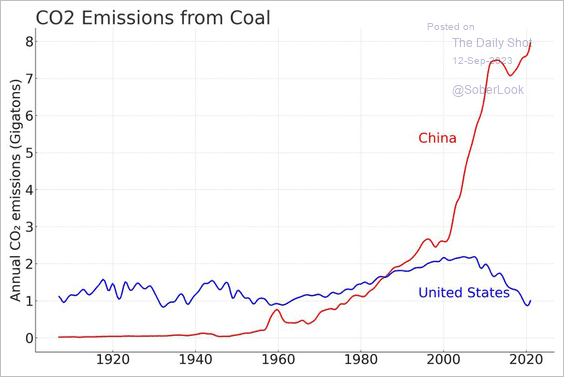

CO2 emissions from coal:

Source: @MichaelAArouet

Source: @MichaelAArouet

——————–

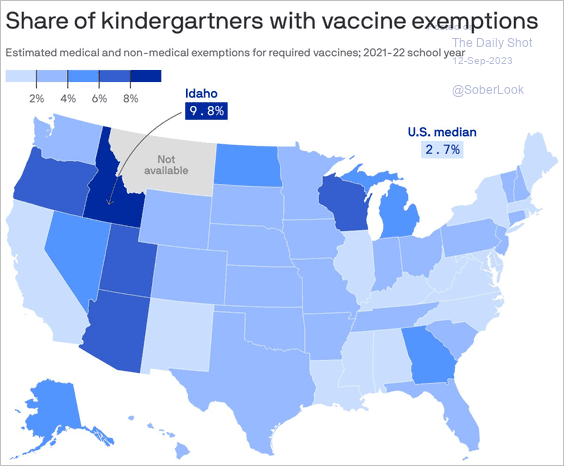

5. Kindergarten vaccine exemption rates:

Source: @axios Read full article

Source: @axios Read full article

6. Alzheimer’s prevalence:

Source: @jeremybney

Source: @jeremybney

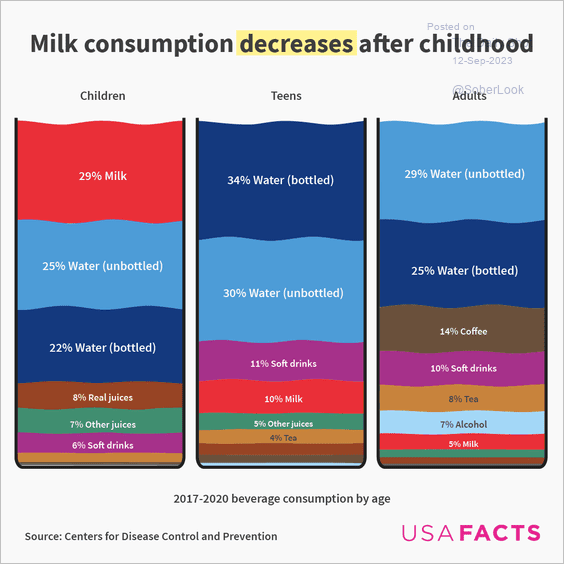

7. Milk consumption by age:

Source: USAFacts

Source: USAFacts

——————–

Back to Index