The Daily Shot: 13-Sep-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

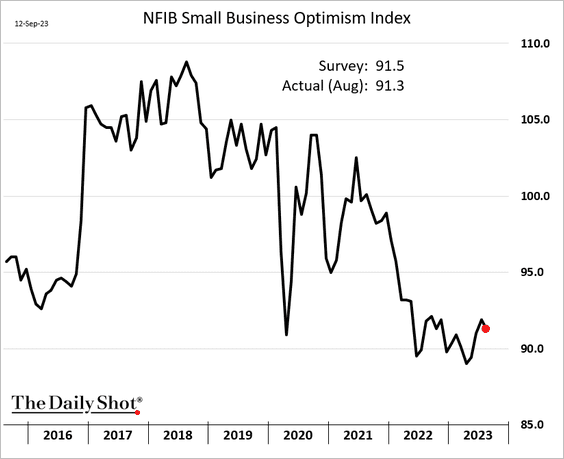

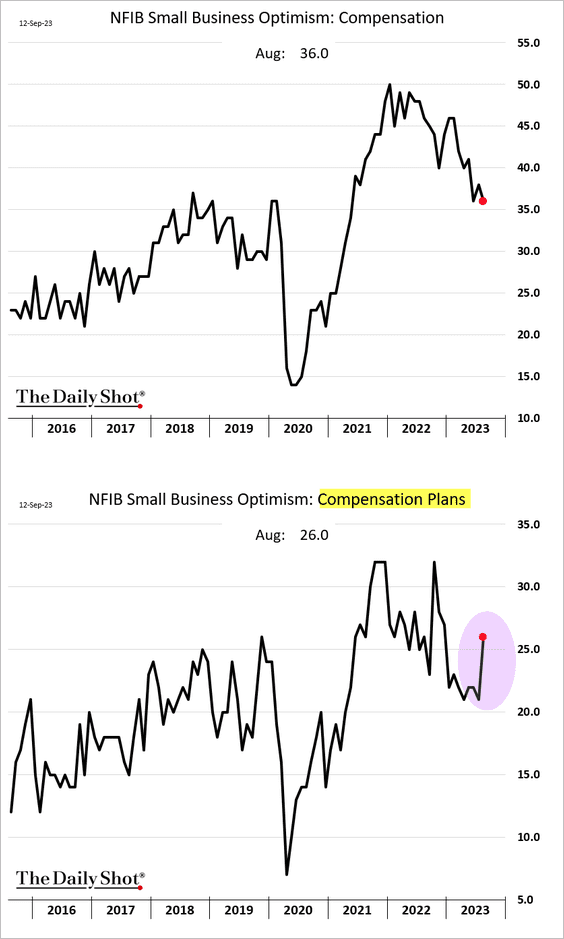

1. The NFIB small business sentiment index edged lower last month.

Source: Reuters Read full article

Source: Reuters Read full article

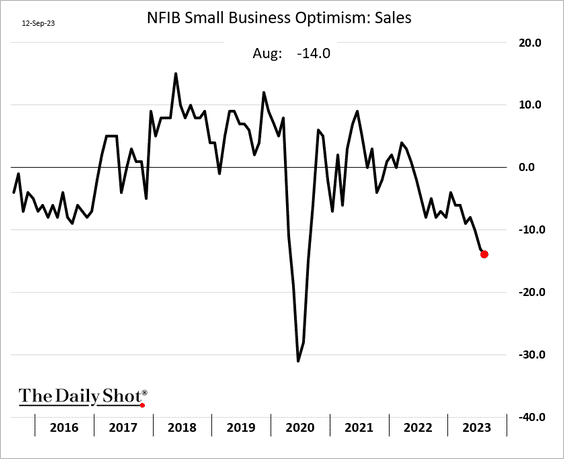

• More firms have been reporting declining sales.

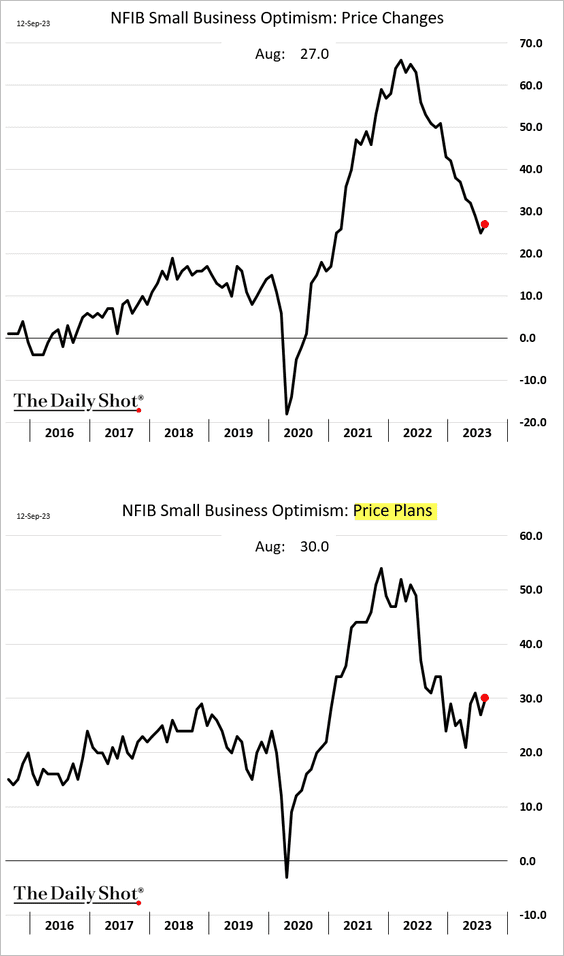

• A larger percentage of companies boosted prices last month.

• Credit was less of an issue in August.

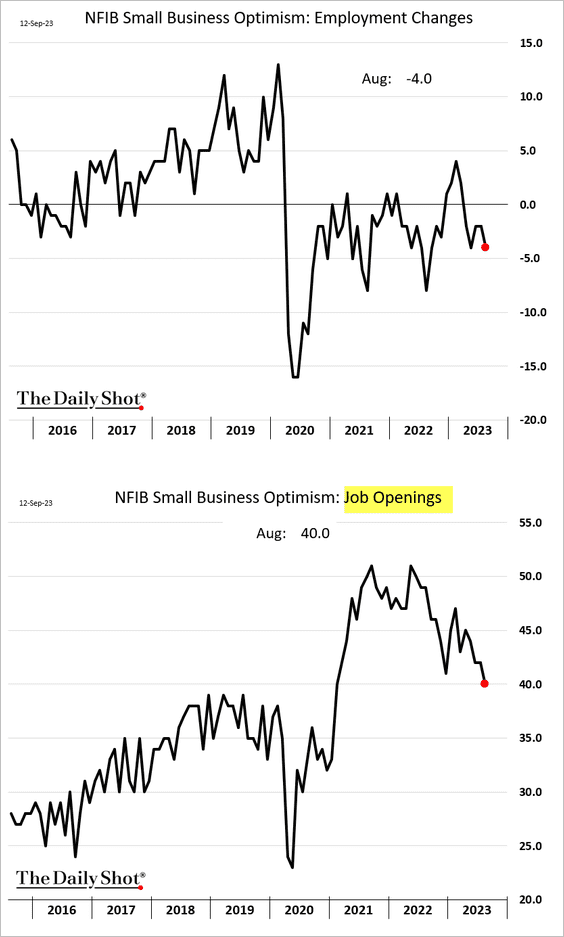

• Hiring is slowing.

• Fewer companies have been boosting wages, but the index of compensation plans surged last month.

——————–

2. Last year, households saw a decline in real incomes due to inflation.

Source: @economics Read full article

Source: @economics Read full article

——————–

3. Total hours worked is running below the post-reopening trend.

Source: Jerome Powell Read full article

Source: Jerome Powell Read full article

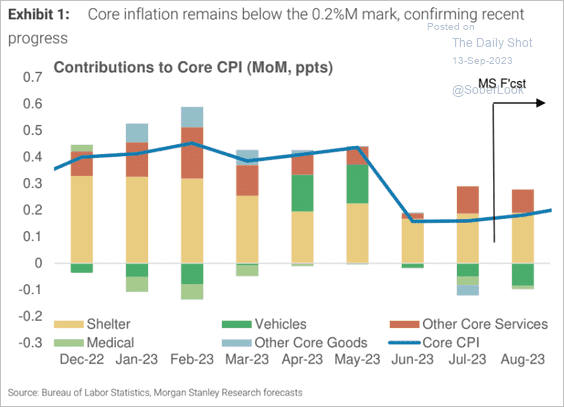

4. Next, we have some updates on inflation.

• Economists expect a modest increase in the core CPI for August.

– Morgan Stanley (0.18% in August vs. 0.16% gain in July):

Source: Morgan Stanley Research

Source: Morgan Stanley Research

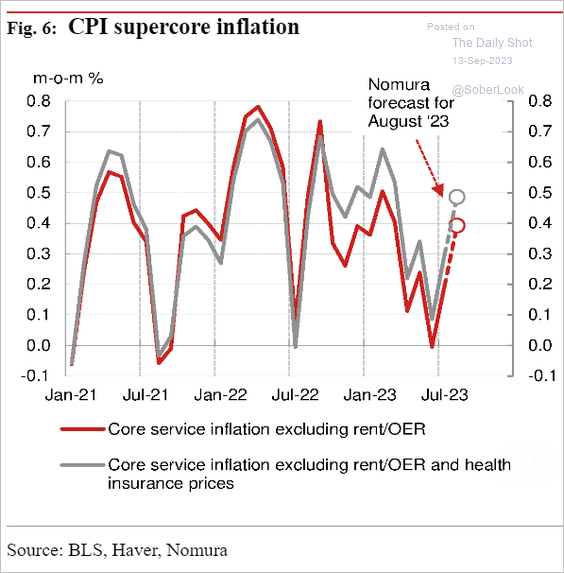

– Nomura (a 0.24% increase):

Source: Nomura Securities

Source: Nomura Securities

• But the supercore CPI is expected to jump.

Source: Nomura Securities

Source: Nomura Securities

• Weaker wage pressures in the food services sector, resulting from more relaxed labor conditions, are expected to reduce food inflation.

Source: Nomura Securities

Source: Nomura Securities

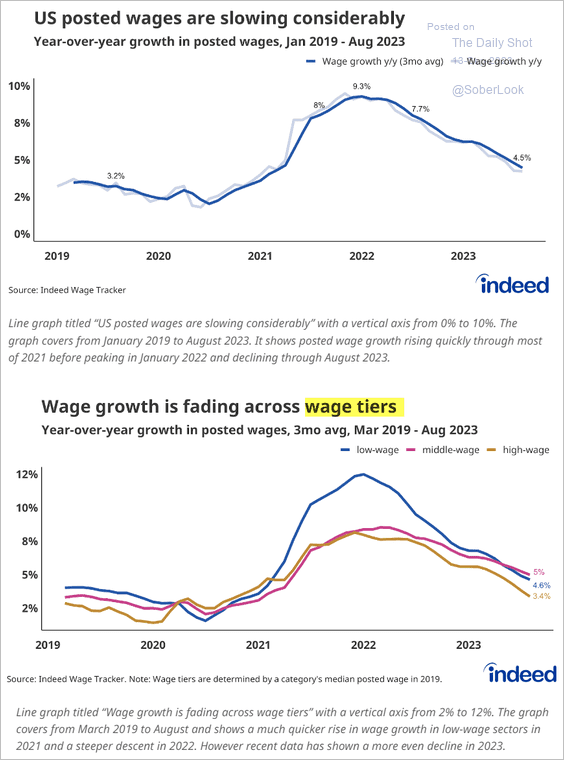

• Data from Indeed continues to show softer wage growth.

Source: Hiring Lab

Source: Hiring Lab

Back to Index

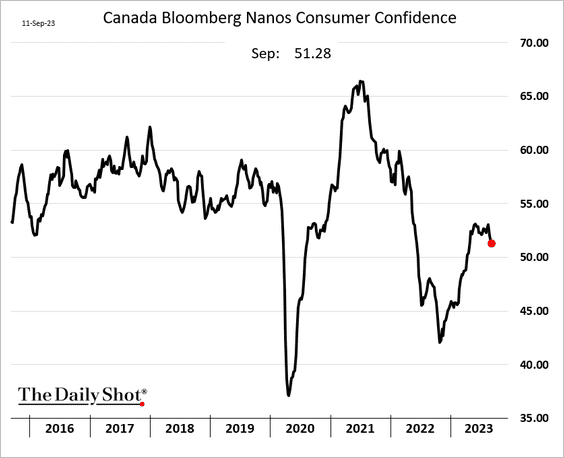

Canada

1. Consumer confidence is weakening again.

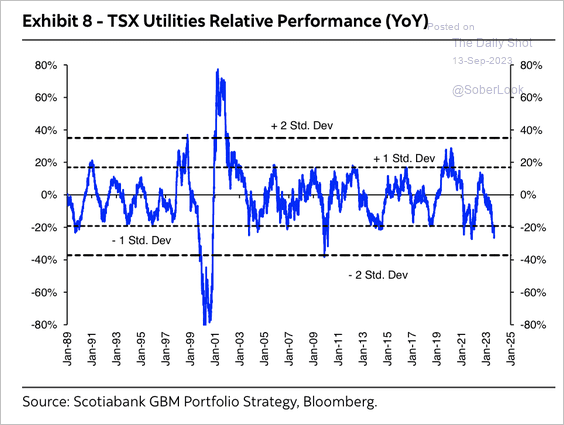

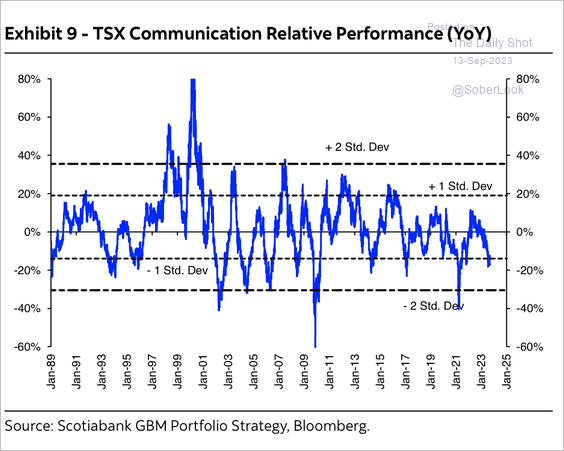

2. The underperformance of TSX Utilities and Communication sectors appears stretched but not yet extreme. (2 charts)

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

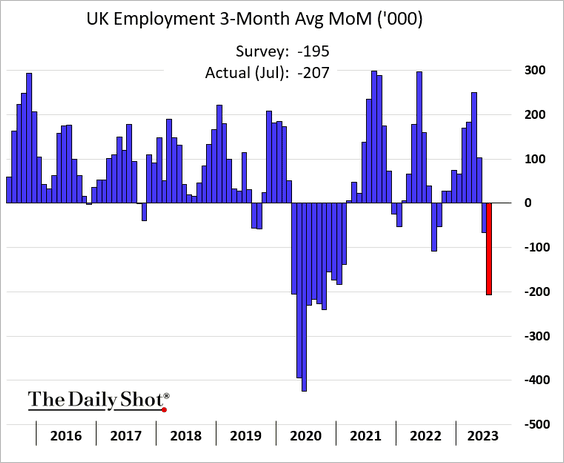

The United Kingdom

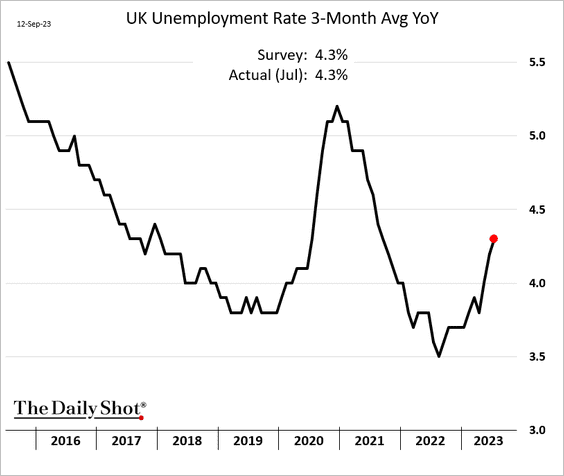

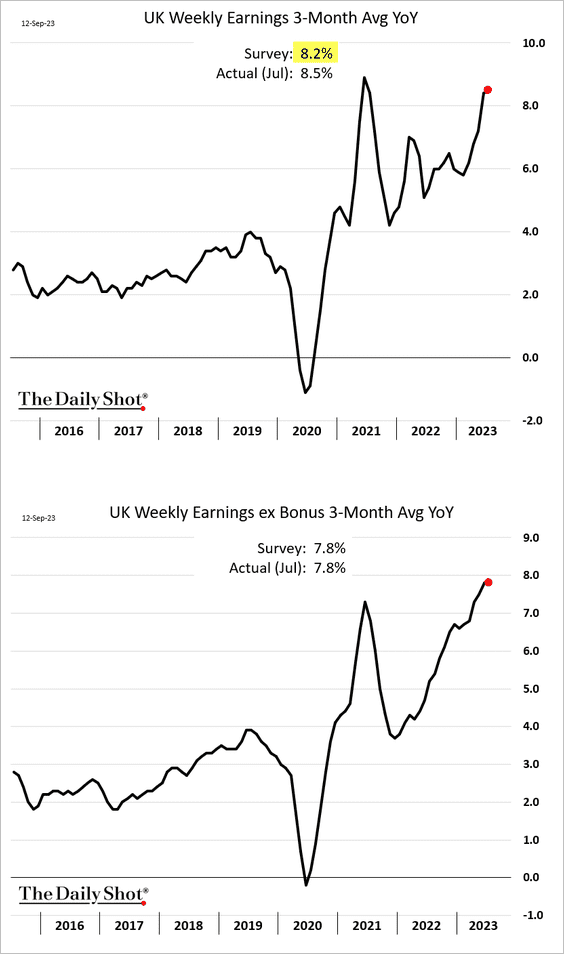

1. The labor market is losing momentum.

• Employment growth (through July):

• Payrolls:

• The unemployment rate:

And yet, wage growth remains quite strong.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

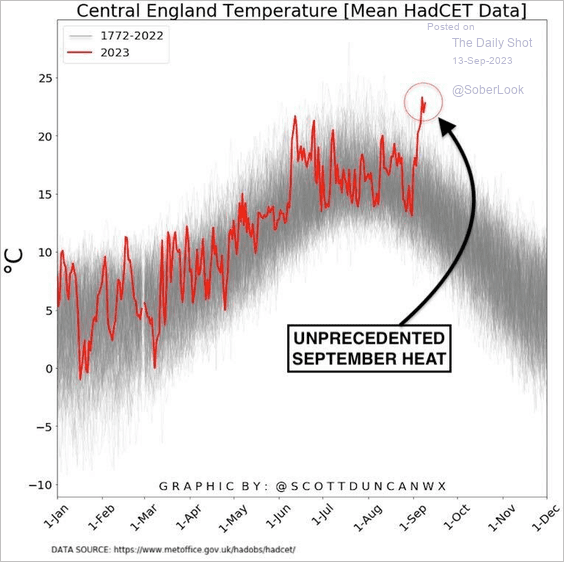

2. It’s been warm in central England.

Source: @ScottDuncanWX

Source: @ScottDuncanWX

Back to Index

The Eurozone

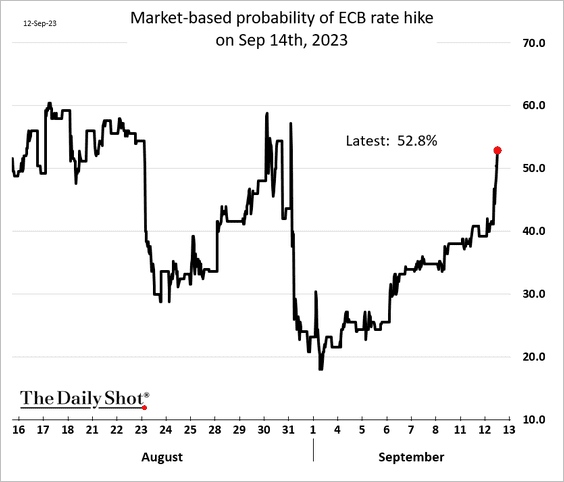

1. The probability of a rate hike on Thursday is roughly a coin toss.

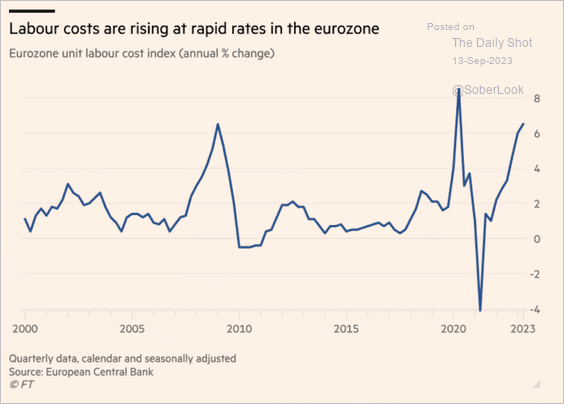

• Rapidly rising labor costs are a concern for the ECB.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

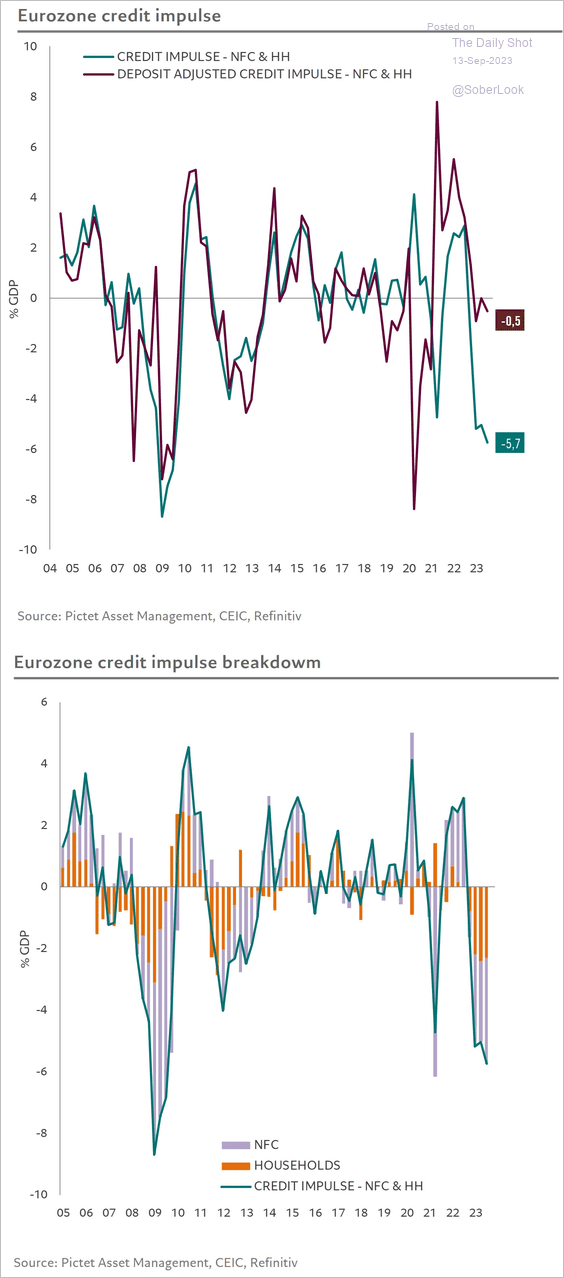

• But it’s hard to be aggressive with rate hikes when the credit impulse crashes.

Source: @skhanniche

Source: @skhanniche

——————–

2. The European Commission lowered its euro-area GDP growth projections.

Source: @economics Read full article

Source: @economics Read full article

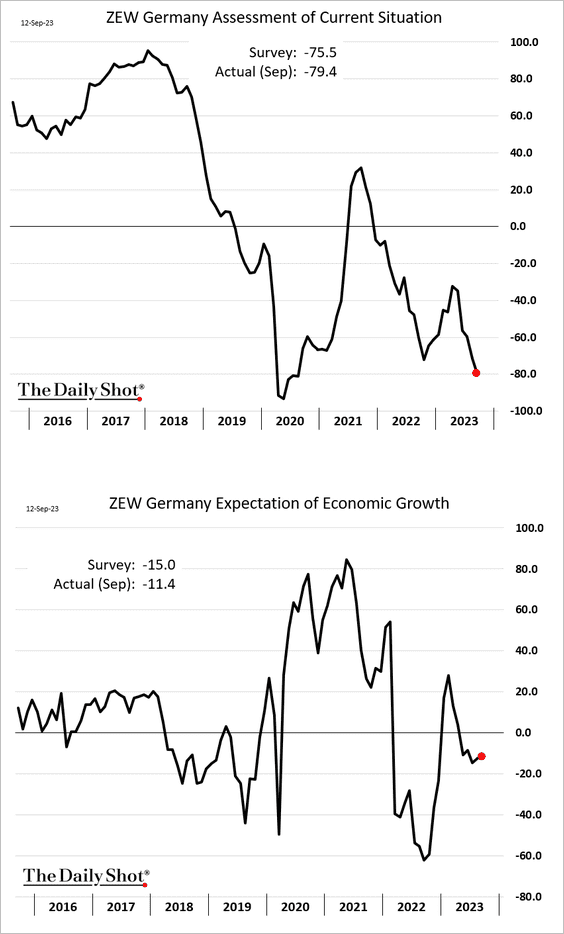

3. Germany’s ZEW expectations index edged higher even as current conditions deteriorated.

• As the PMI report showed, Germany’s construction sector is in trouble.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

• The number of German corporate bankruptcies has been running well above their pre-COVID-era pace.

Source: PGM Global

Source: PGM Global

——————–

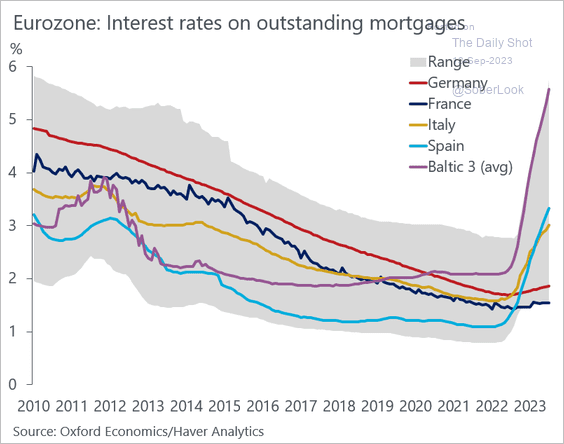

4. Interest rates on outstanding mortgages have risen sharply in some countries.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

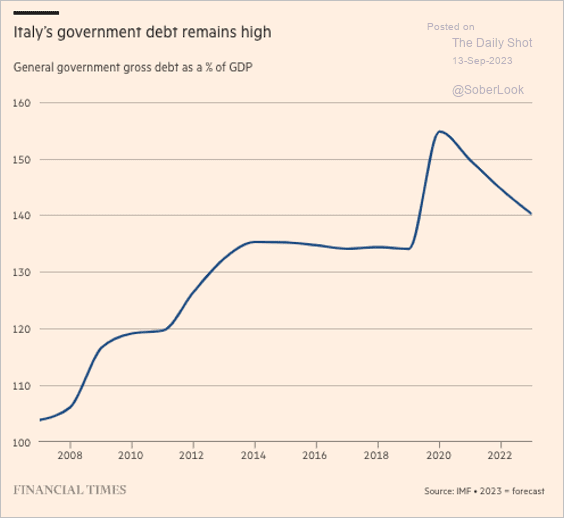

5. Italy’s government debt remains high.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

6. Spain’s tourism spending keeps rising.

Source: Arcano Economics

Source: Arcano Economics

7. Finland’s housing construction activity is sharply lower.

Source: Danske Bank

Source: Danske Bank

Back to Index

Europe

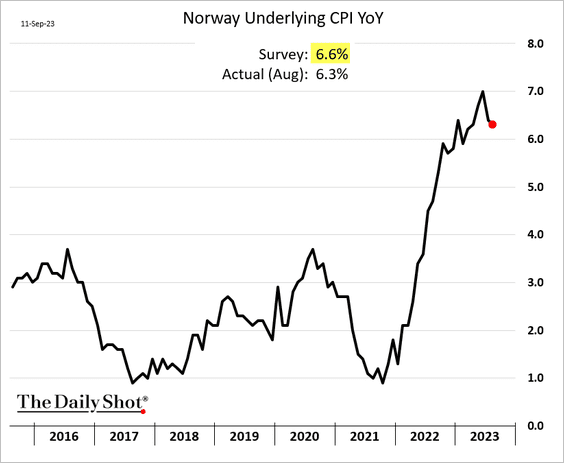

1. Norway’s inflation surprised to the downside.

• The GDP remains on its pre-COVID trend.

——————–

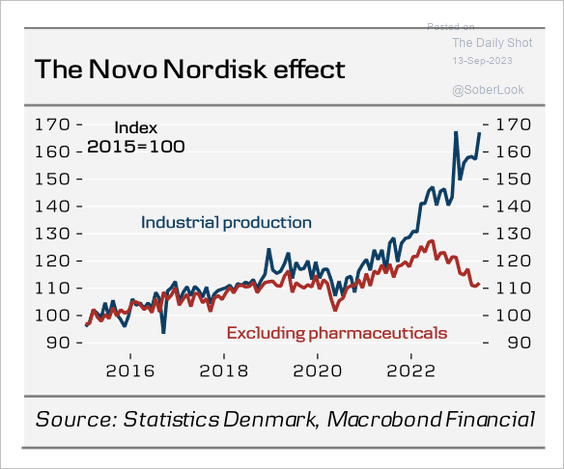

2. Denmark’s industrial production accelerated in recent years, largely because of the pharma sector and the success of Novo Nordisk.

Source: Danske Bank

Source: Danske Bank

Source: Reuters Read full article

Source: Reuters Read full article

——————–

3. The Polish zloty continues to weaken after a larger-than-expected rate cut.

Back to Index

Japan

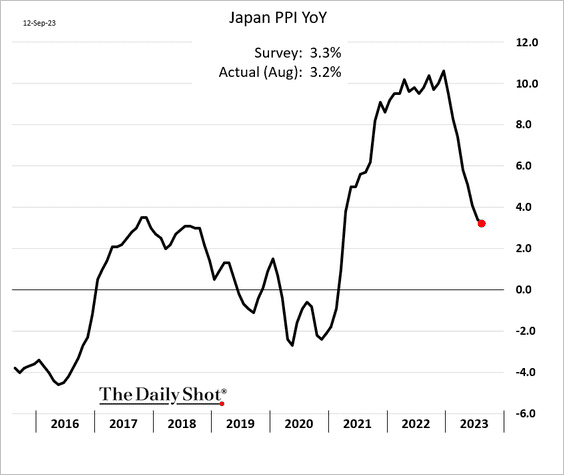

1. The PPI is moderating.

2. The BSI business conditions index improved in Q3.

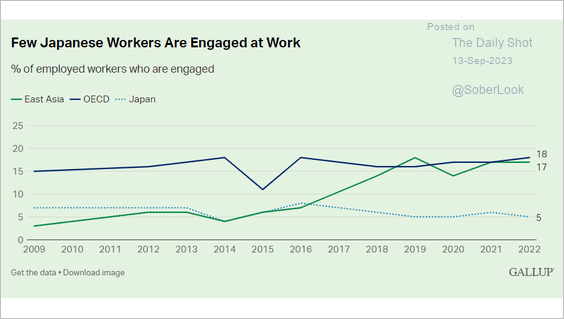

3. Japan’s workers are not very engaged.

Source: Gallup Read full article

Source: Gallup Read full article

Back to Index

Asia-Pacific

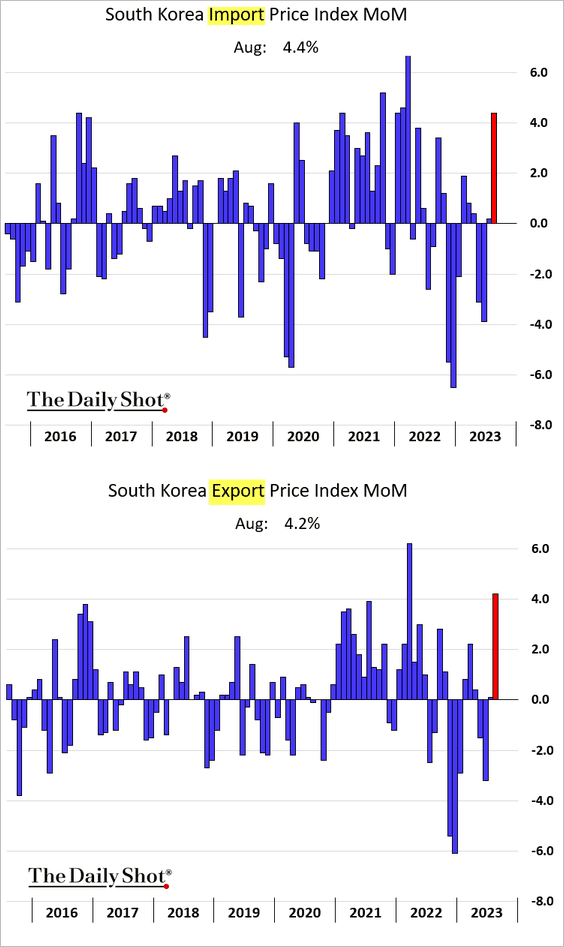

1. South Korea’s unemployment rate hit a record low.

• The nation’s international trade prices surged last month.

——————–

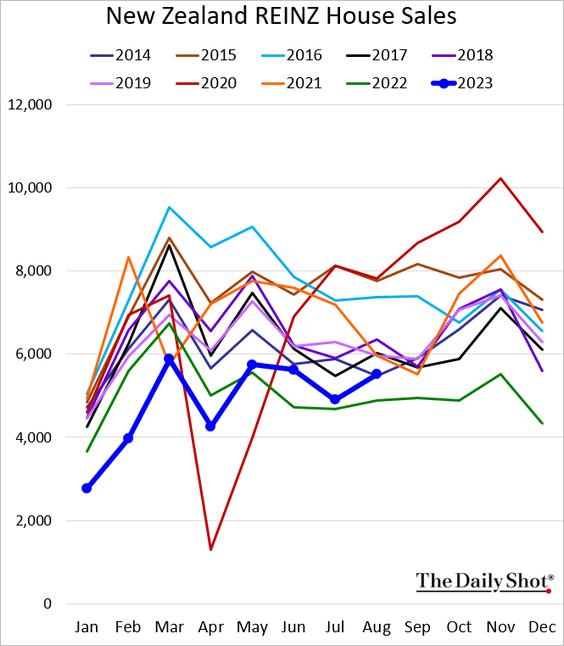

2. New Zealand’s home sales are running above last year’s levels.

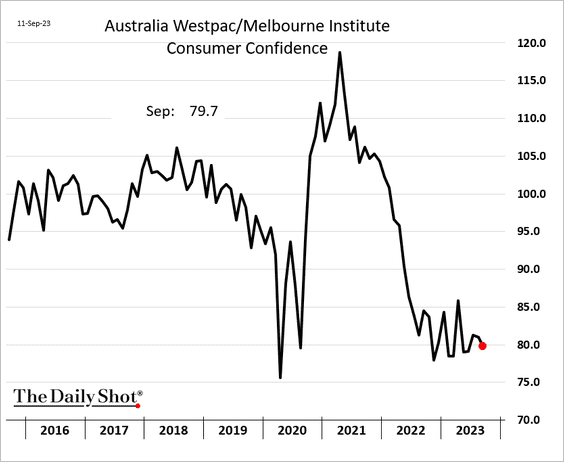

3. Next, we have some updates on Australia.

• Consumer confidence (still depressed):

• Household spending (headed lower):

Source: Capital Economics

Source: Capital Economics

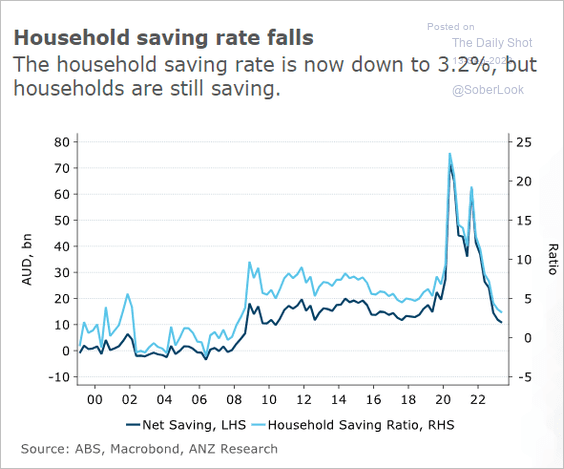

• Saving rate (slowing but still elevated):

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

China

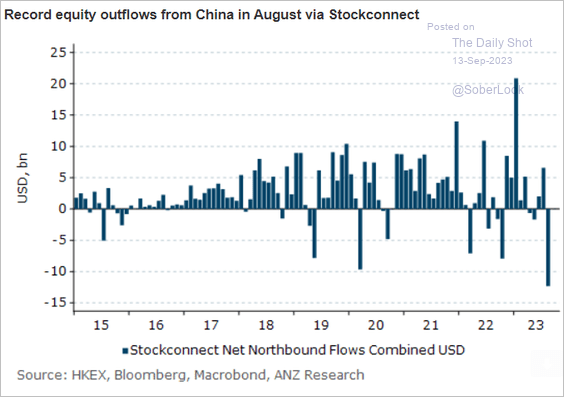

1. Hong Kong-based and foreign investors continue to dump mainland stocks (2 charts).

Source: @ANZ_Research

Source: @ANZ_Research

——————–

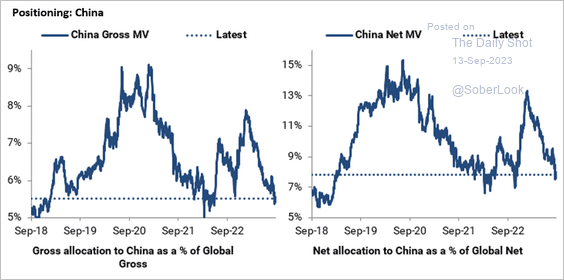

2. Hedge funds remain very cautious on China.

Source: Goldman Sachs; @ResearchQf

Source: Goldman Sachs; @ResearchQf

3. The imbalance between China’s consumption and investment persists.

Source: Reuters Read full article

Source: Reuters Read full article

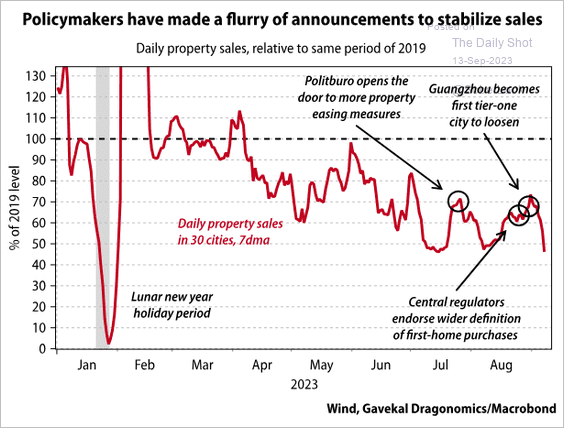

4. Property sales remain depressed relative to last year.

Source: Gavekal Research

Source: Gavekal Research

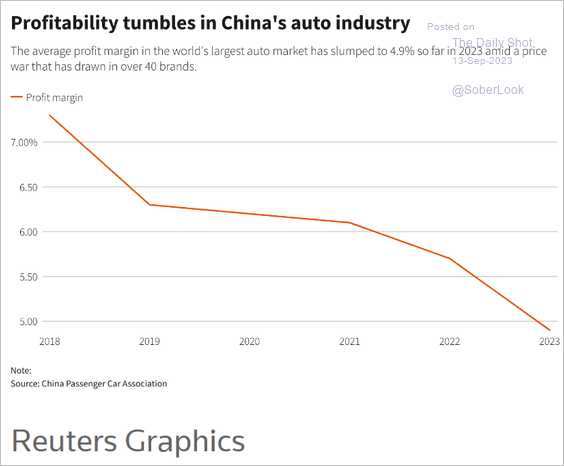

5. The auto industry’s profit margins are shrinking.

Source: Reuters Read full article

Source: Reuters Read full article

6. This map illustrates the evolution of China’s Belt and Road Initiative.

Source: Council on Foreign Relations Read full article

Source: Council on Foreign Relations Read full article

Back to Index

Emerging Markets

1. Brazil’s CPI remains muted.

2. India’s industrial output has been very strong.

Source: The Economic Times Read full article

Source: The Economic Times Read full article

——————–

3. Fund managers have been rotating from EM equities into US shares.

Source: BofA Global Research

Source: BofA Global Research

4. Which economies are most exposed to the impact of El Niño?

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Commodities

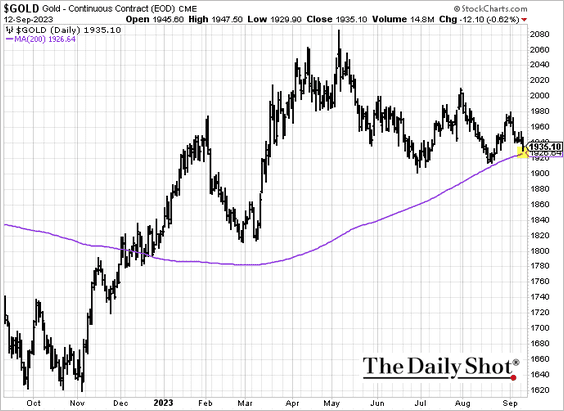

1. Gold futures are at the 200-day moving average.

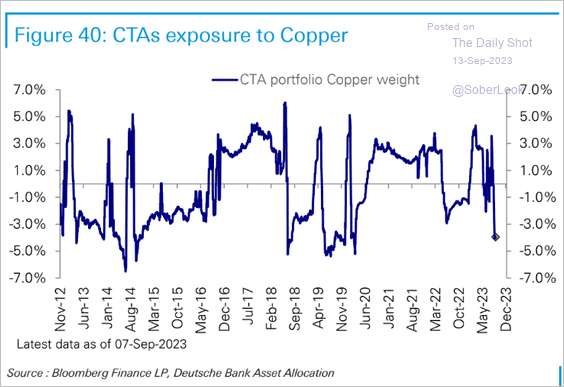

2. CTAs have been trimming their exposure to copper.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

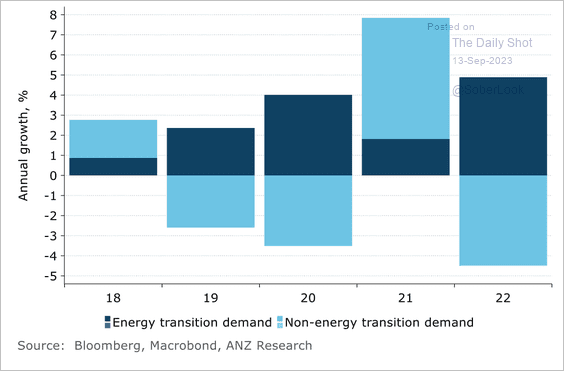

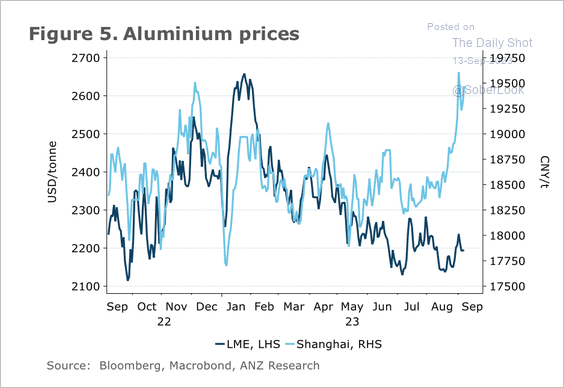

3. Aluminum demand has been supported by the energy transition.

Source: @ANZ_Research

Source: @ANZ_Research

• Aluminum prices on the Shanghai Futures Exchange significantly diverged from LME prices over the past few months. This could be due to China’s investment in grid infrastructure.

Source: @ANZ_Research

Source: @ANZ_Research

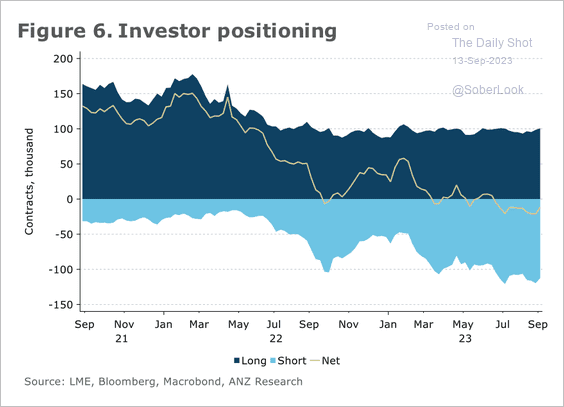

• Investor positioning in LME Aluminum futures is increasingly bearish.

Source: @ANZ_Research

Source: @ANZ_Research

——————–

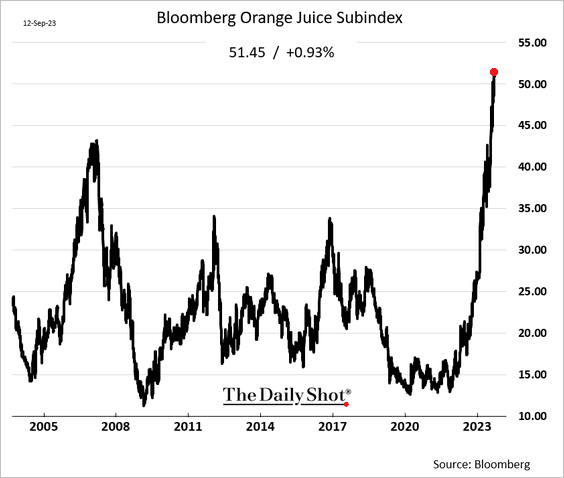

4. US orange juice futures continue to hit record highs due to limited supplies.

Back to Index

Energy

1. Crude oil prices continue to climb.

Source: CNN Business Read full article

Source: CNN Business Read full article

2. The backwardation in the Brent curve is intensifying, indicating tighter supplies.

——————–

3. US crude oil implied demand remains elevated.

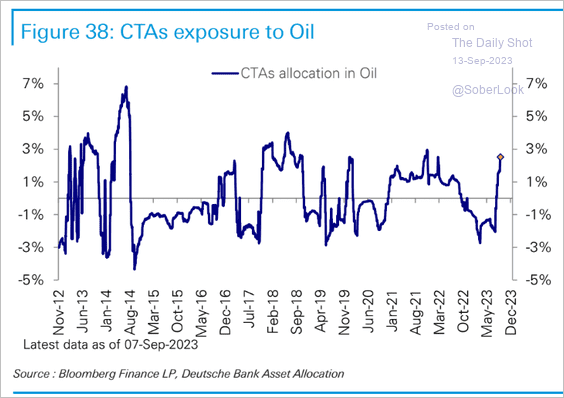

4. CTAs are boosting their exposure to crude oil.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

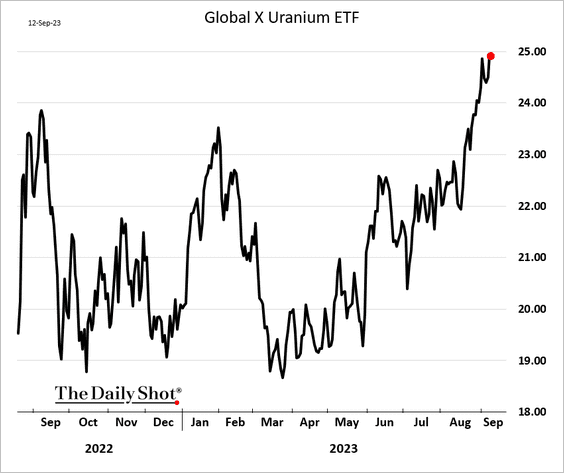

5. The Global X uranium ETF has been rallying.

Back to Index

Equities

1. The Russell 2000/Nasdaq 100 ratio hit a new low as small caps continue to underperform.

2. The S&P 500 equity risk premium is now below the average investment-grade bond spread, pointing to lofty equity valuations.

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Barclays Research

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Barclays Research

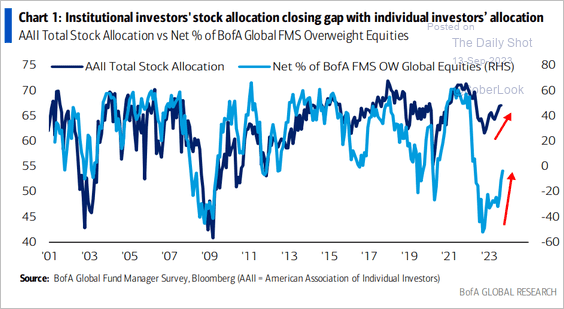

3. Next, let’s take a look at equity positioning.

• Institutional investors have been very bearish and are now catching up to retail investors.

Source: BofA Global Research

Source: BofA Global Research

• JP Morgan’s clients are also boosting equity exposure after being underinvested.

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

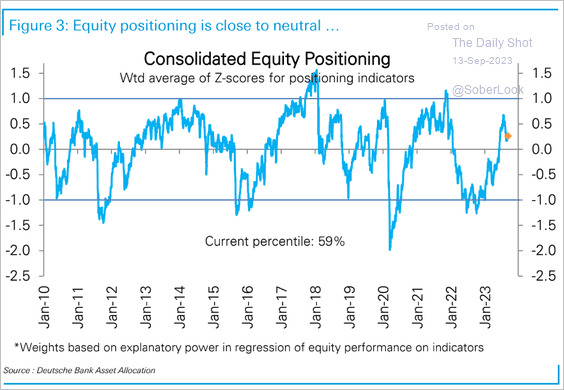

• Here is Deutsche Bank’s aggregate positioning indicator.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

– Tech positioning is off the recent highs.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

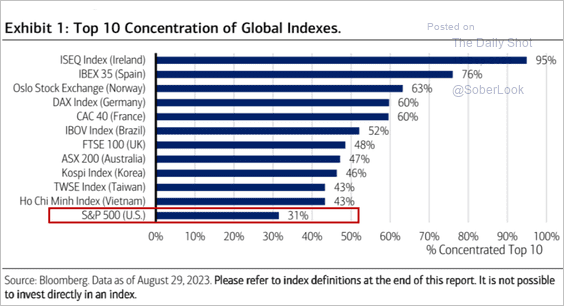

4. Despite rising concentration in the S&P 500, …

Source: BCA Research

Source: BCA Research

… the US large-cap index is more diversified than the global peers.

Source: Merrill Lynch

Source: Merrill Lynch

——————–

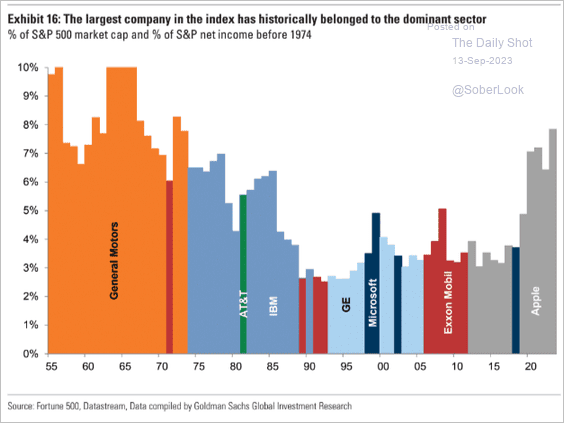

5. This chart shows the largest companies in the S&P 500 over time.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

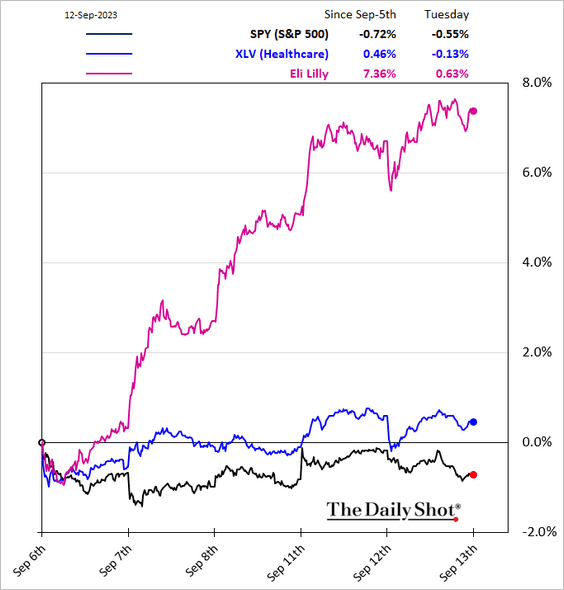

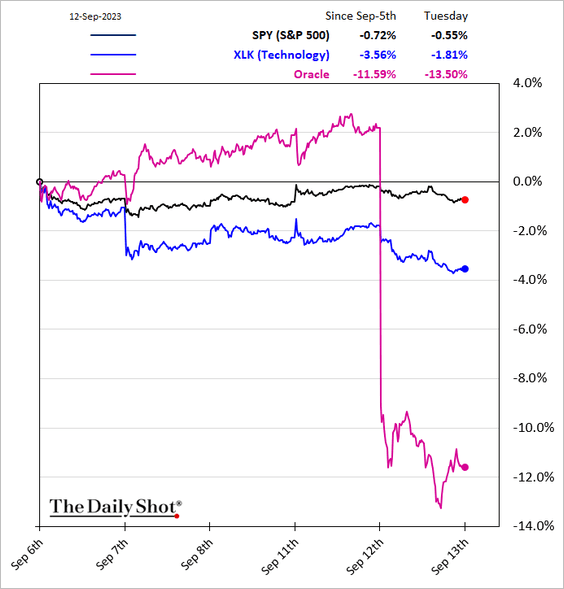

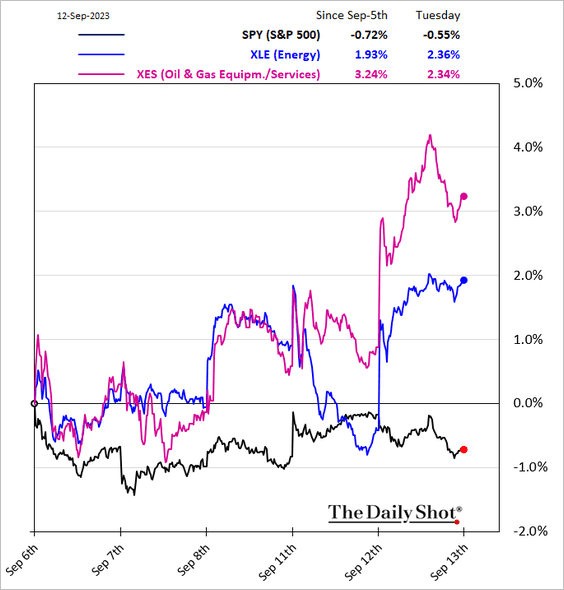

6. Next, we have some sector updates.

• Healthcare:

• Tech:

• Energy:

• Here is a look at current sector valuations versus historical averages.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Credit

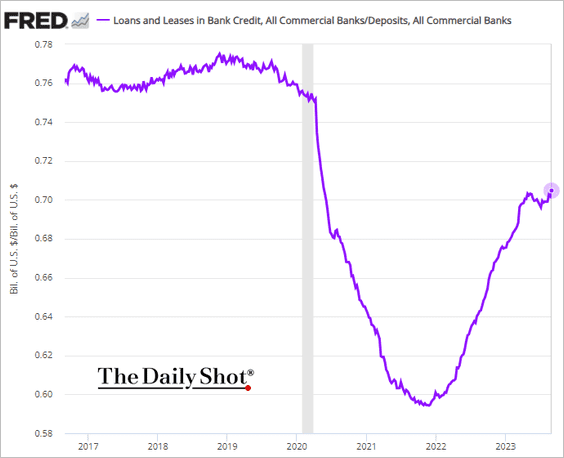

1. US banks’ loan-to-deposit ratio has resumed its climb.

2. Fund managers increasingly see investment-grade bonds outperforming high-yield debt.

Source: BofA Global Research

Source: BofA Global Research

3. Here is a look at rating agencies’ market share.

Source: @genuine_impact

Source: @genuine_impact

Back to Index

Rates

1. Changes in the 10-year Treasury yield are correlated with the US economic surprise index.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

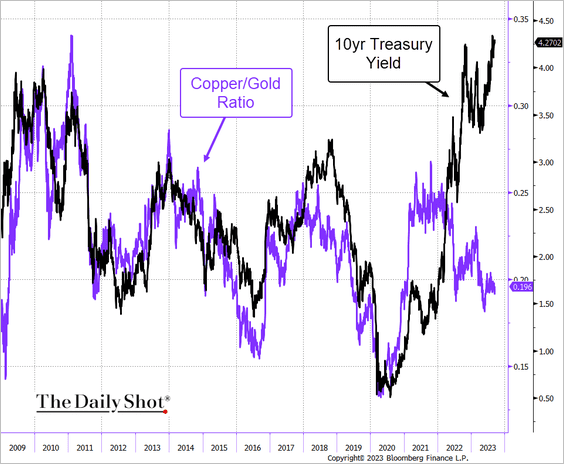

2. The copper-to-gold ratio continues to signal lower Treasury yields ahead.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

3. When will the Fed begin to cut rates?

Source: BofA Global Research

Source: BofA Global Research

——————–

Food for Thought

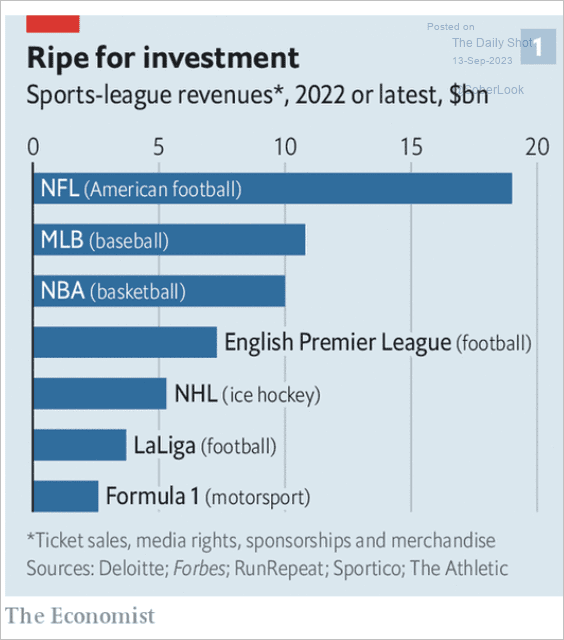

1. Sports media-rights revenues:

Source: The Economist Read full article

Source: The Economist Read full article

• Sports-league revenues:

Source: The Economist Read full article

Source: The Economist Read full article

——————–

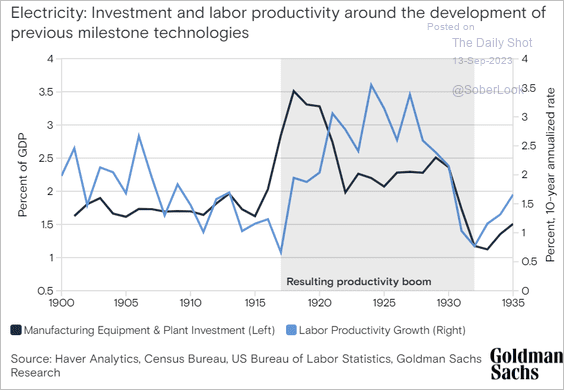

2. Investment and productivity boom due to innovations in electricity:

Source: Goldman Sachs

Source: Goldman Sachs

3. The happiness curve:

Source: The Economist Read full article

Source: The Economist Read full article

4. Advantages of remote work flexibility:

Source: @WSJ

Source: @WSJ

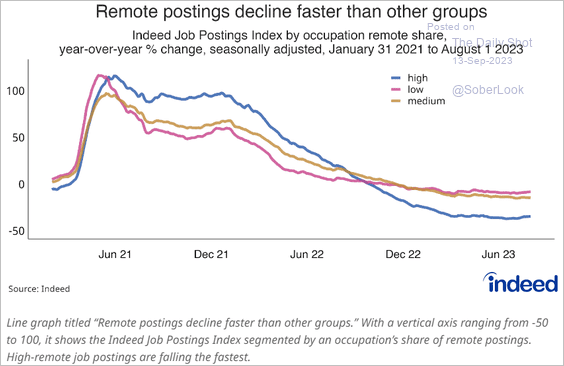

5. Job postings for remote work:

Source: Hiring Lab

Source: Hiring Lab

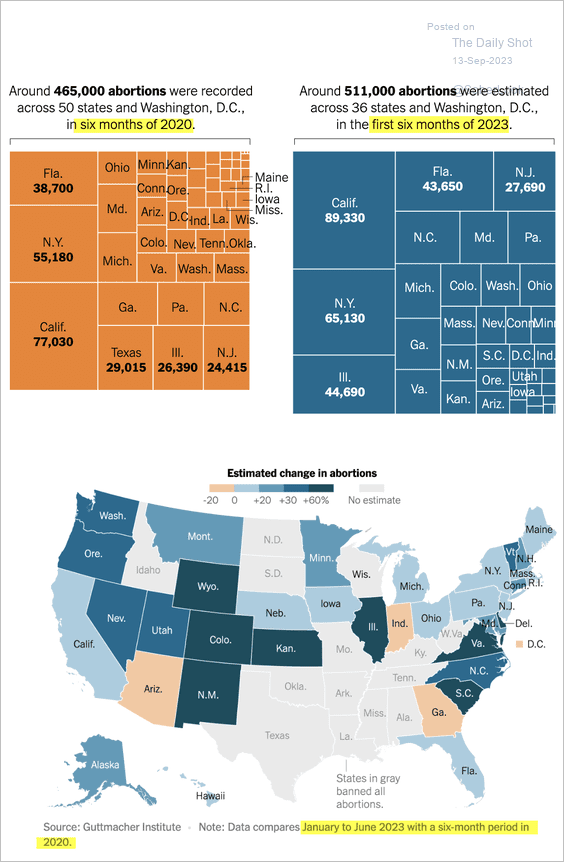

6. Changes in abortions performed:

Source: The New York Times Read full article

Source: The New York Times Read full article

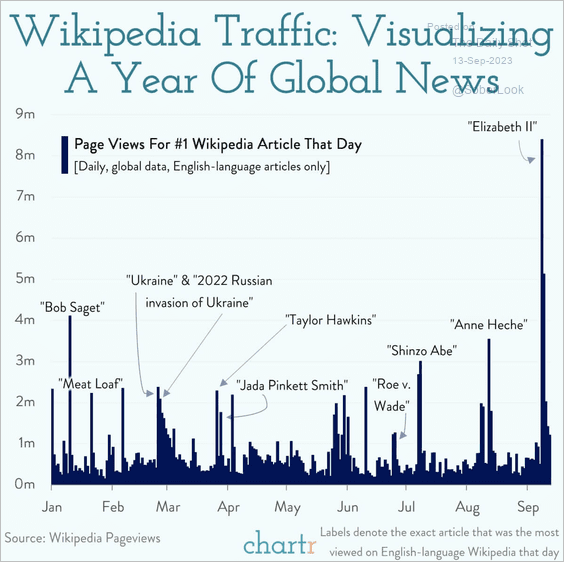

7. Wikipedia traffic:

Source: @chartrdaily

Source: @chartrdaily

——————–

Back to Index