The Daily Shot: 14-Sep-23

• The United States

• The United Kingdom

• The Eurozone

• Japan

• Asia-Pacific

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. The headline CPI accelerated as expected, boosted by gasoline prices.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

The gain in core inflation was higher than expected, …

… with the upside surprise driven by some of the more volatile components. In particular, the increase in airline fares was substantial.

Here is the supercore CPI.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Rent inflation strengthened, …

… but gains in owners’ equivalent rent continue to slow.

Nomura expects housing inflation to gradually ease in the months ahead.

Source: Nomura Securities

Source: Nomura Securities

• New vehicle prices increased while used car prices fell again.

The looming UAW strike could boost car prices in the months ahead.

Source: Reuters Read full article

Source: Reuters Read full article

• On a three-month basis, price gains continue to slow.

2. Here are a couple of additional updates on inflation.

• Online prices (year-over-year):

Source: Adobe Read full article

Source: Adobe Read full article

• S&P 500 companies citing “inflation” on earnings calls:

Source: @FactSethttps Read full article

Source: @FactSethttps Read full article

——————–

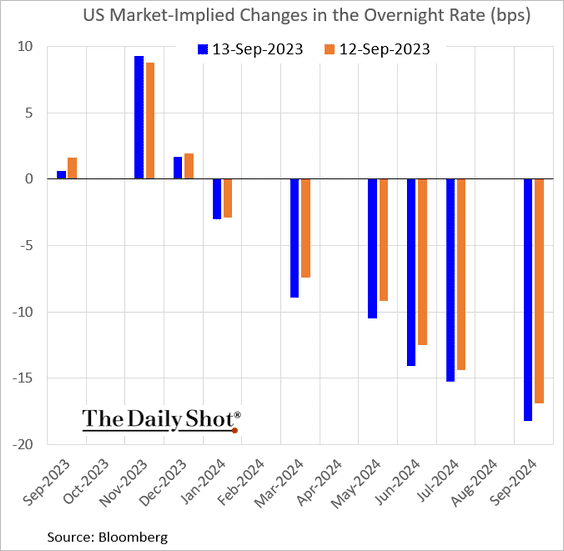

3. Even with the core CPI coming in above expectations, the market’s response to the inflation report remained subdued. The Fed is expected to keep the target rate unchanged this month, with about a 40% chance of a hike in November.

4. Next, we have some updates on the housing market.

• Mortgage applications remain depressed.

Here is the rate lock count.

Source: AEI Housing Center

Source: AEI Housing Center

• Mortgage rates are holding above 7%.

Source: AEI Housing Center

Source: AEI Housing Center

• Home prices are now up on a year-over-year basis, even when adjusted for inflation.

Source: AEI Housing Center

Source: AEI Housing Center

• CoreLogic expects home price appreciation to remain subdued.

Source: CoreLogic

Source: CoreLogic

——————–

5. The federal budget unexpectedly posted a surplus, bolstered by the resumption of student loan repayments.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

The United Kingdom

1. The UK GDP declined in July.

• Services output, industrial production, and construction activity all posted a decline.

• The UK economy is stuck near its 2019 level, showing no growth.

——————–

2. The trade deficit narrowed in July.

3. The housing market rout has accelerated.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

4. Job vacancies continue to ease.

Source: ING

Source: ING

5. The 10-year gilt yield is converging with the 10-year Treasury.

Back to Index

The Eurozone

1. How will markets react to the ECB’s announcement? Here are some scenarios from ING.

Source: ING

Source: ING

2. The ECB’s policy passthrough has been effective. Interest rates on bank loans and deposits have risen sharply.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. The share of variable-rate loans fell since the financial crisis but ticked up over the past year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

4. Euro-area industrial production declined in July, …

… pulled down by Germany.

Source: @DanielKral1

Source: @DanielKral1

——————–

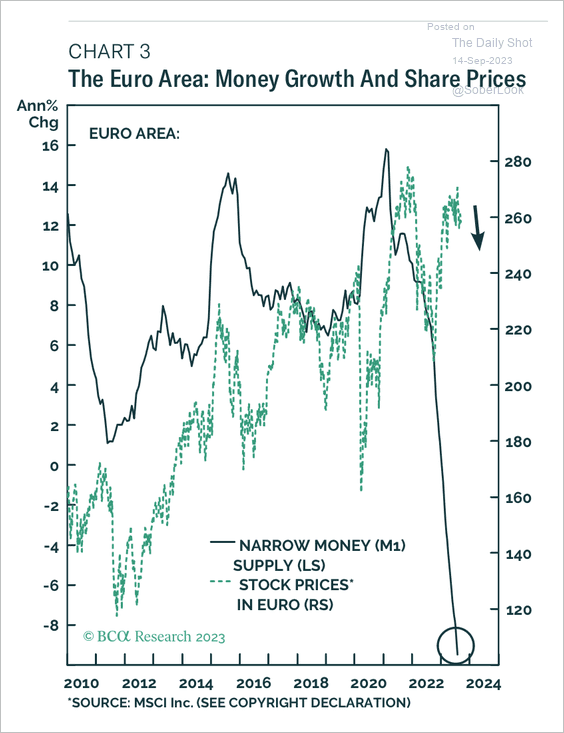

5. Money supply continues to contract, driven by weak bank credit and a shift to long-term liabilities. What does that mean for euro-area stocks?

Source: BCA Research

Source: BCA Research

Lending to households has been crashing.

Source: Longview Economics

Source: Longview Economics

Back to Index

Japan

1. Machinery orders continue to decline.

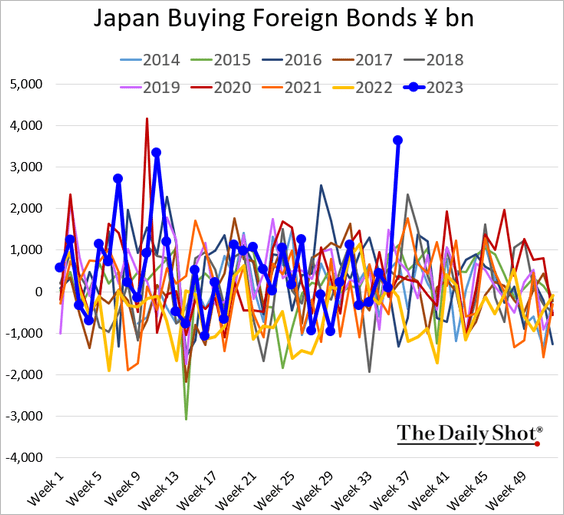

2. Japanese investors bought a lot of foreign bonds last week.

3. Here is the 10-year JGB yield.

4. Shares of financial firms are surging.

5. USD/JPY is approaching the highs of 2022, while the trade-weighted yen declined to a new cyclical low.

Source: Alpine Macro

Source: Alpine Macro

USD/JPY appears overbought.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Asia-Pacific

1. Singapore’s per capita GDP surpasses that of the US.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

2. Next, we have some updates on Australia.

• The jobs report topped expectations last month, boosted by temp workers.

• The labor market expansion has been remarkably strong.

• The unemployment rate held steady.

• The labor force participation rate hit a record high.

Source: Reuters Read full article

Source: Reuters Read full article

• The Aussie dollar jumped in response to the jobs report.

Back to Index

Emerging Markets

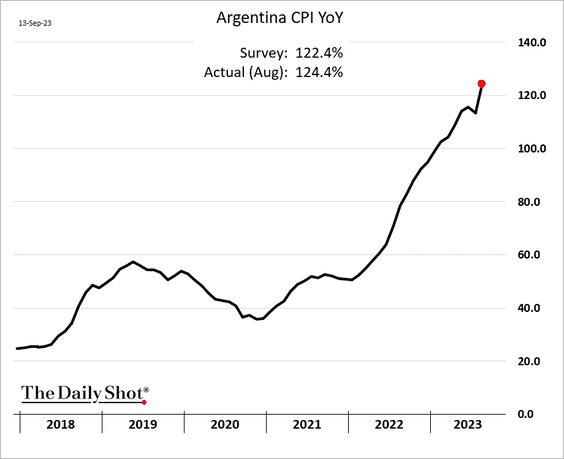

1. Argentina’s central bank held rates steady despite hyperinflation.

Source: @economics Read full article

Source: @economics Read full article

Argentina drew a line in the sand for the official peso exchange rate at 350 to the dollar.

Source: barchart.com

Source: barchart.com

——————–

2. EM equity and bond fund flows have diverged sharply.

Source: EPFR

Source: EPFR

3. Here is something to keep in mind when looking at EM economic data.

Source: World Economics

Source: World Economics

Back to Index

Cryptocurrency

1. Monthly trading volumes on Binance.US collapsed following the SEC’s lawsuit against the exchange.

Source: The Block Data

Source: The Block Data

There are growing concerns about the future of Binance.US.

Source: The Block Read full article

Source: The Block Read full article

——————–

2. Bitcoin’s put/call ratio has risen over the past month.

Source: The Block Data

Source: The Block Data

Back to Index

Energy

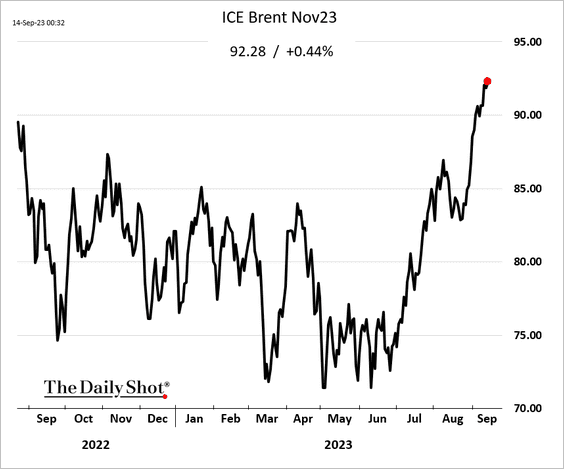

1. Crude oil prices continue to surge on expectations of tight supplies.

Source: @markets Read full article

Source: @markets Read full article

IEA: – The extension of output cuts by Saudi Arabia and Russia through year-end will lock in a substantial market deficit through 4Q23.

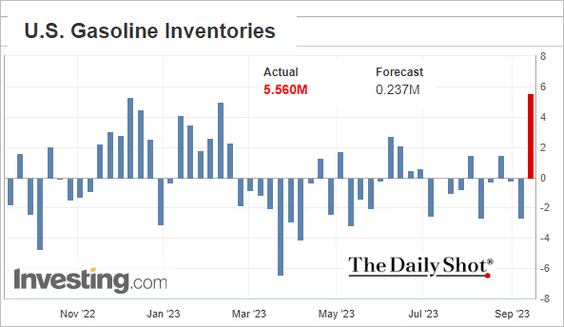

2. US crude oil and product inventories climbed last week.

Here are the levels.

• Gasoline demand eased.

• Refinery runs remain robust.

3. US crude oil production is nearing the pre-COVID peak.

——————–

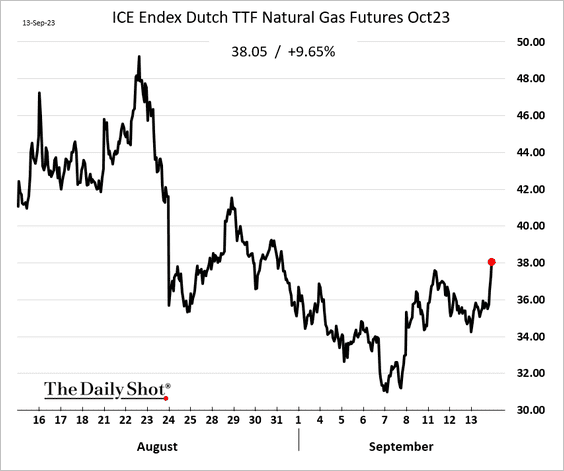

4. European natural gas prices rose 10% on Wednesday.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Equities

1. On average, S&P 500 members continue to widen their underperformance vs. the index.

Here is the median stock performance.

——————–

2. The Russell 2000 ETF (IWM) closed below its 200-day moving average.

But the Russell 2000 implied volatility has been trending lower.

——————–

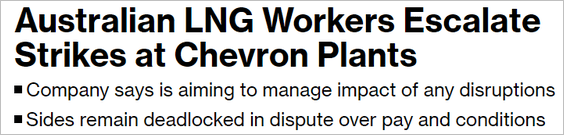

3. Will we see a jump in VIX as the economy slows?

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

3. Below is the distribution of option maturities over time.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

4. Here is a look at cumulative returns during the dot-com bubble. Microsoft was the sole winner out of the top-10 stocks despite lagging early on.

Source: Research Affiliates Read full article

Source: Research Affiliates Read full article

5. Short interest in US stocks continues to hit multi-year lows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Credit

1. US high-yield bonds continue to outperform intermediate-term Treasuries.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

2. Corporate bankruptcies remain elevated.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Consumer discretionary, industrial, and healthcare companies account for the most corporate bankruptcy filings this year.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

3. Betting on rates being near peak, US corporate borrowers have shortened their debt maturities.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

4. Here is a look at sovereign ratings distribution over time.

Source: St. Louis Fed Read full article

Source: St. Louis Fed Read full article

Back to Index

Rates

1. Treasury market implied vol hit the lowest level since February,

2. How restrictive is the Fed’s policy? Here is an estimate from Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. Who owns Treasuries outside the US?

Source: @EconObservatory Read full article

Source: @EconObservatory Read full article

Back to Index

Global Developments

1. The dollar index (DXY) is testing initial resistance at the top of its 2023 range.

• Long-term indicators show the dollar is oversold and holding support.

• The rise in US earnings revisions versus the rest of the world supports further upside for the dollar.

Source: BCA Research

Source: BCA Research

• Speculative positioning in EUR, GBP, BRL, and MXN appears stretched. Could we see additional strength in the dollar?

Source: BCA Research

Source: BCA Research

——————–

2. Here is a look at real policy rates in advanced economies.

Source: @JeffreyKleintop

Source: @JeffreyKleintop

——————–

Food for Thought

1. Depression diagnosis:

Source: Our World in Data Read full article

Source: Our World in Data Read full article

2. Lyme disease cases:

Source: @BW Read full article

Source: @BW Read full article

3. US goods imports percentage by source:

Source: @WSJ Read full article

Source: @WSJ Read full article

4. Projected AI investment:

Source: Goldman Sachs

Source: Goldman Sachs

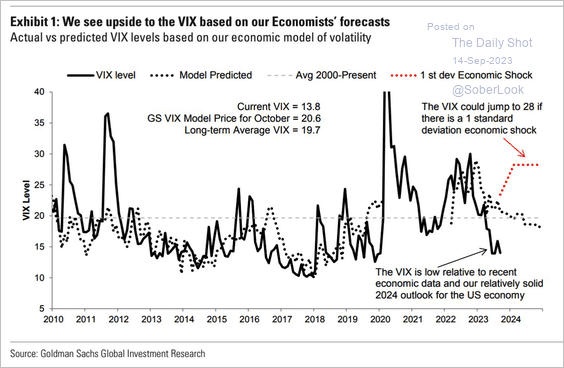

5. Instacart’s IPO pricing is well below peak valuations.

Source: @chartrdaily

Source: @chartrdaily

6. Livestock density:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Back to Index