The Daily Shot: 19-Sep-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Rates

• Global Developments

• Food for Thought

The United States

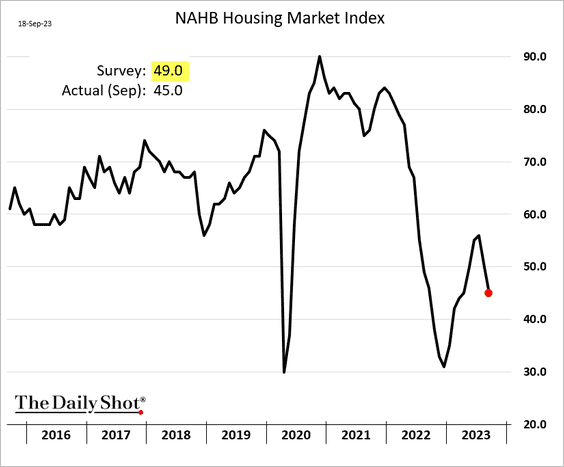

1. Let’s begin with the housing market.

• Homebuilder sentiment unexpectedly dipped this month,

Source: Reuters Read full article

Source: Reuters Read full article

… as elevated mortgage rates and reduced housing affordability take a toll on demand (2 charts).

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Buyer traffic and demand expectations declined sharply.

• An increasing number of homebuyers are backing out of ‘pending sales.’

Source: Redfin

Source: Redfin

• The University of Michigan’s gauge of consumer sentiment regarding housing purchase conditions remains depressed.

• Home prices continue to outpace rents.

Source: Apartment List

Source: Apartment List

• Asking prices on listed homes are well above last year’s levels.

Source: Redfin

Source: Redfin

• Inventories remain low.

Source: Redfin

Source: Redfin

• Demand for vacation homes has been soft.

Source: Redfin

Source: Redfin

——————–

2. Next, we have some updates on inflation.

• Nomura sees a drop in core PCE inflation in August (based on the CPI and PPI reports). The supercore PCE is also expected to show a decline (month-over-month). Will the FOMC adjust the dot plot lower?

Source: Nomura Securities

Source: Nomura Securities

• Forecasts for the US inflation trajectory have been consistently too low.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• The University of Michigan’s long-term consumer inflation expectations highlight a notable discrepancy between the median (the predominant measure) and the mean. This suggests a skewness towards higher inflation expectations, indicating that some consumers anticipate a massive inflation spike.

Source: @TheTerminal, Bloomberg Finance L.P. h/t Chris Low, FHN Financial

Source: @TheTerminal, Bloomberg Finance L.P. h/t Chris Low, FHN Financial

——————–

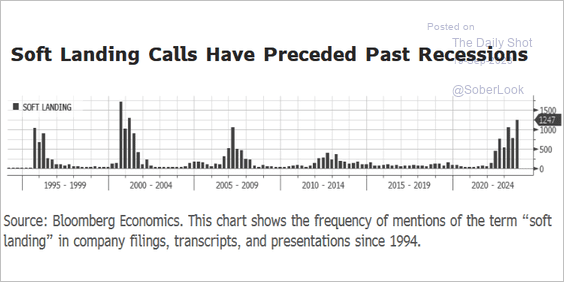

3. Increased talk of a “soft landing” tends to precede a recession.

Source: @AnnaEconomist, @economics Read full article

Source: @AnnaEconomist, @economics Read full article

4. US liquidity conditions are very tight.

Source: Longview Economics

Source: Longview Economics

Back to Index

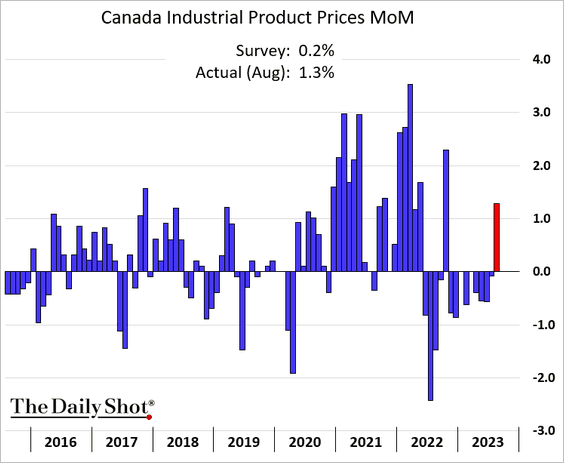

Canada

1. Consumer confidence continues to soften.

2. Housing starts are holding up.

3. Industrial producer prices jumped last month.

Back to Index

The United Kingdom

1. Labor market slack is building.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

2. Before the late 1960s, substantial deficits only occurred during wars. Since then, according to Deutsche Bank, peacetime (and recession-related) deficits have been normalized as a policy tool.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. What are the most important election issues?

Source: @RedfieldWilton

Source: @RedfieldWilton

Back to Index

The Eurozone

1. The Bund curve has been shifting higher across the board.

2. The ECB’s real policy rate remains negative.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. Germany’s industries, which are sensitive to energy prices, continue to struggle.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

4. French nuclear power generation recovers, with the rivers used for reactor cooling returning to a more typical temperature.

Source: Macrobond

Source: Macrobond

5. Ireland’s commercial real estate activity is crashing.

Back to Index

China

1. Foreigners and Hong Kong-based investors continue to exit mainland stocks.

2. China’s stocks continue to trade at a substantial discount to India and US peers.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

3. Here is a look at China’s exports by destination (year-over-year changes).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

4. Fitch downgraded the US dollar debt of Longfor, an investment-grade developer..

Source: Fitch Ratings Read full article

Source: Fitch Ratings Read full article

After last year’s rebound, bond prices are rolling over.

The stock is trending lower as well.

Here is the overall index of property firms.

——————–

5. The AUD/MXN exchange rate is a proxy for relative optimism on China vs. the US.

Back to Index

Emerging Markets

1. Brazil’s Ibovespa index has been stuck in a two-year-long range. Could we see a breakout?

• Most investors expect Ibovespa to trade between 130K and 140K next year, according to a BofA survey of fund managers.

Source: BofA Global Research

Source: BofA Global Research

• Here are their expectations for policy rates and the real. (2 charts)

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

——————–

2. According to Russia’s government, the unemployment rate hit the lowest level in years.

3. Which countries have the highest interest payments as a percentage of government revenues?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Cryptocurrency

1. Bitcoin Cash (BCH) is off to a strong month, while Ether (ETH) is lagging top peers.

Source: FinViz

Source: FinViz

2. XRP’s liquidity has improved significantly after the July court ruling in the Ripple/SEC case.

Source: @KaikoData

Source: @KaikoData

3. Crypto funds saw another week of outflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

Long-bitcoin funds accounted for most outflows last week, although investors started to exit short-bitcoin products.

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

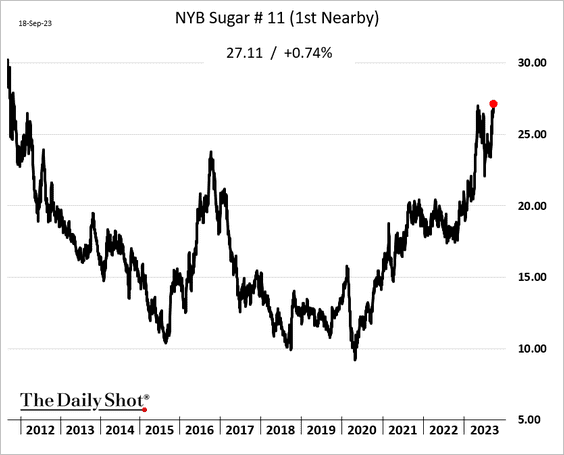

Commodities

1. US corn futures remain under pressure.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

2. Sugar futures hit a multi-year high amid export restrictions in Asia and concerns about the sugar cane harvest in Brazil.

3. Orange juice prices hit another record high.

Further reading

Further reading

4. The rally in oats is fading quickly.

Back to Index

Energy

1. Brent oil performs best when other commodity markets are in an uptrend.

Source: Mensur Pocini, Julius Baer

Source: Mensur Pocini, Julius Baer

• Technicals suggest that crude oil is overbought.

——————–

2. Oil has diverged from inflation expectations.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

3. Here is a forecast for oil market balance and prices from Capital Economics.

Source: Capital Economics

Source: Capital Economics

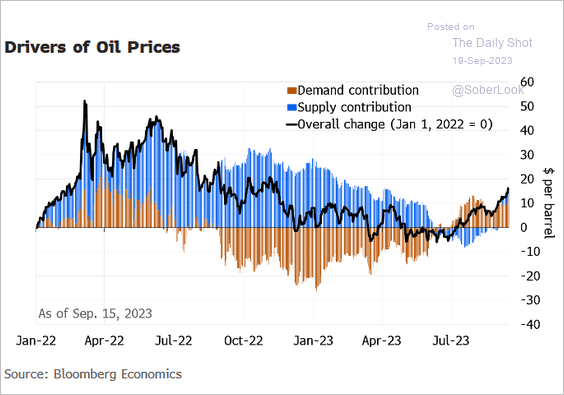

4. The recent crude rally has been driven mostly by higher demand.

Source: @ZiadMDaoud Read full article

Source: @ZiadMDaoud Read full article

5. European natural gas prices are moving lower as Chevron’s Australia LNG exports hold up.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

6. The US is becoming the world’s largest LNG supplier.

Source: @kevinorland, @markets Read full article

Source: @kevinorland, @markets Read full article

Back to Index

Equities

1. The market expects the S&P 500 Q3 earnings to be flat quarter-over-quarter. Deutsche Bank sees an increase.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Will core earnings hit another record high?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Analysts are consistently raising their earnings forecasts for the S&P 500 over the upcoming 12 months.

——————–

2. Recent IPOs have sharply underperformed the broader market.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

• Post-IPO shares lost further ground over the past few days.

• IPO activity has been soft. Will the Instacart and Arm IPOs give the market a boost?

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Source: Markets Insider Read full article

Source: Markets Insider Read full article

——————–

3. Will stronger earnings increase share buybacks?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

4. Equity fund flows have been robust lately.

Source: BCA Research

Source: BCA Research

• Is the market pricing gains in business activity?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

5. US equity valuations remain very high relative to real rates.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

6. Year-to-date, the Russell 2000 (small caps) is down almost 12% vs. the S&P500.

The Russell 2000/S&P 500 ratio hit the lowest level since 2002.

Back to Index

Alternatives

1. Most advisors surveyed by Blackstone raised their allocation to alternatives last year, particularly in private real estate. (2 charts)

Source: Blackstone Read full article

Source: Blackstone Read full article

Source: Blackstone Read full article

Source: Blackstone Read full article

——————–

2. It was a soft August for PE/VC investments relative to recent years.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

3. Here is a look at startups’ median valuation cap and amount raised by industry during the first half of the year.

Source: Carta

Source: Carta

• This table ranks the top metro areas by startup invested capital, organized by industry.

Source: Carta

Source: Carta

• Startup hiring has plummeted over the past year.

Source: Carta

Source: Carta

——————–

4. US private equity middle-market buyouts are gaining significant traction this year.

Source: PitchBook

Source: PitchBook

5. GP deal activity, which involves acquiring stakes in asset managers, is gaining momentum.

Source: @theleadleft

Source: @theleadleft

6. Over the last year, perpetual assets under management among US-listed private equity firms have grown by 13.2%, outpacing total AUM growth of 9.8%, according to PitchBook.

Source: PitchBook

Source: PitchBook

Back to Index

Rates

1. The market continues to reduce its expectations for the pace of Fed rate cuts.

——————–

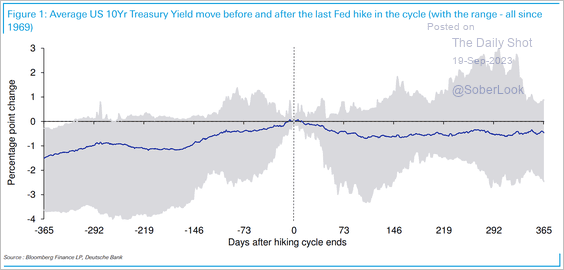

2. Historically, the timing of the last rate hike coincided with a cycle peak in the 10-year Treasury yield.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. Having locked in very low long-term rates, some companies are taking advantage of the inverted yield curve.

Source: @WSJ Read full article

Source: @WSJ Read full article

4. Treasury fund inflows are expected to hit a record high this year.

Source: BCA Research

Source: BCA Research

5. The Fed’s securities portfolio market-to-market losses continue to grow. Of course, in practice, this doesn’t matter because, unlike commercial banks, the Fed has no funding issues.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Global Developments

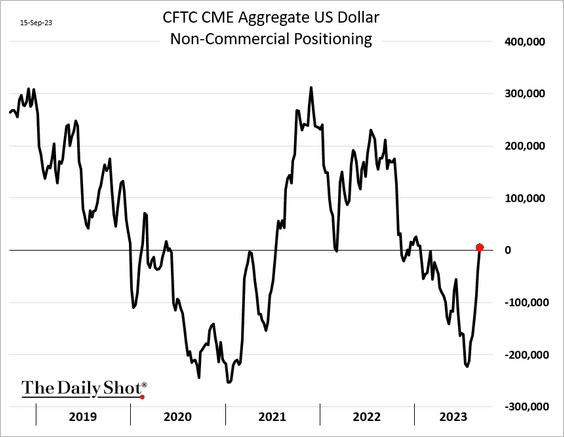

1. Speculative accounts have covered their bets against the dollar.

2. This chart shows the share of renters spending more than 40% of disposable income on rent.

Source: The Economist Read full article

Source: The Economist Read full article

——————–

Food for Thought

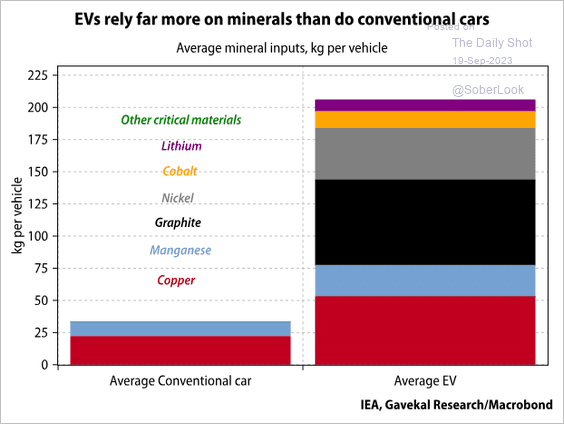

1. Reliance on key minerals in vehicle production:

Source: Gavekal Research

Source: Gavekal Research

2. Mac sales:

Source: @chartrdaily

Source: @chartrdaily

3. Computer and software spending (inflation-adjusted):

Source: Wells Fargo Securities

Source: Wells Fargo Securities

4. Americans with limited English proficiency:

Source: @jeremybney

Source: @jeremybney

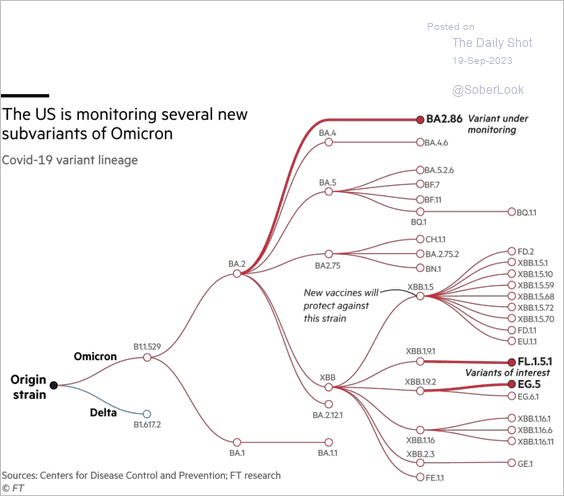

5. COVID variants:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

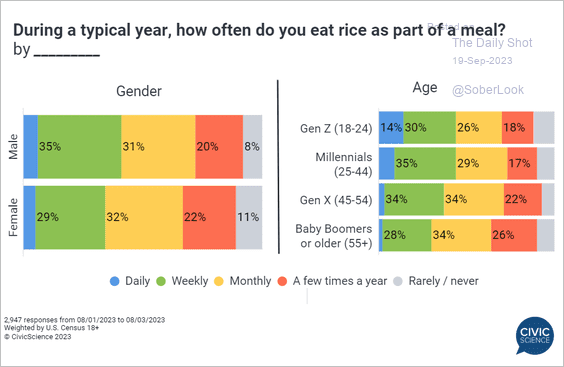

6. Eating rice in the US:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

——————–

Back to Index