The Daily Shot: 18-Sep-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

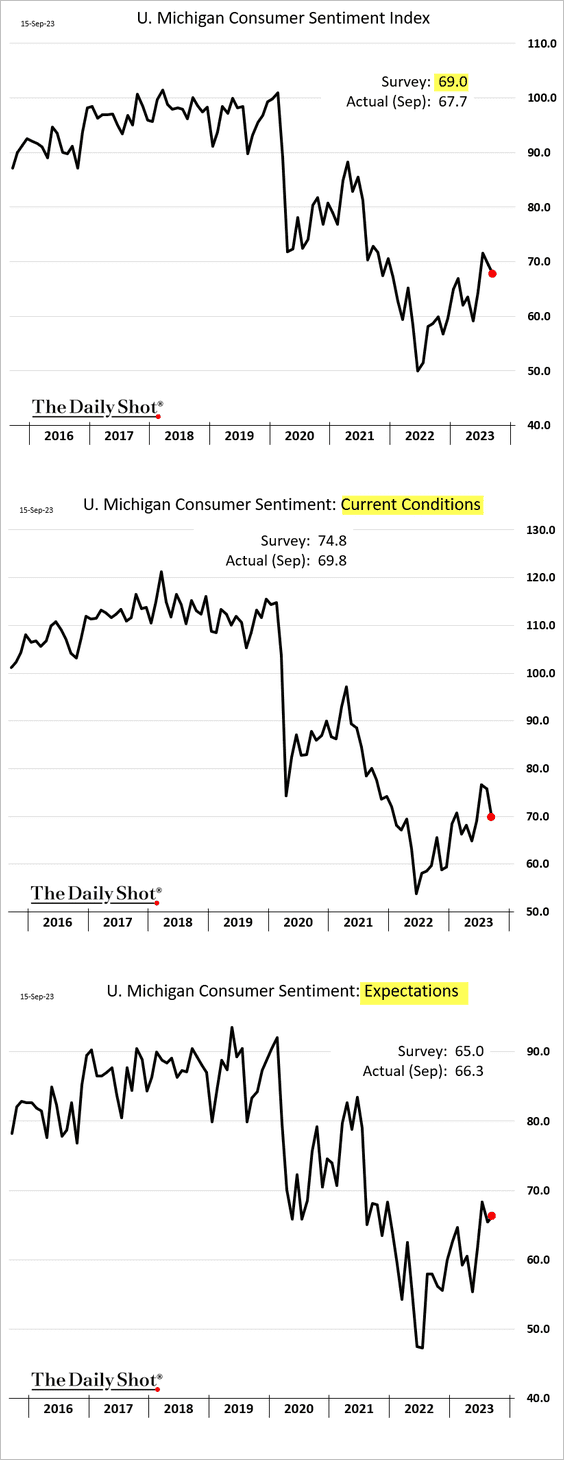

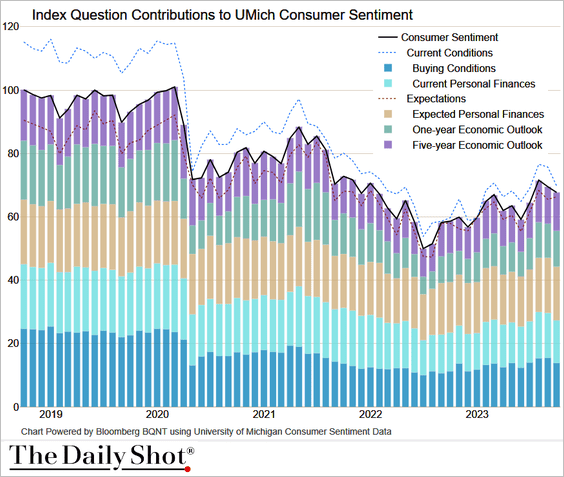

1. The University of Michigan’s consumer sentiment measure declined again, but the expectations index edged higher.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

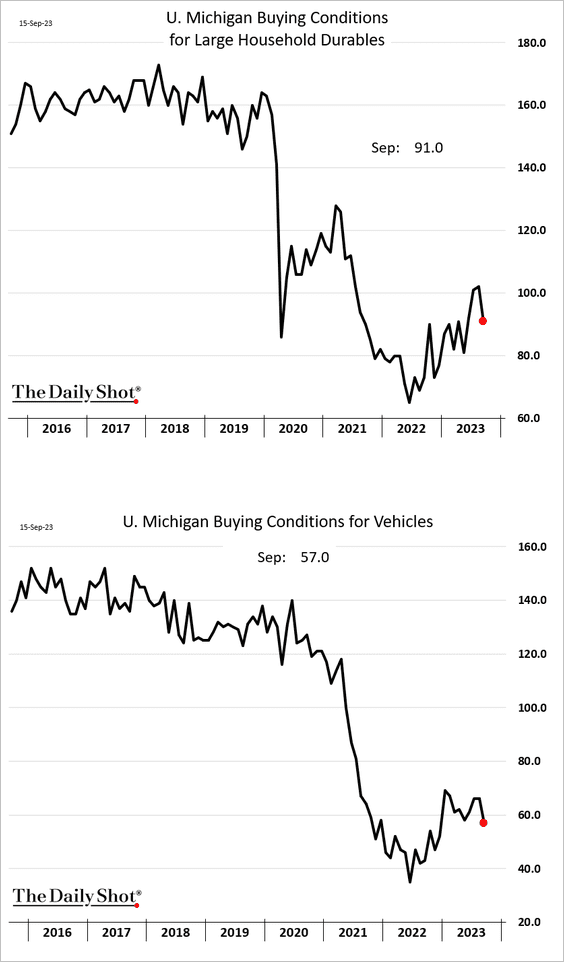

• Buying conditions softened.

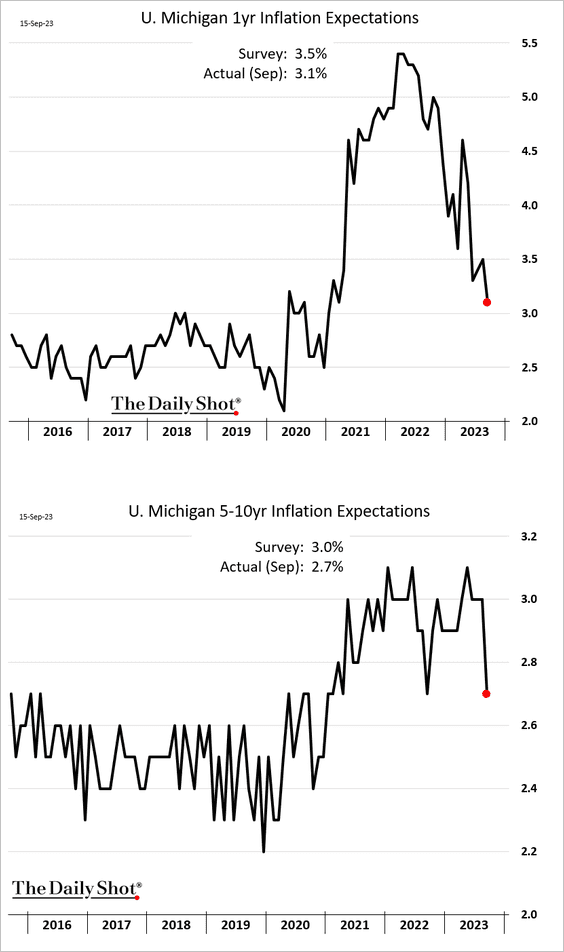

• Inflation expectations eased more than expected.

Source: Reuters Read full article

Source: Reuters Read full article

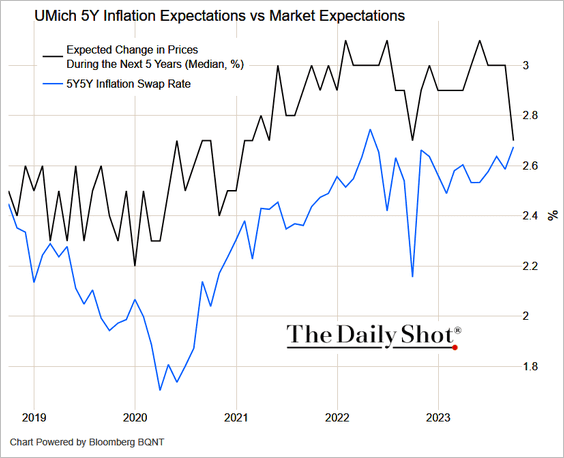

Longer-term consumer inflation expectations have converged with a key market-based inflation expectations indicator (5x5yr inflation swap).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

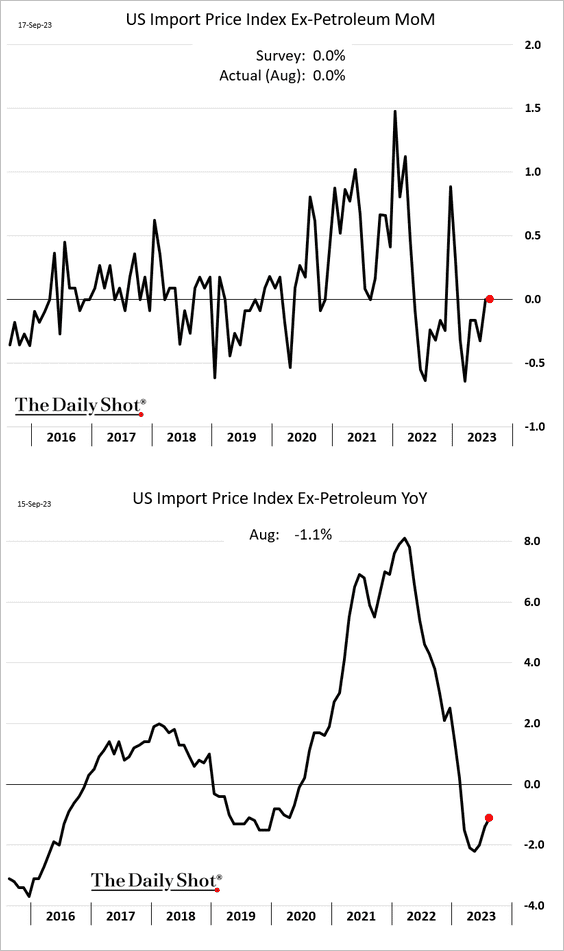

2. Import prices were unchanged in August.

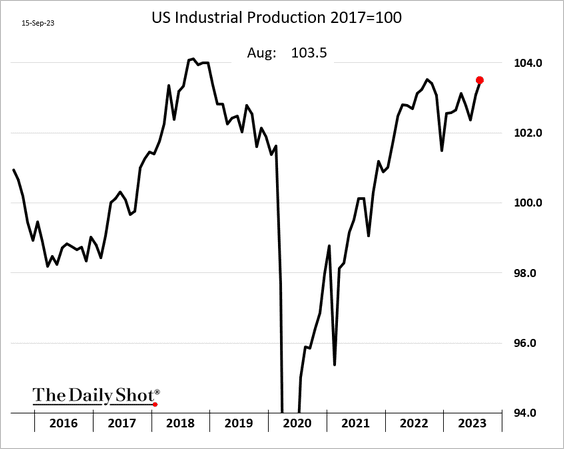

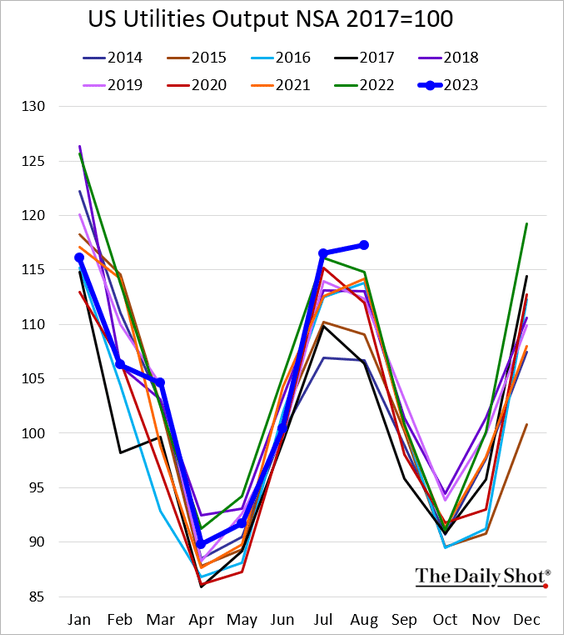

3. Industrial output jumped last month, …

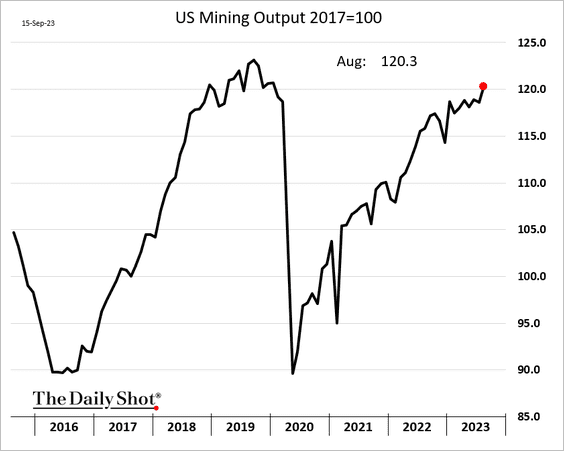

… boosted by crude oil production …

… and strong electricity demand (due to extreme heat in parts of the country).

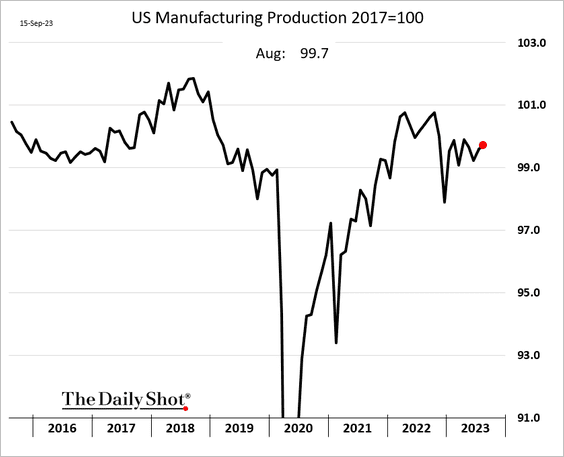

But manufacturing output barely budged.

Source: Reuters Read full article

Source: Reuters Read full article

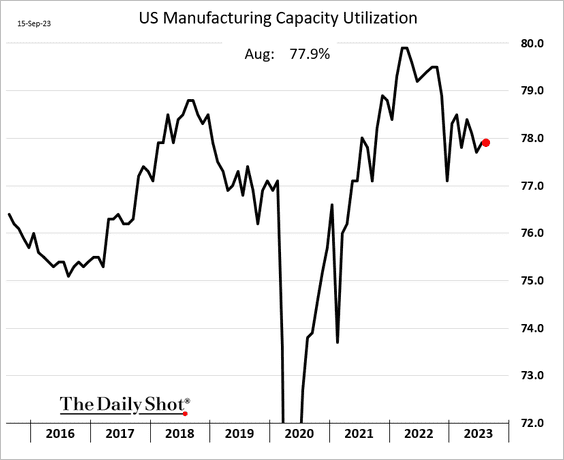

Manufacturing capacity utilization was unchanged.

——————–

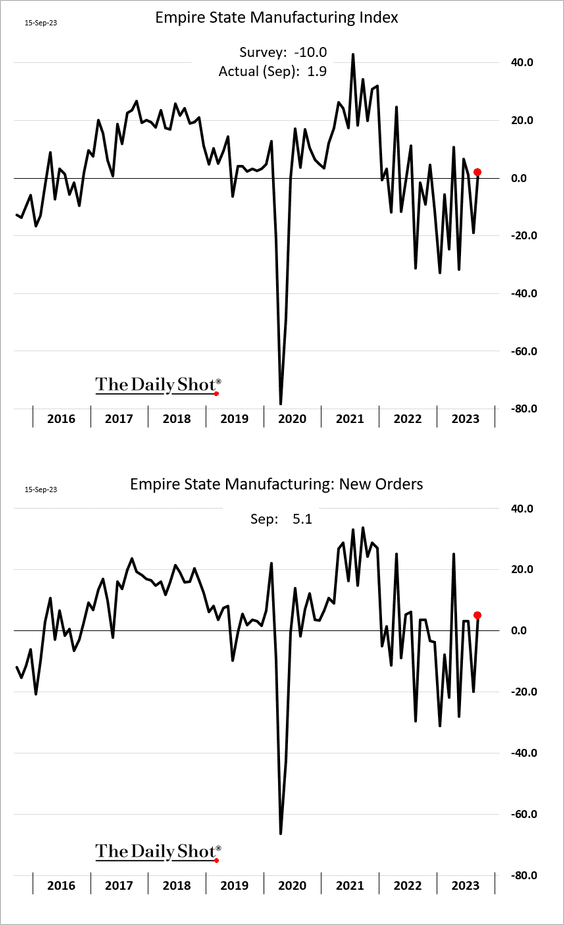

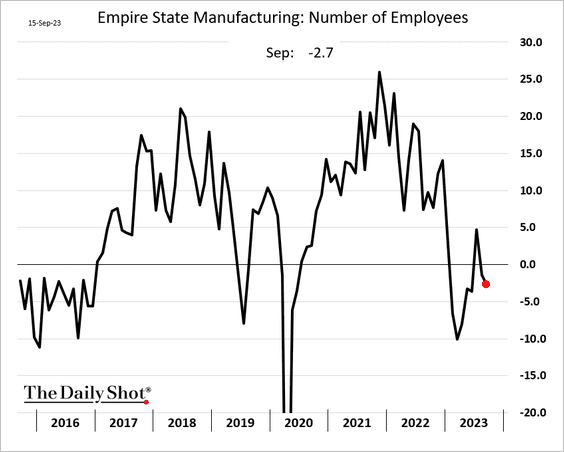

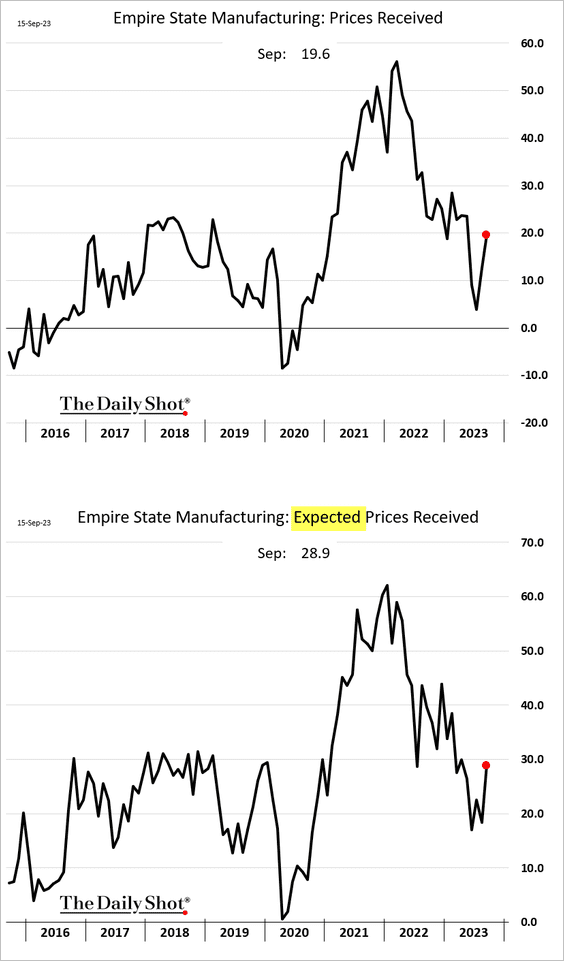

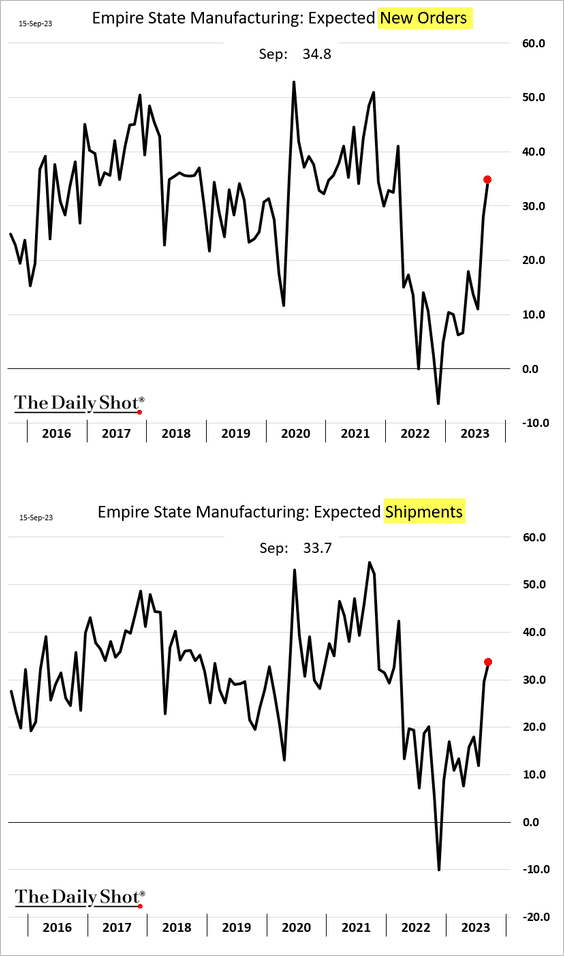

4. Empire Manufacturing, the first regional factory report of the month (from the NY Fed), showed some improvement in September. However, this index has been volatile over the past two years.

• Hiring has stalled.

• A larger percentage of firms in the region are boosting prices.

• Manufacturers are upbeat about future demand.

——————–

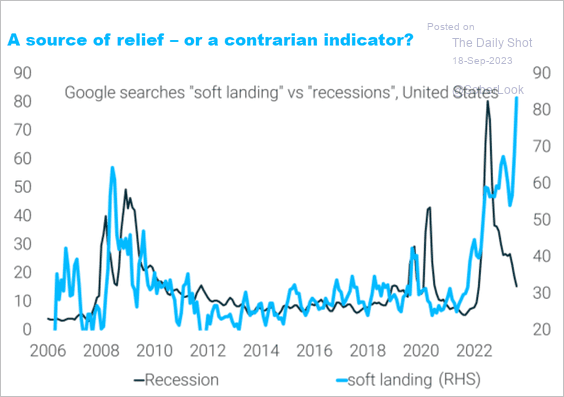

5. Too much enthusiasm about the economy?

Source: TS Lombard

Source: TS Lombard

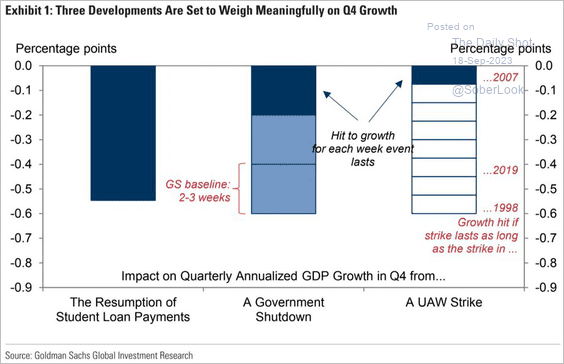

• How might the resumption of student loan payments, coupled with the UAW strike, impact the economic landscape in the upcoming quarter?

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

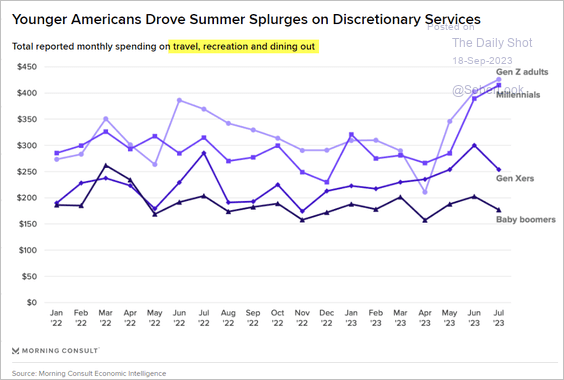

• Which sectors are likely to face challenges due to the resumption of student loan payments?

Source: Morning Consult Read full article

Source: Morning Consult Read full article

Back to Index

Canada

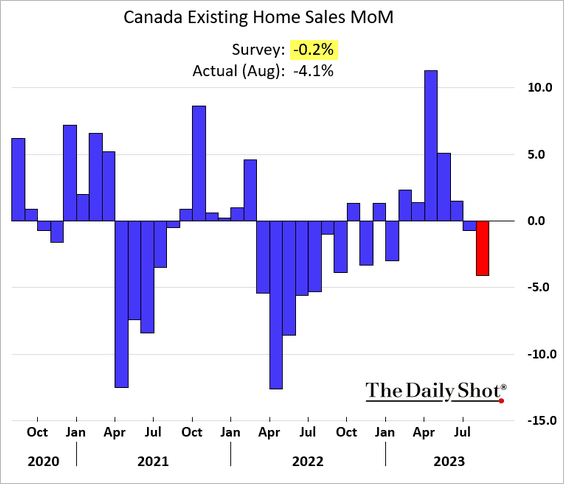

1. Existing home sales declined sharply in August.

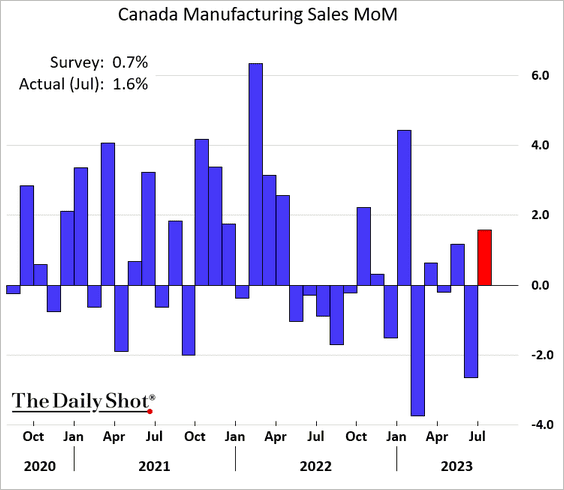

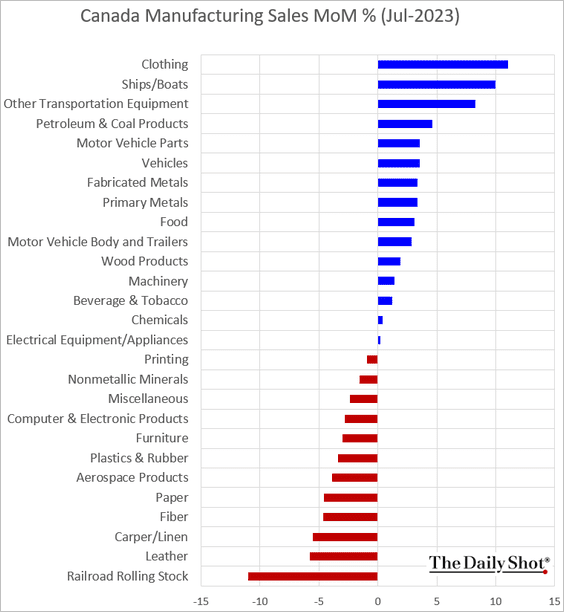

2. Manufacturing sales improved in July.

Here are the changes by industry.

Back to Index

The United Kingdom

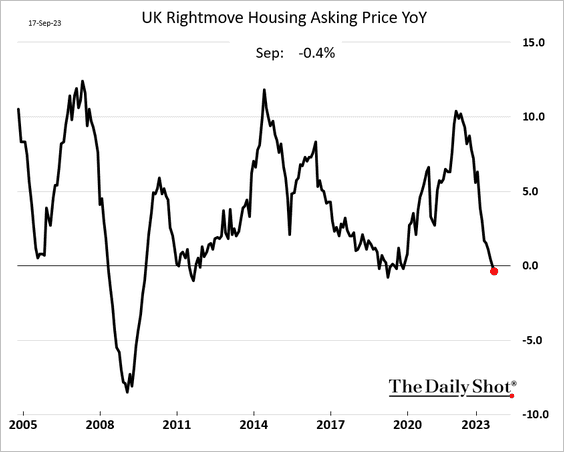

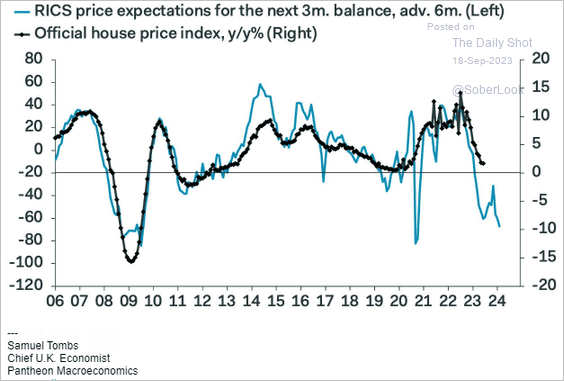

1. The housing market continues to struggle (2 charts).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

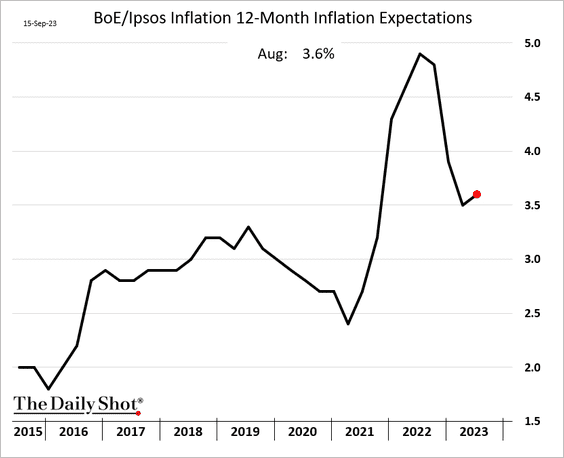

2. Consumer inflation expectations climbed in August.

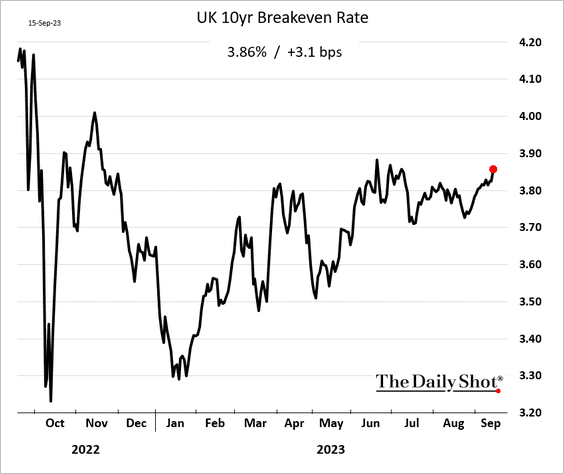

• Market-based inflation expectations have also been rising.

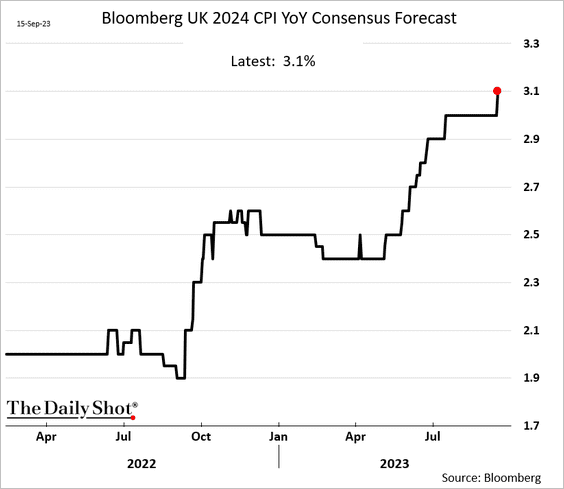

• Economists boosted their inflation forecasts for 2024.

——————–

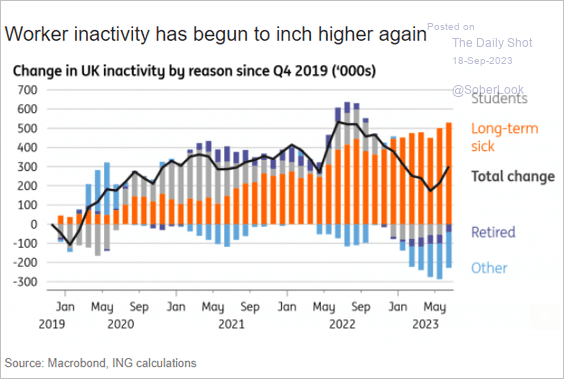

3. Here is a look at worker inactivity.

Source: ING

Source: ING

Back to Index

The Eurozone

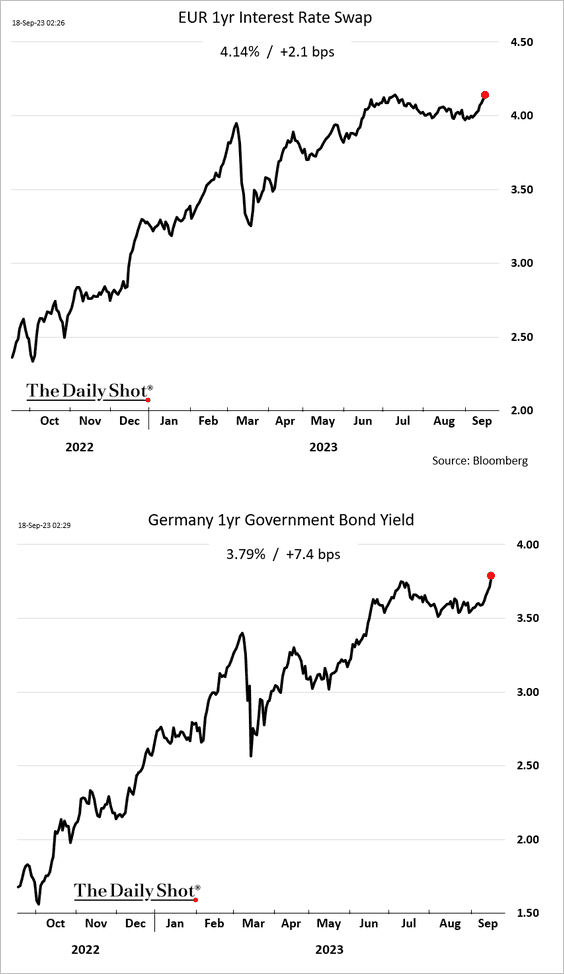

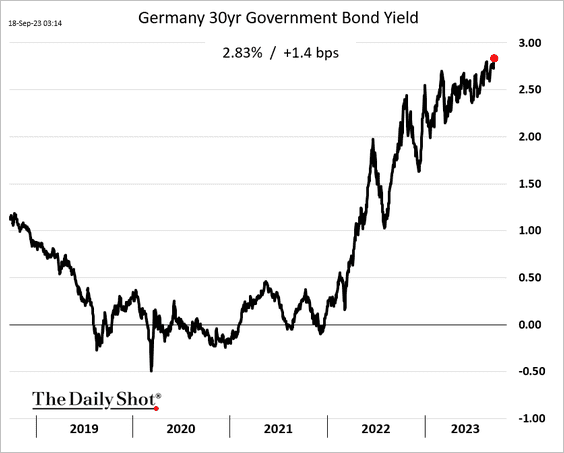

1. Short-term rates are climbing.

The 30-year Bund yield hit a multi-year high.

——————–

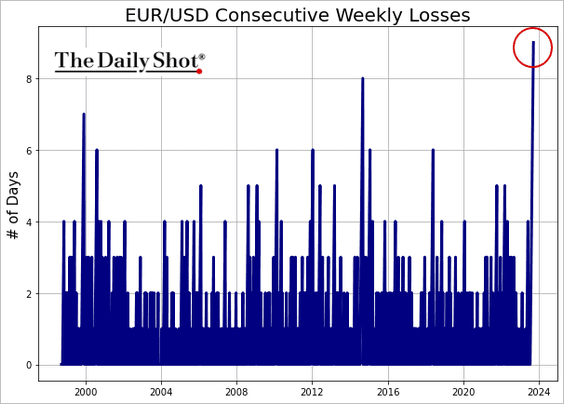

2. EUR/USD has been down for nine weeks in a row.

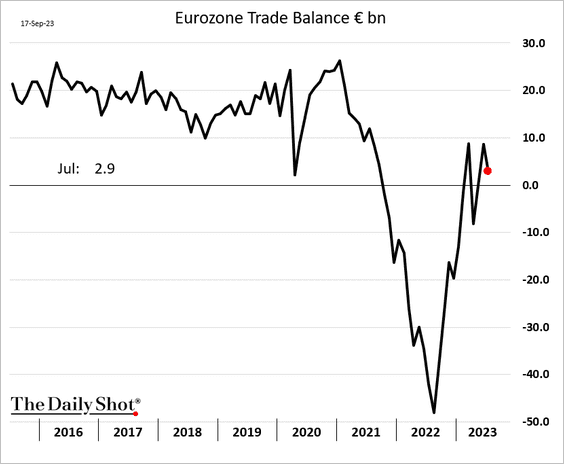

3. The euro-area trade surplus narrowed in July.

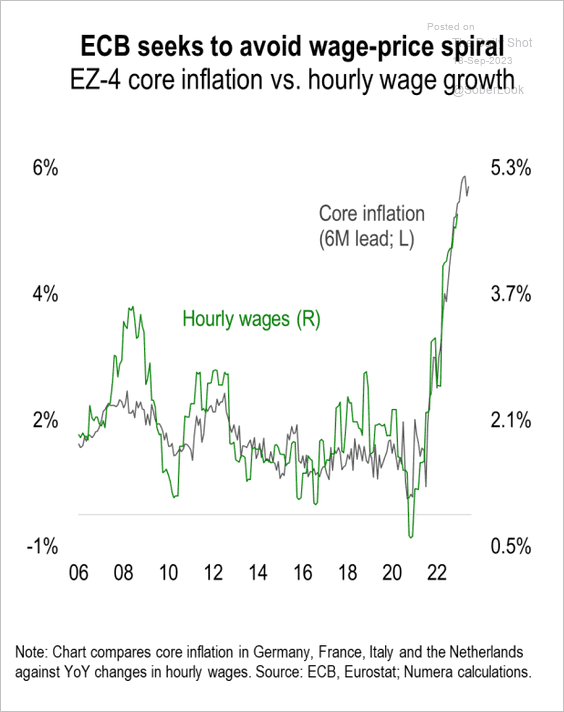

4. Concerns about a wage-price spiral persist.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

Back to Index

Asia-Pacific

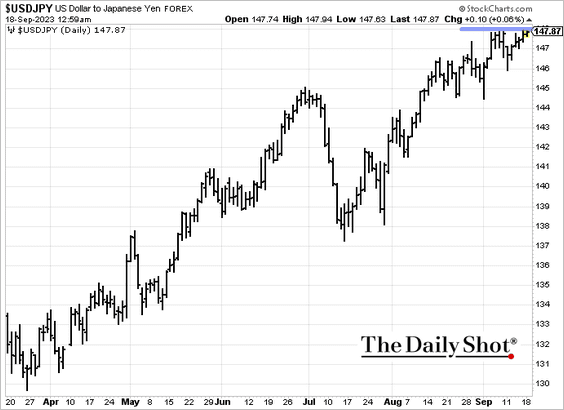

1. Dollar-yen hit resistance at 148.

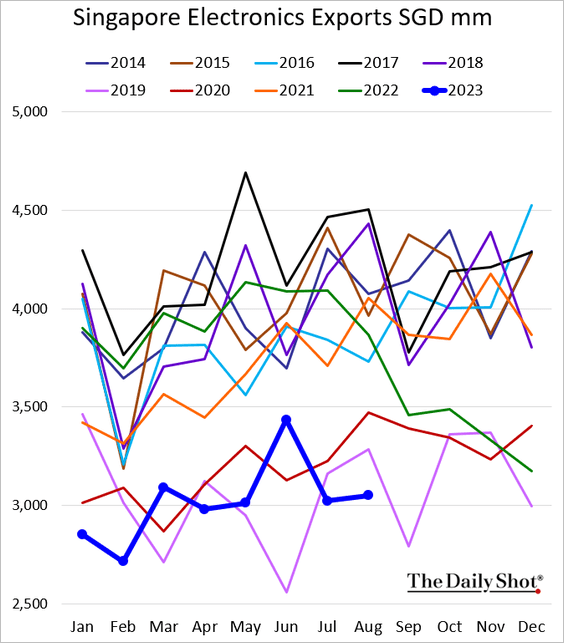

2. Singapore’s electronics exports remain at multi-year lows.

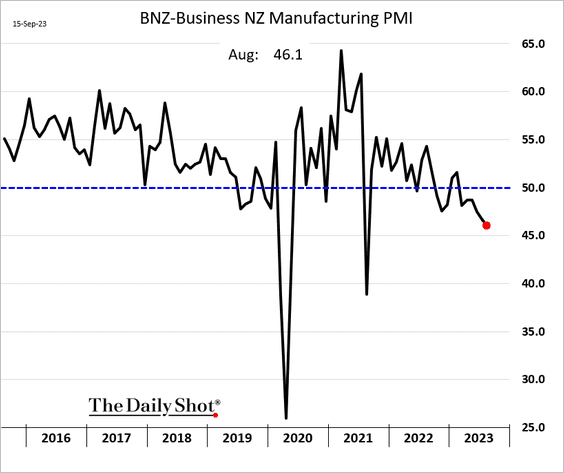

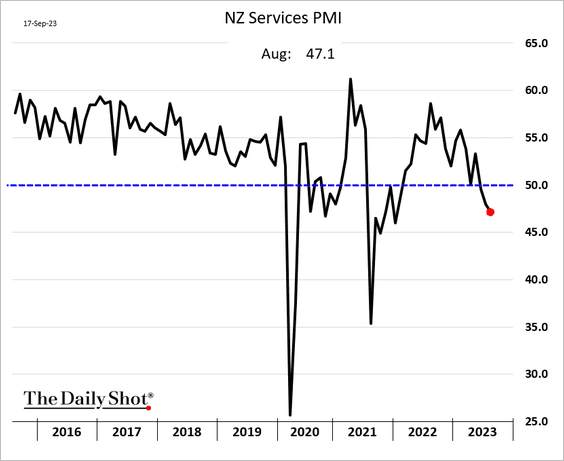

3. The contraction in New Zealand’s business activity has accelerated.

——————–

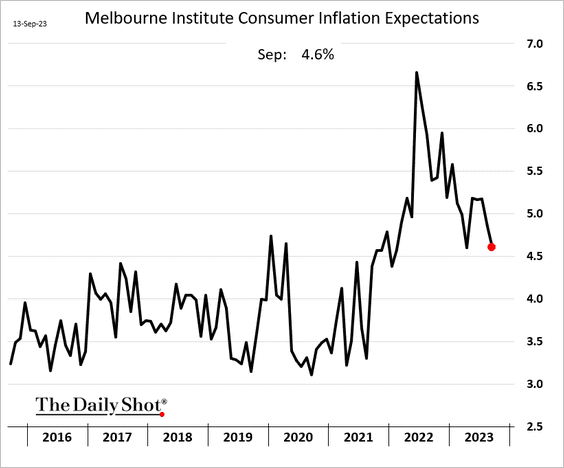

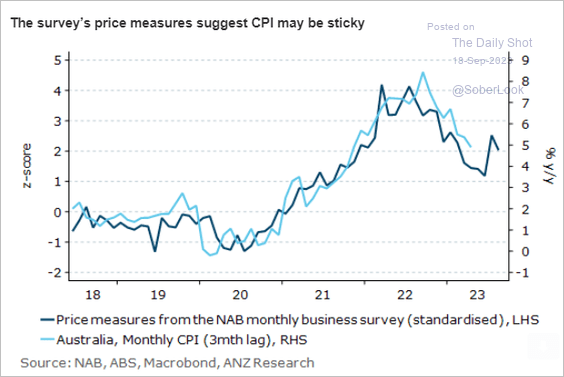

4. Australia’s inflation expectations moderated this month.

However, inflation expectations among businesses remain elevated.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

China

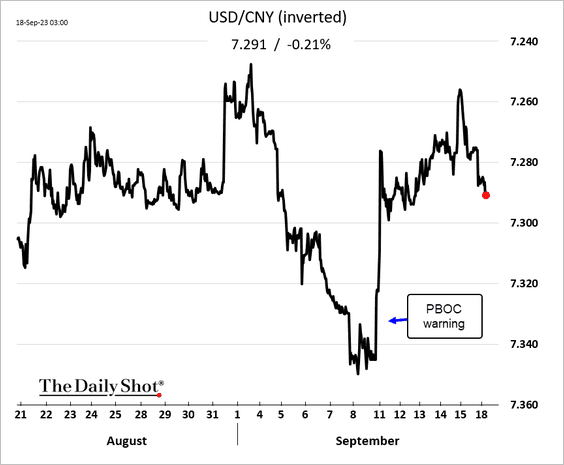

1. The renminbi is sagging again.

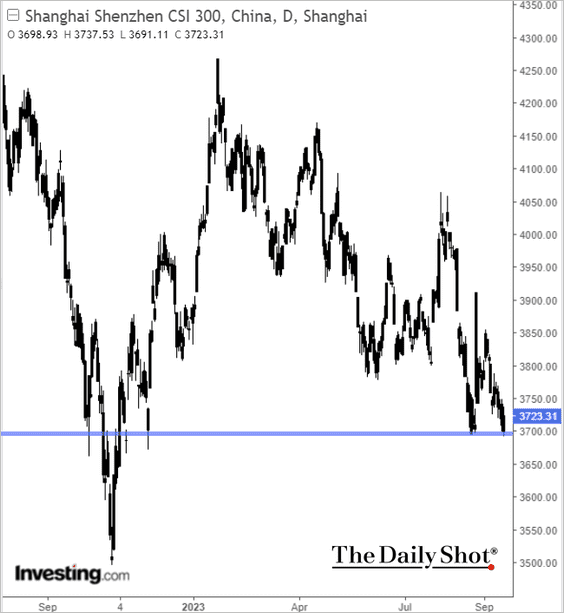

2. The Shanghai Shenzhen CSI 300 Index has been testing support.

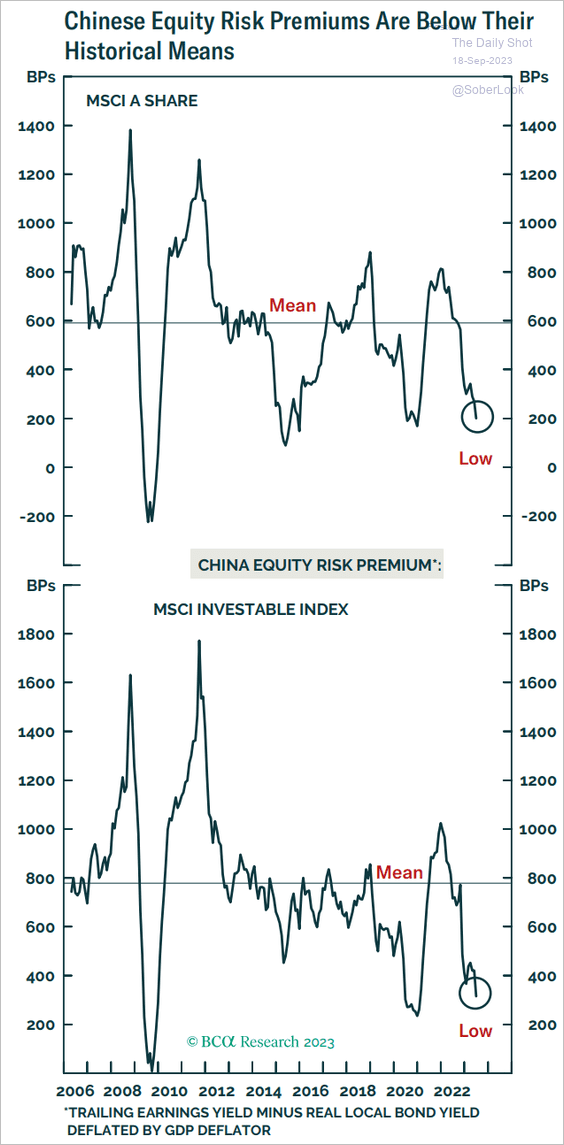

• China’s equity risk premium has been depressed, suggesting elevated stock valuations relative to bonds.

Source: BCA Research

Source: BCA Research

——————–

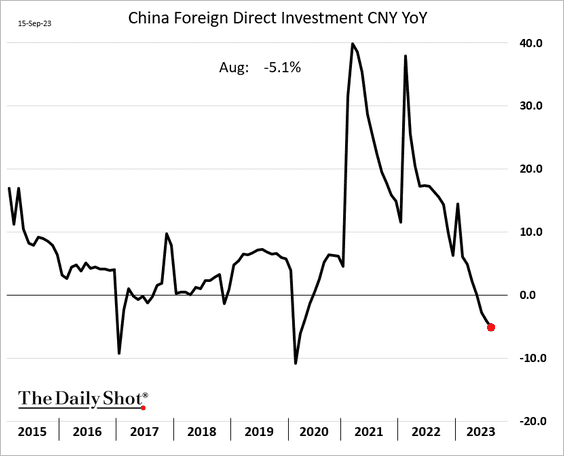

3. Foreign direct investment continues to slow.

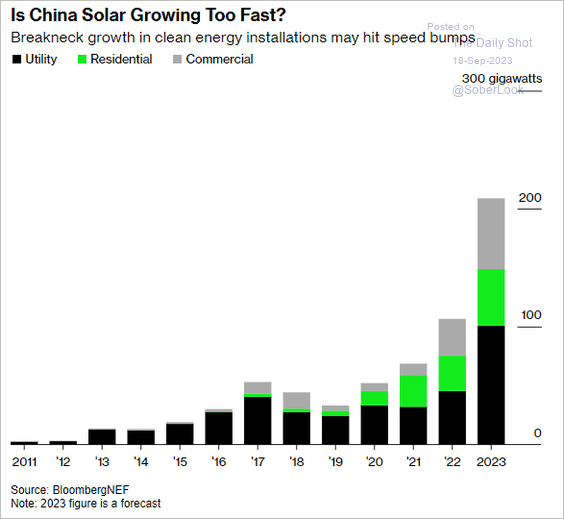

4. Here is a look at solar capacity.

Source: @climate Read full article

Source: @climate Read full article

Back to Index

Emerging Markets

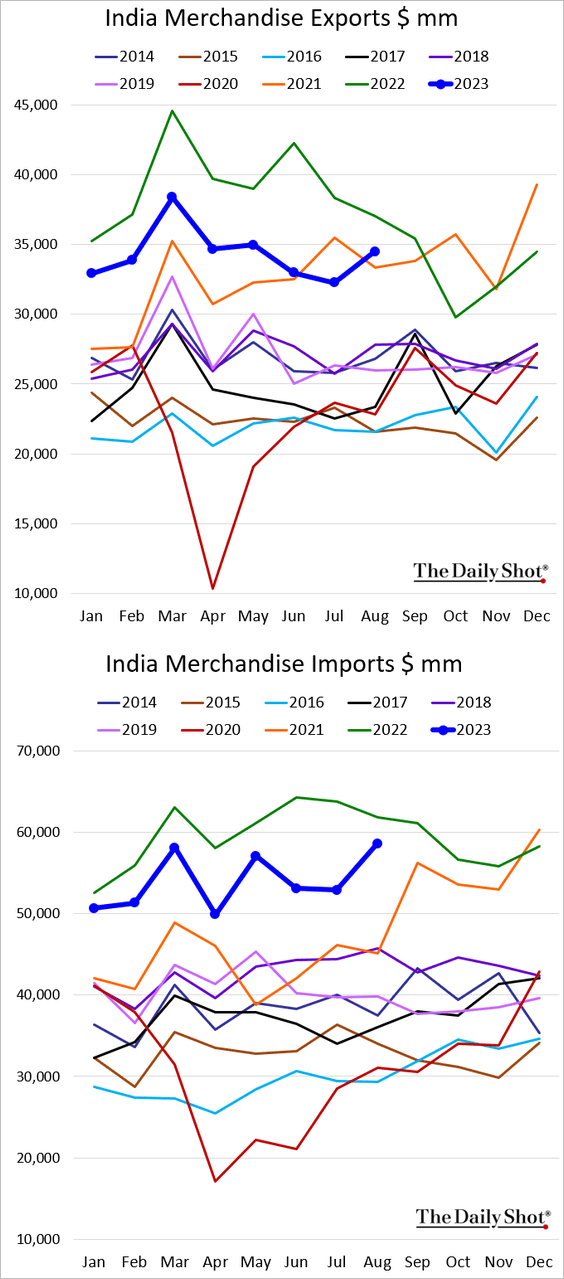

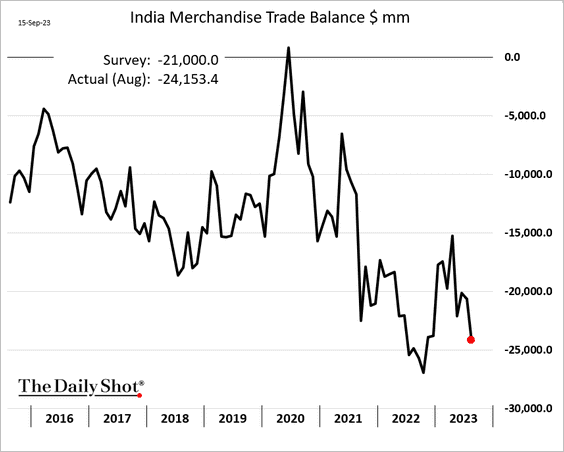

1. India’s exports gained last month, but imports increased even faster, …

… widening the trade deficit.

——————–

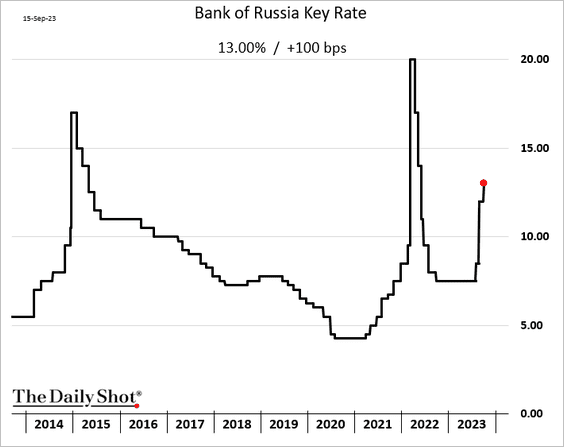

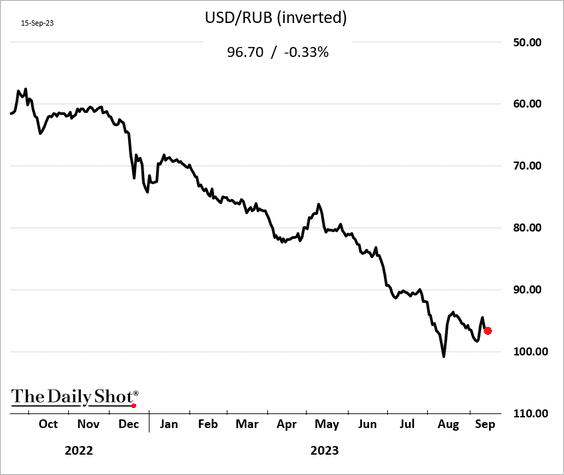

2. The Russian central bank hiked rates again to stabilize the nation’s sinking currency.

The ruble has stabilized, but so far, there is no meaningful rebound.

——————–

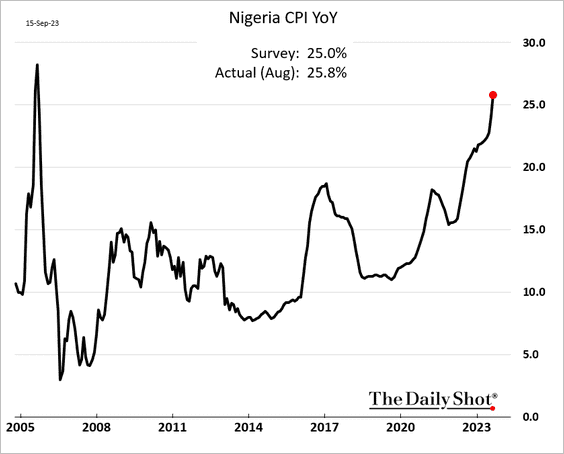

3. Nigeria’s inflation continues to surge.

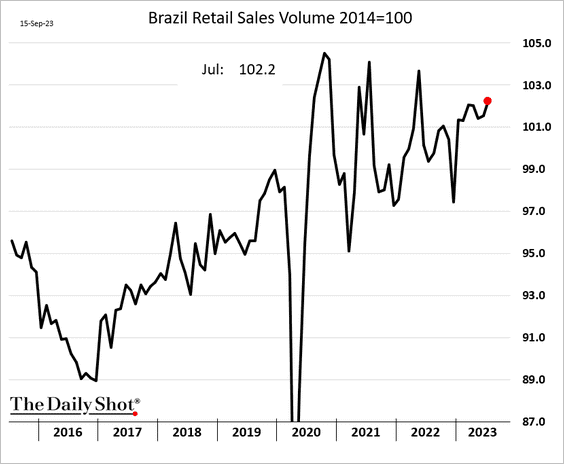

4. Brazil’s real retail sales are trending higher.

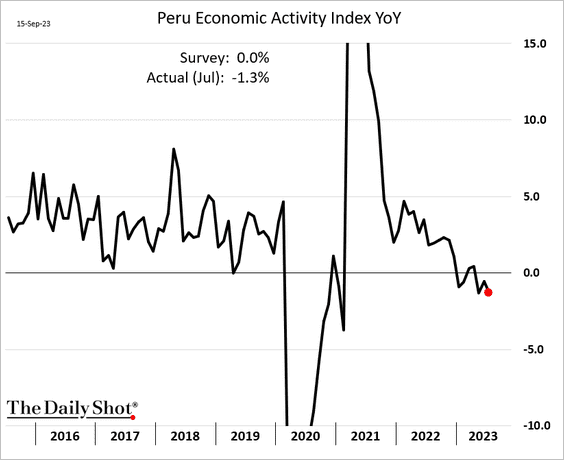

5. Peru’s economy seems to be in recession.

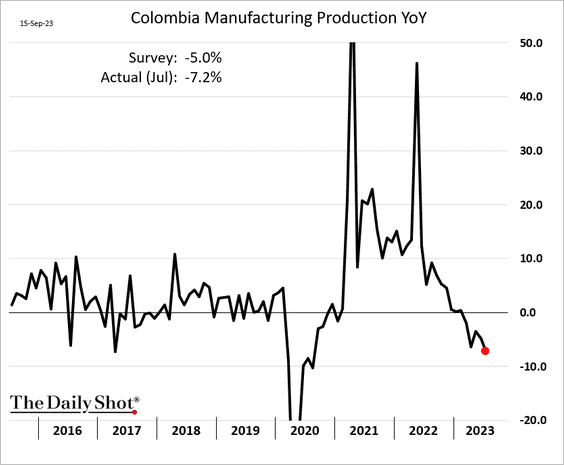

6. Colombia’s manufacturing sector is struggling.

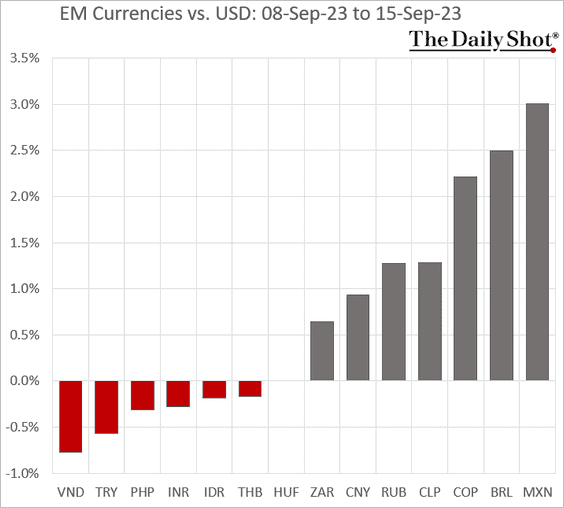

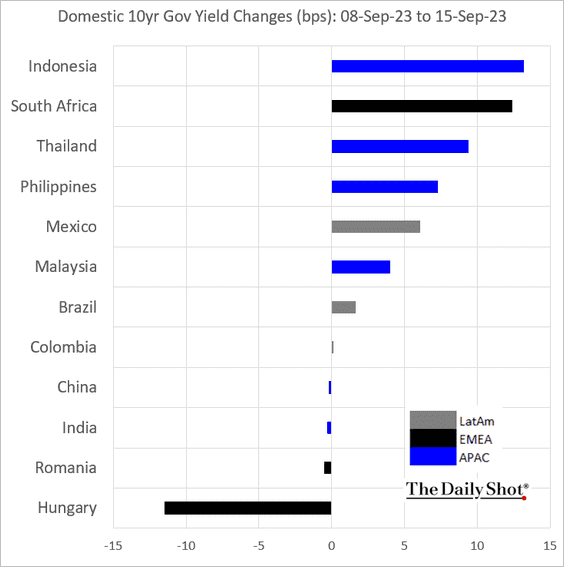

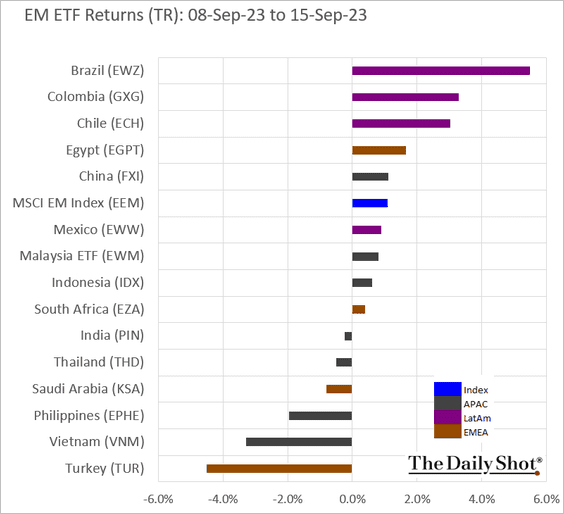

7. Next, we have some performance updates from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

Commodities

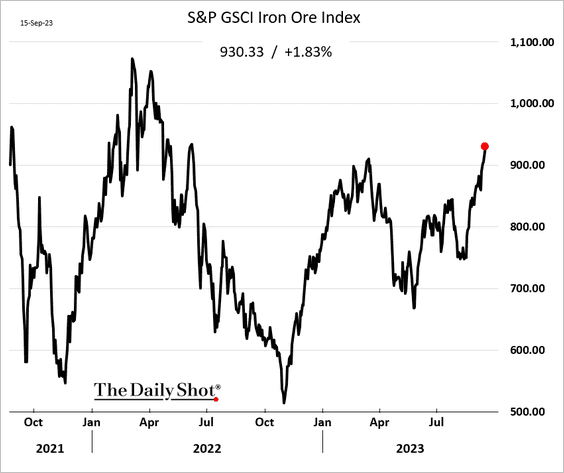

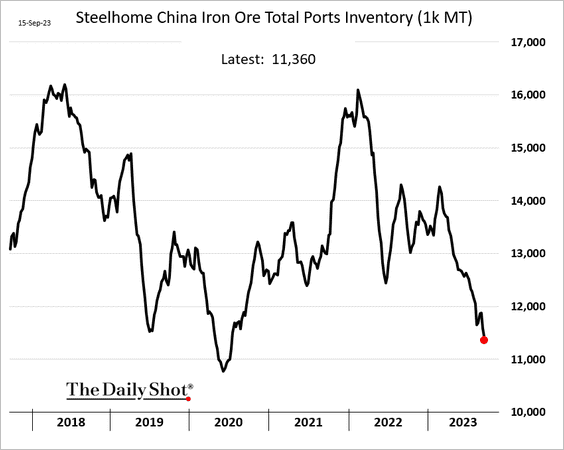

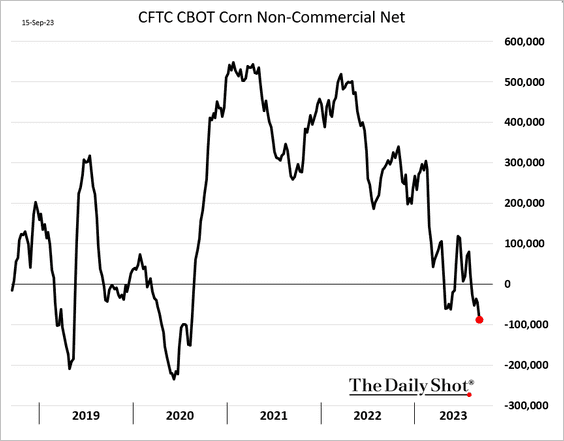

1. iron ore prices keep rising, …

… as inventories in China’s ports shrink.

Source: ForexLive Read full article

Source: ForexLive Read full article

——————–

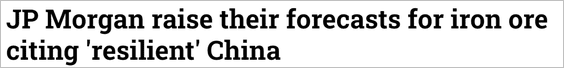

2. Gold implied vol hit the lowest level since 2019.

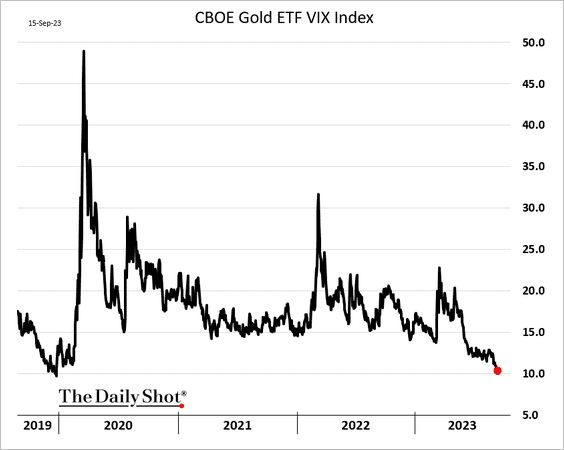

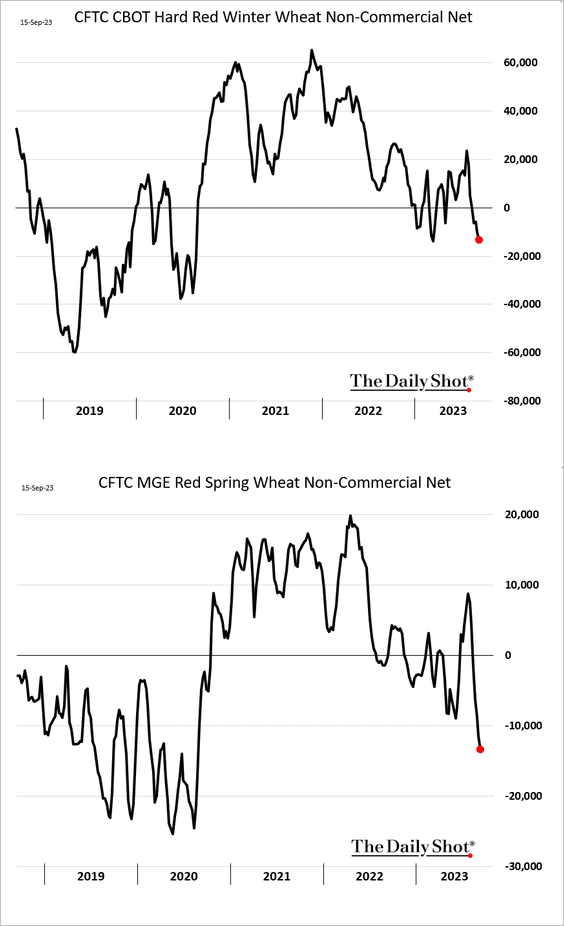

3. US corn and wheat speculative positioning is increasingly bearish.

——————–

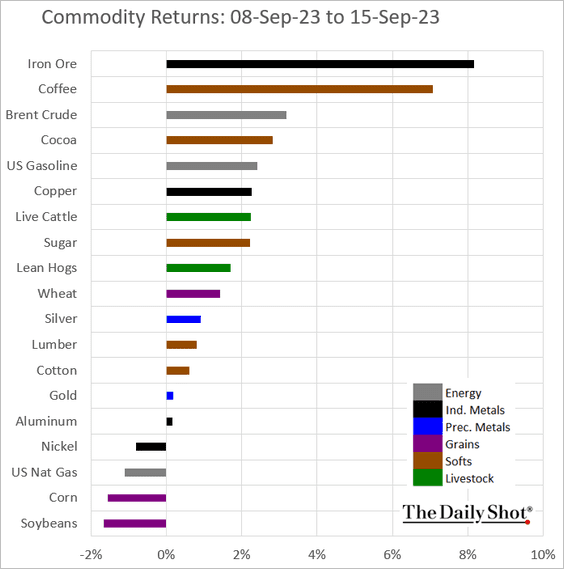

4. Here is last week’s performance across key commodity markets.

Back to Index

Energy

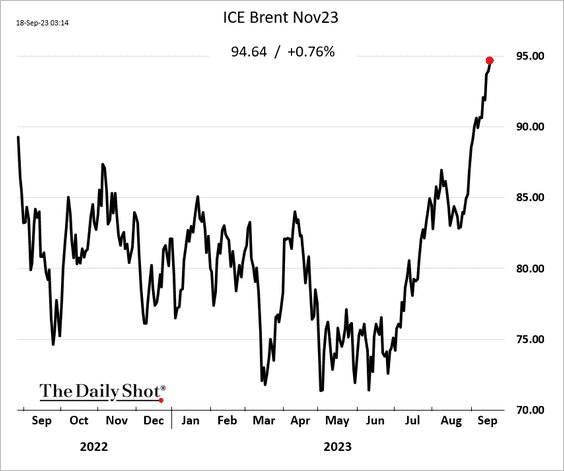

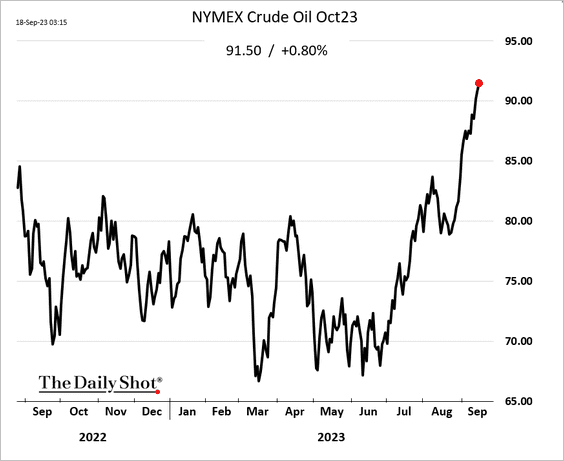

1. Crude prices continue to climb, with Brent approaching $95/bbl.

——————–

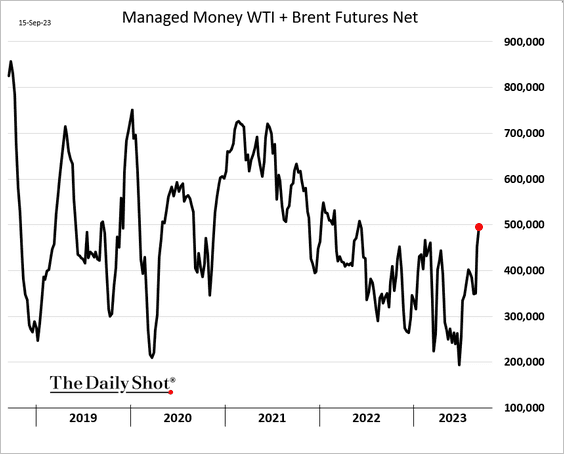

2. Hedge funds are boosting their bets on crude oil.

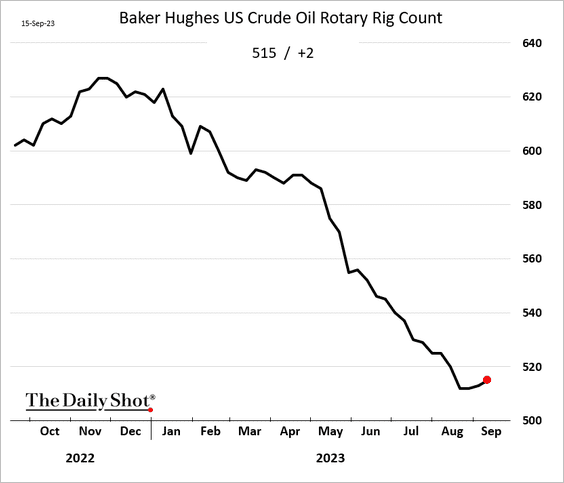

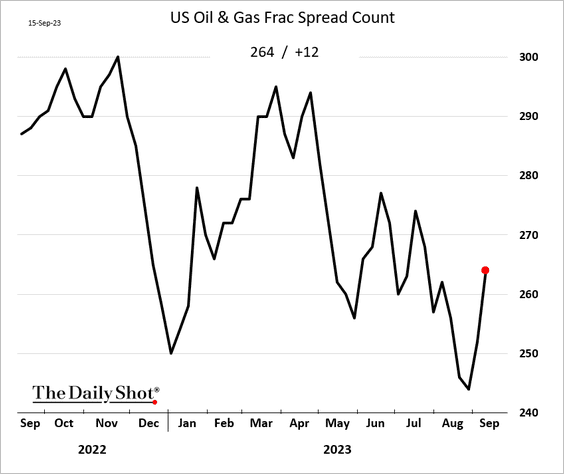

3. US drilling activity is starting to rebound.

• RIg count:

• Frac spread:

——————–

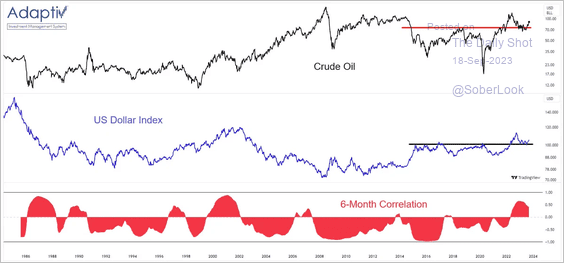

4. WTI crude oil and the dollar are the most correlated in about 20 years.

Source: @the_chart_life

Source: @the_chart_life

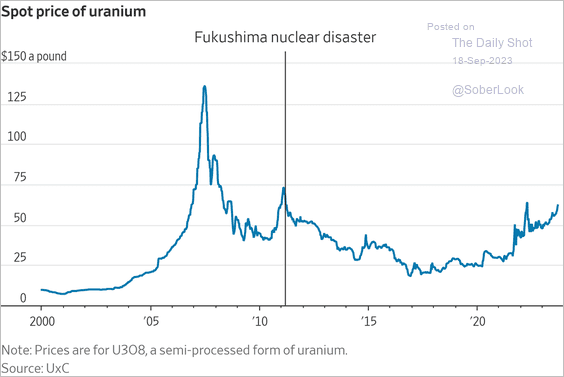

5. Uranium prices are climbing.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

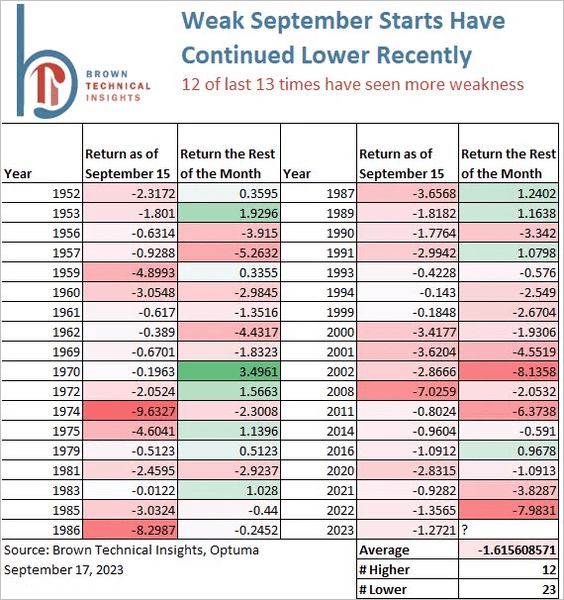

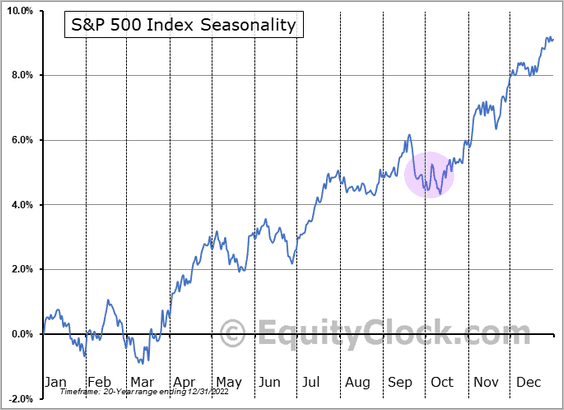

1. The S&P 500 typically struggles after a weak first-half of September.

Source: @scottcharts

Source: @scottcharts

Stocks could face seasonal pressures later in the month.

——————–

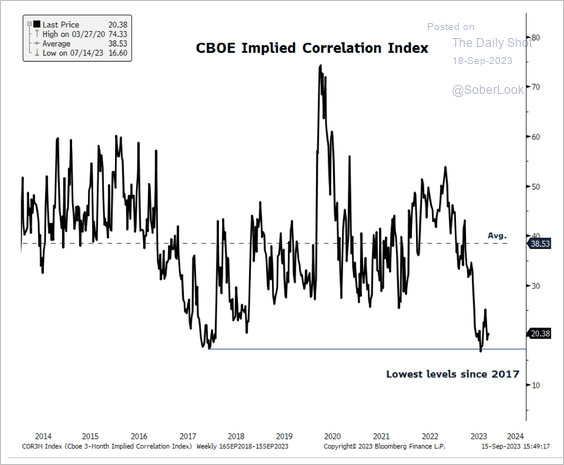

2. The implied correlation between S&P 500 stocks is testing the lowest level since 2017. According to Paradigm Capital, low-correlation environments are typically associated with low-vol conditions.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

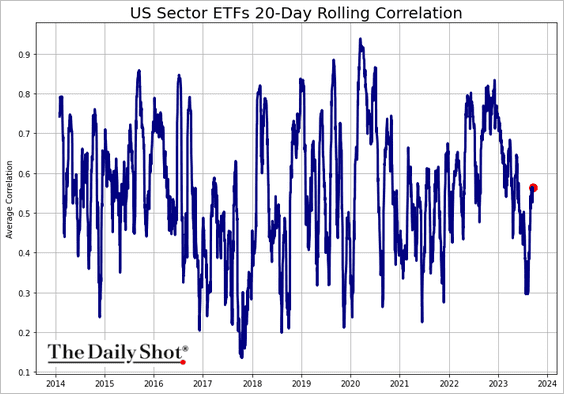

But sector correlations have bounced from recent lows.

——————–

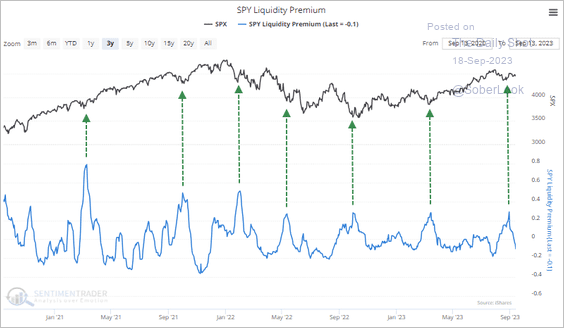

3. The S&P 500’s “liquidity premium” reversed from a period of uncertainty, indicating that investor indecision eased.

Source: SentimenTrader

Source: SentimenTrader

4. On average, more NYSE stocks are making new one-year price lows.

Source: @hmeisler

Source: @hmeisler

5. US high-dividend yield stocks are improving as the uptrend in the 10-year Treasury yield stalls.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

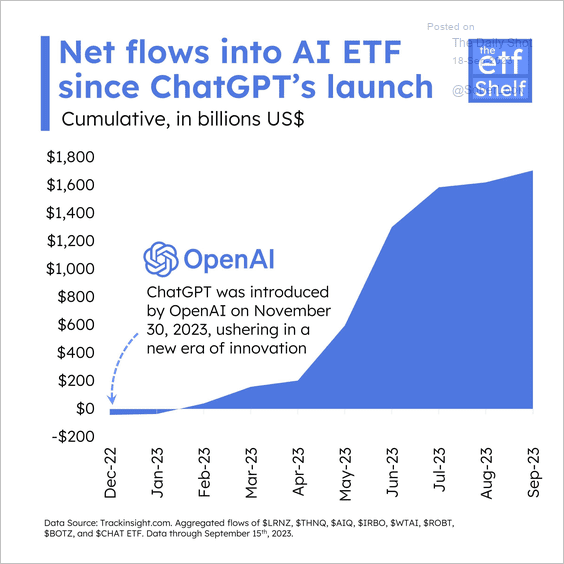

6. Investors have flocked to AI ETFs since the launch of ChatGPT earlier this year.

Source: The ETF Shelf

Source: The ETF Shelf

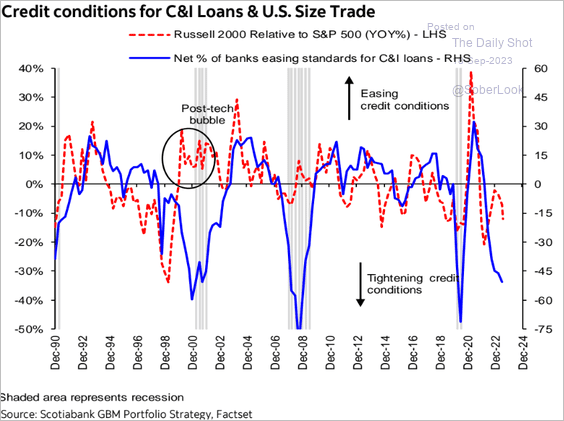

7. Tight credit conditions could weigh on small caps.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

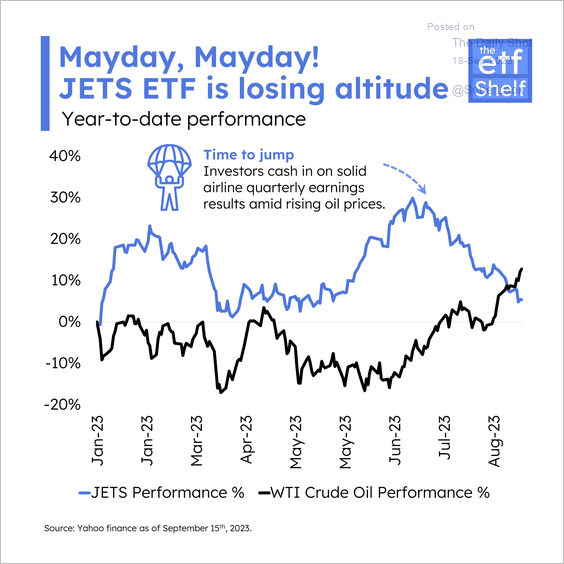

8. Rising oil prices have been a headwind for airline stocks.

Source: The ETF Shelf

Source: The ETF Shelf

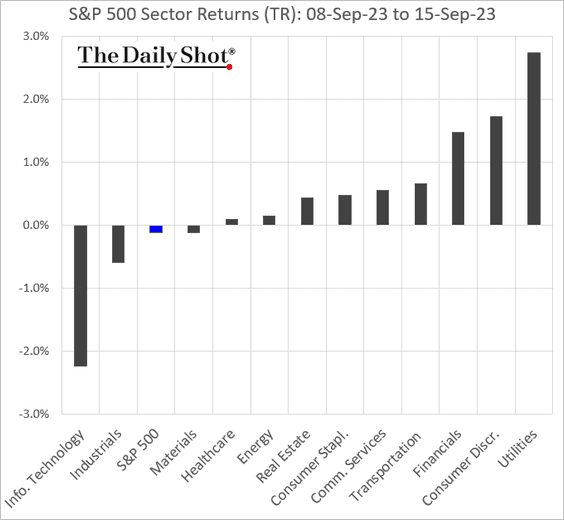

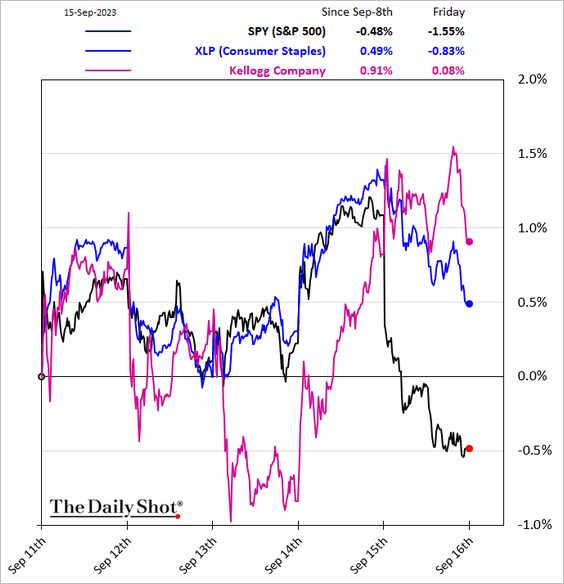

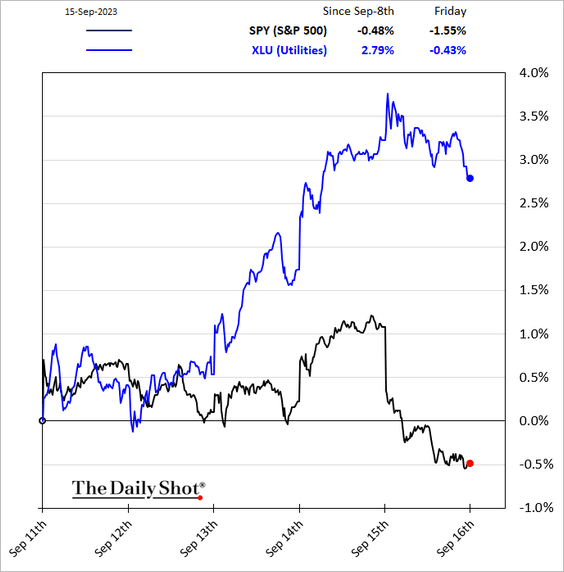

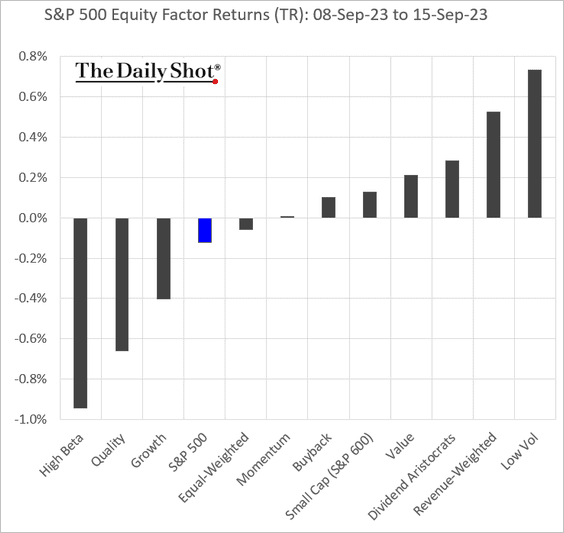

9. Next, we have some performance data from last week.

• Sectors:

– Defensives outperformed last week (2 charts).

• Equity factors:

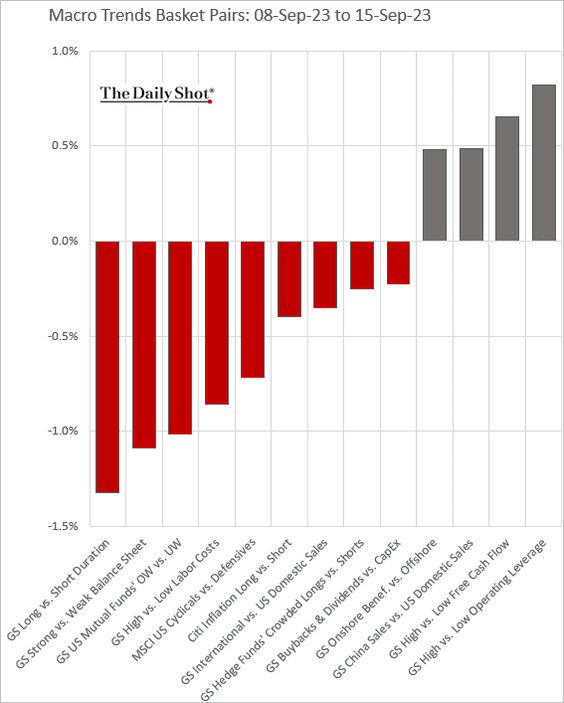

• Macro basket pairs’ relative performance:

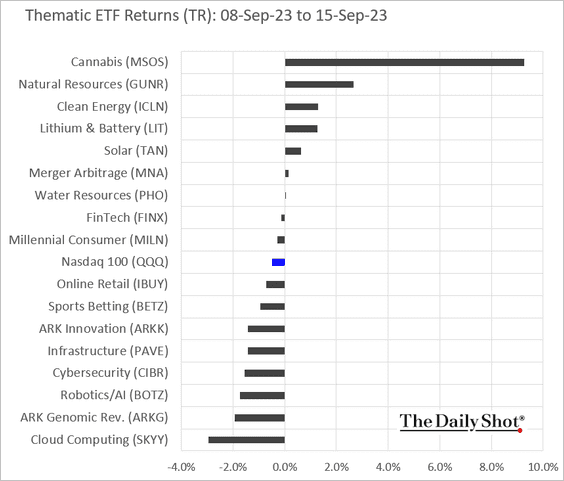

• Thematic ETFs:

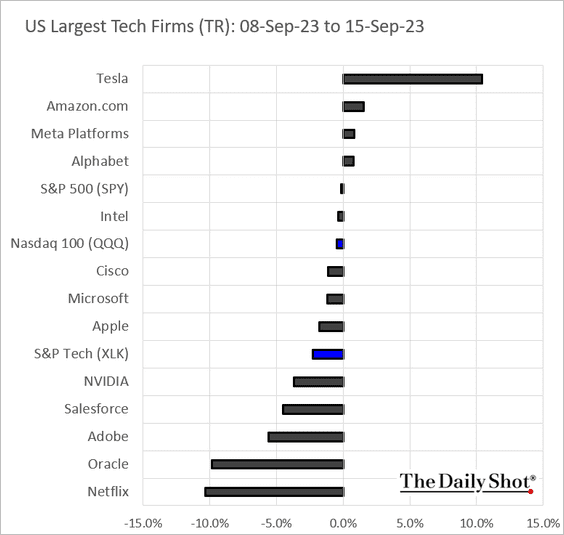

• Largest US tech firms:

Back to Index

Credit

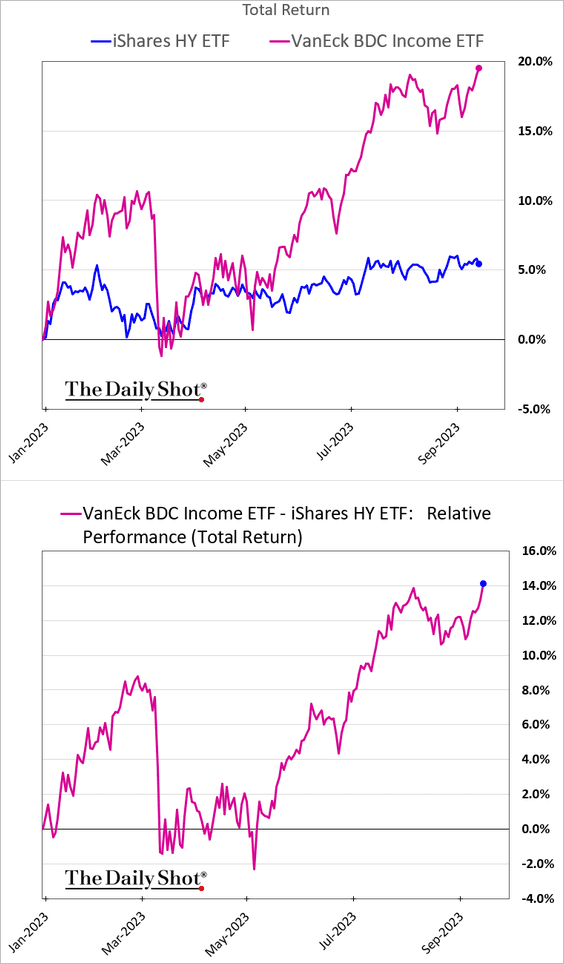

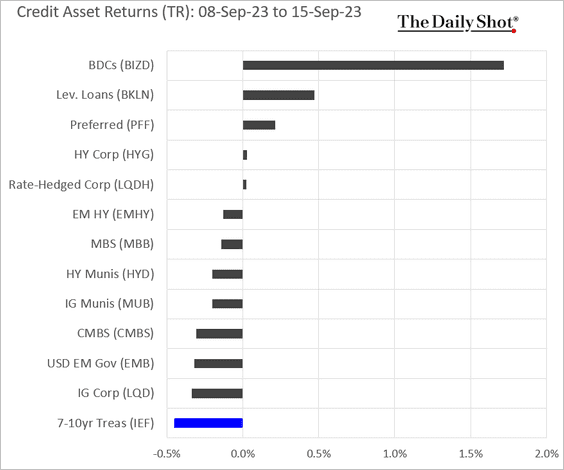

1. BDCs have been surging.

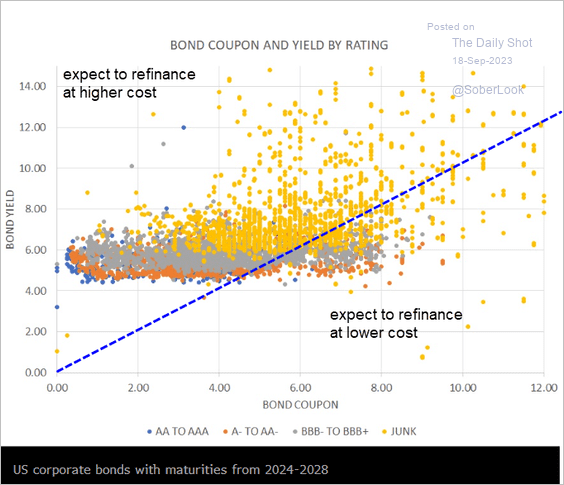

2. Much higher interest costs are ahead for many firms.

Source: @5thrule, @TheTerminal, Bloomberg Finance L.P. Read full article

Source: @5thrule, @TheTerminal, Bloomberg Finance L.P. Read full article

3. Here is last week’s performance across credit asset classes.

Back to Index

Global Developments

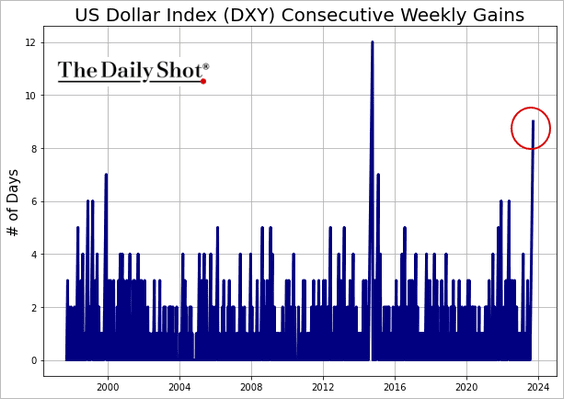

1. It’s been a few years since the US dollar index (DXY) had nine weekly gains in a row.

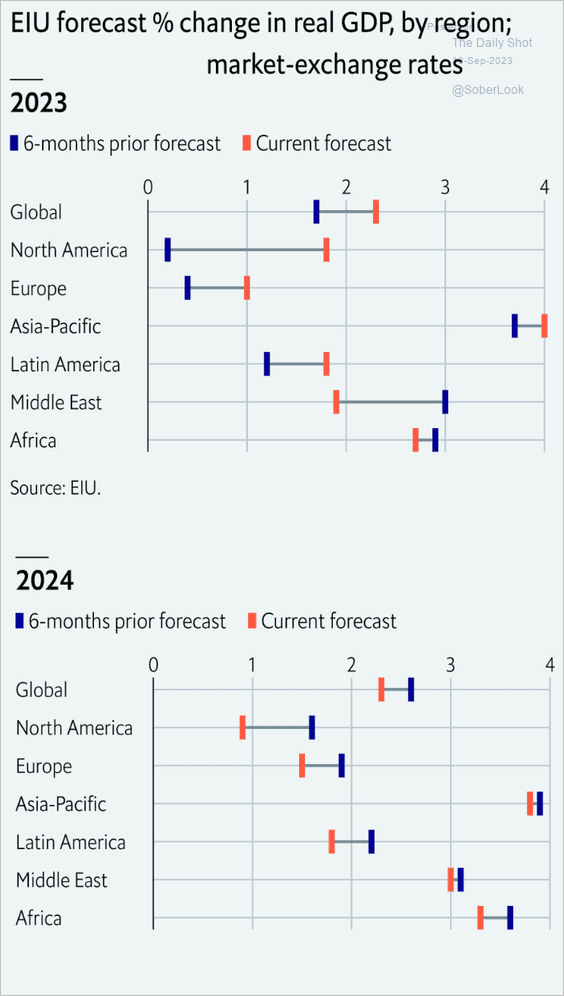

2. Growth forecasts for this year have been revised upward, but projections for 2024 have been lowered.

Source: EIU Read full article

Source: EIU Read full article

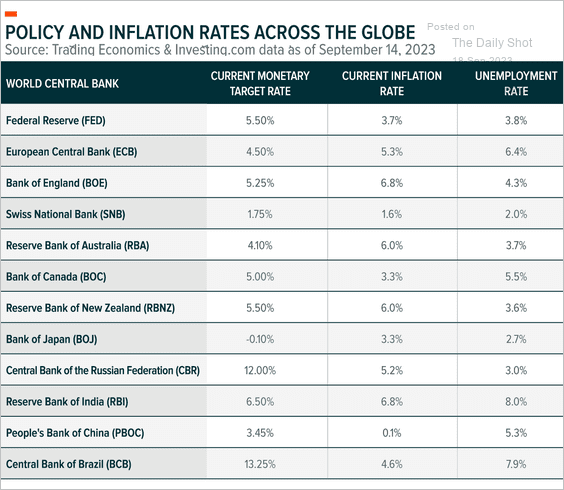

3. Here is a comparison of central bank policy rates, inflation, and unemployment.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

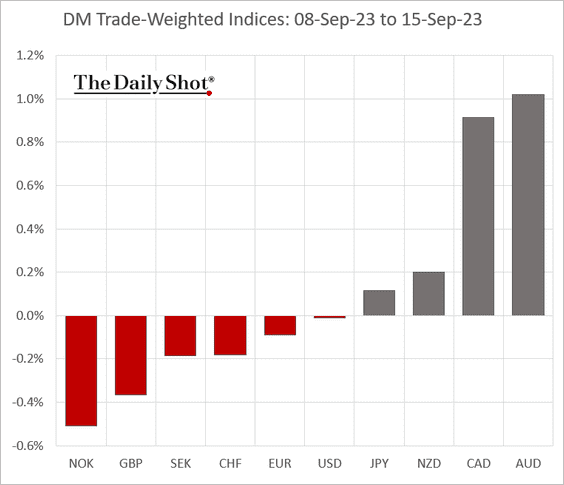

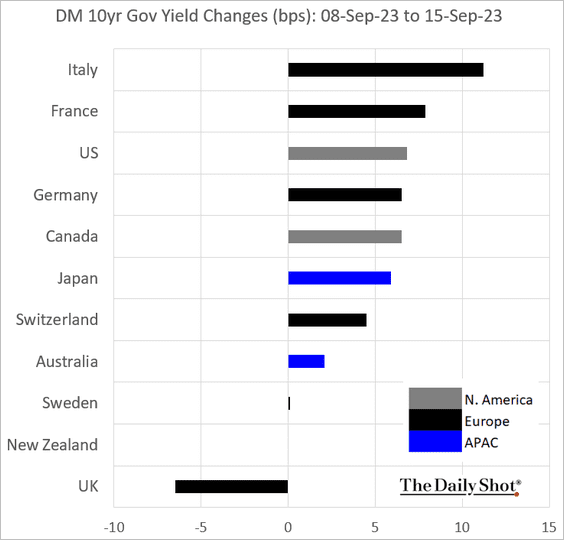

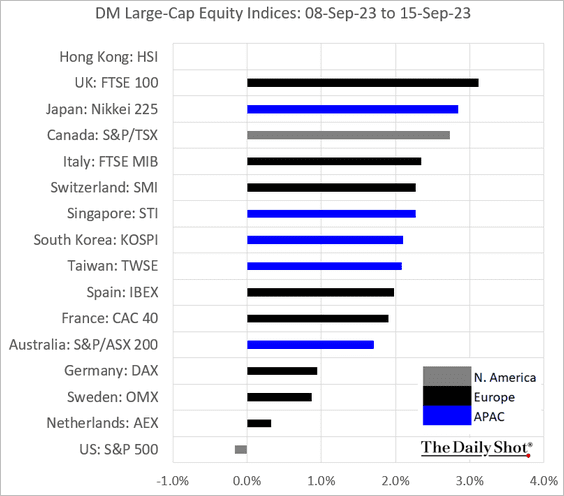

4. Finally, we have last week’s performance data for advanced economies.

• Currencies:

• Bond yields:

• Equities:

——————–

Food for Thought

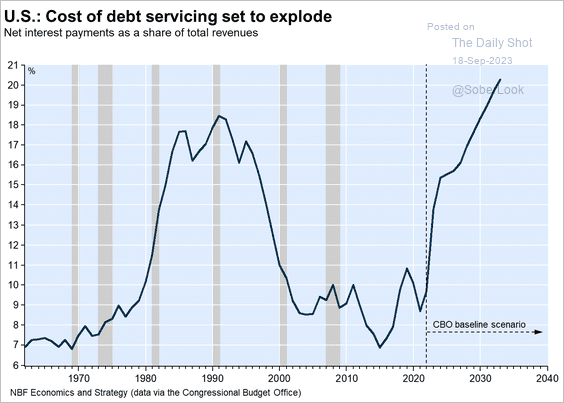

1. The US government’s debt servicing costs:

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

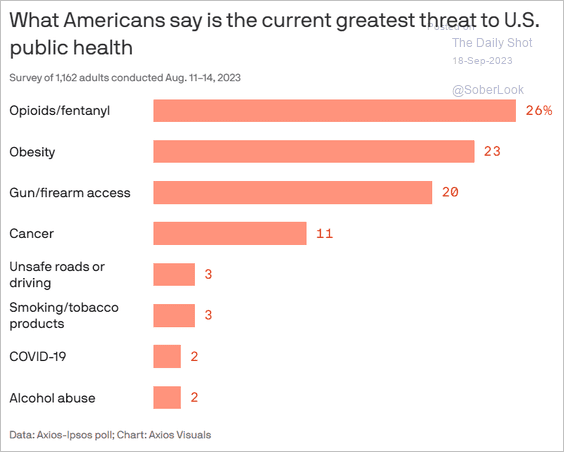

2. Threats to US public health:

Source: @axios Read full article

Source: @axios Read full article

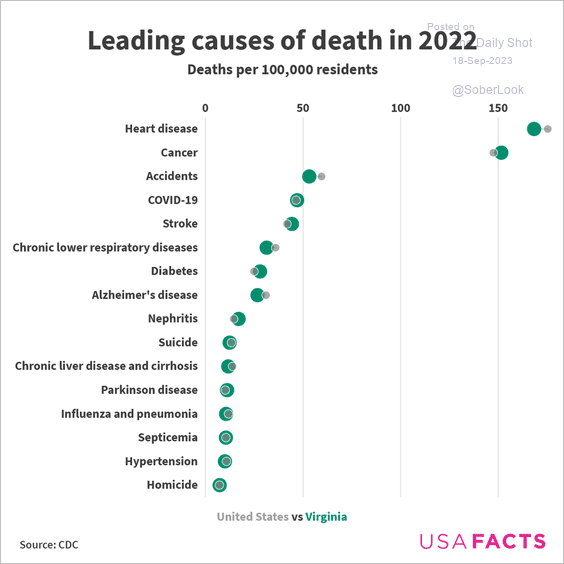

3. US leading causes of death:

Source: USAFacts

Source: USAFacts

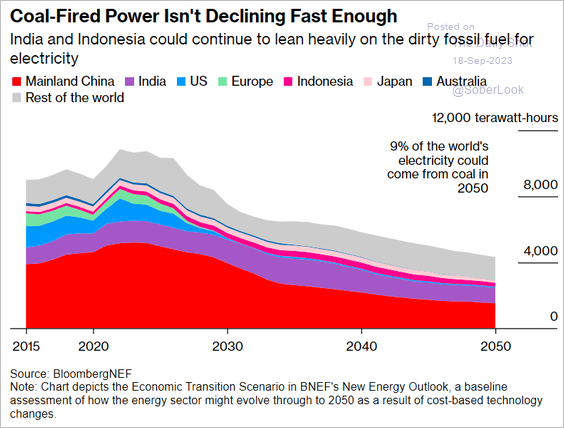

4. Projected coal usage to generate electricity:

Source: @danmurtaugh, @markets Read full article

Source: @danmurtaugh, @markets Read full article

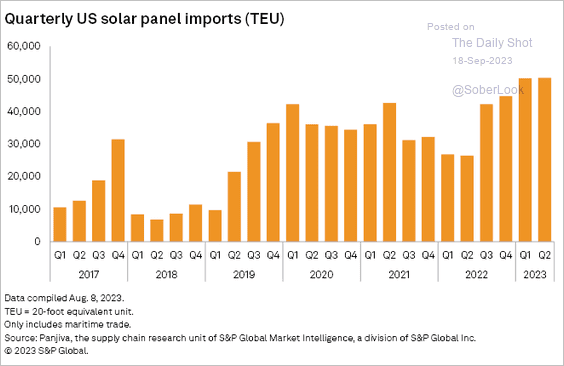

5. US solar panel imports:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

6. How can the US government help the nation’s semiconductor industry?

![]() Source: Brookings Read full article

Source: Brookings Read full article

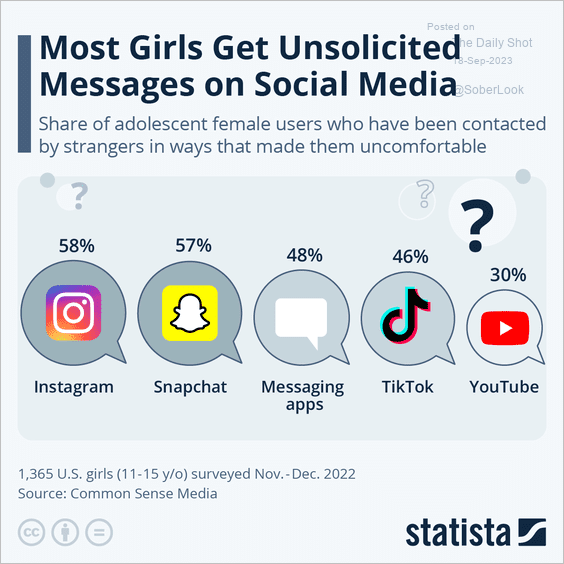

7. Unsolicited messages on social media:

Source: Statista

Source: Statista

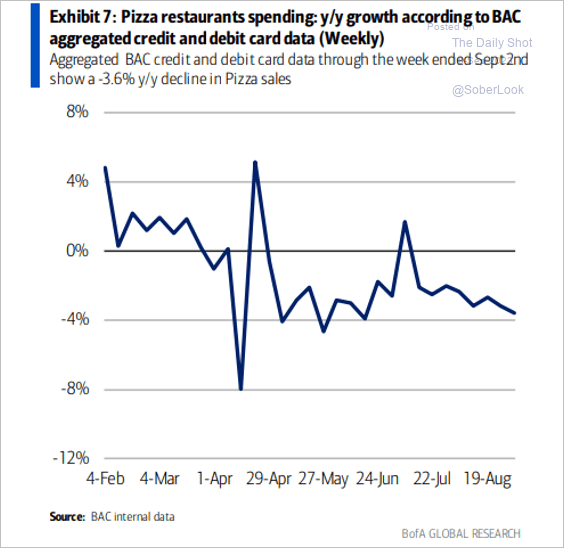

8. Spending on pizza is running well below last year’s levels.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

——————–

Back to Index