The Daily Shot: 20-Sep-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. Treasury yields hit multi-year highs ahead of the FOMC decision as oil prices surge. The Canadian inflation surprise also spooked bond traders.

Here is the Treasury curve.

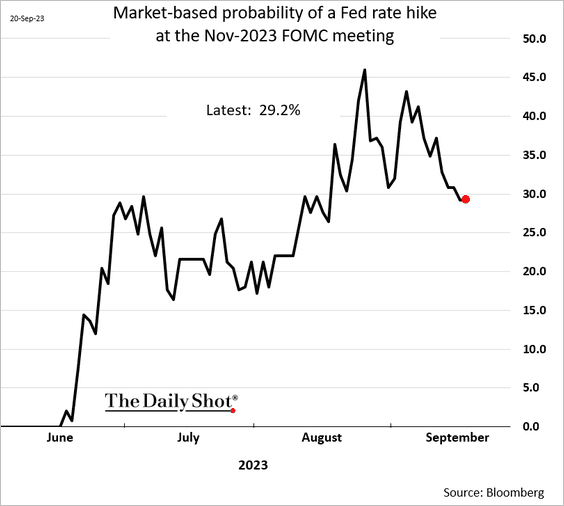

• The Fed is not expected to raise rates today, and the probability of an increase in November dipped below 30%.

• Economists increasingly believe that Fed rate cuts will be slower than previously projected.

Source: Oxford Economics

Source: Oxford Economics

• Based on the current inflation rate, the Fed’s policy is not very restrictive.

Source: @ANZ_Research

Source: @ANZ_Research

• Here are some scenarios and potential market reactions (from ING).

Source: ING

Source: ING

——————–

2. Housing starts tumbled in August, …

… pressured by multi-family housing (down almost 42% from last year).

But building permits jumped.

Such a large divergence between starts and permits is unusual. Here are the seasonally adjusted trends.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

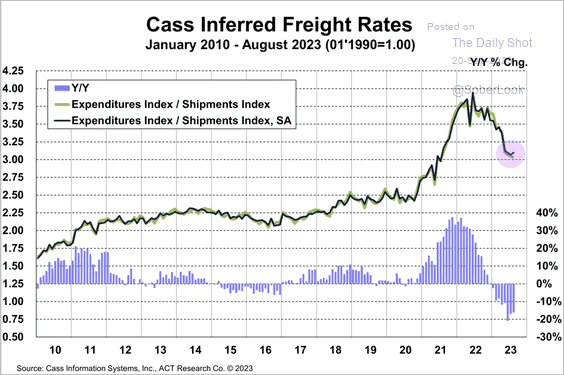

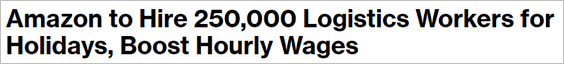

3. Shipping rates appear to be stabilizing as the freight recession eases.

Source: Cass Information Systems

Source: Cass Information Systems

Source: @business Read full article

Source: @business Read full article

——————–

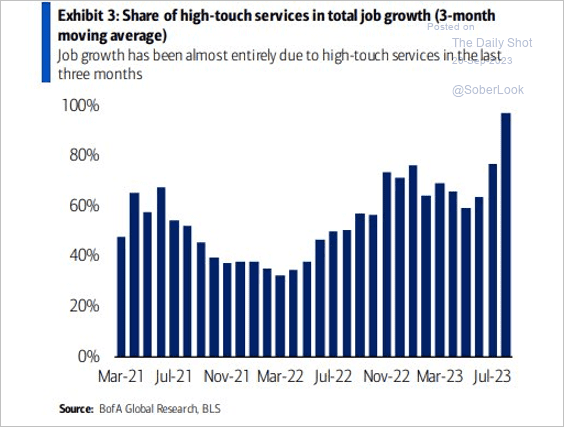

4. Recent employment growth has primarily been in lower-paying, high-touch services. Such a trend could dampen consumer spending.

Source: BofA Global Research; @MichaelAArouet

Source: BofA Global Research; @MichaelAArouet

5. This chart shows the total days lost to work stoppages (through August).

Source: @WSJ Read full article

Source: @WSJ Read full article

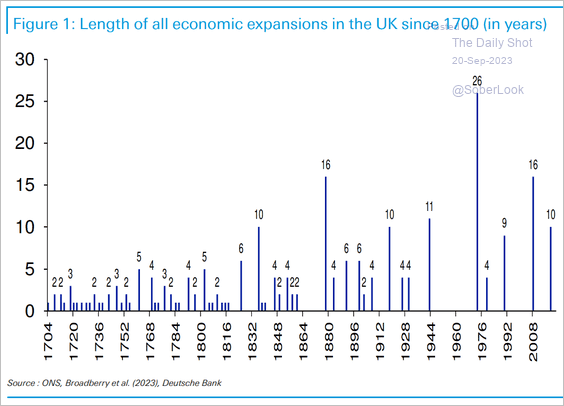

6. The length of economic expansions has increased over the past 40 years.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Canada

1. The August CPI report surprised to the upside.

Core inflation also topped expectations.

Shelter inflation accelerated, …

… with rent CPI hitting the highest level in 40 years.

• Rate hike expectations jumped.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

2. Bond yields surged in response to the CPI surprise.

• The loonie strengthened.

• Stocks declined.

——————–

3. The housing sales-to-new listings ratio declined further in August.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The United Kingdom

1. The BoE rate hike expectations eased significantly over the past 30 days, but the market still expects an increase this week. Will it be the last one of the current cycle?

2. UK wage growth has been outpacing global peers.

Source: Goldman Sachs; @AyeshaTariq

Source: Goldman Sachs; @AyeshaTariq

3. This chart shows the lengths of economic expansions.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

The Eurozone

1. The August headline CPI was revised lower. Core inflation remains elevated.

Here are the contributions to the headline CPI (year-over-year).

——————–

2. The deeply inverted Bund curve points to downside risks for Germany’s industrial production.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

3. The euro-area industrial production looks very different when Ireland’s contribution is removed.

Source: Barclays Research

Source: Barclays Research

Back to Index

Europe

1. Sweden’s housing correction is approaching the GFC levels.

Source: Longview Economics

Source: Longview Economics

• Economists have been downgrading forecasts for next year’s economic growth in Sweden, …

… and boosting inflation projections.

——————–

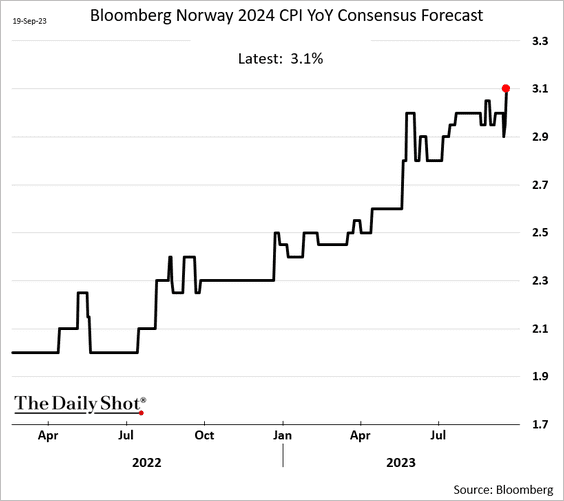

2. Norway’s inflation forecasts were also revised higher.

3. Here is a look at Cesarean births in Europe.

Back to Index

Japan

1. The trade balance remains in deficit.

2. The 10-year JGB yield continues to grind higher.

Back to Index

China

1. Bejing’s new policies aim to reduce down payments and rates for certain home buyers.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

2. Residential construction remains soft.

Source: Arcano Economics

Source: Arcano Economics

3. Here is a look at China’s property market by city size.

Source: Gavekal Research

Source: Gavekal Research

4. Exports to the US are down sharply in recent years.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

The same is true for exports to the world ex-US. According to Wells Fargo, this is partly driven by weak global growth and efforts to diversify supply chains away from China.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

5. Macau visitor arrivals have recovered.

Back to Index

Emerging Markets

1. Brazil’s economic activity edged higher in July.

2. Argentina’s GDP registered the worst decline in the second quarter since the 2020 COVID shock.

3. Mexico’s minium wage has been surging.

Source: Alpine Macro

Source: Alpine Macro

4. The Thai baht remains under pressure.

Back to Index

Energy

1. China’s slowing money supply growth signals slower oil imports ahead.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

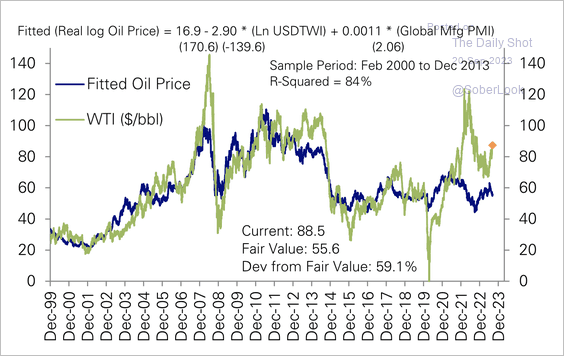

2. WTI crude oil is trading above Deutsche Bank’s fair value estimate based on the dollar and global growth.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. US energy firms have diverted cash toward paying down debt and raising shareholder payouts.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

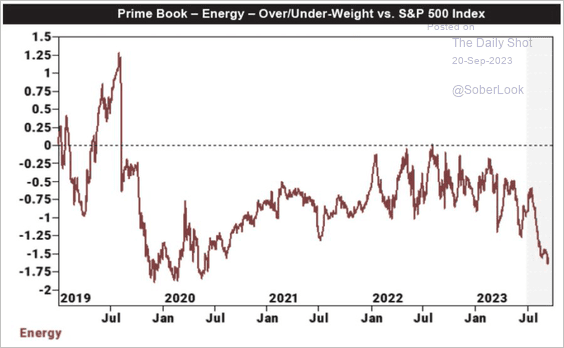

4. Hedge funds are cautious on energy stocks.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

5. US renewable diesel production is surging.

Source: @EIAgov

Source: @EIAgov

Back to Index

Equities

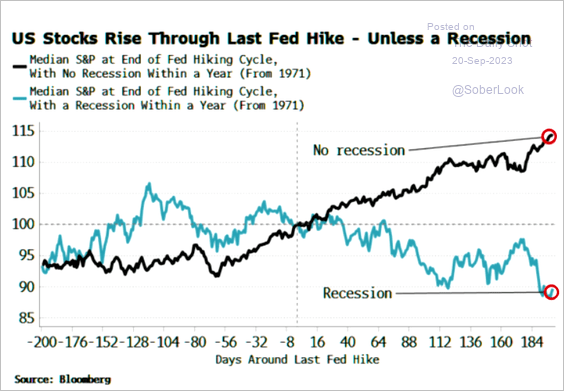

1. As the Fed pauses rate hikes, the stock market performance will depend on whether the US enters a recession.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

2. Over the long term, the S&P 500’s trailing multiple remains above its historical average.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. Goldman’s positioning indicator is back in “stretched” territory.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

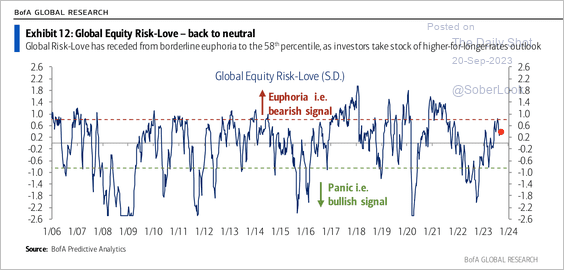

Deutsche Bank’s global equity sentiment indicator has moderated from bullish extremes.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

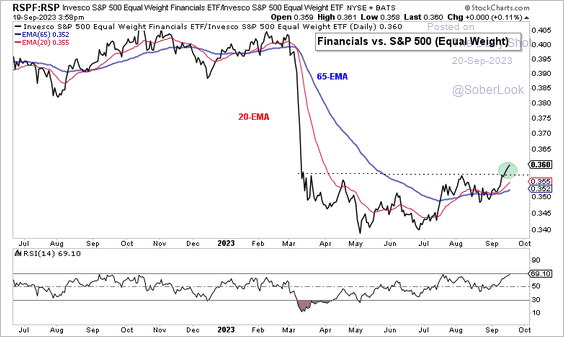

4. Next, we have some updates on financials.

• Bank shares continue to struggle.

• On an equal-weight basis, financials are breaking out relative to the broader market.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

• Financials continue to see outflows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Short interest in financials declined over the past 30 days.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

5. The SOX semiconductor index is testing uptrend support.

![]() h/t @themarketear

h/t @themarketear

6. S&P 600 small-cap stocks continue to exhibit weak earnings relative to the S&P 500.

Source: MRB Partners

Source: MRB Partners

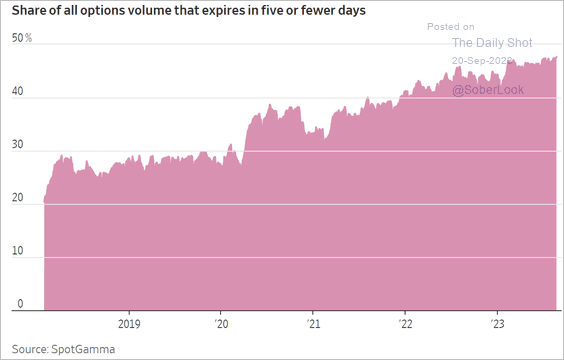

7. Short-term options continue to gain market share.

Source: @WSJ Read full article

Source: @WSJ Read full article

8. Here is a look at realized vol seasonality.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Credit

1. Brokered deposits provide banks with the liquidity they need but are typically much more expensive and less stable.

Source: @WSJ Read full article

Source: @WSJ Read full article

2. There is a substantial lag between tightening credit standards and loan growth.

Source: BCA Research

Source: BCA Research

3. Asia’s syndicated loan volume deteriorated this year.

Source: @markets Read full article

Source: @markets Read full article

4. Here is a look at muni yields compared to Treasuries.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Rates

1. Increased issuance of T-bills (yielding over 5.25%) makes the Fed’s RRP facility less attractive, …

… with money market funds shifting back to T-bills after heavy reliance on RRP earlier in the year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

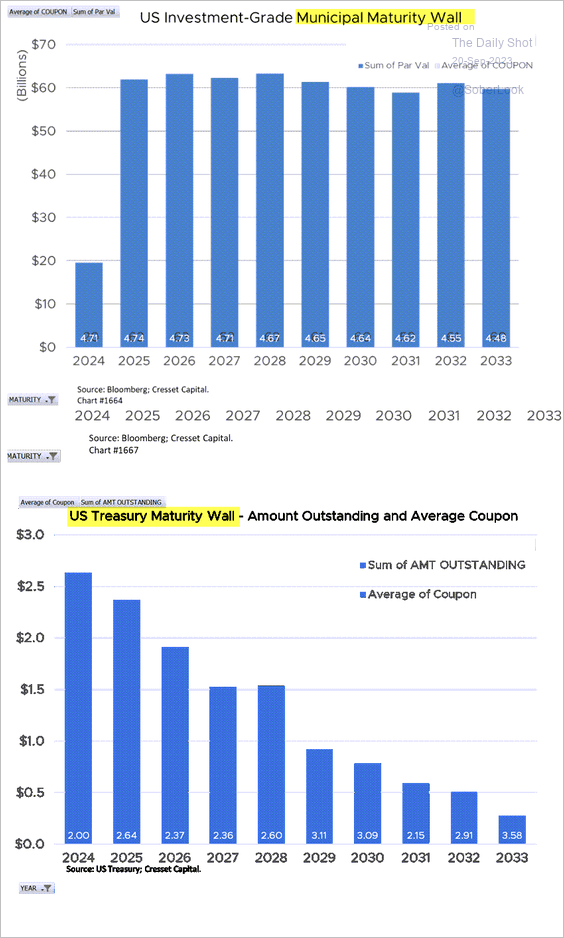

2. Unlike state and local governments, the US Treasury did not term out more of its debt, which is resulting in sharply higher interest expenses.

Source: Jack Ablin, Cresset Wealth Advisors

Source: Jack Ablin, Cresset Wealth Advisors

3. While rising Treasury yields have often led to increased implied volatility, as indicated by the MOVE Index, recent trends have shown Treasury yields surging while the MOVE Index unexpectedly declines.

Source: @TheTerminal, Bloomberg Finance L.P., h/t Deutsche Bank Research

Source: @TheTerminal, Bloomberg Finance L.P., h/t Deutsche Bank Research

Back to Index

Global Developments

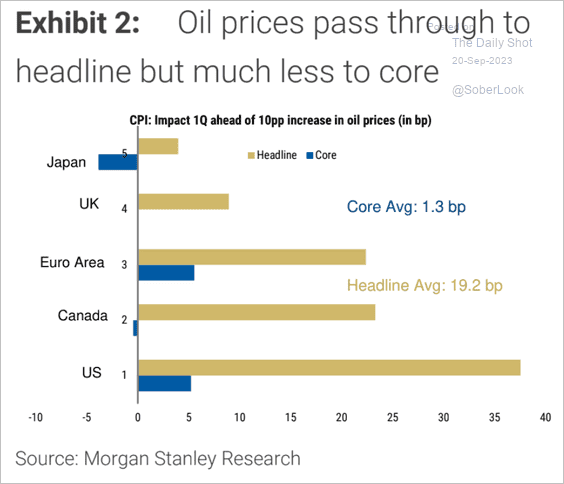

1. How much do oil prices impact consumer inflation?

Source: Morgan Stanley Research

Source: Morgan Stanley Research

2. Here is a look at expectations for economic growth by region.

Source: WEF Read full article

Source: WEF Read full article

3. Tight global liquidity will remain a drag on economic activity.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

4. Which countries are most dependent on trade?

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Food for Thought

1. Federal government healthcare subsidies:

Source: Hoover Institution Read full article

Source: Hoover Institution Read full article

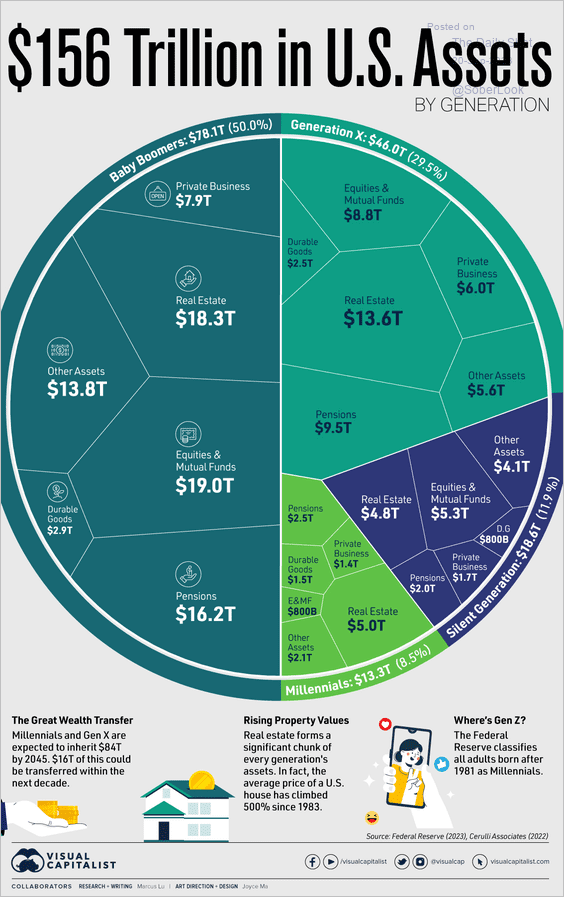

2. Assets by generation:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

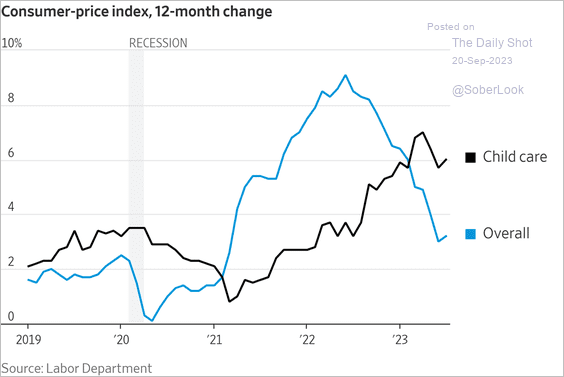

3. US childcare inflation:

Source: @WSJ Read full article

Source: @WSJ Read full article

4. Smoking among US adults:

Source: Gallup Read full article

Source: Gallup Read full article

5. Pay transparency in US job postings:

Source: @nick_bunker, @indeed Read full article

Source: @nick_bunker, @indeed Read full article

6. The most important features when considering a smartphone purchase:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

7. The 2024 GOP presidential nomination probabilities in the betting markets:

Source: @PredictIt

Source: @PredictIt

8. Kids are back in school (doing homework), and ChatGPT is popular again.

Source: @fchollet

Source: @fchollet

——————–

Back to Index